- 1School of Economics and Management, Changsha University of Science and Technology, Changsha, China

- 2School of Economics, Hunan Agricultural University, Changsha, China

Green innovation is an important driver for enterprises to realize sustainable development, but there are “double externalities” of environmental protection and knowledge spillovers. The climate policy uncertainty is a “driver” for corporate green innovation, or a “barrier” hindering corporate green innovation. Existing literature has explored the relationship between the two based on specific industries, but no consistent conclusions have been reached. This article uses study employs data from 3,763 publicly listed companies in China from 2010 to 2020 as an empirical research sample to analyze examine the actual impact of climate policy uncertainty on corporate green innovation and its underlying mechanisms. It further examines the effects of climate policy uncertainty on different types of green innovation activities and the moderating effect of corporate social responsibility. The study finds that climate policy uncertainty can promote corporate green innovation, primarily through channels such as enhancing environmental regulation. Both corporate social responsibility and ESG performance have a positive moderating effect on the relationship between climate policy uncertainty and corporate green innovation. Heterogeneity analysis reveals that climate policy uncertainty can foster green innovation in state-owned enterprises, large enterprises, companies in eastern regions, and those in areas with lower levels of green finance development further research indicates that from the perspective of green innovation motivation, climate policy uncertainty promotes strategic green innovation but does not have a significant effect on substantive green innovation. The findings of this study provide a theoretical foundation and practical insights for the government in formulating relevant climate policies and promoting green innovation in enterprises.

1 Introduction

Since the 20th century, the rapid growth of the global economy has led to substantial energy consumption and carbon dioxide emissions, contributing to a persistent rise in global temperatures. Consequently, climate change has emerged as one of the most significant and urgent social challenges facing humanity in the 21st century (Swim et., 2009). Globally, climate change poses risk of extreme events such as hurricanes, heavy rainfall, and flooding, as well as an increasing frequency of heatwaves, severe cold spells and prolonged droughts. The annual rise in various climate-related extreme events has resulted in a significant increase in loss of life and damage to property, adversely affecting human survival and the sustainable development of economies and societies (Winn et al., 2011; Li and Li, 2024). In efforts to combat climate change, nations around the world have actively engaged in global climate governance, implementing a series of climate policies, including the establishment of stricter greenhouse gas emissions standards and the promotion of a transition from fossil fuels to renewable energy sources (Dang et al., 2023). These initiatives are likely to cause a decline in corporate profits, solvency, and, potentially leading to loan or losses for financial institutions, thereby creating severe negative repercussions for both the real economy and financial markets (Chen et al., 2023a; Chen et al., 2023b; Horbach and Rammer, 2025). Besides, climate policies will also impact the high-quality development of enterprises (Cai et al., 2023). Furthermore, although various policies aimed at mitigating climate change and protecting the environment have been introduced by governments, individual enterprises often struggle to accurately determine the timing, potential impacts, and directions of climate policy changes (Wang et al., 2023a; Wang et al., 2023b). The frequent fluctuations in climate policy present both new development opportunities and risks for business operations.

The essence of climate risk is fundamentally linked to carbon risk (Jorgenson et al., 2019). In 2023, China’s carbon dioxide emissions increased by 565 million tons, reaching a total of 12.6 billion tons—an increase of 4.7%—which accounts for 35% of global emissions. As the world’s largest carbon emitter, China is actively taking measures to combat global climate change. In 2020, the Chinese government announced its goal to peak carbon emissions before 2030 and to achieve carbon neutrality before 2060. Since then, climate policies have rapidly expanded in China, with the country accelerating the development of a “1+N″ policy framework aimed at achieving carbon peaking and neutrality. Local governments are also implementing various initiatives to address climate change (Zhao et al., 2022). The report from the 20th National Congress of the Communist Party of China emphasizes that “promoting green and low-carbon development in economic and social advancement is a critical aspect of achieving high-quality development.” On July 31, 2024, the “Opinions of the Central Committee of the Communist Party of China and the State Council on Accelerating the Comprehensive Green Transformation of Economic and Social Development” highlighted the need to “accelerate the green and low-carbon transformation of the industrial structure” and to “refine the policy framework for green transformation.” Simultaneously, the complexity of climate governance is increasing due to the frequent occurrence of extreme weather events and the growing pressures on economic and social development. Consequently, the uncertainty surrounding macro climate policy in China is rising rapidly (Bai et al., 2023; Lee and Cho, 2023). In this context, climate policy uncertainty may serve as a “catalyst” for fostering corporate green innovation, or it could become a “stumbling block” that inhibits such innovation efforts.

