- 1College of Management, China West Normal University, Nanchong, China

- 2Department of Basic Construction, China West Normal University, Nanchong, China

- 3College of Public Administration, Nanjing Agricultural University, Nanjing, China

Enhancing the development quality of new agricultural business entities is crucial for advancing agricultural modernization and achieving rural revitalization, while alleviating credit constraints is a key pathway toward this goal. Using survey data collected in 2021 from 427 grain-oriented new agricultural business entities in Jiangsu Province, this study employs an accelerated genetic algorithm–based projection pursuit model to measure their development quality and conducts empirical tests to examine the impact of credit constraints and their underlying mechanisms. The results show that: (1) the development quality of new agricultural business entities in Jiangsu still has considerable room for improvement and varies substantially across types, ranking from highest to lowest as agricultural enterprises, cooperatives, family farms, and large-scale farmers. Across benefit dimensions, economic benefits exceed social benefits, which in turn surpass ecological benefits; notably, cooperatives display slightly lower economic benefits than family farms, but their social benefits are second only to agricultural enterprises and far higher than family farms; (2) credit constraints exert significant negative effects on overall development quality as well as on each benefit dimension; and (3) credit constraints indirectly restrict development quality through two key transmission channels—fixed asset investment and the scale of transferred-in farmland. By uncovering these multidimensional mechanisms, this study provides robust empirical evidence on how credit constraints affect the development quality of new agricultural business entities, and offers valuable implications for alleviating credit constraints, improving rural financial supply, and promoting the high-quality development of agricultural business entities.

1 Introduction

The development quality of new agricultural business entities is closely linked to the implementation of the rural revitalization strategy and the advancement of agricultural modernization. Since 2013, China’s “No. 1 Central Document” has continuously focused on the “three rural issues” for 12 consecutive years, repeatedly emphasizing the critical role of these entities in addressing rural challenges and calling for their accelerated cultivation and development (Cheng et al., 2021). Driven by both policy and market forces, the number and scale of these entities have expanded significantly. However, such quantitative growth has not been effectively translated into qualitative improvement. In practice, problems such as insufficient vitality, operational instability, and extensive management remain prevalent. These shortcomings not only weaken the role of new agricultural business entities in promoting agricultural modernization but also constrain the realization of rural revitalization objectives. Therefore, it is imperative to establish a rigorous evaluation system of development quality to comprehensively reveal the actual status and potential weaknesses of these entities, thereby providing a scientific basis for policy optimization and resource allocation, and ultimately facilitating their transformation toward high-quality development.

Achieving this goal requires first clarifying the connotation of “development quality.” Existing studies generally contend that development quality is not merely an extension of economic benefits, but a systematic objective encompassing economic, ecological, and social benefits. From the perspective of agricultural resilience, high-quality development requires entities to possess the capacity to withstand market fluctuations, natural disasters, and institutional shocks, thereby ensuring the long-term stability and sustainability of the agricultural system. From the perspective of the agricultural innovation system, development quality also relies on improvements in technology adoption, organizational innovation, and service provision, which enhance both internal efficiency and external spillover effects. Hence, the evaluation of development quality must move beyond the limitations of single economic indicators and adopt a multidimensional framework that aligns with the dual imperatives of resilience and innovation in the new era of agricultural modernization. Nevertheless, whether enhancing resilience or strengthening innovation capacity, both processes depend on long-term, stable, and large-scale capital investment. Given the constraints of limited self-financing, access to credit becomes a crucial factor in overcoming capital bottlenecks and achieving high-quality development. This underscores the necessity of probing the intrinsic relationship between credit constraints and development quality. As access to credit emerges as a decisive determinant, it is therefore essential to investigate the inherent relationship between credit constraints and development quality.

A review of the existing literature reveals that related studies mainly fall into three strands. First, some focus on the practical dilemmas, constraints, and developmental paths of new agricultural business entities (Kong and Zhou, 2020; Hu et al., 2022). These works are predominantly qualitative and rely on macro-level narratives, emphasizing theoretical interpretation and speculative analysis. While they lay an important foundation for understanding the development of such entities, they remain insufficient in terms of empirical validation and mechanism-oriented exploration. Second, a large body of research has sought to construct evaluation indicators of development quality. One stream adopts single indicators—such as performance measures or satisfaction with cultivation outcomes (Chen and Zhang, 2022; Wang et al., 2014; Kuang, 2021; Ruan et al., 2017; Cheng et al., 2022)—which capture certain aspects of efficiency and structure but overlook environmental and resource costs, thereby failing to reflect the multidimensional requirements of high-quality development. Notably, mainstream approaches often implicitly equate “development quality” with scale expansion or interpret performance solely from a profit-oriented perspective, with inadequate attention to its multidimensional connotations. Other scholars have attempted to establish comprehensive evaluation frameworks that integrate economic, social, and ecological dimensions, providing useful references for systematic assessment. However, these frameworks are often confined to specific types of business entities (e.g., family farms or cooperatives) (He and Xiong, 2014; Ren and Xue, 2018; Guo and Wang, 2022), lacking a unified system that can encompass multiple entity types and allow for comparative analysis. Although some scholars, such as Li and Yu (2020), have attempted preliminary integration at the macro level, they have not developed generalizable indicators based on the commonalities of diverse new agricultural business entities, nor systematically compared development quality across heterogeneous entities. Third, research focusing on the impact of credit constraints on the development quality of new agricultural business entities is relatively closely aligned with the core issues addressed in this study. Existing literature can be further divided into two categories: one emphasizes qualitative exploration of financing conditions, channel selection, model innovation, and constraining factors (Jiang and Li, 2015; Song et al., 2020; Wang et al., 2018); the other primarily examines the direct effects of credit constraints empirically from single dimensions such as income or scale (Cheng and Zou, 2022; Zhou and Chen, 2020). Although some scholars have attempted to construct multidimensional evaluation frameworks, few have systematically incorporated credit constraints into such frameworks, thus failing to effectively reveal the pathways through which they influence development quality.

In conclusion, existing literature offers valuable insights into how credit constraints affect the development quality of new agricultural business entities. However, these studies often neglect to explore the underlying mechanisms through which credit constraints influence development quality. Moreover, few have approached the assessment of development quality from a comprehensive, multidimensional perspective, considering the common characteristics of various types of new agricultural business entities. To address this gap, this paper develops a multidimensional evaluation framework to measure the development quality of these entities. Using survey data from 427 grain-oriented new agricultural business entities in Jiangsu Province, we conduct an empirical analysis to examine the differences in economic, ecological, and social benefits among the entities, as well as the mechanisms through which credit constraints impact their development quality. The findings not only help explain the development quality issues from the perspective of credit constraints but also provide critical insights for policymakers seeking to establish financial service support systems that can enhance the development quality of these entities.

2 Theoretical analysis and research hypotheses

John Elkington’s Triple Bottom Line (TBL) theory argues that businesses, in their pursuit of growth, should aim for a balanced approach that encompasses economic performance, environmental sustainability, and social well-being. Given that new agricultural business entities share many corporate characteristics, the TBL framework provides a suitable lens for evaluating their overall development quality. This paper assesses the development quality of these entities across three key dimensions: economic, ecological, and social benefits. Thus, the development quality of new agricultural business entities can be expressed as the sum of economic benefits (D1q), ecological benefits (D2q), and social benefits (D3q), as shown in Equation (1):

Building on the work of Wang et al. (2018), this paper develops a theoretical model to assess the impact of credit constraints on the development quality of new agricultural business entities. By integrating credit constraints, fixed asset investment, and the scale of transferred-in farmland into the Cobb–Douglas (C-D) production function, the model aims to explore how credit constraints, through the reallocation of production factors, can improve the development quality of these entities. The production function is presented in Equation (2):

Where A represents technological progress, denotes the development quality of new agricultural business entities, M stands for credit constraints, L represents the scale of transferred-in farmland, and K indicates fixed asset investment. , ,and are the elasticity coefficients of credit constraints, the scale of transferred-in farmland, and fixed asset investment on the development quality of new agricultural business entities, respectively, with values ranging between 0 and 1.

In addition, the total cost required is expressed in Equation (3):

In the equation, represents the total development cost of new agricultural business entities, is the unit land rental cost, is the unit fixed asset investment cost, and is the financing interest rate. Therefore, the benefits of new agricultural business entities across each dimension can be expressed as shown in Equation (4):

The partial derivatives with respect to each production factor are shown in Equations (5) and (6):

With other factors held constant, to maximize the benefits across each dimension, the first-order derivatives must be equal to zero, that is, and . Therefore, the following equations can be derived:

Further taking the logarithm of both sides of equations 7, 8, and rearranging, we obtain:

In Equations (9) and (10), the values of , , and all fall within the range [0, 1], implying that and are both greater than 0. This indicates that credit constraints influence the scale of transferred-in farmland and fixed asset investment for new agricultural business entities.

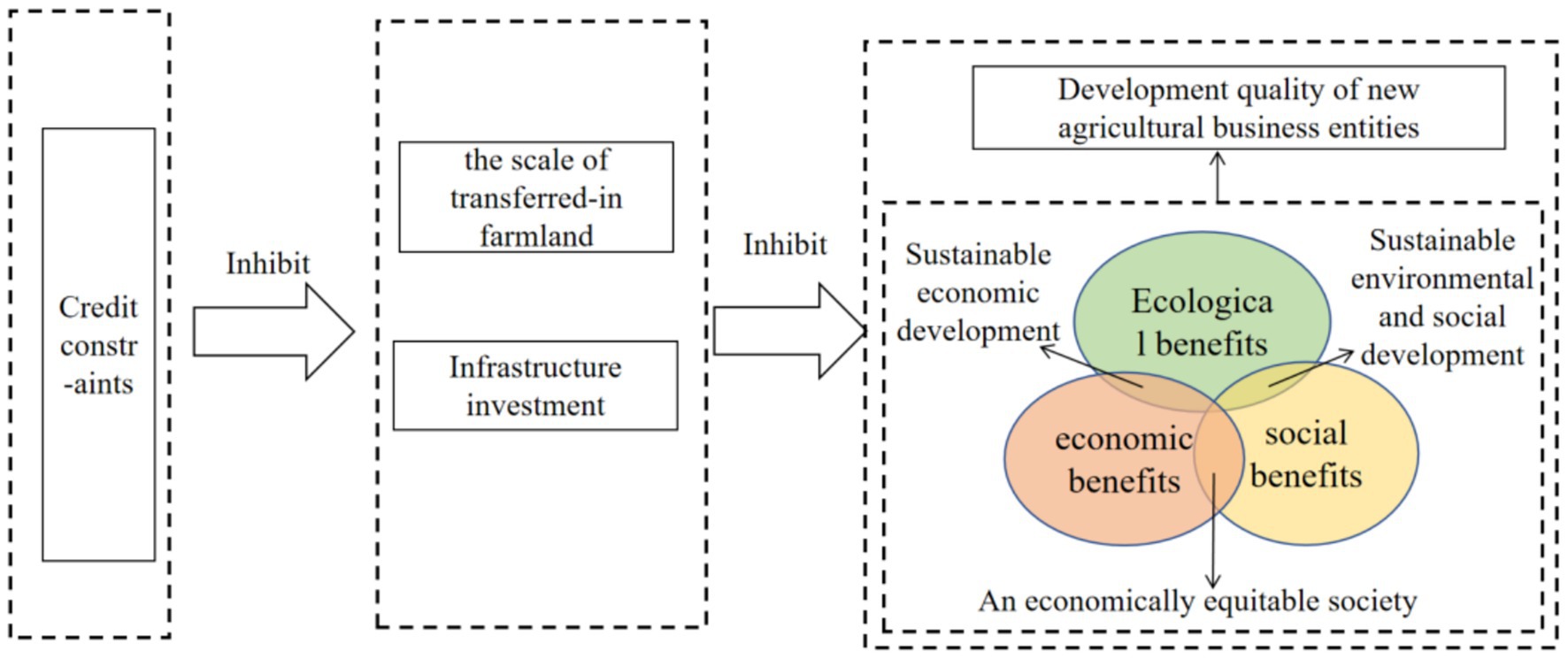

New agricultural business entities achieve economies of scale by acquiring additional cultivated land, thereby striving for higher profitability. However, agricultural productivity is not solely dependent on land; it is also influenced by factors such as agricultural equipment and capital, with capital being a key determinant in the production process. First, given the limitation of self-financing, new agricultural business entities typically exhibit a high demand for external financing. Due to issues like information asymmetry, underdeveloped social guarantee mechanisms, and a lack of adequate collateral, new agricultural business entities often face difficulties in securing effective credit support. This restricts their ability to acquire additional land and reduces land inflows. Second, in the presence of credit constraints, these entities may be unable to adjust their land scale promptly, and the effect of such constraints will spill over to fixed asset investment. Consequently, under credit constraints, it becomes challenging for new agricultural business entities to strike a balance between agricultural input costs and returns, forcing them to adopt suboptimal resource allocations, thereby hindering improvements in their development quality (see Figure 1). Based on this, the following hypothesis is proposed:

Hypothesis 1: Credit constraints inhibit the development quality of new agricultural business entities.

