- 1Business School, Shandong Xiehe University, Jinan, Shandong, China

- 2School of Management, Guangdong University of Science and Technology, Dongguan, China

Climate change poses an urgent challenge to both developed and developing economies, with varying degrees of vulnerability and institutional capacity. This study investigates the impact of energy efficiency, technological and financial innovations, industrial-economic development, and institutional quality on climate change effects (CCE), measured by ecological footprint, across G20 countries. Using panel data from 2000 to 2022, we apply Method of Moments Quantile Regression (MMQR), Dynamic Ordinary Least Squares (DOLS), and Fully Modified Ordinary Least Squares (FMOLS) to capture both distributional effects and long-run relationships. The results reveal that energy and technological innovations significantly reduce CCE in both groups, though the impact is more pronounced in developing economies. In contrast, financial technologies are positively associated with CCE in developing economies, suggesting that the expansion of digital infrastructure without green safeguards may exacerbate environmental degradation. Energy efficiency exhibits a rebound effect in these contexts, undermining its potential benefits. Institutional quality and industrial development, however, consistently demonstrate a mitigating effect on ecological footprint. These findings offer differentiated policy insights: while innovation and governance reforms are critical across all contexts, developing economies require stronger regulatory frameworks to align digital and industrial growth with climate objectives. The study contributes to the broader discourse on sustainable development by identifying context-specific levers for reducing environmental pressures in alignment with the Sustainable Development Goals (SDGs).

1 Introduction

The escalating environmental degradation resulting from human activity has intensified global attention on sustainability, particularly in the context of climate change. As nations pursue the Sustainable Development Goals (SDGs), addressing climate change effects (CCE) has emerged as a central policy and research concern for both developed and emerging economies (Hu et al., 2024a; Hu et al., 2024b). Among them, G20 countries stand out due to their dominant share of global GDP, energy consumption, and greenhouse gas emissions. As such, they play a pivotal role in shaping the trajectory of global climate action (Gupta et al., 2022; Sarkodie, 2021). Understanding the diverse environmental challenges and policy responses within the G20 is critical for steering global progress toward sustainability.

To capture these complexities, we conduct a subgroup analysis by dividing G20 countries into developed and developing economies. The developed economies in our study include Canada, France, Germany, Italy, Japan, the Republic of Korea, and the United Kingdom, while the developing group comprises Argentina, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, and Türkiye. This division allows us to explore how structural differences in economic development, governance, and technology adoption shape environmental outcomes, particularly in the face of climate change.

The variable energy efficiency (EEF) plays a fundamental role in reducing emissions by lowering energy demand without compromising economic output. Enhanced energy efficiency contributes to decoupling economic growth from environmental degradation, particularly in developed nations with mature energy infrastructures. However, in emerging economies, the impact of EEF can be more mixed due to differences in industrial structure and energy access (Awosusi et al., 2022; Ren et al., 2024).

Energy innovations (EI), such as renewable energy technologies and smart grids, are central to the transition toward a low-carbon economy (Shahzad et al., 2023; Zahid et al., 2024). Innovations in clean energy can drastically lower the ecological footprint by replacing fossil fuel-based systems. Yet, the adoption and diffusion of these innovations vary widely between G20 nations, influenced by institutional, financial, and technological readiness (Mahalik et al., 2021). The industrial-economic development index (IEDI) reflects the degree of industrialization and economic output in a country. While industrial development can boost productivity and job creation, it also tends to increase energy consumption and environmental pressure, especially when reliant on carbon-intensive industries. Balancing growth with sustainability remains a major challenge for rapidly industrializing nations (Zafar et al., 2021).

Technological innovation (TIN) is often viewed as a double-edged sword. On one hand, it promotes efficiency, clean technologies, and sustainable practices; on the other, it can intensify environmental degradation through increased production and consumption unless carefully managed. Therefore, its impact on climate change is context-dependent, warranting further empirical exploration (Han et al., 2022; Shahbaz et al., 2020). The role of institutional quality (INQ) is equally vital, as robust institutions enhance the effectiveness of environmental policies, enforce regulations, and facilitate innovation. High-quality institutions are more likely to implement long-term strategies that align technological advancement with environmental goals, particularly in developed countries (Wang et al., 2024; Zheng et al., 2024).

Financial technology (FTN) has emerged as a powerful enabler of sustainable development. By promoting digital financial inclusion, reducing resource-intensive banking practices, and supporting green investment platforms, fintech holds the potential to reduce ecological footprints (Wang et al., 2024; Zheng et al., 2024). However, its environmental impact remains underexplored, especially in the context of large economies with varying levels of technological penetration. While (Xian, 2024) usefully critique fintech’s digital carbon footprints, supporting this study’s finding of fintech’s adverse environmental effects in developing G20 economies, their qualitative approach lacks the econometric rigor and comprehensive scope of our analysis, which uses MMQR, DOLS, and FMOLS to reveal nuanced impacts of energy efficiency, innovations, and institutional quality on ecological footprints. Despite growing interest in these variables, the existing literature often examines them in isolation or within limited country contexts. Few studies offer a comprehensive, multi-variable analysis focused on major global economies like the G20. Furthermore, most empirical research relies on linear estimation methods, which may obscure heterogeneity across countries and distributional differences in environmental outcomes. This creates a notable research gap in understanding how these drivers collectively influence climate change effects (CCE), especially across varying levels of environmental vulnerability and economic development.

This study addresses that gap by empirically examining the effects of EEF, EI, IEDI, INQ, TIN, and FTN on climate change in G20 economies over the period 2000–2022. To capture the distributional dynamics and account for cross-country heterogeneity, we employ the Method of Moments Quantile Regression (MMQR). Additionally, for robust long-run estimations, we use Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) techniques, which account for endogeneity and serial correlation.

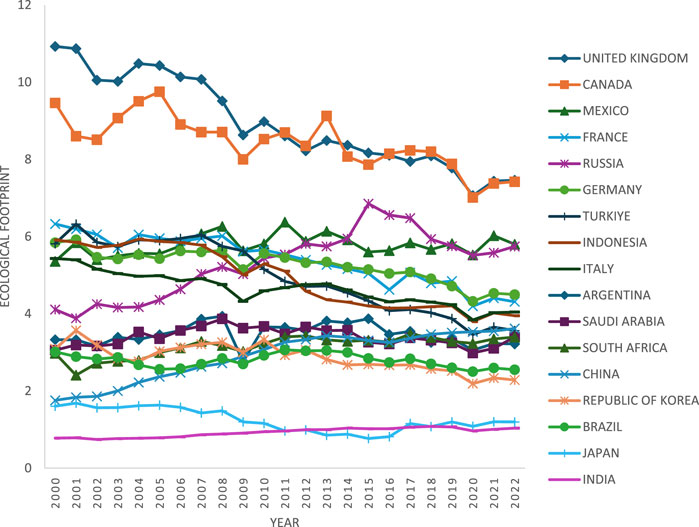

Figure 1 illustrates the ecological footprints of G20 countries over the study period, revealing divergent trends: developed economies such as the UK, Canada, France, and Germany show gradual declines in their footprints, while emerging economies like China, India, and Indonesia exhibit modest increases. These patterns reflect different stages of economic growth, consumption, and environmental policy implementation, underscoring the need for differentiated policy responses (Hu et al., 2023; Mao et al., 2025; Wang et al., 2025).

This study investigates the influence of six key variables on climate change effects (CCE) in G20 economies: energy innovations (EI), technological innovations (TIN), financial technologies (FTN), energy efficiency (EEF), industrial-economic development (IEDI), and institutional quality (INQ). Importantly, CO2 emissions (CE) are now explicitly included to capture direct environmental impacts, while green financing elements are integrated within the FTN index. This ensures a more holistic analysis of the drivers of climate change across both developed and developing G20 nations. Based on existing literature and preliminary insights from the data, we hypothesize that these variables may exhibit heterogeneous effects across countries depending on their level of development.

To reflect these structural differences, we divide the G20 into two subgroups: developed (e.g., Germany, UK, Japan) and developing economies (e.g., China, India, Brazil). We propose the following hypotheses.

• H1 (Developed Economies): EI, TIN, FTN, EEF, IEDI, and INQ are expected to have a negative relationship with CCE—that is, improvements in these areas reduce environmental degradation and support climate change mitigation.

• H2 (Developing Economies): EI, TIN, IEDI, and INQ are expected to have a negative relationship with CCE, contributing to environmental improvements. However, FTN and EEF may exhibit a positive relationship with CCE—implies that, in the absence of robust regulatory frameworks or sustainable infrastructure, fintech expansion and basic efficiency gains may increase environmental pressure rather than reduce it.

These hypotheses reflect the assumption that the same variable may behave differently across development levels and quantiles of environmental vulnerability. By applying Method of Moments Quantile Regression (MMQR), this study captures these distributional effects, offering a more nuanced understanding of how economic, institutional, technological, and financial factors affect climate change outcomes.

The next section presents the relevant literature and theoretical foundations that frame this investigation. Section 3 covers the data and methodology. Moreover, Section 4 unearths the result and discussion while Section 5 engulfs the conclusion and plan endorsements based on empirical observations. Lastly, Section 6 encloses limitations of the current study and future guidelines for further assessments.

