- 1School of Management and Engineering, Nanjing University, Nanjing, China

- 2School of Management, Harbin Normal University, Harbin, China

- 3School of Public Policy and Administration, Chongqing University, Chongqing, China

Green innovation has become a critical measure to address the sustainable development challenges of manufacturing industries, and research has largely neglected the important role of managers as decision-makers within firms. Using a sample of China’s listed manufacturing firms from 2009 to 2019, this study explores the impact of market competition and financialization on corporate green innovation and examines the moderating effect of market competition. The main findings are as follows. First, intense market competition may inhibit corporate green innovation in the context of the Chinese market. Second, managers are willing to sacrifice firms’ long-term interests in exchange for profits in the short run. Third, market competition alleviates the negative association between financialization and corporate green innovation, indicating that the interactions between manufacturing firms may alter managers’ preferences for financial investment. In addition, our study explores heterogeneous impacts of market competition and financialization on corporate green innovation, and the empirical results are consistent with our findings in most cases. Our findings provide support for rational resource allocation in green innovation and can be used to guide manufacturing firms to achieve their goals of sustainable development.

Introduction

The manufacturing industry is a fundamental driving force behind the creation of social wealth, and its development has significant impacts on economic and social well-being. According to a report published by the United Nations Industrial Development Organization (UNIDO) in 2020, high human development index scores are obtained by industrialized countries with high manufacturing value-added per capita (UNIDO, 2020). Human development index values can be used to cluster countries corresponding to industrial development: the countries with higher human development index values belong to the group of industrialized economies whereas lower human development value index values are commonly found in less developed countries, such as some African countries. Therefore, the development of the manufacturing industry plays an important role in promoting social progress, especially in developing countries. However, the development of the manufacturing industry increases the burden on the environment and constrains sustained economic development. With low energy efficiency, manufacturing firms consume a large amount of energy, which makes it one of the largest emitters of greenhouse gas emissions. The Intergovernmental Panel on Climate Change (IPCC) points out that in 2010, the greenhouse gas emissions of manufacturing industries accounted for more than 30% of the world’s total, much more than those of other industries (IPCC, 2014). In addition, manufacturing firms discharge air pollutants, such as PM2.5, during production processes, which causes great harm to public health (Fang et al., 2020).

To properly deal with the contradiction between environmental and economic benefits, managers have increasingly focused on corporate green innovation. Also known as eco-innovation and environmental innovation, green innovation has attracted extensive attention from both academia and industry in recent years. Among existing studies, the definition from OECD (2009) is most representative. It considers green innovation as resulting from a reduction of environmental impacts, regardless of whether the effect is intended, and points out the focal areas of green innovation, including marketing methods, organizations, and institutions. Referring to definitions from other studies (Schiederig et al., 2012; Castellacci and Lie, 2017; El-Kassar and Singh, 2019), two major distinctions of green innovation can be identified: one focusing on its purpose of reducing negative environmental impacts, and the other being its scope, which may go beyond the conventional organizational boundaries of an innovating organization and involve broader social arrangements that trigger changes in existing socio-cultural norms and institutional structures. Based on these notions, numerous studies have demonstrated the positive impact of green innovation on a firm’s development. They indicate that firms can obtain good reputations, build a green image, meet the needs of stakeholders, and achieve long-term business performance by conducting green innovation activities (Hur et al., 2013; Xie et al., 2019). While some studies have emphasized the benefits of green innovation, others have focused on its barriers and challenges. They demonstrate that financial barriers have a more negative impact on green innovation than traditional innovation, as green innovation is characterized by high technical risk and a long payback period (Ghisetti et al., 2017). Firms’ innovation experience is identified as a green innovation barrier, followed by low willingness to pay, high development costs, high commercial uncertainty, and a lack of a favorable political framework (Stucki, 2019). In addition, some studies have explored the motivations and drivers and found that regulatory and customer pressure are the main factors in promoting green innovation (Huang et al., 2016; Ullah et al., 2021), while other factors, such as technological capabilities, customer green demand, and environmental organization capabilities are also important (Cai and Li, 2018).

The majority of the studies on green innovation drivers focus on drivers at the institutional and market levels while overlooking the role of managers as decision-makers. Managerial decisions directly determine firms’ investment strategies, which have a significant influence on the development of firms’ green innovation activities. Managerial decision-making is subject to both external and internal governance mechanisms. As an external governance mechanism, market competition affects managerial decision-making on corporate green innovation through interactions with the firms’ internal governance mechanisms. On the one hand, market competition restrains managers’ short-sighted behavior through the external governance effect and the innovation incentive effect, thereby promoting investment in corporate green innovation. On the other hand, intense market competition reduces firms’ market share, raises the costs of production factors, increases firms’ marketing costs, and further erodes the profitability of manufacturing firms, which ultimately inhibits managers’ motivation to invest in innovation activities.

In terms of the internal governance mechanisms, conflicts of interest between managers and shareholders are inevitable in the light of agent theory. Considering its risk of failure and long return cycle on investment in the light of the environmental externalities, managers have less motivation to invest in corporate green innovation (Lee and Kim, 2011; Abdullah et al., 2016), and tend to make short-sighted operational decisions that align with their interests. Limited resources are then invested in financial assets with the potential to only increase short-term economic gains, especially in the context of lower returns on investments in the real economy compared to that of financial assets. Therefore, the agency-based problems between managers and shareholders could significantly affect the decision-making related to resource allocation, which, ultimately, can impact corporate green innovation.

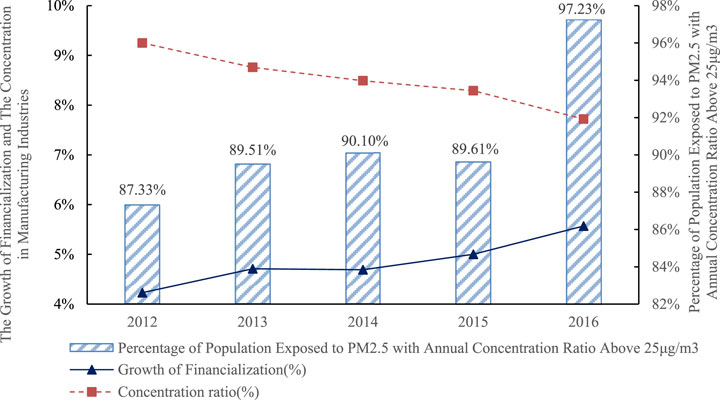

In recent years, with the rapid development of China’s manufacturing industries, severe environmental problems have attracted extensive attention from all sectors of society. According to the 2018 China Statistical Yearbook, the manufacturing industry contributes 27.84% to gross domestic product (GDP), while accounting for 61.88% of total energy consumption, making it the largest emitter of greenhouse gas emissions in China (Jin and Han, 2021). The World Bank also points out that nearly 70% of China’s environmental pollution and 72% of greenhouse gas emissions can be attributed to the manufacturing industry (Li and Zheng, 2017). China does not want to sacrifice environmental protection to promote economic growth, which erodes the profitability of the real economy, especially in manufacturing firms. In this context, managers in manufacturing industries seek approaches for improving firms’ profitability and pay more attention to the excess profits in the finance and real estate sectors. As a result, they increase investment in financial assets in exchange for higher returns, which further aggravates the financialization of manufacturing firms. As shown in Figure 1, it is noteworthy that the emission of air pollutants increases with the competition of China’s manufacturing industries. Moreover, the change of financialization in manufacturing industries is consistent with the proportion of the population exposed to PM2.5, reflecting that the financialization of manufacturing firms may crowd out investment in green innovation, thus resulting in negative impacts on the environment.

Using a sample of China’s listed manufacturing firms from 2009 to 2019, this study explores the impact of market competition and financialization on corporate green innovation. The main contributions of this study are as follows. First, our findings examine the effectiveness of Schumpeter’s innovation theory in the fields of green innovation, suggesting that intense market competition may inhibit corporate green innovation in the context of the Chinese market. Second, our findings explain why manufacturing firms are distracted from their intended purpose in the context of the agent theory, revealing that the managers’ decision preferences on financialization can significantly undermine firms’ sustainable development abilities. Third, our findings demonstrate the role of market competition in altering managers’ preferences for financial investment, implying an interactive mechanism between external and internal governance mechanisms.

This paper is structured as follows: Hypotheses Development provides the literature review and proposes the research hypotheses. Research Design describes the research design. Empirical Results presents the empirical results. Discussion discusses the findings from the empirical results. Conclusions and Policy Recommendations provides the conclusions and recommendations.

