Abstract

In the context of rapidly rising consumer demand for green food, this paper aims to systematically examine how green technology investment and blockchain technology influence the channel selections and operational decisions of members in the sustainable food supply chain. The question of whether conventional farmers should invest in green technology and utilize blockchain to attract more consumers is a critical issue amid the growing consumer demand for green food. We developed two sustainable food supply chain game models: Mode A (online-offline hybrid channel) and Mode H (e-commerce platform channel). These modes include conventional farmers, green farmers, offline supermarkets, e-commerce platforms, and consumers preference to green food. Based on these modes, we explore the operational strategies and profitability of each supply chain member in Scenario N (without blockchain technology) and Scenario B (with blockchain technology), after green farmers introduce blockchain technology in fixed-cost and unit-cost modes. The analysis reveals that when farmers invest in green technology and adopt blockchain technology, food greenness improves, and consumers' willingness to purchase green food increases. Our findings suggest that farmers' green technology are crucial for boosting sales and profitability, particularly in comparison to different distribution channels. We recommend that conventional farmers, who are uncertain about the cost of adopting blockchain for green farmers, should prioritize a mixed online-offline channel that does not include blockchain technology. Notably, offline supermarkets are generally opposed to the introduction of blockchain in the hybrid channel. However, when the fixed or unit cost of blockchain technology falls below a certain threshold, the sales model of “green technology + blockchain technology + e-commerce platform” becomes more profitable for farmers. The results presented in this paper provide new insights for food supply chain members on the benefits and operational choices of adopting blockchain technology and investing in green technology across different channels. Additionally, this paper highlights the significant impact of changes in the cost coefficients of green technology and commission rate on the sales quantity, wholesale prices, and profits of all participants, which is essential for the efficient operation of the sustainable food supply chain.

1 Introduction

The intensification of globalization and the growth of the global population have significantly impacted the sustainability of supply chains, particularly in the food industry. The methods of food production, processing, transportation, and consumption all play a critical role in determining whether the entire food supply chain can achieve sustainable development (Govindan, 2018). The ongoing population growth continues to present challenges regarding resource utilization and food security (Duong et al., 2020). Additionally, as consumer standards rise, there is a rapid increase in the demand for higher-quality food, particularly green food. In 2021, China intensified its efforts to promote green agricultural development by encouraging the adoption of eco-friendly farming practices. Similarly, the European Union's Common Agricultural Policy advocates for environmentally sustainable cultivation methods, supporting the development of organic and green agriculture (Wang L. et al., 2024). The introduction of green food-related policies in multiple countries has also led to an increase in public recognition of green food.

Promoting green consumption requires stimulating consumers' pro-environmental sentiments, particularly on the demand side, which is crucial for enhancing the effectiveness of green policies and facilitating supply-side green reforms. As consumer preferences for green food become increasingly pronounced, farmers are incentivized to adopt green technology to produce environmentally friendly food products and attract a broader consumer base. These green technology include low-carbon processing techniques, eco-friendly packaging, and circular economy solutions (Lu et al., 2024). Consequently, addressing the crisis of consumer trust in green food and enhancing its information transparency have become urgent challenges that the industry must resolve.

The growing consumer demand for comprehensive information on food products, coupled with the need for greater transparency and the lack of trust in the current agricultural supply chain, suggests that blockchain-based data management could be highly beneficial in the agricultural sector (Kamble et al., 2020; Zhang et al., 2025). The decentralized and tamper-resistant characteristics of blockchain technology enable comprehensive traceability throughout all stages of the sustainable food supply chain, thereby ensuring the authenticity of green technology. Consumers can access detailed information regarding the production, processing, and distribution of each food product through blockchain systems, which enhances the credibility of product labeling (Fan et al., 2022). For example, Walmart has utilized blockchain technology to trace agricultural products in the United States and pork products in China. In addition, Ant Group's blockchain platform allows consumers to track the entire production process of food items produced under green technology by scanning QR codes, thereby strengthening their trust in the quality and safety of green food.1 This demonstrates that blockchain is not merely a technological advancement. It provides novel approaches for enhancing transparency and building trust in the global sustainable food supply chain. Nevertheless, the application of blockchain technology imposes additional costs on supply chain participants. Accordingly, determining the operational conditions under which the use of blockchain becomes a rational choice is a central focus of this study.

The rapid growth of e-commerce platforms has significantly expanded the sales channels for green food, with e-commerce platforms increasingly becoming a key sales avenue for these products. According to the Global E-commerce Report (Statista, 2024), global retail e-commerce sales are projected to exceed $4.1 trillion by 2024, with further growth anticipated in the coming years. The sales of green food on e-commerce platforms are also experiencing rapid growth. E-commerce platforms not only offer strong market penetration but also provide consumers with convenient shopping experiences, allowing green food to overcome geographical limitations and meet diverse consumer needs. Furthermore, when combined with blockchain technology, e-commerce platforms can offer a more transparent and trustworthy shopping environment. This paper also focuses on how different enterprises make strategic decisions regarding channel choices and operations, particularly in light of the cost associated with green technology investments in food production and the implementation of blockchain technology.

Specifically, the research questions addressed in this study can be summarized as follows: (1) Should blockchain technology be adopted in different food supply chain modes (online-offline hybrid channels and e-commerce platform channels) for conventional and green food? Do green farmers' choices differ across these channels, and how do these choices affect consumers and the social environment? (2) How does the use of blockchain technology impact green technology investment in food supply chains? What is the optimal strategy for adopting blockchain technology? (3) Which channel choice is more favorable for sustainable food supply chains? How do factors such as green technology investment cost and commission rate influence the adoption of blockchain technology and channel selection in sustainable food supply chains? To address these questions, we first established two sustainable food supply chain game models: one for conventional food sold offline and green food sold online via a hybrid channel (Mode A), and another for both conventional and green food sold online via an e-commerce platform (Mode H). Subsequently, we explored four scenarios based on Mode A and Mode H, considering both non-adoption and adoption of blockchain technology. Additionally, we examined the impact of farmers' green technology investment and blockchain technology on the channel selection of sustainable food supply chains, as well as the influence of consumer preference to food greenness, commission rate, and other factors on the sustainable food supply chain.

The remainder of this paper is organized as follows. Section 2 provides a review of the relevant literature. In Section 3, we describe the research questions and assumptions. Section 4 presents the analysis of the model. In Section 5, we conduct a comparative study of the four scenarios mentioned above. Section 6 concludes the paper and offers managerial implications. All equilibrium results and proofs are summarized in Appendix A.

2 Literature review

Our work is closely related to three key themes in existing research: food supply chain, sustainable food supply chains, and blockchain in the food supply chain. A brief review of these themes is provided below.

2.1 Food supply chain

In the field of food supply chain research, existing studies primarily focus on empirical research regarding issues such as food waste (Richards et al., 2021; Annosi et al., 2021), supply chain disruptions (Blessley and Mudambi, 2022; Singh et al., 2021), financial performance (Zhao et al., 2021), food safety (Jia et al., 2024; Nardi et al., 2020), and preservation challenges (Tabrizi et al., 2018). Jia et al. (2024) developed a quantitative statistical method to measure the diversity of international food supply chains in a detailed and precise manner. The findings indicate that increasing a country's food supply chain diversity enhances its resilience to food shocks. Some scholars have focused on the design and optimization of food supply chain configurations. Jonkman et al. (2019) addressed the supply chain design problem in the agricultural food industry, considering seasonality and harvest timing. Their research demonstrates that the uncertainty in agricultural food supply chains necessitates the identification of better supply chain configurations. Li et al. (2021) also contributed to the optimization of food supply chain configurations.

Additionally, several scholars have conducted modeling studies on food supply chains. Georgiadis et al. (2005) developed a model to analyze the extended supply chain firms at the strategic level, using a system dynamics approach to explore the impact of long-term planning capacity on food supply chains. They investigated capacity planning strategies for food supply chains with transient flows, considering market parameters. Diabat et al. (2012) proposed a model to examine the explanatory structural aspects of various risks in the food supply chain and discussed risk mitigation strategies. Zhang et al. (2023) examined the lack of motivation among suppliers and retailers in an agricultural supply chain to invest in preservation technology for farm products, and analyzed the optimal pricing and investment strategies under different sales models. Beheshti et al. (2022) focused on the role of reverse logistics and closed-loop supply chain optimization techniques in addressing urban food wastage. Their study provides cost-effective solutions for food supply chain managers to collaborate with other supply chain members.

With increasing environmental regulations and consumer demand for healthier food, there is an urgent need to shift the conventional food supply chain model toward a more green and sustainable approach. Several scholars have focused on issues related to pollution and emission reduction within food supply chains. Chebolu-Subramanian and Gaukler (2015) conducted a modeling study of pollution events in a food supply chain consisting of suppliers, processing centers, and retailers, analyzing the effects of product and supply chain attributes on these events. Jiang et al. (2025) examined the demand fluctuations faced by a food supply chain with an environmentally responsible supplier and retailer. They explored the incentives for suppliers to adopt option contracts through a Stackelberg game model, incorporating a strict carbon emission cap, and assessed the impact of these contracts on carbon emissions. Although food supply chain research has made significant progress at both theoretical and practical levels, its complexity and dynamic nature necessitate further investigation, particularly as the external environment evolves and consumer demand for green food continues to grow.

2.2 Sustainable food supply chain

Building upon the conventional food supply chain model, the sustainable food supply chain integrates the principles of green production, green logistics, and green consumption, aiming to achieve the sustainable development of the food supply chain through comprehensive eco-friendly management. In recent years, the sustainable food supply chain has attracted increasing attention from scholars. Regarding sustainable food supply chains, many studies have focused on case-based research. Verdouw et al. (2016) used the aquatic products supply chain as a case study, proposing an architecture to enable the implementation of an information system and verifying its feasibility. Wang Y. et al. (2024) conducted an online questionnaire survey to examine consumer attitudes toward green food consumption on live e-commerce platforms and the factors influencing these attitudes. Sharma et al. (2023) explored the impact of green practices, sustainability, and other factors on the food supply chain using a research methodology that combines fuzzy explanatory structural modeling, decision-making experiments, and interviews, exemplified by the fresh food supply chain in India. Qin et al. (2022) employed an empirical approach to examine the processes and implications of implementing green practices in food supply chains. Using the PLS-SEM model with data from 267 food processing companies in China and Pakistan, their study found that green practices play a crucial role in enhancing organizational performance.

Extrinsic factors, such as green food packaging and consumer preferences for green food, have also been extensively studied by scholars. Regarding green food packaging, Hajiaghaei-Keshteli et al. (2023) focused on identifying the most suitable packaging suppliers within the sustainable food supply chain using the TOPSIS method. At the consumer level, Cao et al. (2020) examined a supply chain of agricultural products comprising cooperatives, businesses, and environmentally conscious consumers, exploring the impact of green standards at different stages of the supply chain. Additionally, some scholars have considered the role of information technology in sustainable food supply chains (Ersoy et al., 2022). Camel et al. (2024) employed a quantitative survey methodology to explore the integration of blockchain technology with green food platforms and analyzed its impact on improving the economic performance of green food platforms. However, these studies overlooked the higher cost associated with green food and the potential issue of “greenwashing” in the context of sustainable food supply chain financing. In our study, we provide a clear decision on whether the food supply chain should undergo a green transition and whether blockchain technology should be applied, while emphasizing the importance of preventing greenwashing to the greatest extent possible.