2 Literature review and theoretical underpinning

2.1 Energy efficiency and climate change effects

Enhancing EEF is essential for minimizing CCE. EEF has the potential to drastically reduce greenhouse gas emissions, one of the main causes of environmental damage. Industries like manufacturing use a lot of energy and produce a lot of greenhouse emissions. The relationship between CCE and building performance is examined by Ashrafian (2023), with particular attention paid to energy use, financial consequences, and occupant comfort. It looks at how future weather may affect school buildings in various climates and analyses comfort, cost, and energy concerns. Results show that for both cost-optimal and practically zero-energy scenarios, there is a chance that in hot regions, primary energy consumption, global expenses, and CO2 emissions could roughly double in the future. As a result, savings would drop from 53%–63% to 13%–30%. On the other hand, the effect on these parameters varies slightly in cold regions, where primary energy consumption and CO2 emissions are lower but global prices are higher.

Additionally, according to the findings of Belaïd and Massié (2023), increases in EEF might contribute up to 25% of Saudi Arabia’s decarbonization by 2060. The significance of EEF in attaining CCE stability and constructing a brighter future is emphasized to accomplish SDGs (Pajek and Košir, 2021) provided guidelines to designers and policymakers for the strong, EEF bioclimatic design of residential structures in Central Europe, with the goal of directing them toward the creation of a resilient and sustainable built environment (Jin and Sun, 2023) utilized the non-radial directional distance function (NDDF) approach to measure EEF as a proxy for sustainable development based on panel data from 280 Chinese cities between 2003 and 2016. Three main findings were found: Firstly, EEF is significantly decreased by higher temperatures. Second, the impact of heat on EEF is consistent across climate zones, indicating that while adaptations in hot locations can lessen the negative effects of heat on output, the resulting increase in energy costs totally offsets this mitigation. Third, if carbon dioxide emissions stay high throughout the 21st century, EEF would drop by 2.82% in the medium period (2041–2060) and by 12.02% in the long term (2061–2080).

2.2 Energy innovations and climate change effects

The fight against CCE and the reduction of the ecological imprint depend heavily on advances in renewable energy. By substituting fossil fuels with renewable energy sources like solar, wind, hydro, and biomass, carbon emissions can be drastically reduced (Appiah et al., 2023) conducted a cross-sectional autoregressive distributed lags approach to examine panel data spanning 29 OECD nations between 1990 and 2020, outcomes revealed that EI enhances the CCE quality of OECD nations, whereas renewable energy has a positive effect on reducing CCE. Furthermore, a bidirectional causal relationship between the use of renewable energy and human growth, CCE, and high EI process is shown in the G-7 nations (Balsalobre-Lorente et al., 2024; Bashir et al., 2023) studied the role of EI, renewable energy, CCE, and environmental innovation. Time frame is from 1995 to 2019 in top manufacturing countries. The panel estimation techniques validate a noteworthy correlation among all the variables under consideration. The results of the CS-ARDL, AMG, CCEMG, and FMOLS studies support the notion that EI, renewable energy, and environmental innovation have a substantial detrimental impact on CCE. It is essential to separate environmental deterioration from economic activities by using EI and renewable energy sources.

2.3 Industrial-economic development index and climate change effects

The Industrial-Economic Development Index (IEDI) is constructed using Principal Component Analysis (PCA) based on two variables: industry (including construction) value added (in current US dollars) and GDP per capita (in constant US dollars) (Appiah et al., 2023). Discovered that industrialization and population density both increase and decrease CCE impact. Modern methods, however, place a strong emphasis on the integration of clean technologies and sustainable industrialization processes (Yang et al., 2021). Employed the Stochastic Impacts by Regression on the Population, Affluence, and Technology (STIRPAT) framework, to examine the effects of industrialization, economic expansion, and globalization processes on the CCE and healthcare expenditures in the ten countries with the highest healthcare expenditures from 1995 to 2018. The upshots of the inquiry suggested that the factors contributing most to the rise in pollution are economic expansion, healthcare spending, and industrialization. Conversely, globalization and the urbanization process, on the other hand, greatly lessen environmental harm (Zhao et al., 2024). Similarly, another study evaluated the effects of industrialization on CCE based on the environmental Kuznets curve hypothesis model framework, FMOLS, DOLS, and CCR estimation techniques as well as ARDL simulation model were incorporated to look at how renewable and non-renewable energy generation interact with both to affect the CCE in China during 1990–2019. Revelations indicated that non-renewable energy generation increases the CCE and causes ecological pollution to worsen, while renewable energy generation and industrialization help in reducing the CCE over time and improve environmental performance (Chen et al., 2024; Xu et al., 2024). Contrary to this, The G-7 economies’ ecological quality is declining as a result of industrialization and the use of fossil fuels for energy (Xu et al., 2023).

GDP, which is commonly used to evaluate economic growth, has a complex and multifaceted relationship with CCE (Zhang et al., 2023a; Zhang et al., 2023b). Globalization, energy consumption, trade, and GDP growth all have positive long-term interactions with the CCE, However, fuel importation has negative effects on Pakistan’s CCE, as per research work of Rehman et al. (2021) The empirical observations of Mohsin et al. (2023) showed a long-term correlation between GDP, energy use, crypto-volume, and CO2 emissions. Additionally, the fully modified ordinary least square, dynamic ordinary least square, and vector error correction model (VECM) confirmed the long-run link. The VECM confirms unidirectional correlation between GDP and energy use and bidirectional causality between environmental degradation and crypto-volume for both long- and short-term scenarios. Increases in the GDP and CCE were determined to represent distinct economic subsystems based on the (Mattila, 2012) findings. Aggregate indicators at the national level had hitherto obscured this fact. The production and consumption of basic goods including wood, paper, fish, crops, animal products, electricity, and building all contributed to CCE in Finnish economy. On the other hand, the primary driver of GDP growth was a rise in demand for services like real estate, health, education, social work, trade, and business services, as well as apartment ownership and rental income. Besides (Zambrano-Monserrate et al., 2020), discovered that a country’s CCE is intensified by biocapacity, trade openness, and GDP; Thus, the first two show substantial indirect effects throughout both time horizons, while the latter shows considerable direct effects. A substantial portion of the CCE variance can be attributed to these causes.

2.4 Institutional quality and climate change effects

Institutional quality has increasingly been recognized as a pivotal factor in shaping the effectiveness of climate change mitigation and adaptation strategies. Strong institutions enhance the design, implementation, and enforcement of environmental regulations, promote transparent governance, and ensure accountability in climate-related policy execution (Jahanger et al., 2022). Within the G20 context, which includes both advanced and emerging economies, variations in institutional strength significantly influence countries’ abilities to respond to climate challenges.

Several studies underscore the role of institutional governance in achieving environmental sustainability. For instance (Acemoglu et al., 2012), argue that inclusive and efficient institutions facilitate innovation and investment in green technologies, which are essential for reducing emissions and transitioning to low-carbon economies. Similarly Hallegatte et al. (2016), highlight that institutional capacity—especially in regulatory enforcement and disaster risk management—is a critical determinant of climate resilience.

Moreover, empirical findings show that countries with higher institutional quality tend to perform better on environmental indicators (Farzin and Bond, 2006) found that rule of law, control of corruption, and regulatory quality are strongly correlated with lower levels of pollution and higher environmental performance. These elements are especially relevant to the G20, where disparities in institutional structures often lead to diverging outcomes in climate action. In developing G20 members, such as India, Indonesia, and Brazil, weak institutional frameworks can hinder the effective implementation of climate policies and exacerbate vulnerabilities to climate impacts (Stern, 2007). In contrast, developed G20 countries, with more robust institutional mechanisms, are generally better equipped to integrate climate considerations into economic and planning decisions (OECD, 2021).

The interaction between institutional quality and climate change effects is also mediated by political stability, policy continuity, and public trust. Studies such as those by Müller and Kruse (2021) emphasize that countries with higher political stability and stronger democratic institutions are more likely to adopt ambitious climate targets and meet international commitments. Given the G20’s global influence, improving institutional quality within its members not only enhances national climate outcomes but also contributes to collective global efforts. Strengthening governance mechanisms, increasing transparency, and fostering inter-institutional collaboration remain essential for aligning economic development with climate resilience in both developed and developing G20 economies.

2.5 Financial technology, technological innovations and climate change effects

Curtailing the CCE can also be greatly aided by FTN and TIN. It has been demonstrated that digitalization and the use of green IT solutions lead to lower energy consumption and carbon emissions. Likewise, TIN promotes environmental sustainability, particularly in nations with moderately sustainable environmental standards (Ahmad and Satrovic, 2023; Barykin et al., 2022) reformed business procedures cost a lot of money, the key outcome is the entire profit from consumer demand for items based on both new and old technology related to CCE. Furthermore, the primary forces behind the inherent linkages between the three systems of industrialization policy, carbon finance, and digital TIN were examined using a gray correlation model.

Although, the strong and positive correlation between the green environmental index and FTN has been verified (Zhao and Hu, 2024). The green environmental index is positively impacted by the three subcategories of FTN: financial digitalization, depth, and breadth (Tamasiga et al., 2022) clarified a growing trend in study focus on the green FTN idea and its connections to green economic growth, CCE mitigation, and greening regulations and guidelines. Furthermore, Lu et al. (2023), looked at the linear (symmetric) and asymmetrical effects on CCE of natural resources (NRR), FTN, environmental regulations (EPS), and renewable energy (RENC). For data analysis, the study used panel CS-ARDL and panel NARDL methodologies on BRICS country data from 1990 to 2020. The results demonstrated the unequal impact of FTN and EPS on CCE. To sum up, there is an intricated and heterogenous interaction between numerous economic and technological elements, CCE, EEF and EI.

