- 1Department of Engineering Management, China Academy of Housing and Real Estate, Zhejiang University of Technology, Hangzhou, China

- 2Department of Engineering Management, Institute of Real Estate Studies, Zhejiang University of Technology, Hangzhou, China

- 3School of Management, Baise University, Baise, China

Unlike previous research on foreign direct investment (FDI), economic growth, and pollution, this study focuses on investigating complex interactions specifically. A dynamic simultaneous equation model is adopted, together with the one-step systematic GMM, drawn upon to empirically analyze 30 Chinese provinces between 2006 and 2017. The results show that FDI does promote economic growth in China which, in turn, positively affects FDI. However, FDI inflow and economic growth both have negative environmental effects. A higher level of environmental pollution corresponds with FDI becoming more attractive. In the case of China, therefore, the pollution-haven hypothesis holds weight. Specifically, industrial environmental pollution is found to positively affect economic growth, indicating this growth to fall on the left side of the environmental Kuznets Curve. Accordingly, therefore, policymakers should look to optimize China’s industrial structure, guide the inflow of high-quality FDI, and promote healthy and sustainable development under the country’s new development philosophy.

1 Introduction

FDI brings funds to a host country and stimulates economic growth via foreign-funded enterprises that settle in undeveloped regions. For China’s “economic miracle,” FDI has played a key role in promoting the country’s transformation from a planned to a market-oriented economy. Nevertheless, extensive FDI can trigger numerous problems, such as environmental pollution and resource depletion. The inflow of FDI into developing countries and regions where energy consumption industries are highly concentrated has resulted in environmental degradation (Grimes and Kentor, 2003; Shah et al., 2022). In response, some countries have implemented strict environmental protection policies. For instance, the 2030 Climate and Energy Policy Framework agreement stipulates that, by 2030, the EU plans to reduce its greenhouse gas (GHG) emissions by 40%. The United States has also committed to reducing its GHG emissions by half by 2030, as well as confirming a commitment to zero emissions by 2050. Developing countries with low infrastructure levels, such as Tunisia, Morocco, and Egypt, are more likely to have poor environmental standards. However, despite having environmental protection policies in place, the economic development in China, India, and Vietnam has not seen such policies strictly enforced. These countries mainly receive their FDI from the United States, Japan, and the EU, which can generate a double-edged impact.

Under the impact of a series of major emergencies, such as the complex international situation and the COVID-19 pandemic, global FDI fluctuated sharply. The COVID-19 pandemic has significantly impacted pollution emissions and air quality, ecology, economic development, and FDI (Chossière et al., 2021; Miyazaki et al., 2021; Pei et al., 2021; Su et al., 2021; Syarifuddin and Setiawan, 2022), causing unprecedented economic and social disruption (Azomahou et al., 2021). The impact of the crisis depends mainly on economic conditions and governance before the COVID-19 pandemic (Azomahou et al., 2021). Mukanjari and Sterner (2020) found that establishing formal ESG “climate change policies” does not affect firm performance during the pandemic. Companies with higher carbon intensity were more affected by crisis events. Calls for a green economic recovery have intensified since the COVID-19 pandemic, with events such as the COVID-19 pandemic making it clear that we need to rethink how we live. In response to the impact of significant events such as the COVID-19 crisis, a correct review of the relationship between FDI, economic growth, and industrial pollution will help improve the ability to cope with crises in the social and economic development process and realize the modernization of the country.

From one perspective, scholars confirm a pollution-haven hypothesis (Hoffmann et al., 2005; Acharyya, 2009; Caglar, 2020; Singhania and Saini, 2021). This theory blames FDI for transferring polluting investments to low-income countries in order to reduce production costs. Furthermore, when countries are in the process of expanding their economic scale, they consume more energy and emit more pollutants that gradually damage environmental quality (Sapkota and Bastola, 2017; Shao, 2017). Alternative research, however, finds that FDIs in OECD countries have aggravated CO2 emissions (Pazienza, 2015), although these factors need to be weighed against the funds, advanced technologies, and knowledge that FDI brings in to drive an economy. Economic growth improves people’s living standards, which in turn is conducive to improving environmental quality. All these suppositions lead to the pollution-halo hypothesis (Bergh and Nijkamp, 1994), which theorizes that to abate the negative effects of FDIs some countries have implemented strict environmental regulation policies forcing the use of environmental technologies. The problem with this approach, however, is that the adoption of these technologies only increases FDI costs, thereby generating a crowding-out effect and resulting in economic damages.

In the early 21st century, Asian countries prioritized achieving economic take-off via industrialization, rather than addressing environmental problems. Consequently, China’s ascendency has shed light on the dynamics at play between FDI, economic growth, and the environment. Given the environmental impact of expanding production scales, economic growth has inevitably led to environmental degradation, with Pakistan being one obvious example of economic development pursued at the expense of its environment (Abbasi and Riaz, 2016; Álvarez-Herránz et al., 2017; Ullah et al., 2022). Other research has explored how the economic growth of 17 countries in the Middle East and North Africa has resulted in a similar negative effect (Abdouli and Hammami, 2017a). China government has begun to shift their focus to improving environmental quality. Such aims, however, may result in conflict with economic development and lead to social issues (Blonigen, 2005; Paul and Singh, 2017).

As a major source of environmental harm, addressing industrial pollution needs prioritizing. The pollutants discharged by industrial enterprises cause serious environmental damage. The 1997 World Bank report China in 2020: Development Challenges in the New Century reveals China to have one of the most serious urban pollution levels in the world, with polluting enterprises and activities estimated to account for 3%–8% of annual GDP. Urbanization inevitably affects environmental quality, with each urbanization stage exerting a different degree of impact.

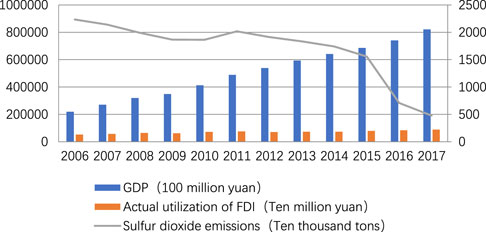

Figure 1 shows China’s economic growth and industrial pollution emissions from 2006 to 2017. To promote green and sustainable development and to comprehensively improve utilization efficiency, China has initiated a green transformation of its economic and social development model. However, the interaction between FDI, economic growth, and industrial pollution is still uncertain. The following questions need to be answered: first, whether China’s rapid economic development can be sustained and whether this growth will come at the expense of the environment; Second, whether China’s rapid economic development has the potential to attract FDI and whether FDI can become a driving force to promote economic growth; Thirdly, whether FDI inflow improves or worsens China’s ecological environment, and whether the more serious environmental pollution is, the more FDI inflow will be attracted. Based on the above considerations, the research objective of this paper is to construct a simultaneous equation model to comprehensively investigate the dynamic evolution characteristics of FDI, industrial pollution, and economic growth in 30 provinces of China during 2006–2017. Furthermore, it explores the interaction effect among the three and provides suggestions on coordinating the relationship between them to achieve green, circular, and sustainable development.

The main contribution of this study to the literature is twofold. Firstly, by combing previous studies on industrial pollution, FDI, and economic growth, the dynamic simultaneous equation model is utilized to evaluate the relationship complexity, including by taking the endogenous problem into consideration. By extending the two-element analysis framework, a simultaneous equation model is constructed capable of analyzing three elements and evaluating their interactive relationships. Secondly, as previous studies on the relationship between environmental pollution and economic growth mostly conclude that economic growth affects environmental pollution, the GMM method is adopted here to study the bidirectional causality. The results show that FDI does promote economic growth in China which, in turn, positively affects FDI. However, FDI inflow and economic growth both have negative environmental effects. A higher level of environmental pollution corresponds with FDI becoming more attractive. Specifically, industrial environmental pollution is found to positively affect economic growth, indicating this growth to fall on the left side of the environmental Kuznets Curve.