2.3 Blockchain in the food supply chain

Blockchain technology, as an emerging information technology in recent years, is widely regarded as a crucial tool for addressing the challenges of information asymmetry and traceability in the food supply chain, owing to its decentralized, tamper-proof, and fully traceable characteristics. In research on the application of blockchain in the food supply chain, most scholars have focused on studying the operational strategies that leverage blockchain technology to track product information (Patelli and Mandrioli, 2020; Srivastava and Dashora, 2022). Latino et al. (2022) found that food traceability can improve market efficiency, enhance information sharing among all supply chain participants, and facilitate communication regarding food quality. Ma D. et al. (2024) examined the role of blockchain in food contamination, exploring its impact on the strategic deployment of retailers' contamination prevention efforts in a supply chain model. Treiblmaier and Garaus (2023) investigated the impact of blockchain technology on consumers' perceptions of product quality, using signal transmission theory and testing models. Ma J. et al. (2024) employed a dynamic game framework under both supplier-led and retailer-led modes to compare product quality levels and market participants' profits in the food supply chain before and after adopting blockchain-based traceability technology.

An increasing number of scholars have employed case studies to examine the role and impact of blockchain technology on food supply chains. Stranieri et al. (2021) analyzed three supply chains with different dimensions using a case study approach. The study's results demonstrated that blockchain technology positively impacts supply chain profitability and facilitates information management within the food supply chain. Casino et al. (2021) conducted a case study of a real supply chain in the dairy industry, proposing various linkages between blockchain-based models and their managerial impacts. Saurabh and Dey (2021) used a rating-based conjoint analysis approach to identify several potential drivers for the application of blockchain technology in the context of a wine supply chain. Ali et al. (2021) based on five in-depth case studies of halal food supply chains, showed that blockchain technology can help halal food SMEs achieve transparency in the food supply chain. Liu et al. (2022) investigated scenarios with and without blockchain in an imported fresh food supply chain, deriving the optimal pricing decision for the supply chain and identifying the conditions under which using blockchain is profitable in each model. Liu et al. (2021) also explored blockchain-enabled traceability, goodwill, and product freshness, examining whether e-platforms choose to resell or broker fresh food sales in competition with different traditional retailers.

Additionally, a few scholars have explored the application of blockchain in green supply chains. Duong et al. (2025) employed a PLS-SEM approach to investigate the impact of blockchain-enabled information transparency on consumers' willingness to purchase organic food. Tao and Chao (2024), drawing on signaling theory and structural equation modeling, examined how blockchain-based food traceability systems influence consumers' willingness to purchase organic agricultural products online. Kumar et al. (2023) identified the enablers of sustainable food supply chain management to improve food security through the use of the Internet of Things (IoT) and blockchain. They analyzed the relationship between these technologies to investigate their role in achieving zero hunger by transforming the sustainable food supply chain. Liu et al. (2020) studied a green produce supply chain with one producer and one retailer, considering changes in the freshness and greenness of produce. They established and analyzed benefit models for producers and retailers before and after adopting blockchain technology, and proposed a supply chain coordination contract with cost and benefit sharing. However, research on the adoption of blockchain in green supply chains is still in its early stages, with scholars neglecting the cost pressures associated with blockchain adoption. Given the significant cost of blockchain technology in practice, it is an important consideration for supply chain members when deciding whether to implement it. Our study focuses on examining the impact of blockchain cost on the choice of operating models for food supply chains. The differences between these studies and our paper are summarized in Table 1.

Table 1

| Representative paper | Food supply chain | Green technology investment | Consumer preference for green food | Blockchain technology | E-commerce platform | Channel selection | Model comparison |

|---|---|---|---|---|---|---|---|

| Jiang et al. (2025) | √ | √ | |||||

| Cao et al. (2020) | √ | √ | √ | ||||

| Ma D. et al. (2024) | √ | √ | √ | √ | |||

| Treiblmaier and Garaus (2023) | √ | √ | |||||

| Stranieri et al. (2021) | √ | √ | |||||

| Liu et al. (2021) | √ | √ | √ | √ | √ | ||

| Duong et al. (2025) | √ | √ | √ | ||||

| Kumar et al. (2023) | √ | √ | √ | ||||

| Liu et al. (2020) | √ | √ | √ | ||||

| This study | √ | √ | √ | √ | √ | √ | √ |

Comparisons between this study and related literature.

As shown in Table 1, existing literature on food supply chain management has become relatively mature, with some scholars also addressing the issue of green investment in food supply chains. Many studies employ econometric analysis or case study methods to examine green supply chains. However, due to the inefficiency of food supply chains and the growing consumer demand for green food, the need to utilize blockchain technology to enhance the economic benefits of green supply chains underscores the necessity for further research in this area. Nevertheless, studies using supply chain models to identify optimal strategies for sustainable food supply chains aimed at improving their economic performance are still limited. Our research is similar to that of Liu et al. (2021). However, their study primarily focuses on the sales channel choices of traditional retailers, without considering green food investment issues or the cost associated with blockchain. Additionally, research on the integration of e-commerce platforms with blockchain technology is still in its early stages. As consumer demand for transparency in green food increases, competition between conventional and green food across multiple channels is becoming a common phenomenon. Given the variety of sales channel choices, determining how different farms and supply chain members can make optimal strategic decisions is an urgent issue that needs to be addressed to improve food supply chain efficiency. Furthermore, based on the cost of adopting blockchain technology, identifying the right timing for green food investment and integrating blockchain technology is a key research challenge.

Within the scope of our research, we innovatively consider the timing for conventional farmers to invest in green technologies and introduce blockchain, providing clear decision-making guidelines. We found that there is no absolute optimal sales model for sustainable food supply chains. Factors such as farmers' investment in green technologies, the cost of using blockchain technology, and the commission fees for e-commerce platform sales are all crucial in influencing farmers' choices of sales channels and the adoption of blockchain technology. Therefore, it is necessary to identify the reasonable ranges for these influencing factors to maximize the profits of all members in the sustainable food supply chain.

3 Problem description and assumptions

3.1 Problem description

This study considers a sustainable food supply chain comprising conventional farmers, green-effort farmers, supermarkets, and e-commerce platforms, where farmers serve as the upstream suppliers of the entire chain. The e-commerce platform earns revenue by charging a commission on consignment sales, while the supermarket profits from the margin between the wholesale and retail prices. Accordingly, farmers can be regarded as the leaders within the supply chain (Zhang et al., 2025). They decide whether to invest in green technology and whether to adopt blockchain technology to enhance the transparency of green attributes, thereby increasing consumer preference for green food and stimulating demand. Moreover, both conventional and green farmers face the option of selling their products through offline supermarket channels or e-commerce platforms.

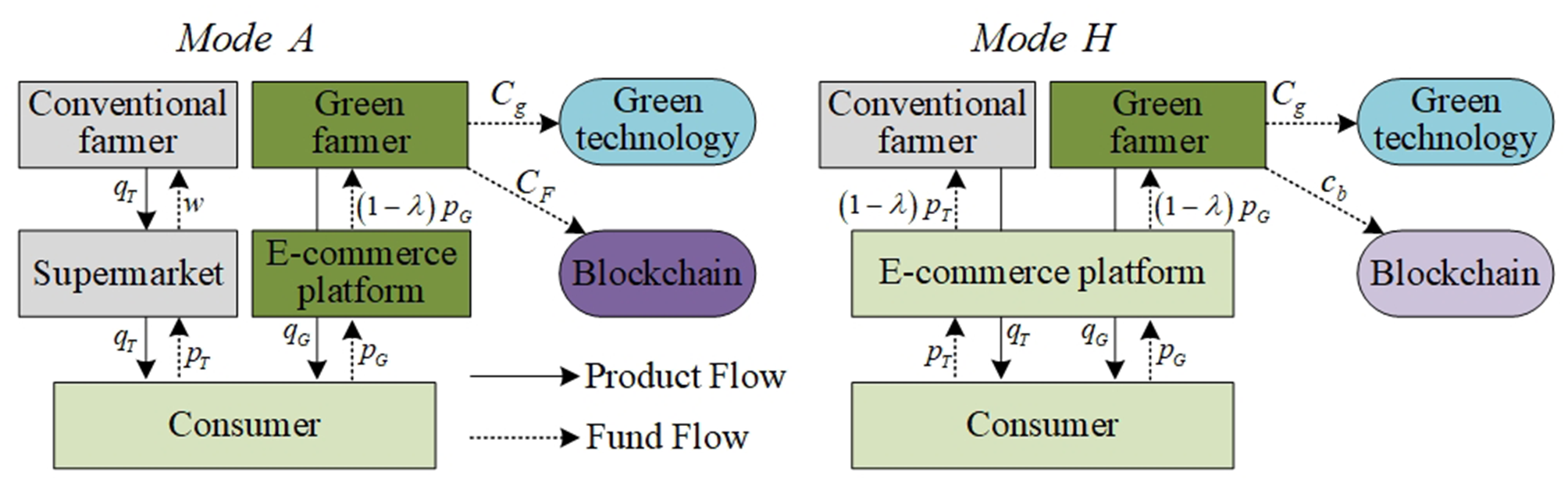

We construct two fundamental sustainable food supply chain structures, referred to as Mode A and Mode H, based on variations in farmers' green technology investment, blockchain adoption, and sales channel selection. Given the substantial costs associated with blockchain infrastructure, and considering real-world practices such as JD Chain2 and AntChain, we do not model the development of blockchain systems by e-commerce platforms. Instead, blockchain services are assumed to be provided by the e-commerce platform, and farmers choose among different blockchain usage cost structures. In Mode A, a fixed cost is charged for the use of blockchain technology (Liu et al., 2021), whereas in Mode H, a unit cost is applied based on the quantity of products sold (Qin et al., 2025), as illustrated in Figure 1.

Figure 1

Sustainable food supply chain structures.

Based on the two basic sustainable food supply chain structures, Mode A and Mode H, and within the framework of a Stackelberg game, we introduce two scenarios: Scenario N, where the green farmers do not adopt blockchain technology, and Scenario B, where the farmers adopt it. Four scenarios are formed, (1) Scenario AN, in which the conventional farmers choose the traditional offline supermarket channel and the green farmers choose the online e-commerce channel and does not adopt blockchain technology; (2) Scenario AB, where conventional farmers choose the traditional offline supermarket channel, green farmers choose the online e-commerce channel and adopt blockchain technology; and (3) Scenario HN, where both conventional and green farmers adopt the online e-commerce platform channel, and green farmers do not adopt blockchain technology. (4) Scenario HB, where both conventional and green farmers adopt online e-commerce platform channels and green farmers adopt blockchain technology.

We adopt a game-theoretic modeling approach because it effectively captures the strategic interactions among different types of farmers, supermarkets, and e-commerce platforms. Game theory enables the identification of equilibrium strategies under various scenarios and facilitates a deeper analysis of how green technology and blockchain adoption impact supply chain members. This approach provides actionable insights for optimizing sustainable agricultural supply chains. The decision-making sequence is structured as follows. In Mode A: Step 1: The farmers decide whether to adopt green technology and blockchain, and the green farmers determine the food greenness. Step 2: The conventional farmers set the wholesale price. Step 3: The green farmers and the conventional farmers independently decide on their respective sales quantities, denoted as qT and qG. In Mode H: Step 1: The farmers decide whether to adopt green technology and blockchain, and the green farmer determines the food greenness. Step 2: The green farmers and the conventional farmers independently decide on their respective sales quantities, qT and qG. We employ backward induction, starting from the final stage and sequentially deriving the optimal decisions at each preceding stage. This ensures that each decision is made with full consideration of future optimal responses, ultimately leading to a globally optimal solution. The equilibrium outcomes for all four scenarios are thus obtained (Ma D. et al., 2024; Niu et al., 2023; Wang et al., 2023).

3.2 Parameter setting and symbol description

The parameter settings and symbol descriptions in this paper are summarized in Table 2.

