- 1School of Economics, Nanjing University of Finance and Economics, Nanjing, Jiangsu, China

- 2Green Economy Development Institute, Nanjing University of Finance and Economics, Nanjing, Jiangsu, China

Introduction:: Although considerable research has explored factors affecting corporate ESG performance and environmental policies, few studies integrate these dimensions to assess the Mountains-Waters Project pilot policy—an expansive ecological restoration initiative in China. This study aims to examine the policy's effects on corporate ESG performance within the Yangtze River Economic Belt, a critical ecological and economic region in China.

Methods:: To investigate the effects of the pilot policy, we use panel data from 129 publicly listed companies across 76 districts (2009—2023). A multi-period difference-in-differences (DID) model is employed to analyze the impact of the policy on corporate ESG performance.

Results:: The findings show that the pilot policy significantly enhances corporate ESG performance. The effects operate through three primary mechanisms: promoting green technologies, boosting media attention, and strengthening government oversight of environmental practices. Furthermore, the effects are more pronounced for high-tech and non-state-owned enterprises, suggesting heterogeneous responses to policy interventions.

Discussion: These results provide novel empirical evidence on the role of environmental policies in advancing corporate sustainability. They also offer valuable insights for the design and implementation of future policies, especially in regions with significant ecological and economic importance like the Yangtze River Economic Belt.

1 Introduction

As global sustainable development gains prominence, corporate Environmental, Social, and Governance (ESG) performance has emerged as a key indicator of long-term growth potential. Studies show that strong ESG performance not only enhances corporate reputation and public trust but also strengthens market competitiveness by optimizing environmental management, promoting social responsibility, and improving governance (Flammer, 2014; Zhang, 2024). Additionally, ESG excellence can lower capital costs (Dhaliwal et al., 2011), enhance operational efficiency (Houston and Shan, 2021), shape investor preferences (Avramov et al., 2022), and drive green innovation and sustainability (Zhou et al., 2023; Han Long et al., 2023). Given these benefits, identifying the factors that influence corporate ESG has become a critical area of research. Notably, as governments worldwide increasingly rely on environmental policies to regulate corporate behavior, understanding their impact on ESG performance has attracted significant attention.

Existing research categorizes ESG determinants into internal and external factors. Internal factors include corporate governance structures (Kuzey et al., 2023), capital market openness (Liao et al., 2022), common ownership (Cheng et al., 2022), and green innovation capabilities (Chen et al., 2022; Xinyue et al., 2021). These elements shape how firms integrate sustainability into their operations. External factors primarily revolve around government-driven environmental policies, which incentivize ESG improvements through mechanisms such as green finance, carbon trading, environmental taxes, and regulatory mandates (Yu et al., 2023; Xu et al., 2023; Wang and Yang, 2024; Chen L. et al., 2024; Lei and Yu, 2023).

In China, green finance policies are widely regarded as catalysts for ESG enhancement, particularly in high-pollution industries, non-state-owned enterprises, and innovation-intensive regions (Xue et al., 2023; Gao D. et al., 2024). Environmental policies exert both punitive and incentivizing effects on ESG performance. Liu Xiaohong et al. (2023) highlight multiple mechanisms through which these policies drive ESG ratings. For instance, environmental tax laws improve ESG performance in polluting industries by accelerating green transformation (He et al., 2023; Li Meiling et al., 2024). Similarly, green credit policies have significantly impacted high-environmental-risk sectors, enhancing ESG outcomes (Han Linzhi et al., 2023). Tax incentives not only boost overall ESG performance but also create positive spillover effects across various dimensions (Zhang et al., 2024). Financial reform pilot programs have further improved ESG metrics in state-owned and high-pollution enterprises (Gao J. et al., 2024). Meanwhile, carbon trading schemes have driven ESG advancements in high-emission industries, particularly in carbon management (Zhang Lei et al., 2023). Finally, low-carbon city pilot programs have strengthened corporate ESG practices by enhancing management quality and increasing external accountability (Wan et al., 2024).

While existing studies provide valuable insights into the relationship between policies and environmental performance (E), significant research gaps remain. First, most studies focus on a single external driving factor, failing to account for the complexity of the external environment. Research has predominantly examined government regulations, environmental protection policies, and ecological civilization initiatives (Zheng et al., 2013; Li 2024; Li et al., 2023), but often in isolation, neglecting potential interactions among multiple drivers. This narrow focus limits the understanding of comprehensive external influences on corporate ESG performance. Second, much of the literature employs static analyses, offering limited insight into causal relationships. Conventional regression models fail to capture the dynamic and lagged effects of external factors on corporate ESG decisions, overlooking the temporal nuances of policy implementation (Zhang and Jung, 2023; Liu Baoliu et al., 2023). Lastly, existing research rarely considers the impact of environmental and social perceptions on corporate ESG strategies. While traditional studies emphasize government regulations and market demand, they often overlook how public perceptions of environmental and social issues shape corporate decision-making (Zhu et al., 2024).

As sustainability concerns gain prominence, companies face mounting pressure from consumers, investors, and the public to integrate ESG considerations into their strategies. While prior research highlights the role of environmental policies in improving corporate environmental performance (E), a critical gap remains in understanding how policies influence broader dimensions of social responsibility (S) and governance (G). This gap is particularly relevant as China transitions from single regulatory measures to multi-dimensional governance approaches. Examining the comprehensive effects of such policy transitions on corporate ESG performance is becoming increasingly essential.

In this context, the Chinese government has introduced the “Integrated Protection and Restoration Strategy for Mountains, Waters, Forests, Farmland, Lakes, Grasslands, and Deserts”—commonly known as the Mountains-Waters Project Pilot Policy. This cross-regional and cross-sector ecological governance initiative aims to enhance ecosystem functionality and promote coordinated regional development. Unlike traditional environmental policies, the Mountains-Waters Project adopts an integrated, synergistic approach, leveraging instruments such as property rights, tax incentives, and capital returns. Beyond generating substantial environmental benefits (E), this policy may also drive corporate engagement in social responsibility (S) and foster governance improvements (G). By imposing ecological restoration mandates, promoting resource integration, and facilitating cross-regional cooperation, the policy creates new external pressures and resource constraints for businesses. These dynamics present a unique opportunity to explore the multi-dimensional impact of comprehensive policies on corporate ESG performance.

Although some studies have examined the role of the Mountains-Waters Project in ecological restoration and green development, most have been limited to policy definition (Liu Muyang et al., 2023; Yan and Zhang, 2021; Zhang D. et al., 2022), ecological restoration recommendations (Zhang Y. X. et al., 2023; Shang et al., 2024; Yang and Cao, 2019; Li Shuangyuan et al., 2024), or assessments of ecological performance (Liu et al., 2021; Yang et al., 2024; Li Qin et al., 2024). However, few studies have systematically analyzed its potential impact on corporate ESG performance. In particular, there is a lack of research on how the Mountains-Waters Project pilot policy influences environmental improvements, social responsibility incentives, and corporate governance structures in an integrated manner. Addressing this gap is crucial for understanding the broader implications of multi-dimensional policies on corporate sustainability and governance.

This study addresses a critical gap by employing a multi-period difference-in-differences (DID) model to evaluate the potential comprehensive impact of the Mountains-Waters Project pilot policy on corporate ESG performance and to uncover its underlying mechanisms. The Yangtze River Economic Belt serves as an ideal natural experiment due to two key factors. First, as a large-scale, government-led ecological restoration initiative, the Mountains-Waters Project has a well-defined launch date and implementation region, making it suitable for empirical analysis. The policy’s structured timeline and phased execution within the Yangtze River Economic Belt enable the application of a DID model to assess its possible effects rigorously. Second, the project’s staggered implementation and region-specific variations in ecological, industrial, and economic structures provide a rich dataset for evaluating its potential heterogeneous effects on corporate ESG performance. This region encompasses high-pollution industries, low-carbon enterprises, and green development firms, offering an optimal setting to examine the policy’s differentiated impact on various corporate sectors.

Accordingly, we treat the Mountains-Waters Project pilot policy as a natural experiment, leveraging panel data from 129 listed companies across 76 counties in the Yangtze River Economic Belt from 2009 to 2023. Using a multi-period DID model, this study systematically investigates the policy’s possible impact on corporate ESG performance while exploring its dynamic interactions with green innovation, media attention, and governmental environmental awareness. By doing so, it bridges a crucial gap in the literature concerning the possible multidimensional effects of external drivers—particularly policy interventions, green innovation, and media influence—on corporate ESG. Additionally, this research provides fresh insights and empirical evidence that contribute to the international discourse on corporate sustainability.

The findings of this study hold significant global relevance, offering critical insights into possible policy-driven corporate sustainability transformations. By examining the interplay between environmental policies, green technology innovation, media influence, and governmental oversight within China’s policy framework, this study generates valuable lessons for environmental policy design in other developing economies. Given that similar environmental policies may exert varying degrees of influence across different geopolitical contexts, our research provides empirical insights into how corporate ESG performance responds to policy interventions, enhancing the broader understanding of policy effectiveness.

By integrating ecological policy with corporate ESG dynamics, this study advances environmental policy evaluation and deepens the understanding of how regulatory frameworks can foster corporate sustainability. Beyond contributing to theoretical discourse, the findings offer practical implications for policymakers in China and globally, guiding the design and assessment of environmental policies in diverse economic settings.

The structure of this paper is as follows: Section 2 provides an overview of the Mountains-Waters Project pilot policy, its background, and the theoretical framework. Section 3 presents the data and methodology used in this study. Section 4 discusses the results and analysis. Section 5 provides further analysis, and Section 6 concludes the study.

