- 1School of Accountancy, Shandong University of Finance and Economics, Jinan, China

- 2Department of Business Administration, Tamkang University, New Taipei, Taiwan

- 3Department of Accounting, Tamkang University, New Taipei, Taiwan

- 4School of Computer Science, Beijing Institute of Technology, Beijing, China

This study aims to examine the nonlinear relationship between environmental, social and governance (ESG) and corporate financial performance (CFP) using Taiwan Stock Exchange (TSE) listed firms with ESG disclosure between 2005 and 2019. The pooled ordinary least square (OLS) regression estimation results indicate the ESG-CFP nexus is a nonlinear (inverted U-shaped pattern). Furthermore, the individual ESG pillars each have a different relationship with CFP. Both the environmental and social pillars have an inverted U-shaped relationship with CFP, whereas there is no significant relationship between the governance pillar and CFP. The concave nonlinear relationship also supports the tenets of the “too-much-of-a-good-thing” effect. This research confirms that TSE listed firms should identify the optimal ESG value (threshold point), where ESG costs and benefits balance, to maintain sustainable development and stakeholder engagement.

Introduction

In addition to COVID-19, the greatest legal challenges for industries worldwide are the Paris Agreement, signed in 2015, and the United Nations Sustainable Development Goals. In response to the global sustainability agenda, enterprises require effective risk management that focuses on traditional financial risks and considers environmental, social and governance (ESG) risks (Hübel and Scholz, 2020). Although Taiwan is not a member of the United Nations, nor a contracting state of the United Nations Climate Convention, it is part of the global supply chain and based on the responsibilities of Earth Citizens, Taiwan’s enterprises must negotiate the potential risks of climate change, and the additional pressure to save energy and reduce emissions.

As ESG gradually establishes itself, investigation into the effect of ESG disclosure on corporate financial performance (CFP) increases, making the ESG-CFP nexus a popular research topic (Minutolo et al., 2019). Although much research has been explored on the ESG-CFP nexus in different economies, views on the ESG-CFP relationship are still contradictory. The stakeholder theory emphasizes that companies should generate returns to stakeholders from ESG investments (Behl et al., 2021). Therefore, a firm’s engagement towards a larger society through ESG concerns will reap sustainable benefits. As a result, there is a positive ESG-CFP nexus (López-Toro et al., 2021; Wong et al., 2021). On the other hand, Friedman (1970) argues that ESG causes under-allocation of resources due to agency problems, increasing additional costs for enterprises implementing ESG (Kumar et al., 2022). Consequence, the negative ESG-CFP nexus creates an unfavorable situation (Buallay et al., 2021; Jyoti & Khanna, 2021). Few studies, however, find a neutral ESG-CFP relationship (Buallay et al., 2022), suggesting that ESG does not affect CFP because the positive effects offset the negative effects.

More recently, some researcher using nonlinear modeling have found U-shaped relationships (e.g., Nuber et al., 2020; Naimy, et al., 2021), and inverted U-shaped relationships (e.g., Buallay et al., 2022; El Khoury et al., 2021). As Pierce and Aguinis (2013) contend, such inconsistent results arise because of the “too-much-of-a-good-thing (TMGT)” effect on the ESG-CFP nexus. The TMGT effect is caused by the possible negative consequences of a favorable antecedent (ESG) when its level reaches a threshold (turning point) after which the additional costs exceed the additional benefits generated (Ahmadova et al., 2022). Furthermore, the above discussion outlines the nonlinear ESG-CFP nexus, but the referenced literatures do not provide sufficient and robust evidence to prove it actually exist.

To this end, the objective of this study is twofold. First, it aims to extend the scope of earlier studies by elucidating such relationship and fill the existing literature gap by identifying whether ESG has an influence on CFP, more specifically, what are the specific impact of ESG on CFP? Second, this study further consideration while analyzing separately the effect of the ESG pillars (environmental, social and governance) on the CFP. Therefore, this paper conducts an empirical study on the ESG-CFP nexus of Taiwan Stock Exchange (TSE) listed firms from 2005 to 2019. The pooled ordinary least square (OLS) regression and fixed effects model has been utilized in this article to analyze the impact of ESG on CFP. This research further investigates the nonlinear ESG-CFP relationship for the individual ESG pillars.

