- 1School of Management, Harbin University of Commerce, Harbin, China

- 2School of Finance, Southwest University of Finance and Economics, Chengdu, China

The Green Credit Policy is a crucial tool for driving the transformation and upgrading of heavily polluting enterprises and protecting the environment. By employing a difference-in-differences (DID) approach to construct a quasi-natural experiment, this paper examines the impact of the policy on the ESG (Environmental, Social, and Governance) performance of heavily polluting enterprises. The results indicate that the policy significantly improves the ESG performance of these enterprises, and this finding remains robust after a series of robustness tests. Additionally, the policy exhibits a “long-tail effect,” meaning its positive impact extends through 2021. Furthermore, panel quantile regression results reveal that the policy has a more pronounced positive impact on enterprises with poorer ESG performance. The study also shows that foreign-owned and mixed-ownership enterprises, as well as larger firms in employee size, do not benefit from the policy, whereas other companies do experience positive effects. Finally, the moderating effect analysis indicates that the age of senior management negatively moderates the policy’s impact, while executives with a financial background and effective internal control systems positively moderate its effects. This paper provides a new perspective for future research on corporate ESG performance and offers theoretical insights for the refinement of future policies.

1 Introduction

Against the backdrop of increasingly severe global climate change and environmental problems, promoting the green transformation of the economy has become an important issue for all countries. As the world’s second-largest economy and the largest carbon emitter, China’s actions and decisions in addressing environmental challenges have drawn significant international attention. The 20th National Congress of the Communist Party of China elevated the concept of “modernization in harmony with nature” to one of the core elements of “Chinese-style modernization,” underscoring the country’s commitment to environmental protection and sustainable development. In this process, Environmental, Social, and Governance (ESG) standards have gradually become critical indicators for assessing a company’s ability to achieve sustainable development (Wang et al., 2022). This is particularly pertinent for heavily polluting industries, as these enterprises not only play a vital role in China’s economic development but also present significant challenges to the country’s environmental protection goals. On the one hand, such enterprises typically belong to energy-intensive and heavy industrial sectors, which not only contribute significantly to employment and sustain rapid economic growth but also accelerate the pace of China’s industrial modernization (Ji and Wu, 2024; Li D. et al., 2024; Meng, 2024; Zhang and Li, 2024). On the other hand, as green development increasingly becomes a global priority, the pollutants emitted by these heavily polluting enterprises, such as waste gas, wastewater, and solid waste, not only pose a threat to ecosystems but also heighten the pressure on governments to pursue sustainable development. Faced with increasingly stringent environmental regulations and the public’s growing demands for sustainable development, these enterprises urgently need to improve their ESG performance to enhance competitiveness and secure long-term development (Zhang, 2022).

Green credit aims to direct financial resources toward environmentally friendly enterprises and projects while reducing credit support for high-polluting and high-energy-consuming enterprises. In particular, for heavily polluting industries, green credit policies exert external pressure by limiting credit availability and raising financing costs, while also providing incentives such as preferential interest rates and policy subsidies. China’s government first referenced green credit policy in a 2007 joint directive issued by the People’s Bank of China and other departments titled “Opinions on Implementing Environmental Policies and Regulations to Prevent Credit Risks (Zhang, 2021).” The implementation of this directive marked the first time China formally regulated green credit policies through legislation (Ma and Yu, 2020). Subsequently, in 2012, the China Banking Regulatory Commission (CBRC) issued the “Green Credit Guidelines” (hereafter referred to as “GCG”), which require financial institutions to identify the pollution risks of different enterprises and implement differentiated credit policies accordingly. The issuance of the GCG represented the first normative document specifically addressing green credit in China and became a pillar of the country’s green credit system (Ding, 2019). Thus, the green credit policies introduced in 2012 provide an excellent natural experiment for this study.

However, since bank credit is a crucial financing channel for enterprises, heavily polluting enterprises, with their high financing needs, are most directly affected by green credit policies (Liu and Wang, 2023). Whether these policies can genuinely fulfill their core purpose—compelling heavily polluting enterprises to improve their ESG performance and achieve transformation and upgrading—remains a topic worth further research and exploration. To this end, this study collected data from Chinese A-share listed companies from 2009 to 2022, using the 2012 GCG as an exogenous policy variable, and constructed a quasi-natural experiment to empirically test the impact of China’s green credit policies on the ESG performance of heavily polluting enterprises, while also analyzing the underlying mechanisms.

Currently, research on the impact of green credit policies on corporate ESG performance remains limited. Existing literature primarily focuses on the economic effects of green credit policies or their role in curbing corporate pollutant emissions. However, ESG scores, which encompass corporate performance in environmental protection, social responsibility, and governance, provide a more comprehensive assessment of a firm’s economic outcomes and environmental governance achievements. Compared to single-dimensional indicators, such as economic benefits or pollution control, ESG metrics offer a holistic view of a company’s progress toward sustainable development, particularly in balancing environmental stewardship, social responsibility, and value creation.

Therefore, Investigating the effects of green credit policies on corporate ESG performance holds significant theoretical and practical value. Such research can deepen our understanding of the efficacy of green financial policies while addressing gaps in the comprehensive evaluation of corporate sustainability. Moreover, it has profound practical implications: it provides policymakers with evidence-based insights to refine green credit initiatives, guides companies in enhancing their environmental governance, social responsibility, and corporate governance practices, and supports the alignment of financial policies with sustainability goals. Additionally, this line of inquiry can serve as a valuable reference for future scholars exploring green finance, corporate environmental governance, and pathways to sustainable development, expanding the scope and depth of research in these domains.

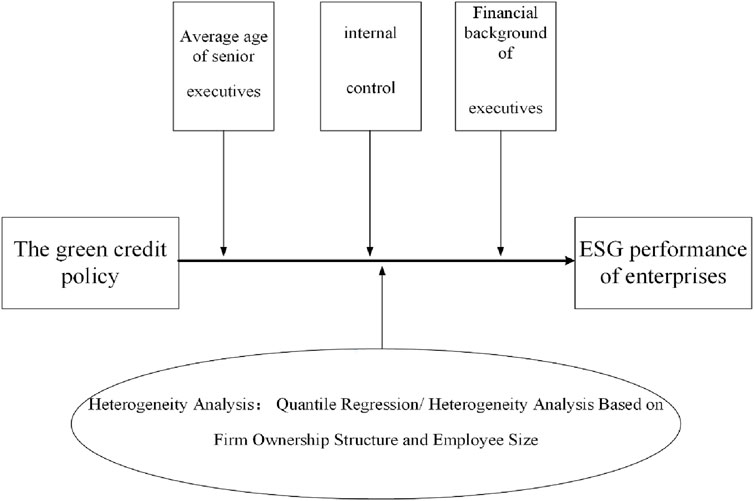

The main contributions of this study are as follows: (1) This empirical research integrates macro-environmental policies with corporate ESG performance, exploring the impact of China’s green credit policy on the ESG performance of heavily polluting enterprises and analyzing the specific mechanisms in depth. This study not only enriches the existing literature on the microeconomic effects of policy but also extends and supplements the research on factors influencing corporate ESG performance, providing new perspectives and evidence for understanding the impact of green credit policy on enterprises. (2) In addition to conducting basic regressions on the ESG performance of heavily polluting enterprises, this study also performs separate regressions on the Environmental, Social, and Governance aspects, offering important theoretical insights into the role of policy in corporate development and optimizing policy design and implementation. (3) While previous literature on corporate microactivities primarily focuses on revealing overall micro-level effects, it often overlooks the differences between firms at different quantiles. To comprehensively consider the heterogeneity of the impact of policy on enterprises with varying ESG performance, Section 5.1 of this study employs an unconditional panel quantile regression model. Through quantile regression, this study examines the impact of green credit policies on heavily polluting enterprises at low, medium, and high ESG performance quantiles. (4) From the perspective of corporate internal governance structures, this study constructs a moderating effect model by using the average age of corporate executives, the effectiveness of internal control systems, and whether executives have a financial background as moderating variables. It explores the specific roles these variables play in the policy implementation process.

2 Literature review and research hypotheses

2.1 Literature

The literature review in this study is divided into two main sections: the effects of green credit policies and the factors influencing corporate ESG performance.

First, the existing research on the effects of green credit policies can be broadly categorized into two areas: the macroeconomic impacts and the microeconomic impacts of these policies.

