- 1Department of Geoscience and Natural Resource Management, University of Copenhagen, Copenhagen, Denmark

- 2Department of Watershed Management and Land Use Planning, Faculty of Forestry Science, National University of Laos, Vientiane, Laos

Although many land deals are never implemented to production stage, little is known about how abandoned projects affect local communities and the government agencies that promote them. This article analyses the effects on local actors, their land access, land use and tenure security of a large-scale bio-fuel land deal in northern Laos that a Chinese company initiated but subsequently abandoned before reaching the planting and production stage. The project left local people bound by contracts without cancellation clauses and with livelihood losses, until the investment contract eventually was annulled by Lao state actors. The deal has prepared the provincial government to receive new investors to further the modernization of agriculture and a land-based economic growth, both in terms of identifying land for development, and experiences gained of how to handle international investors. However, it seems unlikely that local actors can decline future projects when interests of investors and government actors overlap–interests that may not be limited to those officially stated as the objectives of the land deal. A more accurate terminology and additional research is needed to shed light on the outcomes of land deals that for some reason never reach a production stage, whether as a “virtual,” or “failed” land deal.

Introduction

It is well-known that many land deals fail to materialize into actual investments in productive activities (Schoneveld et al., 2011; Cotula, 2013; Nolte et al., 2016; Sipangule, 2017; Nolte, 2020) and/or never deliver the associated expected benefits to governments and employees. However, despite the increasing interest in large-scale land acquisitions in developing countries (Deininger and Byerlee, 2011; Cotula, 2012; Oberlack et al., 2016; Lay and Nolte, 2018), there has been limited research on the effects of unimplemented land deals, understood as those never reaching the production stage. Many studies recognize the issue of abandoned or under-implemented deals in which production may have been initiated at some level (McCarthy et al., 2012; Holden and Pagel, 2013; World Bank UNCTAD, 2014; Agrawal et al., 2019), but the impacts of unimplemented or failed deals have received limited attention except for a few very recent studies (Nolte, 2020; Chung and Gagné, 2021).

It might seem counterintuitive that large land deals should remain unimplemented, especially because they are often portrayed positively by a range of actors as putting “empty,” “idle” or “underused” land to better use (Deininger and Byerlee, 2011; Li, 2011; Lavers, 2012b; Moreda, 2015), by contributing with technological improvements and productivity gains through intensification (World Bank UNCTAD, 2014), infrastructure development (Kugelman, 2009; Lavers, 2012a,b; Schoneveld and Zoomers, 2015), and job creation in rural areas (Li, 2011; Schoneveld et al., 2011; Brautigam, 2015; Lay and Nolte, 2018). However, McCarthy et al. (2012) point out that some investors go into land deals without intending to use the land for the purpose mentioned in permits or project descriptions, and found that partially implemented land acquisitions tend to be a “façade” that cover an agenda of appropriating subsidies or obtaining bank loans based on land permits as collateral (p. 523). They term these situations “virtual land grabbing”, thereby indicating that the land deal may be a vehicle to something other than land control and agricultural production. As an example, Brautigam (2015) describes an ambitious biofuel project in Zambia between 2009 and 2013, where the same Chinese company that is presented in this article pulled out after having aroused much enthusiasm and high-level political support from government (and critique from the political opposition). The departure appeared to have been caused either by domestic political changes in China preventing them from starting at very large scale or because the production was never intended from the outset and thus a “virtual” land grab (see also Schoneveld et al., 2014).

From the perspective of state actors, large-scale land investment projects may also be used primarily for the extension of state domination over frontier areas and/or ethnic minorities (Lavers, 2012a,b, 2016; Baird, 2014; Suhardiman and Giordano, 2014; Moreda, 2015; Moreda and Spoor, 2015). This has been clear since research attention shifted from looking mainly at the international actors in large scale land deals to also focus on the national and local elites (Peluso and Lund, 2011; Lavers, 2012a; Baird, 2014; Bachriadi and Suryana, 2016), because land deals with foreign investors may also be used to promote national political agendas or personal interests (Barney and Van der Meer Simo, 2019; Chung and Gagné, 2021).1

Land deal data and literature often distinguish between the implementation phases (preparation, production, closure) of the land-based investment projects (see for example the Land Matrix). Recent literature on land deal failures defines “failed projects” as those land-based investment projects that do not lead to operational farms (Nolte, 2020) or operations that cease project operation, abandon the land, use less than half the land granted, or do not show higher yields than smallholders (Schönweger and Messerli, 2015). Although they are certainly failed in relation to the stated intentions of higher or more valuable production, it may be relevant to reflect on whether the abandonment or lack of implementation might still be an intended outcome by some actors, or an outcome that can be turned into a benefit for some, while at the detriment of others, thereby reflecting existing unequal power relations (Chung and Gagné, 2021).

While it is logical that failed or unimplemented projects are unlikely to have achieved any of the key expected positive effects like employment creation (Nolte, 2020), it is important to acknowledge that they can have many adverse impacts in the area where they are located. This includes local communities' loss of land access, and negative impacts on soil, water, and biodiversity. While the abandonment of investment projects that were never welcomed by the local population in the first place may be received with some kind of relief for affected communities, the literature shows that it would be naïve to expect things to revert to the situation prior to the investment project. Land-based investments often lack exit strategies (Wåhlin, 2017), and abandonment of projects is unlikely to restore the past status quo as they have often already provoked path-dependent changes (Li, 2017).

The consequences of the failed or unimplemented land deals for local communities are an understudied aspect of large-scale land investments. We argue that an unpacking of the implemented/unimplemented dichotomy by looking at what is at stake for investors, government actors and for local community members can help alert attention to the impacts of “virtual” land grabs, or projects that get abandoned before the production phase. In order to achieve this, we use a longitudinal case-study from northern Laos to analyse whether there are tangible effects of a large-scale land deal that never reached its production stage before it was abandoned by the investor.

Before addressing the case, we start by introducing the theme of land deals and land investment projects with an emphasis on the nuances distinguishing abandoned, failed or “unimplemented” projects, and the need for a better understanding the reasons why some projects stay “unimplemented”, as well as their consequences. We briefly introduce Laos as a relevant setting for studying local development implications of land deals, including the abandoned ones, then we present the study area and the methodology of the study. The remainder of the paper presents what turned out to resemble a virtual land deal, from arrival, excitement, resistance and despair to abandonment and only partial relief. It analyses the local implications and the lasting changes for example as power-struggles intensified during the negotiation between local land rights vis-à-vis the investment project.

Land Deals and Land Development: Abandonment, Failure, or Lack of Implementation

Despite ambitious goals presented by most land investors in the project preparation phase, creating high expectations for host-country benefits, land deals often deviate from the original plans and contracts (Deininger, 2011; Arezki et al., 2013). A study by Boche and Anseeuw (2013) concluded from a southern African context that even among projects that get as far as obtaining formal land rights, many fail prior to reaching the production phase. Schönweger and Messerli (2015) call for more research into why land deals fail, get abandoned or remain unimplemented. “Failures” may be due to unsuccessful activities (Cotula et al., 2014), whether relating to firm internal changes, market-changes or political risks (Nolte, 2020). Globally, large projects, biofuel-projects and projects targeting land that was formerly used by local small-scale farmers or pastoralists have the highest likelihood of failing (Nolte, 2020). Other reasons for low implementation rates include changing investment conditions, unrealistic project design, different technical obstacles, and infrastructural constraints (Deininger and Byerlee, 2011). Furthermore, in a pan-African review of experiences with commercial agriculture, Poulton et al. (2008) highlight the often higher-than-expected costs related to land, negotiations and securing of land investments that follow from local discontent with land allocations to commercial agricultural enterprises. These costs could be related to dealing with local resistance toward the investment projects (Smalley and Corbera, 2012; McAllister, 2015). Deviations from project plans and contracts may also indicate that investors' intended use was different from what was presented in their investment plans (McCarthy et al., 2012; Smalley and Corbera, 2012; Arezki et al., 2013; Schönweger and Messerli, 2015; Chung and Gagné, 2021).

According to several studies, “satisfactory” local benefits depend on projects being profitable and well-managed (Poulton et al., 2008; Deininger and Byerlee, 2011; World Bank UNCTAD, 2014). Thus, unprofitable and non-operational projects are less likely to provide local benefits (ibid.), and failed or unimplemented projects are unlikely to have achieved any of the key expected positive effects like employment creation (Nolte, 2020).