Hypothesis 2: Credit constraints affect the development quality of new agricultural business entities by limiting the scale of transferred-in farmland.

Hypothesis 3: Credit constraints affect the development quality of new agricultural business entities by limiting fixed asset investment.

Figure 1. Mechanisms by which credit constraints affect the development quality of new agricultural business entities.

3 Model, data, and descriptive statistics

3.1 Model construction

3.1.1 Accelerated genetic algorithm and projection pursuit model

This paper measures the development quality of new agricultural business entities by integrating both the indicator selection and measurement methods used by existing scholars, along with the specific characteristics of survey data collected by our research team in 2021. Ultimately, 14 indicators were selected across three dimensions: economic, ecological, and social. To assess the development quality of new agricultural business entities, we combine the strengths of the projection pursuit model with the accelerated genetic algorithm to construct an innovative evaluation model (Xiang et al., 2022). Unlike commonly used subjective and objective weighting methods, this approach effectively avoids the influence of subjective factors in determining indicator weights. It is particularly suited for multidimensional global optimization, offering superior robustness, accuracy, and resistance to interference compared to conventional measurement models. The specific modeling steps are as follows:

Step 1: Standardization of sample indicators. Using new agricultural business entities as the research object, we construct the initial sample set of indicators: , where represents the j-th evaluation indicator value of the i-th sample for new agricultural business entities. and denote the number of samples and the number of evaluation indicators, respectively. To eliminate the impact of different measurement units on the overall evaluation results, data normalization is conducted using Equation (11):

Where and represent the maximum and minimum values of the j-th evaluation indicator, respectively, and is the result of the normalization of the evaluation indicator.

Step 2: Construction of the projection indicator function . The projection pursuit model transforms p-dimensional data into a one-dimensional projection value , with serving as the optimal projection direction.

Here, represents a unit-length vector. The projection index function is defined in Equation (13):

Where and represent the standard deviation and local density of the projection value , respectively. The calculation formulas are shown in Equations (14) and (15):

Where E(z) is the mean of the projection values, R is the window radius for local density, represents the distance between samples, and is the unit step function which equals 0 when , and 1 otherwise.

Step 3: Optimization of the projection index function. When the index set is determined, changes in the projection direction will result in variations in the projection index function . The optimization objective function is formulated in Equations (16) and (17):

Step 4: Analysis of the development quality of new agricultural business entities. By substituting the optimal projection direction vector * into Equation 12, the projection value Z*(i) for each sample of new agricultural business entities can be obtained, representing the development quality of these entities.

3.1.2 Benchmark regression model

To examine the effect of credit constraints on the development quality of new agricultural business entities, this paper proposes the following quantitative model:

In Equation 18, the dependent variable Yi represents the development quality of the i-th new agricultural business entity, Xi denotes the core explanatory variable of credit constraints, Ki represents the control variables, , , and are the coefficients to be estimated, and e is the random error term.

3.1.3 Mediation effect

According to the theoretical analysis, credit constraints may impact the development quality of new agricultural business entities by inhibiting the scale of transferred-in farmland and fixed asset investment. To test this mechanism, this paper employs a mediation effect model (Baron and Kenny, 1986), combining stepwise regression with the bootstrap method to examine how credit constraints influence the development quality of new agricultural business entities. The model is constructed as follows:

Where Y represents the development quality of the i-th new agricultural business entity, Mi represents the mediator variable, Ni represents the core variable, and Xi represents a series of control variables. , , are constants, and , , are random error terms. In Equation 19, represents the overall effect of credit constraints on the development quality of new agricultural business entities. In Equation 20, represents the effect of credit constraints on the mediator variable. In Equation 21, and represent the direct effects of credit constraints and the mediator variable, respectively, on the development quality of the i-th new agricultural business entity. Substituting Equation 20 into Equation 21 yields the mediation effect of credit constraints, indicating that credit constraints influence the development quality of new agricultural business entities through a mediation mechanism.

3.1.4 Propensity score matching

Following the classical framework of counterfactual analysis, the sample is divided into two groups based on whether they experience credit constraints: the treatment group (experiencing credit constraints) and the control group (not experiencing credit constraints). Under the condition of maintaining consistent external factors, this study investigates the impact of credit constraints on the development quality of new agricultural business entities, proceeding in the following steps:

Step 1: Calculate the propensity score. Variables such as individual characteristics, household features, and agricultural production characteristics are used as covariates. The propensity score, indicating whether the sample is subject to credit constraints, is calculated using a Logit model.

In Equation (22), Di = 1 indicates that the sample is subject to credit constraints, Di = 0 indicates that the sample is not, and Xi represents the observable characteristics of the farmers.

Step 2: Conduct propensity score matching. To ensure the robustness of the matching results, this paper selects three mainstream matching methods: kernel matching, K-nearest neighbor matching, and caliper matching.

Step 3: Calculate the average treatment effect. Based on the counterfactual analysis framework, the average treatment effect on the treated (ATT) for the treatment group is calculated to reflect the impact of credit constraints on the development quality of new agricultural business entities.

In Equation (23), denotes the development quality of new agricultural business entities that are subject to credit constraints, indicates the development quality of those not facing such constraints. is an observable variable, while remains unobservable, necessitating the use of propensity score matching to construct a substitute indicator for .

3.2 Data sources

The data used in this study were obtained from field household surveys conducted by the research team between January and April 2021, targeting grain-oriented farmers in Jiangsu Province. As a major and developed agricultural province, Jiangsu leads the nation in land transfer markets, agricultural modernization, and the cultivation of new agricultural business entities, making it an advanced practical sample for this research. Moreover, the economic disparities between Southern Jiangsu, Central Jiangsu, and Northern Jiangsu reasonably represent the eastern, central, and western regions of China, which helps enhance the external validity of the study’s findings. Hence, Jiangsu Province was selected as the research sample. In the sampling process, the research team adopted a stratified sampling method based on regional economic development levels and geographical distribution. First, considering regional and economic differences within Jiangsu, Nanjing and Zhenjiang in Southern Jiangsu, Huai’an in Northern Jiangsu, and Yangzhou in Central Jiangsu were chosen as sample areas to ensure representativeness. Second, within each selected city, two counties were chosen, followed by two towns from each county, and finally 4–5 administrative villages from each town. Finally, about 10 grain-producing farmers were randomly selected from each village for one-on-one questionnaire interviews. The survey covered personal characteristics, family characteristics, agricultural business characteristics, and financial support. A total of 629 questionnaires were collected, of which 601 were valid after excluding outliers and missing data, resulting in a 95.55% effective response rate. To ensure sample comparability, the study excluded small-scale farmers and new agricultural business entities engaged in integrated farming and livestock production, ultimately selecting 427 grain-oriented new agricultural business entities as the final sample.

3.3 Construction of development quality indicators for new agricultural business entities

The construction of the indicator system rests on two primary considerations. First, it is grounded in theoretical and academic foundations. Although the definition of new agricultural business entities has not yet reached full consensus in the academic community, it is widely acknowledged that their enterprise-oriented management features have become increasingly prominent. For instance, employment relationships often exist between family members and hired laborers, and relatively complete financial and production management systems are already in place. To a certain extent, these entities can therefore be regarded as “enterprises” and have gradually become important carriers of agricultural production in China. Against this backdrop, John Elkington’s “triple bottom line” theory provides a critical framework for evaluating their development quality. The theory posits that enterprises must achieve balanced progress across economic prosperity, social welfare, and environmental protection to ensure sustainability. This perspective is consistent with western research on family farm performance evaluation, which also classifies performance into economic, social, and ecological dimensions. Related studies further reinforce this view, with some scholars emphasizing that efficiency, benefit, and sustainability should be integrated into indicator construction (Zhou et al., 2025; Li and Yu, 2020; Ren and Xue, 2018; Gao and Luo, 2023), while others highlight the linkage mechanisms between smallholders and new agricultural business entities, arguing that long-term development can be achieved through green production and social responsibility (Li et al., 2024; Zhang et al., 2025; Liang et al., 2024). Taken together, these studies suggest that evaluating development quality along economic, social, and ecological dimensions is both theoretically forward-looking and practically instructive. Second, the indicator system is also guided by policy foundations. Authoritative national policy documents have set explicit requirements for the development quality of new agricultural business entities, thereby offering direction and standards for indicator construction. For example, the 2019 Opinions on Promoting the Organic Connection between Smallholders and Modern Agriculture issued by the CPC Central Committee and the State Council encouraged new agricultural business entities to support smallholders and promote green agricultural development. Subsequently, the Plan for the High-Quality Development of New Agricultural Business Entities and Service Providers (2020–2022) emphasized placing improvements in development quality and benefit at the top of the agenda. Building on this, the 2025 No. 1 Central Document extended the focus to social benefits, highlighting the importance of strengthening the social contributions of these entities. Collectively, these policies have continuously expanded and deepened the requirements for new agricultural business entities at different stages, providing a strong institutional foundation for constructing an indicator system that aligns closely with national strategic objectives and the broader trajectory of agricultural modernization.