Macroeconomic impacts: Liu et al. employed a financial computable general equilibrium model to assess the systemic effects of green credit policies, focusing on industries such as paper manufacturing, chemicals, cement, and steel. Their findings indicate that these policies significantly suppress investment in energy-intensive industries (Liu et al., 2017). Lamperti et al. explored the relationship between climate change, green credit, and economic dynamics, testing a range of policy interventions. Their study concludes that green credit not only enhances corporate productivity but also reduces pollutant emissions, thereby improving environmental quality (Lamperti et al., 2021). Microeconomic impacts: At the corporate level, Lv et al. analyzed data from listed industrial firms between 2007 and 2022, using a difference-in-differences model to study the impact of the 2012“Green Credit Guidelines” on the green production efficiency of heavily polluting firms in China. Their findings reveal that green credit policies significantly enhance the green production efficiency of these firms, with the effect being particularly pronounced among firms with smaller commercial credit financing scales and lower capital utilization efficiency (Lv et al., 2023). At the financial institution level, Liu and Huang used data from Chinese banks and employed a structural vector autoregression model to explore the relationship between green credit issued by financial institutions and their financial risk management. Their results indicate that a positive shock in green credit issuance negatively impacts the financial risk management of these institutions. Conversely, a positive shock in financial risk management positively influences green credit issuance (Liu and Huang, 2022).

Secondly, in the research on corporate ESG performance, scholars have explored the influencing factors from various external perspectives, including securities regulations (Ji and Sun, 2024), carbon emission reduction policies (Li et al., 2024b), digital inclusive finance (Chen and Liu, 2024), and the uncertainty of external market environments (Wu et al., 2024). Additionally, numerous studies have confirmed the impact of corporate ESG performance on government-business relations (Qi and Wu, 2024a), the legal and environmental risks faced by companies (Xu and Yao, 2024), fund performance (Li et al., 2024c), and capital markets (Guo and Li, 2024).

In summary, the current research on green credit policies primarily focuses on examining their macroeconomic and microeconomic impacts. For instance, studies investigate the effects of such policies on industrial structure, the ecological environment, the positive performance of enterprises and financial institutions, as well as the pollution emission performance of enterprises. However, few scholars have examined the impact of policies on the ESG performance of heavily polluting enterprises. Likewise, research on corporate ESG performance has rarely considered the influence of green credit policies from the perspective of environmental regulation, particularly for heavily polluting industries. This study contributes to the existing literature on corporate ESG performance by providing new insights into the role of green credit policies, offering valuable reference points for future research.

2.2 Research hypotheses

Stakeholder theory posits each of these stakeholder groups exerts significant influence on the company’s operations and development (Ashraf et al., 2022). Green credit policies, by strengthening interactions between firms and their stakeholders, encourage companies to make more proactive improvements in environmental, social, and governance (ESG) aspects. Specifically, these policies can affect a firm’s ESG performance through two primary channels: altering the flow of funds and adjusting financing costs.

First, the alteration of fund flows forms the foundation of the policy logic. Under traditional credit mechanisms, companies primarily secure financing based on profitability, often neglecting environmental and social responsibilities. In contrast, green credit policies prioritize support for companies and projects aligned with sustainable development goals, particularly those focused on environmental protection, resource conservation, and low-carbon technologies. This shift in funding flows compels heavily polluting enterprises to improve their environmental performance to meet the requirements of green credit (Chen et al., 2022).

Second, the adjustment of financing costs serves as a direct incentive for improving corporate ESG performance under green credit policies. Typically, these policies are accompanied by lower loan interest rates and other financial incentives, which reduce the investment costs for environmental projects and green technologies. For heavily polluting companies, this means that adopting environmentally friendly measures not only reduces the risk of non-compliance with environmental regulations but also yields direct economic benefits. Conversely, companies that fail to improve their environmental performance may face higher financing costs or even exclusion from green credit support (Gao et al., 2022).

Based on the above analysis, this study proposes the following research hypothesis:

Hypothesis 1. The implementation of the green credit policy can enhance the ESG performance of heavily polluting enterprises.

The positive impact of green credit policies may vary depending on the ESG performance of the companies themselves. First, companies with poor ESG performance typically have more room for improvement. These firms may have significant deficiencies in environmental protection, social responsibility, and corporate governance, and the implementation of policies offers them substantial incentives for improvement. Given their lower baseline, the intervention of green credit policies can significantly enhance their ESG performance. Second, companies with poor ESG performance may rely on low-cost financing or other incentives provided by green credit policies to improve their environmental management and governance structures. Finally, for companies with strong ESG performance, their market competitiveness, financial health, and access to diverse financing channels reduce their reliance on traditional bank loans (Du and Xu, 2024). In some cases, these policies could even increase their financing costs and risks, thereby diminishing the influence of bank credit policies on these firms (Yang, 2015).

In addition, the positive impact of policies on the ESG performance of heavily polluting enterprises may vary depending on the nature of ownership and the size of the workforce. Regarding ownership structure, state-owned enterprises (SOEs) are often direct implementers of government policies and thus tend to exhibit high compliance with national policies. For private firms with relatively limited resources, the preferential financing conditions and market incentives provided by green credit policies are a significant driving force for improving their ESG performance (Qi and Wu, 2024b). While foreign-invested enterprises are often subject to the global ESG standards of their parent companies or headquarters, and thus typically already maintain high ESG standards and management systems. The marginal impact of domestic green credit policies on further improving their ESG performance is limited. Mixed-ownership enterprises, with their complex ownership structures that include both state and private or foreign components, exhibit more diverse decision-making mechanisms and interest demands. This complex internal governance structure may lead to less effective responses to green credit policies.

Regarding workforce size, smaller enterprises generally face greater financial and resource constraints and exhibit a higher dependence on external financing. The low-cost financing provided by green credit policies is highly attractive to small enterprises, giving them a strong incentive to improve their ESG performance to meet green credit standards. In contrast, larger enterprises typically have more substantial internal funds and resources and more diversified financing channels, resulting in a lower reliance on green credit policies. These enterprises may already have well-established ESG strategies and financial security, thus the marginal impact of policies on their resource allocation is smaller.

Based on the above analysis, this paper proposes the following research hypotheses:

Hypothesis 2. Compared to heavily polluting enterprises with better ESG performance, the green credit policy is more effective in enhancing the ESG performance of heavily polluting enterprises with poorer ESG performance.

Hypothesis 3. The green credit policy significantly improves the ESG performance of state-owned enterprises, private enterprises, and heavily polluting enterprises with smaller employee scales, while having no significant impact on other heavily polluting enterprises.

Existing research has demonstrated that the personal characteristics of corporate executives, including board members, supervisors, and senior management, significantly influence, and even determine, the development of a company (Hakovirta et al., 2023). Older executives typically possess more traditional business perspectives and may exhibit a certain degree of inertia in adapting to new technologies and management methods (Hao et al., 2023). They might approach the new requirements and changes imposed by green credit policies with skepticism, potentially resisting necessary adjustments or investments, or hesitating to embrace innovative technologies or management practices.

The internal control systems of a company also impact the effectiveness of green credit policy implementation. A robust and scientifically designed internal control system ensures that the requirements of policies are systematically enforced. Such systems typically include environmental risk management, internal auditing, and information disclosure mechanisms (Xu and Wang, 2024).

Finally, executives with a financial background often possess a deep understanding of financial policies, market operations, and their implications for the company. They usually have strong risk management capabilities, enabling them to accurately identify and address financial and operational risks posed by external market uncertainties (Carpenter et al., 2004).

Therefore, the following research hypothesis is proposed:

Hypothesis 4. The age of senior management in heavily polluting enterprises negatively moderates the positive impact of the green credit policy on their ESG performance. In contrast, effective internal control systems and senior executives with financial backgrounds positively moderate the policy’s effect on the enterprises’ ESG performance.

The research framework of this study is shown in Figure 1.

3 Empirical design

3.1 Sample selection and data sources

This study uses data from listed companies in the Shanghai and Shenzhen A-shares markets between 2009 and 2022. To ensure the reliability and consistency of the data, the following procedures were applied:

(1) Financial and insurance companies were excluded.

(2) Companies classified as ST, ST*, PT, or PT* were removed.

(3) Companies with a debt-to-assets ratio greater than 1 or less than 0, as well as those with other abnormal financial indicators, were excluded.

(4) Companies with substantial missing data for key variables were removed.

(5) To avoid the impact of extreme values on regression results, all continuous variables were winsorized at the 1% and 99% levels.

