- 1Wuchang University of Technology, Wuhan, China

- 2Hubei Engineering Research Center for BDS-Cloud High-Precision Deformation Monitoring, Wuhan, China

- 3School of Education, Huazhong University of Science and Technology, Wuhan, China

Introduction: Enhancing industrial resilience is the key to achieving sustainable growth in the agricultural economy. The rapid development of information technology nowadays provides innovative solutions for stabilizing agricultural production and supply chains.

Methods: Based on panel data from 270 Chinese cities from 2012 to 2023, this study employed a series of econometric methods, such as two-way fixed effects, two-stage least squares, threshold models, and spatial Durbin models, to analyze the impact of information technology advancements represented by digital inclusive finance (DIF) on the agricultural economy.

Results: The results of data analysis show that DIF has significantly enhanced the agricultural resilience (AR). This positive effect still holds true after robustness tests and the elimination of endogeneity issues. However, this promoting effect is not linear but shows a threshold effect that first declines and then rises. In other words, there is a clear U-shaped relationship in the impact of DIF on the AR. The results of the heterogeneity analysis show that it can present a significant positive effect in different regions, but the effect is more intense in the eastern region. The results of the spatial Durbin model show that this positive effect has a spatial spillover effect. DIF will also have a technological spillover effect on neighboring regions through information platforms, economic exchanges, and trade transportation channels. The results of the mechanism analysis show that entrepreneurial activity is a very important mediating variable.

Discussion: This study takes China's DIF practice as a specific analytical perspective, revealing the positive role of information technology progress on the agricultural economy. Our findings contribute to the achievement of United Nations Sustainable Development Goals 1 and 2.

1 Introduction

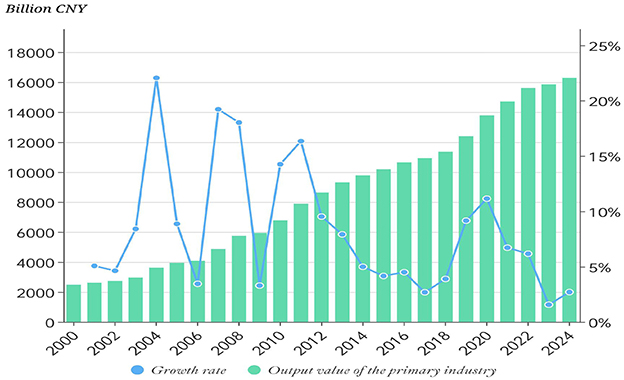

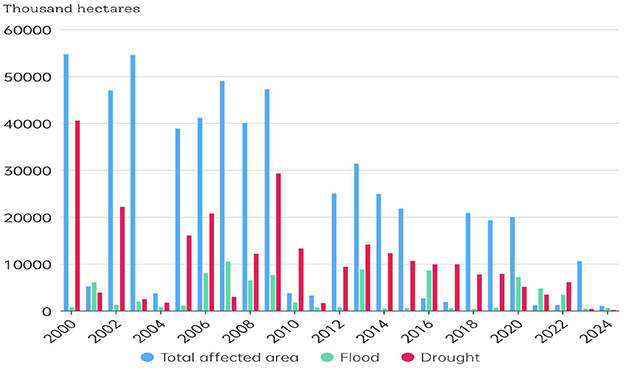

A strong country must first strengthen agriculture, and only when agriculture is strong can the country be strong. An agricultural power is the foundation of a modern socialist power. In view of this, the Chinese government has always attached great importance to the work of “rural areas, rural areas, and rural areas.” From 2004 to the present, the No. 1 document of the Central Committee has always been with the theme of “three rural areas” and has continuously issued documents to strengthen the policy of financial support for agriculture and promote the coordinated development of urban and rural areas. The 2025 Chinese government work report further pointed out that “efforts should be made to do a good job in the work of ‘three rural areas' and further promote the comprehensive revitalization of rural areas.” As a basic industry of the national economy, the improvement of agricultural resilience (AR) is crucial for ensuring national food security, promoting rural revitalization, and achieving sustainable economic development. Agricultural economic resilience means that agricultural economic systems can maintain stable operations, adapt quickly, and achieve sustainable development in the face of multiple challenges such as natural disasters, market fluctuations, and technological changes. At present, geopolitical conflicts are continuing, international trade conflicts are intensifying, extreme climate disasters are frequent, and the international environment is becoming increasingly turbulent. At the same time, the domestic “urban-rural dual structure” has not yet been broken, and the “scissors difference” between workers and peasants still exists, coupled with the inherent vulnerability characteristics of agriculture itself, resulting in a decline in the stability of our country's agricultural development and the urgent need to enhance the AR. As shown in Figure 1, the added value of China's primary industry has been continuously rising from 2000 to 2024, but the growth rate has fluctuated sharply. Especially since 2014, the growth rate of the total output of the primary industry has shown a significant downward trend. The growth rate in most years was less than 5%. The reasons for such fluctuations might be changes in market supply and demand, but they could also be natural factors. Natural factors, such as environmental pollution, climate change, and resource depletion, pose a serious threat to the sustainability of the food and agriculture system (Yang et al., 2025; Guo et al., 2023). As shown in Figure 2, China's agriculture has been severely affected by natural disasters, especially drought. It can be found from the data in Figures 1, 2 that the resilience of China's agriculture is strengthening. This can be observed from the affected area and the growth rate. For instance, in 2020, agriculture showed an upward trend due to the impact of natural disasters, yet the growth rate of agriculture also increased. However, due to the inherent fragility of agriculture, it is highly necessary to continuously enhance AR. From the perspective of social transformation, how to apply science and technology to enhance the resilience of agriculture is an urgent scientific issue that needs to be addressed at present.

Data, information technology, and the Internet have been widely applied in agricultural production (Shi et al., 2025). With the continuous innovation and popularization of digital technology, digital inclusive finance (DIF) has flourished in the wave of digitalization, relying on new generation information technologies such as big data, cloud computing, and mobile Internet to break the shackles of low coverage, high cost, and information asymmetry of traditional financial services, and accurately and efficiently invest financial resources in all aspects of agriculture. It provides farmers and agricultural enterprises with convenient payment and settlement, microcredit support, agricultural insurance, and other diversified financial services, effectively reducing the financial pressure faced by agricultural business entities, stimulating the vitality of agricultural innovation, and becoming the core force to strengthen the AR. At the same time, innovation and entrepreneurship in the agricultural field are becoming more and more active due to scientific and technological progress and diversified market demand, including agricultural production technology innovation, agricultural product variety improvement, and business model transformation, etc., while entrepreneurship is reflected in the creation of new agricultural enterprises, the rise of agricultural product e-commerce and the development of socialized service organizations. These activities not only improve the efficiency and quality of agricultural production, expand the industrial chain, but also enhance the ability of agriculture to cope with markets and risks. It is of great significance to deeply explore the internal logical correlation, interaction mechanism and policy suggestions between DIF, innovation, entrepreneurship, and agricultural economic resilience. It is also an important topic that needs to be studied urgently in the field of agricultural economic research. However, the published literature mainly explores the channels to enhance AR from external factors, such as climate change (Zhou et al., 2025; Bhatnagar et al., 2024), green finance (Zhang et al., 2025), land use (Hartman et al., 2025), and agricultural brands (Liao et al., 2025), while neglecting the role played by the coordinated development of information technology progress and financial applications. The scientific goals that this research needs to achieve are as follows: (1) To analyze whether the impact of DIF on AR is positive or negative. (2) If positive effects take the lead, is this relationship always valid? Are there any characteristics of phased transformation? (3) Are the benefits enjoyed in different regions the same? (4) Does the influence effect have a spatial spillover effect? (5) Importantly, DIF is of great significance to farmers' creativity. Then, can it easily strengthen the channels of entrepreneurial willingness to enhance AR? A comprehensive answer to these questions is of great significance for achieving Sustainable Development Goals (SDGs) 1 and 2.

2 A literature review

DIF has the advantages of low cost, low risk, wide coverage, and high penetration, effectively solving the long-standing problems of high cost, low coverage, and low penetration of traditional finance (Guo et al., 2020). With digital technologies such as big data, the Internet, cloud computing, and artificial intelligence, DIF can broaden the service targets, enable economically backward agricultural main areas to enjoy financing facilities, and accurately identify the credit risks of borrowers and provide necessary financial support for agricultural producers (Guo et al., 2022; Wang and Zhang, 2025). Therefore, it is reasonable to study the impact of DIF on agriculture.

2.1 The impact of DIF on rural society and agricultural economy

At present, the academic community has carried out extensive research on the impact of DIF on agriculture. Many scholars have found that in terms of industrial development, DIF has a positive impact on rural industrial integration (Ge et al., 2022), agricultural industrial structure optimization (Hong et al., 2022), high-quality agricultural development (Li et al., 2023), agricultural function expansion (Wang et al., 2023), rural revitalization (Xiong et al., 2022; Zhang and Huang, 2025; Zhao et al., 2025; Zeng and Zhou, 2025), and agricultural factor mismatch (Hong et al., 2024). The above research holds that modern digital technology has unlocked the potential of rural financial services for agricultural economic growth. This enabling effect mainly relies on the advantages of information technology in alleviating information opacity, optimizing approval processes and enhancing lending efficiency. Relying on the characteristics of combining “digitalization and inclusiveness,” information technology can provide financial services to all social strata and groups, achieving comprehensive coverage of financial services. Published literature has also analyzed the impact of DIF on rural society from the perspectives of the income gap between urban and rural areas and common prosperity (Guo et al., 2024a; Zhang et al., 2024). In terms of environmental protection, DIF has a significant role in promoting agricultural carbon emissions (Sun et al., 2022), agricultural low-carbon transformation (Liu et al., 2022; Wang et al., 2023; Liu and Ren, 2023), agricultural green development (Guo et al., 2024b), and agricultural ecological benefits (Huang and Wang, 2024). At the same time, DIF will effectively improve agricultural green total factor productivity through green technology innovation (Zhang and Li, 2025), land transfer (Shen et al., 2023), and improving the misallocation of agricultural production resources (Zhang and Wang, 2024). The published literature suggests that, thanks to DIF's low-cost and differentiated business strategies, farmers tend to adopt clean production equipment and green technologies in the production process. Against the backdrop of the growing popularity of green consumption, consumers are paying more attention to the quality and “green and organic” attributes of agricultural products. As a result, producers covered by rural finance will actively take measures to achieve a clean and low-carbon transformation. Importantly, DIF has actively integrated the mission goals of green finance into its practice in China, making it easier for environmentally friendly agricultural product producers to access financial resources. This market-guiding role has strengthened the role of DIF in environmental protection (Shen et al., 2023; Shen and Zhang, 2024a,b). In terms of food security, DIF can effectively ensure food security by increasing financing supply, accelerating inventory liquidity, supporting R&D investment (Huang and Nik, 2023), and large-scale farmland management (Lin et al., 2022; Jiang et al., 2024). It can be seen that DIF has a positive effect on many fields related to agriculture.

2.2 The impact of DIF on the AR

Reggiani et al. (2002) were the first to incorporate the term “resilience” into economic research. Martin and Sunley (2015) defined economic resilience as the economic system, after enduring external shocks, making adaptive changes to its economic structure to return to its original development state, so as to make fuller use of resources and achieve new development. As one of the subdivisions of agricultural research, agricultural economic resilience has received increasing attention from the academic community in the context of external shocks such as intensified trade conflicts, frequent extreme natural disasters, and continuous geopolitical conflicts. Since the concept of economic resilience was proposed, Scholars have thoroughly discussed the external factors influencing AR. From the perspective of agricultural policy, the separation of market prices and subsidy policies has strengthened the enthusiasm for agricultural production and market competition, which has a positive effect on agricultural technological innovation and leads to an increase in AR (Yang et al., 2023). The insurance premium subsidy policy has encouraged more farmers to participate in agricultural insurance, leading to an improvement in agricultural risk resistance (Zheng and Zhao, 2025). There are also studies that have analyzed their impacts on AE from the perspectives of population mobility (Qiao and Li, 2025), ecological efficiency (Qiao et al., 2023), social networks (Bahta et al., 2025), and property rights system (Wei et al., 2025).

