- 1School of Economics, Jiangsu University of Technology, Changzhou, China

- 2Faculty of Hospitality and Tourism Management, Macau University of Science and Technology, Taipa, Macao SAR, China

- 3School of Economics and Management, Nanjing Tech University, Nanjing, China

In recent years, with the increasing attention to global warming, low-carbon development has become a global requirement, which has attracted widespread attention from scholars and policymakers around the world. Therefore, this study explores the evolution of spatio-temporal dynamics and heterogeneity of the impact of carbon finance on clean energy development using spatial econometric modelling based on panel data from 30 provinces in China from 2010–2023, and also further explores the role of low-carbon technological innovations in this promotion process. It is found that carbon finance significantly promotes clean energy development, but this contribution decreases with the intervention of low-carbon technology innovation. Secondly, when considering government intervention and market-driven conditions, both amplify the positive impact of carbon finance on the development of clean energy, and the impact of carbon finance varies in different regions. Finally, considering the existence of spatial and regional heterogeneity, carbon finance has the largest impact among the eastern regions, the lowest among the central regions, and the second largest among the western regions. These facts indicate how carbon finance can be an effective means to support the development of clean energy in China. Therefore, in promoting the deep convergence of both carbon finance and clean energy, this study provides theoretical support for rising emerging developing economies such as China.

1 Introduction

From the early 21st century, there has been global recognition of global warming and its harms and threats to human survival, making climate warming an inevitable major issue in theory and practice (Zhou and Li, 2019). As global climate change intensifies and environmental problems become more prominent, low carbon, environmental protection and sustainability have become a global agreement and development direction (Lewis, 2010). Being the world’s biggest carbon emitter and the largest emerging economy, China has an important responsibility to address climate change and promote global development (Guo et al., 2021). To this end, since 2013, the first batch of CO2 emission trading pilots have been carried out in Shenzhen, Beijing, Guangdong, Shanghai, Tianjin, Hubei, and Chongqing. In 2016, trading started in Fujian as the second batch of CO2 trading pilots (Zhou et al., 2024). In 2017, the construction of a unified CO2 emission market was initiated. However, in terms of the level of regional carbon finance (CAF) development, the first seven pilot regional market cities for carbon emissions trading are relatively experienced in development, but the level is uneven; the remaining provinces are relatively lagging behind in carbon finance development. Currently, China’s unified CAF system is undergoing a critical period of construction, and its first compliance cycle was officially launched on 1 January 2021, including 2,225 emitters from the power industry, which will be gradually incorporated into more industries such as petroleum and manufacturing, to control and reduce greenhouse gas (GHG) emissions by making the best possible use of the mechanism of the market.

In the context of “carbon neutrality”, as an emerging financial model, CAF is widely regarded as one of the effective methods to drive sustainable development within the context of the ‘dual carbon’ goal (Zhou and Li, 2019; Guo et al., 2021; Chien et al., 2023). To this end, CAF sustainable development is crucial to achieving China’s carbon capping and carbon neutral goals. To promote its economic sustainable development and enhance its responsible image in the international society, therefore, the Chinese government always placed emphasis on the CO2 emission product trading and the development of the CAF market (Kaifeng and Chuanzhe, 2011). However, as social and economic development progresses, the financial market is playing an ever-increasing role in the overall human environment, and the concept of CAF (Environmental Finance and Green Finance) has gradually emerged. To this end, the CAF aims to channel funds into green and low-carbon sectors, support the clean energy development (CLE), promote the reduction of CO2 emissions, and thus create a virtuous circle of both economic development and environment conservation (Li et al., 2023). Therefore, CAF supports CLE development by providing loans and investments. The development of CLE requires huge capital investment, but it is difficult for traditional financial institutions to meet its financing needs. However, large inflows of funds will undoubtedly exacerbate environmental pollution or promote environmental degradation (Madaleno et al., 2022). For this reason, CAF, as a policy tool for environmental governance, is the basic condition for implementing the “dual carbon” goal and achieving CO2 emission reduction, and plays an important role in leveraging funds to invest in CLE development.

This study aims to explore the decisive role of CAF in the development of CLE in China from 2010 to 2023, and explain its mechanism from the perspective of low-carbon technological innovation (LCTI). To study the heterogeneous impact of CAF on CLE, the researcher also considered such factors as regional economic development level, market drive, government regulation, ecological environment (ecological footprint), and FDI. The contributions of this paper are mainly in four aspects. Firstly, this study introduces a new perspective on the study of CLE by exploring the contribution of CAF. This approach fills a gap in the literature and provides valuable insights into new pathways to accelerate CLE development. Secondly, unlike previous literature focusing on the economic, social and environmental impacts of CAF, this study focuses on the relationship between CAF and CLE. This study discovered the potential of CAF in promoting CLE for the first time, thus filling the gap of previous research, providing a new perspective for the development of CLE through CAF. Thirdly, based on information processing and asymmetry theory, this study will focus on the financing limitations of energy de-carbonisation as viewed from the CAF, and it will discuss whether the CAF makes up for the shortcomings of traditional funding with regard to the objects of support, and whether the CAF has become a new force driving the development of CLE. Finally, in view of the differences of CAF and CLE in different regions of China, this study constructs a comprehensive framework including CAF and CLE, and uses spatial econometric models to systematically explore the regional heterogeneity and asymmetry of CAF on CLE from the perspective of government intervention and market drive. At the same time, it further explores how they amplify the role of CAF in promoting the development of CLE.

The remainder of this paper is structured with the following sections: Part 2 provides a review of previous literature and research hypotheses. Part 3 introduces the descriptive data and research methodology. Part 4 provides the results and further discussion, and Part 5 summarises the findings and limits of the study.

2 Literature review and research hypothesis

With the current economic globalisation and carbon neutrality, low carbon credit finance is an essential driving force to support and guide the development of CLE (Huang, 2022). The essence of CAF is to enhance the guidance of low-carbon credit capital, that is, to guide more financial resources to green and low-carbon fields. At present, most scholars in the fields of energy, social and environmental finance focus their attention on the qualitative analysis of the concept, connotation and operating mechanism of CAF (Zhou and Li, 2019; Antunes et al., 2024). However, the CAF market has not yet been clearly defined, and the concept of “carbon market” is more used internationally, which may be because the international carbon market has strong financial and transaction attributes since its emergence (Bredin et al., 2014; Aglietta et al., 2015; Bridge et al., 2020). Labatt and White (2011) regarded CAF as an independent discipline and separated it from environmental finance, and defined it from both narrow and broad perspectives. For this reason, they believed that in the context of environmental protection, CAF aims to deal with climate change through market changes. Aglietta et al. (2015) focused on the interaction between CAF and environmental sustainability. They found that CAF could solve environmental problems by providing capital, while also driving CLE development. However, due to the late start of CAF in various countries, the information disclosure of CAF varies, so that there is no unified international standard to measure the development level of CAF (Yu and Lo, 2015; Zhou and Li, 2019). So far, academic research on CAF development is mainly conducted at the macro level by Requate and Unold (2003) and Kaifeng and Chuanzhe (2011), whose research perspectives mainly focus on green investment and financing activities for climate change mitigation, which specifically include CO2 emission rights and its derivative trading, CO2emission rights generating GHG gas emission reduction, investment and financing of carbon sink programmes and other relevant green and low-carbon financial intermediary activities (Guo et al., 2021; Geng et al., 2023). For example, Geng et al. (2023) discussed the impact of CAF on sustainable environmental development from the perspectives of macro finance, environment governance and technological development. They believed that CAF could further improve environmental quality through capital, resources and technology investment in promoting CLE consumption-related industries. In addition, Li et al. (2023) support this view from the capital-biased technological progress perspective, where they argue that CAF reinforces the scale and price effects of capital through technological progress, which promotes energy use efficiency and CLE (Zhou and Li, 2022). However, in response to this point of view, Gu et al. (2022) held the opposite opinion. They believed that CAF was just a new financing policy tool, that it was not only affected by price fluctuations, but also had poor market liquidity, thus having certain limitations. To this end, Guo et al. (2021) discussed the impact of carbon finance-related policies on CO2 emission reduction, and found that the higher the level of economic development and the higher the proportion of CLE consumption, the more obvious the intensity of CO2 emission reduction, and that it had a significant spatial effect (Lewis, 2010). Similarly, Wang et al. (2023) conducted further research on CAF in terms of emission reduction strength, and they concluded that energy-saving and environmentally friendly CAF can suppress carbon emissions more significantly than CLE-oriented CAF. Moreover, they also found that CAFs are more significant in reducing emissions in the central and western regions of China, whereas they are not significant in the eastern regions. This result is supported by the studies of Feng et al. (2022) and Tang and Zhou (2023), who also concluded that the abatement effect of CAFs gradually shifted from local to neighbouring areas, where the degree of impact on local areas is weaker and the effect on neighbouring areas is stronger. Therefore, this paper proposes the following research hypotheses.

Hypothesis 1. The development of the carbon finance has significant implications for the clean energy development, with significant spatial heterogeneity.

Hypothesis 2. Carbon finance facilitates the reduction of carbon dioxide emissions, thereby improving environmental quality.

