- University of Warsaw, Faculty of Management, Warsaw, Poland

The aim this study is to analyze the impact of environmental, social, and governance (ESG) measures on energy sector credit ratings. The main hypothesis is as follows: The ESG measures have had a significant impact on energy sector credit ratings during the COVID-19 crisis. The analysis has been conducted by using long-term issuer credit ratings presented by the main credit rating agencies. To verify the hypothesis, quarterly data from financial statements, macroeconomic data, and ESG measures for all companies listed on the stock exchanges from all over the world for the 2000–2021 period were collected. The sector was divided into sub-samples according to the type of sector and the moment of the COVID-19 crisis. It was noticed that a stronger reaction of credit ratings during the COVID-19 crisis on ESG factors, than that before it, was also observed, and confirms the increasing role of ESG measures in the financial market. On the other hand, credit rating agencies take into consideration ESG factors during the first estimation. Later, the mentioned variables lose their importance. This is based on a few reasons. It is still a small sample of entities that publish non-financial statements connected with ESG. Some countries have yet to implement regulations associated with climate risk. The significance of electricity power consumption and CO2 emissions confirms the significance of the mentioned direct or indirect impact of ESG factors. Credit rating agencies are not willing to change credit ratings because usually companies from the energy sector, especially from coal and oil and gas subsectors, are large entities. They sometimes receive financial support from governments. Governments are also stakeholders that create a lower risk of default. In less developed countries, coal is one of the main energy sources, and costs connected with alternative, renewable energy are more expensive. The prepared research also suggests that particular ESG measures have varying significance on credit ratings. Therefore, it can help to analyze and build models by investors. It will not be without significance for estimating the default risk and the cost of the capital. In most cases, the most significant measure is the E factor.

1 Introduction

In recent years, one of the basic problems that the world has experienced is the condition of the environment. The mentioned situation has started to become one of the most dangerous during the last 2 years due to climate change. Frequently, information about new tornados, hurricanes, sweltering heat at nearly 50°C, food shortage, or huge fires over a very large area is reported. In the last years, we have noticed new diseases, which are difficult to combat. The most significant were SARS, MERS, and now COVID-19 with all its variants. The mentioned situation creates a need to measure and verify factors associated with environmental risk. These measures belong to ESG (environmental, social, and governance) factors. The mentioned risk is noticed by regulators and national governments. As a result, regulations are introduced connected with reducing CO2 emissions, water saving, pollution reduction, renewable energy introduction, etc. In April 2021, a draft of the directive on non-financial reporting by the European Commission was published. This will replace the current non-financial reporting directive. The CSRD (Corporate Sustainable Reporting Directive) imposes more reporting obligations and expands the list of entities obligated to report. All large companies—not only those listed on the stock exchanges—will have to report their ESG statements. The CSRD will need to be implemented into national regulations by the Member States by the end of 2023. First reporting will start in 2024 and will take data for 2023.

The OECD Strategy, known as ESG Investing, Environmental Pillar Scoring, and Reporting was published in 2020 to focus attention on the strategic reorientation investment on renewable energy. The main idea is to reduce the carbon footprint and reduce carbon transition. As a result, its use is recommended to climate-risk managers by financial institutions during investment decision making. The mentioned strategy also describes the significance of adapting climate-related risk management, as well as operational processes, to improve water use, waste management, and impact on biodiversity. E scores reflect outputs such as carbon emissions and score metrics that capture the negative effects of business activities on the environment and to understand the impact of climate change on businesses. Many central banks in OECD countries are now in the process of integrating ESG assessment into their investment approaches as one of the tools to better align portfolios with a transition to low-carbon, climate-resilient economies. It is the effect of initiatives such as the Network for Greening the Financial System (NGFS) proposal. It was also noticed that the risk of higher volatility is lower in the case of higher ESG indices. ESG investing is growing rapidly, it was worth 18 trillion USD globally in 2019 (GSIA, 2019). The growth of ESG-related traded investment products exceeded 1 trillion USD.

The COVID-19 pandemic and all problems connected with environmental pollution, especially coal pollution and using green energy instead, bring a new risk connected with the regulation changes. Many institutions have changed their model of financing creditors and placed more attention on the regulation changes connected with climate risk. The mentioned situation is important for the energy sector, especially energy based on coal and petroleum subsectors. It also generates new changes for renewable energy. The presented risk is estimated by credit rating agencies during the risk assessment process. In the analysis of the S&P Global Rating (2021) methodology, the energy sector was sensitive to a few problems during the last years. The oil and gas subsector has risks associated with lockdowns, mild winter, OPEC+ compliance breaks, and rapid energy transition problems. Coal energy risk relates to the ESG regulations. The presented factors that can influence the default risk of companies from the mentioned sector suggested changes in the main methodology used by credit rating agencies to assess the default risk. It confirms the increasing role of the ESG measures during the preparation and modification of credit ratings. It is especially significant because credit ratings determine the cost of capital, especially CDS spreads, interest on bonds, or decisions about investing capital taken by banks, investment funds, insurers, or others. The analysis of the methodologies presented by main credit rating agencies, i.e., S&P, Moody’s, and Fitch, suggested that the ESG measures were not taken to analyze default risk before. In some cases, the CSR polices were used to correct the final credit rating, but the mentioned variable was not the main variable, but the additional feature. The presented analysis gives new insight into the factors that can influence the final credit ratings given by credit ratings agencies.

The presented relationship created the need to analyze the impact of ESG measures on energy sector credit ratings. They are a few reasons why the presented paper has been prepared. At first, in most studies, ESG ratings were analyzed in terms of different sources of information that influence credit ratings. In this paper, the significance of the list of financial, macroeconomic and ESG variables has been tested to determine their influence on long-term issuer credit ratings. In previous analyses, ESG measures have not been taken into consideration. The second reason is that the energy sector is one of the most sensitive in terms of the ESG measures and regulations connected with them. It relates to the obligation to analyze the E factor by financial intermediaries during the analysis of the probability of default and taking investment decisions. Also, the changes in regulations and CO2 emissions have a direct impact on the financial condition of the mentioned sector. Companies that belong to the coal subsector or oil and gas are usually large companies that are listed on the stock exchange. The significance of the ESG impact on lending policies and credit scoring has been verified by Attig et al. (2013) and Birindelli et al. (2015), but the literature suggests that ESG objectives are not clearly defined and used in credit lending policies (Zeidan et al., 2015). On the other hand, Friede et al. (2015) suggest that ESG criteria are not taken into consideration during investment decisions, even if they are important. The mentioned differences can be connected with the type of sector that caused it to be analyzed. And finally, in previous studies about factors that can determine credit ratings, more attention has been put on the whole sample without division in sectors and subsectors. As was suggested before, the energy subsector is not homogenic. In particular, subsectors, i.e., coal, oil and gas, uranium, and renewable energy, have different types of risk, especially when connected with ESG measures. The increasing differences are noticed in recent years, especially during the COVID-19 crisis. Therefore, studies prepared on data before the mentioned period can give different results than those that are in practice. As a result, the following hypothesis has been put forward: ESG measures have had a significant impact on energy sector credit ratings during the COVID-19 crisis. Thus, this paper will empirically examine the impact of ESG factors and the financial condition of companies belonging to the energy sector on a sample of all public and private entities from all over the world—data are available for the years 2000–2021.

The remainder of the paper proceeds as follows. Section 2 presents a literature review of previous studies that investigate the relationship between ESG criteria and the default risk and the practical analysis of the significance of the mentioned factors on investment decisions. Section 3 reports the methodology by describing the features of the data sample and model specification on which this study is based. Section 4 provides a discussion of findings, and then Section 5 concludes by stating the limitations of the current study and consequently suggesting future development.

2 Literature Review

2.1 Impact of Environmental, Social, and Governance Measures on Companies’ Financial Conditions

The analysis of previous studies on the relationship between ESG measures and their impact on companies’ financial condition shows varied results. On the one hand, they present opinions about the lack of influence of the ESG measures on companies’ value and additional profits from introducing ESG policies (Orlitzky et al., 2003; Friede et al., 2015). Some researchers believe that social and environmental factors are not taken into account by financial institutions to verify the potential value of the company, even if they have potentially positive impacts (Cellier and Chollet, 2016; Fatemi et al., 2017; Gutsche et al., 2017; Lins and Servaes, 2017). Others suggest that the mentioned factors are insignificant during investment decision making by investors (Revelli and Viviani, 2015; Revelli, 2017). The described opinions are different in recent research. This can be connected with changes to regulations and more attention being placed on the verification of climate risk. The significance of ESG measures in the credit policy has been described by Zeidan et al. (2015) and Miralles-Quirós and Miralles-Quirós (2017). The law changes associated with climate risk have a direct impact on the macroeconomic condition of companies, in practice, especially from the energy sector. Next, large pollution and high-carbon activity increases the credit margin and credit risk and has a direct impact on loan loss provisions and non-performing loans during the assessment stage by banks.

The significance of the particular ESG factors is also varied in analyses. The S factor is a factor that has been analyzed more often than others. One of the first studies about the impact of CSR on credit rating estimation was prepared by Grunert et al. (2005). Weber et al. (2014) and Weber et al. (2010) verified the impact of social announcements on the abnormal rates of return on stock prices.

There is still a lack of research about the relationship between ESG measures and the probability of default. ESG factors have a direct impact on the cost of capital. The increase in the ESG score decreases yield spreads according to Ge and Lui (2015). As a result, a better, more responsible CSR policy can reduce the cost of debt according to Cooper and Uzur (2015). Because credit ratings are taken during the analysis of the credit risk by banks and assessed as a value of credit margin, we can establish that ESG measures—as a part of the estimation credit rating—have an indirect impact on the cost of debt. As a result, they influence the probability of default, loan loss provisions, and the possibility to receive credit. Hoepner et al. (2016) found S and E factors to have a statistically significant impact on receiving loans. According to the methodology presented by main agencies, indirect or direct impacts of ESG measures can exist. Moreover, the impact of regulations regarding ESG obligations can be noticed, especially climate risk, on the macroeconomic level of the estimation of credit ratings, considering each type of subsector.

