- 1Faculty of Humanities and Management, Yunnan University of Chinese Medicine, Kunming, Yunnan, China

- 2School of Business and Economics, United International University, Dhaka, Bangladesh

Rapid urbanization, economic dependency on natural resources, and ecological damage are major obstacles to environmental sustainability in the Middle East and North Africa (MENA). This paper examines the dynamic interactions among Information and Communication Technology (ICT), technical innovation, financial inclusion, natural resource rent, and environmental sustainability using ecological footprints and load capacity factors as main indicators. The research finds linear and asymmetric correlations using panel data from 2001 to 2022 and sophisticated econometric approaches like Cross-sectionally Autoregressive Distributed Lag (CS-ARDL) and Nonlinear ARDL (NARDL) models. The results expose that by encouraging energy efficiency and sustainable resource use, ICT and technical innovation significantly help to reduce environmental damage. Financial inclusion, however, has two different effects: if not properly controlled, it may encourage unsustainable spending habits even while it helps to provide cash for green ventures. Moreover, natural resource rents greatly worsen environmental damage, supporting the resource curse theory, especially in areas with inadequate government systems. The asymmetry approach emphasizes the varied impacts of positive and negative shocks in ICT and technological innovation on sustainability, thus implying the need for customized policy responses. With a comprehensive view of sustainability in MENA and strong econometric modeling incorporating environmental, technical, and financial components, this paper adds to the body of knowledge. Emphasizing the requirement of legislative frameworks that support green funding, improve institutional quality, and stimulate the use of digital and clean technology, the findings provide policymakers with practical insights. Aligning economic resilience with environmental sustainability would depend mostly on strengthening governance and sustainable investment policies, guaranteeing long-term ecological and economic stability.

1 Introduction

Environmental sustainability in the Middle East and North Africa (MENA) region is increasingly critical, given the unique challenges of arid climates, water scarcity, and rapid urbanization. The region is home to some of the world’s most water-stressed countries, with an alarming 80% of the population living in areas facing high water stress, as reported by the World Bank. The United Nations Environment Programme also highlights that MENA experiences significant biodiversity loss and habitat degradation, exacerbated by climate change and unsustainable agricultural practices. Various initiatives have emerged to address these pressing issues, such as the Arab Strategy for Disaster Risk Reduction, emphasizing the importance of integrating sustainability into national policies. Furthermore, renewable energy projects, particularly solar power investments, are gaining momentum, with the International Renewable Energy Agency indicating that MENA could meet over 80% of its energy needs through renewable sources by 2030. Overall, fostering a culture of environmental sustainability in the MENA region is vital for ecological preservation and its nations’ long-term economic stability and resilience.

Several environmental and social variables influence the complexity of the problem of environmental sustainability in the MENA area. Degradation of the ecosystem, insufficient funding for renewable energy, and growing ecological footprints are the only major obstacles to sustainable development in the area (Anwana and Owojori, 2024; Omojolaibi and Nathaniel, 2020). Many MENA nations still put economic development ahead of environmental protection, leading to excessive carbon emissions and resource loss; this makes their dependence on fossil fuels an important obstacle ((Bahn et al., 2018; Bahn et al., 2021). In addition, these problems are made worse by political unpredictability and economic inequality, which causes both business owners and government officials to lose sight of environmental principles (Hager et al., 2024; Owojori and Anwana, 2024). The adoption of renewable energy sources and the execution of Multilateral Environmental Agreements (MEAs) provide new possibilities for improving sustainability despite these challenges. Given the region’s extensive natural resources, there is a huge opportunity for green financing and investment in renewable energy sources (Ma and Najam, 2024). One potential strategy for bettering environmental results is the use of digital technology with sustainable farming methods (Bahn et al., 2021). In order to achieve their long-term environmental objectives, MENA nations must work together to improve their institutional frameworks and raise public knowledge about sustainability (Gang et al., 2023; Khaled, 2024). In order to provide a sustainable future for the varied people in the MENA area, it will be essential to tackle these interrelated concerns.

The growing emphasis on renewable energy and energy efficiency significantly contributes to environmental sustainability in the MENA region. Studies show that investing in renewable energy technologies is crucial in promoting sustainable development by decreasing dependence on fossil fuels, which are widely used in the region (Aldulaimi and Abdeldayem, 2022; Bargaoui, 2021). Moreover, incorporating green investments alongside energy efficiency initiatives has positively impacted environmental quality. This is supported by research that underscores the connection between these elements and sustainability results (Gang et al., 2023; Kong et al., 2022). Governmental interventions play a crucial role in fostering investments, as well-crafted policies can establish a supportive framework for sustainable practices (Taweel et al., 2015; Xiangling and Qamruzzaman, 2024a). A notable advantage lies in the region’s well-educated demographic, demonstrating a growing awareness of environmental concerns. The ongoing demographic transition is linked to increasing demand for sustainable tourism and development practices, reflecting the priorities of younger generations who emphasize ecological considerations in their consumption behaviors. Furthermore, integrating digital technologies and financial inclusion efforts has enhanced sustainability results, enabling access to vital information and resources for sustainable energy practices (Ma and Najam, 2024; Mahmood et al., 2023; Pereira et al., 2021). On the other hand, various elements challenge environmental sustainability in the MENA region. The persistent socio-political conflicts present a critical challenge, undermining effective governance and resource management and contributing to environmental degradation. Research indicates that conflicts significantly worsen ecological footprints by shifting focus and resources from sustainable practices to urgent economic survival needs (Sowers et al., 2017; Usman et al., 2021). Furthermore, the dependence on oil and gas revenues presents a paradox in which economic growth frequently coincides with heightened environmental degradation. The processes involved in the extraction and consumption of these resources play a substantial role in contributing to CO2 emissions (Mahmood et al., 2023).

The Environmental Kuznets Curve (EKC) hypothesis posits that as economies grow, they may initially experience environmental degradation; however, this trend can shift and improve once income levels reach a certain threshold. In numerous MENA countries, the impact of economic growth remains significantly greater than the advantages offered by advancements in technology and changes in composition, leading to ongoing environmental issues. Moreover, insufficient financial institutions and regulatory frameworks pose a significant barrier to the shift towards cleaner energy sources. Research highlights that the advancements in financial development have not yet resulted in meaningful enhancements in sustainability. Certain factors demonstrate neutral effects on environmental sustainability, with their influence potentially fluctuating depending on the specific contextual conditions in which they are situated. Urbanization presents a complex interplay of both beneficial and detrimental effects on sustainability. Urbanization has the potential to enhance resource efficiency and foster innovation in sustainable practices; however, if not managed effectively, it may also intensify pollution and place significant pressure on local ecosystems (Gang et al., 2023). The interplay between foreign direct investment (FDI) and environmental quality is intricate. On one hand, FDI has the potential to introduce capital and technology that foster sustainable development. On the other hand, if not properly aligned with sustainability objectives, it may contribute to environmental degradation (Pereira et al., 2021; Abdouli and Hammami, 2015). The escalating environmental challenges in the Middle East and North Africa (MENA) region—characterized by arid climates, water scarcity, rapid urbanization, and excessive reliance on fossil fuels—necessitate a comprehensive approach to sustainability. Despite the region’s vast potential for renewable energy and technological advancements, the interplay between economic development and environmental degradation remains a pressing concern. Factors such as inadequate institutional frameworks, socio-political instability, and the overexploitation of natural resources further exacerbate the region’s ecological footprint. This study is motivated by the critical need to identify sustainable pathways for growth, leveraging Information and Communication Technology (ICT), technological innovation, and financial inclusion. By exploring their impacts alongside natural resource dependency, the research seeks to offer evidence-based solutions that align economic resilience with environmental stewardship. The findings aim to guide policymakers in crafting strategies that balance ecological preservation with socio-economic advancement, fostering a sustainable future for the MENA region and beyond.

In light of the complicated consequences of natural resource reliance, this study’s main goal is to evaluate the roles of ICT, technical innovation, and financial inclusion in reducing environmental degradation. Unlike other studies, which often examine these elements independently, this one combines them into a coherent framework, enabling sophisticated knowledge of their interdependence. Apart from conventional carbon emissions measurements, the research presents ecological footprint and load capacity factors as important environmental sustainability measures, providing a more comprehensive picture of ecological wellbeing. The study seeks to answer: RQ1. How do ICT and technological innovation influence environmental sustainability in MENA economies? RQ2. What role does financial inclusion play in shaping ecological footprints, and does it contribute positively or negatively to sustainability efforts? RQ3. How does natural resource rent impact environmental outcomes, and does it align with or contradict the Resource Curse Theory? RQ4. What policy measures can help balance economic growth with ecological preservation in resource-dependent economies?

