- 1School of Economics and Management, Yantai University, Yantai, China

- 2School of Management, Shandong Technology and Business University, Yantai, China

Introduction: Environmental regulation is a vital mechanism for promoting environmental protection and sustainable development, as well as a key factor in driving enterprise transformation, modernization, and enhanced competitiveness.

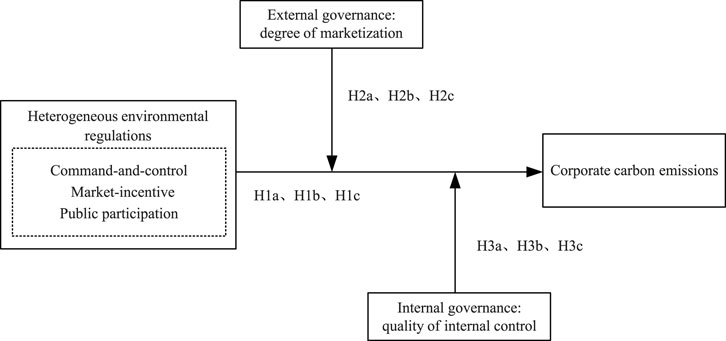

Method: To understand how heterogeneous environmental regulations interact with corporate governance structures to influence emission outcomes is critically important. This study analyzes Chinese A-share manufacturing listed companies from 2015 to 2022, categorizing environmental regulations into three types: command-and-control, market-based incentives, and public participation. It investigates the impacts of these regulations on corporate carbon emissions and explores the moderating effects of internal control quality and marketization from the perspectives of internal and external corporate governance.

Results: The findings indicate that: (1) The impacts of command-and-control and market-based incentive regulations on corporate carbon emissions follow an inverted U-shape, while public participation regulations demonstrate a U-shape. (2) Marketization has strengthened the impact of all three types of environmental regulations on corporate carbon emissions, while the quality of internal control only moderates the influence of command-and-control and market-based incentive regulations, without having an impact on public-participatory environmental regulations. (3) The emission reduction effects of heterogeneous environmental regulations are more pronounced in enterprises with high ESG performance, low financing constraints, and those in growth or maturity stages.

Conclusion: This study provides empirical evidence for governments to implement targeted policies and for enterprises to effectively reduce emissions, contributing to the optimization of environmental regulation policies and the sustainable development of businesses.

1 Introduction

As global warming intensifies, the emission of greenhouse gases has attracted significant global attention. As the representative greenhouse gas, carbon dioxide remains a top priority for energy conservation and emission reduction efforts. In September 2020, China officially committed to achieving “carbon peak” by 2030 and “carbon neutrality” by 2060, directly supporting SDG 13. This aligns with China’s National Plan for SDG Implementation (2021–2025) that prioritizes low-carbon transition through multi-tier environmental regulations, while actively promoting the green and low-carbon transformation of its economy and society. As the most crucial actors within a market economy, enterprises play a decisive role in reducing carbon emissions, achieving the “dual carbon” goals, and promoting the green and low-carbon development of both the economy and society (Ren et al., 2024). However, as “economic agents” in the market, enterprises cannot escape the influence of profit when pursuing carbon reduction. Achieving carbon reduction necessitates substantial financial investment, and the transition to a low-carbon economy involves greater risks. The absence of positive incentives results in inadequate motivation for enterprises to reduce carbon emissions (Wang et al., 2023). Consequently, stimulating enterprises to reduce carbon emissions and achieve green, low-carbon development has become a significant focus for both society and the government.

The negative externalities associated with carbon emissions constrain the effectiveness of market mechanisms in reducing emissions; therefore, government and societal intervention through environmental regulations is necessary to address market failures (Zhang et al., 2021). Environmental regulation, as a societal tool for protecting the environment and regulating pollution, is essential for reducing emissions and achieving the “dual carbon” goals (Shen et al., 2023; Wang and Zhang, 2022). It not only governs pollution behavior but also fosters technological innovation, improves energy efficiency, reduces pollution, and promotes green economic development (Du et al., 2021). Environmental regulations can be classified into formal and informal types based on their sources (Guo et al., 2023). Formal environmental regulations are primarily established by the government and environmental protection agencies, encompassing command-and-control measures and market incentives that encourage enterprises to reduce emissions through law enforcement and market-based approaches (Ren et al., 2023). Informal environmental regulations reflect the environmental awareness of the public and civil organizations, constraining polluters through daily pollution reduction practices, oversight, and punitive mechanisms (Liu Y. et al., 2022).

The process of marketization underscores the central role of the market in resource allocation, involving a series of significant institutional changes across economic, social, legal, and political dimensions (Xing et al., 2021). Especially in regions with a high degree of marketization, the legal system tends to be more robust and developed. This legal framework not only provides clear rules and guidance for market activities but also establishes stringent standards and requirements for enterprises’ environmental responsibilities, including carbon emissions (Chen and Jiang, 2023). Moreover, a high degree of marketization typically aligns with substantial improvements in resource allocation efficiency (Zhang, 2024). Driven by market competition mechanisms, various production factors can flow and combine more flexibly and efficiently, facilitating optimal resource allocation and stimulating both innovation and productivity in enterprises (Zhou and Zhang, 2024). From the perspective of carbon emissions, this enhancement in efficiency has the potential to motivate enterprises to adopt proactive measures to reduce carbon emissions and improve environmental performance, thereby addressing the global climate change challenge while satisfying market demand (Zhang J. et al., 2022).

A stable and robust internal control system is fundamental for enterprises aiming to achieve sustainable development (Liu, 2018; Boulhaga et al., 2023). In an optimally configured internal control environment, internal management pressures can effectively regulate corporate performance, curbing behaviors detrimental to the long-term growth of the enterprise and enhancing the robustness of operations and the integrity of information reporting (Almashhadani, 2021). This mechanism fosters a clean and transparent working atmosphere, laying a solid foundation for sound enterprise operations. Furthermore, as a crucial governance mechanism, internal control can effectively mitigate excessive risk-taking by management, thereby reducing various potential risks faced by the enterprise and preventing risk accumulation to unmanageable levels (Harasheh and Provasi, 2023; Tao et al., 2023). In this context, enterprises with strong internal control mechanisms are more inclined to adopt positive green strategies in the decision-making process, demonstrating their commitment to environmental protection and social responsibility by effectively regulating corporate behaviors that may negatively impact the environment, such as carbon emissions (Monteiro et al., 2021; Shang et al., 2023).

Financial development and economic growth will increase carbon emissions (Alam et al., 2025). Against this backdrop, understanding how heterogeneous environmental regulations interact with corporate governance structures to influence emission outcomes is critically important. First, with China’s ambitious “dual carbon” targets requiring unprecedented emission reductions, identifying the precise regulatory mechanisms that effectively drive corporate decarbonization has urgent policy relevance. Second, the substantial compliance costs for enterprises necessitate evidence-based calibration of regulation intensity to balance environmental and economic objectives. Third, the complex interplay between formal regulations, market forces, and informal social pressures remains underexplored at the micro-level, creating a significant knowledge gap in sustainability governance. Additionally, rigorous examination of how internal governance and external governance moderate regulatory effectiveness becomes essential for designing context-specific decarbonization pathways. Such insights are particularly valuable for policymakers navigating the tension between regulatory stringency and enterprise viability during the green transition.

This paper empirically examines the impact of heterogeneous environmental regulations on carbon emissions of Chinese manufacturing enterprises listed from 2015 to 2022, drawing from both internal and external governance perspectives. The marginal contributions of this study are reflected in three main aspects. First, it broadens the research perspective on the implementation effects of macro environmental regulations at the micro level, providing an empirical foundation for evaluating the effectiveness of environmental regulation policies. Most existing studies on the carbon reduction effects of environmental regulations are based on macro data at the provincial or industry levels, while few examine environmental regulations and enterprises in detail at the micro level. By focusing on the specific impacts of environmental regulation on the carbon emission behaviors of individual enterprises, this paper enhances the understanding of the decision-making processes and mechanisms influencing carbon emissions under such regulations. Second, This study examines the nonlinear relationship between heterogeneous environmental regulations and corporate carbon emissions, along with the internal and external influencing mechanisms, thereby enriching and deepening environmental regulation theory. Existing research on the relationship between environmental regulation and carbon emissions primarily relies on linear relationship assumptions; however, this relationship is complex and variable, influenced by multiple factors. This paper employs a nonlinear regression model to investigate the aforementioned relationship, revealing the potential differing impacts of various types of environmental regulation on corporate carbon emissions at varying intensities. Additionally, this study explores the moderating effects of internal control quality and marketization through the lens of internal and external linkages, offering new insights and approaches for advancing environmental regulation theory. Third, it investigates the impact of heterogeneous environmental regulations on corporate carbon emissions by considering differences in ESG performance, financing constraints, and lifecycle stages among firms. Through this comprehensive analytical framework, the paper provides a more nuanced perspective for assessing the effects of environmental regulations on emission reductions and offers theoretical guidance for enterprises to respond strategically to environmental regulations based on their specific ESG performance, financial status, and lifecycle characteristics.

The remainder of the paper is structured as follows: Section 2 reviews relevant literature and puts forth the research hypothesis. Section 3 outlines the research design: sample and data, variables, and modeling. Section 4 analyzes the empirical results. Section 5 concludes the conclusions and policy implications.

2 Literature review and hypothesis development

2.1 Environmental regulation and corporate carbon emissions

A strong governance framework can promote responsible resource use and reduce carbon emissions (Manigandan et al., 2024). As a policy intervention mechanism, the primary goal of environmental regulation is to address the limitations of market mechanisms in managing environmental externalities, aiming to achieve a harmonious symbiosis and sustainable development between economic growth and natural environmental protection (Zhao X. et al., 2022). This institutional framework forms a comprehensive strategy to constrain emission behavior by constructing administrative norms, leveraging market mechanisms, and stimulating public participation (Wang L. et al., 2022). In general, environmental regulation is regarded as a unique and effective policy tool for regulating the allocation of environmental resources and ensuring the attainment of environmental protection goals. Its impact on carbon emission levels is both direct and characterized by complex mechanisms of action (Lin and Zhang, 2023). Specifically, on one hand, environmental regulatory policies can directly influence the end link of carbon emissions and effectively reduce emissions through measures such as establishing emission caps and implementing emission standards, demonstrating their direct emission reduction efficiency (Du and Li, 2020). On the other hand, these regulations may unintentionally lead to the “green paradox” by increasing compliance costs for enterprises. While strict environmental protection requirements prompt greater investment in environmental protection, they can also result in increased fossil fuel exploitation in the short term, as enterprises may seek to alleviate the pressure of compliance costs through cost transfer or compensation mechanisms (Yin et al., 2022). In recent years, the academic community has increasingly explored the relationship between environmental regulation and carbon emissions, shifting the research focus toward the nonlinear characteristics of environmental regulation. Previous studies have shown that the effects of environmental regulation do not adhere to simple linear logic, exhibiting more complex nonlinear relationships, such as threshold effects, U-shaped curves, or inverted U-shaped curves (Huang and Tian, 2023; Wu et al., 2020). These nonlinear characteristics reveal the varying impacts of environmental regulations on carbon emissions at different intensities and stages. Furthermore, given the diverse means of environmental regulation, including command-and-control, market incentives, and public participation, each type operates through distinct mechanisms and pathways, exerting differentiated influences on the carbon emission behaviors of enterprises.