However, since unimplemented deals never really enter the project management phase, there are methodological challenges related to studying impacts of such deals, especially when there is a lack of longitudinal data. Based on global datasets a decade back, Deininger and Byerlee (2011) found that farming had only started on roughly 1/5 of the announced land deals. Similarly, Cotula et al. (2014) found that most land deals in Ethiopia, Ghana and Tanzania had implemented activities on less than a third of the allocated land, while Johansson et al. (2016) found implementation rates as low as 3 per cent for the contracted land deals in Africa (see also Agrawal et al., 2019). The implementation rate seems to have increased over the years, based on more recent data sets (Nolte et al., 2016), probably because having large “tracts of land occupied without utilization” may be detrimental to governments' goals of increasing agricultural productivity (Arezki et al., 2013, p. 203). Local costs related to unimplemented projects, in terms of lost access to land and other natural resources, and/or displaced employment or investments, are acknowledged in several studies (Deininger and Byerlee, 2011; Li, 2011; World Bank UNCTAD, 2014; Agrawal et al., 2019). All these areas are affected by “land deals in limbo” (Chung and Gagné, 2021, p.596), making it relevant to explore the concepts of both implementation and failure and their consequences.

A failed project is one that does not lead to an operational farm through putting the acquired land rights into productive use (see for example Schönweger and Messerli, 2015; Nolte, 2020), and/or one that was never implemented. As outlined above, there is much anecdotal evidence that some “failed” land deals may be the result of speculation, but it could also be that agricultural investors are more willing to accept high risks than investors in other sectors (Lay and Nolte, 2018; Nolte, 2020). However, some of these deals may indeed be so-called “virtual” land deals where the land control is only a means to access something else (McCarthy et al., 2012), and where agricultural production is not the primary motivation (Arezki et al., 2013). For example, an investment contract may be signed, for a foreign investor to return to its host country and use the investment contract as collateral for favorable loans, or as a way to obtain subsidies, or speculate on future land price developments (McCarthy et al., 2012). In the cases of “virtual” land deals, the investor is likely to obtain the underlying, driving objective, even though the stated productive purpose is never implemented. In such cases, conceptualizing the “abandonment” or lack of implementation as a “failure,” masks that implementation was maybe never the actual purpose of the prospective investor.

When studying the socioeconomic impacts of land deals, one must distinguish between different phases of land investments (Schoneveld et al., 2011; Cotula et al., 2014; World Bank UNCTAD, 2014), as well as between the different actors' role in the investment project. This is also highly relevant in the case of abandoned or partially implemented deals. For example, for government officials, potential benefits and costs are different, and may be differently distributed in time, as some invest into establishing good relationships (Chung and Gagné, 2021) and doing feasibility studies that are likely to generate benefits in the pre-investment phase, such as “finders fees” offered to participating officials (Barney and Van der Meer Simo, 2019). Infrastructure development, tax base increase and economic activity will accrue only as production is prepared. For the investors, however, the costs are likely to dominate in the beginning of the land-based investment (during identification and preparation of the investment project), but this of course becomes irrelevant in case of virtual land deals where the investment never materializes. Seen from the point of view of a local farmer, the loss of land access is likely to start when the investment contract begins, whereas market provision or employment generation may only accrue over time, and it may or may not be attractive from a livelihood, socio-cultural or economic point of view (Barney and Van der Meer Simo, 2019; Nolte, 2020). If the deal is not implemented, the lack of benefits is only more certain, and losses may still have occurred.

The concept of loss is contested and hinge on whether land by different actors is considered as idle or productive, natural or degraded, unclaimed or occupied, or within or outside of expected yield levels (Sowerwine, 2004; Hall et al., 2011; Li, 2011, 2014; Lu and Schönweger, 2017; Rigg, 2020). Much land used by smallholders under low intensity cropping or pasture is classified as available and suitable for investment, as its current use is deemed to fall short of its economic potential (Lu and Schönweger, 2017). It thus becomes a political act to include or exclude who can use or access the land, under which conditions, as well as to define the states' claim to that land as territory (Vandergeest and Peluso, 1995; Lu and Schönweger, 2017). In many post-socialist or post-colonial states, land ultimately belongs to the state, which makes the tenure rights and land access for local land users an issue of constant negotiation with different actors within the state, or foreign investors (Rigg, 2012, 2020; Lu and Schönweger, 2017), the latter often invited by state actors interested in increasing foreign direct investments, access to technology, employment or a “modernized” farming sector (ibid.).2 And when certain land uses in addition are considered of low productive and environmental value, then both the state and foreign investors could consider failed land development efforts to be acceptable as long as they generate the non-productive results such as collateral and increased land control mentioned previously.

The political character of local or national systems of land categorization and regulation, which forward state territorialisation processes, may be largely un-noticed by foreign investors, although interests in promoting land-based investments may coincide between investors (whether being private sector or state actors) and host state actors. Despite of international agendas aiming to protect land and water rights of smallholders and local populations,3 the tools themselves or the implementation of them may fall short of protecting the interests of local people, ethnic minorities, women, or other marginalized groups (Fontana and Grugel, 2016; Zoomers and Otsuki, 2017). Without a certain degree of balance in negotiating power between the parties of an agreement, outgrower schemes will fail to benefit the involved farmers (Lavers, 2012b). This requires that outgrower-farmers must “have the capacity to decline an agreement if it is not in their interests” (Lavers, 2012b, p. 814). Unfortunately, this will often necessitate the active involvement of the state to ensure negotiation support to the local farmers (Li, 2011), something that the vast land-grab literature has shown is often not the case (Baird, 2011, 2014; Lund, 2011; Schoneveld et al., 2011; Borras and Franco, 2012; Borras et al., 2012; Cotula, 2012; Hall et al., 2015; Moreda, 2015; Chung and Gagné,2021).

Land Developments in Laos

Laos provides a relevant setting for studying local development implications of land deals, including the partially implemented or abandoned ones, as land deals are plentiful. The Government of Laos uses its rich natural resources as a growth engine, especially to attract foreign investments (Dwyer, 2007, 2014), presenting Laos as a sparsely populated, land abundant country, with plenty of “underutilized” or “degraded” land (Barney, 2009; Lestrelin et al., 2012). However, the “abundant land” is being placed under stricter control by still incomplete land reforms and land use planning efforts aimed at regulating the use of land and natural resources through mapping and zoning exercises (Lestrelin et al., 2012). These reforms extend the influence of the state into rural communities, often resulting in dispossession or restrictions in traditional use of natural resources (Lund, 2011; Castella et al., 2013; Ducourtieux, 2013; Broegaard et al., 2017; Lu and Schönweger, 2017), and foreign land investors may–from the point of view of state actors–help in this process to extend control over areas, where the state control is still weak or contested.

In Laos, there are multiple competing state institutions involved in land granting activities (Lu and Schönweger, 2017), and despite having a centralized political system, policies are reinterpreted during their implementation at provincial and municipal levels to fit local realities or interests of local actors (Broegaard et al., 2017; Lu and Schönweger, 2017). As a state characterized by fragmented sovereignty (Lund, 2011), different state institutions at different administrative levels may contradict each other in their competition for power (Schönweger et al., 2012; Lu and Schönweger, 2017). Plans at different administrative levels may be ignored or overruled when money is to be made (Dwyer, 2014; Baird and Fox, 2015; Broegaard et al., 2017).

There was a 50-fold increase in land concessions and leases between 2000 and 2009, involving roughly 5 per cent of the country's total land area, even when excluding mining and logging concessions (Schönweger et al., 2012). These figures generally exclude contract-farming arrangements, thus underestimating the full extent of areas under agricultural development projects, despite the fact that several studies have shown that many recent contract-farming arrangements in Laos resemble concessions in their labor and compensation agreements (Dwyer, 2007; Thongmanivong et al., 2009; Kenney-Lazar, 2012; McAllister, 2015). In that way, a national moratorium on land concessions decreed in 2007, due to the uncontrolled development in concessions (Dwyer, 2007), can be circumvented. At the time of a national survey in late 2010, fifteen per cent of all approved projects, representing 31 per cent of the total land area under investment, were not operational, while five per cent of approved projects had been finalized or canceled (Schönweger et al., 2012, p. 27).

The opportunities for rent seeking by state officials are “gigantic” (Sikor and Lund, 2010, p. 15) in settings like Laos where state institutions claim the property rights over land, and thereby have a key role in the authorization of land deals (Lu and Schönweger, 2017). Several studies in Laos document the ways large-scale land deals displace local livelihoods and semi-subsistence activities (Barney, 2007; Kenney-Lazar, 2010; LIWG, 2012; Suhardiman et al., 2015) creating plantations in which former farmers serve as wage laborers (Baird, 2011), while foreign investors and national elites are argued to be the main beneficiaries (Barney, 2009; Andriesse, 2011). However, what happens when land deals are abandoned or never implemented has received little attention.