2 Policy background and theoretical analysis

2.1 Policy background

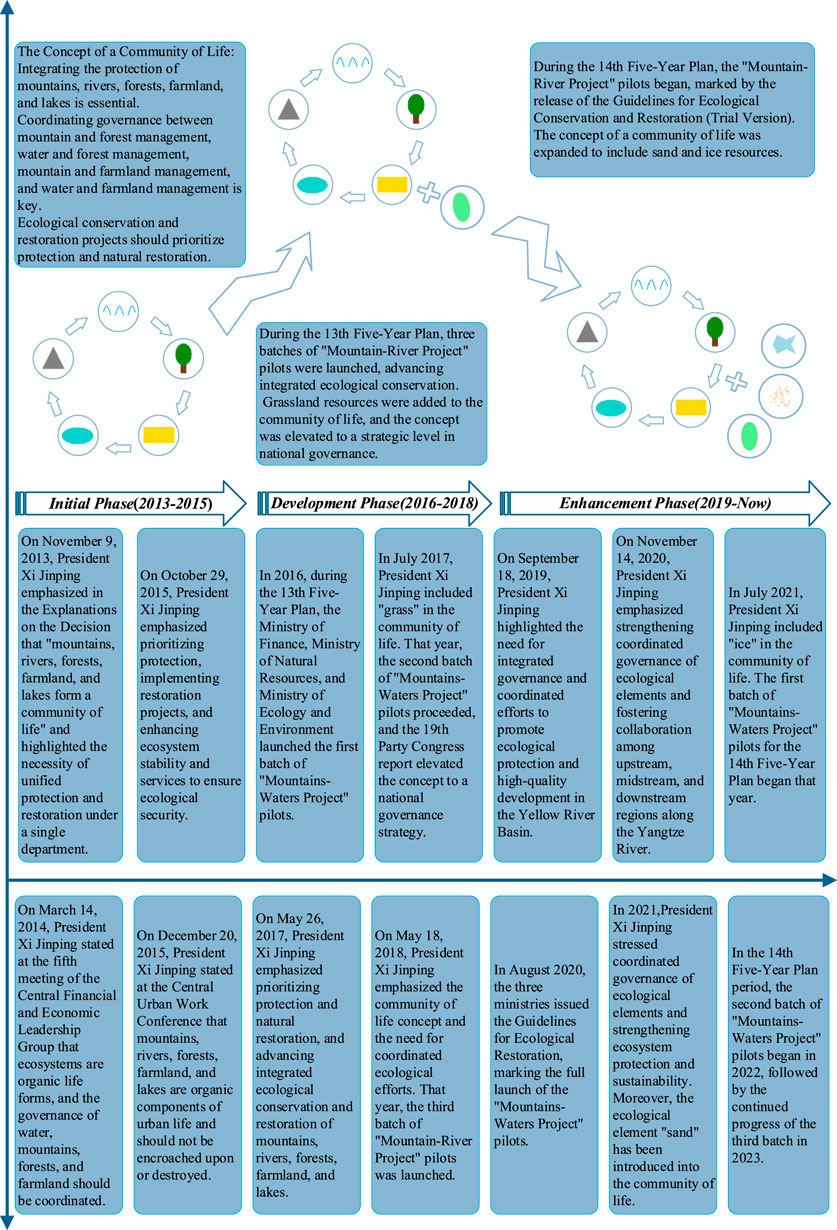

Over recent decades, China aspired to economic development at top speed often neglecting environmental protection, leading to significant issues like water pollution, heavy metal contamination of farmland, and degradation of forests and grasslands. Restoring and managing these environmental resources—mountains-waters-forests-farmlands-lake-grasslands—is crucial for advancing ecological civilization and promoting a virtuous cycle of the economy. Recognizing this urgency, the Chinese Environmental Department launched the Mountains-Waters Project. Currently, China has implemented 52 Mountains-Waters Project initiatives, supported by investments exceeding 260 billion yuan across 27 provinces. Analysis of policy documents reveals three main stages in the project’s development trajectory.

During its initial phase from 2013 to 2015, the Mountains-Waters Project introduced the concept that mountains-waters-forests-farmlands-lake-grasslands form a community of life. This marked a significant national initiative for coordinated natural resource management. At this stage, the concept of “mountains, waters, forests, fields, and lakes as a community of life” and the “Two Mountains Theory” were officially written into government policy documents. However, challenges persisted with fragmented natural resources and unclear responsibilities among government departments in restoration and governance tasks.

During the policy development phase from 2016 to 2019, the Mountains-Waters Project expanded its scope to include grassland resources. This period integrated China’s ecological civilization theory into project plans and organizational reforms, including the establishment of the Ministry of Natural Resources in 2018 to enhance ecological management. The implementation phase included 25 pilot projects across 26 provinces.

The third stage is the policy strengthening stage. This marked the comprehensive implementation of pilot policies for Mountain-Waters projects. Compared to earlier stages, this phase emphasized innovative governance technologies, standardized market operations, and broader coverage in restoration plans. By 2021, the first and second batches of pilot projects from the 13th Five-Year Plan period had completed project acceptance, paving the way for continued progress with 27 pilot projects across 25 provinces under the 14th Five-Year Plan. (The more details of the specific policy can be found in Figure 1).

The Mountains-Waters Project pilot policy, launched by China, aims to achieve ecological restoration and economic development through a series of institutional arrangements and incentives. First, it strengthens penalties for ecological damage by integrating environmental trials into local government systems, utilizing the judiciary’s role in protection. Second, the policy encourages social capital participation through property rights incentives and fiscal support. Third, enterprises meeting restoration standards are granted natural resource usage rights, enabling them to develop diversified ecological industries and benefit from environmental tax incentives. Additionally, the policy follows a “government-led, market-driven” approach, regulating market standards and ensuring transparency, creating a fair investment environment for capital. It also establishes a reasonable capital return and exit mechanism to ensure the sustainable circulation of capital.

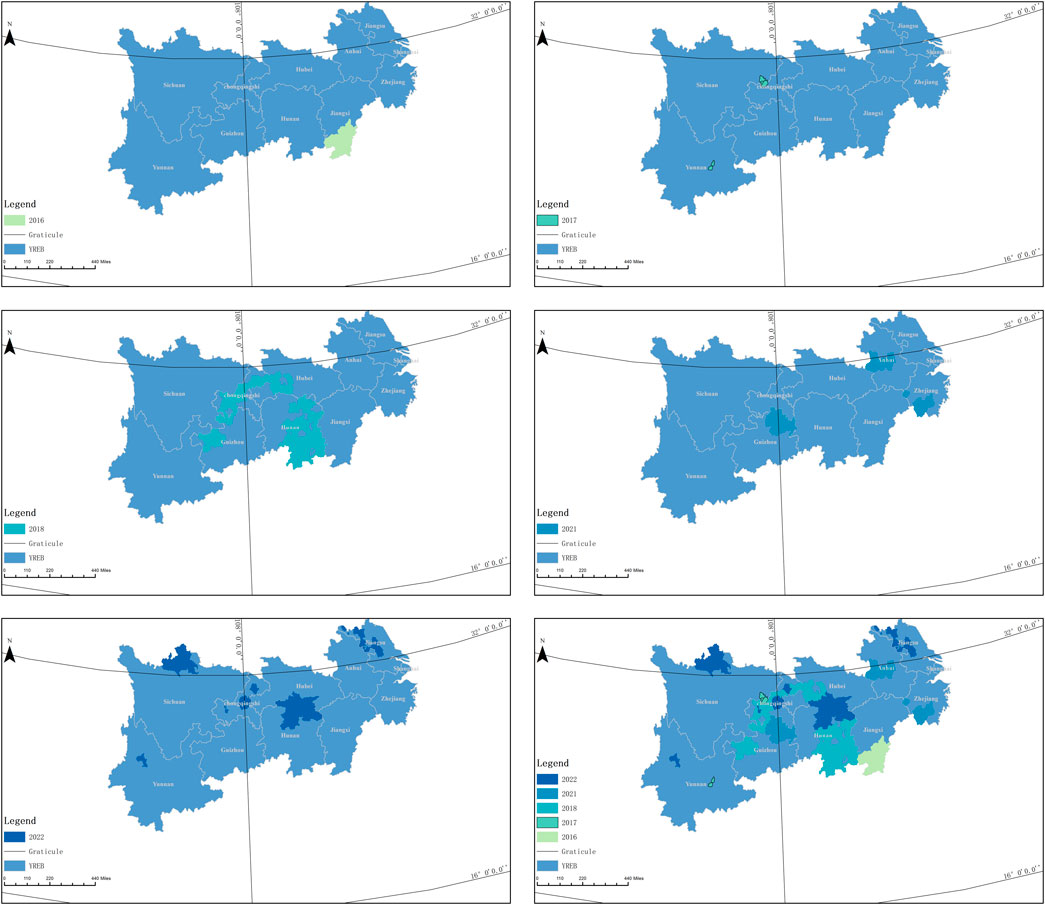

Implementation Status of the Pilot Policy for the Mountains-Waters Projects in the Yangtze River Economic Belt. Since 2016, it has successively launched five batches of Mountains-Waters pilot projects. These projects include the first, second, and third batches initiated in 2016, 2017, and 2018, respectively, and the first and second batches initiated During the next phase in 2021 and 2022. Regarding the coverage of the Mountains-Waters pilot projects, during the first period, the pilot projects encompassed 159 counties across eight provinces: concluding Jiangxi, Sichuan, Yunnan, Chongqing, Guizhou, Hunan, Hubei, and Zhejiang. During the second period, the pilot projects covered 103 counties across nine provinces: Guizhou, Anhui, Zhejiang, Chongqing, Hunan, Jiangsu, Hubei, Sichuan, and Yunnan. (Results are shown in Figure 2).

2.2 Theoretical analysis

2.2.1 Possible influence of the mountains-waters project Pilot Policy on corporate ESG

As one of China’s flagship initiatives for ecological civilization, the Mountains-Waters Project pilot policy aims to integrate environmental conservation with corporate social responsibility. This policy encourages enterprises to adopt greater environmental and social accountability while maintaining economic viability. From the perspectives of Stakeholder Theory and Signal Transmission Theory, this section examines how government guidance and market incentives shape corporate ESG performance under the Mountains-Waters Project framework.

2.2.1.1 Government-led and market-driven combination: application and innovation of Stakeholder Theory

Under the framework of Stakeholder Theory, the Mountains-Waters Project pilot policy integrates government-led and market-driven mechanisms to incentivize companies to balance economic gains with societal, environmental, and economic stakeholder interests. This policy might enhance corporate ESG performance through the following ways.

2.2.1.1.1 Property rights incentive mechanism

The Mountains-Waters Project policy is grounded in the Coase Theorem, which might grant firms that meet ecological restoration standards the rights to utilize ecological resources1. By internalizing externalities through environmental protection and resource utilization, companies can generate profits (Liu and Liu, 2020). This approach not only compels firms to assume environmental responsibility (Xue et al., 2023) but also appears to create economic incentives for1 ecological restoration (Donis et al., 2023), encouraging the integration of social responsibility into corporate strategy (Wan-hu, 2014; Cao and Xiao, 2022).

2.2.1.1.2 Combination of government and market mechanisms

Traditional market mechanisms often struggle with market failures and regulatory insufficiencies in environmental protection (Yi et al., 2021). In contrast, the Mountains-Waters Project policy synergizes government oversight with market dynamics to establish a competitive and equitable investment landscape (Lu et al., 2020). The government fosters corporate participation in ecological restoration through policy design, while market forces, such as social capital involvement and fiscal support2, might propel firms toward sustainable development (Metelytsia and Gagalyuk, 2024). This model may help to surpasses the constraints of Public Goods Theory, which traditionally emphasizes state intervention.

2.2.1.2 Signal Transmission Theory and enhancement of corporate ESG performance

The policy may also influence corporate ESG performance through Signal Transmission Theory, a key principle in information economics. This theory explains how firms strategically disclose information to signal their commitment to sustainability and social responsibility, thereby enhancing investor and public trust.

2.2.1.2.1 Signal transmission mechanism

Under Signal Transmission Theory, firms could communicate their ESG initiatives through information disclosure, demonstrating their environmental and social responsibility efforts to investors, regulators, and the public (Wang, 2024). Amid tightening environmental policies and mounting societal expectations, companies might enhance ESG performance to mitigate information asymmetry (Syahrul Hikam and Haryati, 2023), strengthening investor confidence and public trust (Fischbach et al., 2023). This not only boosts market competitiveness but also potentially enhance corporate legitimacy and reputational capital.

2.2.1.2.2 Transparency and public attention

Moreover, the Mountains-Waters Project pilot policy intensifies corporate environmental supervision, aligning with the Legitimacy Theory. Under this framework, companies improve ESG disclosure transparency (Hoang et al., 2024) to meet public and governmental expectations of corporate responsibility (Liu Sheng et al., 2023). This potentially fosters stronger stakeholder relationships (Vinodkumar and Alarifi, 2020) and supports long-term corporate sustainability.

2.2.1.3 The Policy’s uniqueness and its alignment with traditional theories

Overall, compared to conventional government-driven or market-led policy models, the Mountains-Waters Project pilot policy appears to have unique innovations. It might advance corporate ecological protection through regulation and could incentivize firms to engage in the ecological industry via market mechanisms, potentially achieving a synergy of economic and environmental benefits. This policy innovation may strengthen corporate ESG performance, integrating Stakeholder Theory and Signal Transmission Theory, while enhancing government-market collaboration and reinforcing corporate social responsibility.

