- School of Management, Ocean University of China, Qingdao, China

With the rapid development of the digital economy and the increasingly severe environmental issues, the role of the digital economy in green innovation has been attracting more attention; however, only a limited amount of research has been done in this area. Therefore, based on matching data at the city and manufacturing enterprise level in China during 2011–2018, this paper attempted to integrate the digital economy (more specifically, the Internet and digital finance) with resource allocation and green technology innovation together in a unified scheme. Our study confirmed that the digital economy could significantly promote green technology innovation by manufacturing enterprises, but that digital finance was the dominant feature. Resource allocation efficiency played a partial mediating role between digital economy and green technology innovation. Furthermore, considering the heterogeneity in enterprise ownership and industrial pollution, the digital economy had a more positive effect on green technology innovation in state-owned enterprises (SOEs) and high pollution industries. As for the heterogeneity of region, the Internet significantly contributed to green technology innovation in regions with different levels of development. In the eastern region of China, especially, the influence of digital finance on green technology innovation was more significant. In view of these findings, this study provides important insights for strengthening the integration of the digital economy with green transformation, emphasizing the rationality of resource allocation, and formulating policies for different enterprises.

1 Introduction

The potential contradiction between economic growth and environmental pollution has long threatened the economic structure. Some developed countries attach great importance to environmental protection. For example, the United States has adopted climate and energy security laws and the European Union has proposed green growth as a core strategy. A number of developing countries have also focused on environmental issues, including China (Ji and Zhang, 2019; Zhao et al., 2020), Pakistan (Zhang et al., 2017; Danish and Wang, 2018) and Vietnam (Lin et al., 2013). As the largest developing country in the world, China’s rapid development has been accompanied by environmental deterioration (Ji and Zhang, 2019; Liu et al., 2022). Manufacturing enterprises, as the main contributors of carbon emissions, are directly in line for China’s overall emission reduction target (Ouyang et al., 2019; Zhao et al., 2020; Dou and Gao, 2022). Faced with the relatively crude economic development model of manufacturing enterprises (Ma et al., 2020; Liu et al., 2022), green technology innovation (GTI) as an important way to save energy and reduce emissions (Berrone et al., 2013; Song et al., 2020; Wu et al., 2022) can help manufacturing enterprises obtain many benefits, such as lower energy consumption (Berrone et al., 2013), improved production (Chen et al., 2006; Salvad et al., 2012; Song et al., 2020) and a better social standing (Chang, 2011; Song et al., 2020).

The factors influencing enterprises’ green technology innovation are mainly divided into governmental and market factors. Most studies focused on governmental factors, such as environmental regulations (Berrone et al., 2013; Yu et al., 2017; Qu et al., 2022) and governmental support (Xie et al., 2015; Bai et al., 2019; Wu et al., 2022); however, the positive impact of environmental regulation on green transformation by enterprises has gradually been diminishing (Leiter et al., 2011). To some extent, environmental regulation can increase an enterprise’s operating costs (Berrone et al., 2013; Qu et al., 2022), which will prevent some enterprises from choosing green transformation. Moreover, although governmental support partially subsidizes resources needed for GTI, this may bring dependency problems, and in reality the allocation of innovation resources by enterprises needs to be more dynamic and flexible (Diewert et al., 2018; El-Kassar and Singh, 2019; Feng et al., 2022). Due to the limitations of government help, some scholars have started to study the influence of market factors on enterprises’ green innovation. Using Vietnam as an example, Lin et al. (2013) showed that market demand was positively related to green product innovation. Cuerva et al. (2014) believed that the development of external technology was conducive to improving the internal dynamic ability of enterprises, which enhances green innovation. Cao et al. (2021) and Feng et al. (2022) pointed out that digital finance could solve the financing problems of green innovation, thus avoiding overreliance on the government, and placing enterprises in a better position for promoting GTI; but, market factors cannot be ignored (Wei et al., 2015; El-Kassar and Singh, 2019; Cao et al., 2021).

As an integration of information technology and economic production modes, the digital economy offers a new strategic choice for China’s industrial transformation (Yang et al., 2021). It provides a new research perspective for GTI by liberating social productivity, changing the way knowledge is transferred, and reducing transaction costs (Chihiro et al., 2018; He et al., 2021; Li et al., 2022). Dou and Gao (2022) argued that in areas with a high level of digital economy, cloud computing and big data will drive the transformation of production modes, which will require enterprises to update equipment (Yetis-Larsson et al., 2015; Wang et al., 2022), eliminate traditional production modes (Song et al., 2020; Cao et al., 2021), and achieve a balance between economic and environmental development. Compared with general innovation, sufficient resources are required to support GTI due to its high-risk nature (Cao et al., 2021; Wu et al., 2022). When investment in innovation is limited, enterprises will hesitate to sacrifice other inputs for GTI. Therefore, if manufacturing enterprises cannot reasonably allocate limited resources, GTI will be hindered. With the aid of digital technology, the digital economy can break the constraints of time and space (He et al., 2021; Li et al., 2022), guide the sharing and transmission of labor and capital resources, and promote the green total factor growth rate (Song et al., 2020). In addition, it is worth noting that the digital economy is the driving force for the economic structure transformation, which will tend to eliminate “high-pollution, high-energy-consuming” industries and transform them into green industrial factories (Lu et al., 2021; Dou and Gao, 2022). Based on the above analysis, we introduced resource allocation efficiency as a mediating force between the digital economy and GTI.

In summary, we employed matched data between the digital economy and manufacturing enterprises from 2011–2018 in China in this paper, to examine the impact and mechanism of the digital economy on GTI. We aimed to solve the following three problems. First, starting from the two dimensions of Internet and digital finance development, this paper examined the impact of the digital economy on GTI. Second, we explored whether manufacturing enterprises could promote GTI by improving resource allocation efficiency. And third, a heterogeneity analysis was performed because of the differences in ownership, type of industry and where the manufacturing enterprise was located.

2 Literature review

The digital economy concept was first proposed by Tapscott (1996), who defined it as an economic system that widely uses ICT (information and communication technology). Subsequently, DBCD (2013) defined the digital economy as the networking of society and economy through the internet, mobile phone and sensor networks. It is also described by the European Parliament (2015) as a complex multi-level structure connected by numerous, growing nodes. Diewert et al. (2018) focused on the digital economy and the value it created from the perspective of welfare measurement. Given the two-sided nature of ICT and people’s preferences, Chihiro et al. (2018) measured the digital economy by adding the service value to the national GDP. With the development of the digital economy in China, Tencent Research Institute (2017) constructed a global digital economy model from four dimensions: digital facilities, digital industry, digital innovation and digital governance. Liu et al. (2020) constructed a digital economy system for provinces in China, including informatization, Internet, and digital transactions. These studies have promoted the connotation and measurement of the digital economy, and provided important references for subsequent investigations.

With the rapid development of the digital economy, there have been many studies about whether it can boost innovation. At the macro level, Zhao et al. (2020) pointed out the positive relationship between high-quality development and the digital economy from the perspective of internet and digital finance development. Subsequently, based on the method of Zhao et al. (2020), many studies explored the relationship between the digital economy and high-quality development of cities. For example, Wang et al. (2022) found that GTI was an important mechanism for the integration of digital economy to upgrade industrial institutions. In addition, Lu et al. (2021) argued that the digital economy could drive regional technological innovation. Other scholars believe that the digital economy can reshape the innovation model of traditional industries, accelerate resource allocation, and upgrade industrial infrastructure (Ma et al., 2020; Liu et al., 2022). Moreover, some studies believe that there is a nonlinear relationship between the digital economy and regional innovation. For example, Xu and Hou (2022) maintained that the digital economy’s effects on regional innovation have been increasing marginally. At the micro level, some studies focus on the direct links between the digital economy and the high-quality development of enterprises. Li and Jia (2018) concluded that digital economic development had very little impact on enterprise innovation. However, most scholars maintain a positive attitude towards this relationship. Based on the observations of 50,013 enterprises in 117 developing countries, Paunov and Rollo (2016) found that the development of digital technology promoted innovation. Li et al. (2022) took Asian countries as examples and pointed out that the application of digital technology is beneficial for innovation in business processes. Another part of the existing research focused on the mechanism underlying the relationship between the digital economy and enterprise innovation. Existing studies showed that the digital economy promoted enterprise innovation by mobilizing a company’s dynamic innovative capabilities and appropriately allocating resources. In terms of innovation capabilities, Acemoglu et al. (2016) argued that digital technologies enhance the ability to learn from external knowledge and experience, and become an important way for increasing innovation efficiency. Domazet and Lazić (2017) emphasized that ICT was a key factor of digital economy and could reduce uncertainty in decisions on innovation. Jun et al. (2021) highlighted that the digital platform, improvisation capabilities, and organizational structure showed a positive relationship with innovation. Wu et al. (2022) emphasized that there was an inverted U-shaped relationship between digital economy and the development of enterprises, meaning that moderate digital transformation was most conductive to the high-quality development of enterprises. In terms of the allocation of resources for innovation, a report by the World Bank and the Research and Development Center of the State Council (2019) stated that the digital economy will enable resources, such as technology, capital and manpower to sectors with higher productivity, and promote the transformation of enterprises. Liu and Yan (2021) believed that the digital economy allowed enterprises to divert slack resources such as unused human, social, and organizational capital into innovative activities, thereby alleviating some of the financing constraints of enterprises’ innovation activities.

