- 1School of Economics, Hunan Agricultural University, Changsha, China

- 2School of Finance, Guangdong University of Finance and Economics, Guangzhou, China

- 3Collaborative Innovation Development Center of Pearl River Delta Science and Technology Finance Industry, Guangdong University of Finance and Economics, Guangzhou, China

In response to the dilemma between economic development and environmental protection, green finance is an effective tool for environmental regulation. Based on the stochastic frontier analysis method to measure the energy efficiency of China’s provinces from 2001 to 2017, the promotion effect of green finance on energy efficiency and the intermediary effect of green technology innovation are tested and analyzed in our study. The results show that green finance can significantly improve energy efficiency. Specifically, green finance makes stronger effect on energy efficiency in provinces with rich resource endowments, high levels of economic development, and high degree of marketization. Green finance can improve energy efficiency through the development of new energy technologies and disruptive green innovation, which provides important supports for formulating policies to optimize energy structure and improve energy efficiency.

Introduction

Energy is an important foundation and main driving force for a country’s economic development. However, with the increase in total economic scale and the shortage of fossil energy, the issue of resource security has become the main focus of global attention. In particular, the world is facing the major challenge of climate change. While economic growth depends on energy consumption, it also brings severe environmental pollution (Diakoulaki and Mandaraka, 2007; Sjostron and Ostblom, 2010; Chen et al., 2017). It is necessary to review the long-term economic growth in the context of environmental policy (Burke, 2015), and interest in analyzing the relationship between energy and economic performance has gradually recovered. The development of green finance contributes to the stable economic growth momentum and sustainable economic development (Mohsin et al., 2020; Zhang et al., 2020), which provides a new perspective for our study.

The relationship between energy consumption and economic development has always been the focus of research. A large number of studies have shown that there is a positive correlation between economic growth and energy consumption. The higher the energy consumption is, the greater the output per capita. Whether from the long-term or short-term perspectives, energy consumption has a positive impact on economic growth (Warr and Ayres, 2010; Bildirici et al., 2012; Al-mulali and Sab, 2012; Islam et al., 2013, Saidi and Hammami, 2015), and economic development is closely related to natural resource consumption (Song et al., 2019). At the same time, affected by the unbalanced energy supply-demand relationship, fluctuations in energy prices transfer uncertainty to economic activities, causing economic volatility (Saiti et al., 2018; Bildirici and Badur, 2018; Dagoumas et al., 2020). This effect is even more serious for energy-dependent countries. In addition, with the acceleration of industrialization and urbanization, the demand for energy consumption has also grown rapidly (Qian et al., 2017; Wang and Su, 2019), and the equilibrium state between economic growth and energy consumption has undergone a fundamental change.

Facing the imbalance between energy consumption and economic development, various types of environmental regulations have played active regulatory roles in economic development, such as market reforms (Iimura and Cross, 2018), emission permits and renewable energy penetration (Mahmood and Ayaz, 2018; Arminen and Menegaki, 2019), pollution tax (Sen, 2015), as well as carbon taxes (Du et al., 2020). Some studies have concluded that environmental regulations have a positive impact on energy efficiency (Mandal, 2010; Bi et al., 2014; Zhang et al., 2016a; Zhang et al., 2016b). However, different types of environmental regulations have different effects on energy efficiency (Peng and Zhang, 2019). Dirckinck-Holmfeld (2015) studied the effects of environmental regulations on improving energy efficiency based on Danish enterprise surveys, but found that the Danish government’s environmental permit and ban framework was relatively vague and couldn’t provide the right direction for promoting energy efficiency. Zhang et al. (2021) analyzed the impact of corporate internal governance and external governance factors on the use of renewable energy, and found that companies under the common law system tended to use renewable energy. It can be seen that there are still some controversies about the impact of environmental regulations on energy efficiency.

As traditional environmental regulations and policies have shown more uncertainties in influencing energy efficiency, environmental regulations that promote green finance development have emerged (Wang and Zhi 2016; Zhang et al., 2020; Mohsin et al., 2020; Hafner et al., 2020). Based on the establishment of the green finance framework, the impact of green finance development on energy transition has begun to be studied. On the one hand, in terms of green financial tools, the impact of green bonds and green credits on renewable energy and green energy is analyzed and mixed findings are provided (Taghizadeh-Hesary and Yoshino, 2019; Azhgaliyeva et al., 2020). On the other hand, from the perspective of financial functions, it is confirmed that financial industry plays a role in supporting the development of green economy and the expansion of green finance (Keerthi, 2013; Sachs et al., 2019; Zheng et al., 2020).

As the largest developing country in the world, China has undergone earth-shaking changes after years of rapid social and economic development. The fact that coal resources are abundant and oil and gas resources are relatively scarce has led to an unreasonable energy production and consumption structure. In recent years, China’s renewable energy industry has continued to grow, and its share in the primary energy structure has continued to rise, becoming an important aspect of energy production and consumption. In 2019, China’s total output of renewable energy, nuclear power, and hydropower reached 21.06 EJ, accounting for 14.9% of primary energy consumption. Renewable energy, nuclear power and hydropower accounted for 31.5, 14.8 and 53.7% of total new energy production, respectively.1 At the same time, by the end of 2019, China’s green loan balance reached 10.22 trillion RMB; the scale of international green bond issuance reached 257.7 billion U.S. dollars (approximately 1.8 trillion RMB), which showed an increase of 51.06% over the same period last year; China has issued 31.3 billion United States dollars green bonds that meet the Climate Bond Initiative criterions, ranking second in the global green bond issuance scale.2 Taking China as the research object to study the impact of green finance on energy efficiency is very representative and exemplary.

In our study, the energy efficiency is measured by using the Stochastic Frontier Analysis Method, and the green finance index is calculated by using the Comprehensive Evaluation Method. Then, the panel data models with fixed effects are used to test the impact of green finance on energy efficiency, and we conduct several robustness tests to make sure our results of baseline model reliable. In addition, the heterogeneous impacts of green financial development on energy efficiency are discussed and analyzed, considering differences in resource endowments, differences in economic development levels, and differences in marketization levels. Finally, whether green finance can improve energy efficiency through the development of new energy technologies and disruptive green innovation is tested and discussed. This study contributes to the existing literature in several ways.

First, from the perspective of green finance development, the impact of environmental regulations on energy efficiency is analyzed, supplementing previous studies that focused on control and command environmental regulations (Chen and Zhang, 2012; Dirckinck-Holmfeld, 2015; Hancevic, 2016), but ignored the financial market’s resource allocation function for energy utilization. By testing the impact of green finance on energy efficiency, this paper provides important theoretical value for strengthening the development of green finance as well as coordinating environmental governance and economic sustainability.

Second, considering the differences in resource endowments, economic development, and marketization levels, the heterogeneous impacts of green finance on energy efficiency are analyzed. These results can provide a realistic basis for the formulation of differentiated policies to improve the green financial system and balance the efficiency of regional energy usage. In particular, China is working hard to achieve its carbon peak and carbon-neutral goal. It is of vital importance to discuss regional spatial differences in order to give full play to local advantages and coordinate the development of green finance to improve overall energy utilization efficiency.

Third, the framework for researching the relationship between green finance, technology innovation, and energy efficiency is used to test the innovation effect of green finance, confirming that green finance can significantly improve energy efficiency through promoting green technology innovation. Our study pays more attention to the role of green finance in hedging energy transition risks and transferring green transition risks, supplementing the shortcomings of traditional environmental regulations in controlling transition risks.

The rest of this paper is organized as follows. Literature Review and Hypothesis Formulation reviews relevant literature and proposes hypotheses. Methodology and Data focuses on the model specification and data sources. Main Empirical Results interprets and discusses the empirical results, including the main results and heterogeneous effects with other tests. Impact-channel Tests of Green Technology Innovation presents and discusses the results of impact-channel tests of green technology innovation. Conclusions and policy implications are summarized in Conclusions and Policy Implications.

Literature Review and Hypothesis Formulation

Green Finance Development and Energy Efficiency

In recent years, the research on green finance and energy policy has attracted more and more attention from governments and scholars. The purpose of green finance is to provide financial support for environmental protection related projects to solve the problems caused by climate change and improving energy efficiency. Some scholars have established the research framework of green finance and defined green finance (Wang and Zhi 2016; Taghizadeh-Hesary and Yoshino 2019; Zhang et al., 2020; Mohsin et al., 2020; Hafner et al., 2020). Green finance includes new financial supplies and policies such as green bonds, green banks, carbon market tools, fiscal policies, green central banks, financial technology, and national green development funds. The purpose of green finance is to support projects with environmental benefits, which include supporting for environmental improvement, dealing with climate change, and efficient usage of resources. Lindenberg (2014) also defined climate financing as a part of green finance, focusing on climate change. On August 31, 2016, seven ministries and commissions including the People’s Bank of China jointly issued the Guiding Opinions on Building a Green Financial System, emphasizing the need to support the green transition of the economy by promoting green credit, green bonds, green stock indexes and related products, green development funds, green insurance, carbon finance and other financial tools and related policies. Its purpose is to use green finance to limit financing of polluting companies, promoting energy conservation and emission reduction, and achieving the goal of environmental regulation. It can be seen that the development of green finance helps to coordinate energy transition and sustainable economic development.

