- 1School of Accounting, Dongbei University of Finance and Economics, Dalian, China

- 2School of Environment, Tsinghua University, Beijing, China

This study empirically analyzes the synergistic effects of China’s environmental credit evaluation system and carbon emissions trading policy on enterprise carbon emission intensity. Employing a difference-in-differences approach on 27,718 firm-year observations from China’s A-share listed companies over the period 2007 to 2021, the findings indicate that the dual pilot policy (DPP) significantly reduced carbon emission intensity by approximately 0.184 units. This impact is markedly stronger than that observed when either policy is implemented individually, demonstrating a clear synergistic effect. Mechanism tests reveal that the DPP primarily reduces carbon emission intensity through supervisory mechanisms involving multiple governance bodies, such as market oversight, media scrutiny, and public supervision. Furthermore, the DPP drives reductions in carbon emission intensity through corporate behavior adjustment mechanisms, including increasing environmental investment, promoting green technological innovation, optimizing energy consumption, and enhancing green development efficiency. The results of the heterogeneity analysis indicate that the DPP has a greater impact on reducing emissions in non-state-owned enterprises, mature enterprises, high-carbon and high-pollution industries. This study fills a gap in empirical research on the synergistic effects of the environmental credit evaluation system and the carbon emissions trading pilot policy, providing theoretical support and practical reference for optimizing environmental policy and facilitating corporate low-carbon transition.

1 Introduction

Governments around the world now share the goal of figuring out how to use effective policy tools to control carbon emissions and promote green economic transformation as the challenges posed by climate change to social and economic development grow more severe (Siriwardana and Nong, 2021). At the same time, the escalating threat of climate change has propelled energy transition and sustainable development to the forefront of the global agenda, with nations committed to achieving significant carbon reductions, often guided by international frameworks such as the Paris Agreement. In this global endeavor, the European Union (EU) has been a prominent leader, championing comprehensive strategies like the EU Green Deal and establishing pioneering market-based instruments such as the EU Emissions Trading System. The EU’s proactive stance and extensive experience in these domains have provided valuable insights, alongside a growing recognition of how broader economic policies, such as the trade liberalization of environmental goods, may also influence emissions outcomes (Bacchetta et al., 2025). These international efforts underscore the ongoing search for effective strategies to foster sustainable economies.

Against this international backdrop, China, as a significant global carbon emitter and a key proponent of green development, has been actively working toward these goals through a number of initiatives in recent years. This includes a strong focus on policy innovation aimed at maximizing environmental benefits (Moon et al., 2021). The environmental credit evaluation system (ECES) and the carbon emissions trading pilot policy (CETPP) are two key policy tools employed by the Chinese government in this context to promote carbon reduction and low-carbon transformation among enterprises (Weng and Xu, 2018). The ECES is a novel regulatory model aimed at guiding enterprises to improve their environmental practices through credit management, thereby enhancing their proactivity in legal compliance and social responsibility. In contrast, the CETPP provides a flexible reduction path for enterprises through market mechanisms, effectively lowering overall emission reduction costs (Xu et al., 2023). While both policies play significant roles in environmental governance, existing research primarily focuses on their separate effects. There remains a lack of systematic empirical analysis on their synergistic impact when combined (Chen et al., 2021), particularly concerning the specific mechanisms driving such synergy. Therefore, this study focuses on the comprehensive impact of the DPP, integrating ECES and CETPP, on the carbon emission intensity of enterprises, exploring their synergistic role and underlying pathways in promoting the low-carbon transformation of enterprises. It seeks to address the following key questions: Do the ECES and CETPP generate a synergistic effect when jointly implemented? Through what mechanisms does this potential synergy affect enterprise carbon emission intensity? Are there significant differences in these policy effects across various types of enterprises and industries? Through empirical analysis, this study aims to uncover the in-depth impact of this policy combination on corporate carbon emissions behavior, providing scientific evidence for policymakers to formulate more effective environmental governance strategies.

To situate this research, it is noted that existing literature on the ECES, while less extensive than that on the CETPP, highlights its unique regulatory approach. ECES utilizes credit scoring and public disclosure of corporate environmental behavior, leveraging information transparency and social supervision to incentivize proactive environmental actions and mitigate risks from credit downgrades (Zhang and Huang, 2023). Conversely, the CETPP is well-documented, with studies confirming its effectiveness in reducing corporate carbon emission intensity and fostering technological innovation through market-based mechanisms (Zhang Y. et al., 2020). However, despite the individual assessment of these policies and a growing interest in policy coherence, a significant research gap persists regarding the synergistic effects of jointly implementing ECES and CETPP. While some studies touch upon policy combinations, they generally lack in-depth empirical analysis of their specific synergistic mechanisms and overall combined impact (Chen et al., 2022). Addressing this gap by systematically exploring the synergistic effects of this DPP on corporate carbon reduction is therefore an urgent and important research endeavor.

The following are the study’s innovations: First, unlike previous research that separately analyzes the ECES or CETPP, this study uniquely incorporates both the ECES and the CETPP into the analytical framework from a policy combination perspective. It tests whether the DPP has a synergistic effect in lowering the carbon emission intensity of enterprises using panel data models and the difference-in-differences method, among other econometric techniques. Second, from a perspective that combines the market-level logic and credit-level logic intrinsic to the DPP, this study deeply analyzes how the DPP achieves comprehensive emission reduction targets through diverse supervisory mechanisms involving government, market, media, and public, as well as through adjustments in corporate behavior. Third, the study uses a multidimensional empirical analysis that not only examines the overall effects of DPP, but also analyzes the heterogeneous effects based on company type, life cycle, carbon emission intensity and pollution level differences, thus providing new insights into the heterogeneous performance of DPP companies in the transition process to a low-carbon economy. Additionally, the study explores the robustness of policy effects through various robustness testing methods to ensure the reliability of the research findings. Ultimately, the results of this study offer a new perspective for understanding the synergistic mechanisms of the DPP and provide scientific evidence for policymakers, aiding them in optimizing environmental governance strategies to achieve more efficient carbon reduction and economic green transformation.

2 Theoretical analysis and hypothesis development

Environmental economics traditionally categorizes environmental regulation policies into voluntary, market-based incentive, and command-and-control types. However, the increasing complexity of environmental governance reveals limitations in these traditional singular approaches for effectively addressing corporate carbon emissions (Tang et al., 2022). In response, China introduced the ECES, a novel “environmental credit-type” regulation, and has actively utilized the CETPP. The ECES aims to integrate market and credit mechanisms for enhanced oversight (Liu et al., 2022), while the CETPP, a widely adopted market-based tool, has demonstrated significant emission reduction outcomes globally (Xuan et al., 2020).

2.1 DPP and corporate carbon emissions

The CETPP, rooted in the theory of market-based instruments, functions by establishing a carbon market. It allocates emission allowances under a cap-and-trade system, aiming to achieve emission reduction targets at the lowest societal cost as firms trade allowances to find their most cost-effective abatement strategies (Pang and Duan, 2016; Zhou et al., 2015). The carbon price signals the marginal cost of emissions, economically incentivizing firms towards technological upgrades or operational optimizations (Ye et al., 2015). Concurrently, the ECES integrates corporate environmental behaviors into a comprehensive credit assessment. Drawing on information asymmetry theory and signaling theory, ECES reduces the information gap between firms and external stakeholders by disclosing environmental performance (Hu et al., 2019). This rating impacts firms’ market access, financing conditions (Xu and Li, 2020), and reputation, creating potent long-term incentives for proactive environmental management beyond mere legal compliance (Zuo and Wu, 2022; Zhang et al., 2021).

The distinct yet complementary mechanisms of CETPP and ECES suggest that their combined implementation as a DPP can generate synergistic effects. The CETPP provides direct economic incentives targeting emission quantities, while the ECES introduces broader, reputation-based and credit-linked incentives focusing on overall environmental behavior and long-term credibility. This policy complementarity means the DPP can address a wider range of corporate motivations and potential failures than either instrument alone. Specifically, the DPP creates a dual-pressure system: firms face both tangible CETPP and crucial reputational/financial consequences from their ECES. Information from CETPP compliance can inform ECES ratings, making carbon market signals more salient, while ECES standing can influence a firm’s capacity to invest in green technologies for CETPP compliance. This interconnectedness and reinforced regulatory signaling can more effectively curb opportunistic behavior and compel firms towards holistic and stringent carbon reduction strategies. The following hypothesis is proposed in light of this:

H1. The DPP exhibits a synergistic effect, significantly reducing the carbon intensity of enterprises.

2.2 Mechanism of the DPP

As environmental governance objectives become increasingly complex and diverse, single policy instruments often struggle to effectively address complex corporate behaviors and volatile market conditions (Kirschke and Newig, 2017). The CETPP and ECES not only serve as government constraints on corporate behavior but also engage multiple governance actors, including the government, market, media, and public, to form a comprehensive oversight mechanism. This incentivizes enterprises to implement significant behavioral changes that lead to a significant reduction in carbon emission intensity (Xuan et al., 2020). As the formulator and executor of environmental policies, the government imposes strong constraints on enterprises through the DPP. The CETPP provides companies with a market-oriented platform for emissions reduction, enabling them to make decisions that maximize economic benefits under market constraints. At the core of the CETPP is a market-based quota trading system (Yi et al., 2020). The government sets overall control targets and allocates carbon emission quotas, while enterprises acquire or sell carbon emission rights through market transactions. In this process, the market functions as a key mechanism for resource allocation, guiding enterprises toward low-carbon development. Meanwhile, companies participating in the carbon emissions trading platform are subject to extensive attention and oversight. On one hand, the introduction and pilot implementation of policies are continuously under the spotlight and discussion by various sectors of society. On the other hand, platform trading data can be used by a variety of governance entities, including the public, media, government, and market, to track and oversee corporate emissions. Consequently, when firms face insufficient carbon emission allowances or heightened external oversight, they must resort to technological innovation and management optimization to reduce emissions, thereby avoiding high costs associated with purchasing allowances. From this, in order to accomplish a green, low-carbon transition, this mechanism not only incentivizes enterprises to cut their emissions but also pushes them to make environmentally friendly improvements in a number of areas, including supply chain management, operations, sales, and production.