The endogenous growth theory holds that although capital and labor are important sources of economic growth, the role of endogenous technological innovation within the economy cannot be ignored. It even determines the huge economic disparity between countries. Therefore, it is particularly important to analyze the impact of information technology on the agricultural economy from the perspective of technological innovation. Relevant literature has analyzed from the perspective of information technology innovation and application how digital technology affects economic resilience and achieved fruitful results (Cheng et al., 2024; Yang et al., 2024a; Guo et al., 2025). The powerful application capabilities of digital technology have a good promoting effect on the transformation of agricultural production models, especially the adjustment of industrial structure (Quan et al., 2024; Luo et al., 2025a). A small number of research results have been obtained on how DIF affects agricultural economic resilience. Some scholars have found that DIF can not only directly enhance the AR (Zhao et al., 2023; Shen and Hu, 2024) but also has a positive threshold effect based on its own and traditional financial competition (Zhang and Yu, 2025). The greatest advantage of information technology is to eliminate the information asymmetry between the agricultural product supply chain and the consumer end, making the information of financial borrowers more transparent (Ding et al., 2025; Luo et al., 2025b). In terms of the mechanism of DIF on agricultural economic resilience, some scholars have found that DIF mainly significantly enhances agricultural economic resilience through the upgrading of rural industries (Dai et al., 2023), agricultural technology innovation (Zhu and Sun, 2021; Bao et al., 2025), and rural industrial integration (Peng et al., 2025). From the perspective of micro-individuals, the low-cost financial assistance provided by DIF increases the possibility of rural families increasing their fixed asset investment. This kind of credit assistance will also trigger micro-behaviors such as entrepreneurship and the adoption of new technologies, which will enhance the economic resilience of rural households (Wu and Zhang, 2025).

2.3 Research gap

After reviewing the relevant literature, it can be seen that the current research on DIF in agriculture-related fields has achieved many results, but the correlation between DIF and agricultural economic resilience is relatively lacking. From the perspective of information technology, although there is already a large amount of literature exploring how to enhance the AR (Xue et al., 2025; Xie et al., 2025). However, they are mainly analyzed from the perspectives of the digital economy and digital transformation. Research combined with the economic practice of rural inclusive finance is still insufficient. Previous studies have mostly been based on China's interprovincial panel data, which make the research conclusions lacking in representativeness and prone to divergence between different studies (Gao and Gao, 2024; Yang et al., 2024b; Shen and Hu, 2024). Therefore, in order to improve the credibility and accuracy of empirical results, it is imperative to use more refined panel data for empirical testing. In addition, the exploration of the mechanism of DIF on agricultural economic resilience is still weak, and it needs to be carried out in depth and in many aspects. Based on the above situation, this study selects the panel data of 270 prefecture-level cities in China to carry out an empirical analysis of the impact of DIF on agricultural economic resilience, and innovatively introduces the mechanism variable of “entrepreneurial activity,” and deeply analyzes the internal mechanism between DIF and agricultural economic resilience from the entrepreneurial dimension, in order to provide a more detailed and reliable basis and reference for research in this field. The unique literature contributions of this study are as follows: (1) Data contribution: we refined the data samples to the city level and observed the time series extension. Generally speaking, the estimation results obtained from large-sample empirical data are more reliable. (2) New research findings: based on linear regression, we also analyzed the non-linear relationship between DIF and the AR using a threshold model. The published literature has merely analyzed their linear relationships, ignoring the non-linear effects produced by complex factors in the real world. Just as the law of diminishing marginal returns in economics holds, the positive benefits of any good always change with the variation of demand. We also employed spatial econometrics models to discover potential spatial spillover effects. This is of great significance in the digital economy era, as information exchange among individuals has become more convenient compared to the industrial age. (3) The insight into the research results. Based on the different dimensions of DIF, we also conducted a comprehensive examination of the aspects of coverage breadth, digitalization degree, and user usage depth. (4) New mechanism variables. The mechanisms of technological innovation, industrial transformation, and land transfer have been fully verified; however, the entrepreneurial behaviors of onlookers still need to be studied. We innovatively discovered the mediating role of entrepreneurial activity in DIF, enhancing the AR.

3 Theoretical analysis and research hypothesis

3.1 The direct impact of DIF on the AR

Agricultural economic resilience refers to the ability of agriculture to maintain its status quo and achieve rapid development in the face of crisis, which can be divided into three dimensions: resistance, resilience, and renewal (Li et al., 2022). Among them, good resistance refers to the ability of agriculture to maintain its status quo in the face of a crisis; while resilience refers to the ability of agriculture to recover quickly after a crisis. Renewal power refers to the ability of agriculture to further develop on the original basis. According to the theory of digital empowerment, information technology and inclusive finance have provided agricultural producers and farmers with abundant and low-cost financial funds, enabling them to improve their production and operation models to a greater extent and enhance their ability to resist risks (Li et al., 2025). DIF has a positive impact on the three dimensions of resistance, resilience and renewal, so as to achieve the goal of strengthening the AR.

(1) The credit rationing theory holds that due to information asymmetry and moral hazard, banks are unable to accurately identify the risks of borrowers (Park et al., 2003; Choudhary and Jain, 2022). Therefore, financial institutions would rather reject loan applications from some people at interest rates lower than those that are market-clearing than raise interest rates. In rural areas, information on credit, assets, profitability, and collateral is more uncertain than in urban areas. Meanwhile, the theory of financial exclusion holds that traditional financial institutions, driven by the goal of maximizing profits, will actively exclude low-income groups, small and micro-enterprises, and residents in remote areas, resulting in these groups being unable to access necessary financial services and exacerbating social injustice and the gap between the rich and the poor (Johnen et al., 2025). For a long time, agriculture and rural areas were excluded by financial institutions (Zhao and Wang, 2025). Digital technology is the key to cracking credit rationing. Big data, artificial intelligence, satellite remote sensing, blockchain, and other technologies can effectively alleviate information asymmetry (Feng et al., 2023). For instance, by analyzing farmers' online transaction records, social data, land remote sensing images, etc., financial institutions can conduct more precise risk pricing, enabling farmers who were previously unable to obtain loans due to a lack of collateral and credit records to also receive credit support. DIF can effectively improve the anti-risk ability of agricultural development. On the one hand, with digital technologies such as big data, the Internet, and mobile communications, it has gotten rid of the dependence of traditional finance on physical outlets, which not only greatly improves the coverage of financial services but also effectively improves the efficiency of credit approval. This allows agricultural business entities to alleviate credit constraints and provide equal access to financial services, thereby enabling them to easily and quickly obtain financial support in the face of crises such as natural disasters, market fluctuations, and trade conflicts, thereby improving their resilience in the face of crises. On the other hand, the innovative practice and in-depth application of digital technology in the financial field have reduced the dependence of financial institutions on human capital, thereby significantly reducing their labor costs and significantly reducing the price of financial services provided. This lowers the financing threshold for agricultural business entities and allows them to obtain sufficient financial support to deal with the crisis within the scope they can afford, thereby enhancing their resilience to the crisis.

(2) DIF can effectively enhance the post-disaster recovery capacity of agricultural production. Agriculture is a typical weak industry, facing serious natural risks, market risks, and technological risks. Economic resilience is reflected in the ability of entities to respond and recover from risk shocks. According to risk management theory, complete risk management tools are at the core of building resilience. DIF can collect the lending information of agricultural business entities to the greatest extent with the help of digital technologies such as the Internet and big data, thereby effectively alleviating the troubles caused by information asymmetry. Based on artificial intelligence and other technical means, it can accurately identify the credit risks of agricultural business entities, so as to launch diversified financial services in a targeted manner, and finally efficiently realize the optimal allocation of resources, so that agricultural business entities can obtain credit support in a timely manner after the crisis and quickly resume agricultural production (Tang and Tang, 2025). Digital agricultural insurance has significantly enhanced the efficiency and coverage of claims settlement, helping farmers smooth out consumption and stabilize production, thereby strengthening their resilience to shocks. DIF can accurately identify agricultural risks and reasonably price insurance with the help of digital technologies such as big data and artificial intelligence, thus accelerating the development of digital agricultural insurance (Xu et al., 2025). This enables agricultural insurance to play its role in the event of a crisis, so as to minimize the loss of agricultural business entities and enable them to quickly resume production after the crisis. DIF offers unprecedented risk management tools. Digital payment facilitates savings and capital turnover. Digital credit provides start-up funds for post-disaster production recovery.

(3) DIF can greatly strengthen agricultural renewal. On the one hand, DIF promotes the non-agricultural occupation of rural labor, which, in turn, produces land abandonment and accelerates land circulation, so as to promote large-scale agricultural operation through “small fields and large fields” (Shen et al., 2023; Yang and Meseretchanie, 2024). This further produces economies of scale, reduces the cost and increases the income of agricultural business entities, and then has enough funds to invest in scientific and technological research and development, so as to enhance the renewal power of agriculture. On the other hand, the amount of capital involved in the mechanization and digitalization of agriculture is huge, and the problems of high production risk, unstable income and difficulty in establishing credit in agriculture itself have exacerbated the credit constraints of traditional finance on agricultural business entities. Relying on digital technologies such as big data and the Internet, DIF can provide financial support services to a wider range of groups under the premise of minimizing risks. This enables “long-tail groups” such as agricultural business entities to obtain sufficient financial support to realize agricultural mechanization and digital transformation, thereby promoting the revolutionary improvement of agricultural production efficiency (Gao et al., 2022).

Based on the above analysis, we propose the first research hypothesis:

Hypothesis 1 (H1): DIF can enhance the AR.

3.2 The mediating effect of DIF on agricultural economic resilience

The productivity effect and information spillover effect of modern information technology have a positive impact on employment and entrepreneurship (Shen, 2024; Shen and Zhang, 2024c). As a traditional online tool, the Internet has already had a positive effect on the subjective wellbeing and entrepreneurial behavior of rural residents (Wu et al., 2025). This positive effect will be magnified for emerging digital technologies. Relying on the rapid development and in-depth popularization of digital technology, DIF can effectively solve the pain points of high cost, insufficient coverage and high risk in the traditional financial field, so as to effectively solve the long-standing shortage of funds for entrepreneurial activities in the agricultural field. First of all, DIF breaks the time and space limitations formed by traditional finance relying on physical outlets, and effectively covers all kinds of “long-tail groups” with digital technologies such as the Internet and mobile communications, and relaxes its credit qualifications for relevant practitioners in the agricultural field, so that they can obtain sufficient funds to engage in entrepreneurial activities (Yue et al., 2025). Second, with the help of relevant technical means, it can effectively obtain the loan information of entrepreneurs, so as to accurately assess the credit conditions of entrepreneurs, provide diversified financial services for all kinds of entrepreneurs under the premise of minimizing risks, and provide financial support for their entrepreneurial activities to the greatest extent (Yu et al., 2024; Chen et al., 2025). Finally, with the continuous improvement in the depth of integration between digital technology and the financial industry, the cost of DIF-related services has been significantly reduced, which allows financial institutions to provide financial services to entrepreneurs at a lower price threshold, thereby stimulating the enthusiasm of entrepreneurs and increasing entrepreneurial activity. Based on the above analysis, the article believes that DIF can enhance entrepreneurial activity (Shao et al., 2023).

Entrepreneurship is an important factor influencing regional resilience (Hoffmann et al., 2024; Uzzol and Uddin, 2025). Improving entrepreneurial activity can promote the AR. On the one hand, the increase in entrepreneurial activity can accelerate the innovation and application of agricultural science and technology, thereby promote the optimization and upgrading of agricultural structure, give birth to emerging industrial clusters and diversified formats, and activate new engines for agricultural development, thereby significantly enhancing the AR. On the other hand, the increase in entrepreneurial activity will directly create a large number of jobs, which in turn will drive people's employment level to increase, thereby promoting their income, putting forward new demands for agricultural production, and ultimately promoting the AR. Based on the above analysis, this study believes that the increase in entrepreneurial activity can enhance the AR.

