- 1School of Finance and Economics, Jiangsu University, Zhenjiang, China

- 2Department of Business Administration, Sukkur IBA University, Sukkur, Pakistan

- 3School of Economics and Management, Nantong University, Nantong, China

A common perception is lowering the environmental consequences of firms’ supply chain activities is a costly idea that poses a challenge to the corporate world. This study aimed to examine the relationship between green supply chain management (GSCM) and corporate performance among listed firms in Pakistan, using the general panel method of moments (GMM) and ANOVA techniques. At the same time, the Granger causality technique provides robust results. The study focused on manufacturing firms, covering periods from 2009 to 2020. The study engaged a modified balanced scorecard framework to adopt five metrics of corporate performance, namely, gross profit ratio, net profit ratio, customer dimension, learning growth dimension, and efficiency dimension. The study incorporated the two measures of the GSCM initiative and two control variables. The findings from the panel GMM estimates reveal that GSCM positively and negatively impacted the five corporate performance metrics explored. ANOVA results indicate significant differences in customer satisfaction, profitability, and efficiency performance metrics among the top and low GSCM practicing corporations. On the other hand, Granger causality results specify a moderate causal association between GSCM implementation and firm performance in Pakistan. Implying that poor GSCM practice may not yield the expected benefits, instead, conscientious efforts should be put in place to ensure that practicing GSCM initiative should be effectively carried out.

1 Introduction

Modern-day businesses engage in supply chains to create, transport, and provide value to end consumers in the most efficient and effective means (Green et al., 2012). By collaborating in a distribution network, businesses can concentrate on improving their competencies, achieve economies of scale, and remain competitive in an increasingly competitive business environment (Kozlenkova et al., 2015). The supply chain spurs business performance by integrating businesses to provide value to customers at the least cost (Bagher, 2018). Hence, it is pertinent that business managers design a supply chain that is effective and efficient; needed to maximize consumer satisfaction, promote competitive advantage, and maximize the wealth of their business (Diabat and Govindan, 2011). However, when designing and managing effective and efficient supply chains, the businesses generate externalities to the environment; which are usually detrimental and non-sustainable. That is, increased management of the supply chain among businesses brings about the depletion of natural resources and increased emission of carbon gas and its greenhouse gas components, which pose a serious challenge to the environment (Dadhich et al., 2015). It has, thus, become pertinent that businesses should be responsible for their environment and ensure Green Supply Chain Management (GSCM), which helps to ensure that the practice of supply chain management does not threaten the sustainability of the environment. Thus, businesses should align their performance objective with environmental performance.

In the literature, several dimensions have been proposed on how to practice GSCM among businesses. These include green purchasing, green production, and eco-design (Tan et al., 2016; Khan and Qianli, 2017). With the application of these dimensions, businesses are expected to pursue their supply chain activities within the confines of environmental sustainability. The majority of literature recognizes that GSCM is not only beneficial to the environment but also promotes the firm performance. Sari (2017) and Youn et al. (2013) recognize that measures of green supply chain aided businesses to lower energy consumption and logistic costs, which help to better their performance. Seman et al. (2012) support green technology, especially in manufacturing firms that enhance profits. Similarly, Choi and Hwang (2015) concur that the implementation of GSCM improves both the environment and financial performance of participating businesses. Tan et al. (2016) empirically found that green supply chain management improves firm competitiveness. The empirical results from Laari et al. (2016) corroborate that adding GSCM promotes businesses’ operational and environmental dimensions. Contrarily, Syakila (2016) highlights that GSCM does not always promote firm competitiveness. Likewise, Khan and Qianli (2017) agreed that increased environmental practices lower firms’ profitability because GSCM involves the engagement of large investments in technology. This thus offers a divergent view that GSCM may not contribute to the overall well-being of businesses.

The theoretical perspectives on the matter do not provide a unanimous opinion. For instance, Tripathi and Bains (2013) argued that every business’s responsibility is to maximize profit and wealth for its shareholders. However, pressurizing businesses to act responsibly for the environment amounts to double taxation on firms who already pay taxes (Masulis and Reza, 2015). Eccles et al. (2014) admitted that firms are pressured to participate in environmental sustainability at the expense of investors, leading to agency problems between managers and shareholders. The shareholders’ theory presents another position on this topic, assuming that a business’s failure to identify with all of its shareholders fully poses a risk to maximizing performance indicators. The resource-based theory supports that firms should engage in GSCM practice because it affords them the advantage to achieve competitiveness in an increasingly competitive industry. However, the findings from Hu and Hsu (2010) suggest that insufficient green supply chain management practice may be counterproductive to firm’s performance. This implies that a positive nexus between GSCM and firm performance is dependent on the implementation of the GSCM framework among corporate managers.

In Pakistan, the subject matter of green supply chain management has gained measurable interest among academic scholars, owing to the quality of the environment over time. The World Bank data reveals that Pakistan’s environment has deteriorated since the 1970s, which worsened during the 1990s as greenhouse gas and carbon gas emissions increased in the country; which suggests that an increase in economic activities in the country constituted some harm to the environment (Sohail et al., 2013). Environmental preservation ordinances were promulgated in 1983, which are ineffective at promoting sustainability practice among domestic businesses because existing institutions in the country are weak to enforce them (Sohail et al., 2014). A national environmental action plan (otherwise known as NEAP) was set up in 2001 to improve the environment in the country in support of the United Nations Development Program.

Aslam et al. (2018) expressed great concern toward GSCM practices, as there is low environmental monitoring and collaboration among stakeholders. This is further highlighted by Zhu et al. (2012) who found that there is no clear association between profitability and GSCM engagement among corporate organizations, which explains the low commitment and difference of practices among manufacturers to engage in GSCM practices. Already, developing countries are faced with the challenges of poor environmental quality, which could negatively affect the firm performance therein. Most firms in the developing countries have low incentives to adopt green practices (Miroshnychenko et al., 2017). The factors responsible for the neglect of the environment among corporations in such countries include policy loopholes and assumed additional costs caused by green practices (Han and Huo, 2020). Environmental deterioration and harsh weather are jeopardizing long-term growth and development (Khan et al., 2022). Here, it seems necessary to evaluate environment-friendly activities such as GSCM practices adopted by enterprises and their impact on a firm’s success. Thus, it highlights the gap in the association’s holistic and integrated investigation.