Menz (2010) has an opposing opinion. He found that ESG-CSR factors increase corporate spreads and decrease their credit ratings. This can be an effect of introducing ESG-CSR policies by entities with higher risk premiums to reduce the cost of the capital and improve credit ratings. The presented opinion has been suggested to be unreliable, because of the use of a big data sample (498 European corporate bond spreads) for a 3-year period. Goss and Roberts (2011) have a similar opinion. They suggest that companies with CSR policies pay more for borrowing cash than those that do not have them.

In some research, stronger attention has been placed on the E factor. Stellner et al. (2015) found that the environment saving policy has a more significant impact than social and governance factors. This measure reduces the default risk and increases credit ratings. Social policies have an impact on credit ratings and zero-volatility spreads. The mentioned opinion about the significance of the E factor is also held by Ga-Young et al. (2020). The higher value of the E scores decreases the cost of debt in a small company subsample. They also found that credit ratings cannot explain the impact of ESG measures to analyze bonds by investors that are assessing risk by themselves. ESG factors are not fully reflected in credit ratings. Large investors create pressure to develop ESG criteria.

The negative impact of ESG factors on credit ratings can be an effect of conflict between large investors specialized in climate risk investments who would have to bear the associated costs as shareholders, and managers who receive profits from overinvestments (Goss and Roberts, 2011). It is an effect of the information asymmetry between these two groups. Perez-Batres et al. (2012) found that the high level of ESG increases fixed companies’ costs. ESG factors are also used to devaluate inappropriate company behavior and accounting inaccuracies (Kim et al., 2014). It is assumed that overinvesting in ESG binds meager (financial) resources, and therefore, too poor of an ESG performance should be associated with lower credit risk, and vice versa (Goss and Roberts, 2011).

Boffo et al. (2020) presented some findings connected with the ESG providers. At first, the low correlation between E scores and the ESG scores is observed. Investing in high-scoring ESG portfolios does not necessarily mean that such tilting includes companies that have received high ratings for managing their carbon emissions or risk management. E scores other than environmental metrics have greater weights in the methodologies—it can help investors to understand the long-term transition. As a result, investing in a high E score may, in some cases, inadvertently result in a greater carbon footprint in portfolios. Next, an opinion that portfolio exposures to the energy sector and other industries with high emissions did not decrease, and in some cases materially increased is presented. Quantitative analysis indicates that the number of emissions in these high-ESG portfolios is higher on a gross and average basis for some of the very large ESG funds. This draws attention to the sustainability of such funds for investors that wish to achieve risk-adjusted returns and reduce the carbon footprint of their portfolios. Other types of investment products, such as those tailored to climate transitions, may provide more targeted tools for investors to rebalance portfolios away from companies with carbon extensive outputs or supply chains. Highly tailored low-carbon or carbon-transition portfolios may have asset composition and risk characteristics that stray widely from standard market benchmarks that are most used by institutional investors.

Using different metrics by the different rating agencies may also reflect their preferences for certain approaches by ESG corporate reporting framework providers. As these providers have different ranges of financial materiality, alignment with stakeholder values, climate risk assessment, and mitigation, the weight of the low-carbon impact is varied.

The analysis of the structure of the STOXX600 index and the STOXX600 ESG-X index shows that the ESG index does little to improve the environmental impact relative to the benchmark index. A similar situation is observed for the S&P500 and its ESG counterpart. Moreover, the weight of the energy industry has increased. Rebalancing portfolios away from such companies may inadvertently shift investments toward high E-rated forms that happen to be above-average polluters. The largest companies for STOXX600 indices are Total, BP, and Royal Dutch Shell (with a Refinitiv environmental pillar score at or above 90/100), and for S&P500 indices are Exxon Mobil Co., Chevron Co., CoconoPhilips. Funds, such as the PIMCO Climate Bond fund, the Blackrock iShares Global Green Bond ETF, and the Invesco WilderHill Clean Energy ETF make investment decisions by using ESG measures. They are focused on investing in green bonds, that are certified to be green by third parties or by the institutional investor and are based on the low-carbon issuers, i.e., PIMCO invests in bonds issued to receive financial sources on green projects, while Invesco invests in projects based on clean renewable energy.

Green banks are public and nonprofit financing entities that have been established by national and local governments to leverage public dollars for the purpose of driving private capital into clean power technology and accelerating the entrance of such technologies into the market. Examples of these institutions are California CLEEN Centre, Connecticut Green Bank, Green Energy Market Securitization, GEMS, New Jersey Energy Resilience Bank, New York Green Bank, and Rhode Island Infrastructure Bank. Maryland’s Montgomery Country has established its Montgomery Country Green Bank. The mentioned institutions invest in low-carbon technologies. Many green banks have been established with the further motivations of carbon emission reduction, lowering the cost of capital and energy costs, creating jobs, promoting energy security, and furthering local development of green technology markets. Green banks can use limited public cash to attract private funding into the sector.

Credit ratings are one of the measures used to analyze the default risk by banks and investment institutions. As a result, a decision to assess the impact of ESG factors on credit rating changes has been initiated. The direct or indirect impact of the notes’ changes on the cost of the capital has been observed. Downgrades or upgrades of credit ratings are changed if financial or nonfinancial information is published, so this paper tests if ESG measures lead to favorable credit ratings. If the ESG factor positively impacts a higher credit rating, this means that companies can receive benefits at a lower cost of debt. The energy sector will be included in the analysis as one of the most sensitive to changes to the ESG policies. The mentioned sector is highly sensitive to CO2 emissions’ regulations. The important impact on its financial conditions also has restrictions connected with coal extractions and distribution. In addition, some regulations connected with refinancing renewable energy and atomic energy are also not without significance.

In this study, it is assumed that all ESG criteria have a significant impact on the credit rating changes of the energy sector. In some research, the significance of E factors is highlighted. English (1999) suggested that E factors such as pollution and water saving have a long-term perspective and uncial characters, and that S and G indicators are mostly limited internally (Han et al., 2016; Ga-Young et al., 2020). As a result, the significant impact on the financial statement measures and E factors means that S measures are unimportant.

2.2 Impact of Financial Condition Measures on Corporate Credit Ratings

The analysis of the methodologies presented by credit ratings agencies, according to which the mentioned institutions verify and test the default risk and prepare credit ratings, suggests that the most significant variables are financial and macroeconomic factors. The impact of the mentioned factors is varied in particular sectors and changes especially during crises. A different list of factors is noticed in the case of banks, insurers’ countries, and non-financial entities. In the case of the last group of variables it is noticed, in the stable group of factors, that significance is varied in particular sectors. Each of the analyzed credit rating agencies publish their own methodology and the information about the financial situation for each sector. Taking into account the whole sample without distinguishing the subsamples is a mistake, because each sector has its own specific type of risk. As a result, analysis should be prepared for each sector, and sometimes subsectors separately. This is the main reason why this analysis is prepared for the energy sector with subsectors.

This subsection contains the analysis of the significance of the previous studies about the impact of financial indicators on corporate credit ratings. The main idea is to categorize and introduce them to estimate the final model.

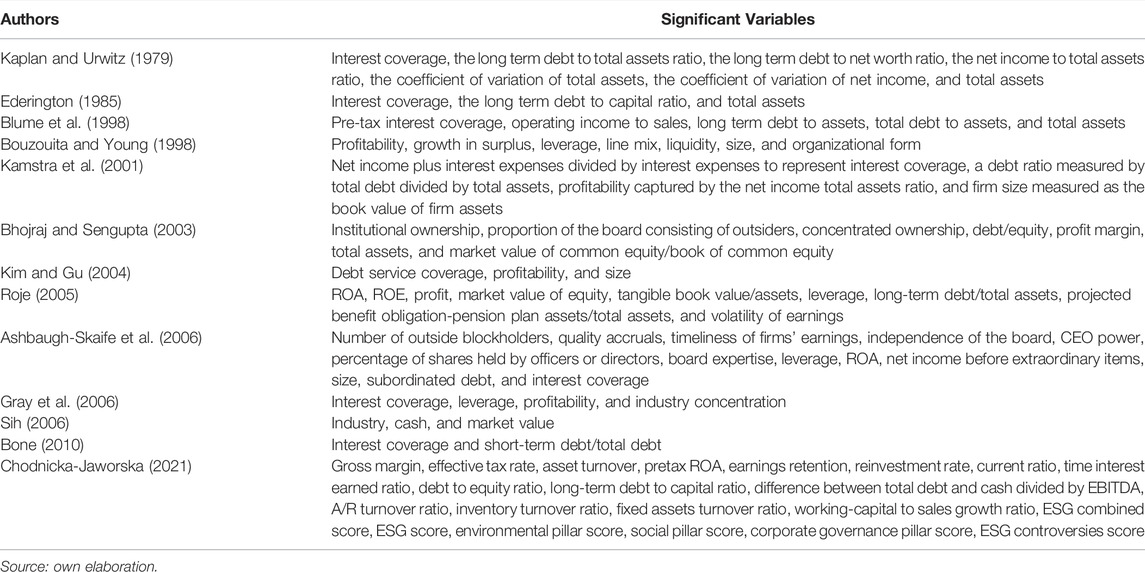

The background of the literature about the analysis of corporate default risk is the model prepared by Altman (1968). The mentioned bankruptcy model was the basis of the next group of models prepared by Kaplan and Urwitz (1979) and Ederington (1985). Each of the presented models has its own group of variables. For example, Kaplan and Urwitz (1979) assessed the size of the company measured by the total assets; they also tested the impact of the leverage, earnings, and profitability ratios. Ederington (1985) underlined the significance of the size of the company but also put attention on the quality of debt ratios. Kamstra et al. (2001) broadened the mentioned list of variables on the net income to total assets ratio, which is a measure of the profitability indicators. The mentioned list of factors has been used in later research. From all of the mentioned studies, the following conclusions are apparent: profitability and earnings factors have a positive impact, leverage ratios have a negative influence, higher credit ratings are given for bigger entities, and the interest coverage on corporate notes is insignificant. Blume et al. (1998) developed a list of variables on the operating income to sales ratio. They also put attention on the ambiguous relationship between leverage ratios and credit ratings, that can be an effect of using correlated debt indicators. The same problem was reviewed by Amato and Furfine (2004).

The most significant studies with their list of variables are presented in Table 1.

In practice, apart from financial and macroeconomic variables, there are other additional factors that influence the credit ratings given by agencies. One of them is the period of cooperation with a particular credit rating agency. If the mentioned period is longer, entities receive higher notes (Mahlmann, 2011). The mentioned problem was noticed by the European Commission, which then brought in changes in regulations connected with credit ratings.