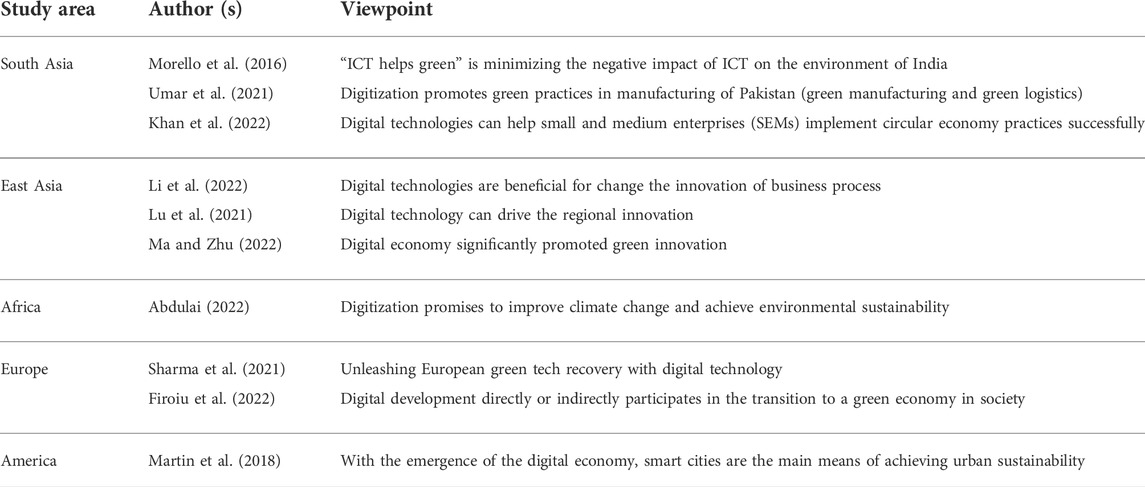

The amount of research on the connection between the digital economy and green innovation has been far from adequate. Only a small number of studies have demonstrated a direct or indirect link between the digital economy and green innovation. For example, Ma and Zhu (2022) and Wang et al. (2022) recognized the linear relationship between digital economy and green innovation. They believed that the development of a digital economy significantly promoted green innovation, but other scholars pointed out that there was a nonlinear relationship between digital economy and green innovation. For example, Dou and Gao (2022) used provincial data as an example to illustrate the double-edged role of the digital economy on green innovation. Dai et al. (2022) also argued that with the development of a digital economy in China, its ability to promote green innovation would be stronger. In addition, some researchers worldwide examined digital technologies (Morello et al., 2016; Lu et al., 2021; Sharma et al., 2021; Firoiu et al., 2022; Khan et al., 2022; Li et al., 2022) and digitization (Martin et al., 2018; Umar et al., 2021; Abdulai, 2022; Ma and Zhu, 2022) to indirectly prove a positive link between the digital economy and green innovation (Table 1).

Previous scholars have done a lot of work, but there are still some deficiencies. First, most studies were limited to the measurement of digital economy at the country and province level; analysis indicators of digital economy at the prefecture level have not been refined. Second, many studies around the world have directly or indirectly explained the important role of digital economy in green innovation, but most were based on the literature review method. There have been few empirical investigations of the connection between digital economy and green innovation. Third, although some scholars have analyzed the benefits of digital economy on resource allocation, only a few papers have been published on the impact of resource allocation efficiency on GTI.

The potential contributions of this study are as follows. Most studies only focused on the impact of the digital economy from the perspective of countries or provinces, while we have extended the research regarding the digital economy to prefecture-level cities. In addition, we linked the regional digital economy to data from enterprises showing their impact at the micro level. In this paper, we discussed digital economy, resource allocation, and GTI within a unified scheme. We utilized econometric models to examine the link between digital economy and GTI, and verified the mediating role of resource allocation efficiency. In other words, we explored the mechanism between the digital economy and GTI. These conclusions not only reveal the implications based on empirical evidence for the high-quality development of enterprises in China, but other countries that care for the environment can also draw inspiration from this study.

3 Theories and hypotheses

3.1 Digital economy development and GTI

3.1.1 Internet development and GTI

According to stakeholder theory, it is important for enterprises to address the demands of stakeholders, which helps to maximize the total economic and social wealth (Freeman, 1984). With the development of network information technology, stakeholders are paying more attention to the environmental policies of the enterprises. Their awareness of green products is gradually increasing, and they will be urging manufacturing enterprises to take responsibility for GTI. The Internet is characterized by a network effect (Paunov and Rollo, 2016), which lessens information asymmetry and promotes cross-organizational interactions between stakeholders and enterprises. All behavioral decisions will be transformed into visual depictions of the data and then presented to the public. In particular, the information about environmental governance and green production of enterprises will naturally receive more attention by stakeholders. Therefore, the external supervision pressure formed by environmental information disclosure and real-time cross-organization interactions will motivate enterprises to strengthen green transformation (Yetis-Larsson et al., 2015; Wang et al., 2022). In addition, stakeholder engagement facilitates the GTI through selecting clean materials, improving energy efficiency, and reducing toxic waste (Chen et al., 2017). Such co-development with stakeholders can also enable the integration of green elements and technical knowledge into the supply chain (Parmigiani et al., 2011). The Internet will help enterprises search for and analyze information about cutting-edge green technologies (Novikov, 2020) and reduce the transactional costs of searching, matching and negotiating. Enterprises can also collect data about consumers’ green preferences from the market, which will offer more possibilities for green innovation development (Xie et al., 2015). Finally, due to the high uncertainty of GTI, it is crucial for enterprises to access real-time data about the innovation process (Awan et al., 2021). By monitoring the entire process in real time via the Internet, manufacturing enterprises can enhance the effectiveness of GTI and reduce energy waste (Huang et al., 2019; Long and Li, 2021). Based on the preceding discussion, Hypothesis 1a was proposed:

Hypothesis 1a. (H1a). The internet development promotes GTI of manufacturing enterprises.

3.1.2 Digital finance development and green technology innovation

Compared with general innovation, GTI is characterized by long payback periods, poor capital liquidity, and high uncertainty risk (Cao et al., 2021; Wu et al., 2022). This means that GTI is often constrained by significant financing costs. In addition to the enterprise’s own funds or government financial subsidies, GTI needs to rely on the support of financial sectors (Wei et al., 2015). Financing is a core component of the technological innovation environment, but sometimes the finance supply is directly related to the development of technological innovation activities (Guo et al., 2020) and conventional financing has many deficiencies in matching capital allocation with technological innovation needs (Wei et al., 2015; Ji and Zhang, 2019). As an inclusive model, digital finance has strengthened its integration with information technology and with advantages such as wide coverage, low cost and high efficiency (Guo et al., 2020). On the one hand, digital finance broadens the potential sources of funds and increases the amount of financing. The long-tail group in the financial market is characterized by variety, smallness, and dispersion, and provides more new financing channels for enterprises (Gomber et al., 2018). Thus, digital financing can effectively reduce financing costs, drive enterprises to deleverage, solve the financing problems of green innovation, and promote the output of GTI (Cao et al., 2021). At the same time, digital finance can broadly diversify the risks of investment in GIT (Guo et al., 2020; Cao et al., 2021). Compared to traditional innovation, GIT often faces higher risks, and technological achievements may not be easily convertible into tangible economic benefits over the short term (Walsh, 2012; Cao et al., 2021). Digital finance effectively spreads the significant risks of GIT over a wider range by attracting dispersed investors (Cao et al., 2021). On the other hand, digital finance can optimize conventional financial services in depth, quality and efficiency (Awan et al., 2021). With the aid of digital technology, digital finance builds a data warehouse, breaks the boundary constraints of traditional financing, and corrects the mismatch between credit resources and green innovation projects (Gomber et al., 2017). In particular, in response to China’s call for green development, digital finance has promoted the development of many clean-energy industries, such as wind power and photovoltaic power generation. As a kind of green financing service (Cao et al., 2021), digital finance provides credit support precisely for the transformation of polluting industries. With adequate financing support, manufacturing enterprises are better motivated to promote GTI (Gomber et al., 2018; Wen et al., 2021). Based on the preceding discussion, Hypothesis 1b is proposed as follows:

Hypothesis 1b. (H1b): The digital finance development promotes GTI of manufacturing enterprises.

3.2 The mediating role of resource allocation efficiency

The resource-based theory posits that resources are valuable, scarce and inimitable, which play a fundamental role in competitive advantages of enterprises (Barney, 1986). Compared with traditional innovation activity, GTI requires more resources for high risk investments (Cao et al., 2021; Wu et al., 2022). However, because an enterprise is constrained by limited resources, only by improving allocation efficiency can it build a sustainable competitive advantage (Richey et al., 2005; Miao et al., 2017).

In fact, the asymmetry of resource supply and demand often leads to bounded rational allocation decisions, which make it difficult for enterprises to deal with market uncertainty (Li, 2014). The development of the digital economy can help enterprises tackle these difficult issues. First of all, the Internet accelerates the flow of resources among innovative entities, reduces flow costs and improves efficiency (Long and Li, 2021). In addition, the Internet allows companies to break the shackles of information transmission between producers and consumers. The cost of searching out information and the loss of efficiency caused by information asymmetry will also be decreased. This allows enterprises to make decisions more accurately. Moreover, according to the characteristics, preferences and potential needs of consumers, enterprises can adjust the cooperating partners in the industrial supply chain in a timely manner and reduce the resource consumption in circulation (Wang et al., 2018). Secondly, digital finance can optimize financial market flexibility and improve the efficiency of financial services. Increased development in the financial market will enable enterprises to obtain funds more quickly and equitably (Gomber et al., 2018).

Lastly, as an informative and digital tool of the modern financial system, digital finance directs more funds to high-efficiency activities by conducting frequent project evaluations. In pursuit of sustainability, free-flowing resources tend to flow into high-productivity activities. The Internet and digital finance technology allows precise decision-making, which will make allocation of scarce resources for innovation more efficient, including human capital, material assets, finances, and knowledge. Therefore, there will be more resources available for enterprises to carry out GTI and support high-quality innovation activities (Cao et al., 2021). Based on the preceding discussion, Hypothesis 2a and Hypothesis 2b are proposed as follows:

Hypothesis 2a. (H2a): The resource allocation efficiency plays a mediating role between Internet development and GTI of manufacturing enterprises.

