- 1Department of Journalism, Faculty of Mass Communication, Yarmouk University, Irbid, Jordan

- 2Department of Public Relations and Advertising, Faculty of Mass Communication, Yarmouk University, Irbid, Jordan

- 3College of Communication and Media Sciences, Zayed University, Dubai, United Arab Emirates

- 4Department of Media, Arts College, Minya University, Cairo, Egypt

- 5Department of Radio and Television, Faculty of Mass Communication, Yarmouk University, Irbid, Jordan

- 6College of Communication, University of Sharjah, Sharjah, United Arab Emirates

This study aims to explore the impact of various factors associated with new media marketing (NMA) activities on brand trust and customer loyalty, focusing on the experience of Jordan Islamic Bank (JIB). Drawing on Relationship Marketing Theory (RMT) and a PLS-SEM methodology, the research analyzes the key dimensions of digital marketing activities—participation, openness, relationship building, and community building—and their role in enhancing customer loyalty. Data was collected from a sample of 355 bank customers via an online survey using a convenience sampling technique. Results showed that openness and community building had a significant impact on enhancing customer engagement, while the relationship between participation and brand trust appeared more complex. Building online communities also emerged as one of the most significant determinants of customer loyalty. The study highlights the importance of developing a value-based, community-centric digital presence to ensure sustainable customer relationships. It also recommends aligning digital marketing strategies with cultural and religious values, which is particularly important in the context of Islamic banks.

1 Introduction

Digital technologies have fundamentally redefined the marketing landscape, significantly in sectors where trust, ethics, and consumer engagement are paramount. Among these technologies, new media platforms – such as social media, websites, and mobile applications, which offer businesses unprecedented opportunities for direct interaction, enabling brands to reach a wider audience with more personalised communication (Alghizzawi et al., 2024b). This shift has been particularly impactful on the financial sector, including Islamic banking in Jordan, where New Media Marketing Activities (NMAs) have emerged as a strategic tool to foster customer engagement and loyalty (Alzahmi, 2020). For Islamic banks, which emphasize trust and ethical engagement within the framework of Shariah law, responsiveness is not merely a marketing luxury but a reputational necessity. Islamic banks in Jordan operate under the principles of Islamic finance, which strictly prohibit interest, uncertainty, and speculative transactions. It adopts profit-and-loss sharing mechanisms, asset-backed financing, and ethical investment strategies based on Shariah law (Al-Kandari et al., 2019). These institutions place a high emphasize on transparency, social responsibility, and moral conduct in financial dealings.

NMAs involve the use of digital platforms to facilitate two-way communication between brands and their customers, creating a more interactive and personalised marketing environment (Singh, 2024). This is particularly relevant for the banking sector, where maintaining customer trust and loyalty is crucial. Social media platforms enable banks to engage directly and in real-time with customers through shared feedback, fostering brand trust and enhancing customer experiences (Alghizzawi et al., 2024b). For Islamic banks, NMAs can support their ethical stance with customer expectations, promoting transparency and openness in communication. These interactions form a foundation for brand trust, especially in service-based industries where trust and satisfaction are primary drivers of repeat business (Ebrahim, 2020; Ibrahim, 2022).

In Jordan, customer loyalty plays a vital role in sustaining a competitive edge. Loyal customers are more likely to provide positive word-of-mouth (WOM), contribute to a stronger brand image, and remain committed to their chosen banks even in competitive markets like Jordan (Ebrahim, 2020). Such values of transparency, trustworthiness, and ethical conduct are essential components in marketing strategies that emphasize ethical and trust-based relationships. Studies have shown that digital engagement through social media can significantly enhance brand trust and customer loyalty by providing consistent and reliable service interactions (Budiman, 2021).

Furthermore, social media marketing (SMM) has also become a widely adopted tool within the Jordanian banking sector, yet its full potential to enhance customer loyalty remains underexplored (Castañeda et al., 2019). The success of Jordanian Islamic banks hinges on their ability to strategically promote their products, ensuring that their marketing efforts resonate with customers’ expectations and needs. For example, to achieve long-term sustainability in both local and international markets, banks must adopt innovative approaches that address emerging challenges and keep pace with modern marketing techniques. As user-friendly hubs, social media platforms enable customers to connect with brands and each other, creating opportunities for banks to build meaningful communities and strengthen customer loyalty.

Despite some skepticism about the effectiveness of online media, research has highlighted the role of social media as a significant driver of financial revenue through increased visibility and engagement (Lilach Bullock and Agbaimoni, 2013). For example, Al- Samirae et al. (2020) emphasize that digital platforms play a vital role in enhancing accessibility and reaching broader audiences. These platforms serve as valuable tools for sharing product information and gathering customer feedback, making them essential for fostering customer engagement. The advent of NMAs has reshaped communication patterns, enabling users to share, engage, and access information more freely than ever before.

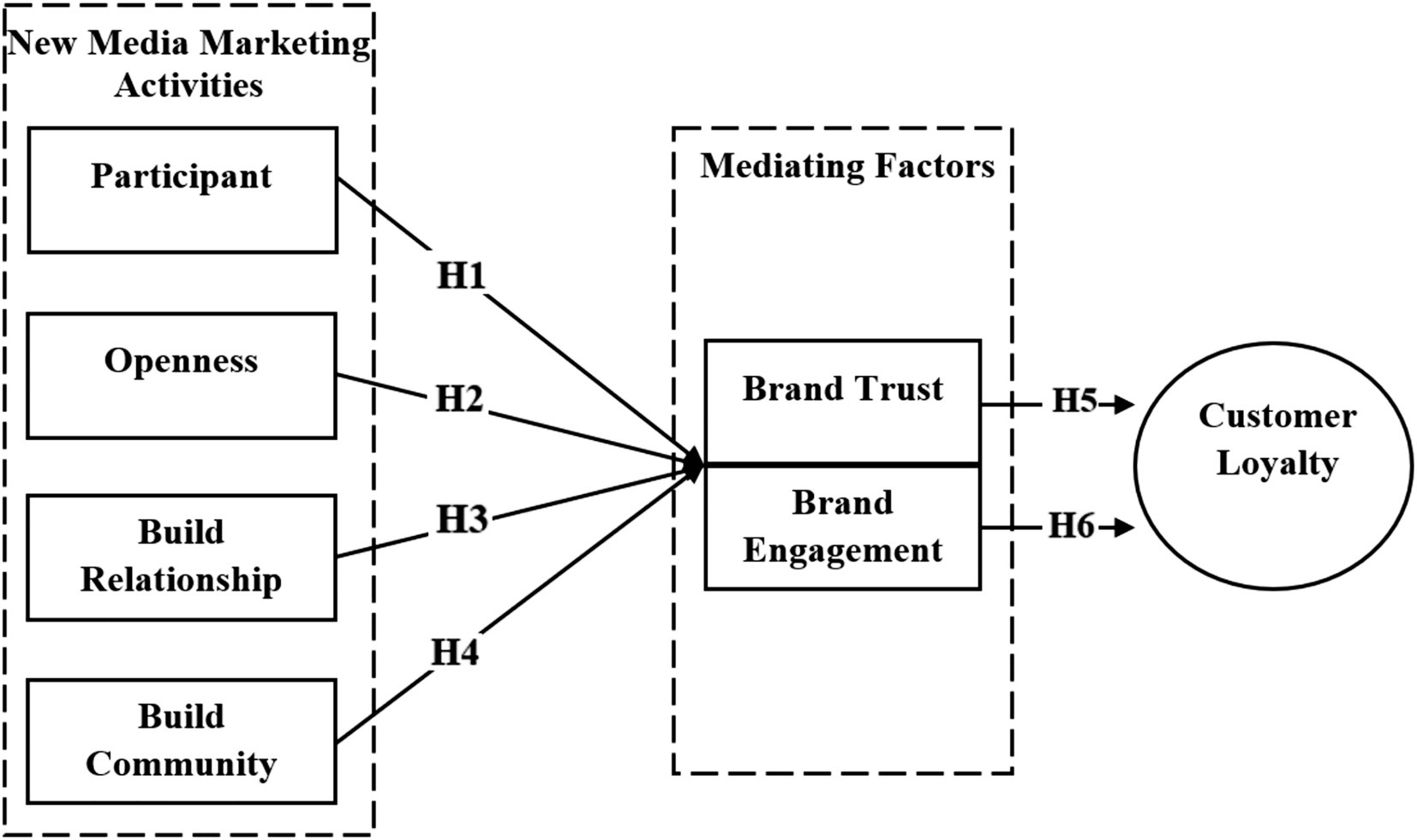

While the integration of digital technologies into conventional banking systems has been extensively documented, empirical investigations focusing on their role within Islamic banking environments remain unexplored. For example, existing studies often neglect to account for how NMAs intersect with culturally and religiously specific factors that shape consumer expectations and brand loyalty in an Islamic banking environment. There remains a notable gap in understanding how relationship marketing operates within culturally specific, ethically regulated, faith-based financial banking systems, where ethical branding plays a vital role. This study addresses this knowledge gap by applying RMT to examine the mechanisms through which NMAs influence brand trust and customer loyalty in Jordan Islamic Bank (JIB) (Grubor et al., 2017; Nurittamont, 2021; Ribeiro et al., 2023). It provides empirical evidence on the influence of NMAs, in a non-Western context, on customer loyalty among Islamic banks in Shariah-compliant institutions and expands the scope of RMT. This study draws on Relationship Management Theory (RMT) to explain how the dimensions of digital marketing activities—participation, openness, relationship building, and community building—contribute to enhancing customer engagement and trust in Jordan Islamic Bank (JIB). Using a structural equation modeling (PLS-SEM) approach, the study seeks to test the causal relationships between these dimensions, on the one hand, and brand trust and customer loyalty, on the other. Therefore, the primary objective of this research is to clarify the role that new media marketing strategies play in enhancing customer loyalty to Jordanian Islamic banks, with a focus on the importance of building digital communities based on values and trust, thus ensuring the sustainability of the relationship between the bank and its customers in a changing banking environment.

