- 1School of Economics and Statistics, Guangzhou University, Guangzhou, China

- 2Centre for New Structural Economics Research, Guangzhou University, Guangzhou, China

Sustainable agricultural transformation necessitates a synergistic evolution between the adoption of technology and institutional innovation. However, prevalent studies frequently regard technology as an exogenous tool, neglecting how its selection is constrained by resource endowments—especially access to credit—and how this subsequently alters contractual governance. Focusing on apple growers in rural China, this study examines how credit capacity affects the interplay between technology adoption and contractual arrangements. Through a comparative case study of three agribusinesses in Yiyuan County, Shandong Province, coupled with mathematical modeling and numerical simulations, we identify a causal chain linking credit capacity → technology choice → contractual adaptation. Key findings indicate: (1) Credit-constrained firms adopt labor-saving technologies incrementally, relying on high-monitoring-cost wage contracts that confine them to low-efficiency equilibria; (2) Firms with greater credit access implement integrated technologies (e.g., smart irrigation, virus-free seedlings, IoT systems) and transition to risk-sharing, incentive-compatible revenue-sharing contracts; (3) Deep technology embedding increases asset specificity and collaborative interdependence, driving endogenous shifts from hierarchical to cooperative governance. Mechanism analysis demonstrates that technology reduces uncertainty and reconfigures factor bargaining power, facilitating contractual adaptation. Policy implications underscore the necessity of activating land-use-right mortgages, cultivating endogenous rural financial systems, and encouraging contract innovations associated with technology services—crucial steps for the inclusion of smallholders in sustainable agri-value chains. This study offers micro-level evidence and a systemic framework for understanding the co-evolution of institutions and technology in agriculture within developing countries.

1 Introduction

Global agriculture is under increasing pressure from resource scarcity, aging labor forces, and climate change, making the sustainable transformation of production systems through technological and organizational innovation a shared challenge for resilient food systems (Wei and Xia, 2018; Li, 2025). In China, rapid urbanization (Shen et al., 2024) has further exacerbated agricultural labor outflow (Xia and Kong, 2021), land fragmentation (Yu et al., 2022), and insufficient capital accumulation (Balana and Oyeyemi, 2022), rendering traditional smallholder farming increasingly inadequate to ensure high-quality agricultural supply and rural revitalization (Nguyen et al., 2020). Against this backdrop, scaling up agricultural intensification, mechanization, and digitalization has become not only a critical pathway to enhance productivity but also a strategic lever to achieve the UN Sustainable Development Goals (FAO, 2021).

Technology is considered a key tool for overcoming constraints in production factors. Modern agricultural technologies, such as integrated water-fertilizer systems, automated drip irrigation, and IoT-based monitoring, can significantly improve resource-use efficiency under the dual constraints of land and labor, thereby propelling the transition of agriculture from “factor-driven” to “innovation-driven” (Gao and Song, 2014; Wolfert et al., 2023). However, the adoption of technology does not happen in a vacuum. The trajectory of technological change is influenced by relative factor scarcity and institutional environments (Hayami and Ruttan, 1970). In many developing countries, including China, smallholder farmers face severe limitations in land, labor, and, especially, capital, which hampers their ability to invest in productivity-enhancing technologies (Zhong, 2021). These constraints are further exacerbated by land fragmentation, weak enforcement of property rights, and limited access to formal credit markets (Séogo and Zahonogo, 2023).

Existing studies predominantly treat technology as an exogenous shock, focusing on its impacts on output, income, or environmental performance (Lu and Cai, 2020; Li and Wan, 2025), yet rarely interrogate how resource constraints of economic agents shape technology adoption itself, let alone recognize that once adopted, technology reconfigures factor allocation and even production relations. This paper advances a core argument: technology adoption is not a neutral application of tools, but an institutional decision endogenously determined by structural constraints, such as credit capacity. When firms with strong credit capacity introduce modern technologies, they not only enhance control over production processes but also alter the organic composition of capital through labor- and land-substituting effects, thereby reshaping power dynamics among factors. This transformation renders fixed-wage contracts—burdened by high supervision costs—increasingly unsustainable, while incentivizing the rise of shareholding systems with superior incentive compatibility. The contractual evolution from “employment” to “co-management” essentially reflects the adaptive restructuring of production relations driven by technological advancements, embodying the micro-level realization of Marx’s axiom that “productive forces determine production relations”.

In the methodology section, this study employs a progressive research approach: “case observation—theoretical deduction—mathematical modeling—policy validation.” Initially, primary data was collected through multiple rounds of field research, based on comparative case studies of three apple-growing enterprises in Yiyuan County, Shandong Province. Utilizing Qualitative Comparative Analysis (QCA) logic, this approach emphasizes the gradient differences in credit capacity while accounting for geographical and institutional environments. Three typical sample categories—"high, ““medium,” and “low”—were constructed to identify the causal transmission mechanism linking “credit capacity—technology selection—contractual structure.” Subsequently, a theoretical framework was developed based on case findings, formalizing the influence pathway of technological choice on contract structure through mathematical modeling. MATLAB numerical simulations were used to validate the trend characteristics of theoretical inferences. Finally, a large-sample robustness test of the core mechanism was conducted using the 2018 nationally representative data from the China Labor Dynamics Survey (CLDS) through logistic regression analysis. This methodological design strikes a balance between the depth of mechanisms and the breadth of inference, enabling systematic argumentation that moves from micro-level cases to macro-level patterns (Yin, 2018; George and Bennett, 2005). Key findings include: (1) Credit-constrained firms adopt partial labor- or water-saving technologies, relying more on wage contracts with higher supervision costs; (2) Well-capitalized firms adopt integrated technology portfolios (e.g., smart irrigation + virus-free seedlings + IoT), achieving factor complementarity via “company + household” profit-sharing systems; (3) Deeper technological embeddedness strengthens asset specificity and interdependence, pushing contractual structures toward risk- and revenue-sharing arrangements.

This study emphasizes that a sustainable agricultural transition necessitates not only technological innovation but also coordinated organizational and governance adaptations, highlighting the concepts of “systemic transformation” and “institution-technology co-evolution.” It reveals the causal chain of “credit capacity → technology adoption → contractual structure,” providing novel theoretical and policy insights into the institutional logic of technology implementation during agricultural modernization in developing contexts. The paper is structured as follows: Section 2 reviews the literature; Section 3 presents fieldwork findings from three cases; Section 4 develops a mathematical model of technology’s contractual impacts; Section 5 validates theoretical trends through numerical simulation; Section 6 conducts robustness tests based on the CLDS national microdata; and Section 7 concludes with policy recommendations, such as activating land-use rights and developing endogenous finance.

This study uses a small-N comparative case design. Maximum variation sampling helps capture wide differences in credit capacity, but the sample is small. We recognize this as a constraint that limits the statistical generalizability of our findings. Still, following theory-building studies (Yin, 2018; Eisenhardt, 1989), our main aim is to identify how credit constraints affect technology adoption and contractual change. To strengthen this, we triangulate qualitative evidence with modeling and large-sample validation. This lets us build a robust, empirically grounded framework for understanding institutional and technological change in agriculture.

2 Literature review

2.1 Determinants of technology adoption: from factor substitution to financial accessibility

The theory of technological choice originates from Hicks’ (1932) “induced innovation hypothesis,” which posits that changes in relative factor prices stimulate technological innovations that substitute abundant factors for scarce ones. Hayami and Ruttan (1970) extended this framework to the agricultural sector, arguing that differences in factor endowments led the United States and Japan onto divergent paths of agricultural modernization—mechanization-intensive in the U.S. versus biotechnology-intensive in Japan. This conceptual foundation was later refined into the “induced technical change theory” (Binswanger and Ruttan, 1978), emphasizing how market signals shape the direction of technological progress.

In the Chinese context, the increasing costs of rural labor and the growing severity of structural labor shortages have heightened interest in labor-saving technologies, making their adoption a central focus of academic research. Zheng and Xu (2017), using crop production mechanization as a case study, empirically demonstrate that rising labor costs significantly promote the diffusion of agricultural machinery. Wang and Peng (2025) further emphasize that an aging rural workforce amplifies the demand for labor-reducing technologies.

However, much of this literature presumes that technology adoption is a passive reaction by rational economic agents to price signals, largely ignoring the mediating roles of individual cognition, social norms, and institutional environments. In contrast, Sok et al. (2021), in a systematic review of 124 studies that applied the Theory of Planned Behavior, found that farmers’ technology adoption decisions are not only driven by economic incentives but also profoundly influenced by subjective norms, perceived behavioral control, and personal attitudes. This implies that even under similar factor price conditions, farmers’ adoption behaviors may exhibit significant regional heterogeneity due to variations in sociocognitive and institutional contexts.

International research highlights the crucial role of financial accessibility in the adoption of technology. Bernard et al. (2017) conducted a field experiment among onion farmers in Senegal, demonstrating that access to credit support significantly increased the adoption rate of water-saving irrigation technologies. Chavas and Nauges (2020) further argue that learning costs under uncertainty exacerbate lags in technology adoption, and only stable financial support can overcome this barrier. Field evidence from Suri and Udry (2022) in Africa indicates that the expansion of mobile financial services has significantly enhanced smallholder farmers’ willingness to invest in improved seeds and fertilizers. Similarly, Zhou and Ding (2024) found in their study on inclusive finance in rural China that digital credit platforms substantially increase the intensity of technology adoption among new agricultural operators.

However, these studies reveal notable discrepancies. While some scholars maintain that financial accessibility directly promotes technology adoption (Bernard et al., 2017), others emphasize that its effectiveness depends critically on complementary social capital and information networks (Suri and Udry, 2022). More importantly, recent empirical work grounded in the Unified Theory of Acceptance and Use of Technology (UTAUT) (He et al., 2025) suggests that although “facilitating conditions” may enhance behavioral intention, actual adoption remains constrained without adequate “perceived monetary value” (PMV) and “social influence.” This implies that merely improving financial supply does not automatically translate into increased adoption of technology. Instead, it underscores the need to examine the interplay between institutional embeddedness and agent-specific agency in shaping adoption outcomes.

2.2 Contract agriculture and contractual governance: institutional restructuring driven by technology

Classical contract theory elucidates the selection of governance structures in agriculture—such as fixed rent, sharecropping, employment, or vertical integration—by examining transaction costs, risk-sharing, and incentive compatibility (Coase, 1937; Williamson, 1985; Cheung, 1969). Grossman and Hart (1986) further contend that increased asset specificity necessitates longer-term contracts or integration to mitigate hold-up risks. These frameworks have effectively clarified agricultural governance arrangements in contexts marked by low technological intensity and infrequent transactions.

However, the advent of precision agriculture and digital technologies has fundamentally transformed the information architecture and asset specificity in agricultural production. Cesilia et al. (2025) found that blockchain-enabled smart contracts significantly reduce trust costs and payment delays, thereby enhancing smallholders’ access to high-value supply chains. This suggests that technology is emerging as a new infrastructural foundation for contract enforcement, diminishing reliance on informal relational governance.

Conversely, domestic research in China primarily focuses on the contractual dilemmas within the “company + farmer” model, often attributing breaches to unclear property rights or weak credit systems (Deng et al., 2020). This research tends to overlook the transformative role of technological change in reshaping the very nature of contracts. More critically, Wang et al. (2024) emphasize significant heterogeneity in the determinants of farmer participation in contract farming, pointing to what they describe as “uncertainty in influencing factors”—a limitation that stems from the fragmented analysis of technology adoption and contractual decisions.

Indeed, Lin and Luo (2026) demonstrate that farmers’ contractual choices are mediated by their perceived monetary value and perceived threat, both of which are directly shaped by the risk profile and specificity of the technologies employed. High-investment, particular technologies simultaneously raise expectations of returns and amplify concerns about opportunistic behavior, thereby incentivizing more stable and safeguarded contractual arrangements. Thus, this study proposes a shift from the binary opposition of “technology versus contract” to a dynamic co-evolutionary perspective: technological advancements increase asset specificity, creating a demand for formalized contracts; in response, contractual innovations—such as guaranteed-price procurement or service outsourcing—offer institutional protections that facilitate the adoption of high-risk technologies.

This interplay holds particular significance within the Chinese context, where collective land ownership and restricted operational rights constrain traditional forms of asset-backed contracting. Under these institutional constraints, the synergistic evolution of technology and contracts becomes not only economically rational but also institutionally adaptive. However, existing research has paid insufficient attention to this interaction. There is an urgent need to develop an integrative analytical framework that incorporates technological attributes, financial accessibility, and institutional environments to uncover the actual logic of modern agricultural governance.

2.3 Co-evolution of technology and contracts: an overlooked interaction mechanism

The endogenous growth theory, as proposed by Romer (1990) and further developed by Aghion and Howitt (1992), has long established that technological progress is an endogenous outcome of economic systems. However, the majority of existing research has concentrated on the direct impact of technology on productivity, often neglecting its role as a driver of institutional change through its transmission mechanism. The essence of this transmission mechanism lies in how the non-rivalrous nature of technological innovation and knowledge spillover effects, as described by Grossman and Helpman (1991), alters the relative value of production factors, thereby disturbing the equilibrium of existing contractual relationships. Acemoglu et al. (2007) introduced the “technology-organization” matching hypothesis, positing that incomplete contract environments limit technology choice by influencing sunk costs associated with investments.

