- 1Chinese Academy of Agricultural Sciences Institute of Agricultural Economics and Development, Beijing, China

- 2Agricultural Information Institute of CAAS, Beijing, China

Narrowing the urban–rural income gap in a sustainable and inclusive manner remains a longstanding concern in development economics. This study investigates how entrepreneurial activity can contribute to narrowing the urban–rural income gap in China, with a focus on technological spillovers and structural transformation. Drawing on a county-level panel dataset from 2000 to 2022, we apply a Double Machine Learning (DML) framework for causal inference. The empirical results show that entrepreneurship significantly reduces the urban–rural income gap, and the findings are robust to a series of validity checks. Mechanism analysis reveals two key pathways through which entrepreneurship helps narrow the income gap. First, it enhances resource allocation efficiency via knowledge and technology spillovers. Second, it promotes industrial upgrading in rural areas. Heterogeneity analysis shows that the effects are particularly pronounced in central and western regions. Across industries, labor-intensive entrepreneurship exerts the strongest equalizing effect, while technology-intensive sectors rely more on spillover channels. The impact of resource-intensive entrepreneurship is comparatively weaker and may be accompanied by negative externalities. This study provides novel empirical evidence on how entrepreneurship can support coordinated urban–rural development and informs the design of regionally and sectorally differentiated innovation policies.

1 Introduction

Income inequality remains a persistent and intensifying global challenge. According to the World Bank’s latest estimates, approximately 44% of the world’s population in 2024 lived on less than $6.85 per day, with 8.5% falling below the extreme poverty line of $2.15 (World Bank, 2024). Among various dimensions of inequality, the urban–rural income gap is particularly salient. In developing countries, internal inequality is primarily driven by urban–rural disparities, which manifest across income, consumption, and a range of non-monetary indicators (Lagakos, 2020).

As the world’s largest developing country, China has experienced rapid economic growth since the launch of its reform and opening-up policies. However, this growth has been accompanied by a widening urban–rural income gap. In 2009, the ratio of urban to rural per capita income peaked at 3.33:1 and declined to 2.56:1 by 2021. Nonetheless, this figure remains significantly higher than the widely acknowledged “alert threshold” of 1.7 (Wang Z, et al., 2024), underscoring the severity of the imbalance. Persistent urban–rural disparities not only hinder coordinated economic development but may also give rise to social risks. In countries such as Chile and Argentina, urban–rural polarization has contributed to economic stagnation, social unrest, and even political crises (Goh and Law, 2023). In China, a widening income gap between urban and rural residents has likewise suppressed rural consumption, discouraged agricultural labor participation, and ultimately undermined improvements in social efficiency (Hu et al., 2023).

To address this structural divide, entrepreneurship-driven development has gained increasing policy attention (Mao et al., 2025; Weng and Wang, 2025). China’s 14th Five-Year Employment Promotion Plan explicitly identifies return-home entrepreneurship as a new engine of income growth for rural residents. It aims to create over 55 million new urban jobs by 2025, with counties positioned as key spaces for integrated entrepreneurship and employment development. According to data from the Ministry of Agriculture and Rural Affairs, more than 12.2 million rural residents had returned to start businesses by the end of 2022, with the number projected to exceed 15 million by 2025 (Wang Y, et al., 2024). Existing research suggests that entrepreneurship plays a vital role in poverty alleviation (Li F, et al., 2023; Sutter et al., 2019), enhancing rural economic dynamism and household income through employment creation, innovation, and investment stimulation (del Olmo-García et al., 2023; Kademani et al., 2024) However, some scholars caution that entrepreneurial gains tend to concentrate among resource-advantaged groups, potentially exacerbating inequality and offering limited benefits to the poorest populations (Ihou and Mansingh, 2025; Matos and Hall, 2020), with questionable impacts on sustained economic growth (Alvarez and Barney, 2014). These findings point to the context-dependent and potentially uncertain nature of entrepreneurship’s distributional effects.

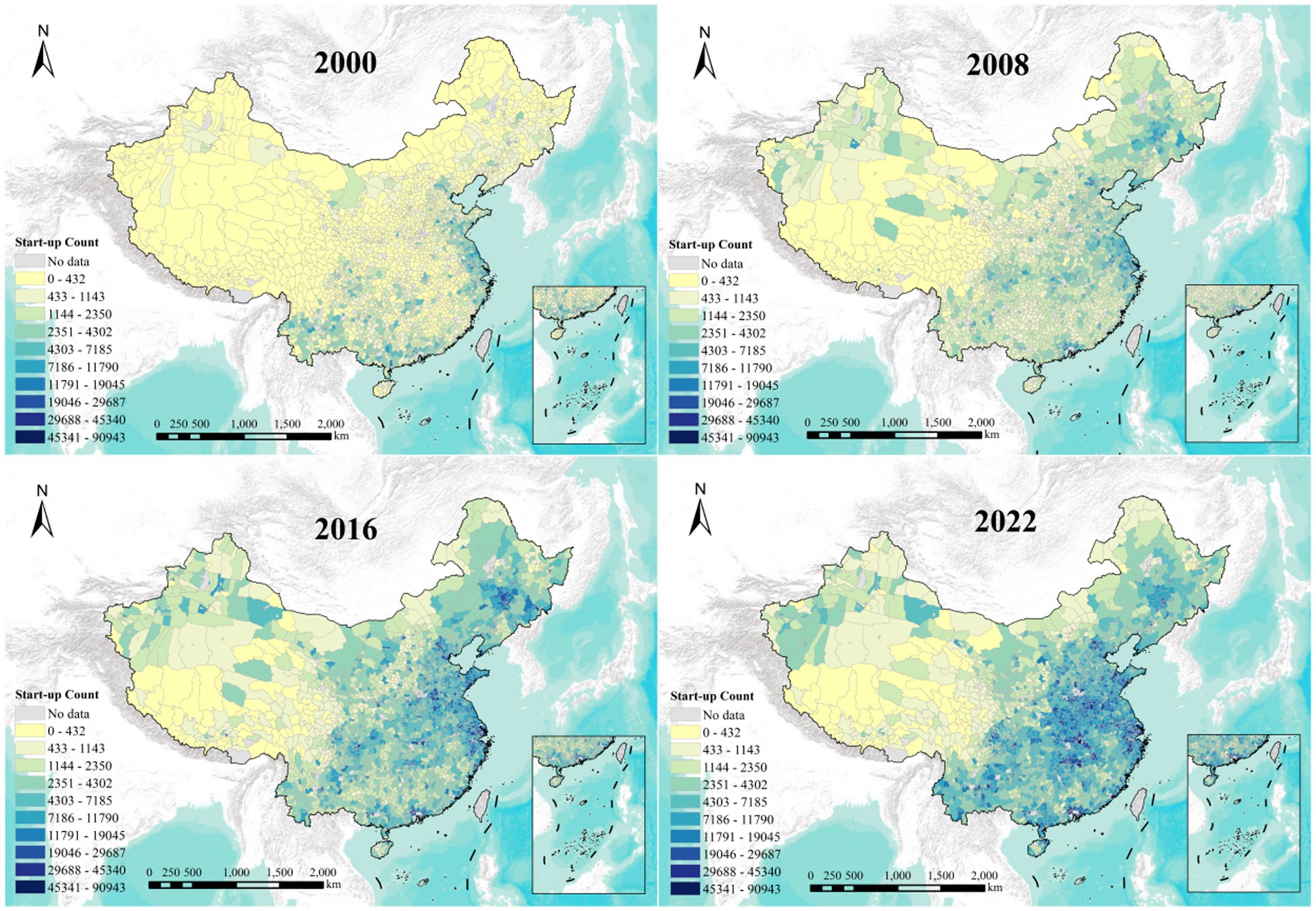

To better contextualize the evolving landscape of entrepreneurial activity in China, Figure 1 presents the spatial distribution of newly registered enterprises across Chinese counties in 2000, 2008, 2016, and 2022. The maps illustrate a pronounced increase in the number and spatial clustering of new enterprises, particularly in the eastern and coastal regions, reflecting significant regional disparities in entrepreneurial intensity.

Figure 1. Spatial distribution of newly registered enterprises in China’s counties. The map file is sourced from the national platform for common geo spatial information services, map review number GS(2024)0650, the base map has not been modified.

Overall, existing evidence on whether entrepreneurship helps reduce the urban–rural income gap remains inconclusive. Most studies focus on entrepreneurship’s impact on aggregate growth, employment, or individual income, but offer limited insight into its role in promoting urban–rural integration—especially at the county level in China. Empirical studies that explicitly address the urban–rural income gap often rely on provincial-level data or qualitative analysis (Lin et al., 2020; Si et al., 2015). From a methodological standpoint, most prior work is grounded in conventional linear regression models, which may fail to capture nonlinear relationships in long panel datasets and are prone to model misspecification or weak estimation robustness (Yang et al., 2020).

In light of these limitations, this study addresses the following core questions: Can entrepreneurship effectively narrow the urban–rural income gap in China? What are the mechanisms through which it operates? Do its effects vary across regions or population groups? To answer these questions, we construct a county-level panel dataset covering 1,517 counties in China from 2000 to 2022 and adopt a double machine learning (DML) framework for causal inference. This approach allows for valid estimation of treatment effects under high-dimensional controls while accommodating both nonlinear and heterogeneous impacts.

The contributions of this study are twofold. First, from a conceptual standpoint, this research adopts a “county-level entrepreneurship and urban–rural income disparity” framework, utilizing long-term county-level panel data to examine how entrepreneurial activities influence income inequality and the underlying mechanisms at play. It also provides a nuanced analysis of various heterogeneous contexts, thereby addressing gaps in the existing literature related to the scale and scope of previous research. Second, in terms of methodology, this study employs the innovative DML approach for causal inference. By effectively controlling for high-dimensional covariates and mitigating endogeneity bias through cross-fitting, this method overcomes the limitations of traditional linear regression models, thus addressing the shortcomings in methodological tools employed by existing studies. The empirical findings reveal that, while entrepreneurship helps reduce the urban–rural income gap, its effects are highly heterogeneous. Specific attention must be paid to the over-competition and farmer marginalization in eastern regions. Policies should focus on stabilizing wage guarantees in labor-intensive industries and strengthening ecological compensation mechanisms to ensure that industrial growth is harmonized with sustainable environmental practices.

The structure of this study is as follows. Section 2 provides a review of the relevant literature. Section 3 presents the theoretical analysis and research hypotheses. Section 4 outlines the research design, including data sources and variable definitions. Section 5 reports the empirical results. Section 6 provides further analysis based on the findings. Section 7 concludes the study and offers policy recommendations.

