- Department of Administrative Sciences, Applied College, University of Bisha, Bisha, Saudi Arabia

Digital finance has piqued the curiosity of academics, students, and institutions all around the globe for more than a decade. Innovative financial services companies are offering a wide range of new financial products and new ways of interacting with customers via digital finance (Fintech). Research on finance and information systems has thus examined these shifts as well as the implications of technological advancements on the financial industry. Through presenting a bibliometric analysis, the article summarizes how scientific research has developed on the connections between financial technology developments and digital finance during the previous years. According to the ScienceDirect database, we base this literature review on journals and articles that have been published. We conducted a content analysis of 343 articles based on the discovered clusters, finding research gaps and suggesting actionable areas for further study. The results offer a solid path for future research in this area. We discuss the significance of the aforementioned publications and articles as well as potential areas of future study. The next step is to analyze the citation linkages between the most important articles to identify how they are related to one another. For financial technology research, the study looks at the way they are organized. The research is concerned with the roles of Fintech and the limits of research in digital financing. We point out potential routes for researchers to take to expand on current knowledge while also seeking possibilities for new, interesting, and creative research that adds to the expansion of the topic of research.

Introduction

The financial industry has witnessed continuous development in providing services due to digitization (Brandl and Hornuf, 2020; Kanungo and Gupta, 2021). This improvement is distinguished by increased communication and better information processing in the client interface and back-office processes. Recently, the emphasis on digitization has shifted from enhancing the performance of conventional tasks to mainly creating employment possibilities and new business models for financial services firms (Gomber et al., 2017; Legner et al., 2017). Digital finance includes many new financial products, financial companies, related financial programs, and new forms of customer interaction (Anjum et al., 2017; Azizi et al., 2021) and interaction offered by financial technology companies and innovative financial services providers, for e.g., Barras (1990), Gomber et al. (2017), and Ozili (2018). In light of this, research on finance and information systems has started to examine these shifts as well as the financial sector’s influence on digital development. Financial technology appears in a short time and attracts much attention from practitioners. Why?

The answer is the ability to switch supply chain networks in almost all business sectors. New business models and technology concepts provide the foundation for innovative financing solutions, knowledge sharing within a firm, and organizational innovation (Abbas et al., 2019a) and knowledge management and sustainable organizational innovation (Abbas et al., 2020), including intelligent, easy-to-use, time and time financial services, and lower costs (Teece, 2010; Gomber et al., 2017; Varga, 2017). Some studies identified a link between the conflicting and creative characteristics of social media and the paths for future research by providing a better understanding of how social networks on the Internet are used (Abbas et al., 2019b; Abbas et al., 2019c; Lebni et al., 2020; Liu et al., 2021). Also, results indicated that corporate social responsibility presented a positive impact on firms’ sustainable performance. Also, therefore, there is a definite necessity to employ media or communication resources to achieve timely progress (Su et al., 2021a; Su et al., 2021b).

Current financial service providers, such as banks and insurance companies, are being challenged by digital finance. Because of the growing competition from FinTech companies, the latter provides unique prospects for employers to contact their younger and more innovative technological clientele (Arner et al., 2015; Joshi, 2020; Wang et al., 2021). Against this background, there is an ongoing discussion on traditional financial intermediaries about handling FinTechs and whether competitive approaches acquisitions and alternatively engaging those firms as service providers that are compatible with their business models, for e.g., Lai (2020); Suprun et al. (2020); Vučinić, 2020. The new opportunities presented by technology allow them to maintain their competitiveness and provide new and attractive services to their clients.

The study of Abbas et al., 2019d proved that highly innovative firms exhibited a propensity for building a business network to achieve sustainable performance. Furthermore, the findings indicated that firms achieving sustained performance did so by applying effective business networks and flexible capacities. The study’s results suggest that it presented a holistic and systematic approach for achieving sustainable performance through the dynamic capacities of businesses.

This study thus contributes to the actual literature by studying the linkage between digital finance and fintech. The bibliometric study data are represented in the overall research work on Digital Finance and FinTech in the ScienceDirect database. These data covered the period from 2006 to 2020, where the focus was on data of recent studies completed, especially in the last 3 years (2018, 2019, and 2020). The following parts of this article are structured as follows: Section Research Method and Questions discusses the research method and research questions. Section Methods and Materials deals with the methods and materials. Section Results and Discussion lays out our results and discussion. Section Conclusion and Limitation presents the conclusion and suggestions.

Research Method and Questions

Research Method

The bibliometric analysis takes all kinds of illumination as a research goal and uses mathematical and statistical methods to study science and technology’s technological trends and development (Moed, 2006; Zhang et al., 2021). Reference measurements have been used extensively to reveal research status and development trends in a field. They have an essential role for researchers to understand a particular research field in depth (van Oorschot et al., 2018; Vatananan-Thesenvitz et al., 2019). Additionally, scientists also use bibliometric methods to systematically study in ScienceDirect database publications to uncover their past, present, and future, especially in recent years, there have been many valuable research findings of this kind. A bibliographic measurement approach was used to analyze all publications in the database.

The main goal of a bibliometric analysis was to collect and evaluate the available research relevant to the area of interest and to produce objective results that can be audited and reproduced over and over again. When it comes to research results, a bibliometric analysis is a rigorous methodological assessment with the goal of grouping existing works on the subject and assisting in the development of evidence-based guidelines for professionals working in the study field (Kitchenham, 2004; Prinsen et al., 2018). A bibliometric analysis should also identify the state of the art about the research subject (Levy and Ellis, 2006).

