- College of Economics and Management, Shenyang Agricultural University, Shenyang, China

Introduction: In light of growing resource constraints and global calls for sustainability, the efficiency of swine production has become a strategic concern in China. China’s swine insurance policy serves as a key institutional mechanism for strengthening risk mitigation and resilience, rigorously evaluation of the policy’s impact on swine production efficiency is essential for optimizing agricultural insurance mechanisms and advancing sustainability in the swine industry.

Methods: This study treats the pilot implementation of the swine insurance policy as a quasi-natural experiment, drawing on panel data from 30 Chinese provinces over the years from 2005 to 2021, it employs a spatial difference-in-differences (SDID) model and a mediation effect model to empirically examine the impact of the swine insurance policy on swine production efficiency.

Results: The results reveal that the swine insurance policy significantly improves swine production efficiency in the implementing provinces and generates substantial spatial spillover effects, the boundary of spatial effect decay is 250 km. Additionally, the policy enhances swine production efficiency by expanding production scale, encouraging structural upgrading, and promoting technology adoption. The heterogeneity analysis by functional swine production regions and farming scale reveals that the effects of swine insurance policy are particularly pronounced in the major production region and among large scale farms.

Discussion: This study investigates the role of China’s swine insurance policy in enhancing swine production efficiency under current resource constraints. Due to data availability constraints, the inability to use more granular data at the city or county level may limit the precision of policy effect identification. Overall, this study is grounded in the practical development needs of China’s swine industry and provides solid theoretical foundations and policy recommendations. The results indicate that swine insurance serves as a vital policy instrument, improves the production efficiency through promoting scale expansion, facilitating structural upgrading and increasing technology adoption. The study offers a new perspective for the sustainable development of the swine industry.

1 Introduction

Rising global demand for animal protein and increasing environmental concerns have made improving swine production efficiency a critical priority for the global food system. The Food and Agriculture Organization (FAO) predicts that global meat demand will grow by more than 70% between 2005 and 2050 (Le Mouël and Forslund, 2017). In 2024, pork accounted for nearly 30% of global meat consumption (Vicente and Pereira, 2024), making it one of the most significant animal protein sources. Rising pork demand, coupled with resource scarcity and stricter environmental regulations, has exposed the unsustainable nature of conventional, input-intensive production systems, which are increasingly incompatible with the pursuit of contemporary swine production. Improving swine production efficiency is of great significance for advancing agricultural modernization.

China holds the top position globally in both pork production and consumption. USDA (United States Department of Agriculture) data indicate that China’s swine production totaled 57.06 million tons in 2024, accounting for 48% of global output. A robust swine industry contributes significantly to rural revitalization, food system resilience, and long-term national food security (Béné et al., 2023). Despite rapid increases in both output and value, China’s swine industry continues to face significant structural challenges (Zhang et al., 2021). These gains have been achieved at the cost of substantial resource overuse and labor-intensive model. In addition, outdated technologies, and limited innovation capacity have contributed to lower production efficiency compared to international benchmarks (Mahfuz et al., 2022). Consequently, raising production efficiency has become a key strategic priority for swine industry (Rauw et al., 2020).

However, the swine industry faces numerous challenges, particularly the uncertainty surrounding production volumes and market prices. In recent years, African Swine Fever (ASF) has emerged as a persistent and highly transmissible disease, causing extreme price fluctuations and widespread supply chain disruptions across the global pork industry (Wang and Li, 2024). In response to these challenges, China launched a swine insurance policy scheme in 2007 to manage risks. However, in countries such as the United States, where the primary risks in swine production stem from market-related factors such as fluctuations in livestock prices and feed costs, the dominant production risk in China arises from disease-induced livestock mortality (Li et al., 2021). In response to this context, swine insurance in China has been widely adopted and is primarily designed to compensate for mortality losses caused by disease outbreaks. In 2024, China’s agricultural insurance premiums reached 152.1 billion RMB, the highest in the world. Given China’s position as the world’s leading pork producer, this dual leadership forms a solid basis for exploring how swine insurance contributes to production efficiency. Accordingly, given the heightened risks and cost pressures, assessing how China’s swine insurance policy affects production efficiency not only holds considerable theoretical significance, but also offers important insights from a major developing country for promoting global livestock systems.

Recent studies on agricultural insurance have largely centered on crops, with limited attention to livestock. However, crop insurance experiences provide valuable guidance for designing more effective livestock insurance systems. Research shows that crop insurance can influence planting decisions, expand cultivated areas, and promote investment by easing credit constraints (Wu, 1999; Glauber et al., 2002; Goodwin and Smith, 2013; Ifft et al., 2015), these mechanisms contribute to more efficient resource allocation, ultimately improving agricultural production efficiency. In addition, recently there has been a growing interest in the spatial dimensions of agricultural insurance implementation (Li and Wang, 2023). In summary, most existing research has concentrated on crop insurance, while livestock insurance, especially swine insurance, has received comparatively limited attention and lacks systematic evaluation.

This study offers three key contributions. Firstly, while prior research on agricultural insurance has largely focused on crop insurance, this study centers on swine insurance, offering a systematic analysis of its effects on production efficiency and the underlying mechanisms, while emphasizing the pivotal role of policy-driven financial tools in promoting the sustainable development of the swine industry. Secondly, unlike most studies that rely solely on the DID method, this study applies a SDID approach to panel data from 30 Chinese provinces spanning 2005–2021, identifies a spatial spillover effect of swine insurance and pinpoints the spatial decay boundary at 250 kilometers. This provides robust empirical evidence on the long-term and dynamic impacts of insurance policies, providing significant guidance for enhancing livestock risk mitigation and advancing sustainable development in livestock production systems. Thirdly, by incorporating the functional regions of China’s swine production system, this study empirically tests for regional heterogeneity in the effects of swine insurance on production efficiency. The findings offer practical guidance for formulating differentiated insurance policies across provinces.

2 Literature review

In recent years, the literature on agricultural insurance and related topics has steadily expanded. Nevertheless, most current studies concentrate on crop insurance, while relatively limited attention devoted to livestock insurance. Although significant differences exist between them in terms of risk types, coverage models, and actuarial design, the historical evolution and practical experience of crop insurance offer valuable references and insights for the development of livestock insurance schemes. In addition, to provide a comprehensive overview of this subject, this study first reviews the relevant literature concerning developed countries, and subsequently shifts its focus to research conducted in developing countries.

2.1 Research on agricultural insurance

Among developed countries, the United States provides a well-documented case of crop insurance implementation. Goodwin and Smith (2013) found that subsidized crop insurance has a positive effect on planted acreage. Moreover, crop insurance encourages farmers to shift toward more heavily subsidized crops (Glauber et al., 2002), leading to notable changes in the crop mix, such as reallocating land from hay and pasture to corn (Wu, 1999). Furthermore, the combination of agricultural insurance and credit mechanisms has been found to stabilize financial resilience and lender portfolios, thereby facilitating greater investment (Ifft et al., 2015). In developing countries’ studies, Hazell (1992) highlighted the role of crop insurance in supporting low-income farmers, particularly in mitigating income losses from catastrophic events. In India, insured farmers are more likely to choose high-yielding crops that carry greater production risks (Mobarak and Rosenzweig, 2012). In Mexico, insurance has been found to encourage maize farmers to adopt more profitable but riskier technologies, such as high-yield hybrid varieties (Freudenreich and Musshoff, 2018), and similar patterns have also been observed in South Africa (Brick and Visser, 2015).

In recent years, the growing application of spatial econometric methods has led to increasing scholarly attention to the spatial effects of agricultural insurance policy implementation. Wen et al. (2023) revealed that the expansion of agricultural insurance generates notable spatial spillover effects, as progress in neighboring regions can create a siphon effect that exacerbates the local imbalance in urban–rural incomes. Mu et al. (2023) found that the implementation of agricultural insurance has a significant positive effect on reducing agricultural carbon emissions, with stronger mitigation outcomes observed in the central and western regions compared to the eastern regio. Li and Wang (2023) found that agricultural insurance contributes to the advancement of agricultural industrialization and exhibits measurable spatial spillover effects.

2.2 Research on livestock insurance

In the context of livestock insurance in the United States, studies show that a 50% government premium subsidy significantly increases farmer participation in Livestock Gross Margin (LGM) insurance (Boyer and Griffith, 2023). Using livestock data from the United States and Canada, Jeffrey et al. (2014) used livestock data from the United States and Canada to examine livestock mortality insurance, applying Bayesian credibility analysis to improve insurance modeling and premium calculation methods. In Australia and New Zealand, where the agricultural sector heavily relies on sheep farming, index-based livestock (IBLI) insurance determines compensation through indicators like rainfall or pasture availability rather than verified losses (Skees et al., 2006). In the context of livestock insurance in developing countries, in Kenya, IBLI uses satellite-derived vegetation indices to estimate regional livestock mortality, offering pastoralists effective protection against climate-induced risks from seasonal variability (Chantarat et al., 2017). Similarly, in Mongolia, IBLI mitigates the impact of adverse weather shocks and helps prevent herd collapse (Mogge and Kraehnert, 2025).

In the context of swine insurance in the United States, coverage is primarily administered by the Risk Management Agency (RMA), with two main products: Livestock Risk Protection (LRP-Swine) and Livestock Gross Margin (LGM-Swine). Given that swine producers face considerable price volatility, these programs focus on income protection rather than mortality risk (Li et al., 2021). Evidence from China shows that swine insurance not only enhances farmers’ willingness to engage in sow breeding, but also encourages greater cooperation with government disease prevention efforts by increasing the likelihood of timely reporting of animal disease cases (Cai et al., 2009; Rao and Zhang, 2020). In recent years, China has piloted innovative tools such as swine price index insurance, which offers a minimum price guarantee to buffer against market shocks and mitigate “pig cycle” effects (Li and Zhang, 2022). Additionally, the “insurance + futures” model launched in 2021 integrates insurance with financial hedging, providing dual protection for both swine and feed prices. These developments reflect China’s ongoing efforts to diversify livestock risk management and enhance policy effectiveness through market-oriented instruments.

2.3 Research on the impact of agricultural insurance on production efficiency

Existing studies on the relationship between agricultural insurance and production efficiency remain limited in scope, and within the Chinese context, the majority of research has primarily concentrated on crop insurance. Research indicates that agricultural insurance enhances efficiency by lowering costs, mitigating risks, and improving input allocation. Ren et al. (2021) found that broader coverage promotes short-term investment, crop specialization, and credit access. Feng et al. (2025) showed that swine insurance improves production efficiency by influencing farmers’ risk attitudes and expanding production scale. In addition, some scholars have explored the environmental dimensions of agricultural insurance. Fang et al. (2021) found that crop insurance plays a positive role in promoting green total factor productivity, especially when complemented by the adoption of sustainable farming practices such as precision sowing and deep fertilization. Li et al. (2022) found that green finance exerts a significant effect on green productivity, following an inverted U-shaped pattern.

In summary, most existing research has concentrated on crop insurance, particularly its impact on cultivated area, cropping structure, farmers’ risk behavior, and investment decisions, while livestock insurance, especially swine insurance, has received comparatively limited attention and lacks systematic evaluation. Secondly, most existing studies on swine insurance focus on isolated dimensions such as income, farming scale, or vaccine use, lacks a systematic and comprehensive investigation into how swine insurance influences the allocation of production factors, limiting our understanding of its role in promoting the development of the swine industry. Lastly, although the spatial spillover effects of crop insurance have begun to attract scholarly interest, there remains a notable gap in exploring whether similar spatial dynamics exist in livestock insurance and how they may differ across regions.

3 Policy background and theoretical analysis

3.1 Policy background on China swine insurance

In 2007, China’s swine industry faced significant challenges, notably marked by a sharp increase in feed prices and the frequent outbreaks of infectious diseases, including highly pathogenic Porcine Reproductive and Respiratory Syndrome (PRRS) and Swine Fever. These events led to a decline in swine production, soaring pork prices, and heightened cyclical volatility in the swine market. To address these risks and stabilize production, the Chinese government issued the “Guidelines on Promoting Policy-Based Agricultural Insurance” in 2007, which for the first time proposed a pilot policy for swine insurance. The program was first launched in four provinces in 2008. Since then, the swine insurance policy has evolved considerably, with continuous improvements in coverage and compensation levels. Over time, it has incorporated environmental standards, disease prevention measures, and green development objectives. Swine insurance has transitioned from a single-purpose risk mitigation tool to a comprehensive policy instrument that supports both industrial modernization and rural income growth, making it a critical pillar of China’s agricultural agenda.

The swine insurance discussed in this paper specifically covers finishing pigs, which are raised primarily for slaughter and subsequent sale as pork. To be eligible, pigs must exceed a body length of 30 centimeters, be raised in hygienic conditions, and have documented vaccination records. The insurance covers pig mortality directly resulting from natural disasters (such as heavy rainfall, floods, and earthquakes), accidents (including landslides and fires), or epidemics (such as foot-and-mouth disease and African swine fever). Compensation is determined based on the pig’s body length at death, ranging from a minimum of 50 RMB to a maximum of 800 RMB. The insurance premium is 42 RMB per pig, with government subsidies covering 80%, leaving the farmer responsible for 8.4 RMB per pig.

