- 1Department of Electrical and Computer Engineering, Makerere University, Kampala, Uganda

- 2Pan African University Life and Earth Sciences Institute (including Health and Agriculture), PAULESI, University of Ibadan, Lagos, Nigeria

Sub-Saharan Africa (SSA) faces a persistent energy crisis, with 600 million people lacking access to electricity. Since the 1990s, government-led reforms have facilitated Independent Power Producers (IPPs) in adding 29.3 GW from 371 projects between 2000 and 2024. However, by 2018, inadequate grid investment had led to overcapacity in some countries while millions remained without electricity, creating a paradox. This study examined the role of political economy, the IPP model, the funding gap in transmission and grid extension, and the impact of renewable energy project development on overcapacity in the power generation sector of SSA. The analysis was based on data from international organizations involved in energy and economic development, national energy plans and reports, and both primary and secondary research. Case studies from Ghana, South Africa, and Ethiopia were selected due to documented overcapacity challenges. The findings revealed that political influence, misaligned investments, and weak grid infrastructure are key contributing factors to overcapacity. Between 2001 and 2023, 97% of private investment was directed towards generation, while only 0.2% supported transmission expansion, leaving grids underfunded. Additionally, 43% of generation projects were awarded through direct negotiations and confidential agreements, resulting in inefficiencies and inflated costs. Take-or-pay Power Purchase Agreements have further exacerbated excess capacity, while transmission delays and weak regional interconnections continue to keep much of the capacity underutilized. Given these points, overcapacity in SSA’s power generation sector is a result of politically driven investments that overlook demand and grid capacity requirements leading to inefficiencies and financial strain. To address this challenge, governments should increase grid expansion investments, enhance regulatory transparency, reform procurement and strengthen regional electricity trade.

1 Introduction

Over 600 million people in Africa lack access to electricity (IEA, 2024a), while some regions experience overcapacity in power generation. In 2018, 48 Sub-Saharan African (SSA) countries, home to nearly one billion people, produced approximately the same amount of electricity as Spain, which has a population of only 45 million (European Investment Bank, 2018). Although SSA struggles with low electricity access rates and insufficient generation capacity to meet demand, the paradox lies in the fact that investments in power generation have also led to overcapacity (Andersen and Pedersen, 2023). According to the Power Africa report (USAID and Power Africa, 2018), several Sub-Saharan African countries had surplus power generation in 2018, while others were expected to face similar challenges by 2025 due to new generation projects coming online. In the East African Power Pool, Ethiopia, Uganda, and Kenya had already exceeded demand. In West Africa, Ghana had the highest surplus, followed by Côte d’Ivoire, Cameroon, and Mali. Meanwhile, Guinea, Liberia, Senegal, and Togo had relatively lower excess capacity. A similar trend was observed in Southern Africa, where South Africa and Angola were already experiencing overcapacity. Looking ahead, the report projected that Benin, Mauritania, Sierra Leone, Rwanda, and Tanzania would also encounter an oversupply of electricity. As a result, a significant portion of the excess power remains underutilized (Mitchell et al., 2019). This paradox, where millions remain without electricity despite claims of overcapacity, represents a complex and misunderstood problem in Africa’s power sector. Policymakers, researchers, and investors hold differing perspectives on the issue, which complicates the path to a unified solution.

The power sector in SSA is burdened with persistent challenges, including insufficient investments (IEA, 2024b), inadequate planning, operational inefficiencies, low utility revenues, limited generation and network capacity, slow progress in expanding electricity access, unreliable supply, and high costs that jeopardize financial sustainability (Eberhard and Shkaratan, 2012). These issues are further exacerbated by insufficient government funding, monopoly control by public utilities that restrict market competition, and political interference, which forces utilities to prioritize political agendas over commercial objectives (African Development Bank, 2013; Dye, 2023) Moreover, many SSA governments lack the financial capacity to meet their power sector demands and are unable to secure affordable loans due to low credit ratings (Eberhard, 2016).

Since 1990, several African countries have adopted market-driven power sector reforms focused on four areas: establishing independent regulatory bodies to enforce standards and ensure accountability, unbundling utilities both vertically and horizontally, introducing private sector participation, and promoting competition within the industry. The author in Imam et al. (2020) investigated the performance of the reforms in the context of government political ideology in SSA. However, those reforms are designed based on European frameworks, which overlook the unique contexts of African countries and assume uniform patterns across regions (Rasmus Hundsbæk et al., 2021). Consequently, the gap between policy formulation and implementation persists, often accompanied by instances of policy reform reversals (Lee and Usman, 2018). Instead of a complete withdrawal by the state, hybrid electricity systems have developed, with state-owned utilities maintaining a dominant role. These reforms frequently conflicted with governments’ political ideologies, as they were often perceived as externally imposed economic restructuring initiatives.

Several models were introduced to enhance private sector involvement in the power sector, such as long-term concessions, BOOT (build, own, operate, and transfer) projects, merchant plants, auction-based long-term power purchase agreements, and dedicated transmission lines for independent power projects (Karekezi and Kimani, 2002; Eberhard and Gratwick, 2011; Eberhard et al., 2017b; 2017a; Eberhard et al., 2018; Lee and Usman, 2018; Rasmus Hundsbæk et al., 2021) Those large-scale projects often attract global companies and international funding, but they come with significant risks for many Sub-Saharan countries. While they are promoted as win-win projects, their complex contracts and financing models are difficult to navigate. This challenge is further intensified by weak financial systems and limited institutional capacity in many of these countries, making it hard to fully understand and manage the risks involved (Pedersen, Winckler Andersen and Nøhr, 2020). The focus on developing individual power supply projects in sub-Saharan Africa, without considering their role within national power systems or regional power pools, risks creating a “tragedy of the commons,” where uncoordinated actions driven by individual interests undermine the shared benefits of a collective resource. Also, those projects are often implemented under the influence of political or bureaucratic elites with corrupted procurement and poor planning often leading to oversupply (Rasmus Hundsbæk et al., 2021). This need arises from unsuitable generation sizes, inappropriate generation technologies, poorly located power plants, and inadequate investment in transmission, distribution, and efforts to promote productive electricity use.

Fewer academic studies have examined the issue of overcapacity, particularly focusing on countries with advanced and well-established grid infrastructures, but all together, they provide valuable insights into the challenges and implications of excess capacity. Moret et al. (2020) discussed overcapacity in the European power system, while Ming et al. (2017) reviewed the overcapacity situation in China’s thermal power industry, including its status quo, policy analysis, and recommendations. The issue of overcapacity in China’s coal power sector has been widely analyzed in previous studies (Yuan et al., 2016; Feng et al., 2018; Wang et al., 2021) whereas Yu et al. (2021) studied overcapacity in China’s renewable energy sector. Wilson (2020) examined overcapacity in the PJM system, highlighting its market dynamics. Additionally, Río and Janeiro (2016) provided a general review of overcapacity in the power sector, detailing its causes, effects, and mitigation strategies. About Africa, Andersen and Pedersen (2023) further explored the paradox of overcapacity in Africa’s energy sectors, illustrating how surplus generation capacity coexists with energy access challenges.

Most studies on overcapacity focus on countries with advanced grid infrastructures and little or no energy poverty. This study addresses a critical gap by examining overcapacity in power systems in Sub-Saharan Africa. It explores how political agendas, governance structures, private sector participation, and weak grid development create a mismatch between generation capacity and actual demand. Unlike previous research, this study uses publicly available data from global energy agencies and national energy plans. It provides a detailed analysis of how political motivations, investment strategies, and transmission constraints shape overcapacity in selected countries. These insights reveal the structural and institutional factors driving the issue. The findings help improve energy planning and support better policy decisions for the region.

This paper begins by outlining the methodologies employed, followed by an analysis of the role of political economy in driving overcapacity within African power systems. It then explores private sector investments in power generation and the existing funding gap in the transmission sector. Global factors contributing to overcapacity are examined alongside case studies from Sub-Saharan Africa. The discussion continues with an assessment of the effects of overcapacity, leading to a review of mitigation and prevention strategies, and concludes with key findings and recommendations.

2 Methods

2.1 Defining overcapacity

The excess capacity theory suggests that firms in monopolistic or imperfectly competitive markets tend to operate their production facilities at a level below what would minimize average costs (Zhang et al., 2014). Overcapacity in power systems refers to a situation where the installed generation capacity exceeds the actual demand for electricity (Moret et al., 2020). However, in the African context, this situation often arises when generation capacity expands more rapidly than the grid’s ability to transmit and distribute electricity to consumers due to a significant imbalance between the investments made in generation and the infrastructure required to distribute that energy efficiently (Andersen and Pedersen, 2023). Overcapacity in this context refers to power generation projects that are built and commissioned but remain underutilized or idled due to inadequate grid infrastructure (Cramton and Ockenfels, 2012; Wang, 2017).