H1. The Mountains-Waters Project pilot policy might help improve corporate ESG performance.

2.2.2 The influence pathways of the mountains-waters project pilot policy on corporate ESG performance

2.2.2.1 Green technology advancement pathway for enterprises

The Mountains-Waters Project pilot policy directly exerts external pressure on enterprises through its stringent penalties for ecological damage. Specifically, the policy holds enterprises accountable for environmental pollution resulting from their production activities (Cui et al., 2024) and requires them to pay corresponding fines for ecological damage (Hu, 2023). This institutional pressure compels enterprises to consider technological innovation as a means to reduce pollution and environmental harm (Wang et al., 2023), thereby lowering the cost of fines (Li et al., 2023) and improving environmental compliance.

The fine mechanism and ecological restoration requirements within the policy force enterprises to bear higher environmental costs (Vincenzo et al., 2024). In the short term, enterprises face higher compliance costs; however, in the long run, to reduce the expenditure on ecological damage fines, enterprises must increase their investment in green technology research and development (Geoffrey Wang et al., 2024). This environmental pressure motivates enterprises to adopt green R&D strategies, which not only help reduce pollution emissions during production processes but also enhance their capacity for innovation in green technologies (Xia, 2022), thereby improving their Environmental, Social, and Governance (ESG) performance.

For example, enterprises innovate in green technologies to optimize production processes and pollution control technologies, reduce emissions, and improve energy efficiency, thereby earning policy rewards or exemptions from penalties (Zhang Y. et al., 2022). In this process, the policy not only requires enterprises to comply with environmental protection standards but also drives them to shift from passive compliance to proactive innovation through incentive measures (Liu Shiliang et al., 2023). Consequently, the Mountains-Waters Project pilot policy, through its penalties for ecological damage, incentives for green technology innovation, and environmental governance requirements, facilitates enterprises’ progress in green technology R&D, ultimately enhancing their ESG performance.

H2. The Mountains-Waters Project pilot policy promotes advancements in green technology R&D and pollution control technologies through its strict penalties for ecological damage, thereby improving enterprises’ ESG.

2.2.2.2 Media attention pathway

With the implementation of the Mountains-Waters Project pilot policy, media attention on enterprises’ environmental behavior has significantly increased. Specifically, under the policy’s requirements, corporate environmental performance has become a focal point of media coverage. The external pressure from public opinion forces enterprises to raise their environmental standards (Zhou and Ding, 2023) and increase their ESG disclosures (Zheng and Zhang, 2024) to avoid the economic consequences arising from reputational damage (Kong, 2024).

Following the policy’s implementation, media outlets focused their attention on corporate environmental pollution behavior. Through negative reporting and public pressure, the media compels enterprises to raise environmental standards and enhance ESG disclosures (Balázs Csillag et al., 2022), including the publicization of their environmental protection measures, technological advancements, and environmental achievements. This process not only drives enterprises to avoid the impact of negative news but also encourages them to proactively respond to the public’s concerns about environmental issues, enhancing their environmental awareness and transparency (Hoang, 2018).

Moreover, the media acts as an “information disseminator” of the policy (Egidius Yuristha et al., 2021), reporting on the policy requirements and government expectations for corporate environmental behavior. Through the reinforcement of policy information dissemination (Grinchevskiy, 2024), the media helps enterprises better understand and comply with environmental regulations and policy requirements. This process makes enterprises more aware of societal expectations regarding their environmental behavior, motivating them to improve environmental measures and strengthen their social responsibility.

Under this external pressure, enterprises enhance their ESG performance and increase the transparency of their information disclosures (Lee and Chung, 2023). This not only improves their social image but also strengthens their social legitimacy and public recognition, ultimately boosting their reputation in both society and the market (Maaloul et al., 2021).

H3. The Mountains-Waters Project pilot policy, by amplifying media attention on corporate environmental behavior and increasing external public pressure, drives enterprises to improve their ESG performance and enhance information disclosure, thereby strengthening their social legitimacy.

2.2.2.3 Government emphasis on environmental protection pathway

The Mountains-Waters Project pilot policy strengthens local governments’ commitment to environmental protection goals, driving them to directly influence corporate behavior through strict regulatory oversight and enforcement measures (Prima et al., 2024). The government has set environmental protection targets and performance indicators, requiring local governments to enhance supervision of corporate environmental behavior and ensure compliance with relevant environmental regulations. The role of government in policy implementation, particularly the regulatory functions of local governments, becomes a key driver for enterprises to improve environmental standards (Chang et al., 2021).

Local governments play a critical role in policy execution (Yue, 2020). The Mountains-Waters Project pilot policy requires local governments not only to formulate environmental protection measures but also to implement specific enforcement and monitoring mechanisms to ensure effective policy implementation. For example, governments establish environmental supervision systems to rigorously check corporate pollution emissions and environmental impacts, penalizing non-compliant enterprises. This government regulatory pressure forces companies to raise their environmental standards (Chang et al., 2021) and adopt stricter pollution control technologies (Li et al., 2023) to comply with regulations and avoid penalties.

Moreover, the government’s policy guidance and enforcement capacity also facilitate coordination between local governments and enterprises (Wang and Fan, 2023). In the policy implementation process, local governments play the roles of both “guides” and “supervisors.” Through effective transmission of policy, enterprises are more likely to focus on green development (Naumova Mihajlovska et al., 2024) and the implementation of sustainable development strategies (Malevskaia-Malevich, 2022) under government guidance. The government’s commitment to environmental protection and its strict policy enforcement directly influences corporate behavior (Xue et al., 2023), prompting enterprises to actively respond in an increasingly stringent regulatory environment. As a result, companies improve their ESG performance by adjusting production processes and strengthening research and development of environmental protection technologies (Liu et al., 2024).

H4. The Mountains-Waters Project pilot policy strengthens local government commitment to environmental protection and enhances regulatory enforcement, directly driving enterprises to respond to government environmental requirements, thereby improving their ESG performance.

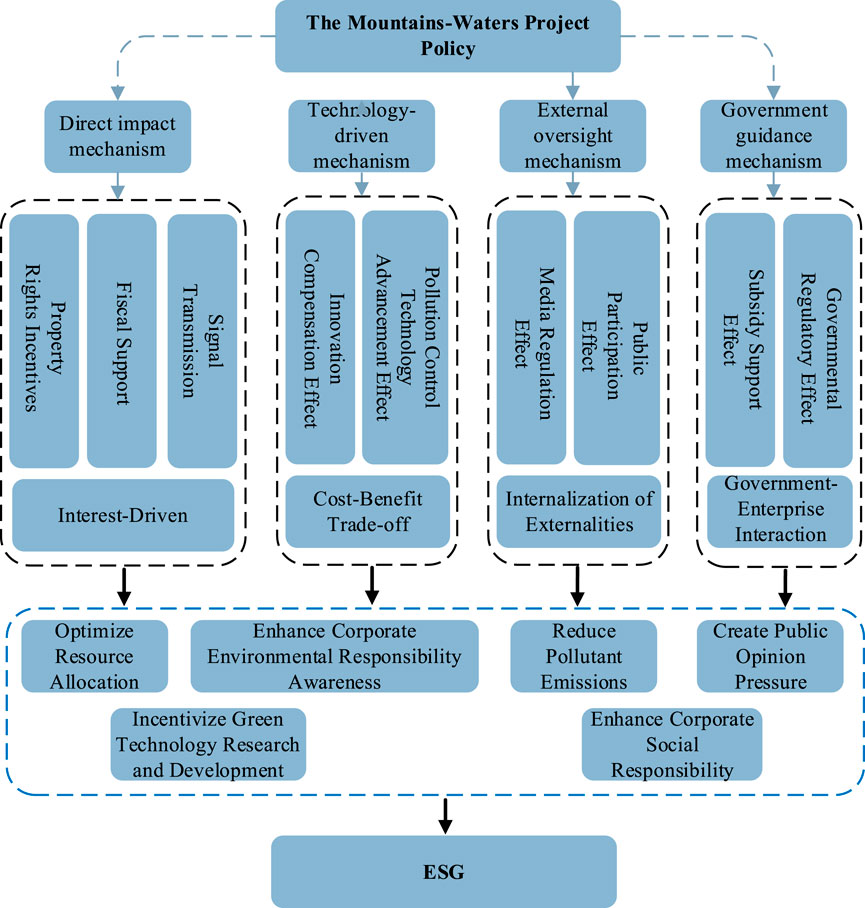

In word, the pilot policy significantly improves corporate ESG performance through three key pathways: advancing green technologies, increasing media attention, and enhancing government environmental oversight (Figure 3).

3 Data and methods

3.1 Data

3.1.1 Identification of pilot counties for the mountains-waters project

As the list of pilot counties for the Mountains-Waters Project is not publicly available in national policies and regulations, this study obtained the detailed list of 159 pilot counties in the Yangtze River Economic Belt covered by the Mountains-Waters Project pilot policy by manually compiling data. The information was gathered through a comprehensive search of official websites of provincial, municipal, and county governments, local news media sites, and consultations with government officials via phone calls. The covered provinces include Jiangxi, Sichuan, Yunnan, Chongqing, Guizhou, Hunan, Hubei, and Zhejiang.

3.1.2 Collection and processing of enterprise data

The ESG data of enterprises were sourced from Bloomberg, while other corporate characteristic data (such as ownership concentration, firm age, and capital intensity) were obtained from the CSMAR database.

Upon obtaining the list of pilot counties and the data of listed companies in these regions, we initially compiled data from 148 companies located in 81 counties across 8 provinces in the Yangtze River Economic Belt. To ensure data validity, we excluded companies with significant missing values. Additionally, although the first three batches of the Mountains-Waters Project pilot policy included two counties in Zhejiang, no listed companies were present in these counties, so all companies from Zhejiang were excluded. Ultimately, we retained data from 129 listed companies in seven provinces (Jiangxi, Sichuan, Yunnan, Chongqing, Guizhou, Hunan, Hubei) from 2009 to 2023 for our study sample.

3.1.3 Media attention and government environmental policy data

Media attention data were sourced from the China Listed Companies Financial News Database (CFND), while data on green technological progress efficiency were obtained from the China Research Data Service Platform (CNRDS). Government emphasis on environmental protection was measured using data from annual government work reports at the municipal level. These datasets provide critical information for assessing the impact of government policies on corporate environmental behavior.

3.1.4 The selection of research subjects

This study focuses on listed companies in the Yangtze River Economic Belt in China, comparing those located in counties covered by the “Mountains-Waters Project” pilot policy with companies in the same provinces but outside the pilot counties. Companies in the pilot regions are directly influenced by the policy, which, through measures such as ecological restoration and resource integration, may have a potential impact on corporate behavior. These companies are selected as the research subjects to evaluate the potential effects of the policy on corporate environmental, social, and governance (ESG) performance. In contrast, companies in non-pilot regions are located in other counties within the Yangtze River Economic Belt. Although geographically similar, they are not directly affected by the policy, thus providing baseline data unaffected by the policy.

This selection is of significant research value. First, although both groups of companies are located in the same provinces, the difference in policy implementation creates a natural experimental condition, which provides strong support for assessing the potential impact of the policy. Second, selecting companies from non-pilot areas effectively avoids cross-policy effects, ensuring the accuracy of the research results. Finally, given the similar environmental policy context across the Yangtze River Economic Belt, this comparative design helps reduce the influence of external factors, enhancing the comparability and validity of the results.

