- 1School of Business, Minnan Normal University, Zhangzhou, China

- 2College of Life Science, Longyan University, Longyan, China

- 3Chinese International College, Dhurakij Pundit University, Bangkok, Thailand

Introduction: Food security is essential for national development, and agricultural insurance is a crucial tool for managing agricultural risks. It plays a key role in enhancing grain production capacity, but its impact across various dimensions has not been thoroughly examined.

Methods: This study develops a multidimensional model of comprehensive grain production capacity based on production function theory. The model incorporates labor productivity, land use efficiency, agricultural technological innovation, and agricultural carbon emissions. We use panel data from 27 Chinese provinces spanning from 2009 to 2021 and apply a fixed-effects model to assess the effects of agricultural insurance on these dimensions. Robustness and endogeneity tests are conducted to ensure the validity of the results.

Results: Our findings demonstrate that agricultural insurance significantly improves overall grain production capacity. The positive effects are particularly notable in labor productivity, land use efficiency, technological innovation, and a reduction in agricultural carbon emissions. Moreover, the impacts are more pronounced in non-major grain-producing areas compared to major ones.

Discussion: These results suggest that agricultural insurance has a vital role in enhancing sustainable grain production. We recommend that policymakers and insurers focus on strengthening the role of agricultural insurance, especially in regions that are less involved in major grain production.

1 Introduction

Food security has long been a core policy concern in China. As a major agricultural country, the stability and development of grain production are of paramount importance for national development. Since the 18th National Congress of the Communist Party of China, food security has been established as a top priority in state governance. In 2024, China’s total grain output exceeded 700 million metric tons for the first time, representing a 1.6% year-on-year increase. This achievement follows nine consecutive years of grain production remaining above 650 million metric tons, reflecting a gradual improvement in the country’s comprehensive grain production capacity (National Bureau of Statistics of China, 2024).

Nevertheless, grain production in China remains highly vulnerable to natural disasters. According to the National Commission for Disaster Reduction, major disasters in 2024 included floods, geological hazards, typhoons, hailstorms, low temperatures, and snowstorms, alongside droughts, earthquakes, wildfires, and sandstorms. These events affected a total of 10.089 million hectares of cropland (State Council of the People’s Republic of China, 2025). In addition, substantial fluctuations in grain prices have significantly dampened the production incentives of grain farmers.

Agricultural insurance has emerged as a critical risk management tool, helping to mitigate agricultural risks, compensate for disaster-related losses, stabilize farmers’ incomes, and maintain production expectations. Since the launch of the central government’s premium subsidy pilot program in 2007, China has steadily expanded its agricultural insurance system. In 2018, full-cost insurance for the three major staple crops (rice, wheat, and corn) was introduced, and by 2024, this program had been rolled out nationwide. As a result, China’s agricultural insurance premium income has reached RMB 150 billion, providing risk coverage exceeding RMB 5 trillion, making it the largest agricultural insurance market globally (Zhang et al., 2025). The rapid expansion of agricultural insurance in China raises an important research question: does this growth merely reflect an increase in premium volume, or does it meaningfully contribute to enhancing comprehensive grain production capacity? Notably, improvements in grain production capacity should not be understood solely as increases in output. Rather, they represent a multidimensional construct that reflects the overall productivity and resilience of the agricultural sector, encompassing labor productivity, land use efficiency, technological innovation, and environmental sustainability. Establishing a robust and operationalizable framework for measuring this comprehensive capacity remains a critical challenge in both academic research and policy practice. Furthermore, as China continues to reform and modernize its agricultural insurance system, it is essential to examine how such reforms can more effectively support sustainable improvements in grain production. Addressing these questions constitutes the core motivation of this study.

To address this issue, this study constructs a comprehensive grain production capacity model based on economic growth theory. The model incorporates four key dimensions: labor productivity, land use efficiency, agricultural technological innovation, and agricultural carbon emissions. Using panel data from 27 provincial-level regions in China covering the period from 2009 to 2021, we conduct an empirical analysis to examine the effect of agricultural insurance on each dimension. The results indicate that agricultural insurance significantly improves labor productivity, land use efficiency, and technological innovation, while also significantly reducing carbon emissions in agriculture. Moreover, these effects vary significantly across regions.

This research contributes to the growing body of literature on agricultural insurance in both theoretical and empirical terms. While prior studies have explored various impacts of agricultural insurance—such as on crop acreage (Goodwin et al., 2004; Yuan and Xu, 2024), crop selection (Jiang et al., 2022; Zhang and Gu, 2025), technology adoption (Mao et al., 2022; Wei et al., 2021), and production resilience (Xie et al., 2025)—most have focused on a single dimension of analysis. Few have conducted a multidimensional evaluation of agricultural insurance’s overall effect. Moreover, studies using index-based methods face limitations in indicator accuracy and system validity.

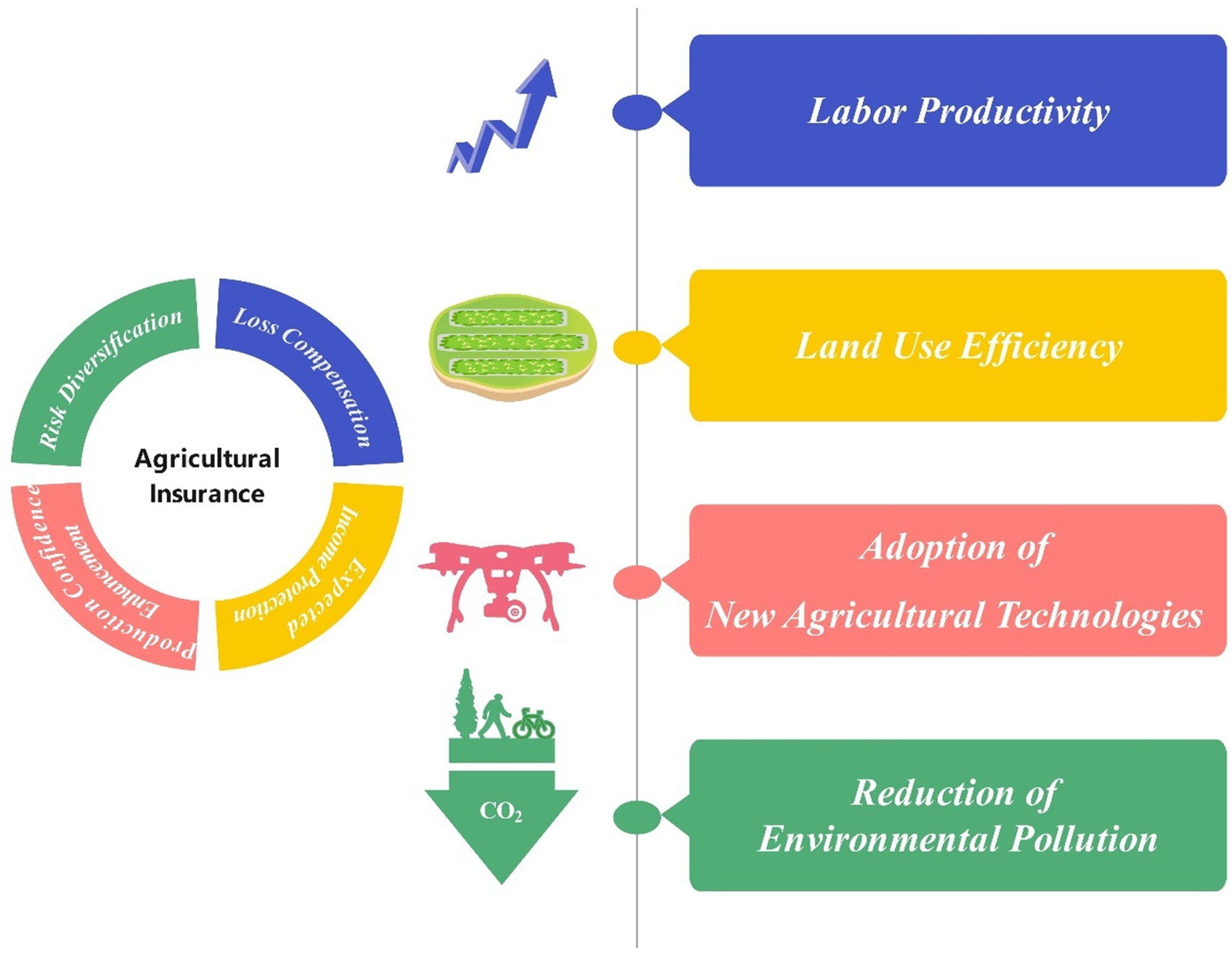

This study offers three key contributions. First, this study provides a comprehensive assessment of the impact of agricultural insurance on grain production capacity by examining four key dimensions: labor productivity, land use efficiency, technological innovation, and agricultural carbon emissions. In doing so, it contributes to the existing literature by extending both the theoretical understanding and empirical evidence on the role of agricultural insurance in agricultural development. While prior studies have typically focused on either single-dimensional analyses or aggregate composite indices, research adopting a multidimensional framework remains limited. This study helps to fill that gap by offering a more nuanced and holistic evaluation of agricultural insurance’s effects on production capacity. Second, it introduces a theoretical framework that captures the mechanisms through which agricultural insurance affects grain production, grounded in an extended production function approach. Third, it emphasizes the need to examine comprehensive outcomes, such as labor productivity, land efficiency, technological innovation, and environmental impacts, rather than focusing solely on scale or input-specific effects. These findings offer policy-relevant insights for both government decision-makers and insurance providers seeking to optimize product design and service delivery (see Figure 1).

Figure 1. The mechanism of agricultural insurance’s impact on comprehensive grain production capacity.

The remainder of the paper is structured as follows: Section 2 reviews the relevant literature. Section 3 presents the theoretical framework and research hypotheses. Section 4 describes the data, empirical model, and variable definitions. Section 5 reports the empirical findings. Section 6 offers concluding remarks and policy implications.

2 Literature review

As a key instrument for agricultural risk management, agricultural insurance has garnered increasing attention in both academic and policy circles in recent years. Existing studies have primarily focused on the multidimensional impacts of agricultural insurance on grain production, encompassing aspects such as input use, production potential, and agricultural resilience. This section reviews the literature across these major dimensions.

First, a substantial body of research has examined the influence of agricultural insurance on input use in crop production. Horowitz and Lichtenberg (1993) analyzed how crop insurance affected the use of fertilizers and pesticides among corn farmers in the U.S. Midwest. Similarly, Goodwin (1996) investigated the relationship between chemical input use and crop insurance purchasing decisions among dryland wheat farmers in Kansas. More recently, Ifft and Jodlowski (2024) employed unsupervised machine learning algorithms to assess conservation-oriented farming practices, finding a significant positive correlation between crop insurance participation and optimal nitrogen balance. In China, Wu et al. (2024) conducted an empirical study in Henan Province and reported that full-cost insurance for wheat significantly reduced pesticide usage.

