- 1School of Government and Management, Nanjing University, Nanjing, China

- 2Business School, Sichuan University, Chengdu, China

- 3College of Economics and Management, Zhejiang University of Water Resources and Electric Power, Hangzhou, China

Do companies disclose their environmental social responsibility to demonstrate their good environmental performance or to cover up their poor environmental performance? This study examines the relationship between the disclosure level of corporate environmental responsibility information and corporate environmental performance based on institutional pressure, using data from Chinese A-share listed companies between 2008 and 2021. The results showed a negative relationship between the two variables, indicating that many firms might disclose environmental information to cover up their poor environmental performance. This phenomenon was more evident among non-state-owned enterprises and the enterprises in the economically underdeveloped regions. This study provides a new theoretical perspective for relevant management institutions to study social responsibility reports and formulate environmental protection policies.

1 Introduction

Environmental disclosure is an important part of the corporate social responsibility report (CSR). It is required by legislation, which aims to encourage the listed companies to protect the environment, drive the development and application of green technology, and achieve sustainable development (Reynolds and Yuthas, 2008). As a result, a growing number of countries began to require listed companies to disclose their social and environmental responsibility reports. Under the promotion of the corporate environmental disclosure policy, the publish of corporate environmental responsibility report has become a social and economic development trend. It is believed that this trend is deemed as a positive signal of environmental improvement from a theoretical perspective.

From a business perspective, corporate environmental responsibility information disclosure (CERID) is used for communicating a firm’s social and environmental policies, practices, and performance with its stakeholders. It can help investors better understand a firm’s value, which may further increase its reputation, competitive advantage, and financial performance by attracting more investment and social support (Devie et al., 2019). Therefore, it can be deduced that if a firm is environmentally responsible and anticipates that the disclosure of environmental information is beneficial, the company would provide greater environmental disclosure. On the contrary, if a company’s environmental performance is poor, it may attempt to disguise the shortcomings and disclose less corporate environmental information to avoid the negative impacts.

Recent arguments suggested many companies’ environmental responsibility reports were doubted in credibility, with important information omitted, manipulated, and selectively provided to mislead the stakeholders. Many regions were found to continue to experience extreme pollution, and the public did not perceive an improvement of environmental quality, which was worth noticing (Maizland, 2021). Although some companies legitimized their actions by disclosing their environmental activities, it needs further analysis on whether they conducted environmental measures and committed to environmental responsibility, as their CSR report showed. Although existing research mainly studied the influences on companies’ environmental performance from the perspective of company characteristics and institutional governance (e.g., company’s scale, age, property rights, and regulation policies) (Khlif et al., 2017), little attention was paid to the relationship between corporate environmental responsibility information disclosure and corporate environmental performance. This study attempts to fill the gap by answering the following two questions: 1) Does the level of CERID reflect the corporate’s actual environmental performance? 2) What is the relationship between the two variables mentioned above?.

Based on the institutional pressure, this study conducted an empirical analysis on the relationship between the level of CERID and corporate environmental performance based on the data of Chinese A-share listed companies during the period of 2008 and 2021. Firstly, we conducted a mechanism analysis. Secondly, two different scenarios were further analyzed. The rest of the paper is arranged as follows: Section 2 is the Literature review. Section 3 is the Methodology. Section 4 is the Empirical results. Section 5 is the Discussion. Section 6 draws the conclusion.

2 Literature review and hypothesis

As the environmental degradation accelerated, the public called for green production. An increasing number of nations imposed requirements on listed companies to disclose their environmental information in the social responsibility report. Although the disclosure of corporate environmental responsibility was projected for a sustainable environment, the disclosure policies were not unified. Some countries adopted voluntary disclosure rules; for instance, the association of south-east Asian nations (ASEAN) countries undertook a voluntary disclosure policy in 2007 (Arena et al., 2018). Malaysia imposed corporate environmental information disclosure requirements in 2013 to promote “green Malaysia” (Joseph et al., 2013). Some countries forced public companies to mandatorily disclose their corporate environmental responsibility information. For example, Italy requested that public firms should release social and environmental reports in 2018. China issued the “Measures” (Measures for the Administration of Legal Disclosure of Enterprise Environmental Information), the latest rule to mandate and standardize environmental disclosure reporting in 2021. Despite the environmental disclosure requirements in China being voluntary in the early ages, the discretionary policy did not slow down environmental degradation, and only 3% of the public firms voluntarily release their environmental information. To deal with the increasingly serious environmental issue, a more stringent regulation was imposed on environmental information disclosure.

Social and environmental responsibility information disclosure also attracted the scholars’ attention. Most existing literature focused on quality and quantity (Deegan and Gordon, 1996; Lu and Abeysekera, 2017), motivation (Milne and Patten, 2002), and the determinants (Hackston and Milne, 1996; Cormier and Gordon, 2001). It was found that the firm’s characteristics including scale (Mahadeo et al., 2011), profitability (Cormier and Magnan, 2003; Maran, 2017), industry categories, environmental sensitivity (Liu and Anbumozhi, 2009), the institutional transitions (Sun et al., 2018) and the types of stakeholders (Liu and Anbumozhi, 2009), such as shareholders (Cormier and Magnan, 2003), the creditor (Choi et al., 1999), and governments were the important factors that impact the disclosure level.

