- Henan Jiuyu Longyuan Energy Service Co., Ltd., Zhengzhou, Henan, China

As a pivotal element of the power market system, the provincial electricity spot market has a critical foundation for effectively improving the efficiency of electricity resource consumption and promoting the clean energy transformation of the new power system. However, it still faces challenges of supervision dysfunction that have led to market imbalances and unfair trade. To enhance supervision efficiency, an obstacle system comprising 50 factors is initially developed through a comprehensive literature review and expert consultation. This system is tailored to the characteristics of the provincial electricity spot market in China and encompasses five dimensions: market structure, market participant behavior, operational mechanisms and performance, transparency and information disclosure, and system security and scheduling. Considering uncertainty and redundancy in subjective obstacle identification, interpretive structural modeling (ISM) is introduced to refine the original decision-making trial and evaluation laboratory (DEMATEL) method to remove redundancy obstacles and further analyze the comprehensive importance and causal relationships. Based on the critical parameters derived from the results, spot price fluctuation level, the effect of regulatory policy implementation, and the completeness and timeliness of information disclosure hold the highest three positions in terms of importance. Additionally, market size and capacity obstacles demonstrate a greater impact on the entire system. The results provide valuable insights for shaping governmental regulations and enterprise practices to address the obstacles effectively. Finally, this paper proposes a series of general solutions and specific policy recommendations for provincial electricity spot market supervision to boost prosperity.

1 Introduction

1.1 Background

Aiming to accelerate the construction of a unified national power market system, enhance the stability and flexible adjustment capacity of the power system, and promote the formation of a new power system that is suitable for China’s national conditions and stronger new energy consumption capacity in January 2022, the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) issued the Guiding Opinions to Accelerate Unified National Power Market System, which provided a framework for accelerating the development of China’s electricity market system (Liu et al., 2022). The provincial electricity market in China has expanded quickly in recent years. According to International Energy Agency (2023a) statistics, 61% of the electricity generation was traded in provincial markets in 2022, representing an increase of 39% from 2021. China’s wholesale power market is dominated by bilateral Medium-to-Long-Term (MLT) contracts, representing 79% of total traded volume.

As a crucial foundation for electricity market reform, the electricity spot market can significantly promote the integration of new energy, optimize electricity resource allocation, and strengthen the stability of the electricity system (Lin et al., 2024). China’s electricity market reform has progressed through three major phases since 1998, each characterized by distinct objectives and structural transformations. The first phase (1998–2002) primarily focused on dismantling the vertical monopoly by separating generation and grid operations at the provincial level, laying the foundation for market-based competition. The second phase (2002–2015) emphasized regional market integration and the introduction of market-oriented electricity pricing, enabling direct transactions between generators and large consumers while maintaining centralized dispatch. The ongoing third phase (2015–present) aims to establish a unified national electricity market, with a strong emphasis on developing electricity spot markets to enhance real-time price signals, optimize resource allocation, and improve system efficiency.

Since pilots were initiated in 2017, seven provinces representing 41% of China’s power demand run spot markets today, including Shanxi, Shandong, Guangdong, and Gansu International Energy Agency (2023b). The status of China’s spot power market pilots is shown in Supplementary Figure S1. However, because the electricity spot market is in a nascent stage, the current effectiveness of electricity spot market supervision is not satisfactory, mainly due to the lack of transparency in the data collection process of electricity spot market supervision, the difficulty in supervising data processing flows and logic, and the difficulty for market participants to access market operation data (Wang et al., 2022). Additionally, the impact of external policy mechanisms on electricity market regulation has not been fully addressed. Carbon pricing, subsidy policies, and regulatory adaptability increasingly influence market efficiency and fairness. This has resulted in the gradual evolution of the electricity spot market at a relatively slow pace. As a pivotal component of the electricity spot market, a comprehensive and rigorous supervision framework is vital to guarantee that the electricity spot market functions within a legal, secure, fair, and effective structure. It can effectively enhance the efficiency of electricity resource allocation, maintain market order, and facilitate the sustainable development of provincial electricity spot markets (Zhang et al., 2024; Lu et al., 2022). Therefore, there is a need to systematically identify, analyze, and evaluate critical supervision obstacles to address the current insufficient supervision issues, promoting the sustainable development of the electricity spot market.

1.2 Literature Review

Nowadays, the supervision of provincial electricity spot markets, along with market optimization and price mechanisms, has attracted significant attention in both academic and policy-making circles (Huang et al., 2024; Gencer et al., 2020; Karahan et al., 2024). Previous research has primarily focused on the challenges related to electricity market regulation, efficiency, and the integration of renewable energy. For example, Gencer et al. (2020) established a behavioral regulatory framework to analyze the electricity market’s development stages and associated regulatory challenges. Karahan et al. (2024) examined the efficiency of spot and futures electricity markets in selected European countries post-restructuring, using entropy to measure market price randomness and volatility, indicating overall market efficiency. Similarly, Csereklyei and Kallies (2024) developed a legal and economic framework to assess the regulatory challenges of the Australian wholesale electricity market during its transition to renewable energy, emphasizing system resilience and investment needs. Other studies have focused on the environmental implications of electricity markets. El and Galiana (2019) explored the impact of emissions regulations on market competition and strategies within an oligopolistic market through a cap-and-trade model, revealing how optimization can enhance market efficiency. Karney (2019) analyzed efficiency improvements in U.S. nuclear power plants following electricity market deregulation, highlighting the synergistic effects of marketization and environmental policies on carbon emissions reduction. Corsatea and Giaccaria (2018) analyze changes in environmental efficiency in the electricity and gas markets of the EU-13 and examine the impact of market reforms on environmental productivity. Guo and Weeks (2022) examined the role of dynamic tariffs and demand response in managing renewable energy volatility, demonstrating that demand regulation through price mechanisms directly affects market stability. Szőke et al. (2021) evaluated the effectiveness of price regulation policies in the Hungarian electricity market and their impact on supplier profitability.

For the carbon-electricity market coupling mechanism and the impact of policy design on market efficiency, Currier (2016) addressed the issue of government cost padding under green subsidy policies, revealing unintended consequences from overlapping regulations. Wei et al. (2024) proposed a multi-timescale coupled model mechanism of the electricity-carbon market to realize the linkage equilibrium between the electricity and carbon markets. Although these studies provide valuable insights into specific issues hindering the application of electricity spot market supervision, they generally treat obstacles in isolation without considering their interrelated nature. The interconnectedness of these obstacles suggests that a holistic approach, one that considers the interrelationships between these factors, would be more effective. This gap in the literature underscores the importance of comprehensive obstacle identification, analysis, and the proposal of targeted solutions.

Until now, several scholars have conducted studies on the comprehensive obstacles to electricity spot market supervision in foreign countries (Karahan et al., 2024; Csereklyei and Kallies, 2024; El and Galiana, 2019). However, due to the unique and context-specific nature of each country’s market and regulatory framework (2021), the insights and recommendations from these studies cannot be directly applied to China. Therefore, this study extends existing research by systematically identifying and analyzing the obstacles to promoting electricity spot market supervision in China, while taking into account its unique national characteristics. For the analysis of the obstacle system, the decision-making trial and evaluation laboratory (DEMATEL) method is recognized as a particularly effective approach and has been widely applied in numerous studies (Paul et al., 2023; Wu et al., 2021). Its strengths lie in its ability to evaluate the interrelationships among factors and provide a structured framework for understanding their influence. For example, Paul et al. (2023) proposed a modified Pythagorean fuzzy VIKOR and DEMATEL approach to evaluate the obstacle system of sustainable carbon dioxide storage. Wu et al. (2021) proposed a novel Cloud-DEMATEL method to analyze hydrogen fuel cell vehicles for application in China. Additionally, DEMATEL has been widely applied in electricity market research to assess the impact of policy measures, technological advancements, and economic factors on market efficiency. However, its reliance on expert judgment often introduces subjectivity, which may lead to inconsistencies in obstacle identification, particularly in complex regulatory environments.