The ECES strengthens corporate environmental responsibility in society and the market through a credit mechanism. The introduction of this credit mechanism means that a company’s environmental performance impacts not only its internal operations but also directly affects its external financing capabilities and market competitiveness (Xu and Li, 2020). The government sets up corporate environmental credit files and assessment systems as the implementing body of the environmental credit evaluation in order to track and evaluate corporate environmental practices on a continual basis (Zhang et al., 2021). This also enhances the government’s efficiency in subsequent environmental supervision of enterprises. Additionally, by making the evaluation results public, external governance entities can effectively supervise corporate environmental behavior. Thus, companies are often proactive in modifying their extensive operational models in favor of cleaner and more efficient green development approaches in this transparent environment, with the goal of maintaining a good market reputation and credit rating. This lowers energy consumption and the intensity of carbon emissions. Overall, under the dual pressure of policy and the collaborative influence of multiple governance entities, companies tend to undergo profound behavioral adjustments. These adjustments are reflected not only in external environmental investments and technological innovations but also in the optimization of internal management models, adjustments in energy consumption structures, and improvements in green production efficiency. To remain competitive in the market and maintain a positive social image, companies must make greater efforts towards green development. These initiatives not only support the company’s overall green transformation and sustainable development, but also aid in lowering carbon emission intensity. Based on this, this paper proposes the following hypothesis:

H2. Through corporate behavioral changes and the oversight mechanisms of various governance actors, such as the government, market, media, and public, the DPP significantly lowers the carbon emission intensity of corporate activities.

3 Research design

3.1 Model construction

To evaluate the policy impact of the DPP—combining the CETPP and the ECES—on corporate carbon emission intensity, we adopt a difference-in-differences (DID) model with a two-way fixed effects specification. The econometric model is designed to compare changes in carbon emission intensity between treated and control firms before and after the implementation of the policy. Accordingly, this study constructs model 1.

The dependent variable, COI, represents corporate carbon emission intensity, while the independent variable, DID, corresponds to the DPP. X denotes the control variables. ut and vi represent year fixed effects and firm fixed effects, respectively, and εit denotes the random disturbance term. Additionally, this study has clustered standard errors at the provincial level.

The DID framework, particularly when augmented with two-way fixed effects, is chosen for its robust capability in evaluating policy interventions within quasi-experimental settings. By effectively differencing out unobserved firm-specific time-invariant factors and common year-specific shocks, this approach generally provides more reliable estimates of the policy effect compared to simpler models like Ordinary Least Squares, which are more susceptible to biases from omitted variables.

However, the validity of DID estimates hinges on several key assumptions and is subject to certain limitations. The cornerstone is the parallel trends assumption, requiring that, absent the DPP, the average outcome for treated and control groups would have followed similar paths over time. This study empirically examines the plausibility of this crucial assumption through graphical analysis of pre-treatment data trends and formal event study specifications.

3.2 Variable definition

3.2.1 Explained variable

This study employs the methodology outlined by Cui et al. (2023) and Zhang et al. (2024) to calculate the direct and indirect carbon emissions generated by a company’s various activities. A company’s total carbon emissions are determined by summing these two categories. Subsequently, the total carbon emissions divided by revenue yields the carbon emission intensity. The majority of the sources for these data are the manually compiled annual corporate disclosures, such as environmental, sustainability, and CSR reports.

3.2.2 Explanatory variable

Since 2013, the ECES has been gradually piloted across provinces, such as Jiangsu, Anhui, Zhejiang, Sichuan, Tibet, etc. Meanwhile, starting in 2013, the CETPP was gradually launched in seven provinces and cities, including Beijing, Shanghai, Tianjin, Guangdong, Hubei, Chongqing, and Shenzhen, whereas Fujian Province initiated its CETPP relatively late, beginning in 2016. This study primarily examines the synergistic effects of the DPP. As the regression analysis in this study is conducted using a difference-in-differences model, the explanatory variable is set as a dummy variable, DID. If a sample firm begins to be affected by the DPP, the DID variable takes a value of 1 from that year onward; otherwise, it is set to 0.

3.2.3 Control variables

Drawing on prior literature (Liu et al., 2023; Chang et al., 2024), this paper accounts for additional variables that might affect a company’s carbon emission intensity. These variables include firm size (SIZE), financial leverage (LEV), return on assets (ROA), sales growth rate (SGR), cash ratio (CASH), firm age (AGE), CEO duality (DUAL), institutional ownership (INST), the proportion of independent directors (IDR), and board size (BSIZE). For detailed definitions of these variables, please refer to Supplementary Appendix A.

3.2.4 Sample selection and data sources

This study utilizes a sample of companies listed on China’s A-share market, covering the period from 2007 to 2021. This specific timeframe was chosen to ensure an adequate pre-policy baseline prior to the broader implementation of the ECES and the CETPP, to encompass their subsequent evolution and potential synergistic impacts, and to provide sufficient post-implementation observation years based on data availability at the time of research.

Following established research practices, the initial sample was screened. Financial sector companies were excluded due to their distinct operational models. Companies designated as ST, ST*, or PT (indicating financial distress or other abnormal conditions) were also omitted. Finally, firms with substantial missing data for key variables essential to the analysis were removed. These procedures resulted in a final dataset of 27,718 firm-year observations. To mitigate the potential influence of extreme values on estimation results, all continuous variables employed in the regression analyses were winsorized at the 1% and 99% percentiles. Enterprise-level financial data were primarily sourced from the CSMAR database, while information related to the ECES and CETPP pilot policies was obtained from official government documents.

4 Empirical analysis

4.1 Descriptive statistics

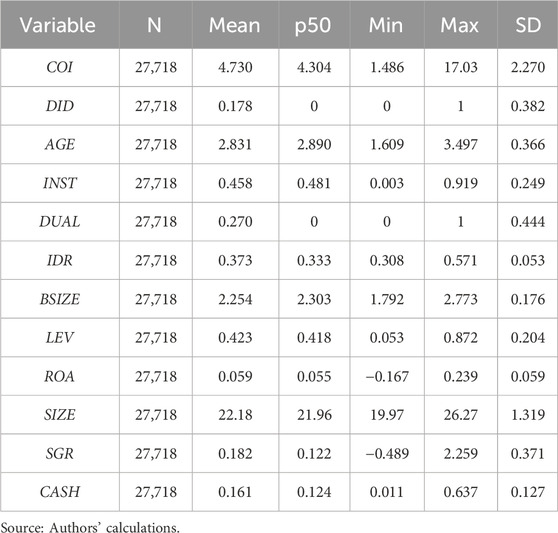

For descriptive statistics tables, the key characteristics of the sample are now elaborated upon.

As illustrated in Table 1, the mean COI is 4.730, indicating that the average carbon emission intensity among the sample firms is relatively high, with a standard deviation of 2.270, suggesting significant variation in carbon emission intensity across firms. The median COI is 4.304, that suggests that the data distribution is reasonably symmetrical because it is near the mean. The DPP variable’s mean is 0.178, which indicates that during the study period, the DPP may have had an impact on 17.8% of the sample firms. The values of the remaining control variables align with realistic expectations and are not elaborated further.

4.2 Baseline regression analysis

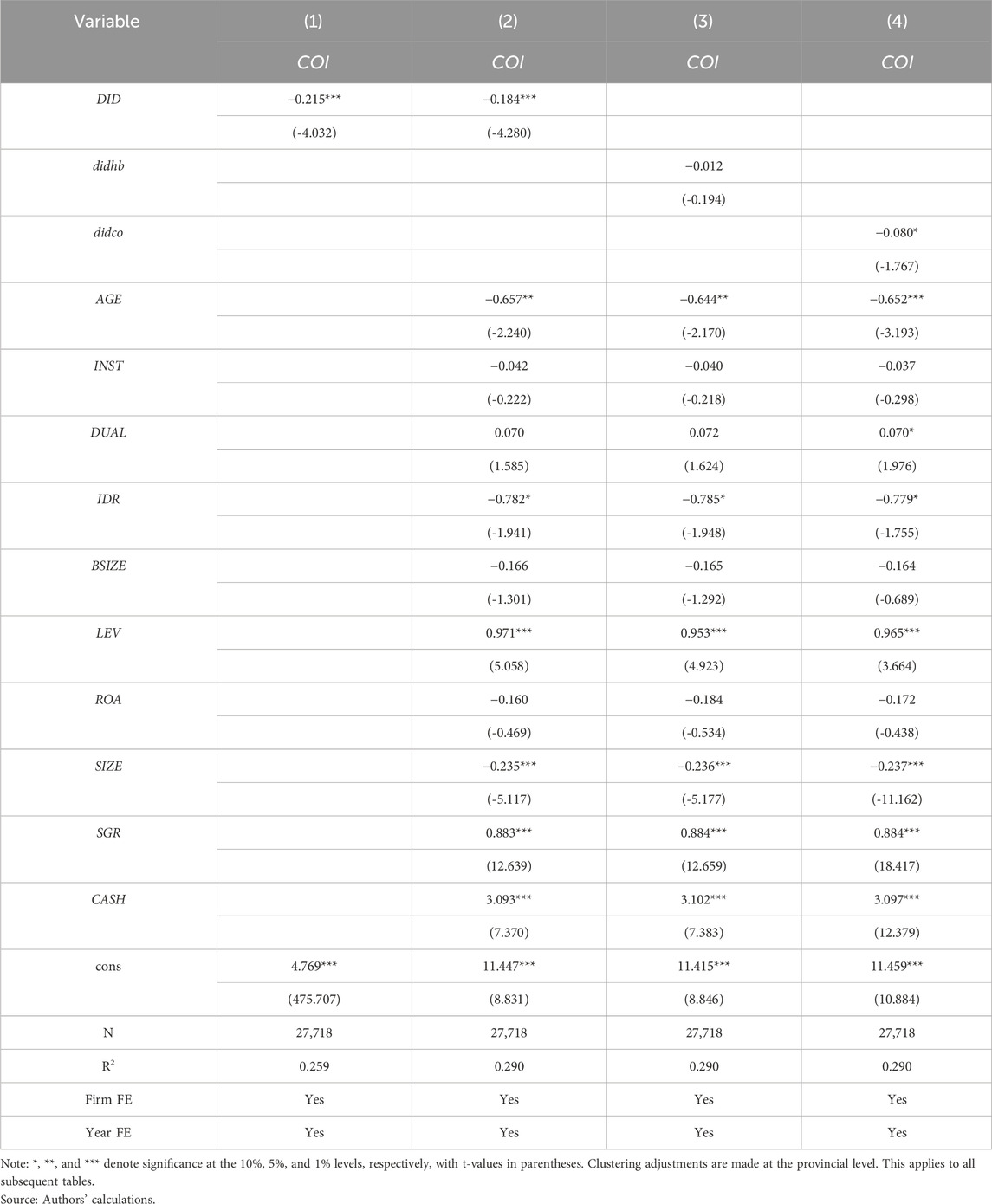

For main regression results tables, the sign, magnitude, and statistical significance of the key coefficients are now discussed; their economic meaning is interpreted, and they are related to the core research questions.

