- 1Management Studies Department, Bahria Business School, Bahria University, Islamabad, Pakistan

- 2Department of Economics, College of Business Administration, Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia

The significance of environmental taxes (ET) and green innovation has become paramount, particularly in light of the post-COP27 objectives and SDGs. This research contributes to the existing body of literature by exzuing the effects of environmental taxes (13), green innovation (SDG-9), green taxes, and financial development (SDG-17) on sustainable environmental quality. Furthermore, this study also investigated the moderating effect of green innovation on the relationship between environmental technologies and GHG emissions. The research utilized data from 36 OECD countries, covering the period from 1990 to 2020, employing DOLS (Dynamic Ordinary Least Square), FMOLS (Fully Modified Ordinary Least Square), and CCR (Canonical Cointegration Regression) methods to evaluate the long-run relationship among the variables. Further, Method of Moment Quantile Regression (MMQR) approach is also employed to reflect the diversity in the association patterns among variables at varying quantiles. Non-parametric BSQR (Bootstrapped Quantile Regression) approach is used to check the robustness of the results. The results demonstrate that the parameters remain consistent in terms of their differences, and there is evidence of long-term cointegration among the variables. The study revealed that the implementation of ET, environmental innovation, financial development, and trade openness has a significant impact on reducing GHG emissions. Moreover, green innovation moderates the association of environmental technologies and GHG emissions. Based on the estimations, the research offers pertinent policy recommendations to policymakers about environmental sustainability. It is crucial to include regulatory policies that promote the use of ET and the adoption of green innovative technologies and investments in the agenda of environmental technological progress to accelerate green technology innovation in OECD countries.

1 Introduction

In response to the detrimental effects of climate change caused by intensified economic activities and a corresponding rise in consumption of energy from industrial development, economies are formulating strategies to mitigate GHG emissions. The strategies comprise eco-innovation, green tax policy, carbon pricing, and the execution of green innovative technology (Marwat et al., 2023). Implementing green strategies can serve as an effective curative for an environment. Green approaches are based on using renewable resources that are closely aligned with environmental sustainability. This approach prioritizes the attainment of SDGs (Bergoiugui and Meziane, 2025; Chakraborty et al., 2025). Ecologists emphasize the need for countries to update their conventional business practices with environmentally friendly technologies to protect the globe from the harmful effects of environmental deterioration (Bontempi et al., 2021; Olabi et al., 2023; Kumar et al., 2025). Studies over the past few years have also highlighted the urgency of integrating sustainable business models that not only reduce emissions but also promote environmental stewardship in industrial operations (Liu et al., 2024). Innovative environmental technology plays a crucial role in developing a low-emission economy. Sustainable innovation incorporates several scientific developments, regulatory frameworks, and corporate strategies to reduce negative environmental effects, improve resource efficiency, and foster sustainable development. Innovative environmental technologies have a positive effect on the reduction of GHG emissions through developing green technologies, sustainable energy, and resource management (Walsh et al., 2022). Despite these advancements, there remain substantial inconsistencies regarding the efficiency of these technologies in various economic contexts, and further studies are required to address these discrepancies.

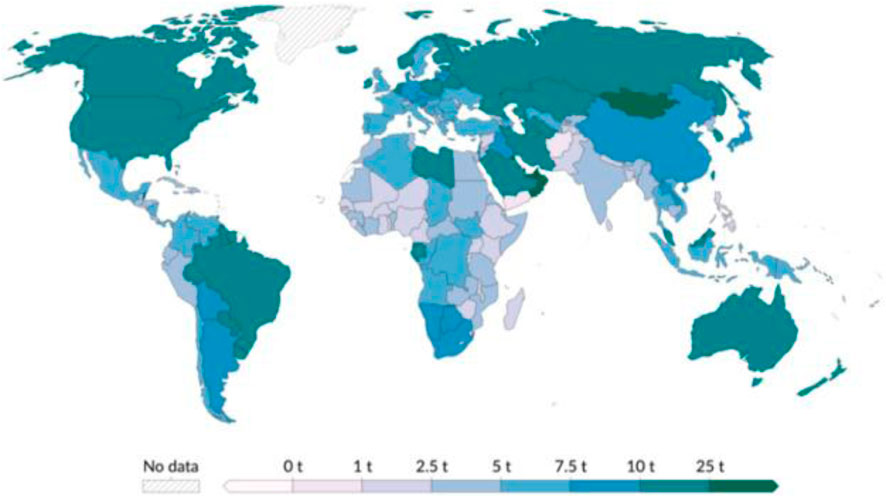

To effectively address global greenhouse gas (GHG) emissions and safeguard environmental resources, it is imperative to foster innovation and extensively use green technologies. Attributes associated with green technologies have a substantial impact on reducing GHGs (Marini Govigli et al., 2022), which have negative effects on natural resources and human wellbeing. R&D departments demonstrate that the implementation of green technologies leads to the creation of advanced systems that have lower levels of pollution and minimize the waste of raw materials, water, and gases (Sharif et al., 2023). Enclosures of this nature enhance the efficacy and efficiency of businesses (Han et al., 2025; Islam, 2025). Nonetheless, a key gap in the literature is the lack of comprehensive analyses on the moderating role of green innovation in advancing the effectiveness of these technologies in reducing emissions. However, advancements in green technologies not only pertain to advanced technical developments but also extend to home and commercial businesses to support their specialized machinery. The notion has been fully accepted by industrialized countries, particularly OECD countries (Wang B. et al., 2023). These countries prioritize the cultivation of socially egalitarian innovative equipment that requires minimal energy and thrives in distributing advanced environmental technologies. Figure 1 illustrates the global greenhouse gas emissions till 2023.

However, developed countries currently account for 40% of global GHG emissions. According to the International Energy Agency (IEA) in 2018, this statistic is projected to change by 2040. Examining sustainability statistics in developed markets demonstrates how they strengthen their sustainable technology advancement ambitions through effective environmental tax measures. This approach assists them to achieve economic resilience and ultimately reduce environmental pollution (Kumar et al., 2022; Sarpong et al., 2023). Furthermore, Bashir et al. (2022) conducted a study on how European countries are attempting to maintain employment in the green technology sector by implementing ET to regulate excessive GHG emissions. These studies underscore the necessity of addressing discrepancies in environmental tax efficiency, as certain markets face challenges in implementing these measures effectively. Taxes influence the way individuals perceive the growth of ecologically damaging products by raising their prices (Fang et al., 2022; Yasmeen et al., 2023). Governments and businesses levy various tariffs on commodities that contain carbon to influence consumer purchasing patterns and facilitate the integration of GHG emissions (Tan et al., 2022; Doğan et al., 2022). These modifications enhance the general commercial approach to the distribution and procurement of commodities.

To combat environmental adverse effects, a significant reduction in greenhouse gas (GHG) emissions is essential. Environmental pricing is a cost-effective and efficient method to achieve an overall decrease in emissions. However, it is not enough solely to ensure the appropriate level of emission reduction required to mitigate the risks associated with pollution. In the context of the emergence of environmental taxes in OECD countries, the primary objective of these levies has been to mitigate and control pollution, ultimately leading to the achievement of environmental sustainability. Recent findings suggest that tax policies need to be more adaptable to local market conditions to fully realize their potential in emission reduction.

However, the influence of climate change on the economy has become increasingly significant. The integration of climate change mitigation and air pollution control strategies has the potential to generate substantial synergistic effects. An alternative method, for instance implementing an environmental tax, is being pursued by economists to increase the overall production costs of energy-intensive equipment (Dias et al., 2022; Wang G. et al., 2023), while also promoting the development of environmentally friendly technologies (Maghyereh et al., 2025; Nasim et al., 2023). Certain exclusive tax policies can serve to encourage businesses to adopt technologies that reduce emissions (Dong et al., 2022; Mushafiq et al., 2023). According to numerous research, economies can implement ET on fossil fuels by employing the top-down energy demand model, providing policies that are proactive and financially stable sufficient to support the growth of green economic activity (Du et al., 2023). Consequently, implementing these tariffs aims to mitigate the adverse effects of climate-related issues (Nedopil, 2023), and encourages the optimal generation of environmentally friendly energy using eco-innovative technologies (Faisal et al., 2023; Kumar and Radulescu, 2024). This enables the integration of ET and the endorsement of innovative environmentally friendly technologies as generally applicable approaches to tackle climate change, while also taking into account specific country circumstances.

Consequently, several effective approaches have been developed for achieving their goals of reducing emissions while simultaneously tackling the issue of climate change. One widely accepted strategy for addressing environmental challenges, in lieu of technological advancements, is the promotion of sustainable financial development (FD) (Abbasi et al., 2022). More specifically, FD encourages and facilitates economic activities such as foreign direct investment (FDI) and stock market activities (Dagar et al., 2022). Further, it enhances commercial activities in the banking and financial sectors, which might potentially contribute to income growth. In parallel, efficient financial systems facilitate lending for renewable energy systems and enable funding for projects that are simultaneously emission-free and environmentally sustainable at a lower interest rate (Hasan and Du, 2023). These cost-effective financing costs can prevent excessive utilization of resources and energy by enhancing innovative competencies (Ali et al., 2023; Ma et al., 2024). Studies have pointed out that financial development can play a larger role in scaling up the adoption of green innovation, particularly in developing countries.