To address these issues, this paper integrates the ISM model to enhance the original DEMATEL method, aiming to achieve more scientific and reliable results in obstacle identification. By first constructing the ISM hierarchy, our model enables a clearer understanding of the hierarchical relationships between the factors and eliminates duplicate indicators, effectively addressing issues of redundancy and uncertainty, which is a common limitation in purely DEMATEL-based studies. The proposed ISM-DEMATEL model reveals the complex interactions among obstacles in the provincial electricity spot market through hierarchical analysis and the visualization of causal relationships. This approach makes the obstacle identification process more scientifically rigorous and precise than traditional methods relying solely on expert judgment. By comprehensively synthesizing the algorithms of both methods, this study clarifies the procedural steps and specific formulas of the ISM-DEMATEL method and solves provincial spot market supervision obstacle identification, analysis, and solutions from the perspective of sustainable development for the first time. In conclusion, while existing research has offered valuable insights into individual factors affecting electricity market regulation, our study contributes by employing a novel integrated approach to analyze the interrelationships among these obstacles in the Chinese context.

1.3 Structure and Innovations of the Paper

This paper seeks to address the following three issues:

➢ What are the critical supervision obstacles hindering the sustainable development of provincial electricity spot markets in China?

➢ How do these obstacles interact with each other and influence the overall market system?

➢ What strategies and measures can be developed to overcome these obstacles and promote sustainable market operation?

This article undertakes several innovative efforts to achieve these objectives, outlined as follows.

1.3.1 Develop a comprehensive obstacle system

This study initially conducts a systematic review of existing literature to identify factors that hinder the sustainable development of provincial electricity spot markets. Based on this analysis, obstacles to market supervision in China are systematically examined by integrating insights from national policy frameworks and expert evaluations. The developed obstacle system incorporates both common and extraordinary characteristics, allowing for adaptation to other national contexts with appropriate adjustments. Furthermore, it serves as a reference framework for addressing broader regulatory challenges in electricity spot markets.

1.3.2 Establish an innovative obstacle analysis model

To manage the issues of uncertainty and redundancy in expert evaluations, this study incorporates the ISM method to enhance the original DEMATEL approach, effectively eliminating redundant obstacles. By leveraging the structural importance attributes of ISM, the methodology is further refined through modifications to the ISM-DEMATEL process. The proposed obstacle analysis model demonstrates versatility and can be applied to factor analysis in other research domains, yielding reliable and robust evaluation outcomes.

1.3.3 Offer targeted recommendations and policy guidance

This study proposes three targeted solutions aimed at addressing the top supervision obstacles, as identified in the results. These solutions not only focus on overcoming the most influential obstacles but also contribute to alleviating related barriers within the system. By addressing key issues, the proposed measures offer actionable insights to enhance the supervision of provincial electricity spot markets. Furthermore, these solutions offer guidance for improving national and regional policy implementation.

The rest of this research is organized as follows: Section 2 constructs a provincial electricity spot market supervision obstacle system. Section 3 introduces the ISM and DEMATEL methodology. Section 4 is the analysis framework of provincial electricity spot market supervision. Section 5 introduces the process of supervision obstacle system establishment. Section 6 is the conclusion and corresponding supervision measures.

2 Obstacles to provincial electricity spot market supervision

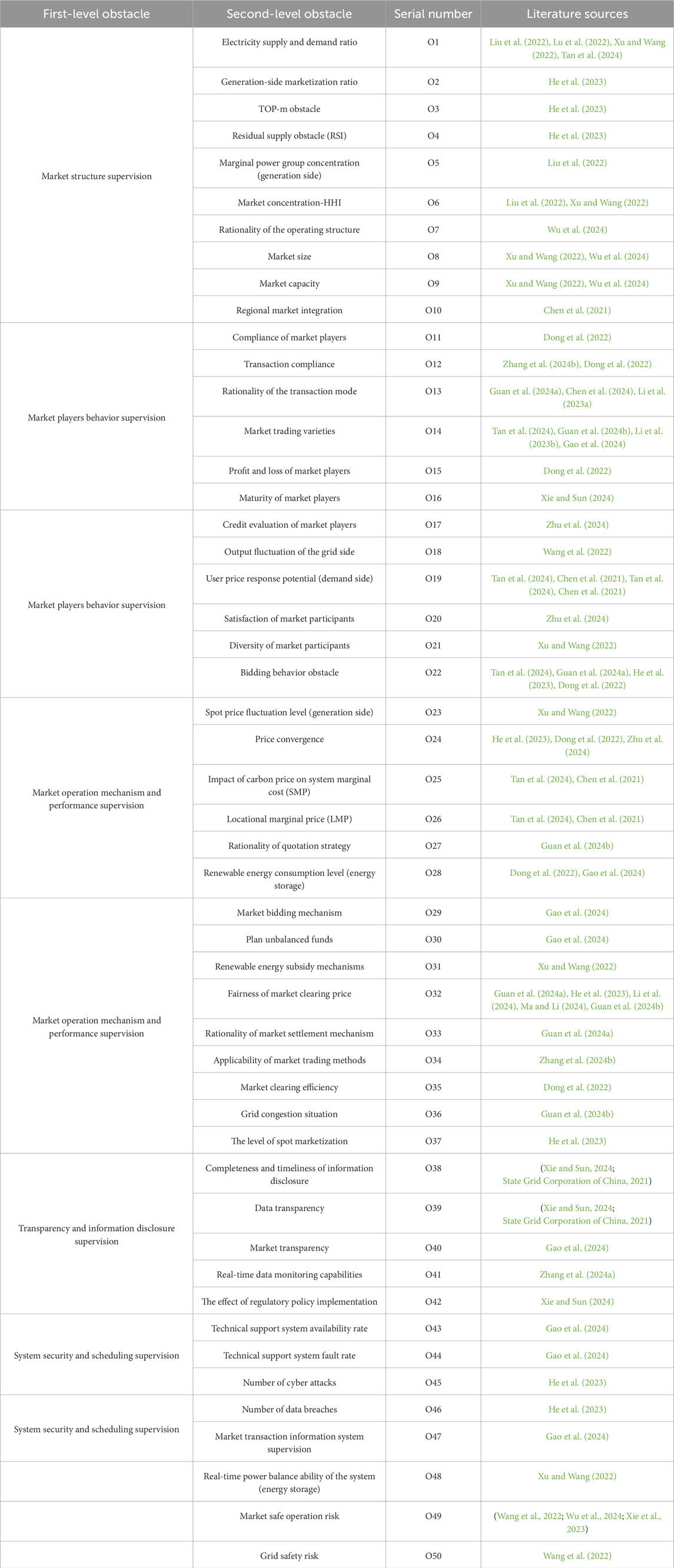

In this section, the potential obstacles to China’s provincial electricity spot market supervision are identified through a comprehensive literature review and expert consultation. First, potential supervision obstacles are extracted and refined based on the literature and relevant materials. A possible criteria list, including spot price fluctuation level, market clearing efficiency, operational mechanisms and performance, and transparency and information disclosure, is proposed. Second, questionnaires were designed and distributed via email to domestic experts, allowing them to select the most critical obstacle factors from the proposed criteria list based on their understanding of China’s development stage and unique characteristics. Additionally, experts were invited to supplement the list with any omitted factors that could impact electricity spot market supervision in China. Based on expert feedback, 50 initial obstacles are determined and further classified into five categories, namely, market structure, participant behaviors, operational mechanisms and performance, transparency and information disclosure, and system security and scheduling obstacles. The obstacle index system is presented in Table 1.

