- 1Guangzhou Institute of International Finance, Guangzhou University, Guangzhou, China

- 2School of Economics and Statistics, Guangzhou University, Guangzhou, China

In this paper, 3,493 non-financial listed companies in China from 2007 to 2018 are selected as samples to study the impact of corporate financialization on green technology innovation through the panel regression model as well as the mediating effect model, so as to identify whether enterprises tend to financial speculation or capital investment. The main conclusions are as follows. First, corporate financialization has a speculative tendency instead of strategic capital investment. Second, corporate financialization shows heterogeneous impact on green technology innovation, which is dominated by capital expenditure. Third, the heterogeneity is reflected in two aspects: attribute characteristics and external environment. The attribute characteristics of the enterprise includes whether the industry belongs to pollution industry and the ownership structure. The external environment includes the location of enterprise and the degree of financing constraints. Fourth, there are significant differences between attribute characteristics and external environment of enterprises in the impact of financialization decision-making behavior. The deviation caused by enterprise attributes is less than 10%, but the deviation caused by external environment is close to 80%.

1 Introduction

Corporate financialization is an important manifestation of economic financialization at the micro entity level, which has an important impact on both enterprises and the real economy. However, there is no consensus on the impact of financialization on enterprises. Generally speaking, there are two views. One is the “reservoir” effect. The theory of “reservoir” points out that the purpose of holding financial assets is to reserve liquidity, so as to prevent the risk of capital chain rupture caused by the impact of cash flow (Smith and Stulz, 1985; Stulz, 1996). The theoretical basis of this view can be traced back to the precautionary saving theory. Compared with the long-term capital expenditure of strategic planning, the liquidity of financial assets is stronger. When enterprises face financial difficulties, they can quickly obtain liquidity by selling financial assets in time to relieve the capital pressure (Gamba and Triantis, 2008; Brown and Petersen, 2011). At the same time, when enterprises believe that they will face macroeconomic uncertainty or potential investment opportunities in the future, they will also prefer to “hold on to cash” (Opler et al., 1999), especially those enterprises with financing constraints (Almeida et al., 2004; Ji et al., 2020). Demir (2009) analyzed the investment portfolio of non-financial enterprises in Argentina and other countries, and concluded that the financialization behavior of enterprises can not only improve the short-term performance of enterprises, but also reduce the negative impact of external financing constraints on the development of the main business, and cope with macroeconomic uncertainty. In addition, Ding et al. (2013) also believed that enterprises’ participation in short-term financial asset allocation activities would help to increase the liquidity of assets and reduce the dependence of enterprises on external financing, so as to “back feed” the possible shortage of funds in the development of their main businesses to a certain extent. Another view is the crowding-out effect. The crowding-out effect is essentially a kind of “investment substitution” behavior. This theory holds that the purpose of enterprise financialization is to pursue profit maximization. Therefore, when the rate of return of financial investment is higher than that of real economic investment, enterprises will replace real economic investment with financial asset investment, otherwise, they will replace financial asset investment with real economic investment (Demir, 2009). The core reason of the crowding-out effect is that the return on financial investment is higher than that on capital investment in strategic planning. The increasing degree of financialization means that the preference of enterprises for financial assets increases, which will reduce industrial investment and produce the crowding-out effect (Tori and Onaran, 2017).

Whether the financialization behavior of enterprises has a “reservoir” effect or a crowding-out effect depends on whether the motivation of financial asset allocation is financial speculation or capital investment. According to the capital profit-seeking theory, enterprises tend to allocate funds to areas with high yield rates, strong liquidity and low adjustment costs. Therefore, if the enterprise is mainly for the purpose of financial speculation profits, the financialization will squeeze out its capital investment. At the same time, high profits in the financial field will aggravate the shortsightedness of business managers, making them pay too much attention to short-term interests and ignore capital investment which is essential for the long-term development of enterprises (Orhangazi, 2008; Tori and Onaran, 2018). If the purpose of corporate financial asset allocation is mainly for strategic planning and long-term sustainable development, the crowding-out effect of financialization on capital, especially technical investment, will be greatly weakened, and may even bring some crowding-in effect. Technology innovation is an important aspect of strategic capital expenditure. In addition, technology innovation shows forward-looking, which is reflected by connecting the sustainable development of enterprises with the society and the environment. Therefore, green technology innovation has become the core focus of enterprises’ real attention to strategic planning.

This paper argues that the corporate financialization motivation can be tested by the external performance of its strategic behavior. Meanwhile, the external performance of corporate strategic behaviors can be reflected by green technology innovation to a large extent. Because the green technology innovation realizes the long-term equilibrium of strategic goal of shareholder value, the social sustainable development and so on. Accordingly, by studying the effect of corporate financialization on green technology innovation and analyzing the mediating variables in the influencing mechanism, we can identify to a certain extent whether the motivation of financialization is speculation or capital investment. Further research on the impact of financialization on green technology innovation can analyze the restraining factors of behavioral motivation. The main contributions of this paper are as follows. First, the corporate financialization has a tendency of speculation and insufficient tendency of strategic capital investment. Although there are differences in the influence of financialization on enterprises, this paper finds through the empirical study that corporate financialization significantly inhibits the innovation of green technology. At the same time, from the analysis of the impact mechanism of corporate financialization on green technology innovation, enterprises mainly achieve the effect of corporate financialization through their own leverage, while the performance of enterprises, namely the net operating profit margin of enterprises, has no mediating effect in the mechanism. Second, the impact of corporate financialization on green technology innovation of capital expenditure shows heterogeneous. The financialization behaviors of enterprises are closely related to the attributes of enterprises, and there is heterogeneity among the samples of different attributes. By extracting the attributes of enterprises, we can find that the industry and ownership attributes of enterprises have a significant impact on the financialization behavior of enterprises. From the perspective of industry attributes, enterprises of heavy polluting industries are more prone to financialized speculation and have stronger inhibition on green innovation of capital investment. From the perspective of the ownership attribute, private enterprises are more inclined to financialized speculation and have stronger inhibition on green innovation of capital investment. Third, the financialization behaviors of enterprises are also closely relative to the external environment. Moreover, different external environments have heterogeneous effects on the green technology innovation of capital expenditure. Through the analysis of the external environment, it is found that the region where the enterprise is located and the degree of financing constraints have a significant impact on the financialization behavior of the enterprise. From the perspective of the region where the enterprises are located, enterprises in central China are more inclined to financialized speculation and have stronger inhibition on green innovation of capital investment. From the perspective of the degree of financing constraints, enterprises with low financing constraints are more inclined to financialized speculation and have stronger inhibition on green innovation of capital investment. Fourth, there are significant differences between the attribute characteristics and external environment of enterprises in the decision-making behaviors of corporate financialization. The empirical results show that, although the two selected attributes have impacts on the decision-making behavior of corporate financialization, the deviation degrees of the impact caused by the two attributes are not more than 10%; whereas the external environment not only has a significant impact on the financialization decision-making behavior of enterprises, but also causes the heterogeneity to deviate from the value of the whole sample by nearly 80%. Enterprises are more sensitive to the external environment in the process of asset allocation.

The rest of the paper is organized as follows. The Section 2 is the literature review. In Section 3, we measure econometrically the overall impact of corporate financialization on green technology innovation. In Section 4, on the basis of Second 2, we analyze the mediating effects of variables in order to identify financial speculation and capital investment behavior in the process of corporate financialization. In Section 5, we study the heterogenous impacts of corporate financialization on green technology innovation from the aspects of enterprise attributes and external environment.

2 Literature Review

The concept of financialization origins from “Economic financialization,” i.e., the economy itself exhibits a financiallike quality or condition. This concept focuses on the definition at the macro level. At the macro level, financialization means the increasing expansion of the financial sector, whose output and profit as growing proportions of the national economy, relative to the non-financial sector (Luo and Zhu, 2014). Excessive financialization results in that the industrial center shifts from the real economy sector to the virtual economy sector, leading to industry hollowing and weakening the fundamental position of the real economy sector. With regard to micro level of definition, the corporate financialization refers to the phenomenon that enterprises allocate large proportions of financial assets in their assets and liabilities and their profits are more from financial channels rather than production-manufacturing (Krippner, 2005). The existing literatures mainly focus on the impacts that entity enterprises participate in financial activities on business operation, industrial investment and so on. Orhangazi (2008) empirically found the significantly negative correlation between corporate financialization level and industrial investment rate, i.e. financial asset investment squeezes out industrial investment. Corporate financial asset allocation significantly reduces the current R&D investment of enterprises (Gleadle et al., 2014). Profits from financial channels also discourage the corporate innovation and business performance. Akkemik and Ozen (2014) found that increasing financial assets, especially those with high returns, will reduce investment in R&D and fixed assets, such that industrial investment is squeezed out, influencing the development of the real economy. However, Ding et al. (2013) thought that enterprises can relieve capital pressure by quickly liquidating financial assets when they are faced with liquidity risk and financing constraints, as financial assets are characterized by strong liquidity and wide market trading. Enterprises can increase their holdings of financial assets to form precautionary reserves, when they are flush with funds. At present, there is no consensus on whether enterprises prefer financial speculation or capital investment in allocating their financial assets.

