- 1School of Management, Beijing Union University, Beijing, China

- 2College of Economics and Management, China Agricultural University, Beijing, China

While digital finance is recognized for enhancing financial inclusion, its micro-level mechanisms—particularly through digital payments—remain underexplored. This study demonstrates how adopting digital payments significantly enhances Chinese farmers’ ability to obtain credit from both sources. Analyzing data from 7,522 households across diverse regions (2017–2019, 2021–2023) using robust methods to address endogeneity and selection bias, we find that digital payment adoption significantly increases farmers’ credit access overall. The findings indicate that digital payments alleviate conditional and price exclusion in formal credit markets, improve farmers’ credit knowledge, and reduce the psychological barriers of credit-constrained borrowers. Furthermore, digital payment adoption enhances informal credit capacity, providing farmers with more funding options. The digital payments enhanced farmers’ satisfaction with accessing credit, exerting a positive influence on both credit intended for agricultural production and credit intended for non-agricultural purposes. The results suggest that digital payment adoption not only enhances formal credit access but also strengthens informal credit networks, offering farmers greater flexibility in meeting their financial needs. Policymakers should prioritize the development of digital financial infrastructure and promote financial literacy to maximize the benefits of digital finance for rural households.

1 Introduction

Rural development cannot be achieved without financial support. Improvements in the availability of formal credit are important for alleviating poverty (Van Gameren et al., 2024; Suri and Jack, 2016), increasing consumption (Sarma and Pais, 2011; Zhang and Zhou, 2025) and employment (Zhan et al., 2025), and promoting high-quality entrepreneurship (Nguyen and Canh, 2021). However, rural households often face severe credit constraints due to a lack of own capital, insufficient collateral, and a weak repayment capacity (Sahu et al., 2004). Even when financial services are available, many farmers are reluctant to seek credit due to psychological barriers or a lack of confidence (Gunn and Hughes-Barton, 2022). Building a robust rural financial ecosystem requires not only efforts from financial institutions but also a shift in farmers’ attitudes toward credit and an improvement in their financial literacy.

Digital finance, as a key driver of financial inclusion, can address many of the shortcomings of traditional financial systems (Ozili, 2018). As a country with a relatively rapid development of digital finance, many scholars have confirmed that digital finance offers advantages such as decreasing marginal costs, alleviating information asymmetry (Zhou and Wang, 2024), expanding financial services, and lowering the threshold of financial services in China, which can significantly enhance household credit accessibility (Kim and Duvendack, 2025). This is particularly beneficial for rural households with limited financial knowledge and low-income levels (Xiong and Yang, 2023), and it can help to reduce residents’ income inequality (Adugna, 2024). In addition, digital finance improves financial literacy (Yang et al., 2023), reshapes financial behavior (Birigozzi et al., 2025), and helps to increase the financial market participation of rural households (Hu and Liu, 2025; Hsueh et al., 2025; Zhang et al., 2025).

While the inclusive value of regional digital finance development is widely recognized, directly analyzing the impact of digital financial inclusion indices may overlook the urban–rural financial gap and fail to reflect the true effects of digital finance on farmers’ credit demand, cognition, and behavior, which leads to limitations in the applicability of study results (Duvendack and Mader, 2020). Therefore, it is crucial to focus on the mechanisms through which financial innovations positively impact individuals, thereby promoting poverty alleviation and economic growth (Beck and Demirgüç-Kunt, 2008). Given that the current adoption of digital finance in rural areas is primarily reflected in the use of digital payments, this study investigates the impact of digital payment usage on farmers’ credit access. The potential contributions of this re-search include the following: (1) the construction of a theoretical framework that analyzes the impact of digital payment adoption on farmers’ credit access from both subjective and objective perspectives, (2) the exploration of the relationship between formal and informal credit under the influence of digital finance, and (3) an examination of the heterogeneous effects of digital payment adoption on credit access across different income levels and credit purposes, providing more universal policy insights for promoting the high-quality development of rural financial inclusion.

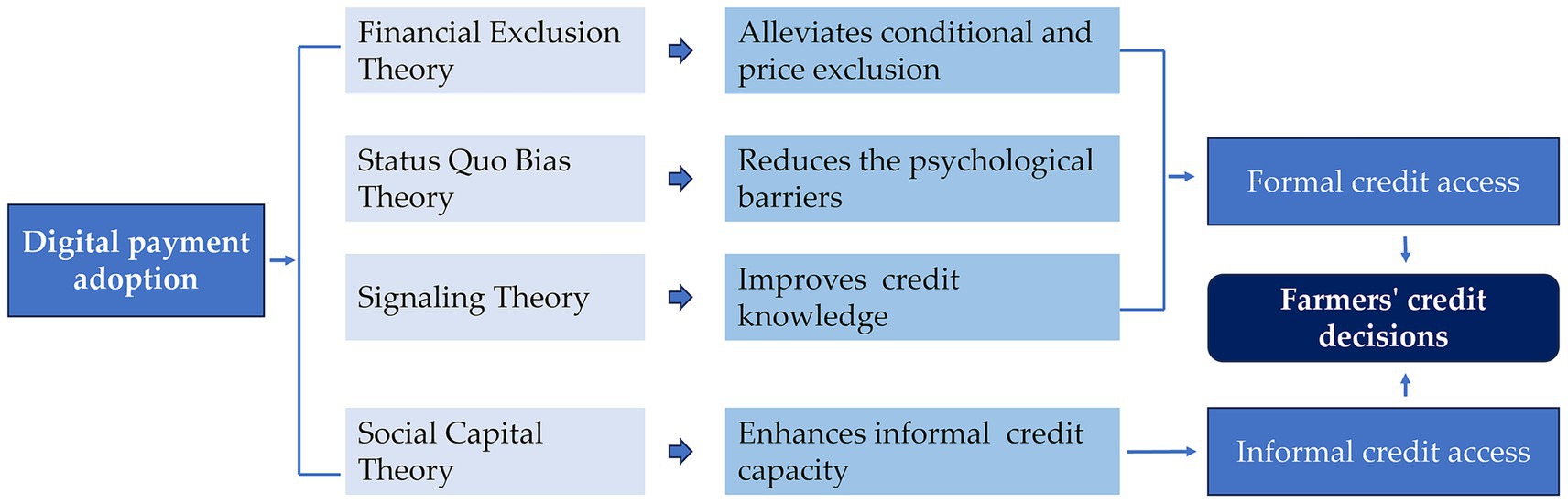

2 Theoretical framework

2.1 Digital payment adoption and formal credit access

Under the rural revitalization strategy, the demand for rural credit is increasing in China. However, rural credit services are either unavailable or costly to provide due to the lack of financial physical outlets (Zhang N. et al., 2024). Most financial institutions impose strict requirements on loans, leading to selective credit provision. A significant proportion of farmers face conditional exclusion due to a lack of collateral, guarantors, or proof of repayment, or they face price exclusion due to the limitations of explicit costs such as long application processes, high interest rates, and other unquantifiable implicit costs (Kempson and Whyley, 1999). Conditional exclusion and price exclusion reduce the possibility of farmers obtaining credit funds through formal financial institutions (Yeung et al., 2017), but the emergence of digital finance is expected to change this predicament. On the one hand, with the characteristics of remoteness, scenario, convenience, and abstraction (Mahler and Murphy, 2024), digital payment has provided conditions for the emergence of many innovative financial products and services, such as merchant loans, agricultural product pledges, and supply chain finance, which can meet farmers’ diverse financial needs in various scenarios, effectively overcoming conditional exclusion (Yao et al., 2018). On the other hand, the use of digital payment precipitates farmers’ transaction data on the Internet to form a large amount of soft information, which enables banks to create multidimensional profiles of farmers, reduce information asymmetry, alleviate the credit discrimination of traditional financial services (Song et al., 2021), and provide credit support for rural households that lack collateral and guarantees. Coupled with a facilitated online financial platform, it effectively shortens the credit approval time, reduces the invisible financing cost of rural households, and ultimately alleviates price exclusion.

Psychological factors play an important role in household economic behavior (Goyal et al., 2021). According to status quo bias theory, individuals tend to stick with what they already have or prefer to maintain the current state of affairs (Godefroid et al., 2023). Compared to formal credit, informal credit has a longer history and remains the primary channel for farmers to meet their credit needs (Gao and Shi, 2023). Farmers often maintain a psychological and geographical distance from formal financial institutions. Conservative biases lead to a lack of understanding and self-imposed exclusion from formal credit (Vlassas et al., 2025).

Once the belief that “formal credit is inaccessible” is formed, it tends to persist. Economists have used conservative bias to explain the insufficient response to information (Garrett and Bond, 2021). Farmers’ unfamiliarity with formal credit and conservative biases lead to an insufficient subjective demand for credit, particularly among “unconfident borrowers,” who may miss out on valuable investment opportunities (Jiang and Wen, 2021; Kon and Storey, 2003). Psychological barrier is detrimental to the improvement of household income and well-being, and it even affects their children’s health and investment in education (Kofinti et al., 2024).

Drawing upon signaling theory from management studies, external parties such as banks and other credit institutions must base their decisions on signals transmitted by senders. Signal transmission incurs costs, and farmers possess limited channels to demonstrate repayment capacity to banks. Digital payments generate ‘soft information’ that resolves transmission challenges, effectively reducing information asymmetry between lenders and borrowers. Digital payment platforms serve as a signaling mechanism, allowing farmers to access information about credit products at a low cost, thereby improving their credit knowledge and helping them overcome the exclusion caused by a lack of financial information (Jamil et al., 2024). Digital payments expose farmers to diverse financial services, enhancing their understanding of formal credit. This exposure reduces biases and self-exclusion, ultimately transforming unconfident borrowers into confident ones.