A dataset containing 3,154 enterprises with a total of 19,774 valid observations was finally obtained. Then, the sample data were matched based on the Management List of Industry Classification for Environmental Verification of Listed Companies issued by the Ministry of Environmental Protection of China in 2008 and the Guidelines for Industry Classification of Listed Companies revised by the China Securities Regulatory Commission (CSRC) in 2012 (Sun et al., 2019; Xin and Wang, 2021). Finally, the sample data were divided into two groups: heavily polluting enterprises (experimental group) and non-heavily polluting enterprises (control group). Industry codes for heavy polluting enterprises: B06, B07, B08, B09, B09, B11, C17, C18, C19, C22, C25, C26, C27, C28, C29, C30, C31, C32, C33, D44. All data in this article are sourced from CSMAR, WIND, and CNRDS databases.

3.2 Variable definition and selection

3.2.1 Explained variable: Corporate ESG performance

This study employs Huazheng’s annual ESG ratings to assess the ESG performance of listed companies in China. The Huazheng rating system classifies ESG performance into nine categories: C, CC, CCC, B, BB, BBB, A, AA, and AAA. Referring to the practice of previous scholars (Weng and Lai, 2024), Furthermore, the study examines Huazheng’s E (Environmental), S(Social), and G (Governance) as separate dependent variables.

3.2.2 Explanatory variable: Treatment effect of GCG

This study uses China’s GCG as an exogenous explanatory variable, represented by the interaction term between the policy dummy variable

3.2.3 Control variables

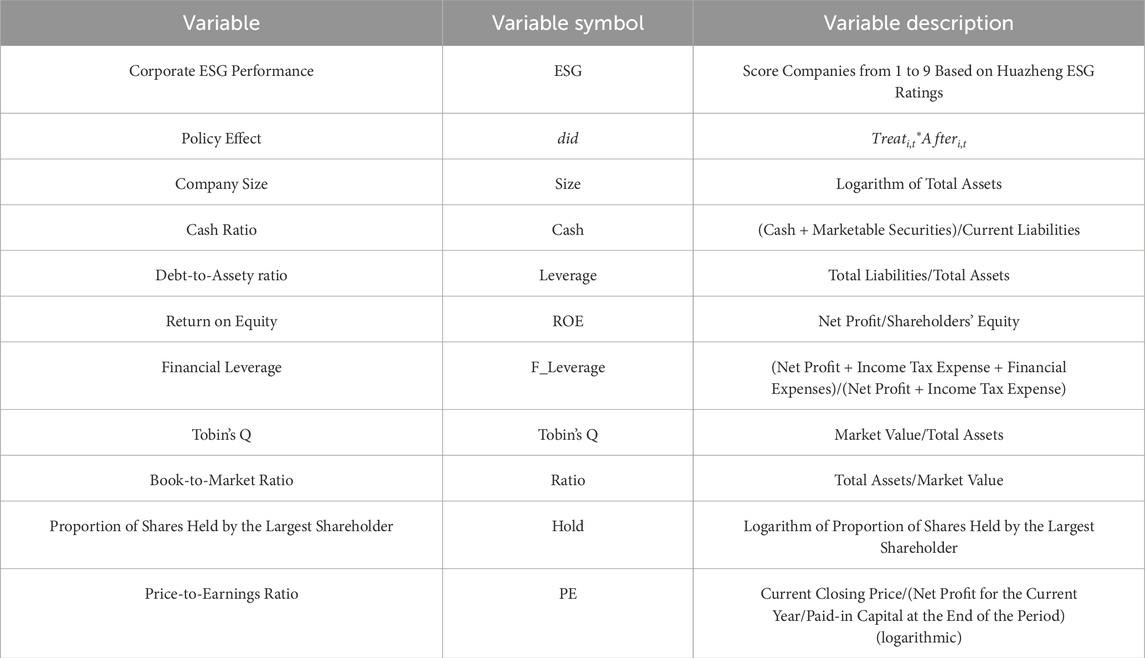

To control for the impact of other company characteristics on corporate ESG performance, this study follows existing literature (Xu and Wang, 2024; Ding et al., 2022) and controls for the following variables: company size (Size), cash ratio (Cash), debt-to-asset ratio (Leverage), return on equity (ROE), financial leverage (F_Leverage), Tobin’s Q (Tobin’s Q), book-to-market ratio (Ratio), proportion of shares held by the largest shareholder (Hold), and price-to-earnings ratio (PE). The specific definitions of the variables are shown in Table 1.

3.3 Model construction

The GCG issued by the China Banking Regulatory Commission in 2012 represents the top-level design of China’s green finance policy, which has since accelerated the advancement of green finance initiatives in the country. From the perspective of firms, the GCG constitutes an exogenous policy shock, allowing the creation of a quasi-natural experiment to evaluate the net effect of the policy on corporate ESG performance. Accordingly, this study draws on the research by Zhang and Hu (2022), categorizing firms directly impacted by the GCG as the treatment group and those not affected as the control group. A Difference-in-Differences (DID) model is employed to analyze the impact of the GCG on the ESG performance of high-pollution enterprises (Xiao and Dong, 2023). The specific regression model is outlined as follows:

where

To address potential issues of heteroscedasticity and serial correlation, all regression results in this study employ robust standard errors with clustering at the firm level.

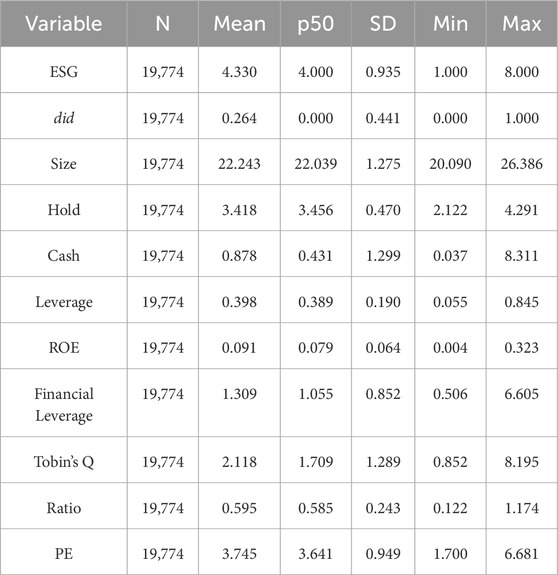

3.4 Descriptives statistics

The descriptive statistics for all variables are presented in Table 2, including the sample size (totaling 19,774 observations), sample mean, median, minimum, and maximum values. As shown in Table 2, the average ESG performance of Chinese listed companies between 2009 and 2022 is 4.33, with a median of 4, a minimum of 1, and a maximum of 8, and the variance is 0.935, indicating that the ESG scores of Chinese listed companies are generally low and exhibit significant variation across firms.