Green technology innovation is forward looking. It needs to coordinate the relationship among society, environment and sustainable development of enterprises (Huang et al., 2019). Therefore, green technology innovation is the core of enterprise strategic planning. This paper focuses on the impact of corporate financialization on green technology innovation, trying to identify whether the motivation of corporate financialization is inclined to financial speculation or capital investment. Schumpeter pointed out in his theory of Economic Development in 1912 that innovation mainly includes production innovation, technical innovation, market innovation, raw material innovation and organizational innovation. Traditional technological innovation mainly helps enterprises to improve their competitiveness through a series of research and development activities such as exploring new technologies, improving processes and creating new products, so as to obtain more economic benefits. In this series of activities, the enterprises’ investment in technological innovation is mainly reflected by the enterprises’ R&D investment. The intensity of R&D investment represents to some extent the deepness of enterprises’ participation in innovation activities. Klingebiel and Rammer (2020) suggested that the rational allocation of resources is one of the important factors to improve the innovation performance of enterprises. First, sufficient funds investing in R&D are conducive to the diversification of R&D projects and the formation of enterprises’ special techniques. Meanwhile, it also can improve the ability of enterprises to resist the uncertain risks brought by technological innovation (Hall et al., 2016; Wu et al., 2020). Second, investment in human resource and equipment for R&D provides the material basis for the smooth development of technological innovation. Increasing investment in technology innovation is conducive to improving the efficiency of technological innovation. Green technological innovation is developed in the process of traditional technology innovation by introducing concepts like ecological environment and green development, emphasizing more on the “green concept” of technology innovation. In carrying out traditional technological innovation activities, enterprises often ignore the impact of innovation on the environment. Different from ordinary technology innovation, green technology innovation shows significant “double externalities” (Rennings, 2000). The first externality is the positive externality of technology and knowledge spillover. Enterprises bear the cost of green technology innovation but do not get the corresponding benefits. Another externality is the negative externality caused by environmental pollution. When the cost of pollution discharge is not included in the cost of production and operation, enterprises lack incentive for green technology innovation. This characteristic can also be called “double market failure” in the market (Jaffe et al., 2005). This is one of the important reasons why green technology innovation is ignored by most enterprises. However, the role of green technological innovation cannot be ignored. Green technology innovation is the key way for enterprises to gain competitive advantage (Hart, 1995). Through the research and development and application of green products and green processes, enterprises can realize the greening of the entire life cycle of products and meanwhile realize economic and environmental benefits (Frondel et al., 2008). The development of green technology innovation is not only conducive to improving the efficiency of natural resources utilization, but also can reduce the production cost of enterprises (Sun et al., 2017). Therefore, research on green technology innovation is of great significance. Existing literatures mainly study the impacts on green technology innovation from the perspectives of environmental regulation, R&D investment, enterprise scale, government support, industrial structure, economic development level, FDI and so on (Okamuro and Zhang, 2006; Feng et al., 2017; Lin and Chen, 2018; Jin et al., 2019), but rarely from the perspective of corporate financial asset allocation.

Through the review of existing literatures, there are few studies on the impact of corporate financialization on green technology innovation by investigating the relationship between them. Thus, in this paper, we devote to working on this gap and identify the motivation for corporate financialization.

3 Econometric Tests on the Impact of Corporate Financialization on Green Technology Innovation

3.1 The Model

Green technology innovation not only highlights the dual strategy of enterprises and society, but also satisfies the sustainable innovation strategy of enterprises, which can be used as an important identification variable of enterprise capital investment. Actually, the capital investment of an enterprise is a strategic investment, so it is relatively difficult to identify the capital investment of an enterprise. It is easier to identify from the perspective of innovation whether enterprises’ capital investment is more inclined to strategic capital allocation. Because innovation is an important means for enterprises to develop upward and form competitive advantage, and maintaining the continuous development of innovation activities has become an important guarantee for enterprises to better enjoy the economic benefits brought by innovation and maintain long-term healthy growth (Qamruzzaman and Wei, 2018; Song et al., 2019). At the same time, innovation activities, with relatively long input-output cycles, have a very strong uncertainty, so capital invested in the innovation field may face more uncertainty (Hall et al., 2016; Haque et al., 2019). In strategic capital investment, technical innovation directly targeting at the products of the enterprise is more favored by enterprises, because its uncertainty is relatively low, and it is more able to achieve the objectives of strategy and performance. The general strategy of technological innovation investment of enterprises is focused more on the corporate planning objectives and less on social strategies and objectives. In terms of the micro and macro correlation, corporate social responsibility is closely related to its strategic planning to a large extent. Green technology innovation covers a package of sustainable innovation perspectives such as corporate social responsibility, the corporate strategic planning and optimal allocation of capital, so it can effectively identify capital investment.

The impact of corporate financialization on green technology innovation will show significant differences in different enterprises and different levels. From the perspective of different enterprises, each enterprise in different stages has different competitors and financial levels. Therefore, in the process of asset allocation, the enterprise’s objectives are also diverse. For example, when the enterprise is in a technology intensive competition industry, it has stronger requirements for strategic capital allocation, stronger technical objectives and awareness of sustainable development, and more inclined to invest in green technology innovation. From the perspective of time dimension, in the process of asset allocation, the development stage and strategic positioning of enterprises restrict the goal of capital allocation. For example, the maximization of shareholders’ interests spurs the enterprise to focus more on the short-term goal and financial speculation (Christophers, 2017), directing to the investment with the highest profit in the process of capital allocation. While green technology innovation needs long-term accumulation and the earnings are uncertain. Panel data model can examine the impact of financialization on green technology innovation from two dimensions, i.e., time and space (Wen et al., 2019). Therefore, this paper adopts the panel data model to conduct quantitative tests on the impact. The basic form of the panel data model is as follows:

where i and t represent the enterprise and the year respectively.

In formula (1), LnGreen is the explained variable, indicating the level of green technology innovation of enterprises. In terms of the output of innovation activities, patents are the direct output of R&D and technological innovation results, and also the international standard to measure the ability of technological innovation (Guan and Gao., 2009). Thus, according to an online tool launched by the World Intellectual Property Organization (WIPO) in 2010 to facilitate the retrieval of patent information related to environmentally sound technologies (EST), namely the “IPC Green Inventory,” the number of green patents of enterprises each year is identified and accounted for, and the natural logarithm is taken as the measurement index of enterprises’ green technology innovation activities.

Financialization is an explanatory variable that represents the financialization of an enterprise. The corporate financialization refers to the phenomenon that enterprises allocate and invest more and more financial assets in their assets and liabilities. Referring to the calculation method of Demir (2009), this paper uses the ratio of financial assets to total assets at the end of the period to measure the financialization behavior of enterprises. Financial assets include transaction financial assets, investment on real estate, long-term financial equity investment, entrusted financial management and trust products. Then they are added up and standardized. In addition, in order to test the robustness of the results, this paper selects a measure of enterprise financialization level from the perspective of income to replace the proportion of financial assets in total assets for model test. The financialization index selected from the income angle (

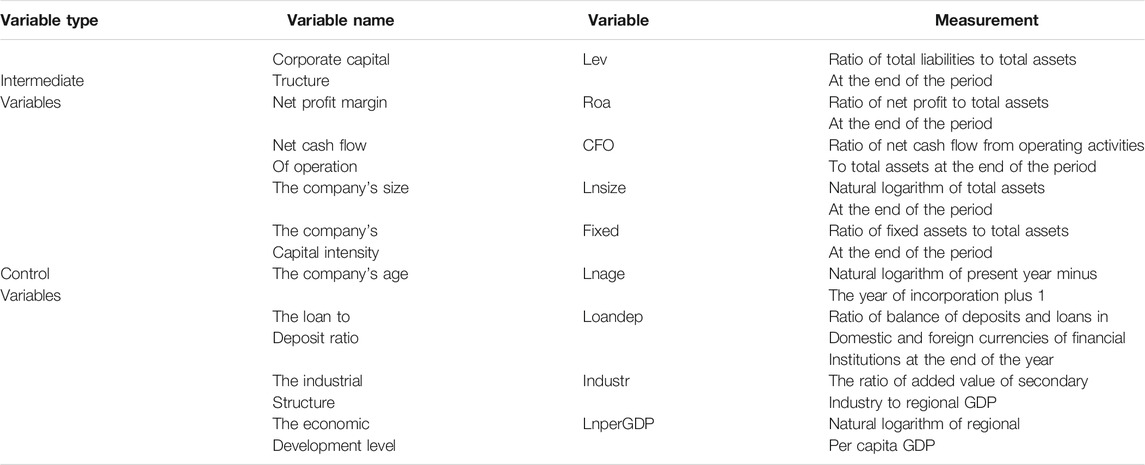

In this paper, relevant control variable X is introduced to control the influence of other characteristics of enterprises on the green technology innovation level. As there are many factors affecting the innovation level of green technology in enterprises, according to relevant theories and existing empirical research (Okamuro and Zhang, 2006; Colombo et al., 2013), other variables affecting the level of green technology innovation are considered in the process of modeling. When studying the impact of enterprise financialization behavior on the level of green technology innovation in society, it is necessary to assume that other influencing factors remain unchanged, that is, other major influencing factors need to be controlled and set as the control variables in the econometric test. Our paper introduces a total of seven control variables from the micro and macro levels, of which four are from the micro level and the rest three are from macro level. The stability of the corporate internal financial status is the basis to ensure the continuous and effective implementation of corporate innovation activities, and is also the source power for enterprises to carry out green technology innovation (Hall, 2002). In addition, the corporate sizes and accumulations can also provide different conditions for green technology innovation activities (Okamuro and Zhang, 2006). Thus, in the micro level, the net cash flow of operation (