This study contributes significantly to the existing literature by offering a nuanced analysis of the interconnected roles of Information and Communication Technology (ICT), technological innovation, financial inclusion, and natural resource rent in shaping environmental sustainability within the MENA region. Unlike previous studies that address these factors in isolation, this research adopts a holistic approach, integrating ecological footprint and load capacity factors as comprehensive environmental impact indicators. Methodologically, it employs advanced econometric techniques, including the CS-ARDL and nonlinear estimation frameworks, to uncover both linear and asymmetric relationships, thereby capturing the complexity of the dynamics at play. Furthermore, the study extends the discourse on the Environmental Kuznets Curve (EKC) hypothesis, highlighting the conditional role of institutional quality and governance in moderating the effects of economic growth on environmental degradation. The research addresses a critical gap in the literature by situating the analysis within the unique socio-economic and political context of the MENA region. It provides actionable insights for achieving sustainable development. The findings enrich theoretical and empirical debates by demonstrating how targeted policy interventions and investments in green technologies can mitigate the environmental impacts of financial and resource-intensive growth models, offering a blueprint for sustainable practices in resource-dependent economies globally.

The article is organized into several sections to explore the research topic comprehensively. The Introduction establishes the study’s significance, highlighting the environmental challenges in the MENA region and the need for sustainable solutions. The Theoretical and Empirical Review discusses foundational theories, such as the Environmental Kuznets Curve (EKC), and reviews empirical studies on ICT, technological innovation, financial inclusion, and natural resources. The Data and Methodology section elaborates on the study’s econometric framework, including panel data analysis, cointegration tests, and asymmetric modeling techniques. The Results and Discussion present key findings, including the impacts of ICT and technological innovation on ecological sustainability, the complex role of financial inclusion, and the environmental consequences of natural resource dependency. The Policy Implications section outlines actionable strategies for enhancing governance, promoting green technologies, and achieving sustainable resource management. Finally, the Conclusion synthesizes the main insights, emphasizing the study’s contribution to the literature and its relevance for policymakers in fostering a sustainable future for the MENA region.

2 Theoretical and empirical review

2.1 CT and environmental sustainability

In recent years, significant advancements in Information and Communication Technology (ICT) have profoundly influenced various aspects of human life, including lifestyle choices, professional practices, and social interactions. This global proliferation of ICT has catalyzed a growing interest in understanding its implications for environmental sustainability. This literature review aims to conduct a comprehensive examination of research that investigates the impacts of ICT on the promotion of environmental sustainability. By analyzing the existing literature, we aim to elucidate ICT’s potential benefits and challenges in pursuing a more sustainable future.

Numerous studies underscore the critical role of ICT in enhancing energy efficiency across various sectors (Lv et al., 2023; Chatti, 2020; Ibrahim and Waziri, 2020; Wang et al., 2015). For instance, ICT facilitates the development of smart grids, advanced metering systems, and energy management applications, which collectively optimize energy consumption and reduce waste. Implementing ICT-driven smart buildings exemplifies this potential, as these structures can automatically adjust lighting and temperature based on occupancy, leading to substantial energy savings (Uddin et al., 2017). Furthermore, ICT-enabled smart transportation systems can improve traffic management, enhance fuel efficiency, and decrease greenhouse gas emissions (Yılmaz and Koyuncu, 2019). These findings highlight the positive contributions of ICT towards energy conservation and environmental sustainability.

Extensive research has also focused on integrating ICT with renewable energy sources to enhance the reliability and efficiency of these systems. ICT is pivotal in enabling real-time monitoring and management of renewable energy outputs, allowing grid operators to balance electricity supply and demand effectively. Studies indicate that ICT-enabled smart grids can accommodate a higher proportion of renewable energy sources, thus reducing reliance on fossil fuels and lowering carbon emissions (Agu, 2023). Additionally, ICT applications such as demand-side management and energy storage optimization can further enhance the utilization of intermittent renewable energy sources (Zeng and Li, 2016). These insights emphasize the significant importance of ICT in facilitating the widespread adoption of renewable energy and advancing toward a low-carbon energy framework. Utilizing remote sensing technologies, Internet of Things (IoT) sensors, and big data analytics allows for continuous, real-time monitoring of environmental parameters such as air and water quality and biodiversity (Twagirayezu et al., 2021). This wealth of data provides policymakers and environmental agencies with critical insights to inform decision-making and implement targeted interventions. For example, ICT-based air quality monitoring systems can identify hotspots and guide strategies to mitigate air pollution, enhancing public health and reducing carbon emissions (Coroamă et al., 2014). These developments illustrate the capacity of ICT to bolster environmental monitoring and management significantly.

Despite its numerous benefits, the widespread adoption of ICT has raised concerns regarding electronic waste (e-waste) and its environmental ramifications. The study of (Kartouti and Juidette, 2023) articulates that the rapid obsolescence of electronic devices and the increasing demand for new ICT products generate substantial amounts of e-waste. Poor disposal and recycling practices can lead to environmental contamination and pose significant health risks (Tam et al., 2018). However, ICT can also be crucial in addressing e-waste challenges by implementing e-waste management systems, recycling initiatives, and promoting circular economy models (Radu, 2016). Furthermore, the findings of (Malmodin et al., 2010; Zapico et al., 2010) advocated that the ICT sector can mitigate its environmental impact by fostering sustainable product design and responsible e-waste disposal practices.

2.2 Financial inclusion and environmental sustainability

The potential of financial inclusion to spur economic development and reduce poverty has garnered much attention. It is defined as making financial services available to people and businesses. In particular, carbon dioxide (CO2) emissions continue to be a hotly debated topic in discussions about its effects on environmental sustainability. This research evaluation classifies the consequences of financial inclusion on environmental sustainability as either good, negative, or neutral. According to several research, there is a strong relationship between financial inclusion and environmental sustainability. By expanding people’s access to banking, savings, and insurance, financial inclusion may encourage the development of greener economic models and purchasing renewable energy sources. To illustrate the point, (Khémiri et al., 2023; Wicaksana, 2023), found that when people and companies have better access to capital, they are more inclined to invest in energy-efficient technology and sustainable farming practices, reducing CO2 emissions. Research suggests financial inclusion might encourage ecologically friendly habits by spurring innovations in this area. In addition, small and medium-sized businesses (SMEs) that have trouble accessing traditional funding sources might find it easier to implement greener technology by integrating financial services. In order to reduce carbon emissions, financial institutions may help small and medium-sized enterprises (SMEs) upgrade their production processes and adopt sustainable technology (Mahato and Jha, 2023). When people in poor countries have easier access to capital, they are more likely to participate in green activities, positively affecting sustainability.

On the other side, some academics are worried that more people having access to financial services would raise CO2 emissions from buying more stuff and making more power. Access to credit could lead people to overspend, which increases consumption and increases their impact on the environment (Ullah et al., 2022). Organizations that are better able to get financing may also increase their output, increasing the demand for resources and their carbon footprint. Agricultural activities spurred by financial inclusion may cause land-use changes, deforestation, and increased pollution; this phenomenon is especially noticeable in fast-urbanizing areas (Liu et al., 2022). Rising CO2 emissions may result from more industrialization and infrastructure investment in developing nations if they have easier access to capital (Gourène and Mendy, 2019). A study conducted by (Erdogan, 2024) found that while financial inclusion can encourage investments in sustainable technology, it also can raise demand for non-renewable energy sources, which might worsen environmental deterioration.

Depending on the situation’s specifics, some research has shown a positive or negative correlation between financial inclusion and ecological sustainability. For instance, the total effect of financial inclusion on carbon dioxide emissions may differ according to regional circumstances and regulatory frameworks, even if it may boost economic activity and encourage sustainable behaviors (Yin et al., 2019). The environmental costs of increasing consumption and production activities could sometimes outweigh the advantages of financial inclusion in encouraging sustainable habits (Franco-Riquelme and Rubalcaba, 2021). There is a danger of increasing consumption and environmental deterioration associated with financial inclusion, even though it may encourage sustainable habits and decrease emissions. Investments in sustainable technology should be encouraged, and policymakers should promote inclusive financing in a balanced manner.