2 Literature review

The rise of new media has transformed the marketing landscape. The integration of social media marketing has provided banking industries, including Islamic banks, with new ways to engage with their customers (e.g., offering personalised interactions and fostering brand loyalty) (Mulia et al., 2020; Ngo and Nguyen, 2016). However, the effectiveness of these digital strategies, especially within the Islamic banks, remains an area that requires further exploration (Thaker et al., 2020). Modern banking marketers must evolve from focusing solely on customer satisfaction to adopting broader strategies that emphasize building brand trust and value (Puspaningrum, 2020). Nonetheless, several studies have debated the relative significance of core versus peripheral service components in sharing customer loyalty, yielding mixed findings (Argenti and Druckenmiller, 2004; Ebrahim, 2020; García-Fernández et al., 2020; Mulia et al., 2020; Shankar et al., 2020; Taylor et al., 2004). This section reviews some of the key aspects (participant, openness, build relationships, and build communities) that we believe are related to new media marketing activities in Islamic banks, their impacts on brand trust, and how they affect customer loyalty for the Jordan Islamic Bank.

2.1 Jordan Islamic Bank (JIB)

The Jordan Islamic Bank (JIB) is one of the oldest and largest Islamic financial institutions in Jordan, established in 1978 as the first bank operating in accordance with Islamic Sharia principles in the Kingdom. Since then, it has played a pivotal role in developing the Islamic banking sector, offering a diverse range of Sharia-compliant financial products and services such as Mudarabah, Murabaha, and Ijarah financing (Habes et al., 2023). JIB is distinguished by its extensive geographical reach through a network of branches and ATMs across various Jordanian cities, in addition to its adoption of modern digital strategies that enable customers to access secure and efficient electronic banking services (Elareshi et al., 2023).

2.2 Relationship marketing theory (RMT) and customer loyalty

The concept of relationship marketing emerged in the 1980s and is generally attributed to the work of Leonard Berry (Berry, 2002), who indicates the importance of attracting, maintaining, and enhancing customer relationships. RMT emphasizes, in the long term, mutually beneficial connections between a business and its customers, rather than focusing solely on short-term transactions (Elbasir et al., 2020). This approach centres on nurturing trust, commitment, and engagement, which fosters a deeper emotional connection with customers (Wang et al., 2023). Prioritising these aspects, RMT aims to enhance customer loyalty, encouraging repeat purchases and sustained brand affinity (Romani et al., 2015). The theory suggests that when customers perceive a brand’s commitment to meeting their needs and maintaining transparent communication, they are more likely to stay loyal, even in the face of competitive offerings (Cazorla Milla and Mataruna, 2019; Hidayat and Idrus, 2023).

In the context of customer loyalty in banks, RMT highlights the importance of personalised interactions and tailored experiences (De Bruin et al., 2021). When banks use data-driven insights to understand and respond to individual customer preferences, they create a sense of value and appreciation, which strengthens loyalty (Grubor et al., 2017; Husnain and Akhtar, 2015; Swaminathan et al., 2020). Effective relationship marketing can turn customers into brand advocates, who not only return for future communications (Althuwaini, 2022; Husnain and Akhtar, 2015; Osei-Frimpong et al., 2019; Thaker et al., 2020). In Islamic banks, these institutions are built upon principles of trust, transparency, and ethical conduct that align with Shariah law (Munandar et al., 2022). They emphasize a relationship-oriented approach by ensuring that their practices reflect fairness and respect toward customers, adhering to Islamic ethical standards such as avoiding interest and engaging in profit-and-loss sharing (Aravik et al., 2022). By prioritising relationship marketing, Islamic banks can strengthen the emotional and ethical bonds with their customers. This focus is particularly important given the trust-based nature of banking in Islamic finance, where customer loyalty is closely tied to perceptions of religious compliance and moral legitimacy. To understand how these interactions cultivate long-term loyalty, we used Relationship Marketing Theory (RMT), a conceptual framework that emphasizes the importance of establishing, developing, and maintaining enduring, mutually beneficial relationships between organisations and their customers (Berry, 2002). RMT has been widely applied in service industries to explain customer loyalty, trust development, and commitment, especially in contexts where relationships extend beyond transactional exchanges (Balliauw et al., 2020; Grubor et al., 2017; Wang et al., 2023). Relationship Marketing Theory (RMT) focuses on building long-term relationships based on trust, commitment, communication, and shared value. In the Jordanian Islamic banking context, these elements are particularly important given customers’ reliance on transparency and Sharia compliance. The literature demonstrates that new media marketing activities such as engagement, openness, relationship building, and community building contribute to enhancing customer trust in the bank, increasing customer satisfaction, and thus fostering sustainable loyalty. According to this framework, RMT is expected to serve as an explanatory mechanism linking Jordan Islamic Bank’s modern digital practices to its customer loyalty.

3 Hypothesis development

3.1 Participation

Participation refers to the active involvement of users and audiences in brand-related activities, including engaging with content through likes, shares, comments, and user-generated content (Yoo et al., 2020). For example, social media enables dynamic engagement and feedback between businesses and their customers, bridging the gap between organisations and customers (Maria et al., 2019). These platforms facilitate open exchanges of ideas and foster a culture of continuous interaction. Social media has already added an essential dimension to traditional marketing strategies, making it possible for businesses to integrate these channels into their overall marketing mix (Moriguchi et al., 2016).

In this new marketing era, customer participation and engagement have become central, reflecting the unique ways in which users interact and experience a brand online (Maderer et al., 2018; McCarthy et al., 2014). When a brand encourages customers to become participants rather than passive, it fosters a sense of involvement and transparency (their voices are heard), which can build trust (Veland et al., 2014). In the digital context, Participation is manifested through customers’ interaction with the bank’s content on new platforms (liking, commenting, sharing, or interacting with awareness campaigns and e-services) (Alghizzawi et al., 2024a). According to RMT, this continuous interaction strengthens trust and commitment and gradually leads to greater satisfaction and sustainable loyalty (Munandar et al., 2022) we assume:

H1: Customer participation positively impacts brand trust and engagement.

3.2 Openness

The success of SMM depends on maintaining transparency, authenticity, and trust with customers. A single negative review can damage an online reputation (Shami and Ashfaq, 2018), making it critical for brands to build and maintain genuine relationships with their customers. Otken and Okan (2016) indicate that social media can significantly influence employer branding and corporate reputation, helping organisations establish a solid presence in the digital space. They found that transparency in communication enhances the perception of a brand. It makes it more relatable and trustworthy to customers (Dwivedi et al., 2018; Plume et al., 2017). This openness is especially valued by younger generations who favour brands that align with their values and communicate openly. Others found that online users are drawn to companies known for their transparency and ethical leadership, such as Apple, Google, and Microsoft (Albaity and Rahman, 2021). Openness is a key pillar of relationship building according to Relationship Marketing Theory (RMT) (Muflih et al., 2024a). It refers to an institution’s transparency and willingness to clearly share information with its customers.

3.3 Openness positively and engagement

Openness translates into clarifying terms and policies, disclosing details of products and services, and ensuring compliance with Sharia standards in Islamic banks (Tuqan et al., 2024). This behavior builds trust and commitment, reduces uncertainty, and leads to customer satisfaction. With repeated interactions, satisfaction translates into sustainable loyalty, represented by continued banking and recommendation (Iskandar et al., 2025). Thus, openness represents an essential bridge between relationship and loyalty (Muflih et al., 2024a). For example, if an Islamic bank shares real-time updates on policy changes via any social media platforms, customers are more likely to perceive the bank as honest and trustworthy (Hatem Falih et al., 2025) we assume

H2: Openness positively impacts brand trust

H2: Openness positively impacts engagement.

3.4 Building relationships and communities

Social media functions as a two-way communication channel that facilitates direct interaction between brands and their customers. Establishing meaningful connections with customers is crucial for businesses, as these interactions help to build trust and loyalty. Through platforms such as Facebook, businesses can address customer inquiries and concerns in real time, fostering stronger relationships (Plume et al., 2017; Voramontri and Klieb, 2019). This shift has fundamentally altered the traditional marketing mix, introducing new challenges and opportunities for marketers (Kuo and Feng, 2013; Liao et al., 2023). These platforms allow brands to create personalised interactions, where customers feel heard and valued. Such personalised digital interactions can deepen customers’ relationships with the brand, fostering stronger emotional and relational bonds (Budiman, 2021; Joo and Teng, 2017; Osei-Frimpong et al., 2019). Understanding the various ways social media shapes brand-customer interactions is essential for developing effective strategies that enhance customer loyalty and engagement (Alghizzawi et al., 2024b; Voramontri and Klieb, 2019).

Building online communities is a strategic aspect of social media marketing that helps brands strengthen their presence and foster deeper customer loyalty. Žitkienė and Deksnys (2018) indicate that online communities play a vital role in reinforcing brand strength, a finding echoed by Ramanathan et al. (2017), who demonstrated that social media communities enhance customer satisfaction and loyalty. These communities allow customers to connect, share experiences, and support each other.

H3: Building relationships positively impacts brand trust and engagement.

It creates a positive environment that benefits both the brand and its audience. Social media, therefore, serves as a hub where users with shared interests (e.g., product, hobby, social issue) can come together (Liao et al., 2023). Based on these communities, businesses and marketers can better understand their target audience and support their offerings with customer needs (Farrell et al., 2019; Liao et al., 2022). For example, if Jordan Islamic Bank (JIB) assigns digital relationship officers to actively engage with frequent online commenters, the personalised follow-up enhances emotional closeness and brand commitment. This heightened interpersonal attention reinforces customers’ emotional closeness to the brand and affirms the bank’s ethical and community-focused identity (Andespa and Yeni, 2024). This environment, based on interaction and shared values, increases customer satisfaction and leads to long-term loyalty, as customers become more connected to the bank on both an emotional and practical level (Muflih et al., 2024b). As such, our next hypotheses are,

H4: Building online communities positively impacts brand trust and engagement.

3.5 Brand trust and brand engagement as predictors of loyalty

Brand trust and engagement are among the most prominent indicators that explain customer loyalty, according to Relationship Marketing Theory (RMT) (Zhang and Jin, 2023). Trust reflects a customer’s perception of a bank’s credibility, transparency, and ability to fulfill its commitments, which forms the basis for building a long-term relationship. Engagement, on the other hand, is embodied in customers’ participation in digital activities, their continuous monitoring of the bank’s services, and their involvement in awareness or community campaigns via new media. This combination of trust and engagement not only increases customer satisfaction but also strengthens an emotional and behavioral connection to the banking brand, leading to sustainable loyalty represented by continued transactions and positive referrals (Iskandar et al., 2025; Tuqan et al., 2024). Add to Brand trust is a crucial factor that directly impacts customer loyalty, as emphasized by the Customer-Loyalty Theory (CLT) (Ebrahim, 2020; Soh et al., 2015). Brand trust fosters a sense of reliability, encouraging customers to continue choosing a brand over competitors. Brand trust and brand engagement, as highlighted by Osei-Frimpong et al. (2019), are strongly interlinked with customer loyalty, suggesting that increased trust in a brand through social media can significantly boost customer retention. Furthermore, customers who feel engaged with a brand (Islamic bank) are more likely to remain loyal, as engagement fosters emotional connections. For example, lower transaction costs and personalised interactions can further enhance brand engagement, increasing customer loyalty (Soh et al., 2015).