Financial technology and the newer “Fintech” topics are gaining further focus as the effect of digitalization on the financial services sector rises (Nicoletti et al., 2017; Leong and Sung, 2018). When it comes to financial services, one of these is why there is a lot of dependence on information, and the other is that most procedures, such as trading on an online platform (Karagiannaki et al., 2017). With new financing models made available, broad and significant digitization of the financial service providers and customers’ needs to occur to facilitate the value chain transformation that is taking place. The word “Fintech” is a contraction of “financial technology,” and Citicorp chairman John Reed most likely coined it in the early 1990s in the light of a newly formed “Smart Card Forum” (Puschmann, 2017). In a digital age, fintech applications redefined today’s product-centered thinking to include emerging ecosystems. Individual channels can become redundant when financial service designers focus on hybrid and incompatible modes of interaction-based consumer operations (Gill et al., 2015).

Research Questions

The actual study compares bibliometric analysis to other methodologies (meta-analysis and systematic review), specifically in digital finance and fintech research. The study’s purpose is tied to its motivation. We will identify its scope and research trends, which will help readers learn more about digital finance and fintech in the scientific community, and the justification and significance of this study’s analysis are obtained from two research topics: the future trends and issues in the literature review on digital finance and fintech.

The following two suggested research questions will help the study accomplish its goals, which are to offer academics and practitioners a systematic, categorized perspective of what has been generated in the literature on digital finance and fintech. According to the main problem, the first question is focused on providing an overall quantitative and longitudinal perspective of the works on this topic, and it is worded as follows:

RQ1. What changes have occurred in the literature on digital finance and fintech?

The following sub-questions were generated from the main question:

RQ1.1. What has been the most influential research, such as those published in ScienceDirect?

RQ1.2. Which important references had the most impact on the studies that were identified?

RQ1.3. Which journals are the most widely read on this topic, and how has the number of publications changed over time?

To find the existing literature to build and develop new studies, a categorization of the key topics and research questions was used to classify the digital finance and fintech activities identified in published materials from the sample into several categories. As a result, the following is the formulation of the second question of this work:

RQ2. What are the most important topics and problems discussed in the scholarly literature on digital finance and fintech?

This section explains the procedure that was followed to complete this bibliometric literature evaluation using a technique that was previously established and verified. Furthermore, bibliometric analysis methods were used to determine the scenario state of the scientific literature on digital finance and fintech (Ikpaahindi, 1985).

Methods and Materials

Bibliometric Data

The quantitative method “bibliometrics” (Fairthorne, 1969; Pritchard, 1969) is one of the most quantitative measures used in evaluating literature. Bibliometric forms have been prevalent in digital finance, but few studies have considered them—nonetheless, citations connected to the concept of payments, protection, deposit, and retail provisioning. Fintech trends have been overlooked in publications. Looking at fintech-related metadata and the publications they connected to, the metadata gives us various viewpoints on each publication series.

The bibliometric study data are represented in the overall research work (in title, abstract, and author keywords for the article) on Digital Finance and FinTech in the ScienceDirect database. These data covered the period from 2006 to 2020, where the focus was on data of recent studies completed, especially in the last 3 years (2018, 2019, and 2020).

Study Methods and Tools

Many researchers (Hood and Wilson, 2001; Osareh, 1996a; Osareh, 1996b; Tsay, 2005) have identified three key bibliometric rules. The first and earliest of these, according to Hood and Wilson (2001), is Lotka’s law (Lotka, 1926) which provides a relationship between authors and articles. Bradford’s law (Bradford, 1934) deals with scattering articles on a scientific subject through scientific journals. Zipf’s law (Zipf, 1949) is interested in the concept of frequency or occurrences.

The bibliometric study data represent the overall research on “Digital Finance and FinTech” in the ScienceDirect database. These data covered the period from 2006–2020. In which, we expected the use of Digital Finance and FinTech because of the closure and quarantine procedures during the epidemic. Therefore, articles from the ScienceDirect database that included fintech keywords in the title, abstract, and author keywords were reviewed and analyzed. Through review articles that were published starting in 2006 and also the literature from 2006 to 2020, the articles were reviewed and analyzed.

According to the processes and approaches used in bibliometric analysis, citation, co-citation, bib. coupling, co-author were analyzed for keywords, for e.g., Zupic and Čater, 2015. The study relied on the citation indicator to find out the main keywords that studies focused on and prominent authors in Digital Finance and FinTech. To determine the network of research relationships between them, the practical stages of preparing the bibliometric study was carried out (study design, data collection, analysis, presentation, and guide); see Lobato et al. (2021).

Following the methodology of preparing the bibliometric study in management and organization, which is explained by Zupic and Čater (2015), the bibliometric analysis was carried out by completing the following steps: research design, study questions, and analysis approach selection (co-occurrence, publication, citation, and co-authorship), bibliometric data compilation, selection, and filtration, analysis (choose the appropriate bibliometric software, clean the data, and generate networks), visualization, and interpretation.

Results and Discussion

Descriptive of Bibliometric Data

Analysts must provide complete knowledge regarding ongoing investigations in their respective fields and scholars that contribute to the analysis. These data change with time. Every day, fresh pieces of knowledge are introduced to the systems due to the advancement of new technology and new research. The usage of mathematical techniques to analyze articles, books, magazines, and other publications is bibliometric analysis. Geographic research, top writers, affiliations, colleges, documents, year-by-year articles, and citation analysis are all included in this report. The literature in this article was collected using the ScienceDirect database. Several networks have created keyword-based and titles in Digital Finance and FinTech science, sources, and authors.

To select the articles for final review, we used a three-step process. First, we collected and stored research articles (research articles, review articles, book chapters, and others) for the specified search keywords in the ScienceDirect databases, with an open beginning period to include as many publications as practical up to December 31, 2020. A total of 343 titles were retrieved during the first search. The article title, authors’ names and affiliations, abstract, keywords, and references were all included in the search results, which were downloaded in a CSV format.