The rise of modern industrial society has led to the emergence of unsustainable production and consumption structures (Mathai et al., 2021; Ma et al., 2024), which particularly integrated with increasing population and socio-economic development, have become significant factors contributing to the escalation of GHG emissions from human activities. However, the implementation of new innovations and technologies necessitates financial resources and a significant amount of time to effectively address the increasing emissions and ensure they are retained pursuant to a certain threshold. Financial resources can be allocated towards the development of technology aimed at sustaining and regulating the environment and temperature at the required level (Bocken and Short, 2021). Thus, the concept of special funds entails the provision of specific financial resources for the purpose of regulating the environment and climate protection.

Literature also suggests that financial mechanisms such as green bonds and sustainable investment funds could be key drivers in supporting the development of environmental technologies (Cheng et al., 2023; Zhao et al., 2024).

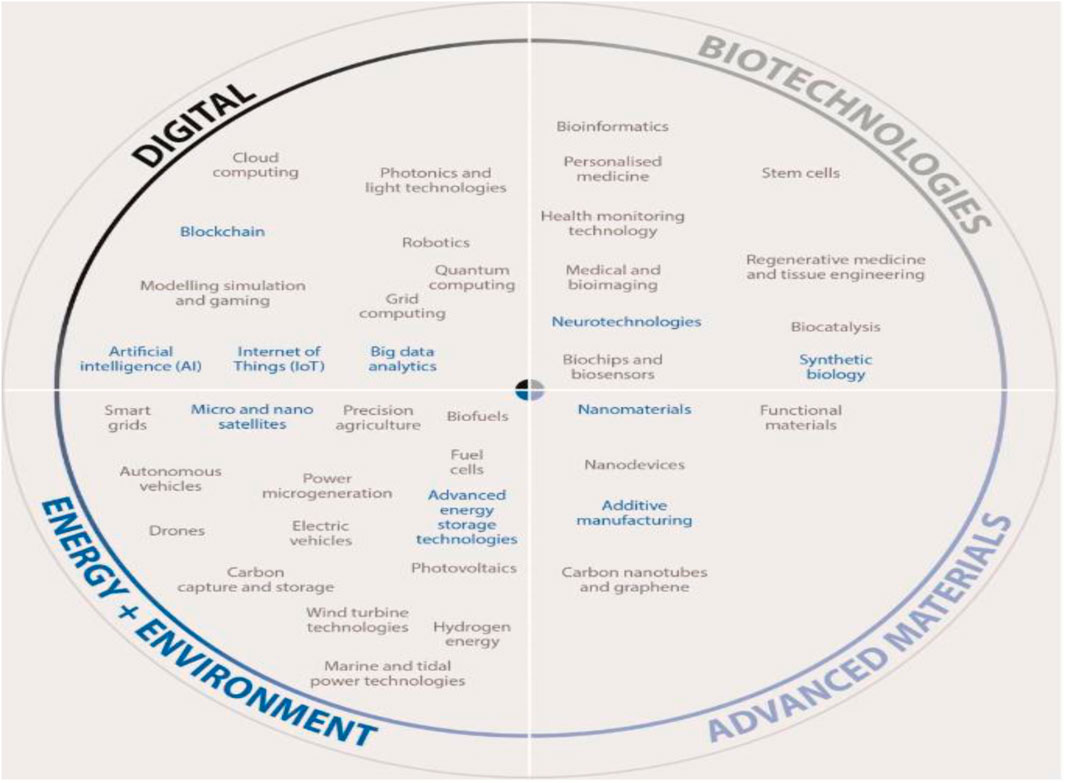

The study selected the OECD countries as a sample due to their economic relevance, substantial data on environment, and consistent economic structures. Therefore, OECD nations have been at the forefront of implementing environmental taxation policies and adopting innovative environmental technologies. These measures are widely recognized for their potential to encourage sustainable long-term development, encourage investments in green innovation, and drive shifts in consumer patterns (Huang and Ren, 2024; Zhao et al., 2023). Figure 2 illustrates the significant and evolving innovations in environmental technologies that are expected to shape the future in OECD countries. Technological advancements in renewable energy, such as solar and wind, are raising new questions about their scalability and overall impact on GHG reduction (Jiang and Wang, 2024; Wang et al., 2025). Currently, the sample countries have implemented a range of ET, embracing carbon taxes, energy taxes, motor vehicle taxes, pollution taxes, product taxes, and other levies targeting environmentally detrimental items and behaviours. ET has emerged as the primary mechanism for implementing environmental regulations in numerous countries within the OECD. According to the OECD (2019) report, projections indicate that the adverse economic impacts resulting from global climate change are expected to reach approximately 3% of the GDP by the year 2060. The attainment of sustainable development within human civilization relies on two fundamental aspects: the prevention of polluted environments and the effective reaction to climate change. Moreover, considering that GHG emissions are a significant contributor to atmospheric pollutants and climate change (Hassan et al., 2023), the primary focus for mitigating environmental pollution and implementing ET should be on GHG emissions (Fu et al., 2023). Particularly, establishing GHG emissions as the benchmark for ET and promoting the adoption of green technologies can be regarded as crucial strategies for addressing the challenges posed by global climate change.

Figure 2. Emerging technologies for future in the OECD region (Source: STI Outlook 2021; OECD report).

The phenomenon of global warming and the rise in greenhouse gas (GHG) emissions have captured the attention of both national governments and international organizations over the past 20 years. As a consequence of this increased awareness, various forums have been formed together to tackle this global externality. The Paris Climate Change Agreement is the most significant initiative. The importance of the environment and climate change is apparent in the SDGs, as 6 out of the 17 goals directly pertain to this challenge. The objective of SDG 13 is to mitigate the escalating GHG emissions, mitigate their repercussions, and maintain the global temperature increase at 1.2°C over the pre-industrial level or at a maximum of 1.5°C above the baseline. To achieve this objective, affluent countries have committed to offering financial contributions and technical support to all countries. However, countries are encouraged to enhance their environmental regulations, levy taxes on those contributing to pollution, and allocate the financial assistance received towards R&D as well as the advancement of environmentally friendly technologies. These efforts reduce worldwide emissions and change the focus towards sustainable development and environmentally-friendly economic growth. Technological progress (SDG 9), such as the development of renewable resources, enables their recycling, restoration, and remanufacturing, leading to positive environmental effects and promoting sustainability. Therefore, this study aims to elucidate crucial research questions by enabling the dynamic effect of this indicator on the model parameters.

i. To what degree does the green innovation moderate the association between environmental related technologies and GHG emissions?

ii. What is the direct relationship of environmental taxes and financial development with GHG emissions?

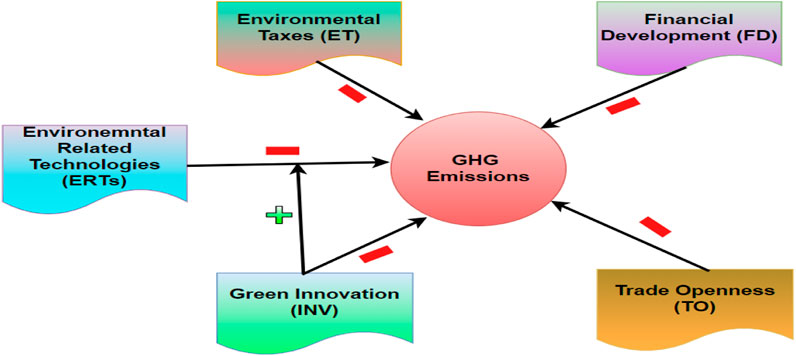

The preliminary approach seeks to encourage the adoption of green innovation in environmental-related technologies to mitigate GHG emissions. Thus, the main objective of the current study is to analyze the moderating role of green innovation between the relationship of environmental related technologies and GHG emissions. Considering the this approach, we contend that green taxes and developed financial systems require further consideration as a policy instrument since their implementation will not only reduce greenhouse gas emissions but also encourage the adoption of environmentally friendly technologies. Thus, the primary concern for policymakers is to implement policy reforms that promote the development of economical and sustainable energy sources to mitigate greenhouse gas emissions. Several policy reforms have been recommended to effectively develop environmental rules that have a significant impact on greenhouse gas (GHG) emissions, from a practical perspective. The economic, energy, and environmental perspectives are particularly focused in the subsequent three contentions: (1) Promoting environmentally friendly technologies, (2) highlighting the significance of technical innovation, and (3) implementing environmental taxes. Moreover, the advancement of nano-technological goods practices and applications through R&D can provide a substantial contribution to environmental conservation. This can be achieved by conserving raw materials, water, and energy, reducing emissions, and minimizing the production of harmful waste. Therefore, the primary objective of the current study is to evaluate the direct impact of ET, green innovation, financial development, and trade openness on GHG emission and the moderating effect of green innovations between environmental-related technologies and GHG emissions in the 36 OECD countries over the period of 1990–2020.

