Abstract

Climate change is one of the most severe threats to human survival and a significant factor influencing financial stability. Different from previous studies, this paper investigates the economic impact of climate change at the micro level based on data from China Meteorological Administration database, and China Household Finance Survey (CHFS) 2017 released in 2019. The empirical findings indicate that climate change contributes to the financial vulnerability of farmers’ households, which is confirmed following robustness tests. The mechanism analysis reveals that climate change has effects on rural households’ financial vulnerability via farmers’ health, credit availability, and agricultural output. Furthermore, the effect of climate change on farmers’ household financial vulnerability (HFV) is more pronounced in farmers with lower education levels. The changes in temperature and precipitation show different intensity effects in different areas, but all of them provide reasonable heterogeneity mechanisms. This paper’s policy value is demonstrated by the fact that it uncovers the effects of climate change on farmers’ HFV, information that may be useful for addressing climate change and rural financial stability.

1 Introduction

Climate change is one of the most severe threats to human survival and a significant factor influencing financial stability. At the World Economic Forum 2022 video conference, the United Nations (UN) emphasized that the world urgently needs to address three major challenges—inequitable vaccine distribution, a revitalized financial system, and climate change—to emerge from the ongoing economic and health crisis and achieve the UN’s Sustainable Development Goals. According to the Intergovernmental Panel on Climate Change (IPCC)’s latest report, ‘Climate Change 2022: Impacts, Adaptation, and Vulnerability’, China will be one of the most affected regions if greenhouse gas emissions are not reduced1. In addition, future climate change will continue to alter the spatial and temporal distributions of temperature and precipitation, increasing the frequency and intensity of extreme events such as heavy rainfalls, floods, droughts, and pest outbreaks. Furthermore, a report by the Financial Stability Oversight Council (FSOC) on Climate-Related Financial Risk20212 emphasizes climate change as a “new threat to United States financial stability”, and thus, it is necessary to regulate and supervise climate-related financial risks. The possible economic and financial risks caused by climate change have become a hot issue in academia.

Climate change have seriously effects on the ecological environment and the normal operation of the social economy (Li et al., 2022a; Li and Wang, 2022). According to some studies, increasing average temperature, which is a type of climate change, negatively affects economic variables such as agriculture (Mendelsohn et al., 1994; Reilly et al., 2003; Schlenker et al., 2005; Fisher et al., 2012; Chen and Gong, 2021), industrial output (Chen and Yang, 2017), and yield or production efficiency growth (Colacito et al., 2019; Kumar and Khanna, 2019; Li et al., 2015). Moreover, the fluctuation in the amount of precipitation is another measure of climate change. Xie et al. (2020) consider the temperature, precipitation, and standard deviations in China’s agricultural policy simulation and projection model (CAPSiM) and find that climate change negatively affects agricultural output, which is similar to the previous conclusion. Lanzafame (2014) investigates the effect of the relationship between temperature and rainfall on economic development in Africa based on the annual data of 36 African countries from 1962 to 2000. Temperature is found to negatively affect every capita income in both short and long term, but there is little support for the assertion that rainfall affects the economy. Unlike the above results, Villavicencio et al. (2013) investigate the impacts of climate change on agricultural total factor productivity (TFP) in the United States, the findings of which show that annual precipitation has a significant positive effect on agricultural TFP but that precipitation intensity has a significant opposite effect, and temperature changes have no effect on agricultural TFP in most areas. These findings shows that the unique characteristics of agriculture and rural areas place them at the center of global climate change adaptation efforts. However, the majority of scholars are concerned with the effects of climate change on a larger scale.

Regarding household financial vulnerability (HFV), the related research is still in its infancy. Early concepts of financial vulnerability evolved from lifecycle theory (Campbell, 2006; Lin and Grace, 2007), which shows the likelihood that a family will be in financial distress in the future (O'Connor et al., 2018) and can be used to measure household financial stability. Mian and Sufi (2009) and Leika and Marchettini (2017) confirm the significant interrelationship between HFV and the stability of financial system. The Financial Stability Review (FSR) of the Bank of Indonesia regards HFV as an assessment of the resilience of macro-financial stability (Noerhidajati et al., 2020). Moreover, some factors affect HFV, including the socioeconomic characteristics of individuals and family-level characteristics. In addition, individual characteristics include age, gender, marital status, education level, and income level, while the characteristics at the family level include indicators of household assets and liabilities, household size, social capital, etc. Using an ordered probit model based on 902 individual respondents in Malaysia, Daud et al. (2019) find that income level, marital status, age, level of education, and financial behavior in money management all strongly influence HFV. They also point out that improving education positively contributes to HFV. In terms of income level, families with low income find it more difficult to deal with emergencies and afford expenditures, which leads to deep HFV among these families. Abdullah Yusof et al. (2015) hold the same view based on data from Malaysia. Moreover, based on data from Indonesia, Noerhidajati et al. (2020) find that middle- and upper-income groups have more debt, resulting in higher HFV compared to lower-income households. Moreover, financial literacy plays a vital role in HFV (Abdullah Yusof et al., 2015; French and McKillop, 2016), attracting much attention among scholars. According to Daud et al. (2019), owning a house helps a household survive severe financial insecurity. Similarly, Lusardi and Mitchelli (2007) emphasize the importance of financial literacy in the improvement of financial fragility and find that the larger scale of the family brings about higher expenditure and consumption levels, which exacerbates HFV. In addition, HFV is also affected by institutional factors, including information sharing arrangements and individual bankruptcy regulation (Jappelli et al., 2010). By reviewing the literature, existing studies have explored mainly the factors influencing HFV at the micro level, neglecting the impact of macroeconomic shocks, especially climate change, as a macro variable on HFV.

This paper aims to determine whether climate change increases the financial vulnerability of rural households. If so, what are the mechanisms of this influence? The major contributions of this paper are as follows. First, this paper fills the research gap regarding climate change and farmers’ HFV. Although the current literature provides theoretical support and methodological inspiration for this paper, a complete analytical framework and empirical results are lacking. The climate change issue is becoming increasingly urgent and is shifting from a future challenge to an ongoing crisis. As the largest developing country all over the world, China has progressed in participating in global climate governance and addressing climate change. This development indicates that this study is highly relevant and may provide empirical inspiration for future research. Second, this paper extends the study of farmers’ HFV. The empirical results show that climate change creates a microeconomic shock and exacerbates HFV. Besides, to ensure the scientific and rigorous findings of this study, different scenarios and measurement methods are considered. In addition, other robustness tests are applied. After a series of tests, the findings of this paper remain significant. Third, how to prevent and respond to climate change and improve the financial vulnerability of households have become critical topics. Yin et al. (2021) point out the perception of flood disaster risk positively contributes to the flood disaster preparedness behaviors of households, and this work regards climate change as a kind of macro risk, provides recommendations for climate change and rural financial stability. Besides, it also confirms the effect of the mechanism of climate change on household financial fragility in rural areas.

The remainder of the paper is organized as follows. Section 2 presents the theoretical analysis and hypothesis development; Section 3 presents the data, variable selection, and methodology; Section 4 presents the empirical results; and Section 5 presents the conclusions and policy recommendations.

2 Theoretical Analysis and Hypothesis Development

2.1 Climate Change and HFV

Researchers define “vulnerability” in terms of the resilience of humans to natural disasters. For example, Kreimer and Arnold (2000) regard vulnerability as the ability of an individual, household, or community to prevent, mitigate, and rebuild in the face of natural hazards, with poor or near-poor households being more vulnerable to natural hazards. The greater vulnerability of poor or near-poor households to natural disasters stems primarily from the fact that vulnerable households have relatively few assets and lack access to necessary capital (Alwang, 2000). Community disaster resilience closely relates to the risk perception in earthquake-stricken areas. The community with better resource endowment, disaster management, information communication, less vulnerability the residents face with (Ma et al., 2021; Ma et al., 2022). Based on obtained primary household data from Akwa Ibom State, Nigeria, Amos et al. (2015) develop a livelihood vulnerability index (LVI) to assess vulnerability and find that households are vulnerable to climate change and that a shortage of adequate finance is the most important challenge. Albert et al. (2021) point out that empirical evidence suggests that higher temperatures and extreme weather can have a negative impact on economic activity. According to Paavola (2008), climate change in Tanzania limits livelihood options for women, children, and those vulnerable groups without adequate access to employment and public services, increasing their insecurity and making their livelihood even worse. In addition, farmers have always found ways to adapt to the impact of climate change, and based on data from Nigeria, Abraham and Fonta (2018) find that the exposure of farmers to climate change significantly relates to their need for financial access as an adaptation strategy. Moreover, according to a survey of 380 resource-poor riverbank erosion-prone households in Bangladesh, Alam et al. (2017) explore the local knowledge of adaptation in response to the perceived impacts of climate change and climatic hazards. The results indicate that changes in the climate and extreme climatic events have an effect on the households’ livelihood and resources, increasing their perceptions of vulnerability. Furthermore, climate change caused by air pollution, natural disasters like earthquake, lead to higher expenditures for insurance purchases (Xu et al., 2018), especially for health insurance (Zhao, 2020), and extreme climate events significantly decrease the expenditure of households heavily dependent on agriculture for their income (Urama et al., 2019). In general, higher household expenditure contributes to HFV when income remains the same.

