- 1School of Economics and Management, Huaibei Institute of Technology, Huaibei, Anhui, China

- 2School of Digital Economics and Management, Wuxi University, Wuxi, Jiangsu, China

- 3Business School, Soochow University, Suzhou, Jiangsu, China

Government regulations and financial constraints challenge companies’ carbon reduction efforts. This study examines a supply chain comprising a retailer and a capital-constrained manufacturer regulated by a carbon cap-and-trade policy. It develops three analytical modes: manufacturer-independent abatement, supply chain loose cooperation for abatement, and energy service company (ESCO) provided abatement. The study explores the optimal carbon reduction levels and patterns for manufacturers, as well as the optimal pricing strategies for supply chain members. Additionally, the extension explores a scenario where supply chain members collaborate closely to reduce emissions and provides a coordination mechanism. Key findings include: (1) Under high interest rates, manufacturers favor ESCO abatement over loose cooperation, with independent abatement being least preferred. (2) While loose cooperation enhances the low-carbon performance of products more effectively than the independent mode, it imposes greater financial pressure on manufacturers. (3) In the ESCO mode, financial burden decreases with higher carbon prices but rises with greater ESCO abatement efficiency. (4) When the abatement revenue-sharing ratio is below a critical threshold, increasing the ratio benefits both the manufacturer and retailer. However, higher carbon prices reduce firm profits while alleviating manufacturers’ financing pressure. (5) The two-part tariff contract developed in this study allows the unit abatement level and firm profits in the independent abatement mode to align with those in the closely cooperative abatement mode. Finally, our findings provide practical insights for government and business decision-makers from a low-carbon perspective.

1 Introduction

The issues arising from excessive carbon dioxide emissions are widely recognized as a significant factor affecting the sustainable development of society (Qin et al., 2021; Li et al., 2023). To tackle this challenge, policymakers have implemented a range of strategies aimed at mitigating carbon emissions (Hu et al., 2023; Qiu et al., 2024). For instance, the European Union has enacted a carbon cap-and-trade policy (CTP), while the Canadian province of British Columbia has implemented a carbon tax policy. Among these strategies, the CTP is regarded as an effective approach to reducing carbon emissions (Xia et al., 2018). Under the CTP, regulatory authorities initially allocate permitted emission credits to regulated firms. The surplus or shortfall of these carbon credits can then be traded in the market (Zhou et al., 2024). In addition to government regulation, stakeholders including consumers and retailers are also putting pressure on manufacturing companies to reduce their high carbon emissions (Hong and Guo, 2019; Gong et al., 2024). For example, an increasing number of consumers are demonstrating a noteworthy inclination towards low-carbon products. Additionally, as market competition evolves from individual firms to supply chains, retail companies are becoming more focused on the environmental practices of upstream suppliers and manufacturers (Yuan et al., 2024). Given the influence of the aforementioned factors, manufacturers within the supply chain must integrate carbon reduction strategies into their daily operational decisions.

The implementation of low-carbon strategies typically requires substantial capital resources, including costs associated with raw material procurement, production and operations, and investments in abatement technologies (Wang et al., 2021; Zhang C. et al., 2024). According to the “Survey Report on the Status of Energy Conservation and Abatement of Chinese Enterprises since the 13th Five-Year Plan,” published in 2019, insufficient capital has become a major challenge in the process of corporate carbon reduction. On the one hand, capital constraints can disrupt companies’ production and abatement plans (Wang et al., 2017). On the other hand, the CTP compels companies to either reduce emissions or purchase additional carbon quotas, further exacerbating their financial burden (Yuan et al., 2024). However, existing research in the low-carbon field rarely takes into account the impact of both of these factors on companies simultaneously. In practice, some capital-constrained manufacturers can obtain financing from financial institutions to implement production and abatement activities (Qin et al., 2020; Zou et al., 2021). For example, in September 2024, the Changchun branch of Industrial Bank Co., Ltd. granted a loan of RMB 29 million to a local cable company to support its carbon abatement initiatives.

In fact, achieving carbon reduction and carbon neutrality is not only a proactive measure for companies to comply with government regulations but also a crucial strategy for enhancing the overall competitiveness of the supply chain (Sun et al., 2023a). Furthermore, the decarbonization of supply chain systems emphasizes collaboration among companies and effective communication between departments, all while considering the overall environmental impact (Li et al., 2022). For example, to encourage supply chain partners to emulate its socially and environmentally responsible practices, HP considers the profitability of its partners and is even willing to provide revenue sharing opportunities (Wu, 2016). Therefore, within the framework of CTP, it is essential to explore whether capital-constrained companies, when deciding to implement carbon reduction actions, should consider the impacts of their decisions on supply chain partners and the overall supply chain system.

As banks impose increasingly stringent requirements on firm size and credit qualifications for loans, some manufacturers encounter obstacles in obtaining financing, which significantly impacts their carbon abatement efforts (Wang et al., 2019). In this scenario, the abatement services provided by energy service companies (ESCOs) serve as a feasible alternative for manufacturers facing capital constraints in their efforts to reduce emissions (Sun et al., 2023a). ESCOs can provide clients with energy-saving and abatement services through contracts while also shouldering the initial costs of abatement (Qin et al., 2017). For example, Siemens can provide specialized energy conservation and abatement service solutions for upstream and downstream supply chain partners, as well as external client companies (Sun et al., 2023a). This not only helps alleviate the financing pressure on capital-constrained companies but also aids them in achieving their abatement targets.

Building upon the aforementioned context, this study constructs a supply chain framework under the CTP, comprising a capital-constrained manufacturer, a retailer, and an ESCO. It explores issues related to members’ financing, production, and carbon abatement. Specifically, this study aims to answer the following questions: (1) How do supply chain members make decisions under different abatement scenarios? (2) Does the CTP exacerbate the manufacturer’s financing pressure? Which abatement strategy proves more advantageous for the manufacturer? (3) When manufacturers reduce emissions independently, is there potential for the supply chain to achieve simultaneous optimization of corporate profitability and unit abatement levels?

To address these issues, this study developed three modes: manufacturer-independent abatement (M mode), supply chain loosely collaborative abatement (C mode), and ESCO provided abatement (E mode). In the M mode, the manufacturer bears all abatement costs and makes decisions regarding the unit abatement level to maximize its profits, as illustrated by the earlier case of the cable company. In the C mode, the manufacturer bears all abatement cost, but determines the unit abatement level from the perspective of optimizing the overall profit of the supply chain, just like the previous HP case. In the E mode, the manufacturer reduces emissions by collaborating with an ESCO, such as Siemens, the ESCO mentioned earlier. Additionally, in the M mode and C mode, the manufacturer needs to secure external financing to obtain the funds necessary for operations and carbon reduction. In the E mode, however, the abatement costs are borne by the ESCO, and the benefits generated from the abatement are shared between the manufacturer and the ESCO according to an agreed-upon ratio. Subsequently, this study constructed a series of analytical models to explore the operation and abatement decision-making issues of firms in the above scenarios. In addition, this study expands the scope of the C mode to encompass scenarios where supply chain members cooperate closely in reducing emissions (C2 mode), and proposes a two-part tariff contract to achieve supply chain coordination.

By analyzing the above modes, several important findings are obtained. First, the financing pressure on manufacturers in the C mode is higher than that in the M mode, and an increase in carbon prices will exacerbate the difference in financing pressure between the two modes. Furthermore, a rise in carbon prices will reduce the financing pressure on manufacturers in the E mode, which consistently remains lower than that in both the M mode and C mode. Second, the profits of the manufacturer and the retailer in the E mode are positively correlated with the revenue sharing ratio when the ratio is below the corresponding threshold, respectively. Moreover, when the interest rate exceeds the corresponding threshold, from a profit-maximization perspective, manufacturers choosing the E mode are more advantageous than selecting the M mode or C mode. Third, the unit abatement level in the C mode exceeds that of the M mode but remains lower than that of the C2 mode. Under certain conditions, the unit abatement level in the C2 mode is lower than that of the E mode. Finally, the two-part tariff contract developed in this study can achieve supply chain coordination in the dual dimensions of unit abatement level and firm profit.

