- 1School of Economics and Management, Fuzhou Institute of Technology, Fuzhou, China

- 2School of Economics and Management, Fuzhou University, Fuzhou, China

The establishment of green finance reform and innovation pilot zones (GFRIPZ) is a crucial initiative in China’s advancement of green finance development. Whether this policy can effectively enhance carbon unlocking efficiency (CUE) constitutes a significant research question. Utilizing panel data from 267 Chinese cities spanning 2011 to 2022 and treating the GFRIPZ policy as a quasi-natural experiment, this study employs a double machine learning (DML) model to empirically investigate the impact of green finance policy on urban carbon unlocking efficiency. The results show that: (1) GFRIPZ significantly enhances CUE, and this conclusion remains valid after undergoing a series of robustness checks. (2) Mechanism validation reveal that GFRIPZ enhances CUE through three pathways: optimizing industrial structure, reducing energy intensity, and strengthening public environmental concern. (3) Heterogeneity analysis indicates that the carbon unlocking effects of GFRIPZ are more pronounced in eastern regions, large cities, non-resource-based cities, cities with higher internet development levels, and cities with advanced financial development. Concurrently, the applicability of GFRIPZ also benefits from regional institutional contexts such as public data openness, carbon emissions trading, and green resource endowment. (4) Spatial spillover effects demonstrate that GFRIPZ significantly enhances CUE in surrounding areas. This research not only provides a novel analytical framework for regional carbon unlocking pathways but also offers policy recommendations for enhancing green finance systems and overcoming carbon lock-in dilemmas.

1 Introduction

Since the advent of industrialization, the global economy has achieved remarkable development. However, the unrestrained expansion of energy consumption and surging carbon emissions have led to continuous climate deterioration and frequent extreme weather events (Su, et al., 2021), posing significant threats to Earth’s ecosystems and human survival. According to statistics from the International Energy Agency (IEA), traditional fossil fuels account for over 80% of global carbon emissions. The unsustainability of this high-carbon model has become increasingly evident, urgently requiring systematic solutions. Therefore, controlling carbon emissions has become humanity’s imperative action against climate change, necessitating a rapid transition from a fossil fuel-dependent extensive economy to low-carbon, decarbonized, and ultimately zero-carbon economic models (Niu and Liu, 2021). As the world’s second-largest economy and biggest carbon emitter, China has actively assumed emission reduction responsibilities. At the 2020 United Nations Climate Change Conference, China solemnly pledged to “strive to peak carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060.” However, while experiencing rapid economic development, China’s economy demonstrates rigid characteristics of high energy demand and carbon intensity. The deep institutionalization of fossil fuel-based energy systems within existing technological and institutional frameworks has created path dependency that is difficult to alter, resulting in a “carbon lock-in effect” (Unruh, 2000). This phenomenon severely impedes the realization of the dual carbon goals. Consequently, identifying effective carbon unlocking pathways and enhancing CUE is a critical practical challenge that China must urgently address.

It should be noted that a reduction in carbon emissions cannot be simplistically equated with carbon unlocking. The former focuses more on flow control, while the latter emphasizes systemic restructuring. Specifically, carbon emissions refer to the total greenhouse gases released directly or indirectly by human activities. Their reduction is typically achieved through temporary governance measures such as improving energy efficiency and clean energy substitution, exhibiting greater immediacy (Li, et al., 2024). In contrast, carbon unlocking underscores breaking the socio-economic system’s dependence on high-carbon development pathways. It aims to achieve profound decoupling between economic growth and carbon emissions (Li, et al., 2023) by restructuring the industrial, technological, and institutional systems (Unruh, 2000). It can thus be regarded as a sufficient but not necessary condition for carbon emission reduction.

Finance, functioning as a pivotal pillar of economic development, maintains an inseparable relationship with carbon emissions (Scholtens and Dam, 2007). Specifically, the progression of green finance demonstrates direct relevance to the attainment of carbon neutrality and carbon peaking objectives. Green finance, fundamentally characterized as a high-efficiency investment and financing mechanism, pursues the dual goals of environmental preservation and high-quality economic advancement. This mechanism achieves carbon reduction and environmental quality improvement through regulatory alignment (Brandi, et al., 2020), while concurrently enabling carbon unlocking via industrial restructuring (Wang, et al., 2020), energy system optimization (Li and Jia, 2017; Wang, et al., 2021), innovation-driven compensation (Wang et al., 2024a), and public awareness cultivation (Wang et al., 2024b). These multifaceted approaches collectively establish innovative pathways for overcoming carbon lock-in constraints. To achieve the “dual carbon” goals and resolve the dilemma between economic development and carbon emissions, China implemented the GFRIPZ policy in 2017, strategically leveraging financial instruments as a powerful lever to drive green development. This policy focuses on precisely directing funds to green industries, prioritizing key areas such as renewable energy development and clean energy infrastructure construction. According to official statistics from the People’s Bank of China, by June 2022, the total green loans in pilot cities had reached RMB 1.1 trillion, constituting 11.7% of all loans, while the balance of green bonds stood at RMB 238.832 billion, with a year-on-year increase exceeding 40%. During policy implementation, the pilot zones not only established special green industry funds to ensure stable capital reserves for green projects, but also provided preferential loan interest rates to reduce financing costs for green enterprises, thereby fully opening capital financing channels for green projects. These measures demonstrate that green finance policy play a crucial role in breaking carbon lock-in and promoting low-carbon economic transformation. However, while existing research has extensively discussed the economic (Irfan, et al., 2022; Zhang, et al., 2021), social (Feng and Zhou, 2024; Yu, 2024), and environmental effects (Feng, et al., 2025; Wang and Gao, 2024) of green finance policies, evidence regarding their impact on CUE remains scarce. Relevant studies have predominantly focused on the effects on carbon emissions (Lei and Wang, 2023; Wang and Gao, 2024; Zhou, et al., 2019), and no study has yet incorporated green finance policies and CUE within a unified framework. Therefore, unlike merely affecting carbon emissions, does green finance policy exhibit a significant carbon unlocking effect? If so, what is the intrinsic transmission mechanism between them? What heterogeneous variation patterns and spatial spillover effects does it possess? How can the universal applicability of policies be ensured? These unresolved issues undoubtedly warrant further exploration. In light of this, we utilize the double machine learning model to provide direct empirical evidence on the impact of green finance policy on CUE, and propose rational policy recommendations based on the research findings and conclusions.

Based on the aforementioned research motivation, the marginal contributions of this paper primarily lie in: (1) A novel research perspective. This paper breaks through the limitations of existing literature on environmental effect assessment (Feng, et al., 2025; Lei and Wang, 2023; Wang and Gao, 2024; Zhou, et al., 2019), innovatively integrates green finance policy and CUE into a unified analytical framework, and is the first to reveal the carbon unlocking effect of green finance policy, filling a critical research gap in this key area. (2) Innovative research methodology. Addressing the challenges of model specification bias and linear constraints faced by mainstream literature relying on traditional Difference-in-Differences (DID) models (Lei and Wang, 2023; Wang, et al., 2024a; Wang and Gao, 2024), this paper innovatively constructs a DML model to conduct an in-depth discussion on the causal relationship between GFRIPZ and CUE; this method effectively overcomes issues such as overfitting, model bias, and the curse of dimensionality, significantly enhancing the robustness and precision of policy effect evaluation. Furthermore, moving beyond the local effects of green finance policy (Yan, et al., 2022), this paper additionally constructs a Spatial Difference-in-Differences (SDID) model to empirically capture the cross-regional carbon unlocking effect of GFRIPZ, revealing the spatial connection between them, in order to provide more reference basis for cross-regional collaborative carbon unlocking. (3) In-depth mechanism analysis. This paper constructs a multi-dimensional transmission pathway and contextualized heterogeneity framework. It not only systematically clarifies the main channels and intrinsic logic of the carbon unlocking effect of GFRIPZ through three pathways: industrial structure optimization, energy intensity reduction, and enhanced public environmental awareness. Simultaneously, this paper also innovatively constructs a multi-dimensional contextual analysis framework; this framework incorporates both fundamental characteristics including geographical location, city size, resource endowment, internet and financial development, and institutional contexts encompassing data openness, carbon trading, and green resource endowment, deeply revealing the complex heterogeneity patterns of policy effects. This provides rich empirical reference for governments to implement corresponding green finance policy measures based on local conditions.

The remainder of this paper is structured as follows. Section 2 reviews the literature on CUE and green finance policy. Section 3 elaborates the policy background and theoretical mechanisms. Section 4 introduces the DML model and research design. Section 5 presents empirical results from the DML model and provides normative analysis. Section 6 conducts the mechanism validation, heterogeneity analysis, spatial spillover effects analysis, and extended analysis. Section 7 concludes the findings and proposes policy recommendations.

2 Literature review

2.1 Research on CUE

Driven by global carbon neutrality goals, the technological lock-in and institutional inertia inherent in traditional high-carbon development models have emerged as central obstacles to climate governance. Carbon unlocking, as a novel theoretical framework for breaking such path dependence, has attracted extensive scholarly attention in recent years.

Unruh first proposed the concept of carbon lock-in (Unruh, 2000), defined as a phenomenon where economic development becomes locked into fossil fuel-based carbon-intensive energy systems due to the formation of “Techno-Institutional Complexes (TIC).” Building on this, Unruh (2002) introduced the concept of carbon unlocking, which fundamentally entails replacing or decarbonizing carbon-based technological regimes to break the carbon lock-in state. However, with escalating environmental challenges and constraints from economic development goals, “efficiency” has become a primary focus for scholars. Based on TIC theory (Unruh, 2002) and socio-technical transition theory (Geels, 2002), numerous studies have explored CUE.

Unlike “carbon intensity (Ang, 2004)” and “carbon productivity (Chung, et al., 1997)”, CUE emphasizes both the degree of carbon lock-in mitigation and the improvement of resource utilization efficiency (Yang and Kim, 2022). Essentially, it quantifies the extent to which carbon lock-in can be overcome within institutional, technological, and societal input frameworks. Wu, et al. (2025) further clarify that CUE, as a core metric for assessing an economic system’s capacity to break carbon lock-in and achieve low-carbon transitions, not only focuses on absolute carbon emission reductions but also emphasizes breaking high-carbon path dependencies through systemic transformations (Wu, et al., 2025). From a static perspective, CUE reflects a region or industry’s low-carbon transition capability at a specific time point. From a dynamic perspective, variations in CUE track transitional progress over time (Chen, et al., 2024).