The knowledge of factors influencing corporate credit ratings is very important because of a few reasons. Credit ratings are the basic measure of estimating default risk (Kang and Liu, 2007). The higher the ratings are, the lower the probability of default, and vice versa (Choy et al., 2006). They are also used to establish the cost of capital. The cost of debt influences the possibility to find investors or even staying on the market (Gray et al., 2006). The external methods of estimation of credit risk are based on credit ratings. The mentioned methods are used by banks and insurers. As a result, they are significant if companies want to receive credit. The standardized methods used by banks, especially in developing countries, is useful to assess the capital adequacy indicators required by regulators. The mentioned method is based on credit ratings. Regulators and investors treat credit ratings as a benchmark during assessment of capital requirements for solvency purposes. Credit ratings also reduce the asymmetry of information between issuers, stakeholders, and supervisors. They are useful during investment decisions, effectively reallocate capital (Papaikonomou, 2010), and classify financial instruments according to their quality and possibility to sell (Pinches and Singleton, 1978). Most professional investors, like money market funds, can only invest in instruments that have got an investment grade. Credit ratings also perform the function of corporate governance (Kang and Liu, 2007).

The presented study is different from others because of various reasons. A homogenic sample was taken, where the energy sector was divided into subsectors. As a result, the findings were more appropriate and better represented the research problem. The only study about the impact of ESG measures on corporate credit rating changes in sectors, that was prepared by Chodnicka-Jaworska (2021), underlined the need to verify the mentioned phenomenon for the energy sector as a specific sector. Most studies were also prepared for local economies. This research helps to analyze the whole market. In this study, credit ratings presented by the biggest credit rating agencies were assessed. Previous studies were based on internal credit ratings presented by banks. In most cases, the mentioned notes were higher than those proposed by credit rating agencies, so they were overestimated. External notes that are given by credit rating agencies are a part of the estimation made by banks to verify the credit and default risk and assess the loan loss provisions and the expected loss. They are also used to make decisions on whether money should be borrowed. They are an important part of investing money in the capital market. In previous studies, the impact of financial determinants or ESG-CSR measures, never both, was analyzed. And finally changes of regulations, the financial situation of the mentioned sector, and new types of risk causes were used by credit rating agencies to develop their methodologies (Camargo, 2009) to not lose their creditability in public opinion.

3 Materials and Methods

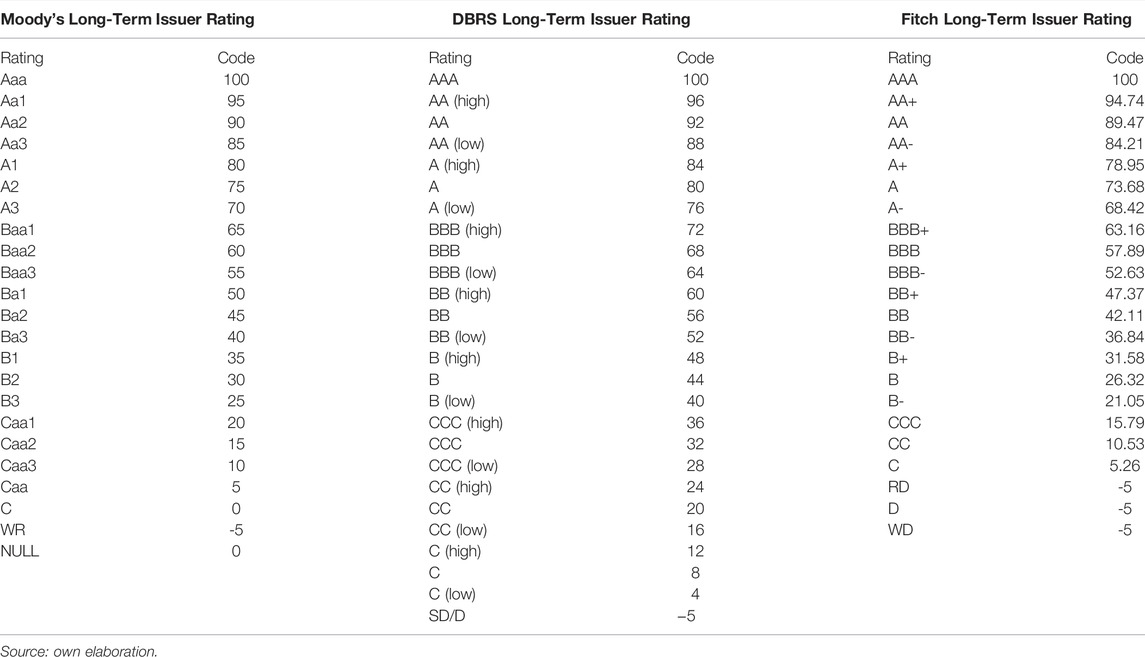

The aim of the paper is to analyze the impact of ESG measures on energy sector credit ratings. The main hypothesis is as follows: ESG measures have a significant impact on energy sector credit ratings during the COVID-19 crisis. To analyze the determinants of the energy sector’s credit ratings, all long-term issuer credit ratings given to companies listed on the stock exchange from all over the world were used. Until the end of July 2021, only a few different credit ratings were proposed by credit rating agencies for the mentioned companies. The mentioned credit ratings were collected from the Refinitiv database. From 2021, S&P’s credit ratings could not be collected from the Refinitiv database. For a better understanding of the problem, energy sector companies’ credit ratings from the period between 1990 and 2021 were collected. A separate analysis for a particular credit rating agency and a period of crisis was prepared. In the analysis, more than 2,800 companies from all countries were analyzed. To analyze the impact of determinants on companies’ credit ratings, the linear decomposition proposed by Ferri et al. (1999) was used. The same methodology was used in other research presented in the literature review. There is also an inherent limitation of using the non-linear method for the decomposition of credit ratings connected with the lack of data about the CDS spreads. Also using 10-years bond to verify the mentioned phenomenon reduces the strength of the sample. The linear method of decomposition is presented in Table 2.

TABLE 2. Decomposition of Moody’s, Dominion Bond Rating Service, and Fitch long-term issuer credit ratings.

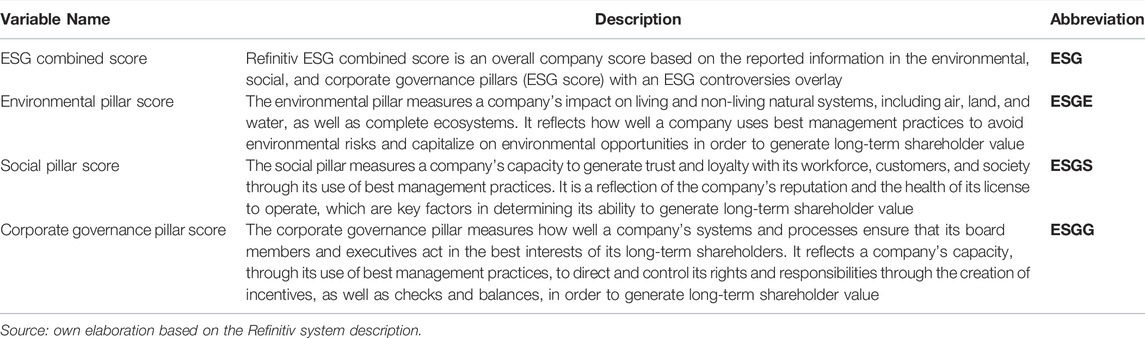

Refinitiv (Thomson Reuters) presents the following ESG measures: the ESG combined score, the environmental pillar score, the social pillar score, and the corporate governance pillar score. The mentioned variables are described in Table 3. Previous literature suggests a varied impact of ESG factors on companies’ financial condition. In the mentioned sector, the significance of these variables can also be different in particular subsectors. Not without significance is the size of the companies, because bigger entities sometimes receive higher ESG indexes and higher credit ratings. This is an effect of buying CO2 certificates. A strong correlation is evident between ESG measures. Separate models have been prepared for each factor.