Some literature hold that enterprises can establish a good reputation, strengthen the business environment, and enhance their market competitiveness by assuming social responsibilities to different stakeholders (Branco and Rodrigues, 2006). For example, El Ghoul et al. (2011) conducted an empirical study on U.S. listed companies (El Ghoul et al., 2011), and found that corporate social responsibility input in environmental governance and social production can assist the companies to acquire a lower interest rate of bank loan, thus creating more advantages for companies.

Therefore, does that mean the higher level of environmental responsibility information a firm disclose, the better environmental performance it conducts? The vast majority of existing literature studied the relationship between a firm’s social responsibility disclosure and its financial performance (Cavaco and Crifo, 2014; Waworuntu et al., 2014; Rhou et al., 2016; Kumar et al., 2018; Sun et al., 2019). However, little attention was paid to the relationship between the level of CERID and the firm’s environmental performance. In reality, although it was anticipated that CERID would result in a more sustainable environment, what the public perceived was the worse of the environmental quality and the rising carbon emissions. Then, what is the real story behind the scene?

Institutional pressure theory points out that in the Chinese context, enterprises need to respond to various government policies in order to obtain the legitimacy of their own operations (Lin and Sheu, 2012). In the process of enterprise operation, fulfilling environmental social responsibility is one of the important contents of enterprise legitimacy (Farache and Perks, 2010; Du and Vieira, 2012; Chauvey et al., 2015; Ellerup Nielsen and Thomsen, 2018). It means that companies need to simultaneously meet the requirements of long-term virtuous development in the pursuit of profit maximization (Archer, 2013). However, in the process of undertaking social responsibility, is it for the long-term development of the enterprise, or is it just a kind of show to gain the legitimacy of their own business in the process of development? For those two different scenarios, we may see two different endings. For companies that fulfill their environmental social responsibility in a genuine way, the better environmental performance may assist them in the long term. According to strategic management theory, different enterprises usually adopt different coping strategies when disclosing environmental social responsibility report, including symbolic social responsibility report disclosure and substantive social responsibility report disclosure. The symbolic social responsibility report disclosure refers to the company’s vision and slogan in the disclosure process, while the substantive social responsibility report disclosure refers to the specific amount of investment (Faisal et al., 2019).

For companies that use CERID to gain business legitimacy, the higher level of CERID, the worse their environmental performance is likely to be. Companies that are sincere about their environmental social responsibility will focus on environmental protection in their operations. In the current business environment, stakeholders such as government, consumers, investors and the media view whether a company is fulfilling its environmental social responsibility as an important signal of whether the company is responsible or not (Delmas and Toffel, 2004; Kassinis and Vafeas, 2006; Lim and Greenwood, 2017). For companies that engage in social responsibility, they usually gain the goodwill of consumers to buy their company’s products (Bagozzi and Dholakia, 2002; Brunk and de Boer, 2020). For job applicants, companies that are actively engaged in social responsibility are perceived to be a good company, thus attracting more applicants (Goodstein, 1994; Croce and Ghignoni, 2012). Thus, with stakeholder attention, if a company is actually fulfilling its environmental social responsibility, then it contributes to environmental performance. Therefore, hypothesis 1 is proposed:

H1:. The higher the quality of environmental information disclosure, the better the company’s performance in environmental aspects.On the contrary, if an enterprise only publishes some corporate vision and slogans when it publishes the environmental and social responsibility report information, it indicates that the enterprise has little investment in environmental and social responsibility, and has nothing to disclose to the public. Therefore, its environmental performance is not good. Therefore, hypothesis 2 is proposed:

H2:. The lower the quality of environmental social responsibility information disclosure, the worse the environmental performance.Different nature of the company has different pressure. For non-state enterprises, they usually face more operating pressure due to their own capital and resource limitations (Guo, 2005; Dai and Cheng, 2015). In order to obtain business legitimacy, they usually obtain the maximum harvest with the minimum investment. As a result, when companies are under pressure to operate with legitimacy, non-state owned enterprises (SOEs) are more likely to adopt cover-up measures, which means that non-SOEs are more likely to announce lower quality of environmental corporate social responsibility reports. However, for state-owned enterprises, under the institutional pressure, the enterprise usually will not have operating pressure. Therefore, enterprises will set a good example in accordance with government regulations, adopt substantial environmental and social responsibility information disclosure, and invest more in environmental protection (Masoud and Vij, 2021). Therefore, hypothesis 3 is proposed:

H3:. Under institutional pressure, the lower the quality of environmental information disclosure, the worse the environmental performance of non-SOEs.According to the geographical distribution of China, there is a big difference between the eastern and central and western regions in terms of the degree of economic development. For enterprises, this brings about differences in terms of capital, talent, technology and management (Asheim et al., 2011; Abramo et al., 2012; Aiello et al., 2012). For the firms in the central and western regions, they usually face the lack of capital and talents in the process of operation, so in order to obtain more capital and talent, then they will do more work to get public recognition. The publication of environmental social responsibility reports is usually one of the important forms. However, for companies in the central and western regions, it is more difficult to make profits than in the eastern regions, so they are more reluctant to raise costs to make real environmental improvements (Collis and Montgomery, 1995; Daniel et al., 2004; Fan et al., 2015). Therefore, hypothesis 4 is proposed:

H4:. Under institutional pressure, the lower the quality of environmental information disclosure in the regions with poor economic development, the worse the environmental performance.

3 Research design

3.1 Data and sample

This study collected financial information from the Chinese Stock Market and Accounting Research Database for the period from 2008 to 2021, with an initial sample of 925 firms and 5,537 observations. First, this study excluded stocks with special treatment, such as ST, *ST, and PT. In China, firms with abnormal financial status or other status would receive the special treatment, indicating that firms had a high risk were delisted. Second, we excluded firms in the observation years with key variables missing. Third, financial industry firms were also omitted because they were different from other firms. Finally, we removed observations with negative leverage, or leverage over 100%. To alleviate the impact of outliers, we winsorized all the variables at the 1% level. The final sample of this study consisted of 5,537 firm-year observations with 925 firms across 14 years.

3.2 Variables

This study attempted to examine the relationship between the level of CERID and corporate environmental performance. This study adopted the environmental protection investment to represent the environmental performance (Cheng and Li, 2022). In order to reduce the interference of industry differences, this paper used the average value of industry environmental protection investment as a benchmark, and used the amount of each enterprise’s environmental protection investment this year minus last year’s amount, then subtracted the average value of the industry in which it was located. The increase in its value was taken as the enterprise’s environmental protection investment this year. The calculation is shown as Eq. 1.

Regarding the level of CERID, this paper measured the quantity and quality of corporate environmental information disclosure from the following 21 aspects on the basis of previous research (Yang et al., 2020). First, the wastewater discharge, COD discharge, SO2 discharge, CO2 discharge, smoke and dust discharge, and industrial solid waste generation were measured in terms of whether environmental information disclosure was qualitatively or quantitatively analyzed. 0 for no relevant description, 1 for only qualitative description, and 2 for both qualitative and quantitative descriptions. Secondly, to measure the environmental protection concept, environmental protection goals, environmental protection management system, environmental protection education and training, environmental protection special actions, environmental incident emergency mechanism, environmental protection honors and awards, and the “three simultaneous” system were introduced, we assigned 1 if that indicator was disclosed, and 0 if it was not disclosed. Thirdly, for the following index: Whether the company was a key pollution monitoring unit, whether the pollutant discharge met the standards, sudden environmental accidents, environmental violations, environmental petition incidents, whether it had passed ISO14001 certification, whether it had passed ISO9001 certification; if it was disclosed, it was assigned the value 1, otherwise it was 0. Finally, the score of the 21 indicator of each firm were summed up to calculate the actual score of each firm’s environmental information disclosure level, and then the actual score of the company’s environmental information disclosure is divided by the maximum possible score of environmental information disclosure (The maximum score of environmental information disclosure in these samples is 24 points). Its calculation formula is shown in formula (2).

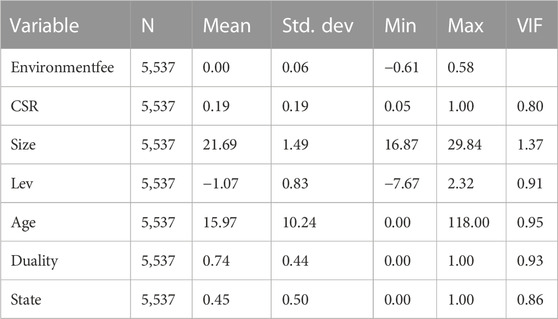

In addition, we controlled for several control variables, including firm size, firm financial risk, whether the positions of general manager and chairman of the firm were combined, firm nature, and firm age. The descriptions of the variables were shown in Table 1.

4 Empirical results

4.1 Statistical analysis

Table 2 provided a descriptive analysis of the variables. It can be seen that the maximum, minimum, mean and standard deviation values of the explained, explanatory and control variables were within a reasonable range and there were no cases of outliers or extreme values. In addition, the results of the variance inflation factor (VIF) test showed that the VIF values were all less than 10, indicating that there were no problems such as high covariance between variables.