Regarding the measurement of CUE, mainstream scholars generally construct input-output systems through an “institution-technology-society” framework and employ Data Envelopment Analysis (DEA) models to assess CUE. For example, He, et al. (2023) applied conventional DEA models to measure China’s industrial CUE levels. Li, et al. (2023) adopted US-SBM models to investigate provincial industrial CUE dynamics in China. Furthermore, Chen, et al. (2024) developed Super-SBM models to quantify regional CUE.

Regarding the influencing factors of CUE, improvements in CUE depend on the choice of carbon unlocking pathways. Scholars widely recognize technological breakthroughs as the primary pathway for carbon unlocking (Niu and Liu, 2021; Xu, et al., 2021). However, when carbon lock-in reaches a certain threshold, systematic change becomes difficult without significant exogenous shocks or behavioral changes (Pierson, 2000). Therefore, to destabilize a society’s core institutions, it is essential to effectively utilize such external shocks and specific events (Li, et al., 2023). Geels, et al. (2017) proposed a multi-level perspective for carbon unlocking, decomposing pathways into three interactive dimensions: technological innovation, institutional adjustments, and social changes. From a cost-benefit perspective, Kalkuhl, et al. (2012) and Mattauch, et al. (2015) explored how tax and subsidy policy play a vital role in enhancing CUE. Similarly, empirical studies have demonstrated the CUE-enhancing effects of policy innovations such as carbon emission trading (Shen, et al., 2020) and innovation-driven urban policy (Zhao, et al., 2023). Additional research has examined the relationships between CUE and infrastructure (Mattauch, et al., 2015), market structures (Carley, 2011), and individual/public behaviors (Mi, et al., 2017).

2.2 Research on green finance policy

As a quintessential green finance instrument, the GFRIPZ policy integrates dual attributes of financial resource allocation and environmental regulation, serving as a critical achievement in advancing green transition and transitioning toward a low-carbon economy. In recent years, green finance policy has garnered increasing scholarly attention, with research primarily focusing on the following aspects:

Firstly, the economic effects of green finance policies. A general consensus has formed regarding the role of green finance policies in promoting economic growth (Irfan, et al., 2022; Zhang, et al., 2021; Zhou, et al., 2022). They are recognized not only for strengthening the macroeconomic financial structure (He et al., 2019a) but also for enhancing regional economic resilience (Zhang, et al., 2023) by improving capital allocation efficiency (Ning, et al., 2023) and increasing total factor productivity (Li and Yang, 2022). Secondly, the social effects of green finance policies. These policies narrow the credit gap between small and medium-sized enterprises and traditional enterprises, effectively mitigating financing discrimination and financing constraints (Yu, 2024). Simultaneously, they improve public health (Feng and Zhou, 2024) by promoting low-carbon industry development, green governance investment, and green food supply, while also creating substantial new employment opportunities (Fu, et al., 2025). Thirdly, the environmental effects of green finance policies. Existing research widely acknowledges the environmental benefits and sustainable development potential of green finance (Feng, et al., 2025; Wang and Gao, 2024; Xiao and Chen, 2024). Specifically, green finance policies not only guide high-pollution production behaviors towards low-pollution alternatives (Xu and Li, 2020) through the capital support effect, inducing social investment (Ma and Fei, 2024), but also leverage the capital allocation effect (Yu, et al., 2021) and technological innovation effect (Hu, et al., 2021) to promote low-carbon technological innovation, reduce energy consumption intensity, and optimize industrial structure (He et al., 2019a; Lei and Wang, 2023). Consequently, they deliver a series of environmental performances, including reducing industrial water pollution (Feng, et al., 2025), lowering carbon emissions (Zhou, et al., 2019), promoting ecosystem restoration, and enhancing biodiversity conservation (Ma and Fei, 2024).

In conclusion, although scholars have extensively discussed the economic, social, and environmental effects of green finance policies, evidence regarding their impact on CUE remains scarce. Related research has often focused on the impact on carbon emissions (Lei and Wang, 2023; Wang and Gao, 2024; Zhou, et al., 2019). Therefore, this research gap presents a potential contribution for our study. To address these gaps, this study treats the GFRIPZ as a quasi-natural experiment, employing DML methods to directly investigate the causal relationship between green finance policy and CUE, while systematically analyzing their underlying mechanisms and heterogeneous variation patterns.

3 Policy background and theoretical analysis

3.1 Policy background

Green finance constitutes financial activities aimed at environmental improvement, mitigating climate deterioration, and resource conservation. To accelerate financial institutions’ green transition and explore carbon unlocking pathways, China launched the GFRIPZ policy. In June 2017, the State Council Executive Meeting designated five initial pilot zones: Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang. Subsequently, Lanzhou New District (Gansu Province) and Chongqing were incorporated into the pilot system in November 2019 and August 2022, respectively. This has established a structured network encompassing seven provinces (regions) across ten pilot zones. GFRIPZ, driven by top-down institutional design, aligns with China’s dual carbon goals and the 14th Five-Year Plan. It leverages the distinct geographical advantages, resource endowments, and industrial characteristics of each pilot zone to pursue differentiated green finance strategies. Concurrently, through synergistic policy incentives (e.g., fiscal subsidies, risk compensation mechanisms) and market-based instruments (e.g., carbon trading, green credit), the policy redirects financial resources toward green sectors, fostering deep integration between green finance and regional economies.

The dual forces of goal-oriented governance and policy prioritization are expected to significantly alleviate carbon lock-in effects in pilot cities compared to non-pilot counterparts. This institutional setting provides a robust quasi-natural experiment for evaluating green finance policy efficacy.

3.2 Theoretical analysis

3.2.1 Direct effects

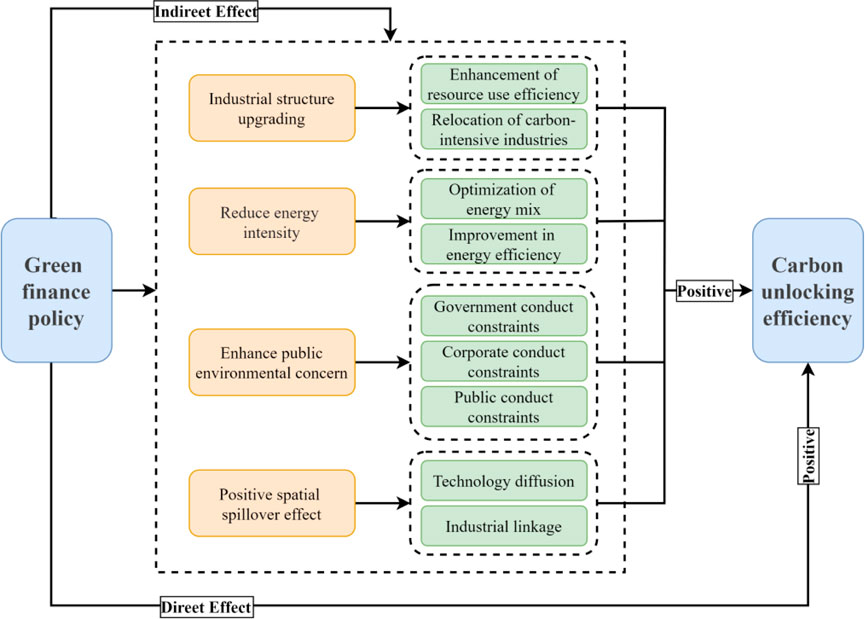

As an innovative green finance policy in China, the GFRIPZ systematically addresses carbon lock-in through differentiated incentive mechanisms, optimized green credit resource allocation, and low-carbon technology R&D (Yan, et al., 2022). First, GFRIPZ establishes an institutional framework incentivizing low-carbon investments via instruments such as green credit, green bonds, and carbon trading (Flammer, 2021; He et al., 2019b). This integration of financial incentives with environmental objectives disrupts the institutional lock-in of high-carbon industries. Second, GFRIPZ reduces capital costs and shares risks to catalyze the development and diffusion of low-carbon technologies (Taghizadeh-Hesary and Yoshino, 2020). Such technological advancements are critical for overcoming the technological lock-in of fossil fuel systems. Third, GFRIPZ lowers the costs of adopting low-carbon products and services by offering financial products like green mortgage loans and vehicle loans, thereby promoting green consumption behaviors (Geddes, et al., 2018). This behavioral shift helps dismantle the social lock-in of carbon-intensive lifestyles. Based on this analysis, we propose:

H1:. GFRIPZ significantly enhances CUE.

3.2.2 Mechanism analysis

The GFRIPZ can enhance CUE by optimizing industrial structures and reducing frictional costs during economic transitions. First, GFRIPZ redirects capital flows to low-carbon industries. For example, by employing financial instruments such as preferential loans and green bonds, GFRIPZ fosters the growth of service sectors and low-carbon industries (He et al., 2019b). This process not only optimizes industrial structures but also enhances resource utilization efficiency while lowering the carbon intensity of the entire economy. Second, GFRIPZ acts as a lubricant during industrial upgrading. It alleviates financing constraints for low-carbon enterprises (Taghizadeh-Hesary and Yoshino, 2020) through capital provision and mitigates risks linked to technological innovation and industrial transition via green insurance and venture capital funds (Zhang, et al., 2019). These interventions effectively reduce economic transition frictions, establish a smoother pathway for industrial restructuring, diminish dependence on high-carbon industries (He et al., 2019b), and ultimately dismantle the sectoral lock-in of carbon emissions. Based on this analysis, we propose:

H2:. GFRIPZ enhances CUE through industrial structure optimization.