In order to address sustainability concerns, EI, IEDI, EEF, INQ, TIN and FTN are all essential. These actions contribute to a more sustainable future, by fostering economic expansion and technological and energy advancement along with IEDI in addition to lessening the ecological imprint. The reviewed literature confirms that EEF, EI, IEDI, FTN, and TIN are all influential in shaping CCE, though their impacts differ based on development context and policy environment. While traditional GDP and industrialization metrics may worsen environmental outcomes, integrating these with innovative and technological mechanisms can help decouple growth from emissions. Institutional quality (INQ) is another implicit variable shown to moderate the effectiveness of these drivers. Despite growing attention, few studies comprehensively assess these variables in tandem across a multi-country panel, highlighting the need for holistic, heterogeneity-sensitive approaches like MMQR.

2.6 Theoretical underpinning

This study is anchored in an interdisciplinary theoretical foundation that draws from Ecological Modernization Theory (EMT), Institutional Theory, the Technology-Environment-Economy (TEE) framework, and the Environmental Kuznets Curve (EKC) hypothesis. These perspectives collectively offer a robust lens through which to examine how economic structures, technological advancements, governance quality, and financial innovations affect environmental outcomes across varying levels of national development.

Ecological Modernization Theory (Jänicke, 2008) posits that technological development and innovation are not inherently harmful to the environment. Instead, when aligned with proactive policies and institutional reforms, technological progress can lead to more sustainable forms of production and consumption. From this standpoint, technological innovation (TIN) and energy innovation (EI) are expected to play transformative roles in mitigating climate change effects (CCE). Likewise, financial technology (FTN) is conceptualized as a facilitator of green finance, promoting investments in clean energy and environmentally friendly infrastructure. EMT supports the notion that these variables can collectively reduce environmental degradation, especially in high-income economies with stronger institutional frameworks.

Institutional Theory (Abell et al., 1992) underscores the role of formal institutions—laws, regulations, governance quality, and enforcement capacity—in shaping national responses to environmental challenges. Institutional quality (INQ) is thus hypothesized to moderate the effectiveness of innovation and development policies. In environments where institutions are transparent, efficient, and accountable, the positive impacts of technology and financial mechanisms on the environment are more likely to be realized. Conversely, weak institutions may result in policy failure, regulatory loopholes, or misallocation of green funds—particularly relevant for some developing G20 countries.

The TEE framework explores how the triadic interaction between economic growth, environmental stress, and technological change defines a nation’s sustainability pathway. This study extends the framework by integrating energy efficiency (EEF) and industrial-economic development (IEDI) as key structural drivers. EEF is assumed to reduce environmental harm by lowering energy intensity and optimizing resource use. However, in some contexts—especially in developing economies—energy efficiency gains may lead to rebound effects, where reduced energy costs spur greater overall consumption. Similarly, IEDI may initially increase ecological pressure due to industrial expansion but can later contribute to mitigation through cleaner technologies, productivity gains, and structural transformation.

The EKC hypothesis (Grossman and Krueger, 1995) postulates an inverted U-shaped relationship between economic development and environmental degradation. In early stages of development, industrialization and energy use increase ecological footprints. As income levels rise, societies demand and invest in cleaner environments, resulting in declining emissions and ecological impact. This theory informs the expected non-linear relationship between IEDI and CCE, especially across different quantiles, where higher environmental stress may trigger stronger mitigation responses in more advanced economies. The conceptual model of the study has been shown in Figure 2.

3 Research data and methodology

This research empirically examines the roles EEF, EI, INQ, FTN, IEDI, TIN and CCE in G20 nations, from 2000 to 2022. We had to exclude the economies of Australia and European Union from this evaluation, as data for CCE and TIN was not available. While the remaining G20 members still represent a significant portion of global economic output and emissions, the exclusion of these two actors may affect the generalizability of the findings.

Australia, as a developed economy with a resource-intensive industrial base and unique climate vulnerabilities, and the EU, as a collective entity with progressive climate policies and high institutional quality, offer distinct policy environments and development trajectories. Their omission may limit the study’s ability to fully capture the range of institutional and economic dynamics present across the G20. Consequently, results may be more reflective of individual national-level experiences, particularly among other developed and emerging economies, rather than the full spectrum of climate governance approaches within the G20 framework.

Table 1 provides the description of the dependent variable (CCE) and independent variables (EEF, EI, INQ, IEDI, TIN, and FTN), along with their data sources. Preliminary tests such as matrix correlation, slope heterogeneity (Hashem Pesaran and Yamagata, 2008), cross-sectional dependence (CSD) test (Pesaran, 2015), CIPS unit root, and Westerlund cointegration test (Persyn and Westerlund, 2008; Westerlund and Edgerton, 2008) have been conducted to ensure the suitability of panel data analysis (Dong and Yu, 2024; Yang et al., 2024). The Westerlund test was selected over other panel cointegration tests such as Pedroni or Kao because it is more robust in the presence of cross-sectional dependence and allows for heterogeneity in the cointegration relationship across panel members—an important consideration given the structural differences among G20 countries. Additionally, the Westerlund test is based on error-correction models, which directly test the existence of cointegration rather than relying on residual-based approaches, offering stronger and more reliable inference in panels with potential short-run dynamics and cross-sectional correlation.

For more accurate empirical findings, this research utilizes the Method of Moments Quantile Regression (MMQR), as proposed by Machado and Santos Silva (2019). MMQR effectively captures the impact of covariates across the full distribution of the dependent variable, allowing individual effects to influence the relationship at all quantile levels. It is particularly useful for examining the relationships between variables at different points of the conditional distribution of CCE, providing a more comprehensive understanding than traditional mean-based models. MMQR accounts for heterogeneity across countries and is robust to outliers and non-normal error distributions, which are common in macroeconomic and environmental data. Unlike models such as GMM or panel ARDL that focus on average or long-run relationships and assume homogeneity across units, MMQR offers more flexibility in capturing asymmetric and non-linear dynamics.

To further validate the robustness of the MMQR results, Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) estimators have also been employed. These cointegration-based methods confirm the long-run relationships identified and reinforce the reliability of the primary findings.

Equation for MMQR technique regarding this research is given in Equation 1.

Where,

Error term is denoted by

Equation 2 depicts the summarization of Slope heterogeneity (Hashem Pesaran and Yamagata, 2008) test.

Where,

However, to find out if panel data exhibits cointegration, the (Westerlund and Edgerton, 2008) test has also been implied before MMQR analysis. A long-term equilibrium relationship between the dependent variable and one or more independent variables is indicated by cointegration. It is based on the error correction model depicted in Equation 3. Where

The Equation 4 given below is supposed to be used when incorporating the Westerlund test in the situation where CCE is the dependent variable and EEF, EI, GDP, ICV, TIN, and FTN are the independent variables:

Dependent variable for the cross-section

An extensive and reliable method for managing complicated data is provided by econometric analysis, which makes use of matrix correlation, slope heterogeneity, cross-sectional dependence tests such as the CIPS unit root test, Westerlund cointegration analysis, and MMQR. Figure 3 shows the flowchart of incorporated test techniques. Moreover, Matrix correlation offers a comprehensive understanding of interdependencies by assisting in the identification of correlations between various variables. Slope heterogeneity improves the precision of model estimations by acknowledging that various cross-sectional units may display a range of behavioral tendencies. Besides, the validity of panel data results is ensured by cross-sectional dependence tests, including the CIPS unit root test, which addresses potential correlations between units. Strong techniques for identifying long-term equilibrium relationships are provided by Westerlund’s cointegration tests, even in the presence of cross-sectional dependence or structural fractures. Furthermore, MMQR offers a refined comprehension of the correlation between variables across several quantiles, hence identifying heterogeneity in the response variable distribution and facilitating more customized policy implications. When combined, these techniques improve the econometric findings’ depth, dependability, and applicability.

4 Results and discussions

4.1 Results

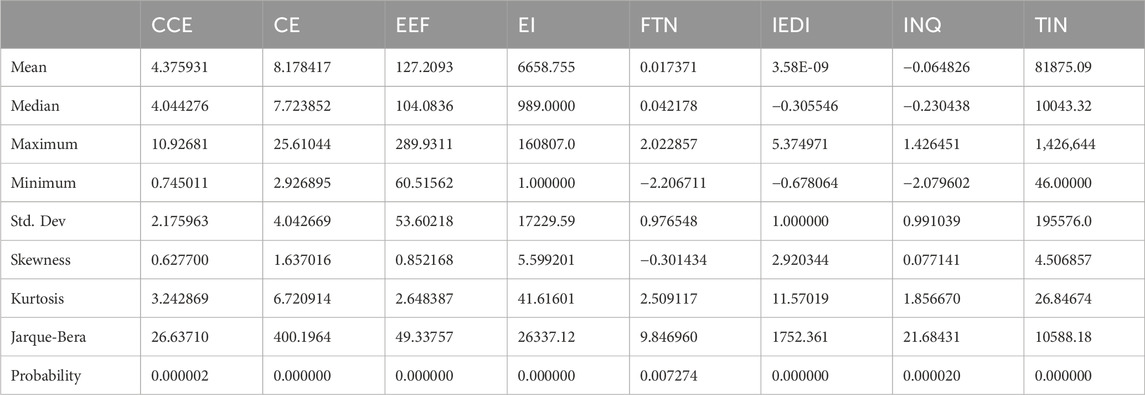

Table 2 presents the descriptive statistics of the variables used in the study, offering key insights into their distributional characteristics. The average ecological footprint (CCE) is 4.38 per capita, with a moderately right-skewed distribution (skewness = 0.63) and slight leptokurtosis, indicating a distribution close to normal but with some outliers. CO2 emissions (CE) have a higher mean of 8.18 per capita and exhibit strong right skewness (1.64) and leptokurtosis (6.72), suggesting the presence of countries with disproportionately high emissions. Energy efficiency (EEF) has a mean of 127.21 and a moderate right skew, indicating that while most countries are clustered around the mean, some exhibit far less efficient energy use. Energy innovations (EI) show extreme skewness (5.60) and very high kurtosis (41.62), driven by a few countries with exceptionally high renewable energy patents. Financial technologies (FTN) and technological innovations (TIN) also show considerable skewness and kurtosis, suggesting uneven technological development across countries. Institutional quality (INQ) and the industrial-economic development index (IEDI) exhibit non-normal distributions as well, with IEDI being highly right-skewed (2.92). Overall, the Jarque-Bera test indicates non-normality in all variables (p < 0.01).