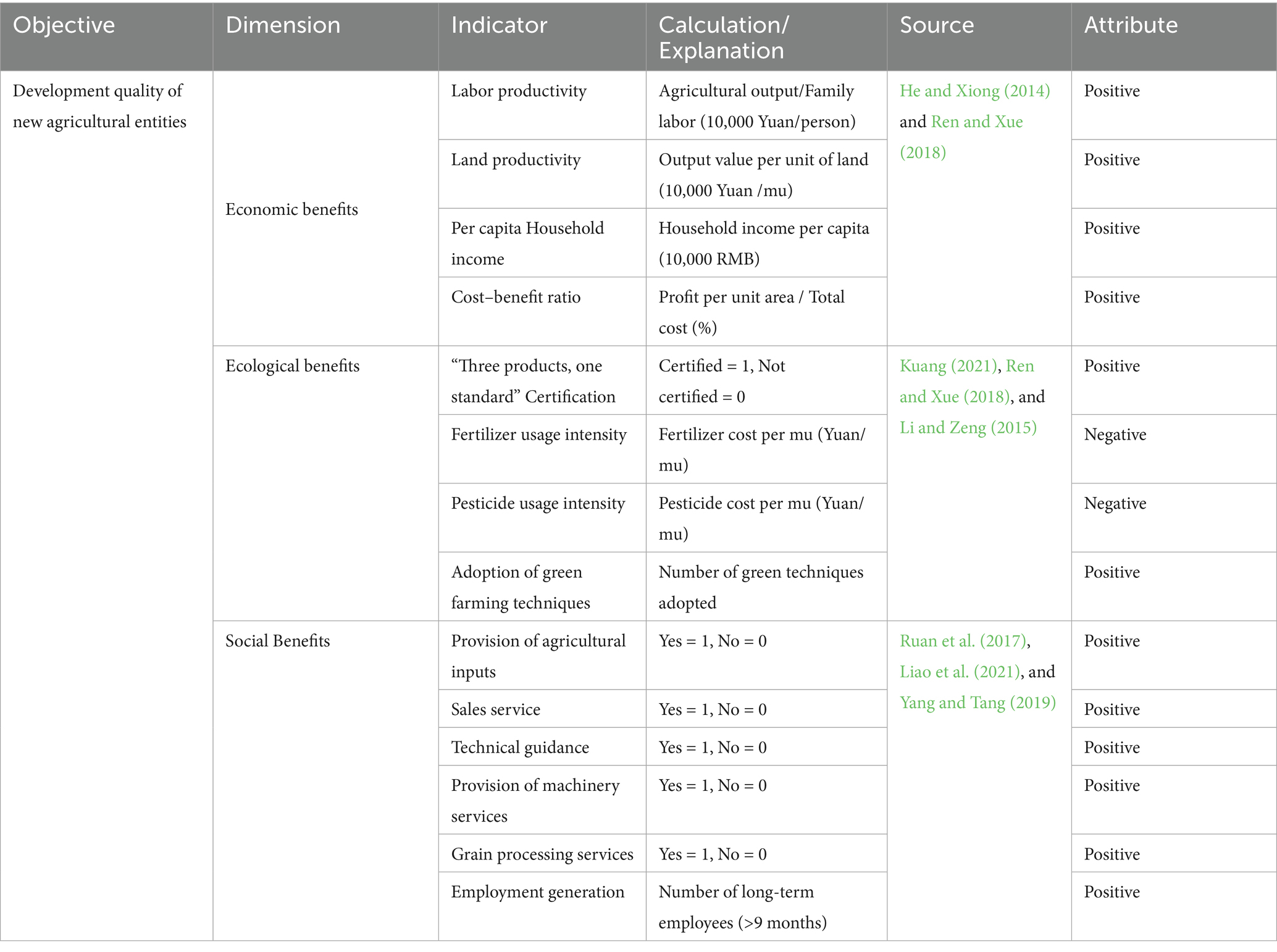

Building on the combined support of the above theoretical, academic, and policy foundations, the research team conducted multiple rounds of internal discussions. Following the principles of importance, representativeness, and measurability, the indicators were examined and screened. In addition, in-depth interviews and pilot surveys were carried out to refine both the wording of the indicators and the structure of the system. Ultimately, a development quality evaluation system for new agricultural business entities was established, as presented in Table 1.

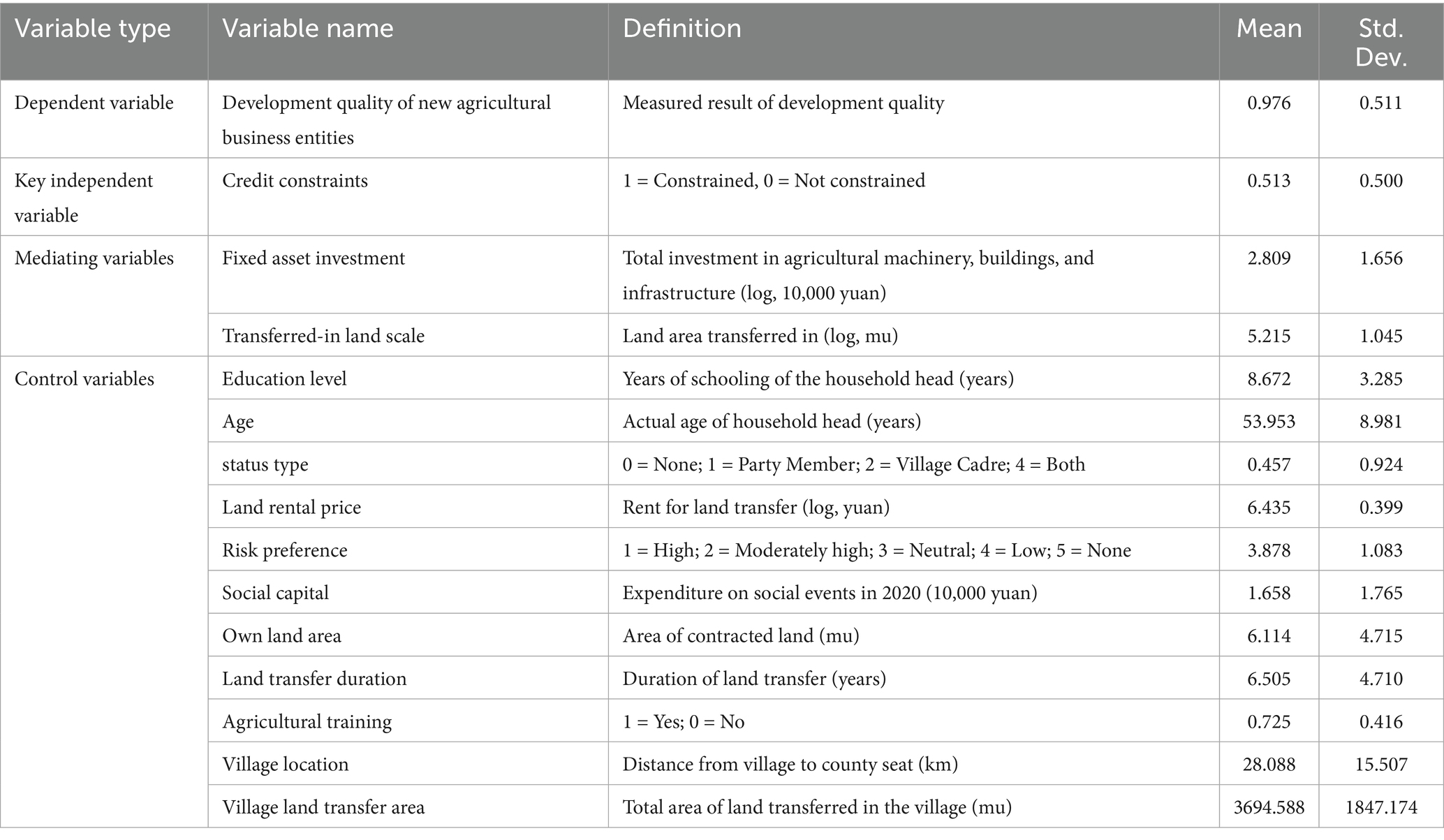

3.4 Variable explanation

Dependent variable: The development quality of new agricultural business entities is measured using three dimensions: economic, ecological, and social benefits. (1) Economic benefits: These reflect the ability of new agricultural business entities to allocate and utilize resources effectively. The evaluation indicators include cost–benefit ratio, land productivity, labor productivity, and per capita household income. A higher cost–benefit ratio indicates better operational advantages and management, allowing for greater profits at lower production costs. Land productivity and labor productivity are key indicators of operational performance, where higher labor productivity shows that household agricultural labor creates more value, and higher land productivity demonstrates greater output per unit of land, indicating a higher level of land intensification. Per capita household income reflects both local economic conditions and the operational performance of agricultural production. (2) Ecological benefits: This dimension evaluates the commitment to green production, environmental protection, and achieving sustainable development goals. Products certified under the “three products and one standard” (green food, organic food, pollution-free agricultural products, and geographical indication agricultural products) must follow sustainable agricultural practices and originate from a favorable ecological environment. Hence, such certifications are key indicators of the ecological benefits of new agricultural business entities. Additionally, fertilizer use, pesticide use, and the adoption of green farming techniques are critical indicators of agricultural pollution levels and environmental protection efforts, making these four indicators representative of ecological benefits. (3) Social benefits: This dimension emphasizes the social contributions of new agricultural business entities. These entities play an essential role in employment generation, technology dissemination, market guidance, and extending the agricultural value chain. They directly and indirectly contribute to improving quality, efficiency, and income for surrounding farmers. Therefore, indicators such as employment generation, provision of agricultural inputs, and sales services are used to measure social benefits.

Core independent variable: Credit constraints refer to the financial constraints faced by new agricultural business entities when accessing formal financial institutions. This study follows the methods used by Boucher et al. (2009) and Yan et al. (2024) measuring credit constraints through the question: “Did you face a shortage of funds during agricultural production but did not apply for credit, or was your application denied?” Respondents who answered “application denied,” “loan insufficient,” or cited reasons such as “loan procedures are too complicated,” “lack of suitable collateral,” “no connections at the bank,” or “interest rates too high” were classified as experiencing credit constraints. Those who answered “did not need credit” or “loan was sufficient” were classified as not experiencing credit constraints.

Mediating variable: This study uses fixed asset investment (Guo and Wu, 2020) and the scale of transferred-in farmland as the internal transmission mechanisms through which credit constraints impact the development quality of new agricultural business entities.

Control variable: Based on existing research, household characteristics, family characteristics, and operational characteristics (Wu, 2020; Xu et al., 2024; Qian and Li, 2020) are also key factors influencing the development quality of new agricultural business entities. The control variables selected in this study include four main aspects: head of household characteristics, family characteristics, farmland and operational characteristics, and regional characteristics. The variable definitions and descriptive statistical analyses are presented in Table 2.