Green et al. (2012) argued that corporations are uncertain about which green practices they are to engage in, and which of them are most profitable to organizational performance and help optimize shareholders’ wealth. Kirchoff et al. (2016) noted that specific green-related practices and capabilities are essential to derive ecological and economic benefits. However, note that many of these GSCM resources and capabilities have not yet been fully examined in the literature (Chan et al., 2016; Laari et al., 2016). Nowadays, innovative capabilities that incorporate environmental safeguards in business activities are critical to sustainability challenges (Awan, 2020). Therefore, it is imperative to inspect performance differences between GSCM’s highly committed firm and GSCM lowly committed firm. Also, there is a gap in the comprehensive understanding of green resources and their association with various performance parameters. It is essential to explore the subject matter in a complex environment, where GSCM policy implementation is inefficient specifically within the less business-friendly environment. Notably, the capacity for a firm to engage its resources toward GSCM practices and derive ecological and economic benefits might be dependent on a firm’s orientation and perception of GSCM. For this reason, Seman et al. (2012) noted that examining a strong strategic focus on GSCM influences a firm’s attitude toward GSCM practices, which in turn influences their capacity to achieve success. Thus, it is critical to analyze the influence of GSCM implementation on the performance of listed firms in Pakistan using panel data analysis. The specific objectives as enumerated and discussed as follows:

-To inspect the causal relationship between GSCM practices and firm performance

-To inspect the effects of GSCM practices on firm’s performance

-To inspect the performance differences of GSCM highly committed and GSCM lowly committed firms

This study finds it imperative to explore the argument using secondary panel data when empirical literature is dominated by primary data analysis. Furthermore, annual reports’ textual analysis clarifies the management’s mindset and strategy focuses on environment preservation without being biased (Loughran et al., 2009; Baier et al., 2020). Also, it is important to highlight whether these practices promote or inhibit performance. The novelty of this study is to explore such practices implementation using annual reports’ text in association with five dimensions of firm performance. The study uses an adjusted balanced scorecard by disaggregating performance dimensions into gross profit ratio, net profit ratio, customer satisfaction, learning and growth, and efficiency metrics. Twenty-five manufacturing firms listed on the Pakistani Stock Exchange are selected for this study, covering the period from 2009 to 2020. The study used general method of moments (GMM), ANOVA, and granger causality data analysis techniques. The GMM is employed to mitigate potential endogeneity problems in the parameter estimates and, thereby produce non-biased estimates.

Similarly, previous studies recognize the environmental and economic benefits of practicing GSCM (Laari et al., 2016). Notwithstanding, there are costs associated with engaging in GSCM. Therefore, the practice of GSCM has its costs and benefits, which many studies in the literature have debated (Chan et al., 2016; Syakila, 2016).

This study’s contribution elucidates the importance of corporate practices in obtaining competitive performance. First, this research widens the scope of green management evaluation by looking at the impact of information provided in the text of annual reports on firm’s performance which offered a comprehensive evaluation of such practices with textual analysis. Second, green management improved corporate performance indicators, and the findings confirmed the premise in part. Third, it is demonstrated that the profitability of enterprises with low and high levels of such activities differs dramatically. Finally, this study also extends the existing literature in the field of green supply chain management and firm performance. Also, this study contributes to academic learning on the importance of the GSCM initiative among businesses in a developing country where environmental protection is not a priority. The study engages five firm performance measures, thus providing robust results on the topic. This study is centered on the resource-based theory and thus highlights how organizational managers can use firm resources to maximize performance metrics, given an ever-dynamic business environment. The results would aid better policy formulation regarding environmental pollution and the practice of green supply chain management. Also, the decision to engage secondary panel data seeks to spur future studies on the topic using secondary data.

This study comprises five sections: the introduction, followed by a literature review of previous studies on the subject matter. Afterward, the third section develops a research methodology, highlighting the data collection method, the measurements of variables, and the methods for estimating the datasets. The fourth segment represents the findings obtained from the data analyzed, while the fifth segment concluded the findings and presented the implications of the study based on the results obtained.

2 Literature Review

2.1 Scope of GSCM

The firms have contributed to achieving sustainable development goals in the current industrial and technical progress period. As a result, the absorption of modern technology acts as a spur for attaining the sustainable development goals (SDGs) by transforming firms, which account for 90% of global businesses, 50% of global employment, and up to 40% of national income in developing countries (World Bank, 2018). The need to protect the environment coupled with summits Rio de Janerio in 1992, the Millennium Development Goals and SDGs campaigns have raised businesses’ awareness to adopt green measures in their operations. Its practice is particularly new to firms in developing countries, who are adopting green solutions in their supply chain management to lower the negative consequences supply chain activities may have on their environment (Seman et al., 2012).

Several definitions are provided to explain GSCM in literature; Chan et al. (2016) regarded GSCM as incorporating the environment into the management of the supply chain. Similarly, Zhu et al. (2012) noted that GSCM included green initiatives to promote environmental sustainability. The practice of GSCM is on the premise to balance the nexus between organizational and environmental performances. GSCM emphasizes the effective, efficient, and broad implementation of green measures to improve the environment. However, Drohomeretski et al. (2014) noted that successful implementation of the GSCM framework requires a holistic approach among all business stakeholders their incompatible benefits would be united and managed into an effective greening of the environment.

GSCM refers to a supply chain that attempts to decrease waste, enhance ecosystem quality, increase eco-efficiency, and improve the recycling process of materials. In practice, GSCM, which includes technological measures, new facilities, vendor training, and labor allocation, aimed to create considerable profits while paying attention to environmental efficiency (Sugandini et al., 2020). The company managers must use the green supply chain management concept to boost output and comply with government requirements on potential pollution (Khaksar et al., 2016). The purpose of GSCM is to enhance a company’s economic, environmental, operational, and social performance (Geng et al., 2017). Practically their impartial measurement proxy is still a literature gap that requires conceptualization with a tangible approach (Karmaker et al., 2021).

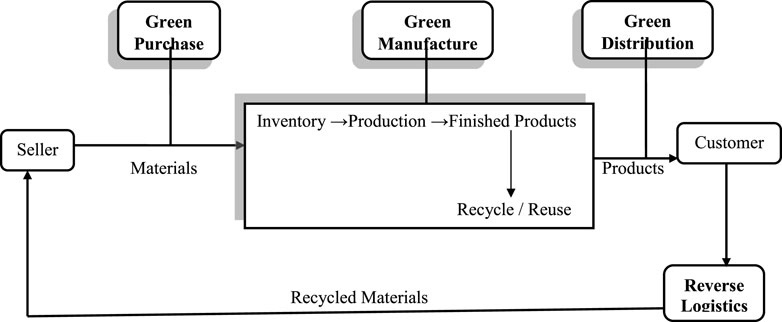

The academic scholars have proposed various frameworks for GSCM practice incorporated into the regular activities of managing supply chains (Ghobakhloo et al., 2013; Wibowo et al., 2018). However, Zhu et al. (2008) noted that GSCM practices fall under four basic dimensions within this framework: green purchasing, green manufacturing; green distribution; and reverse logistics. This can be illustrated graphically in Figure 1.

FIGURE 1. Green supply chain management (GSCM) framework. Source: author’s compilation from Khan and Qianli (2017), Tan et al. (2016), and Zhu et al. (2008).

