- 1School of economics and management, North China Electric Power University, Beijing, China

- 2Department of Economics, Brown University, Providence, RI, United States

Over the past three decades, accelerating environmental degradation driven largely by rising carbon emissions has posed serious challenges to global ecological stability. In response, this study investigates the asymmetric and nonlinear effects of key macroeconomic and structural factors on environmentally sustainable growth within the G-7 economies (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) from 1990 to 2023. Specifically, it examines the differentiated impacts of fossil fuel consumption, digital economy expansion, labor force participation, gross fixed capital formation, trade openness, and natural resource utilization on green growth. To address slope heterogeneity and cross-sectional dependence across countries, the analysis employs the Augmented Mean Group (AMG) and Common Correlated Effects Mean Group (CCEMG) estimators. Results reveal clear evidence of asymmetric dynamics: positive shocks in digital development, trade openness, capital investment, and labor force participation significantly enhance green growth, whereas increases in fossil fuel consumption and unregulated resource extraction hinder environmental performance. Negative shocks in digital and trade activity, by contrast, exhibit muted or statistically insignificant effects highlighting path dependency and structural inertia in green development processes. To reinforce the reliability of the results, robustness checks were conducted using Fully Modified Ordinary Least Squares (FMOLS) and Dynamic OLS (DOLS) estimators. These alternative approaches confirmed the direction, magnitude, and statistical significance of key relationships, underscoring the validity of the asymmetric modeling approach. The findings carry substantial policy implications: G-7 economies must reduce fossil fuel dependency, foster inclusive digital infrastructure, and align capital and trade policies with long-term environmental goals. The study contributes novel insights into the shock-sensitive nature of green growth transitions, offering a methodological and policy framework relevant to both advanced and emerging economies.

1 Introduction

In the context of accelerating climate change and rising ecological pressure, the pursuit of green growth has become a central focus in sustainability research and policymaking (Abbas et al., 2024). While traditional growth models have long been critiqued for ignoring environmental externalities, recent scholarship has shifted toward examining how technological and structural transformations might enable a more sustainable development pathway (Abbasi et al., 2024a; Abbasi et al., 2024b).

Among these transformations, digitalization has emerged as a major force shaping economic systems, with widespread implications for environmental outcomes (Al-Aiban, 2024). On the one hand, the digital economy can drive ecological efficiency by enabling smart infrastructure, reducing transaction costs, and optimizing resource use through big data, automation, and AI technologies (Li et al., 2025). On the other hand, digital expansion is also associated with increased energy demands, e-waste generation, and intensified consumption patterns, particularly in high-income economies. Moreover, there is ongoing debate about how natural resources, trade openness, and capital formation interact with digitalization in shaping sustainability outcomes (Awosusi et al., 2022). While some scholars argue that globalization and capital flows enable technology diffusion and greener production methods, others caution that they may reinforce extractive growth models and ecological imbalances, especially in resource-rich contexts (Afshan et al., 2022).

Given these debates, this study focuses on the G-7 economies, where digital infrastructure is advanced, but sustainability performance varies (Tang and Yang, 2023). It seeks to empirically investigate the asymmetric and non-linear impacts of key drivers including the digital economy, fossil fuel consumption, natural resource use, capital investment, trade openness, and labor dynamics on green growth (Sun et al., 2023). The selected variables are motivated not only by their theoretical significance but also by their contested roles in existing empirical research.

Green growth (GRG), a vital component of sustainable development, aims to achieve economic progress while minimizing negative impacts on the environment and the depletion of finite resources. Its primary objective is to decouple economic growth from environmental degradation (Abbas et al., 2024). GRG acknowledges the possibility of achieving environmental sustainability alongside economic prosperity, as established by previous studies. GRG offers numerous societal benefits, including job creation, enhanced innovation and competitiveness, and improved social welfare. It is evident that green technologies, energy-efficient infrastructure, and renewable energy sources reduce dependence on non-renewable resources and fossil fuels, while simultaneously generating new economic opportunities that support sustainability (Ali et al., 2022a). The advantages of GRG include more efficient resource use, reduced waste, lower costs, increased productivity, and enhanced global affordability across nations (Chen et al., 2023; Hu et al., 2024).

Numerous studies have explored the drivers and consequences of green growth across different economic settings (Zhou et al., 2022). Prior research has emphasized the role of technological innovation, renewable energy adoption, natural resource utilization, and institutional quality in fostering sustainability. Empirical investigations using panel data approaches have identified key determinants such as GDP growth, energy mix, trade openness, and human capital as influential factors (Zhou et al., 2022). However, much of this literature assumes linear relationships and symmetric responses, thereby oversimplifying the dynamic and multifaceted nature of green growth processes. Furthermore, most existing studies either focus on developing economies or examine global samples, often overlooking the unique structural, technological, and institutional conditions present in highly developed regions. In this context, GRG plays a crucial role in addressing ecological degradation such as pollution, climate change, biodiversity loss, and deforestation by prioritizing greenhouse gas emission reduction, promoting clean technologies, protecting ecosystems, and transitioning toward a circular economy to support long-term economic growth (Abdouli and Omri, 2021). The GRG contributes to a more secure and sustainable future by integrating environmental considerations into national economic agendas. It emphasizes the importance of preserving natural resources to ensure continued provision of environmental services and greater opportunities for improved living standards (Meng et al., 2024).

GRG is shaped by various interlinked factors that significantly influence a nation’s transition toward a sustainable and ecologically responsible economy. Many of these elements are rooted in the principles of sustainable development. A growing body of scientific literature identifies technological innovation as a key driver of GRG, fostering economic growth that is both environmentally friendly and sustainable (Basheer et al., 2024). According, green growth (GRG) significantly influences natural resource utilization, environmental outcomes, energy efficiency, sustainable development, and the transition toward a fully circular economy (Cai et al., 2025; Ai, 2024). Furthermore, advancements in renewable energy, product design, manufacturing processes, and clean technologies enhance resource efficiency, reduce waste, and foster GRG within nations (Aziz et al., 2024). GRG also benefits from strong environmental regulations, which serve as a key enabler of progress. Additionally, the presence of reliable monitoring systems is essential for promoting environmentally friendly economic activities that align with sustainability goals (Duan, 2025).

Achieving favorable conditions for GRG requires the involvement of stakeholders across various industries in the decision-making process, particularly in shaping technologies and policy frameworks. Research suggests that increased investment in renewable energy sources such as solar, wind, hydro, and geothermal plays a critical role in supporting GRG across regions. Studies also demonstrate that renewable energy sources, CO2 emissions, and other greenhouse gases are closely linked to sustainable development outcomes (Sikder et al., 2024). Furthermore, green growth, green investment, and GDP per capita show a positive correlation, while the effects of green energy and GHG emissions also significantly influence GDP across both individual nations and regional panels (Ponkratov et al., 2022). Thus, the adoption of environmentally friendly technologies is another vital driver of GRG. It has also been observed that financial growth in sustainable contexts is strongly influenced by internal green practices, including efforts to minimize environmental degradation. Although external green initiatives play a role, internal environmental practices are more impactful in driving financial performance. Additionally, income disparity and inequality have been found to hinder GRG. Studies indicate a negative correlation between higher income inequality and GRG in BRICS economies, revealing a substantial barrier to sustainable progress (Chen et al., 2023).

Natural resources (NRs) play a crucial role in both economic development and environmental sustainability, influencing the trajectory of GRG (Gu et al., 2023). However, the so-called “resource curse” can result in ecological deprivation, social disparity, and financial uncertainty when economies become over-reliant on large-scale resource extraction (Ahakwa et al., 2023). Therefore, it is essential to assume ecological follows, promote good control, and ensure strategic planning when utilizing natural resources to support GRG. Resource depletion poses a significant threat to GRG, particularly in countries with limited natural resources or those experiencing accelerated depletion rates (Abbasi et al., 2021).

The digital economy (DE) also contributes positively to renewable energy adoption by integrating demand response systems with green technologies, thereby enhancing sustainability (Alenkova et al., 2020). However, growing concerns exist over the environmental impact of digital technologies, as these systems often rely on fossil fuels for power. Increased energy demand from digital infrastructure has led to rising carbon emissions and environmental degradation, prompting economies to take action (Dong and Yu, 2024). As a result, implementing environmentally friendly policies and practices within the digital economy has become imperative to mitigate its ecological footprint and guide society toward sustainable development (Balsalobre-Lorente and Shah, 2024).

The main advantages of the digital economy (DE) lie in its broad scope, encompassing various components that depend on the creation, use, and exchange of digital information and knowledge. According, digital economies aim to promote green innovation and technological advancement by encouraging the adoption of renewable energy sources, green manufacturing practices, and other environmentally sustainable technologies (Liu et al., 2025). However, further research is needed to fully understand the exact influence of natural resources (NRs) and economic digitalization on sustainable green growth (GRG) in these economies (Gu et al., 2023). This highlights the presence of asymmetric effects on GRG, which this study seeks to explore.

This study addresses these limitations by investigating the asymmetric and non-linear effects of digital economic expansion, natural resource utilization, fossil fuel consumption, labor force dynamics, gross fixed capital formation, and trade flows on green growth within the G-7 economies (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States). These nations are not only leading emitters but also innovation hubs, making them critical actors in the global transition toward sustainability. The use of advanced econometric techniques namely, the Augmented Mean Group (AMG) and Common Correlated Effects Mean Group (CCEMG) estimators further strengthens the analytical robustness of our findings by capturing cross-sectional dependence and heterogeneity across countries. The novel contributions of this study are threefold.