2.1 Market structure supervision

2.1.1 Electricity supply and demand ratio (O1)

The electricity supply and demand ratio is the ratio between the market power supply capacity and the market power load demand in the corresponding power supply period of each day, as shown in Equation 1, which reflects the balance of supply and demand in the market.

where

2.1.2 Generation-side marketization ratio (O2)

The generation-side marketization ratio is the ratio of electricity clearing on the generation side to the electricity connected to the grid on the generation side, as shown in Equation 2, which is used to measure the progress and effect of the market-oriented reform of the power generation side.

where

2.1.3 TOP-m obstacle (O3)

The TOP-m obstacle is the total installed capacity of the m power generation group with the largest proportion of the installed capacity of all generators in the power generation group participating in the market quotation.

2.1.4 Residual supply obstacle (RSI) (O4)

Residual supply obstacle (RSI) is the sum of the market share of power producers other than a power producer during the trial operation period, as shown in Equation 3.

where

2.1.5 Marginal power group concentration-generation side (O5)

Marginal power group concentration reflects the degree of concentration of marginal power production on the generation side, as shown in Equation 4. If the marginal power group concentration is too high, it means that a small number of generating firms or units dominate the marginal power supply, which may lead to insufficient competition in the market. In addition, these firms or units may manipulate the price by virtue of their market power, thus affecting the fairness and efficiency of the market.

where

2.1.6 Market concentration-HHI (O6)

The Herfindahl–Hirschman obstacle (HHI) is one of the most reliable methods to measure the concentration of the electricity market, which is usually measured by the sum of squares of the market share of each supplier, as shown in Equation 5.

where

2.1.7 Rationality of operating structure (O7)

The rationality of operating structure examines whether the market’s organizational structure facilitates fair and efficient trading. An improperly structured market may result in inefficient resource allocation, information asymmetry, or trading frictions, thereby undermining the stable operation of the market.

2.1.8 Market size (O8)

Market size reflects the total volume and potential of the market to accommodate new participants or transactions, highlighting the robustness of the market infrastructure, as shown in Equation 6.

where

2.1.9 Market capacity (O9)

A market with higher capacity is more likely to attract new entrants and enhance overall liquidity and competitiveness, thereby reducing transaction costs and improving the efficiency of resource allocation, as shown in Equation 7.

where

2.1.10 Regional market integration (O10)

Regional market integration refers to the integration and synergistic operation of different electricity spot markets at the regional level, as shown in Equation 8.

where

2.2 Market player behavior supervision

2.2.1 Compliance of market players (O11)

Compliance of market players serves to monitor the behavior of market participants for compliance with rules and policy requirements, thereby maintaining fairness and order within the market. The specific formula is shown in Equation 9.

where

2.2.2 Transaction compliance (O12)

Transaction compliance monitors the legality and adherence of each transaction to ensure a transparent trading process. It prevents market manipulation and misconduct by monitoring transactions in real time.

2.2.3 Rationality of the transaction mode (O13)

Rationality of the transaction mode refers to evaluating whether the trading model in use is aligned with market demand and technological conditions to ensure efficient and flexible trading, thereby enhancing market responsiveness and meeting the needs of participants.

2.2.4 Market trading varieties (O14)

Market trading varieties reflect the diversity of market products, including electricity futures, spot transactions, and green power, which can be represented by species richness, as shown in Equation 10.

where

2.2.5 Profit and loss of market players (O15)

where

2.2.6 Maturity of market players (O16)

The maturity of market players reflects their ability to comprehend and adapt to market rules and trading processes. A high level of maturity reduces friction in trading and enhances the efficiency of market operations.

2.2.7 Credit evaluation of market players (O17)

Credit evaluation of market players can prevent defaults and reduce financial risks, enhancing market transparency, as shown in Equation 12.

where

2.2.8 Output fluctuation of grid side (O18)

The proportion of wind power and photovoltaic continues to increase and is gradually becoming the main source of electricity. As renewable sources displace conventional power sources from basic power sources to regulatory power sources, the difficulty of power generation forecasting and regulation increases (Roumkos et al., 2020).

2.2.9 User price response potential-demand side (O19)

User price response potential measures the flexibility and possibility of users to adjust their electricity use behavior in the face of market price changes, which is not only affected by the characteristics of the user but also by market rules, tariff structures, electricity consumption habits, and other factors.

2.2.10 Satisfaction of market participants (O20)

Satisfaction of market participants reflects the quality of market services and operations, as shown in Equation 13. A high level of participant satisfaction that the market is well run and has a friendly trading environment helps to attract more participants to the market.

where

2.2.11 The diversity of market participants (O21)

The diversity of market participants measures the number and proportion of different types of participants in the market, as shown in Equation 14.

The formula is based on the HHI obstacle, which reflects the diversity of market participants.

2.2.12 Bidding behavior obstacle (O22)

The bidding behavior obstacle of a power generation group or unit is one of the most intuitive measures to reflect whether it exercises market power, as shown in Equation 15.

where

2.3 Market operation mechanism and performance supervision

2.3.1 Spot price fluctuation level-generation side (O23)

The spot price fluctuation level is the degree of fluctuation of spot market price in a certain period of time, as shown in Equation 16. The volatility and intermittency of power output on the generation side (PV and wind) can directly affect the spot price fluctuation level of the electricity spot market. For example, when many renewable energy sources such as wind power and PV are connected, they are greatly affected by natural conditions, and their output is unstable, which will lead to increased uncertainty in power supply and thus cause increased price fluctuations in the spot market (Stefenon et al., 2023).

where

2.3.2 Price convergence (O24)

Price convergence is the difference between the day-ahead market price and the real-time market price, as shown in Equation 17. A large price difference will inevitably be the source of speculative risk.

where

2.3.3 Impact of carbon price on system marginal cost (SMP) (O25)

The system marginal price is the offer of the last supplier of electrical energy to satisfy load demand. Carbon prices (e.g., the price of allowances in the carbon trading market) directly change the ordering of offers in the market for high-carbon emitting power sources (thermal power) by increasing their marginal costs, which in turn affects SMPs.

2.3.4 Locational marginal price (LMP) (O26)

Locational marginal price is the price determined according to the marginal cost of power generation, transmission congestion cost, and loss cost of each node in the area where the grid congestion is serious and the transmission capacity is often limited.

2.3.5 Rationality of quotation strategy (O27)

Quotation strategy is the strategy that electricity trading participants flexibly formulate and adjust electricity price and quantity according to multiple factors such as market demand, cost, and market competition situation in the real time or near-real time electricity spot market.

2.3.6 Renewable energy consumption level-energy storage (O28)

The renewable energy consumption level is the proportion of renewable energy power generation accepted and consumed by the power system to its total power generation in a certain period of time, as shown in Equation 18, reflecting the utilization rate of renewable energy power in the overall power supply structure. Energy storage (batteries, pumped hydro storage) is one of the important means of solving the problem of renewable energy consumption. It can store renewable energy power generation when it is surplus and release it when needed, improving the dispatchability and utilization efficiency of renewable energy and thus enhancing the renewable energy consumption level.

where

2.3.7 Peak–valley electricity price upside down (O29)

For provinces with a large dependence on external power supply, the bidding space may have a large gap with the actual load characteristics, resulting in inverted peak and valley tariffs, which may lead to time-sharing cross-subsidization shortfalls. The special equation is as shown in Equation 19.

where

2.3.8 Plan unbalanced funds (O30)

Planned unbalanced funds are an inevitable type of funds in the dual-track market. At this stage, we should focus on the fairness of the allocation method and determine the allocation subject and share.

2.3.9 Renewable energy subsidy mechanisms (O31)

Renewable energy subsidy mechanisms have facilitated the large-scale development and utilization of renewable energy by providing economic incentives. This has changed the structure of electricity markets and increased the share of renewable energy in electricity supply. The intermittent and uncertain nature of renewable energy generation has increased the complexity and regulatory difficulty of electricity spot markets.