2.2 Theoretical Framework

An important theory that supports the practice of GSCM is the stakeholders’ theory developed by Ian Mitroff, further improved by Freeman (2015), recognizing stakeholders of a business, asides from its business owners/shareholders, such as customers, investors, and various trade groups. Thus, it recommended that a business is responsible to these parties because they influence the performance directly or indirectly. Another theory that supports the practice of GSCM among businesses is the resource-based theory developed by Barney (1991), explaining how businesses can get a competitive advantage through strategic planning.

However, the theory’s logic has been extended to explain that businesses should engage in GSCM initiatives that improve the environment and performance metrics (Hart and Dowell, 2011). Additionally, Zhu et al. (2012) stated that greening in procurement, manufacturing, and distribution are three GSCM components that can be used to gain a competitive advantage. The proponents of this theory reckon that components of GSCM serve as relevant strategic means for a firm to gain a competitive advantage (Teng, 2007; Hart and Dowell, 2011). Karmaker et al. (2021) proposes conscious resource utilization to eliminate time and resource waste, enhancing productivity and efficiency. Green innovation is a long-term paradigm for problem-solving and decision-making that goes beyond optimization and efficiency (Lichtenthaler, 2019). Based on the foregoing, the GSCM activities can be leveraged to improve a firm’s efficiency and performance.

2.3 Evaluation of Performance Based on GSCM Practices

The majority of empirical literature favors the practice of GSCM among businesses. Awan (2019) examined the relationship between internal environmental investment decisions and firm social sustainability performance in Pakistan. The study found that protection practices promote social sustainability performance in manufacturing firms by focusing on safety, environmental interaction, and sustainable manufacturing. Tan et al. (2016) explored the effects of GSCM on the competitiveness of one hundred and forty-four (144) manufacturing firms in Malaysia, using primary data and partial least squares. There is evidence that GSCM directly impacted the competitiveness of the firms. Whereas, Novitasari and Agustia (2021) suggested that GSCM holds an insignificant impact on the firm’s performance. Chiu and Hsieh (2016) revealed the relationship of GSCM with performance among one hundred and thirty Taiwanese firms show that GSCM measures indirectly affect the firms’ performance.

Furthermore, the study concluded that a higher level of GSCM framework contributed to the firms’ performance. However, Syakila (2016) found that GSCM does not always promote the firm’s competitiveness. Contrarily, Aslam et al. (2018) explored the determinants of GSCM among the listed firms in the Pakistan Stock Exchange using a structural equation model. The study found that customers’ pressure and entrepreneurship positively impact GSCM adoption; and observed that GSCM practice has positive contributions to environmental and corporate performance. Using a different approach, Shafique et al. (2017) studied the effects of GSCM on the profitability of five hundred (500) firms in Pakistan, while moderating the influence of institutional pressure and the mediating effects of green innovation. Moderated regression and correlation analyses were employed to analyze the data. Evidence revealed that GSCM has a strong favorable impact on business performance; institutional pressure significantly moderated the relationship and green innovation mediated this association. The results obtained from these studies are consistent with Khan and Qianli (2017); who found that five GSCM components helped organizations in Pakistan to function better.

Better firm performance represents the capacity to satisfy consumers in terms of timely and speedy delivery of quality goods and services and flexibility and waste removal in manufacturing practices (Green et al., 2012; Lai and Wong, 2012). GSCM decreases greenhouse emissions due to the coordination amongst the systems, suppliers, and customers assists in identifying, and resolving supply chain sustainability issues (Wong et al., 2018). Environmental sustainability reduces the costs, while also meeting customer needs for ecologically friendly products and services, resulting in an increased financial performance.

Additionally, GSCM, which is being used to protect the environment, may assist the businesses in lowering the cost of raw materials and increasing the usage of recycled resources, resulting in an increased profitability and improved firm performance. Choi and Hwang (2015) discovered that GSCM has a positive relationship with financial performance. Rigorous environmental protection practices in the supply chain lead to improved social performance (Awan, 2018). Green supply chain management and green product innovation are two main categories associated with the environment protection practices of the firm (Khan and Qianli, 2017; Awan, 2020). However, when it comes to implementation, there are contrasts incorporate perspectives that require understanding the variables in GSCM. The current study provides a broader understanding of the impact of GSCM and GPI on firm performance, while using different measures for firm performance. Our hypothesis about the impact on corporate performance has yet to be checked.

H1: green supply chain management index (GSCM) index and green product index impact positively on firm profitability.

H1a: GSCM index and green product index impact positively on gross profit ratio.

H1b: GSCM index and green product index impact positively on net profit ratio.

H1c: GSCM index and green product index impact positively on customer satisfaction.

H1d: GSCM index and green product index impact positively on learning and growth.

H1e: GSCM index and green product index impact positively on efficiency.

In general, the implementation of GSCM techniques is expected to improve a company’s environmental performance. However, based on Kim et al. (2011), adopting GSCM practices may not translate to improved financial performance. Although, the economic performance and environmental practices have a beneficial association (Choi and Hwang, 2015). Similarly, Youn et al. (2013) opine that environmental performance promotes financial performance such as through higher revenue and profits. Also, Diabat and Govindan (2011) note that improved environmental quality enhances corporate image and goodwill, which will promote sales and profits. The study of Nikabadi and Shahrokhnia (2019) reveals that innovation and knowledge-sharing culture are highly desired for product development. Appropriate innovative infrastructure has the greatest impact on fostering the improvement of upcoming products. It is also discovered that there is a favorable and important association between culture and new-product development performance, and technology firms differ in terms of innovation and product performance. Similarly, the study by Shafique and Saeed (2020) indicates that differences in innovative and environmental practices yield great benefits for firms when applied to gain a competitive advantage. There are differences in the integration of green practices with social and environmental benefits for the firm (Khan et al., 2022). The environmental and social aspects are linked to the innovativeness and risk-taking capabilities, which can further support the inclination of the firms toward environmental protection reaping benefits in different arrangements (Han and Huo, 2020). According to Zhu et al. (2008), the organizations use GSCM strategies to improve supply chain performance. Whereas the country’s major aim is still economic development (Lee et al., 2013), its manufacturing industry has been driven to enhance its sustainability impact due to growing worldwide attention on environmental concerns. GSCM is a relatively new idea in Pakistan and other developing nations, despite its maturity in certain developed economies. Based on the above discussion this study proposes the following hypotheses:

H2: There is a significant difference in the profitability between GSCM of highly committed firm and GSCM lowly committed firm.

H2a: There is a significant difference in the gross profit ratio between GSCM of highly committed and GSCM lowly committed firms.

H2b: There is a significant difference in the net profit ratio between GSCM of highly committed firm and GSCM lowly committed firm.

H2c: There is a significant difference in customer satisfaction between GSCM of highly committed firm and GSCM lowly committed firm.