Based on the above analysis, Hypothesis 1 is proposed.

H1: Digital payment adoption positively affects farmers’ formal credit access.

2.2 Digital payment adoption and informal credit access

Informal credit in rural China is deeply rooted in the local social and cultural context, relying on farmers’ social networks, interpersonal relationships, and trust (Karlan et al., 2009). From the perspective of social capital theory, this trust-based relational network itself constitutes valuable ‘collateral’, reducing transaction costs and facilitating credit agreements. Digital payment adoption enhances farmers’ informal credit capacity by improving social trust, reducing social interaction costs, and increasing the transparency and traceability of transactions (Krishna et al., 2023; Putrevu and Mertzanis, 2023). Digital payments also automatically record transaction information and generate transaction records, making it easier for rural households to track financial transactions and reducing disputes and costs associated with informal credit (Song et al., 2018). Overall, digital payments contribute to informal credit access for rural households by increasing social trust, reducing socialization and informal credit transaction costs. While digital payment adoption may substitute some informal credit demand by promoting formal credit access, it does not diminish the enhancement of farmers’ informal credit capacity, providing them with more options for credit access. Therefore, this paper puts forward the following hypothesis.

H2: Digital payment adoption positively affects farmers’ informal credit access.

Based on the above literature review and hypothesis, the conceptual framework is schematically depicted in Figure 1.

3 Research design

3.1 Data source

The data used in this study were obtained from the “China Rural Inclusive Finance Survey” conducted by China Agricultural University. The survey employed a stratified random sampling method, selecting provinces from the eastern, central, and western regions of China. Within each province, three counties were selected based on their economic development levels (high, medium, and low), and two natural villages were randomly chosen from each county for household interviews. Data collection was suspended in 2020 due to COVID-19 restrictions, resuming in 2021 with adjusted survey protocols. The survey data from 2017 to 2019 and 2021 to 2023 were used, resulting in a mixed-panel dataset of 7522 households after excluding farmers over 60 years old due to age restrictions on loans. To account for potential structural breaks and annual-specific shocks (such as factors related to the COVID-19 pandemic), we included fixed effects for the survey year in all regression models utilizing cross-year data.

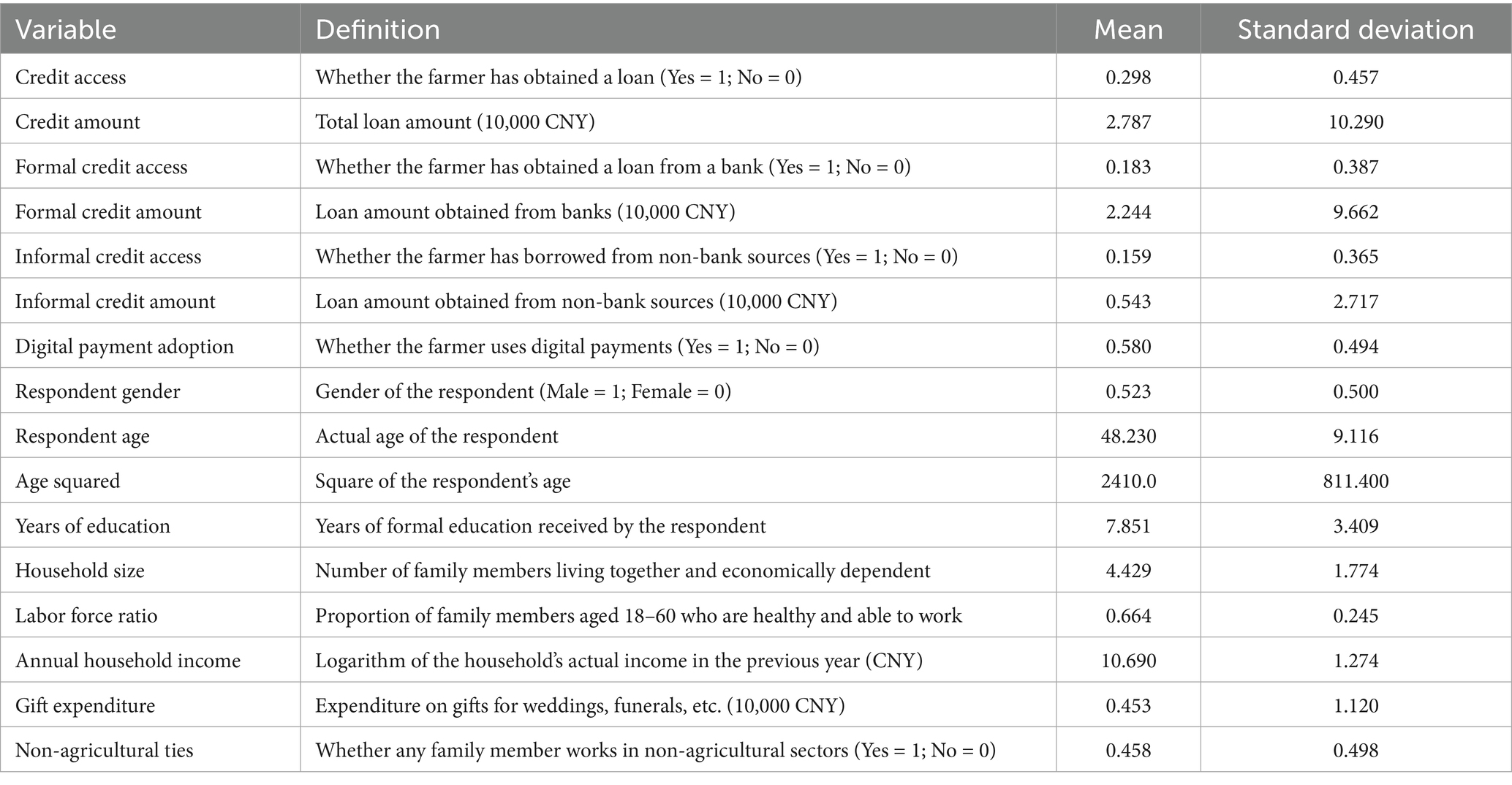

3.2 Variable selection

3.2.1 Dependent variables

This study uses “credit access” and “credit amount” as the dependent variables. If farmers obtain loans from formal financial institutions (e.g., banks) or informal institutions, “credit access” is assigned a value of 1; otherwise, it is assigned a value of 0. The corresponding loan amount is defined as “credit amount.” To further explore the selection of farmers’ credit channels, the dependent variables are further divided into “formal credit access” and “informal credit access,” as well as “formal credit amount” and “informal credit amount”.

3.2.2 Independent variable

The independent variable in this study is the adoption of digital payments. If farmers use WeChat Pay, Alipay, various e-wallet products (e.g., Baidu Wallet, JD Wallet, and Best Pay), or other mobile payment products, “digital payment adoption” is assigned a value of 1; otherwise, it is assigned a value of 0.

3.2.3 Control variables

Drawing on similar studies (Wu et al., 2021; Zhu, 2025), control variables are selected from three aspects: respondent characteristics, household characteristics, and social networks. Additionally, regional factors at the county level and the survey year are controlled for in the regression analysis. The definitions and descriptive statistics of the variables are presented in Table 1.

3.3 Model construction

3.3.1 Baseline model specification

A baseline regression model is constructed to analyze the impact of digital payment adoption on farmers’ credit access, as shown in Equation 1.

In Equation 1, Credit represents “credit access,” Digpayment denotes “digital payment adoption,” α is the intercept term, representing the baseline probability of credit access when all other variables are zero. β is the estimated parameter of Digpayment capturing its marginal effect on credit access. γ is vector of coefficients for the control variables (X). ηc represents county fixed effects. τt represents year fixed effects. μ is the error term, capturing unobserved factors affecting credit access. As the dependent variable “credit access” is a binary discrete variable, a Probit model is used for regression estimation, as shown in Equation 2.

In Equation 2, Φ denotes the cumulative distribution function (CDF) of the standard normal distribution, which is used to model the probability of credit access. δ is the intercept term. θ is the estimated parameter of Digpayment. κ is vector of coefficients for the control variables (X). To analyze the impact of digital payment adoption on credit size, equations are constructed as shown in Equation 3.

In Equation 3, Scale_Credit represents the “credit amount,” which is a continuous variable. λ is the intercept term. ρ is the estimated parameter of Digpayment. φ is vector of coefficients for the control variables (X). v is the error term.

Given that only farmers who have obtained credit have observable credit amounts and that there is a close relationship between credit amount and credit access, the conditional mixed process (CMP) estimation method is employed (Roodman, 2011). This method uses maximum likelihood estimation to jointly estimate Equations 2, 3 as a system, offering greater efficiency and advantages. The treatment effect of the CMP is reflected in the significance of the correlation coefficient between the residuals of the two equations, transformed using Fisher’s z transformation (atanhrho). If this statistic is significant, it indicates that the CMP estimation results are superior to separate estimations (Liu and Chen, 2024).