In the process of CAF promoting the development of CLE, there are many factors that play a boosting role, among which low-carbon technological innovation is an important factor (Kameyama et al., 2016; Mohsin et al., 2021). The development of CAF can promote LCTI through FDI technology spillover, effective allocation of financial resources, financial capital supporting human capital accumulation and so on. However, in the early stage of CAF development, due to market failure, social and technological path dependence, design flaws (for example, total quota, quota allocation method, coverage), etc., the incentive effect of CAF on LCTI is not obvious (Lehmann and Gawel, 2013; Matsuo and Schmidt, 2017). However, the CAF market is uncertain, and if the carbon price is too low or too high, it will not be beneficial for the advancement of emission reduction technologies and the development of economy and society due to the uncertainty of supply caused by the quota allocation method and market regulation, and the unreliability of data quality caused by the imperfect test report and verification system (Zhou and Li, 2019). To this end, based on the uncertainty of the financial market, Zhao et al. (2024) used CAF policy to explore the development mechanism of CLE from both macro and micro perspectives. Their research showed that CAF policy could significantly increase CLE investment, improve CLE utilization, and promote LCTI. This point of view has also been supported by the research conducted by Zhang et al. (2017) and Guo et al. (2021). However, Lin and Zhang (2023) research on China’s CAF market held that without government subsidies and policy support, CLE development and sustainable LCTI would not be possible. On the contrary, Jiang and Xu (2023) research held that neither the policy nor the mechanism of government subsidies could effectively improve the efficiency of LCTI, which was not conducive to the sustainable development of CLE. In general, financial policies help to create a favorable CAF environment. By improving the LCTI efficiency of energy companies, they guide green and low-carbon funds into the CLE field, which has an incentive effect on improving the energy structure and promoting energy sources. Therefore, this paper proposes the following research hypotheses.

Hypothesis 3. Low-carbon technology innovation plays a mediating or moderating role in carbon finance for clean energy development.

3 Research methodology and data

3.1 Model setting

3.1.1 Spatial econometric model

As per the mechanism review of this investigation, the spatial impact of CLE is all-encompassing in the management of the energy and environment, so disregarding spatial elements in the examination of environmental contamination will result in model divergence and impact the precision of the findings (Hao et al., 2025). The CLE between different cities will also be related because of the way they are placed next to each other. Other things in the economic model, except DIE, may also cause effects on neighboring cities because of the way CLE is connected to each other in space. Accordingly, the incorporation of the relevant factors affecting CLE into the model is proposed in this work, with the aim of empirically testing the spatial impact of regional differences of CAF on CLE. The methods of Wang et al. (2022) and Zhong et al. (2024) are drawn upon for this purpose. The following spatial econometric model is therefore constructed in this work.

where,

3.1.2 Mediated effects model

Considering that the causal effect between CAF and CLE may be two-way, CAF is the policy decisive factor for the development of CLE, because CAF has a strong policy dependence, i.e., the activity of the CAF market is restricted to a degree by the national environmental policy, which determines the future development direction of CLE. On the contrary, the development of CLE can promote FDI or capital flow to low-carbon technology innovation, which helps enterprises to reduce environmental governance costs, thus balancing the relation of economic develop and CO2 emission reduction. In other words, CAF may be determined by the endogenous nature of CLE. Additionally, conventional ordinarily ordinary least square (OLS) methods can cause some issues, including bias in estimate, so there is a need to identify a proper technique to achieve a proper estimate (Zhao et al., 2022). Therefore, this study analyzes it by the systematic generalized moment method (SYS-GMM) based on the research of Blundell and Bond (1998), which can improve the estimation efficiency to some extent (Shahbaz et al., 2022; Blundell and Bond, 2023). In addition, CAF may affect CLE through LCTI based on previous literature and our discussion of conduction mechanisms. The mediating effect is the indirect influence that occurs when an outcome is influenced by an intermediate variable (Dong et al., 2022). In order to verify if the factors mentioned above can play the role of mediating variables, we conduct an empirical analysis through the standardized intermediary effect model, thus, the model is as follows.

where,

3.2 Data selection and descriptive statistics

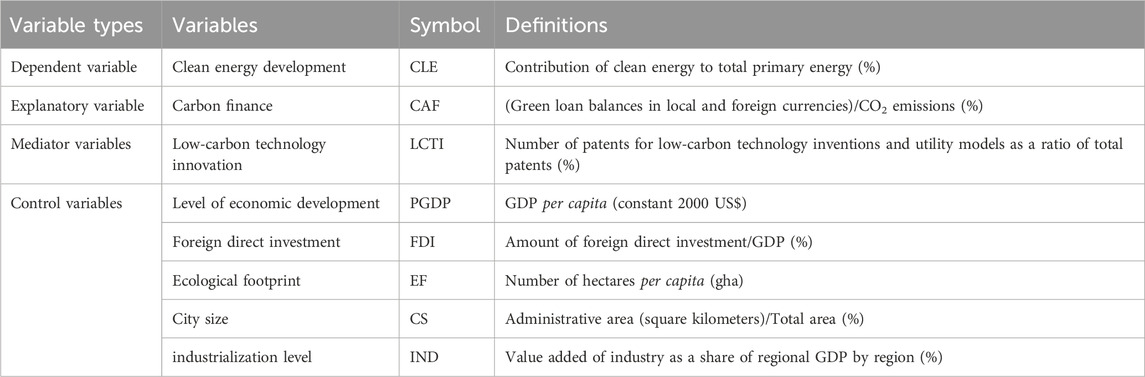

This study is based on relevant literature. It aims to build a comprehensive framework. This framework will include CAF and CLE. It will look at the two dimensions of government intervention and market drive. It will also look at low-carbon technological innovation. The study will explore regional heterogeneity and asymmetry of CAF to CLE. It will do this from a multi-dimensional and multi-level perspective. The study will use panel data. This data comes from 30 provincial administrative regions in China. It does not include Hong Kong, Macau, Taiwan and Tibet. This is because there is no data for these places. The data is from 2010 to 2023. The study will also analyze the intermediary role of LCTI. It will look at the relationship between the two (see Table 1). The data and sources are as follows. The first information about things like PGDP, LCTI, FDI, IND and CS comes from CNKI’s “China Economic and Social Development Statistical Database”. The preliminary information regarding the CEL, CAF and EF variables is taken from the China Statistical Yearbook, China Energy Statistical Yearbook and China Environment Statistical Yearbook. Some of the missing data are supplemented by China’s statistical yearbooks on cities, science and technology, and industrial economy, as well as the CS-MAR database. In addition, considering the heteroscedasticity and applicability of the data, this study takes natural logarithms for the selected variables. Table 1 gives a list of selected variables, descriptions, and symbols, while Table 2 gives descriptive statistical results for each variable data. As shown in Table 2, except for CAF, the averages of the other selected variables are positive, but PGDP has the greatest variability (volatility) relative to the other selected variables, followed by CLE, and EF has the lowest variability. Furthermore, according to the results of the Jarque-Bera test, all variables have a normal distribution at a significant level of 10%. Similarly, the hypothesis was verified by the VIF test results, and no multi-collinearity problem was found between them, because the variance inflation factors of the selected variables are all less than the empirical value of 10.

