- 1School of Accounting, Yunnan University of Finance and Economics, Kunming, China

- 2Deanship of Electronic and Distance Learning, Department of Accounting and Finance, University of Science and Technology, Aden, Yemen

- 3Department of Accounting, College of Business, Jouf University, Jouf, Saudi Arabia

- 4Faculty of Commerce and Economics, Amran University, Amran, Yemen

- 5Department of Accounting, College of Business Administration, Umm Al-Qura University, Makkah, Saudi Arabia

- 6Department of Finance, Universal Business School, Mumbai, India

- 7Faculty of Forestry and Environment, Universiti Putra Malaysia, Selangor, Malaysia

Although accounting functions have been expanded from traditional practices to recent practices, focusing on environmental, social, and governance issues, there is still a shortcoming in conceiving different approaches to creating organizational and human interaction with the environment. In this study, we review the existing research on carbon accounting from 1994 to July 2022 in order to examine its intellectual development and make recommendations for future studies. This study also discusses the scales, methodological choices, and major themes of carbon accounting research, including the most influential articles and top contributing countries, journals, theories, and institutions. The literature was retrieved from the Web of Science (WoS) and Scopus databases, in which 137 articles were obtained from 62 high-quality journals in accounting, environment, and economics. There has been a significant increase in recent years in the number of studies, with the majority taking place in the United Kingdom, Australia, and China, as compared to the United States. On the other hand, the results show that traditional theories, such as the theory of legitimacy, the theory of organization, and the theory of stakeholders, have been evaluated previously. Although a firm’s characteristics and consumer behavior play an important role in improving carbon efficiency, economic and behavioral theories have been underrepresented in the existing literature. Furthermore, it is found that carbon accounting research provides a mechanism through which carbon emissions can be measured and quantified and helps in knowing the emissions status of companies and making the necessary strategic decisions to achieve mitigation. Therefore, policymakers have to foster setting international standards that would compile firms to report their carbon strategies similar to the international financial reporting standards, allowing investors to verify and compare firms that perform well in terms of carbon reduction.

1 Introduction

Researchers in many topics and disciplines have widely used the term “carbon accounting,” but it is given great emphasis in investigating aspects that discuss the integration of climate issues with accounting (Stechemesser and Guenther, 2012). On the other hand, governments all across the globe have adopted various ways to encourage businesses to cut carbon emissions and alleviate the consequences of climate change (He et al., 2021). Furthermore, most of the stakeholders (including investors) are exerting pressure due to concerns about future carbon laws and the physical hazards of climate change endangering infrastructures (Rankin et al., 2011). Countries have strengthened corporate sustainability rules in recent years to conform to national sustainable development goals and global sustainability standards (He et al., 2021). Furthermore, stakeholders’ desire for greater environmental awareness implies that carbon performance is a critical factor in most organizations’ long-term survival (Bowen and Wittneben, 2011; Zhou et al., 2016). As a result, corporate organizations are increasingly under pressure to disclose all climate change hazards (Eleftheriadis and Anagnostopoulou, 2015). Therefore, a significant amount of research on least developed, developing, and highly industrialized nations is being conducted to understand the variables that inspire and/or impede corporate carbon performance (Kumarasiri and Jubb, 2016). Thus, this article has retrieved all studies related to carbon accounting from two sources, WoS and Scopus, in order to answer the following questions.

RQ1: What is the publication trend for carbon accounting research, and what are the top contributing countries to carbon accounting research?

RQ2: What theories and methodological choices have been investigated in the literature, and what are the focused scales of carbon accounting research?

RQ3: What are the main themes and topics that make up the carbon accounting research structure?

RQ4: How can the research perspective develop the profession of carbon accounting?

Previous studies have examined the literature surrounding carbon accounting, such as Stechemesser and Guenther (2012), who conducted a literature review to define carbon accounting. Ascui (2014) presented a review of studies that discussed carbon accounting in only eight journals. Chen et al. (2019) evaluated research on city carbon accounting. He et al. (2021) reviewed corporate carbon accounting in light of the Paris Agreement. However, in light of recent advancements and legislation, the studies did not explore all aspects of carbon accounting or emphasize its role in attaining sustainability. This study examines carbon accounting from statistical and objective perspectives, comparing countries with a great interest in the topic to those where the word is less common. It will also explain the general development in the literature that discusses carbon accounting based on theories. Understanding carbon accounting, from standardizing a definition to finding jobs and tasks, it can perform for institutions and society. This study highlights the diversity of carbon accounting and the evolution of literature and research interests in carbon accounting scales. Ascui (2014) argued that there is a combination of theoretical, normative, and empirical debates on carbon accounting, including studies on carbon accounting education, carbon financial accounting, carbon management accounting, and carbon disclosure and reporting.

There has been an increase in the number of studies conducted in recent times compared to the previous decades as a result of the passage of numerous laws supporting the use of carbon accounting in mitigating carbon emissions in order to achieve sustainability, in addition to the presence of motives related to institutional demands and considerations related to creating value for institutions and strengthening the financial aspects of companies (Chapple et al., 2013; Hartmann et al., 2013; Naranjo Tuesta et al., 2021). Despite this, research interest has been lacking in some countries with significant economic impact on climate, such as the United States and India (Hazaea et al., 2021a). This suggests that research studies should be conducted in both developed and developing countries. This review reveals that carbon accounting does not only contribute to reducing carbon emissions but also works to enhancing the financial performance of companies by enhancing competition and creating added value for institutions financially and socially, which enhances sustainability. This study also showed that the development of research from studies that depended on theoretical investigation and content analysis in the past to studies that rely on international reports for a large group of countries may enhance the broad understanding of carbon accounting as a recently used term.

We follow the definition of carbon accounting, which was based on a proposal from Tang (2017). The author defined carbon accounting as one of the systems that use accounting procedures and methods in order to record, collect, and perform the necessary analysis of climate changes; verify the information; and report on the basic elements of assets, liabilities, expenses, and revenues that have a relationship. Thus, we have collected studies that discuss carbon accounting in accounting, economics, finance, and environmental journals, discussing carbon accounting from the perspective of the accounting profession in the social and economic sectors. Using the keyword “carbon* accounting* from WoS and Scopus, we obtained 137 studies that were used in the analysis.

In light of recent developments and regulations issued in past years, this study contributes to this field by covering the statistical and objective aspects of carbon accounting practice. We expect this study to make substantial contributions to stakeholders and corporate management in highlighting the role that carbon accounting can play in achieving sustainability as the only means by which carbon emissions can be mitigated. In addition, this study demonstrates the significance of carbon accounting in mitigating environmental risks that may affect society. In addition, this study provides an overview that allows one to understand the practice of carbon accounting as one of the new types of accounting and thus how companies’ practice contribute to achieving low-carbon economy. Finally, this study provides directions for future research that can be worked on in a way that contributes to achieving full knowledge of the practice of carbon accounting. These include working to clarify a set of internal and external factors such as economic and organizational pressures and financial and government restrictions and their effects on the practice of carbon accounting.

This review article is organized as follows: Section 1 presents the introduction, Section 2 demonstrates the methodology of the study, Section 3 reveals the results of systematic literature review (SLR), Section 4 discusses the carbon accounting themes, Section 5 highlights the directions for future research, and Section 6 concludes the study and provides implications for policymakers, stakeholders, regulator, and investors.

2 Methodology

This study relies on the structured approach of literature review, which is distinguished from traditional review in terms of the quality of the results and impartiality (Hazaea et al., 2021b). This study follows a rigorous, scientific, transparent, and reproducible methodology based on a search for answers to a set of predetermined questions (Khatib et al., 2021; Hazaea et al., 2022). Studies based on the systematic approach can provide a different and new perspective based on creating more research questions and working to create and build new theories on the same subject under investigation, away from systematic errors and biases (Hazaea et al., 2021b). Furthermore, studies based on systematic reviews provide more replicable and realistic results compared to studies based on narrative reviews (Kotb et al., 2020). We followed the approach specified by He et al. (2021) and Xiao and Watson (2019) and used by Stechemesser and Guenther (2012), which differed from Dumay et al. (2016) in how the phenomenon is implemented and studied.

We believe that conducting a systematic study in carbon accounting may provide a clear path to discovering the information needed by stakeholders to investigate corporate practices on society and the state, as well as the economic and social consequences of carbon. We used the WoS and Scopus databases to obtain high-impact studies, as they are among the most important databases that include high-quality research articles (Khatib et al., 2021). The articles included in WoS are among the most prestigious journals according to the indicators of various countries as they are one of the oldest public references and are appreciated by a wide range of researchers (Casimir and Tobi, 2011). In addition, data included in WoS-indexed journals can reflect academic development and real research results (Xu et al., 2019; An and Alarcón, 2020). Covering the limitations of using the WoS database only as a basis for conducting studies based on the systematic review may lead to not including relevant research results (Xu et al., 2019). The Scopus database has been used as one of the largest databases that include a large and wide range of journals of high quality and impact that are widely accepted by all and sundry (Nerantzidis et al., 2020; Hazaea et al., 2021a).