2 Literature review

2.1 Literature on entrepreneurial activity

Entrepreneurs are key drivers of economic vitality. Entrepreneurial activity not only creates employment opportunities by establishing new businesses but also significantly affects labor demand elasticity and the scale of regional employment (Beaudry et al., 2018). Entrepreneurial decisions are primarily influenced by individual endowments. A large-scale study from the United States reveals that successful entrepreneurs are more likely to be middle-aged rather than young, suggesting that accumulated work experience, industry knowledge, and social networks better explain the probability of success in high-growth entrepreneurship than youth alone (Azoulay et al., 2020). More importantly, entrepreneurship is not merely a function of individual talent or effort; it is deeply embedded in class-based capital acquired at birth—wealth, networks, and cultural dispositions—all of which jointly determine who can successfully launch a business and who is forced to withdraw (Brändle et al., 2025). Entrepreneurship is an expensive experiment in which the majority of ventures fail, and only a few yield extraordinary returns. Effective financial arrangements can lower the cost of trial and error and improve the likelihood of success (Kerr et al., 2014). A quasi-experiment from a Nigerian business plan competition shows that sufficient start-up capital significantly increases business survival (McKenzie, 2017), while extended loan maturities can raise long-term profits but are associated with higher default risks (Field et al., 2013). Evidence from the United States also suggests that although the average exit payoff for entrepreneurs may appear substantial, the high probability of failure greatly undermines the expected return (Hall and Woodward, 2010).

The institutional and policy environment plays a crucial role in shaping the spatial distribution and economic outcomes of entrepreneurial activity (Guzman and Stern, 2020). For example, supported by the US government’s Office of Scientific Research and Development (OSRD), the United States succeeded in building nationwide technology clusters, accompanied by sustained growth in high-tech entrepreneurship and employment (Gross and Sampat, 2023). China’s rapid economic growth since the reform and opening-up period has similarly been driven to a large extent by the rise of township and village enterprises—essentially entrepreneurial initiatives led by farmers and local organizations—which have contributed significantly to poverty reduction, increased consumption, and GDP growth (Huang, 2012). Subsequent studies further reveal that entrepreneurship enhances common prosperity in rural areas through credit support, government subsidies, and social networks, with the strongest effects observed in resource-concentrated and relatively poor counties. Development-oriented and value-driven enterprises are especially effective in promoting employment among low-income households, and the poverty-alleviation impact is further amplified when entrepreneurship training is combined with tax incentives, credit policies, and industrial support programs (Wang Y, et al., 2024; Yang et al., 2025). Meanwhile, land tenure clarification, digital infrastructure construction, and internet accessibility have effectively reduced information and transaction costs, increased entrepreneurial participation, and boosted new business registrations, thereby injecting new momentum into rural entrepreneurship (Cheng et al., 2024; Guo J, et al., 2024; Qing and Chen, 2024; Vargas-Zeledon and Lee, 2024).

2.2 Determinants of the urban–rural income gap

The formation and evolution of the urban–rural income gap are primarily shaped by the level of economic development, which establishes the fundamental structure of income disparities. While overall economic growth tends to raise household income levels, it does not necessarily narrow the income gap between urban and rural areas. In certain regions and developmental phases, economic expansion may even exacerbate existing disparities (Wang Z, et al., 2024). Urban-led growth often concentrates capital, resources, and technology in cities, thereby increasing urban incomes but widening the gap relative to rural residents. Only when urban development reaches diminishing marginal returns and factor spillovers begin to reach rural areas does income convergence become possible (Yan et al., 2025). In terms of human capital, the unequal distribution of educational resources reinforces the urban–rural divide through disparities in skill accumulation. The persistent lack of quality education in rural areas limits labor mobility into high–value-added sectors, thereby entrenching income inequality (Xia et al., 2024; Zhang et al., 2025). Technological and financial conditions also exert divergent effects on the income gap, contingent upon local development stages. The digital economy has the potential to enhance skill premiums, accelerate industrial upgrading, and lower market entry barriers for rural residents; yet, in regions with poor digital infrastructure and limited human capital, it may instead deepen the “digital divide” (Dou et al., 2025; Li et al., 2024). In the early stages of financial development, credit resources often flow disproportionately to urban areas, restricting rural access to financing and further widening income disparities. However, once financial systems reach a critical threshold, inclusive finance policies and financial technologies can mitigate spatial imbalances by facilitating credit flows into rural markets, thereby fostering income convergence (Sun and Tu, 2023). The expansion of financial inclusion not only improves rural access to credit but also enhances their entrepreneurial and investment capacity, serving as a critical lever for structural income improvement. Institutional and property rights reforms have also played a transformative role in redistributing economic incentives. As a cornerstone of rural institutional change, land tenure clarification helps define property boundaries and grants farmers asset-based rights, stimulating the market-oriented flow of rural production factors and enabling entrepreneurial and financial activity (Bu and Liao, 2022). With the deepening of property rights reform, institutional barriers have gradually been dismantled, laying the groundwork for a more equitable income distribution across urban and rural areas.

2.3 Entrepreneurship and the urban–rural income gap

Existing studies generally recognize entrepreneurship as a key mechanism for promoting economic growth and mitigating income inequality, with considerable potential to narrow the urban–rural income gap. Based on provincial panel data, Ma et al. (2021) find that both necessity-driven and opportunity-driven entrepreneurship contribute to reducing this disparity. Evaluations of the pilot program on returning-home entrepreneurship further support this view: Shi et al. (2024) and Guo D, et al. (2024) show that the policy significantly alleviates the income gap by increasing rural household income, thereby confirming the practical role of entrepreneurship in addressing structural inequality.

The effects of entrepreneurial activity on income disparities are also shaped by the type of entrepreneurship. Su et al. (2023) highlight that resource-constrained entrepreneurs often display strong resilience and adaptability; their entrepreneurial behavior not only enhances household welfare but also strengthens the broader vitality of rural communities. Similarly, Morris et al. (2020) emphasize the importance of institutional support, skill training, and community collaboration in building a sustainable entrepreneurial ecosystem that facilitates income redistribution among low-income groups and promotes equity. Institutional environment has been widely identified as a core determinant of entrepreneurial outcomes. Access to credit, social capital, and local governance capacity directly affect the quality and sustainability of entrepreneurship (Wei et al., 2025; Yang et al., 2025). A well-developed institutional framework can activate entrepreneurial potential among middle-income groups, generating structural income gains. At the micro level, Yang et al. (2023) using household-level data, identify human capital, technical skills, and market access as critical drivers of entrepreneurial persistence, while high failure rates pose a major constraint to long-term income improvement. From a macro policy perspective, Tang et al. (2022) argue that entrepreneurship support programs—an integral part of targeted poverty alleviation—have played a substantive role in narrowing the urban–rural income gap.

With the advancement of the digital economy, the mechanisms through which entrepreneurship affects income inequality are undergoing notable transformation. Improved digital infrastructure and broader technology diffusion have expanded entrepreneurial opportunities in rural areas (Xia et al., 2024), with new models such as e-commerce and livestreaming creating significant income gains for rural households (Shen C, et al., 2025). In parallel, the rise of digital finance has substantially lowered financing barriers, providing a more supportive environment for entrepreneurship and generating dual benefits in terms of income redistribution and poverty reduction (Hu et al., 2023; Ye et al., 2025).

2.4 Summary of the review

Existing studies have preliminarily demonstrated the potential of entrepreneurship to reduce the urban–rural income gap, providing valuable insights for this study. However, several important limitations remain. First, much of the current literature relies on single-policy shocks or macro-level provincial panel data, often employing traditional econometric methods that struggle to adequately control for confounding factors in high-dimensional settings. Second, the mechanisms through which entrepreneurship affects the urban–rural income gap remain underexplored. Empirical evidence on mediating channels such as knowledge spillovers and industrial upgrading is still limited. Third, given the uneven regional development and diverse entrepreneurial environments, existing studies rarely examine the heterogeneous effects across different regions and industries, which constrains the design of context-specific policy responses. To address these gaps, this study constructs a panel dataset covering 1,517 counties in China from 2000 to 2022, integrating industrial and commercial enterprise records with county-level socioeconomic data. Employing a novel DML framework, the study provides asymptotically unbiased causal estimates under high-dimensional controls, while allowing for the identification of nonlinear and heterogeneous effects. Furthermore, the study explicitly examines the mediating roles of industrial structure upgrading and knowledge-skill spillovers, offering a comprehensive depiction of how entrepreneurship shapes the urban–rural income gap and its spatial variation. This contributes new empirical evidence to a deeper understanding of the causal relationship between entrepreneurship and income distribution.

3 Theoretical analysis and hypothesis development

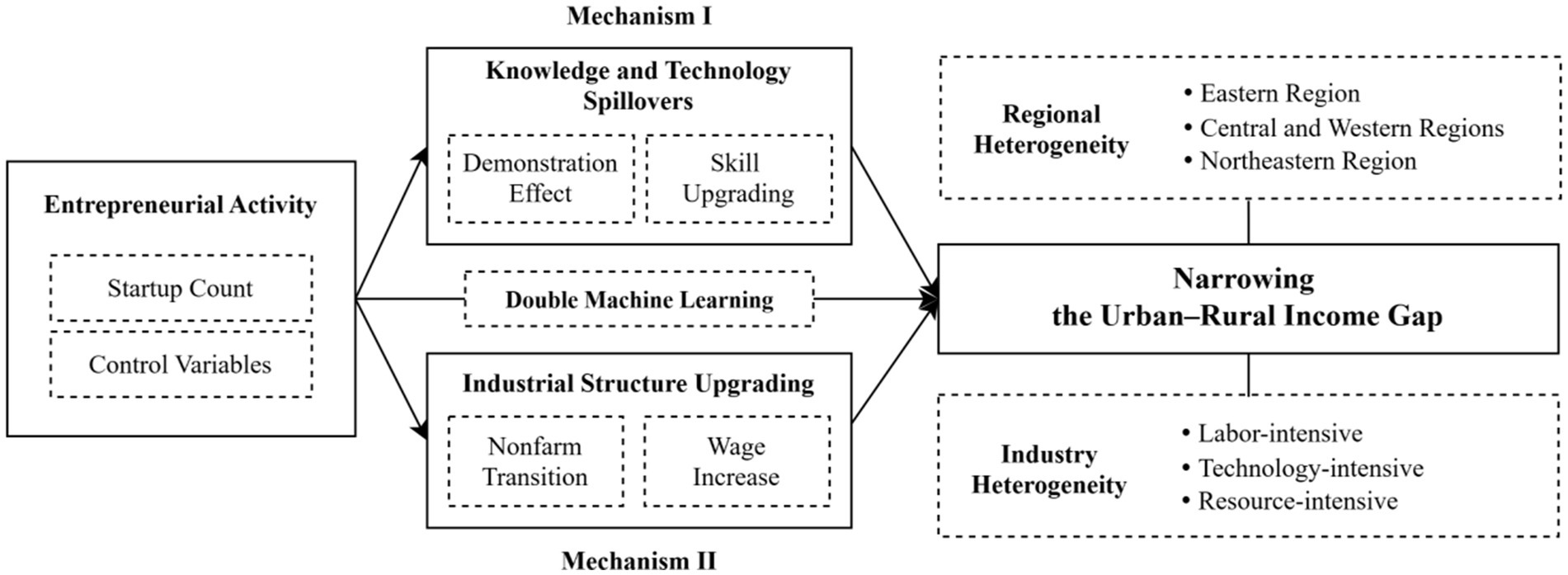

To illustrate the causal logic of how entrepreneurship influences the urban–rural income gap, Figure 2 presents the theoretical framework of this study. Entrepreneurial activity is assumed to affect rural income both directly and indirectly through two key mechanisms: knowledge and technology spillovers and industrial structure upgrading. These mechanisms operate by enhancing skills, improving production efficiency, and facilitating nonfarm employment. The framework also incorporates regional and industry heterogeneity to reflect differentiated effects across development stages and sectoral structures.