4 Empirical analysis and discussion

4.1 Spatial correlation checks

4.1.1 Results of the global spatial correlation tests

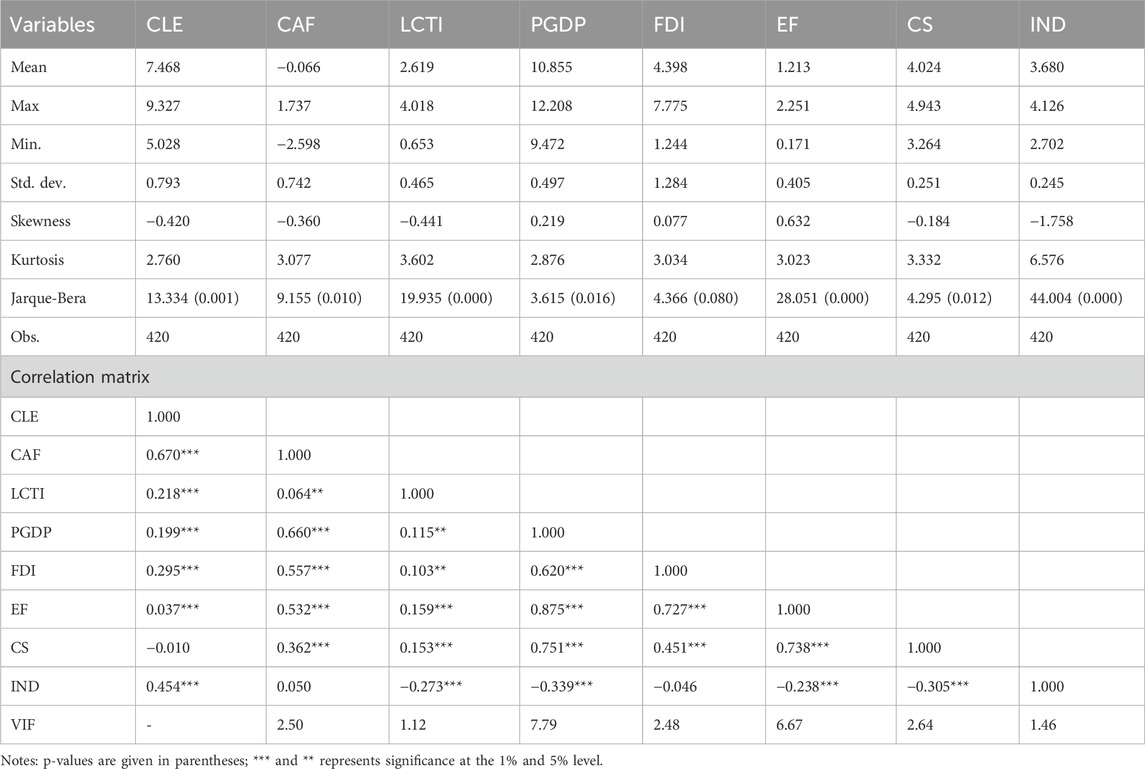

Before undertaking any spatial econometrics tests, it is necessary to use spatial autocorrelation analysis to check if the indicators of variables are autocorrelated or spatially interdependent, in order to improve the accuracy, precision and reliability of the test results. So, using Geary (1954) and Moran (1950), this paper is going to test the global spatial correlation between CAF and CLE using two methods, Moran’s I index and Geary’s C index. Table 3 provides approximations of local Moran’s I and Geary’s C indices for CAF and CLE for 30 provinces in China from 2010 to 2023, derived from the geographic connectivity matrix. The results show that the Geary’s C index of both CAF and CLE is greater than 0 under the geographical distance matrix, but their Moran’s I index is less than 0, except for that of CAF in 2023. In addition, the researchers accidentally found that the Moran’s I and Geary’s C indices of CAF and CLE from 2010 to 2023 were both significant at the significance level of 10%, indicating that both CAF and CLE have significant spatial autocorrelation. In other words, China’s CAF and CLE are not randomly distributed, but show spatial clustering among certain regions (areas). This means that areas with high levels of CAF development and CLE tend to be adjacent to other highly developed areas, but so do underdeveloped areas because of their apparent spatial dependence.