2.3.10 Fairness of market clearing price (O32)

The market clearing price is the key signal of market development. The overall level and trend of market clearing price should reflect the relationship between market supply and demand, unit quotation, and network congestion.

2.3.11 Rationality of market settlement mechanism (O33)

A market settlement mechanism mainly ensures the economic interests of market players through the settlement of electricity energy transactions, settlement of auxiliary services, settlement of capacity markets, and settlement of transmission service fees (Holmberg and Tangeras, 2024).

2.3.12 Applicability of market trading methods (O34)

There are various trading methods in the electricity spot market, including bilateral trading, centralized bidding trading, and listed trading, the choice of which directly affects the trading price and the balance and stability of the spot market.

2.3.13 Market clearing efficiency (O35)

Market clearing efficiency is the speed and effect of realizing the balance of power supply and demand. The obstacle reflects the speed and accuracy of the market clearing process, as shown in Equation 20.

where

2.3.14 Grid congestion situation (O36)

Grid congestion situation refers to the state of the transmission system that cannot meet the desired transmission plan due to the capacity constraints of its own network. The obstacle can be reflected by abnormal quotations and actual markup obstacles.

2.3.15 The level of spot marketization (O37)

The level of spot marketization is the ratio of monthly/annual spot market clearing power to total load power as shown in Equation 21, which is used to calculate the degree of market power liberalization.

where

2.4 Transparency and information disclosure supervision

2.4.1 Completeness and timeliness of information disclosure (O38)

Completeness and timeliness of information disclosure require market participants to disclose relevant information in a timely, accurate, and complete manner, including tariffs, electricity volumes, trading rules, and the behavior of market participants, which can be assessed by comparing the consistency of the disclosed information with the actual situation.

2.4.2 Data transparency (O39)

Data transparency means that real-time data, historical data, and settlement data in the electricity spot market are presented to market parties in a clear, accurate, and timely manner.

2.4.3 Market transparency (O40)

Market transparency refers to the visibility and understandability to the public of information, rules, and trading processes in the marketplace.

2.4.4 Real-time data monitoring capabilities (O41)

Real-time data monitoring capabilities is a comprehensive criterion that reflects the market’s ability to collect, process, analyze, and provide feedback about real-time data.

2.4.5 The effect of regulatory policy implementation (O42)

The effect of regulatory policy implementation is used to measure the presence of abuses of market power in the market and the enforcement of market rules as shown in Equation 22, which is represented by percentages of triggering time periods.

where

2.5 System security and scheduling supervision

2.5.1 Technical support system availability rate (O43)

The technical support system availability rate is the probability that the technical support system is able to work normally under specified conditions. It is an important criterion for the stability and reliability of the technical support system, as shown in Equation 23.

where

2.5.2 Technical support system fault rate (O44)

The technical support system fault rate is the frequency of failures of the technical support system within a specified period of time as shown in Equation 24, reflecting the risk of failures that may be encountered during the operation of the system.

where

2.5.3 Number of cyber attacks (O45)

The number of cyber attacks is the number of malicious attacks on the network system during the operation of the electricity spot market as shown in Equation 25, which relies on logging and reporting from network security monitoring systems.

where

2.5.4 Number of data breaches (O46)

The number of data breaches is the number of times that sensitive data (subscriber information and transaction data) have been leaked to unauthorized third parties in the course of the operation of the electricity spot market due to various reasons, as shown in Equation 26.

2.5.5 Market transaction information system supervision (O47)

Market transaction information system supervision is an important safeguard to ensure fair, just, and transparent markets, which can be represented by interest rate risk sensitivity. The special equation is as shown in Equation 27.

where

2.5.6 Real-time power balance ability of the system (energy storage) (O48)

The real-time power balance ability of the system refers to the ability of the power system to maintain the balance between supply and demand of electricity by adjusting all aspects of power generation, transmission, distribution, and consumption during real-time operation. The energy storage system (batteries, pumped hydro storage) can quickly respond to power changes in the power system, providing or absorbing power in an instant, enhancing the real-time power balance ability of the power system.

2.5.7 Market safe operation risk (O49)

There are a large number of new types of loads, such as electric vehicles, energy storage, controllable loads, virtual power plants, distributed power sources, and microgrids, participating in the market, which makes safe regulation of the market more difficult.

2.5.8 Grid safety risk (O50)

Grid safety risk refers to the risks that may cause safety and production accidents in the course of production and operation activities due to a variety of reasons, such as poor organization, inadequate management, unstandardized behavior, and non-implementation of measures.

3 Methodology

ISM can intuitively present the logical relationship between various elements with a clear and concise model diagram and then analyze the hierarchical structure within the complex system (Zhou et al., 2024). However, the ISM approach is constrained by its failure to consider the relative importance of individual obstacles. The decision-making experiment and evaluation laboratory method (DEMATEL), a systematic analysis method using graph theory and matrix tools (Wang et al., 2024), is widely used to analyze the influence of factors on complex management problems (Yazo-Cabuya et al., 2024). The modified ISM-DEMATEL method determines the logical relationship and hierarchical mechanism structure between obstacles, objectively removes the redundancy and uncertainty of the barriers from the perspective of the hierarchical structure, and further analyzes the comprehensive importance and causal relationships.

3.1 ISM model

ISM, proposed by Professor J. Warfield in 1973 (Sorooshian et al., 2023), can decompose a complex overall system into several subsystems. By using the practical experience and theoretical knowledge of experts and scholars and the modeling function of computers, a multilevel hierarchical structural model is established. The specific steps involved are as follows:

First, the set of influencing factors is determined, and the set S,

The adjacency matrix A is constructed, and the expression is

The matrix G is multiplied continuously to obtain the reachable matrix. The expression of the reachable matrix M is as shown in Equation 29.

The level of each obstacle is divided. The division is based on verifying whether the reachable set R and the leading set Q of each obstacle are satisfied

Finally, the hierarchical structure diagram is constructed, and its skeleton structure is extracted for obstacle screening.

3.2 DEMATEL method

The DEMATEL method was first developed by the Geneva Research Center of the Bartel Memorial Institute to visualize the structure of complex causal relationships through matrices or directed graphs (Si et al., 2018). The specific steps are as follows:

Step 1: Determine the expert direct-influence matrix.

To assess the relationship between n factors

Step 2: The direct-influence matrix of k experts is aggregated to obtain a comprehensive direct-influence matrix

Step 3: The normalized direct-influence matrix

Step 5: The total-influence matrix

Step 5: The influential relation map (IRM) is produced. At this step, the vectors

Let

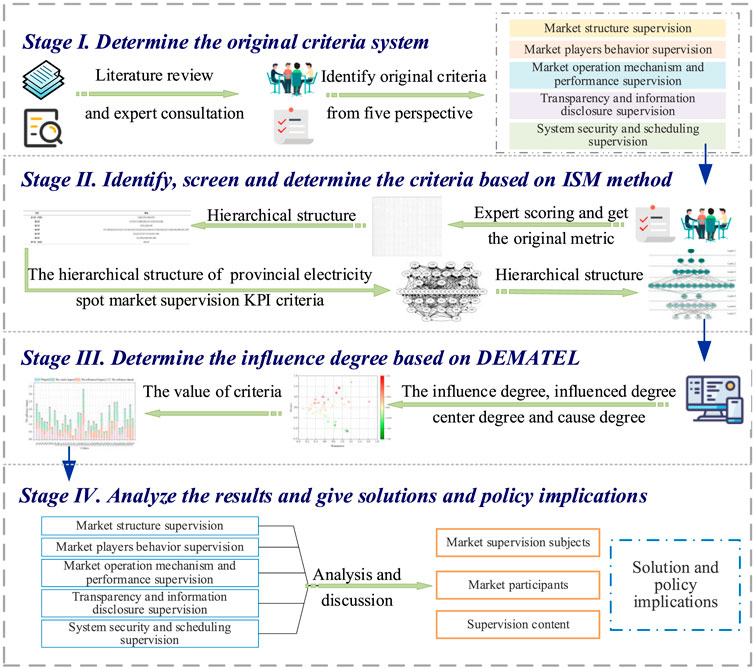

3.3 The analysis framework of this research

The study framework developed in this paper is presented in Figure 1. Initially, the obstacle system for electricity spot market supervision is established by integrating the development status and policy background in China with findings from literature reviews and expert consultations. Then, a novel ISM-DEMATEL method is used to objectively remove redundancy obstacles and further analyze the interaction among obstacles. Based on the analysis results, this study offers general recommendations and policy implications to advance the sustainable development of electricity spot market supervision.