2 Literature review

2.1 Relationship between pollution and FDI

Foreign capital and environmental pollution studies are mainly divided into three streams. The first stream labels FDI’s negative effects as resulting from “Pollution Havens” (Copeland and Scott, 1994; Farooq et al., 2023; Pan H et al., 2023; Shah et al., 2023; Wu and Wang, 2023). Some researchers argue that countries have different policies and environmental standards, with developed countries usually adopting stricter environmental control policies and advanced technologies to reduce environmental pollution (Abdouli and Hammami, 2017b). Other research has confirmed that the challenge of attracting foreign investment and achieving rapid economic development has led to some countries avoiding strict environmental regulations (Shahbaz et al., 2015). Indeed, the strategy of embracing low environmental standards for profit has become increasingly obvious as, to reduce costs, foreign companies place investments in countries with relatively loose environmental regulations. These same investments then contribute to environmental deterioration within the host country, which is transformed into a pollution haven. By using the GMM method to investigate 21 high-polluting developed and developing countries between 1990 and 2016, previous studies have shown how FDI can aggravate environmental pollution, especially in developing countries labeled “pollution havens” (Caglar, 2020; Monica and Neha, 2021). This pollution-haven hypothesis is only valid for low-income countries, however. A positive correlation between pollution emissions and FDI in Latin America, for example, has been identified, calling into question whether low-income countries are capable of improving environmental health by attracting clean and energy-efficient industries through FDI. A study by Hadj and Ghodbane (2021), focusing on the effect of FDI on pollution via energy consumption, confirmed close links by using fixed and variable effect models, which validated the pollution-paradise hypothesis.

The second stream focuses on the positive effects of the pollution-halo hypothesis, positing that FDI brings advanced technologies and management experience to less developed regions, improving both resource-use efficiency and environmental quality (Pan X et al., 2023; Teng et al., 2023; Wang et al., 2023; Xie et al., 2023; Yilanci et al., 2023). Examining the location choices of United States Fortune 500 companies from 1972 to 1978 shows a greater interest in benefiting from a high-quality environment than having low-level environmental protection (Bartik, 1988). One research examining five Asian countries between 1981 and 2011 found different factors to have heterogeneous effects on carbon emissions (Zhu et al., 2016). So, although FDI can increase carbon emissions, its effect is not always judged significant. The pollution-paradise hypothesis tends to hold in low-emission countries, but in middle-to-high-emission countries FDI can be conducive to the overall reduction of carbon emissions. Utilizing a dynamic panel data model with generalized moment’s estimation for 54 countries between 1990 and 2011 showed that an increase in carbon dioxide emissions will lead to a decrease in FDI inflows (Omri et al., 2014). Hence, FDI flowing to industrialized economies was beneficial to developing countries and conducive to the improvement of China’s environmental quality (Ashraf et al., 2020). A causal relationship has been found between FDI and PM2.5 pollution in 11 emerging countries and regions, with the overall effect of FDI on PM2.5 negative, thereby supporting the pollution-halo hypothesis (Xie and Sun, 2020).

The third stream argues that FDI has an uncertain environmental impact (Guo et al., 2023). On the one hand, FDI aggravates environmental pollution via scale and structural effects. On the other, FDI reduces environmental pollution via technological effects, which differ for capital- and labor-intensive industries. One study analyzed China’s FDI and sulfur dioxide emissions, finding these factors to have an inverted U-shaped relationship and that technology adoption increases coal consumption but does not reduce sulfur dioxide emissions. Another study compared 65 countries along “the Belt and Road,” finding FDI to have a pollution-haven effect in low- and middle-income countries and a pollution-halo effect in high-income countries (Muhammad and Long, 2020; Xu et al., 2020). A Turkish study revealed that an FDI decrease leads to a long-term decline in emission growth rate, thereby confirming the asymmetric pollution-halo hypothesis. However, FDI has no effect on environmental pollution in the five BRIC countries: Brazil, Russia, India, China, and South Africa (Shao et al., 2019).

The impact of FDI on environmental pollution in host countries is controversial and can be divided into three categories: first, the pollution-haven hypothesis; The pollution-halo hypothesis; Third, FDI has both positive and negative impacts on the host country’s environment. Such a result is mainly due to scholars’ analysis of the relationship between the two from different perspectives, such as specific industries and specific regions.

Accordingly, hypothesis 1 is proposed: there is a positive (negative) relationship between industrial pollution and FDI inflow, which is consistent with the pollution-haven (halo) hypothesis, and FDI leads to higher emissions in places with weak (strong) environmental regulations.

2.2 Relationship between industrial pollution and economic growth

Previous economic growth and environmental pollution studies have mainly focused on the environmental Kuznets curve (EKC), which assumes an inverted U-curve relationship between economic output and environmental pollution (Omri et al., 2014; Tiba and Omri, 2016; Wu and Wang, 2023). One research avenue argues that environmental pollution increases with economic growth during the early stages of economic development, then decreases with economic growth after the economy reaches a certain level, hence, highlighting the existence of an EKC curve (Isik et al., 2018; Altinoz et al., 2020; Dogru et al., 2020; Alvarado et al., 2021). Some researchers have applied GMM to verify the EKC effect of carbon emissions from 24 emerging economies, finding carbon emissions and economic growth to have an inverted U-shape relationship (Hove and Tursoy, 2019). Other research has used a combined mean group (PMG), panel FMOLS, and panel DOLS to validate the environmental EKC hypothesis for OECD countries. This EKC hypothesis was further validated by the interaction between infrastructure investment in the transportation system and environmental degradation of 21 OECD countries (Erdogan, 2020). Elsewhere, the dynamic link between Pakistan’s CO2 emissions and industrial development was examined for effectiveness, with the variables found to be co-integrated, involving both long- and short-term dynamics that validate the hypothesis (Ali et al., 2021).

An alternative research avenue argues that the EKC curve does not exist (Shah et al., 2023; Farooq et al., 2023). To confirm the hypothesis, therefore, other factors must be considered, such as technological effects, resources, and scale of development. Xie et al. (2023), Khan (2023), and Farooq et al. (2023) found that economic growth has a positive linear relationship with environmental pollution. Within OECD countries, both economic growth and carbon emissions were found to follow a U-shaped relationship (Sohag et al., 2019). Higher levels of economic development, however, contributed to lower levels of pollution emissions, thereby rejecting the EKC hypothesis (Dogan and Inglesi-Lotz, 2020). It was found that CO/CO2 and NO2/CO2 ratios in most developed cities marginally increase along with GDP, but these increase more substantially along with GDP in developing cities, such as Mumbai and Tianjin, whose pollutant emission ratios are very high or even comparable to developed cities (Park et al., 2021). When exploring the effects of economic growth on the use of SO2, NO2, and PM2.5 registered air pollutants, researchers found a U- or N-shaped relationship present between GDP per capita and air pollutants in eastern, western, and central China. These results suggest that the relationship between air pollutants and economic growth is associated with regional factors and the choice of variables (Xu et al., 2019).

The research on the relationship between economic growth and environmental pollution has not reached a consensus conclusion, mainly including linear and non-linear relationships. Therefore, hypothesis 2 is put forward that there is a positive (negative) relationship between industrial pollution and economic growth, and places with light (severe) pollution will promote (hinder) economic growth.

2.3 Relationship between FDI and economic growth

The relationship between FDI and economic growth has received a great deal of research, one stream of which reveals a positive relationship due to FDI directly promoting economic growth (Romer, 1986; Narteh-Yoe et al., 2022; Asafo-Agyei and Kodongo, 2023; Khan and Imran, 2023). Specifically, FDI inflow increases the host country’s capital stock and access to variable funds for financial development, brings in advanced technologies, and promotes economic progression. A higher economic growth sends a positive signal that attracts more FDI (O’Doherty et al., 2003; Jalil and Mahmud, 2009; Saini and Singhania, 2018; Saini and Singhania, 2019).

The Granger causality test has been applied to determine the two-way association between FDI and economic growth within 62 countries between 1975 and 1978, and for 51 countries between 1983 and 1986. The vector error correction model was equipped with an autoregressive distributional lag test to examine the interrelationship among FDI, international trade, and economic growth within 15 selected MENA countries (Kalai and Zghidi, 2019). The results showed the long-standing unidirectional effect of FDI on economic growth. The causal relationship existing among environmental quality, FDI, and economic growth was also analyzed, showing the one-way causal relationship between direct investment stock and economic growth to support the growth hypothesis. In other words, increasing the FDI stock promotes economic growth. By embracing this as a key tool for economic growth, therefore, both developed and developing countries are eager to engage in foreign-to-foreign investment.