4 Analysis of empirical results

4.1 Evaluation results and analysis of the development quality of new agricultural business entities

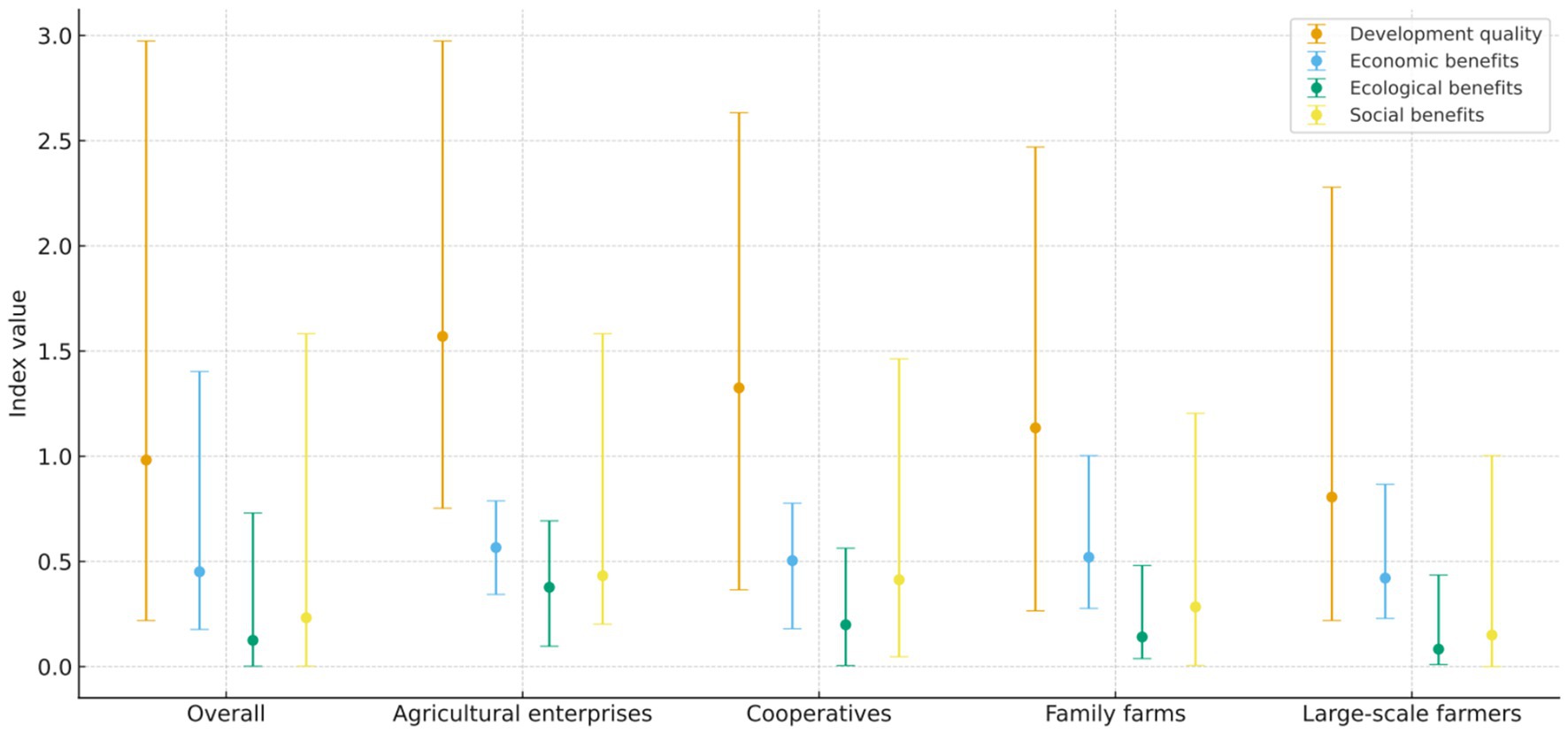

Figure 2 shows that the average development quality of grain-oriented new agricultural business entities in Jiangsu Province is 0.982, with only 44.57% exceeding this average. The highest score is 2.974, while the lowest is 0.219, indicating a significant gap of 2.755. This suggests that there is considerable room for improvement in their development quality, alongside notable disparities among them. Therefore, in the process of cultivating and developing these entities, it is essential to enhance their overall quality while addressing issues of regional imbalance and inadequacy, aiming to reduce the disparities among various types of new agricultural business entities. From the perspective of development quality across different types of entities, the order is as follows: agricultural enterprises > cooperatives > family farms > large-scale farmers. Agricultural enterprises excel across all dimensions, likely due to their comparative advantages and market competitiveness in areas such as production, operations, management, sales, and the extension of the industrial chain, resulting in a higher development quality compared to other types.

Figure 2. Evaluation results and analysis of the development quality of new agricultural business entities.

Analyzing from the perspective of various dimensions of benefits, economic benefits rank highest, followed by social benefits and ecological benefits, with mean values of 0.451, 0.232, and 0.125, respectively. This indicates significant potential for improvement in the ecological and social benefits of new agricultural business entities. In examining the benefits of different types of entities, family farms exhibit slightly higher economic benefits than cooperatives. However, cooperatives approach the social benefits of agricultural enterprises and significantly outperform family farms, demonstrating a strong social driving capacity. This can be attributed to two main factors: First, in 2019, Jiangsu Province conducted a special cleanup of cooperatives, leading to the elimination of numerous “shell cooperatives,” which in turn enhanced the overall social driving capacity of cooperatives in the region. Second, the inherent attributes of cooperatives contribute to their higher social benefits. Therefore, in the future, when the government cultivates and develops agricultural cooperatives, it should not only focus on their outreach and driving capacity but also emphasize the coordinated development of their economic and social benefits, thereby genuinely enhancing their social impact and achieving an increase in social benefits.

4.2 Empirical analysis based on benchmark regression

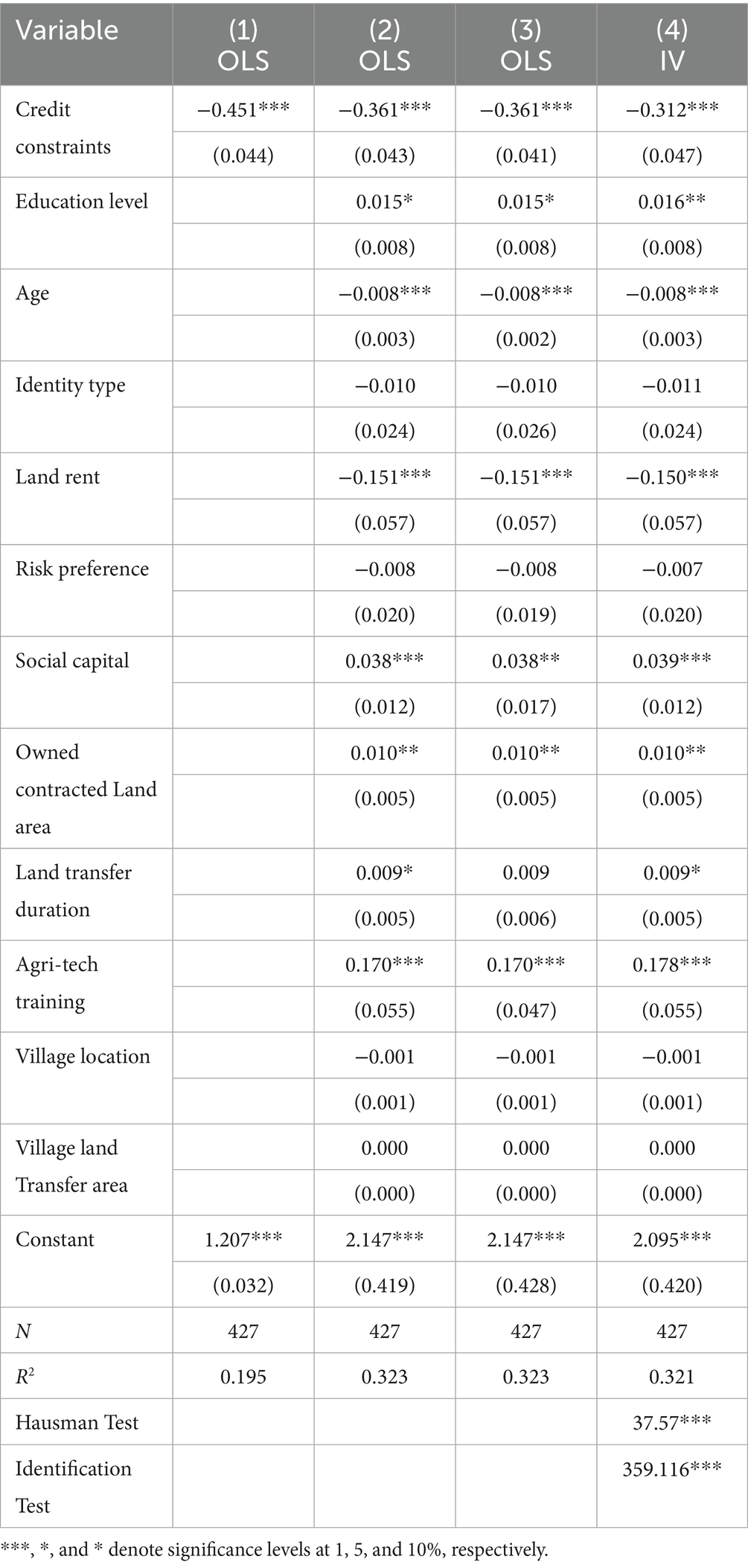

The benchmark regression results presented in Table 3 indicate that credit constraints have a significant negative impact on the development quality of new agricultural business entities, which is consistent with expectations. One possible reason is that new agricultural business entities facing credit constraints struggle to balance agricultural production input and efficiency, thereby affecting their investment decisions and deviating from optimal resource allocation, ultimately hindering the achievement of Pareto efficiency and reducing development quality. Furthermore, variance inflation factor (VIF) testing shows an average VIF of 1.18, well below the threshold of 10, indicating no severe multicollinearity issues in the model. Additionally, clustering standard deviation regression was employed to mitigate the impact of variance on the model results, further validating the robustness of the model specification. Given the potential for bidirectional causality, omitted variable bias, and unobserved variable endogeneity between credit constraints and the development quality of new agricultural business entities, this study addresses these issues by following the approach of Gao et al. (2022) using “the presence of a bank or credit union within 3 kilometers of the household’s community” as an instrumental variable for credit constraints. The instrumental variable regression results in Table 3 show that the Anderson LM statistic for identification is 359.116, which is significant at the 1% level, indicating no identification problems. Furthermore, the Kleibergen-Paap rk Wald F-value for the first stage is 276.166, also significant at the 1% level, suggesting that there are no weak instrument issues, as the F-value is well above 10. This confirms the validity of the instrumental variable selection and the reliability of the estimation results.

In the analysis of control variables, education level has a significant positive impact on the development quality of new agricultural business entities. This is primarily because higher educational levels reflect greater human capital, enabling better allocation and investment of agricultural production factors, thus enhancing development quality. Conversely, age shows a significant negative impact on development quality. This can be explained by the “declining physical ability effect” (Liao et al., 2019); as age increases, both physical capacity and learning ability tend to decrease, adversely affecting agricultural production engagement and limiting development quality. Land rental costs negatively affect the development quality of new agricultural business entities. Rising land costs can hinder economies of scale in farming operations and reduce investments in fixed assets such as machinery, buildings, and infrastructure (Xu et al., 2024), ultimately impeding agricultural modernization and development quality. Social capital also has a significant negative impact on development quality. This is likely because new agricultural business entities can leverage social capital to obtain external assistance and access better production information and resources (Gao et al., 2019), which can improve their overall development. Owned contracted land area is beneficial for enhancing development quality for two main reasons: first, a larger area lowers marginal land costs, facilitating economies of scale; second, with limited own capital, more owned land reduces land input costs, allowing for increased investment in other resources, thus improving development quality. Agricultural technology training positively influences development quality for two reasons: it provides critical information regarding production and management, and it enhances the internal development momentum of new agricultural business entities, thereby improving their development quality. The duration of land transfer rights positively impacts development quality, likely due to a “security effect”(Bradfield et al., 2023). Stable contracts provide assurance for future long-term investment returns, boosting confidence in expected agricultural investment returns, optimizing resource allocation, and improving development quality.