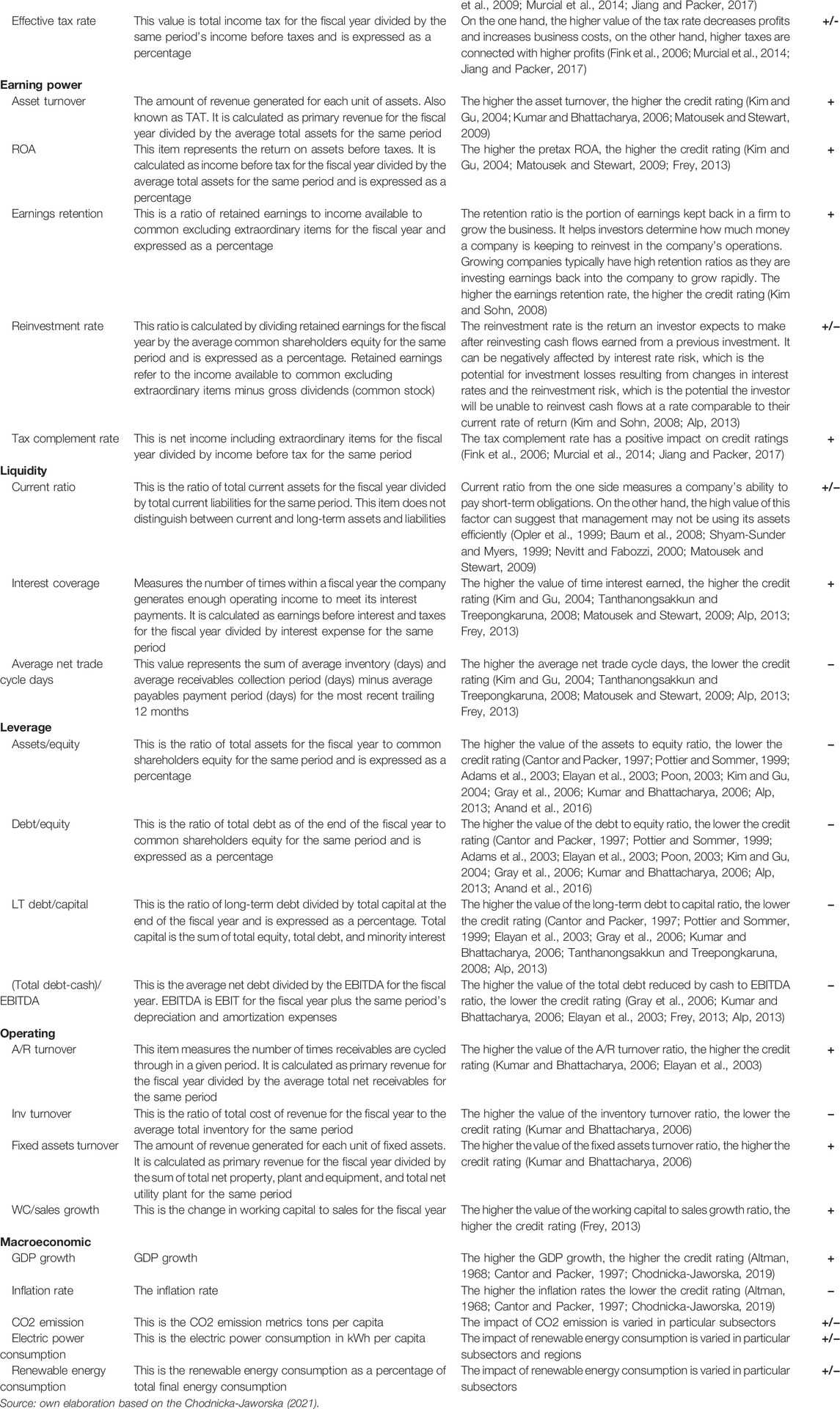

The next group of factors belongs to financial and macroeconomic determinants. The financial indicators have been divided by profitability, earnings power, liquidity, leverage, and operating measures, according to the Chodnicka-Jaworska (2021) research. The description of the particular factors and their impact on the credit ratings changes is presented in Table 4.

Ordered logit panel data models in which energy sector companies’ long-term issuer credit ratings are the dependent variable were used for the analysis. Logit models rely on the verification of the probability unit, which is then transformed into its cumulative probability value from a normal distribution. The final version of the ordered logit model is

Where

where

where

where

where

where

where

The strong correlation between ESG measures creates the need to prepare the analysis for factors separately. In the presented analysis, models were prepared in a subsample for each type of sector. Sectors were divided into four groups, i.e., renewable energy, uranium, coal, oil, and gas.

The presented analysis will be presented in two ways. First, which factors are significant for estimation of the energy sector’s credit ratings will be assessed. Second, changes of the mentioned independent variables influencing statistically significant credit rating changes will be calculated. As a result, the analysis was also prepared on the first differences. A robustness check was undertaken to prepare the final models.

4 Results

4.1 Environmental, Social, and Governance Factors’ Impact on Energy Sector Credit Ratings

The aim of the paper was to analyze the impact of ESG factors on credit rating changes. The analysis was prepared in two parts. First, the impact of only ESG factors on credit rating and the impact of changes of the ESG measures on the credit rating changes were analyzed. The idea was to assess if the mentioned variables were significant during the credit rating assessment by particular agencies, then it was checked if these measure changes were important in later credit rating changes, and if the changes were significant for estimating the default risk changes.

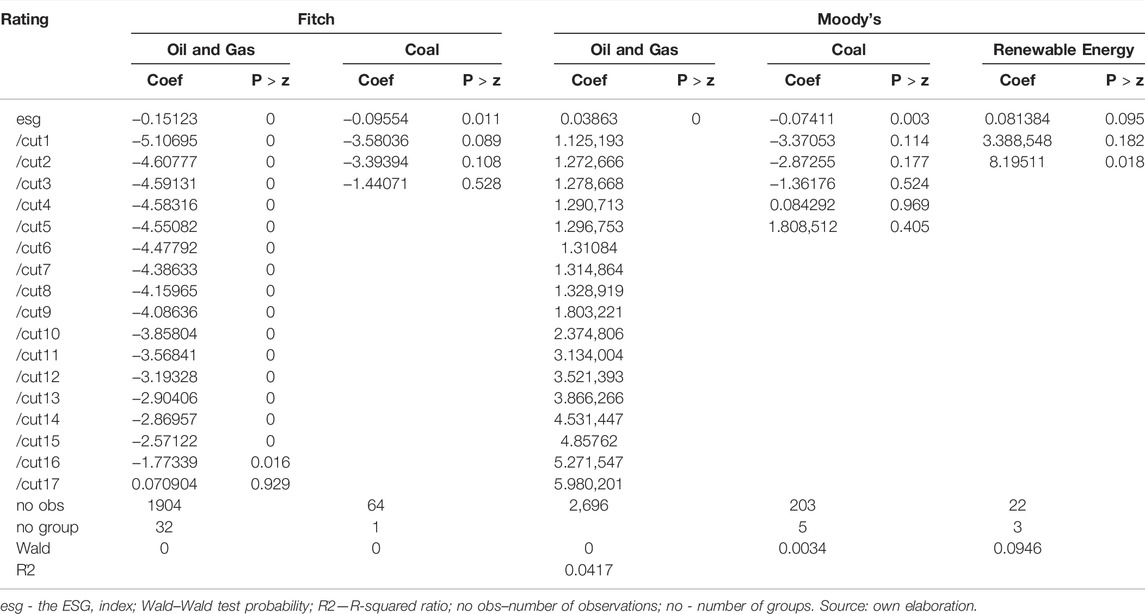

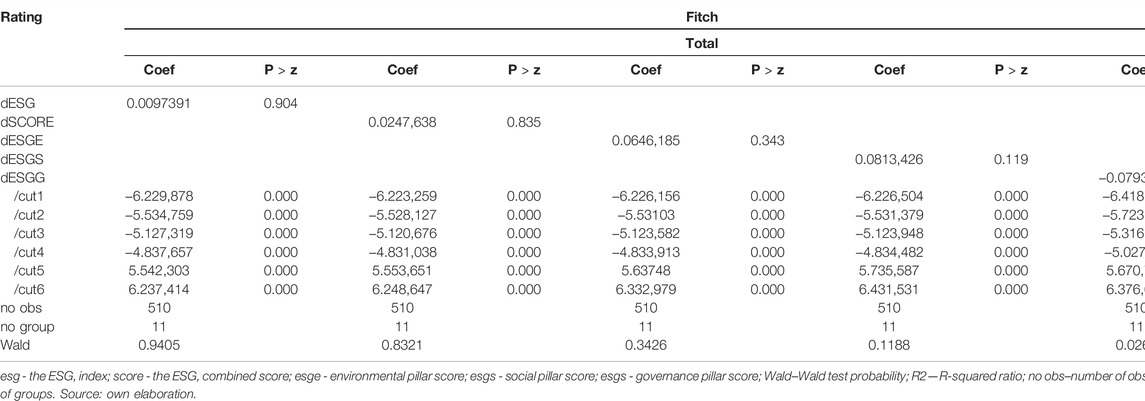

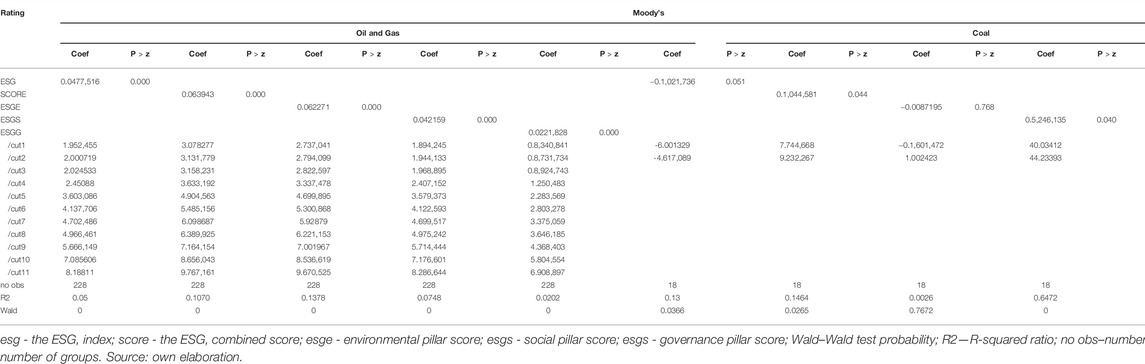

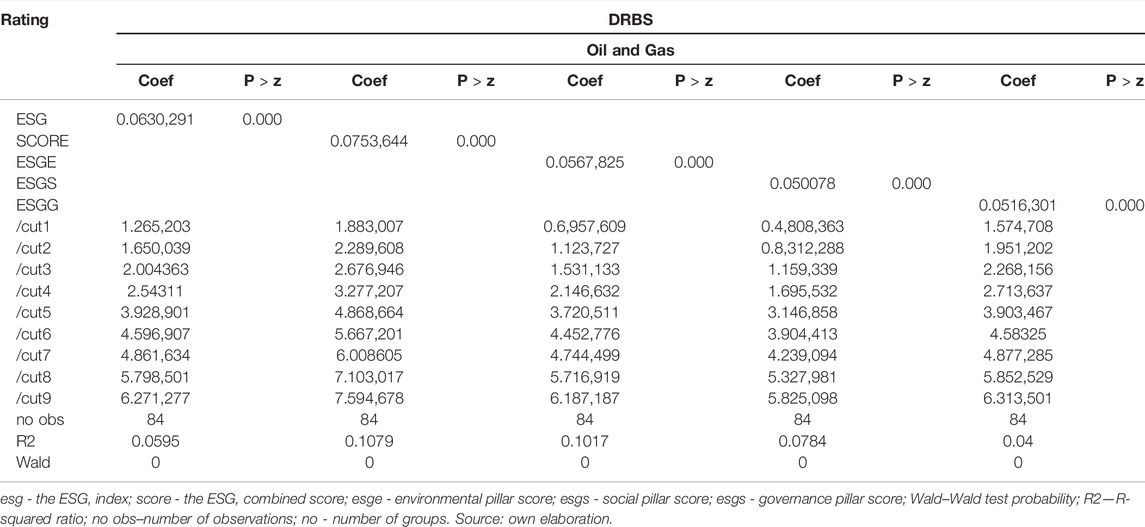

Results of the first estimation of the impact of ESG measures were prepared for long-term issuer credit ratings given by Fitch, Moody’s (Table 5), and DRBS (Table 6) in subsectors. The received findings suggest that the impact of the ESG measures varied for particular credit ratings agencies. For example, notes given by Fitch, DRBS, and Moody’s had negative scores on the higher ESG index in the coal subsample. The mentioned situation is an effect of the current regulation about reducing CO2 emissions. The strongest impact was noticed for the Fitch ratings. As mentioned in the introduction, the ESG directive COP26 drew attention to the reduction of using coal as the source of energy production. Some countries decided to withdraw fully from using coal. The mentioned differences between the strength of the impact of the ESG measures on credit ratings were due to varied subsamples and the size of the companies.