2.3 Technological innovation and CO2 emission

Technological innovation is pivotal in the configuration of society, the economy, and the environment. With the increasing worry about climate change and the need for sustainable development, scholars and policymakers have focused on examining the correlation between technical advancements and carbon dioxide (CO2) emissions. This literature review aims to provide a comprehensive analysis of relevant research investigating the impact of technological innovation on carbon dioxide (CO2) emissions. The study will emphasize the diverse results and their implications for addressing climate change. In the context of carbon dioxide (CO2) emissions, technological innovation encompasses developments in various fields, such as the energy sector, transportation, industry, and agriculture. This complex relationship has been the subject of a great deal of academic study from a variety of perspectives and in a variety of contexts. Technological innovation is essential for climate change to be mitigated and sustainable development goals to be realized. The different ways in which innovations have an impact on CO2 emissions are examined in this overview of the relevant research. Installing energy-efficient technology leading to emission reductions is only one example of the wide variety of outcomes that may result from digitalization, which also carries the risk of introducing new challenges. Policymakers and stakeholders must consider sector-specific methodologies, geographical settings, and the implementation of effective policies that may effectively harness the potential of technological innovation if they are to meet carbon emission reduction targets successfully. Within the framework of global endeavors to combat climate change and achieve environmental sustainability, the examination of the influence of technological innovation on carbon emissions has become an increasingly significant subject. The table presents a succinct overview of nine studies conducted in different countries, utilizing diverse methodologies to investigate the correlation between technological innovation and carbon emissions. Let us thoroughly examine the findings and implications presented in the literature review (Smith et al., 2007). Through econometric analysis, a comprehensive study conducted within the United States has provided evidence of technological innovation’s positive impact on reducing carbon emissions. Technological advancements contribute to reducing carbon emissions by enhancing energy efficiency and promoting healthier production methods. This finding underscores the importance of allocating resources toward developing and implementing cutting-edge technologies to promote sustainable development and mitigate the effects of climate change. Moreover, (Danish, 2021), by executing the dynamic ARDL, documented adverse linkage between GTI and CO2 in the long and short-run assessment. For China (Chen et al., 2020), The study utilizes input-output analysis within the specific context of China. It concludes the varying impact of technological innovation on carbon emissions across different industries. While it is true that certain industries have witnessed a decline in carbon emissions as a direct consequence of their innovative practices, it is important to acknowledge that there are other sectors where emissions have actually increased due to amplified output levels. This statement underscores the necessity of implementing targeted strategies to promote innovation in industries that possess the highest potential for reducing emissions.

The present study (Seo et al., 2018), conducted in South Korea, elucidates the relationship between technological innovation and economic development by applying structural equation modeling. The findings indicate a noteworthy positive correlation between these variables, resulting in an observable escalation in carbon emissions. This discovery presents significant considerations for policymakers regarding balancing economic development and environmental sustainability by fostering the advancement of eco-friendly innovations.

2.4 Natural resources rent and environmental sustainability

The interplay between natural resource rents and environmental sustainability is intricate and layered, revealing a spectrum of positive, negative, and neutral dynamics that vary across different contexts. Research frequently emphasizes the significance of positive relationships, indicating that natural resource rents have the potential to drive economic growth and development, especially in nations abundant in resources. For example, Asiedu et al. (2021) illustrate that natural resource rents are crucial in driving economic growth within West African economies. Their findings indicate that the effective management of these resources has the potential to foster improved sustainability outcomes. Similarly, Onifade and Alola (2023) observes that elevated natural resource rents can foster domestic credit and invigorate private sector growth, potentially indirectly supporting sustainable practices within the MENA region. The viewpoint is further supported by Erdogan, (2024), who contend that globalization can potentially alleviate the adverse effects of resource rents on human wellbeing, thus promoting environmental sustainability.

On the other hand, the adverse effects of natural resource rents on environmental sustainability have been thoroughly documented. A wealth of research demonstrates that excessive dependence on natural resources can result in environmental degradation and heightened pollution levels. Mahmood et al. demonstrate a significant correlation between oil and natural gas rents and elevated CO2 emissions in the MENA region, highlighting the environmental repercussions of resource extraction (Mahmood et al., 2023). Moreover, Achuo et al. (2023) study underscores the fact that the extraction of natural resources frequently results in heightened environmental pollution, especially in developing nations where institutional structures may lack robustness. The “resource curse” phenomenon highlights the paradox where nations endowed with abundant natural resources often face economic growth impediments and detrimental environmental consequences. This situation frequently arises from mismanagement and the pursuit of rent-seeking behaviors, as discussed by Havranek et al. (2016).

Neutral relationships can be identified, indicating that the influence of natural resource rents on environmental sustainability is contingent upon various contextual elements, including the quality of governance and the robustness of institutional frameworks. Khan et al. (2020) propose that the interplay between natural resource rents and financial development is influenced by the quality of institutions, suggesting that effective governance can amplify the beneficial effects of resource rents while reducing their adverse consequences. In a similar vein, the research conducted by Alhassan and Kwakwa (2022) indicates that although the extraction of natural resources may negatively impact environmental quality, the presence of effective governance can mitigate these adverse effects by underscoring the critical role that tailored policies and governance frameworks play in shaping the overall effects of natural resource rents on environmental sustainability. Depending on several contextual circumstances, including the quality of governance and institutional frameworks, some research suggests that natural resource rents and environmental sustainability may have no connection. According to Ma and Najam (2024), a country’s institutional quality determines how natural resource rents affect economic development and environmental quality. Sustainable development may be possible in resource-rich countries with robust legal and policy frameworks by managing natural resource rents to reduce their negative environmental effects. On the other hand, in nations lacking institutions, these rents can worsen environmental damage without producing a significant economic advantage.

2.5 Contribution to the existing literature

First, this paper fills in important voids in current research by offering a thorough, region-specific investigation of the environmental effect of ICT, technological innovation, financial inclusion, and natural resource reliance in MENA economies. Few studies have combined these elements into a comprehensive econometric framework for MENA’s economic and environmental constraints. In contrast, earlier research has looked at these elements in isolation or within more general worldwide settings. Second, unlike usual studies using linear models, this work uses sophisticated econometric approaches like CS-ARDL and NARDL, capturing both short-run and long-run dynamics along with asymmetric effects. Third, it extends the Environmental Kuznets Curve (EKC) hypothesis by including institutional quality and governance, which are often disregarded in studies of regional sustainability. This paper guarantees a balanced approach to economic development and environmental resilience in resource-dependent countries by giving empirical data on policy-driven sustainability paths, thereby presenting practical insights for legislators. This input helps to clarify the conversation around sustainable development in developing nations.

3 Data and methodology of the study

3.1 Theoretical foundation and model construction

The Technology Adoption and Diffusion Theory offers a valuable perspective for analyzing how new technologies, especially information and communication technologies, are accepted and spread throughout societies. This theory highlights essential elements, including relative advantage, compatibility, complexity, trialability, and observability, all of which play a significant role in successfully integrating ICT to foster environmental sustainability (Wibowo et al., 2024). Recent research underscores the significant role of social media in mobilizing environmental action and raising awareness about sustainability initiatives, highlighting the significant role of ICT in enhancing communication and promoting community involvement in initiatives aimed at environmental conservation.

The Innovation Systems Theory enhances this framework by emphasizing the dynamic interactions among diverse actors and institutions within an innovation ecosystem. Entities such as firms, universities, research institutions, and government agencies are integral to promoting technological innovation that underpins environmental sustainability (Dehdar et al., 2022). This theory places significant importance on collaboration and knowledge sharing, underscoring the potential of collective efforts to propel advancements in sustainable practices and technologies.

The theory of financial inclusion plays a crucial role in this study, highlighting how access to financial services is vital for fostering economic development and enhancing social inclusion. Financial inclusion has the potential to drive investments in clean technologies and promote sustainable resource management, ultimately contributing to the overall sustainability of economic activities (Petrova et al., 2023). The dynamics of this relationship hold substantial importance in the MENA region, as the availability of financial resources can profoundly influence the uptake of sustainable technologies and practices.

The Resource Curse Theory presents a compelling viewpoint, positing that nations endowed with abundant natural resources might face impediments to economic growth. This phenomenon can be attributed to Dutch Disease and inherent institutional frailties. This theory highlights the importance of effective resource management and diversification strategies for sustainable development (Corbett, 2013). Within the MENA region, characterized by its rich natural resource endowments, this theory underscores the intricate challenges and potential opportunities in resource management, particularly in the pursuit of sustainability.

The Environmental Kuznets Curve (EKC) Hypothesis presents an intriguing inverted U-shaped correlation between economic growth and environmental degradation. Although pollution may rise in the early stages of economic development, it tends to decrease as income levels improve (Mutchek and Williams, 2014). This hypothesis underscores the critical need to separate economic growth from environmental degradation, a notion gaining traction in contemporary dialogues surrounding sustainable development.

The Circular Economy Framework emphasizes optimizing resource use and reducing waste by promoting the closure of resource loops and minimizing environmental impact. This framework highlights the importance of technological innovation and circular business models in promoting environmental sustainability, indicating that adopting circular practices can greatly diminish ecological footprints (Almusaed et al., 2023). Integrating circular economy principles is vital for promoting sustainable practices in the MENA region, where effective resource management is crucial.

To investigate the interaction of ICT, technical innovation, financial inclusion, natural resources, and environmental sustainability, the research gathers panel data from MENA nations covering 2001–2022. Data is obtained by researchers from credible worldwide databases like the United Nations Environment Program (UNEP), World Bank, International Energy Agency (IEA), and International Telecommunication Union (ITU). Key economic, environmental, and technical indicators abound in the dataset, guaranteeing a thorough covering of the variables under analysis. Researchers cross-valuate many sources before merging them into the econometric model to preserve data dependability. They provide comparability across nations and time by using standardizing methods. Advanced econometric tests evaluate stationarity and solve cross-sectional dependence to guarantee strong estimates. Researchers also use missing data imputation strategies to reduce biases when needed. The last dataset offers linear and nonlinear studies, enabling a sophisticated knowledge of how these elements affect environmental sustainability in MENA countries.