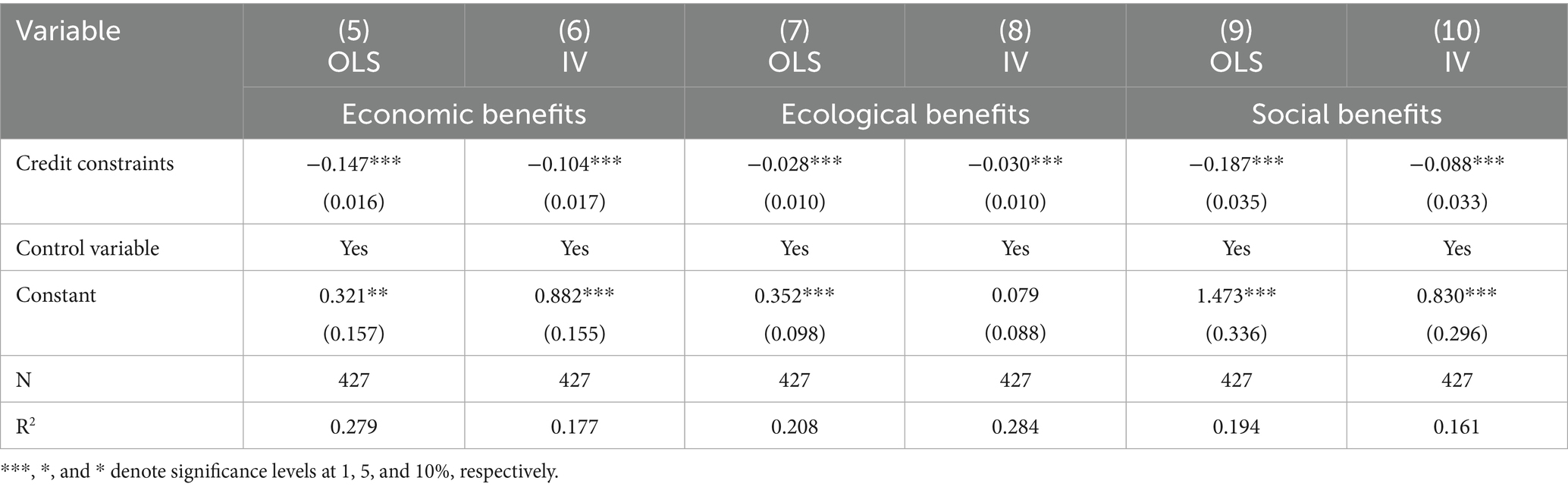

Additionally, Table 4 accurately shows the impact of credit constraints on the economic, ecological, and social benefits of new agricultural business entities. Model 6 indicates that credit constraints negatively affect economic benefits for two reasons: first, credit constraints inhibit optimal factor allocation. Entities facing credit constraints must forgo beneficial investment opportunities, adopting conservative production methods and reducing some input levels, thereby lowering economic benefits; second, credit constraints increase agricultural costs, limiting the expansion of cultivated land and hindering economies of scale, which raises production costs and reduces market negotiation power and procurement advantages, further affecting economic benefits. Model 8 demonstrates that credit constraints have a significant negative impact on ecological benefits. Sustainable agricultural production relies on green practices that require substantial investment. For instance, green land conservation practices are typically more costly, slower to show results, and have longer return periods than conventional fertilizers and pesticides, often leading to a “lemon market” problem. Thus, facing credit constraints may reduce land quality protection efforts, suppressing improvements in ecological benefits. Model 10 shows that credit constraints significantly negatively affect social benefits for two main reasons: first, when facing credit constraints and unable to meet agricultural investment needs with their own funds, entities tend to reduce labor costs; second, constrained entities will decrease investments in advanced agricultural equipment, diminishing spillover effects related to technology, knowledge, and demonstration, thereby reducing their social driving capacity.

Table 4. Model estimation results for the impact of credit constraints on various dimensions of development quality.

4.3 Mechanism examination

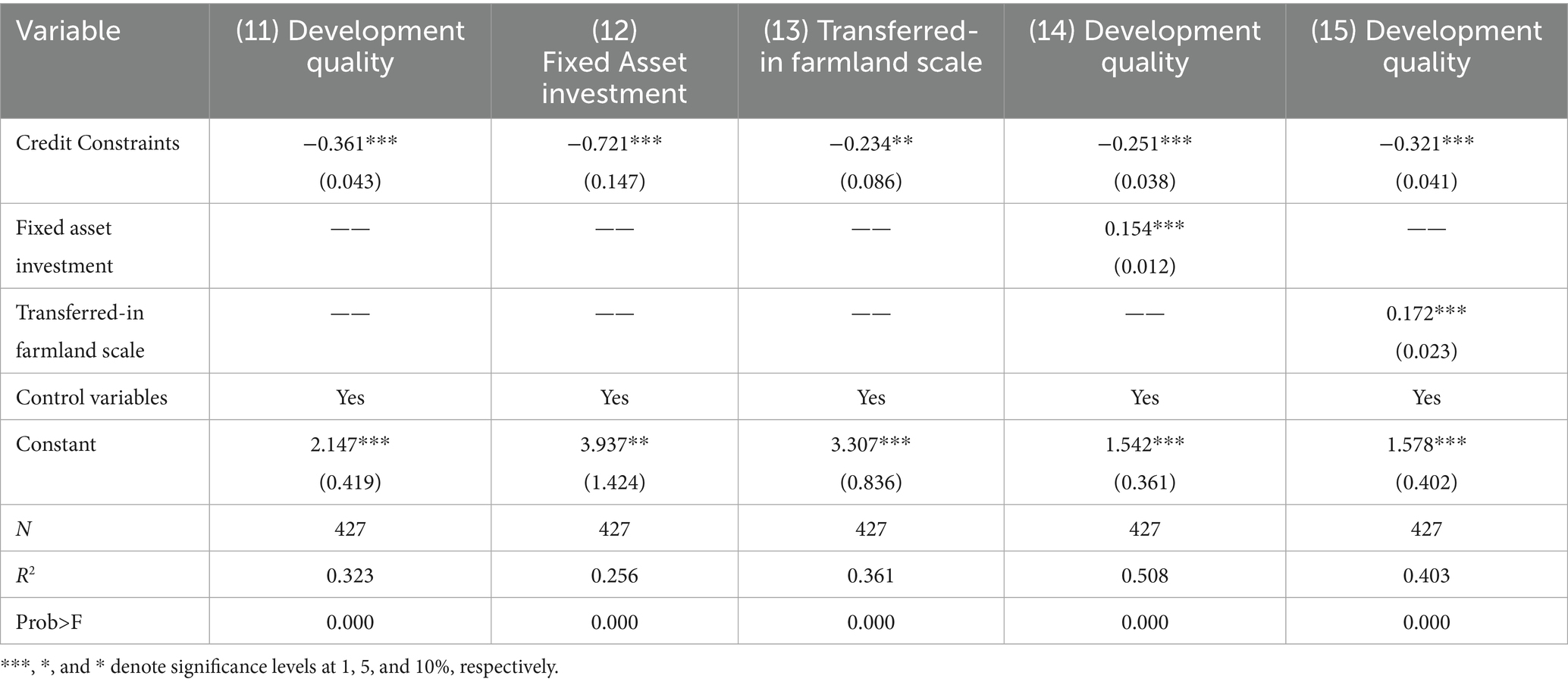

The preceding analysis indicates that credit constraints limit the improvement of development quality among new agricultural business entities. This section further explores the internal transmission mechanisms of how credit constraints affect development quality. As shown in Table 5, credit constraints have a significant negative impact on both the scale of transferred-in farmland and fixed asset investment. After incorporating the mediating variables, the negative influence of credit constraints on the development quality of new agricultural business entities remains significant. Additionally, both fixed asset investment and the scale of transferred-in farmland have a significant positive impact on development quality at the 1% level. Thus, the scale of transferred-in farmland and fixed asset investment exhibit partial mediating effects, with mediating effect values of 11.15 and 30.66%, respectively. This indicates that credit constraints affect development quality by suppressing the scale of transferred-in farmland and fixed asset investment. Consequently, hypotheses H2 and H3 are validated.

Table 5. Mechanism testing for the impact of credit constraints on development quality of new agricultural business entities.