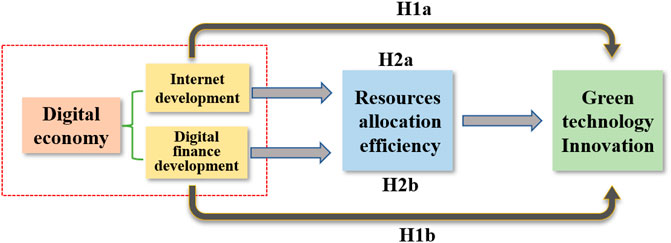

Hypothesis 2b. (H2b): The resource allocation efficiency plays a mediating role between digital finance development and GTI of manufacturing enterprises.The conceptual framework of the research hypothesis has constructed, which is shown in Figure 1.

4 Research design

4.1 Sample and data collection

In this paper, manufacturing enterprises listed on the Shanghai and Shenzhen A-shares market in China were selected as research samples. Because of the lack of a digital finance index before 2011, the panel dataset was constructed from 2011 to 2018, which matched the enterprises’ business registration locations with prefecture-level cities. We carried out the following processes. First, the research sample was selected based on the manufacturing industry code in the 2012 edition of the China Securities Regulatory Commission (CSRC). Second, the data on green patents were based on the Green Patent Research Database (GPRD). The digital financial index was based on the Digital Financial Inclusion Index (2011–2018) compiled by Peking University. Third, the data on prefecture-level cities were obtained from the China City Statistical Yearbook. Lastly, data processing was carried out because some data were missing, namely Xinjiang, Tibet, Hainan and other cities were not included. Samples that were ST or delisted during the sample period were excluded, and samples with ambiguous data were removed. To reduce the effect of outliers, the continuous type data all trailed in the upper and lower 1% quantile. After this processing, a total of 9,958 panel datasets for 222 cities from 2011 to 2018 were formed.

4.2 Variable measurement

4.2.1 Dependent variable: green technology innovation of enterprises (Envrpat)

In previous studies, GTI was measured by R & D investment to reduce energy consumption (Song et al., 2020) and the number of green patents (Wang and Chu, 2019; Dou and Gao, 2022). Referring to Wang and Chu (2019), we used the number of green patent applications to measure GTI in this research. This method was chosen because green patents are the most intuitive and quantifiable reflection of an enterprise’s ability to innovate green technologies. They are beneficial for saving resources, improving energy efficiency, and controlling pollution. Preparing and processing patent applications is time-consuming, and the number of patent application is rather more time-sensitive than granted patents. Finally, in order to avoid the influence of ‘0’, the method of Xu and Cui (2020) was applied to measure green patent applications by adding 1 and taking the logarithm.

4.2.2 Independent variables

There is no unified method for the measurement of the regional digital economy, but the measurement methods of Zhao et al. (2020) are widely accepted. Referring to Zhao et al. (2020), this paper divided the digital economy into two dimensions, Internet development and digital finance development. The development of the digital economy cannot be separated from the progress of the Internet (Paunov and Rollo, 2016; Huang et al., 2019; Yang et al., 2021). Digital finance as a new digital transaction model is also closely related to the development of the digital economy (Fu and Huang, 2018; Guo et al., 2020). This indicator system takes full account of the demand for talent, business output, security of infrastructure and the development of digital finance. With the limited data available at the city level, the indicator system can accurately measure the digital economy development. The measurement of Internet development and digital financial development is shown below.

1) Internet development (Int) is measured by the Internet composite development index. Referring to Huang et al. (2019) and Dou and Gao (2022), from the perspective of internet application and output, we selected four indicators: Internet penetration (number of internet users per 100 people), Internet-related employees (percentage of software and computer service employees), Internet-related output (total telecommunication services per capita) and mobile Internet phone penetration (number of mobile phone users per 100 people). Then we standardized the data on the four indicators and conducted principal component analysis (PCA). The results showed that KMO was 0.748, which is >0.7, and Bartlett’s sphericity was 0, <0.05. In addition, according to the Kaiser rule, a principal component with an eigenvalue of 2.441 is >1. A variance contribution rate of 61.015% was extracted, which can represent most of the information.

2) Digital finance development (DIF) was measured by the digital financial inclusion index compiled by Peking University (Guo et al., 2020). Referring to Zhao et al. (2020) and Li et al. (2022), the index builds a digital financial inclusion indicator system with three dimensions, including the digital financial digitization degree, the digital financial usage depth and the digital financial coverage breadth. This includes a total of 33 specific indicators.

4.2.3 Mediating variable: resource allocation efficiency (TFPdis)

Resource allocation efficiency refers to the efficiency generated by the distribution of each input factor at a given level of technology (Hsieh and Klenow, 2009; Ezra Oberfield, 2013; Chris et al., 2015). More specifically, when an enterprise undertakes a project with specific requirements of capital and work force, the resource allocation efficiency indicates how enterprises should allocate these internal resources most efficiently.

At present, the measurements of resource allocation efficiency in academic circles is mainly based on productivity distribution (Hsieh and Klenow, 2009), additive rate heterogeneity (Oberfield, 2013), and total-factor productivity (Chris et al., 2015). The first two methods take industrial enterprises as research samples and involve industrial added-value data. Considering the characteristics of the research samples, we used productivity distribution to measure resource allocation efficiency of enterprises. It is worth nothing that the lower the dispersion of productivity distribution, the more efficient is the resource allocation. Referring to Chris et al. (2015), they measured productivity distribution by using the standard deviation of the enterprises’ total factor productivity within the same industry, that is TFPdis = sd (lnTFP). This paper used the method of OP to calculate the total factor productivity of enterprises (lnTFP). The advantages of the OP method (Olley and Pakes, 1996) lie in the fact that within the manufacturing sector, the market environment is largely the same, which makes the resource allocation efficiency dependent on the productivity of enterprises themselves. Also, the OP method considers the entry and exit of enterprises, and reflects the dynamic process of resource flow from low-productivity to high-productivity. To sum up, this method solves the endogeneity of TFP and production factors by structuring production functions. Its econometric model is shown below.

where i and t denote the individual enterprise and year; Y is the sales revenue, measured by the main business income; and L is labor input, measured by the number of employees. K is the capital investment, measured by the net value of fixed assets and Age represents the age of the enterprise. Year and id are time and individual fixed effects, respectively, and ɛ is the residual term, including random interference factors that cannot be reflected in the function.

4.2.4 Control variables

In order to comprehensively analyze the impact of the regional digital economy on the GTI, the following control variables were selected in the regression model. (1) Corporate size (lnLabor), which was measured by the natural logarithm of the number of employee. Liu et al. (2022) pointed out that larger enterprises usually have greater innovative capacity. (2) Corporate age (lnAge), which was measured as the number of years passed since a listed enterprise was founded. Some studies have found that when firms have been around longer, they have a greater sense of innovation and the ability to innovate (Xie et al., 2015; Wen et al., 2021). (3) Government support (GS), used the logarithm of the current government funding in the internal expenditure of the enterprise funds, which can complement R & D activities (Wang and Chu, 2019). (4) Shareholding structure (HS), which was measured as the total shareholding ratio of the top five shareholders. The shareholding structure means that the shareholders have control over the business. Decisions within the business can be implemented more quickly (He et al., 2021). (5) Business growth (Growth) represents the profitability of the business, which was measured as the growth rate of the enterprise’s operating income (Wang and Chu, 2019; Dou and Gao, 2022). (6) Financial leverage (Lev) reflects the overall quality and liquidity of the business (He et al., 2021), which was measured as total debt divided by total assets. (7) R&D personnel (lnRDP), which was measured by the logarithm of the number of R&D personnel in the enterprise. (8) R&D intensity (lnRDsum), which was measured by the logarithm of the total R&D expenditure of the enterprise. R&D funding and R&D staff can improve technical equipment, reform processes and carry out innovation (Wei et al., 2015; Ji and Zhang, 2019).

4.3 Model specifications

4.3.1 Benchmark model

Multiple regression analysis is widely used in fields such as econometrics, ecology and finance (Dormann et al., 2013). Many studies often use a set of predictor variables to measure the response to a particular variable. In view of Wei et al. (2015) and He et al. (2021), multiple regression models have been used to measure the relationship between digital technology, venture capital, and green innovation. To test the relationship between regional digital economy and GTI, we constructed the following regression models (see model (1) and model (2)).

where Envrpat is the dependent variable, representing the green technology innovation of enterprises. Int and DIF are independent variables, representing internet development and digital finance development. i represents individual enterprises, and t represents years. Control represents all control variables. In the models, we also control year fixed effects yeart. and individual fixed effects cpi. ɛ is random error term. α1, α2, β1 and β2 represent the coefficients, indicating the coefficient of internet development, digital finance development and control variables. α0 and β0 represent the model intercept terms.

4.3.2 Mediating effect model

Based on the previous theoretical analysis and variables setting, we used the method proposed by Baron and Kenny (1986) to test the moderating effect of TFPdis as follows:

Here, x represents the Int and DIF independent variable and TFPdis represents the mediating variable. Control variables are the same as for the benchmark model.