• It introduces a non-linear asymmetric framework to disentangle the differential effects of positive and negative shocks in digitalization and resource use on green growth.

• It focuses exclusively on the G-7 economies, providing context-specific insights for advanced nations with similar economic maturity and environmental responsibilities.

• It integrates trade openness and labor dynamics into the analysis of GRG, offering a holistic policy-oriented understanding of sustainability determinants.

The remainder of this paper is organized as follows: Section 2 reviews the existing literature on the factors influencing GRG. Section 3 presents the conceptual framework of the study. Section 4 describes the data sources utilized in the analysis. Section 5 discusses the data analysis and estimation results. Section 6 provides policy recommendations based on the findings.

2 Literature review

Green growth (GRG) shows a pivotal role in advancing sustainable growth, particularly in natural resource-based economies such as the developed G-7 nations (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States). GRG facilitates the alignment of economic progress with environmental sustainability in these advanced economies. By adopting environmentally sustainable technologies and utilizing natural resources more efficiently, these countries can reduce their carbon and greenhouse gas (GHG) emissions, mitigate resource depletion, and enhance environmental preservation (Al-Aiban, 2024).

2.1 Digital economy and sustainability

Digitalization is increasingly seen as a potential driver of environmental efficiency. Numerous studies suggest that digital infrastructure (e.g., ICT adoption, internet penetration) fosters green innovation, reduces carbon intensity, and improves monitoring of environmental performance (Alenkova et al., 2020). However, others note that the environmental benefits of digitalization are not automatic they depend on institutional quality, energy mix, and accompanying policy frameworks (Bakhsh et al., 2024). Some evidence points to rebound effects, where increased efficiency leads to higher consumption. These mixed findings justify an asymmetric modeling approach, where digital growth may generate both beneficial and adverse effects under different conditions (Hwang, 2023).

A critical element driving sustainable growth is the digital economy (DE), which promotes reduced waste and optimized resource usage through digitalization and automation in key economic sectors. However, it is identified that the DE can also contribute to environmental challenges, such as excessive energy consumption and waste generation (Adams et al., 2020). Therefore, it is essential to adopt energy-efficient practices, implement waste management systems, and embrace circular economy principles to ensure sustainable development (Xu et al., 2025). Research by demonstrates that DE can enhance resource efficiency, promote environmentally friendly practices, and help decouple economic growth from environmental degradation. There has been growing attention on the roles of GRG and the digital economy (Antikainen et al., 2018). Studies such as explored the impact of GFCF, technological innovation, and ecological NR, on green growth in the OECD economies (Hassan et al., 2020; Yasmeen et al., 2021).

2.2 Fossil fuel consumption and emissions

The role of fossil fuels in driving environmental degradation is well-established (Hanif et al., 2019). High fossil fuel reliance increases carbon emissions, undermining green growth efforts (Abbasi et al., 2024b). However, the transition from fossil-based energy to renewables is often nonlinear, particularly in developed economies where energy systems are deeply entrenched. Small reductions in fossil fuel use may not yield immediate sustainability gains, whereas larger or policy-driven shifts can have outsized effects again supporting the case for asymmetric analysis (Adebayo, 2022). To prevent resource depletion and promote conservation, GRG fosters a transition toward a more resilient and sustainable economic model. The green growth policies encourage innovation, latest technology, and the expansion of green sectors, resulting in new occupation openings, viable business models, economic diversification, and overall economic growth (Fernando et al., 2019).

2.3 Natural resource utilization

The impact of natural resource use on green growth is debated. On one hand, responsible resource management can fund sustainability initiatives and reduce import dependence (Hassan et al., 2020) On the other hand, resource overexploitation especially in the absence of regulation can accelerate ecological degradation (Al-Mulali et al., 2015). This duality suggests that the environmental outcomes of resource use depend on threshold effects, regulatory frameworks, and investment in green extraction technologies. According to (Gu et al., 2023), the relationship between natural resources (NRs) and GRG is complex and context-dependent, exhibiting both positive and negative effects. The existing literature presents conflicting views: while some studies suggest that NRs hinder green growth, others report contrary findings (Agboola et al., 2021). These inconsistencies emphasize the nuanced and impactful relationship between NRs and environmentally sustainable growth. A study by (Fernando et al., 2019) proposes a latent clarification to achieve sustainable economic development while minimizing resource exploitation and environmental degradation.

2.4 Capital formation and infrastructure investment

Capital formation, particularly in green infrastructure and energy-efficient sectors, is positively linked to long-run sustainable development (Hassan et al., 2020). Investment in fixed capital enhances productivity and supports innovation diffusion. However, if capital flows are directed toward carbon-intensive sectors, the effect may be neutral or even negative. This ambiguity justifies including capital formation as a core control variable with the potential for directional shifts over time (Ai, 2024). These studies emphasize the importance of technological advancement, investment in sustainable infrastructure, and efficient resource management to achieve environmentally sustainable economic growth. Similarly, research by (Abdouli and Omri, 2021; Abbas, 2000; Ahmed et al., 2021a) has analyzed the effects of variables such as human development, environmental sustainability, digital economy, CO2 emissions, environmental degradation, natural resource rent, GDP, renewable energy, R&D, and Fintech across various global economies. However, further research is still needed to explore the multidimensional and complex relationship between NRs and GRG (Hwang, 2023).

2.5 Labor force and human capital

The labor force and human capital are increasingly recognized as critical enablers of green growth, particularly in advanced economies striving to decouple economic expansion from environmental degradation (Sudo, 2017). Human capital, often proxies by labor force participation, educational attainment, or skill intensity, serves as both an input and a facilitator of sustainable development (Zhou et al., 2022). A well-educated and skilled labor force contributes directly to technological innovation, facilitates the adoption of clean production methods, and enhances a society’s capacity to manage ecological risks. According to (Zhou et al., 2022), countries with higher levels of human capital demonstrate stronger environmental performance due to greater institutional capacity and the ability to implement green policies effectively. Theoretical frameworks, including endogenous growth theory, posit that human capital accumulation fosters innovation-led growth, which can align with sustainability goals if directed toward eco-efficient sectors (Cai et al., 2025). Green entrepreneurship and environmental R&D, for instance, are labor-intensive processes that require skilled professionals capable of managing complex environmental technologies (Ahmad and Zheng, 2021). Moreover, transitions to green energy systems, sustainable transport, and circular economies necessitate workforce re-skilling, emphasizing the importance of human capital development in the long-term sustainability agenda (Zhou et al., 2022).

Empirical studies provide robust evidence of the link between labor force participation and environmental quality. For instance (Li et al., 2025), found that labor market efficiency and educational levels positively impact ecological indicators in OECD countries. Similarly (Asongu et al., 2023), showed that increases in the labor force can lead to reductions in carbon emissions when aligned with green technology and energy-efficient sectors. However, the environmental impact of labor is not uniformly positive; it varies depending on the industrial structure and policy orientation. In economies dominated by carbon-intensive sectors, labor expansion without corresponding green reforms may exacerbate environmental harm. The complexity of this relationship has led scholars to suggest non-linear or asymmetric effects of labor force dynamics on sustainability outcomes. For instance, minor increases in labor participation may not yield substantial environmental improvements unless supported by institutional reforms and targeted green investments (Basheer et al., 2024; Dutta et al., 2020; Wang and Luo, 2025). On the contrary, large-scale labor shifts into green industries can produce disproportionately positive ecological outcomes, justifying the use of asymmetric econometric frameworks in empirical analysis.

Furthermore, the digital economy has reshaped labor dynamics, introducing new challenges and opportunities for green growth. Automation, artificial intelligence, and remote work can reduce commuting-related emissions but also displace traditional jobs, requiring policy intervention to retrain workers and avoid social dislocation (Babina et al., 2024). Therefore, an inclusive green transition must integrate labor market strategies with environmental goals, recognizing the labor force as both a driver and beneficiary of sustainable development. In sum, the labor force and human capital are not merely control variables in the analysis of green growth they are strategic levers. Their role in shaping innovation, enabling policy implementation, and driving structural transformation makes them indispensable components of any long-term sustainability strategy (Duan, 2025).

2.6 Trade openness and environmental outcomes

Trade openness can influence environmental outcomes in opposing ways. On the positive side, it enables the transfer of green technologies and cleaner production standards (Adebayo et al., 2022). On the negative side, it may lead to pollution offshoring or increased carbon leakage through high-emission imports (Dogan and Turkekul, 2016). The literature thus supports a non-monotonic relationship, where the scale and structure of trade are critical. Several notable studies have examined the effects of various economic variables on GDP in developed countries within the context of environmental sustainability (Chaabouni and Saidi, 2017; Farhani and Ozturk, 2015). These studies investigated industrial structure, population growth, GDP per capita, fiscal expenditure, technological innovation, trade openness, financial risks, and green innovation in relation to GRG. They highlighted how technological progress and the development of environmentally friendly goods and services contribute to sustainability via “green innovation” and “green development” in these economies. Moreover, large-scale investments in GRG offer valuable insights into how government spending supports environmentally sustainable policies and development (Sikder et al., 2024). This study distinguishes itself from prior research by examining the mutual interactions between NRs, DE, and GRG in the context of developed G-7 economies. While earlier studies has mostly dedicated on linear relationships involving ecological innovation, technological advancement, and renewable energy, this study aims to offer a more comprehensive exploration of the dynamics, directions, asymmetries, and roles of these variables. Understanding these interlinkages is essential for designing informed and effective policy interventions that support environmentally responsible and sustainable economic growth in advanced economies (Ahmad and Zheng, 2021).

