- 1Business School, Beijing Technology and Business University, Beijing, China

- 2School of Economics and Management, China University of Labor Relations, Beijing, China

Based on the panel data of China’s A-share non-financial listed enterprises from 2011 to 2020, we empirically explore whether EGS performance can significantly promote corporate value and how to promote it, from the stakeholders’ perspective. We find that: 1) ESG performance significantly improves corporate value. 2) Both media attention and analyst coverage play an intermediary role in the impact of ESG performance on corporate value. 3) Further analysis of the single dimension of ESG illustrates that Environmental (E) and Social (S) have a positive impact on corporate value, but the effect size of Social (S) is smaller, and there is no evidence for a significant relationship between Governance (G) and corporate value. 4) The heterogeneity analysis shows that ESG performance of non-heavily polluting enterprises has a significant positive effect on corporate value, but not on heavily polluting enterprises. Meanwhile, ESG performance of enterprises with a low percentage of institutional investor ownership has a significant positive effect on corporate value, but not with a high percentage. Overall, our study shows that high-quality ESG performance triggers the attention of media and analysts, which in turn promotes corporate value by raising stakeholder pressure. We also analyze the possible causes of heterogeneous results from the perspective of stakeholders, and put forward reasonable suggestions to promote ESG performance and corporate value, as well as protect the interests of stakeholders.

1 Introduction

With the prominence of environmental issues and the rise of the sustainable development concept, the public has become increasingly concerned about the enterprises’ non-financial information, and the rapid development of the Network Era has led to an exponential increase in information transmission speed. Non-financial information disclosure represented by ESG fully considers the rights and interests of the public and is more likely to be favored by stakeholders, which is conducive to the long-term sustainable development of the enterprise and the whole society. In this context, ESG-related issues have become a research hotspot. The concept of ESG originated from ethical investment and responsible investment (Michelson et al., 2004) and it was formally proposed by the United Nations Principles for Responsible Investment (UN-PRI) in 2006. ESG, which stands for Environmental, Social and Governance, aims to comprehensively consider corporate performance from all three dimensions, not just corporate financial performance, and has a great impact on the investment philosophy of investors. Since the United Nations proposed the Sustainable Development Goals (SDG) in 2015, countries have started to introduce ESG-related policies and regulations to promote the development of ESG in their countries, and the ESG concept has developed rapidly worldwide.

As a large energy-consuming country with a huge market volume, China has early attached great importance to sustainable development and green development, although its ESG development is slightly later than developed countries such as Europe and America. For example, the Chinese government has proposed the concept of “Clear waters and green mountains are as valuable as mountains of gold and silver,” which profoundly reveals the dialectical unity relationship between development and protection, and realizes the enrichment and development of Marxist productivity theory. In 2020, China clearly proposed the goals of “carbon peak” by 2030 and “carbon neutral” by 2060 at the United Nations General Assembly. Driven by the “dual carbon” goal, the Ministry of Ecology and Environment successively issued the Reform Plan of Environmental Information Disclosure System According to Law and the Guidelines on the Format of Legal Disclosure of Corporate Environmental Information (Ministry of Ecology and Environment of the People’s Republic of China, 2021; Ministry of Ecology and Environment of the People’s Republic of China, 2022). The Chinese government has clearly put forward the requirements for enterprises to accelerate ESG construction and promote the development of China’s ESG system. Moreover, affected by the low-carbon city pilot policy in China under the “dual carbon” goal, enterprises will achieve the emission reduction goal by improving their green innovation capabilities (Zheng et al., 2021; Wang J. et al., 2022), and promoting the upgrading of the enterprise labor structure (Sun et al., 2022). In this context, improving ESG performance has become a new motivation for corporate green innovation and an important means to attract talent. In addition, China is in the stage of rapid economic development, and some enterprises in China have an imbalance of over-emphasis on financial performance, leading to conflicts of interest with stakeholders. In September 2018, the China Securities Regulatory Commission (CSRC) revised the Code of Corporate Governance for Listed Companies (China Securities Regulatory Commission, 2018), formulated the basic framework for ESG information disclosure, and required enterprises to pay attention to the demands of stakeholders and actively fulfill relevant responsibilities. With the rise of the concept of “responsible investment”, the CSRC issued the Working Guidelines for the Relationship Between Listed Companies and Investors (China Securities Regulatory Commission, 2022) in April 2022, proposing that listed enterprises should involve ESG information in their information disclosure, emphasizing the information transmission function of ESG, and also reflecting the potential value effect of ESG performance.

Compared with the Hong Kong Stock Exchange, which has implemented a semi-mandatory disclosure mode of “disclosure or explanation” since 2016, the Shanghai Stock Exchange and Shenzhen Stock Exchange are still in a voluntary disclosure state. According to the China ESG Development Report 2021 (Wang D et al., 2022), 1,130 listed enterprises in the A-share market disclosed ESG-related information in 2021, accounting for 26.9%. Under this background, what kind of feedback will enterprises receive on their ESG performance? In addition to considering the incentive effect of macro policies and the pressure effect of the regulatory system, it is also necessary to explore the motivation of ESG engagement from the perspective of enterprises. Based on the above situation, the questions of whether enterprises can obtain economic benefits and improve sustainability from high-quality ESG performance and whether ESG performance has an impact on corporate value require an analysis. Moreover, what is the mechanism between ESG performance and corporate value? Researchers have not yet reached clear and comprehensive conclusions on these issues. Therefore, this paper adopts Bloomberg ESG scores data to measure enterprises’ ESG performance, which covers three-dimensional evaluation indicators. From the stakeholder perspective, we use the intermediary effect model to empirically analyze the intermediary impact of media attention and analyst coverage between ESG performance and corporate value. In addition, we further analyze the impact of the single dimension of ESG on corporate value and discuss the heterogeneity of the impact according to pollution degree and institutional investor ownership to supplement and expand relevant research.

There are three main innovations in this study. 1) The paper analyzes the impact of ESG performance on corporate value from the perspective of stakeholders, discusses the positive feedback effects and ways of different stakeholders, and comprehensively analyzes the channels of ESG performance indirectly promoting corporate value. 2) The study further uses the mediating effect model to test the mediation effect of media attention and analyst coverage, compares the positive feedback effects of different stakeholders on ESG performance under the two mechanisms, and broadens the path of relevant research. 3) In the study of Chinese A-share listed enterprises, we use the ESG rating data from Bloomberg database, which covers more enterprises with longer rating years and contains three single dimensions of ESG. We further use the single-dimension indicators of ESG to analyze the impact of different dimensions, complementing the shortcomings of previous literature that only studied ESG at a comprehensive or single level.

The paper is structured as follows: Section “Literature Review and Research Gap” organizes the literature on the effect of ESG performance and its single dimensions on corporate value, the correlational study based on the Stakeholders’ Perspective, the effect of media attention and analyst coverage on ESG performance and corporate value, and then summarizes the research gaps. Section “Theoretical Analysis and Hypotheses Development” provides the theoretical basis and hypotheses. Section “Research Design” introduces the sample, model, variables, and descriptive statistics. Section “Empirical results” presents the benchmark regression, mediating effect analysis and further analysis, and discusses the empirical results. Section “Conclusions and Recommendations” concludes the paper and addresses the relevant recommendations.

2 Literature review and research gap

2.1 ESG performance and corporate value

Research on the impact of ESG performance and corporate value is still in its infancy in China, but a large number of studies have been conducted abroad, and many scholars have suggested a positive relationship between ESG performance and corporate value (Aboud and Diab, 2018; Yen-Yen, 2019; Alareeni and Hamdan, 2020; Behl et al., 2021). Many scholars believe that good ESG performance can improve corporate value by alleviating financing constraints and reducing corporate financing costs. Wong et al. (2021) find that ESG certification reduces corporate cost of capital and leads to a significant increase in Tobin’s Q, and the equity markets are more receptive to ESG ratings of enterprises than debt markets. Feng and Wu (2021) discover that enterprise with a higher level of ESG disclosure also tends to have lower cost of debt, higher credit ratings, and higher ratios of unsecured debt to total debt. Some scholars have also studied the related issues in the direction of enhancing the competitive advantage of enterprises (Jasni et al., 2019; Mohammad and Wasiuzzaman, 2021). With the increasingly fierce competition in the industry, it is difficult to maintain the competitive advantage by products and technologies alone. Good ESG performance can be supported by multiple stakeholders, creating a competitive advantage that is difficult to imitate and thus improving corporate value. In addition, high-quality ESG reports produced by enterprises may improve the credibility of the reports among stakeholders, which enhances corporate reputation (Odriozola and Baraibar-Diez, 2017). A good corporate reputation can reduce the transaction and production costs of enterprises in market competition, and improve corporate value by positively affecting financial performance (Javed et al., 2020).