3.3.2 Mechanism analysis model

To verify the mechanisms through which digital payment adoption affects farmers’ credit access, this study constructs a mediation effect model as shown in Equations 4. The mechanisms include alleviating conditional and price exclusion in formal credit, increasing confidence in accessing formal credit, improving credit knowledge, and enhancing informal credit capabilities. Following Jiang (2022), the analysis focuses on identifying the causal relationship between digital payment adoption and the mediating variables. Let Channel represent the mediating variable. η is the intercept term. ξ is the estimated parameter of Digpayment. π is vector of coefficients for the control variables (X). ε is the error term. The mechanism regression model is designed as follows.

4 Results and analysis

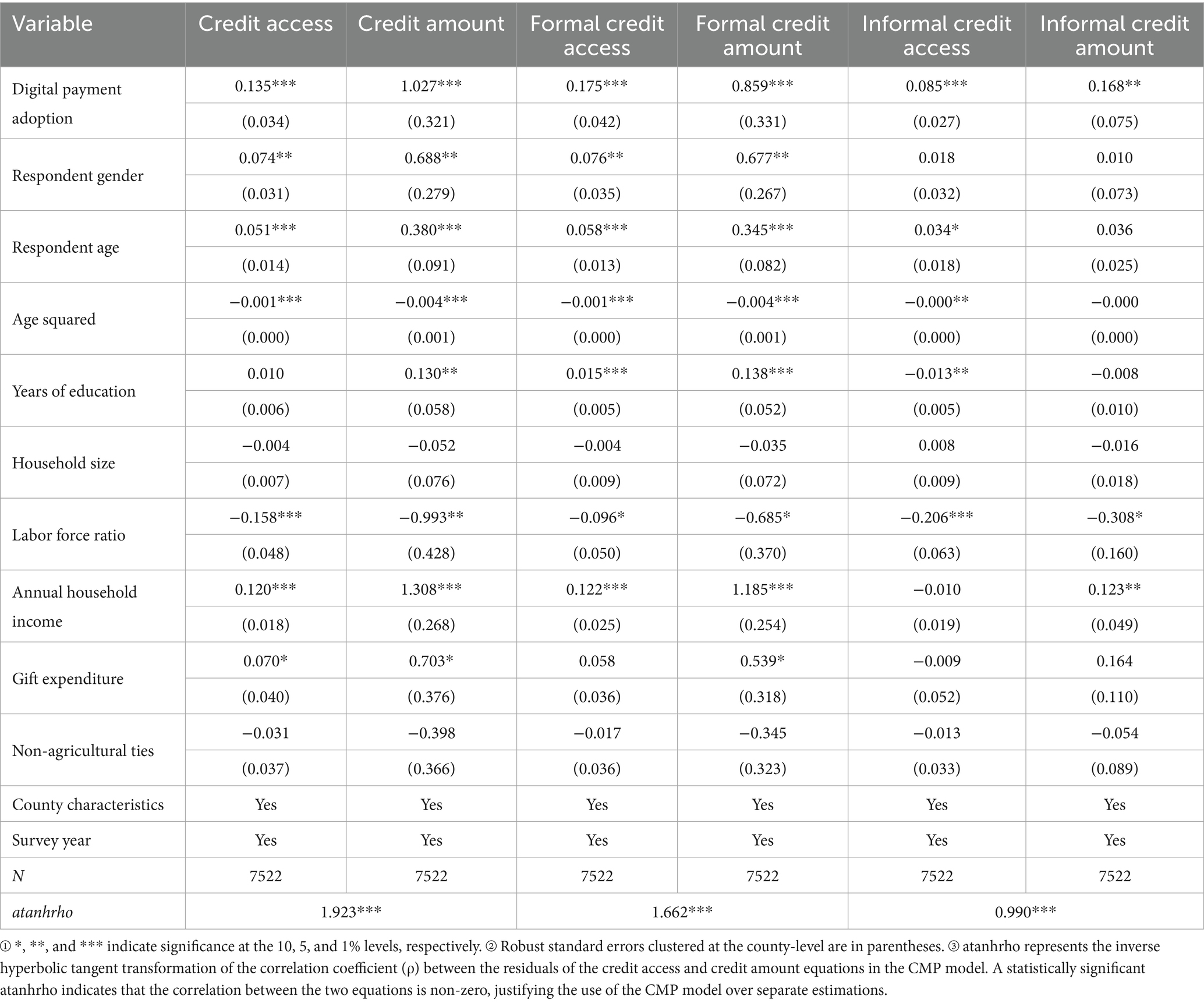

4.1 Baseline model analysis

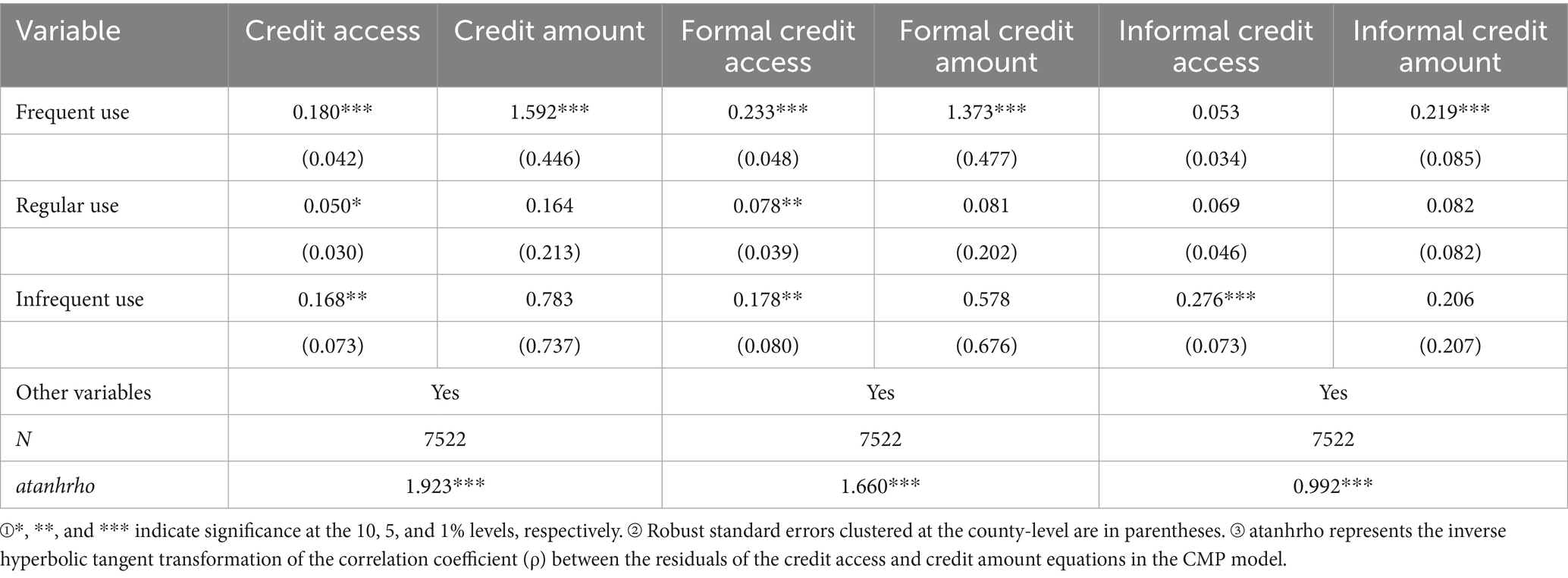

The results of the CMP model estimation (Table 2) show that the CMP statistic atanhrho is significant at the 1% level, indicating that the joint estimation using the CMP model is reasonable. The coefficients for digital payment adoption on farmers’ credit access and credit amount are both statistically significant and positive at the 1% level, and the coefficients for formal and informal credit access are also significantly positive. This suggests that the use of digital payments increases the probability of farmers obtaining credit and helps them secure higher credit amounts, thereby validating Hypotheses. Digital payment adoption stimulates farmers’ potential credit demand and positively impacts both formal and informal credit access.

Based on the regression coefficients of the control variables, the relationship between the respondents’ age and formal credit access follows an inverted “U” shape. As age increases, the probability of farmers obtaining formal credit first rises and then declines, consistent with the age requirements of banks when approving loans. Formal credit institutions often impose restrictions on farmers’ education and income levels, while informal credit relies more on emotional ties and has fewer or no restrictions. Therefore, the number of years of formal education and household income are positively correlated with formal credit access but negatively correlated with informal credit access. This indicates that informal credit plays a significant role for farmers with lower incomes and shorter educational backgrounds, serving as an important supplement to formal credit.