While existing literature provides foundational insights into the relationship between environmental regulations and carbon emissions, research gaps remain unaddressed. First, Micro-level Mechanism Deficiency: Most studies focus on provincial or industrial macro-data neglecting firm-level heterogeneity in response to regulations. The role of internal governance and external governance in moderating this relationship at the enterprise level is underexplored. Second, Oversimplified Linearity Assumptions: Empirical models predominantly assume linear regulation-emission relationships, ignoring potential nonlinear thresholds that may redefine policy calibration. Based on this, this paper attempts to focus on the micro level to explore whether there is a nonlinear effect between environmental regulations and corporate carbon emissions.

Command-and-control environmental regulation refers to a series of laws, regulations, policies and standards closely related to environmental protection promulgated by the government to curb the emission behavior of enterprises, which is characterized by imposing severe penalties on enterprises violating the rules and even forcing them to stop production (Guo et al., 2021). In the initial implementation phase of such regulations, enterprises are faced with severe environmental standards, and in order to meet these standards, they have to invest a large amount of capital and technical resources in pollution control and emission control (Cui et al., 2022). This process not only directly leads to a significant increase in the production cost of enterprises, but also may have a crowding out effect on the original R&D and innovation investment of enterprises to some extent, that is, enterprises reduce innovation investment in other fields due to the pressure of environmental protection (Guo et al., 2023). However, with the continuous implementation of environmental regulations, enterprises have begun to actively explore technological innovation paths in order to reduce costs and enhance market competitiveness. Through technological innovation, enterprises can develop more efficient environmental protection technologies and production processes, which not only reduces carbon emissions, but also realizes cost savings and efficiency improvement, forming the compensation effect of technological innovation, and effectively offsetting the cost increase caused by environmental regulations (Huang and Yi, 2023). Based on the above analysis, it can be reasonably inferred that there may be an inverted U-shaped relationship between the command-and-control environmental regulation and the carbon emissions of enterprises, which rises first and then falls: In the early stage of regulation, the carbon emissions of enterprises may experience a short rising period because they need to invest a lot of resources to meet the environmental protection standards; However, with the continuous implementation of regulations and the continuous deepening of enterprise technological innovation, carbon emissions will gradually reduce and eventually reach a relatively stable level. Based on this, this paper proposes the hypothesis.

Hypothesis 1a. The impact of command-and-control environmental regulation on carbon emissions exhibits an inverted U-shaped relationship.

Market-motivated environmental regulation refers to the government’s use of market mechanisms to encourage enterprises to reduce pollutant and carbon emissions through economic instruments such as pollutant discharge fees, environmental taxes, and emissions trading (Zhong and Peng, 2022). Compared to command-and-control environmental regulations, market-incentive regulations afford enterprises greater autonomy, encouraging them to reduce costs and enhance efficiency through market mechanisms (Liu and Cui, 2024). During the initial implementation stage of market-motivated environmental regulations, enterprises face rising economic costs from pollution charges and environmental taxes, creating strong incentives for them to explore effective strategies for carbon emission reduction in order to mitigate these costs (Wei et al., 2021). In the short term, companies may need to invest substantial funds in pollution and emissions control, resulting in a temporary increase in production costs. However, as market mechanisms continue to improve, market-incentive environmental regulations will provide enterprises with enhanced incentive structures and flexible pollution control methods. Companies can optimize resource allocation through mechanisms such as carbon emission rights trading, thereby achieving energy conservation and emissions reduction at a lower cost (Wang H. et al., 2022). Consequently, from a theoretical perspective, an inverted U-shaped relationship may exist between market-incentive-based environmental regulation and corporate carbon emissions, indicating that emissions initially rise before decreasing; in the early stages of regulation, enterprises’ carbon emissions may increase due to higher economic costs. However, over time, as market mechanisms develop, carbon emissions are likely to decline and eventually stabilize at a new equilibrium. In summary, this paper puts forward the hypothesis.

Hypothesis 1b. The impact of market incentive environmental regulation on corporate carbon emissions exhibits an inverted U-shaped relationship.

Public participatory environmental regulation refers to promoting environmental protection through public involvement alongside direct government intervention. This includes public supervision, environmental advocacy, green consumption, and other behaviors that indirectly influence corporate environmental practices (Li et al., 2020). From the perspective of Legitimacy Theory, organizations seek to operate within the bounds and norms of their respective societies to gain and maintain social legitimacy, a crucial resource for survival and success (Suchman, 1995). Public participatory regulation amplifies societal expectations regarding environmental responsibility, directly challenging a firm’s perceived legitimacy. This regulatory approach emphasizes voluntary and social aspects, aiming to encourage companies to reduce carbon emissions through public pressure. Initially, firms face a legitimacy gap as new environmental standards and heightened public expectations emerge. Closing this gap requires adaptation. In the initial phase of this regulation, companies require time to adapt to new environmental standards and public expectations, which may necessitate additional resources for improving production processes, upgrading environmental facilities, or conducting staff training (Zhang H. et al., 2022). This adaptation period, driven by the need to establish initial compliance and regain threatened legitimacy, often involves incremental changes rather than systemic overhaul. These increases in production costs in the short term may impact enterprise production decisions and result in higher carbon emissions. Furthermore, although public participatory environmental regulations do not directly penalize companies, shifts in public opinion and consumer preferences create pressure on enterprises. Corporate Reputation Theory posits that a firm’s reputation is a valuable intangible asset significantly influenced by stakeholder perceptions (Fombrun and van Riel, 2004). Negative public sentiment regarding environmental performance poses a direct threat to corporate reputation, affecting consumer loyalty, investor confidence, and stakeholder relationships. As this pressure has not yet translated into concrete actions, companies may continue using existing high-carbon emission production methods to maintain short-term profits (Zhao L. et al., 2022). However, with the ongoing implementation of public participatory environmental regulations and the rising public awareness of environmental protection, the legitimacy pressure intensifies, and the potential reputational risks become more concrete and severe. Companies will increasingly recognize that failure to respond proactively jeopardizes their social license to operate (legitimacy) and erodes their valuable reputation capital. To preserve legitimacy and protect their reputation in the face of escalating societal demands, companies will likely adopt substantive measures to reduce carbon emissions (Tang and Li, 2022). This may involve increasing investment in technology research and development, as well as the creation and application of more efficient environmental technologies and production processes, aiming for steady economic growth while reducing carbon emissions (Nie et al., 2022). This shift represents a strategic move beyond mere compliance towards building a positive environmental reputation and securing long-term legitimacy. This continuous process of green innovation not only helps companies enhance their environmental performance but also boosts their market competitiveness. Based on this analysis, integrating insights from legitimacy theory and corporate reputation theory, it can be reasonably inferred that there may be a potential inverse U-shaped relationship between public participation environmental regulations and corporate carbon emissions. Initially, the legitimacy gap and the cost of adaptation, coupled with insufficient immediate reputational damage to trigger major change, lead to a temporary rise in emissions. In the initial stage of regulation implementation, carbon emissions may briefly rise as enterprises adapt to new environmental standards and public expectations; however, as regulations persist and public awareness deepens, the escalating threats to legitimacy and reputation create powerful incentives for substantive action. With advancements in technological innovation driven by the need to secure legitimacy and safeguard reputation, and increased public awareness of environmental protection, carbon emissions are likely to gradually decline and eventually stabilize. Therefore, this paper proposes the hypothesis.

Hypothesis 1c. The impact of public participation environmental regulation on corporate carbon emissions exhibits an inverted U-shaped relationship.

2.2 Moderating effect of marketization degree

As an indicator of the market’s core role in resource allocation, the degree of marketization profoundly influences the decision-making freedom of enterprises and the intensity of market competition (Li et al., 2019). In a highly market-oriented environment, enterprises are subject to more intense market competition, with stringent cost control requirements becoming essential for their survival and development (Zhang, 2021). In this context, enterprises adjust their response mechanisms to environmental regulation policies, tending to adopt strategies focused on technological innovation and efficiency improvements to address the challenges posed by command-and-control environmental regulations (Xiao et al., 2022). Such strategies not only reduce production costs but also enhance the competitive positioning of enterprises within the market. Conversely, in regions with low marketization, enterprises may lack motivation due to insufficient market competition pressure, making it challenging for them to proactively change their production modes and behavioral practices. As a result, the effectiveness of environmental regulatory policies is often limited, and enterprises may lean more on government subsidies or preferential policies to offset the additional costs associated with compliance. Further analysis indicates that the effectiveness of market-motivated environmental regulations, such as emissions trading and carbon tax systems, largely depends on the level of marketization. In a highly market-oriented environment, these market-based policy tools can more effectively guide enterprises in reducing carbon emissions, as enterprises tend to prioritize cost control and efficiency optimization driven by market competition (Liu W. et al., 2022). Additionally, the impact of public participatory environmental regulation is influenced by the degree of marketization; in highly market-oriented areas, the public is generally more concerned about environmental issues and more responsive to corporate environmental performance. This heightened public awareness and engagement in environmental protection fosters strong social oversight and encourages enterprises to lower carbon emissions (Song and Han, 2022). Moreover, regions with high marketization typically have more robust environmental information disclosure mechanisms, further enhancing public environmental awareness and participation, thus reinforcing the effects of public participatory environmental regulations. In summary, the degree of marketization serves as a key regulatory factor that significantly affects the guiding role of environmental regulatory policies on enterprises’ carbon emission behaviors. In a highly market-oriented environment, environmental regulation policies can more effectively promote emissions reductions among enterprises, resulting in dual benefits of environmental protection and economic development. Based on this, this paper proposes the following hypothesis.

Hypothesis 2a. The degree of marketization moderates the impact of command-and-control environmental regulation on the carbon emissions of enterprises.

Hypothesis 2b. The degree of marketization moderates the impact of market-motivated environmental regulations on the carbon emissions of enterprises.

Hypothesis 2c. The degree of marketization moderates the impact of public participatory environmental regulation on the carbon emissions of enterprises.

2.3 The moderating effect of internal control quality

The quality of internal control is a critical reflection of an enterprise’s management level, influencing its ability to effectively implement established policies, ensure the authenticity and integrity of financial reports, and enhance operational efficiency (Hamed, 2023). In the context of environmental regulation, internal control quality directly affects how enterprises respond to regulatory policies and their effectiveness in reducing emissions. Specifically, within a command-and-control regulatory framework, the government establishes stringent carbon emission standards that enterprises must adhere to. In this scenario, enterprises with high-quality internal controls, characterized by strong executive power and efficient management mechanisms, can more effectively implement emission reduction measures, ensuring that carbon emissions remain within prescribed limits (Li and Shen, 2021). In contrast, market incentive environmental regulations guide enterprises to reduce carbon emissions through economic incentives. In this context, companies with high-quality internal controls can better assess the costs and benefits associated with emissions reductions, enabling them to make more rational decisions. Such enterprises are often more inclined to invest in energy-saving and emissions-reduction technologies to achieve both economic and environmental long-term benefits (Luo and Tang, 2021). For public participatory environmental regulations, which rely on public awareness and participation to indirectly influence corporate carbon emission behaviors, enterprises with high-quality internal controls are typically more attuned to corporate social responsibility and brand image maintenance, making them more receptive to public opinion. These enterprises are likely to take proactive emission reduction measures to address the public’s environmental protection concerns, thereby preserving a favorable corporate image (Ge et al., 2021). In summary, internal control quality plays a significant regulatory role in the impact of heterogeneous environmental regulations on corporate carbon emissions. Enterprises with high internal control quality are generally more capable of effectively responding to various environmental regulatory policies and reducing carbon emissions. Conversely, enterprises with low-quality internal controls may struggle to address the challenges posed by environmental regulations due to inadequate management practices. Therefore, when formulating and implementing environmental regulation policies, it is essential to consider the internal control quality of enterprises to enhance the relevance and effectiveness of such policies. Based on this, this paper proposes the following hypothesis.