Therefore, we believe that climate change exacerbates HFV and propose the following hypothesis:

Hypothesis 1Climate change exacerbates farmers’ HFV.

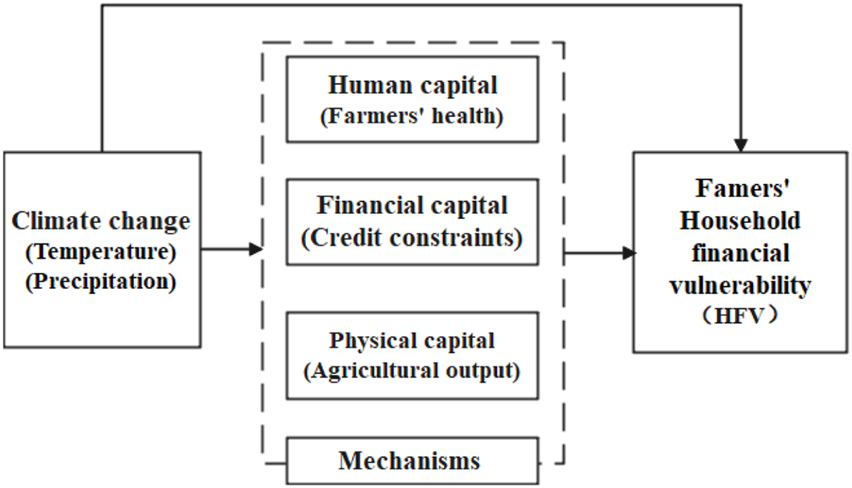

2.2 Mechanisms of Livelihood Capitals

Human, physical and financial capital are important factors that affect the livelihoods of farm households (Vemuri and Costanza, 2006; Xu et al., 2019; Yang et al., 2021) and are also the main areas of vulnerability to the adverse effects of climate change (Handmer et al., 2012). Physical capital consists of the infrastructure and materials needed to support livelihoods. Human capital refers to individuals’ knowledge, health status, etc., for earning a living. Financial capital refers to the financial resources, which typically include cash, savings, credit, remittances, and transfer income, used by households or individuals to achieve their life goals. First, the high dependence of agricultural production on the natural environment makes agriculture often affected by windstorms, rainstorms, hailstorms, persistent drought, and pests and diseases caused by climate change. These factors affect the physical capital of farm households. Second, disease risk affects farm households’ human capital, which leads to the increased financial vulnerability of rural households. Finally, climate change can impair the operations of rural financial institutions, thereby affecting the financial capital of rural households. It is unclear how climate change affects the financial stability of rural households by influencing the cost of livelihoods and thus the financial stability of rural households.

Burgess et al. (2014) uses Indian data to explore whether hot weather shocks affect mortality differently in rural and urban areas and finds a 7.3% increase in annual mortality in rural areas for a per °C increase in average daily temperature. However, there is no evidence of such effects in urban areas, and it is predicted that global warming between 2015 and 2019 will reduce life expectancy in rural areas. According to Bosello et al. (2012), climate shocks affect crop production and people’s health, and the effects on different areas vary. These effects are weaker at higher latitudes and stronger at lower latitudes. Moreover, it is generally agreed that health risk factors significantly worsen the financial vulnerability of farm households and that the higher the health risk is, the higher the probability of expected financial deterioration of farm households. Uddin et al. (2017) provide evidence that climate change has been perceived by most farmers, with increased temperatures and decreased precipitation over the past 20 years, negatively impacting farmers’ health and livelihoods. In addition, concern of health risk plays as the mechanism of the public attention to environment and air pollution (Li et al., 2022b).

On the one hand, the presence of health problems in farm households reduces their income. Casasnovas et al. (2005), Narayan et al. (2010), and Chetty et al. (2016) argue that health affects economic productivity and thus reduces rural household income. On the other hand, health shocks can also affect household financial exposure and household financial decisions through household medical expenditures (Merton, 1969). Christiaensen and Subbarao (2005) find that reducing the incidence of malaria and increasing adult literacy and market openness significantly reduce household economic vulnerability based on data from rural Kenya. One study finds no significant effect of disease shocks on household nonmedical consumption expenditures (Townsend, 1994). The differences in the above findings may be due to the heterogeneous effects of health shocks on the financial risk of households with different incomes or different mechanisms of influencing household risk, both direct (Rosen and Wu, 2004; Wang et al., 2021) and indirect (Berkowitz and Qiu, 2006). In addition, in rural areas, the return to poverty due to illness is still one of the main factors negatively affecting the financial vulnerability of rural households.

Therefore, we believe that climate change worsens farmers’ health, which positively contributes to HFV in rural areas. Therefore, we propose the following hypothesis:

Hypothesis 2Climate change worsens farmers’ health, and then exacerbates farmers’ HFV.Household financial disincentives and underdeveloped credit markets are common in rural areas of many developing countries, resulting in widespread credit constraints for farm households. Hornbeck (2009) believes that financial system overspecialization in sectors such as agriculture may lead to increased vulnerability to climate shocks. The natural disasters caused by climate change undermine the value of collateral for bank loans and inhibit market liquidity through bank financing channels, causing negative shocks to the financial system’s stability. Physical asset damage caused by sudden climate disasters such as floods, hurricanes, high temperatures, or long-term climate problems such as a rise in sea level, precipitation changes, and seawater acidification can directly lead to a decline in the value of collateral in the household and business sectors. This decline in collateral value increases the risk of loan default for households and businesses (Klomp, 2014; Yannis et al., 2018). Furthermore, climate catastrophic shocks can lead to bank lending shyness, making banks more cautious in lending and thus reducing credit supply and market liquidity (Berg and Schrader, 2012; Hosono et al., 2016). Bank lending shyness causes rural households hit by such disaster to face more severe financing constraints and also further increases bank credit default rates, undermining banks’ ability to operate and thus creating a vicious cycle. This bank lending shyness is caused mainly by postdisaster losses, especially the loss of uninsured assets. Bank lending reluctance is more pronounced in developing countries following climate disasters than in developed countries (David, 2011). In turn, natural disasters caused by climate change also affect the rural financial system. Some natural disasters have the potential to damage rural finance offices, equipment, information systems, and records. Disaster losses faced by rural finance clients can also have indirect effects on the microfinance institutions (MFIs) themselves (Pantoja, 2002). In addition, some macroeconomic fluctuations triggered by natural disasters, such as inflation or recession triggered by large-scale disasters, may also indirectly have a significant negative impact on microfinance. For example, after Bangladesh suffered a severe flood disaster in 1998, 25% of Grameen Bank borrowers defaulted on their debts, which led to the cessation of loan repayments and the decline in mandatory savings, which depleted the bank’s liquidity (David, 1998).Therefore, we believe that climate change can increase financing constraints, which can promote HFV. Thus, we propose the following hypothesis:

Hypothesis 3Climate change exacerbates credit constraints, and then exacerbates farmers’ HFV. Villavicencio et al. (2013) show that precipitation and its intensity significantly affect agricultural TFP growth in the United States, while the effect of temperature is not significant. Jin et al. (2002) estimate the change in the TFP of rice in China from 1980 to 1995 with the Tornqvist-Theil index and conclude that climatic factors have significant effects on the TFP growth of rice. Yoji et al. (2016) use spatial geography to investigate the role of climate change in the process of influencing rice TFP and find that there is spatial autocorrelation in rice TFP and that climate change, like socioeconomic factors, has a persistent effect on rice TFP, but the extent of this impact varies across regions. In a general scenario, higher temperatures decrease yields, while more precipitation increases yields (Dell et al., 2014). Dinar (1998) studies how climate change affects Indian agriculture using cross-sectional data from Indian agricultural zones; he uses a general circulation model (GCM) to predict future changes in CO2 levels, affecting temperature and rainfall values in the region. Moreover, with the Ricardian model, he investigates the sensitivity of Indian agriculture to climate change. Based on the livelihoods of coastal farming households in Mozambique and Tanzania, Bunce et al. (2010) argue that if coastal Africa continues to attract migrants and the services of land and marine ecosystems continue to deteriorate, the risks to rural livelihoods from climate change will be amplified in western Africa. In addition, agriculture is the primary source of livelihood for most people in the region. Rising temperatures or changes in rainfall lead to lower river levels, crop failures, delayed planting seasons, lower incomes and reduced crop yields, with significant impacts on the natural resources on which agriculture depends. In addition, this can lead to the increased vulnerability of agriculture-based livelihoods for farmers. Furthermore, there is a significant risk of exacerbating and hastening the current ‘downward spiral’ of underdevelopment, poverty, and environmental degradation (Sissoko et al., 2011).Therefore, we believe that climate change can influence the output of agriculture, which can intensify HFV. Thus, we propose the following hypothesis:

Hypothesis 4Climate change lowers agricultural output, and then exacerbates farmers’ HFV (Figure 1).