The generalized equation of the empirical model is as follows;

CC, TI, FI, NRR, and ICT stand for climate change, technological innovation, financial inclusion, and natural resources rent, respectively. After the log transformation, the above Equation 1 can be displayed in the following manner, See, Equation 2:

β0 is the intercept term, β1,β2,β3, and β4 are the coefficients for the respective independent variables, ϵ is the error term.

The coefficient β1 linked to ICT is anticipated to exhibit a negative sign, indicating that a rise in the adoption of information and communication technology may be associated with a reduction in the impacts of climate change. The reasoning for this expectation is backed by existing literature demonstrating how ICT can improve environmental performance by enhancing efficiency and resource management while fostering increased public involvement in sustainability initiatives. The incorporation of ICT across different sectors has demonstrated a significant enhancement in the monitoring and managing of environmental resources, which in turn helps to alleviate negative impacts associated with climate change.

The coefficient β2 associated with Technological Innovation (TI) is expected to exhibit a negative value, which illustrates the idea that technological advancements have the potential to foster more sustainable practices and diminish greenhouse gas emissions. Advancements in technology frequently lead to more sustainable production techniques and the emergence of renewable energy options, both of which play a vital role in combating climate change. Research indicates that areas that prioritize technological innovation often see a decrease in their carbon footprints, reinforcing the anticipated inverse correlation between technological innovation and climate change.

In the context of Financial Inclusion (FI), one would anticipate that the coefficient β3 will exhibit a positive value, which suggests that without proper management, enhanced financial inclusion could result in a rise in investments that are detrimental to the environment. It is important to recognize that although financial inclusion can enhance access to resources that promote sustainable practices, it may also unintentionally bolster unsustainable practices if investments are not strategically channeled towards green technologies. The relationship is indeed complex, and the positive correlation indicates that there is a possibility for greater financial resources to be directed toward both sustainable and unsustainable initiatives.

Finally, we anticipate that the coefficient β4 for Natural Resources Rent (NRR) will also exhibit a positive value, which is consistent with the Resource Curse Theory, which suggests that nations abundant in natural resources might face impediments to economic growth and environmental sustainability, often stemming from mismanagement and an over-dependence on these resources. The anticipated positive coefficient indicates that increased natural resource rents may intensify the effects of climate change, especially when the revenues are not allocated towards sustainable development efforts.

3.2 Variables definition and rationality for selection

Information and Communication Technology (ICT) encompasses the various technologies that facilitate access to information via telecommunications, the internet, and additional channels. This research evaluates ICT by utilizing indicators such as internet penetration rates, mobile phone usage statistics, and the degree of advancement in digital infrastructure. The choice of ICT as an independent variable is well-founded, given its established impact on boosting productivity, driving innovation, and supporting sustainable practices in diverse sectors. Studies indicate that information and communication technology (ICT) enhances environmental performance through improved resource management and increased public involvement in sustainability efforts. Technological innovation encompasses the development and implementation of novel technologies and the refinement of current technologies aimed at boosting both efficiency and effectiveness. The measurement is conducted through various proxies, including the number of patents filed, expenditures on research and development (R&D), and the rate of new technology adoption across industries. The inclusion of technological innovation is grounded in its capacity to promote sustainable practices and mitigate environmental impacts by utilizing cleaner production techniques and renewable energy alternatives. Research demonstrates that areas that prioritize technological innovation often see a decrease in their carbon footprints, highlighting the significance of this factor concerning climate change. Financial inclusion refers to the ability of individuals and businesses to access and utilize financial services effectively. The assessment uses indicators such as the proportion of individuals holding bank accounts, the accessibility of credit, and the presence of microfinance services. The consideration of financial inclusion as a variable is rooted in recognizing that access to financial resources plays a crucial role in enabling investments in sustainable technologies and practices. Nonetheless, it is acknowledged that financial inclusion may result in heightened investments in environmentally detrimental activities if not steered towards sustainable initiatives. The concept of natural resources rent pertains to the financial returns generated from extracting various natural resources, including oil, gas, and minerals. The assessment is conducted through proxies, including the proportion of GDP attributed to natural resource extraction and the income generated from resource exports. The inclusion of NRR is grounded in the Resource Curse Theory, which suggests that nations abundant in natural resources often encounter difficulties in attaining sustainable development, primarily due to mismanagement and an excessive dependence on these resources. Grasping the intricacies of natural resource management is essential for crafting strategies that foster sustainability while effectively utilizing resource wealth.

As seen in Table 1, the results indicate the variance inflation factors (VIFs) for two models: ecological footprint and load capacity factor. For the ecological footprint model, the VIF values are below 5, with the highest at 3.91 (Y) and the lowest at 1.102 (FI), suggesting low to moderate multicollinearity. The mean VIF for this model is 2.5402, which is within an acceptable range. In the load capacity factor model, VIF values range from 1.8115 (Y) to 3.3818 (T), also below the typical threshold of 5, indicating minimal multicollinearity concerns. The mean VIF for this model is 2.6649, which reinforces the interpretation that multicollinearity is not problematic in either model, allowing for a reliable interpretation of regression coefficients.

3.3 Estimation strategies

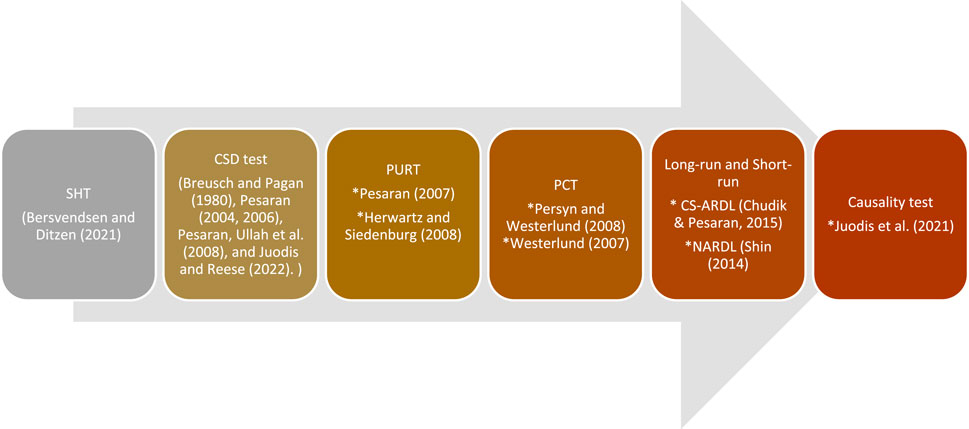

To assess slope heterogeneity, the methodology adheres to the framework established by Bersvendsen and Ditzen (2021), which provides a comprehensive approach for accounting for variability in slopes across individual units within a panel dataset. This methodology facilitates a nuanced examination of the underlying differences in the relationships between variables across various cross-sectional entities. By analyzing slope heterogeneity, researchers can identify and account for potential disparities in how each cross-sectional unit responds to predictors, leading to more accurate and context-specific estimations.

In the second stage of the analysis, the focus shifts to documenting cross-sectional dependency through the application of multiple established tests, including those developed by Breusch and Pagan (1980), Pesaran, (2006), Pesaran (2004), Pesaran et al. (2008), and Juodis and Reese (2022). Cross-sectional dependency is a prevalent concern in panel data analysis, as economic shocks or policy changes affecting one entity often have repercussions for others, thereby creating interdependencies among the units. The aforementioned tests are instrumental in assessing the degree of correlation among observations across different units. This is essential for ensuring that the econometric model accurately reflects the influence of shared shocks or spillover effects.

The third stage evaluates the order of integration for each variable by executing a series of panel unit root tests, specifically the CADF test statistic, CIPS test statistic, and the methodology proposed by Herwartz et al. (2018). These tests are critical for determining whether the variables exhibit stationarity or contain unit roots, as the presence of non-stationary variables can lead to spurious results in regression analyses. The CADF and CIPS tests are particularly advantageous as they account for cross-sectional dependence in the unit root testing process, thereby enhancing their reliability in panel datasets characterized by interconnected entities. This rigorous approach ensures that the econometric analysis is grounded in sound statistical principles, thereby bolstering the credibility of the findings, See, Equation 3:

In Stage 4, the assessment of long-run cointegration is performed utilizing the methodologies established by Persyn and Westerlund (Persyn and Westerlund, 2008) and Westerlund (Westerlund, 2007). These approaches are critical for evaluating the existence of a long-run relationship among the variables of interest within a panel dataset. The framework incorporates considerations for cross-sectional dependence and heterogeneity, offering robust insights into the interconnectedness of variables over extended periods. By applying this methodology, researchers can ascertain whether the variables share a stable, long-term equilibrium relationship, essential for comprehending persistent interactions across different units in the panel. The following statistical equation will be executed to derive the cointegration investigation’s test statistics.