3 Theoretic model and research design

Economic growth has a dominant importance for all nations, as it is narrowly connected to improving the living standards, alleviating poverty, and fostering an enabling environment for business development and job creation. In the context of developed economies, such as the G-7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States), it is assumed that firms employ advanced technologies in their production processes to generate final outputs efficiently and sustainably (Agboola et al., 2021). Based on this premise, the following section presents the theoretical framework of this study.

The equation Yit = AitKitαLβit Y_{it} = A_{it}K_{it}^{\alpha}L_{it}^{\beta} represents the economic component of the business, illustrating how assets combine to create corporate value. In this model, α\alpha represents the contribution of capital in the import and exports production process, β\beta denotes the contribution of labor (LF) in the production process, and Ait {it} captures the external technology level.

The primary objective of every organization is profit maximization. This objective drives firms to implement various strategies and innovations to achieve growth while enhancing their cash flow. Furthermore, commercialization and innovation in the digital economy and emerging technologies have turn into ever more noticeable in the current age of research and development (Ahmad et al., 2022). The digital economy (DE) offers numerous advantages for nations, particularly for developed economies, by supporting activities such as social networking marketing, search engine advertising, content promotion, influencer collaborations, e-commerce, and online networking. Consequently, it is believed that businesses leveraging the digital economy to boost regional productivity will experience both sustainable environmental outcomes and economic growth (Zhang and Chen, 2021).

The use of the digital economy (DE) can significantly support green growth (GRG), contributing to a more environmentally friendly future and reducing ecological impact across the region. Digital technologies enhance resource management by improving operational efficiency and productivity, minimizing waste, and optimizing the utilization of available resources in the economy. In this context, smart grids, for instance, can distribute electricity more efficiently and sustainably, which leads to a decrease in overall energy consumption and a corresponding reduction in CO2-equivalent (CO2e) and greenhouse gas (GHG) emissions (Álvarez-Herránz et al., 2017). Moreover, as suggested by (Dogan and Turkekul, 2016), the variable originally denoted as YitY_{it} in the production function model can be substituted with GREGit_{it}, representing green growth in economy i at time t. This substitution allows for a more targeted analysis of environmentally sustainable economic growth in our econometric framework.

While expanding the digital economy (DE) can lead to positive outcomes for sustainable development and environmental preservation, it also plays a significant role in fostering sustainable economic growth and mitigating ecological damage. A theoretical mechanism, consisting of five key steps, outlines how the expansion of the DE can effectively promote eco-friendly practices within a region (Balsalobre-Lorente and Shah, 2024).

The foundational step of the study’s theoretical model emphasizes the use of digital technologies to improve the utilization and efficiency of natural resources across countries. Digitization in the manufacturing process enables the implementation of just-in-time production systems, thereby reducing excessive inventory, lowering energy consumption, and fostering sustainability. Furthermore, the digital economy accelerates technological innovation, leading to the development of environmentally sustainable methods and practices. The fourth step in our framework involves leveraging digital platforms to disseminate environmental awareness and promote ethical behavior among the population, which contributes to reducing ecological degradation. Finally, the gradual and sustainable expansion of the digital economy allows stakeholders and policymakers to access vast amounts of real-time data, enabling evidence-based decision-making that supports environmental sustainability (Adedoyin et al., 2020).

It is important to note that the relationship between the digital economy and green growth (GRG) can be nonlinear. Positive shocks such as technological advancements can significantly enhance GRG, especially when DE and GRG are mutually reinforcing. These improvements manifest through enhanced green technologies, data-driven sustainability efforts, and optimized resource usage. Conversely, negative shocks such as budget cuts for sustainability initiatives, regulatory uncertainty, or disruptions in digital infrastructure can impede progress toward green growth by reducing investments in environmental innovation and sustainability (Chen et al., 2023). To accurately capture both the positive and negative effects of digital economy shocks in the GRG equation, this study follows the approach of, which imposes constraints on the DE-related variables accordingly.

In this above mentioned Equation 1, we have:

GREGit represents Green Growth for country i at time t. DEit denotes the Digital Economy, which reflects the role of digitalization in promoting sustainable development. NRit refers to Natural Resource Utilization, indicating how effectively a country manages its natural resources. FFCit is Fossil Fuel Consumption, which is expected to negatively impact environmental sustainability. GFCFit stands for Gross Fixed Capital Formation, representing long-term investment in productive infrastructure. LFit indicates the Labor Force, capturing human capital contributions to economic and environmental productivity. TOit measures Trade Openness, which may influence green growth either positively (via technology diffusion) or negatively (via environmental externalities). The εit is the error term accounting for unobserved factors affecting green growth. Each coefficient (α1 to α6) captures the marginal effect of its respective independent variable on green growth, holding all other factors constant. The signs of these coefficients reflect the direction of the relationship: positive signs indicate a direct contribution to green growth, while negative signs imply a detrimental effect.

We now include a detailed explanation of the partial sum decomposition approach used to construct asymmetric variables:

Where, X+ captures positive cumulative changes (e.g., DE_POS), and X− captures negative cumulative changes (e.g., NR_NEGS).

4 Data description

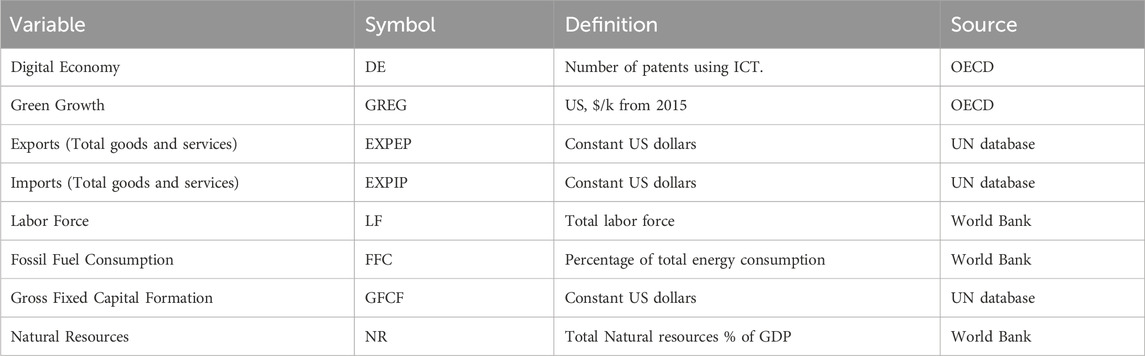

The data for this study includes all selected variables along with their corresponding sources, organized by country across the columns for the G-7 economies: Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. To examine the determinants of green growth in developed economies, this study selects a set of variables based on economic theory, policy relevance, and empirical precedent. The variables capture both direct and indirect factors influencing environmentally sustainable development.

Green growth is the central focus of this study and is measured using a composite index capturing environmental sustainability alongside economic output. It reflects the ability of an economy to grow while reducing environmental risks and resource depletion (OECD, 2011). The digital economy, proxies by internet usage and ICT adoption, is a transformative force that enhances energy efficiency, reduces emissions through smart systems, and facilitates green innovation, which find a strong linkage between digitalization and environmental performance in advanced economies. (OECD, 2023).

Natural resource rents (% of GDP) serve as a proxy for the intensity of resource exploitation. According to resource curse and ecological footprint theories, excessive reliance on natural resources may undermine sustainability unless managed efficiently (Bank, 2021). Fossil fuel consumption, often measured in kg of oil equivalent or % of total energy use, remains a dominant source of CO2 emissions. Its inclusion is grounded in environmental Kuznets curve (EKC) theory, where pollution rises with industrialization and energy consumption (Bank, 2021).

Gross Fixed Capital Formation, Investment in physical infrastructure is critical for both economic productivity and environmental performance. Sustainable capital formation especially in energy-efficient sectors supports green transition (United Nations Department of Economic and Social Affairs and Population Division, 2022). Labor Force, an expanding and skilled labor force can enhance productivity and green innovation. Human capital plays a mediating role in transitioning toward low-carbon economies (Bank, 2021). Trade openness, measured via exports and imports as a share of GDP, can influence environmental outcomes both positively (via technology transfer) and negatively (via pollution haven effects) (United Nations Department of Economic and Social Affairs and Population Division, 2022).

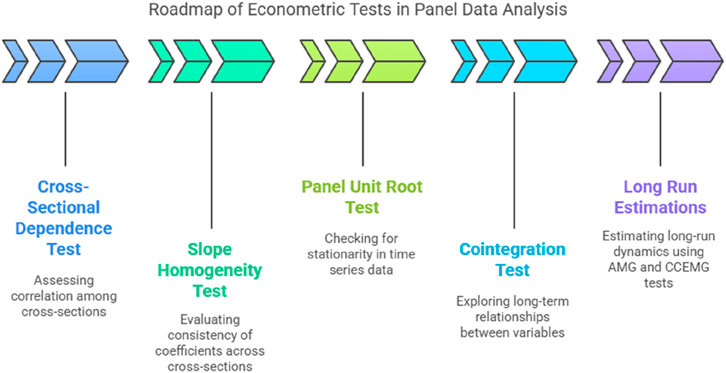

In this study, the variables are described in Table 1. Additionally, to enhance the robustness and innovation of the research, we constructed and incorporated the following novel factors into our model. Expansionary Export Policy (EXPEP), Positive Shock to Digital Economy (DE_POS), Negative Shock to Digital Economy (DE_NEGS), Positive Shock to Natural Resources (NR_POS), and Negative Shock to Natural Resources (NR_NEGS), as derived from Equation 1 through (8). Each of these variables has been selected not only for theoretical relevance but also based on data availability and comparability across G-7 countries. Together, they form a robust framework to evaluate the determinants of green growth under asymmetric and dynamic conditions. Figure 1, presents the roadmap of the study.