TABLE 5. Impact of ESG factors on credit rating changes according to sector division and type of credit rating agency.

TABLE 6. Impact of ESG factors on DRBS long-term issuer credit rating changes according to sector division.

A stronger reaction of credit ratings on the ESG index was noticed for Fitch notes for the oil and gas subsector. In the case of DRBS ratings, for the oil and gas subsample, notes were insensitive to ESG factors. The positive impact of the ESG index on credit ratings was noticed for Moody’s ratings. The mentioned reaction was connected with using oil and gas as a transition source of energy and the size of companies. As mentioned before, bigger entities, especially from the oil and gas subsector receive higher ESG indexes. The renewable energy subsector in Moody’s notes positively reacted to ESG measures. The strongest positive reaction was noticed for the DRBS ratings for the uranium subsector. It is connected with using the energy from uranium and renewable sources as an alternative to the coal and oil and gas subsectors.

The described situation confirms previous findings. A significant impact of the ESG factors on the credit ratings according to Zeidan et al. (2015) and Miralles-Quirós and Miralles-Quirós (2017) was observed. The mentioned reaction was related to various reasons. At first, a positive reaction for the renewable energy subsector was observed. In the mentioned sector, new climate risk ideas were threatened positively by investors. The worldwide policy tends toward pollution reduction and renewable energy is boosted by additional financial sources from governments by receiving subsidies, non-returnable loans, etc. Moreover, some specialized investors, as mentioned earlier, are interested in investing in this type of energy.

On the other hand, the coal subsector reacted negatively, such as in Menz (2010) and Goss and Roberts (2011). They suggested that companies that want to increase credit ratings try to use ESG policies. They did not analyze the energy sector, but in this case, this opinion might be correct. ESG policies can be used to improve notes. They thought that it is typical for companies with higher default risk, but in this case, it can be connected with building an opinion in society about reducing emissions and introducing new lower carbon emission ideas. Companies from the coal sector are usually big entities with high capital and their default risk can relate to the lower carbon policy introduced by regulators and governments.

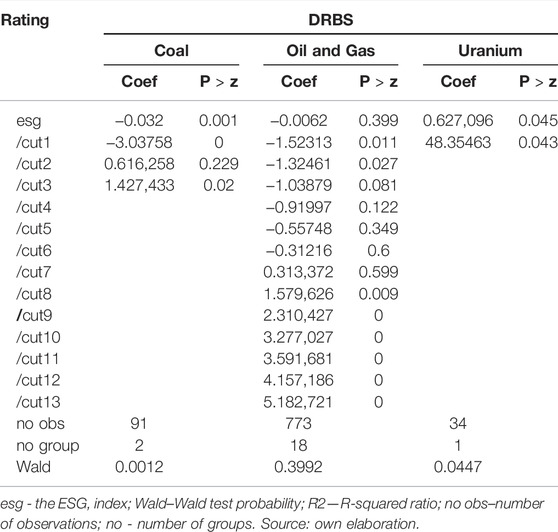

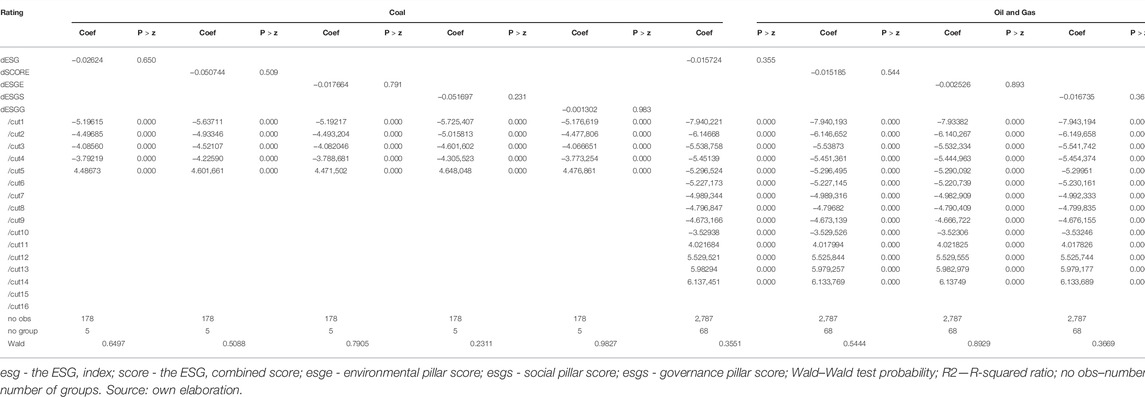

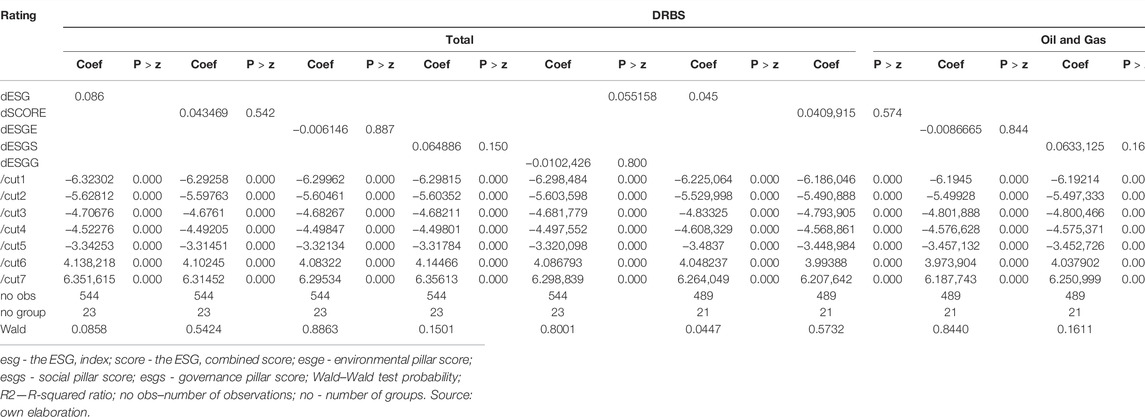

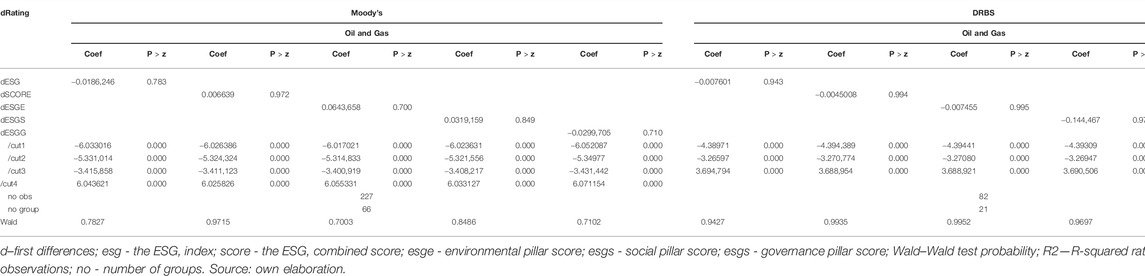

The next step relies on the analysis of changes to the ESG factors on the credit rating changes. The prepared models (Tables 7–9) suggest that in most cases the ESG measures changes were unimportant during decisions based on the verification of credit rating changes. The significance was noticed only in the case of the DRBS analysis made for the oil and gas subsector for the ESG index. The mentioned relationship was related to various reasons. At first, it was connected with the subsample. Mostly big companies were included in the analysis, where the ESG factor changes were insignificant. More important was the analysis of the financial condition changes and the other non-financial factors. In some cases, the owner, or one of the stakeholders of the company was the government—especially in the case of the oil and gas and coal subsector entities. The impact of the type of ownership plays a significant role in the decisions about the credit rating changes. The mentioned relationship was observed by Chodnicka-Jaworska (2019) for banks, where companies with the government as a stakeholder received higher notes. The second reason relates to using ESG factors to create an opinion about being socially and environmentally responsible, as was suggested by Perez-Batres et al. (2012). The third cause relates to the low flexibility of the energy sector credit ratings. In most cases, the mentioned notes were not corrected, as a result, in some subsectors, it was impossible to generate an analysis. The subsample was also smaller. It relates to a lower tendency to change credit ratings given for bigger institutions by credit rating agencies and asymmetry of information.

TABLE 7. Impact of ESG factors on Moody’s long-term issuer credit rating changes according to sector division.

TABLE 8. Impact of ESG factors on DRBS long-term issuer credit rating changes according to sector division.

TABLE 9. Impact of ESG factors on Fitch long-term issuer credit rating changes according to sector division.

An attempt was made to execute an analysis for the COVID-19 crisis impact on the ESG measures and its changes on the credit ratings. Results of the analysis are presented in Tables 10–12, but the sample was small. It was connected with small changes in credit ratings in the mentioned period of time. It can be related to little sensitivity of the energy sector’s credit ratings on the COVID-19 crisis and the anticyclical character of these groups of credit rating changes. Prepared analysis for the COVID-19 crisis period suggested that, similar to the entire analysis period, the statistically significant impact of ESG measure changes on credit rating changes was not noticed.

TABLE 10. Impact of ESG factors on Moody’s long-term issuer credit ratings according to sector division during the COVID-19 crisis.

TABLE 11. Impact of ESG factors on DRBS long-term issuer credit ratings according to sector division during the COVID-19 crisis.

TABLE 12. Impact of ESG factor changes on credit rating changes according to sector division during the COVID-19 crisis.

In the case of the impact of ESG measures on credit ratings, there was a stronger reaction of credit ratings on the mentioned variables during the COVID-19 crisis. For notes given by Moody’s, the strongest reaction in the case of the oil and gas subsample was observed in the E factor. On the other hand, notes given for the coal subsector by Moody’s were more sensitive to the S factor. The analysis made for DRBS suggested that the mentioned ratings in the oil and gas subsample were the equally sensitive to these three groups of factors. It was impossible to prepare this analysis for Fitch ratings due to the sample being too small. The received findings confirmed work by Han et al. (2016), English (1999) and Ga-Young et al. (2020) about the varying impact of ESG measure types, even in the same sector.