Hypotheses Development

Market Competition and Corporate Green Innovation

As an external impact on managers’ decision-making, market competition is likely to have a far-reaching impact on corporate innovation activities. Studies on how market competition influences corporate innovation can be classified into two broad categories: those claiming that a competitive environment is unfavorable for corporate innovation and those proposing that market competition motivates managers to pay more attention to corporate innovation. Among the studies that support the positive role of market competition on corporate innovation, Arrow (1962) is representative. Arrow (1962) considered that corporate innovation is conducive for firms to reduce production costs and earn innovation profits under competitive environments, which motivates managers to conduct corporate innovation activities. In a monopoly market, monopoly profits minimize the motivation to develop corporate innovation, and thus monopolies become content with the status quo. By studying nearly 4,000 enterprises in 24 transitional countries, Carlin et al. (2004) found that firms’ production efficiency and innovative capabilities are enhanced under a competitive environment, which supports the perspective of Arrow (1962). By contrast, Schumpeter (1942) pointed out the negative impacts of market competition on corporate innovation. Schumpeter considered corporate innovation as an endogenous product in the production process, and substantial investment is required to conduct corporate innovation activities. Hence, a strong market position is a necessary guarantee for firms to develop corporate innovation, indicating that large firms have more innovative capabilities. In addition, Schumpeter considered that large firms could achieve monopoly profits, which could make up for the corporate innovation investments and fund more corporate innovation projects. Therefore, a monopoly market is conducive for corporate innovation. Moreover, Schumpeter (1942) suggested that innovators only enjoy temporary monopoly rent, as their technological advantages over new entrants decrease over time and their innovations are finally replaced by rivals’ innovations due to technology spillover. This effect is intensified by fierce market competition, which further shortens the period in which innovators maintain a competitive advantage over their followers (Chen and Liu, 2019). Specifically, intense market competition decreases both innovators’ profits and patent price, thus abating innovators’ motivation to incorporate corporate innovation activities (Nie et al., 2021).

Schumpeter’s findings are supported by other studies. In terms of free competition theory, competition decreases the rents of the monopolist and reduces its market share, resulting in declining profits in the long run. Under such circumstances, firms will have fewer resources, especially fewer financial resources, to invest in corporate innovation, and are likely to encounter difficulties when trying to recover potential investment in new technologies (Felisberto, 2013). From another perspective, large firms tend to produce innovations than small firms for the potential higher valuation they would get in the stock market, which explains the fact that more and higher quality innovations are produced by leading firms in the British market (Blundell et al., 1999). Similar findings are also observed in the Australian market, where a positive correlation between innovation expenditure and excess stock returns is found within large firms operating in concentrated industries, suggesting the positive role of the monopoly market in stimulating corporate innovation (Gallagher et al., 2015). When it comes to green innovation, existing studies provide support to Schumpeter’s findings as well. For instance, a study shows that the positive correlation between CEO foreign experience and corporate green innovation is more pronounced in less competitive markets (Quan et al., 2021). Intense market competition aggravates the negative relationship between labor costs and corporate green innovation, indicating the negative role that intense market competition brings (Gong et al., 2020).

Because of environmental externalities, innovators take a long time to integrate the environmental and conventional attributes of corporate green innovation, and they turn environmental attributes into competitive advantages through the continuous accumulation and improvement of technology (Shang et al., 2021). Throughout integration, technology spillover can reduce innovators’ expected payoff from corporate green innovations, which is further reduced as market competition increases. Therefore, this study proposes the following hypothesis:

H1: Market competition inhibits corporate green innovation.

Financialization and Corporate Green Innovation

At the macro level, financialization refers to both the increasing ratio of financial profits to total profits in non-financial sectors and the increasing ratio of the value-added in the financial industry to GDP (Luo and Zhu, 2014). As financialization of macroeconomics is transmitted at the enterprise level, studies have shown that more non-financial firms are becoming involved in financial investments, and a growing share of their income originates from financial markets, which increases their financial burden (González and Sala, 2014). This phenomenon has brought widespread concern. Existing studies mainly focus on the causes of financialization, from different aspects. From the perspective of corporate governance, Davis and Kim (2015) believed that the orientation toward shareholder value is an important factor for financialization, and they mentioned that the business philosophy of “maximizing shareholder value” (MSV) is a non-negligible factor for the financialization of non-financial firms in the United States. Plys (2014) considered the decline in the rate of profit in real industries as a direct reason for the financialization of non-financial firms, pointing out that non-financial firms tend to increase holdings of cash assets as profit rates decline, thus leading to financialization. Xu and Xuan (2021) pointed out that a firm’s level of income from its core business activities directly determines its financial investment behavior. Specifically, in the context of an unfavorable operating environment, it is difficult for firms to obtain satisfactory investment returns through their core business activities. Therefore, they are inclined to invest in the financial industry, which typically offers high returns in the short term.

Given the importance of firms’ innovation capabilities, researchers have explored the relationship between financialization and corporate innovation. Gehringer (2013) considered financialization as being conducive to corporate innovation, pointing out that it could improve the liquidity of assets and realize their preservation to provide further financial support for corporate innovation in the future. Ding et al. (2021) supported that financialization strengthens firms’ capacities to cope with liquidity risk and financial constraints, as financial assets are characterized by strong liquidity and broad market trading. Therefore, firms will have sufficient economic resources to conduct corporate innovation activities by making a financial investment. Other studies have shown that financialization in business performance improvement can enhance firms’ credit ratings, thus strengthening their external financing abilities, enabling them to obtain the funds required for corporate innovation activities. By contrast, most existing studies point out the negative role of financialization on corporate innovation, emphasizing the crowding-out effect of financialization. Tori and Onaran (2018) studied the financial data for non-financial-listed enterprises in the UK from 1985 to 2013 and found that financialization crowds out firms’ investment in the real economy, which is represented by the decline in firms’ investments in fixed assets. Huang et al. (2021) pointed out that the purpose of enterprise financialization is to pursue profit maximization when the rate of return of financial asset investment is higher than that of real economic investment. Hence, enterprises tend to pay more attention to the benefits brought by financial assets in the process of asset allocation, thus reducing capital investment in R&D activities, such as for green innovation. Huang et al. (2021) studied the heterogeneous impact of financialization on corporate green innovation. Empirical results showed that financialization in both state-owned enterprises (SOEs) and private enterprises inhibit corporate green innovation, with the inhibitory effect being more pronounced in private enterprises. Financialization in enterprises inhibits corporate green innovation, with the inhibitory effect being more pronounced in high-polluting enterprises. Financialization in enterprises with low financial constraints inhibits corporate green innovation, whereas the impact of financialization in enterprises with high financial constraints on corporate green innovation is not significant. All these empirical findings support the crowd-out effect of financialization, indicating its negative impact on corporate green innovation.

As decision-makers of a firm, managers determine the business strategy and investment decisions. Therefore, the value orientation of managers directly determines firms’ green innovation strategy. However, in the context of the agent theory, managers are willing to increase financial investments to enhance a firm’s short-term performance on behalf of their interests in the context of low return on investment in the real economy, thus crowding out investment in corporate green innovation. In addition, considering the long return cycle of corporate green innovation and the potential risks at the development and implementation stages, managers are more likely to ignore the environmental benefits brought by green innovation and reject green innovation projects that bring positive benefits over the long run, which contradicts shareholders’ interests in the long run. Therefore, this study proposes the following hypothesis:

H2: Financialization inhibits corporate green innovation.

Market Competition and Financialization

As an important external governance mechanism, market competition effectively conveys information about firms’ business performance, alleviates the agency problem within the firm, and affects managers’ preference for investment. According to the free cash flow hypothesis, managers are motivated to enlarge the enterprise scale to control more resources (Jensen, 1986). Affected by short-sighted value orientation, managers do not abide by the optimal investment rule, pay less attention to projects that could create sustainable value over the long run, and pursue short-term benefits for their interests. This is shown by their efforts to enhance short-term profits at the expense of long-term value (Bebchuk and Stole, 1993). However, intense market competition alleviates the information asymmetry between shareholders and managers. Shareholders can comprehensively grasp the operation status of the firm and evaluate the value of long-term investment, which restrains the over-investment behavior of managers. Existing studies also show that the over-investment behavior of managers is inhibited and efficiency of investment is improved under a competitive market (Laksmana and Yang, 2015). Moreover, market competition could mitigate the agency problem through the business stealing effect. Under intense market competition, the business stealing effect is amplified, eliciting higher agent effort to improve management quality.

Overall, intense market competition alleviates the agency problem within a firm and inhibits managers’ short-sighted behavior. Therefore, this study proposes the following hypothesis:

H3: Market competition alleviates the negative correlation between financialization and green innovation.

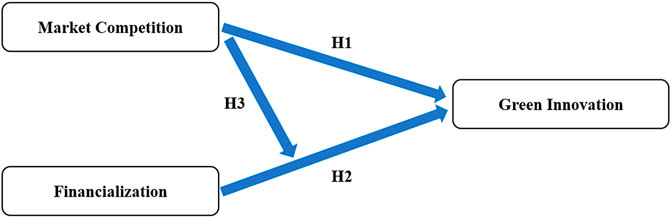

The framework of theoretical research in this study is presented in Figure 2.