4.1.2 Results of the global spatial correlation tests

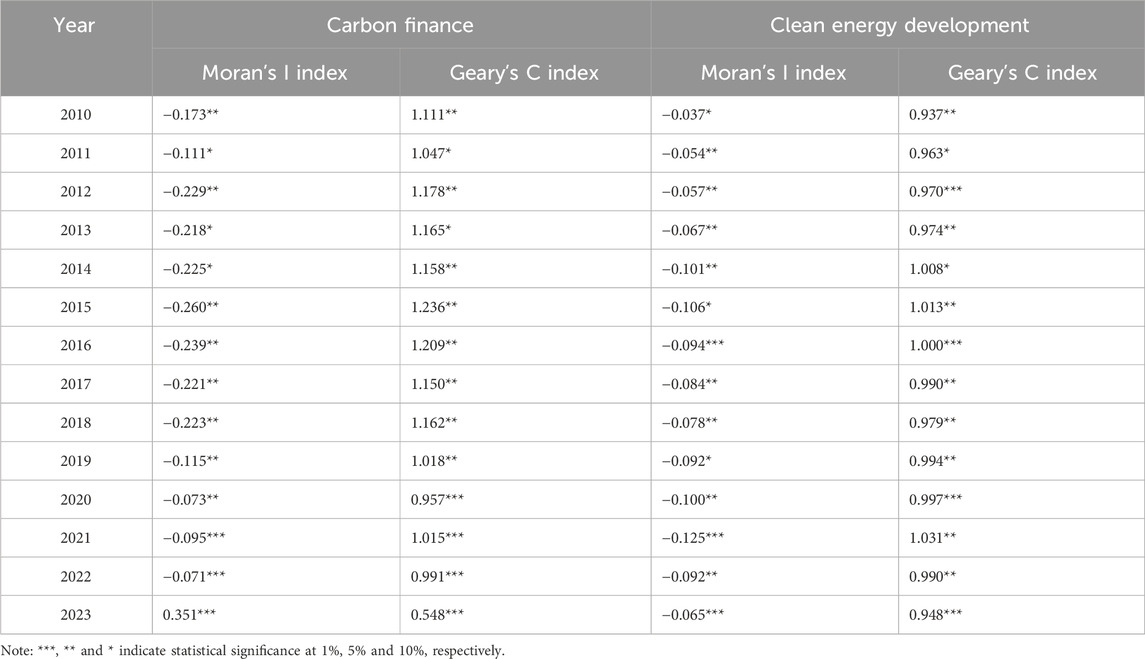

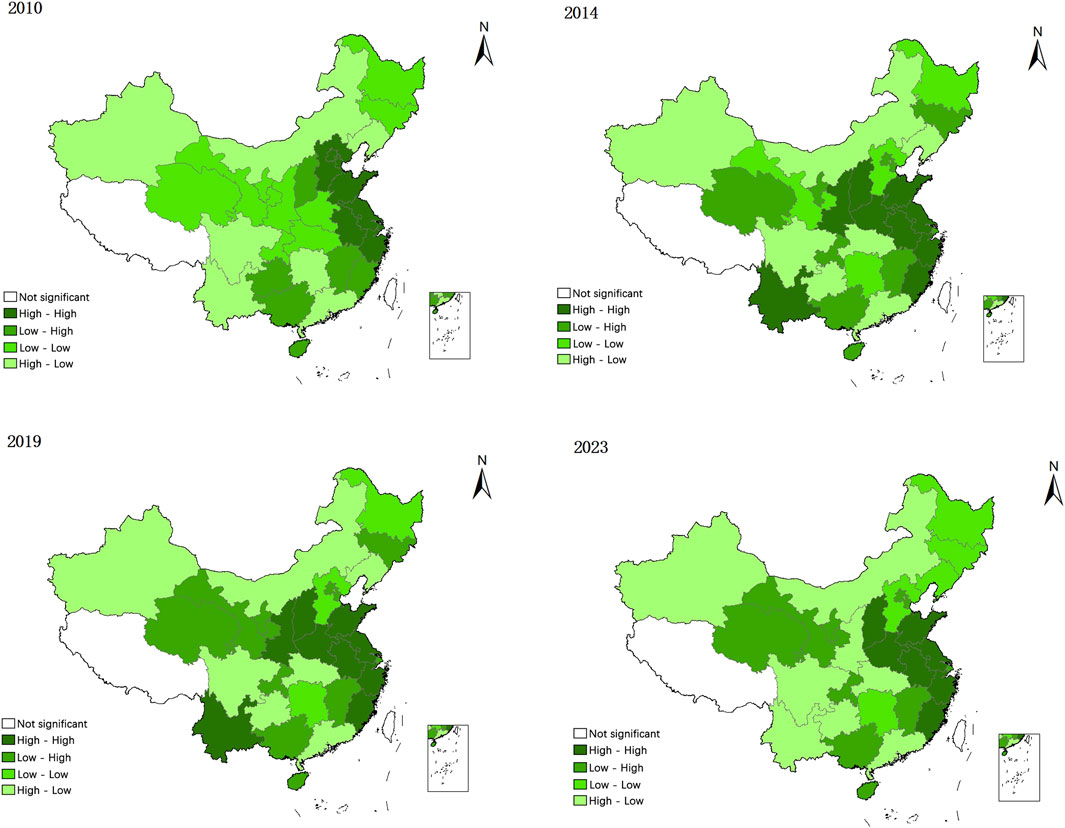

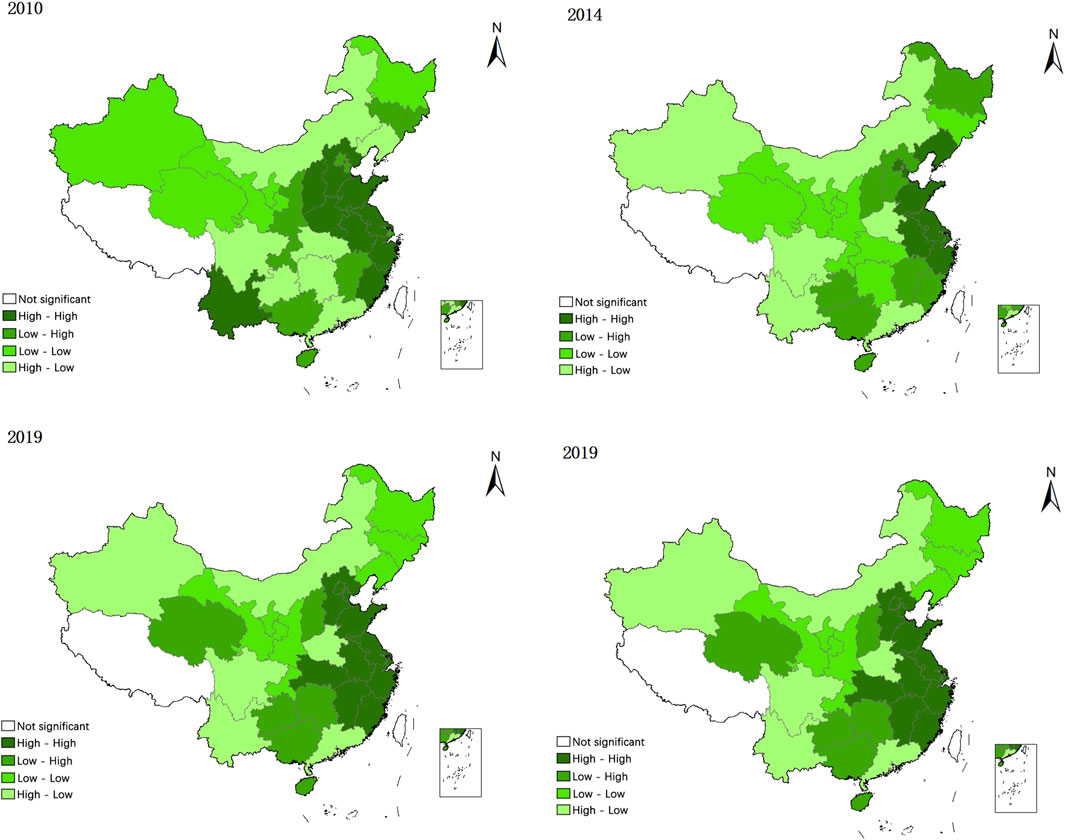

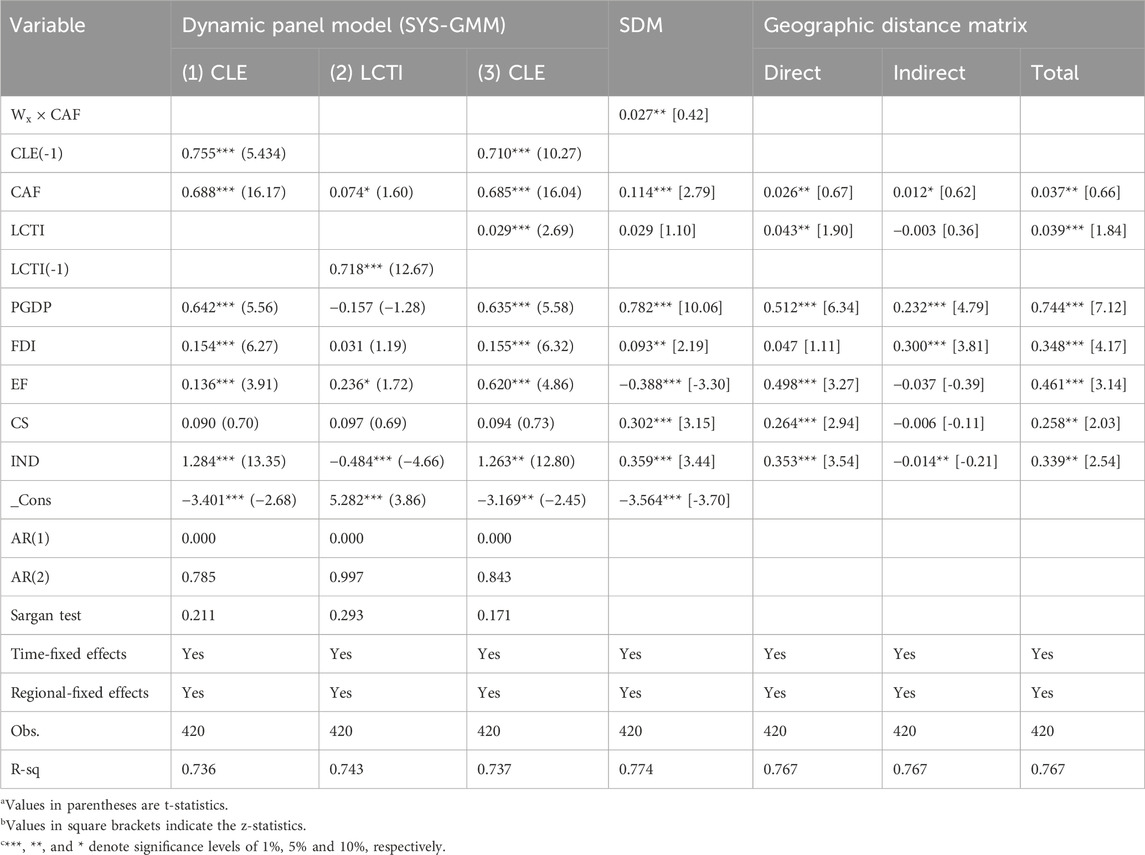

Having used Moran’s I and Geary’s C indices to confirm the existence of spatio-temporal correlation between CAF and CLE in China, we drew a LISA map based on Moran scatter plots to further explore this correlation and test the accuracy and reliability of the results. Figures 1, 2 present LISA maps of the spatial distribution of CAFs and CLEs for 2010, 2014, 2019 and 2023 under the geographic distance matrix based on Moran scatter plots, respectively. According to Figures 1, 2, the CAF and CLE in 30 provinces in China are divided among four types of agglomeration: high-high (H-H) conurbations are bordered by cities of the same high level; low-high (L-H) conurbations are bordered by low and high level; low-low (L-L) conurbations are bordered by low level; high-low (H-L) conurbations are bordered by high and low level provinces and cities. In addition, the researchers also noticed that both CAF and CLE agglomeration areas showed L-H or H-L spatial agglomeration evolution characteristics, but CAF in 2023 showed H-H or L-L spatial agglomeration evolution characteristics. Specifically, according to Figures 1, 2, under the geographical distance matrix, the spatial agglomeration area distribution characteristics of CAF and CLE are basically the same. Specifically, the H-H agglomeration areas of CAF and CLE are mainly distributed in the economically developed and populous eastern coastal areas, while the L-L agglomeration areas are mainly concentrated in the western, central and northeastern regions of China, but the spatial agglomeration areas of CLE are relatively scattered, involving relatively few provinces, which are mainly concentrated in the northeastern region. Moreover, the CAF and CLE and the L-H and H-L conurbations are mainly concentrated on the northern, central, southern, south-western, north-western, north-eastern and other provinces, but the number of CAFs and L-H conurbations is relatively small and they are relatively dispersed. To sum up, both CAF and CLE in China show obvious spatial correlation characteristics (hypotheses 1), for which the traditional econometric regression model is no longer applicable. In other words, quantitative empirical analysis must be carried out using spatial econometric models.

4.2 Verification and selection of spatial measurement models

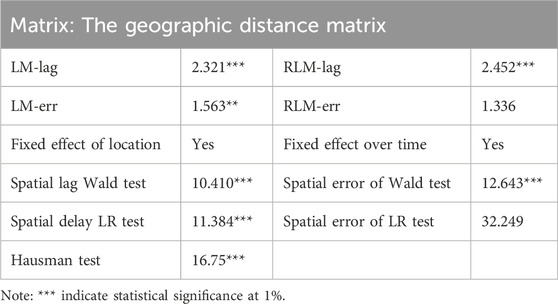

As previously mentioned, there are fundamentally three types of spatio-economic model: SAR, SEM and SDM. Whether the findings of this study are effective and valid depends on the appropriate model being chosen. Thus, in this study, with reference to the spatial model selection criterion proposed by Anselin and Florax (1995), the spatial autoregressive model (SAR) is determined to be the optimal choice when the LM-lag test results are more statistically significant than the LM-err and the RLM-lag is significant while the RLM-err is not. Conversely, if the statistical significance of LM-err is significantly higher than that of LM-lag, while RLM-err passes the significance test and RLM-lag fails, the spatial Durbin model (SDM) becomes a more appropriate modeling scheme (Zhao et al., 2022). According to Table 4, the significance level of the LM-err statistic is significantly better than the LM-lag statistic under the geographic distance matrix, while the R-LM-err statistics are statistically significant while the R-LM-lag statistic fails the significance test. For this reason, we believe that the SDM model is a better fit for this study than the SAR model.

Table 4. Testing results of the selection of spatial econometric models with geographic proximity matrices.

In addition, both time and space fixed effects passed the significance test, which verified the rationality and reliability of using a spatio-temporal double fixed effects model. Additionally, the statistics for the space delay in the Wald test, the space error in the Wald test, the space delay in the SEM model, and the space error in the SEM model are significant. However, Hausman’s test rejects null hypotheses (i.e., random effects), and a fixed-effects model should be chosen to estimate empirically. In summary, we chose the SDM model’s fixed effects in space-time for the baseline regression.