4 Empirical results

4.1 Baseline regression

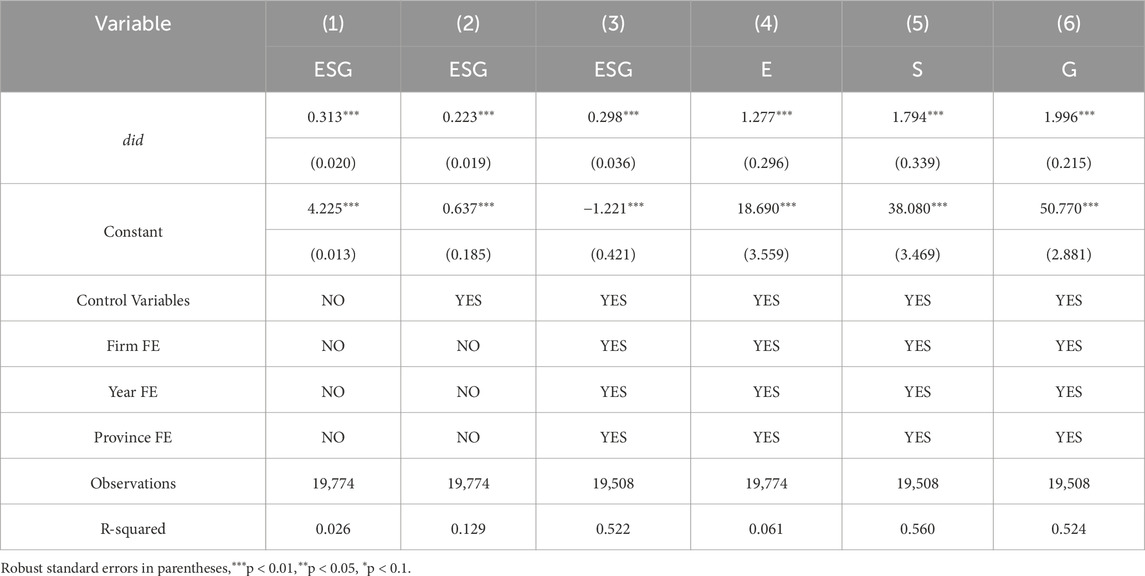

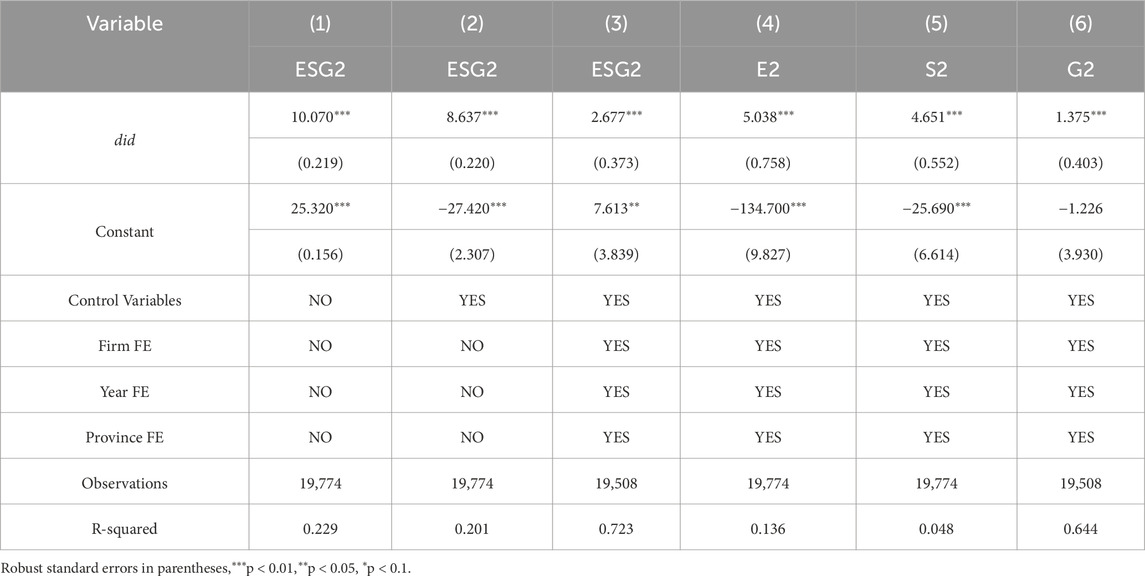

Table 3 presents the regression results for Model 1. Columns 1 through 3 show the impact of the GCG on high-pollution corporate ESG performance under three conditions: without control variables, with control variables, and with control variables along with various fixed effects. The results indicate that, regardless of the inclusion of control variables and fixed effects, the influence of the GCG on high-pollution corporate ESG performance is positive and statistically significant at the 1% level.

More specifically, the coefficient of the key explanatory variable

Additionally, Columns 4 through 6 display the effects of the GCG on high-pollution corporate environmental responsibility (E), social responsibility (S), and corporate governance (G). The regression results reveal that the estimated coefficients for the core explanatory variable,

4.2 Dynamic effect analysis

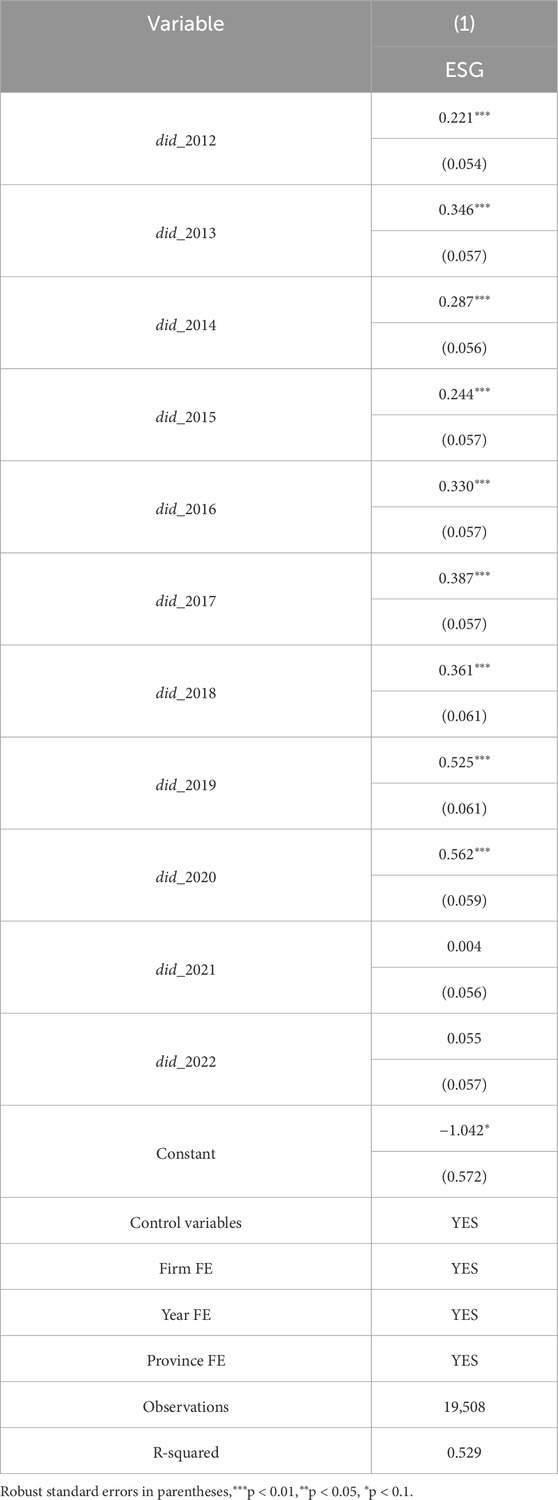

The dynamic effect model examines the sustained impact of the “Guidelines” on the ESG performance of heavily polluting enterprises over different years. The specific regression results are shown in Table 4.

Where

However, it is worth noting that after 2021, the impact of the GCG on the ESG performance of heavily polluting enterprises becomes insignificant, with the regression coefficients diminishing. This suggests that the long-term effect of the GCG is gradually weakening. A possible explanation for this is that, after 2021, as China was grappling with the severe impact of the pandemic, local governments and financial institutions may have gradually relaxed the loan restrictions associated with the Green Credit Policy to help more enterprises recover. This relaxation in policy enforcement likely reduced the impact of the policy on corporate ESG performance.