However, some scholars remain skeptical, arguing that ESG performance has no significant impact on corporate value (Verheyden et al., 2016; Atan et al., 2018) or has a negative impact. According to the theory of neoclassical economics, ESG-related investments with strong externalities do not bring much economic benefit to enterprises, and sometimes even give negative signals to investors that the enterprise has over-invested resources in ESG and ignores its own core competitiveness, which will lead to the poor performance in the market (Wang X et al., 2022). Due to the early inadequate regulatory policies and regulations, some enterprises’ large equipment and core technologies create liability problems such as excessive carbon emissions, noise pollution, and waste of resources. ESG engagement leads to high switching costs and capital investment to alleviate these problems, thus damaging the economic interests of companies (Rassier and Earnhart, 2010). Reimann et al. (2012) believes that enterprises have to make actions such as hiring external auditors and adjusting their organizational structure in order to meet the relevant needs of stakeholders when considering ESG performance, and the high expenses incurred during this period also affect the corporate value. Moreover, ESG ratings may become a tool for self-interest, making the ESG engagement more of a formalistic behavior that is apparently complying with the relevant regulations but is actually used for personal gain (Duque-Grisales and Aguilera-Caracuel, 2021).

2.2 Single dimension of ESG on corporate value

ESG research starts from ESG single dimension. On the influence of a single dimension of ESG, there is still no consensus in academics. The prior literature concentrates on heavily polluting sectors with significant environmental issues and conducts research in the Environmental (E) dimension from the perspectives of information disclosure quality, environmental performance, and environmental regulation. Scholars have different research results. Jiang and Fu (2019) investigate the factors that affect an enterprise’s environmental performance and how they enhance its value from the stakeholders’ perspective. Bukit and Nurlaila (2019) find that while environmental performance has a positive impact on voluntary disclosure, corporate value is not increased, and voluntary disclosure has no bearing on the relationship between environmental information disclosure and corporate value. According to several researchers, the relationship between environmental information disclosure and corporate value is “U” shaped for this phenomenon when looking at the timeliness of environmental performance. Additionally, the quality of management and environmental oversight will influence the connection between corporate value and environmental responsibility (Cheng and Liu, 2022). A structural equation model is used by Wang et al. (2020) to examine the relationship between environmental information disclosure, environmental cost, and business value. The environmental cost is strongly inversely connected with business value, while environmental information disclosure is significantly positively correlated with corporate value, according to the study. Environmental information disclosure can effectively reduce the negative correlation between environmental cost and corporate value. On the Social (S) dimension, academics have always maintained a high degree of enthusiasm in the research of the CSR concept, and there have been many research results about the impact of Social (S) dimension on corporate value. Some academics think that corporate social responsibility will not significantly affect business value (Okafor et al., 2021; Amerta and Soenarno, 2022). When analyzing 386 businesses in India’s BSE500 index, Fahad and Showkat (2021) discover that corporate social responsibility disclosure had a negative influence on corporate profitability and corporate value, mostly because of the impact of environmental and social disclosure ratings. On the Governance (G) dimension, the board structure is typically used by scholars to examine corporate governance performance. Onguka et al. (2020) discover that the size of the board of directors is highly correlated with business value, and there is also a considerable positive association between corporate governance and corporate value. The main factor enhancing corporate value is corporate governance. On the other hand, Ergene and Karadeniz (2021) reach the opposite conclusion, claiming that corporate governance has little bearing on corporate value and there is a negative relationship between corporate value and corporate size. The proportion of women on the board of directors, in addition to its size and independence, will affect the corporate value (Khanh et al., 2020).

2.3 ESG performance and corporate value based on the stakeholders’ perspective

Based on the stakeholder theory, enterprises and stakeholders form a close “community of destiny” (Casciaro and Piskorski, 2005). The sustainable development of enterprises is based on the satisfaction of stakeholders’ demands and the protection of stakeholders’ interests. In this context, high-quality ESG performance has become an important communication medium between enterprises and stakeholders. What kind of feedback from stakeholders on such positive communication has attracted the attention of scholars. For consumers, Bardos et al. (2020) discover that customers may pay more attention to non-financial information of the enterprise than other stakeholders, who contend that actively upholding ESG performance can create a product advantage, improve product market perception, reduce consumer price sensitivity, and enhance corporate value. For creditors, they are usually willing to give enterprises with good ESG performance higher credit ratings and lower debt interest rates (Di Tommaso and Thornton, 2020). When assessing the solvency of enterprises, they will refer to the ESG performance which can represent the sustainable development ability of enterprises, and allows creditors to minimize the risk of failure to recover funds on time. For investors, with the rise of the “green investment” concept, ESG score is an important basis for investors to evaluate the sustainable development ability of enterprises, and plays an increasingly important role in investment decisions. Investors prefer enterprises with high ESG scores (Wang and Yang, 2022). Moreover, Serafeim and Yoon (2022) find that ESG score can predict future news, and investors are less sensitive to negative news from high-quality ESG companies, reducing market reaction and stock price volatility. For government departments, the state has introduced a series of preferential and punishment policies to call on and encourage ESG behaviors. Enterprises can strengthen political ties and obtain government support and subsidies through active ESG participation. In particular, it can also achieve effective communication between enterprises and government regulators, reduce the losses from potential environmental litigation and punishment, and reduce the operational risk of enterprises (Tang et al., 2021). For suppliers, Baumgartner et al. (2020) find that good ESG performance can enhance the bargaining power of enterprises. They tend to cooperate with enterprises with high ESG scores in a long time. They believe that enterprises with high ESG scores have low default risk and benefit from a good corporate image of partners. For employees, the positive ESG practice of enterprises can first directly improve the wages and benefits of employees, focus on employee skills training and health security problems, and provide a better working environment, which can largely avoid negative behaviors and turnover intentions of employees, improve work enthusiasm and attract better employees (Hui, 2021). Moreover, the corporate image shaped by good ESG performance can stimulate employees’ pride in their work and identification with enterprises, and increase their happiness (Li et al., 2020; Bocean et al., 2022), while higher employee identification and satisfaction contribute to the improvement of work efficiency and performance, which indirectly increases corporate value (Wang and Luo., 2013). For management, high-quality corporate ESG performance can also affect managers’ own reputation and salary levels. However, some studies (Burke, 2021; Liu et al., 2022) find that when the ESG performance is included in management’s performance appraisal, if the performance is poor, management will be questioned and pressured by shareholders, affecting their career development and even forced to leave, which will lead management to focus excessively on ESG performance and engage in short-sighted behavior that will harm the overall interests of the enterprise.

2.4 ESG performance, media attention and corporate value

Many studies show that media attention is more like a “double-edged sword”, magnifying the impact of good or bad ESG performance on corporate value. Wong and Zhang (2022) discover that the media’s coverage of ESG-related bad news has a significant negative influence on corporate valuation when examining the relationship between the corporate reputation risk (CRR) and the performance of its stock. The stock performance of businesses in the gaming, cigarette, and alcohol industries is not susceptible to unfavorable ESG reports, according to further industry data. Frost et al. (2022) discover that media coverage of corporate social irresponsibility is inversely correlated with corporate value. Furthermore, it is discovered that businesses with long-term positioning and those in countries with great demand for social responsibility activities are more significantly affected by this negative connection impact. Nur (2021) studies the impact of social media on the value of oil and gas firms, and finds that corporate social media has a positive impact on corporate value, but positive emotions on social media have no impact on the value of oil and gas firms. Using extensive media data from 41 nations between 2000 and 2010, Dang et al. (2021) discover that media coverage has a positive correlation with business value and contributes by lowering information asymmetry and playing a regulatory role. The market worth of the corporate stock will be impacted, in the opinion of Lopez-Tenorio and Romero (2020), by investors’ incorporation of the appraisal of advertising decisions into stock prices. The research results demonstrate that the influence of advertising expenditure varies on various media businesses. It is further discovered that the only way to raise corporate value is to report brand information through particular media.

2.5 ESG performance, analyst coverage and corporate value

In terms of analyst coverage, scholars generally agree that analyst coverage can influence enterprise financial data, and research focuses on the accuracy of analyst forecasts and analyses under different conditions and financial objects. Eckerle et al. (2020) introduce ESG performance into quarterly earnings forecasts, and then analyze the reasons why investor discussions on the expected impact of ESG information on long-term profitability and long-term strategy still lag and suggest practical methods that provide great value to analysts. Goh et al. (2019) study the relationship between intellectual property, financial performance and information environment based on the prediction behavior of financial analysts. The research results demonstrate that patent citation has a stronger correlation with profitability than patent volume, and financial analysts are more attentive to patent citation indicators. However, the study discover that analysts’ projections did not accurately account for the effect of patent citation on future profitability. According to Aouadi and Marsat (2018), ESG disagreements are associated with higher corporate value. Further sample segmentation analysis reveals that the benefit of higher corporate social performance on market value is restricted to businesses receiving significant analyst coverage. Luo et al. (2010) find that positive changes in customer satisfaction improve analysts’ evaluation recommendations, and the effect will be more significant when the market competition is fierce and the financial market has greater uncertainty. Further research finds that analyst recommendations are a mechanism for customer satisfaction to affect corporate value, and those analyst recommendations mediate the effect of changes in satisfaction on corporate excess return, systematic risk, and unsystematic risk. In their study on ESG performance and analyst coverage, Hai et al. (2022) find that ESG information disclosure has greatly increased investment efficiency and is more prevalent among group affiliates and high-level pyramid member enterprises. The study further groups the analyst coverage and industry external financing dependency, indicating that ESG disclosure has a bigger role in improving corporate investment efficiency whether the analyst coverage is lower or the industry external financing dependence is larger.

