- 1School of Management, Hebei University, Baoding, China

- 2The Center of Common Prosperity Research, Hebei University, Baoding, China

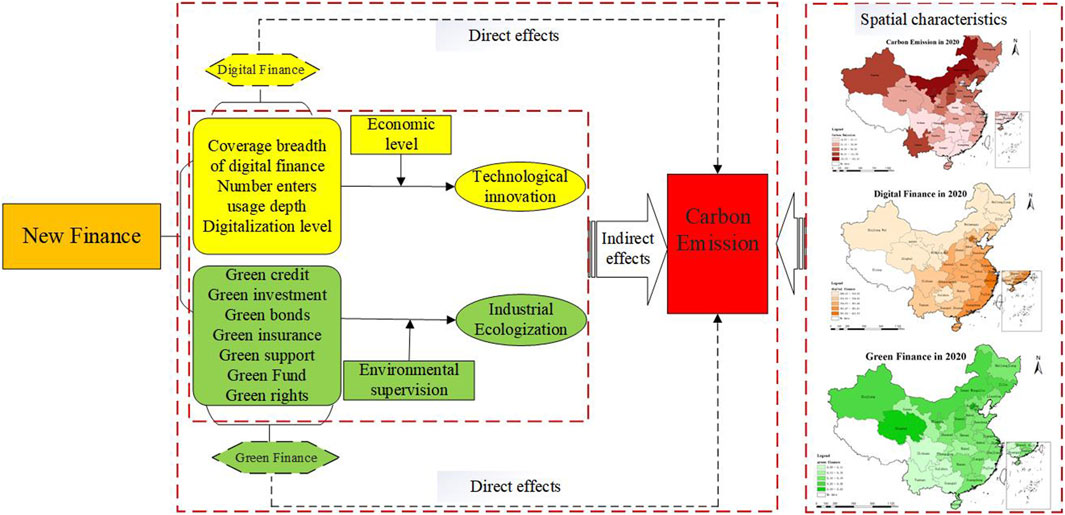

The massive CO2 emission has caused frequent occurrence of climate problems, and a typical response to climate change has reached international consensus. Digital finance and green finance, as a subversion of the traditional financial model, have become significant drivers of global carbon emissions reduction efforts. Based on the panel data, this paper profoundly compares the effects of carbon emissions reduction, mechanisms, and heterogeneous results of two forms of finance. Research finds that technology-centered digital finance focuses on suppressing carbon emissions through technological innovation, and the higher the level of regional economic is, the stronger the role of digital finance in suppressing carbon emissions through technological innovation. The concept-centered green finance focuses on carbon emissions reduction through industrial ecologization, and government-led environmental regulation plays a positive regulatory role. Although the paths of affecting carbon emissions are different, there is a natural fit between the two in terms of the essential goal of carbon emissions reduction. Based on the consideration of the differences in geographic location and financial development level, the carbon emission reduction effects of two forms of finance show apparent heterogeneity. Based on the spatial characteristics of digital finance and carbon emissions, this paper further finds that the digital finance’s carbon emission reduction effects have apparent spatial spillovers. These findings provide an essential direction to formulate a reasonable carbon emissions reduction plan and accelerate realizing the “double carbon” goal.

1 Introduction

China’s economic strength has significantly increased, but the excessive pursuit of economic benefits has neglected environmental benefits. As a result, the sharp contradiction between economy and environment has become a critical issue facing China for a long time. In 2017, China officially launched the unified carbon emissions trading market, and then In 2021, the goal of “carbon peak, carbon neutral” highlights the China’s determination to develop a green economy. As a core element of modern market economy development, finance is a powerful support to ensure enterprise development and promote national economic growth. Based on digital technology, digital finance is a financial means that integrates emerging tools such as the Internet, cloud computing and artificial intelligence into the traditional financial system to achieve innovation in the form of financial services, enrich the content of financial services and expand the scope of financial services (Wu, Guo, Tian and Hong, 2022). Compared to digital finance, the origin of green finance dates back to the 1990s when developed countries proposed the concept of “green finance”. At the beginning of this century, in response to intense criticism from international non-governmental organizations (NGOs) of the environmental damage caused by specific financing projects, green finance, which is based on the principles of sustainable development, became a powerful tool for the international financial industry to address climate change (X. Wang, Huang, Xiang and Huang, 2021). Specifically, green finance is a form of finance that responds to the United Nations’ call, promotes the environmental greening of industries.

As products of development in different times, digital finance and green finance have had a profound impact on China’s economy. Digital finance focuses on encouraging the transformation of heavily polluted industries with the help of technological means, to reduce the carbon emissions of traditional sectors (Song et al., 2023); in contrast, green finance adheres to the core of green development, restricting the production scale of polluted industries through financial constraints to curb industrial carbon emissions (J. Wang and Ma, 2022). Obviously, both digital finance and green finance are important tools for reducing carbon dioxide emissions and protecting the ecological environment in the context of low-carbon economic development. However, the strength of the contribution of digital finance and green finance in carbon reduction, which side has a stronger carbon reduction effect, and whether China’s future carbon reduction work will prioritize technology or philosophy are still unresolved issues.

Although existing research provides a solid foundation for our research, there are still the following shortcomings: Firstly, existing research focuses on the single impact of digital finance or green finance on carbon reduction, lacking a comprehensive analysis that puts the three within the same research framework; Secondly, green concepts and digital technologies provide endogenous and external support for carbon reduction, and there is still a lack of comparative research on the endogenous and exogenous forces of carbon reduction; Thirdly, both the financial system and the ecological environment have obvious regional characteristics, but there are still relatively few studies on finance and carbon emissions that consider spatial factors and overlook the spatial effects of carbon reduction.

The contributions of this research are as follows. Firstly, in terms of research topics. Comprehensively consider the carbon reduction effects of digital finance and green finance, and conduct vertical comparisons to highlight the importance of digital finance or green finance in carbon reduction work, with novel themes to compensate for the shortcomings of single research; Secondly, in terms of research methods. In order to explore the differences in the transmission paths of digital finance and green finance in the process of emission reduction, this article integrates regulatory effects on the basis of a simple mediation model, explores the transmission paths of carbon reduction through different financial means, and based on the consideration of geographical proximity, uses spatial econometric models to test their spatial correlation. The methods are rich and expand the breadth and depth of existing research. Thirdly, in terms of policy value. On the basis of exploring the carbon reduction effect mechanism of digital finance and green finance, this article further verifies the differences in carbon reduction between digital finance and green finance, and further clarifies the direction of policy implementation, providing theoretical reference for accelerating China’s economic green transformation and global carbon reduction work.

The rest of the article is organized as follows. Section 2 reviews and evaluates existing literature on carbon emissions, digital finance, and green finance, and proposes research hypotheses based on theoretical analysis. Section 3 proposes the research design. Section 4, the benchmark regression results, mechanism testing results, and robustness results were reported. Section 5 reports on the heterogeneity of carbon reduction effects between digital finance and green finance, respectively. Section 6, because digital finance has a more significant carbon reduction effect, we delves into the spatial effects of it. Section 7 synthesizes conclusions from the empirical findings and offers reliable recommendations for future carbon emission reduction efforts. The content of the study is illustrated in Figure 1.

2 Literature review and hypothesis development

2.1 Literature review

2.1.1 Research on carbon emissions

The global climate issue is a realistic challenge facing humankind at present. Since the 19th century, most experts and scholars have conducted many exploration on the greenhouse effect. The study has arrived at a unanimous conclusion: human beings are the initiators of global warming. In recent years, some countries have blindly pursued the benefits of economic development, seriously ignoring the harm economic development has brought to the global environment and human health. Therefore, solving the global climate problem is the common goal of humanity. With the continuous deterioration of global climate, various countries’ carbon emission reduction actions have become the main force to mitigate global climate change, and a new pattern of global climate governance has gradually taken shape. The mainstream research on carbon emissions includes the following two categories: First, many study investigates the factors affecting carbon emissions. From the macro level, introducing high-end production equipment and technology from other countries through international trade can reverse the carbon pollution situation with a technology spillover effect (X. Xu et al., 2021). In addition, the government sends environmental protection signals to high-energy-consuming industries through environmental regulation. From the medium level, carbon emission reduction is a crucial measure to promote industrial green transformation to achieve industrial ecology under the call for carbon neutrality and a critical path to enhance national industrial resilience and urban economic resilience (H. Chen et al., 2021). From the micro level, individual education level directly affects personal environmental awareness (Bülbül et al., 2023). In general, the more educated the group, the stronger the ecological concept and the more inclined to use. The second is evaluating the role of national policies on carbon emission reduction. Most studies evaluate the pilot effects of national policies from multiple perspectives through the method of differential differentiation to verify the policies’ effectiveness and further promote them widely (H. Zhang et al., 2021).

2.1.2 Related research on digital finance and carbon emissions

The wide application of digital technologies has opened the door to the digital era and pushed China’s economy into a new stage (Chu et al., 2023). The digital finance can effectively overcome the drawbacks of the traditional financial, enrich the form and content of financial, enhance the flexibility and convenience (Feng et al., 2023). Studies mainly focus on two aspects: at the macro level, studies on the mechanism of digital finance on restraining carbon emissions (X. Liu et al., 2023); At the micro level, for individuals, it provides individual consumers with convenient online transaction channels and dramatically reduces the CO2 emissions generated by offline travel (Pu and Fei, 2022). For enterprises, digital finance provides financial support for enterprises through the redistribution of production factors, promotes the green innovation (Ding et al., 2022). Part of researchs show that the digital finance does not affect CO2 emissions (Chang, 2022; Zheng and Li, 2022); the other part of the research results show that the rapidly developing information technology, as an essential driving force for industrial adjustment, is the core force to curb the industrial carbon emissions (Yin, 2022).

The digital finance, as a critical driving force for China’s economy, is a significant starting point for inclusive green growth. However, its identity positioning and mechanism role in carbon emission reduction work still needs to be further clarified to indicate the precise direction of carbon emission reduction.

2.1.3 Research on green finance and carbon emissions

The Kyoto Protocol, signed in 1997, has made green finance widely concerned by the international community (Sinn, 2008). Later, some scholars put forward the green finance theory that integrates finance with the green environmental industry, aiming at redistributing financial resources with the help of market forces to achieve the purpose of protecting the ecosystem (Huang et al., 2023). China has permanently attached great importance to the green finance. In 2016, the Guiding Opinions on Building a Green Financial System issued by relevant departments in China clarified the policy framework for green finance and point out it is a financial service to maintain economic activities such as resource conservation and efficiency and to combat climate change.

While there is no universally accepted definition globally, the connotation of guiding financial resource allocation with green financial instruments to improve the environment is consistent (Ran and Zhang, 2023). From the measurement of green finance, one is measured by a single indicator, such as public expenditure on environmental protection, interest expenditure of high-energy consumption industry (J. Xu et al., 2023). The other is to comprehensively evaluate by selecting multiple indicators (X. Chen and Chen, 2021; J. Wang et al., 2023). For research content, based on the environmental protection concept of green finance, most existing studies focus on its protection effect on the ecological environment. For example, green finance can reduce pollution by optimizing energy (Yuan et al., 2020; Bai et al., 2022). Specifically, the issuance of green bonds significantly improves enterprises’ green innovation capability and environmental performance (W. Zhang et al., 2022), while green credit improves environmental performance by controlling the financing of high-emission industries (X. Liu et al., 2019; Lv et al., 2023).

2.2 Hypothesis development

The digital finance, as an essential financial means derived from technological change, is strong support to achieve the goal of “double carbon.” From a micro point of view, mobile payment brought by digital finance significantly reduces residents’ dependence on offline financial institutions’ outlets (S. Liu et al., 2023), reduces residents’ transportation frequency, and helps to reduce CO2 emissions. Moreover, the “Ant Forest” and “Green Apple” public welfare activities launched by digital financial platforms have greatly improved residents’ awareness of environmental protection and formed a “positive incentive” for the transformation of residents’ consumption structure (Zheng and Li, 2022). From a macro point of view, digital finance, mainly supported by digital technology, is a vital force in promoting industrial digitalization and digital industrialization. The development of modern information technology has overturned the production mode of traditional industries, transforming intangible modern information technology into tangible information technology industries, which is an inevitable measure to reduce pollutant emissions in the digital era (Zhao, Yang, Li, Liu and Li, 2021). Digital finance provides a basic guarantee for industrial technology investment, reduces technology cost risks, and is a key means to promote industrial digital transformation and reduce carbon pollution (Z. Zhu, Liu, Yu and Cao, 2022).