FIGURE 1

The mechanisms of climate change’s effects on HFV.

3 Data and Methodology

3.1 Model

The independent variable HFV is a dummy variable, so this paper mainly uses the ologit model to verify the impact of climate change on the financial vulnerability of rural households. The regression model is as follows:where is the explained variable; is the core explanatory variable representing climate change (including the changes in temperature and precipitation); i denotes the city; represent other control variables; represents the province fixed effect, and is the error disturbance term.

Furthermore, we explore the underlying mechanisms as well as test the mechanisms of hypotheses 2 to 4. The specific model is set as follows: where represents underlying mechanism variables including farmers’ health, credit accessibility and agricultural output. Models (2) and (3) together aim to find the underlying mechanisms. If the coefficients and are significant, then it may be underlying mechanism.

3.2 Variables

3.2.1 HFV

Following O’Connor et al. (2018) and Loke (2017), this paper uses over-indebtedness and consumer arrears to estimate HFV. The household debt level is used to estimate the over-indebtedness, while emergency saving is the indicator of consumer arrears reflecting household capacity to buffer income shocks. This paper defines household over-indebtedness as a greater than 30% household debt-to-income ratio, which we assign a value of 1. If the household debt-to-income ratio is lower than 30%, the household is defined as non-overindebted and is assigned a value of 0.

Moreover, referring to Loke (2017), a household with savings of less than 3 months of living expenses is regarded as having no emergency savings and is assigned a value of 1, while having emergency savings is assigned a value of 0. Therefore, this paper assigns a value of 0 to households with no over-indebtedness and emergency savings, representing lower financial vulnerability. A value of 1 refers to the households with over-indebtedness but emergency savings, or no over-indebtedness and no emergency savings, representing medium financial vulnerability. A value of 2 indicates that households have both over-indebtedness and no emergency savings, indicating a high level of financial vulnerability. The scale of HFV ranges from 0 to 2, with a higher value indicating a higher level of financial vulnerability and a lower ability to withstand economic risks. In addition, emergency savings and over-indebtedness are dichotomous variables.

3.2.2 Climate Change

Climate change is a long-term process with small fluctuations in adjacent years. Because of the availability of data with a relatively short observation period, the average value of variable changes each year is very small, affecting the representativeness of the indicators. This paper uses the changes in temperature and precipitation to estimate climate change during the observation period. Therefore, following the measurement of risk and change (Christiano et al., 2014; Shimojo et al., 1991), it refers to the high-low method of volatility as the proportion of value (maximum-minimum) to the minimum value to estimate the changes in temperature (Tc) and precipitation (Pc).

3.2.3 Other Variables

Following the literature, this paper controls for individual and household characteristic variables. Individual-level variables include gender, age, education, marital status, and physical condition. Household-level variables include household size, family income, housing status, and whether the household operates a business. The intermediate variables include farmers’ health, credit constraints and agricultural output. Based on the questions of China Household Finance Survey (CHFS) 2017, the explanations are shown in Table 1.

TABLE 1

| Variables | Explanation | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| HFV | 0 = no over-indebtedness and having emergency savings | 0.3432 | 0.4757 | 0 | 2 |

| 1 = over-indebtedness but having emergency savings or no over-indebtedness and having no emergency savings | |||||

| 2 = both over-indebtedness and having no emergency savings | |||||

| Tc | Changes in temperature | 0.1992 | 0.1798 | 0.0104 | 2.2704 |

| Pc | Changes in precipitation | 1.4520 | 0.4698 | 0.6945 | 4.9049 |

| Gender | 1 = male | 1.1039 | 0.3051 | 1 | 2 |

| 2 = female | |||||

| Age | 61.7197 | 11.9394 | 18 | 97 | |

| Education | 1 = no schooling at all | 2.4721 | 0.9439 | 1 | 8 |

| 2 = primary school | |||||

| 3 = junior high | |||||

| 4 = high school | |||||

| 5 = technical high school | |||||

| 6 = college/vocational school | |||||

| 7 = bachelor’s degree | |||||

| 8 = master’s degree | |||||

| 9 = doctorate degree | |||||

| Marriage | 0 = no spouse | 0.8845 | 0.3196 | 0 | 1 |

| 1 = having a spouse | |||||

| Family members | Numbers | 3.5558 | 1.7386 | 1 | 15 |

| Family income | Ln (family total income) | 10.0442 | 1.2913 | 6.9088 | 15.4250 |

| Number of houses | 1.1541 | 0.4071 | 0 | 6 | |

| Whether operates a business | 0 = no | 0.0964 | 0.2951 | 0 | 1 |

| 1 = yes | |||||

| Farmers’ health | 1 = very bad | 3.0936 | 1.0430 | 1 | 5 |

| 2 = bad | |||||

| 3 = ordinary | |||||

| 4 = good | |||||

| 5 = very good | |||||

| Credit constraints | 0 = no | 0.0857 | 0.2799 | 0 | 1 |

| 1 = yes | |||||

| Agricultural output | Ln (agricultural GDP) | 26.3289 | 13.5825 | 2.3462 | 60.0550 |

Descriptive analysis.

3.3 Data Source and Descriptive Statistics

This article uses data from the CHFS 2017, which was released in 2019 by the Southwestern University of Finance and Economics. The database was obtained from the fourth round of the national survey, covering 29 provinces, autonomous regions and municipalities. In addition, the climate change data, including those on temperature and precipitation from 1991 to 2017, come from the China Meteorological Administration database.

Combining the purpose of the study and data accessibility, this work processes the data as follows. First, we match the climate change data of the 2017 prefecture-level cities with the data of CHFS 2017 and exclude the index data of Tibet and Xinjiang. Second, the samples of nonagricultural households and other forms of households are also excluded. Third, we exclude households whose heads are less than 18 years old. Fourth, missing values and outliers are also excluded from the data. After the above data processing, there are 9,059 valid observations as farmers left in the sample in 2017. Table 1 shows the descriptive statistics of the major variables.

4 Empirical Results

4.1 Baseline Regression Based on the Ologit Model

Table 2 reports the baseline regression results of climate change on farmers’ HFV in terms of temperature and precipitation. According to the results, both changes in temperature and precipitation positively contribute to the farmers’ HFV during the observation period, which supports Hypothesis 1. In terms of risk, climate change implies higher fluctuations and risks, which increase the complexity of household finance and then lead to financial vulnerability. Age has a negative effect on HFV. Compared to young farmers, older farmers may have more experience and skills to deal with financial problems and less HFV. The more family members there are, the easier it is for them to get into financial trouble, which supports the views of Lusardi and Mitchelli (2007). The higher income and wealth are, the easier it is for farmers to overcome financial vulnerability, which is similar to the conclusion of Noerhidajati et al. (2020). In addition, according to the negative coefficients of education and health, if farmers have more knowledge and are in better physical condition, their household finances are more stable.

TABLE 2

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Tc | 1.1561*** | 0.5253* | ||

| (0.1300) | (0.2905) | |||

| Pc | 0.3601*** | 0.5048*** | ||

| (0.0449) | (0.0625) | |||

| Gender | −0.0582 | −0.0503 | ||

| (0.0876) | (0.0878) | |||

| Marriage | 0.0648 | 0.0749 | ||

| (0.0866) | (0.0868) | |||

| Age | −0.0464*** | −0.0461*** | ||

| (0.0024) | (0.0024) | |||

| Education | −0.0224 | −0.0252 | ||

| (0.0286) | (0.0286) | |||

| Farmers’ health | −0.2347*** | −0.2316*** | ||

| (0.0286) | (0.0248) | |||

| Family members | 0.1602*** | 0.1661*** | ||

| (0.0163) | (0.0163) | |||

| Family income | −0.2816*** | −0.2886*** | ||

| (0.0222) | (0.0224) | |||

| Number of houses | 0.5159*** | 0.5030*** | ||

| (0.0606) | (0.0609) | |||

| Whether operates a business | 0.4794*** | 0.4732*** | ||

| (0.0823) | (0.0830) | |||

| Province FE | Yes | Yes | Yes | Yes |

| Pseudo R 2 | 0.0077 | 0.1051 | 0.0051 | 0.1094 |

| N | 9,059 | 9,059 | 9,059 | 9,059 |

Baseline regression results.

Note: Standard errors are in parentheses; *, ** and *** indicate statistical significance at the 10, 5 and 1% levels, respectively.