2.6 Literature gap

From the previous literature review, it can be found that a large number of scholars have investigated the impact and mechanism of ESG performance on corporate value, yet the majority of the literature merely evaluates comprehensive ESG performance. Due to the complexity of ESG indicators, there is relatively little literature that makes an in-depth analysis of the segmentation indicators of ESG performance. In addition, the majority of research focuses on financing issues, corporate reputation, and competitive advantages. Few studies examine the relationship between ESG performance and corporate value from the stakeholders’ perspective and further consider the mechanism of media attention and analyst coverage. Overall, the research on the impact and path of ESG performance on corporate value is still relatively insufficient. This paper will supplement research on the effect of ESG performance from the stakeholders’ perspective.

3 Theoretical analysis and hypotheses development

3.1 Basic hypothesis

Many enterprises believe that their ESG engagement will inevitably lead to huge costs in various dimensions, and it seems to conflict with corporate goals such as maximizing shareholder value, and sending negative signals to investors (Wang X. et al., 2022), which often leads to inactive ESG engagement. Therefore, more in-depth analyses will help better understand ESG engagement. According to stakeholder theory, on the one hand, enterprises are closely linked with stakeholders, not just the shareholders. Corporate goals such as maximizing shareholder value are achieved by considering the interests of stakeholders, and it is necessary to meet stakeholders’ demands. Moreover, short-sighted behavior that overemphasizes shareholder primacy and ignores stakeholders’ interests can harm enterprises’ efficient and effective operations, board decision-making is beneficial to the enterprise in the short term, but it often sacrifices long-term value (Aluchna et al., 2022). On the other hand, Stakeholders have positive beliefs in the enterprise with good ESG performance, which positively influences their corporate value. The high-quality ESG performance of the enterprise will cause positive feedback from various stakeholders, such as generating positive market reactions, increasing product price elasticity, reducing loan interest rates, and obtaining tax and subsidy preferences (Bardos et al., 2020; Feng and Wu, 2021; Wang and Yang, 2022). This positive feedback from stakeholders has an indirect and long-term effect on corporate value. Therefore, Hypothesis 1 is proposed as follows:

3.2 Mediation hypothesis

ESG performance affects corporate value in various ways, which is a very complicated problem. The influence of ESG performance on corporate value is mainly achieved by transmitting good information to stakeholders through good ESG performance, so as to obtain positive returns from stakeholders. According to signal theory, ESG disclosure reduces information asymmetry between enterprises and stakeholders, so as to have a deeper and broader understanding of enterprises. Media attention and analyst coverage are important channels for enterprises to convey information to stakeholders, and there are great differences in the range of information, quality, and objectives of ESG reports. On the one hand, media attention emphasizes the breadth of information transmission. Considering the difference in reading groups’ ability to interpret ESG reports, the media will simplify the ESG-related information in order to widely and easily convey the enterprise’s good news to consumers, the government, and other stakeholders (Hammami and Zadeh, 2019). In addition, the media is also pursuing information transmission speed. Especially with the rapid development of network media, media reports can make stakeholders know about corporate ESG engagement more quickly. (Lee et al., 2022). Analyst coverage emphasizes the depth of information transmission. Based on related expertise, analysts can obtain more valuable and truthful information with further in-depth analysis of the ESG report. And favorable analyst coverage enhances the confidence of investors and creditors in corporate prospects (Keloharju et al., 2012). On the other hand, media attention and analyst coverage can play the role of “soft supervision” in the capital market (Liu et al., 2022). When there is a negative ESG-related event, the media will spread and amplify unfavorable information, causing fluctuations in the enterprise share price (van der Meer and Vliegenthart, 2018). Analysts can identify and exclude exaggerated contents in the ESG report with their expertise, and hidden and potential corporate problems can be more easily exposed. In summary, good ESG performance gains favorable media attention and analyst coverage, making a wide range of stakeholders have positive beliefs in the enterprise and thus indirectly affecting corporate value. Based on the above analysis, the following research hypotheses are proposed:

3.3 Logical Framework

Based on the basic analysis of ESG performance on corporate value and mediating effect of media attention and analyst coverage, we further analyze the impact of ESG performance on corporate value from single dimension. In addition, we analysis the heterogeneity of pollution degree and institutional investor ownership, discussing the different impacts between heavily polluted and non-heavily polluted enterprises and between enterprises with high percentage and low percentage of institutional investor ownership. The logical relationship on the above theoretical analysis and research hypotheses are presented in Figure 1.

4 Research design

4.1 Data

We use all A-share listed enterprises on the Shanghai Stock Exchange (SHSE) and Shenzhen Stock Exchange (SZSE) in China as the initial research sample. Considering the feasibility of all variable data, we choose data from 2011 to 2020. In order to ensure the validity of all conclusions, the sample is cleaned as follows: 1) Excluding the sample with abnormal or missing data. 2) Excluding the special treatment enterprises (ST and *ST enterprises). 3) Excluding financial enterprises. 4) To eliminate the influence of extreme values, all continuous variables are winsorized at the 1% and 99% levels. Finally, we obtain 7,941 unbalanced panel data. ESG scores of A-share listed enterprises are from the Bloomberg database. The data about the institutional investor ownership in the heterogeneity analysis are obtained from CFND (Financial News Database of Chinese Listed Companies). And other data are obtained from CSMAR (China Stock Market & Accounting Research Database).

4.2 Model

4.2.1 Benchmark model

The following model is used to test the effect of ESG performance on corporate value:

In model (1), the explained variable

4.2.2 Mediating effect model

The mediating effect model, proposed by Wen et al. (2004), is used to analyse the mediating effect of media attention and analyst coverage. In addition to model (1), model (2)-model 5) are further estimated as follows:

4.3 Variable definitions and measurement

4.3.1 Explained variable

Corporate value is measured in various ways, such as ROE, ROA, or Tobin’s Q. Based on previous literature (Kim and Kim, 2014; Velte, 2017; Wong et al., 2021), we use Tobin’s Q, denoted by TobinQ, to measure corporate value in view of market value changes.

4.3.2 Explanatory variable

Considering the authority, coverage, and other factors of the ESG database, we refer to the research (Buallay, 2019; Behl et al., 2021) and use the Bloomberg database ESG scores of A-share listed enterprises, which has evaluated the ESG information disclosure of listed enterprises since 2009, covering tens of thousands of enterprises in more than 80 countries, containing three single-dimensions of ESG. The weighted ESG disclosure score is normalized to range from the lowest disclosure level, indicated by 0.1 to the highest disclosure level of 100. A higher score indicates a better ESG performance.

4.3.3 Mediating variables

Based on previous research (Li et al., 2022; Yi et al., 2022), we use the natural logarithm of the total number of content news in online media and newspaper financial news from the CFND to measure media attention. CFND data covers a wide range and has research significance. The higher the number of media reports, the higher the media attention to the enterprise. Following the previous study (Hassan, 2018; Hai et al., 2022), we use the number of analysts in the year of a listed enterprise from the CSMAR database to measure analyst coverage.

4.3.4 Control variables

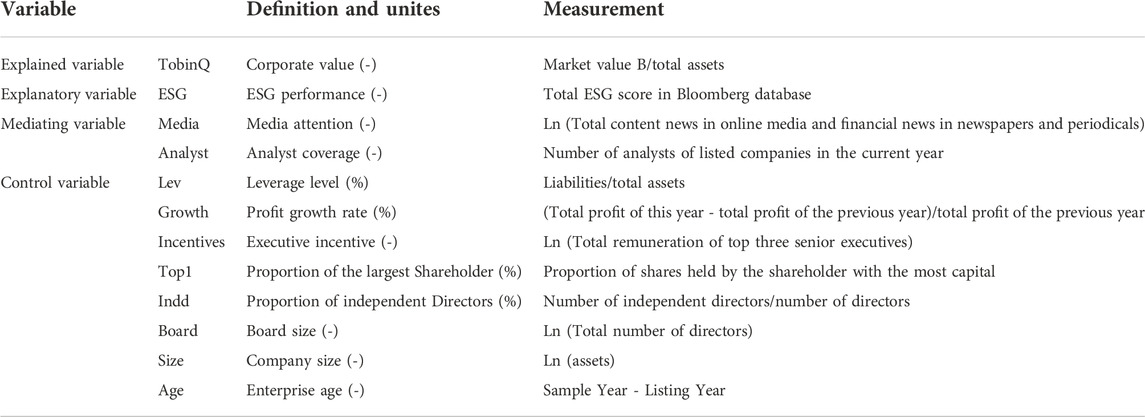

Based on previous research (Chi et al., 2013; Feng and Wu, 2021; Tang et al., 2021), we control for the following factors that may affect corporate value, including Lev, Growth, Incentives, Top1, Indd, Board, Size, and Age. The variable definition is presented in Table 1.