The effect of DPP on the carbon emission intensity of firms is shown in columns (1) and (2) of Table 2. In column (1), it can be observed that DPP significantly reduces firms’ carbon emissions (A = −0.215, p < 0.01). In column (2), after further controlling for other variables, the DID coefficient slightly decreases to −0.184 while maintaining significance. These findings support the conclusion of Hypothesis 1 by showing that DPP significantly reduces firms’ carbon emission intensity and thereby promotes firms’ transition to low-carbon operations.

Table 2 examines how a single pilot program affects corporate carbon emissions intensity in columns (3) and (4). The results in column (3) show that the carbon emission intensity of firms is negatively, but not significantly, impacted by the independent implementation of the ECES (didhb). The regression results in column (4) show that the independent implementation of the CETPP (didco) has some impact on reducing firms’ carbon emission intensity, although it is relatively weak (A = −0.080, p < 0.1). Comparing the regression results of DPP with those of the single pilot policy shows that DPP is significantly more effective than the single pilot policy. This also suggests that combining ECES with the CETPP can create more effective synergies, significantly reducing firms’ carbon emission intensity.

4.3 Robustness checks

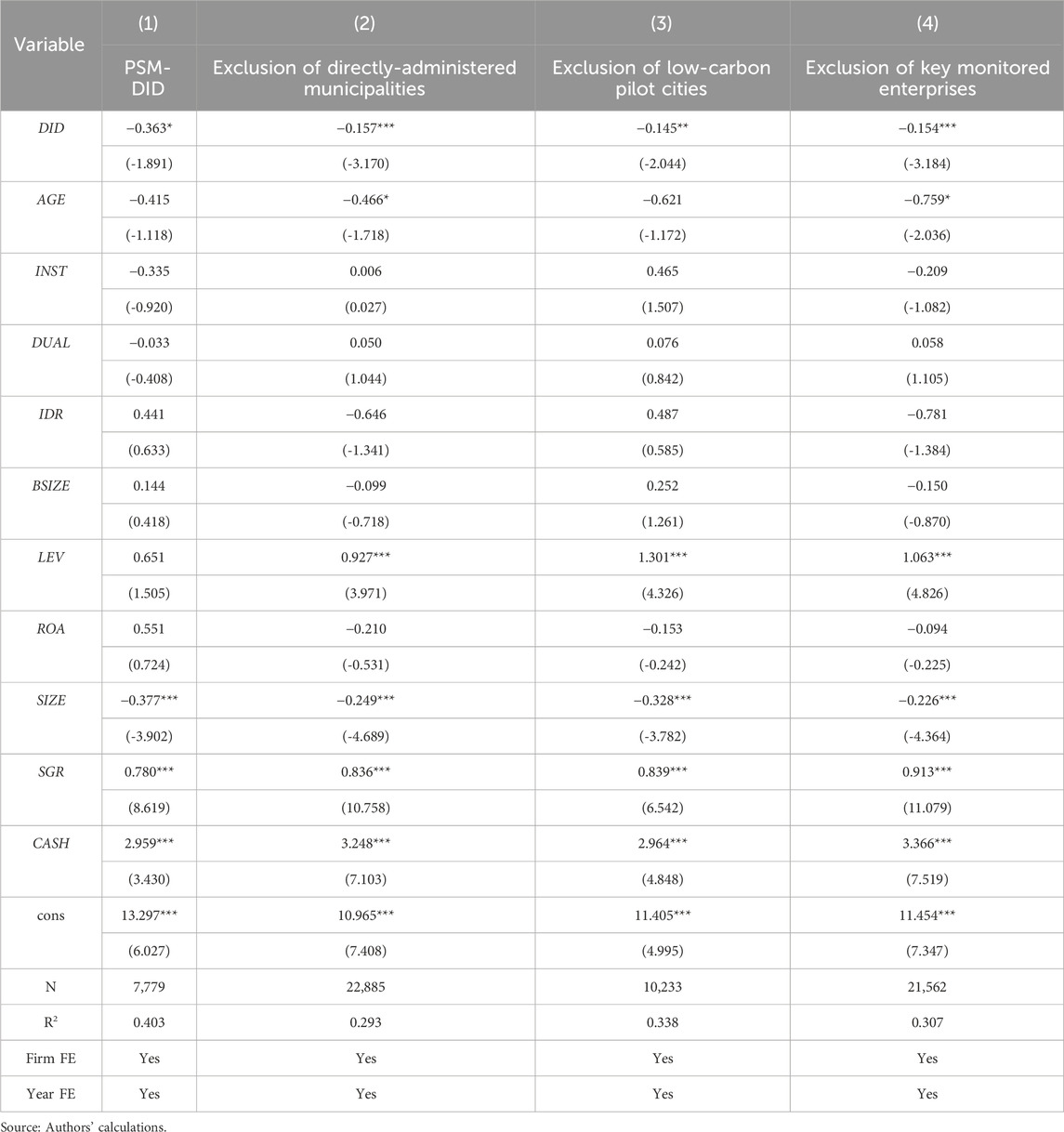

This paper performed several tests to confirm the validity of the aforementioned conclusions. These tests included the use of the PSM-DID method, a parallel trends test, a placebo test, consideration of lag effects, removal of samples from municipalities, removal of other policy interferences, and alternative clustering techniques.

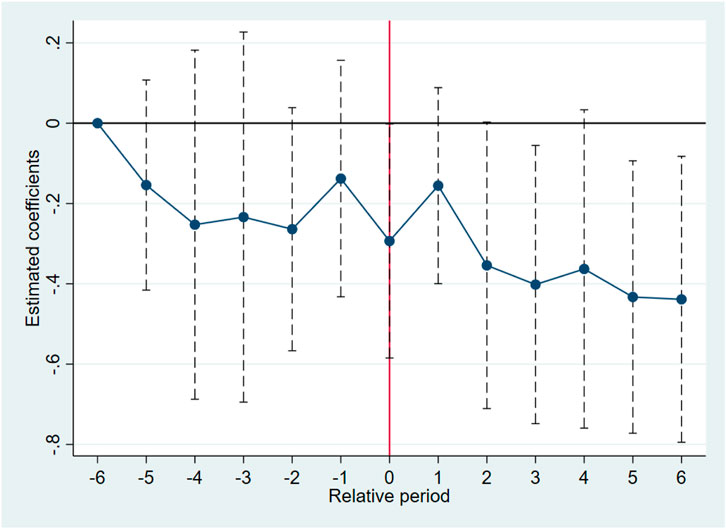

4.3.1 Parallel trends test

In conducting a DID analysis, the parallel trends assumption is essential. Thus, to ensure the validity of the analysis results, this study will perform a parallel trends test. The sixth year before the policy implementation (pre_6) is used as the reference period. As shown in Figure 1, the effect values for each period before policy implementation (pre_5, pre_4, pre_3, pre_2, pre_1) are all close to zero and exhibit relatively small fluctuations within the confidence interval. This suggests that the carbon emission intensity of firms did not exhibit any noteworthy trends prior to the implementation of the policy pilot. However, there was a notable drop in the carbon emission intensity after the policy was put into place. This phenomenon suggests that the policy has a significant impact, demonstrating a clear effect on emission reduction.

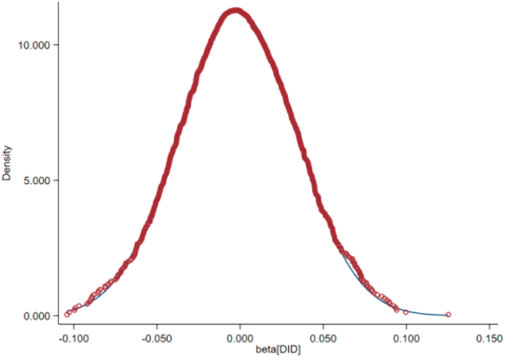

4.3.2 Placebo test

This paper aims to verify through a placebo test that the impact of the DPP on corporate carbon emission intensity is not the result of chance. Regression is carried out once more using model (1), with a fresh treatment group and control group being created at random. A thousand times is this process repeated. Figure 2 illustrates the results, where it can be noted that the spread of the estimated values approximates a normal distribution, centered around zero. This symmetry indicates that the estimated policy effect coefficients are generally close to zero. The DPP has a strong effect on corporate carbon emissions, as the placebo test demonstrates.

4.3.3 PSM-DID

The PSM-DID approach is employed to evaluate the impact of the DPP on corporate carbon emission intensity, with the aim of mitigating the selection bias. With the control variables from the baseline regression acting as covariates, a one-to-one nearest neighbor matching technique is specifically used to match each treatment group company with a control group company.

Column (1) of Table 3 displays the results, demonstrate that the DPP significantly reduces corporate carbon emission intensity. This suggests that even after eliminating sample selection bias, the emission reduction effect of the policies remains significant, further supporting the conclusions of the baseline analysis.

4.3.4 Exclusion of directly-administered municipalities

Directly-administered municipalities often have stricter environmental regulations, which may influence the overall results. The regression results after excluding the sample of directly-administered municipalities (see Table 3, column (2)) show that even when directly-administered municipalities are excluded from the sample, the emission reduction effect of the policy remains significant (A = −0.157, p < 0.01). It can be concluded that the policy effect is not confined to specific areas but has broader applicability.