Second, several studies have investigated the role of agricultural insurance in enhancing production potential. Birovljev et al. (2015) argued that appropriately priced insurance premiums can stimulate agricultural production capacity. Li et al. (2025) demonstrated that the widespread adoption of crop insurance led to increased farm income and grain output. Zhou et al. (2024) explored the impact of agricultural insurance on grain production resilience and found an inverted U-shaped relationship, with regional heterogeneity playing a significant role.

Third, research has explored the mechanisms through which agricultural insurance affects crop production. Zou et al. (2022) found that insurance coverage promotes labor productivity and land use efficiency while encouraging specialization among farmers, thereby boosting agricultural output. Kouakou et al. (2024) emphasized that crop yields are vulnerable to climate and weather shocks, and that insurance mitigates these risks, stabilizing farm incomes—a factor that has drawn considerable public sector attention. Aglasan et al. (2024) observed that counties with higher crop insurance coverage experienced lower losses during droughts, heatwaves, and excessive rainfall events. Zheng and Ning (2025) found that agricultural insurance facilitates the reallocation of labor resources, which is critical for improving total factor productivity. Similarly, Quan et al. (2024) noted that policy-based agricultural insurance enhances agricultural resilience by promoting large-scale farming, optimizing crop structures, and boosting productivity—particularly in regions characterized by high natural risk and trade dependence.

Fourth, recent frontier research has explored the effects of green finance and green taxation on sustainable development, highlighting their positive roles in promoting environmental outcomes. Scholars have proposed various analytical frameworks and confirmed, through empirical investigations, the beneficial impacts of green instruments on green transformation. For instance, Wang C. F. et al. (2024) and Wang R. et al. (2024) developed a green innovation model mediated by green technology, based on survey data from 447 manufacturing firms in Dhaka, Bangladesh. Their findings indicate that both green logistics and green finance significantly promote green innovation. Zhen and Rahman (2024) examined the relationship between environmental management accounting (EMA), green financing, and ESG (environmental, social, and governance) performance. They found that sustainable production fully moderated the relationship between EMA and ESG outcomes, although it did not mitigate the link between green financing and ESG performance. In the domain of green taxation, Uddin et al. (2023) analyzed the mediating role of energy efficiency between green taxation and sustainability. Their results revealed that green taxes have a significant positive effect on environmental and social sustainability, though no impact was found on economic sustainability. Similarly, Rahman (2025) investigated the joint effects of renewable energy financing and governance quality on carbon emissions in BRICS countries. They reported that a 1% increase in renewable energy financing reduces carbon emissions by 0.293%, and improved governance lowers emissions by 0.028%, while a 1% increase in fossil fuel financing leads to a 0.335% increase in carbon emissions. Lastly, Sun et al. (2024) assessed both the direct and mediating effects of green taxation and energy efficiency on ESG performance. The study found a significant positive association between green tax policies and ESG outcomes, with energy efficiency initiatives enhancing all dimensions of ESG performance. Moreover, green taxation was shown to play a mediating role between energy efficiency and ESG achievements.

Despite these valuable contributions, several research gaps remain. First, most existing studies focus on the effects of insurance on single production factors, lacking a comprehensive analysis of its multidimensional impacts. Second, empirical assessments often rely on singular proxy variables, such as total grain output or resilience indicators, which fall short of capturing the complexity of comprehensive production capacity. While composite indices offer a broader perspective, they are sensitive to the choice of indicators and methodology, leading to limitations in robustness and comparability. Third, many studies lack a clear theoretical framework to articulate the mechanisms through which agricultural insurance influences different dimensions of production.

In response to these gaps, the present study advances the literature by constructing a comprehensive production function model that integrates four critical dimensions: labor productivity, land use efficiency, technological innovation, and agricultural carbon emissions. We analyze the impact of agricultural insurance on each of these dimensions and explore the underlying mechanisms of influence, thereby contributing new empirical and theoretical insights to the field.

3 Theoretical framework and research hypotheses

In the existing literature, scholars commonly employ classical production functions to analyze agricultural output. One widely used approach is the Cobb–Douglas (CD) production function, as exemplified by Cha et al. (2022) and Li et al. (2024). In addition to the standard form, several studies have proposed modifications to the CD function to better capture the dynamics of agricultural production (Luo and Song, 2022). Another commonly adopted framework is the Solow production function, originally developed by Solow (1956), which provides a foundational model for analyzing long-term growth (Kong, 2019; Duan, 2015). The basic form of the Solow model can be expressed as follows (as shown in Equation 1):

Although the Solow model provides a useful framework for understanding economic growth, it does not account for environmental constraints such as resource depletion or pollution. To address this limitation, scholars have proposed extended models. For instance, in Advanced Macroeconomics, Romer (2021) incorporates natural resources and land into a modified production function based on the Cobb–Douglas form (as shown in Equation 2):

where Y(t) denotes output at time t; K(t) is capital input; R(t) represents natural resources; T(t) is land input; A(t) indicates the level of technology or knowledge; and L(t) is labor input. The exponents α > 0, β > 0, and γ > 0 are the output elasticities of capital, natural resources, and land, respectively. The term [A(t)L(t)] 1 − α − β − γ reflects the contribution of labor and technology under the constraint that the sum of all output elasticities equals one, i.e., α + β + γ + λ = 1, ensuring constant returns to scale.

Building on the extended Solow model discussed above, this study recognizes that comprehensive grain production capacity must account for the essential inputs of production factors such as labor, land, and technology. At the same time, grain production is inherently linked to sustainability concerns, particularly with respect to environmental impacts. To incorporate these considerations, this paper draws on the “green Solow model” introduced by Ding and Wu (2017), which integrates environmental constraints into the production function. Specifically, agricultural pollution (denoted as 𝐸) is introduced as a negative externality to capture the environmental cost associated with agricultural activities. From this perspective, comprehensive grain production capacity should not be understood as a mere aggregate of grain output. Instead, it should be assessed as a multidimensional construct that reflects the productive “capacity” across labor productivity, land use efficiency, technological innovation, and environmental impact.

Thus, we define the comprehensive grain production capacity function as shown in Equation 3:

Where Y(t) represents the comprehensive grain production capacity at time t; T(t) is land input; A(t) denotes the level of agricultural technology or knowledge; L(t) is agricultural labor input; and E(t) captures agricultural pollution or carbon emissions. The parameters β > 0 and γ > 0 reflect the positive output elasticities of land and the combined effects of technology and labor, respectively, while φ < 0 captures the negative elasticity associated with environmental pollution, indicating its detrimental effect on agricultural productivity.

The integration of agricultural insurance into grain production serves as an effective risk management mechanism that can significantly mitigate production volatility, stabilize farmers’ income expectations, and provide a range of auxiliary services—including disaster preparedness training, early warning systems, post-disaster assistance, and claims settlement. Early warning mechanisms enable farmers to detect potential risks in advance and implement preventative measures, thereby enhancing production efficiency. For example, when insurers anticipate that accumulated temperatures in a given year may fall below historical norms, they issue timely alerts. Farmers can respond by adopting early-maturing crop varieties or adjusting planting schedules to minimize potential yield losses (Sun et al., 2025).

Post-disaster recovery efforts can help farmers minimize losses, while insurance claim services provide critical financial support for restoring agricultural production. For instance, in a maize field located in Changping District, Beijing, heavy rainfall on July 19–20, 2016, caused severe flooding. In response, an agricultural research team conducted a damage assessment using LiDAR data collected via an unmanned aerial vehicle (UAV) platform (Gan et al., 2017). By extracting canopy height information from the LiDAR point cloud, the researchers developed a flood damage monitoring model based on variations in maize canopy height. Using a dual-threshold classification method grounded in normal distribution statistics, they were able to assess the severity of flood damage at a regional scale. Field measurements were used to validate the remote sensing results, yielding an overall classification accuracy of 72.15%. The findings not only provided a precise, data-driven basis for agricultural insurance claims but also offered valuable insights for disaster recovery planning, policy development, and resource allocation.

These functions of agricultural insurance—particularly risk diversification and income stabilization—strengthen farmers’ confidence in future production and returns. As a result, participation in agricultural insurance may lead to improvements in key dimensions of grain production capacity, including labor productivity, land use efficiency, and technological innovation. Moreover, in some cases, agricultural insurance can also promote environmental sustainability by enforcing cleaner production standards and reducing agricultural pollution. A case in point is the fattening pig insurance policy in China, which explicitly requires insured animals to undergo harmless disposal after death, thereby reducing environmental contamination and public health risks (Wu et al., 2025).

However, agricultural insurance may also induce farmers to increase their overall capital investment. Under conditions of budgetary or resource constraints, this reallocation of funds may lead to a reduction in other essential inputs in grain production. Such crowding-out effects could, in turn, diminish land productivity, labor efficiency, and incentives for technological innovation in agriculture. Based on this potential trade-off, the following hypothesis is proposed:

H1a: Agricultural insurance enhances comprehensive grain production capacity across the dimensions of labor productivity, land use efficiency, technological innovation, and reduction of agricultural carbon emissions.

H1b: Agricultural insurance does not significantly enhance comprehensive grain production capacity across these dimensions.

In China, agricultural insurance policies and implementation differ significantly across regions, particularly between major grain-producing and non-major grain-producing areas. According to policy documents issued by the Ministry of Finance, since 2003, 13 provinces (including Heilongjiang, Jilin, Liaoning, Inner Mongolia, Hebei, Henan, Shandong, Jiangsu, Anhui, Sichuan, Hunan, Hubei, and Jiangxi) have been designated as major grain-producing regions. These provinces generally enjoy better agricultural infrastructure and accounted for 78% of national grain output in 2024.

In contrast, non-major grain-producing areas, often located in hilly or mountainous regions, tend to have weaker agricultural infrastructure. However, driven by China’s rural revitalization strategy, these regions have experienced gradual improvements in agricultural conditions and rapid development of niche agricultural sectors. As a result, there are clear regional disparities in both the level of agricultural insurance development and the overall grain production capacity.

Accordingly, we propose the following competing hypotheses regarding regional heterogeneity:

H2a: Agricultural insurance has no significant heterogeneous effect on comprehensive grain production capacity between major and non-major grain-producing areas.

H2b: Agricultural insurance has a significantly heterogeneous effect on comprehensive grain production capacity between major and non-major grain-producing areas.

4 Data sources, model specification, and variable descriptions

4.1 Data sources

The data used in this study are drawn primarily from several authoritative sources: China Rural Statistical Yearbook (2010–2022), China Insurance Yearbook (2010–2022), China Agricultural Yearbook (2010–2022), and China Education Yearbook (2010–2022). Due to significant data omissions for certain regions, the analysis focuses on 27 provincial-level administrative units in mainland China, excluding Beijing, Shanghai, Tianjin, Hong Kong SAR, Macao SAR, and Taiwan Province.

