- 1School of Economics, Harbin University of Commerce, Harbin, Heilongjiang, China

- 2School of Management, Harbin Institute of Technology, Harbin, Heilongjiang, China

- 3School of Information Engineering, Heilongjiang Polytechnic, Harbin, Heilongjiang, China

Introduction: Economic freedom is widely regarded as a key determinant of economic prosperity. However, its influence on green economic growth (GEG), particularly within the context of sustainable development, remains underexplored. This study seeks to address this gap by examining the relationship between economic freedom and GEG, with a focus on both European Union (EU) and non-EU countries.

Methods: Using panel data from 28 EU and non-EU countries between 2012 and 2021, the study employs a two-way fixed effects model to explore the impact of economic freedom on GEG. The analysis incorporates mediation, moderation, and heterogeneity testing to understand the various factors at play. Energy security risk is tested as a mediating factor, while government efficiency and corruption control are assessed for their moderating roles.

Results: The findings reveal that economic freedom significantly promotes GEG, with energy security risk serving as a key mediator. Specifically, higher economic freedom reduces energy security risks, which subsequently supports the growth of a green economy. Moreover, government efficiency and corruption control are found to moderate the relationship, enhancing the positive impact of economic freedom on GEG, particularly in non-EU countries. Heterogeneity analysis shows that economic freedom has a significant positive effect on GEG in non-EU countries, but no such effect is observed in EU countries, likely due to stricter environmental regulations and more extensive social welfare systems.

Discussion: These results suggest that while economic freedom plays a positive role in fostering GEG, the effectiveness of this relationship is contingent upon the regulatory environment, including government efficiency and corruption control. Policymakers are encouraged to strengthen regulatory frameworks, improve governmental efficiency, and manage energy security risks to create an environment conducive to sustainable green economic growth.

Highlights

Economic freedom significantly contributes to green economic growth.

Economic freedom promotes green economic growth by affecting energy security risk.

Government efficiency and control of corruption both positively moderate the process of economic freedom affecting green economic growth.

Economic freedom significantly contributes to green economic growth in non-EU countries, but not in EU countries.

Government efficiency and control of corruption positively moderate the impact of economic freedom on green economic growth in non-EU countries, but not in EU countries.

1 Introduction

Human activities in recent decades have triggered a series of serious environmental challenges, including climate change, atmospheric pollution, water scarcity, loss of biodiversity, and depletion of natural resources (Lin and Zhou, 2022; Mishra, 2023). These issues have raised concerns on a global scale, with a growing realization that the environmental costs of traditional economic growth models are unsustainable (Sultana, 2023) At the same time, advances in climate science have revealed the serious threat of climate change, which has prompted the international community to take action through international treaties such as the Paris Agreement (Wang et al., 2024b). In this regard, the ‘green economy’ has emerged as a strategy to address the aforementioned challenges (Huang, 2022). The green economy represents an economic model that balances sustainability and economic growth by reducing the reliance on finite natural resources, minimizing environmental damage, and encouraging innovation and investment in areas such as clean energy, sustainable transport, ecosystem protection, and the circular economy (Chen et al., 2023). Its goal is to promote prosperity while reducing carbon emissions, waste, and resource depletion, thereby advancing sustainable development and future generations’ quality of life (Lin and Xu, 2024). Therefore, green economic growth (GEG) is receiving increasing global attention, with many countries and regions taking proactive steps to promote this economic model to address environmental challenges and build more sustainable social and economic systems for the future (Söderholm, 2020).

GEG refers to an economic development model that seeks to foster economic growth while minimizing environmental degradation and conserving natural resources for future generations (Yang et al., 2024b). Unlike traditional economic growth, which often leads to increased resource depletion and environmental harm, GEG focuses on achieving a balance between economic prosperity and environmental sustainability (Zheng et al., 2024). It involves promoting cleaner production technologies, improving energy efficiency, increasing the share of renewable energy in the energy mix, reducing carbon emissions, and ensuring that natural resources are used in a sustainable manner.

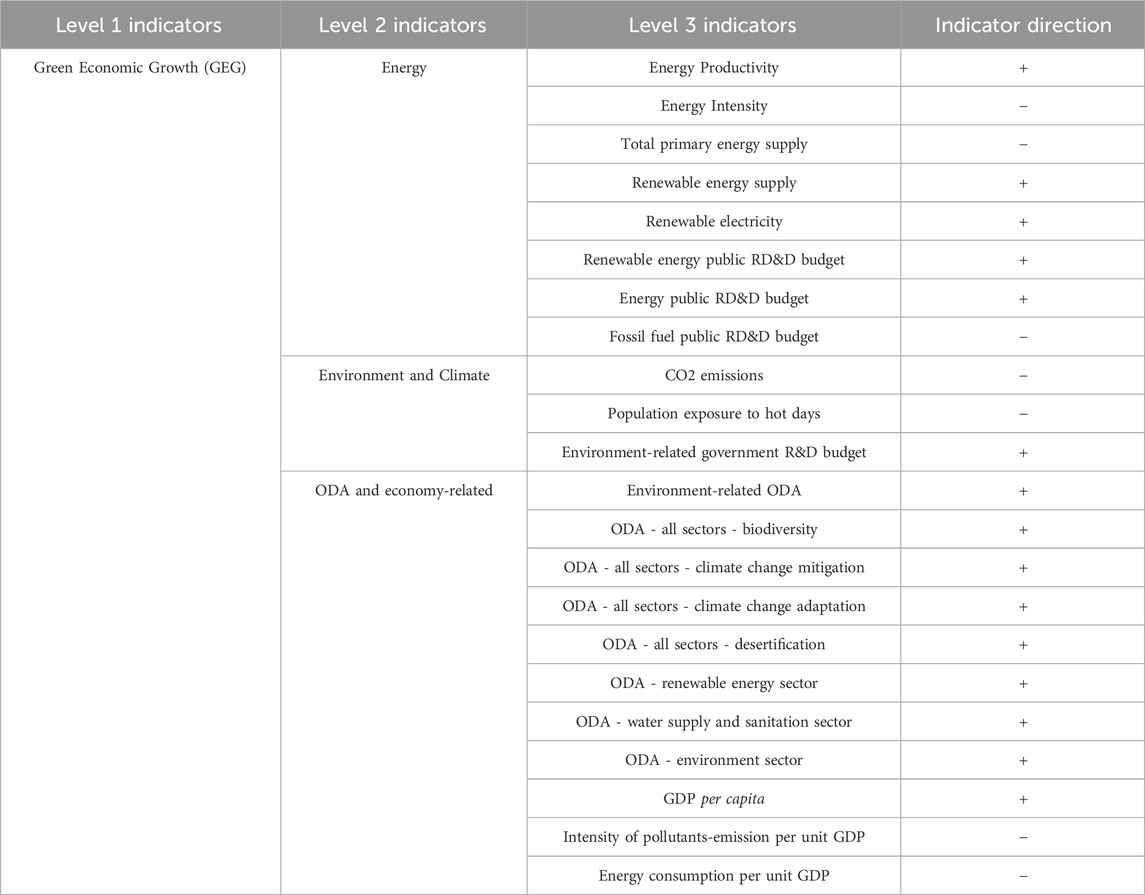

For the purpose of this study, GEG is operationalized as a composite index that captures various dimensions of sustainable economic development. Specifically, we constructed the GEG index using 20 indicators across three broad categories: energy efficiency and renewable energy adoption, environmental quality (including CO2 emissions), and the role of official development assistance (ODA) directed towards environmental and green energy projects. The index reflects both the environmental impact of economic activities and the level of investment in green technologies, aiming to provide a holistic measure of a country’s green economic performance.

There are key differences between GEG and traditional models of economic development, an important one being the concept of economic freedom. Since it is market-driven, traditional economic development encourages economic freedom, competition, and innovation, though this is typically accompanied by excessive resource consumption and environmental damage (Tag and Degirmen, 2022). Economic freedom, however, does not necessarily conflict with the green economy; the former can be in harmony with the latter. Part of the principle of economic freedom is to promote entrepreneurship, efficient resource usage, and effective market functioning. In the context of GEG, economic freedom can provide a favorable environment for clean technologies and environmentally friendly innovations. Competition in the free marketplace can drive businesses to find greener solutions, decrease the cost of clean technologies, and accelerate sustainable development such as in renewable energy and sustainable transport (Yi, 2014). In addition, economic freedom typically attracts domestic and international investment, as it lowers legal and political risks and increases expectations of return on investment. This provides essential financial support for the development of sustainable infrastructure and clean technologies. In a free market, moreover, firms face pressure from society and consumers to take more environmentally and socially responsible actions, which can encourage firms to support environmental initiatives and actively participate in the green economy. However, economic freedom can also bring potential disincentives. Businesses in a free market may focus more on short-term profits and shareholder returns than on long-term environmental goals, leading to resource wastage and environmental damage. Economic freedom can also cause wealth inequality and social discontent by making it difficult to popularize environmentally friendly and green technologies (Pretty, 2013).