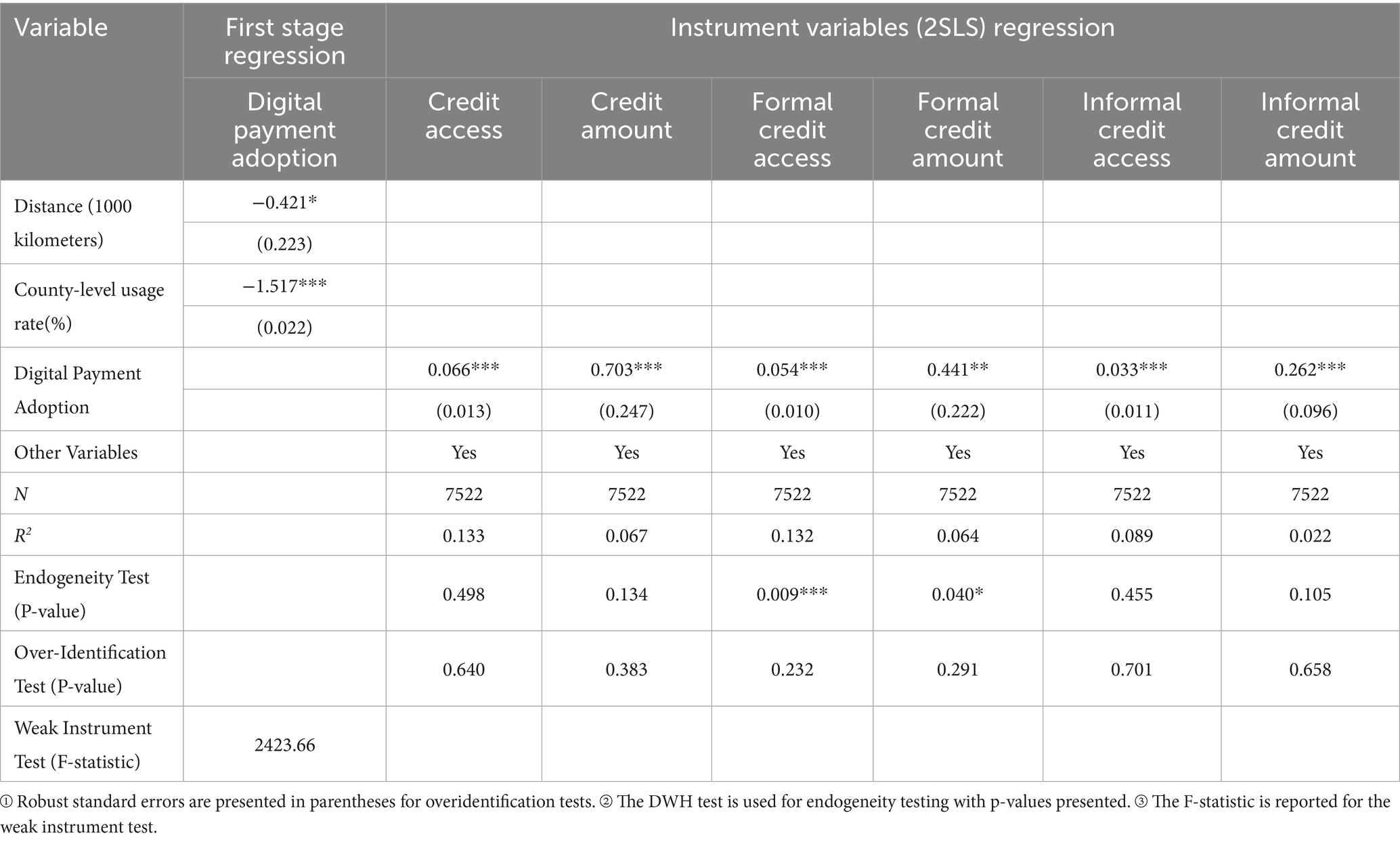

4.2 Endogeneity considerations

To address potential endogeneity issues between farmers’ credit access and digital payment adoption, an instrumental variable (IV) approach is employed. Drawing on the previous literature (Su et al., 2021; He and Li, 2019), the distance from the farmer’s village to the county government and the average level of digital payment adoption in the county (excluding the household in question) during the survey year are selected as IVs for digital payment adoption. As the endogenous explanatory variable (digital payment adoption) is binary, the two-stage least squares (IV-2SLS) method is used to ensure consistent estimates under heteroskedasticity (Cameron and Trivedi, 2022).

Table 3 presents the regression results from the first stage of the Two-Stage Least Squares (2SLS) method. Among the instrumental variables, the coefficient for distance from the county government was significantly negative, consistent with theoretical expectations. The negative coefficient for the average level of digital payment usage among other households within the county, while contrary to simple peer effect expectations, may be attributed to modeling factors such as the reflection problem in social interaction models under fixed effects, or could indicate localized competition or negative information dissemination. The joint F-statistic of 2423.66 substantially exceeds the critical value established by Stock and Yogo (2005), indicating no weakness in the instrumental variable. The over-identification tests show that all p-values are greater than 0.1, indicating that the selected IVs are exogenous. Compared to the baseline regression, the coefficients are significantly positive, supporting the baseline results. While the instrumental variables approach helps mitigate endogeneity concerns, we acknowledge the presence of unobserved heterogeneity.

4.3 Robustness analysis

4.3.1 Biprobit model

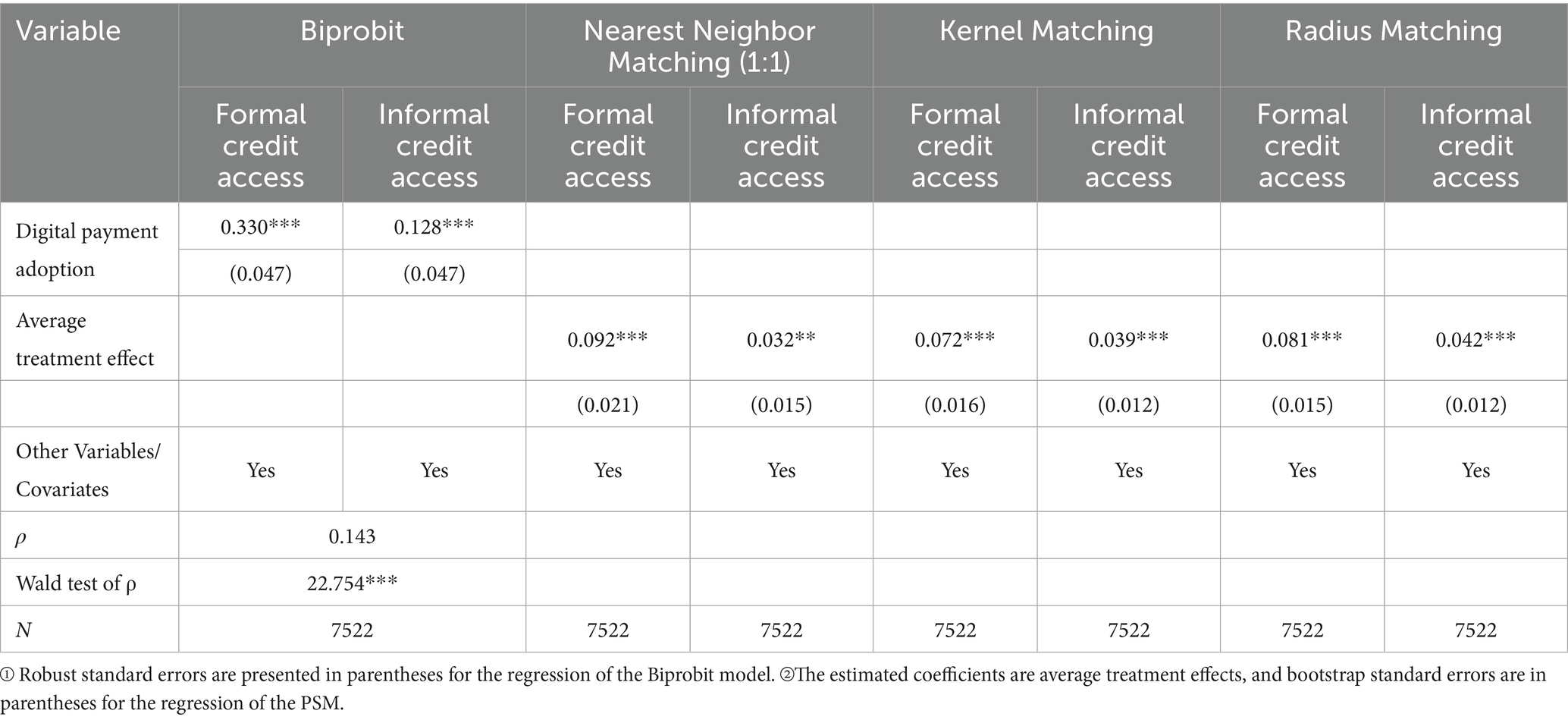

Considering the potential correlation between formal and informal credit access, a Biprobit model is constructed to simultaneously estimate the impact of digital payment adoption on both types of credit access. The results in Table 4 show that the Wald test rejects the null hypothesis of ρ = 0, and ρ is positive, indicating that digital payment adoption positively affects both formal and informal credit access, promoting mutual enhancement.

4.3.2 Propensity score matching model

To address selection bias due to observable characteristics, the propensity score matching (PSM) method is used. Farmers using digital payments are treated as the treatment group, while those not using digital payments form the control group. The control variables are used as covariates. The results in Table 4 show that the average treatment effect of digital payment adoption is significantly positive, indicating that farmers using digital payments have a higher probability of obtaining both formal and informal credit.