The main contributions of this study encompass several aspects. First, among the limited existing studies addressing corporate capital constraints and carbon reduction, few scholars simultaneously consider the impacts of the CTP and consumer preferences (e.g., Wang and Peng, 2023; Yang and Xu, 2024). This study comprehensively examines the impacts of factors such as carbon prices, interest rates, and abatement methods on the operational and abatement strategies of capital-constrained manufacturers within this context. Second, unlike existing literature that examines companies’ choices of financing methods and operational decisions (e.g., Sun et al., 2023b; Zhang et al., 2023), this study is based on the objective premise of capital constraints faced by emission-reducing entities. It explores the choice of corporate abatement strategies from the perspectives of abatement levels, profits, and external financing pressure. Third, current research in the low-carbon field has largely overlooked the role of specialized ESCOs in abatement (e.g., Jena et al., 2023; Yuan et al., 2024). The present study innovatively incorporates the role of ESCOs in abatement under the premise that manufacturers face capital constraints, and compares the differences between independent abatement by manufacturers and abatement by ESCOs. Finally, this study develops a new two-part tariff contract that optimizes the unit reduction levels and profits of both companies within the supply chain.

The content of this article is outlined as follows: Section 2 offers a comprehensive review of the related literature. Section 3 involves the construction of the research mode and the description of related assumptions. Section 4 analyzes the influence of key parameters. Section 5 compares the equilibrium strategies of related modes. Section 6 provides numerical analysis. Section 7 addresses mode extension. Finally, Section 8 refines the research conclusions and presents management implications. Supplementary Appendix A provides the proofs of the relevant lemmas, corollaries, and propositions.

2 Literature review

The literature streams relevant to this study encompass two principal areas: supply chain carbon reduction under government regulation, and research on supply chain operational strategies under capital constraints. Therefore, this section aims to provide a comprehensive review and critique of existing literature within these two domains.

2.1 Supply chain carbon reduction under government regulation

In recent years, environmental issues have sparked a growing interest among scholars (Chen et al., 2024). Government regulatory policies play a crucial role in addressing these environmental challenges, becoming a focal point of attention (Qin et al., 2021). Among these policies, carbon taxes, green subsidies, and cap-and-trade mechanisms are the most commonly studied (Zhou et al., 2024; Fan et al., 2024). For example, Sarkar et al. (2022) studied a variable production system consisting of two manufacturers of substitutable products under the influence of carbon tax, CTP and green technology. The authors found that the variable production system can play a positive role in reducing emissions and increasing corporate profits. Chaudhari et al. (2023) examined the impact of down-cash-credit payments on perishable goods business strategies under carbon tax policy.Yang and Xu (2024) examined the impact of three low-carbon policies, namely, carbon cap-and-trade, carbon caps, and carbon taxes, on the abatement and operational strategies of multiple manufacturers in a competitive market environment.

In alignment with the research theme, this paper concentrates its attention on existing studies conducted within the context of CTP. In this particular research domain, Xu et al. (2017) constructed a make-to-order supply chain consisting of a retailer and an emission-regulated manufacturer and explored the production and pricing issues of supply chain members. The authors found that an increase in the unit carbon price can increase the optimal production quantity, but reduce the profits of both companies. Ebrahimi et al. (2022) analyzed the impact of technological investments by manufacturers aimed at reducing emissions and improving product quality, as well as the green investments made by retailers, on the sustainability performance of the supply chain in the context of the CTP.The conclusion shows that retailers’ green efforts can improve manufacturers’ sustainability levels. Sarkar and Guchhait (2023) employed a mathematical modeling approach to investigate the impact of information asymmetry on firm profitability, service levels, and carbon emission within a green supply chain consisting of one manufacturer and multiple unreliable buyers. Cai and Jiang (2023) investigated the effects of CTPs and channel power structures on corporate abatement and pricing decisions in scenarios where manufacturers and suppliers each hold dominant positions, as well as in cases characterized by Nash competition between the two firms. Furthermore, a few scholars have considered the capital constraints and financing issues of firms in low-carbon supply chains. Tang and Yang (2020) studied the optimal abatement and pricing strategies of a capital-constrained manufacturer under two financing modes: bank loans and prepayments. With the development of e-commerce, Xu et al. (2023) studied the operating decision-making problem of manufacturers in the platform supply chain under market model and resale model. Yuan et al. (2024) explored the channel encroachment and abatement decisions of manufacturers under the CTP, considering whether retailers engage in low-carbon investments. The results show that retailers’ low-carbon investment can improve the carbon abatement level per unit product in both single-channel and dual-channel situations.

In addition, some scholars have studied the issues of abatement under the CTP from other perspectives. Kang and Tan (2023) employed an evolutionary game approach to study the carbon reduction investment decisions and strategy stability of manufacturers and suppliers under the CTP. They found that the stable strategy for the system is for the manufacturer to invest in abatement, while the supplier does not. Zou et al. (2023) studied the impact of retailers’ risk aversion behavior on product pricing, carbon reduction levels, and manufacturer profits in supply chains based on the CTP, and found that an increase in retailers’ risk aversion levels can reduce manufacturers’ carbon emissions. Song et al. (2024) performed a comparative analysis of the differences in corporate profits and carbon reduction levels between independent and joint management of carbon quotas in the supply chain. The study concluded that joint management of carbon quotas can increase corporate profits and reduce carbon emissions.

In summary, many studies have explored the issue of supply chain abatement, and most of them assume that the firms responsible for abatement have sufficient capital resources (e.g., Sarkar et al., 2022; Sarkar and Guchhait, 2023; Yang and Xu, 2024; Song et al., 2024). Given the high-cost nature of abatement in practical scenarios, it holds substantial importance to incorporate the capital constraints faced by carbon-reducing companies into analyses. Although some scholars have considered the capital constraints faced by carbon-reducing companies (e.g., Tang and Yang, 2020; Song et al., 2024), their primary focus has centered on the exploration of abatement issues within varying decision-making models or distinct financing schemes. Moreover, they have overlooked the impact of carbon CTPs on companies’ carbon reduction and financing strategies. In contrast to these previous studies (e.g., Kang and Tan, 2023; Zou et al., 2023; Yuan et al., 2024), this article stands out by conducting a comparative analysis of different abatement strategies within the framework of the same financing model.

2.2 Decision-making of the supply chain under capital constraints

Research in this area often focuses on the financing strategy choices of companies, with external institutional financing and trade credit financing being the two commonly used methods (Wang et al., 2022; Jena et al., 2023). For example, Ding and Wan (2020) investigated the choice of financing strategies for suppliers under two financing modes: bank loans and manufacturer advances. Their findings indicate that manufacturers are consistently willing to provide advance financing to suppliers. Li et al. (2020) analyzed supply chain members’ preferences for three modes of trade credit, bank loans, and blended financing in a co-opetitive supply chain consisting of competing suppliers and a capital-constrained manufacturer. Similarly, Sun et al. (2023b) compared the impact of e-commerce platform financing and logistics company financing on the operational decisions of capital-constrained manufacturers within the e-commerce supply chain. They found that when interest rates are the same, manufacturers tend to prefer the financing model offered by e-commerce platforms. On the other hand, some scholars in this field have explored the operational issues of capital-constrained companies. Wang et al. (2022) analyzed the impact of guarantee company types (conservative and adventurous) on financing and operational decisions of capital-constrained retailers in a supply chain finance consisting of a credit guarantee company and an online lending platform. Zhang et al. (2023) examined the financing scheme choices of capital-constrained retailers under two scenarios: when a manufacturer introduces a direct sales channel and when it does not. They also explored the potential impact of different financing schemes on the manufacturer’s encroachment strategies.

In recent years, to provide an integrated solution for decision-making issues related to capital constraints, operations, and carbon reduction within supply chains, some scholars have incorporated supply chain finance into the field of low-carbon/green supply chains (Shi et al., 2023). In this area, Qin et al. (2020) scrutinized the impact of prepayment financing on supply chain carbon reduction and production. The authors concluded that, in scenarios where manufacturers face no financial constraints, prepayment financing with low price discounts can enhance the profits of supply chain partners. Xu and Fang (2020) compare the differences of supply chain members in terms of the quantity ordered and the level of abatement under partial credit guarantee (PCG) financing and a combination of trade credit and PCG financing within a supply chain consisting of a supplier and a financially constrained manufacturer. Wang and Peng (2023) studied the ordering and abatement strategies in a supply chain under manufacturers’ carbon emission rights pledge financing. The study found that under carbon emission rights pledge financing, there is an optimal unit abatement level that maximizes the retailer’s order quantity. Zhang Q. et al. (2024) studied the optimal green investment decisions and production operation strategies of capital-constrained manufacturers under bank financing and retailer credit financing. The study found that when the difference in financing interest rates is small, retailer credit financing is the dominant strategy for manufacturers.