Given the intense competition in today’s market, companies are increasingly focused on building strong customer relationships to gain a competitive edge (Wibowo et al., 2020). Note that prior studies typically treat brand trust and brand engagement as separate antecedents of customer loyalty (Ebrahim, 2020; Soh et al., 2015). However, in financial services sectors, ethical legitimacy and personal relationships are highly interdependent, such as in Islamic banking, the two constructs often operate in a closely coupled manner (Al-Kandari et al., 2019; Grubor et al., 2017). With the rapid pace of technological change, customers have easy access to alternatives. It is crucial for brands to consistently deliver value and satisfaction to retain their loyalty (Kristal, 2019). Our study is built on these two insights, proposing that NMAs enhance brand trust and brand engagement, leading to greater customer satisfaction and loyalty, which we hypothesized.

Customer loyalty is positively affected by (H5) brand trust and (H6) brand engagement.

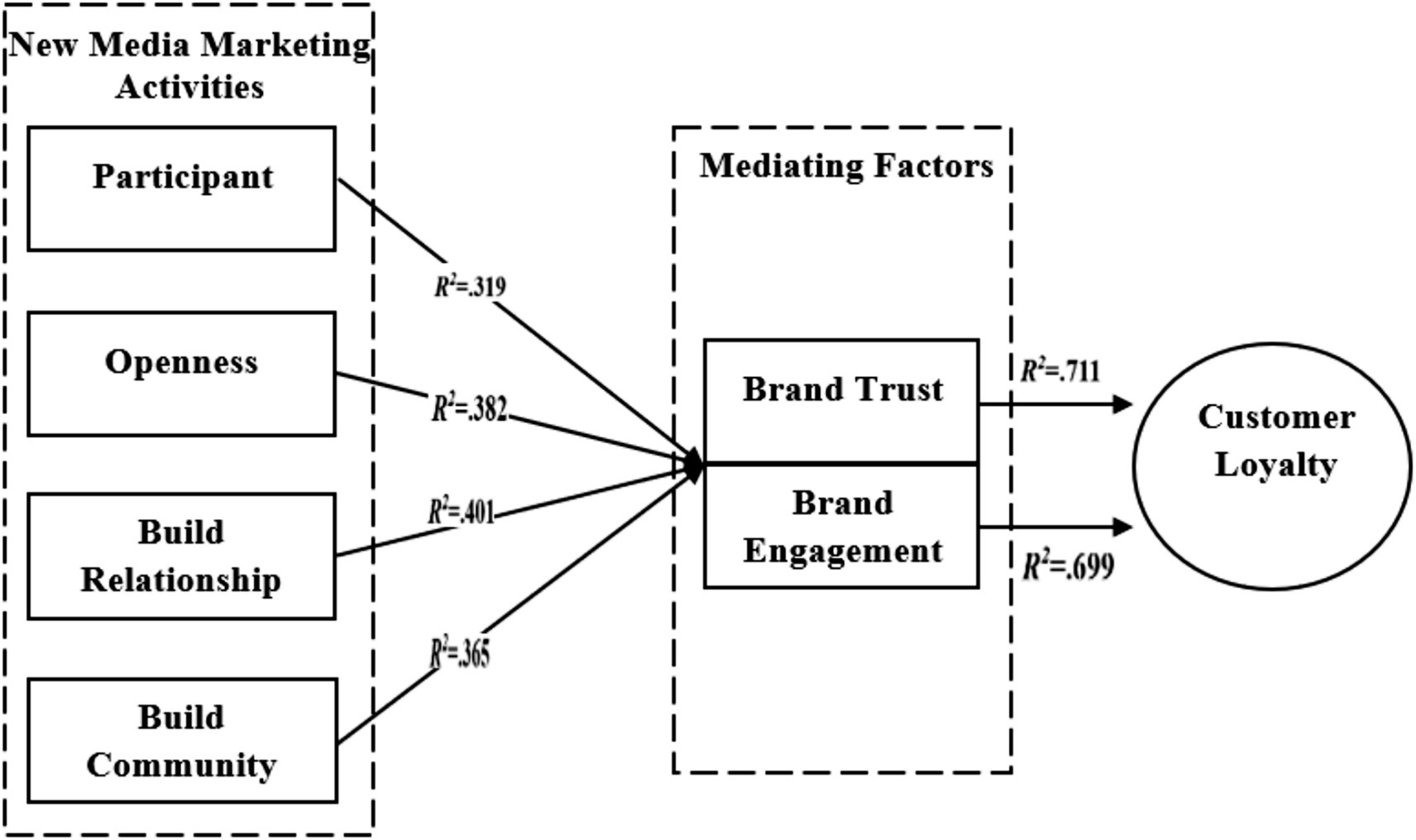

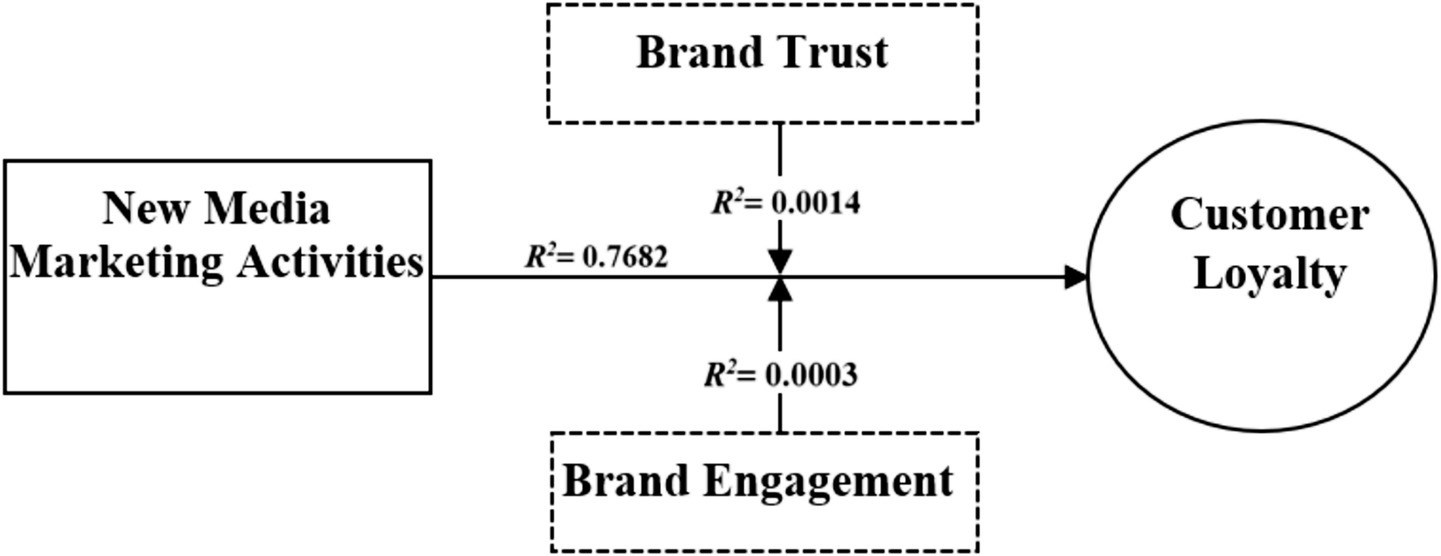

Figure 1 illustrates the relationship between NMAs (H1-H4) and customer loyalty through the mediating effects of brand trust and engagement (H5-H6). The activities, such as participation, openness, etc., are treated as drivers of NMAs. This implies that engaging customers in participatory activities, being transparent, building strong relationships, and fostering a sense of community can positively influence how they perceive and interact with the Jordan Islamic Bank (JIB). Furthermore, the model is coherent and aligned with established theories (e.g., RMT) in marketing and brand engagement. It recognizes that NMAs can build a positive perception (trust) and interaction (engagement) with customers, which in turn translates into loyalty.

Figure 1. The relationship between NMAs and customer loyalty through the mediating effect of brand trust and engagement.

H6: Brand trust and brand engagement mediate the relationships between NMAs and customer loyalty.

3.6 Brand trust and brand engagement as mediating factors

In our research on new media marketing, customer loyalty is one of the key outcomes that organisations seek to enhance by building strong and dynamic customer relationships (Jiang et al., 2016; Juanamasta et al., 2019; Kakeesh et al., 2021). Among the key dimensions contributing to loyalty are brand trust and brand engagement (Hatamleh et al., 2023). Although existing literature treats trust and engagement as independent concepts, there is a growing trend in recent studies to consider them as complementary components of the concept of “relationship quality,” particularly in digital and service environments such as banking. Trust is the foundation of engagement, and further engagement is often reinforced by the type of trust organisations among their customers (Morgan and Hunt, 1994). According to Morgan and Hunt (1994) theory of commitment and trust in relationships marketing, brand trust is an essential component of engagement. Recent studies also indicate that incorporating brand trust and brand engagement into a common mediating factor more accurately reflects the psychological and behavioural dynamics of customers when interacting with digital marketing content (Alghizzawi et al., 2024b). For example, Kim et al. (2019) argue that positive interactions with a brand in a digital environment enhance trust, and vice versa; brand trust enables customers to interact/engage more freely, leading to a reciprocal relationship whose dimensions cannot be easily separated. In the Jordanian context, the importance of this integration is heightened by the development of digital marketing tools at banks and the increasing reliance of customers on digital interactions rather than traditional transactions (Julaeha, 2024). Abkenar et al. (2021) indicate that effective digital interactions between Jordanian banks and customers lead to improved levels of trust and stimulate active engagement, which directly impacts loyalty intentions. This interactive relationship justifies considering brand trust and brand engagement as a unified mediating factor within the conceptual model.