Based on the above analysis, we propose the second research hypothesis:

Hypothesis 2 (H2): DIF can strengthen the anti-volatility ability of the agricultural economy by improving the activity of entrepreneurship, and ultimately enhance the AR.

4 Research design

4.1 Variable setting

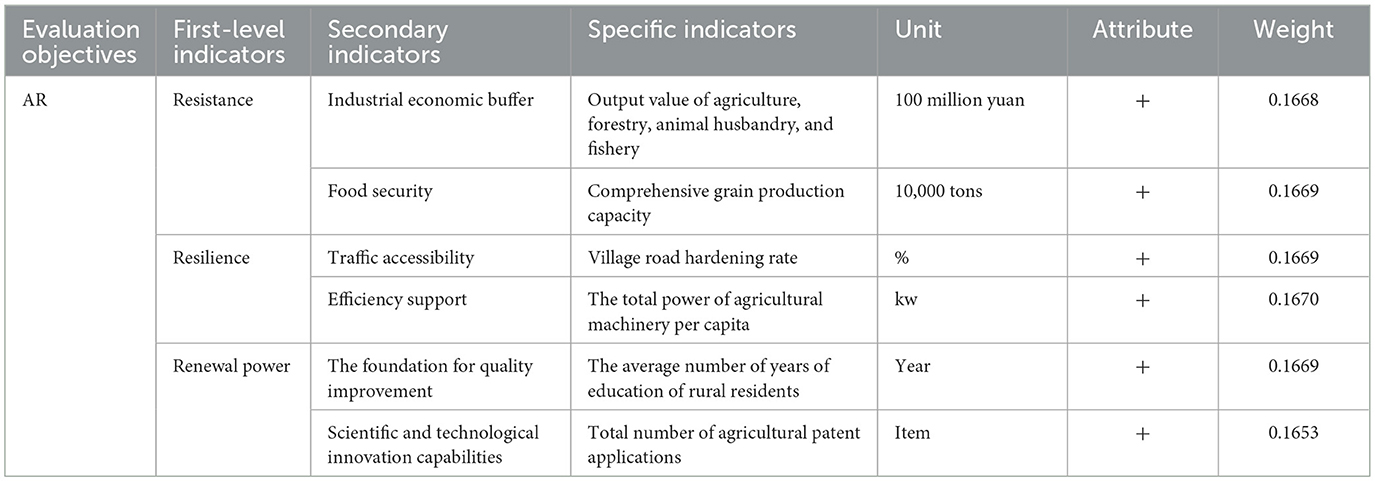

4.1.1 Interpreted variables

The interpreted variable of the article is agricultural economic resilience (AER). Regarding the measurement methods of agricultural economic resilience, the comprehensive evaluation value based on the comprehensive evaluation index system and the sensitivity index based on a single indicator are mainly concentrated. Compared with the sensitivity index, the comprehensive evaluation value can more comprehensively reflect the multi-dimensional characteristics of agricultural economic resilience. Therefore, based on the availability and scientific nature of the data, this study evaluates the AR from three dimensions: resistance, resilience and renewal. In the selection of secondary indicators, resistance is characterized by two indicators: industrial economic buffer and food security, and is represented by two specific indicators: agriculture, forestry, animal husbandry, and fishery output value and comprehensive grain production capacity. The resilience is characterized by two indicators: traffic accessibility and efficiency support, and is represented by two specific indicators: village road hardening rate and per capita total power of agricultural machinery. The renewal power is characterized by two indicators: efficiency and quality improvement, and scientific and technological innovation ability, which are represented by two specific indicators: the average number of years of education of rural residents and the total number of agricultural patent applications. In summary, this study constructs a comprehensive evaluation index system of agricultural economic resilience consisting of three first-level indicators, six second-level indicators and six specific indicators. The detailed information is shown in Table 1. Finally, the data involved in the comprehensive evaluation index system are standardized, translational, entropy method weighting and linear weighting, and finally, a comprehensive evaluation system of agricultural economic resilience is obtained.

4.1.2 Core explanatory variables

The core explanatory variable of the article is digital financial inclusion (DIF). This variable is characterized by the Digital Financial Inclusion Index jointly compiled by Peking University and Ant Financial. At the same time, to ensure dimensional consistency, divide the index by 100 as the final core explanatory variable.

4.1.3 Mediating variables

The mediating variable of the article was entrepreneurial activity (EAL). This variable is characterized by the number of start-ups per 100 people.

4.1.4 Control variables

According to the published literature, six indicators related to agricultural economic resilience are selected as control variables (Xu, 2025; Xu and Lu, 2025). (1) Agricultural enterprise development level (AEDL). The logarithmic value of the main business income of agricultural product processing enterprises above a designated size. (2) Rural transportation level (RTL). It is expressed by the logarithmic value of the number of cars per 100 households. (3) Rural resource utilization efficiency (RRUE). It is expressed by the proportion of comprehensive utilization of livestock and poultry manure to the total amount of livestock and poultry manure generated. (4) Rural environmental protection (REP). It is expressed by the proportion of green vegetation coverage area to the total area of the village. (5) Rural education level (REL). It is expressed by the proportion of full-time teachers with bachelor's degrees or above in rural compulsory education schools in the total number of teachers. (6) Rural communication level (RCL). It is expressed by the proportion of administrative villages that have opened Internet broadband services to the total number of villages.

4.2 Model construction

4.2.1 Benchmark regression model

This article selects the dual fixed-effect model of fixed city and year to empirically test the direct impact of DIF on agricultural economic resilience. The model is built as follows:

Among them, ARit represents the AR in the t year of city i, DIFit represents the digital financial inclusion index of city i in t year, Controlit represents the relevant control variables of city i in the t year, γi represents the individual fixed effect, μt represents the time fixed effect, εit is the random perturbation term, α0 is the constant term, and α1 and α2 are the coefficients of variables.

4.2.2 Mediation effect model

To identify the mediating mechanism by which DIF affects the AR, this study, following the approach of the published literature, conducted an empirical test using a three-stage mediating effect model (Yang and Shen, 2023; Hu et al., 2025).

Among them, β0 and θ0 are both constant terms. the coefficients, β1, β2, θ1, θ2, and θ3 all are the coefficients of the corresponding variables, the EALit represent the entrepreneurial activity of city i in the t year, and the rest of the symbols are consistent with model (1).

4.3 Data sources

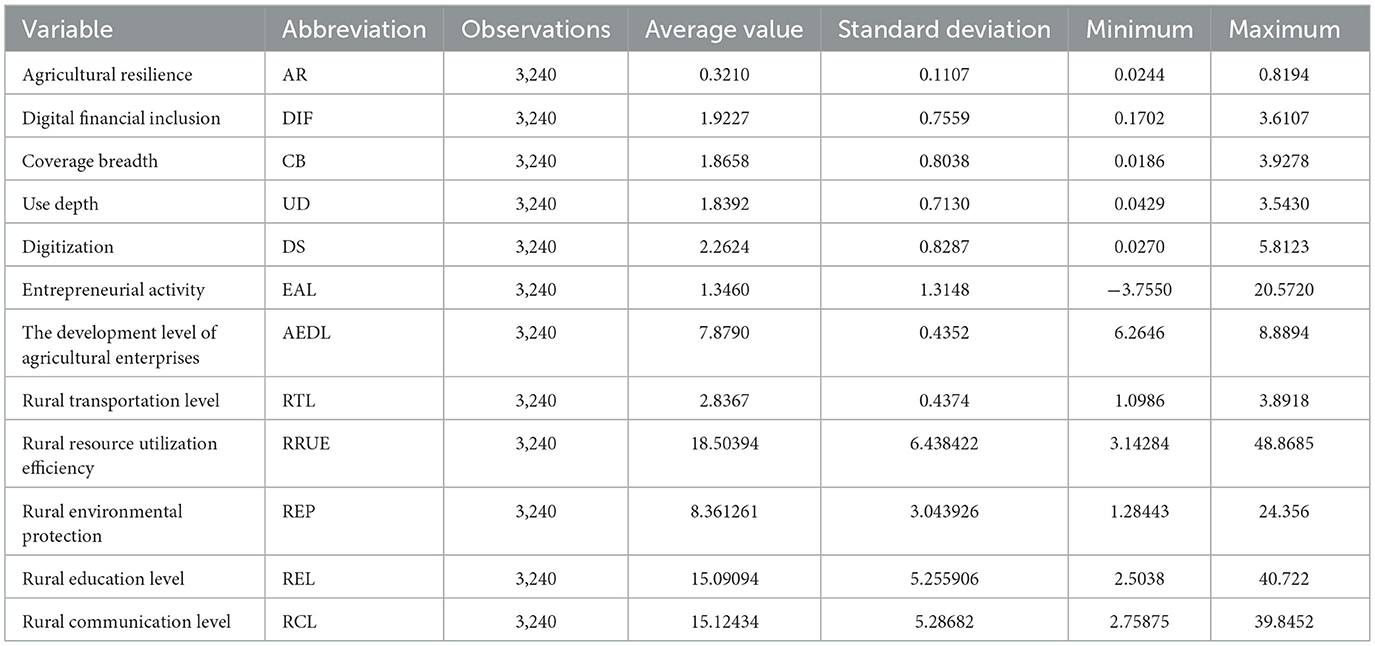

This article selects the panel data of 270 prefecture-level cities from 2012 to 2023 as research samples. The data mainly comes from the “Peking University Digital Inclusive Finance Index,” the “China Urban Statistical Yearbook,” the “China Rural Statistical Yearbook,” and the authoritative data website (https://mark.com/). For some missing data, the interpolation method is used to supplement it. The descriptive statistics of each variable are shown in Table 2.