However, their analytical framework primarily builds on the technology lock-in effect stemming from factor complementarity. This paper advances the research by shifting the perspective from “how contract quality constrains technology adoption” to “how credit capacity reshapes contractual structures through technology choice.” We specifically examine how credit availability expands firms’ technological options in developing countries with imperfect factor markets, thereby endogenously generating contract arrangements better suited to new technologies.

Historical institutional studies (Greif, 1997) and contemporary empirical evidence (DePaula, 2023; Benin, 2015) indicate that contract forms consistently evolve in response to technology-induced changes in transaction costs. DePaula (2023) finds that the adoption of precision agriculture technology promotes information transparency within cooperatives, thereby enhancing trust and cooperative willingness among members. Benin’s (2015) study of China’s agricultural machinery socialized services also reveals that the emergence of specialized service organizations is reshaping how smallholder farmers connect with markets. These studies suggest that technology serves not only as a tool for productivity enhancement but also as a catalyst for organizational change. When technology alters the relative importance of factors within the production process, existing contractual arrangements become unsustainable and require adaptive adjustments. Building on this foundation, this paper examines the transmission mechanisms of credit capacity, technology choice, and contractual structure within China’s distinctive land tenure system. This approach engages in a productive dialogue with Acemoglu’s theory, collectively refining the theoretical landscape of technology-institutional co-evolution.

2.4 Positioning of this study

This study, rooted in the realities of rural China, aims to transcend geographical boundaries by establishing a “technology-contract” bidirectional feedback framework. This framework situates the Yiyuan County case within a broader theoretical context. Utilizing a comparative case study approach (Yin, 2018), the paper investigates the disparities in credit capacity, technology selection, and contractual structures across three agricultural enterprises. It uncovers a distinct transmission chain: Credit liberalization → Technological upgrading → Factor reallocation → Contract innovation → Efficiency enhancement. This pathway not only echoes Hayami-Ruttan’s classic proposition but also offers new micro-level evidence to comprehend agricultural modernization in developing countries. More significantly, the paper contends that technology choice is itself an institutional act, with its depth and breadth contingent upon the resource mobilization capacity of economic agents within specific institutional contexts. We further suggest that financial accessibility does not function independently but generates multiplier effects by activating the “technology-contract” co-evolution mechanism. This perspective rectifies the linear approach of traditional “technological determinism,” propelling agricultural economics from “adoption factor checklist” studies towards more profound explanations of “institutional-technological symbiotic evolution.”

3 Field visits to three agricultural companies and economic explanations

3.1 Research design and variable operationalization

This study utilizes a comparative case study methodology (Yin, 2018), aiming to dissect selected cases to uncover their internal logic. Consequently, the primary objective is not to test linear variable relationships or perform probabilistic inference, but rather to identify the causal mechanism chain linking credit capacity, technology choice, and contractual structure. 1Three apple-producing agricultural enterprises in Yiyuan County have been selected as the focal cases. The selection criteria adhere to the principle of “controlling for environmental variables while highlighting core explanatory variables,” underpinned by a “small sample, in-depth investigation” strategy. All three enterprises operate in similar hilly topography, with comparable climatic, precipitation, and soil conditions. They also face common structural challenges, including rural labor outmigration, land fragmentation, and market uncertainty. Against this shared environmental backdrop, the cases are differentiated according to their markedly distinct levels of credit capacity, forming a typology of high, medium, and low access to finance—thus constituting a naturally occurring comparative framework. This design helps isolate external environmental influences and sharpen focus on how credit capacity, as a key independent variable, shapes technological adoption and contractual arrangements. It aligns with the logic of maximum variation sampling (Patton, 2002), which enhances the identification of both common patterns and divergent outcomes across heterogeneous cases. Furthermore, it supports the identification of causal influences by minimizing confounding factors (George and Bennett, 2005). The subsequent analysis is based on multiple rounds of field surveys conducted between 2018 and 2024, drawing on semi-structured interviews, direct observations, and enterprise-level operational and financial records.

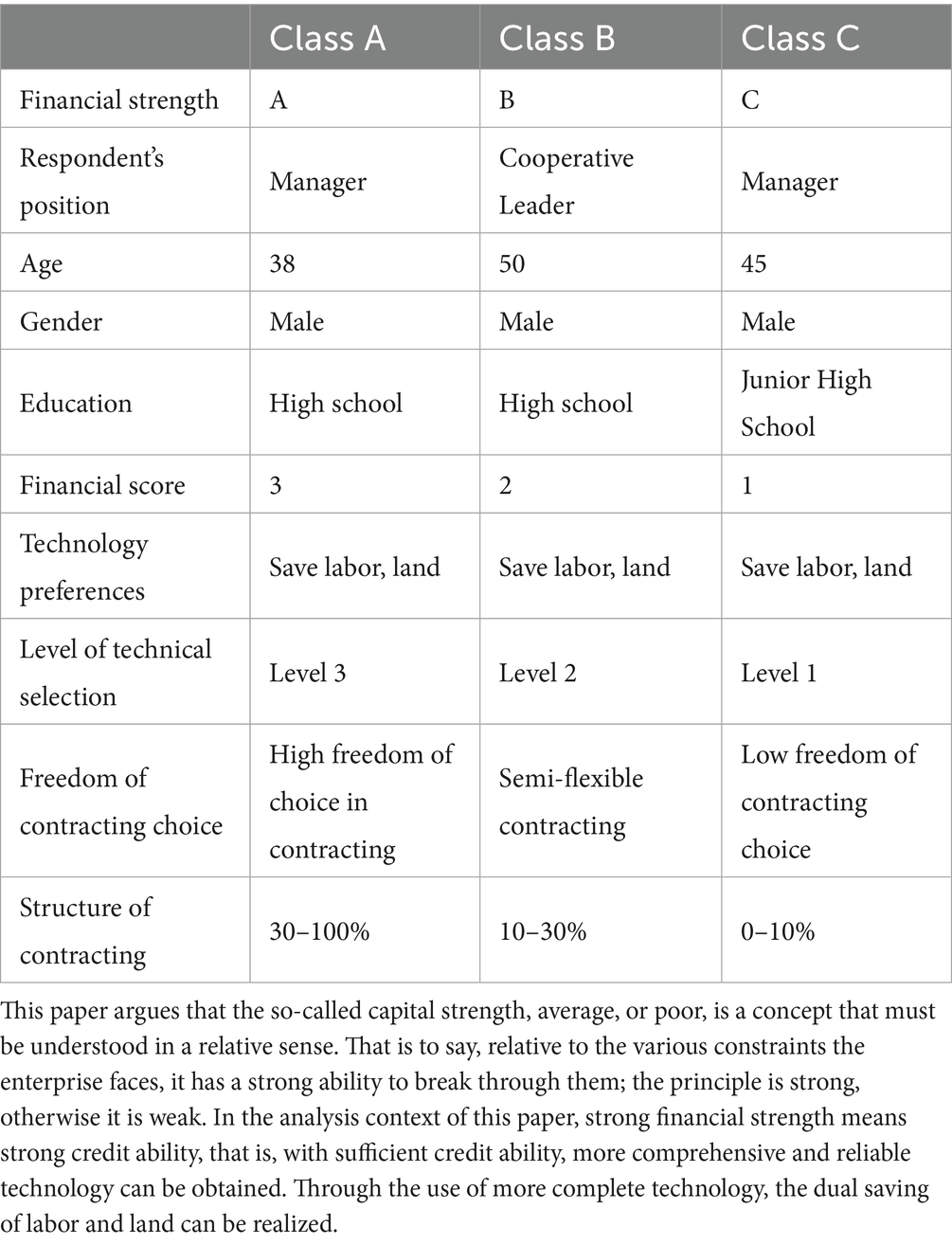

The three enterprises are categorized into three groups based on their credit capacity, with the classification derived from multi-source data triangulation: (1) banks’ credit limits and actual loan records, extracted from enterprise financial statements and corroborated through interviews with managers; (2) the scale of fixed asset investments, particularly upfront expenditures on intelligent irrigation systems and Internet-of-Things (IoT) monitoring infrastructure; and (3) diversity of financing channels, including access to government-backed guarantee loans, supply chain finance, or digital lending platforms. The data reveal significant disparities in financial accessibility: Class A enterprises invest over 3 million yuan annually in technological upgrades, Class B ranges between 0.8 and 1.2 million yuan, and Class C falls below 300,000 yuan. This gradient in credit capacity forms the foundational independent variable that explains differences in technology adoption and contractual structuring across the cases. By anchoring the classification in observable, quantifiable indicators of financial resource mobilization, the study strengthens internal validity. It ensures that differences in downstream outcomes—particularly in technological sophistication and governance design—can be meaningfully linked to variations in access to credit.

Building upon this classification, the study defines the following variables:

(1) Credit capacity = credit line + actual loan amount + intensity of technological investment (annual average) + diversity of financing channels (scored from 1 to 3);

(2) Technology accessibility = ability to timely access required technical services from suppliers + capacity to bear upfront sunk costs;

(3) Level of technology adoption = single labor-saving technology (e.g., simple sprinkler irrigation, Level 1), partially integrated technologies (e.g., integrated water-fertilizer management with domestically bred improved varieties, Level 2), or brilliant systems (e.g., virus-free seedlings, automated drip irrigation, and IoT-enabled remote monitoring, Level 3). This typology is based on the framework developed by Gao and Song (2014) regarding the diffusion pathways of agricultural technologies in China.

(4) Contractual structure = share of revenue-sharing arrangements (wage-based contracts = 0%, cooperative/revenue-sharing contracts = 100%), treated as a continuous variable.

Field survey data indicate that Class A enterprises have fully deployed the third-tier technological package, while Class B remains at the second tier. Class C either adopts only Level 1 technologies or continues with traditional farming practices. This hierarchical pattern of technology adoption directly reflects the constraining effect of credit capacity on the feasible set of technological choices available to agricultural enterprises. By linking financial endowment to both technological sophistication and governance design, the findings underscore the role of credit access as a critical determinant shaping the trajectory of agricultural modernization (see Table 1).

We selected three cases using theoretical saturation and maximum variation sampling (Patton, 2002), not statistical representativeness. By choosing enterprises at the high, medium, and low ends of credit capacity, we create a quasi-experimental design. This helps isolate the effect of financial access on technology and contracts. The design shows the evolutionary path of institutional adaptation—from wage employment to revenue sharing—under different resource conditions. Though the sample is small, these cases are information-rich and well chosen to reveal core mechanisms. As in Greif (1994) and Eisenhardt (1989), a few strong cases can reveal powerful theoretical insights when they show clear patterns.

3.2 Credit access, technology adoption, and contractual transformation: evidence from three apple enterprises

This study operationalizes the contractual arrangements between enterprises and farmers into two primary forms: wage-based contracts, in which the firm pays a fixed wage and farmers provide labor, and revenue-sharing contracts, in which farmers contribute both land and labor as equity and receive a predetermined share of net profits. This classification is grounded in the classical contract theories of Coase (1937) and Cheung (1969), and further localized to reflect China’s institutional context of the “separation of three rights” in rural land ownership, contracting, and operating rights. Empirical findings reveal a clear pattern: 90% of contracts in Class A enterprises are revenue-sharing, compared to 30% in Class B, and 0% in Class C, where wage-based contracts dominate exclusively. This gradient—where higher credit capacity correlates with a greater share of revenue-sharing arrangements—suggests a systematic and non-random institutional response. Rather than being arbitrary, this contractual choice represents a rational adaptation by firms to reduce monitoring costs and achieve risk-sharing under conditions of technological intensification.

Specifically, while firms employ wage-based contracts to hire specialized workers responsible for maintaining centralized infrastructure (e.g., control systems and main pipelines), all expanded orchard plots are managed under revenue-sharing agreements. Expansion in this context refers to the enterprise’s scaling up through land transfer contracts with additional neighboring households, building upon its original operational base. These newly incorporated orchards share access to a centralized command system maintained by fixed technicians, requiring only marginal investments in integrated water-fertilizer and automated drip irrigation systems to sustain productive operations. This configuration captures the essence of technological scale efficiency in modern agriculture—where fixed costs are leveraged across a larger area, and marginal expansion becomes increasingly cost-effective. Furthermore, the revenue-sharing model enables both the operator and participating households to co-bear production and market risks. Field investigations indicate that this “shared orchard” model not only enhances firm-level profitability but also generates substantial gains for participating farmers, who report annual incomes of 150,000 to 200,000 yuan—significantly exceeding returns from traditional farming or wage labor alone. Thus, the adoption of revenue-sharing contracts emerges not merely as a financial arrangement but as an institutional innovation that aligns incentives, distributes risks, and unlocks scalable, inclusive growth in agricultural modernization.