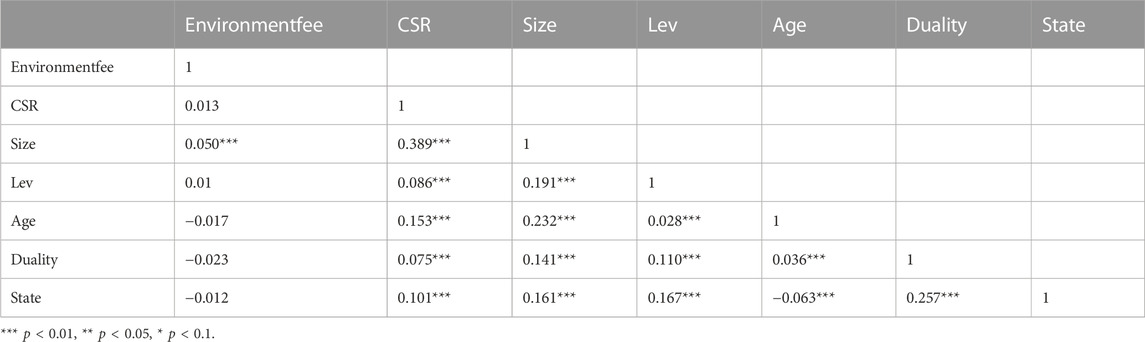

Table 3 showed the correlation between the indicators was below 0.5, indicating that there was no high correlation issue between the indicators. The results of Tables 2, 3 showed that the indicators were selected reasonably.

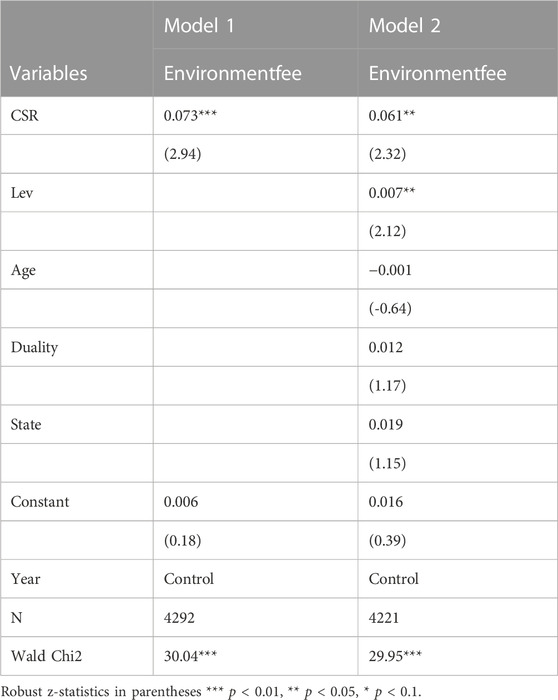

4.2 Baseline regression

The results of the baseline regressions in this paper were analyzed in Table 4. The main research objective of this paper was to explore whether corporate disclosure of environmental social responsibility served to mask poor corporate environmental performance or indeed promoted corporate environmental protection. Model 1 did not contain control variables and Model 2 contained all control variables, both of which showed that the higher level of CERID, the more environmental protection investment the companies generated (Coefficient = 0.061, p < 0.05). This suggested that corporate environmental social responsibility disclosure is a cover-up behavior.

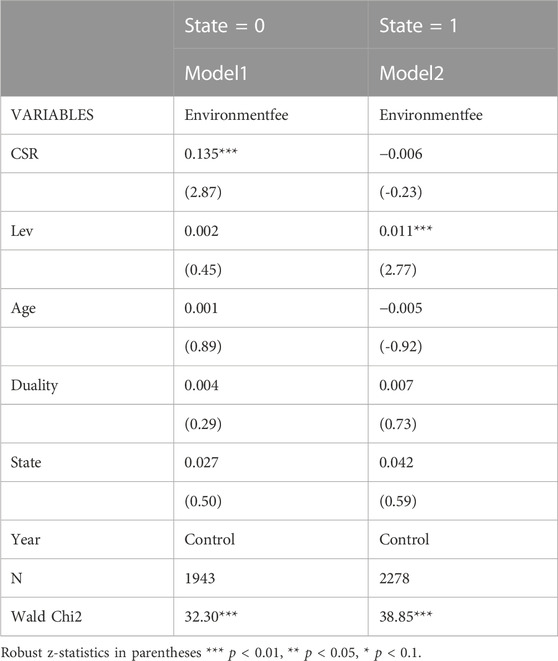

4.3 Further analysis

In addition, we further analyzed the relationship between CERID and environmental performance for companies of different nature and in different regions, so as to identify whether CSR disclosure was a fulfillment of environmental protection responsibilities or a cover-up behavior. Model 1 of Table 5 analyzed the relationship between the fulfillment of environmental social responsibility and corporate environmental performance of non-state enterprises. The results showed that the higher level of CERID by non-state enterprises, the more they spent on emission fees. Model 2 analyzed the relationship between the fulfillment of environmental social responsibility by state-owned enterprises and corporate environmental performance. The results showed that the higher level of CERID of SOEs, the less they spent on environmental protection investment. Therefore, it can be seen that CERID was adopted by non-SOEs as a cover-up strategy, while the cover-up behaviour was not found in SOEs.