Furthermore, this study provides significant contributions to the existing body of knowledge from various perspectives. First: Prior research on the role of ET, environmental policies, and innovation in GHG mitigation efforts has been limited, despite their prominence as an aspect of debate at global forums. Hence, we conducted an investigation to assess the direct and long-term implications of environmental innovation, ET, and FD on the transition towards a GHG-free economy. Second: Furthermore, it is significant that none of the prior research efforts have examined the potential moderating effect of innovation on the relationship between environmental-related technologies and GHG emissions specifically in the context of OECD nations. Third: The primary purpose of this research is to propose strategies to reduce GHG emissions in the 36 OECD nations. The study evaluates the moderating effect of green innovation programs, a crucial concern for policymakers aiming to achieve sustainable economic development. Furthermore, it aims to measure the influence of ET, providing insights into the efficiency of market-driven approaches in encouraging the reduction of emissions. Fourth: This study can be valuable for directing the development of future environmental tax policies. The development of innovation derives from the acquisition of delicate insights, such as the determination of suitable taxes and circumstances to boost the efficacy of green energy sources. This, consequently, contributes to the advancement of knowledge for the development of effective environmental policies. When tackling critical global challenges, the significance of this study is evident. Furthermore, employing distinct methodologies, numerous governments and regions formulated strategies to mitigate GHG emissions. In 2013, the European Parliament initiated a project called the “General Union Environment Action Programme to 2020” intending to implement regulations specifically focused on environmental pricing to mitigate the escalating environmental pollution impact of the European Union. These initiatives stimulated investigation into the significance of the environment, innovation, and emission prices in the process of abatement. Therefore, it is imperative to conduct a full analysis of the advantages associated with implementing integrated policy actions to achieve SDGs. Fifth: This study examined the relationship between five key factors, specifically focused on SDGs, Greenhouse Gasses (GHG), SDG 13-Environmental Taxes (ET), SDG 9- green innovation (INV), SDG 17-Financial Development (FD), and the interaction between environment-related technologies and Green Innovation (ERT*INV), through the application of dynamic panel testing. The analysis specifically focused on the 36 OECD countries. Thus, to evaluate the long-term relationship among selected variables, long-run DOLS, FMOLS, and CCR estimation models are employed. Further, the MMQR technique is employed to estimate the coefficient values at different quantiles. To validate the results of MMQR, the study also used BSQR (Bootstrapped Quantile Regression) approach. Therefore, the relationship between the development of environmental policies and technological innovation is essential, since innovation in technology has the capacity to decrease the long-term costs associated with attaining environmental objectives. This is especially true in the context of climate change, where the expected future expenses of reducing greenhouse gas (GHG) emissions are significantly affected by the technological trajectory of the economic system.

The further sections of the paper are outlined as follows: Section 2 presents a comprehensive summary of the research on empirical evidence. Section 3 outlines our empirical methodology. Section 4 discusses the empirical evidence and findings; Section 5 offers conclusion and implications for policy.

2 Literature review

Porter hypothesis proposed by posits that environmental regulations, for instance, environmental taxes can encourage innovation and boost competition, hence promoting environmental sustainability. Governments can provide an economic stimulus for businesses to invest in R&D, adhere to innovative technologies, and produce sustainable products by imposing taxes on pollutants. This can therefore, results in development of innovative and ecofriendly technologies, approaches and businesses practices that alleviate environmental consequences. The porter hypothesis contends that environmental taxes can stimulate innovation, encourage businesses to review their existing framework, simultaneously integrating more sustainable strategies. Through innovation and adhering with environmental standards businesses may attain cost savings, enhance efficiency, and strengthen competitiveness, also reducing their impact on environment and encouraging sustainability.

Further, proposed the Sustainable Innovation Theory that highlights the crucial role of innovation to achieve sustainability. This notion is based on the rules of sustainable development, which strives to integrate economic, social and environmental concerns. Innovative technologies entail the adoption and execution of sustainable technologies. By adopting green innovative approaches, businesses can mitigate their environmental effects, promote social contributions, and enhance their economic standing. The sustainable innovation theory highlights several drivers that promote green innovation for environmental sustainability. This theory proposes a framework for businesses to implement green innovative strategies and foster a green future. This theory emphasizes the crucial role of innovation in developing sustainability, urging businesses to engage in innovative solutions that coincide with social, economic and environmental concerns.

The significance of sustainable growth has been progressively highlighted because of the escalating environmental concerns and their ramifications for society. The concerns over global warming have significantly increased in recent years due to the degradation of climate indicators. OECD economies are actively promoting the notion of sustainable development and are committed to achieving the goals of the UN Agenda. However, for the intent of this article, we primarily examine OECD economies as a sample of this study. Extensive research has been conducted on the impact of environmental taxation, technological advancement, adoption of eco-friendly technology, and FD on environmental quality. However, these vary in terms of geographical location, and the specific factors and models employed. Therefore, a discussion and concern emerge concerning the choice to pursue a decrease of GHG emissions through the enactment of taxes and the adoption of ecologically sustainable innovative technologies.

Countries globally are seeking innovative methods to mitigate ecological degradation. Green technologies are widely recognized and highly efficient in preventing environmental degradation (Xi et al., 2022; Ahmad et al., 2023; Amin et al., 2023; Su et al., 2024; Fatima et al., 2024a). Eco-innovation enables businesses in countries to transition towards ecologically sustainable technology, such as renewable energy sources (Hassan et al., 2024; Li et al., 2023; Chen et al., 2024). Prior studies on green innovation have identified numerous strategies through which green innovation could promote sustainability (Khan et al., 2022; Mehmood et al., 2024). These developments optimize innovative technologies, resulting in a prompt decrease in energy consumption and an enhancement in sustainable environment (SaberiKamarposhti et al., 2024; Sun et al., 2022a). Sustainable technologies play a crucial role in facilitating economic shifts and advancement. To mitigate ecological degradation, this is being achieved by shifting from traditional economic growth, which relies on traditional manufacturing elements, to an innovation-driven approach (Wang et al., 2021; Chen et al., 2023). To mitigate ecological degradation, this is being achieved by shifting from traditional economic growth, which relies on traditional manufacturing elements, to an innovation-driven approach (Aydin and Degirmenci, 2024).

Sustainable technologies can mitigate detrimental effects through both their direct and indirect effects. Green innovative technologies indirectly influence several aspects, including the progress of renewable resources (Fatima et al., 2024c; Liu et al., 2025), enhancement of energy efficiency, and the promotion of sustainable and effective utilization of traditional resources (Yin et al., 2022). Further, Nazir et al. (2023) have provided another perspective on the significance of green innovation in promoting sustainable development (Nishtar and Afzal, 2023). Their empirical study demonstrates that green innovation promotes highly financially independent countries lower environmental damage in the long run. Moreover, Qin et al. (2023) extensively examined the positive impact of innovation on enhancing ecological integrity in developed countries. Mehmood et al. (2023) utilized the wavelet approach to examine the impact of technology breakthroughs on sustainable development. The study emphasizes that technology advancement is a significant factor contributing to environmental deterioration in Japan. Similarly, Sakariyahu et al. (2023) evaluated data spanning from 2000 to 2018 to assess the relationship of innovation and environmental degradation in 25 African nations. The study findings indicate that the use of green innovation significantly enhances sustainability in the environment. The global development of sustainable innovation could potentially be attributed to two fundamental interconnected triggers. These factors involve escalating energy consumption and environmental contamination. The increasing energy demand, primarily associated with rising population, and growing urbanization, spurs production of energy and thus ultimately causes environmental degradation (Aydin et al., 2023). Consequently, green innovation, containing patents of environmental technologies holds vital relevance. This approach helps to reduce environmental damage by deploying innovative technologies that improve the effectiveness of non-renewable energy resources.

Environmental Taxes (ET) emerged as a viable approach that could mitigate environmental degradation. According to Sarpong et al. (2023), a limited number of countries actively adopted environmental charges during the 1990s. The situation has experienced constant shifts, with ET assuming an increasingly prominent role in efforts to mitigate climate change. In 2020, the ET in the EU accounted for 2.2% of the GDP (Usman and Alola, 2023; Zhou et al., 2023; Fatima et al., 2024b). ET can be imposed in diverse forms, including taxes on energy (Hussain et al., 2023), transportation (Ahmed et al., 2022), resources (Jahanger et al., 2023), and other related areas. Imposing taxes on fossil fuels, such as non-renewable resources and electricity, is crucial for decreasing energy use and reducing greenhouse gas (GHG) emissions (Aziz et al., 2024; Zhang and Zheng, 2023). ET is a significant component of the environmental policies implemented by the OECD (Chen, 2022; Khan et al., 2023). The development of international environmental law occurred in 1972 with the United Nations Conference on the Human Environment in Stockholm, Sweden. In the subsequent year, OECD countries introduced the concept of “polluter pays,” which mandates that those who pollute must cover the expenses associated with releasing pollutants to internalize the external costs. Since the 1990s, OECD economies have initiated green tax reforms to shift from conventional taxes to ET. The objective is to address adverse environmental effects and minimize the negative impact of taxes on other economies (Hu et al., 2022). Thus, it can be argued that ET is recognized as an effective policy mechanism for minimizing GHG emissions and reducing the effect of climate change. ET imposes a direct penalty on GHG emissions, providing a financial encouragement for individuals and businesses to reduce their ecological impact, consequently stimulating innovations and lowering emissions.

Furthermore, researchers have also revealed the positive impact of FD on environmental quality (Sun et al., 2022b; Wang L. et al., 2023). Suggested that green finance has supplanted conventional finance by implementing a carbon tax on projects focused on carbon and allocating financial resources towards the advancement of low-carbon technologies. In a similar vein, Chien et al. (2023) examined the relationship between FD and carbon emissions and concluded that FD has a substantial impact in reducing carbon emissions in G20 countries. To address climate change preemptively, global economies are shifting financial investments from high-polluting initiatives to low-polluting alternatives, with a focus on cleaner investment solutions (Han et al., 2022; Wu et al., 2023). Financial instruments, such as green bonds and credits, play a crucial role in tackling climate-related challenges by effectively meeting the growing need for low-carbon initiatives (Peng D. et al., 2023). A further conclusion is that green funds assist in mitigating carbon emissions (Fatima et al., 2023a). Demonstrated the negative effect of green taxes on carbon emissions in the major nations with the largest carbon emissions. This result validates the findings of (Zhen et al., 2023), emphasized the vital role of green investment in achieving an environmentally friendly future and mitigating GHG emissions (Kamal et al., 2023). Further confirmed the impact of green credit on the decrease of carbon emissions intensity (CEI) in China. However, they found that this reduction effect varies significantly across different regions. Kamal et al. (2023) further confirmed the impact of green credit on the decrease of carbon emissions intensity (CEI) in China. However, they found that this reduction effect varies significantly across different regions. Thus, from the existing literature, it can be argued that FD could potentially affect GHG emissions by impacting energy consumption patterns. This could substantially contribute to long-run emission reduction by stimulating green financing, boosting energy consumption, and fostering environmental sustainability.