Energy security plays a critical mediating role in the relationship between economic freedom and GEG. Economic freedom encourages market competition and private entrepreneurial vigor, which may stimulate greater investment flows into clean and renewable energy (Yang et al., 2024a). These investments reduce dependence on conventional energy sources and strengthen energy security. A free market environment also fosters the development of green technologies, mitigating national energy security risks (Yan et al., 2023). Furthermore, economic freedom typically attracts international investments in energy infrastructure, which can help diversify a country’s energy supply, making it more resilient to energy shocks. Therefore, energy security, as a mediator, can significantly influence the impact of economic freedom on GEG, either by facilitating or hindering the transition to greener and more sustainable energy sources.

To achieve GEG, the government’s function is crucial in maintaining a balance between the facilitating and inhibiting effects of economic freedom. Governments can steer the free market in a sustainable and environmentally friendly direction by enacting environmental regulations and policies. However, issues of government efficiency and corruption can play a key regulatory role in this process (Wang et al., 2025). Government efficiency refers to a state’s ability to efficiently administer and enforce environmental regulations, thereby ensuring that businesses comply with green standards, increase innovation, and enhance their investment in sustainable technologies. Efficient governments can channel resources, including subsidies or tax incentives, more effectively, ensuring that green initiatives are well-supported and not squandered (Zhao et al., 2024).

On the other hand, corruption may undermine the ability of governments to manage and regulate environmental issues. Corruption gives way to the non-enforcement of environmental regulations and misuse of environmental resources, enabling businesses to evade their responsibilities. Corruption hinders the implementation of environmental policies, reduces the effectiveness of green initiatives, and diminishes a country’s ability to promote a green economy (Wang et al., 2024a). It disrupts the resource allocation necessary for sustainable development and green projects, often diverting funds from critical green investments. Therefore, anti-corruption measures and transparent governance are essential to ensure the successful implementation of policies that promote GEG. Taken together, energy security, government efficiency, and anti-corruption measures are crucial mediators and moderators in the relationship between economic freedom and GEG. Economic freedom may offer opportunities for green growth, but its full potential can only be realized when supported by robust energy security and efficient, corruption-free government institutions (Naimoğlu et al., 2025).

To adequately measure the influence of economic freedom on GEG, this research analyzed balanced panel data for 28 countries from 2012 to 2021. Referring to relevant GEG literature (Zhang et al., 2021; Lee and He, 2022), the TOPSIS entropy method was used to construct a national GEG index using 20 indicators, which differs from the previous literature as it examines the effect of ODA on a country’s GEG. ODA includes environment-related ODA, biodiversity, desertification, climate change mitigation, climate change adaptation, renewable energy sector, water and sanitation sector, environment sector, and more. The national GGI index was then employed to empirically test the economic freedom–GEG relationship, taking into account the mediating role of energy security and the moderating roles of government efficiency and corruption. Subsequently, the complete sample was divided into European Union (EU) and non-EU member countries for heterogeneity analysis. This study’s in-depth exploration offers a more comprehensive understanding of the link between economic freedom and GEG. The findings are expected to provide policymakers with a more strategic and sustainable policy rationale for economic development and GEG.

This section has presented the research background and aims. The following four sections of this paper are as follows: Section Two reviews the literature in the relevant fields; Section Three details the selected data and research methodology; Section Four reports and discusses the results of the empirical analyses; and Section Five summarizes the overall findings and presents specific policy recommendations.

2 Literature review and hypotheses

2.1 Literature review

The first part of the literature review discusses the existing research on the determinants of GEG, with a specific focus on economic freedom. The second part introduces the formulation of hypotheses related to this relationship.

A significant part of past literature has explored the relationship between economic freedom and GEG, with some studies arguing that economic freedom fosters innovation, technological progress, and the development and adoption of green technologies. This view emphasizes the positive role of market mechanisms, protection of property rights, and free competition in encouraging firms to invest in environmental innovation (Smulders et al., 2014). Economic freedom is believed to steer resources toward environmental protection, improve energy efficiency, and enable sustainable economic growth (Milani, 2006).

However, other scholars offer a contrasting perspective, suggesting that economic freedom may exacerbate environmental burdens. In this view, the competitive pressures of a free market could incentivize firms to adopt cost-reducing, environmentally harmful production methods, thus intensifying resource overconsumption and environmental pollution (Lederer et al., 2018). From this standpoint, economic freedom may hinder the implementation of effective environmental policies and obstruct environmental investments, limiting the development of a green economy.

In addition to these perspectives, it is crucial to consider ecological economics theories, which provide valuable insights into the complex relationship between economic freedom and environmental outcomes. For example, the Jevons Paradox (Jevons, 1865) suggests that improvements in the efficiency of resource use, often driven by market incentives and technological advancements, may paradoxically lead to an overall increase in resource consumption. This occurs because as efficiency gains make the use of resources cheaper, demand for those resources rises, potentially offsetting the environmental benefits of greater efficiency. Therefore, while economic freedom can spur technological innovations that improve efficiency, it might simultaneously increase overall consumption, raising questions about its long-term impact on GEG.

The Environmental Kuznets Curve (EKC) theory provides a framework for understanding the relationship between economic development and environmental degradation. According to the EKC, environmental degradation initially worsens with economic growth, but after a certain point, as a society becomes wealthier, it may prioritize environmental protection, leading to improved environmental quality. This nonlinear relationship suggests that economic freedom, as a driver of economic growth, might first exacerbate environmental challenges but could eventually contribute to greener economic outcomes as nations reach higher levels of development and invest more in environmental technologies.

These ecological economics theories suggest that the effects of economic freedom on GEG are not linear or straightforward. While economic freedom can provide incentives for innovation and environmental improvements, its impact must be contextualized within broader theories such as the Jevons Paradox and the EKC. In light of these considerations, it becomes clear that the relationship between economic freedom and GEG is complex and dependent on various factors, including the level of technological development, regulatory frameworks, and consumption patterns. Thus, the empirical literature on this subject must consider these theoretical nuances to better understand how economic freedom can both foster and hinder GEG. The following section reviews relevant studies from diverse regions and perspectives to provide a comprehensive view of this relationship.

Importantly, recent literature has started exploring how economic freedom’s impact on GEG is contingent upon the presence of mediating factors like energy security and moderating factors like government efficiency and corruption. Scholars have recognized that while economic freedom can create opportunities for green investment, its impact on GEG is significantly influenced by the national energy security context, the efficiency of government regulations, and the degree of corruption. The growing body of research highlights that energy security strengthens the connection between economic freedom and GEG, whereas ineffective governance or corruption can disrupt the policy implementation needed to support green growth. Syed et al. (2024) found that while natural resources generally promote economic growth, their interaction with geopolitical risk can validate the natural resource curse hypothesis by hindering growth. Durani et al. (2023) showed that economic policy uncertainty and renewable energy reduce carbon emissions, while financial development and employment increase emissions in BRICST countries. Song et al. (2019) explored economic openness and research and development (R&D) investment as predictors of GEG using data from 29 provinces in China. They found a nonlinear negative U-shaped impact of economic openness and a non-favorable impact of R&D investment in the short term, similar to Mohsin et al. (2022). Zhang et al. (2021) explored the influence of public expenditure on GEG using panel data from Belt and Road countries from 2008 to 2018, revealing that public expenditure promotes GEG. This finding supports the study of Lin and Zhu (2019). In addition, using panel data from 2008 to 2018, Lee and He (2022) demonstrated that the impact of natural resources on GEG varies across 30 provinces in China.

Notably, most extant research on GEG predictors has been conducted on China (Cheng et al., 2021; Wang et al., 2022; Hao et al., 2023). Although China’s development is important for the global green economy, it is somewhat biased to use only one sample country for a study. Moreover, no known analysis of economic freedom’s impact on GEG has been conducted. To make up for these shortcomings in the previous literature, this study selected balanced panel data from 28 countries from 2012 to 2021 for analysis.

The method of measuring GEG varies across literature. For example, Hao et al. (2023) and Song et al. (2019) used green GDP per capita, while Zhang et al. (2021) and Cheng et al. (2021) constructed a GEG index comprising five indicators. Lin and Zhou (2022) also constructed an index, albeit with six indicators. This study argues that using only a few indicators to measure GEG is misleading. Moreover, scholars have not considered the possible effect of official aid on GEG. Aid from other countries and international organizations contribute significantly to green energy projects, environmental conservation, and sustainable infrastructure development, thus providing financial, technical, and policy support to facilitate the development of a green economy. Therefore, upon synthesizing the relevant indicators of official aid and reviewing current research methods, this study employed the TOPSIS entropy value technique to construct a national GEG index with 20 indicators.