4.3.5 Exclusion of other policy effects

During the sample period, other relevant policies mainly include low-carbon pilot cities and key monitored enterprises1. To ensure that the effects of the DPP are not confounded by other policies, this study excludes samples that could potentially interfere with the policy effects. This allows the analysis to more accurately capture the independent impact of the DPP, ensuring the validity of the analysis results. After excluding these samples, the results again suggest (see Table 3, columns (3) and (4)) that the implementation of the DPP effectively facilitated the low-carbon transition of firms (A = −0.145, p < 0.05; A = −0.154, p < 0.01).

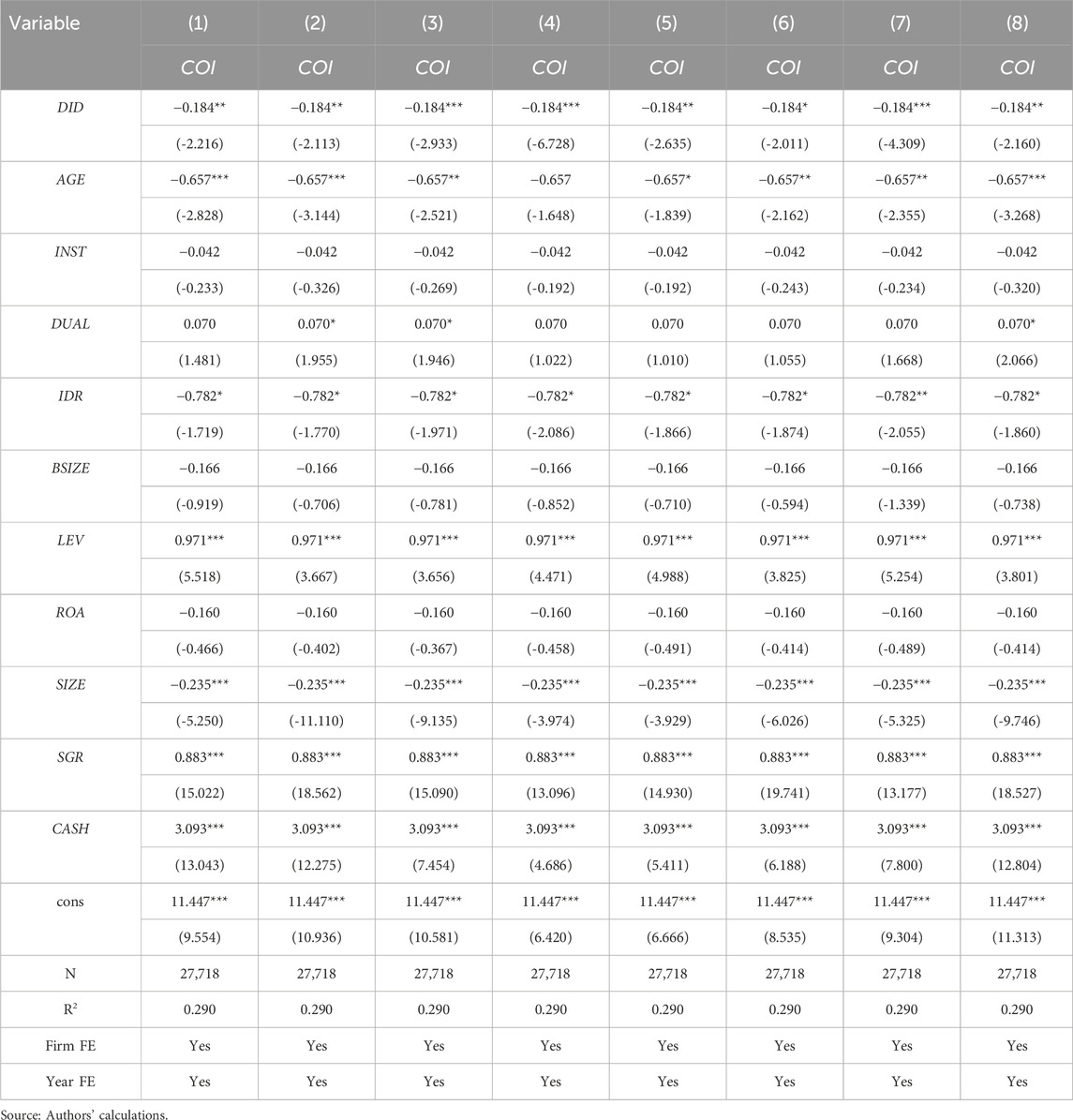

4.3.6 Alternative clustering methods

This study re-estimates the regressions using clustering methods at the firm level, industry level, industry-province level, time-province level, time-firm level, time-industry level, firm-province level, and firm-industry level to ensure the robustness of the results.

Columns (1) to (8) of Table 4 illustrate how the DPP affects firms’ carbon emission intensity, with conclusions remaining unchanged as previously stated.