Research Design

Models

To test the hypotheses proposed in Hypotheses Development, this study uses panel data models to analyze the association among market competition, financialization, and corporate green innovation. Considering the influence of potential endogeneity, independent variables and control variables lag 1 year and the dependent variable is in its current value. The empirical models also control the year- and industry-fixed effects. The basic empirical models are as follows:

In Eqs 1–3,

The relationship between financialization and corporate green innovation may be affected by market competition, indicating that market competition may have a moderating role in this relationship. Therefore, this study introduces the interaction term of market competition and financialization (

Variables

Dependent Variables

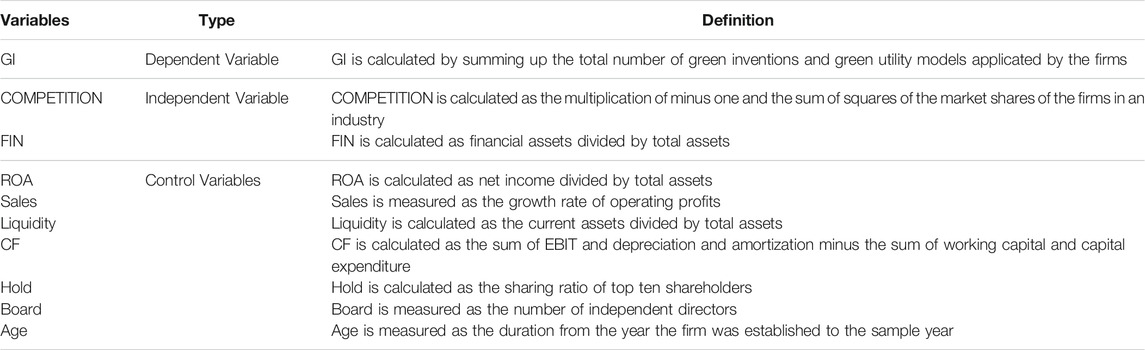

Corporate green innovation (GI) represents the green innovation capability of non-financial firms. Due to the difficulties in evaluating and quantifying corporate innovation, researchers consider the number of patent applications as an important indicator of corporate innovation (Lindman and Söderholm, 2016). Referring to the definition of a patent in the law of the People’s Republic of China, this study measures corporate green innovation by summing the total number of green inventions and green utility models applied by the firms.

Independent Variables

Market competition (Competition) represents a business environment, in which different firms compete with one another solely on the merits of their goods and services. As an external mechanism for disciplining managers, market competition can affect managers’ decision-making around green innovation. Widely used indicators of market competition in the existing literature include the Herfindahl Index (HHI) and the Concentration Ratio (CR), with the former calculated as the sum of squares of the market shares of the firms in an industry which ranges from near 0 to 1.0; the latter is calculated as the sum of the market share percentage held by the largest specified number of firms in an industry. Because the Herfindahl Index takes into account the distribution of firms with different sizes in the industry, it can more accurately reflect market competition compared to the Concentration Ratio (Pavic et al., 2016). Therefore, this study selects the Herfindahl Index as a measure of market competition. Referring to Dhaliwal et al. (2014), this study builds a new variable (Competition) for ease of illustration:

The closer the variable is to -1, the less competitive the market is; the closer the variable is to 0, the more intense the market competition becomes.

Financialization (FIN) represents the proportion of firms’ investments in financial assets, which can produce more operating profits from the financial and real estate industries. In terms of the asset structure, firms’ assets can be categorized as operating assets and financial assets. Referring to Demir (2009), this study measures the financialization of manufacturing firms using the ratio of financial assets to total assets. Based on Chinese Accounting Standards, financial assets include derivative financial instruments, trading financial assets, net financial assets available for sale, net long-term investments on bonds, net hold-to-maturity investments, net short-term investments, disbursement of loans and advances, long-term financial equity investments, net investment properties, and entrusted investments and trust products in other liquid assets.

Control Variables

Following previous studies, this study selects control variables from corporate finance, corporate governance, and corporate characteristics, all of which can affect corporate innovation. We include return on assets (ROA) to control for the role of internal resources in financing innovation (Amore et al., 2013); the amount of sales revenue (Sales) to control for the firm size, as large companies have more complex activities (Kanakriyah, 2021); the number of liquid assets (Liquidity) to control for firm’s risk-taking behaviors, as firms with stable earnings streams can afford to take risks (Chun and Lee, 2017); free cash flow (CF) to control for firm’s over-investment behavior, as over-investment increases with firm’s internally-generated cash flow (Jiang, 2016); the shareholding ratio of top ten shareholders (Hold) to control for control rights of the major shareholders (Lin and Luan, 2020); board size (Board) to control for the supervisory effectiveness of the independent board (Zhuang et al., 2018); and the firm age (Age), as older firms tend to have fewer incentives to innovate (Lin et al., 2011). Table 1 provides definitions of all variables used in the empirical analysis.

Data Sources

Using the sample of China’s A-share listed firms on the Shenzhen Stock Exchange and the Shanghai Stock Exchange from 2009 to 2019, this study examines the impact of market competition and financialization on corporate green innovation in the manufacturing industry. There are two reasons for selecting manufacturing firms as samples. First, manufacturing firms usually face problems with pollution control. With increasing emphasis placed on environmental protection by regulatory authorities, manufacturing firms have a strong motivation for green development. Second, the financialization of non-financial firms has been a popular topic, and manufacturing firms account for the majority of non-financial firms. This study uses 2009 as the first year of the sample period because the Ministry of Ecology and Environment of the People’s Republic of China published the “National Environmental Protection Technology Evaluation and Management Measures” in 2009 to promote the progress of environmental protection technology, improve the investment benefits of environmental protection, standardize the evaluation of environmental protection technology, and provide guidance for the development of the green innovation activities of enterprises. This study uses 2019 as the last year of the sample period because the pandemic in 2020 had a profound impact on the real economy, changing the modes of production and operations of manufacturing firms to a great extent. Therefore, this study sets 2019 as the end year of the sample period to avoid the “noise” of the economic shock.

The main data sources of this study are the Chinese Research Data Services Platform database and the China Stock Market and Accounting Research (CSMAR) database. The green innovation data are derived from the Chinese Research Data Services Platform database, and both the data for market competition and financialization are derived from the financial statement database of the CSMAR database. For control variables, the data on corporate finance and governance are derived from the CSMAR database. All continuous variables are winsorized at 1% at both tails, which can minimize the influence of extreme values in the empirical analysis.

Empirical Results

Descriptive Statistical Analysis

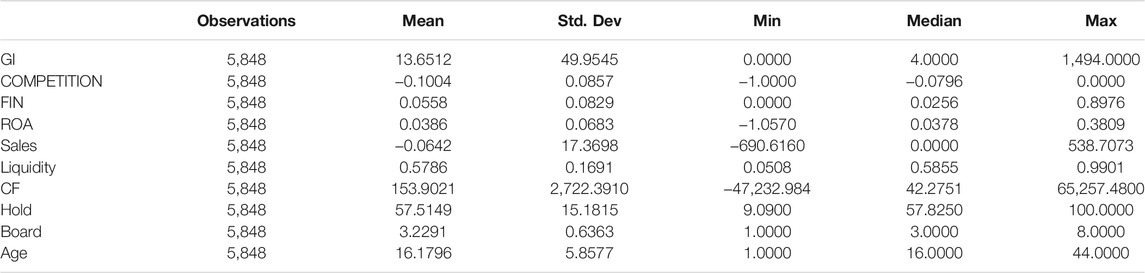

Table 2 presents the descriptive statistics of all variables used in the empirical models. The mean and standard deviation of green innovation are 13.6512 and 49.9545, respectively, with a minimum value of 0 and a maximum value of 1,494, indicating the significant differences in the green innovation of manufacturing firms. The mean and standard deviation of market competition are −0.1004 and 0.0857, respectively, with a minimum value of −1.0 and a maximum value of 0, demonstrating the intense competition among manufacturing firms. For the financialization of manufacturing firms, the difference between the maximum (0.8976) and the median (0.0256) is large, indicating that more than half of manufacturing firms are overly reliant on financial assets. For the co-variates, the means of ROA and Sales are 0.0386 and -0.0642, respectively, indicating both the low profitability and weak growth of manufacturing firms. It is also noteworthy that the difference between the minimum and the maximum values of Sales is large, reflecting the divergence in the operating status of manufacturing firms. The mean and standard deviation of Liquidity are 0.5786 and 0.1691, respectively, which indicates that the distribution of current assets in high-polluting industries is balanced. For cash flow, the mean and median are 153.9021 and 42.2751, and the minimum value and the maximum value are −47,232.9840 and 65,257.4800, respectively, which demonstrates that most manufacturing firms have tight cash flows. Ownership concentration (Hold), board size (Board), and company age (Age) are in the normal ranges and require no further discussion.

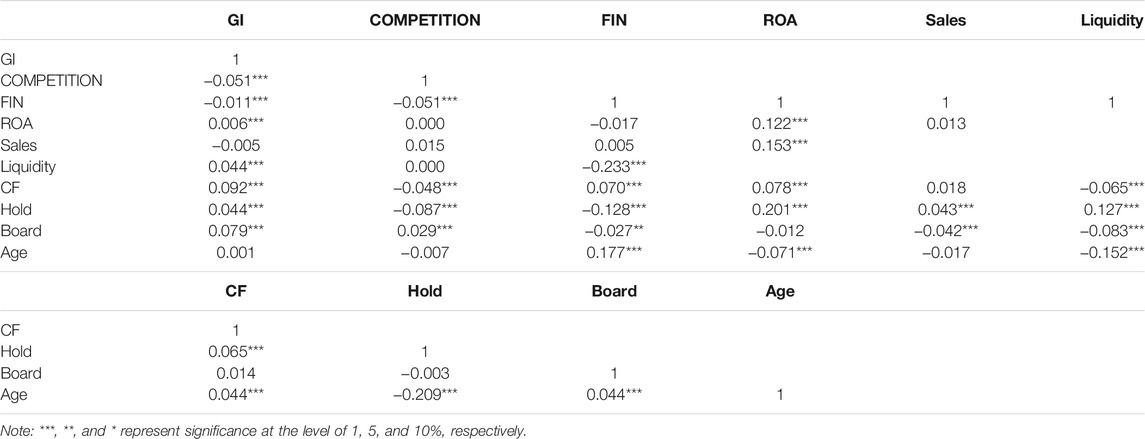

The results of the Pearson correlation matrix are reported in Table 3. The correlation coefficient between COMPETITION and GI is −0.051, significant at the 1% level, indicating that there is a negative association between market competition and corporate green innovation, and also indicating that intense market competition could inhibit corporate green innovation. The correlation coefficient between FIN and GI is −0.011, significant at the 1% level, showing that there is a negative association between financialization and corporate green innovation thus indicating that financialization of manufacturing firms could also inhibit corporate green innovation. The absolute correlation coefficients between all co-variates and innovation are <0.5, which indicates that independent variables and control variables can effectively describe corporate green innovation.