Stage 5 estimates the long-run and short-run coefficients through the Cross-Sectionally Augmented Autoregressive Distributed Lag (CS-ARDL) model. The CS-ARDL approach is particularly advantageous as it effectively captures the dynamic relationships within the panel, accommodating both immediate (short-run) and enduring (long-run) effects of explanatory variables on the dependent variable. By estimating these coefficients, researchers can evaluate the speed at which variables adjust in the short run and the stability and magnitude of long-term associations. This comprehensive analysis ultimately provides a nuanced understanding of the dynamic interdependencies in the panel data, facilitating more informed conclusions regarding the relationships among the variables Chudik and Pesaran (2015).

The fundamental framework of the study is as follows, See, Equation 4:

In Equation 4,

In Equation 5,

From the above Equation 6, the speed of adjustment can be documented with

In Stage 6, the study adopts an asymmetric framework by employing the nonlinear estimation approach introduced by Shin et al. (2014) to capture potential non-linearities and asymmetries in the relationships between variables. This framework facilitates the differentiation between positive and negative changes, allowing for an analysis of how upward and downward variations in one variable may influence another differently. By focusing on asymmetry, this method provides a more nuanced understanding of relationships that may not be adequately captured under conventional linear models, particularly when responses to positive versus negative changes are not uniform. Such an approach enhances insights into the underlying economic or financial dynamics, thereby improving the robustness and realism of the estimated relationships within the model (Lee et al., 2021; Permuter et al., 2011). The following asymmetric equations, Equation 7, will be executed to derive the asymmetric coefficients of ICT, TI, NRR, and FI.

Where,

By incorporating the above-decomposed variables, the asymmetric equation can be displayed in the following manner, see Equation 9:

Where,

the standard Wald test is performed to examine the short-term symmetry β = β+ = β− and long-term symmetry λ = λ+ = λ− for remittance, export earnings, infrastructure development, TI, and economic growth. After confirming the long-run association, the dynamic multiplier effect is assessed, where a 1% change in

Stage 7 involves assessing directional causality through the Juodis et al. (2021) panel causality test. This test looks at the direction of causal effects in panel data while considering cross-sectional dependence and heterogeneity. It is a big improvement over other tests that look at causality, which might assume that units are all the same or not look at dependence structures. The JKS approach facilitates unit-specific causality assessments, enabling a more accurate evaluation of causal linkages within complex datasets. Unlike other causality tests, the JKS test is designed to reduce problems caused by false causality. This makes finding real causal relationships more reliable and accurate (Amblard and Michel, 2012; Vreeken, 2015; Wienöbst et al., 2022). The integration of these advanced methodologies not only enriches the analytical framework but aligns with contemporary developments in causal inference and econometric modeling. Using Shin’s nonlinear estimation and the JKS causality test together will help the study discover more about how variables change over time. This will lead to a better understanding of the causes of the studied panel data.

This study makes a dual methodological contribution. It initially incorporates a thorough econometric framework that goes beyond traditional linear methods by integrating the Cross-Sectionally Augmented Autoregressive Distributed Lag (CS-ARDL) and Nonlinear Autoregressive Distributed Lag (NARDL) models. These methodologies allow the study to identify short-run and long-run dynamics while considering asymmetries frequently neglected in earlier research. Furthermore, it utilizes sophisticated panel data methodologies to tackle essential econometric issues, including cross-sectional dependency, slope heterogeneity, and long-run equilibrium relationships, guaranteeing robust and reliable findings. The rationale for the selected methodologies is grounded in their relative benefits compared to conventional approaches employed in analogous environmental and economic research. The CS-ARDL model is highly appropriate for this study because it effectively addresses the differences among countries and simultaneously captures both short-term and long-term impacts of the explanatory variables. This represents a notable advancement compared to conventional panel regression models, which often overlook the unique country-specific variations in reactions to environmental policies or economic shifts. Additionally, employing NARDL facilitates the identification of nonlinear relationships, essential for comprehending the varying impacts of rising and falling levels of ICT adoption, financial inclusion, and reliance on natural resources on environmental sustainability. Previous studies have largely overlooked the existence of asymmetric effects; however, it is well-recognized that economic and environmental responses can diverge significantly when confronted with policy changes or technological innovations. The study also utilizes comprehensive diagnostic tests, such as the slope heterogeneity test, cross-sectional dependency tests, and panel unit root tests, to confirm the reliability of the econometric model. The Westerlund cointegration test provides additional support for long-term relationships among the variables, thereby enhancing the reliability of the estimated outcomes. The methodological rigor of this study sets it apart from previous research by guaranteeing that prevalent econometric issues, including omitted variable bias, spurious regression, or structural breaks, do not influence the conclusions reached. Implementing this advanced methodological framework equips policymakers with clearer and more practical insights regarding the sustainability challenges faced in the MENA region. The results highlight the significance of focused policy measures in improving ICT and technological innovation while also addressing financial inclusion and resource dependence in a manner that harmonizes economic growth with environmental sustainability.

4 Estimation and interpretation

4.1 Pre-estimation assessment

Stage 1 deals with the assessment slop of heterogeneity with the framework introduced by Ditzen and the output reported in Table 2. The Δ stat and adj Δ stat are statistically significant at 1%, implying the rejection of homogeneous properties in the research variables.

Table 2. Results of the SH test of Bersvendsen and Ditzen (2021).

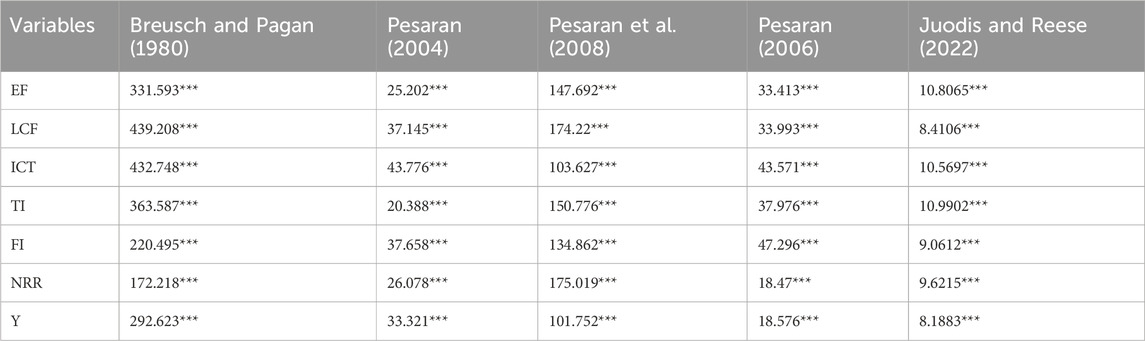

Cross-sectional dependency test results in Table 3 exhibited statistical significance at a 1% level in all cases, articulating the sharing of common dynamics among research units.

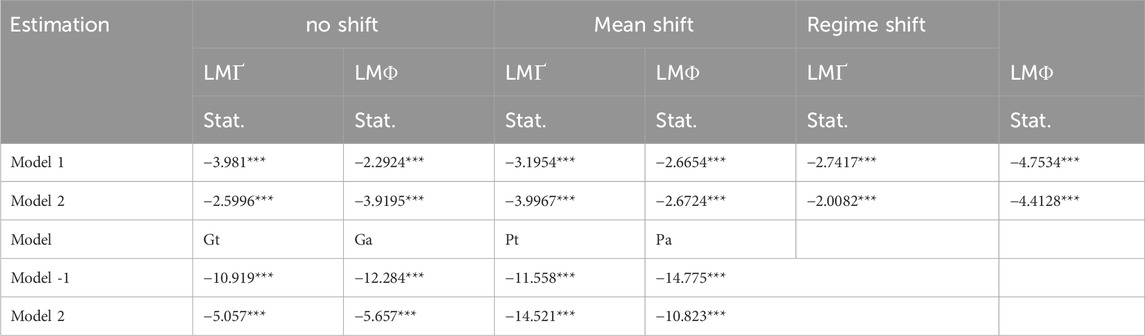

After the assessment of SHT and CSD, the next phase deals with the documentation of the order of integration through the execution of the panel unit root test introduced by Pesaran and Herwartz. Table 4 displayed the output of panel unit root tests and unveiled the mixed order of integration: few variables exposed stationary at a level operation, and few became stationary after the first difference. The following section estimates the long-run association among the research units.

Stage 4 investigates the long-run association among the variables in three constructed models. The output in Table 5 is statistically significant at a 1% level, suggesting the long-run presence.