The development of green finance is conducive to investment in energy projects and promotes green economic growth. Azhgaliyeva et al. (2020) analyzed the issuance of green bonds and green bond policies of the Association of Southeast Asian Nations (ASEAN), and found that two-thirds of the green bonds issued by the ASEAN were used to fund renewable energy and energy efficiency projects to improve energy efficiency to meet the rapid growth of energy demand. Based on investment theoretical models with projects scale considered, Taghizadeh-Hesary and Yoshino (2019) confirmed that the green credit guarantee schemes could reduce the risks of green finance and increase the returns on green energy projects. Zheng et al. (2020) found that the agglomeration of financial resources could promote the development of green economy, and there were spatial differences in the effects of financial agglomeration. However, some other studies have pointed out that fossil fuels still dominate energy investment, and financial institutions are more interested in fossil fuel projects than green projects, which may threaten the expansion of green energy required to provide energy security and achieving air pollution emission goals. It may be explained that there may exist several risks by adopting new technologies, causing lower returns on investing in these new technologies (Keerthi, 2013; Sachs et al., 2019).

Based on the relationship between green finance and energy efficiency, the hypothesis H1 is expressed as follows.

H1: The development of green finance can improve energy efficiency.

In addition, some studies have found that the development of green finance is affected by resource endowments, economic levels and levels of marketization. There exist heterogeneous impacts of green financial development on energy efficiency (Wang et al., 2020a; Zheng et al., 2020; Chen et al., 2021). Therefore, the hypothesis H1a is proposed.

H1a: There are heterogeneous impacts of green financial development on energy efficiency, across different levels of abundant resources, different levels of economic growth, and different levels of marketization.

The Intermediary Effect of Green Technology Innovation

The promotion effect of green finance on ecological innovation has been extensively confirmed, including on green technology innovation (Chassagnon and Haned, 2015) and green patents (Marin-Vinuesa et al., 2020), the R and D investment (Costa-Campi et al., 2017; Oh et al., 2020), as well as financial performance (Duque-Grisales et al., 2020; Xiang et al., 2020). Jones (2015) pointed out that sustainable finance and green finance encouraged investment in new technologies and innovations, which include renewable energy technologies. D’Orazio and Valente (2019) discussed the role of green finance in promoting green investment and emphasized the importance of green finance to the development of green technology. Wang et al. (2021), Wang et al. (2021b), Wang et al. (2021c) confirmed that green finance has important influence on technology innovation, which is also empirically supported at the micro-enterprise level (Li et al., 2021; Liu et al., 2021).

Additionally, green technology innovation has a direct impact on the improvement of energy efficiency. Cagno et al. (2015) studied the impact of technology innovation on energy efficiency, and they found technology innovation can effectively improve the energy efficiency of enterprises. Based on the Stochastic Frontier Analysis Method, (Miao et al., 2017), analyzed the impact of green technology innovation on the efficiency of natural resource utilization, and found that the level of natural resource utilization efficiency is relatively high when affected by the green technology innovation. Wurlod and Noaill (2018) tested the impact of green innovation on energy intensity in the industrial sectors of 17 OECD countries, and found that green innovation contributed to the decline in energy intensity of most industries. (Pan et al., 2019). studied the dynamic relationship among environmental regulation, technology innovation and energy efficiency, pointing out that technology innovation has played an important role in improving energy efficiency.

Based on the above analysis, we hold the point of view that green technology innovation plays an intermediary effect on the impact of green finance on energy efficiency. In order to distinguish the types of green technology innovation, the two aspects of green technology innovation, which are new energy technology development and disruptive green innovation, would be adopted to conduct impact-channel tests of green technology innovation. Therefore, the following hypotheses H2a and H2b are put forward.

H2a: The development of green finance improves energy efficiency through influencing new energy technology development.

H2b: The development of green finance promotes energy efficiency by improving green innovation capabilities.

Methodology and Data

Model Specification

Based on H1, in order to test the impact of green finance on energy efficiency, a panel data model with fixed effects is constructed:

where subscripts

Additionally, in order to test H2a and H2b, a two-step estimation method is used to test the impact channel of green technology innovation. First, we need to test whether green finance has a significant impact on green technology innovation, which can be analyzed by estimating Eq. 2. Second, the development of green technology innovation (

In Eq. 2, there are two aspects that can reflect green technology innovation (

Variable Measurement

Stochastic Frontier Analysis and Energy Efficiency Measurement

According to the stochastic frontier theory, the inefficiency of production technology is the main factor that causes the difference between actual output and frontier production. Based on the stochastic frontier model for panel data proposed by Battese and Coeli (1995), the technical efficiency of input and output in the process of provincial energy consumption is used to characterize provincial energy efficiency. At the same time, based on the practice of Wu et al. (2020), the undesirable output variable is introduced in the stochastic frontier model, and the stochastic frontier production function of provincial energy efficiency is constructed as follows.

where,

In order to reflect the output per unit of energy consumption, that is, the energy efficiency in economic growth, Eq. 4 is divided by

where,

To simplify parameter estimation, we take natural logarithms of Eq. 5, and Eq. 6 can be obtained.

Finally, provincial energy efficiency can be expressed by the ratio of the expected value of actual output of regional energy consumption to the expected value of output when the technology is fully effective (

Compilation of Green Finance Development Index

Environmental pollution and the degradation of natural resources have received increasing attention, and the financial industry has considered these issues, launching various financial products specifically for environmental protection, such as green bonds. At present, green finance is playing an increasingly important role in environmental protection and promoting economic transition (Wang et al., 2020b; Meo and Karim, 2021), and it has also become an important supplement to environmental regulations and energy policies (Falcone et al., 2018; Jin et al., 2021; Wang et al., 2021a, 2021b, 2021c). The Chinese government vigorously regulates environmental degradation and pollution, promising to achieve carbon neutrality by 2060. This requires comprehensive investment in green projects and technologies, promoting the implementation of green finance policies that support green development. Only in this way can green finance develop rapidly (Yu et al., 2021).

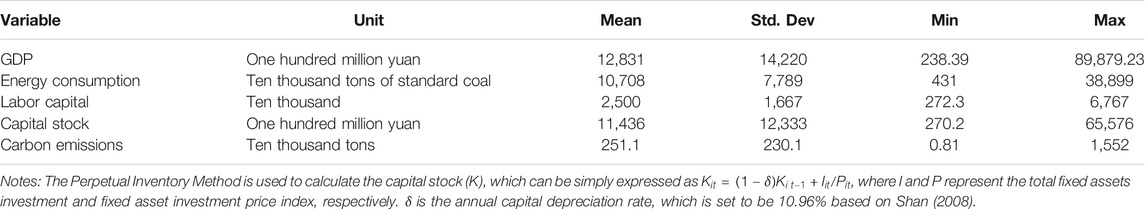

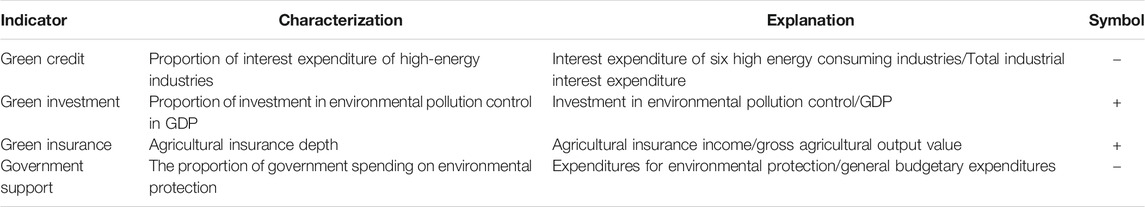

For the measurement of the development of green finance, scholars have conducted a lot of studies from the perspective of the fund supply side, the fund demand side and the characteristics of green finance (Liu et al., 2019; Zhou et al., 2020). However, the measurement of green finance by using a single variable cannot comprehensively reflect the overall level of green finance development. Based on Jiang et al. (2020), the index of China’s provincial green finance development is measured from four dimensions, namely, green credit, green investment, green insurance, and government support, and Table 2 reports specific indicators. After standardizing the indicator data, the Entropy Weight Method is used to calculate the weight of each indicator, so as to calculate the provincial annual green development index.