5 Empirical results

5.1 Benchmark regression results

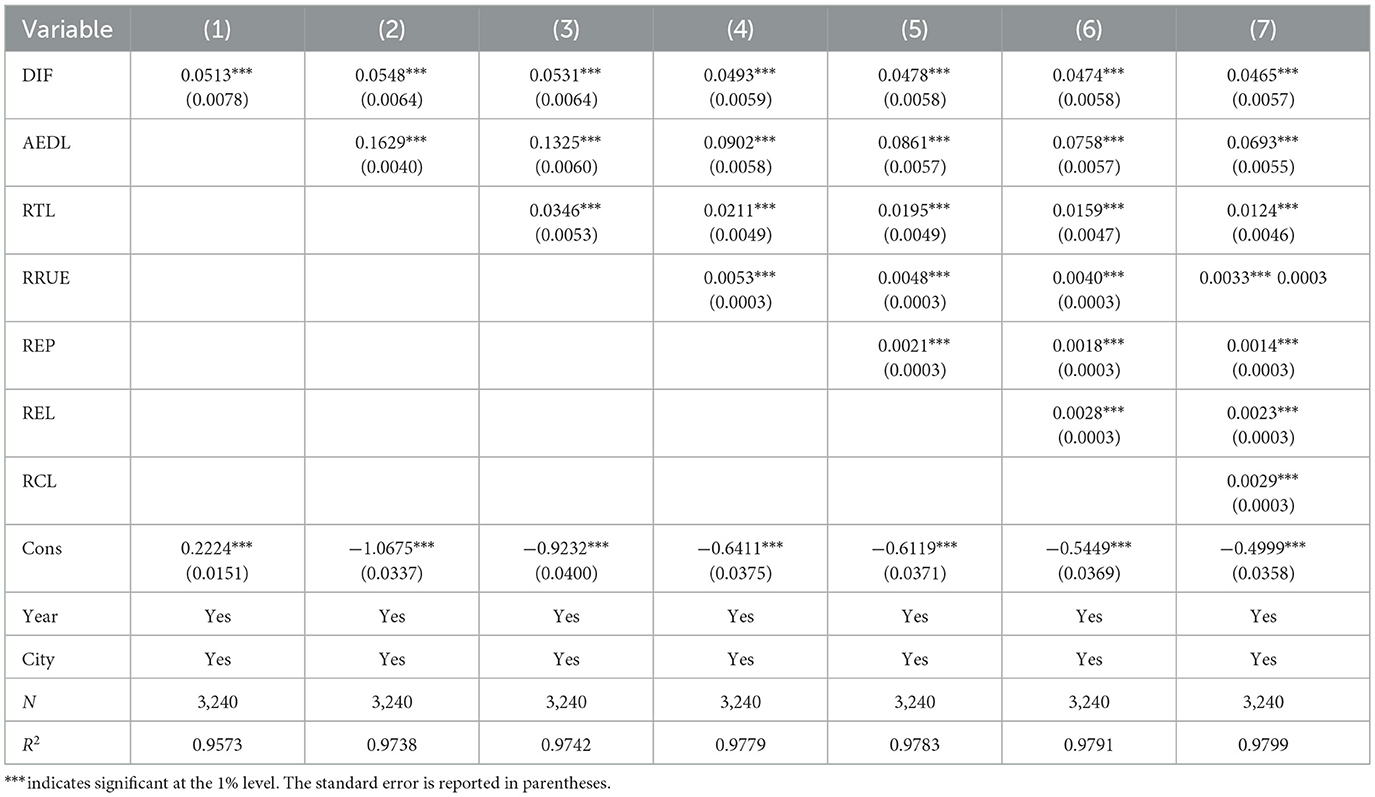

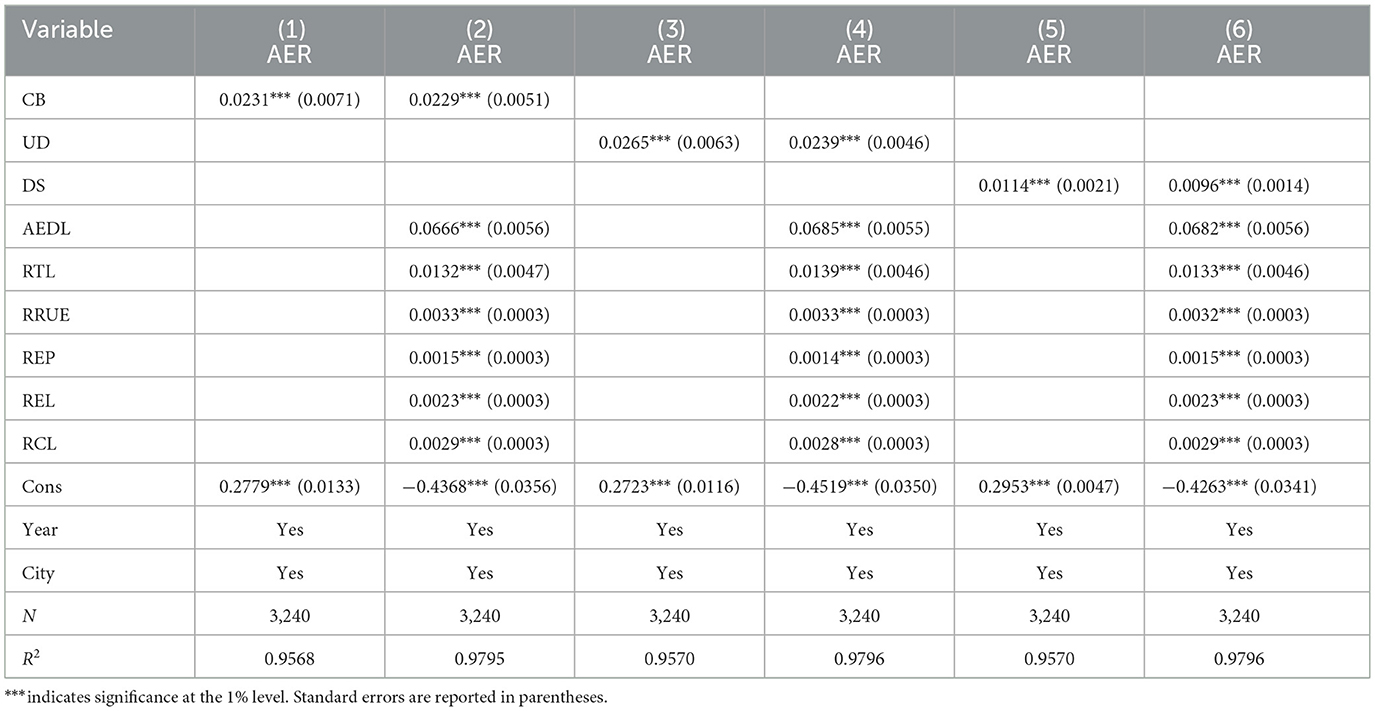

Table 3 presents the analysis results of baseline regression: Column (1) is the regression data without the control variable, and Columns (2)–(7) are the regression results after the control variable is added step by step. The data show that the impact of DIF on the AR is significantly positive at the statistical level of 1%, regardless of whether control variables are included, which indicates that DIF can effectively enhance the AR. DIF has excellent characteristics, including wide coverage, low cost, and low risk, and can work together on the AR from the three aspects of resistance, resilience, and renewal, thereby promoting its significant enhancement. Therefore, Hypothesis 1 is proven.

In terms of control variables, the development level of agricultural enterprises, rural transportation, rural resource utilization efficiency, rural environmental protection, rural education level, and rural communication level are positive at the 1% significance level, indicating that these control variables can also enhance agricultural economic resilience. The improvement of the development level of agricultural enterprises can enhance the ability of the agricultural economy to cope with market fluctuations by expanding the scale of production, optimizing the industrial structure and increasing jobs. The progress of rural transportation can accelerate the circulation of agricultural products, reduce transportation costs, and make the agricultural economy more resilient in the logistics link. The improvement of rural resource utilization efficiency will help to achieve sustainable use of resources, reduce dependence on external resources, and stabilize the foundation of agricultural economic development. Good rural environmental protection can promote the development of ecological agriculture, improve the brand quality and market competitiveness of agricultural products, and enhance the AR. The improvement of rural education level can cultivate professionals for agriculture, innovate agricultural technology and management models, and help the agricultural economy adapt to changes. The upgrading of rural communication level facilitates the dissemination and exchange of agricultural information, timely grasps market dynamics, makes accurate decisions, and effectively enhances the AR.

5.2 Robustness test

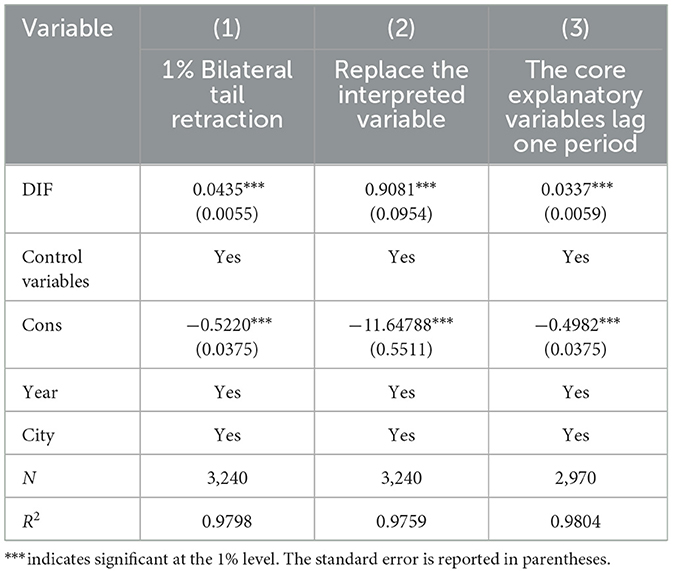

In order to verify the robustness of the benchmark regression results, the robustness of the model is tested by the following three methods: 1% bilateral tailing, replacement of interpreted variables, and lagging treatment of core explanatory variables. Table 4 shows the robustness test results, where Columns (1)–(3) are the robustness test results of 1% bilateral tailing treatment, replacement of the interpreted variable and the lag of the core explanatory variable by one period, respectively. The test results show that DIF still significantly enhances the AR at the 1% level. This proves that the benchmark regression results are reliable and robust.

5.3 Endogenous test

In order to avoid the endogenous problem caused by a mutual causal relationship, the instrumental variable method is used to carry out endogenous analysis. In the process of selecting instrumental variables, based on the ideas that have already been published, the interaction between the number of post offices per 100 people and the number of Internet users in the previous year, as well as the digital inclusive financial index that lags two periods behind, are selected as two instrumental variables (Huang et al., 2025; Li and Han, 2025; Su et al., 2025). The early Internet infrastructure had a very weak correlation with the economic growth of modern agriculture. It took a long time for Internet applications to rise in rural areas. As an important channel for economic exchanges and shipping cooperation, the post office made a significant contribution to economic growth when information technology was not yet widely applied. With the increasing demand for information exchange among people, traditional mail delivery cannot meet the needs of residents. This has directly led to the rapid development of the Internet, digital connectivity and digital finance. Therefore, post offices have historically promoted economic development, and their density has also influenced economic intensity. Therefore, we have reason to believe that instrumental variables meet the requirements of correlation and exclusivity.

Columns (1)–(4) in Table 5 show the endogenous test results of these two instrumental variables. The regression data in the first stage showed that the F-value of both instrumental variables was greater than 10, and both were significantly positive at the statistical level of 1%, which indicated that the selected instrumental variables did not have the problem of weak instrumental variables, and were positively correlated with DIF. The results of the second stage of regression show that the enhancement effect of DIF on agricultural economic resilience still exists significantly at the level of 1%. It can be concluded that even considering the endogenous problem, digital financial inclusion can still significantly improve the AR, and Hypothesis 1 is further validated and supported.