H2d: There is a significant difference in the learning and growth between GSCM of highly committed and GSCM lowly committed firms.

H2e: There is a significant difference in the efficiency of GSCM of highly committed firm and GSCM lowly committed firm.

3 Methodology

3.1 Measurement of Variables

3.1.1 Dimension of Performance

Gross profit ratio (GPR) is measured as the ratio of gross profit to total revenue; net profit ratio (NPR) is measured as the ratio of net profit to total revenue, customer satisfaction (CUS), the dimension of performance is measured as the total sales, learning and growth (LGR) dimension of performance is measured as the number of firm employees, efficiency (EFF) dimension of performance is measured as the ratio of total sales to total assets.

3.1.2 GSCM Indicators

The green supply chain management index (GSI) measures green supply chain management that focuses mainly on how the corporate supply chain impacts the environment. This variable measures the existence of four GSCM practices, which are the presences of production processes to lower environmental impacts of the supply chain; life cycle assessment to source materials; ISO 14001 criteria for selecting suppliers; and termination of the supply chain that does not meet environmental criteria. Green Product Index (GPI) is another green supply chain management indicator that focuses on how corporate products encourage environmental sustainability. It measures the existence of three GSCM practices. These are the existence of a product that improves environmental quality; the existence of product features that promote environmental quality; and the existence of design of products for recycling, reuse, and reduction of environmental pollution. In the construction of both indexes of GSCM points, each parameter of the index abovementioned is assigned from minimum 0 to maximum 1 by evaluating the focus on GSCM parameters in the annual reports of selected corporations (Miroshnychenko et al., 2017).

The other variables engaged in this study are firm size (SIZ) and board size (BSI) measured by taking the log of total assets and the total number of executive members on the board of the firm, respectively. The data for this study is gathered from annual reports of fifteen manufacturing firms listed on the Pakistan Stock Exchange (Goh et al., 2016) from 2009 through 2018. The manufacturing firms are suitable for this sort of investigation because their range of activities includes the input of materials, production, distribution, and finally the end-user incorporating all the processes of supply chain activities (Yusoff et al., 2021).

3.2 Model Specification

To analyze the impact of green supply chain management on firm’s performance, the firm’s performance is modeled as a function of green supply chain management. Following Miroshnychenko et al. (2017), green supply chain management is decomposed into two indexes, which are the green supply chain management index (GSI) and the green product index (GPI). The firm size and board size are included as control variables. Hence, the model of this study is stated in functional form as follows:

Equation 1 is disaggregated to accommodate five dimensions of the firm’s performance; which are gross profit ratio, net profit ratio, customer satisfaction, the learning and growth, and efficiency dimension. Hence, Eq. 1 produces

Equation 2: In linear form the abovementioned Eq. 1 for performance dimensions can be stated as

where α0, β0, π0, Ω0, and

3.3 Estimation Techniques

The study engaged two estimation techniques. The first technique is the general method of moments (GMM) proposed by Arellano and Bond (1991) and Arellano and Bover (1995) offering linear and non-biased parameter estimates that have the least variances which is particularly used when there is a potential problem of endogeneity in a regression model. ANOVA is also employed to ascertain significant differences in performance among top and least firms practicing GSCM in Pakistan. Another statistical technique used is granger causality to ascertain whether a particular time series can be used to forecast another. The use of granger causality helps to provide robust results on the phenomenon investigated.

Certain factors are compelled to use the GMM analysis technique mainly. First, it takes an omitted time-invariant country effect in the penal data. Second, GMM is a more efficient model when the data contain autocorrelation and heteroscedasticity issues (Roodman, 2006). Third, there are chances that endogeneity problems may arise due to which the results may deteriorate but system GMM also encounters endogeneity (Akbar et al., 2016; Duru et al., 2016). The endogeneity problem is when the explanatory variable and error term is correlated. Before engaging the GMM estimator, the study engaged appropriate tests to ascertain that the data is reliable and valid for empirical analysis. To assess the validity of the instruments used for the GMM estimation, the study made use of Sargan’s statistics. It is employed for over-identifying limitations, which are typically used to see if an estimated parameter is impacted when the number of instrumental variables exceeds the number of estimated parameters (Arellano and Bond, 1991). The study showed that the instruments were valid and that the over-identifying limits would not be rejected. Moreover, the study engaged the Wald statistic to check for the presence of heteroscedasticity. The results showed that heteroscedasticity is absent in the datasets. Further, the study tested for serial autocorrelation using the AR (1) and AR (2) statistics. The results of AR (2) show that there is an absence of serial autocorrelation in the datasets.

4 Results and Discussion

4.1 ANOVA Results

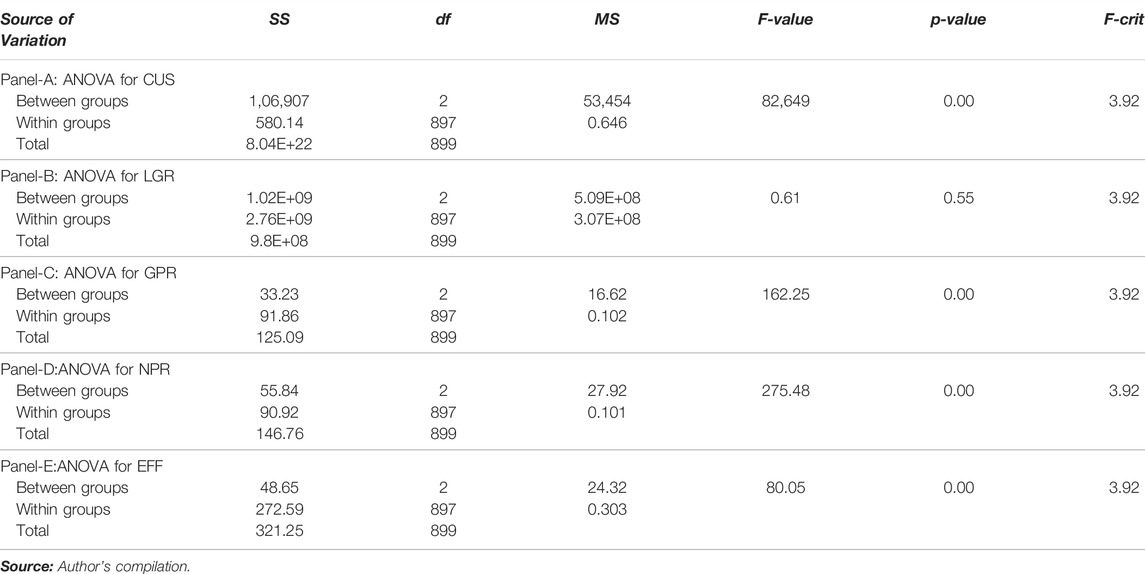

In Table 1, the ANOVA results indicate differences in performance metrics among top and least firms practicing green supply chain management in Pakistan. For the learning growth performance dimension (LGR) there is no significant difference among firms practicing GSCM. However, at the 1% level, there is a significant difference in customer (CUS) performance dimension among the top and low GSCM performing firms in Pakistan. Also, at the 1% level, there is a significant difference in gross profit ratio (GPR), net profit ratio (NPR), and efficiency (EFF) performance indicators among the top and low GSCM performing firms in Pakistan. These results indicate that the firms with high participation in GSCM initiatives experience the difference in performance metrics from those with low GSCM practices. The results confirm the acceptance of the second alternate hypothesis.