Economic growth is encouraged through trade openness, which allows for the efficient transfer of resources between countries with their comparative advantages. The impact on the environment varies depending on the specific pathway by which it is introduced (Ibrahim et al., 2022; Pata et al., 2023; Hausknost and Hammond, 2020). The negative effect comes primarily from inadequate regulations on the environment, which tend to attract businesses that generate high levels of pollution. However, Trade may attract certain industries to countries where the exchange of information from these businesses promotes the adoption of more environmentally friendly methods of manufacturing, leading to a cleaner environment (Adebayo et al., 2023). Furthermore, the global exchanges between nations and multinational enterprises have facilitated the transfer of technology advancements to poorer countries, thereby contributing to the promotion of a sustainable environment. Rennings (2000) defines environmental innovation as the development or alteration of processes, practices, or structures that have positive effects on the environment and promote environmental sustainability. It asserts that the implementation of cleaner technologies could reduce environmental risk and mitigate pollution and the excessive use of resources. It asserts that the implementation of cleaner technologies could reduce environmental risk and mitigate pollution and the excessive use of resources.

The pressure exerted by environmentalists, governments, organizations, and civil society compels countries and businesses to conduct sustainability assessments, hence stimulating their potential for effective innovation (Fatima et al., 2023b). The study of (Tong et al., 2022) highlights the importance of environmental innovation in promoting sustainable development and cleaner production to combat environmental pollution. The orthodox argue that funding environmental management practices leads to higher costs, reducing the financial gains for businesses (Ofori et al., 2023; Shahzad, 2020). Further (Wu et al., 2023), emphasize the crucial role of an organization’s strategy in addressing this issue. The concept of green growth implies that making preliminary investments in environmental management may contribute to a reduction in operational expenses and ultimately result in greater financial benefits in the future (Du et al., 2023). Therefore, businesses or countries have the potential to enhance their benefits and improve their credibility by integrating innovation into their production and environmental management practices in early phases. Therefore, businesses or countries have the potential to enhance their benefits and improve their credibility by integrating innovation into their production and environmental management practices in early phases.

2.1 Limitations in literature and contributions

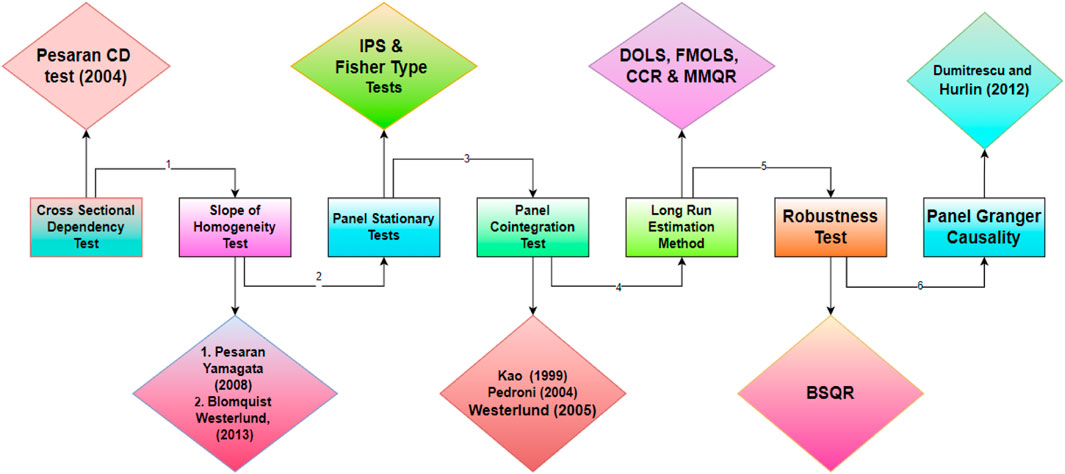

In general, recent research has yielded valuable insights into the impact of various factors on environmental quality. However, there still exists a lack of relevant studies specifically investigating the moderating role of green innovation for environment related technologies and GHG emissions. Further, direct relation between ET, INV, FD, trade openness, and GHG emissions in OECD countries. Furthermore, a significant deficiency lies in the neglect of the fundamental function of INV in evaluating the effect of ERTs on GHG emission from the moderation perspective. To summarize, the examination of the current body of research in the previous sections uncovers substantial shortcomings that this study intends to address. More precisely, while the economies of the OECD have a substantial influence on global greenhouse gas (GHG) emissions, there is a lack of comprehension on particular variables that cause or mitigate an increase in GHG emissions. Figure 3 depicts a theoretical framework employed in the present study that includes a comprehensive list of variables and builds upon the findings of (Iyke-Ofoedu et al., 2024). Moreover, the present study used the DOLS, FMOLS, and CCR methodologies to estimate the model, in contrast to prior investigations that relied on classic panel estimating techniques. The DOLS approach is suitable because it effectively deals with the problem of endogeneity and serial correlation that exists in the normal ordinary least squares (OLS) approach. This strategy utilizes cross-section-specific lags and leads to the initial variation of independent variables to further improve the model. While doing so, this study considered other factors and incorporated dynamic methodologies. Therefore, the empirical findings derived from DOLS, FMOLS, and CCR methods are more reliable and coherent. Further, the DOLS, FMOLS, and CCR techniques are valuable in obtaining estimates for both short-term and long-term effects across a range of countries in a panel dataset. This study also employed the MMQR and BSQR models, rather than the conventional quantile regression model, because the reliability and credibility of these approaches is higher. Moreover, this study might promote the formulation of specific development approaches with the objective of accomplishing a transition towards low emissions. This can be achieved by implementing additional emissions trading (ET), embracing environmentally-friendly innovation, and enhancing the financial system in OECD countries.

3 Material and empirical tests

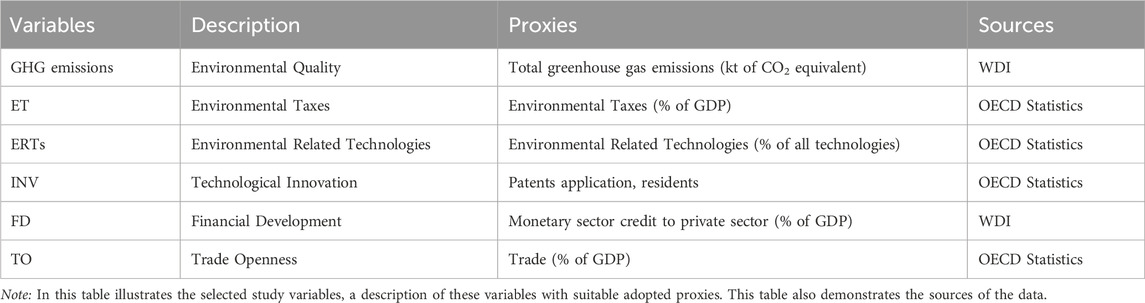

The present research analyzes data to assess the moderating effect of INV on the relationship between environmental-related technologies (ERTs) and greenhouse gas (GHG) emissions. Further, it examines the direct impact of ET (ET), (INV), financial development (FD), and trade openness (TO) on GHG emissions. The selection of OECD countries for this research is based on their international standing for adopting stringent ET, maintaining strong financial systems, and actively pushing technological breakthroughs in the broader context of climate change. The study’s sample consists of the top 36 OECD nations (refer to Table A1), which are at the forefront of eco-innovation. The dataset used spans from 1990 to 2020. Table 1 illustrates the explanation for specific variables.

The selected dependent variable for evaluating environmental quality is GHG emission, specifically measured as the total amount of GHG emissions in kilotons of CO2 equivalent. The study measures the independent variables using precise indices. ET is ET measure as % of GDP, ERTs refers to the measurement of Environmental Related Technologies as a proportion of all technologies. INV is technological innovation measure as patents, application, and residents. FD is evaluated by calculating the monetary sector credit to the private sector as a percentage of GDP. TO is a measure that is not specified. Patent applications are used to evaluate technological innovation. The data regarding particular variables is acquired from many sources, including the OECD Statistics1 and World Development Indicators2 (WDI).

3.1 Empirical methodology

Based on prior studies, we have developed a formula (Equation 1, which illustrates the direct impact of ET, green innovation, financial development, and trade openness on GHG emissions. This formulation is consistent with prior studies that examine the impact of environmental technologies, innovation, financial development, and trade openness on greenhouse gas emissions (Pesaran, 2007; Kao and Chiang, 2001) Similar equations have been widely used in studies exploring the interplay between environmental policies and economic variables (e.g., Kao and Chiang, 2001; Pedroni, 2004). Furthermore, the estimation also takes into consideration the moderating effect of green innovation on the association between environmental-related technologies and GHG emissions (Pesaran, 2007; Kao and Chiang, 2001; Pedroni, 2004; Park, 1992; Machado and Santos Silva, 2019). This is consistent with established models in the literature that examine the role of innovation in enhancing environmental outcomes (Machado and Santos Silva, 2019).

In the given Equation 2, “i” represents country, and “t” indicates periods, while the “ɛit” reflects the error term. The linear representation of these variables follows the conventional structure used in panel data cointegration studies, such as those by Kao and Chiang (2001) and Pedroni (2004). Similar models have been applied to examine long-run relationships between environmental variables and economic performance (e.g., Pesaran, 2007; Park, 1992).