The extent to which government macro policies can influence and guide corporate green innovation activities, as well as their quality, depends significantly on the strategic choices made by enterprises (Han and Cao, 2021; Wang and Li, 2023). Green innovation is a crucial focus for driving corporate green transformation and is viewed as a vital driver for achieving sustainable development (Wang et al., 2022). It is characterized by long development cycles, significant investments, and high risks, and it faces dual market failures stemming from the “dual externality” of environmental protection and knowledge spillover. Consequently, companies often require external support and oversight to effectively pursue green innovation (Wang et al., 2024a; Wang et al., 2024b; Wang et al., 2024c; Yan et al., 2024). Given the increasing uncertainty surrounding climate policies, companies are likely to adopt a more cautious stance toward green innovation. Climate policy uncertainty has emerged as a major challenge for businesses engaged in the green innovation process. Therefore, investigating how climate policy uncertainty influences corporate green innovation, including its direction and mechanisms, can deepen our understanding of the relationship between climate policy uncertainty and corporate green innovation in the context of climate change. This understanding can offer valuable insights for developing scientifically sound climate policies and advancing corporate green innovation.

In recent years, there has been a growing academic focus on climate policy uncertainty. However, review of past research shows most studies have concentrated on the effects of climate policy uncertainty on macroeconomic development and energy transitions (Zhang et al., 2024a; Zhang et al., 2024b; Lin, 2024), corporate investment activities (Zhao et al., 2025; Chang et al., 2024), corporate pollution emissions (Wang et al., 2024a; Wang et al., 2024b; Wang et al., 2024c; Chen et al., 2023a; Chen et al., 2023b), total factor (Ren et al., 2022; Wang et al., 2022), corporate green investment (Song and Dong, 2024), and bond issuance (Wang and Zhou, 2023; Zhai et al., 2024). Research into the impact of climate policy uncertainty on corporate green innovation is limited. The “suppression theory” posits that climate policy uncertainty negatively affects corporate green innovation. Zhang et al. (2024a) and Zhang et al. (2024b) found a significant inhibiting effect of climate policy uncertainty on corporate green innovation. The persistent rise in climate policy uncertainty undermines corporate willingness to engage in green innovation by increasing financing constraints and reducing risk appetite. The indirect effect of risk appetite is exemplified in what is known as the “masking effect.” Furthermore, climate policy uncertainty adversely impacts corporate green innovation by lowering research and development investments (Niu et al., 2023), reducing green subsidies, and limiting companies’ capacity to meet environmental and social responsibilities (Sun et al., 2024). Conversely, the “support theory” suggests that climate policy uncertainty can enhance corporate green innovation. Bai et al. (2023) indicate that climate policy uncertainty positively contributes to green innovation in industrial enterprises, as it leads to stricter regional environmental regulations and increased corporate research and development investment, ultimately enhancing corporate capabilities for green innovation. Li et al. (2024) investigated the impact of climate policy uncertainty on green innovation in Chinese agricultural enterprises and found a positive correlation between policy uncertainty and green innovation in this sector. Huo et al. (2024) find that climate policy uncertainty positively affects corporate green innovation performance. And organizational inertia can positively moderate the impact of climate policy uncertainty on corporate green innovation performance.

Previous research on the relationship between climate policy uncertainty and corporate green innovation activities has not yielded consistent conclusions and has several shortcomings. Firstly, existing literature rarely differentiates between types of green innovation activities and fails to investigate the distinct impacts of climate policy uncertainty on substantive green innovation activities versus strategic green innovation activities from the perspective of innovation motivation. Company may engage in green innovation not only to achieve technological advancements or market competitive advantages but also for other strategic motives, such as responding to government policies or obtaining government subsidies (Tong et al., 2014; Li and Zheng, 2016; Liao, 2020). Secondly, existing studies often focus on specific industries, such as industrial or agricultural firms (Bai et al., 2023; Li et al., 2024), lacking a comprehensive large-sample micro-analysis of corporate green innovation. Consequently, estimates of the driving factors behind corporate green innovation may exhibit a degree of generalizability bias.