4.2 Coefficients estimation with CS-ARDL estimation

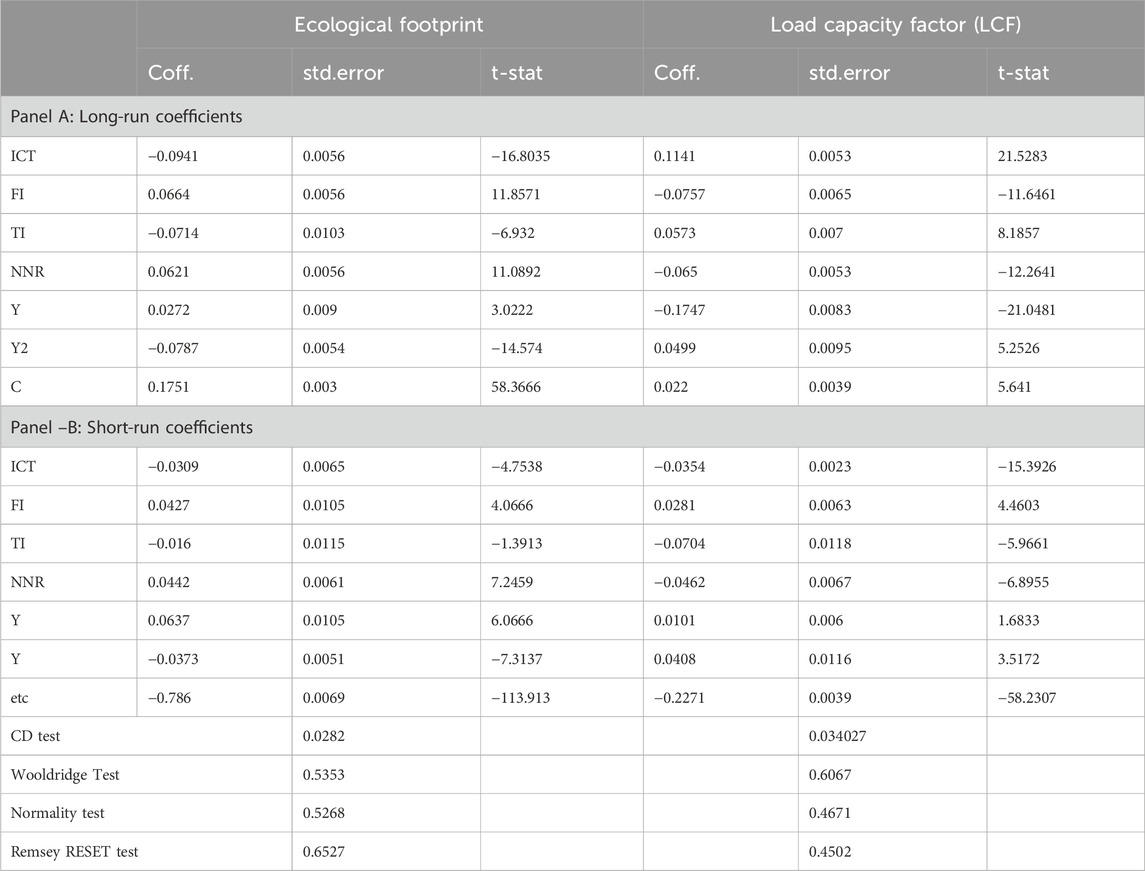

With a statistically significant result, see Table 6, the coefficient for Information and Communication Technology (ICT) about the ecological footprint is −0.0941. This means that more ICT is linked to a smaller ecological footprint. Consistent with other studies that emphasize the importance of ICT in fostering sustainability, this indicates that improved infrastructure and utilization of ICT may result in less environmental consequences and more efficient management of resources. A positive and statistically significant relationship exists between increased ICT and load capacity, as shown by the Load Capacity Factor (LCF) coefficient of 0.1141. Supporting sustainability efforts, this positive link shows that ICT may improve systems’ ability to handle loads efficiently. A short-term rise in information and communication technology (ICT) is associated with a small but statistically significant reduction in the ecological footprint, as shown by the short-run coefficient for ICT impacting the ecological footprint of −0.0309. With a considerable short-term negative effect, the LCF coefficient is −0.0354. The short-term effect highlights how ICT may help reduce environmental problems right away.

The long-run coefficient for the ecological footprint in the context of Financial Inclusion (FI) is 0.0664, indicating a significant correlation between increasing financial investment and a larger ecological footprint (t-stat = 11.8571). Le et al. (2020), Li and Qamruzzaman (2023) found that financial inclusion, if not channeled towards sustainable activities, may lead to increased consumption and environmental deterioration. This result is in line with that research. In contrast, LCF has a significant negative coefficient of −0.0757, suggesting that increased financial investment reduces load capacity. While financial resources are necessary, it is important to allocate them wisely to prevent overwhelming systems, as shown by this negative association. The ecological footprint coefficient for short-run FI is 0.0427, showing a positive and statistically significant effect. With a value of 0.0281, LCF has a modest but statistically significant beneficial impact. This indicates that financial inclusion has favorable short-term benefits on the ecological footprint, even if it might lead to greater consumption.

A long-run coefficient of −0.0714 for the ecological footprint for Technological Innovation (TI) suggests a strong relationship between increased TI and a considerable decrease in environmental effect. According to Liu (2011), Piao and Managi (2023), this lends credence to the idea that technological progress might result in greener behaviors. With a 0.0573 coefficient for LCF and a t-statistic of 8.1857, it is clear that technical innovation has a favorable effect. This indicates that new developments may improve systems’ ability to handle loads efficiently. The short-run TI coefficient of −0.016 for the ecological footprint shows a small negative correlation, not statistically significant. There is a strong negative effect in the short term, as shown by the LCF coefficient of −0.0704. The results show that new technologies are good in the long run, but they may not have the same impact in the near run.

Regarding Natural Resources Rent (NRR), the long-run ecological footprint coefficient is 0.0621, which means a significant relationship exists between increasing natural resource use and an increased ecological footprint. According to the Resource Curse Theory, which posits that unsustainable management of natural resources may cause environmental deterioration (Aye and Edoja, 2017; Grzelak, 2022), this discovery aligns with that theory. A statistically significant negative relationship exists between the increasing use of natural resources and load capacity, as shown by the LCF coefficient of −0.065. A positive impact is shown by NNR’s short-run coefficient of 0.0442 concerning the ecological footprint. A short-term negative impact is shown by the LCF coefficient of −0.0462. This indicates that using natural resources may have both a negative effect on load capacity and an adverse effect on the environment.

The ecological footprint has a positive and statistically significant association with income (Y) with a short-run coefficient of 0.0637, and a small but non-significant positive impact is shown by the LCF coefficient of 0.0101. There may be a correlation between increasing income levels and larger environmental consequences. The short-run coefficient of −0.0373 suggests a substantial negative association for the ecological footprint concerning Y2 (income squared). The coefficient shows a substantial positive but modest impact for LCF, which is 0.0408. The results show that increasing money may have more negative effects on the environment initially, but these negative effects may eventually be reduced. There is a high negative correlation between the ecological footprint (−0.786) and LCF (−0.2271), as well as the coefficient for the error correction term (etc.), in both models, suggesting a substantial negative effect. This highlights the significance of these parameters in attaining sustainability and implies that they quickly restore long-term balance in these interactions.

The findings show that while innovation in technology and information communication technologies help with sustainability, there are complicated links between financial inclusion and the use of natural resources that must be carefully managed to lessen the negative environmental effects. This is consistent with previous research (Colignatus, 2020), highlighting the importance of sector-specific policies in fostering sustainable behaviors.