Where, Equation 3 builds upon the work of Machado and Santos Silva (2019), who explored the interaction effects between environmental technologies and green innovation on environmental outcomes. The inclusion of interaction terms, such as those in this equation, has been widely used in economic environmental models to test moderating effects (e.g., Park, 1992; Pedroni, 2004). Figure 4 demonstrates the empirical estimation steps followed in the analysis.

3.2 Long run estimation techniques

We employed three advanced panel estimation techniques, namely, Dynamic O.L.S. (DOLS) (Kao and Chiang, 2001), Fully Modified O.L.S. (FMOLS) (Pedroni, 2004), and Canonical Cointegration Regression (CCR) (Park, 1992), to analyze the long-run association of the variables under consideration. The DOLS testing paradigm was proposed by Kao and Chiang (2001). The test is based on Monte Carlo simulation conditions. Pedroni (2004) proposed the FMOLS testing framework, while Park (1992) introduced the Canonical Cointegration Regression (CCR). Each series on the panel has distinct intercepts. Under this situation, statistical models such as O.L.S., which rely on the premise of a normal distribution, could generate results that are influenced by biases. The current research entailed estimating the subsequent equation for long-term cointegration:

3.2.1 Fully modified ordinary least square

The FMOLS estimator evolved as a modification of the classic OLS method to calculate the cointegration association. It addresses the issues of endogeneity and serial correlation, which are commonly encountered when using conventional OLS. FMOLS is an approach that assists in improving genetic characteristics while providing accurate forecasts. FMOLS outperforms other empirical techniques while estimating cointegration or long-run coefficients.

3.2.2 Dynamic ordinary least square

To attempt to eliminate autocorrelation, a parametric approach referred to as DOLS is employed for incorporating lag values into the model at the first difference from the baseline. The DOLS methodology has several merits over the FMOLS technique, the most important of which are highlighted below: (i) it can deal with limited sample sizes; (ii) it incorporates dynamic components into the model; (iii) it can resolve refractions in dynamic regression, and it can be employed for a wide variety of parameters. Thus, the elimination of secondary biases and the enhancement of systemic trends in the research are made feasible with DOLS. In order to generate reliable estimations for both short-term and long-term trends, the DOLS approach can be utilized for both stationary and non-stationary variables.

The following Equation 5 represents the Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS):

The equation

Equation 6 is the conventional format of the Dynamic Ordinary Least Squares (DOLS) model, which includes the expansion of cointegration regression. This model incorporates lagged parameters with implications associated to the asymmetric error factor in the cointegration equation. The DOLS estimator suggests that the expected long-term relationship of two

3.2.3 Canonical cointegration regression

The CCR analysis is conducted by regressing the independent variables at various time lags on the specified values. This enables for the analysis of the long-term relationship that exists between a dependent variable and its predictive variables. The estimation methodology applied to the CCR model is exclusively based on regression analysis. However, employing this approach is both cost-effective and crucial for addressing the linear regression component (Park and Zhao, 2010). Thus, determining the suitable time lags and sequence of occurrences is a crucial obstacle for the approach to investigation. The CCR estimations are expressed using the following Equation 7, which holds in a broader sense.

The equation above represents the static transition between

3.2.4 Method of moment quantile regression

The present study utilized a novel estimation technique, primarily the MMQR test, which was principally developed by the research by Machado and Santos Silva (2019), to address this issue. MMQR in comparison with earlier regression techniques, employs contemporaneous conditions to determine outcomes by asserting the presence of the moment function or imposing distribution assumptions. The MMQR technique prevails as it incorporates into consideration the conditional heterogeneous covariance that results from the components of the endogenous explanatory variables. The MMQR approach demonstrates the association among the parameters by analyzing multiple quantiles. The utilization of the panel quantile regression approach allows for the evaluation of distributional and heterogeneous effects across quantiles (Aziz et al., 2020). Moreover, it precisely represents empirical evidence on the relationship between the variables under investigation, while considering the consistent contribution exerted by differences in distribution.

Consequently, the examination of the method reveals different associations between selected parameters in different conditional distributions which cannot be attained using traditional regressions that depend on average variable estimations. Assessing the tested variables at the conditional distribution within conditional quantiles is essential for determining the distributive influence of the independent variable on the dependent variable across various quantile ranges.

In order to calculate the conditional quantiles Qy (τ|X) for the location-scale variant model, the equation (Equation 2) presented below is derived:

The likelihood of δi + Zit γ > 0 = 1. The parameters (α, ϑ, δi, γ′) are estimated. The item i fixed is shown by (αi, δi ΄). The variables i range from 1 to n, and Z represents a K-vector of selected components of X. These components are displayed in a distinct format, specifically denoted by the value of l in Equation 3.

The variable “X” is consistently and autonomously distributed across each fixed “i” and is not influenced by variations over time (“t”). The parameter μit is distributed independently and consistently over time (t) and is parallel to Xit΄. It is also normalized to confirm the current status mentioned in Machado and Santos Silva’s (2019) study, which states that this variable, along with others, does not suggest inflexible exogeneity. Therefore, Equation 2 is denoted by Equation 4 as illustrated as follows: The equation (Equation 4) can be expressed as

In Equation 4, the vectors indicating the independent variables are denoted as Xit. The function Qy (τ|X) depicts the distribution of quantiles for the response variable Yit, which is influenced by the value of the independent variable Xit ΄. The expression αit(τ) = αit + δiq (τ) represents the scalar coefficient which reflects the fixed effect of the quantile–τ for individual i.

4 Results and discussion

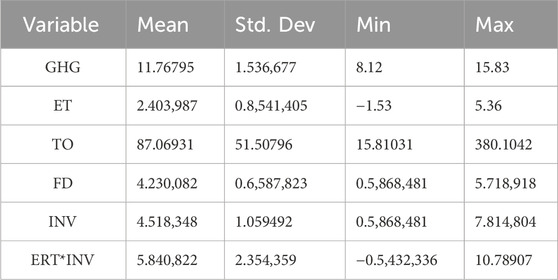

Table 2 displays the summary data for all variables, including GHG, ERT, INV, FD TO, and ERT*INV. The positive average values of all variables illustrate the strong efficacy of environmental tax revenue (ERT) and eco-innovation in OECD economies. Environmental taxation, eco-innovation, and advanced green technologies are crucial in promoting the utilization of green energy sources to regulate greenhouse to pursue sustainability in the environment.

Based on the findings in Table 2, it can be observed that TO exhibits the highest standard deviation value compared to all other variables. This suggests that TO is the least stable parameter in the statistical framework.

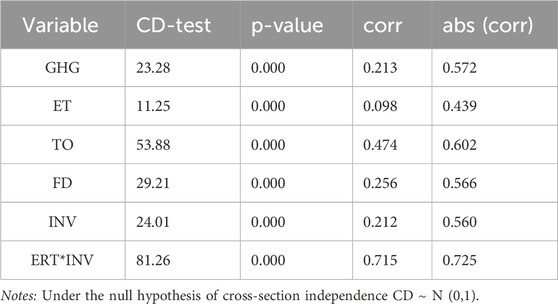

When performing the stationarity test and cointegration test, it is crucial to ascertain the presence of cross-section dependency in the panel data to prevent any misleading outcomes. Table 3 presents the empirical findings from the cross-section dependency test (Pesaran in 2015). The alternative hypothesis posits the presence of CD in the data, while the test results indicate that all variables support the alternative hypothesis at a significance level of 1%. The findings suggest that there is cross-section dependence in the study data. The tests show that every variable met the alternative hypothesis at 1% significance level. This implies that the economies in the OECD are integrated and the interactions among the variables are affected by regional and international factors. To prevent biased results, this interdependence should be considered in the econometric model. However, despite these links, countries may adopt various approaches to reduce GHG emissions, as evidenced by the variations among them.

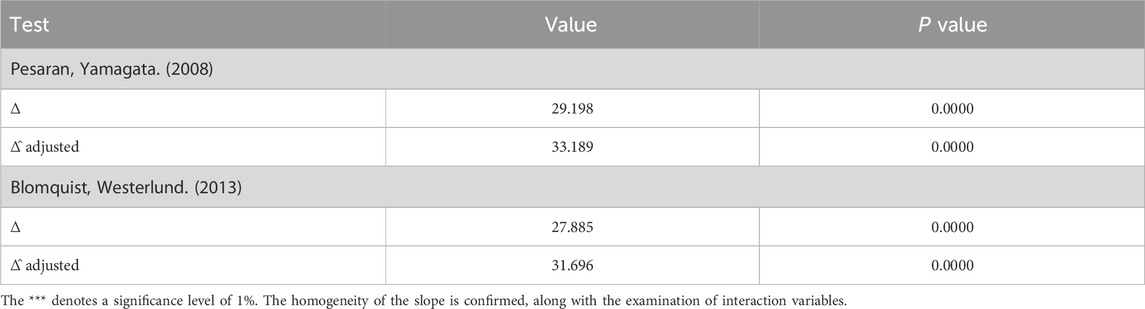

Although countries are interrelated, they can however have their unique strategy. Hence, it is crucial to examine disparities among nations. Therefore, following the analysis of the CD, we examined the homogeneity of parameters by employing the Pesaran and Yamagata (2008) and Blomquist, Westerlund (2013) slope homogeneity test, which is based on ∆ and ∆^^ corrected.