Meanwhile, the profits of enterprises’ participation in financialization may change their financial structures, which will make differences to the green technology innovation (Frank and Goyal, 2009). Thus, we introduce the capital structure and net profit margin of enterprises as mediating variables to explore the influence mechanism of corporate financialization on green technology innovation. The detailed description and measurement method of the above variables are shown in Table 1, where

3.2 Data Source and Descriptive Analysis

The time dimension of data selected in this paper is from 2007 to 2018, and the research object is 3,493 listed non-financial enterprises in China. Due to the lack of data of some indicators in individual years, the data in this paper belongs to unbalanced panel data. The data of green technology innovation come from the State Intellectual Property Office of China (SIPO). The data of financialization are all from China’s CSMAR database. When the income of financial channel is negative and the operating profit is positive, or the income of financial channel is positive and the operating profit is negative, the measurement results of corporate financialization may be the same, but obviously the contribution of the enterprise financial income is different, so samples with negative finantialization are deleted when measuring the financialization level from the perspective of income. The data of control variables at the micro level are obtained from China CSMAR database and matched to each observed individual by year and security code. The data of macro-level control variables are derived from EPS, regional financial operation reports, and National Bureau of Statistics, and are matched to each observed individual by year and region. In order to eliminate the possible influence of outliers on the robustness of regression results, 1% winsorize truncation processing was carried out for

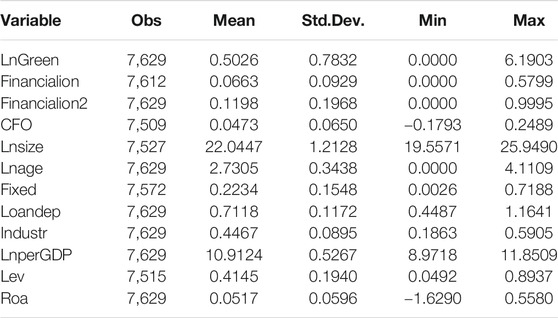

Table 2 reports descriptive statistics for all variables. On the whole, the minimum value of enterprise green technology innovation is 0.0000, the maximum value is 6.1903 and the average value is 0.5026, indicating that the overall level of enterprise green technology innovation is not high. In terms of corporate financialization, the minimum value of holding financial assets is 0.0000, the maximum value is 0.5799, and the average value is 0.0663, indicating that the financialization degree of different listed non-financial enterprises is quite different. In addition, this paper also carries out descriptive statistics of sub-samples from four aspects: the ownership attribute, the industry attribute, the region and the financing constraint, as shown in Figure 1.

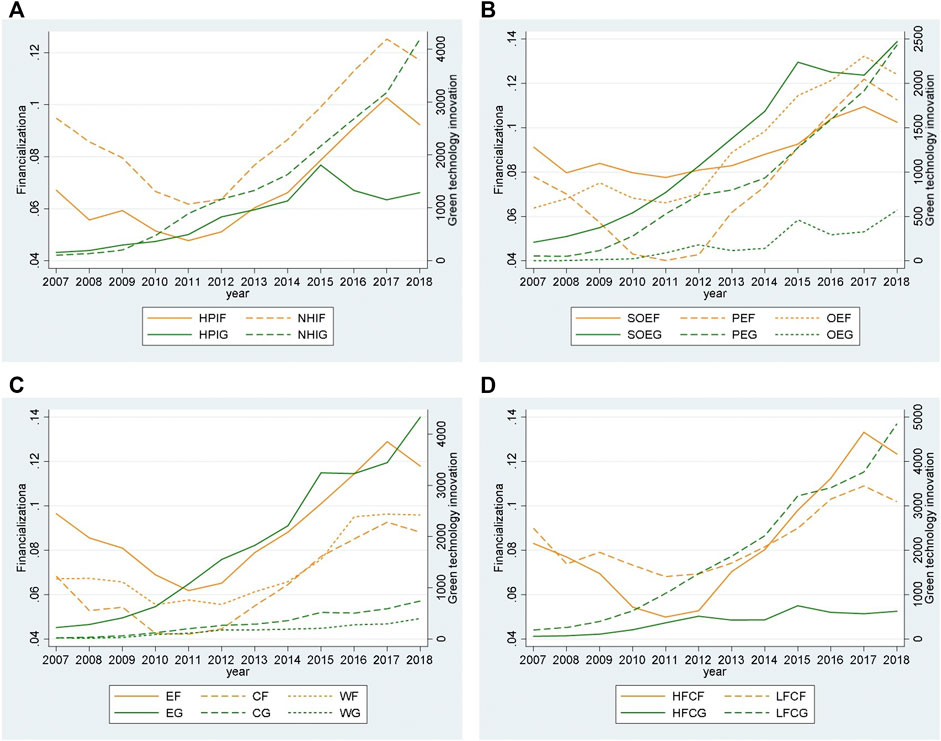

FIGURE 1. Line charts of the annual mean of financialization degree and the sum of green technology innovation quantity in each year: (A) the line chart of enterprises in industries with different pollution degrees. HPIF and NHIF represent annual means of financialization degree of enterprises in the heavy pollution industry and the non-heavy pollution industry respectively; HPIG and NHIG represent annual total of green innovation quantity of enterprises in the heavy pollution industry and the non-heavy pollution industry respectively; (B) the line chart of enterprises under different ownership. SOEF, PEF and OEF respectively represent the annual average of the financialization degree of state-owned enterprises, private enterprises and other enterprises; SOEG, PEG and OEG respectively represent the sum of the green innovation quantity of state-owned enterprises, private enterprises and other enterprises in each year; (C) the line chart of enterprises in different regions. EF, CF and WF respectively represent the annual average of the financialization degree of enterprises in the east, central and west of China, and EG, CG and WG respectively represent the sum of the number of green innovation of enterprises in the east, central and west of China. (D) the line chart of enterprises with different financing constraints. HFRF and LFRF respectively represent the annual average of financialization degree of enterprises with high financing constraints and low financing constraints, while HFRG and LFRG respectively represent the sum of green innovation quantity of enterprises with high financing constraints and low financing constraints in each year.

It can be seen from Figure 1A that the financialization level of enterprises in the heavy pollution industry and the non-heavy pollution industry as a whole shows a trend of first decline and then rise. The annual average of the financialization level of enterprises in the heavy pollution industry is lower than that of enterprises in the non-heavy pollution industry, and the financialization level of enterprises in the two industries reaches the maximum at the same time in 2017. From 2007 to 2015, the green technology innovation ability of enterprises in the heavy polluting industry is roughly the same as that of enterprises in the non-heavy polluting industry. After 2015, there is a significant gap. The green technology innovation ability of enterprises in the non-heavy pollution industry is constantly improving, while that of the heavy pollution industry is declining. In Figure 1B, the financialization level of state-owned enterprises and other enterprises shows an overall upward trend. However, the financialization level of private enterprises decreases first and then increases with time, with a large range of changes. From 2007 to 2015, the financialization level of state-owned enterprises is higher than that of private enterprises, but after 2015, the financialization level of private enterprises surpasses that of state-owned enterprises. The financialization levels of state-owned enterprises, private enterprises and other enterprises all reach the maximum in 2017. For green technology innovation ability, state-owned enterprises are the highest, private enterprises are the second, and other enterprises are the lowest. However, the green technology innovation ability of these three types of enterprises has been continuously improved with the change of time. Among them, state-owned enterprises and private enterprises have been promoted at a faster speed, while other enterprises have been promoted at a slower speed. As can be seen from Figure 1C, the financialization level of enterprises in the eastern, central and western regions shows an overall trend of first declining and then rising. The financialization level of eastern enterprises is the highest, followed by western enterprises, and that of central enterprises is the lowest. For the green technology innovation ability, the eastern enterprises are the strongest, the central enterprises are the second, and the western enterprises are the weakest. The green innovation ability of eastern enterprises increases rapidly with time, while that of central and western enterprises increases slowly with time. According to Figure 1D, the financialization level of enterprises with high and low financing constraints presents an overall trend of decline and then rise. From 2007 to 2014, the financialization level of enterprises with low financing constraints is higher than that of enterprises with high financing constraints. After 2014, the financialization level of enterprises with high financing constraints exceeds that of enterprises with low financing constraints, and the financialization level of the two types of enterprises reaches the highest value in 2017. As for the innovation ability of green technology, enterprises with low financing constraints have significantly improved over time and are much better than those with high financing constraints.