Table 2

| Parameters | Definitions |

|---|---|

| a | Total market potential |

| Retail price of green food in scenario J, where J ∈ {AN, AB, HN, HB} | |

| Retail price of conventional food in scenario J, where J ∈ {AN, AB, HN, HB} | |

| wJ | Wholesale price of conventional farmers in scenario J, where J ∈ {AN, AB} |

| λ | The commission rate |

| η | The coefficient of consumers' food greenness preference before adopting blockchain technology |

| γ | The coefficient of consumers' food greenness preference after adopting blockchain technology |

| CF | Fixed cost of blockchain technology |

| cb | Unit blockchain technology cost |

| Green technology investment cost in scenario J, where J ∈ {AN, AB, HN, HB} | |

| k | The coefficient of green technology investment cost |

| gJ | Food greenness in scenario J, where J ∈ {AN, AB, HN, HB} |

| The sales quantity of i in scenario J, where i ∈ {T, G, R, O}, J ∈ {AN, AB, HN, HB}, T (Conventional farmers), G (Green farmers), R (Supermarkets), O (E-commerce platforms) | |

| The profit of i in scenario J, where i ∈ {T, G, R, O}, J ∈ {AN, AB, HN, HB} |

Notations.

3.3 Assumptions

Assumption 1. Based on the literature of Liang and Ye, we assume that the inverse demand function for conventional farmers is , where J ∈ {AN, AB, HN, HB}. The inverse demand function for green farmers without adopting blockchain technology is , where J ∈ {AN, HN}, and the inverse demand function for Farmers G with blockchain adoption is , where J ∈ {AB, HB}(Liang and Ye, 2024). Referring to the work of Niu et al. (2021a) to highlight the increased transparency of green food information and the stronger consumer preference for green food after green farmers adopt blockchain technology, we assume that η = 1, .

Assumption 2. To ensure that all equilibrium outcomes and the profits of supply chain members are positive, the parameter intervals are kept consistent during model comparison, assuming that , , where , (Niu et al., 2023).

Assumption 3. According to the commission structures of large e-commerce platforms such as JD, Taobao, and Amazon, we assume the commission rate λ is an exogenous variable and (Zou et al., 2020).

Assumption 4. To ensure that all equilibrium results are positive, the parameter ranges are kept consistent during the model comparison process. It is assumed that the green technology investment cost is , and , (Zou et al., 2020; Xu et al., 2025).

Assumption 5. In practice, small-scale farmers may face technological barriers to adopting blockchain, and consumer acceptance of blockchain-traced food may vary across regions. However, since this study focuses on examining the impact of farmers' adoption of green technology and blockchain under different channel structures on the supply chain, we assume that farmers do not face any technical obstacles in adopting blockchain and that there are no regional differences in consumer preferences toward blockchain-enabled traceability (Duong et al., 2025; Tao and Chao, 2024; Wang et al., 2023; Niu et al., 2021b).

4 Model analysis

This section analyzes the equilibrium results and the profits of supply chain members for Mode A and Mode H, considering Scenario N (AN, HN) without blockchain adoption and Scenario B (AB, HB) with blockchain adoption. Additionally, the comparative study of supply chain members' channel choices across the four scenarios is presented.

4.1 Mode A

4.1.1 Scenario N: without blockchain technology

In the Scenario AN, the conventional farmers decide the wholesale price wAN and sales quantity of conventional food , while green farmers decide the food greenness gAN and sales quantity , without introducing blockchain technology. The e-commerce platform determines the commission rate, and green farmers share the sales revenue with the e-commerce platform based on the commission rate. The profit functions for conventional farmers, green farmers, supermarkets, and e-commerce platforms can be expressed as follows:

The equilibrium outcomes of Scenario AN are obtained by solving the problem by backward induction, is shown in Table 3.

Table 3

| Equilibrium outcomes | |||

|---|---|---|---|

| gAN* | |||

| wAN* | |||

Equilibrium outcomes of Scenario AN.

Proposition 1. Comparing the green food channel and the conventional food channel in Scenario AN:

(1) The sales quantity of green food is higher than that of conventional food, i.e., ;

(2) The profit of green farmers is higher than that of conventional farmers, i.e., ;

(3) Ifand, the profit of offline supermarkets is higher than that of e-commerce platforms, i.e., .

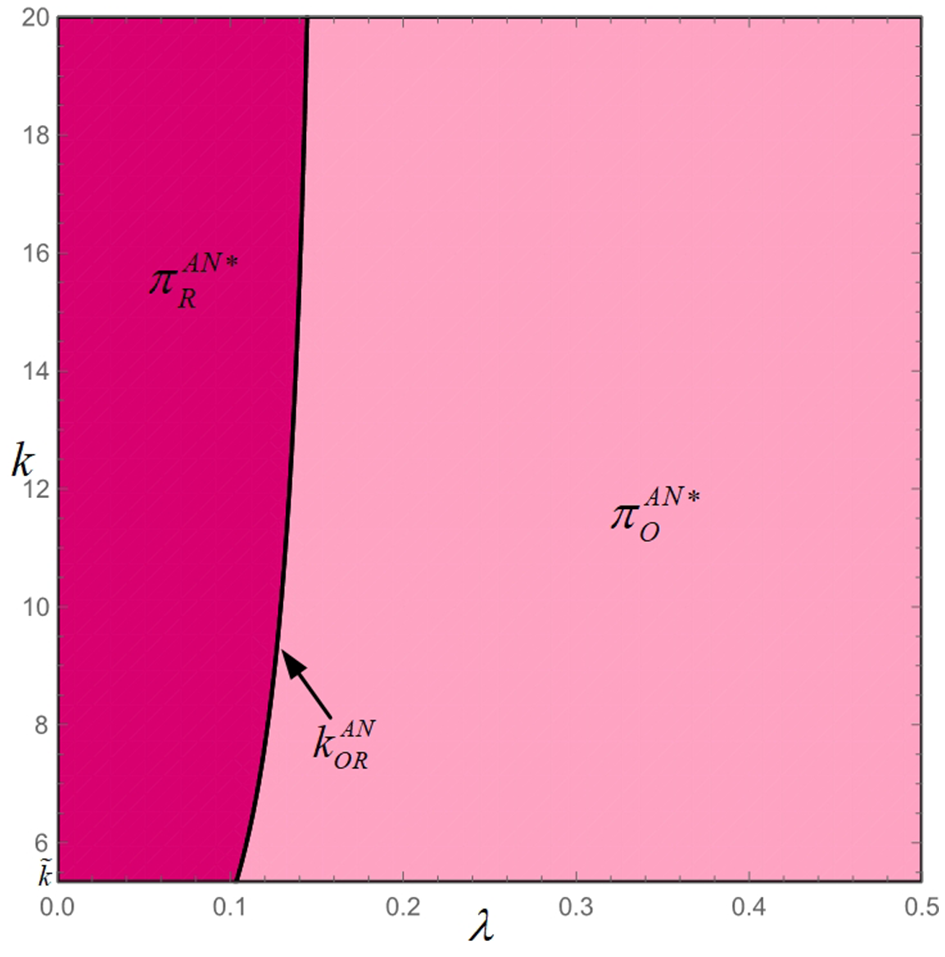

Proposition 1. (1) and (2) indicate that, compared to the conventional food channel, the green food channel in Scenario AN leads to higher sales quantity of green food (i.e., ). This is because green farmers, who invest in green technology, are favored by consumers. Additionally, the profit of green farmers is greater than that of conventional farmers (i.e., ), as shown in Figure 2. This demonstrates that investing in green technology and selling green food through e-commerce platform is profitable for green farmers.

Figure 2

Impact of λ and k on .

Proposition 1. (3) shows that, unlike in Propositions 1. (1) and (2), green farmers who invest in green technology have both a sales and profit advantage. When the commission rate is relatively low and the cost coefficient of green technology investment is high (i.e., and ), e-commerce platform selling green food will lose their profit advantage, as illustrated in Figure 3. This indirectly indicates that the cost coefficient of green technology investment not only affects the profits of farmers but also influences the profits of e-commerce platforms.

Figure 3

Impact of λ and k on and .

4.1.2 Scenario B: with blockchain technology

In the Scenario AB, the conventional farmers decide the wholesale price wAB and sales quantity of conventional food , while green farmers decide the food greenness gAB and sales quantity , with introducing blockchain technology. The e-commerce platform determines the commission rate, and green farmers share the sales revenue with the e-commerce platform based on the commission rate. The profit functions for conventional farmers, green farmers, supermarkets, and e-commerce platforms can be expressed as follows:

The equilibrium outcomes of Scenario AB are obtained by solving the problem by backward induction, is shown in Table 4.

Table 4

| Equilibrium outcomes | |||

|---|---|---|---|

| gAB* | |||

| wAB* | |||

Equilibrium outcomes of Scenario AB.

Proposition 2. Comparing the green food channel and the conventional food channel in Scenario AB:

(1) The sales quantity of green food is higher than that of conventional food, i.e., ;

(2) If, the profit of green farmers is higher than that of conventional farmers, i.e., ;

(3) If, and, the profit of supermarket is higher than that of e-commerce platform, i.e., .