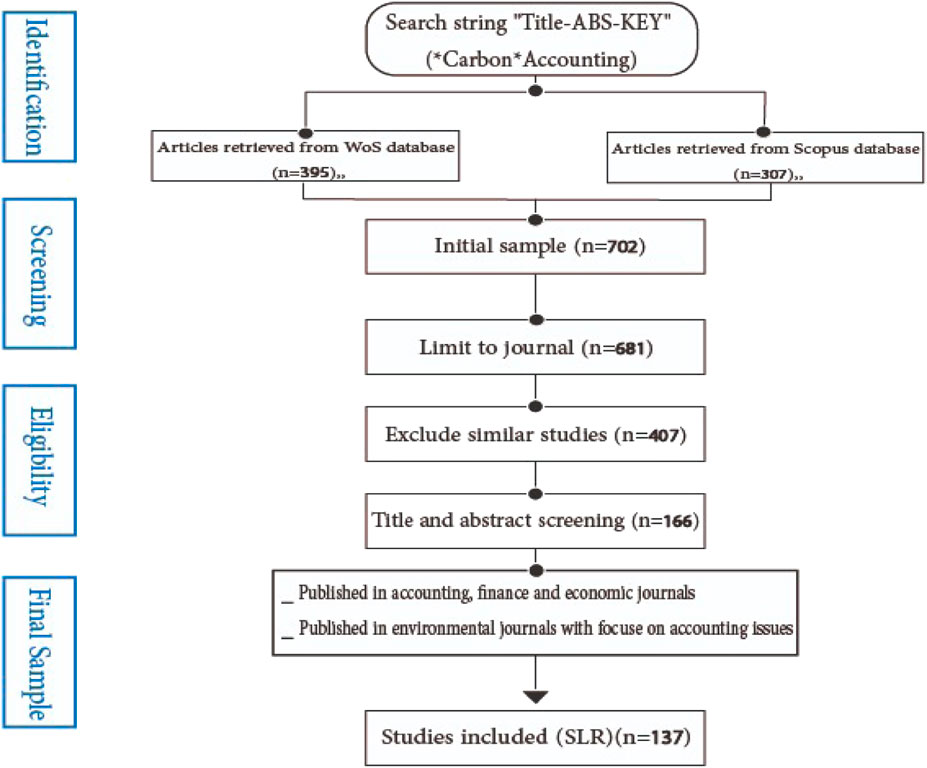

We reviewed some previous studies (Schaltegger and Csutora, 2012; Cacho et al., 2017; Gibassier et al., 2020a) to identify the gaps and research questions that this study answered. We used the keyword “carbon* accounting*” in search of relevant documents. We did not limit the years for our study; therefore, the articles started from 1994 until July 2022. The search result from the WoS database revealed 395 studies and 307 studies from the Scopus database. We used a protocol based on several points, the most important of which are 1) studies should be in English language only, 2) studies should be published in journals; therefore, the conference papers and books are excluded, and 3) the articles were published in accounting, finance, and economics journals or articles, discussing carbon accounting and published in environmental journals. Therefore, all articles that discuss carbon accounting with no focus on the subject matter of accounting were excluded, and duplicate documents were also excluded. In total, 137 articles met the inclusion (research protocol) criteria and were retained for the analysis. Figure 1 shows the mechanism of action to obtain the final sample.

FIGURE 1. Research protocol. Adapted by Hazaea et al. ((2021b), p. 5)