Accurate measurement of progress toward sustainability is essential for GEG. Various studies propose different indicators for assessing the progress of the Sustainable Development Goals (SDGs) and GEG, especially regarding economic freedom and sustainability. While traditional indicators like green GDP and energy efficiency are widely used, more comprehensive frameworks are needed.

Recent studies have expanded on sustainable development indicators. Wu et al. (2022) analyze how SDG interactions evolve over time, identifying a process of decoupling followed by re-coupling as development progresses. This insight is crucial for understanding how SDGs relate and inform policy priorities.

Brown (2021) highlighted the importance of transparent metrics to track private sector contributions to SDG2 (Zero Hunger), which can also apply to GEG, particularly in renewable energy and sustainable agriculture. Engel-Cox and Chapman (2023) emphasized that energy security is a key factor in transitioning to a green economy, underlining the relationship between economic freedom and energy-related SDGs. Ioannou et al. (2023) examined the trade-offs in carbon capture and utilization (CCU), demonstrating that while CCU can aid in achieving SDG 13 (climate action), it may negatively impact other SDGs, such as water scarcity and health. Their findings stress the need for balanced technology development that considers multiple SDGs. Mhlanga and Dzingirai (2024) explored how responsible business practices in the Global South, supported by effective metrics, can promote sustainable development, bridging economic freedom with GEG. Diaz-Sarachaga (2021) introduced a new system to monetize corporate impacts on SDGs, identifying a weak linkage between business activities and SDGs, which suggests a need for better frameworks to align corporate actions with sustainability. Lastly, Zhou et al. (2022) provided insights into urban scaling patterns in China, demonstrating the importance of tailored metrics for city-level sustainable development. Their study adds to the understanding of how urbanization impacts GEG in highly urbanized economies.

These studies emphasize the importance of comprehensive, transparent, and locally adapted indicators for GEG. Such metrics are essential for linking economic freedom to GEG and guiding policy and investment decisions.

2.2 Hypothesis development

Economic freedom helps to stimulate innovation and competition in the marketplace, which in turn encourages businesses to adopt greener technologies and practices; this promotes GEG (Alraja et al., 2022). However, economic freedom can also lead to inadequate environmental regulation, which can drive businesses to adopt cheap but environmentally unfriendly production methods to reduce costs and improve competitiveness; this inhibits GEG (Rapsikevicius et al., 2021). Scholars such as Lederer et al. (2018) further argue that in the absence of strong environmental policies, the pressures of a competitive market can lead firms to prioritize short-term economic gains over long-term environmental sustainability. This results in overconsumption of resources and increased environmental degradation, thereby hindering GEG. Therefore, this study assumed the following correlation between economic freedom and GEG.

Hypothesis 1a. Economic freedom promotes GEG.

Hypothesis 1b. Economic freedom inhibits GEG.

Economic freedom can increase energy security by encouraging private sector investment and innovation, as well as by reducing energy dependence on unstable regions (Gnansounou, 2008). This increases opportunities for the development of renewable energy and environmentally friendly technologies, fueling GEG. Nonetheless, economic freedom can sometimes trigger market-led energy extraction, such as fossil fuels, to attain short-term economic profits. This disregard for the environment may diminish a country’s energy security and limit the growth of the green economy (van Niekerk, 2020). In line with Engel-Cox and Chapman (2023), who emphasize the critical role of energy security in the transition to a green economy, it is hypothesized that while economic freedom may promote renewable energy development, it may also lead to over-extraction of non-renewable energy sources, impeding GEG. Therefore, it was hypothesized that.

Hypothesis 2a. Economic freedom promotes GEG by affecting energy security risk.

Hypothesis 2b. Economic freedom inhibits GEG by affecting energy security risk.

Improvements in government efficiency can facilitate the effective implementation of economic freedom policies and strengthen regulations pertaining to renewable energy and the environment, thereby contributing to GEG (Mihaela et al., 2021). However, increased government efficiency can also lead to excessive government intervention in the market, increasing the burden on green businesses and restricting economic freedom, thus negatively impacting GEG (Sadeh et al., 2020). In line with Mhlanga and Dzingirai (2024), who argue that overly stringent government policies may stifle innovation and create burdens for businesses, this study suggests that an overly interventionist government might undermine the positive effects of economic freedom. On this basis, this study proposed that.

Hypothesis 3a. Government efficiency positively moderates the effect of economic freedom on GEG.

Hypothesis 3b. Government efficiency negatively moderates the effect of economic freedom on GEG.

The presence of corruption may lead to inequitable and non-transparent resource allocation, weakening the effectiveness of economic freedom policies. This prompts governments to pay more attention to environmental regulation and sustainable development, meaning that corruption acts as a positive regulator and promotes GEG (D'Agostino et al., 2023). However, Yue et al. (2020) argue that corruption may undermine environmental protection efforts, weaken regulatory frameworks, and limit the diffusion of green technologies. Corruption can also skew public policy, diverting resources away from critical green projects and impeding the development of a green economy. These potential effects were hypothesized as follows.

Hypothesis 4a. Corruption control positively moderates the effect of economic freedom on GEG.

Hypothesis 4b. Corruption control negatively moderates the effect of economic freedom on GEG.

3 Research methodology and data

3.1 Dependent variable

GEG (Green): To construct a more comprehensive and accurate national GEG index, this study employs the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) entropy method, a robust approach that integrates TOPSIS with an entropy-based weighting system. This combined method provides an objective, data-driven solution for multi-indicator composite index construction. TOPSIS is a widely used multi-criteria decision-making (MCDM) method that ranks alternatives based on their proximity to an ideal solution. In this context, the “ideal solution” represents the optimal state of GEG, with the highest performance across all indicators. By calculating the Euclidean distance between each country’s performance and the ideal solution, TOPSIS generates rankings that reflect how closely each country aligns with this optimal state (Sun et al., 2023).

However, the complexity of GEG requires more nuanced treatment of the various indicators to assign appropriate weights. To address this, entropy weighting is introduced, a statistical technique that measures the amount of uncertainty or variability in each indicator. The entropy method calculates the “entropy” of each indicator, quantifying the dispersion or unpredictability in its values. Indicators with higher entropy (greater variability) are assigned more weight, reflecting their greater ability to provide valuable information about green growth. Conversely, indicators with lower entropy (less variability) receive lower weights, as they contribute less to distinguishing between countries' performance. This approach ensures that each indicator’s contribution to the final composite index is data-driven and reflective of its informational content, reducing the risk of subjective bias in the weighting process.

The combination of TOPSIS and entropy weighting is especially suitable for measuring GEG, which is inherently a complex, multidimensional concept. GEG encompasses not only environmental factors, such as carbon emissions and energy consumption, but also broader economic and social dimensions, such as energy productivity, renewable energy supply, and ODA for green sectors (Song et al., 2019; Lee and He, 2022). Measuring GEG with a small set of indicators often fails to capture the full scope of this multidimensional concept. By integrating 22 indicators, we aim to cover a wider range of factors that contribute to green growth, ensuring a more holistic and accurate assessment.

The strength of the TOPSIS entropy method lies in its ability to dynamically adjust the weights of each indicator based on its variability, ensuring that the most informative indicators have a greater impact on the final GEG index. This eliminates the need for subjective decisions in weighting, which could otherwise skew the results. Furthermore, it allows for a more balanced and accurate representation of GEG by giving appropriate emphasis to the key drivers, such as energy efficiency, renewable energy production, and economic and social aspects of green growth (He et al., 2019).

In addition to improving the accuracy and reliability of the index, the integration of TOPSIS and entropy weighting also enhances the interpretability of the final composite index. While including 22 indicators may initially seem complex, this combined method allows us to aggregate them into a single, clear index that reflects the underlying dimensions of green growth. The aggregation process ensures that the relative importance of each indicator is appropriately accounted for, providing a transparent and understandable representation of each country’s green economic performance. This method also ensures that the final index remains comprehensive while avoiding potential over-simplifications or distortions that could arise from using too few or overly aggregated indicators.

To further validate the robustness of the GEG index and ensure its credibility, we performed robustness checks by comparing our GEG index with other established sustainability indices, such as the SDG Index (Zhang et al., 2023). This comparison acts as an external benchmark, reinforcing the reliability of our results. The SDG Index is a globally recognized tool for assessing progress toward sustainable development, and the strong correlation between our GEG index and the SDG Index further validates the accuracy and relevance of our methodology. The alignment between the two indices suggests that the TOPSIS entropy method provides a consistent and credible measure of GEG, capable of capturing the same key trends as other widely accepted sustainability measures. The metrics for GEG are constructed as shown in Table 1.

