- 1Institute of Mineral Resources, Chinese Academy of Geological Sciences, Beijing, China

- 2Chinese Academy of Geological Sciences, Beijing, China

- 3Research Center for Strategy of Global Mineral Resources, Chinese Academy of Geological Sciences, Beijing, China

- 4MNR Key Laboratory of Metallogeny and Mineral Assessment, Institute of Mineral Resources, CAGS, Beijing, China

Iron ore serves as a critical resource underpinning global industrialization, extensively utilized in steel production and infrastructure development. Amid increasing complexities in the global economic landscape, risks and uncertainties within iron ore supply chains have intensified, particularly under the influence of geopolitical conflicts and trade protectionism. Leveraging 2023 iron ore trade data, this study constructs a global iron ore trade network using complex network theory and develops a cascading failure model to assess systemic vulnerabilities. Key findings include: ⅰ:The iron ore trade system exhibits a centralized structure dominated by China, Australia, and Brazil, resulting in elevated supply risks. Supply disruptions could propagate crises, potentially disrupting supply chains in over 40% of participating nations.ⅱ:Community 1 (China, Australia, Brazil) accounts for 90% of trade volume and demonstrates heightened susceptibility to cascading failures. In contrast, Community 2 (Canada, Germany, South Africa) mitigates crisis propagation through diversified supply strategies. Enhanced cross-community linkages facilitated by nations like India reduce systemic risks. ⅲ:Critical node failures yield disproportionate impacts: Increasing the risk resilience parameter β from 0.2 to 0.4 reduces cascade magnitude by 62%. While Brazilian disruptions trigger extensive spatial propagation, Australia’s export concentration renders downstream industries more vulnerable to paralysis despite narrower geographic impacts. Based on the evaluation results of the global iron ore trade network, relevant suggestions such as developing emerging supply sources and constructing a deduction system were put forward.

1 Introduction

Iron ore is a pivotal strategic resource in global industrialization, primarily utilized in steel production and extensively applied across construction, manufacturing, and infrastructure development (Zhang et al., 2016). With the accelerating integration of the global economy (Zhang, 2023), the structural complexity and inherent fragility of iron ore trade networks have become increasingly pronounced. In recent years, geopolitical tensions, trade protectionism, and anti-globalization trends (Fan, 2022; Wang et al., 2023; Zhang et al., 2024a) have exacerbated uncertainties in iron ore supply chains (Gu, 2016), posing significant challenges to the stability of global trade networks. Addressing these challenges necessitates a systematic investigation into the structural characteristics of iron ore trade networks and the mechanisms underlying risk propagation, which holds significant theoretical and practical implications for enhancing supply chain resilience.

Complex network theory provides a robust analytical framework to explore the topological architecture and dynamic evolution of iron ore trade networks (Wang et al., 2021). By constructing network models, this approach identifies the roles of nations in global trade, deciphers the evolution of trade relationships, and evaluates the vulnerability of critical nodes (Pan, et al., 2022; Chen, et al., 2023). Methodologies such as community detection and node centrality analysis (Souza et al., 2020) enable the identification of core nations and their influence on supply chain robustness (Mei et al., 2024). Furthermore, cascading failure models simulate the systemic impacts of geopolitical shocks or external disruptions (Yang, et al., 2023; Yin, et al., 2024), offering actionable insights for risk mitigation and supply chain governance.

This study constructs a 2023 global iron ore trade network using data from the UN Comtrade Database, systematically analyzing its structural properties, including small-world characteristics, scale-free topology, and community structures. A cascading failure model is employed to simulate the dynamic responses of supply chains under external shocks, with a focus on the bridging roles of nations and their impact on network vulnerability and resilience. Through structural analysis, this research aims to uncover systemic risks inherent in the trade network and proposes strategic recommendations to enhance stability, thereby strengthening the risk resilience of global iron ore supply chains.

2 Data and methods

2.1 Data

The trade data for iron ore used in this study is derived from the 2023 United Nations Commodity Trade Database (UN Comtrade). The commodity is classified as “Iron Ores and Concentrates” with the HS code 2601 (excluding pyrites). Due to minor discrepancies in statistical standards across different countries, the import data has been consistently adopted as the primary data source for this analysis, while records involving imports of less than 10,000 tons and invalid entries were excluded to ensure data quality and reliability.

2.2 Iron Ore Trade Network Model

The iron ore trade network is conceptualized as a directed graph, where nodes represent countries, and directed edges represent trade flows between them, with the direction indicating the flow of trade and the weight denoting trade volume. The network is denoted as