Baseline Model Regression Results

To explore the impact of market competition and financialization on corporate green innovation, this study uses empirical models based on Eqs 1–4 to test the hypotheses proposed in Hypotheses Development. Referring to Dechezleprêtre et al. (2013), this study uses negative binomial regression to estimate the coefficients of these models considering the distribution characteristics of green innovation data. First, univariate analysis is used to explore the impact of market competition or financialization on corporate innovation in manufacturing industries. Then, co-variates are introduced into the regression analysis. Finally, the interaction between market competition and financialization is examined. The baseline results of overall samples are reported in Table 4.

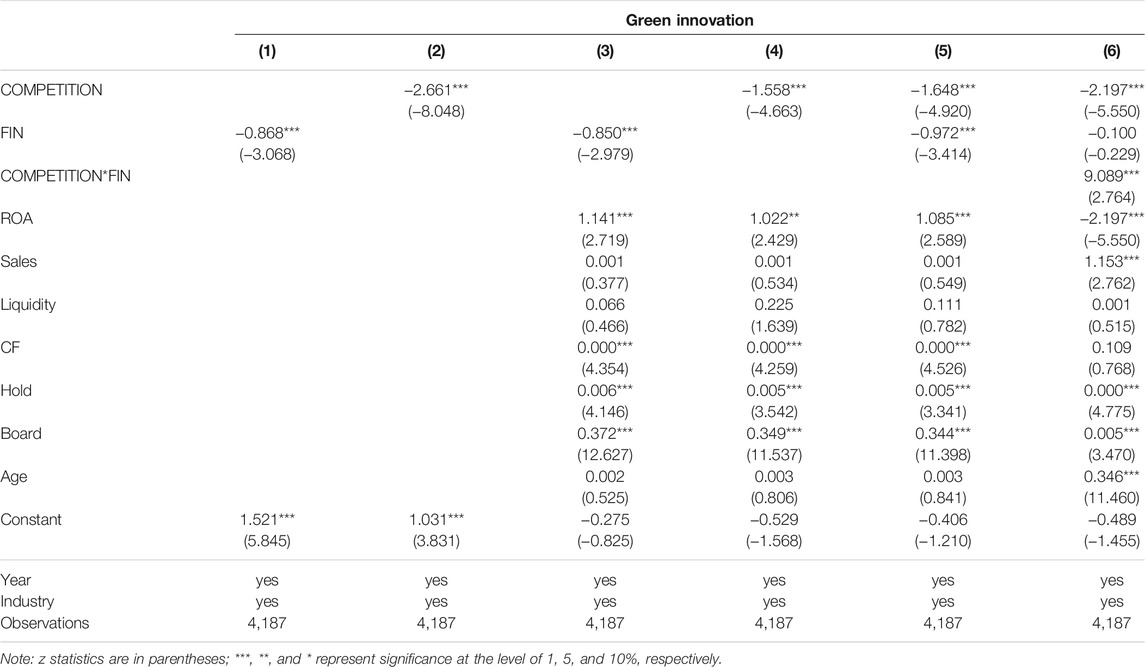

In Table 4, columns 1) and 2) show the impact of market competition and financialization, respectively, on corporate green innovation without considering the co-variates. The coefficients of market competition and financialization are -2.661 and -0.868, respectively, and significant at the 1% level. After introducing the co-variates, the results in columns 3) and 4) indicate that both market competition and financialization have a negative correlation with corporate green innovation. Results show that strong profitability, smooth cash flow, concentrated ownership structure, and a large number of independent directors have a positive correlation with corporate green innovation. Column 5) explores the impact of market competition and financialization on corporate green innovation, and the coefficients of market competition and financialization are -1.648 and-0.972, respectively, significant at the 1% level. The results in columns (1)–5) demonstrate that both market competition and financialization inhibit corporate green innovation. These results support H1 and H2 proposed in Hypotheses Development. The moderating effect of market competition is shown in column (6). The coefficient of the interaction term (COMPETITION*FIN) is 9.089, significant at the 1% level, indicating that market competition alleviates the negative correlation between financialization and green innovation, which supports H3. The findings suggest that financialization crowds out manufacturing firms’ investment in green innovation, while the interaction between firms alters managers’ preferences for financial investment, especially under intense market competition.

Heterogeneity Analysis

Ownership

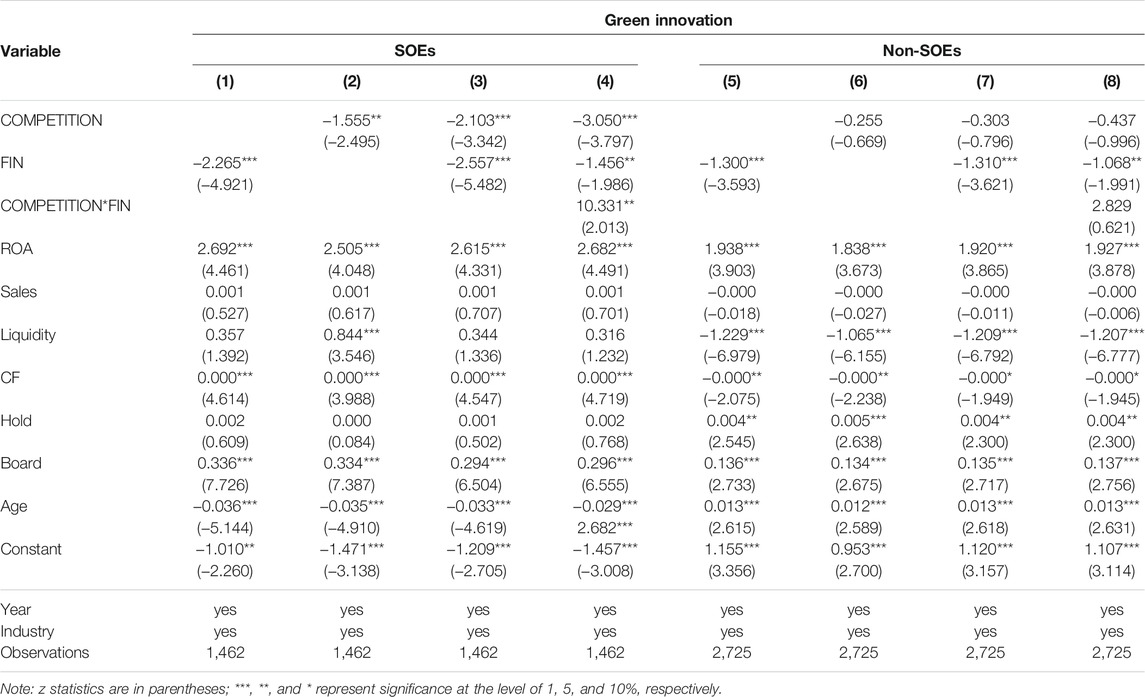

Firms with different property rights usually implement different investment strategies, which lead to different corporate innovation behaviors. According to Schumpeter’s theory, large firms usually have stronger market power than small and medium-sized firms, meaning they are more capable of conducting corporate innovation activities. In China, state-owned enterprises (SOEs) usually have a solid market position and advantages in assets and technology compared to non-SOEs, which strengthen their capabilities in carrying out corporate green innovation activities. In addition, SOEs have a close relationship with the government and usually have policy advantages, allowing them to obtain more public resources, including capital, land, and technology (Ruiqi et al., 2017). By contrast, non-SOEs are more vulnerable to market competition. Non-SOEs are at a disadvantage compared to SOEs in terms of scale, technology, and financing capabilities, meaning that they have to develop new technologies and products to find space for survival and opportunities for development. For this reason, this study divides the research samples into a subsample of SOEs and a subsample of non-SOEs (Table 5).

In Table 5, columns 1) and (2), respectively, show the impact of market competition and financialization on corporate green innovation in the subsample of SOEs. The coefficients of market competition and financialization are -1.555 and -2.265, respectively, significant at the 1% level, indicating that both market competition and financialization inhibit corporate green innovation for SOEs, which is further supported by the results shown in column (3). The results of column 4) indicate that market competition weakens the negative correlation between financialization and green innovation in the subsample of SOEs. Columns 5) and (6), respectively, show the impact of market competition and financialization on corporate green innovation in the subsample of non-SOEs. The coefficient of financialization is -1.300 and is significant at the 1% level, suggesting that the financialization of non-SOEs inhibits corporate green innovation. However, the impact of market competition on corporate green innovation is not significant, which could be explained by the fact that managers of non-SOEs can formulate green innovation strategies under an intensely competitive environment. The results in column 8) show that the moderating effect of market competition is not significant in the subsample of non-SOEs. According to the empirical results in Table 5, financialization limits corporate green innovation for both SOEs and non-SOEs. Market competition has an inhibitory effect on corporate green innovation in the subsample of SOEs while weakening the negative correlation between financialization and green innovation.