3.3 Empirical Results

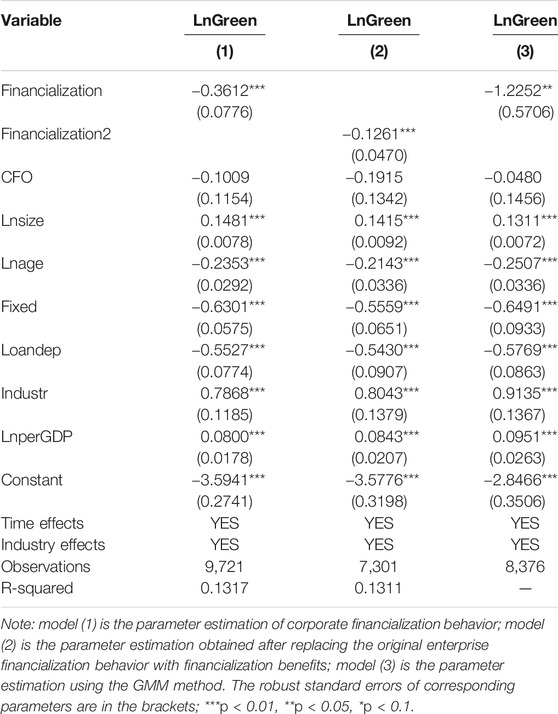

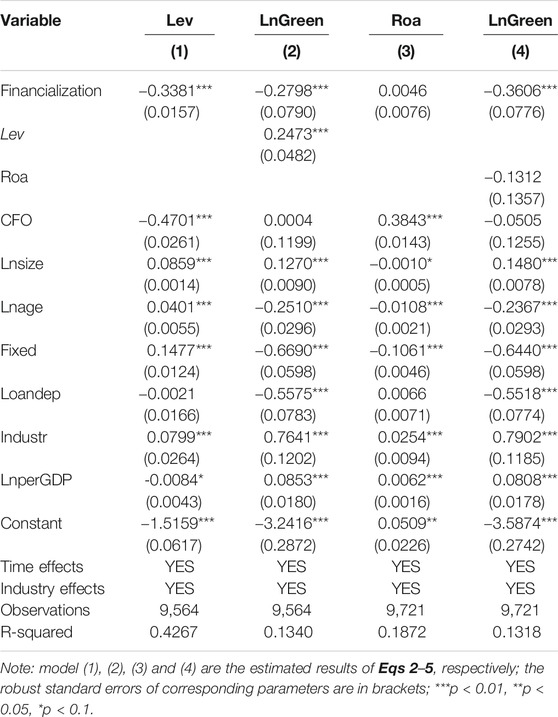

The goal of this section is to explore the impact of corporate financialization on green technology innovation. Therefore, on the basis of the relevant preprocessing of variables, such as the stability test, the benchmark regression of the model is conducted. In addition, this paper also carries out the robustness test from the following two aspects: first, based on the robustness test of estimation variables, the level of financialization is measured from the perspective of obtaining benefits from financialization, and benchmark regression is carried out; second, based on the robustness test of estimation methods, in order to control the endogeneity of the model, the first-order lag term of capital intensity and the first-order lag term of net profit margin of enterprises are used as instrumental variables. The GMM method is used to estimate the parameters. The results of the model parameter estimation are shown in Table 3.

TABLE 3. Estimation results of the impact of corporate financialization on green technology innovation

Table 3 reports the results of the parameter estimation. The coefficient of corporate financialization in model 1 is −0.3612 (p < 0.01). At the same time, model 2 and model 3 in Table 3 respectively give the parameter estimation results obtained by the financialization alternative variable and the GMM method. The symbols of the parameter estimation results are consistent with those of model (1), with only slight differences in the absolute value and significance of the coefficient, indicating that the estimation results are robust. From the empirical results, it can be seen that whether the measurement method of explanatory variables or the estimation method of the model is changed, the regression coefficient of corporate financialization passes the significance level of 5% and shows a negative effect. These results indicate that the financialization behavior of enterprises has a significant negative impact on green technology innovation, that is to say, the higher the financialization degree of enterprises, the greater the level of green technology innovation of enterprises will be inhibited. From the perspective of control variables, the coefficients of empirical net cash flow, enterprise age, enterprise capital density, deposit loan ratio are significantly negative at the level of 1%, indicating that these factors have a restraining effect on the level of green technology innovation of enterprises; the coefficients of company size, industrial structure and economic development level of the region where the enterprise is located are significantly positive at the level of 1%, indicating that these factors are conducive to promoting the green technology innovation of enterprises. From the above analysis, it can be seen that the financial assets allocation of enterprises has a restraining effect on the green technology innovation of strategic capital investment, so the financial target of enterprises is more inclined to financial speculation. Due to the characteristics of high yield, financial investment has attracted numerous non-financial enterprises to participate in financial asset investment. In the process of allocating financial assets, enterprises with the goal of obtaining short-term profits will spend more of their capital on financial investment and reduce their investment in green technology innovation. The corporate financialization has a “crowding out” effect on the green technology innovation, thus inhibiting the improvement of green technology innovation ability. Green technology innovation, to a certain extent, can reflect the external strategic behavior of enterprises. It belongs to the capital investment of enterprises. The corporate financialization has a restraining effect on the green technology innovation, which indicates that corporate financialization is inclined to financial speculation rather than capital investment.

4 Identification of Corporate Financialization Motivation–Based on the Analysis of the Impact Mechanism

4.1 The Model

Corporate financialization has a restraining effect on green technology innovation, but the identification of corporate financialization motivation needs to be further analyzed through the impact mechanism. From the theory of financial optimal allocation, if an enterprise maximizes the value of shareholders through financial allocation and does not consider the impact of any other indicators, the goal of financial asset allocation is speculation oriented (Stockhammer, 2005). Corporate financialization based on financial speculation will have an impact on the capital structure of enterprises and further affect the green technology innovation of enterprises. Orhangazi (2008) found in his study of non-financial enterprises in the United States that the pursuit of financial profits would lead enterprises to pay too much attention to short-term interests and neglect their sustainable development. In the process of financial asset allocation, in order to achieve the multi-objective of shareholder value, reputation and social responsibility, corporate financialization is dominated by capital investment (Arizala et al., 2013). The profits by corporate financialization based on capital investment can provide sufficient funds for the operation of enterprises. However, corporate financialization based on sustainable development can not only provide long-term incentive functions and shared opportunities for technological innovation, but also disperse corporate risks and promote the development of technological innovation activities (Tadesse, 2002). The enterprise’s green technology innovation is the capital investment that reflects the enterprise’s strategy. Therefore, by examining the impact mechanism of the corporate financialization on the green technology innovation, the corporate financialization motivation in the decision-making process can be identified to a certain extent. The influence of corporate financialization on green technology innovation mechanism needs to be analyzed from the perspective of financial capital operation mechanism. When corporate financialization is to fully maximize the shareholders value, the speculative financial asset allocation is dominant, and the financial operation is more likely to be realized by using the corporate capital structure, because the corporate capital structure uses the financial leverage effect more, thus giving play to the profit-seeking function of capital to a greater extent. When the financialization behavior of enterprises is dominated by strategic capital investment, the enterprise aims to achieve profit, reputation and long-term strategic investment as the operating mechanism, then the enterprise operation process is oriented by the enterprise’s continuous net profit, then the long-term performance plays a very important intermediary role in the impact mechanism (Li et al., 2017).

Based on this, this paper assumes that: when the capital structure plays a mediating effect in the impact mechanism, the corporate financialization is dominated by profit seeking speculation; when the long-term asset profit performance plays a mediating effect, corporate financialization is dominated by strategic capital investment. Based on theoretical analysis and research hypothesis, this paper adopts the sequential test method to test the impact mechanism of corporate financializatioin on green technology innovation step by step.

Firstly, the comprehensive effect of corporate financialization on green technology innovation is tested, that is, no mediating variable is added into the estimation equation. As shown in Eq.1.

Secondly, in order to identify whether corporate financialization has an impact on the mediating variables, the following model is constructed with each mediating variable as the explained variable and the corporate financialization as the core explanatory variable.

In formula (2) and (3), subscripts i and t represent the enterprise and the year respectively.