Other research finds the relationship between FDI and economic growth to be insignificant or even negative (Pradhan, 2009). As far as its potential (industrial, commercial and financial resources) is concerned, Russia does not attract all the FDI it matches (Fabry and Zeghni, 2002). Economic growth and financial development can develop independently, while FDI cannot affect economic growth by influencing financial development. It has also been argued that FDI can block economic growth by hindering domestic economic development due to lax policies and privatization, with the presence of financial liberalization limiting the role of economic development in attracting FDI inflows (Boyd and Smith, 1992). Furthermore, the OLS method has found no significant short- or long-term relationship between FDI and economic growth in Turkey (Temiz and Gkmen, 2014).

Whether theoretically or empirically, FDI has a positive or negative impact on the host country’s economic growth. This impact is related to the host country’s development potential. However, the inflow of foreign capital can bring advanced technology and financial support to the host country, which is conducive to economic development. The sustainable economic development of the host country is attractive to the inflow of foreign capital. Therefore, hypothesis 3 is that FDI inflow will promote economic growth, which can attract FDI inflow.

2.4 Relationship between pollution, FDI, and economic growth

FDI accelerates economic development and promotes employment but is also a double-edged sword in that its effects may be negative too, such as with environmental pollution and damage (Bildirici and Çoban Kayıkçı, 2023). An empirical study analyzed the relationship between FDI, economic growth, and pollution for 14 Latin American countries, based on time series data from 1980 to 2010, concluding FDI to be positively associated with environmental pollution, thereby supporting the EKC hypothesis (Sapkota and Bastola, 2017). The researchers added that Latin America should focus on FDI policies that attract clean and energy-efficient industries with the potential to improve environmental health and promote economic growth. This theoretical analysis reveals a complex interrelationship that should be further explored, while the existing problems also need to be addressed to enable further economic development. Accordingly, strategies for managing a healthy relationship between FDI and environmental protection have become a key research problem.

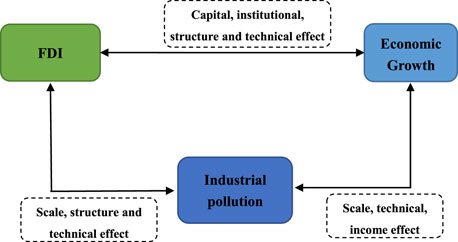

In response, researchers should systematically investigate the influencing mechanisms among the key factors. Specifically, the relationship between FDI and environmental pollution should be further analyzed based on the pollution-haven and pollution-halo hypotheses, which point to the presence of scale, structural, and technology effects as defining (Behera and Dash, 2017; Liu, et al., 2019; Caglar, 2020). The EKC curve model illustrates the interactions between economic growth and pollution via the effects of scale, technology, income, and policy (Brock and Taylor, 2005; Lin et al., 2016). Meanwhile, the capital, technology, institutional, and structural effects between FDI and economic growth should be understood based on economic growth theory (Welela, 2018).

In short, many studies have examined the relationship between FDI and environmental pollution, economic growth and FDI, and FDI and economic growth. However, only some studies have analyzed the impact of environmental pollution on economic growth. Moreover, the relationship between the three is complicated (as shown in Figure 2 below), so putting them into the same framework and studying their mutual relationship is necessary. Therefore, this paper constructs a simultaneous equation model and uses the GMM method to evaluate the dynamic evolution characteristics and interaction effects of FDI, economic growth, and industrial pollution in the era of comprehensive green economic and social development transformation.

3 Models and data

3.1 Simultaneous equation models

As shown in previous studies investigating interactions between industrial pollution, FDI, and economic growth, a single regression analysis cannot comprehensively portray the interrelationships. Plus, using the Cobb–Douglas (C–D) production function form to build a simultaneous equation model cannot solve the endogeneity problem caused by two-way causality (Omri et al., 2014; Liu et al., 2018). The basic form of the C–D production function is

Where Y denotes economic growth, A denotes total factor productivity, L denotes labor force, K denotes capital stock, and FDI denotes the actual amount of FDI utilized. At this point, we have

Where i and t denote the situation of the ith province in year t. By setting output per capita

According to economic growth theory, capital stock (K) is an important factor. Plus, in addition to sulfur dioxide emissions, FDI, and GDP per capita, economic growth may be affected by population size (pop), technology level (tec), government intervention (gov), and trade openness (open). These control variables are added to Eq. 3 as part of the econometric analysis to control for their effects on the dependent variable. Eq. 4 is an economic growth model that describes the effects of industrial pollution (P), FDI, and control variables [6, 22, 63]:

P and Y affect FDI at a certain level, and FDI considers production costs, such as workers’ wages and human capital level (hum). According to international trade theory, labor cost is an important measure of a country’s comparative advantage, which China has been attracting foreign investment with. However, given that pollution control level (reg) and trade openness (open) are two other important factors that influence FDI, they are used as control variables in the pollution model to obtain the following equation (Wang and Chen, 2014):

Another equation is established to describe the effect of FDI and economic growth (Y) on industrial pollution (P). Given that the pollution level is also closely related to environmental regulation (reg), technology level (tec), urbanization level (urb), trade openness (open), and industrial structure (str), all of these variables are added to Eq. 6 as control variables. The following industrial pollution model is then obtained (Dogan and Inglesi-Lotz, 2020; Li et al., 2020):

One period of dependent variable lag level (i.e., economic growth, FDI inflow, and industrial pollution) can affect current levels. The lag term of the dependent variables, therefore, is introduced in Eq. 4–6 to construct the following dynamic simultaneous equation models:

3.2 Variables selection

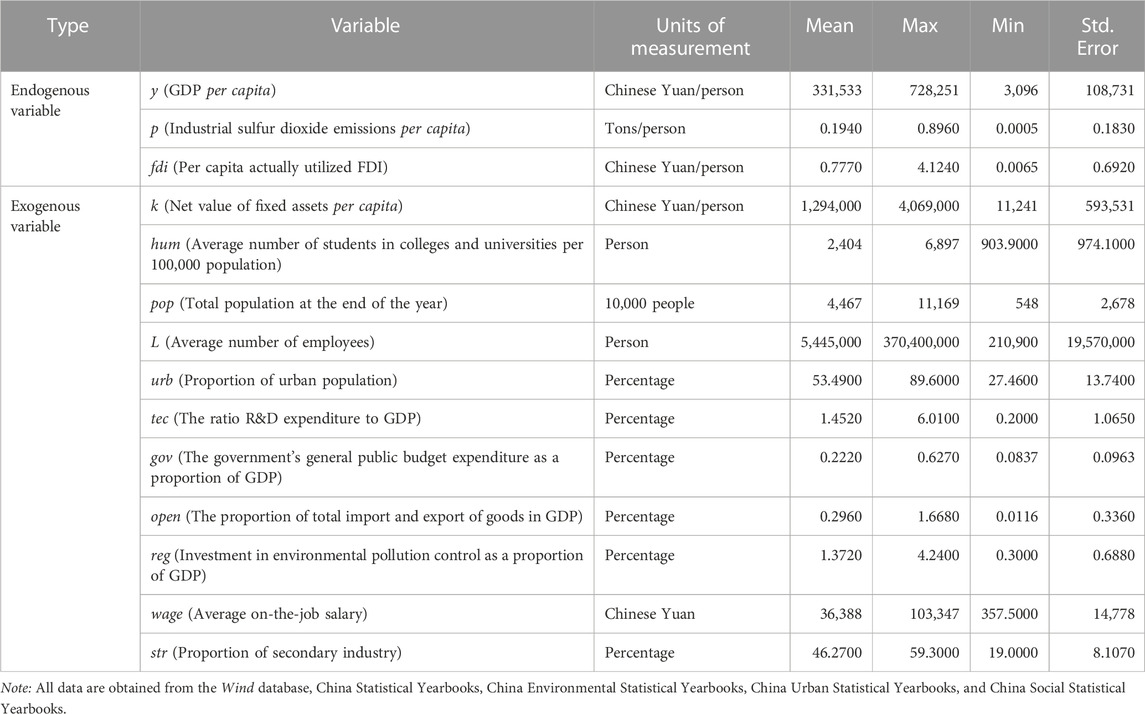

Economic growth is expressed in terms of GDP and converted to actual values by using CPI, taking 2006 as the base period. Industrial pollution (P) is expressed as industrial sulfur dioxide emissions, while FDI is expressed as the actual amount of FDI utilized by each region, which is initially converted to RMB using the annual average exchange rate of USD to RMB, then converted to actual 2006 values by using CPI.