5.4 Mechanism analysis

5.4.1 Mechanism analysis of subsystems

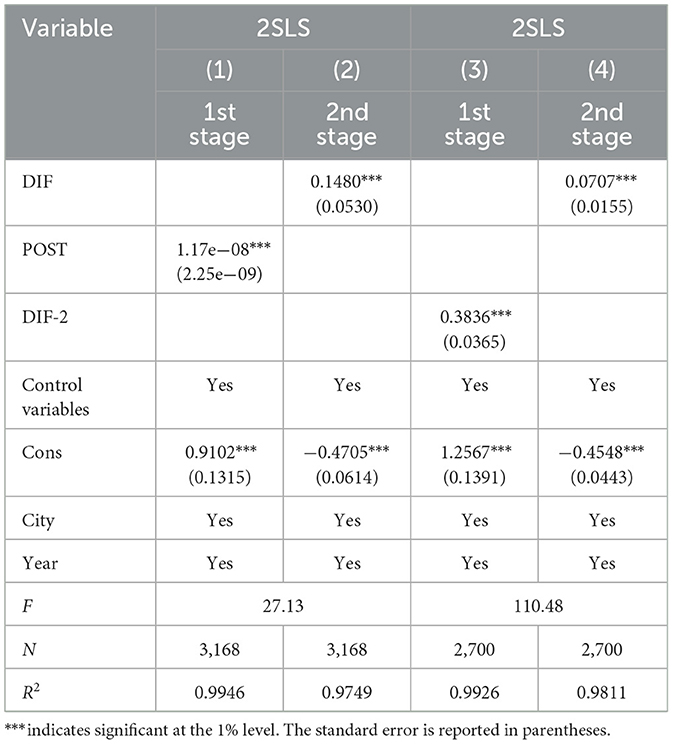

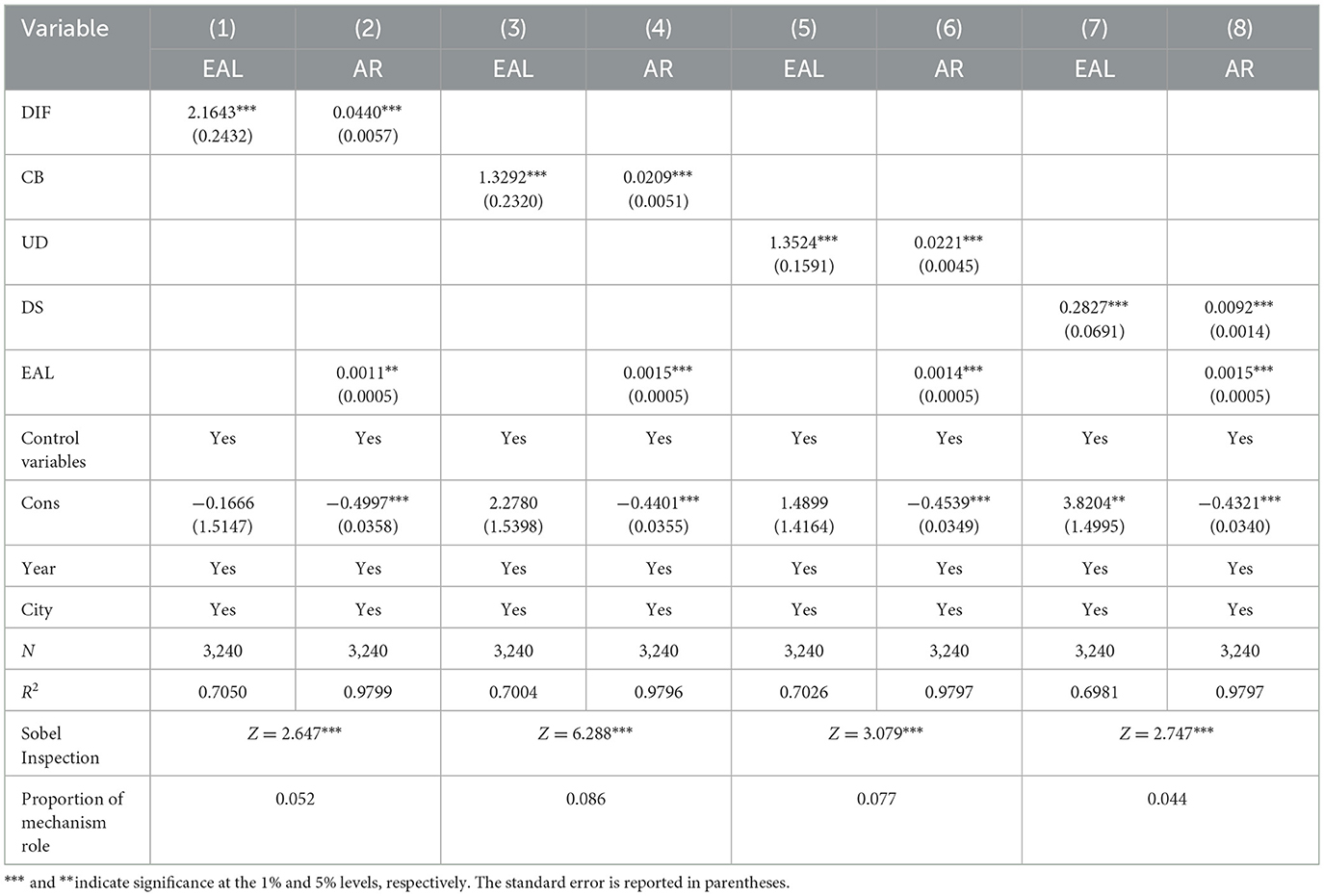

Columns (1) and (2) in Table 6 show the mechanism test of entrepreneurial activity in the process of DIF to enhance agricultural economic resilience. Among them, the data of Column (1) shows that the impact of DIF on entrepreneurial activity is significantly positive at the statistical level of 1%, which indicates that DIF can significantly improve entrepreneurial activity; Column (2) shows that the regression coefficient of entrepreneurial activity is significantly positive at the statistical level of 5%, indicating that this variable can effectively strengthen the AR. It can be seen that DIF can effectively enhance the AR by improving the activity of entrepreneurship, and the mechanism based on entrepreneurial activity is established. At the same time, in order to further enhance the reliability of the mechanism of action, the Sobel test was used to carry out the test. The results showed that the Z-value was 2.647, which passed the significance test at the 1% level, and the proportion of the mechanism of action was 0.052, which confirmed the robustness of the mechanism. On the one hand, DIF lowers the entry threshold for financial services and effectively stimulates their entrepreneurial enthusiasm by providing low-interest and low-risk financial products to all kinds of entrepreneurs, thereby promoting the increase of entrepreneurial activity. On the other hand, entrepreneurial activity further has a positive impact on the AR by accelerating the promotion of agricultural science and technology and creating jobs. Therefore, Hypothesis 2 is confirmed.

Columns (3)–(8) are the subsystems of DIF, that is, the test results of the mechanism of coverage, depth of use and degree of digitalization. The results show that the subsystem can also significantly enhance the AR by improving entrepreneurial activity, and both pass the Sobel test, indicating that the mechanism based on entrepreneurial activity still exists in the subsystem of DIF. The goal of DIF is to provide financial service support for all levels and groups of society, and the improvement of the coverage of its subsystem will directly benefit the “long-tail group,” so that they can obtain sufficient financial support for entrepreneurial activities, and then effectively promote the improvement of new agricultural productivity. The increase in the depth of use means that the types of financial services for the “long-tail group” have increased, which enables them to have equal access to financial services and make full use of these financial services to carry out entrepreneurial activities, so as to promote the AR through the promotion of science and technology and the increase of employment. The increase in digitalization will directly reduce the cost and price of various financial services, lower the threshold for obtaining financial services, and stimulate the enthusiasm of agricultural business entities to carry out entrepreneurial activities, thereby having a positive effect on the AR.

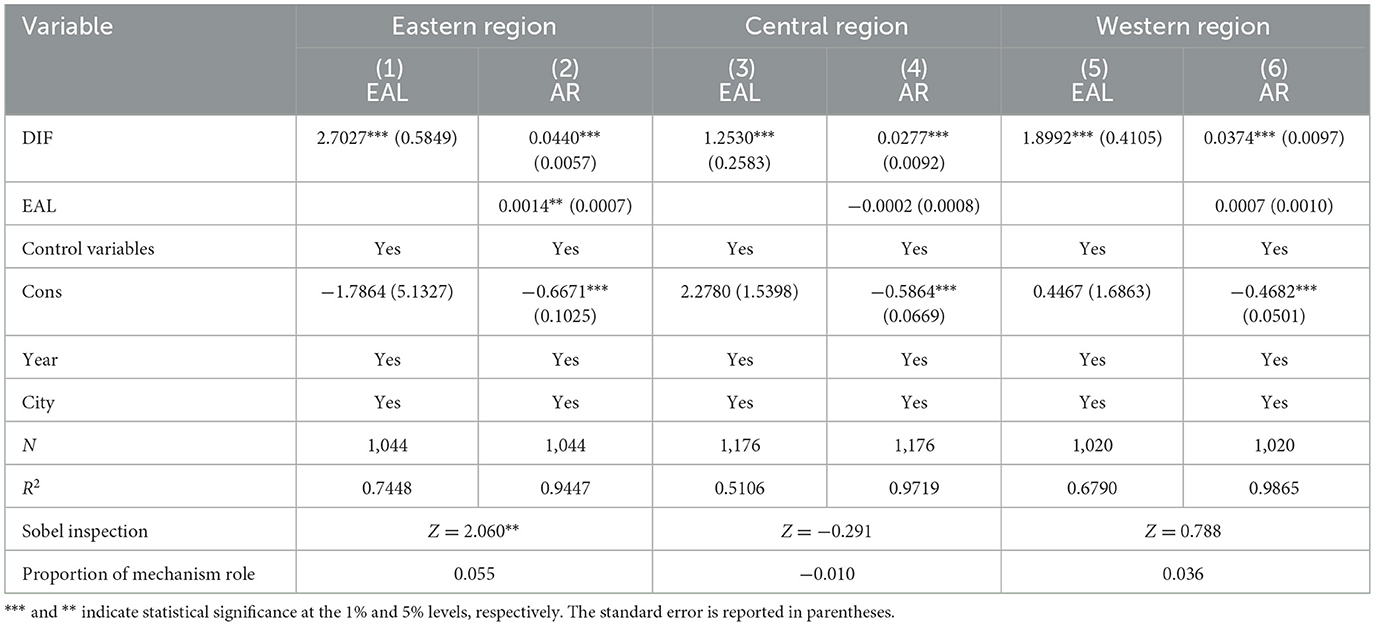

5.4.2 Mechanism analysis of regional heterogeneity was included

In order to explore whether this mechanism is established in different regions, 270 prefecture-level cities are divided into the following three regions: eastern, central, and western, and the mechanism is tested, respectively. Table 7 shows the results of the mechanistic analysis of regional heterogeneity. Columns (1), (3), and (5) show that in the eastern, central and western regions, DIF can improve entrepreneurial activity; Columns (2), (4), and (6) show that entrepreneurial activity can significantly enhance agricultural economic resilience in the eastern region, but not significantly in the central and western regions. At the same time, the Sobel test shows that this mechanism of action is established in the eastern region, but not in the central and western regions. The above results show that the mechanism of DIF to enhance agricultural economic resilience by increasing entrepreneurial activity is established in the eastern region, but not in the central and western regions. The eastern region has a complete network infrastructure, dense financial service outlets, a developed economy and diversified industrial structure, and rich educational resources, so that entrepreneurs have high financial literacy, advanced financial culture, strong policy support and sufficient market competition. These conditions are conducive to the efficient reach of DIF to entrepreneurs, online and offline collaborative services, entrepreneurs can use diversified financial products and multi-industry integration to start businesses, with the help of policy preferences and obtain high-quality services in competition, so as to effectively enhance entrepreneurial activity and enhance the AR. However, the central and western regions have insufficient network coverage, few financial outlets, lagging economic development, a single industrial structure, and a limited education level, resulting in weak financial awareness, poor policy implementation and insufficient market competition. This makes it difficult for DIF to carry out smoothly, and entrepreneurs have limited access to resources and a weak ability to use financial tools, making it difficult to fully use them to enhance their entrepreneurial activity, and then it is difficult to enhance the AR.

6 Further analysis

6.1 Analysis of threshold effect

6.1.1 Threshold effect test

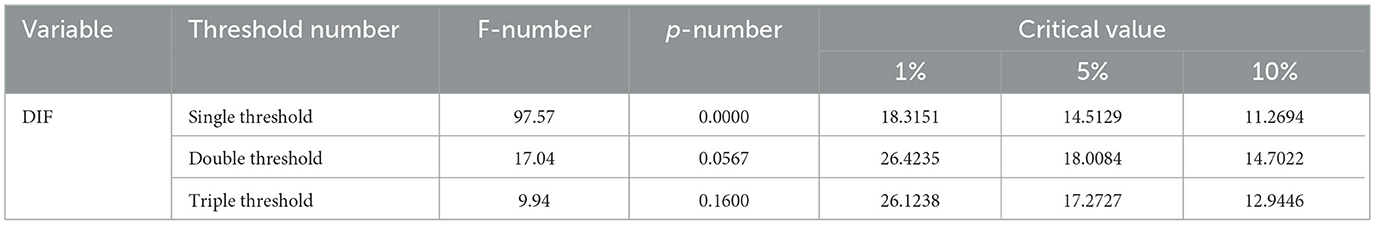

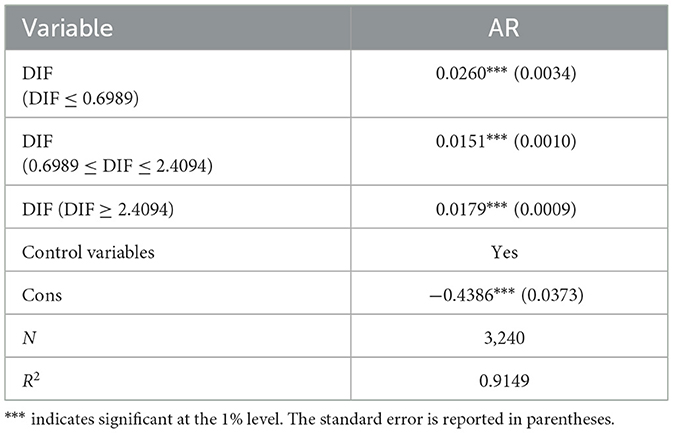

The critical value theory holds that if market entities want to utilize external resources, they must first possess certain internal capabilities to absorb and transform them. DIF varies significantly in different regions and at different stages, and thus, the resulting impact effects will also differ. Both theory and reality strongly suggest that the relationship between DIF and AR is more likely to be non-linear. Its influence may have critical points or thresholds. Before and after reaching these points, the influence mechanism, direction, and even magnitude will undergo significant changes. Ignoring this non-linearity may lead to biased or even incorrect conclusions. In order to determine the number of thresholds, the threshold effect is tested. Table 8 shows the test data for the threshold effect. The test results show that the model passes the single threshold effect and double threshold effect at the significance level of 1% and 10%, respectively, while the triple threshold effect test fails. Based on this, it was decided to construct a double threshold model to explore the non-linear effect of DIF on AR.