Based on this, this study uses Chinese listed companies from 2010 to 2020 as the empirical research sample to analyze the practical impact of climate policy uncertainty on corporate green innovation and its underlying mechanisms. Furthermore, it examines the impact of climate policy uncertainty on different types of green innovation activities as well as the moderating effect of corporate social responsibility. The marginal contributions of this study are as follows: First, in terms of theory, this study enriches the research on the impact of climate policy uncertainty on corporate green innovation based on a large sample of data, distinguishing between substantive green innovation and strategic green innovation, rather than being limited to a particular industry. Second, based on a green innovation motivation perspective, this study exploring the heterogeneous effects of climate policy uncertainty on different types of corporate green innovation activities. Third, both internal governance factors—corporate social responsibility and corporate ESG performance and external environmental governance factors—environmental regulation are incorporated into the analytical framework of the relationship between climate policy uncertainty and corporate green innovation, investigating how these internal and external governance factors influence the mechanisms between climate policy uncertainty and corporate green innovation, thereby expanding the boundaries of research on the relationship between the two from the perspective of internal and external environmental governance.

The rest sections are organized as follows. Section 2 is the theoretical mechanism and research hypotheses. Section 3 presents the data and methodology. Section 4 shows the detailed empirical results analysis. Section 5 is mechanism analysis and heterogeneity analysis. Section 6 is further analysis. Section 7 gives the conclusions and policy implications based on the results we obtained.

2 Theoretical mechanism and research hypotheses

2.1 Theoretical mechanism

Considering that the impact of climate policy uncertainty on R&D investment is different from that on ordinary capital investment, this article draws on the research of Bloom et al. (2007), Gu et al. (2018), and Wang et al. (2021), through quantitative analysis of the dynamic model, this study elaborates on how climate policy uncertainty affects corporate green innovation. Assume that the production function of enterprises during conforms to the Cobb-Douglas production function form. We construct Equation 1:

Where

At the same time, the demand function faced by the enterprise with a constant price elasticity of demand is (Equation 3):

Where represents the external demand shock faced by the enterprise.

Therefore, the revenue function of the enterprise is (Equation 4):

Definition

Substituting Equation 2 into Equation 4, the firm’s revenue function is given by (Equation 5):

Transform it into a first-order second-degree equation (Equation 6):

Due to the emergence of climate policy uncertainty and green innovation behaviors, enterprises face non-negligible R&D costs, equipment investment costs, and labor costs at the same time. On one hand, the costs are influenced by both the initial carbon emission levels

Among them,

The cost function for the enterprise is (Equation 9):

The enterprise profit function is (Equation 10):

The enterprise aims to maximize profit, thus Equation 11 is obtained:

At this point, the relationship between climate policy uncertainty and optimal green innovation can be understood as follows:

2.2 Research hypotheses

2.2.1 Climate policy uncertainty can promote corporate green innovation

To address climate change, countries globally are actively engaged in climate governance, formulating and implementing a series of relevant policies. However, climate uncertainty significantly impacts the implementation and effectiveness of climate policies (Borenstein et al., 2019). Consequently, climate policy uncertainty is an inevitable challenge for countries during the low-carbon transition process. Practically, for enterprises, climate policy uncertainty mainly encompasses two aspects: on one hand, it refers to the uncertainty about when the government will introduce climate policies; on the other hand, it refers to the uncertainty regarding the economic consequences that climate policies will bring (Nordhaus, 2019; Zhai et al., 2024).

Firstly, compared to production and operational activities, corporate green innovation represents an endeavor that involves both risk and long-term commitment. From the perspective of real options theory, whether a company makes an investment decision in an uncertain environment primarily depends on balancing the expected returns against the costs of potential losses. The higher the level of climate policy uncertainty, the greater the likelihood of changes in the product market and production technology. Under the guidance of the green development concept, the importance of green innovation to enterprises is continually increasing. Companies can secure more opportunities through early investments in green innovation, turning these opportunities into actual productive power and forming a first-mover advantage. Consequently, management is inclined to investments in green innovation (Aghion et al., 2005).