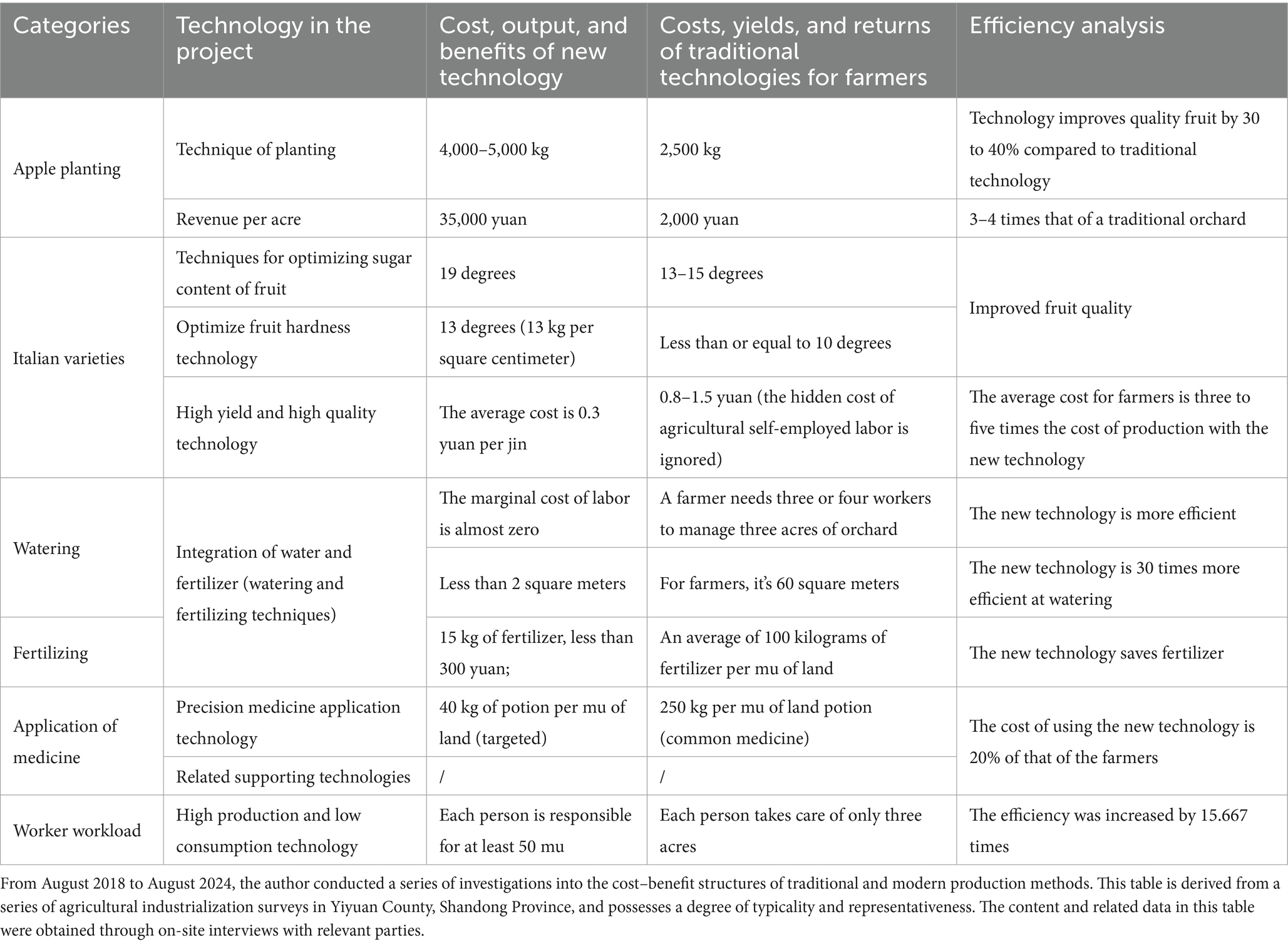

Table 2 systematically reveals the productivity gap resulting from technological disparities. Firms in Category A, supported by robust credit, have fully implemented intelligent technologies, achieving yields of 4,000–5,000 kg per hectare—1.6 to 2 times higher than those of traditional farmers (2,500 kg)—and generating income of 35,000 yuan per hectare, which is 17.5 times greater than conventional levels. The crux lies in technology-driven resource precision and factor savings. Integrated water and fertilizer systems reduce marginal labor costs to nearly zero, with irrigation occupying less than 1/30 of the land required by traditional methods; precision pesticide application uses only 16% of the volume applied by smallholders, cutting costs to 20%; a single worker can manage 50 mu of orchard, achieving an efficiency 16.7 times that of traditional farming. These indicators demonstrate that high technological investment significantly reduces supervisory costs and dependence on production factors, enabling firms to break free from wage-based employment and shift toward sharecropping contracts that align incentives and share risks—thus supporting the expansion of the “shared orchard” model.

In contrast, Category C firms, constrained by limited access to credit, adopt labor-saving technologies selectively, fail to conserve land or labor inputs, incur high supervisory costs, and are compelled to rely on wage labor, thereby trapping them in a cycle of inefficiency. Therefore, Table 2 does not merely illustrate technological superiority but substantiates the central mechanism of this study: credit capacity shapes a dual divergence in production efficiency and contractual structure by determining the feasible set of technology choices. Technology acts as the mediator, institutions emerge as the outcome, and efficiency serves as the manifestation.

Research Methodology: This section utilizes the logic of Qualitative Comparative Analysis (QCA) to systematically compare three representative cases, thereby identifying the causal chain linking “credit capacity—technology choice—contractual structure.” Despite the limited sample size, the internal validity of causal inference is enhanced by controlling for geographical and institutional contexts, clearly operationalizing variables, and triangulating data from multiple sources. This study does not pursue statistical significance in large samples but focuses on revealing mechanism-based patterns, providing a solid empirical foundation for constructing the mathematical model in Section IV (refer to George and Bennett, 2005).

4 Model: agricultural technology and contracting

Referring to the theoretical incentive mechanism model of Laffont and Martimort (2002), this part analyzes the wage contract and sharing contract structure between the leading enterprise (assuming that only the leading enterprise employs the farmer, and the model only considers the production link) and the farmer (Xiao and Yang, 2023). It mainly discusses how the degree of agricultural technology choice affects the trade-off between enterprises and farmers in these two contracts. Why does this model only discuss the contracting behavior between leading enterprises and farmers? Compared with new business entities such as agricultural cooperatives and family farms, wage contracting and sharing contracting between leading enterprises and farmers are more common. The core of these two types of contract conversion is to balance the costs and benefits. Therefore, focusing on the analysis of the contracting model between leading enterprises and farmers can not only make the logic more clear, but also be applicable to other agricultural operators.

4.1 Technology selection and contract structure

4.1.1 Behaviors of leading enterprises

Suppose there is a leading enterprise and a number of rural households in the economy. The leading enterprise is the owner of capital, and the rural households are the owners of labor and land contract management rights. In order to maximize profits, the leading firm has an incentive to expand the scale of production in order to achieve the purpose of scale operation. According to the above analysis, in order to maximize operating profit, leading enterprises under different credit constraints are motivated to “purchase” different degrees of agricultural technology. After the credit constraints are relaxed, the biggest constraint for leading enterprises to achieve scale operation is land ownership constraint. Leading enterprises will acquire land through land transfer contract and land equity contract, but these two contracts have completely different meanings for enterprises. The former through the fixed flow scale land rent, and hire the right to operate agricultural labor (usually need to pay in advance, take up enterprise working capital); The latter directly transforms farmers into risk and benefit sharers of enterprises, and then distributes profits after making profits. However, the distribution of these two kinds of contracts is affected by many constraints and subject selection.

Suppose the level of technology choice or the technology intensity coefficient determined by the enterprise’s credit capacity is ( ), and at this technological level, the optimal land scale obtained from the land transfer contract and the land equity contract is , and the probability of obtaining the optimal scale is , at this time, the obtainable output is , where is a concave function, and is the effort level of the farmers participating in agricultural production.

If the successful transfer and shareholding to the land scale matching the technical level fails, the land scale at this time is recorded as , the probability of not obtaining the optimal land scale is v, and the obtainable output is . It is assumed that: ), where represents the income growth potential of the leading enterprise due to the change in the contractual structure, that is, the probability that the leading enterprise achieves moderate-scale operation through the change in the contractual structure, which can be regarded as the probability that the contractual structure of the leading enterprise matches its technical choice level t (i.e., technology-contract). Since the fixed wage contract between the leading enterprise and the farmers is transformed into a land and labor factor shareholding contract, it is conducive to the transfer and allocation efficiency of labor and land factors. The leading enterprise has the motivation to obtain the production factors for scale operation through the change in the contractual structure (Deng et al., 2020).

It is further necessary to point out that the formation of contracts between leading enterprises and farmers is the result of a mutual choice, that is, it needs to achieve mutual incentive compatibility. Because farmers’ contract choices have “preference dependence” and threshold effects, when a certain critical point (threshold value) is triggered, it will cause a leap in farmers’ preferences from one contract model to another. That is, farmers weigh between signing a fixed wage contract or a share contract with leading enterprises. The trigger point for the transformation from the former to the latter is when farmers, taking the demand of leading enterprises as the reference point and considering their own endowments and capabilities, weigh the expected “equal” income of different contracts. It is assumed that farmers’ contract choices are influenced by factors such as their endowment structure ( ), their own capabilities ( ), and the expected income of the share contract ( ). Additionally, farmers’ endowment structure ( ) and their labor capabilities ( ) constitute their comprehensive capabilities . For farmers who meet the demands of leading enterprises, the latter will have the incentive to seek contracts with them. When their expected income is greater than the expected income of the share contract ( ), they will choose the fixed wage contract; when the expected income of the fixed wage contract is less than that of the share contract, that is, when > , there will be an incentive to form a share contract. Specifically, farmers’ income can be expressed as:

Where, ( ) is the proportion of the wage contract reached between the farmer and the enterprise, correspondingly ,is the proportion of the sharing contract, is the fixed wage paid to the farmer, is the fixed rent of the land transferred by the enterprise, is the sharing proportion that the farmer can get in the sharing contract, is the price of agricultural products. is all the expenditure that the leading enterprise needs to pay to the farmers. Since this model examines the problem of contract structure transformation, it assumes that the farmers have both fixed wage contract and sharing contract, that is , only the situation is analyzed.

For the convenience of analysis, it is assumed that the leading enterprise divides all the agricultural land into two pieces, and one piece of land is transferred by land rent R. The enterprise employs farmers to carry out complete production and operation, and has complete residual control and claim rights. In terms of operation, the production technology of this plot is attached to the former and outsourced to the farmers. In particular, it is pointed out that because the enterprise undertakes the infrastructure construction, the farmers only participate in part of the production and management links, so the output income is shared proportionally.

Assuming that the output of the part of farmland where the farmer enters into the sharing contract is , and the output of the part of the plot where the leading enterprise hires laborers is , the total output of the enterprise is:

In order to simplify the analysis, it is assumed that the following relationship exists: , where denotes the relative importance of farmers concluding the sharing contract to the production of the leading enterprise.

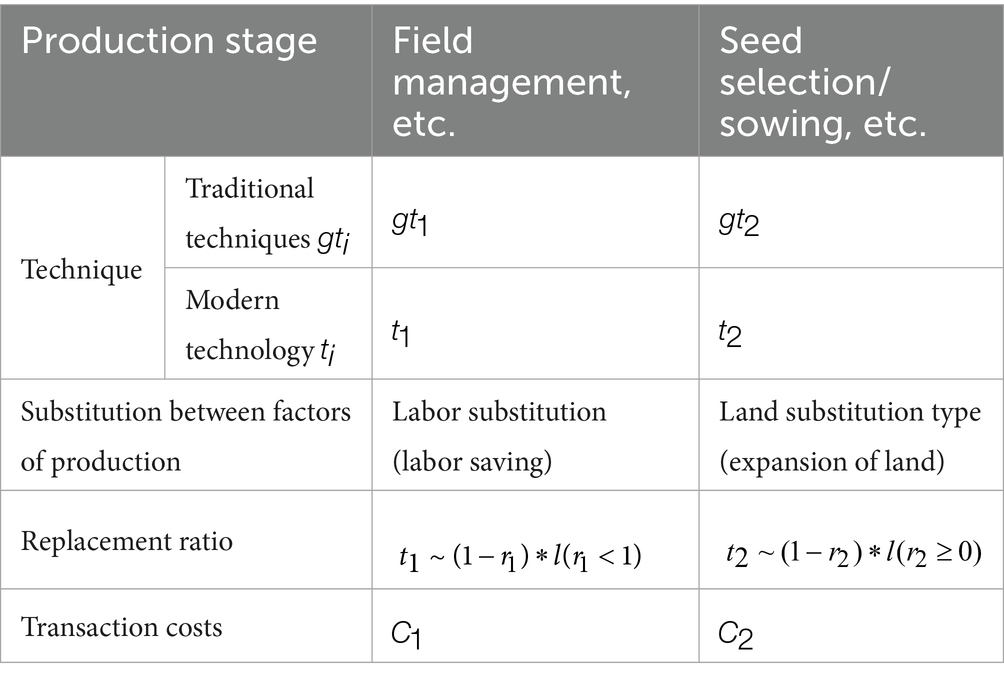

Further assume that under different capital levels, leading enterprises can choose two production technologies: and , and the upfront costs of these two technologies are and . At the same time, the fixed costs that leading enterprises need to pay for land transfer and daily management is . Technology is labor-replacing, and the substitution ratio of “technology-labor” is . If leading enterprises choose this technology, the number of laborers replaced is , and the number of laborers needed for agricultural production after choosing this technology is . The reduction in the number of laborers hired by leading enterprises means a saving in capital (cash flow), and the leading enterprises can save a portion of the workers’ wages each month. The total amount of funds saved is . Technology is land-replacing. Choosing a land-replacing production technology can increase the output per unit of land, thereby increasing the output on the original land scale. Choosing technology is equivalent to “increasing” land input (to achieve the target output, the land input required by technology can be reduced by several times). Assuming the substitution coefficient of “technology-land” is 0), then when leading enterprises choose technology , the effective land scale of the enterprise will become times the original land scale (see Table 3).

