- 1Western Ecological Civilization Research Center, Chengdu University of Technology, Chengdu, China

- 2Institute of Regional Economics, Sichuan Academy of Social Sciences, Chengdu, China

- 3School of Economics, Southwestern University of Finance and Economics, Chengdu, China

- 4School of Finance and Business, Chengdu Vocational & Technical College of Industry, Chengdu, China

- 5College of Economics and Management, Mianyang Teachers’ College, Mianyang, China

An examination of the evolution and underlying patterns of China’s fiscal agricultural subsidy policies since the beginning of the new century reveals that these subsidies have played a measurable role in curbing the abandonment of cultivated land. This study employs a neoclassical growth model to theoretically examine how fiscal subsidies for agriculture influence farmland abandonment. Using panel data from 2003–2020 across 30 Chinese provinces, the study employs static panel and dynamic panel fixed effect models to assesses the effects of fiscal subsidies for agriculture on both the intensity of farmland abandonment and the actual multiple cropping index. The findings reveal that: fiscal subsidies for agriculture contribute to an increase in actual multiple cropping areas and effectively reduce the abandonment intensity of cultivated land; farmland abandonment demonstrates a degree of path dependence, with past levels influencing current rates; the regulatory impact of fiscal subsidies for agriculture on farmland abandonment is influenced by mechanization levels, natural conditions, and agricultural employment population. Specifically, regions with higher agricultural mechanization levels, favorable natural conditions, and larger agricultural populations exhibit greater efficacy in curbing farmland abandonment. This study provides developing countries with a reference framework for formulating targeted policies to manage farmland abandonment.

1 Introduction

The global food market faces significant challenges from the Ukraine crisis, COVID-19 pandemic, extreme weather events, and other factors, leading to growing concerns about food security worldwide. Although cultivated land is essential for food production in China, a vast majority of its arable land remains underutilized, with idle areas present across more than 30 provinces, cities and autonomous regions. According to the latest data from the Ministry of Agriculture and Rural Affairs of China, the arable land abandonment rate in China has risen from 5.2% in 2020 to 8.7% in 2024, an increase of 3.5 percentage points over the four-year period. The problem is mainly concentrated in regions such as the Northeast and the mountainous areas in the Southwest. The growing trend of land abandonment further exacerbates the long-term threat to food security. Consequently, addressing farmland abandonment has become a critical component in ensuring food security.

To effectively tackle farmland abandonment, it is essential to first identify its underlying causes. Within academic discourse, five primary explanations have been identified: (1) the “natural condition theory” (Alix-Garcia et al., 2012), which posits that land abandonment is driven by adverse natural conditions; (2) the “technological progress theory” (Li S. F. and Li X. B., 2016), which suggests that advancements in agricultural technology reduce the need for arable land, leading to its abandonment; (3) the “cost–benefit theory” (Cao, 2003), which highlights high opportunity costs and relatively low returns on investment in farming, prompting farmers to abandon farmland as a rational choice; (4) the “labor transfer theory” (Tian et al., 2010), which asserts that labor migration from agriculture to urban sectors leads to a labor shortage and results in farmland abandonment; and (5) the “institutional obstacle theory” (Tian et al., 2018), which underscores that inadequate land systems and agricultural policies create burdens for farmers, ultimately leading to farmland abandonment.

The attribution analysis conducted on land abandonment reveals its complex nature, influenced by multiple factors at both macro and micro levels. At a macro level, land abandonment is shaped by interrelated natural, economic, technological, and policy factors (Li J. G. and Li P., 2016). On a micro level, farmers decide to abandon land based on rational input–output analysis (Geng and Zhang, 2024). Therefore, key determinants of land abandonment include the level of agricultural comparative income and farmers’ ability to sustain profitable agricultural activities within specific social and historical contexts. Interventions to address land abandonment, such as eliminating institutional barriers (Chen, 2022), strengthening agricultural price support (Li Y. P., 2018; Li J. G., 2018), upgrading agricultural infrastructure (Dong et al., 2023), and adjusting operational practices (Zou et al., 2023), are essential for enhancing agricultural comparative advantage, boosting farmers’ incomes, and increasing their productivity. Ultimately, these measures aim to regulate land abandonment effectively (Duan, 2019).

Most scholars argue that agriculture, a vulnerable industry facing risks from nature and the market, requires specific government support and transfer payments to enhance its comparative returns. Among these measures, fiscal subsidies for agriculture are commonly utilized by governments to bolster and support the agricultural sector (Li et al., 2019). Academic discourse suggests four strategies to mitigate farmland abandonment: firstly, fiscal subsidies can raise agricultural income levels and motivate farmers to produce more; secondly, they can improve farming conditions and intensify land use to counter cultivated land marginalization (Huang, 2009); thirdly, these subsidies can enhance farmers’ ability to withstand natural disasters (Fan et al., 2023); lastly, fiscal subsidies can foster the emergence of new agricultural enterprises and attract migrant workers, scientists, technicians, and entrepreneurs back to rural areas for farming (Hu and Zhou, 2022).

The literature review reveals the crucial role of fiscal subsidies in managing cultivated land abandonment, providing a foundation for this study’s analysis. However, gaps exist in the current research. Firstly, a lack of systematic theoretical analysis hinders understanding of how fiscal subsidies influence cultivated land abandonment. Secondly, official macro-statistics on cultivated land abandonment are scarce, with academic research relying mainly on sampling surveys or remote sensing data. Sampling surveys are labor-intensive and lack universality, while remote sensing data, although covering large areas instantly, do not align with the seasonal, climate-dependent, and uncertain nature of agricultural production. This study innovates by offering a novel theoretical framework and empirical analysis of fiscal subsidies’ impact on cultivated land abandonment. Drawing on the neoclassical growth model, the paper theoretically examines how fiscal subsidies regulate cultivated land abandonment. Additionally, a model is developed to compare actual and potential multiple cropping indices, representing abandonment intensity. Panel data from 30 Chinese provinces spanning 2003 to 2022 are analyzed to assess the influence of fiscal subsidy policies on cultivated land abandonment, culminating in proposed strategies and recommendations.

2 Policy background and mechanism analysis

Fiscal subsidies for agriculture are institutional arrangements aimed at ensuring national food security and promoting the development of the food industry during specific economic stages ***(Li Y. P., 2018; Li J. G., 2018). These subsidies have evolved over time in response to changing social and economic conditions, leading to variations in policy objectives, beneficiaries, and methods. It is imperative to examine the evolution of agricultural subsidy policies in China and their implications for agricultural productivity. Understanding how fiscal support affects farmland abandonment is crucial in this context.

2.1 An overview of fiscal subsidy policies for agriculture in the 21st century

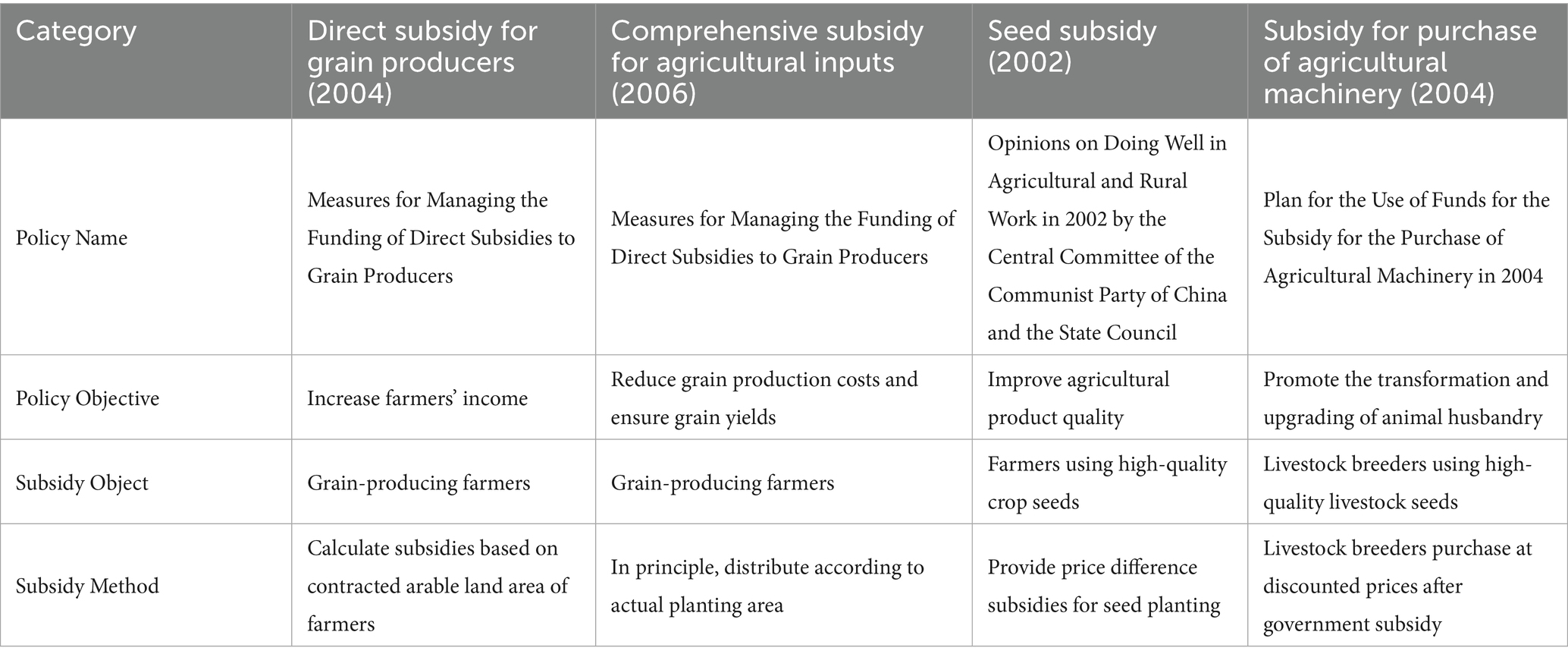

Fiscal subsidies for agriculture in China originated with “fixed loss subsidies for machine farming” in the late 1950s and later expanded to include price subsidies for agricultural products and inputs. Prior to 2000, the agricultural subsidy system predominantly favored industry over agriculture, resulting in what can be described as “negative subsidies” that disadvantaged farmers while benefiting urban consumers. However, with the onset of the new century, the central government shifted towards a more balanced approach through initiatives such as the “two exemptions and four subsidies” for farmers, signaling a transition from “negative” to “positive” agricultural subsidies. Consequently, it is imperative to examine the regulatory impact of fiscal subsidies for agriculture on farmland abandonment, focusing particularly on the post-2000 period (as shown in Table 1).