4.2 Financial and Macroeconomic Situation Impact on Energy Sector Credit Ratings

The next step of the analysis relied on researching the impact of financial and macroeconomic variables on credit ratings and their first differences (Supplementary Appendixes 1–8). This research was prepared according to the type of credit rating agency and the type of energy sector. The first group of models was prepared for Moody’s long-term issuer credit ratings for coal and gas and oil subsectors. In the case of the coal subsector, a significant impact was observed especially for the E and G factors; the S factor was insignificant. In the case of their changes, their impact was insignificant. Only for Moody’s notes was it possible to make this type of estimation. Other agencies published too few ratings numbers or did not change them to verify the mentioned impact. A significant relationship for the coal subsector was observed for CO2 emissions. If the mentioned emissions in a particular country were higher, notes given for entities increased. It was connected with the source of energy and low-carbon policy. The described relationship could also be due to the level of wealthiness of a society. In poor and developing countries, more energy is produced from traditional energy sources. If the CO2 emission is higher, it is usually connected with more sensitive energy production from coal. Usually, the mentioned countries do not have an alternative energy source, or they are more expensive.

In the case of the coal subsector’s credit ratings, the statistically significant impact occurred in the inventory turnover ratio, the value of working capital to sale ratio, and the current ratio. The high value of working capital as a percentage of sales decreased credit ratings. It was connected with the reduction in investment and having plenty of cash in the current capital. The mentioned situation in the low-carbon policy—where the investment decisions were connected with finding new, more ecological coal sources and using the newest technologies was important—caused a negative impact on credit ratings. The current ratio had a positive impact on the mentioned situation. Having a higher value of current assets than current liabilities reduced the default risk and problems with short-term insolvency. The inventory ratio—calculated as the cost of goods to average inventory—had a negative impact on the mentioned credit ratings. A high ratio implied strong sales or insufficient inventory to support sales. It also suggested selling coal with a low margin. The mentioned situation also stimulated investments and financing new coal deposits, sometimes with a high cost of extraction. If Moody’s changed long-term issuer credit ratings, attention was placed on the average net trade cycle days. The mentioned variable increased notes. It shows how long cash is frozen in the trading cycle before it can be used as cash again. It also shows how much cash is frozen in unsold coal.

The next step relied on the analysis of the oil and gas subsector. The prepared models suggested some important results. At first, similar to the coal subsector, a significant impact of the ESG measures on credit ratings was observed. For Moody’s notes, only the G factor was insignificant. For Fitch, the S factor was insignificant, but on the other hand, for DRBS, the only statistically important impact was the G factor. The mentioned situation confirmed the previous opinion about the varied significance of the ESG measures on the cost of capital, here as one of the measures of the higher probability of the default risk. In the case of Moody’s subsample, the strongest impact was noticed for S indicators, for Fitch, E indicators, and for DRBS, G indicators. The significance of the S factor was underlined by Weber et al. (2010), Weber et al. (2014), Menz (2010), and Goss and Roberts (2011). They suggested that companies that have a CSR policy pay more for borrowing capital than those that do not have one. Moody’s ratings confirmed that opinion. The significance of the E score, according to Stellner et al. (2015), suggested that smaller companies only received positive effects from an E policy. The opinion of English (1999) regarding global interaction between the E factor and limited internal effect of S and G indicators, on the cost of capital, confirmed the presented results; on the other hand, the ESG factor changes, accept DRBS notes, were unimportant for credit rating changes. As a result, companies can try to receive higher credit ratings and introduce ESG policies (Goss and Roberts, 2011). The improvement of the ESG policies was insignificant for change notes.

Next, the impact of macroeconomic variables on credit rating changes was assessed. The significance of the particular factors varied. GDP growth is one of the measures that is used to analyze the wealthiness of a society. In the opinion presented by Fitch, the mentioned variables had a positive impact on credit ratings. In more developed countries, the probability of default of companies from the oil and gas subsector is lower. The analysis prepared in other research suggested that the developed oil and gas sector also had a positive impact on GDP growth. As a result, the mentioned relationship had a spiral effect. The statistically significant impact of the inflation rate was noticed in the case of Moody’s notes, but the strength of influence was very low. Low inflation had a positive effect on the economy. If, in the inflation of the basket of goods and services, the costs of oil and gas have a high weight, it can positively influence the financial condition of the mentioned companies. Electric power consumption also has a very weak negative impact on credit ratings. It should be analyzed with the value of coal used to produce energy indicators. Here, the CO2 emission ratio was used to verify the mentioned relationship. This variable had a significant impact on Moody’s and DRBS notes and a positive impact on Fitch ratings. The value of CO2 emissions was strictly connected to the coal subsector as an alternative source of energy. In addition, not without significance were regulations taken by governments to reduce CO2 emissions and introduce new technologies to improve the environment condition, new ideas such as electric cars, new engine norms in cars, etc. The described relationship was strictly connected with the mentioned reasons and the analyzed sample.

In the case of the impact of macroeconomic variable changes on credit rating changes, a negative significant impact of CO2 emissions and positive inflation rate changes only for Moody’s notes was observed. As a result, the macroeconomic situation, the level of pollution, and the level of economic growth had a significant impact on companies involved in oil and gas subsector financial conditions.

Next, the impact of microeconomic variables on credit ratings of companies from the oil and gas subsector was verified. The mentioned variables were divided into a few groups. The first one was the group of profitability ratios in which factors such as EBITDA margin and the tax income rate are included. From this group of indicators, only the EBITDA margin had a statistically significant impact on credit ratings given by Fitch and Moody’s. The mentioned factor measures a company’s operating profit as a percentage of its revenue. It is focused on business essentials, its operating profitability, and cash flows. A stronger relationship was noticed for Fitch ratings, than Moody’s. If it rises, higher credit ratings are received by companies from the oil and gas subsector.

The next group of indicators were those connected with the companies’ earnings power. In this mentioned group of indicators, factors such as the asset turnover ratio, return on asset ratio, tax complement ratio, reinvestment rate, earnings retention rate, and total assets to common equity ratio were used. The strongest impact of the mentioned variable on credit ratings was on the asset turnover ratio, which measures the efficiency of a company’s assets in generating revenue or sales. If it is higher, higher notes are given by the credit rating agency, especially by Moody’s. Return on assets had a statistically significant impact on Moody’s credit rating. The increase in the total assets to common equity ratio had a negative impact on the credit ratings given by Moody’s. The low weight of the common equity in the total assets suggested the high default risk because companies do not have the possibility to finance from the capital if they have issues with solvency. The complement ratio did not have a statistically significant impact on the credit ratings given by analyzed institutions. The reinvestment rate refers to the rate at which cash flows from an investment can be reinvested into another. It is also the amount of interest that an investor can earn when the cash flow from one investment is taken out and placed in another. It creates interest risk when an investor buys a new bond and retains the bond on demand. As a result, the mentioned variable did not have a direct impact.

The next group of factors that was analyzed included liquidity ratios, such as the current ratio, interest coverage ratio, and average net trade cycle days ratio. The high value of the current ratio had a strong positive impact on the Fitch credit ratings. The mentioned relationship between current assets and current liabilities helped to assess the ability to pay off short-term debts. The weak positive (Moody’s rates) or negative (Fitch notes) impact was noticed for the average net trade cycle days ratio. It represents the sum of the average inventory and receivable collection period minus the average payables payment period. It presents how long the cash is tied up in the trade cycle before coming back out as cash again. This net number of days can either be positive (usually) or negative. When the net trade days are positive, the company needs to fund those days with net income or a line of credit. When the net trade cycle is negative, the firm is being paid for the service or product before the firm pays its vendor.

The models also verified the impact of the leverage ratios on credit ratings, including the long-term debt to equity ratio and history net debt to EBITDA. The long-term debt to equity ratio suggests that if a company borrows capital for a long time, and if the mentioned indicator is high, it decreases the weight of the equity ratio in total assets. It increases the default risk, so if the mentioned variable is higher, and credit ratings should be lower. The described situation was observed in the case of Moody’s and DRBS ratings, where the latter was more sensitive to this factor. Fitch ratings reacted positively to the mentioned variable. It was connected with the type of sample and borrowing capital from banks and capital market as a way to collect money for investment, then finding new stakeholders. Only during the ratings estimation by Fitch was the history of net debt to EBITDA ratio analyzed. If the mentioned indicator was higher, credit ratings were lower, which was due to the increasing default risk and high value of debt and low incomes to repay it.

The last group of financial indicators that were verified were operating ratios, including the net income to liabilities ratio, inventory turnover ratio, fixed assets turnover ratio, value of working capital to sale ratio, and return on long-term capital ratio. From the mentioned variables, only a few had a statistically significant impact on the credit ratings. The inventory turnover ratio is the rate at which inventory stock is sold or used or replaced. It is calculated by dividing the cost of goods by average inventory for the same period. A higher ratio tends to point to strong sales and a lower one to weak sales. The mentioned variable had a negative impact on notes proposed by Moody’s and Fitch. It related to high costs connected with extraction and maintaining oil and gas. The fixed assets turnover ratio had a strong negative impact on credit ratings given by Moody’s and especially by Fitch. It measures how well a company uses its fixed assets to generate sales. It is calculated by dividing net sales by net of its property, plant, and/or equipment. It should be compared with competitors. A low ratio shows that a firm does not efficiently use its fixed assets to generate sales. It is worth creditors and investors checking how well a company can repay loans used to purchase equipment. The return on long-term capital ratio quantifies how much return a company has generated using its long capital. On the mentioned variable, sensitive credit ratings were given by DRBS and Fitch. The mentioned relationship varied as it was connected with the sample that had been taken for analysis. The last factor that was only significant for Fitch was the working capital to sale ratio.

The analysis prepared for financial indicator changes on the credit rating changes suggested that when DRBS changed notes, the return on assets ratio was particularly important, however, the relationship was negative. It can be connected with the sample, and it should be analyzed by comparing investment and inventory. In the case of rating changes by Moody’s, there was a statistically significant negative impact on the total assets to common equity ratio. The interest coverage ratio determines how easily a company can pay interest on its outstanding debt. It is calculated by dividing a company’s earnings before interest and taxes by its interest expense during a given period. The changes of the mentioned variable had a positive impact on the credit rating changes presented by Moody’s. A positive reaction of credit ratings on changes of the long-term debt to equity ratio was observed, which was related to borrowing capital from banks and capital market as a way of collecting money for investment, then finding new stakeholders.