Let represent the combined impact of two technologies, which can also be called the technology intensity coefficient. If , it indicates that the two technologies are independent and their influence on output is completely independent. If , it indicates that there is a certain degree of correlation between the two technologies. If , it indicates that the two technologies have a high degree of complementarity. The degree of technology selection affects the agricultural production process through three paths. First, the level of technology is directly linked to agricultural output. Second, the level of technology affects the “quality” and standardization degree of the final product, such as the standardization of nutritional components and shape. Third, the credit capacity that determines the level of technology also reflects the market potential of enterprises (such as the degree of market anchoring, market radius, etc.). Enterprises with strong credit capacity often correspond to a large and stable market2. Therefore, considering the comprehensive impact of technology, here is used to represent the technology multiplier, that is, the comprehensive impact of technology on agriculture is . Since at this time the influence of technology and non-technological influences are highly coupled and both manifest as an increase in profitability, for the sake of simplifying the analysis, here is used to represent the comprehensive impact of technology on agriculture.

4.1.2 Farmer’s behavior

Referring to Holmström and Milgrom (1991), assume that the effort level of the farmer is , and the cost of exerting such effort is a convex function , where >0) represents the marginal cost of effort for work quality. The production function involving the farmer is , where is a random disturbance that, a normal distribution with a variance of . Thus, ), and the variance indicates the degree of risk in the agricultural production process. When an enterprise selects modern technology, the natural risks in the production process (such as natural disasters like gales, hail, torrential rain, drought, etc.) can be partially or fundamentally mitigated. That is to say, technology selection can reduce the variance of . Simultaneously, technology selection enhances the standardization degree and pass rate of the product, reducing the quantity of low-quality products and thereby lowering market risks. There exists , that is, (multiple) technology choices can reduce the uncertainty in the agricultural production process (here represents technology, and , indicates that there are types of technology). Further assume that the farmer’s utility function is , and >1) is the farmer’s risk aversion coefficient. The certainty equivalent of the utility function can be expressed as: .

Existing research has pointed out that a worker’s educational level, health status, age, etc., all exhibit a negative correlation with their risk aversion coefficient (Ward and Singh, 2014). Thus, is a variable directly related to labor quality, with a smaller value indicating higher quality of the farmer’s labor. Under normal circumstances, the employment wage system attracts risk-averse3 labor; the share system is more likely to absorb risk-neutral production and operation-oriented farmers (Liu and Zhou, 2020). It can be seen that there is a certain degree of correlation between contracting preferences and the quality of the farmer’s labor. When farmers prefer a fixed wage contract, their labor quality or skill level ( being the mean) is lower, indicating a high tendency towards risk aversion; when farmers prefer a share contract, their labor quality is higher, indicating a low degree of risk aversion.

4.1.3 Leading enterprises and contract structure

Due to the complementary factors owned by the leading enterprise and the farmers, the enterprise will conclude a satisfactory contract with the farmers to achieve the goal of profit maximisation (see Equation 1). This contract must be incentive compatible with the farmers and the enterprise, that is, it must meet the following conditions:

Where, Equations 2, 3 are the “farmer participation constraints” that enterprises need to consider when making optimal decisions, that is, the enterprise production should take into account the “Individual Rationality constraints” (IR) and “Incentive Compatibility constraints” (IC) of farmers. The former means that the utility obtained by farmers from contracting should not be less than the maximum expected utility obtained from non-contracting; The latter refers to the situation where if is the action that the employer hopes the farmer will take, and ∈A is any action that the farmer can choose, then only when the expected utility that the farmer gains from choosing is greater than the expected utility from choosing , will the farmer choose to exert the effort of .

Since the “incentive compatibility constraint” of farmers’ participation is tight, that is, the equation should be satisfied first, and the optimal effort level of farmers’ participation in cooperation can be obtained:

The effort level of farmers ( ) is not only related to the wage contract (because ), but also to the incentive level of the share contract ( ). That is to say, from the perspective of farmers, they will make trade-offs among different contracts. When the proportion of farmers participating in the share contract is larger or the share ratio they receive after accepting the share contract ( ) is higher, farmers are more inclined to put in more effort. Obviously, compared with the fixed wage, the share contract is more favored by “rational” farmers and leading enterprises.

The following is to study the behavior of the leading enterprises in the conclusion of the contract. In this paper, what factors determine the leading enterprises’ choice of contracting? Are leading enterprises more inclined to choose sharing contracts? The goal of the leading firm is to determine the optimal farmer effort level by constructing the Lagrangian function and taking the derivative under the condition that the farmer participation constraint (IR) and incentive compatibility constraint (IC) are satisfied. As follows:

From Equations 4, 5, the proportion of farmers who enter into a profit-sharing contract with leading enterprises can be obtained as:

From Equations 5, 6, if the leading enterprise and the farmer reach an incentive compatible contract, the optimal effort level of the farmer and the optimal contracting structure of the two under the condition of maximizing the profit of the enterprise, the economic implications of these two equations are obvious.

From Equation 5, two implications can be derived: Firstly, under incentive compatibility, the effort level of farmers is positively proportional to the probability of their large-scale operation ( ), and further, to the “technology-contract matching probability” ( ). This impels leading enterprises to continuously adjust their contracting structure in accordance with the degree of their technology selection. Secondly, the effort level of farmers is influenced by the degree of technology selection of leading enterprises . The higher the degree of technology selection , the more “simple labor” is substituted4. Hence, the labor performed by these workers is termed “simple labor”.

The economic implications derivable from Equation 6 are as follows. Since the sharing ratio is often determined prior to contracting, given , the proportion of farmers entering into the sharing contract is related to three factors: Firstly, the probability of the leading enterprise achieving scale operation , as previously stated, this mechanism drives the leading enterprise to constantly adjust its contracting structure based on the degree of its technological choice. Secondly, the technological selection level of the leading enterprise, which is associated with the substitutable production factors of agricultural technology and the contracting negotiation ability resulting from the scarcity of factors. Thirdly, the significance of farmers’ participation in the sharing contract to the leading enterprise ( ). It can be construed that the higher the output resulting from the sharing contract, the more inclined the leading enterprise and farmers are to enter into the sharing contract. Concurrently, the sharing contract must also satisfy the participation constraint of farmers (see Equation 2).

From the foregoing analysis, it is evident that the sharing contract will be concurrently selected by the leading enterprise and farmers, and such selection becomes more “rigid” and “robust” due to the introduction of technology and the breakthrough of various constraints. Hence, the following proposition is derived.

Proposition 1: If the leading enterprise has more funds to make technology choices, for the purpose of profit maximization, the leading enterprise tends to reduce the size of farmers who sign fixed wage contracts and turn more to sharing contracts.

4.1.4 Risk, contracting and proportion of sharing

The above discussion considers the share ratio as a “constant quantity,” but it also specifically clarifies that this “constant quantity” is the outcome of prior bargaining between the two parties. However, the following situations can lead us to view the share ratio as a “variable” or an “undetermined quantity”:

(1) Both contracting parties should have the motivation to select new technologies. During a period of profound changes in the urban–rural structure, due to labor shortages and land rights constraints, coupled with the improvement of agricultural product quality by technology, both parties, especially the leading enterprises, have a strong incentive to introduce applicable or advanced technologies that save labor and land. The stronger the credit capacity of the leading enterprises, the more comprehensive the technologies they introduce.

(2) The choice of technology and, after the technology is introduced into the specific process of agricultural production and operation, the substitution ratio of technology for factors or the relative bargaining power of factors changes. The technology selection leads to the emergence of new benefits within the share framework, making the already concluded share contract unable to precisely delineate the “(right) attribution” of the new benefits. Consequently, the two contracting parties are highly likely to enter a new bargaining process, and the share ratio will change until both parties are satisfied.

The above analysis logic is not in contradiction with the logic disclosed in the previous text.

In fact, contract selection is a dynamic process of continuous adaptation to changes in constraints (Deng and Mi, 2002). To overcome labor and land rights constraints, new technologies will be continuously introduced into the production and operation process when credit is accessible. The effective utilization of new technologies in various aspects of agriculture will affect the “discourse power” of agricultural participants in the production process, ultimately influencing the share ratio of both parties. The contracting structure and share ratio between the leading enterprises and farmers also change due to changes in technology selection. To describe the influencing factors of the share ratio of the contracting parties, first calculate the share ratio of farmers under the participation constraint in Equation 3:

Substituting Equation 6 into Equation 7, the share ratio of the contract between the farmers and the leading enterprises under the incentive compatibility condition and different degrees of technology selection5 can be obtained as:

It is known that represents the risk control level after the leading enterprises make their technological choices, and represents the leading enterprises’ univariate technological choice6. represents the risk size (or risk level) after univariate technological risk avoidance. Assuming , when , then ; indicates that the enterprise makes bivariate technological choices (with a risk control level of ). As the degree of technological choice deepens, the standardization, proceduralization of agricultural production, and the “trademarking” and “branding” of agricultural products increase accordingly, and the market risk of agricultural operations will decrease accordingly. At this time, it is assumed that , and . It should be noted that when the enterprise does not choose any new technology, the risk it faces will not change at all, and at this time, its risk coefficient is , and . Equation 8 indicates that, given other conditions remain unchanged, the risk control levels of different technological choice levels are different, that is . Therefore, the following inference can be made:

Equation 9 elucidates that, given other conditions remaining constant, if the risk control capability brought about by technological selection enhances, farmers can obtain a greater proportion of the share in the bargaining process. The emergence of this outcome is attributed to two reasons. Firstly, due to technological factors, as the degree of technological selection substituting for labor and land increases, the agricultural labor employed in production becomes “less but more refined,” at this juncture, agricultural labor possesses relative scarcity and its comparative advantage is manifested, thereby agricultural laborers in the share contract acquire a certain right to bargain. Secondly, it is because of the changes in the degree of risk control resulting from technology. Although generally speaking, the magnitude of is contingent upon the bargaining between the two contracting parties, yet, since the choice of technology alters the risk distribution, distinct technological selections will lead to different risk control capabilities and thereby generate different outcomes. This implies that the relationship between technology and risk will enter into the bargaining based on the interests of both parties and to a certain extent determine the share ratio of the two contracting parties.

If the contracting parties, especially the leading enterprises, make no technological choices, at this time it is similar to the constant returns to scale in agricultural production, that is, , that is, there is . At the same time, since there is a lack of necessary technological input, there will be . . The economic implication here is that if no new technology is introduced, farmers will be at a disadvantage in the sharecropping contract and the share they can obtain will be reduced. That is to say, at this time, the sharecropping contract will not be able to attract higher-quality risk-neutral farmers, and risk-averse farmers will account for a higher proportion among all farmers and choose the “fixed wage” contract that guarantees a stable income regardless of the harvest.

Proposition 2: given the negotiability of farmers’ land rights, leading enterprises choose technical system, the more into the possibility of leading enterprise and farmers concluded into contracts and increase farmers can be divided into ratio will change accordingly.

4.2 The model development: endowment structure and technology choices

The achievement of agricultural performance ultimately hinges upon the economic efficiency of various factors in agricultural production (Hayami and Ruttan, 1970), and technology selection serves as a substitution for scarce factors, further optimizing the allocation of resources on a new “technology platform” to realize efficiency enhancement. Industrial upgrading and technology selection are influenced by the endowment structure. Generally speaking, if there is an acute shortage of labor force, provided there is a certain credit (financing) capacity, labor-saving technologies will be adopted; if the cost of obtaining land management rights is excessively high, land-saving technologies need to be introduced. This indicates that, under specific circumstances, agricultural technology selection is a response to the structure of agricultural resource endowments and its variations. Hence, the degree of technology selection and the coverage of technology in the production process will be impacted by factor endowments. To investigate the relationship between the technology selection of leading enterprises, the endowment structure, and the contracting structure, we hypothesize that the “global” (including the production of all producers) and “local” (specifically referring to the production of farmers who have concluded share contracts) production functions conform to the Cobb–Douglas form: , , and the returns to scale are constant, that is, . Employing the capital-labor ratio to represent the resource endowment structure, then the profit maximization problem of the enterprise can be expressed as:

Similarly, by constructing the Lagrangian function from the Equations 10–12, taking the derivative of subsequently yields (see Equation 13):

Proposition 3: Under the precondition that agricultural production is subject to capital constraints and labor constraints, for leading enterprises, under the given factor endowment structure, namely, when the capital-labor endowment structure remains unchanged, the intensity of technology selection is positively correlated with the variation in the contracting structure .