China transitioned from a grain price protection system to a grain direct subsidy system in 2001 to alleviate the burden on farmers and enhance their motivation(Yang and Kong, 2020). Pilot reforms of the grain direct subsidy were initiated in major grain-producing regions such as Anhui and Jilin the following year. The nationwide implementation of the “grain direct subsidy” took place in 2004, with subsequent expansion in 2005 to encompass “three subsidies”: grain direct subsidy, agricultural machinery purchase subsidy, and improved seed subsidy. By 2006, China augmented the “three subsidies” with comprehensive subsidies for agricultural materials, establishing the “four subsidies” framework that included direct grain subsidies, comprehensive agricultural material subsidies, improved variety subsidies, and agricultural machinery and tool purchase subsidies(Gong and Li, 2022). In 2007, China introduced the agricultural insurance premium subsidy policy to mitigate economic losses from natural disasters and ensure the orderly progression of agricultural production. In 2015, China consolidated the direct grain subsidies, improved variety subsidies, and comprehensive agricultural material subsidies into agricultural support and protection subsidies under the “three subsidies” pilot reform, with a specific focus on endorsing large-scale farmers in agriculture to uphold the principle of prioritizing subsidies for those who contribute significantly to food production(Yang et al., 2022).

2.2 The internal mechanism of fiscal subsidy policies for agriculture to mitigate farmland abandonment

Fiscal subsidies for agriculture can play a crucial role in regulating farmland abandonment. This study employs the neoclassical growth model to examine how fiscal agricultural subsidy policies influence farmland abandonment. The analysis starts with the assumption that agricultural producers are rational economic agents driven by profit maximization. Their production decisions are guided by the goal of maximizing net income(Cheng, 2015), determining choices such as whether to cultivate land, what crops to grow, and the scale of cultivation. Importantly, these production decisions directly impact the extent of farmland abandonment. Both extensive and intensive production inputs ultimately influence farmland abandonment by affecting the actual multiple cropping index.

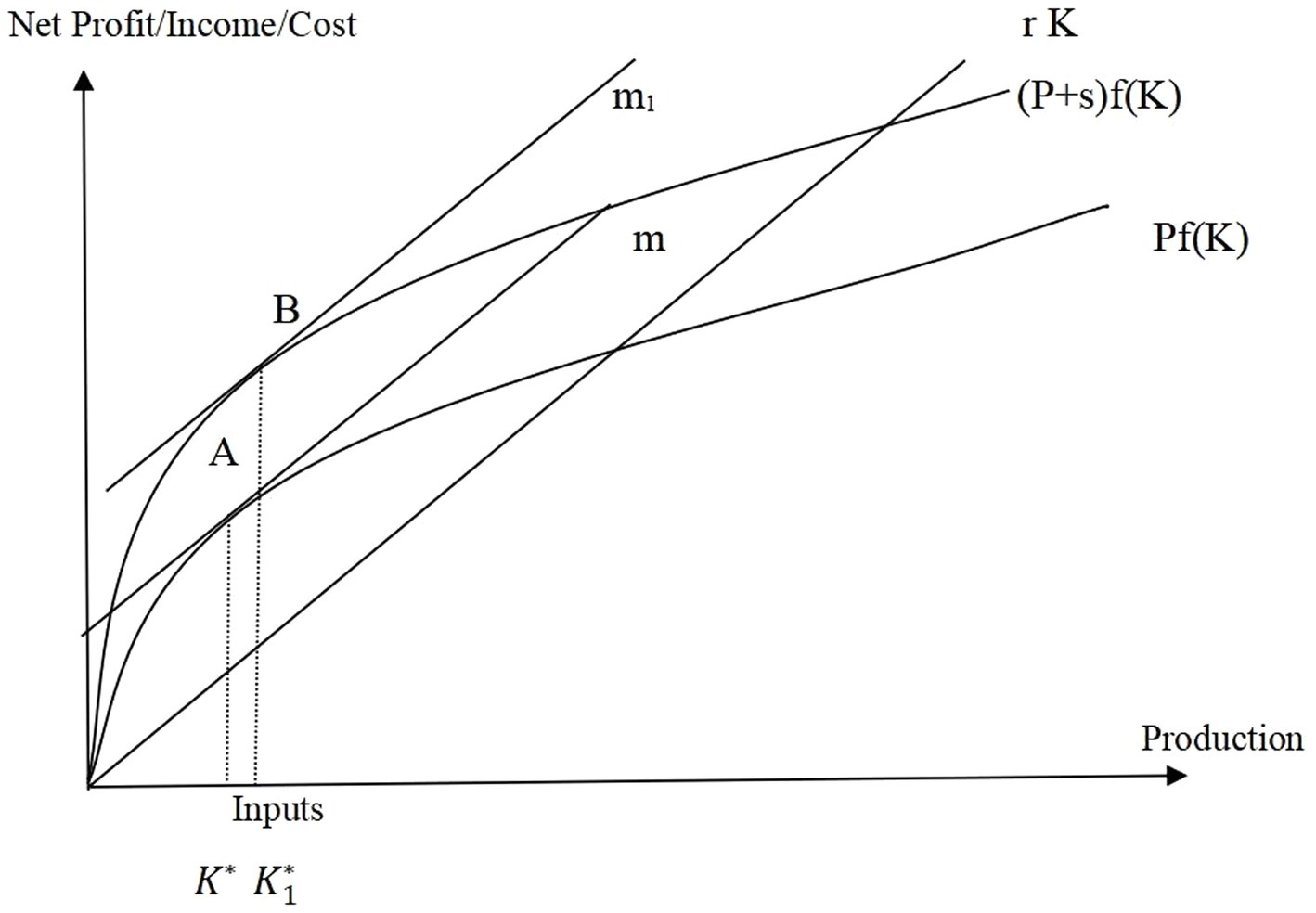

In the context of the neoclassical growth model, the optimal decision-making model for input production by agricultural producers can be described as. The key condition for agricultural producers to maximize their net revenue is the equality of marginal revenue and marginal cost which is described as . In other words, the tangent line ‘m’ of the cost function intersects the agricultural production income curve at point A, signifying the point at which agricultural producers can achieve maximum net revenue. At this point, the net income of agricultural producers can be maximized, corresponding to the optimal production inputs (). The maximum net income for agricultural producers is .

We assume that the fiscal subsidies for agriculture are tied to grain output, with a marginal subsidy rate of s, and the total fiscal subsidy for agriculture is represented as . The optimal production input decision model for agricultural producers then becomes: . With the influence of the fiscal subsidy, the agricultural production revenue curve shifts from to . The condition for maximizing net revenue for agricultural producers remains unchanged, requiring that marginal revenue equals marginal cost, which is described as . The translation line m1 of the cost function rK is tangent to the agricultural production revenue curve at point B, corresponding to an increased maximum net income . The optimal production inputs expand from K* to (as shown in Figure 1). This shift indicates that the fiscal subsidies for agriculture linked to grain output plays a significant role in enhancing agricultural production input and mitigating the abandonment of cultivated land.

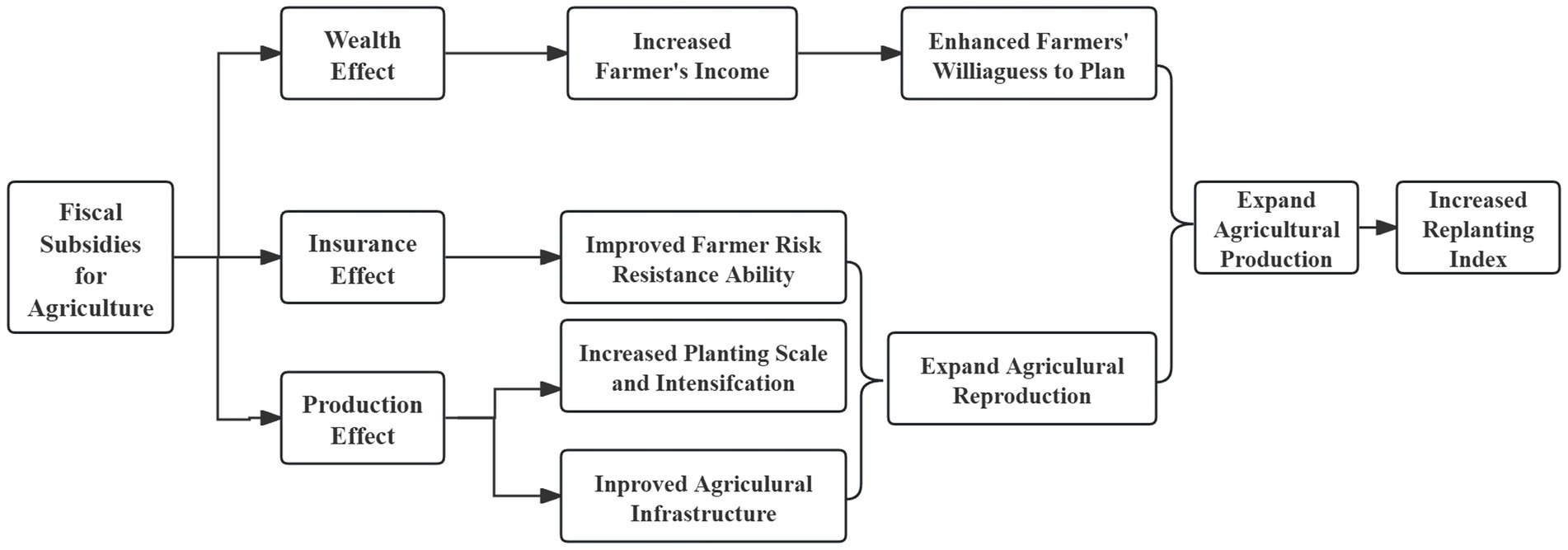

The analysis above demonstrates that fiscal subsidy policies for agriculture can effectively control farmland abandonment. However, the mechanisms through which financial subsidies for agricultural support regulate farmland abandonment remain unclear. By examining the policy objectives, subsidy methods, and subsidy tools of fiscal support for agriculture, it is evident that the fiscal support for agriculture subsidy policy can influence farmland abandonment through three key effects (as shown in Figure 2).