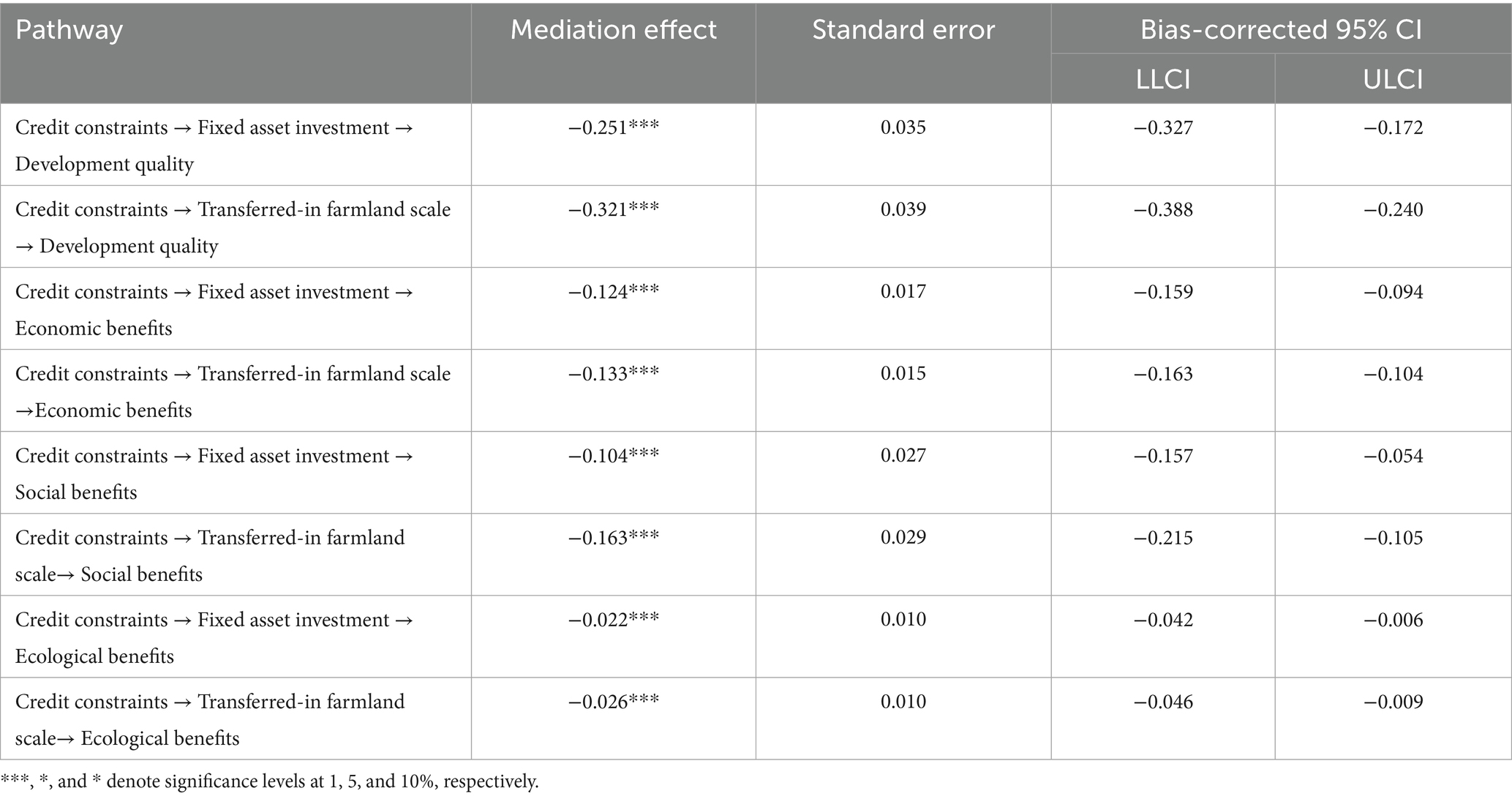

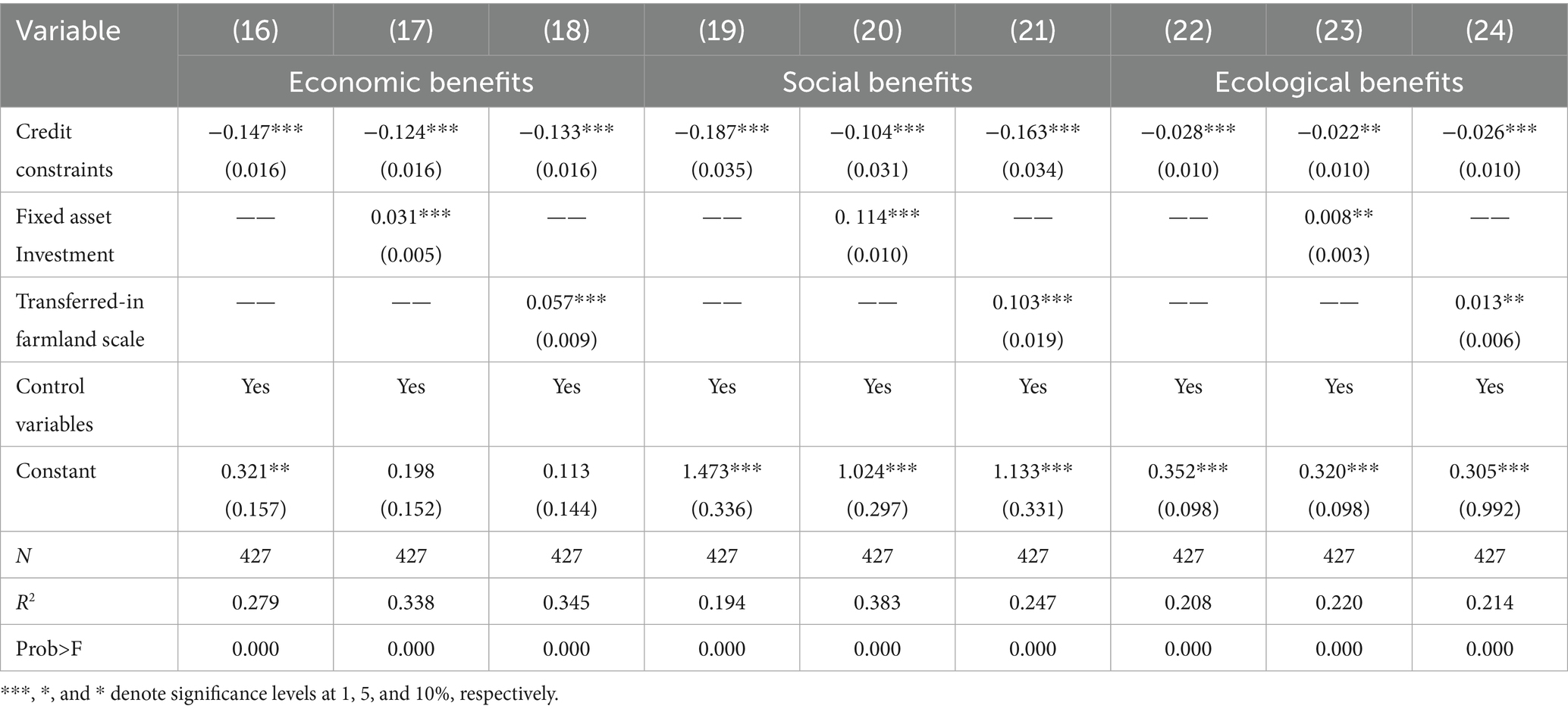

From the perspective of multidimensional benefits, the influence path of “credit constraints → fixed asset investment, the scale of transferred-in farmland → all dimensions of benefits for new agricultural business entities” remains valid. The mediating effect values of the scale of transferred-in farmland on economic, social, and ecological benefits are 9.64, 12.90, and 12.17%, respectively. Meanwhile, the mediating effect values of fixed asset investment on economic, social, and ecological benefits are 15.45, 44.03, and 21.24%, respectively. This indicates that credit constraints impact the enhancement of various dimensions of benefits by suppressing the scale of transferred-in farmland and fixed asset investment (see Table 6).

Table 6. Mechanism testing for the impact of credit constraints on various dimensional benefits of new agricultural business entities.

To test the robustness of the mediating effects, a bootstrap method was employed for re-estimation. The results in Table 7 indicate that in the impact of credit constraints on the development quality of new agricultural business entities and their various dimensions of benefits, the confidence intervals for both mediating variables—fixed asset investment and the scale of transferred-in farmland—do not include zero. This signifies that both fixed asset investment and the scale of transferred-in farmland have a significant negative mediating effect, indicating that the results are robust.

4.4 Robustness estimation

4.4.1 Propensity score matching (PSM) method

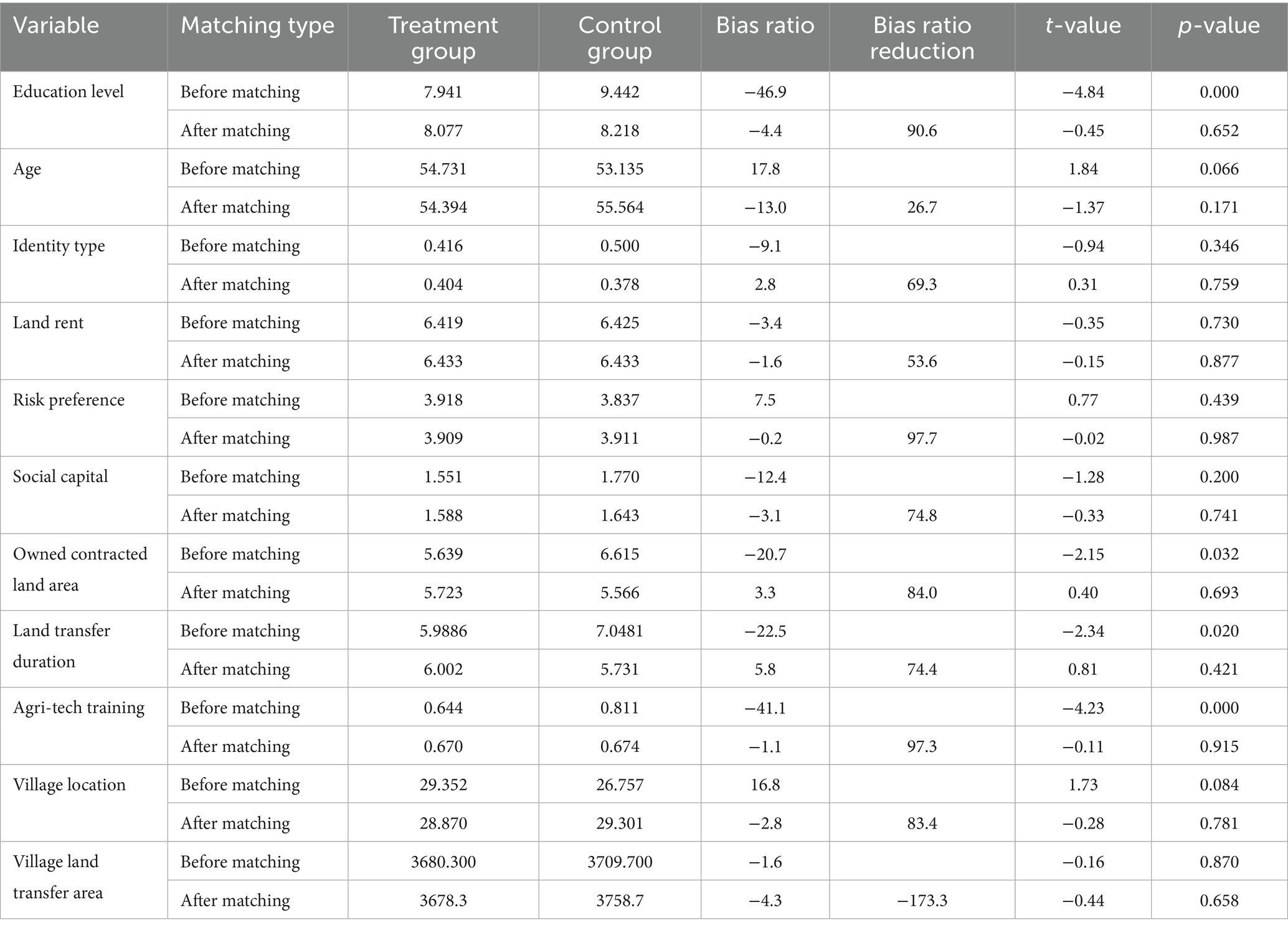

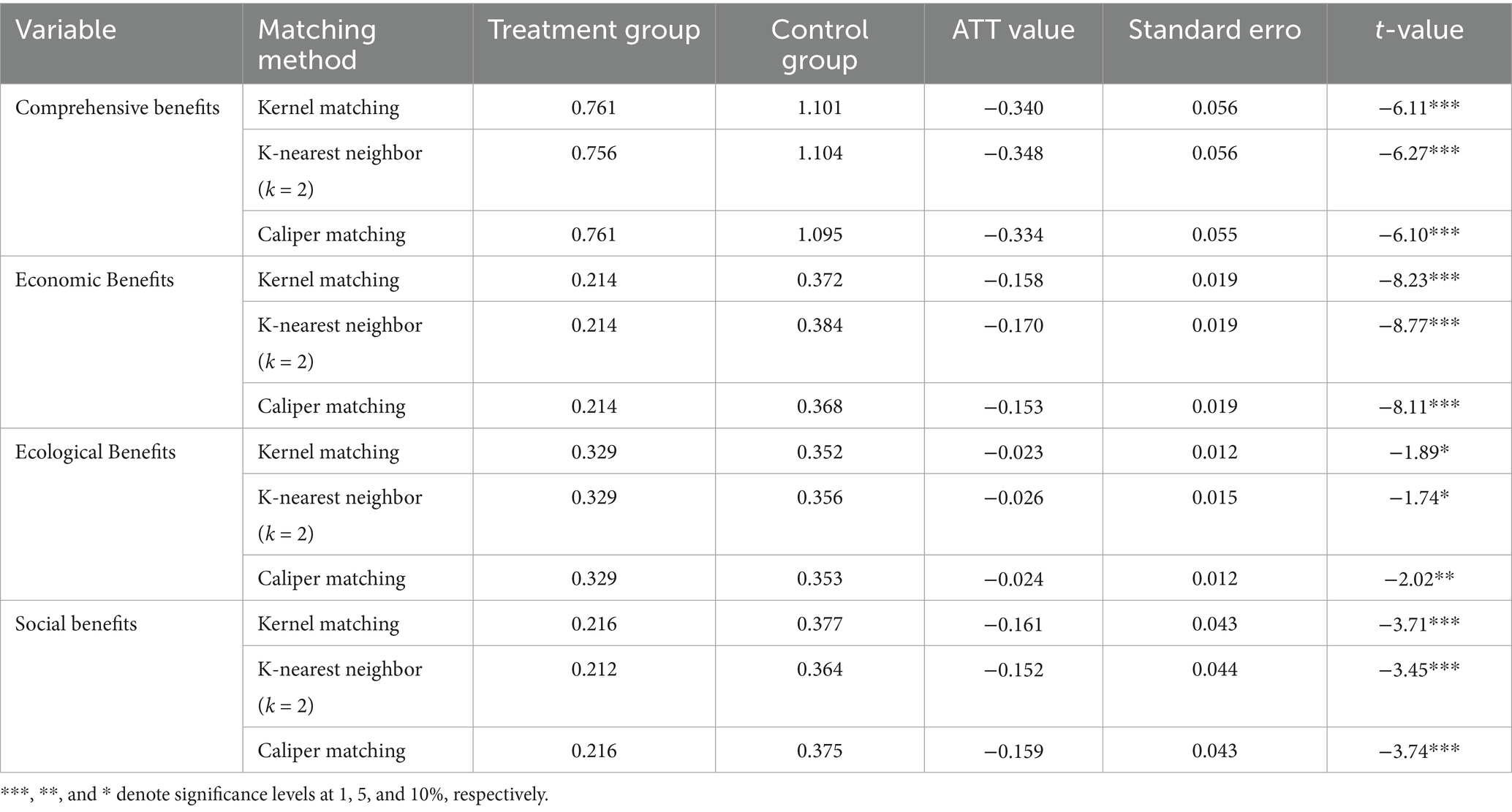

This study employs the Propensity Score Matching (PSM) model to further assess the robustness of the regression results. As shown in Table 8, the absolute values of the standard errors for all matched variables are less than 10, and there are no significant differences among all variables post-matching. This indicates that propensity score matching effectively reduces systematic differences between the two groups, demonstrating a good matching effect. The results of other matching methods are similar to those in Table 8, with good matching effects across all dimensions; therefore, they are not listed individually in this paper (Table 8).