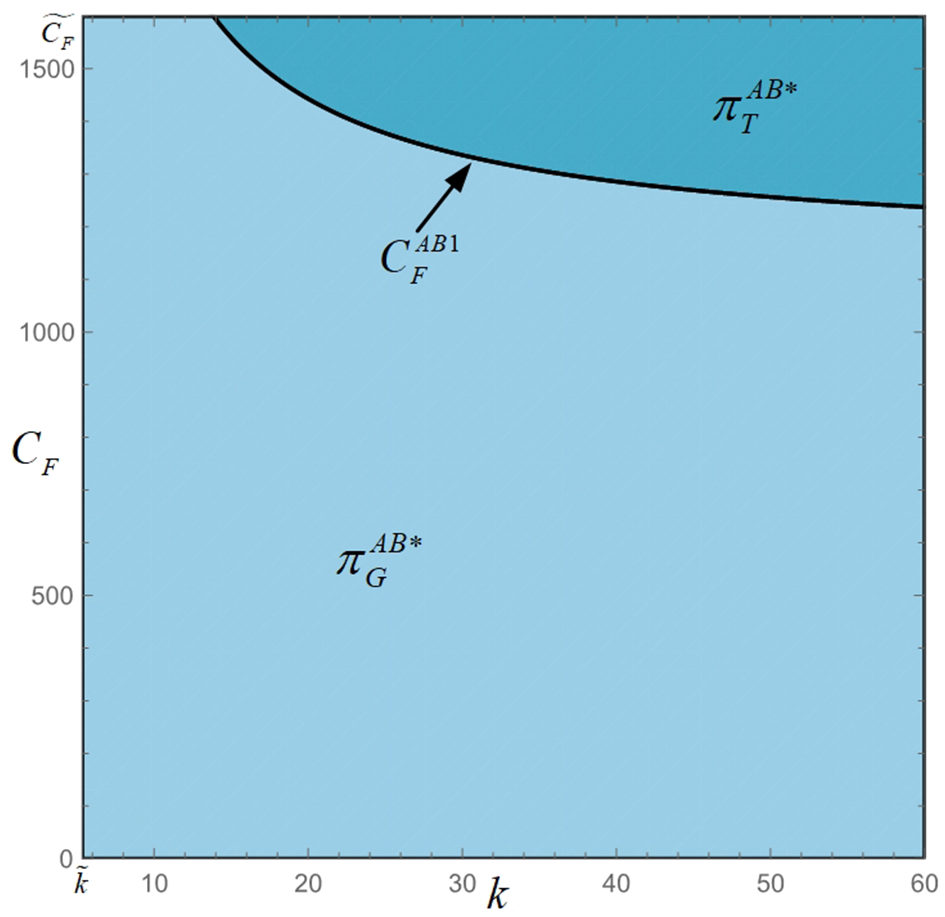

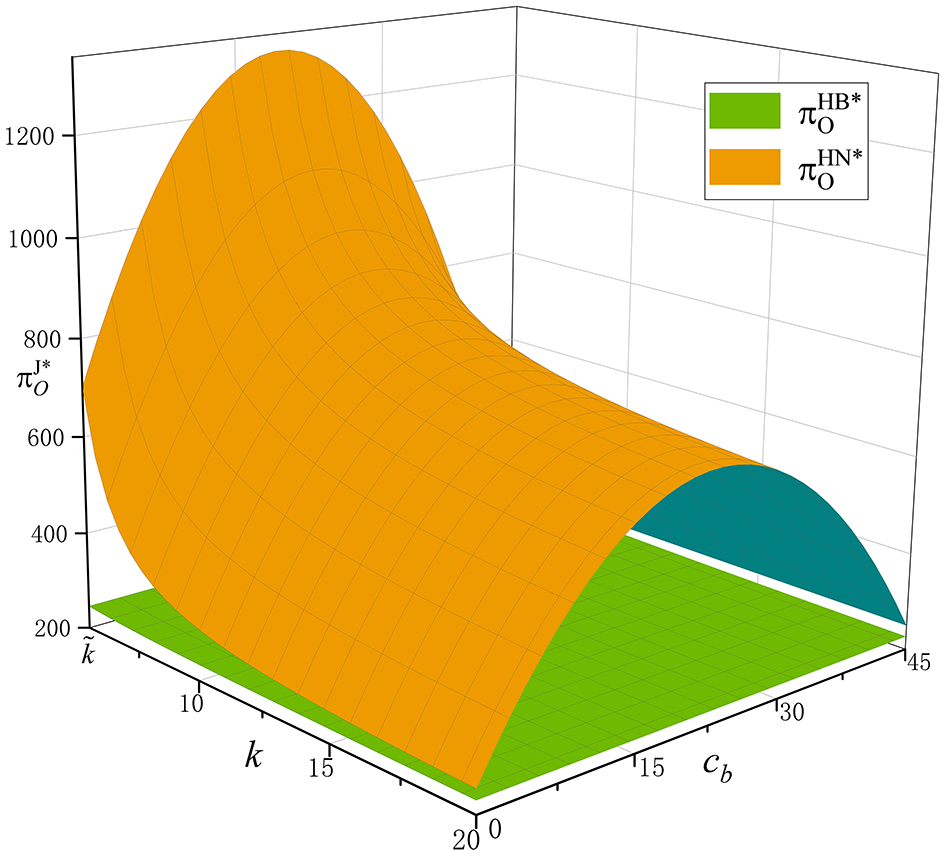

Proposition 2. (1) indicates that, similar to Proposition 1. (1), in the Scenario AB, the green food channel consistently outperforms the conventional food channel in terms of sales. This is because green farmers, who invest in green technology, are favored by consumers. After adopting blockchain technology, the sales quantity of green food is always greater than that of conventional food (i.e., ). However, whether green farmers, after adopting blockchain technology, have a price advantage over conventional farmers depend on the fixed cost of blockchain technology. Proposition 2. (2) shows that when the fixed cost of blockchain are below a certain threshold (i.e., ), green farmers will earn higher profits (i.e., ), as illustrated in Figure 4.

Figure 4

Impact of k and CF on and .

It is important to note that in Proposition 2. (3), even when supermarket selling conventional food are more profitable (i.e., ), the fixed cost of blockchain need to be controlled within a certain range (i.e., ), as shown in Figure 5. This is because, when the commission rate is relatively low and the cost coefficient of green technology investment is high (i.e., and ), supermarket is more profitable. In this case, for all supply chain members to avoid being overwhelmed by excessive blockchain cost, the fixed cost of blockchain technology must be kept within a reasonable range.

Figure 5

Impact of k and CF on and .

4.2 Mode H

4.2.1 Scenario N: without blockchain technology

In the Scenario HN, both conventional farmers and green farmers sell conventional and green food through e-commerce platform. Conventional farmers decide the sales quantity of conventional food , while green farmers decide the food greenness gHN and sales quantity of green food . Additionally, green farmers decide not to adopt blockchain technology. Both conventional and green farmers share the sales revenue with the e-commerce platform based on the commission rate λ. The profit functions for conventional farmers, green farmers, and the e-commerce platforms can be expressed as follows:

The equilibrium outcomes of Scenario HN are obtained by solving the problem by backward induction, is shown in Table 5.

Table 5

| Equilibrium outcomes | |||

|---|---|---|---|

| gHN* | |||

Equilibrium outcomes of Scenario HN.

Proposition 3. Comparing the green food channel and the conventional food channel in Scenario HN:

(1) The sales quantity of green food is higher than that of conventional food, i.e., ;

(2) The profit of green farmers is higher than that of conventional farmers, i.e., ;

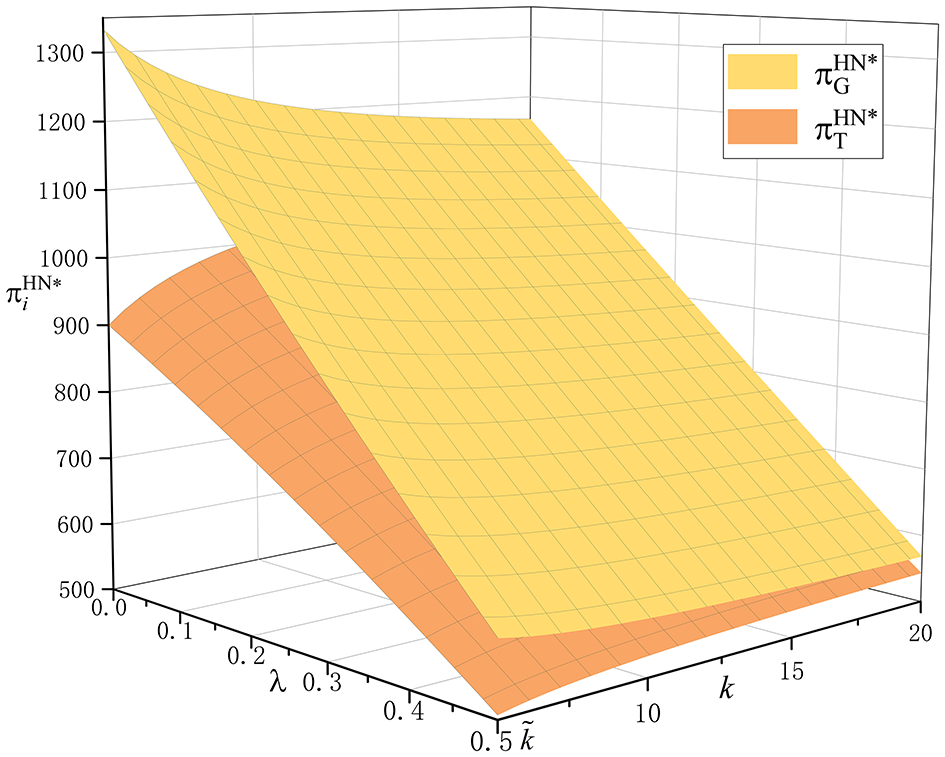

Proposition 3. (1) and (2) indicate that, compared to the green food and conventional food channels in the Scenario HB, the results are similar to Proposition 1. Due to the green farmers' investment in green technology, which is favored by consumers, the sales quantity of green food is greater than that of conventional food (i.e., ). Furthermore, the profit of green farmers is greater than that of conventional farmers (i.e., ), as shown in Figure 6.

Figure 6

Impact of λ and k on .

Proposition 3 demonstrates that investing in green technology is profitable for farmers in the food supply chain. Combined with Proposition 1, it can be observed that, regardless of whether conventional food is sold through offline supermarket channel or e-commerce platform, the investment in green technology by farmers is a key factor in increasing profits, when compared to different sales channels.

4.2.2 Scenario B: with blockchain technology

In the Scenario HB, both conventional farmers and green farmers sell conventional and green food through e-commerce platform. Conventional farmers decide the sales quantity of conventional food , while green farmers decide the food greenness gHB and sales quantity of green food . Additionally, green farmers decide to adopt blockchain technology. Both conventional and green farmers share the sales revenue with the e-commerce platform based on the commission rate λ. The profit functions for conventional farmers, green farmers, and the e-commerce platforms can be expressed as follows:

The equilibrium outcomes of Scenario HB are obtained by solving the problem by backward induction, is shown in Table 6.

Table 6

| Equilibrium outcomes | |||

|---|---|---|---|

| gHB* | |||

Equilibrium outcomes of Scenario HB.

Proposition 4. Comparing the green food channel and the conventional food channel in Scenario HB:

(1) If, the sales quantity of green food is higher than that of conventional food, i.e., ;

(2) If, the profit of green farmers is higher than that of conventional farmers, i.e., ;

Proposition 4. (1) indicates that, compared to the green food and conventional food channels in the Scenario HB, the unit cost of blockchain is a key factor influencing food sales. When the unit cost of blockchain is high (), the sales quantity of green food exceeds that of conventional food (). From the consumer's perspective, as the blockchain cost paid by green farmers increases, the greenness of the food becomes more authentic, which can enhance consumers' preference for green food that adopts blockchain technology, thus increasing the sales quantity of green food.

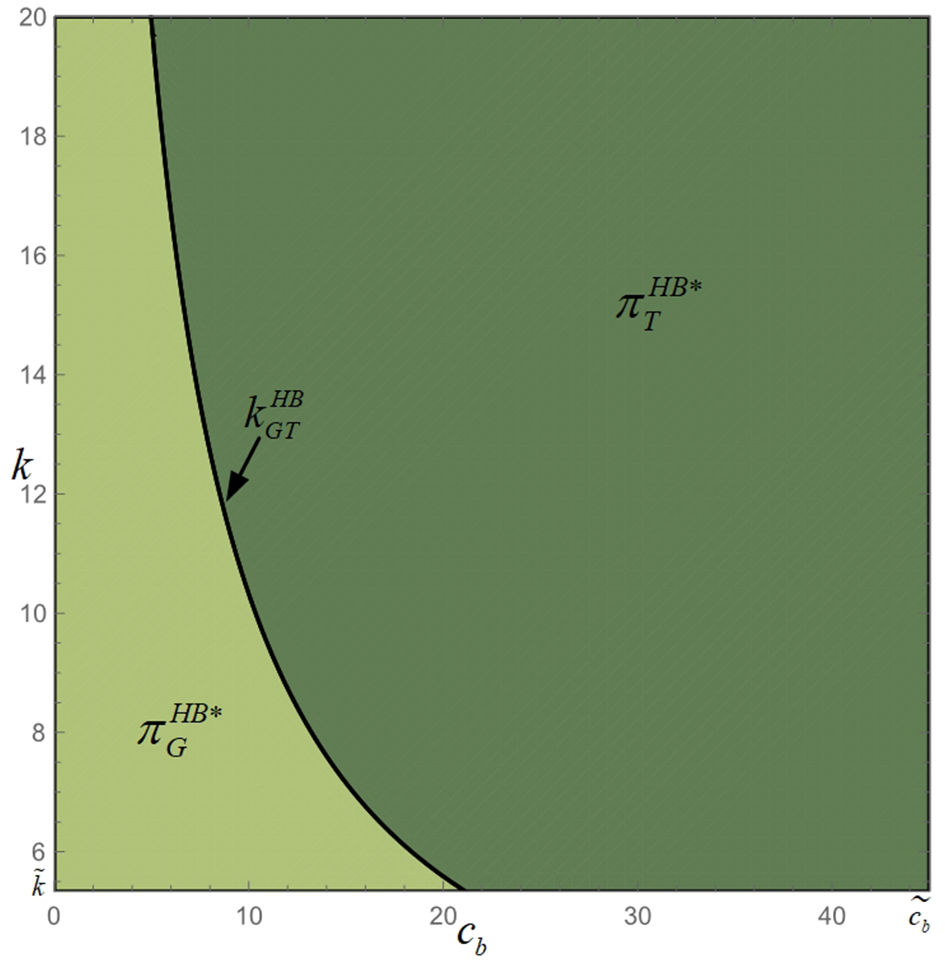

Proposition 4. (2) shows that, from the profit perspective of conventional and green farmers, when the cost coefficient of green food technology is relatively low (), the profit of green farmers is greater than that of conventional farmers (), as illustrated in Figure 7. This is because the profits of both conventional and green farmers depend not only on changes in sales quantity but also on whether they invest in green technology. The size of the green technology investment cost coefficient plays a more critical role for green farmers.