Among the control variables, capital stock is calculated as follows using the perpetual inventory method:

The level of openness to the outside world (open) is expressed as the share of total imports and exports of goods in regional GDP, wage is expressed as the average wage, environmental regulation level (reg) is expressed as the investment in environmental pollution control as a share of GDP, urbanization level (urb) is measured by the share of urban population, human capital level (hum) is expressed as the average number of students in higher education per 100,000 population, and industrial structure (str) is expressed as secondary industry share (Soytas et al., 2007; Zhu L et al., 2019; Zhu W et al., 2019).

Considering the availability, reliability, and accuracy of the data, this study selected the panel data of 30 provinces and cities in China from 2006 to 2017 for empirical analysis (Tibet was excluded due to missing data) as the observation object, while individual missing data were supplemented according to the mean value method. All data are obtained from the Wind database, China Statistical Yearbooks, China Environmental Statistical Yearbooks, China Urban Statistical Yearbooks, China Social Statistical Yearbooks, and the statistical yearbooks of provinces and cities. The symbols, names, and unit attributes of the above statistical variables are specified in Table 1.

3.3 Estimation methods

Given that explanatory variables with one-period lag are included in Eqs 4–6, using the classical OLS approach may lead to biased estimation results. Meanwhile, the generalized method of moments (GMM) can address the endogeneity problem in the models and obtain consistent estimates (Bond, 2002; Hille, 2018; Hashmi and Alam, 2019).

GMM offers two advantages for this study. Firstly, per capita pollutant emissions, per capita foreign direct inflows, and per capita GDP may be determined at the same time. Dynamic panel GMM can effectively control the endogeneity of the explanatory variables by selecting appropriate instrumental variables (Çoban and Topcu, 2013). Secondly, when the unobservable variables are related to explanatory variables or when some influencing factors are omitted, GMM uses differential conversion data to overcome the problem of missing variables. System GMM (SYS-GMM), which includes one- and two-step GMM, is used because the weight matrix of the two-step estimation depends on the estimated parameters and the standard deviation is biased downward, which provides neither significant efficiency improvements nor reliable estimators (Arellano and Bond, 1991; Arellano and Bover, 1995; Monica and Neha, 2021). To test the rationality of the estimation method, the results of one-step difference GMM and one-step SYS-GMM are also presented.

4 Results and discussion

4.1 Panel unit root tests

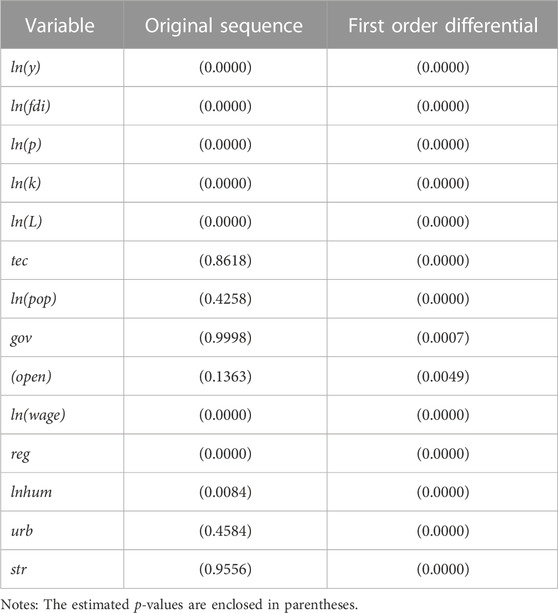

Given that this article uses large N small T panel data, the HT method is used in the panel unit root test to avoid the regression phenomena in the regression process and to ensure that the results are unbiased and effective. The test results are shown in Table 2.

The three indexes of the original sequence ln(pop), tec, and urb are non-stationary variables, whereas the other variables are stable. However, after the first-order difference, each variable becomes stable. The next step, therefore, is to test for a long-term co-integration relationship among the variables.

4.2 Panel co-integration tests

Kao test is performed to test the co-integration among economic growth, FDI, and sulfur dioxide emissions for each influence factor. Table 3 reveals the p-values of each equation variable with economic growth, FDI, and SO2 emissions to be less than 0.1, which passes the significance test and so indicates the presence of a long-term co-integration relationship among economic growth, FDI, and SO2 emissions.

4.3 Empirical results and analysis

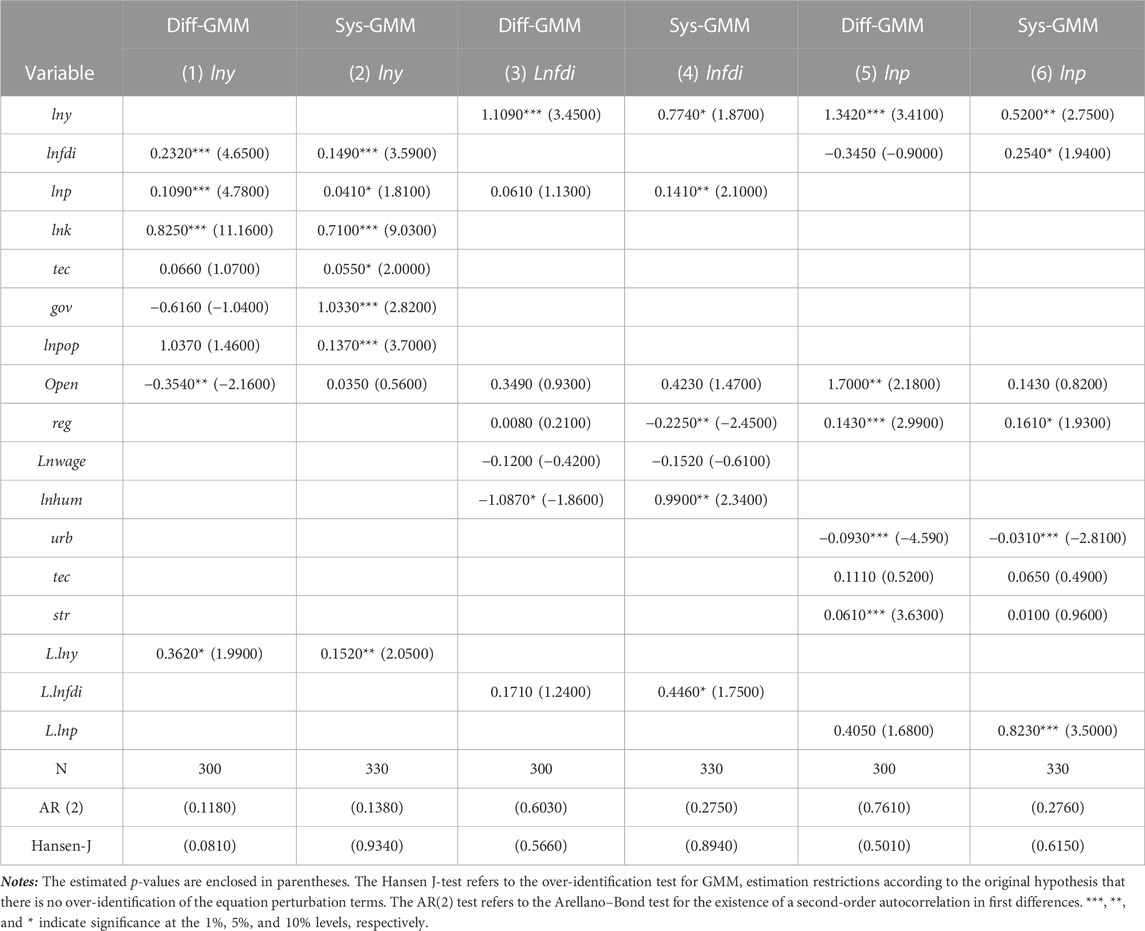

Table 4 presents the estimations obtained using Stata16.0, one-step differential GMM, and one-step system GMM methods, using economic growth, FDI, and industrial pollution and their lagged variable as endogenous variables. For those problems related to order sequence, the regression results of each equation are valid. The Hansen-J value indicates that the selected instrumental variable passes the over-identification test and meets the requirements of correlation and exogeneity. SYS-GMM outperforms differential GMM in terms of the significance of the explanatory variable’s coefficient and the Hansen-J value. The SYS-GMM estimation results, therefore, are used for analysis reference.