Study Area and Methods

We focused our case study on a province in north-eastern Laos, which has one of the lowest GDP per capita in the country with less than half the national average at US$ 1.179 (at US$ 1,179 vs. US$ 2,636).4 The research further focused on a district that was the main target of a Chinese investment, and which is among the poorest districts in the province (Messerli et al., 2008). The province has one of the highest forest covers in Laos and has relatively recently joined efforts to attract investors, thus being one of the newest resource frontiers in the country. Since the late 2000s, maize has boomed as a cash crop in the area, mainly supplying the Vietnamese market through smallholder contract farming arrangements (Vongvisouk et al., 2016). Not all villages have areas that are suitable for maize cultivation, so district and provincial government employees are on the constant lookout for profitable crops or income opportunities for the remaining villages – opportunities that align with the national government's ambitious economic growth goals, even though they may contradict environmental or land use policies (Broegaard et al., 2017).

One of these crops is Vernicia Montana Lour (in Lao: Mak Khao), a biofuel crop which is native to Southeast Asia, but also widely grown in tropical Africa, where it is known as “Chinese wood oil tree.” It was already grown by individual households in the district, and its production cycle is thus well-known in the district: It produces seeds after 2–3 years in humid soils, reaches full production after 5 years and produces for 30–50 years. Oil, for example lamp oil, is extracted from the seeds. The market for Mak Khao was unstable as farmers were selling the dry seeds or fresh fruits to interested traders, mainly Vietnamese, passing by at irregular intervals. With the arrival of the company, the prospects for Mak Khao were suddenly lifted to another level as the company planned to establish a bio-diesel factory in Laos with the aim of exporting biodiesel to China or Vietnam, and to the local Lao market.

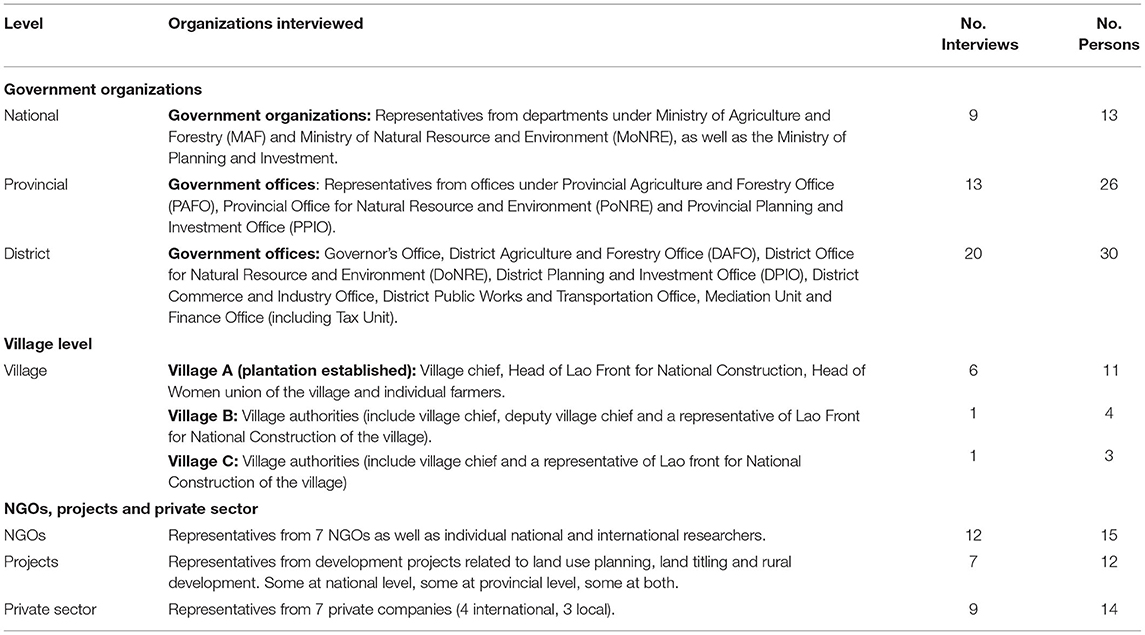

Fieldwork was carried out in the province between March 2013 and November 2018 with 4 visits totalling 3 months. We followed the ups and downs of the investment-endeavor from 2013 to 2018, including negotiations, creation of expectations and concerns, and the abrupt departure of the company in 2014, with the resulting disappointment, and partial relief when the project was formally canceled years later. Interviews were carried out at provincial, district and village levels with government officials from different sectors as well as investors, NGO representatives, individual farmers, and a number of Civil Society Organizations, supplemented with interviews at national level national to understand procedures and rules related to foreign direct investments within agriculture. Interview persons were selected through a snowballing methodology, starting–as required by Lao regulations for research interviews–with central state top personnel, who then gave permission to contact informants at the next administrative level, until reaching village level. Interviews were carried out with informants from different sectorial institutions (Agriculture and Forestry, Natural Resources and Environment, Planning and Investment) at national, provincial and district level (and additionally with the Commerce and Industry office, the Public Works and Transportation Office and the Mediation unit and Finance office at district level), as well as with territorially focused actors (District governor, village chiefs and other representatives in village committees). These interviews were supplemented by interviews with NGOs, project staff related to land use planning and rural development, and private sector representatives. A total of 78 interviews were carried out with 128 persons (Table 1).

Within the district, our main emphasis was on a village relatively close to the district capital, as this became the main target of the biofuel plantation activities and where the pilot Mak Khao plantation was established. We also studied two additional villages that were targets of the biofuel plantation project, and where contracts were signed, but the project never reached the implementation stage here. These two villages were both located further away from the district capital and at high altitudes.

Interviews, group interviews and field-walks focused on information flows, negotiations and decision-making with regards to the biofuel investment, as well as changes in livelihoods, land use and perceptions of land rights certainty. At provincial and district levels, frank talks were facilitated by the intimate knowledge of the area by one of the authors, who grew up in the province. All rural fieldwork was carried out in Lao and immediately translated to and from English by the Lao-speaking author, while notes were taken in English by another author. Interviews were coded and analyzed using Nvivo software Version 8. In the text, we use abbreviations and numbers for interviewees to indicate whether the interviewees were at village (Vx), district (Dx) or provincial level (Px), or the company representative (C), but do not in the text distinguish between different interviews with the same interviewee. Copies of documents were obtained from village, district and provincial authority levels in Lao and (partially) translated for the purpose of analysis. See Appendix 1 for more information on fieldwork and interviews.

Results

Land Deal Development

The Chinese company had for several years searched for land in Laos for a large biofuel and industrial wood plantation, and according to its representative, the company had a “very good relationship to the Provincial Governor” (C) in the province. The government's openness and the way it welcomed the company, which was described as distinct from southern provinces with more foreign investor experience, was decisive for the company's decision to invest here (C). The company representative reproduced the image of Laos, often presented by the Lao government as well, as a resource frontier, where land and other national resources are relatively plentiful and easy to access. Judging from the representative's highlighting of the “good relationship” with a welcoming provincial governor, this was the key to the company's access to land. The company focused on long-term benefits and originally proposed 100-year contracts, but the provincial governor reduced them to 50 years. However, it was the impression of the company representative that the villagers did not understand that the contract was going to influence them for 50 years. “Local people focus more on the short-term. They pay little attention to the long-term. For example, they did not ask any questions about the 50 years; they just accepted,” he said (C). Later, when interviewing influenced farmers and village authorities, it turned out that the timeframe and exit conditions were never brought up in the initial meetings (V1, V5, V6). It was, however, an issue of great concern for them when it appeared in the contracts.

After district authorities expressed their positive interest, the provincial governor ordered a feasibility study which was paid by the company.5 During interviews with district technical staff right after their involvement in the fieldwork in early 2013, they highlighted the economic development opportunity that the project would bring for the farmers, explaining that the project was especially well-suited for their district because Mak Khao grows in areas unfit for maize. Thus, it could be a new cash crop for those villages that had been unable to benefit from the ongoing maize boom and the associated economic development (D1).