Fiscal subsidies for agriculture have a wealth effect, alleviating financial constraints on producers, boosting their disposable income, enhancing their enthusiasm for grain production, and curbing farmland abandonment. Given the public goods nature (e.g., food security) and externalities (e.g., water and soil conservation, environmental protection) of agriculture, market prices do not fully reflect the value of agricultural products(Cheng, 2011). Discrepancies exist in the pricing of industrial and agricultural products, with industrial products typically overpriced relative to their value while agricultural products are undervalued. Moreover, the decrease in production costs for agricultural products lags behind that of industrial products, leading to a widening income gap between the two sectors. Consequently, a significant transfer of agricultural resources (including labor and capital) to non-agricultural sectors occurs, contributing to farmland abandonment. Financial aid in agriculture serves to stabilize agricultural income by aligning it with product prices and input costs, fostering producers’ commitment to grain production, and safeguarding national food security.

Fiscal subsidy policies for agriculture serve as a form of insurance, mitigating losses stemming from natural disasters, diseases, market fluctuations, and other adversities. This support ensures sustainable agricultural production, reduces the risk of abandoned arable land, and bolsters the resilience of agricultural producers against the inherent uncertainties and vulnerabilities of the industry. Given the high-risk nature of agricultural production due to biological and environmental factors, coupled with the perishable and low-value nature of many agricultural products, financial assistance plays a crucial role in offsetting economic losses, safeguarding the fundamental capacity for agricultural reproduction, and minimizing the likelihood of abandoned cultivated land.

Fiscal subsidies for agriculture have a significant impact on production by facilitating the expansion of agricultural input, enhancing agricultural production conditions and infrastructure, promoting intensification and scale of production, and ultimately mitigating land abandonment. Abandoned lands, often found in remote areas with poor irrigation and high slopes, can benefit from fiscal subsidies directed towards improving agricultural production conditions and irrigation capacity, thereby easing farming challenges. Moreover, in China, challenges persist in advancing agricultural science and technology, as well as implementing agricultural intensification, mechanization, and large-scale production. Targeted fiscal subsidies towards moderate-scale agricultural entities can bolster production intensification and scale. Additionally, directing fiscal subsidies towards vocational training for farmers, enhancing basic rural public services, encouraging the return of migrant workers to rural areas, and facilitating agricultural entrepreneurship by agricultural technicians can further stimulate agricultural productivity and reduce land abandonment.

3 Methodology

Based on the theoretical analysis presented above, we constructed fixed-effect models for static and dynamic panels. We specified independent variables, dependent variables, and control variables. Using panel data spanning 2003 to 2020 from 30 provinces, we empirically analyzed the effects of fiscal subsidies for agriculture on the intensity index of farmland abandonment and the actual multiple cropping index.

3.1 Model

To investigate the impact of fiscal subsidies for agriculture on rural farmland abandonment, we have developed the following measurement model:

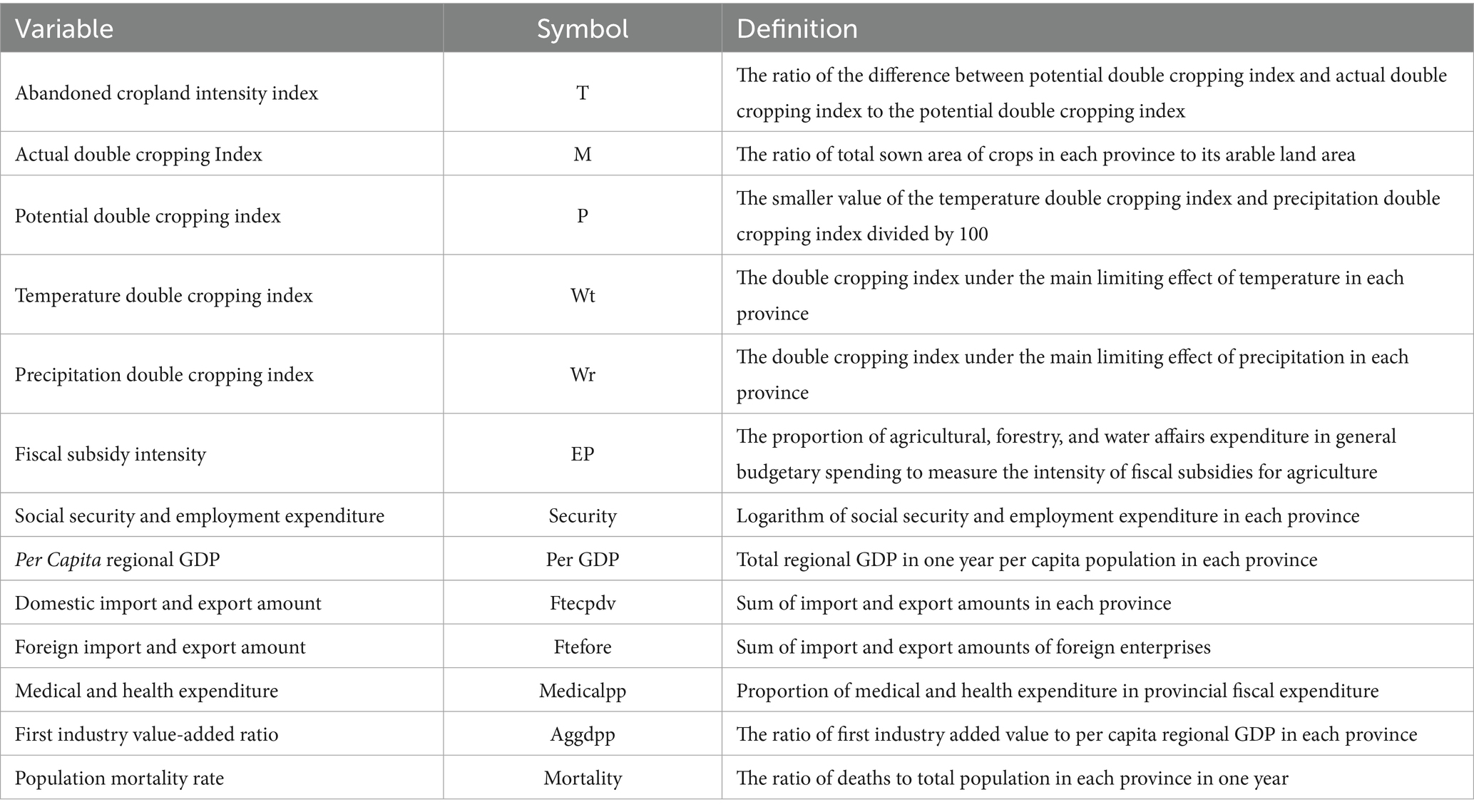

The subscripts i and t denote the province and year, respectively. and denote the farmland intensity index and actual multiple index of each province. A higher farmland intensity index indicates a greater degree of abandonment in the area, while a higher actual multiple cropping index suggests a lower degree of abandonment. is the primary explanatory variable in this study. Following Chen et al. (2010), we measure the intensity of fiscal subsidies for agriculture in each province by calculating the proportion of fiscal support within the total agricultural financial expenditure. Represents a set of additional control variables, which will be elaborated upon later. Denotes a fixed effect, represents the time effect, and accounts for random interference.

Equations 1, 2 represent static panel data. However, given the path dependence associated with cultivated land abandonment, we augment these equations by incorporating the first-order lag terms of the abandoned farmland intensity index and the actual multiple species index. This adjustment aims to account for potential dynamic effects in the model. The resulting dynamic panel model is expressed as follows:

Herein, Ti,t–1 in Equation 3 and Mi,t–1 in Equation 4 represent the first-order lag terms of the farmland abandonment intensity index and the actual multiple cropping index, respectively, while the control variables align with Equations 1, 2.

3.2 Variables

The main variables will be explained descriptively below, as defined in Table 2.

3.2.1 Abandoned arable land

In this study, we utilized the farmland abandonment intensity index () and the actual multiple cropping index () to calculate the regional farmland abandonment index.

The actual multiple cropping index () denotes the real extent of cultivated land utilization within a region during a specific time frame, considering social and natural constraints, economic development, policy enforcement, and other relevant factors. It is calculated by dividing the total crop sown area in each province by the cultivated land area of that province. The calculation formula is as follows:

In the equation, denotes the actual multiple cropping index of the region, where SA represents the sown area and CA represents the cultivated area for the year. A higher actual multiple cropping index corresponds to reduced farmland abandonment in the region. The formula for the farmland abandonment intensity index is outlined as follows:

The potential multiple cropping index () and the actual multiple cropping index () of a region within a year indicate the level of farmland abandonment. The difference between these indices reflects the degree of farmland abandonment, with the ratio of farmland abandonment to the potential multiple cropping index representing the abandonment intensity (). The potential multiple cropping index () signifies the maximum arable land utilization under specific natural conditions. Following the methodology of He et al. (2016) and the “cumulative temperature-precipitation model,” we identified the lower values of the cumulative temperature and precipitation multiple cropping indices within a region in a year as the potential multiple cropping index [())].