The results shown in Table 4 demonstrate the existence of country-specific variations within these economies. The results suggest that the slopes demonstrate diversity, whereas the null hypothesis is decisively rejected at a level of significance of 1%. The results shown in Table 4 reveal that there are significant differences between countries within these economies. Previous research has pointed out the varying impacts of environmental policies across different nations. The findings indicate that the slopes exhibit diversity, leading to a strong rejection of the null hypothesis at the 1% significance level. This rejection suggests that the influence of environmental taxes, green innovation, and financial development on GHG emissions differs from one country to another. It emphasizes the necessity of considering specific national characteristics when developing environmental policies. The observed heterogeneity among countries highlights the importance of customized strategies instead of a uniform approach to achieving sustainable development goals.

To assess stationarity in panel data, it is necessary to analyze additional econometric factors such as slope heterogeneity, structural break, and CD. The stationarity structure of all the variables employed in this study has been investigated using IPS and Fisher type tests. The null hypothesis underlying the non-stationary test asserts the presence of a unit root in panel data. The finding presented in Table 5 demonstrates the rejection of the null hypothesis of a unit root.

Therefore, based on the findings of Pesaran (2007), all the variables are found to be stationary at the first difference. Similarly, the Fisher-type results demonstrate that all the variables exhibit a unit root problem at the level but become stationary at the first difference.

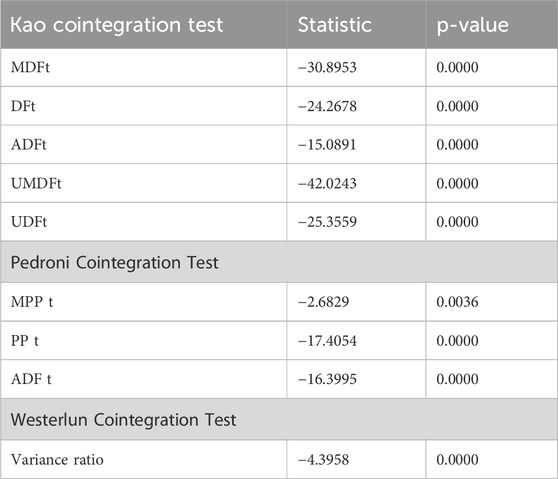

The Kao, Pedroni, and Westerlund cointegration test in Table 6 indicates that the null hypothesis, which suggests the absence of cointegration, is rejected. This implies the presence of two cointegration vectors. Therefore, indicating the presence of cointegration across the variables over the analyzed timeframe. The cointegration results indicate that environmental taxes, green innovation, financial development, and trade openness are interconnected in the long term, affecting GHG emissions in OECD countries. This finding supports the idea that these variables move together in the long run and suggests that policies targeting one of these areas may have enduring impacts on emissions reduction.

4.1 Long run panel cointegration analysis

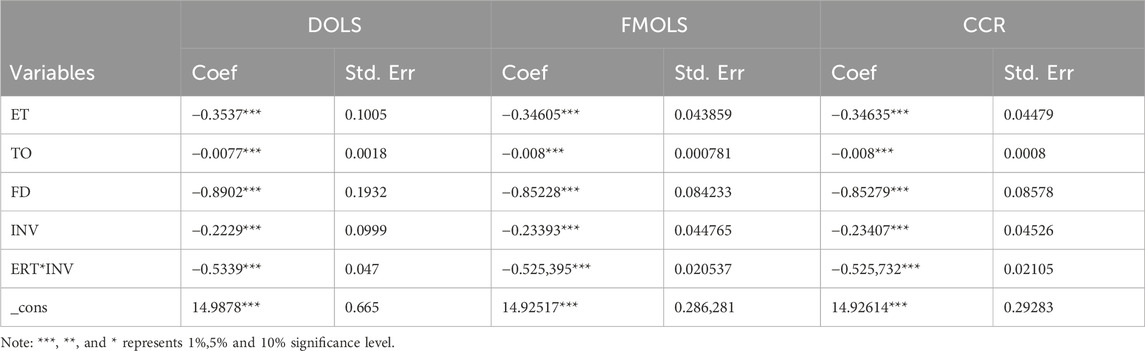

The cointegration test results provide the possibility to estimate the long-term and short-term effects of ET, INV, FD, TO, and ERT*INV on GHG. This study employed an assortment of regression approaches, which include dynamic least squares (DOLS), fully modified least squares (FMOLS), and canonical cointegrating regression (CCR), to assess the long-term association of the variables. Table 7 displays the results of DOLS, FMOLS, and CCR methods for assessing a long-term association between variables. The results of three estimations techniques indicate a long-term relationship among the selected variables. Based on the estimation, it is confirmed that ET have a statistically significant negative impact of 1% in all three estimations. Thus, a 1% increase in ET will result in a reduction of GHG emissions by 35.37%, 34.61%, and 34.63% respectively.

Similarly, both INV and FD have a significant negative impact on GHG emissions. The coefficients for eco-innovation demonstrate the adoption of green innovation contributes to reduce GHG by 22.29%, 23.39%, and 23.40% respectively. Further, a 1% increase in the financial sector results in a reduction of GHG emissions by 0.8902, 0.8522, and 0.8527 in all three approaches. The outcomes of green innovation align with the findings of Sun et al. (2023). Simultaneously, the results of financial development are similar to Raihan, (2023). Both determinants are crucial in effectively mitigating GHG emissions over a long period of time.

Moreover, the significance of green innovation in mitigating greenhouse gas (GHG) emissions has received substantial prominence in the field of environmental technology, leading to a more sustainable environment. The interactive role of INV in environmental technologies and GHG emissions illustrates that green innovative technologies can produce or utilize alternative energy sources and substances that emit a lower amount of GHG per unit of usable product or service. The empirical findings suggest that green innovation (INV), the primary emphasis of this study, has a considerable moderating role between the association of emissions and environmental quality. Specifically, a 1% increase in ERT*INV is associated with a reduction of −0.5339%, −0.525,395%, and −0.52573% in GHG emissions. This demonstrate that climate technology, such as crops that can resist drought, technologies that provide early warnings, and barriers to protect against rising sea levels, have the potential to collectively contribute to the significant decrease in emissions for achieving global net zero energy by 2050. This demonstrates that a high degree of INV leads to the enhancement of environmental sustainability, resulting in a reduction of GHG emissions. Technological innovation impacts environmental quality by altering energy consumption, organizational framework, and the integration of technology into environmental regulation. The study of Ning et al. (2023) and You et al. (2022) confirms these results, which demonstrated that environmental innovation moderates the relationship between environmental technologies and GHG emissions leading to a reduction in emissions in the OECD countries. Further, the analysis reveals the negative association between the combined impact of green innovation and environmental technologies on greenhouse gas (GHG) emissions. It demonstrates that certain OECD nations are employing high-technology innovations to effectively lower GHG emissions. In this context, policymakers and the governing bodies of these countries should encourage the development of innovative and more sustainable solutions by lowering the financial barriers associated with eco-friendly projects and technologies. Moreover, any tax imposed on items related to innovation in technology should be either reduced or completely eliminated in order to promote their adoption. To enhance environmental sustainability, it is essential to have support from both the commercial and government sectors for innovative technological initiatives.

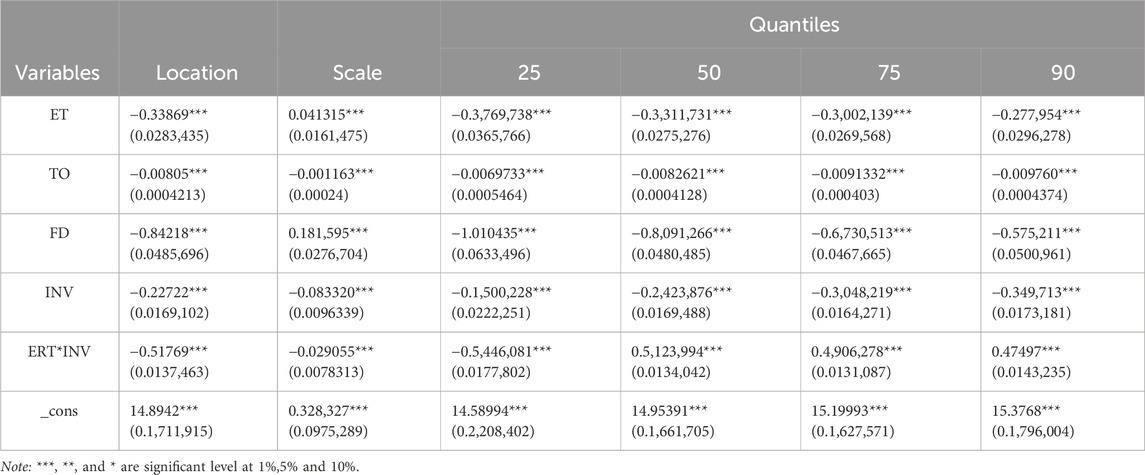

The results of MMQR, as reported in Table 8, offer distinct and intriguing patterns across different quantiles. MMQR investigates exogenous determinants and significant aspects that significantly influence the long-term growth and progress of OECD countries. The environmental tax exhibits a negative and substantial influence on GHG emissions, with coefficient values of −0.3769% and 0.2779% across the 25th to 90th quantiles. The findings indicate that a 1 unit increase in ET leads to a decrease of −0.37697, −0.33117, −0.300,213, and −0.27795 kt of GHG emissions from the 25th to the 90th quantile. The imposition of ET inevitably increases the cost of contaminating activities. Implementing ET discourages both manufacturers and consumers from generating further emissions. Furthermore, the income generated by ET could be advantageous for reinvesting in green and sustainable environmental efforts. The findings align significantly with the latest results of who investigate the relationship between emission and ET in OECD countries.