6.1.2 Threshold effect regression results

Table 9 shows the regression results of the double threshold effect model. The data show that when the development level of DIF is lower than the first threshold value (0.6989), its impact coefficient on agricultural economic resilience is 0.0260, and it passes the 1% significance level test. When it is between the first and second threshold values, the coefficient of influence is 0.0151, which also passes the test at the 1% significance level. When the second threshold value (2.4094) is exceeded, the coefficient of impact is 0.0179, which still passes the 1% significance level test. It can be seen that the impact coefficients of each stage are positive, but there are differences in the values, showing the characteristics of U-shaped changes that first decrease and then rise. This means that no matter what stage of development DIF is in, it can have a significant role in promoting the improvement of AR, but there is a non-linear change law of first weakening and then enhancing, and its positive impact shows a fluctuating trend of first high, then low and then up. In the early stage, when DIF first entered the agricultural field, with innovative financial models and resources, microcredit filled the gap in agricultural funds in a timely manner, and e-commerce finance broadened the sales channels of agricultural products, which effectively boosted the AR. However, with the advancement of development, market competition has become increasingly fierce; some digital inclusive financial products have appeared in chaos, non-compliant platforms have emerged, disrupting the order of the financial market, and the financial risks faced by agricultural business entities have increased. After that, the regulatory system was gradually built and improved, DIF returned to the right track and developed in an orderly manner, and financial institutions went deep into all links of the agricultural industry chain to develop customized financial services according to the characteristics of different links such as agricultural production, processing, and sales, once again injecting strong impetus into the enhancement of AR and making its positive impact rise again.

6.2 Spatial spillover effect

6.2.1 Spatial autocorrelation analysis

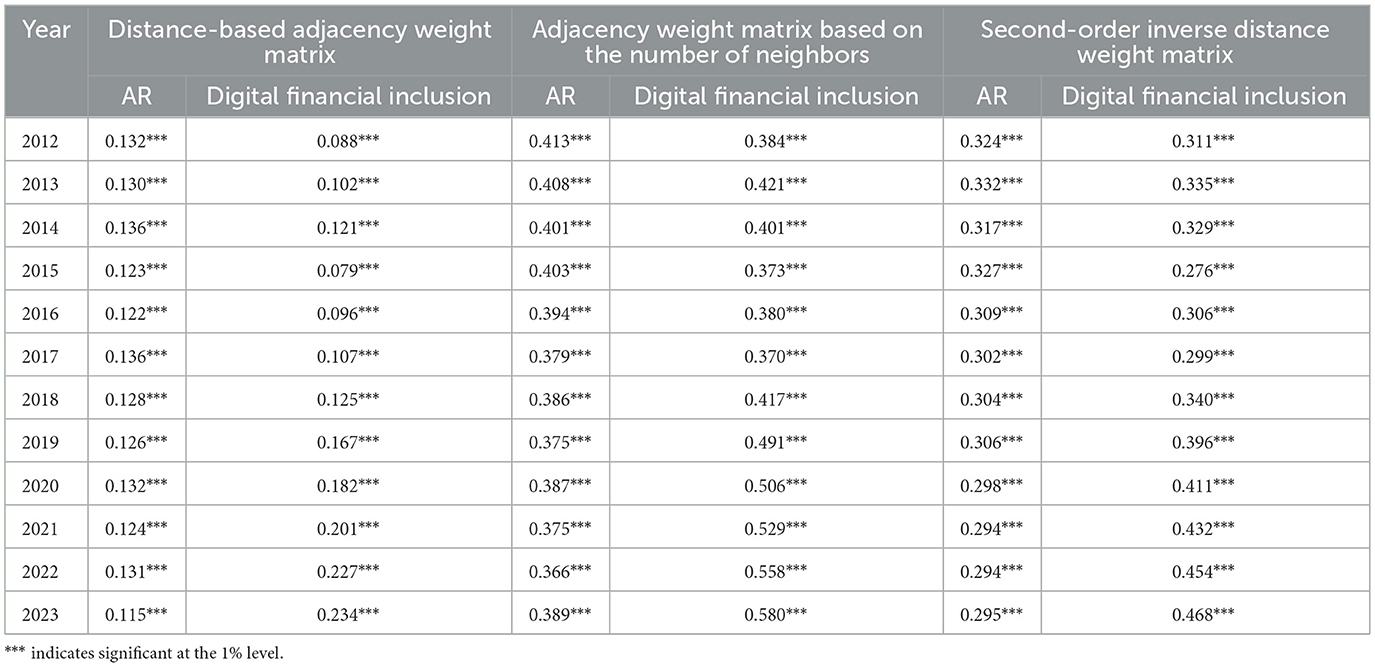

Spatial externality holds that the behavior of one entity will have non-market impacts on other entities adjacent to it in space, including positive externalities and negative externalities. Just as economic geography reveals, there are extensive and close spatial correlations among economic affairs (Liu and Lian, 2025; Zheng et al., 2025). Agricultural economic activities and financial activities are by no means operating independently in a “vacuum”; they have profound spatial correlations. Ignoring this correlation will lead to incorrect model Settings, resulting in biased estimation results and missing key mechanisms of action. First, the spatial autocorrelation test is carried out on the explained variables and the core explanatory variables to judge the necessity of spatial econometric analysis. In order to improve the robustness of the test results, the global Moran index from 2012 to 2023 is calculated under three spatial weight matrices: distance-based adjacency weight matrix, adjacency weighting matrix based on proximity number, and second-order inverse distance weight matrix. Table 10 shows that among the three spatial weight matrices, the global Moran index of AR and DIF over the years is significantly positive at the 1% significance level, indicating that there is spatial autocorrelation between these two variables. Therefore, it is necessary to further construct a spatial econometric model to carry out the analysis of the spatial spillover effect.

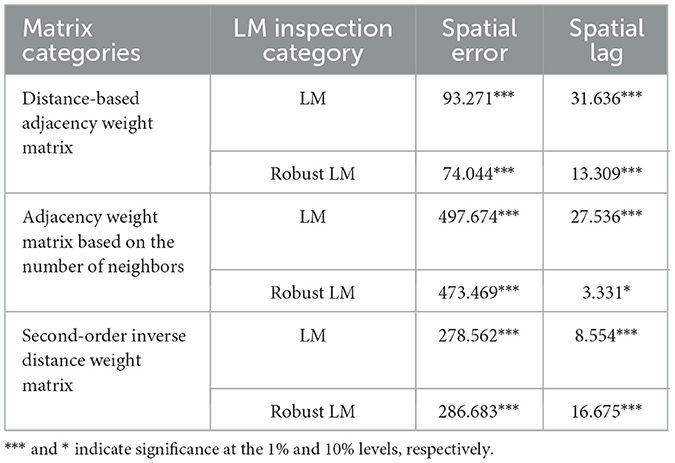

6.2.2 Lagrange multiplier test

In this article, the lagrange multiplier (LM) test is used to clarify the type of spatial econometric model to be adopted. Table 11 shows that the spatial lag and spatial error of the distance-based adjacency weight matrix and the second-order inverse distance weight matrix significantly reject the null hypothesis at the level of 1%, while the spatial lag and spatial error of the adjacency weight matrix based on the number of adjacents significantly reject the null hypothesis at the level of 10% and 1%, respectively, indicating that the spatial lag model, spatial error model and spatial Durbin model can all be adopted. In order to visually present the spatial spillover effect of DIF on AR and to take into account the simplicity and interpretability of the model, this study decided to use the spatial lag model for spatial econometric analysis.

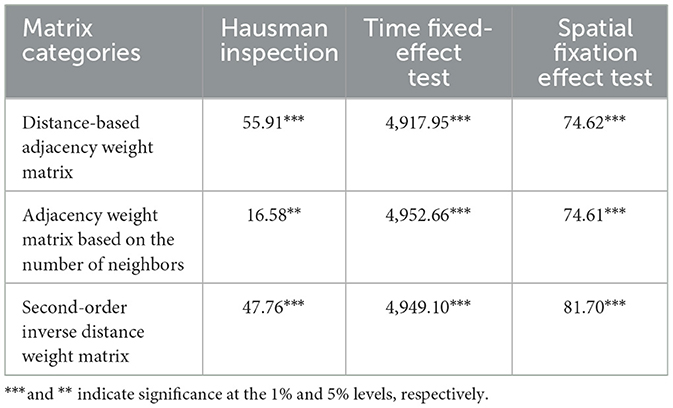

6.2.3 Pre-test of spatial econometric model

Table 12 shows the results of the fixed effect test. The results show that under the three spatial weight matrices, the models all pass the Hausman test, so it is decided to use the fixed-effect model, and both pass the significance test in the test of time fixation and space fixed effect, so the spatial and spatial double fixed space lag model is finally used for spatial econometric analysis.

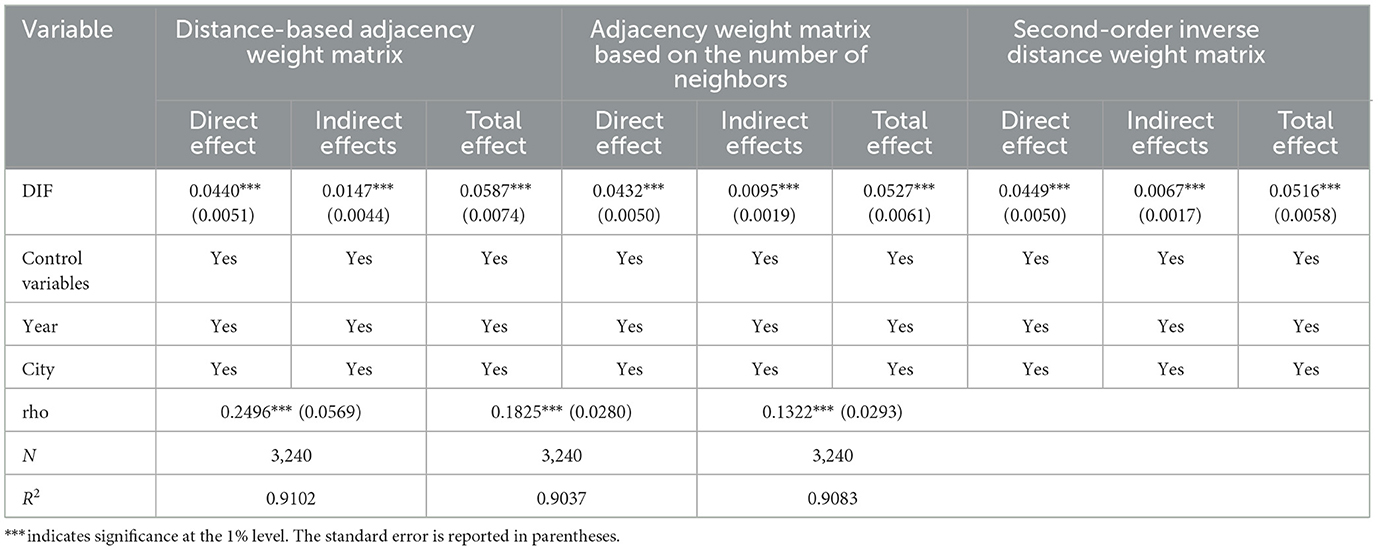

6.2.4 Spatial econometric analysis

Table 13 shows the regression results of the spatial lag model. The results show that under the three spatial weight matrices, the direct effect enhances the AR at the 1% significance level, which is another validation of Hypothesis 1. The indirect effect also enhances the AR at the 1% significance level, and accounts for 25%, 18%, and 13% of the total effect, respectively, indicating that DIF has a strong positive spatial spillover effect on AR. At the same time, the rho value of the spatial effect coefficient under the three spatial weight matrices is also significantly positive at the 1% level, which further confirms the positive spatial spillover effect of DIF on AR. To sum up, DIF can not only enhance the AR in the region but also play an effective role in enhancing the AR in the surrounding areas. DIF has a positive spatial spillover effect on AR, mainly due to many factors. First of all, DIF relies on the Internet and other information technologies to break through geographical limitations, and the mature digital financial model, rich financial products and service experience in developed regions can quickly spread to surrounding areas through information dissemination, talent flow and business expansion. Second, the development of DIF is conducive to the optimal allocation of resources between regions, and the flow of capital, technology and other factors will flow between regions according to market demand, driving the integration of agricultural production factors in a broader range, so that the interdependence of agricultural economy in various regions is improved, and the ability to synergize and resist risks is enhanced, which in turn has a positive spatial spillover effect on the AR.