3.2 Theoretical analyses and research hypotheses

3.2.1 The direct impacts between swine insurance and swine production efficiency

The primary function of swine insurance is to enhance farmers’ risk management capacity. By leveraging the law of large numbers, it distributes production risks across time and space, ultimately improving production efficiency (Hazell, 1992). Firstly, swine insurance provides preventive benefits prior to the occurrence of disasters. Participation in insurance programs is often accompanied by regular dissemination of risk management and disease prevention information by insurers, which raises farmers’ awareness, reduces the probability of losses, and improves production outcomes. Secondly, swine insurance exhibits a leverage effect. With government premium subsidies, insured farmers gain substantial risk protection at relatively low cost. This mechanism transfers unpredictable production risks to insurance providers, effectively spreading risk (Schultz and Kuznets, 1972), alleviating farmers’ psychological stress, and enhancing their willingness to invest in production. Finally, swine insurance provides post disaster compensation. The most immediate function of insurance is to cover losses resulting from insured risks. When such events occur, farmers receive indemnity payments, which can be used to offset short-term losses, sustain production continuity, and prevent disruptions caused by financial constraints. This mechanism helps maintain production capacity and enhances production efficiency (Janzen and Carter, 2013). Based on this analysis, the following hypothesis is proposed:

H1: Swine insurance policy can increase swine production efficiency.

3.2.2 The spatial spillover impacts of swine insurance on swine production efficiency

According to Tobler’s First Law of Geography, everything is interconnected, but spatial proximity strengthens the degree of interaction (Tobler, 1970). In China, swine production exhibits strong spatial correlations. As transportation networks and information infrastructure continue to improve, the movement of production factors across regions has become increasingly fluid, which enables the swine industry in one province to positively influence and drive the development of swine production in neighboring areas. When promoting swine insurance, the Chinese government typically implements the program in phases across administrative regions. However, the policy’s effectiveness is not con-strained by geographical boundaries, since insured farmers across different regions often face similar types of risk exposure, the insurance policy tends to generate substantial spatial effects (Wang et al., 2024). On one hand, swine insurance is often accompanied by the promotion of advanced husbandry techniques and biosecurity measures, such as the safe disposal of deceased pigs, which can disseminate to neighboring regions through peer interactions and demonstration effects among farmers, resulting in positive knowledge spillovers. On the other hand, by offering risk protection and financial compensation, swine insurance contributes to a stable production environment in areas with high participation rates, mitigating market disruptions caused by regional supply fluctuations. The resulting improvements in production efficiency can diffuse into adjacent regions, amplifying the policy’s broader spatial impact. Based on this analysis, the following hypothesis is proposed:

H2: Swine insurance policy has spatial spillover effects and can promote swine production efficiency in neighboring areas.

3.2.3 Mechanism effects of swine insurance on swine production efficiency

Building on the theoretical framework of new institutional economics, North (1990) highlights those institutions, often materialized through policy instruments, are fundamental to shaping economic outcomes. Well-designed institutional and policy frameworks regulate individual’s behavior, improve resource allocation, and sustain long-term economic development. Swine insurance strengthens farmers’ ability to obtain loans (Boyd et al., 2013), with the combined effects of insurance and credit incentives encouraging farmers to expand their production scale. This is attributable to the fact that livestock insurance in-creases lenders’ confidence in loan repayment, as insured livestock can act as tangible or inferred collateral, thereby effectively alleviating farmers’ credit constraints. With adequate production resources, farmers are more likely to expand their operations due to positive expectations about future outcomes (Cai et al., 2009). Moreover, large-scale farming often adopts stricter disease prevention measures and production practices, thereby lowering the incidence and severity of infectious diseases and other natural disasters (Zhang et al., 2019). Furthermore, large-scale production optimizes the allocation of resources, reduces average production costs, and encourages more efficient input use, thereby supporting high-yield, low-cost operations at scale, and improving production efficiency. Based on this analysis, the following hypothesis is proposed:

H3: Swine insurance policy improves production efficiency by promoting scale expansion.

Swine insurance supports the modernization of the swine industry by optimizing factor inputs and guiding structural transformation (Wu et al., 2024), thereby enhancing overall pro-duction efficiency. Swine insurance embeds environmental and hygiene standards into its contract terms, requiring compliance with sanitation protocols for eligibility and conditioning compensation on proper disposal of deceased pigs. These institutional mechanisms promote standardized and regulated farming practices, which reduce mortality and production losses while enhancing operational stability and laying the groundwork for specialization (Wang et al., 2023). On the other hand, by offsetting the adverse effects of production risks, swine insurance supports the economic stability of farmers, reducing income volatility, and improving financial certainty. These improvements strengthen farmers’ confidence to invest and expand production. As capital and technological resources are increasingly integrated and optimized, the swine farming sector is gradually transitioning from traditional extensive practices to more specialized and intensive production models. This shift has led to a marked increase in both production scale and professional division of labor. The rise of specialized farming has further promoted skill development and efficient resource utilization, thereby significantly improved productivity of the swine industry. Based on this analysis, the following hypothesis is proposed:

H4: Swine insurance policy improves production efficiency by facilitating structural upgrading.

Swine production is considered a vulnerable sector, with farmers typically belonging to economically disadvantaged groups who exhibit limited resilience to external risks. Concerns over income uncertainty discourage them from adopting advanced technologies, leading to a preference for low-risk, low-return traditional farming practices that are often inefficient (Bulte and Lensink, 2023). Swine insurance strengthens farmers’ resilience against production risks, partially offsets the production risks associated with technology adoption, alleviates their risk-related psychological concerns, and encourages the uptake of more advanced but riskier farming technologies (Karlan et al., 2014). In addition, the new growth theory posits that the adoption of new technologies is a key driver of productivity improvement (Solow, 1956). The adoption of advanced farming technologies in swine production constitutes an economic act of technological innovation. While it entails additional costs related to machinery and technology, it reduces reliance on traditional labor and other input factors. Moreover, it facilitates productivity gains through modernization, thereby reshaping operational costs, ultimately enhancing production efficiency. Based on this analysis, the following hypothesis is proposed:

H5: Swine insurance policy improves production efficiency by advancing farming techniques.

4 Materials and methods

4.1 Study design

The empirical analysis is based on a provincial panel dataset comprising 30 Chinese provinces from 2005 to 2021, together with data on the implementation of the swine insurance policy. After confirming spatial autocorrelation test, the SDID model is employed for empirical analysis. The results reveal that the swine insurance policy significantly im-proves swine production efficiency in the implementing provinces and generates substantial spatial spillover effects, the boundary of spatial effect decay is 250 km. Additionally, the policy improves swine production efficiency by expanding farming scale, encouraging structural upgrading, and promoting technology adoption. Furthermore, analysis of het-erogeneity across different functional swine production regions reveals that the efficiency-enhancing effects of swine insurance are particularly pronounced in the major production region. The detailed research framework is presented in Figure 1.

4.2 Model

4.2.1 Difference-in-differences model

Adopting the methodological framework of Beck et al. (2010), this study utilizes a difference-in-differences (DID) model to evaluate the impact of the swine insurance policy on swine production efficiency. Treatment group is assigned to provinces that adopted the swine insurance policy, while non-implementing provinces function as the control group. The model specification is presented below:

In Equation 1, denotes the dependent variable, representing swine production efficiency. is the intercept term; indexes the province; and indexes the year. The core explanatory variable , equals 1 if province adopted the swine insurance policy in year , and 0 otherwise. The coefficient represents the main parameter of interest, reflecting the policy’s impact. represents a set of control variables, with denoting their associated coefficients. and represent province and year fixed effects respectively, and is the random error term.

4.2.2 Spatial difference-in-differences model

Drawing on the work of LeSage and Pace (2009), this study emphasizes the ne-cessity of accounting for spatial correlation and spatial dependence structures when evaluating swine insurance policy effects. The core idea of the spatial differ-ence-in-differences (SDID) approach lies in integrating spatial autocorrelation into the tra-ditional DID framework by incorporating a spatial weight matrix and spatial lag terms. This design explicitly considers geographic proximity and spatial interactions, thereby enhancing the accuracy of the estimation. The basic form of the model is expressed as follows:

In Equation 2, and denote different provinces; the spatial autocorrelation coefficient of the dependent variable is denoted by , capturing the strength of spatial interactions between provinces. denotes the geographic distance-based spatial weight matrix at the provincial level, with as its elements. and represent the coefficients of the spatial interaction terms for the DID variable and control variables, respectively. All other variables retain the same definitions as specified in Equation 1.

4.2.3 Mediation effects model

To further explore the mechanisms through which the swine insurance policy affects production efficiency, this study draws on the methodology proposed by Jiang (2022) for mechanism testing, with the specific model outlined as follows shown in Equation 3:

In this model, denotes the mediating variable, and captures the effect of the explanatory variable on the mediating variable. All other variables retain the same definitions as specified in Equations 1, 2.

4.2.4 Spatial weight matrix

In this study, a geographic distance weight matrix is constructed, where each element is determined by the geographic distance between provinces and , calculated based on their latitude and longitude coordinates. The weights are assigned as the inverse of the distance between provinces, with closer provinces receiving higher weights and more distant provinces receiving lower weights. The detailed construction method is presented as as shown in Equation 4:

4.3 Data sources and variable selection

4.3.1 Data sources

Data for this study are sourced from provincial-level panel datasets for 30 provinces in China from 2005 to 2021, combined with records of swine insurance policy implementation. China’s swine insurance policy was initiated in 2007. Selecting 2005–2021 as the sample period ensures coverage of the pre-policy phase, early implementation, mid-term adjustments, and the policy’s response to major challenges after 2020, such as the African Swine Fever outbreak, thereby guaranteeing a systematic and comprehensive analysis. Moreover, since 2005, China’s agricultural policy agenda has increasingly emphasized sustainable development, implementing strategic initiatives aimed at reducing pollution and strengthening environmental protection. Swine production, as a critical sector, has been required to align economic objectives with ecological sustainability. Covering 2005 to 2021 allows for a comprehensive observation of how swine insurance evolved from a basic risk management tool to a key driver of sustainable industry transformation, offering critical insights into its contribution to long-term efficiency improvements.

Data for calculating swine production efficiency in this study are sourced from the National Compilation of Agricultural Products Cost and Benefit Statistics. The starting year of swine insurance policy for each province was identified through information obtained from the official websites of provincial agricultural authorities and related policy documents. Data for other variables were obtained from authoritative sources such as the China Animal Husbandry and Veterinary Yearbook, the China Rural Yearbook, and provincial-level statistical yearbooks and the websites of relevant governmental agencies. All sources are verified and credible.

4.3.2 Dependent variable

Methods for measuring swine production efficiency primarily include Data Envelopment Analysis (DEA) and Stochastic Frontier Analysis (SFA) (Zhou et al., 2015; Wu et al., 2022). DEA, a nonparametric approach, does not require a predefined functional form or assumptions about the random distribution of error terms, and it effectively handles the challenges of multiple inputs and outputs in swine production. Consequently, it has been widely adopted in empirical studies. To overcome the radial and angular limitations of traditional DEA models, Tone proposed the Slack-Based Measure (SBM) model (Tone, 2001), which incorporates slack variables into efficiency evaluation. Building on this, this study employs the Super Efficiency SBM model to estimate swine production efficiency. Assume a set of decision-making units, each characterized by input variables. Let denote the intensity vector, with and representing the matrices of inputs and desirable outputs. The efficiency of swine production is denoted by . Accordingly, the SBM model is defined as shown in Equation 5, with the constraints detailed in Equations 6 and 7:

The descriptions of inputs and desirable outputs are shown in Table 1.

4.3.3 Independent variable

To rigorously assess the impact of the swine insurance policy on swine production efficiency, this study employs a DID approach by constructing a policy dummy variable, defined according to the provincial-level implementation status and timing of the policy. Specifically, the DID indicator variable equals 1 for province in year if the swine insurance policy was implemented, and 0 otherwise.