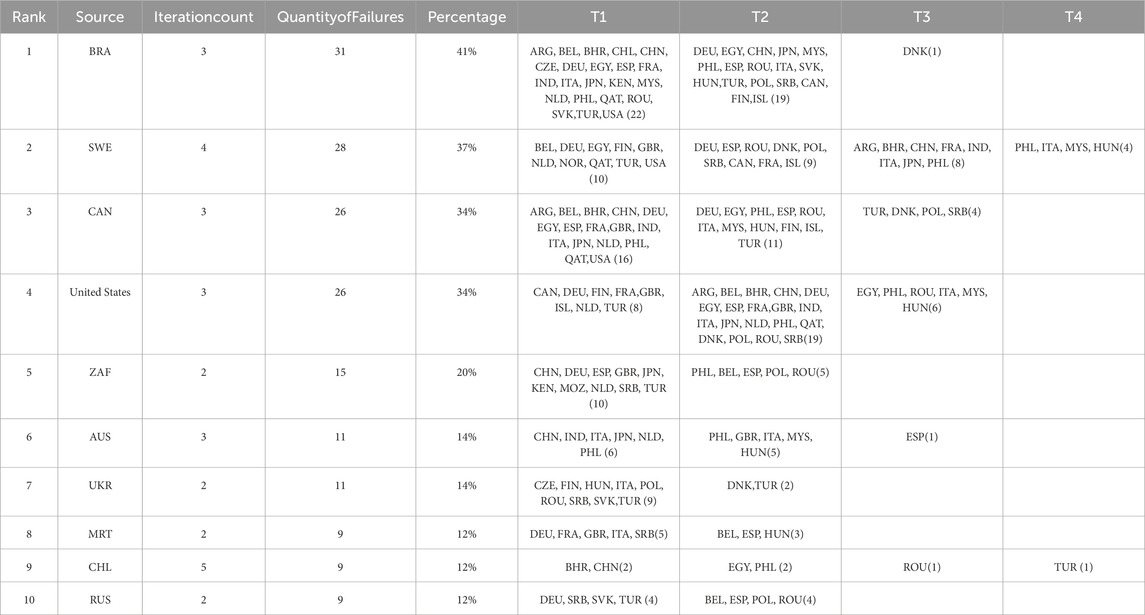

To assess the trade status of individual countries within the network, centrality metrics (such as degree centrality and average weighted degree), network characteristics (including average path length and clustering coefficient), and community detection methods were employed (Xu, 2015; Shi, 2020). These analyses collectively provide insights into the structural features of the global iron ore trade network (Table 1).

Table 1. Explanation of network indicators (Wang, 2009; Li et al., 2018; Li and Xiong, 2021; Hua, 2021; Han, 2023).

2.3 Cascade failure model

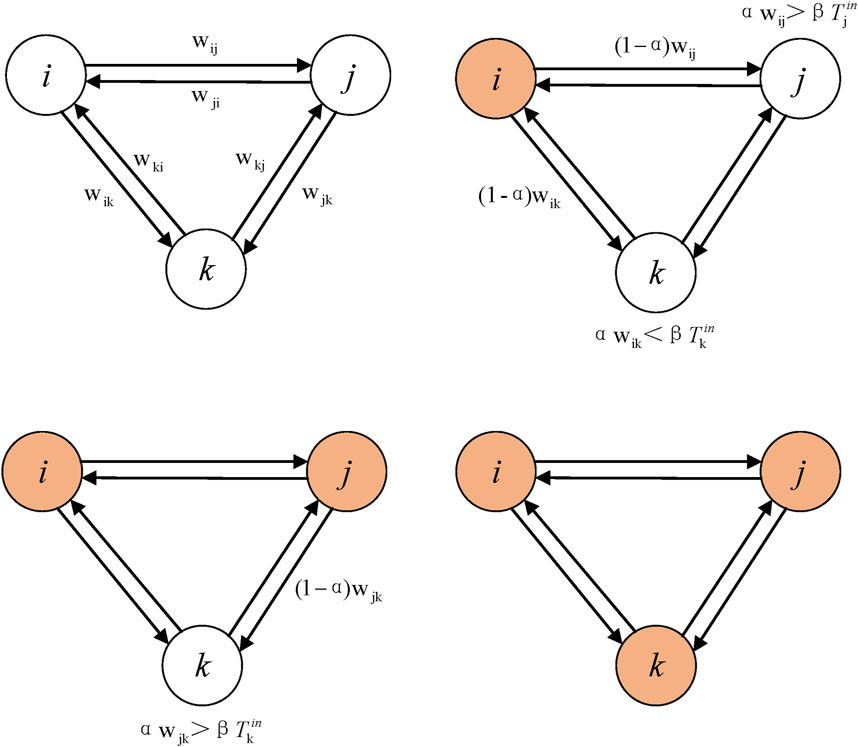

The international trade network is characterized by extensive trade routes, numerous intermediaries, and a complex economic and political policy environment (Zhang et al., 2024b). Although such a network aims to facilitate mutual benefits among nations (Wang, 2024), factors like trade protectionism, geopolitical tensions, and anti-globalization have shaped today’s intricate global political and economic landscape supplement (Zhang, 2024; Zhu, 2025). When any trade entity within the network encounters a shock, it triggers a risk crisis in related economies, leading to a cascading effect that may threaten a significant portion of the nodes or even the entire network with collapse (Zhang et al., 2024a; Zhang et al., 2024b)—commonly referred to as a cascade failure or avalanche process (Lee et al., 2011) (Figure 1).

The cascade failure model algorithm is implemented as follows:

In the initial state, all nodes are considered to be in a normal condition. The total import-export trade volume of country i is initialized as the load

If country i suffers a shock, it becomes the initial crisis propagation source, with an export reduction of

At this point, the import volume of the nodes linked to country i (i.e., country j) will decrease by

Steps (3) are repeated until no new abnormal nodes are observed in the network, at which point the simulation ends.

3 Structural characteristics analysis of the iron ore trade network

3.1 Overall structural characteristics analysis

The 2023 iron ore trade network comprises 76 countries actively participating in global trade, with a total of 216 trade links between them. The network’s average path length is 2.536, while the clustering coefficient is 0.121. By comparison, a randomly generated network has an average path length of 3.189 and a clustering coefficient of 0.023. These results indicate that the iron ore trade network exhibits superior connectivity and a higher degree of clustering, highlighting its small-world characteristics.