In summary, the TOPSIS entropy method allows for an objective, data-driven approach to the complex task of measuring GEG. By integrating entropy-based weighting with TOPSIS’s proximity-based ranking, we are able to accurately reflect the multidimensional nature of GEG and avoid the potential biases introduced by subjective weighting. This methodology ensures that the final index is not only more accurate and comprehensive but also transparent and interpretable. By incorporating both environmental and economic indicators and ensuring that each indicator is weighted based on its informational content, this method provides a more nuanced and reliable picture of national green growth performance. Ultimately, this approach contributes to the broader literature on sustainable development by offering a robust, reproducible framework for evaluating GEG across countries.

3.2 Independent variable

Economic Freedom (Free): Economic freedom is the ability of individuals and firms in a market economy to freely own, exchange, and use property and resources with minimal government intervention (Candela and Geloso, 2021). As it is composed of multifaceted indicators, this study followed Graafland and Lous (2018) by referring to the Heritage Foundation’s annual Index of Economic Freedom. The index consists of four dimensions: rule of law (property rights, government integrity, and judicial effectiveness), size of government (government spending, tax burden, and fiscal health), regulatory efficiency (freedom of commerce, freedom of labor, and monetary freedom), and open markets (freedom of trade, freedom of investment, and financial freedom).

3.3 Intermediary variable

Energy Security Risk (Security): Energy security risk refers to a country or region’s possession of an adequate and stable supply of affordable energy to meet its needs and maintain its economic and national security (Yergin, 2006). Referring to Månsson et al. (2014), this study chose energy import dependence use to measure energy security. Lower percentages generally indicate higher levels of energy security, as countries are less dependent on external energy supplies.

3.4 Moderator variables

Government Efficiency (Efficiency): Government efficiency is the extent to which the government uses resources, performs duties, and achieves desired outcomes with the least amount of waste, cost, and time (Lee and Whitford, 2009). In line with Ding et al. (2022), this study utilized the Government Efficiency Assessment Index (GEAI) from the World Bank Development Database to measure the level of government efficiency. A higher index value indicates better government efficiency.

Government Corruption Control (Corruption): Government corruption is the misuse of power, office, or resources by public officials for personal gain. It is a form of unethical behavior that goes against public interest (Singh, 2022). Corruption can cause the implementation of government policies to become inefficient and alter the influence of economic freedom on GEG. This study measured it using the Control of Corruption (COC) index from the World Bank’s Development Database, where a higher COC index represents a lower level of state corruption in a country.

3.5 Control variables

Gross domestic product (GDP) per capita (pgdp): National economic growth can lead to the overexploitation of resources and environmental pollution, as increases in industrial production and consumption are often accompanied by higher energy consumption and emissions. This can cause serious harm to human health, disrupt the ecosystem and ecological balance, worsen carbon emissions, and inhibit GEG. In contrast, national economic growth can provide opportunities for GEG, as more investments and innovations encourage sustainable development and green technology development. Economic growth can also provide more resources for environmental protection projects and ecological restoration, which can improve environmental quality. Therefore, this study adopted GDP per capita to measure national economic development, and the expected sign is positive or negative.

Population (Population): Large population sizes can promote GEG by providing more human resources, accelerating the research, development, and application of green technologies, and creating employment opportunities. However, large-scale populations can also increase resource consumption and environmental pressures, such as rising energy demand, expanded land use, and increased waste emissions, which may hurt GEG. This study employed population density (the number of people per square kilometer of land) as a measure of population, with a positive or negative expected sign.

National Innovation (Innovation): Innovation is an important driver of green technologies and innovations, including cleaner production technologies, renewable energy, and energy-efficient equipment. By encouraging national innovation and green technology research and development, global environmental governance can be promoted by increasing resource efficiency and reducing environmental impacts (Cong et al., 2024b). Therefore, to assess the impact of innovation on GEG, this study uses the national innovation index to measure the level of national innovation with a positive expected sign.

Government Expenditures (Expenditures): A government’s final consumption expenditures may exert an important effect on GEG. When governments increase their spending on green areas, such as renewable energy, environmentally friendly infrastructure, and green technology research and development, they stimulate the growth of related industries, create jobs, and expand the green economy. Referring to Wang et al. (2022), this study selected total government general final consumption expenditure to measure the level of government expenditure, which is predicted to have a positive sign.

Foreign Direct Investment (FDI): Foreign direct investment (FDI) can have a twofold impact on GEG. First, it fosters the growth of a green economy by introducing green technologies and sustainable practices, promoting the development of local green industries, enhancing resource efficiency, decreasing environmental pollution, and facilitating the adoption of renewable energy and clean technologies (Cong et al., 2024a). However, FDI may also lead to the prioritization of short-term profits at the expense of environmental protection and sustainability, which may trigger environmental damage and the over-exploitation of resources; this would inhibit GEG. This study utilized net FDI as a percentage of GDP to measure FDI, which is expected to be positive or negative.

Urbanization (Urban): Urbanization, which is usually accompanied by population concentration and increased economic activity, fosters the development of green industries. Cities demand clean energy, sustainable transport, efficient buildings, and environmentally friendly services, among other things, thereby creating market opportunities and driving the innovation and adoption of green technologies. Urbanization also promotes the efficient use of resources, such as easier waste management and a circular economy, which helps to reduce environmental pollution. Altogether, it contributes to the growth of a green economy. At the same time, urbanization comes with several challenges. Urban development can lead to expanded land use, ecosystem destruction, and resource scarcity. Environmental problems may also be exacerbated by large-scale urban congestion, air pollution, and energy demand, thereby inhibiting GEG. This study utilized the urban population as a share of the total population to evaluate the extent of urbanization, with the expectation of a positive or negative sign.

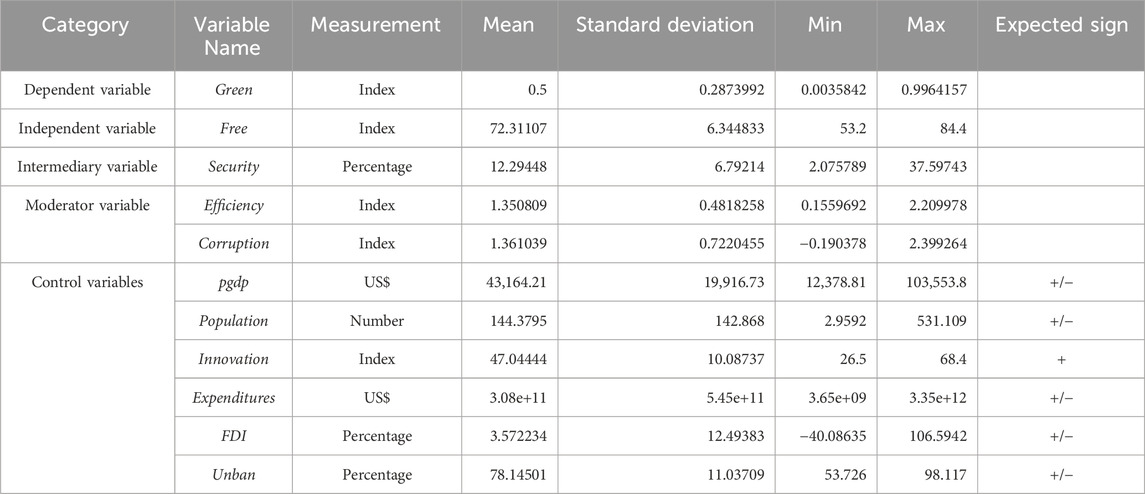

3.6 Description of data

This study analyzed panel data for 28 EU and non-EU countries from 2012 to 2021. All sample countries are listed in Appendix List 1. All data were obtained from the OECD database and the World Bank Development Database. Table 2 reports the descriptive analysis results for the full sample. A test for multicollinearity showed that the variance inflation factor (VIF) values for all constructs were below 51, indicating no evidence of estimation bias due to multicollinearity.

3.7 Empirical methodology

The main advantage of the fixed effects model is that it can control unobservable characteristics inherent in individuals, thus eliminating individual-related confounders and allowing a more accurate estimation of an independent construct’s impact on a dependent construct. Therefore, similar to Cong et al. (2023), this study used individual and time two-way fixed effects models. To reduce the effect of heteroskedasticity, the variables of economic freedom, energy security, GDP per capita, population size, national innovation, general government consumption expenditures, FDI and urbanization were treated as logarithms. Equations 1, 2 show the linkage between economic freedom and GEG as tested in the two-way fixed effects model.

In Equation 2,

To assess the reliability of the benchmark estimates, robustness tests were conducted to account for potential unobserved limitations in the study design that could otherwise render the benchmark regression results on the economic freedom–GEG relationship a mere statistical artifact. Among these tests, a placebo test was implemented following the approach of Ding et al. (2022) and Wang et al. (2025) to determine whether the observed relationship was purely coincidental or reflected a genuine causal mechanism. This test involved modifying the original dataset by randomly deleting certain observations and reallocating the remaining data, thereby disrupting the inherent structure and any potential causal link between economic freedom and GEG. The modified dataset was then used to re-estimate Equation 2, and the results were compared to those obtained from the baseline model. The fundamental logic behind this approach is that if the observed relationship between economic freedom and GEG in the benchmark model is genuine, the estimated causal effect derived from the placebo test should differ significantly from that of the baseline test. Conversely, if the relationship identified in the original regression is merely an artifact of data structure or statistical coincidence, then the placebo test would yield similar estimates, indicating that the baseline results may lack substantive economic significance. By applying this robustness check, the study aims to ensure that its findings are not driven by arbitrary data patterns but rather reflect an inherent economic mechanism, thereby strengthening the credibility of the empirical conclusions.