From a methodological perspective, integrating brand trust and brand engagement under a second-order construct is justified if the data show that both variables are strongly related and together form a higher dimension that represents relationship quality. According to Sarstedt et al. (2020), constructing a standard model using a hierarchical component model allows for the representation of multidimensional concepts within a single variable, provided there is statistical support through confirmatory factor analysis (Hair Jr and Lukas, 2014; Sarstedt et al., 2021) indicate when constructs are highly interrelated and conceptually integrated, it may be appropriate to model them as a second-order latent construct or a composite mediator, especially when the goal is to assess their joint mediating effect. This strategy enhances the economy of the model and aligns with the research objectives of understanding how NMAs affect customer loyalty in Jordan Islamic Bank (JIB). Therefore, incorporating brand trust and brand engagement as a common mediating factor not only simplifies the conceptual model but also reflects the complex reality of the digital customer experience in the Jordanian banking context, where positive digital interactions generate feelings of brand trust and brand engagement. This integration enhances the explanatory power of the model and facilitates the process of testing the causal paths between digital marketing and customer loyalty.

Furthermore, in this study, brand trust and brand engagement were conceptualised and operationalised as a combined mediating construct between NMAs and customer loyalty. While these two constructs are frequently treated as distinct mediators in relationship marketing literature (Ebrahim, 2020; Osei-Frimpong et al., 2019), there is a methodological precedent for combining closely related relational constructs when theoretical and contextual considerations support their interdependence (Grubor et al., 2017; Sarstedt et al., 2021). The decision to model these two constructs together was driven by three factors. First, in Islamic banking, trust and engagement are often relationally intertwined, as ethical compliance and reputational involvement with financial brands (Al-Kandari et al., 2019). Second, from a model perspective, combining these constructs improved the model’s fit indices and reduced collinearity, addressing the challenges of sample size constraints and model complexity common in SEM applications (Hair et al., 2019). Finally, prior studies in culturally embedded financial environments have adopted similar approaches, modelling trust-related constructs collectively where the constructs operate symbiotically in sharing customer loyalty (Grubor et al., 2017; Husnain and Akhtar, 2015).

4 Methodology and data analysis

4.1 Design and sampling

This study adopts a self-completion, with a cross-sectional survey design, guided by RMT, to examine how new NMAs influence brand trust and customer loyalty in Islamic banking, JIB. The study setting is JIB, one of the leading Islamic financial institutions in Jordan. Customers of JIB who have interacted with the bank through its official digital media platforms. These users were selected because their exposure to NMAs makes them relevant respondents for assessing digital engagement and loyalty.

The study relied on a convenience sampling approach combined with a purposive sampling technique, applying specific criteria to ensure the representation of key demographic characteristics of banking sector customers, such as gender, age, educational level, geographic location, and employment status (Farrokhi and Mahmoudi-Hamidabad, 2012; Sedgwick, 2013). This approach enabled the selection of participants with actual experience with Jordan Islamic Bank (JIB) services, enhancing the suitability of the sample for the research objectives.

This study adopted the Partial Least Squares Structural Equation Modeling (PLS-SEM) approach as the primary analytical methodology to test the proposed model and verify the relationships between the variables. PLS-SEM is a popular and effective method in management and marketing research, characterized by its flexibility in handling complex models and its ability to test multidimensional latent constructs (Hair et al., 2019). The choice of PLS-SEM in this study is based on several methodological justifications. The research model is highly complex, integrating multiple variables engagement, openness, relationship building, community building, brand trust, perceived value, and customer loyalty. These constructs are interconnected through direct and indirect relationships, making PLS-SEM more suitable than traditional methods for estimating complex models. Furthermore, PLS-SEM is a suitable option considering sample size limitations, as it allows for the analysis of relatively moderate sample sizes, such as the sample of 355 participants in this study, compared to the larger sample size requirements of covariance-based methods (CB-SEM). Third, PLS-SEM aligns with a prediction-oriented approach, which is consistent with the objectives of this study, which aims to explore how new media marketing activities contribute to predicting customer loyalty through trust and engagement (Table 1).

Regarding the sample size, the minimum required was determined based on the PLS-SEM analysis guideline, which assumes that the sample size should be equal to ten times the maximum number of internal or external links directed toward any latent variable in the model (Sarstedt et al., 2021). Since the model used includes a maximum of X links, the minimum required was (10 x X) (Kristen Hare, 2016). The number of valid responses collected (354) far exceeded this minimum, enhancing the strength and reliability of the statistical results.

4.2 Measurement

For this measurement, a-24 items associated with perceptions and attitudes toward the Jordan Islamic Bank (JIB) were divided into two parts. The eight constructs – participant, openness, build relationships, build communities, new media marketing activities, brand trust, brand engagement, and customer loyalty – are characterised and composed of different indicators (Table 2). These items were developed from the literature review with some modification to fit with the local culture, Jordan.

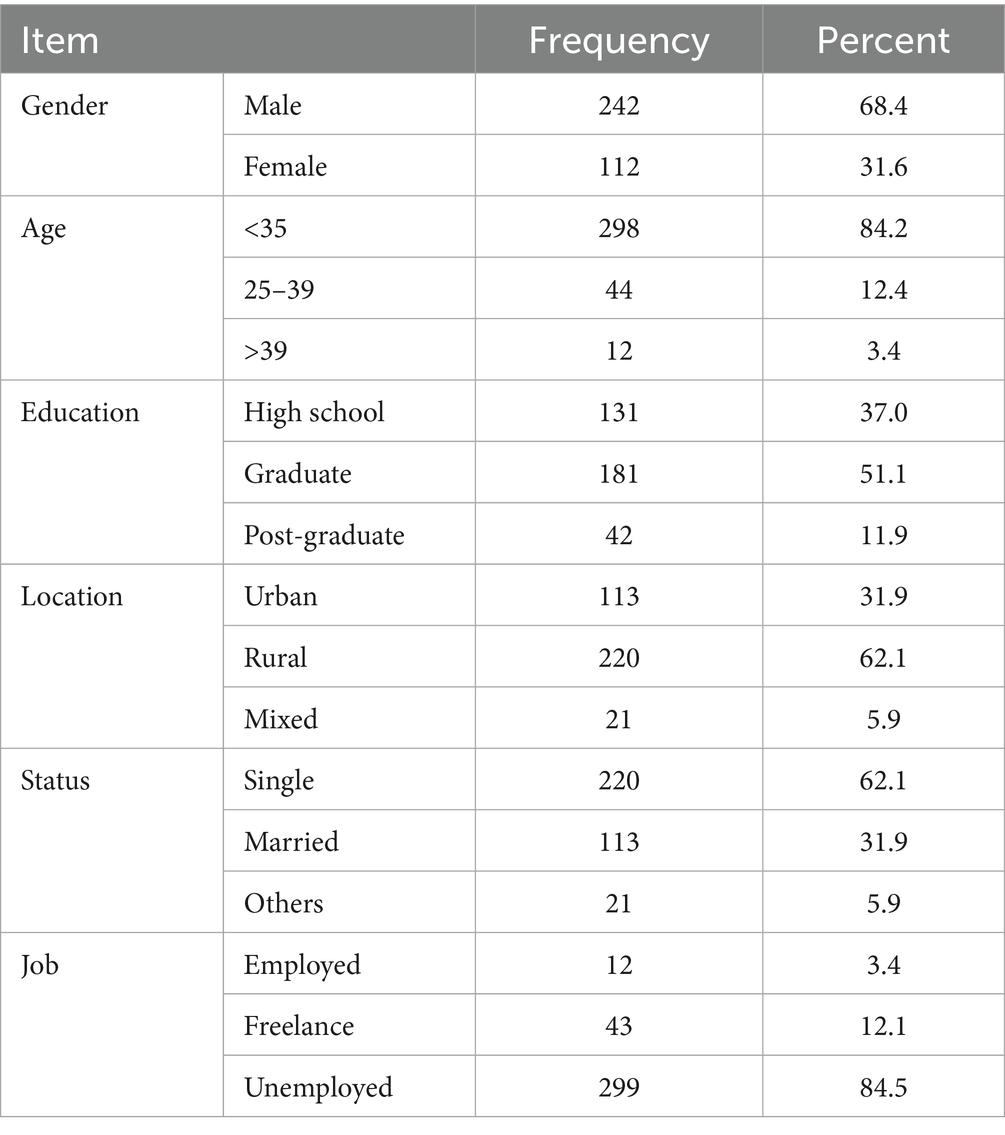

Finally, respondents were invited to provide details about their gender, age, education, location, status, and job. The sample was predominantly male (68.4%) compared to female, with the majority of them are younger than 35 years old (84.2%), have a graduate degree (51.1%), reside in rural areas (62.1%), being single (62.1%), and unemployed (84.5%). These figures highlight a youthful, highly educated, yet largely unemployed demographic, with notable differences between rural and urban living conditions. Most existing literature focuses on general marketing strategies without considering the unique dynamics of Islamic banking and the role of digital platforms in fostering loyalty. This study addresses this gap by providing empirical evidence on the influence of NMAs on customer loyalty among Jordan Islamic Bank (JIB) in Jordan.

5 Findings

5.1 Measurement model analysis convergent validity

A convergent validity of the measurement model was evaluated to ensure the reliability of the constructs (Alarcón and Sánchez, 2015). Convergent validity is essential in Structural Equation Modelling (SEM), as it measures the consistency among survey items. Table 2 shows the results of the convergent validity analysis of the latent constructs in the study model using factor loadings (FL), average variance extracted (AVE), Cronbach’s alpha (CA), and composite reliability (CR). According to the statistical criteria recommended in the PLS-SEM literature (Hair et al., 2019), convergent validity is achieved when factor loadings exceed the reference value (0.70 where possible, with 0.60 acceptable in exploratory studies), AVE ≥ 0.50, CR ≥ 0.70, and CA ≥ 0.70, while CA ≥ 0.70 indicates good internal reliability. The results indicate that most of the indicators exceeded the 0.70 threshold, demonstrating that the items designed to measure each dimension are strongly related to their latent variable. The comparison table shows that excluding indicators with low factor loadings significantly enhanced the measurement validity of the model. In the first stage, several indicators such as PRT3, OPN3, BRL2, BRL3, BCM2, BCM3, BRT3, BEN2, and CSL2 showed loading values below the recommended threshold (0.60), which weakens convergent validity. According to the recommendations of Hair et al. (2019), retaining such indicators could negatively affect the quality of the model; therefore, it was decided to remove them after confirming that they do not represent an essential and indispensable dimension. After the purification process, the Average Variance Extracted (AVE) values for all constructs increased to exceed the minimum threshold of (0.50), indicating that the shared variance between the indicators and the latent variable has become acceptable. The Composite Reliability (CR) values also showed a significant improvement, all exceeding the minimum threshold of (0.70), reflecting better internal consistency among the remaining indicators. In contrast, some indicators showed relatively low loading coefficients, such as the customer loyalty component (CSL1 = 0.63). However, the overall average variance extracted (AVE) and composite reliability (CR) values exceeded the minimum thresholds (0.57 and 0.84, respectively), supporting the overall validity of the component. The openness component (OPN) achieved loading coefficients ranging from 0.64 to 0.79, with an average variance extracted (AVE) value of 0.55 and a composite reliability (CR) value of 0.83, indicating acceptable validity despite some variability among the indicators.