Moreover, with increasing government attention on environmental issues, the role of green finance in the operational decisions of firms has attracted the interest of some scholars. For instance, Huang et al. (2020) compared three green subsidy models—green credit, manufacturing subsidies, and sales subsidies—in a supply chain involving capital-constrained green manufacturers. The author believes that when the loan is unlimited and the total subsidy amount is the same, the green credit model performs best in terms of market demand, social welfare and environmental benefits, while the sales subsidy model performs worst. An et al. (2021) conducted a comparative analysis of the operational and financial decisions made by supply chain firms when utilizing bank green credit financing versus traditional trade credit financing. The findings reveal that both financing modes can effectively curb the carbon emissions of firms, while which financing mode is more effective depends on the bank’s interest rate. In addition, given the reality that green loans are sometimes used by manufacturers for non-green development purposes, Wang et al. (2024) examined the value of blockchain technology in curbing the misuse of green loans within the supply chain.

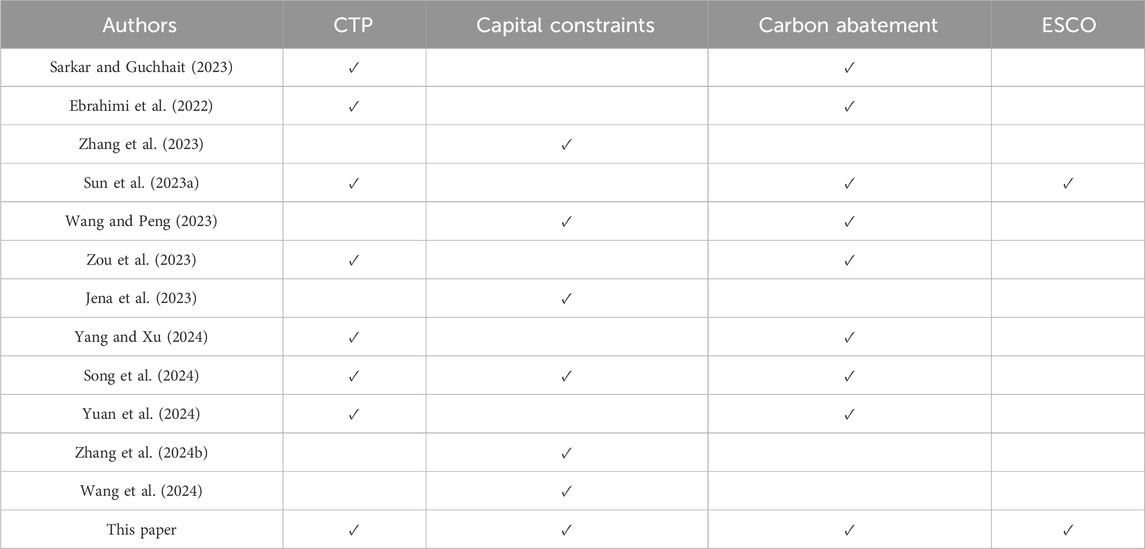

The above literature mostly focuses on the financing decisions of firms and their impacts, but ignores the issue of carbon abatement (e.g., Jena et al., 2023; Zhang et al., 2023). This study discusses the abatement strategy choices of companies under the premise of capital constraints. Although some scholars have considered the financing and operational decisions related to carbon reduction for capital-constrained firms (e.g., Shi et al., 2023; Wang and Peng, 2023), they often overlook the effects of CTP and consumer preferences. This study, in contrast, is conducted in the context of both the CTP and consumer low-carbon preference. Moreover, existing research focuses on companies resolving capital constraints for carbon reduction through direct financing (institutional financing and credit financing), while neglecting the unique role of specialized ESCOs in carbon reduction (e.g., Zhang Q. et al., 2024; Wang et al., 2024). This study further explores the scenario where manufacturers outsource abatement projects to ESCOs to alleviate their financing pressure. Table 1 shows the differences and innovations of this paper compared with existing similar studies.

3 Model framework

3.1 Problem description

Under the CTP, this study examines a supply chain that comprises a capital-constrained manufacturer, a retailer, and an ESCO. The manufacturer sells the products to the retailer, who then sells them to consumers.The unit production cost, wholesale price, and retail price are

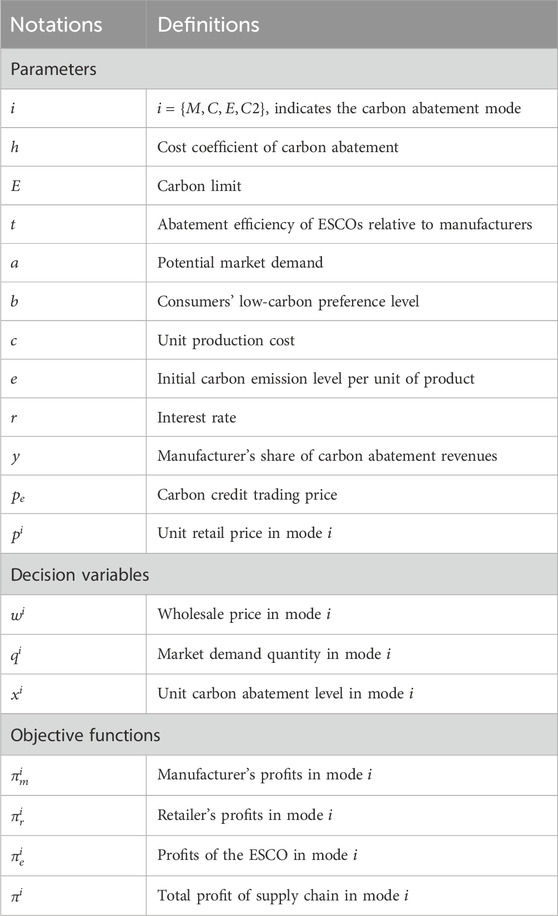

This study primarily focuses on exploring manufacturers’ choices regarding carbon reduction strategies under M mode, C mode, and E mode, as well as the effects of factors such as interest rates, abatement cost coefficients, and revenue sharing ratios. Furthermore, this study considers the development of a contractual mechanism to facilitate close cooperation among supply chain members, ultimately enhancing profits for each enterprise and improving the level of carbon abatement per unit of product. Table 2 describes the main variables and parameters that emerged in this study.

3.2 Relevant assumptions and explanations

Referring to Wang and Li (2021), the demand function in this article is defined as follows:

Without sacrificing generality, the study assumes that the manufacturer has no initial funds, and there is no risk of bankruptcy (Jing et al., 2012; Sun et al., 2023b). The interest rate for the external loan obtained by the manufacturer is denoted as

4 Equilibrium outcomes

4.1 Independent abatement by the manufacturer

In the M mode, the manufacturer is required to secure the capital needed for production and abatement through loans and to pay the corresponding interest. The carbon credits generated from abatement are entirely owned by the manufacturer. Additionally, based on the principle of maximizing their respective profits, the manufacturer first determines the wholesale price and the unit carbon abatement level, after which the retailer determines the order quantity. The objective functions for both the manufacturer and the retailer in the M mode are presented below.

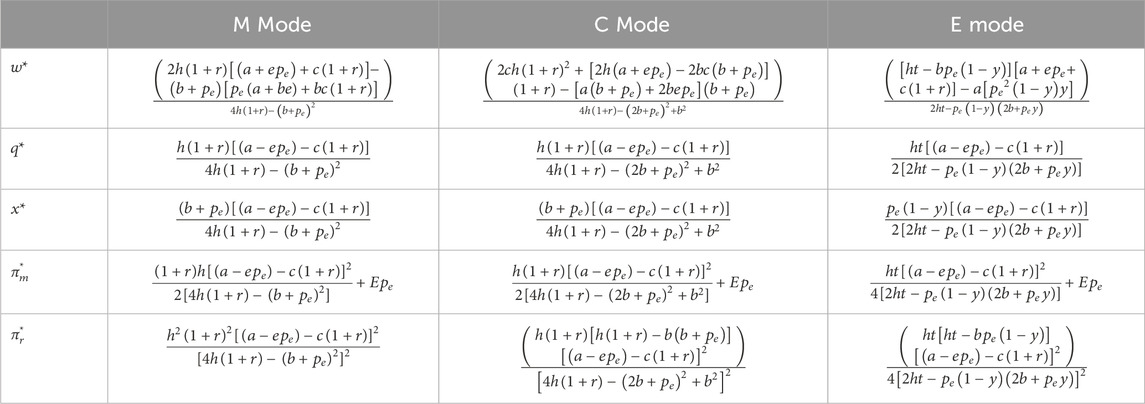

Lemma 1. By solving Equations 1, 2, we can obtain the optimal wholesale price, demand, unit abatement level, and profits in the M mode. Details are provided in Table 2.