3 Results of SLR

3.1 Publication trends per year

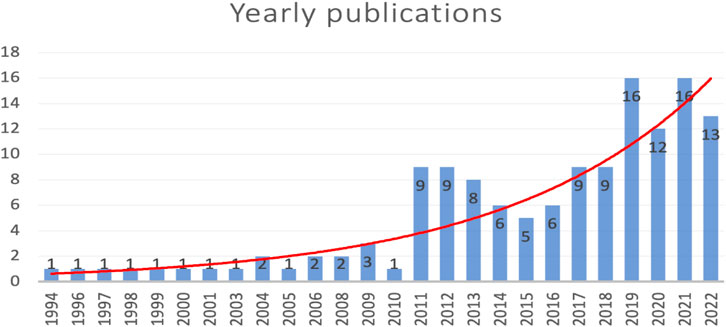

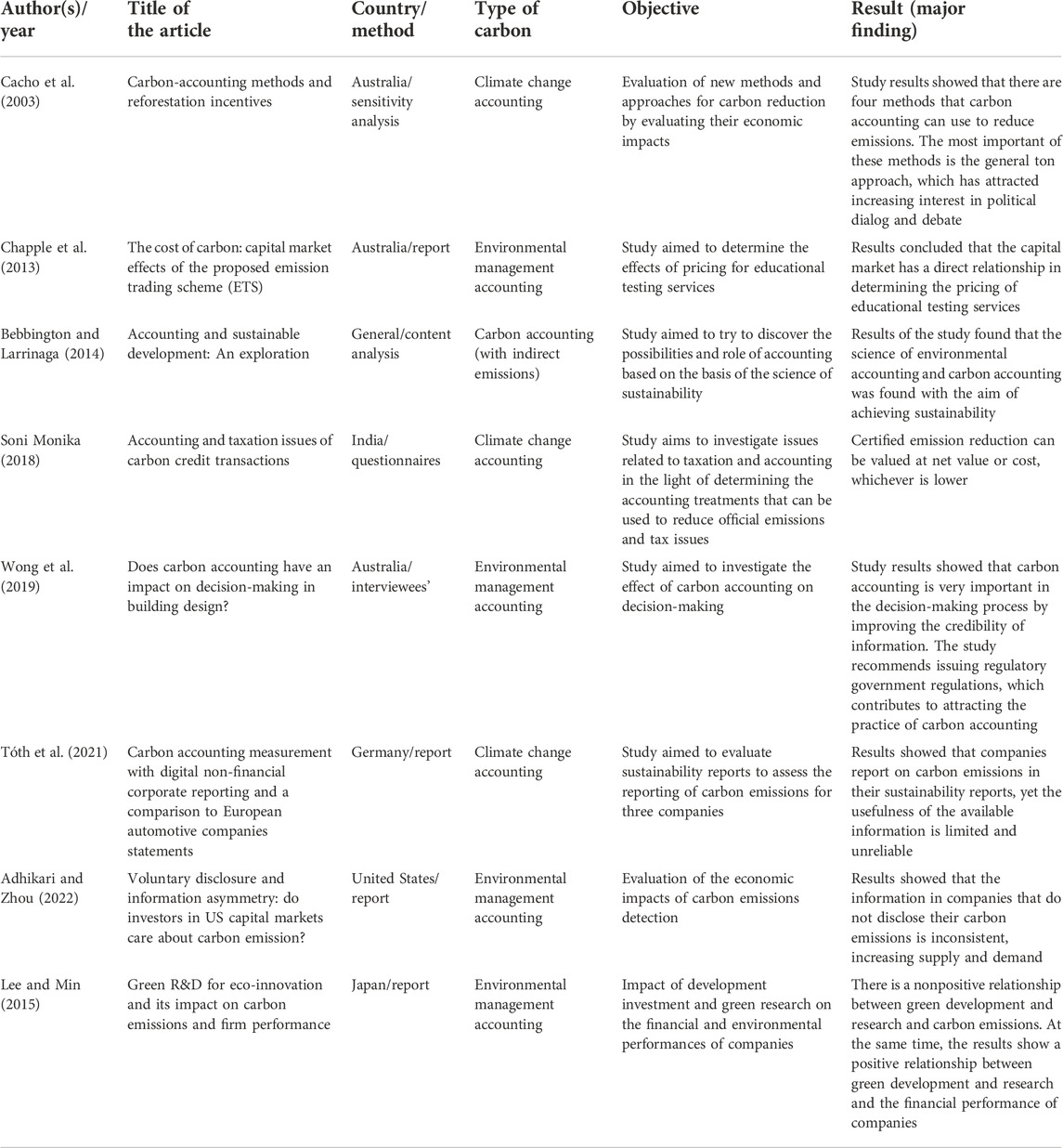

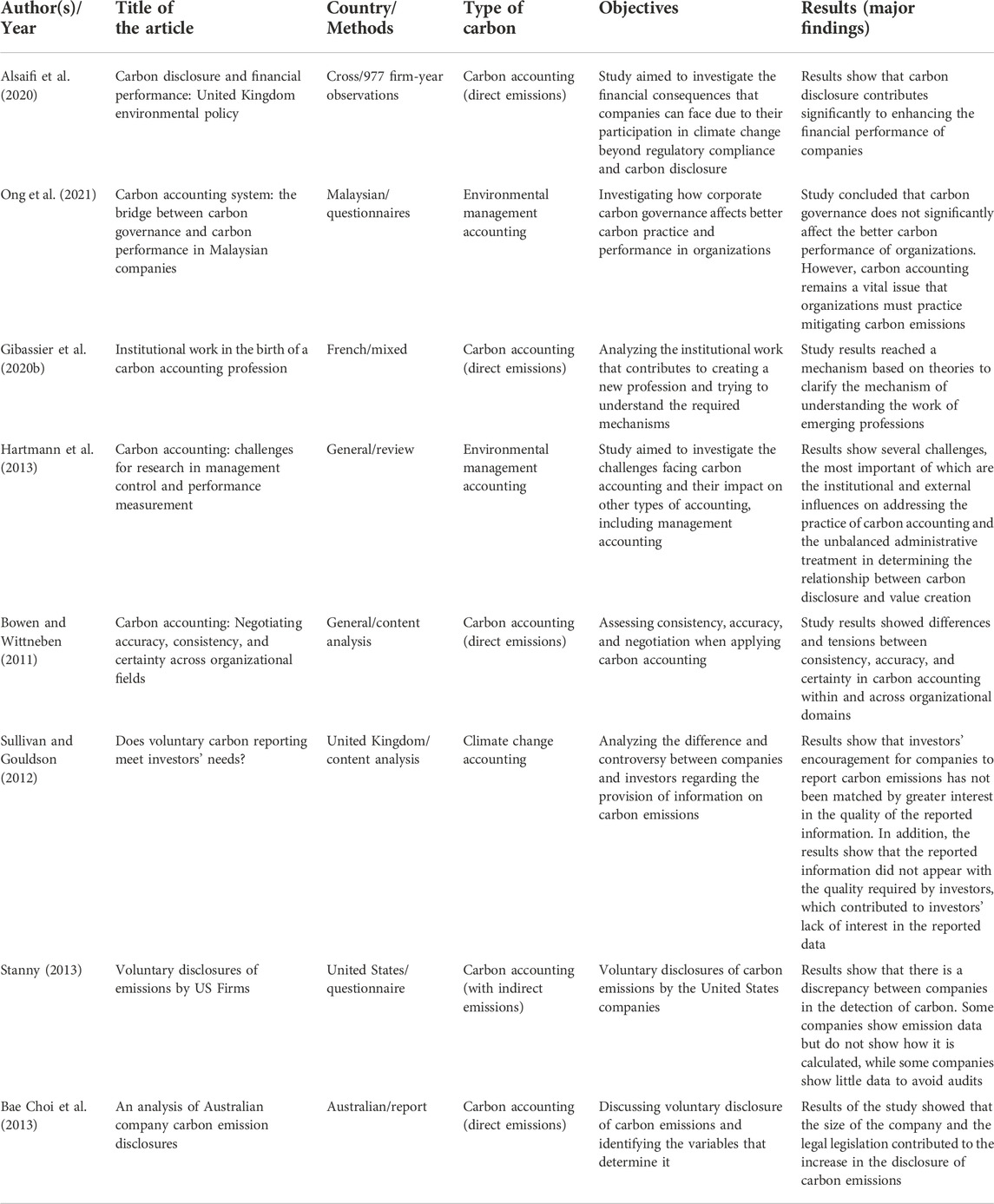

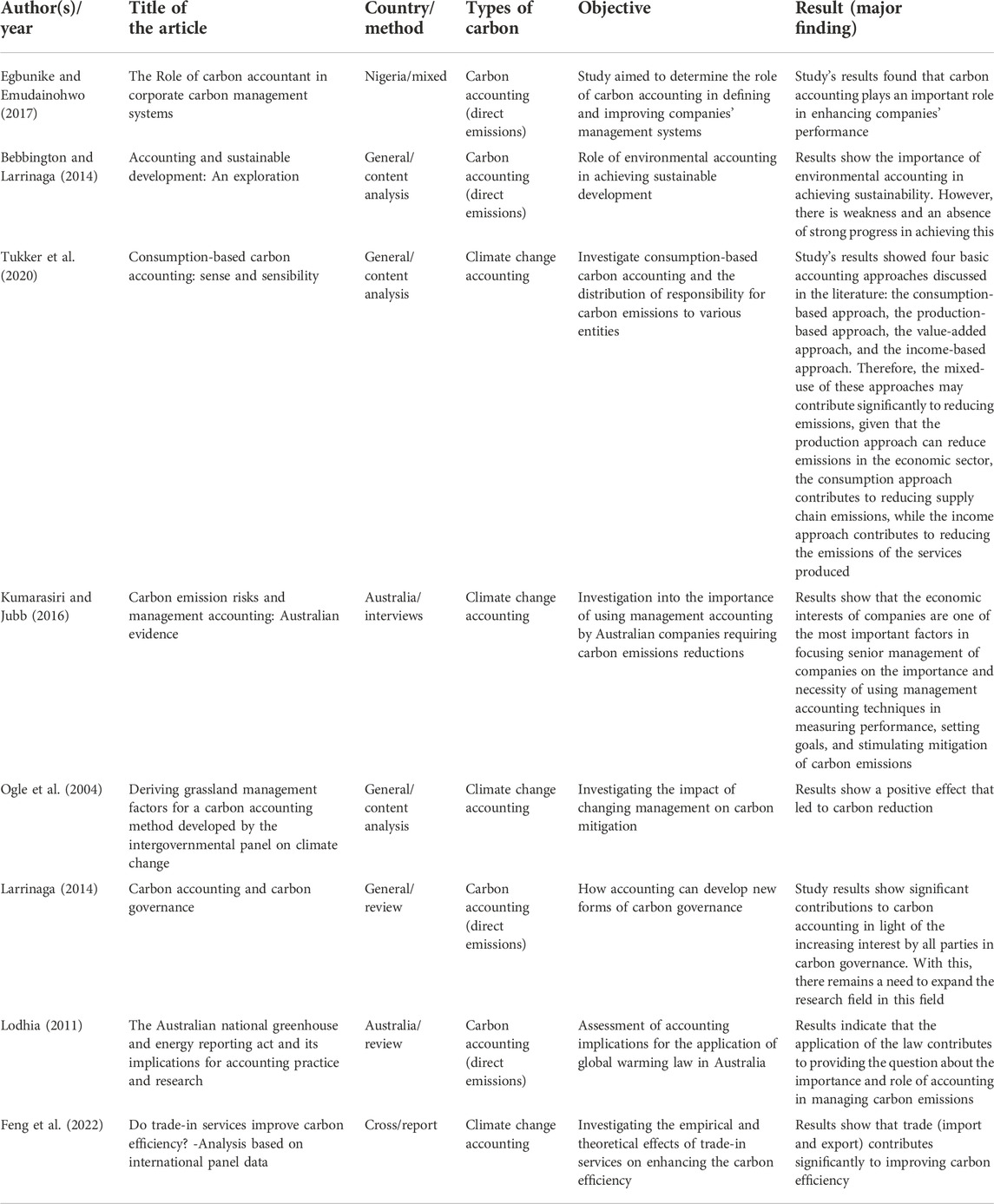

Figure 2 shows the distribution of the literature that discusses carbon accounting based on the year of publication. The figure shows that researchers’ interest in this topic has grown significantly over the last 10 years, especially between 2019 and July 2022. This increase could be explained by the growing need from international organizations to increase clarity through enhanced research on carbon accounting (Hartmann et al., 2013). These statistical findings corroborate the findings of previous studies, which indicated that carbon accounting in the modern era has sparked widespread interest. Alsaifi et al. (2020) and Ascui and Lovell (2012) emphasized that carbon accounting has developed rapidly in the last decade. The results of Schaltegger and Csutora (2012) showed that there is a rapid development in carbon accounting as it is one of the important areas in the development of sustainability management due to the requirements of climate change, which seek the search for modern methods and mechanisms and its development through scientific research. On the other hand, some countries, such as Australia, have started issuing national plans to examine the importance and impact of the necessary testing services on the stock market using carbon accounting (Chapple et al., 2013). In addition, the expansion of the programs used to reduce carbon emissions as a result of the demands of institutions to develop carbon accounting to meet environmental changes so that it can be used in preparing reports and making decisions, which contributes to creating value for institutions (Hartmann et al., 2013). As for the results of the study conducted by Le Breton and Aggeri (2018), it is revealed that the field of carbon accounting is emerging, and therefore there is great interest from researchers to know the topic from its various aspects, especially with its connection to environmental changes. Nartey (2018) emphasized that carbon accounting is considered a part of sustainability accounting, through which it is possible to provide information on emissions in environmental changes that benefit the management of institutions in a way that contributes to achieving sustainability. This may be one of the important indicators to explain the interest of researchers in recent years in this topic. The results of other studies, such as Soni and Bhanawat (2018), show that the need to know the role of carbon accounting in reducing emissions has made researchers conduct multiple studies to achieve this. As a result of climate change, companies are facing many challenges related to carbon accounting, which could be the reason for the increase in literature discussing carbon accounting.

3.2 Literature distributions by country

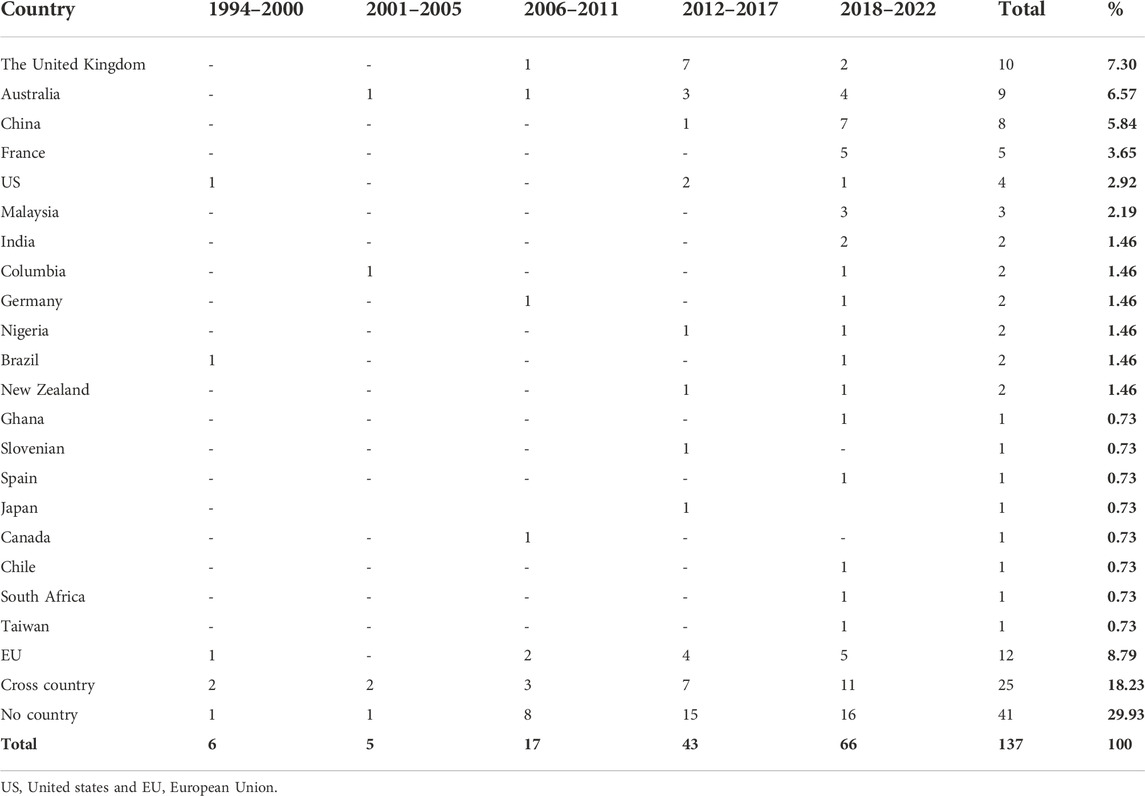

In this part, we reviewed the country covered by the studies to identify the country and region that pay attention to this topic and determine the reasons for that. It appears from Table 1 that the countries belonging to the European continent are the countries that have taken greater interest than countries on other continents. Therefore, 10 studies were conducted in the United Kingdom, and five studies were carried out in France, totaling 15 studies in Europe. The results indicate that European countries are researching carbon accounting more than other countries because global climate change impacts Europe in many ways: changes in average and extreme temperature and precipitation, warmer seas, increasing sea level, and declining snow and ice cover on land and sea. These have had a wide range of effects on ecosystems, socioeconomic sectors, and human health. Some studies show that the European countries’ introduction of emissions trading in 2005 necessitated a significant amount of knowledge in order to determine the activities related to carbon accounting. In addition, the skills and capabilities of accountants should be developed to enable them to disclose strategic and physical climate information and how to enhance it. This promotes standards for disclosing strategic and material information related to climate (Ascui and Lovell, 2012). In France, too, some laws require commercial companies to include carbon labels on all consumer products and information related to carbon dioxide (Martineau and Lafontaine, 2020). Australia and China came second, with nine and eight studies for each country, respectively. This may also be because the Australian government has worked to present many national schemes for emission trading. Therefore, the study by Chapple et al. (2013) confirmed that their goal is to investigate the impact of educational testing services on the stock market. In addition, the effects of implementing a mandatory carbon reporting system have not been detected (Hartmann et al., 2013). Therefore, this may be some of the reasons for the increase of studies in this country. The absence of studies that discuss carbon accounting in countries with a high impact on industries and environmental changes, such as the United States and Turkey, as well as some countries that pay less attention, such as China, is surprising and scary, and therefore, future studies may take research samples or a case study on these countries. In addition, future studies can discuss the impact of issuing laws that require companies to issue carbon accounting reports and reports related to environmental changes and carbon emissions and their contributions to reducing emissions and achieving sustainability. It should be noted that the use of data from multiple countries appeared from 2018 to 2022 in a large way, which is evidence of the great orientation of researchers toward this topic to identify the importance of reducing emissions at the regional and international levels. More studies based on these reports can improve carbon accounting research.