Findings conclude to a significant concave (an inverted U-shaped pattern) ESG-CFP nexus. Besides, further investigation exposes both the environmental and social pillars have an inverted U-shaped nexus with CFP, whereas there is no significant relationship between the governance pillar and CFP. Therefore, the results of the study’s inverted U-shaped ESG-CFP nexus provide substantial insight into the complex nature of the trade-off between ESG costs and benefits; this will help scholars and stakeholders understand the concept to pursuit sustainable development.

Our study makes some contributions to literature, theory, and managerial implications. First, we contribute to the meta-theory of TMGT (Pierce and Aguinis, 2013) by highlighting the nonlinear ESG-CFP nexus to complement the existing inconclusive findings. Also, we also both utilize the three-step procedure proposed by Lind and Mehlum. (2010) and recommended by Haans et al. (2016) to identify the non-linear relationship whether actually exists or not. Second, we found both the environmental and social pillars have an inverted U-shaped nexus with CFP, however, the governance pillar was found insignificant with CFP. Specifically, our findings offer managerial implications for companies that neither too much nor too little ESG is favorable and that they should find their own optimal ESG levels.

The originality of this study is one of the few studies to find a nonlinear ESG-CFP nexus, suggesting that too much ESG activity damages the benefits of CFP to the point that the nexus between ESG and CFP becomes negative. This study emphasizes that companies should ensure the costs and benefits of ESG performance to maintain sustainability and stakeholder engagement.

Method

Sample composition

Analysis was completed on 87 TSE listed firms with ESG disclosure from 2005 to 2019. Taiwanese firms were chosen for this research due to their gradual disclosure of ESG ratings since 2005. After excluding financial holding and insurance firms, the final data set consisted of 69 firms from 2005 to 2019, generating 763 cross section firm-year observations. The data on ESG measures were obtained from Bloomberg and financial data were retrieved from the Taiwan Economic Journal.

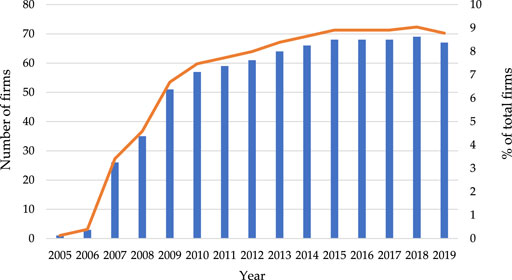

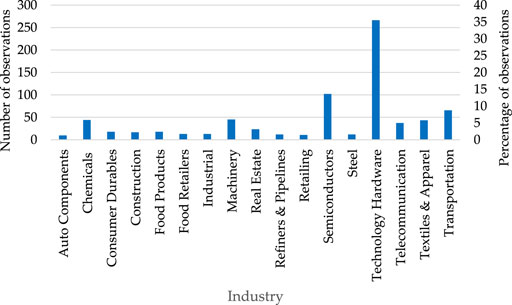

In 2005, only one firm (0.13%) had an ESG score; however, this number increased rapidly between 2005 and 2013. ESG disclosure continues to rise between 2013 and 2019, resulting in approximately 63% of firm-year observations occurring during this period (Figure 1). The sample’s primary industry divisions are Technology Hardware (35.32%) and Semiconductors (13.63%) (Figure 2).

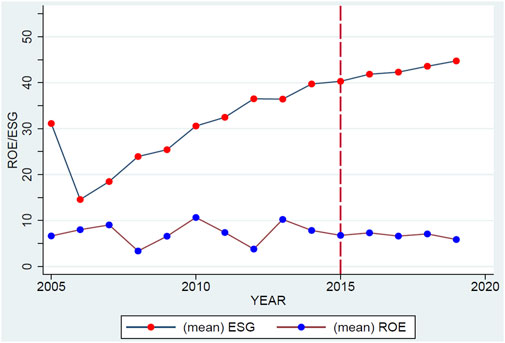

In Figure 3, the vertical dashed red line denotes the year 2015 and evidences ESG scores increase after the 2015 Paris Agreement. Thus, investigating whether ESG scores after 2015 have different implications to ESG scores prior to 2015 is beneficial.

Model

The pooled OLS regression model is used to assess the effect of ESG disclosure on TSE listed firms’ CFP in terms of return on equity (ROE). The regression model is estimated as follows:

The dependent variables are ROE in each year (t) for each individual firm (i). ROE is an approved and accepted way to measure CFP. The independent variable is the ESG score, developed by Bloomberg, as a proxy for ESG disclosure. This proxy is also commonly used in business practices due to its credibility. Furthermore, the ESG score is divided into its single components to analyze the potential impact they each have on CFP.