While fixed effects models can control for inherent individual characteristics, panel data may still be subject to endogeneity bias due to omitted variables or unobserved factors, especially when there is a potential endogenous relationship between variables. Therefore, this study tested for endogeneity and then applied the two-stage least squares (2SLS) method with instrumental variables to address any emergent endogeneity problems. Specifically, following the approach of Zhang et al. (2023) and Yang et al. (2024a) and Yang et al. (2024b), the lagged first-order term of the explanatory construct ‘economic freedom’ was used as an instrumental variable to resolve endogeneity. The choice of the lagged first-order term as an instrumental variable is justified by its ability to satisfy both exogeneity and endogeneity conditions. First, the lagged term is not directly affected by GEG, thus meeting the exogeneity condition and avoiding the introduction of new causal bias. Second, the lagged term reasonably reflects the actual situation of economic freedom, making it an appropriate proxy to capture the variation in economic freedom, thus satisfying the endogeneity condition. As a result, the use of the lagged first-order term of economic freedom as an instrumental variable is valid and fulfills both homogeneity and endogeneity requirements, ensuring the reliability of the results.

To test the possible mediating effect in the above relationship, this study refers to Wang et al. (2024a) and Wang et al. (2024b). A regression equation was developed using energy security as a mediating variable. First, the direct linkage between economic freedom and energy security was assessed, as determined by the significance of the coefficient β1 in Equation 3. Second, Equation 4 was developed to represent the relationship between economic freedom Ln(Free), the mediator variable Ln (Security), and the dependent variable GEG (Green). The significance of the regression coefficients β and γ were then tested to confirm the presence of the mediating effect of energy security on the relationship between economic freedom and GEG.

Considering possible conditional factors affecting the link between economic freedom and GEG, government efficiency (Efficiency) and corruption (Corruption) were incorporated as two moderating variables in this relationship. As presented in Equation 5, this study first assessed the effect of government efficiency on GEG (Green), conditional on the exclusion of economic freedom. Second, the moderating variable government efficiency and the interaction term between economic freedom and government efficiency [Ln(Free)*(Efficiency)], were added to Equation 2, producing Equation 6 to explore the moderating role of government efficiency between economic freedom and GEG. Likewise, the link between corruption (Corruption) and GEG was assessed conditionally on the exclusion of economic freedom, as shown in Equation 7. Based on this, the moderating variable corruption and the interaction term between economic freedom and corruption [Ln(Free)*(Corruption)] were added to Equation 2, yielding Equation 8 on the moderating role of corruption between economic freedom and GEG.

4 Empirical results and discussion

4.1 Baseline regression results

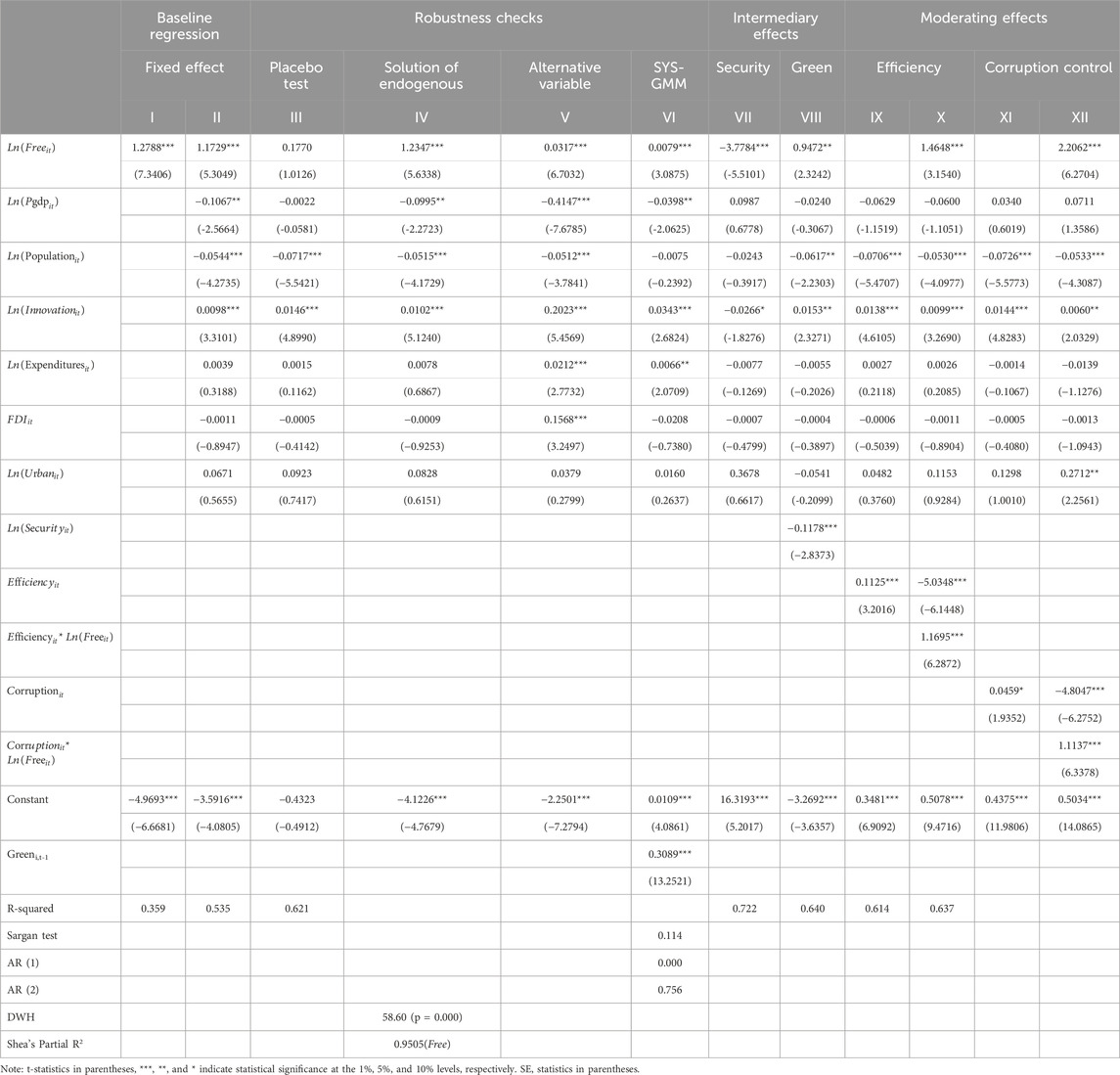

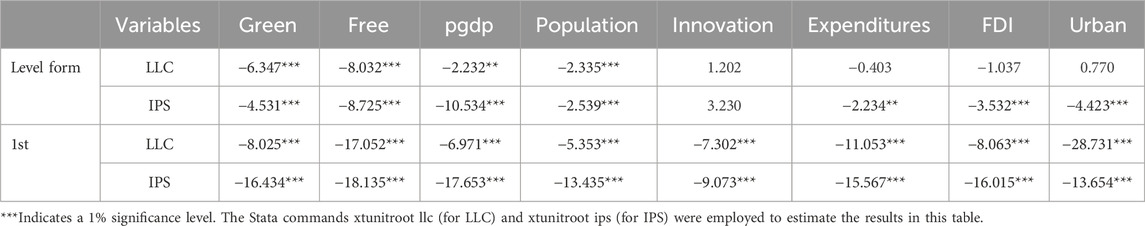

Before performing the regression analysis, we conducted Levin-Lin-Chu (LLC) and Im-Pesaran-Shin (IPS) unit root tests and found that not all variables were stationary in their level form, but they became stationary when they reached the first difference, as shown in TableA1. The baseline test results are reported in Column I and Column II of Table 3, where Column I omits the control variables and Column II includes them. First, the empirical results in Column I and Column II show that economic freedom significantly contributes to GEG, proving that Hypothesis 1a holds. Economic freedom promotes GEG, likely because less government intervention and more flexible market mechanisms can stimulate enterprise innovation, reduce the cost of pro-environmental technologies, and encourage the development of renewable energy and eco-friendly industries. This free market environment encourages businesses to adopt environmentally friendly practices, improve resource efficiency, and minimize carbon emissions, thus attaining a mutually beneficial outcome for both economic growth and ecological sustainability.