3.1.5 Control of selection bias

To mitigate the potential impact of selection bias on the estimation results, we employed propensity score matching (PSM) in our robustness checks. Specifically, we controlled for factors that could influence the policy’s effect, such as corporate ownership concentration, listing age, capital intensity, labor productivity, leverage, and future growth opportunities, thus ensuring the accuracy and reliability of the results.

3.1.6 Justification of statistical methodology

In this study, we applied a Difference-in-Differences (DID) model to assess the impact of the Mountains-Waters Project pilot policy on corporate ESG performance. The pilot policy is characterized by its phased implementation, with clearly defined timeframes and geographic scope, making the DID method particularly appropriate.

Phased Implementation: The Mountains-Waters Project pilot policy was implemented in different regions and at different times. The DID method allows us to compare changes in the treatment group (companies in the pilot counties) before and after the policy implementation, enabling precise identification of the policy effects.

Clear Time and Location: The implementation scope and timing of the policy are clearly defined. By comparing companies in the pilot counties (treatment group) with non-pilot companies from the same provinces (control group), we can distinctly differentiate the two groups and accurately estimate the policy’s impact.

3.2 Model specification

3.2.1 Baseline regression model

After an initial exploration of the potential causal relationship between the Mountains-Waters Project pilot and corporate ESG performance, to deepen our understanding of this relationship and precisely identify its underlying causal mechanisms, we treat the Mountains-Waters Project pilot policy as an exogenous policy shock that is independent of the company’s original ESG development path, with subsequent changes in corporate ESG viewed as the direct consequences potentially triggered by this policy shock. Given the unique nature of the Mountains-Waters Project pilot policy's implementation, which occurs in batches and at multiple time points, we design it as a quasi-natural experiment to maximize the use of the natural variation in this policy experiment to evaluate its effects (Equation 1). Through this design, we can more precisely control potential confounding factors, thereby revealing the net effect of the Mountains-Waters Project pilot policy on corporate ESG. Specifically, the benchmark model is specified as follows:

Where

3.2.2 Mechanism model

Based on the above theoretical analysis, the Mountains-Waters Project pilot policy promotes corporate ESG practices through three core pathways: accelerating the efficiency of corporate green technological progress, enhancing media attention to environmental issues, and raising environmental awareness at the government level. To precisely capture and analyze the causal relationship and internal transmission mechanism between this policy and corporate ESG performance, we have constructed the following model (Equations 2, 3):

Where

3.3 Variable selection

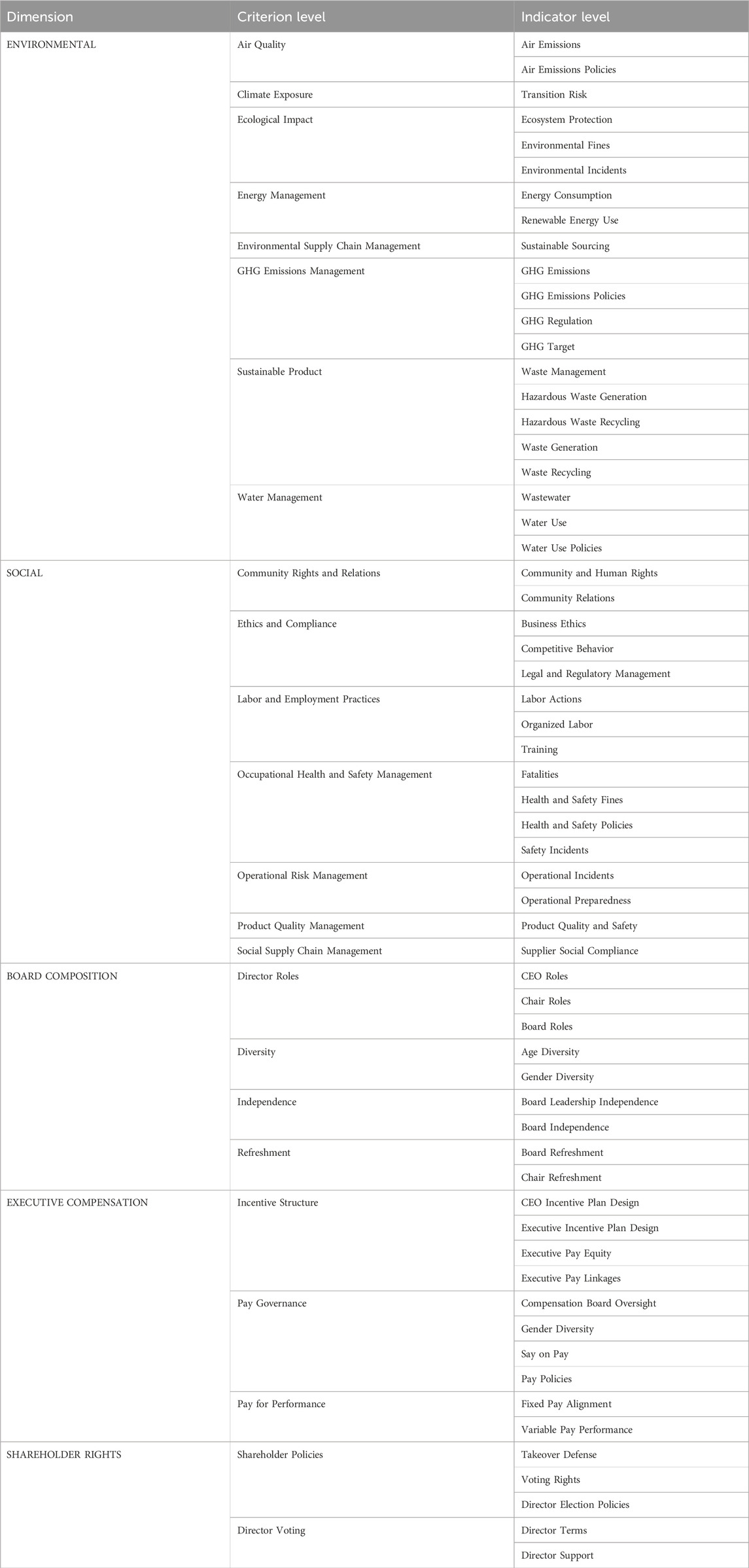

3.3.1 Dependent variable (

The ESG score of the enterprise is used as the dependent variable in this article. Specifically, following the approach of Doddy Ariefianto et al., 2024, We have obtained the ESG score from the latest Bloomberg indicator system. The measurement indicators for ESG according to Bloomberg are detailed in Table 1.

3.3.2 Explanatory variable (

The pilot of the Mountains-Waters Project is taken as the core explaining variable in this article. It is an interaction term that indicates whether the enterprise was covered by the policy in that year. Following the methodologies used by Guo and Zhong. (2022) in constructing core explanatory variables using a multi-period DID, if the company is covered by the Mountains-Waters Project pilot in that year, it is assigned a value of 1, otherwise, it is 0.

3.3.3 Control variables (

Following the approaches of Wan et al. (2024), Zhu and Zhang (2024), He (2024), Zhou (2024), and Jiang et al. (2023), we control for other factors that may affect ESG scores, including ownership concentration (

3.3.4 Mechanism variables

To further verify the conclusions drawn from the theoretical analysis in the previous section, we have constructed the following mechanism variables: efficiency of green technology progress (

4 Results and discussion

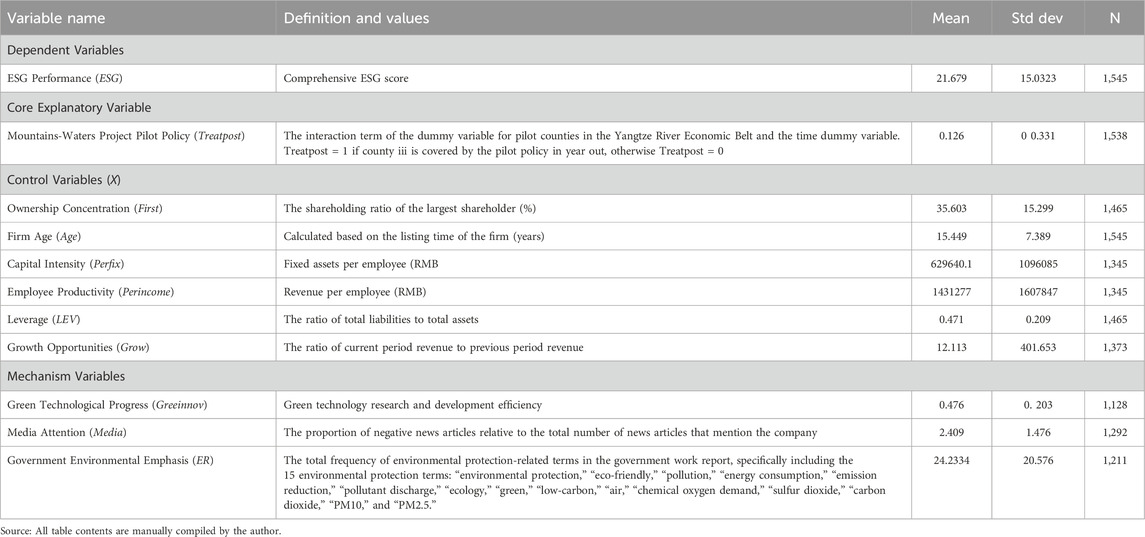

4.1 Variable definitions and descriptive statistics

For more information, please refer to Table 2.

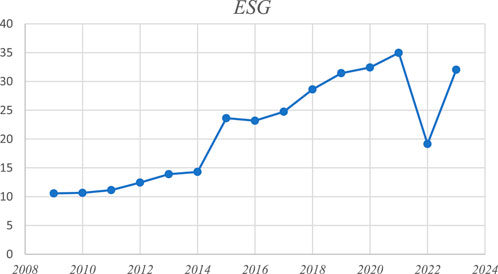

4.2 Analysis of annual ESG scores and the impact of the mountains-waters project pilot policy

To preliminarily assess the potential influence of the Mountains-Waters Project pilot policy on corporate ESG performance, we analyze annual ESG scores from 2009 to 2023. As shown in Figure 4, corporate Environmental, Social Responsibility, and Governance (ESG) performance exhibited significant fluctuations, particularly after 2015, when scores saw a marked increase. This trend suggests that from 2015 to 2021, ESG scores reflected both policy-driven shifts and advancements in green technologies.

4.2.1 Initial stage (2009–2014): slow growth in scores

Between 2009 and 2014, corporate ESG scores grew gradually. In 2009, the score was 10.57, rising marginally to 10.66 in 2010. Subsequent increases were similarly modest, reaching 11.14 in 2011, 12.44 in 2012, 13.90 in 2013, and 14.29 in 2014. During this period, ESG performance remained rudimentary, with minimal policy incentives and limited public focus on corporate sustainability. The absence of a systematic drive for green development and sustainable business practices constrained significant ESG advancements.

4.2.2 Policy expectation and sudden jump in 2015

A sharp inflection point occurred in 2015, when ESG scores surged to 23.62, signaling a dramatic shift from prior trends. Given that the Mountains-Waters Project pilot policy was officially implemented in 2016—and that the Chinese government often signals policy directions in advance—enterprises likely anticipated regulatory changes and preemptively adopted environmental governance and social responsibility measures. This surge suggests not only an early response to forthcoming policy but also proactive corporate engagement with evolving regulatory expectations.