5 Numerical simulation: the trajectory of choice and economic logic

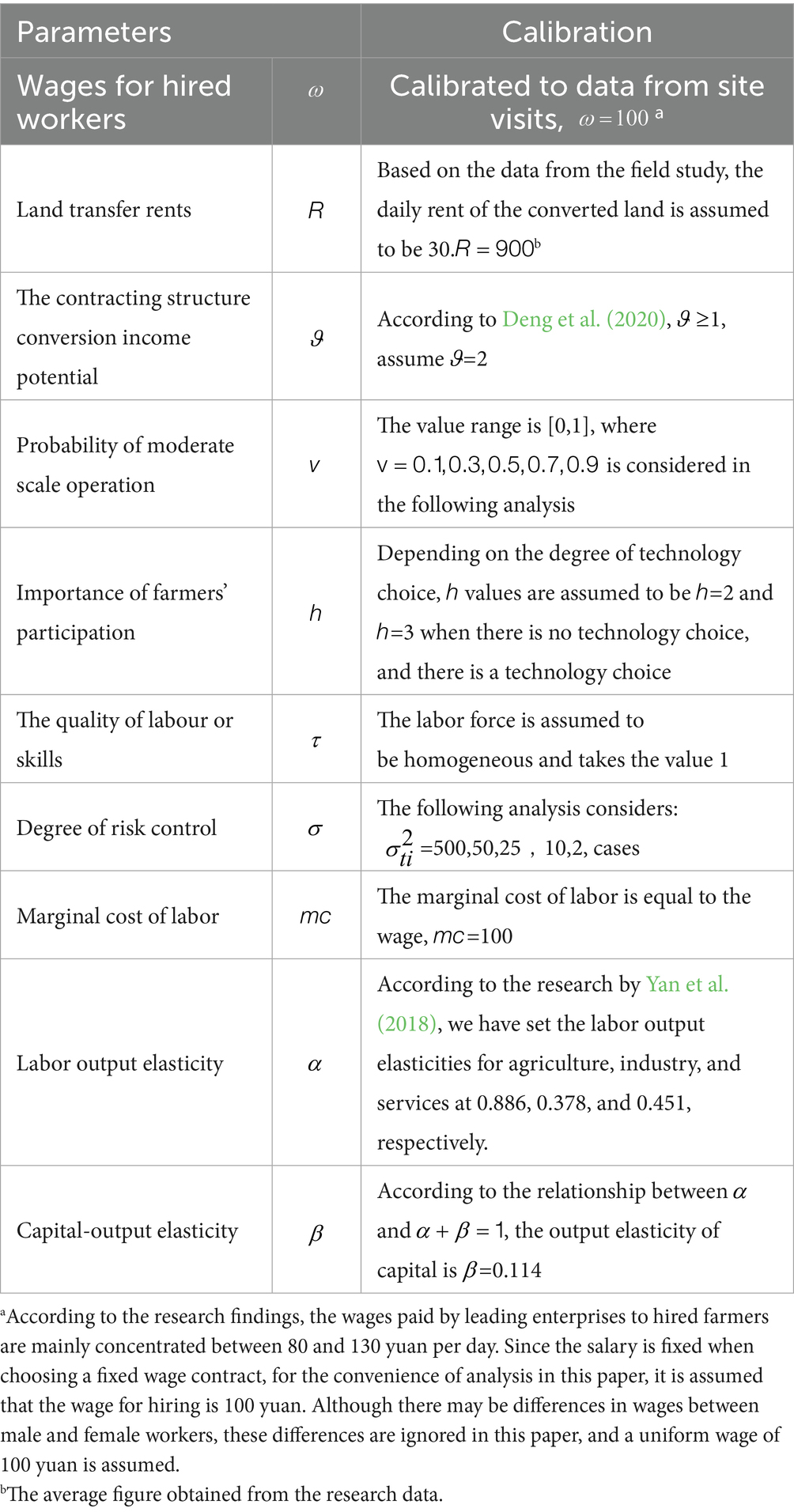

The previous section analyzed the relationship between technology choice and contractual structure, providing fundamental theoretical insights. Given the availability of microdata and the comparative historical institutional analysis approach adopted in this paper, this section uses Matlab to simulate the trajectories of technology and contract choices made by enterprises and farmers under the condition of maximizing their interests. Based on parameter calibration, it depicts the relationship and changing trends among technology choice, contractual structure, share ratio, and economic performance. The parameters that need to be calibrated in the numerical simulation include , and the parameter calibration is shown in Table 4. Due to the regional, industrial, and subjective nature of analyzing the technology choice behaviors of farmers and leading enterprises, this paper will combine empirical facts and relevant data obtained from field research to select parameters consistent with the actual situation when calibrating them.

5.1 Benchmark reference

This section primarily examines the relationship between the profitability of enterprises and the effort level of workers, without considering the “interference” of technology selection. Taking this as a basic reference, it then adds the influence of different degrees of technology selection to obtain a “relatively robust” result. At this time, the expression form of the enterprise’s profit maximization is: . Since the technological difference between leading enterprises and farmers is relatively small at this time, the difference in their output is more reflected in scale efficiency. It is assumed that the relationship between the output of the farmers’ participation in the production link in the share contract and the total output is: . This section examines several fundamental scenarios, including the effect of leading enterprises achieving scale operations (the change in probability v), the impact of varying farmers’ effort levels x on profits, and the effect of changes in the share ratio s on enterprise profits.

It should be noted that the choice of technology and the operating costs of enterprises do not affect the choice of contracting structure, so it is assumed that the discounted value of the technology selection cost is . Since the technology selection and contracting structure being compared are those of the same type of agricultural product production enterprises, the price of agricultural products is standardized as follows: p = 1. To simulate the specific structure, further assumptions need to be made about the specific form of the production function, and let , where is the random disturbance term.