The control variables—Company size (SIZE), Financial leverage (LEV), Firm age (AGE), Growth rate of owner’s equity (OEG), and Net profit margin (NPM)—are used in the model, as previous research confirms they determine ROE (Chang and Wu, 2021; Saygili et al., 2022) SIZE is assessed by the natural logarithm of total assets; LEV is calculated by the total debts divided by total assets; AGE is determined by the number of years the company has been incorporated; OEG is calculated using the percentage change in owner’s equity over the prior period; and NPM is the ratio of net income to sales.

Results

Descriptive statistics

The descriptive statistics of the variables utilized in this model are outlined in Table 1. The ESG disclosure score, which varies between 0 and 100, has a mean value of 36.663, indicating that, on average, the sample firms disclosed limited ESG information. The average score of ESGG was the highest (52.852), then ESGS (38.61). This indicates that TSE listed firms more often consider sustainability measures and initiatives relating to board members and executives. ESGE has the lowest mean score, 32.746, which infers there is a weakness in the efforts of TSE listed firms to integrate environmental management policies and systems.

Investigation confirms each variable has an adequate variance inflation factor between 1.01 and 1.24, indicating there are no multi-collinearity issues among the independent variables (Table 1) (Hair et al., 2017).

Nonlinear ESG-CFP relationship

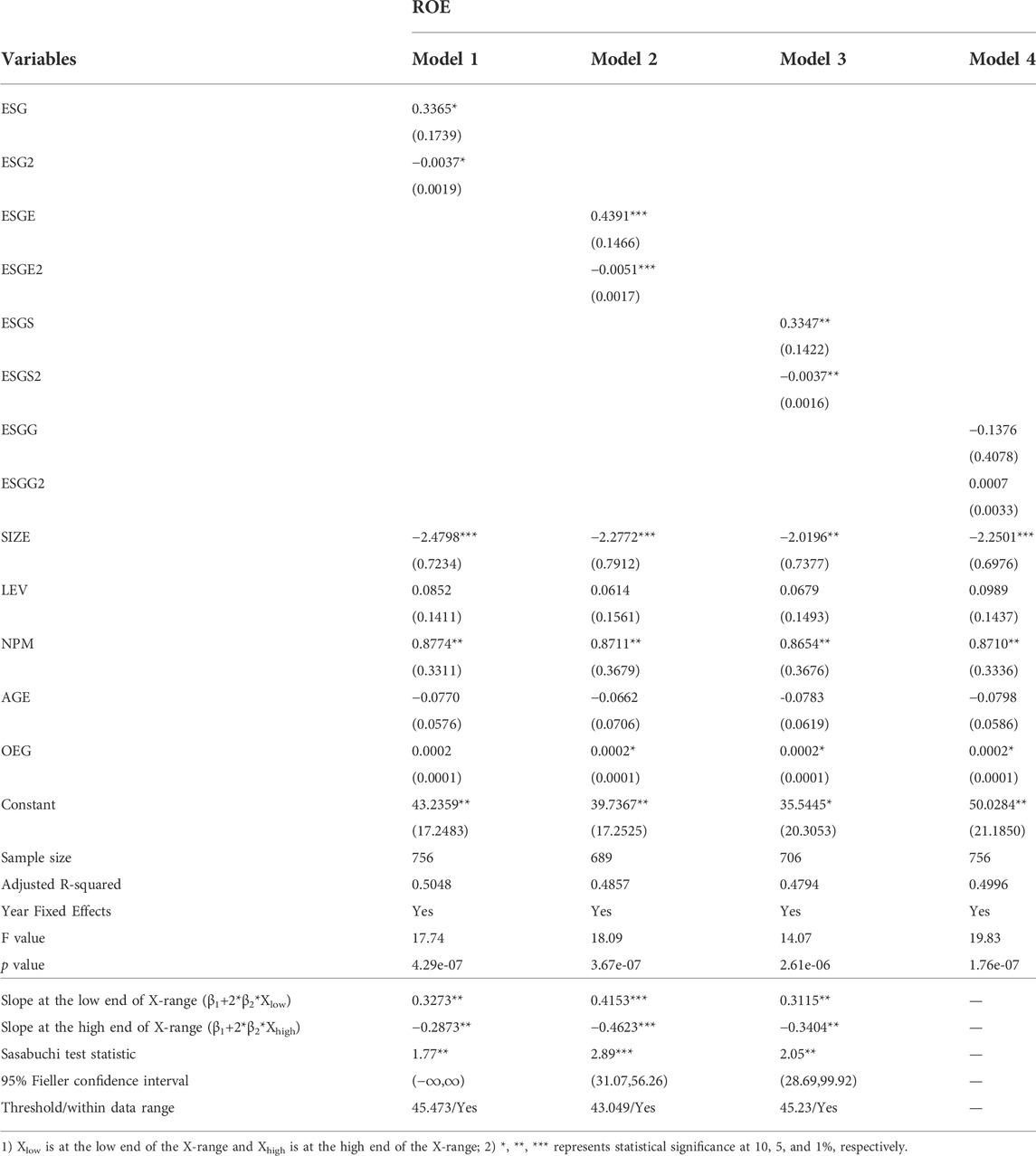

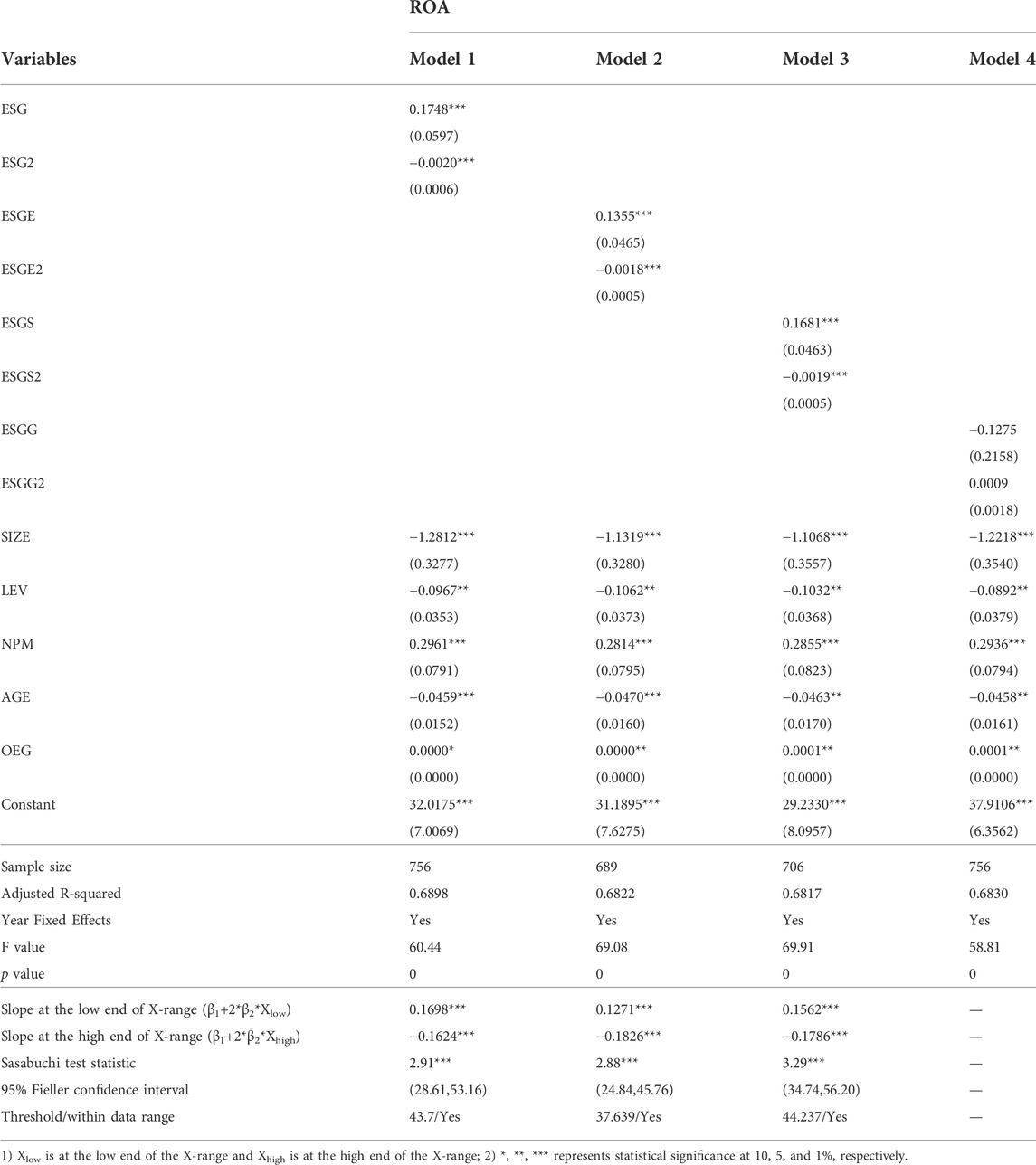

To choose between fixed effects and random effects models, the Hausman. (1978) test was performed. The Hausman test revealed the chi-square value as 36.24 and significant at the 1% level, thus the null hypothesis (random effects) was rejected. Consequently, this study utilized the fixed effects model. Table 2 summarizes the pooled OLS regression with fixed effects results (including adjustment for heteroscedasticity).