Moreover, these results are aligned with the results of Nikabadi and Shahrokhnia (2019) revealing that difference in performance is achieved with innovation in product development. Furthermore, ANOVA results confirm the resource-based theory which posits that businesses should engage their resources to attain competitiveness (Tan et al., 2016). This is mainly due to the significant differences in customer satisfaction, gross profit ratio, net profit ratio, and efficiency performance metrics among the top and low GSCM practicing corporations investigated which are supported by previous studies (Barney, 1991; Hart and Dowell, 2011; Sohail et al., 2013).

4.2 Granger Causality Results

Granger causality results reported in Table 2 highlighted only significant granger cause results; extended results are not reported due to their insignificance. The results indicate that both GSI and GPI granger cause learning growth (LGR) metric performance of the firms investigated. On the other hand, LGR also Granger cause GSI. GPI holds a strong position here to granger causes gross profit ratio, net profit ratio, and efficiency performance metrics of the corporations investigated. Moreover, the results elucidate that neither GSI nor GPI measures of GSCM practices granger cause customer dimension metric among the corporations explored in Pakistan. The results inferred that the GPI measure of GSCM practice exhibits a strong impression on performance factors. However, GSI exerts a weak influence on the performance measures of corporations in Pakistan. This highlights that not enough GSCM practices are followed among corporations in Pakistan, which have not translated in their performance metrics which is aligned with the literature (Sohail et al., 2014; Laari et al., 2016; Sari, 2017).

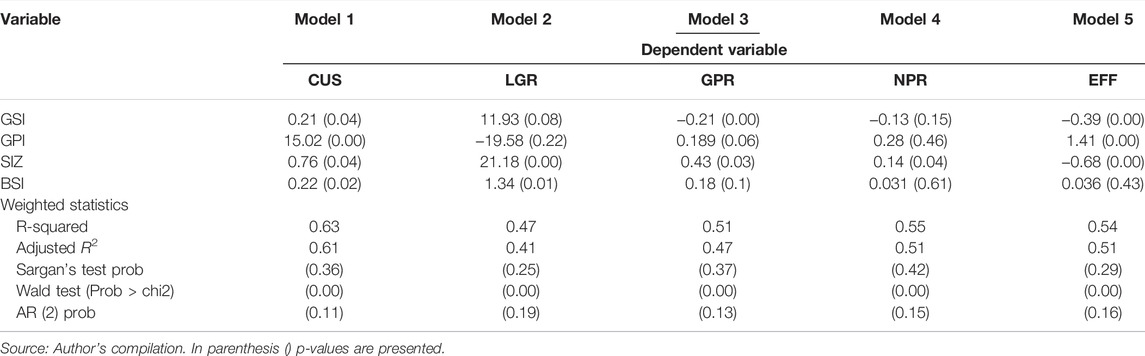

4.3 GMM Panel Regression Results

The results in Table 3 revealed that the GSI component of GSCM practices significantly affects the corporate performance. It positively determines customer satisfaction and learning growth dimension metrics but holds a negative association with gross profit ratio, net profit ratio, and efficiency metrics. This explains that firms with higher GSI increases their customer dimension by increasing their sales and also increasing their number of employees (LGR dimension) which enhances overall growth prospects. The contrary results specify that a higher GSI component negatively affects profitability ratio and efficiency in terms of asset utilization due to the focus on processes improvement by protecting the environment.

The GPI component of GSCM practice exerts a significantly positive impact on the customer aspect, profitability ratios, and efficiency performance metrics of the corporations investigated in Pakistan. The parameter estimates confirm that GPI contributes to increases in sales, efficiency, net profit ratio, and gross profit ratio. Furthermore, clarifying that growth in GPI promotes sales, asset utilization, and firm profitability with the product features that improve environmental quality or reusability. However, the learning growth performance metric is not significantly affected by the GPI component. This implies that the number of employees metric is not considered connected to green product features. Nonetheless, the board size and firm size contribute positively to the firms’ customer, learning growth, and profitability ratios. This implies that growth in investment and board members cause growth in performance indicators.

The estimates from the panel regression results revealed that Pakistan’s GSCM practice is a significant determinant of corporate performance. The Green product index (GPI) helps to improve the gross profit ratio (GPR performance dimension), net profit ratio (NPR performance dimension), sales, and corporate efficiency (EFF performance dimension). The promotion of GSCM initiatives in terms of green products helps in improving the corporate relationship with its customers (CUS performance dimension) and profitability. These findings are aligned with Khan and Qianli (2017), Shafique et al. (2017), Aslam et al. (2018), whose results offer sufficient evidence that the practices of green products initiatives enhance the corporate performance in Pakistan.

On the other hand, the green supply chain management index (GSI) also promotes the firm’s performance in terms of customer satisfaction and learning growth parameters. However, there is an evidence of a negative association of GSI with profitability and asset utilization. This implies that business partners’ collaboration, safety, sustainability, and environmental protection practices are not meaningfully transferred to offer a higher level of economic, environmental, operational, and social performance contrary to the findings of Geng et al. (2017), who offer the inclusion of such practices to get superior performance. Furthermore, these findings imply that there is a need for more conscious efforts and meaningful implementation of these practices to translate them into the success factors for the firm along with optimization for the society (Sugandini et al., 2020).

Importantly, the panel regression estimates that GSCM indexes influence at least the five corporate performance metrics explored in this study, this confirms that GSCM does not only influence internal performance metrics (Gross profit ratio, net profit, efficiency, and learning growth dimension) of corporations in Pakistan, but it also influences external performance metric (customer dimension) of corporations in Pakistan. Thus, supporting the stakeholders’ theory in terms of the impression of firms’ activities to larger groups in society and also resource-based theory suggesting appropriate use of means leads to superior performance (Teng, 2007; Freeman, 2015; Saeed et al., 2018). However, the panel regression results also revealed that GSCM indexes can contribute to a decline in performance metrics among the corporations, as the GSI component negatively impacted gross profit ratio, net profit ratio, and efficiency ratio metrics. The previous studies also supported the claim that GSCM does not always promote firm competitiveness (Masulis and Reza, 2015; Syakila, 2016; Miroshnychenko et al., 2017). Therefore, in this condition H1 is partially accepted. Furthermore, the results supported the importance of engaging in such practices due to significant differences in profitability, customer satisfaction, and efficiency among the top and low GSCM practicing corporations. However, the manufacturing sector activities does help in environmental sustainability by aligning their production and distribution processes with green and environment-friendly sustainable practices (Awan, 2020; Yusoff et al., 2021).