Control Variables

According to the existing studies and data availability, the control variables that affect energy efficiency are selected as follows:

1) Industrialization level (

2) Urbanization level (

3) The degree of openness (

4) Population density (

Data Sources

In this paper, we adopt the provincial data from 2001 to 2017, including 30 provinces/cities in China. The data we use to conduct empirical study are mainly from the following databases. 1) The provincial economic data come from the Statistical Yearbook of China and Statistical Yearbook of Provinces, which are published by the National Bureau of Statistics of China. 2) The provincial energy and environmental data come from China Energy Statistical Yearbook and Environment Statistical Yearbook of China. 3) The provincial financial data come from China Financial Statistical Yearbook and China Insurance Yearbook. 4) The data of Chinese green patents come from the China Patent database, which is published by the National Intellectual Property Administration in China. After merging the above databases, we obtained a panel dataset of maximum 510 province-year observations from 30 provinces/regions from 2001 to 2017.

Variable Description

Descriptive statistics are summarized in Table 3. The mean of energy efficiency (

In addition, we also provide descriptive statistics for industrialization, urbanization, degree of openness, and population density. To a certain extent, they all show differences in local development. Therefore, the heterogeneous effect of green finance on energy efficiency needs to be tested in the following part.

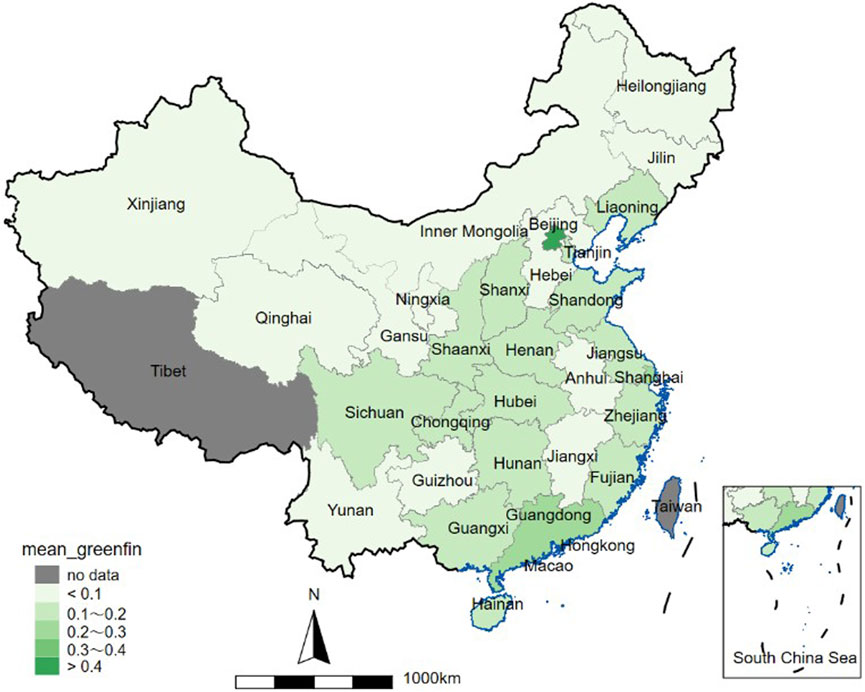

In order to visualize the regional differences in China’s energy efficiency and green finance development, the geographical distribution of the mean of energy efficiency and the mean of green finance index are shown in Figures 1, 2.

During the sample period, regions with high levels of green finance development index also have relatively high levels of energy efficiency. Specifically, the energy efficiency of the eastern region is the highest, followed by that of the central region, and the energy efficiency of the western region is the smallest. In terms of green finance development, similar regional distribution characteristics are also presented, which shows that the development of green finance has become an important environmental regulation, improving regional energy efficiency by means of fund guidance.

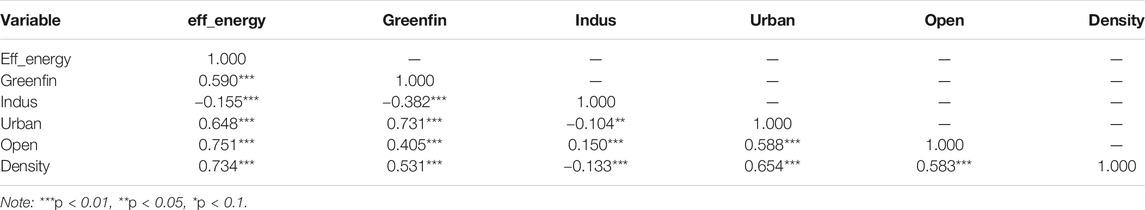

Table 4 summarizes the Pearson correlations among variables, avoiding estimation errors caused by multicollinearity between explanatory variables before estimating parameters. It can be seen that the correlation coefficient between energy efficiency and green finance development is significantly positive, that is, the higher the level of green finance development is, the higher the energy efficiency of the region is, which is consistent with the analysis in the hypothesis.

As shown in Table 4, most of the control variables are significantly correlated with the green finance development index. However, the correlation coefficient between the urbanization level and the explanatory variable is greater than 0.5, indicating that the multicollinearity between the variables is not a significant problem.

Main Empirical Results

Estimation Results of the Baseline Model

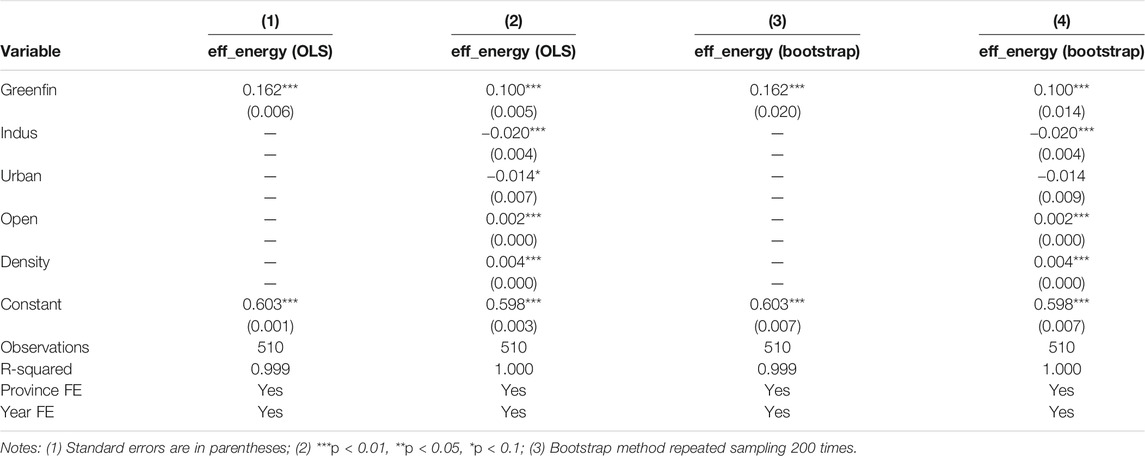

The estimation results of the impact of green finance on energy efficiency are reported in Table 5. Under different settings (i.e., without controlling any other factors, column (1); and controlling all variables, column (2)), the coefficients of

Additionally, the results show that the coefficients of the control variables are consistent with the expected in Literature Review and Hypothesis Formulation, which are displayed in columns (2) and (4) of Table 5. In order to simplify the analysis, we only discuss the estimated coefficients of the control variables in column (2). The coefficient of the level of industrialization is significantly negative at the 1% level, indicating that the higher the proportion of the secondary industry’s value added in GDP is, the lower the energy efficiency. On the one hand, the secondary industry development heavily relies on the usage of fossil energy. With the technological level or per unit energy consumption fixed, as energy costs increase, industrialization cannot promote the improvement of energy efficiency. Similarly, this can also explain the changes in energy efficiency in the process of urbanization. Over-reliance on the consumption of fossil energy to develop the local economy cannot improve the energy efficiency. On the other hand, with the continuous upgrading of industries, the proportion of the secondary industry’s value added in GDP has shown a downward trend. However, energy efficiency has been continuously improved, resulting in a negative impact on energy efficiency due to industrialization together. Besides, the coefficient of the degree of openness is statistically positive at the 1% level, which shows that regions that are more open to the outside world are conducive to transfer of industries with backward production capacity, reducing energy consumption and improving energy efficiency; it may also be open to the outside world to improve energy efficiency by introducing green innovation technology (Mimouni and Temimi, 2018). The coefficient of population density is significantly positive at the level of 1%, indicating that the higher the population density is, the higher the energy efficiency is. The possible explanation is that the high population density may mean that the service industry is also more developed, resulting in higher energy efficiency (Morikawa, 2012).