Figure 7

Impact of cb and k on and .

5 Model comparison

In this section, we examine the advantages of adopting blockchain technology and assess which sales channel is more profitable. We compare different scenarios from various perspectives, focusing on a comparison between “AN vs. AB” and “HN vs. HB”.

5.1 AN VS. AB

Corollary 1. In Mode A, sensitivity analysis ofkresults in:

(1) For the food greenness, we haveand;

(2) For the wholesale price, we haveand;

(3) For the sales quantity of conventional food, we haveand

(4) For the sales quantity of green food, we haveand.

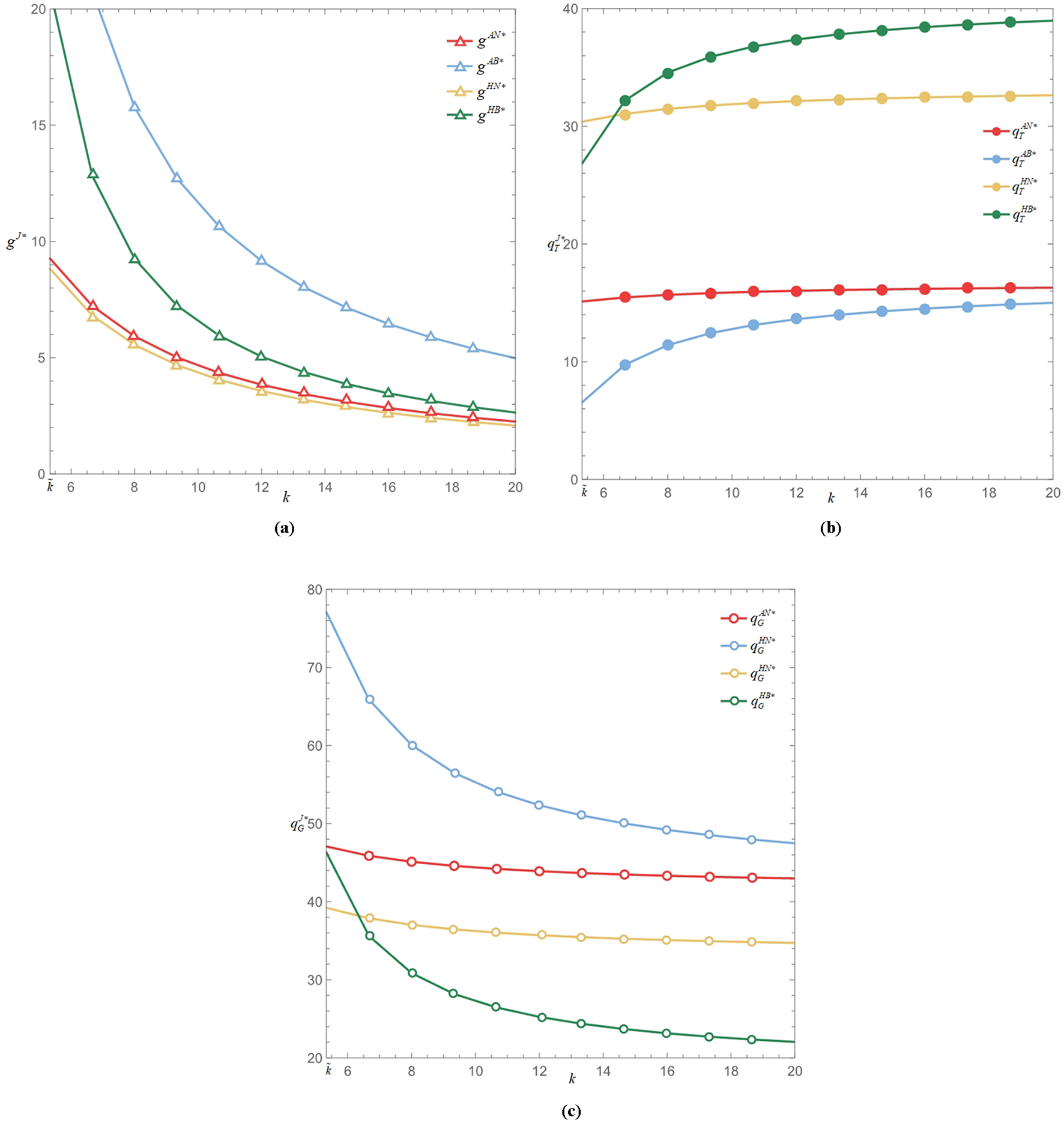

Corollary 1 indicates that, based on Mode A, the cost coefficient of green technology will affect the equilibrium outcomes in both scenarios N and B, regardless of whether green farmers introduce blockchain technology. Moreover, the impact of the green technology investment cost coefficient on food greenness, wholesale price, conventional food sales quantity, and green food sales quantity follows the same trend in both scenarios N and B. As the green technology investment cost coefficient increases, both food greenness and green food sales quantity decrease (, ; , ). This is because an increase in the green technology investment cost coefficient raises the cost of green technology investment, and excessive cost lead green farmers to reduce their investment in food greenness. As a result, the wholesale price and sales quantity of conventional food will increase (, ; , ). There is always a “one increases, the other decreases” situation between the sales quantity of conventional and green food.

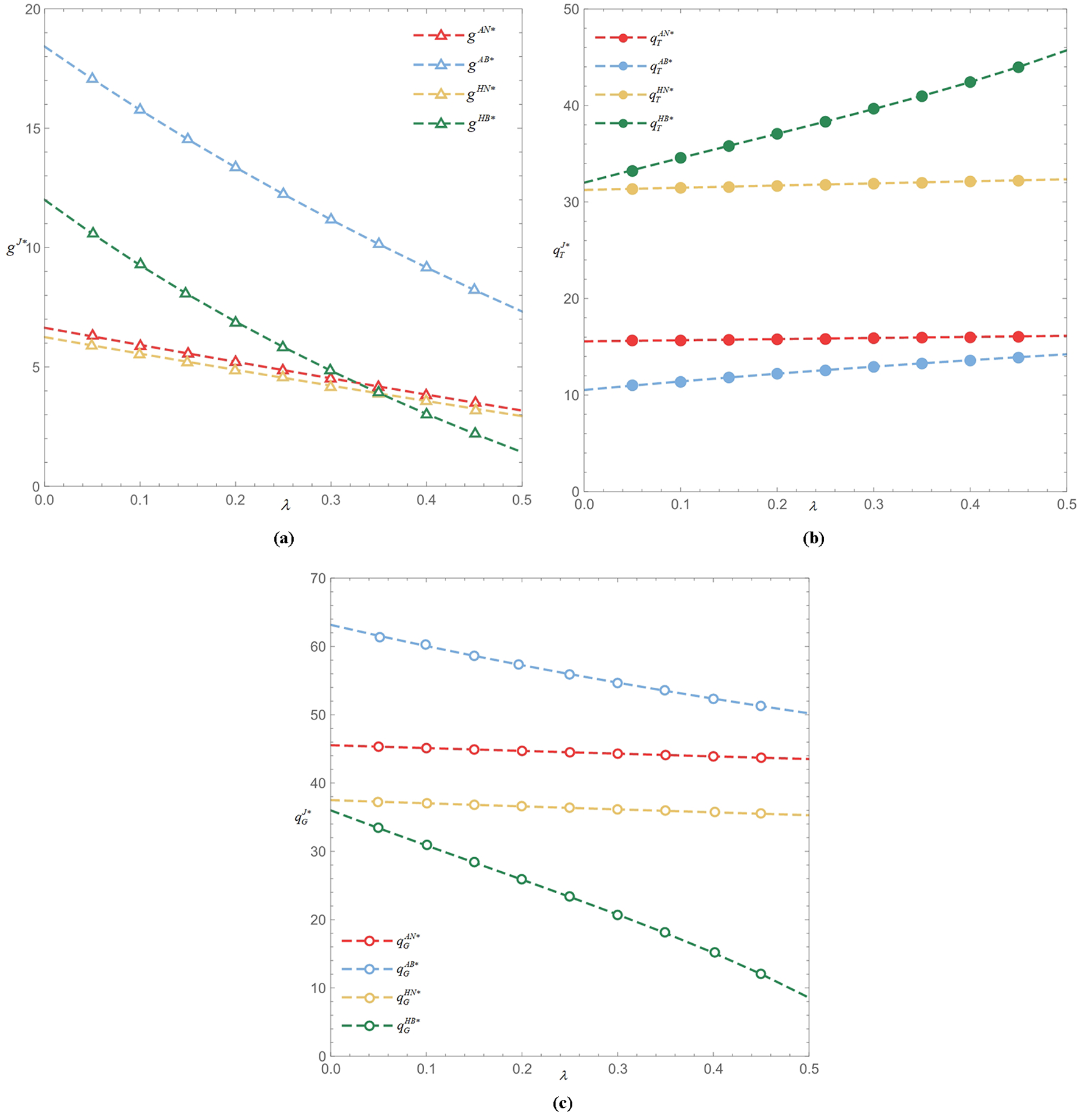

Corollary 2. In Mode H, sensitivity analysis of λ results in:

(1) For the food greenness, we haveand;

(2) For the wholesale price, we haveand;

(3) For the sales quantity of conventional food, we haveand;

(4) For the sales quantity of green food, we haveand.

Corollary 2 indicates that, based on Mode A, the commission rate will affect the equilibrium outcomes in both scenarios N and B, regardless of whether green farmers introduce blockchain technology. Additionally, the impact of the commission rate on food greenness, wholesale price, conventional food sales quantity, and green food sales quantity follows the same trend in both scenarios N and B. As the commission rate increases, both food greenness and green food sales quantity decrease (, ; , ). This is because an increase in the commission rate raises the profits allocated to the e-commerce platform, thereby increasing sales cost. Excessive cost cause green farmers to reduce its investment in food greenness. As a result, the wholesale price and sales quantity of conventional food will increase (, ; , ). Compared to Corollary 1, the “one increases, the other decreases” situation between the sales quantity of conventional and green food does not change with variations in the commission rate.

Proposition 5. Comparing the Scenario AN and Scenario AB:

(1) The food greenness in Scenario AB is higher than that in Scenario AN, i.e., gAB* > gAN*;

(2) The wholesale price in Scenario AB is lower than that in Scenario AN, i.e., wAB* < wAN*;

(3) The sales quantity of conventional food in Scenario AB is lower than that in Scenario AN, i.e., ;

(4) The sales quantity of green food in Scenario AB is higher than that in Scenario AN, i.e., .

Proposition 5 indicates that, based on Mode A, after green farmers adopt blockchain technology, the values of food greenness, wholesale price, conventional food sales quantity, and green food sales quantity differ between scenarios N and B. Proposition 5. (1) and (4) show that after adopting blockchain technology, the food greenness and green food sales quantity of green farmers are higher than in scenarios where blockchain is not adopted (i.e., gAB* > gAN*, ). This is because, with blockchain technology, the greenness information of green food becomes clearer and more transparent. This measure enhances consumer trust in green food, increases consumer preference for it, and subsequently boosts the sales quantity of green food. Proposition 5. (2) and (3) indicate that, after adopting blockchain technology, the sales quantity of green food takes precedence, thereby displacing the sales quantity of conventional food. When the sales quantity of conventional products decreases, conventional farmers respond by lowering wholesale prices to cope with the decline in sales (wAB* < wAN*, ).