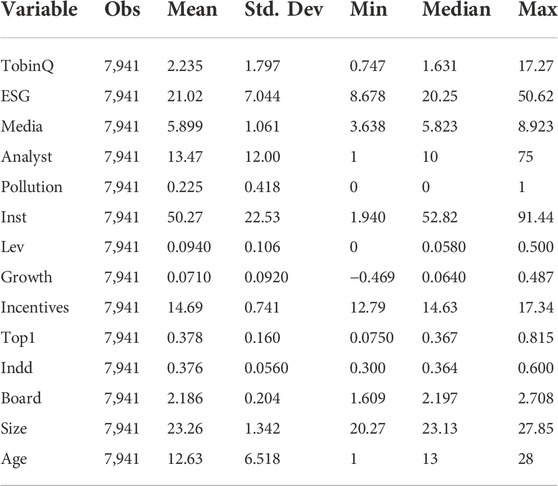

4.4 Descriptive statistics

Table 2 reports the descriptive statistics of the variables. It shows that the average ESG score of the sample enterprises is 21.02, the standard deviation is 7.044, and the maximum and minimum values are 50.62 and 8.678 respectively, indicating a large gap between the ESG levels of the sample enterprises. The mean values of media attention and analyst coverage are 5.899 and 13.47 respectively, indicating a large difference in media attention and analyst coverage among sample enterprises. The results of other variables are consistent with prior literature.

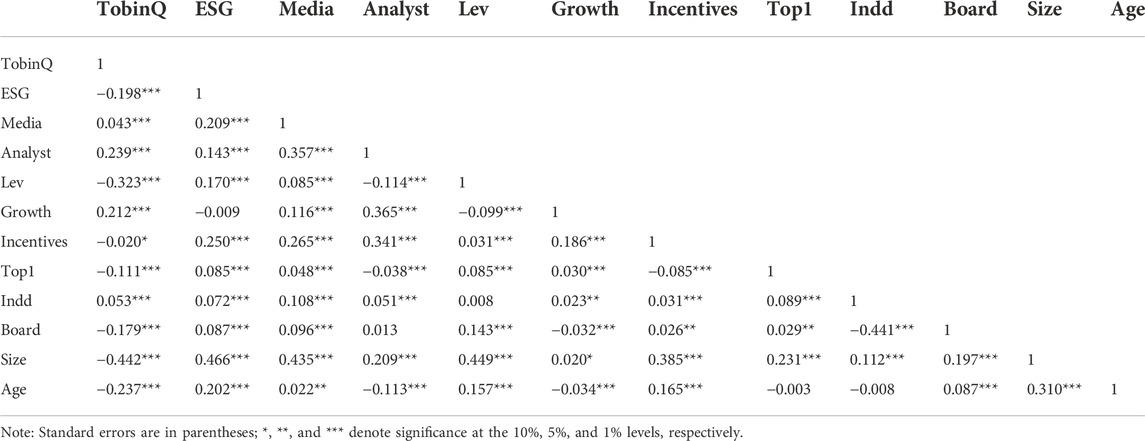

As shown in Table 3, the Pearson correlation coefficient between ESG performance and corporate value has passed the statistical test at the level of 1%. The results preliminarily support that ESG performance will affect corporate value, but this effect is negatively correlated, indicating that panel data may have problems such as variance and time lag, leading to biased estimation results. Therefore, we fully considered the control variables in the study, and carried out the time lag test in the subsequent study. In addition, we conducted the variance inflation factors (VIF). The test results range from 1.13 to 2.43, and the correlation coefficients among the variables are generally low, which indicates that multicollinearity does not occur.

5 Empirical results

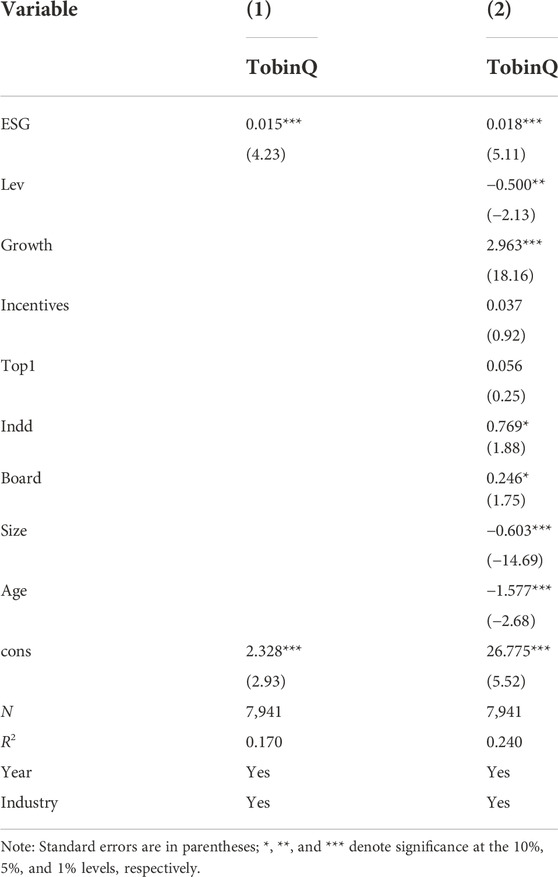

5.1 Benchmark regression results

According to model (1), column 1) in Table 4 reports the univariate regression result of ESG performance on corporate value. We further control for other variables in column 2). All columns control for the year and industry-fixed effects. In column (1), the ESG coefficient is 0.015, which is significantly positive at the 1% level. After further controlling for other relevant factors, the coefficient in column 2) is still significantly positive at the 1% level with a coefficient of 0.018, which is both statistically and economically significant. It indicates that for every 1% increase in ESG performance, the corporate value will increase by 0.018% on average, that is, ESG performance can significantly improve corporate value. The results show that ESG performance has the value creation function, and a good ESG performance can obtain positive feedback from multiple stakeholders, thus improving corporate value. The regression results are consistent with H1.

5.2 Robustness tests

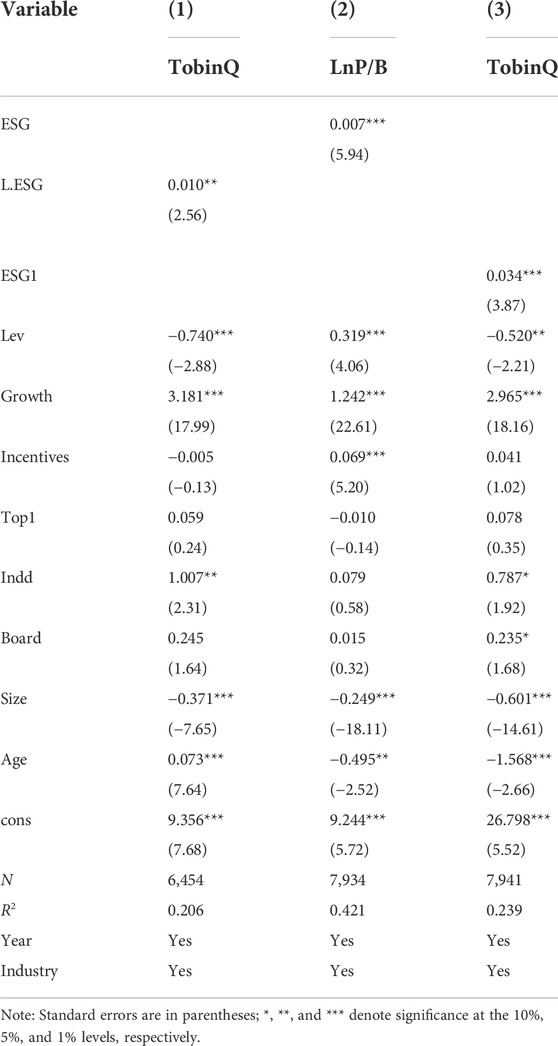

The benchmark regression results suggest that high-quality ESG performance significantly improves corporate value. However, potential reverse causality, measurement errors, and other endogeneity issues may affect the estimation results. In order to test the robustness of the previous conclusions, we refer to the research of scholars (Chi et al., 2013), and use the following methods to conduct robustness tests: 1) Lagging one period for the explanatory variable. 2) Alternative measure of the explained variable. 3) Alternative measure of the explanatory variable. The results are shown in Table 5.

5.2.1 Lagging one period for explanatory variable

Considering that there may be endogenous problems caused by two-way causality, we lag one period for ESG and re-estimate the benchmark regression. Column 1) of Table 5 shows that the coefficient of L. ESG is 0.010, which is significantly positive at the 5% level, indicating that after using lagging data, ESG performance still significantly promotes corporate value.

5.2.2 Alternative measure of explained variable

We change the indicator of corporate value, which is measured by the natural logarithm of Price-to-Book Ratio (LnP/B). Column 2) shows that the coefficient of ESG is 0.007, which is significantly positive at the 1% level, indicating that after using a different evaluation method, corporate value is still significantly promoted by ESG performance.

5.2.3 Alternative measure of explanatory variable

We replace the measurement method of ESG rating and adopt the ten-point system for re-scoring. Column 3) shows that the coefficient of ESG1 is 0.034, which is significantly positive at the 1% level, indicating that after using a different ESG evaluation method, ESG performance still significantly promotes corporate value.

In Table 5, we find that the estimated coefficients are still significant, indicating that the benchmark regression conclusion is robust.

