- 1Business School, Hohai University, Nanjing, China

- 2School of Industry and Urban Construction, Hengxing University, Qingdao, China

- 3School of Management Science and Engineering, Nanjing University of Information Science and Technology, Nanjing, China

- 4Jiangsu Trendy Information Technology Co., Ltd., Nanjing, China

- 5School of Finance and Logistics Management, Nanjing University of Railway Technology, Nanjing, China

- 6School of Business and Law, Sanjiang University, Nanjing, China

Green finance (GF), as a critical policy tool for supporting green development, plays a pivotal role in directing capital flows toward low-carbon and environmentally friendly industries. This provides essential support for the green transformation (GT) of the logistics industry (LI). However, limited research exists on the regional GT of the LI from the perspective of GF and LI integration. To address this gap, this study develops an evaluation index system for the integration of GF and the LI, as well as a separate system for assessing the GT of the LI. Using panel data from 30 Chinese provinces spanning 2010 to 2022, the study employs the Super-SBM-Undesirable model and the coupling coordination degree model for evaluation and analysis. Additionally, a threshold effect model is applied to examine the nonlinear relationship between GF-LI integration and the GT of the LI, alongside a heterogeneity analysis to explore regional disparities. The findings reveal three key insights: (1) In recent years, the integration of GF and the LI in China has significantly improved, advancing from a mildly imbalanced stage to moderate and high levels of coordination. However, significant regional disparities in the level of integration persist. (2) The integration of GF and the LI has a significant positive effect on the GT of the regional LI, characterized by an S-shaped relationship. (3) The impact of GF-LI integration on the GT of the LI exhibits notable regional heterogeneity. Compared with existing research results, this study expands the application scope of GF, focusing on the GT of the LI, a fundamental service industry, and further verifies the universality of GF in promoting low-carbon devel-opment in different industries. In addition, current research on the GT of the LI mainly focuses on technological innovation, environmental regulation, and supply chain optimization, while there is less attention paid to how GF can promote the GT of the LI through industrial integration.

1 Introduction

With the intensification of global climate change and the advancement of sustainable development goals, the green economy has become a central issue in economic transformation worldwide. The logistics industry (LI), as a vital pillar of economic activity, has significantly contributed to economic growth through its rapid expansion. However, it has also led to excessive resource consumption and environmental degradation (Piecyk and Björklund, 2015). The China Green Logistics Development Report (2023) states that carbon emissions from China’s LI account for approximately 9% of the nation’s total carbon emissions (Ju et al., 2023). With the growing demand for logistics, accelerating the green transformation (GT) of the LI has become an essential requirement for addressing environmental challenges, enhancing corporate competitiveness, and promoting sustainable economic development. Balancing the improvement of logistics efficiency with achieving GT has become an urgent issue that needs to be addressed. Green finance (GF), as a significant policy tool supporting green development, can provide robust support for the GT of the LI by directing capital flows toward low-carbon and environmentally friendly industries (Dhayal et al., 2025a). However, as a significant contributor to carbon emissions, the LI’s financial support mechanisms for GT remain insufficiently explored. Characterized by long value chains, multiple operational links, and a wide array of participating entities, the logistics sector follows a transformation trajectory that fundamentally differs from those of manufacturing and energy industries. This divergence underscores the urgent need for dedicated research into the coupling mechanisms and effects between GF and the LI.

In recent years, the integration of GF and the GT of the LI has garnered growing academic interest. On one hand, existing studies have extensively examined the role of GF in advancing the green development of traditional sectors such as industry and agriculture (Afzal et al., 2022). On the other hand, research on the measurement methods and influencing factors of the GT efficiency of the LI has also become increasingly prominent (Ferrari et al., 2018). Despite these advancements, current research still exhibits several key shortcomings: (1) A lack of quantitative analysis on the integration of GF and the LI. Existing studies often examined the impact of GF from a single-dimensional perspective, lacking systematic measurement of the integration level of the two industries. (2) Insufficient understanding of the nonlinear relationship between GF and the GT of the LI. A few studies have explored the marginal effects of GF but have not yet revealed potential threshold effects between integration levels and the GT of the LI. (3) A lack of regional heterogeneity analysis. The GT of the LI may exhibit significant regional characteristics due to differences in economic development levels, policy environments, and resource endowments, which have been insufficiently addressed in existing studies. Moreover, although GF has yielded notable results in advancing the GT of other industries, policy support targeting the logistics sector remains inadequate. There is a notable absence of dedicated financial subsidies, tax incentives, and tailored green finance policies. Additionally, the lack of coordination between GF initiatives and the GT of the LI has hindered the development of a systematic and synergistic policy framework. Existing policies often adopt a one-size-fits-all approach, overlooking regional economic disparities and failing to provide differentiated support across diverse local contexts. Consequently, there is an urgent need for more refined and flexible policy measures specifically designed for the logistics sector to foster deeper integration between GF and the LI.

To bridge the aforementioned research gap, this study utilizes panel data from 30 Chinese provinces spanning the years 2010–2022 and applies a series of econometric models to systematically examine the mechanisms and effects of the coupling and coordinated development between GF and the LI on the GT of the logistics sector. First, an indicator system is constructed based on the conceptual frameworks of GF development, LI development, GT of logistics, and the coupling coordination between the two sectors. Second, the Super-SBM-Undesirable model is employed to evaluate the efficiency of GT in the LI. Third, the coupling coordination degree model is used to assess the integration level between GF and the logistics sector. Fourth, a threshold effect model is adopted to analyze the nonlinear relationship between their coordinated development and the GT of logistics, followed by a heterogeneity analysis to explore regional disparities. Finally, targeted policy recommendations are proposed to accelerate the GT of the LI, aiming to address existing policy gaps.

The key innovations of this study are as follows: (1) It employs the Super-SBM-Undesirable model to evaluate and analyze the current state of GT in China’s LI. (2) It introduces and quantifies the coupling coordination level between GF and the logistics sector, addressing a critical gap in research on the integrated development of these two fields. (3) This study creatively constructs an S-shaped theoretical model to examine the impact of green finance-logistics integration on GT efficiency, and empirically validates the existence of this nonlinear relationship, offering a fresh perspective for advancing GF theory. (4) It incorporates regional heterogeneity analysis to reveal differences in policy implementation paths across regions, thereby providing a theoretical foundation for targeted policy-making and coordinated regional development.