This study employs three methods—kernel matching, K-nearest neighbor matching, and caliper matching—to estimate the average treatment effect of credit on the development quality of new agricultural business entities, with results presented in Table 9. The estimated average treatment effect on the treated (ATT) values using these three methods are −0.340, −0.348, and −0.334, all significant at the 1% level. Although the ATT values derived from different matching methods exhibit some variation, they remain highly consistent, indicating a strong and significant negative effect of credit constraints on the development quality of new agricultural business entities. From a multidimensional perspective, the ATT values are also significant, further confirming the substantial negative effect of credit constraints on the various dimensions of benefits for these entities. In summary, the conclusion that credit constraints inhibit the improvement of development quality and various dimensions of benefits for new agricultural business entities is robust.

Table 9. Average treatment effect of credit constraints on the development quality of new agricultural entities.

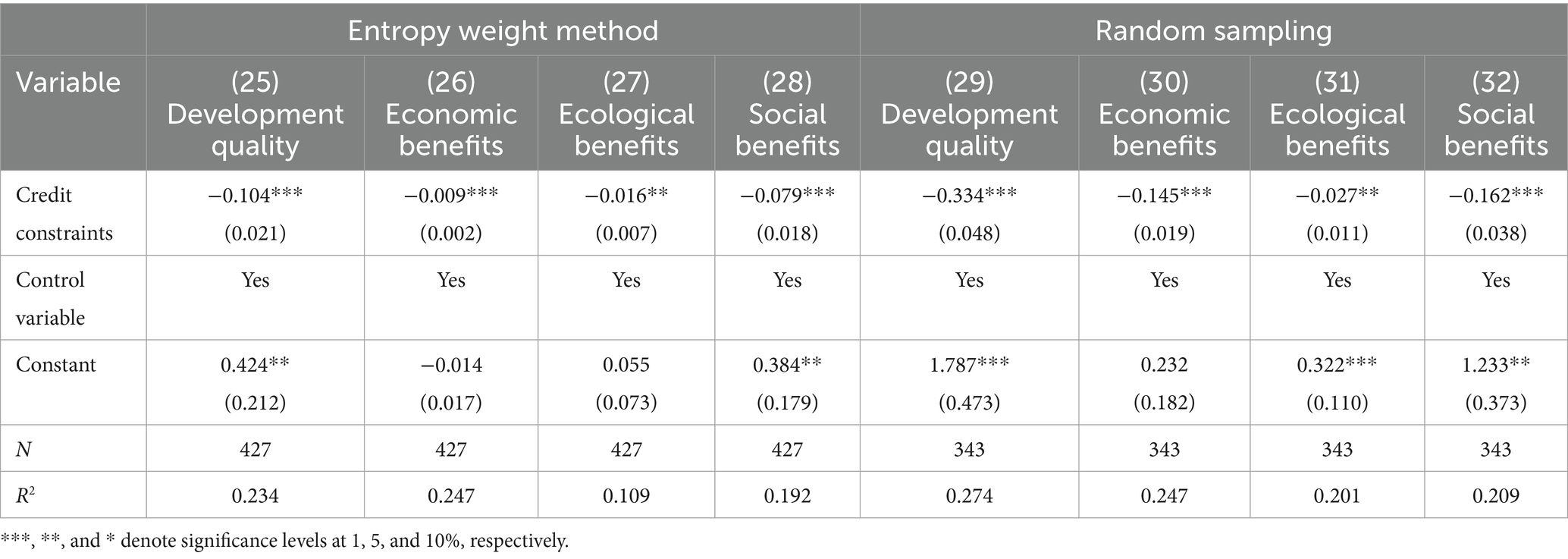

4.4.2 Testing by changing measurement methods and random sampling

To further establish the reliability of the regression results, this study first employs the entropy weight method to re-measure the development quality of new agricultural business entities. After replacing the dependent variable, the influence of credit constraints on development quality remains significant. Secondly, a random sample of 80% of the dataset was selected for re-regression, and the core variable continues to be significant at the 1% level. This strongly supports the conclusion that credit constraints inhibit the improvement of development quality and various dimensions of benefits for new agricultural business entities. All results are consistent with previous findings, further affirming the robustness of the research conclusions (Table 10).

5 Discussion

New agricultural business entities are crucial forces in promoting agricultural modernization and rural revitalization. However, their development requires substantial capital investment, and under conditions of limited collateral, high operational risks, and information asymmetry, they generally face severe credit constraints. These constraints create persistent capital bottlenecks that hinder improvements in development quality. Against this backdrop, this study not only responds to practical needs by exploring pathways to ease credit constraints, but also demonstrates methodological innovation. Specifically, the contributions of this study lie in two aspects. First, the theoretical perspective is broadened. Moving beyond the limitations of single-dimension performance measures, this study constructs an indicator system encompassing economic, social, and ecological benefits, and proposes a “credit constraints–factor inputs–development quality” framework that systematically uncovers the internal logic through which rural finance influences development via resource allocation. This framework addresses the complexity and multidimensionality of agricultural development and offers a new analytical perspective for future research. Second, the mechanism pathways are empirically identified. In addition to testing the direct effect of credit constraints, this study uses a mediation model to quantify the roles of fixed asset investment and the scale of transferred-in farmland, revealing their heterogeneous impacts across benefit dimensions. This approach refines mechanism identification and strengthens the robustness and applicability of the results, while also offering methodological value for related research. Building on these innovations, the empirical results of this study both align with and extend existing literature.

More specifically, this study shows that the development quality of new agricultural business entities still has room for improvement and displays clear heterogeneity, ranking agricultural enterprises > cooperatives > family farms > large-scale farmers. This is generally consistent with prior findings that agricultural enterprises hold clear advantages, while family farms and large-scale farmers are disadvantaged due to financing and risk-bearing constraints (Ruan et al., 2017; Tong and Li, 2022). The novelty lies in the finding that cooperatives demonstrate slightly lower economic benefits than family farms, in contrast to studies highlighting their advantages in scale management and market bargaining, reflecting deficiencies in cooperative governance efficiency and distribution mechanisms at the regional level (Deng et al., 2022; Zhang and Chen, 2024). Moreover, cooperatives demonstrate strong social benefits, ranking second only to agricultural enterprises and significantly above family farms, thereby enriching the understanding of their social function. The study also confirms that credit constraints significantly suppress development quality, consistent with Peng et al. (2025) and Cheng and Wei (2025). In contrast to earlier studies that relied on single indicators, this research draws on the “triple bottom line” framework to integrate credit constraints and development quality, and systematically assesses their impacts across economic, social, and ecological dimensions. This multidimensional approach reveals heterogeneous effects of credit constraints and overcomes the limitations of one-dimensional analyses. Finally, with respect to mechanisms, this study identifies the mediating roles of fixed asset investment and the scale of transferred-in farmland, consistent with Zhou and Chen (2020), Chen and Yan (2020), and Li and Qian (2022) on the pivotal role of rural finance in resource allocation. Crucially, it further quantifies their differential contributions across dimensions, thereby deepening the understanding of mechanisms. By extending the analysis to comparative research across heterogeneous entities, the study also resonates with Li and Yu (2020)’s macro-level framework of development quality while enhancing explanatory power through micro-level differentiated comparisons. Collectively, the findings not only validate and extend existing research but also provide references for developing countries facing financing constraints, underdeveloped land transfer systems, and high operational risks, helping them alleviate credit bottlenecks, optimize resource allocation, and improve development quality.

Nevertheless, several limitations should be acknowledged. First, the data are drawn exclusively from Jiangsu Province. While representative, they cannot fully reflect conditions in diverse geographic regions; future research should extend to a national scale and consider the heterogeneity of different landforms. Second, the analysis is based on cross-sectional data, which can reveal correlations but not dynamic processes or causal sequencing. Longitudinal or panel data would allow for stronger identification of long-term effects. Third, due to data limitations, some potentially more informative indicators could not be included. Future research should therefore integrate multidimensional and multi-source big data. Despite these limitations, this study provides valuable theoretical and empirical insights, offering both academic and practical implications for optimizing rural financial policies and advancing high-quality agricultural development.

6 Conclusion and recommendations

Drawing on survey data from 427 grain-oriented new agricultural business entities in Jiangsu Province, this study develops a theoretical framework of “credit constraints–factor input–development quality” to uncover the internal mechanisms through which credit constraints affect development quality. The findings indicate that: (1) there is considerable room for improvement in the development quality of new agricultural business entities, with substantial heterogeneity across types; (2) credit constraints exert significant negative effects on development quality as well as on economic, social, and ecological benefits; and (3) credit constraints indirectly inhibit development quality through two key transmission channels: the scale of transferred-in farmland (mediating effect of 11.15%) and fixed asset investment (mediating effect of 30.66%). Fixed asset investment exerts the stronger effect, particularly in enhancing social benefits (44.03%), whereas the scale of transferred-in farmland generates relatively balanced negative effects across economic (12.90%), social (9.64%), and ecological (12.17%) benefits.