2.2 Data sources

This review adopts a structured, data-driven approach to examining overcapacity in Sub-Saharan Africa’s power generation sector. It synthesizes data from global energy agencies, including the International Renewable Energy Agency (IRENA), the International Energy Agency (IEA), and Power Africa. Additional insights on investment trends, policies, and electricity markets are drawn from institutions such as the World Bank and the African Development Bank (AfDB). To assess electricity generation capacity, demand forecasts, and regulations, national reports and power sector plans from Ethiopia, Ghana, and South Africa are analyzed. This is further supported by secondary research, including peer-reviewed journal articles, industry reports, and conference proceedings. Investment-related data on power generation, transmission, and distribution infrastructure is sourced from the World Bank Group’s Private Infrastructure Projects Database, which tracks over 10,000 projects from 1984 to 2024 (The World Bank, 2024). This study focuses on the period 2000–2024, examining financing structures, technology deployment, and contract mechanisms. The analysis compares key factors such as project award methods, private-sector participation, and contract values in electricity infrastructure. By integrating data from multiple sources, this review identifies the causes of overcapacity, assesses its economic and policy impacts, and explores strategies for optimizing future investments.

2.3 Analytical framework

This review employs a mixed-methods framework, combining quantitative analysis of capacity trends with qualitative evaluation of political and economic drivers. Quantitative analysis focuses on evaluating the gap between installed capacity and electricity demand, using data from 2000 to 2024. Key indicators such as capacity utilization rates, reserve margins, and capacity additions are analyzed to identify patterns of overcapacity. Investment trends and project financing structures are assessed using data on private sector participation and investment per megawatt added.

Qualitative analysis employs thematic coding to evaluate political and economic drivers. Categories include regulatory frameworks, procurement models (e.g., competitive tenders vs unsolicited bids), institutional governance, and macroeconomic factors. The analysis explores how these factors influence capacity expansion decisions and whether they contribute to overcapacity, especially in the context of political or economic imperatives.

The review also integrates case studies from Ethiopia, Ghana, South Africa, Kenya, and Nigeria to compare how different regulatory and market structures impact capacity planning outcomes. By combining these quantitative and qualitative methods, the review offers a comprehensive assessment of the drivers of overcapacity and proposes recommendations for aligning future investments with sustainable power sector development.

2.4 Selection criteria for study countries

The selection of Ethiopia, Ghana, and South Africa is based on their strategic roles within their respective regional power pools and their influence on Sub-Saharan Africa’s electricity sector. These countries are pivotal in shaping generation capacity, cross-border trade, and energy policy, making them ideal case studies for analyzing overcapacity dynamics.

Ethiopia, a key participant in the East African Power Pool (EAPP), had the region’s highest surplus installed capacity as of 2018, according to Power Africa (USAID and Power Africa, 2018). It is also the leading electricity exporter within the pool, actively engaging in cross-border power transactions (Mondal et al., 2017). In the West African Power Pool (WAPP), Ghana has one of the most developed power sectors but has faced chronic overcapacity since 2010, prompting critical discussions on capacity optimization and market restructuring (Dye, 2023). South Africa, home to Eskom, historically one of the world’s most influential utilities, has grappled with overcapacity since the early 2008s, highlighting the complexities of aligning generation expansion with demand growth and system reliability (UNECA, 2018).

These countries were selected not only due to their overcapacity challenges but also for their leadership in regional electricity markets and their broader impact on sectoral development. Their experiences provide insights into how regulatory frameworks, economic conditions, and market structures drive overcapacity and affect grid stability and investment efficiency across the region.

3 The role of political economy in overcapacity in African power generation sector

Political economy factors play a significant role in contributing to overcapacity in African power sector by shaping energy policies, grid infrastructure development, and investment decisions. The power sector in sub-Saharan Africa remains predominantly under government ownership, despite ongoing reform efforts over the years (Ackah and Gatete, 2024). According to Ogunleye (2017), these reform policies are uncoordinated, conflicting, and lack clear objectives. The African Development Bank, argue that in most countries, the implementation those reforms has been inadequate due to inappropriate design, limited capacity for implementation, and constrained financial resources in addition to the monopolistic practices that prevents the competition (African Development Bank, 2013). On the other hand, governments in sub-Saharan African, generally consider electricity utilities as instruments for political favoritism and corruption, hindering the development of a reliable electricity (Tagliapietra and Tagliapietra, 2017). Investment decisions aimed at increasing generation capacity are often driven by political agendas, leading to focusing on short-term projects with minimal impact (Lakmeeharan et al., 2020)., and bypassing essential technical planning (Dye, 2023), but the reality is that having more installed capacity does not ensure increased electricity access (Ortega-Arriaga et al., 2021). Using government influence on utility operation, ambitious generation targets are often set based on unrealistic GDP growth projections and without adequate infrastructure or funding (Ackah and Gatete, 2024). These political interference plays a critical role in exacerbating overcapacity in Africa’s power sector.

Political agendas influence the approval of large-scale generation projects, frequently motivated by the objective of attracting foreign investment or achieving political commitments (Eberhard, 2016). However, easy approval for the construction of new power plants can contribute to electricity oversupply in several ways (Ming et al., 2017). A simplified authorization process can lead to a surge in projects and excess generating capacity (del Río and Janeiro, 2016). Without thorough analysis, there’s a risk of approving projects that do not align with actual electricity demand, resulting in capacity imbalances. Moreover, expedited approvals often overlook the need for a balanced energy mix, favoring specific types of power plants that exacerbate these imbalances. Hence, Easily granted administrative authorizations, lacking accurate demand and grid capacity assessments, can expose investments in the power generation sector to financial risks and contribute to overcapacity (del Río and Janeiro, 2016; Ren et al., 2021).

4 Private sector investments in African power generation

In the past, public utilities in sub-Saharan Africa have traditionally relied on government funding to support the expansion of generation capacity (Alhassan et al., 2024). However, this trend is shifting as many countries failed to finance their energy needs, and most utilities lack investment-grade ratings, making it difficult for them to secure sufficient debt financing at affordable rate (Eberhard and Shkaratan, 2012; Eberhard, 2016). Also, rising debt repayments is a very big challenge to secure funding for capital-intensive clean energy projects (IEA, 2024b). The most rapidly growing sources of new funding comes from Independent Power Producers (IPPs), concession finance, and Development Finance Institutions (DFIs) (Eberhard et al., 2016; Simone and Bazilian, 2019; Zhou et al., 2024). Concessional public finance providers are crucial for mobilizing private investment as well as offering vital grants and concessional funding (IEA, 2023). However, donors often prioritize technologies and projects that align with their own interests, rather than addressing the actual needs of recipient countries (Pedersen, Winckler Andersen and Nøhr, 2020). This creates a misalignment between the goals of project developers and the expectations of finance providers (IEA, 2023).

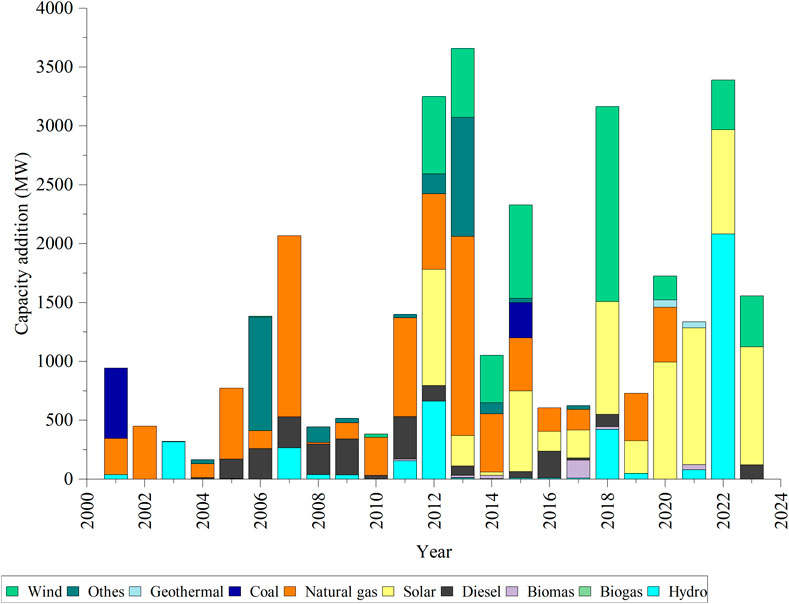

Referring to the World Bank Group’s Private Participation in Infrastructure (PPI) database (The World Bank, 2024), Sub-Saharan Africa experienced substantial private investment in the power sector between 2001 and 2023, primarily through IPPs (see Figure 1). During this period, 371 projects were undertaken, with 342 focused on power generation. Of these projects, 43% were awarded through competitive bidding, 17% through direct negotiations, 15% via license schemes, and 26% through confidential award methods. Over this time, IPPs installed 8,985 MW of natural gas capacity, followed by solar (7,653 MW), wind (5,182 MW), and hydro (4,182 MW). Smaller contributions came from diesel (2,405 MW), coal (900 MW), and other sources such as geothermal, biogas, and biomass (see Figure 2).