The feasibility study covered all 76 villages in the district of more than 216.000 hectares. Based on satellite images and field visits, the study identified 56,958 ha, or roughly a quarter of the district territory as being feasible for Mak Khao and Mai Hien (Melia Azadirachta L.) plantations, while completely ignoring local land uses and previously elaborated land use plans at district and provincial level. On this basis, the provincial governor gave an investment license to the Chinese company, indicating the district as the main target district of the investment in the province.6 This was followed by a framework contract on plantation promotion for up to the stipulated area of 56,958 ha, and potentially targeting all 76 villages in the district.7 Although the provincial level officials dealing with natural resources had recently developed Macro Land Use Plans for all villages in the district, these were not consulted (P1), nor were any of the agencies that funded these plans. District planners were asked to help prepare a contract to be signed between the company and the district level authorities. However, elaborating contracts on investments was a completely new activity for the government officials, especially at district level, and there was limited experience and capacity with regards to contract formulation, monitoring, and evaluation (D2). At the provincial level, the eagerness to gain experience, while not scaring away the investor, influenced the decision by the planning officials at provincial level to omit standard requirement for the investor to deposit money prior to starting operations (P2, P3).8 The provincial level planning staff assumed that the information they received was reliable and did not consider any influence of asymmetric power relations on data or contract proposals (P3). No requests were made for advice or support from other provinces with previous experience in large-scale foreign land investments.

The investor invited high-level provincial and district authorities to participate in a study tour to the company's headquarter in China. According to the company representative, participants were selected based on whether they would be able to help the project (C). Participants were impressed by the size and economic strength of the company, as well as the stories they had heard about their bio-diesel factory and biofuel plantations in Africa. During interviews, several shared their excitement about having such an investor in the province, as they expected that it would lead to development, infrastructure, and prosperity (D2, P2, P4).

Returning home, the provincial authorities established a project coordination group and appointed a government official to be the provincial coordinator for the Chinese investment project. It was now his responsibility to assist the company representatives during negotiations with various villages in the district in order to identify land to establish the first plantations. The provincial coordinator was excited about the project and saw it as an excellent agricultural development project that could diversify cash crops, bring economic growth, and create employment opportunities in the villages. In his own words, a project that could make him “succeed as government official in serving his country by bringing economic development to the farmers in this poor part of Laos” (P4). Additionally, in his spare time, he established a nursery with 283,500 Mak Kao and Mai Hien seedlings to be sold to the investor for more than 215 million Lao Kip (~27,000 USD9 or around 15 times the national GPD/capita in 2013)10.

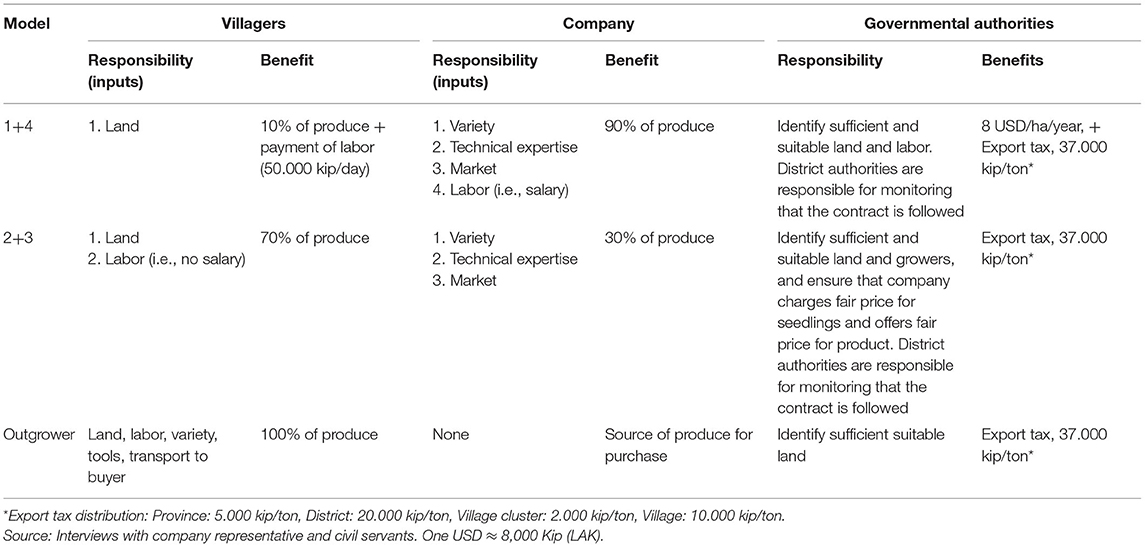

During the last half of 2013 the company and project coordinator prepared two investment models categorized as contract farming in addition to an out-grower model. Table 2 summarizes the distribution of responsibilities and benefits between actors for the different models. The two main models proposed were “1 + 4” whereby farmers would provide the land and get a salary for their work and “2 + 3” whereby they would provide the land, get a higher share of produce, but no salary. Several of the interviewees used “1 + 4” and “concession” interchangeably and villagers consistently called the “1 + 4” contract a “concession contract.” However, the word “concession” was avoided in all official papers due to the national moratorium on land concessions (see Dwyer, 2007).

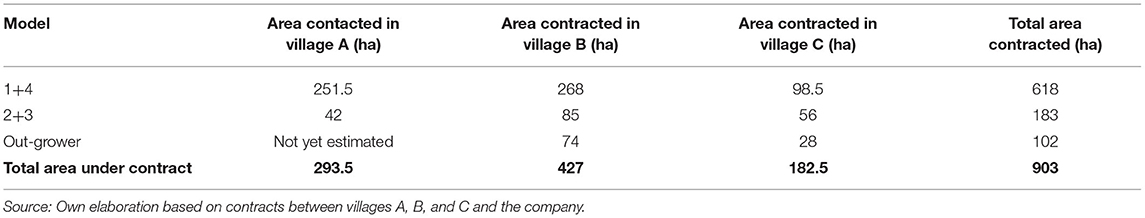

Based on the feasibility study, three villages (A, B, and C) were identified for project promotion by the provincial project coordinator and district level technical staff. Project promotion involved visits to the villages by the company representatives, accompanied by district and provincial technical staff. Their goal (formulated by the company) was to identify 1,000 ha of suitable land for the establishment of the first plantation, preferably under the 1+4 model. The district and provincial level technical staff also took part in the subsequent negotiations between the company and the villages, recommending that the villagers entered into contracts with the company, as this would create economic development for the villages.

In village A, the villagers first received the project presentation and the prospects of cash crop income with excitement. Combining the 1+4 and the 2+3 models, they expected to have paid work (in relation to the 1+4 establishment), while waiting for the Mak Khao to become productive in their own upland fields (using the 2+3 model) (V1). Forty-six of 51 households signed up as being interested in participating in the project–the remaining five households had businesses or government employment and therefore had no time or need to participate. Upon reflection, the villagers became skeptical about the salary and working conditions in the 1+4 model. Although district staff emphasized that there would be no transfer of ownership of the land in the 1+4 model, the village headman felt differently about the model. “In this model it is as if the company just uses local land for free, and the villagers just become laborers,” he said (V1). The villagers preferred the 2+3 model, as it would leave them more say about their land and its management (V1). When comparing documents and different interviews, it seems as if the minutes from the interest-expression meeting between each village and the investor were later re-elaborated into what then appeared as a survey of land to be used for the biofuel production in the village. According to the village head, however, no survey was ever made. Moreover, none of the local actors were in agreement with the 1+4 model having become the dominant mode of production in the contract material for all villages (Table 3).

In village A, where the company wanted to establish its first plantation, the location of the biofuel plantation was also an issue of contention. The company was interested in establishing the plantation under the 1+4 model on the village grassland. The villagers did not agree with this location as cattle provided one of their most important sources of income. Although the village authorities referred to the village Land Use Plan (made in 2012 by DAFO, delimiting village land into different land use classes) to argue against this location, district authorities highlighted the importance of changing the farming system for the sake of development (V1&2).

Feeling pressured by the district and provincial authorities to accept the plantation on their grassland, the village authorities tried to negotiate a land rent for the use of the village land. However, before they got as far to discuss the rental fee per hectare, the company had obtained a 1+4 contract signed by provincial level authorities. According to the village headman, when he further insisted on a land rent, the provincial-level project coordinator answered with a reference to the land law: “No, this is State land, so the provincial level should receive the fee for the land. Local people receive the fee for the labor” (V1). The village authorities ceased negotiating when national law was brought into the discussion, as the reply indicated that their land rights were limited, almost without any practical meaning, vis-à-vis the interests and power of the state institutions. They also felt threatened by the implicit interpretation of the request of village land rent as challenging national law.

In villages B and C, the village leaders were never excited about the agricultural development proposal presented by the company and the government representatives. They pointed out to the government officials that their land would not be suitable due to the high altitude and associated cold climate, but the technical staff insisted otherwise. As the Headman of Village B expressed: “We did not propose to participate. On the contrary, we have been told to produce in grassland, but we know that it is not productive. Mak Khao was forced on us by the province and the district; mainly the coordinators from both levels” (V5).