4 Obstacle analysis

Referring to relevant literature (Wu et al., 2021), the research team invited five highly experienced experts to assess the degree of mutual influence among the obstacle factors impeding the supervision of provincial electricity spot markets. During the expert seminar, linguistic values were utilized to align with natural human thinking and expression patterns. The mutual influence between factor pairs was subsequently classified into four levels for clarity and precision, including “no influence (0),” “low influence (1),” “medium influence (2),” “high influence (3),” and “very high influence (4).”

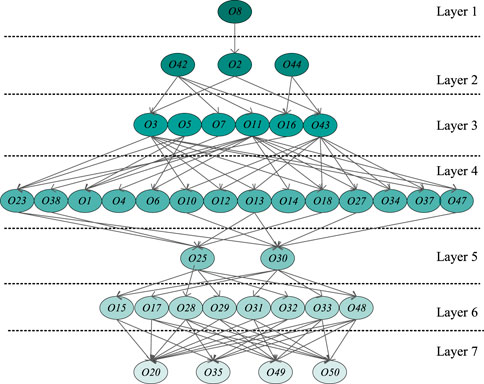

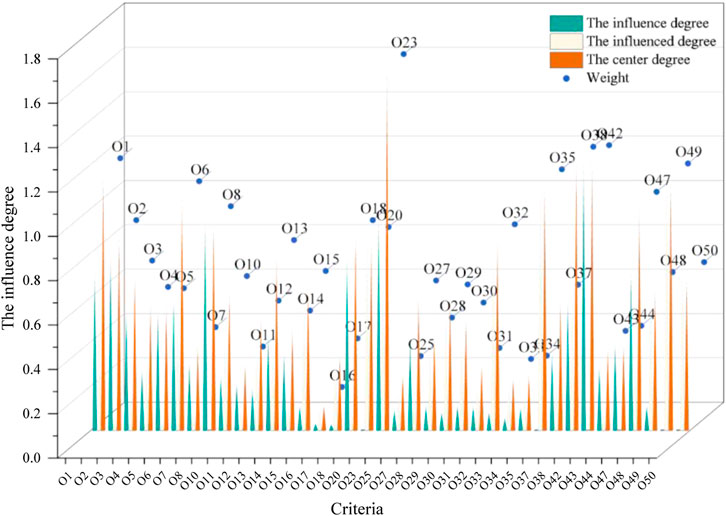

The proposed ISM-DEMATEL model was then applied for further analysis of the provincial electricity spot market supervision obstacle system. Following Section 3.1, with 12 redundant obstacles eliminated, the total relation structure among 38 obstacles is obtained, presented in Figure 2. Subsequently, the aggregate importance and prioritization of each obstacle identified in Section 3.2 is shown in Table 2.

As shown in Figure 2, market size (O8), positioned at the top of the structural model, represents the fundamental supervision obstacle constraining provincial electricity spot market development. Furthermore, the direct obstacles, including satisfaction of market participants (O20), market clearing efficiency (O35), market safe operation risk (O49), and grid safety risk (O50), can be mitigated by addressing deeper underlying obstacles. Notably, the effects of regulatory policy implementation (O42) and O44 are independent obstacles, with O42 determined by the adequacy of the regulatory framework and the operational behavior of regulators and O44 influenced by the technical level of the system itself. Neither is directly linked to market size or capacity.

Most supervision obstacles are concentrated in the middle layer, where the most regulatory measures are required. As illustrated in Figure 2, technological advancements are crucial in enhancing regulatory efficacy and promoting greater transparency and information disclosure within the electricity spot market. Additionally, challenges such as climate change, the uncertainty of renewable energy output, and fluctuating user demand exacerbate supply–demand imbalances in the market. Addressing these issues through accurate load forecasting and reducing spot price volatility can optimize market clearing efficiency, increase renewable energy utilization, minimize resource wastage, and lower operational costs. Furthermore, the immaturity of information trading systems contributes to gridlock, data breaches, and various security challenges, which compromise public trust in the electricity spot market and impede the integration of regional markets.