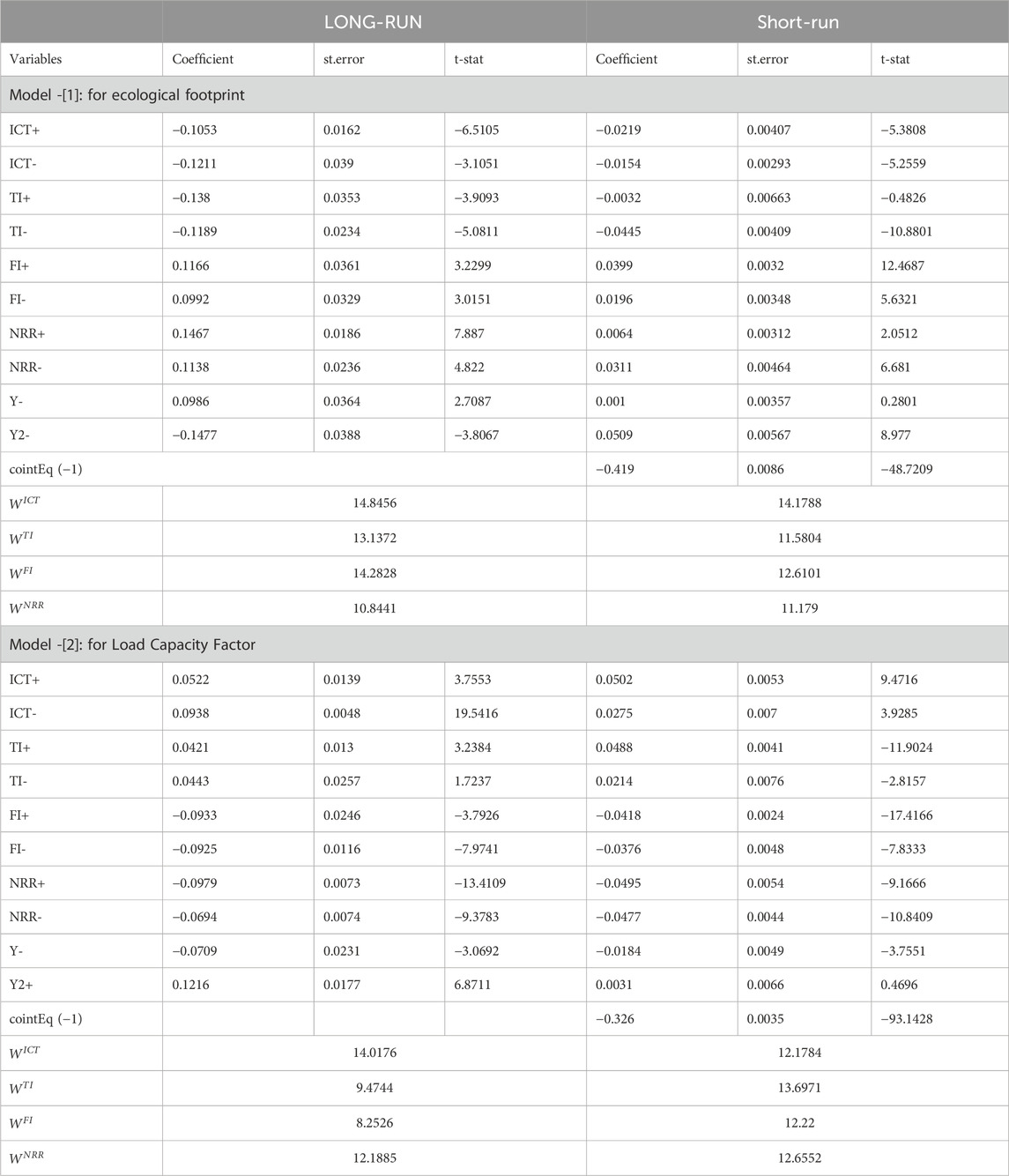

4.3 Asymmetric coefficients of ICT, FI, TI, and NRR on EF and load capacity factor

Table 7 displayed the asymmetric coefficients. The long-run and short-run coefficients reveal asymmetric influences of Information and Communication Technology (ICT), Technological Innovation (TI), Financial Inclusion (FI), and Natural Resources Rent (NRR) on the ecological footprint. In the long run, positive changes in ICT (ICT+) hurt the ecological footprint, with a coefficient of −0.1053 and a statistically significant t-stat of −6.51, indicating that ICT improvements reduce environmental pressures over time. The impact is slightly stronger for negative changes in ICT (ICT-), with a coefficient of −0.1211, suggesting that reductions in ICT development lead to an even greater environmental benefit. In the short run, positive and negative ICT shocks show smaller but significant negative effects on ecological footprint, with coefficients of −0.0219 and −0.0154, respectively. This indicates that ICT influences are felt immediately, although the effects are less pronounced than in the long run.

For Technological Innovation (TI), the long-run coefficients for both positive (TI+) and negative (TI-) changes are also negative, with TI + at −0.138 and TI- at −0.1189, both significant. This suggests that technological advances lead to a reduction in ecological footprint over time, and any setbacks in innovation also contribute positively to environmental preservation, albeit with a slightly lower impact. In the short run, however, the influence of TI+ is minimal and insignificant (−0.0032), indicating that technological improvements may not have an immediate environmental effect. Conversely, a negative shock in TI (TI-) shows a much larger negative effect in the short run (−0.0445, highly significant), suggesting that when technological innovation declines, the ecological footprint reduces significantly in the short term, perhaps due to reduced production pressures.

Financial Inclusion (FI) also demonstrates an asymmetrical influence on ecological footprint, where positive changes (FI+) have a positive long-run effect with a coefficient of 0.1166, indicating that financial inclusion may increase ecological footprint, possibly due to expanded access to resources and consumption. Negative changes in FI (FI-) also have a positive, though slightly lower, long-run effect (0.0992). In the short run, positive and negative financial inclusion shocks show even stronger effects (0.0399 and 0.0196, respectively), suggesting that changes in financial inclusion have an immediate and substantial impact on environmental outcomes, likely as financial resources influence consumption and production quickly.

Natural Resources Rent (NRR) further highlights asymmetry, as positive changes (NRR+) have a significant positive long-run effect (0.1467), indicating that increased reliance on natural resources escalates ecological footprint over time. Similarly, negative shocks (NRR-) have a positive impact, though weaker (0.1138). In the short run, positive NRR shocks have a smaller immediate effect (0.0064) than negative shocks (0.0311), suggesting that reduced reliance on natural resources can quickly benefit the environment. Overall, the error correction term (−0.419, highly significant) confirms that any short-run deviations from long-run equilibrium are corrected swiftly, ensuring the model’s stability.

The asymmetric long-run and short-run coefficients in Model 2, examining the load capacity factor, reveal how positive and negative changes in key economic and environmental factors—such as Information and Communication Technology (ICT), Technological Innovation (TI), Financial Inclusion (FI), and Natural Resources Rent (NRR)—influence the dependent variable in varying degrees over different timeframes. Positive changes in ICT (ICT+) have a coefficient of 0.0522 in the long run, indicating a small yet significant positive impact on the load capacity factor. However, when ICT experiences negative changes (ICT-), the coefficient rises to 0.0938, indicating a stronger negative effect on load capacity, revealing a notable asymmetry in how ICT fluctuations impact the load capacity factor. This difference suggests that reductions in ICT infrastructure or investment could have a more substantial adverse effect on the capacity than similar positive investments might enhance it, highlighting a vulnerability in the system to ICT reductions.

Technological Innovation (TI) exhibits a smaller asymmetry between positive (TI+) and negative (TI-) coefficients in both the long and short run. TI + has a long-run coefficient of 0.0421, while TI- shows a similar positive impact of 0.0443. This near-parity indicates that improvements and declines in technological innovation have a comparable effect on load capacity in the long term, albeit modestly positive. In the short run, however, TI+ is associated with greater fluctuation than TI-, which may indicate that technological advancements can create immediate but volatile effects. In contrast, technological declines have a more gradual, less pronounced influence.

Financial Inclusion (FI) reveals a marked asymmetry in its coefficients, with both positive (FI+) and negative (FI-) changes having substantial negative impacts on load capacity. FI + has a long-run coefficient of −0.0933, meaning that improvements in financial inclusion may reduce the load capacity factor over time, potentially due to increased consumption or resource strain. The effect is similarly negative for FI-, with a long-run coefficient of −0.0925, indicating that reductions in financial inclusion also detract from load capacity. This could suggest that both expansions and contractions in financial inclusion lead to increased resource demands that negatively impact the load capacity. However, contractions appear to have a more immediate short-term effect than expansions.

Lastly, Natural Resources Rent (NRR) exhibits a similarly asymmetric yet consistently negative influence on load capacity, regardless of direction. Positive changes in NRR (NRR+) are associated with a long-run coefficient of −0.0979, while negative changes (NRR-) have a slightly smaller impact at −0.0694. This asymmetry suggests that while increases in resource rents have a slightly stronger negative impact on load capacity, reductions in these rents also contribute negatively. The overall negative influence of NRR on load capacity may reflect an increased environmental strain associated with the reliance on natural resources, regardless of fluctuations in rent values. The significant cointegration coefficient (−0.326) further indicates a quick adjustment process, suggesting that any deviations from equilibrium in the load capacity factor will revert relatively quickly, reinforcing the stability of the model in capturing these asymmetric effects.