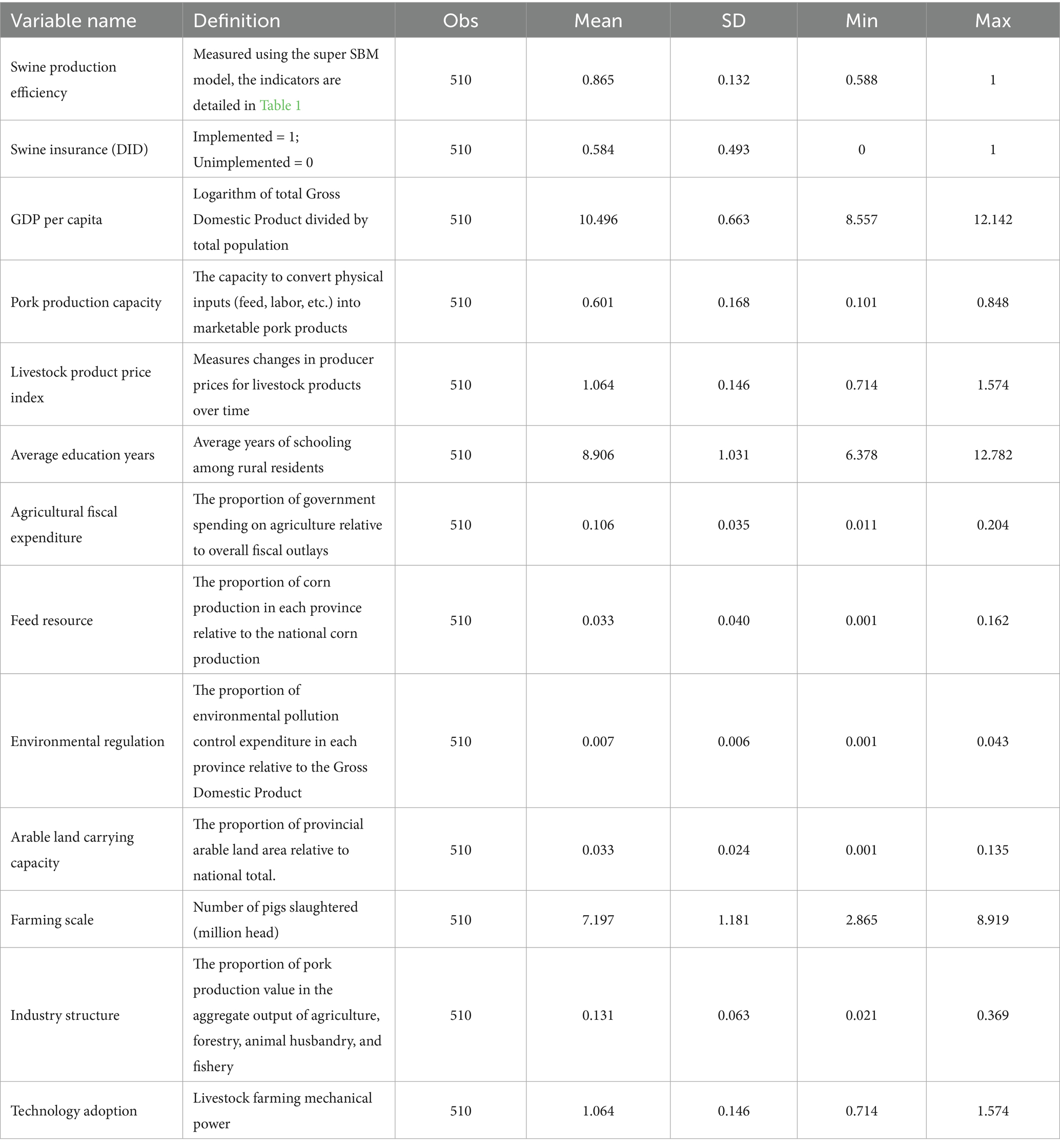

4.3.4 Control variables

To effectively isolate the impact of the swine insurance policy from potential confounding factors and to ensure the scientific rigor and reliability of the findings, this study draws on prior literature (Zhu et al., 2023), to identify relevant control variables from multiple dimensions such as macroeconomic environment, policy support, swine production, and socioeconomic conditions. Specifically, the selected control variables include GDP per capita, pork production capacity, livestock product price index, average education years, agricultural fiscal expenditure, feed resource, arable land carrying capacity. Table 2 presents the definitions and descriptive statistics of all variables used in the analysis.

4.3.5 Mediating variables

The mediating variables include farming scale, industry structure, and technology adoption. Based on the theoretical framework described above, swine insurance enhances the efficiency of swine production by means of farming scale, industry structure and technology adoption. To empirically examine this relationship, the study uses provincial swine production output (number of pigs slaughtered) as an indicator of farming scale, the proportion of pork output value in the total output value of agriculture, forestry, animal husbandry, and fisheries as a measure of industry structure, and the total mechanical power of farming equipment in livestock sector as an indicator of technology adoption. Table 2 presents the definitions and descriptive statistics of all variables used in the analysis.

5 Results

5.1 Parallel trend test

The validity of the difference-in-differences (DID) approach hinges on the fulfillment of the parallel trends assumption between the treatment and control groups. If this condition holds, the selection of the treatment and control groups can be regarded as statistically random, thereby ensuring the credibility of the DID regression results. Drawing on the approach of Beck et al. (2010), this study adopts an event study design to examine whether the parallel trends assumption holds. The corresponding model is specified as shown in Equation 8:

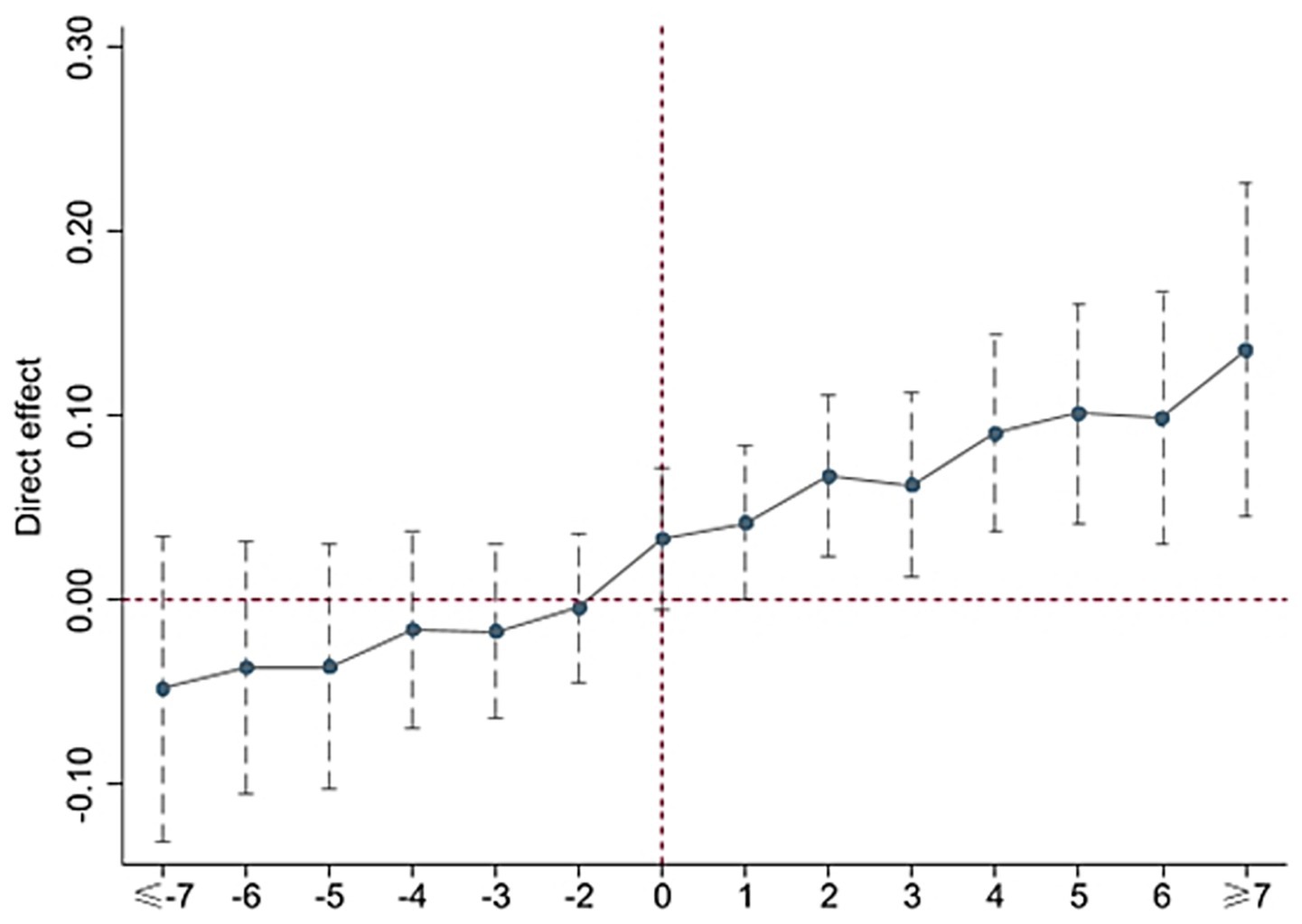

represents the key coefficient of interest in the parallel trends test, estimating how swine production efficiency differs between the treatment and control groups in year . Given the limited number of observations before the seventh period preceding the policy intervention and after the seventh period following the intervention, this study examines the trend differences between the treatment and control groups from seven periods before to seven periods after the policy shock based on the event study specification. Figure 2 illustrates the results of the parallel trends test.

As shown in Figure 2, the estimated coefficients before the policy implementation exhibit relatively stable and statistically insignificant variations, thereby passing the parallel trend test. This indicates that prior to the implementation of the swine insurance policy, the trends in swine production efficiency across provinces were similar, with no systematic differences, thus providing a reliable benchmark for accurately evaluating the policy’s effects. The post-treatment dynamic effect analysis reveals that the estimated coefficients began to rise significantly starting from the second year after the pilot policy was introduced. This finding suggests that the swine insurance policy significantly improved swine production efficiency, albeit with a certain degree of time lag.

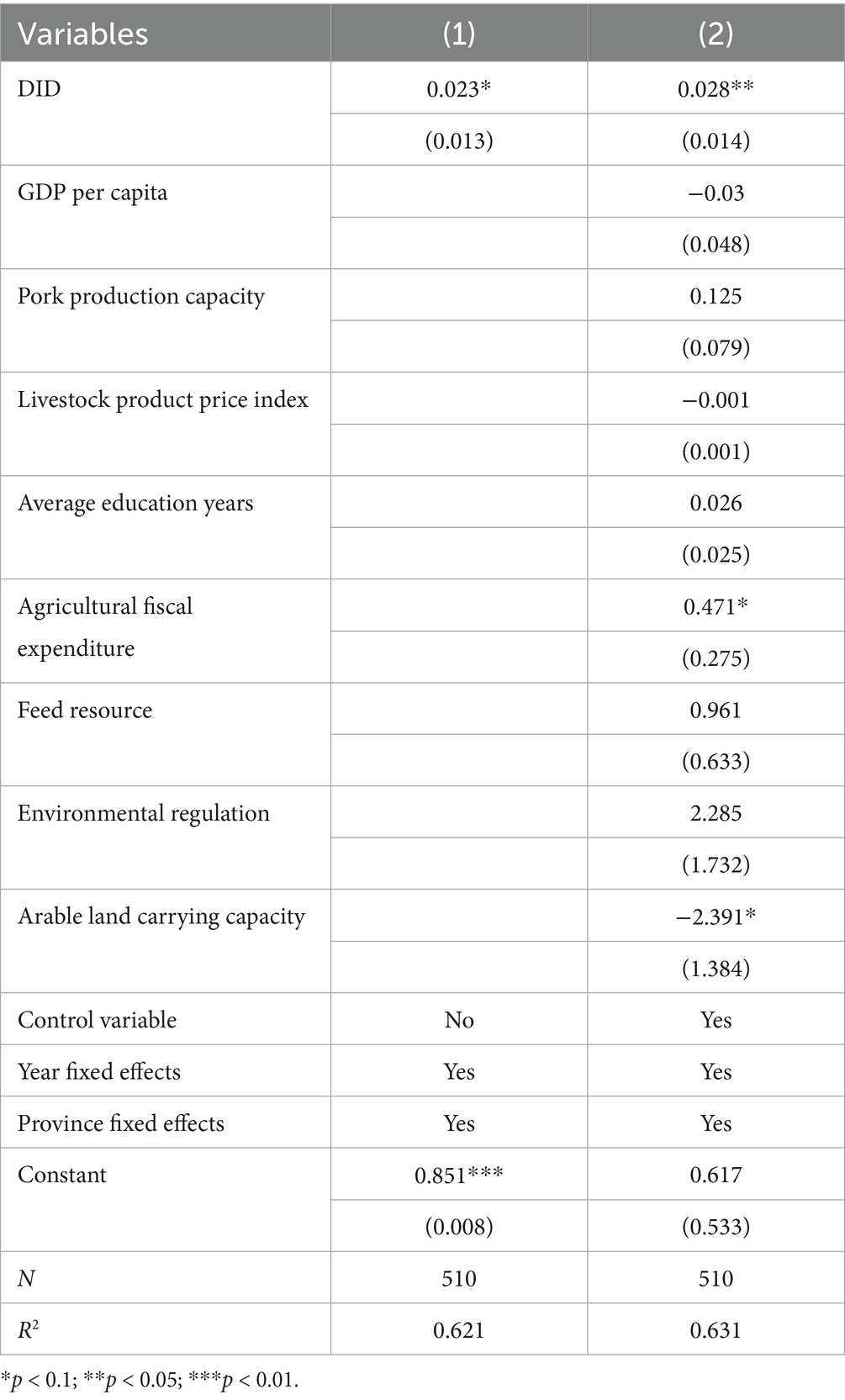

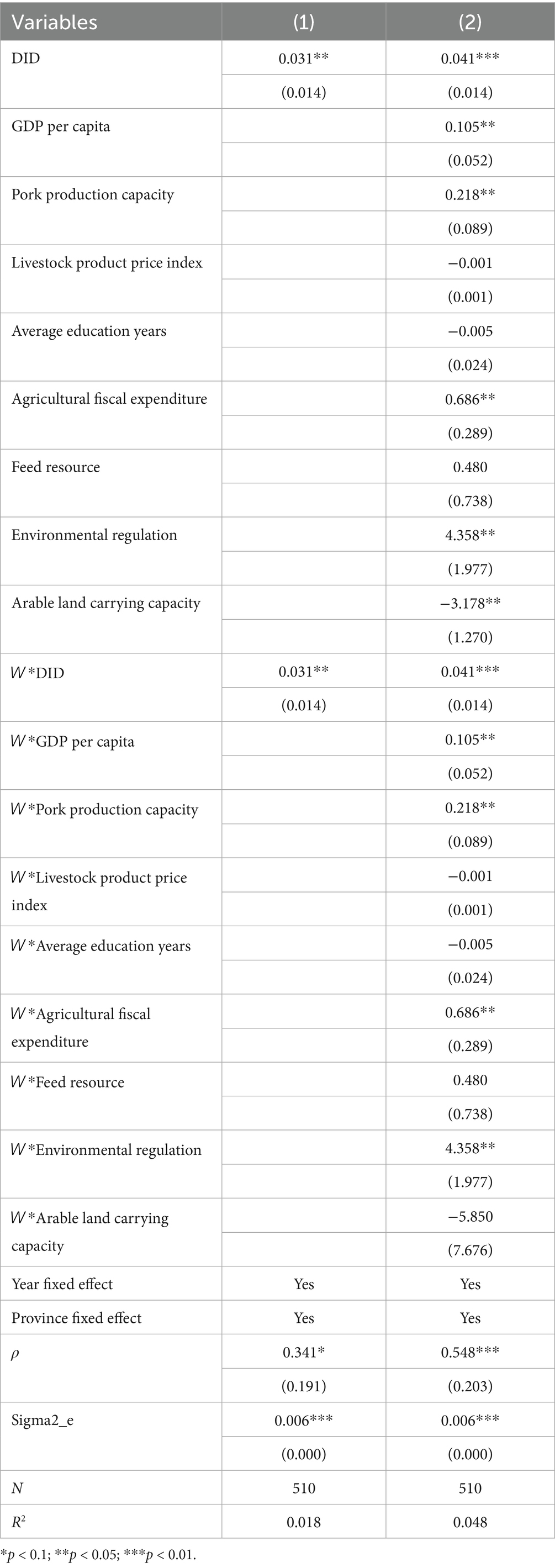

5.2 Baseline regression of DID

Table 3 summarizes the DID-based estimates of the swine insurance policy’s impact on production efficiency. Column (1) reports results with only time and province fixed effects, while Column (2) incorporates all control variables. The analysis primarily focuses on Column (2), where the DID coefficient is 0.028 and statistically significant at the 5% level. This coefficient suggests that, relative to provinces without the swine insurance policy, swine production efficiency in pilot provinces increased by 0.028. Therefore, Hypothesis H1 is supported.