Proposition 6. Comparing the Scenario AN and Scenario AB:

(1) The profit of conventional farmers in Scenario AB is lower than that in Scenario AN, i.e., ;

(2) If, the profit of green farmers in Scenario AB is higher than that in Scenario AN, i.e., ;

(3) The profit of supermarket in Scenario AB is lower than that in Scenario AN, i.e., ;

(4) The profit of e-commerce platform in Scenario AB is higher than that in Scenario AN, i.e., .

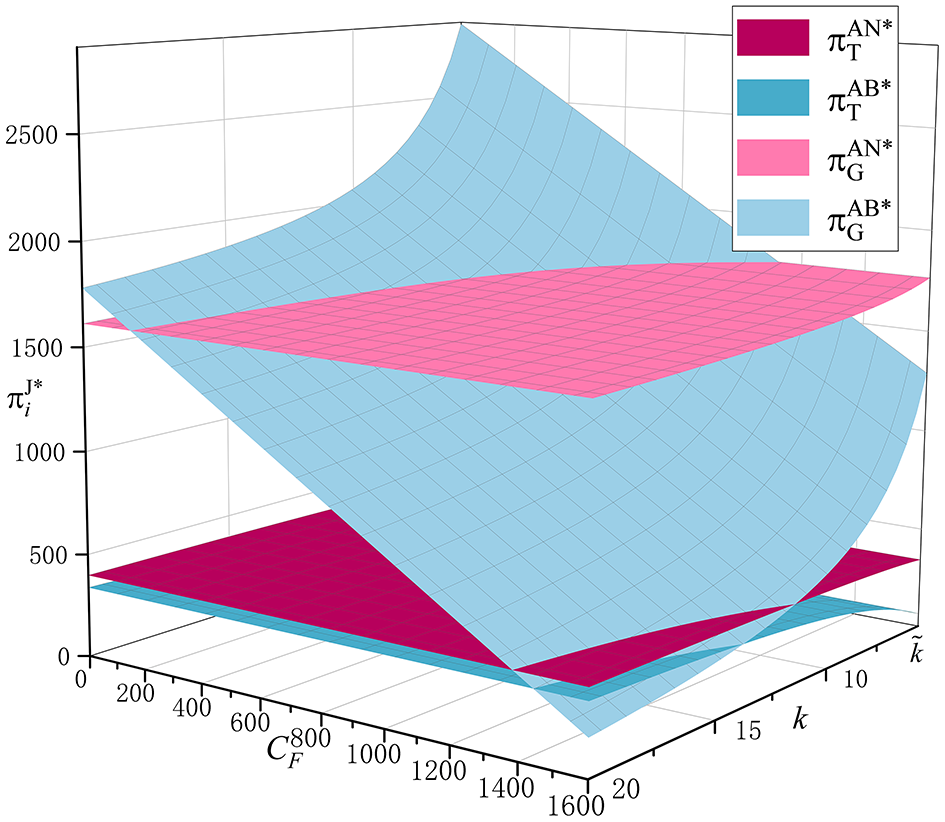

Proposition 6 indicates that, based on Mode A, after green farmers adopt blockchain technology, the profits of conventional farmers, green farmers, supermarkets, and e-commerce platforms differ, as illustrated in Figures 8, 9.

Figure 8

Impact of k and CF on .

Figure 9

Impact of λ and CF on .

Proposition 6. (1), (3), and (4) show that when green farmers adopt blockchain technology, the profits of conventional farmers and supermarkets selling conventional food decrease, while the profits of e-commerce platforms selling green food increase. This suggests that for both producers and sellers of conventional food, profits will decline if they only sell conventional food. Proposition 6. (2) shows that the profit changes for green farmers depends on the fixed cost associated with adopting blockchain technology. When the fixed cost for blockchain technology are below a certain threshold, the profits of green farmerswill increase.

5.2 HN VS. HB

Corollary 3. In Mode H, sensitivity analysis ofkresults in:

(1) For the food greenness, we haveand;

(2) For the sales quantity of conventional food, we haveand;

(3) For the sales quantity of green food, we haveand.

Corollary 3 indicates that, based on Mode H, the cost coefficient of green technology investment will affect the equilibrium outcomes in both scenarios N and B, regardless of whether green farmers adopt blockchain technology. Furthermore, the impact of the green technology investment cost coefficient on food greenness, conventional food sales quantity, and green food sales quantity follows the same trend in both scenarios N and B. As the green technology investment cost coefficient increases, both food greenness and green food sales quantity decrease (, ; , ). This is because an increase in the green technology investment cost coefficient raises the cost of green technology investment, and excessive cost lead green farmers to reduce their investment in food greenness. As a result, the sales quantity of conventional food will increase (, ).

When comparing Corollary 1 with Corollary 3, as shown in Figure 10, it can be concluded that the trend of the impact of the green technology investment cost coefficient on food greenness and sales quantity remains unaffected by changes in the sales channels. In other words, the “one increases, the other decreases” phenomenon between the sales quantity of conventional and green food does not change due to variations in sales channels.

Figure 10

Impact of k on gJ*, and . (a) Food greenness; (b) The sales quantity of green food; (c) The sales quantity of conventional food.

Corollary 4. In Mode H, sensitivity analysis of λ results in:

(1) For the food greenness, we haveand;

(2) For the sales quantity of conventional food, we haveand;

(3) For the sales quantity of green food, we haveand.

Corollary 4 demonstrates that, based on Mode H, the commission rate affects the equilibrium outcomes in both Scenario N and Scenario B, regardless of whether blockchain technology is adopted by green farmers. Furthermore, the impact of the commission rate on food greenness, the sales quantity of conventional food, and the sales quantity of green food exhibits similar trends in both scenarios. This is illustrated in Figure 11, combining Corollary 2 with Corollary 4.

Figure 11

Impact of λ on gJ*, and . (a) Food greenness; (b) The sales quantity of green food; (c) The sales quantity of conventional food.

As the commission rate increases, the food greenness and the sales quantity of green food both decrease (, ; , ). This is because a higher commission rate increases the profit allocated to the e-commerce platform, raising the sales cost. The increased cost lead green farmers to reduce their investment in food greenness. In this case, the sales quantity of conventional food will increase (, ). It indicates that the sales quantity of both conventional and green foods is not influenced by the adoption of blockchain technology in response to changes in the commission rate.

Proposition 7. Comparing the Scenario HN and Scenario HB:

(1) If, the food greenness in Scenario HB is higher than that in Scenario HN, i.e., gHB*>gHN*;

(2) If, the sales quantity of green food in Scenario HB is higher than that in Scenario HN, i.e., ;

(3) If, the sales quantity of conventional food in Scenario HB is lower than that in Scenario HN, i.e., .

Proposition 7 shows that, based on Mode H, the greenness of food, the sales quantity of conventional food, and the sales quantity of green food are all influenced by the unit cost of blockchain technology after green farmers adopt it, in both Scenario N and Scenario B. Proposition 7 (1) and (2) indicate that when the unit cost of blockchain is below a certain threshold (), the greenness of food increases with the adoption of blockchain technology (gHB* > gHN*). This is because blockchain technology makes the green information of food clearer and more transparent, which enhances consumer trust in green food, increases consumer preference for it, and consequently drives up the sales quantity of green food (). Proposition 7 (3) suggests that when green farmers adopt blockchain technology, and the unit cost of blockchain is below a certain threshold (), the sales quantity of green food dominates, displacing the sales quantity of conventional food ().

Proposition 8. Comparing the Scenario HN and Scenario HB:

(1) If, the profit of conventional farmers in Scenario HB is lower than that in Scenario HN, i.e., ;

(2) If, the profit of green farmers in Scenario HB is higher than that in Scenario HN, i.e., ;

(3) If,,and, the profit of e-commerce platform in Scenario HB is lower than that in Scenario HN, i.e., .