Secondly, Knight’s theory of uncertainty identifies uncertainty as one of the core sources of competitive advantage for enterprises is uncertainty. If the future were entirely predictable, companies would forfeit their profit sources (Knight, 1921). As micro entities in within the market, enterprises’ operations are invariably influenced by their external environment. Amidst policy uncertainty, the external environmental risks confronting enterprises intensify, imposing greater demands on their dynamic adjustment and adaptive capabilities. As climate change escalates, a company’s dynamic adjustment and adaptive abilities increasingly rely on the resources it possesses and its green innovation capabilities. Consequently, enterprises must pursue green innovation to secure future competitive advantages and profits (Li et al., 2009).

Finally, prospect theory delineates two perspectives: certainty effect and reflection effect. The certainty effect pertains to the propensity of individuals to opt for certain returns over uncertain gambles when presented with a choice between a definite gain and a gamble; conversely, the reflection effect suggests that when choosing between certain loss and a gamble, most people will choose to gamble. Thus, based on prospect theory, climate policy uncertainty will increase the degree of profit volatility. When climate policy uncertainty potentially leads to a decline in future earnings, the risk preference of corporate managers significantly increases, and their awareness of risk and crisis is heightened, thereby inclining them towards inclined to rely on green innovation for survival and development.

2.2.2 Climate policy uncertainty, environmental regulation, and corporate green innovation

The intensity of environmental regulation is closely linked to the uncertainty surrounding climate policies, with increased policy uncertainty further intensifying such regulation. The “Porter Hypothesis” posits that environmental regulation does not inhibit corporate green innovation; instead, it fosters its development. This occurs because the “compensatory effect” of the innovation incentives generated by environmental regulation surpasses the “crowding out effect” associated with the involved costs. Environmental regulation can effectively reframe negative externalities faced by enterprises as internal management challenges. As the intensity of environmental regulation escalates, compliance costs for businesses rise, prompting them to increase investments in green R&D, enhance green production, and develop green innovation capabilities to bolster profits and secure long-term benefits, rather than relying solely on end-of-pipe solutions. Market-based environmental regulation can partially offset corporate green innovation expenditures, while public participation-based regulation may impose reputational pressures on firms, motivating them to prioritize their green image and amplify green investments (Xu et al., 2024).

2.2.3 Corporate social responsibility, climate policy uncertainty, and corporate green innovation

Green innovation is an enterprise activity that necessitates substantial investment, has a protracted timeline, and entails significant risk; it cannot be achieved solely by enterprises independently. Companies that effectively fulfill their social responsibilities are better equipped to absorb and integrate diverse green knowledge entities, strengthen collaboration, and promote both green product and green process innovation (Yuan and Cao, 2022). According to signaling theory, in an environment characterized by climate policy uncertainty, companies that exhibit a strong sense of social responsibility and effectively discharge their corporate social obligations will convey positive signals of active engagement, accountability, and long-term development to both internal and external stakeholders, including shareholders, consumers, and the government. This can lead to enhanced recognition and attention from stakeholders, as well as support for their green innovation initiatives, thereby fostering these activities. Companies can secure green innovation resources by establishing strong cooperative relationships with external stakeholders to bolster their green innovation efforts (Dangelico et al., 2017). Furthermore, firms dedicated to corporate social responsibility possess superior capabilities to integrate and reconfigure resources to tackle the challenges of environmental degradation and climate change, alongside a heightened level of environmental insight (Abbas, 2024).

2.2.4 Corporate ESG performance, climate policy uncertainty, and corporate green innovation

Stakeholder theory posits that enterprises should not only consider the rights of shareholders but also address the rights of other stakeholders to balance the needs of various interest groups and achieve business objectives. Signaling theory suggests that due to information asymmetry, investors have limited access to information, compelling them to demand higher returns, which may increase the company’s capital costs. Consequently, by disclosing pertinent information such as operational status, financial performance, and development plans, companies can convey positive signals to attract investor attention, thereby reducing capital costs and achieving desired outcomes. From the perspectives of stakeholder and signaling theories, companies that actively disclose ESG information can facilitate green innovation (Ruan et al., 2024). Furthermore, ESG disclosure enhances a company’s transparency, attracts increased analyst attention, and strengthens external oversight, which in turn improves the company’s green innovation capabilities and mitigates challenges associated with technological spillovers. A high ESG rating not only boosts a company’s market image and competitiveness but also draws more green investments (Peng and Kong, 2024).