4.2 Robustness Tests

The possible endogeneity problems in this paper are problems about measurement error and omitted variables in models. This paper provides three methods with which to test the robustness in Tables 3, 4. The first method is to change the models. From ologit to oprobit, columns (1) and 4) show the results. Regarding the ordered variables as continuous variables, the model is changed from ologit to ordinary least squares (OLS), the results of which are shown in columns (3) and (6). The second method is to replace the measurement of HFV, the results of which are provided in columns (2) and (5) in Table 3.

TABLE 3

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Oprobit | Ologit | OLS | Oprobit | Ologit | OLS | |

| Tc | 0.3263* | 0.5172* | 0.1191* | |||

| (0.1671) | (0.2914) | (0.0619) | ||||

| Pc | 0.2966*** | 0.5042*** | 0.0985*** | |||

| (0.0365) | (0.0623) | (0.0109) | ||||

| Gender | −0.0364 | −0.0559 | −0.0102 | −0.0329 | −0.0477 | −0.0088 |

| (0.0518) | (0.0876) | (0.0165) | (0.0518) | (0.0878) | (0.0164) | |

| Age | 0.0290 | 0.0668 | −0.0091*** | 0.0343 | 0.0768 | −0.0090*** |

| (0.0513) | (0.0864) | (0.0004) | (0.0515) | (0.0867) | (0.0004) | |

| Education | −0.0276*** | −0.0464*** | −0.0049 | −0.0274*** | −0.0460*** | −0.0052 |

| (0.0014) | (0.0024) | (0.0056) | (0.0014) | (0.0024) | (0.0056) | |

| Marriage | −0.0130 | −0.0214 | 0.0063 | −0.0148 | −0.0242 | 0.0077 |

| (0.0170) | (0.0286) | (0.0158) | (0.0170) | (0.0287) | (0.0158) | |

| Farmers’ health | −0.1394*** | −0.2351*** | −0.0444*** | −0.1373*** | −0.2321*** | −0.0435*** |

| (0.0146) | (0.0248) | (0.0048) | (0.0147) | (0.0248) | (0.0047) | |

| Family members | 0.0965*** | 0.1600*** | 0.0329*** | 0.0997*** | 0.1659*** | 0.0340*** |

| (0.0097) | (0.0163) | (0.0033) | (0.0097) | (0.0163) | (0.0033) | |

| Family income | −0.1668*** | −0.2815*** | −0.0573*** | −0.1701*** | −0.2884*** | −0.0582*** |

| (0.0132) | (0.0223) | (0.0043) | (0.0133) | (0.0224) | (0.0043) | |

| Number of houses | 0.3073*** | 0.5147*** | 0.1050*** | 0.2984*** | 0.5025*** | 0.1010*** |

| (0.0357) | (0.0606) | (0.0126) | (0.0358) | (0.0610) | (0.0126) | |

| Whether operates a business | 0.2884*** | 0.4809*** | 0.0985*** | 0.2842*** | 0.4748*** | 0.0962*** |

| (0.0491) | (0.0824) | (0.0175) | (0.0493) | (0.0832) | (0.0175) | |

| Province FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Pseudo R 2 | 0.1048 | 0.1054 | 0.1090 | 0.1098 | ||

| Adjusted R 2 | 0.1255 | 0.1307 | ||||

| N | 9,059 | 9,059 | 9,059 | 9,059 | 9,059 | 9,059 |

Robustness test results: changing models.

Note: Standard errors are in parentheses; *, ** and *** indicate statistical significance at the 10, 5, and 1% levels, respectively.

TABLE 4

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| βR1 | βR2 | βF1 | βF2 | βR1 | βR2 | βF1 | βF2 | |

| Tc | 1.1561*** | 0.8428*** | 1.0003*** | 0.5257* | ||||

| (0.1300) | (0.1331) | (0.1395) | (0.2907) | |||||

| Pc | 0.3601*** | 0.3846*** | 0.4184*** | 0.5010*** | ||||

| (0.0449) | (0.0463) | (0.0473) | (0.0625) | |||||

| 7.42 | 1.66 | 7.18 | 4.3 | |||||

| Province FE | Yes | Yes | ||||||

| Pseudo R 2 | 0.0077 | 0.0610 | 0.0901 | 0.1056 | 0.0051 | 0.0625 | 0.0905 | 0.1098 |

| N | 9,059 | 9,059 | 9,059 | 9,059 | 9,059 | 9,059 | 9,059 |

Robustness test results: Oster’s method.

Note: Standard errors are in parentheses; *, ** and *** indicate statistical significance at the 10, 5 and 1% levels, respectively.

Furthermore, farmers’ HFV is caused by complex factors, and climate change also faces unobservable effects. Therefore, the analysis of the relationship between climate change and farmers’ household vulnerability also faces the problem of endogeneity due to the omission of unobservable variables. Referring to Altonji et al. (2005) and Oster (2017), this paper introduces different observable variables to estimate the bias in parameter estimates due to unobservable variables by observing the change in parameter estimates in a direct way. reflects the changes in estimated parameters, and = |βF/(βR-βF)|, where βR denotes the parameter estimates of the core explanatory variables when the constrained control variables are introduced, and βF denotes the parameter estimates of the core explanatory variables when all observable variables are introduced as control variables. A larger value implies that the omitted variables are less likely to affect the parameter estimates of the core explanatory variables. The first constrained model introduces only the core explanatory variable climate change, while the second constrained model introduces climate change and household head characteristics variables, including gender, marriage, age, education and physical condition. Based on the two constrained models described above, the two full models take the household characteristics variables, the use of the internet and province fixed effects. Table 4 shows that the results and the coefficients of the parameter estimates of the constrained and full models are all more than 1 in columns (1) to (8), which means that the parameter estimates are less influenced by the omitted variables (Altonji et al., 2005).

In summary, after several robustness tests, the direction of the regression coefficients of the explanatory variables as well as their significance remain consistent with the baseline regression results, which indicates that the results of the empirical analysis are robust.

4.3 Underlying Mechanisms of Household Capital

4.3.1 Mechanism of Farmers’ Health in the Relationship Between Climate Change and Farmers’ HFV

To test the mechanism of farmers’ health in hypothesis 2, climate change influences farmers’ HFV via farmers’ health. According to Zeng et al. (2021), it uses farmers’ health to represent human capital. Farmers’ health is estimated on the basis of answers in the CHFS 2017 results. Table 5 shows the results. It can be seen that temperature changes have a negative effect on farmers’ health at the 1% confidence level in column (1). The effects of precipitation changes also have a negative effect on farmers’ health at the 1% confidence level in column (2). Perhaps the changes in temperature and precipitation increase the possibilities for farmers to suffer from disease, especially respiratory problems, which is pointed out by Bartholy and Pongrácz (2018). Xue et al. (2019) also find that increased temperature change is associated with a higher probability of decreased mental health. Moreover, the coefficient of farmers’ health and HFV is negative, reflecting that the better a farmer’s physical condition is, the lower his or her HFV at the 1% confidence level in column (3). If farmers have trouble in terms of their physical condition, then they find it more difficult to earn money, and such expenditure may be focused on helping them become healthier. Therefore, they are more likely to face financial problems. In other words, climate change negatively affects farmers’ health and then increases their financial vulnerability. These results support hypothesis 2.

TABLE 5

| Variables | I1 (Farmers’ Health) | HFV | |

|---|---|---|---|

| (1) | (2) | (3) | |

| Tc | −0.4156*** | ||

| (0.1156) | |||

| Pc | −0.1278*** | ||

| (0.0395) | |||

| Farmers’ health | −0.2361*** | ||

| (0.0247) | |||

| Gender | −0.2080*** | −0.2111*** | −0.0560 |

| (0.0717) | (0.0718) | (0.0874) | |

| Marriage | −0.0631 | −0.0675 | 0.0635 |

| (0.0696) | (0.0697) | (0.0865) | |

| Age | −0.0244*** | −0.0235*** | −0.0466*** |

| (0.0019) | (0.0018) | (0.0024) | |

| Education | 0.1774*** | 0.1848*** | −0.0235 |

| (0.0221) | (0.0221) | (0.0286) | |

| Family members | −0.0886*** | −0.0879*** | 0.1593*** |

| (0.0127) | (0.0126) | (0.0163) | |

| Family income | 0.2672*** | 0.2684*** | −0.2814*** |

| (0.0176) | (0.0176) | (0.0223) | |

| Number of houses | 0.1577*** | 0.1670*** | 0.5179*** |

| (0.0461) | (0.0463) | (0.0606) | |

| Whether operates a business | 0.3058*** | 0.3186*** | 0.4766*** |

| (0.0641) | (0.0641) | (0.0822) | |

| Province FE | Yes | Yes | Yes |

| Pseudo R 2 | 0.0359 | 0.0357 | 0.1047 |

| N | 9,059 | 9,059 | 9,059 |

Mechanism of farmers’ health.