5 Conclusion

The prepared analysis suggested the existence of the impact of ESG measures on energy sector credit ratings. The hypothesis that ESG measures have had a significant impact on energy sector credit ratings during the COVID-19 crisis has also been confirmed. A stronger reaction of credit ratings during the COVID-19 crisis on ESG factors, than that before it, has also been observed. This confirms the increasing role of ESG measures in the financial market. On the other hand, credit rating agencies take into consideration ESG factors during the first estimation. Later, the mentioned variables lose their importance. This is based on a few reasons. It is still a small sample of entities that publish non-financial statements connected with ESG. Some countries have yet to implement regulations associated with climate risk. The significance of electricity power consumption and CO2 emissions confirm the significance of the mentioned direct or indirect impact of ESG factors. In the near future, it will be worth recalculating the presented models for longer periods, because in some cases, limitations connected with the size of the sample have been observed. Credit rating agencies are not willing to change credit ratings, because usually, companies from the energy sector, especially from coal and oil and gas subsectors, are large entities. They sometimes receive financial support from governments. Governments are also stakeholders that create a lower risk of default. In less developed countries, coal is one of the main energy sources, and costs connected with alternative, renewable energy are more expensive. In future research on a larger sample, it would be worth analyzing the mentioned relationship according to a country’s development and a company’s size.

The presented study also confirms the need to analyze the impact of the mentioned ESG factors on the long-term credit ratings in subsamples, i.e., coal, oil and gas, uranium, and renewable energy. Credit rating agencies put a lot of attention on the current regulations. The effect of this is the varied impact of the mentioned measures on the credit rating changes. The notes given for the entities from the coal subsector react negatively to these factors. The oil and gas subsector nearly do not react to them. A positive impact has been noticed for the uranium and renewable energy subsectors. It shows that these sectors can be divided into three groups, in which credit ratings react in an opposite manner to the ESG measures. Not without significance is the type of companies’ portfolio, especially the size of them. The mentioned analysis will be developed in the future because of the war in Ukraine. Europe’s dependence on oil and gas supplies as a source of energy, problems connected with the situation in Ukraine, and presented sanctions can reduce the significance of ESG policies, especially in the case of poorer countries. It is possible that coal will be threatened as a transitional source of energy, but it strictly depends on political decisions and the mentioned war. The mentioned opinion can be observed on the stock prices of the entities from the coal subsector, especially during the first days of war. Next, countries who do not have an alternative method to coal and oil and gas should invest more in the renewable energies.

Credit ratings are sensitive to ESG measures during the first moment of being given notes. It is because the energy sector, especially coal and oil and gas subsectors, belongs to big companies, sometimes with the government as one of the investors. Credit ratings of the mentioned companies are quite stable and do not present fluctuations. ESG measures are also threatened as a marketing tool and a way to promote an environmentally and socially responsible policy. The presented findings suggest that investors should pay more attention to the type of ownership. Also, more attention should be paid to the construction of ESG indexes. The low volatility of credit ratings of companies from the energy sector has been noticed during the COVID-19 crisis. It confirms the previous opinions about the anticyclical character of these groups of ratings. Prepared analysis for the COVID-19 crisis period suggests that, similar to the entire analysis period, the statistically significant impact of ESG measure changes on credit rating changes is not noticed.

The prepared research also suggests that particular ESG measures have varying significance on credit ratings. Therefore, it can help to analyze and build models by investors. It will not be without significance to estimate the default risk and the cost of the capital. In most cases, the most significant measure is the E factor. In the case of the impact of ESG measures on credit ratings, the stronger reaction of credit ratings on the mentioned variables during the COVID-19 crisis is noticed. For notes given by Moody’s, the strongest reaction in the case of the oil and gas subsample comes from the E factor. On the other hand, notes given for the coal subsector by Moody’s are more sensitive to the S factor. The analysis made for DRBS suggests that the mentioned ratings in the oil and gas subsample are equally sensitive to these three groups of factors.

The received findings can be useful for lending companies, investors, and regulators. They can also be helpful for companies that would like to receive credit ratings for them to decide which factors they should focus on. They also confirm the opinion that ESG measures are significant for the costs of capital. The presented research also suggests that ESG measures are not the main group of variables that determine credit rating changes.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2022.817679/full#supplementary-material

References

Adams, M., Burton, B., and Hardwick, P. (2003). The Determinants of Credit Ratings in the United Kingdom Insurance Industry. J. Busn. Finan. Acc. 30, 539–572. doi:10.1111/1468-5957.00007

Altman, E. I. (1968). Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. J. Finance 23 (4), 589–609. doi:10.1111/j.1540-6261.1968.tb00843.x

Alp, A. (2013). Structural Shifts in Credit Rating Standards. J. Finan. 68, 2435–2470. doi:10.1111/jofi.12070

Amato, J. D., and Furfine, C. H. (2004). Are Credit Ratings Procyclical? J. Banking Finance 28, 2641–2677. doi:10.1016/j.jbankfin.2004.06.005

Anand, V., Soomro, K. A., and Solanki, S. K.. (2016). Determinants of Credit Rating and Optimal Capital Structure Among Pakistani Banks. Rom. Econ. J. 19 (60), 169–182.

Ashbaugh-Skaife, H., Collins, D., and LaFond, R. (2006). The Effects of Corporate Governance on Firms’ Credit Ratings. J. Account. Econ. 42 (1), 203–243. doi:10.1016/j.jacceco.2006.02.003

Attig, N., El Ghoul, S., Guedhami, O., and Suh, J. (2013). Corporate Social Responsibility and Credit Ratings. J. Bus Ethics 117 (4), 679–694. doi:10.1007/s10551-013-1714-2

Baum, C. F., Caglayan, M., Stephan, A., and Talavera, O. (2008). Uncertainty Determinants of Corporate Liquidity. Econ. Model. 25, 833–849. doi:10.1016/j.econmod.2007.11.006

Bhojraj, S., and Sengupta, P. (2003). Effect of Corporate Governance on Bond Ratings and Yields: The Role of Institutional Investors and outside Directors∗. J. Bus 76 (3), 455–475. doi:10.1086/344114

Birindelli, G., Ferretti, P., Intonti, M., and Iannuzzi, A. P. (2015). On the Drivers of Corporate Social Responsibility in banks: Evidence from an Ethical Rating Model. J. Manag. Gov 19, 303–340. doi:10.1007/s10997-013-9262-9

Blume, M. E., Lim, F., and Mackinlay, A. C. (1998). The Declining Credit Quality of U.S. Corporate Debt: Myth or Reality? J. Finance 53, 1389–1413. doi:10.1111/0022-1082.00057

Boffo, R., and Patalano, R. (2020). ESG Investing: Practices, Progress and Challenges. OECD Paris. Available at www.oecd.org/finance/ESG- Investing-Practices-Progress-and-Challenges.pdf

Bone, R. B. (2010). Determinantes dos ratings corporativos na indústria petrolífera: o caso da Repsol- YPF. Revista Eletrônica de Administração 16 (1), 1–21.

Bouzouita, R., and Young, A. (1998). A Probit Analysis of Best Ratings. J. Insurance Issues 21 (1), 23–34.

Camargo, A. C. B. (2009). Bônus corporativos: um estudo sobre as variáveis que afetam o rating de uma emissão (Dissertação de mestrado). Rio de Janeiro, Brasil: Programa de Pós-Graduação em Administração de Empresas, Pontifícia Universidade Católica do Rio de Janeiro.

Cantor, R., and Packer, F. (1997). Differences of Opinion and Selection Bias in the Credit Rating Industry. J. Bank. Finan. 10, 1395–1417. doi:10.1016/S0378-4266(97)00024-1

Cellier, A., and Chollet, P. (2016). The Effects of Social Ratings on Firm Value. Res. Int. Business Finance 36, 656–683. doi:10.1016/j.ribaf.2015.05.001

Chodnicka-Jaworska, P. (2019). Determinanty credit ratingów oraz ich wpływ na rynek finansowy. Warszawa: PWE.

Chodnicka-Jaworska, P. (2021). ESG as a Measure of Credit Ratings. Risks 9 (12), 226. doi:10.3390/risks9120226

Choy, E., Gray, S., and Ragunathan, V. (2006). Effect of Credit Rating Changes on Australian Stock Returns. Account. Finance 46 (5), 755–769. doi:10.1111/j.1467-629x.2006.00192.x

Cooper, E. W., and Uzur, H. (2015). Corporate Social Responsibility and the Cost of Debt. J. Account. Finance 15 (8), 11–30.

Daniels, K., Ejara, D. D., and Vijayakumar, J. (2009). An Empirical Analysis of the Determinants and Pricing of Corporate Bond Clawbacks. J. Corp. Finan. 15, 431–446. doi:10.1016/j.jcorpfin.2009.03.003

Ederington, L. H. (1985). Classification Models and Bond Ratings. Financial Rev. 20, 237–262. doi:10.1111/j.1540-6288.1985.tb00306.x

Elayan, F. A., Wei, H. H., and Meyer, T. O. (2003). The Informational Content of Credit Rating Announcements for Share Prices in a Small Market. J. Econ. Finan. 27, 337–356. doi:10.1007/BF02761570

English, M. R. (1999). Who Are the Stakeholders in Environmental Risk Decisions? - How Should They Be Involved? A. Kjell (Wien, Sweden: International Atomic Energy Agency (IAEA)).

Fatemi, A., Glaum, M., and Kaiser, S. (2018). ESG Performance and Firm Value: The Moderating Role of Disclosure. Glob. Finance J. 38, 45–64. doi:10.1016/j.gfj.2017.03.001

Ferri, G., Liu, L. G., and Stiglitz, J.. (1999). The Procyclical Role of Rating Agencies: Evidence from the East Asian Crisis. Econ. Notes 28 (3), 335–355. doi:10.1111/1468-0300.00016

Fink, J., Grullon, G., Fink, K., and Weston, J.. (2010). Firm Age and Fluctuations in Idiosyncratic Risk. J. Financ. Quant. Anal. 45, 1253–1278. doi:10.1017/S0022109010000487

Frey, C. B. (2013). “Patent Information and Corporate Credit Ratings: An Empirical Study of Patent Valuation by Credit Rating Agencies,” in Intellectual Property Rights and the Financing of Technological Innovation: Public Policy and the Efficiency of Capital Markets. Editors C. B. Frey. (Cheltenham: Edward Elgar Publishing), 72–97.