5.3 Robustness tests

5.3.1 Placebo test

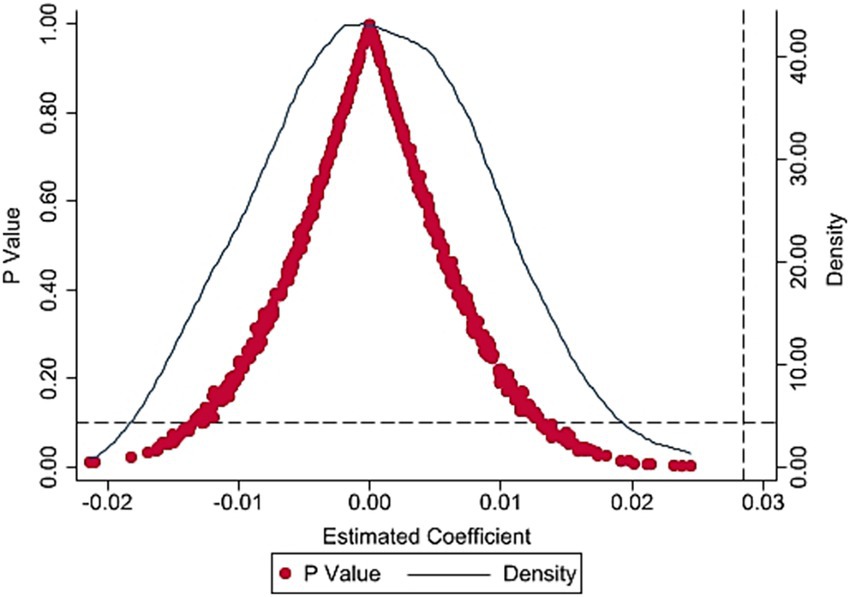

Following Chetty et al. (2008), this study constructs 500 random shocks of the effect of implementing policy on swine production efficiency, generating randomized pseudo-treatment and pseudo-policy implementation time variables. Consequently, 500 pseudo-interaction terms are obtained. As shown in Figure 3, the estimated coefficients are centered around zero, and the majority of their p-values exceed 0.1, indicating that the impact of the swine insurance policy on swine production efficiency is unlikely to be driven by unobserved confounding factors. Therefore, the findings remain robust and reliable.

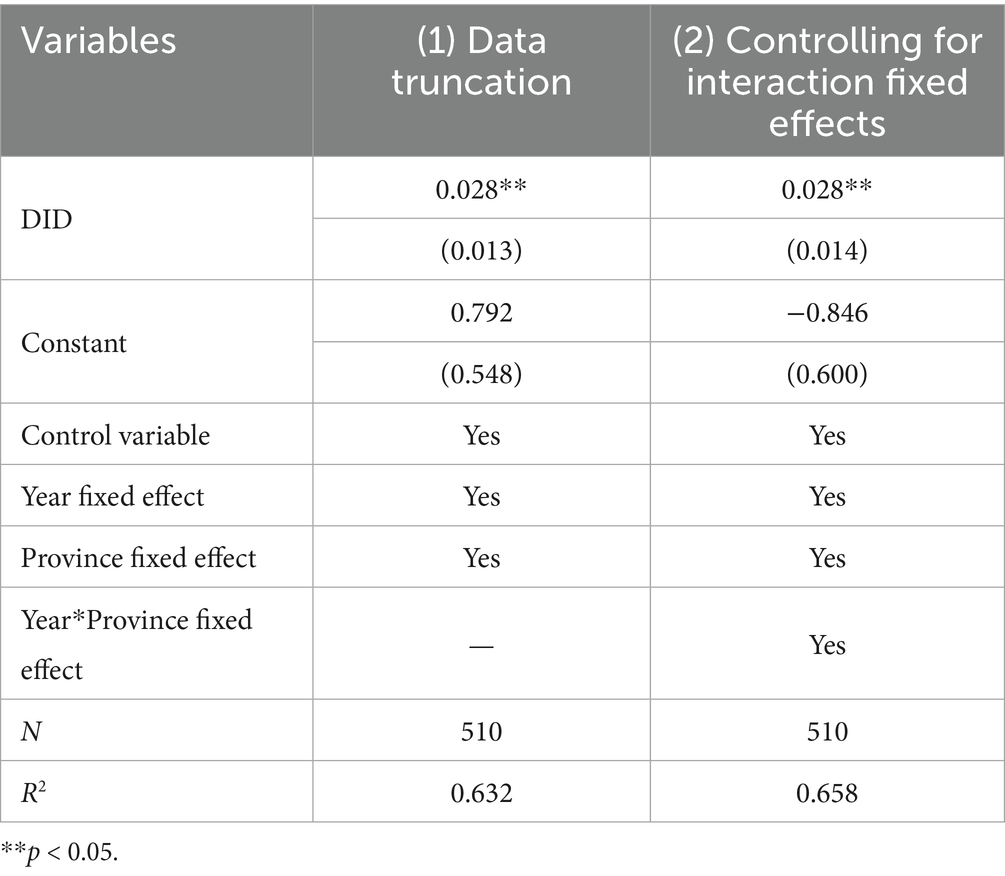

5.3.2 Data truncation

To address potential bias from extreme values, this study applies a two-sided truncation at the 1% level to both the dependent variable and the key independent variable before conducting the parameter estimation. As reported in Column (1) of Table 4, the coefficient of the swine insurance policy on production efficiency remains significantly positive at the 5% level. Thus confirming the reliability of the baseline estimation results.

5.3.3 Controlling for interaction fixed effects

After controlling for omitted variables using a two-way fixed effects approach, this study further introduces province-by-year interaction fixed effects into the baseline model, following Bai (2009), to address potential biases arising from unobserved cross-sectional and temporal heterogeneity. This adjustment captures differential impacts of common shocks across provinces and years, thereby enhancing the robustness of the estimation. The results are reported in Column (2) of Table 4.

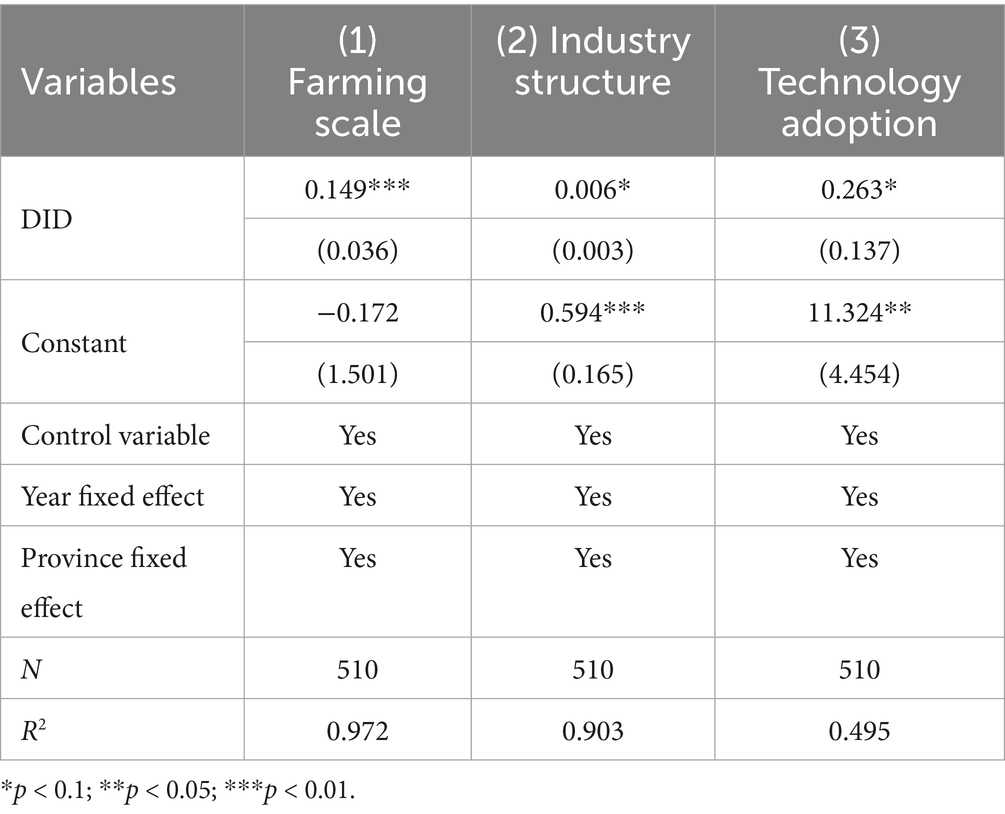

5.4 Intermediary mechanism

Grounded in the theoretical framework and the mediation effects model above, swine insurance enhances production efficiency primarily by enabling farmers to expand their production scale, facilitating structural upgrading of the industry, and promoting the adoption of advanced farming technologies. To empirically verify these mechanisms, we employed Equation 3. As shown in Table 5, Regression (1), (2), and (3) examine the mediating mechanisms of farming scale, industry structure, and technology adoption, respectively. The results confirm that all three mediating variables have statistically significant effects.

Specifically, the results from Regression (1) indicate that the impact of swine insurance policy on the scale of swine farming is significantly positive, with a coefficient of 0.149 at the 1% significance level. This finding suggests that the provinces implementing the insurance program experienced a notable expansion in swine farming compared to those without the policy. By reducing business uncertainties and operational risks, swine insurance boosts farmers’ confidence, motivating them to increase their production scale. Furthermore, swine insurance improves farmers’ access to credit, alleviates financial constraints, and strengthens their investment capabilities. These factors facilitate economies of scale, reduce production costs per unit, and ultimately improve both resource allocation and overall production efficiency.

Results from Regression (2) indicate that the swine insurance policy has a positive and statistically significant impact on industry structure, with a regression coefficient of 0.006 at the 10% significance level. This suggests that provinces implementing the insurance policy experienced improvements in their swine industry structure relative to those without the policy. By establishing specific standards as preconditions for insurance coverage, swine insurance encourages farmers to adopt standardized and regulated farm management practices. These practices effectively reduce animal mortality and optimize farm management structures, thereby facilitating structural upgrading within the swine industry and ultimately enhancing production efficiency.

Results from Regression (3) indicate that the swine insurance policy significantly enhances farming technology, with a regression coefficient of 0.263 at the 10% significance level. This finding suggests that provinces adopting the insurance policy have experienced a notable improvement in technological practices compared to those without the policy. Therefore, swine insurance enhances overall production efficiency by promoting the adoption of advanced farming technologies. Farmers, typically risk-averse, often resort to traditional, low-risk but inefficient traditional production methods. Swine insurance mitigates these perceived risks, encouraging farmers to adopt more advanced technologies. Consequently, this shift optimizes farming practices, enhances technological efficiency, and significantly improves overall swine production efficiency.