Finally, this paper constructs model (4) and model (5), including the explained variable (

In formulas (4) and (5), subscripts i and t represent the enterprise and the year respectively, and other variables are the same as those in formula (1).

If the estimated coefficients

4.2 Empirical Results

The objective of this section is to identify the motivation of enterprise financialization based on the analysis of the impact mechanism. Compared with the simple analysis of independent variables’ impact on dependent variables, this section adopts the mediating effect model to conduct mechanism analysis, which can further analyze the process and mechanism of independent variables’ impact on dependent variables. The concept of mediating effect originated from psychological research to measure the influence of independent variables on independent variables indirectly through mediating variables. With the maturity of the mediating effect testing method, the concept has been gradually introduced into a wider range of fields. In this paper, a comprehensive mediating test procedure is adopted, which combines various independent test methods proposed by Judd and Kenny (1981); Sobel (1982); Baron and Kenny (1986). It can not only control the error rates of the first type and the second type, but also ensure a high statistical efficiency. The results of parameter estimation with the corporate capital structure and the net operating profit margin as the mediating variables are shown in Table 4.

TABLE 4. Estimation results of the impact of corporate financialization on green technology innovation.

In Table 4, the mediating effect test results of

5 Heterogeneity Analysis of Corporate Financialization DECISION-MAKING Behavior

Although the above results can help us understand the corporate financialization decision-making behavior as a whole, the motivation of different enterprises to make financialization decision is affected by many aspects. Since the financialization decision-making behavior of an enterprise may be influenced by its own attribute characteristics and external environment, this section analyzes the difference in the impact of enterprise financialization on green technology innovation according to the difference in enterprise attribute characteristics and external environment, so as to reveal the heterogeneity of enterprise financialization decision-making behavior.

5.1 Based on Enterprise Attribute Characteristics

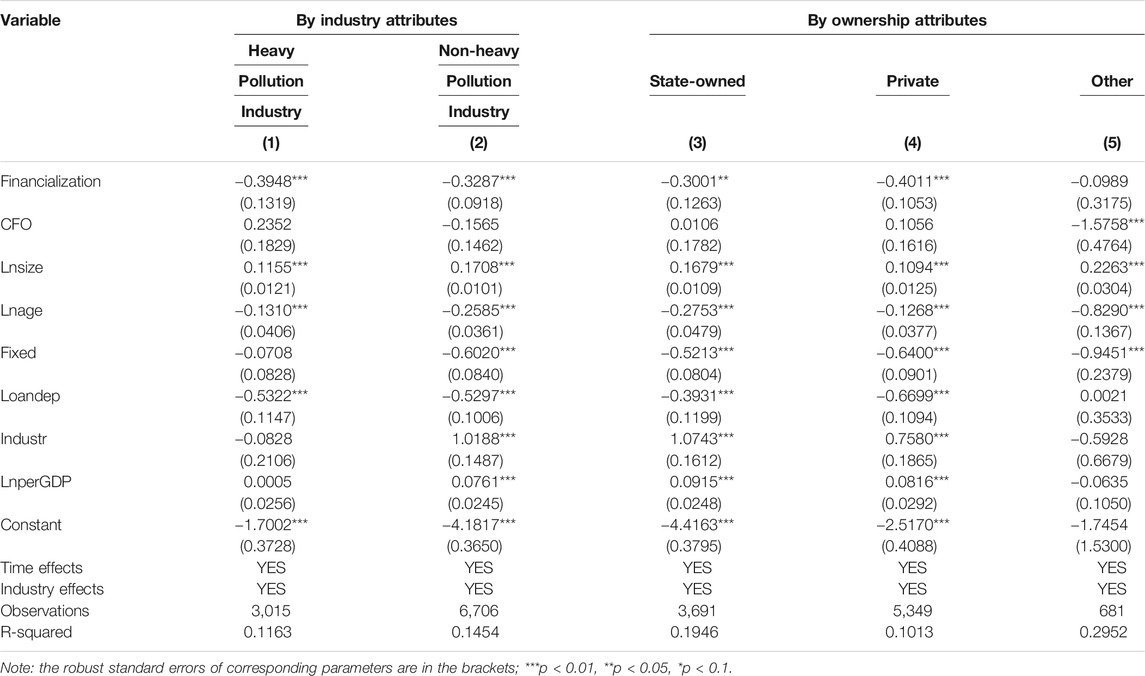

Enterprises are faced with different attributes, such as different industry and ownership characteristics, which will show differences in financial decision-making behavior. From the perspective of industry characteristics, the financialization behavior of enterprises in industries with different pollution levels may have different degrees of impact on green technology innovation. According to Gray (1987), environmental regulation has a certain impact on the green technology innovation of enterprises. Therefore, the green technology innovation ability of enterprises with different pollution levels may be different. As enterprises in heavy polluting industries pollute the environment to a greater extent than those in non-heavy polluting industries, their green technology innovation may be more difficult, leading to enterprises being more inclined to financial speculation, reducing the incentive for green technology innovation Gleadle et al. (2014). Based on this, according to the pollution characteristics of the industry in which the enterprises are located, this paper divides the enterprises into two sub-samples: enterprises in the heavy pollution industry and enterprises in the non-heavy pollution industry. From the perspective of ownership characteristics of enterprises, the impact of their financialization on green technology innovation will also change. The ownership structure of enterprises determines a series of governance structure issues such as how to allocate resources, how to cooperate between ownership and operators, and how owners cooperate and control enterprises, which leads to the difference in the impact on green technology innovation among enterprises under different ownership (Liu et al., 2020). For state-owned enterprises, since their capital is controlled by the state, their decision-making objectives need to conform to the objectives of the state capital, which should coordinate the development strategy of the whole economy. Therefore, generally speaking, the coordination of strategy, sociality and shareholder value is emphasized in the process of capital allocation. Private enterprises are relatively small in size, and their biggest advantage lies in the flexibility of making decisions, and their financial goal is single, namely the maximization of shareholder value. For other types of enterprises, the internal characteristics and objectives are relatively heterogeneous, but the number of them is relatively small, so they are treated in a single class. Therefore, the sample enterprises are divided into three sub-samples: state-owned enterprises, private enterprises and other enterprises.

Based on the above theoretical analysis, samples are divided according to industry attributes and ownership attributes. According to the industry attributes, samples can be divided into enterprises in the heavy pollution industry and those in the non-heavy pollution industry1. According to the attributes of ownership, samples can be divided into state-owned enterprises, private enterprises and other enterprises. The panel regression model is adopted, and the results of parameter estimation as shown in Table 5.

TABLE 5. Estimation results of the impact of corporate financialization on green technology innovation.

Table 5 reports the impact of corporate financialization on green technology innovation in different types of enterprises. In the grouped regression of enterprises in the non-heavy pollution industry and the heavy pollution industry, the regression coefficients of corporate financialization are −0.3948 and −0.3287 respectively and both pass the significance level test of 1%, but the absolute value of the regression coefficient of enterprises in the heavy pollution industry is greater than that of enterprises in the non-heavy pollution industry. These results show that corporate financialization has an inhibitory effect on the green technology innovation of enterprises in both heavily polluted and non-heavily polluted industries, and the inhibitory effect in enterprises of heavily polluted industries is greater than that in enterprises of non-heavily polluted industries. Compared with enterprises in non-heavy polluting industries, enterprises in heavy polluting industries produce more pollutants in the production process and pollute the environment more greatly. It is technically difficult and high-cost to improve the production processes and products by green innovation. Thus it lacks innovation incentive. The financialization of enterprises in heavy polluting industries is more concerned with financial benefits, which inhibits the green technology innovation. The behaviors of corporate financialization is embodied as financial speculation.

In the grouped regression of state-owned enterprises, private enterprises and other enterprises, the regression coefficients of corporate financialization are −0.3001, −0.4011 and −0.0989, respectively. The financialization regression coefficients of state-owned enterprises and private enterprises all pass the significance level test of 5%, while that of other enterprises fails to pass the significance test. Therefore, it can be seen that the financialization of state-owned enterprises and private enterprises has an inhibitory effect on the green technology innovation, and the latter has a greater inhibitory effect than the former. State-owned enterprises possess abundant innovation resources and invest more in R&D and innovation activities. Moreover, state-owned enterprises shoulder the responsibility of national strategic development and need to assume more social responsibilities. However, private enterprises tend to avoid uncertain risks brought by innovation and invest less in independent R&D. Thus, in the process of asset allocation, state-owned enterprises pay more attention to the improvement of green technology innovation capability than private enterprises, so the financialization behaviors of state-owned enterprises have less inhibitory effect on green technology innovation than private enterprises.