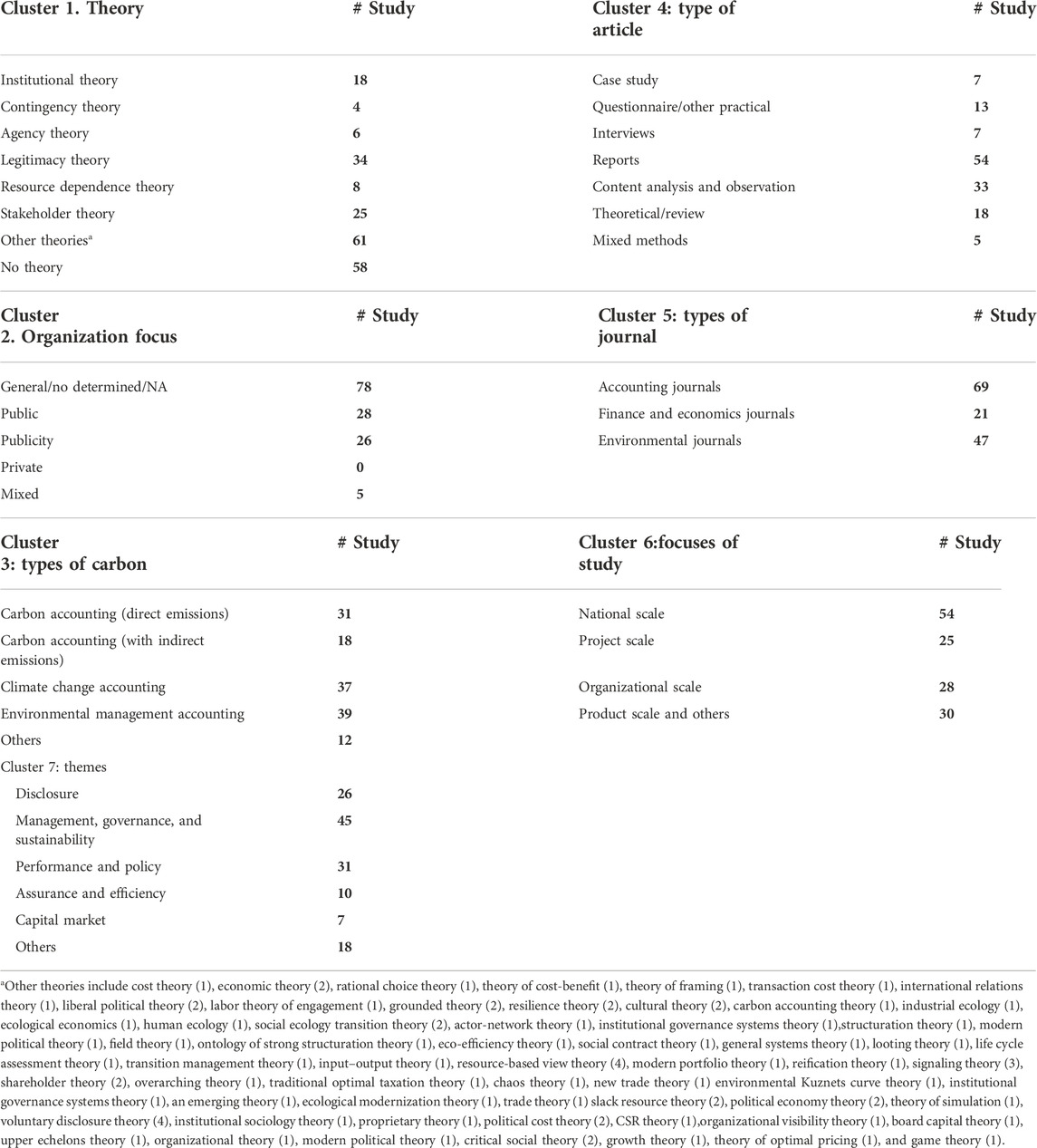

3.3 Underpinning theories

In Table 2, cluster 1, we review the theories used in the literature. The analysis results show that there are 67 theories used in 79 studies. In contrast, the other studies included in the sample of this study, which amounted to 58 studies, did not use any theory. We follow many studies that used this classification, which is useful in knowing the extent of the impact of previous studies and the clarity of their results (Hazaea et al., 2021a; Khatib et al., 2021). Statistical results show that the theory of legitimacy came first, as it was based on 34 studies. This is evidence that this theory is the most important theory that has been investigated to explain the environmental and social aspects and the extent of their disclosure (Solikhah et al., 2020). Stakeholder theory came second, which was based on 25 studies. This theory emphasizes that the pressure exerted by stakeholders determines companies’ environmental behavior and practice (Kumarasiri, 2017), as well as the theory of the institution, which was used in 18 studies. This theory works to describe the changes that occurred in successive periods and to work on evaluating the development of accounting systems to facilitate obtaining the relevant information related to it. We note that the development of the literature has also resulted in a development in the use of new theories that are different from the traditional theories. In addition, the results of statistical analyses show that contemporary studies have used more theories than the older studies, and this is one of the indicators that come to the development of scientific research in this subject. It should be noted that 58 studies, with more than 40% of the studies sample, did not use theories. Future studies should expand the use of theories related to carbon to obtain clearer results and understanding, which contributes to knowing the role of accounting in reducing carbon emissions clearly.

3.3.1 Legitimacy theory

This theory is one of the most important theories that explain the environmental and social aspects of accounting (Nartey, 2018). This theory works to clarify the correlations between emissions from all units of revenue (or environmental performance) and economic- and location-based performance to identify and disclose opportunities that result from climate change (Ascui, 2014). Some studies have indicated that legitimacy theory can be used to voluntarily disclose carbon determinants, which helps companies in interpreting and analyzing pressures imposed by society, government, and external parties. The theory also contributes to the development of effective methodological frameworks that enhance the transparency of carbon emissions controls (He et al., 2021). Despite the great importance of this theory in explaining the mechanism of decision-making according to the environmental changes of individual companies, it is not sufficient to explain the significant expansion witnessed by the practice of carbon auditing (Tang, 2019). Finally, it is argued that the legitimacy theory is one of the most important theories for explaining organizational behavior; developing and implementing mechanisms, directions, and policies for social responsibility; and communicating their findings (Zyznarska-Dworczak, 2018).

3.3.2 Stakeholder theory

This theory is one of the political economy theories that is frequently used in carbon accounting. This theory explains the pressure exerted by stakeholders on institutions and organizations and their effects on environmental and management decisions (Ascui and Lovell, 2012) and also confirms that companies that enjoy high-quality governance tend to be more knowledgeable and aware of the issues resulting from climate change, which motivates them to improve national production in line with the expectations of stakeholders and society (Luo, 2019). According to this theory, the achievement of sustainability by enterprises requires more pressure on the issues of social consequences and climate change than enterprises currently undertake in the various organizational activities (Naranjo Tuesta et al., 2021).

3.3.3 Institutional theory

This theory is one of the most important theories used in environmental accounting studies and carbon reports (Nartey, 2018). According to this theory, working to mitigate climate change is a stem issue, which can be solved using various methods, employing regulatory areas in the overlapping carbon accounting (Callon, 2009). Institutional theory can explain the strategies and options available for carbon accounting companies to develop to respond to regulations and policies resulting from climate change to gain legitimacy (Haraldsson and Tagesson, 2014). As a result of new policies and regulations that may lead to the imposition of carbon costs and increase the change in competitive standards between sectors and industries, the enterprise theory may contribute to the explanation on how the institutional environment can create or increase the economic and competitive advantage of companies more than the competitive advantage supported by resources—internal affairs of these institutions (Ratnatunga and Jones, 2012).

3.3.4 Resource dependence theory

This theory is based on the assumption that companies must deal with the environment that surrounds them, including companies and other institutions, to obtain resources (Archibald, 2007). Many studies show that this relationship and participation include many benefits and reciprocal dependencies between all parties, including environmental pressures that affect making changes in internal components of companies, such as members of boards of directors and their actions to obtain resources (Davis and Adam Cobb, 2010; Mardini and Elleuch Lahyani, 2021). In addition, this theory emphasizes the importance of providing resources to be available to those in charge of the board of directors (Hillman and Dalziel, 2003). Based on these findings, we conclude that this theory contributes to providing a deep vision that clarifies the rationale for appointing competent and experienced managers in a way that facilitates the provision of a better understanding of the various situations and practices, including environmental problems (Khatib et al., 2021), especially in industries that are associated with a high carbon impact, such as opaque industries.

3.3.5 Other theories

Studies that discussed carbon accounting included many other theories that focus on and are interested in analyzing the relationship between accounting and environmental changes. Contingency theory assumes differences in carbon accounting practices that reflect the personal needs of institutions and companies (Nartey, 2018). Therefore, this theory assumes that the practice of corporate managers aims to search for solutions based on individual actions (Burritt et al., 2011). Input–output theory shows that carbon accounting has a strong and deep relationship with economic methodology (Kennelly et al., 2019). Therefore, carbon accounting can provide a deeper understanding of carbon accounting methods than other accounting methods based on production (Kennelly et al., 2019). The signaling theory is one of the theories that is used in carbon disclosure, as this theory confirms that companies are working to reveal their true position that appears through reports regarding carbon emissions as a result of the market, social, economic, institutional, and regulatory pressures due to their association with disclosure incentives (He et al., 2021).