Note: Standard errors are in parentheses; *, **, and *** indicate statistical significance at the 10, 5 and 1% levels, respectively.

4.3.2 Mechanism of Credit Constraint Between Climate Change and Farmers’ HFV

According to Zeng et al. (2021), the shortage of funds reflects the financial risk of farmers’ livelihood risks, it takes use of credit constraint to assess financial risk. The mechanism of credit constraint in hypothesis 3, that is, that climate change influences credit constraint and then has an effect on farmers’ HFV, is tested. When credit constraint has a value of 1, it means that farmers face financing difficulties. In addition, the value of the credit constraint of 0 reflects farmers’ easy access to credit. The values come from the results of the CHFS 2017 questionnaire. Table 6 shows that changes in temperature positively contribute to credit constraints at the 1% confidence level in column (1), while changes in precipitation positively contribute to credit constraints at the 10% confidence level in column (2). Climate change increases risks, which makes it more difficult for farmers to obtain credit. Moreover, the coefficient of credit constraints and HFV is positive, reflecting that the higher the credit constraint is, the higher the HFV at the 1% confidence level in column (3). In other words, when farmers have less access to credit, they will face higher HFV. These results support Hypothesis 3.

TABLE 6

| Variables | I2 (Credit Constraints) | HFV | |

|---|---|---|---|

| (1) | (2) | (3) | |

| Tc | 0.5758*** | ||

| (0.1507) | |||

| Pc | 0.1492* | ||

| (0.0837) | |||

| Credit constraints | 0.9395*** | ||

| (0.0835) | |||

| Gender | −0.2735* | −0.2638* | −0.0327 |

| (0.1484) | (0.1475) | (0.0883) | |

| Marriage | −0.0448 | −0.0374 | 0.0742 |

| (0.1350) | (0.1348) | (0.0872) | |

| Age | −0.0226*** | −0.0240*** | −0.0460*** |

| (0.0035) | (0.0034) | (0.0024) | |

| Education | −0.1086** | −0.1224*** | −0.0157 |

| (0.0439) | (0.0442) | (0.0288) | |

| Farmers’ health | −0.1982*** | −0.2005*** | −0.2250*** |

| (0.0401) | (0.0402) | (0.0249) | |

| Family members | 0.0425* | 0.0409* | 0.1604*** |

| (0.0240) | (0.0240) | (0.0163) | |

| Family income | 0.0089 | 0.0082 | −0.2902*** |

| (0.0335) | (0.0335) | (0.0225) | |

| Number of houses | −0.0179 | −0.0307 | 0.5252*** |

| (0.0962) | (0.0963) | (0.0612) | |

| Whether operates a business | 0.1982 | 0.1811 | 0.4624*** |

| (0.1244) | (0.1240) | (0.0827) | |

| Province FE | Yes | Yes | Yes |

| Pseudo R 2 | 0.0186 | 0.0176 | 0.1159 |

| N | 9,059 | 9,059 | 9,059 |

Mechanism of credit constraints.

Note: Standard errors are in parentheses; *, ** and *** indicate statistical significance at the 10, 5 and 1% levels, respectively.

4.3.3 Mechanism of Agricultural Output Between Climate Change and Farmers’ HFV

To test the mechanism of credit constraint in hypothesis 4, climate change affects agricultural output and then influences farmers’ HFV. Agricultural output is measured by the logarithm of agricultural gross domestic product, referring to some literature, such as Temple (2006) and Skuras et al. (2010). Table 7 shows that temperature changes have a negative effect on agricultural output at the 1% confidence level in column (1), consistent with the findings of Dell et al. (2012). Precipitation also has a negative effect on agricultural output in column (2) during the observation period. Moreover, the coefficient of agricultural output and HFV is negative at the 10% confidence level in column (3), which shows that higher agricultural output alleviates HFV. This finding validates Hypothesis 4.

TABLE 7

| Variables | I3 (Agricultural Output) | HFV | |

|---|---|---|---|

| (1) | (2) | (3) | |

| Tc | −0.5379*** | ||

| (0.0460) | |||

| Pc | −0.1195*** | ||

| (0.0148) | |||

| Agricultural output | −0.1002* | ||

| (0.0575) | |||

| Gender | −0.0658** | −0.0609** | −0.0766 |

| (0.0262) | (0.0267) | (0.0956) | |

| Marriage | 0.0507** | 0.0407 | 0.0337 |

| (0.0248) | (0.0252) | (0.0939) | |

| Age | 0.0013* | 0.0022*** | −0.0464*** |

| (0.0007) | (0.0007) | (0.0026) | |

| Education | −0.0145* | −0.0118 | −0.0260 |

| (0.0081) | (0.0081) | (0.0303) | |

| Farmers’ health | −0.0241*** | −0.0228*** | −0.2437*** |

| (0.0071) | (0.0072) | (0.0267) | |

| Family members | −0.0165*** | −0.0124*** | 0.1656*** |

| (0.0046) | (0.0046) | (0.0176) | |

| Family income | 0.0293*** | 0.0285*** | −0.2958*** |

| (0.0066) | (0.0067) | (0.0242) | |

| Number of houses | −0.0092 | −0.0032 | 0.5013*** |

| (0.0169) | (0.0170) | (0.0638) | |

| Whether operates a business | 0.0271 | 0.0432* | 0.4981*** |

| (0.0234) | (0.0234) | (0.0867) | |

| Province FE | Yes | Yes | Yes |

| Adjusted R 2 | 0.0248 | 0.0121 | |

| Pseudo R 2 | 0.1103 | ||

| N | 8,047 | 8,047 | 8,047 |

Mechanism of agricultural output.

Note: Standard errors are in parentheses; *, **, and *** indicate statistical significance at the 10, 5, and 1% levels, respectively.

4.4 Heterogeneity Analysis

4.4.1 Different Areas

Because of China’s vast territory and diverse climate, the impacts of climate change on each region vary (Both and Visser, 2001). It is worth investigating the different effects of climate change on farmers’ HFV in different areas. According to the classification for the middle, east, west and northeast by the National Bureau of Statistics, the empirical results show that farmers in middle and northeastern areas are more likely to suffer from increasing HFV from changes in temperature, which can be seen in Table 8. Perhaps the central and northeastern plains are vast and have a high proportion of subsistence agricultural production. The increased vulnerability is more pronounced when farmers’ agriculture is subject to temperature change shocks. Moreover, from Table 8, the role of increasing precipitation in exacerbating HFV is shown to be significantly higher in the east than in the rest of the areas in China. In addition, unstable precipitation is the main reason for the frequent occurrence of drought. The eastern region is heavily influenced by monsoons and is a concentrated area in terms of the population and economy, and the greater the fluctuation in precipitation is, the more obvious the increase in household vulnerability in the eastern region is than in the rest in China.

TABLE 8

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| East | Middle | West | Northeast | |