2 Literature review

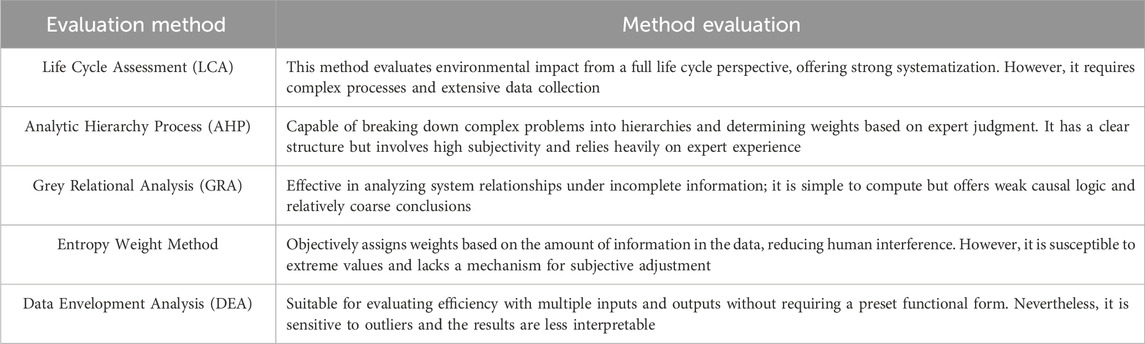

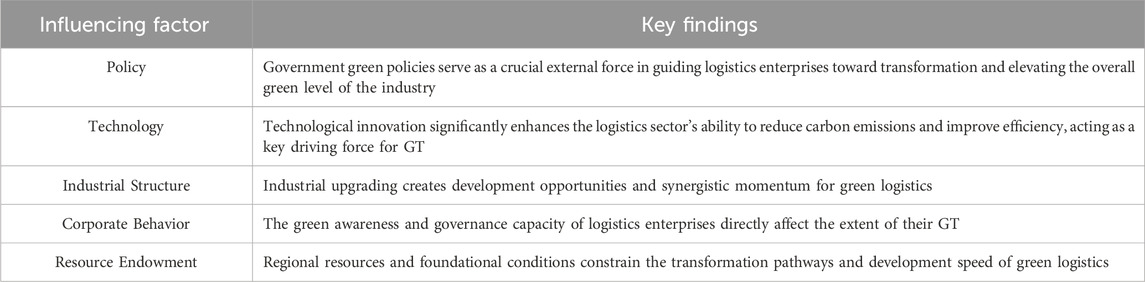

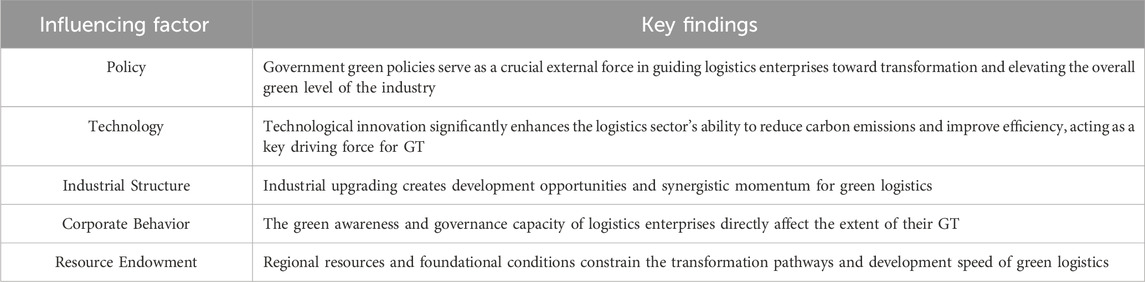

First, the GT of the LI has become a key global concern, with its core objective being the realization of low-carbon, efficient, and sustainable logistics services (Karagülle, 2012). The study systematically reviews the relevant literature on the GT of the LI from three aspects: evaluation of GT, analysis of influencing factors, and regional differences, to analyze the research progress on this topic. (1) A scientific evaluation of the GT of the LI represents the foundation for studying its mechanisms and policies. Many scholars use methods such as life cycle analysis, analytic hierarchy process, and data envelopment analysis models to evaluate the GT of the LI, as shown in Table 1 (Dekker et al., 2012; Chan et al., 2006; Markovits-Somogyi and Bokor, 2014). For example, Bai applied the super-SBM model to measure the green efficiency of the LI in major Chinese cities (Bai et al., 2022a). It was found that the efficiency of coastal cities in the east was generally higher than that of inland cities. In addition, some studies combine dynamic change analysis methods, such as the Malmquist index method, to capture the temporal evolution characteristics of green efficiency (Rusli et al., 2022). For instance, Long’s analysis using the Malmquist index found that the green efficiency of the LI shows a slow upward trend globally (Long et al., 2020). Among these, Asian countries are experiencing faster growth rates than European and American countries. (2) The analysis of the influencing factors of the GT of the LI is key to revealing its development path and optimization strategies. The GT of the LI is influenced by various factors, including external conditions such as policy, technology, and industrial structure, as well as endogenous factors such as corporate behavior and regional resource endowments, as shown in Table 2 (Xu and Xu, 2022; Dhayal et al., 2025b; Liu and Li, 2019; Yan et al., 2022; Xu et al., 2022). Existing studies indicate that stringent environmental regulations can significantly accelerate the application of green technologies in logistics companies. Specifically, European countries have successfully improved the energy efficiency of logistics transportation by implementing strict carbon emission standards (Peters et al., 1998). In terms of industrial structure upgrading, Chen and other scholars point out that regions with a high proportion of the secondary industry often experience higher carbon emission intensity in logistics, making GT more challenging (Chen and Zhang, 2022). Similarly, the improvement in urbanization levels has had a significant impact on the centralization and efficiency of logistics demand. Some studies suggest that during the rapid urbanization process in Southeast Asia, the modernization of logistics facilities has not advanced synchronously, leading to a lag in GT (Nguyen, 2021). (3) The study of regional differences in the GT of the LI is also an important basis for formulating region-specific policies and achieving coordinated development. The GT of the LI exhibits significant regional differences worldwide. For example, the green efficiency of the LI is generally higher in OECD countries, especially in Nordic countries. Due to their well-established green policy support and advanced technological reserves, these countries are at the forefront of green logistics globally (Çakır, 2017). In contrast, African countries face severe constraints on the development of green logistics due to weak infrastructure, lack of funding, and low technological levels (Buvik and Takele, 2019). This disparity exists not only between developing and developed countries, but also between different countries or provinces within the same region. For instance, Quan and other scholars point out that the eastern regions of China, with their developed economy and advanced technology, exhibit higher efficiency in green logistics, while the central and western regions have relatively lower efficiency due to inadequate infrastructure and uneven policy enforcement (Quan et al., 2020). Although the aforementioned studies have made significant progress in calculating green logistics efficiency and analyzing influencing factors, existing literature mainly focuses on research related to a single industry or a single-dimensional factor. This depicts the lack of a systematic study of the GT of the LI from the perspective of industrial integration.

As an important means of promoting green economy, research on the integration of GF with other industries has gradually attracted academic attention. Relevant studies primarily focus on the mechanisms of GF, the theory and practice of industrial integration, and the measurement and impact assessment of integration levels. (1) The mechanism of GF serves as a key driving force for the GT of industries. GF significantly promotes the development of green industries by optimizing resource allocation, incentive mechanisms, and innovative capital supply, as shown in Table 3 (Khan et al., 2022). Numerous studies have shown that green financial instruments, such as green credit and green bonds, play a crucial role in supporting the research and application of green technologies (Gilchrist et al., 2021). For example, research by Madaleno and colleagues found that the implementation of green credit policies significantly reduced the credit costs of high-polluting industries and increased the investment willingness of clean technology enterprises (Madaleno et al., 2022). Germany’s green bond market has effectively promoted the financing of clean energy projects, providing financial support for the low-carbon transition of traditional energy enterprises (Schäfer, 2018). In addition, GF has demonstrated remarkable effectiveness in optimizing corporate capital structures and improved the accessibility of green project finance (Li et al., 2023). (2) The theory and practice of industrial integration are key pathways to achieving the coordinated development of financial resources and the real economy. The concept of integrating GF with other industries originates from sustainable development theory, emphasizing the synergy between financial resources and the real economy (Yin and Xu, 2022a). Theoretical studies suggest that GF can promote the transformation of traditional industries towards green development models through funding for technological innovation and policy guidance (Jiakui et al., 2023). In practice, GF has driven significant transformation in industries such as energy and manufacturing (Dhayal et al., 2024). For example, green credit has supported technological upgrades in high-energy-consuming enterprises within China’s manufacturing industry and accelerated industrial upgrade in the renewable energy field (Wu et al., 2022). However, in the LI which is a critical foundational industry, the involvement of GF remains in its infancy, with existing studies primarily focusing on policy analysis and case studies. For instance, Zhu’s case study emphasizes the role of GF policies in advancing the development of new energy vehicle fleets within logistics enterprises. However, systematic and cross-regional studies on this topic remain scarce (Zhu et al., 2023a). (3) Measuring the integration level of GF with other industries is both a challenge and a focus in current research. Some scholars have proposed coupling coordination models based on indicator systems to measure the integration depth of GF with various industries (Tomal, 2021). For example, the indicator system developed by Dong et al. has been widely applied to assess the integration level of GF with green urbanization (Dong et al., 2021). However, specific measurement studies focused on the LI remain relatively scarce, with most existing literature limited to qualitative analysis. Yuan proposed the impact pathways of GF on the transformation of cold chain logistics but failed to evaluate its effects within a quantitative framework (Yuan et al., 2024). Moreover, existing studies have rarely considered the impact of regional heterogeneity on integration levels, limiting the broader applicability of their findings (Zhao et al., 2023). In summary, current research has made significant progress in the mechanisms of GF, the theory and practice of industrial integration, and the measurement of integration levels. However, research on the integration of GF with the LI remains inadequate.

In recent years, scholars have extensively employed the DEA method in studies evaluating industrial GT, particularly those accounting for undesirable outputs. DEA, a non-parametric technique based on linear programming, is widely utilized to assess the relative efficiency of multiple decision-making units (DMUs) under environments characterized by multiple inputs and outputs (Bowlin, 1998). However, traditional DEA models such as the CCR and BCC models exhibit limited capacity in handling undesirable outputs, rendering them inadequate in accurately capturing the efficiency variations inherent in the GT process (Mardani et al., 2017). To address this limitation, Tone introduced the non-radial, non-angular Slacks-Based Measure (SBM) model, which effectively considers the slacks in both inputs and outputs (Chang et al., 2014). Building upon the SBM framework, Andersen further developed the Super SBM model, enabling the ranking of DMUs even when multiple units achieve an efficiency score of one (Lee, 2021). In the context of green economic transformation, where undesirable outputs such as CO2 emissions and energy consumption are prevalent, the model has been further refined into the Super SBM Undesirable model (Cecchini et al., 2018). This variant allows the incorporation of negative output variables and has been widely applied in research on energy efficiency, industrial GT, and ecological efficiency. For instance, Meng employed the Super SBM Undesirable model to measure the green efficiency of China’s manufacturing sector, while Guo utilized it to evaluate the impact of green credit on the efficiency of green technological innovation (Meng and Qu, 2022; Guo et al., 2022). The model offers two distinct advantages: first, its capacity to handle undesirable outputs aligns well with the measurement demands of GT; second, it enhances the discriminatory power in efficiency ranking, making it suitable for cross-sectional and longitudinal analyses across multiple regions and years. Therefore, this study adopts the Super SBM Undesirable model as the evaluation tool for assessing the GT efficiency of the LI, representing both a continuation of existing green efficiency assessment methodologies and a contextually appropriate extension in light of the logistics sector’s GT.

Although the aforementioned studies provide valuable references for the integration of GF and the GT of the LI, several shortcomings remain. First, research on the integration of GF with the LI is insufficient. Current studies primarily focus on the application of GF in traditional high-emission industries such as energy and manufacturing, with limited attention to the LI, which features a complex supply chain and significant emissions. As a result, the specific pathways through which GF impacts the GT of the LI have not been fully elucidated. Second, the exploration of nonlinear relationships is inadequate. Existing literature often assumes a linear relationship between GF and industrial green development, overlooking the potential for phase-specific variations. Specifically, during different stages of integration between GF and the LI, the marginal effects on the GT of the LI may vary significantly, yet this issue remains under-researched. Third, research on regional heterogeneity is not sufficiently in-depth. Although some studies have noted the impact of regional differences on the GT of the LI, they have not thoroughly examined the disparities in the integration of GF and the LI across regions.