Hypothesis 3a. The quality of internal control moderates the impact of command-and-control environmental regulation on the carbon emissions of enterprises.

Hypothesis 3b. The quality of internal control moderates the impact of market-incentivized environmental regulation on the carbon emissions of enterprises.

Hypothesis 3c. The quality of internal control moderates the impact of public participatory environmental regulation on the carbon emissions of enterprises.

To sum up, the theoretical framework of this paper is shown in Figure 1.

3 Research design

3.1 Sample selection and data source

This study utilizes research samples from A-share manufacturing companies listed in China from 2015 to 2022. The revised Environmental Protection Law, enacted on 1 January 2015, is often referred to as the “strictest environmental protection law in history.” Under this law, both private and state-owned enterprises are held accountable for violations, facing appropriate penalties for any infringement, and severe punishment for malicious pollution. The enforcement of the new Environmental Protection Law has intensified the pressure on enterprises with high levels of pollution and energy consumption, effectively promoting the advancement of environmental regulations and emission reductions, thus contributing significantly to improving environmental quality and safeguarding the ecological environment. Consequently, this paper designates 2015 as the starting point of the study, underscoring the urgent need for energy conservation and emissions reduction in the manufacturing industry. Therefore, this paper focuses on Chinese manufacturing enterprises as the research subjects.

Data on administrative penalties for environmental protection were hand-collected from the China Statistical Yearbook and the China Environmental Statistical Yearbook. Environmental protection tax (pollutant discharge fee) data were sourced from the China Environmental Yearbook, the China Tax Yearbook, and the Wind database. Data on public environmental concern were obtained from Baidu Index, using the keyword search index from Baidu’s official website. Internal control data were derived from the Dubois Internal Control and Risk Management database. Corporate carbon emissions data were collected from annual reports, social responsibility reports, and sustainability reports of listed companies, with additional relevant financial data sourced from the CSMAR database. Due to data unavailability for Hong Kong, Macau, Taiwan, and Tibet, these regions were excluded from this study. To ensure the accuracy of the empirical results, the following measures were implemented during the data collection process: ST and *ST listed companies were excluded; listed companies with substantial losses of key variable data post-2015 were also excluded; continuous variables were tail-trimmed at the 1% and 99% levels to mitigate the impact of extreme values. After individually matching enterprise panel data with provincial panel data according to the respective regions, a final total of 14,390 annual observations were obtained, with data processing completed using Stata16 software.

3.2 Variable selection

3.2.1 Dependent variable

The dependent variable in this study is corporate carbon emissions (CE). Based on the research of Cui et al. (2023) and Wang et al. (2024), cumulative carbon emissions from listed companies encompass emissions from combustion and fugitive sources, waste treatment, production processes, and land use conversion. However, considering that manufacturing enterprises may not be involved in the carbon emission project of “land use conversion”, to avoid calculation errors, this paper uses the first three items to calculate the carbon emissions of enterprises. The specific formula is shown as Equation 1.

3.2.2 Independent variables

This study categorizes environmental regulations into three types—command-and-control, market-incentive, and public participation—considering their different operational modes, as referenced in the research of Wang L. et al. (2022). Command-and-control environmental regulation (ER1) is quantified using the natural logarithm of the number of administrative penalty cases issued by environmental protection departments (Liu L. et al., 2022). Market-incentive environmental regulation (ER2) is measured by the natural logarithm of the environmental protection tax (pollutant discharge fee) (Song and Han, 2022). Notably, with the enactment of the Environmental Protection Tax Law of the People’s Republic of China on 1 January 2018, the pollutant discharge fee, which had been in place for over 30 years, was replaced by the environmental protection tax. Consequently, this study utilizes pollutant discharge fees to measure data prior to 2018, while data after 2018 are measured using the environmental protection tax. Public participation environmental regulation (ER3) is assessed using the natural logarithm of public environmental concern (Dong et al., 2023).

3.2.3 Moderating variables

The degree of marketization (Market). Marketization refers to the extent to which market mechanisms facilitate resource allocation, encompassing a series of economic, social, legal, and political institutional changes. In regions with a higher degree of marketization, the legal environment is relatively developed, enhancing the efficiency of resource allocation and promoting the effective utilization of various production factors. In this study, the marketization index of China’s provinces is employed to measure the degree of marketization in the regions where the enterprises are located (Yan and Gong, 2021).

Internal control quality (IC). Based on the research of Li et al. (2022), this study selects the internal control index provided by Dubois’ Internal Control and Risk Management database of listed companies to assess the quality of internal control in enterprises. The Dubois internal control index is recognized for its accuracy and widespread use in the field of internal control research. This study utilizes the percentage form of the Dubois Index as a quantitative metric to evaluate the effectiveness of internal control.

3.2.4 Control variables

Drawing on the research of Dai et al. (2022) and Xu et al. (2023) and considering the key influencing factors of corporate carbon emissions, this study identifies the following control variables: (1) enterprise age (Age). Older firms face technological lock-in that elevates emissions. (2)asset-liability ratio (Lev). High leverage constrains environmental investment, increasing emissions. (3) ratio of independent directors (Indep). Higher independent director ratios (Indep) strengthen environmental oversight, reducing emissions. (4) enterprise growth (Growth). Rapid growth initially increases emissions through scaled production, but enables efficiency gains over time. (5) Tobin’s Q (TobinQ). Firms with high Tobin’s Q invest in sustainability to enhance long-term value. (6) proportion of the largest shareholder (Top1). Concentrated ownership may prioritize short-term gains over decarbonization. (7) net interest rate on total assets (Roa). strong profitability (Roa) provides resource slack for low-carbon innovation. (8) ownership type (Soe). State-owned enterprises may be more compliant with environmental regulations. (9) management expense ratio (Mfee). Elevated management expense ratios (Mfee) signal agency problems that divert resources from sustainability. (10) cash ratio (Cflow). Abundant cash flow promotes green research and development and reduces the carbon emissions of enterprises. Furthermore, this study accounts for fixed effects by industry and year. Detailed definitions of all variables are presented in Table 1.

3.3 Model setting

To verify the impact of heterogeneous environmental regulations on corporate carbon emissions, this study constructed a fixed-effect model and incorporated a quadratic term of environmental regulations to examine the inverse U-shaped relationship among these variables. The econometric model is shown in Equation 2.

where: CEi,t represents enterprise carbon emissions; ERi,t denotes three different types of environmental regulation; Xi,t includes a series of control variables. Additionally, α is a constant term, and εi,t is a random disturbance term. If β1 < 0 and β2 > 0, the relationship between environmental regulation and enterprise carbon emissions follows an inverted U-shaped curve. Otherwise, the relationship is characterized as a U-shaped curve.

To examine the impact of regulatory variables on heterogeneous environmental regulations and corporate carbon emissions, this study introduces interaction terms between the primary and secondary terms of regulatory variables and heterogeneous environmental regulations, building upon the previous model. Based on the research of Haans et al. (2016), Equations 3, 4 are established. Among them, Equation 3 examines the regulatory role of marketization, and Equation 4 examines the regulatory role of internal control.

where: Marketi,t and ICi,t represent the degree of marketization and the quality of internal control, respectively. The remaining variables are defined as stated in Equation 2. If the estimates of β4 in Equations 3, 4 are significantly positive or negative, it indicates that the degree of marketization and the quality of internal control have a moderating effect.

4 Empirical results and analysis

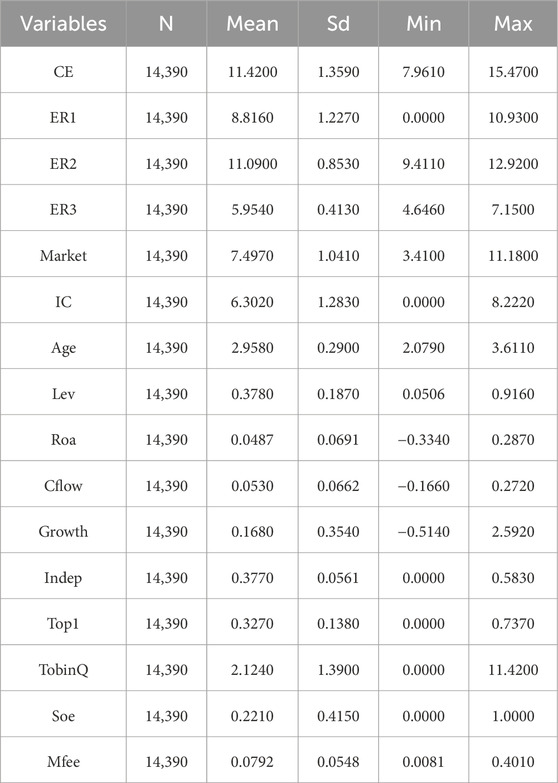

4.1 Descriptive statistics

Table 2 presents the results of the descriptive statistical analysis of the main variables in this study. During the sample period, the average CE of enterprises is 11.42, with a notable range, indicating that the overall carbon emission level in the manufacturing industry is relatively high. This suggests that many of the sample enterprises are grappling with energy conservation and emissions reduction challenges. The mean values of ER1, ER2 and ER3 are 8.816, 11.09, and 5.954, respectively, with standard deviations of 1.227, 0.853, and 0.413, respectively. This reflects a significant disparity in the intensity of environmental regulation among provinces in China. Simultaneously, the mean values for IC and Market are 6.302 and 7.497, with standard deviations of 1.283 and 1.041, respectively, indicating notable differences in internal and external governance across various enterprises. The statistical data for the remaining control variables are also generally consistent with reality and fall within a reasonable range. Additionally, the standard deviation of most variables is smaller than the mean, suggesting a relatively low dispersion coefficient and good sample stability.

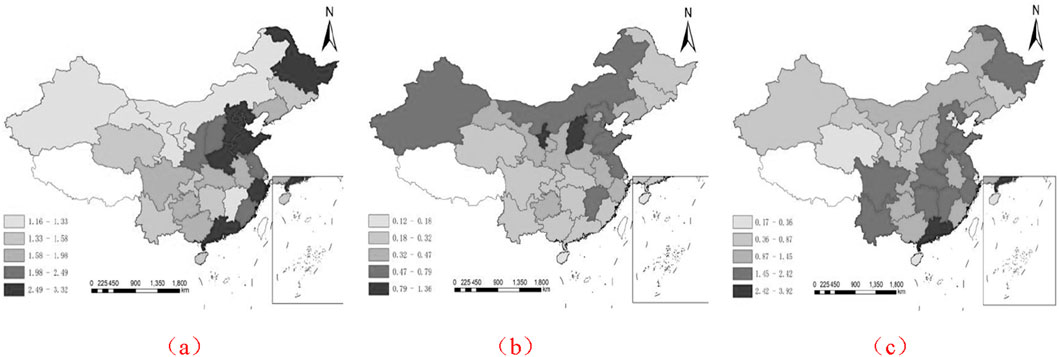

Figure 2 shows the spatial and temporal distribution of the three types of environmental regulation. It can be seen that the spatial distribution of the level of environmental regulation in China shows a clear stepped pattern. The eastern region, especially coastal cities, has the highest environmental regulation, followed by the central region, and the western region has the lowest environmental regulation. In general, the intensity of environmental regulation in each region has a large gap, the development is not balanced, and the sustainable development performance of heavily polluting enterprises is generally in a low state, therefore, it is of great practical significance to study the impact of heterogeneous environmental regulation on the sustainable development performance of enterprises.