The cumulative temperature multiple planting index potential () was determined using temperature thresholds of 3,400 °C, 4,200 °C, 5,200 °C, and 6,200 °C. The index () represents the sum of daily temperatures over 365 days in each province (°C). The calculation formula is as follows:

The precipitation multiple cropping index potential () is determined using a threshold of 500 mm and 1,200 mm for average annual precipitation (mm). The calculation formula is as follows:

3.2.2 Fiscal support for agriculture (EP)

Following the method by Chen et al. (2010), this study employs the ratio of expenditure allocated to agriculture, forestry, and water affairs within the general government budget as a metric to gauge the level of fiscal backing for agriculture across different provinces. This expenditure category encompasses the entirety of fiscal spending on agriculture and is considered a reliable indicator of fiscal assistance to the agricultural sector. Li S. F. and Li X. B. (2016) posited that fiscal subsidies for agriculture play a crucial role in mitigating farmland abandonment, serving as a primary strategy to counter this trend in China. Currently, financial aid to agriculture stands as a pivotal financial resource for agricultural advancement, with the provision of direct or indirect subsidies for agricultural activities proving beneficial in augmenting farmers’ income, enhancing their willingness to engage in cultivation, and diminishing instances of farmland abandonment.

3.2.3 Control variables

Firstly, social security and employment expenditure encompassing pension, unemployment benefits, social assistance, vocational training, and minimum living support reflect fiscal outlays on social security and employment. This aims to enhance the social security system, boost employment opportunities, mitigate social tensions, and stabilize societal progress. Zhang (2021) contends that enhancing the rural social security system can effectively rejuvenate the labor force, protect workers’ interests comprehensively, and bolster their engagement in agricultural activities. Secondly, per capita GDP serves as a pivotal indicator of economic development and living standards within a region. A higher per capita GDP signifies more advanced economic growth and elevated living standards for residents. Jiang et al. (2022) posit that regions with heightened economic development and urbanization rates possess a solid foundation for ensuring the adequate supply of grains and essential agricultural products, potentially mitigating issues related to abandoned farmland. Thirdly, the import–export volume of a province plays a pivotal role in the context of economic globalization, facilitating increased international trade activities. This phenomenon broadens China’s agricultural trade market, showcases domestic agricultural comparative advantages, and attracts foreign capital investments. Chen (2017) argues that direct foreign capital inflows can offer financial backing for agricultural research and production in China, bridging gaps in research and development funding, fostering capital accumulation, promoting technological innovation, and thereby reducing instances of abandoned farmland. Fourthly, the import–export volume of foreign-funded enterprises within a region over a specific period reflects the region’s economic development level, international competitiveness, and appeal to foreign investments. Zhang and Xu (2025) assert that a higher import–export volume indicates a broader sales market and increased demand for agricultural products, enabling farmers to reap greater benefits from foreign trade and effectively curbing farmland abandonment. Fifthly, government expenditure on medical and healthcare services encompasses various aspects of the healthcare sector crucial for people’s daily lives, serving as a vital pillar for ensuring healthy living conditions. Fan et al. (2024) argue that higher spending on medical and healthcare services signifies more comprehensive basic public services within a region. Improved access to medical assistance for rural residents can enhance agricultural productivity. Lastly, the population mortality rate, calculated as the ratio of deaths within a region in a year to the average total population during that period, is a key indicator of living standards and health conditions in different regions. This metric reflects the quality of life and labor force dynamics within a region. Chen et al. (2025) suggest that a lower population mortality rate indicates better health conditions among the population, resulting in a larger available labor force for production and living. In rural areas, where many elderly individuals continue farming, this may lead to a reduction in farmland abandonment.

3.3 Data

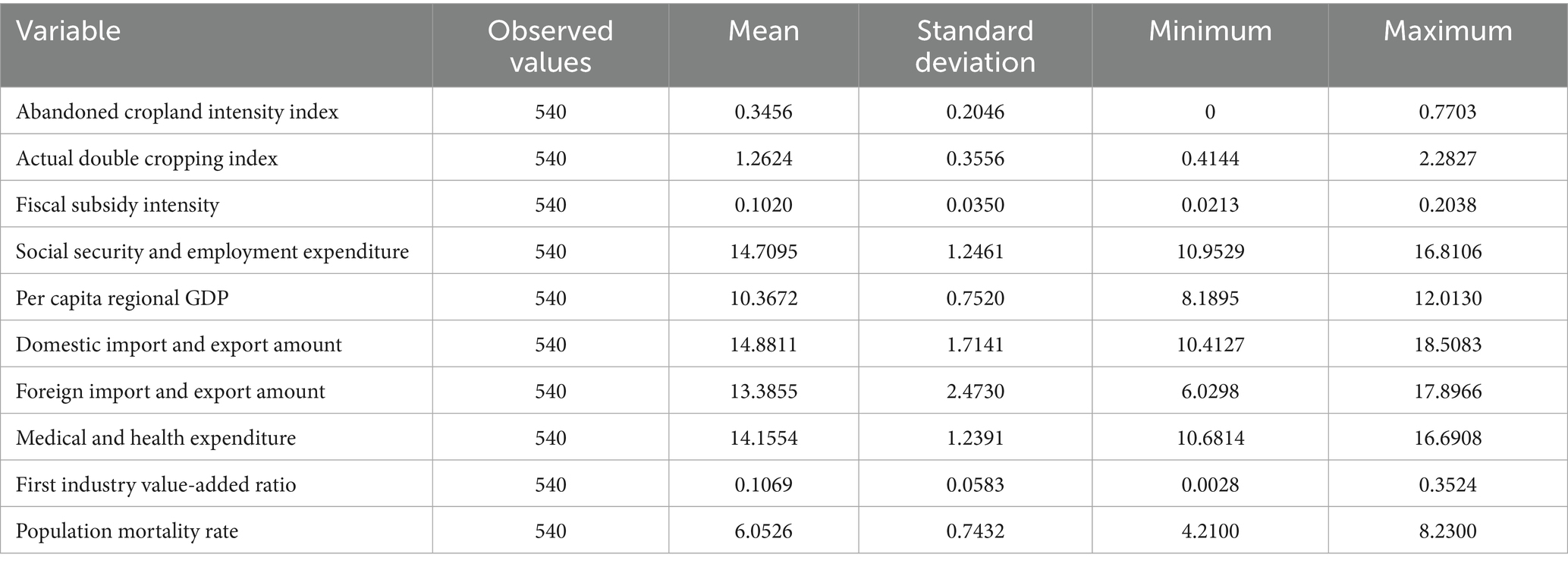

The study utilizes panel data from 30 provinces spanning the years 2003 to 2020, excluding the Tibet Autonomous Region due to significant missing data. This time frame was selected to coincide with China’s implementation of fiscal subsidies for agricultural development and substantial changes in cultivated land, providing a more precise analysis of farmland abandonment trends. Data sources include the China Statistical Yearbook and provincial statistical yearbooks. Descriptive statistics for the variables are presented in Table 3 based on the detailed data analysis.

4 Results and discussion

4.1 Baseline regression results

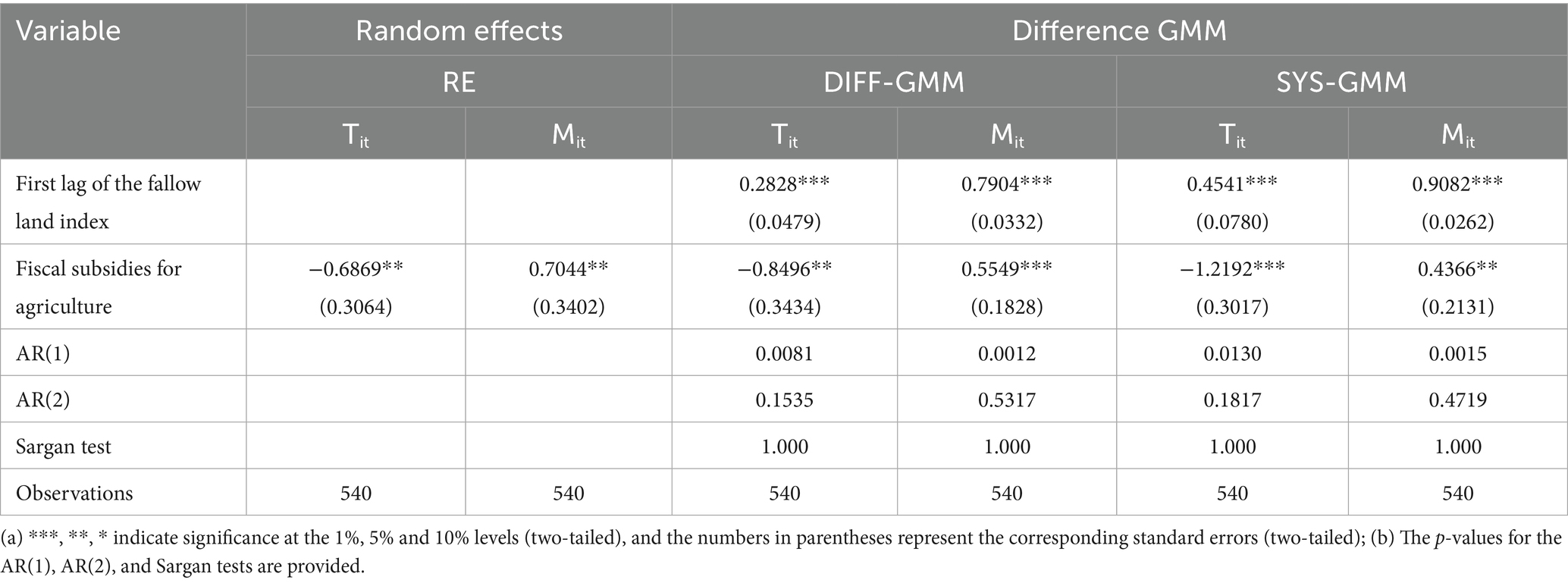

In this study, the static panel model estimation technique is applied to estimate models (1) and (2). The regression outcomes of the fixed effects model are presented in the static panel column of Table 4.