To address the aforementioned shortcomings, we employ the Super-SBM-Undesirable model to evaluate the GT of China’s LI. Secondly, we use a coupling coordination degree model to measure the integration level of GF and the LI, and apply a threshold effect model to examine its nonlinear impact on the GT of the LI. Finally, we conduct a regional heterogeneity analysis to explore the regional characteristics exhibited by the GT of the LI due to regional differences.

3 Theoretical analysis and research hypothesis

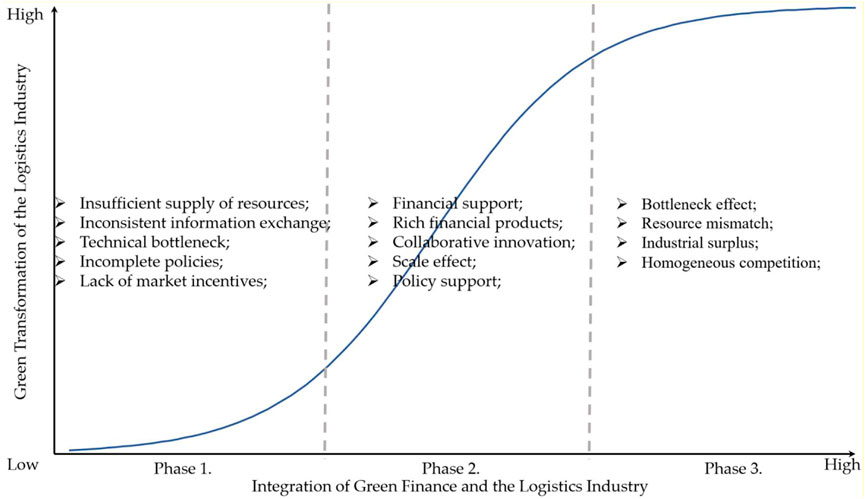

The integration of GF and the LI may not exhibit a linear impact on the GT of the LI but rather demonstrates distinct phased characteristics as the level of integration deepens. As shown in Figure 1.

(1) Early Stage: Low level integration with limited promotion effect. In the initial stage of integrating GF with the LI, numerous constraints limit the effectiveness of GF in driving the GT of the LI. First, the insufficient supply of financial resources serves as a critical bottleneck. Green financial products, such as green credit and green bonds, are still in their developmental phase, and financial institutions tend to adopt conservative risk assessment practices. As a result, the scale of funding remains inadequate to meet the substantial capital demands required for the GT of the LI. This limitation stifles the potential of GF to support comprehensive green initiatives within the industry (Zhu et al., 2023b). Second, insufficient information coordination further weakens the environmental benefits of GF. Due to information asymmetry between financial institutions and logistics enterprises, the matching efficiency of green financial resources is low. This mismatch results in financial products being poorly designed or misallocated, leaving some resources either underutilized or idle (Bui et al., 2024). Third, technological barriers present a significant challenge during this phase. The development and adoption of green technologies often require substantial financial and technical thresholds. However, GF exhibits limited capability to intervene in these high-threshold projects, slowing progress in critical areas such as energy-saving technologies and new energy vehicles (Wang et al., 2024). Moreover, this initial phase also encounters issues such as incomplete policies and insufficient market incentives (Barut et al., 2023). Local governments may lack adequate fiscal subsidies and tax incentives to encourage green initiatives. Additionally, the market demand for green logistics remains underdeveloped, providing little motivation for enterprises to adopt sustainable practices. This lack of external incentives compounds the internal challenges faced by logistics enterprises, slowing the overall progress of GT. To overcome these limitations, policy guidance and mechanism innovation are needed to gradually deepen the integration of these two industries, laying a solid foundation for subsequent development.

(2) Mid-Term Stage: Moderate integration enhances the promoting effect. In the mid-term phase of GF and LI integration, their synergistic effects become increasingly evident. This phase is characterized by notable advancements in collaborative innovation, economies of scale, and strengthened policy support. The collaboration between GF and logistics enterprises deepens, enabling logistics companies to access greater amounts of low-cost funding (Du et al., 2022). These financial resources are channeled into acquiring new energy equipment and optimizing operational models, driving the adoption and innovation of green technologies within the industry. As green financial products, such as green supply chain finance, mature, the scale of funding progressively expands. This growth supports critical initiatives, including the optimization of logistics networks and the construction of green warehousing, which significantly enhance the overall efficiency of the LI’s GT (Judijanto et al., 2024). These advancements not only improve operational processes but also reduce the environmental footprint of logistics enterprises, contributing to broader sustainability goals. Government intervention plays a crucial role in amplifying the impact of GF during this phase. Through fiscal support and tax incentives, governments reduce the cost burden of GT for enterprises, encouraging greater investment in sustainable practices. These measures stimulate enthusiasm among enterprises to adopt green solutions and foster deeper integration between GF and the LI. The combined effects of private sector collaboration, innovative financial products, and government support collectively promote sustainable development within the LI, marking a pivotal step toward achieving long-term environmental and economic goals (Zhu et al., 2020).

(3) Late Stage: High-level integration leads to diminishing marginal effects. In the high-level integration phase of GF and the LI, although the promotion effect has reached a considerable scale, the marginal returns gradually decrease. This primarily manifests in bottleneck effects, resource misallocation risks, and industrial overcapacity. Long development cycles for technology and declining investment returns create bottlenecks in the GT process (Bai and Lin, 2023). Excessive reliance on GF may concentrate funds in certain areas, such as the procurement of new energy vehicles, while neglecting other critical aspects, leading to resource misallocation (Liu et al., 2020). Moreover, intensified competition due to the homogenization of green technologies undermines the overall transformation effect and may even result in industrial overcapacity (Wang and Wang, 2021). Thus, both enterprises and governments should focus on optimizing resource allocation, fostering technological innovation, and promoting industrial upgrades, avoiding over-reliance on a single model to ensure the sustainability and efficiency of the GT.

In conclusion, this study proposes the following research hypothesis: The integration of GF and the LI exerts an S-shaped curve impact on GT. Specifically, in the initial stage, the integration of the two industries has a limited effect on promoting the GT of the LI. As the level of integration increases, improvements in financial support, technological innovation, and the policy environment gradually enhance the transformation effect, leading to a phase of high efficacy. However, as integration deepens further, issues such as resource misallocation, technological homogenization, and market saturation cause diminishing marginal returns. This ultimately reaches a saturation or decline and forms a typical S-shaped pattern.

4 Research design

4.1 Evaluation of GT in the LI

The Super-SBM-Undesirable model is suitable for evaluating the GT of China’s LI, primarily because it simultaneously considers both positive and negative outputs, offering a comprehensive reflection of the multifaceted impacts in the GT process (Shah et al., 2022). In this process, the LI not only focuses on improving economic efficiency and resource utilization but also addresses negative issues such as energy consumption and pollutant emissions. The model effectively handles resource misallocation and nonlinear relationships in GT, identifying bottlenecks and resource distribution issues that arise during the transformation. Additionally, the Super-SBM model’s super-efficiency analysis capability plays a critical role in identifying regions with exceptional performance, offering valuable lessons that can be applied to other areas and contributing to the overall green GT of the LI (Xiao et al., 2022). The model’s flexibility allows it to accommodate logistics enterprises of varying scales and types, making it a versatile tool for performance evaluation. By providing a comprehensive assessment of the LI’s GT, the model supports governments in optimizing resource allocation, formulating targeted policies, and making informed decisions to promote sustainable development.

Building on prior research, this study constructs the Super-SBM-Undesirable model by integrating the SBM model—renowned for its ability to address undesirable outputs, as proposed by Tone—with the super-efficiency evaluation model developed by Andersen, as outlined in Equation (1) (Tone et al., 2020; Andersen and Petersen, 1993). This approach enhances the model’s analytical precision and applicability, making it an effective tool for examining the intricate dynamics of GF and LI integration.

In Equation 1,

To comprehensively evaluate the current state of GT in China’s LI, this study constructs a three-tiered indicator system-comprising inputs, desirable outputs, and undesirable outputs-based on the Super SBM Undesirable model, as shown in Table 4. The selection of indicators is informed by the relevant research of scholars such as Bai, while also fully considering data availability, representativeness, and alignment with the conceptual connotation of GT (Bai et al., 2022b). At the input level, labor, energy, and capital are identified as key variables, representing the dependence on human resources, the efficiency of energy utilization, and the extent of investment in green infrastructure, respectively. At the desirable output level, the value-added of the LI and freight turnover are employed to capture economic performance and service efficiency. At the undesirable output level, carbon emissions are introduced to reflect the environmental constraints of GT. This indicator system provides a comprehensive framework for depicting the efficiency characteristics and ecological performance of the logistics sector’s green transition.

4.2 Evaluation of industry integration

The coupling coordination degree model is a mathematical tool designed to evaluate the interactions and coordinated development levels between systems. It is particularly effective in analyzing the degree of coupling among multiple subsystems and determining whether these subsystems can develop synergistically. Widely applied across diverse fields such as economics, ecology, and sociology (Xing et al., 2019), this model provides valuable insights into system dynamics. Accordingly, this study adopts the coupling coordination degree model to assess the coordinated development relationship between GF and the LI, as outlined in the following steps.