4.2 Abatement with loose cooperation in supply chains

In the C mode, the manufacturer still needs to obtain all the funds needed for production and abatement through loans, with corresponding interest payments. In this mode, the manufacturer first determines the wholesale price with the aim of individual profit maximization. Next, the retailer determines the order quantity to maximize its profit. Finally, the manufacturer sets the unit carbon abatement level to maximize the overall profit of the supply chain. The objective functions for both companies and the entire supply chain system are presented below.

Lemma 2. By solving Equations 3–5, we can derive the optimal wholesale price, demand, unit abatement level, and profits in the C mode. Details are provided in Table 2.

4.3 Energy service company provides abatement services

In the E mode, all upfront costs of abatement are borne by ESCO, and the manufacturer only needs to bear the cost of production. Additionally, the revenues generated from carbon credit balances resulting from carbon reductions are jointly shared between the manufacturer and the ESCO. The decision-making sequence commences with the manufacturer determining the wholesale price, followed by the retailer deciding the order quantity, and ultimately, the ESCO takes charge of determining the unit abatement level. The objective functions for the manufacturer, retailer, and ESCO are presented below.

Lemma 3. By solving Equations 6–8, we can obtain the optimal wholesale price, demand, unit reduction level, and profits in the E mode. Details are provided in Table 3.

4.4 Analysis and discussion

The equilibrium strategy discussed in Section 4.3 demonstrates that the optimal decision-making of the enterprise is influenced by factors such as interest rates, abatement cost coefficients, and revenue sharing ratios. Subsequently, we will elucidate the distinct roles of each factor in different modes through the following corollaries.

Corollary 1. (1) In all three modes, as the interest rate or the abatement cost coefficient increases, the unit abatement level and demand decrease, while the wholesale price rises. (2) In the E mode, when the revenue sharing ratio is below a certain threshold, the wholesale price decreases as the revenue sharing ratio increases (i.e.,

Corollary 1 (1) aligns with intuition, as the increase in either the interest rate or the carbon abatement cost coefficient directly affects the production costs of the product. Under the mechanisms of cost pass-through or value-based pricing, the wholesale price of the product rises, while demand and the carbon reduction level decline. Therefore, for capital-constrained companies, it is crucial to explore financing solutions with lower interest rates and to optimize the costs of abatement technologies. The insight behind Corollary 1 (2) is that the revenue sharing ratio directly influences the abatement motivation of ESCOs as well as the profits of both companies. Manufacturers need to weigh the wholesale benefits against the abatement benefits in mode E to maximize their total benefits. For example, when revenue sharing is low, wholesale benefit dominates the manufacturer’s total benefit. However, as the revenue sharing ratio increases, the importance of abatement benefits rises. To maximize total benefits, the manufacturer may adopt a strategy of moderate price reductions to boost market demand, thus motivating the ESCO to enhance unit abatement levels.

Corollary 2. (1) In all three modes, the optimal profit of the manufacturer and the retailer decreases as the interest rate or abatement cost coefficient increases. (2) In the E mode, when the revenue sharing ratio is lower than the corresponding threshold, the optimal profits of the manufacturer (i.e.,

Corollary 2 (1) suggests that changes in costs due to interest rates or carbon reductions will inevitably be transmitted to the profit side of the company. Corollary 2 (2) arises because when the revenue sharing ratio is low, both market demand and the manufacturer’s abatement gains increase as the revenue sharing ratio increases, leading to higher total manufacturer profits. Correspondingly, retailer profits may also increase as a result of increased market demand.

Based on the findings of Corollary 2, capital-constrained companies should estimate the impact of financing interest rates and abatement costs on the profitability of supply chain members before undertaking abatement activities. Furthermore, when a manufacturer chooses an ESCO’s abatement service, it should evaluate the market performance of the product before determining the revenue sharing ratio with the ESCO. Additionally, the business objectives for the product should be moderately adjusted according to the agreed-upon revenue sharing ratio to achieve profit maximization. Moreover, maintaining clear communication and an incentive mechanism between the abatement companies and ESCOs is essential to facilitate dynamic collaboration between both parties.

5 Abatement strategy options for the manufacturer

In this section, different abatement modes are compared in terms of three dimensions: unit abatement level, manufacturer’s profit, and financing pressure. These comparisons provide valuable references for the manufacturer when selecting abatement strategies. It is noteworthy that the profit of the retailer is not a major consideration for the manufacturer when choosing an abatement strategy. Therefore, this study only demonstrates the differences in retailer profits across modes in the subsequent numerical analysis. Through comparative analysis, we obtained the following propositions.

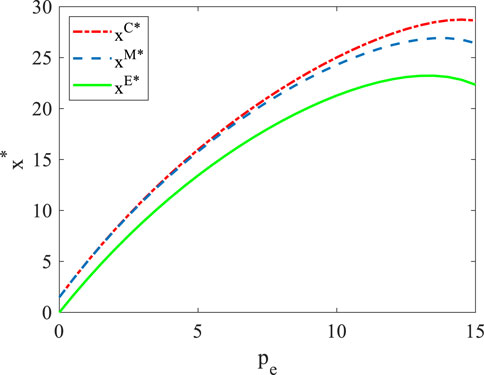

Proposition 1. In modes M, C, and E, the optimal unit abatement level satisfies the following relationship:

(1)

Proposition 1 (1) indicates that choosing the C mode is more favorable for the manufacturer in reducing the unit abatement level compared to the M mode. The C mode enables manufacturers to consider the impact of abatement activities on retailer profits to a moderate extent. This collaborative mindset not only strengthens the relationships among supply chain members but also enhances the sustainability and competitiveness of the supply chain. In the context of consumers possessing low-carbon preferences, the C mode is likely to achieve better environmental and economic benefits.

Proposition 1 (2) shows that when the interest rate falls below a certain threshold, it is more advantageous for manufacturers to choose the M mode rather than the E mode to reduce unit carbon emission levels. This indicates that, despite the constraints imposed by CTPs, the potential benefits of carbon abatement remain a significant factor in shaping companies’ abatement targets. When interest rates fall below a certain threshold, manufacturers can fully capture the benefits of abatement in M mode, further incentivizing their efforts. As a result, the unit abatement level in M mode surpasses that in E mode. However, when the interest rate surpasses a specific threshold, the manufacturer’s abatement costs will significantly rise with increasing interest rates, resulting in a decrease in the level of abatement in the M mode. However, ESCO is not directly affected by interest rates, so the unit abatement level in E mode will be higher than that in M mode.

Proposition 1 (3) finds that when the interest rate falls below a certain threshold, the unit abatement level in the C mode surpasses that of the E mode. However, when the interest rate exceeds the threshold, the situation is reversed. The reason is similar to Proposition 1 (2).

Proposition 2. The optimal profit of the manufacturer in modes M, C, and E conforms to the following relationship:

(1)

Proposition 2 (1) infers that the manufacturer consistently achieves higher profits in the C mode than in the M mode. Within the framework of the C mode, the manufacturer decides on the abatement level with the objective of maximizing the overall profit of the supply chain. This approach can, to some extent, align its actual abatement level more closely with the theoretical optimal state, thereby fully realizing the positive effects of abatement. This finding suggests that companies should prioritize collaboration with supply chain partners in the carbon reduction process to maximize the positive externalities of carbon reduction. By doing so, they can enhance the operational efficiency and low-carbon competitiveness of the entire supply chain, ensuring that individual gains are accompanied by collective benefits.

Propositions 2 (2) and (3) demonstrate that the manufacturer will be more profitable in M or C mode than in E mode when the interest rate is below the respective threshold. However, the results are reversed when interest rates are above these thresholds, respectively. When the interest rate is low, the burden of abatement costs on the manufacturer is also lower in modes M or C, while the manufacturer still receives the full benefit of the abatement. In the E mode, although the manufacturer does not have to bear the abatement cost, it must share the abatement benefit with the ESCO. Therefore, when the net abatement benefit that the manufacturer obtains in M mode or C mode is higher than the abatement benefit it shares from E mode, the manufacturer should avoid choosing E mode. In addition, the thresholds in (2) and (3) will decrease as the ESCO abatement efficiency increases. This indicates that, with all other conditions held constant, ESCOs can win the abatement project of the manufacturer by enhancing their abatement efficiency.