The estimation approach in this study relies on static panel regression, incorporating a potential path dependence of arable land abandonment by including the first-order lag term of the explanatory variables. Dynamic panel models (3) and (4) are then constructed for estimation purposes. To address endogeneity concerns and ensure the robustness of the estimation outcomes, the differential GMM model (DIFF-GMM) and the systematic GMM model (SYS-GMM) were employed to examine the causal link between fiscal subsidies for agriculture and arable land abandonment.

The results of the estimations are presented in Table 4. The static panel fixed effect model reveals that the coefficient estimate of fiscal subsidies for agriculture on the intensity index of abandoned farmland is negative, while the coefficient estimate of the actual multiple species index is positive, both of which are statistically significant. These findings indicate that fiscal subsidies for agriculture effectively mitigates farmland abandonment intensity and increases the actual area under multiple cropping. Specifically, a 1% increase in government agricultural subsidies leads to a 0.69% reduction in arable land abandonment intensity and a 0.70% increase in the actual multiple cropping index. Financial aid for agriculture directly enhances agricultural income competitiveness, alleviates farmers’ financial burdens, improves agricultural production technology and mechanization to some extent, boosts farmers’ willingness to participate in agricultural activities and investments, thereby fostering agricultural expansion, and restraining cultivated land abandonment.

After incorporating the dynamic effect by including the first-order lag term of the farmland abandonment index in the model, the estimation results from the dynamic panel difference GMM model indicate a negative impact of fiscal subsidies for agriculture on the farmland abandonment intensity index and a significantly positive impact on the actual multiple cropping index. Specifically, the GMM model estimates reveal that a 1% increase in fiscal subsidies for agriculture leads to a 1.22% reduction in the farmland abandonment index and a 0.44% increase in the actual multiple cropping index. These findings confirm the role of fiscal subsidies for agriculture in mitigating farmland abandonment in China. Fiscal subsidies for agriculture, serving as a crucial mechanism to enhance farmers’ income, stabilize agricultural production, and ensure national food security, facilitate rural land transfer, rejuvenate rural collective economy, retain rural population in agricultural activities, expand the area under multiple cropping, and alleviate farmland abandonment. The regression outcomes of the dynamic panel analysis presented in Table 4 further demonstrate the significance, at the 1% level, of the first-order lag terms of both the arable land abandonment index and the actual multiple cropping index. This suggests a certain degree of path dependence in arable land abandonment, wherein past levels of abandonment influence current levels, underscoring the need to address arable land abandonment promptly to prevent a decline in farmers’ planting intentions and exacerbation of farmland abandonment trends.

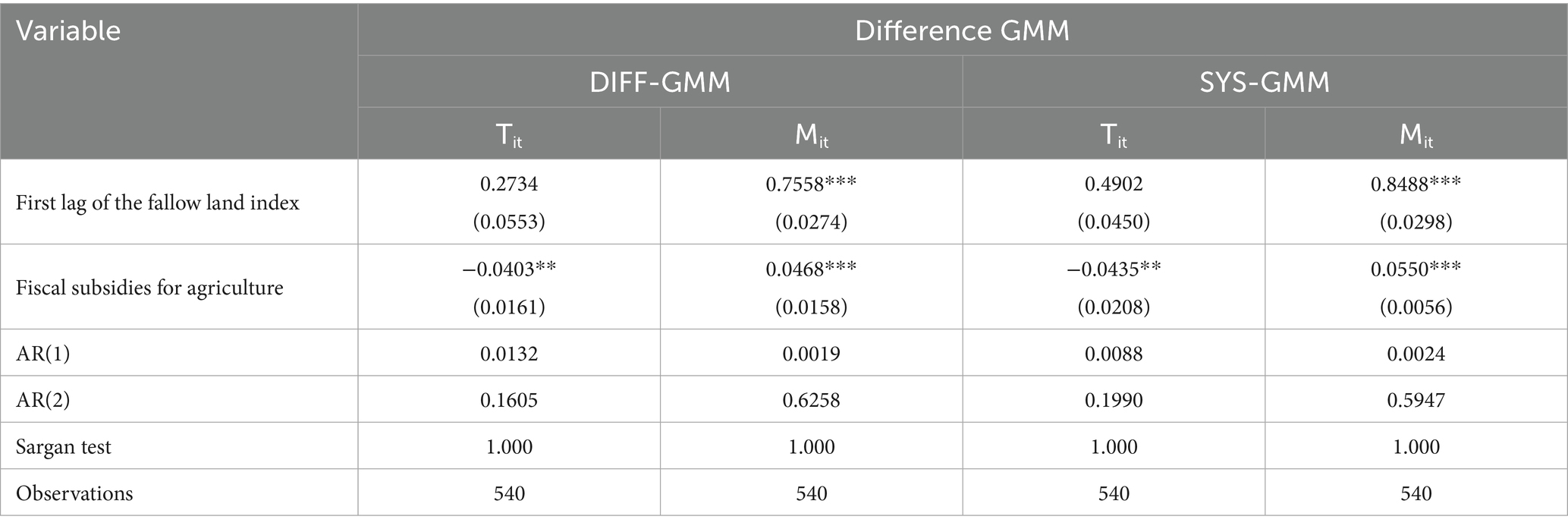

4.2 Robustness checks

This study utilizes the ratio of government general budget expenditure as a proxy for the level of provincial financial assistance to agriculture. To assess the reliability of the findings, Zhang and Li (2022) employ the logarithm of the ratio of water transaction expenditure of the rural population as an alternative measure of financial support for agriculture. The results of the estimations are presented in Table 5. Both the systematic GMM model and the differential GMM model yield results that align with the core regression outcomes, underscoring the robustness of the analysis.

4.3 Further discussion

4.3.1 Mechanization level

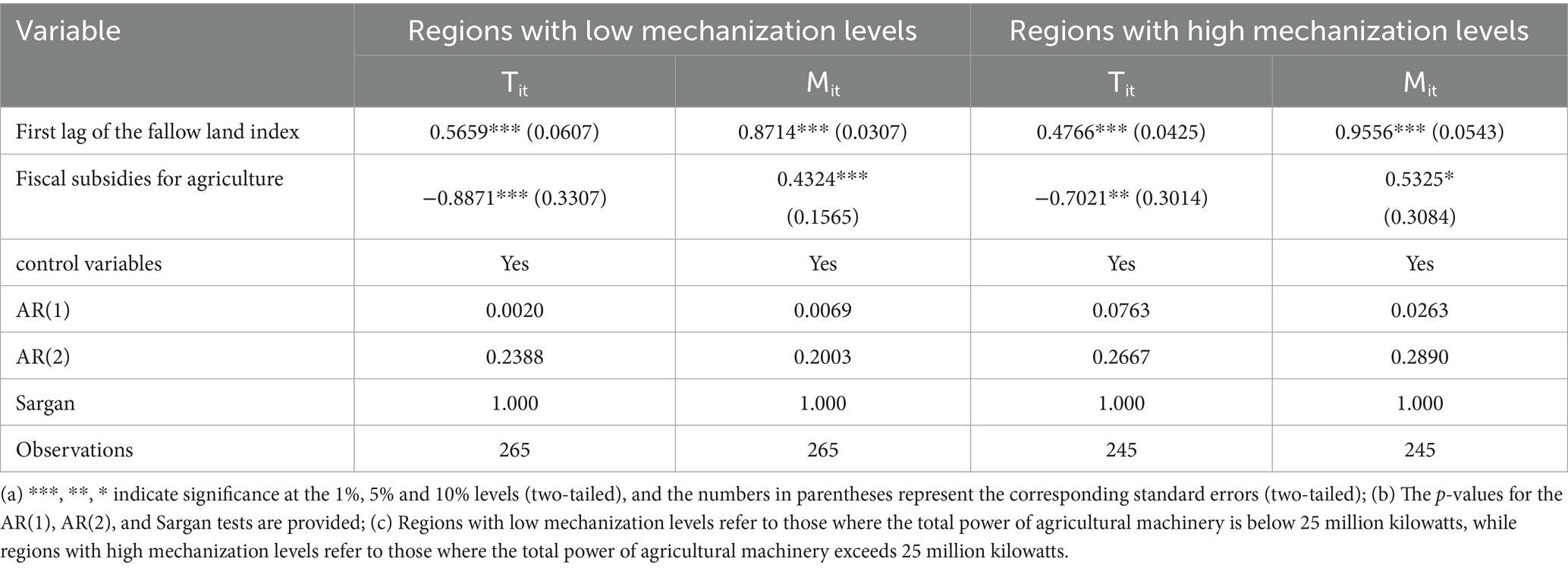

Enhancing agricultural mechanization can boost production efficiency, mitigate labor shortages, and reduce cultivated land abandonment(Hong et al., 2022). Based on the actual impact of agricultural mechanization levels on farmland abandonment, this study stratifies the sample based on the national average total power of agricultural machinery into two subsets: one exceeding the average and the other falling below it. This division aims to explore variations in the effects of fiscal subsidies on land abandonment in agriculture. The subset surpassing the average indicates a higher regional total power of agricultural machinery compared to the national average, while the subset below the average signifies a lower regional total power. This stratification enhances our comprehension and examination of the national distribution of agricultural machinery power and regional disparities. Analyzing these subsets facilitates a comprehensive understanding of regional agricultural machinery power levels and mechanization progress. The estimation results of the system GMM are shown in Table 6.