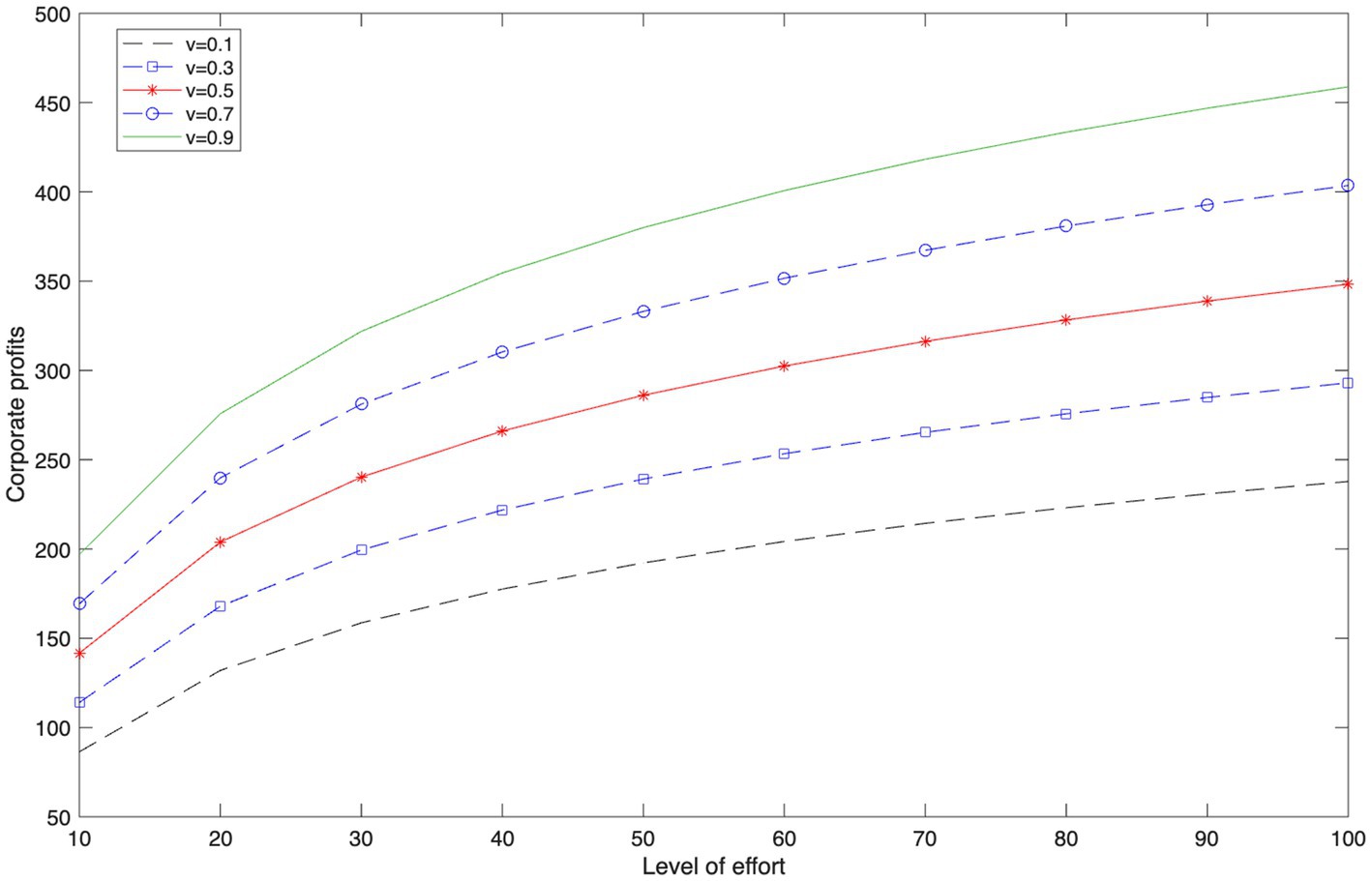

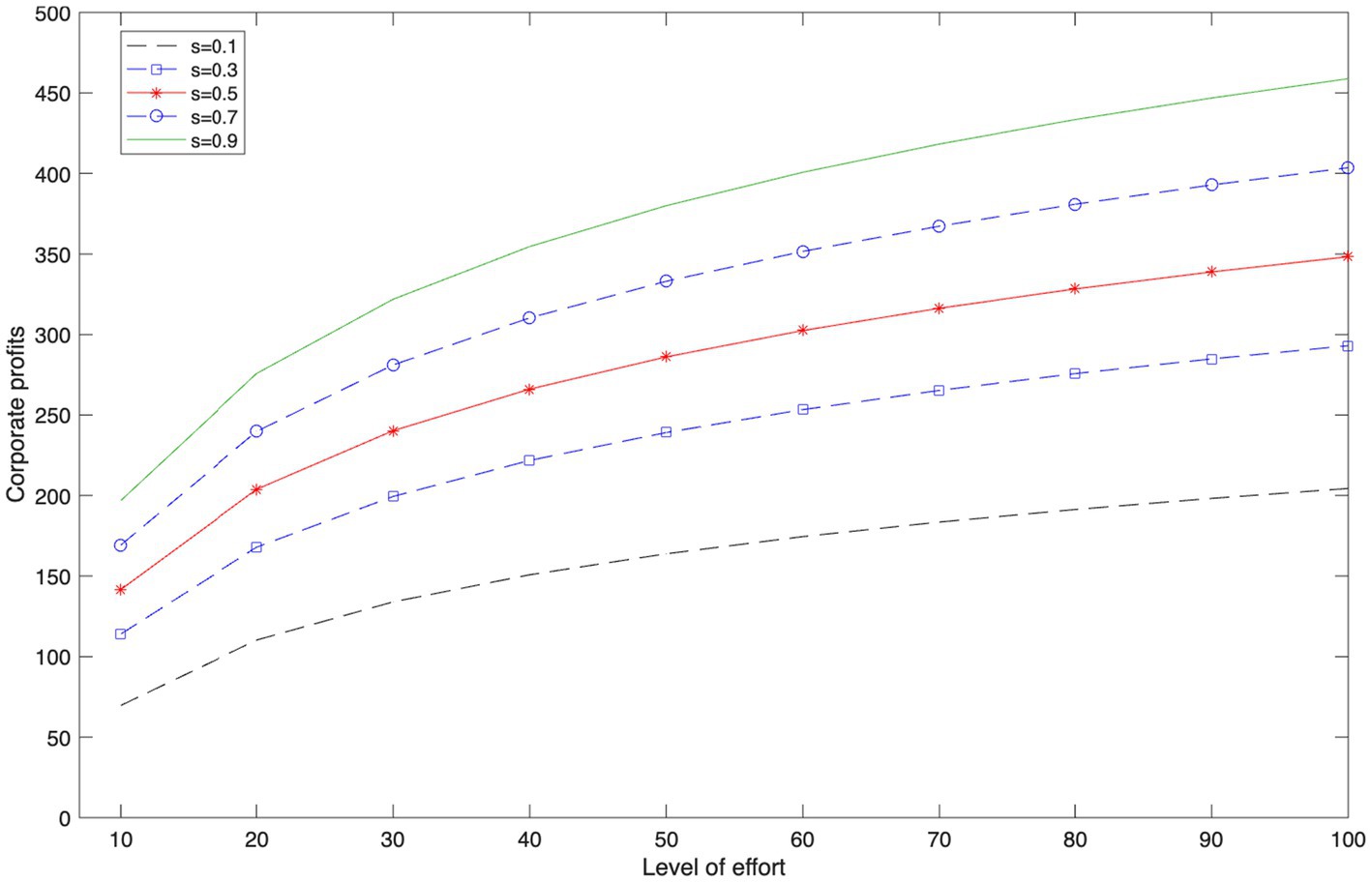

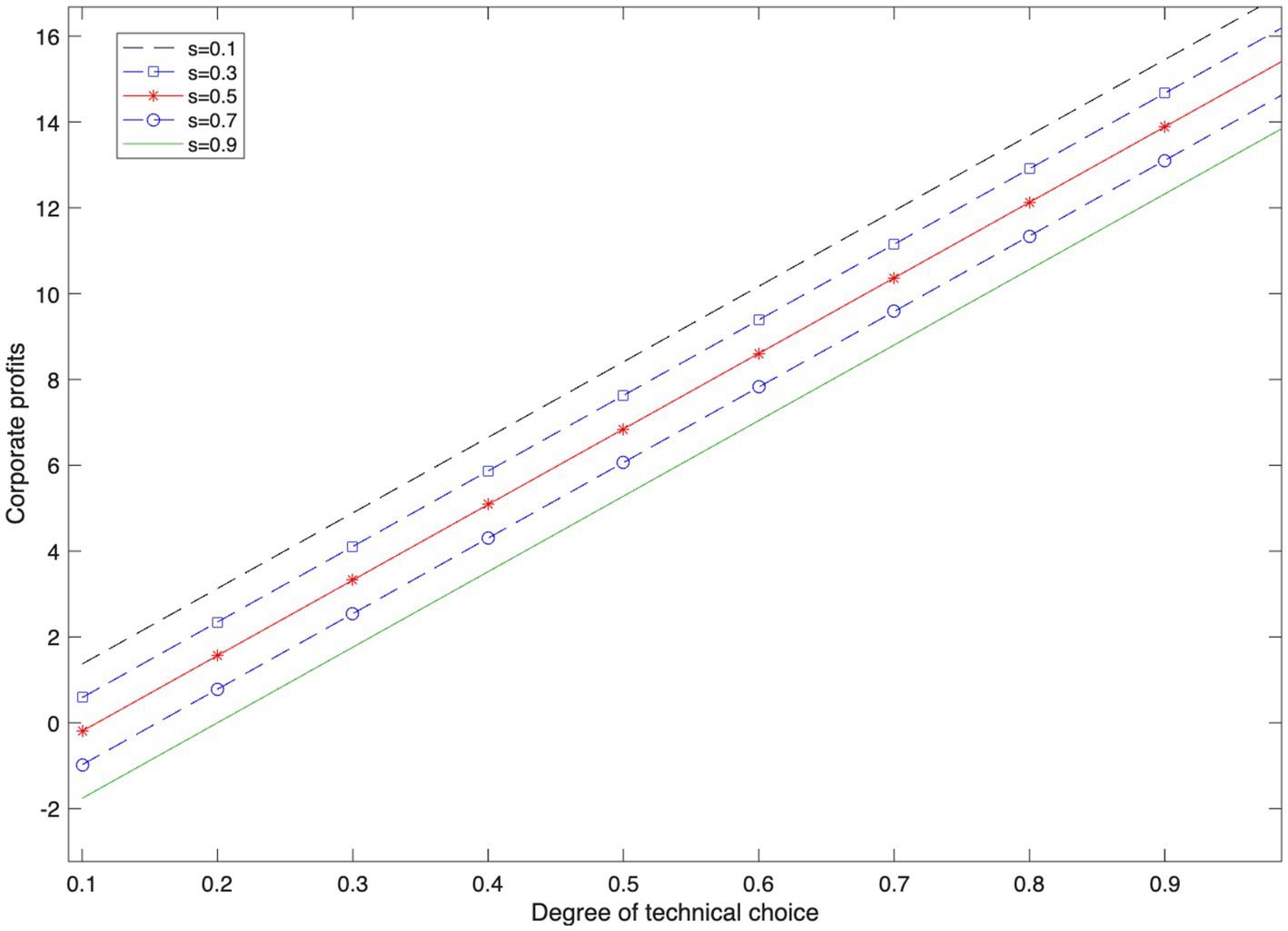

Here, we analyze the relationship between the effort level of the farmers hired by the leading enterprise and the enterprise’s profit under the condition that the probability of achieving scale operation by the leading enterprise is different, that is, when . To simplify the analysis, when examining the relationship between the effort level of farmers and the enterprise’s profit, it is assumed that the contracting structure θ and the proportion of the share contracts are exogenous, with both values set to 0.5, as shown in Figure 1. Additionally, we analyze the relationship between the effort level of the farmers hired by the leading enterprise and the enterprise’s profit under the condition that the proportion of the share contract is different, that is, when . To simplify the analysis, at this time, it is assumed that the contracting structure and the probability of achieving scale operation are exogenous, and both values are 0.5, which can be seen in Figure 2.

Figure 1 indicates that under diverse probabilities of achieving scale operation, an escalation in the effort degree of workers can augment the profit level of the enterprise. At the same effort level, an increase in the probability of achieving scale operation directly results in a growth in the expected profit level.

Figure 2 demonstrates that the effort level of farmers is positively correlated with the profit of the enterprise; and at the same profit level, an increase in the proportion of the share contract prompts participating farmers to exhibit a higher effort propensity. Further analysis reveals why there emerges an “incentive paradox” where, at the same effort level, the lower the share ratio, the higher the enterprise profit. The reason lies in that when enterprises adopt traditional farming techniques, their cooperation with farmers is mostly in the form of wage contracts; and when the share contract ratio is high, workers under the wage contract might reduce their effort degree based on this as a benchmark.

5.2 The degree of technology choice and contracting structure

This section analyzes the impact of the degree of technology selection of leading enterprises, that is, the size of the value, on the contractual structure among business entities. Since the magnitude of the t value does not alter the relationship and trend between variables, to make the results clearer, this section’s analysis discusses the situation where ( . At this point, the expression for enterprise profits is:

It is further assumed that, due to the deepening of technology selection, the contribution of leading enterprises to the gross domestic product relatively increases. To distinguish this from the aforementioned benchmark situation without technology selection, it is assumed at this point that the proportion of the production process in which farmers participate in the share contract is 1/3, that is, . The following still analyzes from two perspectives: the probability of different scale operations and different share ratios.

5.2.1 Technology choice and contracting structure: a perspective of scale operation

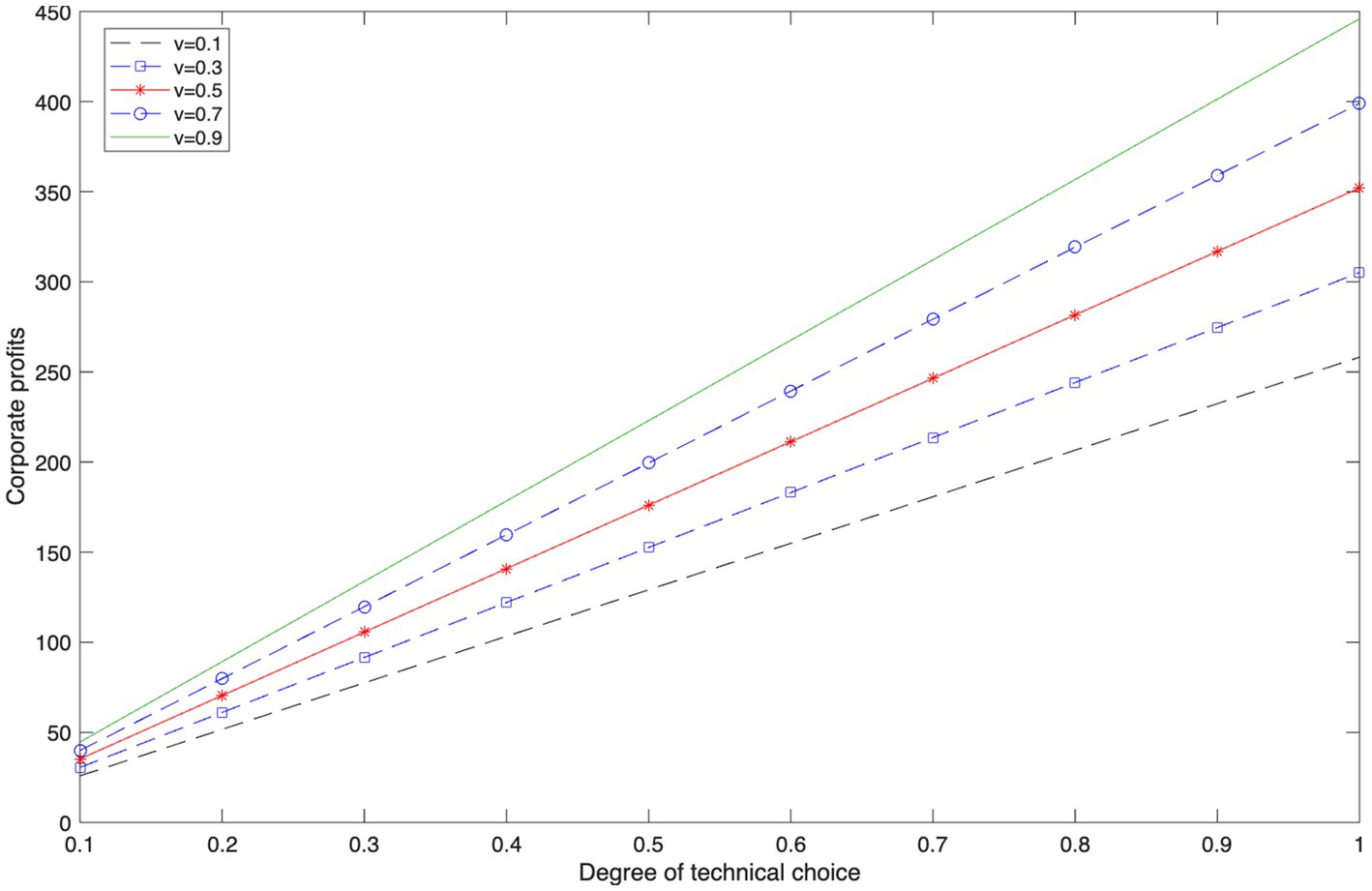

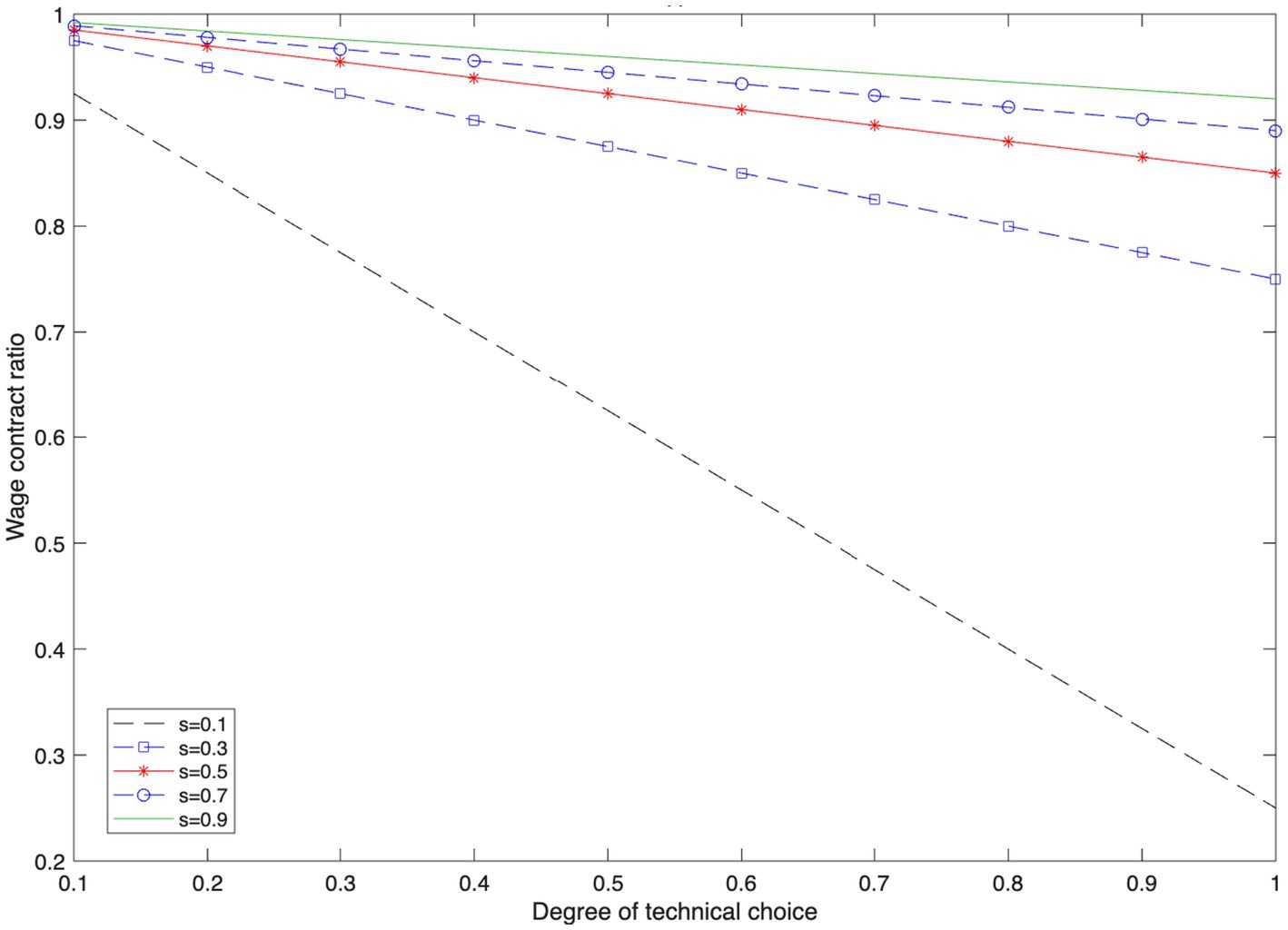

Here, we analyze the relationship between the leading enterprise’s technology selection degree and the enterprise’s profit level, as well as the relationship between the contract structure and the technology selection degree under the condition that the probability of achieving scale operation by the leading enterprise is different, that is, . To simplify the analysis, when analyzing the relationship between the leading enterprise’s technology selection degree and the enterprise’s profit level, it is assumed that the contract structure and the proportion of the share contract are exogenous and both have a value of 0.5. To be consistent with the previous analysis, it is still assumed that the farmers put in half the effort, that is, the farmers’ effort level is =50, and the result can be obtained as shown in Figure 3. When analyzing the relationship between the contract structure and the technology selection degree, the basic assumptions are the same as above, and the result is shown in Figure 4.