Proposition 3. In modes M, C, and E, the total amount of loans required by the manufacturer to operate under the optimal production and abatement scenarios are

This proposition assesses the manufacturer’s loan pressure based on the total loans required. However, directly comparing

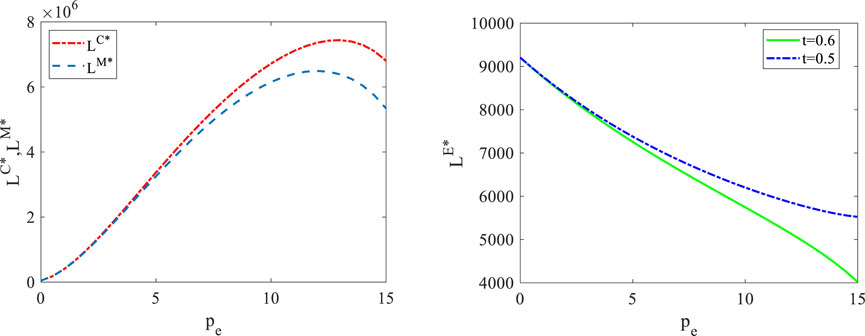

As depicted in Figure 1A, when the carbon price is low, there is no significant difference in the manufacturer’s loan pressure between the C mode and the M mode. However, as the carbon price increases, the loan pressure on the manufacturer in the C mode gradually exceeds that in the M mode. This is due to the higher unit abatement level and market demand in the C mode, which necessitates more capital for production and abatement. The disparity in loan amounts between the two modes tends to widen under the combined influence of abatement and demand. Furthermore, when the carbon price surpasses a specific threshold, the manufacturer’s loan pressure begins to decrease in both C and E modes. This phenomenon occurs when the carbon price exceeds a certain threshold, imposing stricter constraints on manufacturers under the CTP. At this point, the manufacturer’s unit abatement level has already reached its peak. Manufacturers may find it more cost-effective to reduce production than to invest in further carbon reductions. This suggests that governments should regulate carbon trading prices promptly to prevent overly stringent CTPs that make emissions reduction economically unfeasible for firms.

Figure 1B shows that as the carbon price increases, the financial pressure on the manufacturer in E mode decreases. This is mainly because a higher carbon price incentivizes ESCOs to set more ambitious carbon abatement targets, allowing manufacturers to share greater benefits from trading carbon credits. Moreover, the more efficient the ESCO is in reducing emissions, the higher the financial pressure on the manufacturer. This suggests that manufacturers with capital constraints must carefully evaluate the abatement efficiency of ESCOs when selecting their abatement services. An ESCO with high abatement efficiency may increase the financing pressure on the manufacturer. The reason for this is that higher levels of abatement stimulate market demand, which in turn increases the pressure on manufacturers to finance production.

Figure 1. (A). Effect of carbon prices on manufacturers’ loan pressure in modes C and M. (B). Effect of carbon prices on manufacturers’ loan pressure in mode E.

6 Numerical analyses

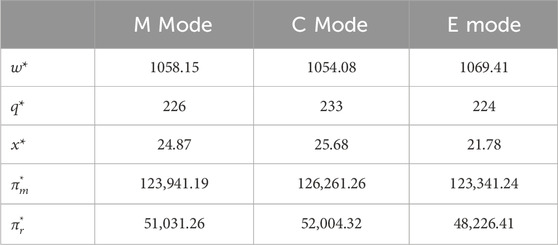

This section employs numerical analysis to further explore the effects of interest rates and carbon prices on optimal unit abatement levels and corporate profits across different modes. The parameter values utilized in this section are

6.1 The impact of interest rates

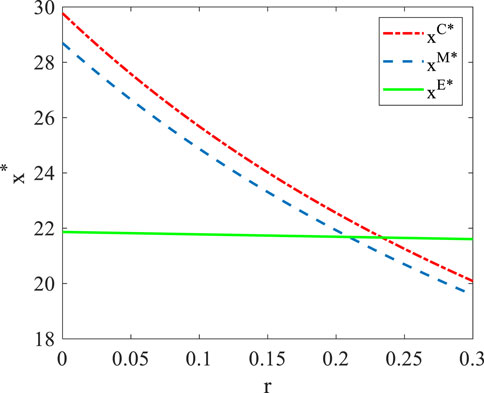

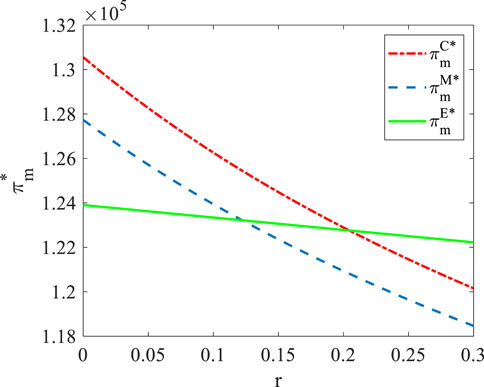

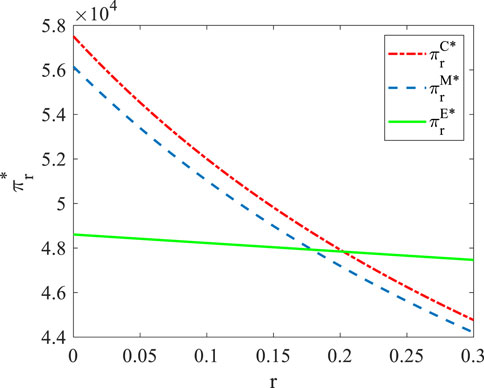

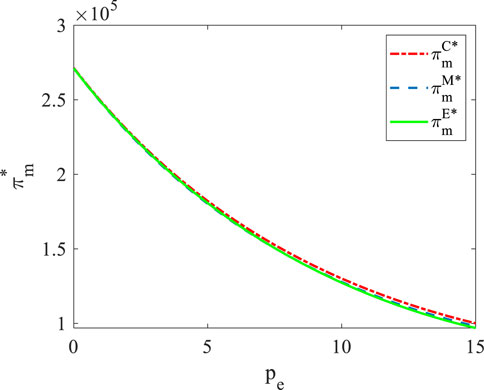

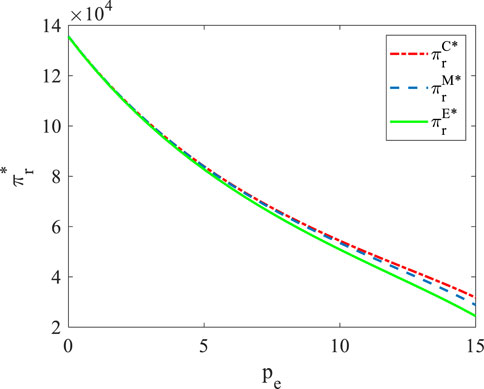

Figures 2–5 provide insights into the influence of the interest rate on unit abatement levels and corporate profits,

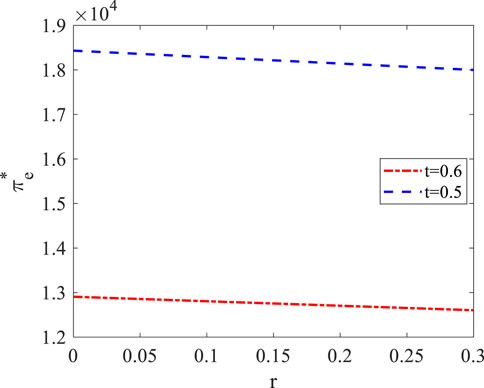

Figures 2–4 indicate that as interest rates increase, unit carbon reductions, manufacturer profits, and retailer profits exhibit differentiated downward trends across each mode. This further supports the findings of Corollaries 1 and 2. Meanwhile, this conclusion aligns with some findings of An et al. (2021), who also suggested that changes in interest rates have a differentiated impact on the carbon reduction levels of firms across various abatement scenarios. Moreover, the C mode outperforms the M mode in both unit abatement levels and the profitability of manufacturers and retailers. However, when interest rates surpass the respective thresholds, E mode progressively outperforms M mode and C mode. Furthermore, since the interest rate directly affects production costs, its impact on the manufacturer’s profit is more significant than its effect on the unit abatement level. Figure 5 demonstrates that the profits of ESCOs exhibit a declining trend as interest rates increase, and these profits are positively related to abatement efficiency. The reason for this is that an increase in interest rates will elevate production costs for the manufacturer and decrease market demand, ultimately resulting in reduced profits for the ESCO.