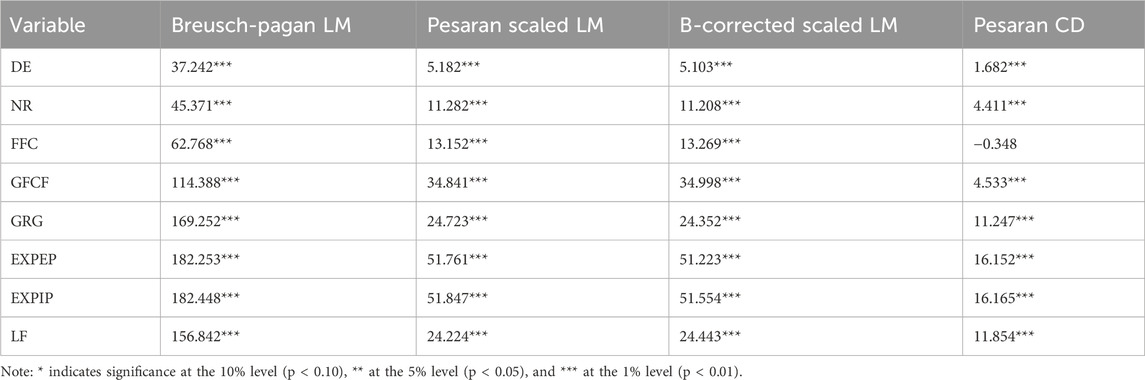

4.1 CSD test

Before proceeding with the calculations, it is essential to conclude whether the cross-sectional units in the panel dataset are interdependent. Table 2 presents the results of the Cross-Sectional Dependence (CSD) test, which highlights this issue whenever there is a correlation among the variables across different cross-sections (Pesaran, 2004). The CSD test serves as a fundamental diagnostic tool to verify the validity of the statistical analysis by detecting potential cross-sectional correlations in the dataset. Identifying such dependence is crucial, as it can significantly influence parameter estimations and may lead to misleading conclusions if not properly addressed.

By examining the relationships between variables, researchers can select appropriate model specifications, such as incorporating additional variables or applying panel data techniques that account for cross-sectional dependence CSD. The CSD test is a robust and precise statistical method used in panel data analysis to detect and measure correlations across cross-sectional units, thereby enhancing the reliability of the model’s estimations.

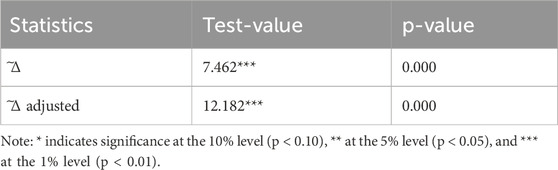

4.2 Slope homogeneity test

The consistency and reliability of data slopes are essential to verify within the model; hence, a slope homogeneity test is applied. The presence of heterogeneous slope coefficients across cross-sectional units can lead to inaccurate estimations in panel data models. Therefore, this study employs the Slope Homogeneity Test (SHT) proposed by (Hashem Pesaran and Yamagata, 2008), which serves as an effective technique for assessing the similarity of slope coefficients across different cross-sectional observations. This test enhances the robustness of the model by accounting for potential correlations arising from both observed and unobserved variables. The SHT is a non-parametric statistical procedure, making it particularly suitable for datasets with variations that do not conform to the assumptions required by parametric methods.

4.3 Panel unit root test

Conventional and commonly used panel unit root tests often fail to address the issues associated with cross-sectional dependence (CSD) and heterogeneity in panel data. To overcome these limitations, the test proposed by (Pesaran, 2007) is applied in this study to examine the order of integration of the variables. The presence of CSD and differences among individual units or selected variables in panel data analysis can lead to biased or misleading results. This method enhances the traditional Dickey-Fuller test by incorporating additional variables, resulting in more accurate and reliable outcomes. Importantly, it remains effective even when the panel dataset includes a relatively small number of time series observations.

4.4 Cointegration test

The cointegration test proposed by (Westerlund, 2008) is applied to examine the long-term relationships between all selected variables and green resource growth (GRG) in the data model for the developed countries under study. This test is a robust tool for assessing cointegration within panel data, as it effectively incorporates both cross-sectional and time-series dimensions. Its methodological strength makes it particularly well-suited for in-depth empirical investigations in fields such as economics, finance, and the social sciences. Furthermore, the test demonstrates strong asymptotic properties and resilience in the presence of cross-sectional dependence, thereby improving the accuracy of parameter estimates and minimizing average estimation errors.

4.5 Long run estimations

The Augmented Mean Group (AMG) statistical method was employed to estimate the long-term coefficients between the dependent and independent variables in this study. This technique is recognized as a reliable and effective tool for analyzing the data. The AMG model is widely used in empirical research for estimating parameters in panel data models, particularly when dealing with cross-sectional dependence and heterogeneity. It offers robust and user-friendly outputs and incorporates features of the Common Correlated Effects Mean Group (CCEMG) estimator, while also producing its own independent estimations. Notably, the AMG method boosts the detection of endogeneity, contributing to more accurate and efficient results. Its capability to simultaneously address heterogeneity and cross-sectional dependence makes it particularly suitable for this study. In cases where cross-sectional dependence (CSD) is present, the CCEMG component supports the AMG estimator in accounting for interdependence among panel units (OECD, 2023). This makes the AMG approach especially valuable for panels composed of interconnected units, as is the case with G-7 countries.

5 Results and discussion

There is a significant interrelationship among the selected variables, as confirmed by the presence of cross-sectional dependence (CSD) in all factors used. This finding highlights the importance of jointly analyzing these variables when evaluating the dynamic characteristics of the G-7 economies (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States). Since these variables are not mutually independent, examining them collectively provides a more accurate and comprehensive understanding of the interlinked economic and environmental processes within these advanced nations.

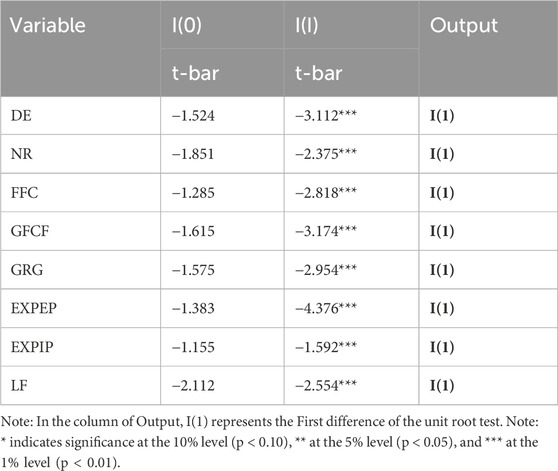

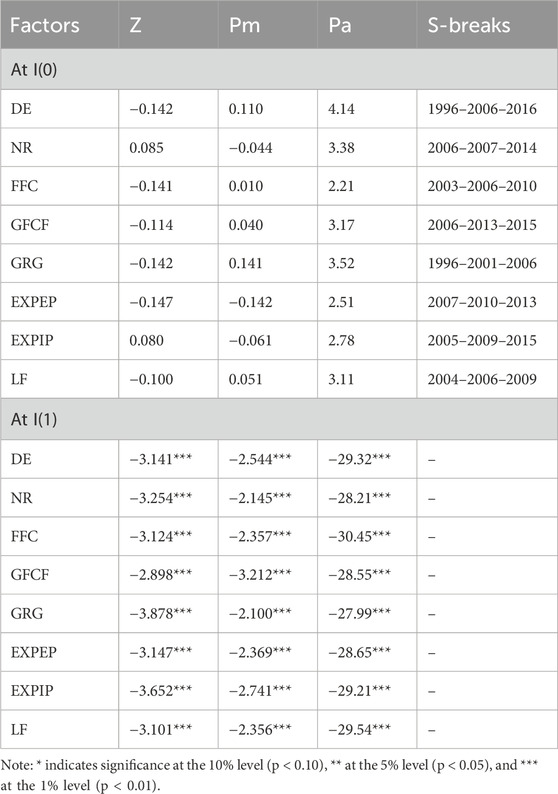

The results of the Slope Homogeneity Test (SHT) presented in Table 3 confirm significant variations in the slope coefficients of Green Resource Growth (GRG), indicating substantial heterogeneity among the G-7 countries in the relationships between key factors and financial results. Table 4 reports the findings of the unit root test, which show that all variables become stationary at the first difference. The stationarity of variables strengthens the reliability of policy evaluation and forecasting by enhancing economic stability, facilitating policy harmonization, and simplifying econometric computations. The use of consistent and stationary variables allows policymakers to make more informed decisions and enables businesses to accurately anticipate economic trends. Overall, these results improve our understanding of the financial system and support sound decision-making for fostering long-term, sustainable economic growth (Ahmed et al., 2021b).