Friede, G., Busch, T., and Bassen, A. (2015). ESG and Financial Performance: Aggregated Evidence from More Than 2000 Empirical Studies. J. Sust. Finance Investment 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Ga-Young, J., Hyoung-Goo, K., Ju-Yeong, L., and Kyounghun, B. (2020). This Effect Is Particularly Salient for the Firms with High Information Asymmetry Such as Small Firms. Sustainability 2 (8), 3456. doi:10.3390/su12083456

Galil, K. (2003). The Quality of Corporate Credit Rating: An Empirical Investigation. Beer-Sheva: Ben-Gurion University of the Negev, Working Paper.

Ge, W., and Liu, M. (2015). Corporate Social Responsibility and the Cost of Corporate Bonds. J. Account. Public Pol. 34 (6), 597–624. doi:10.1016/j.jaccpubpol.2015.05.008

Goss, A., and Roberts, G. S. (2011). The Impact of Corporate Social Responsibility on the Cost of Bank Loans. J. Banking Finance 35 (7), 1794–1810. doi:10.1016/j.jbankfin.2010.12.002

Gray, S., Mirkovic, A., and Ragunathan, V. (2006). The Determinants of Credit Ratings: Australian Evidence. Aust. J. Manage. 31 (2), 333–354. doi:10.1177/031289620603100208

Grunert, J., Norden, L., and Weber, M. (2005). The Role of Non-financial Factors in Internal Credit Ratings. J. Banking Finance 29, 509–531. doi:10.1016/j.jbankfin.2004.05.017

GSIA (2019). Global Sustainable Investment Review 2018. Global Sustainable Investment Alliance. Available at http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf

Gutsche, R., Schulz, J. F., and Gratwohl, M. (2017). Firm-value Effects of CSR Disclosure and CSR Performance. J. Environ. L. Pol. 40 (4), 332–349. doi:10.2139/ssrn.2821691

Han, J.-J., Kim, H. J., and Yu, J. (2016). Empirical Study on Relationship between Corporate Social Responsibility and Financial Performance in Korea. Ajssr 1, 61–76. doi:10.1186/s41180-016-0002-3

Hoepner, A., Oikonomou, I., Scholtens, B., and Scholtens, M. (2016). The Effects of Corporate and Country Sustainability Characteristics on the Cost of Debt: An International Investigation. J. Business Finance Account. 43 (1-2), 158–190. doi:10.1111/jbfa.12183

Jiang, X., and Packer, F. (2017). Credit Ratings of Domestic and Global Agencies: What Drives the Differences in China and How are They Priced? Bank for International Settlements, BIS Working Papers 648.

Kamstra, M., Kennedy, P., and Suan, T.-K. (2001). Combining Bond Rating Forecasts Using Logit. Financial Rev. 36, 75–96. doi:10.1111/j.1540-6288.2001.tb00011.x

Kang, Q., and Liu, Q. (2007). Credit Rating Changes and CEO Incentives. Working Paper. Social Science Research Network.

Kaplan, R. S., and Urwitz, G. (1979). Statistical Models of Bond Ratings: A Methodological Inquiry. J. Bus 52, 231–261. doi:10.1086/296045

Kim, H., and Gu, Z. (2004). Financial Determinants of Corporate Bond Ratings: An Examination of Hotel and Casino Firms. J. Hospitality Tourism Res. 28 (1), 95–108. doi:10.1177/1096348003261217

Kim, Y., and Sohn, S. Y. (2008). Random Effects Model for Credit Rating Transitions. Eur. J. Oper. Res. 184, 561–573.

Kim, Y., Li, H., and Li, S. (2014). Corporate Social Responsibility and Stock price Crash Risk. J. Banking Finance 43, 113. doi:10.1016/j.jbankfin.2014.02.013

Kumar, K., and Bhattacharya, S. (2006). Artificial Neural Network vs. Linear Discriminant Analysis in Credit Ratings Forecast: A Comparative Study of Prediction Performances. Rev. Acc. Finan. 5, 216–227. doi:10.1108/14757700610686426

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. J. Finance 72 (4), 1785–1824. doi:10.1111/jofi.12505

Matousek, R., and Stewart, C. (2009). A Note on Ratings of International Banks. J. Finan. Reg. Comp. 17, 146–155. doi:10.1108/13581980910952586

Logue, D. E., and Merville, L. J. (1972). Financial Policy and Market Expectations. Finan. Manag. 1, 37–44. doi:10.2307/3665142

Mählmann, T. (2011). Is There a Relationship Benefit in Credit Ratings?*. Rev. Finance 15 (3), 475–510. doi:10.1093/rof/rfq032

Menz, K.-M. (2010). Corporate Social Responsibility: Is it Rewarded by the Corporate Bond Market? A Critical Note. J. Bus Ethics 96 (1), 117–134. doi:10.1007/s10551-010-0452-y

Miralles-Quirós, M. d. M., and Miralles-Quirós, J. L. (2017). Improving Diversification Opportunities for Socially Responsible Investors. J. Bus Ethics 140, 339–351. doi:10.1007/s10551-015-2691-4

Murcial, F., Cruz de Souza, F., Dal-Ri, M., Suliani, R., and Borba, J. A.. (2014). The Determinants of Credit Rating: Brazilian Evidence. BAR 11, 188–209. doi:10.1590/S1807-76922014000200005

Opler, T., Pinkowitz, L., Stulz, R., and Williamson, R. (1999). The Determinants and Implications of Corporate Cash Holdings. J. Finan. Econ. 52, 3–46. doi:10.1016/S0304-405X(99)00003-3

Orlitzky, M., Schmidt, F. L., and Rynes, S. L. (2003). Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 24 (3), 403–441. doi:10.1177/0170840603024003910

Papaikonomou, V. L. (2010). Credit Rating Agencies and Global Financial Crisis. Stud. Econ. Finance 27 (2), 161–174. doi:10.1108/10867371011048643

Perez-Batres, L. A., Doh, J. P., Miller, V. V., and Pisani, M. J. (2012). Stakeholder Pressures as Determinants of CSR Strategic Choice: Why do Firms Choose Symbolic Versus Substantive Self-Regulatory Codes of Conduct? J. Bus. Ethic. 110, 157–172. doi:10.1007/s10551-012-1419-y

Pinches, G. E., and Singleton, J. C. (1978). The Adjustment of Stock Prices to Bond Rating Changes. J. Finance 33 (1), 29–44. doi:10.1111/j.1540-6261.1978.tb03387.x

Poon, W. P. (2003). Are Unsolicited Credit Ratings Biased Downward? J. Bank. Finan. 27, 593–614. doi:10.1016/S0378-4266(01)00253-9

Poon, W. P., and Chan, K. C.. (2008). The Effects of Credit Ratings on Stock Returns in China. Chin. Econ. 41, 34–55. doi:10.2753/CES1097-1475410203

Pottier, S., and Sommer, D. (1999). Property-Liability Insurer Financial Strength Ratings: Differences Across Rating Agencies. J. Risk Insur. 66, 621–642.

Revelli, C. (2017). Socially Responsible Investing (SRI): From Mainstream to Margin? Res. Int. Business Finance 39, 711–717. doi:10.1016/j.ribaf.2015.11.003

Revelli, C., and Viviani, J.-L. (2015). Financial Performance of Socially Responsible Investing (SRI): What Have We Learned? A Meta-Analysis. Bus Ethics Eur. Rev. 24 (2), 158–185. doi:10.1111/beer.12076

Roje, G. (2005). “The Role of Accounting Determinants in Predicting Long Term Credit Ratings,” in Proceedings of the European Accounting Association Congress (Gotheborg, Sweden: European Accounting Association), 28.

S&P Global Rating (2021). General Criteria: Environmental, Social, And Governance Principles In Credit Ratings. Available at https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/sourceId/12085396

Shyam-Sunder, L., and Myers, S. C. (1999). Testing Static Tradeoff Against Pecking Order Models of Capital Structure. J. Finan. Econ. 51, 219–244. doi:10.1016/S0304-405X(98)00051-8

Sih, A. (2006). Predição do grau de ratings corporativos (Dissertação de mestrado). Rio de Janeiro, Brasil: Programa de Pós- Graduação do Departamento de Engenharia Elétrica, Pontifícia Universidade Católica do Rio de Janeiro.

Stellner, C., Klein, C., and Zwergel, B. (2015). Corporate Social Responsibility and Eurozone Corporate Bonds: The Moderating Role of Country Sustainability. J. Banking Finance 59, 538–549. doi:10.1016/j.jbankfin.2015.04.032

Tanthanongsakkun, S., and Treepongkaruna, S. (2008). Explaining Credit Ratings of Australian Companies: An Application to the Merton Model. Aust. J. Manag. 33, 261–275. doi:10.1177/031289620803300203

Weber, O., Diaz, M., and Schwegler, R. (2014). Corporate Social Responsibility of the Financial Sector - Strengths, Weaknesses and the Impact on Sustainable Development. Sust. Dev. 22, 321–335. doi:10.1002/sd.1543

Weber, O., Scholz, R. W., and Michalik, G. (2010). Incorporating Sustainability Criteria into Credit Risk Management. Business Strategy Environ. 50, 39–50. doi:10.1016/j.advenzreg.2009.10.021

Keywords: energy sector, default risk, COVID-19, credit ratings, crisis

Citation: Chodnicka-Jaworska P (2022) Environmental, Social, and Governance Impact on Energy Sector Default Risk—Long-Term Issuer Credit Ratings Perspective. Front. Energy Res. 10:817679. doi: 10.3389/fenrg.2022.817679

Received: 18 November 2021; Accepted: 28 March 2022;

Published: 10 May 2022.

Edited by:

Joni Jupesta, Research Institute of Innovative Technology for the Earth, JapanCopyright © 2022 Chodnicka-Jaworska. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Patrycja Chodnicka-Jaworska, cGNob2RuaWNrYUB3ei51dy5lZHUucGw=

Patrycja Chodnicka-Jaworska

Patrycja Chodnicka-Jaworska