By the end of 2013, contracts had been signed by company representatives and village authorities for 903 hectares within the three villages (IP4 and document obtained). As shown in Table 3, the 1+4 model was the dominant one, covering two thirds of the area under contract. Besides being the preferred production model by the company, it would also give the provincial and district authorities an income from land rent. It is our interpretation that this unequal distribution of the two models reflect the different negotiating power of the parties, village population on the one hand, and district and provincial officials and company representatives on the other. Despite formal village land tenure not being affected by the 1+4 investment contract, the contract transferred all land use and access rights and related decision-making for the next 50 years to the company. Furthermore, the contract allowed the company to transfer the land to others during that period, something that may be indicative of a speculative investment agenda.

The investor focused on establishing the first plantation in Village A based on a 1+4 contract involving 203 hectares of land, which now had to be identified and delimited. According to the villagers, the company asked them for 100 hectares of grassland. Unfortunately, the villagers were not familiar with the measuring unit “hectares,” and when they were later told by the company that the identified land was insufficient, they had to rely on the company and their identification of a second area, approximately as large as the first one to complement the deficit. By delimiting the majority of the village grassland for the biofuel plantation, the villagers faced major changes in their livelihoods. The households had to reduce the number of livestock considerably and five households entirely gave up livestock raising (V1-4). None of the households in Village A started implementing the 2+3 model because the investor's representative did not allow them to (V1-4).

In May-July 2014 the company hired villagers to clear and fence one of the two delimited plantation areas and plant seedlings. The village authorities renegotiated the terms of payment, although these were stipulated in the contract, so that daily payments were made to temporary workers, while “overseers” were paid monthly. The overseers were village authorities, who were promised 2,500,000 Kip/month (about 310 USD/month), but, according to the interviewed village members, only got one quarter of that amount (V1-4). The company failed to provide fertilizer. When the head of the district technical staff realized this, he doubted the professionalism of the company for the first time and feared that the investors would also disregard other aspects of the agreements (D2). In August 2014, the company representatives went for a visit to the headquarter in China and hired overseers from the village to look after the plantation until October, when they would be back. A verbal agreement was made about payments to be made when the company representatives would return (V1-4).

Abandonment

By early 2015, the representatives of the investment company still had not returned and village authorities were tired of waiting. They contacted the project coordinator at the provincial level with questions about the fence maintenance and the planned development of the second delimitated plantation plot but were told to wait and that the investor would be back after Chinese New Year. Later they contacted district level technical staff to ask whether they could use the grassland since the company did not use it. They also requested the authorities to cancel the contract with the company, as the company did not fulfill their agreements and owed money to the villagers (V1-4). Yet, nothing happened, because such decisions are out of the hands of the district level authorities. When interviewed, district level authorities expressed that the contract should be canceled to ensure that other investors could come and make the land productive and create economic growth (D3). Later that year, a large area of the plantation burned after a fire that got out of control when the surrounding grasslands were burned. Fences were left open in parts so cattle could access the plantation. No one looked after the plantation anymore, but at the same time no-one dared to fully re-claim the land for cattle grazing.

People from the other two target villages also wished that the contracts be canceled (V5&6). As expected, The Mak Khao plants were frost-intolerant and villagers from Village B and C resented the bad advice given by provincial and district technical staff. None of the villagers knew anything about exit conditions and, indeed, no cancellation on their part was mentioned in the contract–only the company had the right to cancel.

Moreover, the negotiation process with the company and the authorities had negatively affected the perception of tenure security. The head of village A felt that they did not have rights to their land anymore and that village authorities were undermined by decisions made at higher administrative levels about the village land, despite its demarcation through the land use planning process. The local authorities felt that they now only experienced the duties related to village lands, without the associated rights: “Rights to land and forest… We only feel them in the case of forest fires: If there is a forest fire, then the district says: ‘That is your area; please go and stop it”’ (V1).

There were local rumors that the investment had been a scam to obtain Laotian documents that would allow the company to receive Chinese subsidies for foreign direct investments, or, in other words, a “virtual land grab.” Provincial level planning officials lamented that they got so eager and waived the required deposit to be made by foreign investors. In the future, they would investigate investor backgrounds better, said the Deputy Director, adding that pressure to accept investors had eased recently with increasing numbers of interested investors in the province (P2). Nonetheless, the provincial level officials saw it as an asset for Village A that a biofuel plantation had been established, even though the investor was gone. The biofuel plantation was putting land “that wasn't used” into use and “it does not affect livelihoods nor land use plans. Mak Khao is planted in bare land areas that are not used for agriculture. Furthermore, biofuel is only an extra activity,” adding to the existing livelihoods (P2). This rosy picture of the development potential brought to the village by the abandoned investment project clearly ignored the heavy dependency on livestock in the three villages and the negative livelihood consequences with reduced access to grazing.

In our last visit (November 2018), we were told by the former project coordinator that the project had finally been canceled. A cancellation letter had been issued and the company had paid its debts of over 200.000 million Kip (~26.000 USD) to different actors in the province (P4). This had been achieved–with the help of the highest provincial authorities–by putting pressure on the Laotian counterpart of the company in Vientiane. However, the trail of the cancellation and the compensation ended at the provincial level. Neither district officials nor village authorities had seen the cancellation letter (D4, D2 and V1) and in village A, the overseers still claimed not to have been paid. Nonetheless, just rumors about the letter had tangible effects. According to the District Governor, the land had been turned fully back to the communities, who were now “again free to use the land as they please” (D4). Provincial level officials said they would still welcome the company back, but that they would have to make a stronger contract, ensuring that plantations would materialize into production stage next time (P4). When the district officials informed the villagers that the project had been canceled, the villagers had taken down the barbed wire fence and divided it between those village members who were owed the most by the project. They returned to using the land as a common area for livestock grazing, as before the project. While the “plantation” is in bad shape, most households in the village now grow Mak Kao on a small scale. They sell the seeds, which have increased in price, to Lao or Vietnamese traders passing by (V1).

The village head and the other authorities from village A expressed concern about the role that the government officials had in establishing an entry-point for investors to the village land. “Authorities sided with the company…not [with] the villagers!” (V1). He was frustrated about the ease with which the higher-level authorities took land rights away from the village. “There is nowhere to go for advice or support,” he expressed. In the future, they would plan to ignore project proposals from the government (V1), as negotiations regarding the biofuel plantation had clearly shown them, through intimidation and fraud, that their land-use rights were not respected, and that confrontation was to be avoided. Government officials at district and provincial level knew this and expressed that they felt that their authority had been negatively affected vis-à-vis the villagers, as they endorsed the company through their presence during the project negotiations (D2, P2).

Discussion

The investment and subsequent abandonment by the Chinese company is a case in point confirming what has been shown elsewhere that land deals often fail to follow their original plans (Deininger, 2011; Arezki et al., 2013; Boche and Anseeuw, 2013). Our study thus responds to the calls for more research into why land deals fail, get abandoned or never get implemented (Schönweger and Messerli, 2015), and our longitudinal approach fills a gap of understanding how the local effects of abandonment evolve as government agencies and involved farmers slowly realize that the deal will remain unimplemented. The case study is also an example of what can be interpreted ex-post as a “virtual land grab” (McCarthy et al., 2012), as the documentation of the land and investment contracts most likely enabled the company to meet the firm's internal goals in its home country. While it is unclear exactly why the investor left Laos, the situation is similar to the instance when the same company abandoned a large-scale biofuel project in Zambia (Brautigam, 2015).

This does not mean that there was no implementation at all. Politically, the large-scale land deal actually “implemented” an expansion of state presence into the rural area, adding to previous efforts such as land use planning (Lestrelin et al., 2012; Castella et al., 2013; Broegaard et al., 2017). The relative poverty of the province and the eagerness of the provincial government to catch up economically with other provinces further exacerbated an unequal negotiation process between farmers, authorities, and company. This is common in states characterized as fragmented where different government agencies and provinces pursue contradicting goals or simply compete for power (Lund, 2011; Lu and Schönweger, 2017). In such a setting, state institutions get a dual-position operating both as a land-claimant vis-à-vis local land users, and as the authority that decides on land issues (Sikor and Lund, 2010), a situation not uncommon where land de jure is state property, like in many socialist and post-socialist countries. In our case study, local people temporarily regained their land access, but these rights may still be challenged if new investors search for a land deal as provincial planners and technical advisors are keen to get new investors to come to the province.