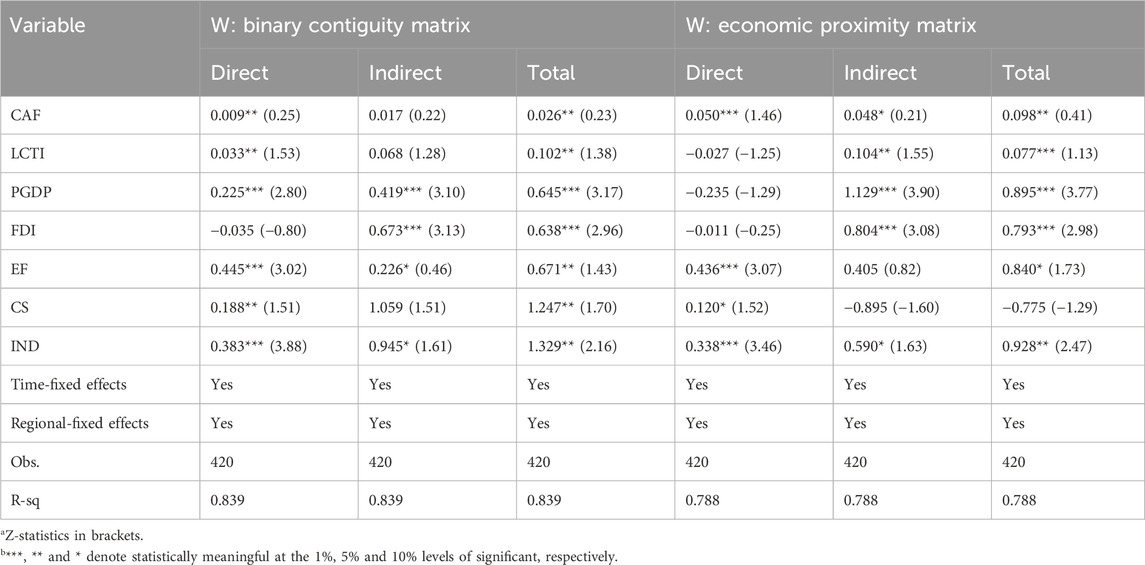

4.3 Structure CLE benchmark regression

Table 5 presents the benchmark regression results based on the SDM model and the mediating effect test. In order to investigate the influence of CAF on the development of CLE under different conditions, and how LCTI amplifies the promotion effect of CAF on the development of CLE, this study gradually integrates the control variables in the benchmark regression. First, the benchmark test of two-way fixed effects (column (1)) and the SYS-GMM regression results of CAF on CLE (column (2)) show that CAF development can promote LCTI progress. In addition, after gradually adding the LCTI mediating variable on the basis of column (1), the regression coefficient of column (3) is still positive and statistically significant at the significance level of 1%, which indicates that LCTI plays a mediating role (Rogge and Schleich, 2018), consistent with Hypothesis 3. Secondly, in the results of the spatial-temporal fixed effect of the SDM model, the researchers find that the coefficient of CAF is positive at a significance level of 1%, which shows that the development of carbon finance plays a decisive role in promoting the development of clean energy (Polzin et al., 2015). At the same time, it further shows that the rapid development of the CAF market is conducive to reducing risk exposure and establishing a good investment environment to promote investment in CLE (such as wind energy, solar energy and biomass energy, etc.) with mature low-carbon technologies, and this result is consistent with CAF’s impact on local CLE. The estimated coefficient of spatial spillover effect (

In addition, based on the geographic distance matrix, this study also gives the spatial spillover decomposition of the SDM model, including direct impact, indirect impact and total impact. From the perspective of impact paths, the direct impact, indirect impact and total impact of CAF, PGDP and FDI are basically consistent with the mediating effect test results based on Pooled OLS estimation. They all have a positive impact on CLE, but the impact paths of LCTI, EF, CS and IND are variable. Specifically, LCTI, EF, CS, and IND all significantly promote local CLE development, but significantly hinder the CLE development in adjacent areas (except LCTI, EF, and CS), and their total effects at the 5% significance level are 0.039, 0.461, 0.258, and 0.339, respectively. This conclusion is supported by the research conducted by Zhou and Li (2019), Geng et al. (2023), who believed that CAF could promote sustainable economic, social and environmental development by promoting LCTI progress with funds and resources to enhance the endogenous power of CLE development (Wang et al., 2024) and the Hypothesis 2 is tested. However, Shao et al. (2021) and Su et al. (2023) believed that there was a negative correlation between LCTI and CLE, which was mainly related to local CAF policies and industrial structures.

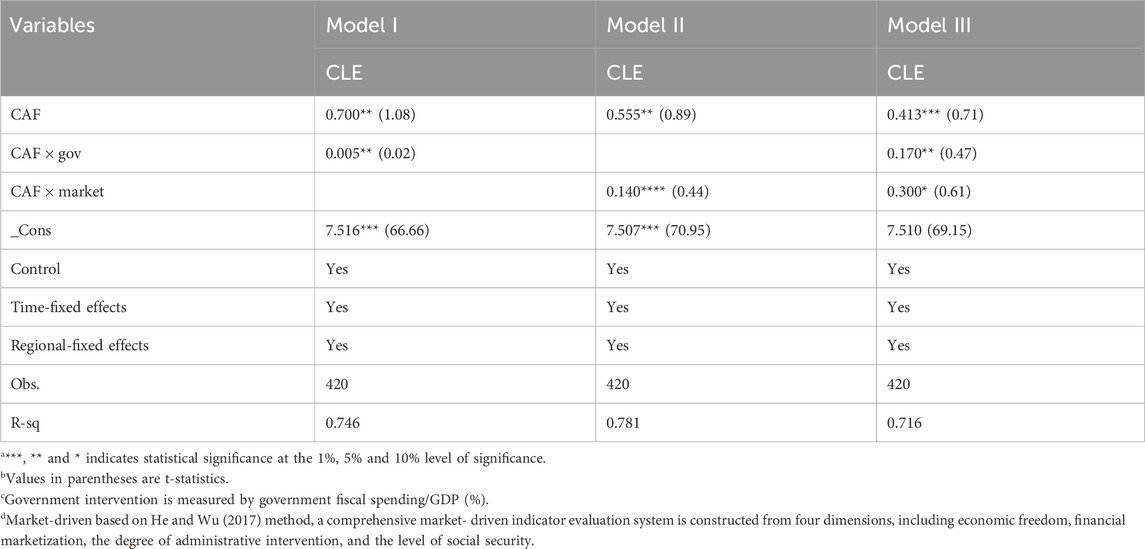

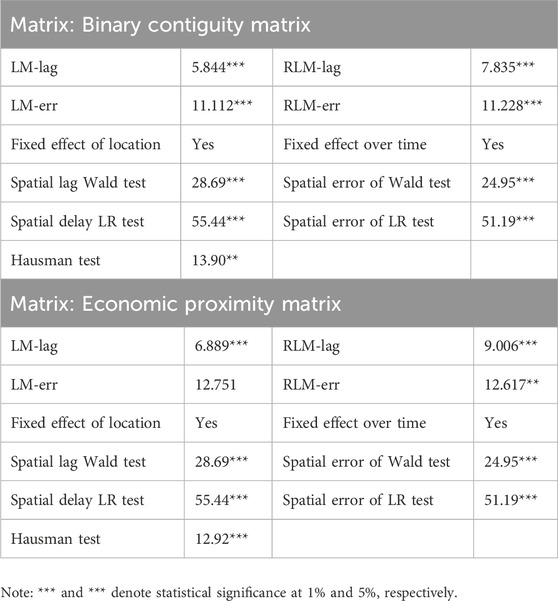

4.4 Robustness checks

To ensure the robustness of the results of the spatial econometric analysis, this study conducted a sensitivity test on the spatial weighting matrix. Based on the adoption of geographic proximity matrix in the baseline regression, two alternatives, binary adjacency matrix and economic distance matrix, are further introduced to validate the reliability of the research findings and to improve the credibility of the results by comparing the estimation results of the CAF on the spillover effect of CLE under different spatial weight settings. Generally speaking, the binary contiguity matrix is set according to whether two regions are adjacent to each other geographically. Theoretically, the interaction, or spatial correlation, between the two regions increases with the distance between them. Table 6 presents the results of the spatial econometric model tests based on the binary adjacency matrix and the economic distance matrix, whose coefficient directions and statistical significance are highly consistent with the test conclusions of the baseline regression model. On this basis, Table 7 further reports the regression estimation results of the CAF’s effect on the role of CLE under the two spatial weighting matrices. According to Table 7, taking the geographic matrix as an example, the direct, indirect, and total effects of CAF are 0.009, 0.017, and 0.026, respectively, but the indirect effect is insignificant and not statistically significant, which suggests that both local and neighboring CAFs contribute to the development of CLEs, while the positive effect is ignored because the neighboring areas are not statistically significant. Obviously, it is not necessarily wrong that this occurs because we have only focused on the significance of the indicator, a result supported by the studies of Qin et al. (2022) and Sun et al. (2022), who concluded that the indirect effect of CAF on CLE is lagged and asymmetric. Apparently, the level of CAF development in neighboring regions depends on the local environmental policy, and there is mutual imitation among regions, that is, the environmental policy behavior of a region will be “infected” to the surrounding neighboring regions, and there is often a certain degree of lag, or delayed, or neighbor avoidance of this behavior. On the other hand, except the direct effect of FDI, the direct effect, indirect effect and total effect of other variables are all positive and statistically significant, which is also confirmed by the regression results under the economic distance matrix. However, the difference is that under the economic matrix, the direct effect of LCTI and PGDP, the indirect effect of CS and the total effect are all negative, but not statistically significant.