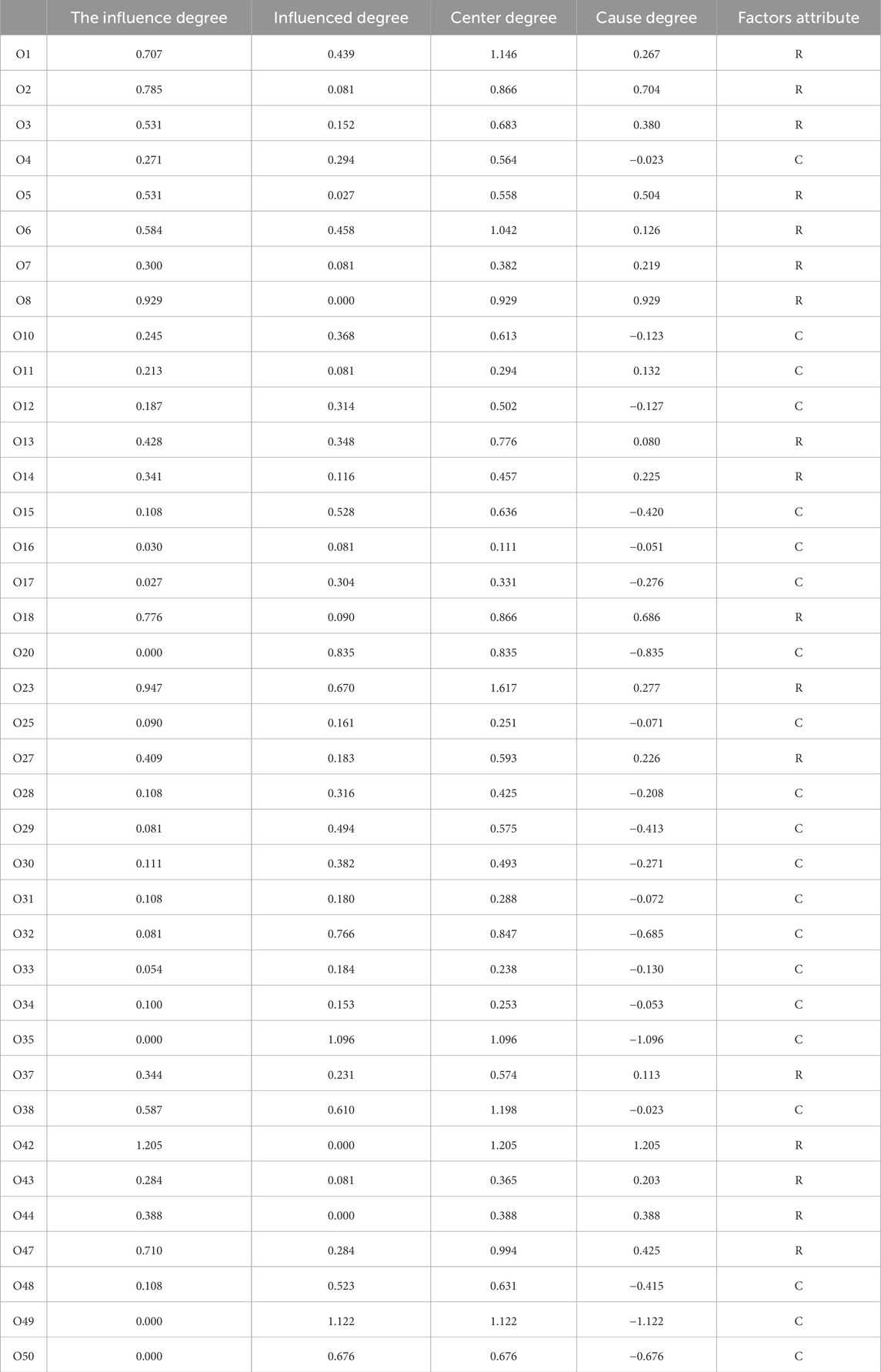

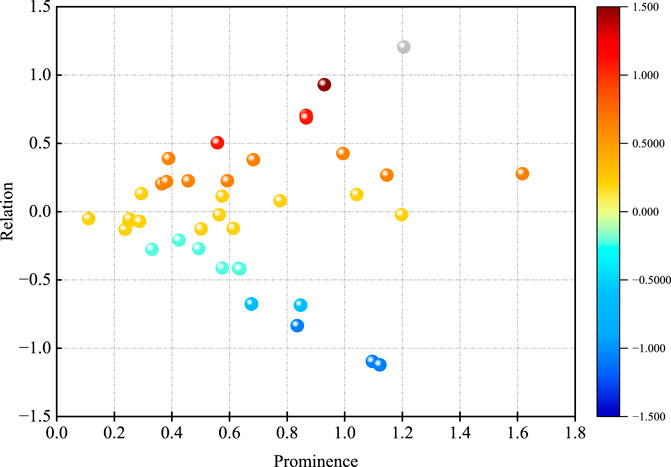

Figure 3 presents the center-cause degree scatter plot of the supervision obstacles, providing an intuitive representation of the significance of each element within the evaluation system. Elements positioned further to the right indicate higher importance. As can be seen from Figure 3, the effect of regulatory policy implementation (O42) exerts a relatively high effect on the provincial electricity spot market supervision obstacle system, while market safe operation risk (O49), market clearing efficiency (O35), and satisfaction of market participants (O20) are relatively high affected by other obstacle factors. The order of effect degree of the top three factors on the provincial electricity spot market supervision obstacle system is O42 > O23 > O8, and the rank of affected degree is O49 > O35 > O20. It shows that the values of

The provincial electricity spot market supervision obstacle system is divided based on the polarity of their net influences. The obstacles are classified into two groups: the cause group and the effect group. The cause group includes O4, O10, O12, O15, O16, O17, O20, O25, O28, O29, O30, O31, O32, O33, O34, O35, O38, O48, O49, and O50, while the effect group includes O1, O2, O3, O5, O6, O7, O8, O11, O13, O14, O18, O23, O27, O37, O42, O43, O44, and O47. The net influences of obstacles in the cause group are positive, indicating that these obstacles influence other factors rather than being influenced. Conversely, obstacles in the effect group are primarily affected by other factors. Based on these findings, it can be concluded that addressing the obstacles in the cause group is a more effective strategy for resolving the issues within the provincial electricity spot market supervision obstacle system.

Ultimately, the comprehensive importance degrees are determined by simultaneously evaluating

Based on the analysis of the top three obstacles, we further dissect how interactions with generation-side actors, demand response (DR), and energy storage systems exacerbate or mitigate these challenges. Empirical evidence from China’s provincial markets is integrated to illustrate these dynamics.

For generation-side participants, thermal power plants, dominant in marginal pricing, amplify spot price fluctuation through fuel cost volatility and carbon compliance risks (Li et al., 2023). In Guangdong province, coal price surges in 2021 drove aggressive thermal bidding, spiking system marginal prices (SMP) to ¥1.5/kWh during peaks (Liu et al., 2022). Intermittent renewables (wind/PV) escalate residual supply risks, indirectly inflating spot price fluctuation via forecasting errors (e.g., 15%–20% day-ahead deviations in Gansu). Opacity in traditional generators’ operational data directly impairs the completeness and timeliness of information disclosure, while blockchain-integrated renewables in Shandong improved the completeness and timeliness of information disclosure compliance by 35% through forecast transparency.

For the demand side (demand response and electric vehicles), demand-side programs reduce spot price fluctuation by flattening peak reliance on marginal thermal units (International Energy Agency, 2023a). For example, the industrial demand side in Jiangsu lowered peak prices by 18%, yet low residential participation limits scalability with less than 5%. For regulatory policy implementation, demand-side rules of different provinces create cross-provincial compliance chaos, such as real-time incentives in Zhejiang and day-ahead schemes in Guangdong.

For energy storage, storage alleviates spot price fluctuation via price arbitrage (Cai et al., 2023). For example, Guangdong’s battery systems reduced 2022 peak-valley price ratios by 40%. However, underdeveloped compensation mechanisms (e.g., absent capacity payments) deter investments, capping spot price fluctuation gains. In addition, regulatory role ambiguity impedes regulatory policy implementation; Anhui’s 2023 classification of storage as “generation” delayed policy enforcement by 6 months due to load-shifting conflicts.

5 Supervision solutions for the provincial electricity spot market

From the above analysis, to advance the sustainable development and widespread application of provincial electricity spot markets, the top list of supervision obstacles includes the effect of regulatory policy implementation (O42), spot price fluctuation level (O23), and the completeness and timeliness of information disclosure (O38). These obstacles are identified as having significant interconnections and exerting a profound influence on the overall market supervision framework. The detailed analysis and corresponding solutions are presented below.

i. To address the issue of spot price fluctuations, a comprehensive price monitoring system should be established to track real-time variations accurately. Additionally, implementing a price early warning mechanism is recommended, where fluctuations exceeding predefined thresholds trigger the timely dissemination of early warning signals. These signals would assist market participants in making informed adjustments to their trading strategies. Furthermore, optimizing the price formation mechanism is essential. This can be achieved by fostering an effective linkage between the electricity spot market and the medium and long-term market, ultimately establishing a rational price transmission mechanism.

ii. Improve the effect of regulatory policy implementation. In light of the evolving electricity spot market, periodic reviews and refinements of regulatory policies are necessary to maintain their adaptability to market dynamics. Targeted measures, such as enhanced information dissemination and specialized training programs, can improve market participants’ comprehension and compliance with these policies. Furthermore, establishing a mechanism for tracking and evaluating policy implementation, along with providing regular feedback on outcomes, offers a structured approach to identifying deficiencies and facilitating timely adjustments. This approach aligns the regulatory framework with the goals of sustainable market development.

iii. Establish an information disclosure audit mechanism including the establishment of a special auditing organ or position to review and verify the content of information disclosure to ensure the authenticity and accuracy of the information. In addition, relevant departments should strictly check the timeliness of information disclosure to ensure that information can be released and updated in a timely manner. Information technology means, such as big data and cloud computing, are greatly adopted to improve the automation and intelligence of information disclosure.

6 Conclusion

A comprehensive and rigorous supervision framework is vital to guarantee that the electricity spot market functions within a legal, secure, fair, and effective structure. Obstacles to the popularization and application of provincial electricity spot market supervision in China are reviewed comprehensively in this paper. The identified provincial electricity spot market supervision obstacle system consists of market structure supervision, market subject behaviors, market operation mechanisms and performance, transparency, and information disclosure, as well as system security and scheduling obstacles, with a total of 50 items. Then, a novel ISM-DEMATEL method is provided to remove redundancy obstacles, further analyzing the interrelationships among these factors.