Figure 2. Spatial and temporal distribution of environmental regulations in China. (a)Command-and-control environmental regulation (b)Market incentive environmental regulation (c)Public participation environmental regulation.

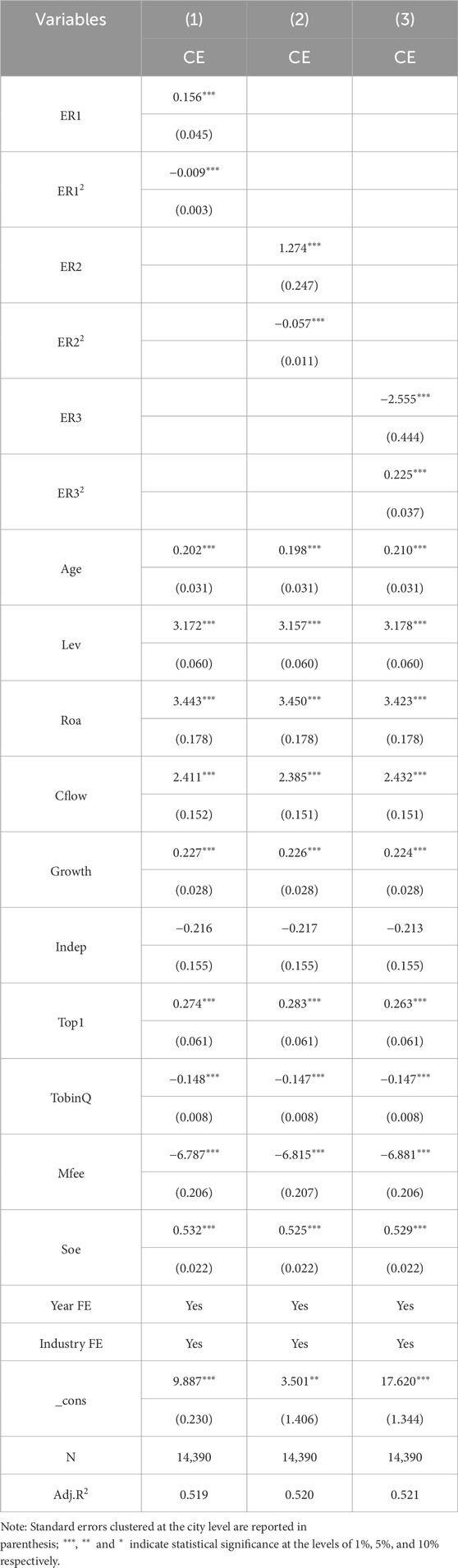

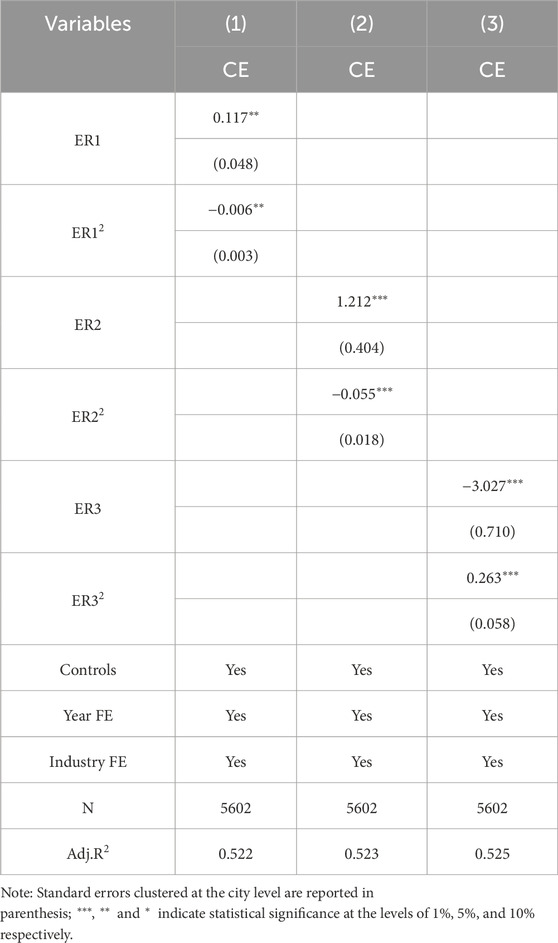

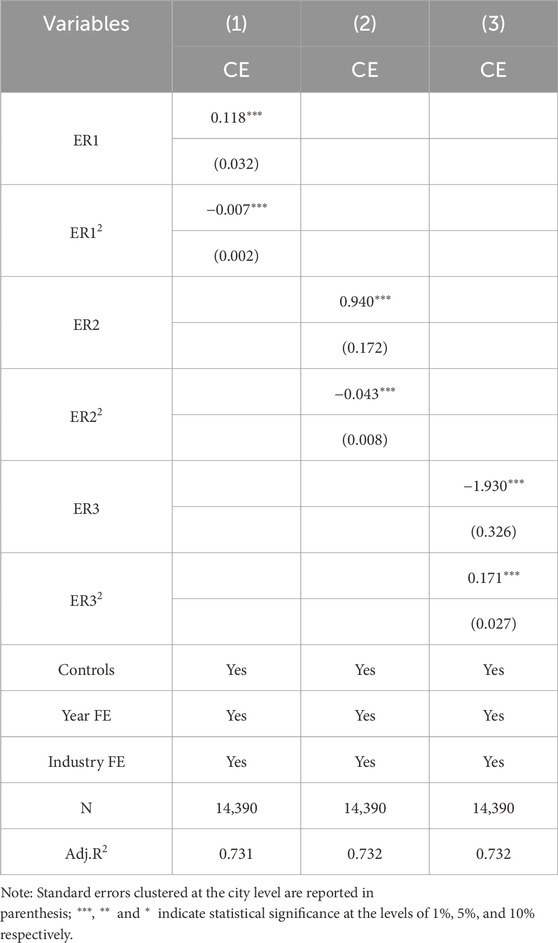

4.2 Baseline regression analysis

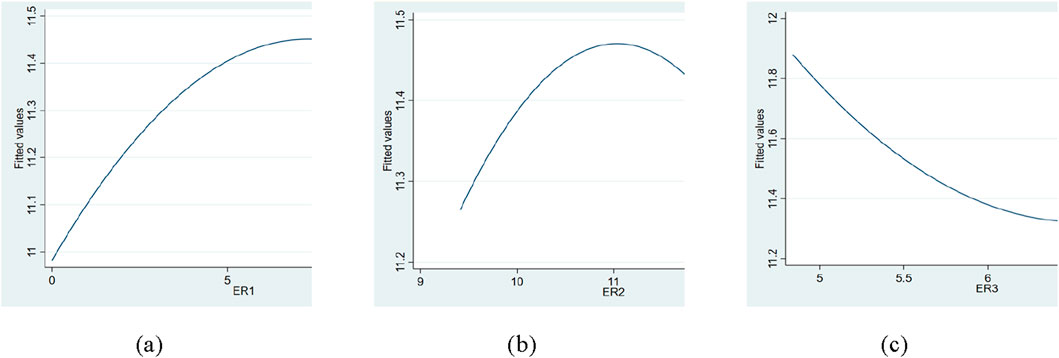

This study investigates the relationship between heterogeneous environmental regulations and corporate carbon emissions, employing regression model (2) with results presented in Table 3. The findings in columns (1) and (2) reveal that the first-order coefficients for ER1 and ER2 are significantly positive at the 1% level, whereas their second-order coefficients are significantly negative at the same level, preliminarily confirming an inverted U-shaped relationship between these two types of environmental regulation and corporate carbon emissions. Conversely, the results in column (3) demonstrate that the first-order coefficient for ER3 is significantly negative at the 1% level, while its second-order coefficient is significantly positive, indicating a U-shaped relationship with corporate carbon emissions.

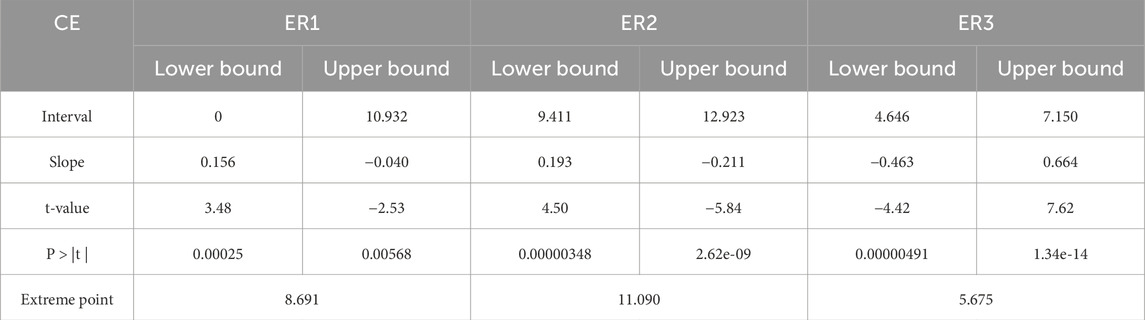

Referencing the work of Lind and Mehlum (2010), this study employs the “U-test” to further validate the inverted U-shaped relationship between environmental regulation and CE, with test results displayed in Table 4. The overall t-value for the baseline model of ER1 is 2.53 (p < 0.01), affirming the existence of an inverted U-shaped relationship. Furthermore, the peak point for ER1 is identified as 8.691, suggesting that the inflection point is reached when the number of administrative penalty cases handled by environmental protection departments reaches 5,949. This peak point falls within the sample range of ER1, thus corroborating the inverted U-shaped curve relationship, as shown in Figure 3a. The results indicate that 8.691 serves as the inflection point for ER1; when the number of cases surpasses 5,949, its positive impact on reducing corporate carbon emissions will gradually emerge, ultimately fulfilling the objective of lowering CE, thereby supporting Hypothesis 1a. Over the past 10 years since the implementation of the new Environmental Protection Law, the number of environmental penalty cases has been on a downward trend after reaching a peak in 2017. In 2023, the number of penalty cases decreased by 66% compared to 2017. This indicates that as law enforcement intensifies and enterprises’ awareness of compliance improves, the number of penalty cases can indeed effectively reduce pollution emissions after crossing a certain critical point. Combining descriptive statistics with inflection points, the critical point (5,949 cases) is far lower than the actual law enforcement scale, indicating that the current law enforcement intensity has far exceeded the theoretical optimal value. This requires policymakers to further promote “precise law enforcement”, shifting the focus of law enforcement from the number of cases to the quality of law enforcement, and avoiding the burden on enterprises caused by a “one-size-fits-all” approach through differentiated supervision.

Figure 3. Relationship between environmental regulation and carbon emissions. (a)Command-and-control environmental regulation, (b)Market incentive environmental regulation, (c)Public participation environmental regulation.