6.3 Heterogeneity analysis

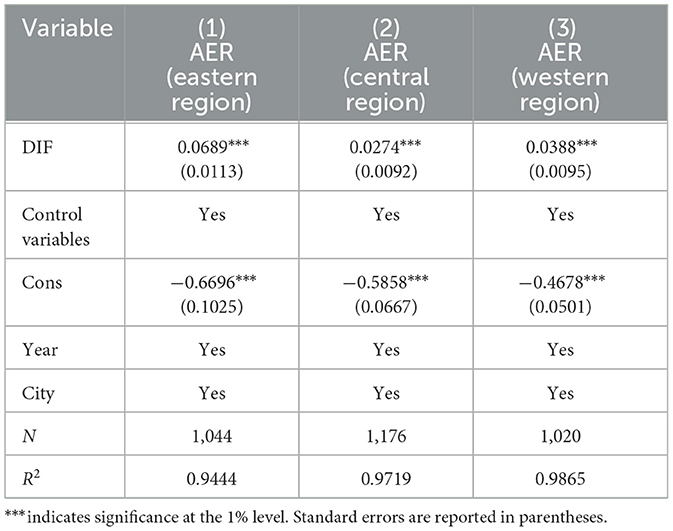

6.3.1 Regional heterogeneity

According to the classification standards of the National Bureau of Statistics, 270 prefecture-level cities were divided into three regions: eastern, central, and western, and then regression analysis was carried out. The estimated results of the regional heterogeneity test are shown in Table 14. The analysis results show that DIF has passed the 1% significance level test in the eastern, central and western regions, indicating that it can effectively enhance the AR in these three regions. At the same time, the influence coefficient of the eastern region (0.0689) was much higher than that of the central region (0.0274) and the western region (0.0388). The eastern region has a high level of economic development, more complete digital infrastructure construction, and network communication is not only convenient and efficient but also has a wide coverage, which provides a solid guarantee for the efficient promotion of digital inclusive financial services and can more accurately connect with the needs of all aspects of the agricultural economy. Its financial market is highly mature, with many financial institutions and strong innovation capabilities, and can develop rich and diverse, as well as adaptable, financial products and services to meet the diversified financial demands of the agricultural economy and enhance resilience. At the same time, the eastern region has rich educational resources, and agricultural practitioners have a relatively higher level of financial literacy and knowledge, and can have a deeper understanding and flexible use of digital inclusive financial tools. In addition, the degree of industrial integration in the eastern region is deep, and the coordinated development of agriculture and secondary and tertiary industries is close, and DIF can play a full role in the diversified industrial ecology and enhance the stability and ability of the agricultural economy to resist risks. As a result, its impact on AR is more prominent, much higher than that of the central and western regions.

6.3.2 Dimensional heterogeneity

Table 15 shows the impact of each subsystem of DIF on the AR. The results show that the coefficients of the impact of coverage breadth, depth of use and digitalization level on AR all pass the 1% significance level test, indicating that the subsystems of DIF can effectively enhance AR. The expansion of coverage has enabled more agricultural entities in remote areas to access digital financial services, break geographical restrictions, and allow financial resources to widely benefit all corners of the agricultural field. The increase in the depth of use means that agricultural practitioners can make full use of the functions of DIF, whether it is complex financial risk management tools or diversified payment and settlement methods, which can better help agricultural production and operation decisions and optimize resource allocation. Accurate big data analysis can provide financial product recommendations that better meet the needs of agricultural economic entities, reduce transaction costs and information asymmetry, enhance the ability of the agricultural economy to cope with uncertainty, and jointly act on the improvement of AR from multiple dimensions.

7 Conclusions and policy recommendations

7.1 Conclusion

The published literature has focused on analyzing the impact of digital technology on economic resilience (Wang et al., 2024, 2025; Yang et al., 2024a). However, we have narrowed our perspective to the agricultural industry and conducted a detailed analysis of how DIF affects AR. This study uses the panel data of 270 prefecture-level cities across the country from 2012 to 2023 as research samples, and uses a variety of measurement methods to carry out empirical analysis. First, the two-way fixed-effect model is constructed to empirically test the direct effect of DIF on AR. Second, based on the benchmark regression model, a mediating effect model is constructed to empirically explore the mediating transmission role of entrepreneurial activity in the process of enhancing the AR through DIF. Furthermore, in order to comprehensively clarify the various impact paths of DIF on AR, the threshold effect model and the spatial lag model are constructed, respectively, and their threshold characteristics and spatial spillover effects are analyzed. Finally, a heterogeneity analysis is carried out to clarify the impact of DIF on AR in different regions and sub-dimensions. The results are as follows: (1) DIF has a significant positive effect on AR. Our results are consistent with those of the published literature (Gao et al., 2024). (2) We still have some novel discoveries. The promotion effect of DIF on AR will show the threshold characteristics of first weakening and then increasing with its own development. (3) The impact of DIF on AR has a positive spatial spillover attribute. (4) DIF has a significant role in promoting AR in the eastern, central and western regions, but the impact coefficient of the eastern region is significantly higher than that in the central and western regions, and its sub-dimensions can have an enhanced effect on AR. (5) DIF can strengthen the AR by increasing entrepreneurial activity, and this mechanism is also effective in its sub-dimensions, but heterogeneity analysis shows that this mechanism only plays a role in the eastern region. The unique findings of this study are of great significance for achieving SDGs 1 and 2, especially the goal of sustainable food production.

7.2 Policy recommendations

To fully leverage the enabling role of information technology in the AR, based on research findings, we believe that the following policy measures are recommended.

(1) The government should narrow the regional DIF gap and improve its overall level by increasing investment in the digital infrastructure of the central and western regions, specifically in network base stations and financial service terminals. Administrative institutions should build and improve the regulatory framework for DIF, use tax incentives, financial subsidies and other policies to guide and support in the early stage of development, and strengthen standardized regulatory measures after development matures to ensure that its positive impact on AR continues to be effective.

(2) According to the characteristics of the threshold effect of DIF first falling and then rising, formulate phased policies for precise adaptation. Government departments and financial regulatory agencies should encourage financial innovation and moderately relax access in the early stage, and guide financial resources to tilt toward the agricultural sector; In the later stage, we will strengthen risk prevention and control and compliance review to ensure the smooth operation of DIF in the agricultural economic system and stabilize its role in promoting AR.

(3) Deeply explore the spatial spillover effect of DIF, and actively advocate inter-regional collaborative cooperation. Rural financial institutions and agricultural administrative departments should establish a cross-regional agricultural financial cooperation mechanism to promote the interaction and sharing of financial resources, technical experience, talent information, and other elements between regions. The eastern region transmits advanced digital financial management experience and technology application models to the central and western regions, and the central and western regions contribute rich agricultural resources and characteristic industrial projects, achieve complementary advantages, and drive the overall AR.

(4) Thoroughly analyze the reasons for the advantages of DIF in promoting AR in the eastern region, systematically summarize the successful experience and promote it in combination with the actual situation in the central and western regions. Deeply explore the unique agricultural resources and industrial potential of the central and western regions, integrate the characteristic advantages of DIF to innovate service models and financial products, develop and adapt financial service packages around characteristic agricultural products, improve the impact coefficient of DIF on AR in the central and western regions, and promote the balanced development of the regional agricultural economy.

(5) Formulate targeted policies to encourage the deep integration of entrepreneurship and DIF. In the eastern region, we will further optimize the entrepreneurial environment, improve the entrepreneurship support system, set up special funds for entrepreneurship, and provide subsidies for entrepreneurial venues, etc., so as to enhance the AR with the help of entrepreneurial activity. Deeply explore the linkage model between entrepreneurship and DIF suitable for the central and western regions, carry out entrepreneurship training and financial literacy popularization activities in combination with local conditions, cultivate more agricultural entrepreneurial entities, and promote the sustainable development of the agricultural economy.

8 Research limitations and future prospects

Although we have analyzed in detail how DIF affects AR, there is still room for improvement in this study. This study employed TEFE to analyze how DIF affects AR. However, the model was affected by omitted variables and reverse causality, which inevitably led to deviations in the estimation results. At present, the Chinese government is promoting pilot policies related to technology finance. Therefore, we advocate that future research can utilize the technology finance policies implemented in rural areas and conduct empirical tests through policy evaluation methods. The result of the data analysis is an ideal state. The result of linear regression can only yield the mean. However, the real world is complex. The impact of DIF on AR is influenced by a variety of factors, including natural endowment, farmers' quality and industrial foundation. Our research has found that there are obvious deficiencies in guiding real practice. We call for relevant case analyses. In particular, this research is highly dependent on China's practical experience. Therefore, researchers from other countries should be cautious about the theories we use and the policy recommendations we put forward.

Data availability statement

Publicly available datasets were analyzed in this study. The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

YWan: Investigation, Project administration, Software, Visualization, Writing – original draft. WL: Conceptualization, Data curation, Formal analysis, Resources, Visualization, Writing – review & editing. RW: Data curation, Formal analysis, Investigation, Methodology, Writing – original draft. MZ: Formal analysis, Investigation, Software, Validation, Writing – original draft. YWang: Data curation, Investigation, Resources, Validation, Writing – original draft.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This study was supported by the Private Education Quality Research Center Scientific Research Development Fund (grant number: X2024ZS001) and Hubei Engineering Research Center for BDS-Cloud High-Precision Deformation Monitoring (grant number: HBBDGJ202511Y).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bahta, Y. T., Mare, F., and Moshugi, E. (2025). Strengthening agricultural drought resilience of commercial livestock farmers in south Africa: an assessment of factors influencing decisions. Climate 13:154. doi: 10.3390/cli13080154

Bao, A., He, M., Zhou, Q., and Gao, H. (2025). The impact of industrial policies oriented toward the digital economy on the resilience of the agricultural industrial chain. Front. Sustain. Food Syst. 9:1634474. doi: 10.3389/fsufs.2025.1634474

Bhatnagar, S., Chaudhary, R., Sharma, S., Janjhua, Y., Thakur, P., Sharma, P., et al. (2024). Exploring the dynamics of climate-smart agricultural practices for sustainable resilience in a changing climate. Environ. Sustain. Indic. 24:100535. doi: 10.1016/j.indic.2024.100535

Chen, Z., Zhang, J., and Liu, X. (2025). Encouraging entrepreneurship through digital inclusive finance. Finance Res. Lett. 74:106715. doi: 10.1016/j.frl.2024.106715

Cheng, X., Ge, F., Xu, M., and Li, Y. (2024). The heat island effect, digital technology, and urban economic resilience: evidence from China. Technol. Forecast. Soc. Change 209:123802. doi: 10.1016/j.techfore.2024.123802

Choudhary, M. A., and Jain, A. (2022). Finance and inequality: the distributional impacts of bank credit rationing. J. Financ. Intermed. 52:100997. doi: 10.1016/j.jfi.2022.100997