5.5 Heterogeneity analysis

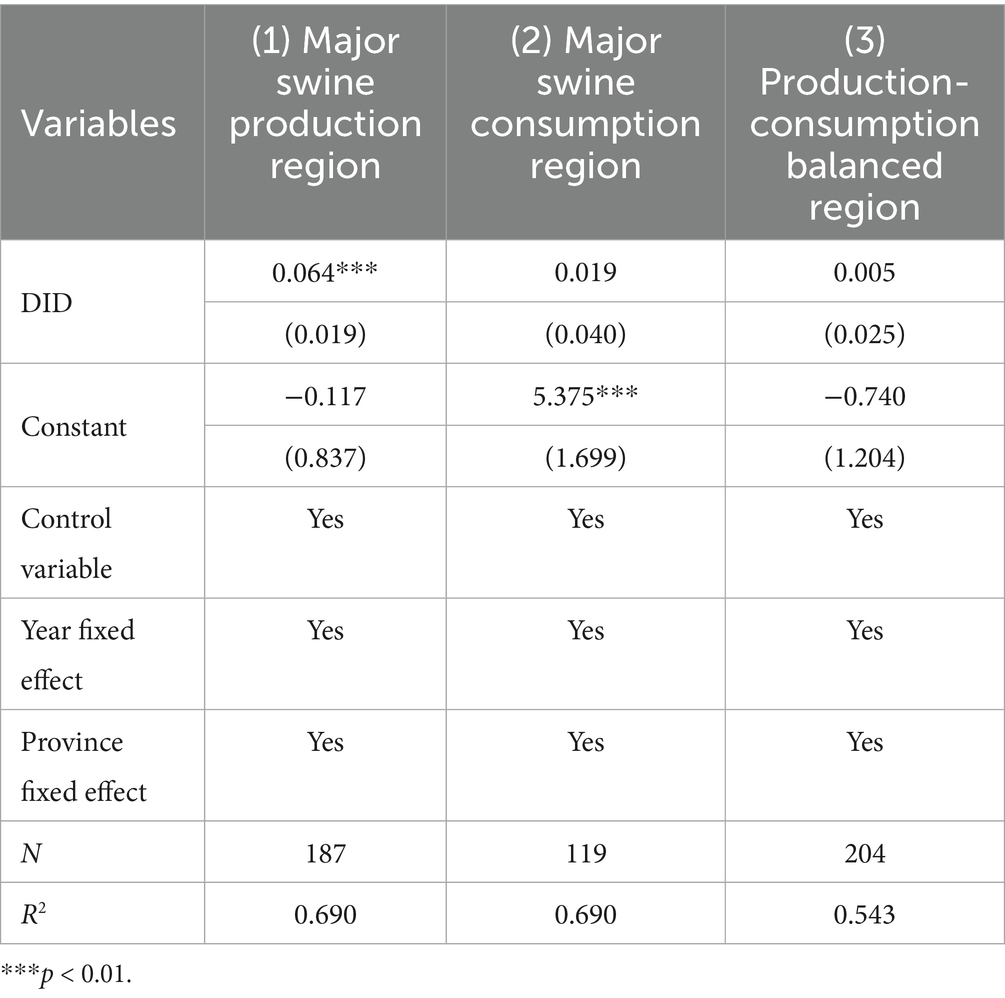

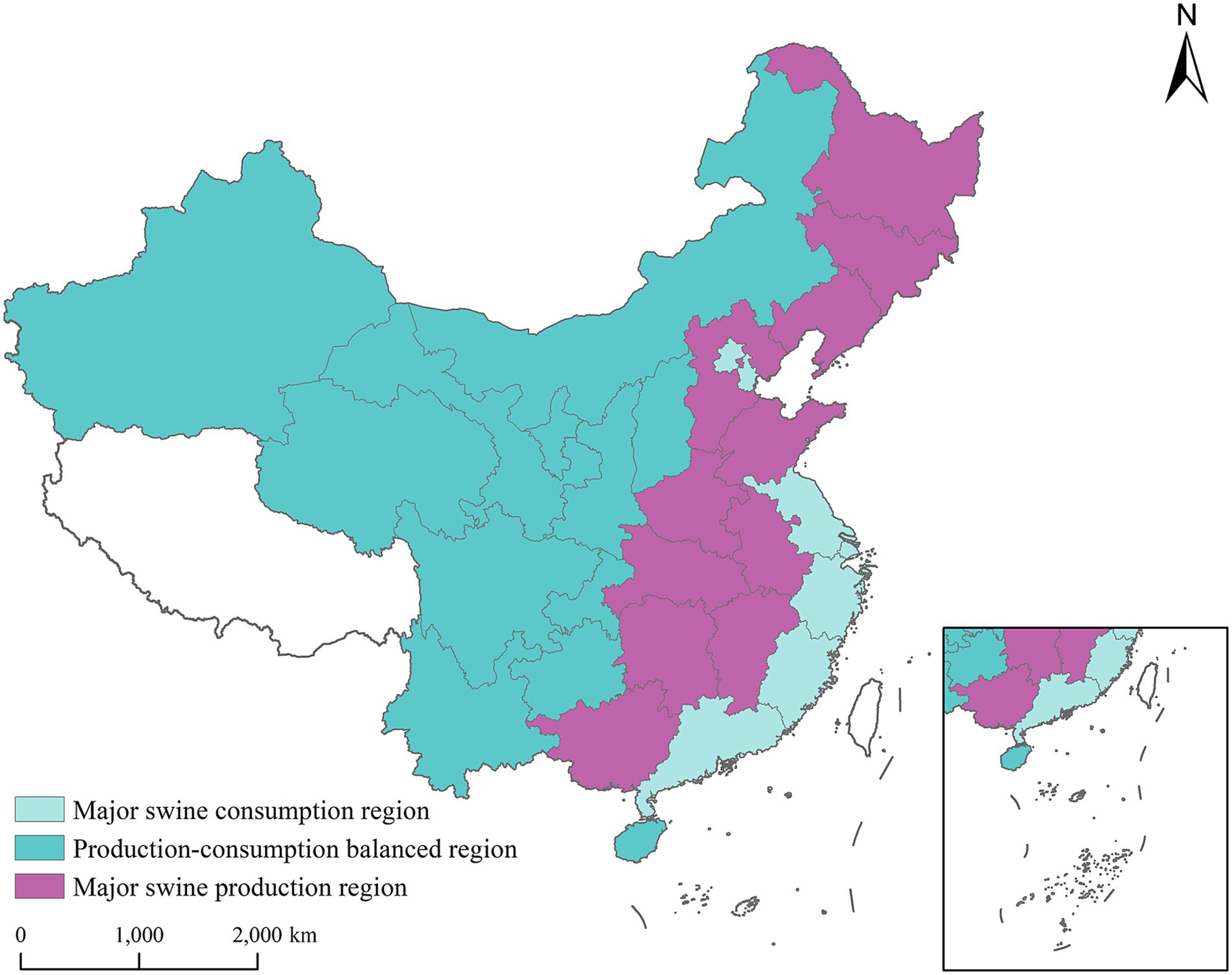

5.5.1 Heterogeneity analysis based on swine functional regions

Considering the significant regional disparities across China in resource endowments, market conditions, government support, and production methods, the impact of swine insurance on swine production efficiency is expected to differ notably by region. Aligned with sustainable development goals, the Ministry of Agriculture and Rural Affairs released the” Action Plan for Accelerating the Recovery and Development of Swine Production” in 2019, which, for the first time, categorizes China’s swine industry into major swine production regions, major swine consumption regions, and production-consumption balanced regions. Each functional region plays a distinct role within the swine production-consumption system, characterized by systematic differences in industry structures and development priorities. Accordingly, this study performs a heterogeneity analysis based on the functional swine production regions, with regression results presented in Table 6. The empirical results reveal that the effect of swine insurance on improving production efficiency is particularly significant in major swine production regions.

This heterogeneity analysis enables a clear understanding of regional variations in swine insurance impacts. From Figure 4, compared to major consumption region and production-consumption balanced regions, major production areas exhibit a higher elasticity of production efficiency response to swine insurance. Major swine production region characterized by a high concentration of swine farming activities, benefit more directly from risk mitigation provided by insurance schemes. These findings suggest that targeted expansion and optimization of swine insurance programs in major production regions could further enhance overall productivity and contribute to the sustainable development of the swine industry. Directly splitting the sample as described above may lead to a reduction in sample size, thereby decreasing the statistical power of the tests. To enhance the robustness of the results, this study constructs a unified model that includes interaction terms between the policy dummy and region dummies. As shown in Appendix Table 1, the results are consistent with those obtained from the subsample regressions.

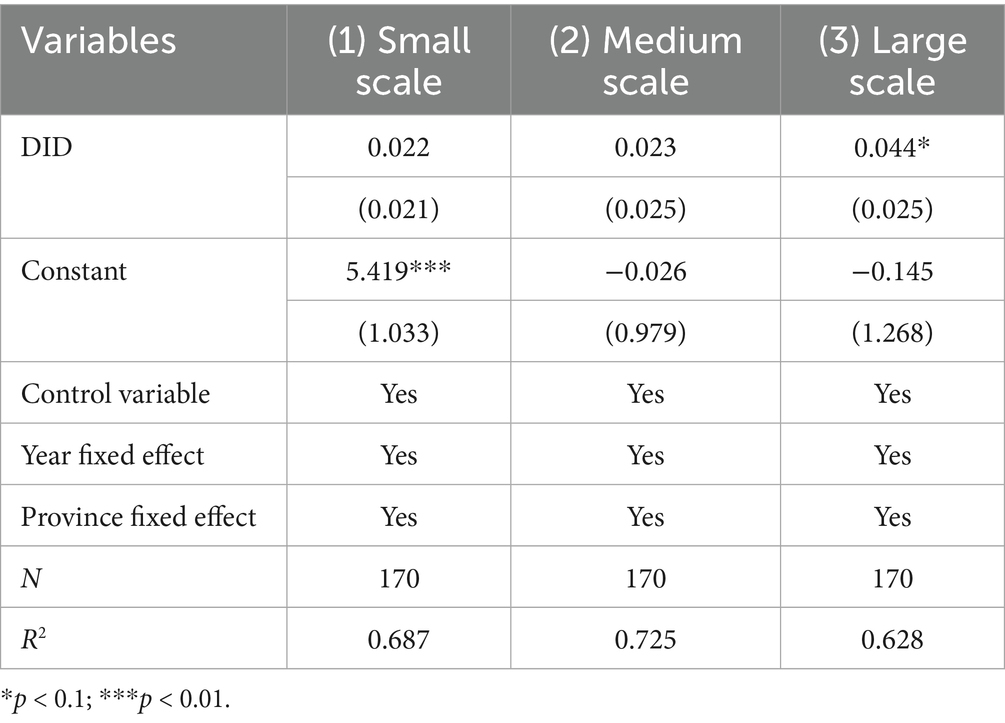

5.5.2 Heterogeneity analysis based on farming scale

In examining the impact of the swine insurance policy on swine production efficiency, farming scale may represent an important source of heterogeneity. Farms of different scales exhibit substantial variation in their capacity for resource allocation and responsiveness to policy interventions. Moreover, farming scale is also a critical pathway for promoting the production efficiency of the livestock sector. The differentiated effects of policy instruments across farming scale categories are closely linked to the precision and effectiveness of policy implementation. Therefore, it is necessary to incorporate farming scale as a grouping variable and conduct heterogeneity analysis. As shown in Table 7, this study classifies farming scale into three categories, small scale, medium scale, and large scale.

The regression results show that the DID coefficient for large scale farming in column (3) is 0.044, which is statistically significant at the 10% level. This indicates that the swine insurance policy significantly improves production efficiency among largescale producers. A possible explanation is that largescale farms tend to have stronger awareness of insurance, better risk management capabilities, and higher responsiveness to policy implementation, allowing the policy effects to be more effectively transmitted to production behavior. Similarly, the results obtained from introducing interaction terms between the policy dummy and region dummies, as reported in Appendix Table 2, are consistent with those from the subgroup analysis.

5.6 Spatial difference-in-differences analysis

5.6.1 Spatial correlation test

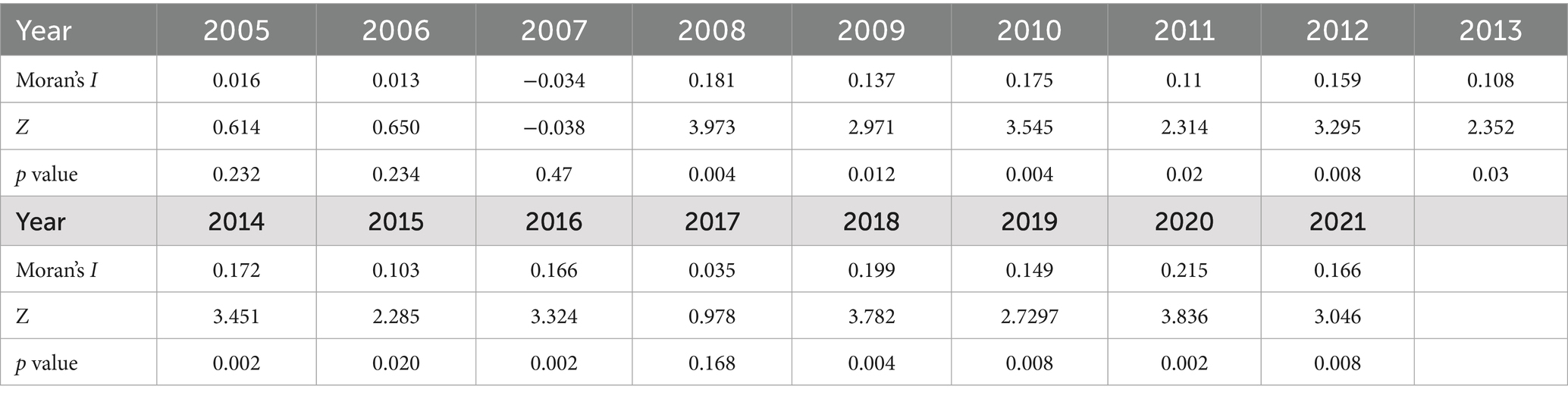

This study employs the global Moran’s index, an important measure for spatial autocorrelation, to investigate the spatial dependence of swine production efficiency across 30 provinces in China. The formula for the global Moran’s index is expressed as shown in Equation 9:

Here, denotes the observed value for province , and represents the mean of all observed values. The Moran’s I index ranges from −1 to 1. A value of I>0 indicates that high-value regions are clustered with other high-value regions and low-value regions with other low-value regions, suggesting positive spatial autocorrelation; the larger the value, the stronger the spatial clustering. Conversely, I<0 indicates that high-value regions are adjacent to low-value regions, reflecting negative spatial autocorrelation, and the greater the absolute value, the stronger the negative spatial relationship. As shown in Table 8, the Moran’s I index remains significantly positive throughout the sample period, indicating a strong and consistent positive spatial autocorrelation in swine production efficiency across the 30 provinces of China.