3.4 Organization focus

This part discusses the distribution of the literature on the type of unit or sector in which the study was conducted. Through this distribution, it is possible to identify the parties interested in applying carbon accounting. This classification has been followed in many recent studies; for example, Kotb et al. (2020), Hazaea et al. (2021a), and Hazaea et al. (2021b contribute to identifying the sectors in which carbon accounting research has been conducted. Table 2, cluster 2, shows that the number of research studies conducted without specifying the sector in which the research was conducted or the investigative studies based on general/no determined/NA came first with 78 studies, as these studies did not specify the type of institution in which the research was conducted. Due to encouragement from some governments, such as China, the public sector studies came in second with 28 studies. The third is the studies conducted on the stock markets with 26 studies. We expect that there are factors that may encourage researchers to conduct research using data from the public and governmental sectors, especially in light of the desire of governments to encourage researchers to discover the phenomenon more, which facilitates the implementation and practice of what the state seeks properly, especially about environmental changes. Surprisingly, no studies address carbon accounting in the private sector, which necessitates additional research and investigation in future studies. Moreover, future studies may increase the importance of carbon accounting in the economic sector based on data from public reports of international organizations and institutions. Furthermore, studies need to be conducted in a number of public sectors, especially in countries such as China, the United States, Malaysia, and Russia that have a significant environmental impact (Tang, 2019; He et al., 2021; Ong et al., 2021).

3.5 Types of carbon

In Table 2, cluster 3, studies are distributed based on the transformations in the concept and function of carbon accounting. It was divided into four sections based on the distribution approved by Csutora and Harangozo (2017): 1) carbon accounting (direct emissions), 2) carbon accounting (with indirect emissions), 3) climate change accounting, and 4) environmental management accounting. In addition, we made an additional distribution of studies (others) that did not primarily clarify their classification. Environmental management accounting came first with 39 studies. This type came as a result of the increasing interest of companies in early development at the company level (environmental costs). These studies focus on how to save costs when using available resources (Lohmann, 2009; Warwick and Ng, 2012; Chapple et al., 2013). Climate change accounting came second with 37 studies. This type emerged due to companies shifting to focus on costs resulting from climate adaptation instead of focusing on costs associated with emissions (Csutora and Harangozo, 2017). This type focuses on providing comprehensive and systematic coverage of all of the impacts of climate change, supply chains, and product costs, thus broadening the horizon toward climate accounting as an alternative to carbon accounting. Carbon accounting (direct emissions) came third with 31 studies. This type of carbon accounting focuses on the audit and reporting of carbon-related emissions at regulatory levels. Companies tend to increase their regulatory attention to climate change of this type. Carbon accounting (with indirect emissions) came with 18 studies. This type focuses on providing systematic and comprehensive coverage of carbon emissions and supply chains and costs associated with products. In contrast, this type of carbon accounting was developed because companies focused on the effects of overseas production and needed to know what these effects were (Csutora and Harangozo, 2017). There have been 12 studies that discuss other topics related to carbon accounting.

3.6 Types of articles

In this section, we review the types of studies that discussed carbon accounting. The studies were divided into seven types, as shown in Table 2, cluster 4; first came the studies that used annual reports with a number of 54 studies, and this may be due to the ease of obtaining reports from government institutions and stock exchanges. It is noted that there is a tendency to conduct research from realistic data based on reports that companies or organizations maintain to ensure obtaining real results that are closer to reality (Ghani et al., 2018; Kotb et al., 2020), where these studies discuss the role of carbon accounting in the system (Sial et al., 2021), the effects of corporate governance on carbon accounting (Cordova et al., 2020; Luo and Tang, 2021), carbon accounting and financial performance (Naranjo Tuesta et al., 2021), preparing financial reports and practicing disclosure (Kumar and Firoz, 2020), the impact of the emissions trading plan resulting from the impact of the capital market (Chapple et al., 2013), and carbon management and firm value (Shrestha et al., 2022). The results of these studies show the importance of carbon accounting in controlling climate change and reducing emissions, thus enhancing the performance of companies financially, environmentally, and organizationally, although it is necessary to conduct research based on the application of the case or explain the impact based on appropriate analysis in the field of knowledge of emissions, which may not be covered and known through the use of reports. These indicate the need to conduct various studies based on different methods of analysis.

As a second group, the authors used content analysis and observation with 33 studies, which may reflect the difficulty of analyzing data from companies. Thus, researchers tend to analyze the content. In contrast, researchers paid less attention to studies based on questionnaire and interview, which is where future studies may focus. These can provide more realistic information on carbon emissions and the role of carbon accounting in mitigating them. Carbon accounting is compared to traditional accounting in reducing carbon emissions, where data collection methods based on primary data are one of the most important ways to obtain data in the search for factors that affect the economic aspects (Roopa and Rani, 2012). It is also important to conduct studies using questionnaires and interviews through which it is possible to identify the various factors, whether external or internal, that affect the practice of carbon accounting, including economic, regulatory, and governance pressures, and financial constraints.

3.7 Types of journals

Based on the type and field of the journal, we distributed the literature under investigation in cluster 5 of Table 2. Our focus was on studies that discussed carbon accounting in accounting, finance, management, environment, and sustainability, and we obtained 137 studies included in this category (Hazaea et al., 2021a; Hristov et al., 2021). Journals are classified into three types. The first type includes accounting and auditing journals, the second type includes finance and economics magazines, and the third type includes environmental and sustainability journals.

Table 2, cluster 5, shows accounting and auditing journals had the highest number of studies, with 69. The accounting, auditing, and accountability journals came first with 11 studies; sustainability accounting, management, and policy journals ranked second with 10 studies; accounting and finance journal with five studies; and Australian Accounting Review with four studies. The reason for this large number of studies in accounting journals may be due to the protocol we followed in analyzing studies that discussed carbon accounting in the accounting field only. In addition, it may be an indication of the link between carbon accounting and the field of accounting in the economic and financial aspects, given the achievement of some studies and the application of carbon accounting as being mainly related to emissions without linking them to the economic aspect. Although the sample under investigation was confined to discussing carbon accounting research in the fields of accounting, economics, and finance, the literature published in the journals of environmental and sustainability came second with 47 studies. This indicates the view of researchers and those interested in considering carbon accounting as an environmental accounting issue that aims to help companies reduce environmental emissions. The Journal of Cleaner Production came first with 14 studies. In addition to the accounting and auditing journals we mentioned earlier, this journal is a pioneer in publishing environmental accounting topics. With 21 studies, Journals of Economics and Finance ranked third.

It should be noted that these journals emphasize the important role of carbon accounting in reducing emissions and preserving the environment. It is important to note that most of the journals that discuss the topic of carbon accounting are among the best journals among researchers, which have a high impact factor, such as Journal of Cleaner Production Science Citation Index, Impact Factor 11.072, Accounting, Auditing and Accountability Journal, Social Sciences Citation Index, IF 4.89, and Sustainability Accounting, Management and Policy Journal, SSCI, IF 3.96. The impact of these studies on regulators, stakeholders, and readers can be determined by the importance of the research findings of these studies.

3.8 Focus of the study

We followed Stechemesser and Guenther (2012) and then divided the studies based on four scales, namely, national scale, project scale, organizational scale, and product scale. We adopt this analysis in order to be able to display the content and focus of the studies under investigation. In our distribution and when determining the metrics in each article, we encountered some difficulties in classifying some articles, and therefore the scale that was explained more was adopted considering the article belongs to it. Therefore, the main task in working to reduce climate change and reduce emissions falls on the shoulders of governments.