5.2 Discriminant validity analysis

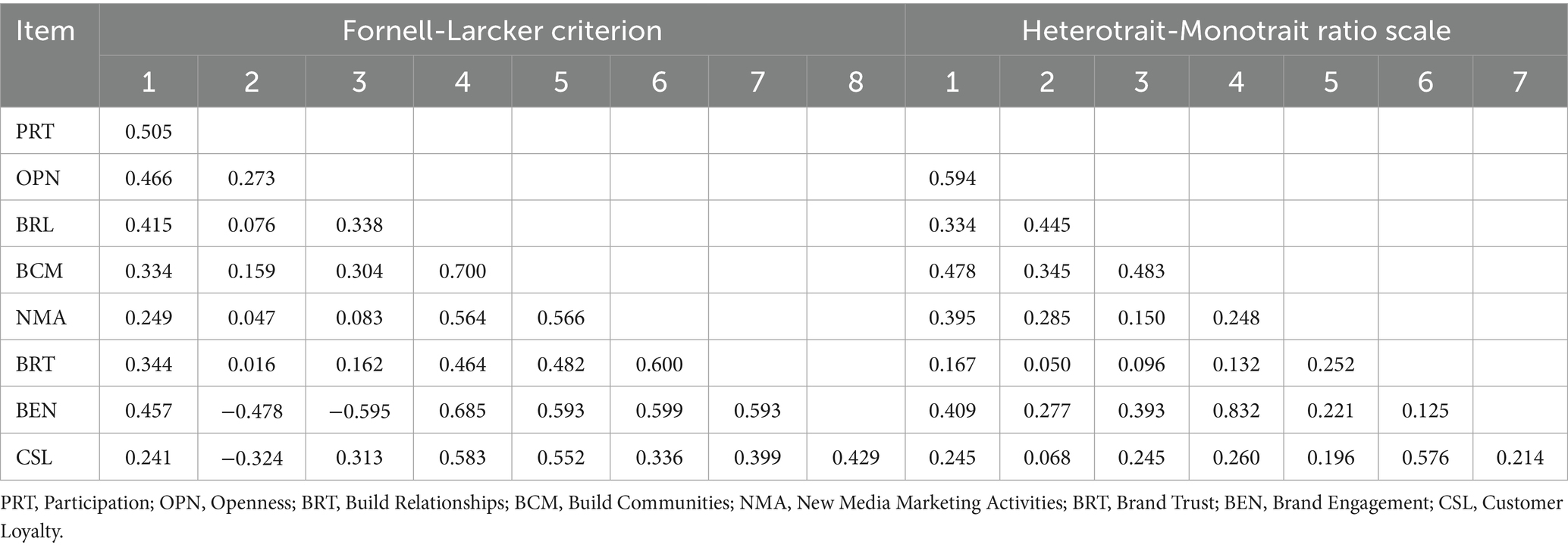

This study also involved a comprehensive assessment of the measurement model’s discriminant validity and goodness of fit as indicated by Henseler et al. (2015). The Fornell-Larcker criterion was employed to evaluate discriminant validity (Table 3). The analysis revealed that the square roots of all AVE values (in bold) were greater than their respective correlation values, thus satisfying the criterion. Furthermore, the Heterotrait-Monotrait (HTMT) ratio was also calculated to be below 0.85, which supports the presence of discriminant validity within the measurement model (Henseler et al., 2015). Overall, the data show that constructs in the measurement model have acceptable levels of discriminant validity, as evidenced by the Fornell-Larcker criterion and HTMT ratios.

5.3 Goodness of fit

The final step in this analysis involved assessing the model’s goodness of fit, which evaluates how well the observed data supports the expected outcomes. This is a critical aspect in structural model testing (Hair et al., 2019). This assessment helps to determine whether the hypothesised model is a suitable representation of the data collected. The analysis revealed a chi-square value of X2 = 0.172 (df = 18), p = 0.000, suggesting that the model fit is statistically significant. Furthermore, the goodness of fit index was 0.936, which indicates a perfect fit between the model and the observed data. The Standardized Root Mean Square Error of Approximation (RMSEA) was recorded at 0.071. According to Chepkirui and Huang (2021), an RMSEA value within the range of 0.05 to 0.08 is considered acceptable, and the obtained value falls within this range, reinforcing the model’s validity. “The model produced a CFI of 0.936 and an RMSEA of 0.071. While they jointly indicate an acceptable model fit, as both meet commonly accepted cut-off criteria for fit indices (CFI ≥ 0.90; RMSEA ≤ 0.08).

5.4 Structural model evaluation

Coefficients of determination R2.

The coefficients of determination, represented as R2 values, for each latent variable. R2 value is a crucial indicator that reflects the predictive power of a model, showing how well exogenous (independent) variables explain the variance in endogenous (dependent) variables. Essentially, it measures the extent to which changes in the independent variables predict changes in the dependent variable.

Figure 2 presents the R2 values for the latent constructs, ranging from 0.319 to 0.711. These values indicate a robust predictive power of the model, with higher values suggesting a more substantial influence of the independent variables on respective dependent constructs. For example, participation has an R2 value of 0.319, indicating that 31.9% of its variability is explained by the dependent variables. Brand trust has the highest R2 value (0.711), suggesting that 71.1% of its variance is accounted for by the factors influencing it, reflecting strong predictive validity.

These findings also confirm that the independent variables are significant in explaining the variations in the dependent variables, reinforcing the strength and relevance of the model’s predictive relationships.

5.5 Hypotheses testing

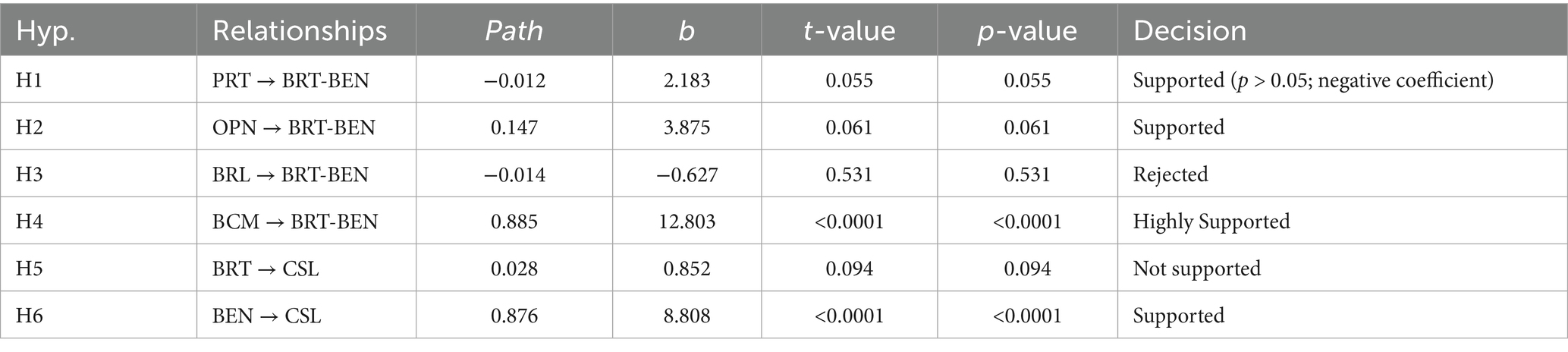

The second phase of the analysis focused on testing the proposed hypotheses using structural path analysis, which assesses the strength and direction of the relationship between variables. Path coefficients, t-values, and significance levels were evaluated to determine the validity of each hypothesis. Path analysis offers a more nuanced understanding of these relationships compared to simple regression analysis, making it ideal for complex models like ours (Sarstedt et al., 2021) (Table 4).

In response to H1 (participation’s influence on brand trust and engagement), the study posited that participation positively affects brand trust and engagement (β = −0.012, p = 0.055), suggesting a slight but significant influence, supporting the hypothesis. Research suggests that active participation in new media platforms enhances a brand’s visibility and engagement levels (Kaplan and Haenlein, 2010). However, the relatively low path coefficient here suggests that the impact of the participant might be moderated by other factors such as content quality and audience receptivity. This supports studies that argue that mere participation is not sufficient without strategic engagement and alignment with audience expectations (Kietzmann et al., 2011).

The corrected results in the table show that some of the model’s main hypotheses did not receive the required statistical support, while others were strongly supported. This explains the discrepancy in the impact of new media marketing (NMA) activities on brand trust and customer loyalty at Jordan Islamic Bank. First, the relationship between engagement (PRT) and perceived brand trust (BRT-BEN) (H1) was not supported, as the path coefficient value was negative (−0.012) and the p-value (p = 0.055) was higher than the conventional threshold (0.05). This suggests that engagement alone may not be sufficient to enhance brand trust, and that deeper interaction or different patterns of engagement may be needed to align with customer expectations in the Islamic banking context. Second, the relationship between openness (OPN) and brand trust (BRT-BEN) (H2) was also not statistically significant (p = 0.061). Although the path coefficient was positive (0.147), the lack of significance suggests that openness, despite its theoretical importance, did not translate into a strong impact on customer trust in this sample. This may reflect the bank’s need to improve its transparency and openness strategies to align with the public’s cultural and religious expectations. Third, the relationship between building relationships (BRL) and brand trust (H3) was not supported (p = 0.531), indicating that merely building superficial relationships through new media does not necessarily lead to enhanced brand trust. This is consistent with the literature suggesting that shallow or inconsistent relationships do not create real value for customers. In contrast, the relationship between building community (BCM) and brand trust (H4) was strong and strongly supported (β = 0.885, p < 0.001). This demonstrates that building digital communities around the bank is a key factor in enhancing customer trust, as it creates a sense of belonging and translates into deeper loyalty. The relationship between brand trust (BRT) and customer loyalty (CSL) (H5) was not statistically significant (p = 0.094). Although the trend was positive, the lack of significance confirms that trust alone is not sufficient to foster loyalty; it must be combined with other factors such as perceived value and digital community. Finally, the relationship between perceived benefit (BEN) and customer loyalty (H6) was strong and supported (β = 0.876, p < 0.001), reflecting that the tangible value customers perceive from Islamic banking services is a key driver of loyalty. Overall, the results reveal that perceived value and community building are the most influential determinants of customer loyalty, while participation, openness, and traditional relationship building did not achieve the expected effect. This suggests that customer loyalty in Islamic banks relies more on building communities based on trust and shared value than on individual interactions or partial openness.