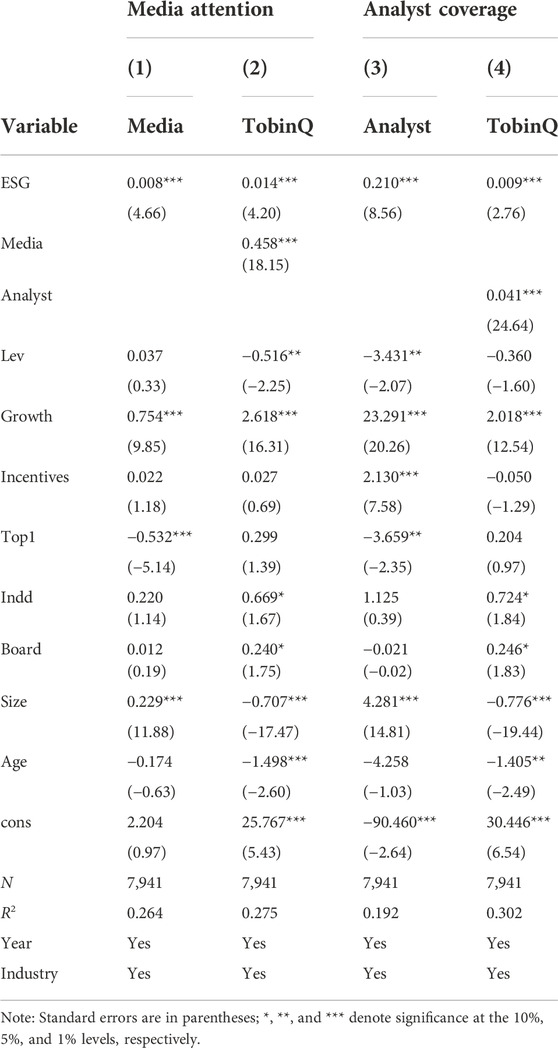

5.3 Mediating effect analysis

Benchmark regression analysis shows that high-quality ESG performance can promote corporate value. Therefore, how does ESG performance improve corporate value? We will further analyze its mechanism from two mediating variables: media attention and analyst coverage, as shown in models 2)–(5). The rest of the variables are consistent with the definition of variables in the model (1). The mediating effect results are listed in Table 6.

Column 1) reports the effect of ESG on Media attention. The results show that the ESG coefficient is 0.008, which is significantly positive at the 1% level, indicating that ESG performance has attracted media attention significantly. Column 2) reports ESG and media attention on corporate value. The results show that the coefficients of ESG and Media are 0.014 and 0.458 respectively, and both are significantly positive at the 1% level, indicating that media attention plays a mediating role in the impact of ESG performance on corporate value. Therefore, hypothesis H2 is verified.

Based on the coefficients of ESG and Media are 0.210 and 0.041 respectively, and both are significantly positive at the 1% level, a similar effect could be obtained from columns 3) and 4) of Table 6, indicating that analyst coverage mediates the relationship in our benchmark regression. Therefore, hypothesis H3 is verified.

The above analysis shows that the high quality of ESG performance delivers good information to stakeholders through external supervision (e.g., media attention and analyst coverage), which is beneficial to enhance corporate value.

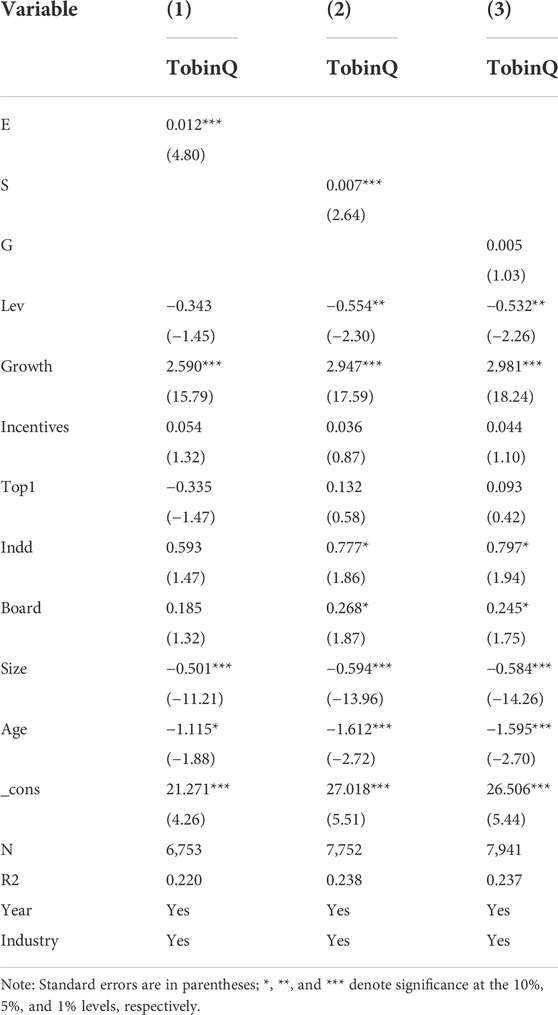

5.4 Further analysis

5.4.1 Single dimension analysis

As a comprehensive indicator, ESG has a different degree of impact on corporate value from single dimension. Therefore, this paper continues to use Bloomberg data, including Environmental (E), Social (S) and Governance (G) indicators, to further analyze the impact of single dimension of ESG on corporate value. From columns 1) and 2) in Table 7, the coefficients of Environmental (E) and Social (S) are 0.012 and 0.007 respectively, which are significantly positive at the 1% level, while in column (3), the coefficients of Governance (G) are not significant. The research illustrates that among indicators that constitute three dimensions of ESG, Environmental (E) and Social (S) have a positive and significant impact on corporate value, but Social (S) has a lower effect size than Environmental (E), and there is no evidence for a significant relationship between Governance (G) and corporate value.

The reason may be as follows. On the one hand, environmental performance can play a more positive role in signal transmission (Li et al., 2018). The effect of environmental-level improvements is more intuitive, which is easy to attract the attention of the media and analysts to generate a better information transmission effect. On the other hand, the popularization of the “green economy” concept has led to more positive feedback from stakeholders on the environmental dimension. The Chinese government has always advocated that the relationship between ecological environment protection and economic development is not contradictory and antagonistic, but dialectical and unified. The government departments will give support in terms of taxes and subsidies to encourage the green economic behavior of enterprises. In recent years, “green life” is also popular among consumers, who are very concerned about whether products are environmentally friendly and whether production is low-consumption. Investors also begin to pay attention to the concept of “green investment”, and will consider the ESG performance of enterprises when making investment decisions. Referring to Xie et al. (2019), we analyze the Social (S) dimension from the internal and external perspectives respectively. The improvement of internal employee benefits, health and safety, and vocational training will increase employee satisfaction and happiness, which in turn will improve productivity (Hui, 2021). After perceiving the CSR behavior of the enterprise, the external public will recognize the corporate image, and gradually develop the corporate reputation, thus obtaining more positive feedback from external stakeholders. In addition, social responsibility involves a wide range of groups, which is easy to generate good information transmission effect. In terms of Governance (G) dimension, it is observed from the sample data that the mean scores of Governance (G) ratings are generally high among enterprises, leading to an insignificant score gap, which affects the improvement of corporate value by Governance (G) dimension. Moreover, the performance of the Governance (G) dimension is more related to the internal structure of the enterprise, resulting in a narrow perception range and hindering the positive feedback of stakeholders.