Overall, the present study’s finding highlighted the importance of effective green supply chain management among corporations in developing countries to drive their overall performances. These findings are consistent with previous research in a similar context (Awan, 2018; Karmaker et al., 2021; Khan et al., 2022). Furthermore, shallow GSCM practices may not yield the expected benefits; instead, conscientious efforts are needed to ensure continuous GSCM initiatives that comprehensively benefit stakeholders and the environment. To achieve outstanding financial results in today’s competitive market, a firm must pursue a cohesive resource-based strategy that articulates its goals to create, acquire, and use green resources that enhance performance and support the environment.

This study is not without some challenges and limitations that can be improved upon by future studies. For instance, this study focuses on a few parameters of GSCM, which future researchers can improve upon by exploring other measures of GSCM. Moreover, this study centers on businesses and corporations in Pakistan. The future researchers can advance this by exploring other developing countries and comparing them with the developed countries. Additionally, the focus of this study was only on the practices of GSCM and firms’ performance. Other factors, such as green innovation or green innovation intensity, should be used to examine business performance in future studies. It is well understood that GSCM raised the operating expenses in enterprises; thus, future research studies can highlight the sort of operating factors that can get affected due to such practices.

5 Conclusion

This study investigates the association between green supply chain management (GSCM) and corporate performance among Pakistani listed companies by using the panel general method of moments (GMM) and ANOVA, while the Granger causality methodology provides robust results. The results from this study revealed that GSCM practice plays a significant role in determining corporate performance in Pakistan. The GSCM initiative helps to profitability, customer satisfaction, asset utilization, and growth dimensions of the corporations. It is important to understand that a superficial approach to GSCM may not deliver the desired results; instead, conscious efforts must be made to guarantee ongoing GSCM activities benefiting all stakeholders and the environment. In today’s competitive market, a company must follow a unified resource-based strategy that articulates its goals for creating, acquiring, and using green resources that improve performance and benefit the environment. The uniqueness of this study elucidates the role of a company’s practice in achieving competitive performance by providing evidence on various performance indicators and offering evidence not based on opinion but rather factual knowledge. Although it is widely known that GSCM procedures do not immediately provide advantages and instead increase operating costs in firms, if fully implemented, they contribute to greater financial performance.

5.1 Implications

This study depicted that adopting GSCM approaches helps a firm be responsible toward society as a whole. Business managers, shareholders, and policymakers are all affected by GSCM practices engaged in corporations. This study helped managers to better understand how organizational managers can engage in green practices to achieve competitive advantage in an ever-dynamic business world. This assumption is based on resource-based theory’s arguments that governments and companies should implement GSCM policies that benefit society as a whole. With the support of developing nations, the growing need for the adoption of green practices will support the realization of SDGs. However, the companies must raise their knowledge of the need to incorporate green practices into their operations to gain higher performance and safeguard the society and the environment from the detrimental effects of supply chain activities.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

Conceptualization: SK and SQ; methodology: IS and RA; software: SK, IS, and RA; validation: SQ and SK; formal analysis: SK and RA; resources: SQ; writing (original draft preparation): SQ and SK; writing (review and editing): SQ; project administration: and SQ; funding acquisition: SQ. All authors have read and agreed to the published version of the manuscript.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Akbar, S., Poletti-Hughes, J., El-Faitouri, R., and Shah, S. Z. A. (2016). More on the Relationship between Corporate Governance and Firm Performance in the UK: Evidence from the Application of Generalized Method of Moments Estimation. Res. Int. Bus. Finance 38, 417–429. doi:10.1016/j.ribaf.2016.03.009

Arellano, M., and Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 58 (2), 277–297. doi:10.2307/2297968

Arellano, M., and Bover, O. (1995). Another Look at the Instrumental Variable Estimation of Error-Components Models. J. Econ. 68 (1), 29–51. doi:10.1016/0304-4076(94)01642-d

Aslam, H., Rashid, K., Wahla, A. R., and Tahira, U. (2018). Drivers of Green Supply Chain Management Practices and Their Impact on Firm Performance: A Developing Country Perspective. J. Quant. Methods 2 (1), 87–113. doi:10.29145/2018/jqm/020104

Awan, U. (2018). Effects of Buyer-Supplier Relationship on Social Performance Improvement and Innovation Performance Improvement. Int. J. Appl. Manag. Sci. 11 (1), 21–35. doi:10.1504/IJAMS.2019.096657

Awan, U. (2019). Impact of Social Supply Chain Practices on Social Sustainability Performance in Manufacturing Firms. Int. J. Innovation Sustain. Dev. 13 (2), 198–219. doi:10.1504/ijisd.2019.10019789

Awan, U. (2020). “Steering for Sustainable Development Goals: A Typology of Sustainable Innovation,” in Industry, Innovation and Infrastructure. Editors W. Leal Filho, A. M. Azul, L. Brandli, A. Lange Salvia, and T. Wall (Cham: Springer International Publishing), 1–12. doi:10.1007/978-3-319-71059-4_64-1

Bagher, A. (2018). The Effect of Supply Chain Capabilities on Performance of Food Companies. J. Finance Mark. 2 (4), 1–9. doi:10.35841/finance-marketing.2.4.1-9

Baier, P., Berninger, M., and Kiesel, F. (2020). Environmental, Social and Governance Reporting in Annual Reports: A Textual Analysis. Financial Mark. Institutions Instrum. 29 (3), 93–118. doi:10.1111/fmii.12132

Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. J. Manag. 17 (1), 99–120. doi:10.1177/014920639101700108

Chan, H. K., Yee, R. W. Y., Dai, J., and Lim, M. K. (2016). The Moderating Effect of Environmental Dynamism on Green Product Innovation and Performance. Int. J. Prod. Econ. 181, 384–391. doi:10.1016/j.ijpe.2015.12.006

Chiu, J.-Z., and Hsieh, C.-C. (2016). The Impact of Restaurants' Green Supply Chain Practices on Firm Performance. Sustainability 8 (1), 42. doi:10.3390/su8010042

Choi, D., and Hwang, T. (2015). The Impact of Green Supply Chain Management Practices on Firm Performance: The Role of Collaborative Capability. Operations Manag. Res. 8 (3), 69–83. doi:10.1007/s12063-015-0100-x

Dadhich, P., Genovese, A., Kumar, N., and Acquaye, A. (2015). Developing Sustainable Supply Chains in the UK Construction Industry: A Case Study. Int. J. Prod. Econ. 164, 271–284. doi:10.1016/j.ijpe.2014.12.012