4.3 Robust tests

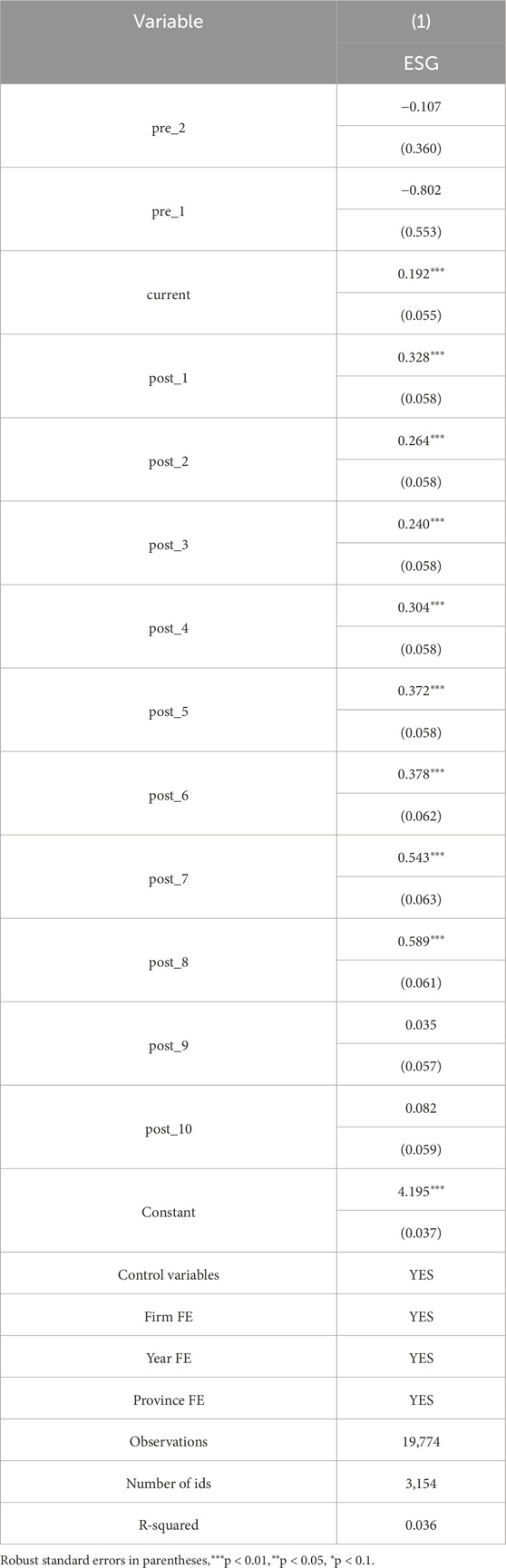

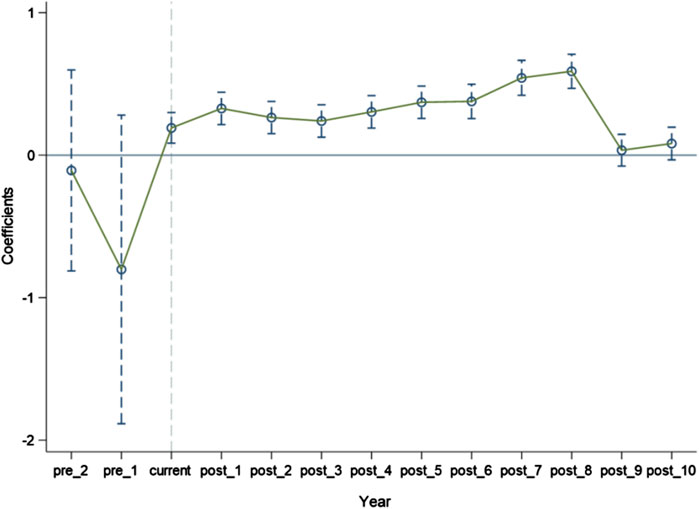

4.3.1 Parallel trend test

Before conducting the DID empirical study, it is essential to verify whether the selected sample data meets the parallel trend. This requires that, before the implementation of the GCG, the ESG performance of heavily polluting enterprises and non-polluting enterprises exhibited similar trends. According to the basic principles of the parallel trend, one period within the sample observation period is selected as the “benchmark” (baseline group), and the other periods are compared against this benchmark. Typically, the baseline group is either the first period of the observation period or the period immediately preceding the policy implementation. To avoid multicollinearity, the baseline group is excluded from the analysis, and regression is then performed.

In this study, we excluded the 2009 sample data and constructed the model shown in Equation 2. The key to the parallel trend test is to examine whether there were significant differences between the control group and the treatment group before 2012.

In Equation 2,

From Table 5, it can be seen that the coefficients

4.3.2 Replacement of the explanatory variable

To further validate the baseline regression results and eliminate the possibility that the significance of the core explanatory variable’s regression coefficient is driven by the sensitivity of the explained variable’s proxy indicators, this study replaces the explained variable’s proxy indicators with those from the ESG rating sub-database in the WIND database. The regression results after replacing the explained variable are presented in Table 6. These results indicate that, even after replacing the explained variable in the baseline model, the regression coefficient of the core explanatory variable remains positive and significant at the 1% level. This suggests that the baseline regression results are not sensitive to the proxy indicators of the explained variable, further confirming Hypothesis 1 and the robustness of baseline regression results.

4.3.3 Shorten the time window

Given that the sample period spans from 2009 to 2022, the extended timeframe may have allowed other events during this period to influence corporate ESG performance. To ensure the robustness of the regression results, eliminate potential interference from other events, and address issues such as data limitations or missing data, this section employs a shortened time window to test the robustness of the policy’s impact on the ESG performance of heavily polluting enterprises. Specifically, we selected sample data from 2009 to 2019 for the regression analysis. As shown in Table 7, the coefficient for the key explanatory variable,

4.3.4 PSM-DID

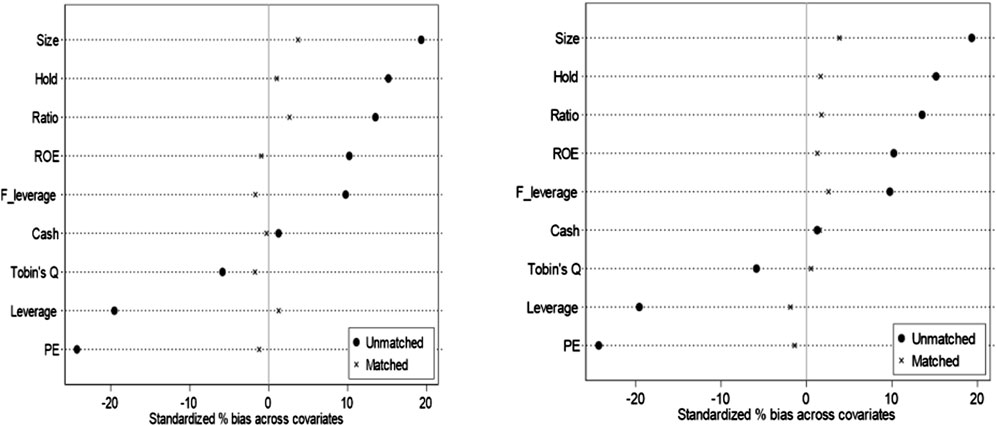

The PSM-DID method is widely used in empirical research, particularly in evaluating the effects of policies or interventions. The method first uses PSM to match the treatment and control groups, ensuring that they are similar in observable characteristics, thereby reducing selection bias. Following the matching process, the DID method is applied to the matched dataset to estimate the causal effect of the policy or intervention (Sun and Shi, 2019).

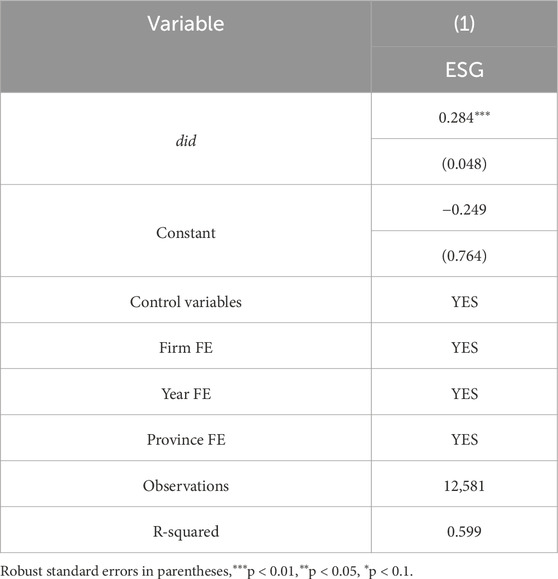

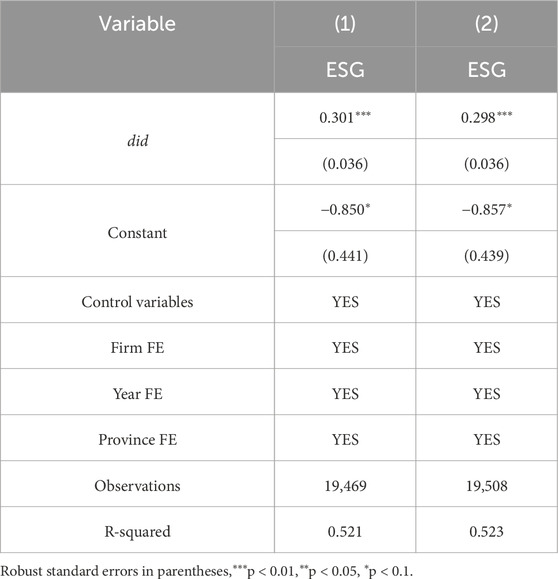

The main PSM methods used in this paper are the 1:3 nearest neighbor matching method and the Mahalanobis distance matching method. The matching results are illustrated in Figure 3, where it can be observed that, after matching, the differences in covariates between the treatment and control groups are significantly reduced, indicating that both matching methods have achieved good results. Subsequently, our study conducts regression analysis using the matched data, with the results presented in Table 8. The first column shows the regression results after nearest-neighbor matching, and the second column displays the results after Mahalanobis distance matching. The coefficients for both methods are positive and statistically significant at the 1% level, consistent with the main regression results.

Figure 3. The results of PSM (Left: 1:3 nearest neighbor matching. Right: Mahalanobis distance matching).