“Green” is a kind of environmental protection concept; its concept is more abstract, involving a more comprehensive range. On the premise of accurately identifying green enterprises, green finance tracks and locates the flow of financial resources, gives priority to providing financial support for enterprises’ environmental production and environmental governance, and thus reduces carbon pollution production activities (Lin et al., 2022). Although the internal concepts of digital finance and green finance are different, the essential goals of pollution reduction and of them have a natural consistency.

Hypothesis 1:. Both digital finance and green finance have significant carbon reduction effects.

Driven by the fourth industrial Revolution, technology has become a key production factor for modern industries to improve productivity. However, the high cost of technology makes most enterprises prohibitive, and this development bottleneck of enterprises provides an important direction for digital finance to achieve environmental protection goals. Digital finance focuses on embedding digital technology into the financial system, adjusting traditional industrial structure by employing financial technology, promoting industrial digital transformation, and thus reducing the emission of industrial pollutants (J. Xu et al., 2023). Digital finance empowers traditional industries through digital technologies, promotes the transparency and synergy of data factor flow, realizes the accurate matching of production factors, reduces the number of polluting industries (Xue et al., 2022). Digital finance has significantly improved the ability to identify, and deal with financial risks, and encourage enterprises to innovate (M. Zhang and Liu, 2022).

The widespread popularity of digital finance is guaranteed by a strong foundation of economic development. A sound economic foundation not only provides strong material guarantees for technological innovation to play a role in carbon reduction in digital finance, but also provides strong conditions for deepening the development of digital finance and realizing its economic and social benefits. Generally speaking, the higher the level of economic development in a region, the stronger its ability to accept and adapt to emerging things such as digital finance, and the more it can fully leverage the impact of digital finance on regional social production activities. Therefore, the economic level plays an important role that cannot be ignored in promoting technological innovation through digital finance and thereby affecting the process of carbon emissions. Based on this, hypotheses 2a and 2b are proposed.

Hypothesis 2a:. The digital finance inhibits carbon emissions by promoting technological innovation.

Hypothesis 2b:. Economic growth can strengthen the mediating role of technological innovation in the process of carbon emission reduction in digital finance.

The “green” and “financial” attributes of green finance make it adhere to the essential goal of “environmental sustainability.” in addition to directly helping China to “reduce carbon,” (Zhan, Wang and Zhong, 2023), it can also further indirectly affect carbon emission reduction by driving the ecological transformation of industrial development. The green finance promotes the green industry and tertiary industry by reallocating financial elements, focusing on providing credit support and preferential incentives (Zhou and Qi, 2022), and strictly constraining the financing of projects in “two high” industries to force them to accelerate industrial transformation and promote industry development in the direction of ecology (W. Xu et al., 2023). The transformation of industrial ecology means that the proportion of green industries will gradually increase. In contrast, industries with heavy pollution will gradually withdraw or be reconfigured. This industrial structure adjustment effectively inhibits carbon emissions from economic activities (B. Wang et al., 2023).

Although green finance can reduce carbon pollution, the realization of carbon reduction goals needs to be escorted by mandatory legal means (Feng, Bilivogui, Wu and Mu, 2023). Environmental regulation is a mandatory means to compel enterprises to adopt emission reduction strategies, in the context of loose environmental regulations, enterprises face lower costs of environmental violations. Although green finance provides preferential dividends for green production activities, it is difficult to truly encourage enterprises to abandon traditional production models with high efficiency, Ding et al., 2022). Under strict environmental supervision, enterprises face high costs of environmental violations. Under the dividend effect of green finance, they will actively adopt industrial transformation strategies, and the carbon reduction effect of green finance will be strengthened. In this process, the government will play the role of a “guide” to guide financial institutions to carry out green finance-related businesses and play a regulatory complementary role in driving the transformation of industry (J. Wang and Ma, 2022; S. Zhu et al., 2014). Hypotheses 3a and 3b are proposed.

Hypothesis 3a:. Green finance achieves carbon reduction by promoting industrial ecological transformation.

Hypothesis 3b:. Environmental regulation can strengthen the intermediary role of industrial ecological transformation in the process of carbon emission reduction in green finance.

Unbalanced regional development is one of the main contradictions in China. China’s industrial distribution and industrial structure are important reasons for the differences in carbon emissions in different regions. Generally speaking, economically developed areas pay attention to the economic benefits and sustainability of industrial development. Therefore, compared with economically underdeveloped areas, their industrial structure is more reasonable, environmental awareness is more potent, and environmental pollution is relatively small (Zhang, Bao, Liu and Yang, 2022). As an innovative form based on the old financial model, digital finance and green finance are deeply affected by the old finance. The richer the financial resources, and the stronger the financial allocation capacity, the more favorable it is to enjoy the financial resource allocation dividends. On the contrary, it is difficult for regions with financial disadvantages to capture the development opportunities of emerging financial forms, and it is even more difficult to extend them to industrial transformation.

Hypothesis 4:. The carbon reduction effects of digital finance and green finance are significantly heterogeneous.

The green finance pays more attention to promoting carbon emission reduction by cutting into the “green” concept of sustainable development, which is essential in alleviating regional ecological pollution. Digital technology has alleviated information asymmetry and weakened traditional difficulties in economic interaction caused by geographical distance, while digital finance based on digital technology can fully leverage modern information technology to achieve the diffusion of financial resources (Wang and Guo, 2022). Therefore, in contrast, the spatial characteristics of digital finance are more prominent. Unlike traditional finance, the unique network diffusion and external effects of digital finance help to break the spatial boundaries of financial markets, accelerate the flow of different production factors between regions, accelerate the trading progress of financial markets, and to some extent promote technological innovation. In this process, the “radiation effect” of digital finance not only accelerates the flow of funds and technology in surrounding areas, but also provides practical references for the development model of digital finance, economic growth effects, and ecological protection effects in surrounding areas, which can effectively drive regional digital finance to play a role in carbon reduction (M. Zhang and Liu, 2022). Meanwhile, the “radiation effect” of digital finance accelerates the flow of technology in the surrounding areas. The last hypothesis is proposed.

Hypothesis 5:. The carbon emission reduction effect of digital finance has obvious spatial and geographical radiation effect.

3 Variable selection, data sources and model settings

3.1 Variable selection, data sources

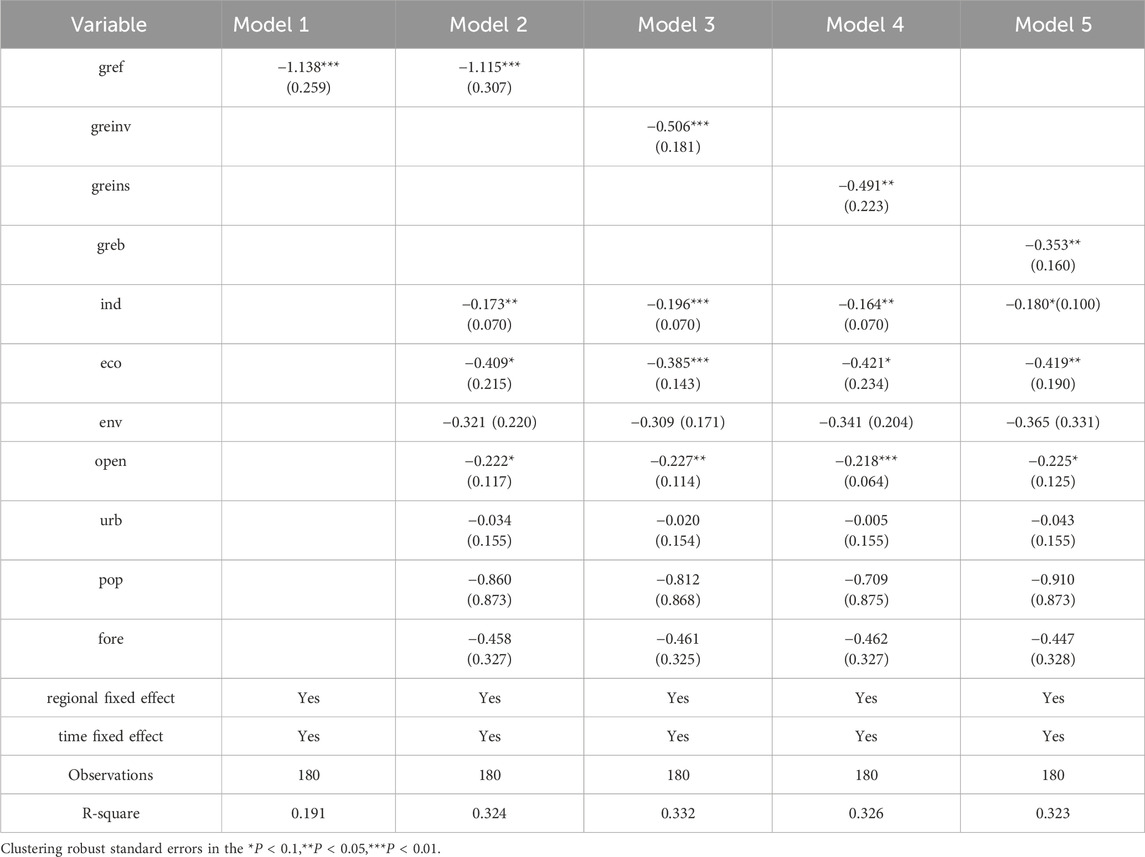

Firstly, the explained variable in this research is carbon emissions. Concerning the methods proposed by the IPCC, we use the standard coal method to calculate the total carbon emissions.

In this,

Secondly, the core explanatory variable are digital Finance (digf) and green Finance (gref). Existing studies primarily employ three methods to measure digital finance: The first approach involves measuring the regional development level of digital finance based on the frequency of related keywords searched by web crawlers (Ding et al., 2022). The second is to evaluate the effect of policies (Zhong and Jiang, 2021). The third is to build a digital financial index based on comprehensive indicators (Cao et al., 2021). Among them, the third measurement method is the most widely used. This paper utilizes the Digital Financial Inclusion Index, which is jointly compiled by the Digital Financial Research Center of Peking University and Ant Group.

Since its establishment in 2010, the Green Climate Fund (GCF) has been defined as “investment financing that provides environmental benefits” for developing countries to address climate change through various financial instruments and financing Windows for climate-resilient development (D. Zhang et al., 2019). Compared with the Green Climate Fund, the content of the green financial system is more abundant. Based on these opinions, this paper has further enriched and established a comprehensive evaluation index system of green finance. Finally, the score is calculated by the entropy method through the steps of standardization processing, sample weight calculation, index information entropy calculation, information entropy redundancy calculation, and index weight calculation.

Thirdly, technological innovation (tech) and industrial ecolonization (ie) are selected as the mediating variables for digital finance carbon reduction and green finance carbon reduction, respectively. Here, technological innovation is represented by the logarithm of the market technology contract transaction amount, while industrial decolonization is measured using an environmental efficiency indicator.

where

Economic foundation (eco) and environmental regulation (env) are chosen as moderating variables. The logarithm of the per capita GDP represents the economic foundation. Environmental regulation is indicated by the frequency of terms related to carbon emission reduction in local government reports.

Finally, according to the existing research literature, this paper selects some control variables. (1)The industrial structure is represented by the ratio of the added value of the secondary industry to GDP (ind). (2) The level of openness (open) is represented by the ratio of total imports and exports to GDP. (3) Urbanization level (urb), indicated by the proportion of urban population to the total population. (4) Population density (pop) is included as a control variable, measured by the number of permanent residents per square kilometer. (5) Forest cover rate (fore), with forests serving as the ‘lungs of the Earth,’ significantly contribute to reducing carbon dioxide in the air. At the same time, we also include the level of economic foundation (eco) and environmental regulation (env) in the range of control variables.

Taking into account that a significant turning point in the development of digital finance and green finance may alter their carbon reduction effects, this study, to highlight the most recent developments in the role of digital finance and green finance in carbon reduction, sets the important milestones in their development as the starting point of the research, thereby determining the study interval. The launch of Yu'E Bao in 2013 is regarded as the inaugural year of China’s digital finance development. In 2015, China issued the “Overall Plan for Ecological Civilization System Reform” first established the goal of creating a green financial system. Therefore, the panel data of 30 provinces (excluding Tibet, Hong Kong, Macao, and Taiwan) in China from 2013 to 2020 is selected as the research sample to test the impact of digital finance on carbon emissions. The data of 30 provinces from 2015 to 2020 is selected as the research sample to test the relationship between green finance and carbon emissions. The data mainly come from the Center for Digital Inclusive Finance of Peking University, China Statistical Yearbook, and Local Government Reports. The statistical description of variables are shown in Table 1.