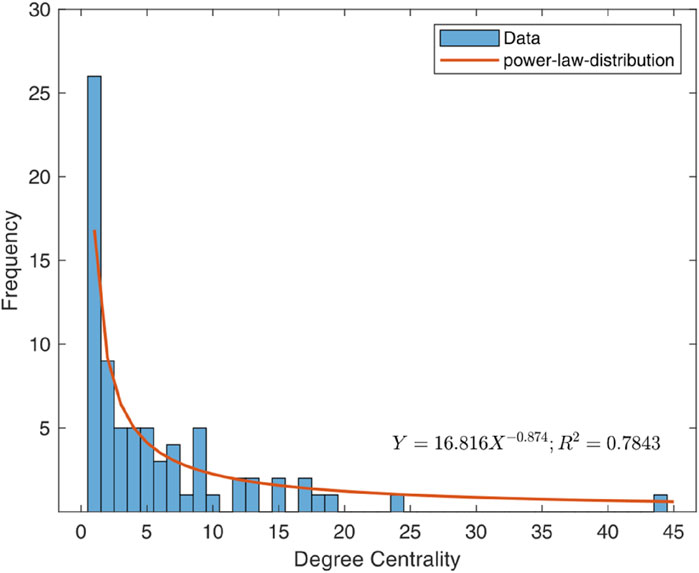

As illustrated in Figure 2, only a limited number of nodes in the iron ore trade network possess high degree centrality, whereas the majority of nodes have low degree centrality, approximating a power-law distribution with prominent scale-free features. This implies that a small number of key countries play a pivotal role in the trade network, and their disruption could significantly compromise network robustness, highlighting the network’s inherent vulnerability to shocks involving high-degree nodes.