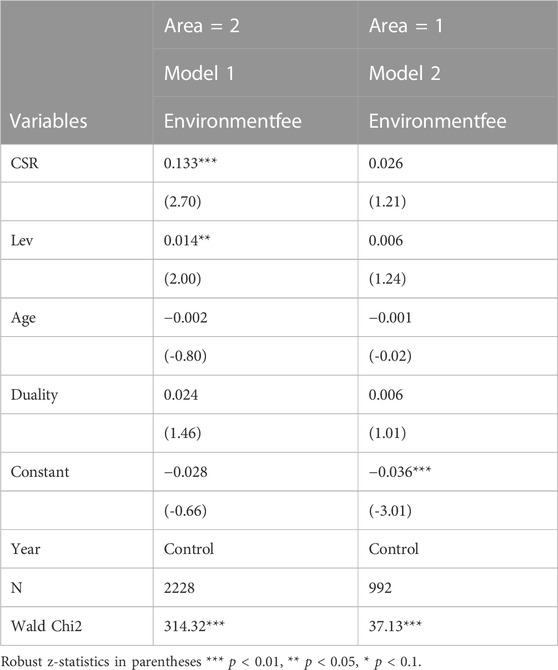

Table 6 further analyzed the relationship between the level of CERID and corporate environmental performance in different regions. Model 1 analyzed the relationship between CSR disclosure and corporate environmental performance in the central and western regions, and the results indicated that the higher level of CERID in the central and western regions, the more environmental fee the companies was charged. Model 2 analyzed the relationship between CSR disclosure and corporate environmental performance in the eastern region, and the results showed that the higher level of CERID in the eastern region, the lower the corporate environmental emission fee. Therefore, this suggested that for economically underdeveloped regions, such as the central and western regions, disclosing environmental responsibility information was a way to cover up the environmental misconduct of enterprises.

5 Discussion

Institutional pressure suggests that business activities need to satisfy stakeholders in order to gain legitimacy in their operations. This study analyzed the relationship between the level of CERID and corporate environmental performance of Chinese A-share listed companies, using data from 2008 to 2021.

First, a cover-up phenomenon was found between the corporate environmental disclosure and environmental performance of the listed companies. That is, the better the quality of corporate environmental information disclosure, the worse the corporate environmental performance, indicating more emission and charges. This is inconsistent with the conclusions of several recent studies. For example, Liu et al. (2021) argued that the mandatory corporate social responsibility (CSR) disclosure can significantly improve the overall environmental performance. However, their conclusions were sourced from a short-term data set of CSR reports (an earlier period during 2004 and 2012), while our work uses data of the corporate environmental responsibility information from the recent 14 years, and the results can better elucidate the current environmental situation. Peng et al. (2021) selected Chinese A-share chemical listed companies from 2006 to 2017 as the research sample, and studied the impact that corporate environmental responsibility placed on environmental performance. They found that corporate environmental responsibility had an insignificant positive impact on environmental performance. Moreover, they argued that corporate environmental performance has a significant positive impact on environmental responsibility. Regarding those literature, it can be seen that the conclusions of previous studies were not consistent, which may be influenced by the sample set. A more comprehensive sample with a longer period of time span can draw a more robust conclusion. To further validate the relationship between the level of CERID and corporate environmental performance, this paper adopted a larger sample and confirmed a negative relationship between the two variables.

Second, the cover-up behavior of non-state enterprises was more prominent. For non-state owned enterprises, in the process of operation, due to the limitation of their own resources, in order to obtain the legitimacy of operation, they covered up their poor environmental performance by releasing higher level of environmental responsibility information. This was inconsistent with the conclusion of Liu et al. (2021), who believed that mandatory social responsibility disclosure can significantly improve the environmental performance of non-state owned enterprises. However, we found that the goals and objectives of non-state owned enterprises were inconsistent with environmental responsibility to some extent. Even though those enterprises have provided a higher level of information disclosure, they produced an increased amount of pollution at the same time. The CERID of non-state owned enterprises had become a cover-up tool for their environmental damage.

Third, the cover-up behavior was more prominent in economically underdeveloped regions. For enterprises in economically underdeveloped regions, in order to obtain more capital, technology, talents and management experience, they published a higher level of environmental responsibility information to disguise their environmental performance so as to gain the recognition of stakeholders. The green behavior of the listed enterprises in the emerging economies was more considered as impression management, rather than the real improvement of environmental performance (Dögl and Holtbrügge, 2014). However, their conclusion was based on the comparisons of the listed companies between developed and developing countries, which may overlook the other potential factors such as culture, and politics. Based on the economic level, this paper analysed the environmental performance differences of the listed companies among different regions in China and unveiled the cover-up phenomenon.

6 Conclusion

6.1 Theoretical implication

The theoretical contributions of this paper include the following aspects: Firstly, it enriched the influencing factors of environmental performance. In previous studies, more studies have explored how to improve the environmental performance of firms from the perspective of corporate governance and government governance (Adnan et al., 2018). This study examined the relationship between the level of CERID and corporate environmental performance from the perspective of social environmental responsibility.