Furthermore, the statistics demonstrate substantial and distinct impacts in relation to ET, patent innovation, and the interaction of ERT*INV across different quantiles ranging from the 25th to the 90th. This specifies that the null hypothesis, which suggests that these variables do not affect GHG, is rejected. The coefficients indicate a negative correlation between green innovation and GHG emissions. Furthermore, this association becomes stronger when it progresses from lower to higher quantiles. A 1% increase in innovation results in a decrease of GHG emissions of 0.150%–0.349%. This suggests that the advancement of eco-friendly technology alleviates the pressure on the environment by developing devices and machinery that primarily depend on renewable energy sources or utilize energy more effectively. The application of green innovation (INV) is logical as it enables the effective optimization of the advantages of Renewable Energy Consumption (REC) by facilitating the transition from non-renewable to environmentally friendly energy sources. These results confirm the study conducted of Luo et al. (2023) and Raihan et al. (2022) which suggested that green innovation has a crucial role in achieving the aim of reducing GHG emissions, even when considering other macroeconomic variables. However, the detrimental consequences resulting from the combination of INV and ERTs align with our assumptions, while technical innovation is essential for creating superior technology that facilitates the attainment of sustainable development. Moreover, the increasing degree of innovation suggests that the technological effectiveness associated with expanding innovation contributes to reducing greenhouse gas (GHG) emissions in the sample nations. This is logical as the increase in innovation results in the emergence of more advanced technology that utilizes a reduced number of resources. Furthermore, technical advancement is imperative for the advancement of eco-friendly technology that may discourage the consumption of polluting energy sources. From the findings, it can be argued that economic growth promotes substituting outdated, highly polluting technologies with modern, environmentally friendly technology, thereby enhancing the overall environmental condition. Enhancing the efficient and persistent application of new technologies and innovations is crucial to decreasing GHG emissions and stimulating the development of environmentally friendly economies. Therefore, governments need to convert all types of innovation and technology investment programs into environmentally friendly strategies. Implementing environmentally friendly innovation and technology policies will effectively tackle both environmental and socioeconomic concerns, while also promoting sustainable economic development. The implementation of green policies will stimulate the development of sustainable innovation and technology structures that can effectively tackle the challenges and uncertainties associated with new advancements in innovation and technology (Cheng et al., 2025).

Moreover, Table 8 illustrates that the interaction of innovation and environmental technology consistently and negatively affects GHG emissions in OECD economies across all quantiles ranging from 0.5446% to 0.4749% across all quantiles from 25th to the 90th. The term “green innovation” in environmental technologies refers to the goal of reducing GHG emissions while simultaneously maintaining the environment. Further, the establishment of emission-free economy, the growth of the renewable energy industry, the development of financial sector, advancements in technology, government levies and support all play a role in decreasing GHG emissions over the 25th to 90th quantiles. Energy consumers in these particular categories possess a significant potential to contribute to worldwide efforts with the goal of tackling climate change and reducing GHG emissions through the implementation of environmental levies, the adoption of eco-friendly technologies, and the transition to alternative energy sources. These anticipated results are similar with the study of Peng X. Y. et al. (2023) and Akram et al. (2023).

The results illustrate that FD also fosters environmental sustainability. In particular, a 1% increase in FD results in a reduction in GHG of about −1.010435%, −0.8,091,266%, −0.6,730,513%, and −0.5,752,113% across all quantiles. This effect is statistically significant at a 1% level of significance. The findings support the assertion that a robust financial system facilitates access to funding at lower costs, hence expediting the liquidity and augmenting the capital formation and technological progress of renewable energy sectors. The investment in financial institutions and energy-efficient technologies ultimately promotes reduced energy consumption by encouraging investment on low-emission products. By resolving unbalanced promotions, resource deficits, and insufficient threat disclosure and pricing, OECD nations may effectively consider long-term climate hazards and opportunities. This will ensure that funds for low-emission, resilient infrastructure are appropriately distributed. These findings additionally reinforce the aim of the COP 27 agenda, which emphasizes the necessity of substantial investments in renewable energy by including the financial sector to decrease GHG emissions. These findings are aligned with the study of Zhen et al. (2023). Their findings demonstrate that string financial system contributes to the mitigation of GHG emissions in EU countries. The negative correlation between trade openness and GHG emissions implies that OECD nations are progressively promoting sustainable trade practices and policies. This is consistent with the findings of Wenlong et al. (2023), who highlight the capacity of international trade to decrease emissions and promote sustainable development. Considering the significant impact of the OECD on global trade regulations, these results emphasize the necessity of harmonizing trade practices with sustainable development objectives.

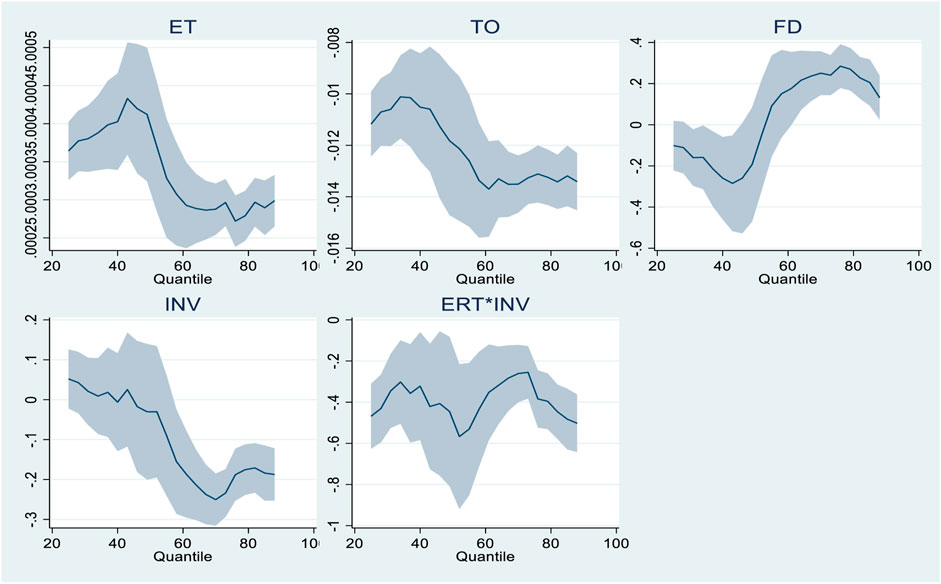

Further, summarizing the MMQR findings for OECD nations not only yields significant insights into the associations between these important factors and GHG emissions but also assists in tackling current economic and environmental concerns. These findings emphasize the significance of implementing sustainable practices, pursuing alternative sources of energy, and enhancing financial frameworks to attain an adequate equilibrium between economic development and safeguarding the environment in the OECD region. Further the results demonstrate that the effective use of ERTs, in tandem with green innovation, has a significant potential for developing a framework for sustainable development for countries to accomplish the SDGs and COP27 goals. The result will support OECD countries in achieving Sustainable Development Goals 7 and 13. Figure 5 illustrates the influence of independent variables on the explanatory variable (GHG emissions) at various quantiles. The overall trends indicate that the variables ET, INV, FD, and interaction ERTs*INV are associated with a reduction in GHG emissions in the nations included in the sample.

4.1.1 Robustness check

The outcomes derived from the MMQR are validated and reinforced by using a non-parametric robustness study utilizing the BSQR (Bootstrapped Quantile Regression) method. Table 9 demonstrates the results of BSQR analysis. The apparent negative correlation between ET and GHG emissions across different quantiles is consistent with the previous findings of the MMQR analysis. This emphasizes the validity of the argument that sustainable tax methods must take account of the environment’s consequences. Furthermore, the presence of negative coefficients for FD and trade openness across all quantiles in Table 9 confirms the findings of the MMQR analysis, which suggest that international collaboration, as demonstrated by trade openness, can effectively contribute to the reduction of GHG emissions.

Furthermore, the findings presented in Table 9 concerning parameters such as green innovation and the interplay between innovation and environmental related technologies align with the insights derived from the MMQR analysis.

This confirms that the implementation of eco-innovation and the use of green technologies are crucial for reducing GHG emissions. These results validated using MMQR, provide strong evidence that specific policy measures are necessary to address emissions reduction and environmental sustainability in different sectors of emissions distribution within OECD economies. These insights provide a strong basis for establishing policy decisions and executing measures that are reinforced with evidence and aimed at attaining a more environmentally friendly and sustainable future.

4.1.2 Panel causality test analysis

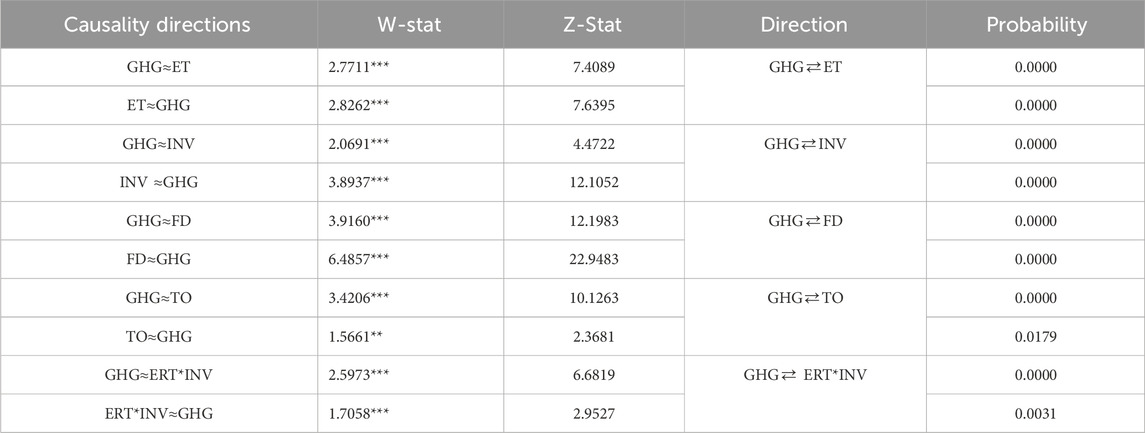

In the end, we examine the cause-and-effect connection among the independent variables and the dependent variable. The MMQR approach elucidates the relationships among parameters at various quantiles, but it does not offer an explanation of causation for such relationships. In order to formulate efficient tactics, it is crucial to comprehend the trajectories of these relationships. To examine causality among research parameters, this study employed standard causality methods, such as the causality test proposed by Dumitrescu and Hurlin (2012), taking consideration of the existence of the CSD.