3.2 Model setting

Based on the research objectives and the above research hypotheses, the following econometric model is constructed to empirically test the carbon emission reduction effects of digital finance and green finance.

The first one is the direct effects model, which explores the impact of digital finance and green finance on carbon emissions (Y. Wu and Liu, 2024). The specific formula is as follows:

The second is the mediation effect model, which tests the mechanism and path of carbon reduction in digital finance and green finance (Song et al., 2023). The specific formula is as follows:

The third is a mediation model with regulation, which tests the moderating role of economic growth and environmental regulation in the transmission path (McLarnon & O’Neill, 2018). This study constructs the following mediation effect model with moderation:

The fourth is the spatial regression model, which tests the spatial spillover of carbon reduction in digital finance and green finance. This paper first conducts empirical analysis based on the spatial geographical weight matrix (W1). If the distance(d) between two cities is closer, the weight will be smaller; otherwise, the weight will be more enormous. The expression is as follows:

The spatial adjacency matrix (W2) is a traditional 0–1 matrix and a classical non-negative matrix, which is often used to reflect whether there is an adjacency relationship between regions. If two regions are not adjacent, the value is 0; if they are adjacent, the value is 1. The specific expression is as follows:

The spatial economic distance matrix (W3) is measured by regional GDP.

Based on the proximity of geographical locations and the mobility of economic resources, this paper uses a spatial econometric model to examine the spatial impact (L. Wang, Sun and Xv, 2023).

W is the spatial weight matrix, and the remaining variables are the same as above.

4 Empirical analysis

4.1 Benchmark regression analysis

Theoretically, both digital finance and green finance will have a particular effect on carbon emissions. We first test this effect of them using the SUR method, which pushes the heterogeneity of group coefficients. We obtain the test statistic x2 (1) = 11.68, and the p-value is 0.0004. The null hypothesis was rejected at the 1% significance level, indicating a clear disparity in their carbon reduction effects. Next, this part analyzes and compares the carbon reduction effects of them, respectively.

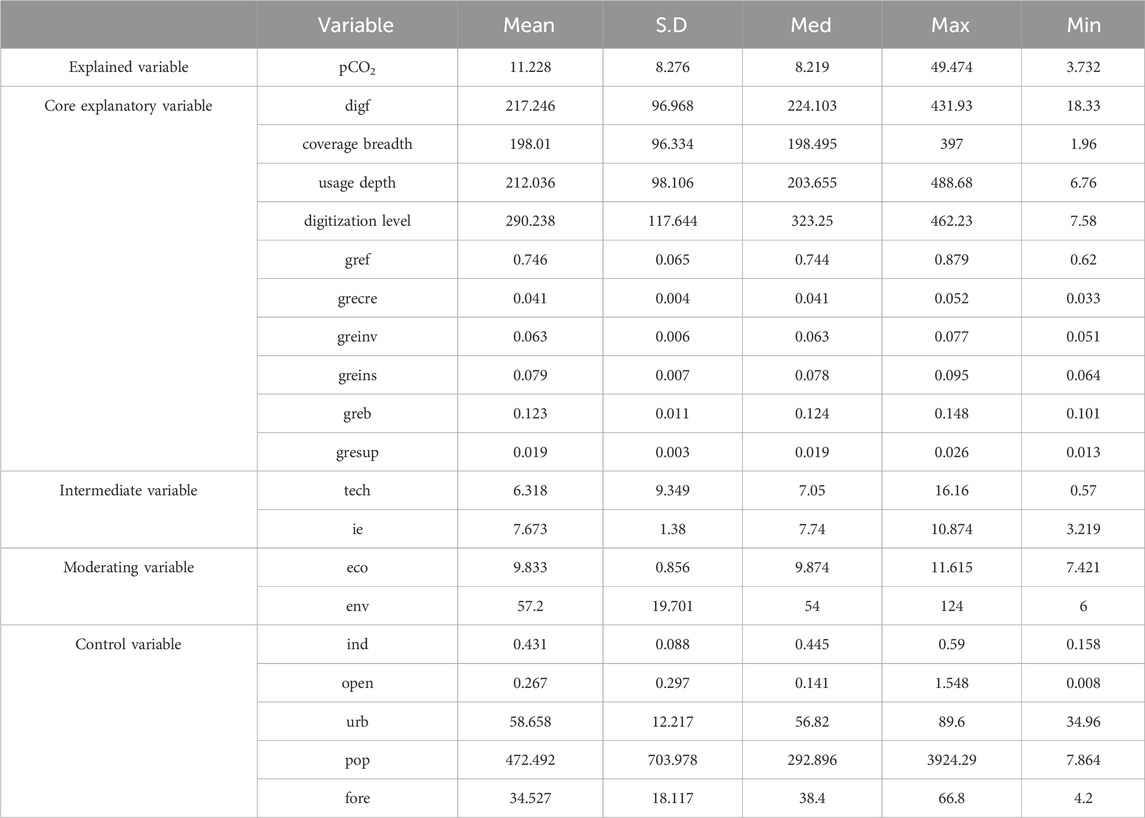

In the global digital era, all walks of life are grasping the opportunities for digital development and gradually transforming to digital. This part focuses on the impact of digital finance on carbon emissions and further explores the effects from its three dimensions, as shown in Table 2. Whether in univariate regression analysis or in regression controlling for other variables, the result passes the significance test with a negative coefficient, indicating that it can exert a restraining influence on carbon emissions, and the three control variables of industrial structure, environmental regulation, and urbanization level can effectively suppress carbon emissions. Model three shows the impact of coverage breadth on carbon emissions. Under the dual fixed effect model controlling individuals and time, it has an obvious negative effect. Model four show that there is also a negative correlation between the usage depth and carbon emissions. Likewise, model five show that the negative impact of digitalization on carbon emissions is tested at 1% level. Comparatively speaking, the coverage breadth has the most noticeable impact, which once again demonstrates the importance of improving the inclusiveness of digital finance.

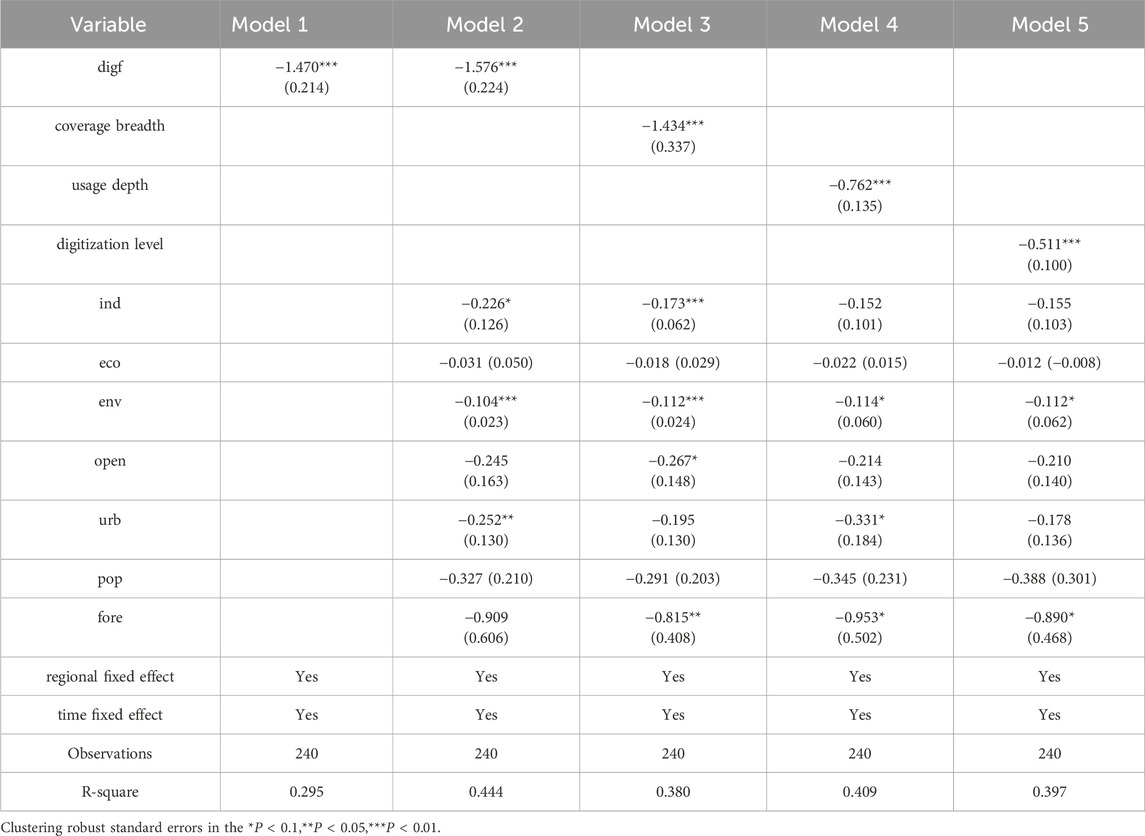

In addition to the form of digital finance in the new era, it is also necessary to consider the green finance policy that has attracted global attention. Green finance is a sustainable finance integrating “green” and “finance.” Its positive externality features play a crucial role in balancing economiy and climate environment. In the coming decades, China will need a lot of investment to protect environment, so green finance may be a breakthrough to solve this problem. Therefore, this part analyzes the impact of green finance and its sub-dimensions on China’s carbon emissions explicitly, and the results are shown in Table 3.

Model one shows the impact of green finance on carbon emissions under the dual fixed effects of individual and time. It is found that it passes the test at 1%, indicating that it has a pronounced carbon emission reduction effect. After adding a series of control variables to Model 1, Model two found that the significance and correlation of the impact of green finance on carbon emissions remained unchanged, once again verifying the role of green finance, and the industrial structure, economic foundation, and the level of openess can also suppress carbon emissions. Specifically, among the various financial instruments included in green finance, it is found that only green investment, insurance, and bonds substantially impact carbon emissions, as shown in Models three to five in Table 3. Green investment suppressed carbon emissions at a significant level of 1%, and green insurance and green bonds hid carbon emissions at a level of 5%. Table 3 reflect the importance of green finance’s capital guidance function in restraining and limiting carbon emissions.

The results presented in Tables 2, 3 indicate that both are important financial instruments for carbon reduction, thus preliminarily validating Hypothesis 1. This result is in line with the actual situation of China’s economic development and is consistent with the results obtained in existing research, indicating that this study has certain practical reference value. Although the concepts of digital finance and green finance are different, their essential carbon emission reduction goals have natural compatibility and internal unity.

4.2 Mediating effect analysis

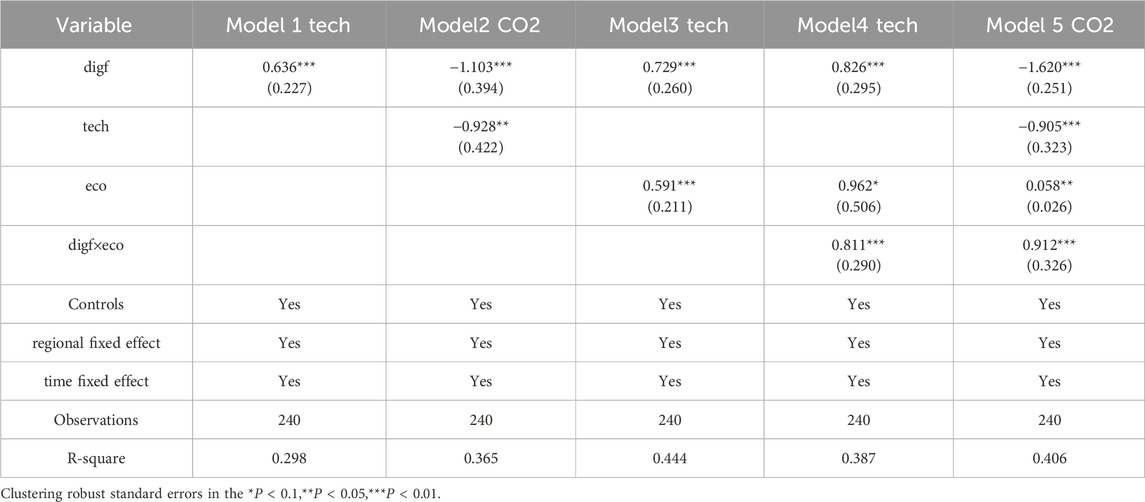

Digital finance promotes the transformation of traditional industries by using industrial digitalization and digital industrialization, alleviates the environmental pollution caused by carbon emissions. In Table 4 Models one to Model 2, it is found that digital finance has a positive promoting effect on technological innovation. Technological innovation significantly impact carbon emissions; that is, digital finance has a mechanism to inhibit carbon emissions by fostering technological innovation, and hypothesis 2a is verified.