The role of provincial and municipal government officers in the negotiations between the foreign investor representatives and the local farmers and village authorities was characterized by favoritism toward the investor and lacked the required “degree of balance” for large-scale land investments to benefit out-growers (Lavers, 2012a). This is likely to occur when investors and influential government actors have overlapping interests (Li, 2011). However, information, advice, and knowledge of how to handle large scale land deals were lacking across the board. None of the interviewed Laotian actors in the province (except for staff at one provincial institution) had access to legal advice, nor did any of the local farmers' or villagers' associations have prior experiences with foreign investors. Unsurprisingly, the negotiations produced contracts that were unattractive for the villagers and advanced a specific kind of development toward cash crops and “modernization of agriculture,” further expanding the formal state influence on land use and the highly political character of the process as has been seen elsewhere (Borras et al., 2012; Rigg, 2020).

For the Lao decision makers and high-level technical staff, the land deal entailed a mix of career moves, ambitions to fulfill government policies, and personal benefits (although such personal benefits were never directly explained in the interviews). The pressure to fulfill the government's ambitious goals of economic growth, “modernization” and extending state sovereignty may also overrule local community interests in the future (German et al., 2011; Lavers, 2016). This lack of attention to local costs associated with large-scale land deals seems to be especially prevalent in settings where state institutions claim land rights (Sikor and Lund, 2010; Lund, 2011; Lu and Schönweger, 2017). Ultimately, the failure to respect villagers' interests, plans and livelihoods negatively affects how the villagers view the local authorities and creates everyday forms of resistance (Sikor, 2006; Ducourtieux, 2013; Hall et al., 2015). In the Laotian case, this was phrased as a desire to ignore future proposals from state institutions.

The negative effects that the investment had on the local livelihoods follows the general experience documented in the land-grab literature in which livelihood activities and land access are lost from the onset of a land deal, while potential positive livelihood impacts only materialize later, if at all, (Nolte, 2020; Chung and Gagné, 2021). The case also reiterates the contested and politized nature livelihoods that hinges on whether the land use of the local actors is recognized as important and productive, or seen as “backwards,” low-yielding or even denied political recognition by being labeled “idle” or on “unclaimed” land (Vandergeest and Peluso, 1995; Hall et al., 2011; Li, 2011, 2014; Lu and Schönweger, 2017; Rigg, 2020). In the examined case-study, national, provincial and even municipal decision-makers consider that the local production system requires modernization toward more cash-crop production, and livelihood losses suffered by local people from their more traditional land uses are ignored or considered insignificant compared to the expected gains from modernization.

Similarly, the discourse on “abandoned” or “unimplemented” land deals diverts attention from the political and non-productive aspirations that in some cases seem to be more important for investors and high-level planners and policy makers than the stated production-oriented goals. It is not only implemented land deals that can serve to enhance state sovereignty and fulfill higher economic and political visions with little regard for local people's opinions and right to self-determination (Dao, 2015; Lavers, 2016). The unimplemented and abandoned deals can have similar effects (Chung and Gagné, 2021).

Conclusions

This case study argues that simply portraying land deals that fall short of reaching the production phase as “failed” or “unimplemented” may conceal their negative implications for livelihoods and rights. This inaccurate terminology highlights the productive aspects of land deals, thereby overshadowing the political aspirations of land deals, which may not see production as the primary goal.

Furthermore, we show how land claims rarely vanish when the investor disappears after abandoning, or only partially implementing the land investment deal. Once land has been destined for cash crop production, planners expect it to contribute to national economic growth. What matters in this process of extending state influence is not whether an investor stays or leaves, but only that an investor was there (Lavers, 2016; Chung and Gagné, 2021). Discussing “unimplemented” or “abandoned” investment projects give the superficial impression of something being terminated and retracted, thereby letting the affected area return to a pre-investment situation. However, we show that by examining “unimplemented” large-scale land deals from a local land use and livelihood perspective, these projects still serve as a fulcrum for opening the land to planning and investment interests that are external to those of the local land users.

More research is needed for documenting and analyzing these processes of abandonment of stated objectives of land deals, paying attention to non-productive and political aspirations as well as to the different (mainly local) effects. Systematic research is lacking on what happens after the initial abandonment of a large-scale land deal. How often and how soon do land gets “opened up” into new investment-deals? How do local actors respond to second-round investment projects, and in what way are the municipal, provincial or national technical staff and politicians involved? Shedding light on these questions requires long timeframes in order to follow the development of the relationships “produced in and through place, property, power and production” (Wolford et al., 2013, p. 189) in the governance of the “unimplemented” land deals, or land deals that turn out to be motivated by other factors that those stated–maybe not only by the investor.

Data Availability Statement

The datasets presented in this article are not readily available because the data are not intended for uploading, as the individual interviews may possibly lead to the recognition of interviewed individuals, although names of places and persons are anonymized. Requests to access the datasets should be directed to cmlra2UuYnJvZWdhYXJkQGlnbi5rdS5kaw==.

Ethics Statement

The studies involving human participants were reviewed and approved by Det Frie Forskningsråd, Samfund og Erhverv. Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements.

Author Contributions

RB, TV, and OM have contributed to research design, fieldwork, analysis, and article writing. RB has led the work. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the Danish Council for Independent Research-Social Sciences under the research project Property and Citizenship in Developing Societies (ProCit), Grant # 11-104613 and the European Community's Seventh Framework Research Programme under the Grant Agreement # 265286 for the research project Impacts of Reducing Emissions from Deforestation and Forest Degradation and Enhancing Carbon Stocks (I-REDD+). The funding sources had no involvement in the study design, collection, analyses and interpretation of data, or in the writing process.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2022.789809/full#supplementary-material

Footnotes

1. ^It is relevant to see the state as operating through multiple actors across many levels and sectors, sometimes with contradicting interests, as argued by Wolford and colleagues in their call for an unbundling of the state, to see “government and governance as relationships, people and processes” (Wolford et al., 2013, p. 189). This enables a better understanding of the dynamic relationships of territory, sovereignty, authority and subjects that shape and are shaped by land deals (Wolford et al., 2013).

2. ^In this sense, all land initiatives affect the ongoing construction of new patterns of ownership and control over nature in frontier areas, working to reconfigure or to entrench political power, and providing new opportunities for particular actors while marginalizing others' (McCarthy et al., 2012).

3. ^For example through the High Level Panel of Experts on tenure rights (HLPE, 2011), the Principles for Responsible Investment in Agriculture and Food Systems (CFS, 2014), or through the development of standard requirements of the involvement of local populations (e.g., FPIC).

4. ^Data for DGP/capita 2019 data from https://psc-ho.lsb.gov.la and https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=LA, visited February 20, 2022.

5. ^Following Lao PDR National Assembly Law on Investment Promotion, Article 23, Clause 2, dated July 8th, 2009.

6. ^Agreement of Provincial Governor, No.1389/PG, dated on 28/12/2012.

7. ^Contract No. 0199/PAFO, dated on 4/4/2013.

8. ^Following the Lao PDR National Assembly Law on Investment Promotion, Article 23, Clause 5, dated July 8th, 2009.

9. ^Contract No. 149/SALaM, dated on 2/1/2014.

10. ^GPD/capita information from https://wits.worldbank.org/CountryProfile/en/Country/LAO/StartYear/2010/EndYear/2013/Indicator/NY-GDP-PCAP-CD (visited January 17, 2021).

References

Agrawal, A., Brown, D., and Sullivan, J. (2019). Are global land grabs ticking socio-environmental bombs or just inefficient investments? One Earth. 1, 159–162. doi: 10.1016/j.oneear.2019.10.004

Andriesse, E. (2011). State Capitalism and Vulnerable Livelihoods in Lao PDR. Rethinking Development in an Age of Scarcity and Uncertainty. New Values, Voices and Alliances for Increased Resilience. University of York: EADI and DSA.

Arezki, R., Deininger, K., and Selod, K. (2013). What drives the global “Land Rush”?. The World Bank Economic Review. 29, 207–233. doi: 10.1093/wber/lht034

Bachriadi, D., and Suryana, E. (2016). Land grabbing and speculation for energy business: a case study of ExxonMobil in East Java, Indonesia. Can. J. Dev. Stud. 37, 578–594. doi: 10.1080/02255189.2016.1197825

Baird, I. G. (2011). Turning land into capital, turning people into labour: primitive accumulation and the arrival of large-scale economic land concessions in the lao people's democratic republic. New Proposals: Journal of Marxism and Interdisciplinary Inquiry. 5, 10–26. Available online at: https://ojs.library.ubc.ca/index.php/newproposals/article/view/2264

Baird, I. G. (2014). The global land grab meta-narrative, asian money laundering and elite capture: reconsidering the cambodian context. Geopolitics. 19, 431–453. doi: 10.1080/14650045.2013.811645

Baird, I. G., and Fox, J. (2015). How land concessions affect places elsewhere: telecoupling, political ecology, and large-scale plantations in Southern Laos and Northeastern Cambodia. Land. 4, 436. doi: 10.3390/land4020436

Barney, K. (2007). Power, Progress and Impoverishment: Plantations, Hydropower, Ecological Change and Rural Transformation in Hinboun District, Lao PDR. Toronto, York Centre for Asian Research, York University.