Financial Constraints

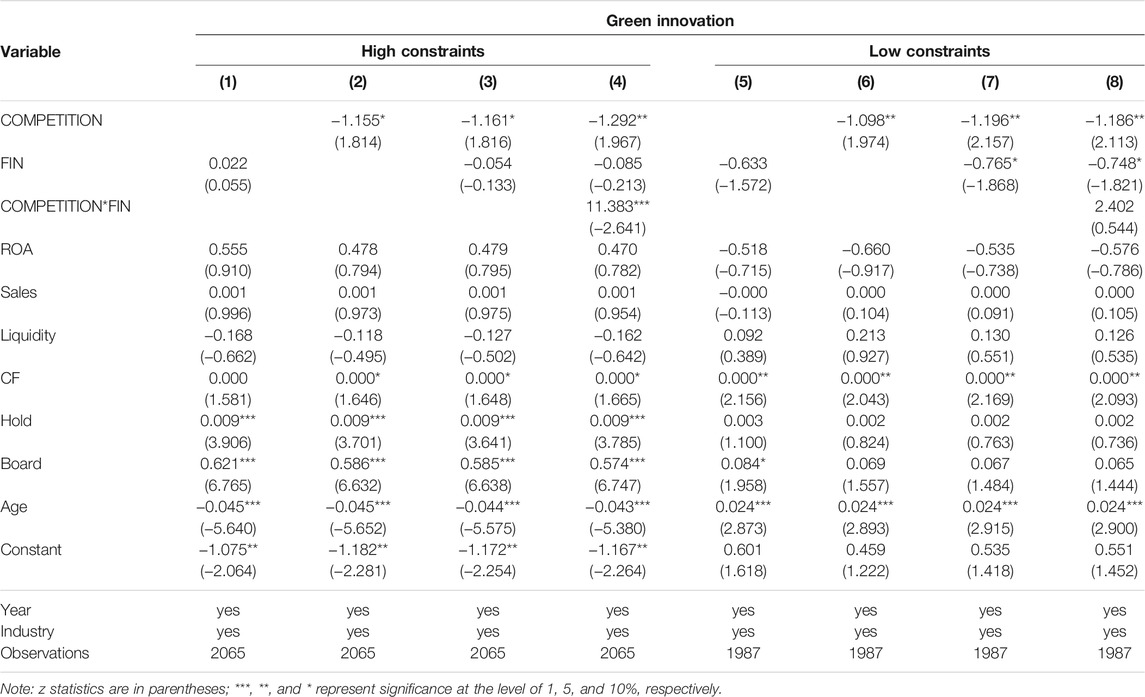

China’s financial system is a bank-oriented system that requires commercial banks to allocate financial resources through indirect financing, leaving limited external financing channels for enterprises, especially for small and medium-sized enterprises. The moral hazard and credit rationing caused by the information asymmetry between firms and commercial banks extend firms’ credit constraints, thereby further increasing financial constraints at the macro level. Financial constraints significantly affect managers’ decision-making on investments and, therefore, have a far-reaching impact on corporate innovation behavior (Chang et al., 2019). Referring to Hadlock and Pierce (2010), this study calculates the levels of financial constraints faced by manufacturing firms in the Chinese market. The research sample is divided into two subsamples: one with low financial constraints (financial constraint is higher than the median) and one with high financial constraints (financial constraint is lower than the median). The regression results of different financing constraints are reported in Table 6.

In Table 6, columns 1) and (2), respectively, explore the impact of market competition and financialization on corporate green innovation under high financial constraints. The coefficient of market competition is −1.155, significant at the 10% level, and the coefficient of financialization is not significant, indicating managers’ motivation for precautionary reserves to make financial investments. In the results of column (3), the coefficient of market competition is −1.161, significant at the 10% level, and the coefficient of financialization is not significant. The moderating effect of market competition under high financial constraints is shown in column (4), and the results indicate that market competition alleviates the negative correlation between financialization and corporate green innovation. Columns 5) and (6), respectively, explore the impact of market competition and financialization on corporate green innovation with low financial constraints. The coefficient of market competition is −1.098, significant at the 5% level, and the coefficient of financialization is not significant. As shown in column (7), the coefficient of market competition is -1.196, significant at the 5% level, and the coefficient of financialization is -0.765, significant at the 10% level, suggesting that financialization inhibits corporate green innovation under low financial constraints. Column 8) shows the moderating effect of market competition, and the results demonstrate that market competition does not alleviate the negative correlation between financialization and corporate green innovation under low financial constraints. According to the empirical results shown in Table 6, market competition inhibits corporate green innovation in both samples. In the subsample of high financial constraints, a highly competitive environment may abate managers’ motivation to invest in financial assets, whereas in the subsample of low financial constraints, the effect is not significant.

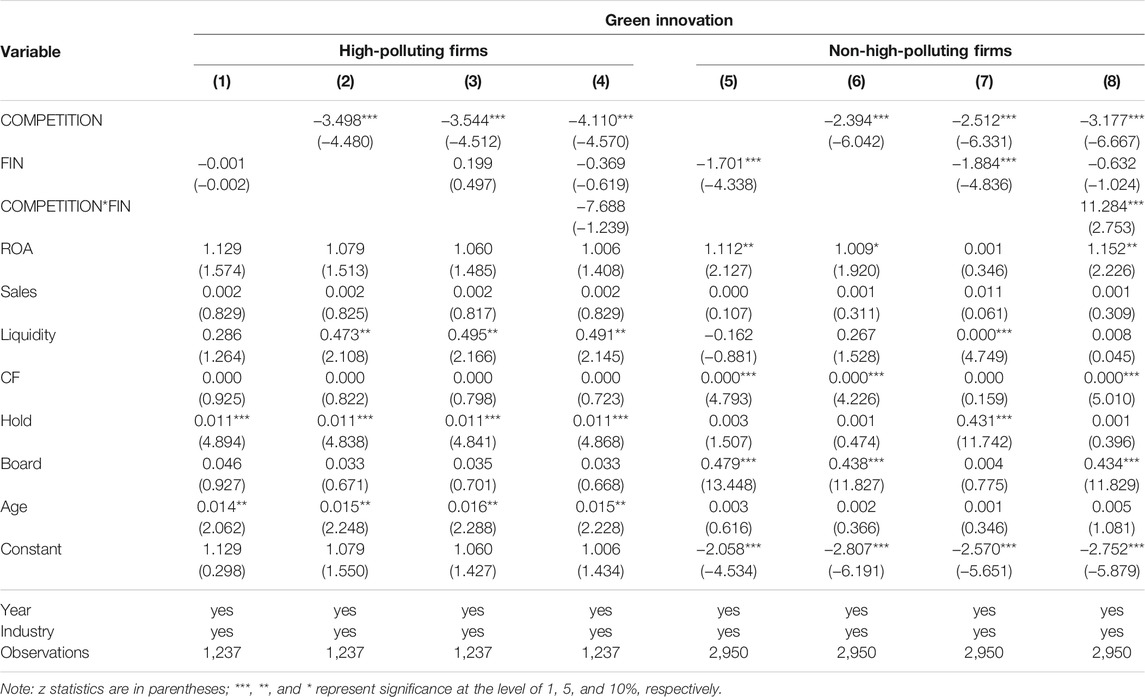

Pollution Discharge

High-polluting firms are usually strongly motivated to fulfill corporate social responsibility (CSR). From the perspective of altruism, destruction of the ecological environment by manufacturing firms’ production stimulates the civic awareness of managers, who are more willing to fulfill CSR as compensation (Logsdon and Wood, 2018). From an egocentric perspective, high-polluting firms tend to fulfill CSR to earn a reputation for environmental protection. Therefore, CSR of high-polluting firms affects managers’ business philosophy of maximizing profits, resulting in a divergence of business strategies between high-polluting firms and non-high-polluting firms. According to the “Management List of Listed Companies in Environmental Protection Verification Industries,” released by China’s State Environmental Protection Administration in 2008, high-polluting industries include thermal power, steel, cement, electrolytic aluminum, coal, metallurgy, chemical, petrochemical, building materials, paper, brewing, pharmaceutical, fermentation, textile, leather, and mining. This study divides the research samples into a subsample of high-polluting firms and a subsample of non-high-polluting firms. The regression results are reported in Table 7.