On the basis of the above discussion, this article puts forth hypothesis:

H1. Climate policy uncertainty can significantly promote corporate green innovation.

H2. Climate policy uncertainty promotes corporate green innovation by enhancing environmental regulation.

H3. Corporate social responsibility can enhance the promoting effect of climate policy uncertainty on corporate green innovation.

H4. Corporate ESG performance can enhance the promoting effect of climate policy uncertainty on corporate green innovation.

3 Data and methodology

3.1 Model specification

This study seeks to investigate and bridge the existing research gap regarding how climate policy uncertainty affects corporate green innovation behaviors, thereby offering robust empirical support for relevant theories and practices. Based on a solid theoretical foundation and existing research frameworks, this article employs quantitative analysis to provide empirical evidence that reveals the potential causal chain between climate policy uncertainty and corporate green innovation. In alignment with the methodologies of Gu et al. (2018) and Bai et al. (2023), we construct Equation 12:

In Equation 12,

Next, drawing on the studies of Chen et al. (2020a); Chen et al. (2020b) and Jiang (2022), we construct the mediating mechanism model (Equation 13):

3.2 Research sample and data source

Combined with the discussion in the theoretical analysis section, this study selects listed companies in China from 2010 to 2020 as the research sample. There are two main reasons for choosing listed companies as the research object. First, due to data availability considerations, listed companies are more timely and complete in the disclosure of green innovation, environmental performance and other related data, and their financial information is more accurate after auditing; second, listed companies are the “leader” in promoting China’s high-quality development and the “vanguard” in promoting the green transformation, so it is of strong practical significance to study the green open development path of listed companies. Secondly, listed companies are the “leader” in promoting China’s high-quality development and the “vanguard” in promoting green transformation, and the study of the green development path of listed companies has strong practical significance. This paper chooses 2010-200 as the sample interval for the following two considerations: first, some key indicators (e.g., green patent classification standards) have not yet formed a uniform format before 2010, which makes the core explanatory variables of this paper less comparable before and after 2010, and the data of some key variables (e.g., CSR) are only publicly available up to 2020, so in order to ensure the accuracy and inter-temporal comparability of variable In order to ensure the accuracy of measurement and cross-period comparability, we choose 2010-200 as the sample interval. Second, 2010-2020 covers China’s 12th Five-Year Plan and 13th Five-Year Plan periods, during which climate policies were intensively introduced and frequently adjusted (e.g., carbon trading pilot, revision of environmental protection tax law), providing a rich scenario for examining the impact of climate policy uncertainty on green innovation. At the same time, this avoids the impact of exogenous shocks such as the 2008 global financial crisis.

The main sources of data used in this paper are as follows. Data for the climate policy uncertainty index is sourced from the index calculated by MA et al. (2023); green patent data is obtained from the China National Research Data Service Platform (CNRDS); and the economic characteristic data of the listed companies is obtained from CSMAR database. The original data has been processed as follows: 1) Data for companies classified as ST, PT, and ST* during the sample period was excluded; 2) Data for companies in the financial, insurance, and real estate sectors was removed; 3) Samples with missing values for the dependent variable and key economic characteristics were excluded; 4) To prevent the influence of extreme values, a 1% winsorization was applied to continuous variables. Following the screening process, a panel data set comprising 3,763 listed companies and 27,498 observations spanning 11 years was obtained.

3.3 Measurements of variables

3.3.1 Dependent variable

Corporate Green Innovation (GI). Green patents represent the knowledge outputs of corporate green innovation, directly reflecting the level and capability of corporate green innovation. Compared to input-based indicators, the output of green patents more accurately represents a company’s green innovation capability and performance, and is widely used to measure corporate green innovation (Zhou et al., 2012; Li et al., 2017). Therefore, this measures corporate green innovation from the output perspective. The total number of green patent applications made by listed companies in the current year, plus one, is logged to assess corporate green innovation. In the robustness check section, this study uses the total number of green patent grants, plus one, logged to measure corporate green innovation (SI) to ensure the reliability of the research conclusions. Additionally, drawing on the studies of Tong et al. (2014), Li and Zheng (2016), and Liao (2020), this article study further distinguishes between types of green patents to analyze the structure of corporate green innovation, we classify the behavior of enterprises applying for “high-quality” invention patents as substantive innovation, while the behavior of enterprises applying for utility model patents and design patents is classified as strategic innovation. Corporate green innovation is categorized into substantive green innovation (GIG) and strategic innovation (GII), and is measured by the logged number of green invention patent applications plus one and the logged number of green utility model patent applications plus one, respectively.