Figure 3 presents the influence of the variation in the technology selection degree of leading enterprises on the enterprise profits. Also, at the same current technology level, the enhancement of the probability of scale operation will increase the profits of enterprises, meaning that scale operation can exert the scale effect of the technology level and raise the output level of enterprises. Furthermore, the deepening of the technology selection degree will further magnify the effect of scale operation on the improvement of output. Figure 4 shows the relationship between the technology selection level of enterprises and the contracting structure among the participating entities. The higher the technology selection degree, the more the participating entities tend to transform the employment wage contract into a profit-sharing contract.

5.2.2 Technology choice and contracting structure: a perspective on split ratios

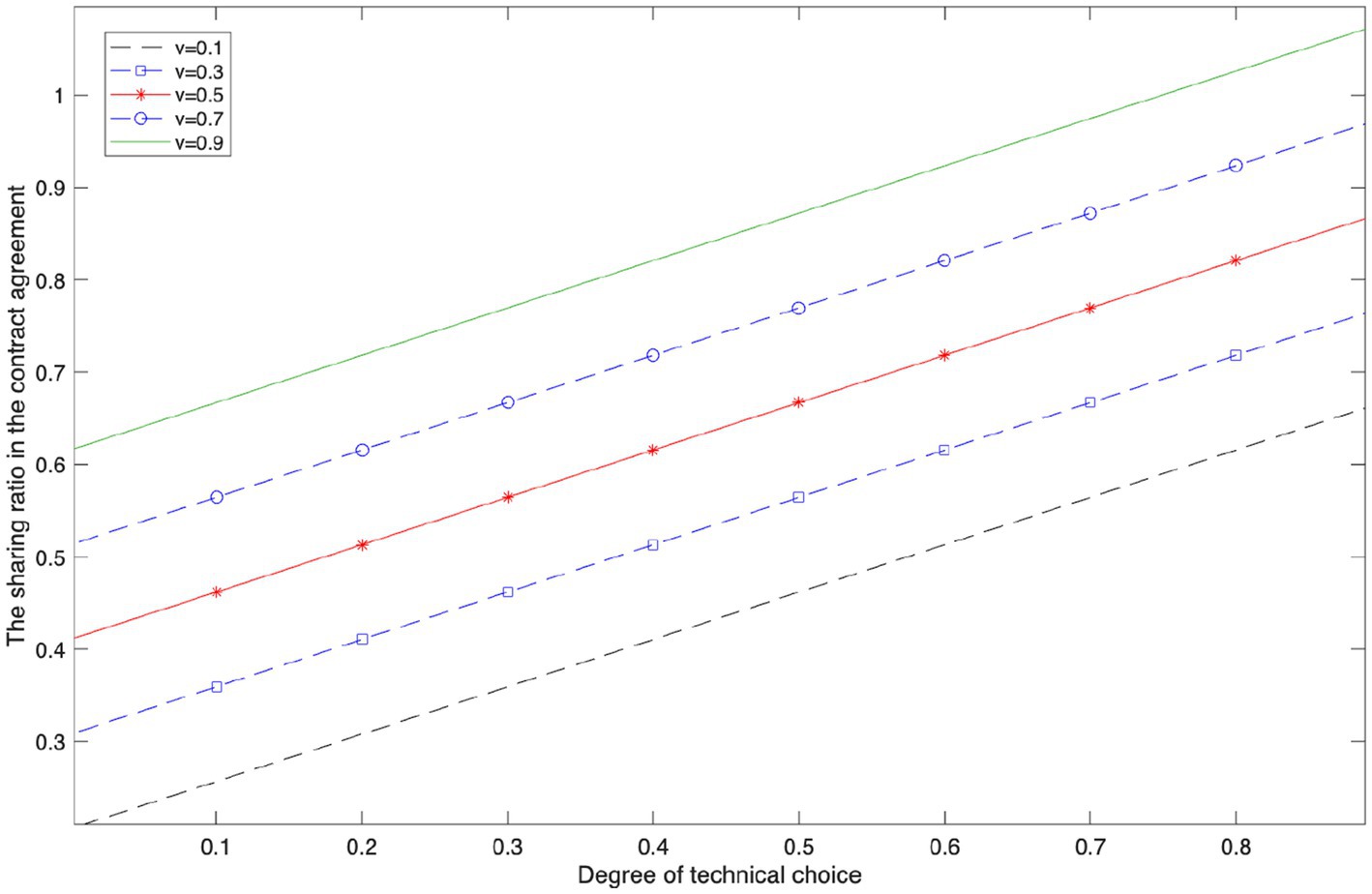

Here, we analyze the relationship between the technology selection degree of the leading enterprise and the enterprise’s profit level, as well as the relationship between the contracting structure and the technology selection degree, under the condition of different proportions of the share contract, namely . To simplify the analysis, when analyzing the relationship between the technology selection degree of the leading enterprise and the enterprise’s profit level, it is assumed that the contracting structure and the proportion of the share contract are exogenous, and both have a value of 0.5. To remain consistent with the previous analysis, it is still assumed that farmers exert half of their effort, that is, the effort level of farmers is =50, and the result can be obtained as shown in Figure 5. When analyzing the relationship between the contracting structure and the technology selection degree, the basic assumptions are the same as above, and the result is as shown in Figure 6.

Figure 5 reveals that, when attaining the same profit level, the higher the ratio of the sharing contract, the higher the demand for the enterprise’s technology selection level; on the contrary, leading enterprises with lower technology selection levels are more prone to adopt wage contract structures and can tolerate relatively lower sharing ratios. It can be observed from Figure 6 that, with the profit level controlled, the higher the technology selection level, the more inclined enterprises are to conclude sharing contracts with farmers.

5.2.3 Technology selection and revenue-sharing contract ratio

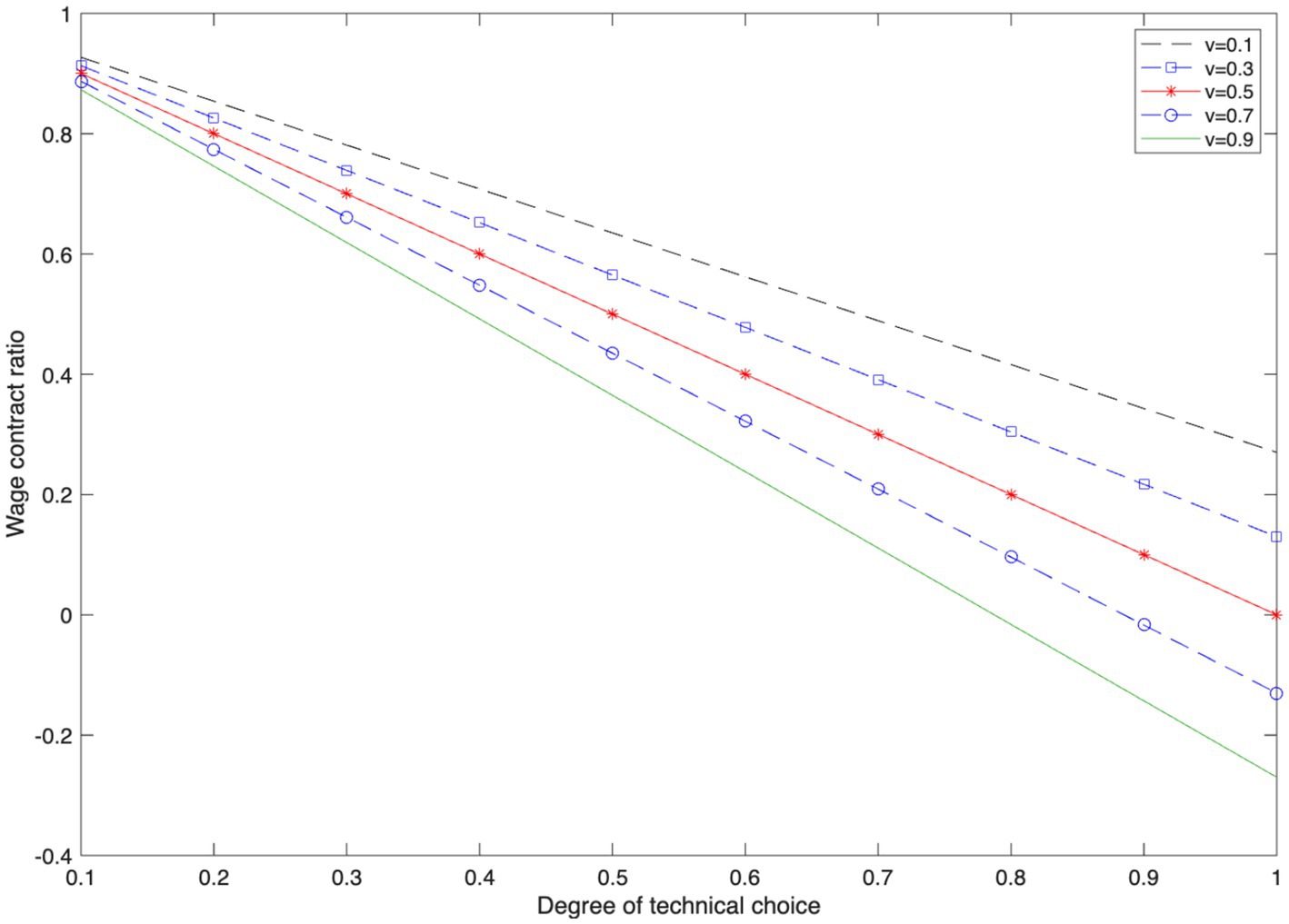

When technology selection becomes the core element for leading enterprises, the key concern for them is the marginal effect of the degree and scope of technology selection on preventing operational and natural risks. Since technology selection is positively correlated with product standardization and negatively correlated with operational risks in agriculture, thus, there is . Given sufficient funds, enterprises are inclined to mitigate market and natural risks through technology selection. The intensification of technology in production and operational processes enhances the complementarity of factors, and revenue-sharing contracts will be opted for by more leading enterprises and farmers, demonstrating that the sharing ratio and technology selection are closely related variables. Theoretically, the key variable to delineate the relationship between the two is the risk coefficient , as can be inferred from Equation 7 and Formula .

Figure 7 shows the impact of the degree of technology selection on the share ratio in the share contract. It can be seen that as the degree of technology selection deepens, the share ratio shows a positive correlation with it. Moreover, the higher the probability of achieving moderate-scale operation, the larger the share ratio that farmers can obtain in the share contract concluded between leading enterprises and farmers.