Similarly, the baseline model for ER2 records an overall t-value of 4.5 (p < 0.01), which substantiates the previously mentioned inverted U-shaped relationship, as shown in Figure 3b. The peak point for ER2 is 11.09, also within the sample range, indicating that an environmental protection tax revenue of 65,513 million yuan corresponds to the inflection point. Consequently, once a province’s environmental protection tax collection exceeds 65,513 million yuan, ER2 will act to suppress CE, thereby supporting Hypothesis 1b. The above two regression results are consistent with Yin let al. (2022)’s findings. That is, the direct impact of environmental regulation on carbon emissions follows an inverted U-shaped curve. Specifically, when the intensity of environmental regulation is relatively low, it primarily manifests as a green paradox effect. As environmental regulation tightens, it transitions into compulsory emission reduction for carbon emissions. And after exceeding 65.513 billion yuan, the emission reduction effect of the tax begins to appear, which is consistent with the theory of “compensation effect of innovation” in environmental economics - enterprises to reduce tax burden Enterprises take the initiative to carry out energy-saving and emission reduction technological innovation.

Unlike ER1 and ER2, ER3 exhibits a U-shaped nonlinear relationship with CE; following verification through the “U-test”, the overall t-value of this baseline model is 4.42 (p < 0.01), validating the U-shaped relationship, as shown in Figure 3c. The peak point for ER3 is 5.675, located within the sample range, indicating that the inflection point is reached when public environmental concern hits 291, thereby reinforcing the U-shaped relationship. The findings suggest that a moderate level of ER3 can effectively reduce CE; however, once public environmental concern rises beyond 291, CE is expected to gradually increase, which contradicts Hypothesis 1c. This U-shaped relationship may stem from the capacity of public concern over environmental issues to mobilize public opinion and exert pressure on companies, heightening their risk of violations (Zhang et al., 2023). With respect to ER3, its lack of mandatory constraints implies that the impetus for companies to enhance energy conservation and emission reduction may arise from consumer green principles and the influence of environmental NGOs. An appropriate level of ER3 can significantly improve both the economic and environmental performance of corporate technological innovation. However, excessive regulation may lead to dominant cost effects, which not only fail to stimulate corporate innovation but additionally heighten operational pressures, causing companies to lose significant initiative and leadership in pollution reduction efforts (Yang et al., 2023). Consequently, when excessive public information disclosure elevates decision-makers’ processing costs, the effectiveness of ER3 may be inhibited, leading to counterproductive emission reduction outcomes (Ye et al., 2023). According to descriptive statistics, the current average level of ER3 has exceeded the inflection point. This indicates that the current public-participatory environmental regulations in various provinces have generally increased the carbon emissions of enterprises. Under such circumstances, the government should determine a reasonable critical value based on the attention index and implement differentiated management: when the threshold is lower than this, the public is encouraged to participate in supervision through channels such as environmental protection complaints and green consumption. After exceeding the threshold, the government steps in to regulate the heat of public opinion, preventing enterprises from falling into a vicious cycle of “public opinion response - weak emission reduction”.

4.3 Robustness analysis

4.3.1 Two-stage instrumental variable method

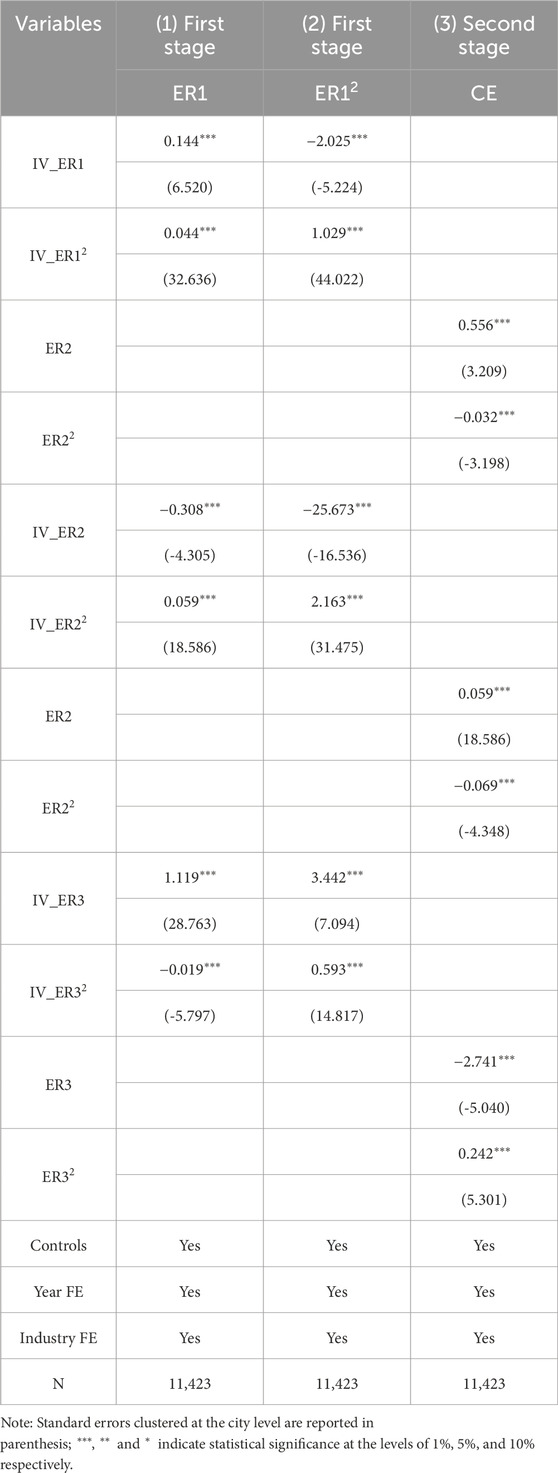

This study examines the relationship between provincial-level independent variables and corporate-level dependent variables, which can help mitigate the interference caused by reverse causality. However, firms with high levels of carbon emissions may be more susceptible to the effects of environmental regulation. Specifically, companies with greater carbon emissions are likely to face stricter oversight, potentially introducing reverse causality issues. To address potential sample self-selection bias and the endogeneity of bidirectional causality, this study employs the instrumental variable method. Since lagged variables have already occurred and are considered predetermined, they can generally serve as instrumental variables. Consequently, this study utilizes the first-order lagged terms of environmental regulation and its squared term as instrumental variables for two-stage least squares regression (2SLS), with results presented in Table 5. Columns (1) and (2) provide the first stage of regression results, indicating that the regression coefficients are significantly positive, suggesting that the instrumental variables possess both exogeneity and relevance. Column (3) presents the second stage of regression results, demonstrating a significant inverted U-shaped relationship between ER1 and ER2 with CE, while ER3 exhibits a significant U-shaped relationship with CE. Overall, these findings indicate that the results remain robust after controlling for endogeneity through instrumental variables.

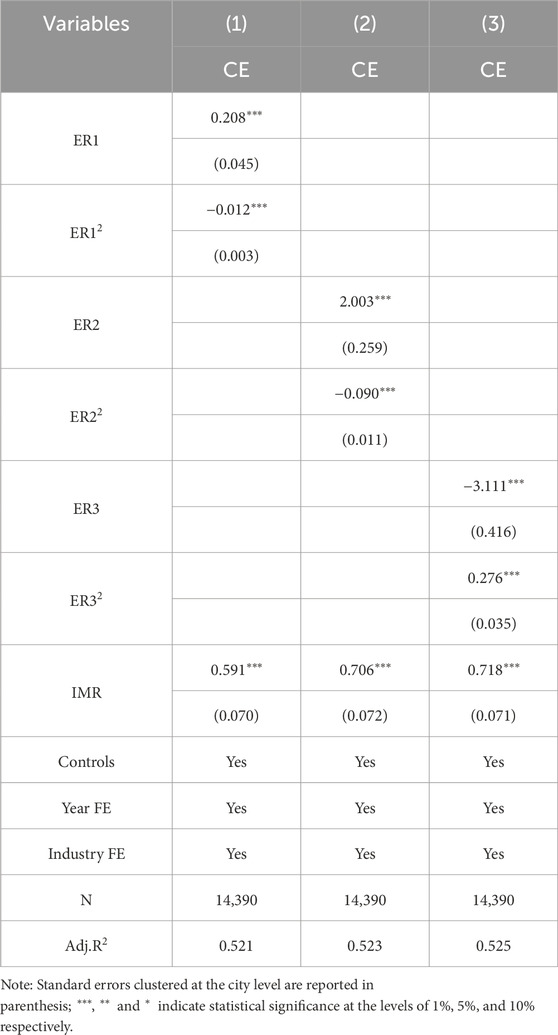

4.3.2 Two-stage Heckman method

Given the potential non-compliance with random sampling principles in this study, which may result in sample selection bias, the Heckman two-step method is employed to mitigate endogeneity issues arising from this bias. In the first stage, a Probit model is constructed using control variables consistent with the benchmark regression, while controlling for industry and year fixed effects. External variables are incorporated into the model, followed by regression analysis to calculate the inverse Mills ratio (IMR). In the second stage, the calculated IMR is integrated into the benchmark model for regression. The results presented in Table 6 indicate that after addressing potential sample selection issues, ER1 and ER2 continue to exhibit a significant inverted U-shaped relationship with CE, while ER3 maintains a significant U-shaped relationship with CE, thereby suggesting that the findings of this study remain robust.