This test examines the existence of various attributes in panel data and demonstrates a cause-and-effect connection by performing distinct regressions for each dataset. Furthermore, the W-bar is utilized for estimating mean statistics, whereas Z-bar statistics, which depict a standard distribution of normalcy, are employed for assessing the importance of causation. The findings of this examination are presented in Table 10. The results indicate that the independent variables have a significant impact on GHG emissions, indicating the existence of a bidirectional causation between the dependent and independent variables in OECD nations.

5 Conclusion and policy recommendations

The rapid expansion of economic activity and the overuse of fossil resources have a profound effect on sustainable development. In light of the growing challenge of greenhouse gas (GHG) emissions, a variety of strategies have been suggested. Recent studies highlight the importance of technological innovation in reducing environmental harm. However, the evidence regarding the direct link between green innovation, environmental taxation, financial development (FD), and GHG emissions has been inconsistent. Additionally, there is a notable lack of empirical research examining how the iinteractions between green innovation and environmental technologies can help lower GHG emissions, especially in OECD countries.

This study aims to fill these gaps by exploring how environmental taxes, green innovation, and financial development work together to reduce GHG emissions in OECD nations. It also looks into how green innovation moderates the relationship between environmental technologies and GHG emissions. By employing advanced methods such as DOLS, FMOLS, and CCR, the study assess the long-term effects of these factors on GHG emissions reduction from 1990 to 2020. Furthermore, this research builds on earlier studies that focused on the direct impacts of green innovation on environmental sustainability (You et al., 2022; Usman et al., 2023; Hassan et al., 2024). The study also utilizes the MMQR technique (Machado and Santos Silva, 2019) to deepen the understanding of variable relationships across different quantile distributions, providing a more precise and robust analysis than traditional panel quantile regression. The application of bootstrap quantile regression (BSQR) further supports the findings from the MMQR analysis.

The research highlights the significant role of environmental taxes (ET), green innovation (INV), and financial development (FD) in reducing GHG emissions. The results demonstrate that green innovation strengthens the relationship between environmental technologies and GHG emissions. The MMQR analysis reveals substantial differences across quantiles, suggesting that green innovation and financial systems are crucial in driving GHG reductions in the sample countries. The findings also indicate that the introduction of environmental taxes and the enhancement of green innovation are effective strategies for mitigating GHG emissions in OECD countries.

To reach net zero GHG emissions, it’s essential to enhance the efficiency of investments in eco-friendly technologies and innovative manufacturing practices. While securing financial backing from private entities can be challenging, public-private partnerships can help address these hurdles. Effective mitigation policies, such as emission taxes, are crucial for achieving sustainability. Emission taxes act as a powerful economic tool to lower emissions while also generating funds for environmental initiatives. These policies shape production, consumption, and investment choices, promoting alternatives that have minimal or no emissions.

In conclusion, the investigation of OECD countries utilizing MMQR techniques certainly suggests that ET and interaction of ERT*INV are crucial to environmental sustainability. The findings reveal that ET and ERTs*INV contributes to lower GHG emissions in OECD countries. This synergic effect serves as an effective catalyst for sustainable development, boosting economies’ shift to sustainable economies. By implementing ET and by fostering green innovation in environmental-related technologies, policymakers can develop an integrated strategy to achieve sustainable development, thus, maintaining a cleaner, more sustainable future. Furthermore, OECD nations may utilize their skills and resources to collaborate sustainable practices, determine consistent standards, and integrate policy efforts to combat global environmental issues, thus, consequently enhancing their commitment to ecological sustainability and governance in the global economy.

In summary, to meet sustainability targets, OECD countries must focus on green innovation across different sectors. Collaborative efforts between environmental technologies and green innovation will be vital in cutting down GHG emissions. Furthermore, governments should implement strict environmental regulations to avoid the “pollution haven” issue and foster sustainable development.

5.1 Policy recommendations

Based on the above findings Several policy recommendations are drawn: First Based on these results, it is recommended that governments of OECD countries prioritize enhancing the environmental impact of innovations to improve environmental sustainability without any delay. It is crucial to address the consequences of several factors such as aging populations, innovations in technologies, climate change, and global warming. This requires the acquisition of new environmentally-friendly skills and adherence to green performance standards in order to promote the development of green economies. OECD countries should integrate their technological advancement and investment policies into green initiatives. Implementing environmentally conscious innovation and technology policies will effectively tackle both environmental and economic concerns, while also promoting sustainable economic development. The implementation of green policies will stimulate the development of sustainable innovation and technology structures that can effectively manage the risks and uncertainties associated with new advancements in innovation and technology. Second; To successfully transition to low-emission practices, OECD countries should begin by actively reducing greenhouse gas (GHG) emissions and decreasing the extent of fossil fuel consumption. At the same time, they may enhance their strategies to integrate environmental taxes. Third; Moreover, the incorporation of technological innovations, especially in environmentally friendly technologies, is essential for improving the efficiency of fossil fuel extraction methods, including mining, coal production, and natural gas extraction. Consequently, this results in a decrease in greenhouse gas (GHG) emissions. In order to mitigate particular risks related to technological investments, policymakers should formulate robust and durable policies that allocate sustained and secure funding for technological investments to businesses, scientific and research institutions, and universities through budgetary allocations. Fourth; Further, OECD nations can implement measures such as strengthening domestic financial market institutions, augmenting financial support, and promoting international capital inflows to attain sustainable development. The competent authorities of the OECD nations can improve the efficiency of government administration in order to generate a suitable, productive, and safe investment atmosphere. This is intended to attract multinational companies to establish themselves, thus lending credibility to the local markets. OECD countries can promote the economic growth through the supply of low-carbon technologies and human resources support by actively engaging in research and development (R&D) activities to enhance their innovative. Further, it is crucial for OECD nations, particularly those reliant on natural resources, to enhance their energy consumption structure by transitioning from current consumption patterns to sustainable alternatives. OECD governments should actively encourage the widespread adoption of clean energy, such as solar energy, in the everyday lives and production activities of their people. Additionally, it is imperative to implement specific policies in regions that have varying levels of economic growth and available resources.

5.2 Limitations and future suggestions of study

This study is subject to certain limitations. The current study mostly used a linear model to assess the influence of several variables on GHG emissions. In future research, using non-linear analytic methods, such as the NARDL quantile-based regression analysis, might provide a more thorough comprehension of the association. The study emphasizes the growing significance of environmental taxation, green innovation, and the adoption of eco-friendly technology. Future research studies should explore the impact of financial inclusion and digitalization on greenhouse gas (GHG) emissions. This study used the moderating role of green innovation for the association of environmental technologies while future research can check the role of governance in promoting innovative green technologies to mitigate environmental degradation. Further, the current study used GHG as a measure of environmental quality. Future research can use CO2 emission, ecological footprints or load capacity factors to measure environmental quality in sample countries. However, the primary emphasis is on the economic aspect and environmental consequences in order to mitigate environmental deterioration in OECD nations. Future research might be broadened to include more economies.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data-explorer.oecd.org/.

Author contributions

AK: Conceptualization, Formal Analysis, Methodology, Writing – original draft. AS: Supervision, Validation, Visualization, Writing – review and editing. HA: Data curation, Formal Analysis, Methodology, Writing – review and editing. NF: Formal Analysis, Methodology, Validation, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Princess Nourah bint Abdulrahman University Researchers Supporting Project number (PNURSP2025R549), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

2World Development Indicators | DataBank (worldbank.org)

References

Abbasi, K. R., Hussain, K., Haddad, A. M., Salman, A., and Ozturk, I. (2022). The role of financial development and technological innovation towards sustainable development in Pakistan: fresh insights from consumption and territory-based emissions. Technol. Forecast. Soc. Change 176, 121444. doi:10.1016/j.techfore.2021.121444

Adebayo, T. S., Akadiri, S. S., Riti, J. S., and Tony Odu, A. (2023). Interaction among geopolitical risk, trade openness, economic growth, carbon emissions and its implication on climate change in India. Energy and Environ. 34 (5), 1305–1326. doi:10.1177/0958305x221083236

Ahmad, N., Youjin, L., Žiković, S., and Belyaeva, Z. (2023). The effects of technological innovation on sustainable development and environmental degradation: evidence from China. Technol. Soc. 72, 102184. doi:10.1016/j.techsoc.2022.102184

Ahmed, N., Sheikh, A. A., Hamid, Z., Senkus, P., Borda, R. C., Wysokińska-Senkus, A., et al. (2022). Exploring the causal relationship among green taxes, energy intensity, and energy consumption in nordic countries: Dumitrescu and Hurlin causality approach. Energies 15 (14), 5199. doi:10.3390/en15145199