Table 4. The moderating effect of economic growth on carbon emission reduction of digital finance mediated by technological innovation.

As the critical factor of technological progress, the economic base will inevitably play a role in this mechanism. Therefore, we further investigated the regulating role of economic growth in the digital financial carbon emission reduction transmission path mediated by technological innovation. In Models 3 to 5, the correlation coefficient of digital finance is 0.729, and that of economic growth is 0.591, indicating that the economic growth is a key factor influencing the promotion of technological progress. The interaction term between the digital economy and economic growth is added, and it is found that the interaction term coefficient passes the test and is positive. Finally, the results of Model five show that the coefficient of the intermediary variable is significantly negative, and the coefficient of the interaction term is positive, indicating that economic growth can strengthen the intermediary role of technological innovation. Hypothesis 2b is verified.

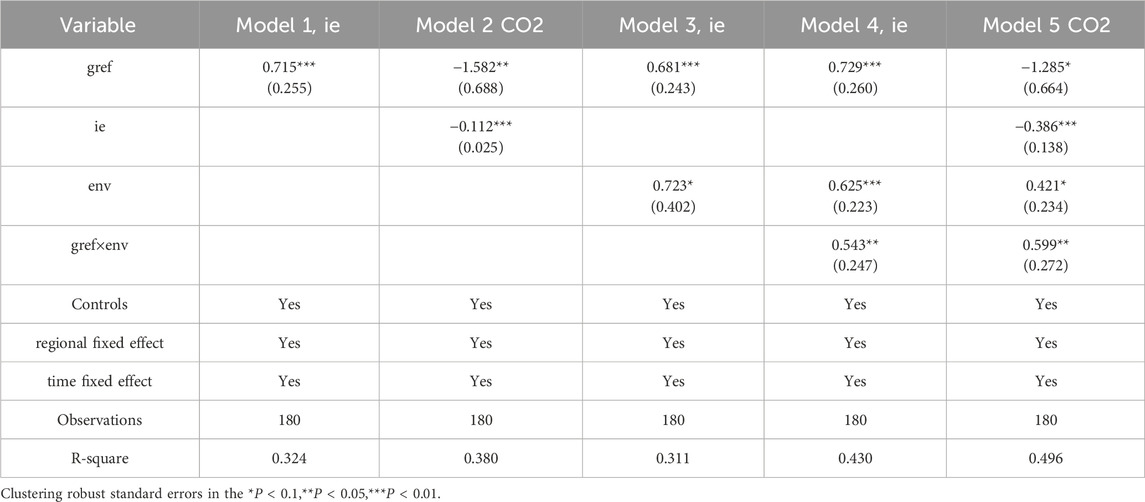

Environmental regulation will encourage to innovate green technology, and promote green development. As an essential ecological regulation tool, green finance can stimulate enterprises to innovate technology by increasing polluting enterprises’ financing costs, sunk costs, and environmental violation costs, thus curbing carbon emissions and improving ecological benefits. Model 1 to Model 2 in Table 5 test the mediating effect of industrial ecologization. We found that green finance has a significantly positive promoting effect on industrial ecology, and the negative relationship between industrial ecologization and carbon emissions passes the test. Hypothesis 3a is verified.

Table 5. The Moderating effect of environmental regulation on carbon emission reduction through green finance mediated by industrial ecologization.

The results of Model 3 to Model 5 show that environmental regulation has a specific positive role in promoting industrial ecologization, and the interaction coefficient is positive, indicating that ecological regulation plays an essential positive regulating role in green finance’s impact on industrial ecology. In Model 4 and Model 5, we found that environmental regulation plays a positive regulating role in the transmission path of green finance to promote industrial ecological transformation. Hypothesis 3b is verified.

This part of the empirical research differs from existing studies that mainly rely on simple mediation models for mechanism testing. This study considers the complexity of various factors in the carbon reduction path of digital finance and green finance, and constructs a complex mediation model with moderating effects, further expanding the methods used in existing research. The empirical results obtained are more convincing and provide feasible directions for carbon reduction work.

4.3 Robustness test

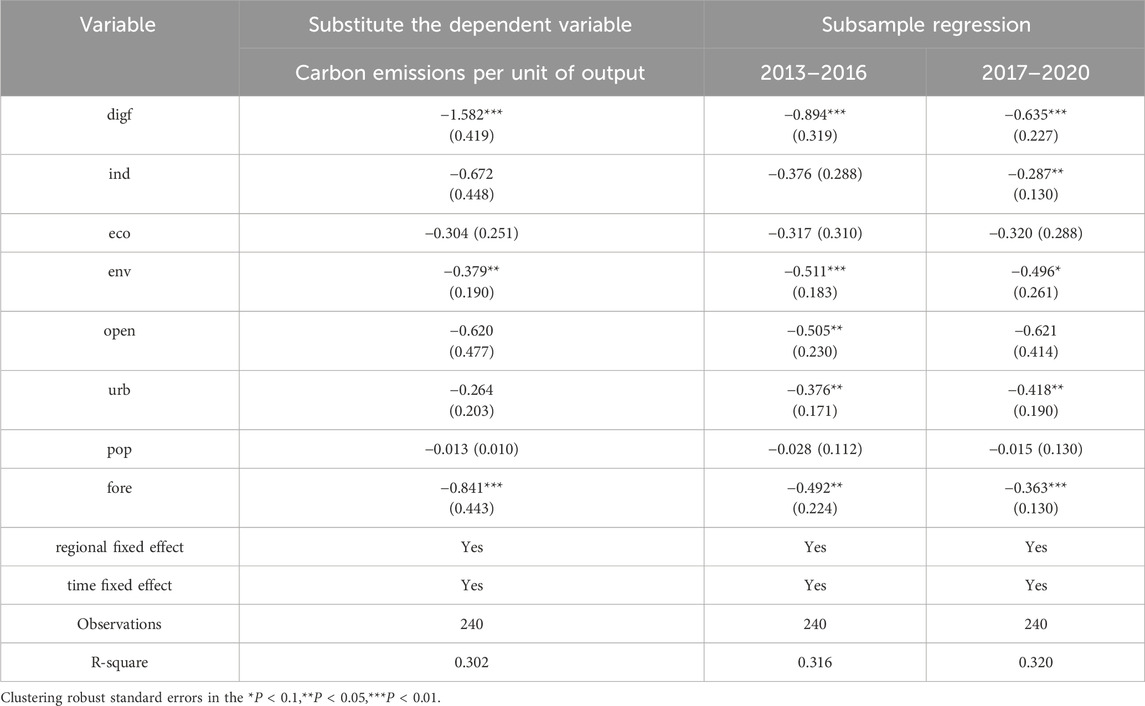

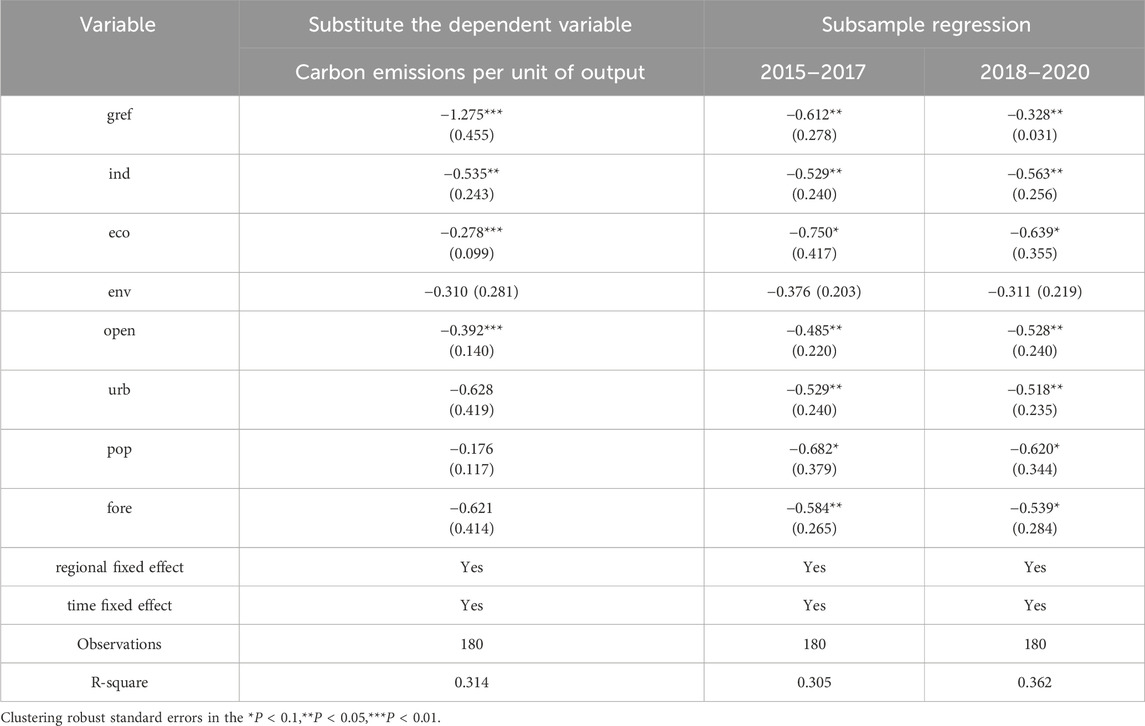

The above research hypothesis is preliminarily verified by benchmark regression. Nonetheless, it would be premature to draw definitive conclusions at this juncture. This paper test the robustness: First, replace the explained variables. Considering that carbon emissions come not only from the lives of social residents but also from the emission of pollutants from social and economic production, replacing carbon emissions per capita with carbon emissions per unit of output can also reflect the intensity of carbon emissions. Second, subsample regression. According to the sample period, the whole sample was divided into sub-samples of different sample periods and tested respectively to observe whether the research results were reliable.

In Table 6, the significance and correlation have not changed significantly after replacing explanatory variables, indicating that digital finance can effectively reduce carbon emission intensity. In the sub-sample regression, the results during 2013–2016 and 2017-2020 are consistent with the results of the total sample. In Table 7, the statistical results after replacing explanatory variables and sub-sample regression are roughly consistent with the baseline results. Moreover, it is found that the carbon emission reduction effect of digital finance is still more significant than that of green finance, which again confirms Hypothesis 1.