Financial support under the green finance framework is a critical factor in reducing energy intensity. First, the GFRIPZ facilitates the aggregation of green financial resources, offering renewable energy and energy-saving enterprises within the pilot zones more favorable financing conditions and accessible funding channels. In contrast, high-energy-consuming, high-polluting, and high-emission (“three-high”) enterprises face stricter financing constraints (Song, et al., 2021). This mechanism compels high-energy-consuming firms to transition toward low-carbon practices, thereby transforming the coal-dominated energy consumption structure. Second, through government interventions such as fiscal interest subsidies and risk compensation mechanisms, the GFRIPZ not only mitigates risks for environmental enterprises engaged in low-carbon technological innovation and equipment R&D but also reduces energy transition risks for high-energy-consuming firms. These measures collectively lower energy intensity and advance structural energy adjustments alongside low-carbon development (Wang, et al., 2021). Based on this analysis, we propose:

H3:. GFRIPZ enhances CUE through energy intensity reduction.

The GFRIPZ strengthens public environmental concern through multidimensional channels. First, by influencing corporate green investment decisions, the GFRIPZ enhances environmental performance and information disclosure (Zhang, et al., 2024), thereby heightening public awareness of the environmental impacts of economic activities. Second, the development of green financial products and services progressively intensifies public attention to environmental issues (Pedersen, et al., 2021). Furthermore, GFRIPZ implementation strengthens public environmental concern through environmental education initiatives and the dissemination of green development principles (Yan, et al., 2022). This reinforced public environmental concern resonates with green financial policy, functioning as both a “booster” for policy implementation and an “amplifier” of policy effectiveness, ultimately contributing to the disruption of carbon emission social lock-ins. Specifically, this strengthening effect creates bottom-up pressure for governments to provide enhanced policy safeguards for carbon unlocking activities (Zhang, et al., 2024), while incentivizing enterprises to preserve their environmental reputation through accelerated low-carbon technology adoption (Khatibi, et al., 2021). Concurrently, it reflects the formation of individual low-carbon values and consumption behavior constraints among the public (Zhang, et al., 2024). Collectively, these impacts enhance CUE through policy reinforcement, technological innovation, and behavioral regulation. Based on this analytical framework, we propose Hypothesis 4:

H4:. GFRIPZ enhances CUE through the strengthening of public environmental concern.

3.2.3 Spatial spillover effects

With the advancement of the First Law of Geography, spatial correlation has become a critical and non-negligible issue in environmental policy research (Feng, et al., 2020), a principle that equally applies to green financial policy. First, from the perspective of geographical proximity spillovers, the GFRIPZ generates radiation effects on neighboring regions through technology diffusion, capital flows, and industrial linkages, resulting in synergistic unlocking effects. Second, regarding industrial transfer, although the GFRIPZ may drive pollution-intensive industries to relocate to non-pilot areas, it simultaneously compels surrounding regions to pursue low-carbon technological innovation (Dai, et al., 2023), thereby enhancing their capacity to break carbon lock-ins. Third, in terms of technology diffusion, the GFRIPZ promotes regional low-carbon technological innovation. Such innovation is not confined to local areas but spreads to adjacent regions through spatial spillover effects, further driving interregional collaborative innovation in low-carbon technologies (Yu, et al., 2022), which helps dismantle technological carbon lock-ins in neighboring areas. Based on this analysis, we propose Hypothesis 5:

H5:. GFRIPZ exhibits positive spatial spillover effects, meaning that it can enhance CUE in neighboring regions.

Figure 1 illustrates the specific impact pathways in this paper.

4 Research design

4.1 Model construction

Current research on evaluating the effects of green finance policy predominantly employs the DID model. However, DID approaches are often constrained by model specification biases and restrictive linear assumptions. In this context, the Double Machine Learning (DML) methodology proposed by Chernozhukov, et al. (2018) has emerged as a revolutionary tool for addressing complex causal inference challenges. While traditional causal inference methods suffer from multiple limitations due to their reliance on stringent assumptions, DML effectively integrates the flexibility of machine learning with the unbiased framework of econometrics. This innovative approach successfully overcomes critical methodological challenges including multicollinearity (Hansen and Kozbur, 2014), sample selection bias (Belloni, et al., 2014), model misspecification (Knaus, et al., 2021), and the curse of dimensionality (Chernozhukov, et al., 2018).

Therefore, drawing on the research by Chen and Wang (2024), Qian, et al. (2025), and Wang, et al. (2025), we establish a DML model to identify the influence of GFRIPZ on CUE. The specific model is as shown in Equation 1 and Equation 2:

Where

Where

First, we estimate

Next, we estimate the regression function

Finally, using the residual estimator

Through the aforementioned two-step machine learning estimation, we effectively eliminate the influence of confounding variables

4.2 Variable selection

4.2.1 Dependent variable

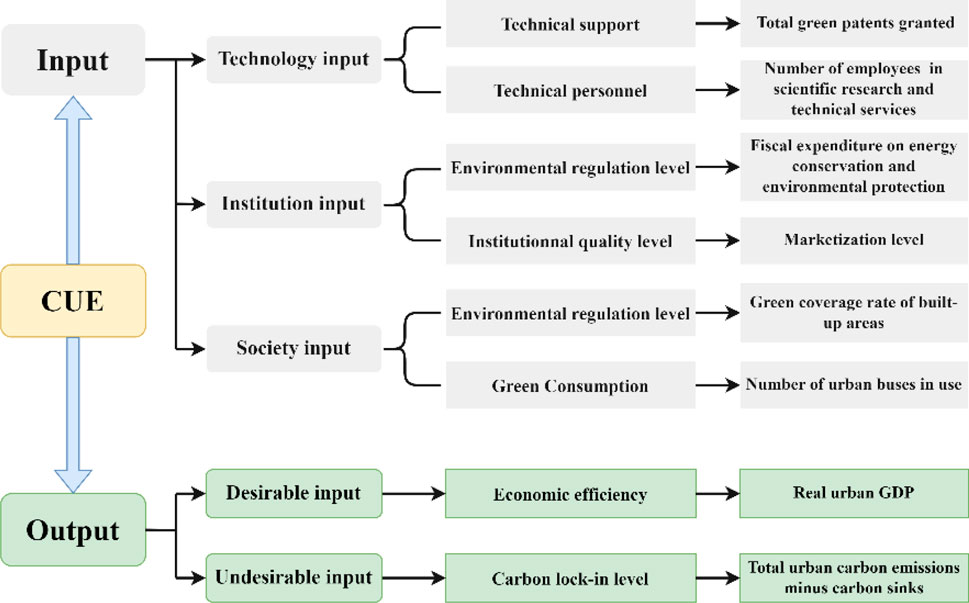

The CUE metric seeks to balance socioeconomic benefits and ecological sustainability by evaluating both the efficiency of input utilization in production activities and the ecological costs incurred to achieve desired outputs. Therefore, drawing on existing research (Chen, et al., 2024; Feng, et al., 2025) and integrating the TIC theory, this paper constructs a “Technology-Institution-Society” input framework. Simultaneously, it treats carbon lock-in level as the undesirable output and economic effects as the desirable output, thereby establishing an input-output system for CUE. Building upon this foundation, it employs the super-efficiency SBM model to quantify CUE. Specifically, the technology input dimension includes technological support and technical talent are measured by the number of authorized green patents and the count of scientific research and technical service personnel, respectively. The institutional input dimension incorporates environmental regulation intensity and institutional quality, proxied by fiscal expenditures on energy conservation and environmental protection, and the degree of marketization. The community input dimension encompasses environmental awareness and green consumption, operationalized through the green coverage rate in urban built-up areas and the number of operational public buses. For outputs, real GDP (with 2011 as the base year) quantifies the desired output, while carbon lock-in levels serve as the undesired output. The integrated CUE evaluation framework is systematically illustrated in Figure 2.

4.2.2 Core explanatory variable

Green financial policy. We treat the GFRIPZ as a quasi-natural experiment. Drawing on relevant research (Feng, et al., 2025), the green finance policy effect (Policy) is represented by the interaction term (

4.2.3 Control variables

To ensure the accuracy of policy effect estimation, we further controlled for other factors potentially influencing CUE in the model. Drawing on existing research, the control variables in this paper are selected as follows: Urbanization level (UR) is measured by the urbanization rate. Based on urban agglomeration theory, while urbanization can enhance energy efficiency through scale effects (Glaeser and Kahn, 2010), it may also exacerbate carbon lock-in due to the rapid expansion of infrastructure (Zhao, et al., 2024); The degree of openness (OPEN) is measured by the ratio of actual utilized foreign direct investment to GDP. International trade theory suggests foreign investment can generate technology spillover effects (Jia, et al., 2019), but the “Pollution Haven Hypothesis” indicates it may also facilitate the transfer of high-carbon industries (Khanna, et al., 2025); Human capital level (HC) is measured by the proportion of college students enrolled, as the higher-educated population is more likely to drive low-carbon technology innovation (Zhou, et al., 2024); Fiscal dependence (FD) is measured by the ratio of local fiscal revenue to GDP. According to fiscal decentralization theory, higher fiscal dependence may weaken the intensity of local government environmental governance (Khan, et al., 2021); Internet penetration rate (IP) is measured by the number of internet users per 100 people. From the perspective of the digital economy, the development of information and communication technology can break carbon lock-in by optimizing resource allocation (Añón Higón, et al., 2017); Consumption level (SCL) is measured by per capita retail sales of consumer goods, as consumption upgrading may compel low-carbon transformation on the supply side through demand-side pressure (Fan, et al., 2022).