| a | ||||

| Tc | 0.1056 | 2.1766*** | 0.2943 | 1.1347*** |

| (0.8166) | (0.6522) | (0.2481) | (0.2711) | |

| Gender | 0.0836 | −0.1907 | 0.0282 | −0.1802 |

| (0.1568) | (0.1712) | (0.1425) | (0.2558) | |

| Marriage | 0.0763 | 0.2967* | 0.0632 | −0.1499 |

| (0.1608) | (0.1617) | (0.1474) | (0.2387) | |

| Age | −0.0388*** | −0.0498*** | −0.0445*** | −0.0490*** |

| (0.0043) | (0.0043) | (0.0040) | (0.0068) | |

| Education | 0.0342 | −0.1156** | −0.0029 | −0.1952** |

| (0.0493) | (0.0479) | (0.0491) | (0.0907) | |

| Farmers’ health | −0.2393*** | −0.2054*** | −0.3153*** | −0.2571*** |

| (0.0443) | (0.0431) | (0.0431) | (0.0653) | |

| Family members | 0.1105*** | 0.1403*** | 0.1815*** | 0.2834*** |

| (0.0291) | (0.0277) | (0.0273) | (0.0532) | |

| Family income | −0.1909*** | −0.3432*** | −0.3220*** | −0.3277*** |

| (0.0377) | (0.0415) | (0.0381) | (0.0619) | |

| Number of houses | 0.5969*** | 0.4958*** | 0.4606*** | 0.3451** |

| (0.0892) | (0.1161) | (0.1115) | (0.1742) | |

| Whether operates a business | 0.4649*** | 0.6868*** | 0.4011*** | 0.1192 |

| (0.1189) | (0.1514) | (0.1557) | (0.2857) | |

| Province FE | Yes | Yes | Yes | Yes |

| Pseudo R 2 | 0.0755 | 0.0809 | 0.0927 | 0.1007 |

| N | 2,722 | 2,680 | 2,523 | 1,134 |

| b | ||||

| Pc | 0.7055*** | 0.2776** | 0.5862*** | 0.3513*** |

| (0.1061) | (0.1081) | (0.0848) | (0.0929) | |

| Gender | 0.1090 | −0.1522 | −0.0163 | −0.3075 |

| (0.1654) | (0.1715) | (0.1475) | (0.2632) | |

| Marriage | 0.0535 | 0.2769* | −0.0138 | −0.1714 |

| (0.1672) | (0.1615) | (0.1525) | (0.2502) | |

| Age | −0.0428*** | −0.0493*** | −0.0484*** | −0.0528*** |

| (0.0047) | (0.0044) | (0.0042) | (0.0070) | |

| Education | 0.0444 | −0.1021** | −0.0350 | −0.1591* |

| (0.0549) | (0.0484) | (0.0507) | (0.0907) | |

| Farmers’ health | −0.2005*** | −0.2110*** | −0.3167*** | −0.2307*** |

| (0.0498) | (0.0444) | (0.0446) | (0.0670) | |

| Family members | 0.1282*** | 0.1308*** | 0.1957*** | 0.2522*** |

| (0.0304) | (0.0282) | (0.0284) | (0.0544) | |

| Family income | −0.1999*** | −0.3360*** | −0.3101*** | −0.3053*** |

| (0.0407) | (0.0428) | (0.0400) | (0.0640) | |

| Number of houses | 0.5932*** | 0.4958*** | 0.4163*** | 0.3472* |

| (0.0965) | (0.1194) | (0.1165) | (0.1803) | |

| Whether operates a business | 0.4640*** | 0.6599*** | 0.4159** | 0.0294 |

| (0.1320) | (0.1552) | (0.1638) | (0.2793) | |

| Province FE | Yes | Yes | Yes | Yes |

| Pseudo R 2 | 0.0874 | 0.0775 | 0.1015 | 0.0941 |

| N | 2,722 | 2,680 | 2,523 | 1,134 |

Heterogeneity of areas.

Note: Standard errors are in parentheses; *, **, and *** indicate statistical significance at the 10, 5 and 1% levels, respectively.

4.4.2 Education

Whether different educational backgrounds have different impacts on the effects of climate change on farmers’ HFV remains to be seen. To determine the value of education, this heterogeneity analysis was performed. Therefore, education is classified by whether the national entrance examination should be taken. High education includes college or vocational school and above. Table 9 shows the results. Against different education backgrounds, the changes in temperature and precipitation have the same effects. Specifically, farmers with lower education levels and household financial vulnerabilities are more likely to be influenced by climate change. This finding implies that education is important in improving farmers’ HFV caused by climate change. Therefore, farmers should learn more to overcome the negative effects of climate change.

TABLE 9

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Low Education | High Education | Low Education | High Education | |

| Tc | 1.0394*** | −0.6244 | ||

| (0.1401) | (1.1432) | |||

| Pc | 0.4141*** | 1.5825 | ||

| (0.0472) | (1.0900) | |||

| Gender | −0.0323 | −0.9650 | −0.0074 | −1.3983 |

| (0.0865) | (1.1652) | (0.0859) | (1.0693) | |

| Marriage | 0.0678 | 0.3750 | 0.0748 | 0.3890 |

| (0.0857) | (0.9438) | (0.0856) | (1.0042) | |

| Age | −0.0482*** | −0.0106 | −0.0502*** | −0.0087 |

| (0.0023) | (0.0226) | (0.0023) | (0.0235) | |

| Farmers’ health | −0.2517*** | −0.3309 | −0.2548*** | −0.4394 |

| (0.0243) | (0.3002) | (0.0244) | (0.2913) | |

| Family members | 0.1671*** | 0.1985 | 0.1681*** | 0.2045 |

| (0.0156) | (0.1578) | (0.0156) | (0.1622) | |

| Family income | 0.2968*** | −0.4395 | −0.3036*** | −0.4361 |

| (0.0215) | (0.2821) | (0.0217) | (0.2758) | |

| Number of houses | 0.5257*** | 0.2466 | 0.4966*** | −0.4219 |

| (0.0596) | (0.4149) | (0.0596) | (0.6232) | |

| Whether operates a business | 0.4640*** | 0.3019 | 0.4342*** | 0.2003 |

| (0.0822) | (0.6147) | (0.0820) | (0.6606) | |

| Province FE | Yes | Yes | Yes | Yes |

| Pseudo R 2 | 0.0908 | 0.0793 | 0.0911 | 0.1095 |

| N | 8,973 | 86 | 8,973 | 86 |

Heterogeneity of education.

Note: Standard errors are in parentheses; *, **, and *** indicate statistical significance at the 10, 5 and 1% levels, respectively.

5 Conclusion and Implications

This paper investigates the economic impact of climate change at the micro level using data from the CHFS 2017 and China Meteorological Administration database. The empirical findings indicate that temperature and precipitation changes positively contribute to the financial vulnerability of farmers’ households. After some robustness tests, this conclusion is confirmed. The mechanism analysis reveals that climate change has an impact on rural households’ financial vulnerability via farmers’ health, credit availability, and agricultural output. Furthermore, the effect of climate change on farmers’ HFV is more evident in farmers with low education. The farmers in the middle and northeastern areas are more likely to suffer from increasing HFV from temperature changes, while the aggravating effects on HFV of precipitation changes in the east are stronger than those in the west, middle and northeastern regions.

According to our findings, it is critical to consider how to prevent and respond to climate change and reduce HFV. Specific policy recommendations are as follows. First, it is urgent to establish a climate change risk management system. Climate change leads to frequent natural disasters, which requires relevant policy departments to strengthen climate observation. Furthermore, early warning mechanisms should be deployed to increase the speed and breadth of climate information dissemination among macroregions and microhomes. Additionally, it is pertinent to develop emergency preparedness plans for climate change, improve households’ ability to cope with climate change through various means, like skills training, and reduce the harm of climate change on household health. Second, the government should promote education, especially financial literacy, which is su−ggested to enhance the practical ability of financial participation. Among the required actors, the government, community committees, and financial public welfare organizations should conduct a variety of financial literacy activities to increase resident households’ financial participation and the effectiveness of their behavioral decisions. Educational efforts to promote financial risk knowledge should also be stepped up to improve rural households’ ability to handle risks and enhance their self-protection awareness. They can be more rational and scientific in their decision making and less risky in their participation in acquiring financial resources. Third, the government should improve scientific guidance for rural households’ agricultural production and operation and assist them in various areas, such as agricultural insurance and agricultural response to climate change. These efforts will improve rural households’ agricultural production ability to combat severe natural disasters.

Statements

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: CHFS 2017, China Meteorological Administration database.

Author contributions

SY reviews literature, KZ writes the conclusion and helps empirical study. TL write the introduction and with the rest two students collect the relative literature and data, analyze results and translate and revise the whole paper.

Funding

This work was supported by the Philosophy and Social Science Research Project of Hubei Provincial Department of Education (No. 21Y241) and the Doctoral Students Research Innovation Projects (No. 202210550) of Zhongnan University of Economics and Law.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1.^The report “Climate Change 2022: Impacts, Adaptation and Vulnerability” (IPCC), available at https://report.ipcc.ch/ar6wg2/pdf/IPCC_AR6_WGII_FinalDraft_FullReport.pdf.

2.^The report “Climate-Related Financial Risk 2021” (FSOC), available at https://www.federalregister.gov/documents/2021/05/25/2021-11168/climate-related-financial-risk.

References

1

Abdullah Yusof S. Abd Rokis R. Wan Jusoh W. J. (2015). Financial Fragility of Urban Households in Malaysia. Jem49 (1), 15–24. 10.17576/jem-2015-4901-02

2

Abraham T. W. Fonta W. M. (2018). Climate Change and Financing Adaptation by Farmers in Northern Nigeria. Financ. Innov.4 (1), 1–17. 10.1186/s40854-018-0094-0

3

Alam G. M. M. Alam K. Mushtaq S. (2017). Climate Change Perceptions and Local Adaptation Strategies of Hazard-Prone Rural Households in Bangladesh. Clim. Risk Manag.17, 52–63. 10.1016/j.crm.2017.06.006

4

Albert C. Bustos P. Ponticelli J. (2021). The Effects of Climate Change on Labor and Capital Reallocation. NBER: Working paper series.

5

Altonji J. G. Elder T. E. Taber C. R. (2005). Selection on Observed and Unobserved Variables: Assessing the Effectiveness of Catholic Schools. J. Political Econ.113 (1), 151–184. 10.1086/426036

6

Alwang J. (2000). Vulnerability: A View from Different Disciplines. Washington, D. C: The World Bank Social Protection Discussion Paper Series, No. 0115.