4.2 Model specification

4.2.1 Baseline estimation model

Based on the theoretical framework presented earlier, we construct a two-way fixed effects model to examine the relationship between agricultural insurance and comprehensive grain production capacity. To mitigate heteroskedasticity and normalize the data, both dependent and independent variables are log-transformed. The baseline model is specified as follows (as shown in Equation 4):

Where Ykit denotes the kth dimension of comprehensive grain production capacity for province iii in year ttt, including labor productivity, land use efficiency, agricultural technological innovation, and agricultural carbon emissions. Xit represents the agricultural insurance density, measured as the core explanatory variable. Zlit is a vector of control variables such as education level, rural Engel coefficient, industrial and urban–rural coordination levels, fiscal expenditure on agriculture, and disaster area ratio. μi and θt represent province-specific and time-specific fixed effects, respectively, which control for unobserved heterogeneity and macroeconomic shocks. γit is the idiosyncratic error term. For estimation, all continuous variables are transformed into natural logarithms to address heteroscedasticity and allow interpretation of coefficients as elasticities. This equation serves as the foundational model to investigate the multidimensional effects of agricultural insurance using provincial panel data from China spanning 2009 to 2021.

4.3 Variable descriptions

4.3.1 Dependent variable

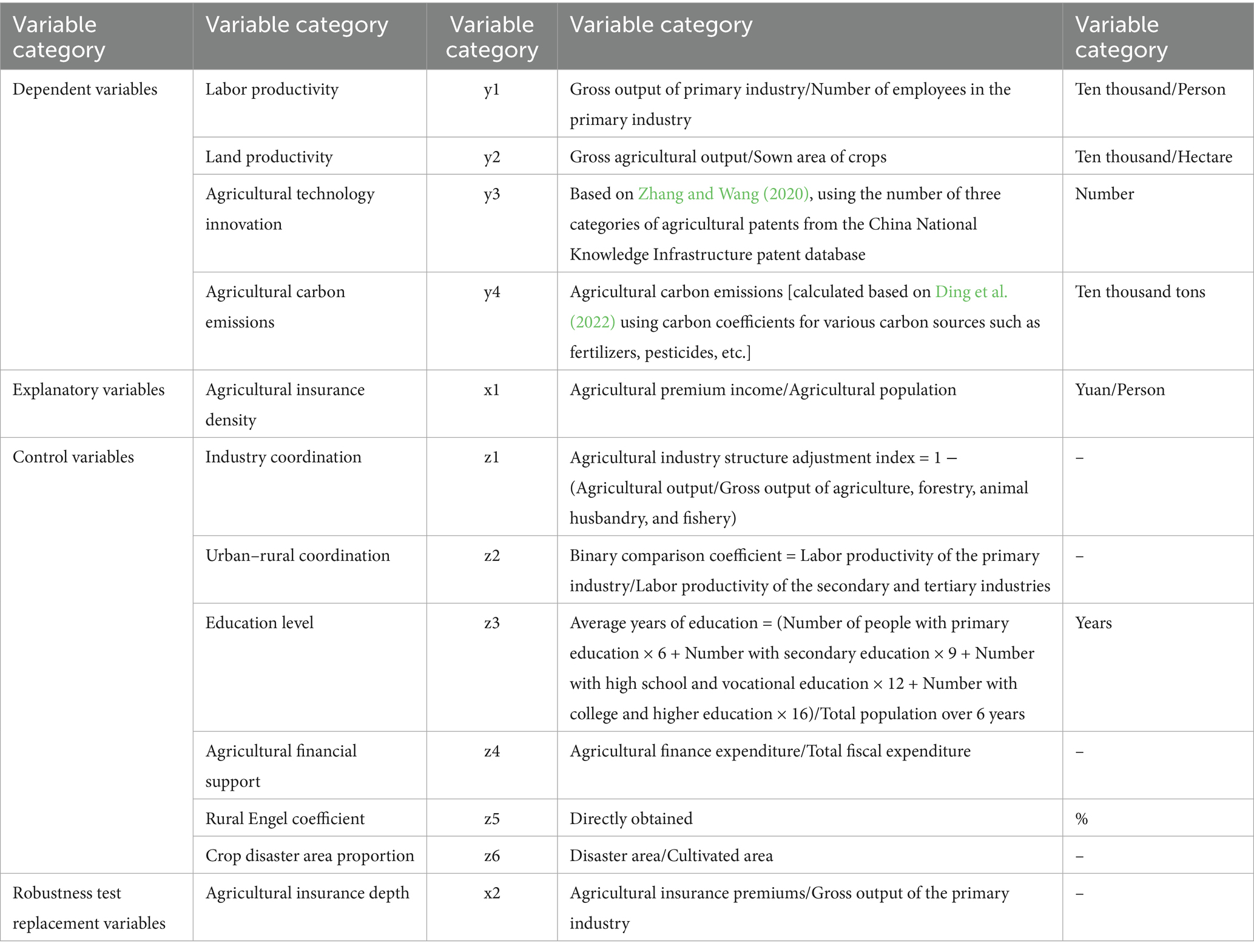

Comprehensive grain production capacity is a multidimensional construct that cannot be accurately captured by a single indicator. While previous studies have employed composite indices or efficiency-based approaches such as Data Envelopment Analysis (DEA) and Stochastic Frontier Analysis (SFA) to assess grain production capacity, these methods often mask the individual contributions of specific production factors. As a result, they fail to identify structural weaknesses or diagnose issues within distinct dimensions or stages of the production process. This limitation may ultimately introduce bias into the analysis and hinder a nuanced understanding of comprehensive grain production capacity. Given that grain production is highly sensitive to climatic conditions and input levels (Yang and Lin, 2021; Gong, 2021), we follow Yang et al. (2023) in using four distinct indicators to represent comprehensive capacity: labor productivity, land use efficiency, agricultural technological innovation, and agricultural carbon emissions. The theoretical mechanisms outlined in the preceding section are further validated through empirical analysis across four distinct dimensions. Detailed definitions and calculation methods are presented in Table 1.

4.3.2 Key independent variable

The core independent variable in this study is the level of agricultural insurance. While previous research has used total premium income (Yue et al., 2021) or indemnity payouts (Chen and Jiang, 2023) as proxies, these absolute measures may be biased due to regional disparities in economic development. To better reflect relative differences across provinces, we adopt agricultural insurance density (i.e., premiums per capita or per unit of rural population) as the main measure. For robustness checks and to address potential endogeneity, we also use agricultural insurance depth (i.e., premiums as a share of agricultural GDP) as an alternative measure.

4.3.3 Control variables

Control variables include a range of economic, social, and environmental indicators: Household characteristics, such as education level and rural Engel coefficient, capture household economic status and consumption structure; Industrial structure and regional development, measured through industrial coordination and urban–rural coordination indices, reflect the balance and integration of economic sectors; Government support, proxied by the ratio of agricultural, forestry, and water-related fiscal expenditure to total government spending, indicates the extent of state involvement in agricultural development; Natural conditions, represented by the ratio of disaster-affected arable land to total cultivated land, account for exposure to climate-related shocks.

4.4 Descriptive statistics

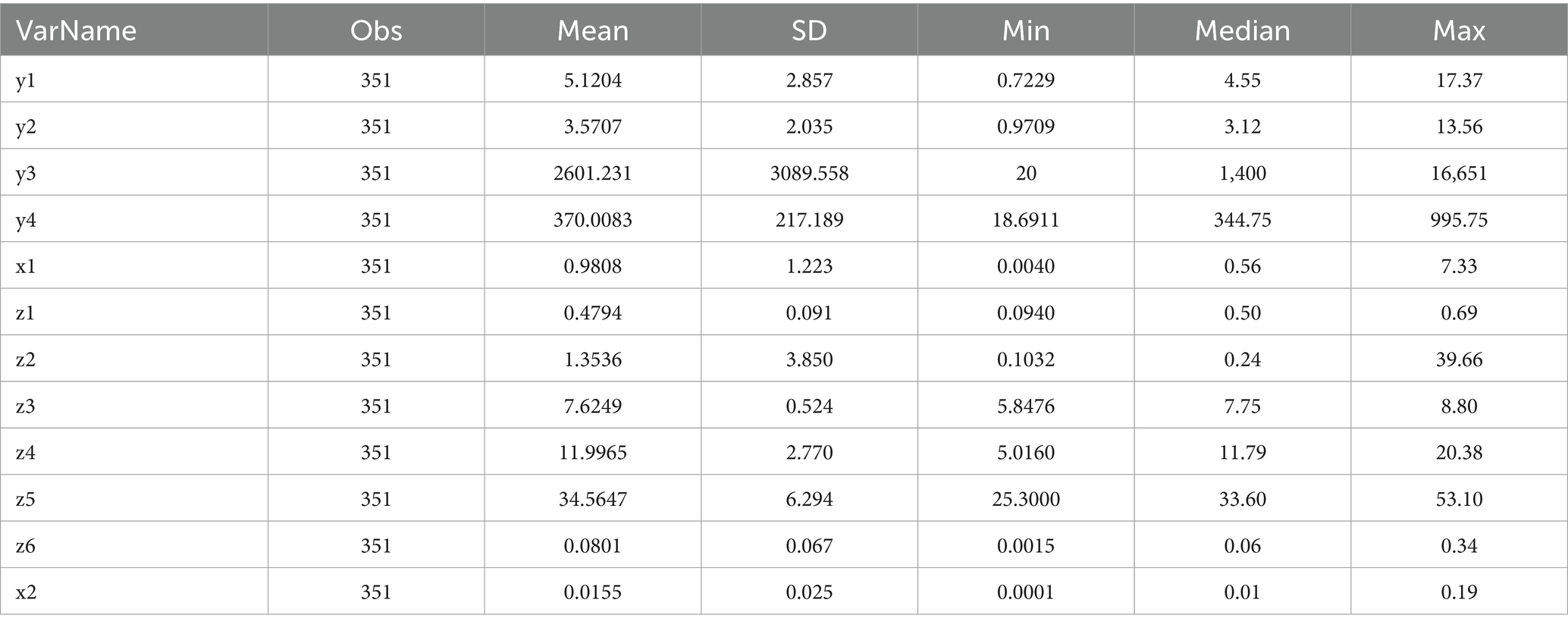

Table 1 presents the names, abbreviations, calculation methods, and units of all major variables. Table 2 summarizes the descriptive statistics. Substantial regional variation exists across all four dimensions of the dependent variable—labor productivity, land use efficiency, technological innovation, and agricultural carbon emissions. Similarly, agricultural insurance density varies widely across provinces, ranging from a minimum of 0.0040 to a maximum of 7.33 hundred RMB per capita, with a mean of 0.9808 and a median of 0.56. These discrepancies indicate significant heterogeneity in the penetration and effectiveness of agricultural insurance across different regions.