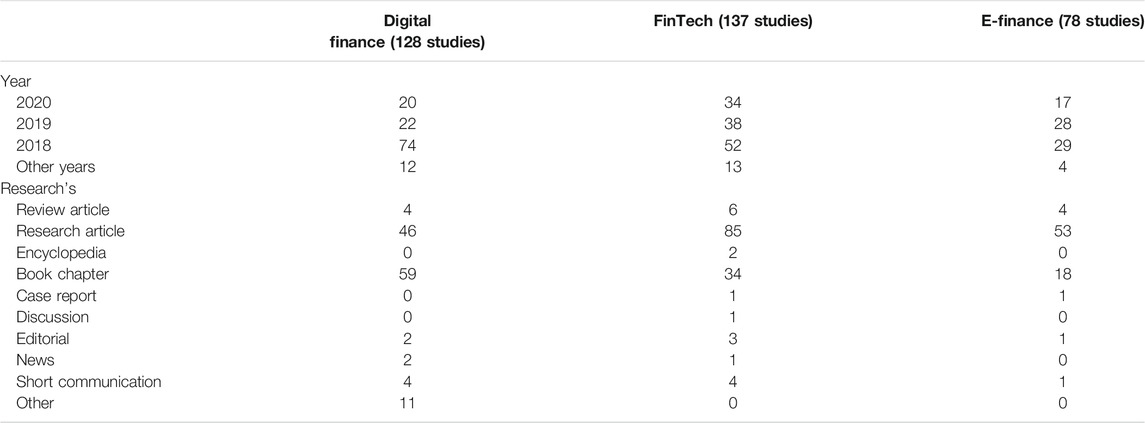

We retrieved published research via a topic search of Digital Finance and FinTech of the ScienceDirect database on January 01, 2020. The following search terms were used: topic = (“Digital Finance” or “e-Finance” or “FinTech” Or “Fintech”), in title-abs-key from 2006 to 2020, and we got 343 studies (184 research articles and 14 review articles; 111 book chapters, 02 encyclopedias, 02 case reports, and 32 others) distributed over 15 years, as shown in Table 1. The database used in bibliometric analysis or previous studies in a topic of digital finance and FinTech is described here, using numerical expressions (descriptive statistics).

Identifying various contributing publications may enable the identification of the most relevant journal outlets in each area. The various publishing ports are shown in Table 1. According to the number of published articles, research articles contribute the most, while book chapters rank second. Table 1 shows that the topics of digital finance, FinTech, and e-finance constitute a modern knowledge field, especially since most studies have been completed in the last 3 years (2018, 2019, and 2020). Moreover, most of these studies are research articles or book chapters; this explains the abundance of production in this type of research, which can be clearly shown in the following figure.

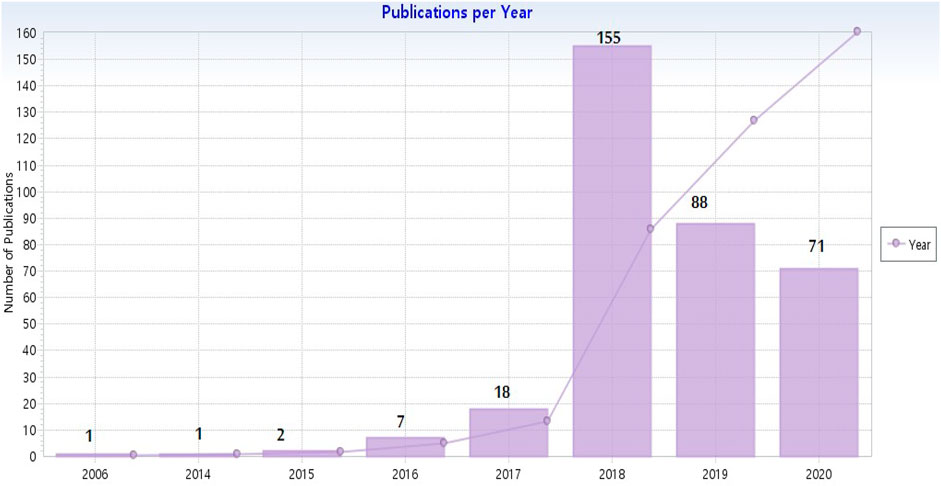

Figure 1 shows that most of the research has been performed in recent years: 155 in 2018, 88 in 2019, and 71 in 2020. Why is the curve appearing to rise, indicating the novelty of digital finance and financial technology as an area of knowledge in the financial management discipline?

For this research, the ScienceDirect database with all types of already published and unpublished publications is considered. There are many types of publications such as articles, journals, conference papers, and book chapters in a database. When researching for FinTech regulations, publication types that formed the majority were articles and conference papers and very few research studies were published in notes, conference reviews, and letters. When the results from the query were analyzed, all kinds of publications were articles, magazines, conference reviews, book chapters, etc. From 2006–2020, the trend has been increasing since 2006 and is being researched and explored more and more. Below line graph shows this trend:

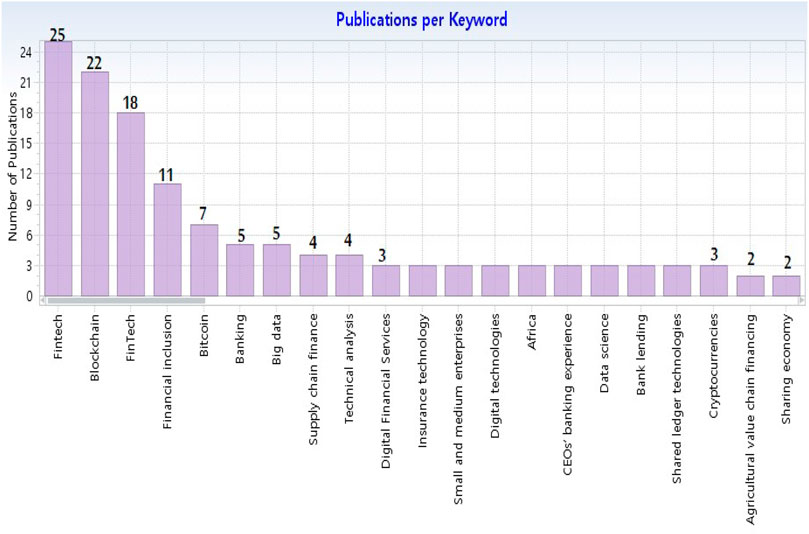

Figure 2 shows that most studies used the following keywords: Fintech, blockchain, financial inclusion, bitcoin, banking, big data, etc.; this indicates that the previous studies used focus on the topic of digital finance and fintech.

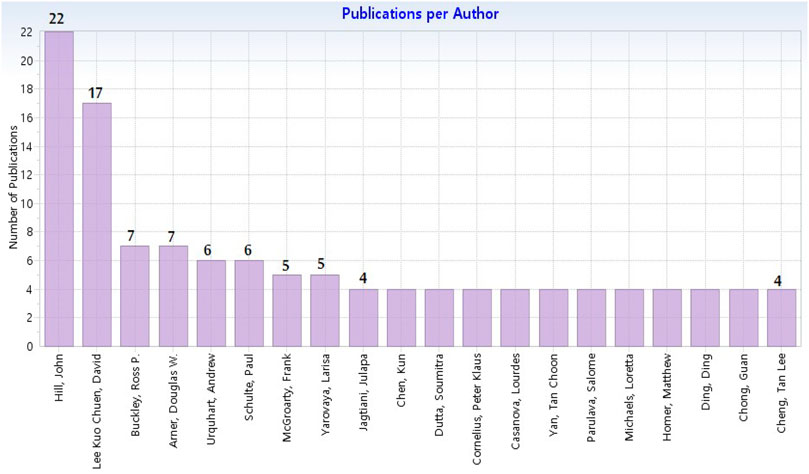

In the last 3 years, it appears that the most prominent researchers in the area of digital finance and fintech are John Hill and David Lee Kuo Chuen; any researcher should refer to these in this specialty Figure 3.

Bibliometric Analysis and Networks

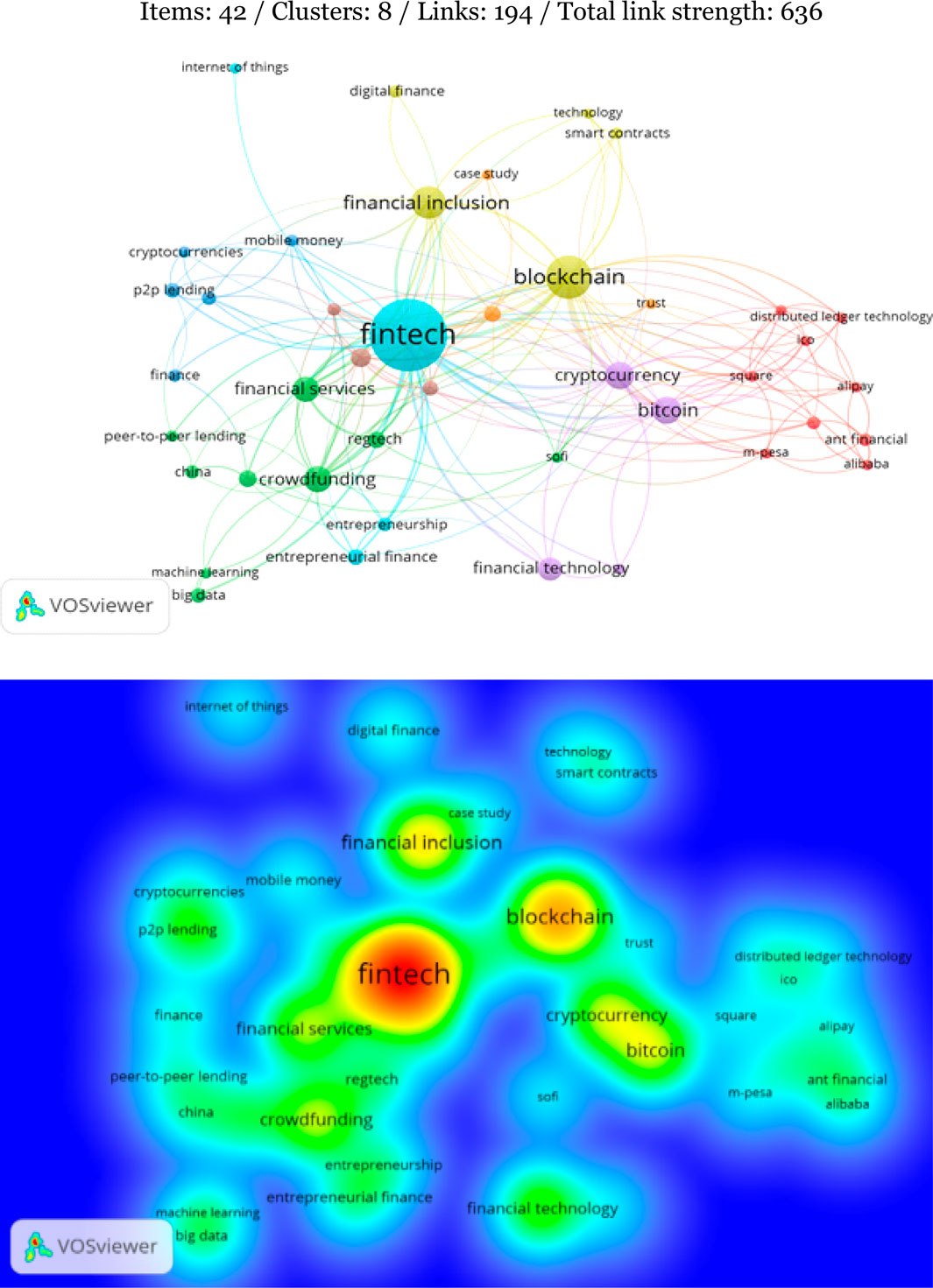

Items: 42 / Clusters: 8 / Links: 194 / Total link strength: 636.