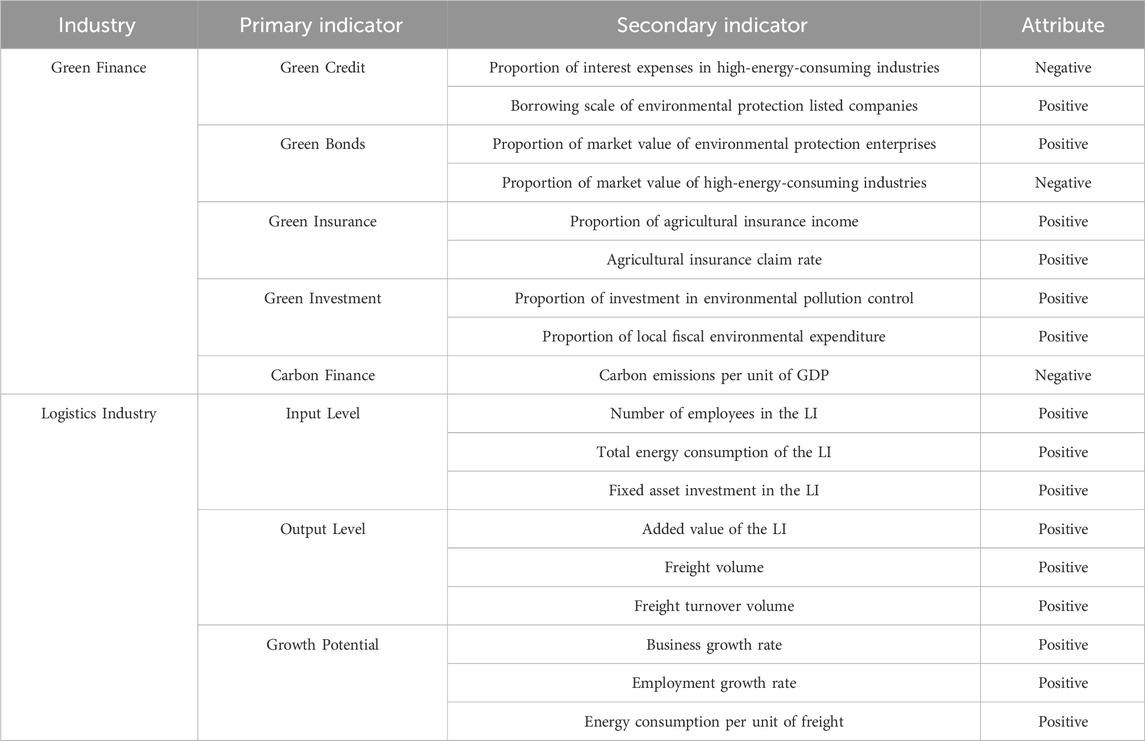

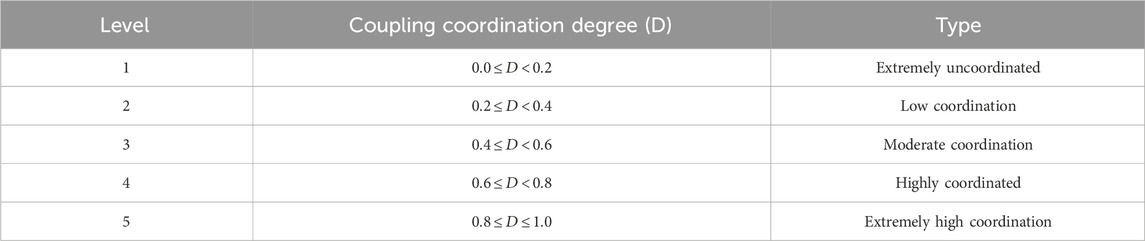

Step 1: Build a system indicator system. This study establishes an evaluation indicator system for the two industries based on the Coupling Coordination Degree Model. Drawing on extensive domestic and international research, and aligning with the principles of green development and the practical needs of the logistics sector’s GT, the indicator selection adheres to the principles of scientific validity, systematic structure, representativeness, and data accessibility. A total of 18 secondary indicators are carefully selected from two dimensions—GF and the LI—as detailed in Table 5 (Rahman et al., 2024). The GF dimension encompasses five primary indicators: green credit, green bonds, green insurance, green investment, and carbon finance. These are designed to comprehensively evaluate the capacity of financial resource allocation to guide green and low-carbon industries, to impose constraints on high-carbon sectors, and to support environmental governance and carbon reduction initiatives. The LI dimension, on the other hand, comprises indicators from three perspectives: input levels, output performance, and growth potential. These reflect the foundational investments in human, energy, and capital resources, operational outcomes, and prospects for future development, thereby illustrating both the path and achievements of green-oriented progress. The overall framework emphasizes the design of indicators that balance coordination and differentiation. It accounts for the dual role of GF in providing positive incentives for green industries and exerting regulatory pressure on carbon-intensive sectors, while highlighting the LI’s objectives of reducing emissions and improving efficiency through GT. By integrating both positively and negatively oriented indicators, the system aims to fully capture the coupling characteristics and coordination mechanisms between GF and the LI, thereby ensuring that the measurement of coupling coordination is scientifically rigorous, systematically structured, and empirically insightful.

Step 2: Comprehensive evaluation of subsystems. Using the previously established evaluation indicator system, the entropy method is employed to comprehensively assess each subsystem, yielding a comprehensive evaluation value. The calculation process is detailed in Equation 2 (Porta et al., 1999). In this formula:

Step 3: Calculate the coupling degree. The coupling degree reflects the interaction between multiple subsystems. The calculation formula is shown in Equation 3 below. n is the number of subsystems. The coupling degree C ranges from 0 to 1. The closer the value is to 1, the higher the degree of coupling between the systems, indicating a stronger interaction and coordination between the subsystems.

Step 4: Calculate the coupling coordination degree. The coupling coordination degree, based on the coupling degree, takes into account the overall development level of the systems. The calculation formula is shown in Equation 4 below.

Step 5: Coupling coordination level division. According to the degree of coupling coordination D, the coupling coordination state can be divided into different levels, as shown in Table 6.

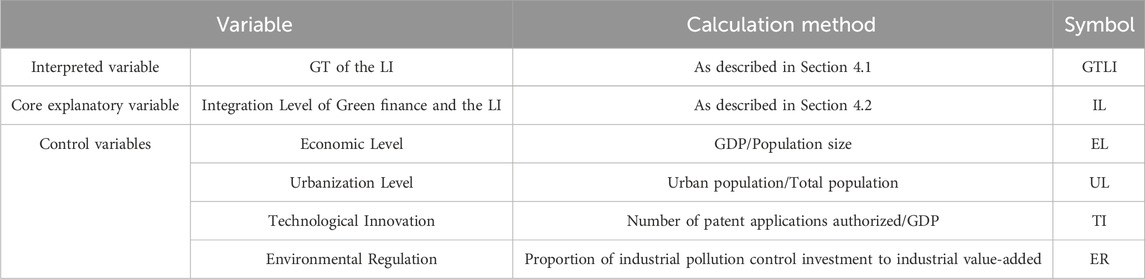

4.3 Variable settings

Based on a systematic review of existing research and considering the specific characteristics of GT in China’s LI, the study has developed a research indicator framework. In this framework, the GT of the LI serves as the dependent variable, while the coupling coordination degree between GF and the LI is the core independent variable. To ensure the scientific validity of the model and the reliability of the results, we also incorporate a comprehensive set of control variables, including economic level, urbanization level, technological level, and environmental regulation (Lean et al., 2014; Bretzke, 2013; Moldabekova et al., 2021; Ngo, 2021). Specifically, the economic level, reflected by regional GDP per capita, serves as a fundamental supporting factor for the GT of the LI. The urbanization level, measured by the proportion of the urban population to the total population, captures the potential impact of urbanization on adjusting logistics demand structures and promoting green development. Technological level, a key driver of GT, is assessed through the number of patents granted per unit of GDP, representing the role of technological innovation in advancing green technologies. Environmental regulation, a core aspect of policy constraints and incentives, is represented by the proportion of industrial pollution control investment to industrial value-added, highlighting the guiding role of environmental policies in fostering green production and operations within enterprises.

The selection of the aforementioned variables creates a comprehensive and scientifically grounded indicator system, encompassing economic, social, technological, and policy dimensions. This system not only provides a holistic depiction of the integration between GF and the LI but also elucidates the mechanisms by which this integration drives the GT of the LI. By offering a robust theoretical framework and data foundation, this indicator system lays the groundwork for empirical analysis. The detailed indicator system and variable design, including variable definitions, calculation methods, and abbreviations, are presented in Table 7.

4.4 Model construction

To explore the impact mechanism of the integration of GF and the LI on the GT of the LI, an verify the potential nonlinear relationship, we adopted a threshold effect model. The threshold effect model is a method used to test and quantify the nonlinear relationship between variables. It works by setting one or more thresholds to divide the sample space, analyzing whether the relationship between the dependent and independent variables differs under different threshold conditions (Lee et al., 2011). This model can effectively reveal the nonlinear characteristics of the relationship between variables, making it particularly suitable for testing situations where critical points or turning points exist in certain economic or social phenomena. Drawing on the research of Hansen and other scholars, we use the coupling coordination degree of the two industries as the threshold variable and construct the threshold effect model, as shown in Equation 5.

In Equation 5, i represents the province, and t represents the year.

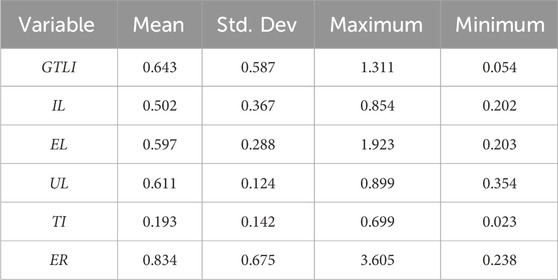

4.5 Data interpretation

We select panel data from 30 provinces in China (excluding Hong Kong SAR, Macao SAR, Taiwan Province, and Tibet Autonomous Region) from 2010 to 2022 as the research sample. The data sources primarily include the China Statistical Yearbook, China Energy Statistical Yearbook, China Logistics Statistical Yearbook, and the CNRDS database. For missing values in the dataset, we applied linear interpolation for reasonable imputation to ensure data integrity and coherence. After obtaining and organizing the data, we conducted a detailed descriptive statistical analysis of the main variables in the selected sample. This step aims to reveal the basic distribution characteristics of each variable, including its mean, minimum value, maximum value, and standard deviation. The specific statistical results are shown in Table 8.