5 Empirical results and analysis

5.1 Descriptive statistics

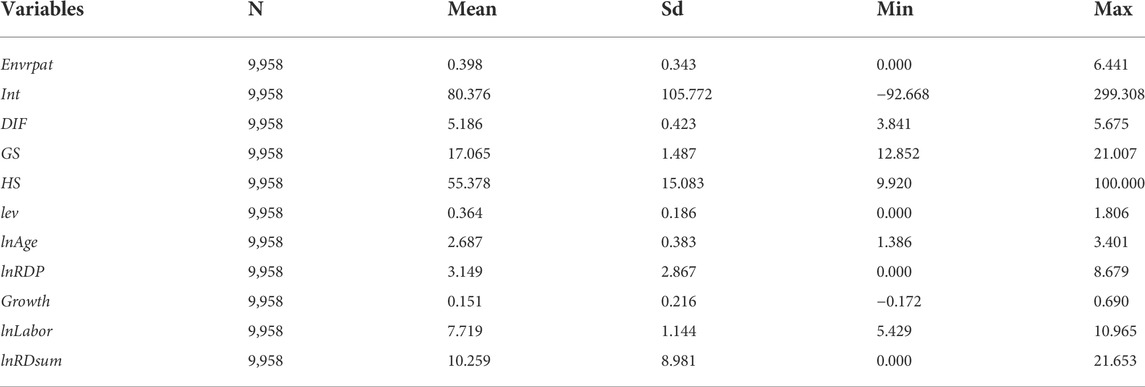

Firstly, the average number of green patent applications of the samples was 0.398, which revealed that the GTI capability of manufacturing enterprises needed to be improved (Table 2). The standard deviation, maximum, and minimum are 0.343, 6.441 and 0, which indicate large difference in the GTI of manufacturing enterprises. Secondly, the average value of Int was 80.376, indicating an emphasis on internet construction, but due to the economic influence between different regions, there was a significant difference between maximum and minimum with respect to Int. Finally, the average value of DIF was 5.186, which proved that digital finance was at an initial stage. The kurtosis, skewness and JB values were also calculated for each variable (standard values of kurtosis and skewness are 0 and 3), and It can be seen that neither the kurtosis nor the skewness value of each variable in this study differed from the standard value by >1. This finding is similar to Zhang and Cai (2020), who reported that when the absolute difference in skewness was <1 and the absolute difference in kurtosis was <2, the distribution of the samples could still be considered normal. Moreover, referring to Azzalini and Valle (1996), Paul and Zhang (2010) and Mameli et al. (2012), when the samples had a skewed-normal distribution, it did not affect the subsequent empirical analysis.

5.2 Empirical results

5.2.1 Benchmark regression results

In a multiple regression model, we needed to perform a Hausman test first to determine whether a fixed effect or a random effect was chosen. If the Hausman test was significant, we chose a fixed effect, otherwise a random effect was chosen (Wei et al., 2015; He et al., 2021). Subsequently, we used Stata15 to test whether the coefficients on the independent variables were significant, which could be used to explain the changes in the dependent variable.

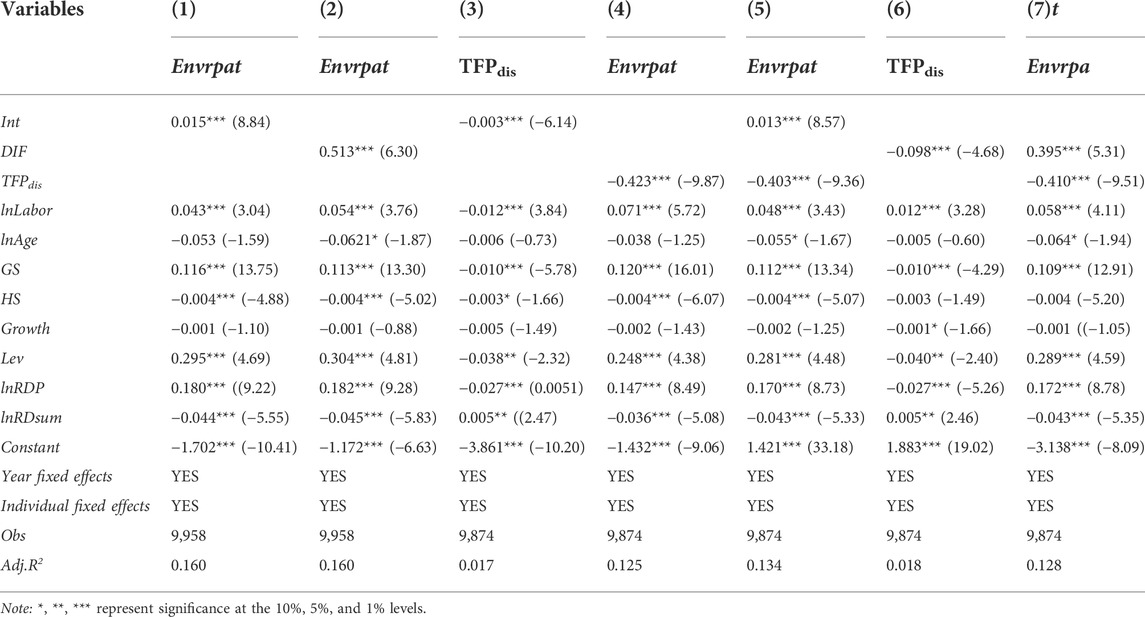

Models (1) and (2) were used to test the relationship between the digital economy (more specifically Internet and digital finance) and the GTI of manufacturing enterprises. The Hausman tests in models (1) and (2) were 21.81 and 21.11 respectively, which was significant at 1%. Therefore, we construct a time-to-individual fixed model to analyze the impact of Int and DIF on GTI. According to Table 3, the coefficients of Int and DIF were 0.015 and 0.513, and statistically significant at 1%. The results implied that both the Internet and digital finance could significantly promote GTI of manufacturing enterprises. Among these, the impact of DIF on GTI was stronger.

One possible explanation is that manufacturing enterprises undertake high risks when they invest in green innovation (Wu et al., 2022). Although the Internet has reduced the cost of information collection and increased consumer attention to GTI, the value created by GTI is easily shared by others due to its loose property rights. Obtaining sufficient R & D funds is crucial for GTI, and this is difficult for enterprises themselves, and even with government financial help. That means that GTI has to rely on the support of the financial sector (Wei et al., 2015). Due to its advantages of wide coverage, low cost, and high efficiency (Guo et al., 2020), digital financing can broaden the sources of funds and effectively alleviate the financial constraints for GTI. In the external policy environment, digital financing can reduce information asymmetry, promote information sharing, and help financial institutions give more support to green projects. Therefore, compared with Internet development, digital finance has more significance for helping enterprises carry out GTI. Thus, H1 and H2 are verified.

5.2.2 Mediating regression results

Models (4), (5), and (6) were used to test the mediating role of resource allocation efficiency between the digital economy and GTI (Table 3). In columns 3 and 6, the coefficients of Int and DIF were −0.003 and −0.091, with significance at 1%, indicating that the Internet and digital finance have created a favorable environment for resource allocation. More specifically, the Internet can overcome space-time constraints and enhance the effectiveness of information sharing, while digital finance can increase the liquidity of resources, which improves the asymmetry of resource allocation. The coefficient of TFPdis in column (4) is −0.423 and significant at 1%, which indicates that resource allocation efficiency will promote GTI of enterprises. Combined with the results in columns (5) and (7), the coefficients of TFPdis are −0.403 and −0.410, and the coefficients of DIF and Int are 0.013 and 0.395, respectively. All coefficients are significant at 1%, which indicates that both Internet and digital finance can promote the green technological innovation capability by facilitating resource allocation efficiency. So H3 (a, b, c) are verified.

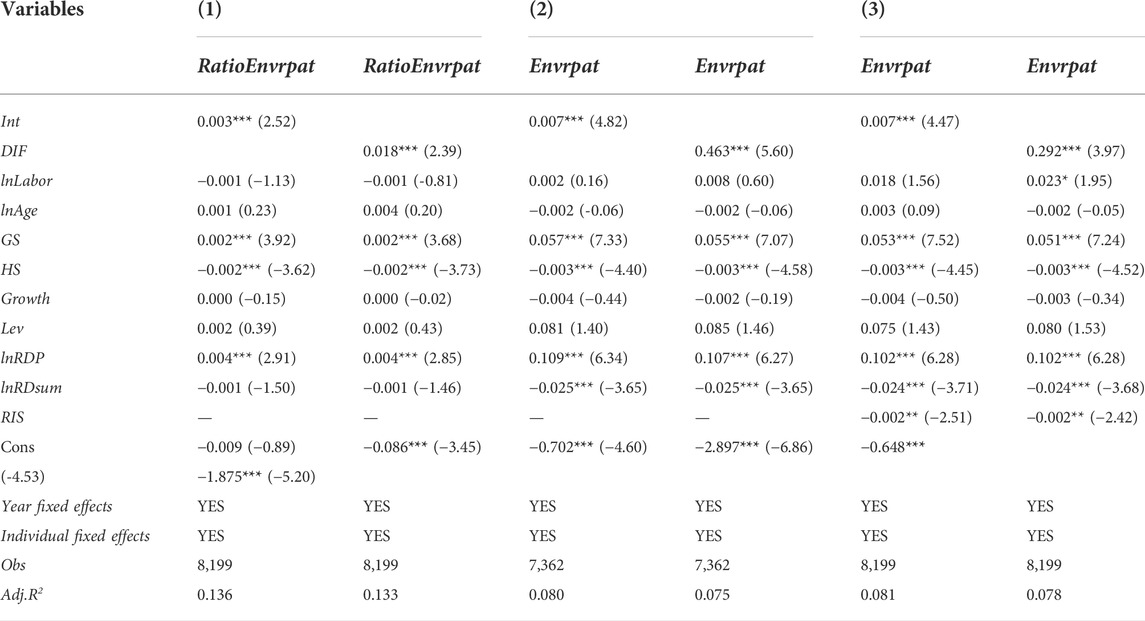

5.3 Robustness checks

We conducted the following robustness checks. First, we replaced the measurement of the dependent variable with the number of green patent applications of the listed enterprises (RatioEnvrpat) (Wang and Chu, 2019). The result is presented in column (1) of Table 4. Second, we excluded certain samples. Based on the 2012 “Industrial Transformation and Upgrading Plan” from the General Office of the State Council (PRC), we deleted the samples from 2011, and the results are shown in column 2 of Table 4. Lastly, concerning the omitted variables, we considered that regional factors also had an impact on enterprises’ GTI, so we added the regional industrial structure (RIS) to the benchmark model and the results are shown in column 3 of Table 4. Clearly, the positive relationship between digital economy and GTI is robust.