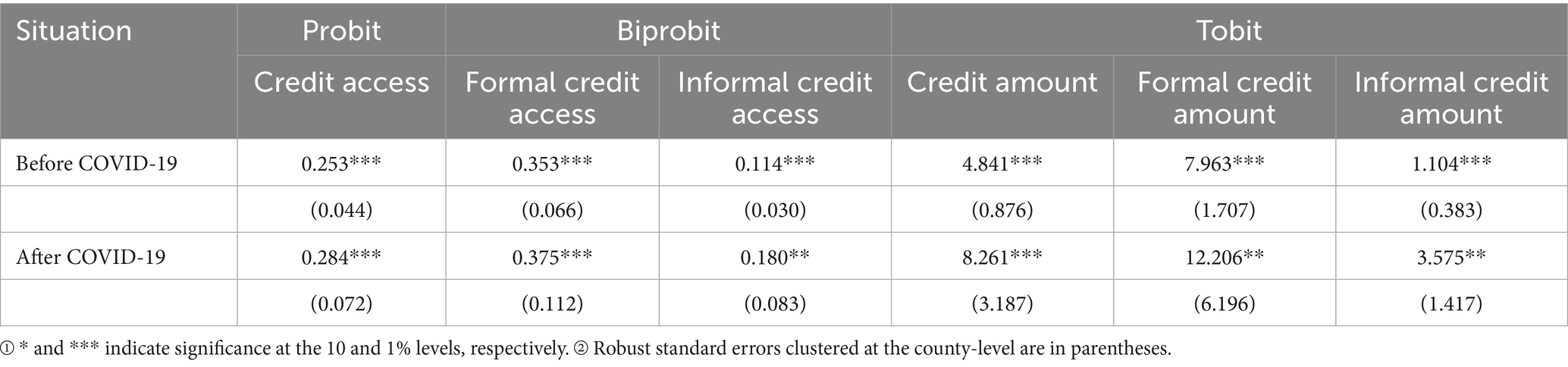

4.3.3 Comparison of regression results before and after COVID-19 pandemic

Furthermore, to address concerns that the relationship between digital payments and credit access might be influenced by the structural changes during the COVID-19 pandemic (for which 2020 data is missing), we conducted a subsample analysis. We split the data into pre-pandemic (2017–2019) and post-peak-pandemic (2021–2023) periods. The results in Table 5 indicate that the coefficients for digital payment adoption remain positive and statistically significant in both subsamples, confirming the robustness of our main findings across different timeframes.

5 Mechanism analysis of digital payment adoption on farmers’ credit access

5.1 Alleviating conditional and price exclusion

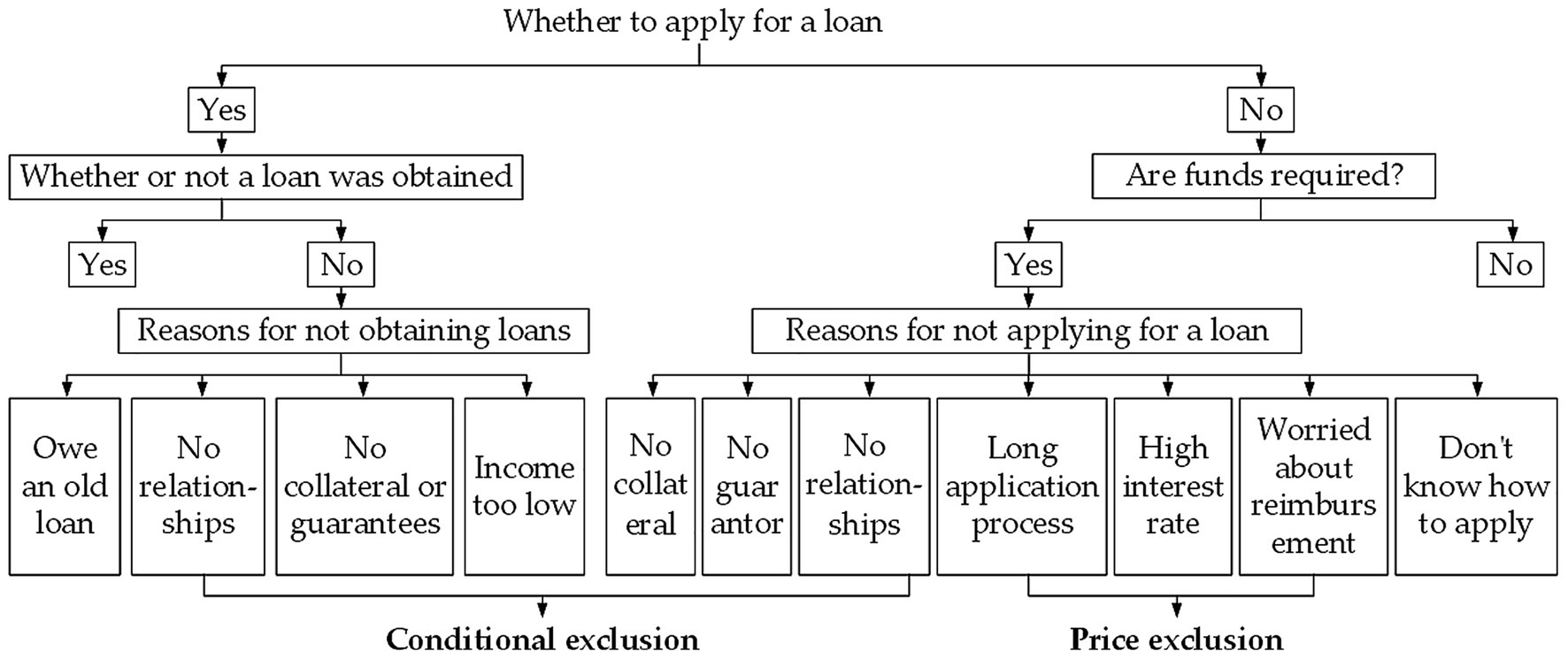

To demonstrate that the adoption of digital payments alleviates formal credit exclusion, “conditional exclusion” and “price exclusion” are selected as dependent variables. If a farmer has a financial need but does not apply for a loan due to a lack of interpersonal relationships, collateral, or guarantees, or if the application for a loan is rejected due to the above reasons, the farmer is considered to be facing conditional exclusion, and the conditional exclusion variable takes a value of 1; otherwise, it takes a value of 0. If a farmer does not apply for a loan from a bank due to the constraints of explicit costs such as a too-long application process, a high interest rate, and other implicit costs that are difficult to quantify, the farmer is considered to be facing price exclusion, and the price exclusion variable takes a value of 1; otherwise, it takes a value of 0. The process of determining whether farmers face conditional or price exclusion is illustrated in Figure 2.

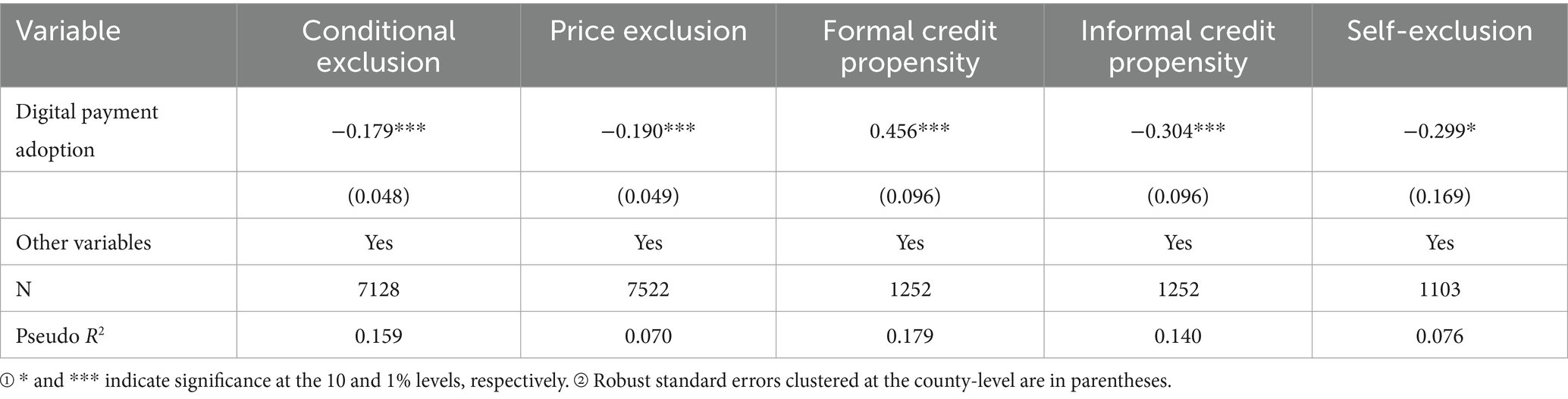

Based on the Probit model, the regression results in Table 6 show that the coefficients for digital payment adoption on conditional and price exclusion are significantly negative, indicating that digital payment adoption alleviates the conditional and price exclusion faced by farmers in formal credit markets. By using digital payments, farmers can better understand and familiarize themselves with the credit products and services provided by digital financial platforms, accumulate transaction-related data, and obtain loans at lower credit costs, thereby more effectively overcoming conditional and price exclusion in traditional formal credit models. These findings indicate that through digital payments, farmers can more effectively overcome traditional barriers—high collateral requirements (key conditionality) and high transaction/interest costs (price core)—thereby accessing credit under more favorable implicit terms.

5.2 Reducing the psychological barriers

By asking farmers about their preferred funding sources for productive needs (e.g., business), the variables “formal credit propensity” (preference for formal credit channels), “informal credit propensity” (preference for informal credit channels), and “self-exclusion” (choosing to forgo opportunities rather than seek loans) are set as dependent variables. These variables reflect farmers’ willingness to obtain funds through formal or informal channels in the future, indicating their confidence in accessing formal credit markets and helping to understand future trends in rural credit markets. The Probit model results in Table 6 show that digital payment adoption increases farmers’ willingness to obtain credit through formal channels such as banks or credit unions, enhancing their confidence in accessing formal credit. The results also indicate that digital payment adoption reduces farmers’ willingness to obtain loans through informal channels. As digital payments become more widespread, farmers are more inclined to obtain funds from formal credit channels, indicating significant potential for the development of formal credit markets, while informal credit demand may further narrow. Additionally, digital payment adoption effectively alleviates farmers’ “self-exclusion,” suggesting that digital payments encourage farmers to seek external funding, thereby increasing overall credit demand in rural financial markets.