5 Results

5.1 Analysis of the integration of the two industries

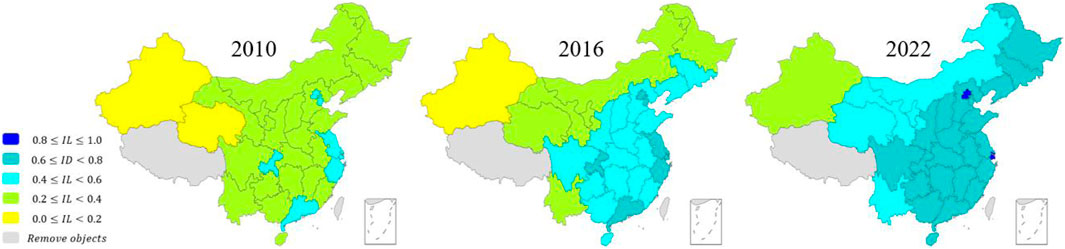

Based on the coupling coordination degree model and the sample data, the evaluation results of the integration level of GF and the LI in China are shown in Figure 2.

From 2010 to 2022, the integration between GF and the LI in China exhibited a clear upward trend, evolving from mild imbalance to moderate and even high coordination. This progress can be attributed to the systematic enhancement of GF policies, the modernization of the LI, and the implementation of regional coordinated development strategies. Since 2010, the Chinese government has introduced key policies, such as the Green Credit Guidelines and the Green Finance Development Plan (2016–2020), which have provided substantial financial support for green industries. As a result, the LI, a major beneficiary of GF, has made significant strides in greening its operations. These advancements include the accelerated adoption of new energy vehicles and the promotion of smart logistics technologies, leading to increasingly evident synergies between GF and the LI. However, despite the notable national improvements in coupling and coordination, regional disparities persist. The gap between the eastern regions and the central and western regions remains unbridged, highlighting the need for more targeted efforts to address these imbalances.

Regionally, the eastern developed provinces have taken the lead in entering the high coordination stage, while the central and western provinces continue to improve, though significant regional disparities persist. These differences are closely related to factors such as regional economic development levels, policy support intensity, logistics infrastructure construction, and the distribution of GF resources. (1) Eastern Region: The eastern region has consistently led the national integration level, with the coupling coordination degree rapidly improving from a mild coordination stage in 2010 to a high coordination stage by 2022. This progress is largely attributed to a robust economic foundation, substantial policy support, abundant GF resources, and advanced technological innovation. For example, Shanghai has facilitated the adoption of new energy logistics vehicles and park renovations through green bonds, achieving a coupling coordination degree of 0.85 in 2022—the highest in the nation. (2) Central Region: Provinces like Henan and Hubei have made significant progress in recent years. The coupling coordination degree has improved from the mild imbalance stage (around 0.3–0.4) to the moderate coordination stage (around 0.6–0.7), but there are still inter-provincial imbalances. Taking Henan as an example, leveraging national logistics hub policies and GF support, the coupling coordination degree reached 0.68 in 2022, positioning it among the leading provinces in the central region. (3) Western Region: The western region, despite its late start and weak foundation, has shown notable progress, with a relatively low overall coupling coordination degree but rapid growth. In 2010, the region was in the mild imbalance stage (around 0.2–0.3) but gradually advanced to the preliminary coordination stage by 2022. Certain areas, such as Sichuan and Shaanxi, are beginning to close the gap. Benefiting from the Belt and Road initiative, the western region has made significant strides in improving logistics infrastructure and attracting GF inflows. For instance, Sichuan supported the adoption of new energy vehicles and the development of a green logistics network, achieving a coupling coordination degree of 0.65 in 2022. While all regions have demonstrated continuous improvement in integration levels, the gap between the eastern region and the central and western regions remains substantial. This underscores the need for enhanced regional coordination to promote balanced national integration and development.

5.2 Empirical analysis of the integration of the two industries on the GT of the LI

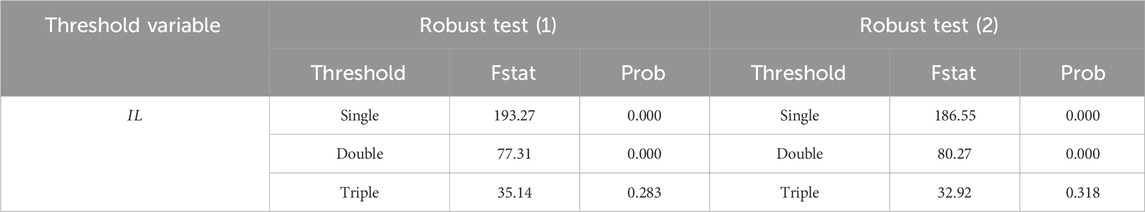

Using the integration level of GF and the LI as the threshold variable, the study employed Stata 15.0 to conduct single-threshold, double-threshold, and triple-threshold significance tests to determine the number of thresholds (Seo and Shin, 2016). The test results are presented in Tables 9, 10.

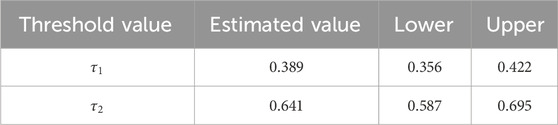

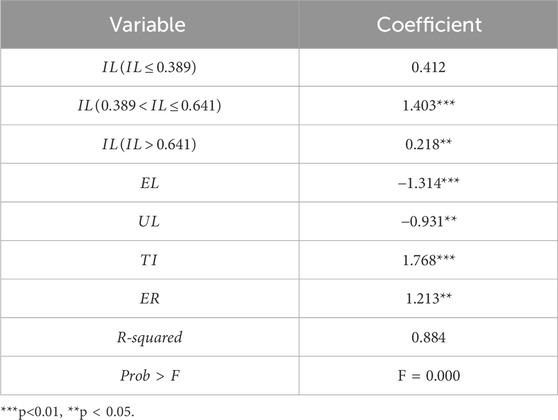

As shown in Table 9, the F-values for the single-threshold and double-threshold tests are significant at the 1% level, passing the threshold significance tests. However, the F-value for the triple-threshold test is not significant, indicating the absence of a triple-threshold effect. This suggests a double-threshold effect between the integration of GF and the LI’s GT. Therefore, this study adopts a double-threshold effect model to analyze the impact of industrial integration on the GT of the LI. According to Table 10, the double-threshold values are 0.389 and 0.641, respectively. Based on these thresholds, the level of industrial integration is divided into three intervals: low integration level [0, 0.389], medium integration level [0.389, 0.641], and high integration level [0.641, 1]. Finally, the regression results of the threshold effect model are presented in Table 11.

As shown in Table 11, the impact of the integration level between GF and the LI on the GT of the LI exhibits nonlinear characteristics. In the low-level integration phase (IL ≤ 0.389), the regression coefficient is 0.412, but it is not significant. This indicates that the integration of the two industries has not yet exerted a noticeable positive effect on GTLI during this phase. In the medium-level integration phase (0.389 < IL ≤ 0.641), the regression coefficient significantly increases to 1.403, demonstrating that the promotion effect of industrial integration on GTLI reaches its peak with a strong and significant driving force. In the high-level integration phase (IL > 0.641), the regression coefficient drops to 0.218. Although still positive, the marginal effect weakens significantly. Despite the insignificance of the coefficient in the low-level integration phase, the overall model analysis and theoretical framework suggest that the impact of GF and the LI integration on GTLI follows an S-shaped pattern. Based on these regression results, we further analyzed the specific impact mechanisms within each phase.

(1) Low-level integration Phase: In the low-level integration phase (IL ≤ 0.389), the promoting effect of GF on the GT of the LI is weak and insignificant. This phase is characterized by the limited dissemination of green financial products and services, making it difficult for logistics enterprises to secure sufficient funding to support GT efforts. Moreover, enterprises exhibit low awareness of green development, and the application rate of green technologies and equipment is insufficient, resulting in a weak foundation for GT. Additionally, the infrastructure for green logistics, such as new energy vehicles and green warehousing, remains underdeveloped, further hindering the overall green development of the LI. For instance, in underdeveloped provinces in central and western regions like Tibet and Qinghai, the green financial system is still immature, with weak green credit policies and limited policy support. As a result, investments in green logistics equipment by enterprises are minimal, leading to negligible progress in GT. These regions are characterized by small-scale logistics enterprises, outdated technologies, and insufficient infrastructure, exacerbating the challenges of achieving green development. (2) Medium-level integration Phase: In the medium-level integration phase (0.389 < IL ≤ 0.641), the integration of GF with the LI significantly promotes GT, exhibiting a robust facilitation effect. During this phase, GF policies are progressively implemented, with financial institutions providing substantial support for green logistics projects. This drives enterprises to invest in green technologies and infrastructure development. Additionally, the application of advanced technologies and economies of scale improve the efficiency of green development in the LI. Within the LI, competition and demonstration effects are gradually emerging, encouraging more enterprises to actively engage in GT. Economically developed provinces along the eastern coast, such as Jiangsu and Zhejiang, serve as prime examples. These regions have well-established GF policies, with financial institutions supporting the development of new energy logistics vehicles and green warehousing through green loans and subsidies. For instance, many areas in Jiangsu have introduced large-scale fleets of new energy logistics vehicles and solar-powered warehousing facilities, realizing significant green development benefits. Policy incentives in these regions have also attracted more enterprises to participate in GT initiatives. (3) High-level Integration Phase: In the high-level integration phase (integration level > 0.641), the promoting effect of GF on the GT of the LI begins to weaken. While GF continues to drive green initiatives, its marginal effectiveness declines, and issues related to over-integration arise. Redundant resource allocation and technological bottlenecks lead to reduced efficiency, while the costs of further advancing GT increase sharply. In some cases, insufficient regulatory coordination results in a mismatch between financial support and the actual needs of enterprises, diminishing the effectiveness of transformation efforts. For example, Guangdong and Shanghai, as regions with high integration levels between GF and the LI, have successfully achieved widespread adoption of new energy logistics vehicles and green warehousing facilities. However, inefficiencies such as underutilized charging stations and surplus vehicles have started to emerge. Additionally, enterprises in these regions are approaching technological bottlenecks, where further advancements require significantly higher marginal costs. As a result, the pace of GT improvements has noticeably slowed.