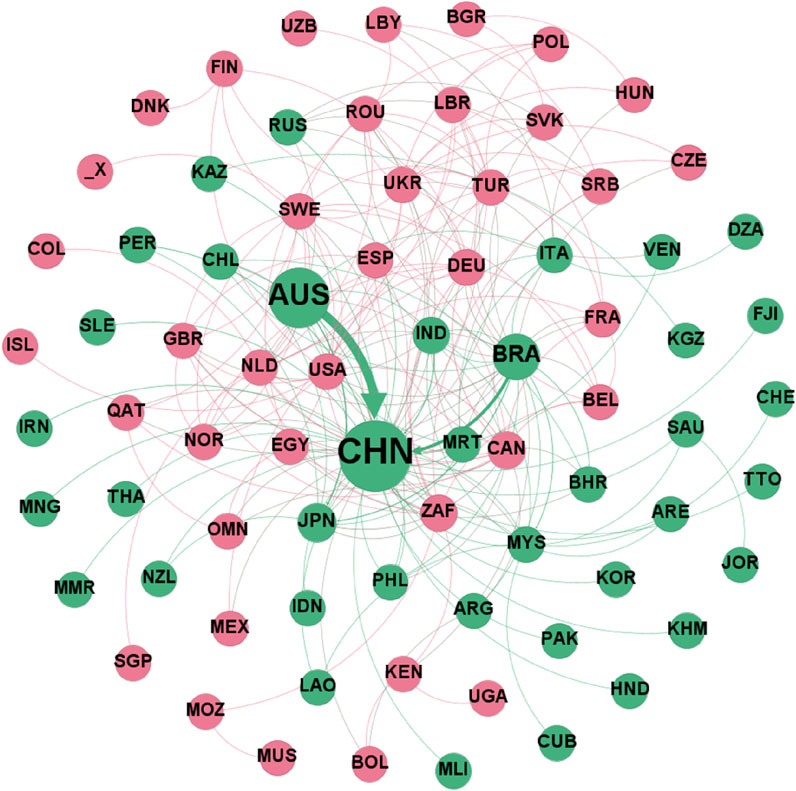

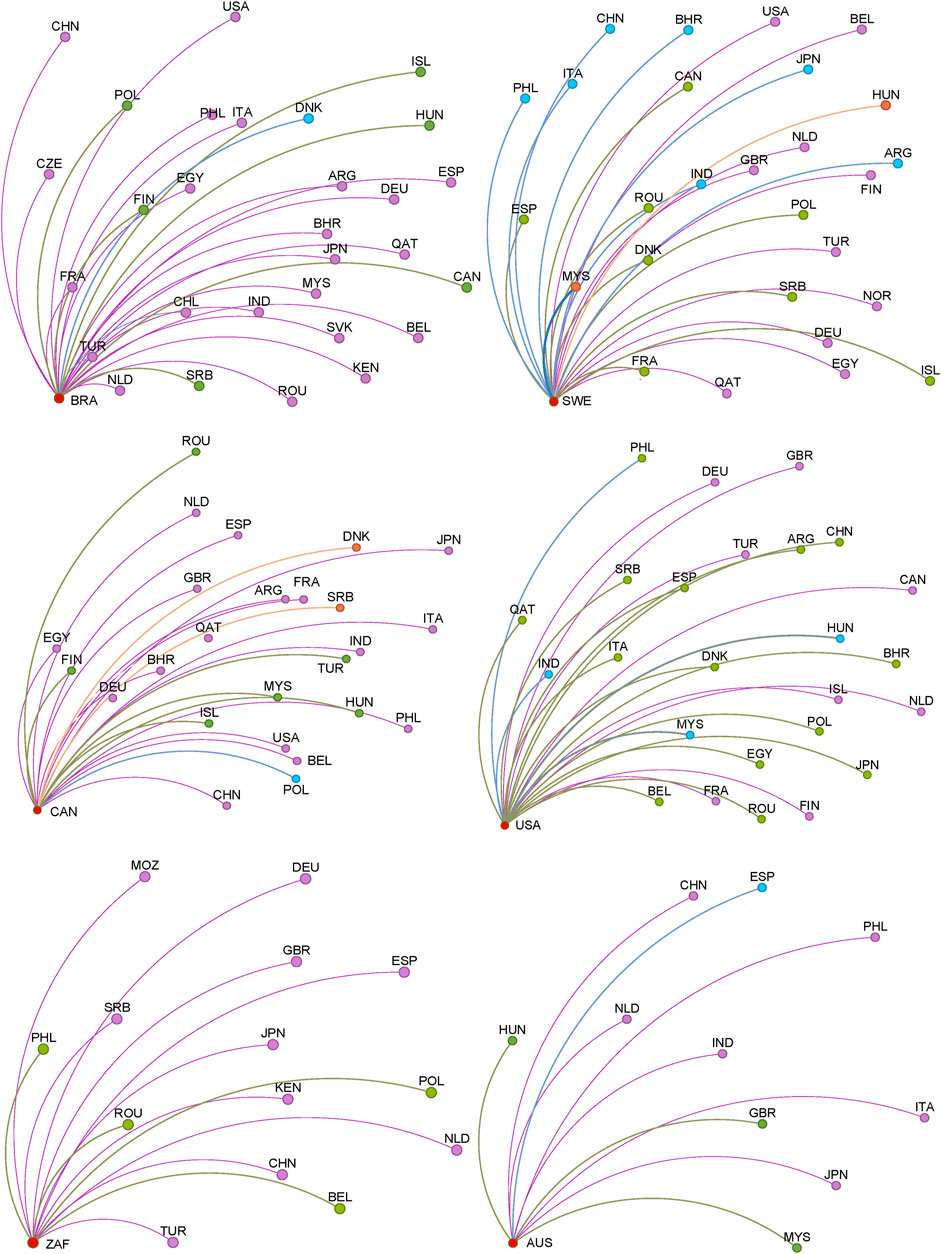

3.2 Community analysis

Through modularity analysis, the global iron ore trade network can be partitioned into two predominant communities (Table 2). Community 1 encompasses major resource-rich nations such as China, Australia, and Brazil, along with leading consumer countries, accounting for 90% of the global trade volume. The intricate and robust internal connections within this community are deeply rooted in the high concentration of supply and demand dynamics (Figure 3). As the world’s largest iron ore consumer, China has forged enduring and stable bilateral trade partnerships with Australia and Brazil. Additionally, India and Russia play a pivotal role in reallocating iron ore resources within the region, thereby significantly reinforcing the internal cohesion of Community 1. The formation of this community is intricately intertwined with the geographical distribution of iron ore reserves, long-standing trade agreements, and geo-economic interdependencies.

Community 2 is primarily composed of countries from Europe, the Americas, and Africa, including Canada, Germany, South Africa, and the United States, contributing 10% to the global trade volume (Figure 3). In stark contrast to Community 1, Community 2 exhibits pronounced characteristics of supply chain diversification. For instance, the United States and Germany not only maintain close trade ties with the major producing nations in Community 1 but also source iron ore from a multitude of countries. This strategic approach helps mitigate their reliance on any single supplier. Meanwhile, South Africa and Canada ensure regional supply stability through a complex web of multilateral trade relationships. This diversification strategy endows Community 2 with enhanced resilience, enabling it to better withstand supply shocks and risks.

In summary, Community 1 hinges on highly concentrated supply and demand relationships, rendering it more susceptible to disruptions when critical nodes fail. Conversely, Community 2 has bolstered its robustness by diversifying its supply sources, allowing for a more effective response to supply chain interruptions. The community-based analysis underscores that resource distribution patterns, economic cooperation frameworks, and supply chain diversification strategies are pivotal determinants of the vulnerability and resilience of the iron ore trade network.

In light of the above analysis, to fortify the stability of the global iron ore supply chain, the following recommendations are put forth. Firstly, major consumer countries within Community 1, notably China, should intensify cooperation with emerging resource suppliers in Africa, such as Guinea, and in Southeast Asia. This would facilitate a gradual diversification of supply sources and reduce over-reliance on Australia and Brazil. Secondly, efforts should be made to promote regional cooperation among countries in Community 2, which would enhance the overall resilience of the trade network. Lastly, leveraging financial instruments such as supply chain financing and insurance mechanisms can significantly enhance the flexibility and risk-coping capabilities of the supply chain. By implementing these measures, a more resilient and adaptable global iron ore trade network can be established, minimizing systemic risks and ensuring the long-term sustainability of the supply chain.

3.3 Trade network node centrality analysis

The calculation of node centrality metrics for the trade network (Table 3) reveals that countries such as China, Australia, Brazil, Canada, Japan, India, and Germany occupy a central role in the global iron ore trade network. The following provides a detailed analysis based on six aspects: in-degree, out-degree, in-strength, out-strength, betweenness centrality, and closeness centrality.

China assumes the top position in both in-degree and in-strength metrics within the iron ore trade network, unequivocally establishing its pivotal role as the linchpin of global iron ore imports. This preeminence is manifested through its unparalleled import frequency and scale, which are in perfect alignment with its status as the world’s largest steel producer. The in-degree metric serves as a reflection of the extensive array of countries from which China sources its iron ore, underscoring the breadth of its import portfolio. In contrast, the in-strength metric quantifies the sheer magnitude of its total import volume, emphasizing the scale of its demand. Germany and Japan closely trail behind China, solidifying their positions as significant players in the global iron ore import landscape. Their substantial import activities play a crucial and supportive role in sustaining their highly industrialized economies.

Brazil secures the first rank in terms of out-degree among all global iron ore exporting nations. Impressively, the number of countries to which Brazil exports iron ore constitutes approximately 29% of the total number of trading nations in the global iron ore market in 2023. This remarkable statistic underscores Brazil’s far-reaching influence across the global iron ore supply chain, particularly its preeminent position in catering to the demands of the Asian and European markets. Concurrently, Australia claims the top spot in terms of out-strength, with its export volume commanding a substantial 55% share of the total global iron ore trade. This dominance highlights Australia’s unparalleled position as a leading supplier in the global iron ore market. When considering both out-degree and out-strength in tandem, it becomes evident that Brazil excels in diversifying its export markets, while Australia leverages its formidable production capacity to achieve substantial export volumes on a global scale.

India emerges as the leader in terms of betweenness centrality, a testament to its indispensable role as a crucial intermediary within the global iron ore trade network. As a measure of a node’s capacity to act as a facilitator or “broker” between other nodes (Zhao et al., 2024; Chen et al., 2022), India’s high betweenness centrality underscores its pivotal function in fostering connections among diverse trading nations. This role not only enhances India’s standing in international trade but also contributes significantly to the overall connectivity and efficiency of the global iron ore trade network. Additionally, Malaysia and China exhibit relatively high levels of betweenness centrality, signifying their substantial contributions to promoting global trade linkages and reinforcing their roles as key players in facilitating international commerce.