For further analysis, it can be seen from Table 3 that in the case of the full sample, the financialization regression coefficient is −0.3612. Based on this coefficient, the deviation degree of different types of samples from the full sample can be calculated. From the perspective of industry attributes of enterprises, the upward deviation of heavy pollution industry is 9.30% (0.3948 − 0.3612)

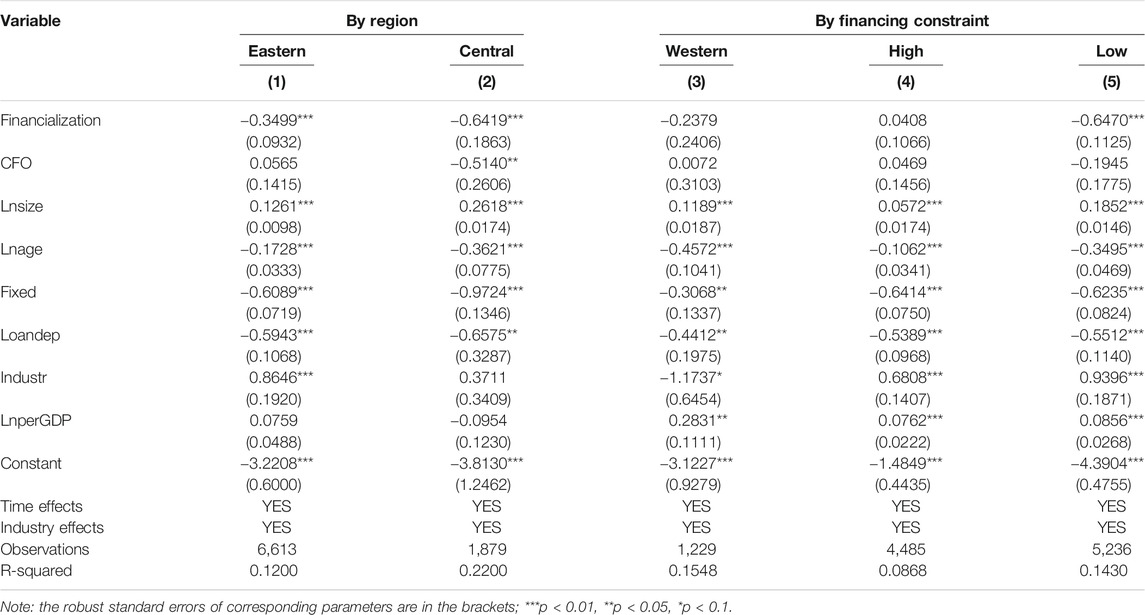

5.2 Based on the Impact of External Environment

Different external environment, such as different regions and financing constraints, will lead to different financialization decision-making behavior. The corporate financialization of enterprises in different regions may have different degrees of impact on green technology innovation. Since China is a vast country with different levels of economic development and corporate culture, the conditions for technological innovation are also different. So the impact of corporate financialization on green technology innovation varies in different regions. The eastern region has advantages in the economic development level, science and technology, and the eastern enterprises are relatively mature. Compared with the central enterprises and western enterprises, the objective of financial asset allocation of eastern enterprises is more inclined to strategic capital investment. According to the different regions where the enterprises are located, this paper divides the enterprises into three sub-samples: eastern enterprises, central enterprises and western enterprises.

From the perspective of financing constraints faced by enterprises, the impact of corporate financialization behavior on green technology innovation will also change with the different financing constraints. Due to its long-term and uncertain nature (Tian and Wang, 2014), the innovation activities of enterprises are subject to serious financing constraints (Acharya and Xu, 2017). Whether the enterprise has sufficient capital will affect its financialization behavior, and thus have a certain impact on the innovation of green technology (Li and Lu, 2017; Zhang et al., 2020). Enterprises with low financing constraint have more capital than those with high financing constraint, leading to differences in capital allocation. According to the financing constraints faced by enterprises, this paper divides enterprises into two sub-samples: enterprises with high financing constraints and enterprises with low financing constraints.

Based on the above theoretical analysis, the samples are divided according to the location of the enterprise and the degree of financing constraint. Among them, enterprises can be divided into eastern enterprises, central enterprises and western enterprises according to their location; according to the degree of financing constraints, they can be divided into high financing constraint enterprises and low financing constraint enterprises2. The panel regression model is used, and the results of parameter estimation are shown in Table 6.

TABLE 6. Estimation results of the impact of corporate financialization on green technology innovation.

Table 6 reports the impact of corporate financialization behavior on green technology innovation among different types of enterprises. In the grouped regression of eastern enterprises, central enterprises and western enterprises, the regression coefficient of corporate financialization are −0.3499, −0.6419, −0.2379, respectively. The financialization regression coefficients of eastern enterprises and central enterprises pass the significance level test of 1%, and the latter is about twice of the former, while the financialization regression coefficients of western enterprises fail to pass the significance test. From these results, it can be seen that the financialization behavior of eastern enterprises and central enterprises has a restraining effect on green technology innovation, and the restraining effect of the latter is greater than that of the former, but there is no sufficient evidence to prove that the financialization behavior of western enterprises will have an impact on green technology innovation. The eastern region enjoys advantageous geographical location, strong economic strength, rapid economic development and rich innovation resources. Enterprises in the eastern region are more forward-looking in strategic planning and pay more attention to long-term strategic development. In the process of allocating financial assets, enterprises in eastern region will pay more attention to the development of green technology innovation compared with enterprises in central region, although they are inclined to financial speculation, so as to realize their own long-term development.

In the grouped regression of high financing constraint enterprises and low financing constraint enterprises, the regression coefficients of corporate financialization behavior are 0.0408 and −0.6470, respectively. The latter passes the significance level test of 1%, while the former fails to pass the significance test. Therefore, the financialization behavior of enterprises with low financing constraints has a negative impact on green technology innovation, but there is not enough evidence to show that the financialization behavior of enterprises with high financing constraints has an impact on green technology innovation. On the one hand, the high profitability of financial investment attracts enterprises. On the other hand, enterprises with low financing constraints are more likely to obtain external financial support, so they will increase their investment in financial assets, thus reducing their green technology innovation input and leading to “crowding out” effect on green technology innovation. The financialization behaviors of enterprises with low financing constraints are not conducive to the improvement of green technology innovation ability, which reflects that enterprises pursues profit maximization, i.e., the motivation of corporate financialization with low financing constraints is inclined to financial speculation.

In the same way, combined with Table 3 for further analysis, it can be seen that in the case of the full sample, the financial regression coefficient is −0.3612. Based on this coefficient, the degree of deviation of different types of samples from the full sample can be calculated. From the perspective of the enterprise location, the eastern enterprises deviate 3.13% downward, and the average level of financial inhibition on green technology innovation is relatively weak; the central enterprises deviate 77.71%, and the financial inhibition on green technology innovation is much stronger than the average level. It can be seen that, due to the level and stage of economic development, regional corporate culture and other external factors, central enterprises have stronger inhibition on the green technology innovation. From the perspective of financing constraints faced by enterprises, enterprises with low financing constraints deviate from 79.13% upward, and their financialization behavior has strong inhibition on green technology innovation. Thus it can be seen that enterprises with low financing constraints are more inclined to financial speculation in their financialization decision-making behavior. Comparing the region where the enterprise is located with the financing constraint condition, the deviation degree caused by the financing constraint is larger, which further strengthens the behavioral motivation of the corporate financialization decision.

6 Conclusion

In this paper, 3,493 non-financial listed companies in China from 2007 to 2018 are selected as samples to study the impact of corporate financialzation on green technology innovation through the panel regression model and the mediation effect model, and then to identify whether enterprises tend to financial speculation or capital investment. The main conclusions are as follows:

First, corporate financialzation tends to be speculative, and the strategic capital investment tendency is insufficient. At present, there are still disputes on the impact of corporate financialzation on enterprises themselves. This paper further tests the negative relationship between corporate financialization behavior and green technology innovation ability through empirical research on China’s non-financial listed companies. By studying the mediating effect in the process of corporate optimal financial allocation, it is found that the financialization of enterprises mainly influences the innovation of green technology through the mediating role of financial leverage, and it is concluded that the motivation of financial asset allocation of enterprises is more inclined to financial speculation. From the perspective of reasons, enterprises need to accumulate for a long time in green technology innovation activities, which require both sustained and stable financial support and integrative knowledge acquired by enterprises, and the benefits brought by innovation activities are uncertain. Therefore, on the whole, the financialization behavior of enterprises is not conducive to green technology innovation, but is dominated by speculative goals.

Second, the financialization decision-making behavior of enterprises shows heterogeneity in both attribute characteristics and external characteristics. Corporate financialization decision-making behavior is closely related to corporate attribute characteristics, and there is heterogeneity among samples with different attribute characteristics. For enterprises in different industries, the financialization of enterprises in heavily polluted industries has a stronger inhibitory effect on green technology innovation than that of enterprises in non-heavily polluted industries. For enterprises with different ownership attributes, the financialization of private enterprises has a stronger inhibitory effect on green technology innovation than that of state-owned enterprises. For enterprises in different regions, the financialization behavior of enterprises in central China has a stronger inhibitory effect on green technology innovation than that of enterprises in the east, and there is not enough evidence to show the relationship between the financialization behavior and green technology innovation of enterprises in the west. For enterprises with different financing constraints, the financialization behavior of enterprises with low financing constraints has an inhibitory effect on the innovation of green technology, but there is not enough evidence to show that the financialization behavior of enterprises with high financing constraints has an impact on the innovation of green technology.