The regression coefficients of the control variables EL and UL are significantly negative. (1) The inhibitory effect of EL on the green development of the LI is primarily reflected in its high energy consumption characteristics, path dependence, and blind expansion tendencies. As a key indicator of regional economic development, an increase in per capita GDP is often accompanied by greater demand for freight transportation and energy consumption, thereby reinforcing the LI’s high-emission characteristics. Furthermore, in the absence of stringent environmental regulations, economic expansion often prioritizes production and logistics demands over GT objectives. This tendency reinforces a high-energy, high-emission growth trajectory, further hindering progress toward sustainable development. (2) The inhibitory effect of UL on the LI’s green development is more closely related to the concentration of logistics demand. Higher levels of urbanization indicate a significant concentration of urban populations and economic activities, driving a sharp increase in demand for traditional logistics services. This surge often promotes the expansion of conventional logistics models, delaying GT due to market pressures. Additionally, rapid urbanization is typically accompanied by intensive construction and excessive resource consumption, exacerbating environmental pollution. These challenges create substantial obstacles to the GT of the LI, making the adoption of sustainable practices more difficult. Notably, the regression coefficients of the control variables for TI and ER are significantly positive, highlighting their supportive role in driving GT. (3) Technological innovation facilitates the development and adoption of green logistics technologies, such as energy-efficient transportation tools, smart warehousing systems, and green supply chain management solutions. It also enhances operational efficiency and resource allocation, enabling logistics enterprises to reduce operational costs while minimizing environmental impacts. Moreover, technological innovation stimulates market competition, encouraging firms to accelerate technological iterations and promote industry-wide green upgrades. (4) Environmental regulation, as a critical external policy tool, supports GT through constraints and incentives. Strict environmental regulations compel logistics enterprises to invest in green technologies, such as new energy vehicles and low-emission facilities, while internalizing pollution costs, which incentivizes optimization of logistics processes, reduction of resource waste, and minimization of emission intensity. Additionally, environmental regulation provides financial support for green technology research and sustainable development strategies through subsidies, tax incentives, and other measures. These mechanisms collectively highlight the pivotal roles of technological innovation and environmental regulation in driving the GT of the LI.

5.3 Robustness test

The robustness test ensures that the model results remain reliable and valid when faced with various potential anomalies, thereby enhancing the credibility and interpretability of the research (Sharma et al., 2022). In this study, we perform robustness tests by altering the calculation method of the core explanatory variables and adding control variables. The test results are presented in Tables 12, 13, 14.

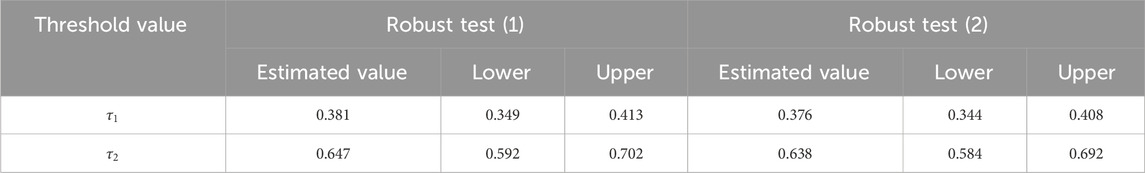

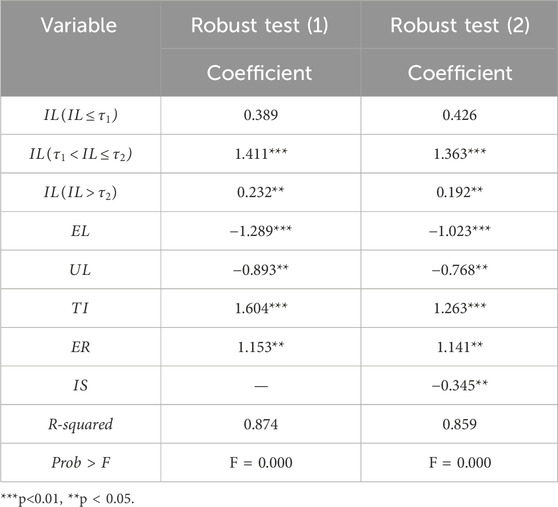

(1) We replaced the entropy method with principal component analysis (PCA) to recalculate the integration level of GF and the LI (core explanatory variable). Using PCA, we extracted the principal components of each subsystem and assigned appropriate weights to calculate the integration level. We then reconstructed the threshold effect model with the new core explanatory variable to test whether the threshold effect remains significant. As shown in the column (1) of the Robust Test in Tables 12, 13, 14, the model still exhibits two significant threshold values, 0.381 and 0.647. These are close to the threshold values of the original model. The regression coefficients of the threshold variables are consistent with the original model in terms of direction and significance in each interval, confirming the robustness of the model results.

(2) Next, we added industrial structure (the proportion of the secondary industry, IS) as a new control variable and re-estimated the model. The results are shown in the column (2) of the Robust Test (2) in Tables 12, 13, 14. After controlling for the interference of industrial structure, the significance of the threshold values and the S-shaped relationship between variables still hold. Furthermore, the direction of the regression coefficients of the threshold variables in each stage remains unchanged. Specifically, the regression coefficient in the low-level integration phase is still insignificant, the promotion effect is the strongest in the medium-level integration phase, and a diminishing marginal effect is observed in the high-level integration phase. The regression coefficient of the newly added control variable is negative, indicating that when the proportion of the secondary industry is high, it has a suppressive effect on the GT of the LI. This is because the secondary industry typically includes manufacturing and heavy industries, which have high logistics demand but are often associated with high energy consumption and pollution.

5.4 Heterogeneity analysis

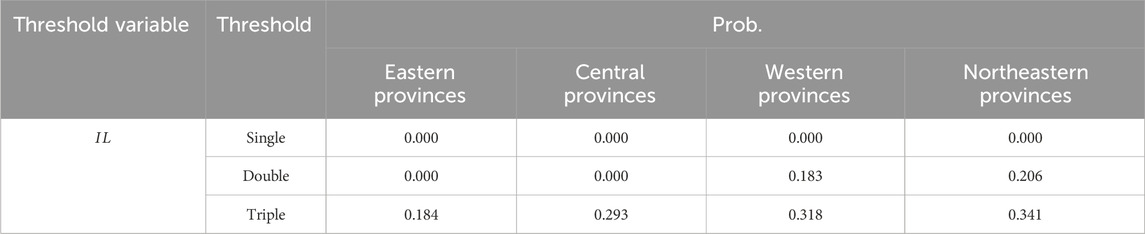

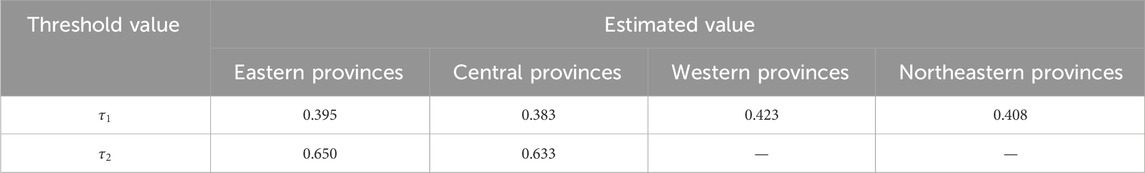

Significant differences in factors such as economic development, GF, industrial structure, and resource availability across provinces in China result in varying impacts of industrial integration on the GT of the LI (Yu et al., 2021). To account for this heterogeneity, we divided the study sample into four major regions—East, Central, West, and Northeast China—based on China’s geographical division standards. The analysis results are presented in Tables 15, 16, 17.

As shown in Tables 15, 16, 17, the Eastern and Central provinces of China passed the double-threshold test, while the Western and Northeastern provinces only passed the single-threshold test: Firstly, in the Eastern provinces, the promoting effect of industrial integration is most significant in the second stage, driven by a well-established financial system and advanced logistics infrastructure, such as the widespread adoption of new energy vehicles and smart warehouses. However, in the third stage, the marginal effect diminishes, and challenges related to resource allocation efficiency begin to surface. Furthermore, in the Central provinces, the threshold values are similar to those in the Eastern provinces, with industrial integration significantly promoting GT in the second stage. This effect is largely attributed to strong policy support and growing acceptance of green technologies by enterprises. However, in the third stage, limited logistics infrastructure and technological capabilities reduce the coefficient to 0.327, reflecting a decline in the promoting effect. Moreover, in the Western provinces, the integration level of GF and the LI remains generally low. However, once the initial threshold is surpassed, GF significantly enhances the GT of the LI. The low level of integration in this region is primarily due to economic underdevelopment and resource constraints. Nevertheless, national policy support and the implementation of pilot projects have effectively accelerated the GT process. Lastly, in the Northeastern provinces, the high proportion of traditional industries, sluggish economic growth, and limited application of green technologies in logistics enterprises have significantly constrained the development of high-level industrial integration.