Model (2) in Table 4 shows that the coefficient of lnfdi is 0.149 in the economic growth equation, which is significant at the 1% level. In other words, for every 1 percentage point increase in FDI per capita, the regional economy increases by 0.149 percentage points, thereby suggesting that FDI promotes regional economic growth. Meanwhile, the coefficient of Lnp is 0.041, which means that, for every 1 percentage point increase in industrial sulfur dioxide emissions per capita, the regional economy increases by 0.041 percentage points at the 10% significance level. This positive correlation supports the assumption that China endures environmental damage for the sake of economic growth and confirms the country to be in a stage of rapid industrialization, with high-pollution manufacturing as the supporting industry. Among the control variables, the coefficient of lnk is 0.71 and significantly positive, indicating that the stock of fixed capital can positively contribute to the development of China’s economy (Hamdi et al., 2014). A comparison of the lnfdi and lnk coefficients reveals that, during the study period, domestic fixed capital achieves a greater contribution to China’s economic development compared with FDI. The coefficient of lnpop is 0.137, which is significant at the 1% level, whereas the coefficient of tec is 0.055, which is significantly positive at the 10% level. China, therefore, is dominated by labor-intensive industries, featuring a level of technology that, to a certain extent, can also contribute to its economic growth. The coefficient of gov is significantly positive at the 1% statistical level, indicating that the Chinese government can reasonably allocate local general budget expenditure costs, allowing them to effectively and reasonably utilize financial resources. The coefficient of open is positive yet insignificant, thereby suggesting that foreign opening levels do not have a significant role in promoting economic growth.

In Model (4), the coefficient of lny is 0.774 and significant at the 10% level, suggesting that for every 1 percentage point increase in the economy FDI per capita increases by 0.774 percentage points. The host country’s economic development level is among the key factors that foreign investors consider. A larger scale of economic development indicates a greater market potential and higher potential for attracting foreign investors (Omri and Sassi-Tmar, 2015). The coefficient of lnp is 0.141 and significant at the 5% level, suggesting that for every 1 percentage point increase in industrial SO2 emissions per capita FDI increases by 0.141 percentage points. In other words, a greater amount of industrial sulfur dioxide emissions results in more serious environmental pollution. This finding may be ascribed to the fact that, for some industries, higher pollution lowers environmental standards, whereas lower expenditure on environmental protection for foreign investors corresponds to lower costs and greater FDI inflows (Blanco et al., 2013; Bildirici and Çoban Kayıkçı, 2023). Among the control variables, the coefficient of lnwage is −0.152 and insignificant, suggesting that even though labor cost can affect FDI entry to some extent, this factor is not of high consideration among foreign investors. The coefficient of reg is −0.225 and significant at the 5% level, indicating that environmental regulation has a suppressive effect on FDI inflows. This result validates the pollution-haven hypothesis that a greater degree of pollution can effectively attract more FDI. The coefficient of lnhum is significantly positive, indicating that FDI is closely related to local human capital level and that human capital enhances the ability of cities to attract FDI.

In Model (6), the coefficient of lny is 0.52 and significant at the 5% significance level, suggesting that for every 1 percentage point increase in economic growth, per capita sulfur dioxide emissions increase by 0.52 percentage points. China’s economic development stays on the left side of the EKC curve, while the degree of environmental pollution increases with economic growth (Shahbaz et al., 2015; Lau et al., 2014; Bildirici and Çoban Kayıkçı, 2023). The coefficient of lnfdi is 0.254 and significant at the 10% significance level, suggesting that for every 1 percentage point increase in per capita FDI, per capita industrial sulfur dioxide emissions increase by 0.254 percentage points (He, 2006; Acharyya, 2009; Ren et al., 2014; Wu and Wang, 2023). In other words, FDI inflow leads to further environmental degradation, thereby verifying the pollution-haven hypothesis. Among the control variables, the coefficient of open is 0.143 and insignificant, thereby indicating that the degree of openness is not the main cause of pollution. Meanwhile, the coefficient of reg is 0.161 and significant at the 10% level, indicating that China’s environmental regulation is ineffective, that the country may still be in the early stages of implementing environmental protection policies, and that its technical equipment and policy methods are not effective in improving the environment. The coefficient of urb is −0.031 and significant at the 1% level, indicating that a higher level of urbanization can reduce industrial pollution for two possible reasons. Firstly, urban areas are not conducive to the establishment of large factories. Secondly, a higher level of development increases people’s awareness of the importance of environmental protection and inspires environmental protection initiatives, thereby contributing to pollution reduction. The coefficient of tec is 0.065 and insignificant, suggesting that technology level does not have a suppressive effect on SO2 emissions.

The first-order lagged coefficients of lny, lnfdi, and lnp are all significantly positive. This result also supports the validity of using the dynamic panel model. The coefficient of L.lnfdi is 0.446, suggesting that for every 1% increase in FDI during the previous period the current period increases by 0.446%. FDI shows an agglomeration effect because foreign investors tend to focus on location when choosing investments. To reduce the risks posed by uncertain factors such as culture, economy, market situation, and host country preferential policies, foreign investors tend to be drawn to those areas where foreign capital is relatively concentrated. Meanwhile, the flow of foreign capital into the high-emission manufacturing industry will increase industrial sulfur dioxide emissions and intensify environmental pollution. For the environment, pre-pollution will significantly aggravate the deterioration of current environmental levels. Timely population control measures, therefore, should be adopted to avoid ecosystem destruction.

5 Conclusion

By using a dynamic panel coefficient model, this paper analyzes the panel data of 30 provinces and cities in China between 2006 and 2017 with the aim of understanding whether introducing foreign investments produces a pollution-haven or pollution-halo effect on China’s environment, whether economic growth and foreign investment inflow have a mutual promotion effect, and whether an EKC exists between economic growth and pollution.

On the one hand, FDI inflows promote China’s economic growth, but economic growth also brings harm to the environment. Seeing that a high level of environmental pollution is conducive to FDI taking place, these inflows do pose a threat to China’s environment, thereby validating the pollution-paradise hypothesis. So, despite the negative relationship between environmental regulations and FDI inflows, China’s present environmental regulations do not actually benefit the country’s environment. Moreover, foreign investors choose to invest in those areas with poor environmental standards, thereby exacerbating these complications. On the other hand, the scale of economic development positively affects FDI, indicating that economic growth and FDI inflows can promote each other. Actively introducing FDI while supervising and improving foreign investment access policy can promote China’s economic growth yet deteriorate its environment at the same time. Green thresholds should be established, therefore, ensuring that the inflow of highly polluting foreign investment is strictly gated and managed, the industrial structure of FDI is balanced, and the development of high-tech industries accelerated. When foreign investors consider green industries, some preferential treatment may be advisable to encourage additional investments in sustainable development.

Economic growth harms the environment, whereas industrial pollution positively affects economic growth. In this case, China’s economic development leans on the left side of the EKC curve, meaning that the country sacrifices its environment for the sake of economic development. Therefore, China needs to change its economic development model and emphasize the quality of economic growth. At the same time, the government should strengthen environmental supervision, introduce high-quality FDI, and play the role of foreign investment in improving the environment.