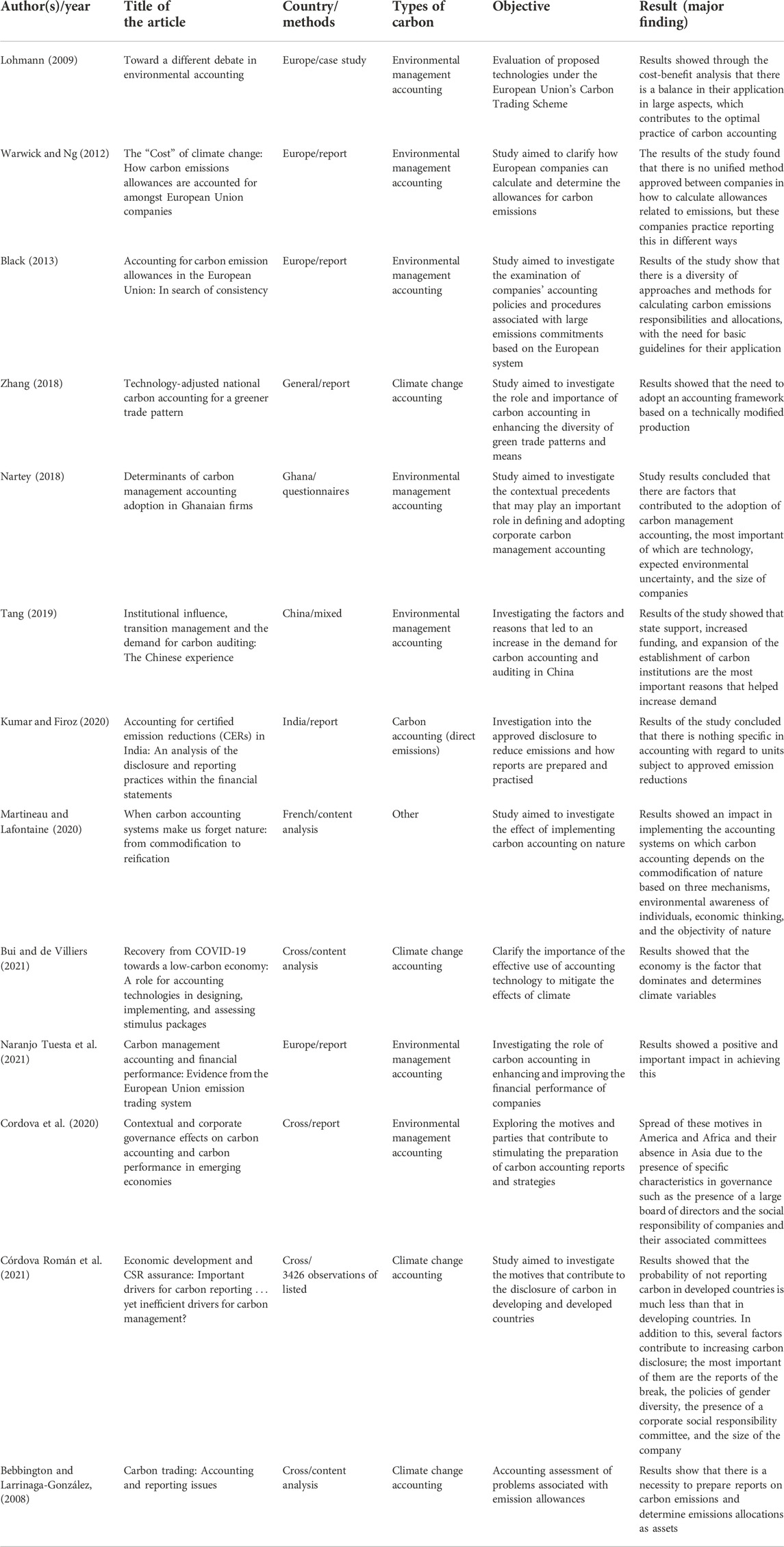

3.8.1 National scale

It can be said that this measure depends on nonfinancial accounting, that is, noncash accounting. The associated environmental changes have increased in light of the current industrial developments. Therefore, countries, especially developed countries, have worked to issue many programs and policies that seek to reduce carbon emissions by working with institutions and organizations. This is where the studies discuss the role of carbon accounting in reducing emissions at the region, city, and state levels. Therefore, many terms are used in defining this measure, such as footprint accounting, environmental and social carbon accounting, carbon emissions accounting, financial carbon accounting, and general carbon accounting, which is an accounting that includes all carbon flows that are associated with all ecosystems (Kubeczko, 2003). This measure was discussed in 54 studies out of the total sample under investigation. For example, Lövbrand and Stripple (2011) discussed how climate management could be achieved in terms of technical, practical, and computational practices. It was found that carbon accounting could be used to measure flows and stocks and work to demarcate, identify, and aggregate them statistically. In addition, it insists on calculating carbon. As a result, the mathematical methods for carbon accounting can provide different perspectives on the climate. Also, Cordova et al. (2020) investigate the motives through which it is possible to explore the factors and driving forces of the strategies followed in managing carbon reduction and issuing reports in emerging countries. The results showed the presence of many factors, such as the large board of directors and the committee related to corporate social responsibility, with the reliance on social and environmental performance in the policy of executive compensation. Furthermore, the results of the companies show that countries in Africa and the United States are among the regions that report the most carbon emissions. Martineau and Lafontaine (2020) investigate whether the implementation of carbon accounting systems contributes to society’s apathy toward nature. The study results show that understanding carbon systems may push society to forget nature through the way society views the relationship between society and the environment from a neutral and emotional point of view. Therefore, it should deal with nature objectively and commodified. Table 3 summarizes some studies related to this scale.

3.8.2 Project scale

This refers to the nonmonetary measurement and evaluation of the emissions of heating gases and carbon and compensation for projects with the monetary evaluation of the emissions that occurred with the evaluation of compensation balances to inform the stakeholders, investors, and project owners to develop specific methodologies and methods. According to this scale, studies may focus on monetary and nonmonetary aspects together (Stechemesser and Guenther, 2012). It is possible to refer to the studies classified within this scale by the presence of some terms that indicate the practice of carbon accounting under the project, such as carbon trade accounting, carbon accounting system, accounting for emissions, green accounting, and carbon flow accounting. Le Breton and Aggeri (2020) discuss how the deployment and development of a carbon accounting tool by any public organization can affect any corporate business. The findings help to reducing gas emissions and promote the transition to strategies based on carbon reduction. In addition, it can contribute to determining the financing methods for each company. Bebbington and Larrinaga (2014) discuss how carbon accounting possibilities can be explored in light of sustainability methodology and science. According to the findings of Bebbington and Larrinaga (2014), one of the most important reasons for the emergence of carbon accounting as part of environmental and social accounting is the failure to achieve sustainable development. In addition, the current trend of accounting, in light of the demands to direct its practice toward achieving sustainability, contributed to the emergence of different types of traditional accounting. Chapple et al. (2013) discuss the empirical evaluation of the impact of a trading plan related to carbon emissions on the assumed market value of nonperforming or damaged companies. According to the findings of Chapple et al. (2013), the penalties that companies face may result from the existence of obligations related to the extent of achieving mitigation costs or future compliance, implying that the degree of market influence dependent on the possibility capital markets being evaluated. Table 4 summarizes some studies related to the project scale.

3.8.3 Organizational scale

This scale also focuses on the monetary and nonmonetary aspects of carbon accounting. Many terms have been used to define this type of scale, such as CO2 (emissions) accounting, carbon (statement) accounting, carbon cost accounting, and carbon management accounting (Stechemesser and Guenther, 2012). In this type, a distinction must be made between environmental accounting and its use in financial accounting and management accounting (Ratnatunga, 2008); hence, the need to distinguish between carbon financial accounting and carbon management accounting is required (Ratnatunga, 2007). Mardini and Elleuch Lahyani (2021) assess the extent to which the presence of foreign managers in the management of enterprises is related to the performance of companies’ carbon emissions and disclosure. The findings of Elleuch Lahyani (2021) revealed that the presence of foreign directors on company boards is associated with a significant positive impact on disclosure and carbon emission performance. Sial et al. (2021) analyze the challenges that institutions and organizations may face while controlling emissions from heating gases, considering the complexities of climate change. The results show that transitioning toward a green economy from the traditional economy is one of the most important challenges, which requires organizations to implement high-quality administrative work based on achieving balances. Ong et al. (2021) discuss how carbon governance applied by companies can affect the practice of high carbon performance by investigating the relationship between carbon performance in companies and carbon management and the extent to which they are affected by accounting for carbon as a mediating variable. The results showed that carbon performance is positively affected by the application of carbon accounting as a vital topic that companies must apply and publish to contribute to improving the mitigation of carbon emissions. Table 5 summarizes some studies related to carbon accounting.

3.8.4 Product scale and others

This scale is concerned with nonmonetary aspect of carbon accounting. Many terms have been used to define this measure under carbon accounting, such as CO2 accounting, carbon flow accounting, and greenhouse gas accounting (Stechemesser and Guenther, 2012). Although the use of this scale is considered new, 30 studies from the sample investigation discussed this scale with its incorporation into other issues in some studies. Wilting and Vringer (2009) discussed the consumer approach as an alternative approach to environmental accounting, which includes and contains pressures related to the environment and related to domestic consumption imports. The results showed that consumers contribute to reducing the pressures related to the environment through new policies and methods. In addition, the findings show that there is a difference between international environmental pressures and consumer pressures. Feng et al. (2022) investigate the extent to which the carbon efficiency is affected by trade, taking into consideration several factors, including technological innovation, market size, and structural adjustments. The results show that trade through import and export has an important and positive impact on improving the carbon efficiency. Tang and Ge (2018) investigate the impact of the production of goods and services on carbon emissions. The results showed that producing goods and services is one of the most important factors contributing to the increase in carbon emissions. Finally, carbon accounting can be viewed on this scale by measuring emissions associated with products to enhance the awareness of consumers, media, and stakeholders. Table 6 summarizes the studies related to carbon accounting.

3.9 Thematic analysis

Over the past few years, researchers have become increasingly interested in assessing carbon accounting from a strategic and environmental perspective (Ascui and Lovell, 2012; Le Breton and Aggeri, 2018; Bui and Fowler, 2019). Many empirical, normative, philosophical, and critical studies have been conducted with a great focus on carbon management accounting studies, carbon disclosure, carbon performance, and reporting (Faria, 2019; Tukker et al., 2020; Dong et al., 2022; Han et al., 2022). However, it appears that there is a wide research field for future studies to work on, including carbon education, political and materialism forms of carbon accounting, capital market empowerment, and collaboration with practitioners and professionals. This will lead to the liberalization of carbon accounting and its practice for environmental and strategic assessment, providing diverse opportunities in education and practice and encouraging cooperation, which contributes to creating modern accounts free from traditional accounting practices and restrictions. To identify research gaps related to the investigation of the topics studied in the literature to guide future research to work on covering them, we conducted a comprehensive investigation of all of the articles under investigation and classified them into six categories, which are disclosure (26 studies), management and governance (45 studies), performance and policy (31 studies), assurance and efficiency (10 studies), capital market (seven studies), and others (18 studies).