It is noted from the Figure 4A,B that there are 8 clusters in the network that the researcher can take in the field of digital finance and FinTech as research thematic namely Fintech and its related clusters, financial inclusion and blockchain, cryptocurrency and bitcoin, financial services, entrepreneurial finance, P2P lending, distributed ledger technology, and trust.

The researcher should delve deeper into fintech, blockchain, financial inclusion, cryptocurrency, and bitcoin, as shown in the density and the following table in all these areas.

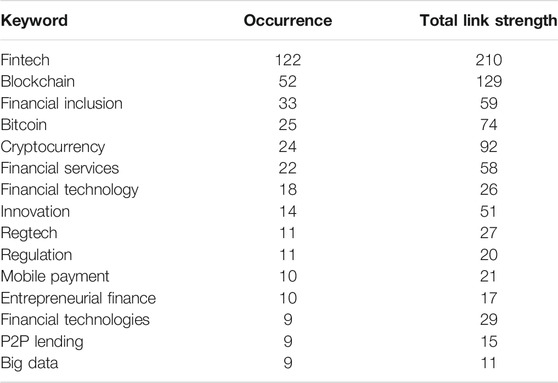

The most common terms used in previous studies were fintech, blockchain, financial inclusion, cryptocurrencies, financial services, and bitcoin. These should be concerned with the research and analysis of researchers in digital finance and FinTech. Now, we come to examine the most visible researchers in this field Table 2.

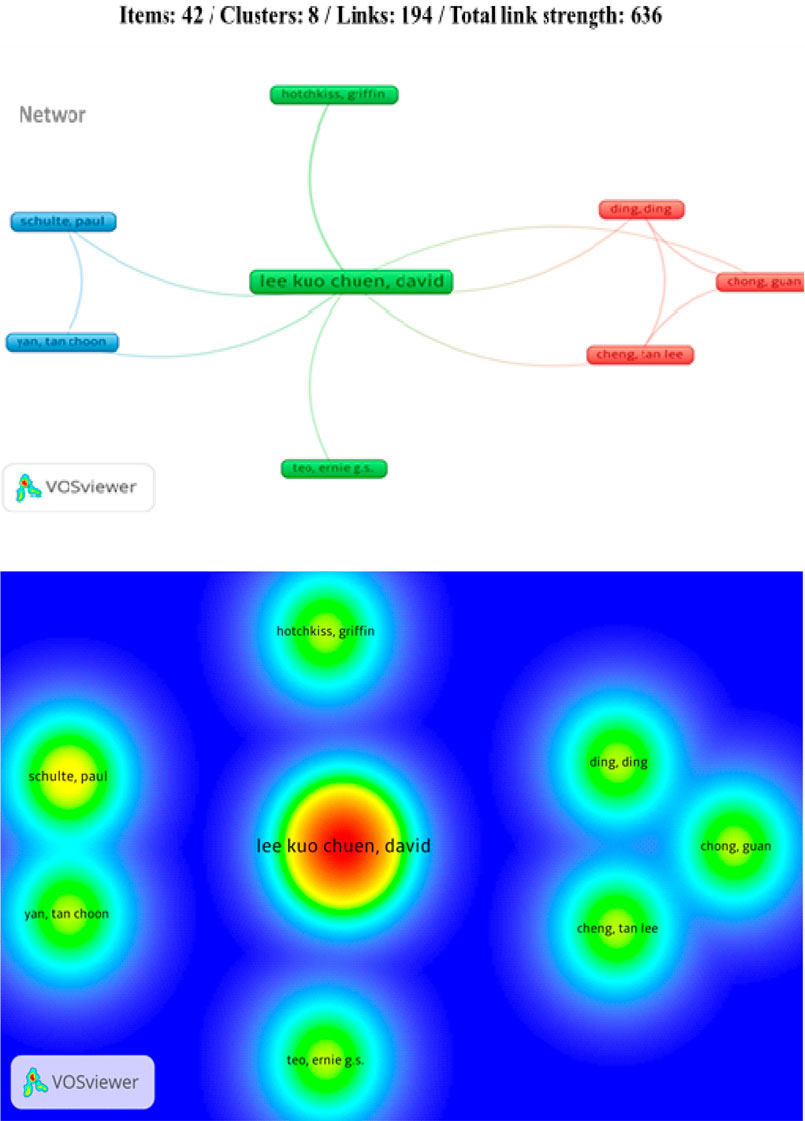

It appears in the Figures 5A,B that the primary researcher in the area of digital finance and FinTech to which all other researchers are related is David Lee Kuo Chuen, and this should return all researchers to his research because of its importance in the field which was similar to the following study: Chuen (2015), Chuen and Deng (2017), Nian and Chuen (2015), and Chuen et al. (2017).