Figure 1. Distribution of Project Award Methods for Private Power Sector Investments in Sub-Saharan Africa (2001–2023). Data sourced from the World Bank Group’s PPI database (The World Bank, 2024).

Figure 2. Installed Generation Capacity from Private Sector Investments (IPPs) in Sub-Saharan Africa (2001–2023) (The World Bank, 2024).

Generation projects, particularly those in renewable energy, often attracted significant public and private investment due to factors such as reliable revenue models, protective measures like take-or-pay agreements and sovereign guarantees, minimal legal challenges related to land use, and promising financial returns (World Bank, 2017). Governments do not take on debt directly but instead rely almost entirely on unsolicited proposals to source new energy projects. In these cases, private companies raise the funds, construct, and own the plants (Imam et al., 2020). Most of these contracts are Power Purchase Agreements (PPAs) that include a “take-or-pay” clause (Dye, 2020). This clause protects private companies by guaranteeing revenue, even if the utility does not consume the electricity (Dyk, Tanya Calitz and James Todd, 2020). It requires the electricity utility to pay investors for typically 90% of the power made available, regardless of whether it is used or not (Dye, 2020).Without such guarantees, investors and financial institutions would be reluctant to finance energy infrastructure developments. Unfortunately, information regarding these unsolicited proposals is not publicly available. The only publicly disclosed aspects of these PPAs are the project name, contract type, technology or fuel source, location, and total project cost (Imam et al., 2020). The accumulation of multiple contracts with undisclosed details also hampers public understanding of the broader power system’s sustainability (Imam et al., 2020).

5 Funding gap in transmission sector

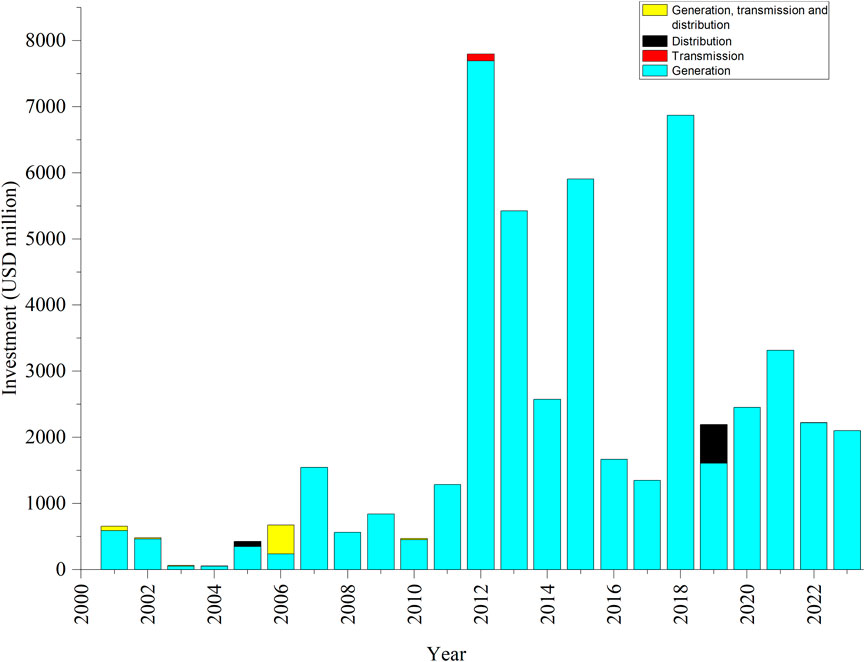

The recent surge in energy investments, particularly in renewable power generation, is hampered by inefficient and inadequate grids (IEA, 2024a). Historically, private investment in Africa’s power sector has focused on generation and, to a lesser extent, distribution, leaving transmission severely underfunded (Power Africa, 2014). As illustrated by Figure 3, the World Bank’s Private Participation in Infrastructure database shows that between 2001 and 2023, private sector investment in Sub-Saharan Africa totaled USD 51 billion. Of this, 97% went to generation, 0.2% to transmission, 1% to distribution, and 1% to combined projects (World Bank 2017). In 2020, only 3% of global electricity sector investment reached Sub-Saharan Africa, with just 0.5% allocated to grid extension and reinforcement (Deloitte, 2023). Investors prefer projects with guaranteed revenue, low risks, and legal protections like take-or-pay agreements and sovereign guarantees, along with minimal land use challenges and bankable returns. In such cases, utilities are responsible for building transmission lines, but they often face funding shortages, leading to delays. According to a 2011 World Bank report (World Bank Group, 2011), Africa has the lowest per capita transmission line coverage globally, despite its vast land and dispersed population. The total transmission line length of 38 African countries is shorter than that of Brazil or the U.S. Moreover, Africa lacks regional interconnections, despite efforts to strengthen the existing power pools and move towards a unified electricity market (Ayele et al., 2024). Africa’s transmission networks face unclear cost allocation, poor project design, inadequate planning, and restrictive regulatory barriers that limit network growth and deter private investment. Lengthy negotiations, complex financing, and a lack of enabling policies for private sector participation transmission lines further hinder infrastructure expansion, especially in Sub-Saharan Africa (Alegre, 2018). As a consequence, newly generation projects remain idle for years waiting for grid access or be canceled due to network limitations, creating challenges for governments in approving new-generation projects when existing assets are underutilized (Alegre, 2018). A reliable, modern transmission and distribution network is crucial to connect generation sites with load centers and strengthen local, regional, and international interconnections. However, cross-border projects are costly and demand careful coordination between governments and utilities (IEA, 2019).

Figure 3. Contract Values for Electricity Infrastructure Investments with Private Participation in Sub-Saharan Africa 2001–2023: Source (The World Bank, 2024).

6 Impact of renewable energy policies on overcapacity in sub-Saharan Africa

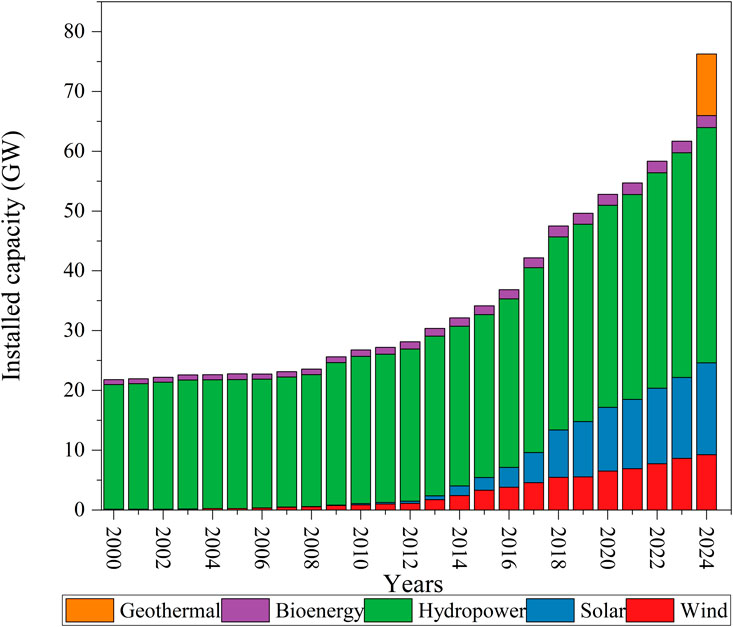

Renewable energy (RE) deployment in Sub-Saharan Africa (SSA) has grown steadily since 2000, supported by national and regional policy initiatives. According to (IRENA, 2025), hydropower capacity increased from 20.8 GW in 2000 to 39.3 GW by 2024, solar from negligible levels to 15.4 GW, and wind from less than 1 GW–9.2 GW as shown in Figure 4. Bioenergy and geothermal power have also expanded. Investment trends mirror this growth, with electricity sector investment projected to rise from USD 30 billion in 2022 to USD 120 billion in 2030, over half directed toward renewables, notably solar PV(IEA, 2024a). However, the expansion of RE capacity has not been matched by equivalent investments in grid infrastructure, system flexibility, or energy storage. Grid limitations, weak regional interconnections, and inadequate digitalization constrain the ability to integrate variable renewable energy (VRE), heightening the risk of underutilization (IEA, 2024a). Policy frameworks have largely prioritized generation-side incentives over comprehensive system development, which contributes to emerging overcapacity risks. Using the capacity utilization rate as an indicator, underutilized RE assets can inflate reserve margins and operational inefficiencies. South Africa illustrates this challenge, where 19.9 GWh of renewable energy was curtailed between January and June 2024 due to transmission bottlenecks (National Energy Regulator of South Africa, 2022). Although data on curtailment across SSA remains limited, the risk is substantiated by similar experiences elsewhere, such as China’s solar and wind sectors in the early 2010s, where rapid capacity additions outpaced grid readiness (Hu et al., 2020; Yu et al., 2021). Without stronger alignment between renewable energy development and system planning, SSA countries risk replicating patterns of structural overcapacity. Thus, while renewable energy policies have accelerated generation expansion, their role in mitigating overcapacity will remain constrained unless integrated approaches to grid modernization, storage, and system operations are prioritized.