The results of the control variables in Column II of Table 3 show that GDP per capita and population size significantly impede GEG, while national innovation significantly enhances GEG. Countries with high GDP per capita tend to face higher resource demands and consumption, leading to increased energy usage, waste generation, and ecological stress. Similarly, countries with large populations typically require more infrastructure and resources, which can lead to inappropriate land development and ecosystem threats. National innovation, on the other hand, contributes to GEG because innovation and transformation facilitate the diffusion and application of environmentally friendly technologies. The drive for national innovation is not only at the technological level but also involves requirements for energy efficiency, waste management, and emission reductions in industrial production processes. Governments have promoted the development of a green economy by encouraging businesses to adopt environmentally friendly practices through regulatory and incentive measures, such as tax reduction policies and environmental subsidies. These results suggest that economic freedom has a significant positive effect on GEG, potentially enhancing ecological sustainability by reducing government intervention, stimulating innovation in firms, and promoting the adoption of environmentally friendly technologies. However, policymakers should be concerned about whether this effect may be constrained in a particular country or region due to factors such as energy security, government efficiency, and corruption control. Therefore, when formulating relevant policies, governments must recognize the potential constraints of these external factors on the development of a green economy and design a policy framework that can overcome these challenges.

4.2 Robustness check results

To test the stability of the results of the benchmark test, this study conducted relevant robustness tests, namely, the placebo test and the two-stage least squares test. Column III of Table 3 shows the outcomes of the placebo assessment. The insignificant coefficients of the placebo test results indicate that economic freedom’s effect on GEG is not a placebo, proving that the benchmark test results are robust.

Additionally, considering the possible endogeneity problem between the variables in the benchmark test, this study conducted the two-stage least squares test, as reported in Column IV of Table 3. First, the explanatory variables in the model were tested for endogeneity. The result of the Durbin-Wu-Hausman (DWH) test statistic was 58.6, with statistical significance at P < 0.01. Therefore, the hypothesis that all explanatory variables are exogenous was rejected. Instead, it was demonstrated that the explanatory variables in the model were endogenous. To further verify the reliability of the instrumental variables, the R2 of the Shea component of the instrumental variables was around 0.1, indicating no weak instrumental variable problem. Overall, the two-stage least squares test concurs that economic freedom significantly contributes to GEG, further proving that the benchmark results are reliable. In column V, the GEG is replaced by the national sustainable development index. The results show that economic freedom remains significant at the 1% level, which proves that the benchmark results are robust. In addition, the results of the system-GMM estimation are shown in column VI. The results of the GMM are consistent with those of the benchmark regression. In addition, the lagged variables of GEG have a statistically significant positive coefficient at the 1% significance level, indicating that countries with a higher degree of economic freedom tend to have a higher level of green economic development in the future.

4.3 Intermediary effect results

Columns VII and VIII of Table 3 show the regression results of the mediating effect of energy security. First, Equation 3 was applied to examine the impact of economic freedom on energy security. The statistics in Column VII show that economic freedom significantly reduces energy security risk, possibly because it encourages market competition and investment by private firms, which diversifies the country’s sources of energy supply. The competitive nature of the market economy encourages innovation and efficiency, driving the development of new energy technologies and lowering energy costs. Such diversification and technological innovation reduce the overdependence on particular sources of energy, thereby mitigating a country’s risk when faced with energy supply disruptions or volatility in international energy markets. In addition, economic freedom attracts foreign investment and international energy cooperation, further increasing the country’s energy security. Subsequently, the mediating variable Security was introduced into regression Equation 4 along with economic freedom and GEG. The results in Column VIII show that the absolute value of the coefficient representing the relationship between economic freedom and GEG decreases with the addition of energy security. This suggests that the introduction of energy security risk weakens the influence of economic freedom on GEG because such risk increases the uncertainty associated with economic freedom. A green economy usually requires more investment and policy support to promote the development of sustainable energy and environmentally friendly technologies. However, uncertainty in energy supply makes private firms and investors more cautious and reduces their investment in the green economy, thus weakening the positive influence of economic freedom on GEG. Therefore, energy security risk can dilute the nexus between economic freedom and a green economy, proving Hypothesis 2b to be valid. The positive impact of economic freedom is reduced by the risk of energy security, indicating that countries need to balance the stability of the energy supply while promoting a green economy. To meet this challenge, governments should enhance energy security, especially by promoting the development of renewable energy (e.g., wind and solar) and cross-border energy cooperation to reduce dependence on traditional energy sources. In addition, governments should consider modern energy infrastructure, especially smart grids, and energy storage technologies, to improve the flexibility and reliability of energy systems and thus ensure the sustainable development of a green economy.

4.4 Moderating effect results

Columns IX to XII of Table 3 assess the moderating impacts of government efficiency and corruption control on the relationship between economic freedom and GEG. Equation 5 was first applied to assess the link between government efficiency and GEG, which was shown to be significant (see Column IX). Based on this, Equation 6 was utilized to assess the moderating role of government efficiency in the economic freedom–GEG link. The results in Column X indicate that the interaction term between economic freedom and government efficiency is significant, confirming that government efficiency plays a positive moderating role in economic freedom’s influence on GEG; hence, Hypothesis 3a holds. An efficient government can provide a clear legal and policy framework to support the growth of the green economy. This includes reducing lengthy administrative procedures, lowering regulatory barriers, and providing fiscal and tax policies that encourage innovation in sustainable energy and environmentally friendly technologies. When the government demonstrates efficiency in these areas, it is better able to coordinate and support private sector investment, which then alleviates market uncertainty and promotes sustainable growth in the green economy sector. Government efficiency can therefore reinforce the positive impact of economic freedom on the green economy and accelerate the adoption of sustainable technologies.

Columns XI and XII explore the possible moderating role of corruption control in the influence of economic freedom on GEG. Using Equation 7, the results in Column XI suggest that corruption control can improve GEG. Subsequently, Equation 8 was implemented to investigate the moderating role of corruption control in the relationship between economic freedom and GEG. The results in Column XII demonstrate that the coefficient of the interaction term between corruption control and economic freedom is positive and significant at the one percent level, confirming the positive moderating role of corruption control as per Hypothesis 4a. The application of economic freedom in the green economy requires transparent and fair market conditions to attract investment and drive innovation in environmental technologies. Corruption weakens the fairness and competitiveness of the market, leading to unfair rivalry, discriminatory policies, and non-transparent decision-making. This atmosphere renders markets unattractive to businesses that wish to invest and operate in a green economy. Improving government efficiency and corruption control can significantly enhance the contribution of economic freedom to GEG. Therefore, policymakers should focus on improving the government’s implementation capacity, simplifying administrative procedures, and ensuring transparent policy implementation and use of funds. To this end, the government can introduce digital technologies such as e-government platforms to improve the transparency of decision-making and the efficiency of resource allocation. At the same time, the government should strengthen anti-corruption mechanisms to ensure the effective use of environmental funds and prevent waste of resources and failure of policy implementation.

4.5 Heterogeneity analysis

The baseline and robustness tests have validated the desirable effect of economic freedom on GEG. However, a more comprehensive understanding of the degree to which this effect varies between countries requires a heterogeneity test of the full sample. It is worth noting that this study’s 28-country sample included 18 EU member states across Europe and 10 non-EU member states from both within and outside Europe. This diverse sample composition enabled the synthesis of the legal, policy, cultural, and economic heterogeneity between EU and non-EU countries, particularly in examining the relationship between GEG and economic freedom. Thus, this study was able to assess the influence of economic freedom on GEG more precisely, regardless of whether the country belongs to the EU. Importantly, it provides detailed representative findings that offer policymakers more accurate information to support nations’ sustainable GEG goals.

The results of the empirical heterogeneity test are presented in Table 4. Columns I and V in the table represent the baseline test results of the economic freedom–GEG relationship in EU and non-EU countries. It was observed that economic freedom has no significant effect on GEG in EU countries but has a significant positive effect on GEG in non-EU countries. Meanwhile, Columns II and VI show that energy security still mediates this effect in non-EU countries. Additionally, Columns III and IV, as well as Columns VI and VII, indicate that government efficiency and corruption control still positively moderate economic freedom’s effect on GEG in non-EU countries, but not in EU countries.

There are several possible reasons for the variations in the influence of economic freedom on GEG in EU and non-EU countries. First, EU countries typically impose stricter environmental regulations and standards to ensure environmental protection and sustainability. This means that even in an environment of relative economic freedom, these countries impose more environmental regulations, limiting the development of some environmentally harmful industries; this slows GEG. In contrast, non-EU countries may lack similar environmental regulations and restrictions, making it easier for new industries in the green economy to flourish. Second, EU countries typically have stronger social welfare systems, which means that their governments invest more resources in the environmental sector to meet public demand for environmental sustainability. However, this can lead to higher production costs, reducing the competitiveness of some environmental industries. In non-EU countries, lower social welfare expenditures may reduce production costs and thus promote a green economy.