In summary, the heterogeneity analysis indicates that the impact of the integration of GF and the LI on the GT of the LI varies significantly across regions. The Eastern and Central provinces pass the double-threshold test, showing a multi-stage promoting effect of industrial integration on the GT of the LI. Among them, the Eastern provinces have the most significant promoting effect due to improved policies and advanced technologies. The Central provinces are developing steadily however, it is constrained by resource allocation efficiency. In contrast, the Western and Northeastern provinces only pass the single-threshold test, primarily due to the low level of industrial integration, weak GF systems, and insufficient infrastructure and technological capabilities. Furthermore, in the high-integration stage, both the Eastern and Central provinces experience diminishing marginal effects, highlighting the need to improve resource utilization efficiency through technological innovation and policy optimization. Therefore, the study recommends that the Eastern provinces prioritize resource optimization to achieve high-level green development, the Central provinces enhance technological innovation and financial support, and the Western and Northeastern provinces focus on improving infrastructure and implementing robust policy measures to accelerate the integration of GF and the LI.

6 Discussion

This study analyzes data from 30 provinces in China from 2010 to 2022, revealing the promoting effect of the integration of GF and the LI on the GT of the LI, along with its nonlinear relationship and regional heterogeneity. Below, we compare and discuss the results from both horizontal and vertical dimensions.

Firstly, we find that the integration level of GF and the LI in China has significantly improved in recent years, progressing from mild misalignment to moderate and high coordination stages. This finding is consistent with existing research on the integration of GF with other industries. For instance, studies by Zhang, Yin, and Han have explored the integration of GF with the digital economy, economic growth, and agriculture, respectively (Zhang and Zhao, 2023; Yin and Xu, 2022b; Han et al., 2023). In contrast, this study expands the application of GF by focusing on the GT of the LI, a fundamental service sector. This highlights the universality of GF in promoting low-carbon development across various industries. Significant regional differences in integration levels were also observed. Eastern provinces exhibit higher integration levels due to their advanced economic development and stronger policy implementation compared to central and western provinces. These findings align with Fang’s research on regional disparities in China’s GF (Fang and Shao, 2022). Additionally, Zhang pointed out that differences in GF levels often stem from variations in infrastructure, technological innovation capabilities, and policy support—factors that are especially prominent in the LI (Zhang, 2023). These results underscore that GF plays a pivotal role not only in high-carbon-emission industries but also in facilitating the GT of service industries, further demonstrating its broad applicability in driving sustainable development.

Secondly, using the threshold effect model, the study reveals that the integration of GF and the LI follows an S-shaped trajectory in influencing the GT of the LI. This progression consists of three distinct phases: an initial inefficient phase, a rapid improvement phase, and a subsequent stable development phase. This nonlinear characteristic contrasts sharply with existing discussions on the marginal effects of GF, which primarily focus on either increasing or diminishing returns. By identifying this S-shaped relationship, the study broadens the understanding of GF’s role in the GT of the LI. Previous studies by Sun, Dhayal, and Rasoulinezhad, have highlighted the importance of GF in promoting green transformations in manufacturing, industrial, and energy sectors (Sun et al., 2023; Dhayal et al., 2023; Rasoulinezhad and Taghizadeh-Hesary, 2022). However, they have not identified the phased nature of GF’s impact nor examined its role within industrial integration. Similarly, research on the GT of the LI has largely emphasized technological innovation, environmental regulation, and supply chain optimization, while giving limited attention to how GF fosters GT through industrial integration. For example, Anser explored the role of technological upgrades in enhancing carbon emission efficiency in logistics but overlooked GF as a critical external support tool (Anser et al., 2020). Likewise, Lai focused on the constraining effects of environmental regulation on the LI’s green development but did not incorporate the perspective of financial resources (Lai and Wong, 2012). In contrast, the analysis of the threshold effects of GF-LI integration, reveals that the synergistic mechanisms play across different development stages. This approach provides a novel and comprehensive perspective on the interplay between GF and the LI, advancing the research on sustainable development in service industries.

Thirdly, the study also indicates a significant regional heterogeneity in the impact of the integration of GF and the LI on the GT of the LI. For instance, integration in the eastern region has the most significant impact on improving GT efficiency, while the central and western regions demonstrate greater development potential. This finding aligns with Kumar et al., who observed that in economically developed regions, GF more effectively fulfills its resource allocation function, thereby accelerating the GT process (Kumar et al., 2024). Similarly, Muganyi et al. highlighted that weak infrastructure, low adoption rates of green technologies, and limited financing capacity for green projects are critical barriers to the GT of the central and western regions (Muganyi et al., 2021).

Finally, this study takes China as a case to explore the nonlinear impact of the integration between GF and the LI on the efficiency of the industry’s GT. Although the empirical analysis is based on data from China, the findings are also applicable to other developing countries with similar industrial foundations and at comparable stages of GF development. In many such countries, the logistics sector is likewise characterized by high energy consumption and carbon emissions, while GF remains in its nascent or intermediate phase, with relatively low efficiency in financial resource allocation. As a result, the role of GF in driving the GT of the logistics sector may also exhibit an S-shaped pattern—being limited in the early stages, significantly effective in the mid-term, and potentially showing diminishing returns when excessively relied upon. Therefore, this study not only offers policy recommendations for optimizing the integration pathway of GF and the LI in China, but also provides valuable insights for other developing economies in designing GF strategies and promoting industrial green transitions. In particular, for Belt and Road countries, BRICS nations, and similar economies, establishing effective GF guidance mechanisms, optimizing industrial structures, and enhancing institutional support are crucial steps toward improving green transition efficiency and achieving sustainable development goals.

7 Conclusion and policy implications

7.1 Conclusion

This study systematically analyzes the facilitating effects and mechanisms of the integration of GF and the LI on the GT of the LI. It reveals that in recent years, the integration level of GF and the LI in China has significantly improved, progressing from mild misalignment to moderate and high coordination. However, significant disparities exist among provinces. The eastern region, leveraging its strong economic foundation and policy support, has taken the lead in achieving high coordination. The central region has made notable progress but remains uneven in development, while the western region, despite its weak foundation, has maintained steady growth. Secondly, the integration of GF and the LI significantly affects the efficiency of GT in logistics, exhibiting an S-shaped relationship. At low levels of integration, its contribution to GT is limited. As the integration level increases, the marginal effect on GT gradually strengthens. However, once the integration surpasses a certain threshold, its effects tend to saturate or even weaken. Finally, regional heterogeneity significantly influences the integration effects. In the eastern region, advanced policies and cutting-edge technologies enable integration to have the most significant impact on GT. In contrast, the central region faces challenges from resource allocation inefficiencies, the western region struggles with lagging economic development and limited resources, and the northeastern region is hindered by a high reliance on traditional industries. These factors collectively constrain the enhancement of the facilitating effects of integration in these regions.

7.2 Policy implications

Significant disparities in economic development, industrial structure, resource endowment, and policy environments among provinces have led to varying conditions for GT in their LI. To foster the integration of GF and the LI and accelerate the GT across provinces, we propose the following targeted policy recommendations based on the study’s findings and regional characteristics.

Eastern provinces have achieved a high level of coordination between GF and the LI; however, the diminishing marginal effects are becoming evident, necessitating a focus on advanced resource integration and innovation-driven strategies. First, the study recommends an advance innovation in green financial products. Developed provinces such as Zhejiang and Guangdong can introduce green credit securitization instruments tailored to the LI, such as carbon-neutral bonds or green logistics special-purpose bonds. This will facilitate the promotion and application of green technologies. Second, digitalization and intelligent technology should be further empowered. Provinces like Shanghai and Jiangsu can expand the adoption of smart logistics technologies, including AI-based dispatching systems and blockchain-based traceability solutions. This will optimize logistics routes and enhance operational efficiency. Lastly, the study suggests that the role of policy as a demonstration tool should be strengthened. For instance, leveraging the collaborative development of the Beijing-Tianjin-Hebei region as a model, cross-regional mechanisms for GF and logistics cooperation can be established, to encourage local governments to share experiences in green projects and amplify the spillover effects of effective policies.

Central provinces exhibit steady development but require improvements in resource allocation efficiency, necessitating more precise policy support and wider adoption of green financial tools. To this end, this paper proposes an acceleration on the inclusiveness of GF. Provinces such as Hunan and Henan should enhance green credit support for small and medium-sized logistics enterprises, particularly through low-interest loans or subsidies for the purchase of new energy logistics vehicles and energy-efficient warehousing equipment. Additionally, the development of green logistics infrastructure is crucial. Drawing on the experiences of transportation hubs like Wuhan, investment in green freight corridors should be increased, along with the creation of comprehensive logistics parks to improve regional resource integration. Furthermore, fostering green logistics pilot enterprises is essential. In provinces like Jiangxi and Anhui, eligible logistics companies could be selected for GT pilot programs, supported by financial incentives and tax reductions to promote the adoption of green logistics models.