The results of heterogeneity estimation for agricultural mechanization levels indicate that the model successfully passes AR(2) and Sargan tests, confirming the consistency and validity of the GMM estimation results. In regions characterized by high mechanization levels, a 1% increase in fiscal subsidies leads to a reduction of 0.702% in the farmland abandonment intensity index and a 0.533% effective increase in the actual multiple cropping index. Conversely, in areas with low mechanization levels, a 1% rise in fiscal subsidies for agriculture results in a 0.887% decrease in the farmland abandonment index and a 0.432% rise in the actual multiple cropping index. These findings suggest that regions with advanced agricultural mechanization possess a solid agricultural foundation, where fiscal subsidies for agriculture, coupled with mechanization, can enhance farmers’ inclination towards agricultural production. In contrast, regions with low agricultural mechanization levels exhibit greater developmental potential but suffer from low agricultural production efficiency, inadequate production conditions, and a scarcity of agricultural labor. The provision of fiscal subsidies for agriculture has stimulated increased participation in agricultural activities, thereby enhancing labor productivity, elevating the technical proficiency of agricultural production, and notably reducing arable land abandonment.

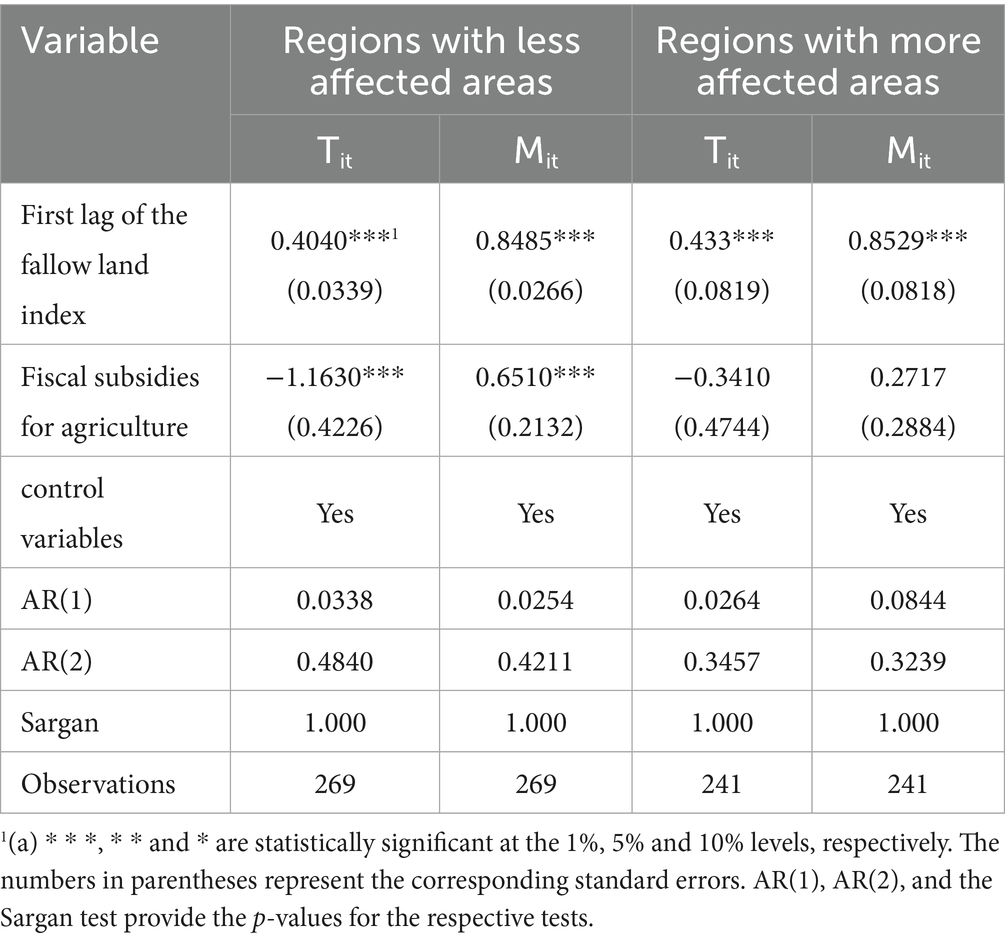

4.3.2 The area of arable land affected by disasters

China’s extensive territory and diverse climates, influenced by terrain, are susceptible to meteorological disasters such as droughts and floods, impacting agricultural production. This study categorizes the overall sample into two subgroups based on disaster prevalence: areas with less than 900,000 ha affected by disasters, and areas with more extensive disaster impact. The dynamic panel data analysis reveals that the disparity in disaster-affected areas across regions influences the efficacy of fiscal subsidies for agriculture in mitigating farmland abandonment. Specifically, in regions with minor disaster impact, a 1% rise in fiscal subsidies for agriculture correlates with a 1.163% reduction in the farmland abandonment intensity index and a 0.651% increase in the actual multiple cropping index, both statistically significant at the 0.001 level (Table 7). The strategic geographical positioning, favorable climatic conditions, abundant labor resources, and high level of mechanization enable fiscal subsidies for agriculture to foster agricultural development and curtail arable land abandonment. Conversely, regions affected by inadequate agricultural production conditions, limited natural resources, and other constraints exhibit less pronounced effects of fiscal subsidies for agriculture on farmland abandonment.

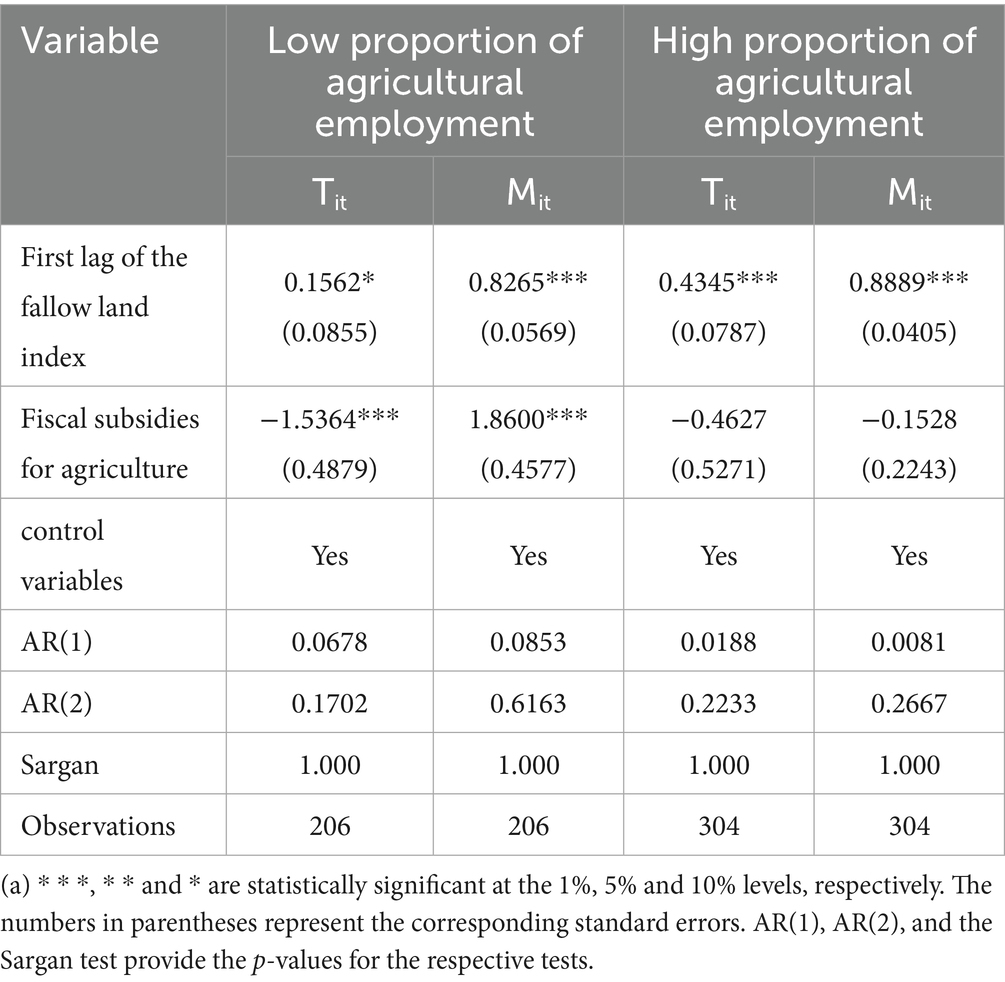

4.3.3 Agricultural employed population

Agriculture, as a fundamental sector of our economy, plays a crucial role in national economic development by not only supplying essential food for economic activities and livelihoods but also addressing labor employment challenges. To assess the impact of agricultural employment proportions on farmland abandonment, we analyzed data from 30 provinces, categorizing them into sub-samples based on low and high agricultural employment rates. Our findings, presented in Table 8, reveal that variations in the quantity and expertise of agricultural workers influence the effectiveness of fiscal subsidies for agriculture in mitigating farmland abandonment. In regions with lower agricultural employment, a 1% increase in fiscal subsidies led to a 1.536% reduction in farmland abandonment intensity and a 1.860% rise in actual multiple cropping. These results underscore the pronounced impact of fiscal subsidies for agriculture in curbing farmland abandonment in regions with lower agricultural employment rates, indicative of higher economic and social development levels and enhanced agricultural productivity. Such subsidies facilitate advancements in agricultural mechanization, bolster agricultural production incentives, and alleviate arable land abandonment.