The conclusions drawn from the analysis are summarized as follows:

1) The total relationship structure among 38 obstacles is obtained, and 12 redundant obstacles are eliminated. From the perspective of a hierarchical structure of obstacles, market size (O8) emerges as the fundamental obstacle constraining provincial electricity spot market supervision. Additionally, the effect of regulatory policy implementation (O42) and the fault rate of the technical support system (O44) are identified as independent obstacles, uninfluenced by other factors. Specifically, the effect of regulatory policy implementation depends largely on the adequacy of the regulatory framework and the operational behavior of regulators, while the fault rate of the technical support system (O44) is determined by the technical capacity of the system itself. Neither of these obstacles is directly linked to the size or capacity of the market.

2) The top three factors in the provincial electricity spot market supervision obstacle system are O42 > O23 > O38. Spot price fluctuation level obstacle is identified as the top of the obstacle system, which is also the main focus of the electricity spot market research in the future. The spot price fluctuation level affects market stability, investor confidence, and the overall competitiveness of electricity trading, necessitating further exploration into price stabilization mechanisms and real-time regulatory interventions.

3) Transparency and information disclosure (O38) demonstrate high centrality and influence, highlighting their role as key safeguards for provincial electricity spot market supervision. Enhanced transparency in market information reduces the risk of market manipulation, standardizes the trading behavior of participants, and facilitates electricity trading under fair conditions. Addressing these challenges is fundamental to improving market stability and fostering a more reliable electricity spot trading system.

4) Specific factors, such as market learning efficiency (O35) and market safe operation risk (O49), exhibit a negative causal effect and are heavily influenced by other market variables. This underscores the need for government and regulatory authorities to implement more precise and targeted monitoring measures, enabling these factors to be managed and reducing their adverse impact on overall market performance.

Despite significant progress in the development of China’s electricity spot market, several challenges remain. Market volatility, regulatory inconsistencies across provinces, and the evolving role of renewable energy integration pose major obstacles to achieving a fully functional and unified market. The intermittent nature of renewable generation increases price fluctuations, necessitating more effective risk management and forecasting mechanisms. Meanwhile, the absence of a standardized regulatory framework across different provincial markets creates inefficiencies and hinders cross-regional electricity transactions. Additionally, existing regulatory mechanisms must be continuously refined to keep pace with market innovations and technological advancements. Future research should focus on strategies to enhance market stability, improve cross-regional coordination, and leverage emerging technologies such as big data analytics and artificial intelligence for more dynamic and adaptive regulatory oversight.

To conclude the discussion above, it is essential to leverage government planning and regulatory guidance to address the key supervision obstacles in provincial electricity spot markets. From a macro perspective, it is crucial to refine policy frameworks and establish specialized supervisory institutions to ensure effective market governance. Efforts should also focus on optimizing market structure and enhancing transparency through improved information disclosure mechanisms. Additionally, policy rules related to price monitoring, market operation supervision, and security management should be clarified and regularly updated. From a micro perspective, targeted measures are needed to promote the active participation of diverse market entities, particularly renewable energy suppliers, while fostering innovation in technical support systems and market operation mechanisms. Incentives such as preferential trading policies should also be introduced to support the sustainable development of the provincial electricity spot market.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

YL: conceptualization, formal analysis, methodology, software, visualization, writing – original draft, and writing – review and editing. WX: conceptualization, supervision, visualization, writing – original draft, and writing – review and editing. YZ: conceptualization, resources, supervision, visualization, writing – original draft, and writing – review and editing. XZ: data curation, resources, supervision, validation, writing – original draft, and writing – review and editing. LY: data curation, resources, supervision, validation, writing – original draft, and writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

Authors YL, WX, YZ, XZ, and LY were employed by Henan Jiuyu Longyuan Energy Service Co., Ltd.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2025.1544722/full#supplementary-material

References

Cai, H., Sun, J., and Xie, Y. (2023). Strategic economic allocation of integrated energy system considering energy storage peak-vallry price spread arbitrage. Sichuan Electr. Power Technol., 35–42. doi:10.16527/j.issn.1003-6954.20230506

Chen, Q., Fang, X., Guo, H., Wang, X., Yang, Z., Cao, R., et al. (2021). Progress and key issues for construction of electricity spot market. Autom Electr. Power Syst 45 (6), 3–15. doi:10.7500/AEPS20210221002

Chen, Y., Xu, X., Fan, X., Song, L., Li, G., Wang, B., et al. (2024). Decision-making for inter-provincial spot power purchases of power grid companies under two-level electricity market. Elect. Power Constr., 1–15.

Corsatea, T. D., and Giaccaria, S. (2018). Market regulation and environmental productivity changes in the electricity and gas sector of 13 observed EU countries. Energy 164, 1286–1297. doi:10.1016/j.energy.2018.08.145

Csereklyei, Z., and Kallies, A. (2024). A legal-economic framework of wholesale electricity markets: assessing Australia's transition. Energy Pol. 195, 114377. doi:10.1016/j.enpol.2024.114377

Currier, K. M. (2016). Incentives for cost reduction and cost padding in electricity markets with overlapping “green” regulations. Util. Pol. 38, 72–75. doi:10.1016/j.jup.2015.10.004

Dong, J., Dou, X., Bao, A., Zhang, Y., Liu, D., et al. (2022). Day-ahead spot market price forecast based on a hybrid extreme learning machine technique: a case study in China. Sustainability 14 (13), 7767. doi:10.3390/su14137767

El, K. S., and Galiana, F. D. (2019). Investigating emission regulation policy in the electricity sector: modeling an oligopolistic electricity market under hourly cap-and-trade. Energy Ecnom 78, 428–443. doi:10.1016/j.eneco.2018.05.037

Gao, S., Bai, X., Shang, Q., Weng, Z., and Wu, Y. (2024). A joint electricity market-clearing mechanism for flexible ramping products with a convex spot market model. Sustainability 16 (6), 2390. doi:10.3390/su16062390

Gencer, B., Larsen, E. R., and van Ackere, A. (2020). Understanding the coevolution of electricity markets and regulation. Energy Pol. 143, 111585. doi:10.1016/j.enpol.2020.111585

Guan, L., Chang, J., Sun, D., Wang, D., Huang, G., Zhang, R., et al. (2024a). Analysis and reflection on trial operation of inter-provincial electricity spot markets in China. Auto Electr. Power Syst 48 (11), 2–10. doi:10.7500/AEPS20230728012

Guan, L., Zhou, L., Liu, B., Tao, H., Luo, Z., and Zhang, G. (2024b). Analysis and enlightenment of long-time-scale negative electricity prices in Shandong electricity spot market of China during may day holiday. Autoof Electr. Power Syst. 48 (14), 1–7. doi:10.7500/AEPS20230906002

Guo, B., and Weeks, M. (2022). Dynamic tariffs, demand response, and regulation in retail electricity markets. Energy Ecnom 106, 105774. doi:10.1016/j.eneco.2021.105774

He, S., He, X., Lou, S., Li, Z., Chen, Z., Gu, H., et al. (2023). Key monitoring indicators and market power analysis in monthly settlement trial operation of southern China electricity spot market (starting with Guangdong province). Power Syst. Tech. 47 (1), 175–184. doi:10.13335/j.1000-3673.pst.2022.0776

Holmberg, P. A., and Tangeras, T. (2024). A survey of capacity mechanisms: lessons for the Swedish electricity market. Energy J. 44 (6), 275–304. doi:10.5547/01956574.44.6.phol

Huang, S., Shi, J., Wang, B., An, N., Li, L., Wang, C., et al. (2024). A hybrid framework for day-ahead electricity spot-price forecasting: a case study in China. Appl. Energy 373, 123863. doi:10.1016/j.apenergy.2024.123863

International Energy Agency (2023a). Building a unified national power market system in China. IEA, Pris. Available online at: https://www.iea.org/reports/building-a-unified-national-power-market-system-in-china (Accessed December 15, 2024).

International Energy Agency (2023b). Global EV outlook 2023: charging infrastructure and grid integration. Available online at: https://www.iea.org/reports/global-ev-outlook-2023.