These findings appear counterintuitive, as the literature generally suggests a positive relationship between customer loyalty and brand trust and engagement (Alrubaiee et al., 2017). For the positive impact of brand engagement, it supports the findings of Swaminathan et al. (2020), who argue that well-structured digital marketing efforts can significantly boost user interaction and engagement. It means that new media provides a dynamic platform for brands to interact with customers, fostering deeper engagement through tailored content and interactive experiences (Dessart et al., 2020).

Based on the previous findings, a regression analysis was conducted to assess the impact of new media marketing activities (NMAs) on customer loyalty at Jordan Islamic Bank (JIB) via the two mediating factors: brand trust and brand engagement (Hypothesis H7). The hypothesis was based on the assumption that NMAs positively influence customer loyalty. PLS-SEM was used to test this effect, as illustrated in Figure 3. The results revealed that the R2 value for brand trust (β = 0.0011) indicated a weak impact of NMAs on trust, while the R2 values for both brand trust and engagement were relatively low, indicating a limited direct impact. In contrast, the coefficient of determination for customer loyalty was high (R2 = 0.876), indicating that a significant portion of the loyalty variance is explained by brand trust and engagement, confirming their role as key mediators. The results highlight that brand engagement is a stronger mediator than brand trust, as this interaction reflects the importance of ongoing digital communication in motivating loyalty. The results also confirm that Islamic banks particularly benefit from relationship-building practices consistent with RMT principles, such as improving communication channels, promoting ethical behavior, and focusing on customer needs, all of which enhance customer trust and satisfaction, and thus their sustainable loyalty.

6 Discussion

In the context of Islamic banks, our findings imply how NMAs influence customer loyalty within Islamic banking. Jordan Islamic Bank (JIB), being an Islamic bank, operates in a market where customer engagement is highly influenced by ethical practices and adherence to Islamic or Shariah principles, which can partially reinforce trust and credibility as indicated by RMT (Berry, 2002). Consistent with prior (Husnain and Akhtar, 2015; Shankar et al., 2020), our study confirms bank’s participation in new media should be accompanied by messaging that resonates with the values and beliefs of its target audience, openness and community-building.

However, our analysis confirmed that openness positively influences BRT and BEN. For Jordan Islamic Bank (JIB), transparency in communication and openness in sharing financial information and product offerings are likely to be critical in building trust with customers. Note that the principle of Islamic banking often emphasizes ethical transparency in all financial dealings. The positive relationship in our findings suggests that when Jordan Islamic Bank (JIB) communicates openly on new media platforms (e.g., its compliance with Sharia principles), it can effectively attract and engage customers who value transparency in financial services. This also reinforces RMT’s emphasize on trust but extends it by demonstrating that trust is not solely transactional or experiential but deeply tied to moral legitimacy (Ebrahim, 2020).

Our third hypothesis is linked to the building relationships’ influence on BRT and BEN. However, the lack of a significant impact of building relationships on NMA could indicate that relationship-building alone may not drive immediate engagement or participation in Jordan Islamic Bank (JIB) digital initiatives (Ngo and Nguyen, 2016; Soh et al., 2015). This may be due to the need for deeper, more meaningful engagement that supports the bank’s ethical and religious commitments. Customers of Jordan Islamic Bank (JIB) may prioritize content that speaks to their values and provides clarity on financial products’ compliance with Islamic law over general relationship-building efforts. Thus, the bank might need to focus more on providing value-driven content rather than relying solely on relationship-building strategies on digital platforms.

Regarding brand trust, our findings highlight the importance of aligning its NMAs with Islamic principles. Customers of Jordan Islamic Bank (JIB) might react negatively to aggressive marketing tactics that are common in other sectors but might be perceived as inconsistent with the values of Jordan Islamic Bank (JIB), therefore, might need to ensure that its new media strategies emphasize transparency, ethics, and customer service to avoid any negative impact on brand trust. Trust, thus, is a critical factor which leads to customer loyalty. This also applies to brand engagement, as our findings suggest that targeted and value-aligned digital marketing can enhance customer loyalty. This means, for Jordan Islamic Bank (JIB), that the bank’s new media strategies (e.g., campaigns highlighting the social and community-oriented aspects of Islamic banking, having Q&A sessions on social media) can foster greater interaction with their customers. Such practices can lead to customer satisfaction and enhance loyalty.

6.1 Implications

This study contributes theoretically to the scientific literature by extending Relationship Marketing Theory (RMT) to the field of Islamic digital banking, providing empirical evidence from a non-Western, Shari’ah-compliant financial environment. The findings highlight that ethical brand building and trust-building mechanisms in such environments are not limited to transactions alone, but are deeply intertwined with moral legitimacy, cultural identity, and digital authenticity. The study suggests that the application of RMT must be adapted to the local context, such that its relational structures incorporate culturally relevant ethical expectations in environments where organizational legitimacy is derived from religious and faith-based values. Practically speaking, this study adds to new media marketing research, demonstrating that not all dimensions of engagement are equally influential, with community building and openness emerging as stronger factors than relationship building or general engagement (Alghizzawi et al., 2024b). In addition to its theoretical contributions, this study offers significant practical implications for Islamic banks, particularly the Jordan Islamic Bank (JIB). The findings reveal that new media marketing activities (NMAs), such as openness and community building, are crucial tools for enhancing customer trust and loyalty. Therefore, the management of Islamic banks should invest in developing interactive digital platforms that focus on building online communities based on Islamic values, thereby ensuring increased engagement and transparency with customers. The results also indicate that a mere digital presence is insufficient; it must be supported by value-rich content that educates customers about Islamic financial products and highlights the bank’s commitment to ethical practices.

7 Conclusion

This study seeks to deepen our understanding of the role of new media marketing activities (NMAs) in enhancing brand trust and customer loyalty in the Jordanian Islamic banking context, focusing on Jordan Islamic Bank (JIB). The results demonstrate that openness and community building are key indicators of engagement and loyalty, while public engagement alone is insufficient if not coupled with transparency and ethical considerations. The study also demonstrates that applying Relationship Marketing Theory (RMT) provides a robust framework for understanding how Islamic banks can foster long-term relationships based on trust and shared values, rather than limited to transactional interactions. In doing so, the study makes a dual contribution: theoretically, by expanding the literature on RMT in a non-Western, Sharia-compliant environment, and practically, by guiding Islamic banks toward digital strategies based on community building and transparency to foster sustainable loyalty. These findings underscore the importance of integrating the digital and value dimensions in maintaining Islamic brand positioning and enhancing their competitiveness in the contemporary financial landscape.

7.1 Limitations and future research

This study acknowledges four main limitations. First, its focus only on Jordanian Islamic banks raises questions about its applicability to other geographical regions and industries. Second, the dependence on a convenient sampling technique introduces potential biases and restricts the scope of the study. Third, this study was based on a cross-sectional survey, thus, it reports only mere correlations rather than any causal evidence. Finally, although the measurement model achieved acceptable composite reliability and convergent validity for most constructs, several variables exhibited Cronbach’s alpha values below the conventional threshold (0.750). While values above 0.700 are generally acceptable, the relatively lower internal consistency coefficients observed for certain NMA dimensions suggest potential limitations in the external validity and reliability of these scales within Islamic banking. This may reflect cultural or contextual differences in how Jordan Islamic Bank (JIB) customers interpret standard relationship marketing constructs originally developed in a Western financial context. Future research could explore the specific types of community-building activities that are most effective in other Islamic banking markets or examine the role of digital content types in enhancing engagement.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/supplementary material.

Ethics statement

Ethical approval was not required for the study involving humans in accordance with the local legislation and institutional requirements. Written informed consent to participate in this study was not required from the participants or the participants’ legal guardians/next of kin in accordance with the national legislation and the institutional requirements.

Author contributions

ZT: Conceptualization, Investigation, Methodology, Resources, Writing – original draft. AA-K: Conceptualization, Investigation, Methodology, Software, Writing – original draft. HS: Conceptualization, Investigation, Resources, Writing – original draft. AH: Conceptualization, Investigation, Methodology, Resources, Writing – original draft. MH: Conceptualization, Formal analysis, Investigation, Methodology, Software, Validation, Writing – original draft, Writing – review & editing. ME: Conceptualization, Methodology, Resources, Writing – original draft, Writing – review & editing. FO: Conceptualization, Investigation, Methodology, Resources, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abkenar, S. B., Kashani, M. H., Mahdipour, E., and Jameii, S. M. (2021). Big data analytics meets social media: a systematic review of techniques, open issues, and future directions. Telemat. Inform. 57:101517. doi: 10.1016/j.tele.2020.101517

Al- Samirae, Z., Alshibly, S., and Alghizzawi, M. (2020). Excellence in drawing up marketing mix strategies for small and medium enterprises (SMEs) and their impact on the marketing performance. Bus. Manage. Econ. Res. 63, 30–36. doi: 10.32861/bmer.63.30.36

Alarcón, D., and Sánchez, J. A. (2015). Assessing convergent and discriminant validity in the ADHD-R IV rating scale: user-written commands for average variance extracted (AVE), composite reliability (CR), and Heterotrait-Monotrait ratio of correlations (HTMT). Spanish STATA Meeting 2015 22, 1–39.

Albaity, M., and Rahman, M. (2021). Customer loyalty towards Islamic banks: the mediating role of trust and attitude. Sustainability 13:10758. doi: 10.3390/su131910758

Alghizzawi, M., Al Shibly, M. S., Ezmigna, A. A. R., Shahwan, Y., and Binsaddig, R. (2024a). “Corporate social responsibility and customer loyalty from a literary perspective” in Artificial intelligence and economic sustainability in the era of industrial revolution 5.0. eds. A. M. M. Al-Sartawi and A. I. Nour (Cham: Springer), 1083–1094. doi: 10.1007/978-3-031-56586-1_79

Alghizzawi, M., Habes, M., Hailat, K. Q., Safori, A., and Angawi, M. (2024b). Understanding the effectiveness of digital media marketing on sports brand loyalty: a review. Bus. Anal. Capabilities Artif. Int. Enabled Anal. Appl. Challenges Digital Era 1, 215–225.