Diabat, A., and Govindan, K. (2011). An Analysis of the Drivers Affecting the Implementation of Green Supply Chain Management. Resour. Conserv. Recycl. 55 (6), 659–667. doi:10.1016/j.resconrec.2010.12.002

Drohomeretski, E., Gouvea da Costa, S. E., Pinheiro de Lima, E., and Garbuio, P. A. D. R. (2014). Lean, Six Sigma and Lean Six Sigma: An Analysis Based on Operations Strategy. Int. J. Prod. Res. 52 (3), 804–824. doi:10.1080/00207543.2013.842015

Duru, A., Iyengar, R. J., and Zampelli, E. M. (2016). The Dynamic Relationship between CEO Duality and Firm Performance: The Moderating Role of Board Independence. J. Bus. Res. 69 (10), 4269–4277. doi:10.1016/j.jbusres.2016.04.001

Eccles, R. G., Ioannou, I., and Serafeim, G. (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 60 (11), 2835–2857. doi:10.1287/mnsc.2014.1984

Freeman, R. E. (2015). “Wiley Encyclopedia of Management,” in Stakeholder Theory. Editor Cooper, C. L.. doi:10.1002/9781118785317.weom020179

Geng, R., Mansouri, S. A., and Aktas, E. (2017). The Relationship between Green Supply Chain Management and Performance: A Meta-Analysis of Empirical Evidences in Asian Emerging Economies. Int. J. Prod. Econ. 183, 245–258. doi:10.1016/j.ijpe.2016.10.008

Ghobakhloo, M., Tang, S. H., Zulkifli, N., and Ariffin, M. (2013). An Integrated Framework of Green Supply Chain Management Implementation. Int. J. Innovation, Manag. Technol. 4 (1), 86.

Goh, B. W., Lee, J., Ng, J., and Ow Yong, K. (2016). The Effect of Board Independence on Information Asymmetry. Eur. Account. Rev. 25 (1), 155–182. doi:10.1080/09638180.2014.990477

Green, K. W., Zelbst, P. J., Meacham, J., and Bhadauria, V. S. (2012). Green Supply Chain Management Practices: Impact on Performance. Supply Chain Manag. Int. J. 17 (3), 290–305. doi:10.1108/13598541211227126

Han, Z., and Huo, B. (2020). The Impact of Green Supply Chain Integration on Sustainable Performance. Industrial Manag. Data Syst. 120 (4), 657–674. doi:10.1108/IMDS-07-2019-0373

Hart, S. L., and Dowell, G. (2011). Invited Editorial: A Natural-Resource-Based View of the Firm. J. Manag. 37 (5), 1464–1479. doi:10.1177/0149206310390219

Hu, A. H., and Hsu, C. W. (2010). Critical Factors for Implementing Green Supply Chain Management Practice: An Empirical Study of Electrical and Electronics Industries in Taiwan. Manag. Res. Rev. 33 (6), 586–608. doi:10.1108/01409171011050208

Karmaker, C. L., Ahmed, T., Ahmed, S., Ali, S. M., Moktadir, M. A., and Kabir, G. (2021). Improving Supply Chain Sustainability in the Context of COVID-19 Pandemic in an Emerging Economy: Exploring Drivers Using an Integrated Model. Sustain. Prod. Consum. 26, 411–427. doi:10.1016/j.spc.2020.09.019

Khaksar, E., Abbasnejad, T., Esmaeili, A., and Tamošaitienė, J. (2016). The Effect of Green Supply Chain Management Practices on Environmental Performance and Competitive Advantage: A Case Study of the Cement Industry. Technol. Econ. Dev. Econ. 22 (2), 293–308. doi:10.3846/20294913.2015.1065521

Khan, H. U. R., Usman, B., Zaman, K., Nassani, A. A., Haffar, M., and Muneer, G. (2022). The Impact of Carbon Pricing, Climate Financing, and Financial Literacy on COVID-19 Cases: Go-For-Green Healthcare Policies. Environ. Sci. Pollut. Res., 1–13. doi:10.1007/s11356-022-18689-y

Khan, S. A. R., and Qianli, D. (2017). Impact of Green Supply Chain Management Practices on Firms' Performance: An Empirical Study from the Perspective of Pakistan. Environ. Sci. Pollut. Res. 24 (20), 16829–16844. doi:10.1007/s11356-017-9172-5

Kim, J. H., Youn, S., and Roh, J. J. (2011). Green Supply Chain Management Orientation and Firm Performance: Evidence from South Korea. Int. J. Serv. Operations Manag. 8 (3), 283–304. doi:10.1504/ijsom.2011.038973

Kirchoff, J. F., Tate, W. L., and Mollenkopf, D. A. (2016). The Impact of Strategic Organizational Orientations on Green Supply Chain Management and Firm Performance. Int. J. Phys. Distribution Logist. Manag. 46 (3), 269–292. doi:10.1108/ijpdlm-03-2015-0055

Kozlenkova, I. V., Hult, G. T. M., Lund, D. J., Mena, J. A., and Kekec, P. (2015). The Role of Marketing Channels in Supply Chain Management. J. Retail. 91 (4), 586–609. doi:10.1016/j.jretai.2015.03.003

Laari, S., Töyli, J., Solakivi, T., and Ojala, L. (2016). Firm Performance and Customer-Driven Green Supply Chain Management. J. Clean. Prod. 112, 1960–1970. doi:10.1016/j.jclepro.2015.06.150

Lai, K.-H., and Wong, C. W. Y. (2012). Green Logistics Management and Performance: Some Empirical Evidence from Chinese Manufacturing Exporters. Omega 40 (3), 267–282. doi:10.1016/j.omega.2011.07.002

Lee, S. M., Rha, J. S., Choi, D., and Noh, Y. (2013). Pressures Affecting Green Supply Chain Performance. Manag. Decis. 51 (8), 1753–1768. doi:10.1108/MD-12-2012-0841

Lichtenthaler, U. (2019). An Intelligence-Based View of Firm Performance: Profiting from Artificial Intelligence. J. Innovation Manag. 7 (1), 7–20. doi:10.24840/2183-0606_007.001_0002

Loughran, T., McDonald, B., and Yun, H. (2009). A Wolf in Sheep’s Clothing: The Use of Ethics-Related Terms in 10-K Reports. J. Bus. Ethics 89 (1), 39–49. doi:10.1007/s10551-008-9910-1

Masulis, R. W., and Reza, S. W. (2015). Agency Problems of Corporate Philanthropy. Rev. Financ. Stud. 28 (2), 592–636. doi:10.1093/rfs/hhu082

Miroshnychenko, I., Barontini, R., and Testa, F. (2017). Green Practices and Financial Performance: A Global Outlook. J. Clean. Prod. 147, 340–351. doi:10.1016/j.jclepro.2017.01.058

Nikabadi, M. S., and Shahrokhnia, A. (2019). Multidimensional Structure for the Effect of Innovation Culture and Knowledge Sharing on the New Product Development Process with Emphasis on Improving New Product Development Performance. Middle East J. Manag. 6 (4), 494–512. doi:10.1504/MEJM.2019.10021661

Novitasari, M., and Agustia, D. (2021). Green Supply Chain Management and Firm Performance: The Mediating Effect of Green Innovation. J. Industrial Eng. Manag. 14 (2), 391–403. doi:10.3926/jiem.3384

Roodman, D. (2006). “How to Do Xtabond2,” in Paper presented at the North American Stata Users' Group Meetings 2006, July 2006.