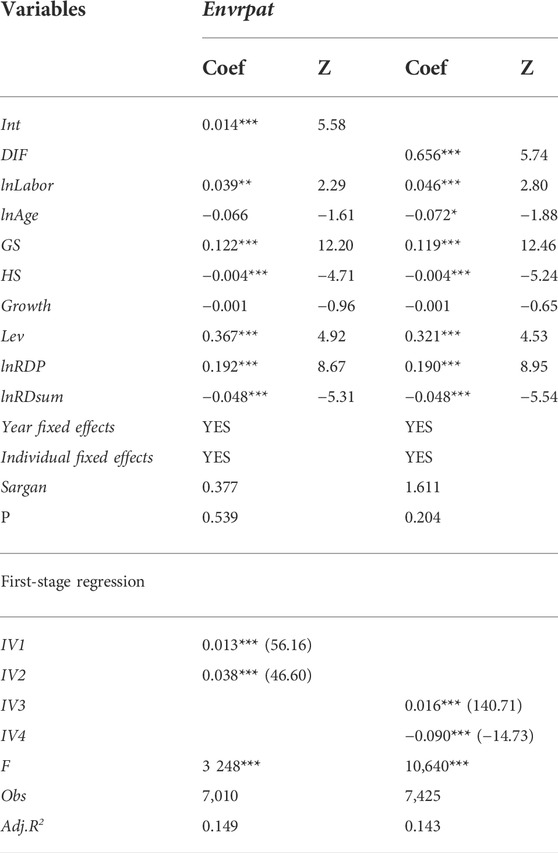

5.4 Endogeneity tests

This study may have the following endogeneity problems: (1) When innovation ability in a certain region is strong, it may pull digital economy development into that region. (2) There may also be individual selection bias. Manufacturing is a high-energy, resource-intensive industry, with a strong motivation for GTI. In order to solve the endogeneity problems, this paper adopted the instrumental variables for processing endogeneity. Referring to Huang et al. (2019), the number of landline telephones and post offices in history (1984) were selected for Int as instrumental variables. Internet development first began with the popularization of landline telephones, before which people’s information communication was mainly realized through the postal service. With the popularization of the Internet, the relationship that once existed between landline telephones as well as post offices and manufacturing technology innovation has been disappearing. In addition, because the selected instrumental variables contain cross-sectional data, they cannot be applied to the measurement of panel data directly. With reference to Nunn and Qian (2014), we constructed an interaction between the number of landlines and the number of post offices per 10,000 people (related to individual variation) in each city in 1984, and the number of national Internet users (related to time) in the previous year, respectively.

Since the Chinese digital finance index, DIF, is influenced by more than one hundred cities, the impact of one city is not significant. Therefore, drawing on Fu and Huang (2018), the ‘Bartik instrument’ (multiply by the first-order lagged digital finance index ∆DFt-1 and the first-order difference in time) was constructed as an instrumental variable. At the same time, considering the influence of geography on regional digital finance development, the interaction between the distance of a city to Hangzhou and the average level of national digital finance was selected as another instrumental variable.

In this paper, 2SLS regression was used to test for endogeneity, and the results are shown in Table 5. In the first-stage regression, the F-statistics are greater than 10, which indicates that there are no weak instrumental variables. Among them, the coefficients of the instrumental variables of Int are positive, indicating that there is a significant positive relationship between the number of landlines and post offices and regional Internet development. The coefficients of the ‘Bartik instrument’ were significantly positive, but the coefficients of the other were negative, which indicates that the greater the distance from Hangzhou, the more unfavorable the digital finance development in that region. In the second-stage regression, the Sargan test statistics were 0.377 and 1.611, corresponding to p values of 0.539 and 0.204, which supports acceptance of the original hypothesis and shows that there is no over-identification. These results suggest that the positive relationship between digital economy and GTI will not change.

5.5 Heterogeneity analysis

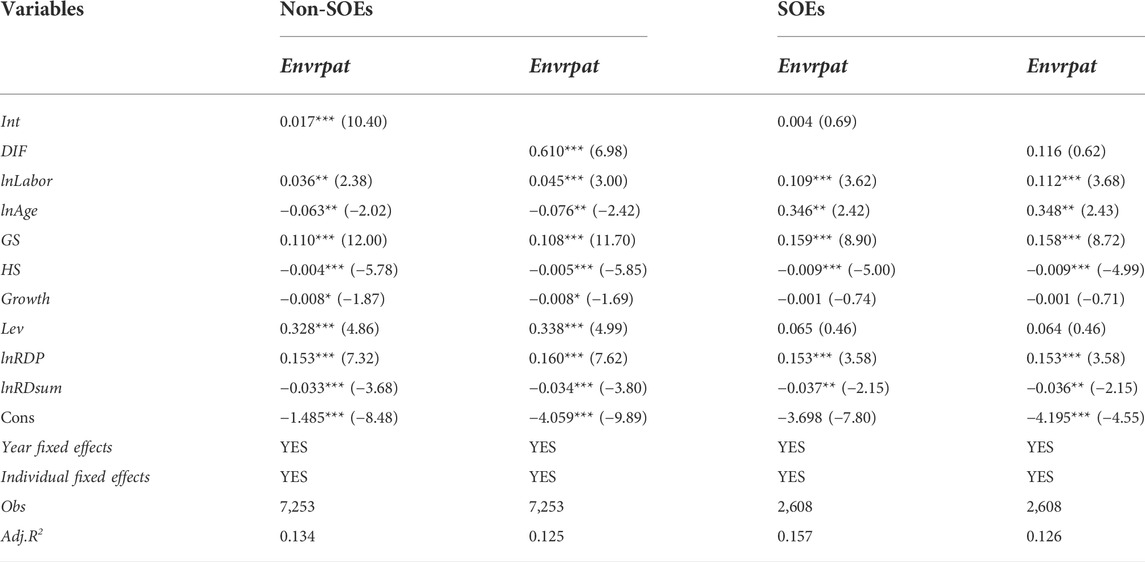

5.5.1 Heterogeneity of enterprise ownership

Differences in the nature of ownership will affect operation efficiency and business logic (Chen et al., 2017). Based on the nature of actual controllers calculated by the CSMAR, we divided all the enterprises into non-state-owned enterprises (non-SOEs) and state-owned enterprises (SOEs). Non-SOEs include private and foreign-funded enterprises, while SOEs included holding and wholly owned enterprises at the central, provincial and municipal levels. The regression results in Table 6 show that the coefficients of SOEs are not significant, while the coefficients of non-SOEs are significant at 1%. The results indicate that non-SOEs prefer to use the digital economy to promote GTI. Possible reasons include: (1) Int has reduced the asymmetry of information and achieved cross-organizational interactions between stakeholders and enterprises. As environmental pollution becomes more and more serious, it is urgently necessary for manufacturing enterprises to carry out green transformation. However, the actual decision-makers of SOEs are appointed by the government in China. Due to ownership by the state, they tend to adopt conservative investment strategies in production and operations (He et al., 2015). The decision-makers lack the power to use digital technology for green technological innovation. In contrast, the senior executives of non-SOEs have more influence, and their individual behavior converges with the goals of the enterprises. In the face of fierce competition for survival, non-SOEs have to speed up their use of the opportunities afforded by the digital economy. (2) GTI is an innovative activity that requires a considerable investment, and all enterprises need to provide sufficient financial support for it. SOEs are subject to more government intervention, but also enjoy more government policy bias in technological innovation. Meanwhile, under the government’s credit endorsement, they will receive extra care from banks and enjoy priority in credit resource allocation (Chen et al., 2017). On the contrary, the financing constraints of non-SOEs in GTI are more severe. They have to seize the opportunities of digital financing to alleviate the dilemma of lack of funds.