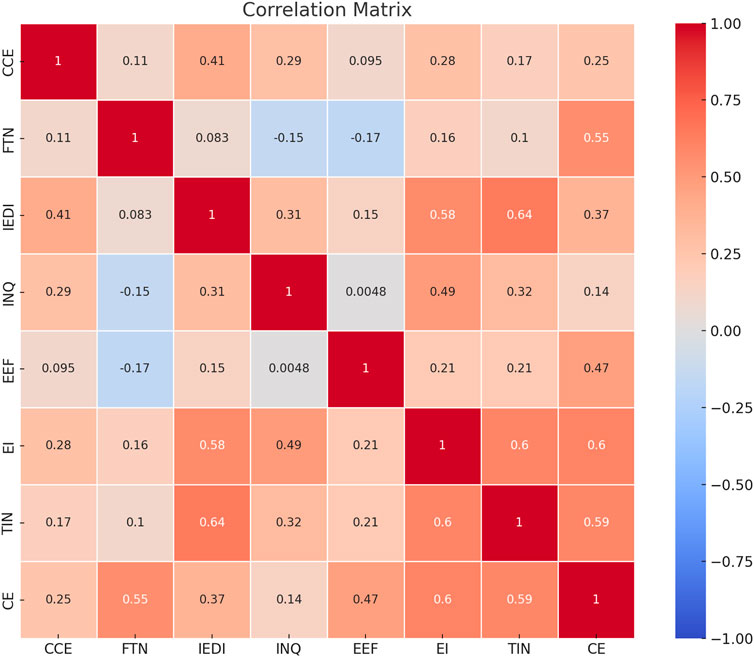

Figure 4 presents the correlation matrix for the variables in the study, revealing the strength and direction of pairwise relationships. The results show that most correlations are positive, though generally moderate in magnitude. Notably, energy innovations (EI) and technological innovations (TIN) exhibit a strong positive correlation (0.60), suggesting that advancements in one area are often accompanied by developments in the other. Similarly, EI also shows a strong correlation with CO2 emissions (0.60), indicating that countries with high innovation activity may also have higher emissions—potentially due to industrialization. Financial technologies (FTN) have a moderate to strong positive correlation with CO2 emissions (0.55), highlighting the potential environmental impact of expanding digital infrastructure. Institutional quality (INQ) and industrial-economic development (IEDI) show moderate positive associations with EI (0.49 and 0.58 respectively), suggesting that better governance and economic development foster innovation. Energy efficiency (EEF) shows only weak correlations with other variables, except for a moderate relationship with CO2 emissions (0.47), possibly reflecting its role in emissions control. Overall, the matrix indicates limited multicollinearity (no correlation above 0.80), supporting the suitability of these variables for econometric modeling.

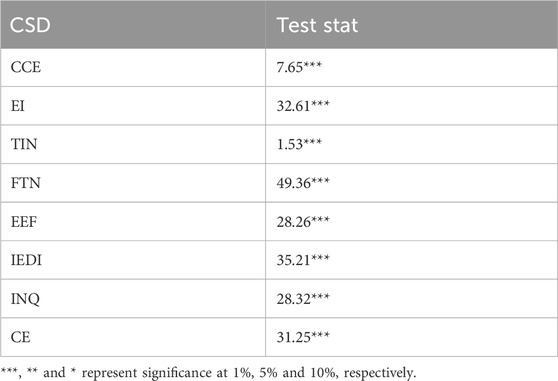

The results of the cross-sectional dependence (CSD) analysis in Table 3 reveal statistically significant dependence across all variables, including climate change effects (CCE), energy innovations (EI), technological innovations (TIN), financial technologies (FTN), energy efficiency (EEF), industrial-economic development index (IEDI), institutional quality (INQ), and CO2 emissions (CE). This indicates that the observations in the panel dataset are not independent across countries, which is typical in global panel data where shared economic, environmental, or technological shocks may influence multiple units simultaneously. Given the presence of CSD, it becomes essential to employ econometric techniques that account for this feature.

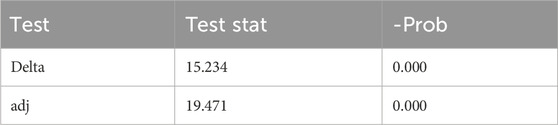

Table 4 presents the results of the slope heterogeneity test, where both the delta and adjusted delta statistics are highly significant (p = 0.000), confirming the presence of heterogeneity in slope coefficients across panel units. This suggests that the relationship between explanatory variables and CCE varies significantly across countries, reinforcing the need for flexible modeling approaches that accommodate country-specific dynamics.

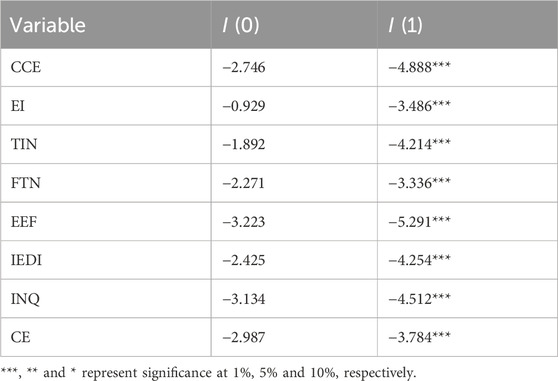

The CIPS unit root test results in Table 5 further reinforce the appropriateness of second-generation panel techniques. All variables, including CCE, EI, TIN, FTN, EEF, IEDI, INQ, and CE, are found to be non-stationary at level [I (0)] but become stationary after first differencing [I (1)], with all first-difference test statistics being significant at the 1% level. This validates the use of panel cointegration techniques for identifying long-run equilibrium relationships.

Table 6 reports the Westerlund and Edgerton (2008) cointegration test results, all of which provide strong evidence in favor of cointegration among the variables. The Gt, Ga, Pt, and Pa test statistics are all significant, with p-values well below the 1% threshold. This confirms the existence of a long-term equilibrium relationship between climate change effects and the selected explanatory variables, despite the presence of cross-sectional dependence and heterogeneous slopes. The robustness of the Westerlund test under various forms of dependency makes it a particularly valuable tool in validating the empirical model and ensuring reliable long-run inference.