5 Heterogeneity analysis

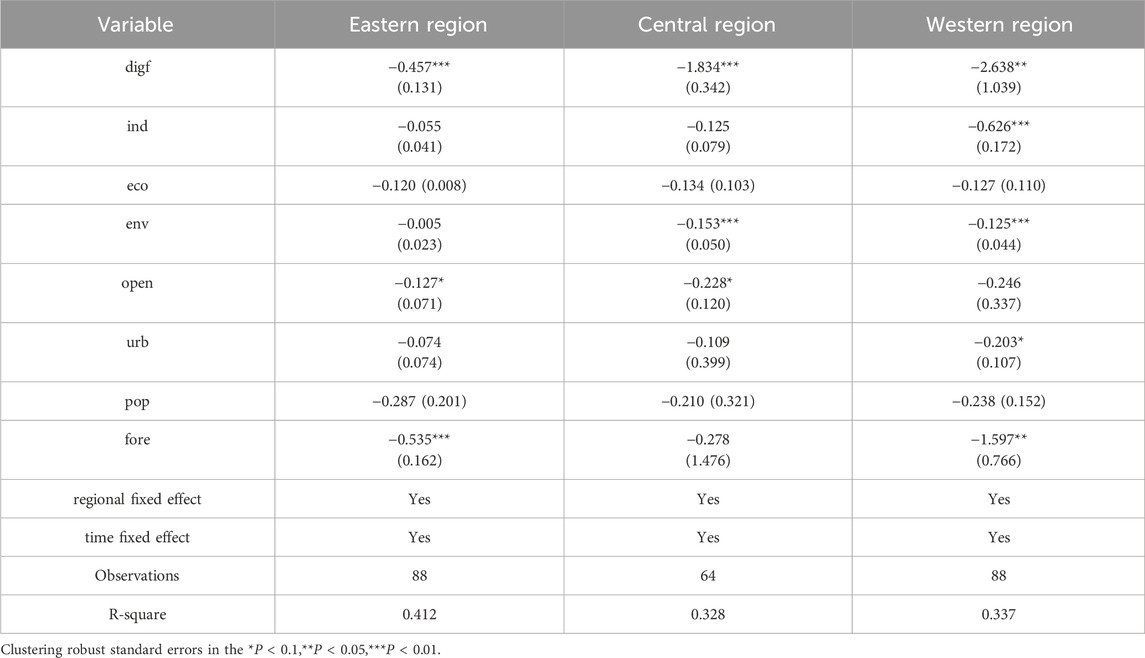

5.1 Heterogeneity analysis based on regional development

Uneven regional development has been an essential feature of China’s social and productive development for a long time. Therefore, this section analyzes the heterogeneity of the impacts of digital finance and green finance on carbon emissions in the three major regions of China, respectively (Sun and Chen, 2022). In Table 8, we found that the carbon emissions of digital finance in the three major regions of eastern, central, and western China have passed significance tests at the 1%, 1%, and 5% levels, with correlation coefficients of −0.457, −1.834, and −2.638, respectively. In the eastern region, the level of openness and forest coverage can effectively suppress carbon emissions; The inhibitory effect of environmental regulation and the level of openness on carbon emissions in the central region has passed a significance test; In the western region, industrial structure, environmental regulation, urbanization level, and forest cover rate have effectively suppressed carbon emissions. Obviously, digital finance is able to inhibit carbon emissions in different regions, but in comparison, its inhibitory effect in the western region is more substantial. The reasons for this result may include: first, the economic foundation of the region of the west is significantly weaker than that of the eastern and central areas, so it is more sensitive to digital financial services; second, in the eastern and central regions of China, the industrial structure tends to be optimized and upgraded, but the western region is still dominated by the traditional industries, which is more harmful to the environment.

There are significant differences between geographic regions, which may lead to the heterogeneity of emission reduction, and we will verify this conjecture in the following regression analysis of different regional sub-samples. In Table 9, we find that green finance passes the test at the 1% or 10% level for carbon emissions in three regions, the correlation coefficients are negative, and the industrial structure of the three major regions has effectively suppressed local carbon emissions, which suggests that green finance has a specific inhibitory effect on carbon emissions in the three major areas of China, especially in the western area, where the inhibitory effect is the most significant. Possible reasons for this include the following two points: First, the region of the west is rich in energy resources, especially the large scale of natural gas and coal reserves, which provides favorable conditions for the energy industry. Green finance reduces regional carbon emissions by guiding capital into green industries with higher production efficiency, constraining financial support for highly polluting industries. Second, following the inclusion of Guizhou and Xinjiang in China’s first batch of Green Finance Reform and Innovation Pilot Zones, Chongqing and Gansu have also been integrated, which highlights the remarkable results of green finance development in the western region.

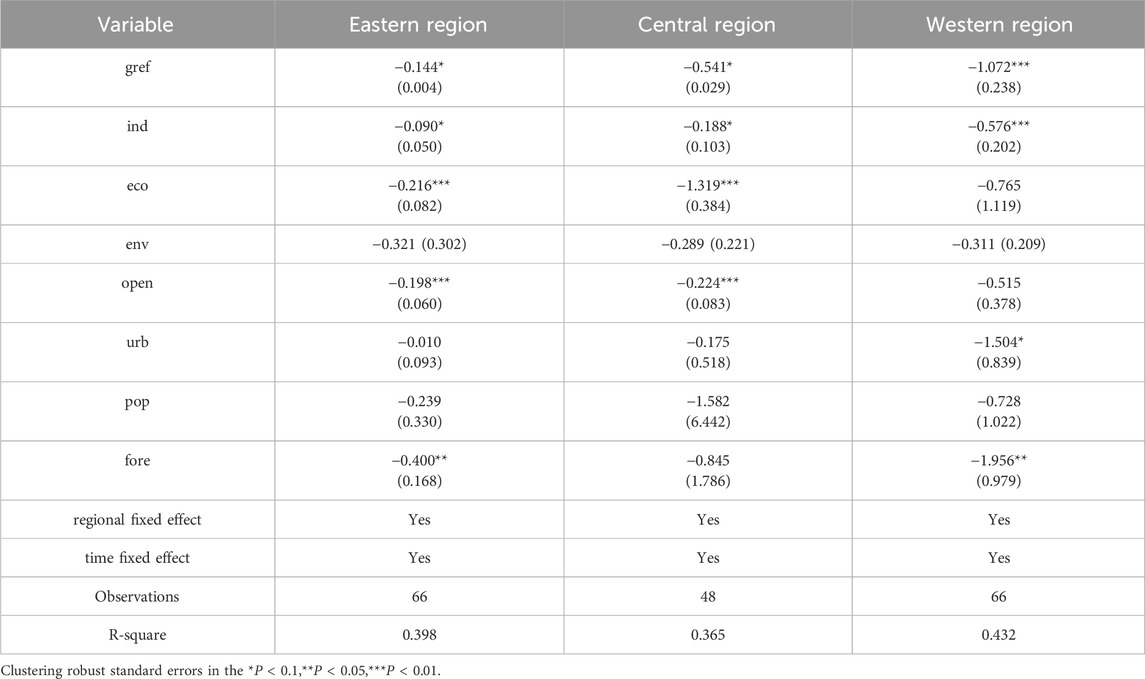

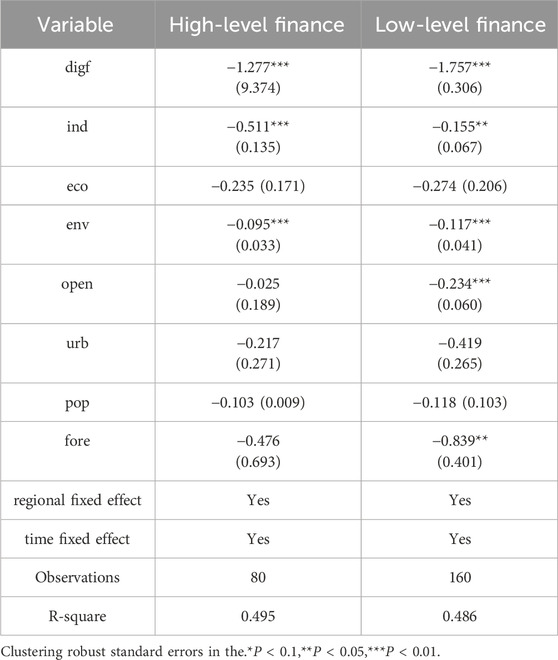

5.2 Heterogeneity analysis based on financial development level

How does digital finance affect carbon emissions under different economic levels? Will there be significant differences? This section measures the level of financial development by the deposit to loan ratio of each province, and uses the median as the standard to divide high-level and low-level financial regions (Wang and Guo, 2022), exploring the impact of digital finance and green finance on carbon emissions at different levels of financial development. Table 10 gives the answers to these questions. We find that digital finance passes the significance test at the 1% level for carbon emissions in high-level and low-level financial regions, and whether it is a high-level financial region or a low-level financial region, industrial structure and environmental regulation are conducive to reducing carbon emissions. However, comparing the effect of carbon emission reduction of digital finance in high-level financial regions and low-level financial regions, it is found that digital finance has a more prominent role in carbon emission reduction in low-level economic development regions, which may be because emerging forms of financial services such as digital finance provide more opportunities for the development of low-financial level regions so that low-financial level regions can fully tap and enjoy the digital economic dividend, and then apply this dividend in carbon emission reduction work, to realize the double benefits of economy and ecology.

Table 10. Results of the impact of digital finance on carbon emissions under different levels of financial development.

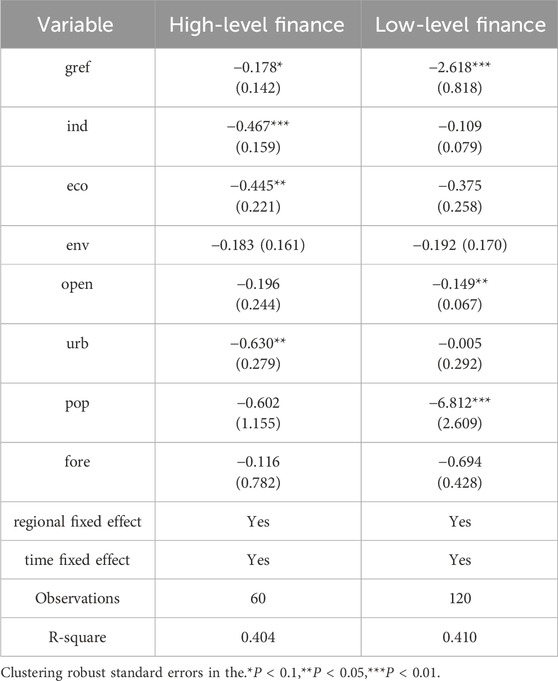

Green finance realize low-carbon economic transformation. Financial resources are the core body of green finance and the critical factor for the continuous operation and development of microeconomic activities, and the effects of it on carbon emissions in different financial environment may differ. Table 11 indicates that green finance plays a role in mitigating carbon emission pollution in both high-level financial and low-level financial regions. The control variables of industrial structure, economic foundation, population density, level of openess to the outside world, and level of urbanization have a positive effect on suppressing carbon emissions. Still, the significance and absolute value of the regression coefficients of it in the sample group of lower levels of economic development are significantly more considerable than those in the sample group of higher levels of economy. The possible reason is that regions with lower levels of financial have lower eco-efficiency and more substantial financing constraints, and green finance promotes green technological innovation by guiding the rational flow of capital.

Table 11. Results of the impact of green finance on carbon emissions under different levels of financial development.

The results in Tables 8–11 fully illustrate the heterogeneity of the carbon emission reduction effects of two financial types in different regions and other financial levels in China, and Hypothesis four is verified.

Existing research on financial carbon reduction only considers regional heterogeneity caused by geographical differences in heterogeneity analysis, ignoring the impact of differences in financial development levels on the role of financial carbon reduction. Therefore, in the heterogeneity analysis section, this study comprehensively analyzed the carbon emission reduction effects of digital finance and green finance in the eastern, central, and western regions of China, as well as regions with different levels of financial development, based on geographical location and financial development level. The research results are consistent with the economic and financial development levels of different regions in China, which is conducive to formulating carbon emission reduction plans according to local conditions.