6.2 The impact of carbon trading prices

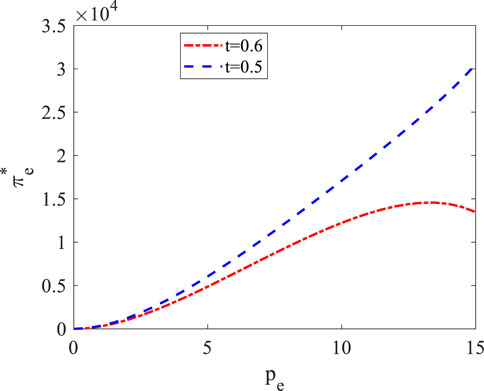

Figures 6–9 depict the influence of carbon trading prices on unit abatement levels and corporate profits, r = 0.1.

As shown in Figure 6, the unit abatement level under all three modes initially increases with the carbon price, before eventually declining. This finding is distinctly different from certain conclusions by Qin et al. (2021), who argued that an increase in carbon price consistently reduces the manufacturer’s carbon reduction level. Additionally, the abatement level in the C mode gradually exceeds that in the M mode. It is noteworthy that, even when pe = 0, the unit abatement levels remain positive in both C mode and M mode. This observation highlights that consumers’ preference for low-carbon products inherently motivates firms to reduce emissions. Furthermore, the CTP acts as a catalyst, accelerating the low-carbon transformation of these firms.

Figures 7, 8 depict a trend in which the profits of both the manufacturer and the retailer decrease as the carbon price rises. In this numerical scenario, a high carbon price increases the abatement and financing costs for manufacturers, directly reducing their profits. Retailer profits also show a similar downward trend with the shift in manufacturer costs.

Figure 9 illustrates that the profits of the ESCO initially increase and then decrease as the carbon price rises. The declining trend occurs earlier when the abatement efficiency is lower. With a fixed revenue-sharing ratio, a higher carbon price directly boosts the profits of the ESCO. However, once the unit abatement level reaches a certain threshold, further increases in the carbon price no longer lead to higher abatement. In this scenario, the manufacturer reduces production in response to carbon regulations, consequently diminishing the profits of the ESCO.

7 Extended mode: supply chain close cooperation decision-making and coordination

In the previous modes, the supply chain members make decisions independently. In this section, we consider extending the C mode in the previous article to the scenario where members within the supply chain work closely together. As an ideal market structure, supply chain members in the close cooperation scenario form an alliance and jointly make various decisions to maximize overall profits. The close cooperation mode can provide a benchmark for the coordination and optimization of supply chain systems in other modes, as well as provide additional management insights for our study. To distinguish it from the related modes in the previous section, we refer to the close cooperation mode in this section as the C2 mode.

7.1 Close cooperation within the supply chain to reduce emissions

In the C2 mode, the manufacturer and the retailer make decisions based on the principle of maximizing overall supply chain profits. They jointly bear the carbon abatement and production costs while collaboratively determining the unit abatement level and order quantity. The objective function of the supply chain system is shown in the following Equation 9.

Lemma 4. In the C2 mode, the optimal product demand quantity, unit abatement level, and overall system profit within the supply chain are as follows:

The equilibrium strategies in the C2 mode can be obtained by using a similar solution method as in the previous section. Subsequently, this study compared and analyzed the differences in key equilibrium strategies under the C mode and the C2 mode, and obtained the following proposition.

Proposition 4. The optimal unit abatement level in C2 mode is consistently higher than that in C mode.

Proposition 4 indicates that while the C mode allows the manufacturer to set a higher unit abatement level from an overall standpoint, both companies continue to determine wholesale and retail prices based on their profit objectives, and the double marginalization issue in the supply chain persists. The distinction lies in the fact that the C2 mode not only provides more assistance in addressing the double marginalization issue but also involves both companies sharing the cost of abatement in this scenario. Hence, the optimal unit abatement level in C2 mode is greater than that in C mode.

7.2 Two-part tariff contract

The double marginalization problem diminishes the efficiency of the supply chain system, preventing manufacturers and retailers from attaining optimal profits (El Ouardighi et al., 2016). Notably, this problem also obstructs the attainment of optimal unit abatement levels within the supply chain, which is detrimental to environmental protection. Given the widespread use of two-part tariff contracts in industries such as credit cards, membership-based retail stores (e.g., Costco and Sam’s Club), television, and wireless subscriptions (Yang and Ma, 2017; Bai et al., 2017), this section utilizes a two-part tariff contract to facilitate the coordination of the low-carbon supply chain system under manufacturer independent abatement mode.

In the two-part tariff contract, the manufacturer enacts abatement decisions based on the unit abatement level (

Proposition 5. The two-part tariff contract developed in this study can efficiently coordinate the profits of supply chain members while maximizing the level of unit abatement when transfer payment

Proposition 5 demonstrates that in the contract developed in this study, the total profit of the supply chain reaches the level of the C2 mode. Furthermore, the unit abatement level, manufacturer profit, and retailer profit outperform the scenario of manufacturer-independent abatement. Additionally, it’s worth noting that the threshold intervals

8 Conclusion

Although many studies have investigated corporate abatement and capital constraints within supply chains, relatively few have comprehensively examined the interplay of abatement, financing, and operational decision-making for capital-constrained enterprises. In the limited available research, scholars often focus on the choice of financing methods, particularly external and internal financing, and their respective impacts. However, there is a scarcity of studies that explore how capital-constrained enterprises choose abatement strategics in the context of CTPs and growing consumer preferences for low-carbon products. In response to this gap, the study constructs a supply chain consisting of a capital-constrained manufacturer, a retailer, and an ESCO, and then explores the financing, abatement, and operational issues of members under different scenarios, and designs a two-part tariff contract to coordinate the profits and unit abatement levels of supply chain members. Some key conclusions and managerial insights from this study are as follows.

8.1 Research findings

This study yields the following findings: (1) Both abatement and financing costs influence the wholesale price, product demand, and unit abatement levels through pricing mechanisms, ultimately affecting corporate profits. This contrasts with the findings of Cai and Jiang (2023), who argue that abatement costs are not transferred through pricing strategies. (2) Compared to the independent abatement mode, the loose cooperation mode achieves a higher abatement level but imposes greater financial pressure on manufacturers, a disparity that intensifies as carbon prices rise. In contrast, financial pressure in the ESCO abatement mode decreases with higher carbon prices and remains lower than in both the independent and loose cooperation modes. This confirms that the financing and abatement strategies of manufacturers are influenced by various factors, including interest rates, market size, and the levels of abatement (Zhang Q. et al., 2024). (3) When the revenue sharing ratio is below a certain threshold, the manufacturer’s profit in the ESCO mode increases with the ratio. Furthermore, manufacturers in the loose cooperation mode consistently achieve higher profits than in the independent mode. However, when interest rates remain below a specific threshold, manufacturers can attain greater profitability in either the independent or loose cooperation mode compared to the ESCO mode. The key difference is that the abatement companies in this study face capital constraints and can only achieve this conclusion when the financing interest rate is below a specific threshold. (4) An increase in interest rates or abatement cost coefficients leads to a reduction in retailer profits. When the revenue sharing ratio is below a certain threshold, retailer profits exhibit a negative relationship with the revenue sharing ratio. (5) In the extended analysis, the study reveals that the unit abatement level is higher in the close cooperation mode than in the loose cooperation mode. Additionally, the two-part tariff contract can optimize the unit abatement level and supply chain member profits in the manufacturer-independent abatement mode.

8.2 Management insights

The management insights from this study are as follows: (1) Policymakers should maintain relatively high carbon prices to enhance companies’ incentives for carbon abatement and encourage capital-constrained firms to engage in abatement collaborations with ESCOs. Additionally, the government should provide low-interest financing support to firms implementing carbon reduction measures to alleviate financial constraints and enhance overall carbon reduction efficiency. (2) Companies aiming to implement carbon abatement should establish abatement targets from a supply chain-wide perspective. This approach not only fosters improved collaboration among enterprises but also enhances the effectiveness of carbon abatement in driving product demand. Consequently, this strategy enables the supply chain to achieve a sustainable competitive advantage. Additionally, companies facing capital constraints should actively seek preferential low-carbon financial services, while remaining mindful of how financing costs influence both their abatement decisions and product markets. (3) Manufacturers facing capital constraints should closely monitor the potential implications of fluctuations in carbon prices on their financial pressures and abatement strategies. When carbon prices are low, one effective strategy for manufacturers to reduce emissions and alleviate financial pressures is to consider outsourcing abatement activities to specialized ESCOs. (4) By determining the unit abatement level from a supply chain-wide perspective, manufacturers can achieve a dual benefit of economic and environmental gains without necessarily engaging in direct collaboration with other firms. In addition, after selecting ESCO services, firms should establish a reliable communication mechanism and determine an appropriate revenue-sharing ratio for carbon reductions. This decision should be based on a comprehensive understanding of government carbon policies, product market conditions, and the ESCO’s abatement efficiency. (5) ESCOs should consider both carbon price dynamics and their clients’ financial conditions when delivering abatement services. For instance, if a client company experiences capital constraints, the ESCO should consider reducing the abatement level if the client’s financing rate is high. In addition, the two-part tariff contract can play a role in optimizing corporate profits and unit abatement levels.