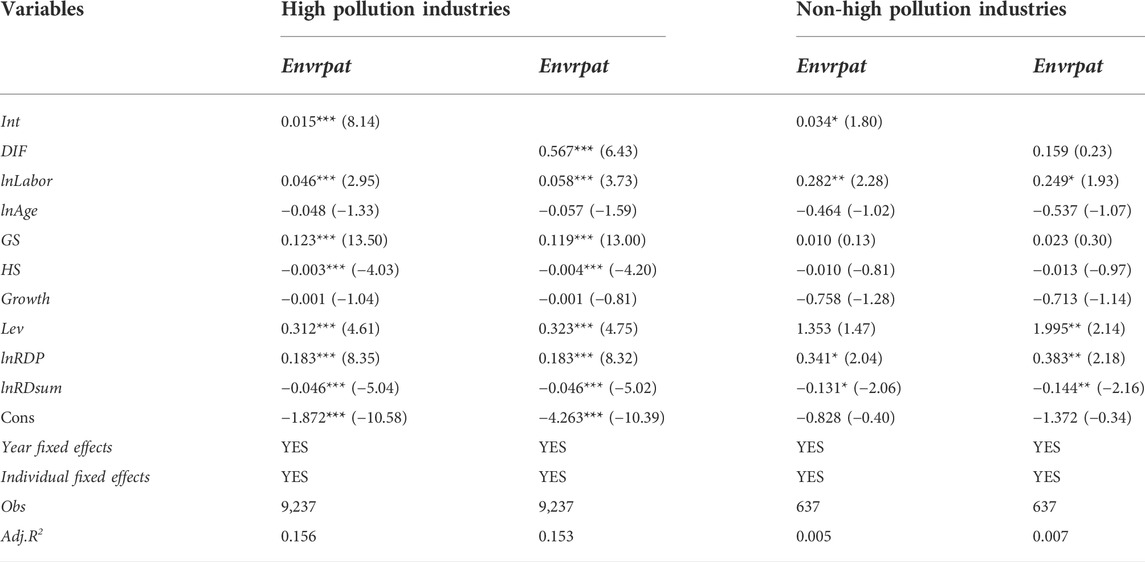

5.5.2 Heterogeneity of industrial pollution level

According to the guidelines for environmental information disclosure by the Ministry of Ecology and Environment of the People’s Republic of China in 2010, 16 industries including thermal power, steel and cement were classified as high-polluters. The rest are considered as non-high pollution industries. The results in Table 7 show that the coefficients of non-high pollution industries are not significant, while all coefficients of high-pollution industries are significant at 1%. The possible reasons for this are as follows: (1) Rapid Internet development breaks down the information barriers among enterprises, markets, and consumers. With more attention and supervision by stakeholders (He et al., 2021), the enterprises in high pollution industries are more motivated to seize the opportunities offered by the digital economy to upgrade the products and processes and improve their GTI capability. Moreover, the Internet provides a realistic path for highly polluting enterprises to explore green production, clean energy, green infrastructure and green services. (2) In 2007, the green-credit policy of China incorporated environmental information into the credit approval mechanism. This raised the threshold for loan financing for high pollution industries (Wen et al., 2021). Although highly polluting enterprises are willing to engage in GTI, they are often limited by resource constraints. As a new low-cost, multi-channel financing method, digital finance greatly reduces the financing pressure on enterprises. Highly polluting enterprises are more motivated to use digital finance to get social capital, which benefits the green transformation. For non-high pollution industries, enterprises have been given more preferential treatment in terms of green credits. Therefore, in order to respond to environmental demands and alleviate cost pressures, the high-pollution industries have stronger motivations to carry out GTI with digital economy.

5.5.3 Heterogeneity of regional development level

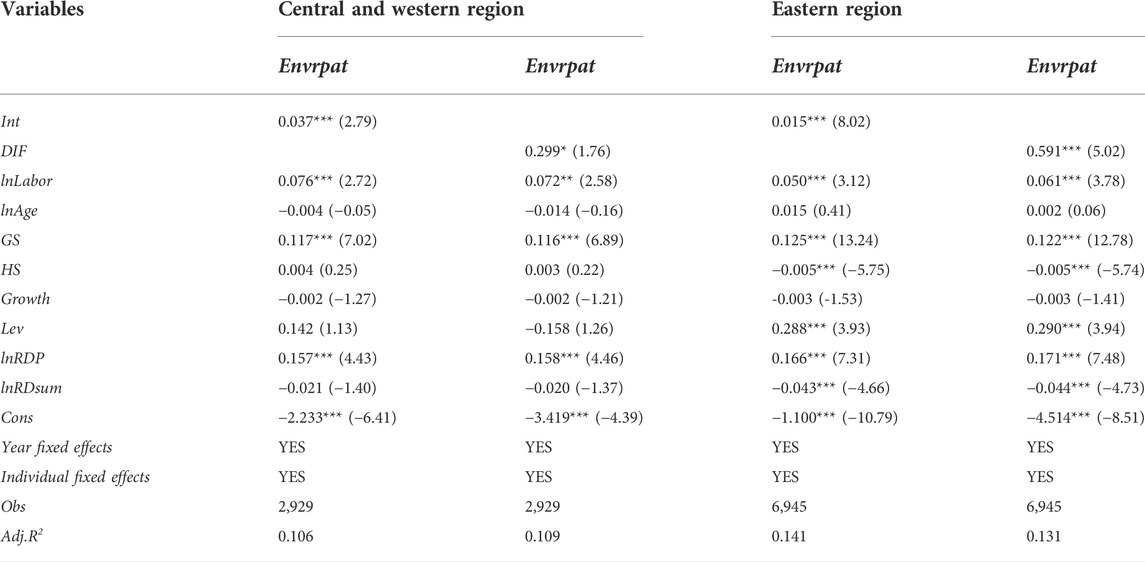

In recent years, the ‘Matthew effect’ has appeared in China’s regional economic development, which indicates that there are gaps in capital, talents, and R & D level in different regions (Qu et al., 2022). Therefore, according to geographical location, we divided the area into central, western, and eastern regions. The regression results in Table 8 show that Int has significantly promoted GTI in all regions at 1% significance. DIF was significant at the level of 10% in the central and western region, but at a level of 1% in the eastern region. The possible explanations are as follows: (1) The Internet development between different regions has been narrowed in China. As early as 2013, the government of China added a statement that the “National Internet backbone directly points” to the central and western regions, which accelerated the construction of Internet infrastructure. At present, there is no obvious difference between the regions with regard to Internet development, which may explain why the Internet development of all regions significantly promoted GTI at the level of 1%. (2) Compared with the central and western regions, the eastern region has unique geographical advantages, including advanced technology resources and capital accumulation. The eastern region has surpassed the central and western regions in digital financial development, civil society capital activity and operation efficiency (Wu et al., 2022). These advantages have created an external environment for manufacturing enterprises to carry out GTI. However, in the central and western region, digital finance development is relatively backward. For example, due to the emphasis on economic growth, local governments are more likely to weaken environmental regulations to attract investment. Under loose environmental policies, enterprises are also more inclined to reduce investment in environmental protection. In the worst case, they may accelerate their own development at the expense of the environment; therefore, enterprises in the central and western regions, may have lower motivations to carry out GTI.

6 Conclusion and implications

6.1 Conclusions

This paper aimed to study the impact of the digital economy (Internet and digital finance development) on GTI of manufacturing enterprises. The data was collected from listed Chinese manufacturing enterprises and 222 prefecture-level cities from 2011 to 2018. The main conclusions are that both Internet and digital finance development are conducive to enhancement of GTI for manufacturing enterprises. This conclusion is similar to those of Martin et al. (2018) and Wang et al. (2022), who found that the digital level of a region could benefit the green innovation of enterprises. Moreover, we found that resource allocation efficiency played a mediating role in the digital economy and GTI. In other words, the digital economy not only affected GTI directly, but also had an indirect impact on GTI through resource allocation efficiency. Lastly, we conducted a further heterogeneity analysis. On the one hand, compared with low-pollution industries (or SOEs), the digital economy has a greater impact on the GTI of high-pollution industries (or non-SOEs). On the other hand, although different regions develop differently, the GTI of manufacturing enterprises is significantly affected by Internet development. Compared with developing regions, however, the GTI of manufacturing enterprises in developed regions can benefit more quickly from digital finance.

6.2 Implications

The above conclusion lead to the following implications:

1) Manufacturing enterprises should make full use of the opportunities offered by the digital economy to achieve green transformations. Manufacturing enterprises should actively utilize the development of the Internet and other digital technologies, specifically by building an Internet platform and accelerating the integration of GTI and Internet development. External innovation subjects can become better connected, such as through environmental protection agencies, research institutes and other stakeholders in the supply chain. In addition, local governments should encourage financial banks and other institutions to invest in GTI. For example, insurers are encouraged to develop green insurance businesses that can support GTI, which is beneficial for overcoming the financial constraints of manufacturing enterprises and increasing their motivation to do research on green innovations.

2) Manufacturing enterprises have to focus on rational resource allocation, which can help more innovation resources flow into green transformation. On the one hand, with the support of digital infrastructure, manufacturing enterprises can make better use of the intelligence, automation and customization of resource allocation in the process of GTI. Manufacturing enterprises should not only invest resources in GTI, but also pay more attention to improvement of resource allocation through digital technology. On the other hand, manufacturing enterprises should strengthen and refine their use of digital finance, build a modern information database, and upgrade the project evaluation system.

3) The government needs to formulate policies for different enterprises to better carry out GTI. First, based on the heterogeneity of ownership, environmental policies should be differentiated for different enterprises. Due to the lack of supervision, green transformation should be added to performance appraisals in SOEs. For non-SOEs, governments should provide more support to ensure that funding and talents are sufficient for GTI. Second, a unified environmental policy cannot reasonably reflect the environmental governance of different industries. The low-pollution industries are dominated by the innovation compensation effect, which indicates that sufficient material incentives can promote GTI. Therefore, the government should improve the innovation incentive mechanism. For high-pollution industries, the government should establish an efficient cost-sharing mechanism, which will motivate them to invest more for GTI. Third, the government should adjust environmental policies in different regions based on their unique socioeconomic development level. Specifically, in developing regions, the government should carry out digital infrastructure development, which can support and motivate enterprises to upgrade equipment and phase out backward capacity. In order to truly achieve green transformation, the government should also introduce advanced talents to developing regions. In developed regions, the government should fully grasp the historical opportunities, seek progress in a stable manner, and make long-term efforts to solve the difficulties and problems in green transformation. The government has to strengthen its position and take a leading role in demonstrating and exploring the effective modes of GTI.

6.3 Limitations and future research

Some limitations arising from this study provide further research directions. First, the research sample was selected from China. Future studies should include global samples to expand the applicability of the results. Secondly, the digital economy is a complex system that continuously evolves with the development of new digital technology. The indicators of the digital economy need to be further refined. Third, the measurement of GTI should be studied in greater depth. Although the numbers of green patent applications are often used to measure GTI, the information conveyed by the number of patents is limited. Further research can consider the process of GTI, such as the quality of green patents. Finally, several unexplored avenues between the digital economy on GTI await investigation. This paper considers the role of resource allocation efficiency between digital economy and GTI. But this avenue may not be the only one. Further research may comprehensively study the enterprise dynamic capabilities, financial constraints etc.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: China Securities Regulatory Commission; Green Patent Research Database; City Statistical Yearbook; Digital Financial Inclusion Index by Peking University.

Author contributions

JN: conceptualization, writing-review and editing, methodology. QY: conceptualization, writing-original draft, data collection, methodology. AY: writing-original draft, writing reviewing and editing.