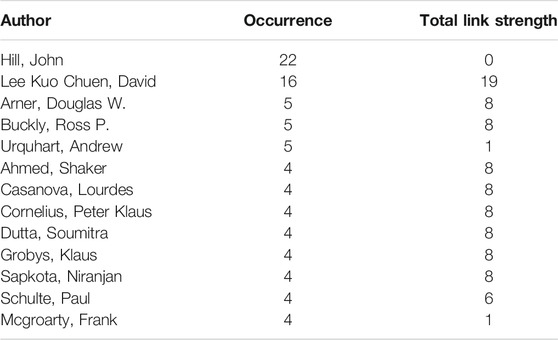

There too, John Hill’s research has not been widely used by other researchers, so we find that his name did not appear on the network and the density. The results of the following table show this.

The Table 3 results show that the most visible researcher in digital finance and FinTech is John Hill, especially his research (Hill, 2018). Still, his research is not used by other researchers who are more visible in this field. On this basis, we can say that the study of David Lee Kuo Chuen is more influential than the research of John Hill in this field; this does not negate the return to his research but must refer to it because of its great importance in this field.

Conclusion and Limitation

Conclusion

This article aims to explain digital finance and financial technology (Fintech), two distinct trends imposed in these areas. The second part of this article uses bolometric analysis with the ScienceDirect database to determine research progress in the field. This reveals that these superpowers are also driving research on the topic, with the most significant digital finance and financial technology publications, and FinTech is emerging on the market (Omarova, 2021). We highlighted specific aspects that need further discussion based on the bibliometric analyses of the research focused on implementing FinTech and digital finance and its application disciplines. The methodologies and new main study topics are all discussed in the published studies.

Bibliometric analyses are a well-established method of meta-analytical investigation (Paul and Criado, 2020) or so-called “meta-reviewed” of the literary world. Bibliometric analyses reveal key articles and explain critically if and within articles relate to any study subject or analyze how many other articles have been cited by one another. Finally, these analyses will assess the success of individual writers and their publications and their effect. The bibliometric citation analysis thus enables the meta-analytical evaluation of the history of a particular area or discipline and the identification of main strands and theoretical frameworks.

The analysis suggests a fundamental unit of study. It, therefore, goes farther than a single count of publications to cover impact centers and maps of relations between articles in a particular field of science (Kim and McMillan, 2008; McKiernan et al., 2019). The meta-analysis of quotations thus represents the utility of the literature in other similar researchers (Timulak, 2009). The bibliometric cycle review approach is an appropriate meta-analytic instrument for improving the three research objectives described previously. It provides insights into the research area of digital finance and the pattern of correlations in the Fintech industry.

This research will assist scholars and financial policymakers who are interested in digital finance in understanding the current state of Fintech needs and identifying trends in the corporate boardroom. It also supports the emerging acknowledgment that Fintech will play a critical element in the world endeavor to achieve digital financial trends, which is outlined in this research. Furthermore, digital finance and Fintech publications develop with the regularity, the multidisciplinary nature of digital finance, and the high-disciplinary individual’s inclusions. The high- or low-quality literature around digital finance is getting better, and individuals are involved.

The findings of this study can help the digital finance and Fintech industries develop policies and processes to enhance the emerging digital finance trends in the future. Financial and non-financial institutions can directly assess the financing process as strategic dimensions and policy makers’ vision.

Limitations of Research

This study has some methodological limitations, which may be addressed in future research. First, this research analyzed one database, ScienceDirect, which limited research in articles; other databases, such as Web of Science or Scopus, may be suggested in future bibliometric analyses. Second, it may envision future research from the source or topic of the publications, which may help develop a more comprehensive perspective on financial technology and digital finance.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author Contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The author extends his appreciation to the Deputyship for Research & Innovation, Ministry of Education in Saudi Arabia, to fund this research work through the project number UB-56-1442.

References

Abbas, J., Aman, J., Nurunnabi, M., and Bano, S. (2019b). The Impact of Social Media on Learning Behavior for Sustainable Education: Evidence of Students from Selected Universities in Pakistan. Sustainability 11 (6), 1683. doi:10.3390/su11061683

Abbas, J., Hussain, I., Hussain, S., Akram, S., Shaheen, I., and Niu, B. (2019a). The Impact of Knowledge Sharing and Innovation upon Sustainable Performance in Islamic Banks: A Mediation Analysis through an SEM Approach. Sustainability 11 (15), 4049. doi:10.3390/su11154049

Abbas, J., Mahmood, S., Ali, H., Raza, M., Ali, G., Aman, J., et al. (2019c). The Effects of Corporate Social Responsibility Practices and Environmental Factors through a Moderating Role of Social Media Marketing on Sustainable Performance of Firms' Operating in Multan, Pakistan. Sustainability 11 (12), 3434. doi:10.3390/su11123434

Abbas, J., Raza, S., Nurunnabi, M., Minai, M. S., and Bano, S. (2019d). The Impact of Entrepreneurial Business Networks on Firms' Performance through a Mediating Role of Dynamic Capabilities. Sustainability 11 (11), 3006. doi:10.3390/su11113006

Abbas, J., Zhang, Q., Hussain, I., Akram, S., Afaq, A., and Shad, M. A. (2020). Sustainable Innovation in Small Medium Enterprises: the Impact of Knowledge Management on Organizational Innovation through a Mediation Analysis by Using SEM Approach. Sustainability 12 (6), 2407. doi:10.3390/su12062407

Anjum, M. N., Xiuchun, B., Abbas, J., Shuguang, Z., and McMillan, D. (2017). Analyzing Predictors of Customer Satisfaction and Assessment of Retail Banking Problems in Pakistan. Cogent Business Manag. 4 (1), 1338842. doi:10.1080/23311975.2017.1338842

Arner, D. W., Barberis, J., and Buckley, R. P. (2015). The Evolution of Fintech: A New post-crisis Paradigm. Geo. J. Int'l L. 47, 1271. doi:10.2139/ssrn.2676553