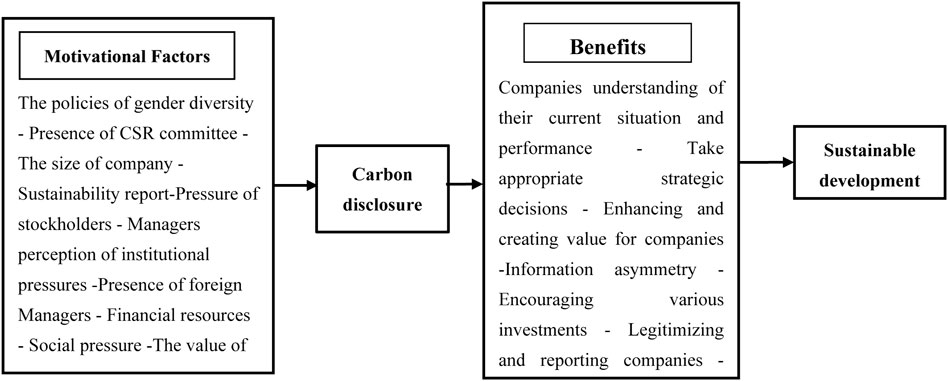

3.10 Carbon disclosure

The importance of carbon disclosure has evolved significantly in recent years, as it has become one of the important issues in making strategic decisions by companies (Alsaifi et al., 2020). In addition, one of the most important factors that contribute to carbon disclosure is the interest of stakeholders and their demand for reports and the increase in competition between companies (Alsaifi et al., 2020). Thus, companies work to submit their carbon disclosure reports to government agencies in various ways, the most important of which is the annual corporate reports, corporate social responsibility reports, sustainability reports, or specific organizational schemes (He et al., 2021). Some literature discusses the importance of carbon disclosure and the factors that contribute to motivating companies to submit carbon disclosure (Córdova Román et al., 2021; Mardini and Elleuch Lahyani, 2021; Adhikari and Zhou, 2022). However, some studies confirm that carbon disclosure in developed countries is much greater than disclosure in developing countries. These are the result of several factors, the most important of which are the reports on sustainability, the policies on gender diversity, the presence of a corporate social responsibility committee, and the size of the company (Córdova Román et al., 2021). The results of a study by Kumar and Firoz (2020) show that the lack of mandatory procedures by governments requiring companies to submit carbon disclosure reports is one of the main factors that encourage nondisclosure reports. The study results showed that the pressures of companies and stakeholders are among the most important factors affecting carbon disclosure. In addition, managers perceive institutional pressures (Vaseyee Charmahali et al., 2021). Another study showed that the presence of foreign managers in companies is one of the most important factors in disclosing carbon as a result of their tendency to try to enhance transparency related to the environment and work to reduce information asymmetry, which enhances the improvement of the legitimacy of companies (Mardini and Elleuch Lahyani, 2021). According to this analysis, reporting carbon to companies offers companies and society several benefits. One of the most important benefits is that companies are better able to understand their current situation and performance, which allows them to make appropriate strategic decisions that contribute to sustainability (Haslam et al., 2014). In their study conducted on a sample of US companies, Adhikari and Zhou (2022) found that companies providing integrated disclosure reports have no challenges regarding information asymmetry. In addition, companies can enjoy low supply and demand margins. A study by Pitrakkos and Maroun (2020) found that the disclosure of carbon emissions by companies has important implications for legitimizing and reporting companies and increasing stakeholders’, regulators’, and investors’ confidence. The result of the study showed that disclosure of carbon reports could enhance and improve credibility and reality when making decisions (Wong et al., 2019). Carbon disclosure can enhance and create value for companies (Kumar and Firoz, 2020). Disclosure of carbon might contribute significantly to encouraging various investments to know companies’ behavior better (Mora Rodríguez et al., 2020). Clearly, the disclosure of carbon by companies has many benefits, but the disclosure will not occur unless there are some incentives that encourage companies to submit carbon reporting (Haslam et al., 2014). These factors may be related to the company, the community, the government or stakeholders, and financial aspects (Tang, 2019). If these incentives are available, companies can disclose carbon, which may help them enhance performance, maintain their value among society, and thus achieve sustainable development (Haslam et al., 2014). Finally, in light of the current situation, most carbon disclosures by institutions remain voluntary despite increased pressure, government rules, and regulations. Although some literature discusses the reasons for carbon disclosure, there is an absence of studies that discuss the role of the governmental and political sides in supporting companies to submit disclosure reports due to the fact that climate change is a fundamentally political issue. Therefore, this may be one of the main areas for future studies. In addition, we believe that providing carbon information to managers, shareholders, and government officials may allow companies to identify risks and consequences and understand their current state. Future studies can investigate this by conducting studies using interviews, or the questionnaire through which a clear explanation of these questions can be obtained. On other hand, based on economic theories, future studies can investigate the economic factors represented by the company size, profitability, liquidity, and financial stagnation and their impact on motivating companies to disclose carbon. The factors and benefits associated with disclosure can be illustrated in the Figure 3.

4 Please see Supplementary Appendix S1 which shows all of the factors

By presenting the drivers and determinants that contribute to carbon accounting disclosure, policymakers, researchers, and regulators of carbon accounting practice can explain and understand the pressures that companies face from society, governments, and regulatory parties. Furthermore, it can be used to create clear and effective regulatory rules and foundations that improve transparency in carbon mitigation and control.

4.2 Management, governance, sustainability, and carbon accounting

Carbon management accounting is an essential part of sustainability accounting designed to provide management information (Nartey, 2018). Carbon management refers to the ability of companies to reduce the carbon emissions, resulting from the conduct of their activities (Hartmann et al., 2013). In contrast, Tang and Luo (2014) indicate that it is the ability to manage everything issued by the company and has to do with carbon. Many important topics have been extensively discussed in the literature, including factors influencing carbon management and governance practices and regulatory changes in carbon management practice. The results of a study by Burritt et al. (2011) showed that carbon management provides many benefits, the most important of which are 1) gaining competitive advantages as a result of exceeding and applying regulatory and legislative requirements in reporting carbon emissions and 2) providing the ability to improve and increase the effectiveness and efficiency of information collection and dissemination. Carbon management contributes to providing and supporting all organizational levels in companies in the decision-making process and facilitating the challenges faced by decision-makers, including the challenges of compliance with energy and product innovation regulations (Schaltegger and Csutora, 2012). Through the diversification of product-based carbon accounting approaches and the organization as a common carbon management accounting system, carbon management accounting can be activated and its effectiveness increased in enhancing external communication, performance, and efficiency (Gibassier and Schaltegger, 2015). The results of the study by Nartey (2018) shows that several factors positively affect the adoption of carbon management accounting in companies, including the company’s strategy, size, structure, technology, and perceived environmental uncertainty. On the other hand, the result of a study by Lewandowski (2017) and Naranjo Tuesta et al. (2021) shows that carbon management accounting has a positive and important impact on improving the financial performance of companies. One of the most important challenges facing the application of carbon management accounting is climate change (Sial et al., 2021).

Carbon governance is management and organizational capacity focused on involving companies in carbon activities and how carbon emissions can be mitigated through opportunities and risks, in addition to how to deal with them and the mechanisms resulting from governance (Tang and Luo, 2014). According to the theories of stakeholders and the theory of legitimacy, effective governance contributes significantly to the protection of stakeholders, which contributes positively to the impact on the environmental performance of companies (Bebbington et al., 2012). Some findings from the research literature revealed that there is no significant relationship between carbon accounting and carbon governance, implying that carbon governance has no effect on the practice of carbon accounting in companies (Larrinaga, 2014; Ong et al., 2021). On the other hand, a study by Lee (2012) showed that environmental control greatly enhances the alignment between the company’s strategies in carbon management and measuring carbon performance. Thus, decision-makers in companies can benefit from the ability to provide useful information. Furthermore, carbon performance practice can be enhanced in the supply chain (Lee, 2012). On the other hand, the results of Cordova et al. (2020) study showed that several factors could contribute to reducing emissions, including the size of companies and the presence of corporate social responsibility committees. Finally, it can be said that the study of carbon accounting management can contribute to understanding how accounting can manage and practice carbon management. There are different accounting principles and meanings, such as risk, performance evaluation, reporting, disclosure, accounting regulations, and procedures linked to carbon management systems, enabling companies to enhance their capabilities in reducing carbon emissions. Future studies could further investigate the factors that support the practice of carbon management accounting and the environmental factors that help achieve this.

4.3 Performance and policy and carbon accounting

Carbon performance can be expressed by measuring the quality of companies’ performance and management’s ability to control carbon emissions (He et al., 2022). In the literature, the factors that affect carbon performance are discussed, such as the difficulties that companies face in measuring the quality of performance. According to a study by Luo et al., (2012), carbon performance is positively affected by the quality of overall governance, thus enhancing corporate social responsibility toward carbon performance. According to the findings of Ong et al. (2021), T-carbon performance is not significantly affected by the quality of carbon governance but rather is positively affected by the extent of the practice and application of carbon accounting as an important topic that contributes to carbon emission reduction. At the same time, the findings of Mardini and Elleuch Lahyani’s (2021) show that the presence of foreigners on corporate boards of directors contributes to improving carbon performance. They are working to reduce the volume of information consistency and improve environmental transparency because they rely on extensive scientific experience and knowledge to provide comprehensive knowledge and information about sustainability. As for the findings of Ong et al. (2022), they showed that carbon accounting and carbon risk management have a significant and positive impact on carbon performance. In addition, carbon accounting has a significant positive effect on the relationship between carbon risk management and carbon performance. However, Damert et al. (2017) found that institutional pressure and financial benefits have no positive effect on carbon performance, and thus carbon competitiveness has not continued to increase. Although long-term improvements in carbon performance are not related to carbon reduction activities, eventually, Tang and Luo (2014) discovered that the quality of carbon management has a significant impact on carbon performance. Future research may expand on this topic, as the current literature does not fully explain how carbon can be measured, which may expand and increase reliability and comparability when reporting carbon emissions.

4.4 Assurance, audit and efficiency, and carbon accounting

There are studies that prove that there is a difference between assurance and audit in the regulatory and legal environment, the required competencies, the threshold of relative importance, organizational participation, the difference in accounting methods, and the quality of users of assurance reports (Olson, 2010). According to Hazaea et al. (2021a), traditional audit assurance differs from carbon assurance in that traditional audit assurance, which is based on the implementation of operations covering expenditures, revenues, and financial expenditures; reviewing laws; and reviewing internal management reports. In contrast, carbon assurance covers auditing carbon derivatives and what they are related to. Assurance functions are one of the new functions in various fields (Zhang et al., 2020; Hazaea et al., 2021b). Carbon assurance is an essential part of environmental assurance, through which it is possible to know how countries and societies can adapt to environmental changes in order to achieve economic development and strengthen national control (Chen and Mei, 2012). Recently, carbon data assurance functions have been created in response to recently issued carbon-specific instructions and regulations, which require reliable and accurate information on carbon emissions (Martinov-Bennie and Hoffman, 2012). Feng et al. (2022) discussed the experimental and theoretical effects of import and export trades in services on and the efficiency of carbon emissions by relying on many factors, the most important of which are structural modifications, technological innovations, and market size. The results of the study showed that there is a dampening effect on the carbon efficiency as a result of trade-in services. According to the findings of Tang (2019), the recent increase in interest in the practice of carbon auditing was due to the establishment of carbon institutions and organizations and the interest and increase in government funding. Moreover, the result shows that carbon auditing can be used as one of the tools in economic and social reforms, which can enhance social, technical, and organizational innovation and contribute to enhancing sustainability. Córdova Román et al. (2021)demonstrate that the company’s guarantee is one of the primary motivators for disclosing of carbon emissions. The literature has dealt with the field of assurance not broadly, and therefore, future studies may work on conducting studies through which it is possible to understand and know about carbon assurance. Future research may investigate factors that promote carbon assurance. Institutional factors, governmental factors, organizational factors, and social factors are all discussed. Future studies can also be conducted through which it is possible to know the environmental impact of the countries, in which carbon assurance can be applied. On the other hand, industrial transformation and economic development are among the most important reasons for practicing carbon assurance. However, there are few studies that discussed carbon assurance in countries that are witnessing these transformations, such as the United States, China, and East Asian countries (Green and Taylor, 2013; Tang, 2019). Therefore, this may be a research area for future studies.

4.5 Other topics

In light of the growing interest among researchers in investigating carbon accounting, we review some of the topics discussed in the literature that relates to carbon accounting. For example, Chapple et al. (2013) discuss the capital market’s impact on the Australian Government’s carbon emissions trading scheme. The findings revealed that the capital market views companies with high carbon intensity as having a low market value, indicating that the market has an impact on the emissions trading plan. Andrade et al. (2018) identify companies’ challenges when defining a production-based carbon inventory. The findings revealed that one of the most important difficulties is the lack of complete information that would help estimate emissions, especially information related to consumer services and goods. In contrast, some studies discussed different topics, such as accounting and carbon market risks (Jin et al., 2020; Ong et al., 2022). For example, Baltar de Souza Leão et al. (2020) investigate carbon accounting and emissions inventory analysis. Kurz and Apps (2006) discuss carbon monitoring and reporting system development. Sullivan and Gouldson (2012) examine the investor perceptions and reporting carbon emissions, while Faria (2019) explains the concept of avoiding carbon emissions and environmental policy discourses. Rankin et al. (2011) highlight voluntary reporting on carbon emissions and corporate governance theory, while Chu et al. (2013) determine the factors that motivate Chinese companies to issue carbon reports. Despite the emergence of a large and rapid development in the discussion of carbon accounting with other accounting and economic topics, some are still limited.