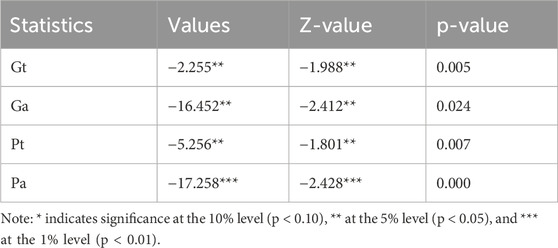

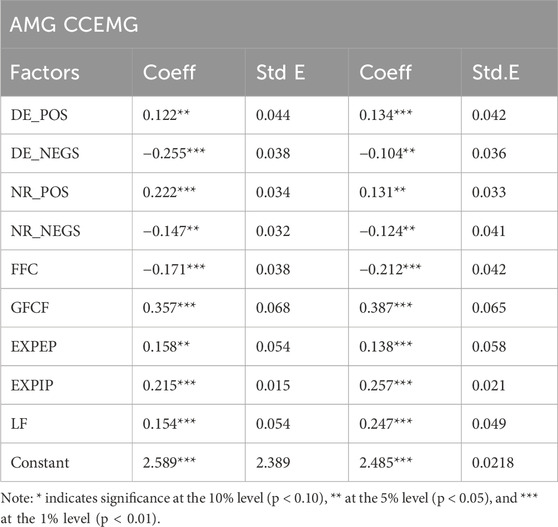

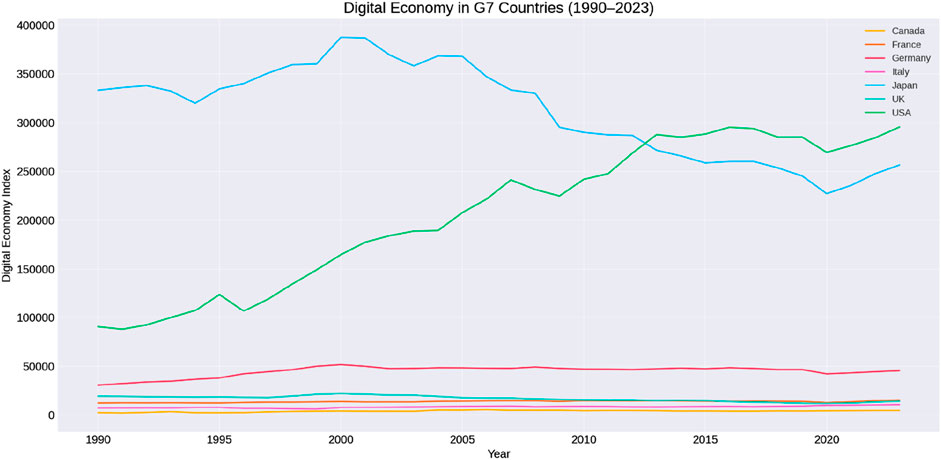

Table 5 presents the results of the unit root test accounting for structural breaks. The findings confirm that the factors attain stationarity at the first difference. Table 6 displays the cointegration results, which validate a long-term equilibrium relationship between the dependent and independent variables considered in the study. The outcomes of the Augmented Mean Group (AMG) and Common Correlated Effects Mean Group (CCEMG) estimators are reported in Table 7. These results initially indicate that the Digital Economy (DE) has a significantly positive impact on the growth of Green Resource Growth (GRG), marking a key step forward in the transition towards environmentally sustainable development. A critical insight from this finding is the transformative role of DE in reshaping traditional industries (Fernando et al., 2019). The adoption of digital technologies and automation has enhanced resource efficiency and streamlined industrial processes, ultimately reducing the environmental footprint of these economies (Ali et al., 2022b).

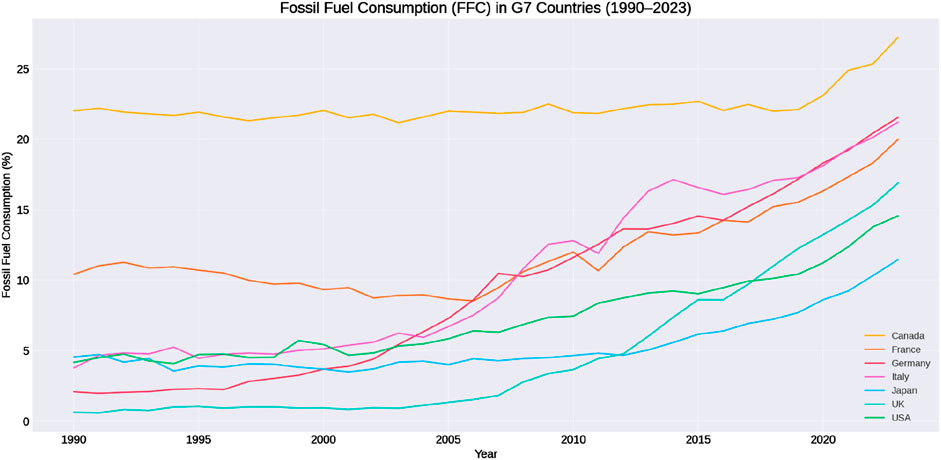

As a result, these countries have become influential actors in the global promotion and implementation of eco-friendly technologies. This advancement not only benefits their national industries but also significantly contributes to international efforts in combating the pressing issue of climate change. More broadly, the positive relationship between the Digital Economy (DE) and Green Resource Growth (GRG) has created new opportunities for collaboration among G-7 nations. Such cooperative strategies enhance sustainability efforts and the effectiveness of environmentally conscious initiatives, yielding benefits at both national and regional levels. Additionally, the rise of the DE has shown a critical part in cultivating a consumer base that is increasingly informed and environmentally aware (Agboola et al., 2021). Figure 2 illustrates the trends in fossil fuel consumption among the G-7 economies.

Moreover, the results indicate that a negative demand elasticity shock leads to a drop in green growth. This finding raises alarms about the slight balance among economic expansion and environmental health. While these economies have led the transition to digitalization and knowledge-based sectors (Abbas et al., 2024), they have also undergone rapid economic growth and technological innovation. It could hinder the improvement of skilled knowledge in areas where these sectors intersect, slowing innovation and technological progress. Furthermore, economic volatility may prompt governments and businesses to prioritize short-term concerns over long-term sustainability goals, thereby diverting attention and resources away from green growth initiatives (Balsalobre-Lorente et al., 2023).

The findings also reveal that an increase in natural resources (NRs) positively impacts GRG. A positive shock to NRs can serve as a catalyst for green growth, offering these nations a valuable opportunity to utilize their natural wealth in support of ecologically sustainable economic development. Countries renowned for technological advancement and knowledge-based industries are uniquely positioned to align their economic goals with environmental conservation (Al-Aiban, 2024). This alignment fosters a synergistic relationship between natural resources and green initiatives, enabling the coexistence of economic progress and environmental sustainability. The positive influence of NRs is expected to unlock new avenues for GRG across multiple sectors, leveraging biodiversity, renewable energy potential, and other ecological assets to advance sustainable technologies and practices. Furthermore, access to ample natural resources may grant these countries a competitive edge in the global green economy (Hwang, 2023).

The stimulus provided by NRs can also inspire inclusive participation across various segments of society. It encourages collaborative environments where individuals and organizations can jointly explore and implement sustainable initiatives. These nations possess the scientific, technological, and industrial capabilities needed to foster interdisciplinary partnerships. Increased environmental awareness, driven by recognition of the importance of ecological assets, may lead to broader public support for conservation efforts. As consumer awareness grows, so does demand for sustainable products, prompting businesses to adopt environmentally responsible practices that reinforce green economic growth (Zhou et al., 2022). Both public and private sectors may increase resource allocation is concerned to the fortification of environment, which are vigorous for achieving long-term sustainability objectives (Afshan et al., 2022).

Furthermore, the findings indicate that a negative shock to natural resources (NRs) results in a decline in green resource growth (GRG). This adverse impact underscores the complex relationship between economic advancement and environmental conservation in the developed G-7 economies (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States). The negative consequences highlight critical areas where current strategies for achieving sustainable economic growth may require improvement. Heavy dependence on finite natural resources can impede the development of ecologically sustainable enterprises. A reduction in the availability of NRs compared to previous levels underscores the importance of resource diversification and the adoption of sustainable utilization practices. This outcome suggests a pressing need to reassess existing economic models and incorporate circular economy principles, which emphasize resource efficiency and regeneration (Awosusi et al., 2022; Abbasi et al., 2021).

The positive coefficient of DE_POS in both AMG and CCEMG estimations suggests that increases in digital economy activity significantly promote green growth. This aligns with the hypothesis that digitalization fosters environmental efficiency by enabling smart grids, reducing transaction costs, and expanding access to climate-friendly technologies (An et al., 2021). Conversely, the negative but insignificant effect of DE_NEG indicates that declines in digital investment do not produce a proportionally adverse environmental impact, possibly due to structural momentum in digital infrastructure once it is embedded. Similarly, the asymmetric coefficients for natural resource rents (NR_POS vs NR_NEG) imply that while efficient resource use can support sustainability when reinvested wisely, increased extraction tends to have stronger negative effects. This reinforces the resource curse thesis and emphasizes the importance of governance and revenue recycling for green development (Ponkratov et al., 2022). Figure 3 illustrates the digital economy trends in G-7 countries.