3.1 The direct impact of entrepreneurial activity on the urban–rural income gap

The direct impact of entrepreneurial activity on the urban–rural income gap is primarily realized through its effect on raising farmers’ incomes. Schumpeter’s theory of creative destruction posits that entrepreneurs disrupt existing equilibrium by introducing new products, adopting new technologies, and opening new markets, thereby enhancing total factor productivity and triggering new waves of economic growth (Ghazy et al., 2022; Schumpeter, 2021). Endogenous growth theory further suggests that entrepreneurship-driven accumulation of knowledge and technology has the characteristics of a local public good: the higher the density of entrepreneurship, the stronger the knowledge spillovers, and the more sustainable the economic growth (Romer, 1990). However, this innovation dividend is not spatially uniform. New economic geography indicates that excessively concentrated urban centers experience diminishing marginal returns due to rising congestion costs, while peripheral areas with scarce resources may benefit from a “late-mover advantage” that yields higher marginal returns on new capital and technology (Krugman, 1991). When entrepreneurial activity is deployed in rural areas—where production factors are scarcest—the marginal returns to capital and technology are amplified, and newly created jobs can absorb surplus local labor, thereby increasing rural wages and business income. This “amplified income elasticity” effect implies that entrepreneurial investment of equal scale tends to yield greater growth dividends in rural areas than in urban ones, thus providing an economic foundation for the convergence of the urban–rural income gap.

Inclusive growth theory further emphasizes that the key to transforming economic growth into broad-based welfare lies in whether productive opportunities are extended to low-income groups (Amponsah et al., 2023). When the marginal returns of entrepreneurship-induced output and employment are higher in rural areas than in urban areas, the share of growth dividends captured by rural residents increases accordingly, thus laying an economic foundation for the convergence of the urban–rural income gap. In China, the dual urban–rural structure continues to manifest as an overconcentration of capital, technology, and highly skilled labor in urban centers. If entrepreneurial investment can effectively guide the downward diffusion of these three key factors at the county level, it may help reverse the current pattern of unequal distribution. Based on this reasoning, we propose the following research hypothesis:

Hypothesis 1. Entrepreneurial activity helps reduce the urban–rural income gap.

3.2 Mechanism of influence

Schumpeterian entrepreneurship not only reallocates capital but also serves as a critical conduit for the diffusion of new knowledge and technologies. Innovation Diffusion Theory suggests that any new technology or organizational model is initially adopted by a small group of early adopters and subsequently spreads to a wider population through demonstration, imitation, and social networks (Miller and Garnsey, 2000; Rogers, 2003). In rural areas, entrepreneurial activity contributes not only to the creation of new enterprises but also to the introduction of innovations in technology and knowledge—particularly in agricultural production, management, and marketing (Chirinda et al., 2024). The concept of technology spillover emphasizes that such innovations not only enhance the returns of the pioneering firm but also disseminate to surrounding farmers and businesses via channels such as training, labor mobility, and supply chain interactions (Acs et al., 2009). A direct outcome of knowledge and technology spillovers is the improvement of labor skill endowments. Entrepreneurs and early employees accumulate complex skills—such as market insight, digital operations, and quality management—through practice, and these skills are subsequently transmitted to the broader rural labor force through training, labor movement, and social imitation. As skill levels increase, rural workers experience a rise in both marginal productivity and bargaining power, leading to wage growth that may exceed that of their urban counterparts with similar characteristics (Audretsch and Keilbach, 2007). Based on this, we propose the following research hypothesis:

Hypothesis 2: Entrepreneurial activity narrows the urban–rural income gap by increasing farmers’ income through knowledge and technology spillovers.

The Lewis dual-sector model posits that when capital and technology penetrate the traditional agricultural sector and absorb surplus labor, the industrial structure inevitably shifts from low-productivity primary agriculture to higher value-added manufacturing and modern services (Lewis, 1954). Structural transformation theory further indicates that as non-agricultural sectors expand, rural workers increasingly derive income not solely from agricultural profits but also from both wage-based and self-employed sources (Herrendorf et al., 2014). In this transformation process, entrepreneurship serves as a frontier vehicle for industrial migration. Startups are often the first to introduce high value-added activities—such as light manufacturing, agricultural product processing, rural tourism, and e-commerce platforms—into counties and townships, thereby facilitating the agglomeration of capital, technology, and talent in rural areas. As entrepreneurial activity drives the expansion of non-agricultural industries in rural regions, traditional agriculture-dominated employment structures are replaced by a more diversified sectoral composition including manufacturing, services, and rural e-commerce. The average wages associated with these new employment opportunities typically exceed those of agricultural labor, thereby significantly boosting overall rural incomes. Based on this, we propose the following research hypothesis:

Hypothesis 3: Entrepreneurial activity narrows the urban–rural income gap by increasing farmers’ income through industrial structure upgrading.

4 Research design

4.1 Data source

The core data on enterprise counts used in this study are sourced from the National Enterprise Credit Information Publicity System of China, which provides detailed records of all formally registered enterprises in each county across different years. The dataset includes over 30 variables such as enterprise name, operational status, registered capital, date of establishment, date of approval, industry classification, and business scope. The dependent and control variables are compiled from statistical yearbooks and official statistical bulletins published annually by provinces, municipalities, and counties. Through further data matching and cross-verification, a balanced panel dataset covering 1,517 counties and districts in China from 2000 to 2022 was ultimately constructed.

In the data processing phase, this study adopts the methodology outlined by He et al. (2023), beginning with the identification and removal of erroneous and duplicate entries. This includes using the unique combination of county and year to eliminate duplicates, as well as manually verifying and correcting any outliers. To address missing values, we apply a combination of linear interpolation, polynomial interpolation, and mean imputation for a small number of instances. Additionally, variables exhibiting large standard deviations were log-transformed to mitigate skewness and enhance model robustness. All imputation procedures were conducted in strict adherence to data cleaning protocols, ensuring the reliability and consistency of the results.

4.2 Variable definition

4.2.1 Dependent variable

The dependent variable in this study is the urban–rural income gap. It is measured as the ratio of per capita disposable income of urban residents to that of rural residents across years. Given the long time span of the dataset, the impact of entrepreneurial activity on farmers’ income may be influenced by price fluctuations. Therefore, based on the annual Consumer Price Index (CPI), the actual urban–rural income gap is adjusted to constant 2010 prices to ensure comparability over time.

4.2.2 Independent variable

The independent variable in this study is entrepreneurial activity, which is measured by the number of newly registered enterprises in each county across years. Specifically, we first use information on registration and approval dates to identify the establishment year of each enterprise, and then cross-check this with operational status data to determine the actual survival period of each firm. Based on this, we calculate the annual number of new registrations at the county level. The count of newly registered enterprises serves as one of the most direct indicators of entrepreneurial activity, as it reflects the frequency of entrepreneurial events and the level of local economic dynamism. It also allows for a dynamic depiction of temporal trends and spatial heterogeneity in county-level entrepreneurship. In addition, we construct a startup density variable, defined as the number of new enterprises per unit of permanent population in each county, and use it for robustness checks.

4.2.3 Control variables

Following related studies, this paper includes several control variables, such as the level of economic development, education level, government size, market size, administrative area, social welfare level, and financial development. Specifically, the level of regional economic development serves as a fundamental factor influencing both farmers’ income and entrepreneurial activity, as economically developed regions typically offer more employment opportunities and higher income levels. In this study, per capita GDP is used to represent economic development. Financial development affects the availability of capital for entrepreneurial activity. A more developed financial system enables entrepreneurs to access start-up funding through bank loans and venture capital, thereby promoting entrepreneurial dynamism. This study measures financial development using the ratio of financial institution loan balances to regional GDP. Government size reflects a local government’s capacity for macro-level regulation and policy support. Regions with larger governments often have stronger fiscal capacity and implementation ability, enabling them to provide more social protection and employment opportunities for rural residents. This paper uses the ratio of local government fiscal expenditure to regional GDP to represent government size (Lv et al., 2022). The level of social welfare indirectly influences entrepreneurial activity by shaping residents’ basic security and risk preferences. Regions with stronger social welfare systems can provide entrepreneurs with a more robust safety net, thereby reducing entrepreneurial risk, stimulating entrepreneurial intentions, and enhancing the economic security of rural residents—ultimately contributing to income growth. In this study, the number of beds in social welfare institutions is used to control for social welfare levels. Education level is a key indicator of human capital, directly affecting both the skill accumulation of entrepreneurs and the income level of rural residents. This paper measures education level using the ratio of enrolled students in regular secondary schools to the total regional population. As the DML method can effectively address high-dimensional controls through regularization algorithms, this study includes quadratic terms of all control variables in the regression to improve model fit. Additionally, two-way fixed effects at the county and year levels are included to account for unobserved heterogeneity.

Table 1 presents the descriptive statistics of the main original variables. The mean value of the urban–rural income gap is 2.433, with a standard deviation of 0.759. The mean value of entrepreneurial activity is 3,272.92, with a standard deviation of 4,292.167, indicating substantial variation in both the urban–rural income gap and entrepreneurial activity across counties.

4.3 Methods

Previous studies commonly use two-way fixed effects models for causal inference, which assume linearity and may fail to capture nonlinear relationships in long panels with numerous controls. High-dimensional multicollinearity can lead to unstable coefficient estimates, and the model typically identifies average treatment effects without addressing endogeneity, revealing key limitations. To overcome these issues, machine learning methods like random forests and LASSO are increasingly adopted, offering nonparametric modeling, automatic variable selection, and the ability to capture complex nonlinear relationships. However, these methods may suffer from convergence issues and unreliable causal inference when model specification or variable selection is imperfect (Athey and Imbens, 2019; Mullainathan and Spiess, 2017). DML improves upon traditional methods by combining orthogonalization and cross-fitting to remove bias from high-dimensional confounders while accommodating nonlinearity and heterogeneity, thus improving causal effect estimation accuracy and reliability, even in the presence of model misspecification and endogeneity (Chernozhukov et al., 2018).

DML has been widely used to assess causal relationships in economic phenomena. For instance, Dube et al. (2020) used DML to study task payment variations on Amazon Mechanical Turk, finding evidence of monopsony power even in “thick” labor markets. Yang et al. (2020) showed that large accounting firms positively impact audit quality. In this study, we use a large county-level panel dataset spanning over two decades, with numerous control variables. Traditional regression methods in such settings may suffer from multicollinearity and variable selection bias. Moreover, to explore the complex relationship between entrepreneurial activity and the urban–rural income gap, challenges like endogeneity and heterogeneous treatment effects must be addressed. DML overcomes these issues by automatically selecting and orthogonalizing key covariates, mitigating endogeneity, and capturing nonlinear and heterogeneous effects across regions and sectors, thereby enhancing model precision and causal inference reliability. Following Chernozhukov et al. (2018) and Zhang and Li (2023), the DML model used in this study is specified as follows:

Let index counties and years. The dependent variable denotes the urban–rural income gap, while the core explanatory variable captures entrepreneurial activity. The parameter of interest, represents the treatment effect. High-dimensional covariates are incorporated using machine learning methods to estimate the nuisance function . The error term has a conditional mean of zero. Based on Equations 1, 2, the treatment coefficient is estimated as follows:

As seen in Equation 3, represents the estimated effect of entrepreneurial activity on the urban–rural income gap. The first term serves as a weighting factor for entrepreneurial activity, while the second term captures the difference between the observed income gap and the part explained by control variables, . This adjustment isolates the effect of entrepreneurial activity, providing a more accurate estimate of its impact (Shen N, et al., 2025; Zhou et al., 2025).