The estimation results of the pooled OLS regression indicate, the coefficients of ESG and ESG2 are positive and negative respectively, and both are significant (p < 0.1), which suggests the relationship between ESG and CFP is an inverted U-shaped (concave) (Table 2). NPM has a positive influence on ROE at the 5% significance level and SIZE has a negative influence on ROE at the 1% significance level. LEV, OEG and AGE have no significant effect on ROE.

The three-step procedure proposed by Lind and Mehlum. (2010) and recommended by Haans et al. (2016) were conducted to evaluate the viability of the nonlinear ESG-CFP nexus as: 1) the coefficient at ESGlow is significant and positive (β1+ 2*β2*ESGlow = 0.3273, p < 0.05); 2) the coefficient at ESGhigh is significant and negative (β1+2*β2*ESGhigh = −0.2873, p < 0.05); 3) both 1) and 2) co-exist. The threshold (45.473) of the curve is within the data range. The Fieller (1954) method shows the 95% confidence interval is within the data range and proves the inverted U-shaped relationship between ESG and CFP exists (Table 2, Model 1).

Nonlinear nexus between individual ESG pillars and CFP

ESG was separated into its individual pillars, ESGE, ESGS, and ESGG, and the fixed effects estimator approach was utilized for all the regression equation estimates. According to the three-step procedure proposed by Lind and Mehlum. (2010) and recommended by Haans et al. (2016), ESGE and ESGS have a concave (inverted U-shaped) relationship with CFP, whereas there is no significant relationship between ESGG and CFP (Table 2, Models 2–4).

Robustness check

To assess the robustness of the results, sensitivity analysis used ROA as an alternative indicator of CFP, as recommended by Azmi et al. (2021) and Conca et al. (2021). The results concur with the original findings, verifying the concave (inverted U-shaped) nexus between ESG and CFP in TSE listed firms. The results of the three-step procedure proposed by Lind and Mehlum. (2010) and Haans et al. (2016), performed to support the inverted U-shaped nexus, confirm there is an inverted U-shaped relationship with ROA, which is consistent with ROE (Table 3, Model 1). ESGE and ESGS also have an inverted U-shaped relationship with ROA, whereas there is no significant ESGG-ROA relationship. These findings are also consistent with the ROE results (Table 3, Models 2–4).

Discussion

The empirical investigation samples 69 Taiwan publicly listed firms with ESG disclosure from 2005 to 2019. The pooled OLS regression model, and the three-step procedure proposed by Lind and Mehlum. (2010) and Haans et al. (2016), reveal multiple findings.

First, the results confirm an inverted U-shaped ESG-CFP relationship, which infers TSE listed enterprise managers must be conscious of diminishing marginal benefits on increased ESG activity as beyond the threshold point, resources would be more effective if reallocated away from ESG activities. Equally, these findings support the “too-much-of-a-good-thing (TMGT)” perspective (Trumpp & Guenther, 2017), and consistent with the contentions of Azmi et al. (2021), Wu and Chang (2022).