Funding

This work was supported by the National Natural Science Foundation of China (No.71804169), MOE (Ministry of Education in China) Project of Humanities and Social Sciences (No. 18YJC630125) and 2022 Qingdao Social Science Planning Research Project (No. QDSKL2201015).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdulai, A. R. (2022). A new green revolution (GR) or neoliberal entrenchment in agri-food systems? Exploring narratives around digital agriculture (DA), food systems, and development in sub-sahara africa. J. Dev. Stud., 1–17. doi:10.1080/00220388.2022.2032673

Acemoglu, D., Akcigit, U., and Kerr, W. R. (2016). Innovation network. Proceedings of the National Academy of Sciences 113 (41), 11483–11488. doi:10.1073/pnas.1613559113

Awan, U., Shamim, S., Khan, Z., Zia, N. U., Shariq, S. M., and Khan, M. N. (2021). Big data analytics capability and decision-making: The role of data-driven insight on circular economy performance. Technol. Forecast. Soc. Change 168, 120766. doi:10.1016/j.techfore.2021.120766

Azzalini, A., and Valle, A. D. (1996). The multivariate skew-normal distribution. Biometrika 83 (4), 715–726. doi:10.1093/biomet/83.4.715

Barney, J. B. (1986). Strategic factor markets: Expectations, luck, and business strategy. Manag. Sci. 32 (10), 1231–1241. doi:10.1287/mnsc.32.10.1231

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Berrone, P., Fosfuri, A., Gelabert, L., and Gomez‐Mejia, L. R. (2013). Necessity as the mother of ‘green’inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 34 (8), 891–909. doi:10.1002/smj.2041

Cao, S., Nie, L., Sun, H., Sun, W., and Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: Evidence from China's regional economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

Chen, Y. S., Lai, S. B., and Wen, C. T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 67 (4), 331–339. doi:10.1007/s10551-006-9025-5

Chen, Y., Wang, Y., Nevo, S., Benitez, J., and Kou, G. (2017). Improving strategic flexibility with information technologies: Insights for firm performance in an emerging economy. J. Inf. Technol. 32 (1), 10–25. doi:10.1057/jit.2015.26

Chihiro, W., Kashif, N., Yuji, T., and Pekka, N. (2018). Measuring GDP in the digital economy: Increasing dependence on uncaptured GDP[J]. Technological forecasting and social change. doi:10.1016/j.techfore.2018.07.053

Chris, E., Virgiliu, M., and Daniel, Y. X. (2015). Competition, markups, and the gains from international trade. Am. Econ. Rev. 105 (10), 3183–3221. doi:10.1257/aer.20120549

Cuerva, M. C., Triguero-Cano, Á., and Córcoles, D. (2014). Drivers of green and non-green innovation: Empirical evidence in low-tech SMEs. J. Clean. Prod. 68, 104–113. doi:10.1016/j.jclepro.2013.10.049

Dai, D., Fan, Y., Wang, G., and Xie, J. (2022). Digital economy, R&D investment, and regional green innovation—analysis based on provincial panel data in China. Sustainability 14 (11), 6508. doi:10.3390/su14116508

DanishWang, B., and Wang, Z. (2018). Imported technology and CO2 emission in China: Collecting evidence through bound testing and VECM approach. Renew. Sustain. Energy Rev. 82, 4204–4214. doi:10.1016/j.rser.2017.11.002

Department of Broadband (2013). in Advancing Australia as a digital economy: An update to the national digital economy strategy.Communications and the digital economy (DBCD).

Diewert, W. E., Fox, K. J., and Schreyer, P. (2018). The digital economy, new products and consumer welfare. Burkina faso: Economic Statistics Centre of Excellence. https://EconPapers.repec. org/RePEc: nsr: escoed: escoe-dp-2018-16.

Domazet, I., and Lazić, M. (2017). Information and communication technologies as a driver of the digital economy. Glas. Srp. Geogr. društva, 11–19.

Dormann, C. F., Elith, J., Bacher, S., Buchmann, C., Carl, G., Carré, G., et al. (2013). Collinearity: A review of methods to deal with it and a simulation study evaluating their performance. Ecography 36 (1), 27–46. doi:10.1111/j.1600-0587.2012.07348.x

Dou, Q., and Gao, X. (2022). The double-edged role of the digital economy in firm green innovation: Micro-evidence from Chinese manufacturing industry. Environ. Sci. Pollut. Res. Int., 1–19. doi:10.1007/s11356-022-20435-3

El-Kassar, A. N., and Singh, S. K. (2019). Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. change 144, 483–498. doi:10.1016/j.techfore.2017.12.016

Feng, S., Zhang, R., and Li, G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Firoiu, D., Pîrvu, R., Jianu, E., Cismaș, L. M., Tudor, S., and Lățea, G. (2022). Digital performance in EU member states in the context of the transition to a climate neutral economy. Sustainability 14 (6), 3343. doi:10.3390/su14063343

Freeman, R. E. (1984). Strategic management: Stakeholder approach. MABoston: Pitman. doi:10.1007/s10640-013-9664-9

Fu, Q. Z., and Huang, Y. P. (2018). “Digital finance’s heterogeneous effects on rural financial demand: Evidence from China household finance survey and inclusive digital finance index,” in CNKI:SUN:JRYJ, Beijing: Journal of Financial Research, 68–84. (In Chinese).

Gomber, P., Kauffman, R. J., Parker, C., and Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 35 (1), 220–265. doi:10.1080/07421222.2018.1440766

Gomber, P., Koch, J. A., and Siering, M. (2017). Digital finance and FinTech: Current research and future research directions. J. Bus. Econ. 87 (5), 537–580. doi:10.1007/s11573-017-0852-x

Guo, F., Wang, J. Y., Wang, F., Kong, T., Zhang, X., and Cheng, Z. Y. (2020). Measuring China’s digital financial inclusion: Index compilation and spatial characteristics. China Econ. Q. 19 (04), 1401–1418. In Chinese. doi:10.13821/j.cnki.ceq.2020.03.12

He, Y., Chiu, Y. H., and Zhang, B. (2015). The impact of corporate governance on state-owned and non-state-owned firms efficiency in China. North Am. J. Econ. Finance 33, 252–277. doi:10.1016/j.najef.2015.06.001

He, Z., Lu, W., Hua, G., and Wang, J. (2021). Factors affecting enterprise level green innovation efficiency in the digital economy era–evidence from listed paper enterprises in China. BioResources 16 (4), 7648–7670. doi:10.15376/16.4.7648-7670

Hsieh, C., and Klenow, P. (2009). Misallocation and manufacturing TFP in China and India*. Q. J. Econ. 124 (4), 1403–1448. doi:10.1162/qjec.2009.124.4.1403

Huang, Q. H., Xu, Y. Z., and Zhang, S. L. (2019). Internet development and productivity growth in manufacturing industry: Internal mechanism and China experiences. China Ind. Econ. (08), 5–23. In Chinese. doi:10.19581/j.cnki.ciejournal.2019.08.001

Ji, Q., and Zhang, D. (2019). How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128, 114–124. doi:10.1016/j.enpol.2018.12.047

Jun, S., Wood, J., and Park, S. (2018). Multivariate multiple regression modelling for technology analysis. Technol. Analysis Strategic Manag. 30 (3), 311–323. doi:10.1080/09537325.2017.1309015

Jun, W., Nasir, M. H., Yousaf, Z., Khattak, A., Yasir, M., Javed, A., et al. (2021). Innovation performance in digital economy: Does digital platform capability, improvisation capability and organizational readiness really matter? Eur. J. Innovation Manag. doi:10.1108/EJIM-10-2020-0422

Khan, S. A. R., Piprani, A. Z., and Yu, Z. (2022). Digital technology and circular economy practices: Future of supply chains. Oper. Manag. Res., 1–13. doi:10.1007/s12063-021-00247-3

Leiter, A. M., Parolini, A., and Winner, H. (2011). Environmental regulation and investment: Evidence from European industry data. Ecol. Econ. 70 (4), 759–770. doi:10.1016/j.ecolecon.2010.11.013

Li, J., Chen, L., Chen, Y., and He, J. (2022). Digital economy, technological innovation, and green economic efficiency—empirical evidence from 277 cities in China. MDE. Manage. Decis. Econ. 43 (3), 616–629. doi:10.1002/mde.3406

Li, M., and Jia, S. (2018). Resource orchestration for innovation: The dual role of information technology. Technol. Anal. Strateg. Manag. 30, 1136–1147. doi:10.1080/09537325.2018.1443438

Li, Y. (2014). Environmental innovation practices and performance: Moderating effect of resource commitment. J. Clean. Prod. 66, 450–458. doi:10.1016/j.jclepro.2013.11.044

Lin, R. J., Tan, K. H., and Geng, Y. (2013). Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 40, 101–107. doi:10.1016/j.jclepro.2012.01.001

Liu, J., Yang, Y. J., and Zhang S, F. (2020). Research on the measurement and driving factors of China’s digital economy. Shanghai J. Econ. (06), 81–96. In Chinese. doi:10.19626/j.cnki.cn31-1163/f.2020.06.008

Liu, L. N., and Yan, Z. K. (2021). The impact of the digital economy on business innovation - based on a redundant resource perspective. Wuhan. Finance Mon. (08), 71–79. In Chinese. doi:10.3969/j.issn.1009-3540.2021.08.008

Liu, X., Zhang, J., Liu, T., and Zhang, X. (2022). Can the special economic zones promote the green technology innovation of enterprises? An evidence from China. Front. Environ. Sci. 197. doi:10.3389/fenvs.2022.870019

Liu, Y., Yang, Y., Li, H., and Zhong, K. (2022). Digital economy development, industrial structure upgrading and green total factor productivity: Empirical evidence from China’s cities. Int. J. Environ. Res. Public Health 19 (4), 2414. doi:10.3390/ijerph19042414

Long, G. Q., and Li, S. (2021). Does the energy internet improve the efficiency of resource allocation? Theoretical mechanism and case analysis IOP conference series: Earth and environmental science. IOP Conf. Ser. Earth Environ. Sci. 691 (1), 012021. doi:10.1088/1755-1315/691/1/012021