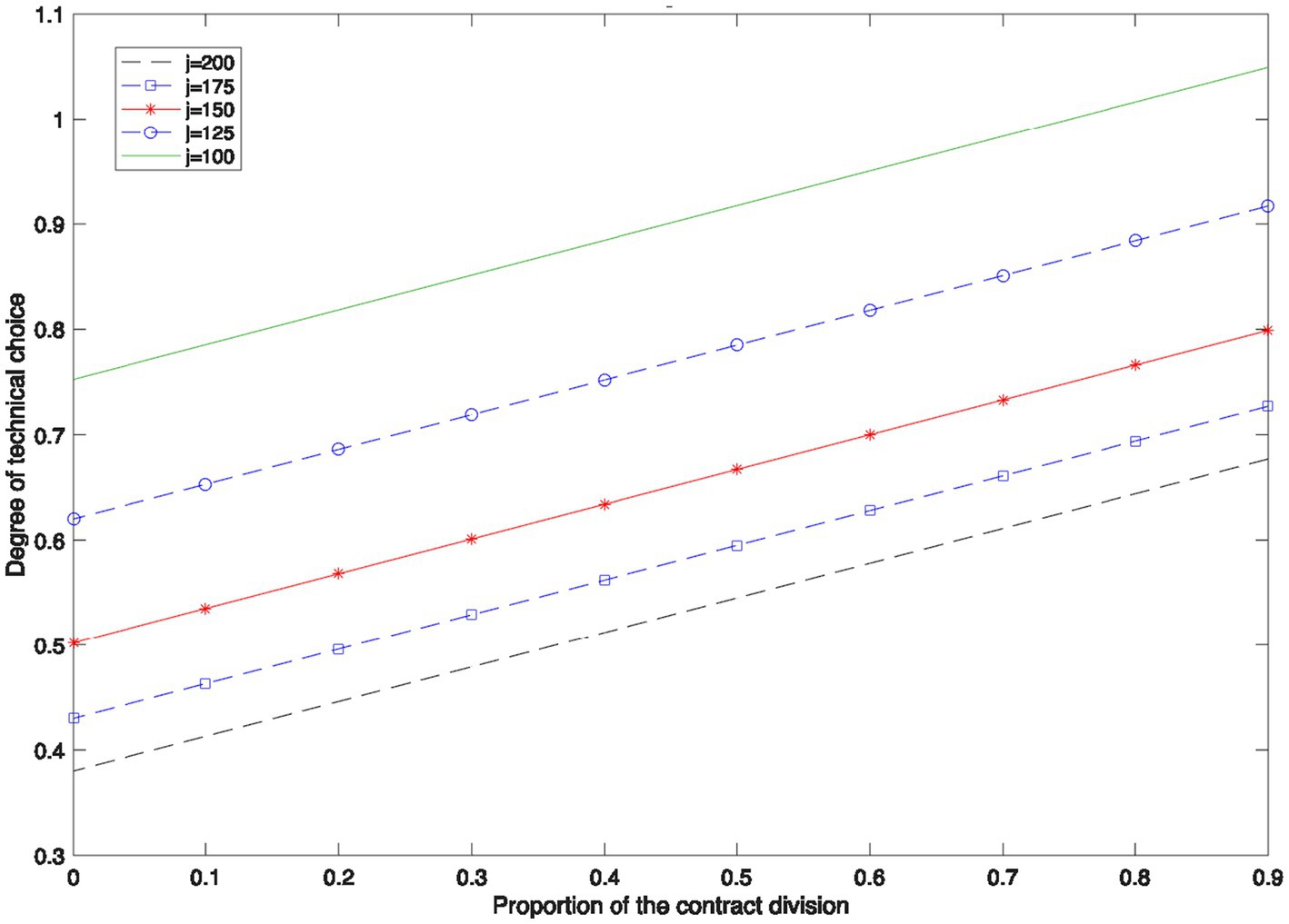

5.2.4 Endowment structure, contractual structure and technology choice

The theoretical model verifies that the resource endowment structure of leading enterprises and farmers (primarily referring to capital and labor) exerts a significant influence on technology selection and contractual structure. This part further simulates the interaction between the technology selection level of leading enterprises and the contractual structure under specific resource endowment circumstances. As depicted in Figure 8, the relationship between the contractual structure and technology selection is in accordance with the previous analysis. Technology selection will modify the contractual structure, and as technology selection intensifies, the revenue-sharing contract will receive greater “preference.”

6 Robustness tests: an empirical analysis based on the CLDS national sample

The aforementioned case studies and theoretical models elucidate the intrinsic transmission mechanism of “credit capacity—technology choice—contract structure.” To assess the universality and robustness of this mechanism across a broader sample, this section conducts econometric analysis using large-scale national data from the China Labor-force Dynamics Survey (CLDS). Conducted by the Center for Social Science Surveys at Sun Yat-sen University, the CLDS employs computer-assisted random sampling to collect multidimensional information on Chinese society and labor through a longitudinal tracking system. The data demonstrate national representativeness and high quality.

6.1 Data sources and model development

This section employs data from the CLDS 2018 survey (which includes the core variables of this paper in its questionnaire). The initial sample consisted of 13,502 households. To align with the research focus of this paper, we conducted the following processing steps: First, we retained only households with agricultural household registration status to concentrate on genuine rural economic entities. Second, we excluded all samples with missing values in key variables. After these selections, we obtained a balanced panel dataset consisting of 6,622 rural households. This sufficiently large sample size provides robust support for subsequent statistical inferences.

To validate the core finding from the case study—that technological adoption promotes contractual engagement—this study employs a multivariate logistic regression model. The dependent variable, Contract, captures whether a household has entered into planting or breeding contracts with agricultural firms or cooperatives, a typical binary variable (0–1). When the outcome variable is discrete rather than continuous, the assumptions of ordinary least squares (OLS) regression are violated, whereas the logistic model effectively estimates the nonlinear effects of independent variables on the probability of contract participation. Thus, it constitutes an appropriate method for the empirical analysis in this section. Moreover, the key explanatory variable—technological intensity—is an ordered categorical variable, while the control variables include both continuous and discrete measures. The logistic model accommodates such mixed variable types robustly. Accordingly, the following logistic model is specified:

where denotes the household, and represents the probability that household enters into an agricultural contract; is the core independent variable measuring the household’s level of technology adoption; is a vector of control variables, including the household head’s age, education level, total household size, annual household income, total cultivated land area, and household credit access; is the constant term, denotes the coefficients to be estimated, and is the random error term. The model aims to precisely identify the net effect of technological adoption on households’ contractual decisions, after controlling for other confounding factors.

6.2 Variable selection

All variables in this section are derived from the CLDS 2018 questionnaire, with specific definitions and processing as follows:

Dependent Variable: Contract Participation. This variable is constructed from the questionnaire item “F6.17.w18: Have you signed a planting or breeding contract with an agricultural company (cooperative)?” A response of “Yes” is coded as 1, and “No” as 0. Out of 6,622 valid samples, 34.82% of farmers indicated that they have signed contracts, suggesting that contract farming has reached a certain level of adoption in China’s rural areas, yet there is still considerable potential for expansion.

The core independent variable is Technology Level (TechLevel), which assesses the extent to which households apply technology in agricultural production. This aligns with the questionnaire question: “What method is currently used to cultivate the farmland for grain crop production in your household?” Responses were treated as an ordered categorical variable: traditional farming (non-mechanized) was coded as 1; partially mechanized as 2; and fully mechanized as 3. This coding represents a progressive adoption of technology, from lower to higher levels, consistent with the operational definition of “technology selection level” in the case studies. It enables the examination of whether technological advancements systematically improve farmers’ potential to integrate into modern contractual value chains.

Control variables. To mitigate omitted variable bias as much as possible, we introduced the following control variables based on existing literature:

Household head age (Age): Continuous variable, measured in years. Age may influence risk preference and willingness to adopt new contractual models.

Head of Household Education (Education): Ordinal categorical variable coded as follows: Primary school/private tutoring or below = 1; Junior high school, technical school = 2; Regular high school, vocational high school, technical secondary school = 3; College, undergraduate degree = 4; Master’s degree = 5; Doctorate = 6. Educational attainment typically correlates positively with information access, learning capacity, and contract comprehension.

Family Size (FamilySize): Continuous variable, measured in persons. Reflects household labor endowment and internal resource allocation.

Annual Household Income (Income): Continuous variable, measured in yuan. Log-transformed to mitigate heteroscedasticity. Income level represents household economic strength and risk tolerance.

Total Cultivated Land Area (LandArea): Continuous variable, measured in mu. Land scale is a critical agricultural resource, directly influencing economies of scale in technology adoption and the attractiveness of contract farming participation.

Household Credit Level (Credit): A binary variable constructed based on the question: “Have you ever successfully obtained loans from formal financial institutions such as banks or credit unions for productive investments?” “Yes” is coded as 1, and ‘No’ as 0. This variable directly corresponds to the “credit constraint” in the core mechanism of this paper and serves as a key control variable for testing case study findings.

Additionally, all continuous variables underwent descriptive statistics and variance inflation factor (VIF) tests prior to regression analysis to ensure the model was free from severe multicollinearity issues.

6.3 Test results and analysis

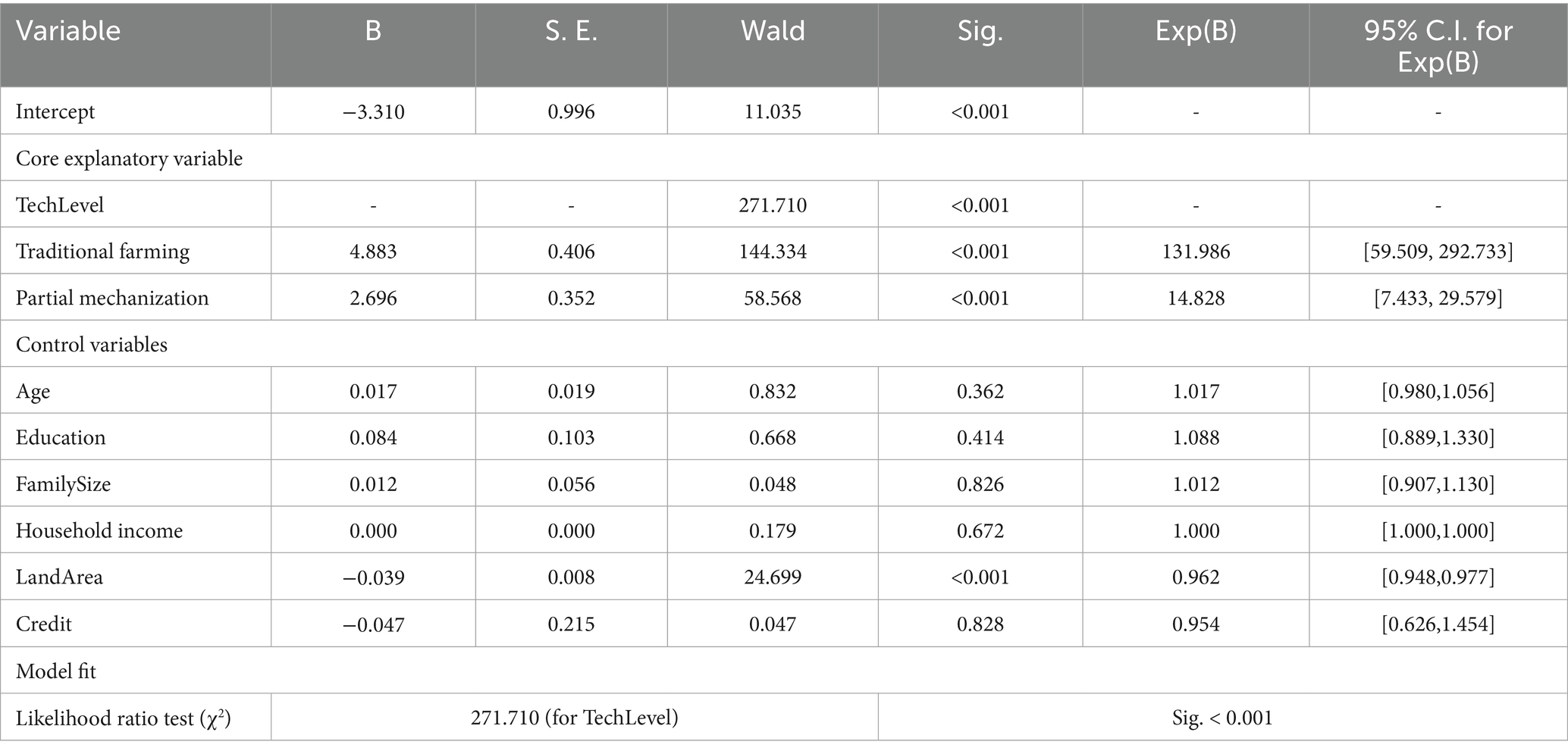

To examine the core proposition of this paper at the large-sample statistical level, we conducted a multiple logistic regression analysis using the CLDS data. The key results of the model are presented in the Table 5.

6.3.1 The decisive role of technology choice: microevidence from the shift from “hiring” to “co-operating”

The most significant finding of the model is that the level of agricultural technology (TechLevel) exerts an extremely significant influence on farmers’ decisions regarding contract participation (likelihood ratio test chi-square value = 271.710, p < 0.001). Consistent with the case study findings, parameter estimates further reveal a nonlinear relationship between technology choice and contract mode.

Using “fully mechanized” as the reference group, both “traditional farming” and “partially mechanized” exhibit significantly positive coefficients. This suggests that, in comparison to farmers who have achieved full mechanization, those with lower technological levels are significantly more likely to enter into contracts. Although this may seem counterintuitive, this finding elegantly validates the theoretical logic presented in this paper. Case studies indicate that after leading enterprises introduce comprehensive smart technologies (corresponding to “full mechanization” here), production processes become highly standardized and controllable. Their reliance on traditional farmers’ labor is minimized, and their production model approaches that of “industrial farms.” Consequently, their need to sign production contracts with external farmers diminishes.

Conversely, enterprises at the “partially mechanized” stage (such as Category B enterprises in the case study) that cannot yet fully replace labor and land with their technological systems have a strong intrinsic need to establish “risk-sharing, profit-sharing” contractual relationships with farmers. This allows them to expand their scale of operations and achieve factor complementarity. This aligns with the model’s finding that the probability of contract signing among “partially mechanized” farmers is 14.8 times higher than that of “fully mechanized” farmers (Exp(B) = 14.828). Meanwhile, the exceptionally high occurrence ratio for “traditional farming” households (Exp(B) = 131.986) may reflect a different scenario: due to technological limitations and low asset specificity, these farmers primarily engage in the most basic form of contract farming—the “order-based” model where companies provide key inputs and technology. Their contractual relationship resembles ‘outsourcing’ rather than “joint operation.”