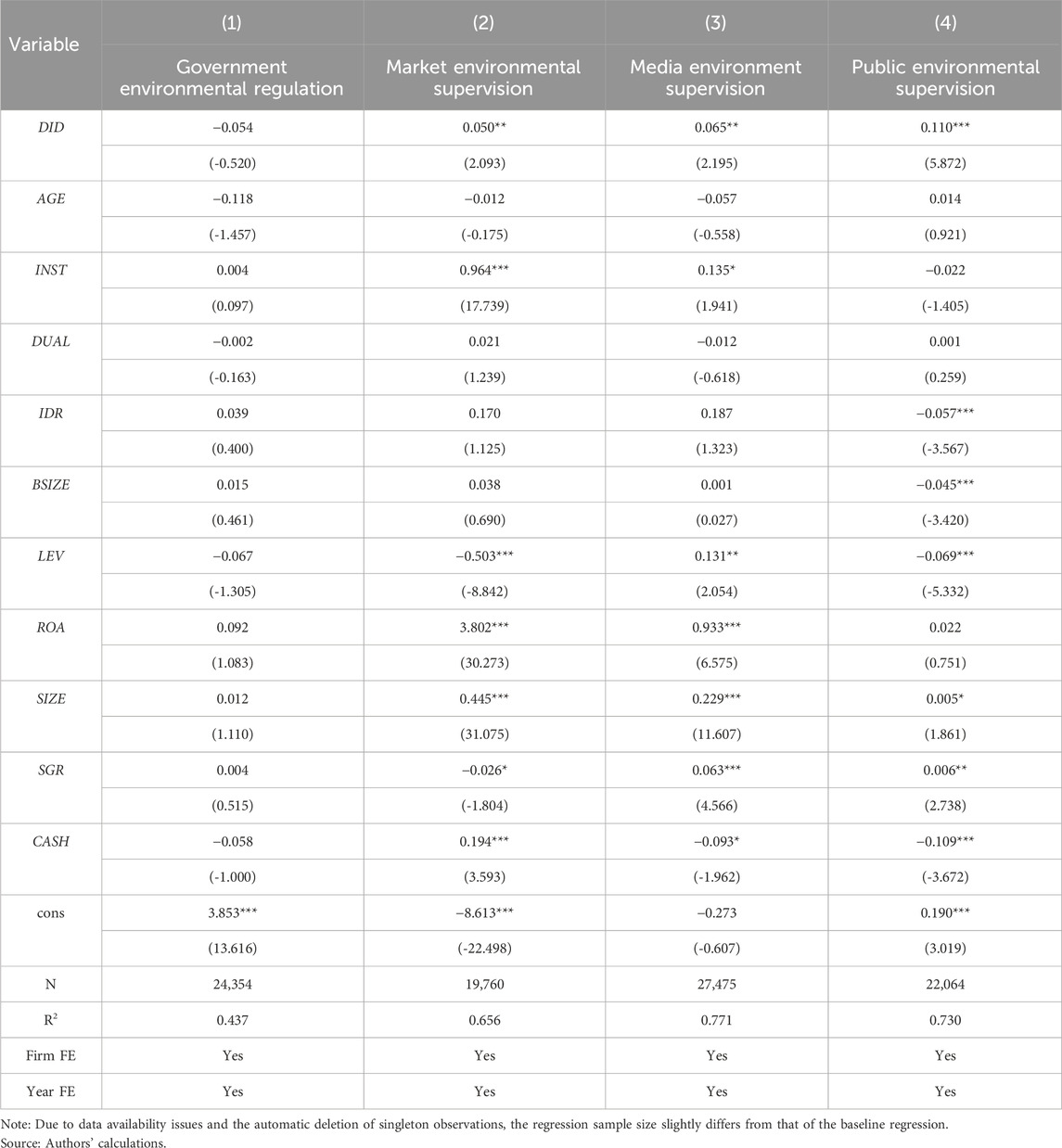

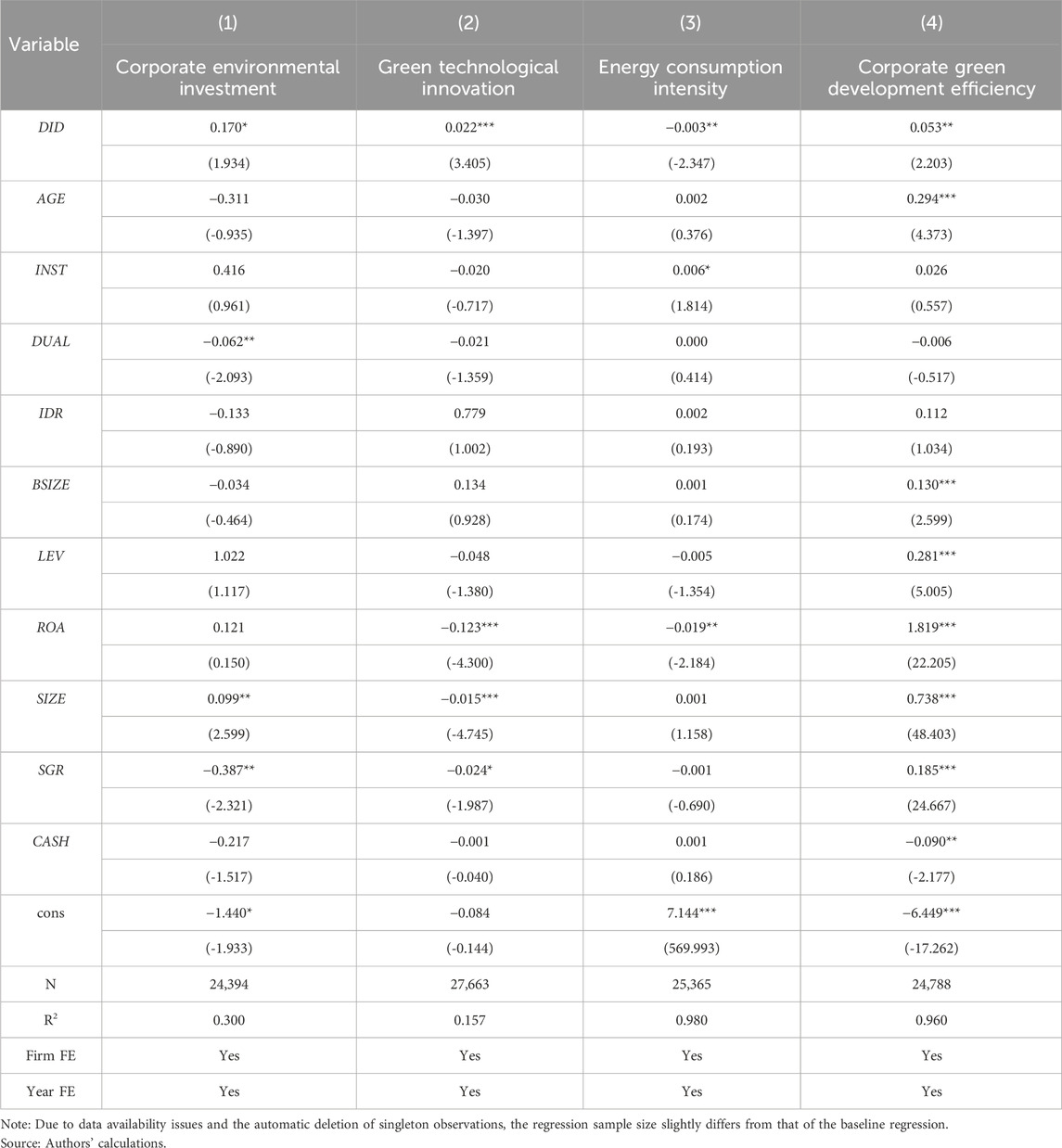

5 Potential mechanism analysis

In the discussion of Hypothesis 2, this study posits that the DPP significantly reduces firms’ carbon emission intensity through supervisory mechanisms involving multiple governance actors such as the government, market, media, and public, as well as through corporate behavioral adjustments. To this end, this study will conduct an empirical analysis of these supervisory mechanisms and corporate behavioral adjustment mechanisms. The supervisory mechanisms of multiple governance actors include government environmental regulation, market environmental oversight, media environmental oversight, and public environmental oversight; the corporate behavioral adjustment mechanisms encompass environmental investment, green technological innovation, energy consumption, and green development efficiency.

Regarding the testing methods for the mediation mechanisms, although the stepwise regression method is often used as a well-established approach, it is subject to considerable debate due to issues of endogeneity. To address this issue and verify the effectiveness of the aforementioned mechanism, this study adopts the method of Jiang (2022), examining only the impact of the explanatory variable on the mechanism variable.

5.1 Supervisory mechanisms of multiple governance actors

The first is the government environmental regulation mechanism. This refers to the way in which the implementation of the DPP enables the government to acquire more environment-related data from enterprises, thereby increasing its focus on the environmental behavior of local enterprises and enhancing the efficiency of environmental regulation, which in turn affects corporate carbon emissions. To test this mechanism, this study refers to the method used by Chen et al. (2021), utilizing the frequency of words related to environmental regulation such as “pollution” and “smog” in government work reports to measure government environmental regulation. The findings in the first column of Table 5 indicate that the impact of the DPP on government environmental regulation is not significant (coefficient of −0.054). This result suggests that although the DPP aims to enhance corporate environmental responsibility through market and credit mechanisms, its direct impact on the intensity of government environmental regulation is limited. Possible reasons include the influence of various factors on government environmental regulation, such as the economic benefits to local governments and the uneven distribution of regulatory resources. In some regions, governments may prioritize economic development over strict environmental regulation, leading to a lack of significant direct regulatory effects at the government level.

The second mechanism is market environmental supervision. This refers to the use of environmental credit evaluations and carbon emissions trading data by capital market participants when selecting investment targets, thereby compelling enterprises to enhance their environmental investments and manage carbon emissions. To explore the market environmental supervision mechanism, this paper uses the natural logarithm of the number of analysts following a company (i.e., the number of analyst teams tracking the company in a given year plus one) as disclosed in the CSMAR database to measure market supervision. The specific estimation results, as present in the second column of Table 5, indicate that the DPP significantly increased market supervision of corporate environmental activities (with a coefficient of 0.050, p < 0.05). This outcome implies that the DPP, by improving the transparency of information on corporate environmental performance, encourages external analysts to pay more attention to corporate environmental behaviors. At the same time, the increased scrutiny by analysts may also lead investors to place greater emphasis on corporate environmental risks, making a company’s environmental performance directly affect its market valuation and financing capability, thereby reducing corporate carbon emission intensity.

The third mechanism is media environmental supervision. This refers to the use of environmental credit evaluation results and carbon emissions trading information by online media to monitor corporate environmental behavior. Media reports can influence public perception and exert public opinion pressure, thereby affecting corporate environmental decision-making. Therefore, following the method of Guo and Lu (2021), this study uses the disclosure of online media attention from the CNRDS database (i.e., the natural logarithm of the total number of news stories about the company plus one) to measure media environmental supervision. As indicated in column (3) of Table 5, it is observed that the DPP significantly increased media attention to corporate environmental behavior (coefficient of 0.065, p < 0.05). This suggests that after the implementation of the DPP, the supervisory role of the media was significantly enhanced, possibly because the policy reduced information asymmetry regarding corporate environmental performance and increased media focus on environmental issues. With strengthened media supervision, companies may place greater emphasis on environmental compliance and image maintenance to avoid the market and public pressure from negative reports. Accordingly, the DPP significantly reduced corporate carbon emission intensity through media environmental supervision.

The fourth mechanism is public environmental supervision. Public oversight exerts direct pressure on companies through social opinion and consumer behavior, prompting them to improve their environmental practices. Following the approach of Cheng and Liu (2018), this study conducted keyword searches on the Baidu search engine and used Python tools to scrape the average daily search volumes for terms such as “environmental pollution” and “carbon emissions” at the prefecture-level city scale across the country from 2007 to 2021. These act as proxy indicators for public environmental supervision. The estimation results are found in column (4) of Table 5, where the DPP significantly increased public attention to corporate environmental behavior (coefficient of 0.110, p < 0.01). This suggests that the policy’s implementation increased the exposure of corporate environmental information, while facilitating the public’s ability to obtain pertinent information and participate in supervision. Enhanced public supervision may encourage companies to prioritize environmental issues to avoid reputational damage and loss of market share. Consequently, the DPP significantly reduced corporate carbon emission intensity through public environmental supervision.

5.2 Mechanisms for adjusting corporate behavior

The first aspect is the intensity of corporate environmental investment. As a key form of corporate behavior adjustment, environmental investment reflects the actual commitment of companies to environmental policies, illustrating their willingness to address pollution control and environmental protection. Following the approach of Jin and Xu (2020), corporate environmental investment is measured as the natural logarithm of the total amount invested in environmental projects plus one for listed companies. As shown in column (1) of Table 6, the DPP significantly promotes corporate environmental investment (coefficient of 0.170, p < 0.10). This indicates that, under the multifaceted pressures brought by the DPP, companies have significantly increased their environmental investment efforts to implement cleaner production and enhance environmental compliance, thereby reducing carbon emission intensity.

The second aspect is green technological innovation. Green technological innovation is a crucial strategic choice for firms in response to environmental policies. Advances in green technology can aid firms in optimizing production processes and influence their environmental performance. Following the methodology of Kim et al. (2021) and Liu et al. (2023), the degree of green innovation is determined by taking the natural logarithm of the total number of green patent applications filed by enterprises plus one. A noteworthy positive correlation (coefficient of 0.022, p < 0.05) has been observed between corporate green technological innovation and the DPP, as shown in Table 6 of column (2). This implies that under the impetus of the DPP, firms are striving for green R&D and technological innovation. The improvement in green technological innovation not only helps firms meet current environmental regulations and enhance competitiveness but also provides a technological guarantee for sustainable development, effectively reducing firms’ carbon emission intensity.

The third aspect is energy consumption intensity. Given that one of the primary sources of carbon emissions is energy consumption, a company’s energy consumption intensity directly influences its carbon emission intensity. Higher energy consumption intensity typically indicates more greenhouse gas emissions. Utilizing the methodology of Song et al. (2024), this study uses fossil energy consumption and clean gas consumption as metrics for energy consumption. The “General Principles for Calculation of Comprehensive Energy Consumption” (GB/T2589-2008) specifically state that a firm’s energy consumption intensity is determined by taking the natural logarithm of its standard coal consumption, which is obtained by converting the firm’s fuel oil and coal consumption into standard coal consumption. The empirical analysis in column (3) of Table 6 presents a negative correlation between the DPP and firms’ energy consumption (coefficient of −0.003, p < 0.05). This suggests that the DPP encourages firms to take measures to reduce energy consumption, improve energy efficiency, or shift towards the use of clean energy. This reduction in energy consumption helps firms achieve lower carbon emission intensity and comply with policy requirements.

The fourth aspect is corporate green development efficiency. An essential metric for assessing a company’s environmental responsibility and capacity for sustainable development is green development efficiency. Adopting the method of Wang et al. (2020), this study gauges the effectiveness of green development using the green total factor productivity of firms. According to Chen (2024), this paper employs the SBM-ML method is used to calculate the green total factor productivity index. Positive correlation between the DPP and firms’ green total factor productivity is shown by the results in Table 6 in column (4). (coefficient of 0.053, p < 0.05). This indicates that the DPP has facilitated the overall green transformation of enterprises, improved the efficiency of green development, and strengthened their sustainable development capabilities. In other words, by enhancing the green total factor productivity, enterprises have not only reduced carbon emission intensity but also improved economic benefits while complying with environmental policies, ultimately achieving effective green development.