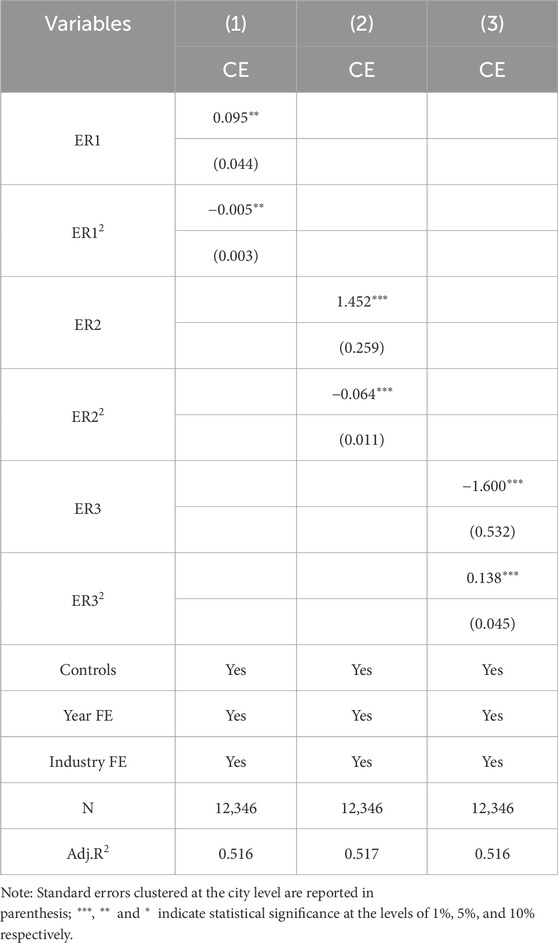

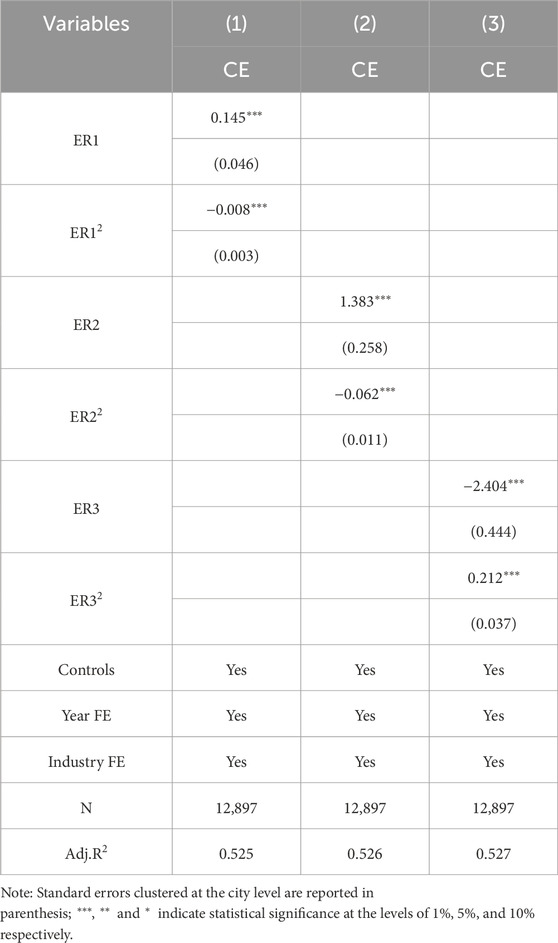

4.3.3 Remove special areas

Significant economic and social disparities exist among various regions of China. Municipalities directly under the central government, compared to other provinces, possess distinct advantages in terms of economic development, policy implementation, and talent accumulation. The effects of environmental regulation may demonstrate biases relative to other provinces. Consequently, this study performs a regression analysis after excluding samples from the four municipalities of Beijing, Tianjin, Shanghai, and Chongqing, with the results presented in Table 7. Additionally, special economic zones are predominantly situated in coastal areas or regions with unique economic statuses. These areas leverage their geographical advantages to facilitate foreign trade and attract foreign investment, resulting in significant differences between special economic zones and other regions. The analysis is repeated after excluding the seven special economic zones established since the initiation of China’s reform and opening-up, as outlined in Table 8. Notably, the research findings remain robust even after the removal of these special areas.

4.3.4 Remove special years

During the sample coverage period of this paper, environmental policies and regulations underwent significant changes that likely influenced corporate carbon emissions behavior. Following the Paris Agreement in 2016, substantial transformations occurred in the global climate governance landscape. In 2016 and 2017, China intensified its carbon emission regulations and initiated the development of a national carbon market. Subsequently, in 2020 and 2021, carbon neutrality targets and a clear “1 + N” policy framework were introduced. Consequently, this paper excludes data from 2016, 2017, 2020, and 2021, as these years may have been directly impacted by major policy events, and conducts a regression analysis on the remaining years’ data. The regression results are presented in Table 9. Notably, after excluding these specific years, the regression results remain robust.

4.3.5 Replace the dependent variable

Based on the research conducted by Wang et al. (2023), this paper estimates corporate carbon emissions by utilizing the carbon emissions from various industries alongside operating costs. The industrial carbon emissions are calculated using the industrial energy consumption data published in the China Statistical Yearbook and the carbon dioxide conversion factor provided by the Xiamen Energy Conservation Center (Lin and Jia, 2019). Furthermore, the calculated actual values are adjusted to mitigate the influence of outliers. The formula for estimating corporate carbon emissions is presented as follows:

where CE i,t are the carbon emissions of company i in period t; C j,t refers to the energy consumption of industry j in the period t; 2.493 is the carbon dioxide conversion factor of 1 ton of standard coal, that is, 2.493 kg of carbon dioxide will be emitted per 1 ton of standard coal consumed; cost_ f i,t is the main business cost of company i in period t, and cost_i j,t is the main business cost of industry j of company i in period t.

The CE calculated using the aforementioned formula serve as the substitute variables for the explained variables in this study for re-regression, with the results presented in Table 10. The findings indicate that the benchmark regression results remain robust.

4.4 Moderating effect test

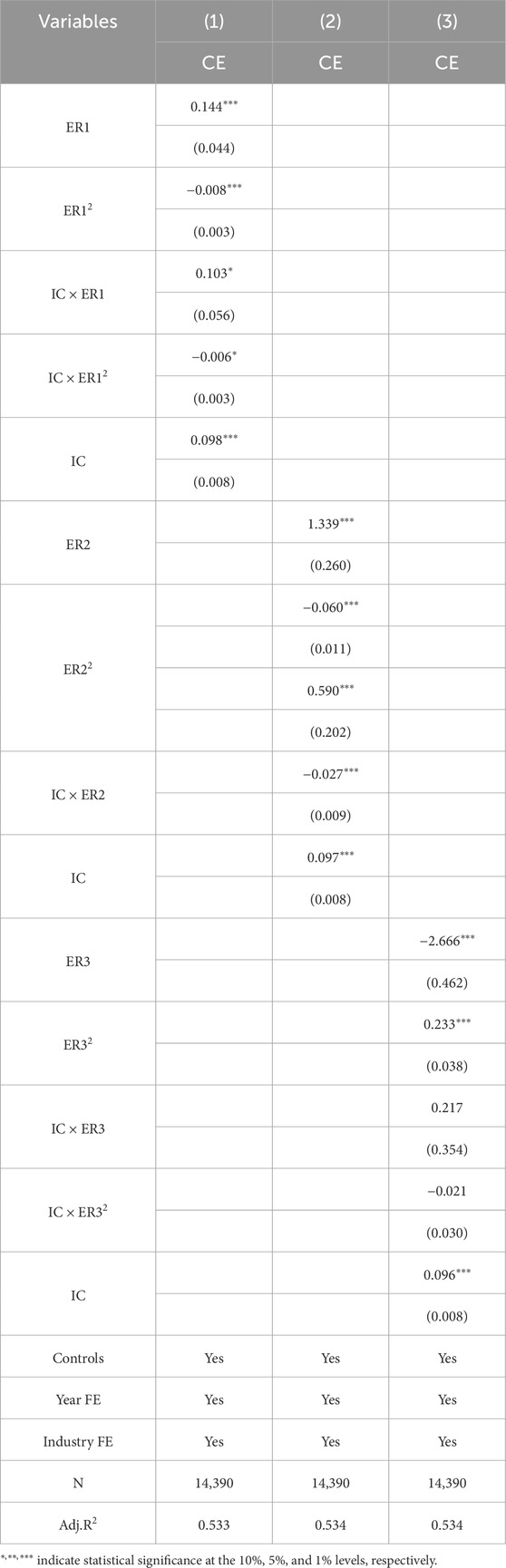

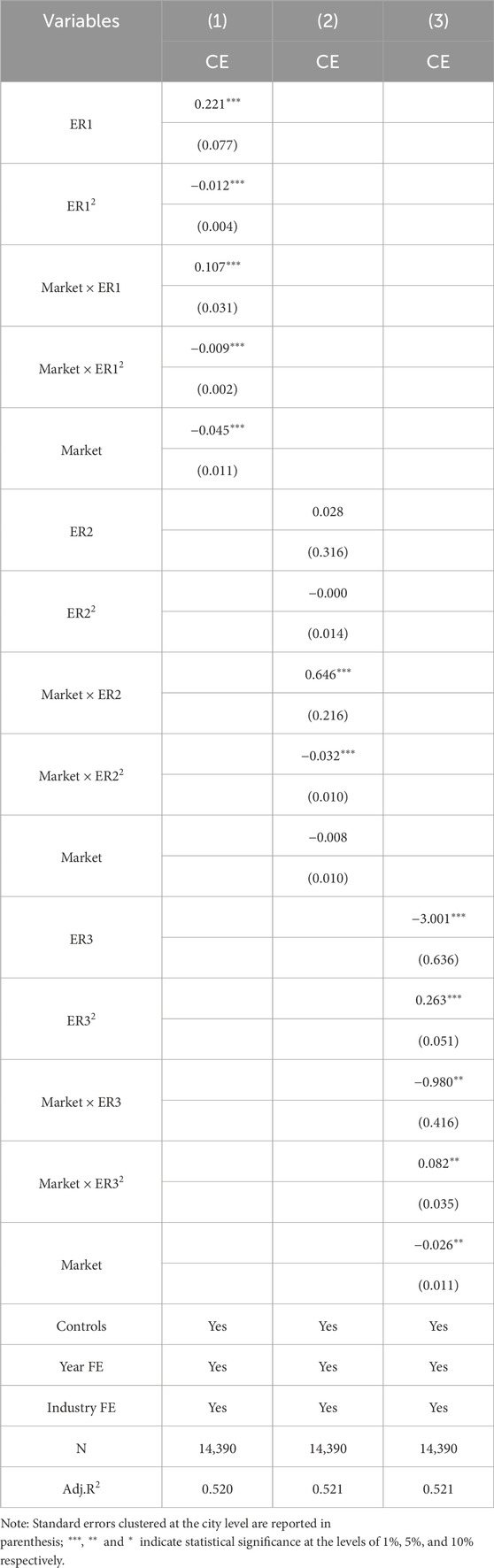

On the basis of the previous analysis, this paper tests the moderating effects of IC and Market from the perspective of internal and external governance, and the results are shown in Tables 11, 12.

The results presented in Table 11 indicate that the interaction terms between IC and ER12, as well as ER22, are significantly negative at the 10% and 1% levels, respectively. In contrast, the interaction term between IC and ER32 is not significant, suggesting that IC primarily moderates the effects of ER1 and ER2 on CE. Building on the research conducted by Haans et al. (2016) concerning the moderating effects of U-shaped curves, this study investigates changes in the inverted U-shaped curve induced by IC, with a focus on both the curve’s slope and inflection point. To determine whether IC alters the slope of the curve, the coefficient β4 from model (3) is examined. If β4 is significantly greater than zero, an increase in IC will decrease the absolute value of the inverted U-shaped slope, thereby flattening the curve; conversely, if β4 is less than zero, the curve will become steeper. The data in the table reveal that the β4 values for ER1 and ER2 are both significantly negative, indicating that IC increases the steepness of the inverted U-shaped relationship. This implies that as the intensity of environmental regulation rises, enhancing IC can strengthen its suppressive effect on CE. Furthermore, the movement of the inflection point in this inverted U-shaped relationship is jointly determined by β1, β2, β3, and β4, as illustrated in model (3). When the expression β1β4 - β2β3 is negative, the inflection point shifts to the left; otherwise, it shifts to the right. Given that the values of β1β4 - β2β3 for ER1 and ER2 are both negative, this suggests that increasing IC will move the inflection point leftward, thereby accelerating its arrival. Consequently, considering the impact of IC on the slope of the inverted U-shaped curve allows us to conclude that increasing IC will reinforce the curve, enhance the suppressive effects of ER1 and ER2 on CE, and mitigate the negative impacts on corporate carbon reduction during its early stages, thus supporting Hypothesis 2a and Hypothesis 2b. However, since the interaction term between IC and ER32 is not significant, IC does not moderate the impact of ER3 on CE, leading to the invalidation of Hypothesis 2c. These results may arise from the fact that ER3 primarily motivates corporate action through external pressures, such as heightened public environmental awareness and active participation in environmental monitoring to expose corporate pollution behaviors, thereby compelling government agencies to implement corresponding measures and indirectly prompting companies to strengthen their carbon emission controls (Zhang et al., 2023). Hence, the effectiveness of this regulation is more reliant on public information disclosure and government responsiveness rather than on IC.