Table 6. Contiguity matrix and economic proximity matrix test results for spatial econometric model selection.

4.5 Further analysis

4.5.1 Government intervention and market driven

Table 8 shows the regression results considering the impact of CAF on CLE under government intervention and market-driven conditions. First, in Model I, we only consider the influence of CAF on CLE under the condition of government intervention, and the results show that the influence coefficient of CAF on CLE is 0.700 at the significance level of 5%, while the coefficient of cross-term (

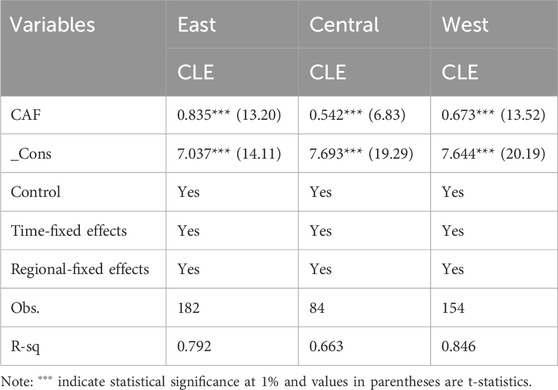

4.5.2 Regional heterogeneity

Within the framework of existing studies, this study further considers the characteristics of regional heterogeneity by dividing the 30 provincial-level administrative regions in mainland China (Hong Kong, Macau, Taiwan, and Tibet are not included due to data availability) into three major economic regions: the eastern coastal developed region (13 provinces), the central inland transition region (6 provinces), and the western remote underdeveloped region (11 provinces). Table 9 shows the results of estimating the effect of CAF on CLE under regional heterogeneity. The results show that the effects of CAF on CLE in the eastern, central and western regions are 0.835, 0.542 and 0.673, respectively, with positive signs and all are statistically significant at the 1% significance level. This finding further confirms that there is significant regional variability in the effects of CAF, and that the magnitude of its impact is characterized by an unbalanced distribution across regions. Hypothesis 1 is tested.

4.6 Discussion

Due to global warming and the frequent occurrence of extreme weather, the coordination of environmental protection and economic growth have become a common concern of the international community, and it has become a consensus to solve this problem by using property rights theory to build a multi-level CO2 trading market through government multilateral agreements (Huang, 2022; Zhou eta al., 2024). Therefore, based on the perspective of low-carbon technological innovation, this study aims to explore the impact of CAF on the development of CLE in China in the context of “carbon neutrality” in multiple dimensions and through multiple methods, to make up for the shortcomings of existing research. Firstly, this study found that CAF has a positive spatial spillover effect on CLE from a multi-level, multi-dimensional and multi-regional perspective, which is consistent with the research conclusions drawn by Lewis (2010), Guo et al. (2021), Yu et al. (2022) and Wang et al. (2023). The results show that CAF can not only promote the development of local CLE under the nearest neighbor matrix, geographical matrix and economic matrix, but also promote the development of adjacent areas. However, the impact on adjacent areas is relatively weak, mainly because in regional space, such as urban agglomerations, cities are relatively close to and interconnected with one another, and there are many possibilities their interaction in terms of industry and space. Therefore, there is a strong imitation learning effect between adjacent regions, which is very likely to form an isomorphism of industries, making it possible for similar or identical industries to gather in space (Xu et al., 2023). However, although the regional space within the urban agglomeration has a certain degree of similarity, it does not mean that the regions are homogeneous, so this imitation effect is often lagging or delayed, or neighbor avoidance, which makes it possible to have a certain degree of spatial heterogeneity. Nevertheless, this finding is again contrary to the findings of Li et al. (2022), Zhou et al. (2022), and Lian et al. (2024), who concluded that CAF aggregation inhibited CLE development and showed an inverted “U” shaped relationship in the regionally and spatially relevant domains, but that this effect waned over time. It seems that these studies have ignored that CAF has broken through the boundaries of traditional financial activities, and to some extent has realized the information flow and cross-time and space interaction between CLE, economy and environment. Specifically, the rapid development of CAF can effectively solve the typical negative externality problem of greenhouse gas emissions, and is a mainstream choice to promote CO2 emission reduction and achieve carbon neutrality. At the same time, the CAF market can guide funds (for example, FDI) to flow to green and low-carbon fields, providing necessary financial support for the development of CLE.

Secondly, CAF is “anchored on the advantages of policy and market, with effective market and active government promoting each other”, which implies that the market and the government play a pivotal role in the sustainable development and effects of CAF. Therefore, this study analyzes the mechanism of CAF’s effect on the sustainable development of CLE from the dual dimensions of GOV and MARK. The empirical results show that although both GOV and MARK can enhance the promotion effect of CAF on CLE, the moderating effect of MARK is significantly stronger than that of GOV. This conclusion is similar to the findings of Du et al. (2023) and Guo et al. (2023), who suggest that CAF does not rely on a single driver throughout the process of CEL development, but rather is driven by an alternation of policy factors (GOV) and market factors (MARK), which work together, but the driving role of GOV is diminishing over time. Similarly, this finding is also contrary to the findings of Wang et al. (2021), Gao and Yuan (2022), Wu et al. (2023), who believed that GOV suppressed this positive impact effect and had a nonlinear “U-shaped relationship”. One possible explanation is that in the context of “carbon neutrality”, the development of CAF and CLE stems from the strategic choices of governments. Since the majority of current CO2 emissions come mainly from fossil energy consumption, the development of the CAF market has greatly promoted the implementation of CO2 emission reduction plans in countries around the world, playing a very significant role in enhancing the distribution of ecological and environmental funds, advancing the change of development methods, and realizing the balanced and sustainable economic, social and environmental development. In other words, CAF is becoming a new engine driving the development of the low-carbon economy. Driving the structural transformation of the energy industry and promoting the low-carbon green transformation and development of the energy industry with the carbon market as a carrier are not only an urgent need in reality, but also the development direction of industries, which will help realize the goal of “carbon neutrality” (Zhao et al., 2023).

Finally, considering that the existence of spatial heterogeneity may cause the impact of CAF on CLE development to manifest itself differently in different regions, based on the way of dividing geographic location and city size, we explore the heterogeneous impact of CAF on CLE development in the three dimensions of the eastern, central, and western regions, respectively. The study found that CAF had the largest impact effect in the eastern region, the smallest in the central region, and the second-largest in the western region. The main reason for this result is that, on the one hand, the eastern region has a higher scale of carbon investment and financing, a higher efficiency per unit of emission reduction projects, and is in the forefront of the country in promoting the development of economic decarbonization and financial decarbonization, which to a certain extent reflects the rapid development of CAF in the eastern region as compared with the other regions, and the regional distribution of CAF development is basically consistent with the current distribution trend of China’s financial agglomeration level from east to west, and is also highly correlated with the spatial distribution of different financial industry agglomerations. On the other hand, although there is a big gap between the development level of CAF in the western region and that in the eastern region, there is a strong national policy and resource preference for this region, and it has a significant late-mover advantage. Therefore, the CAF market construction process in the western region is fast, and CAF plays the most obvious role in narrowing the regional gap in CLE development. In addition, the central region has comparative advantages in coal and hydropower resources, and is an important energy production and export base in China. However, the CO2 trading market in the central region is still in the early stages of development, so that the trading is not active and the degree of financialization is not high, but the gap in the level of CAF development among the provinces and cities in the central region is small, so CAF has played a driving role in narrowing the development of the provinces and cities in the central region. The reason is that the function of the CAF market has not yet been fully established, and it cannot give full play to the optimization of resource allocation. Therefore, the development of CLTI, which mainly relied on government financial incentives in the early stage, allows the CAF market to promote the development of CLE by encouraging investors, power producers and consumers to choose cleaner and more diversified power sources (Wang et al., 2014).

5 Conclusion and policy recommendations

Against the background of the rapid development of carbon finance market and the green transformation of the energy industry in China, this study constructs the impact mechanism of the relationship between carbon finance and clean energy development from the three perspectives of carbon finance, clean energy development and low-carbon technological innovation, and at the same time, using the panel data of 30 provinces in China in 2010–2023 and spatial econometric modeling, we examined the regional heterogeneity and asymmetry of carbon finance on clean energy development from a multilevel, multidimensional and multiregional viewpoint, and further investigated the mediating role of low-carbon technological innovations between the two. The study finds that the positive impact of carbon finance on local clean energy development is much greater than that on neighbouring regions, both in the proximity matrix, geographic matrix and economic matrix frameworks, and in the multidimensional framework, and provides further evidence that low-carbon technological innovation is the main path of action to promote sustainable clean energy development. It is clear that carbon finance initiatives play a key role in promoting clean energy development, and their impact is regulated by market-driven, government-intervened energy efficiency strategic initiatives, but it seems that the positive impact of market driving is far greater than that of government intervention. In addition, the positive impact of carbon finance on clean energy development has been confirmed by a series of robustness tests, and under the condition of considering the existence of spatial and regional heterogeneity, carbon finance has the greatest impact in the eastern region and the smallest in the central region. The main reason is that the level of carbon finance aggregation and the degree of carbon market segmentation in the eastern region are relatively high, so that the positive impact of carbon finance seems to be stronger, and vice versa.