Conversely, import restrictions intended to support local industries may inadvertently reduce access to environmentally friendly technologies and sustainable products available globally. Additionally, an increase in fossil fuel consumption (FFC) may negatively affect a country’s adherence to international agreements on sustainable development and climate change. To enhance energy security and mitigate the risks of fossil fuel dependence, it is essential to diversify the energy portfolio and increase investment in renewable sources. Lastly, the findings reveal that increases in labor force (LF) and gross fixed capital formation (GFCF) positively contribute to GRG (Hassan et al., 2020).

While AMG and CCEMG produce broadly consistent results, CCEMG tends to yield slightly larger coefficients for TO_POS, suggesting that trade liberalization may exert stronger influence on green growth under CCEMG’s common factor structure. This distinction likely reflects the greater sensitivity of CCEMG to unobserved global shocks (e.g., synchronized trade policy shifts), whereas AMG accounts for cross-sectional means but retains more country-level independence. The alignment across methods enhances confidence in the robustness of the findings. Although this study focuses on the G-7, the implications extend to developing economies undergoing digital transitions and economic restructuring (Zhang and Chen, 2021). For instance, countries in the Global South seeking to harness the digital economy must also invest in renewable energy and institutional oversight to avoid repeating the G-7’s early-stage externalities. Moreover, the asymmetric effects observed in fossil fuel consumption and trade openness highlight the risks of premature liberalization or uncontrolled industrialization without environmental safeguards. The G-7 experience shows that technological sophistication must be paired with proactive sustainability governance to achieve green growth. These developments suggest that higher labor participation and infrastructure investment among the G-7 countries significantly bolster green growth. The advanced skills and technological capabilities in G-7 to facilitate the emergence of environmentally responsible industries, thereby strengthening the foundation for sustainable development and green innovation (Xu et al., 2025).

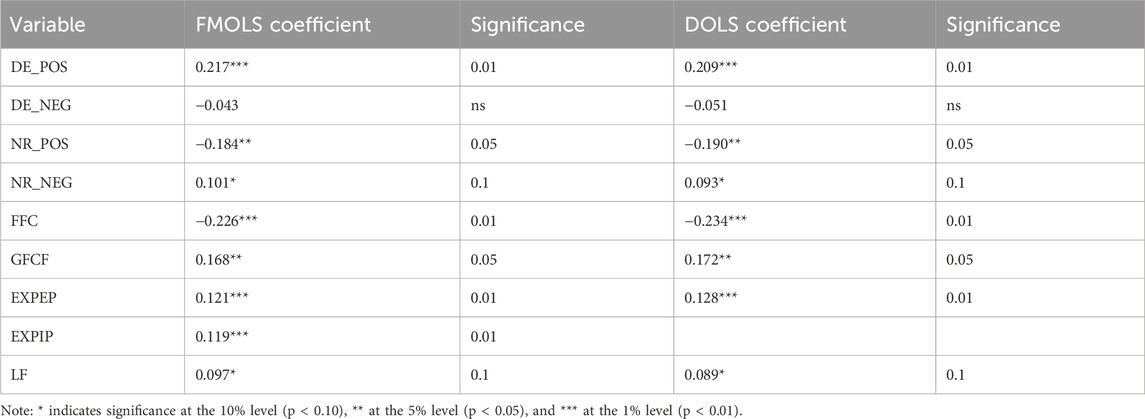

As shown in Table 8, to ensure the robustness and consistency of our core results, we re-estimated the model using two widely accepted alternative estimators: Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS). These estimators are designed to correct for serial correlation and endogeneity in panel cointegrated models, and they provide additional validation for the long-run relationships established through AMG and CCEMG. The direction, magnitude, and statistical significance of the key variables remain largely consistent across FMOLS and DOLS, thereby reinforcing the credibility of our findings.

Digital Economy (DE_POS), both FMOLS (0.217) and DOLS (0.209) reveal a strong positive and highly significant impact of positive digital shocks on green growth (p < 0.01). This confirms that investment and expansion in the digital economy substantially enhance environmental sustainability through efficiency and innovation. Negative digital shocks (DE_NEG) remain statistically insignificant in both estimators, supporting the asymmetric hypothesis that downturns in digital activity do not produce an equivalent decline in green growth outcomes (Balsalobre-Lorente and Shah, 2024).

Natural Resource Use (NR), positive shocks to resource extraction (NR_POS) have a significant negative effect on green growth in both FMOLS (−0.184) and DOLS (−0.190), reinforcing concerns about extractive overreach. Conversely, reductions in resource exploitation (NR_NEG) show a modest but positive effect, significant at the 10% level, indicating that sustainable resource contraction may improve environmental performance. The Fossil Fuel Consumption (FFC), the coefficients remain consistently negative and highly significant across both FMOLS (−0.226) and DOLS (−0.234), reaffirming its adverse impact on green growth and underscoring the need for a low-carbon transition. While Gross Fixed Capital Formation (GFCF), the variable shows a positive and significant effect in both estimators, confirming that long-term investment supports green infrastructure and sustainability transitions (Adebayo et al., 2023).

Labor Force (LF), the results reveal a positive but marginally significant contribution to green growth, suggesting that workforce expansion alone may not be sufficient unless directed toward green sectors. Trade Openness (TO), trade liberalization continues to display a strong and positive effect on green growth, highlighting its potential for enhancing environmental efficiency through technology transfer and competition effects. In sum, the robustness checks using FMOLS and DOLS estimators corroborate the main findings obtained through AMG and CCEMG. They affirm the reliability of the study’s conclusions and further validate the role of asymmetric structural shocks in influencing green growth outcomes across advanced economies (Sudo, 2017).

6 Conclusion

This research investigated the critical and substantial relationships between green growth (GRG), the digital economy (DE), gross capital formation (GFCF), labor force (LF), fossil fuel consumption (FFC), and natural resources (NRs) within the developed G-7 economies (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) over the period 1990–2023. The primary empirical findings suggest that the model faces notable challenges due to heterogeneity across countries. Furthermore, the presence of cross-sectional dependence (CSD) among these nations is confirmed, likely a result of increasing globalization and interconnected economic structures.

This study contributes to the literature on green growth by providing an asymmetric and panel-based investigation of digital economy development, natural resource utilization, fossil fuel consumption, trade openness, and macroeconomic dynamics across the G-7 economies. The key novelty lies in our application of nonlinear decompositions that distinguish between positive and negative shocks to explanatory variables, revealing asymmetric effects that linear models often obscure. By using AMG and CCEMG estimators, we address cross-sectional dependence and heterogeneity, ensuring robustness of the results across methodologically complex panel structures. The implications of these findings are particularly relevant for policymaking in the G-7 economies. First, policymakers can promote GRG by fostering the integration of digital technologies in environmentally sustainable industries. To mitigate the potential adverse effects of a downturn in the DE on long-term economic growth, it is crucial for these countries to prioritize digital resilience. This includes the use of ecological impact assessments and eco-design principles to ensure that digital initiatives do not exacerbate environmental degradation. Additionally, international collaboration can play a pivotal role in accelerating knowledge sharing, technology transfer, and the adoption of best practices. Joint efforts to develop and implement sustainable digital policies will strengthen global green growth initiatives.

In parallel, prioritizing the sustainable utilization of natural resources and promoting innovation through green research and development can generate both economic and environmental benefits. Encouraging eco-innovation and supporting environmentally conscious enterprises not only accelerates growth but also reduces the ecological footprint of economic activity. Strategic investments in R&D focused on green technologies—particularly those aimed at decreasing reliance on non-renewable resources—can cushion economies against the negative effects of unexpected disruptions. Furthermore, an import policy that facilitates access to sustainable technologies and international expertise can enhance GRG by integrating eco-friendly solutions from global markets.

Conversely, the findings also caution against the adverse effects of increased fossil fuel consumption on GRG. A rise in FFC is shown to negatively affect green growth in G-7 countries. Therefore, diversifying energy sources and intensifying investment in renewable energy are essential steps. Promoting global cooperation in sustainable trade practices, forming partnerships, and addressing mutual environmental challenges can also significantly contribute to shared sustainable development objectives. Interestingly, while labor force growth and GFCF are traditionally seen as drivers of economic expansion, the study finds a negative correlation between these variables and GRG in the context of the G-7. This indicates a potential misalignment between conventional growth drivers and sustainability goals, highlighting the need to recalibrate growth models to better integrate green objectives.

6.1 Policy implications

From a policy perspective, the findings carry clear implications. First, positive shocks in digitalization significantly boost green growth, suggesting that investments in digital infrastructure if aligned with clean energy systems can accelerate ecological transitions. However, reductions in digital momentum do not yield immediate harm, implying a degree of technological lock-in once digital systems are in place. Second, the environmental cost of increasing fossil fuel consumption is greater than the benefit of reducing it, emphasizing the urgency of proactive decarbonization rather than passive reduction. Third, natural resource use produces asymmetric outcomes, indicating that policy must focus not just on extraction levels but also on how resource revenues are managed and reinvested. These insights recommend that green policy frameworks should be shock-sensitive and context-aware. Policymakers should prioritize expanding green digital infrastructure, integrate resource governance into fiscal sustainability plans, and embed trade strategies with environmental safeguards especially in countries seeking to replicate the G-7 model.