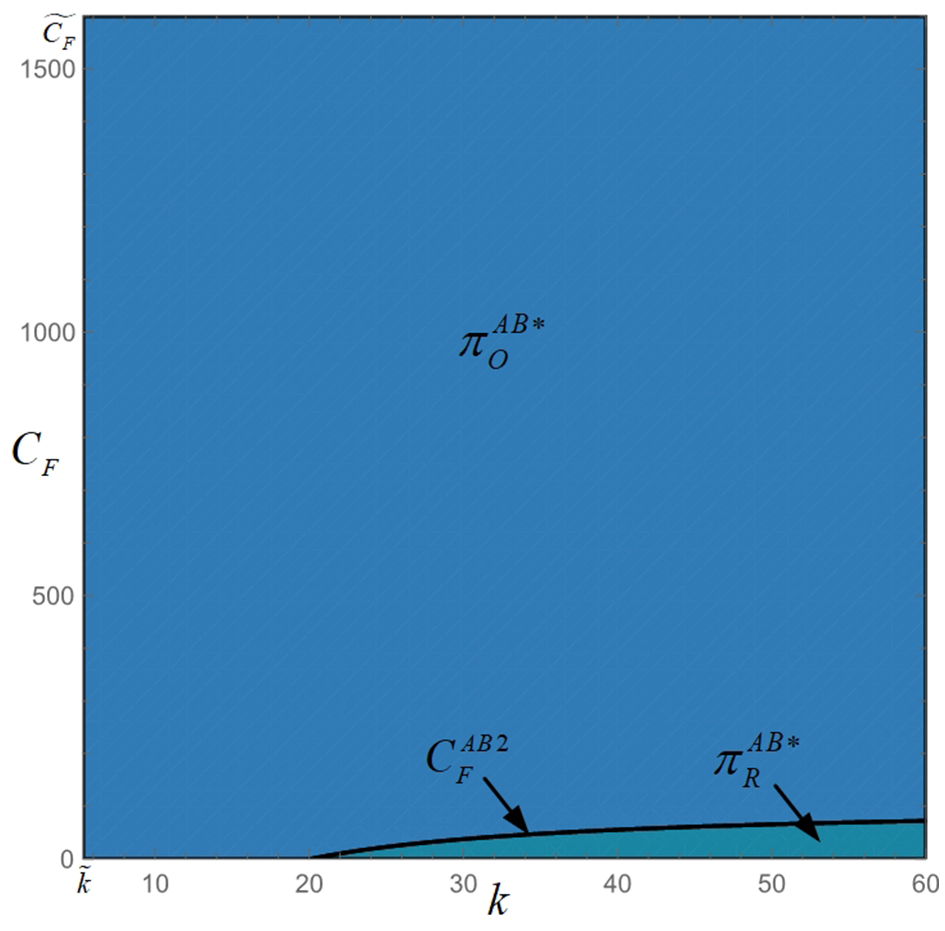

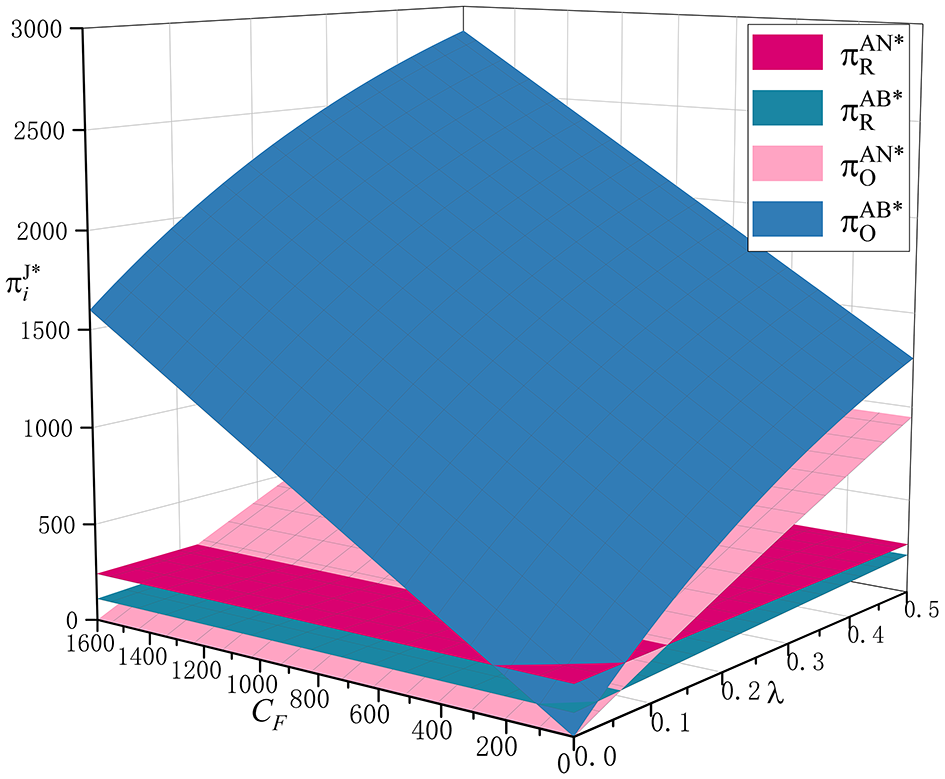

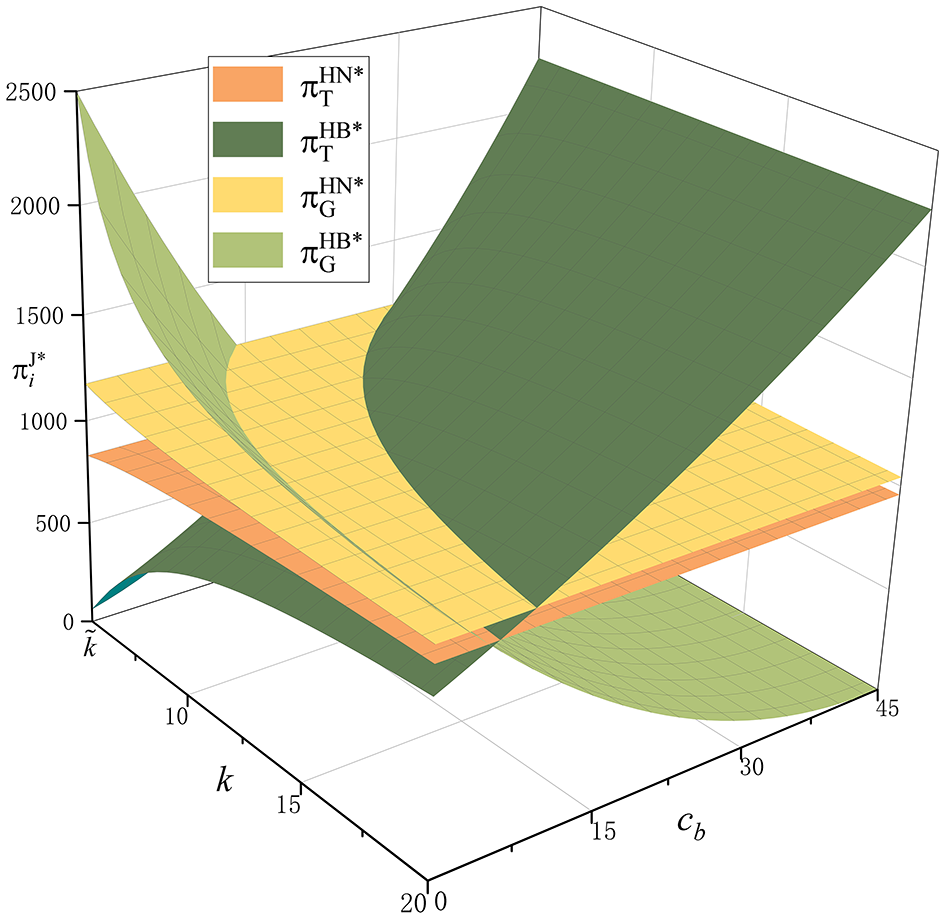

Proposition 8 demonstrates that, based on Mode H, after green farmers adopt blockchain technology, the profits of conventional farmers, green farmers, and the e-commerce platforms differ, as shown in Figure 12.

Figure 12

Impact of k and cb on .

Proposition 8 (1) indicates that when the unit cost of blockchain is below a certain threshold, the profit of conventional farmers in Scenario N is greater. This is due to the increase in the sales quantity of conventional food in Scenario N, as indicated in Proposition 7 (3), which leads to higher profits for conventional farmers in Scenario N. Proposition 8 (2) suggests that after green farmers adopt blockchain technology, when the unit cost of blockchain is below a certain threshold, the profit of conventional farmers in Scenario N remains larger. Similar to Proposition 8 (1), the profit variation of green farmers is also driven by changes in the sales quantity of green products. Proposition 8 (3) reveals the possibility that, in Scenario N without blockchain, the e-commerce platform could achieve higher profits, as shown in Figure 13. This occurs because, in Mode H, both green and conventional foods are sold on the e-commerce platform, and the sales quantity is influenced by various factors, which in turn affect the platform's profits. In this case, the e-commerce platform in different scenarios should strive to maximize its own profit.

Figure 13

Impact of k and cb on .

6 Conclusion

6.1 Main findings

We constructed two sustainable food supply chain models to explore the impact of green technology investment, blockchain technology, and sales channel selection in sustainable food supply chains. We considered four operational scenarios: online-offline mixed channels without blockchain (AN), online-offline mixed channels with blockchain (AB), e-commerce platform without blockchain (HN), and e-commerce platform with blockchain (HB). First, we applied game theory to determine the optimal strategies for each scenario, including food greenness, sales quantity of conventional and green foods, and the profits of each supply chain member. Additionally, we examined the impact of factors such as consumer preference for green food, the cost coefficient of green technology investment, and the commission rate on the operational decisions of the sustainable food supply chain, and conducted a sensitivity analysis. Next, we performed an internal comparison of each scenario based on whether farmers invest in green technology, as well as a comparative study of the four scenarios from the perspective of whether blockchain technology is adopted. We identified the timing and conditions for adopting blockchain technology and selecting sales channels in the sustainable food supply chain, yielding some interesting results.

First, we find that the positive effect of blockchain adoption on improving food greenness and increasing sales quantity does not apply uniformly across all sales channels. In Mode H, the adoption of blockchain technology attracts more consumers and stimulates demand for green food only when the unit cost of blockchain remains within a certain threshold. Additionally, blockchain adoption enhances the food greenness and improves the profit of green farmers. However, if the primary goal is to improve food greenness and expand the sales quantity of green food, Mode A proves to be a more suitable channel structure for the introduction of blockchain technology. Given that green technology often involve low-carbon processing methods and circular economy solutions, improvements in food greenness also contribute to broader environmental benefits.

Second, the fixed and unit costs associated with blockchain technology significantly affect farmers' profitability. For conventional farmers, it is generally preferable to choose sales channels without blockchain adoption. Moreover, in certain scenarios, although the sales quantity of green food increases, the high costs of blockchain services may erode farmers' profits, particularly when the cost coefficient of green effort is high. Therefore, effectively controlling both the fixed and unit costs of blockchain technology within the supply chain is crucial for ensuring a balanced distribution of benefits among stakeholders.

Finally, regardless of the sales channel chosen, green farmers are able to achieve higher profits compared to conventional farmers. After investing in green technology, the cost coefficient of green technology investment affects the equilibrium outcomes and profits in all four scenarios, whether the farmers choose online-offline mixed channels or e-commerce platform channels. As the cost coefficient of green technology investment and the commission rate decrease, both food greenness and sales quantity increase. Conversely, the sales quantity of conventional food decreases, and this trend is not influenced by the introduction of blockchain technology.

6.2 Managerial insights

Based on the key findings above, we draw the following important managerial implications:

1. From the perspective of farmers: Farmers should carefully evaluate both the fixed and unit costs associated with blockchain technology to ensure that these expenses do not exert excessive pressure on their overall profitability. Effectively controlling blockchain costs is essential for enhancing the market competitiveness of green food. When making green technology investments, green farmers should also consider adopting blockchain technology, as it not only strengthens consumer trust in green food but also improves product differentiation and market position. In situations where conventional farmers are unable to estimate the cost of blockchain adoption by green farmers, it is advisable for them to choose a hybrid online-offline channel without blockchain implementation.

2. From the perspective of supermarkets and e-commerce platforms: E-commerce platforms demonstrate significant advantages in the marketing of green food. Platform managers should encourage farmers to explore e-commerce channels, particularly for green food, as these channels can expand market reach and promote higher food greenness. Nonetheless, traditional offline supermarkets remain competitive in the sale of conventional food. Therefore, the optimal choice of sales channel should be tailored to the specific characteristics of each food type.

3. From the perspective of governments and policymakers: our findings confirm the advantages of producing green food in combination with blockchain adoption. To foster the development of the green food market, policymakers should consider providing financial subsidies for green technology investments or technical support for blockchain adoption. Furthermore, they should promote collaboration between farmers and sales platforms across different channels to jointly advance the sustainable development of the green food industry.

Statements

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YZ: Writing – original draft, Software, Formal analysis, Writing – review & editing, Investigation, Validation. JS: Validation, Methodology, Writing – review & editing, Conceptualization, Writing – original draft, Funding acquisition, Supervision.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by Philosophy and Social Sciences Research Project in Shaanxi Province (No. 2025HZ0677).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2025.1638313/full#supplementary-material

References

1

AliM.ChungL.KumarA.ZailaniS.TanK. (2021). A sustainable Blockchain framework for the halal food supply chain: lessons from Malaysia. Tech. Forecast. Soc. Change. 170:120870. 10.1016/j.techfore.2021.120870

2

AnnosiM.BrunettaF.BimboF.KostoulaM. (2021). Digitalization within food supply chains to prevent food waste. Drivers, barriers and collaboration practices. Indus. Market. Manag. 93, 208–220. 10.1016/j.indmarman.2021.01.005

3

BeheshtiS.HeydariJ.SazvarZ. (2022). Food waste recycling closed loop supply chain optimization through renting waste recycling facilities, Sustain. Cities. Soc. 78:103644. 10.1016/j.scs.2021.103644

4

BlessleyM.MudambiS. (2022). A trade war and a pandemic: disruption and resilience in the food bank supply chain, Indus. Market. Manag. 102, 58–73. 10.1016/j.indmarman.2022.01.002

5

CamelA.BelhadiA.KambleS.TiwariS.TourikiF. (2024). Integrating smart Green Product Platforming for carbon footprint reduction: the role of blockchain technology and stakeholders influence within the agri-food supply chain, Int. J. Prod. Econ. 272:109251. 10.1016/j.ijpe.2024.109251

6

CaoY.TaoL.WuK.WanG. (2020). Coordinating joint greening efforts in an agri-food supply chain with environmentally sensitive demand. J. Clean. Prod. 277:123883. 10.1016/j.jclepro.2020.123883

7

CasinoF.KanakarisV.DasaklisT.MoschurisS.StachtiarisS.PagoniM.et al. (2021). Blockchain-based food supply chain traceability: a case study in the dairy sector, Int. J. Prod. Res. 59, 5758–5770. 10.1080/00207543.2020.1789238

8

Chebolu-SubramanianV.GauklerG. (2015). Product contamination in a multi-stage food supply chain, Eur. J. Operat. Res. 244, 164–175. 10.1016/j.ejor.2015.01.016