Secondly, we illustrated the cover-up behavior in corporate environmental information disclosure, which explained the conflict between public perception and environmental responsibility disclosure. Previous scholars believed that the higher level of CSR disclosure means the enterprises actively participated in social protection, indicating they contributed more in social improvement. However, this paper drew the opposite conclusion with empirical evidence. Based on a larger data set analysis, the paper found the environmental performance of companies deteriorated with greater disclosure. The conclusions of this paper reflected the objective perception of the public and provided a new perspective for the research on CSR disclosure (Ali et al., 2017).

Thirdly, it identified the moderating effects of corporate nature and regional differences on environmental responsibility disclosure and environmental performance, which further expanded the theoretical scope of research on corporate environmental responsibility disclosure. The results showed the application of institutional pressure that can be used to explain the listed companies’ CEIRD. Due to the shortage of various resources, non-state owned listed companies in the economically underdeveloped areas adopted the cover-up strategy to react to the Corporate Environment Reporting policy and social concerns, that is, they published higher level of CERID to cover up their environmental pollution behaviour for the purpose of establishing and maintaining their brand image, and acquiring market and social support.

6.2 Practical implication

The policy implications of this study are divided into the following points: First, environmental social responsibility disclosure in China does not substantially contribute to corporate environmental performance improvement. This indicates that CSR disclosure in China is currently only in a literal sense and is not specifically applied in practice. Second, there is still much room for improvement in environmental protection in China, which is mainly at the level of coping with government policies and regulations. In order to solve environmental problems, the government should set up a series of reasonable incentives and penalties. Third, the government should set up specific environmental information disclosure methods and contents for specific enterprises and select third-party authorities to evaluate them, so as to promote the truthful disclosure of environmental social responsibility information.

6.3 Limitations

There are some limitations of this study: First, environmental performance can be influenced by many factors, and we only included the main variables. Future research may employ a more complex model. Second, the conclusion was only reached from the analysis of the data set of Chinese listed companies, and the conclusion may not be applied to all other countries. Future research may examine the relationship between CER and environmental performance in the developing countries and the underdeveloped countries.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: CSMAR database.

Author contributions

Conceptualization, FY; Methodology, TL; Software, FY; Validation, TL; Formal analysis, TL; Writing and revise: FY.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abramo, G., D'Angelo, C. A., and Solazzi, M. (2012). A bibliometric tool to assess the regional dimension of University-industry research collaborations. Scientometrics 91, 955–975. doi:10.1007/s11192-011-0577-5

Adnan, S. M., Hay, D., and van Staden, C. J. (2018). The influence of culture and corporate governance on corporate social responsibility disclosure: A cross country analysis. J. Clean. Prod. 198, 820–832. doi:10.1016/j.jclepro.2018.07.057

Aiello, F., Iona, A., and Leonida, L. J. E. E. (2012). Regional infrastructure and firm investment: Theory and empirical evidence for Italy. Empir. Econ. 42, 835–862. doi:10.1007/s00181-010-0445-9

Ali, W., Frynas, J. G., and Mahmood, Z. (2017). Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: A literature review. Corp. Soc. Responsib. Environ. Manag. 24, 273–294. doi:10.1002/csr.1410

Archer, C. (2013). Corporate social responsibility, stakeholder theory and climate change: Is green the new black for ExxonMobil? cambridge, UK: Cambridge University Press, 9–17.

Arena, C., Liong, R., and Vourvachis, P. (2018). Carrot or stick: CSR disclosures by southeast asian companies. Sustain. Account. Manag. Policy J. 9, 422–454. doi:10.1108/sampj-06-2016-0037

Asheim, B. T., Boschma, R., and Cooke, P. (2011). Constructing regional advantage: Platform policies based on related variety and differentiated knowledge bases. Reg. Stud. 45, 893–904. doi:10.1080/00343404.2010.543126

Bagozzi, R. P., and Dholakia, U. M. (2002). Intentional social action in virtual communities. J. Interact. Mark. 16, 2–21. doi:10.1002/dir.10006

Branco, M. C., and Rodrigues, L. L. (2006). Corporate social responsibility and resource-based perspectives. J. Bus. ETHICS 69, 111–132. doi:10.1007/s10551-006-9071-z

Brunk, K. H., and de Boer, C. (2020). How do consumers reconcile positive and negative CSR-related information to form an ethical brand perception? A mixed method inquiry. J. Bus. ETHICS 161, 443–458. doi:10.1007/s10551-018-3973-4

Cavaco, S., and Crifo, P. (2014). CSR and financial performance: Complementarity between environmental, social and business behaviours. Appl. Econ. 46, 3323–3338. doi:10.1080/00036846.2014.927572

Chauvey, J.-N., Giordano-Spring, S., Cho, C. H., and Patten, D. M. (2015). The normativity and legitimacy of CSR disclosure: Evidence from France. J. Bus. ETHICS 130, 789–803. doi:10.1007/s10551-014-2114-y