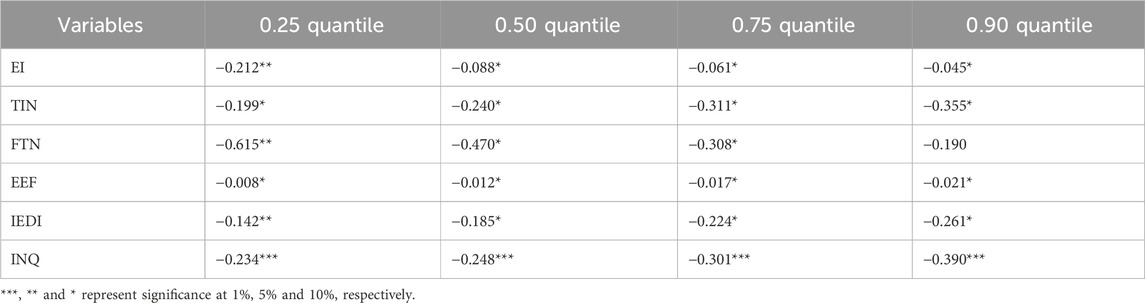

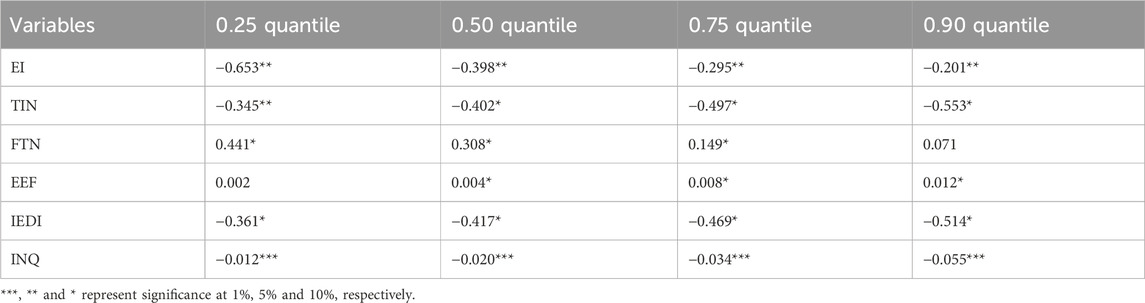

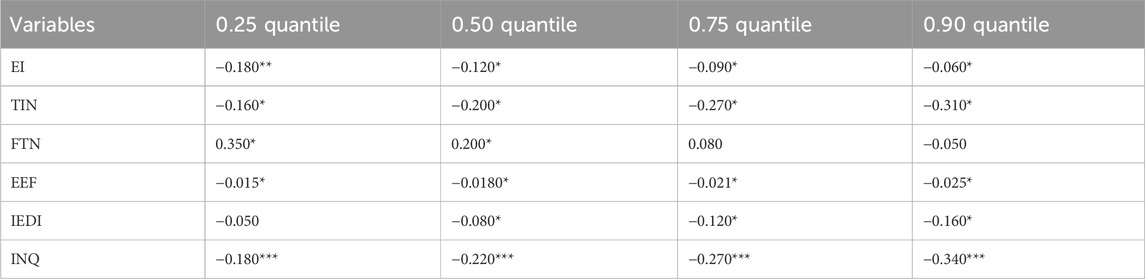

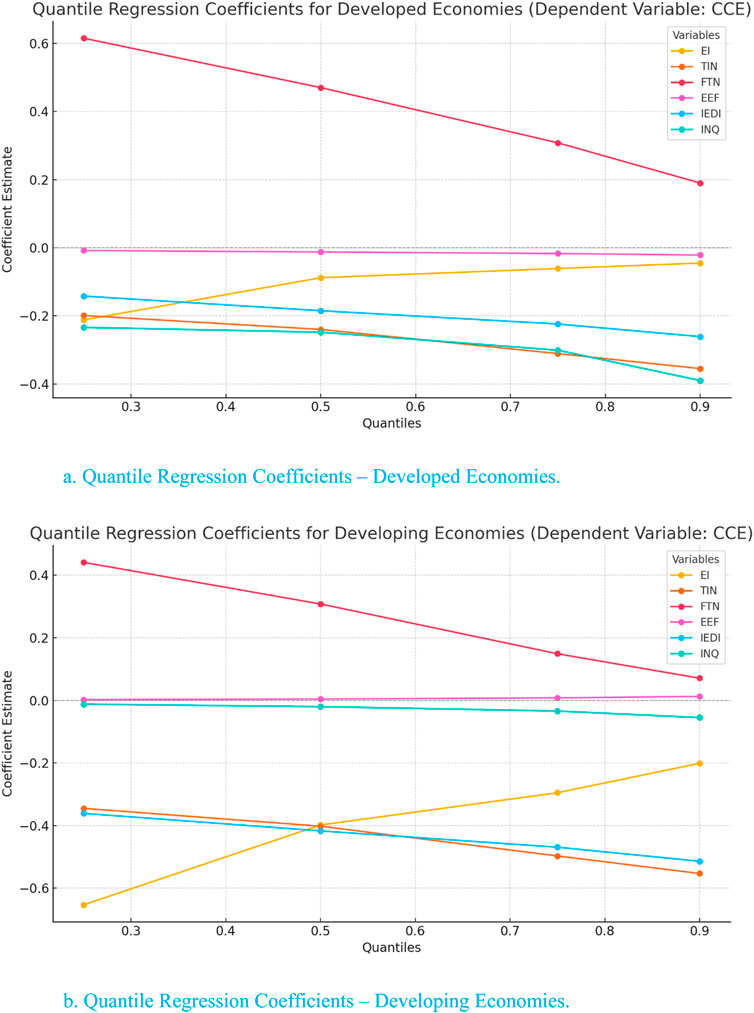

The Method of Moments Quantile Regression (MMQR) results, presented in Tables 7 and 8, provide important insights into the heterogeneous effects of various explanatory variables on climate change effects (CCE) across different quantiles of the ecological footprint distribution within G20 countries. By dividing the panel into developed and developing economies, the analysis captures structural and policy-driven variations in the drivers of climate change across different development levels.

For developed G20 economies, the results in Table 7 reveal that all selected variables—energy innovations (EI), technological innovations (TIN), financial technologies (FTN), energy efficiency (EEF), the industrial-economic development index (IEDI), and institutional quality (INQ)—have a consistently negative and statistically significant effect on CCE across all quantiles. This suggests that improvements in these domains contribute to reductions in ecological footprint, irrespective of the country’s environmental performance level. However, the magnitude of these effects tends to diminish at higher quantiles. For instance, the negative influence of energy innovations and financial technologies is more pronounced in countries with lower ecological footprints (e.g., at the 0.25 and 0.50 quantiles) and weakens in countries with higher environmental degradation. This pattern may reflect diminishing returns in high-emission economies or differences in policy implementation and saturation effects. Notably, institutional quality exerts the strongest and most consistent negative influence across all quantiles, highlighting the central role of governance in mitigating environmental impacts in more advanced economies.

The MMQR estimates for developing G20 economies, as shown in Table 8, present a more intricate and varied pattern of results. While energy innovations (EI) and technological innovations (TIN) maintain a statistically significant and negative impact on CCE across all quantiles, the magnitude of their effect is notably larger compared to developed economies. This suggests that innovation policies in developing nations can produce substantial environmental benefits, especially at the lower quantiles, where countries are in the early stages of industrialization and likely to experience more significant environmental improvements from such innovations. The higher impact at these stages highlights the potential for these economies to leapfrog traditional, polluting technologies and adopt cleaner, more sustainable practices.

In contrast, financial technologies (FTN) show a positive relationship with CCE across most quantiles, particularly at the lower and middle quantiles. This implies that the expansion of digital and financial infrastructure in less developed economies could inadvertently increase environmental pressure. This may occur due to the insufficient incorporation of green policies or technologies within financial sectors, combined with the lack of strong regulatory frameworks that could otherwise mitigate the environmental consequences of such rapid expansion. Without proper green finance and sustainable technological integration, the benefits of digital and financial growth could be overshadowed by negative environmental outcomes.

Moreover, energy efficiency (EEF) shows a positive and increasing effect on CCE across the quantiles, pointing to a critical issue: rebound effects. This indicates that energy-saving measures, although implemented to reduce overall energy consumption, may be insufficient or even counterproductive in some developing contexts. Rebound effects refer to the phenomenon where improvements in energy efficiency lead to higher energy consumption than anticipated, often due to lower operational costs or increased demand. In developing countries, this might be exacerbated by growing industrial and residential energy demands, insufficient infrastructure to support more efficient technologies, and a lack of integrated green policies to ensure that efficiency improvements lead to long-term environmental benefits. Therefore, while energy efficiency initiatives are crucial, they need to be complemented with stricter regulations and policies to prevent rebound effects from undermining their potential to reduce CCE.

Both IEDI and INQ show negative and significant effects on CCE, with stronger impacts observed at higher quantiles. This reinforces the importance of institutional quality and economic restructuring in tackling climate change, especially in the most polluting developing economies. Higher-quality institutions and more advanced stages of industrial-economic development can better support policies that reduce environmental impacts. As these economies advance, institutional reforms and more sustainable economic models become increasingly necessary to curb the growing environmental pressures associated with industrialization.

The varied impacts of these factors highlight the complex interplay between innovation, economic development, and institutional capacity in addressing climate change in developing G20 economies. More attention is needed to ensure that policies targeting energy efficiency and financial technology expansion incorporate sustainable practices and regulations to mitigate unintended environmental consequences, particularly through addressing the rebound effect.

Figure 5a illustrates the variation in estimated coefficients across quantiles (0.25–0.90) for key explanatory variables affecting climate change effects (CCE) in developed G20 economies. Negative coefficients for EI, TIN, IEDI, and INQ highlight their mitigating role, while FTN shows a diminishing positive impact at higher quantiles. The results suggest a differentiated influence of economic, technological, and institutional factors across the CCE distribution.

Figure 5. (a) Quantile regression coefficients–developed economies. (b) Quantile regression coefficients–developing economies.

Figure 5b presents the quantile regression coefficients for developing G20 economies, showing how each variable impacts climate change effects (CCE) at different points of the distribution. EI, TIN, IEDI, and INQ demonstrate increasingly negative effects, reinforcing their importance in climate mitigation. FTN and EEF show positive coefficients, especially at lower quantiles, suggesting nuanced trade-offs between development and environmental sustainability.

Comparing Figures 5a,b reveals distinct patterns in how key drivers influence climate change effects (CCE) across the quantile spectrum in developed and developing economies. In both groups, energy innovations (EI), technological innovation (TIN), and institutional quality (INQ) consistently reduce CCE, though the magnitude of impact is generally stronger in developing countries. Notably, financial technology (FTN) contributes positively to CCE in both contexts, but its effect diminishes more rapidly in developing economies. Energy efficiency (EEF) shows contrasting effects—mitigating in developed economies but increasing CCE in developing ones—suggesting differing stages of energy transition. These contrasts underscore the importance of context-specific climate policies tailored to the developmental and institutional realities of each group.