Figure 4. Renewable energy (RE) deployment in Sub-Saharan Africa 2000–2024 (IRENA, 2024).

7 Global factors contributing to overcapacity in power systems

Globally, inaccurate projection of electricity demand is a common cause of overinvestment in generation capacity in many countries (Río and Janeiro, 2016; Mehedi and Ali, 2021). This can be associated with uncertainty in electricity demand, fuel prices, renewable energy output, and economic growth (Aien et al., 2016; Hong et al., 2020). Overestimating demand leads to overcapacity, while underestimating it risks supply shortages (Kandil et al., 2008; Hyndman and Fan, 2010). On the other hand, investments in power generation sector are based on overestimated electricity demand, influenced by overly optimistic economic prosperity leading to a mismatch between the expansion of power generation capacity and actual electricity demand (Centre for Research on Energy and Clean Air, 2022). This is the case of England and whales in 1973 (Papadopoulos, 1981), Pennsylvania New Jersey Maryland (PJM) (Wilson, 2020) and China between 2010-2015 (Lin et al., 2018). On the other hand, the surplus capacity within the power system can be attributed to the growing deployment of intermittent renewable energy sources such as wind and solar power. Countries such as China, the United States, and European Union members have implemented aggressive policies and economic incentives to boost renewable energy capacities (IEA, 2023), setting up several initiatives in place to promote the utilization of renewable energy sources and increase their proportion in the overall energy mix (Kozlova et al., 2023). The rapid drop in capital costs for solar and wind energy (Elegbede and Tippett, 2022), along with government subsidies like grants, loans, tax incentives, and other support programs, have driven increased investments in renewables (Deloitte, 2020). Investors are drawn to renewable energy due to its cost competitiveness government subsidies, and potential returns leading to overbuilding of renewable power plants which are not aligned with the grid requirements (Zhang et al., 2016). Inadequate investment in grid infrastructure hinders the utilization of growing renewable energy capacities, especially in developing countries with outdated transmission lines (Ortega-Arriaga et al., 2021). Transmission projects take longer to complete than renewable energy plants, leading to a lack of capacity to deliver generated electricity (Yang et al., 2012). This results in underutilization of newly installed power facilities (Dong et al., 2018; Ye et al., 2018; Liu et al., 2021). Finally, government policies, regulations, and incentives, such as subsidies, loans and grants, heavily influence investment decisions in the power sector (Xiong and Yang, 2016). These subsidies can drive continuous investment in new projects, even when existing capacity is sufficient, increasing the risk of overcapacity. This increases the risk of overcapacity in the system (Yu et al., 2021). This is the case of overcapacity in Chinese PV industry (Zhang et al., 2016; Hu et al., 2020), and Combined-Cycle Gas Turbines in Europe between years 2000–2010 (Hach and Spinler, 2016; Moret et al., 2020).

8 Overcapacity case studies in sub-Saharan Africa

In 2018, USAID and Power Africa, (2018) analyzed the power capacity of various African countries, reporting on the overcapacity at that time and projecting the situation for 2025 based on projects that were in the pipeline. In East Africa power pool, Ethiopia, Kenya, Tanzania, Uganda, and Rwanda had a combined overcapacity of 878 MW, with Ethiopia leading at 1,212 MW, while Rwanda and Tanzania faced deficits. By 2025, the region was expected to have a total overcapacity of 3,430 MW. In West Africa, Ghana had the highest overcapacity at 1,286 MW, but the region overall had a deficit of 1,826 MW, largely due to Nigeria’s significant shortfall. In Southern Africa, South Africa had an overcapacity of 8,847 MW in 2018, projected to be 8,769 MW by 2025, while Angola had an overcapacity of 2,492 MW in 2018, with a projection of 2,850 MW by 2025. This section details the overcapacity issues in selected countries, focusing on Ghana, South Africa, and Ethiopia.

The issue of overcapacity in Ghana’s power sector is clearly demonstrated by data from the 2024 National Energy Statistics report (Energy Commission, 2024). Between 2014 and 2016, Ghana’s investments in power generation projects were managed through government-led procurement processes that bypassed standard procedures and excluded key regulatory stakeholders, including the national utility company, GRIDCo. During this time, around 43 new Power Purchase Agreements (PPAs), primarily for thermal power plants, were signed without adequate consideration of demand forecasts. In 2000, the system peak demand was 1,162 MW with an installed capacity of 1,652 MW. By 2018, installed capacity had risen to 4,472 MW, while system peak demand was 2,525 MW, resulting in an overcapacity of approximately 1,493 MW, calculated with 18% reserve margin (Energy Commission, 2019). In 2023, installed capacity increased further to 5,639 MW, with peak demand at 3,618 MW, leading to an overcapacity of about 1,372 MW (Energy Commission Ghana, 2023). In an attempt to address the excess capacity, the government proposed exporting the surplus electricity to neighboring countries. However, this plan was hindered by inadequate transmission infrastructure and the neighboring countries’ focus on achieving energy independence by prioritizing their own power sector development. This made Ghana’s strategy to mitigate overcapacity through exports impractical and ultimately unsuccessful (Dye, 2023).

South Africa power sector has been characterized by the swing between power shortage and power surplus like China (Zhang et al., 2014). Since 1980, South Africa experienced overcapacity in their electricity sector until 2000s with capacity reserve margin of around 40%. Having overcapacity for 20 years justifies inefficiency in planning, investment and government failure. The government intended to support economic transformation goals but due to the lack of coherent policy and planning, coupled with political interests and corruption scandals, it ended up having overcapacity. In an attempt to limit the extent of surplus capacity that was looming as a result of over-planning, construction of generation sets was delayed and plans for new stations were cancelled since the early 1980s until 1995. Older plant was decommissioned or mothballed (Kessides, 2020). Since 1998, South Africa’s government was warned to run out of electricity by 2007 increasing energy demand but no new investment was made despite Eskom’s numerous requests to build new power stations leading to the crisis of capacity shortage of 2008. In late 2004, SA government gave Eskom the mandate to build but it was too late to bring big new baseload power stations on to the grid fast enough to prevent a shortfall in generating capacity until 2018 where the excess capacity was report again by Power Africa. Currently, according to SAPP, South Africa has installed capacity of available capacity of 48,463 MW, peak demand of 41,374 MW including reserve margin and the excess capacity of 7,089 MW. Thus, investment in energy infrastructure must be continuous and consistent as the current the apparent surplus generation can be wiped out overnight, and then the capacity shortage returns.

The paper (Lavers et al., 2021) examines the political economy of electricity generation planning in Ethiopia during the EPRDF era (1991-2019). Overcapacity stems from political ambitions for rapid expansion and the desire to be a regional electricity exporter that led to unrealistic demand estimates and megaprojects, questionable designs of large-scale projects not aligned with actual demand. the plans for large-scale electricity exports to countries like Egypt other region countries faced political and technical obstacles, meaning the excess capacity could not be utilized as envisioned. A report published by Power Africa (Power Africa et al., 2018), a U.S. government initiative supporting the development of power projects and grid infrastructure in Africa, shows that in 2018 Ethiopia had an overcapacity of 1,212 MW. It is expected that by 2025, this overcapacity will increase to 1,898 MW based on ongoing and committed power generation projects. According to the African Development Bank, (2023) in 2022, Ethiopia’s installed generation capacity was 5,320 MW, with an effective capacity of 5,044 MW, primarily from hydropower, which makes up 96.1% of the total. By January 2023, the national peak demand, including exports, was 3,297 MW, indicating that the country has a notable surplus in power generation capacity.