Robustness Tests

In order to ensure the robustness of the estimation results of the baseline model, we run several robustness tests, including replacing dependent variable, replacing key independent variable, and dealing with endogeneity.

Replacing Dependent Variable

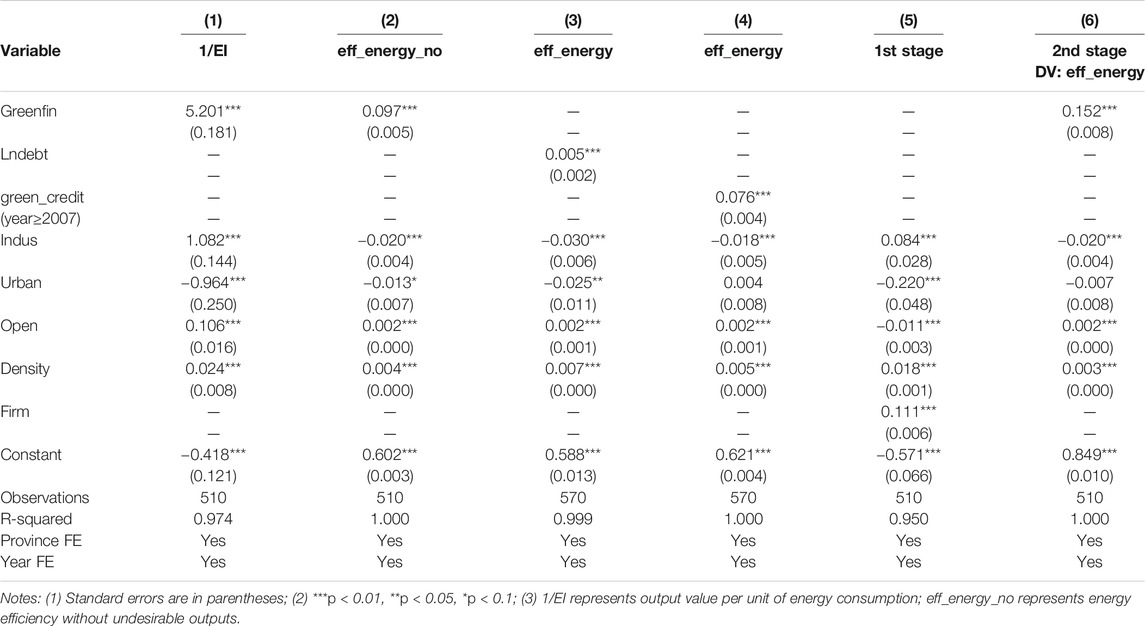

There are many approaches to measure energy efficiency, and it is necessary to re-estimate the baseline model with dependent variable measured by using other approach, to avoid possible measurement errors and simultaneity bias. Among several measurement approaches, output value per unit of energy consumption (

The estimation results are shown in columns (1) and (2) of Table 6, respectively. It can be seen that the impact of the Green Finance Index on one over energy intensity (

Replacing Key Independent Variable

The green finance index is a measurement by using comprehensive indicators to reflect the overall level of local green finance development. However, it may also be affected by the Entropy Weight Method’s weighting of indicators, causing estimation biases to the final regression results. In this regard, we adopt two approaches to tackle this problem.

First, the natural logarithm of the total loans of financial institutions (

Second, a dummy variable that indicates the implementation of green credit policy is introduced. In July 2007, the Ministry of Environmental Protection of the People’s Republic of China, the People’s Bank of China, and the China Banking Regulatory Commission jointly issued the Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks, marking that green credit as an economic instrument has fully entered the main battlefield of pollution reduction in China. The development of green credit policy is an important supplement to environmental regulation, and we can construct a dummy variable that reflects the development of green finance. Therefore, the dummy variable green_credit, indicating the post-treatment period, is introduced; that is,

The estimation results are shown in columns (3) and (4) of Table 6, respectively. After the green finance index is replaced by

Dealing With Endogeneity

Potential endogeneity due to reverse causality or simultaneity may question our identification strategy. To deal with this problem, we adopt the instrumental variable method to re-estimate our baseline model (Albouy et al., 2016). We use the number of listed companies as an instrumental variable, because it has a strong correlation with the level of local financial development. On the one hand, listed companies are highly innovative and are important promoters of development of local green finance. On the other hand, listed companies have undertaken more environmental governance responsibilities and are in great need of green financial support. In addition, this variable has little relevance to energy efficiency at the provincial level.

According to firms’ location of registration, the number of list companies is added up, and we take the natural logarithm of the number of list companies as the instrument which is used to estimate the baseline model based on the Two Stage Least Square (2SLS) estimation method. The 2SLS estimation results are shown in columns (5) and (6) of Table 6. The estimation results of the first stage show that the coefficient of the number of listed companies is significantly positive at the 1% level; in the second stage estimation, the coefficient of the fitted green finance index is significantly positive. Therefore, after controlling the potential endogeneity, our main empirical results remain robust, and that the green financial development can promote the energy efficiency is further confirmed.

Heterogeneity Analysis

In the part of descriptive statistics, we find that the difference between energy efficiency and green finance index at the provincial level may be an important source of the heterogeneous impact of green financial development on energy efficiency. In this section, we will analyze and discuss the heterogeneous impact of green financial development on energy efficiency, considering differences in resource endowments, differences in economic development levels, and differences in marketization levels.

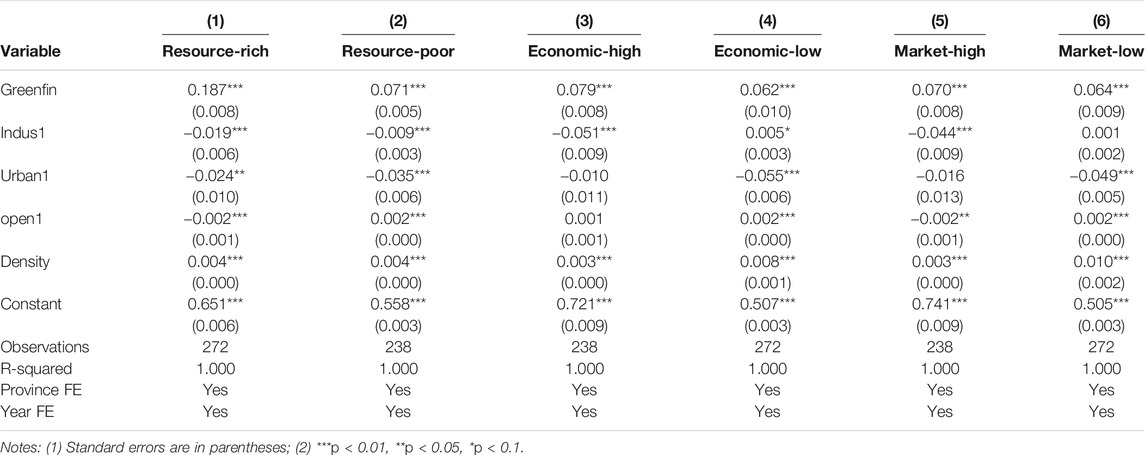

Differences in Resource Endowments

Taking that the energy resources endowment of a country directly affecting the energy consumption structure into consideration, there may be differences in energy efficiency across different regions (Wang et al., 2020b). According to the median of the energy resources production, the sub-samples above the median are resource-rich regions, and the sub-samples below the median are resource-poor regions.

The estimation results of each group are shown in columns (1) and (2) of panel A in Table 7. In provinces with rich resource endowments, the coefficient of the green finance index is significantly positive and higher than that of provinces with poor resource endowments. On the one hand, regions with rich resource endowments can speed up the transition of energy consumption structure through the development of green finance. As a result, the decline in traditional energy usage makes the improvement of energy efficiency more obvious. On the other hand, in regions with poor resource endowments, there may be only few effects of green finance participating in environmental regulations, whose scale effect would also be lower than that in regions with rich resource endowments. Meanwhile, the development of green finance in regions with low resource endowments has significantly lower promotion effect on energy efficiency than that in regions with rich resource endowments.

Differences in Economic Development Levels

Taking into account the differences in the level of economic development of various provinces may have different effects on the development of green finance (Zheng et al., 2020), according to the median of the GDP per capita, the sub-samples above the median are the provinces with high levels of economic development, and the sub-samples below the median are the provinces with low levels of economic development.