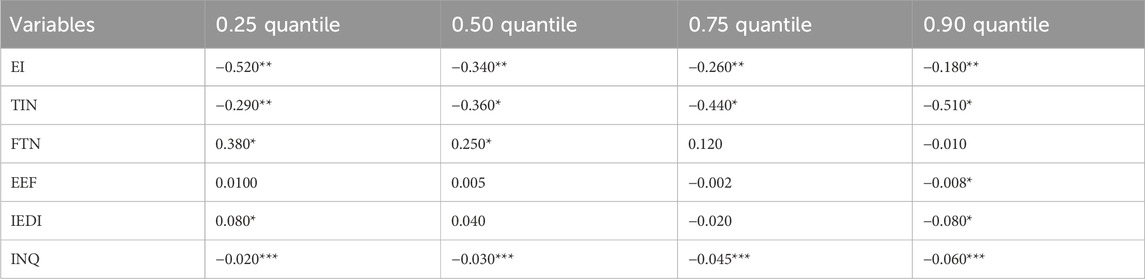

For both developed and developing economies, the MMQR analysis with CO2 emissions per capita as shown in Tables 9 and 10 largely supports the initial findings from the ecological footprint analysis. The patterns observed in the impact of energy innovations (EI), technological innovations (TIN), and financial technologies (FTN) on CO2 emissions are similar to those observed with ecological footprints, underscoring the robustness of the relationships. The energy efficiency (EEF) variable also shows consistent effects across both measures, providing further confidence in the results.

This alternative measure of climate change impact, CO2 emissions per capita, enhances the validity of the findings by confirming that the key factors influencing climate change—innovation, energy use, financial technologies, and institutional quality—hold significant relationships with environmental outcomes across different indicators. The use of both ecological footprint and CO2 emissions strengthens the overall analysis and addresses the concern of robustness by using complementary metrics to assess environmental impact.

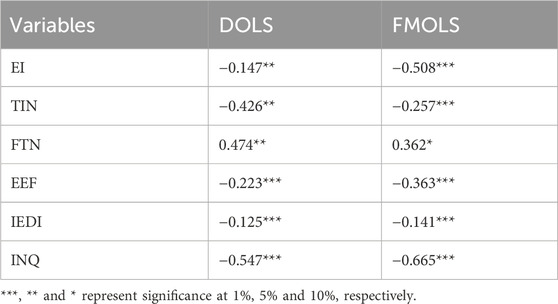

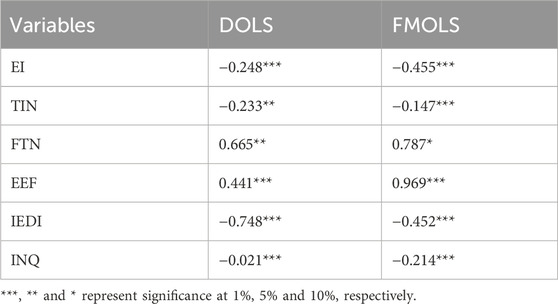

The results from the Dynamic Ordinary Least Squares (DOLS) and Fully Modified Ordinary Least Squares (FMOLS) estimations, as shown in Tables 11 and 12, for both developed and developing economies, with climate change effects measured by ecological footprint (CCE) as the dependent variable, offer further robustness to the analysis and provide valuable insights into the long-run relationships between the variables. The findings highlight the significant role of energy innovations (EI) in reducing the ecological footprint across both groups, with a more pronounced long-term effect in developing economies.

Furthermore, financial technologies (FTN) exhibit a positive relationship with the ecological footprint, particularly in developing economies, suggesting that the expansion of digital and financial infrastructure might inadvertently increase environmental pressure if not accompanied by green policies. The consistent negative relationship between energy efficiency (EEF) and ecological footprint in both estimations underscores its importance as a tool for mitigating climate change impacts. Additionally, both the Industrial-Economic Development Index (IEDI) and Institutional Quality (INQ) display negative and significant effects, reinforcing the importance of strong institutions and economic restructuring in reducing environmental degradation, particularly in higher-polluting contexts. Overall relationship among the independent variables with dependent variable has been shown in Figure 6.

4.2 Discussion

This study explores the impact of economic, technological, and institutional factors on climate change, measured by the ecological footprint (CCE), in G20 economies. The findings, derived from Method of Moments Quantile Regression (MMQR), Dynamic Ordinary Least Squares (DOLS), and Fully Modified Ordinary Least Squares (FMOLS) methodologies, reveal nuanced insights into how these variables interact with climate outcomes across developed and developing economies.

For developed economies, the results confirm that energy innovations (EI) and technological innovations (TIN) have a consistently negative effect on CCE, especially at the higher quantiles. These findings support the Environmental Kuznets Curve (EKC) hypothesis, which posits that environmental degradation decreases with economic development and technological advancement (Grossman and Krueger, 1995). The positive relationship between institutional quality (INQ) and climate change mitigation also resonates with existing literature, which suggests that robust governance structures enhance the adoption of sustainable practices (Cadoret and Padovano, 2016). Specifically, the stronger negative effects at higher quantiles indicate that in more advanced economies, the institutional framework plays a significant role in driving environmental improvements. However, financial technologies (FTN) show a weaker and less significant relationship with CCE, suggesting that while digital and financial infrastructure are critical, their environmental impacts in developed economies remain modest, aligning with previous studies indicating that financial technologies do not always result in immediate environmental gains (Dafermos et al., 2018).

In developing economies, energy innovations (EI) and technological innovations (TIN) demonstrate a significantly stronger negative impact on climate change effects (CCE), particularly at lower quantiles, compared to developed counterparts. This finding aligns with the argument that earlier stages of industrialization offer more substantial gains from innovation, where the adoption of clean technologies can leapfrog outdated, polluting practices (Iorember et al., 2024). However, financial technologies (FTN) are positively associated with CCE in these economies, especially at lower and middle quantiles, highlighting a critical policy gap. This may stem from the fact that rapid digital and financial inclusion, in the absence of corresponding regulatory oversight, can fuel increased energy consumption through data-driven platforms, mobile devices, and digital infrastructure—echoing concerns raised by recent studies (Kashif et al., 2024; Zahid et al., 2025). Such dynamics point to a classic rebound effect, where improvements in financial access and energy efficiency paradoxically stimulate greater resource use. The observed positive relationship between energy efficiency (EEF) and CCE at higher quantiles reinforces this concern, suggesting that without behavioral change and green policy alignment, efficiency gains can be undermined by increased demand—a phenomenon widely discussed in the literature on energy rebound effects (Greening et al., 2000). These insights call for integrated regulatory frameworks that guide both FinTech and efficiency improvements toward genuinely sustainable outcomes.

The analysis also underscores the role of industrial-economic development in shaping climate change outcomes. For both developed and developing economies, IEDI demonstrates a negative relationship with CCE, highlighting the importance of transitioning to sustainable industrial practices. However, the weaker effects in developing economies may be indicative of the challenges posed by resource-intensive industries and the lack of adequate infrastructure and regulatory systems (Stern, 2007). These results suggest that while economic development is crucial for reducing environmental degradation, it must be accompanied by structural changes toward green technologies and sustainable industries, particularly in developing countries.

5 Conclusion and strategy endorsements

5.1 Conclusions

This study provides a comprehensive analysis of the long-run and distributional effects of various economic, institutional, and technological factors on climate change effects (CCE), measured by ecological footprint, across the G20 economies. By distinguishing between developed (Canada, France, Germany, Italy, Japan, Republic of Korea, United Kingdom) and developing (Argentina, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, Türkiye) nations, the analysis reveals significant heterogeneity in the environmental impacts of energy innovations (EI), technological innovations (TIN), financial technologies (FTN), energy efficiency (EEF), industrial-economic development (IEDI), and institutional quality (INQ). The findings demonstrate that while innovations contribute to reducing ecological pressure in both groups, the magnitude and pathways of their effects differ. Moreover, financial technologies and energy efficiency pose environmental trade-offs in developing economies due to rebound effects and weak regulatory environments. These insights highlight the need for development-specific climate strategies and confirm that one-size-fits-all approaches may be inadequate for achieving sustainable progress across the G20.

5.2 Policy implications

The empirical findings of this study underscore the need for differentiated and targeted climate policies across the G20, firmly grounded in the observed impacts of financial technologies, innovations, energy efficiency, industrial development, and institutional quality. For developing economies, where financial technology (FTN) exhibits a positive association with ecological footprint, regulation must focus on aligning digital finance growth with green development objectives. This could include mandating climate disclosure standards for digital lenders, integrating green scoring mechanisms into credit algorithms, and incentivizing climate-aligned financial products, such as digital platforms that reward low-carbon behavior through green bonds or carbon credit marketplaces. For example, in India and Brazil, governments can work with FTN regulators to introduce sandbox environments specifically for green FinTech solutions, ensuring scalability and compliance.

Energy efficiency (EEF), although typically seen as environmentally beneficial, demonstrates rebound effects in developing nations, where improvements in energy-saving technologies inadvertently lead to increased consumption. Therefore, energy policies must be demand-side focused, including behavioral nudges, progressive energy tariffs, and carbon taxation to internalize environmental costs and mitigate rebound. Industrial policies should distinguish between manufacturing and service-based sectors. In heavily industrialized economies like China and Indonesia, strategies should focus on green manufacturing modernization, such as through cleaner production technologies, circular economy models, and low-carbon industrial parks. In contrast, service-oriented economies should invest in digital green skills development and smart service delivery platforms that reduce carbon footprints.

This study’s findings have direct implications for several SDGs. The negative effects of technological (TIN) and energy (EI) innovations on climate change effects across both developed and developing economies affirm progress toward SDG 9 (Industry, Innovation, and Infrastructure) and SDG 13 (Climate Action), highlighting innovation’s potential to reduce environmental stress. However, the positive environmental burden linked to FinTech in developing countries flags a challenge for SDG 8 (Decent Work and Economic Growth) and SDG 12 (Responsible Consumption and Production), where growth without sustainability risks undermining long-term progress. By suggesting policy mechanisms like green FTN regulation and rebound-effect mitigation, this research provides tangible pathways to integrate innovation with sustainability—advancing the interconnectedness of SDGs, rather than treating them in silos. Moreover, the consistent significance of institutional quality (INQ) across quantiles supports the role of SDG 16 (Peace, Justice, and Strong Institutions) in enabling effective climate governance.