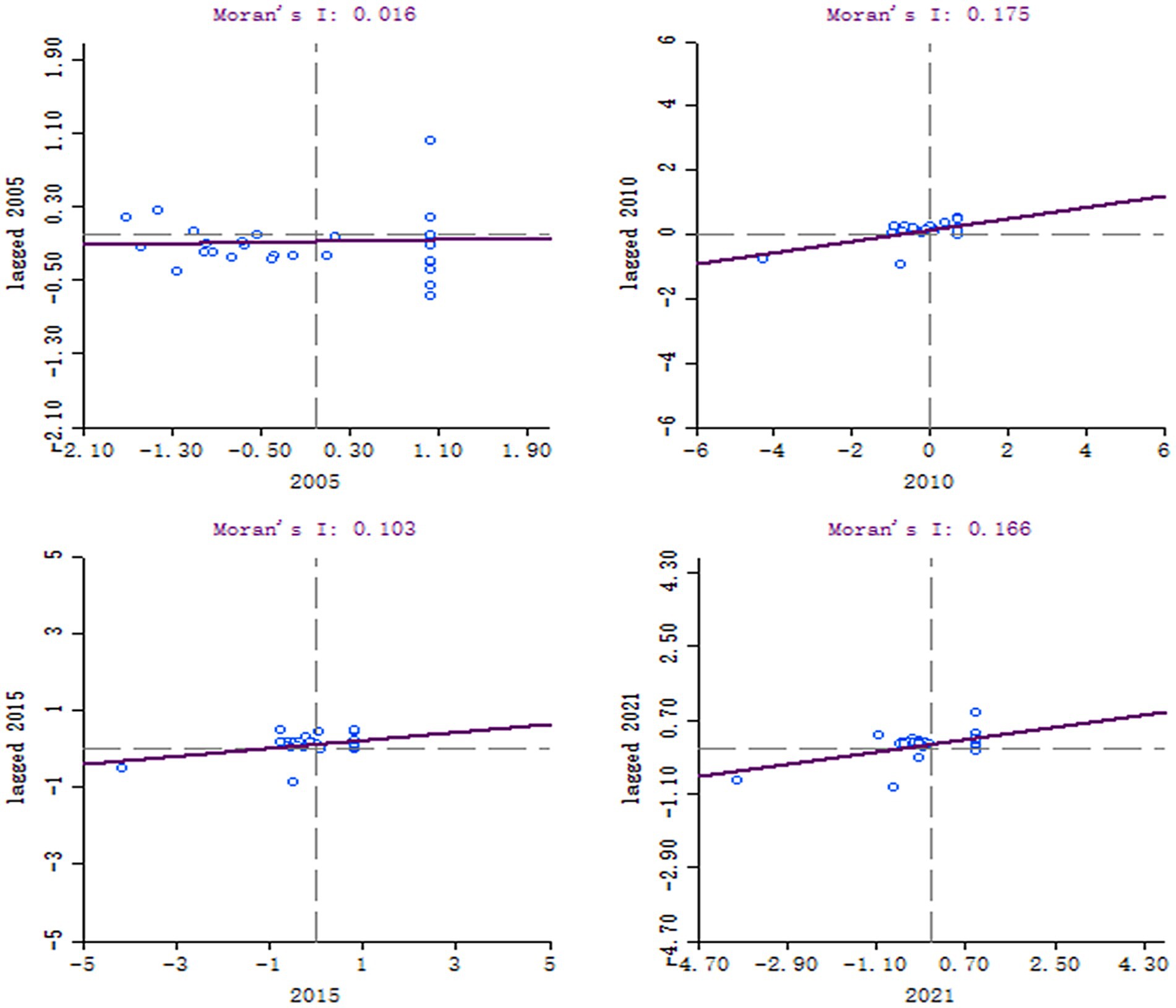

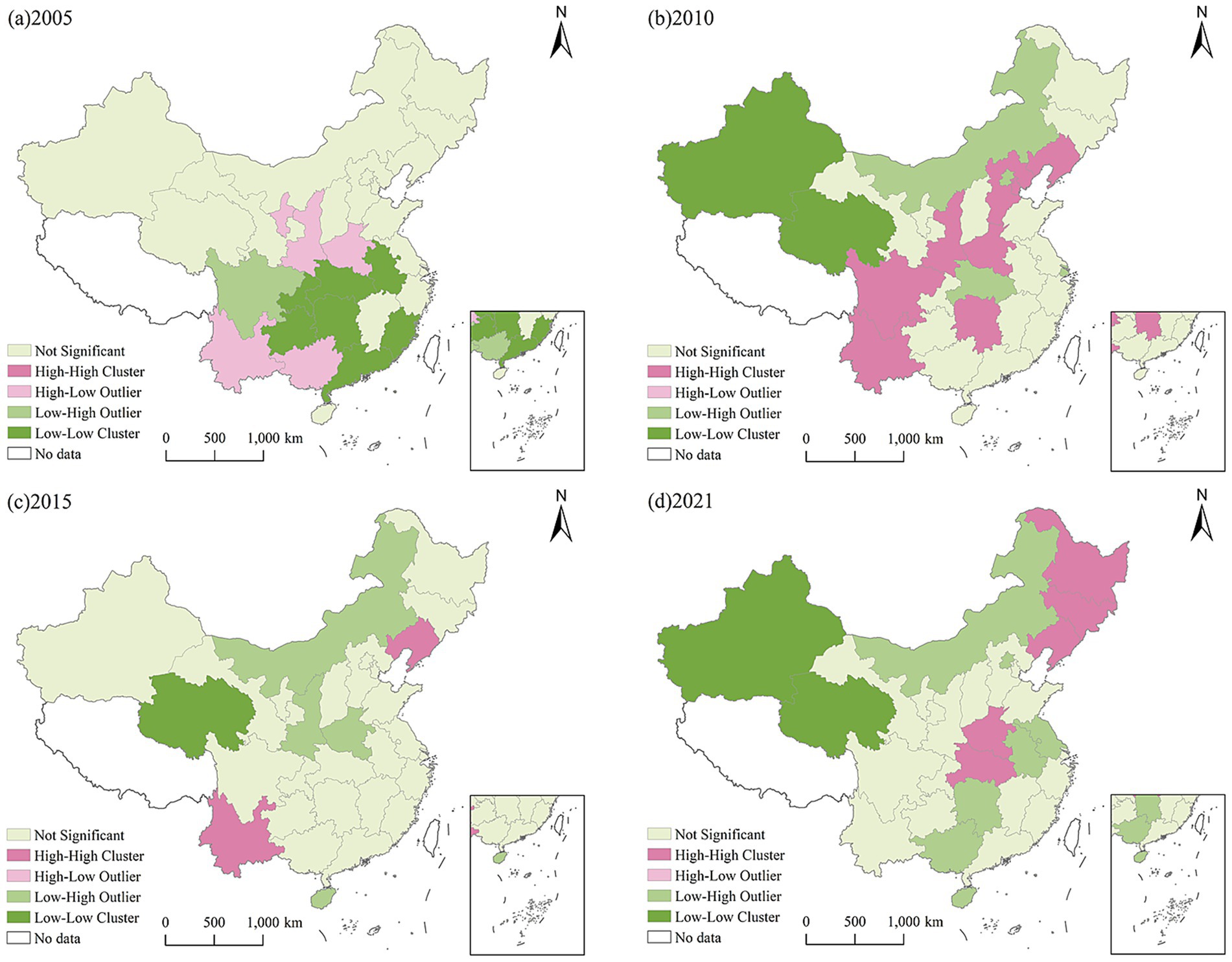

To further investigate the specific patterns of spatial correlation, this study employs local Moran’s I scatter plots for a more detailed analysis. This study presents the analysis results for the years 2005, 2010, 2015, and 2021 in Figure 5. The results indicate that most provinces fall within the first and third quadrants, suggesting the presence of High-High (H-H) and Low-Low (L-L) spatial clustering in swine production efficiency. Moreover, the fitted regression line in the scatter plots passes through the first and third quadrants, further confirming the existence of significant positive spatial autocorrelation in swine production efficiency.

The Local Moran’s I scatter plot provides a preliminary classification of sample points into different quadrants but does not offer a comprehensive statistical test of the local correlation patterns or the significance of spatial clusters across regions. Therefore, this study further constructs a LISA (Local Indicators of Spatial Association) cluster map to conduct a more detailed analysis in Figure 6.

Figure 6. LISA agglomeration map of swine production efficiency. (a) 2005, (b) 2010, (c) 2015, 569 and (d) 2021.

It is noteworthy that the number of provinces exhibiting High-High (H-H) clustering has gradually declined. One possible explanation is the tightening of environmental regulations, the designation of livestock exclusion zones, the reduction of swine farming activities, and the stricter land use controls implemented in southern coastal regions after 2015. These policies constrained the potential for further large-scale expansion in regions with previously high production efficiency, thereby weakening the intensity of High-High clustering. Another contributing factor may be the functional region program of swine production implemented in 2019, which designated the northeastern and central regions as emerging major production areas, leading to the rapid development of the swine industry in these regions.

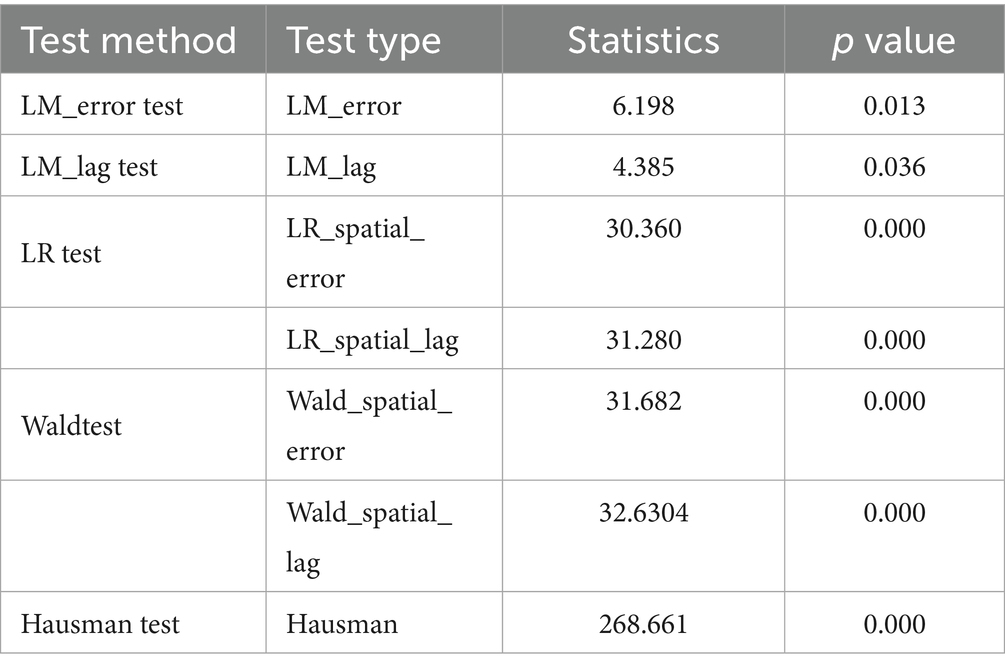

5.6.2 Selection of spatial econometric models

The significance test of Moran’s I statistic indicates the presence of spatial autocorrelation, necessitating the construction of a spatial econometric model. However, the specific form of the model remains uncertain, requiring further diagnostic tests to determine the appropriate specification (Elhorst, 2014). The results are presented in Table 9. First, based on the results of the Lagrange Multiplier (LM) test, Robust LM test, Wald test, and Likelihood Ratio (LR) test, the Spatial Durbin Model (SDM) is selected for the regression analysis. Finally, the Hausman test results confirm that a fixed effects specification of the SDM is appropriate.

5.6.3 Baseline regression of the spatial difference-in-differences model

Table 10 displays the baseline regression outcomes. Column (1) presents estimates obtained without incorporating control variable, while Column (2) presents the baseline estimates incorporating both control variables and time and province fixed effects. With a statistically significant coefficient of 0.041 at the 1% level, the DID estimate indicates that swine insurance policy significantly improves swine production efficiency. Furthermore, under the spatial weight matrix , the results reveal a significant positive spatial spillover effect of the swine insurance policy on neighboring provinces. Therefore, Hypothesis H2 is further supported. The implementation of swine insurance provides farmers with risk protection, thereby reducing their risk expectations. This stabilization of expectations enables farmers to better plan their production scale and structure, mitigating irrational decision-making caused by market fluctuations and ultimately enhancing production efficiency. The increased stability in production behavior can influence neighboring regions through market supply and demand linkages, thereby promoting improvements in swine production efficiency in surrounding areas.