3.3.2 Independent variable

Climate Policy Uncertainty (CCPU). Since Baker et al. (2016) pioneered the calculation of the Macroeconomic Policy Uncertainty Index, uncertainty, especially economic policy uncertainty, has become an important research area. With the worsening of global climate change, the impact of climate policy uncertainty on enterprises has become increasingly significant. Some scholars have used the Climate Policy Uncertainty Index (CPU) developed by Gavriilidis (2021) for the United States; however, due to the policy differences between the U.S. and China, the U.S. data cannot simply be substituted for the climate policy uncertainty index for China (Wang et al., 2024a; b; c). Ma et al. (2023) employed deep learning algorithms (MacBERT model) and detailed manual auditing to conduct text analysis on climate policy, based on 1,755,826 articles from six mainstream newspapers, including the People’s Daily, Guangming Daily, Economic Daily, Global Times, Science and Technology Daily, and China News Service. They constructed annual and monthly climate policy uncertainty indices for China at the national, provincial, and municipal levels for the first time. This article uses the measurement results from Ma et al. (2023) to assess climate policy uncertainty, while the robustness check section employs the CPU index for measurement.

3.3.3 Mediating variable

Environmental Regulation (ER). In terms of measuring the intensity of environmental regulation, existing literature at home and abroad generally uses indicators such as the number of environmental regulation policies, investment variables for pollution control, and pollution emission density. Drawing on the research of Liu and He (2021), this article measures environmental regulation by the proportion of completed industrial pollution control investment to the second industry’s total output. Additionally, referencing the study by Liu et al. (2023), it uses the ratio of the amount invested in waste gas and wastewater pollution control to industrial output value to measure the intensity of environmental regulation. The larger the ratio, the greater the emphasis placed on environmental governance in the region, and the higher the environmental constraints and pressures faced by enterprises.

3.3.4 Moderator variable

Corporate Social Responsibility (CSR). Given that corporate social responsibility (CSR) involves numerous stakeholders, including employees, suppliers, and customers, a multidimensional evaluation of CSR performance from the stakeholders’ perspective can provide a more complete and accurate reflection of a company’s fulfillment of its social responsibilities (Chen et al., 2020a; Chen et al., 2020b). The evaluation system for listed companies’ social responsibility reports on Hexun.com relies on both the annual reports and the social responsibility reports of listed companies. It establishes primary indicators from five dimensions: shareholder responsibility, employee responsibility, responsibility towards suppliers, customers, and consumer rights, environmental responsibility, and social responsibility. Under each primary indicator, secondary and tertiary indicators are set up to evaluate corporate social responsibility performance. This approach not only avoids the one-sidedness of relying solely on the company’s social responsibility report for evaluation but also presents a multidimensional view of the company’s fulfillment of its social responsibilities. This article measures social responsibility using the logarithm of the corporate social responsibility score index from Hexun, referencing the research of Li and Guo (2022) and Yang et al. (2024).

Corporate ESG Performance (ESG). Currently, the academic community primarily measures corporate ESG performance using scores from third-party rating agencies. The Huazheng ESG rating indicators are based on the development experience of mainstream ESG systems abroad and are combined with the characteristics of the domestic market to establish a three-level indicator evaluation system, which is highly representative. The Huazheng ESG rating categorizes the ESG performance of all listed companies into nine tiers, with grades ranging from low to high as follows: C, CC, CCC, B, BB, BBB, A, AA, and AAA. This article measures corporate ESG performance using the Huazheng ESG rating, assigning values from 1 to 9 based on the ESG rating levels of listed companies, where a lower rating corresponds to a value of 1 and a higher rating corresponds to a value of 9, referencing the studies of Fang and Hu (2023) and Zeng et al. (2024).