4.4 Examination of the mechanism of action

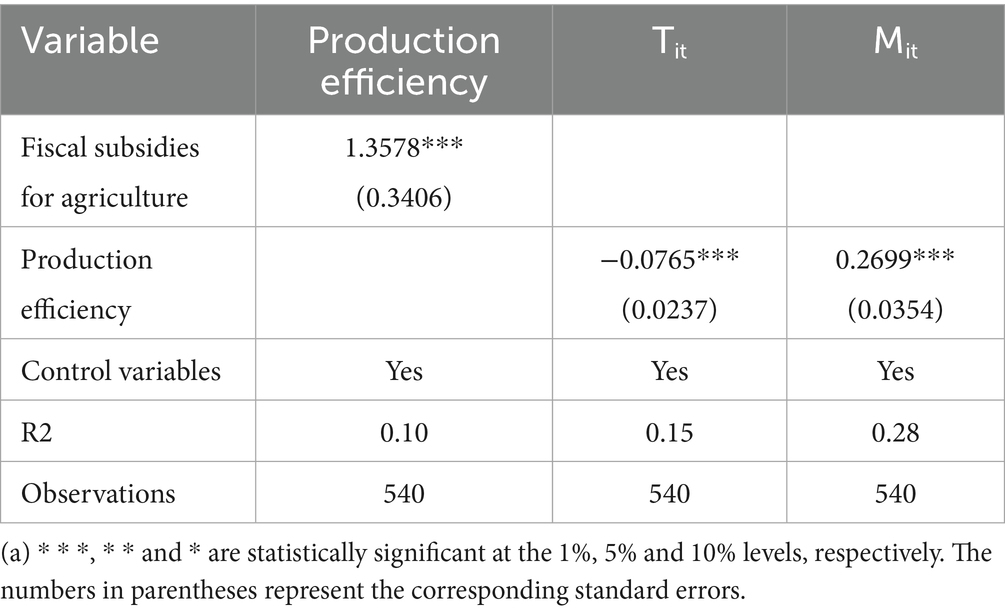

4.4.1 Production effect

Fiscal subsidies for agriculture play a crucial role in promoting modern agricultural production by facilitating the adoption of advanced technologies. Subsidies aimed at purchasing agricultural machinery serve to reduce the costs associated with acquiring such equipment. This, in turn, leads to a significant increase in the return on investment, drives up mechanization rates, and directly mitigates the issue of abandoned farmland resulting from labor shortages. Additionally, differential subsidy schemes are designed to incentivize large-scale operations. By subsidizing the transfer of arable land, economies of scale are achieved, thereby lowering overall agricultural production costs. Furthermore, subsidies targeting the preservation of arable land fertility operate through a mechanism that links subsidies to land fertility. Specifically, plots that are left abandoned forfeit subsidy eligibility for the following year, thereby imposing a constraint on continuous farming practices. To empirically evaluate these assertions, this study employs the logarithm of agricultural output value added as a metric of agricultural production efficiency to assess the extent to which agricultural subsidies can address the challenge of abandoned farmland by enhancing agricultural production efficiency.

The findings in Table 9 suggest that the abandonment of cultivated land can enhance agricultural production efficiency, leading to a decrease in the likelihood of land abandonment. This beneficial cycle of “economic incentives—efficiency enhancement—income assurance” serves to reduce abandonment rates. To promote sustainable use of cultivated land resources, future policies should focus on refining subsidy allocation and implementing a dynamic monitoring system.

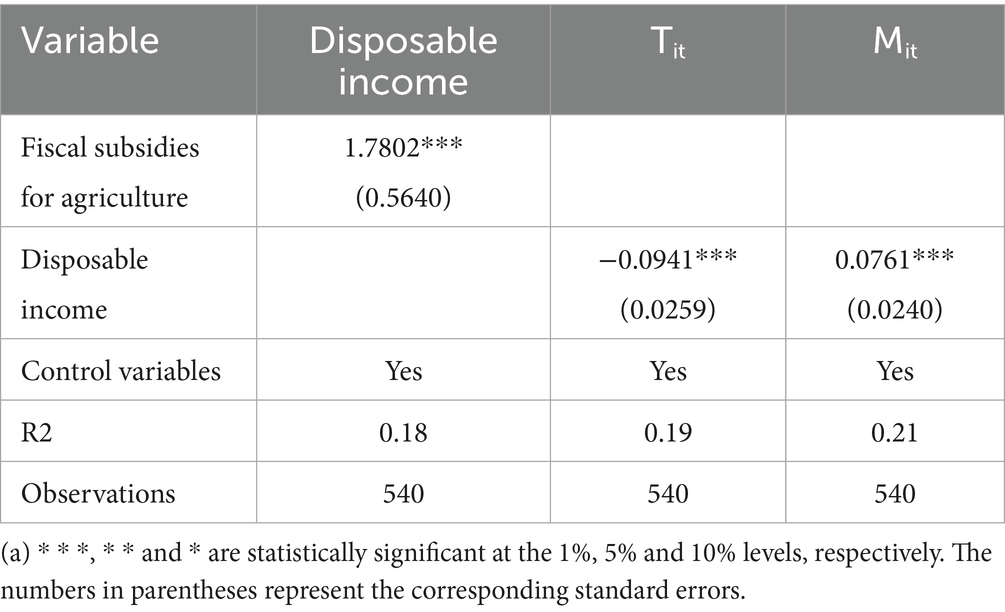

4.4.2 Wealth effect

Fiscal subsidies for agriculture effectively mitigates cultivated land abandonment by boosting rural residents’ income, evident in three key aspects. Firstly, direct income subsidies notably elevate farming’s comparative income. For instance, the cultivated land protection subsidy bolsters farmers’ household income and the opportunity cost of agricultural production, diminishing the economic appeal of non-agricultural employment. This subsidy bolsters farmers’ inclination to resume cultivation. Secondly, agricultural subsidies foster diverse income streams through expanding the industrial chain. Subsidies for agricultural product processing stimulate cooperative development, enabling farmers to access triple incomes comprising “rent + dividend + wage.” Thirdly, employment training, backed by subsidies, enhances human capital. Training in skills like agricultural machinery operation boosts farmers’ supplementary income, lessening the financial imperative for complete abandonment of cultivation. Following the execution of the “Project to Enhance the Quality of Ten Million Farmers” in Zhejiang Province, participating farmers have significantly heightened their cultivated land utilization rate.

This study examines the impact of agricultural subsidies on cultivated land abandonment through rural residents’ income. The results indicate a substantial positive effect of agricultural subsidies on rural residents’ per capita income, consequently mitigating cultivated land abandonment. Specifically, the analysis in Table 10 reveals that a 1% rise in agricultural subsidies correlates with a 1.7802% increase in rural residents’ disposable income, thereby playing a crucial role in reducing cultivated land abandonment.

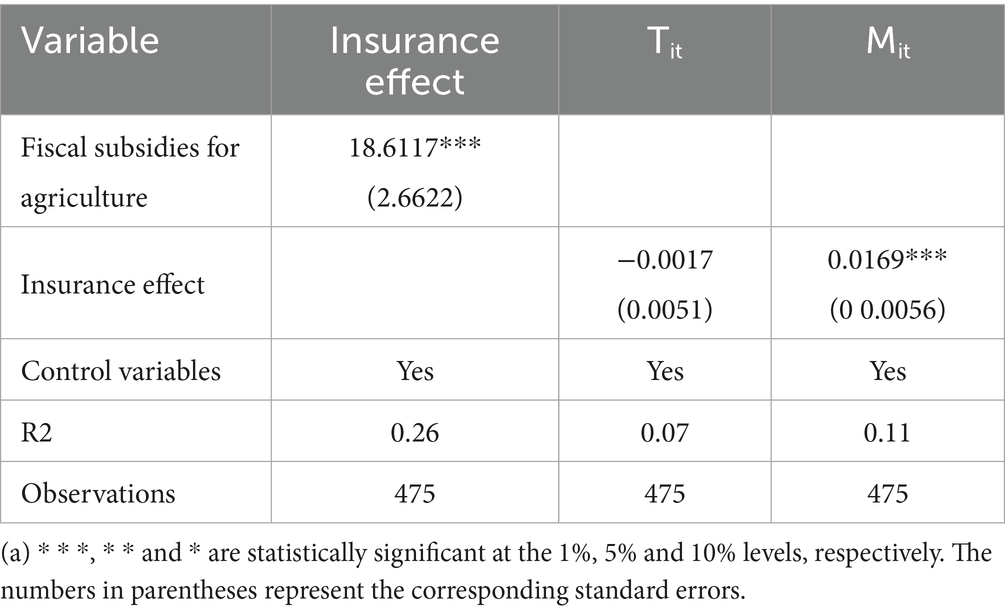

4.4.3 Insurance effect

Fiscal subsidies for agriculture has implemented a risk prevention and control mechanism to mitigate cultivated land abandonment by enhancing the protective function of agricultural insurance. Its impact pathways are primarily evident in three key aspects. Firstly, premium subsidies directly boost insurance participation rates. The central government has raised the subsidy ratio for insurance premiums of the three primary staple grain crops, thereby lowering insurance costs for farmers. By 2023, the national agricultural insurance participation rate had surpassed 80%, marking a historic high and substantially bolstering farmers’ resilience to risks. Secondly, agricultural insurance compensation mitigates losses stemming from natural disasters. Facilitated by the premium subsidy policy, agricultural insurance payouts totaled 112.4 billion yuan in 2023, enabling affected farmers to receive compensation equivalent to 70–90% of their production costs, effectively averting farmland abandonment due to disasters. Thirdly, innovative insurance products broaden the coverage scope. With subsidy backing, novel insurance products like full-cost insurance and income insurance have been introduced, elevating the coverage from direct physical and chemical costs to overall production expenses and notably decreasing the variability in farmers’ anticipated income.

This study examines how agricultural subsidies mitigate cultivated land abandonment by analyzing insurance compensation expenditures across provinces. Table 11 presents detailed findings, indicating that agricultural subsidies notably boost insurance compensation expenditures, elevate the actual multiple cropping index of cultivated land, and decrease the intensity index of cultivated land abandonment. The process involves a mechanism wherein subsidies encourage insurance participation, leading to risk mitigation and stabilized production expectations. Consequently, farmers are better equipped to sustain their farming enthusiasm amidst natural and market uncertainties.

5 Conclusions and recommendations

This study synthesizes theoretical and empirical analysis to draw three key conclusions: (1) Agricultural fiscal subsidies generally lead to increased multiple cropping areas while mitigating land abandonment; (2) Farmland abandonment exhibits path dependence, with past experiences influencing current rates. Failing to address abandonment may exacerbate farmers’ reluctance to farm further; (3) Fiscal subsidies enhance farmland abandonment control by improving agricultural income competitiveness and encouraging farming participation and investment in agriculture. Additionally, mechanization levels, natural conditions, and agricultural labor force significantly influence the regulatory impact of fiscal subsidies on land abandonment. Regions with high mechanization, favorable natural conditions, and large-scale agricultural labor forces exhibit stronger effects from fiscal subsidies in curbing abandonment. These findings have important policy implications for improving agricultural fiscal support to address land abandonment issues. Recommendations include clarifying beneficiary goals for agricultural subsidies, enhancing subsidy mechanisms, and optimizing utilization strategies.