5 Empirical analysis

5.1 Baseline regression results

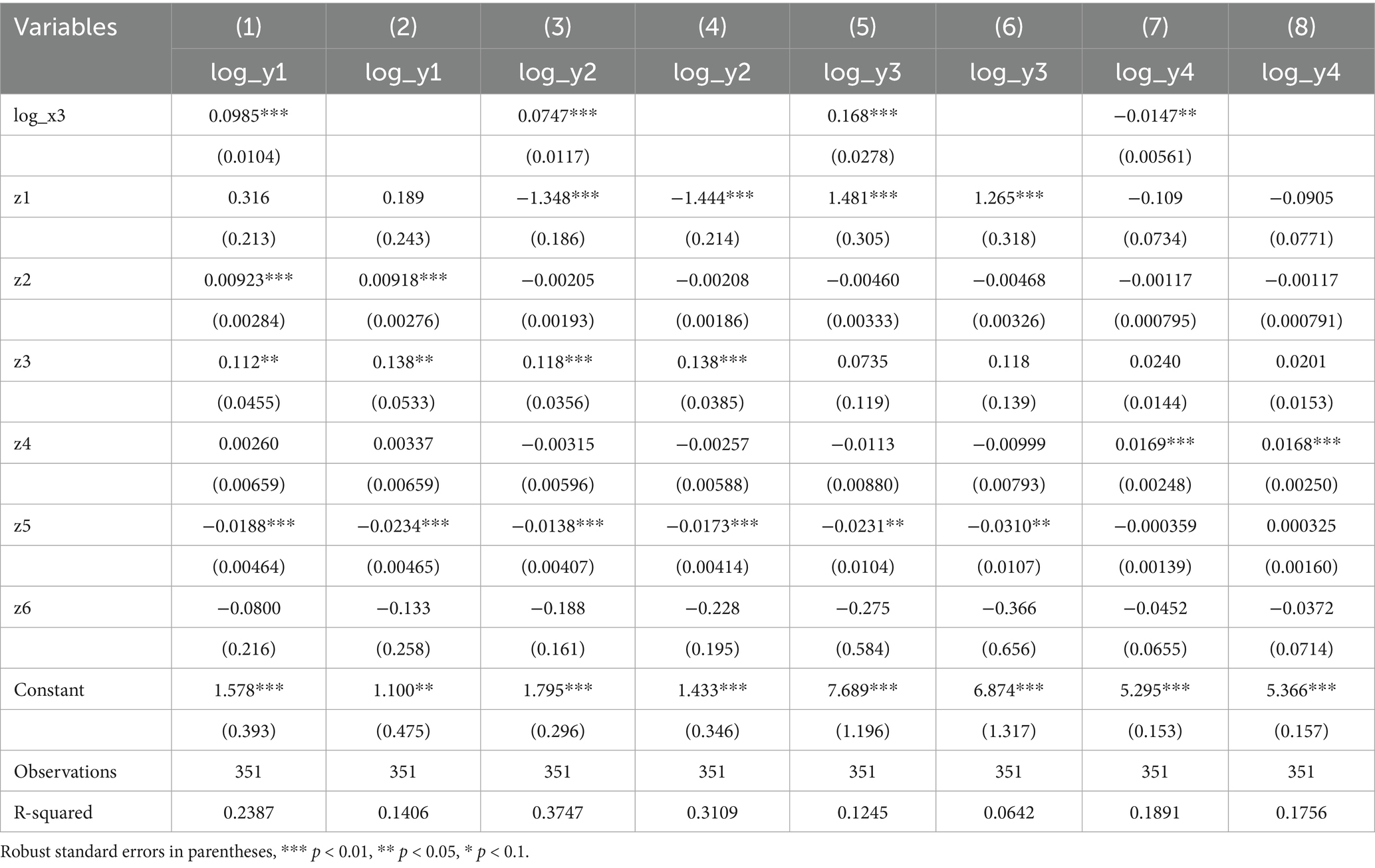

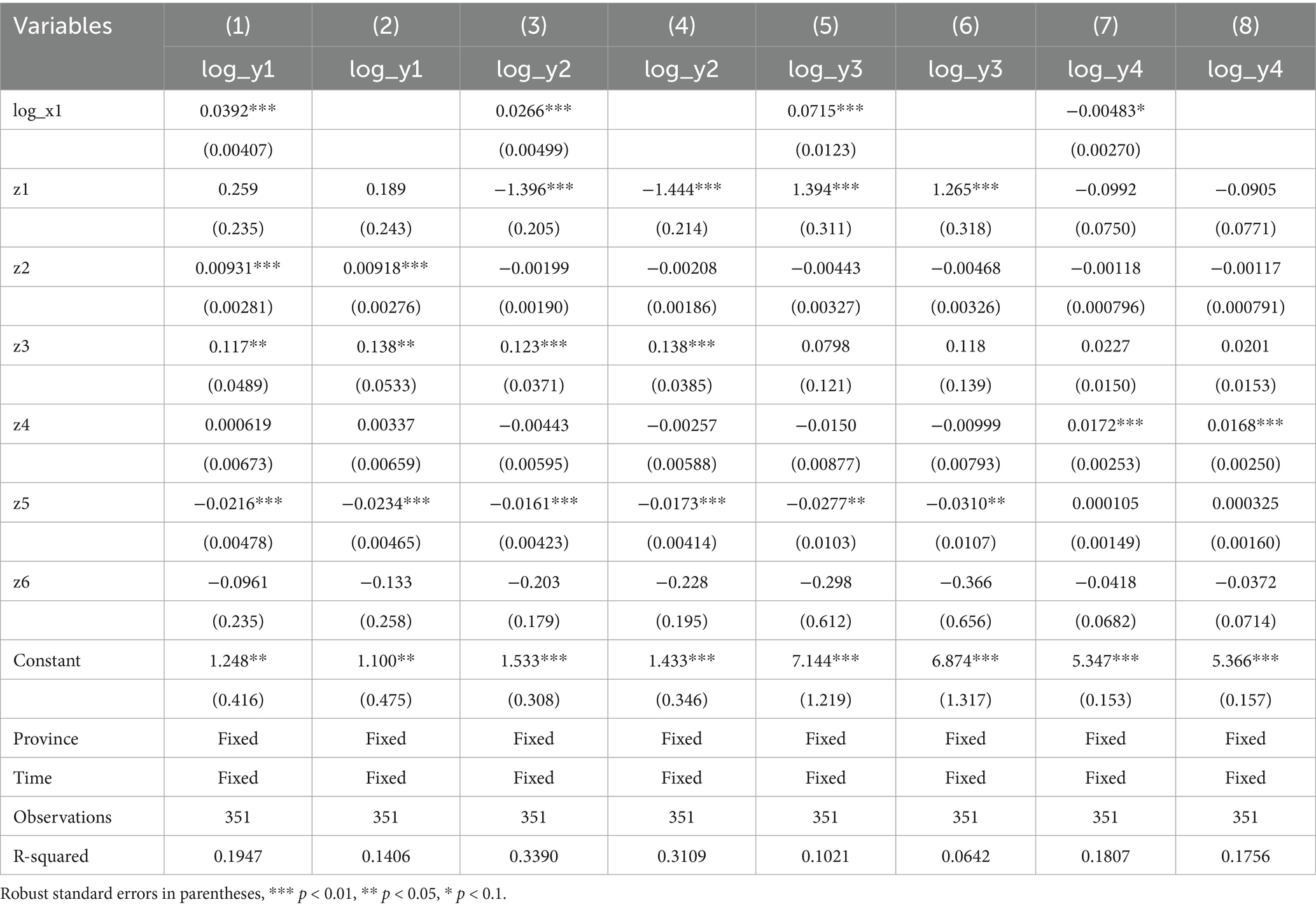

This study employs a two-way fixed effects model to estimate the impact of agricultural insurance on comprehensive grain production capacity (see Equation 4). The regression results are reported in Table 3. Columns (1) and (2) present the effects of agricultural insurance on labor productivity. The positive and statistically significant coefficients suggest that agricultural insurance significantly enhances labor productivity in grain production. Columns (3) and (4) display the results for land use efficiency, with positive coefficients indicating that agricultural insurance contributes to more efficient land utilization. Columns (5) and (6) report the estimates for agricultural technological innovation, where the positive coefficients imply that insurance coverage facilitates innovation in agricultural practices. Finally, Columns (7) and (8) show that agricultural insurance has a statistically significant negative effect on agricultural carbon emissions, suggesting that insurance adoption may help reduce environmental impact.

Table 3. Regression results of the impact of agricultural insurance on grain comprehensive production capacity.

5.2 Robustness and endogeneity tests

To validate the reliability of the baseline findings, we conduct a series of robustness and endogeneity checks. These include alternative variable specifications, instrumental variable regressions, and lagged independent variable models, with the following results:

5.2.1 Alternative explanatory variable

First, we replace the core independent variable—agricultural insurance density—with agricultural insurance depth, which reflects the share of agricultural insurance premiums in agricultural GDP. This variable, often used in the literature (e.g., Wang C. F. et al., 2024; Wang R. et al., 2024; Wang et al., 2025), provides a complementary measure of insurance coverage. We also apply logarithmic transformation for consistency. As shown in Table 4, the regression results for all four dimensions of comprehensive production capacity remain significant and directionally consistent with the baseline model, supporting the robustness of our findings.