This research contributes to and expands upon established theoretical frameworks such as the Environmental Kuznets Curve (EKC) and rebound effect theory. Our findings challenge the assumption that technological diffusion and economic growth alone will yield environmental benefits. Instead, the results suggest that contextual factors—especially institutional quality and regulatory strength—are critical mediators of environmental outcomes. In particular, the observed positive environmental effect of FTN in developing contexts contradicts simplistic digital optimism and supports emerging theoretical critiques on “digital carbon footprints.” Real-world examples reinforce these patterns: in South Africa and Mexico, rapid FinTech expansion has outpaced regulatory oversight, potentially exacerbating unsustainable consumption. Conversely, Japan’s integration of digital platforms with carbon markets exemplifies how technology can be steered toward decarbonization.

The sectoral divergence in policy effectiveness also aligns with calls for granular green industrial policy (Rodrik, 2014), affirming that industrial versus service sectors require differentiated carbon mitigation strategies. This study therefore highlights that innovation, when poorly governed, can perpetuate ecological degradation, especially in economies lacking strong institutions. Future research could build upon this by exploring sector-specific carbon productivity, the role of green digital finance ecosystems, and the co-evolution of climate institutions and technology adoption across varying development stages.

6 Limitations and future directions

Despite offering valuable insights into the environmental dynamics of G20 economies, this study has several limitations that provide direction for future research. First, although ecological footprint per capita is a comprehensive metric for climate change effects, it may not capture other vital environmental dimensions such as air pollution, biodiversity loss, or climate vulnerability, suggesting the need for multi-indicator approaches in future studies. Second, the cross-country nature of this analysis, while informative, overlooks intra-country variations such as regional industrial structures, urbanization patterns, and localized institutional performance; future work could benefit from subnational or sectoral data to offer a more nuanced perspective. Additionally, while this study establishes strong associations using MMQR, DOLS, and FMOLS estimations, it does not fully explore causal mechanisms, especially concerning how financial technologies contribute to ecological pressures in developing nations or how institutions mediate innovation outcomes. Therefore, future research could incorporate methods such as instrumental variable regressions, spatial econometrics, or case studies to delve deeper into these dynamics. Moreover, investigating how different sectors—particularly manufacturing versus services—respond to climate policy could enhance policy relevance, especially as countries transition toward greener economies.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

HZ: Formal analysis, Funding acquisition, Validation, Visualization, Investigation, Software, Writing – review and editing. RA: Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abell, P., North, D. C., Alt, J. E., and Shepsle, K. A. (1992). Institutions, institutional change and economic performance. Br. J. Sociol. 43, 299. doi:10.2307/591470

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102, 131–166. doi:10.1257/aer.102.1.131

Ahmad, M., and Satrovic, E. (2023). How does monetary policy moderate the influence of economic complexity and technological innovation on environmental sustainability? The role of green central banking. Int. J. Finance Econ. 29, 4197–4224. doi:10.1002/ijfe.2872

Appiah, M., Li, M., Naeem, M. A., and Karim, S. (2023). Greening the globe: uncovering the impact of environmental policy, renewable energy, and innovation on ecological footprint. Technol. Forecast. Soc. Change 192, 122561. doi:10.1016/j.techfore.2023.122561

Ashrafian, T. (2023). Enhancing school buildings energy efficiency under climate change: a comprehensive analysis of energy, cost, and comfort factors. J. Build. Eng. 80, 107969. doi:10.1016/j.jobe.2023.107969

Awosusi, A. A., Xulu, N. G., Ahmadi, M., Rjoub, H., Altuntaş, M., Uhunamure, S. E., et al. (2022). The sustainable environment in Uruguay: the roles of financial development, natural resources, and trade globalization. Front. Environ. Sci. 10. doi:10.3389/FENVS.2022.875577

Balsalobre-Lorente, D., Nur, T., Topaloglu, E. E., and Evcimen, C. (2024). Assessing the impact of the economic complexity on the ecological footprint in G7 countries: fresh evidence under human development and energy innovation processes. Gondwana Res. 127, 226–245. doi:10.1016/j.gr.2023.03.017

Barykin, S., Yadykin, V., Badenko, V., Sergeev, S., Bezborodov, A., Lavskaya, K., et al. (2022). Innovative analysis in climate change: evidence from developed European countries. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.1048621

Bashir, M. F., Pan, Y., Shahbaz, M., and Ghosh, S. (2023). How energy transition and environmental innovation ensure environmental sustainability? Contextual evidence from Top-10 manufacturing countries. Renew. Energy 204, 697–709. doi:10.1016/j.renene.2023.01.049

Belaïd, F., and Massié, C. (2023). The viability of energy efficiency in facilitating Saudi Arabia’s journey toward net-zero emissions. Energy Econ. 124, 106765. doi:10.1016/j.eneco.2023.106765

Cadoret, I., and Padovano, F. (2016). The political drivers of renewable energies policies. Energy Econ. 56, 261–269. doi:10.1016/j.eneco.2016.03.003

Chen, Y., Li, Q., and Liu, J. Y. (2024). Innovating sustainability: VQA-based AI for carbon neutrality challenges. J. Organ. End User Comput. 36, 1–22. doi:10.4018/JOEUC.337606

Dafermos, Y., Nikolaidi, M., and Galanis, G. (2018). Climate change, financial stability and monetary policy. Ecol. Econ. 152, 219–234. doi:10.1016/j.ecolecon.2018.05.011

Dong, X., and Yu, M. (2024). Time-varying effects of macro shocks on cross-border capital flows in China’s bond market. Int. Rev. Econ. Finance 96, 103720. doi:10.1016/j.iref.2024.103720

Farzin, Y. H., and Bond, C. A. (2006). Democracy and environmental quality. J. Dev. Econ. 81, 213–235. doi:10.1016/j.jdeveco.2005.04.003

Greening, L. A., Greene, D. L., and Difiglio, C. (2000). Energy efficiency and consumption - the rebound effect - a survey. Energy Policy 28 (6–7), 389–401. doi:10.1016/S0301-4215(00)00021-5

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110 (2), 353–377. doi:10.2307/2118443

Gupta, M., Saini, S., and Sahoo, M. (2022). Determinants of ecological footprint and PM2.5: role of urbanization, natural resources and technological innovation. Environ. Challenges 7, 100467. doi:10.1016/j.envc.2022.100467

Hallegatte, S., Bangalore, M., Bonzanigo, L., Fay, M., Kane, T., Narloch, U., et al. (2016). “Shock waves: managing the impacts of climate change on poverty,” in Shock waves: managing the impacts of climate change on poverty. doi:10.1596/978-1-4648-0673-5

Han, J., Raghutla, C., Chittedi, K. R., Tan, Z., and Koondhar, M. A. (2022). How natural resources affect financial development development? Fresh evidence from top-10 natural resouce abundant countries. Resour. Policy 76, 102647. doi:10.1016/J.RESOURPOL.2022.102647

Hashem Pesaran, M., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econ. 142 (1), 50–93. doi:10.1016/j.jeconom.2007.05.010

Hu, F., Ma, Q., Hu, H., Zhou, K. H., and Wei, S. (2024a). A study of the spatial network structure of ethnic regions in Northwest China based on multiple factor flows in the context of COVID-19: evidence from Ningxia. Heliyon 10 (2), e24653. doi:10.1016/j.heliyon.2024.e24653

Hu, F., Mou, S., Wei, S., Qiu, L., Hu, H., and Zhou, H. (2024b). Research on the evolution of China’s photovoltaic technology innovation network from the perspective of patents. Energy Strategy Rev. 51, 101309. doi:10.1016/j.esr.2024.101309

Hu, F., Qiu, L., Wei, S., Zhou, H., Bathuure, I. A., and Hu, H. (2023). The spatiotemporal evolution of global innovation networks and the changing position of China: a social network analysis based on cooperative patents. R&D Manag. 54, 574–589. doi:10.1111/radm.12662

Iorember, P. T., Gbaka, S., Işık, A., Nwani, C., and Abbas, J. (2024). New insight into decoupling carbon emissions from economic growth: do financialization, human capital, and energy security risk matter? Rev. Dev. Econ. 28 (3), 827–850. doi:10.1111/rode.13077

Jahanger, A., Usman, M., and Balsalobre-Lorente, D. (2022). Linking institutional quality to environmental sustainability. Sustain. Dev. 30 (6), 1749–1765. doi:10.1002/SD.2345

Jänicke, M. (2008). Ecological modernisation: new perspectives. J. Clean. Prod. 16 (5), 557–565. doi:10.1016/j.jclepro.2007.02.011

Jin, G., and Sun, Y. (2023). Too hot for sustainable development: climate change and energy efficiency. Clim. Change Econ. 14 (3). doi:10.1142/S2010007823500148

Kashif, U., Shi, J., Naseem, S., Dou, S., and Zahid, Z. (2024). ICT service exports and CO2 emissions in OECD countries: the moderating effect of regulatory quality. Econ. Change Restruct. 57 (3), 94. doi:10.1007/s10644-024-09685-y