4.3 Data sources and analysis

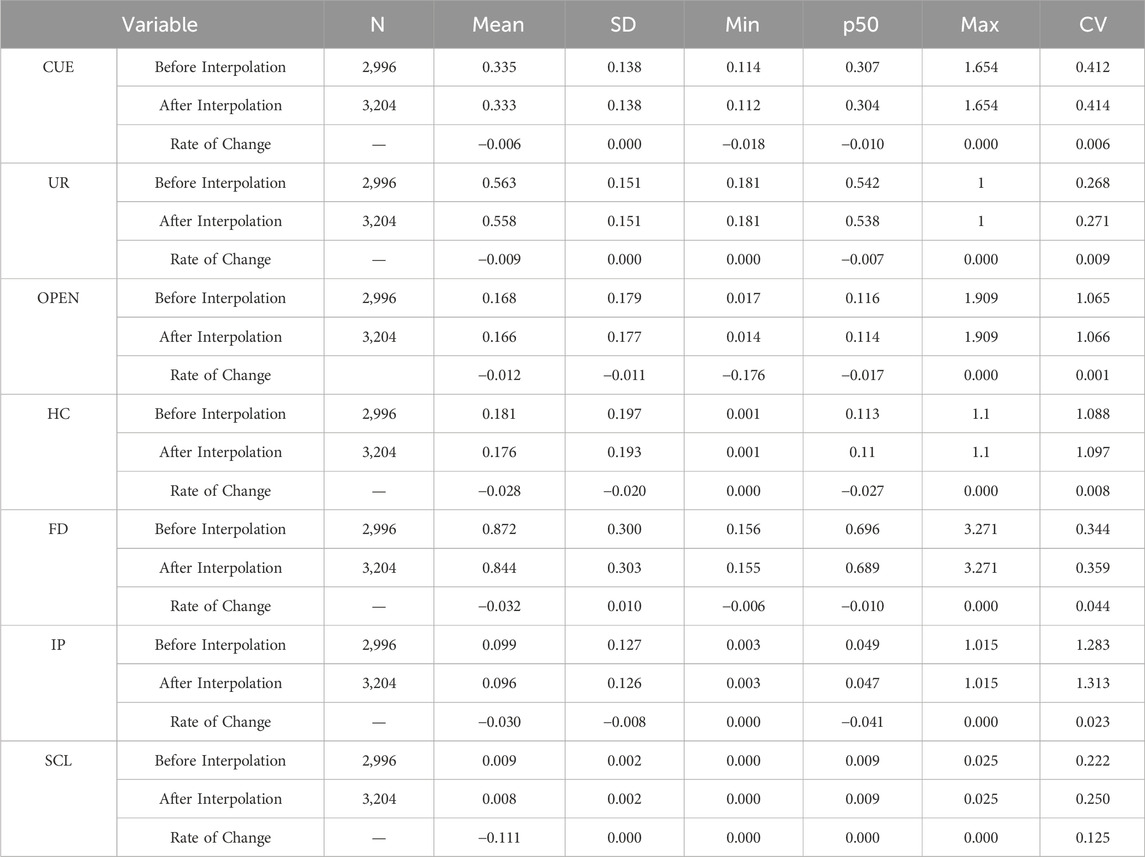

Due to severe data unavailability at the county level, such as variables within the dependent variable system including the number of authorized green patents, the count of scientific research and technical service personnel, fiscal expenditures on energy conservation and environmental protection, and the degree of marketization, as well as a series of control variables including UR and OPEN which are even more inaccessible, we were unable to examine district-level differences more granularly. Consequently, this study ultimately selected the period 2011–2022 as the sample period and focused on 267 prefecture-level cities in China as the research subjects. All data used were sourced from the China City Statistical Yearbook, the CEIC database, and government work reports.

Simultaneously, to ensure the integrity of the data structure, enable a comprehensive assessment of the green finance policy effects, and facilitate subsequent spatial effect analysis, this paper employed the linear interpolation method to supplement partially missing data. The selection of this method is based on the following considerations: On one hand, indicators in Chinese city-level panel data typically exhibit gradual changes between adjacent years, aligning with the assumption of a continuous and smooth trend required for linear interpolation. On the other hand, the proportion of missing values in the raw data is low, and the missing values are predominantly isolated occurrences within single years, significantly reducing the risk of systematic bias. Furthermore, compared to more complex methods such as spline interpolation or KNN interpolation, linear interpolation generally offers better computational efficiency and interpretability.

However, it must be specifically noted that the linear interpolation method inevitably leads to some underestimation of the true variability of the variables. This underestimation may manifest, on one hand, as a weakening of the time-varying effects of policy shocks, and on the other hand, as a compression of heterogeneity among cities. Therefore, this paper will validate the scientific soundness of this method through two approaches: first, a comparison of descriptive statistics, and second, robustness checks. Table 1 presents the descriptive statistical results of the main variables before and after interpolation. It is evident that the changes in all statistical metrics before and after interpolation remain minimal. In particular, the rates of change for the standard deviation, median, and coefficient of variation are largely close to zero. This clearly indicates that the impact of linear interpolation on variability is very limited. Additionally, this paper further conducts robustness checks later on, and the results similarly demonstrate that the interpolation method has no significant impact on the regression conclusions, further reinforcing the rationality of employing interpolation.

5 Empirical result

5.1 Results of the baseline regression

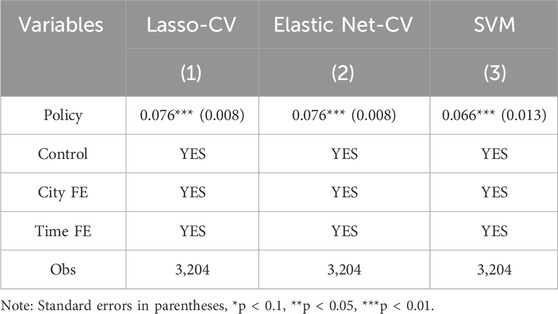

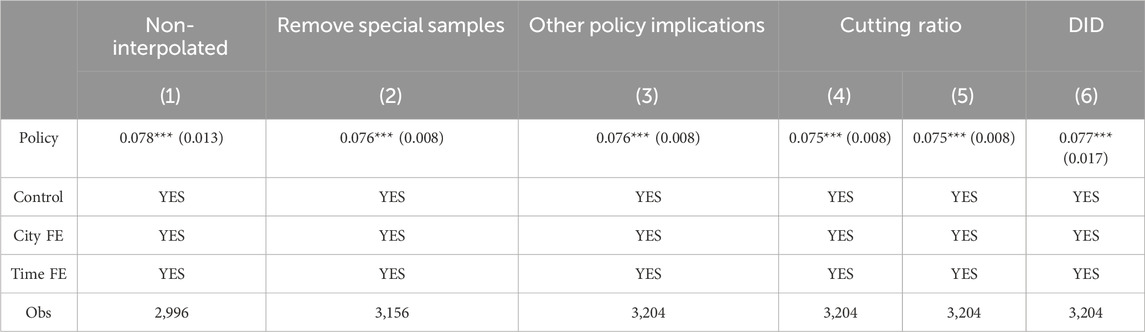

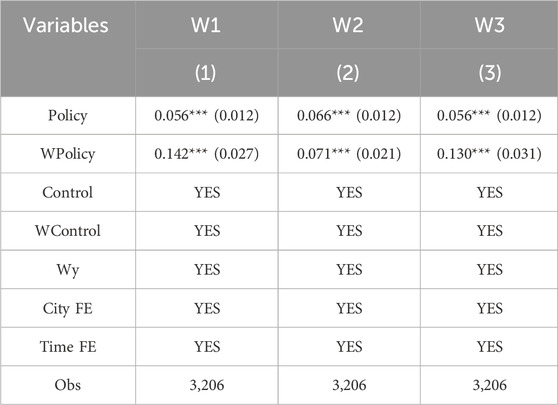

Table 2 reports the estimation results of the baseline regression. To assess the robustness of the policy treatment effect, we employ three machine learning methods: Lasso regression with cross-validation (Lasso-CV), Elastic Net regression with cross-validation (Elastic Net-CV), and Support Vector Machine (SVM). The results show that the estimated treatment effect of

5.2 Robustness test

5.2.1 Eliminating the impact of interpolation

Given that the linear interpolation method employed in this study may lead to underestimation of the true variability of variables, thereby affecting the accurate estimation of policy effects, we conducted additional regressions using non-interpolated data. The estimation results are presented in Column (1) of Table 3. It is evident that after eliminating the impact of linear interpolation, the treatment coefficient remains significantly positive and consistent with the baseline regression results. This not only ensures the robustness of the baseline regression findings but also demonstrates that the interpolation method has no significant impact on the regression conclusions.

5.2.2 Exclusion of special samples

Given the unique advantages of municipalities directly under the central government (e.g., Beijing and Shanghai) in policy environments, infrastructure development, and public service levels, including all cities in the regression analysis may introduce estimation bias. To address this, we exclude these municipalities from the sample and re-estimate the model using the remaining observations. As shown in Column (2) of Table 3, the treatment coefficient remains statistically significant and positive after excluding special samples, demonstrating the robustness of the baseline regression results.

5.2.3 Controlling for confounding policy

During the implementation of GFRIPZ, other concurrent policy—including the Comprehensive Demonstration Pilot for Energy Conservation and Emission Reduction Fiscal Policy (Ren, et al., 2024), the Pilot on Paid Use and Trading of Energy Consumption Rights (Du, et al., 2023), and the Pilot on Emission Rights Trading (Zhou, et al., 2019) — may influence the CUE of pilot cities, leading to biased policy effect estimates. To control for these confounding policy effects, we added dummy variables representing the aforementioned policy to the baseline model and re-estimated it using the DML approach. As presented in Column (3) of Table 3, the DML estimates remain robust after accounting for potential interference from other policy, confirming the consistency of our findings.

5.2.4 Model parameter adjustments

To mitigate potential bias in the model specification of the DML method and enhance data utilization efficiency, we re-estimate the model by varying the sample splitting ratios to 10 and 3. The results, as presented in Columns (4) and (5) of Table 3, show that the estimated treatment coefficients remain positive and statistically significant at the 1% level, indicating that the GFRIPZ significantly enhances CUE. This outcome further confirms the robustness of the baseline regression findings.

5.2.5 Change of estimation model

To further verify the robustness of the baseline regression results, this study conducts robustness checks by constructing a traditional Difference-in-Differences (DID) model. The specific model is specified as shown in Equation 8:

Where

The estimation results of the DID model are presented in Column (6) of Table 3. It shows that even after replacing the model, the treatment coefficient remains significantly positive at the 1% level, consistent with the baseline regression results. This not only confirms the robustness of the baseline findings but also reaffirms the significant causal relationship between GFRIPZ and CUE.