We hope that this study will provide relevant empirical evidence and new theoretical insights for promoting clean energy development in emission-intensive economies such as China As well as based on the above findings, we emphasize the following policy implications.

Firstly, financial support for clean energy transformation should be increased and financing channels should be broadened. Making full use of multi-level financial products and market systems at home and abroad, relying on carbon finance, science and technology finance and other support policies and tools, energy enterprises can further enrich their external financing channels and reduce capital costs. Secondly, tap the space of domestic and foreign markets to enhance the level of internationalization. In terms of utilizing the domestic capital market, energy enterprises can give full play to the role of listed platforms to enhance the level of asset securitization. Taking advantage of listed companies as the fulcrum, increase the specialization and integration, promote more high-quality resources to listed companies to converge, and strengthen market value management. Thirdly, optimize the structure of capital supply and enhance support for key areas and weak links in the clean energy transition. Based on the advantage of the financial platform in docking with the market, it has actively promoted the effective convergence and synergistic development of green finance, transition finance and inclusive finance, dynamically adjusted the scope of support for relevant policies, and increased support for the technical reform of coal and power generation to reduce carbon emissions, the research and development of low-carbon technologies, and the updating of power industry equipment. Finally, give full play to the role of the market mechanism and improve the efficiency of carbon financial resource allocation in the field of clean energy transition. To promote the development of green and transition finance, it is necessary to improve the standard system, accelerate the promotion of pilots, clarify the areas and technical paths supported by transition finance, and establish a unified carbon emission accounting system to provide data support for green investment and financing. At the same time, the scope of mandatory environmental information disclosure should be expanded to promote standardized disclosure by energy enterprises, strengthen green data sharing, reduce information asymmetry, and enhance the efficiency of financial resource allocation.

However, this study still has some limitations that need to be eliminated in future studies. For example, this study only examines the impact of carbon finance on clean energy development and its regional heterogeneity from the perspective of low-carbon technological innovation in two dimensions: government intervention and market drive. However, many other possible influencing factors have not been taken into account, such as environmental legislation (environmental regulation), energy efficiency governance, marketization, government policies, the potential of environmental regulators, and research and development. In future research, more research work is needed to investigate how these factors amplify or suppress the role of carbon finance in promoting clean energy development. In addition, this study investigated the situation in China using only single data, but a single country may not be sufficient to provide reliable and valid data support, for this reason there is a need to include more economies in the future in the current research framework to improve the reliability of the results.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

RC: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Resources, Software, Writing – original draft, Writing – review and editing. YH: Conceptualization, Data curation, Funding acquisition, Investigation, Methodology, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review and editing. YJ: Data curation, Formal Analysis, Investigation, Methodology, Supervision, Validation, Visualization, Writing – review and editing. HZ: Data curation, Formal Analysis, Investigation, Methodology, Supervision, Validation, Visualization, Writing – review and editing. SL: Conceptualization, Data curation, Formal Analysis, Methodology, Resources, Software, Supervision, Validation, Visualization, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the Social Science Foundation of Jiangsu Province (24ZHB001) and Social Science Fund of Jiangsu University of Technology (KYY22505).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2025.1528983/full#supplementary-material

References

Aglietta, M., Hourcade, J. C., Jaeger, C., and Fabert, B. P. (2015). Financing transition in an adverse context: climate finance beyond carbon finance. Int. Environ. agreements Polit. law Econ. 15, 403–420. doi:10.1007/s10784-015-9298-1

Anselin, L., and Florax, R. J. (1995). “New directions in spatial econometrics: introduction,” in New directions in spatial econometrics, 3–18. doi:10.1007/978-3-642-79877-1_1

Antunes, J., Hadi-Vencheh, A., Jamshidi, A., Tan, Y., and Wanke, P. (2024). Efficiency of low-carbon finance: its interrelationships with industry and macroeconomic environment. J. Knowl. Econ. 15, 15328–15364. doi:10.1007/s13132-023-01658-2

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 87 (1), 115–143. doi:10.1016/S0304-4076(98)00009-8

Blundell, R., and Bond, S. (2023). Reprint of: initial conditions and moment restrictions in dynamic panel data models. J. Econ. 234, 38–55. doi:10.1016/j.jeconom.2023.03.001

Bredin, D., Hyde, S., and Muckley, C. (2014). A microstructure analysis of the carbon finance market. Int. Rev. Financial Analysis 34, 222–234. doi:10.1016/j.irfa.2014.03.003

Bridge, G., Bulkeley, H., Langley, P., and van Veelen, B. (2020). Pluralizing and problematizing carbon finance. Prog. Hum. Geogr. 44 (4), 724–742. doi:10.1177/0309132519856260

Chien, F., Vu, T. L., Phan, T. T. H., Van Nguyen, S., Anh, N. H. V., and Ngo, T. Q. (2023). Zero-carbon energy transition in ASEAN countries: the role of carbon finance, carbon taxes, and sustainable energy technologies. Renew. Energy 212, 561–569. doi:10.1016/j.renene.2023.04.116

Dong, F., Hu, M., Gao, Y., Liu, Y., Zhu, J., and Pan, Y. (2022). How does digital economy affect carbon emissions? Evidence from global 60 countries. Sci. Total Environ. 852, 158401. doi:10.1016/j.scitotenv.2022.158401

Du, J., Shen, Z., Song, M., and Vardanyan, M. (2023). The role of green financing in facilitating renewable energy transition in China: perspectives from energy governance, environmental regulation, and market reforms. Energy Econ. 120, 106595. doi:10.1016/j.eneco.2023.106595

Feng, L., Shang, S., An, S., and Yang, W. (2022). The spatial heterogeneity effect of green finance development on carbon emissions. Entropy 24 (8), 1042. doi:10.3390/e24081042

Gao, K., and Yuan, Y. (2022). Does market-oriented reform make the industrial sector “greener” in China? Fresh evidence from the perspective of capital-labor-energy market distortions. Energy 254, 124183. doi:10.1016/j.energy.2022.124183

Geary, R. C. (1954). The contiguity ratio and statistical mapping. incorporated statistician 5 (3), 115–146. doi:10.2307/2986645

Geng, L., Hu, J., and Shen, W. (2023). The impact of carbon finance on energy consumption structure: evidence from China. Environ. Sci. Pollut. Res. 30 (11), 30107–30121. doi:10.1007/s11356-022-24303-y

Gu, G., Zheng, H., Tong, L., and Dai, Y. (2022). Does carbon financial market as an environmental regulation policy tool promote regional energy conservation and emission reduction? Empirical evidence from China. Energy Policy 163, 112826. doi:10.1016/j.enpol.2022.112826

Guo, Q., Su, Z., and Chiao, C. (2021). Carbon emissions trading policy, carbon finance, and carbon emissions reduction: evidence from a quasi-natural experiment in China. Econ. Change Restruct. 55, 1445–1480. doi:10.1007/s10644-021-09353-5

Guo, W., Yang, B., Ji, J., and Liu, X. (2023). Green finance development drives renewable energy development: mechanism analysis and empirical research. Renew. Energy 215, 118982. doi:10.1016/j.renene.2023.118982

Hao, Y., Jiang, Y., and Lv, S. (2025). Can the digital economy effectively contribute to the clean energy transition? A provincial panel data analysis from China. Environ. Innovation Soc. Transitions 56, 101003. doi:10.1016/j.eist.2025.101003

He, G., and Wu, X. (2017). Marketization, occupational segregation, and gender earnings inequality in urban China. Soc. Sci. Res. 65, 96–111. doi:10.1016/j.ssresearch.2016.12.001

Huang, D. (2022). Green finance, environmental regulation, and regional economic growth: from the perspective of low-carbon technological progress. Environ. Sci. Pollut. Res. 29 (22), 33698–33712. doi:10.1007/s11356-022-18582-8

Jiang, Z., and Xu, C. (2023). Policy incentives, government subsidies, and technological innovation in new energy vehicle enterprises: evidence from China. Energy Policy 177, 113527. doi:10.1016/j.enpol.2023.113527

Kaifeng, L., and Chuanzhe, L. (2011). Construction of carbon finance system and promotion of environmental finance innovation in China. Energy Procedia 5, 1065–1072. doi:10.1016/j.egypro.2011.03.188

Kameyama, Y., Morita, K., and Kubota, I. (2016). Finance for achieving low-carbon development in Asia: the past, present, and prospects for the future. J. Clean. Prod. 128, 201–208. doi:10.1016/j.jclepro.2014.12.089

Labatt, S., and White, R. R. (2011). Carbon finance: the financial implications of climate change. John Wiley and Sons.