Al-Kandari, A. A., Gaither, T. K., Alfahad, M. M., Dashti, A. A., and Alsaber, A. R. (2019). An Arab perspective on social media: how banks in Kuwait use instagram for public relations. Public Relat. Rev. 45:101774. doi: 10.1016/J.PUBREV.2019.04.007

Alrubaiee, L. S., Aladwan, S., Abu Joma, M. H., Idris, W. M., and Khater, S. (2017). Relationship between corporate social responsibility and marketing performance: the mediating effect of customer value and corporate image. Int. Bus. Res. 10:104. doi: 10.5539/ibr.v10n2p104

Althuwaini, S. (2022). The effect of social media activities on brand loyalty for banks: the role of brand trust. Adm. Sci. 12, 148–158. doi: 10.3390/admsci12040148

Alzahmi, A. (2020). Electronic marketing for financial services: a case study on Islamic banks in the United Arab Emirates. Int. J. Innov. Eng. Res. Technol. 7, 110–116.

Andespa, R., and Yeni, Y. H. (2024). Fostering customer loyalty among Muslim clients: strategies for Islamic banks. Hamdard Islam. 47:51. doi: 10.57144/hi.v47i1.499

Aravik, H., Amri, H., and Febrianti, R. (2022). The marketing ethics of Islamic banks: a theoretical study. Islamic Banking J. Pemikiran Dan Pengembangan Perbankan Syariah 7, 263–282. doi: 10.36908/isbank.v7i2.344

Argenti, P. A., and Druckenmiller, B. (2004). Reputation and the corporate brand. Corp. Reput. Rev. 6, 368–374. doi: 10.1057/palgrave.crr.1540005

Balliauw, M., Onghena, E., and Mulkens, S. (2020). Identifying factors affecting the value of advertisements on football clubs’ and players’ social media: a discrete choice analysis. Int. J. Sports Mark. Sponsor. 22, 652–676. doi: 10.1108/IJSMS-12-2019-0138

Berry, L. L. (2002). Relationship marketing of services perspectives from 1983 and 2000. J. Relationsh. Mark. 1, 59–77. doi: 10.1300/j366v01n01_05

Budiman, S. (2021). The effect of social media on brand image and brand loyalty in generation Y. J. Asian Financ. Econ. Bus. 8, 1339–1347. doi: 10.13106/jafeb.2021.vol8.no3.1339

Castañeda, J.-A., Martínez-Heredia, M.-J., and Rodríguez-Molina, M.-Á. (2019). Explaining tourist behavioral loyalty toward mobile apps. J. Hosp. Tour. Technol. 10, 415–430. doi: 10.1108/JHTT-08-2017-0057

Cazorla Milla, A., and Mataruna, L. (2019). Social media preferences, interrelations between the social media characteristics and culture: a view of Arab nations. Asian Soc. Sci. 15, 71–77. doi: 10.5539/ass.v15n6p71

Chepkirui, J., and Huang, W. (2021). A path analysis model examining self-concept and motivation pertinent to undergraduate academic performance: a case of Kenyan public universities. Educ. Res. Rev. 16, 64–71. doi: 10.5897/ERR2021.4123

De Bruin, L., Roberts-Lombard, M., and De Meyer-Heydenrych, C. (2021). Internal marketing, service quality and perceived customer satisfaction. J. Islam. Mark. 12, 199–224. doi: 10.1108/JIMA-09-2019-0185

Dessart, L., Veloutsou, C., and Morgan-Thomas, A. (2020). Brand negativity: a relational perspective on anti-brand community participation. Eur. J. Mark. 54, 1761–1785. doi: 10.1108/EJM-06-2018-0423

Dwivedi, Y. K., Kelly, G., Janssen, M., Rana, N. P., Slade, E. L., and Clement, M. (2018). Social media: the good, the bad, and the ugly. Inf. Syst. Front. 20, 419–423. doi: 10.1007/s10796-018-9848-5

Ebrahim, R. S. (2020). The role of trust in understanding the impact of social media marketing on brand equity and brand loyalty. J. Relationsh. Mark. 19, 287–308. doi: 10.1080/15332667.2019.1705742

Elareshi, M., Habes, M., Safori, A., Attar, R. W., Noor Al adwan, M., and Al-Rahmi, W. M. (2023). Understanding the effects of social media marketing on customers’ bank loyalty: a SEM approach. Electronics 12:1822. doi: 10.3390/electronics12081822

Elbasir, M., Elareshi, M., and Habes, M. (2020). The influence of trust, security and reliability of multimedia payment on the adoption of EPS in Libya. Multicult. Educ. 6, 341–354. doi: 10.5281/zenodo.4312133

Farrell, T., Fernandez, M., Novotny, J., and Alani, H. (2019). “Exploring misogyny across the Manosphere in Reddit,” in Proceedings of the 10th ACM conference on web science, 87–96. doi: 10.1145/3292522.332604

Farrokhi, F., and Mahmoudi-Hamidabad, A. (2012). Rethinking convenience sampling: defining quality criteria. Theory Pract. Lang. Stud. 4, 784–792. doi: 10.4304/tpls.2.4.784-792

García-Fernández, J., Fernández-Gavira, J., Sánchez-Oliver, A. J., Gálvez-Ruíz, P., Grimaldi-Puyana, M., and Cepeda-Carrión, G. (2020). Importance-performance matrix analysis (Ipma) to evaluate servicescape fitness consumer by gender and age. Int. J. Environ. Res. Public Health 17, 1–19. doi: 10.3390/ijerph17186562

Grubor, A., Djokic, I., and Milovanov, O. (2017). The influence of social media communication on brand equity: the evidence for environmentally friendly products. Appl. Ecol. Environ. Res. 15, 963–983. doi: 10.15666/aeer/1503_963983

Habes, M., Alghizzawi, M., Elareshi, M., Ziani, A., Qudah, M., and Al Hammadi, M. M. (2023). “E-marketing and customers’ Bank loyalty enhancement: Jordanians’ perspectives” in The implementation of smart Technologies for Business Success and Sustainability. eds. A. Hamdan, H. M. Shoaib, B. Alareeni, and R. Hamdan (Cham: Springer), 37–47.

Hair, J. F. Jr., and Lukas, B. (2014). Marketing research. New York, NY: McGraw-Hill Education Australia.

Hair, J. F., Risher, J. J., Sarstedt, M., and Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 31, 2–24. doi: 10.1108/EBR-11-2018-0203/FULL/HTML

Halim, S. B. K., Osman, S. B., Al Kaabi, M. M., Alghizzawi, M., and Alrayssi, J. A. A. (2023). “The role of governance, leadership in public sector organizations: a case study in the UAE” in Digitalisation: Opportunities and challenges for business: Volume 2. eds. B. Alareeni, A. Hamdan, R. K. Hamdan, and R. Khoury (Cham: Springer), 301–313.

Hare, K. (2016). Journalism is a stressful career, but work doesn’t have to be miserable - Poynter. Cham: Springer.

Hatamleh, I. H. M., Safori, A. O., Habes, M., Tahat, O., Ahmad, A. K., Abdallah, R. A.-Q., et al. (2023). Trust in social media: enhancing social relationships. Soc. Sci. 12:416. doi: 10.3390/socsci12070416

Hatem Falih, O., Abedin, B., Yahyazadehfar, M., Safari, M., and Kassim, E. S. (2025). Exploring customer loyalty in Islamic banking: a model for the Iraqi market. J. Islam. Mark. doi: 10.1108/JIMA-04-2024-0148

Henseler, J., Ringle, C. M., and Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 43, 115–135. doi: 10.1007/s11747-014-0403-8

Hidayat, K., and Idrus, M. I. (2023). The effect of relationship marketing towards switching barrier, customer satisfaction, and customer trust on bank customers. J. Innov. Entrep. 12:29. doi: 10.1186/s13731-023-00270-7

Husnain, M., and Akhtar, W. (2015). Relationship marketing and customer loyalty: Evidence from banking sector in Pakistan. GJMBR-E: Marketing 15, 1–14.

Ibrahim, B. (2022). Social media marketing activities and brand loyalty: a meta-analysis examination. J. Promot. Manag. 28, 60–90. doi: 10.1080/10496491.2021.1955080

Iskandar, A. S., Muhajir, M. N. A., Erwin, E., and Fasiha, F. (2025). Customer loyalty model in Islamic bank: mosque perspective. J. Islamic Mark. 16, 447–461. doi: 10.1108/JIMA-11-2023-0349

Jiang, L., Jun, M., and Yang, Z. (2016). Customer-perceived value and loyalty: how do key service quality dimensions matter in the context of B2C e-commerce? Serv. Bus. 10, 301–317. doi: 10.1007/s11628-015-0269-y

Jibril, A. B., Kwarteng, M. A., Chovancova, M., and Pilik, M. (2019). The impact of social media on consumer-brand loyalty: a mediating role of online based-brand community. Cogent Bus Manag 6:640. doi: 10.1080/23311975.2019.1673640

Joo, T.-M., and Teng, C.-E. (2017). Impacts of social media (Facebook) on human communication and relationships. Int. J. Knowl. Content Dev. Technol. 7, 27–50.

Juanamasta, I. G., Wati, N. M. N., Hendrawati, E., Wahyuni, W., Pramudianti, M., Wisnujati, N. S., et al. (2019). The role of customer service through customer relationship management (CRM) to increase customer loyalty and good image. Int. J. Sci. Technol. Res. 8, 2004–2007.