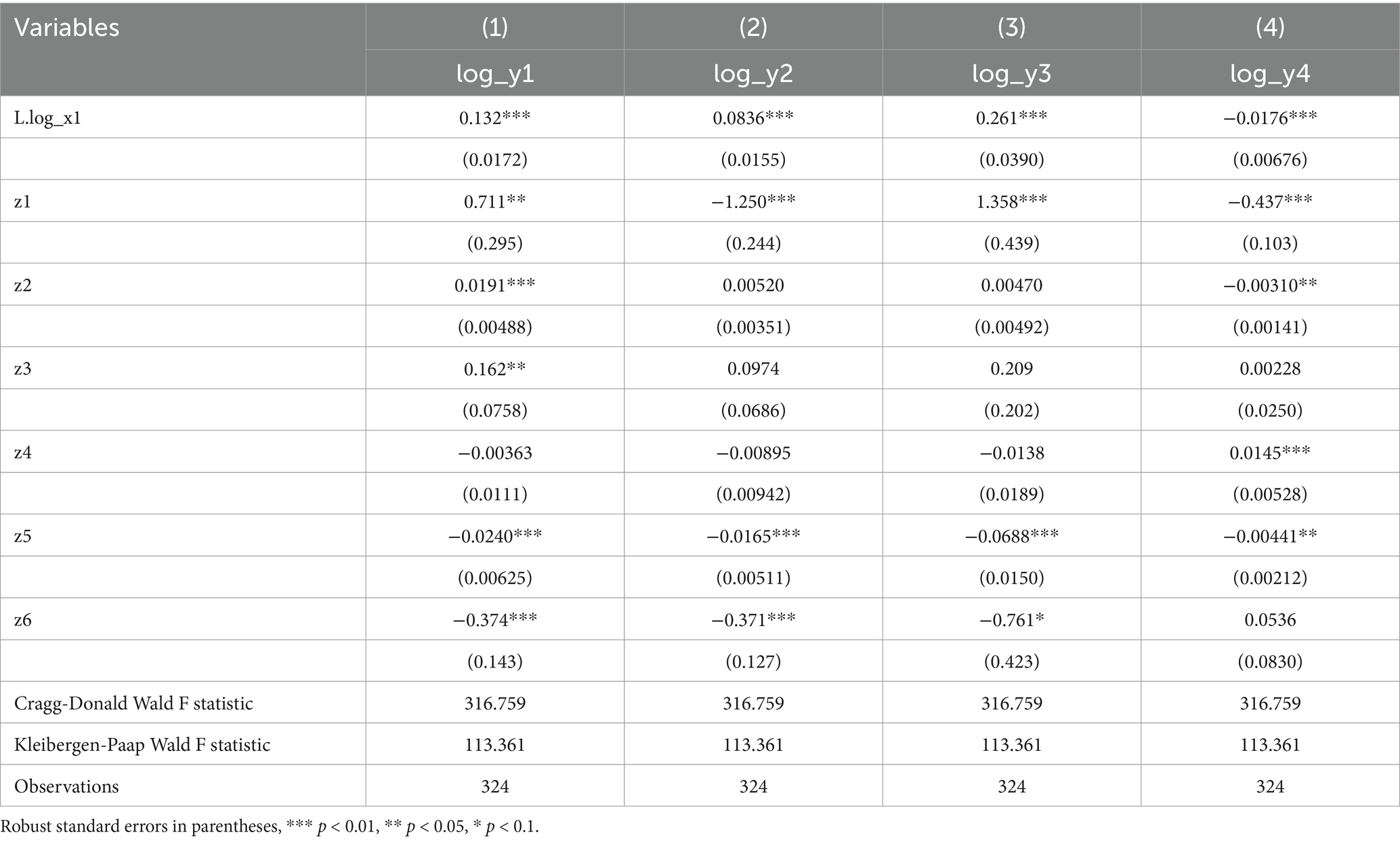

5.2.2 Instrumental variable estimation

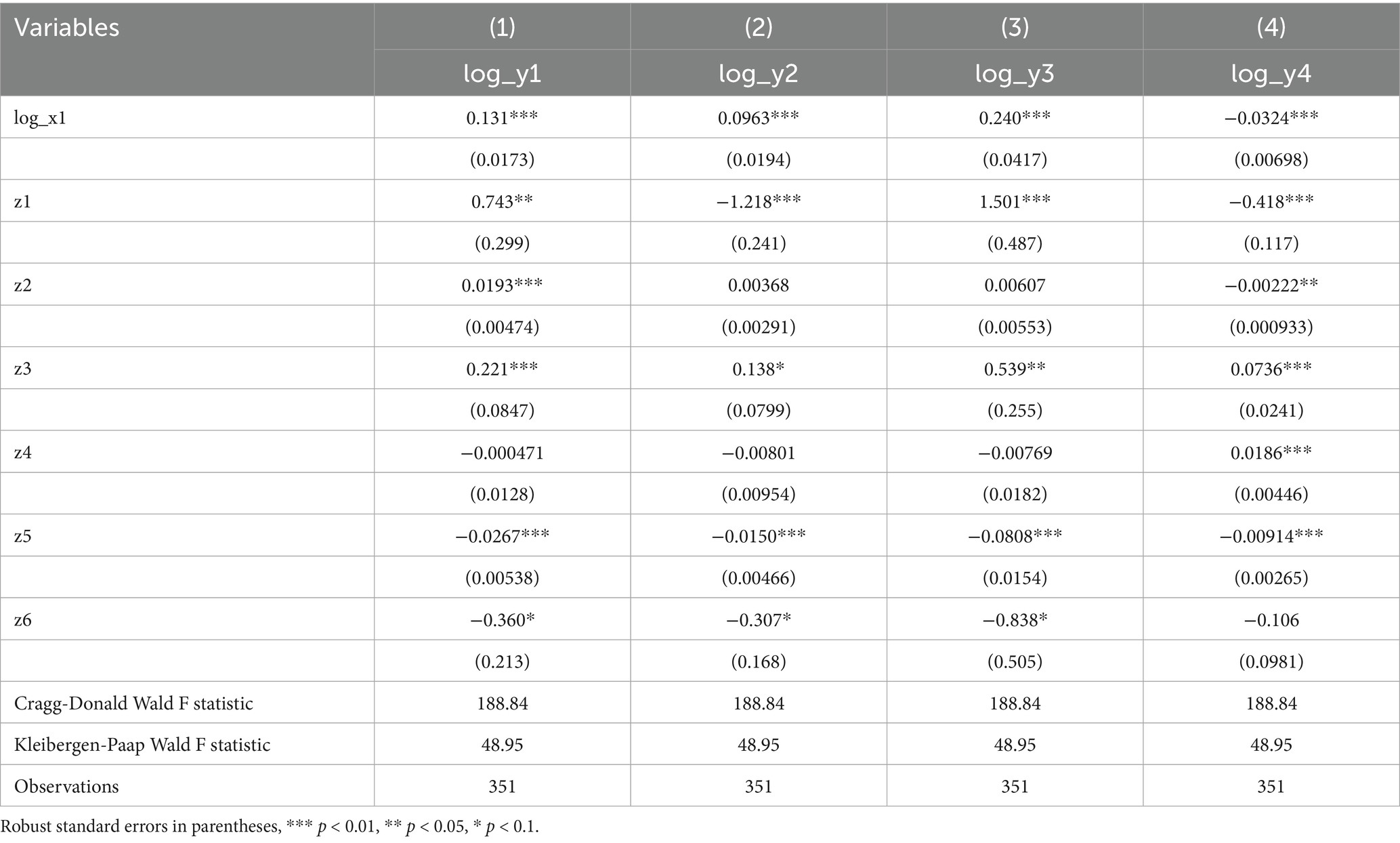

To address potential endogeneity, we employ the per-unit disaster area indemnity expenditure as an instrument, defined as total indemnity payments divided by affected farmland area. This study employs the two-stage least squares (2SLS) method to address potential endogeneity. Table 5 presents the 2SLS regression results using “agricultural insurance compensation expenditure per unit of disaster-affected area” as the instrumental variable. The estimated coefficients are consistent with those from the baseline OLS regressions and remain statistically significant at the 1% level. To evaluate the strength of the instrumental variable, both the Cragg–Donald Wald F-statistic and the Kleibergen–Paap Wald F-statistic are reported. The results indicate that the instrumental variable passes the weak instrument test, confirming its relevance and validity.

5.2.3 Lagged independent variable

Given that agricultural insurance may exhibit lagged effects—wherein previous-year policy developments influence current production outcomes—we introduce a one-period lag of agricultural insurance density as an alternative instrument. This approach is also supported by prior studies (e.g., Zhu, 2022; Chen, 2024). Table 6 presents the 2SLS results using this lagged variable. The instrument passes standard weak instrument diagnostics, and the regression results remain statistically significant and consistent with the baseline findings, suggesting that the effects of agricultural insurance persist over time.