Brazil demonstrates exceptional performance in terms of closeness centrality, indicating its remarkable ability to establish rapid connections with other countries. This attribute enables Brazil to significantly reduce the time required for the transmission of information and resources, conferring a distinct advantage in terms of information dissemination and resource allocation within the trade network. Simultaneously, Algeria and Ukraine also exhibit elevated levels of closeness centrality, highlighting their agility and proficiency in acquiring information within the global trade network. These capabilities empower them to respond promptly to dynamic market changes, ensuring their competitiveness and adaptability in the face of evolving trade dynamics.

In summary, the core nodes within the iron ore trade network play an indispensable role in maintaining the stability of the global supply chain. The disruption or failure of a select few key countries has the potential to trigger a cascading effect, reverberating throughout the network and jeopardizing the supply security of other nations. To fortify the resilience of the global iron ore supply chain, it is imperative to implement strategic measures such as diversifying supply sources, strengthening regional cooperation initiatives, and harnessing the potential of supply chain financial instruments. By adopting a comprehensive approach, these measures will contribute to ensuring the long-term sustainability and stability of the global supply chain, safeguarding the interests of all stakeholders involved in the iron ore trade.

4 Analysis of crisis communication in trade supply

4.1 Analysis of crisis propagation and risk mitigation capacity of major iron ore exporting countries

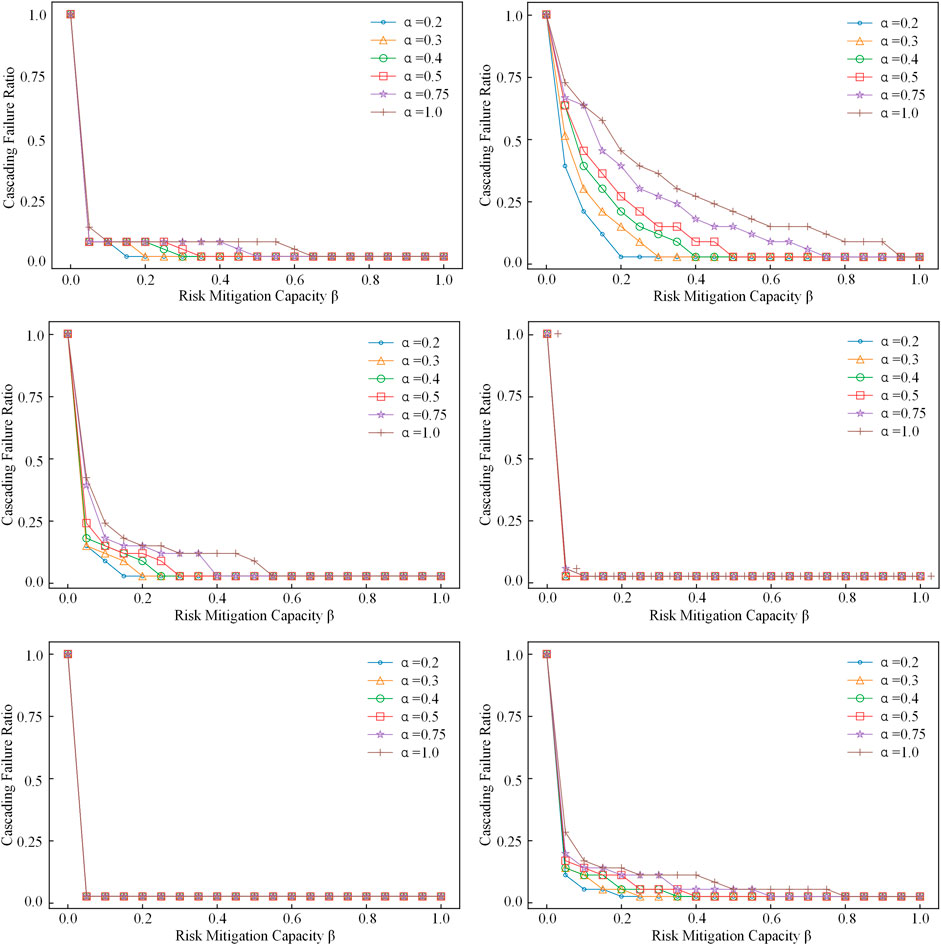

An analysis of the cascading failure ratio and risk mitigation capacity of the top six iron ore exporting countries reveals that (Figure 4), as the shock parameter α decreases, the cascading failure ratio of trading partner countries significantly declines with an increase in the risk mitigation capacity parameter β. This indicates that enhancing risk mitigation capacity can effectively reduce the chain reactions and overall fragility of the trade network when subjected to external shocks. Under different shock parameters α, each country exhibits distinct trends in cascading failure ratios. When the risk mitigation capacity β is low, the cascading failure ratio is close to 1, indicating that most nodes cannot withstand the initial shock and thus enter a failure state. However, as β increases—particularly when β exceeds 0.4—the cascading failure ratio rapidly drops to near zero, suggesting a significant enhancement in the network’s robustness. This phenomenon is especially pronounced when the shock parameter α is high (e.g., α = 1.0), highlighting the importance of enhancing risk mitigation capacity to alleviate systemic collapses triggered by major shocks.

For Australia and Brazil, the two largest iron ore exporters, significant differences are observed in their responses to crisis propagation in the trade network. Brazil exports to 24 countries, demonstrating a relatively diversified export network, whereas Australia primarily exports to eight major countries. This concentration of export markets makes Australia more vulnerable to external shocks. Despite being the largest iron ore exporter globally, Australia’s focused export destinations mean that any external disturbance could quickly and profoundly impact its primary trading partners. Thus, although Australia has a higher overall export volume, the concentration of its market structure slightly reduces its influence in terms of trade risk propagation compared to Brazil.