6 Limitations and future directions

Although this study supplements the research on the relationship between FDI, economic growth, and industrial pollution under the same framework, it still has shortcomings that need further improvement. First of all, due to the limitations of data availability and data processing methods, only per capita industrial sulfur dioxide emission is selected as the proxy variable of industrial pollution, which has certain defects in measuring industrial pollution. Subsequent studies can expand this based on data richness. Secondly, this study did not analyze the relationship mechanism among the three. In the follow-up study, more in-depth research should be carried out on the theoretical and specific effect mechanisms of the interaction between the three. Finally, the panel data of 30 provinces in China from 2006 to 2017 are studied in this paper. In future work, the scope of the study can be expanded to other regions with different economic and social conditions, which is conducive to the comparison and generalization of the research results.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This work was supported by Zhejiang Philosophy and Social Science Planning Project (22NDJC053YB), Zhejiang Provincial Natural Science Foundation (LZ22G030001), National Social Science Fund of China (16BJL053), The Fundamental Research Funds for the Provincial Universities of Zhejiang (GB202003004).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, F., and Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 90, 102–114. doi:10.1016/j.enpol.2015.12.017

Abdouli, M., and Hammami, S. (2017a). Economic growth, FDI inflows and their impact on the environment: An empirical study for the MENA countries. Qual. Quantity 51 (1), 121–146. doi:10.1007/s11135-015-0298-6

Abdouli, M., and Hammami, S. (2017b). Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. Int. Bus. Rev. 26 (2), 264–278. doi:10.1016/j.ibusrev.2016.07.004

Acharyya, J. (2009). FDI, growth and the environment: Evidence from India on CO2 emission during the last two decades. J. Econ. Dev. 34 (1), 43–58. doi:10.35866/caujed.2009.34.1.003

Ali, M. U., Zhimin, G., Asmi, F., Xue, Z., and Muhammad, R. (2021). The nexus between environmental degradation and Industrial development in Pakistan and roles of financial development and fossil fuel. Environ. Prog. Sustain. Energy 40. doi:10.1002/ep.13621

Altinoz, B., Apergis, N., and Aslan, A. (2020). Energy consumption, carbon dioxide emissions and economic growth: Fresh evidence from panel quantile regressions. Energy Res. Lett. 1 (3), 17075. doi:10.46557/001c.17075

Alvarado, R., Tillaguango, B., López-Sánchez, M., Ponce, P., and Işık, C. (2021). Heterogeneous impact of natural resources on income inequality: The role of the shadow economy and human capital index. Econ. Analysis Policy 69 (5), 690–704. doi:10.1016/j.eap.2021.01.015

Álvarez-Herránz, A., Balsalobre, D., Cantos, J. M., and Shahbaz, M. (2017). Energy innovations-GHG emissions nexus: Fresh empirical evidence from OECD countries. Energy Policy 101, 90–100. doi:10.1016/j.enpol.2016.11.030

Ang, J. B. (2008). Economic development, pollutant emissions and energy consumption in Malaysia. J. Policy Model. 30 (2), 271–278. doi:10.1016/j.jpolmod.2007.04.010

Anwar, S., and Sun, S. (2011). Financial development, foreign investment and economic growth in Malaysia. J. Asian Econ. 22 (4), 335–342. doi:10.1016/j.asieco.2011.04.001

Arellano, M., and Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58 (2), 277–297. doi:10.2307/2297968

Arellano, M., and Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. J. Econ. 68 (1), 29–51. doi:10.1016/0304-4076(94)01642-d

Asafo-Agyei, G., and Kodongo, O. (2022). Foreign direct investment and economic growth in sub-saharan Africa: A nonlinear analysis. Econ. Syst. 46 (4), 101003. doi:10.1016/j.ecosys.2022.101003

Ashraf, A., Doytch, N., and Uctum, M. (2020). Foreign direct investment and the environment: Disentangling the impact of greenfield investment and merger and acquisition sales. Sustain. Account. Manag. Policy J. 12 (1), 51–73. doi:10.1108/sampj-04-2019-0184

Azomahou, T. T., Ndung’u, N., and Ouedraogo, M. (2021). Coping with a dual shock: The economic effects of COVID-19 and oil price crises on African economies. Resour. Policy 72, 102093. doi:10.1016/j.resourpol.2021.102093

Bartik, T. J. (1988). The Effects of environmental regulation on business location in the United States. Growth & Change 19 (3), 22–44. doi:10.1111/j.1468-2257.1988.tb00473.x

Behera, S. R., and Dash, D. P. (2017). The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew. Sustain. Energy Rev. 70, 96–106. doi:10.1016/j.rser.2016.11.201

Bergh, J., and Nijkamp, P. (1994). Dynamic macro modelling and materials balance: Economic-environmental integration for sustainable development. Econ. Model. 11 (3), 283–307. doi:10.1016/0264-9993(94)90006-x

Bildirici, M., and Çoban Kayıkçı, F. (2023). Energy consumption, energy intensity, economic growth, FDI, urbanization, PM2.5 concentrations nexus[J]. Environ. Dev. Sustain., 1–19. doi:10.1007/s10668-023-02923-9

Blanco, L., Gonzalez, F., and Ruiz, I. (2013). The impact of FDI on CO2 emissions in Latin America. Oxf. Dev. Stud. 41 (1), 104–121. doi:10.1080/13600818.2012.732055

Blonigen, B. A. (2005). A Review of the empirical literature on FDI determinants. Atl. Econ. J. 33 (4), 383–403. doi:10.1007/s11293-005-2868-9

Bond, S. R. (2002). Dynamic panel data models: A guide to micro data methods and practice. Portuguese Econ. J. 1 (2), 141–162. doi:10.1007/s10258-002-0009-9

Boyd, J. H., and Smith, B. D. (1992). Intermediation and the equilibrium allocation of investment capital: Implications for economic development. Ann. N. Y. Acad. Sci. 30 (3), 409–432. doi:10.1016/0304-3932(92)90004-l

Brock, A., and Taylor, M. S. (2005). Economic growth and the environment: A review of theory and empirics. Handb. Econ. Growth 1, 1749–1821. doi:10.1016/S1574-0684(05)01028-2

Caglar, A. E. (2020). The importance of renewable energy consumption and FDI inflows in reducing environmental degradation: Bootstrap ARDL bound test in selected 9 countries. J. Clean. Prod. 264, 121663. doi:10.1016/j.jclepro.2020.121663

Chossière, G. P., Xu, H., Dixit, Y., Isaacs, S., Eastham, S. D., Allroggen, F., et al. (2021). Air pollution impacts of COVID-19-related containment measures. Sci. Adv. 7 (21), eabe1178. doi:10.1126/sciadv.abe1178

Çoban, S., and Topcu, M. (2013). The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. 39, 81–88. doi:10.1016/j.eneco.2013.04.001

Copeland, B. R., and Scott, T. M. (1994). North-South trade and the environment. Narnia 109 (3), 755–787. doi:10.2307/2118421

Dogan, E., and Inglesi-Lotz, R. (2020). The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: Evidence from European countries. Environ. Sci. Pollut. Res. 27 (11), 12717–12724. doi:10.1007/s11356-020-07878-2

Dogru, T., Bulut, U., Kocak, E., Isik, C., Suess, C., and Sirakaya-Turk, E. (2020). The nexus between tourism, economic growth, renewable energy consumption, and carbon dioxide emissions: Contemporary evidence from OECD countries. Environ. Sci. Pollut. Res. 27 (32), 40930–40948. doi:10.1007/s11356-020-10110-w

Erdogan, S. (2020). Analyzing the environmental Kuznets curve hypothesis: The role of disaggregated transport infrastructure investments. Sustain. Cities Soc. 61, 102338. doi:10.1016/j.scs.2020.102338

Fabry, N., and Zeghni, S. (2002). Foreign direct investment in Russia: How the investment climate matters. Communist Post-Communist Stud. 35 (3), 289–303. doi:10.1016/s0967-067x(02)00012-0

Farooq, U., Tabash, M. I., Anagreh, S., Al-Rdaydeh, M., and Habib, S. (2023). Economic growth, foreign investment, tourism, and electricity production as determinants of environmental quality: Empirical evidence from GCC region[J]. Environ. Sci. Pollut. Res., 1–13. doi:10.1007/s11356-023-25545-0

Grimes, P., and Kentor, J. (2003). Exporting the greenhouse: Foreign capital penetration and CO? Emissions 1980-1996. J. World-Systems Res. 9 (2), 261–275. doi:10.5195/jwsr.2003.244