The estimation results of each group are shown in columns (3) and (4) of Table 7. No matter in provinces with high levels of economic development or low levels of economic development, the green financial development can significantly promote energy efficiency. However, in regions with high levels of economic development, the impact of green finance on energy efficiency is slightly higher than that in regions with low levels of economic development. The level of economic development can be used to measure the economic output of energy consumption. Green financial policies exert positive effects on energy efficiency by increasing the financing costs of high-polluting companies, resulting in reducing energy consumption. At the same time, in areas with high levels of economic development, the willingness of enterprises to reduce fossil energy consumption is stronger, and green financial policies can effectively cooperate with environmental regulations to achieve the goal of improving energy efficiency.

Differences in Marketization Levels

The development of green finance may be affected by the level of market development. In the context of different levels of marketization, the impact of green finance on energy efficiency may be different (Chen et al., 2021). Based on the method measuring levels of marketization proposed by Fan et al. (2012), the marketization index is calculated during the sample period. Based on the annual median of the marketization index, the sub-samples above the median are the provinces with high levels of marketization, and the sub-samples below the median are the provinces with low levels of marketization.

The test results of differences in marketization levels are shown in columns (5) and (6) of Table 7. The results show that green financial development makes significant promotion effect on energy efficiency in both provinces with high levels of marketization and low levels of marketization. However, there are certain regional differences in the degree of impact, and green finance has a higher impact on energy efficiency in regions with high levels of marketization. A reasonable explanation is that the higher the level of marketization is, the more conducive it is to the development of green finance business. There may be differences in influence channels and regulatory intensity between green finance policies and environmental regulations. The green finance policy is mainly to improve the energy structure by alleviating the degree of capital financing constraints. In contrast, strict but flexible environmental regulations can reduce the degree of information asymmetry, and are more conducive to guiding enterprises to use green energy, developing green technologies, and improving energy efficiency.

Considering the heterogeneous impact of green financial development on energy efficiency, when suffering from differences in resource endowments, differences in economic development levels, and differences in marketization levels, the development of green finance cannot be implemented in a homogeneous manner. The local advantages should be taken according to the resource conditions and economic characteristics of each region, and a green finance development mode suitable for the local area should be developed. In addition, it is necessary to comprehensively consider factors such as levels of economic development, geographical location, and industries with local characteristics, to fully explore the feasibility of green finance development policies and financial tools in various regions, promoting green finance practices more widely. The green finance can provide sufficient financing means for the development of regional green industries to support the improvement of the ecological environment and the efficient use of resources, thereby effectively improving regional energy efficiency.

Impact-Channel Tests of Green Technology Innovation

As one of the largest coal consumers in the world, China is facing serious energy and environmental problems which can be solved by strengthening the clean and efficient use of coal resources. In promoting the third transition of fossil energy such as petroleum, coal, natural gas, etc. to new energy, major breakthroughs in some key technologies and strengthening of ecological environment protection are required to realize low-carbon and clean utilization of coal. Some coal-burning equipment has been upgraded to solve the problems of high consumption of pollutants and excessive emission caused by long-term use, aging, backward design and manufacturing technology of coal-burning equipment. Specifically, green technology innovation is an important path to achieve ecological protection and improve energy efficiency, and the government’s active adoption of environmental regulations (ER) to promote green technology progress is the key to solve environmental and economic difficulties (Li and Du, 2021). The Porter Hypothesis points out that strict but flexible environmental regulations can trigger innovations, making production processes more efficient, and it has been widely confirmed (Ford et al., 2014; Wang et al., 2019). Some studies have shown that both institutional quality and green innovation have significant positive impacts on the improvement of energy efficiency (Li and Lin, 2018; Liu et al., 2021). Therefore, it is necessary for us to discuss whether the technological innovation path of green finance can promote the improvement of energy efficiency. In this section, considering the two aspects of technological innovation impact channels, namely, new energy technology development and disruptive green innovation, whether green finance has a smooth effect or a severe impact on energy efficiency through innovation channels would be tested and analyzed.

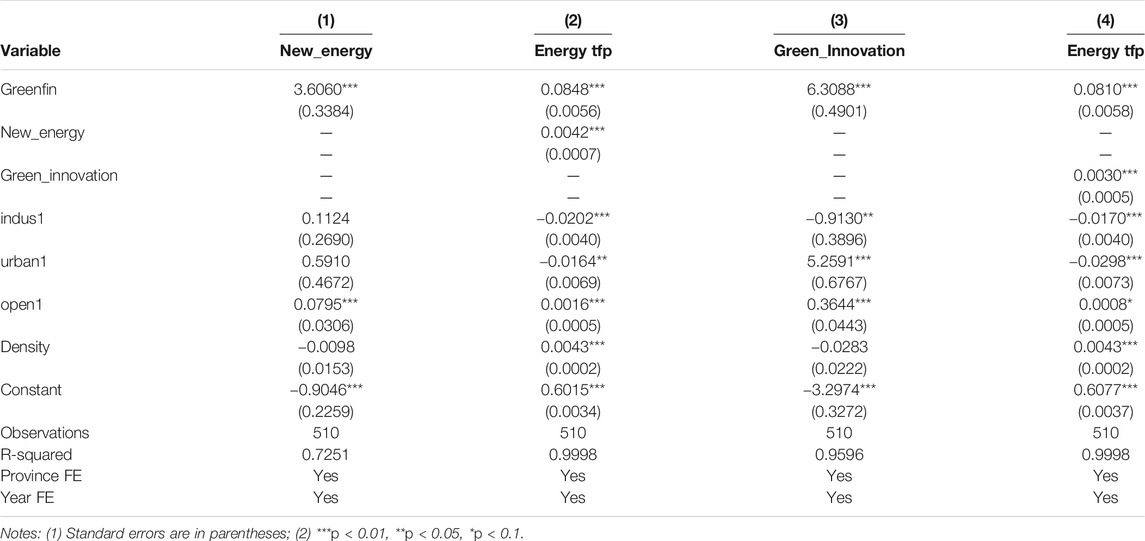

Impact-Channel Tests of New Energy Technology Development

China’s coal-based primary energy consumption structure will not fundamentally change in the short term. In order to protect the environment, it is necessary to reduce the direct combustion of bulk coal. At the same time, with the advancement of technology, the development and utilization cost of new energy continues to drop. Compared with fossil energy, new energy has strong competitiveness. In other words, the development of new energy technologies is a key direction supported by the green finance (Wang and Zhi, 2016), and energy efficiency can be greatly improved by optimizing the energy structure.

Therefore, new energy technology development (

Impact-Channel Tests of Disruptive Green Innovation

Disruptive green innovation is regarded as a sustainable way to achieve a low-carbon environment (Sun et al., 2019; Jermsittiparsert et al., 2020), and green innovation has a leap-forward impact on energy efficiency. Although some studies have confirmed the impact mechanism of environmental regulations on the efficiency of regional green innovation (Fan et al., 2021), different types of environmental regulations have different effects on green development performance. Market-based environmental regulations have a positive impact on the green development of the industry by encouraging green process innovation instead of green product innovation (Feng and Chen, 2018). There has been a longstanding debate on the effects of environmental regulations on disruptive green innovation.

From the perspective of green finance, we discuss the intermediary effect of green innovation in the process of environmental governance policies affecting energy efficiency. Therefore, disruptive green innovation (

In summary, the green finance can promote energy efficiency through green technology innovation. First, the financial support effect of green finance can provide financing services for the clean energy industries, which can guide financial institutions to gradually increase investment in technology research and development in the green and low-carbon field. As a result, the proportion of new energy consumption in total energy consumption will be further increased, thereby improving energy utilization efficiency. Second, the incentive effect of green finance can make it easier to support new energy enterprises, and financial products and tools such as credits and bonds are used to vigorously develop green projects, which can reduce the financing costs of green innovation projects, guiding more companies to develop green technologies and use clean energy. Third, the allocation effect of green finance can effectively solve the financing difficulties caused by the long return period of investment in new energy projects and unpredictable risk factors, hedging the risks of energy transition, and promoting the process of low-carbon green development.

Conclusions and Policy Implications

In order to cope with the dilemma between economic development and environmental protection brought about by energy consumption, various countries or regions have adopted environmental regulations to improve energy efficiency. Although there have been a large number of studies discussing the impact of environmental regulations on energy efficiency (Ford et al., 2014; Feng and Chen, 2018; Wang et al., 2019), few studies have been conducted to analyze its impact on energy efficiency from the perspective of green finance development. Especially, the innovative mechanism of the impact of green finance on energy efficiency needs further analysis. Therefore, the annual panel data of 30 provinces or cities in China at the provincial level from 2001 to 2017 are used to test the promotion effect of green finance on energy efficiency and the intermediary effect of green technology innovation, and the following conclusions are drawn.