Dai, H., Wei, J., and Chen, Y. (2023). Research on the impact of digital inclusive finance on our country's agricultural economic resilience. Price Theory Pract. 470, 144–148. doi: 10.19851/j.cnki.CN11-1010/F.2023.08.233

Ding, Z., Yue, X., and Liu, J. (2025). Examining the role of digital economy on supply chain resilience: an empirical analysis of China's food sector. Front. Sustain. Food Syst. 9:1589133. doi: 10.3389/fsufs.2025.1589133

Feng, Y., Mei, D., and Zhao, H. (2023). Auction-based deep learning-driven smart agricultural supply chain mechanism. Appl. Soft Comput. 149:111009. doi: 10.1016/j.asoc.2023.111009

Gao, Q., Cheng, C., Sun, G., and Li, J. (2022). The impact of digital inclusive finance on agricultural green total factor productivity: evidence from China. Front. Ecol. E10:905644. doi: 10.3389/fevo.2022.905644

Gao, Q., Sun, M., and Chen, L. (2024). The impact of digital inclusive finance on agricultural economic resilience. Financ. Res. Lett. 66:105679. doi: 10.1016/j.frl.2024.105679

Gao, X., and Gao, R. (2024). A study of the impact of digital financial inclusion on the resilience of the agricultural chain. Front. Sustain. Food Syst. 8:1448550. doi: 10.3389/fsufs.2024.1448550

Ge, H., Li, B., Tang, D., Xu, H., and Boamah, V. (2022). Research on digital inclusive finance promoting the integration of rural three-industry. Int. J. Environ. Res. Public Health 19:3363. doi: 10.3390/ijerph19063363

Guo, D., Li, L., and Pang, G. (2024a). How does digital inclusive finance affect county's common prosperity: theoretical and empirical evidence from China. Econ. Anal. Policy 82, 340–358. doi: 10.1016/j.eap.2024.03.016

Guo, F., Wang, J. Y., Wang, F., Kong, T., and Cheng, Z. Y. (2020). Measurement China's digital financial inclusion: index compilation and spatial characteristics. China Econ. Q. 19, 1401–1418. doi: 10.13821/j.cnki.ceq.2020.03.12

Guo, H., Gu, F., Peng, Y., Deng, X., and Guo, L. (2022). Does digital inclusive finance effectively promote agricultural green development?—A case study of China. Int. J. Environ. Res. Public Health 19:6982. doi: 10.3390/ijerph19126982

Guo, J., Chen, L., and Kang, X. (2024b). Digital inclusive finance and agricultural green development in China: A panel analysis (2013–2022). Financ. Res. Lett. 69:106173. doi: 10.1016/j.frl.2024.106173

Guo, M., Wang, J., Liu, H., and Zhai, H. (2025). Analyzing the role of digital technology to enhance firms' green innovation resilience: A moderated mediation model. Int. J. Prod. Econ. 288:109720. doi: 10.1016/j.ijpe.2025.109720

Guo, X., Yang, J., Shen, Y., and Zhang, X. (2023). Prediction of agricultural carbon emissions in China based on a GA-ELM model. Front. Energy Res. 11:1245820. doi: 10.3389/fenrg.2023.1245820

Hartman, S., Whiteside, R., Smaliychuk, A., and Dronova, I. (2025). Land abandonment as an indicator of Ukrainian agricultural resilience during Russia's war against Ukraine. Appl. Geogr. 183:103744. doi: 10.1016/j.apgeog.2025.103744

Hoffmann, V. E., Viana, L. F. C., Dalcero, K., and Almeida, M. S. C. D. (2024). The opening and closing of firms before a shock: lessons on entrepreneurship and regional resilience in Santa Catarina, Brazil. Regional Sci. Policy Prac. 16, 100057. doi: 10.1016/j.rspp.2024.100057

Hong, M., Tian, M., and Wang, J. (2022). Digital inclusive finance, agricultural industrial structure optimization and agricultural green total factor productivity. Sustainability 14:11450. doi: 10.3390/su141811450

Hong, X., Chen, Q., and Wang, N. T (2024). The impact of digital inclusive finance on the agricultural factor mismatch of agriculture-related enterprises. Financ. Res. Lett. 59:104774. doi: 10.1016/j.frl.2023.104774

Hu, J., Li, Y., Xiong, W., and Yuan, J. (2025). Can digital inclusive finance suppress energy ecological footprint? moderated mediation effect test based on technological innovation. Int. Rev. Econ. Financ. 103:104491. doi: 10.1016/j.iref.2025.104491

Huang, G., Yang, Q., Zhang, H., Wang, L., and Li, X. (2025). Research on the driving effect of digital inclusive finance on the integration of agriculture, culture and tourism. Int. Rev. Financ. Anal. 106:104531. doi: 10.1016/j.irfa.2025.104531

Huang, H., and Wang, Z. (2024). The impact of digital inclusive finance on agricultural ecological efficiency: theoretical framework, mechanism analysis and spatial spillover effect. Modern Financ. Econ. 44, 3–17. doi: 10.19559/j.cnki.12-1387.2024.01.001

Huang, S., and Nik, A. N. H. (2023). Enhancing food security through digital inclusive finance: evidence from agricultural enterprises in China. Int. J. Environ. Res. Public Health 20:2956. doi: 10.3390/ijerph20042956

Jiang, J., Guo, M., and Kan, Y. (2024). The impact of digital inclusive finance on residents' health level. Southeast Acad. Res. 302, 98–108. doi: 10.13658/j.cnki.sar.2024.04.008

Johnen, C., Mader, A., Nsengumuremyi, A., and Mußhoff, O. (2025). Financial inclusion along the rural-urban continuum: empirical evidence from a decomposition analysis in Kenya between 2012 and 2021. World Dev. 194:107073. doi: 10.1016/j.worlddev.2025.107073

Li, H., Jin, X., Liu, J., Feng, D., Xu, W., and Zhou, Y. (2022). Analytical framework for integrating resources, morphology, and function of rural system resilience—An empirical study of 386 villages. J. Clean. Prod. 365:132738. doi: 10.1016/j.jclepro.2022.132738

Li, H., Shi, Y., Zhang, J., Zhang, Z., Zhang, Z., Gong, M., et al. (2023). Digital inclusive finance and the high-quality agricultural development: Prevalence of regional heterogeneity in rural China. PLoS ONE 18:e0281023. doi: 10.1371/journal.pone.0281023

Li, L., Wei, K., Han, J., and Zhu, Y. (2025). Digital empowerment and the development resilience in rural households: causal inference based on double machine learning. Empir. Econ. 69, 1187–1227. doi: 10.1007/s00181-025-02767-4

Li, Y., and Han, Y. (2025). The unexpected effect of digital inclusive finance on: enterprise resilience. Financ. Res. Lett. 78:107148. doi: 10.1016/j.frl.2025.107148

Liao, K., Li, C., and Jiang, L. (2025). How geographical indication products impact agricultural economic resilience: evidence from China. Chin. Econ. Rev. 94:102527. doi: 10.1016/j.chieco.2025.102527

Lin, Q., Dai, X., Cheng, Q., and Lin, W. (2022). Can digital inclusive finance promote food security? Evidence from China. Sustainability 14:13160. doi: 10.3390/su142013160

Liu, J., and Ren, Y. (2023). Can digital inclusive finance ensure food security while achieving low-carbon transformation in agricultural development? Evidence from China. J. Clean. Prod. 418:138016. doi: 10.1016/j.jclepro.2023.138016

Liu, L., Wang, G., and Song, K. (2022). Exploring the role of digital inclusive finance in agricultural carbon emissions reduction in China: insights from a two-way fixed-effects model. Front. Environ. Econ. 1:1012346. doi: 10.3389/frevc.2022.1012346

Liu, Y., and Lian, X. (2025). The spatial spillover effect of digital economy on regional tax Revenue: an empirical study based on the decay boundary and spillover path. Int. Rev. Econ. Financ. 102:104352. doi: 10.1016/j.iref.2025.104352

Luo, K., Liu, S., Zhang, Y., Zeng, M., and Zhao, D. (2025a). Digital pathways to resilience: assessing the impact of digitalization on agricultural production resilience in China. Chin. Econ. Rev. 90:102375. doi: 10.1016/j.chieco.2025.102375

Luo, W., Zuo, S., Song, Y., and Tang, S. (2025b). The impact of data elements on agricultural economic resilience: a dynamic QCA analysis. Front. Sustain. Food Syst. 8:1510328. doi: 10.3389/fsufs.2024.1510328

Martin, R., and Sunley, P. (2015). On the notion of regional economic resilience: conceptualization and explanation. J. Econ. Geogr. 15, 1–42. doi: 10.1093/jeg/lbu015

Park, A., Loren Brandt, L., and Giles, J. (2003). Competition under credit rationing: theory and evidence from rural China. J. Dev. Econ. 71, 463–495. doi: 10.1016/S0304-3878(03)00037-3

Peng, P., Peng, B., and Wang, H. (2025). Research on the impact of high-quality development of inclusive finance on rural industrial integration: evidence from 1576 counties in China from 2014 to 2021. Stud. Int. Financ. 454, 16–26. doi: 10.16475/j.cnki.1006-1029.2025.02.002

Qiao, G., Chen, F., Xu, C., Li, Y., and Zhang, D. (2023). Study with agricultural system resilience and Agro-ecological efficiency synergistic evolutionary in China. Food Energy Secur. 13:e514. doi: 10.1002/fes3.514

Qiao, J., and Li, X. (2025). The differential effects of bidirectional urban–rural mobility on agricultural economic resilience: evidence from China. Sustainability 17:7692. doi: 10.3390/su17177692

Quan, T., Zhang, H., Quan, T., and Yu, Y. (2024). Unveiling the impact and mechanism of digital technology on agricultural economic resilience. Chin. J. Popul. Resour. Environ. 22, 136–145. doi: 10.1016/j.cjpre.2024.06.004

Reggiani, A., Graaff, T. D., and Nijkamp, P. (2002). Resilience: an evolutionary approach to spatial economic systems. Netw. Spat. Econ. 2, 211–229. doi: 10.1023/A:1015377515690

Shao, K., Ma, R., and Kamber, J. (2023). An in-depth analysis of the entrepreneurship of rural Chinese mothers and the digital inclusive finance. Telecommun. Policy 47:102593. doi: 10.1016/j.telpol.2023.102593

Shen, Y. (2024). Future jobs: analyzing the impact of artificial intelligence on employment and its mechanisms. Econ. Change Restructuring 57:34. doi: 10.1007/s10644-024-09629-6

Shen, Y., Guo, X., and Zhang, X. (2023). Digital financial inclusion, land transfer, and agricultural green total factor productivity. Sustainability 15:6436. doi: 10.3390/su15086436

Shen, Y., and Hu, G. (2024). How does digital inclusive finance improve rural economic resilience? Evidence from China. Digit. Econ. Sustain. Dev. 2:12. doi: 10.1007/s44265-024-00035-4

Shen, Y., and Zhang, X. (2024a). Finance-driven sustainable development: the impact of green finance on agricultural non-point source pollution and its pathways. Front. Sustain. Food Syst. 8:1430670. doi: 10.3389/fsufs.2024.1430670

Shen, Y., and Zhang, X. (2024b). Cleaner production: analysis of the role and path of green finance in controlling agricultural nonpoint source pollution. Economics 18:20220118. doi: 10.1515/econ-2022-0118

Shen, Y., and Zhang, X. (2024c). The impact of artificial intelligence on employment: the role of virtual agglomeration. Humanit. Soc. Sci. Commun. 11:122. doi: 10.1057/s41599-024-02647-9

Shi, L., Zhao, J., Du, X., Tan, Y., Lei, T., Xu, M., et al. (2025). Achieving sustainable green agriculture: analyze the enabling role of data elements in agricultural carbon reduction. Front. Earth Sci. 13:1618999. doi: 10.3389/feart.2025.1618999

Su, F., Tao, S., and Ying, R. (2025). Agricultural transformation in the digital age: digital inclusive finance and the development of new agricultural business entities. Financ. Res. Lett. 72:106614. doi: 10.1016/j.frl.2024.106614