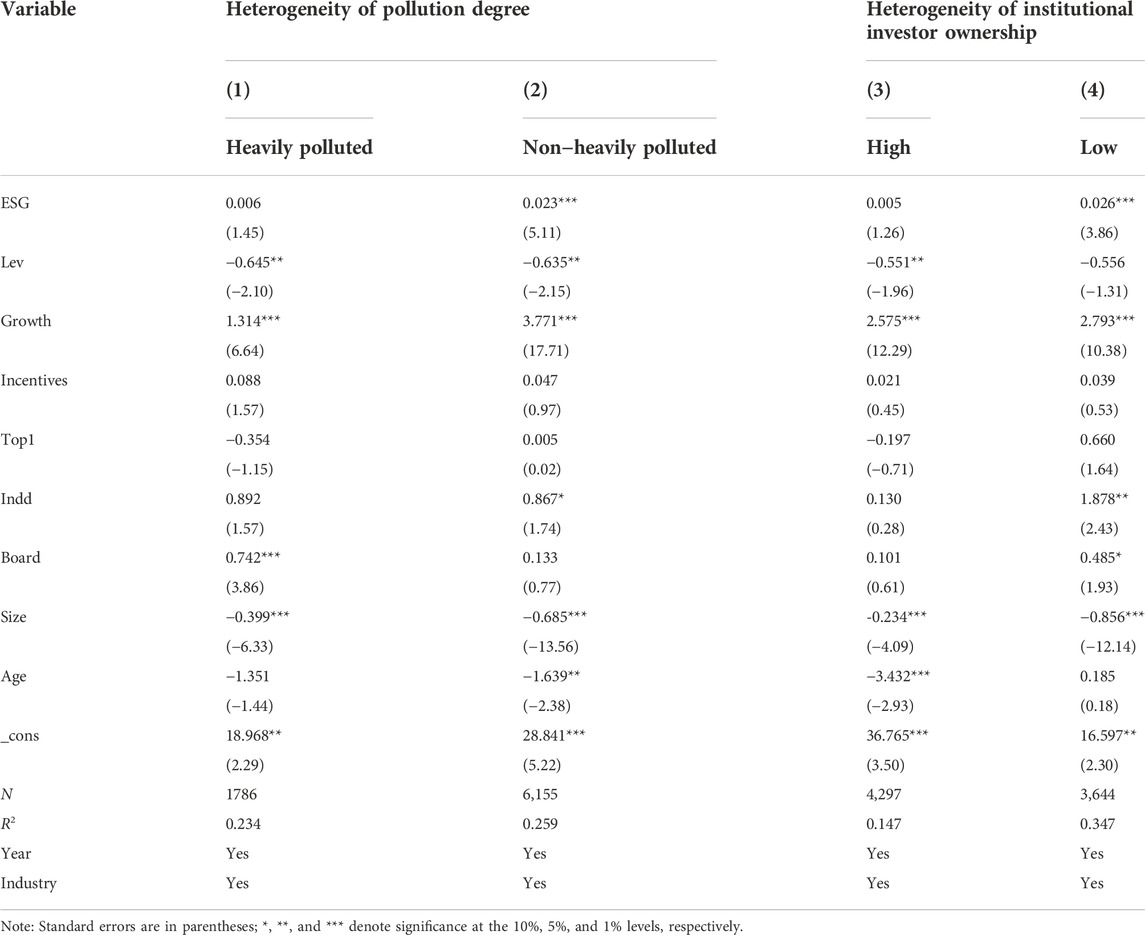

5.4.2 Heterogeneity analysis of pollution degree

According to standards in Guidelines for the Industry Classification of Listed (China Securities Regulatory Commission, 2012) and the classification method of Liu et al. (2019), enterprises are divided into heavily polluting enterprises and non-heavily polluting enterprises, to assess the heterogeneity of the impact of ESG performance on corporate value. From columns 1) and 2) in Table 8, the ESG performance of non-heavily polluting enterprises has a significantly positive impact on corporate value, while that of heavily polluting enterprises is not significant. The results indicate that compared with heavily polluting enterprises, the ESG performance of non-heavily polluting enterprises has a significant positive effect on corporate value.

There may be two reasons. On the one hand, under China’s “dual carbon” goal, heavily polluting enterprises are subject to more stringent environmental regulations. Enterprises may take formalistic actions to cater to the “hard regulation” of the government and the “soft regulation” of third-party ESG ratings. For example, excessive pursuit of the quantity and neglect of quality of green innovative technologies aggravate the “foam” of ESG performance, thus inhibiting the effect of ESG performance on corporate value (Liu et al., 2022). On the other hand, stakeholders are more likely to perceive the impact of environmental issues. They believe that practice of increasing ESG score of heavily polluting enterprises is reasonable, so they reduce the sensitivity to the ESG performance of heavily polluting enterprises, thus affecting the improvement of their corporate value (Wang and Yang, 2022).

5.4.3 Heterogeneity analysis of institutional investor ownership

Niu et al. (2013) argue that institutional investor ownership will negatively affect enterprises’ voluntary disclosure, and voluntary ESG information disclosure may have a negative effect on the relationship between ESG performance and corporate value. Risk-averse institutional investors don’t encourage enterprises to increase the cost of information disclosures, and the improvement of ESG performance is regarded as risk management, rather than a way of increasing corporate value (Aluchna et al., 2022). Therefore, referring to the data of China Research Data Service Platform (CNRDS), we use the proportion of the shares held by institutional investors in the outstanding A shares to measure institutional investor ownership, which is divided into high and low. From columns 3) and 4) of Table 8, ESG performance of enterprises with a low percentage of institutional investor ownership has a significantly positive impact on corporate value, while that of enterprises with a high percentage of institutional investor ownership is not significant, indicating that compared with enterprises with a high percentage of institutional investor ownership, ESG performance of enterprises with a low percentage of institutional investor ownership has a significant positive effect on corporate value.

There may be three reasons. Firstly, stakeholders believe that the high-quality ESG performance of enterprises with a high percentage of institutional investor ownership may be more due to the agreement and indicator requirements of institutional investors, or the enterprises hope to attract more institutional investors through high-quality ESG performance. This motivation to whitewash ESG ratings reduces the sensitivity of corporate value to ESG performance. Secondly, institutional investors, under the pressure of their clients, are more cautious about the high investment behavior of ESG, while the short-term behavior of institutional investors will also lead to managers’ shortsightedness, reduce the effect of enterprise’s ESG practice, and then inhibit the positive impact of ESG performance on corporate value (Glossner, 2019; DesJardine et al., 2020). Thirdly, at the initial stage of China’s ESG construction, institutional investors did not pay enough attention to the demands of stakeholder groups. Some institutional investors only paid attention to the demands of key stakeholders and ignored those who did not involve core resources. Institutional investors believed that this would not have a great impact on enterprises (Bird et al., 2007). However, it may weaken the positive feedback power of stakeholders on ESG performance, thus reducing the effect of ESG performance on corporate value.

6 Conclusion and recommendations

6.1 Conclusion

Based on the panel data of China’s A-share non-financial listed enterprises on the Shanghai Stock Exchange (SHSE) and Shenzhen Stock Exchange (SZSE) from 2011 to 2020, we conducted an empirical study on whether EGS performance can significantly promote corporate value and how to promote it, from the stakeholders’ perspective. Our study finds that: 1) ESG performance significantly improves corporate value. With a series of robustness tests, the conclusion is still valid. 2) According to the mediating effect analysis, high-quality ESG performance triggers the attention of medias and analysts, which in turn promotes corporate value by raising stakeholder pressure. Thus, both media attention and analyst coverage play an intermediary role in the impact of ESG performance on corporate value. 3) Further, the single dimension analysis illustrates that Environmental (E) and Social (S) have a positive impact on corporate value, but the effect size of Social (S) is smaller, and there is no evidence for a significant relationship between Governance (G) and corporate value. 4) From the heterogeneity analyses, we find that ESG performance of non-heavily polluting enterprises has a significant positive effect on corporate value, but not of heavily polluting enterprises. Meanwhile, ESG performance of enterprises with a low percentage of institutional investor ownership has a significant positive effect on corporate value, but not with a high percentage.

6.2 Recommendations

Combined with the research conclusions, several recommendations are provided as follows. 1) For an enterprise, the benchmark regression results show that enterprises should have a new understanding of the ESG concept, and transform from the previous passive “cost expenditure view” to the active “capital investment view”. Enterprises should also increase ESG-related investment and upgrade it to the strategic level, so as to promote the sustainable development of enterprises. In addition, from the perspective of stakeholders and combined with the mediating effect results, the paper finds that enterprises need to pay attention to the demands of stakeholders, so as to improve corporate value. Enterprises also need to actively establish cooperation with the media and analysts, invite them to participate more in ESG-related activities, and enhance the positive feedback effect of stakeholders with their powerful information transmission ability. 2) For an investor, the heterogeneity analysis shows that institutional investors in China do not respond to ESG performance, which inhibits ESG practices of enterprises. As the concept of ESG is popularized in China and the ESG system is improved, institutional investors should fully consider the enterprises’ ESG performance to measure their sustainable development capacity and investment potential when making investment decisions. It not only avoids investment losses caused by the short-sightedness of investors, but also forces enterprises to improve ESG performance. 3) For the government, through the robustness test, the paper finds that due to the different rating standards among third-party institutions, some enterprises have a large gap in the score ranking among different institutions, making it difficult for stakeholders to identify corporate ESG performance. Therefore, the government should increase its support to Chinese ESG third-party rating institutions, and give certain policy guidance in terms of evaluation weights and evaluation levels, so as to localize the ratings to be more suitable for Chinese listed enterprises. In addition, according to the analysis of the heterogeneity of heavily polluted enterprises, the government should formulate “differentiated” policy and provide more tax and subsidy support to heavy polluters with high-quality ESG performance in order to encourage them to actively improve their ESG performance.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

YZ: conceptualization, validation, investigation, methodology, resources, writing–original draft, writing–review, and editing. BW: conceptualization, literature, data curation, software, writing–original draft, writing–review, and editing. XS: resources, funding acquisition, writing–original draft, proofreading language, and supervising. XL: literature, methodology, data curation, software, and writing–original draft. All authors contributed to the article and approved the submitted version.