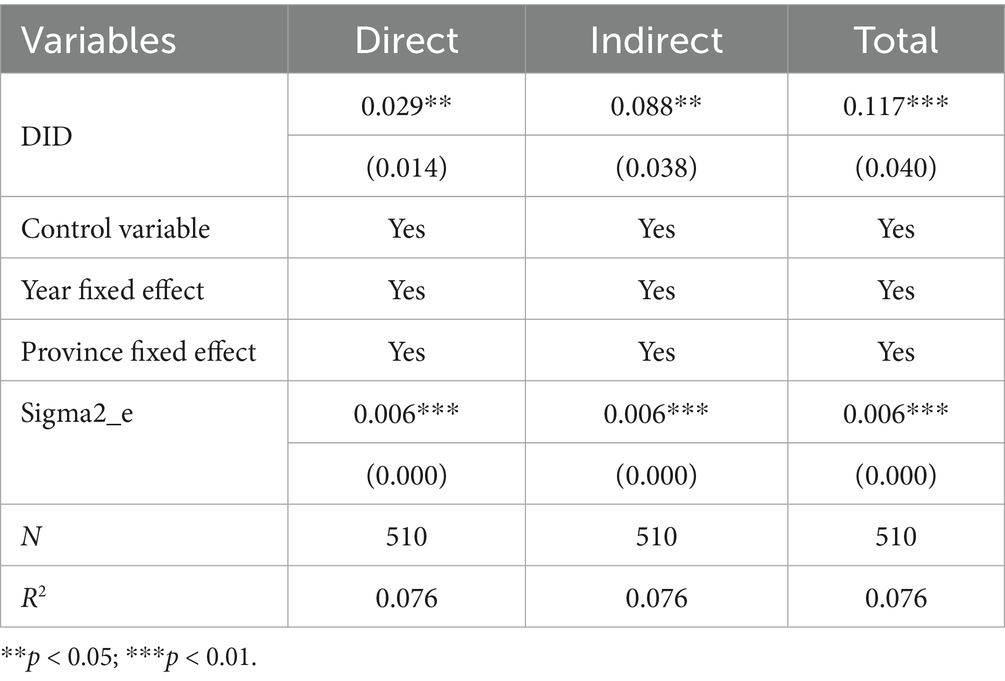

To gain deeper insight into how the swine insurance policy influences the spatial spillover of production efficiency, this study applies the partial derivative method to decompose the spatial econometric model into direct, indirect, and total effects, following the approach of LeSage and Pace (2009). This allows for a detailed analysis of the spatial interaction among variables. Specifically, the direct effect captures the impact of swine insurance policy on swine production efficiency within the province itself; the indirect effect, also referred to as the spatial spillover effect, reflects its influence on neighboring provinces; and the total effect measures the combined impact on both the originating and neighboring provinces. As shown in Table 11, the decomposition results indicate that the direct, indirect, and total effects of the core explanatory variable, swine insurance, are all statistically significant. Specifically, the implementation of swine insurance leads to an average increase of 0.035 in swine production efficiency within the province and an average increase of 0.203 in neighboring provinces. These findings demonstrate that swine insurance enhances production efficiency both locally and regionally, confirming the existence of a positive spatial spillover effect and providing further support for Hypothesis H2.

5.6.4 Spatial attenuation boundary analysis

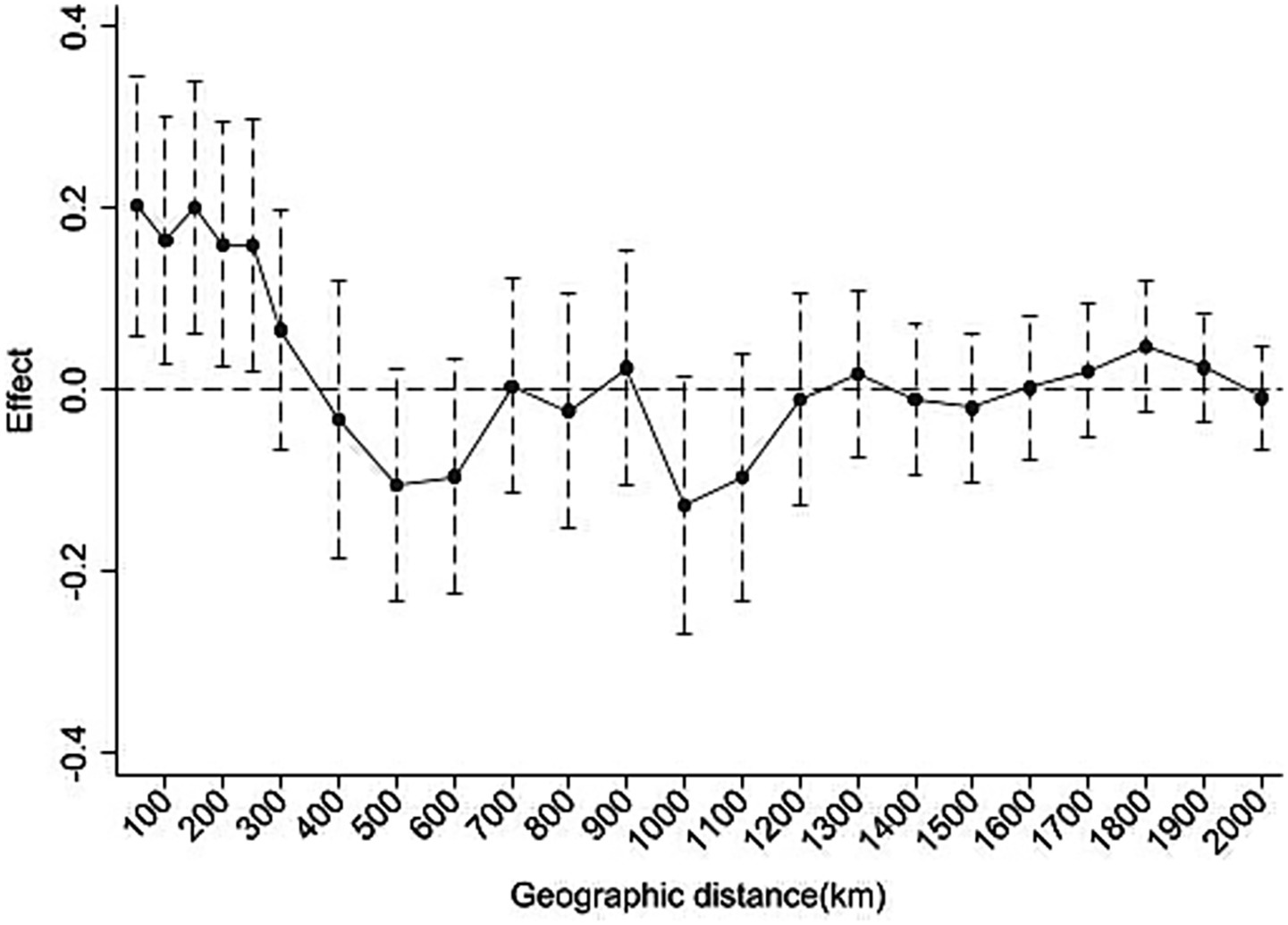

Generally, spatial correlation tends to diminish as the distance between provinces increases, leading to the formation of regional boundaries in the spatial spillover effects of policy-based swine insurance on production efficiency. To address this, we impose a distance threshold on the elements of the spatial weight matrix to estimate the boundary of spatial decay.

In Equation 10, denotes the distance threshold. We initially set the value of at 50 km and gradually increased it in increments of 50 km, up to a maximum of 2000 km. Figure 7 reports the indirect effects of swine insurance under different distance thresholds. It can be observed that the positive spatial spillover effects on neighboring regions’ swine production efficiency are primarily concentrated within 250 km. This finding suggests that the implementation of swine insurance primarily enhances swine production efficiency within a 250 km radius of the implementing province. Beyond 250 km, the indirect effects gradually converge to zero, indicating that the spatial spillover effects progressively diminish and eventually disappear.

5.6.5 Robustness test of spillover effects

This study conducts a robustness test by replacing the spatial weight matrix. Given that the spillover effects of policies are often significantly influenced by geographical distance, and that their intensity may decay as distance increases, constructing a weight matrix based on the inverse square of the geographical distance can directly capture this nonlinear attenuation, providing a more accurate depiction of the continuous variation in spatial effects. Constructing a weight matrix based on the inverse square of the geographical distance can directly capture this nonlinear attenuation, providing a more accurate depiction of the continuous variation in spatial effects, as shown in Equation 11:

The regression results based on the replaced weight matrix are presented in Table 12. It can be observed that both the direct and indirect effects of the policy implementation remain significantly positive under the alternative specification. To better enhance the credibility of the spatial spillover findings, this study further incorporates an adjacency-based spatial weight matrix, as shown in Appendix Table 3, the results remain statistically significant. Theses finding further confirms the robustness of the study’s results.

6 Discussion

This study examines the impact of China’s swine insurance policy on swine production efficiency using provincial panel data from 2005 to 2021. Employing a spatial difference-in-differences (SDID) model, it finds that the policy significantly improves production efficiency in implementing provinces and generates positive spatial spillover effects within a 250 km decay boundary. Heterogeneity analysis further reveals that the effects are most pronounced in major swine production regions.

First, this study broadens the scope of agricultural insurance research by extending the analytical focus to livestock insurance, and systematically examines the impact of economic policy instruments on the sustainable development of the swine industry. This stands in contrast to the findings of Bulte and Lensink (2023) in Tanzania, who argue that in institutionally weak environments, agricultural insurance may undermine informal contractual relationships between farmers and traders, thereby reducing farmers’ access to modern agricultural inputs and hindering the process of agricultural modernization. However, this study presents a contrast example from the Chinese context, the empirical results indicate that China’s swine insurance policy significantly improves swine production efficiency. This divergence may be attributed to several institutional differences. To start with, swine insurance in China is implemented under strong government leadership, supported by substantial fiscal subsidies and strict policy enforcement, which enhances the credibility of the policy and encourages farmer participation. Unlike in some countries where agricultural insurance may displace informal arrangements, China’s swine insurance system serves to strengthen and complement the existing rural financial and service institutions. Then, China’s swine insurance policy does not function in isolation, but is closely integrated with other regulatory measures such as animal disease prevention, environmental compliance, and standardized production practices, forming a comprehensive policy system aimed at the sustainable development of the swine industry.

Moreover, an important contribution of this study is the identification of significant positive spatial spillover effects of swine insurance on production efficiency, which is consistent with findings in the crop insurance literature (Elabed and Carter, 2014). Insurance can stabilize local farmers’ investment expectations and indirectly influence neighboring regions through market linkages and knowledge diffusion. However, compared to crop production, swine production involves more complex value chains and is subject to stricter regulatory oversight, particularly in disease prevention and environmental compliance. Therefore, the observed spillover effects of swine insurance may also stem from the diffusion of standardized farming practices and biosecurity measures driven by broader sustainability-oriented policies. In addition, the empirical results show that the spatial spillover effects of swine insurance are most significant within a 250 kilometers range, but diminish rapidly beyond this distance. This finding is consistent with existing literature (Liu and Yang, 2025), which suggests that the spatial spillover effects of agricultural policies are generally significant within a range of 100 to 300 kilometers, and tend to decay sharply with increasing distance (Liu et al., 2024). This can be attributed to the structural characteristics of the swine industry, which heavily depends on regionally resources such as feed supply chains and market distribution networks (Geng et al., 2022). These key production factors are typically concentrated within provincial economic zones, often corresponding to a geographic radius of less than 250 kilometers. From an agricultural policy perspective, the presence of spatial spillover effects suggests a potential “radiation effect” on neighboring regions, thereby amplifying the overall benefits of the policy. This finding provides theoretical support for expanding the coverage of swine insurance and strengthening cross-regional policy coordination. It also highlights the need to incorporate spatial interlinkages into the design and evaluation of future agricultural policies.

Additionally, the heterogeneity analysis further reveals that the effect of swine insurance on production efficiency is most pronounced in major swine production regions. This result is consistent with findings from crop insurance literature regarding its impact on grain production resilience (Hou and Wang, 2024). Two main factors may explain the stronger policy effect. On the one hand, major swine production regions typically host large-scale, specialized farms, supported by more advanced disease prevention systems and stronger policy implementation capacity, all of which provide a solid foundation for effective policy transmission. On the other hand, farmers in these regions generally operate at larger scales and are more profit-oriented, making them more sensitive to fluctuations in both risk and return. Consequently, they have stronger incentives to adopt risk management tools such as insurance to stabilize output and secure income. The higher levels of economic investment and expected returns in these areas enhance farmers’ responsiveness to policy signals, thereby amplifying the effectiveness of the swine insurance policy.

Furthermore, to assess the generalizability and contextual applicability of the findings, a comparison is made with agricultural insurance policies implemented in other countries and regions. The empirical findings of this study indicate that, under China’s strong policy support, including substantial fiscal subsidies and strict regulatory enforcement, swine insurance significantly enhances production efficiency and generates spatial spillover effects. This institutional context is comparable to that of developed countries such as the United States and New Zealand, where government-backed agricultural insurance programs have successfully contributed to income stabilization and increased resilience in the agricultural sector (Boyer and Griffith, 2023; Skees et al., 2006). These cases suggest that robust institutional support, adequate fiscal funding, and a well-functioning regulatory framework are critical prerequisites for agricultural insurance policies to achieve their intended outcomes. However, the generalizability of these findings depends on the institutional environments of other countries. In developing regions such as East Africa and Mongolia, index-based livestock insurance (IBLI) has shown effectiveness in mitigating climate-related risks (Chantarat et al., 2017; Mogge and Kraehnert, 2025). Nevertheless, as noted by Bulte and Lensink (2023), in areas with weak governance, low levels of farmer trust, and underdeveloped infrastructure, such policies often face significant implementation challenges and limited effectiveness. Therefore, the institutional applicability of swine insurance policies must be carefully assessed when adapting them to other national contexts. For regions with relatively weak institutional capacity, a phased approach may be more appropriate, starting with the development of reliable insurance data systems and farmer education programs, followed by the gradual introduction of more sophisticated policy instruments.