4.2.3 Sustained growth post-policy implementation (2016–2021)

Following the policy’s formal launch in 2016, corporate ESG scores continued their upward trajectory. Scores rose from 23.18 in 2016 to 24.74 in 2017, reaching 28.61 in 2018. By 2019, they climbed to 31.43, increasing further to 32.42 in 2020 and peaking at 34.96 in 2021. This sustained growth may suggest that the policy might influence corporate behavior by driving investment in environmental initiatives, strengthening social responsibility commitments, and improving governance frameworks. Given the policy’s explicit emphasis on green development and sustainability, it likely fostered corporate advancements in green technology, pollution control, and social governance, contributing to improved ESG performance.

4.2.4 Short-term fluctuations and policy adaptation (2022–2023)

However, in 2022, ESG scores declined sharply from 34.96 in 2021 to 19.14 before rebounding to 32.04 in 2023. This volatility may be attributed to economic pressures following the COVID-19 pandemic, which likely constrained corporate ESG investments. Additionally, the post-policy adaptation phase may have played a role, as firms adjusted their internal strategies to align with evolving regulatory expectations. The partial recovery in 2023 suggests that companies gradually adapted to economic and policy shifts, reaffirming the long-term influence of regulatory frameworks on corporate ESG engagement.

In conclusion, trends in ESG scores offer valuable insights into the Mountains-Waters Project pilot policy’s potential impact on corporate sustainability performance. The sharp uptick in 2015 underscores the significance of policy anticipation effects, while sustained post-2016 growth highlights the policy’s role in driving corporate ESG improvements. Short-term fluctuations further suggest that companies might face adjustment periods and external pressures during policy transitions. Future research should explore the long-term implications of policy-driven ESG transformations to provide deeper insights into sustainable corporate governance.

4.3 Preliminary assessment of the relationship between policy intervention and ESG

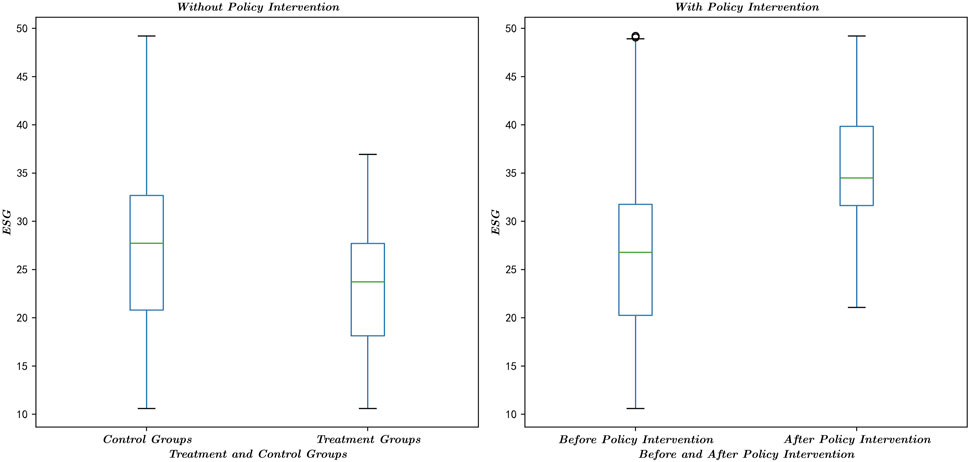

The results in Figure 5 indicate that, in the absence of policy intervention, the difference in corporate ESG between the control and treatment groups is minimal, with the control group exhibiting slightly higher ESG performance. However, following policy implementation, corporate ESG surpasses pre-trial levels. This suggests that, without intervention, ESG disparities among firms remain insignificant. Conversely, under policy enforcement, ESG performance in the treatment group increases significantly, implying a potentially positive policy impact on corporate ESG (Figure 5).

Figure 5. Changes in corporate ESG performance under conditions with and without policy intervention.

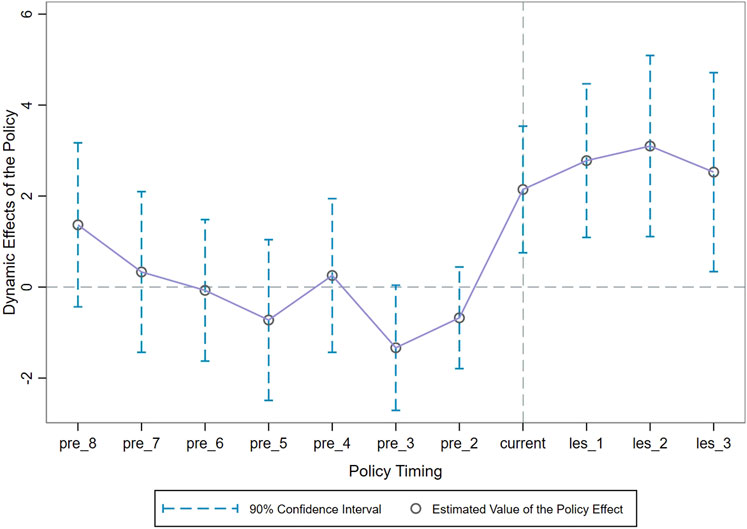

4.4 Test results of dynamic effects of policy—further verification of the relationship between policy intervention and ESG

The results in Figure 6 further illustrate that, after controlling for unobservable factors such as time and individual effects, all estimates for the 9 years preceding the Mountains-Waters Project pilot policy remain statistically indistinguishable from zero. This confirms the absence of significant economic effects prior to policy implementation and validates the parallel trend hypothesis. However, during the policy implementation period and the subsequent 4 years, all estimates become significantly positive. This seems to suggest that the policy’s economic effects may have begun to materialize, preliminarily indicating a causal link between the Mountains-Waters Project pilot and corporate ESG performance. These findings lay a foundation for the subsequent empirical analysis in this study (Figure 6).

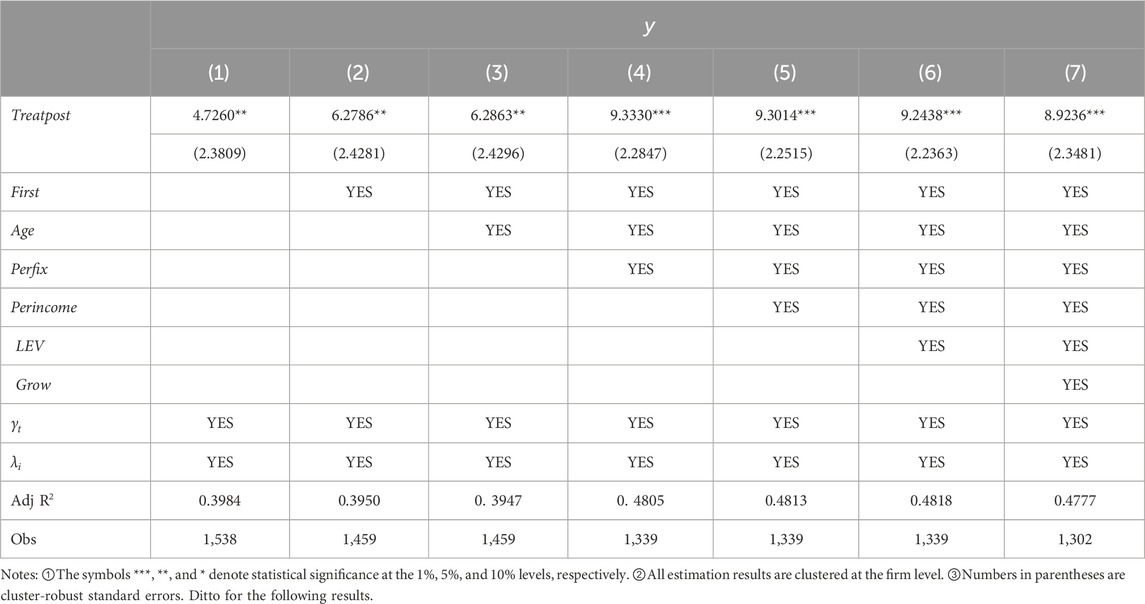

4.5 Baseline regression estimation results—final confirmation of the relationship between policy intervention and ESG

To ensure the robustness of the estimation results, we employ a stepwise approach to adding control variables in the regression analysis. The first column presents regression results without control variables, accounting only for time and individual effects, while subsequent columns incrementally introduce additional controls. The regression results, which control for time and individual fixed effects while progressively incorporating control variables, reveal that the coefficient for the Mountains-Waters Project pilot policy (

4.6 Robustness analysis

4.6.1 Placebo test

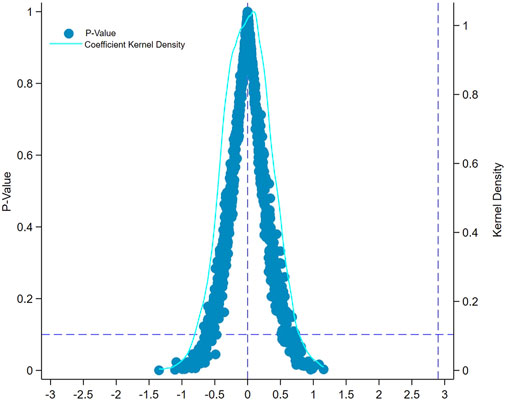

The baseline regression results suggest a potential positive impact of the Mountains-Waters Project pilot policy on firms’ ESG performance. However, this observed effect may not be entirely attributable to the policy, as unobserved factors could also play a role. Even without the pilot policy, firms’ ESG performance may improve due to various external influences. To rigorously assess the potential policy’s impact while controlling for confounding factors, this study employs a placebo test using a self-sampling method. This approach involves randomly generating a fictitious treatment group from the full sample while keeping the control variables unchanged. Specifically, the sample undergoes 1,000 rounds of random sampling and testing to simulate a scenario without the pilot policy, verifying whether the observed policy effects might be indeed attributable to the Mountains-Waters Project.

Figure 7 presents the placebo test results, showing that the policy’s regression coefficients approximate a normal distribution and are largely insignificant. The distribution of the fictitious coefficients deviates significantly from the true value of 8.9236 (represented by the vertical solid reference line). This indicates that the baseline regression results are unlikely to be driven by random chance, which may indirectly support the potential effectiveness of the Mountains-Waters Project pilot policy in enhancing firms’ ESG performance. Thus, the placebo test confirms the hypothesis that the policy has a potential positive impact (Figure 7).