In addition, cultural and social attitudes play a role in this difference. Societies in EU countries are generally more environmentally friendly and sustainable, so consumers are more likely to support green products and services, which creates market demand for a green economy. In contrast, societies in some non-EU countries may be more focused on economic growth rather than environmental awareness, resulting in relatively low market demand for the green economy in these countries. Finally, government efficiency and corruption control have a positive moderating effect in non-EU countries, where there is usually greater variation in these factors. In this case, higher levels of government efficiency and corruption control can reinforce the positive effect of economic freedom on green economy investment and development. In contrast, in EU countries, where government efficiency and corruption control are generally superior, these factors may not significantly influence the relationship between economic freedom and GEG, as governments are already relatively efficient in promoting environmental policies and green economy initiatives. Given the differences in the impact of economic freedom on GEG between EU and non-EU countries, policy recommendations should be tailored to the specific circumstances of each country. In EU countries, where governments have generally already established relatively stringent environmental regulations, policies should focus on supporting the green transition, including encouraging businesses to adopt green technologies through tax incentives and fiscal policies, while gradually reducing subsidies for highly polluting industries. In non-EU countries, governments can rely more on market mechanisms to promote rapid growth of the green economy by providing incentives for investment in green technologies and strengthening the development of green infrastructure.

5 Conclusion

This research has examined the effect of economic freedom on GEG in 28 EU and non-EU countries from 2012 to 2021. The results of two-way fixed effects model, two-stage least squares, and a placebo test analysis indicate that economic freedom significantly contributes to national GEG. To account for other potential predictors of GEG, the study also incorporated several control variables, namely, national GDP per capita, population size, industrial development, government consumption expenditures, FDI, and urbanization. The findings show that economic growth and population growth significantly hamper GEG, while industrial development significantly cultivates GEG. In terms of mediating effects, this study reveals that energy security risk weakens the influence of economic freedom on GEG. In addition, the study provides evidence that both government efficiency and corruption control play a positive moderating role in the impact of economic freedom on GEG. Lastly, an analysis of heterogeneity proves that the effect of economic freedom on GEG varies between EU and non-EU countries.

This study reveals the crucial role of economic freedom in driving GEG and points out that the positive impact of economic freedom is moderated by a variety of factors, including energy security, government efficiency, and corruption control. Therefore, policymakers need to design targeted and locally tailored interventions to maximize the potential of economic freedom in the development of green economies. First, economic freedom can promote green growth, but this effect is often constrained by environmental regulations. Therefore, governments should strengthen environmental protection policies, especially in highly polluting and energy-intensive industries, and promote stricter environmental standards. For example, industry-specific carbon emission quotas can be implemented, coupled with tax incentives, to encourage companies to adopt environmentally friendly technologies. In addition, governments should also provide more tax breaks and financial support for the R&D of green technologies to promote the growth of green innovation.

The role of national innovation in the green economy cannot be ignored, so investment in R&D of green technologies needs to be increased. Governments should promote green infrastructure projects by fostering public-private partnerships (PPPs) and providing dedicated funding and incentives for businesses that invest in green technologies. These policies will not only drive technological innovation but also promote rapid development in areas such as renewable energy and green manufacturing. Moreover, research has found that promoting green consumption is equally crucial. Governments can encourage consumers and businesses to choose environmentally friendly products through green procurement campaigns and environmental certification systems, thereby promoting a green transformation of society as a whole.

However, the research also shows that energy security risks could undermine the contribution of economic freedom to GEG. Therefore, policymakers must ensure stability and diversification of energy supplies. To this end, governments should prioritize investment in renewable energy and strengthen cross-border energy cooperation to reduce the risk of energy disruptions through diversified supply chains. In addition, modern energy infrastructure (such as smart grids and energy storage technologies) will improve the reliability of the energy system and help promote the sustainable development of the green economy.

Government efficiency and corruption control are also important factors in achieving GEG. Research shows that governments should simplify administrative processes, reduce unnecessary bureaucracy, and ensure efficient policy implementation. By introducing digital government platforms and strengthening anti-corruption mechanisms, transparency can be improved, the risk of corruption can be reduced, and the smooth implementation of green policies can be promoted. More importantly, policies should be tailored to different national contexts. For example, in EU countries, where environmental regulations and social welfare systems are stronger, policies should promote the green transition through tax incentives and green subsidies, and gradually phase out subsidies for highly polluting industries. In non-EU countries, where environmental regulations are weaker, policies can rely more on market mechanisms, such as providing investment incentives, strengthening green infrastructure construction, and special subsidies.

Finally, given that climate change and environmental degradation are global challenges, international cooperation is crucial to the success of the green economy. Governments should promote technology transfer and international joint R&D projects, especially the transfer of renewable energy and green manufacturing technologies from developed to developing countries. At the same time, transnational green funds can be used to finance green projects in developing countries and promote the integrated development of a global green economy. In summary, by addressing issues such as energy security, government efficiency, and corruption, and designing policies based on the actual situation in different countries, favorable conditions can be created for the growth of a green economy, which in turn will promote global green transformation and joint efforts to combat climate change.

5.1 Limitations of research

Some limitations of this study should be considered when interpreting the results. First, given the rapidly changing global economic and environmental landscape and data availability, using data from 2012 to 2021 may have weakened the relevance of the findings. More recent data would have provided a better understanding of the current dynamic relationship between economic freedom and GEG. Moreover, the study only focused on 28 EU and non-EU countries, which limits the generalizability of the findings. Future research should expand the scope to include other regions. Although key control variables were included, other unobservable factors, such as technological progress or global environmental policies may also affect GEG and merit further research.

Data availability statement

The datasets presented in this article are not readily available because Authors provide data on request. Requests to access the datasets should be directed to MTgyNDY1ODE5OTFAMTYzLmNvbQ==.

Author contributions

XH: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review and editing. JJ: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Writing – original draft, Writing – review and editing. YF: Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1The results of the multicollinearity test are available on request.

References

Alraja, M. N., Imran, R., Khashab, B. M., and Shah, M. (2022). Technological innovation, sustainable green practices and SMEs sustainable performance in times of crisis (COVID-19 pandemic). Inf. Syst. Front. 24, 1081–1105. doi:10.1007/s10796-022-10250-z

Brown, M. E. (2021). Metrics to accelerate private sector investment in sustainable development goal 2—zero hunger. Sustainability 13 (11), 5967. doi:10.3390/su13115967

Candela, R. A., and Geloso, V. (2021). Economic freedom, pandemics, and robust political economy. South. Econ. J. 87 (4), 1250–1266. doi:10.1002/soej.12489

Chen, S., Wang, F., and Haroon, M. (2023). The impact of green economic recovery on economic growth and ecological footprint: a case study in developing countries of Asia. Resour. Policy 85, 103955. doi:10.1016/j.resourpol.2023.103955

Cheng, Z., Li, X., and Wang, M. (2021). Resource curse and green economic growth. Resour. Policy 74, 102325. doi:10.1016/j.resourpol.2021.102325

Cong, S., Chin, L., and Abdul Samad, A. R. (2023). Does urban tourism development impact urban housing prices? Int. J. Hous. Mark. Analysis 18, 5–24. doi:10.1108/IJHMA-04-2023-0054

Cong, S., Chin, L., Senan, M. K. A. M., and Song, Y. (2024a). The impact of the digital economy on urban house prices: comprehensive explorations. Int. J. Strategic Prop. Manag. 28 (3), 163–176. doi:10.3846/ijspm.2024.21474

Cong, S., Chin, L., and Xu, L. (2024b). Exploring the non-linear relationship and mechanisms linking green finance to tourism development. J. Asia Pac. Econ., 1–32. doi:10.1080/13547860.2024.2391162

D'Agostino, E., De Benedetto, M. A., and Sobbrio, G. (2023). Does the economic freedom hinder the underground economy? Evidence from a cross-country analysis. Econ. Polit. (Bologna, Italy) 40 (1), 319–341. doi:10.1007/s40888-022-00288-2

Diaz-Sarachaga, J. M. (2021). Monetizing impacts of Spanish companies toward the sustainable development goals. Corp. Soc. Responsib. Environ. Manag. 28 (4), 1313–1323. doi:10.1002/csr.2149

Ding, Y., Chin, L., Li, F., and Deng, P. (2022). How does government efficiency affect health outcomes? The empirical evidence from 156 countries. Int. J. Environ. Res. public health 19 (15), 9436. doi:10.3390/ijerph19159436

Durani, F., Bhowmik, R., Sharif, A., Anwar, A., and Syed, Q. R. (2023). Role of economic uncertainty, financial development, natural resources, technology, and renewable energy in the environmental Phillips curve framework. J. Clean. Prod. 420, 138334. doi:10.1016/j.jclepro.2023.138334