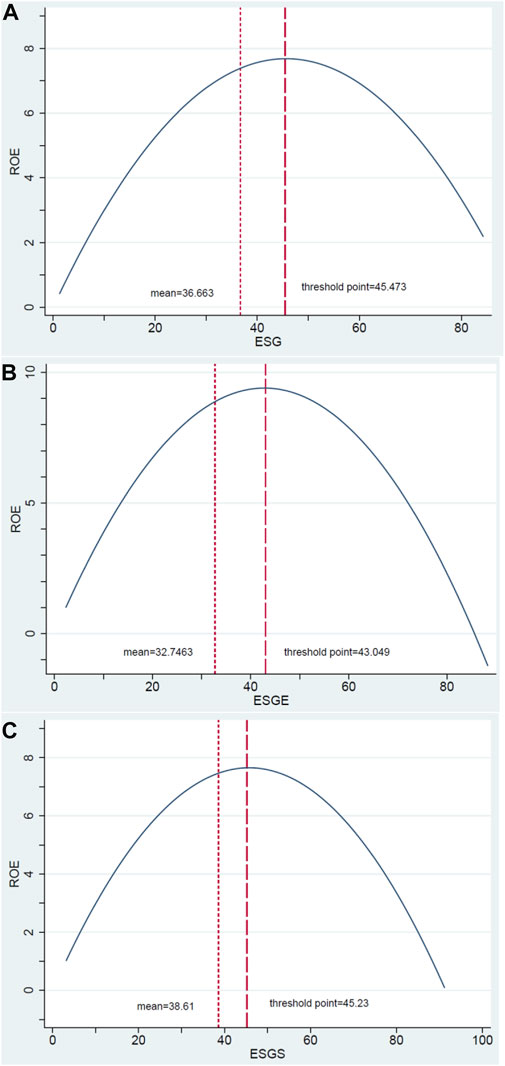

After the first-order derivation, the optimal value of ESG (threshold point) is 45.473 (Table 3; Figure 4A) and is higher than the average ESG value (36.663). Most TSE listed firms are in the ESG-low regime, indicating the predominant effect of ESG on CFP is positive, nonlinear, and statistically significant. These firms benefit from ESG investment but must maintain the optimal ESG value to ensure maximum CFP.

FIGURE 4. The inverted U-shaped ESG-CFP nexus (A); ESGE-CFP relationship (B); and ESGS-CFP relationship (C).

Second, the results confirm that the ESGE-CFP relationship also has an inverted U-shaped pattern, which is justified by the law of diminishing marginal returns (LDMR). This finding supports the TMGT perspective and agrees with the contentions of Lahouel et al. (2022), and Wu and Chang (2022). The optimal ESGE value is 43.049 (Table 3; Figure 4B) and is higher than the average ESGE value (32.747), which suggests that most TSE listed firms are in the ESG-low regime. This implies the predominant effect of ESG on CFP is positive, nonlinear, and statistically significant. Consequently, most TSE listed companies benefit from ESGE investment but should identify the number of resources they need to devote to ESGE to improve CFP and enhance stakeholders’ expectations.

Third, the findings evidence the ESGS-CFP relationship is also an inverted U-shape. The optimal ESGS value is 45.23 (Table 3; Figure 4C) and is higher than the average ESGS value (38.61), which suggests that improving ESGS helps to improve CFP in TSE listed firms. Based on these findings, this research concludes that when firms devote their resources to non-profit social activities, they will have less long-term resources that could have been used to invest in positive net present value projects, putting the firm at a disadvantage (Balabanis et al., 1998), which supports the TMGT effect.

The effect of the ESGG pillar on CFP was not significant, indicating poor perception of governance investment by market participants. This result concurs with the propositions of Chang and Wu. (2021), and El Khoury et al. (2021).

Conclusion

The impact ESG has on CFP still varies. Undoubtedly, our study contributes to the gap in ESG literature by clarifying the effects of ESG on CFP (proxied by ROE and ROA) and positing a nonlinear ESG-CFP relationship for TSE listed firms with voluntary ESG disclosure. The results also confirm ESGE, ESGS and ESGG have differing impacts on CFP. ESG, ESGE and ESGS have nonlinear (inverted U-shaped) effects on CFP, which is in line with the TMGT effect. This infers TSE listed enterprise managers must be conscious of diminishing marginal benefits on increased ESG activity as beyond the threshold point, resources would be more effective if reallocated away from ESG activities.

Theoretical implications

This study yields several theoretical contributions. First, our findings offer support to the TMGT perspectives and empirically confirm an inverted U-shaped ESG-CFP nexus exists by employing the three-step procedure proposed by Lind and Mehlum. (2010) and Haans et al. (2016). In other words, the mechanism by which ESG affects CFP depends on different ESG performance levels. Moreover, in accordance with the work of Lahouel et al. (2022), we endorse that in the context of investigating the association between an antecedent (ESG) and a desirable outcome (CFP), testing for nonlinear effects between variables should be the rule rather than the exception in business research.

Managerial implication

This research also has significant and timely implications for helping managers better design and manage their companies’ ESG practices, an issue that is expected to increase in importance in the wake of the COVID-19 pandemic. The managerial implication of this finding confirms that neither too much nor too little ESG is unfavorable and the optimal ESG level should be identified and maintained.

Practical/social implication

This study’s findings have crucial implications for policymakers and practitioners. Our findings also emphasize the need for caution when firms pursue ESG, as excess ESG practices will be detrimental to CFP. Enterprise managers should observe the TMGT effect of ESG activities closely and verify the ESG threshold points of the enterprise, as this is critical to ensure a balance between demand and supply for ESG activities.