The results presented in Table 12 indicate that the interaction terms between Market and ER12 (Market × ER12), as well as ER22 (Market × ER22), are significantly negative at the 1% level, while the interaction term with ER32 (Market × ER32) is significantly positive at the 5% level. This finding suggests that Market moderates the effects of ER1, ER2, and ER3 on CE. The data further reveals that the β4 values for ER1 and ER2 are both significantly less than zero, signifying that Market steepens the inverted U-shaped curve. This implies that as the intensity of environmental regulation increases, enhancing Market can strengthen its suppressive effect on CE. Additionally, the β1β4 - β2β3 values for ER1 and ER2 are both negative, indicating that as Market increases, the inflection point will shift leftward, thus accelerating its arrival. Similarly, the β4 value for ER3 is significantly greater than zero, suggesting that Market also steepens the U-shaped curve. Concurrently, the β1β4 - β2β3 value for ER3 is positive, indicating that as Market increases, the inflection point will shift rightward, thereby slowing its arrival. Consequently, increasing Market will reinforce the U-shaped curve, enhance the suppressive effect of ER3 on CE, and mitigate its negative impacts on corporate carbon reduction in later stages. In summary, Market plays a moderating role in the influence of all three types of environmental regulation on CE, thereby validating Hypothesis 3a, Hypothesis 3b, and Hypothesis 3c.

4.5 Heterogeneity analysis

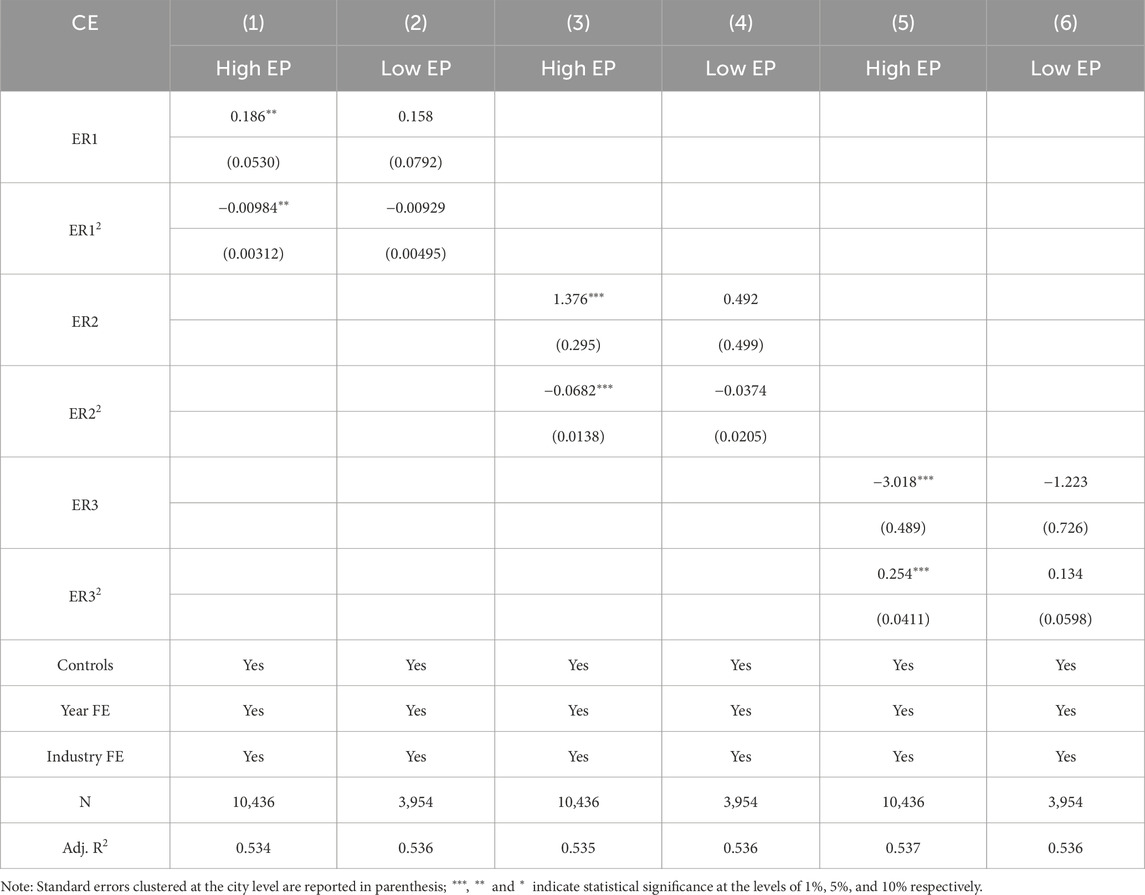

4.5.1 Heterogeneity of ESG performance

Environmental, Social, and Governance (ESG) performance is a critical indicator of corporate sustainability. Companies that demonstrate high ESG performance effectively communicate their commitment to environmental protection, social responsibility, and corporate governance, thus enhancing their reputation and attracting greater investment (Ye and Xu, 2023). These companies integrate ESG principles into their corporate strategies, focusing not only on short-term economic gains but also on long-term sustainable development. Consequently, in the context of achieving dual carbon goals, the ESG performance of enterprises plays a vital role in their efforts to reduce carbon emissions and combat climate change. Firms with robust ESG performance typically excel in areas such as environmental protection, resource utilization, and energy efficiency, thereby contributing to their carbon reduction targets (Li and Xu, 2024). Accordingly, this paper adopts the more relevant environmental dimension E of Huazheng’s ESG ratings to group firms, and divides the sample into high and low groups based on the median. This categorization aims to explore the differences in the impacts of environmental regulation on corporate carbon emissions at varying levels of environmental performance, with specific regression results reported in Table 13. The findings reveal that among companies with high ESG performance, ER1 and ER2 exhibit a significant inverted U-shaped impact on CE, while ER3 demonstrates a significant U-shaped impact. In contrast, these effects are not significant in the sample of companies with lower environmental performance. A plausible explanation is that companies with high environmental performance possess more extensive experience and higher standards in environmental protection, resulting in greater responsiveness to environmental regulations. When faced with these regulations, such companies can rapidly adjust their production strategies and implement effective measures to reduce carbon emissions to comply with regulatory requirements (Cong et al., 2022).

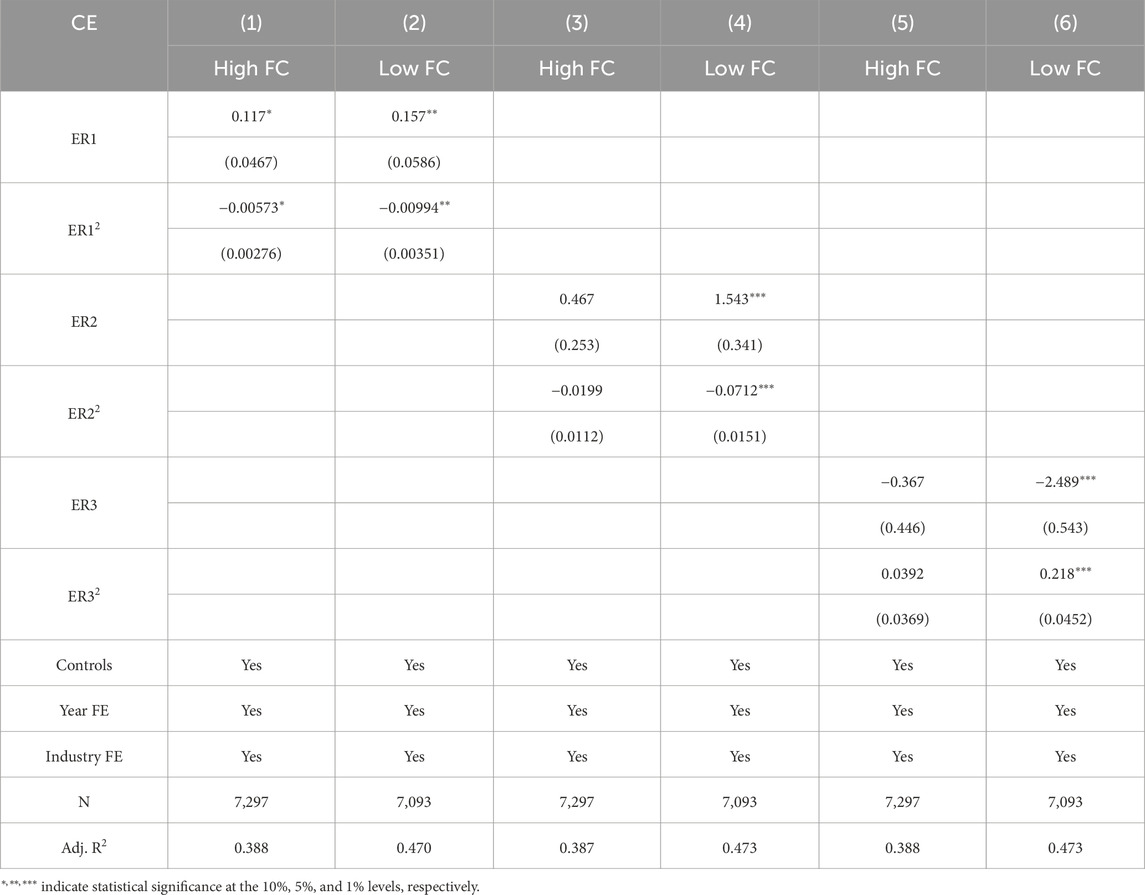

4.5.2 Heterogeneity of the level of financing constraints

Financing constraints are among the primary factors that restrict the scale and pace of development. External financing constraints compel enterprises to rely more heavily on internal cash flow, which is relatively limited (Yang and Han, 2023). Due to challenges in obtaining financing and high associated costs, Chinese companies often encounter developmental challenges; when faced with high financing thresholds, they frequently sacrifice environmental benefits by allocating funds to production projects characterized by “low investment, short cycles, and quick returns” (Deng et al., 2022). Furthermore, financing constraints can inhibit firms’ technological innovation in energy conservation and environmental protection, leading to increased carbon emissions and impeding the green transformation of production processes (Sun and Shen, 2024). In light of this, this paper utilizes the FC index to quantify financing constraints and further categorizes the sample into high and low groups based on the median, thereby exploring the differences in the impacts of environmental regulations on corporate carbon emissions across varying levels of financing constraints. Specific regression results are presented in Table 14. The findings suggest that among companies with low external FC, the carbon reduction effects of the three environmental regulations are more pronounced. In contrast, firms with high FC experience weaker or even non-significant carbon reduction effects from environmental regulations. A possible explanation for this outcome is that to meet environmental regulatory standards, many firms must depend on external financing to invest in low-carbon strategies. When the external financing environment is relatively accommodating, companies can access substantial funds at lower costs, thereby facilitating green technological innovation and enhancing their capacity to manage innovation risks (Yu et al., 2022). Additionally, lower FC indicates that companies face greater scrutiny from stakeholders, which increases pressure to adjust their environmental strategies, improve sustainable development capabilities, and adopt a “win-win” strategy that meets the value demands of external investors (Wang M. et al., 2022).