In Table 7, columns 1) and (2), respectively, show the impact of market competition and financialization on corporate green innovation in the subsample of high-polluting firms. The coefficient of market competition is -3.498, significant at the 1% level, indicating that intense market competition inhibits the green innovation of high-polluting firms. The coefficient of financialization is not significant, reflecting the fact that CSR restrains the managers of high-polluting firms from expanding the scale of financial assets with the motivation of maximizing profits. In the results shown in column (3), market competition inhibits corporate green innovation (-3.544, significant at the 1% level), whereas the impact of financialization on corporate green innovation is not significant. The moderating effect of market competition on high-polluting firms is shown in column (4), and the results indicate that market competition does not alleviate the negative correlation between financialization and corporate green innovation. Columns 5) and (6), respectively, show the impact of market competition and financialization on corporate green innovation in the subsample of non-high-polluting firms. The coefficients of market competition and financialization are -2.394 and -1.701, significant at the 1% level. In the results of column (7), the coefficients of market competition and financialization are −2.512 and −1.884, respectively, significant at the 1% level, indicating that without the constraints of CSR, managers of non-high-polluting firms increase financial investment for their interests, while crowding out investments in corporate green innovation. Column 8) explores the moderating effect of market competition on non-high-polluting firms, and the results demonstrate that market competition alleviates the negative correlation between financialization and corporate green innovation. According to the empirical results in Table 7, market competition inhibits corporate green innovation in both samples. Subject to corporate social responsibility, managers of high-polluting firms have strong preferences for corporate green innovation instead of financial investments. By contrast, managers of non-high-polluting firms have strong motivation to make financial investments, and their preferences for financial investment would be largely altered under intense market competition.

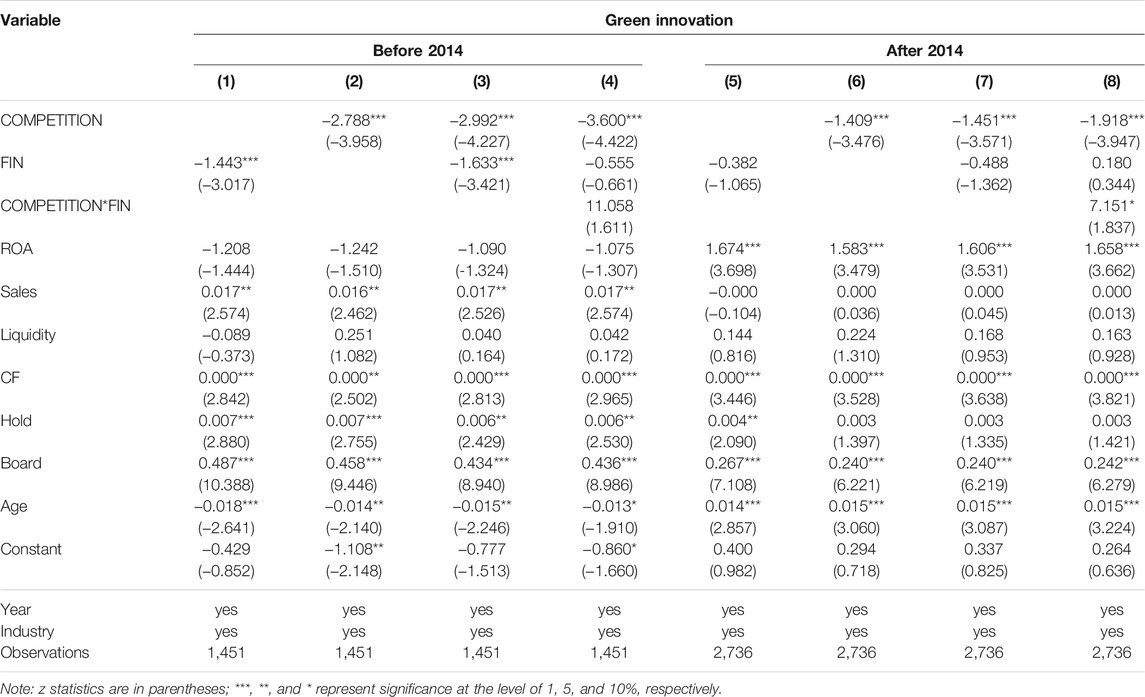

Environmental Protection Policy

Reasonable environmental policies not only stimulate firms’ continuation of innovation activities but also create an innovative compensation effect, the benefits of which exceed even the direct cost brought by environmental regulation, which ultimately improves firms’ economic and environmental performances. From one perspective, reasonable environmental policy improves managers’ environmental recognition, which motivates managers to strengthen green innovation investment. From another perspective, managers regard green innovation as a response to environmental policies, which can further alleviate the pressure brought by environmental policies. In 2014, the Ministry of Ecology and Environment of the People’s Republic of China improved The Environmental Protection Law, controlling pollution discharge and encouraging more efforts toward environmental protection. Therefore, this study divides the research into a subsample before 2014 and a subsample after 2014. The regression results of different periods are reported in Table 8.

In Table 8, columns 1) and (2), respectively, show the impact of market competition and financialization on corporate green innovation before 2014. The coefficients of market competition and financialization are -2.788 and -1.443, respectively, significant at the 1% level. In the results shown in column (3), there is a negative correlation between either market competition or financialization and corporate green innovation, supporting the results shown in columns 1) and (2). This implies that both market competition and financialization inhibit corporate green innovation before the environmental policy. This could be explained by the managers’ preference for financial investment without environmental obligations before the environmental policy. The moderating effect of market competition before 2014 is shown in column (4), and the results indicate that market competition cannot alleviate the negative correlation between financialization and corporate green innovation. Hence, under lax environmental policy, interactions between firms in a competitive market environment do not affect managers’ investment preferences. Columns 5) and (6), respectively, show the impact of market competition and financialization on corporate green innovation after 2014. The coefficient of market competition is -1.409, significant at the 1% level, whereas the coefficient of financialization is not significant. In the results shown in column (7), there is a negative correlation between market competition and corporate green innovation, whereas the impact of financialization on corporate green innovation is not significant. Column 8) explores the moderating effect of the market competition after 2014, and the results demonstrate that market competition alleviates the negative correlation between financialization and corporate green innovation. According to the empirical results in Table 8, with the strict environmental policy, market competition efficiently alters managers’ preference for financial investment, ensuring increased investment in corporate green innovation.

Discussion

As an indicator of the national productivity level, the manufacturing industry is a driving force that promotes the development of the economy; however, a series of environmental problems have attracted much attention. To alleviate the sharp conflicts between firm development and environmental protection, managers of manufacturing firms have realized the important role of green innovation in firms’ sustainable development. However, due to the agency problem between shareholders and managers, managers of manufacturing firms often make short-sighted business strategies on behalf of their interests, shown by increased investment in financial assets to achieve short-term economic benefits. Market competition also has a significant impact on managers’ decision-making on corporate green innovation. Because of environmental externalities, innovators take a long period to integrate the environmental and conventional attributes of corporate green innovations, and they turn the environmental attributes to their competitive advantage through the accumulation and improvement of technology. However, the potential competitiveness obtained from corporate green innovation is likely to be imitated and surpassed as competition in the markets increase. The period in which firms maintain a competitive advantage over competitors will be shortened as market competition increases, reducing managers’ motivation to invest in corporate green innovations (Chen and Liu, 2019). Nevertheless, market competition alleviates the negative correlation between financialization and corporate green innovation, indicating that interaction between firms alters managers’ preferences for financial investment. As an external governance mechanism, market competition is an effective means to reduce agency costs by effectively conveying information about firms’ business performance and alleviating the information asymmetry between shareholders and managers. Market competition could elicit higher agent effort, reducing managers’ incentives for myopic behaviors. The empirical results of this study are consistent with the findings of Liu et al. (2021) and Huang et al. (2021).

Our study also explores the heterogeneous impacts of market competition and financialization on corporate green innovation. In terms of different ownerships, the financialization of both SOEs and non-SOEs inhibits corporate green innovation. With a strong external financing capability, SOEs are inclined to have more idle funds than non-SOEs, enabling managers to increase investment in financial assets. However, intense market competition alleviates the information asymmetry between managers of SOEs and government shareholders, thus strengthening managers’ motivation to develop green innovation activities to show their diligence, which is consistent with the findings of Rong et al. (2017). By contrast, non-SOEs are more vulnerable to intense market competition. Therefore, managers from non-SOEs must strengthen green innovation investment, to build a technology barrier and win market share. As for financial constraints, firms under high financial constraints are willing to increase financial investment with the motivation of precautionary reserves to cope with underlying business risk and smooth future cash flow, which they do by holding liquid financial assets. Therefore, the financialization of firms under high financial constraints does not inhibit corporate green innovation. By contrast, under low financial constraints, firms are inclined to over-invest in financial assets, which supports the findings of Jia and Zhou (2021). Furthermore, under intense market competition, firms increase investment in the main business in the face of uncertainties to regain market share from competitors and maintain their market position, forcing them to move scarce resources toward production and operations. Regarding high-polluting firms, financialization does not inhibit corporate green innovation in the light of CSR, which is similar to the findings of Cegarra-Navarro et al. (2016). By contrast, the financialization of non-high-polluting firms inhibits corporate green innovation due to a lack of CSR obligations. In addition, market competition inhibits corporate green innovation regarding both high-polluting firms and non-high-polluting firms. Finally, reasonable environmental policy can regulate managers’ conduct on financial investment, nudging them toward increasing green innovation investment in response to the supervision of regulators. Further, environmental policy also arouses the environmental recognition of managers. Therefore, managers have more motivation to invest in corporate green innovation while curbing investment in financial assets, which is consistent with the findings of Huang and Chen (2022).