9 Effects of overcapacity

While overcapacity in power systems can enhance supply stability, it has several adverse effects. One significant consequence is the underutilization of new power plants (Simon Nicholas, 2020; Mehedi and Ali, 2021). In some instances, power plants may experience drastically reduced operating hours, leaving them idle for extended periods (Deloitte, 2020; Simon Nicholas, 2020), or plants become stranded assets where they are no longer viable or economical to operate (Caldecott and McDaniels, 2014). In severe cases, overcapacity can lead to the premature shutdown of a facility when generating costs consistently exceed electricity prices, rendering the plant economically unviable (Cui et al., 2021). Power plants may then be temporarily taken offline, closed, or permanently decommissioned, resulting in irreversible investments (Caldecott and McDaniels, 2014; Javadi et al., 2019; Komorowska et al., 2020). Consequently, If multiple plants are retired early, power system reliability and resource adequacy may suffer, prompting the need for emergency transmission network upgrades, generation capacity replacement, and a revised operational approach (North American Electric Reliability Corporation, 2018).

Overcapacity in the power generation sector has immediate financial and economic consequences, affecting investments, electricity prices, and system efficiency (Wilson, 2020). It can lead to higher capacity charges for both producers and consumers (Hawker et al., 2017). Governments often provide financial incentives to investors and independent power producers to cover the costs of underutilized capacity, straining national economic progress and distorting the wholesale electricity market (Genoese et al., 2015; Javadi et al., 2019). Overcapacity also reduces returns on investment, discouraging future investments in generation, especially as the sector shifts toward new energy models. Additionally, maintaining excess capacity can lock in outdated technologies, slowing down innovation and the adoption of more efficient, sustainable energy solutions (Seel et al., 2021).

10 Mitigation and prevention of overcapacity

Overcapacity in developing countries often arises from delays in transmission infrastructure, which lag behind the rapid construction of renewable energy plants (Mitchell et al., 2019). Wind, solar, and hydropower facilities are typically located in resource-abundant but distant areas and have shorter construction times compared to the five to 10 years often required for transmission line development, leading to imbalances between generation and delivery (Lee, 2018; Spyrou et al., 2017). To address these problems, NREL proposed a Renewable Energy Zone (REZ) transmission design tool to efficiently plan, approve, and build transmission lines connecting areas with abundant renewable resources, favorable topography, and developer interest to the grid (Jennifer and Leisch, 2018). Another solution to mitigate overcapacity in power systems is grid interconnection, which connects regions with excess installed capacity to those with a capacity deficit. This reduces the need for additional capacity and enables countries with power shortages to import cheaper electricity from surplus regions, avoiding the cost of building new power plants (Power Africa et al., 2018). For example, in the 1990s, the “Power Bridge” project was established to link Russia’s thermal power plants to Japan’s grid, allowing the export of surplus electricity (UN.ESCAP, 2020). A similar proposal was made to connect China with Europe to sell its excess capacity to sell surplus capacity from China to Europe (Wu and Zhang, 2018). Africa has developed regional electricity interconnection projects, known as power pools, to enhance electricity exchanges between countries and create a regional market (Odetayo and Walsh, 2021; McCluskey et al., 2022). However, these efforts face challenges due to underdeveloped transmission networks, limited interconnection infrastructure, and a lack of clear regulations for grid access, including wheeling charges (Elabbas et al., 2023). Grid interconnection helps reduce the need for new power plants and delays capacity expansion. By sharing resources across systems, utilities can replace domestic generation with imported power, thus avoiding the costs of developing additional conventional or renewable plants and the associated fuel and operational expenses (United Nations, 2006; Wu and Zhang, 2018; Wu et al., 2021).

Literature emphasizes the role of policies and regulations in managing power system overcapacity through controlling the scale of building new power plants, sustainable integration of renewables, reducing feed-in tariffs, and reducing or eliminating financial incentives to prevent excessive growth and maintain system balance (del Río and Janeiro, 2016; Lin et al., 2018). In 2015, China implemented these measures to control overcapacity by halting unapproved thermal power projects, denying grid access to illegally built plants, delaying approvals for new plants, and reducing feed-in tariffs to curb investor interest in thermal power (Ming et al., 2017).

Flexibility is widely seen as a cost-effective way to address overcapacity in power systems. Research shows that it can boost electricity consumption and improve the use of both conventional and renewable energy plants (Dahiru, Vuokila, and Huuhtanen 2022; IRENA, 2018). In this regard surplus electricity can be applied in areas like heating with Combined Heat and Power (CHP) systems, cooling with Combined Cooling, Heating, and Power (CCHP) systems, and hydrogen production through power-to-gas (P2G) technology (Wang et al., 2019; Son et al., 2021). After conversion, surplus power can be stored as natural gas using natural gas storage (NGS), or stored as heat or ice using thermal storage systems (TSS), or being stored as hydrogen using P2G technology (Sanaye and Shirazi, 2013; Lawder et al., 2014; Farhadi and Mohammed, 2016; Carmo and Stolten, 2018; AL Shaqsi et al., 2020; Koohi-Fayegh and Rosen, 2020; US Department of Energy, 2020). Additionally, excess electricity can be used in road and railway transport applications by investing in electric vehicles and buses powered entirely by batteries or hydrogen fuel cells, electrified railways, and metros (Renewable and Agency, no date; International Renewable Energy Agency, 2021). The analysis by Lund and Münster (2003) suggests that investing in flexibility is the best and cost effective solution to mitigate overcapacity than building high-voltage transmission lines.

11 Conclusion and policy recommendations

This review has examined the political-economic drivers and grid infrastructure challenges behind power generation overcapacity in selected Sub-Saharan African (SSA) countries. Despite significant investments, millions remain without electricity, highlighting structural inefficiencies where politically driven policies, weak grid infrastructure, and uncoordinated investments have led to underutilized capacity and financial strain on utilities.

This analysis highlights the significant role of political economy in driving overcapacity. Investment decisions have often been shaped by short-term political agendas rather than energy planning driven by demand and grid capacity. Governments have prioritized large-scale generation projects to attract foreign investment or meet political commitments, frequently overlooking transmission constraints and realistic demand forecasts. Consequently, poorly integrated power systems have developed, limiting the efficient distribution and trade of electricity. Non-transparent power purchase agreements, particularly those with take-or-pay clauses, have placed heavy financial burdens on utilities by requiring payment for unused electricity. Another major finding is the impact of private sector investment. While IPPs have expanded installed capacity, many projects face delays in grid connection due to slow transmission development. Insufficient investment in transmission infrastructure and weak regional interconnection have resulted in stranded capacity, compounding inefficiencies in the sector.

These findings highlight the need for policy reform to align generation expansion with transmission and distribution capacity. Governments should prioritize grid upgrades, improve regulatory transparency, and reform procurement to reduce overcapacity risks. Enhancing cross-border electricity trade would help utilize surplus capacity, while flexible, demand-driven contracts are key to avoiding future imbalances.

Despite the importance of these findings, this study is limited by restricted access to detailed and reliable overcapacity data. Many utilities are unwilling to disclose such information due to reputational risks, regulatory scrutiny, and potential impacts on investor confidence. This limitation highlights the need for further research to quantify the economic impact of stranded generation assets, assess the financial sustainability of power purchase agreements, and identify best practices for integrated power system planning in SSA. Additionally, a critical review of renewable energy policies in the region is essential, particularly regarding their role in overcapacity. Although many countries have adopted ambitious renewable targets, often influenced by external funding and incentives, weak grid infrastructure and inaccurate demand forecasting present serious risks that may exacerbate capacity imbalances.

Author contributions

VN: Conceptualization, Methodology, Resources, Software, Writing – original draft, Writing – review and editing. GB: Conceptualization, Supervision, Writing – review and editing. EM: Supervision, Writing – review and editing. DN: Validation, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

The author gratefully acknowledges the support received through the Mobility of African Scholars for Transformative Engineering Training (MASTET) program. This scholarship contributed significantly to the author’s academic journey and capacity development during doctoral studies.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ackah, I., and Gatete, C. (2024). “Advances in african economic,” in Social and political development energy regulation in Africa dynamics, challenges, and opportunities.

African Development Bank (2013). Energy sector policy of the AfDB group. Available online at: http://www.afdb.org/fileadmin/uploads/afdb/Documents/Policy-Documents/Energy_Sector_Policy_of_the_AfDB_Group.pdf.

African Development Bank (2023). Eastern Ethiopia electricity grid reinforcement project: Project appraisal report. Report No. P-ET-FA0-020. Abidjan, Côte d’Ivoire: African Development Bank. Available online at: https://mapafrica.afdb.org/en/projects/46002-P-ET-FA0-020.

Aien, M., Hajebrahimi, A., and Fotuhi-Firuzabad, M. (2016). A comprehensive review on uncertainty modeling techniques in power system studies. Renew. Sustain. Energy Rev. 57, 1077–1089. doi:10.1016/j.rser.2015.12.070

Alegre, J. (2018). Scaling-up energy investments in Africa for inclusive and sustainable growth report of the africa-europe high-level platform for sustainable energy investments in Africa, 1–88. Available online at: https://international-partnerships.ec.europa.eu/system/files/2020-05/report-africa-europe-high-level-platform-sei_en.pdf.