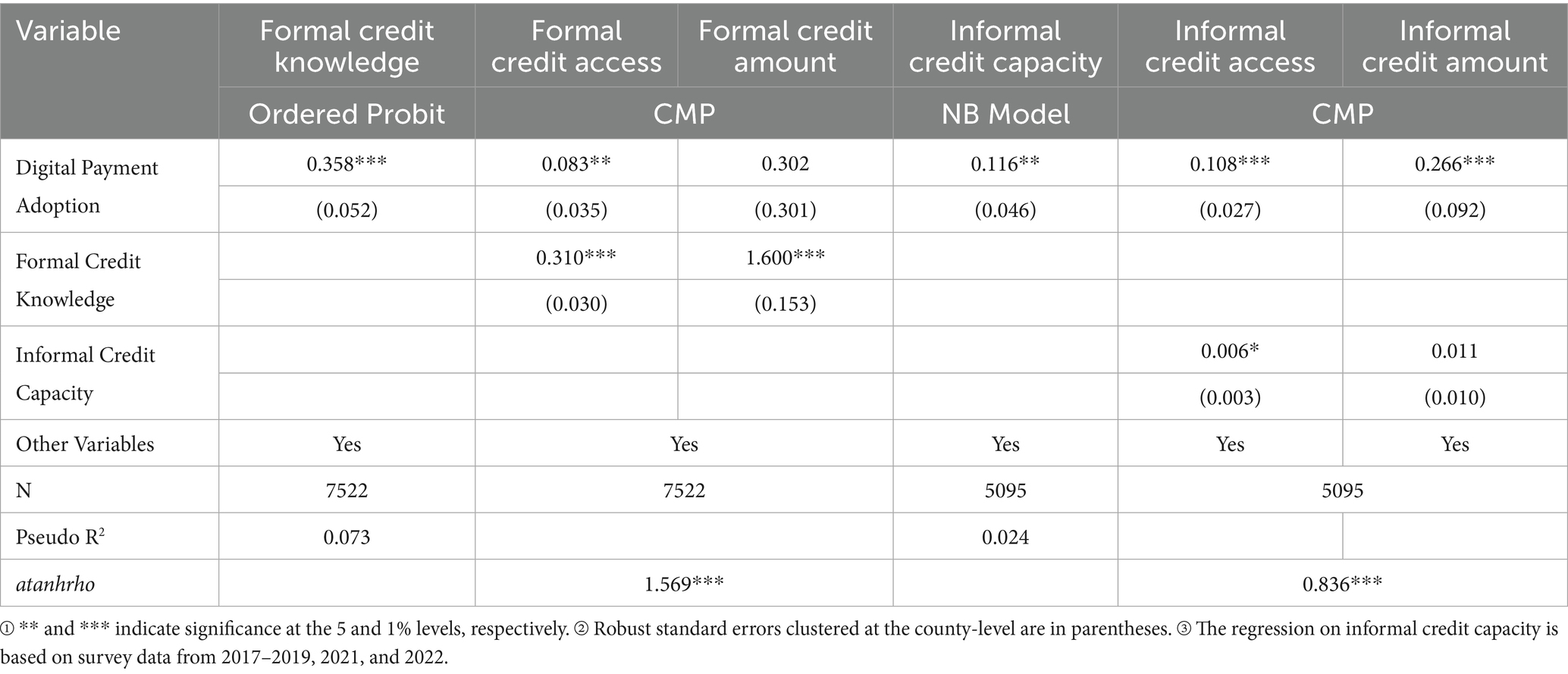

5.3 Improving credit knowledge

Farmers’ credit knowledge is divided into five levels based on their understanding of formal credit. The ordered Probit model results in Table 7 show that digital payment adoption significantly improves farmers’ credit knowledge. Generally, a certain level of credit knowledge is a prerequisite for farmers to actively apply for formal credit. Digital payment adoption, by improving farmers’ credit knowledge, facilitates formal credit access. Following this logic, credit knowledge is included in the regression for formal credit access and credit amount. The results suggest that digital payment adoption increases the probability of farmers obtaining formal credit by improving their credit knowledge while also helping to increase the amount of formal credit obtained.

Table 7. Regression results of digital payment adoption on credit knowledge and informal credit capacity.

5.4 Enhancing informal credit capacity

Informal credit plays a crucial role for low-income farmers excluded from formal credit markets, serving as a potential financial safety net for household resilience. The variable “informal credit capacity” is measured via the number of people that farmers can turn to for funds. Given the distribution characteristics of this variable, a negative binomial regression model is used for estimation. Table 7 shows that digital payment adoption enhances farmers’ informal credit capacity, effectively reducing the cost of obtaining informal credit and providing farmers with more funding options. For farmers with a strong informal credit capacity, informal credit channels are a more convenient option for meeting short-term, small-scale, non-productive funding needs. Therefore, informal credit capacity is included in the regression for informal credit access. The results show that informal credit capacity significantly increases the probability of farmers obtaining informal credit. Evidently, digital payments strengthen farmers’ informal social networks, manifested as a positive impact on informal credit capacity, which in turn enhances access to informal credit.

6 Further analysis

6.1 Frequency of digital payment use and farmers’ credit access

It has been confirmed that digital payment adoption helps increase the probability of farmers obtaining credit. However, does the frequency of digital payment use affect its impact on credit access? To explore this, based on the number of times farmers use digital payments on a daily basis, three frequencies of use were classified as: frequent users (almost daily use), infrequent users (less than once a week), and regular users (balances in between). The regression results in Table 8 show that different frequencies of digital payment use positively affect formal credit access while only infrequent use has a significant effect on informal credit access. As the frequency of digital payment use increases, the coefficient for informal credit access gradually decreases, suggesting that the “demand expansion effect” of digital payments on informal credit may evolve into a “substitution effect” for formal credit. This may prompt farmers to transition from informal to formal credit channels in order to meet their funding needs.

Regarding the impact of different frequencies of digital payment use on credit amounts, the coefficients of frequent and infrequent digital payments use are relatively large. This phenomenon may be attributed to the fact that infrequent use has a larger marginal effect on credit access, while frequent use helps improve both subjective and objective conditions for credit access. For informal credit, only the frequent use of digital payments has a significant impact on informal credit amounts. A possible reason for this phenomenon is that farmers with less frequent digital payment use primarily rely on informal credit to meet smaller funding needs. The frequent use of digital payments enhances farmers’ informal credit capacity, allowing them to meet larger funding needs through both formal and informal credit channels.

6.2 Heterogeneity in the impact of digital payment adoption on farmers’ credit access

With the deepening of inclusive finance policies and the development of digital finance, the effective supply and accessibility of formal credit in rural areas have significantly improved. The advantages of formal credit over informal credit will become more pronounced, leading more farmers to shift from informal to formal credit markets (Tian et al., 2022). From this perspective, digital payment adoption will have a profound impact on farmers’ demand for formal credit. Therefore, this study further explores the heterogeneity in the impact of digital payment adoption on farmers’ formal credit access, analyzing whether digital payment adoption helps meet farmers’ formal credit needs and exploring the potential changes and growth space in farmers’ credit demand as digital payments become more widespread.

6.2.1 Do the effects of digital payment adoption on formal credit access differ for farmers with different income levels

Increased credit demand and accessibility can significantly promote farmers’ income growth (Zhang F. et al., 2024). However, “elite capture” leads to distortions in the structure and function of rural credit funds, disadvantaging low-income farmers in accessing credit. To explore whether the impact of digital payment adoption on formal credit access varies by income level, farmers are divided into high- and low-income groups based on median income. The regression results in Table 9 show that digital payment adoption significantly affects both high- and low-income farmers, and the inter-group difference is not significant (p-value = 0.863 based on the seemingly unrelated regression test). Digital payment adoption improves formal credit access for farmers regardless of income level, effectively avoiding the “elite capture” issue. A possible reason for this phenomenon is that digital payments are easy to use and have low costs, reducing transaction costs in daily life. Farmers of different income levels have a high acceptance of digital payments, helping to bridge the “usage gap” in the digital divide (Khanal et al., 2021), thereby positively affecting formal credit access for farmers across income levels.

6.2.2 Does digital payment adoption improve credit access for different purposes?

Farmers use formal credit mainly for productive purposes, including agricultural and non-agricultural development. Credit for agricultural production investment, agricultural working capital, and the purchase of agricultural machinery is classified as agricultural development credit, while credit for non-agricultural investment and working capital is classified as non-agricultural development credit. The impact of digital payment adoption on credit access for different purposes is worth exploring. Table 9 shows that digital payment adoption positively affects credit for non-agricultural development and those for agricultural purposes, with no significant differences observed between these groups (p-value = 0.890 based on the seemingly unrelated regression test). The adoption of digital payments facilitates farmers’ development of agricultural activities and other industries.

6.2.3 Does digital payment adoption meet farmers’ credit needs?

Providing appropriate and effective financial services at affordable costs to all social strata and groups with financial service needs is the essence of inclusive finance. Although digital payment adoption has been shown to increase the probability of farmers obtaining formal credit, whether it meets their credit needs requires further analysis. Farmers whose credit needs are unmet (including those who did not apply due to exclusion) are assigned a value of 0, while those who obtained formal loans and met their credit needs are assigned a value of 1. The regression results in Table 9 show that digital payment adoption significantly improves farmers’ credit satisfaction, and the effect increases with the frequency of digital payment adoption. A possible reason for this phenomenon is that the frequent use of digital payments enriches the effective information that farmers accumulate online, compensating for their lack of hard information. Financial institutions can assess farmers’ risks at lower costs and more accurately meet their credit needs.