6 Further analysis

6.1 Patterns of spatial evolution

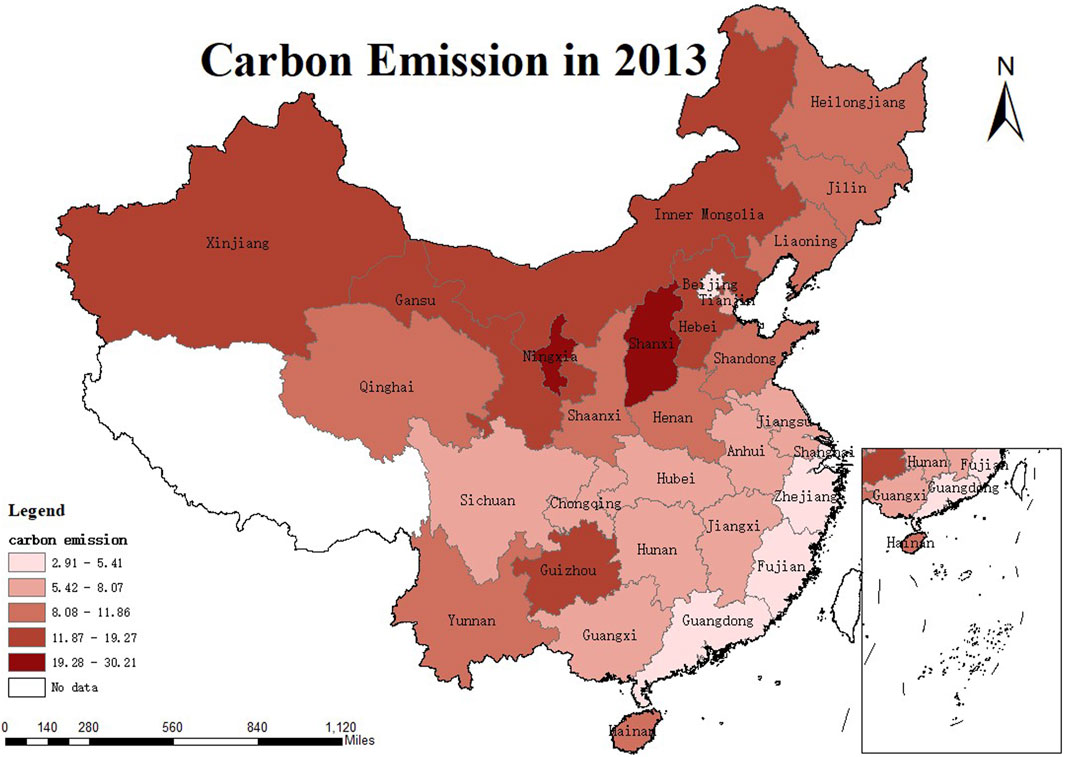

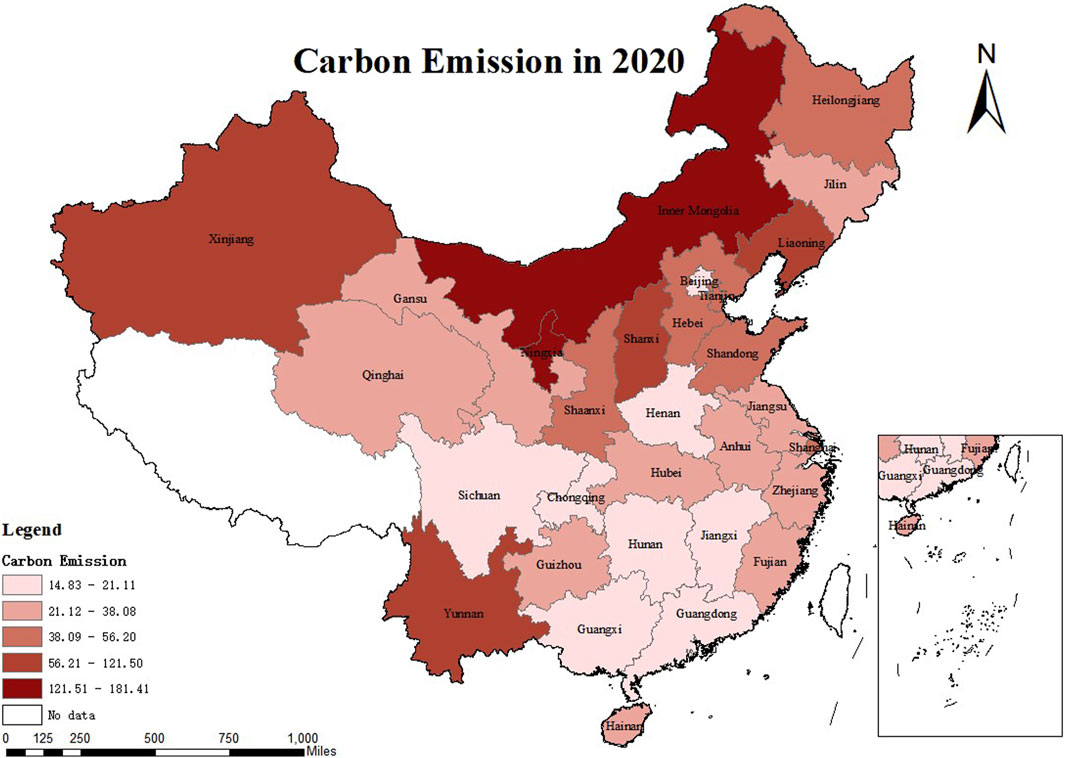

The industrial structure of a region is a critical factor in determining the degree of carbon pollution. Since industrial agglomeration and uneven regional development are significant problems facing China’s economic development for a long time, there are bound to be specific spatial differences in carbon emissions per unit of output. In order to further observe the distribution of carbon emissions, digital finance, and green finance in different provinces of China, this study utilizes Arcgis to map the spatial evolution patterns of the three, respectively, as shown in Figures 2–7. Figures 2, 3 show the spatial pattern of carbon emission intensity of China in 2013 and 2020. We find that the intensity of carbon pollution in the northern region is significantly higher than in the southern region. In contrast, the intensity of carbon emission in the eastern coastal region is smaller.

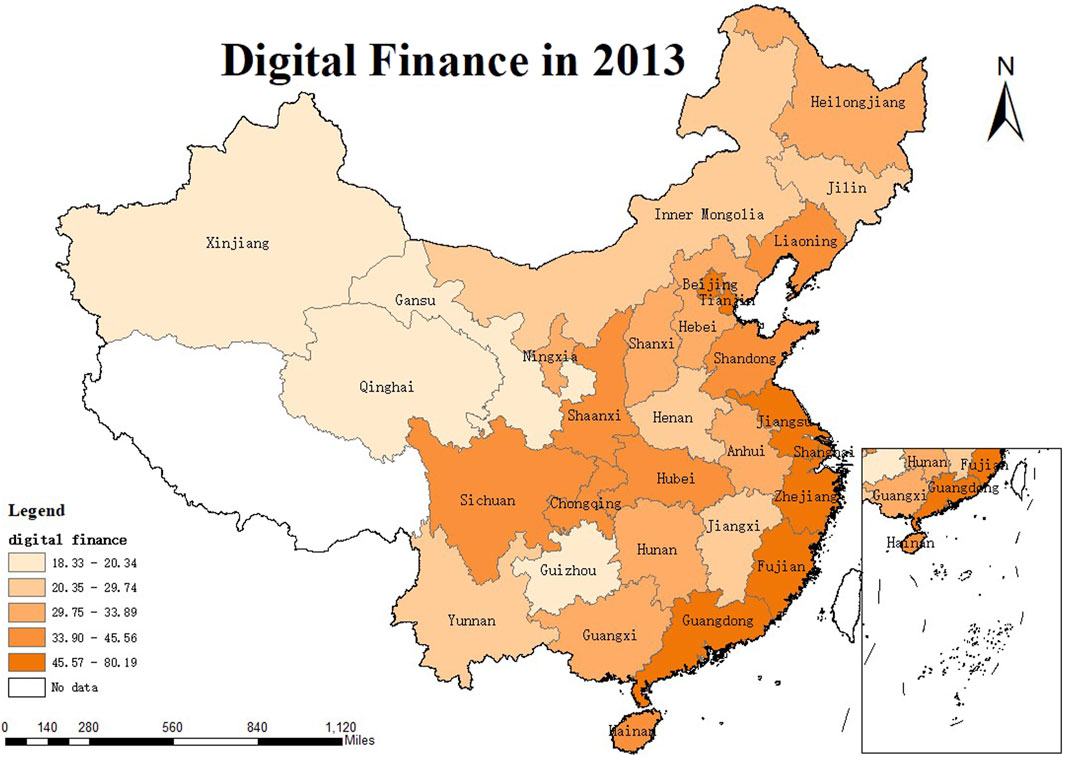

Figures 4, 5 show the spatial distribution pattern of digital finance levels in different provinces in China in 2013 and 2020. From the perspective of time evolution, from 2013 to 2020, China’s overall digital finance level increased significantly, which also indicates that the digital economy based on digital technology injects new vitality into the traditional financial system and brings infinite dividends to the financial industry; from the perspective of spatial pattern, the level of digital finance in China’s southeastern coastal is significantly higher than that in the inland, and it shows a gradual decrease from the seaside to the inland. This spatial distribution result is consistent with that of China’s regions. The result of this spatial distribution is related to the economic foundation and the popularity of digital infrastructure. Generally speaking, the advanced location advantage and good economic foundation make the eastern coastal region more capable of taking the lead in enjoying digital dividends than the inland region to promote the optimization and enhance industrial and economic resilience.

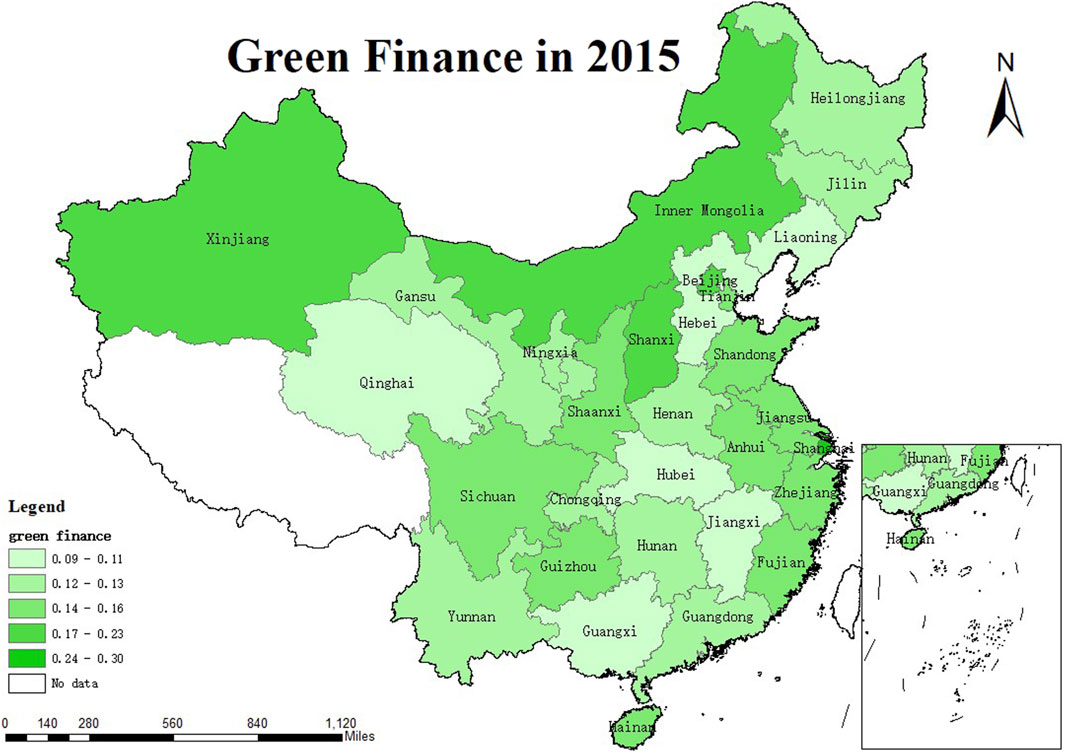

The concept of “green finance” arose in the context of international governmental organizations restraining the financing of polluting projects and has gradually become an essential financial tool for countries to protect environment. Figures 6, 7 show the spatial distribution of the level of green finance in each region of China in 2015 and 2020. Figures 6, 7 show that the level of green finance in most regions of China has been improved, with the level of green finance in the northern region being particularly prominent, which is a particular fit with the spatial distribution of high-carbon emission industries. From the viewpoint of the time series evolution of green finance level from 2015 to 2020, most regions’ green finance level has improved.

6.2 Spatial correlation and dependence tests

We find that the carbon emission reduction effect of digital finance is more significant than that of green finance, reflecting that digital finance supported by technology will become the critical direction for China to realize the “dual carbon” goal. According to the “information hinterland theory,” the distribution of financial resources in China shows apparent spatial unevenness. In this section, we focus on digital finance to further test whether there is spatiality in the impact of digital finance on carbon emissions.

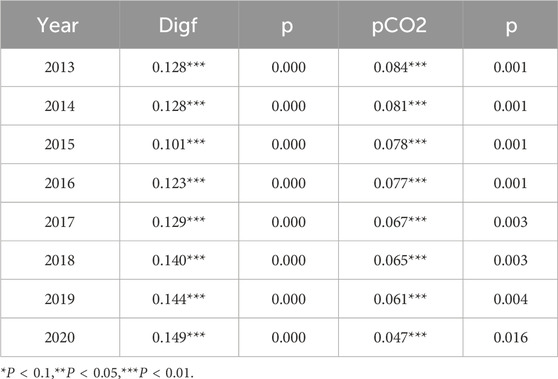

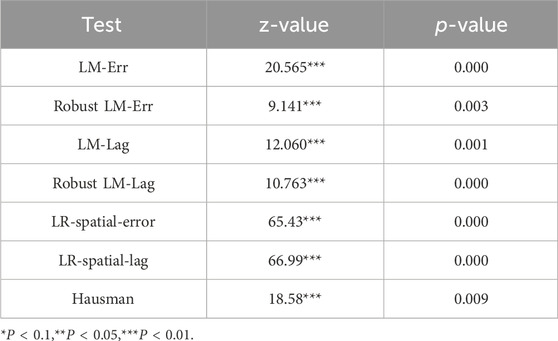

First, we test the spatial autocorrelation. In Table 12, the global Moran’s I in 2013–2020 pass the significance test, indicating that both digital finance and carbon emissions have strong spatial autocorrelation. Secondly, this study follows the rules of “specificity to generality” and “generality to specificity.” It combines the LM and LR tests to select the optimal model. The statistical results in Table 13 show that using the SDM is most suitable for this study. Finally, the Hausman test was used to select random or fixed effects, and it was found that this study needs to use the SDM model with both time and individual sets.