5 Empirical results and discussion

5.1 Baseline regression results

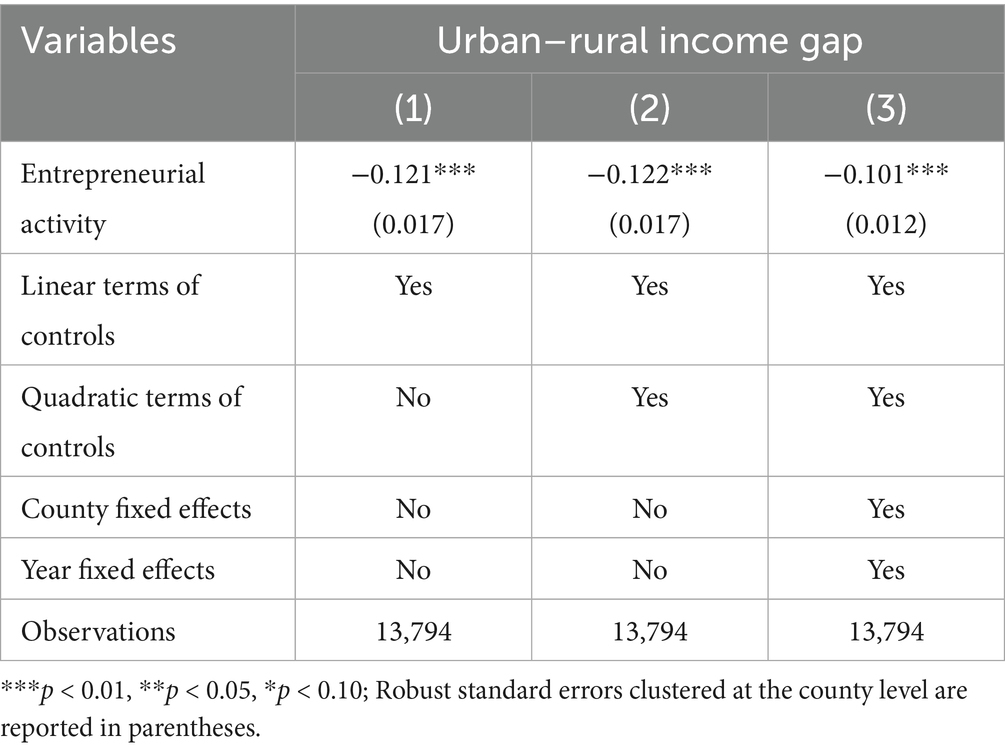

Table 2 reports the baseline estimation results based on the DML approach. Column (1) presents the estimates including only the linear terms of the control variables. Column (2) includes both the linear and quadratic terms. Column (3) further controls for county and year fixed effects. Across all specifications, the coefficient on entrepreneurial activity remains significantly negative at the 1% level, indicating that entrepreneurial activity consistently reduces the urban–rural income gap. Thus, Hypothesis 1 is supported.

5.2 Robustness checks

5.2.1 Estimation using a two-way fixed effects model

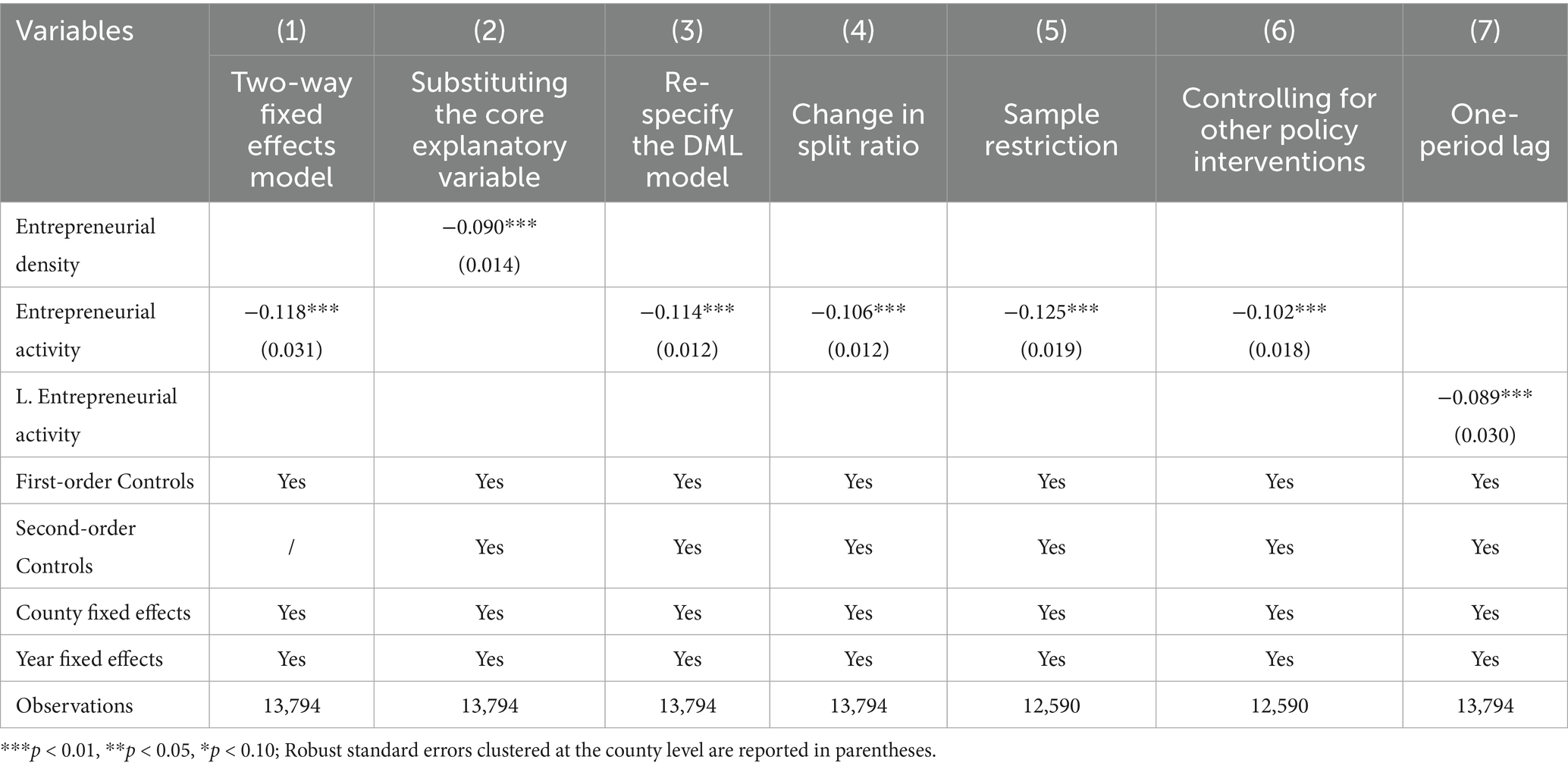

While the DML method offers substantial advantages in handling high-dimensional controls and accounting for heterogeneity, it may exhibit a certain degree of “black-box” behavior in variable selection and model specification, potentially limiting the interpretability of the results. To address this concern and enhance robustness, a two-way fixed effects model is employed as a complementary estimation strategy. By simultaneously controlling for both unit and time fixed effects, this model effectively mitigates endogeneity caused by unobserved time-invariant heterogeneity and provides strong explanatory power and comparability within classical panel data analysis. As shown in Column (1) of Table 3, the estimated coefficient of entrepreneurial activity remains significantly negative at the 1% level, consistent in sign and significance with the DML estimation. This result not only reinforces the robustness of the causal inference presented earlier but also provides additional empirical support, from the perspective of traditional econometrics, for the conclusion that entrepreneurship plays a meaningful role in narrowing the urban–rural income gap.

5.2.2 Substituting the core explanatory variable

Given the considerable variation in population size across counties, using only the number of newly established enterprises may exaggerate the entrepreneurial “activity” of more populous counties. To address this, we construct a county-level entrepreneurial density variable by taking the ratio of the number of new enterprises to the county’s year-end population, and use it as a substitute for the core explanatory variable. As a proportional measure, entrepreneurial density better captures the relative intensity of entrepreneurial activity. By accounting for population size, this measure enables more equitable and meaningful comparisons across counties. As shown in Column (2) of Table 3, the coefficient on entrepreneurial density remains significantly negative, indicating that the main finding is robust to this alternative specification.

5.2.3 Re-specify the DML model

To ensure that the results are not driven by model misspecification within the DML framework, we conduct robustness checks from the following perspectives. First, we replace the original random forest algorithm with a gradient boosting algorithm to assess the potential sensitivity of the results to the choice of machine learning method. Second, we alter the sample-splitting ratio in the DML procedure, changing it from 1:4 to 1:6, to examine whether the estimation results are sensitive to the sample partitioning scheme. Column (3) of Table 3 reports the estimates based on the alternative machine learning algorithm, while Column (4) presents the results under the modified sample split ratio. In both cases, the coefficient on entrepreneurial activity remains significantly negative, indicating that the main findings are robust to changes in model specification.

5.2.4 Sample restriction

The global COVID-19 pandemic since 2020 has had a profound impact on economic activity. The pandemic may have led to sharp declines in entrepreneurial activity, widespread business closures, and contractions in labor markets. These abnormal shocks could distort the reliability and stability of the estimation results. To mitigate such potential disturbances, we exclude post-2020 data from the sample. Column (5) of Table 3 presents the regression results after dropping the observations from 2020 onward. The coefficient on entrepreneurial activity remains significantly negative at the 1% level, indicating that the main conclusion is robust even when excluding the pandemic period.

5.2.5 Controlling for other policy interventions

Before China achieved full poverty alleviation in 2020, a number of officially designated national-level poverty counties existed. These counties, as policy pilot zones under the national poverty alleviation strategy, received targeted transfers, industrial support, and infrastructure investment programs (Zhou et al., 2018). Such policies may independently affect household income through mechanisms like improved agricultural productivity and expanded non-agricultural employment opportunities. As a result, they may introduce competing explanations to entrepreneurial activity and confound the identification of causal effects. To mitigate estimation bias arising from overlapping policy interventions, we carefully identify and control for the influence of national-level poverty county policies. Based on the official list of poverty counties and their year of exit from poverty, we construct dynamic dummy variables to account for potential policy-related interference. As shown in Column (6) of Table 3, the coefficient on entrepreneurial activity remains significantly negative at the 1% level even after controlling for these policy effects, indicating that the main conclusion holds.

5.2.6 One-period lag

This section conducts a robustness check by introducing a one-period lag of the key explanatory variable, entrepreneurial activity, to examine the stability of the main findings. We use the lagged variable of new enterprises in the regression model. The results, as shown in Column (7) of Table 3, remain significantly negative, indicating the robustness of the findings.