4.3.5 Placebo test

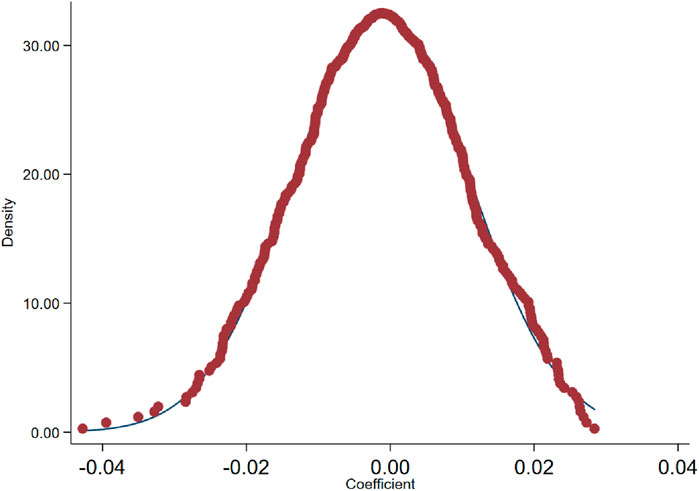

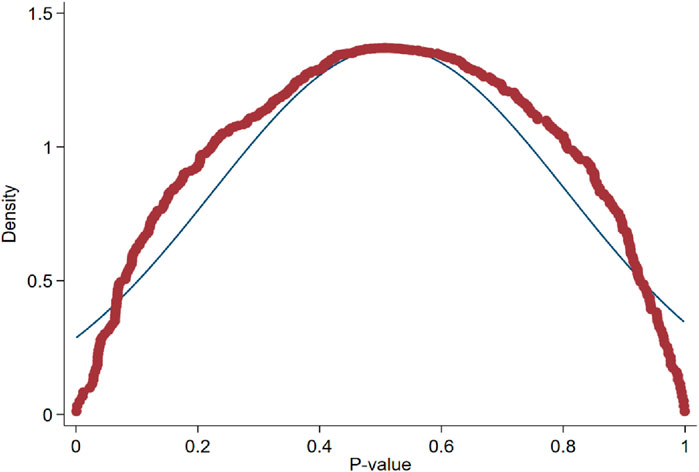

Considering that random factors may have an impact on the accurate estimation of policy effects, this study refers to the practice of previous scholars and adopts the method of a fictitious treatment group for the placebo test (Gao et al., 2022; Bo, 2023). In this process, sample firms are randomly selected as the experimental group, with the remaining firms serving as the control group. To ensure the validity and scientific rigor of the test, this random selection process was repeated 500 times, generating corresponding samples. Subsequently,

From the kernel density plot of the regression coefficients, it can be observed that the coefficients of the randomly selected experimental groups approximate a standard normal distribution, with estimated coefficients clustering around 0. Furthermore, the kernel density plots for the p-values show that the p-values of the randomly selected experimental groups also follow a standard normal distribution, with most p-values around 0.5, indicating that the random coefficients of most virtual experimental groups are not significant. In summary, the results of this placebo test confirm the reliability of the baseline regression results, effectively ruling out the influence of other factors on the regression outcomes.

5 Heterogeneity analysis

5.1 Quantile regression

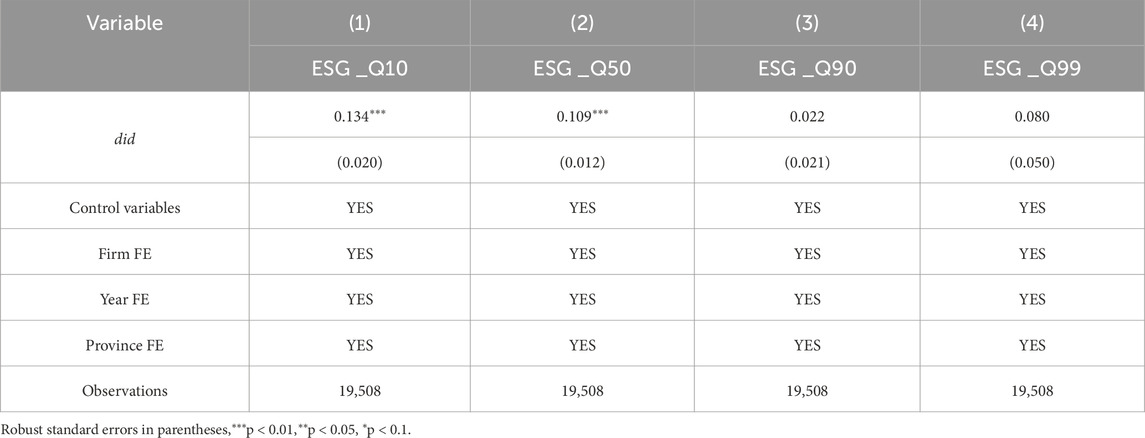

To more comprehensively analyze the impact of the GCG on the ESG performance of heavily polluting enterprises, especially in evaluating policy effects across different quantiles, this section employs a panel quantile regression model. The specific regression results are detailed in Table 9.

From Table 9, it can be observed that at the 10th and 50th quantiles of the sample data, the estimated coefficients of the core explanatory variable are positive and significant at the 1% level, with the regression coefficient at the 10th quantile being greater than that at the 50th quantile. At the 90th and 99th quantiles, the estimated coefficients of the core explanatory variable are positive but not significant. These results indicate that the “Green Credit Guidelines” have a significant impact on enterprises with lower ESG performance.

The observed phenomenon can be explained by the following factors: For firms with poor ESG performance, their inadequate environmental practices hinder their ability to meet the lending criteria and financing conditions stipulated by green credit policies. This limitation significantly restricts their growth prospects. To secure financing or expand their operations, such firms are compelled to actively enhance their environmental performance to comply with the standards set by policies, thereby improving their overall ESG performance. Conversely, firms with already great ESG performance are more likely to naturally satisfy the policy’s lending requirements due to their superior environmental practices. As a result, these firms do not need to undertake additional efforts to obtain green credit. Furthermore, these firms may have already invested extensively in environmental protection and social responsibility. Consequently, the marginal benefits of further improvements for obtaining GCG diminish, leading to a lack of significant additional positive impact from the GCG for such firms.

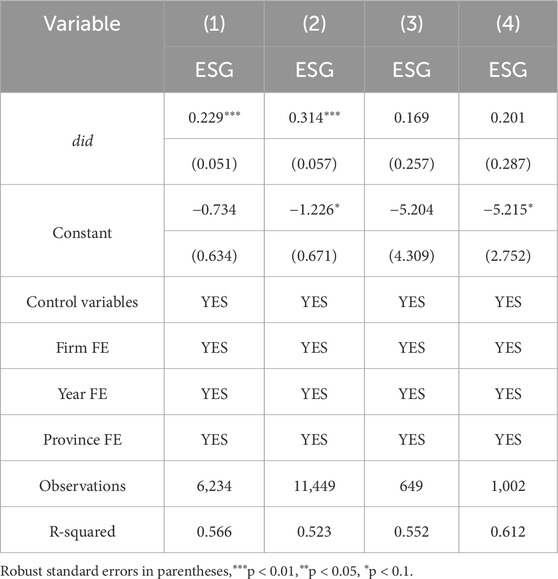

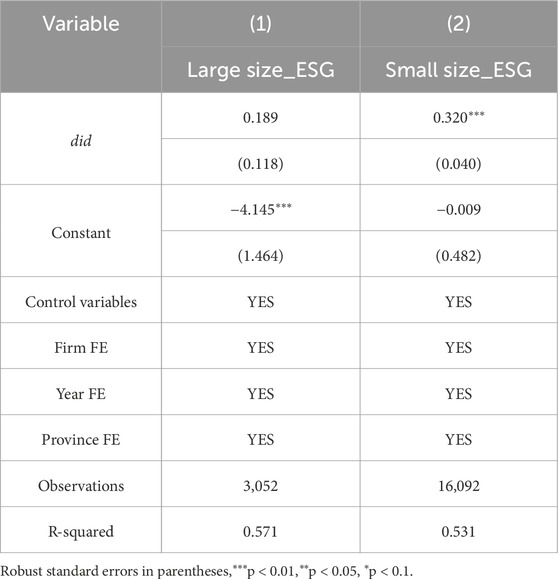

5.2 Heterogeneity analysis based on firm ownership structure and employee size

The impact of GCG may vary depending on the ownership structure and the employee size of a company. In this study, we group the sample data based on ownership structure and employee size to analyze these differences. In terms of ownership structure, the sample is divided into four categories: state-owned enterprises (SOEs), private enterprises, foreign-funded enterprises, and mixed-ownership enterprises. We then conduct separate regressions for each group, with the results presented in Table 10. The findings indicate that the policy has a significant positive effect on SOEs and private enterprises, while the impact on non-SOEs and foreign-funded enterprises is not significant. Regarding employee size, following the approach of previous scholars (Liu et al., 2023), the sample is split into large-scale enterprises (above the median employee size) and small-scale enterprises (below the median employee size). The regression results are displayed in Table 11. As shown in Table 11, the policy does not have a significant effect on large-scale enterprises but does have a significant positive impact on small-scale enterprises.