5.3 Regional heterogeneity analysis

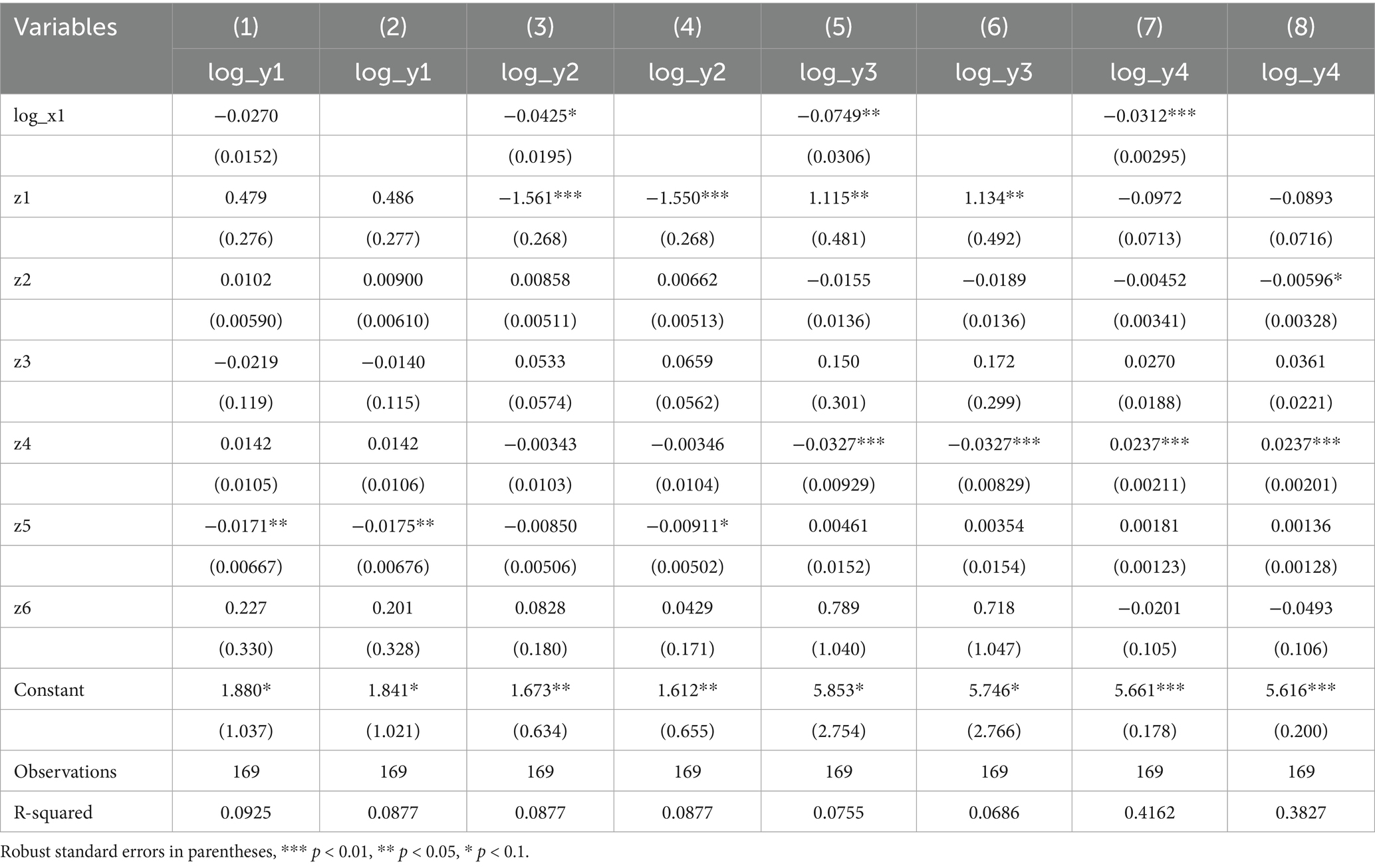

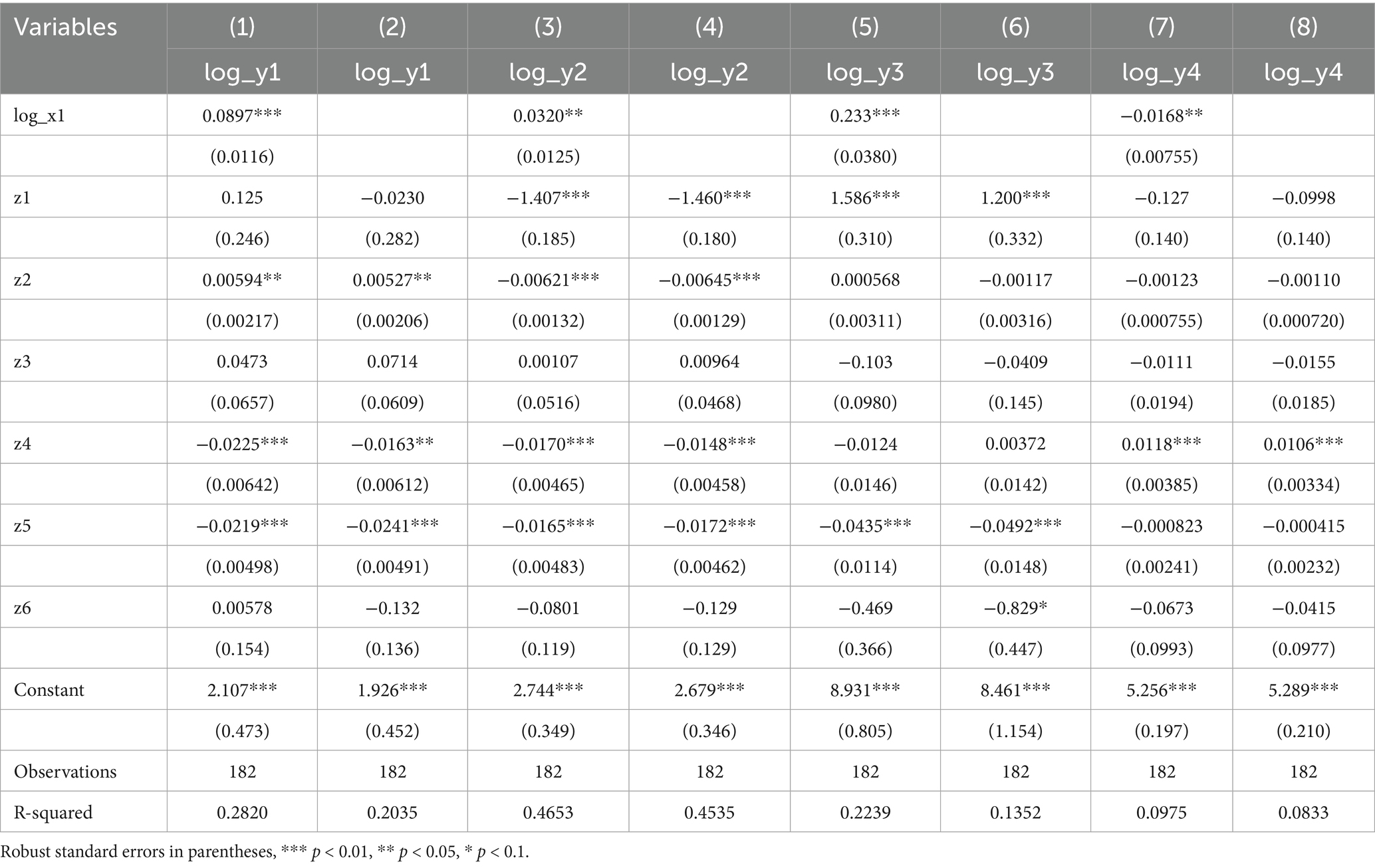

We further investigate whether the effects of agricultural insurance vary across regions, focusing on differences between major grain-producing areas and non-major grain-producing areas (including grain-marketing and grain-balanced regions). Based on data availability, the analysis includes 27 provinces. As noted in Section 4.1, the excluded provinces are all non-major grain-producing areas.

The classification identifies 13 major grain-producing provinces (e.g., Heilongjiang, Henan, Shandong, Sichuan, etc.) and 14 non-major grain-producing provinces (e.g., Fujian, Zhejiang, Guangdong, etc.).

Table 7 reports the regression results for the major grain-producing areas. The coefficients show that agricultural insurance does not significantly affect labor productivity, and it exhibits negative effects on land use efficiency, technological innovation, and carbon emissions. In contrast, Table 8 presents the results for non-major grain-producing areas, where agricultural insurance shows a consistently positive impact across labor productivity, land efficiency, and technological innovation, while also significantly reducing carbon emissions.

These findings suggest that agricultural insurance is more effective in enhancing comprehensive grain production capacity in non-major grain-producing areas. This may be attributed to comparatively weaker agricultural infrastructure and limited policy support in these regions, where insurance mechanisms serve as a more critical buffer against risks.

6 Discussion

The empirical findings of this study confirm that agricultural insurance has significant positive effects on multiple dimensions of comprehensive grain production capacity in China, thereby supporting Hypothesis H1a. Specifically, agricultural insurance is found to enhance labor productivity, land use efficiency, and technological innovation, while also contributing to the reduction of agricultural carbon emissions. While these conclusions are broadly consistent with existing research, certain distinctions are worth noting.

In terms of labor productivity, our results align with prior studies. For instance, Chai et al. (2025) found that farmer participation in agricultural insurance significantly facilitates the reallocation of labor toward the agricultural sector. Similarly, Zou et al. (2022) reported that insurance coverage improves both labor productivity and per capita cultivated land. Our empirical analysis corroborates these findings, indicating that agricultural insurance meaningfully boosts labor productivity in grain production. Zou et al. (2022) findings suggest that agricultural insurance has a positive effect on labor productivity—a conclusion that is corroborated by the empirical evidence presented in this study. The results demonstrate that agricultural insurance significantly enhances labor productivity in grain production.

Regarding land use efficiency, although fewer studies have directly examined this dimension, existing evidence suggests that agricultural insurance may promote scale expansion in agricultural production. Zheng and Deng (2024) argued that insurance is an important driver of large-scale farming and green agricultural development. Pavlov et al. (2016), using simulation analysis of Russian agricultural producers, found that low-premium crop insurance effectively stimulates production. Likewise, Yu et al. (2018) showed that premium subsidies can lead to increased planting areas. Our results further substantiate these conclusions by demonstrating that agricultural insurance significantly improves land use efficiency. Although this study does not directly examine the effect of agricultural insurance on the scale of agricultural production, the empirical results indicate that agricultural insurance significantly enhances land use efficiency. This finding suggests that agricultural insurance influences land utilization through improvements in efficiency.

With respect to technological innovation, prior research has also highlighted a positive linkage between insurance and the adoption of modern agricultural technologies. For example, Tang et al. (2019), based on field surveys in Heilongjiang and Jiangsu provinces, observed that weather index insurance significantly promotes technology adoption among farmers. Similarly, Zhang and Zhang (2025) identified insurance participation as a key determinant in household farms’ decisions to adopt green technologies. These studies reinforce our finding that agricultural insurance plays a constructive role in encouraging technological innovation in agriculture. Zhang and Zhang (2025) findings are consistent with the empirical results of this study and further support the positive role of agricultural insurance in promoting technological innovation in agriculture. They suggest that insured farmers are more likely to adopt new technologies.

In terms of environmental outcomes, particularly agricultural carbon emissions, our results are in line with Ahmed et al. (2022), who showed that increasing insurance coverage or reducing air pollution contributes to higher green total factor productivity in agriculture. However, Zhang and Chen (2024), based on data from prefecture-level cities in Hubei Province, reported that the carbon-reduction effect of agricultural insurance weakens as farm size increases. In contrast, our study finds that agricultural insurance significantly reduces carbon emissions in both major and non-major grain-producing regions. This discrepancy may be due to differences in sample scope and regional characteristics.

The regional heterogeneity analysis confirms Hypothesis H2b, revealing that agricultural insurance exerts significantly different effects on comprehensive grain production capacity across regions. Specifically, the positive impact of insurance is more pronounced in non-major grain-producing areas, whereas its effect is limited or insignificant in major grain-producing regions. This finding runs counter to initial expectations. Major grain-producing areas typically possess better agricultural infrastructure, earlier policy support, and more established insurance systems. However, the empirical results suggest that agricultural insurance does not significantly enhance production capacity in these regions.

Further examination of the data reveals that the average agricultural insurance density is higher in major grain-producing regions (1.1347) compared to non-major regions (0.8379). However, insurance depth—defined as the ratio of agricultural insurance premiums to agricultural GDP—is lower in major regions (0.0114) than in non-major ones (0.0193). This implies that despite broader insurance coverage in major regions, the intensity of coverage is relatively weak, which may explain the limited effect on production capacity. While no existing studies directly conclude that agricultural insurance has an insignificant impact on the comprehensive grain production outcomes in major grain-producing regions, several pieces of research offer related findings. For instance, Chen and Lin (2023) highlights significant regional heterogeneity in both the output and income effects of agricultural insurance. Similarly, in a study of provinces located in China’s key grain-producing areas, identifies regional disparities in the income-enhancing effects of agricultural insurance (Lv, 2024). Specifically, the positive income effect is more pronounced in the middle and lower reaches of the Yangtze River and in the Northeast, whereas in the Huang-Huai-Hai region, the effect is relatively weak. Moreover, Lv (2024) notes that agricultural insurance coverage remains relatively low in some regions and that its effectiveness is closely associated with farmers’ income levels. As income levels rise, the marginal income-enhancing effect of agricultural insurance tends to diminish. Lv (2024) findings suggest that the impact of agricultural insurance is not uniform across regions and may vary according to both geographic and socioeconomic factors.