5.3 Endogeneity test

Although this study employs a long-period panel dataset and controls for county and year fixed effects, the risk of potential endogeneity still exists. On the one hand, county-level entrepreneurial activity may increase farmers’ income; on the other hand, higher income levels in rural areas may, in turn, lead to more frequent entrepreneurial activity. To address this concern, we construct an instrumental variable within the DML framework. Drawing on recent studies published in leading journals, we use the average business environment at the prefectural level as the instrument. Specifically, it is proxied by the number of active enterprises in a prefecture divided by the number of administrative divisions under its jurisdiction (Lin et al., 2023).

In terms of relevance, the business environment at the prefectural level is closely related to entrepreneurial activity at the county level. The business environment is a key external factor influencing the creation and development of enterprises, encompassing policy support, administrative efficiency, tax incentives, infrastructure development, and more. Prefectural governments can directly or indirectly influence the level of entrepreneurial activity within counties through the formulation and implementation of relevant policies (Liu et al., 2025). Regarding the exclusion restriction, there is institutional separation and indirect policy transmission between prefectures and counties. Prefectures are higher-level administrative units than counties and are geographically distinct. The business environment policies at the prefectural level affect farmers’ income indirectly by influencing entrepreneurial activity at the county level, rather than directly impacting household income (Huang et al., 2025). These policies need to be implemented by county governments in order to influence local entrepreneurship.

In addition, this study controls for county-level economic development, financial development, and social welfare, and applies clustered standard errors at the county level to absorb potential omitted variable bias. Taken together, we argue that the average business environment at the prefectural level does not exert a direct effect on farmers’ income.

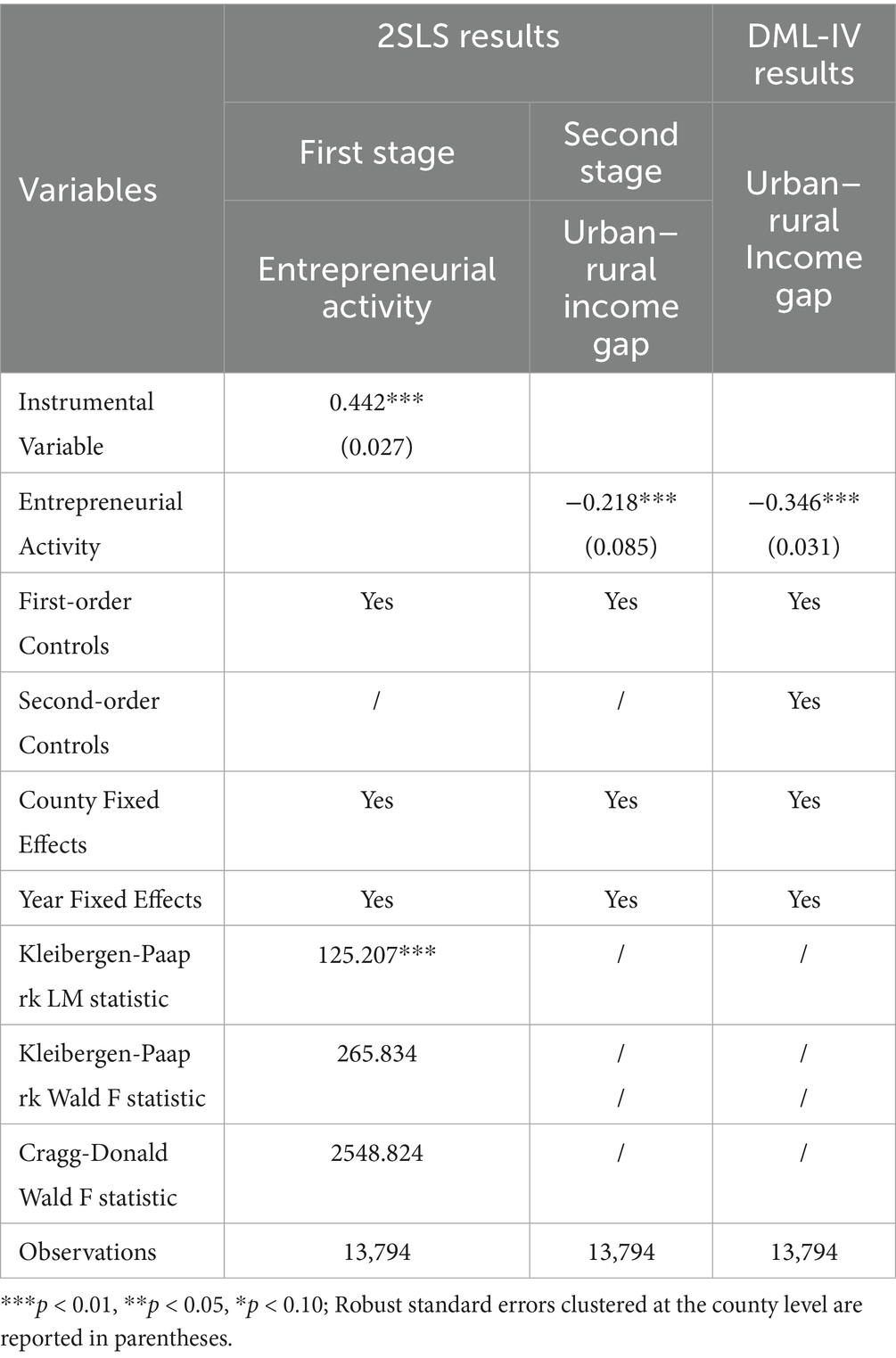

To address the potential endogeneity of the entrepreneurial activity variable, this study employs both Double Machine Learning for Instrumental Variables (DML-IV) and the traditional Two-Stage Least Squares (2SLS) approach. Table 4 reports that the DML-IV estimation yields a significant negative effect of entrepreneurial activity on the urban–rural income gap. The estimated coefficient is −0.346 and is statistically significant at the 1% level, suggesting that entrepreneurship substantially contributes to narrowing income disparities between urban and rural areas.

The DML-IV framework enhances robustness through sample splitting, cross-fitting, and residual orthogonalization. However, it only provides second-stage causal effect estimates and does not report first-stage regression results. To improve transparency, a conventional 2SLS model is additionally estimated. In the first stage, the instrumental variable is significantly and positively associated with entrepreneurial activity, with a coefficient of 0.442, indicating strong explanatory power. The Kleibergen–Paap LM statistic is 125.207, rejecting the null hypothesis of underidentification. The Kleibergen–Paap rk Wald F statistic is 265.834, which exceeds the Stock–Yogo critical threshold of 16.38, thereby alleviating concerns of weak instruments. In the second stage, the estimated coefficient for entrepreneurial activity is −0.218, also significant at the 1% level. The sign and significance are consistent with the DML-IV results, reinforcing the robustness of the main conclusion (Table 5).

5.4 Mechanism analysis

In this section, we first examine the direct impact of entrepreneurial activity on farmers’ income. Columns (1) and (2) of Table 6 present the effects of entrepreneurial activity on the income of urban and rural residents, respectively. The results show that the income-enhancing effect of entrepreneurial activity is significantly stronger for rural residents than for their urban counterparts. Theoretical analysis suggests that rural economies are typically less diversified, with traditional agricultural income being relatively low and volatile. Entrepreneurial activity creates new employment opportunities and income sources for farmers—particularly in non-agricultural sectors—offering more stable and higher income levels. As a result, the income-boosting effect of entrepreneurship is more pronounced in rural areas, contributing more effectively to the narrowing of the urban–rural income gap. In what follows, we further explore the indirect effects of entrepreneurial activity.

5.4.1 Knowledge and technology spillover

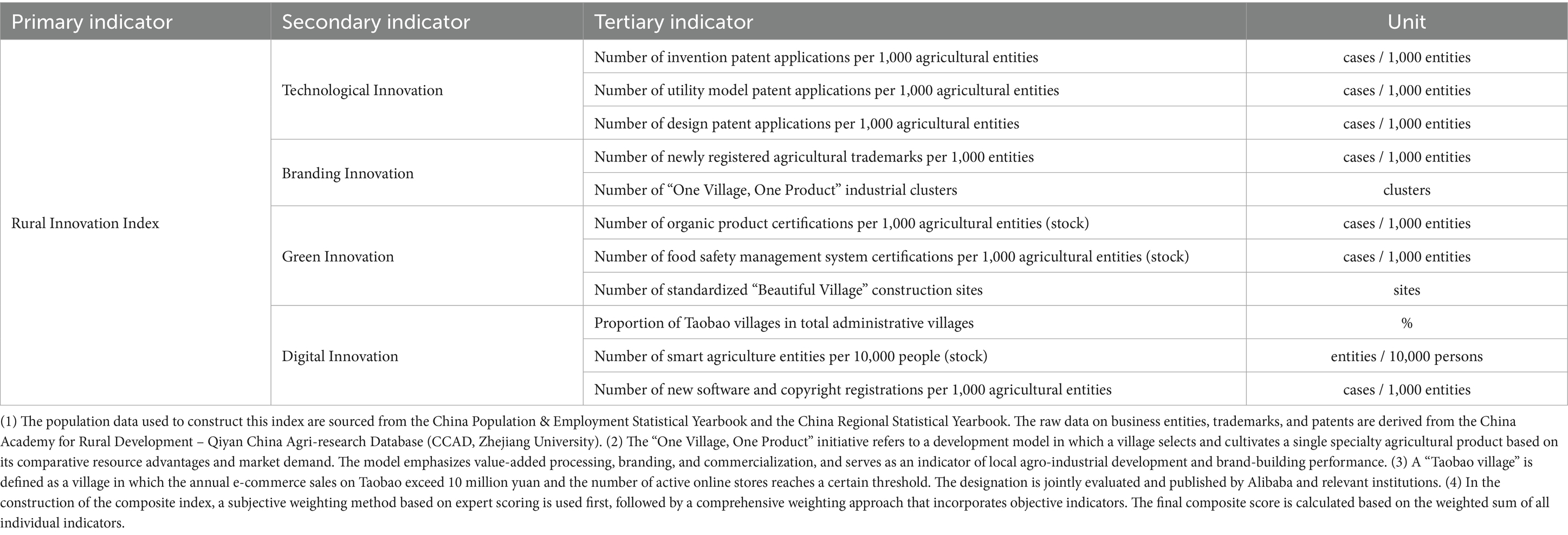

The knowledge and technology spillover channel reflects how entrepreneurial activity transmits new technologies, methods, and models throughout the rural economy via demonstration effects, labor mobility, and linkages along the industrial value chain. Following Ruan et al. (2024), we use the “Rural Innovation Index” to measure this mediating variable. The construction and weighting methodology of the index are detailed in Table 4. This index captures the overall level of rural innovation, encompassing dimensions such as technological R&D, brand development, green production, and digital adoption.