Guo, T., Zheng, B., and Kamal, M. A. (2023). Have environmental regulations restrained FDI in China? New evidence from a panel threshold model[J]. Environ. Sci. Pollut. Res., 1–17. doi:10.1007/s11356-022-24841-5

Hadj, T. B., and Ghodbane, A. (2021). A moderated mediation model of the effect of FDIs on CO2 emissions: Panel data evidence from GCC countries. J. Knowl. Econ. 11, 1–22. doi:10.1007/s13132-021-00765-2

Hamdi, H., Sbia, R., and Shahbaz, M. (2014). The nexus between electricity consumption and economic growth in Bahrain. Econ. Model. 38, 227–237. doi:10.1016/j.econmod.2013.12.012

Hashmi, R., and Alam, K. (2019). Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J. Clean. Prod. 231, 1100–1109. doi:10.1016/j.jclepro.2019.05.325

He, J. (2006). Pollution haven hypothesis and environmental impacts of foreign direct investment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol. Econ. 60 (1), 228–245. doi:10.1016/j.ecolecon.2005.12.008

Hille, E. (2018). Pollution havens: International empirical evidence using a shadow price measure of climate policy stringency. Empir. Econ. 54 (3), 1137–1171. doi:10.1007/s00181-017-1244-3

Hoffmann, R., Lee, C. G., Ramasamy, B., and Yeung, M. (2005). FDI and pollution: A granger causality test using panel data. J. Int. Dev. 17 (3), 311–317. doi:10.1002/jid.1196

Hove, S., and Tursoy, T. (2019). An investigation of the environmental Kuznets curve in emerging economies. J. Clean. Prod. 236, 117628. doi:10.1016/j.jclepro.2019.117628

Isik, C., Dogru, T., and Turk, E. S. (2018). A nexus of linear and non-linear relationships between tourism demand, renewable energy consumption, and economic growth: Theory and evidence. Int. J. Tour. Res. 20 (1), 38–49. doi:10.1002/jtr.2151

Jalil, A., and Mahmud, S. F. (2009). Environment Kuznets curve for CO2 emissions: A cointegration analysis for China. Energy Policy 37 (12), 5167–5172. doi:10.1016/j.enpol.2009.07.044

Kalai, M., and Zghidi, N. (2019). Foreign direct investment, trade, and economic growth in MENA countries: Empirical analysis using ARDL bounds testing approach. J. Knowl. Econ. 10 (1), 397–421. doi:10.1007/s13132-017-0460-6

Khan, M. T., and Imran, M. (2023). Unveiling the carbon footprint of europe and central asia: Insights into the impact of key factors on CO2 emissions[J]. Archives Soc. Sci. A J. Collab. Mem. 1 (1), 52–66. doi:10.5281/zenodo.7669782

Khan, M. (2023). Shifting gender roles in society and the workplace: Implications for environmental sustainability[J]. Politica 1 (1), 9–25. doi:10.5281/zenodo.7634130

Lau, L. S., Choong, C. K., and Eng, Y. K. (2014). Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: Do foreign direct investment and trade matter?. Energy Policy 68, 490–497. doi:10.1016/j.enpol.2014.01.002

Li, Z., Song, Y., Zhou, A., Liu, J., Pang, J., and Zhang, M. (2020). Study on the pollution emission efficiency of China's provincial regions: The perspective of Environmental Kuznets curve. J. Clean. Prod. 263, 121497. doi:10.1016/j.jclepro.2020.121497

Lin, B., Omoju, O. E., Nwakeze, N. M., Okonkwo, J. U., and Megbowon, E. T. (2016). Is the environmental Kuznets curve hypothesis a sound basis for environmental policy in Africa?. J. Clean. Prod. 133, 712–724. doi:10.1016/j.jclepro.2016.05.173

Liu, Y., Zhang, Z., and Zhou, Y. (2018). Efficiency of construction land allocation in China: An econometric analysis of panel data. Land Use Policy 74, 261–272. doi:10.1016/j.landusepol.2017.03.030

Liu, J., Qu, J., and Zhao, K. (2019). Is China's development conforms to the environmental Kuznets curve hypothesis and the pollution haven hypothesis? J. Clean. Prod. 234, 787–796. doi:10.1016/j.jclepro.2019.06.234

Miyazaki, K., Bowman, K., Sekiya, T., Takigawa, M., Neu, J. L., Sudo, K., et al. (2021). Global tropospheric ozone responses to reduced NO x emissions linked to the COVID-19 worldwide lockdowns. Sci. Adv. 7 (24), eabf7460. doi:10.1126/sciadv.abf7460

Monica, S., and Neha, S. (2021). Demystifying pollution haven hypothesis: Role of FDI. J. Bus. Res. 123, 516–528. doi:10.1016/j.jbusres.2020.10.007

Muhammad, S., and Long, X. (2020). Institutional factors and CO2 emissions nexus: A comparative analysis on the basis of income level. J. Clean. Prod. 279 (1), 123539. doi:10.1016/j.jclepro.2020.123539

Mukanjari, S., and Sterner, T. (2020). Charting a “green path” for recovery from COVID-19. Environ. Resour. Econ. 76, 825–853. doi:10.1007/s10640-020-00479-0

Narteh-Yoe, S. B., Djokoto, J. G., and Pomeyie, P. (2022). Aid, domestic and foreign direct investment in small states[J]. Econ. Research-Ekonomska Istraživanja, 1–18. doi:10.1080/1331677X.2022.2160998

O'Doherty, J., Critchley, H., Deichmann, R., and Dolan, R. J. (2003). Dissociating valence of outcome from behavioral control in human orbital and ventral prefrontal cortices. J. Neurosci. Official J. Soc. Neurosci. 23 (21), 7931–7939. doi:10.1523/jneurosci.23-21-07931.2003

Omri, A., Nguyen, D. K., and Rault, C. (2014). Causal interactions between CO2 emissions, FDI, and economic growth: Evidence from dynamic simultaneous-equation models. Econ. Model. 42, 382–389. doi:10.1016/j.econmod.2014.07.026

Pan, H., Dong, L., and Sun, R. (2023). Study on the environmental effects of two-way foreign direct investment in China’s service industry[J]. Indoor Built Environ., 1420326X221139821. doi:10.1177/1420326X221139821

Pan X, X., Wang, Y., Tian, M., Feng, S., and Ai, B. (2023). Spatio-temporal impulse effect of foreign direct investment on intra- and inter-regional carbon emissions. Energy 262, 125438. doi:10.1016/j.energy.2022.125438

Park, H., Jeong, S., Park, H., Labzovskii, L. D., and Bowman, K. W. (2021). An assessment of emission characteristics of Northern Hemisphere cities using spaceborne observations of CO2, CO, and NO2. Remote Sens. Environ. 254, 112246. doi:10.1016/j.rse.2020.112246

Paul, J., and Singh, J. (2017). The 45years of FDI research: Approaches, advances and analytical areas. World Econ. 40 (11), 2512–2527. doi:10.1111/twec.12502

Pazienza, P. (2015). The Environmental impact of the FDI inflow in the transport sector of OECD countries and policy implications. Int. Adv. Econ. Res. 21 (1), 105–116. doi:10.1007/s11294-014-9511-y

Pei, L., Wang, X., Guo, B., Guo, H., and Yu, Y. (2021). Do air pollutants as well as meteorological factors impact corona virus disease 2019 (COVID-19)? Evidence from China based on the geographical perspective[J]. Environ. Sci. Pollut. Res. 28, 35584–35596. doi:10.1007/s11356-021-12934-6

Pradhan, R. P. (2009). The FDI-led-growth hypothesis in ASEAN-5 countries: Evidence from cointegrated panel analysis. Int. J. Bus. Manag. 4 (12), 153–164. doi:10.5539/ijbm.v4n12p153

Ren, S., Yuan, B., Ma, X., and Chen, X. (2014). International trade, FDI (foreign direct investment) and embodied CO2 emissions: A case study of Chinas industrial sectors. China Econ. Rev. 28, 123–134. doi:10.1016/j.chieco.2014.01.003