In contrast, Brazil’s export network is characterized by a high level of diversification, with exports distributed across a broader range of countries. This diversification strategy enhances Brazil’s risk mitigation capacity in the event of a crisis affecting a single country or region. However, as a crucial bridging country, a shock to Brazil not only affects its direct trade partners but could also propagate through cascading effects across the entire network. This makes Brazil’s supply chain disruption particularly detrimental to the global iron ore market.

When comparing other key exporters, such as South Africa, Canada, India, and Peru, distinct trends are observed under similar shock parameters. Overall, enhancing the risk mitigation capacity β effectively reduces the risk of systemic failure for all countries; however, due to differences in roles, connectivity, and market distribution within the network, their resilience to shocks also varies. For instance, South Africa and Canada exhibit relatively strong robustness through multilateral trade relationships with multiple countries, while India, due to its critical position in terms of betweenness centrality, poses a significant threat to overall network transmission paths if it fails.

Based on these analyses, the following strategies are recommended for major iron ore exporters to enhance network resilience and robustness: First, countries with highly concentrated markets, such as Australia, should actively seek market diversification to reduce reliance on a single market. Second, countries should strengthen multilateral trade cooperation within and across regions to increase network connectivity and flexibility, thereby enhancing the overall robustness of the network. Finally, it is advisable to leverage financial instruments, such as supply chain financing and insurance mechanisms, to increase the stability of supply chains and mitigate the negative impacts of external shocks.

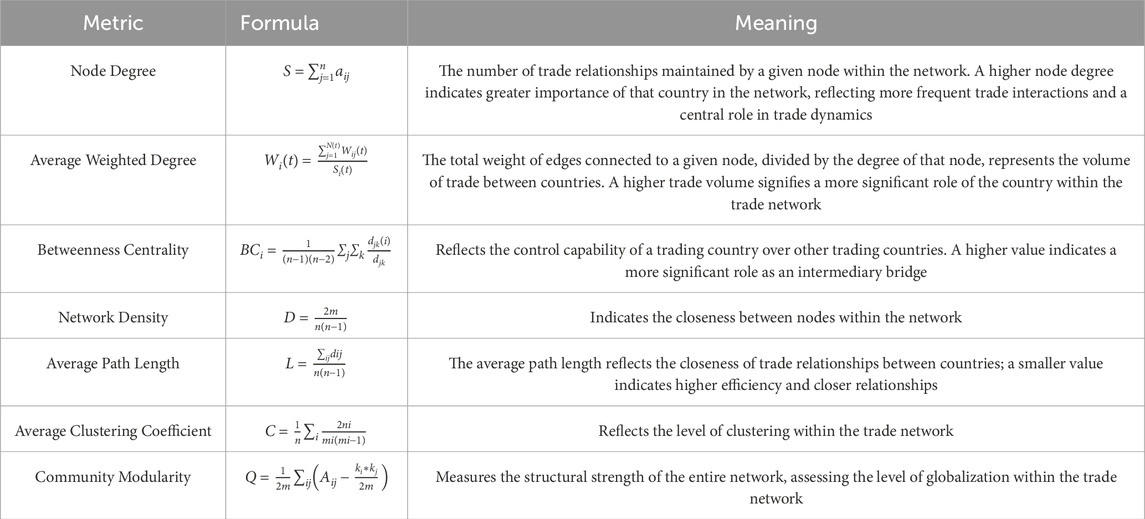

4.2 Top 10 countries in cascading failures

As indicated by the data in Table 4 and shown in Figure 5, among the top ten countries in terms of cascading failure rankings, Brazil, Sweden, Canada, the United States, South Africa, Australia, Ukraine, Mauritania, Chile, and the Russian Federation are the countries with the widest influence scopes. Among these countries, Brazil has the largest cascading failure impact, affecting 31 countries, which accounts for 41% of the total participants in the global iron ore trade. This extensive spread of disruption is mainly attributed to Brazil’s critical position in the global iron ore market, with its export markets spanning multiple major economies. As one of the world’s largest iron ore exporters, Brazil has significant influence over core importers such as China, Germany, and Japan. If Brazil’s exports are hindered, it could lead to raw material shortages in these countries, thereby affecting the stability of the global supply chain.

Figure 5. The first round is represented in purple, the second in green, the third in blue, and the fourth in orange. (The above results were obtained with settings of α = 0.1 and β = 0.005).

Sweden, an important iron ore supplier in Europe, has cascading failures impacting 28 countries, accounting for 37% of trade participants. Sweden’s iron ore exports are primarily directed towards European and Middle Eastern countries, and supply chain disruptions could lead to regional consequences, potentially triggering a larger chain reaction through the interconnected European economy. Compared to Brazil, Sweden’s impact is more regionalized, but its influence within Europe should not be underestimated, particularly concerning the supply security of countries like Germany, Finland, and Belgium.

Canada and the United States each impact 26 countries, representing 34% of trade participants. These two North American nations play important bridging roles in the iron ore trade network, and disruptions in their supply chains would directly affect the supply and demand dynamics of multiple importing countries in Europe and Asia. As a major global economy, a disruption in the U.S. trade network would not only affect iron ore supplies but could also create a chain reaction involving other trade commodities that rely on its economic stability.

South Africa and Australia have relatively smaller cascading failure scales, affecting 15 and 11 countries, respectively. Despite Australia’s limited number of affected countries, its heavy reliance on major markets such as China means that any supply chain disruption could directly impact these key importers. Meanwhile, South Africa’s close trade ties with multiple African countries grant it significant regional importance. Disruptions in South Africa’s supply chain could significantly affect regional economies due to its pivotal role in resource redistribution.

Ukraine, Mauritania, Chile, and the Russian Federation also rank in the top 10, affecting 14 and 9 countries, respectively. These countries typically act as regional bridge nodes within the iron ore trade network, and disruptions in their supply chains can have significant regional impacts, though their overall systemic impact on the global supply chain is relatively minor. Nevertheless, the influence of these countries is crucial within their regions, as their supply chain stability is directly linked to the availability of iron ore resources.