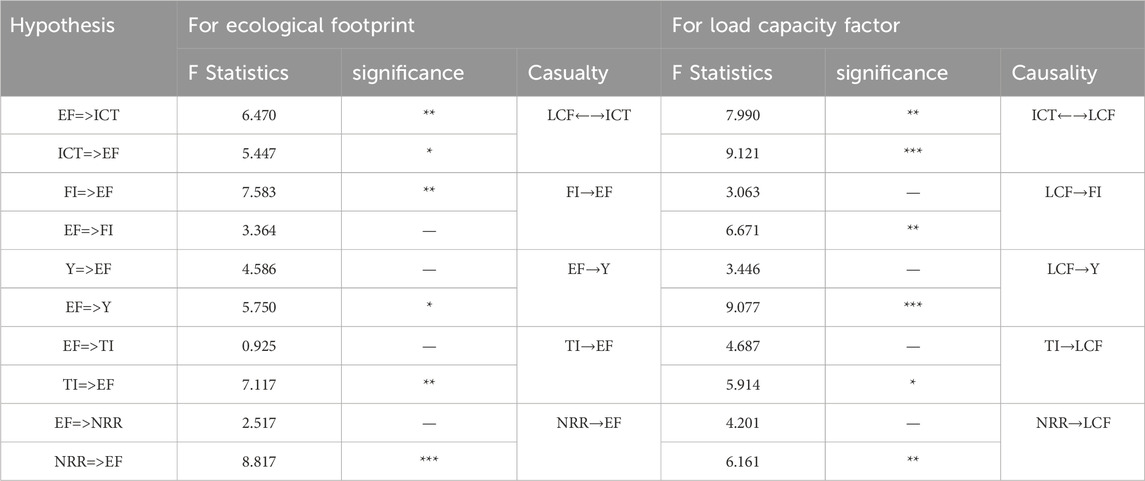

The results of the JKS causality test, see Table 8, for the ecological footprint (EF) model reveal significant bidirectional causality between EF and ICT, suggesting a two-way relationship where advancements in ICT influence the ecological footprint, and changes in the ecological footprint also drive ICT developments. Additionally, unidirectional causality exists from financial inclusion (FI) to EF and from EF to economic output (Y), indicating that financial inclusion is critical in shaping environmental outcomes. At the same time, ecological degradation has implications for economic performance. Interestingly, there is no evidence of causality between EF and natural resource rents (NRR) or Technological Innovation (TI), apart from a unidirectional influence of TI on EF. These findings underscore the complexity of interactions between the EF framework’s technological, financial, and environmental dimensions. In the load capacity factor (LCF) model, significant bidirectional causality is observed between LCF and ICT, highlighting a mutually reinforcing relationship. Financial inclusion (FI) also influences LCF unidirectionality, emphasizing its role in enhancing environmental capacity. Notably, economic output (Y) and natural resource rents (NRR) exert unidirectional effects on LCF, suggesting that economic growth and resource utilization are critical determinants of environmental sustainability. Trade intensity (TI) and LCF also share a significant relationship, with TI impacting LCF. These results illustrate the interconnectedness of socio-economic factors in determining ecological capacity and emphasize the importance of policy interventions that integrate economic and environmental objectives.

5 Discussion

The negative coefficient for ICT indicates that increased ICT usage correlates with a reduced ecological footprint, aligning with existing literature that underscores the role of ICT in enhancing sustainability through improved resource management and infrastructure. This finding is further supported by studies highlighting how ICT facilitates more efficient resource utilization, thereby mitigating environmental impacts (Yin and Qamruzzaman, 2024; Qamruzzaman, 2024; Xiangling and Qamruzzaman, 2024b). The positive relationship between ICT and load capacity suggests that ICT advancements can enhance systems’ capacity to manage loads effectively, which is crucial for sustainable development. This is consistent with the assertion that ICT can bolster operational efficiencies across various sectors, leading to better environmental outcomes. The short-run effects of ICT on both the ecological footprint and load capacity further emphasize the immediate benefits of ICT in addressing environmental challenges, suggesting that investments in ICT can yield quick returns in sustainability efforts (Chatterjee et al., 2020). The proliferation of ICT in the Middle East and North Africa MENA has been associated with lower ecological footprints. In a recent study by (Hassan et al., 2023), it is emphasized that with ICT adoption across different sectors of an economy, GDP can grow while lowering emission intensity, or in other words, economic development and environmental degradation can be decoupled, making the case for ICT as a potential driver of green growth through promotion for environmental innovativeness and efficiency. Ayub (2022) supports this claim when he focuses on ICT as a valuable solution to minimize environmental problems and contribute to sustainability. In addition, Xiangling and Qamruzzaman (2024a) takes ICT as a spearhead of sustainable energy development, so its study also favors green growth from the viewpoint of environmental preservation in MENA. According to research conducted by Pata and Destek (2023), ICT is a crucial technology (along with renewable energy) that directly improves the load capacity factor and indirectly contributes positively to sustainability assessments. This is also well represented in the work of Fareed et al. (2021), where a holistic ecological indicator, like load capacity factor, is proposed as appropriate for assessing environmental sustainability. They concluded that ICT is sustainable as it enhances this aspect. In addition, the Institutional context in ICT is important for its function in effective sustainability promotion. Xue et al. (2021) showcasing the fundamental role of institutional quality towards environmental sustainability across MENA countries, which leads to the idea that good governance could enhance the positive effect of ICT on ecological outcomes. This is in line with Alnafisah et al., 2024, who states that innovation concerning technological advances may only lower carbon emissions if institutions are strong. Nevertheless, there are counterarguments where ICT can have unbeneficial environmental sustainability consequences. While some scholars have indicated that ICT can promote efficiency, others suggest it generates an increase in consumption and waste, possibly aggravating environmental problems without appropriate management (Simpson et al., 2019).

The analyses reveal a negative relationship between financial investment and ecological footprints in the case of MENA countries while suggesting that under specific circumstances, increasing financial inclusion may contribute to economic growth without threatening environmental sustainability. The finding that financial investments positively correlate to the growth of ecological footprints shows that if sustainability does not play a significant role in financial investment, the growth of finance and the real economy will induce environmental destruction. The Resource Curse Theory argues that with no sustainable management, financial inclusion can lead to over-consumption and environmental degradation (Ponce et al., 2022). In this regard, Ahmad et al. (2021) points out that investment in finance, both within the socio-economic development sector and outside, can reduce ecological footprints but only if they are diverted towards sustainable development. Ponce et al. (2022) contend that inclusion stimulates consumption and therefore escalates the ecological footprint, especially in the developing part of the world with frail institutional environments. Similarly, Ahmad et al. (2022) stresses that investment comes with adverse environmental degradation which need to be strategically applied to harness its growth level without spoiling the resources of ecology. That load capacity factor (LCF) in fact needs to be balanced, or else environmental systems will be overstressed, also pointing to the reality that financial resources are not enough for sustainability purposes. In addition, the negative sign found with respect to the load capacity factor reflects that financial resources need to be allocated carefully. In line with this (Ayub, 2022; Ahmad et al., 2022), financial risk may prevent the transition to renewable energy technologies and highlight a second complication in the relationship between financial development and environmental quality. On the other hand, several studies also indicate that sustainable financial development can improve environmental quality. For instance, (Dada et al., 2022), contend that environmental regulations offer a stabilizing force that, when integrated into the structure of financial systems, can support ecological progress toward sustainability, which suggests that the interaction is not purely negative as necessary; instead, this suggests it depends on the political and regulatory background. The ramifications of such findings are profound on a global scale. By its inherent complexities as an economic and environmental case study, the MENA region is a classic example of such a notion on the balance between financial development needs. The results imply that although financial development is conducive to economic expansion, it must be combined with strict environmental policies to avoid ecological collapse. More generally speaking, this is consistent with the global conversation about sustainable development in which there has been growing pressure on financial systems to be more effective in delivering positive environmental outcomes. Financial investments and ecological footprints are intertwined in a complex interplay of factors.

The relationship between technological innovation (TI) and ecological footprints in the MENA domain presents mixed findings concerning environmental sustainability through technological advancements. The negative link of TI with ecological footprints in the long run collaboration and its association with LCF (Load capacity factor) has proven that technological innovations have a moderate impact on a sustainable environment and can promote green technology effectively towards a greener environment globally and locally. As an illustration, Jima and Makoni (2023) state that technology has a great place in minimizing the harmful impacts caused by environmental degradation through wiser usage of resources and, thus, less waste. Similarly Ahmad et al. (2022) articulates that TI for clean technologies could result in mitigated ecological footprints, meaning if we have sustainable portfolios or projects, we can promise a cleaner planet. Some studies have also confirmed that countries that are more technologically innovative tend to exhibit lower levels of ecological footprints—this has been found in both the G7 and across countries. Nevertheless, the short-run impact of TI tells a different story. Technological innovations may not have immediate effects, signifying a time lag for attaining environmental benefits from new technologies. According to Ozili (2022), TI could be a double-edged sword. Although the long-run benefits of TI are obvious, in the short-run and due to adaptation lags, technology deployment generates negative effects on ecological footprints because initial environmental costs would likely affect new technologies deployment. In the stud (Leitão et al., 2022) advocated that policymakers may need to be patient in order to realize the potential benefits of TI and continue funding innovation in the long term. In addition, external factors like economic structure, regulatory frameworks, and societal preparedness for technological adoption highlight the intricacy of the relationship between TI and ecological footprints. Specifically, it is argued that the economic nature of a country can play a key role in determining the capacity of technological innovations to mitigate ecological footprints indicating that the context should be considered when appraising TI effects. AsPata Pata and Destek (2023), Simpson et al. (2019), Sahoo et al. (2024) noted. At the same time, TI can potentially reduce the negative impact of tourism on the environment, but it might not be effective until compatible policies and infrastructure are established. With a global perspective, such findings also tap into debates about how technological progress can enable sustainable development. Due to the distinctive environmental and economic features of MENA countries, this region is perhaps one of the most pertinent examples for exploring how TI can be utilized in practice to drive resilience. We find that despite the promise of TI to address ecological footprints, much of its success hinges on enabling institutional and economic settings. The long-term benefits of technological innovation on the ecological footprints in the MENA region exist despite the negative short-run effects of technological innovation on ecological footprints. Despite the high potential of TI for reducing environmental impacts, it may be less striking in terms of immediate effect, which underscores the importance of strategic planning and investing in sustainable technologies. This means that policymakers need to act purposefully by combining catalyzing innovation with understanding the time lag in reaping the full potential benefits of technology (Kazemzadeh et al., 2022).