9

DiabatA.GovindanK.PanickerV. (2012). Supply chain risk management and its mitigation in a food industry, Int. J. Prod. Res. 50, 3039–3050. 10.1080/00207543.2011.588619

10

DuongC.NguyenT.NgoT.BuiT.TranN. (2025). Perceived blockchain-relate information transparency and organic food purchase intention: an extension of the theory of planned behaviour with the moderation role of blockchain-based trust, Br. Food J. 127, 1131–1152. 10.1108/BFJ-06-2024-0610

11

DuongL.Al-FadhliM.JagtapS.BaderF.MartindaleW.SwainsonM.et al. (2020). A review of robotics and autonomous systems in the food industry: from the supply chains perspective. Trends Food Sci. Tech. 106, 355–364. 10.1016/j.tifs.2020.10.028

12

ErsoyP.BörühanG.ManglaS.HormazabalJ.KazancogluY.LafciC. (2022). Impact of information technology and knowledge sharing on circular food supply chains for green business growth. Bus. Strategy Environ. 31, 1875–1904. 10.1002/bse.2988

13

FanZ.-P.WuX.-Y.CaoB.-B. (2022). Considering the traceability awareness of consumers: should the supply chain adopt the blockchain technology?Ann. Operat. Res. 309, 837–860. 10.1007/s10479-020-03729-y

14

GeorgiadisP.VlachosD.IakovouE. (2005). A system dynamics modeling framework for the strategic supply chain management of food chains. J. Food Eng. 70, 351–364. 10.1016/j.jfoodeng.2004.06.030

15

GovindanK. (2018). Sustainable consumption and production in the food supply chain: a conceptual framework, Int. J. Prod. Econ. 195, 419–431. 10.1016/j.ijpe.2017.03.003

16

Hajiaghaei-KeshteliM.CenkZ.ErdebilliB.ÖzdemirY.Gholian-JouybariF. (2023). Pythagorean fuzzy topsis method for green supplier selection in the food industry. Exp. Syst. Appl. 224:120036. 10.1016/j.eswa.2023.120036

17

JiaJ.YangW.WuF.CuiX. (2024). Elevated diversity of the supply chain boosts global food system resilience. Environ. Res. Lett.19:024049. 10.1088/1748-9326/ad2434

18

JiangZ.-Z.LuZ.WangZ. (2025). The impact of contract types on carbon-capped food supply chains: options versus wholesale. Int. J. Prod. Res.63, 4719–4748. 10.1080/00207543.2024.2442540

19

JonkmanJ.Barbosa-PóvoaA.BloemhofJ. (2019). Integrating harvesting decisions in the design of agro-food supply chains. Eur. J. Operation. Res. 276, 247–258. 10.1016/j.ejor.2018.12.024

20

KambleS.GunasekaranA.GawankarS. (2020). Achieving sustainable performance in a data-driven agriculture supply chain: a review for research and applications. Int. J. Prod. Econ. 219, 179–194. 10.1016/j.ijpe.2019.05.022

21

KumarM.ChoubeyV.RautR.JagtapS. (2023). Enablers to achieve zero hunger through IoT and blockchain technology and transform the green food supply chain systems. J. Clean. Prod. 405:136894. 10.1016/j.jclepro.2023.136894

22

LatinoM.MenegoliM.LazoiM.CoralloA. (2022). Voluntary traceability in food supply chain: a framework leading its implementation in agriculture 4.0. Tech. Forecast. Soc. Change178:121564. 10.1016/j.techfore.2022.121564

23

LiH.LiD.JiangD. (2021). Optimising the configuration of food supply chains, Int. J. Prod. Res. 59, 3722–3746. 10.1080/00207543.2020.1751337

24

LiangL.YeF. (2024). Information transparency and business mode selection in online platforms under manufacturer competition. J. Bus. Res.170:114324. 10.1016/j.jbusres.2023.114324

25

LiuP.LongY.SongH.-C.HeY.-D. (2020). Investment decision and coordination of green agri-food supply chain considering information service based on blockchain and big data. J. Clean. Prod. 277:123646. 10.1016/j.jclepro.2020.123646

26

LiuS.HuaG.KangY.ChengT.XuY. (2022). What value does blockchain bring to the imported fresh food supply chain?Transport. Res. Part E: Logis. Transport. Rev. 165:102859. 10.1016/j.tre.2022.102859

27

LiuY.MaD.HuJ.ZhangZ. (2021). Sales mode selection of fresh food supply chain based on blockchain technology under different channel competition. Comput. Indus. Eng. 162:107730. 10.1016/j.cie.2021.107730

28

LuQ.LiaoC.ShiV.XuZ. (2024). Implementation mode selection for blockchain technology in green product traceability. Int. J. Prod. Econ.276:109372. 10.1016/j.ijpe.2024.109372

29

MaD.ZhangK.ShaoW.HuJ. (2024). Considering the cascade threat in the food supply chain for the retailer's “blockchain and contamination prevention effort” strategic deployment. Exp. Syst. Appl. 255:124517. 10.1016/j.eswa.2024.124517

30

MaJ.FanJ.ZhuM.ChenJ. (2024). Dynamic game research of food agricultural products supply chain based on blockchain traceability technology. Kybernetes10.1108/K-12-2023-2636

31

NardiV.AulerD.TeixeiraR. (2020). Food safety in global supply chains: a literature review. J. Food Sci. 85, 883–891. 10.1111/1750-3841.14999

32

NiuB.DongJ.LiuY. (2021a). Incentive alignment for blockchain adoption in medicine supply chains. Transport. Res. Part E: Logis. Transport. Rev. 152:102276. 10.1016/j.tre.2021.102276

33

NiuB.MuZ.CaoB.GaoJ. (2021b). Should multinational firms implement blockchain to provide quality verification?Transport. Res. Part E: Logis. Transport. Rev.145:102121. 10.1016/j.tre.2020.102121

34

NiuB.RuanY.XuH. (2023). Turn a blind eye? E-tailer's blockchain participation considering upstream competition between copycats and brands. Int. J. Prod. Econ.265:109009. 10.1016/j.ijpe.2023.109009

35

PatelliN.MandrioliM. (2020). Blockchain technology and traceability in the agrifood industry. J. Food Sci. 85, 3670–3678. 10.1111/1750-3841.15477

36

QinJ.FuH.WangZ.LyuX. (2025). Financing decisions in capital-constrained supply chains considering uncertain emission reduction outputs and blockchain technology applications. Int. J. Prod. Res.10.1080/00207543.2025.2483432

37

QinX.GodilD.SarwatS.YuZ.KhanS.ShujaatS. (2022). Green practices in food supply chains: evidence from emerging economies. Operat. Manag. Res. 15, 62–75. 10.1007/s12063-021-00187-y

38

RichardsC.HurstB.MessnerR.O'ConnorG. (2021). The paradoxes of food waste reduction in the horticultural supply chain. Industr. Market. Manag. 93, 482–491. 10.1016/j.indmarman.2020.12.002

39

SaurabhS.DeyK. (2021). Blockchain technology adoption, architecture, and sustainable agri-food supply chains. J. Clean. Prod. 284:124731. 10.1016/j.jclepro.2020.124731

40

SharmaM.AntonyR.TsagarakisK. (2023). Green, resilient, agile, and sustainable fresh food supply chain enablers: evidence from India. Ann. Operat. Res.347, 13–39. 10.1007/s10479-023-05176-x

41

SinghS.KumarR.PanchalR.TiwariM. (2021). Impact of COVID-19 on logistics systems and disruptions in food supply chain. Int. J. Prod. Res.59, 1993–2008. 10.1080/00207543.2020.1792000

42

SrivastavaA.DashoraK. (2022). A fuzzy ISM approach for modeling electronic traceability in agri-food supply chain in India. Ann. Operat. Res. 315, 2115–2133. 10.1007/s10479-021-04072-6

43

Statista (2024). Available online at: https://www.statista.com/topics/871/online-shopping/#topicOverview (Accessed January 20, 2025).

44

StranieriS.RiccardiF.MeuwissenM.SoregaroliC. (2021). Exploring the impact of blockchain on the performance of agri-food supply chains. Food Control. 119:107495. 10.1016/j.foodcont.2020.107495

45

TabriziS.GhodsypourS.AhmadiA. (2018). Modelling three-echelon warm-water fish supply chain: a bi-level optimization approach under Nash-Cournot equilibrium. Appl. Soft Comput. 71, 1035–1053. 10.1016/j.asoc.2017.10.009

46

TaoZ.ChaoJ. (2024). The impact of a blockchain-based food traceability system on the online purchase intention of organic agricultural products. Innov. Food Sci. Emerg. Tech.92:103598. 10.1016/j.ifset.2024.103598

47

TreiblmaierH.GarausM. (2023). Using blockchain to signal quality in the food supply chain: the impact on consumer purchase intentions and the moderating effect of brand familiarity. Int. J. Inform. Manag.68:102514. 10.1016/j.ijinfomgt.2022.102514

48

VerdouwC.WolfertJ.BeulensA.RiallandA. (2016). Virtualization of food supply chains with the internet of things. J. Food Eng. 176, 128–136. 10.1016/j.jfoodeng.2015.11.009

49

WangJ.ZhangQ.HouP.LiQ. (2023). Effects of platform's blockchain strategy on brand manufacturer's distribution strategy in the presence of counterfeits. Comput. Industr. Eng.177:109028. 10.1016/j.cie.2023.109028

50

WangL.ChenL.LiC. (2024). Research on strategies for improving green product consumption sentiment from the perspective of big data. J. Retail. Consum. Serv. 79:103802. 10.1016/j.jretconser.2024.103802

51

WangY.LanJ.PanJ.FangL. (2024). How do consumers' attitudes differ across their basic characteristics toward live-streaming commerce of green agricultural products: a preliminary exploration based on correspondence analysis, logistic regression and decision tree. J. Retail. Consum. Serv. 80:103922. 10.1016/j.jretconser.2024.103922

52

XuG.TangY.XuS. (2025). Promotion strategies of food delivery O2O supply chain considering service congestion effect with anti-food waste regulation. Front. Sustain. Food Syst. 9:1512675. 10.3389/fsufs.2025.1512675

53

ZhangQ.CaoW.ZhangZ. (2023). Operational decisions and game analysis in the agricultural supply chain: invest or not?Kybernetes52, 1190–1222. 10.1108/K-07-2021-0585

54

ZhangW.WuL.JiL. (2025). Blockchain technology adoption strategies for the shipping costs bearer in the fresh product supply chain. Front. Sustain. Food Syst.9:1550985. 10.3389/fsufs.2025.1550985

55

ZhaoX.WangP.PalR. (2021). The effects of agro-food supply chain integration on product quality and financial performance: evidence from Chinese agro-food processing business. Int. J. Prod. Econ.231:107832. 10.1016/j.ijpe.2020.107832

56

ZouT.ZouQ.HuL. (2020). Joint decision of financing and ordering in an emission-dependent supply chain with yield uncertainty, Comput. Indus. Eng. 152:106994. 10.1016/j.cie.2020.106994

Summary

Keywords

sustainable food supply chain, green technology, blockchain technology, channel selection, food greenness

Citation

Zhang Y and Shang J (2025) Green technology investment and channel selection in sustainable food supply chain based on blockchain technology. Front. Sustain. Food Syst. 9:1638313. doi: 10.3389/fsufs.2025.1638313

Received

30 May 2025

Accepted

28 July 2025

Published

20 August 2025

Volume

9 - 2025

Edited by

Eleni Zafeiriou, Democritus University of Thrace, Greece

Reviewed by

Quanpeng Chen, Southwestern University of Finance and Economics, China

Shaojian Qu, Nanjing University of Information Science and Technology, China

Updates

Copyright

© 2025 Zhang and Shang.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuting Zhang zhangyt@stu.xidian.edu.cn

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.