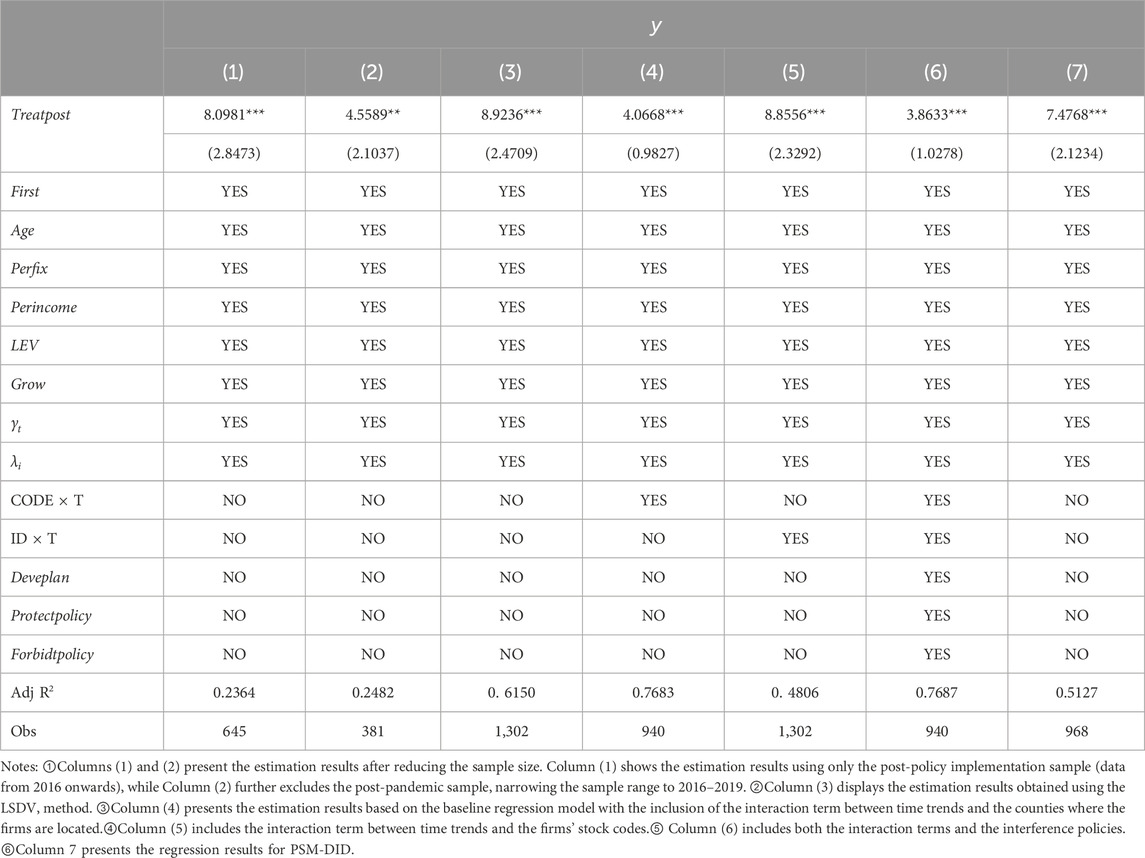

4.6.2 Sensitivity analysis

To assess the Mountains-Waters Project pilot policy’s impact on corporate ESG, we first conduct a benchmark regression analysis using full-sample data from before and after the policy’s implementation. However, recognizing that including pre-policy data may introduce inaccuracies, we refine our sample selection strategy to enhance robustness. To more precisely estimate the potential policy’s effect, we retain only post-policy data as our research sample and use its results as a robustness check. The first column of Table 4 presents the findings, showing a policy coefficient of 8.0981—highly consistent with the benchmark regression results—tentatively confirming the robustness of the benchmark analysis. This suggests that the Mountains-Waters Project pilot policy may have contributed to improved corporate ESG performance (Table 4).

Although this approach enhances estimation accuracy, external disruptions such as the COVID-19 pandemic could introduce data irregularities by increasing missing or abnormal values. To mitigate this issue, we apply a stricter data-cleaning process, excluding data significantly affected by the pandemic post-2019. The results in column 2 of Table 4 indicate a policy coefficient of 4.5589, significant at the 1% level, providing further evidence of the policy’s potential impact on corporate ESG and demonstrating strong robustness across different sample sizes (Table 4).

Finally, to eliminate potential biases arising from estimation method selection, we reapply the LSDV method for regression while maintaining the original sample size and accounting for sample characteristics. The estimated results in column 3 of Table 4 yield a policy coefficient of 8.9236, closely aligned with the benchmark regression findings. This confirms the robustness and reliability of the benchmark regression results, effectively mitigating the risk of bias due to estimation method selection (Table 4).

4.6.3 Controlling for baseline variables

When exploring the potential impact of the Mountains-Waters Project pilot policy on corporate ESG, a core consideration lies in the selection mechanism of the pilot regions. This policy tends to be implemented in areas with significant representativeness and prominent landscape and water environmental issues. This non-random regional selection strategy deviates from the randomization requirement under ideal conditions of the multi-period DID model. Given the complex and diverse factors such as regional economic development levels, unique geographical locations, and cultural environments, which may all influence corporate ESG behaviors, directly applying an unadjusted benchmark model for regression analysis could lead to sample selection bias, thereby affecting the accuracy and validity of the estimation results. We follow Wang and Ge (2022) methodology by adding interaction terms between regional and company baseline factors and time linear trends in the baseline model and re-conducting the regression analysis to improve the accuracy and robustness of the model estimates. The fourth and fifth columns of Table 4 show that the coefficients for the policy are 4.0668 and 8.8556, respectively. We can consider that by adding benchmark variables to alleviate the non-randomness of sample selection, the pilot of Mountains-Waters Project may have contributed to the improvement of corporate ESG. The conclusions drawn from the benchmark regression model in this paper seem to exhibit strong robustness (See Table 4).

4.6.4 Excluding other policy interference

The benchmark regression results tentatively suggest that the Mountains-Waters Project pilot may effectively enhance corporate ESG performance. However, this observed positive effect cannot be solely attributed to the pilot itself. To more precisely identify the policy’s potentially impact, we systematically reviewed concurrent pilot initiatives that could influence corporate ESG outcomes. Three major policies were identified as potential confounders: (1) the Yangtze River Economic Belt Development Plan (Development Plan), (2) the Yangtze River Protection Law (Protection Law), and (3) the China Fishery Law Enforcement Sword 2021 special enforcement action plan (Fishing Ban Plan).

To mitigate potential interference from these policies in our model estimation, we introduced three dummy variables. Specifically, the variable deveplan equals 1 if a firm’s county falls under the Development Plan in a given year and 0 otherwise. Similarly, protectpolicy and forbidtpolicy indicate coverage under the Protection Law and the Fishing Ban Plan, respectively.

After incorporating these control variables, the sixth column of Table 4 reports a policy coefficient of 3.8633, statistically significant at the 1% level. This suggests that even after accounting for the influence of other policies, the pilot initiative appears to have positively contributed to corporate ESG performance. The robustness of the benchmark regression results is thus supported (Table 4).

4.6.5 Mitigating self-selection bias

Assessing the Mountains-Waters Project’s potential impact on corporate ESG behavior requires recognizing that regions may apply for pilot status based on specific considerations. Consequently, policy variable values may be influenced by non-random factors such as firm characteristics, economic conditions, or other external factors—many of which are embedded in the model’s disturbance term. If the policy variable correlates with the disturbance term, endogeneity issues may arise, leading to self-selection bias and distorted regression estimates. To address this, we apply propensity score matching (PSM) to refine the control group selection based on baseline regression results. Matching covariates include equity concentration, firm listing age, capital intensity, labor productivity, debt levels, and future growth prospects. A 1-to-2 nearest-neighbor matching without replacement is performed, ensuring comparability between treated and control firms by excluding unmatched observations. The re-matched sample is then used for re-estimation to tentatively validate the robustness of our findings. The results, presented in the seventh column of Table 4, indicate a positive and consistent policy coefficient, aligning with the benchmark regression estimates. This reinforces the conclusion that, after mitigating sample selection bias, the Mountains-Waters Project pilot policy has likely played a significant role in promoting corporate ESG growth (Table 4).

5 Further analysis

5.1 Mechanism analysis

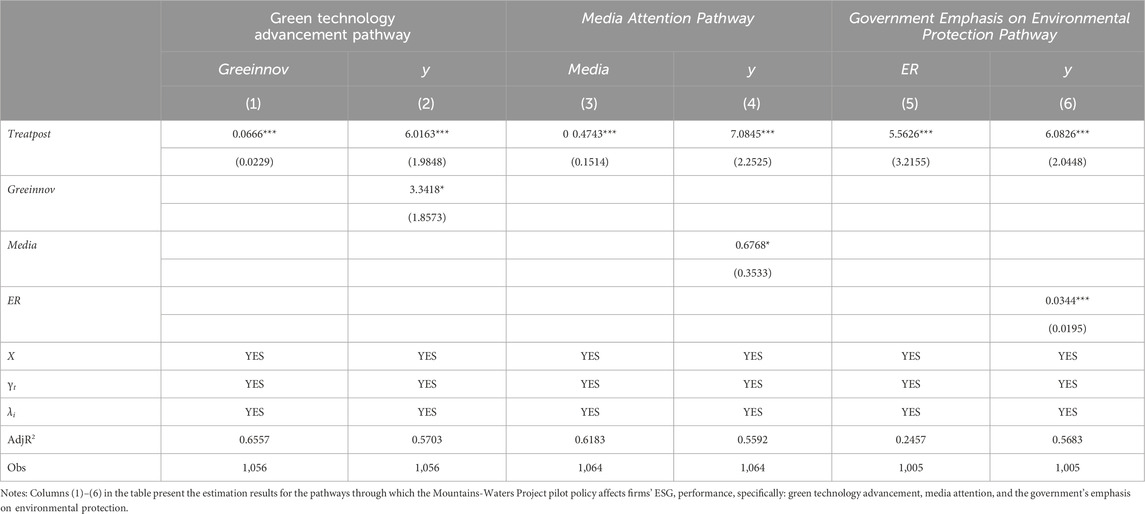

5.1.1 Green technology advancement pathway

To verify the mediating role of “Green Technology Advancement” discussed in the theoretical analysis, we further construct a mediation model with green technological progress (Greeinnov) as the mediator variable to analyze how the policy influences corporate Environmental, Social, and Governance (ESG) scores through green technology innovation.

The regression results in Column (1) of Table 5 show that the Mountains-Waters Project pilot policy (Treatpost) significantly promotes green technological progress (coefficient = 0.0666, standard error = 0.0229, statistically significant at the 1% level), indicating the positive impact of the policy on green technology innovation. Furthermore, green technological progress has a significant positive effect on corporate ESG performance (coefficient = 3.3418, standard error = 1.8573, statistically significant at the 10% level), suggesting that innovations in green technology help improve ESG performance.

The further mediation effect test reveals that the Mountains-Waters Project pilot policy not only has a direct positive impact on corporate ESG through green technological progress but also indirectly improves ESG scores through this mediator variable. Specifically, the policy promotes green technological progress (coefficient = 0.0666), which, in turn, enhances the ESG performance of firms (coefficient = 3.3418), resulting in an indirect effect of 0.2226 (0.0666 × 3.3418). This finding suggests that the positive impact of the Mountains-Waters Project pilot policy on corporate ESG is not only direct but also significantly mediated through green technological progress.

5.1.2 Media attention pathway

To verify the mediating role of “Media Attention” discussed in the theoretical analysis, we further constructed a mediation effect model. Based on the regression results in Table 5, we examined the mechanism through which the Mountains-Waters Project pilot policy (Treatpost) affects corporate ESG performance via media attention (Media). Specifically, the regression results in Column (3) of Table 4 show that the policy significantly influences media attention, with a coefficient of 0.4743 and a standard error of 0.1514, statistically significant at the 1% level. This indicates that the policy implementation significantly increased media attention toward firms.

Further, in Column (4) of Table 5, the coefficient for the impact of media attention on corporate ESG is 0.6768, with a standard error of 0.3533, statistically significant at the 10% level. This suggests that increased media attention significantly improves corporate ESG performance.

Together, these results imply that the Mountains-Waters Project pilot policy indirectly promotes improvements in corporate ESG through increased media attention. Specifically, the indirect effect of the policy can be calculated as follows: 0.4743 (Treatpost’s impact on Media) × 0.6768 (Media’s impact on ESG) = 0.3200. This result indicates that media attention plays a significant mediating role in the policy’s impact on corporate ESG performance.

Moreover, the policy’s direct effect (coefficient = 7.0845, standard error = 2.2525, statistically significant at the 1% level) further supports the positive influence of the policy on corporate ESG performance.

In conclusion, the Mountains-Waters Project pilot policy not only enhances corporate ESG performance through its direct effects, but also indirectly promotes corporate sustainability and social responsibility by increasing media attention. This suggests that media attention plays an important role in disseminating policy effects and driving changes in corporate behavior, providing further theoretical support for the policy’s implementation.