Karahan, C. C., Odabaşı, A., and Tiryaki, C. S. (2024). Wired together: integration and efficiency in European electricity markets. Energy Ecnom 133, 107505. doi:10.1016/j.eneco.2024.107505

Karney, D. H. (2019). Electricity market deregulation and environmental regulation: evidence from U.S. nuclear power. Energy Ecnom 84, 104500. doi:10.1016/j.eneco.2019.104500

Li, C., Wang, H., Yan, X., and Bian, Y. W. (2023a). Forward contracting and spot trading in electricity markets. Ann. Opera Res. doi:10.1007/s10479-023-05547-4

Li, R., Tang, B., Shen, M., and Zhang, C. (2023b). Low-carbon development pathways for provincial-level thermal power plants in China by mid-century. J. Environ. Manag. 342, 118309. doi:10.1016/j.jenvman.2023.118309

Li, Y., Yang, Y., Zhang, F., and Li, Y. (2024). A Stackelberg game-based approach to load aggregator bidding strategies in electricity spot markets. J. Energy Storage 95, 112509. doi:10.1016/j.est.2024.112509

Lin, Q., Chen, W., Zhao, X., Zhou, S., Gong, X., and Zhao, B. (2024). Research on a price prediction model for a multi-layer spot electricity market based on an intelligent learning algorithm. Front. Energy Res. 12, 1308806. doi:10.3389/fenrg.2024.1308806

Liu, Y., Jiang, Z., and Guo, B. (2022). Assessing China’s provincial electricity spot market pilot operations: lessons from Guangdong province. Energy Pol. 164, 112917. doi:10.1016/j.enpol.2022.112917

Lu, T., Zhang, W., Wang, Y., Xie, H., and Ding, X. (2022). Medium- and long-term trading strategies for large electricity retailers in China's electricity market. Energies 15 (9), 3342. doi:10.3390/en15093342

Ma, Y., and Li, T. (2024). Research on day-ahead clearing methods for electricity spot markets integrating carbon trading. Sci Techn Manag. Res 44 (12), 193–201. doi:10.3969/j.issn.1000-7695.2024.12.023

Paul, T. K., Jana, C., Pal, M., and Simic, V. (2023). Sustainable carbon-dioxide storage assessment in geological media using modified Pythagorean fuzzy VIKOR and DEMATEL approach. J. Hydro Energy 48 (25), 9474–9497. doi:10.1016/j.ijhydene.2022.12.024

Roumkos, C., Biskas, P. N., and Marneris, I. G. (2020). Integration of European electricity balancing markets. Energies 15 (6), 2240. doi:10.3390/en15062240

Si, S., You, X., Liu, H., and Zhang, P. (2018). DEMATEL technique: a systematic review of the state-of-the-art literature on methodologies and applications. Math. Problems Eng. 2018, 1–33. doi:10.1155/2018/3696457

Sorooshian, S., Tavana, M., and Ribeiro-Navarrete, S. (2023). From classical interpretive structural modeling to total interpretive structural modeling and beyond: a half-century of business research. J. Bus. Res 157, 113642. doi:10.1016/j.jbusres.2022.113642

State Grid Corporation of China (2021). State grid accelerates implementation of new requirements for power market information disclosure. Electrotech. Appli 40 (06), 2.

Stefenon, S. F., Seman, L. O., Mariani, V. C., and Coelho, L. D. (2023). Aggregating prophet and seasonal trend decomposition for time series forecasting of Italian electricity spot prices. Energies 16 (3), 1371. doi:10.3390/en16031371

Szőke, T., Hortay, O., and Farkas, R. (2021). Price regulation and supplier margins in the Hungarian electricity markets. Energy Ecnom 94, 105098. doi:10.1016/j.eneco.2021.105098

Tan, H., Guo, W., Zheng, W., Li, S., and Wu, Y. (2024). Review and outlook of worldwide spot market development. Power Gener. Tech., 1–11.

Wang, D., Sun, J., and Wei, C. (2024). Influencing factor analysis and enterprise evaluation of lithium-ion battery recycling on improved DEMATEL method. J. Intelligent and Fuzzy Syst. 46 (3), 6149–6169. doi:10.3233/JIFS-224124

Wang, H., Wang, C., and Zhao, W. (2022). Decision on mixed trading between medium- and long-term markets and spot markets for electricity sales companies under new electricity reform policies. Energy 15 (24), 9568. doi:10.3390/en15249568

Wei, Z., Jing, Z., and Ji, T. (2024). Research on the linkage equilibrium mechanism between power market and carbon market based on multi-timescale coupling modeling. Power Syst. Tech., 1–15. doi:10.13335/j.1000-3673.pst.2024.1150

Wu, W., Xiao, Y., Wang, X., Wang, Z., Guan, L., Zhao, T., et al. (2024). Coordinated clearing method for two-stage inter- and intra-provincial electricity spot market under spillover risk constraints. Autom Elect Power Syst 48 (4), 66–75. doi:10.7500/AEPS20230509011

Wu, Y., Liu, F., He, J., Wu, M., and Ke, Y. (2021). Obstacle identification, analysis and solutions of hydrogen fuel cell vehicles for application in China under the carbon neutrality target. Energy Pol. 159, 112643. doi:10.1016/j.enpol.2021.112643

Xie, J., Liu, S., Sun, X., Deng, H., and Jiang, H. (2023). Electricity market clearing mechanism considering market power risk prevention. Electr. Power Constr. 44 (4), 18–28. doi:10.12204/j.issn.1000-7229.2023.04.003

Xie, J., and Sun, Z. (2024). Analysis and outlook of the electricity spot market in the southern region. Energy Sci Tech 22 (02), 36–39.

Xu, G., and Wang, X. (2022). Research on the electricity market clearing model for renewable energy. Energies 15 (23), 9124. doi:10.3390/en15239124

Yazo-Cabuya, E. J., Herrera-Cuartas, J. A., and Ibeas, A. (2024). Organizational risk prioritization using DEMATEL and AHP towards sustainability. Sustainability 16 (3), 1080. doi:10.3390/su16031080

Zhang, L., Tian, C., Li, Z., Yin, S., Xie, A., Wang, P., et al. (2024a). The impact of participation ratio and bidding strategies on new energy's involvement in electricity spot market trading under marketization trends-an empirical analysis based on henan province, China. Energies 17 (17), 4463. doi:10.3390/en17174463

Zhang, R., Ling, X., Ren, X., Bie, Z., Feng, K., and Zeng, D. (2024b). Bi-Level clearing model of inter- and intra-provincial electricity spot markets based on multiple order. Automa Ele Power Syst 48 (11), 111–121. doi:10.7500/AEPS20230415002

Zhou, L., Wang, J., Dai, G., Tang, M., and Qiu, j. (2024). DEMATEL and ISM analysis of factors influencing coal spontaneous combustion in longwall gobs. J. South. Afr. Inst. Min. Metallurgy 124 (5), 231–238. doi:10.17159/2411-9717/856/2024

Keywords: provincial electricity spot market supervision, obstacle identification, key obstacle, ISM-DEMATEL methods, supervision proposal

Citation: Li Y, Xue W, Zhang Y, Zheng X and Yang L (2025) Promoting the sustainable development of the provincial electricity spot market: supervision obstacle identification, analysis, and solutions based on the ISM-DEMATEL model. Front. Energy Res. 13:1544722. doi: 10.3389/fenrg.2025.1544722

Received: 13 December 2024; Accepted: 13 March 2025;

Published: 23 April 2025.

Edited by:

Yirui Wang, Ningbo University, ChinaCopyright © 2025 Li, Xue, Zhang, Zheng and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yi Li, enhjMTIzMTIzNjE4QDE2My5jb20=

Yi Li

Yi Li Wulei Xue

Wulei Xue