Western provinces, characterized by a lower integration level, should prioritize infrastructure development and leverage policy support and technological advancements to enhance GT efficiency. Greater policy-driven financial support is essential, with the central government allocating dedicated green development funds to underdeveloped regions like Guizhou and Yunnan for the procurement and maintenance of new energy logistics vehicles and clean energy warehousing equipment. Additionally, directing financial resources toward green projects is crucial. Policy-based financial institutions, such as the China Development Bank, can establish specialized green funds to support the development of green logistics infrastructure in provinces like Gansu and Qinghai. Promoting clean energy technologies should be a key priority, with Sichuan and Chongqing serving as pilot regions for the adoption of new energy solutions, particularly in electric logistics vehicles and clean energy supply stations, to facilitate the localization of green technologies. Lastly, fostering regional industrial collaboration is vital. Establishing an interprovincial LI cooperation platform in western China could help integrate dispersed resources, enhance economies of scale, and advance GT levels.

The northeastern provinces face challenges in GT due to sluggish economic growth and a high proportion of traditional industries. To address this, the focus should be on advancing the application of green financial tools and transforming the traditional LI. It is recommended to promote the transformation and upgrading of old industrial bases. In northeastern provinces like Liaoning and Jilin, more support should be provided for the technological renovation of traditional logistics enterprises, with a focus on promoting new energy freight vehicles, energy-efficient loading and unloading equipment, and other green technologies. Additionally, GF service platforms should be established. Cities like Harbin can set up GF information service platforms to connect logistics enterprises with green financial products, enhancing the accessibility of GF. Attracting external investment and fostering technological cooperation is also crucial. Domestic and international green technology companies should be encouraged to collaborate with logistics enterprises in the northeastern region, to accelerate GT through technology transfer and localized innovation. Lastly, nurturing emerging green LI should be prioritized. Policymakers should combine the advantages of agricultural resources in Heilongjiang, explore logistics models for green supply chain and smart agriculture, and promote the construction of a green logistics system for agricultural products.

7.3 Limitations and future recommendations

Although this study reveals the dynamic impact mechanism of the integration of GF and the LI, there are still several limitations that should not be overlooked. First, some of the indicators in Tables 4, 5 primarily rely on domestic data sources, such as the National Bureau of Statistics and industry-specific survey databases. The availability of these indicators on a global scale are limited, especially in international databases like those of the World Bank. This restricts the applicability of the research methods in an international context. Secondly, while the threshold effect model used in this study is suitable for exploring nonlinear relationships, its ability to address the complex endogeneity issues between variables is limited. Although robustness checks have been conducted to mitigate potential biases from endogeneity, further optimization of model selection is needed in the future, possibly by integrating causal inference methods to enhance the credibility of the conclusions. Lastly, the impact mechanism of the integration of the two industries on the GT of the LI involves multiple factors, however, this study mainly focuses on direct effects. There is insufficient consideration of indirect influences, such as technological innovation, energy efficiency, and industrial structure, which lead to an incomplete explanation of the underlying mechanisms.

Based on the aforementioned limitations, future research can deepen and improve this study from the following directions. First, further enhance the applicability of the proposed method on a global scale. Specifically, adjustments to the indicator system and model for different countries or regions should be explored to improve the method’s universality. This will help reveal both the commonalities and differences in the integration of GF and the LI across various economies. Second, at the model level, it is recommended to introduce more advanced methods such as dynamic panel models, causal inference models (e.g., regression discontinuity, difference-in-differences), to explore the causal mechanisms between the integration of the two industries and the GT of the LI, while addressing potential endogeneity issues. Additionally, employing methods such as multilevel models and quantile regression can facilitate a more detailed analysis of the heterogeneous impacts across different development stages and regions. Third, the indirect effects of GF on the GT of the LI should be explored. This includes focusing on the mediating effect of technological innovation and analyzing how GF enhances the greening of logistics through investments in research and development and the diffusion of technology. The study should also examine the synergistic effect of policies and market mechanisms, uncovering the combined impact of GF policies and market-based mechanisms such as carbon trading. Finally, attention should be given to the dynamic adjustment of enterprise behavior and decision-making, analyzing how companies’ low-carbon actions, incentivized by GF, contribute to the GT. By adopting multiple perspectives, future research will further illuminate the complex mechanisms between GF and the GT of the LI, providing scientific evidence for policy-making and industry practice.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

LD: Methodology, Validation, Formal Analysis, Writing – review and editing. DT: Conceptualization, Formal Analysis, Project administration, Supervision, Writing – review and editing. EA: Visualization, Writing – review and editing. MZ: Formal Analysis, Software, Validation, Writing – review and editing. HZ: Formal Analysis, Software, Validation, Writing – review and editing. YK: Conceptualization, Formal Analysis, Data curation, Investigation, Methodology, Validation, Writing – original draft. LZ: Data curation, Formal Analysis, Investigation, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

Authors MZ and HZ were employed by Jiangsu Trendy Information Technology Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Afzal, A., Rasoulinezhad, E., and Malik, Z. (2022). Green finance and sustainable development in Europe. Econ. research-Ekonomska istraživanja 35 (1), 5150–5163. doi:10.1080/1331677X.2021.2024081

Andersen, P., and Petersen, N. C. (1993). A procedure for ranking efficient units in data envelopment analysis. Manag. Sci. 39 (10), 1261–1264. doi:10.1287/mnsc.39.10.1261

Anser, M. K., Yousaf, Z., and Zaman, K. (2020). Green technology acceptance model and green logistics operations: “to see which way the wind is blowing”. Front. Sustain. 1, 3. doi:10.3389/frsus.2020.00003

Bai, D., Dong, Q., Khan, S. A. R., Chen, Y., Wang, D., and Yang, L. (2022a). Spatial analysis of logistics ecological efficiency and its influencing factors in China: based on super-SBM-undesirable and spatial Dubin models. Environ. Sci. Pollut. Res. 29, 10138–10156. doi:10.1007/s11356-021-16323-x

Bai, D., Dong, Q., Khan, S. A. R., Chen, Y., Wang, D., and Yang, L. (2022b). Spatial analysis of logistics ecological efficiency and its influencing factors in China: based on super-SBM-undesirable and spatial Dubin models. Environ. Sci. Pollut. Res. 29, 10138–10156. doi:10.1007/s11356-021-16323-x

Bai, R., and Lin, B. (2023). Nexus between green finance development and green technological innovation: a potential way to achieve the renewable energy transition. Renew. Energy 218, 119295. doi:10.1016/j.renene.2023.119295

Barut, A., Citil, M., Ahmed, Z., Sinha, A., and Abbas, S. (2023). How do economic and financial factors influence green logistics? A comparative analysis of E7 and G7 nations. Environ. Sci. Pollut. Res. 30 (1), 1011–1022. doi:10.1007/s11356-022-22252-0

Bowlin, W. F. (1998). Measuring performance: an introduction to data envelopment analysis (DEA). J. cost analysis 15 (2), 3–27. doi:10.1080/08823871.1998.10462318

Bretzke, W. R. (2013). Global urbanization: a major challenge for logistics. Logist. Res. 6 (2), 57–62. doi:10.1007/s12159-013-0101-9

Bui, T. D., Chan, F. T. S., Do, T. T. T., Nguyen, T. N. L., Lim, M. K., and Tseng, M. L. (2024). Green supply chain finance model in logistics and transportation industry: improving from policies and regulation and financial digitalisation practices. Int. J. Logist. Res. Appl., 1–34. doi:10.1080/13675567.2024.2356679

Buvik, A. S., and Takele, T. B. (2019). The role of national trade logistics in the export trade of African countries. J. Transp. Supply Chain Manag. 13 (1), 1–11. doi:10.4102/jtscm.v13i0.464Available online at: https://hdl.handle.net/10520/EJC-1c0d2354b1.

Çakır, S. (2017). Measuring logistics performance of OECD countries via fuzzy linear regression. J. Multi-Criteria Decis. Analysis 24 (3-4), 177–186. doi:10.1002/mcda.1601

Cecchini, L., Venanzi, S., Pierri, A., and Chiorri, M. (2018). Environmental efficiency analysis and estimation of CO2 abatement costs in dairy cattle farms in Umbria (Italy): a SBM-DEA model with undesirable output. J. Clean. Prod. 197, 895–907. doi:10.1016/j.jclepro.2018.06.165

Chan, F. T. S., Chan, H. K., Lau, H. C. W., and Ip, R. W. (2006). An AHP approach in benchmarking logistics performance of the postal industry. Benchmarking An Int. J. 13 (6), 636–661. doi:10.1108/14635770610709031

Chang, Y.-T., Park, H. S., Jeong, J. B., and Lee, J. W. (2014). Evaluating economic and environmental efficiency of global airlines: a SBM-DEA approach. Transp. Res. Part D Transp. Environ. 27, 46–50. doi:10.1016/j.trd.2013.12.013

Chen, H., and Zhang, Y. (2022). Regional logistics industry high-quality development level measurement, dynamic evolution, and its impact path on industrial structure optimization: finding from China. Sustainability 14, 14038. doi:10.3390/su142114038

Dekker, R., Bloemhof, J., and Mallidis, I. (2012). Operations Research for green logistics-An overview of aspects, issues, contributions and challenges. Eur. J. operational Res. 219 (3), 671–679. doi:10.1016/j.ejor.2011.11.010

Dhayal, K. S., Agrawal, S., Agrawal, R., Kumar, A., and Giri, A. K. (2024). Green energy innovation initiatives for environmental sustainability: current state and future research directions. Environ. Sci. Pollut. Res. 31 (22), 31752–31770. doi:10.1007/s11356-024-33286-x