Funding

We acknowledge financial support from Educational Teaching Reform Project of China University of Labor Relations (Grant No. JG2115), the National Natural Science Foundation of China (Grant No. 71672003, 72172008), and Beijing International Consumption Center City Advanced Innovation Center Cultivation Project.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aboud, A., and Diab, A. (2018). The impact of social, environmental and corporate governance disclosures on firm value: Evidence from Egypt. J. Account. Emerg. Econ. 8 (4), 442–458. doi:10.1108/JAEE-08-2017-0079

Alareeni, B. A., and Hamdan, A. (2020). ESG impact on performance of US S&P 500-listed firms. Corp. Gov. Int. J. Bus. Soc. 20 (7), 1409–1428. doi:10.1108/CG-06-2020-0258

Aluchna, M., Roszkowska-Menkes, M., Kaminski, B., and Bosek-Rak, D. (2022). Do institutional investors encourage firm to social disclosure? The stakeholder salience perspective. J. Bus. Res. 142, 674–682. doi:10.1016/J.JBUSRES.2021.12.064

Amerta, A., and Soenarno, Y. N. (2022). The impact of enterprise risk management, corporate social responsibility, and sustainability report on firm value in banking sector of Indonesia, Malaysia and Thailand. CECCAR Bus. Rev. 31, 62–72. doi:10.37945/cbr.2022.05.07

Aouadi, A., and Marsat, S. (2018). Do ESG controversies matter for firm value? Evidence from international data. J. Bus. Ethics 151 (4), 1027–1047. doi:10.1007/s10551-016-3213-8

Atan, R., Alam, M. M., Said, J., and Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Manag. Environ. Qual. 29 (2), 182–194. doi:10.1108/MEQ-03-2017-0033

Bardos, K. S., Ertugrul, M., and Gao, L. S. (2020). Corporate social responsibility, product market perception, and firm value. J. Corp. Finance 62, 101588. doi:10.1016/j.jcorpfin.2020.101588

Baumgartner, K. T., Ernst, C. A., and Fischer, T. M. (2020). How corporate reputation disclosures affect stakeholders’ behavioral intentions: Mediating mechanisms of perceived organizational performance and corporate reputation. J. Bus. Ethics 175 (2), 361–389. doi:10.1007/s10551-020-04642-x

Behl, A., Kumari, P. S. R., Makhija, H., and Sharma, D. (2021). Exploring the relationship of ESG score and firm value using cross-lagged panel analyses: case of the Indian energy sector. Ann. Oper. Res. 313 (1), 231–256. doi:10.1007/S10479-021-04189-8

Bird, R., Hall, A. D., Momente, F., and Reggiani, F. (2007). What corporate social responsibility activities are valued by the market? J. Bus. Ethics 76 (2), 189–206. doi:10.1007/s10551-006-9268-1

Bocean, C. G., Nicolescu, M. M., Cazacu, M., and Dumitriu, S. (2022). The role of social responsibility and ethics in employees’ wellbeing. Int. J. Environ. Res. Public Health 19 (14), 8838. doi:10.3390/ijerph19148838

Buallay, A. (2019). Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Manag. Environ. Qual. 30 (1), 98–115. doi:10.1108/MEQ-12-2017-0149

Bukit, R. B., and Nurlaila, (2019). Environmental performance, voluntary disclosure, and corporate value. IOP Conf. Ser. Earth Environ. Sci. 260 (1), 012081. doi:10.1088/1755-1315/260/1/012081

Burke, J. J. (2021). Do boards take environmental, social, and governance issues seriously? Evidence from media coverage and CEO dismissals. J. Bus. Ethics 176 (4), 647–671. doi:10.1007/S10551-020-04715-x

Casciaro, T., and Piskorski, M. J. (2005). Power imbalance, mutual dependence, and constraint absorption: A closer look at resource dependence theory. Adm. Sci. Q. 50 (2), 167–199. doi:10.2189/asqu.2005.50.2.167

Cheng, Q., and Liu, F. (2022). Research on the impact of environmental information disclosure on corporate value based on the empirical data of listed companies in heavy-polluting industries. Sci. Technol. Manag. Res. 42 (1), 177–185. doi:10.3969/j.issn.1000-7695.2022.1.024

Chi, G., Wang, Z., and Yang, J. (2013). Has EVA assessment improved firm value? Empirical evidence from state-owned listed companies of China. Account. Res. 34 (11), 60–66. Available online at: https://cnki.com.cn/Article/CJFDTotal-KJYJ201311009.htm.

China Securities Regulatory Commission. (2018). Code of corporate governance for listed companies. Available online at: http://www.csrc.gov.cn/csrc/c100028/c1001175/content.shtml

China Securities Regulatory Commission. (2012). Guidelines for the industry classification of listed. Available online at: http://www.csrc.gov.cn/csrc/c101864/c1024632/content.shtml

China Securities Regulatory Commission. (2022). Working guidelines for the relationship between listed companies and investors. Available online at: http://www.csrc.gov.cn/csrc/c100028/c2334692/content.shtml

Dang, T. L., Huynh, T. H. H., and Nguyen, M. T. (2021). Media attention and firm value: International evidence. Int. Rev. Finance 21 (3), 865–894. doi:10.1111/irfi.12305

DesJardine, M. R., Marti, E., and Durand, R. (2020). Why activist hedge funds target socially responsible firms: The reaction costs of signaling corporate social responsibility. Acad. Manage. J. 64 (3), 851–872. doi:10.5465/amj.2019.0238

Di Tommaso, C., and Thornton, J. (2020). Do ESG scores effect bank risk taking and value? Evidence from European banks. Corp. Soc. Responsib. Environ. Manag. 27 (5), 2286–2298. doi:10.1002/csr.1964

Duque-Grisales, E., and Aguilera-Caracuel, J. (2021). Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 168 (2), 315–334. doi:10.1007/s10551-019-04177-w

Eckerle, K., Whelan, T., and Tomlinson, B. (2020). Embedding sustainability performance and long-term strategy in the earnings call. J. Appl. Corp. Finance 32 (2), 85–99. doi:10.1111/jacf.12408

Ergene, S. B., and Karadeniz, E. (2021). Corporate governance and firm value: Evidence from lodging companies. J. Glob. Bus. Insight 6 (1), 74–91. doi:10.5038/2640-6489.6.1.1165

Fahad, P., and Showkat, A. B. (2021). CSR disclosure and firm performance: evidence from an emerging market. Corp. Gov. Int. J. Bus. Soc. 21 (4), 553–568. doi:10.1108/CG-05-2020-0201

Feng, Z., and Wu, Z. (2021). ESG disclosure, REIT debt financing and firm value. J. Real Estate Finan. Econ. 34, 1–35. doi:10.1007/s11146-021-09857-x

Frost, T., Shan, L. W., Tsang, A., and Yu, M. (2022). Media coverage of corporate social irresponsibility and audit fees: International evidence. Int. J. Audit. 26 (4), 467–493. doi:10.1111/IJAU.12291

Glossner, S. (2019). Investor horizons, long-term blockholders, and corporate social responsibility. J. Bank. Finance 103, 78–97. doi:10.1016/j.jbankfin.2019.03.020

Goh, J., Lee, J., Hur, W., and Ju, Y. (2019). Do analysts fully reflect information in patents about future earnings? Sustainability 11 (10), 2869. doi:10.3390/su11102869

Hai, M., Fang, Z., and Li, Z. (2022). Does business group’s conscious of social responsibility enhance its investment efficiency? Evidence from ESG disclosure of China’s listed companies. Sustainability 14 (8), 4817. doi:10.3390/su14084817

Hammami, A., and Zadeh, M. H. (2019). Audit quality, media coverage, environmental, social, and governance disclosure and firm investment efficiency: Evidence from Canada. Int. J. Account. Inf. Manag. 28 (1), 45–72. doi:10.1108/IJAIM-03-2019-0041

Hassan, O. A. G. (2018). The impact of voluntary environmental disclosure on firm value: Does organizational visibility play a mediation role? Bus. Strategy Environ. 27 (8), 1569–1582. doi:10.1002/bse.2217

Hui, Z. (2021). Corporate social responsibilities, psychological contracts and employee turnover intention of SMEs in China. Front. Psychol. 12, 754183. doi:10.3389/fpsyg.2021.754183

Jasni, N. S., Yusoff, H., Zain, M. M., Yusoff, N. M., and Shaffee, N. S. (2019). Business strategy for environmental social governance practices: Evidence from telecommunication companies in Malaysia. Soc. Responsib. J. 16 (2), 271–289. doi:10.1108/SRJ-03-2017-0047

Javed, M., Rashid, M. A., Hussain, G., and Ali, H. Y. (2020). The effects of corporate social responsibility on corporate reputation and firm financial performance: Moderating role of responsible leadership. Corp. Soc. Responsib. Environ. Manag. 27 (3), 1395–1409. doi:10.1002/csr.1892

Jiang, C., and Fu, Q. (2019). A Win-Win outcome between corporate environmental performance and corporate value: From the perspective of stakeholders. Sustainability 11 (3), 921. doi:10.3390/su11030921

Keloharju, M., Knüpfer, S., and Linnainmaa, J. (2012). Do investors buy what they know? Product market choices and investment decisions. Rev. Financ. Stud. 25 (10), 2921–2958. doi:10.1093/rfs/hhs090

Khanh, V. T. V., Hung, D. N., Van, V. T. T., and Huyen, H. T. (2020). A study on the effect of corporate governance and capital structure on firm value in Vietnam. 10. 5267/j. Ac. 6 (3), 221–230. doi:10.5267/j.ac.2020.3.004

Kim, M., and Kim, Y. (2014). Corporate social responsibility and shareholder value of restaurant firms. Int. J. Hosp. Manag. 40, 120–129. doi:10.1016/j.ijhm.2014.03.006

Lee, M. T., Raschke, R. L., and Krishen, A. S. (2022). Signaling green! firm ESG signals in an interconnected environment that promote brand valuation. J. Bus. Res. 138, 1–11. doi:10.1016/J.JBUSRES.2021.08.061

Li, Y. B., Zhang, G. Q., Wu, T. J., and Peng, C. L. (2020). Employee’s corporate social responsibility perception and sustained innovative behavior: Based on the psychological identity of employees. Sustainability 12 (20), 8604. doi:10.3390/su12208604

Li, Y. W., Gong, M. F., Zhang, X. Y., and Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 50 (1), 60–75. doi:10.1016/j.bar.2017.09.007

Li, Z., Shao, Y., Li, Z., and Li, M. (2022). ESG information disclosure, media supervision and corporate financing constraints. Sci. Decis. Mak. 29 (7), 1–26. doi:10.3773/j.issn.1006-4885.2022.07.001

Liu, B., Lu, J., and Qu, T. (2022). Formalism or substantialism: Research on green innovation under soft market supervision of ESG rating. Nankai Bus. Rev. 31, 1–24. Available online at: https://cnki.net/kcms/detail/12.1288.F.20220905.1521.002.html.