The above analysis reveals that cascading failures in the iron ore trade network exhibit significant clustering characteristics, where the failure of a few key nodes can lead to widespread supply chain disruptions. Particularly for major exporters like Brazil, Sweden, Canada, and the United States, their positions within the global iron ore trade network are critical, and any disruption in their supply chains could have severe consequences for multiple countries. Therefore, exploring effective strategies to enhance the supply chain resilience of these key countries and mitigate the systemic risks posed by external shocks represents a crucial research direction in the study of the stability of the global iron ore trade network.

5 Conclusion

Through an in-depth analysis of the complexity and vulnerability of the global iron ore trade network, the following key conclusions have been drawn:

1. The stability of the global iron ore trade system is highly dominated by a few core countries (such as China, Australia, and Brazil), and this centralized structure leads to significant systemic risks. Research shows that if the above-mentioned countries experience supply disruptions due to natural disasters or geopolitical conflicts, more than 40% of the trading participating countries globally will face supply crises.

2. Community division and node centrality analysis have revealed the supply chain characteristics and vulnerabilities of the iron ore trade network. Community 1 (China, Australia, Brazil) accounts for 90% of the global trade volume. The highly concentrated supply chain in this community means that a supply disruption in Brazil can trigger a cascading failure rate of 41%. Community 2 (Canada, Germany, South Africa, etc.) reduces the impact of cascading failures by 23% through a diversified supply strategy, enhancing its shock resistance. Countries with high betweenness centrality (such as India) play a bridging role in the trade network, strengthening cross-community connections and helping to reduce systemic risks.

3. Cascading failure analysis indicates that the failure of a few key nodes may trigger widespread supply chain disruptions. When the risk resistance parameter β increases from 0.2 to 0.4, the scale of the cascading effect drops sharply by 62%. The disruption in Brazil affects 41% of the countries. Although the impact range of Australia is only 14% due to its concentrated exports to China (55%), it can trigger a chain paralysis of downstream industries, resulting in a deeper impact.

4. Improving the risk resistance of each country has a significant effect on reducing the vulnerability of the global iron ore trade network. To this end, the following measures are recommended: First, accelerate the development of emerging resource supply regions in Africa (such as the Simandou iron ore mine in Guinea) and Southeast Asia, break the single dependence on traditional core nodes, and achieve the diversification of supply sources. Second, utilize financial tools such as supply chain financing and insurance mechanisms to enhance the flexibility and risk resistance of the supply chain. For example, establish diversified financing channels, introduce supply chain financing models, integrate the resources of steel mills, set up centralized inventory and logistics control centers, reduce financing costs, and improve capital efficiency. At the same time, through tools such as freight insurance and logistics guarantee insurance, disperse risks such as transportation interruptions and port congestion. Finally, construct a mineral resource deduction system based on digital twin and AI algorithms, simulate multiple emergency paths (such as alternative land transportation channels and multimodal transportation solutions among multiple countries), evaluate the cost efficiency, transportation timeliness, and feasibility of different routes in real time, and formulate the optimal emergency strategy in advance to provide dynamic decision-making support for supply chain resilience. Through these measures, the stability and risk resistance of the global iron ore supply chain can be significantly enhanced.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

CL: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Visualization, Writing – original draft. TZ: Data curation, Writing – review and editing. GW: Methodology, Writing – review and editing. SL: Visualization, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Basic Science Center Project for National Natural Science Foundation of China (Grant No. 72088101, the Theory and Application of Resource and Environment Management in the Digital Economy Era), and The Integrated Project of the Major Research Plan of the National Natural Science Foundation of China (No. 92162321), and Construction of a Digital Sandbox Deduction and Decision-making Consultation System for Resource Security (Grant No. DD20230565), and Integration and dynamic updating of national survey data of mineral resources (Grant No. DD20190613), Dynamic assessment of global mineral reserves (Grant No. DD20230564), National Nonprofit Institute Research Grant of Institute of Mineral Resources, CAGS (Grant No. K1611).

Acknowledgments

The authors would like to thank Anjian Wang who provided valuable suggestions during the writing of this paper. The editor and two reviewers are appreciated for their helpful and constructive comments that greatly contributed to the improvement of this paper.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Chen, M., Wang, X. T., Jiang, W., and Zhang, X. M. (2023). Assessment method for the importance of supply chain network nodes under cascading failures. J. Wuhan Univ. Technol. 45 (07), 132–138. doi:10.3963/j.issn.16714431.2023.07.020

Chen, Y. Q., Xing, X. F., Cheng, D. L., Xue, Y. K., Wu, F., and Zhang, D. W. (2022). Construction of national agricultural informatization knowledge graph based on citespace and intermediary centrality algorithm. J. Southwest Minzu Univ. Nat. Sci. Ed. 48 (01), 75–81. doi:10.11920/xnmdzk.2022.01.011

Fan, L. (2022). Research on the influence of trading partner countries scale of iron ore on domestic steel price [D]. Beijing, China: University of International Business and Economics. doi:10.27015/d.cnki.gdwju.2022.000791

Gu, L. (2016). Research on strategic reserve of iron ore resources in China after the reversal of the international iron ore supply and demand pattern [D]. Yunnan Province, China: Kunming University of Science and Technology. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=u3gpgSR0TKd_dsU_R1jNQnkbMJEkWwKUIvHEOsH_LRsv_oJxSdOZm4Zv_Bo9GixF8pVS6b5j8q5BpNX3oakANdKVLrQa-NyvSw9jyoO5FwJeb6Cw4ZZYW8gU7JDt-qThA1qfe-SEPwAms5NcqSJKFBsiF4GcCYbR81_1jFwkZrzVbABqi64vYR_CcXT72m8YtqSUqRY2TeM=&uniplatform=NZKPT&language=CHS.