First, the green finance can significantly improve energy efficiency, especially in provinces with rich resource endowments, high levels of economic development, and high degree of marketization, the promotion effect of green finance is more obvious. These mean that the development of green finance with regional characteristics can optimize energy efficiency and realize the transition of energy consumption structure. While ensuring the sustainable development of the economy, the green finance is conducive to improving the environmental quality of China’s provinces, fully reflecting its active role in promoting the construction of ecological civilization and promoting the development of green economy. Second, the test results of the impact channel of green technology innovation show that green finance can improve energy efficiency through the development of new energy technologies and green innovation paths. The green finance helps to solve the financing difficulties caused by the long return period of investment in new energy projects and unpredictable risk factors, by allocating financial supply that matches the capital demand for green technology innovation. The development of green finance is of vital importance to improve green productivity, green technology innovation and low carbon emissions by guiding the flow of funds to green technology innovation, which can reduce environmental pollution and energy consumption, thereby improving energy efficiency and achieving green economic growth. In addition, we have confirmed the robustness of the conclusions by replacing the dependent variable, replacing key independent variable, and using instrumental variables to deal with endogenous issues.

Our conclusion that green finance promotes energy efficiency is conducive to the formulation of environmental policies. First, the top priority mission is to establish and improve the green financial system. Only in this way can we expand the scale of green finance, giving full play to resource allocation capabilities. A sound institutional environment is conducive to guiding enterprises to fulfill environmental responsibilities, effectively coordinating the relationship between economic development and environmental protection. Second, in accordance with local characteristics, the government should formulate differentiated green finance policies to reduce regional differences in energy efficiency; at the same time, the inter-regional cooperation should be strengthened to jointly promote the overall improvement of energy efficiency. Third, green financial service capabilities should be improved to promote the development and utilization of green technology innovation. Through the improvement of new energy technology, the cost of new energy use can be effectively reduced, and the energy structure can be further optimized.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

JP: methodology, formal analysis, and writing the manuscript. YZ: validation, formal analysis, and writing the manuscript.

Funding

This research is funded by the National Social Science Foundation of China (No. 19AJY027).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors are grateful to reviewers and editors for helpful comments and suggestions.

Footnotes

1BP Statistical Review of World Energy 2020, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf

2The data is from the China Green Finance Development Report (2019) compiled by the People's Bank of China.

3According to the transaction prices provided by China’s carbon emissions trading market, the average daily settlement price from 2013 to 2017 is 32.2 CNY/ton, which is used as the emission cost per unit carbon dioxide emission.

References

Al-mulali, U., and Binti Che Sab, C. N. (2012). The Impact of Energy Consumption and CO2 Emission on the Economic Growth and Financial Development in the Sub Saharan African Countries. Energy 39, 180–186. doi:10.1016/j.energy.2012.01.032

Albouy, D., Graf, W., Kellogg, R., and Wolff, H. (2016). Climate Amenities, Climate Change, and American Quality of Life. J. Assoc. Environ. Resource Economists 3, 205–246. doi:10.1086/684573

Arminen, H., and Menegaki, A. N. (2019). Corruption, Climate and the Energy-Environment-Growth Nexus. Energ. Econ. 80, 621–634. doi:10.1016/j.eneco.2019.02.009

Azhgaliyeva, D., Kapoor, A., and Liu, Y. (2020). Green Bonds for Financing Renewable Energy and Energy Efficiency in South-East Asia: A Review of Policies. J. Sustainable Finance Investment 10, 113–140. doi:10.1080/20430795.2019.1704160

Battese, G. E., and Coelli, T. J. (1995). A Model for Technical Inefficiency Effects in A Stochastic Frontier Production Function for Panel Data. Empirical Econ. 20, 325–332. doi:10.1007/BF01205442

Bi, G.-B., Song, W., Zhou, P., and Liang, L. (2014). Does Environmental Regulation Affect Energy Efficiency in China's thermal Power Generation? Empirical Evidence from a Slacks-Based DEA Model. Energy Policy 66, 537–546. doi:10.1016/j.enpol.2013.10.056

Bildirici, M. E., and Badur, M. M. (2018). The Effects of Oil Prices on Confidence and Stock Return in China, India and Russia. Quant. Financ. Econ. 2, 884–903. doi:10.3934/QFE.2018.4.884

Bildirici, M. E., Bakirtas, T., and Kayikci, F. (2012). Economic Growth and Electricity Consumption: Auto Regressive Distributed Lag Analysis. J. Energ. South. Afr. 23, 29–45. doi:10.17159/2413-3051/2012/v23i4a3176

Burke, M., Hsiang, S. M., and Miguel, E. (2015). Climate and Conflict. Annu. Rev. Econ. 7, 577–617. doi:10.1146/annurev-economics-080614-115430

Cagno, E., Ramirez-Portilla, A., and Trianni, A. (2015). Linking Energy Efficiency and Innovation Practices: Empirical Evidence from the Foundry Sector. Energy Policy 83, 240–256. doi:10.1016/j.enpol.2015.02.023

Chassagnon, V., and Haned, N. (2015). The Relevance of Innovation Leadership for Environmental Benefits: A Firm-Level Empirical Analysis on French Firms. Technol. Forecast. Soc. Change 91, 194–207. doi:10.1016/j.techfore.2014.02.012

Chen, B., Yang, Q., Li, J. S., and Chen, G. Q. (2017). Decoupling Analysis on Energy Consumption, Embodied GHG Emissions and Economic Growth - the Case Study of Macao. Renew. Sustainable Energ. Rev. 67, 662–672. doi:10.1016/j.rser.2016.09.027

Chen, Q., Ning, B., Pan, Y., and Xiao, J. (2021). Green Finance and Outward Foreign Direct Investment: Evidence from A Quasi-Natural Experiment of Green Insurance in China. Asia Pac. J. Manag.. doi:10.1007/s10490-020-09750-w

Cheng, Z., Liu, J., Li, L., and Gu, X. (2020). Research on Meta-Frontier Total-Factor Energy Efficiency and its Spatial Convergence in Chinese Provinces. Energ. Econ. 86, 104702. doi:10.1016/j.eneco.2020.104702

Costa-Campi, M. T., García-Quevedo, J., and Martínez-Ros, E. (2017). What Are the Determinants of Investment in Environmental R&D?. Energy Policy 104, 455–465. doi:10.1016/j.enpol.2017.01.024

Dagoumas, A. S., Polemis, M. L., and Soursou, S.-E. (2020). Revisiting the Impact of Energy Prices on Economic Growth: Lessons Learned from the European Union. Econ. Anal. Pol. 66, 85–95. doi:10.1016/j.eap.2020.02.013

Diakoulaki, D., and Mandaraka, M. (2007). Decomposition Analysis for Assessing the Progress in Decoupling Industrial Growth from CO2 Emissions in the EU Manufacturing Sector. Energ. Econ. 29, 636–664. doi:10.1016/j.eneco.2007.01.005

Dirckinck-Holmfeld, K. (2015). The Options of Local Authorities for Addressing Climate Change and Energy Efficiency through Environmental Regulation of Companies. J. Clean. Prod. 98, 175–184. doi:10.1016/j.jclepro.2014.12.067

D’Orazio, P., and Valente, M. (2019). The Role of Finance in Environmental Innovation Diffusion: An Evolutionary Modeling Approach. J. Econ. Behav. Organ. 162, 417–439. doi:10.1016/j.jebo.2018.12.015

Du, H., Chen, Z., Zhang, Z., and Southworth, F. (2020). The Rebound Effect on Energy Efficiency Improvements in China's Transportation Sector: A CGE Analysis. J. Management Sci. Eng. 5, 249–263. doi:10.1016/j.jmse.2020.10.005

Duque‐Grisales, E., Aguilera‐Caracuel, J., Guerrero‐Villegas, J., and García‐Sánchez, E. (2020). Does Green Innovation Affect the Financial Performance of Multilatinas? the Moderating Role of ISO 14001 and R&D Investment. Bus. Strategy Environ. 29, 3286–3302. doi:10.1002/bse.2572

Falcone, P. M., Morone, P., and Sica, E. (2018). Greening of the Financial System and Fuelling a Sustainability Transition. Technol. Forecast. Soc. Change 127, 23–37. doi:10.1016/j.techfore.2017.05.020

Fan, F., Lian, H., Liu, X., and Wang, X. (2021). Can Environmental Regulation Promote Urban Green Innovation Efficiency? an Empirical Study Based on Chinese Cities. J. Clean. Prod. 287, 125060. doi:10.1016/j.jclepro.2020.125060

Fan, G., Wang, X., and Ma, G. (2012). The Contribution of Marketization to China's Economic Growth. China Economist 7, 4–16.