Alhassan, H., Kwakwa, P. A., and Cobbinah, M. T. (2024). “Energy financing in Africa: the prospects and challenges,” in Reference Module in Social Sciences. Elsevier.

AL Shaqsi, A. Z., Sopian, K., and Al-Hinai, A. (2020). Review of energy storage services, applications, limitations, and benefits. Energy Rep. 6, 288–306. doi:10.1016/j.egyr.2020.07.028

Andersen, O. W., and Pedersen, R. H. (2023). The paradox of overcapacity in African energy sectors. Energy Sustain. Dev. 72 (December 2022), 83–87. doi:10.1016/j.esd.2022.11.011

Ayele, S., Shen, W., Mulugetta, Y., and Worako, T. K. (2024). Governance of renewable energy procurement via private suppliers: the Ethiopian experience. Energy Policy 184 (August 2023), 113889. doi:10.1016/j.enpol.2023.113889

Caldecott, B., and McDaniels, J. (2014). “Stranded generation assets: implications for European capacity mechanisms, energy markets and climate policy,” in (Stranded Assets Programme Working Paper). Smith School of Enterprise and the Environment. United Kingdom: University of Oxford, 1–62. Available online at: https://www.smithschool.ox.ac.uk/sites/default/files/2022-04/Stranded-Generation-Assets.pdf.

Carmo, M., and Stolten, D. (2018). “Energy storage using hydrogen produced from excess renewable electricity: power to hydrogen,” in Science and engineering of hydrogen-based energy technologies: hydrogen production and practical applications in energy generation. Elsevier Inc.

Centre for Research on Energy and Clean Air (2022). Ripe for Closure: accelerating the energy transition and saving money by reducing excess fossil fuel capacity (South Asia). J. Music. Res. doi:10.1080/01411896.2021.2022408

Cramton, P., and Ockenfels, A. (2012). Economics and design of capacity markets for the power sector. Z. Energiewirtsch. 36 (April), 113–134. doi:10.1007/s12398-012-0084-2

Cui, R. Y., Hultman, N., Cui, D., McJeon, H., Yu, S., Edwards, M. R., et al. (2021). A plant-by-plant strategy for high-ambition coal power phaseout in China. Nat. Commun. 12 (1), 1468. doi:10.1038/s41467-021-21786-0

Dahiru, A. R., Vuokila, A., and Huuhtanen, M. (2022). Recent development in Power-to-X: Part I - a review on techno-economic analysis. J. Energy Storage 56 (PA), 105861. doi:10.1016/j.est.2022.105861

Deloitte (2020). Profitability of gas-fired power plants in Europe: is the storm behind us?, 15–18. Available online at: https://docslib.org/doc/2002448/profitability-of-gas-fired-power-plants-in-europe-is-the-storm-behind-us.

Deloitte (2023). Africa’s energy outlook: renewables as the pathway to energy prosperity. Available online at: https://energycentral.com/system/files/ece/nodes/633394/za-africa-energy-outlook-2023.pdf.

Dong, C., Qi, Y., Dong, W., Lu, X., Liu, T., and Qian, S. (2018). Decomposing driving factors for wind curtailment under economic new normal in China. Appl. Energy 217 (January), 178–188. doi:10.1016/j.apenergy.2018.01.040

Dye, B. J. (2020). Ideology matters: political machinations, modernism, and myopia in Rwanda’s electricity boom. Energy Res. Soc. Sci. 61 (November 2019), 101358. doi:10.1016/j.erss.2019.101358

Dye, B. J. (2023). When the means become the ends: Ghana’s “good governance” electricity reform overwhelmed by the politics of power crises. New Polit. Econ. 28 (1), 91–111. doi:10.1080/13563467.2022.2084517

Dyk, J. van, Calitz, T., and Todd, J. (2020). Power purchase: Africa’s shift to take-and-pay clauses. Available online at: https://www.pinsentmasons.com/out-law/analysis/power-purchase-africa-take-pay-clauses (Accessed December 16, 2024).

Eberhard, A. (2016). Powering Africa: facing the financing and reform challenges. Rev. d’Economie Du. Dev. 23 (HS), 39–48. doi:10.3917/edd.hs03.0039

Eberhard, A., Gratwick, K., Morella, E., and Antmann, P. (2016). Independent power projects in sub-saharan Africa: lessons from five key countries. Energy Policy, 390–424. doi:10.1596/978-1-4648-0800-5

Eberhard, A., Gratwick, K., and Kariuki, L. (2018). Kenya’s lessons from two decades of experience with independent power producers. Util. Policy 52, 37–49. doi:10.1016/j.jup.2018.04.002

Eberhard, A., Gratwick, K., Morella, E., and Antmann, P. (2017a). Accelerating investments in power in sub-Saharan Africa. Nat. Energy 2 (2), 17005. doi:10.1038/nenergy.2017.5

Eberhard, A., Gratwick, K., Morella, E., and Antmann, P. (2017b). Independent power projects in sub-saharan Africa: investment trends and policy lessons. Energy Policy 108, 390–424. doi:10.1016/j.enpol.2017.05.023

Eberhard, A., and Gratwick, K. N. (2011). IPPs in sub-saharan Africa: determinants of success. Energy Policy 39 (9), 5541–5549. doi:10.1016/j.enpol.2011.05.004

Eberhard, A., and Shkaratan, M. (2012). Powering Africa: meeting the financing and reform challenges. Energy Policy 42, 9–18. doi:10.1016/j.enpol.2011.10.033

Elabbas, M. A. E., de Vries, L., and Correljé, A. (2023). African power pools and regional electricity market design: taking stock of regional integration in energy sectors. Energy Res. and Soc. Sci. 105, 103291. doi:10.1016/j.erss.2023.103291

Elegbede, O., and Tippett, A. (2022). Understanding the U.S. Renewable energy market: a guide for international investors 2022. Available online at: https://www.trade.gov/sites/default/files/2022-04/2022SelectUSARenewableEnergyGuide.pdf.

Energy Commission (2019). Integrated power sector master plan for Ghana: Volume 2 – Main Report. Accra: Energy Commission. Available online at: https://www.energycom.gov.gh/index.php/planning/ipsmp-data.

Energy Commission Ghana (2023). Integrated power sector master plan for Ghana: volume 2 – main report. Accra: Energy Commission. Available online at: https://www.energycom.gov.gh/index.php/planning/ipsmp-data.

Energy Commission (2024). National Energy Statistical Bulletin. Accra: Energy Commission. Available online at: https://www.energycom.gov.gh/index.php/planning/energy-statistics?download=641%3A2024-energy-statistics.

European Investment Bank (2018). Energy finance in sub-saharan Africa. Luxembourg: European Investment Bank.

Farhadi, M., and Mohammed, O. (2016). Energy storage technologies for high-power applications. IEEE Trans. Industry Appl. 52 (3), 1953–1961. doi:10.1109/TIA.2015.2511096

Feng, Y., Wang, S., Sha, Y., Ding, Q., Yuan, J., and Guo, X. (2018). Coal power overcapacity in China: province-Level estimates and policy implications. Resour. Conservation Recycl. 137, 89–100. doi:10.1016/J.RESCONREC.2018.05.019

Genoese, F., Egenhofer, C., Hogan, M., Redl, C., Steigenberger, M., Graichen, P., et al. (2015). The future of the European power market. Intereconomics 50 (4), 176–197. doi:10.1007/s10272-015-0541-3

Hach, D., and Spinler, S. (2016). Capacity payment impact on gas-fired generation investments under rising renewable feed-in - a real options analysis. Energy Econ. 53, 270–280. doi:10.1016/j.eneco.2014.04.022

Hawker, G., Bell, K., and Gill, S. (2017). Electricity security in the European union—the conflict between national capacity mechanisms and the single market. Energy Res. Soc. Sci. 24, 51–58. doi:10.1016/j.erss.2016.12.009

Hong, T., Pinson, P., Wang, Y., Weron, R., Yang, D., and Zareipour, H. (2020). Energy forecasting: a review and outlook. IEEE Open Access J. Power Energy 7 (Xx), 376–388. doi:10.1109/OAJPE.2020.3029979

Hu, H., Tang, P., Zhu, Y., Hu, D., and Wu, Y. (2020). The impact of policy intensity on overcapacity in low-carbon energy industry: evidence from photovoltaic firms. Front. Energy Res. 8 (September), 1–13. doi:10.3389/fenrg.2020.577515

Hyndman, R. J., and Fan, S. (2010). Density forecasting for long-term peak electricity demand. IEEE Trans. Power Syst. 25 (2), 1142–1153. doi:10.1109/TPWRS.2009.2036017

IEA (2019). Africa energy outlook 2019. Paris: IEA. Available online at: https://www.iea.org/reports/africa-energy-outlook-2019, Licence: CC BY 4.0.