Azizi, M. R., Atlasi, R., Ziapour, A., Abbas, J., and Naemi, R. (2021). Innovative Human Resource Management Strategies during the COVID-19 Pandemic: A Systematic Narrative Review Approach. Heliyon 7, e07233. doi:10.1016/j.heliyon.2021.e07233

Barras, R. (1990). Interactive Innovation in Financial and Business Services: The Vanguard of the Service Revolution. Res. Pol. 19 (3), 215–237. doi:10.1016/0048-7333(90)90037-7

Brandl, B., and Hornuf, L. (2020). Where Did FinTechs Come from, and where Do They Go? the Transformation of the Financial Industry in Germany after Digitalization. Front. Artif. Intell. 3, 8. doi:10.3389/frai.2020.00008

Chuen, D. L. K., and Deng, R. H. (2017). Handbook of Blockchain, Digital Finance, and Inclusion: Cryptocurrency, Fintech, Insurtech, Regulation, Chinatech, mobile Security, and Distributed Ledger. London, UK: Elsevier.

Chuen, D. L. K. (2015). Handbook of Digital Currency: Bitcoin, Innovation, Financial Instruments, and Big DataLondon, UK: Academic Press.

Fairthorne, R. A. (1969). Empirical Hyperbolic Distributions (Bradford‐Zipf‐Mandelbrot) for Bibliometric Description and Prediction. J. documentation 25 (4), 319–343. doi:10.1108/eb026481

Gill, A., Bunker, D., and Seltsikas, P. (2015). Moving Forward: Emerging Themes in Financial Services Technologies’ Adoption. Commun. Assoc. Inf. Syst. 36 (1), 12. doi:10.17705/1cais.03612

Gomber, P., Koch, J.-A., and Siering, M. (2017). Digital Finance and FinTech: Current Research and Future Research Directions. J. Bus Econ. 87 (5), 537–580. doi:10.1007/s11573-017-0852-x

Hood, W. W., and Wilson, C. S. (2001). The Literature of Bibliometrics, Scientometrics, and Informetrics. Scientometrics 52 (2), 291–314. doi:10.1023/a:1017919924342

Ikpaahindi, L. (1985). An Overview of Bibliometrics: its Measurements, Laws and Their Applications. Libri 35, 163.

Kanungo, R. P., and Gupta, S. (2021). Financial Inclusion through Digitalisation of Services for Well-Being. Technol. Forecast. Soc. Change 167, 120721. doi:10.1016/j.techfore.2021.120721

Karagiannaki, A., Vergados, G., and Fouskas, K. (2017). “The Impact of Digital Transformation in the Financial Services Industry: Insights From an Open Innovation Initiative in Fintech in Greece.,” in Mediterranean Conference on Information Proceedings 2. (MICS), Genoa, Italy. Available at: http://aisel.aisnet.org/mcis2017/2

Kim, J., and McMillan, S. J. (2008). Evaluation of Internet Advertising Research: A Bibliometric Analysis of Citations from Key Sources. J. Advertising 37 (1), 99–112. doi:10.2753/joa0091-3367370108

Kuo Chuen, D. L., Guo, L., and Wang, Y. (2017). Cryptocurrency: A New Investment Opportunity? Jai 20 (3), 16–40. doi:10.3905/jai.2018.20.3.016

Lai, K. P. (2020). “FinTech: The Dis/Re-Intermediation of Finance?,” in The Routledge Handbook of Financial Geography. London, UK: Routledge, 440–457. doi:10.4324/9781351119061-24

Lebni, J. Y., Toghroli, R., Abbas, J., NeJhaddadgar, N., Salahshoor, M. R., Mansourian, M., et al. (2020). January 1, 2020). A Study of Internet Addiction and its Effects on Mental Health: A Study Based on Iranian University Students [Original Article]. J. Educ. Health Promot. 9 (1), 205. doi:10.4103/jehp.jehp_148_20

Legner, C., Eymann, T., Hess, T., Matt, C., Böhmann, T., Drews, P., et al. (2017). Digitalization: Opportunity and challenge for the Business and Information Systems Engineering Community. Business Inf. Syst. Eng. 59 (4), 301–308. doi:10.1007/s12599-017-0484-2

Leong, K., and Sung, A. (2018). FinTech (Financial Technology): what Is it and How to Use Technologies to Create Business Value in Fintech Way? Int. J. Innovation, Manag. Techn. 9 (2), 74–78. doi:10.18178/ijimt.2018.9.2.791

Levy, Y., and Ellis, T. J. (2006). A Systems Approach to Conduct an Effective Literature Review in Support of Information Systems Research. Informing Science 9. doi:10.28945/479

Liu, F., Wang, D., Duan, K., and Mubeen, R. (2021). Social media Efficacy in Crisis Management: Effectiveness of Non-pharmaceutical Interventions to Manage the COVID-19 Challenges [Original Research]. Front. Psychiatry 12 (1099), 626134. doi:10.3389/fpsyt.2021.626134

Lobato, C. G., Cristino, T. M., Faria Neto, A., and Costa, A. F. B. (2021). Lean System: Analysis of Scientific Literature and Identification of Barriers for Implementation from a Bibliometric Study. Gestão & Produção 28 (1), 1–26. doi:10.1590/1806-9649.2020v28e4769

Lotka, A. J. (1926). The Frequency Distribution of Scientific Productivity. J. Wash. Acad. Sci. 16 (12), 317–323.

McKiernan, E. C., Schimanski, L. A., Nieves, C. M., Matthias, L., Niles, M. T., and Alperin, J. P. (2019). Meta-research: Use of the Journal Impact Factor in Academic Review, Promotion, and Tenure Evaluations. Elife 8, e47338. doi:10.7554/eLife.47338

Moed, H. F. (2006). Citation Analysis in Research Evaluation. Netherlands: Springer Science & Business Media.