Feng, Z., and Chen, W. (2018). Environmental Regulation, Green Innovation, and Industrial Green Development: An Empirical Analysis Based on the Spatial Durbin Model. Sustainability 10, 223. doi:10.3390/su10010223

Ford, J. A., Steen, J., and Verreynne, M.-L. (2014). How Environmental Regulations Affect Innovation in the Australian Oil and Gas Industry: Going beyond the Porter Hypothesis. J. Clean. Prod. 84, 204–213. doi:10.1016/j.jclepro.2013.12.062

Hafner, S., Jones, A., Anger-Kraavi, A., and Pohl, J. (2020). Closing the green Finance gap - A Systems Perspective. Environ. Innovation Societal Transitions 34, 26–60. doi:10.1016/j.eist.2019.11.007

Hajko, V. (2014). The Energy Intensity Convergence in the Transport Sector. Proced. Econ. FinanceFinanc 12, 199–205. doi:10.1016/S2212-5671(14)00336-0

Iimura, A., and Cross, J. S. (2018). The Impact of Renewable Energy on Household Electricity Prices in Liberalized Electricity Markets: A Cross-National Panel Data Analysis. Utilities Policy 54, 96–106. doi:10.1016/j.jup.2018.08.003

Islam, F., Shahbaz, M., Ahmed, A. U., and Alam, M. M. (2013). Financial Development and Energy Consumption Nexus in Malaysia: A Multivariate Time Series Analysis. Econ. Model. 30, 435–441. doi:10.1016/j.econmod.2012.09.033

Jermsittiparsert, K., Somjai, S., and Toopgajank, S. (2020). Factors Affecting Firm's Energy Efficiency and Environmental Performance: the Role of Environmental Management Accounting, Green Innovation and Environmental Proactivity. Ijeep 10, 325–331. doi:10.32479/ijeep.9220

Jiang, L., Wang, H., Tong, A., Hu, Z., Duan, H., Zhang, X., et al. (2020). The Measurement of Green Finance Development Index and its Poverty Reduction Effect: Dynamic Panel Analysis Based on Improved Entropy Method. Discrete Dyn. Nat. Soc. 2020, 1–13. doi:10.1155/2020/8851684

Jin, Y., Gao, X., and Wang, M. (2021). The Financing Efficiency of Listed Energy Conservation and Environmental Protection Firms: Evidence and Implications for Green Finance in China. Energy Policy 153, 112254. doi:10.1016/j.enpol.2021.112254

Jones, A. W. (2015). Perceived Barriers and Policy Solutions in Clean Energy Infrastructure Investment. J. Clean. Prod. 104, 297–304. doi:10.1016/j.jclepro.2015.05.072

Keerthi, B. S. (2013). A Study on Emerging Green Finance in India: Its Challenges and Opportunities. Int. J. Manag. Soc. Sci. Ses. 2, 49–53.

Li, J., and Du, Y. (2021). Spatial Effect of Environmental Regulation on Green Innovation Efficiency: Evidence from Prefectural-Level Cities in China. J. Clean. Prod. 286, 125032. doi:10.1016/j.jclepro.2020.125032

Li, K., and Lin, B. (2018). How to Promote Energy Efficiency through Technological Progress in China?. Energy 143, 812–821. doi:10.1016/j.energy.2017.11.047

Li, T., Li, X., Li, X., and Albitar, K. (2021). Threshold Effects of Financialization on enterprise R & D Innovation: a Comparison Research on Heterogeneity. Quant. Financ. Econ. 5 (5), 496–515. doi:10.3934/QFE.2021022

Lin, B., and Zheng, Q. (2017). Energy Efficiency Evolution of China's Paper Industry. J. Clean. Prod. 140, 1105–1117. doi:10.1016/j.jclepro.2016.10.059

Lindenberg, N. (2014). Definition of Green Finance. DIE Mimeo. Available at: https://ssrn.com/abstract=2446496.

Liu, R., Wang, D., Zhang, L., Zhang, L., Glade, T., and Murty, T. S. (2019). Can Green Financial Development Promote Regional Ecological Efficiency? A Case Study of China. Nat. Hazards 95, 325–341. doi:10.1007/s11069-018-3502-x

Liu, S., Shen, X., Shen, X., Jiang, T., and Failler, P. (2021). Impacts of the Financialization of Manufacturing Enterprises on Total Factor Productivity: Empirical Examination from China's Listed Companies. Green. Finance 3, 59–89. doi:10.3934/GF.2021005

Liu, Y., Wang, A., and Wu, Y. (2021). Environmental Regulation and green Innovation: Evidence from China's New Environmental protection Law. J. Clean. Prod. 297, 126698. doi:10.1016/j.jclepro.2021.126698

Lv, Y., Chen, W., and Cheng, J. (2020). Effects of Urbanization on Energy Efficiency in China: New Evidence from Short Run and Long Run Efficiency Models. Energy Policy 147, 111858. doi:10.1016/j.enpol.2020.111858

Mahmood, T., and Ayaz, M. T. (2018). Energy Security and Economic Growth in Pakistan. Pakistan J. Appl. Econ. 28, 47–64. Available at: http://www.aerc.edu.pk/wp-content/uploads/2018/05/Paper-759-TAHIR-IV.pdf.

Mandal, S. K. (2010). Do Undesirable Output and Environmental Regulation Matter in Energy Efficiency Analysis? Evidence from Indian Cement Industry. Energy Policy 38, 6076–6083. doi:10.1016/j.enpol.2010.05.063

Marín-Vinuesa, L. M., Scarpellini, S., Portillo-Tarragona, P., and Moneva, J. M. (2020). The Impact of Eco-Innovation on Performance through the Measurement of Financial Resources and Green Patents. Organ. Environ. 33, 285–310. doi:10.1177/1086026618819103

Markovic, D. S., Zivkovic, D., Cvetkovic, D., and Popovic, R. (2012). Impact of Nanotechnology Advances in ICT on Sustainability and Energy Efficiency. Renew. Sustainable Energ. Rev. 16, 2966–2972. doi:10.1016/j.rser.2012.02.018

Meo, M. S., and Karim, M. (2021). The Role of Green Finance in Reducing CO2 Emissions: An Empirical Analysis. Borsa Istanb. Rev.. doi:10.1016/j.bir.2021.03.002

Miao, C., Fang, D., Sun, L., and Luo, Q. (2017). Natural Resources Utilization Efficiency under the Influence of Green Technological Innovation. Resour. Conservation Recycling 126, 153–161. doi:10.1016/j.resconrec.2017.07.019

Mimouni, K., and Temimi, A. (2018). What Drives Energy Efficiency? New Evidence from Financial Crises. Energy policy 122, 332–348. doi:10.1016/j.enpol.2018.07.057

Mohsin, M., Taghizadeh-Hesary, F., Panthamit, N., Anwar, S., Abbas, Q., and Vo, X. V. (2020). Developing Low Carbon Finance Index: Evidence from Developed and Developing Economies. Finance Res. Lett. 101520, 101520. doi:10.1016/j.frl.2020.101520

Morikawa, M. (2012). Population Density and Efficiency in Energy Consumption: An Empirical Analysis of Service Establishments. Energ. Econ. 34, 1617–1622. doi:10.1016/j.eneco.2012.01.004

Oh, M., Shin, J., Park, P. J., and Kim, S. (2020). Does Eco‐innovation Drive Sales and Technology Investment? Focusing on Eco‐label in Korea. Bus Strat Env 29, 3174–3186. doi:10.1002/bse.2565

Pan, X., Ai, B., Li, C., Pan, X., and Yan, Y. (2019). Dynamic Relationship Among Environmental Regulation, Technological Innovation and Energy Efficiency Based on Large Scale Provincial Panel Data in China. Technol. Forecast. Soc. Change 144, 428–435. doi:10.1016/j.techfore.2017.12.012

Pavlyk, V. (2020). Assessment of Green Investment Impact on the Energy Efficiency Gap of the National Economy. Fmir 4, 117–123. doi:10.21272/fmir.4(1).117-123.2020

Peng, D., and Zhang, J. (2019). The Impact of Environmental Regulation on China’s Total Factor Energy Efficiency-An Empirical Test Based on Provincial Panel Data. J. Ind. Technol. Econ. 38, 59–67.