IEA (2023). Financing clean energy in Africa. Paris: IEA. Available online at: https://www.iea.org/reports/financing-clean-energy-in-africa, Licence: CC BY 4.0.

IEA (2024a). Clean energy investment for development in Africa, Paris. Available online at: https://www.iea.org/reports/clean-energy-investment-for-development-in-africa.

IEA (2024b). World energy investment 2024. Paris: IEA. Available online at: https://www.iea.org/reports/world-energy-investment-2024, Licence: CC BY 4.0.

Imam, M. I., Jamasb, T., and Llorca, M. (2020). Political economy of reform and regulation in the electricity sector of sub-saharan Africa. Department of Economics. Copenhagen Business School.

International Renewable Energy Agency (IRENA) (2021). Sector coupling in facilitating integration of variable renewable energy in cities. Available online at: https://www.irena.org/publications/2021/Oct/Sector-Coupling-in-Cities.

IRENA (2018). Power system flexibility for the energy transition. Abu Dhabi: IRENA. Available online at: https://www.irena.org/publications/2018/Nov/Power-system-flexibility-for-the-energy-transition.

IRENA (2025). Renewable Capacity Statistics 2023, Renewable capacity statistics 2025. Available online at: www.irena.org.

Javadi, M. S., Nezhad, A. E., Shafie-khah, M., Siano, P., and Catalão, J. P. (2019). Assessing the benefits of capacity payment, feed-in-tariff and time-of-use programme on long-term renewable energy sources integration. IET Smart Grid 2 (4), 602–611. doi:10.1049/iet-stg.2018.0298

Jennifer, E., and Leisch, N. L. (2018). Transmission planning studies for the renewable energy Zone (REZ) process HOW CAN WE SUPPLY LOAD. Colorado, United States: National Renewable Energy Laboratory, 1–4.

Kandil, M. S., El-Debeiky, S. M., and Hasanien, N. E. (2008). Long-term load forecasting for fast-developing utility using a knowledge-based expert system. IEEE Power Eng. Rev. 22 (4), 78. doi:10.1109/mper.2002.4312144

Karekezi, S., and Kimani, J. (2002). Status of power sector reform in Africa: impact on the poor. Energy Policy 30 (11), 923–945. doi:10.1016/S0301-4215(02)00048-4

Kessides, I. N. (2020). The decline and fall of eksom: a South African tragedy. Glob. Warming Policy Found. Rep.

Komorowska, A., Benalcazar, P., Kaszyński, P., and Kamiński, J. (2020). Economic consequences of a capacity market implementation: the case of Poland. Energy Policy 144, 111683. doi:10.1016/j.enpol.2020.111683

Koohi-Fayegh, S., and Rosen, M. A. (2020). A review of energy storage types, applications and recent developments. J. Energy Storage 27 (October 2019), 101047. doi:10.1016/j.est.2019.101047

Kozlova, M., Huhta, K., and Lohrmann, A. (2023). The interface between support schemes for renewable energy and security of supply: reviewing capacity mechanisms and support schemes for renewable energy in Europe. Energy Policy 181 (April), 113707. doi:10.1016/j.enpol.2023.113707

Lakmeeharan, K., Manji, Q., Nyairo, R., and Poeltner, H. (2020). Solving Africa’s infrastructure paradox. New York: McKinsey & Company. Available online at: https://www.mckinsey.com/industries/infrastructure/our-insights/solving-africas-infrastructure-paradox.

Lavers, T., Terrefe, B., and Gebresenbet, F. (2021). Powering development: the political economy of electricity generation in the EPRDF’s Ethiopia. SSRN Electron. J., 1–34. doi:10.2139/ssrn.4011274

Lawder, M. T., Suthar, B., Northrop, P. W. C., De, S., Hoff, C. M., Leitermann, O., et al. (2014). Battery energy storage system (BESS) and battery management system (BMS) for grid-scale applications. Proc. IEEE 102 (6), 1014–1030. doi:10.1109/JPROC.2014.2317451

Lee, A. D., and Usman, Z. (2018). Taking stock of the political economy of power sector reforms in developing countries: a literature review taking Stock of the political Economy of power sector Reforms in developing countries: a literature review [preprint]. World Bank Policy Research Working Paper No. 8518. Available online at: https://ssrn.com/abstract=3238358.

Lee, N. (2018). Renewable energy Zone (REZ) transmission planning process. Available online at: https://www.osti.gov/biblio/1426064.

Lin, J., Kahrl, F., and Liu, X. (2018). A regional analysis of excess capacity in China’s power systems. Resour. Conservation Recycl. 129, 93–101. doi:10.1016/j.resconrec.2017.10.009

Liu, D., Zhang, S., Cheng, H., Liu, L., Zhang, J., and Zhang, X. (2021). Reducing wind power curtailment by risk-based transmission expansion planning. Int. J. Electr. Power Energy Syst. 124 (July 2020), 106349. doi:10.1016/j.ijepes.2020.106349

Lund, H., and Münster, E. (2003). Management of surplus electricity-production from a fluctuating renewable-energy source. Appl. Energy 76 (1–3), 65–74. doi:10.1016/S0306-2619(03)00048-5

McCluskey, A., Strzepek, K. M., and Rose, A. (2022). Electricity trade impacts on regional power pools in Sub-Saharan Africa. Renew. Energy Focus 41, 33–54. doi:10.1016/j.ref.2022.01.001

Mehedi, H., and Ali, I. (2021). The power sector of Bangladesh 2021_Excess capacity and capacity charge is weighing down the Bangladesh economy. Available online at: https://bwged.blogspot.com.

Ming, Z., Ping, Z., Shunkun, Y., and Hui, L. (2017). Overall review of the overcapacity situation of China’s thermal power industry: status quo, policy analysis and suggestions. Renew. Sustain. Energy Rev. 76, 768–774. doi:10.1016/j.rser.2017.03.084

Mitchell, J., Teixeira, A., Doig, S., Glick, D., Henly, C., and Wang-Thomas, S. (2019). Creating a profitable balance capturing the $110 billion Africa power-sector opportunity with planning. Boulder: Rocky Mountain Institute. Available online at: https://rmi.org/wp-content/uploads/2018/05/seed_supply_imbalance.pdf.

Mondal, M. A. H., Bryan, E., Ringler, C., and Rosegrant, M. (2017). Ethiopian power sector development: renewable based universal electricity access and export strategies. Renew. Sustain. Energy Rev. 75, 11–20. doi:10.1016/j.rser.2016.10.041

Moret, S., Babonneau, F., Bierlaire, M., and Maréchal, F. (2020). Overcapacity in European power systems: analysis and robust optimization approach. Appl. Energy 259, 113970. doi:10.1016/j.apenergy.2019.113970

National Energy Regulator of South Africa (NERSA) (2022). Report on Monitoring of Renewable Energy Performance of Power Plants – Progress of Performance up to 2021 – Issue 19 – March 2022. Pretoria: NERSA. Available online at: https://www.nersa.org.za/report-on-monitoring-of-renewable-energy-performance-of-power-plants-progress-of-performance-up-to-2021-issue-19-march-2022/.

North American Electric Reliability Corporation (2018) NERC (2018). Report title | report date I generation retirement scenario special reliability assessment. Available online at: https://www.nerc.com/news/Pages/Scenario-Highlights-Potential-Risks-from-Accelerated-Retirements;-Urges-Risk-Informed-Planning,-Review-of-Existing-Tools-.aspx.

Odetayo, B., and Walsh, M. (2021). A policy perspective for an integrated regional power pool within the Africa Continental Free Trade Area. Energy Policy 156, 112436. doi:10.1016/j.enpol.2021.112436

Ogunleye, E. K. (2017). “Political economy of nigerian power sector reform,” in The Political Economy of Clean Energy Transitions. Editors D. Arent, C. Arndt, M. Miller, F. Tarp, and O. Zinaman (Oxford). doi:10.1093/oso/9780198802242.003.0020

Ortega-Arriaga, P., Babacan, O., Nelson, J., and Gambhir, A. (2021). “Grid versus off-grid electricity access options: a review on the economic and environmental impacts,” in Renewable and sustainable energy reviews (Elsevier Ltd). doi:10.1016/j.rser.2021.110864

Papadopoulos, R. (1981). Communications on energy. Energy Policy 9 (2), 153–155.doi:10.1016/0301-4215(81)90178-6

Pedersen, R. H., Winckler Andersen, O., and Nøhr, H. (2020). Trends in development assistance to new nenewable energy in sub-Saharan Africa. Available online at: www.diis.dk.

Power Africa (2014). Understanding power transmission financing. Understanding Power Purchase Agreements, version 1.3. Washington, DC: Power Africa. Available online at: https://ppp.worldbank.org/sites/default/files/2024-09/Africa_Understanding_Power_Purchase_Agreements_0.pdf.