Research limitations/future research

The study was limited to a single country. Future research should consider conducting a cross-country study to determine how ESG affects CFP and whether there is an inverted U-shaped relationship between ESG-CFP, which might help establish comparative analysis.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: Taiwan Economic Journal database (https://www.finasia.biz) and https://www.bloomberg.com.

Author contributions

Conceptualization, K-SW and B-GC; Data curation, K-SW; Formal analysis, K-SW and B-GC; Funding acquisition, XT; Methodology, K-SW and B-GC; Project administration, XT, YG and XZ; Software, B-GC; Writing original draft, K-SW and B-GC; Writing review; editing, K-SW and B-GC.

Funding

This study is supported by international cooperation research project of Shandong University of Finance and Economics “(Research on the Construction of Intelligent Accounting Professional Standards from the Perspective of the Integration of Higher Education in Northeast Asia),” The National Social Science Foundation of China (Grant No.: 18 ZDA076), The Class A Project of Social Science Foundation of Education Department of Shandong Province (Grant No.: J17RA229), and three Horizontal Projects (Grant No.: 2020HX061; 2020HX062; 2020HX050).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmadova, G., Delgado-M´arquez, B. L., Pedauga, L. E., and Leyva-de la Hiz, D. I. (2022). Too good to be true: The inverted U-shaped relationship between home-country digitalization and environmental performance. Ecol. Econ. 196, 107393. doi:10.1016/j.ecolecon.2022.107393

Azmi, W., Hassan, M. K., Houston, R., and Karim, M. S. (2021). ESG activities and banking performance: International evidence from emerging economies. J. Int. Financial Mark. Institutions Money 70, 101277. doi:10.1016/j.intfin.2020.101277

Balabanis, G., Phillips, H. C., and Lyall, J. (1998). Corporate social responsibility and economic performance in the top British companies: Are they linked? Eur. Bus. Rev. 98 (1), 25–44. doi:10.1108/09555349810195529

Behl, A., Raghu Kumari, P. S., Makhija, H., and Sharma, D. (2021). Exploring the relationship of ESG score and firm value using cross-lagged panel analyses: Case of the Indian energy sector. Ann. Oper. Res. 313, 231–256. doi:10.1007/s10479-021-04189-8

Buallay, A., Al-Ajmi, J., and Barone, E. (2022). Sustainability engagement’s impact on tourism sector performance: Linear and nonlinear models. J. Organ. Chang. Manag. 35 (2), 361–384. doi:10.1108/JOCM-10-2020-0308

Buallay, A., El Khoury, R., and Hamdan, A. (2021). Sustainability reporting in smart cities: A multidimensional performance measures. Cities 119, 103397. doi:10.1016/j.cities.2021.103397

Chang, B. C., and Wu, K. S. (2021). The nonlinear relationship between financial flexibility and enterprise risk-taking during the COVID-19 pandemic in Taiwan’s semiconductor industry. oc. 12 (2), 307–333. doi:10.24136/oc.2021.011

Conca, L., Manta, F., Morrone, D., and Toma, P. (2021). The impact of direct environmental, social, and governance reporting: Empirical evidence in European-listed companies in the agri-food sector. Bus. Strategy Environ. 30, 1080–1093. doi:10.1002/bse.2672

El Khoury, R., Nasrallah, N., and Alareeni, B. (2021). ESG and financial performance of banks in the MENAT region: Concavity-convexity patterns. J. Sustain. Finance Invest., 1–26. doi:10.1080/20430795.2021.1929807

Fieller, E. C. (1954). Some problems in interval estimation. J. R. Stat. Soc. Ser. B B16, 175–185. doi:10.1111/j.2517-6161.1954.tb00159.x

Friedman, M. (1970). A theoretical framework for monetary analysis. J. Polit. Econ. 78 (2), 193–238. doi:10.1086/259623

Haans, Richard F. J., Pieters, C., and He, Z. L. (2016). Thinking about U: Theorizing and testing U- and inverted U-shaped relationships in strategy research. Strateg. Manag. J. 37 (7), 1177–1195. doi:10.1002/smj.2399

Hair, J. F., Hult, G. T. M., Ringle, C. M., and Sarstedt, M. (2017). A primer on partial Least squares structural equation modeling (PLS-SEM). 2nd ed. Thousand Oaks: Sage.