5.1.3 Government emphasis on environmental protection pathway

To verify the mediating role of “Government Emphasis on Environmental Protection” discussed in the theoretical analysis, we further constructed a mediation effect model. Based on the regression results in Table 5, this study examined the mechanism through which the Mountains-Waters Project pilot policy (Treatpost) affects corporate ESG performance via government environmental focus (ER).

First, the regression results in Column (5) of Table 5 show that the policy significantly influences the government’s environmental focus, with a coefficient of 5.5626 and a standard error of 3.2155, statistically significant at the 1% level. This indicates that the policy significantly increased the government’s emphasis on environmental protection.

Further, in Column (6) of Table 5, the coefficient for the impact of government environmental focus on corporate ESG performance is 0.0344, with a standard error of 0.0195, and it is statistically significant at the 1% level. This suggests that the government’s focus on environmental issues significantly enhances corporate ESG performance.

Moreover, the direct effect of the Mountains-Waters Project pilot policy on corporate ESG performance is also significant, with a coefficient of 6.0826 and a standard error of 2.0448, statistically significant at the 1% level. This further corroborates the policy’s direct positive impact on corporate ESG improvement.

Together, these results suggest that the Mountains-Waters Project pilot policy not only directly influences corporate ESG performance, but also indirectly improves corporate ESG performance by increasing the government’s focus on environmental protection. Specifically, the indirect effect of the policy can be calculated as follows: 5.5626 (Treatpost’s impact on ER) × 0.0344 (ER’s impact on ESG) = 0.1916. This indirect effect demonstrates that the government’s emphasis on environmental protection plays a mediating role in transmitting the policy’s effects.

In conclusion, the Mountains-Waters Project pilot policy not only directly improves corporate ESG performance, but also indirectly fosters corporate sustainability by enhancing the government’s focus on environmental protection, thereby providing further support for the policy’s effectiveness in promoting corporate social responsibility.

In conclusion, Hypotheses 2, 3, and 4 have been empirically validated.

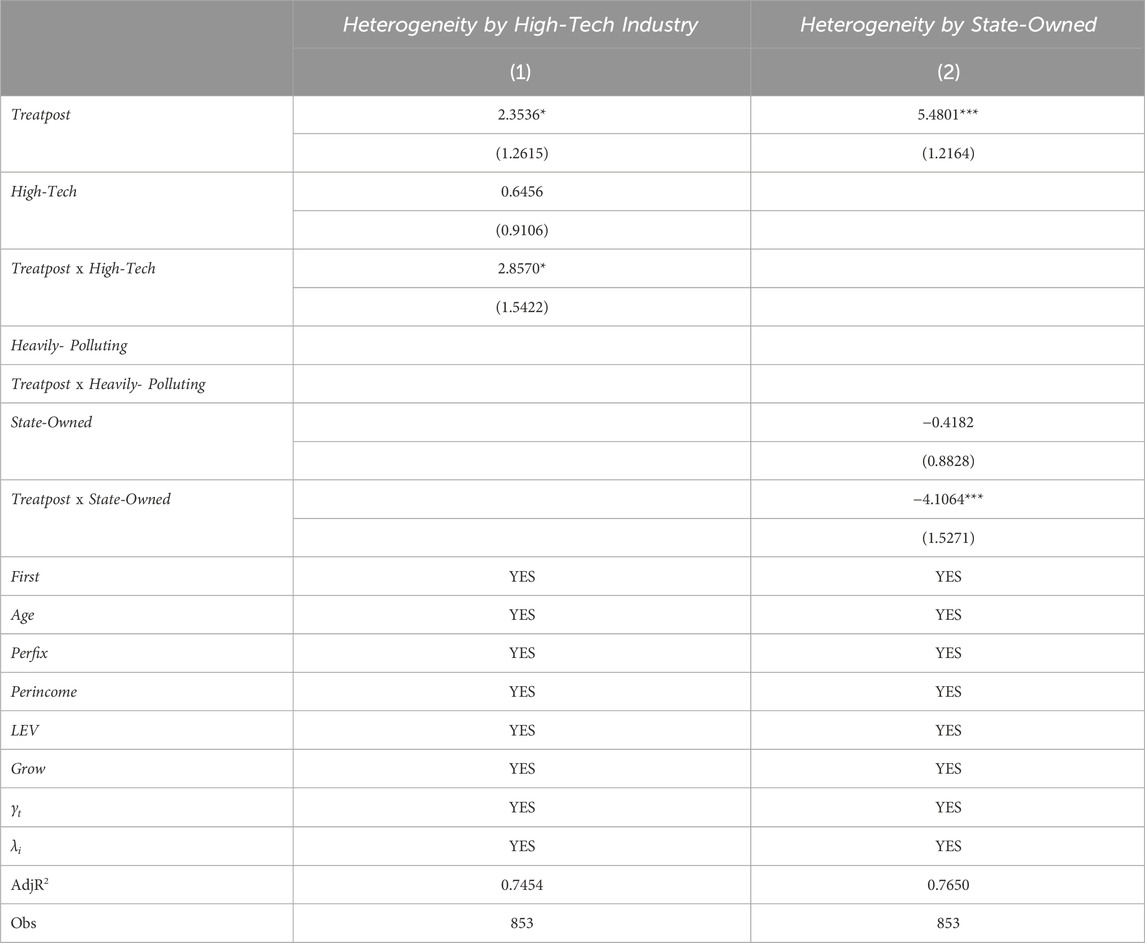

5.2 Heterogeneity analysis

5.2.1 Heterogeneity by high-tech industry

Technology, as an important factor influencing corporate ESG performance, has been shown in numerous studies to significantly promote improvements in ESG outcomes (Li Fengzuo et al., 2024; Fan et al., 2023; Jun and Zhu, 2023). To examine the differential impact of the Mountains-Waters Project pilot policy on various types of enterprises (e.g., high-tech vs non-high-tech), we introduced a dummy variable indicating whether a firm is in the high-tech sector (High-Tech) and its interaction term with the pilot policy (Treatpost × High-Tech).

The results in Column (1) of Table 6 show that the coefficient for Treatpost is 2.3536 with a standard error of 1.2615, which is statistically significant at the 10% level (p < 0.10). This indicates that, on average, the ESG performance of firms increased by 2.3536 after the policy implementation, highlighting the overall positive impact of the Mountains-Waters Project pilot. The coefficient for High-Tech is 0.6456 with a standard error of 0.9106, but it is not statistically significant (p > 0.10), suggesting that the effect of being a high-tech firm alone does not have a significant impact on ESG scores.

The interaction term Treatpost × High-Tech has a coefficient of 2.8570 with a standard error of 1.5422, and it is statistically significant at the 10% level (p < 0.10). This indicates that the Mountains-Waters Project pilot policy has a significant positive effect on the ESG performance of high-tech firms. Specifically, the improvement in ESG performance for high-tech firms following the policy implementation is notably greater than that for non-high-tech firms. This may be due to the policy’s reliance on advancements in green technology, where high-tech industries have a stronger technological foundation and are therefore more responsive to policy changes (Table 6, Column 1).

5.2.2 Heterogeneity by state-owned

State-owned and non-state-owned enterprises differ significantly in terms of governance structures, decision-making processes, and resource allocation, which may result in distinct responses to policies (Wang et al., 2024). By distinguishing between state-owned and non-state-owned enterprises, we can better analyze the policy’s impact on different types of firms and uncover the heterogeneous effects in their ESG practices (Esa Salomaa, 2020). To this end, we introduce a dummy variable for state-owned enterprises (State-Owned) and its interaction term with the Mountains-Waters Project pilot policy (Treatpost × State-Owned).

The results in Column (2) of Table 6 show that the coefficient for Treatpost is 5.4801 with a standard error of 1.2164, which is statistically significant at the 1% level (p < 0.01). This indicates that the Mountains-Waters Project pilot policy has a significant positive impact on the ESG performance of all firms, with an average increase of 5.4801 in their ESG scores, reflecting the policy’s positive effect on corporate ESG performance. The coefficient for State-Owned is −0.4182 with a standard error of 0.8828, but it is not statistically significant (p > 0.10), suggesting that the ownership type itself does not have a direct effect on ESG scores.

The interaction term, Treatpost × State-Owned, has a coefficient of −4.1064 with a standard error of 1.5271, and it is statistically significant at the 1% level (p < 0.01). This indicates that the improvement in ESG performance after the policy implementation is significantly lower for state-owned enterprises compared to non-state-owned firms, highlighting the heterogeneous policy effects across different ownership types. This phenomenon can be attributed to two main factors: ① Closer Government-Enterprise Relations: The behavior of state-owned enterprises often reflects the administrative intentions of the government. Prior to the implementation of the Mountains-Waters Project pilot policy, both government and societal pressures required state-owned enterprises to take on higher environmental and social responsibilities, prompting them to improve ESG performance to align with government policy requirements (Lin Ouwen and Guan, 2024). As a result, the changes in ESG performance for state-owned enterprises were relatively stable before and after policy implementation, leading to a smaller impact of the pilot policy on their ESG scores. ② Government-Enterprise Collusion: Given the critical role of state-owned enterprises in local economic development, local governments often impose less stringent environmental regulations on these firms to promote economic growth (Jeremiah et al., 2023). Consequently, the impact of the Mountains-Waters Project pilot policy on the ESG performance of state-owned enterprises is relatively muted (see Table 6, Column 2).

6 Conclusion

In the context of balancing environmental protection and economic development, accurately identifying the intrinsic link between the Mountains-Waters Project pilot policy and corporate ESG is of significant importance. Unlike previous research that primarily focuses on the ecological performance of the Mountains-Waters Project pilot, this study explores the potential impact of the pilot policy on corporate ESG performance from a unique economic perspective. The aim of this paper is to provide scientific and systematic theoretical support and practical guidance for policy formulation to ensure ecological protection while promoting healthy, stable, and sustainable economic development. Our research findings tentatively suggest that the Mountains-Waters Project pilot policy may promote corporate ESG performance through three potential pathways: improving the efficiency of green technology progress in firms, increasing media attention, and enhancing government environmental awareness. However, due to factors such as policy sensitivity, there is significant heterogeneity in the policy’s impact on corporate ESG. Specifically, the policy effects appear to be more pronounced in high-tech and non-state-owned firms. Based on these research findings, we draw the following policy implications.

7 Recommendations for firms

7.1 Enhance green technology innovation

Firms should prioritize increasing investment in green technology innovation through enhanced R&D efforts and the application of green technologies. The Mountains-Waters Project key policy can directly promote the acceleration of green technology R&D and application by providing fiscal incentives such as tax reductions and subsidies.

7.2 Strengthen cooperation with media and government

Firms should actively release sustainability reports and enhance communication and cooperation with media and the government to increase public and governmental attention to their ESG performance. Transparent environmental commitments and effective communication will not only support long-term development in environmental protection but also help avoid “greenwashing” practices.

7.3 Optimize supply chain management

Firms should collaborate with suppliers that meet high environmental standards to ensure that every stage of the supply chain adheres to enhanced environmental and social responsibility practices. This will not only improve the firm’s ESG scores but also contribute to the overall sustainable development of the industry.

8 Recommendations for policymakers

8.1 Strengthen policy incentives and green technology support

The Mountains-Waters Project policy should encourage firms to invest more in green technology R&D and application, especially in non-state-owned and high-tech industries. This can be achieved through fiscal incentives such as tax reductions and subsidies. Targeted support, including special funds and technical guidance, should be provided to these industries to accelerate their green transformation and enhance the overall ESG performance of the sector.