Theoretically, entrepreneurs not only improve their own output and income but also generate spillover effects by inspiring neighboring villagers, transferring technical knowledge through labor mobility, and driving industrial upgrading through coordination. These effects lead to broader changes in production and business practices. Empirically, we test this mechanism by using the index as a mediating variable. Column (3) of Table 6 reports the regression results. We find that entrepreneurial activity has a significant positive effect on knowledge and technology spillover. This indicates that in addition to directly increasing entrepreneurs’ operating income, a substantial portion of the impact is transmitted through raising the overall level of knowledge and technology diffusion within the village. This in turn encourages non-entrepreneurial households to adopt more advanced production, management, and marketing methods, thereby increasing farmers’ income and narrowing the urban–rural income gap. Hypothesis 2 is supported.

5.4.2 Industrial structure upgrading

Industrial structure upgrading refers to the process by which economic activity shifts from the primary sector to the secondary and tertiary sectors. In this study, we measure the degree of rural industrial upgrading by calculating the ratio of the combined employment in the secondary and tertiary sectors to the employment in agriculture, forestry, animal husbandry, and fishery. A higher ratio indicates that non-agricultural sectors are increasingly absorbing rural labor, signaling a more diversified economic structure and greater potential for economic growth.

As shown in Column (4) of Table 6, entrepreneurial activity significantly promotes industrial structure upgrading. In rural areas, traditional agriculture—characterized by outdated production methods and limited returns—often fails to meet farmers’ income growth needs. In contrast, the secondary and tertiary sectors typically involve higher technological content, stronger market competitiveness, and more generous wage earnings. Entrepreneurial activity directly facilitates the expansion of non-agricultural sectors such as manufacturing, services, and rural e-commerce into rural areas, creating more high-paying job opportunities. As a result, farmers are more likely to shift from traditional agricultural sectors to higher-income non-agricultural employment. This transition not only boosts their individual income but also narrows the income gap with urban residents driven by differences in industrial structure. Hypothesis 3 is supported.

6 Further analysis

From a causal inference perspective, heterogeneity analysis is not only a robustness check on whether the “average treatment effect” holds under different conditions, but also an important approach to reinforcing the validity of causal claims (Jiang, 2022). If the impact of entrepreneurship on the urban–rural income gap varies significantly across different dimensions, it suggests that the effect is unlikely to be accidental or context-specific, but rather a genuine and systematic outcome of entrepreneurial activity. In the context of this study, significant regional differences in economic development, industrial structure, and factor endowments justify conducting further heterogeneity analysis across regions and industries.

6.1 Regional heterogeneity analysis

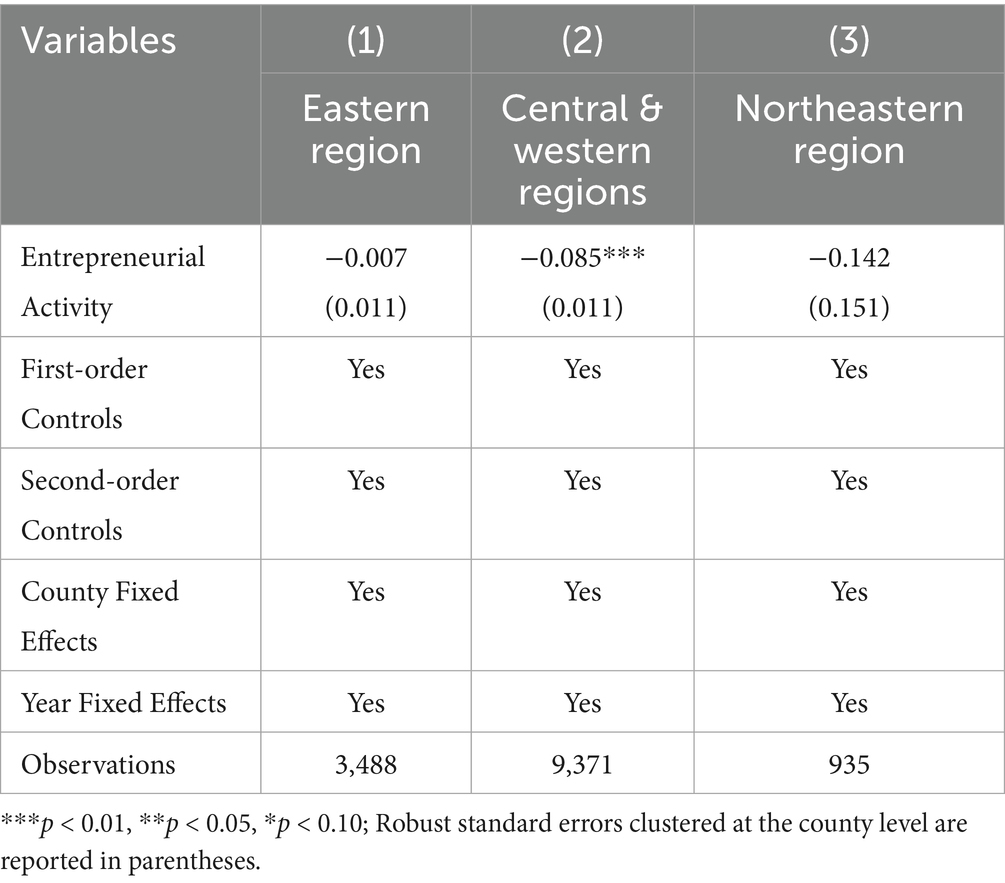

China is a vast country with significant regional disparities in economic development, industrial structure, and resource endowments. To reflect the socioeconomic conditions across different areas more accurately, the National Bureau of Statistics divides the country into four major regions: the eastern, central, western, and northeastern regions. Table 7 presents the empirical results of the regional heterogeneity analysis.

In the eastern and northeastern regions, the effect of entrepreneurial activity on the urban–rural income gap is negative but not statistically significant. In contrast, entrepreneurial activity significantly reduces the urban–rural income gap in the central and western regions. This pattern can be attributed to the fact that eastern China, being economically more developed, has already experienced widespread and mature entrepreneurial activity. In such competitive markets, the impact of entrepreneurship on income disparities may be offset by other factors, resulting in weaker effects. In the northeastern region, some areas are experiencing challenges such as population outflow and industrial restructuring, which limit the potential of entrepreneurial activity to influence the income gap. In contrast, the central and western regions have more homogeneous economic structures, with agriculture still playing a dominant role. In these areas, entrepreneurship—especially in non-agricultural sectors—can drive economic transformation, create more job opportunities, and provide farmers with access to higher-income non-agricultural employment. This leads to a significant increase in rural income and a narrowing of the urban–rural income gap. Moreover, the relatively underdeveloped market environment in the central and western regions means that entrepreneurial activity often receives more government support and resource allocation. This institutional advantage further enhances the impact of entrepreneurship on income inequality.

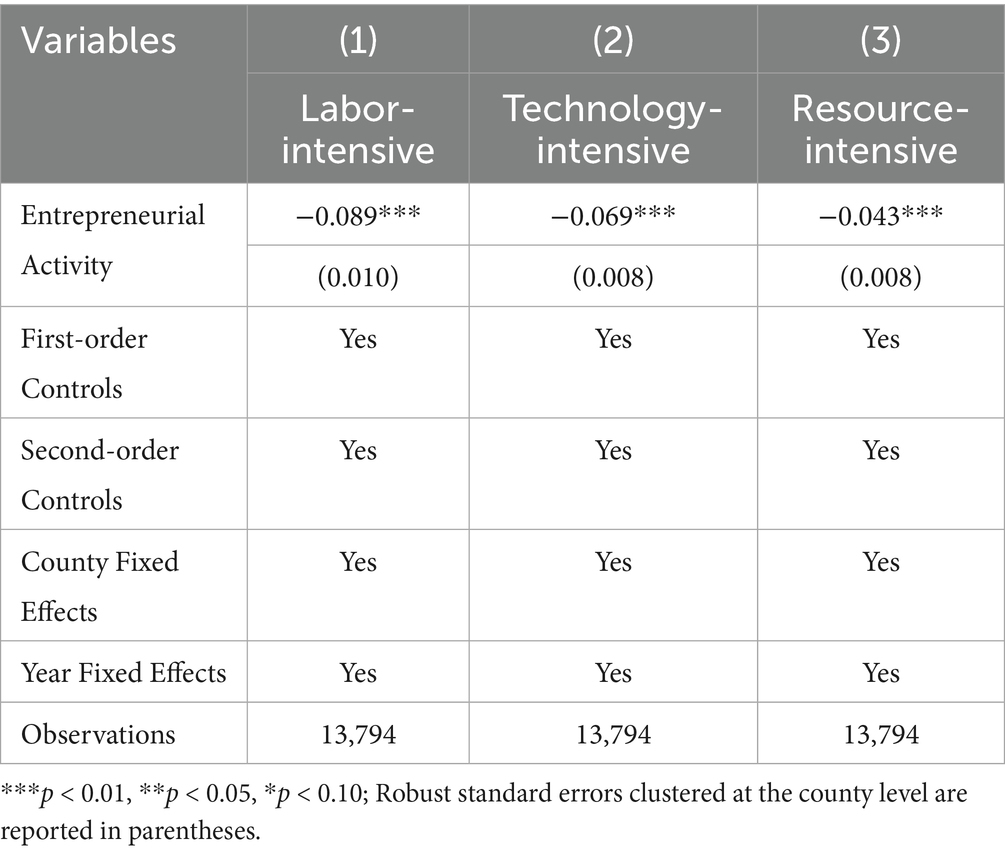

6.2 Industry heterogeneity analysis

Different types of entrepreneurial activity vary in terms of factor intensity, technological sophistication, and target populations. Following the industry classification framework of Li L, et al. (2023), this study categorizes entrepreneurship into three types: labor-intensive, technology-intensive, and resource-intensive. We examine their differentiated effects on narrowing the urban–rural income gap. As shown in Table 8, all three types of entrepreneurship—labor-intensive, technology-intensive, and resource-intensive—significantly contribute to reducing the income disparity between urban and rural areas.

In terms of specific effect sizes, labor-intensive entrepreneurship contributes the most to narrowing the urban–rural income gap. This is primarily because labor-intensive industries typically rely on large volumes of labor and are often concentrated in low-income rural areas. In such regions, labor-intensive entrepreneurial activities can absorb a substantial amount of rural labor, thereby directly increasing farmers’ income. Compared with other types of entrepreneurship, labor-intensive sectors tend to offer more employment opportunities and higher wage income in the short term. As a result, they have a more immediate and pronounced impact on rural income, making them particularly effective in reducing the urban–rural income gap (Guo et al., 2022).

Although technology-intensive industries also exhibit a significant effect, their underlying mechanism differs. These types of enterprises do not primarily rely on absorbing large numbers of rural workers as a pathway to increase income. Instead, they are more likely to benefit urban residents through high-wage growth (Xiao et al., 2024). Nevertheless, their greatest advantage lies in the spillover effects of knowledge and technology. New technologies, management models, and platform-based innovations tend to diffuse through industrial chains and complementary services, reaching rural areas and indirectly benefiting farmers, thereby helping to reduce the urban–rural income gap.

In contrast, resource-intensive industries typically rely on abundant local natural resources during their early entrepreneurial stages. These enterprises often demand land and raw materials from local farmers, which can directly increase rural income through rents, labor payments, and material procurement. This contributes positively to narrowing the urban–rural income gap. However, from a long-term perspective, if such enterprises lack sound resource management and benefit-sharing mechanisms, they may trigger negative externalities such as resource depletion, environmental degradation, or inequitable distribution of returns. These issues can ultimately undermine the sustained income benefits for farmers (Schneider, 2017).