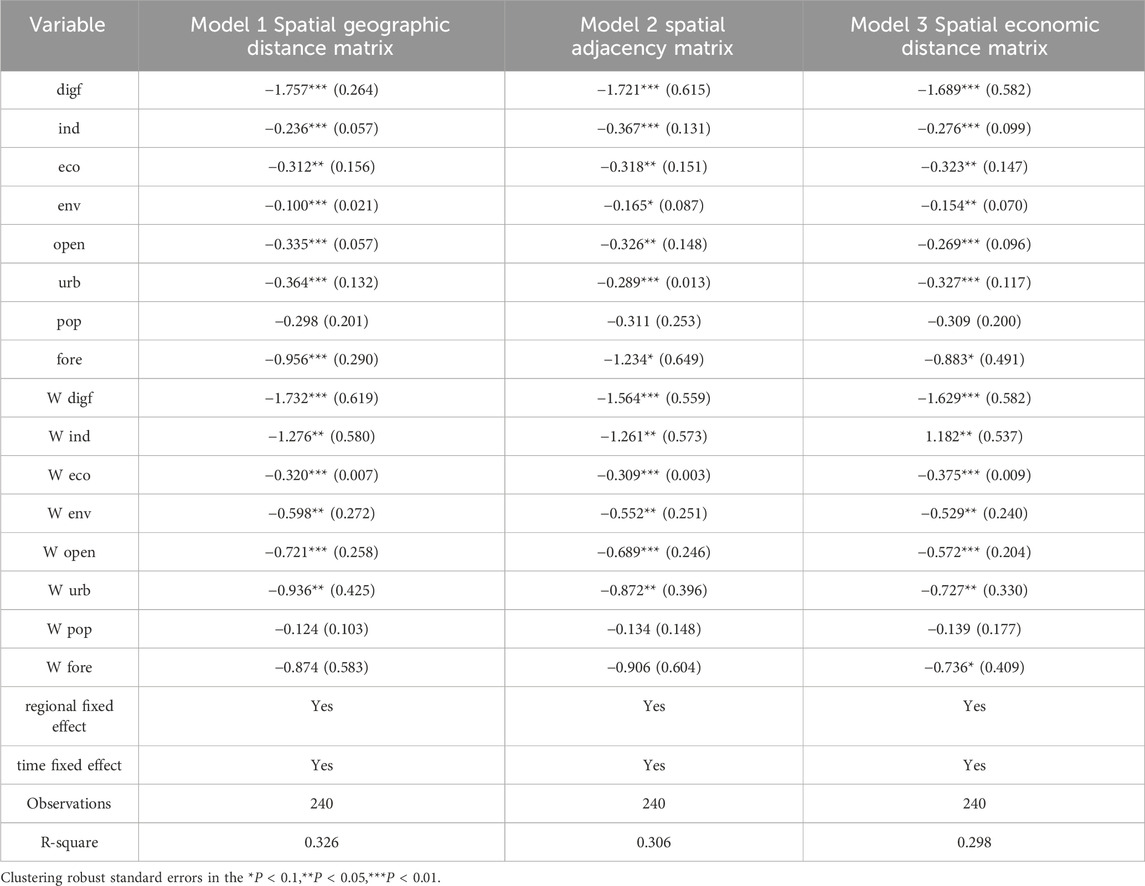

Regional linkage development has become the geo-economics development trend. Based on geographic proximity, the characteristics of digital financial inclusion and inclusiveness determine that there may be a specific spatial radiation effect, i.e., digital financial benefits can not only have an impact on the economic development of the region but also have a spillover effect on the economic development of the surrounding areas. In addition, carbon emissions are the primary source of pollution in heavily polluted industrial agglomeration areas, and the resulting air pollution has a robust spatial diffusion, seriously affecting the production and living activities of people. Therefore, we use the SDM to empirically test the “neighborhood effect” of digital finance on carbon emissions. In model one of Table 14, the spatial effect is assumed to be under the spatial geographic distance matrix, and we find that the spatial regression coefficient is −1.732 and passes the test of significance, which means that digital finance has apparent spatial effects on carbon emissions. In order to strengthen the reliability of this result, we replace the spatial geographic distance matrix in Model 1 with the spatial neighboring matrix and spatial economic distance matrix, respectively, and the results are reported in Models two and 3, respectively. We found that the correlation and significance of the spatial coefficients did not change either under the different matrix, and most of the control variables have passed the significance test for their impact on carbon emissions. Hypothesis five can be verified.

Previous studies on spatial regression analysis mostly used only one matrix for testing, and the results lacked reliability. This study tested the spatial effect of digital finance carbon emission reduction under three different matrices, and the results obtained were basically consistent, fully demonstrating that the carbon emission reduction effect of digital finance has spatial spillover and is similar to the spatial test results of digital finance carbon emission reduction in some existing studies.

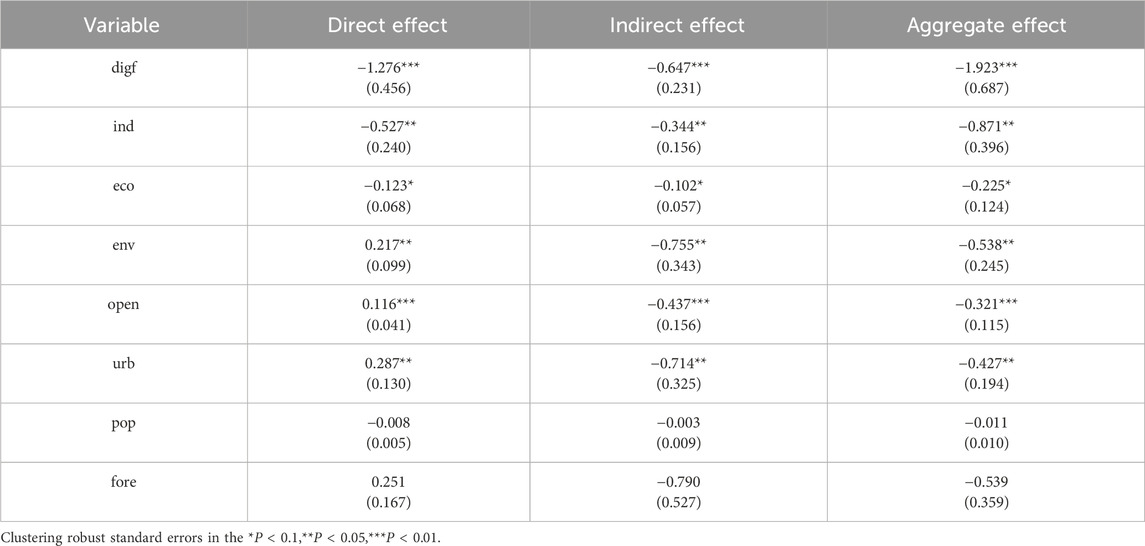

Since SDM contains the lag terms of the dependent and independent variables, the direct estimates in the model can not directly explain the real impact between the variables. It is necessary to decompose the spatial effects using the partial division method, and the results of the decomposition are shown in Table 15. From Table 15, we find that the total impact, direct impact, and indirect impact all pass the significance test. The correlation coefficients are all harmful, indicating that digital finance has a noticeable spatial carbon emission reduction effect. This result means that digital financial dividend can benefit the neighboring areas, inhibit the carbon emissions of the adjacent regions, and then alleviate the negative impacts on the socio-economic development. The digital financial dividend can benefit neighboring regions and curb carbon emissions, thus helping its adverse effects on social and economic development. Whether based on relevant theories or practical tests, the carbon emission reduction benefits of digital finance to the region are always more significant than the benefits to the neighboring areas, and this conclusion also reflects the significance of continuously improving the universality, inclusiveness, and sharing of digital finance.

7 Research conclusions and recommendations

7.1 Conclusions

Excessive CO2 emission, as a significant threat to the global ecological environment, is a challenge of the times shared by all countries worldwide. Digital finance and green finance, as essential products in different eras, have changed the traditional financial model with technology and concept as the core, respectively, providing essential opportunities for green development. We empirically analyze the impact, mechanism of action, and heterogeneity results of digital finance and green finance on carbon emissions and compare the degree of contribution, respectively. Meanwhile, we further analyze the spatial effect of digital finance carbon emission reduction, which has a more substantial carbon emission reduction effect, as the main body. The study has several findings:

First, both digital finance and green finance have inhibited carbon emissions, and both can point out the direction for envirmental protection.

Second, digital finance mainly realizes carbon emission reduction through technological innovation, and the level of economic development plays an essential positive regulating role in the link of digital finance influencing technological innovation as well as in the whole transmission mechanism. Green finance centered on the green concept is more inclined to reduce pollution through industrial ecologization, in which the stronger the environmental regulation, the stronger the carbon emission reduction effect of green finance mediated by industrial ecology.

Third, due to the variability of geographic regions and the level of financial development, the carbon emission reduction effect of digital finance and green finance presents obvious heterogeneity. Fourth, finance and carbon emissions in China have obvious spatial geographic characteristics, and the inhibitory effect has a robust geographic radiation effect.

Compared with existing research, this study comprehensively compares the carbon reduction effects of digital finance and green finance, expands the boundaries of existing research, and draws research conclusions that further enrich existing research, which is beneficial for providing useful references for global carbon reduction work.

7.2 Recommendations

We proposes the following recommendations.

First, strengthen the construction of digital infrastructure and improve the universality and inclusiveness of digital finance. As an emerging financial model of information modernization, the inhibiting effect of digital finance on carbon emissions mainly comes from the popularization of digital financial technology. From the viewpoint of the spatial pattern of digital finance, there is apparent regional variability in digital finance, which mainly stems from the differences in the distribution of digital infrastructure. Efforts should be made to improve the digital infrastructure in less developed regions and rural areas to prevent them from falling into the “middle-level trap” and improve the accessibility and universality of digital infrastructure. At the same time, for the “digital refugee” groups arising from the digital divide, specific digital financial care models should be designed to expand digital finance coverage further and improve digital finance’s inclusiveness.

Second, improve the green finance system and unleash the carbon suppression potential of green finance. On the one hand, guiding financial institutions to expand the scale of green finance, innovate green finance products, enrich green financing methods, and provide a good green finance foundation for the green transformation and development of industries; On the other hand, establishing special credit projects for green finance to support energy conservation and emission reduction, increasing credit support, providing strong financial support for environmentally friendly enterprises, and stimulating the transformation and upgrading of the traditional energy industry.

Third, relying on digital technology to promote industrial optimization and upgrading and help traditional industries transform into a green economy. The government should publicize and popularize digital technology and application training, enhance the direct transmission effect of digital technology on industrial empowerment, and strengthen the positive driving effect on industrial transformation and upgrading. At the same time, micro-enterprises should dare to accept the challenges brought by new things, seize the critical opportunities brought by digital technology to improve the production efficiency of enterprises and realize the upgrading and modernization of traditional industries with the support of technological innovation.

Fourth, strengthen the flow of regional financial resources and enhance the synergy of cross-regional digital financial carbon suppression. In the process of the deep integration of digital finance and traditional finance, to give full play to the spillover effect of digital finance on carbon emission reduction, it is necessary to enhance the exchanges and cooperation of financial institutions in neighboring regions, and set up a unified platform for standard trans-regional early warning and pollution data sharing, so as to create multi-party cooperation and mutual support of the Low-carbon life circle, with the city circle as a pilot, to point and face, promote the whole country, strengthen the cross-regional flow of digital financial innovations, encourages the formation of spatial radiation effect of digital economic green economy effect.