The mechanism tests in this study indicate that the DPP significantly impacts firms’ carbon emission intensity through the supervision mechanisms of multiple governance entities (such as market, media, and public oversight) and corporate behavioral adjustment mechanisms (such as environmental investment, green innovation, energy consumption, and green development efficiency). As the DPP progresses, the oversight from the market, media, and public has significantly strengthened. Consequently, firms, under pressure from these entities, have actively engaged in environmental investments, green innovation, optimizing energy consumption, and promoting green development. In other words, the DPP has effectively advanced firms’ low-carbon transformation through multiple pathways and significantly reduced their carbon emission intensity.

6 Heterogeneity test

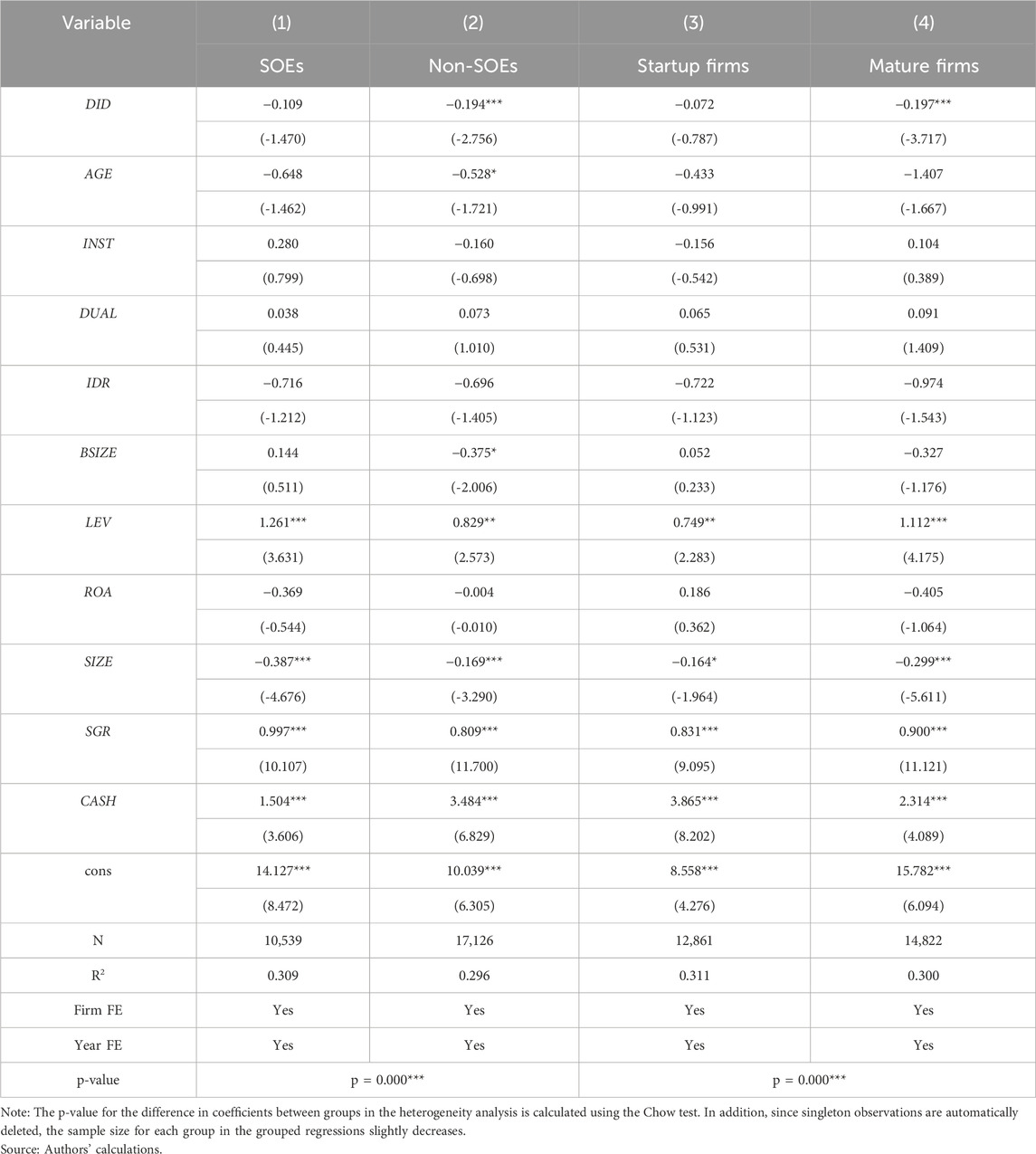

It is crucial to take into account the heterogeneity at the levels of firm type, lifecycle, carbon emission intensity, and pollution level in order to gain a deeper understanding of the synergistic impact of the ECES and CETPP on firms' carbon emission intensity. Firm type (such as state-owned vs. non-state-owned enterprises), lifecycle stage (such as startup vs. maturity), carbon emission intensity (such as high-carbon vs. low-carbon industries), and pollution level (such as high-pollution vs. low-pollution industries) all influence firms’ behavioral patterns and their responses to policies. Therefore, analyzing these heterogeneities can reveal the effectiveness of the DPP in different contexts, aiding in the formulation of more targeted policy measures and achieving more precise environmental governance.

6.1 Heterogeneity by firm type

Diverse firm types experience different effects from the DPP with regard to carbon emission intensity; in particular, resource allocation, market pressure, and policy enforcement differ significantly between state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs). SOEs typically have more resources and stronger market positions, whereas non-SOEs face greater market competition pressure and resource constraints, potentially leading to different responses to the policy. Therefore, this study categorizes the sample into SOEs and non-SOEs for regression analysis. The DPP has no discernible impact on the carbon emission intensity of SOEs, as shown in columns (1) and (2) of Table 7. This might be because, during policy implementation, state-owned enterprises, with their strong risk resistance and resource advantages, exhibit a weaker response to policy pressures. In contrast, among non-SOEs, the policy significantly reduces carbon emission intensity (with a DID coefficient of −0.194, p < 0.01), indicating that these firms more quickly adjust strategies, increase environmental investments, and enhance management efficiency to meet policy requirements. As a result, it is clear that the DPP has a greater influence on non-state-owned enterprises, illustrating the policy’s distinct effects on companies with various ownership arrangements.

6.2 Lifecycle heterogeneity

The stage of a firm’s lifecycle can affect the effectiveness of policies, as startup firms and mature firms exhibit significant differences in resource endowment, technological capability, market positioning, and speed of policy response. Mature firms typically have a strong management and technological foundation, whereas startups, with limited resources, may face greater challenges in responding to policies. Based on this, this study groups firms by the median age for testing. As shown in columns (3) and (4) of Table 7, the DPP has no impact on the carbon emission intensity of start-up companies (with a DID coefficient of −0.072). However, for mature firms, the policy significantly reduces carbon emission intensity (with a DID coefficient of −0.197, p < 0.01). This suggests that startups, often smaller in scale and with limited resources and relatively insufficient technological capabilities, may focus more on basic survival issues and market expansion in their early development stages. They may lack sufficient funds and manpower to implement complex environmental measures and technological improvements. In contrast, mature firms have typically accumulated abundant resources and technical experience, possessing strong financial strength and innovation capability. Therefore, under the influence of the DPP, these mature firms not only have more capital for environmental investments but can also leverage their technological advantages to improve production processes, enhance energy efficiency, and promote comprehensive green development, thereby effectively reducing carbon emission intensity.