Conclusions and Policy Recommendations

Conclusion

Green innovation is a crucial instrument allowing manufacturing firms to balance the relationship between economic value creation and sustainable development. However, previous research has largely neglected the role of managers, whose decisions directly determine firms’ investment strategies, which have a significant influence on the development of firms’ green innovation activities. Using the sample of China’s listed manufacturing firms from 2009 to 2019, this study explores the relationship between market competition, financialization, and corporate green innovation in the Chinese market. The main conclusions are as follows.

First, intense market competition may inhibit corporate green innovation in the context of the Chinese market, which accords with Schumpeter’s innovation theory. Second, managers’ decision preferences on financialization will crowd out firms’ investments in corporate green innovation, which would significantly undermine firms’ sustainable development abilities. Third, market competition has a moderating effect on the relationship between financialization and corporate green innovation, indicating the role of market competition in altering managers’ preferences for financial investment. Finally, regarding the heterogeneous impacts of market competition and financialization on corporate green innovation, the empirical results from other studies are consistent with our findings in most cases.

Recommendations and Limitations

As the backbone of the real economy, the manufacturing industry is a driving force behind national economic development. Hence, the rational decision-making of managers is crucial to the sound development of the manufacturing industry, which can create extensive social value. According to the theoretical and empirical analysis, this study has some implications as follows.

At the firm level, managers of manufacturing enterprises should continue firms’ long-term value creation, reduce reliance on financial investment, and increase input into corporate green innovation, as green innovation is instrumental to the long-term sustainable development of manufacturing firms. Although financialization can improve firms’ short-term business performance, it crowds out investment in corporate green innovation, damages firms’ long-term competitive advantages, destroys firms’ long-term value creation, and thus negatively impacts the long-term interests of shareholders and stakeholders.

At the government level, policymakers should develop a proper understanding of the impact of market competition on green innovation. While intense market competition could inhibit green innovation, its role in alleviating the agency problem within firms and altering managers’ preference for financial investment cannot be ignored. Therefore, policymakers should prevent excessive competition by setting up an industry admittance threshold and reinforcing the protection of intellectual property. They should also ensure fair competition among manufacturing firms by boosting the competitiveness of small and medium-sized firms. In addition, policymakers should strengthen the regulations on financial markets, prompt financial institutions to focus on their main business, make their services accessible to small and micro businesses, strengthen their ability to serve the wider economy, and prevent distractions from their intended purpose.

This study has three main limitations. Considering the availability of data, this study selects A-share-listed manufacturing companies in the Chinese market as research samples without consideration of other unlisted companies. Thus, the findings of this study might not completely represent the characteristics of the manufacturing industry in the Chinese market. In terms of research design, this study only considers the linear effect of market competition and financialization on corporate green innovation. However, there may be non-linear relationships that influence the accuracy of the empirical findings. In addition, because there might be a balance point between the impact of market competition and financialization on green innovation, further research is needed to identify the optimal proportion of the two.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author Contributions

Conceptualization, YG and LF; methodology, YG and XY; software, LF; formal analysis: XY; writing—original draft preparation, YG; writing—review and editing, LF and XY; visualization, LF. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Philosophy and Social Sciences Research Planning Foundation of Heilongjiang Province of China (grant number 19GLD234).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdullah, M., Zailani, S., Iranmanesh, M., and Jayaraman, K. (2016). Barriers to green Innovation Initiatives Among Manufacturers: the Malaysian Case. Rev. Manag. Sci. 10, 683–709. doi:10.1007/s11846-015-0173-9

Amore, M. D., Schneider, C., and Žaldokas, A. (2013). Credit Supply and Corporate Innovation. J. Financial Econ. 109, 835–855. doi:10.1016/j.jfineco.2013.04.006

Arrow, K. J. (1962). “Economic Welfare and the Allocation of Resources to Invention,” in The Rate and Direction of Inventive Activity: Economic and Social Factors (Princeton: Princeton University Press), 609–626. Available at: http://www.nber.org/books/univ62-1. doi:10.1515/9781400879762-024

Bebchuk, L. A., and Stole, L. A. (1993). Do Short-Term Objectives Lead to under- or Overinvestment in Long-Term Projects? J. Finance 48, 719–730. doi:10.1111/j.1540-6261.1993.tb04735.x

Blundell, R., Griffiths, R., and Van Reenen, J. (1999). Market Share, Market Value and Innovation in a Panel of British Manufacturing Firms. Rev. Econ. Stud. 66, 529–554. doi:10.1111/1467-937X.00097

Cai, W., and Li, G. (2018). The Drivers of Eco-Innovation and its Impact on Performance: Evidence from China. J. Clean. Prod. 176, 110–118. doi:10.1016/j.jclepro.2017.12.109

Carlin, W., Schaffer, M. E., and Seabright, P. (2004). A Minimum of Rivalry: Evidence from Transition Economies on the Importance of Competition for Innovation and Growth. Contrib. to Econ. Anal. Policy 3, 241–285. doi:10.2202/1538-0645.1284

Castellacci, F., and Lie, C. M. (2017). A Taxonomy of green Innovators: Empirical Evidence from South Korea. J. Clean. Prod. 143, 1036–1047. doi:10.1016/j.jclepro.2016.12.016

Cegarra-Navarro, J.-G., Reverte, C., Gómez-Melero, E., and Wensley, A. K. P. (2016). Linking Social and Economic Responsibilities with Financial Performance: The Role of Innovation. Eur. Manage. J. 34, 530–539. doi:10.1016/j.emj.2016.02.006

Chang, K., Zeng, Y., Wang, W., and Wu, X. (2019). The Effects of Credit Policy and Financial Constraints on Tangible and Research & Development Investment: Firm-Level Evidence from China's Renewable Energy Industry. Energy Policy 130, 438–447. doi:10.1016/j.enpol.2019.04.005

Chen, J., and Liu, L. (2019). Profiting from Green Innovation: The Moderating Effect of Competitive Strategy. Sustainability 11, 15. doi:10.3390/su11010015

Chun, S., and Lee, M. (2017). Corporate Ownership Structure and Risk-Taking: Evidence from Japan. J. Gov. Regul. 6, 39–52. doi:10.22495/jgr_v6_i4_p4

Davis, G. F., and Kim, S. (2015). Financialization of the Economy. Annu. Rev. Sociol. 41, 203–221. doi:10.1146/annurev-soc-073014-112402

Dechezleprêtre, A., Glachant, M., and Ménière, Y. (2013). What Drives the International Transfer of Climate Change Mitigation Technologies? Empirical Evidence from Patent Data. Environ. Resource Econ. 54, 161–178. doi:10.1007/s10640-012-9592-0

Demir, F. (2009). Financial Liberalization, Private Investment and Portfolio Choice: Financialization of Real Sectors in Emerging Markets. J. Develop. Econ. 88, 314–324. doi:10.1016/j.jdeveco.2008.04.002

Dhaliwal, D., Huang, S., Khurana, I. K., and Pereira, R. (2014). Product Market Competition and Conditional Conservatism. Rev. Account. Stud. 19, 1309–1345. doi:10.1007/s11142-013-9267-2

Ding, S., Guariglia, A., Knight, J., and Yang, J. (2021). Negative Investment in china: Financing Constraints and Restructuring versus Growth. Econ. Develop. Cult. Change 69, 1411–1449. doi:10.1086/706825

El-Kassar, A.-N., and Singh, S. K. (2019). Green Innovation and Organizational Performance: The Influence of Big Data and the Moderating Role of Management Commitment and HR Practices. Technol. Forecast. Soc. Change 144, 483–498. doi:10.1016/j.techfore.2017.12.016

Fang, J., Tang, X., Xie, R., and Han, F. (2020). The Effect of Manufacturing Agglomerations on Smog Pollution. Struct. Change Econ. Dyn. 54, 92–101. doi:10.1016/j.strueco.2020.04.003

Felisberto, C. (2013). Liberalisation, Competition and Innovation in the Postal Sector. Empir. Econ. 44, 1407–1434. doi:10.1007/s00181-012-0573-5

Gallagher, D. R., Ignatieva, K., and McCulloch, J. (2015). Industry Concentration, Excess Returns and Innovation in Australia. Account. Finance 55, 443–466. doi:10.1111/acfi.12074

Gehringer, A. (2013). Growth, Productivity and Capital Accumulation: The Effects of Financial Liberalization in the Case of European Integration. Int. Rev. Econ. Financ. 25, 291–309. doi:10.1016/j.iref.2012.07.015

Ghisetti, C., Mancinelli, S., Mazzanti, M., and Zoli, M. (2017). Financial Barriers and Environmental Innovations: Evidence from EU Manufacturing Firms. Clim. Pol. 17, S131–S147. doi:10.1080/14693062.2016.1242057

Gong, R., Wu, Y.-Q., Chen, F.-W., and Yan, T.-H. (2020). Labor Costs, Market Environment and green Technological Innovation: Evidence from High-Pollution Firms. Int. J. Environ. Res. Public Health 17, 522. doi:10.3390/ijerph17020522

González, I., and Sala, H. (2014). Investment Crowding-Out and Labor Market Effects of Financialization in the US. Scott. J. Polit. Econ. 61, 589–613. doi:10.1111/sjpe.12059

Hadlock, C. J., and Pierce, J. R. (2010). New Evidence on Measuring Financial Constraints: Moving beyond the KZ index. Rev. Financ. Stud. 23, 1909–1940. doi:10.1093/rfs/hhq009