7 Discussion

This study uses panel data from 1,517 counties in China (2000–2022) and applies the DML approach to examine entrepreneurship’s impact on the urban–rural income gap. The results indicate that entrepreneurship reduces the income disparity, with a stronger effect on rural residents. The mechanisms include knowledge and technology spillovers and industrial structure upgrading, which improve farmers’ productivity and facilitate labor shifts to non-agricultural sectors, boosting rural wage income.

Heterogeneity analysis shows that labor-intensive entrepreneurship has the strongest income-boosting effect due to its job creation capacity. While technology-intensive entrepreneurship offers indirect benefits through knowledge spillovers, resource-intensive entrepreneurship may yield short-term gains but risks negative long-term environmental impacts. Regional variations reveal that entrepreneurship has a more significant income-reducing effect in central and western regions, reflecting differences in development and policy support.

Although entrepreneurship offers significant potential benefits, it should not be encouraged unconditionally, as it may also result in unintended negative consequences. One such concern is increased competition. In resource-constrained regions, excessive entrepreneurial activity can lead to market saturation and fierce price competition. Many small enterprises may struggle to compete with larger, better-capitalized firms, leading to their failure and undermining the expected economic gains (Kerr et al., 2014). Furthermore, entrepreneurial activities may contribute to the concentration of economic benefits among a small elite. In capital- and technology-intensive sectors, successful entrepreneurs tend to be those with access to greater resources and technical expertise, while many rural residents, lacking capital or technological skills, may fail to benefit and may even be marginalized (Frid et al., 2016). This concentration of wealth could exacerbate income inequality in rural areas, contradicting the goal of reducing the urban–rural income gap through entrepreneurship.

To address these issues, targeted policy interventions are essential. The government should focus on supporting smaller-scale entrepreneurs while ensuring a fairer competitive environment by regulating market concentration and preventing the dominance of larger firms. Policies should also prioritize extending the benefits of entrepreneurship to underrepresented groups, particularly those lacking capital or technical expertise, to mitigate the risk of wealth concentration among a small elite. Additionally, it is crucial to balance entrepreneurial activity to avoid market saturation, which could harm small enterprises and undermine expected economic gains. By fostering a more inclusive entrepreneurial ecosystem, the government can enhance the effectiveness of entrepreneurship in reducing the urban–rural income gap and promoting sustainable, equitable growth.

Future research could further explore the role of different types of government support in fostering entrepreneurship. Specifically, investigating the impact of financial assistance, tax incentives, and training programs on entrepreneurial success could provide valuable insights into how tailored policies can more effectively promote sustainable entrepreneurial growth. Moreover, understanding the long-term sustainability of the entrepreneurial effects observed in this study remains an important avenue for future inquiry. It would be valuable to examine whether the initial positive effects on income disparity persist over time or diminish as economic conditions evolve.

8 Conclusion

8.1 Main conclusion

This study finds that entrepreneurial activity significantly contributes to narrowing the urban–rural income gap, with both direct effects and multiple indirect mechanisms at play. Compared to its impact on urban residents, entrepreneurship exerts a stronger income-enhancing effect on rural populations.

Knowledge and technology spillovers, as well as industrial structure upgrading, serve as key mediating channels through which entrepreneurship reduces the income gap. On the one hand, the diffusion of entrepreneurial knowledge and technology improves farmers’ production methods and boosts their business income. On the other hand, entrepreneurship facilitates the shift of rural labor toward the secondary and tertiary sectors, leading to a notable increase in wage income.

The impact of entrepreneurship also exhibits significant heterogeneity across regions and industries. Regionally, the gap-narrowing effect is more pronounced in central and western China than in the eastern and northeastern regions, highlighting its greater income-raising potential in less-developed areas. At the industry level, labor-intensive entrepreneurship contributes the most by directly creating employment opportunities and raising farmers’ income. Technology-intensive sectors primarily generate inclusive benefits through knowledge spillovers, while the overall impact of resource-intensive sectors remains limited.

8.2 Policy recommendations

Based on the above findings, this study proposes the following three policy recommendations:

Implement region-specific strategies tailored to local conditions. In eastern China, address structural challenges such as rising costs and promote inclusive technological advancements that integrate smallholder farming with modern agricultural practices. In central and western regions, leverage industrial relocation and preferential policies to support labor-intensive entrepreneurial projects, thereby enhancing local economic vitality. In northeastern China, introduce policies to incentivize talent retention and foster a dynamic market environment, unlocking regional development potential.

Emphasize strategic sectoral priorities and coordinated industrial layout. Support labor-intensive industries through targeted subsidies, credit incentives, and workforce training programs, facilitating stronger collaboration between farmers and enterprises. Encourage the growth of technology-intensive sectors to foster knowledge diffusion, ensuring that the benefits are widely disseminated while preventing the formation of “technology enclaves” that may marginalize rural populations. In resource-intensive industries, implement ecological compensation mechanisms and incentivize the adoption of sustainable practices to align economic growth with environmental stewardship.

Strengthen technology dissemination and industrial integration. Accelerate the adoption of agricultural innovations through the development of rural technology service platforms and agricultural innovation demonstration zones, thereby enhancing productivity and income stability. Increase support for non-agricultural industries to drive structural upgrading in the rural economy, fostering greater integration between agricultural and non-agricultural sectors. This will diversify income sources, improve income security, and contribute to narrowing the urban–rural income gap.

Promote fair competition. Provide targeted support to smaller-scale entrepreneurs, regulate market concentration, and ensure that the benefits of entrepreneurship are more equitably distributed, particularly among underrepresented groups. This will mitigate the risk of wealth concentration and prevent market saturation, ensuring that entrepreneurial activity does not undermine the viability of small enterprises.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

SH: Writing – review & editing, Conceptualization, Methodology, Writing – original draft, Formal analysis, Data curation. LL: Conceptualization, Writing – review & editing, Methodology, Writing – original draft, Data curation, Formal analysis. GW: Funding acquisition, Resources, Writing – review & editing, Conceptualization. XW: Conceptualization, Software, Writing – review & editing, Methodology.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This project is funded by the National Key R&D Program of China (Project No.: 2024YFD1601303); the Agricultural Science and Technology Innovation Program (Project No.: CAAS-ZDRW202420) and the Agricultural Science and Technology Innovation Program (Project No.: 10-IAED-RC-07-2025).

Conflict of interest

The author(s) declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., and Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Bus. Econ. 32, 15–30. doi: 10.1007/s11187-008-9157-3

Alvarez, S. A., and Barney, J. B. (2014). Entrepreneurial opportunities and poverty alleviation. Entrep. Theory Pract. 38, 159–184. doi: 10.1111/etap.12078

Amponsah, M., Agbola, F. W., and Mahmood, A. (2023). The relationship between poverty, income inequality and inclusive growth in sub-Saharan Africa. Econ. Model. 126:106415. doi: 10.1016/j.econmod.2023.106415

Athey, S., and Imbens, G. W. (2019). Machine learning methods that economists should know about. Annu. Rev. Econ. 11, 685–725. doi: 10.1146/annurev-economics-080217-053433

Audretsch, D. B., and Keilbach, M. (2007). The theory of knowledge spillover entrepreneurship. J. Manag. Stud. 44, 1242–1254. doi: 10.1111/j.1467-6486.2007.00722.x

Azoulay, P., Jones, B. F., Kim, J. D., and Miranda, J. (2020). Age and high-growth entrepreneurship. Am. Econ. Rev. Insights 2, 65–82. doi: 10.1257/aeri.20180582

Beaudry, P., Green, D. A., and Sand, B. M. (2018). In search of labor demand. Am. Econ. Rev. 108, 2714–2757. doi: 10.1257/aer.20141374

Brändle, L., Rönnert, A.-L., Moergen, K. J. N., and Zhao, E. Y. (2025). Social class origin and entrepreneurship: an integrative review and research agenda. J. Bus. Ventur. 40:106503. doi: 10.1016/j.jbusvent.2025.106503

Bu, D., and Liao, Y. (2022). Land property rights and rural enterprise growth: evidence from land titling reform in China. J. Dev. Econ. 157:102853. doi: 10.1016/j.jdeveco.2022.102853

Cheng, C., Gao, Q., Ju, K., and Ma, Y. (2024). How digital skills affect farmers’ agricultural entrepreneurship? An explanation from factor availability. J. Innov. Knowl. 9:100477. doi: 10.1016/j.jik.2024.100477

Chernozhukov, V., Chetverikov, D., Demirer, M., Duflo, E., Hansen, C., Newey, W., et al. (2018). Double/debiased machine learning for treatment and structural parameters. Econ. J. 21, C1–C68. doi: 10.1111/ectj.12097

Chirinda, N., Abdulkader, B., Hjortsø, C. N., Aitelkadi, K., Salako, K. V., Taarji, N., et al. (2024). Perspectives on the integration of Agri-entrepreneurship in tertiary agricultural education in Africa: insights from the AgriENGAGE project. Front. Sustain. Food Syst. 8:1348167. doi: 10.3389/fsufs.2024.1348167

del Olmo-García, F., Domínguez-Fabián, I., Crecente-Romero, F. J., and del Val-Núñez, M. T. (2023). Determinant factors for the development of rural entrepreneurship. Technol. Forecast. Soc. Chang. 191:122487. doi: 10.1016/j.techfore.2023.122487

Dou, R., Zhu, B., Chen, W., Li, Q., Zhang, S., and Xu, W. (2025). How does townships’ economic landscape affect urban–rural income inequality in China? Socio Econ. Plan. Sci. 98:102150. doi: 10.1016/j.seps.2024.102150

Dube, A., Jacobs, J., Naidu, S., and Suri, S. (2020). Monopsony in online labor markets. Am. Econ. Rev. Insights 2, 33–46. doi: 10.1257/aeri.20180150

Field, E., Pande, R., Papp, J., and Rigol, N. (2013). Does the classic microfinance model discourage entrepreneurship among the poor? Experimental evidence from India. Am. Econ. Rev. 103, 2196–2226. doi: 10.1257/aer.103.6.2196

Frid, C. J., Wyman, D. M., and Coffey, B. (2016). Effects of wealth inequality on entrepreneurship. Small Bus. Econ. 47, 895–920. doi: 10.1007/s11187-016-9742-9

Ghazy, N., Ghoneim, H., and Lang, G. (2022). Entrepreneurship, productivity and digitalization: evidence from the EU. Technol. Soc. 70:102052. doi: 10.1016/j.techsoc.2022.102052

Goh, L. T., and Law, S. H. (2023). The crime rate of five Latin American countries: does income inequality matter? Int. Rev. Econ. Financ. 86, 745–763. doi: 10.1016/j.iref.2023.03.036

Gross, D. P., and Sampat, B. N. (2023). America, jump-started: World war II R&D and the takeoff of the US innovation system. Am. Econ. Rev. 113, 3323–3356. doi: 10.1257/aer.20221365

Guo, J., Cheng, Z., and Wang, B. Z. (2024). Internet development and entrepreneurship. China Econ. Rev. 88:102280. doi: 10.1016/j.chieco.2024.102280

Guo, D., Jiang, K., Xu, C., and Yang, X. (2022). Industrial clustering, income and inequality in rural China. World Dev. 154:105878. doi: 10.1016/j.worlddev.2022.105878

Guo, D., Li, L., Pang, G., and Qiao, L. (2024). Does migrant workers’ returning home to start businesses narrow the urban-rural income gap in counties——evidence from the pilot policy of returning home to start businesses. Chin. J. Popul. Sci. 38, 50–65.