Liu, C., Xu, W., Cai, L., and Zhang, X. (2019). Environmental pressure and bank loan covenant of heavy polluting enterprise. China Popul. Resour. Environ. 29 (12), 121–130. doi:10.12062/cpre.20190802

Lopez-Tenorio, P. J., and Romero, J. (2020). Investors’ response to advertising: The role of media. J. Mark. Manag. 36 (15-16), 1505–1526. doi:10.1080/0267257X.2020.1767680

Luo, X., Homburg, C., and Wieseke, J. (2010). Customer satisfaction, analyst stock recommendations, and firm value. J. Mark. Res. 47 (6), 1041–1058. doi:10.1509/jmkr.47.6.1041

Michelson, G., Wailes, N., van der Laan, S., and Frost, G. (2004). Ethical investment processes and outcomes. J. Bus. Ethics 52 (1), 1–10. doi:10.1023/B:BUSI.0000033103.12560.be

Ministry of Ecology and Environment of the People’s Republic of China. (2022). Guidelines on the format of legal disclosure of corporate environmental information. Available online at: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk05/202201/t20220110_966488.html

Ministry of Ecology and Environment of the People’s Republic of China. (2021). The reform plan of environmental information disclosure system according to law. Available online at: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202105/t20210525_834444.html

Mohammad, W. M. W., and Wasiuzzaman, S. (2021). Environmental, social and governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Clean. Environ. Syst. 2, 100015. doi:10.1016/J.CESYS.2021.100015

Niu, J., Wu, C., and Li, S. (2013). Institutional investor types, equity characteristics and voluntary disclosure. Manag. Rev. 25 (3), 48–59. doi:10.14120/j.cnki.cn11-5057/f.2013.03.018

Nur, D. P. E. (2021). The impact of social media on firm value: A case study of oil and gas firms in indonesia. J. Asian Finance, Econ. Bus. 8 (3), 987–996. doi:10.13106/jafeb.2021.vol8.no3.0987

Odriozola, M. D., and Baraibar-Diez, E. (2017). Is corporate reputation associated with quality of CSR reporting? Evidence from Spain. Corp. Soc. Responsib. Environ. Manag. 24 (2), 121–132. doi:10.1002/csr.1399

Okafor, A. A., Bosede, N., and Adusei, M. (2021). Corporate social responsibility and financial performance: Evidence from U.S tech firms. J. Clean. Prod. 292, 126078. doi:10.1016/J.JCLEPRO.2021.126078

Onguka, D., Iraya, C., and Nyamute, W. (2020). Impact of corporate governance on corporate value for companies listed at the Nairobi Securities Exchange. Int. J. Econ. Finance 12 (12), 70. doi:10.5539/IJEF.V12N12P70

Rassier, D. G., and Earnhart, D. (2010). Does the porter hypothesis explain expected future financial performance? The effect of clean water regulation on chemical manufacturing firms. Environ. Resour. Econ. (Dordr). 45 (3), 353–377. doi:10.1007/s10640-009-9318-0

Reimann, F., Ehrgott, M., Kaufmann, L., and Carter, C. R. (2012). Local stakeholders and local legitimacy: MNEs’ social strategies in emerging economies. J. Int. Manag. 18 (1), 1–17. doi:10.1016/j.intman.2011.06.002

Serafeim, G., and Yoon, A. (2022). Stock price reactions to ESG news: The role of ESG ratings and disagreement. Rev. Acc. Stud. 27, 1–31. doi:10.1007/S11142-022-09675-3

Sun, X., Zheng, Y., Zhang, C., Li, X., and Wang, B. (2022). The effect of China’s pilot low-carbon city initiative on enterprise labor structure. Front. Energy Res. 9, 821677. doi:10.3389/fenrg.2021.821677

Tang, Y., Ma, W., and Xia, L. (2021). Quality of environmental information disclosure, internal control “Level” and enterprise value: Empirical evidence from listed companies in heavy polluting industries. Account. Res. 42 (7), 69–84. Available online at: https://cnki.com.cn/Article/CJFDTotal-KJYJ202107006.htm.

van der Meer, T., and Vliegenthart, R. (2018). The consequences of being on the agenda: The effect of media and public attention on firms’ stock market performance. Communications 43 (1), 5–24. doi:10.1515/commun-2017-0027

Velte, P. (2017). Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 8 (2), 169–178. doi:10.1108/JGR-11-2016-0029

Verheyden, T., Eccles, R. G., and Feiner, A. (2016). ESG for all? The impact of ESG screening on return, risk, and diversification. J. Appl. Corp. Finance 28 (2), 47–55. doi:10.1111/jacf.12174

Wang, B., and Yang, M. (2022). A study on the mechanism of ESG performance on corporate value: Empirical evidence from A-share listed companies in China. Soft Sci. 36 (6), 78–84. doi:10.13956/j.ss.1001-8409.2022.06.11

Wang, D., Sun, Z., Wang, K., and Zhang, H. (2022). China ESG development report 2021. Bei Jing: Economic & Management Publishing House.

Wang, J., Xu, H., and Xu, J. (2022). Can the target responsibility system of air pollution control achieve a win-win situation of pollution reduction and efficiency enhancement? Front. Energy Res. 9, 821686. doi:10.3389/FENRG.2021.821686

Wang, L., Li, C., and Li, S. (2020). Can environmental information disclosure regulate the relationship between environmental cost and enterprise value? Int. J. Environ. Pollut. 67 (2-3-4), 95–110. doi:10.1504/IJEP.2020.117787

Wang, X., Luan, X., and Zhang, S. (2022). Corporate R&D investment, ESG performance and market value: The moderating effect of enterprise digital level. Stud. Sci. Sci. 40, 1–16. doi:10.16192/j.cnki.1003-2053.20220606.001

Wang, Y., and Luo, Y. (2013). Corporate social responsibility, employee recognition and corporate value relevance. Res. Financial Econ. Issues 35 (1), 98–103. doi:10.19654/j.cnki.cjwtyj.2013.01.016

Wen, Z., Chang, L., Hau, K., and Liu, H. (2004). Testing and application of the mediating effects. Acta Psychol. Sin. 49 (5), 614–620. Available online at: https://cnki.com.cn/Article/CJFDTotal-XLXB200405016.htm.

Wong, J. B., and Zhang, Q. (2022). Stock market reactions to adverse ESG disclosure via media channels. Br. Account. Rev. 54 (1), 101045. doi:10.1016/J.BAR.2021.101045

Wong, W. C., Batten, J. A., Ahmad, A. H., Mohamed-Arshad, S. B., Nordin, S., and Adzis, A. A. (2021). Does ESG certification add firm value? Finance Res. Lett. 39, 101593. doi:10.1016/j.frl.2020.101593

Xie, Y., Shi, H., and Qin, Y. (2019). Research on the influence of internal and external corporate social responsibility gap on enterprise value. J. Hunan Univ. 33 (6), 48–55. doi:10.16339/j.cnki.hdxbskb.2019.06.008

Yen-Yen, Y. (2019). The value relevance of ESG disclosure performance in influencing the role of structured warrants in firm value creation. Pol. J. Manag. Stud. 20 (1), 468–477. doi:10.17512/pjms.2019.20.1.40

Yi, L., Jiang, Y., and Yao, S. (2022). Research on the value creation effect of corporate ESG practice: A test based on the perspective of external pressure. South China J. Econ. 40 (10), 93–110. doi:10.19592/j.cnki.scje.391581

Keywords: ESG performance, corporate value, media attention, analyst coverage, stakeholder, mediating effect

Citation: Zheng Y, Wang B, Sun X and Li X (2022) ESG performance and corporate value: Analysis from the stakeholders’ perspective. Front. Environ. Sci. 10:1084632. doi: 10.3389/fenvs.2022.1084632

Received: 30 October 2022; Accepted: 23 November 2022;

Published: 13 December 2022.

Edited by:

Hong-Dian Jiang, China University of Geosciences, ChinaReviewed by:

Jing Wei, China Mobile Digital Intelligence Technology Co. Ltd., ChinaWenhui Chen, Beijing University of Chemical Technology, China

Copyright © 2022 Zheng, Wang, Sun and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaoyang Sun, c3VueGlhb3lhbmdfc3VubnlAMTYzLmNvbQ==

Yuhua Zheng

Yuhua Zheng Baosheng Wang

Baosheng Wang Xiaoyang Sun

Xiaoyang Sun Xuelian Li

Xuelian Li