Additionally, regional differences in agricultural development models and policy environments may contribute to these divergent outcomes. In major grain-producing regions, the presence of multiple central and provincial government agricultural initiatives may crowd out the effects of insurance policies, thus diluting their impact. In contrast, in non-major grain-producing regions—where policy support and infrastructure are typically less robust—agricultural insurance may fill a critical gap in risk management systems, thereby yielding more substantial benefits in terms of production capacity. Zhou (2023) conducted a dynamic empirical analysis of subsidy policies in China’s major grain-producing regions, reaching conclusions that are largely consistent with those of the present study. He argues that policies such as the minimum purchase price policy, temporary grain storage policy, subsidies for agricultural machinery purchases, and agricultural insurance play a critical role in enhancing farmers’ incentives to grow grain, boosting grain output, and safeguarding national food security. However, the abrupt cancellation of any single policy may lead to a significant reduction in the planting area and market price of specific crops. Although a rebound may occur in subsequent years, the long-term effect of such subsidies tends to diminish and eventually becomes statistically insignificant. In addition, Guo and Zhang (2023) contends that the current benefit-compensation mechanism for major grain-producing areas remains inadequate. Guo and Zhang (2023) empirical findings suggest that the yield-enhancing effects of compensation policies have been gradually weakening over time.

7 Conclusion

Drawing on panel data from 27 Chinese provinces spanning the period 2009–2021, this study empirically investigates the impact of agricultural insurance on comprehensive grain production capacity. The findings reveal that agricultural insurance exerts a significant positive effect on labor productivity, land use efficiency, and agricultural technological innovation, while also significantly reducing agricultural carbon emissions. These results suggest that agricultural insurance serves not only as a risk management tool but also as an important driver of production efficiency and green transformation in the agricultural sector. The robustness and endogeneity tests further confirm the reliability of the empirical model.

Additionally, the analysis reveals substantial regional heterogeneity. In major grain-producing areas, the effect of agricultural insurance on comprehensive production capacity is statistically insignificant, potentially due to more mature agricultural infrastructure and long-standing policy support in these regions. In contrast, non-major grain-producing regions exhibit significantly stronger positive effects across all dimensions—particularly in enhancing labor productivity, improving land use efficiency, and fostering technological innovation—underscoring the role of insurance in filling institutional and infrastructural gaps.

7.1 Policy recommendations

Based on the empirical findings, the following policy recommendations are proposed:

First, at the governmental level, efforts should be made to strengthen top-level policy design and further improve the agricultural insurance system. This includes advancing the legal framework for agricultural insurance, reinforcing the reinsurance system, expanding the coverage of catastrophic agricultural insurance, and continuously refining relevant supporting policies. The scope of full-cost insurance for grain should be gradually expanded beyond the three major staple crops (rice, wheat, and corn) to include a broader range of grain varieties. Fiscal incentives such as tax exemptions, subsidies, and performance-based awards should be used to encourage more insurers to participate in agricultural insurance provision. Governments at all levels should intensify outreach efforts by leveraging both traditional media—such as radio, television, and bulletin boards—and modern platforms, including WeChat and the internet, to raise farmers’ awareness of agricultural insurance and increase participation rates. At the grassroots level, relevant government departments should take advantage of the agricultural off-season to organize training sessions on agricultural insurance, serving as a bridge between farmers and insurance providers. Moreover, they should foster effective communication and collaboration with insurers throughout the entire process—including underwriting, production cycle management, post-disaster assistance, and claims settlement—to ensure the smooth and efficient implementation of agricultural insurance programs. Full-process regulatory oversight should also be reinforced to ensure effective implementation and orderly operation of the insurance system.

Second, at the insurance industry level, although the market has begun transitioning from traditional indemnity-based products to more innovative income-based and index-based models, the current scope of these new products remains limited. Insurance companies should continue to innovate and develop regionally tailored products that address the diverse needs of farmers. Insurance companies should also strengthen operational management and leverage technologies such as mobile internet, 3S (Remote Sensing, GIS, and GPS), and big data analytics to enhance the efficiency and quality of agricultural insurance services. Furthermore, insurers should leverage agricultural insurance technologies (AgriTech) to improve product design and operational efficiency. Partnerships with technology firms can help create more user-friendly, data-driven products that align with the realities of Chinese agriculture, ultimately improving both insurance coverage and service quality.

7.2 Limitations and future research

While the robustness and endogeneity tests affirm the reliability of the empirical results, this study faces several limitations:

First, due to data constraints, the analysis does not account for the long-term effects of agricultural insurance on productivity. Investigating these temporal dynamics could offer deeper insights into the sustainability of insurance-driven improvements in production capacity. Future research should explore these long-term impacts using extended panel data or longitudinal survey methods.

Second, this study is based on provincial-level panel data, which limits the granularity of insights into farm-level behaviors and production decisions. Future studies could incorporate micro-level surveys or case studies to examine the actual implementation and effectiveness of agricultural insurance among different farmer groups, thereby enabling a more precise evaluation of its productivity-enhancing mechanisms.

Finally, while this study focuses on four key dimensions—labor productivity, land use efficiency, technological innovation, and carbon emissions—comprehensive grain production capacity is a multidimensional construct that may include other relevant indicators. Future research could develop a more comprehensive index system and examine additional influencing factors to provide a more nuanced understanding of the multifaceted role agricultural insurance plays in grain production systems.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

DH: Writing – original draft, Formal analysis, Funding acquisition, Methodology, Investigation, Software, Conceptualization, Data curation. XW: Supervision, Writing – review & editing, Conceptualization.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by Fujian Provincial Social Science Foundation Project (Grant No. FJ2025C163), Fujian Province Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era Research Center Project (Grant No. FJ2023XZB014), National Social Science Foundation of China (Grant No. 23XJY011).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declared that they were an editorial board member of Frontiers, at the time of submission. This had no impact on the peer review process and the final decision.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aglasan, S., Rejesus, R. M., Hagen, S., and Salas, W. (2024). Cover crops, crop insurance losses, and resilience to extreme weather events. Am. J. Agric. Econ. 106, 1410–1434. doi: 10.1111/ajae.12431

Ahmed, N., Hamid, Z., Mahboob, F., Rehman, K. U., Ali, M. S., Senkus, P., et al. (2022). Causal linkage among agricultural insurance, air pollution, and agricultural green total factor productivity in the United States: pairwise granger causality approach. Agriculture 12:1320. doi: 10.3390/agriculture12091320

Birovljev, J., Vojinovic, Z., and Balaban, M. (2015). Potential of agricultural production and its impact on insurance premiums. Ekonomika Poljoprivrede 62, 705–722. doi: 10.5937/ekoPolj1503705B

Cha, J. Y., Jiang, Y. N., and Cao, K. P. (2022). An empirical study on the factors influencing agricultural economic growth in Yunnan Province — Based on the Cobb-Douglas production function. Agritech 42, 162–164.

Chai, Z. H., Ren, J., and Li, S. N. (2025). The impact of agricultural insurance on farmers' labor resource allocation. Agric. Technol. Econ. 5, 88–106. doi: 10.13246/j.cnki.jae.20250107.001

Chen, Y. Y. (2024). The impact of agricultural insurance on agricultural output in Sichuan Province. Yunnan University of Finance and Economics. doi: 10.27455/d.cnki.gycmc.2024.000777

Chen, W., and Jiang, Y. S. (2023). Agricultural credit, agricultural insurance, and rural residents' income growth: empirical test from the perspective of capital flow. Finance Theory Pract. 44, 26–33. doi: 10.16339/j.cnki.hdxbcjb.2023.01.004

Chen, Y., and Lin, L. F. (2023). The welfare effect of policy-based agricultural insurance: an analysis from farmers' perspective. China Rural Survey 1, 116–135. doi: 10.20074/j.cnki.11-3586/f.2023.01.007

Ding, L. L., and Wu, Q. (2017). The impact of industrial land input on economic growth under environmental restraints in China: analysis based on the Green Solow Model. Resour. Sci. 39, 620–628. doi: 10.18402/resci.2017.04.04

Ding, B. G., Zhao, Y., and Deng, J. H. (2022). Measurement, decoupling characteristics, and driving factors of carbon emissions in China's planting industry. China Agric. Resourc. Reg. Plann. 43, 1–11. doi: 10.7621/cjarrp.1005-9121.20220501

Duan, T. T. (2015). Estimation of the contribution rate of agricultural scientific and technological progress based on Solow residual method. J. Jiangxi Agric. Univ. 27, 116–119. doi: 10.19386/j.cnki.jxnyxb.2015.12.027

Gan, P., Dong, Y. S., Sun, L., Yang, G. J., Li, Z. H., Yang, F., et al. (2017). Assessment of maize flood disaster using UAV-based LiDAR data. Sci. Agric. Sin. 50, 2983–2992. doi: 10.3864/j.issn.0578-1752.2017.15.012

Gong, B. L. (2021). Agricultural technological progress and productivity: review and outlook. Hangzhou, China: Zhejiang University Press.

Goodwin, S. (1996). Crop insurance, moral hazard, and agricultural chemical use. Am. J. Agric. Econ. 78, 428–438. doi: 10.2307/1243714

Goodwin, B. K., Vandeveer, M. L., and Deal, J. L. (2004). An empirical analysis of acreage effects of participation in the Federal Crop Insurance Program. Am. J. Agric. Econ. 86, 1058–1077. doi: 10.1111/j.0002-9092.2004.00653.x

Guo, Y. Y., and Zhang, Q. (2023). Innovative research on benefit compensation mechanisms in major grain-producing areas: strategic considerations based on food security issues. Open J. 3, 88–95. doi: 10.19625/j.cnki.cn44-1338/f.20230419.001

Horowitz, J. K., and Lichtenberg, E. (1993). Insurance, moral hazard, and chemical use in agriculture. Am. J. Agric. Econ. 75, 926–935. doi: 10.2307/1243980

Ifft, J., and Jodlowski, M. (2024). Farm heterogeneity and leveraging federal crop insurance for conservation practice adoption. Appl. Econ. Perspect. Policy 46, 572–594. doi: 10.1002/aepp.13407

Jiang, S. Z., Fu, S., and Li, W. Z. (2022). Can agricultural insurance subsidies adjust crop planting structure? — evidence from a quasi-natural experiment in China. Insur. Stud. 6, 51–66. doi: 10.13497/j.cnki.is.2022.06.004

Kong, X. Z. (2019). Agricultural Economics. 2nd Edn. Beijing: China Renmin University Press, 116–117.