Fifthly, the Government’s environmental regulation should be increased to enhance the synergistic emission reduction power of financial digitization and greening. Although the carbon emission reduction effect of green finance is weaker than that of digital finance, green finance has added an essential impetus to carbon emission reduction by guiding capital flow, in which government-led environmental regulation has strengthened the carbon emission reduction effect of green finance. Local governments should effectively utilize the information advantage of ecological management to strictly control carbon emissions by formulating command policies such as market access restrictions, total pollution control, and corporate emission standards. In addition, the Chinese Government should focus on the international carbon tax system and introduce incentive policies such as carbon tax specifically targeting carbon emissions at the right time, focusing on guiding the flow of financial resources from high-emission, heavily polluting traditional overcapacity industries to green and environmentally friendly strategic emerging industries, in order to strengthen further the synergistic carbon-suppression power of finance.

7.3 Limitations and future research

This study still has more deficiencies, which are worth exploring further. Firstly, in the analysis of carbon emission reduction mechanism of digital finance and green finance, we only analyze their respective carbon emission reduction mechanisms individually, and we do not explore the synergistic effect of both on carbon emission reduction, which is a critical content that needs to be deeply explored; Secondly, the whole study is carried out from a macro perspective, exploring the carbon emission reduction effects of digital finance and green finance through industrial adjustment or ecological improvement, but not yet considering how they affect micro households or residents’ lives and thus reduce carbon emissions, which provides potential space for future related research.

Data availability statement

The original contributions presented in the study are included in the article, other information is available from the corresponding author upon request.

Author contributions

SJ: Writing–original draft, Writing–review and editing. LW: Conceptualization, Data curation, Methodology, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1433044/full#supplementary-material

References

Bai, J., Chen, Z., Yan, X., and Zhang, Y. (2022). Research on the impact of green finance on carbon emissions: evidence from China. Econ. Research-Ekonomska Istraživanja 35 (1), 6965–6984. doi:10.1080/1331677x.2022.2054455

Chang, J. (2022). The role of digital finance in reducing agricultural carbon emissions: evidence from China’s provincial panel data. Environ. Sci. Pollut. Res. 29 (58), 87730–87745. doi:10.1007/s11356-022-21780-z

Chen, H., Guo, W., Feng, X., Wei, W., Liu, H., Feng, Y., et al. (2021). The impact of low-carbon city pilot policy on the total factor productivity of listed enterprises in China. Resour. Conservation Recycl. 169, 105457. doi:10.1016/j.resconrec.2021.105457

Chen, X., and Chen, Z. (2021). Can green finance development reduce carbon emissions? Empirical evidence from 30 Chinese provinces. Sustainability 13 (21), 12137. doi:10.3390/su132112137

Chu, H., Yu, H., Chong, Y., and Li, L. (2023). Does the development of digital finance curb carbon emissions? Evidence from county data in China. Environ. Sci. Pollut. Res. 30 (17), 49237–49254. doi:10.1007/s11356-023-25659-5

Ding, N., Gu, L., and Peng, Y. (2022). Fintech, financial constraints and innovation: evidence from China. J. Corp. Finance 73, 102194. doi:10.1016/j.jcorpfin.2022.102194

Feng, S., Liu, J., and Xu, D. (2023). Digital financial development and indirect household carbon emissions: empirical evidence from China. Environ. Dev. Sustain. doi:10.1007/s10668-023-03603-4

Feng, W., Bilivogui, P., Wu, J., and Mu, X. (2023). Green finance: current status, development, and future course of actions in China. Environ. Res. Commun. 5 (3), 035005. doi:10.1088/2515-7620/acc1c7

Huang, J., An, L., Peng, W., and Guo, L. (2023). Identifying the role of green financial development played in carbon intensity: evidence from China. J. Clean. Prod. 408, 136943. doi:10.1016/j.jclepro.2023.136943

Lin, Z., Liao, X., and Yang, Y. (2022). China’s experience in developing green finance to reduce carbon emissions: from spatial econometric model evidence. Environ. Sci. Pollut. Res. 30 (6), 15531–15547. doi:10.1007/s11356-022-23246-8

Liu, S., Zhu, M., and Ling, W. (2023). Research on the impact of population aging and endowment insurance on household financial asset allocation- Evidence on CFPS data. Finance Res. Lett. 54, 103719. doi:10.1016/j.frl.2023.103719

Liu, X., Chong, Y., Di, D., and Li, G. (2023). Digital financial development, synergistic reduction of pollution, and carbon emissions: evidence from biased technical change. Environ. Sci. Pollut. Res. 30 (50), 109671–109690. doi:10.1007/s11356-023-29961-0

Liu, X., Wang, E., and Cai, D. (2019). Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Finance Res. Lett. 29, 129–135. doi:10.1016/j.frl.2019.03.014

Lv, C., Fan, J., and Lee, C.-C. (2023). Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 397, 136573. doi:10.1016/j.jclepro.2023.136573

McLarnon, M. J. W., and O’Neill, T. A. (2018). Extensions of auxiliary variable approaches for the investigation of mediation, moderation, and conditional effects in mixture models. Organ. Res. Methods 21 (4), 955–982. doi:10.1177/1094428118770731

Pu, Z., and Fei, J. (2022). The impact of digital finance on residential carbon emissions: evidence from China. Struct. Change Econ. Dyn. 63, 515–527. doi:10.1016/j.strueco.2022.07.006

Shi, F., Ding, R., Li, H., and Hao, S. (2022). Environmental regulation, digital financial inclusion, and environmental pollution: an empirical study based on the spatial spillover effect and panel threshold effect. Sustainability 14 (11), 6869. doi:10.3390/su14116869

Sinn, H.-W. (2008). Public policies against global warming: a supply side approach. Int. Tax Public Finance 15 (4), 360–394. doi:10.1007/s10797-008-9082-z

Song, X., Yao, Y., and Wu, X. (2023). Digital finance, technological innovation, and carbon dioxide emissions. Econ. Analysis Policy 80, 482–494. doi:10.1016/j.eap.2023.09.005

Sun, H., and Chen, F. (2022). The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour. Policy 76, 102588. doi:10.1016/j.resourpol.2022.102588

Wang, B., Wang, Y., Cheng, X., and Wang, J. (2023). Green finance, energy structure, and environmental pollution: evidence from a spatial econometric approach. Environ. Sci. Pollut. Res. 30 (28), 72867–72883. doi:10.1007/s11356-023-27427-x

Wang, H., and Guo, J. (2022). Impacts of digital inclusive finance on CO2 emissions from a spatial perspective: evidence from 272 cities in China. J. Clean. Prod. 355, 131618. doi:10.1016/j.jclepro.2022.131618

Wang, J., and Ma, Y. (2022). How does green finance affect CO2 emissions? Heterogeneous and mediation effects analysis. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.931086

Wang, J., Tian, J., Kang, Y., and Guo, K. (2023). Can green finance development abate carbon emissions: evidence from China. Int. Rev. Econ. Finance 88, 73–91. doi:10.1016/j.iref.2023.06.011

Wang, L., Sun, Y., and Xv, D. (2023). Study on the spatial characteristics of the digital economy on urban carbon emissions. Environ. Sci. Pollut. Res. 30 (33), 80261–80278. doi:10.1007/s11356-023-28118-3

Wang, X., Huang, J., Xiang, Z., and Huang, J. (2021). Nexus between green finance, energy efficiency, and carbon emission: covid-19 implications from BRICS countries. Front. Energy Res. 9, 786659. doi:10.3389/fenrg.2021.786659

Wu, M., Guo, J., Tian, H., and Hong, Y. (2022). Can digital finance promote peak carbon dioxide emissions? Evidence from China. Int. J. Environ. Res. Public Health 19 (21), 14276. doi:10.3390/ijerph192114276

Wu, Y., and Liu, Y. (2024). How does the digital economy affect urban CO2 emissions? Mechanism discussion and empirical test. Environ. Dev. Sustain. doi:10.1007/s10668-024-04502-y

Xu, J., Chen, F., Zhang, W., Liu, Y., and Li, T. (2023). Analysis of the carbon emission reduction effect of Fintech and the transmission channel of green finance. Finance Res. Lett. 56, 104127. doi:10.1016/j.frl.2023.104127

Xu, W., Feng, X., and Zhu, Y. (2023). The impact of green finance on carbon emissions in China: an energy consumption optimization perspective. Sustainability 15 (13), 10610. doi:10.3390/su151310610

Xu, X., Wang, Q., Ran, C., and Mu, M. (2021). Is burden responsibility more effective? A value-added method for tracing worldwide carbon emissions. Ecol. Econ. 181, 106889. doi:10.1016/j.ecolecon.2020.106889

Xue, Q., Feng, S., Chen, K., and Li, M. (2022). Impact of digital finance on regional carbon emissions: an empirical study of sustainable development in China. Sustainability 14 (14), 8340. doi:10.3390/su14148340

Yin, Y. (2022). Digital finance development and manufacturing emission reduction: an empirical evidence from China. Front. Public Health 10, 973644. doi:10.3389/fpubh.2022.973644

Yuan, Q., Yang, D., Yang, F., Luken, R., Saieed, A., and Wang, K. (2020). Green industry development in China: an index based assessment from perspectives of both current performance and historical effort. J. Clean. Prod. 250, 119457. doi:10.1016/j.jclepro.2019.119457

Zhan, Y., Wang, Y., and Zhong, Y. (2023). Effects of green finance and financial innovation on environmental quality: new empirical evidence from China. Econ. Research-Ekonomska Istraživanja 36 (3), 2164034. doi:10.1080/1331677X.2022.2164034

Zhang, D., Zhang, Z., and Managi, S. (2019). A bibliometric analysis on green finance: current status, development, and future directions. Finance Res. Lett. 29, 425–430. doi:10.1016/j.frl.2019.02.003

Zhang, H., Huang, L., Zhu, Y., Si, H., and He, X. (2021). Does low-carbon city construction improve total factor productivity? Evidence from a quasi-natural experiment in China. Int. J. Environ. Res. Public Health 18 (22), 11974. doi:10.3390/ijerph182211974

Zhang, M., and Liu, Y. (2022). Influence of digital finance and green technology innovation on China's carbon emission efficiency: empirical analysis based on spatial metrology. Sci. Total Environ. 838, 156463. doi:10.1016/j.scitotenv.2022.156463

Zhang, W., Zhu, Z., Liu, X., and Cheng, J. (2022). Can green finance improve carbon emission efficiency? Environ. Sci. Pollut. Res. 29 (45), 68976–68989. doi:10.1007/s11356-022-20670-8

Zhang, X., Bao, K., Liu, Z., and Yang, L. (2022). Digital finance, industrial structure, and total factor energy efficiency: a study on moderated mediation model with resource dependence. Sustainability 14 (22), 14718. doi:10.3390/su142214718

Zhao, H., Yang, Y., Li, N., Liu, D., and Li, H. (2021). How does digital finance affect carbon emissions? Evidence from an emerging market. Sustainability 13 (21), 12303. doi:10.3390/su132112303

Zheng, H., and Li, X. (2022). The impact of digital financial inclusion on carbon dioxide emissions: empirical evidence from Chinese provinces data. Energy Rep. 8, 9431–9440. doi:10.1016/j.egyr.2022.07.050

Zhong, W., and Jiang, T. (2021). Can internet finance alleviate the exclusiveness of traditional finance? evidence from Chinese P2P lending markets. Finance Res. Lett. 40, 101731. doi:10.1016/j.frl.2020.101731

Zhou, C., and Qi, S. (2022). Has the pilot carbon trading policy improved China's green total factor energy efficiency? Energy Econ. 114, 106268. doi:10.1016/j.eneco.2022.106268

Zhu, S., He, C., and Liu, Y. (2014). Going green or going away: environmental regulation, economic geography and firms' strategies in China's pollution-intensive industries. Geoforum 55, 53–65. doi:10.1016/j.geoforum.2014.05.004

Keywords: global climate, digital finance, green finance, carbon emission reduction, “double carbon” goal

Citation: Jiang S and Wang L (2024) All paths to the same end?—a comparative study on carbon emissions reduction effects of digital finance and green finance. Front. Environ. Sci. 12:1433044. doi: 10.3389/fenvs.2024.1433044

Received: 15 May 2024; Accepted: 16 July 2024;

Published: 01 August 2024.

Edited by:

Ji Zheng, The University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Diby Francois Kassi, Henan University, ChinaMaham Furqan, Oregon State University, United States

Copyright © 2024 Jiang and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Li Wang, d2wxNTEzMjgyMDc5OEAxNjMuY29t

Shasha Jiang

Shasha Jiang Li Wang

Li Wang