8.3 Limitations and future research directions

This study still has some limitations. First, we have concentrated on a single financing mode for the manufacturer. In future research, it would be worthwhile to explore how different financing modes impact the choices of the manufacturer regarding abatement strategies. Second, considering the ongoing growth of e-commerce and logistics, it holds significant importance to investigate the issues related to abatement faced by capital-constrained manufacturers operating within dual sales channels. Third, this study exclusively addressed carbon emissions in the context of product production. In future research, it would be valuable to integrate carbon emissions and abatement factors associated with product sales into the research framework.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

PK: Funding acquisition, Project administration, Resources, Software, Writing – review and editing. PY: Conceptualization, Formal Analysis, Methodology, Supervision, Writing – original draft.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was primarily supported by the Scientific Research Program for Higher Education Institutions of Anhui Province (Grant No. 2022AH052255), the Postgraduate Research and Practice Innovation Program of Jiangsu Province (Grant No. KYCX21_2924), and Wuxi University Research Start-up Fund for High-level Talents (Grant No. 2025r071).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2025.1438229/full#supplementary-material

References

An, S., Li, B., Song, D., and Chen, X. (2021). Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Operational Res. 292 (1), 125–142. doi:10.1016/j.ejor.2020.10.025

Bai, Q., Chen, M., and Xu, L. (2017). Revenue and promotional cost-sharing contract versus two-part tariff contract in coordinating sustainable supply chain systems with deteriorating items. Int. J. Prod. Econ. 187, 85–101. doi:10.1016/j.ijpe.2017.02.012

Bai, Q., Jin, M., and Xu, X. (2019). Effects of carbon emission reduction on supply chain coordination with vendor-managed deteriorating product inventory. Int. J. Prod. Econ. 208, 83–99. doi:10.1016/j.ijpe.2018.11.008

Cai, J., and Jiang, F. (2023). Decision models of pricing and carbon emission reduction for low-carbon supply chain under cap-and-trade regulation. Int. J. Prod. Econ. 264, 108964. doi:10.1016/j.ijpe.2023.108964

Chaudhari, U., Bhadoriya, A., Jani, M. Y., and Sarkar, B. (2023). A generalized payment policy for deteriorating items when demand depends on price, stock, and advertisement under carbon tax regulations. Math. Comput. Simul. 207, 556–574. doi:10.1016/j.matcom.2022.12.015

Chen, Y., Li, Q., and Liu, J. (2024). Innovating sustainability: VQA-based AI for carbon neutrality challenges. J. Organ. End User Comput. (JOEUC) 36 (1), 1–22. doi:10.4018/joeuc.337606

Ding, W., and Wan, G. (2020). Financing and coordinating the supply chain with a capital-constrained supplier under yield uncertainty. Int. J. Prod. Econ. 230, 107813. doi:10.1016/j.ijpe.2020.107813

Ebrahimi, S., Hosseini-Motlagh, S. M., Nematollahi, M., and Cárdenas-Barrón, L. E. (2022). Coordinating double-level sustainability effort in a sustainable supply chain under cap-and-trade regulation. Expert Syst. Appl. 207, 117872. doi:10.1016/j.eswa.2022.117872

El Ouardighi, F., Sim, J. E., and Kim, B. (2016). Pollution accumulation and abatement policy in a supply chain. Eur. J. Operational Res. 248 (3), 982–996. doi:10.1016/j.ejor.2015.08.009

Fan, W., Wu, X., and He, Q. (2024). Digitalization drives green transformation of supply chains: a two-stage evolutionary game analysis. Ann. Operations Res., 1–20. doi:10.1007/s10479-024-06050-0

Fu, K., Li, Y., Mao, H., and Miao, Z. (2023). Firms’ production and green technology strategies: the role of emission asymmetry and carbon taxes. Eur. J. Operational Res. 305 (3), 1100–1112. doi:10.1016/j.ejor.2022.06.024

Gong, Q., Wu, J., Jiang, Z., Hu, M., Chen, J., and Cao, Z. (2024). An integrated design method for remanufacturing scheme considering carbon emission and customer demands. J. Clean. Prod. 476, 143681. doi:10.1016/j.jclepro.2024.143681

Hong, Z., and Guo, X. (2019). Green product supply chain contracts considering environmental responsibilities. Omega 83, 155–166. doi:10.1016/j.omega.2018.02.010

Hu, F., Qiu, L., Xiang, Y., Wei, S., Sun, H., Hu, H., et al. (2023). Spatial network and driving factors of low-carbon patent applications in China from a public health perspective. Front. public health 11, 1121860. doi:10.3389/fpubh.2023.1121860

Huang, S., Fan, Z. P., and Wang, N. (2020). Green subsidy modes and pricing strategy in a capital-constrained supply chain. Transp. Res. Part E Logist. Transp. Rev. 136, 101885. doi:10.1016/j.tre.2020.101885

Huang, X., Tan, T., and Toktay, L. B. (2021). Carbon leakage: the impact of asymmetric regulation on carbon-emitting production. Prod. Operations Manag. 30 (6), 1886–1903. doi:10.1111/poms.13181

Jena, S. K., Padhi, S. S., and Cheng, T. C. E. (2023). Optimal selection of supply chain financing programmes for a financially distressed manufacturer. Eur. J. Operational Res. 306 (1), 457–477. doi:10.1016/j.ejor.2022.07.032

Jing, B., Chen, X., and Cai, G. (2012). Equilibrium financing in a distribution channel with capital constraint. Prod. Operations Manag. 21 (6), 1090–1101. doi:10.1111/j.1937-5956.2012.01328.x

Kang, K., and Tan, B. Q. (2023). Carbon emission reduction investment in sustainable supply chains under cap-and-trade regulation: an evolutionary game-theoretical perspective. Expert Syst. Appl. 227, 120335. doi:10.1016/j.eswa.2023.120335

Li, G., Wu, H., and Xiao, S. (2020). Financing strategies for a capital-constrained manufacturer in a dual-channel supply chain. Int. Trans. Operational Res. 27 (5), 2317–2339. doi:10.1111/itor.12653

Li, N., Deng, M., Mou, H., Tang, D., and Fang, Z. (2022). Government participation in supply chain low-carbon technology R&D and green marketing strategy optimization. Sustainability 14 (14), 8342. doi:10.3390/su14148342

Li, T., Yu, L., Ma, Y., Duan, T., and Huang, W. (2023). Carbon emissions of 5G mobile networks in China. Nat. Sustain. 6 (12), 1620–1631. doi:10.1038/s41893-023-01206-5

Liu, Z. L., Anderson, T. D., and Cruz, J. M. (2012). Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Operational Res. 218 (3), 602–613. doi:10.1016/j.ejor.2011.11.027

Ouyang, J., and Fu, J. (2020). Optimal strategies of improving energy efficiency for an energy-intensive manufacturer considering consumer environmental awareness. Int. J. Prod. Res. 58 (4), 1017–1033. doi:10.1080/00207543.2019.1607977

Qin, J., Fu, H., Wang, Z., and Xia, L. (2021). Financing and carbon emission reduction strategies of capital-constrained manufacturers in E-commerce supply chains. Int. J. Prod. Econ. 241, 108271. doi:10.1016/j.ijpe.2021.108271

Qin, J., Han, Y., Wei, G., and Xia, L. (2020). The value of advance payment financing to carbon emission reduction and production in a supply chain with game theory analysis. Int. J. Prod. Res. 58 (1), 200–219. doi:10.1080/00207543.2019.1671626

Qin, Q., Liang, F., Li, L., and Wei, Y. M. (2017). Selection of energy performance contracting business models: a behavioral decision-making approach. Renew. Sustain. Energy Rev. 72, 422–433. doi:10.1016/j.rser.2017.01.058

Qiu, L., Xia, W., Wei, S., Hu, H., Yang, L., Chen, Y., et al. (2024). Collaborative management of environmental pollution and carbon emissions drives local green growth: an analysis based on spatial effects. Environ. Res. 259, 119546. doi:10.1016/j.envres.2024.119546