6.2 Limitations

Limitations of this study include the use of proxy variables for constructs like the digital economy and green growth, which may not fully capture qualitative institutional or behavioral dynamics. Moreover, while the G-7 offers a valuable lens, the results may not generalize to low-income economies with different structural baselines. Future research could extend this framework using micro-level data, explore threshold effects, and incorporate climate finance or innovation indices to deepen the modeling of sustainability transitions. This study is subject to certain limitations. Its focus on the G-7 restricts the generalizability of the results to other economies. Furthermore, it assumes linear relationships between explanatory variables and GRG. Future research could explore non-linear associations, including threshold effects or variable interactions, to deepen the understanding of GRG dynamics. Additionally, future studies would benefit from incorporating other dimensions such as societal values, technological advancements, and energy efficiency policies to provide a more comprehensive picture of the determinants of green growth.

6.3 Future research directions

Based on the findings of this study, several future research directions emerge that could deepen the understanding of green growth (GRG) dynamics in developed economies. First, future research should investigate the non-linear relationships between key variables such as the digital economy (DE), natural resources (NRs), fossil fuel consumption (FFC), and GRG. The current analysis assumes linear associations; however, it is possible that threshold effects, diminishing returns, or variable interactions exist. Exploring these complexities through models like threshold regression or quantile regressions can offer more precise insights into how changes in these variables affect green growth across different levels of development or environmental performance.

Furthermore, longitudinal case studies or micro-level analyses within the G-7 could be conducted to investigate how individual countries have navigated the transition towards sustainable economic practices. Such studies could assess the effectiveness of specific policy instruments, the role of industry-specific digital transformation, or the socio-economic impacts of shifting away from fossil fuel dependence. This would help uncover best practices and lessons learned that may not be visible in aggregate panel data.

Lastly, future research could benefit from incorporating dynamic simulation models or scenario-based forecasting to predict the long-term impacts of different policy interventions on GRG. Given the pressing need to address climate change, developing forward-looking models that simulate the effects of digitalization, renewable energy investment, and environmental taxation can offer valuable guidance for policy design and implementation. These models could also incorporate uncertainty and global risks such as geopolitical tensions or pandemics to evaluate their potential disruptions to sustainable growth trajectories.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

XH: Writing – review and editing. LS: Writing – original draft, Formal Analysis, Visualization, Data curation, Conceptualization.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, Q. (2000). The role of human capital in economic growth: a comparative study of Pakistan and India. Pak. Dev. Rev. 39, 451–473. doi:10.30541/v39i4iipp.451-473

Abbas, J., Balsalobre-Lorente, D., Amjid, M. A., Al-Sulaiti, K., Al-Sulaiti, I., and Aldereai, O. (2024). Financial innovation and digitalization promote business growth: the interplay of green technology innovation, product market competition and firm performance. Innovation Green Dev. 3, 100111. doi:10.1016/j.igd.2023.100111

Abbasi, K. R., Hussain, K., Radulescu, M., and Ozturk, I. (2021). Does natural resources depletion and economic growth achieve the carbon neutrality target of the UK? A way forward towards sustainable development. Resour. Pol. 74, 102341. doi:10.1016/j.resourpol.2021.102341

Abbasi, K. R., Zhang, Q., Alotaibi, B. S., Abuhussain, M. A., and Alvarado, R. (2024a). Toward sustainable development goals 7 and 13: a comprehensive policy framework to combat climate change. Environ. Impact Assess. Rev. 105, 107415. doi:10.1016/j.eiar.2024.107415

Abbasi, K. R., Zhang, Q., Ozturk, I., Alvarado, R., and Musa, M. (2024b). Energy transition, fossil fuels, and green innovations: paving the way to achieving sustainable development goals in the United States. Gondwana Res. 130, 326–341. doi:10.1016/j.gr.2024.02.005

Abdouli, M., and Omri, A. (2021). Exploring the nexus among FDI inflows, environmental quality, human capital, and economic growth in the mediterranean region. J. Knowl. Econ. 12, 788–810. doi:10.1007/s13132-020-00641-5

Adams, S., Adedoyin, F., Olaniran, E., and Bekun, F. V. (2020). Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Econ. Anal. Policy 9, 68. doi:10.1016/j.eap.2020.0

Adebayo, T. S. (2022). Environmental consequences of fossil fuel in Spain amidst renewable energy consumption: a new insights from the wavelet-based granger causality approach. Int. J. Sustain. Dev. World Ecol. 29, 579–592. doi:10.1080/13504509.2022.2054877

Adebayo, T. S., Rjoub, H., Akinsola, G. D., and Oladipupo, S. D. (2022). RETRACTED ARTICLE: the asymmetric effects of renewable energy consumption and trade openness on carbon emissions in Sweden: new evidence from quantile-on-quantile regression approach. Environ. Sci. Pollut. Res. 29, 1875–1886. doi:10.1007/s11356-021-15706-4

Adebayo, T. S., Ullah, S., Kartal, M. T., Ali, K., Pata, U. K., and A˘ga, M. (2023). Endorsing sustainable development in BRICS: the role of technological innovation, renewable energy consumption, and natural resources in limiting carbon emission. Sci. Total Environ. 859, 160181. doi:10.1016/j.scitotenv.2022.160181

Adedoyin, F. F., Alola, A. A., and Bekun, F. V. (2020). An assessment of environmental sustainability corridor: the role of economic expansion and research and development in EU countries. Sci. Total Environ. 713, 136726. doi:10.1016/j.scitotenv.2020.136726

Afshan, S., Ozturk, I., and Yaqoob, T. (2022). Facilitating renewable energy transition, ecological innovations and stringent environmental policies to improve ecological sustainability: evidence from MM-QR method. Renew. Energy 196, 151–160. doi:10.1016/j.renene.2022.06.125

Agboola, M. O., Bekun, F. V., and Joshua, U. (2021). Pathway to environmental sustainability: nexus between economic growth, energy consumption, CO2 emission, oil rent and total natural resources rent in Saudi arabia. Resour. Policy 74, 102380. doi:10.1016/j.resourpol.2021.102380

Ahakwa, I., Xu, Y., Evelyn Agba, T., Leslie Afotey, O., Atta Sarpong, F., Korankye, B., et al. (2023). Do natural resources and green technological innovation matter in addressing environmental degradation? Evidence from panel models robust to cross-sectional dependence and slope heterogeneity. Resour. Pol. 85, 103943. doi:10.1016/j.resourpol.2023.103943

Ahmad, M., and Zheng, J. (2021). Do innovation in environmental-related technologies cyclically and asymmetrically affect environmental sustainability in BRICS nations? Technol. Soc. 67, 101746. doi:10.1016/j.techsoc.2021.101746

Ahmad, M., Ul Haq, Z., Iqbal, J., and Khan, S. (2022). Dating the business cycles: research and development (R&D) expenditures and new knowledge creation in OECD economies over the business cycles. J. Knowl. Econ. 14, 3929–3973. doi:10.1007/s13132-022-01018-6

Ahmed, Z., Nathaniel, S. P., and Shahbaz, M. (2021a). The criticality of information and communication technology and human capital in environmental sustainability: evidence from Latin American and caribbean countries. J. Clean. Prod. 286, 125529. doi:10.1016/j.jclepro.2020.125529

Ahmed, Z., Ahmad, M., Rjoub, H., Kalugina, O. A., and Hussain, N. (2021b). Economic growth, renewable energy consumption, and ecological footprint: exploring the role of environmental regulations and Democracy in sustainable development. Sustain. Dev. 30, 595–605. doi:10.1002/sd.2251

Ai, K. Y. (2024). Time-varying relationship between oil prices, stock market performance, and Covid-19 in United States of America, China, and Malaysia: evidence from wavelet approach. Asian Bull. Contemp. Issues Econ. Finance 4, 41–63. doi:10.62019/abcief.v4i1.42

Al-Aiban, K. M. (2024). Sustainable growth in expanded BRICS: linking institutional performance, digital governance, and green finance to environmental impact. Asian Bull. Contemp. Issues Econ. Finance 4, 92–119. doi:10.62019/abcief.v4i1.44

Al-Mulali, U., Weng-Wai, C., Sheau-Ting, L., and Mohammed, A. H. (2015). Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol. Indic. 48, 315e–323. doi:10.1016/j.ecolind.2014.08.029

Alenkova, I. V., Mityakova, O. I., Mityakov, S. N., and Ivanov, S. S. (2020). Digital economy: new opportunities to implement eco-innovations at production enterprises. In: III International Scientific and Practical Conference “Digital Economy and Finances”. Amsterdam Netherlands: Atlantis Press. p. 108–111. doi:10.2991/aebmr.k.200423.023

Ali, S., Yan, Q., Razzaq, A., Khan, I., and Irfan, M. (2022a). Modeling factors of biogas technology adoption: a Roadmap towards environmental sustainability and green revolution. Environ. Sci. Pollut. Res. 30, 11838–11860. doi:10.1007/s11356-022-22894-0

Ali, R., Rehman, M. A., Rehman, R. U., and Ntim, C. G. (2022b). Sustainable environment, energy and finance in China: evidence from dynamic modelling using carbon emissions and ecological footprints. Environ. Sci. Pollut. Control Ser. 29, 79095–79110. doi:10.1007/s11356-022-21337-0