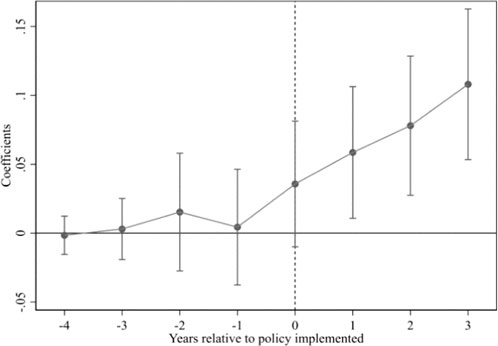

Subsequently, we employ an event study approach to further examine the pre-treatment parallel trends and post-treatment dynamic effects. The dynamic model is specified as shown in Equation 9:

Where

Figure 3 presents the parallel trends test results. It demonstrates that prior to GFRIPZ implementation, there were no significant differences in CUE between pilot and non-pilot zones, indicating parallel development trends that satisfy the parallel trends assumption.

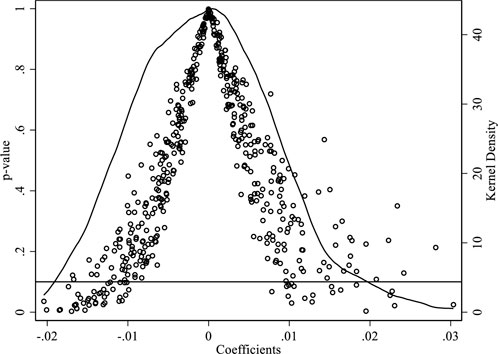

Additionally, we conduct a randomized placebo test to mitigate potential confounding effects from unobservable variables. Specifically, we randomly select a “pseudo-treatment group” from all sample cities, matching the size of the actual treatment group in the baseline regression. The interaction term between this pseudo-group and the policy timing dummy constitutes a “pseudo-policy variable,” which replaces the original policy variable in the regression. By repeating this process 500 times, we obtain 500 estimated coefficients and their p-values. Figure 4 displays the placebo test results. It reveals that most estimated coefficients cluster around zero and deviate significantly from the true estimated coefficient, confirming that the placebo test is passed.

6 Further analysis

6.1 Mechanism validation

Based on the theoretical framework established earlier, the GFRIPZ enhance CUE through three primary pathways: industrial structure optimization, energy intensity reduction, and strengthened public environmental concern. To empirically identify these mechanisms, we follow the approach of Shen, et al. (2024) and specify the mechanism validation model as shown in Equations 10, 11:

Where

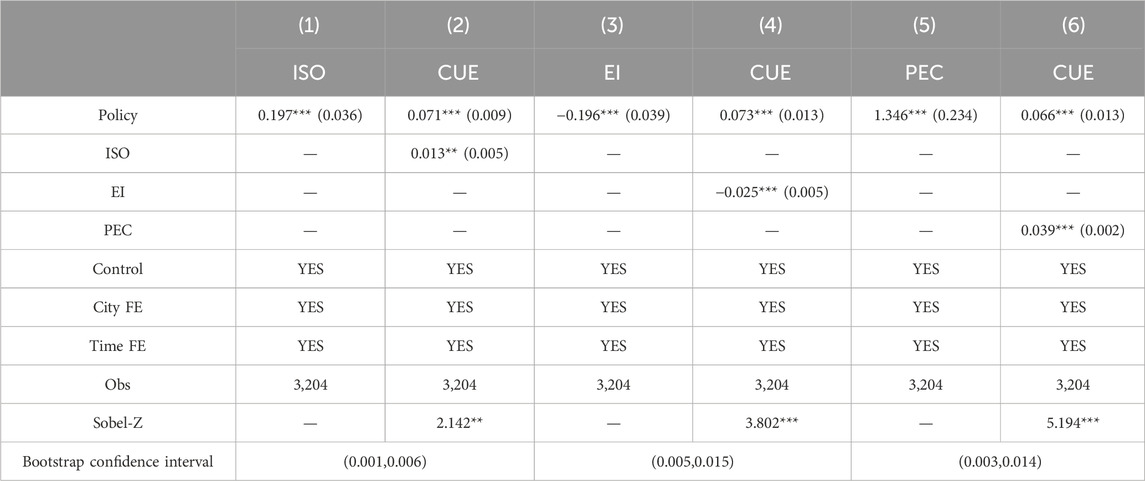

6.1.1 Industrial structure mechanism

The GFRIPZ reduces frictional costs in corporate transformation through the implementation of green financial instruments, providing smooth transition pathways for industrial structure optimization. This facilitates the shift of traditional “three-high” industries toward low-carbon sectors. Such structural optimization helps cities reduce their reliance on high-carbon industries (He et al., 2019b), thereby breaking carbon lock-in and improving carbon unlocking efficiency. To validate this mechanism, this study adopts the ratio of the tertiary industry’s added value to the secondary industry’s added value as a measure of industrial structure optimization (ISO). The mechanism test results are presented in Columns (1) and (2) of Table 4. The results in Column (1) show that the coefficient of Policy is significantly positive at the 1% level, indicating that the implementation of GFRIPZ significantly optimizes industrial structure. The results in Column (2) demonstrate that after incorporating the mediating variable ISO, the treatment coefficient of Policy on CUE remains significantly positive at the 1% level. However, its absolute value decreases compared to the baseline regression, while the coefficient of ISO is significantly positive at the 5% level. This suggests the existence of a positive partial mediation effect, meaning GFRIPZ implementation enhances CUE by promoting industrial structure optimization. Furthermore, the Sobel test yields a Z-statistic of 2.142, significant at the 5% level. The 95% confidence interval from 1,000 bootstrap tests is (0.001, 0.006), which is positive and excludes zero. These results further confirm the presence of a mediation effect through industrial structure optimization.

6.1.2 Energy intensity reduction mechanism

The GFRIPZ employs a dual approach to reduce societal energy intensity. On one hand, it mitigates risks for enterprises engaging in low-carbon technology innovation and energy transition through incentive mechanisms (Wang, et al., 2021). On the other hand, it compels high-energy-consuming enterprises to pursue low-carbon transformation and achieve energy conservation and emission reduction via regulatory constraints (Song, et al., 2021). These combined effects effectively lower overall energy intensity and enhance CUE. To validate this mechanism, this study adopts the ratio of energy consumption to GDP as the metric for Energy Intensity (EI), following the methodology of Li and Lin (2015). The mechanism test results are presented in Columns (3) and (4) of Table 4. Column (3) shows that the coefficient of Policy is significantly negative at the 1% level, indicating that GFRIPZ implementation significantly reduces energy intensity. Column (4) results demonstrate that after introducing the mediating variable EI, the treatment coefficient of Policy on CUE remains significantly positive at the 1% level. However, its absolute value decreases compared to the baseline regression, while the coefficient of EI is significantly negative at the 1% level. This confirms a positive partial mediation effect, implying that GFRIPZ enhances CUE through reducing energy intensity. Additionally, the Sobel test yields a Z-statistic of 3.802, significant at the 1% level. The 95% confidence interval from 1,000 bootstrap tests is (0.005, 0.015), which is positive and excludes zero. These findings further verify the mediating role of energy intensity.

6.1.3 Public environmental concern mechanism

The implementation of the GFRIPZ has expanded channels for public access to environmental information and enriched incentive mechanisms for civic participation, thereby strengthening public environmental concern (Pedersen, et al., 2021; Zhang, et al., 2024). This strengthened public environmental concern fosters low-carbon awareness among individuals and induces self-regulating consumption behaviors (Fu and Ding, 2024), which reduce unnecessary resource depletion and carbon emissions. This process further contributes to breaking societal lock-ins and enhancing CUE. To validate this mechanism, we employ the Baidu search index for “environmental pollution” following the methodology of Liu and Mu (2016) to quantify the strength of public environmental concern (PEC). The mechanism test results are presented in Columns (5) and (6) of Table 4. Column (5) indicates that the coefficient of Policy is significantly positive at the 1% level, demonstrating that GFRIPZ implementation significantly strengthens public environmental concern. Column (6) results reveal that after including the mediating variable PEC, the treatment coefficient of Policy on CUE remains significantly positive at the 1% level. However, its absolute value decreases relative to the baseline regression, while the coefficient of PEC is significantly positive at the 1% level. This provides evidence for a positive partial mediation effect, implying that GFRIPZ enhances CUE by strengthening public environmental concern. Moreover, the Sobel test yields a Z-statistic of 5.194, significant at the 5% level. The 95% confidence interval from 1,000 bootstrap tests is (0.003, 0.014), which is positive and excludes zero. These results robustly validate the mediating role of public environmental concern.

6.2 Heterogeneity analysis

6.2.1 Geographical location heterogeneity

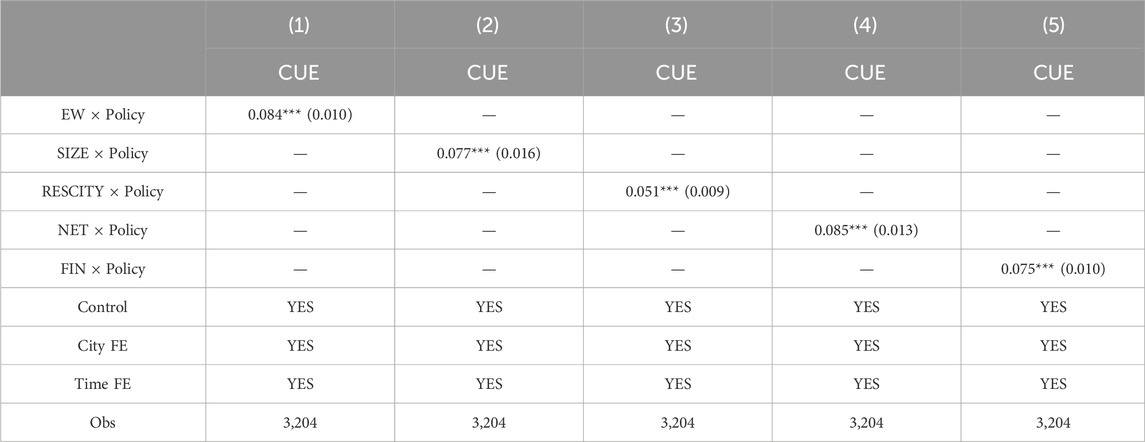

Since the implementation of the 14th Five-Year Plan, key national policy documents including the Guidance on Promoting a New Landscape in Western Development in the New Era and the *14th Five-Year Plan for Regional Coordinated Development* have established “leveraging the first-mover advantages of eastern regions to boost the rise of less-developed western regions” as their core strategic orientation. These policies explicitly propose developing an “Eastern Leadership-Regional Synergy-Industrial Linkage” model to build a new pattern of opening-up featuring land-sea coordination and east-west reciprocity. This strategic framework not only emphasizes the exemplary role of eastern regions in technological innovation, institutional reform, and factor allocation, but also prioritizes concrete mechanisms such as east-west pairing assistance, joint construction of industrial parks, and infrastructure connectivity. These measures aim to facilitate the flow of advanced production factors to western regions. Geographically, the GFRIPZ may exhibit differential impacts depending on whether cities are located in eastern or western China. Accordingly, we divide all city samples into eastern and western groups based on the Hu Huanyong Line (also known as the Heihe-Tengchong Line), assigning a value of 1 to cities east of the line and 0 to those west of it, thereby constructing a geographical dummy variable (