Huang, C., and Chen, Y. (2022). How to Enhance the Green Innovation of Sports Goods? Micro- and Macro-Level Evidence from China's Manufacturing Enterprises. Front. Environ. Sci. 9, 1–20. doi:10.3389/fenvs.2021.809156

Huang, X.-X., Hu, Z.-P., Liu, C.-S., Yu, D.-J., and Yu, L.-F. (2016). The Relationships between Regulatory and Customer Pressure, green Organizational Responses, and green Innovation Performance. J. Clean. Prod. 112, 3423–3433. doi:10.1016/j.jclepro.2015.10.106

Huang, Z., Li, X., and Chen, S. (2021). Financial Speculation or Capital Investment? Evidence from Relationship between Corporate Financialization and Green Technology Innovation. Front. Environ. Sci. 8, 1–16. doi:10.3389/fenvs.2020.614101

Hur, W.-M., Kim, Y., and Park, K. (2013). Assessing the Effects of Perceived Value and Satisfaction on Customer Loyalty: A ‘Green' Perspective. Corp. Soc. Responsib. Environ. Mgmt. 20, 146–156. doi:10.1002/csr.1280

IPCC (2014). Climate Change 2014 Mitigation of Climate Change Working Group III Contribution to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Available at: https://www.ipcc.ch/site/assets/uploads/2018/02/ipcc_wg3_ar5_full.pdf (Accessed November 19, 2021).

Jensen, M. C. (1986). Agency Cost of Free Cash Flow, Corporate Finance, and Takeovers. Am. Econ. Rev. 76, 323–329. doi:10.2139/ssrn.99580

Jia, Q., and Zhou, J. n. (2021). The Dark Side of Stock Market Liberalization: Perspectives from Corporate R&D Activities in China. North Am. J. Econ. Finance 58, 101498. doi:10.1016/j.najef.2021.101498

Jiang, X. (2016). Over-Investment of Free Cash Flow during CEO's Tenure. Technol. Invest. 07, 51–58. doi:10.4236/ti.2016.73007

Jin, B., and Han, Y. (2021). Influencing Factors and Decoupling Analysis of Carbon Emissions in China’s Manufacturing Industry. Environ. Sci. Pollut. Res. Int. 28 (45), 64719–64738. doi:10.1007/s11356-021-15548-0

Kanakriyah, R. (2021). The Impact of Board of Directors’ Characteristics on Firm Performance: A Case Study in Jordan. J. Asian Financ. Econ. Bus. 8, 341–350. doi:10.13106/jafeb.2021.vol8.no3.0341

Laksmana, I., and Yang, Y.-W. (2015). Product Market Competition and Corporate Investment Decisions. Rev. Account. Financ. 14, 128–148. doi:10.1108/RAF-11-2013-0123

Lee, K.-H., and Kim, J.-W. (2011). Integrating Suppliers into green Product Innovation Development: An Empirical Case Study in the Semiconductor Industry. Bus. Strat. Env. 20, 527–538. doi:10.1002/bse.714

Li, W.-L., and Zheng, K. (2017). Product Market Competition and Cost Stickiness. Rev. Quant Finan Acc. 49, 283–313. doi:10.1007/s11156-016-0591-z

Lin, B., and Luan, R. (2020). Do government Subsidies Promote Efficiency in Technological Innovation of China's Photovoltaic Enterprises? J. Clean. Prod. 254, 120108. doi:10.1016/j.jclepro.2020.120108

Lin, C., Lin, P., Song, F. M., and Li, C. (2011). Managerial Incentives, CEO Characteristics and Corporate Innovation in China's Private Sector. J. Comp. Econ. 39, 176–190. doi:10.1016/j.jce.2009.12.001

Lindman, Å., and Söderholm, P. (2016). Wind Energy and Green Economy in Europe: Measuring Policy-Induced Innovation Using Patent Data. Appl. Energ. 179, 1351–1359. doi:10.1016/j.apenergy.2015.10.128

Liu, Y., Chen, Y., Ren, Y., and Jin, B. (2021). Impact Mechanism of Corporate Social Responsibility on Sustainable Technological Innovation Performance from the Perspective of Corporate Social Capital. J. Clean. Prod. 308, 127345. doi:10.1016/j.jclepro.2021.127345

Logsdon, J. M., and Wood, D. J. (2018). Business Citizenship: From Domestic to Global Level of Analysis. Bus. Ethics Strateg. 12, 175–207. doi:10.4324/9781315261102-11

Luo, Y., and Zhu, F. (2014). Financialization of the Economy and Income Inequality in China. Econ. Polit. Stud. 2, 46–66. doi:10.1080/20954816.2014.11673844

Nie, P.-y., Chan, W., and Hong-xing, W. (2021). Technology Spillover and Innovation. Technol. Anal. Strateg. Manag. 34, 1–13. doi:10.1080/09537325.2021.1893294

OECD (2009). Sustainable Manufacturing and Eco-Innovation: Towards a Green Economy. Available at: https://www.oecd.org/env/consumption-innovation/42957785.pdf (Accessed December 22, 2021).

Pavic, I., Galetic, F., and Piplica, D. (2016). Similarities and Differences between the CR and HHI as an Indicator of Market Concentration and Market Power. Br. J. Econ. Manag. Trade 13, 1–8. doi:10.9734/bjemt/2016/23193

Plys, K. (2014). Financialization, Crisis, and the Development of Capitalism in the USA. World Rev. Polit. Econ. 5, 24–44. doi:10.13169/worlrevipoliecon.5.1.0024

Quan, X., Ke, Y., Qian, Y., and Zhang, Y. (2021). CEO Foreign Experience and Green Innovation: Evidence from China. J. Bus. Ethics, 1–23. doi:10.1007/s10551-021-04977-z

Rong, Z., Wu, X., and Boeing, P. (2017). The Effect of Institutional Ownership on Firm Innovation: Evidence from Chinese Listed Firms. Res. Pol. 46, 1533–1551. doi:10.1016/j.respol.2017.05.013

Ruiqi, W., Wang, F., Xu, L., and Yuan, C. (2017). R&D Expenditures, Ultimate Ownership and Future Performance: Evidence from China. J. Bus. Res. 71, 47–54. doi:10.1016/j.jbusres.2016.10.018

Schiederig, T., Tietze, F., and Herstatt, C. (2012). Green Innovation in Technology and Innovation Management - an Exploratory Literature Review. R. D Manag. 42, 180–192. doi:10.1111/j.1467-9310.2011.00672.x

Schumpeter, J. A. (1942). Capitalism, Socialism, and Democracy. 3rd Edition. New York: Harper & Row.

Shang, T. T., Tian, M., Tao, N., and Chen, Y. (2021). Market-Oriented Green Innovation Model: Conceptualisation and Scale Development of Disruptive green Innovation. Asian J. Technol. Innov. doi:10.1080/19761597.2021.1968304

Stucki, T. (2019). What Hampers green Product Innovation: The Effect of Experience. Industry and Innovation 26, 1242–1270. doi:10.1080/13662716.2019.1611417

Tori, D., and Onaran, Ö. (2018). The Effects of Financialization on Investment: Evidence from Firm-Level Data for the UK. Cambridge J. Econ. 42, 1393–1416. doi:10.1093/CJE/BEX085

Ullah, S., Khan, F. U., and Ahmad, N. (2021). Promoting Sustainability through Green Innovation Adoption: A Case of Manufacturing Industry. Environ. Sci. Pollut. Res. 18, 7885. doi:10.1007/s11356-021-17322-8

UNIDO (2020). What Industrialization Means for Well-Being and Why it Matters. Available at: https://www.unido.org/stories/what-industrialization-means-well-being-and-why-it-matters (Accessed November 19, 2021).

Xie, X., Zhu, Q., and Wang, R. (2019). Turning green Subsidies into Sustainability: How Green Process Innovation Improves Firms' Green Image. Bus Strat Env 28, 1416–1433. doi:10.1002/bse.2323

Xu, X., and Xuan, C. (2021). A Study on the Motivation of Financialization in Emerging Markets: The Case of Chinese Nonfinancial Corporations. Int. Rev. Econ. Financ. 72, 606–623. doi:10.1016/j.iref.2020.12.026

Keywords: green innovation, market competition, financialization, manufacturing industries, sustainable development

Citation: Guo Y, Fan L and Yuan X (2022) Market Competition, Financialization, and Green Innovation: Evidence From China’s Manufacturing Industries. Front. Environ. Sci. 10:836019. doi: 10.3389/fenvs.2022.836019

Received: 15 December 2021; Accepted: 15 February 2022;

Published: 09 March 2022.

Edited by:

Huaping Sun, Jiangsu University, ChinaReviewed by:

Feng Wang, Chongqing University, ChinaDianxi Hu, Yuxi Normal University, China

Fanxin Meng, Beijing Normal University, China

Copyright © 2022 Guo, Fan and Yuan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lijun Fan, c2h0ZmxqQDEyNi5jb20=; Xiaohao Yuan, eXVhbnhpYW9oYW9AY3F1LmVkdS5jbg==

Yineng Guo

Yineng Guo Lijun Fan

Lijun Fan Xiaohao Yuan

Xiaohao Yuan