This study has several limitations. First, the implementation data on swine insurance is measured at the provincial level. Due to data availability constraints, the inability to use more granular data at the city or county level may limit the precision of policy effect identification. Second, this study focuses exclusively on finishing pig insurance, as it is the most widely implemented swine insurance type in China. Future research would benefit from incorporating other forms of insurance, such as income insurance, insurance plus futures, and index-based insurance, once relevant data become available. A more comprehensive analysis would enable a deeper understanding of how different insurance instruments affect swine production efficiency and offer more targeted policy recommendations. Another limitation of this study is the inability to fully rule out the influence of omitted variable bias. Due to constraints in data availability and completeness, the model does not include certain institutional factors, such as veterinary service coverage, local epidemic prevention capacity and environmental regulation enforcement, which are important for capturing institutional and regional heterogeneity more comprehensively.

7 Conclusions and policy implications

Swine insurance serves as a vital policy instrument that reduces income volatility, reinforces production confidence, and enhances farmers’ resilience, thereby contributing to the sustainable development of the swine industry. This study uses panel data from 30 Chinese provinces between 2005 to 2021, and applies a spatial difference-in-differences (SDID) model to assess the impact of swine insurance policy on production efficiency and its spatial spillover effects. The key empirical conclusions are outlined below.

Based on the SDID model, and after passing the parallel trend and placebo tests, the results indicate that, compared to provinces without the implementation of swine insurance policy, those with the policy implemented experienced an increase in swine production efficiency. Furthermore, the policy effect of swine insurance exhibits significant spatial spillovers effect, with the spatial effect decay of 250 kilometers.

Secondly, based on the mediation effects model, the mechanism analysis demonstrates that swine insurance improves the production efficiency through promoting scale expansion, facilitating structural upgrading and increasing technology adoption. The implementation of swine insurance alleviates farmers’ risk perceptions, enhances their production enthusiasm, and strengthens their capacity to cope with external shocks. By alleviating the risks involved in the adoption of advanced production methods, swine insurance accelerates the industry’s transformation toward greater scale, standardization, modernization, and technological integration, thereby increase the swine production efficiency.

The heterogeneity analysis in this study is based on functional swine production regions and farming scale. In China, functional swine production regions are categorized into major swine production regions, major swine consumption regions, and production–consumption balanced regions. The empirical results indicate that the effect of swine insurance on improving production efficiency is particularly significant in major swine production regions and among large scale farms.

From an agricultural policy perspective, examining the effects of swine insurance on production efficiency provides important insights for policymakers. It facilitates the investigation of how policy tools may be utilized to promote the sustainable growth of the swine sector, offering meaningful policy implications.

Firstly, it is essential to establish a more comprehensive swine insurance policy system. The government should increase support for swine insurance through expanded coverage, higher protection levels, and improved compensation standards. Building upon the practices of countries with well-established livestock insurance frameworks, including the United States and New Zealand, diversified products such as index insurance and income insurance could be incorporated into China’s practice. Establishing an interprovincial policy coordination mechanism to facilitate information sharing in areas such as breeding technologies, price forecasts, and disease surveillance would enhance the spatial transmission of policy spillover effects. In addition, modern insurance technologies, such as AI-based pig identification can be used to support the development of a more accurate insurance database. Integrating regional climate, disease, and market information will enable the design of more effective insurance products. A robust swine insurance system would play a key role in advancing the development of China’s swine industry.

Secondly, facilitate production scale expansion and structural upgrading in the swine industry. Policymakers should integrate swine insurance with initiatives aimed at optimizing farm structures and encouraging scale enlargement. Targeted insurance incentives should be provided to standardized and intensive farming operations, while small-scale farmers should be guided toward forming family farms, cooperatives, or commercial entities. In parallel, insurance policies should be coordinated with measures such as environmental infrastructure development, waste resource utilization, and improved breeding programs to facilitate the transformation of the traditional swine sector toward a more green and efficient model.

Thirdly, promote technology adoption and industrial modernization. The government should fully leverage the dual role of insurance in risk reduction and behavioral incentives by implementing the “insurance + technical services” model. This approach would provide insured farmers with support in disease forecasting, smart farm management, and feeding optimization, reducing the uncertainty and costs of adopting new technologies. Additionally, the development of integrated insurance data platforms that combine information on farming environments, disease outbreaks, and market dynamics would improve product precision and service delivery, fostering the integration of technology and insurance and accelerating the modernization of the swine industry.

Lastly, strengthen policy support for major swine production regions. The government should enhance policy prioritization and resource allocation toward major swine production regions and large scale farms. In these regions, increasing premium subsidies, expanding insurance coverage, and improving compensation standards can help maximize the effectiveness of insurance policies. Based on the distinct risk profiles, production modes, and industrial foundations across functional zones, differentiated insurance product portfolios should be designed to better match local conditions. At the same time, coordination between major production regions and non-production areas should be promoted through cross-regional policy alignment and information sharing, thereby amplifying the spatial spillover effects of insurance. Optimizing resource allocation and establishing a coordinated and functionally differentiated policy framework would enhance the overall resilience and efficiency of the swine production system and contribute to stable capacity with the agriculture system.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary material.

Author contributions

JF: Conceptualization, Formal analysis, Writing – original draft. WZ: Methodology, Writing – review & editing. LW: Writing – review & editing, Data curation. BH: Writing – review & editing, Software. FX: Writing – review & editing, Funding acquisition.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by National Social Science Fund of China “Exploring Pathways for High-Quality Development of Agricultural Insurance and Policy Enhancement” (23BJY171) https://xm.npopss-cn.gov.cn/; and Humanities and Social Science Fund of Ministry of Education of China “Investigating the Impact Mechanisms and Effects of Full-Cost Insurance on Crop Farmers’ Production Decisions—Evidence from a Quasi-Natural Experiment in Key Crop-Producing Regions of Northeast China” (20YJC790149) https://www.sinoss.net/; and The Educational Department of Liaoning Province “Research on the Linkage Adjustment Mechanism between Agricultural Insurance Compensation Rate and Premium Rate” (JYTYB2024071) https://jyt.ln.gov.cn/.

Acknowledgments

The authors are grateful to the institutions that provided funding.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2025.1636598/full#supplementary-material

References

Bai, J. (2009). Panel data models with interactive fixed effects. Econometrica 77, 1229–1279. doi: 10.3982/ECTA6135

Beck, T., Levine, R., and Levkov, A. (2010). Big bad banks? The winners and losers from bank deregulation in the United States. J. Finance 65, 1637–1667. doi: 10.1111/j.1540-6261.2010.01589.x

Béné, C., Devereux, S., and Fanzo, J. (2023). “Achieving food security through a food systems lens” in Resilience and food security in a food systems context. eds. C. Béné and S. Devereux (Berlin: Springer International Publishing), 31–52.

Boyd, M., Pai, J., and Porth, L. (2013). Livestock mortality insurance: development and challenges. Agric. Finance Rev. 73, 233–244. doi: 10.1108/AFR-04-2013-0019

Boyer, C. N., and Griffith, A. P. (2023). Livestock risk protection subsidies changes on producer premiums. Agric. Finance Rev. 83, 201–210. doi: 10.1108/AFR-05-2022-0066

Brick, K., and Visser, M. (2015). Risk preferences, technology adoption and insurance uptake: a framed experiment. J. Econ. Behav. Organ. 118, 383–396. doi: 10.1016/j.jebo.2015.02.010

Bulte, E., and Lensink, R. (2023). Why agricultural insurance may slow down agricultural development. Am. J. Agric. Econ. 105, 1197–1220. doi: 10.1111/ajae.12353

Cai, H., Chen, Y., Fang, H., and Zhou, L. (2009). Microinsurance, trust and economic development: evidence from a randomized natural field experiment. PIER Working Paper No. 09-034.

Chantarat, S., Mude, A. G., Barrett, C. B., and Tuevey, C. G. (2017). Welfare impacts of index insurance in the presence of a poverty trap. World Dev. 94, 119–138. doi: 10.1016/j.worlddev.2016.12.044

Chetty, R., Looney, A., and Kroft, K. (2008). Salience and taxation: theory and evidence. Finance Econ. Dis. Ser. 2008, 1–46. doi: 10.17016/feds.2009.11

Elabed, G., and Carter, M. (2014). Ex-ante impacts of agricultural insurance: Evidence from a field experiment in Mali. Davis: University of California.

Elhorst, J. P. (2014). Matlab software for spatial panels. Int. Reg. Sci. Rev. 37, 389–405. doi: 10.1177/0160017612452429

Fang, L., Hu, R., Mao, H., and Chen, S. (2021). How crop insurance influences agricultural green total factor productivity: evidence from Chinese farmers. J. Clean. Prod. 321:128977. doi: 10.1016/j.jclepro.2021.128977

Feng, J., He, S., Wan, C., Liu, J., and Xie, F. (2025). The effect of swine insurance participation on swine production efficiency: evidence from China. PLoS One 20:e0317759. doi: 10.1371/journal.pone.0317759

Freudenreich, H., and Musshoff, O. (2018). Insurance for technology adoption: an experimental evaluation of schemes and subsidies with maize farmers in Mexico. J. Agric. Econ. 69, 96–120. doi: 10.1111/1477-9552.12226

Geng, N., Liu, Z., Wang, X., Meng, L., and Pan, J. (2022). Measurement of green total factor productivity and its spatial convergence test on the pig-breeding industry in China. Sustain. For. 14:13902. doi: 10.3390/su142113902

Glauber, J. W., Collins, K. J., and Barry, P. J. (2002). Crop insurance, disaster assistance, and the role of the federal government in providing catastrophic risk protection. Agric. Finance Rev. 62, 81–101. doi: 10.1108/00214900280001131

Goodwin, B. K., and Smith, V. H. (2013). What harm is done by subsidizing crop insurance? Am. J. Agric. Econ. 95, 489–497. doi: 10.1093/ajae/aas092

Hazell, P. B. R. (1992). The appropriate role of agricultural insurance in developing countries. J. Int. Dev. 4, 567–581. doi: 10.1002/jid.3380040602

Hou, D., and Wang, X. (2024). Unveiling the role of agricultural insurance in driving rural industry revitalization in China. Heliyon 10:e34483. doi: 10.1016/j.heliyon.2024.e34483

Ifft, J. E., Kuethe, T., and Morehart, M. (2015). Does federal crop insurance lead to higher farm debt use? Evidence from the agricultural resource management survey. Agric. Finance Rev. 75, 349–367. doi: 10.1108/AFR-06-2014-0017

Janzen, S. A., and Carter, M. R. (2013). After the drought: the impact of microinsurance on consumption smoothing and asset protection. NBER Working Papers. Available online at: http://www.nber.org/papers/w19702.

Jeffrey, P., Boyd, M., and Porth, L. (2014). Insurance premium calculation using credibility analysis: An example from livestock mortality insurance. J. Risk Insur. 82: 341–357. doi: 10.1111/jori.12024

Jiang, T. (2022). Mediating effect and moderating effect in the empirical study of causal inference. China Ind. Econ. 5, 100–120. doi: 10.19581/j.cnki.ciejournal.2022.05.005

Karlan, D., Osei, R., Osei-Akoto, I., and Udry, C. (2014). Agricultural decisions after relaxing credit and risk constraints. Q. J. Econ. 129, 597–652. doi: 10.1093/qje/qju002

Le Mouël, C., and Forslund, A. (2017). How can we feed the world in 2050? A review of the responses from global scenario studies. Eur. Rev. Agric. Econ. 44, 541–591. doi: 10.1093/erae/jbx0006

Lesage, J., and Pace, R. K. (2009). Introduction to spatial econometrics. Boca Raton, FL: Chapman and Hall CRC.

Li, G., Jia, X., Khan, A., Khan, S., and Luo, J. (2022). Does green finance promote agricultural green total factor productivity? Considering green credit, green investment, green securities, and carbon finance in China. Environ. Sci. Pollut. Res. 30, 36663–36679. doi: 10.1007/s11356-022-24857-x

Li, J., and Wang, Z. (2023). Assessing the spatial effects of agriculture insurance on agriculture industry development. Stat. Decis. 39, 163–167. doi: 10.13546/j.cnki.tjyjc.2023.01.030

Li, Y., and Zhang, H. (2022). A research on the role of hog margin Insurance in the Regulation of hog market-taking Sichuan Province as an example. Insur. Stud. 12, 74–89. doi: 10.13497/j.cnki.is.2022.12.005

Li, Y., Zhou, H., and Chang, Q. (2021). Comparative analysis of policy based swine insurance between China and America. HLJ Anim.Sci. 22, 20–25. doi: 10.1388/j.cnki.hljxmsy.2021.03.0010

Liu, Y., and Yang, H. (2025). The overall spatial spillover effects of local agricultural policy: a study on China’s corn stockpiling policy based on adaptive expectation theory and spatial Durbin model. Agri. Econ. 71, 160–172. doi: 10.17221/9/2024-AGRICECON

Liu, M., Zhong, T., and Lyu, X. (2024). Spatial spillover effects of “new farmers” on diffusion of sustainable agricultural practices: evidence from China. Land 13:119. doi: 10.3390/land13010119

Mahfuz, S., Mun, H. S., Dilawar, M. A., and Yang, C. (2022). Applications of smart technology as a sustainable strategy in modern swine farming. Sustain. For. 14:2607. doi: 10.3390/su14052607

Mobarak, A. M., and Rosenzweig, M. R. (2012). Selling formal insurance to the informally insured. SSRN E. J. doi: 10.2139/ssrn.2009528.933

Mogge, L, and Kraehnert, K. (2025). Perception and protection: The effect of risk exposure on demand for index insurance in Mongolia. J. Environ. Econ. Manag. 130. doi: 10.1016/j.jeem.2024.103113

Mu, L, Wang, Y, and Mao, H. (2023). Does agricultural insurance drive variations in carbon emissions in China? Evidence from a quasi-experiment. Pol. J. Environ. Stud. 32: 653–665. doi: 10.15244/pjoes/155869