Barney, K. (2009). Laos: the making of a ‘relational resource frontier’. Geogr. J. 175, 146–159. doi: 10.1111/j.1475-4959.2009.00323.x

Barney, K., and Van der Meer Simo, A. (2019). “Forest plantations and smallholder livelihoods: evidence from community. case studies in Lao PDR.” In: ACIAR Project FST/2014/047 - Project Working Paper, Vol. 5. Available online at: https://www.researchgate.net/publication/332142490_Forest_Plantations_and_Smallholder_Livelihoods_Evidence_from_Community_Case_Studies_in_Lao_PDR/link/5e58c2b74585152ce8f4c12c/download (accessed December 18, 2021).

Boche, M., and Anseeuw, W. (2013). Unraveling “land grabbing”: Different models of large-scale land acquisition in Southern Africa, The Hague, IIS, LDPI, IDS, PLAAS.

Borras, S. M., Kay, C., Gómez, S., and Wilkinson, J. (2012). Land grabbing and global capitalist accumulation: key features in Latin America. Can. J. Dev. Stud. 33, 402–416. doi: 10.1080/02255189.2012.745394

Borras, S. M. Jr., and Franco, J. C. (2012). Global land grabbing and trajectories of agrarian change: a preliminary analysis. J. Agrar. Chang. 12, 34–59. doi: 10.1111/j.1471-0366.2011.00339.x

Broegaard, R. B., Vongvisouk, T., and Mertz, O. (2017). Contradictory land use plans and policies in Laos: tenure security and the threat of exclusion. World Dev. 89, 170–189. doi: 10.1016/j.worlddev.2016.08.008

Castella, J.-C., Lestrelin, G., Hett, C., Bourgoin, J., Fitriana, Y. R., Heinimann, A., et al. (2013). Effects of landscape segregation on livelihood vulnerability: moving from extensive shifting cultivation to rotational agriculture and natural forests in Northern Laos. Hum. Ecol. 41, 63–76. doi: 10.1007/s10745-012-9538-8

CFS (2014). Principles for Responsible Investment in Farmland. The Committee on World Food Security. UNPRI Report. Available online at: https://www.fao.org/3/au866e/au866e.pdf (accessed December 19, 2021).

Chung, Y. B., and Gagné, M. (2021). Understanding land deals in limbo in Africa: A focus on actors, processes, and relationships. Afr. Stud. Rev. 64, 595–604. doi: 10.1017/asr.2021.73

Cotula, L. (2012). The international political economy of the global land rush: a critical appraisal of trends, scale, geography and drivers. Peasant Stud. 39, 649–680. doi: 10.1080/03066150.2012.674940

Cotula, L. (2013). The great African land grab? Agricultural investments and the global food system. London and New York, Zed. doi: 10.5040/9781350223196

Cotula, L., Oya, C., Codjoe, E. A., Eid, A., Kakraba-ampeh, M., Keeley, J., et al. (2014). Testing claims about large land deals in Africa: findings from a multi-country study. J. Dev. Stud. 50, 903–925. doi: 10.1080/00220388.2014.901501

Dao, N. (2015). Rubber plantations in the Northwest: rethinking the concept of land grabs in Vietnam. Peasant Stud. 42, 347–369. doi: 10.1080/03066150.2014.990445

Deininger, K. (2011). Challenges posed by the new wave of farmland investment. Peasant Stud. 38, 217–247. doi: 10.1080/03066150.2011.559007

Deininger, K., and Byerlee, D. (2011). Rising Global Interest in Farmland. Can it yield sustainable and equitable benefits?. Washington D.C.: The World Bank. doi: 10.1596/978-0-8213-8591-3

Ducourtieux, O. (2013). Lao state formation in phôngsali villages: rising intervention in the daily household phounoy reaction. Asian Stud. Rev. 37, 451–470. doi: 10.1080/10357823.2013.771771

Dwyer, M. (2007). Turning Land into Capital: A Review of Recent Research on Land Concessions for Investment in the Lao PDR. Vientiane: Working Group on Land Issues.

Dwyer, M. (2014). Micro-geopolitics: capitalizing security in Laos's golden quadrangle. Geopolitics. 19, 377–405. doi: 10.1080/14650045.2013.780033

Fontana, L. B., and Grugel, J. (2016). The politics of indigenous participation through “free prior informed consent”: reflections from the bolivian case. World Dev. 77, 249–261. doi: 10.1016/j.worlddev.2015.08.023

German, L., Schoneveld, G., and Mwangi, E. (2011). Processes of Large-Scale Land Acquisition by Investors: Case Studies from Sub-Saharan Africa. Global Land Grabbing. Institute of Development Studies, Brighton: LDPI.

Hall, D., Hirsch, P., and Li, T. M. (2011). Powers of exclusion: Land dilemmas in Southeast Asia. Honolulu, HI: University of Hawaii Press.

Hall, R., Edelman, M., Borras, S. M., Scoones, I., White, B., and Wolford, W. (2015). Resistance, acquiescence or incorporation? An introduction to land grabbing and political reactions ‘from below’. Peasant Stud. 42, 467–488. doi: 10.1080/03066150.2015.1036746

HLPE (2011). Land Tenure and International Investments in Agriculture. Rome: UN Committee on Food Security High Level Panel of Experts Report.

Holden, J., and Pagel, M. (2013). Transnational land acquisitions. What are the drivers, levels, and destinations, of recent transnational land acquisitions?. Nathan Associates LTD. Available online at: https://landmatrix.org/media/uploads/farmlandgraborguploadsattachment20130304-transnational-land-acquisitions-10pdf.pdf

Johansson, E. L., Fader, M., Seaquist, J. W., and Nicholas, K. A. (2016). Green and blue water demand from large-scale land acquisitions in Africa. PNAS. 113, 11471–11476. doi: 10.1073/pnas.1524741113

Kenney-Lazar, M. (2010). Land Concessions, Land Tenure, and Livelihood Change: Plantation Development in Attapeu Province, Southern Laos. Vientiane: Faculty of Forestry, National University of Laos.

Kenney-Lazar, M. (2012). Plantation rubber, land grabbing and social-property transformation in southern Laos. Peasant Stud. 39, 1017–1037. doi: 10.1080/03066150.2012.674942

Kugelman, M. (2009). “Introduction and Acknowledgements.” in Land Grab? The Race for the World's Farmland, Eds M. Kugelman and S. L. Levenstein (Washington, D.C.: Woodrow Wilson International Center for Scholars).

Lavers, T. (2012a). ‘Land grab’ as development strategy? The political economy of agricultural investment in Ethiopia. Peasant Stud. 39, 105–132. doi: 10.1080/03066150.2011.652091

Lavers, T. (2012b). Patterns of agrarian tranformation in Ethiopia: State-mediated commercialisation and the 'land grab'. Peasant Stud. 39, 795–822. doi: 10.1080/03066150.2012.660147

Lavers, T. (2016). Agricultural investment in Ethiopia: undermining national sovereignty or tool for state building? Dev. Change. 47, 1078–1101. doi: 10.1111/dech.12256

Lay, J., and Nolte, K. (2018). Determinants of foreing land acqusitions in low- and middle-income countries. J. Econ. Geogr. 18, 59–86. doi: 10.1093/jeg/lbx011

Lestrelin, G., Castella, J.-C., and Bourgoin, J. (2012). Territorialising sustainable development: the politics of land-use planning in Laos. J. Contemp. Asia. 45, 581–602. doi: 10.1080/00472336.2012.706745

Li, T. M. (2011). Centering labor in the land grab debate. Peasant Stud. 38, 281–298. doi: 10.1080/03066150.2011.559009

Li, T. M. (2014). What is land? assembling a resource for global investment. Trans. Inst. Br. Geogr. 39, 589–602. doi: 10.1111/tran.12065

Li, T. M. (2017). Rendering land investible: five notes on time. Geoforum. 82, 276–278. doi: 10.1016/j.geoforum.2017.04.004

LIWG (2012). Cases from the field: Coffee Plantation in Paksong District, Champasak. Vieniane: Land Issues Working Group (LIWG).