Based on these findings, several policy recommendations are proposed. First, enhance access to credit and reduce financing constraints. Building on the No. 1 Central Document on improving rural financial services, further innovations in credit products and services are required. Specifically, reliance should be placed on agricultural credit instruments such as Jiangsu’s Sunong Loan, directly linking the credit ratings of new agricultural business entities with the risk compensation fund to provide differentiated credit support for entities with low development quality and high financing demand. Additionally, in cooperation with local rural credit cooperatives, the Agricultural Bank of China, and other financial institutions, a regular financial training mechanism should be established to enhance the financing capacity and financial literacy of these entities, thereby addressing financing difficulties and reducing financing costs at the source. Second, improve land transfer systems and supporting agricultural infrastructure. By promoting performance guarantee insurance for land transfer and incorporating it into the central government’s agricultural insurance premium subsidy program, a “post-output rent payment” model can be achieved, alleviating the financial pressure during the early stages of large-scale operations. In addition, coordination between agricultural machinery subsidies and credit support should be strengthened, and special credit products should be developed to support machinery and supporting infrastructure investment. Third, introduce market mechanisms to upgrade agricultural infrastructure. Ensure that industrial capital can achieve reasonable returns on investments in rural infrastructure, thereby attracting more investment in agricultural infrastructure. This will support rural revitalization, alleviate financial pressures on both the government and new agricultural business entities, and enhance the quality of agricultural infrastructure in rural areas.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Ethics statement

Ethical approval was not required for the studies involving humans because Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

LC: Conceptualization, Investigation, Methodology, Project administration, Writing – original draft. PH: Data curation, Investigation, Writing – review & editing. WZ: Conceptualization, Visualization, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by the Research Start-up Fund of China West Normal University (Grant No. 493201).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51, 1173–1182. doi: 10.1037/0022-3514.51.6.1173 (1986)

Boucher, S. R., Guirkinger, C., and Trivelli, C. (2009). Direct elicitation of credit constraints: conceptual and practical issues with an application to Peruvian agriculture. Econ. Dev. Cult. Change 57, 609–640. doi: 10.1086/598763

Bradfield, T., Butler, R., Dillon, E. J., Hennessy, T., and Loughrey, J. (2023). The impact of long-term land leases on farm investment: evidence from the Irish dairy sector. Land Use Policy 126:106553. doi: 10.1016/j.landusepol.2023.106553

Chen, Z., Meng, Q., Xu, R., Guo, X., and Cai, C. (2022). How rural financial credit affects family farm operating performance: an empirical investigation from rural China. J. Rural. Stud. 91, 86–97. doi: 10.1016/j.jrurstud.2022.03.003

Chen, Z., and Yan, H. (2020). Rural finance and infrastructure construction——an empirical analysis based on propensity score matching. J Agrotech Econ, 11, 43–55. doi: 10.13246/j.cnki.jae.2020.11.004

Chen, Z., and Zhang, Y. (2022). Has rural finance promoted the agriculture large-scale operation in China: based on the survey data of two national family farm demonstration bases. Issues Agric. Econ. 5, 83–97. doi: 10.13246/j.cnki.iae.20220509.002

Cheng, L., Cui, Y., Duan, K., and Zou, W. (2022). The influence of new agricultural business entities on farmers’ employment decision. Land 11:112. doi: 10.3390/land11010112

Cheng, L., and Wei, Z. (2025). Research on the impact of debt financing on the production performance of large-scale grain producers. Rural Economy. 4, 137–145. doi: 10.26957/j.cnki.cn51-1029/f.2025.04.011

Cheng, L., and Zou, W. (2022). Can contract stability improve farmland quality protection behaviors on family farms?—based on spatial econometric analysis. J. Southwest Univers. 48, 107–119. doi: 10.13718/j.cnki.xdsk.2022.02.010

Cheng, L., Zou, W., and Duan, K. (2021). The influence of new agricultural business entities on the economic welfare of farmer’s families. Agriculture 11:880. doi: 10.3390/agriculture11090880

Deng, H., Kong, L., and Liao, X. (2022). The essence of cooperatives and policy reflection. China Rural Survey. 3, 32–48.

Gao, Y., Liu, B., Yu, L., Yang, H., and Yin, S. (2019). Social capital, land tenure and the adoption of green control techniques by family farms: evidence from Shandong and Henan provinces of China. Land Use Policy 89:104250. doi: 10.1016/j.landusepol.2019.104250

Gao, X., and Luo, X. (2023). Theoretical development of macroeconomic expectation farmers cooperatives: development logic, practical challenges and optimization paths. Soc. Sci. Front. 2, 58–65.

Gao, N., Ma, Y., and He, Q. (2022). Demand for financing, credit constraints and fraud victimisation. J. World Econ. 45, 134–161. doi: 10.19985/j.cnki.cassjwe.2022.04.005

Guo, X., and Wang, D. (2022). The evaluation and analysis of family farm development quality in China. J. Huazhong Agric. Univers. 3, 22–35. doi: 10.13300/j.cnki.hnwkxb.2022.03.003

Guo, X., and Wu, F. (2020). Operation scale, credit availability and fixed asset investment of family farms. Economic Review Journal. 7, 92–105+2. doi: 10.16528/j.cnki.22-1054/f.202007092

He, J., and Xiong, X. (2014). The family farm performance evaluation: institutional arrangements or environmental compatibility. Reform. 8, 100–107.

Hu, K., Huo, L., and Kong, R. (2022). Cultivation of new agricultural business entities: policy evolution and practical response. Research on Economics and Management. 43, 94–107.

Jiang, W., and Li, L. (2015). Financing model innovation of new agricultural management entities under the background of internet banking in China. Finance Econ. 8, 1–12.

Kong, X., and Zhou, Z. (2020). The development of new agricultural management entities must break through the institutional obstacles. Hebei Acad. J. 40, 110–117.

Kuang, X. (2021). Family farm: management level measurement and influence factor research. Jianghan Tribune. 9, 78–83.

Li, Y., and Qian, Z. (2022). How does the efficiency of family farms be improved by relaxing credit constraints: empirical analysis based on survey data of family farms from Songjiang district, Shanghai. J Agrotech Econ. 11, 65–77. doi: 10.13246/j.cnki.jae.2022.11.008

Li, K., Shi, L., and Zhang, H. (2024). The influence of the development of new agricultural business entities on the intensity of agricultural carbon emission: "carbon reduction effect" or "carbon lncrease effect". J Agrotech Econ. 11, 51–73. doi: 10.13246/j.cnki.jae.20240905.001

Li, D., and Yu, X. (2020). Construction and measurement of the evaluation system for the development of new agricultural management entities. Econ. Rev. J. 2, 113–120. doi: 10.16528/j.cnki.22-1054/f.202002113

Li, X., and Zeng, F. (2015). Comprehensive evaluation index system of family farm and its design: a case study of Hunan province. J. Hunan Univers. Sci. Technol. 18, 79–85. doi: 10.13582/j.cnki.1672-7835.2015.06.015

Liang, Q., Han, Z., and Liu, W. (2024). Is the development of new agricultural business entities inclusive of smallholder farmers. Econ. Theory Business Manage. 44, 37–56.

Liao, X., Deng, H., and Shen, G. (2021). On the high-quality development mechanism of farmers' cooperatives. J. Nanjing Agric. Univers. 21, 148–158. doi: 10.19714/j.cnki.1671-7465.2021.0030

Liao, L., Long, H., Gao, X., and Ma, E. (2019). Effects of land use transitions and rural aging on agricultural production in China’s farming area: a perspective from changing labor employing quantity in the planting industry. Land Use Policy 88:104152. doi: 10.1016/j.landusepol.2019.104152

Peng, P., Zhu, L., and Luo, J. (2025). How does digital finance affect the resilience of family farms: taking planting family farms as an example. Chinese Rural Economy. 4, 146–165. doi: 10.20077/j.cnki.11-1262/f.2025.04.016

Qian, Z., and Li, Y. (2020). The values and influence factors of family farms' efficiency. Journal of Management World 36, 168–181+219. doi: 10.19744/j.cnki.11-1235/f.2020.0060

Ren, Z., and Xue, X. (2018). Empirical evaluation of the efficiency of family farm development——based on 541 family farms in Shandong. J Agrotech Econ. 3, 56–65. (in Chinese). doi: 10.13246/j.cnki.jae.2018.03.005

Ruan, R., Cao, B., Zhou, P., and Zhen, F. (2017). The driving capacity of new agricultural management entities and its determinants: an analysis based on data from 2615 new agricultural management entities in China. Chin. Rural Econ. 11, 17–32. doi: 10.20077/j.cnki.11-1262/f.2017.11.002

Song, H., Shi, B., and Wu, B. (2020). The new agricultural business entities: basic characteristics, financing needs and policy implications. Rural Economy. 10, 73–80.

Tong, G., and Li, W. (2022). A comparative study on the production efficiency of new agricultural business entities: evidence from maize growers in four provinces. Dongyue Tribune 43, 140–147. doi: 10.15981/j.cnki.dongyueluncong.2022.04.017

Wang, Y., Gao, Q., and Gou, L. (2014). If the rural financial support promotes the new agricultural management subject cultivation——theoretical model and empirical test. Financial Econ. Res. 29, 89–99.

Wang, J., Xiao, Q., and Li, J. (2018). Financing predicament and countermeasure of new agricultural proprietors. Issues Agric. Econ. 2, 71–77. doi: 10.13246/j.cnki.iae.2018.02.008

Wu, F. (2020). Technical efficiency measurement and influence factor analysis of family farm based on SFA. J. Huazhong Agric. Univers. 6, 48–56+162-163. doi: 10.13300/j.cnki.hnwkxb.2020.06.006

Xiang, J., Tan, S., Tan, X., Long, J., Xiao, T., and Wang, W. (2022). Spatiotemporal assessment of water security in the Dongting Lake region: insights from projection pursuit method and sparrow search algorithm. J. Clean. Prod. 378:134447. doi: 10.1016/j.jclepro.2022.134447

Xu, Y., Huo, Y., and Guo, X. (2024). Relationship of arable land scale and high-quality development of farmers’ cooperatives: evidence from grain production cooperatives in China. Sustainability 16:2389. doi: 10.3390/su16062389

Yan, Y., Zhang, H., and Zhang, M. (2024). Study on the impact of digital financial inclusion on low-carbon agricultural development in Guizhou province——empirical analysis based on two-way fixed effects model and mediated effects model. Procedia Comput. Sci. 242, 428–435. doi: 10.1016/j.procs.2024.08.164

Yang, D., and Tang, Y. (2019). Performance and rating of farmers' cooperatives from the perspective of collusion. J Agrotech Econ. 3, 75–86. doi: 10.13246/j.cnki.jae.20181010.002

Zhang, L., and Chen, T. (2024). Theoretical foundation and practical pathways of new quality agricultural productive forces empowering high quality development of farmers' specialized cooperatives. Agric. Econ. Manag. 6, 24–36.

Zhang, L., Yuan, W., and Chen, T. (2025). Reshaping the close interest linkage mechanism between new agricultural businesses and smallholder farmers: a case study of Xiao qiao dian village, bin Chuan county, Yunnan province. Issues Agric. Econ. 4, 64–79. doi: 10.13246/j.cnki.iae.20250226.001

Zhou, Y., and Chen, H. (2020). Research on the governance effect of scale farmers' debt financing. J Agrotech Econ. 10, 48–60.

Keywords: credit constraints, development quality, fixed asset investment, the scale of transferred-in farmland, projection pursuit model

Citation: Cheng L, Han P and Zou W (2025) Impact of credit constraints on the development quality of new agricultural business entities: evidence from Jiangsu Province, China. Front. Sustain. Food Syst. 9:1641946. doi: 10.3389/fsufs.2025.1641946

Edited by:

Siphe Zantsi, Agricultural Research Council of South Africa (ARC-SA), South AfricaReviewed by:

Walter Shiba, Agricultural Research Council of South Africa (ARC-SA), South AfricaWeiyi Ju, Wenzhou University of Technology, China

Copyright © 2025 Cheng, Han and Zou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lingjuan Cheng, MjAxOTIwOTAxN0BuamF1LmVkdS5jbg==

Lingjuan Cheng

Lingjuan Cheng Pengju Han2

Pengju Han2