Nian, L. P., and Chuen, D. L. K. (2015). “Introduction to Bitcoin,” in Handbook of Digital Currency (London, UK: Academic Press), 5–30. doi:10.1016/b978-0-12-802117-0.00001-1

Nicoletti, B., Nicoletti, W., and Weis, (2017). Future of FinTech. Basingstoke, UK: Palgrave Macmillan.

Omarova, S. T. (2021). “Fintech and the Limits of Financial Regulation: A systemic perspective,” in Routledge Handbook of Financial Technology and Law. London, UK: Routledge44–61.

Osareh, F. (1996a). Bibliometrics, Citation Analysis and Co-Citation Analysis: A Review of Literature I. Libri 46 (3), 149–158. doi:10.1515/libr.1996.46.3.149

Osareh, F. (1996). Bibliometrics, Citation Anatysis and Co-Citation Analysis: A Review of Literature II. Ann. Phys. 46 (4), 217–225. doi:10.1515/libr.1996.46.4.217

Ozili, P. K. (2018). Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanbul Rev. 18 (4), 329–340. doi:10.1016/j.bir.2017.12.003

Paul, J., and Criado, A. R. (2020). The Art of Writing Literature Review: What Do We Know and what Do We Need to Know? Int. Business Rev. 29 (4), 101717. doi:10.1016/j.ibusrev.2020.101717

Prinsen, C. A., Mokkink, L. B., Bouter, L. M., Alonso, J., Patrick, D. L., De Vet, H. C., et al. (2018). COSMIN Guideline for Systematic Reviews of Patient-Reported Outcome Measures. Qual. Life Res. 27 (5), 1147–1157. doi:10.1007/s11136-018-1798-3

Puschmann, T. (2017). Fintech. Business Inf. Syst. Eng. 59 (1), 69–76. doi:10.1007/s12599-017-0464-6

Su, Z., McDonnell, D., Cheshmehzangi, A., Li, X., and Cai, Y. (2021a). The Promise and Perils of Unit 731 Data to advance COVID-19 Research. BMJ Glob. Health 6 (5), e004772. doi:10.1136/bmjgh-2020-004772

Su, Z., McDonnell, D., Wen, J., Kozak, M., Šegalo, S., Xiang, L., et al. (2021b). Mental Health Consequences of COVID-19 media Coverage: the Need for Effective Crisis Communication Practices. Globalization and Health 17 (1), 4. doi:10.1186/s12992-020-00654-4

Suprun, A., Petrishina, T., and Vasylchuk, I. (2020). “Competition and Cooperation between Fintech Companies and Traditional Financial Institutions,” in E3S Web of Conferences, Ukraine, April 22, 2000. Available at: https://doi.org/10.1051/e3sconf/202016613028. doi:10.1051/e3sconf/202016613028

Teece, D. J. (2010). Business Models, Business Strategy and Innovation. Long range Plann. 43 (2-3), 172–194. doi:10.1016/j.lrp.2009.07.003

Timulak, L. (2009). Meta-analysis of Qualitative Studies: A Tool for Reviewing Qualitative Research Findings in Psychotherapy. Psychotherapy Res. 19 (4-5), 591–600. doi:10.1080/10503300802477989

van Oorschot, J. A., Hofman, E., and Halman, J. I. (2018). A Bibliometric Review of the Innovation Adoption Literature. Technol. Forecast. Soc. Change 134, 1–21. doi:10.1016/j.techfore.2018.04.032

Varga, D. (2017). Fintech, the new era of Financial Services. Vezetéstudomįny-Budapest Manag. Rev. 48 (11), 22–32. doi:10.14267/veztud.2017.11.03

Vatananan-Thesenvitz, R., Schaller, A. A., and Shannon, R. (2019). A Bibliometric Review of the Knowledge Base for Innovation in Sustainable Development. Sustainability 11 (20), 5783. doi:10.3390/su11205783

Vučinić, M. (2020). Fintech and Financial Stability Potential Influence of FinTech on Financial Stability, Risks and Benefits. J. Cent. Banking Theor. Pract. 9 (2), 43–66. doi:10.2478/jcbtp-2020-0013

Wang, C., Wang, D., Abbas, J., Duan, K., and Mubeen, R. (2021). 2021-September-03)Global Financial Crisis, Smart Lockdown Strategies, and the COVID-19 Spillover Impacts: A Global Perspective Implications from Southeast Asia [Original Research]. Front. Psychiatry 12 (1099), 643783. doi:10.3389/fpsyt.2021.643783

Zhang, J., Jiang, L., Liu, Z., Li, Y., Liu, K., Fang, R., et al. (2021). A Bibliometric and Visual Analysis of Indoor Occupation Environmental Health Risks: Development, Hotspots and Trend Directions. J. Clean. Prod. 300, 126824. doi:10.1016/j.jclepro.2021.126824

Keywords: digital finance, fintech, bibliometric analysis, ScienceDirect database, e-finance

Citation: Brika SKM (2022) A Bibliometric Analysis of Fintech Trends and Digital Finance. Front. Environ. Sci. 9:796495. doi: 10.3389/fenvs.2021.796495

Received: 16 October 2021; Accepted: 14 December 2021;

Published: 10 January 2022.

Edited by:

Lucian-Ionel Cioca, Lucian Blaga University of Sibiu, RomaniaReviewed by:

J. Abbas, Shanghai Jiao Tong University, ChinaLuigi Aldieri, University of Salerno, Italy

Copyright © 2022 Brika. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Said Khalfa Mokhtar Brika, c2JyaWthQHViLmVkdS5zYQ==

Said Khalfa Mokhtar Brika

Said Khalfa Mokhtar Brika