Cheng, Z., and Li, X. (2022). Do raising environmental costs promote industrial green growth? A quasi-natural experiment based on the policy of raising standard environmental protection investment. J. Clean. Prod. 343, 131004. doi:10.1016/j.jclepro.2022.131004

Choi, I., Nisbett, R. E., and Norenzayan, A. (1999). Causal attribution across cultures: Variation and universality. Psychol. Bull. 125, 47–63. doi:10.1037/0033-2909.125.1.47

Collis, D. J., and Montgomery, C. A. (1995). Competing on resources: Strategy in the 1990s. Knowl. Strategy, 25–40. doi:10.1016/b978-0-7506-7088-3.50005-x

Cormier, D., and Gordon, I. M. (2001). An examination of social and environmental reporting strategies. Accounting. Auditing Account. J. 14, 587–617. doi:10.1108/EUM0000000006264

Cormier, D., and Magnan, M. (2003). Environmental reporting management: A continental European perspective. J. Account. public Policy 22, 43–62. doi:10.1016/s0278-4254(02)00085-6

Croce, G., and Ghignoni, E. (2012). Employer-provided training and knowledge spillovers: Evidence from Italian local labour markets. Reg. Stud. 46, 339–353. doi:10.1080/00343404.2010.497136

Dai, X., and Cheng, L. (2015). Public selection and research and development effort of manufacturing enterprises in China: State owned enterprises versus non-state owned enterprises. Innovation 17, 182–195. doi:10.1080/14479338.2015.1011053

Daniel, F., Lohrke, F. T., Fornaciari, C. J., and Turner, R. A. (2004). Slack resources and firm performance: A meta-analysis. J. Bus. Res. 57, 565–574. doi:10.1016/s0148-2963(02)00439-3

Deegan, C., and Gordon, B. (1996). A study of the environmental disclosure practices of Australian corporations. Account. Bus. Res. 26, 187–199. doi:10.1080/00014788.1996.9729510

Delmas, M., and Toffel, M. W. (2004). Stakeholders and environmental management practices: An institutional framework. Bus. Strategy Environ. 13, 209–222. doi:10.1002/bse.409

Devie, D., Kamandhanu, J., Tarigan, J., and Hatane, S. E. (2019). Do environmental performance and disclosure bring financial outcome? Evidence from Indonesia. World Rev. Sci. Technol. Sustain. Dev. 15, 66–86. doi:10.1504/wrstsd.2019.10019999

Dögl, C., and Holtbrügge, D. (2014). Corporate environmental responsibility, employer reputation and employee commitment: An empirical study in developed and emerging economies. Int. J. Hum. Resour. Manag. 25, 1739–1762. doi:10.1080/09585192.2013.859164

Du, S., and Vieira, E. T. (2012). Striving for legitimacy through corporate social responsibility: Insights from oil companies. J. Bus. ETHICS 110, 413–427. doi:10.1007/s10551-012-1490-4

El Ghoul, S., Guedhami, O., Kwok, C. C., and Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? J. Bank. finance 35, 2388–2406. doi:10.1016/j.jbankfin.2011.02.007

Ellerup Nielsen, A., and Thomsen, C. (2018). Reviewing corporate social responsibility communication: A legitimacy perspective. Corporate Communications: An International Journa, 23, 492–511. doi:10.1108/ccij-04-2018-0042

Faisal, F., Napitupulu, M. A., and Chariri, A. (2019). Corporate social and environmental responsibility disclosure in Indonesian companies: Symbolic or substantive? Pertanika J. Soc. Sci. Humanit. 27, 259–277.

Fan, X., Yang, X., and Chen, L. (2015). Diversified resources and academic influence: Patterns of University–industry collaboration in Chinese research-oriented universities. Scientometrics 104, 489–509. doi:10.1007/s11192-015-1618-2

Farache, F., and Perks, K. J. (2010). CSR advertisements: A legitimacy tool? Corp. Commun. Int. J. 15, 235–248. doi:10.1108/13563281011068104

Goodstein, J. D. J. A. o. M. j. (1994). Institutional pressures and strategic responsiveness: Employer involvement in work-family issues. Acad. Manage. J. 37, 350–382. doi:10.5465/256833

Guo, B. (2005). Technological development, technology spillover and profitability: An industry level empirical analysis of Chinese manufacturing industries. Technol. Analysis Strategic Manag. 17, 279–292. doi:10.1080/09537320500211268

Hackston, D., and Milne, M. J. (1996). Some determinants of social and environmental disclosures in New Zealand companies. Account. auditing Account. J. 9, 77–108. doi:10.1108/09513579610109987

Joseph, C., Nichol, E. O., Janggu, T., and Madi, N. (2013). Environmental literacy and attitudes among Malaysian business educators. Int. J. Sustain. High. Educ. 14, 196–208. doi:10.1108/14676371311312897