The reasons for these observed phenomena may be as follows:

Ownership Structure: Firstly, in China’s economic system, SOEs often enjoy substantial policy and resource support and bear a portion of social responsibilities. As a result, when the GCG is introduced, SOEs can respond quickly and leverage these policies to enhance their ESG performance. Secondly, although private enterprises do not have the same level of policy advantages as SOEs, they face intense market competition. To maintain competitiveness, private enterprises may be more inclined to improve their ESG performance to meet the requirements of the policy, thereby expanding their financing options.

Employee Size: Large-scale enterprises typically possess more abundant resources and stronger financing capabilities, allowing them to access funds through various channels beyond green credit. Even if green credit policies are in place, these enterprises may not rely on this specific policy to meet their financing needs, leading to a negligible impact. In contrast, small-scale enterprises have relatively limited resources and financing channels. GCG offers them a crucial financing opportunity, making them more motivated to improve their ESG performance to meet policy requirements and secure the necessary financial support.

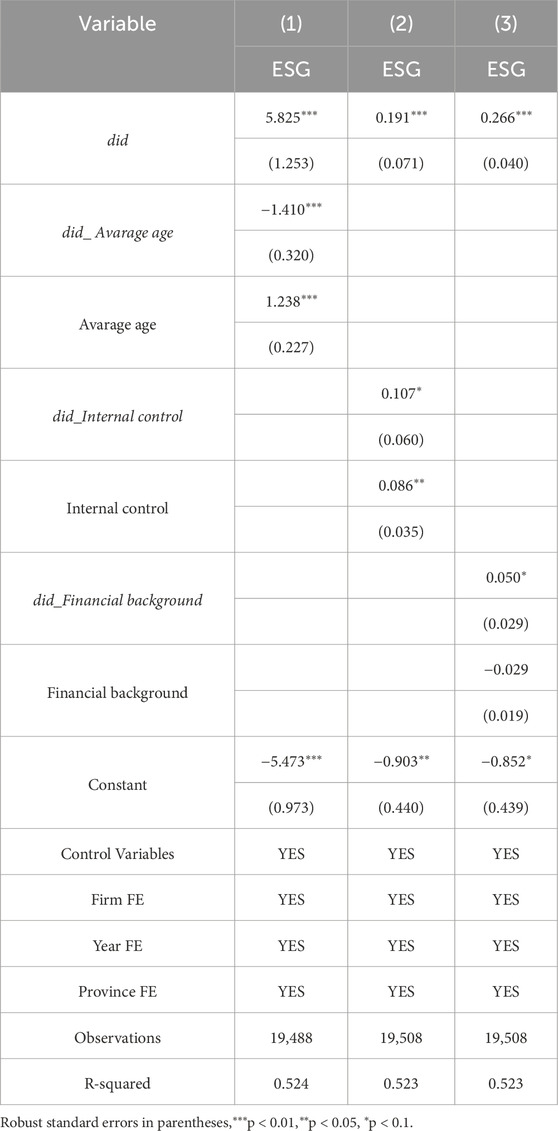

6 Further analysis on moderating effects

To further examine the mechanisms through which the policy affects the ESG performance of heavily polluting enterprises, this study constructs a moderation effect model as shown in Equation 3. The model incorporates the following moderating variables: the average age of senior executives, the effectiveness of internal control systems, and whether executives have a financial background.

The moderating variable, denoted as

(1) Average age of senior executives: This variable is calculated as the average age of the board members, supervisors, and senior management personnel within the company.

(2) Effectiveness of internal control systems: Information regarding the effectiveness of the company’s internal control systems is also sourced from the CSMAR database. The variable is coded as 1 if the internal controls are effective and 0 if they are not.

(3) Financial background of executives: This variable is derived from the CSMAR database, indicating whether the top executives have a financial background. The variable is 1 if the executives have work experience in banking, insurance, securities, investment banking, etc., and 0 otherwise.

The specific regression results, which incorporate these moderating variables, are presented in Table 12.

As shown in Table 12, the term

7 Conclusion

This study utilizes the “Green Credit Guidelines” issued by the China Banking Regulatory Commission (CBRC) in 2012 as an exogenous shock to establish a quasi-natural experiment. Using a sample of A-share listed companies in China from 2009 to 2022 and employing a difference-in-differences (DID) methodology, this paper systematically investigates the impact of China’s green credit policies on the ESG (Environmental, Social, and Governance) performance of heavily polluting enterprises. The primary findings are as follows: (1) The green credit policy significantly enhances the ESG performance of heavily polluting enterprises, and this conclusion remains valid across various robust tests. (2) The dynamic effects model indicates that the policy’s impact on ESG performance is both immediate and sustained, generally intensifying over time. However, the “long-tail effect” of the policy diminishes after 2021. (3) The quantile regression analysis reveals that the policy exerts a significant positive impact on the ESG performance of heavily polluting enterprises situated below the 50th percentile, while no significant impact is observed for firms above the 50th percentile. This suggests that the greater the ESG performance of a heavily polluting enterprise, the lesser the incremental positive impact of the policy. (4) The heterogeneity analysis demonstrates that the policy significantly benefits the ESG performance of state-owned enterprises, private enterprises, and smaller enterprises in terms of employee size, whereas the impact is not significant for other types of firms. (5) The moderating effect model shows that the average age of executives in listed firms negatively moderates the positive effect of the policy on firms’ ESG performance, while effective internal control systems and executives with financial backgrounds positively moderate the positive effect of the policy on firms’ ESG.

8 Policy recommendations

Based on the conclusions drawn from this study, the following policy recommendations are proposed:

For Government Agencies: The government should further refine the green credit policy, tailoring measures to address the specific needs of different types and sizes of enterprise employees. In response to the observed decline in the policy’s “long-tail effect” post-2021, it is advisable to introduce new incentives or policy adjustments to maintain its long-term effectiveness. Given the significant positive impact of green credit on smaller employee-size enterprises, the government should offer additional support to small and medium-employee-sized enterprises by lowering the application thresholds for green credit, providing dedicated funds, or offering tax incentives to facilitate improvements in their ESG performance. To enhance corporate executives’ understanding and commitment to green credit policies, the government could collaborate with financial institutions to conduct educational and training programs, particularly focusing on how to leverage green credit to boost ESG performance.

For Financial Institutions: Financial institutions should optimize their green credit assessment criteria based on the ESG performance of enterprises, particularly those in heavily polluting industries, to ensure that credit resources are more effectively allocated to firms with the potential for significant ESG improvements. Additionally, they should develop more green financial products tailored to SMEs, such as green bonds and green insurance, to meet the diverse financing needs of companies striving to enhance their ESG performance. Furthermore, financial institutions should strengthen their assessment of ESG-related risks within companies, particularly focusing on the age structure of executives and the effectiveness of internal control systems, to better identify and manage potential risks.

For Enterprises: Enterprises should establish and strengthen internal control systems to ensure that they can effectively improve their ESG performance under the policy. Robust internal controls not only help mitigate risks but also enhance the competitiveness of firms in securing green credit. Companies should also prioritize diversity within their executive teams, particularly by incorporating leaders with financial backgrounds, to better understand and capitalize on green credit policies. For enterprises with poor ESG performance, it is crucial to develop and implement long-term ESG improvement strategies, viewing green credit policies as an integral part of sustainable development rather than a short-term initiative.

Through the implementation of these policy recommendations, governments, financial institutions, and enterprises can collaborate more effectively to fully leverage green credit policies in enhancing corporate ESG performance, thereby advancing the broader goal of sustainable economic development.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

GJ: Investigation, Methodology, Writing – original draft. EB: Data curation, Formal analysis, Methodology, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/feart.2025.1502190/full#supplementary-material

References

Ashraf, D., Rizwan, M. S., and L’Huillier, B. (2022). Environmental, social, and governance integration: the case of microfinance institutions. Account. and Finance 62 (1), 837–891. doi:10.1111/acfi.12812

Bo, Y. (2023). How does green credit policy promote green innovation of compaines? Mod. Econ. Res. (02), 45–55. doi:10.13891/j.cnki.mer.2023.02.003

Carpenter, M. A., Geletkanycz, M. A., and Sanders, W. G. (2004). Upper echelons research revisited: antecedents, elements, and consequences of top management team composition. J. Manag. 30 (6), 749–778. doi:10.1016/j.jm.2004.06.001

Chen, Z. G., Zhang, Y. Q., Wang, H. S., Ouyang, X., and Xie, Y. X. (2022). Can green credit policy promote low-carbon technology innovation? J. Clean. Prod., 359. doi:10.1016/j.jclepro.2022.132061

Chen, T., and Liu, C. (2024). Research on the impact of digital inclusive finance on corporate ESG performance: a moderation effect based on heavy pollution industries and media attention. Commun. Finance Account. 15, 37–42. doi:10.16144/j.cnki.issn1002-8072.2024.15.020

Ding, J. (2019). Green credit policy, credit resources allocation and strategic response of enterprises. Econ. Rev. (04), 62–75. doi:10.19361/j.er.2019.04.05

Ding, J., Li, Z., and Huang, J. (2022). Can green credit policies promote enterprise green innovation? A policy effect differentiation perspective. J. Financial Res. (12), 55–73.