Romer, P. M. (1986). Increasing returns and long-run growth. J. Political Econ. 94 (5), 1002–1037. doi:10.1086/261420

Saini, N., and Singhania, M. (2018). Corporate governance, globalization and firm performance in emerging economies: Evidence from India. Int. J. Prod. Perform. Manag. 67 (8), 1310–1333. doi:10.1108/ijppm-04-2017-0091

Saini, N., and Singhania, M. (2019). Performance relevance of environmental and social disclosures: The role of foreign ownership. Benchmarking Int. J. 26 (6), 1845–1873. doi:10.1108/bij-04-2018-0114

Sapkota, P., and Bastola, U. (2017). Foreign direct investment, income, and environmental pollution in developing countries: Panel data analysis of Latin America. Energy Econ. 64, 206–212. doi:10.1016/j.eneco.2017.04.001

Shah, M. H., Salem, S., Ahmed, B., Ullah, I., Rehman, A., Zeeshan, M., et al. (2022). Nexus between foreign direct investment inflow, renewable energy consumption, ambient air pollution, and human mortality: A public health perspective from non-linear ardl approach. Front. public health 9, 814208. doi:10.3389/fpubh.2021.814208

Shah, W. U. H., Yasmeen, R., Sarfraz, M., and Ivascu, L. (2023). The repercussions of economic growth, industrialization, foreign direct investment, and technology on municipal solid waste: Evidence from OECD economies. Sustainability 15 (1), 836. doi:10.3390/su15010836

Shahbaz, M., Solarin, S. A., Sbia, R., and Bibi, S. (2015). Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected african countries. MPRA Pap. 50, 215–224. doi:10.1016/j.ecolind.2014.11.007

Shao, Q., Wang, X., Zhou, Q., and Balogh, L. (2019). Pollution haven hypothesis revisited: A comparison of the brics and mint countries based on vecm approach. J. Clean. Prod. 227, 724–738. doi:10.1016/j.jclepro.2019.04.206

Shao, Y. (2017). Does FDI affect carbon intensity? New evidence from dynamic panel analysis. Int. J. Clim. Change Strategies Manag. 10 (1), 27–42. doi:10.1108/ijccsm-03-2017-0062

Singhania, M., and Saini, N. (2021). Demystifying pollution haven hypothesis: Role of FDI. J. Bus. Res. 123, 516–528. doi:10.1016/j.jbusres.2020.10.007

Sohag, K., Kalugina, O., and Samargandi, N. (2019). Re-visiting environmental Kuznets curve: Role of scale, composite, and technology factors in OECD countries. Environ. Sci. Pollut. Res. 26 (27), 27726–27737. doi:10.1007/s11356-019-05965-7

Soytas, U., Sari, R., and Ewing, B. T. (2007). Energy consumption, income, and carbon emissions in the United States. Ecol. Econ. 62 (3-4), 482–489. doi:10.1016/j.ecolecon.2006.07.009

Su, F., Fu, D., Yan, F., Xiao, H., Pan, T., Xiao, Y., et al. (2021). Rapid greening response of China's 2020 spring vegetation to COVID-19 restrictions: Implications for climate change. Sci. Adv. 7 (35), eabe8044. doi:10.1126/sciadv.abe8044

Syarifuddin, F., and Setiawan, M. (2022). The relationship between COVID-19 pandemic, foreign direct investment, and gross domestic product in Indonesia. Sustainability 14 (5), 2786. doi:10.3390/su14052786

Temiz, D., and Gkmen, A. (2014). FDI inflow as an international business operation by MNCs and economic growth: An empirical study on Turkey. Int. Bus. Rev. 23 (1), 145–154. doi:10.1016/j.ibusrev.2013.03.003

Teng, Y., Jin, Y., Wen, H., Ye, X., and Liu, C. (2023). Spatial spillover effect of the synergistic development of inward and outward foreign direct investment on ecological well-being performance in China[J]. Environ. Sci. Pollut. Res., 1–15. doi:10.1007/s11356-023-25617-1

Tiba, S., and Omri, A. (2016). Literature survey on the relationships between energy, environment and economic growth. Renew. Sustain. Energy Rev. 69, 1129–1146. doi:10.1016/j.rser.2016.09.113

Ullah, I., Rehman, A., Svobodova, L., Akbar, A., Shah, M. H., Zeeshan, M., et al. (2022). Investigating relationships between tourism, economic growth, and CO2 emissions in Brazil: An application of the nonlinear ARDL approach[J]. Front. Environ. Sci. 52. doi:10.3389/fenvs.2022.843906

Wang, D. T., and Chen, W. Y. (2014). Foreign direct investment, institutional development, and environmental externalities: Evidence from China. J. Environ. Manag. 135 (4), 81–90. doi:10.1016/j.jenvman.2014.01.013

Wang, J., Yang, L., and Yang, J. (2023). How sustainable environment is influenced by the foreign direct investment, financial development, economic growth, globalization, innovation, and urbanization in China[J]. Environ. Sci. Pollut. Res., 1–16. doi:10.1007/s11356-023-25634-0

Welela, Z. A. (2018). Analysis of the nexus between gross domestic savings and economic growth in Ethiopia: Evidence from Toda-Yamamoto causality approach. J. Econ. Sustain. Dev. 9 (19), 14–27. doi:10.20546/IJCRAR.2018.609.005

Wu, Q., and Wang, R. (2023). Do environmental regulation and foreign direct investment drive regional air pollution in China? [j]. Sustainability 15 (2), 1567. doi:10.3390/su15021567

Xie, Q., and Sun, Q. (2020). Assessing the impact of fdi on PM2.5 concentrations: A nonlinear panel data analysis for emerging economies. Environ. Impact Assess. Rev. 80, 106314. doi:10.1016/j.eiar.2019.106314

Xie, Q., Yan, Y., and Wang, X. (2023). Assessing the role of foreign direct investment in environmental sustainability: A spatial semiparametric panel approach. Econ. Change Restruct. 56, 1263–1295. doi:10.1007/s10644-022-09470-9

Xu, S. C., Miao, Y. M., Gao, C., Long, R. Y., Chen, H., Zhao, B., et al. (2019). Regional differences in impacts of economic growth and urbanization on air pollutants in China based on provincial panel estimation. J. Clean. Prod. 208, 340–352. doi:10.1016/j.jclepro.2018.10.114

Xu, C., Zhao, W., Zhang, M., and Cheng, B. (2020). Pollution haven or halo? The role of the energy transition in the impact of FDI on SO2 emissions. Sci. Total Environ. 763 (2), 143002. doi:10.1016/j.scitotenv.2020.143002

Yilanci, V., Cutcu, I., Cayir, B., and Saglam, M. S. (2023). Pollution haven or pollution halo in the fishing footprint: Evidence from Indonesia. Mar. Pollut. Bull. 188, 114626. doi:10.1016/j.marpolbul.2023.114626

Zhu, H., Duan, L., Guo, Y., and Yu, K. (2016). The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 58, 237–248. doi:10.1016/j.econmod.2016.05.003

Zhu L, L., Hao, Y., Lu, Z. N., Wu, H., and Ran, Q. (2019). Do economic activities cause air pollution? Evidence from China's major cities. Sustain. Cities Soc. 49, 101593. doi:10.1016/j.scs.2019.101593

Keywords: triangle-relationship, foreign direct investment, industrial pollution, economic growth, China

Citation: Zhang J, Han R, Song Z and Zhang L (2023) Evaluation of the triangle-relationship of industrial pollution, foreign direct investment, and economic growth in China’s transformation. Front. Environ. Sci. 11:1123068. doi: 10.3389/fenvs.2023.1123068

Received: 13 December 2022; Accepted: 22 March 2023;

Published: 04 April 2023.

Edited by:

Barbara Piekarska, Medical University of Warsaw, PolandReviewed by:

Desire Wade Atchike, Taizhou University, ChinaKhalid Zaman, The University of Haripur, Pakistan

Muhammad Haroon Shah, Wuxi University, China

Copyright © 2023 Zhang, Han, Song and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Juanfeng Zhang, anVhbmZlbmd6aEBob3RtYWlsLmNvbQ==

Juanfeng Zhang

Juanfeng Zhang Rui Han2

Rui Han2