7

Amos E. Akpan U. Ogunjobi K. (2015). Households' Perception and Livelihood Vulnerability to Climate Change in a Coastal Area of Akwa Ibom State, Nigeria. Environ. Dev. Sustain17, 887–908. 10.1007/s10668-014-9580-3

8

Bartholy J. Pongrácz R. (2018). A Brief Review of Health-Related Issues Occurring in Urban Areas Related to Global Warming of 1.5°C. Curr. Opin. Environ. Sustain.30, 123–132. 10.1016/j.cosust.2018.05.014

9

Berg G. Schrader J. (2012). Access to Credit, Natural Disasters, and Relationship Lending. J. Financial Intermediation21 (4), 549–568. 10.1016/j.jfi.2012.05.003

10

Berkowitz M. K. Qiu J. (2006). A Further Look at Household Portfolio Choice and Health Status. J. Bank. Finance30 (4), 1201–1217. 10.1016/j.jbankfin.2005.05.006

11

Bosello F. Nicholls R. J. Richards J. Roson R. Tol R. S. J. (2012). Economic Impacts of Climate Change in Europe: Sea-Level Rise. Clim. Change112 (1), 63–81. 10.1007/s10584-011-0340-1

12

Both C. Visser M. E. (2001). Adjustment to Climate Change Is Constrained by Arrival Date in a Long-Distance Migrant Bird. Nature411 (6835), 296–298. 10.1038/35077063

13

Bunce M. Rosendo S. Brown K. (2010). Perceptions of Climate Change, Multiple Stressors and Livelihoods on Marginal African Coasts. Environ. Dev. Sustain12 (3), 407–440. 10.1007/s10668-009-9203-6

14

Burgess R. Deschenes O. Donaldson D. Greenstone M. (2014). The Unequal Effects of Weather and Climate Change: Evidence from Mortality in India. Cambridge, United States: Massachusetts Institute of Technology, Department of Economics. Manuscript.

15

Campbell J. Y. (2006). Household Finance. J. Finance61 (4), 1553–1604. 10.1111/j.1540-6261.2006.00883.x

16

Casasnovas G. L. Rivera B. Currais L. (2005). Health and Economic Growth: Findings and Policy Implications. Mit Press.

17

Chen S. Gong B. (2021). Response and Adaptation of Agriculture to Climate Change: Evidence from China. J. Dev. Econ.148, 102557. 10.1016/j.jdeveco.2020.102557

18

Chen X. Yang L. (2017). Temperature and Industrial Output: Firm-Level Evidence from China. J. Environ. Econ. Manag.95 (5), 257–274. 10.1016/j.jeem.2017.07.009

19

Chetty R. Stepner M. Abraham S. Lin S. Scuderi B. Turner N. et al (2016). The Association between Income and Life Expectancy in the United States, 2001-2014. JAMA315 (16), 1750–1766. 10.1001/jama.2016.4226

20

Christiaensen L. J. Subbarao K. (2005). Towards an Understanding of Household Vulnerability in Rural Kenya. Policy Res. Work. Pap. Ser.14 (4), 520–558. 10.1093/jae/eji008

21

Christiano L. J. Motto R. Rostagno M. (2014). Risk Shocks. Am. Econ. Rev.104 (1), 27–65. 10.1257/aer.104.1.27

22

Colacito R. Hoffmann B. Phan T. (2019). Temperature and Growth: a Panel Analysis of the united states. J. money, credit Bank.51 (2-3), 313–368. 10.1111/jmcb.12574

23

Daud S. N. M. Marzuki A. Ahmad N. Kefeli Z. (2019). Financial Vulnerability and its Determinants: Survey Evidence from Malaysian Households. Emerg. Mark. Finance Trade55 (9), 1991–2003. 10.1080/1540496x.2018.1511421

24

David C. (1998). Microcredit Dream Washed Away Financial Times. London Edition. October, 1: 4.

25

David C. A. (2011). How Do International Financial Flows to Developing Countries Respond to Natural Disasters?IMF Work. Pap.11 (4), 1–38. 10.2202/1524-5861.1799

26

Dell M. Jones B. F. Olken B. A. (2012). Temperature Shocks and Economic Growth: Evidence from the Last Half Century. Am. Econ. J. Macroecon.4 (3), 66–95. 10.1257/mac.4.3.66

27

Dell M. Jones B. F. Olken B. A. (2014). What Do We Learn from the Weather? the New Climate-Economy Literature. J. Econ. Literature52 (3), 740–798. 10.1257/jel.52.3.740

28

Dinar A. (1998). Measuring the Impact of Climate Change on Indian Agriculture, World Bank Technical Papers.

29

Fisher A. C. Hanemann W. M. Roberts M. J. Schlenker W. (2012). The Economic Impacts of Climate Change: Evidence from Agricultural Output and Random Fluctuations in Weather: Comment. Am. Econ. Rev.102 (7), 3749–3760. 10.1257/aer.102.7.3749

30

French D. McKillop D. (2016). Financial Literacy and Over-indebtedness in Low-Income Households. Int. Rev. Financial Analysis48 (12), 1–11. 10.1016/j.irfa.2016.08.004

31

Handmer J. Honda Y. Kundzewicz Z. W. Arnell N. Benito G. Hatfield J. et al (2012). “Changes in Impacts of Climate Extremes: Human Systems and Ecosystems,” in In Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation: Special Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, 231–290.

32

Hornbeck R. (2009). The Enduring Impact of the American Dust Bowl. Boston: NBER Working Paper, No. 15605.

33

Hosono K. Miyakawa D. Uchino T. Hazama M. Ono A. Uchida H. et al (2016). Natural Disasters, Damage to Banks, and Firm Investment. Int. Econ. Rev.57 (4), 1335–1370. 10.1111/iere.12200

34

Jappelli T. Pagano M. Maggio M. D. (2010). Households' Indebtedness and Financial Fragility. CSEF Work. Pap.I (1), 26–35. 10.12831/736312

35

Jin S. Huang J. Hu R. Rozelle S. (2002). The Creation and Spread of Technology and Total Factor Productivity in China's Agriculture. Am. J. Agric. Econ.84 (4), 916–930. 10.1111/1467-8276.00043

36

Klomp J. (2014). Financial Fragility and Natural Disasters: an Empirical Analysis. J. Financial Stab.13, 180–192. 10.1016/j.jfs.2014.06.001

37

Kreimer A. Arnold M. (2000). Managing Disaster Risk in Emerging Economies. Washington, D.C.: World Bank Publications, Vol. 2.

38

Kumar S. Khanna M. (2019). Temperature and Production Efficiency Growth: Empirical Evidence. Clim. Change156 (1), 209–229. 10.1007/s10584-019-02515-5

39

Lanzafame M. (2014). Temperature, Rainfall and Economic Growth in Africa. Empir. Econ.46 (1), 1–18. 10.1007/s00181-012-0664-3

40

Leika M. Marchettini D. (2017). A Generalized Framework for the Assessment of Household Financial Vulnerability. Washington, D.C.: IMF Working Paper. WP/17/228.

41

Li C. Xiang X. Gu H. (2015). Climate Shocks and International Trade: Evidence from China. Econ. Lett.135 (10), 55–57. 10.1016/j.econlet.2015.07.032

42

Li X. Hu Z. Cao J. Xu X. (2022a). The Impact of Environmental Accountability on Air Pollution: a Public Attention Perspective. Energy Policy161, 112733. 10.1016/j.enpol.2021.112733

43

Li X. Zhao C. Huang M. (2022b). Reassessing the Effect of Low-Carbon City Policy in China: New Evidence from the Nighttime Light Data. Front. Energy Res.9, 1–15. 10.3389/fenrg.2021.798448

44

Li X. Wang D. (2022). Does Transfer Payments Promote Low-Carbon Development of Resource-Exhausted Cities in china?Earth's Future10 (1), 1–20. 10.1029/2021ef002339

45

Lin Y. Grace M. F. (2007). Household Life Cycle Protection: Life Insurance Holdings, Financial Vulnerability, and Portfolio Implications. J Risk Insur.74 (1), 141–173. 10.1111/j.1539-6975.2007.00205.x

46

Loke Y. J. (2017). Financial Vulnerability of Working Adults in Malaysia. Contemp. Econ.11 (2), 206. 10.5709/ce.1897-9254.237

47

Lusardi A. Mitchelli O. S. (2007). Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education. Bus. Econ.42 (1), 35–44. 10.2145/20070104

48

Ma Z. Guo S. Deng X. Xu D. (2021). Community Resilience and Resident's Disaster Preparedness: Evidence from China's Earthquake-Stricken Areas. Nat. Hazards108 (1), 567–591. 10.1007/s11069-021-04695-9

49

Ma Z. Zhou W. Deng X. Xu D. (2022). Community Disaster Resilience and Risk Perception in Earthquake-Stricken Areas of China. Disaster Med. Public Health Prep., 1–11. 10.1017/dmp.2021.342

50

Mendelsohn R. Nordhaus W. D. Shaw D. (1994). The Impact of Global Warming on Agriculture: A Ricardian Analysis. Am. Econ. Rev.89 (4), 753–771. http://links.jstor.org/sici?sici=0002-8282%28199409%2984%3A4%3C753%3ATIOGWO%3E2.0.CO%3B2-N&origin=repec.