Third, the corporate attributes and external environment of enterprises are significantly different from each other in the process of corporate financialization. From the empirical results, it can be seen that although the two selected corporate attributes have an impact on the decision-making behavior of enterprise financialization, the deviation degree of the influence of the two attributes does not exceed 10%. while the external environment not only has a significant impact on the decision-making behavior of enterprises, but also causes the heterogeneity to deviate from the value of the full sample by nearly 80%. Based on this, enterprises are more sensitive to the external environment in the process of asset allocation.

The existing literatures mainly focus on the effect of corporate financialization on industrial investment, studying whether the corporate financialization is a “reservoir effect” or a “crowding effect” on industrial investment (Demir, 2009; Duchin, 2010; Baud and Durand, 2012). Differently, this paper would like to identify whether the motivation for corporate financialization is financial speculation or strategic investment by studying the effect of corporate financialization on green technology innovation and analyzing whether corporate financialization squeezes out green technology innovation. Our results show corporate financialization has an inhibitory effect on green technology innovation. Green technology innovation is the focus of corporate strategic planning. Our results indicate that the corporate financialization pays more attention to short-term interests and neglect long-term development. Tendency to financial speculation is significant. It is consistent with the existing results that financialization has a “crowding out” effect on industrial investment (Orhangazi, 2008; Tori and Onaran, 2017). For enterprises, especially those oriented by the financial market, improving financial performance and maximizing shareholders’ interests have become the core activities (Lazonick, 2003). The adverse effects of financialization have been demonstrated in countries such as the United States (Lazonick, 2010).

Combined with the research conclusions, this paper puts forward the following policy recommendations: first, since the financialization of enterprises inhibits the innovation of green technology and shows the tendency of financial speculation, on the one hand, it is necessary to regulate the financial asset allocation behavior of enterprises, guide enterprises to aim at long-term development (Mertzanis, 2018) and assume certain social responsibility (Hu et al., 2020); on the other hand, it is necessary to narrow the profit gap between the financial field and the real economy, and take further steps to promote financial services for the real economy. Besides, the monopoly position of financial industries must be broken through. By relaxing the access to the financial industry and balancing the profits among industries, the power of green technology innovation of enterprises can be improved. Second, different enterprises should have different strategies (Zhu et al., 2020). According to the financialization behavior caused by the difference in enterprise attribute characteristics, the government should formulate differentiated support policies in combination with the industry and ownership attribute characteristics of enterprises, and encourage enterprises to carry out green technology innovation activities (Huang et al., 2019), especially private enterprises and enterprises in heavily polluted industries. Third, it is necessary to foster a better external business environment. From the perspective of the influence of enterprise attributes and external environment on the financialization decision, the external environment has a significant impact on the motivation of enterprise financialization. Therefore, it is necessary for the government to further create a better business environment and reduce the inhibition of external environment on the corporate strategic investment.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

The work was supported by National Office for Philosophy and Social Sciences (No. 20BTJ022).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Footnotes

1Classification of the heavy pollution industry and the heavy pollution industry: according to the “Guidance on Industry Classification of Listed Companies” revised by China Securities Regulatory Commission in 2012 and the “Classified Management Directory of Listed Companies’ Environmental Verification Industries” and the “Guidelines on the Disclosure of Environmental Information of Listed Companies” formulated by the Ministry of Environmental Protection in 2008, heavy polluting industries in this paper refer to: coal mining and washing industry, oil and gas industry, ferrous metal mining and processing industry, nonferrous metal mining and processing industry, textile industry leather, fur, feather and their products and shoe-making, paper-making and paper products, petroleum processing, coking and nuclear fuel processing, chemical raw materials and chemical products manufacturing, pharmaceutical manufacturing, chemical fiber manufacturing, non-metallic mineral products, ferrous metal smelting and rolling processing, non-ferrous metal smelting and rolling processing, metal products, electric power, thermal production and supply industry (16 categories); other industries are non-heavy pollution industries.

2Division of financing constraints: enterprise scale is used as the proxy variable of financing constraints to measure the intensity of financing constraints. Low enterprise scale indicates high financing constraint; otherwise, the financing constraint is low. In this paper, the enterprise size is divided according to the median, and the enterprise size is ranked from small to large. The top 50% of enterprises are high financing constraint enterprises, and the last 50% are low financing constraint enterprises.FIGURE 1Line charts of the annual mean of financialization degree and the sum of green technology innovation quantity in each year: (A) the line chart of enterprises in industries with different pollution degrees. HPIF and NHIF represent annual means of financialization degree of enterprises in the heavy pollution industry and the non-heavy pollution industry respectively; HPIG and NHIG represent annual total of green innovation quantity of enterprises in the heavy pollution industry and the non-heavy pollution industry respectively; (B) the line chart of enterprises under different ownership. SOEF, PEF and OEF respectively represent the annual average of the financialization degree of state-owned enterprises, private enterprises and other enterprises; SOEG, PEG and OEG respectively represent the sum of the green innovation quantity of state-owned enterprises, private enterprises and other enterprises in each year; (C) the line chart of enterprises in different regions. EF, CF and WF respectively represent the annual average of the financialization degree of enterprises in the east, central and west of China, and EG, CG and WG respectively represent the sum of the number of green innovation of enterprises in the east, central and west of China. (D) the line chart of enterprises with different financing constraints. HFRF and LFRF respectively represent the annual average of financialization degree of enterprises with high financing constraints and low financing constraints, while HFRG and LFRG respectively represent the sum of green innovation quantity of enterprises with high financing constraints and low financing constraints in each year.

References

Acharya, V. V., and Xu, Z. (2017). Financial dependence and innovation: the case of public versus private firms. J. Financ. Econ 124, 223–243. doi:10.1016/j.jfineco.2016.02.010

Akkemik, K. A., and Ozen, S. (2014). Macroeconomic and institutional determinants of financialisation of non-financial firms: case study of Turkey. Soc. Econ. Rev. 12, 71–98. doi:10.1093/ser/mwt006

Almeida, H., Campello, M., and Weisbach, M. S. (2004). The cash flow sensitivity of cash. J. Finance. 59, 1777–1804. doi:10.1111/j.1540-6261.2004.00679.x

Arizala, F., Cavallo, E., and Galindo, A. (2013). Financial development and tfp growth: cross-country and industry-level evidence. Appl. Financ. Econ. 23, 433–448. doi:10.1080/09603107.2012.725931

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51, 1173–1182. doi:10.1037//0022-3514.51.6.1173

Baud, C., and Durand, C. (2012). Financialization, globalization and the making of profits by leading retailers. Soc. Econ. Rev. 10, 241–266. doi:10.1093/ser/mwr016

Brown, J. R., and Petersen, B. C. (2011). Cash holdings and R&D smoothing. J. Corp. Finance. 17, 694–709. doi:10.1016/j.jcorpfin.2010.01.003

Christophers, B. (2017). Seeing financialization? stylized facts and the economy multiple. Geoforum. 85, 259–268. doi:10.1016/j.geoforum.2017.06.024

Colombo, M. G., Croce, A., and Guerini, M. (2013). The effect of public subsidies on firms’ investment-cash flow sensitivity: transient or persistent? Res. Pol. 42, 1605–1623. doi:10.1016/j.respol.2013.07.003

Demir, F. (2009). Financial liberalization, private investment and portfolio choice: financialization of real sectors in emerging markets. J. Dev. Econ. 88, 314–324. doi:10.1016/j.jdeveco.2008.04.002

Ding, S., Guariglia, A., and Knight, J. (2013). Negative investment in China: financing constraints and restructuring versus growth. Econ. Dev. Cult. Change. 37, 1490–1507. doi:10.1086/706825

Duchin, R. (2010). Cash holdings and corporate diversification. J. Finance. 65, 955–992. doi:10.1111/j.1540-6261.2010.01558.x

Feng, C., Wang, M., Liu, G., and Huang, J. (2017). Green development performance and its influencing factors: a global perspective. J. Clean. Prod. 144, 323–333. doi:10.1016/j.jclepro.2017.01.005

Frank, M. Z., and Goyal, V. K. (2009). Capital structure decisions: which factors are reliably important? Financ. Manag. 38, 1–37. doi:10.1111/j.1755-053x.2009.01026.x

Frondel, M., Horbach, J., and Rennings, K. (2008). What triggers environmental management and innovation? empirical evidence for Germany. Ecol. Econ. 66, 153–160. doi:10.1016/j.ecolecon.2007.08.016

Gamba, A., and Triantis, A. J. (2008). The value of financial flexibility. J. Finance. 63, 2263–2296. doi:10.1111/j.1540-6261.2008.01397.x