The underlying causes lie in two structural disparities between eastern and western regions. Firstly, differences in developmental foundations shape policy transmission efficiency. As the forefront of China’s reform and opening-up, eastern regions have cultivated a multi-dimensional opening network through four decades of export-oriented growth. Centered on international financial hubs like Shanghai and Shenzhen, with the Yangtze River Delta and Pearl River Delta as pivotal clusters, this geographical advantage has accumulated substantial institutional capital. In contrast, western regions—despite their locational potential as Belt and Road land corridors—suffer from inadequate infrastructure density. This impedes agglomeration of cross-border capital, technology, and talent essential for green finance policies, directly constraining GFRIPZ’s real-economy transmission efficiency. Secondly, the innovation capacity gradient affects policy outcomes. Eastern regions leverage integrated industrial chains to demonstrate dual excellence in low-carbon innovation quantity and quality, creating strong agglomeration effects. Western regions, however, face multidimensional bottlenecks: insufficient human capital, overdependence on traditional industries, and underdeveloped technology markets, severely restricting intra-regional innovation circulation. This technological generation gap prevents western regions from achieving developmental leaps through technological advancement under GFRIPZ, unlike their eastern counterparts. Consequently, GFRIPZ exerts stronger CUE-enhancing effects east of the Hu Huanyong Line (China’s geographical demarcation line).

6.2.2 Heterogeneity of city size

As an important dimension measuring urban development disparities, city size not only reflects differences in population agglomeration, economic aggregate, and spatial distribution, but is also closely related to key factors such as industrial structure optimization capacity, technological innovation intensity, and resource allocation efficiency. Cities of different scales undoubtedly exhibit significant divergences in absorption capacity for green financial resources, efficiency of low-carbon technology conversion, and carbon emission governance models. Therefore, from the perspective of city size, GFRIPZ may demonstrate significant differential characteristics due to city size. In this regard, based on the definition of city size in China’s 2015 Notice on Adjusting City Size Classification Standards, this study divides sample cities into large cities and small-medium cities according to municipal district population size, where cities with municipal district population exceeding 3 million are defined as large cities and assigned a value of 1, otherwise as small-medium cities and assigned a value of 0. This constructs a city size dummy variable (SIZE), and its interaction term (

The reasons are as follows: first, large cities usually possess denser financial institution networks and specialized service capabilities, and this agglomeration effect strengthens the synergy of policy implementation. Relatively, small-medium cities are constrained by limited numbers of financial institutions and shortage of professionals, making it difficult to meet policy requirements; second, the industrial structure of large cities is mainly dominated by high-value-added services and advanced manufacturing, where innovation in financial instruments is more effective for their low-carbon transition. The proportion of such enterprises in small-medium cities is low, with relatively insufficient policy demand, leading to diluted policy effects; additionally, large cities concentrate more research institutions and consumer markets, and the resulting scale effects provide strong driving force for green technology application. Small-medium cities find it difficult to replicate such infrastructure, resulting in relatively weaker policy effects. Therefore, GFRIPZ has a stronger CUE-enhancing effect in large cities.

6.2.3 Heterogeneity of resource endowment

Resource endowment, as the foundational condition for regional development, not only determines the initial direction of factor allocation, but also shapes long-term development trajectories through industrial lock-in effects. China’s resource-based cities universally exhibit the typical trinity of “heavy industrial structure, singular growth drivers, and concentrated environmental pressures.” This development model, formed through resource extraction, exhibits a non-negligible inherent tension with the low-carbon transition logic required by the GFRIPZ policy. Given varying resource endowment levels, the GFRIPZ may exert differential effects across cities. To investigate this, we categorize all sample cities into two groups based on the criteria for resource-based cities defined in China’s National Sustainable Development Plan for Resource-Based Cities (2013–2020), assigning a value of 1 to non-resource-based cities and 0 to resource-based cities. This creates a resource endowment dummy variable (

The reasons are as follows: on the one hand, the industrial structure lock-in effect in resource-based cities leads to policy transmission blockages. Resource-based cities face dependence on three paths—factor allocation inertia, sunk cost constraints, and associated industry attachment—which commonly form “high-carbon lock-in” characteristics. The resulting investment preference for traditional resource industries means that even though GFRIPZ introduces substantial incentive policies for low-carbon industries, it still lacks attractiveness to social capital, thereby weakening policy effectiveness. On the other hand, resource-based cities also confront dual constraints of market demand limitations and institutional transformation resistance. Specifically, resource-based cities generally face population shrinkage pressure, resulting in insufficient scale of low-carbon markets. Simultaneously, fiscal revenue in resource-based cities is highly dependent on resource-related taxes, causing local governments to face the trade-off dilemma between “short-term fiscal pains” and “long-term uncertain benefits” when promoting green transitions, consequently leading to rigid policy response mechanisms. Therefore, compared to resource-based cities, GFRIPZ exhibits stronger CUE-enhancing effects in non-resource-based cities.

6.2.4 Heterogeneity of internet development levels

Against the backdrop of rapid digital economy development, green finance is undergoing profound technological transformation. Internet technologies—through underlying infrastructures like 5G communications, big data analytics, and blockchain smart contracts—deeply integrate with operational scenarios such as green credit, green insurance, and carbon finance, spawning a new “Internet Plus Green Finance” ecosystem. This technology empowerment not only revolutionizes financial supply modes but also possesses the potential to reshape policy transmission mechanisms. Consequently, the GFRIPZ may exhibit significant differential effects depending on the level of urban internet development. To address this, this study employs the number of internet users per 100 people in each region as a proxy for urban internet development. Cities with internet development levels above the median are assigned a value of 1, while those below the median are assigned 0, constructing a dummy variable for internet development level (

The reasons are as follows: on the one hand, regions with high internet development levels possess stronger technology empowerment capabilities, which can provide diversified support for implementing green finance policies. Advanced network infrastructure reduces geographical constraints on green financial services, enabling widespread application of digital tools like blockchain traceability and AI risk assessment, creating market spaces unreachable by traditional finance, promoting innovative businesses such as green supply chain finance, and significantly enhancing cross-regional green capital allocation efficiency. On the other hand, internet technology also reconstructs the policy transmission environment and social interaction patterns. For example, enhanced government digital governance capabilities greatly improve cross-departmental data sharing efficiency, breaking “information silos” in traditional policy implementation. Simultaneously, in high-internet-development regions, policy signals can rapidly penetrate to enterprises and the public through channels like social media and government platforms. Enterprises can precisely capture green finance policy dividends via big data analytics to proactively adjust production processes to meet green credit standards, while the public can more conveniently invest in green financial products. This dual mechanism of technology empowerment and social synergy enables GFRIPZ to more effectively activate green production factors in internet-developed regions. Therefore, GFRIPZ exhibits stronger CUE-enhancing effects in cities with higher internet development levels.

6.2.5 Heterogeneity of financial development levels

Due to significant gradient differences in dimensions such as capital allocation efficiency, risk pricing capacity, and completeness of financial instruments across regional financial systems, such structural disparities cause the functional performance of financial systems in mobilizing social capital, dispersing environmental risks, and optimizing resource allocation to exhibit marked geographical differentiation. Consequently, GFRIPZ may similarly demonstrate significant differential characteristics due to disparities in regional financial development levels. To address this, this study employs the ratio of deposit and loan balances to GDP as an indicator of urban financial development. Cities with financial development levels above the median are assigned a value of 1, while those below are assigned 0, thereby constructing a financial development level (

The underlying reasons are twofold: firstly, regions with higher financial development levels possess more efficient capital allocation mechanisms that enable precise channeling of policy dividends released by GFRIPZ toward low-carbon technology innovation and green industry projects through market-based screening. This facilitates the transformation of low-carbon industries, thereby amplifying policy-driven effects on carbon efficiency enhancement. Secondly, stronger risk pricing capabilities and comprehensive financial instruments provide risk buffering and fund mobilization advantages for policy implementation. Financial institutions can hedge market uncertainties arising from environmental policies by developing derivatives like carbon futures and carbon options, reducing risk premiums for green investments. Simultaneously, this generates investment demonstration effects, continuously attracting long-term capital such as insurance funds and pension funds, forming sustained and stable green capital supply, consequently strengthening policy effects on CUE enhancement. Therefore, GFRIPZ exerts stronger CUE-enhancing effects in cities with higher financial development levels.