Du, Y., and Xu, Y. (2024). The impact of ESG performance on corporate financing costs: a review of research. Bus. and Econ. (07), 85–88. doi:10.19905/j.cnki.syjj1982.2024.07.028

Gao, D., Mo, X., Duan, K., and Li, Y. (2022). Can green credit policy promote firms’ green innovation? Evidence from China. Sustainability 14 (7), 3911. doi:10.3390/su14073911

Guo, W., and Li, Y. (2024). ESG performance and disorderly capital expansion: empirical evidence from corporate mergers and acquisitions. Collect. Essays Finance Econ., 1–15. doi:10.13762/j.cnki.cjlc.20240812.004

Hakovirta, M., Denuwara, N., Topping, P., and Eloranta, J. (2023). The corporate executive leadership team and its diversity: impact on innovativeness and sustainability of the bioeconomy. Humanit. and Soc. Sci. Commun. 10 (1), 144. doi:10.1057/s41599-023-01635-9

Hao, E., Wang, B., and Wang, W. (2023). Regional cultural differences and earnings management in listed companies: research from the perspective of divorce rate. China Soft Sci. (11), 133–145.

Ji, X., and Wu, Z. (2024). Environmental collaborative governance and ESG performance of heavily polluting enterprises. Contemp. Finance and Econ. (10), 153–164. doi:10.13676/j.cnki.cn36-1030/f.20240911.002

Ji, Y., and Sun, J. (2024). Does the implementation of the new Securities Law affect corporate ESG? A dual perspective based on ESG performance and rating divergence. Friends Account. (17), 71–78.

Lamperti, F., Bosetti, V., Roventini, A., Tavoni, M., and Treibich, T. (2021). Three green financial policies to address climate risks. J. Financial Stability. 54, 100875. doi:10.1016/j.jfs.2021.100875

Li, D., Zhou, Z., and Liu, D. (2024a). How to achieve high-level corporate environmental responsiveness in heavy-polluting enterprises? Res. Econ. Manag. 45 (11), 126–144. doi:10.13502/j.cnki.issn1000-7636.2024.11.008

Liu, J. Y., Xia, Y., Fan, Y., Lin, S. M., and Wu, J. (2017). Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Prod. 163, 293–302. doi:10.1016/j.jclepro.2015.10.111

Liu, W., and Wang, Y. (2023). Green innovation effect of pilot zones for green finance reform: evidence of quasi natural experiment. Technol. Forecast. Soc. Change 186, 122079. doi:10.1016/j.techfore.2022.122079

Liu, H., and Huang, W. L. (2022). Sustainable financing and financial risk management of financial institutions-case study on Chinese banks. Sustainability 14 (15), 9786. doi:10.3390/su14159786

Liu, Y., Shao, Y., and Xue, Y. (2023). The redistribution effect of tax reform on enterprise employee education funds: theoretical logic and empirical evidence. J. Finance Econ. 49 (09), 49–63. doi:10.16538/j.cnki.jfe.20230617.402

Li, X., Yang, Q., and Zhou, M. (2024b). Market based environmental regulation, carbon emissions, and corporate environmental performance: evidence from China’s carbon market. China Soft Sci. (08), 200–210.

Li, X., Zhao, R., and Wang, J. (2024c). Does ESG investment improved fund performance—— discussion on the impact of ESG investment on the relationship between performance and capital flow. Nankai Econ. Stud. (06), 185–203. doi:10.14116/j.nkes.2024.06.011

Lv, C., Fan, J., and Lee, C.-C. (2023). Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 397, 136573. doi:10.1016/j.jclepro.2023.136573

Ma, Y., and Yu, M. (2020). Can green credit reduce corporate emissions? J. Southwest Minzu Univ. Soc. Sci. Ed. 41 (08), 116–127.

Meng, Q. (2024). Research on the impact of data factor marketization on green innovation of industrial enterprises. Mod. Ind. Econ. Inf. 14 (12), 173–176+9. doi:10.16525/j.cnki.14-1362/n.2024.12.056

Qi, L., and Wu, Y. (2024a). Has the ESG performance of enterprises improved the relationship between government and enterprises—— based on empirical evidence from private enterprises. J. Financial Dev. Res., 1–10. doi:10.19647/j.cnki.37-1462/f.2024.08.003

Qi, L., and Wu, Y. (2024b). Does the ESG performance of enterprises improved the relationship between government and enterprises—— based on empirical evidence from private enterprises. J. Financial Dev. Res., 1–10. doi:10.19647/j.cnki.37-1462/f.2024.08.003

Sun, J. X., Wang, F., Yin, H. T., and Zhang, B. (2019). Money talks: the environmental impact of China's green credit policy. J. Policy Anal. Manag. 38 (3), 653–680. doi:10.1002/pam.22137

Sun, Y., and Shi, B. (2019). The effect of green credit policy on enterprise innovation: an empirical study based on PSM-DID model. Ecol. Econ. 35 (07), 87–91+160.

Wang, N., Li, D., Cui, D., and Ma, X. (2022). Environmental, social, governance disclosure and corporate sustainable growth: evidence from China. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.1015764

Weng, Z., and Lai, Z. (2024). ESG performance and preventing stock market risk: path analysis based on stock price synchronicity. Stat. Res. 41 (08), 56–68. doi:10.19343/j.cnki.11-1302/c.2024.08.004

Wu, T., Li, L., and Liu, J. (2024). How environmental uncertainty influences ESG performance of enterprises. Enterp. Econ. 43 (08), 152–160. doi:10.13529/j.cnki.enterprise.economy.2024.08.014

Xiao, J., and Dong, Y. (2023). The impact of green credit policy on enterprise environmental performance——evidence from listed enterprise in heavy polluting industries. J. Jiangsu Univ. Sci. Ed. 25 (02), 89–100+12. doi:10.13317/j.cnki.jdskxb.2023.019

Xin, W., and Wang, Y. (2021). Research on the green innovation promoted by green credit policies. J. Manag. World 37 (06), 173–188+11. doi:10.19744/j.cnki.11-1235/f.2021.0085

Xu, W., and Yao, L. (2024). ESG information disclosure, legal environment, and corporate risk. Friends Account. 18, 96–103.

Xu, Y., and Wang, Y. (2024). Has the green credit policy improved corporate ESG performance?Empirical evidence from A-share listed companies. Ind. Econ. Res. (02), 59–72. doi:10.13269/j.cnki.ier.2024.02.005

Yang, N. (2015). Capital Structure,Technological innovation and firm performance——based on the empirical analysis of listed companies in China. Soc. Sci. Beijing (07), 113–120. doi:10.13262/j.bjsshkxy.bjshkx.150715

Zhang, D. (2022). Environmental regulation and firm product quality improvement: how does the greenwashing response? Int. Rev. Financial Anal. 80, 102058. doi:10.1016/j.irfa.2022.102058

Zhang, X., and Hu, J. (2022). Has the green credit policy deterred investment in heavily polluting enterprises? Shandong Soc. Sci. (08), 138–146. doi:10.14112/j.cnki.37-1053/c.2022.08.015

Keywords: the green credit policy, heavy-pollution enterprises, ESG performance, DID method, China

Citation: Jia G and Bai E (2025) The green credit policy and the ESG performance of heavily polluting enterprises in China. Front. Earth Sci. 13:1502190. doi: 10.3389/feart.2025.1502190

Received: 26 September 2024; Accepted: 14 May 2025;

Published: 05 June 2025.

Edited by:

Hailong Li, Central South University, ChinaReviewed by:

Stephen Mccord, University of Michigan, United StatesShikuan Zhao, Chongqing University, China

Copyright © 2025 Jia and Bai. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Guiqiong Jia, MTgyMjE1OTg5MTZAMTYzLmNvbQ==

Guiqiong Jia

Guiqiong Jia E. Bai1,2

E. Bai1,2