Peters, G. P., Minx, J. C., Weber, C. L., and Edenhofer, O. (2011). Growth in Emission Transfers via International Trade from 1990 to 2008. Proc. Natl. Acad. Sci. 108, 8903–8908. doi:10.1073/pnas.1006388108

Qian, H., Wu, L., and Tang, W. (2017). “Lock-In” Effect of Emission Standard and its Impact on the Choice of Market Based Instruments. Energy Econ 63, 41–50. doi:10.1016/j.eneco.2017.01.005

Sachs, J. D., Woo, W. T., Yoshino, N., and Taghizadeh-Hesary, F. (2019). “Importance of Green Finance for Achieving Sustainable Development Goals and Energy Security,” in Handbook of Green Finance. Sustainable Development. Editors J. Sachs, W. Woo, N. Yoshino, and F. Taghizadeh-Hesary (Singapore: Springer), 3–12. doi:10.1007/978-981-13-0227-5_13

Saidi, K., and Hammami, S. (2015). The Impact of Energy Consumption and CO2 Emissions on Economic Growth: Fresh Evidence from Dynamic Simultaneous-Equations Models. Sustainable Cities Soc. 14, 178–186. doi:10.1016/j.scs.2014.05.004

Saiti, B., Dahiru, A., Dahiru, A., and Guran Yumusak, I. (2018). Diversification Benefits in Energy, Metal and Agricultural Commodities for Islamic Investors: Evidence from Multivariate GARCH Approach. Quant. Financ. Econ. 2, 733–756. doi:10.3934/QFE.2018.3.733

Sen, S. (2015). Corporate Governance, Environmental Regulations, and Technological Change. Eur. Econ. Rev. 80, 36–61. doi:10.1016/j.euroecorev.2015.08.004

Shan, H. J. (2008). Re-Estimating the Capital Stock of China: 1952–2006. J. Quant. Tech. Econ. 10, 17–31.

Sjöström, M., and Östblom, G. (2010). Decoupling Waste Generation from Economic Growth - A CGE Analysis of the Swedish Case. Ecol. Econ. 69, 1545–1552. doi:10.1016/j.ecolecon.2010.02.014

Song, Y., Huang, J., Zhang, Y., and Wang, Z. (2019). Drivers of Metal Consumption in China: An Input-Output Structural Decomposition Analysis. Resour. Pol. 63, 101421. doi:10.1016/j.resourpol.2019.101421

Sun, H., Edziah, B. K., Sun, C., and Kporsu, A. K. (2019). Institutional Quality, Green Innovation and Energy Efficiency. Energy policy 135, 111002. doi:10.1016/j.enpol.2019.111002

Taghizadeh-Hesary, F., Rasoulinezhad, E., and Yoshino, N. (2019). Energy and Food Security: Linkages through Price Volatility. Energy Policy 128, 796–806. doi:10.1016/j.frl.2019.04.01610.1016/j.enpol.2018.12.043

Taghizadeh-Hesary, F., and Yoshino, N. (2019). The Way to Induce Private Participation in Green Finance and Investment. Finance Res. Lett. 31, 98–103. doi:10.1016/j.frl.2019.04.016

Tenaw, D. (2021). Decomposition and Macroeconomic Drivers of Energy Intensity: The Case of Ethiopia. Energ. Strategy Rev. 35, 100641. doi:10.1016/j.esr.2021.100641

Wang, C., Li, X.-w., Wen, H.-x., and Nie, P.-y. (2021a). Order Financing for Promoting Green Transition. J. Clean. Prod. 283, 125415. doi:10.1016/j.jclepro.2020.125415

Wang, M., Gu, R., Gu, R., Wang, M., and Zhang, J. (2021b). Research on the Impact of Finance on Promoting Technological Innovation Based on the State-Space Model. Green. Finance 3, 119–137. doi:10.3934/GF.2021007

Wang, M., Li, X., and Wang, S. (2021c). Discovering Research Trends and Opportunities of Green Finance and Energy Policy: A Data-Driven Scientometric Analysis. Energy Policy 154, 112295. doi:10.1016/j.enpol.2021.112295

Wang, Q., and Su, M. (2019). The Effects of Urbanization and Industrialization on Decoupling Economic Growth from Carbon Emission - A Case Study of China. Sustainable Cities Soc. 51, 101758. doi:10.1016/j.scs.2019.101758

Wang, S., Liu, H., Pu, H., and Yang, H. (2020b). Spatial Disparity and Hierarchical Cluster Analysis of Final Energy Consumption in China. Energy 197, 117195. doi:10.1016/j.energy.2020.117195

Wang, Y., Sun, X., and Guo, X. (2019). Environmental Regulation and Green Productivity Growth: Empirical Evidence on the Porter Hypothesis from OECD Industrial Sectors. Energy Policy 132, 611–619. doi:10.1016/j.enpol.2019.06.016

Wang, Y., and Zhi, Q. (2016). The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energ. Proced. 104, 311–316. doi:10.1016/j.egypro.2016.12.053

Warr, B. S., and Ayres, R. U. (2010). Evidence of Causality between the Quantity and Quality of Energy Consumption and Economic Growth. Energy 35, 1688–1693. doi:10.1016/j.energy.2009.12.017

Wu, H., Hao, Y., and Ren, S. (2020). How Do Environmental Regulation and Environmental Decentralization Affect green Total Factor Energy Efficiency: Evidence from China. Energ. Econ. 91, 104880. doi:10.1016/j.eneco.2020.104880

Wurlod, J.-D., and Noailly, J. (2018). The Impact of Green Innovation on Energy Intensity: An Empirical Analysis for 14 Industrial Sectors in OECD Countries. Energ. Econ. 71, 47–61. doi:10.1016/j.eneco.2017.12.012

Xiang, X., Liu, C., Yang, M., and Zhao, X. (2020). Confession or Justification: The Effects of Environmental Disclosure on Corporate Green Innovation in China. Corp Soc. Responsib Environ. Manag. 27, 2735–2750. doi:10.1002/csr.1998

Yu, C.-H., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for Green Finance: Resolving Financing Constraints on Green Innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Yu, H. (2012). The Influential Factors of China's Regional Energy Intensity and its Spatial Linkages: 1988-2007. Energy Policy 45, 583–593. doi:10.1016/j.enpol.2012.03.009

Zhang, C., He, W., and Hao, R. (2016a). Analysis of Environmental Regulation and Total Factor Energy Efficiency. Curr. Sci. 110 (10), 1958–1968. doi:10.18520/cs/v110/i10/1958-1968

Zhang, D., Zhang, Z., Ji, Q., Lucey, B., and Liu, J. (2021). Board Characteristics, External Governance and the Use of Renewable Energy: International Evidence. J. Int. Financial Markets, Institutions Money 72, 101317. doi:10.1016/j.intfin.2021.101317

Zhang, M., Lian, Y., Zhao, H., and Xia-Bauer, C. (2020). Unlocking Green Financing for Building Energy Retrofit: A Survey in the Western China. Energ. Strategy Rev. 30, 100520. doi:10.1016/j.esr.2020.100520

Zhang, P., Zhang, P. P., and Cai, G. Q. (2016b). Comparative Study on Impacts of Different Types of Environmental Regulation on Enterprise Technological Innovation. China Popul. Resour. Environ. 26, 8–13.

Zhang, Y. J. (2020). How Does Income Inequality Affect Energy Efficiency? Empirical Evidence from 33 Belt and Road Initiative Countries. J. Clean. Prod. 269, 122421. doi:10.1016/j.jclepro.2020.122421

Zheng, Y., Chen, S., Chen, S., and Wang, N. (2020). Does Financial Agglomeration Enhance Regional Green Economy Development? Evidence from China. Green. Finance 2, 173–196. doi:10.3934/GF.2020010

Zheng, Y., Qi, J., and Chen, X. (2011). The Effect of Increasing Exports on Industrial Energy Intensity in China. Energy Policy 39, 2688–2698. doi:10.1016/j.enpol.2011.02.038

Keywords: green finance, energy efficiency, green technology innovation, panel data model, environmental policy

Citation: Peng J and Zheng Y (2021) Does Environmental Policy Promote Energy Efficiency? Evidence From China in the Context of Developing Green Finance. Front. Environ. Sci. 9:733349. doi: 10.3389/fenvs.2021.733349

Received: 30 June 2021; Accepted: 14 July 2021;

Published: 23 July 2021.

Edited by:

Qiang Ji, Institutes of Science and Development (CAS), ChinaReviewed by:

Khaldoon Albitar, University of Portsmouth, United KingdomBin Mo, Guangzhou University, China

Copyright © 2021 Peng and Zheng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuhang Zheng, eWh6aGVuZ0BnZHVmZS5lZHUuY24=

Jiaying Peng

Jiaying Peng Yuhang Zheng

Yuhang Zheng