51

Merton R. C. (1969). Lifetime Portfolio Selection under Uncertainty: The Continuous-Time Case. Rev. Econ. Statistics51, 247–257. 10.2307/1926560

52

Mian A. R. Sufi A. (2009). House Prices, Home Equity-Based Borrowing, and the u.S. Household Leverage Crisis. Boston: NBER Working Papers. 10.3386/w15283

53

Narayan S. Narayan P. K. Mishra S. (2010). Investigating the Relationship between Health and Economic Growth: Empirical Evidence from a Panel of 5 Asian Countries. J. Asian Econ.21 (4), 404–411. 10.1016/j.asieco.2010.03.006

54

Noerhidajati S. Purwoko A. B. Werdaningtyas H. Kamil A. I. Dartanto T. (2020). Household Financial Vulnerability in Indonesia: Measurement and Determinants. Econ. Model96 (C), 433–444. 10.1016/j.econmod.2020.03.028

55

O'Connor G. E. Newmeyer C. E. Wong N. Y. C. Bayuk J. B. Cook L. A. Komarova Y. et al (2018). Conceptualizing the Multiple Dimensions of Consumer Financial Vulnerability. J. Bus. Res.12, 421–430. 10.1016/j.jbusres.2018.12.033

56

Oster E. (2017). Unobservable Selection and Coefficient Stability: Theory and Evidence. J. Bus. Econ. Statistics35 (4), 1–18. 10.1080/07350015.2016.1227711

57

Paavola J. (2008). Livelihoods, Vulnerability and Adaptation to Climate Change in Morogoro, Tanzania. Environ. Sci. Policy11 (7), 642–654. 10.1016/j.envsci.2008.06.002

58

Pantoja E. (2002). Microfinance and Disaster Risk Management Experiences and Lessons Learned. Washington, D.C.: World Bank working paper.

59

Reilly J. Tubiello F. McCarl B. Abler D. Darwin R. Fuglie K. et al (2003). U.S. Agriculture and Climate Change: New Results. Clim. Change57 (1-2), 43–67. 10.1023/a:1022103315424

60

Rosen H. S. Wu S. (2004). Portfolio Choice and Health Status. J. Financial Econ.72 (3), 457–484. 10.1016/s0304-405x(03)00178-8

61

Schlenker W. Michael Hanemann W. Fisher A. C. (2005). Will U.S. Agriculture Really Benefit from Global Warming? Accounting for Irrigation in the Hedonic Approach. Am. Econ. Rev.95 (1), 395–406. 10.1257/0002828053828455

62

Shimojo M. Tsuda N. Iwasaka T. Inada M. (1991). Age-related Changes in Aortic Elasticity Determined by Gated Radionuclide Angiography in Patients with Systemic Hypertension or Healed Myocardial Infarcts and in Normal Subjects. Am. J. Cardiol.68 (9), 950–953. 10.1016/0002-9149(91)90415-h

63

Sissoko K. Keulen H. V. Verhagen J. Tekken V. Battaglini A. (2011). Agriculture, Livelihoods and Climate Change in the West African Sahel. Reg. Environ. Change11 (1), 119–125. 10.1007/s10113-010-0164-y

64

Skuras D. Tsekouras K. Tzelepis D. Dimara E. (2010). The Effects of Regional Capital Subsidies on Productivity Growth: a Case Study of the Greek Food and Beverage Manufacturing Industry. J. Regional Sci.46 (2), 355–381. 10.1111/j.0022-4146.2006.00445.x

65

Temple G. (2006). Rich Nations, Poor Nations: How Much Can Multiple Equilibria Explain?J. Econ. Growth11 (1), 5–41. 10.1007/s10887-006-7404-5

66

Townsend R. M. (1994). Risk and Insurance in Village India. Econometrica62 (3), 539–591. 10.2307/2951659

67

Uddin M. N. Bokelmann W. Dunn E. S. (2017). Determinants of Farmers' Perception of Climate Change: a Case Study from the Coastal Region of Bangladesh. Am. J. Clim. Change6 (1), 151–165. 10.4236/ajcc.2017.61009

68

Urama N. E. Eboh E. C. Onyekuru A. (2019). Impact of Extreme Climate Events on Poverty in Nigeria: a Case of the 2012 Flood. Clim. Dev.11 (1), 27–34. 10.1080/17565529.2017.1372267

69

Vemuri A. W. Costanza R. (2006). The Role of Human, Social, Built, and Natural Capital in Explaining Life Satisfaction at the Country Level: toward a National Well-Being Index (NWI). Ecol. Econ.58 (1), 119–133. 10.1016/j.ecolecon.2005.02.008

70

Villavicencio X. Mccarl B. A. Wu X. Huffman W. E. (2013). Climate Change Influences on Agricultural Research Productivity. Clim. Change119 (3-4), 815–824. 10.1007/s10584-013-0768-6

71

Wang W. Zhang C. Guo Y. Xu D. (2021). Impact of Environmental and Health Risks on Rural Households' Sustainable Livelihoods: Evidence from China. Int. J. Environ. Res. Public Health18 (20), 10955. 10.3390/ijerph182010955

72

Xie W. Huang J. Wang J. Cui Q. Robertson R. Chen K. (2020). Climate Change Impacts on china's Agriculture: the Responses from Market and Trade. China Econ. Rev.62, 101256. 10.1016/j.chieco.2018.11.007

73

Xu D. Liu E. Wang X. Tang H. Liu S. (2018). Rural Households' Livelihood Capital, Risk Perception, and Willingness to Purchase Earthquake Disaster Insurance: Evidence from Southwestern China. Int. J. Environ. Res. Public Health15 (7), 1319. 10.3390/ijerph15071319

74

Xu D. Deng X. Guo S. Liu S. (2019). Sensitivity of Livelihood Strategy to Livelihood Capital: An Empirical Investigation Using Nationally Representative Survey Data from Rural China. Soc. Indic. Res.144 (1), 113–131. 10.1007/s11205-018-2037-6

75

Xue T. Zhu T. Zheng Y. Zhang Q. (2019). Declines in Mental Health Associated with Air Pollution and Temperature Variability in China. Nat. Commun.10 (1), 1–8. 10.1038/s41467-019-10196-y

76

Yang H. Huang K. Deng X. Xu D. (2021). Livelihood Capital and Land Transfer of Different Types of Farmers: Evidence from Panel Data in Sichuan Province, China. Land10 (5), 532. 10.3390/land10050532

77

Yannis D. Maria N. Giorgos G. (2018). Climate Change, Financial Stability and Monetary Policy. Ecol. Econ.152, 219–234. 10.1016/j.ecolecon.2018.05.011

78

Yin Q. Ntim-Amo G. Ran R. Xu D. Ansah S. Hu J. et al (2021). Flood Disaster Risk Perception and Urban Households' Flood Disaster Preparedness: The Case of Accra Metropolis in Ghana. Water13 (17), 2328. 10.3390/w13172328

79

Yoji K. Kudo R. Iizumi T. Yokozawa M. (2016). Technological Spillover in Japanese Rice Productivity under Long-Term Climate Change: Evidence from the Spatial Econometric Model. Paddy Water Environ.14 (1), 131–144. 10.1007/s10333-015-0485-z

80

Zeng X. Guo S. Deng X. Zhou W. Xu D. (2021). Livelihood Risk and Adaptation Strategies of Farmers in Earthquake Hazard Threatened Areas: Evidence from Sichuan Province, China. Int. J. Disaster Risk Reduct.53, 101971. 10.1016/j.ijdrr.2020.101971

81

Zhao W. (2020). Effect of Air Pollution on Household Insurance Purchases. Evidence from China Household Finance Survey Data. Plos one15 (11), e0242282. 10.1371/journal.pone.0242282

Summary

Keywords

climate change, farmers’ household financial vulnerability, livelihood capitals, credit constraints, health, agricultural output

Citation

Yang S, Zou K, Lei T, Ni Z and Yang J (2022) Climate Change and Farmers’ Household Financial Vulnerability: Evidence From China. Front. Environ. Sci. 10:908428. doi: 10.3389/fenvs.2022.908428

Received

30 March 2022

Accepted

03 May 2022

Published

14 July 2022

Volume

10 - 2022

Edited by

Dingde Xu, Sichuan Agricultural University, China

Reviewed by

Zimin Liu, Southwest University, China

Yueji Zhu, Hainan University, China

Daniel Aidoo-Mensah, University of Energy and Natural Resources, Ghana

Updates

Copyright

© 2022 Yang, Zou, Lei, Ni and Yang.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tianyi Lei, tyray1992@163.com

This article was submitted to Interdisciplinary Climate Studies, a section of the journal Frontiers in Environmental Science

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.