Power Africa (2018). Power Africa transmission roadmap to 2030: a practical approach to unlocking electricity trade. Washington, D.C.: USAID.

Rasmus Hundsbæk, P., Ole, W. A., and Ilse, R. (2021). The political economy of energy transitions in sub-saharan Africa: contributions to an analytical framework. Copenhagen: Danish Institute for International Studies (DIIS).

Ren, M., Branstetter, L. G., Kovak, B. K., Armanios, D. E., and Yuan, J. (2021). Why has China overinvested in coal power?. Energy J. 42 (2), 113–134. doi:10.5547/01956574.42.2.mren

Río, P. D., and Janeiro, L. (2016). Overcapacity as a barrier to renewable energy deployment: the Spanish case. J. Energy 2016, 1–10. doi:10.1155/2016/8510527

Sanaye, S., and Shirazi, A. (2013). Thermo-economic optimization of an ice thermal energy storage system for air-conditioning applications. Energy Build. 60, 100–109. doi:10.1016/j.enbuild.2012.12.040

Seel, J., Millstein, D., Mills, A., Bolinger, M., and Wiser, R. (2021). Plentiful electricity turns wholesale prices negative. Adv. Appl. Energy 4 (October), 100073. doi:10.1016/j.adapen.2021.100073

Simone, T., and Bazilian, M. (2019). The role of international institutions in fostering sub-Saharan Africa’s electrification. Electr. J. 32 (2), 13–20. doi:10.1016/j.tej.2019.01.016

Simon Nicholas, S. J. A. (2020). ‘Bangladesh power review’. Cleveland, OH: Institute for energy Economics and financial analysis, 1–19.

Son, Y. G., Oh, B. C., Acquah, M. A., Fan, R., Kim, D. M., and Kim, S. Y. (2021). Multi energy system with an associated energy hub: a review. IEEE Access 9, 127753–127766. doi:10.1109/ACCESS.2021.3108142

Spyrou, E., Ho, J. L., Hobbs, B. F., Johnson, R. M., and McCalley, J. D. (2017). What are the benefits of Co-optimizing transmission and generation investment? Eastern interconnection case study. IEEE Trans. Power Syst. 32 (6), 4265–4277. doi:10.1109/TPWRS.2017.2660249

Tagliapietra, S., and Tagliapietra, S. (2017). Electrifying Africa: how to make Europe’s contribution count Executive summary. Available online at: https://www.econstor.eu/bitstream/10419/173113/1/PC-17-2017.pdf.

The World Bank (2024). Private participation in infrastructure (PPI) database. Washington, D.C.: World Bank Group. Available online at: https://ppi.worldbank.org/en/ppi (Accessed October 1, 2024).

UNECA (2018). Energy crisis in Southern Africa: future prospects. Addis Ababa. Available online at: https://archive.uneca.org/sites/default/files/PublicationFiles/energy_crisis_in_southern_africa_future_prospects_final.pdf.

UN.ESCAP (2020). Regional power grid connectivity for sustainable development in North-East Asia: policies and strategies. Available online at: https://hdl.handle.net/20.500.12870/3007.

United Nations (2006). Multi dimensional issues in international electric power grid interconnections. New York, United States: United Nations Publication, 15–49. Available online at: https://sustainabledevelopment.un.org/content/documents/interconnections.pdf.

USAID and Power Africa (2018). Power Africa transmission roadmap. Available online at: https://www.usaid.gov/sites/default/files/documents/1860/PA_Transmission_Roadmap_508.pdf.

US Department of Energy (2020). Electricity storage technology review prepared for U.S. Washington, D.C.: US Department of Energy, 2020. Available online at: https://www.energy.gov/sites/default/files/2020/10/f79/ElectricityStorageTechnologiesReport.pdf.

Wang, C., Dong, S., Xu, S., Yang, M., He, S., and Dong, X. (2019). Impact of power-to-gas cost characteristics on power-gas-heating integrated system scheduling. IEEE Access 7, 17654–17662. doi:10.1109/ACCESS.2019.2894866

Wang, D., Xue, X., and Wang, Y. (2021). Overcapacity risk of China’s coal power industry: a comprehensive assessment and driving factors. Sustain. Switz. 13 (3), 1426–1523. doi:10.3390/su13031426

Wang, L. (2017). Causes of and solutions to overcapacity in the new energy industry: taking wind energy and solar energy as examples. Chin. J. Urban Environ. Stud. 05 (01), 1750005. doi:10.1142/S2345748117500051

Wilson, J. (2020). Over-procurement of generating capacity in PJM: causes and consequences. New York, United States: Natural Resources Defense Council. [Preprint].

World Bank (2017). Linking up: public-private partnerships in power transmission in Africa (French). Washington, D.C.: World Bank Group. Available online at: http://hdl.handle.net/10986/27807.

World Bank Group (2011). Linking up: public-private partnerships in power transmission in Africa (French). Washington, D.C.: World Bank Group. Available online at: http://documents.worldbank.org/curated/en/732991514396573906.

Wu, C., and Zhang, X. P. (2018). Economic analysis of energy interconnection between Europe and China with 100% renewable energy generation. Glob. Energy Interconnect. 1 (5), 528–536. doi:10.14171/j.2096-5117.gei.2018.05.001

Wu, C., Zhang, X. P., and Sterling, M. J. H. (2021). Economic analysis of power grid interconnections among Europe, North-East Asia, and North America with 100% renewable energy generation. IEEE Open Access J. Power Energy 8 (January), 268–280. doi:10.1109/OAJPE.2021.3085776

Xiong, Y., and Yang, X. (2016). Government subsidies for the Chinese photovoltaic industry. Energy Policy 99 (September), 111–119. doi:10.1016/j.enpol.2016.09.013

Yang, M., Patiño-Echeverri, D., and Yang, F. (2012). Wind power generation in China: understanding the mismatch between capacity and generation. Renew. Energy 41, 145–151. doi:10.1016/j.renene.2011.10.013

Ye, Q., Jiaqi, L., and Mengye, Z. (2018). Wind curtailment in China and lessons from the United States wind curtailment in China and lessons from the United States. China’s Energy Transition Ser. Available online at: https://www.brookings.edu/wp-content/uploads/2018/03/wind-curtailment-in-china-and-lessons-from-the-united-states.pdf.

Yu, S., Lu, T., Hu, X., Liu, L., and Wei, Y. M. (2021). Determinants of overcapacity in China’s renewable energy industry: evidence from wind, photovoltaic, and biomass energy enterprises. Energy Econ. 97, 105056. doi:10.1016/j.eneco.2020.105056

Yuan, J., Li, P., Wang, Y., Liu, Q., Shen, X., Zhang, K., et al. (2016). Coal power overcapacity and investment bubble in China during 2015–2020. Energy Policy 97 (2016), 136–144. doi:10.1016/j.enpol.2016.07.009

Zhang, H., Zheng, Y., Ozturk, U. A., and Li, S. (2016). The impact of subsidies on overcapacity: a comparison of wind and solar energy companies in China. Energy 94, 821–827. doi:10.1016/j.energy.2015.11.054

Zhang, L., Ruan, J., and Ding, J. (2014). The institutional power shortage in China: capacity shortage or capacity under-utilisation?. Appl. Energy 136, 480–494. doi:10.1016/j.apenergy.2014.08.106

Keywords: sub-Sahara Africa, power generation, gird infrastructure, energy policy, power purchase agreement

Citation: Ndayishimiye V, Bakkabulindi G, Miyingo EW and Nibagwire D (2025) Power generation overcapacity in selected sub-Saharan African countries: political-economic drivers and grid infrastructure challenges. Front. Energy Res. 13:1549844. doi: 10.3389/fenrg.2025.1549844

Received: 22 December 2024; Accepted: 29 April 2025;

Published: 22 May 2025.

Edited by:

Claudio A. Agostini, Adolfo Ibáñez University, ChileReviewed by:

Azam Ghezelbash, Pukyong National University, Republic of KoreaAhmed Rashed, Economics Lecturer Department of Economics and Foreign Trade Faculty of Commerce and Business Administration Helwan University Cairo, Egypt

Copyright © 2025 Ndayishimiye, Bakkabulindi, Miyingo and Nibagwire. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Vedaste Ndayishimiye, dmVkYXN0ZS5uZGF5aXNoaW1peWUyOUBzdHVkZW50cy5tYWsuYWMudWc=, dmVkYXN0ZW5kYXlpc2hpbWl5ZUB5YWhvby5jb20=

Vedaste Ndayishimiye

Vedaste Ndayishimiye Geofrey Bakkabulindi1

Geofrey Bakkabulindi1 Deborah Nibagwire

Deborah Nibagwire