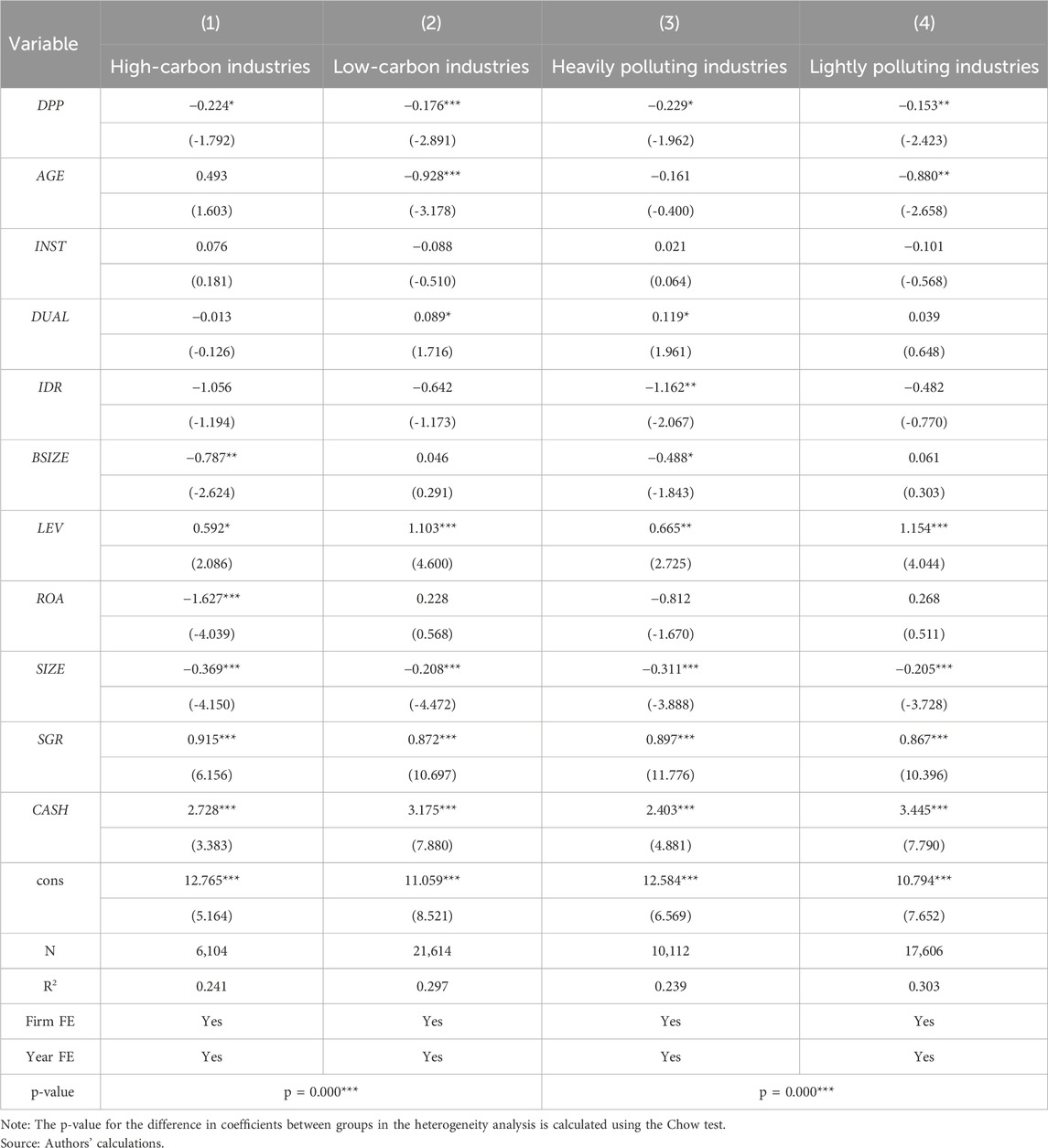

6.3 Heterogeneity by carbon emission intensity

Industry type determines the carbon emission characteristics of firms and their ability to respond to policies. High-carbon industries, such as manufacturing, typically have high emission intensity and thus become key targets for policy regulation, while low-carbon industries may have a lower emission baseline and may respond differently to policies. Based on this, this study categorizes the sample into high-carbon and low-carbon industries following the industry classification standards of Yu et al. (2023) and Tang et al. (2022). The regression is then re-run on the subsamples using the difference-in-differences method based on Model (1). As seen from columns (1) and (2) of Table 8, in high-carbon industries, the DPP significantly reduces carbon emission intensity (with a DID coefficient of −0.224, p < 0.10); in low-carbon industries, the policy also significantly reduces carbon emission intensity (with a DID coefficient of −0.176, p < 0.01), but the impact of the DPP is more pronounced in high-carbon industries.

The explanation for this could be that high-carbon industries (such as steel, chemicals, and power) typically have high carbon emission intensity and a larger emission baseline. This means that policy interventions can achieve greater emission reductions in these industries. Therefore, when the DPP is implemented, firms within these industries face greater pressure to reduce emissions, and the policy impact is more significant. Moreover, high-carbon industries are often the focus of policy regulation, facing stricter emission standards and stronger policy enforcement. To comply with these stringent policy requirements, firms must adopt more proactive emission reduction measures, such as increasing environmental investments, conducting technological upgrades, and improving energy efficiency, which effectively reduce carbon emission intensity.

6.4 Heterogeneity by pollution level

The effectiveness of a policy’s implementation can be impacted by a company’s pollution level and whether or not it is part of a highly polluting industry. Specifically, heavily polluting industries typically face stricter regulation and greater social pressure, whereas lightly polluting industries may have cleaner production processes, face less regulatory intensity, and may respond to policies differently. Referring to Long et al. (2022), this paper categorizes the sample into heavily polluting and lightly polluting industries. As shown by columns (3) and (4) of Table 8, the DPP considerably lowers the carbon emission intensity of highly polluting industries (with a DID coefficient of −0.229, p < 0.10); in lightly polluting industries, the policy also results in a significant emission reduction effect (with a DID coefficient of −0.153, p < 0.05). This suggests that both highly and lightly polluting industries are significantly hampered by the DPP, though the effect is stronger in the former.

The more substantial impact of the DPP on heavily polluting industries is primarily due to the larger baseline of pollution emissions, stronger policy pressure, and more urgent demand for emission reductions. After policy implementation, firms in these industries have undertaken more intensive emission reduction measures, resulting in a greater decrease in carbon emission intensity. In contrast, while lightly polluting industries are also affected by the policy and show significant emission reduction effects, their smaller pollution baseline and relatively lower demand for emission reductions mean that the policy’s inhibitory effect is numerically slightly lower than in heavily polluting industries.

7 Discussion and conclusions

7.1 Discussion

This study’s central finding is the significant synergistic effect of the DPP—integrating the ECES and the CETPP—in reducing corporate carbon emission intensity. This result advances understanding beyond the documented individual effects of CETPP (Zhang W. et al., 2020) and ECES regulations (Guo et al., 2025). The empirical validation of this specific policy combination’s enhanced efficacy supports theoretical propositions on well-designed policy mixes (Rogge and Reichardt, 2016), suggesting that the market-based incentives of CETPP, similar in principle to those in international carbon markets like the EU ETS, are substantially amplified when complemented by the credit constraints and public scrutiny fostered by ECES, reflecting principles of policy complementarity and enhanced regulatory signaling.

The mechanisms through which the DPP operates further illuminate this synergy. The findings indicate that the DPP strengthens both external supervisory pressures (from market, media, and public actors) and promotes internal corporate behavioral adjustments (including environmental investment, green technological innovation, and energy optimization). This aligns with broader literature suggesting that comprehensive and multi-faceted policy signals can trigger more profound corporate responses than single instruments alone (Lambin et al., 2014), consistent with established theories of organizational response to institutional pressures and incentives. The DPP appears to induce a holistic shift in corporate environmental strategy, a comprehensive approach also advocated in some international environmental governance frameworks.

The heterogeneity analysis refines these insights, showing a more pronounced DPP impact on non-state-owned enterprises (non-SOEs), mature enterprises, and firms in high-carbon or heavily polluting sectors. The greater responsiveness of non-SOEs often aligns with literature pointing to their typically higher sensitivity to market incentives and reputational factors compared to state-owned counterparts, a pattern consistent with theoretical expectations based on differing governance structures and market orientations. Similarly, that mature firms and those in high-carbon or heavily polluting sectors exhibit stronger responses is consistent with studies suggesting these firms may possess greater capabilities to adapt (Fesenfeld, 2025) or face more significant pressure and abatement opportunities under such environmental regulations (Chen et al., 2024). These differentiated impacts underscore the importance of considering firm-specific characteristics in policy design and evaluation.

7.2 Conclusions

From the perspective of combining market-incentive and credit-based environmental regulation, this study systematically investigated the synergistic effects of the CETPP and the ECES on corporate carbon emission intensity. The primary conclusions drawn from the theoretical and empirical analysis are as follows:

First, concerning the overall impact, the findings demonstrate that the DPP has a significant suppressive effect on corporate carbon emissions. This confirms the effectiveness of this policy combination in fostering corporate low-carbon transition. Furthermore, when compared to the effects of single pilot policies (i.e., either ECES or CETPP implemented alone), the impact of the DPP is notably more pronounced, verifying that the integrated approach of the DPP more effectively promotes firms’ emission reduction efforts and thus exhibits a clear synergistic advantage.

Second, regarding the transmission mechanisms, the analysis reveals that the DPP influences corporate carbon emission intensity through two primary pathways. These include the enhancement of supervisory mechanisms involving multiple governance bodies (such as market oversight, media scrutiny, and public supervision), and the promotion of substantive corporate behavior adjustments towards environmental responsibility (such as increased environmental investment, fostered green technological innovation, optimized energy consumption, and improved green development efficiency).

Third, in terms of heterogeneous effects, the study identifies that the DPP’s emission reduction impact is significantly stronger in non-state-owned enterprises, mature enterprises, and firms operating within high-carbon and heavily polluting industries. This suggests that the policy’s effectiveness can vary depending on specific enterprise characteristics and sectoral contexts.

7.3 Policy implications

The findings of this study offer several pertinent insights for the design and optimization of environmental governance strategies aimed at fostering corporate low-carbon transition.

First, the demonstrated synergistic effect when the ECES and the CETPP are jointly implemented underscores the value of integrated policy approaches. Policymakers should therefore prioritize the development and coordinated rollout of complementary environmental regulatory instruments, moving beyond a reliance on standalone measures. This necessitates enhanced inter-departmental collaboration to ensure policy coherence and maximize collective impact. Second, understanding the transmission mechanisms of the DPP is crucial for effective implementation. Given that the DPP operates by strengthening multi-stakeholder supervisory pressures and incentivizing proactive corporate environmental behaviors, policy efforts should focus on further empowering these channels. This includes enhancing the transparency and public accessibility of environmental credit information and potentially designing complementary incentives to support enterprises in their green investments and technological upgrading. Third, the heterogeneous impacts of the DPP across different firm types suggest the need for more nuanced and targeted policy application. For instance, the greater responsiveness of non-state-owned enterprises and mature firms, as well as those in high-carbon sectors, indicates where such combined policies can yield the most significant initial results. For other firm categories, policymakers might consider tailored supportive measures or adapted regulatory designs to enhance their engagement and emission reduction outcomes.

7.4 Limitations and future research

While this study reveals the synergistic effects of the DPP from multiple perspectives, certain limitations should be acknowledged. First, this study primarily investigates the combination of ECES and CETPP, without examining the effects of other potential policy combinations, such as interactions with environmental taxes or green subsidies. Second, while the model used in the study effectively reveals the overall impact of the policy, its simplified assumptions may overlook some complex real-world factors. These include variations in local government implementation stringency and the influence of internal corporate governance characteristics on policy responses, which could introduce some unobserved heterogeneity in the results. Third, this paper also does not explore in depth the impact of China’s significant regional economic and institutional disparities on policy effectiveness.