5 Future research agenda

Herein we discuss the limitations and gaps in the literature that has been investigated, which would pave the way for future research. This study is designed to provide an answer to the four questions that were identified according to the protocol that was followed. We note that there is an indication that the practice of carbon accounting was as a result of the protocols and regulations issued in many countries, including China, Australia, and the European Union countries. Therefore, the community’s fear of the effects of climate change prompted companies to adopt the use of accounting in an attempt to mitigate the effects of the climate, which calls for action research to understand carbon accounting clearly, and this is evident through the increase in studies that have been conducted in the last 5 years compared to previous decades. This development in the literature led to the consideration of carbon accounting as an accounting and research field independent of social issues or as part of corporate social responsibility toward society. Thus, the literature indicates the importance of accounting in reducing carbon emissions. However, a distinction must be made between traditional and carbon accounting in their practice and implementation.

Traditional accounting is the basis through which carbon accounting was developed and through which sustainable development can be achieved (He et al., 2022). The analysis revealed that the United Kingdom topped the list of countries where research was conducted when compared to the rest of the countries, where the number of studies reached 10. In comparison, Australia, China, and France came second. It can be said that the legislation issued in Europe (Kyoto Protocol and the EU ETS) and the Paris Agreement on climate have greatly contributed to the interest of researchers in researching the importance and practice of carbon accounting and its importance in achieving sustainability. We note that most of the studies discussing carbon accounting were conducted in developed countries. It is revealed that there is a lack of studies that discuss the practice of carbon accounting in the United States and the Arab region. Therefore, studies can be conducted given these countries’ expected role and effective impact on the policies of practicing carbon accounting. In addition, it is believed that conducting studies in countries with a large industrial impact, such as China, India, Malaysia, Japan, and Russia, in which we expect large emissions, and developing countries may contribute to knowing the practice of carbon accounting more clearly, which facilitates providing a clearer and balanced vision on the effects of climate change and the role of carbon accounting in mitigating emissions. On the other hand, several countries in the European Union and China have established service centers for educational testing, which is considered one of the largest global centers for carbon trading, which may encourage conducting multiple studies and contribute to knowing the practice and importance of carbon accounting.

The results of this study show an average use of theories, particularly the theory of legitimacy, stakeholders, and institutional theory in carbon accounting studies. This is an indication that studies still contain theories that are used in noncompulsory (voluntary) carbon disclosure, which indicate that carbon emissions and related management are related to various markets, economics, regulatory, social, and institutional pressures, and this is related to disclosure; future studies may use behavioral and economic theories in investigating the practice of carbon accounting and the factors that can be an incentive for companies to submit carbon reports to the competent authorities and interested parties. We believe that using other theories may add a deeper understanding of the field of carbon accounting research. Concerning institutions that used data to investigate the practice of accounting, we find the absence of using private institutions’ data, and this may be an area for future research; considering the investigation of the contribution of these institutions to preserving the environment as part of the social responsibility adopted by these companies, more studies in the public sector also have expanded the field of research. The analysis of the results showed that there is a need to conduct studies based on the questionnaire and the interview, which significantly contribute to the knowledge development in carbon accounting. In addition, real information can be obtained about the motives and factors that can encourage companies to submit carbon reports as part of corporate social responsibility voluntarily.

There is a widespread of research in high-impact and effective accounting journals among researchers and academics, which is an important indicator of the importance of the research results. The lack of articles that discuss carbon accounting from an economic and financial point of view may be an area for future research. On the other hand, the studies were divided into four sections, the regulatory scope, the national scope, the project scope, and the product scope, as the studies focused largely on investigating carbon accounting and its impact on the national scale, and this may be due to the international agreements that call for action to mitigate carbon emission. In terms of emissions, future studies may discuss carbon accounting at the project scale and the organizational and institutional scopes in a broader way, through which it is also possible to know the factors that help reduce emissions. In addition, future studies can be conducted focusing on the product, which may contribute to identifying some of the causes of increased emissions. Future studies can conduct further research to determine the factors that can motivate companies to disclose carbon. However, some literature has discussed this, and there are factors that have not been investigated economically, organizationally, and politically. In addition to this, the importance of ensuring carbon accounting can be investigated in motivating companies to provide the best methods for measuring carbon and working to improve carbon performance. Although some literature clarifies the importance of carbon accounting in improving investment and green trade, it does not clarify how this can be achieved, what obligations the company must abide by, and the social and economic consequences that companies may be exposed to; future studies can investigate this. It is interesting that no studies discuss the importance of technological development in carbon accounting; therefore, future studies may examine the importance of using blockchain in carbon accounting. In addition, future studies can conduct research showing the importance of using accounting techniques to help stimulus packages mitigate the effects of climate change and achieve economic growth, especially in light of environmental changes and the COVID-19 crisis. Furthermore, while reviewing the previous studies, no study was found based on comparative analysis; therefore, a comparative study could be conducted between the most polluted countries. Another line of inquiry could be to undertake a comparison study on carbon accounting among the industries that are most responsible for the rise in greenhouse gas emissions. This occurs in the lack of accounting standards that would govern the work and practice of carbon accounting, particularly when recording companies’ financial statements and documenting carbon-related provisions in financial statements. Future studies may discuss how the practice of carbon accounting can be adopted according to the current international accounting standards. This contributes to providing basic guidelines and instructions that companies can follow. Finally, only one study by Sullivan and Gouldson (2012)discussed the importance of carbon emissions reports in attracting investors. Future studies may expand the conduct of studies using interviews or questionnaires, which would clarify the investors’ view of the importance of the reports prepared by companies and the controversy in some of the discussions that made it clear that investors see the lack of great benefit from these reports.

5.1 Carbon accounting and COVID-19

In light of the current developments represented in the outbreak of COVID-19, a great trend and focus have contributed to the increase in the demand for decarbonization. In this situation, many organizations and governments will try to decarbonize, but this entails building strategies based on preserving the economic and social aspects. Future studies may address how decarbonization can be carried out and its impact on carbon management for organizations, companies, and individuals in light of the changes imposed by the COVID-19 crisis. In addition, future studies can discuss the current methods used in decarbonization and their effectiveness in light of the COVID-19 crisis, and whether it is possible to develop different approaches that can contribute to decarbonization and reduction in light of the current environmental changes. In the end, future studies can discuss the impact of COVID-19 on carbon management and what lessons can be learned from them in order to contribute to the development of carbon management strategies.

6 Conclusion and recommendations

The issue of carbon accounting has grown rapidly among various interested parties, such as companies, international organizations, researchers, and society. However, empirical research based on real data and reviews that discuss the role and importance of carbon accounting in reducing emissions and its role in the companies and society is still limited. Therefore, we followed a methodological approach through which a comprehensive investigation of the past literature to examine the role of carbon accounting in various companies and societies using 137 studies that have been published in peer-reviewed journals was conducted. The results revealed that carbon accounting provides a mechanism through which carbon emissions can be measured and quantified and helps in knowing the status of companies and making the necessary strategic decisions to achieve mitigation. This study provides a qualitative analysis of the existing literature on carbon accounting by presenting a comprehensive investigation of the literature published in accounting and finance journals and environmental journals on an accounting topic. The review highlights the role of carbon accounting in achieving sustainable development to a large extent for all parties and stakeholders and confirms the important role of carbon accounting in emphasizing the achievement of sustainable development as one of the most important means that contribute significantly to reducing carbon emissions. In general, the study results show that the role of carbon accounting in promoting and achieving sustainable development is very important, especially in light of the availability of incentives to practice carbon accounting. Through the results of the study, all parties such as agencies, international organizations, investors, regulators, and government agencies can enhance their understanding of the role of carbon accounting toward society, companies, and environment, which may constitute a basis upon which to conduct a variety of experiments and research. There is a need to issue regulations and mechanisms for carbon accounting through which it can be practiced professionally, as a result of its importance in various topics, including enhancing the financial performance of companies, attracting foreign investments, encouraging green trade, and making strategic decisions that enable companies to compete and survive.

It should be noted that there are some gaps that future studies can work on, which are discussed in the previous section, with emphasis on the need to conduct studies from real data based on company reports to cover the literature gap that was dominated by the descriptive aspect based on content analysis and measurement, and the future literature can also investigate the basic functions of carbon accounting in light of nondisclosure and comparing it with its role under disclosure and the extent of its impact on greenhouse. However, we believe that legislation must issue instructions that can contribute to achieving this.

Future research can focus on the recommendations mentioned in the previous sections. Finally, this study can provide the necessary guidance and instructions needed by policymakers and companies to identify beneficial methods and best practices for carbon accounting and mitigation. Policymakers have to foster setting international standards that compile firms to report their carbon strategies, allowing investors to verify and compare firms that are performing well in terms of carbon reduction. Firms’ top management has to formulate sound carbon strategies and systems to reduce the carbon effect. On the production management level, firms’ should have carbon accounting software to be associated with the management information system in order to know the total reduction in carbon emission. Furthermore, marketing management has to go with strategies of launching environment-friendly products and services. More importantly, financial managers have to adopt new techniques for evaluating carbon performance and reporting financial performance. Academic institutions have to allocate a budget for environmental-based research that aims to measure carbon emissions reduction and suggest frameworks for carbon accounting disclosure, which will guide those in charge of companies to mitigate emissions and preserve the environment. The findings of this study provide a vision for company managers in a way that enhances their awareness of the importance of practicing carbon accounting, which contributes to helping them to make appropriate decisions by comparing benefits and costs and helping them design plans related to climate change and design the necessary policies. Similar to other studies, this study includes some limitations that can be met and worked on in future studies. We used one keyword while searching for the literature in WoS and Scopus. Future studies can expand keywords related to carbon accounting, such as carbon management and disclosure, which will be used to obtain the literature. In addition, other databases such as ABDC, ABS, and Google Scholar can be used in search of relevant literature.

Data availability statement