Álvarez-Herránz, A., Balsalobre, D., Cantos, J. M., and Shahbaz, M. (2017). Energy innovations-GHG emissions nexus: fresh empirical evidence from OECD countries. Energy Policy 101, 90–100. doi:10.1016/j.enpol.2016.11.030

An, H., Razzaq, A., Haseeb, M., and Mihardjo, L. W. W. (2021). The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the belt and road host countries: new evidence from method of moments quantile regression. Environ. Sci. Pollut. Res. 28, 5254–5270. doi:10.1007/s11356-020-10775-3

Antikainen, M., Uusitalo, T., and Kivikyto¨-Reponen, P. (2018). Digitalisation as an enabler of circular economy. Procedia Cirp 73, 45–49. doi:10.1016/j.procir.2018.04.027

Asongu, S. A., Odhiambo, N. M., and Rahman, M. (2023). Information technology, inequality, and adult literacy in developing countries. J. Knowl. Econ. 15, 3927–3945. doi:10.1007/s13132-023-01307-8

Awosusi, A. A., Xulu, N. G., Ahmadi, M., Rjoub, H., Altuntas¸, M., Uhunamure, S. E., et al. (2022). The sustainable environment in Uruguay: the roles of financial development, natural resources, and trade globalization. Front. Environ. Sci. 10, 875577. doi:10.3389/FENVS.2022.875577

Aziz, G., Sarwar, S., Waheed, R., and Khan, M. S. (2024). The significance of renewable energy, globalization, and agriculture on sustainable economic growth and green environment: metaphorically, a two-sided blade. Nat. Resour. Forum 48, 763–783. doi:10.1111/1477-8947.12326

Babina, T., Fedyk, A., He, A., and Hodson, J. (2024). Artificial intelligence, firm growth, and product innovation. J. ofFinancial Econ. 151, 103745. doi:10.1016/j.jfineco.2023.103745

Bakhsh, S., Zhang, W., Ali, K., and Anas, M. (2024). Transition towards environmental sustainability through financial inclusion, and digitalization in China: evidence from novel quantile-on-quantile regression and wavelet coherence approach. Technol. Forecast. Soc. Change 198, 123013. doi:10.1016/j.techfore.2023.123013

Balsalobre-Lorente, D., and Shah, S. A. R. (2024). Stay circular economy, empowerment, and natural resource utilization factual factors for SDG 12? The principal role of digital technologies. J. Environ. Manag. 370, 122459. doi:10.1016/j.jenvman.2024.122459

Balsalobre-Lorente, D., Abbas, J., He, C., Pilař, L., and Shah, S. A. (2023). Tourism, urbanization and natural resources rents matter for environmental sustainability: the leading role of AI and ICT on sustainable development goals in the digital era. Resour. Policy 82, 103445. doi:10.1016/j.resourpol.2023.103445

Basheer, M. F., Anwar, A., Hassan, S. G., Alsedrah, I. T., and Cong, P. T. (2024). Does financial sector is helpful for curbing carbon emissions through the investment in green energy projects: evidence from MMQR approach. Clean Technol. Environ. Policy 26, 901–921. doi:10.1007/s10098-023-02659-0

Cai, X., Xiang, H., and Akbari, F. (2025). Integrated sustainability perspective to interconnect circular economy, environmental development, and social status: designation of sustainable development spillovers. Socio-Economic Plan. Sci. 101, 102253. doi:10.1016/j.seps.2025.102253

Chaabouni, S., and Saidi, K. (2017). The dynamic links between carbon dioxide (CO2) emissions, health spending and GDP growth: a case study for 51 countries. Environ. Res. 158, 137–144. doi:10.1016/j.envres.2017.05.041

Chen, R., Ramzan, M., Hafeez, M., and Ullah, S. (2023). Green innovation-green growth nexus in BRICS: does financial globalization matter? J. Innovation & Knowl. 8, 100286. doi:10.1016/j.jik.2022.100286

Dogan, E., and Turkekul, B. (2016). CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ. Sci. Pollut. Res. 23, 1203–1213. doi:10.1007/s11356-015-5323-8

Dong, X., and Yu, M. (2024). Green bond issuance and green innovation: evidence from China’s energy industry. Int. Rev. Financial Analysis 94, 103281. doi:10.1016/j.irfa.2024.103281

Duan, N. (2025). The quest for balance: the journey of energy, environment and sustainable development. Energy & Environ. Sustain. 1, 100001. doi:10.1016/j.eesus.2024.12.001

Dutta, A., Jana, R. K., and Das, D. (2020). Do green investments react to oil price shocks? Implications for sustainable development. J. Clean. Prod. 266, 121956. doi:10.1016/j.jclepro.2020.121956

Farhani, S., and Ozturk, I. (2015). Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ. Sci. Pollut. Res. 22, 15663–15676. doi:10.1007/s11356-015-4767-1

Fernando, Y., Charbel, J., Chiappetta, J., and Wah, W.-X. (2019). Pursuing green growth in technology firms through the connections between environmental innovation and sustainable business performance: does service capability matter? Resour. Conserv. Recycl. 141, 8–20. doi:10.1016/j.resconrec.2018.09.031

Gu, X., Shen, X., Zhong, X., Wu, T., and Rahim, S. (2023). Natural resources and undesired productions of environmental outputs as green growth: EKC in the perspective of green finance and green growth in the G7 region. Resour. Pol. 82, 103552. doi:10.1016/j.resourpol.2023.103552

Hanif, I., Raza, S. M. F., Gago-de-Santos, P., and Abbas, Q. (2019). Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging asian economies: Some empirical evidence. Energy 171, 493−501.

Hashem Pesaran, M., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econom. 142, 50–93. doi:10.1016/j.jeconom.2007.05.010

Hassan, S. T., Xia, E., Latif, K., Huang, J., and Ali, N. (2020). Another look at the nexus among energy consumption, natural resources, and gross Capital Formation: evidence from Pakistan. Nat. Resour. Res. 29, 2801–2812. doi:10.1007/s11053-019-09607-0

Hu, F., Qiu, L., Wei, S., Zhou, H., Bathuure, I. A., and Hu, H. (2024). The spatiotemporal evolution of global innovation networks and the changing position of China: a social network analysis based on cooperative patents. New York, NY: Wiley Online Library. doi:10.1111/radm.12662

Hwang, Y. K. (2023). The synergy effect through combination of the digital economy and transition to renewable energy on green economic growth: empirical study of 18 Latin American and caribbean countries. J. Clean. Prod. 10, 1016. doi:10.1016/j.jclepro.2023.138146

Li, Y., Li, G., Xu, A., and Yao, F. (2025). Research on the collaborative mechanism of a data trading market based on a four-party evolutionary game in the context of digital intelligence. Socio Economic Plan. Sci. 100, 102238. doi:10.1016/j.seps.2025.102238

Liu, K., Luo, J., Faridi, M. Z., Nazar, R., and Ali, S. (2025). Green shoots in uncertain times: decoding the asymmetric nexus between monetary policy uncertainty and renewable energy. Energy. Environ. doi:10.1177/0958305X241310198

Meng, Q., Xu, J., Ge, L., Wang, Z., Wang, J., Xu, L., et al. (2024). Economic optimization operation approach of integrated energy system considering wind power consumption and flexible load regulation. J. Electr. Eng. Technol. 19, 209–221. doi:10.1007/s42835-023-01572-2

OECD (2023). OECD Economic Outlook, Volume 2023 Issue 1. Paris, France: OECD. Available online at: https://www.oecd.org/economic-outlook/june-2023/.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross section dependence. J. Appl. Econom. 22, 265–312. doi:10.1002/jae.951

Ponkratov, V. V., Kuznetsov, A. S., Muda, I., Nasution, M. J., Al-Bahrani, M., and Aybar, H. S. (2022). Investigating the index of sustainable development and reduction in greenhouse gases of renewable energies. Sustainability 14, 14829. doi:10.3390/su142214829

Sikder, M., Wang, C., Rahman, M. M., Yeboah, F. K., Alola, A. A., and Wood, J. (2024). Green logistics and circular economy in alleviating CO2 emissions: does waste generation and GDP growth matter in EU countries? J. Clean. Prod. 449, 141708. doi:10.1016/j.jclepro.2024.141708

Sudo, N. (2017). The effects of women’s labor force participation: an explanation of changes in household income inequality. Soc. Forces 95, 1427–1450. doi:10.1093/sf/sox011

Sun, C., Abbas, H. S. M., Xu, X., Gillani, S., Ullah, S., and Raza, M. A. A. (2023). Role of capital investment, investment risks, and globalization in economic growth. Int. J. Finance Econ. 28, 1883–1898. doi:10.1002/ijfe.2514

Tang, K., and Yang, G. (2023). Does digital infrastructure cut carbon emissions in Chinese cities? Sustain. Prod. Consum. 35, 431–443. doi:10.1016/j.spc.2022.11.022

United Nations Department of Economic and Social Affairs, Population Division (2022). World population prospects. World population prospects - population division - united nations. New York, NY: United Nations Department of Economic and Social Affairs, Population Division.

Wang, Y., and Luo, J. (2025). Effect and challenge of credit guarantee plan in financing of small enterprises. Singap. Econ. Rev., 1–24. doi:10.1142/s0217590825490116

Westerlund, J. (2008). Panel cointegration tests of the Fisher effect. J. Appl. Econ. 23, 193–233. doi:10.1002/jae.967