Lu, Y., Tian, T., and Ge, C. (2023). Asymmetric effects of renewable energy, fintech development, natural resources, and environmental regulations on the climate change in the post-covid era. Resour. Policy 85, 103902. doi:10.1016/j.resourpol.2023.103902

Machado, J. A. F., and Santos Silva, J. M. C. (2019). Quantiles via moments. J. Econ. 213 (1), 145–173. doi:10.1016/J.JECONOM.2019.04.009

Mahalik, M. K., Mallick, H., and Padhan, H. (2021). Do educational levels influence the environmental quality? The role of renewable and non-renewable energy demand in selected BRICS countries with a new policy perspective. Renew. Energy 164, 419–432. doi:10.1016/J.RENENE.2020.09.090

Mao, F., Yuan, Y., and Zhang, F. (2025). Firm-level perception of uncertainty, risk aversion, and corporate real estate investment: evidence from China’s listed firms. Econ. Analysis Policy 85, 1428–1441. doi:10.1016/j.eap.2025.02.002

Mattila, T. (2012). Any sustainable decoupling in the Finnish economy? A comparison of the pathways and sensitivities of GDP and ecological footprint 2002-2005. Ecol. Indic. 16, 128–134. doi:10.1016/j.ecolind.2011.03.010

Mohsin, M., Naseem, S., Zia-ur-Rehman, M., Baig, S. A., and Salamat, S. (2023). The crypto-trade volume, GDP, energy use, and environmental degradation sustainability: an analysis of the top 20 crypto-trader countries. Int. J. Finance Econ. 28 (1), 651–667. doi:10.1002/ijfe.2442

Müller, W., and Kruse, S. (2021). Modes of drought climatization: a frame analysis of drought problematization in Germany across policy fields. Environ. Policy Gov. 31 (5), 546–559. doi:10.1002/eet.1954

Pajek, L., and Košir, M. (2021). Exploring climate-change impacts on energy efficiency and overheating vulnerability of bioclimatic residential buildings under central European climate. Sustain. Switz. 13 (12), 6791. doi:10.3390/su13126791

Persyn, D., and Westerlund, J. (2008). Error-correction-based cointegration tests for panel data. Stata J. 8 (2), 232–241. doi:10.1177/1536867X0800800205

Pesaran, M. H. (2015). Testing weak cross-sectional dependence in large panels. Econom. Rev. 34, 1089–1117. doi:10.1080/07474938.2014.956623

Rehman, A., Radulescu, M., Ma, H., Dagar, V., Hussain, I., and Khan, M. K. (2021). The impact of globalization, energy use, and trade on ecological footprint in Pakistan: does environmental sustainability exist? Energies 14 (17), 5234. doi:10.3390/en14175234

Ren, Y., Zhang, J., and Wang, X. (2024). How does data factor utilization stimulate corporate total factor productivity: a discussion of the productivity paradox. Int. Rev. Econ. Finance 96, 103681. doi:10.1016/j.iref.2024.103681

Renewable Energy - Our World in Data (2025). Available online at: https://ourworldindata.org/renewable-energy#article-citation.

Rodrik, D. (2014). Green industrial policy. Oxf. Rev. Econ. Policy 30, 469–491. doi:10.1093/oxrep/gru025

Sarkodie, S. A. (2021). Environmental performance, biocapacity, carbon and ecological footprint of nations: drivers, trends and mitigation options. Sci. Total Environ. 751, 141912. doi:10.1016/j.scitotenv.2020.141912

Shahbaz, M., Raghutla, C., Chittedi, K. R., Jiao, Z., and Vo, X. V. (2020). The effect of renewable energy consumption on economic growth: evidence from the renewable energy country attractive index. Energy 207, 118162. doi:10.1016/j.energy.2020.118162

Shahzad, F., Fareed, Z., Wan, Y., Wang, Y., Zahid, Z., and Irfan, M. (2023). Examining the asymmetric link between clean energy intensity and carbon dioxide emissions: the significance of quantile-on-quantile method. Energy and Environ. 34 (6), 1884–1909. doi:10.1177/0958305X221102049

Stern, N. (2007). “The economics of climate change: the stern review,” in The economics of climate change: the stern review. doi:10.1017/CBO9780511817434

Tamasiga, P., Onyeaka, H., and Ouassou, E. (2022). Unlocking the green economy in African countries: an integrated framework of FinTech as an enabler of the transition to sustainability. Energies 15 (22), 8658. doi:10.3390/en15228658

Wang, J., Xu, H., and Wang, M. (2025). Technology diffusion considering technological progress and multiple policy combinations based on evolutionary game theory. Technol. Soc. 81, 102799. doi:10.1016/j.techsoc.2024.102799

Wang, J., Zhu, G., and Chang, T. C. (2024). Unveiling the relationship between institutional quality, fintech, financial inclusion, human capital development and mineral resource abundance. An Asian perspective. Resour. Policy 89, 104521. doi:10.1016/J.RESOURPOL.2023.104521

Westerlund, J., and Edgerton, D. L. (2008). A simple test for cointegration in dependent panels with structural breaks. Oxf. Bull. Econ. Statistics 70 (5), 665–704. doi:10.1111/j.1468-0084.2008.00513.x

Xian, M. (2024). Impact of inclusive growth, environmental policy incentives, fintech and globalization on environmental sustainability in G20 countries. Sustainability 17 (1), 50. doi:10.3390/su17010050

Xu, A., Wang, W., and Zhu, Y. (2023). Does smart city pilot policy reduce CO2 emissions from industrial firms? Insights from China. J. Innovation Knowl. 8, 100367. doi:10.1016/j.jik.2023.100367

Xu, X., Liu, Z., Liu, W., Pei, C., Wu, X., and Nie, Z. (2024). A sustainable development benchmarking framework for energy companies based on topic mining and knowledge graph: the case of oil and gas industry. Renew. Sustain. Energy Rev. 196, 114350. doi:10.1016/j.rser.2024.114350

Yang, B., Usman, M., and jahanger, A. (2021). Do industrialization, economic growth and globalization processes influence the ecological footprint and healthcare expenditures? Fresh insights based on the STIRPAT model for countries with the highest healthcare expenditures. Sustain. Prod. Consum. 28, 893–910. doi:10.1016/j.spc.2021.07.020

Yang, X., Chen, J., Li, D., and Li, R. (2024). Functional-coefficient quantile regression for panel data with latent group structure. J. Bus. Econ. Statistics 42, 1026–1040. doi:10.1080/07350015.2023.2277172

Zafar, M. W., Saleem, M. M., Destek, M. A., and Caglar, A. E. (2021). The dynamic linkage between remittances, export diversification, education, renewable energy consumption, economic growth, and 2 emissions in top remittance-receiving countries. Sustain. Dev. 30, 165–175. doi:10.1002/sd.2236

Zahid, Z., Zhang, J., Gao, C., and Oláh, J. (2025). ICT-driven strategies for enhancing energy efficiency in G20 economies: moderating the role of governance in achieving environmental sustainability. Energies 18 (3), 685. doi:10.3390/en18030685

Zahid, Z., Zhang, J., Shahzad, M. A., Junaid, M., and Shrivastava, A. (2024). Green Synergy: interplay of corporate social responsibility, green intellectual capital, and green ambidextrous innovation for sustainable performance in the industry 4.0 era. PLoS One 19 (8), e0306349. doi:10.1371/journal.pone.0306349

Zambrano-Monserrate, M. A., Ruano, M. A., Ormeño-Candelario, V., and Sanchez-Loor, D. A. (2020). Global ecological footprint and spatial dependence between countries. J. Environ. Manag. 272, 111069. doi:10.1016/j.jenvman.2020.111069

Zhang, S., Li, X., Zhang, C., Luo, J., Cheng, C., and Ge, W. (2023a). Measurement of factor mismatch in industrial enterprises with labor skills heterogeneity. J. Bus. Res. 158, 113643. doi:10.1016/j.jbusres.2023.113643

Zhang, S., Zhang, C., Su, Z., Zhu, M., and Ren, H. (2023b). New structural economic growth model and labor income share. J. Bus. Res. 160, 113644. doi:10.1016/j.jbusres.2023.113644

Zhao, S., and Hu, P. (2024). Analysis of the impact of carbon finance on digital green technology innovation of enterprises. Appl. Math. Nonlinear Sci. 9 (1). doi:10.2478/amns.2023.2.01307

Zhao, S., Zhang, L., Peng, L., Zhou, H., and Hu, F. (2024). Enterprise pollution reduction through digital transformation? Evidence from Chinese manufacturing enterprises. Technol. Soc. 77, 102520. doi:10.1016/j.techsoc.2024.102520

Keywords: energy efficiency, FinTech, industrialization, energy advancements, climate change

Citation: Zhao H and Arshad R (2025) Repercussions of energy efficiency, FinTech, industrialization, and technological advancements on climate change: evidence from G20 countries. Front. Environ. Sci. 13:1557830. doi: 10.3389/fenvs.2025.1557830

Received: 09 January 2025; Accepted: 27 May 2025;

Published: 05 June 2025.

Edited by:

Lira Lazaro, São Paulo Center for Energy Transition Studies (CPTEn), BrazilReviewed by:

Kwadwo Boateng Prempeh, Sunyani Technical University, GhanaZohaib Zahid, Jiangsu University, China

Copyright © 2025 Zhao and Arshad. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rimsha Arshad, cmltc2hhYXJzaGFkMzEzQHlhaG9vLmNvbQ==

Hongyang Zhao1

Hongyang Zhao1 Rimsha Arshad

Rimsha Arshad