Sarkar, B., and Guchhait, R. (2023). Ramification of information asymmetry on a green supply chain management with the cap-trade, service, and vendor-managed inventory strategies. Electron. Commer. Res. Appl. 60, 101274. doi:10.1016/j.elerap.2023.101274

Sarkar, B., Kar, S., Basu, K., and Guchhait, R. (2022). A sustainable managerial decision-making problem for a substitutable product in a dual-channel under carbon tax policy. Comput. and Industrial Eng. 172, 108635. doi:10.1016/j.cie.2022.108635

Savaskan, R. C., and Van Wassenhove, L. N. (2006). Reverse channel design: the case of competing retailers. Manag. Sci. 52 (1), 1–14. doi:10.1287/mnsc.1050.0454

Shi, J., Liu, D., Du, Q., and Cheng, T. C. E. (2023). The role of the procurement commitment contract in a low-carbon supply chain with a capital-constrained supplier. Int. J. Prod. Econ. 255, 108681. doi:10.1016/j.ijpe.2022.108681

Song, H., Ding, M., and Dai, Y. (2024). Joint management strategy of carbon allowance in the supply chain under free carbon allowance. Innovation Green Dev. 3 (4), 100159. doi:10.1016/j.igd.2024.100159

Sun, J., Yuan, P., and Hua, L. (2023b). Pricing and financing strategies of a dual-channel supply chain with a capital-constrained manufacturer. Ann. Operations Res. 329 (1), 1241–1261. doi:10.1007/s10479-022-04602-w

Sun, J., Yuan, P., and Li, G. (2023a). Reducing supply chain carbon emissions in consideration of energy service companies under the cap-and-trade mechanism. Ann. Operations Res., 1–28. doi:10.1007/s10479-023-05496-y

Tang, R., and Yang, L. (2020). Impacts of financing mechanism and power structure on supply chains under cap-and-trade regulation. Transp. Res. Part E Logist. Transp. Rev. 139, 101957. doi:10.1016/j.tre.2020.101957

Wang, C., Chen, X., Jin, W., and Fan, X. (2022). Credit guarantee types for financing retailers through online peer-to-peer lending: equilibrium and coordinating strategy. Eur. J. Operational Res. 297 (1), 380–392. doi:10.1016/j.ejor.2021.05.054

Wang, F., Yang, X., Zhuo, X., and Xiong, M. (2019). Joint logistics and financial services by a 3PL firm: effects of risk preference and demand volatility. Transp. Res. Part E Logist. Transp. Rev. 130, 312–328. doi:10.1016/j.tre.2019.09.006

Wang, L., and Peng, K. (2023). Carbon reduction decision-making in supply chain under the pledge financing of carbon emission rights. J. Clean. Prod. 428, 139381. doi:10.1016/j.jclepro.2023.139381

Wang, M., Li, B., and Song, D. (2024). The impact of blockchain on restricting the misuse of green loans in a capital-constrained supply chain. Eur. J. Operational Res. 314 (3), 980–996. doi:10.1016/j.ejor.2023.11.003

Wang, N., and Li, Z. (2021). Supplier encroachment with a dual-purpose retailer. Prod. Operations Manag. 30 (8), 2672–2688. doi:10.1111/poms.13400

Wang, Y., Chen, W., and Liu, B. (2017). Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. J. Clean. Prod. 140, 1118–1128. doi:10.1016/j.jclepro.2016.10.058

Wang, Y., Lv, L., Shen, L., and Tang, R. (2021). Manufacturer’s decision-making model under carbon emission permits repurchase strategy and capital constraints. Int. J. Prod. Res. 62, 8073–8091. doi:10.1080/00207543.2021.1934909

Wu, C. H. (2016). Collaboration and sharing mechanisms in improving corporate social responsibility. Central Eur. J. Operations Res. 24, 681–707. doi:10.1007/s10100-014-0377-0

Wu, T., and Kung, C. C. (2020). Carbon emissions, technology upgradation and financing risk of the green supply chain competition. Technol. Forecast. Soc. Change 152, 119884. doi:10.1016/j.techfore.2019.119884

Xia, L., Guo, T., Qin, J., Yue, X., and Zhu, N. (2018). Carbon emission reduction and pricing policies of a supply chain considering reciprocal preferences in cap-and-trade system. Ann. Operations Res. 268, 149–175. doi:10.1007/s10479-017-2657-2

Xu, S., and Fang, L. (2020). Partial credit guarantee and trade credit in an emission-dependent supply chain with capital constraint. Transp. Res. Part E Logist. Transp. Rev. 135, 101859. doi:10.1016/j.tre.2020.101859

Xu, X., Chen, Y., He, P., Yu, Y., and Bi, G. (2023). The selection of marketplace mode and reselling mode with demand disruptions under cap-and-trade regulation. Int. J. Prod. Res. 61 (8), 2738–2757. doi:10.1080/00207543.2021.1897175

Xu, X., Zhang, W., He, P., and Xu, X. (2017). Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 66, 248–257. doi:10.1016/j.omega.2015.08.006

Yang, R., and Ma, L. (2017). Two-part tariff contracting with competing unreliable suppliers in a supply chain under asymmetric information. Ann. Operations Res. 257, 559–585. doi:10.1007/s10479-015-1888-3

Yang, Y., and Xu, X. (2024). Production and carbon emission abatement decisions under different carbon policies: supply chain network equilibrium models with consumers’ low-carbon awareness. Int. Trans. Operational Res. 31 (4), 2734–2764. doi:10.1111/itor.13242

Yuan, P., Sun, J., and Ivanov, D. (2024). Manufacturer encroachment and carbon reduction decisions considering cap-and-trade policy and retailer investment. Front. Eng. Manag. 11, 326–344. doi:10.1007/s42524-024-0301-9

Zhang, C., Xiao, G., and Xu, L. (2024a). Manufacturers’ emission-reduction investments in competing supply chains with Prisoner’s Dilemma: the economic and environmental impacts of Retailer (s) capital Constraint (s). Transp. Res. Part E Logist. Transp. Rev. 187, 103602. doi:10.1016/j.tre.2024.103602

Zhang, L. H., Zhang, C., and Yang, J. (2023). Impacts of power structure and financing choice on manufacturer’s encroachment in a supply chain. Ann. Operations Res. 322 (1), 273–319. doi:10.1007/s10479-022-04793-2

Zhang, Q., Chen, K., Wang, S., and Zhang, Z. (2024b). Green production investment policy and financing format selection for a capital-constrained manufacturer. Comput. and Industrial Eng. 194, 110349. doi:10.1016/j.cie.2024.110349

Zhao, K., Yang, Z. F., Zhuo, Y., and Zhang, S. (2023). Carbon emission reduction mechanism of the pharmaceutical supply chain: Quadrilateral evolutionary game models. Front. Environ. Sci. 11, 1084343. doi:10.3389/fenvs.2023.1084343

Zhou, F., Chen, T., and Lim, M. K. (2024). Strategic low-carbon technology supervision in the closed-loop supply chain: an evolutionary game approach. J. Clean. Prod. 450, 141609. doi:10.1016/j.jclepro.2024.141609

Zhou, F., Chen, T., Tiwari, S., Si, D., Pratap, S., and Mahto, R. V. (2023). Pricing and quality improvement decisions in the end-of-life vehicle closed-loop supply chain considering collection quality. IEEE Trans. Eng. Manag. 71, 4231–4245. doi:10.1109/tem.2023.3238106

Zou, H., Qin, J., and Zheng, H. (2023). Equilibrium pricing mechanism of low-carbon supply chain considering carbon cap-and-trade policy. J. Clean. Prod. 407, 137107. doi:10.1016/j.jclepro.2023.137107

Keywords: cap-and-trade, capital constraints, carbon abatement, energy service company, supply chain management

Citation: Kong P and Yuan P (2025) Carbon abatement strategies for a capital-constrained manufacturer considering cap-and-trade regulation. Front. Environ. Sci. 13:1438229. doi: 10.3389/fenvs.2025.1438229

Received: 25 May 2024; Accepted: 26 May 2025;

Published: 27 June 2025.

Edited by:

Ismail Suardi Wekke, Institut Agama Islam Negeri Sorong, IndonesiaReviewed by:

Mohamed R. Abonazel, Cairo University, EgyptOmprakash Sarkar, Luleå University of Technology, Sweden

Mitali Sarkar, Sejong University, Republic of Korea

Copyright © 2025 Kong and Yuan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Pengpeng Yuan, eXBwMDIxNEAxNjMuY29t

Panpan Kong1

Panpan Kong1 Pengpeng Yuan

Pengpeng Yuan