Saeed, A., Jun, Y., Nubuor, S., Priyankara, H., and Jayasuriya, M. (2018). Institutional Pressures, Green Supply Chain Management Practices on Environmental and Economic Performance: A Two Theory View. Sustainability 10 (5), 1517. doi:10.3390/su10051517

Sari, K. (2017). A Novel Multi-Criteria Decision Framework for Evaluating Green Supply Chain Management Practices. Comput. Industrial Eng. 105, 338–347. doi:10.1016/j.cie.2017.01.016

Seman, N. A. A., Zakuan, N., Jusoh, A., Arif, M. S. M., and Saman, M. Z. M. (2012). Green Supply Chain Management: a Review and Research Direction. IJMVSC 3 (1), 1–18. doi:10.5121/ijmvsc.2012.3101

Shafique, I., and Saeed, M. (2020). Linking Elements of Entrepreneurial Orientation and Firm Performance: Examining the Moderation of Environmental Dynamism. Middle East J. Manag. 7 (1), 93–108. doi:10.1504/mejm.2020.105228

Shafique, M., Asghar, M., and Rahman, H. (2017). The Impact of Green Supply Chain Management Practices on Performance: Moderating Role of Institutional Pressure with Mediating Effect of Green Innovation. Bus. Manag. Econ. Eng. 15 (1), 91–108. doi:10.3846/bme.2017.354

Sohail, M. T., Delin, H., Talib, M. A., Xiaoqing, X., and Akhtar, M. M. (2014). An Analysis of Environmental Law in Pakistan-policy and Conditions of Implementation. Res. J. Appl. Sci. Eng. Technol. 8 (5), 644–653. doi:10.19026/rjaset.8.1017

Sohail, M. T., Huang, D., Bailey, E., Akhtar, M. M., and Talib, M. A. (2013). Regulatory Framework of Mineral Resources Sector in Pakistan and Investment Proposal to Chinese Companies in Pakistan. Am. J. Industrial Bus. Manag. 03 (05), 514–524. doi:10.4236/ajibm.2013.35059

Sugandini, D., Muafi, M., Susilowati, C., Siswanti, Y., and Syafri, W. (2020). Green Supply Management and Green Marketing Strategy on Green Purchase Intention: SMEs Cases. J. Industrial Eng. Manag. 13 (1), 79–92. doi:10.3926/jiem.2795

Syakila, N. (2016). The Influence of Green Supply Chain Management Practices on Firm Competitiveness Performances. Available at SSRN 2882969.

Tan, C. L., Zailani, S. H. M., Tan, S. C., and Shaharudin, M. R. (2016). The Impact of Green Supply Chain Management Practices on Firm Competitiveness. Int. J. Bus. Innovation Res. 11 (4), 539–558. doi:10.1504/ijbir.2016.079507

Teng, B.-S. (2007). Corporate Entrepreneurship Activities through Strategic Alliances: A Resource-Based Approach toward Competitive Advantage. J. Manag. Stud. 44 (1), 119–142. doi:10.1111/j.1467-6486.2006.00645.x

Tripathi, A., and Bains, A. (20132013). Evolution of Corporate Social Responsibility: A Journey from 1700 BC till 21st Century. Int. J. Adv. Res. 1 (8), 788–796.

Wibowo, M. A., Handayani, N. U., and Mustikasari, A. (2018). Factors for Implementing Green Supply Chain Management in the Construction Industry. J. Industrial Eng. Manag. 11 (4), 651–679. doi:10.3926/jiem.2637

Wong, C. W. Y., Wong, C. Y., and Boon-itt, S. (2018). How Does Sustainable Development of Supply Chains Make Firms Lean, Green and Profitable? A Resource Orchestration Perspective. Bus. Strat. Env. 27 (3), 375–388. doi:10.1002/bse.2004

World Bank (2018). Annual Report. Available at: https://openknowledge.worldbank.org/handle/10986/30326 (Accessed November 20, 2021).

Youn, S., Yang, M. G., Hong, P., and Park, K. (2013). Strategic Supply Chain Partnership, Environmental Supply Chain Management Practices, and Performance Outcomes: an Empirical Study of Korean Firms. J. Clean. Prod. 56, 121–130. doi:10.1016/j.jclepro.2011.09.026

Yusoff, Y. M., Omar, M. K., Zaman, M. D. K., and Yusoff, Y. M. (2021). Practice of Business Sustainability. Evidence from the Malaysian Manufacturing Sector. Middle East J. Manag. 8 (2-3), 278–295. doi:10.1504/mejm.2021.114011

Keywords: green supply chain management, general method of moments, corporate performance, granger causality, Pakistan

Citation: Qalati SA, Kumari S, Soomro IA, Ali R and Hong Y (2022) Green Supply Chain Management and Corporate Performance Among Manufacturing Firms in Pakistan. Front. Environ. Sci. 10:873837. doi: 10.3389/fenvs.2022.873837

Received: 11 February 2022; Accepted: 14 April 2022;

Published: 12 May 2022.

Edited by:

Gagan Deep Sharma, Guru Gobind Singh Indraprastha University, IndiaReviewed by:

Usama Awan, Lappeenranta University of Technology, FinlandSrikanta Routroy, Birla Institute of Technology and Science, India

Copyright © 2022 Qalati, Kumari, Soomro, Ali and Hong. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sikandar Ali Qalati, c2lkcWFsYXRpQGdtYWlsLmNvbQ==; Sonia Kumari, c29uaWEua3VtYXJpQGliYS1zdWsuZWR1LnBr

†ORCID: Sikandar Ali Qalati, orcid.org/0000-0001-7235-6098; Sonia Kumari, orcid.org/0000-0002-8272-1332; Ishfaque Ahmed Soomro, orcid.org/0000-0002-8302-757X; Rajib Ali, orcid.org/0000-0001-9830-953X; Yifan Hong, orcid.org/0000-0002-9689-6096

Sikandar Ali Qalati

Sikandar Ali Qalati Sonia Kumari

Sonia Kumari Ishfaque Ahmed Soomro

Ishfaque Ahmed Soomro Rajib Ali

Rajib Ali Yifan Hong

Yifan Hong