Lehmann, P., and Gawel, E. (2013). Why should support schemes for renewable electricity complement the EU emissions trading scheme? Energy Policy 52, 597–607. doi:10.1016/j.enpol.2012.10.018

Lewis, J. I. (2010). The evolving role of carbon finance in promoting renewable energy development in China. Energy Policy 38 (6), 2875–2886. doi:10.1016/j.enpol.2010.01.020

Li, C., Fan, X., Hu, Y., Yan, Y., Shang, G., and Chen, Y. (2022). Spatial spillover effect of green finance on economic development, environmental pollution, and clean energy production across China. Environ. Sci. Pollut. Res. 29 (58), 87858–87873. doi:10.1007/s11356-022-21782-x

Li, G., Wu, H., Jiang, J., and Zong, Q. (2023). Digital finance and the low-carbon energy transition (LCET) from the perspective of capital-biased technical progress. Energy Econ. 120, 106623. doi:10.1016/j.eneco.2023.106623

Lian, Y., Shang, Y., and Qian, F. (2024). RETRACTED ARTICLE: spatial effects of green finance development in Chinese provinces under the context of high-quality energy development. Econ. Change Restruct. 57 (2), 23. doi:10.1007/s10644-024-09600-5

Lin, B., and Zhang, A. (2023). Government subsidies, market competition and the TFP of new energy enterprises. Renew. Energy 216, 119090. doi:10.1016/j.renene.2023.119090

Madaleno, M., Dogan, E., and Taskin, D. (2022). A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 109, 105945. doi:10.1016/j.eneco.2022.105945

Matsuo, T., and Schmidt, T. S. (2017). Hybridizing low-carbon technology deployment policy and fossil fuel subsidy reform: a climate finance perspective. Environ. Res. Lett. 12 (1), 014002. doi:10.1088/1748-9326/aa5384

Mohsin, M., Taghizadeh-Hesary, F., Panthamit, N., Anwar, S., Abbas, Q., and Vo, X. V. (2021). Developing low carbon finance index: evidence from developed and developing economies. Finance Res. Lett. 43, 101520. doi:10.1016/j.frl.2020.101520

Moran, P. A. (1950). Notes on continuous stochastic phenomena. Biometrika 37 (1/2), 17–23. doi:10.2307/2332142

Polzin, F., Migendt, M., Täube, F. A., and von Flotow, P. (2015). Public policy influence on renewable energy investments—A panel data study across OECD countries. Energy policy 80, 98–111. doi:10.1016/j.enpol.2015.01.026

Qin, M., Su, C. W., Zhong, Y., Song, Y., and Lobonț, O. R. (2022). Sustainable finance and renewable energy: promoters of carbon neutrality in the United States. J. Environ. Manag. 324, 116390. doi:10.1016/j.jenvman.2022.116390

Requate, T., and Unold, W. (2003). Environmental policy incentives to adopt advanced abatement technology:. Eur. Econ. Rev. 47 (1), 125–146. doi:10.1016/S0014-2921(02)00188-5

Rogge, K. S., and Schleich, J. (2018). Do policy mix characteristics matter for low-carbon innovation? A survey-based exploration of renewable power generation technologies in Germany. Res. Policy 47 (9), 1639–1654. doi:10.1016/j.respol.2018.05.011

Shahbaz, M., Wang, J., Dong, K., and Zhao, J. (2022). The impact of digital economy on energy transition across the globe: the mediating role of government governance. Renew. Sustain. Energy Rev. 166, 112620. doi:10.1016/j.rser.2022.112620

Shao, X., Zhong, Y., Liu, W., and Li, R. Y. M. (2021). Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 296, 113189. doi:10.1016/j.jenvman.2021.113189

Su, C. W., Liu, F., Stefea, P., and Umar, M. (2023). Does technology innovation help to achieve carbon neutrality? Econ. Analysis Policy 78, 1–14. doi:10.1016/j.eap.2023.01.010

Sun, Y., Guan, W., Cao, Y., and Bao, Q. (2022). Role of green finance policy in renewable energy deployment for carbon neutrality: evidence from China. Renewable Energy, 197, 643–653. doi:10.1016/j.renene.2022.07.164

Tang, X., and Zhou, X. (2023). Impact of green finance on renewable energy development: a spatiotemporal consistency perspective. Renew. Energy 204, 320–337. doi:10.1016/j.renene.2023.01.012

Wan, Y., Sheng, N., Wei, X., and Su, H. (2023). Study on the spatial spillover effect and path mechanism of green finance development on China's energy structure transformation. J. Clean. Prod. 415, 137820. doi:10.1016/j.jclepro.2023.137820

Wang, J., Luo, X., and Zhu, J. (2022). Does the digital economy contribute to carbon emissions reduction? A city-level spatial analysis in China. Chin. J. Popul. Resour. Environ. 20 (2), 105–114. doi:10.1016/j.cjpre.2022.06.001

Wang, K. L., Zhao, B., Ding, L. L., and Miao, Z. (2021). Government intervention, market development, and pollution emission efficiency: evidence from China. Sci. Total Environ. 757, 143738. doi:10.1016/j.scitotenv.2020.143738

Wang, T., Gong, Y., and Jiang, C. (2014). A review on promoting share of renewable energy by green-trading mechanisms in power system. Renew. Sustain. Energy Rev. 40, 923–929. doi:10.1016/j.rser.2014.08.011

Wang, Z., Cao, X., Ren, X., and Gozgor, G. (2024). Digital finance and the energy transition: evidence from Chinese prefecture-level cities. Glob. Finance J. 61, 100987. doi:10.1016/j.gfj.2024.100987

Wu, S., Qu, Y., Huang, H., and Xia, Y. (2023). Carbon emission trading policy and corporate green innovation: internal incentives or external influences. Environ. Sci. Pollut. Res. 30 (11), 31501–31523. doi:10.1007/s11356-022-24351-4

Xu, J., Wang, J., Li, R., and Gu, M. (2023). Is green finance fostering high-quality energy development in China? A spatial spillover perspective. Energy Strategy Rev. 50, 101201. doi:10.1016/j.esr.2023.101201

Yu, X., and Lo, A. Y. (2015). Carbon finance and the carbon market in China. Nat. Clim. Change 5 (1), 15–16. doi:10.1038/nclimate2462

Yu, X., Zhou, Y., and Liu, X. (2022). Impact of financial development on energy consumption in China: a spatial spillover analysis. Energy Strategy Rev. 44, 100975. doi:10.1016/j.esr.2022.100975

Zhang, N., Yu, K., and Chen, Z. (2017). How does urbanization affect carbon dioxide emissions? A cross-country panel data analysis. Energy Policy 107, 678–687. doi:10.1016/j.enpol.2017.03.072

Zhao, J., Jiang, Q., Dong, X., Dong, K., and Jiang, H. (2022). How does industrial structure adjustment reduce CO2 emissions? Spatial and mediation effects analysis for China. Energy Econ. 105, 105704. doi:10.1016/j.eneco.2021.105704

Zhao, S., Zhang, L., An, H., Peng, L., Zhou, H., and Hu, F. (2023). Has China's low-carbon strategy pushed forward the digital transformation of manufacturing enterprises? Evidence from the low-carbon city pilot policy. Environ. Impact Assess. Rev. 102, 107184. doi:10.1016/j.eiar.2023.107184

Zhao, Y., Sun, H., and Ma, D. (2024). Exploring the impact of carbon finance policy on photovoltaic market development–An experience from China. Sol. Energy 272, 112494. doi:10.1016/j.solener.2024.112494

Zhong, C., Hao, Y., Wang, C., and Wang, L. (2024). Analysis of regional differences and spatial and temporal evolution of tourism carbon emissions in China: considering carbon sink effect. Curr. Issues Tour. 28, 1282–1305. doi:10.1080/13683500.2024.2331075

Zhou, K., and Li, Y. (2019). Carbon finance and carbon market in China: progress and challenges. J. Clean. Prod. 214, 536–549. doi:10.1016/j.jclepro.2018.12.298

Zhou, M., and Li, X. (2022). Influence of green finance and renewable energy resources over the sustainable development goal of clean energy in China. Resour. Policy 78, 102816. doi:10.1016/j.resourpol.2022.102816

Zhou, Q., Cui, X., Ni, H., Gong, L., and Mao, S. (2024). The impact of China's carbon trading policy on enterprises' energy-saving behavior. Heliyon 10 (2). doi:10.1016/j.heliyon.2024.e2432

Keywords: carbon finance, clean energy development, low-carbon technology innovation, spatial econometric model, mediated effect

Citation: Cui R, Hao Y, Jiang Y, Zhang H and Lv S (2025) Has carbon finance been able to promote clean energy development? — a low-carbon technology innovation perspective. Front. Environ. Sci. 13:1528983. doi: 10.3389/fenvs.2025.1528983

Received: 15 November 2024; Accepted: 04 July 2025;

Published: 22 July 2025.

Edited by:

Jinyu Chen, Central South University, ChinaReviewed by:

Mohamed R. Abonazel, Cairo University, EgyptEda Bozkurt, Atatürk University, Türkiye

Ali Altıner, Recep Tayyip Erdoğan University, Türkiye

Copyright © 2025 Cui, Hao, Jiang, Zhang and Lv. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuanyuan Hao, aGFveXlAanN1dC5lZHUuY24=

†ORCID: Yuanyuan Hao, orcid.org/0000-0002-4990-4380

Rui Cui1

Rui Cui1 Yuanyuan Hao

Yuanyuan Hao