Kassinis, G., and Vafeas, N. (2006). Stakeholder pressures and environmental performance. Acad. MANAGE J. 49, 145–159. doi:10.5465/amj.2006.20785799

Khlif, H., Ahmed, K., and Souissi, M. (2017). Ownership structure and voluntary disclosure: A synthesis of empirical studies. Aust. J. Manag. 42, 376–403. doi:10.1177/0312896216641475

Kumar, A., Sinha, A., Arora, A., and Aggarwal, A. (2018). Impact of CSR activities on the financial performance of firms. MUDRA J. Finance Account. 5, 75–89. doi:10.17492/mudra.v5i01.13037

Lim, J. S., and Greenwood, C. A. J. P. R. R. (2017). Communicating corporate social responsibility (CSR): Stakeholder responsiveness and engagement strategy to achieve CSR goals. Public Relat. Rev. 43, 768–776. doi:10.1016/j.pubrev.2017.06.007

Lin, R.-j., and Sheu, C. (2012). Why do firms adopt/implement green practices?–an institutional theory perspective. Procedia-Social Behav. Sci. 57, 533–540. doi:10.1016/j.sbspro.2012.09.1221

Liu, X., and Anbumozhi, V. (2009). Determinant factors of corporate environmental information disclosure: An empirical study of Chinese listed companies. J. Clean. Prod. 17, 593–600. doi:10.1016/j.jclepro.2008.10.001

Liu, Y., Failler, P., and Chen, L. (2021). Can mandatory disclosure policies promote corporate environmental responsibility?—quasi-natural experimental research on China. Int. J. Environ. Res. Public Health 18, 6033. doi:10.3390/ijerph18116033

Lu, Y., and Abeysekera, I. (2017). What do stakeholders care about? Investigating corporate social and environmental disclosure in China. J. Bus. ETHICS 144, 169–184. doi:10.1007/s10551-015-2844-5

Mahadeo, J. D., Oogarah-Hanuman, V., and Soobaroyen, T. (2011). A longitudinal study of corporate social disclosures in a developing economy. J. Bus. ETHICS 104, 545–558. doi:10.1007/s10551-011-0929-3

Maizland, L. (2021). China’s fight against climate change and environmental degradation. Newyork, USA: Council on Foreign Relations.

Maran, T. (2017). Mimicry and meaning: Structure and semiotics of biological mimicry. Berlin, Germany: Springer.

Masoud, N., and Vij, A. (2021). Factors influencing corporate social responsibility disclosure (CSRD) by Libyan state-owned enterprises (SOEs). Cogent Bus. Manag. 8, 1859850. doi:10.1080/23311975.2020.1859850

Milne, M. J., and Patten, D. M. (2002). Securing organizational legitimacy: An experimental decision case examining the impact of environmental disclosures. Accounting. Auditing Account. J. 15, 372–405. doi:10.1108/09513570210435889

Peng, B., Chen, S., Elahi, E., and Wan, A. (2021). Can corporate environmental responsibility improve environmental performance? An inter-temporal analysis of Chinese chemical companies. Environ. Sci. Pollut. Res. 28, 12190–12201. doi:10.1007/s11356-020-11636-9

Reynolds, M., and Yuthas, K. (2008). Moral discourse and corporate social responsibility reporting. J. Bus. ETHICS 78, 47–64. doi:10.1007/s10551-006-9316-x

Rhou, Y., Singal, M., and Koh, Y. (2016). CSR and financial performance: The role of CSR awareness in the restaurant industry. Int. J. Hosp. Manag. 57, 30–39. doi:10.1016/j.ijhm.2016.05.007

Sun, W., Zhao, C., and Cho, C. H. (2019). Institutional transitions and the role of financial performance in CSR reporting. Corp. Soc. Responsib. Environ. Manag. 26, 367–376. doi:10.1002/csr.1688

Sun, W., Zhao, C., Wang, Y., and Cho, C. H. (2018). Corporate social responsibility disclosure and catering to investor sentiment in China. Manag. Decis. 56, 1917–1935. doi:10.1108/md-08-2017-0806

Waworuntu, S. R., Wantah, M. D., and Rusmanto, T. (2014). CSR and financial performance analysis: Evidence from top ASEAN listed companies. Procedia-Social Behav. Sci. 164, 493–500. doi:10.1016/j.sbspro.2014.11.107

Keywords: CSR, environmental performance, social pressure, corporate behavior, environmental input

Citation: Yun F, Lan T and Chen Y (2023) Cover-up or true? does CSR disclosure really contribute to corporate environmental performance?. Front. Environ. Sci. 11:1139088. doi: 10.3389/fenvs.2023.1139088

Received: 06 January 2023; Accepted: 23 March 2023;

Published: 11 April 2023.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Ionel Bostan, Ștefan cel Mare University of Suceava, RomaniaTao Ge, Nantong University, China

Copyright © 2023 Yun, Lan and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tian Lan, bGFudGlhbnNjdXNjdUAxNjMuY29t

Feifei Yun1

Feifei Yun1 Tian Lan

Tian Lan