Kouakou, E., Brunette, M., Koenig, R., and Delacote, P. (2024). Crop yield risks and nitrogen fertilisation: implications for crop insurance in France. Rev. Econ. Polit. 134, 701–737. doi: 10.3917/redp.345.0701

Li, F., He, D., Liu, J., and Hong, N. (2025). Does crop insurance increase farmers’ income? Evidence from the pilot program of agricultural catastrophe insurance in China. Econ. Anal. Policy 86, 1002–1019. doi: 10.1016/j.eap.2025.04.019

Li, J., Wang, C., and Yuan, Z. (2024). How does green finance enhance food security? From the perspectives of rural human capital and agricultural industry agglomeration. J. Jinan Univ. (Soc. Sci. Ed.) 34, 52–68. doi: 10.20004/j.cnki.ujn.2024.01.007

Luo, Z. Q., and Song, S. M. (2022). Digital inclusive finance and agricultural industrial upgrading: evidence from Cobb-Douglas production function. Sci. Technol. Econ. 35, 31–35. doi: 10.14059/j.cnki.cn32-1276n.2022.02.008

Lv, X. J. (2024). Research on the impact of agricultural insurance on farmers’ income in major grain-producing area. North China University of Technology. doi: 10.26926/d.cnki.gbfgu.2024.000694

Mao, H., Hu, R., Zhou, L., and Sun, J. (2022). Agricultural insurance, credit, and farmers' green agricultural technology adoption behavior: empirical analysis based on cotton farmers. Agric. Technol. Econ. 11, 95–111. doi: 10.13246/j.cnki.jae.2022.11.004

National Bureau of Statistics of China. Announcement by the National Bureau of Statistics on the 2024 Grain Production Data. Available online at: https://www.stats.gov.cn/sj/zxfb/202412/t20241213_1957744.html (Accessed December 13, 2024).

Pavlov, A., Kindaeva, A., Vinnikova, I., and Kuznetsova, E. (2016). Crop insurance as a means of increasing efficiency of agricultural production in Russia. Int. J. Environ. Sci. Educ. 11, 11863–11868.

Quan, T. S., Li, J., and Zhang, H. (2024). Does policy-oriented agricultural insurance improve agricultural economic resilience? Based on a quasi-natural experiment of full-cost insurance and income insurance pilots. J. Hunan Agric. Univ. (Soc. Sci. Ed.) 25, 18–26. doi: 10.13331/j.cnki.jhau(ss).2024.05.003

Rahman, M. M. (2025). Synergistic effects of energy financing and good governance on carbon emissions. Sustain. Futures. 9:100739. doi: 10.1016/j.sftr.2025.100739

Romer, D. (2021). Advanced macroeconomics, translated by Wu, H. B., & Gong, G. (pp. 28–34). Shanghai: Shanghai University of Finance and Economics Press.

Solow, R. M. (1956). A contribution to the theory of economic growth. Q. J. Econ. 70, 65–94. doi: 10.2307/1884513

State Council of the People’s Republic of China. (2025). Office of the National Commission for Disaster Prevention, Reduction, and Relief. The Ministry of Emergency Management Releases the Basic Situation of National Natural Disasters in 2024. Available online at: https://www.gov.cn/lianbo/bumen/202501/content_6999765.htm (Accessed January 18, 2025).

Sun, Y. L., Rahman, M. M., Xinyan, X., Siddik, A. B., and Islam, M. E. (2024). Unlocking environmental, social, and governance (ESG) performance through energy efficiency and green tax: SEM-ANN approach. Energ. Strat. Rev. 53:101408. doi: 10.1016/j.esr.2024.101408

Sun, Y. X., Yu, X. R., and Su, F. (2025). Research on crop insurance pricing based on two-dimensional estimation of risk in time and space. Insur. Stud. 4, 43–59. doi: 10.13497/j.cnki.is.2025.04.004

Tang, Y., Yang, Y., Ge, J., and Chen, J. (2019). The impact of weather index insurance on agricultural technology adoption: evidence from a field economic experiment in China. China Agric. Econ. Rev. 11, 622–641. doi: 10.1108/CAER-05-2018-0107

Uddin, K. M. K., Rahman, M. M., and Saha, S. (2023). The impact of green tax and energy efficiency on sustainability: evidence from Bangladesh. Energy Rep. 10, 2306–2318. doi: 10.1016/j.egyr.2023.09.050

Wang, C. F., Rahman, M. M., Siddik, A. B., Wen, Z. G., and Sobhani, F. A. (2024). Exploring the synergy of logistics, finance, and technology on innovation. Sci. Rep. 14:21918. doi: 10.1038/s41598-024-72409-9

Wang, Y. N., Song, Y. X., and Wan, M. Y. (2025). The impact of policy-oriented agricultural insurance on soil and water loss control. J. For. Econ. Manage. 24, 94–102. doi: 10.16195/j.cnki.cn36-1328/f.2025.01.10

Wang, R., Xiong, Z. W., and Hu, Y. F. (2024). The mechanism of agricultural insurance's impact on agricultural carbon emissions and its spatial spillover effect. J. Yunnan Univ. Finance Econ. 40, 32–47. doi: 10.16537/j.cnki.jynufe.000991

Wei, T. D., Liu, Y., Wang, K., and Zhang, Q. (2021). Can crop insurance encourage farmers to adopt environmentally friendly agricultural technology—the evidence from Shandong Province in China. Sustainability 13:13843. doi: 10.3390/su132413843

Wu, Y. H., Duan, X. D., Liu, R. F., Ma, H. Y., and Zhang, Y. M. (2024). How does full-cost insurance for wheat affect pesticide use? From the perspective of the differentiation of farmers' production scale. Environ. Res. 242:117766. doi: 10.1016/j.envres.2023.117766

Wu, C. X., Lou, Y. Y., Chen, C. Y., Fan, Z. K., and Tang, H. (2025). Practice and optimization strategy of the linkage mechanism between harmless disposal of dead pigs and insurance. J. Anim. Husb. Vet. Med. 44, 58–62.

Xie, C., Kuang, Y. P., Wen, H. X., and Wu, X. Q. (2025). Agricultural agglomeration or industrial integration: how does agricultural insurance bolster agricultural resilience in China? Front. Sustain. Food Syst. 9, 1531287. doi: 10.3389/fsufs.2025.1531287

Yang, Q., Jia, J. F., Liu, J., and Xu, Q. (2023). How do agricultural machinery subsidies affect comprehensive grain production capacity? A perspective from socialized agricultural machinery services. Manage. World 39, 106–123. doi: 10.19744/j.cnki.11-1235/f.2023.0147

Yang, Y. W., and Lin, W. L. (2021). Agricultural machinery subsidies, socialized agricultural machinery services, and farmers' income increase. Agric. Technol. Econ. 9, 16–35. doi: 10.13246/j.cnki.jae.2021.09.002

Yu, J., Smith, A., and Sumner, D. A. (2018). Effects of crop insurance premium subsidies on crop acreage. Am. J. Agric. Econ. 100, 91–114. doi: 10.1093/ajae/aax058

Yuan, Y., and Xu, B. (2024). Can agricultural insurance policy adjustments promote a ‘grain-oriented’ planting structure? Measurement based on the expansion of the high-level agricultural insurance in China. Agriculture 14:708. doi: 10.3390/agriculture14050708

Yue, D. Q., Ma, Q., Hou, Y. L., and Zhou, Z. W. (2021). Development of agricultural insurance in Xinjiang and its influencing factors: an empirical analysis. Hubei Agric. Sci. 60, 153–156. doi: 10.14088/j.cnki.issn0439-8114.2021.08.032

Zha, J. Y., Jiang, Y. N., and Cao, K. P. (2022). An empirical study on the influencing factors of agricultural economic growth in Yunnan Province: based on Cobb-Douglas production function. Agric. Technol. 42, 162–164. doi: 10.19754/j.nyyjs.20220330035

Zhang, L. T., and Chen, T. (2024). Evidence from 13 cities and prefectures in Hubei Province. J. South-Central Univ. Nationalities (Humanit. Soc. Sci. Ed.) 2, 1–10. doi: 10.19898/j.cnki.42-1704/C.20240130.01

Zhang, W., Deng, B. Y., Zhong, W. X., Liu, X. Y., and Zhang, Y. H. (2025). Empowering agricultural green transformation through rural green insurance: an empirical study based on spatial econometric model. Res. Agric. Modernization 46, 117–130. doi: 10.13872/j.1000-0275.2024.2187

Zhang, P. F., and Gu, H. Y. (2025). Farming or working: the employment choices of farmers under agricultural insurance. Agric. Technol. Econ. 1, 95–110. doi: 10.13246/j.cnki.jae.2025.01.004

Zhang, J. X., and Wang, H. L. (2020). Environmental regulation, agricultural technological innovation, and agricultural carbon emissions. J. Hubei Univ. (Philos. Soc. Sci. Ed.) 47, 147–156. doi: 10.13793/j.cnki.42-1020/c.2020.04.018

Zhang, Y. Y., and Zhang, Q. (2025). Can insurance purchasing promote the adoption of green technology in integrated crop-livestock family farms? Evidence from 155 provincial-level demonstration family farms in Shandong Province. China Agric. Resourc. Reg. Plann., 1–12. Available online at: http://kns.cnki.net/kcms/detail/11.3513.S.20241128.1256.014.html

Zhen, T. Y., and Rahman, M. M. (2024). Greening emerging economies: enhancing environmental, social, and governance performance through environmental management accounting and green financing. Sustainability 16:4753. doi: 10.3390/su16114753

Zheng, J., and Deng, M. Z. (2024). Agricultural insurance, large-scale farming, and green agricultural development. East China Econ. Manage. 38, 59–70. doi: 10.19629/j.cnki.34-1014/f.230820006

Zheng, J., and Ning, T. (2025). Agricultural insurance, labor resource allocation, and total agricultural factor productivity. J. Cent. Univ. Finance Econ. 3, 66–82. doi: 10.19681/j.cnki.jcufe.2025.03.007

Zhou, K. (2023). Research on the effect evaluation of China's grain subsidy policy. Zhongnan University of Economics and Law. doi: 10.27660/d.cnki.gzczu.2023.000148

Zhou, M., Niu, H., Wei, C., and Chen, S. W. (2024). The impact of agricultural insurance protection on food production resilience. China Agric. Resourc. Reg. Plann. 45, 44–55.

Zhu, W. C. (2022). The impact of agricultural insurance policy on food security. Nankai University. doi: 10.27254/d.cnki.gnkau.2022.000043

Keywords: agricultural insurance, comprehensive grain production capacity, food security, regional heterogeneity, China

Citation: Hou D and Wang X (2025) Can agricultural insurance enhance comprehensive grain production capacity? Mechanisms of risk protection and production incentives. Front. Sustain. Food Syst. 9:1649495. doi: 10.3389/fsufs.2025.1649495

Edited by:

Md. Emran Hossain, Bangladesh Agricultural University, BangladeshReviewed by:

Mohammed Alnour, Erciyes University, TürkiyeMd. Mominur Rahman, Bangladesh Institute of Governance and Management (BIGM), Bangladesh

Copyright © 2025 Hou and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xin Wang, ODIwMTkwMDhAbHl1bi5lZHUuY24=

Dainan Hou1

Dainan Hou1 Xin Wang

Xin Wang