Lu, J., and Schönweger, O. (2017). Great expectations : Chinese investment in Laos and the myth of empty land. Territ. Politic. Gov. 7, 61–78. doi: 10.1080/21622671.2017.1360195

Lund, C. (2011). Fragmented sovereignty: land reform and dispossession in Laos. Peasant Stud. 38, 885–905. doi: 10.1080/03066150.2011.607709

McAllister, K. (2015). Rubber, rights and resistance: the evolution of local struggles against a Chinese rubber concession in Northern Laos. Peasant Stud. 42, 817–837. doi: 10.1080/03066150.2015.1036418

McCarthy, J. F., Vel, J. A. C., and Afiff, S. (2012). Trajectories of land acquisition and enclosure: development schemes, virtual land grabs, and green acquisitions in Indonesia's Outer Islands. Peasant Stud. 39, 521–549. doi: 10.1080/03066150.2012.671768

Messerli, P., Heinimann, A., Epprecht, M., Souksavath, P., Chanthalanouvong, T., and Minot, N. (2008). Socio-economic ATLAS of Lao PDR: An analysis based on the 2006 population and housing census. Bern and Vientiane: University of Bern, Geographica Bernensia.

Moreda, T. (2015). Listening to their silence? the political reaction of affected communities to large-scale land acquisitions: insights from Ethiopia. Peasant Stud. 42, 517–539. doi: 10.1080/03066150.2014.993621

Moreda, T., and Spoor, M. (2015). The politics of large-scale land acquisitions in Ethiopia: state and corporate elites and subaltern villagers. Can. J. Dev. Stud. 36, 224–240. doi: 10.1080/02255189.2015.1049133

Nolte, K. (2020). Doomed to fail? Why some land-based investment projects fail. Appl. Geogr. 122, 102268. doi: 10.1016/j.apgeog.2020.102268

Nolte, K., Chamberlain, W., and Giger, M. (2016). International Land Deals for Agriculture. Fresh insights from the Land Matrix: Analytical Report II. Bern, Montpellier, Hamburg; Pretoria: CDR, CIRAD, GIGA, University of Pretoria.

Oberlack, C., Tejada, L., Messerli, P., Rist, S., and Giger, M. (2016). Sustainable livelihoods in the global land rush? archetypes of livelihood vulnerability and sustainability potentials. Glob. Environ. Change. 41, 153–171. doi: 10.1016/j.gloenvcha.2016.10.001

Peluso, N., and Lund, C. (2011). New frontiers of land control: introduction. Peasant Stud. 38, 667–681. doi: 10.1080/03066150.2011.607692

Poulton, C., Tyler, G., Hazell, P., Dorward, A., Kydd, J., and Stockbridge, M. (2008). Commercial agriculture in Africa: lessons from success and failure. Background paper for the Competitive Commercial Agriculture on Sub-Saharan Africa (CCAA) Study, Washington and Rome, WB/FAO.

Rigg, J. (2012). Unplanned Development: Tracking Change in South-East Asia. London, New York: Zed Books. doi: 10.5040/9781350223769

Rigg, J. (2020). Rural Development in Southeast Asia. Cambridge, MA: Cambridge University Press. doi: 10.1017/9781108750622

Schoneveld, G. C., German, L. A., and Davison, G. (2014). The developmental implications of Sino-African economic and political relations. A preliminary assessment for the case of Zambia. Working Paper. Bogor: CIFOR.

Schoneveld, G. C., German, L. A., and Nutakor, E. (2011). Land-based investments for rural development? a grounded analysis of the local impacts of biofuel feedstock plantations in Ghana. Ecol. Soc. 16:10. doi: 10.5751/ES-04424-160410

Schoneveld, G. C., and Zoomers, A. (2015). Natural resource privatisation in Sub-Saharan Africa and the challenges for inclusive green growth. Int. Dev. Plan. Rev. 37, 95–118. doi: 10.3828/idpr.2015.10

Schönweger, O., Heinimann, A., Epprecht, M., Lu, J., and Thalongsengchanh, P. (2012). Concessions and Leases in the Lao PDR: Taking Stock of Land Investments. Bern and Vientiane: Centre for Development and Environment (CDE), University of Bern.

Schönweger, O., and Messerli, P. (2015). Land acquisition, investment, and development in the lao coffee sector: successes and failures. Crit. Asian Stud. 47, 94–122. doi: 10.1080/14672715.2015.997095

Sikor, T. (2006). Analyzing community-based forestry: local, political and agrarian perspectives. For Policy Econ. 8, 339–349. doi: 10.1016/j.forpol.2005.08.005

Sikor, T., and Lund, C. (2010). Access and property: A Question of Power and Authority. The Politics of Possession: Property, Authority and Access to Natural Resources, 1–22. doi: 10.1002/9781444322903.ch1

Sipangule, K. (2017). Agribusiness, smallholder tenure security and plot-level investments: evidence from rural Tanzania. Afr. Dev. Rev. 29, 179–197. doi: 10.1111/1467-8268.12271

Smalley, R., and Corbera, E. (2012). Large-scale land deals from the inside out: findings from Kenya's Tana Delta. Peasant Stud. 39, 1039–1075. doi: 10.1080/03066150.2012.686491

Sowerwine, J. (2004). Territorialisation and the politics of highland landscapes in Vietnam: negotiating property relations in policy, meaning and practice. Conserv. Soc. 2, 97–136. Available online at: https://www.jstor.org/stable/26396568

Suhardiman, D., and Giordano, M. (2014). Legal plurality: an analysis of power interplay in mekong hydropower. Ann. Assoc. Am. Geogr. 104, 973–988. doi: 10.1080/00045608.2014.925306

Suhardiman, D., Giordano, M., Keovilignavong, O., and Sotoukee, T. (2015). Revealing the hidden effects of land grabbing through better understanding of farmers' strategies in dealing with land loss. Land Use Policy. 49, 195–202. doi: 10.1016/j.landusepol.2015.08.014

Thongmanivong, S., Phengsopha, K., Chantavong, H., Dwyer, M., and Oberndorf, R. (2009). Concession or Cooperation? Impacts of Recent Rubber Investment on Land Tenure and Livelihoods: A Case Study from Oudomxai Province, Lao PDR. Bangkok: National University of Laos (NUoL), Rights and Resources Initiative (RRI) and Regional Community Forestry Training Center for Asia and the Pacific (RECOFTC).

Vandergeest, P., and Peluso, N. L. (1995). Territorialization and state power in Thailand. Theory and Society 24, 385–426. doi: 10.1007/BF00993352

Vongvisouk, T., Broegaard, R. B., Mertz, O., and Thongmanivong, S. (2016). Rush for cash crops and forest protection: neither land sparing nor land sharing. Land Use Policy. 55, 182–192. doi: 10.1016/j.landusepol.2016.04.001

Wåhlin, M. (2017). No business, no rights. Human rights impacts when land investments fail to include responsible exit strategies. The case of Addax Bioenergy in Sierra Leone. Report #86. Swedwatch. Available online at: https://swedwatch.org/wp-content/uploads/2017/11/86_Sierra-Leone_NY.pdf (accessed December 19, 2021).

Wolford, W., Borras, S. M J.r., Hall, R., Scoones, I., and White, B. (2013). Governing global land deals: the role of the state in the rush for land. Dev Change. 44, 189–210. doi: 10.1111/dech.12017

World Bank and UNCTAD (2014). The practice of responsible investment principles in larger-scale agricultural investments. Implications for Corporate Performance and Impact on Local Communities. World Bank report # 86175-GLB. Washington: World Bank and UNCTAD. p. 80.

Keywords: abandoned land deal, land grab, land access, tenure security, Laos

Citation: Broegaard RB, Vongvisouk T and Mertz O (2022) The Impact of Unimplemented Large-Scale Land Development Deals. Front. Sustain. Food Syst. 6:789809. doi: 10.3389/fsufs.2022.789809

Received: 05 October 2021; Accepted: 25 May 2022;

Published: 27 June 2022.

Edited by:

Pablo Pacheco, World Wildlife Fund, United StatesReviewed by:

Carla Roncoli, Emory University, United StatesKuan-Chi Wang, Academia Sinica, Taiwan

Keith Barney, Australian National University, Australia

Copyright © 2022 Broegaard, Vongvisouk and Mertz. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rikke Brandt Broegaard, cmlra2UuYnJvZWdhYXJkQGlnbi5rdS5kaw==

Rikke Brandt Broegaard

Rikke Brandt Broegaard Thoumthone Vongvisouk

Thoumthone Vongvisouk Ole Mertz

Ole Mertz