Gleadle, P., Parris, S., Shipman, A., and Simonetti, R. (2014). Restructuring and innovation in pharmaceuticals and biotechs: the impact of financialisation. Crit. Perspect. Account. 25, 67–77. doi:10.1016/j.cpa.2012.10.003

Gray, W. B. (1987). The cost of regulation: OSHA, EPA and the productivity slowdown. Am. Econ. Rev. 77, 998–1006

Guan, J., and Gao, X. (2009). Exploring the h-index at patent level. J. Am. Soc. Inf. Sci. Technol. 60, 35–40. doi:10.1002/asi.20954

Hall, B. H. (2002). The financing of research and development. Oxf. Rev. Econ. Pol. 18, 35–51. doi:10.1093/oxrep/18.1.35

Hall, B. H., Moncadapaternocastello, P., Montresor, S., and Vezzani, A. (2016). Financing constraints, R&D investments and innovative performances: new empirical evidence at the firm level for Europe. Econ. Innovat. N. Technol. 25, 183–196. doi:10.1080/10438599.2015.1076194

Haque, A., Fatima, H., Abid, A., and Qamar, M. A. J. (2019). Impact of firm-level uncertainty on earnings management and role of accounting conservatism. Quantitative Finance and Economics. 3, 772–794. doi:10.3934/qfe.2019.4.772

Hart, S. L. (1995). A natural-resource-based view of the firm. Acad. Manag. Rev. 20, 986–1014. doi:10.5465/amr.1995.9512280033

Hu, M., Zhang, D., Ji, Q., and Wei, L. (2020). Macro factors and the realized volatility of commodities: a dynamic network analysis. Resour. Pol. 68, 101813. doi:10.1016/j.resourpol.2020.101813

Huang, Z., Liao, G., and Li, Z. (2019). Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change. 144, 148–156. doi:10.1016/j.techfore.2019.04.023

Jaffe, A. B., Newell, R. G., and Stavins, R. N. (2005). A tale of two market failures: technology and environmental policy. Ecol. Econ. 54, 164–174. doi:10.1016/j.ecolecon.2004.12.027

Ji, Q., Zhang, D., and Zhao, Y. (2020). Searching for safe-haven assets during the covid-19 pandemic. Int. Rev. Financ. Anal. 71, 101526. doi:10.1016/j.irfa.2020.101526

Jin, W., Zhang, H., Liu, S., and Zhang, H. (2019). Technological innovation, environmental regulation, and green total factor efficiency of industrial water resources. J. Clean. Prod. 211, 61–69. doi:10.1016/j.jclepro.2018.11.172

Judd, C. M., and Kenny, D. A. (1981). Process analysis estimating mediation in treatment evaluations. Eval. Rev. 5, 602–619. doi:10.1177/0193841x8100500502

Klingebiel, R., and Rammer, C. (2020). Resource allocation strategy for innovation portfolio management. Strat. Manag. J. 35, 246–268. doi:10.1002/smj.2107

Krippner, G. R. (2005). The financialization of the american economy. Soc. Econ. Rev. 3, 173–208. doi:10.1093/ser/mwi008

Lazonick, W. (2003). The theory of the market economy and the social foundations of innovative enterprise. Econ. Ind. Democr. 24, 9–44. doi:10.1177/0143831x03024001598

Lazonick, W. (2010). Innovative business models and varieties of capitalism: financialization of the U.S. corporation. Bus. Hist. Rev. 84, 675–702. doi:10.1017/s0007680500001987

Li, C., and Lu, J. (2017). R&D, financing constraints and export green-sophistication in China. China Econ. Rev. 47, 234–244. doi:10.1016/j.chieco.2017.08.007

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: evidence from China top 100. J. Clean. Prod. 141, 41–49. doi:10.1016/j.jclepro.2016.08.123

Lin, B., and Chen, Z. (2018). Does factor market distortion inhibit the green total factor productivity in China? J. Clean. Prod. 197, 25–33. doi:10.1016/j.jclepro.2018.06.094

Liu, Z., Li, X., Peng, X., and Lee, S. (2020). Green or nongreen innovation? different strategic preferences among subsidized enterprises with different ownership types. J. Clean. Prod. 245, 118786. doi:10.1016/j.jclepro.2019.118786

Luo, Y., and Zhu, F. (2014). Financialization of the economy and income inequality in China. Economic and Political Studies. 2, 46–66. doi:10.1080/20954816.2014.11673844

Mertzanis, C. (2018). Complexity, big data and financial stability. Quantitative Finance and Economics. 2, 637–660. doi:10.3934/qfe.2018.3.637

Okamuro, H., and Zhang, J. X. (2006). Ownership structure and R&D investment of Japanese start-up firms. CEI Working Paper Series No. 2006-1. Kunitachi, Tokyo, Japan: Hitotsubashi University

Opler, T. C., Pinkowitz, L., Stulz, R. M., and Williamson, R. (1999). The determinants and implications of corporate cash holdings. J. Financ. Econ. 52, 3–46

Orhangazi, O. (2008). Financialisation and capital accumulation in the non-financial corporate sector: a theoretical and empirical investigation on the US economy: 1973-2003. Camb. J. Econ. 32, 863–886. doi:10.1093/cje/ben009

Qamruzzaman, M., and Wei, J. (2018). Investigation of the asymmetric relationship between financial innovation, banking sector development, and economic growth. Quant. Financ. Econ. 2, 952–980. doi:10.3934/qfe.2018.4.952

Rennings, K. (2000). Redefining innovation-eco-innovation research and the contribution from ecological economics. Ecol. Econ. 32, 319–332. doi:10.1016/s0921-8009(99)00112-3

Smith, C. W., and Stulz, R. M. (1985). The determinants of firms’ hedging policies. J. Financ. Quant. Anal. 20, 391–405. doi:10.2307/2330757

Sobel, M. E. (1982). Asymptotic confidence intervals for indirect effects in structural equation models. Socio. Methodol. 13, 290. doi:10.2307/270723

Song, Y., Ji, Q., Du, Y., and Geng, J. (2019). The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ. 84, 104564. doi:10.1016/j.eneco.2019.104564

Stockhammer, E. (2005). Shareholder value orientation and the investment-profit puzzle. J. Post Keynes. Econ. 28, 193–215. doi:10.2753/pke0160-3477280203

Sun, L., Miao, C., and Yang, L. (2017). Ecological-economic efficiency evaluation of green technology innovation in strategic emerging industries based on entropy weighted TOPSIS method. Ecol. Indicat. 73, 554–558. doi:10.1016/j.ecolind.2016.10.018

Tadesse, S. (2002). Financial architecture and economic performance: international evidence. J. Financ. Intermediation. 11, 429–454. doi:10.1006/jfin.2002.0352

Tian, X., and Wang, T. Y. (2014). Tolerance for failure and corporate innovation. Rev. Financ. Stud. 27, 211–255. doi:10.1093/rfs/hhr130

Tori, D., and Onaran, O. (2017). The effects of financialisation and financial development on investment: evidence from firm-level data in europe. SSRN. doi:10.2139/ssrn.3064062

Tori, D., and Onaran, O. (2018). The effects of financialization on investment: evidence from firm-level data for the UK. Camb. J. Econ. 42, 1393–1416. doi:10.1093/cje/bex085

Wen, F., Xu, L., Ouyang, G., and Kou, G. (2019). Retail investor attention and stock price crash risk: evidence from China. Int. Rev. Financ. Anal. 65, 101376. doi:10.1016/j.irfa.2019.101376

Wu, F., Zhao, W., Ji, Q., and Zhang, D. (2020). Dependency, centrality and dynamic networks for international commodity futures prices. Int. Rev. Econ. Finance. 67, 118–132. doi:10.1016/j.iref.2020.01.004

Zhang, D., Li, J., and Ji, Q. (2020). Does better access to credit help reduce energy intensity in China? evidence from manufacturing firms. Energy Pol. 145, 111710. doi:10.1016/j.enpol.2020.111710

Keywords: corporate financialization, green technology innovation, enterprise attribute, external environment, heterogeneous impact

Citation: Huang Z, Li X and Chen S (2021) Financial Speculation or Capital Investment? Evidence From Relationship Between Corporate Financialization and Green Technology Innovation. Front. Environ. Sci. 8:614101. doi: 10.3389/fenvs.2020.614101

Received: 05 October 2020; Accepted: 07 December 2020;

Published: 14 January 2021.

Edited by:

Qiang Ji, Chinese Academy of Sciences, ChinaReviewed by:

Jiangbo Geng, Zhongnan University of Economics and Law, ChinaWeixing Cai, Guangdong University of Finance and Economics, China

Copyright © 2021 Huang, Li and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shuanglian Chen, Y2hlbnNsQGd6aHUuZWR1LmNu

Zhehao Huang

Zhehao Huang Xue Li2

Xue Li2