Julaeha, L. S. (2024). The role of content marketing in brand loyalty: an empirical analysis. MASMAN Master Manajemen 2, 117–132. doi: 10.59603/masman.v2i2.509

Kakeesh, D., Al-Weshah, G., and Al-Ma’aitah, N. (2021). Maintaining customer loyalty using electronic customer relationship management (e-CRM): qualitative evidence from small food businesses in Jordan. Stu. Appl. Econ. 39:7. doi: 10.25115/eea.v39i7.4810

Kaplan, A. M., and Haenlein, M. (2010). Users of the world, unite! The challenges and opportunities of social media. Bus. Horiz. 53, 59–68. doi: 10.1016/j.bushor.2009.09.003

Kietzmann, J. H., Hermkens, K., McCarthy, I. P., and Silvestre, B. S. (2011). Social media? Get serious! Understanding the functional building blocks of social media. Bus. Horiz. 54, 241–251. doi: 10.1016/j.bushor.2011.01.005

Kim, H.-D., Kim, Y., and Mantecon, T. (2019). Short-term institutional investors and agency costs of debt. J. Bus. Res. 95, 195–210. doi: 10.1016/j.jbusres.2018.10.019

Kuo, Y.-F., and Feng, L.-H. (2013). Relationships among community interaction characteristics, perceived benefits, community commitment, and oppositional brand loyalty in online brand communities. Int. J. Inf. Manag. 33, 948–962. doi: 10.1016/j.ijinfomgt.2013.08.005

Liao, J., Wang, W., Du, P., and Filieri, R. (2022). Impact of brand community supportive climates on consumer-to-consumer helping behavior. J. Res. Interact. Mark. 22, 1–19. doi: 10.1108/JRIM-03-2022-0069

Liao, J., Wang, W., Du, P., and Filieri, R. (2023). Impact of brand community supportive climates on consumer-to-consumer helping behavior. J. Res. Interact. Mark. 17, 434–452. doi: 10.1108/JRIM-03-2022-0069

Lilach Bullock,, and Agbaimoni, O. (2013). Social media marketing — why businesses need to use it and how. Cham: Springer.

Maderer, D., Parganas, P., and Anagnostopoulos, C. (2018). Brand-image communication through social media: the case of European professional football clubs. Int. J. Sport Commun. 11, 319–338. doi: 10.1123/ijsc.2018-0086

Maria, S., Pusriadi, T., Hakim, Y. P., and Darma, D. C. (2019). The effect of social media marketing, word of mouth, and effectiveness of advertising on brand awareness and intention to buy. J. Manajemen Indonesia 19:107. doi: 10.25124/jmi.v19i2.2234

McCarthy, J., Rowley, J., Jane Ashworth, C., and Pioch, E. (2014). Managing brand presence through social media: the case of UK football clubs. Internet Res. 24, 181–204. doi: 10.1108/IntR-08-2012-0154

Morgan, R. M., and Hunt, S. D. (1994). The commitment-trust theory of relationship marketing. J. Mark. 58, 20–38. doi: 10.1177/002224299405800302

Moriguchi, T., Khattak, M. A., Farhan, M., Firdaus, M., Worasutr, A., Hakim, A. L., et al. (2016). Contemporary practices of Musharakah in financial transactions. Int. J. Manag. Appl. Res. 3, 65–76. doi: 10.18646/2056.32.16-005

Muflih, M., Iswanto, B., and Purbayati, R. (2024a). Green loyalty of Islamic banking customers: combined effect of green practices, green trust, green perceived value, and green satisfaction. Int. J. Ethics Syst. 40, 477–494. doi: 10.1108/IJOES-03-2023-0062

Muflih, M., Zen, M., Purbayati, R., Kristianingsih, K., Karnawati, H., Iswanto, B., et al. (2024b). Customer loyalty to Islamic mobile banking: evaluating the roles of justice theory, religiosity, satisfaction and trust. Int. J. Bank Mark. 42, 571–595. doi: 10.1108/IJBM-03-2023-0187

Mulia, D., Usman, H., and Parwanto, N. B. (2020). The role of customer intimacy in increasing Islamic bank customer loyalty in using e-banking and m-banking. J. Islam. Mark. 12, 1097–1123. doi: 10.1108/JIMA-09-2019-0190

Munandar, J. M., Oktaviani, D., and Angraini, Y. (2022). How important is CRM toward customer’s loyalty to conventional and Islamic bank marketing strategy? J. Islamic Mark. 13, 246–263. doi: 10.1108/JIMA-07-2019-0146

Ngo, M. V., and Nguyen, H. H. (2016). The relationship between service quality, customer satisfaction and customer loyalty: an investigation in Vietnamese retail banking sector. J. Compet. 8, 103–116. doi: 10.7441/joc.2016.02.08

Nurittamont, W. (2021). “Understanding service quality and service loyalty: an empirical study of mobile phone network service in the central region of Thailand,” in The 2016 WEI international academic conference, 140–146.

Osei-Frimpong, K., McLean, G., and Famiyeh, S. (2019). Social media brand engagement practices. Inf. Technol. People 33, 1235–1254. doi: 10.1108/ITP-05-2018-0220

Plume, C. J., Dwivedi, Y. K., and Slade, E. L. (2017). Social media in the marketing context. Oxford: Chandos Publishing.

Puspaningrum, A. (2020). Social media marketing and brand loyalty: the role of brand trust. J. Asian Financ. Econ. Bus. 7, 951–958. doi: 10.13106/JAFEB.2020.VOL7.NO12.951

Ramanathan, U., Subramanian, N., and Parrott, G. (2017). Role of social media in retail network operations and marketing to enhance customer satisfaction. Int. J. Oper. Prod. Manag. 37, 105–123. doi: 10.1108/IJOPM-03-2015-0153

Ribeiro, T., Calapez, A., Almeida, V., and Matsuoka, H. (2023). Understanding the role of sport values on social capital and word-of-mouth on the internet: a case study of Esports games. Simul. Gaming 54, 645–679. doi: 10.1177/10468781231197175

Romani, S., Grappi, S., Zarantonello, L., and Bagozzi, R. P. (2015). The revenge of the consumer! How brand moral violations lead to consumer anti-brand activism. J. Brand Manag. 22, 658–672. doi: 10.1057/bm.2015.38

Sarstedt, M., Ringle, C. M., and Hair, J. F. (2021). “Partial least squares structural equation modeling” in Handbook of market research. eds. C. Homburg and M. Klarmann (Cham: Springer), 587–632.

Shami, S., and Ashfaq, A. (2018). Strategic political communication, public relations, reputation management & relationship cultivation through social media. J. Res. Soc. Pak. 2, 139–154.

Shankar, A., Jebarajakirthy, C., and Ashaduzzaman, M. (2020). How do electronic word of mouth practices contribute to mobile banking adoption? J. Retail. Consum. Serv. 52:101920. doi: 10.1016/J.JRETCONSER.2019.101920

Singh, P. (2024). Beyond the basics: exploring the impact of social media marketing enablers on business success. Heliyon 10:e26435. doi: 10.1016/j.heliyon.2024.e26435

Soh, K. L., Chin, S. H., and Wong, W. P. (2015). A theoretical model to investigate customer loyalty on logistics service providers for sustainable business performance. Int. J. Bus. Perform. Supply Chain Model. 7, 212–232. doi: 10.1504/IJBPSCM.2015.071609

Swaminathan, V., Sorescu, A., Steenkamp, J.-B. E. M., Gibson O’guinn, T. C., and Schmitt, B. (2020). Branding in a hyperconnected world: refocusing theories and rethinking boundaries. J. Mark. 84, 24–46. doi: 10.1177/0022242919899905

Taylor, S. A., Goodwin, S., and Celuch, K. (2004). The importance of brand equity to customer loyalty. J. Prod. Brand. Manag. 13, 217–227. doi: 10.1108/10610420410546934

Thaker, H. M. T., Khaliq, A., Mand, A. A., Hussain, H. I., Thaker, M. A. B. M. T., and Pitchay, A. B. A. (2020). Exploring the drivers of social media marketing in Malaysian Islamic banks: an analysis via smart PLS approach. J. Islam. Mark. doi: 10.1108/JIMA-05-2019-0095

Thu, T. V. T., and Phuong, Q. V. T. (2021). The impact of social media marketing on brand loyalty: case study of Samsung smartphones in Vietnam. Ann. Appl. Sport Sci. 5, 73–80.

Tuqan, A., Abdeljawad, I., and Saleem, I. (2024). “Islamic financial ethics and customer loyalty in the Islamic finance industry: a review of literature and future directions” in Artificial intelligence and economic sustainability in the era of industrial revolution 5.0. eds. A. M. M. Al-Sartawi and A. I. Nour (Cham: Springer), 959–973.

Veland, R., Amir, D., and Samije, S.-D. (2014). Social media channels: the factors that influence the behavioural intention of customers. Int. J. Bus. Globalisation 12, 297–314. doi: 10.1504/IJBG.2014.060214

Voramontri, D., and Klieb, L. (2019). Impact of social media on consumer behaviour. Int. J. Inf. Decis. Sci. 11:4191. doi: 10.1504/ijids.2019.10014191

Wang, X., You, X., Xu, Y., and Zheng, J. (2023). Online posting intention: do the social communication and brand equity of esports matter? Int. J. Sports Mark. Sponsor. 25, 161–187. doi: 10.1108/IJSMS-09-2023-0189

Wibowo, A., Chen, S.-C., Wiangin, U., Ma, Y., and Ruangkanjanases, A. (2020). Customer behavior as an outcome of social media marketing: the role of social media marketing activity and customer experience. Sustainability 13:189. doi: 10.3390/su13010189

Yoo, M., Hong, J., and Jang, C. W. (2020). Suitability of YouTube videos for learning knee stability tests: a cross-sectional review. Arch. Phys. Med. Rehabil. 101, 2087–2092. doi: 10.1016/j.apmr.2020.05.024

Zhang, X., and Jin, H. (2023). How does smart technology, artificial intelligence, automation, robotics, and algorithms (STAARA) awareness affect hotel employees’ career perceptions? A disruptive innovation theory perspective. J. Hosp. Mark. Manag. 32, 264–283. doi: 10.1080/19368623.2023.2166186

Keywords: new media marketing activities (NMAs), brand trust, customer loyalty, online community, Islamic banking, relationship marketing theory

Citation: Tahat ZY, Al-Kadi AB, Saad H, Al Hadeed A, Habes M, Elareshi M and Al Olaimat F (2025) How new media marketing activities affect customer loyalty in Islamic Jordanian banks. Front. Commun. 10:1681417. doi: 10.3389/fcomm.2025.1681417

Edited by:

Steven Bellman, University of South Australia, AustraliaReviewed by:

Osama Wagdi, Egyptian Russian University, EgyptShakir Ullah, Fayetteville State University, United States

Copyright © 2025 Tahat, Al-Kadi, Saad, Al Hadeed, Habes, Elareshi and Al Olaimat. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mohammed Habes, bW9oYW1tYWQuaGFiZXNAeXUuZWR1Lmpv; Mokhtar Elareshi bWVsYXJlc2hpQHNoYXJqYWguYWMuYWU=

Zuhair Yassin Tahat1

Zuhair Yassin Tahat1 Hamza Saad

Hamza Saad Ali Al Hadeed

Ali Al Hadeed Mohammed Habes

Mohammed Habes Mokhtar Elareshi

Mokhtar Elareshi Farhan Al Olaimat

Farhan Al Olaimat