6.2.6 Heterogeneity analysis of institutional contextualization

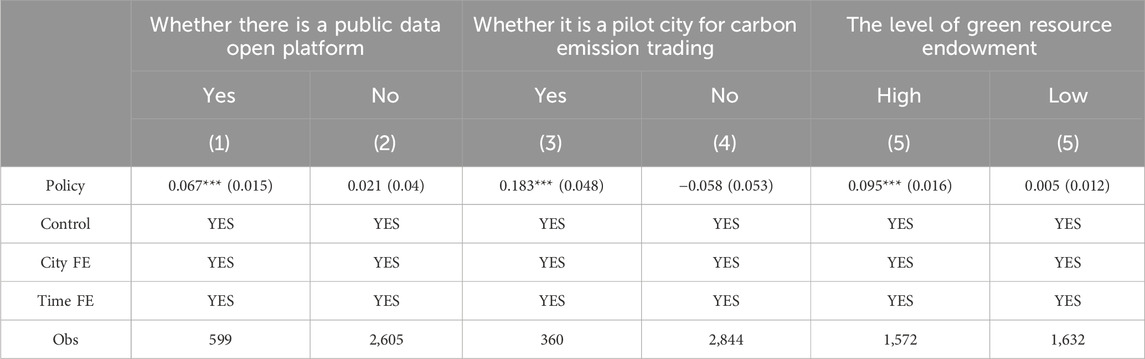

Considering that the success of GFRIPZ in pilot zones may benefit from certain unique institutional conditions, thus limiting its generalizability. Therefore, this study conducts heterogeneity analysis of institutional contextualization from three dimensions: public data openness, carbon emission trading, and initial green resource endowment, to reveal differentiated mechanisms of policy effects.

Public data openness serves as a crucial institutional foundation for green finance development, where enhanced data transparency helps reduce information asymmetry and strengthens supervision and feedback mechanisms for policy implementation. In regions with higher data openness, financial institutions can more accurately identify green projects and optimize resource allocation efficiency, thereby improving carbon unlock efficiency. For example, by disclosing corporate environmental data and carbon emission information, financial institutions can assess project risks more precisely, reducing “greenwashing” behaviors. Consequently, GFRIPZ is likely to benefit from local public data openness levels. In view of this, based on the presence of public data openness platforms, this study divides sample cities into two groups for regression analysis, with specific heterogeneity results shown in Columns (1) and (2) of Table 6. The regression results show that in cities with public data openness platforms, the treatment coefficient is significantly positive at the 1% level, whereas in cities without public data openness platforms, the treatment coefficient is insignificant. This result indicates that GFRIPZ indeed benefits substantially from local public data openness levels.

Carbon emission trading pilots, as market-based emission reduction mechanisms, can guide corporate behavior through price signals and enhance synergistic effects of green finance policies. By establishing carbon emission trading markets, pilot regions form clear carbon pricing mechanisms that incentivize enterprises to invest in low-carbon technologies and green projects. Therefore, GFRIPZ is likely to benefit from institutional advantages generated by carbon emission trading pilots. In view of this, based on whether they are carbon emission trading pilot cities, this study divides sample cities into two groups for regression analysis, with specific heterogeneity results shown in Columns (3) and (4) of Table 6. The regression results show that in carbon emission trading pilot cities, the treatment coefficient is significantly positive at the 1% level, whereas in non-pilot cities, the treatment coefficient is insignificant. This difference suggests that GFRIPZ’s success likely benefits from more mature market mechanisms and stronger policy enforcement in pilot regions.

Green resource endowment is a critical factor for green finance development. Regions with abundant forest resources and high green resource endowment undoubtedly possess stronger carbon sink capacities, providing more stable ecological foundations for green finance projects. Therefore, GFRIPZ’s success is highly likely to benefit from local green resource endowment levels. In view of this, based on initial forest coverage rates, this study divides sample cities into two groups: those above the average are defined as high green resource endowment cities, and those below as low endowment cities, both undergoing regression analysis, with specific heterogeneity results shown in Columns (5) and (6) of Table 6. The regression results show that in cities with higher green resource endowment, the treatment coefficient is significantly positive at the 1% level, whereas in resource-scarce regions, the treatment coefficient is insignificant. This result closely relates to the ecological value of forest carbon sinks, as regions with high green resource endowment can enhance policy emission reduction effects through natural carbon sequestration mechanisms. Therefore, GFRIPZ’s success indeed partially benefits from pilot regions’ green resource endowment levels.

The above analysis confirms that the impact of GFRIPZ on CUE is not homogeneous, but rather benefits considerably from empowerment by its unique and relatively superior institutional environments (such as public data openness, carbon emission trading pilots, and green resource endowment). This implies that direct replication of pilot experiences may fail to achieve target expectations, since non-pilot regions lacking similar data support, mature carbon markets, or corresponding green foundations will likely face severely constrained policy effectiveness manifestation. Therefore, enhancing the universal applicability and effectiveness of policies hinges crucially on identifying and bridging gaps in critical institutional elements between target regions and successful pilot zones, following context-specific principles to differentially construct supporting systems for policy implementation.

6.3 Spatial effects analysis

6.3.1 Spatial DID model specification

The preceding analysis indicates that green financial capital guided by GFRIPZ exhibits distinct spatial characteristics. It may generate spillover effects on neighboring regions through channels such as low-carbon technology diffusion, capital flows, and industrial linkages, thereby helping to dismantle green financial barriers between regions and jointly enhance regional CUE. To identify these spatial spillover effects, this study constructs a SDID model. The model is specified as shown in Equation 12:

Where

6.3.2 Spatial econometric model specification tests

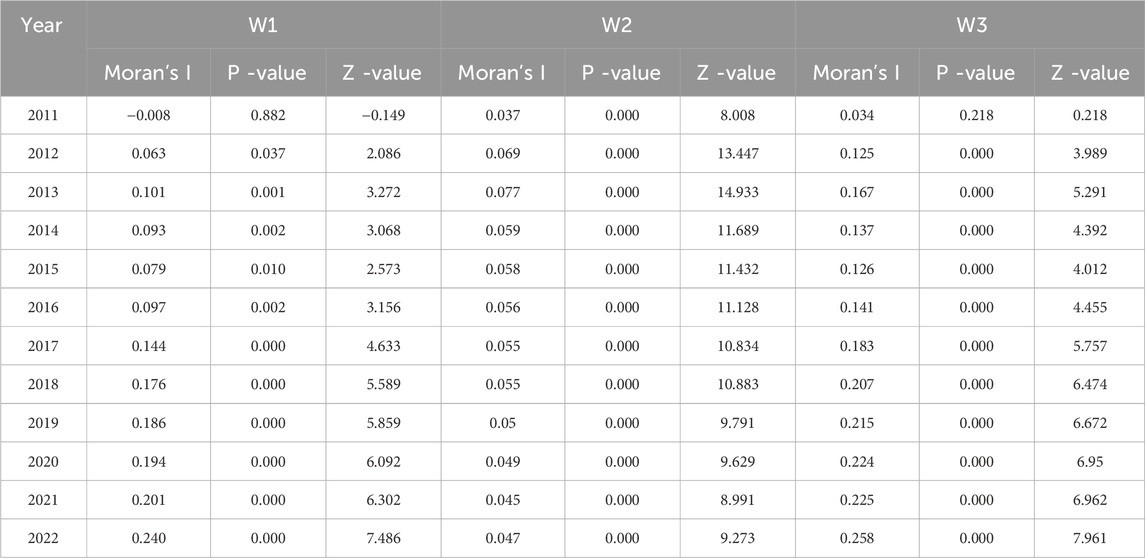

Based on three spatial weight matrices, this study employs the Global Moran’s I index to examine the spatial dependence of urban CUE - a prerequisite for constructing spatial regression models. As shown in Table 7, the Moran’s indices of urban CUE have been significantly greater than zero since 2012. This indicates the existence of distinct positive spatial autocorrelation among cities’ CUE, with an overall strengthening trend over time, thereby justifying the necessity of establishing spatial econometric models.

6.3.3 Global spatial autocorrelation test

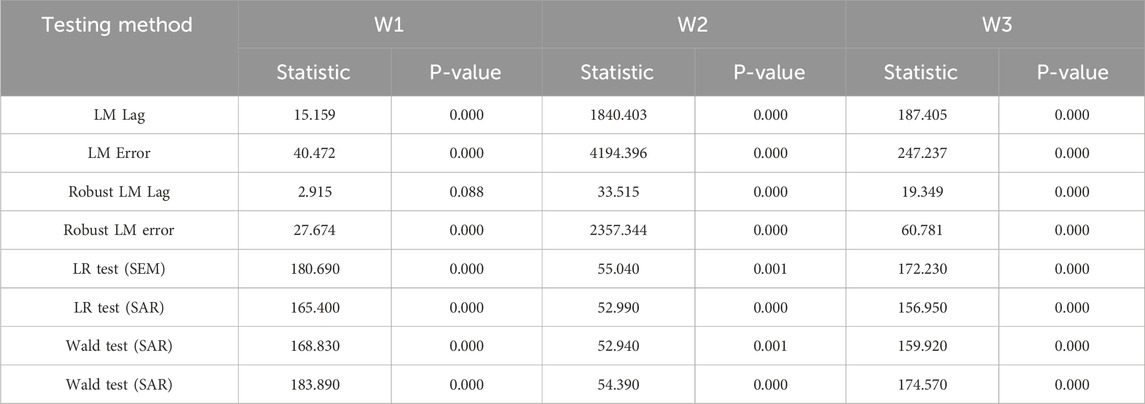

To validate the rationality of spatial model construction, this study employs Lagrange Multiplier (LM), Likelihood Ratio (LR), and Wald tests to examine whether the Spatial Durbin Model (SDM) degenerates into Spatial Error Model (SEM) or Spatial Lag Model (SAR) under different spatial weight matrices. As shown in Table 8, all test results demonstrate statistical significance at conventional levels. Therefore, the SDM does not degenerate into either SEM or SAR models, confirming the appropriateness of maintaining the general SDM specification.

6.3.4 Spatial effects analysis

Building on the preceding analyses that have validated the rationality and necessity of the constructed SDID, we proceed to detailed regression analysis. Columns (1), (2), and (3) in Table 9 present the regression results under the economic distance matrix, inverse geographic distance matrix, and economic-geographic nested matrix, respectively. The spatially lagged term

The underlying mechanism lies in the dual role of GFRIPZ: while directly promoting regional low-carbon technological innovation, it facilitates the diffusion of low-carbon technologies to adjacent areas through spatial knowledge spillovers, thereby driving collaborative innovation in low-carbon technologies across neighboring regions. Furthermore, the deepening interregional green financial cooperation enhances the absorptive capacity for such spillovers, creating a virtuous cycle that synergistically improves urban CUE.