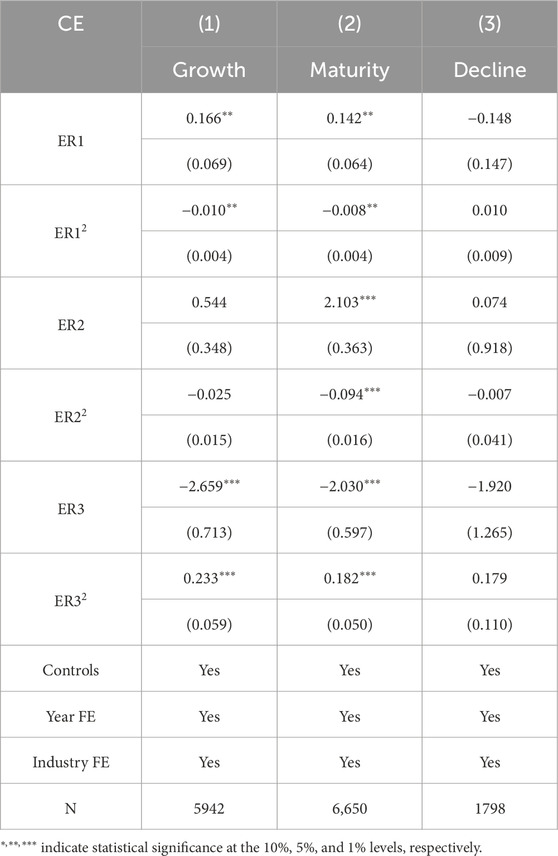

4.5.3 Heterogeneity of enterprise life cycle

Enterprises at different stages of their life cycles exhibit variations in information constraints, production characteristics, business strategies, and capital needs, all of which influence their investment priorities. Through an analysis of the heterogeneity of the enterprise life cycle, the potential for emission reduction and the actual emission reduction effects of companies in diverse development stages, including maturity, growth, and decline, can be more clearly understood in the context of environmental regulations. Accordingly, this paper categorizes the life cycle of listed manufacturing enterprises into three stages: growth, maturity, and decline, to explore the differential impact of heterogeneous environmental regulations on carbon emissions at each stage (Li et al., 2024). Drawing on Dickinson’s cash flow method, based on the characteristics of the net cash flows from operating activities, investing activities and financing activities of listed companies, they are classified into the growth stage, the mature stage and the decline stage (Dickinson, 2011). The regression results are presented in Table 15. Findings indicate that, within the sample of enterprises in the growth and maturity stages, most environmental regulations exhibit a favorable impact on carbon emission reduction, with the most significant effects observed in the maturity stage. Conversely, in the sample of enterprises in the decline stage, the carbon emission reduction effects of the three environmental regulations are not significant. This may be attributed to the fact that mature enterprises typically possess relatively robust financial, technical, and human resources, enabling them to invest more capital in the development of environmental protection facilities and technological upgrades, thereby enhancing their emission reduction capabilities. Furthermore, the management systems and implementation mechanisms of mature enterprises are generally well-developed, ensuring the effective enforcement of environmental policies and supporting reductions in carbon emissions. Growing enterprises, in their rapid development phase, demonstrate strong innovation momentum; thus, they can enhance production efficiency and reduce carbon emissions by adopting new technologies and processes, achieving a win-win scenario that balances environmental protection with economic benefits (Chen, 2023). In contrast, enterprises in the recession period frequently encounter challenges such as funding shortages, outdated technologies, and talent drain, leading to inadequate investment in environmental protection infrastructure and technological advancements, as well as limited emission reduction outcomes. Additionally, during a recession, these enterprises primarily face survival pressures, and declining market competitiveness can hinder their ability to allocate resources to long-term initiatives, such as carbon emission reduction. Consequently, they may prioritize short-term advantages while overlooking long-term environmental benefits, resulting in suboptimal emission reduction performance (Zhang et al., 2024).

5 Conclusions and policy recommendations

5.1 Research conclusions

This paper examines China’s A-share listed manufacturing enterprises from 2015 to 2022 to explore the impact of heterogeneous environmental regulations on CE, while also verifying the regulatory effects of IC and Market on this relationship from the perspectives of internal and external governance.

The empirical study yields the following conclusions: (1) Both ER1 and ER2 exhibit a significant inverted U-shaped relationship with CE, whereas ER3 demonstrates a significant U-shaped relationship with CE. This indicates that the carbon reduction effects of environmental regulations are only realized when the intensity of these regulations reaches a certain critical threshold. (2) From the perspective of internal governance, IC strengthens the inverted U-shaped impact of ER1 and ER2 on CE but does not regulate the U-shaped impact of ER3 on CE. In terms of external governance, Market positively moderates the nonlinear effects of ER1, ER2, and ER3 on CE. (3) The heterogeneity analysis reveals that the emission reduction effects of environmental regulations are more pronounced in samples of enterprises characterized by high ESG performance, low financing constraints, and those in the growth and maturity stages. This indicates that the impact of heterogeneous environmental regulations on carbon emissions varies across different sample levels.

5.2 Policy recommendations

First, the government should optimize the intensity of environmental regulations and implement dynamic adjustments to balance the economic burden on enterprises with the effectiveness of emission reductions. Given the inverted U-shaped relationship between command-and-control and market-incentive environmental regulations, it is essential to accurately calibrate regulation intensity to prevent both excessive and insufficient measures. Such as for command-and-control regulations (ER1), the critical threshold of 5,949 annual administrative penalty cases must be exceeded to transition from increased compliance costs to net emission reductions—provinces below this benchmark should consider whether they can appropriately expand their law enforcement resources. In addition, excessive public concern can lead to an increase in carbon emissions. The government can optimize the forms of public participation and establish a reasonable supervision platform. Reduce mere public opinion supervision, transform confrontational public opinions into constructive improvement plans, and drive enterprises to reduce emissions.

Second, based on the empirical discovery of the synergistic regulatory mechanism of internal control and marketization level on heterogeneous environmental regulation, the government should aim to enhance the internal control quality of enterprises and deepen market-oriented reforms to develop differentiated governance policies tailored to the characteristics of each enterprise. In terms of internal governance, there should be a strong advocacy for the establishment and improvement of internal control systems within companies, incorporating environmental performance into assessments and enhancing environmental management through positive incentives. Preferential policies should be granted to enterprises with robust internal controls and strong environmental protection performance, while supervision and guidance should be intensified for those with weak internal controls and poor environmental outcomes. In terms of external governance, mechanisms such as carbon emission trading markets and green finance should be established to promote emission reductions through economic incentives. This must be accompanied by measures to ensure fair competition and transparency within the market, alongside enhanced oversight of carbon markets. Additionally, differentiated policies should be formulated according to the degree of regional marketization. Regions with high marketization should leverage market mechanisms, while those with lower marketization should focus on strengthening government guidance and support, thereby enhancing enterprises’ environmental performance and market competitiveness.

Third, the government should develop differentiated environmental regulation policies based on the characteristics of enterprises’ ESG performance, levels of financing constraints, and life cycle stages, to achieve more precise emission reduction outcomes. For enterprises demonstrating excellent ESG performance, the government should increase support through financial subsidies, tax incentives, and other measures to stimulate their enthusiasm for emission reduction. Furthermore, ESG performance should be integrated into assessment and financing conditions, guiding companies toward long-term development. For enterprises facing various financing constraints, the government should optimize the financial environment, providing multiple financing channels for those with low constraints to reduce costs and encourage environmental technology innovation. Special financing support for environmental protection should be offered to high-constraint enterprises, such as discounted loan interest and risk compensation funds, to facilitate their green transformation. Simultaneously, government policies should be tailored to the life cycle stage of enterprises. For those in the growth and maturity stages, the government should leverage their developmental advantages by increasing investment in environmental protection through policy guidance, thus achieving a win-win scenario for emission reductions and economic benefits. For enterprises in decline, environmental supervision and guidance should be strengthened to promote industrial restructuring or transformation, thereby improving both environmental performance and market competitiveness.

Fourth, optimize environmental policy mix to enhance synergistic effects, the interactive effects between regulation types must be leveraged to amplify policy impact. For example, coupling market-incentive mechanisms (ER2) with public participation (ER3) creates synergistic pressure in high-marketization regions. Conversely, low-marketization areas benefit from pairing command-and-control regulations (ER1) with public oversight (ER3), where community monitoring compensates for weak market signals—Non-governmental organizations can be authorized to report violations, thereby triggering compulsory penalties.

5.3 Limitation

First, this study has certain limitations in terms of data, primarily reflected in the scope of the data. Specifically, the paper only examined manufacturing listed companies on China’s A-share market. It did not cover service industries, agriculture, or the vast number of unlisted small and medium-sized enterprises (SMEs). Consequently, the conclusions drawn may not fully reflect the overall impact of environmental regulation on corporate carbon emissions. Subsequent research could enhance the generalizability and credibility of the findings by expanding the scope of the sample data.

Second, the impact of environmental regulation on corporate carbon emissions is a multidimensional and complex issue, the effects of which may result from the combined action of various internal and external factors. Although this study has attempted to incorporate moderating factors such as executives’ green awareness and financing constraints into the analytical framework, other potentially important influencing factors have not been sufficiently explored. Future research could further expand the analytical framework to delve deeper into other factors influencing the mitigation effectiveness of environmental regulation.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

DL: Conceptualization, Formal Analysis, Investigation, Methodology, Resources, Validation, Writing – original draft, Writing – review and editing. YL: Data curation, Investigation, Resources, Software, Validation, Writing – original draft, Writing – review and editing. KL: Supervision, Visualization, Writing – review and editing. DL: Project administration, Supervision, Visualization, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. The paper is supported by the Social Science Found of National Province (Grant: 24BGL032).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alam, M. S., Manigandan, P., Kisswani, K. M., and Baig, I. A. (2025). Achieving goals of the 2030 sustainable development agenda through renewable energy utilization: comparing the environmental sustainability effects of economic growth and financial development. Sustain. Futur. 9, 100534. doi:10.1016/j.sftr.2025.100534

Almashhadani, M. (2021). Internal control mechanisms, CSR, and profitability: a discussion. Int. J. Bus. Manag. Invent. 10 (12), 38–43. doi:10.35629/8028-1012023842

Boulhaga, M., Bouri, A., Elamer, A. A., and Ibrahim, B. A. (2023). Environmental, social and governance ratings and firm performance: the moderating role of internal control quality. Corp. Soc. Responsib. Environ. Manag. 30 (1), 134–145. doi:10.1002/csr.2343

Chen, P. (2023). Corporate social responsibility, financing constraints, and corporate carbon intensity: new evidence from listed Chinese companies. Environ. Sci. Pollut. Res. 30 (14), 40107–40115. doi:10.1007/s11356-023-25176-5

Chen, F., and Jiang, G. (2023). The nonlinear relationship between resource endowments and carbon emissions: threshold effects of marketization degree and urban services agglomeration. Appl. Econ. 56, 7549–7562. doi:10.1080/00036846.2023.2288038

Cong, Y., Zhu, C., Hou, Y., Tian, S., and Cai, X. (2022). Does ESG investment reduce car-bon emissions in China? Front. Environ. Sci. 10, 977049. doi:10.3389/fenvs.2022.977049

Cui, S., Wang, Y., Zhu, Z., Zhu, Z., and Yu, C. (2022). The impact of heterogeneous environmental regulation on the energy eco-efficiency of China’s energy-mineral cities. J. Clean. Prod. 350, 131553. doi:10.1016/j.jclepro.2022.131553

Cui, X., Xu, N., Yan, X., and Zhang, W. (2023). How does social credit system constructions affect corporate carbon emissions? Empirical evidence from Chinese listed companies. Econ. Lett. 231, 111309. doi:10.1016/j.econlet.2023.111309

Dai, W., Zhang, X., and Xu, C. (2022). The impacts of fiscal subsidies on the carbon emissions of mining enterprises: evidence from China. Int. J. Environ. Res. Public Health 19 (23), 16256. doi:10.3390/ijerph192316256