Engel-Cox, J. A., and Chapman, A. (2023). Accomplishments and challenges of metrics for sustainable energy, population, and economics as illustrated through three countries. Front. Sustain. Energy Policy 2, 1203520. doi:10.3389/fsuep.2023.1203520

Gnansounou, E. (2008). Assessing the energy vulnerability: case of industrialised countries. Energy Policy 36 (10), 3734–3744. doi:10.1016/j.enpol.2008.07.004

Graafland, J., and Lous, B. (2018). Economic freedom, income inequality and life satisfaction in OECD countries. J. Happiness Stud. 19, 2071–2093. doi:10.1007/s10902-017-9905-7

Hao, X., Li, Y., Ren, S., Wu, H., and Hao, Y. (2023). The role of digitalization on green economic growth: does industrial structure optimization and green innovation matter? J. Environ. Manag. 325 (A), 116504. doi:10.1016/j.jenvman.2022.116504

He, L., Zhang, L., Zhong, Z., Wang, D., and Wang, F. (2019). Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J. Clean. Prod. 208, 363–372. doi:10.1016/j.jclepro.2018.10.119

Huang, S. Z. (2022). Do green financing and industrial structure matter for green economic recovery? Fresh empirical insights from Vietnam. Econ. Analysis Policy 75, 61–73. doi:10.1016/j.eap.2022.04.010

Ioannou, I., Galán-Martín, Á., Pérez-Ramírez, J., and Guillén-Gosálbez, G. (2023). Trade-offs between sustainable development goals in carbon capture and utilisation. Energy and Environ. Sci. 16 (1), 113–124. doi:10.1039/d2ee01153k

Lederer, M., Wallbott, L., and Bauer, S. (2018). Tracing sustainability transformations and drivers of green economy approaches in the Global South. J. Environ. and Dev. 27 (1), 3–25. doi:10.1177/1070496517747661

Lee, C., and He, Z. (2022). Natural resources and green economic growth: an analysis based on heterogeneous growth paths. Resour. Policy 79, 103006. doi:10.1016/j.resourpol.2022.103006

Lee, S. Y., and Whitford, A. B. (2009). Government effectiveness in comparative perspective. J. Comp. Policy Analysis Res. Pract. 11 (2), 249–281. doi:10.1016/10.1080/13876980902888111

Lin, B., and Xu, C. (2024). Reaping green dividend: the effect of China's urban new energy transition strategy on green economic performance. Energy 286, 129589. doi:10.1016/j.energy.2023.129589

Lin, B., and Zhou, Y. (2022). Measuring the green economic growth in China: influencing factors and policy perspectives. Energy 241, 122518. doi:10.1016/j.energy.2021.122518

Lin, B. Q., and Zhu, J. P. (2019). Fiscal spending and green economic growth: evidence from China. Energy Econ. 83, 264–271. doi:10.1016/j.eneco.2019.07.010

Månsson, A., Johansson, B., and Nilsson, L. J. (2014). Assessing energy security: an overview of commonly used methodologies. Energy 73, 1–14. doi:10.1016/j.energy.2014.06.073

Mhlanga, D., and Dzingirai, M. (2024). “Responsible business and sustainable development: the use of data and metrics in the Global South: a conclusion,” in In responsible business and sustainable development (Routledge), 247–254.

Mihaela, S., Răileanu, S. M., Beata, G., and Urszula, M. (2021). The impact of quality of governance, renewable energy and foreign direct investment on sustainable development in cee countries. Front. Environ. Sci. 9. doi:10.3389/fenvs.2021.765927

Milani, B. (2006). What is green economics? Race. Poverty and Environ. 13 (1), 42–44. Available online at: http://www.jstor.org/stable/41495686.

Mishra, R. K. (2023). Fresh water availability and its global challenge. Br. J. Multidiscip. Adv. Stud. 4 (3), 1–78. doi:10.37745/bjmas.2022.0208

Mohsin, M., Taghizadeh-Hesary, F., Iqbal, N., and Saydaliev, H. B. (2022). The role of technological progress and renewable energy deployment in green economic growth. Renew. Energy 190, 777–787. doi:10.1016/j.renene.2022.03.076

Naimoğlu, M., Şahin, S., and Özbek, S. (2025). Governance, corruption, trade openness, and innovation: key drivers of green growth and sustainable development in türkiye. Sustain. Dev. doi:10.1002/sd.3346

Pretty, J. (2013). The consumption of a finite planet: well-being, convergence, divergence and the nascent green economy. Environ. Resour. Econ. 55, 475–499. doi:10.1007/s10640-013-9680-9

Rapsikevicius, J., Bruneckiene, J., Lukauskas, M., and Mikalonis, S. (2021). The impact of economic freedom on economic and environmental performance: evidence from European countries. Sustainability 13 (4), 2380. doi:10.3390/su13042380

Sadeh, A., Radu, C. F., Feniser, C., and Borşa, A. (2020). Governmental intervention and its impact on growth, economic development, and technology in OECD countries. Sustainability 13 (1), 166. doi:10.3390/su13010166

Singh, D. (2022). The causes of police corruption and working towards prevention in conflict-stricken states. Laws 11 (5), 69. doi:10.3390/laws11050069

Smulders, S., Toman, M., and Withagen, C. (2014). Growth theory and “green growth.”. Oxf. Rev. Econ. Policy 30 (3), 423–446. doi:10.1093/oxrep/gru027

Söderholm, P. (2020). The green economy transition: the challenges of technological change for sustainability. Sustain. Earth 3 (1), 6. doi:10.1186/s42055-020-00029-y

Song, X. G., Zhou, Y. X., and Jia, W. (2019). How do economic openness and R&D investment affect green economic growth? evidence from China. Resour. Conservation Recycl. 146, 405–415. doi:10.1016/j.resconrec.2019.03.050

Sultana, F. (2023). Whose growth in whose planetary boundaries? Decolonising planetary justice in the Anthropocene. Geo Geogr. Environ. 10 (2), e00128. doi:10.1002/geo2.128

Sun, Y. P., Gao, P. P., Tian, W. J., and Guan, W. M. (2023). Green innovation for resource efficiency and sustainability: empirical analysis and policy. Resour. Policy 81, 103369. doi:10.1016/j.resourpol.2023.103369

Syed, Q. R., Durani, F., Kisswani, K. M., Alola, A. A., Siddiqui, A., and Anwar, A. (2024). Testing natural resource curse hypothesis amidst geopolitical risk: global evidence using novel Fourier augmented ARDL approach. Resour. Policy 88, 104317. doi:10.1016/j.resourpol.2023.104317

Tag, M. N., and Degirmen, S. (2022). Economic freedom and foreign direct investment: are they related? Econ. Analysis Policy 73, 737–752. doi:10.1016/j.eap.2021.12.020

van Niekerk, A. (2020). Inclusive economic sustainability: SDGs and global inequality. Sustainability 12 (13), 5427. doi:10.3390/su12135427

Wang, F., Gillani, S., Balsalobre-Lorente, D., Shafiq, M. N., and Khan, K. D. (2025). Environmental degradation in South Asia: implications for child health and the role of institutional quality and globalization. Sustain. Dev. 33 (1), 399–415. doi:10.1002/sd.3124

Wang, F., Gillani, S., Nazir, R., and Razzaq, A. (2024b). Environmental regulations, fiscal decentralization, and health outcomes. Energy and Environ. 35 (6), 3038–3064. doi:10.1177/0958305x231164680

Wang, F., Gillani, S., Razzaq, A., Nazir, R., Shafiq, M. N., and Li, B. (2024a). Synergistic impacts of technological advancement and environmental hazards on social change and human well-being in South Asia. Technol. Forecast. Soc. Change 208, 123721. doi:10.1016/j.techfore.2024.123721

Wang, J. L., Wang, W., Ran, Q., Irfan, M., Ren, S., Yang, X., et al. (2022). Analysis of the mechanism of the impact of internet development on green economic growth: evidence from 269 prefecture cities in China. Environ. Sci. Pollut. Res. 29, 9990–10004. doi:10.1007/s11356-021-16381-1

Wu, X., Fu, B., Wang, S., Song, S., Li, Y., Xu, Z., et al. (2022). Decoupling of SDGs followed by re-coupling as sustainable development progresses. Nat. Sustain. 5 (5), 452–459. doi:10.1038/s41893-022-00868-x

Yan, H., Qamruzzaman, M., and Kor, S. (2023). Nexus between green investment, fiscal policy, environmental tax, energy price, natural resources, and clean energy—a step towards sustainable development by fostering clean energy inclusion. Sustainability 15 (18), 13591. doi:10.3390/su151813591

Yang, X., Shafiq, M. N., Nazir, R., and Gillani, S. (2024a). Unleashing the influence mechanism of technology innovation and human development for ecological sustainability in emerging countries. Emerg. Mark. Finance Trade 60 (10), 2276–2299. doi:10.1080/1540496x.2024.2308180