6.4 Extended analysis

The institutional environment serves not only as the “soil” for policy implementation but also as a key variable constraining the generalizability of research findings. Significant divergences undoubtedly exist across regions and countries in institutional dimensions like government governance paradigms and market maturity, which may limit the transferability of this study’s conclusions. In view of this, this study systematically deconstructs the mechanisms through which institutional environments affect the extrapolability of research results from governmental and market dimensions, aiming to provide theoretical support for precise adaptation and effective implementation of GFRIPZ policies in broader governance contexts.

6.4.1 Governmental context

Government environmental regulation, as a crucial component of the institutional environment, represents the legalization degree and enforcement efficiency of environmental regulations, playing pivotal guiding and constraining roles in GFRIPZ implementation. On one hand, stringent and effective environmental regulations provide robust institutional safeguards for the carbon unlocking effects of GFRIPZ policies. Specifically, higher environmental regulation levels imply increased environmental costs for enterprises, thereby forcing enterprises to boost investments in green technology innovation and enhance energy use efficiency (Qin, et al., 2024), ultimately strengthening GFRIPZ’s promotion effect on CUE. On the other hand, lower government environmental regulation levels may result in insufficient motivation for green transition among enterprises, constraining GFRIPZ policy effectiveness. Under such circumstances, even with policy implementation, enterprises may prioritize funding short-term profitable projects over low-carbon development, thereby weakening policy carbon unlocking effects. Therefore, government environmental regulation levels may be key factors affecting the transferability of GFRIPZ’s carbon unlocking effects.

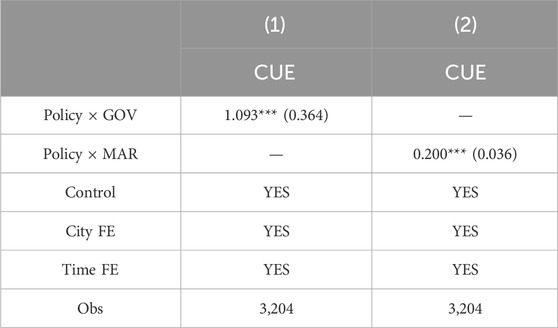

In view of this, referencing Bao and Liu (2022), this study uses Python to analyze and compile frequencies of environment-related keywords in municipal government work reports from 2011 to 2022, characterizing government environmental regulation levels by their ratio to total word counts. Cities with regulation levels above the median are assigned a value of 1, others 0, constructing a government environmental regulation level (GOV) dummy variable. Its interaction term with the policy dummy (Policy × GOV) is introduced as the core unlocking variable into the baseline model for regression. Specific regression results in Column (1) of Table 10 show the interaction coefficient significantly positive at 1%, indicating stronger carbon unlocking effects in regions with higher environmental regulation levels. This demonstrates that the legalization degree and enforcement efficiency characterized by government environmental regulation levels are indeed critical factors affecting GFRIPZ policy transferability, thus validating the above analysis.

6.4.2 Market context

Market integration degree reflects the efficiency and breadth of market resource allocation, representing another vital dimension of institutional environments. In regions with higher market integration, resources flow freely across broader areas, creating favorable conditions for effective GFRIPZ implementation. On one hand, market integration helps break regional barriers, facilitating optimal allocation of green financial resources (Chen, et al., 2021). When market integration is high, green finance funds flow more efficiently to enterprises and projects with strong low-carbon innovation capabilities and high emission reduction potential, improving fund utilization efficiency, promoting green technology diffusion, and thereby enhancing GFRIPZ’s promotion effect on CUE. On the other hand, in regions with severe market fragmentation, green finance resources may suffer from local protectionism, causing inefficient allocation and reducing policy effectiveness. Local protectionism might direct support to high-pollution enterprises while depriving low-carbon firms of necessary resources, hindering carbon unlocking processes. Therefore, market integration degree may also be a key factor affecting the transferability of GFRIPZ’s carbon unlocking effects.

In view of this, referencing Yue and Han (2025), this study characterizes market integration indices using reciprocals of market segmentation indices. Cities with integration indices above the median are assigned a value of 1, others 0, constructing a market integration index (MAR) dummy variable. Its interaction term with the policy dummy (Policy × MAR) is introduced as the core unlocking variable into the baseline model for regression. Specific regression results in Column (2) of Table 10 show the interaction coefficient significantly positive at 1%, indicating stronger carbon unlocking effects in regions with higher market integration indices. This demonstrates market integration degree as a critical institutional factor affecting research generalizability: higher integration enhances policy effectiveness while lower integration weakens it, thus validating the above analysis.

7 Conclusions and policy recommendations

7.1 Conclusions

The GFRIPZ policy is a crucial initiative for breaking carbon lock-in in China, with significant implications for achieving the dual carbon targets. Using panel data from 267 Chinese cities spanning 2011 to 2022, this study constructs a green finance policy dummy variable using GFRIPZ and applies the DML method to empirically examine the impact of green finance policy on CUE. The specific conclusions are as follows: (1) GFRIPZ significantly enhances urban CUE, and this finding remains valid after a series of robustness checks. (2) Mechanism validation reveals that GFRIPZ enhances CUE through optimizing industrial structure, reducing energy intensity, and strengthening public environmental concern. (3) Heterogeneity analysis reveals stronger carbon unlocking effects in eastern regions, large cities, non-resource-based cities, cities with higher internet development levels, and cities with advanced financial development. Simultaneously, GFRIPZ’s applicability benefits from institutional contexts including regional public data openness, carbon emission trading, and green resource endowment. (4) Spatial effect analysis indicates that GFRIPZ generates positive spatial spillover effects, significantly enhancing CUE in neighboring regions. (5) Institutional environments significantly influence the extrapolability of GFRIPZ’s carbon unlocking effects, with stronger policy impacts in regions exhibiting higher governmental environmental regulation levels and market integration degrees.

7.2 Policy recommendations

First, it is imperative to continuously optimize green finance policy while strengthening policy coordination and dynamic adjustments. On one hand, enhanced coordination should be established between green finance policy and industrial, energy, and environmental sectors through cross-departmental policy coordination mechanisms. A unified green finance policy framework should be formulated to ensure alignment of policy objectives and complementarity of policy instruments. On the other hand, dynamic adjustments to policy instrument portfolios should be implemented based on the developmental stages of pilot zones, transitioning from initial incentive-driven approaches to later-stage market-oriented decentralization to enhance policy sustainability. Additionally, a policy evaluation and feedback mechanism should be established to timely adjust policy priorities, ensuring continuous alignment with regional development needs.

Second, concerted efforts should be made to promote the synergistic improvement of industrial structure, energy intensity, and environmental accountability. For carbon-locked industries, differentiated green finance support policy should be formulated to implement incentive and constraint mechanisms. Concurrently, low-carbon technological innovation should be encouraged through strategic support for emerging industries. Green finance instruments should be utilized to incentivize enterprises to enhance energy efficiency and optimize energy mix. The construction of energy internet infrastructure should be accelerated, leveraging digital technologies to optimize energy allocation and reduce overall energy intensity. Furthermore, environmental information disclosure requirements should be strengthened to enhance transparency of environmental responsibilities among enterprises and financial institutions. Environmental performance metrics should be incorporated into corporate credit rating systems to elevate public participation in unleashing carbon unlocking effects.

Third, differentiated policy implementation is crucial to avoid the pitfalls of “one-size-fits-all” approaches. For central and western regions facing dual challenges of ecological fragility and economic underdevelopment, policy priorities should initially focus on ecological restoration and low-carbon industry cultivation, with subsequent gradual strengthening of green finance capacity building. For small and medium-sized cities, given their relatively scarce factor resources and relatively weak carrying capacity, which make it difficult for policy effects to be fully realized, actions can include introducing provincial-level green finance platforms to expand regional market cooperation, while also collaborating with universities to jointly establish programs for targeted training of urgently needed professionals. In addition, it is necessary to focus on formulating “small and refined” green finance products tailored to local characteristic industries, in order to overcome the dual constraints of “insufficient supply” and “weak demand” in green finance. In resource-endowed regions, policy support should facilitate low-carbon transformation of traditional industries through transition incentives and green finance instruments that promote industrial chain extension and diversification. For cities with underdeveloped digital infrastructure, integration of green finance with digital technologies should be prioritized to address efficiency and coverage gaps in green financial services. This includes enhancing digital infrastructure, empowering financial technology applications, and exploring digital green finance models. In financially underdeveloped cities, capacity building should be reinforced through combined external support and internal capability enhancement to improve green financial service provision.

Fourth, the spatial spillover effects of policy should be fully leveraged to establish a comprehensive carbon unlocking development framework. Pilot cities should take the lead in establishing cross-regional green finance cooperation platforms, strengthening infrastructure interconnectivity, and constructing regional low-carbon technology innovation networks. These initiatives should facilitate the diffusion of low-carbon technologies, optimize carbon resource allocation, and enhance regional energy synergy efficiency, thereby exerting radiation effects on neighboring cities. Non-pilot cities should actively capitalize on policy spillovers from pilot cities by integrating into regional green finance networks and establishing specialized policy docking mechanisms. This approach enables them to absorb low-carbon technology transfers and successful experiences from pilot cities, ultimately developing differentiated green finance systems tailored to local conditions to enhance carbon unlocking capabilities.

Fifth, regarding policy transferability and scalability, subsequent promotion requires two-pronged efforts in optimizing institutional contexts and strengthening institutional environments. In institutional contexts, strengthen the construction of public data openness and sharing mechanisms to promote cross-departmental green data integration and standardized management, providing data support for green finance policy implementation; improve carbon emission trading market systems by enriching trading varieties and mechanisms to enhance market liquidity and pricing efficiency; tap into green resource endowment potential by establishing eco-value transformation mechanisms that convert resource advantages into low-carbon development advantages. In institutional environments, elevate government environmental regulation levels, intensify policy enforcement and assessment to form forcing mechanisms for policy implementation. Additionally, advance market integration construction to break regional barriers and facilitate cross-regional flows of green factors, creating favorable market conditions for broad applicability of green finance policies. Through dual optimization of institutional contexts and environments, enhance policy carbon unlocking effects and extrapolability.

7.3 Limitations and future studies

Currently, this study still has some limitations, but these limitations also offer certain implications for future research.