7 Discussion and conclusions

The findings of this study provide significant insights into the impact of digital payment adoption on farmers’ credit access, offering both theoretical and practical implications for rural financial inclusion and development. The results align with and extend those of previous research on digital finance and rural credit markets while also addressing several gaps in the literature.

7.1 Interpretation of results

Based on a theoretical analysis and survey data from 7522 farmers in eastern, central, and western regions from 2017 to 2019 and 2021 to 2023, this study finds that digital payment adoption significantly increases the probability of farmers obtaining credit and positively impacts credit amounts. This study demonstrates that digital payment adoption significantly enhances farmers’ access to both formal and informal credit, validating Hypotheses 1 and 2. This finding is consistent with that of prior studies that highlight the role of digital finance in reducing transaction costs and improving financial accessibility for underserved populations (Hu and Liu, 2025; Jamil et al., 2024; Jiang and Wen, 2021). The positive impact of digital payment use on credit access is particularly pronounced for formal credit, suggesting that digital payments not only mitigate traditional barriers such as conditional and price exclusion but also bridge the gap between farmers and formal financial institutions. This aligns with the literature on digital financial inclusion, which emphasizes the potential of digital platforms to democratize access to financial services (Kofinti et al., 2024).

The study also identified the underlying mechanisms by which the adoption of digital payments affects farmers’ access to credit. The mechanisms include alleviating conditional and price exclusion in formal credit, reducing psychological barriers, and improving the credit knowledge of credit-constrained borrowers in rural areas; these findings support Hypotheses 1. Digital payment adoption also enhances informal credit capacity, providing farmers with more funding options, thus supporting Hypothesis 2. The reduction in psychological barriers is particularly noteworthy, as it underscores the transformative potential of digital payments in expanding rural credit markets. This differs from the previous literature that focused on the impact of digital finance on objective credit conditions. Furthermore, the improvement in informal credit capacity suggests that digital payments empower farmers by enhancing their social networks, which are critical for accessing credit in rural contexts.

Different frequencies of digital payment use positively affect formal credit access while only infrequent use has a significant effect on informal credit access. As the frequency of digital payment use increases, the “demand expansion effect” of digital payments on informal credit may evolve into a “substitution effect” for formal credit, which could lead farmers to shift from informal to formal credit channels in order to meet their funding needs. Additionally, digital payment adoption improves credit satisfaction for farmers with credit needs. Our findings indicate that digital payments support rural economic diversification by facilitating credit access for both agricultural and non-agricultural productive activities.

This study highlights the transformative role of digital payments in improving rural credit access and financial inclusion. The results suggest that digital payment adoption not only enhances formal credit access but also strengthens informal credit networks, offering farmers greater flexibility in meeting their financial needs. Policymakers should prioritize the development of digital financial infrastructure and promote financial literacy to maximize the benefits of digital finance for rural households.

7.2 Implications

Theoretical Implications: This study contributes to the growing body of literature on digital finance by highlighting the mechanisms through which digital payments influence farmers’ credit access. The findings suggest that digital payments not only reduce barriers to formal credit but also strengthen informal credit networks, providing a more comprehensive understanding of how digital finance can bridge the urban–rural financial divide. The study also underscores the importance of psychological factors, such as the “unconfident borrower” mentality, in shaping credit behavior, offering new insights into the behavioral economics of rural finance.

7.3 Practical implications

The results have important implications for policymakers and financial institutions. First, this study highlights the need to expand digital financial infrastructure in rural areas, ensuring that farmers have access to affordable and convenient digital payment platforms. Second, financial institutions should leverage digital payment platforms to disseminate credit information and improve financial literacy among rural households. Third, the findings suggest that digital payments can serve as a tool for promoting financial inclusion, particularly for low-income and marginalized groups. Policymakers should consider integrating digital finance into broader rural development strategies to enhance credit accessibility and support rural revitalization.

7.4 Limitations and future research

While this study provides valuable insights, it has some limitations. First, the findings originate from China’s specific context—a nation characterized by a rapidly developing digital financial ecosystem and unique financial institutions. Whether these results can be generalized to countries with different market structures and cultural backgrounds requires further validation. Second, this study focuses on the short- to medium-term effects of digital payment adoption. Longitudinal studies are needed to assess the long-term impact of digital finance on rural credit markets and household welfare. Furthermore, due to data limitations, this study cannot directly examine the impact of digital payments on specific loan contract terms (e.g., interest rates, repayment periods, collateral requirements). Finally, this study does not fully explore the potential negative effects of digital payments, such as increased financial risks or over-indebtedness. Future research should investigate these issues to provide a more balanced understanding of the role of digital finance in rural development.

8 Conclusion

In conclusion, this study provides robust evidence that digital payment adoption significantly enhances farmers’ access to both formal and informal credit, offering a transformative pathway for rural financial inclusion. By alleviating conditional and price exclusion in formal credit markets, improving farmers’ credit knowledge, and reducing psychological barriers among credit-constrained borrowers, digital payments bridge the gap between rural households and formal financial institutions. Furthermore, the study reveals that digital payments strengthen informal credit networks, providing farmers with greater flexibility in meeting their financial needs. Notably, the positive impact of digital payments is more pronounced for non-agricultural credit access, highlighting the need for targeted policies to address the unique challenges of agricultural financing. This research contributes to the growing literature on digital finance by uncovering the dual role of digital payments in enhancing both formal and informal credit access, a novel perspective that underscores the importance of digital financial infrastructure in rural development. Policymakers and financial institutions should prioritize expanding digital payment platforms and promoting financial literacy to maximize the benefits of digital finance for rural households, ultimately fostering sustainable rural revitalization and economic growth.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Author contributions

BC: Writing – original draft, Methodology, Investigation, Software, Conceptualization, Validation, Funding acquisition, Data curation, Writing – review & editing, Supervision, Formal analysis. JX: Writing – review & editing, Validation, Data curation.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the R&D Program of Beijing Municipal Education Commission (Research project: Path and Policy Research on Relative Poverty Alleviation of Residents in Beijing-Tianjin-Hebei Region Empowered by Digital Finance; grant no. SM202311417005), Beijing Federation of Social Sciences, Beijing Philosophy and Social Sciences Planning Office (Beijing Social Science Fund Youth Project: Research on the Mechanism for Cultivating Endogenous Motivation among Low-Income Farming Households in Beijing through the Participation of Industrial Revitalisation Leaders in Rural Governance; grant no. 24JJC015), Beijing Union University (Educational Reform Project: Teaching Reform and Practice of Financial Markets Courses Empowered by AI; grant no. JJ2025Y036).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adugna, H. (2024). Fintech dividend: how would digital financial services impact income inequality across countries? Technol. Soc. 77:485. doi: 10.1016/j.techsoc.2024.102485

Beck, T., and Demirgüç-Kunt, A. (2008). Access to finance: an unfinished agenda. World Bank Econ. Rev. 22, 383–396. doi: 10.1093/wber/lhn021

Birigozzi, A., De Silva, C., and Luitel, P. (2025). Digital payments and GDP growth: a behavioural quantitative analysis. Res. Int. Bus. Finance 75:768. doi: 10.1016/j.ribaf.2025.102768

Cameron, A. C., and Trivedi, P. K. (2022). Microeconometrics using Stata volume II: nonlinear models and causal inference methods., second edition. College Station, Texas: Stata press. Available online at: https://search.ebscohost.com/login.aspx?authtype=uid&custid=s8396414&groupid=main&profile=ehost&defaultdb=nlebk.%20Ask%20the%20Librarian%20for%20details.

Duvendack, M., and Mader, P. (2020). Impact of financial inclusion in low- and middle-income countries: a systematic review of reviews. J. Econ. Surv. 34, 594–629. doi: 10.1111/joes.12367

Gao, J., and Shi, Q. (2023). Financial behavior changes of rural households in China under the background of urbanization: based on the data of ten villages in Zhejiang. Issues Agric. Econ. 1, 89–106. doi: 10.13246/j.cnki.iae.20230119.002

Garrett, R. K., and Bond, R. M. (2021). Conservatives’ susceptibility to political misperceptions. Sci. Adv. 7:eabf1234. doi: 10.1126/sciadv.abf1234

Godefroid, M. E., Plattfaut, R., and Niehaves, B. (2023). How to measure the status quo bias? A review of current literature. Manag. Rev. Q. 73, 1667–1711. doi: 10.1007/s11301-022-00283-8

Goyal, K., Kumar, S., and Xiao, J. J. (2021). Antecedents and consequences of personal financial management behavior: a systematic literature review and future research agenda. Int. J. Bank Mark. 39, 1166–1207. doi: 10.1108/IJBM-12-2020-0612

Gunn, K. M., and Hughes-Barton, D. (2022). Understanding and addressing psychological distress experienced by farmers, from the perspective of rural financial counsellors. Aust. J. Rural Health 30, 34–43. doi: 10.1111/ajr.12815

He, J., and Li, Q. (2019). Digital finance and farmers’ entrepreneurship. Chin. Rural Econ. 1, 112–126. doi: 10.20077/j.cnki.11-1262/f.2019.01.008

Hsueh, S. C., Zhang, S., and Hou, L. (2025). Mitigating financial investment polarization: the role of digital payments in enhancing household participation. Emerg. Mark. Financ. Trade 61, 154–170. doi: 10.1080/1540496X.2024.2379465

Hu, S., and Liu, D. (2025). Digital economy, financial literacy, and financial risk-taking in rural households. Int. Rev. Econ. Finance 98:922. doi: 10.1016/j.iref.2025.103922

Jamil, S. A., Hamid, I., Alam, M. S., and Ahmad, S. (2024). Digitizing prosperity: How digital finance transforms agricultural incomes in China. Asia-Pacific Financial Markets.