Han, T. T. (2023). Research on industrial system vulnerability based on complex network analysis. Inst. Disaster Prev. doi:10.27899/d.cnki.gfzkj.2023.000023

Hua, L. (2021). The impact of the intermediary centrality of innovation networks on enterprise innovation performance. China - Arab States Sci. Technol. Forum, (09), 81–83. doi:10.16525/j.cnki.14-1362/n.2021.08.75

Lee, K. M., Yang, J. S., Kim, G., Lee, J., Goh, K. I., and Kim, I. (2011). Impact of the topology of global macroeconomic network on the spreading of economic crises. PLoS ONE 6 (3), e18443. doi:10.1371/journal.pone.0018443

Li, M., Liu, Z. Y., and Wang, J. P. (2018). The international iron ore trade law under the background of complex network. China Min. Mag. 27 (04), 45–52.

Li, T., and Xiong, Y. H. (2021). The changes of Chinese family research in recent 20 Years:social network analysis based on keyword Co-occurrence. Popul. Soc. 37 (06), 26–42. doi:10.14132/j.2095-7963.2021.06.003

Mei, Y., Gao, H. C., and Ning, H. F. (2024). “Analysis on the evolution process and characteristics of trade spatial pattern of digital content industry —based on complex network analysis,” in Northern economy and trade, (09), 49–58.

Pan, Q. Q., Liu, R. R., and Jia, C. X. (2022). Cascading failures on complex networks with weakly dependent groups. Acta Phys. Sin. 71 (11), 93–106. doi:10.7498/aps.70.20210850

Shi, Y. (2020). Analysis of international iron ore trade patterns based on the background of complex networks. Metall. Manag. (07), 179+181.

Souza, R. C. D., Figueiredo, D. R., Rocha, A. A. D. A., and Ziviani, A. (2020). Efficient network seeding under variable node cost and limited budget for social networks. Information Sciences, 2019. doi:10.1016/j.ins.2019.11.029

Wang, C. Y. (2024). Research on the development trends of international trade enterprises under the new situation. Invest. Entrepreneursh. 35 (05), 191–193.

Wang, J. D. (2009). Domestic information services research concept network analysis based on complex network method. Beijing, China: New Technology of Library and Information Service, 10, 56–61.

Wang, W. Y., He, C. F., and Ren, Z. R. (2021). Evolution of mineral resources trade network in China. J. Nat. Resour. 2021 (7), 1893–1908. doi:10.31497/zrzyxb.20210718

Wang, X. X., Zhong, W. Q., and Zhu, D. P. (2023). Research on supply risk propagation in the global nickel ore trade network. Acta Geosci. Sin. 44 (02), 361–368. doi:10.3975/cagsb.2022.111902

Xu, B. (2015). Social network analysis of the international iron ore trade pattern. Econ. Geogr. 35 (10), 123–129. doi:10.15957/j.cnki.jjdl.2015.10.018

Yang, L., Wu, S., and Li, H. (2023). Review of supply chain networks cascading failure. Supply Chain Manag. 4 (12), 51–59. doi:10.19868/j.cnki.gylgl.2023.12.005

Yin, X. X., Tao, Y. W., Zhao, X. Q., Shi, L., and Li, W. L. (2024). Research on crisis propagation effect in international trade network based on cascading failure model: take semiconductors as an example. J. Sys. Sci. and Math. Scis. 44 (5), 1389–1411. doi:10.12341/jssms23865

Zhang, D. Y., Wu, J. J., Yang, X., Ma, Z. A., and Zhu, T. L. (2024a). Research progress on cascading failures in complex networks. Shandong Sci. 37 (02), 85–96. doi:10.3976/j.issn.1002-4026.20230179

Zhang, F. Q. (2024). Comparative study on financing modes and risk management of the international trade supply chain for iron ore imports. J. Metall. Financ. Account. 43 (5), 32–34.

Zhang, J. X. (2023). Research on the relationship between international trade and economic development and the environment. Bus. Exhib. Econ. 2023 (11), 75–78. doi:10.19995/j.cnki.CN10-1617/F7.2023.11.075

Zhang, L., Yang, H. P., Feng, A. S., and Tan, X. M. (2016). Utilization and analysis of supply and demand of global iron ore resources. Conservation Util. Mineral Resour. 2016 (6), 57–63. doi:10.13779/j.cnki.issn1001-0076.2016.06.012

Zhang, Q., Mo, Z. X., and Yang, L. R. (2024b). Simulation and reliability analysis of cascading failure models in complex financial networks. Operations Res. Manag. Sci. 33 (04), 112–117. doi:10.12005/orms.2024.0120

Zhao, Y. K., Zhang, C. Y., Zhu, C. Y., and Zhu, J. M. (2024). Social network analysis and similarity research on the influence of music based on entropy weight-factor analysis. J. Commun. Univ. China Natural Sci. Ed. 31 (03), 34–41. doi:10.16196/j.cnki.issn.1673-4793.2024.03.003

Keywords: iron ore trade, supply risk, complex network, crisis propagation, cascade failure

Citation: Liu C, Zhao T, Wang G and Liu S (2025) Research on the supply risk propagation in the global iron ore trade network. Front. Earth Sci. 13:1520813. doi: 10.3389/feart.2025.1520813

Received: 31 October 2024; Accepted: 26 March 2025;

Published: 12 May 2025.

Edited by:

Lin Chi, University of Shanghai for Science and Technology, ChinaReviewed by:

Meihui Jiang, Nanjing University of Information Science and Technology, ChinaZhenshan Yang, Chinese Academy of Sciences (CAS), China

Copyright © 2025 Liu, Zhao, Wang and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ting Zhao, NzcxODk5NDYwQHFxLmNvbQ==

Chao Liu

Chao Liu Ting Zhao

Ting Zhao Gaoshang Wang1,2,3,4

Gaoshang Wang1,2,3,4