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica 46, 1251–1271. doi:10.2307/1913827

Hübel, B., and Scholz, H. (2020). Integrating sustainability risks in asset management: The role of ESG exposures and ESG ratings. J. Asset Manag. 21 (1), 52–69. doi:10.1057/s41260-019-00139-z

Jyoti, G., and Khanna, A. (2021). Does sustainability performance impact financial performance? Evidence from Indian service sector firms. Sustain. Dev. 29, 1086–1095. doi:10.1002/sd.2204

Kumar, A., Gupta, J., and Das, N. (2022). Revisiting the influence of corporate sustainability practices on corporate financial performance: An evidence from the global energy sector. Bus. Strategy Environ. 1, 23. doi:10.1002/bse.3073

Lahouel, B. B., Zaied, Y. B., Managi, S., and Taleb, L. (2022). Re-thinking about U: The relevance of regime-switching model in the relationship between environmental corporate social responsibility and financial performance. J. Bus. Res. 140, 498–519. doi:10.1016/j.jbusres.2021.11.019

Lind, J. T., and Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxf. Bull. Econ. Stat. 72 (1), 109–118. doi:10.1111/j.1468-0084.2009.00569.x

López-Toro, A. A., Sánchez-Teba, E. M., Benítez-Márquez, M. D., and Rodríguez-Fernández, M. (2021). Influence of ESGC indicators on financial performance of listed pharmaceutical companies. Int. J. Environ. Res. Public Health 18, 4556. doi:10.3390/ijerph18094556

Minutolo, M., Kristjanpoller, W. D., and Stakeley, J. (2019). Exploring environmental, social, and governance disclosure effects on the S&P 500 financial performance. Bus. Strategy Environ. 28 (6), 1083–1095. doi:10.1002/bse.2303

Naimy, V., Ei Khoury, R., and Iskandar, S. (2021). ESG versus corporate financial performance: Evidence from East Asian firms in the industrials sector. Sustain. Econ. 39 (3), 1–24. doi:10.25115/eea.v39i3.4457

Nuber, C., Velte, P., and Hörisch, J. (2020). The curvilinear and time‐lagging impact of sustainability performance on financial performance: Evidence from Germany. Corp. Soc. Responsib. Environ. Manag. 27 (6), 232–243. doi:10.1002/csr.1795

Pierce, J. R., and Aguinis, H. (2013). The too-much-of-a-good-thing effect in management. J. Manag. 39, 313–338. doi:10.1177/0149206311410060

Sasabuchi, S. (1980). A test of a multivariate normal mean with composite hypotheses determined by linear inequalities. Biometrika 67 (2), 429–439. doi:10.1093/biomet/67.2.429

Saygili, E., Arslan, S., and Birkan, A. O. (2022). ESG practices and corporate financial performance: Evidence from Borsa Istanbul. Borsa Istanb. Rev. 22 (3), 525–533. doi:10.1016/j.bir.2021.07.001

Trumpp, C., and Guenther, T. (2017). Too little or too much? Exploring U-shaped relationships between corporate environmental performance and corporate financial performance. Bus. Strategy Environ. 26 (1), 49–68. doi:10.1002/bse.1900

Wong, W. C., Batten, J. A., Ahmad, A. H., Mohamed-Arshad, S. B., Nordin, S., and Adzis, A. A. (2021). Does ESG certification add firm value? Financ. Res. Lett. 39, 101593. doi:10.1016/j.frl.2020.101593

Keywords: environmental, social and governance (ESG), corporate financial performance, inverted U-shaped, too-much-of-a-good-thing, stakeholder engagement, sustainable development

Citation: Teng X, Ge Y, Wu K-S, Chang B-G, Kuo L and Zhang X (2022) Too little or too much? Exploring the inverted U-shaped nexus between voluntary environmental, social and governance and corporate financial performance. Front. Environ. Sci. 10:969721. doi: 10.3389/fenvs.2022.969721

Received: 15 June 2022; Accepted: 19 July 2022;

Published: 17 August 2022.

Edited by:

Elie Bouri, Lebanese American University, LebanonReviewed by:

Ahmed Imran Hunjra, Ghazi University, Pakistan, PakistanMário Nuno Mata, Instituto Politécnico de Lisboa, Portugal

Copyright © 2022 Teng, Ge, Wu, Chang, Kuo and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kun-Shan Wu, a3Vuc2hhbkBtYWlsLnRrdS5lZHUudHc=

Xiaodong Teng1

Xiaodong Teng1 Kun-Shan Wu

Kun-Shan Wu Bao-Guang Chang

Bao-Guang Chang