Lu, H., Song, C., and Lingling, L. (2021). Digital economy, innovation environment and urban innovation capabilities. Sci. Res. Manag. 42 (4), 35. doi:10.19571/j.cnki.1000-2995.2021.04.004

Ma, D., and Zhu, Q. (2022). Innovation in emerging economies: Research on the digital economy driving high-quality green development. J. Bus. Res. 145, 801–813. doi:10.1016/j.jbusres.2022.03.041

Ma, S., Zhang, Y., Liu, Y., Yang, H., Lv, J., and Ren, S. (2020). Data-driven sustainable intelligent manufacturing based on demand response for energy-intensive industries. J. Clean. Prod. 274, 123155. doi:10.1016/j.jclepro.2020.123155

Mameli, V., Musio, M., Sauleau, E., and Biggeri, A. (2012). Large sample confidence intervals for the skewness parameter of the skew-normal distribution based on Fisher's transformation. J. Appl. Statistics 39 (8), 1693–1702. doi:10.1080/02664763.2012.668177

Martin, C. J., Evans, J., and Karvonen, A. (2018). Smart and sustainable? Five tensions in the visions and practices of the smart-sustainable city in europe and north America. Technol. Forecast. Soc. Change 133, 269–278. doi:10.1016/j.techfore.2018.01.005

Miao, C., Fang, D., Sun, L., and Luo, Q. (2017). Natural resources utilization efficiency under the influence of green technological innovation. Resour. Conservation Recycl. 126, 153–161. doi:10.1016/j.resconrec.2017.07.019

Morello, E., Toffolo, S., and Magra, G. (2016). Impact analysis of ecodriving behaviour using suitable simulation platform (ICT-EMISSIONS project). Transp. Res. Procedia 14, 3119–3128. doi:10.1016/j.trpro.2016.05.252

Nathan, N., and Nancy, Q. (2014). US food aid and civil conflict. Am. Econ. Rev. 104 (6), 1630–1666. doi:10.1257/aer.104.6.1630

Novikov, S. V. (2020). Data science and big data technologies role in the digital economy. TEM J. 9 (2), 756–762. doi:10.18421/TEM92-44

Oberfield, E. (2013). Productivity and misallocation during a crisis: Evidence from the Chilean crisis of 1982[J]. Rev. Econ. Dyn. 16 (1). doi:10.1016/j.red.2012.10.005

Olley, S., and Pakes, A. (1992). The dynamics of productivity in the telecommunications equipment industry. Econometrica 64 (6), 1263–1297. doi:10.3386/W3977

Ouyang, X., Zhuang, W., and Sun, C. (2019). Haze, health, and income: An integrated model for willingness to pay for haze mitigation in Shanghai, China. Energy Econ. 84, 104535. doi:10.1016/j.eneco.2019.104535

Parmigiani, A., Klassen, R. D., and Russo, M. V. (2011). Efficiency meets accountability: performance implications of supply chain configuration, control, and capabilities. Journal of Operations Management 29 (3), 212–223. doi:10.1016/j.jom.2011.01.001

Paul, S. R., and Zhang, X. (2010). Testing for normality in linear regression models. J. Stat. Comput. Simul. 80 (10), 1101–1113. doi:10.1080/00949650902964275

Paunov, C., and Rollo, V. (2016). Has the internet fostered inclusive innovation in the developing world? World Dev. 78, 587–609. doi:10.1016/j.worlddev.2015.10.029

Qu, F., Xu, L., and Chen, Y. (2022). Can market-based environmental regulation promote green technology innovation? Evidence from China. Front. Environ. Sci. 757. doi:10.3389/fenvs.2021.823536

Richey, R. G., Genchev, S. E., and Daugherty, P. J. (2005). The role of resource commitment and innovation in reverse logistics performance. Int. J. Phys. Distribution Logist. Manag. 35, 233–257. doi:10.1108/09600030510599913

Salvadó, J. A., de Castro, G. M., Verde, M. D., and López, J. E. N. (2012). Environmental innovation and firm performance: A natural resource-based view. Palgrave Macmillan.

Sharma, R., de Sousa Jabbour, A. B. L., Jain, V., and Shishodia, A. (2021). The role of digital technologies to unleash a green recovery: Pathways and pitfalls to achieve the European green deal. J. Enterp. Inf. Manag. 35, 266–294. doi:10.1108/JEIM-07-2021-0293

Song, M., Zhao, X., and Shang, Y. (2020). The impact of low-carbon city construction on ecological efficiency: Empirical evidence from quasi-natural experiments. Resour. Conservation Recycl. 157, 104777. doi:10.1016/j.resconrec.2020.104777

Tapscott, D. (1996). The digital economy: Promise and peril in the age of networked intelligence [M]. New York: McGraw-Hill.

Umar, M., Khan, S. A. R., Muhammad Zia-ul-haq, H., Yusliza, M. Y., and Farooq, K. (2021). The role of emerging technologies in implementing green practices to achieve sustainable operations. TQM J. 34, 232–249. doi:10.1108/TQM-06-2021-0172

Wang, J., Wang, W., Ran, Q., Irfan, M., Ren, S., Yang, X., et al. (2022). Analysis of the mechanism of the impact of internet development on green economic growth: Evidence from 269 prefecture cities in China. Environ. Sci. Pollut. Res. 29 (7), 9990–10004. doi:10.1007/s11356-021-16381-1

Wang, L., Ma, L., Wu, K. J., Chiu, A. S., and Nathaphan, S. (2018). Applying fuzzy interpretive structural modeling to evaluate responsible consumption and production under uncertainty. Industrial Manag. Data Syst. 118, 432–462. doi:10.1108/IMDS-03-2017-0109

Wang, S. L., and Fan, Y. (2020). Study on the contribution of data production factors. Shanghai J. Econ. (07), 32–39+117. doi:10.19626/j.cnki.cn31-1163/f.2020.07.005

Wang, X., and Chu, X. (2019). External financing and enterprises' green technology innovation: A study based on the threshold model of firm size. Syst. Engineering-Theory Pract. 39, 2027–2037. doi:10.12011/1000-6788-2018-1350-11

Walsh, P. R. (2012). Innovation Nirvana or Innovation Wasteland? Identifying commercialization strategies for small and medium renewable energy enterprises. Technovation 32 (1), 32–42. doi:10.1016/j.technovation.2011.09.002

Wei, Z., Yuguo, J., and Jiaping, W. (2015). Greenization of venture capital and green innovation of Chinese entity industry. Ecol. Indic. 51, 31–41. doi:10.1016/j.ecolind.2014.10.025

Wen, H., Lee, C. C., and Zhou, F. (2021). Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 94, 105099. doi:10.1016/j.eneco.2021.105099

World Bank Group and the Development Research Center of the State Council, P. R. China (2019). Innovative China: New drivers of growth. Washington, DC: World Bank.

Wu, G., Xu, Q., Niu, X., and Li, T. (2022). How does government policy improve green technology innovation: An empirical study in China. Front. Environ. Sci. 723 (9), 794–799. doi:10.3389/fenvs.2021.799794

Xie, X. B., Wu, Y., and Yan, L. (2015). Enterprise green development path and policy suggestions under the background of digital age. Ecol. Econ. 31 (11), 88–91. In Chinese. doi:10.3969/j.issn.1671-4407.2015.11.020

Xu, J., and Cui, J. B. (2020). Low-carbon cities and firms’ green technological innovation. China Ind. Econ. (12), 178–196. In Chinese. doi:10.19581/j.cnki.ciejournal.2020.12.008

Xu, X. L., and Hou, J. C. (2022). Promotion, acceleration and spillover: The impact of digital economy development on regional innovation performance. Technol. Prog. Policy 39, 50–59. doi:10.6049/kjjbydc.2020120616

Yang, X. D., Wu, H., Ren, S., Ran, Q., and Zhang, J. (2021). Does the development of the internet contribute to air pollution control in China? Mechanism discussion and empirical test. Struct. Change Econ. Dyn. 56, 207–224. doi:10.1016/j.strueco.2020.12.001

Yetis-Larsson, Z., Teigland, R., and Dovbysh, O. (2015). Networked entrepreneurs: How entrepreneurs leverage open-source software communities. Am. Behav. Sci. 59, 475–491. doi:10.1177/0002764214556809

Yu, W., Ramanathan, R., and Nath, P. (2017). Environmental pressures and performance: An analysis of the roles of environmental innovation strategy and marketing capability. Technol. Forecast. Soc. Change 117, 160–169. doi:10.1016/j.techfore.2016.12.005

Zhang, J., and Cai, H. (2020). The impact of customer participation in virtual community on new product development performance——moderating effect of virtual social capital. Sci. Technol. Prog. Policy (07), 16–25. (in Chinese). doi:10.6049/kjjbydc.2019030501

Zhang, B., Wang, B., and Wang, Z. (2017). Role of renewable energy and non-renewable energy consumption on EKC: Evidence from Pakistan. J. Clean. Prod. 156, 855–864. doi:10.1016/j.jclepro.2017.03.203

Keywords: digital economy, internet development, digital finance, resource allocation, green technology innovation

Citation: Ning J, Yin Q and Yan A (2022) How does the digital economy promote green technology innovation by manufacturing enterprises? Evidence from China. Front. Environ. Sci. 10:967588. doi: 10.3389/fenvs.2022.967588

Received: 13 June 2022; Accepted: 26 July 2022;

Published: 01 September 2022.

Edited by:

Muhammad Mohsin, Hunan University of Humanities, Science and Technology, ChinaReviewed by:

Runsen Yuan, Yanshan University, ChinaMuhammad Zeeshan, Liaoning Technical University, China

Copyright © 2022 Ning, Yin and Yan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jing Ning, bmluZ2ppbmdAb3VjLmVkdS5jbg==

Jing Ning

Jing Ning Qiaorong Yin

Qiaorong Yin