Future research can explore several areas in greater depth. First, by obtaining richer dynamic panel data, researchers can further analyze the impacts of alternative environmental policy mixes and their specific interaction pathways. Secondly, studies could incorporate more micro-level data, considering factors like internal corporate governance mechanisms and managerial decision-making behavior, to explore how specific internal factors (e.g., board composition, CEO incentives) mediate firm strategies under multiple environmental policy pressures and their effects on carbon emissions. Finally, taking into account the differences in regional economic development and policy enforcement, future research should further investigate how varying regional contexts (e.g., industrial structure, marketization level, local enforcement capacity) moderate DPP effectiveness, aiming to identify optimal, context-specific policy implementation paths and provide a scientific basis for the development of more precise and effective environmental policy strategies.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JW: Conceptualization, Formal Analysis, Investigation, Writing – original draft. QL: Conceptualization, Funding acquisition, Data curation, Methodology, Supervision, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the National Social Science Foundation Youth Program of China (No.21CGL052).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2025.1497502/full#supplementary-material

Footnotes

1Key enterprises under environmental supervision refer to firms included in the “National List of Key Enterprises for Environmental Supervision,” which is published annually by the Ministry of Ecology and Environment of China

References

Bacchetta, M., Bekkers, E., Solleder, J. M., and Tresa, E. (2025). The potential impact of environmental goods trade liberalization on trade and emissions. Energy Econ. 141, 108051. doi:10.1016/j.eneco.2024.108051

Chang, K., Luo, D., Dong, Y., and Xiong, C. (2024). The impact of green finance policy on green innovation performance: evidence from Chinese heavily polluting enterprises. J. Environ. Manag. 352, 119961. doi:10.1016/j.jenvman.2023.119961

Chen, J., Qi, J., Gao, M., Li, Y., and Song, M. (2021). Economic growth, air pollution, and government environmental regulation: evidence from 287 prefecture-level cities in China. Technol. Econ. Dev. Econ. 27 (5), 1119–1141. doi:10.3846/tede.2021.14875

Chen, L., Wang, D., and Shi, R. (2022). Can China’s carbon emissions trading system achieve the synergistic effect of carbon reduction and pollution control? Int. J. Environ. Res. Public Health 19 (15), 8932. doi:10.3390/ijerph19158932

Chen, Q. (2024). Impact of sentiment tendency of media coverage on corporate green total factor productivity: the moderating role of environmental uncertainty. Finance Res. Lett. 65, 105637. doi:10.1016/j.frl.2024.105637

Chen, Y., Zhu, Q., and Sarkis, J. (2024). Heterogeneity in corporate green supply chain practice adoption: insights from institutional fields. Bus. Strategy Environ. 33 (2), 389–406. doi:10.1002/bse.3499

Cheng, J., and Liu, Y. (2018). The effects of public attention on the environmental performance of high-polluting firms: based on big data from web search in China. J. Clean. Prod. 186, 335–341. doi:10.1016/j.jclepro.2018.03.146

Cui, X., Xu, N., Yan, X., and Zhang, W. (2023). How does social credit system constructions affect corporate carbon emissions? Empirical evidence from Chinese listed companies. Econ. Lett. 231, 111309. doi:10.1016/j.econlet.2023.111309

Fesenfeld, L. P. (2025). The effects of policy design complexity on public support for climate policy. Behav. Public Policy 9 (1), 106–131. doi:10.1017/bpp.2022.3

Guo, S., Yang, Y., and Neng, L. (2025). How the environmental credit evaluation system affects corporate pollution emissions: evidence from China. J. Environ. Manag. 373, 123643. doi:10.1016/j.jenvman.2024.123643

Guo, Z., and Lu, C. (2021). Corporate environmental performance in China: the moderating effects of the media versus the approach of local governments. Int. J. Environ. Res. Public Health 18 (1), 150. doi:10.3390/ijerph18010150

Hu, X., Huang, H., Pan, Z., and Shi, J. (2019). Information asymmetry and credit rating: a quasi-natural experiment from China. J. Bank. and Finance 106, 132–152. doi:10.1016/j.jbankfin.2019.06.003

Jiang, T., and Luo, Z. B. (2022). LOC102724163 promotes breast cancer cell proliferation and invasion by stimulating MUC19 expression. China Ind. Econ. 23 (05), 100–120. doi:10.3892/ol.2022.13220

Jin, Z., and Xu, J. (2020). Impact of environmental investment on financial performance: evidence from Chinese listed companies. Pol. J. Environ. Stud. 29 (3), 2235–2245. doi:10.15244/pjoes/111230

Kim, I., Pantzalis, C., and Zhang, Z. (2021). Multinationality and the value of green innovation. J. Corp. Finance 69, 101996. doi:10.1016/j.jcorpfin.2021.101996

Kirschke, S., and Newig, J. (2017). Addressing complexity in environmental management and governance. Sustainability 9 (6), 983. doi:10.3390/SU9060983

Lambin, E. F., Meyfroidt, P., Rueda, X., Blackman, A., Börner, J., Cerutti, P. O., et al. (2014). Effectiveness and synergies of policy instruments for land use governance in tropical regions. Glob. Environ. change 28, 129–140. doi:10.1016/j.gloenvcha.2014.06.007

Liu, L., Li, M., Gong, X., Jiang, P., Jin, R., and Zhang, Y. (2022). Influence mechanism of different environmental regulations on carbon emission efficiency. Int. J. Environ. Res. Public Health 19 (20), 13385. doi:10.3390/ijerph192013385

Liu, X., Liu, F., and Ren, X. (2023). Firms' digitalization in manufacturing and the structure and direction of green innovation. J. Environ. Manag. 335, 117525. doi:10.1016/j.jenvman.2023.117525

Long, F., Lin, F., and Ge, C. (2022). Impact of China's environmental protection tax on corporate performance: empirical data from heavily polluting industries. Environ. impact Assess. Rev. 97, 106892. doi:10.1016/j.eiar.2022.106892

Moon, J. Y., Oh, S. H., Park, Y., Lee, S. H., and Kim, E. (2021). Increasing global climate ambition and implications for Korea. KIEP Res. Pap. Word Econ. Brief, 21–28. doi:10.2139/ssrn.3885434

Pang, T., and Duan, M. (2016). Cap setting and allowance allocation in China's emissions trading pilot programmes: special issues and innovative solutions. Clim. Policy 16 (7), 815–835. doi:10.1080/14693062.2015.1052956

Rogge, K. S., and Reichardt, K. (2016). Policy mixes for sustainability transitions: an extended concept and framework for analysis. Res. policy 45 (8), 1620–1635. doi:10.1016/j.respol.2016.04.004

Siriwardana, M., and Nong, D. (2021). Nationally determined contributions (NDCs) to decarbonise the world: a transitional impact evaluation. Energy Econ. 97, 105184. doi:10.1016/j.eneco.2021.105184

Song, D., Chen, L., and Wang, B. (2024). How environmental trading achieve the synergistic effects of pollution and carbon reduction: theoretical and empirical evidence. J. Quant. and Technol. Econ. 41 (02), 171–192. doi:10.13653/j.cnki.jqte.20231214.004

Tang, M., Cheng, S., Guo, W., Ma, W., and Hu, F. (2022). Effects of carbon emission trading on companies’ market value: evidence from listed companies in China. Atmosphere 13 (2), 240. doi:10.3390/atmos13020240

Wang, K. L., Pang, S. Q., Ding, L. L., and Miao, Z. (2020). Combining the biennial malmquist–luenberger index and panel quantile regression to analyze the green total factor productivity of the industrial sector in China. Sci. Total Environ. 739, 140280. doi:10.1016/j.scitotenv.2020.140280

Weng, Q., and Xu, H. (2018). A review of China’s carbon trading market. Renew. Sustain. Energy Rev. 91, 613–619. doi:10.1016/j.rser.2018.04.026

Xu, S., Pan, W., and Wen, D. (2023). Do carbon emission trading schemes promote the green transition of enterprises? Evidence from China. Sustainability 15 (8), 6333. doi:10.3390/su15086333

Xu, X., and Li, J. (2020). Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 264, 121574. doi:10.1016/j.jclepro.2020.121574

Xuan, D., Ma, X., and Shang, Y. (2020). Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 270, 122383. doi:10.1016/j.jclepro.2020.122383

Ye, B., Jiang, J., Miao, L., Li, J., and Peng, Y. (2015). Innovative carbon allowance allocation policy for the shenzhen emission trading scheme in China. Sustainability 8 (1), 3. doi:10.3390/su8010003

Yi, L., Bai, N., Yang, L., Li, Z., and Wang, F. (2020). Evaluation on the effectiveness of China’s pilot carbon market policy. J. Clean. Prod. 246, 119039. doi:10.1016/j.jclepro.2019.119039

Yu, P., Hao, R., and Sun, Y. (2023). How do the designs of emission trading system affect the value of covered firms—A quasi-natural experiment based on China. Energy Econ. 126, 106944. doi:10.1016/j.eneco.2023.106944

Zhang, S., Wu, Z., Wang, Y., and Hao, Y. (2021). Fostering green development with green finance: an empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 296, 113159. doi:10.1016/j.jenvman.2021.113159

Zhang, W., Li, J., Li, G., and Guo, S. (2020). Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 196, 117117. doi:10.1016/j.energy.2020.117117

Zhang, Y., and Huang, Y. (2023). Killing two birds with one stone or missing one of them? The synergistic governance effect of China’s carbon emissions trading scheme on pollution control and carbon emission reduction. Sustainability 15 (13), 10147. doi:10.3390/su151310147

Zhang, Y., Li, S., Luo, T., and Gao, J. (2020). The effect of emission trading policy on carbon emission reduction: evidence from an integrated study of pilot regions in China. J. Clean. Prod. 265, 121843. doi:10.1016/j.jclepro.2020.121843

Zhang, Y., Zhao, Y., and Zheng, Q. (2024). Managerial climate attention and corporate carbon emissions: sincerity or disguise? Int. Rev. Econ. and Finance 94, 103421. doi:10.1016/j.iref.2024.103421

Zhou, X., Fan, L. W., and Zhou, P. (2015). Marginal CO2 abatement costs: findings from alternative shadow price estimates for shanghai industrial sectors. Energy Policy 77, 109–117. doi:10.1016/j.enpol.2014.12.009

Keywords: low-carbon transition, environmental credit evaluation, carbon emissions trading, dual pilot policy, synergistic effects

Citation: Wang J and Luo Q (2025) Synergistic effects of environmental credit evaluation and emissions trading in promoting enterprise carbon reduction. Front. Environ. Sci. 13:1497502. doi: 10.3389/fenvs.2025.1497502

Received: 17 September 2024; Accepted: 16 June 2025;

Published: 08 July 2025.

Edited by:

Huwei Wen, Nanchang University, ChinaReviewed by:

Gui Jin, China University of Geosciences Wuhan, ChinaMirela Panait, Petroleum and Gas University of Ploieşti, Romania

Copyright © 2025 Wang and Luo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qingfeng Luo, cWluZ2ZlbmdsbHVvQGZveG1haWwuY29t

Jingyuan Wang

Jingyuan Wang Qingfeng Luo

Qingfeng Luo