Jiang, T. (2022). Mediating effects and moderating effects in causal inference. China Ind. Econ. 5, 100–120. doi: 10.19581/j.cnki.ciejournal.2022.05.005

Jiang, B., and Wen, T. (2021). Research progress on agricultural supply chain finance (ASCF). Issues Agric. Econ. 1, 84–97. doi: 10.13246/j.cnki.iae.2021.02.008

Karlan, D., Mobius, M., Rosenblat, T., and Szeidl, A. (2009). Trust and social collateral. Q. J. Econ. 124, 1307–1361. doi: 10.1162/qjec.2009.124.3.1307

Kempson, H., and Whyley, C. (1999). Kept out or opted out? Understanding and combating financial exclusion. The Policy Press. Available online at: https://api.semanticscholar.org/CorpusID:153025286

Khanal, S., Bhattarai, S., Bhattarai, S. B., Adhikari, U., Sharma, D., and Pandey, M. (2021). Disparities between developed and emerging economies in digital divide and ICT gap to bring agricultural sustainability. Fundam. Appl. Agric. 6, 309–322. doi: 10.5455/faa.78371

Kim, M., and Duvendack, M. (2025). Digital credit for all? An empirical analysis of mobile loans for financial inclusion in Kenya. Inf. Technol. Dev. 31, 559–576. doi: 10.1080/02681102.2024.2402996

Kofinti, R. E., Koomson, I., and Peprah, J. A. (2024). Borrower discouragement and multidimensional child deprivation in Ghana. J. Econ. Inequal. 22, 49–67. doi: 10.1007/s10888-023-09578-6

Kon, Y., and Storey, D. J. (2003). A theory of discouraged borrowers. Small Bus. Econ. 21, 37–49. doi: 10.1023/A:1024447603600

Krishna, B., Krishnan, S., and Sebastian, M. P. (2023). Understanding the process of building institutional trust among digital payment users through national cybersecurity commitment trustworthiness cues: a critical realist perspective. Inf. Technol. People 38, 714–756. doi: 10.1108/ITP-05-2023-0434

Liu, Q., and Chen, A. (2024). Social network: a stepping stone or a stumbling block for the human capital accumulation of rural-urban migrants? J. Quant. Technol. Econ. 41, 172–191. doi: 10.13653/j.cnki.jqte.20231117.008

Mahler, M., and Murphy, A. (2024). Risk of desirable user experiences: insights from those who create, facilitate and accept mobile payments. Electron. Commer. Res. 2024:835. doi: 10.1007/s10660-024-09835-4

Nguyen, B., and Canh, N. P. (2021). Formal and informal financing decisions of small businesses. Small Bus. Econ. 57, 1545–1567. doi: 10.1007/s11187-020-00361-9

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev. 18, 329–340. doi: 10.1016/j.bir.2017.12.003

Putrevu, J., and Mertzanis, C. (2023). The adoption of digital payments in emerging economies: challenges and policy responses. Digit. Policy. Regul. Gov. 26, 476–500. doi: 10.1108/DPRG-06-2023-0077

Roodman, D. (2011). Fitting fully observed recursive mixed-process models with cmp. Stata J. 11, 159–206. doi: 10.1177/1536867X1101100202

Sahu, G. B., Madheswaran, S., and Rajasekhar, D. (2004). Credit constraints and distress sales in rural India: evidence from Kalahandi District. Orissa. J. Peasant Stud. 31, 210–241. doi: 10.1080/0306615042000224285

Sarma, M., and Pais, J. (2011). Financial inclusion and development. J. Int. Dev. 23, 613–628. doi: 10.1002/jid.1698

Song, W., Huang, Z., and Ye, C. (2018). The impact of digital finance use on rural household livelihood strategy selection: evidence from the China rural household panel survey. Chin. Rural Econ. 1, 84–101. doi: 10.20077/j.cnki.11-1262/f.2023.06.006

Song, H., Li, M., and Yu, K. (2021). Big data analytics in digital platforms: how do financial service providers customise supply chain finance? Int. J. Oper. Prod. Manag. 41, 410–435. doi: 10.1108/IJOPM-07-2020-0485

Stock, J. H., and Yogo, M. (2005). “Testing for weak instruments in linear IV regression” in Identification and inference for econometric models: Essays in honor of Thomas Rothenberg. eds. D. W. Andrews, J. H. Stock, and T. J. Rothenberg (Cambridge: Cambridge University Press), 80–108.

Su, L., Peng, Y., Kong, R., and Chen, Q. (2021). Impact of e-commerce adoption on farmers’ participation in the digital financial market: evidence from rural China. J. Theor. Appl. Electron. Commer. Res. 16, 1434–1457. doi: 10.3390/jtaer16050081

Suri, T., and Jack, W. (2016). The long-run poverty and gender impacts of mobile money. Science 354, 1288–1292. doi: 10.1126/science.aah5309

Tian, H., Wang, A., and Zhu, Z. (2022). Digital empowerment: the impact of internet usage on farmers’ credit and its heterogeneity. J Agrotech Econ 1, 82–102. doi: 10.13246/j.cnki.jae.2022.04.008

Van Gameren, E., García-Mora, F., and Mora-Rivera, J. (2024). Does use of formal and informal credit reduce poverty in rural Mexico? Dev. Policy Rev. 42:e12798. doi: 10.1111/dpr.12798

Vlassas, I., Giannakopoulos, N., and Kallandranis, C. (2025). SMEs employment growth under heterogeneous credit constraints. J. Small Bus. Manag. 1–42, 1–42. doi: 10.1080/00472778.2025.2501086

Wu, Y., Li, X., Li, J., and Zhou, L. (2021). Digital finance and household portfolio efficiency. J. Manag. World 37, 92–104. doi: 10.19744/j.cnki.11-1235/f.2021.0094

Xiong, J., and Yang, J. (2023). Rural financial exclusion in the context of digitalization: digital opportunity or digital divide. J Agrotech Econ 5, 111–122. doi: 10.13246/j.cnki.jae.20221130.001

Yang, J., Wu, Y., and Huang, B. (2023). Digital finance and financial literacy: evidence from Chinese households. J. Bank. Financ. 156:107005. doi: 10.1016/j.jbankfin.2023.107005

Yao, M., Di, H., Zheng, X., and Xu, X. (2018). Impact of payment technology innovations on the traditional financial industry: a focus on China. Technol. Forecast. Soc. Change 135, 199–207. doi: 10.1016/j.techfore.2017.12.023

Yeung, G., He, C., and Zhang, P. (2017). Rural banking in China: geographically accessible but still financially excluded? Reg. Stud. 51, 297–312. doi: 10.1080/00343404.2015.1100283

Zhan, Y., Gao, D., Feng, M., and Yan, S. (2025). Digital finance, non-agricultural employment, and the income-increasing effect on rural households. Int. Rev. Financ. Anal. 98:3897. doi: 10.1016/j.irfa.2024.103897

Zhang, M., Chen, Z., and Chen, Y. (2025). The impact of digital finance on insurance participation. Financ. Res. Lett. 73:670. doi: 10.1016/j.frl.2024.106670

Zhang, F., Li, Y., and Zhang, L. (2024). The rural inclusive financial service points and household credit in rural China. Nankai Econ. Stud. 1, 215–232. doi: 10.14116/j.nkes.2024.02.012

Zhang, N., Yang, Z., Yu, X., and Liu, D. (2024). Credit rating and income gap among rural households: tracking research based on quasi-natural experiment. J Agrotech Econ 2, 128–144. doi: 10.13246/j.cnki.jae.20230605.001

Zhang, S., and Zhou, Q. (2025). The impact of digital finance on farmers’ consumption decisions: an analysis based on the moderating effect of risk preference. Int. Rev. Financ. Anal. 99:928. doi: 10.1016/j.irfa.2025.103928

Zhou, S., and Wang, J. (2024). How digital finance improves the urban - rural financial dual structure in China: from the perspective of formal credit rationing for households. Econ. Rev. 1, 72–89. doi: 10.19361/j.er.2024.01.05

Keywords: digital payments, rural credit access, formal credit, informal credit, credit exclusion, unconfident borrowers

Citation: Chen B and Xiao J (2025) Digital payments enhance both formal and informal credit access for rural households: evidence from China. Front. Sustain. Food Syst. 9:1676462. doi: 10.3389/fsufs.2025.1676462

Edited by:

Idowu Oladele, Global Center on Adaptation, NetherlandsReviewed by:

Diah Wahyuningsih, Trunojoyo University, IndonesiaJunlin He, Universiti Malaya, Malaysia

Copyright © 2025 Chen and Xiao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Baozhen Chen, Z2x0YmFvemhlbkBidXUuZWR1LmNu

Baozhen Chen

Baozhen Chen Jialin Xiao2

Jialin Xiao2