The primary goal is to specify the recipients and beneficiaries of agricultural subsidies, enhance the efficacy of such financial aid to safeguard cultivated land, decisively restrict the conversion of cultivated land for non-agricultural or non-grain purposes, and establish a robust foundation for national food security. Initially, it is crucial to precisely define the recipients, including land farmers holding land contracts, large-scale grain producers, and family farms. Subsequently, to ensure the targeted allocation of fiscal subsidies for agriculture, it is essential to expand the scope of subsidized crops beyond food staples like cotton and oil to encompass other economically valuable crops, while preserving soil fertility and land use types. Lastly, to enhance the precision and effectiveness of subsidies, adjustments to the criteria for financial support should be made promptly in response to agricultural market dynamics, the diverse requirements of agricultural stakeholders, and regional agricultural development disparities, thereby optimizing the impact of agricultural financial assistance.

One strategy involves enhancing agricultural subsidy mechanisms to maximize the incentive effect of fiscal subsidies. By encouraging skilled agricultural workers to return to rural areas, this approach can bolster local economies and promote entrepreneurship in agriculture. Adhering to the principle of “those who produce receive subsidies,” we should implement targeted support for active agricultural producers and cultivated land, thereby reducing farmers’ production costs and operational risks while ensuring stable income. Strengthened oversight through measures such as satellite imagery, field inspections, and community reporting can enhance accountability during subsidy disbursement. Monitoring measures should prioritize initiatives to prevent land abandonment and promote crop diversification.

Effective utilization of fiscal subsidies can support agricultural policies, improve local agricultural services and farmer livelihoods, benefiting society while enhancing grain production, agricultural efficiency, and farmers’ incomes. Priority should be given to large-scale farmers and the cultivation of local agricultural products with distinct characteristics for optimizing agricultural support and safeguarding subsidies. Subsidizing the purchase of agricultural machinery aims to improve equipment quality, increase mechanization levels in vulnerable areas, and reduce costs for adopting advanced, safe, energy-efficient, and environmentally friendly machinery. This initiative will also encourage the use of micro-machine technology suitable for hilly regions. It also supports a shift towards more scalable, intensified, and modernized agricultural practices.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JGL: Funding acquisition, Conceptualization, Formal analysis, Writing – review & editing, Writing – original draft. JSL: Conceptualization, Project administration, Supervision, Writing – review & editing. ZL: Investigation, Methodology, Writing – review & editing, Validation.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by the Research Funds of Sichuan Provincial Philosophy and Social Sciences (SCJJ25ND081).

Acknowledgments

The authors would like to thank enumerators who participated in data collection for providing valuable information.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alix-Garcia, J., Kuemmerle, T., and Radeloff, V. C. (2012). Prices, land tenure institutions, and geography: a matching analysis of farmland abandonment in post-socialist Eastern Europe. Land Econ. 88, 425–443. doi: 10.3368/le.88.3.425

Cao, F. (2003). Dialectical view on rural cultivated land abandonment: a case study of Guiyang County. J. Jiangxi Univ. Finance Econ. 2, 40–43.

Chen, Q. R. (2022). Analyzing farmers cultivated-land-abandonment behavior: integrating the theory of planned behavior and a structural equation model. Land 11:1777-1777. doi: 10.3390/land11101777

Chen, X. H. (2017). The impact of FDI on the industrial upgrade of Jilin Province. [Master’s thesis]. Changchun, China: Jilin University.

Chen, F., Fan, Q. Q., and Gao, T. M. (2010). Agricultural policy, grain yield, and grain production adjustment capacity. Econ. Res. 45, 101–114.

Chen, M., Liu, Y., and Zhan, X. Y. (2025). Spatial variations and determinants of city-level standardized mortality rates in China, 2000–2020. Geogr. Res. 4, 1085–1101.

Cheng, G. Q. (2011). Design and policy choice of China's agricultural subsidy system. 1st Edn. Beijing: China Development Press.

Cheng, H. J. (2015) Research on the income effect of agricultural subsidy policies from the perspective of household production behavior. [Master's thesis]. [Dalian, China] Northeastern University of Finance and Economics

Dong, S. J., Xin, L. J., Li, S. F., Xie, H. L., Zhao, Y. L., Wang, X., et al. (2023). Study on the degree of terrace abandonment and spatial pattern differentiation in China. Acta Geograph. Sin. 78, 3–15.

Fan, S. B., Yang, M., and Peng, S. C. (2023). Research on the impact of agricultural subsidy policies and adjustment direction. Sci. Decis. Making. 4, 131–151.

Fan, M. J., Yang, R., Liu, Y., and Zhang, W. M. (2024). Health output effect of government’s multi-dimensional medical expenditure: Based on the dual perspective of health level and health gap. China Soft. Science. 8, 83–96.

Geng, L., and Zhang, Y. (2024). A novel interpretation of farmland abandonment: evidence from the famine experience. Front. Sustain. Food Syst. 8:1409066. doi: 10.3389/fsufs.2024.1409066

Gong, M. G., and Li, H. J. (2022). Effect of China's agricultural subsidy policies and optimization. Acad. Exch. 3, 92–104.

He, W. S., Wu, W. B., Yu, Q. Y., Hu, W. J., Tan, J. Y., and Hu, Y. N. (2016). Spatial pattern changes of cultivated land multiple cropping potential in China from 1980 to 2010. China Agric. Resour. Reg. Plann. 37, 7–14.

Hong, J., Luo, W. Y., and Wang, C. C. (2022). Temporal and spatial characteristics and driving factors of cultivated land abandonment in mountainous areas of Youxi County, Fujian Province. Yunnan Geogr. Environ. Res. 34, 9–17.

Hu, X., and Zhou, X. H. (2022). Real dilemma and policy layout of preventing cultivated land abandonment in Japan. Asia-Pac. Econ. 1, 59–69. doi: 10.16407/j.cnki.1000-6052.2022.01.013

Huang, L. M. (2009) Research on marginalization of farmland and its effects. [Dissertation].[Wuhan, China] Huazhong Agricultural University

Jiang, C. Y., Li, J. R., and Gong, H. Z. (2022). Common features of world-leading agricultural nations and insights for the future. Academics. 8, 127–144.

Li, Y. P. (2018). The logic of occurrence and solutions for land abandonment. De Economist 10, 90–96. doi: 10.16158/j.cnki.51-1312/f.2018.10.012

Li, J. G. (2018). Research on the transformation of China's agricultural subsidy system and policy choices. Shanghai Econ. Res. 7, 119–128. doi: 10.19626/j.cnki.cn31-1163/f.2018.07.012

Li, S. F., and Li, X. B. (2016). Progress and prospect on farmland abandonment. Acta Geograph. Sin. 71, 370–389.

Li, J. G., and Li, P. (2016). Abandoned farmland and its classification governance in China: an extended analysis based on Marx's theory of rent. Finan. Sci. 12, 47–54.

Li, J. G., Li, J. S., and Ren, H. (2019). Impact of agricultural subsidies on food security and farmers' income increase: an analysis measurement based on Marx's reproduction theory. Econ. Manag. 33, 20–26.

Tian, Y. J., Li, X. B., Ma, G. X., and Hao, H. G. (2010). Influences of labor emigration from agriculture on the production abandonment of cultivated land in ecological sensitive areas. China Land Sci. 24, 4–9. doi: 10.13708/j.cnki.cn11-2640.2010.07.004

Tian, L., Zhou, W., He, W., Zhao, X., Liu, D., and Zhang, J. (2018). Spatio-temporal evolution and potential analysis of crop index in Sichuan Province during 2000-2016. Chin. J. Eco-Agric. 26, 1206–1216. doi: 10.13930/j.cnki.cjea.171086

Yang, Z. Q., and Kong, D. M. (2020). Changes in China’s agricultural subsidy policies, effect evaluation, and institutional optimization. Reform. 10, 114–127.

Yang, Q., Peng, C., and Xu, Q. (2022). Has the reform of the "three agricultural subsidies" promoted land transfer among households? China Rural Econ. 5, 89–106.

Zhang, Y. (2021). Research on balanced welfare development of rural children in distress under the concept of inclusive development. J. Hunan Agric. Univ. (Soc. Sci.). 3, 77–83. doi: 10.13331/j.cnki.jhau(ss).2021.03.010

Zhang, Y. X., and Li, Z. J. (2022). Fiscal support for agriculture, development of inclusive finance, and household poverty alleviation and income increase: a heterogeneity study based on six central provinces. Econ. Issues Explor. 4, 180–190.

Zhang, Q. M., and Xu, M. Z. (2025). A Study on the spatio-temporal evolution and regional differences in the eco-efficiency of China’s agricultural exports. Stats. Decis. 14, 117–121. doi: 10.13546/j.cnki.tjyjc.2025.14.020

Keywords: fiscal subsidies for agriculture, farmland abandonment, neoclassical growth model, agricultural production, replanting index

Citation: Li J, Li J and Lin Z (2025) Regulation effect of fiscal subsidies for agriculture on farmland abandonment: empirical evidence from China. Front. Sustain. Food Syst. 9:1657765. doi: 10.3389/fsufs.2025.1657765

Edited by:

Weiwei Zheng, Northwest A&F University, ChinaReviewed by:

Yihao Tian, Sichuan University, ChinaYongda He, Shanxi University of Finance and Economics, China

Copyright © 2025 Li, Li and Lin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Junsong Li, bGlqdW5zb25nQGNkaXZ0Yy5lZHUuY24=

Jungao Li1,2,3

Jungao Li1,2,3 Junsong Li

Junsong Li Zhijian Lin

Zhijian Lin