8.2 Improve ESG reporting and transparency requirements

Policies should introduce clear ESG reporting requirements to improve transparency in environmental, social, and governance performance. This will facilitate government oversight and ensure firms fulfill their environmental commitments under the policy, helping to avoid superficial “greenwashing.”

8.3 Enhance communication and coordination between government and firms

Policymakers should enhance communication with firms and regularly hold promotional and training activities on the Mountains-Waters Project policy. By ensuring that firms fully understand the policy content and implementation requirements, the government can foster greater engagement and participation, promoting the adoption and implementation of effective ESG measures.

8.4 Strengthen policy monitoring and evaluation mechanisms

A comprehensive monitoring and evaluation system should be established during policy implementation. Regular assessments of the Mountains-Waters Project policy’s effectiveness will help the government identify any shortcomings and make necessary adjustments, ensuring the policy reaches its full potential in improving firms’ ESG performance.

9 Potential challenges and unintended consequences in policy implementation

9.1 Imbalance in green technology innovation

Some firms might focus their resources on short-term applications of green technology while neglecting long-term sustainable research and development. This imbalance could result in the policy’s effects falling short of expectations.

9.2 Information asymmetry issues

Certain firms might engage in “greenwashing” to boost their ESG scores without making actual environmental improvements. Policymakers should enhance oversight of corporate ESG disclosures to ensure that firms’ environmental commitments are genuinely implemented.

9.3 Delayed response of state-owned enterprises

Due to the close relationship between local governments and state-owned enterprises, there may be more lenient environmental policies, leading to slower ESG improvements in state-owned enterprises. Policymakers should increase regulatory oversight of state-owned enterprises to ensure they respond equally to the policy.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

ZH: Conceptualization, Formal Analysis, Methodology, Writing–review and editing. LJ: Data curation, Investigation, Methodology, Software, Visualization, Writing–original draft, Writing–review and editing, Funding acquisition. ZL: Investigation, Supervision, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1More details can be found in: https://www.gov.cn/zhengce/content/2021-11/10/content_5650075.htm

2More details can be found in: https://www.gmw.cn/xueshu/2022-09/28/content_36054697.htm

3More details can be found in: https://www.gmw.cn/xueshu/2022-09/28/content_36054697.htm

References

Avramov, D., Cheng, S., Lioui, A., and Tarelli, A. (2022). Sustainable investing with ESG rating uncertainty. J. Financial Econ. 145 (2), 642–664. doi:10.1016/j.jfineco.2021.09.009

Balázs Csillag, J., Marcell Granát, P., and Neszveda, G. (2022). Media attention to environmental issues and ESG investing. Financial Econ. Rev. 21 (4), 129–149. doi:10.33893/fer.21.4.129

Cao, J., Li, W., and Xiao, S. (2022). Does mixed ownership reform affect private firms’ ESG practices? Evidence from a quasi-natural experiment in China. Financial Markets. Institutions Instrum. 31 (2-3), 47–86. doi:10.1111/fmii.12164

Chang, K.-C., Wang, Di, Lu, Y., Wen, C., Ren, G., Liu, Li, et al. (2021). Environmental regulation, promotion pressure of officials, and enterprise environmental protection investment. Front. Public Health 9, 724351. doi:10.3389/fpubh.2021.724351

Chen, C., Li, W.-Bo, and Zhang, H. (2024). How do property rights affect corporate ESG performance? The moderating effect of green innovation efficiency. Finance Res. Lett. 64, 105476. doi:10.1016/j.frl.2024.105476

Chen, L., Chen, Y., and Gao, Y. (2024). Digital transformation and ESG performance: a quasinatural experiment based on China’s environmental protection law. Int. J. Energy Res. 2024, 1–16. doi:10.1155/2024/8895846

Chen, S., and Chen, D. (2018). Haze pollution, government governance, and high-quality economic development. Econ. Res. J. (02), 20–34. (in Chinese). Available online at: https://kns.cnki.net/kcms2/article/abstract v=_GofKS1StuQLfgGk8AEiueuZma7yYd8eW5VVpM4BdkC69_UP4lfJCYB5n-hLN6KD25WVIKnqMyvZeD3d6c8UwkNb5VvWSZE1jfJzmNY85Iaqdf2oBf3z4Vxib6BgKIkKBfGHEM0IO9OgdIOqTOv_jJfC_e-w8bc-hZsp5MZinfDKCJa-qDSuSMtzwmv4RPj4Frp4NIbz3q4=&uniplatform=NZKPT&language=CHS

Chen, Z., Xinyue, H., and Chen, F. (2022). Green innovation and enterprise reputation value. Bus. Strategy Environ. 32 (4), 1698–1718. doi:10.1002/bse.3213

Cheng, X., Wang, H., and Wang, X. (2022). Common institutional ownership and corporate social responsibility. J. Bank. Finance 136, 106218. doi:10.1016/j.jbankfin.2021.106218

Cui, L., Chen, Z., Huang, Y., and Yu, H. (2024). Window dressing: changes in atmospheric pollution at boundaries in response to regional environmental policy in China. J. Environ. Econ. Manag. 125, 102948. doi:10.1016/j.jeem.2024.102948

Dhaliwal, D. S., Li, O. Z., Tsang, A., and Yang, Y. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: the initiation of corporate social responsibility reporting. Account. Rev. 86 (1), 59–100. doi:10.2308/accr.00000005

Doddy Ariefianto, M., Rahmansyah, F., Wijaya, V., and Audreane, V. (2024). The role of environment social and governance (ESG) score to cost of debt: evidence from ASEAN countries. Int. J. Finance and Econ. doi:10.1002/ijfe.3056

Donis, S., Gómez, J. L. S., and Salazar, I. (2023). Economic complexity, property rights and the judicial system as drivers of eco-innovations: an analysis of OECD countries. Technovation 128, 102868. doi:10.1016/j.technovation.2023.102868

Egidius Yuristha, R. M., Soponyono, E., and Rozah, U. (2021). “Criminal liability for the disseminator of eigenrichting through social media: law number 11 of 2008 concerning electronic information and transactions,” in Proceedings of the 1st international conference on science and technology in administration and management information, ICSTIAMI 2019, 17-18 july 2019, jakarta, Indonesia. doi:10.4108/eai.17-7-2019.2303228

Fan, M., Liu, J., Tajeddini, K., and Khaskheli, M. B. (2023). Digital technology application and enterprise competitiveness: the mediating role of ESG performance and green technology innovation. Environ. Dev. Sustain. doi:10.1007/s10668-023-03979-3

Fischbach, J., Adam, M., Dzhagatspanyan, V., Méndez, D., Frattini, J., Kosenkov, O., et al. (2023). Automatic ESG assessment of companies by mining and evaluating media coverage data: NLP approach and tool, 2823–2830. doi:10.1109/bigdata59044.2023.10386488

Flammer, C. (2014). Does product market competition foster corporate social responsibility? Evidence from trade liberalization. Strategic Manag. J. 36 (10), 1469–1485. doi:10.1002/smj.2307

Gao, Da, Zhou, X., and Jing, J. (2024). Unlocking sustainability potential: the impact of green finance reform on corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 31 (5), 4211–4226. doi:10.1002/csr.2801

Gao, J., Hua, G., and Huo, B. (2024). Green finance policies, financing constraints and corporate ESG performance: insights from supply chain management. Operations Manag. Res. 1345–1359. doi:10.1007/s12063-024-00509-w

Geoffrey Wang, G., Feng, X., Tian, Li, and Tu, Y. (2024). Environmental regulation, green technology innovation and enterprise performance. Finance Res. Lett. 68, 105983. doi:10.1016/j.frl.2024.105983

Grinchevskiy, A. S. (2024). Media as an instrument of Russia's information policy. Socialʹnye i Gumanit. znania 10 (3), 278. doi:10.18255/2412-6519-2024-3-278-287

Guo, Q., and Zhong, J. (2022). The effect of urban innovation performance of smart city construction policies: evaluate by using a multiple period difference-in-differences model. Technol. Forecast. Soc. Change 184, 122003. doi:10.1016/j.techfore.2022.122003

Han, L., Guo, F., and Chang, C.-P. (2023a). How does ESG performance promote corporate green innovation? Econ. Change Restruct. 56 (4), 2889–2913. doi:10.1007/s10644-023-09536-2

Han, L., Shi, Y., and Zheng, J. (2023b). Can green credit policies improve corporate ESG performance? Sustain. Dev., 2678–2699. doi:10.1002/sd.2803

He, Yu, Zhao, X.-L., and Zheng, H. (2023). How does the environmental protection tax law affect firm ESG? Evidence from the Chinese stock markets. Energy Econ. 127, 107067. doi:10.1016/j.eneco.2023.107067

He, Z. (2024). The impact of dual-pilot policy for low-carbon and innovative cities on companies' ESG performance. CRC Press Eb. 802–810. doi:10.1201/9781003508816-116

Hoang, K., Pham, L., Ngo, T., and Trinh, H. H. (2024). The real effect of stringent environmental policy: ESG performance versus ESG disclosure. doi:10.2139/ssrn.4916801

Hoang, T. G. (2018). The role of the integrated reporting in raising awareness of environmental, social and corporate governance (ESG) performance. Dev. Corp. Gov. Responsib. 47–69. doi:10.1108/s2043-052320180000014003

Houston, J. F., and Shan, H. (2021). Corporate ESG profiles and banking relationships. Rev. Financial Stud. 35 (7), 3373–3417. doi:10.1093/rfs/hhab125

Hu, Q. (2023). Duopoly game with green efficiency based on ecological modernization theory. Adv. Econ. Manag. Political Sci. 2 (1), 27–35. doi:10.54254/aemps.2023017

Jeremiah, A., Atiku, S. O., and Villet, H. J. (2023). Leadership effectiveness and sustainability of state-owned enterprises. Pract. Prog. Profic. Sustain., 55–80. doi:10.4018/978-1-6684-9711-1.ch004

Jia, W., and Zhang, S. (2024). Environmental protection tax, green innovation, and environmental, social, and governance performance. Finance Res. Lett. 65, 105592. doi:10.1016/j.frl.2024.105592

Jiang, L., Hu, Y., and Su, Y. (2023). Does green finance improve corporate ESG performance? empirical evidence from the green finance reform and innovation pilot zone policy in China. doi:10.2139/ssrn.4649088

Jun, D., and Zhu, Q. (2023). ESG performance and green innovation in a digital transformation perspective. Am. J. Econ. Sociol. doi:10.1111/ajes.12541

Kong, X. (2024). Corporate ESG responsibility, external supervision, and corporate reputation. Trans. Econ. Bus. Manag. Res. 9, 393–403. doi:10.62051/zvk8mx43

Kuzey, C., Al-Shaer, H., Karaman, A. S., and Ali, U. (2023). Public governance, corporate governance and excessive ESG. Corp. Gov. 23 (7), 1748–1777. doi:10.1108/cg-01-2023-0028

Lee, A., and Chung, T.-L. (2023). Transparency in corporate social responsibility communication on social media. Int. J. Retail and Distribution Manag. 51 (5), 590–610. doi:10.1108/ijrdm-01-2022-0038

Lei, X., and Yu, J. (2023). Striving for sustainable development: green financial policy, institutional investors, and corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 1177–1202. doi:10.1002/csr.2630

Li, B. (2024). The implementation of the new environmental protection law and its impact on corporate development. Highlights Bus. Econ. Manag. 39 (0), 895–900. doi:10.54097/3x20s891