Guzman, J., and Stern, S. (2020). The state of American entrepreneurship: new estimates of the quantity and quality of entrepreneurship for 32 US states, 1988–2014. Am. Econ. J. Econ. Pol. 12, 212–243. doi: 10.1257/pol.20170498

Hall, R. E., and Woodward, S. E. (2010). The burden of the nondiversifiable risk of entrepreneurship. Am. Econ. Rev. 100, 1163–1194. doi: 10.1257/aer.100.3.1163

He, K., Zhu, X., and Li, F. (2023). Accumulating carbon to form “energy”: how can carbon trading policy alleviate rural energy poverty? J. Manag. World 39, 122–144. doi: 10.19744/j.cnki.11-1235/f.2023.0143

Herrendorf, B., Rogerson, R., and Valentinyi, Á. (2014). “Growth and structural transformation” in Handbook of economic growth. eds. P. Aghion and S. N. Durlauf, vol. 2 (Elsevier), 855–941. Avilable online at: https://www.sciencedirect.com/science/article/abs/pii/B9780444535405000069

Hu, D., Guo, F., and Zhai, C. (2023). Digital finance, entrepreneurship and the household income gap: evidence from China. Inf. Process. Manag. 60:103478. doi: 10.1016/j.ipm.2023.103478

Huang, X., Yang, E., and Wang, W. (2025). Has the integration of fiscal agricultural funds promoted rural entrepreneurship? Int. Rev. Econ. Financ. 99:104044. doi: 10.1016/j.iref.2025.104044

Ihou, A. F. Y., and Mansingh, J. P. (2025). Pathways to farmers’ entrepreneurship: the role of entrepreneurial mindset. Front. Sustain. Food Syst. 9:1584522. doi: 10.3389/fsufs.2025.1584522

Jiang, T. (2022). Mediating effects and moderating effects in causal inference. China Industrial Econ. 5:5. doi: 10.19581/j.cnki.ciejournal.2022.05.005

Kademani, S., Nain, M. S., Singh, R., Kumar, S., Parsad, R., Sharma, D. K., et al. (2024). Unveiling challenges and strategizing solutions for sustainable Agri-entrepreneurship development. Front. Sustain. Food Syst. 8:1447371. doi: 10.3389/fsufs.2024.1447371

Kerr, W. R., Nanda, R., and Rhodes-Kropf, M. (2014). Entrepreneurship as experimentation. J. Econ. Perspect. 28, 25–48. doi: 10.1257/jep.28.3.25

Lagakos, D. (2020). Urban-rural gaps in the developing world: does internal migration offer opportunities? J. Econ. Perspect. 34, 174–192. doi: 10.1257/jep.34.3.174

Lewis, W. A. (1954). Economic development with unlimited supplies of labour. Manch. Sch. 22, 139–191.

Li, X., He, P., Liao, H., Liu, J., and Chen, L. (2024). Does network infrastructure construction reduce urban–rural income inequality? Based on the “broadband China” policy. Technol. Forecast. Soc. Change 205:123486. doi: 10.1016/j.techfore.2024.123486

Li, L., Wang, R., and Peng, S. (2023). The thirty-years growth of entrepreneur: entrepreneurship leads enterprises towards high-quality development: a comprehensive report on the 30-year survey of the growth and development of Chinese entrepreneurs. J. Manag. World 39, 113–136. doi: 10.19744/j.cnki.11-1235/f.2023.0046

Li, F., Zang, D., Chandio, A. A., Yang, D., and Jiang, Y. (2023). Farmers’ adoption of digital technology and agricultural entrepreneurial willingness: evidence from China. Technol. Soc. 73:102253. doi: 10.1016/j.techsoc.2023.102253

Lin, S., Gu, C., Si, X., and Yan, Y. (2023). County-level entrepreneurship, farmers’ income increase and common prosperity: an empirical study based on Chinese county-level data. Econ. Res. J. 58, 40–58.

Lin, S., Winkler, C., Wang, S., and Chen, H. (2020). Regional determinants of poverty alleviation through entrepreneurship in China. Entrep. Reg. Dev. 32, 41–62. doi: 10.1080/08985626.2019.1640477

Liu, X., Xu, Z., Zhang, K., Kang, Z., and Xie, X. (2025). Can upgrading development zones enhance regional entrepreneurial activity? Evidence from Chinese enterprise registration data. Int. Rev. Econ. Financ. 98:103903. doi: 10.1016/j.iref.2025.103903

Lv, B., Chen, Y., and Zhan, J. (2022). Government budget management,tax collection behaviors and business efficiency. Econ. Res. J. 57, 58–77.

Ma, T., Lu, J., and Wang, X. (2021). Entrepreneurial economic development and urban—rural income gap———on the basis of different types of entrepreneurship. Inquiry Econ. Issues 10, 27–34.

Mao, D., Chen, J., and Hu, S. (2025). Urban-rural economic inequality: is social entrepreneurship the solution? China Agric. Econ. Rev. doi: 10.1108/CAER-12-2023-0371

Matos, S., and Hall, J. (2020). An exploratory study of entrepreneurs in impoverished communities: when institutional factors and individual characteristics result in non-productive entrepreneurship. Entrep. Reg. Dev. 32, 134–155. doi: 10.1080/08985626.2019.1640476

McKenzie, D. (2017). Identifying and spurring high-growth entrepreneurship: experimental evidence from a business plan competition. Am. Econ. Rev. 107, 2278–2307. doi: 10.1257/aer.20151404

Miller, D., and Garnsey, E. (2000). Entrepreneurs and technology diffusion: how diffusion research can benefit from a greater understanding of entrepreneurship. Technol. Soc. 22, 445–465. doi: 10.1016/S0160-791X(00)00021-X

Morris, M. H., Santos, S. C., and Neumeyer, X. (2020). Entrepreneurship as a solution to poverty in developed economies. Bus. Horiz. 63, 377–390. doi: 10.1016/j.bushor.2020.01.010

Mullainathan, S., and Spiess, J. (2017). Machine learning: an applied econometric approach. J. Econ. Perspect. 31, 87–106. doi: 10.1257/jep.31.2.87

Qing, J., and Chen, J. (2024). Digital village construction and its mechanistic on farmer entrepreneurship. Financ. Res. Lett. 70:106258. doi: 10.1016/j.frl.2024.106258

Rogers, E. M. (2003). Diffusion of innovations. 5th Edn: Simon and Schuster. Available online at: https://books.google.com.sg/books?id=9U1K5LjUOwEC

Romer, P. M. (1990). Endogenous technological change. J. Polit. Econ. 98, S71–S102. doi: 10.1086/261725

Ruan, J., Yang, Q., Ye, W., and Zhang, Y. (2024). Rural entrepreneurship development in China: index construction and measurement analysis. Econ. Manag. 38, 9–18.

Schneider, M. (2017). Wasting the rural: meat, manure, and the politics of agro-industrialization in contemporary China. Geoforum 78, 89–97. doi: 10.1016/j.geoforum.2015.12.001

Schumpeter, J. A. (2021). The theory of economic development. Taylor & Francis. Routledge. Avilable online at: https://www.google.co.jp/books/edition/The_Theory_of_Economic_Development/ffUlEAAAQBAJ?hl=zh-CN&gbpv=0

Shen, C., Wu, X., Shi, L., Wan, Y., Hao, Z., Ding, J., et al. (2025). How does the digital economy affect the urban–rural income gap? Evidence from Chinese cities. Habitat Int. 157:103327. doi: 10.1016/j.habitatint.2025.103327

Shen, N., Zhou, J., Zhang, G., Wu, L., and Zhang, L. (2025). How does data factor marketization influence urban carbon emission efficiency? A new method based on double machine learning. Sustain. Cities Soc. 119:106106. doi: 10.1016/j.scs.2024.106106

Shi, X., Cui, L., Song, W., and Huang, Z. (2024). Can returning home for entrepreneurship narrow the urban-rural income gap: empirical evidence from national pilot counties for returning home for entrepreneurship. J Agrotech Econ, 1–19. doi: 10.13246/j.cnki.jae.20241016.001

Si, S., Yu, X., Wu, A., Chen, S., Chen, S., and Su, Y. (2015). Entrepreneurship and poverty reduction: a case study of Yiwu, China. Asia Pac. J. Manag. 32, 119–143. doi: 10.1007/s10490-014-9395-7

Su, Y., Song, J., Lu, Y., Fan, D., and Yang, M. (2023). Economic poverty, common prosperity, and underdog entrepreneurship. J. Bus. Res. 165:114061. doi: 10.1016/j.jbusres.2023.114061

Sun, S., and Tu, Y. (2023). Impact of financial inclusion on the urban-rural income gap—based on the spatial panel data model. Financ. Res. Lett. 53:103659. doi: 10.1016/j.frl.2023.103659

Sutter, C., Bruton, G. D., and Chen, J. (2019). Entrepreneurship as a solution to extreme poverty: a review and future research directions. J. Bus. Ventur. 34, 197–214. doi: 10.1016/j.jbusvent.2018.06.003

Tang, J., Gong, J., Ma, W., and Rahut, D. B. (2022). Narrowing urban–rural income gap in China: the role of the targeted poverty alleviation program. Econ. Anal. Policy 75, 74–90. doi: 10.1016/j.eap.2022.05.004

Vargas-Zeledon, A. A., and Lee, S.-Y. (2024). Configurations of institutional enablers that foster inclusive entrepreneurship: a fuzzy-set qualitative comparative analysis. J. Innov. Knowl. 9:100549. doi: 10.1016/j.jik.2024.100549

Wang, Y., Li, B., Niu, X., and Li, B. (2024). Return-to-hometown entrepreneurship and employment of low-income households: evidence from national returned entrepreneurial enterprise data of China. Econ. Anal. Policy 84, 1714–1729. doi: 10.1016/j.eap.2024.10.051

Wang, Z., Zheng, X., Wang, Y., and Bi, G. (2024). A multidimensional investigation on spatiotemporal characteristics and influencing factors of China’s urban-rural income gap (URIG) since the 21st century. Cities 148:104920. doi: 10.1016/j.cities.2024.104920

Wei, S., Wu, Z., Stenholm, P., and Su, Z. (2025). Positive deviance: income inequality and entrepreneurs’ pursuit of innovative entrepreneurship. J. Int. Manag. 31:101257. doi: 10.1016/j.intman.2025.101257

Weng, Y., and Wang, S. (2025). Perception of land rights, village industrial development, and household entrepreneurial behavior—evidence from non-farm entrepreneurship in rural China. Front. Sustain. Food Syst. 8:1509213. doi: 10.3389/fsufs.2024.1509213

World Bank (2024). Poverty, prosperity, and planet report 2024: Pathways out of the Polycrisis. DC: World Bank.