3.3.5 Contral variables

Referring to the studies of Qi et al. (2018), Ma et al. (2021), and Sun et al. (2024), this article considers other factors that may influence corporate green innovation, both at the individual firm level and at the provincial level. Specifically, control variables at the individual firm level include: Firm Size (Size, natural logarithm of the number of employees), larger enterprises may have more resources to invest in R&D, but they may also have a rigid organizational structure that reduces innovation efficiency and needs to be controlled to exclude scale effects from interfering with the results. Fixed Assets Ratio (FIXED, fixed assets to total assets), asset-heavy enterprises face higher green transition costs, which may inhibit short-term innovation. Board Size (Board, natural logarithm of the number of people on the board of directors), large boards may delay green innovation decisions due to differences of opinion and need to be controlled to capture the impact of governance structures. Balance Sheet Ratio (Lev, total liabilities to total assets), highly indebted enterprises face financing constraints that may reduce long-term innovation investment. Cashflow Ratio (Cashflow, net cash flow to total assets), adequate cash flow may mitigate investment volatility due to policy uncertainty and needs to be controlled for its independent role. Growth Capability (Growth, growth rate of operating income), high-growth enterprises prefer strategic investments (including green innovation) to maintain market position. Equity concentration (Top1, percentage of shares held by the first largest shareholder), large shareholders may avoid green innovation risks due to short-term earnings pressures and need to be controlled to separate governance effects. Tobin Q (TobinQ, natural logarithm of firms’ Tobin’s Q values), TobinQ enterprises are more likely to boost long-term valuations through green innovation and need to control for their endogenous drivers. Firm maturity (ListAge, natural logarithm of the number of years a firm has been listed), mature enterprises may be less dynamic in green innovation due to path dependence (Sørensen and Stuart, 2000), while young enterprises may be more flexible. Control variables at the provincial level include: regional development level (lnGDP, natural logarithm of provincial gross domestic product per capita), differences in the level of regional development may lead to different climate policy uncertainty and corporate green innovation capabilities, with controls capturing their individual effects more accurately.

4 Empirical analysis

4.1 Descriptive statistical analysis

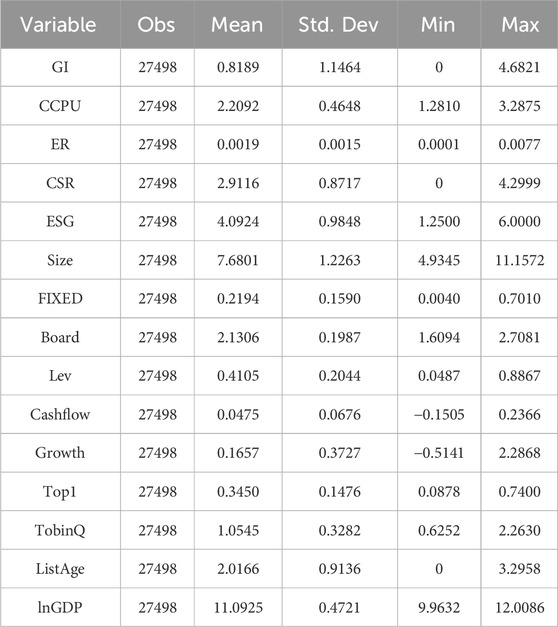

The descriptive statistics of the main variables are presented in Table 1. A total of 27,498 data points were collected in this study. By observing the table, it can be noted that the mean of corporate green innovation (GI) is 0.819, indicating substantial disparities in green innovation capability among listed companies, with a maximum value of 4.68 and minimum value of 0, suggesting that some companies exhibit relatively weak green innovation capabilities. The mean of climate policy uncertainty (CCPU) exceeds the standard deviation, indicating considerable volatility during the sample period. Similarly, the mean of environmental regulation (ER) alsoes the standard deviation, reflecting significant fluctuations during the same period. The mean of corporate social responsibility (CSR) is 2.912, suggesting that the overall level of social responsibility among the sampled companies is relatively high. The average corporate ESG performance (ESG) is 4.092, indicating that the ESG performance of the sampled companies is generally average.

4.2 Correlation analysis

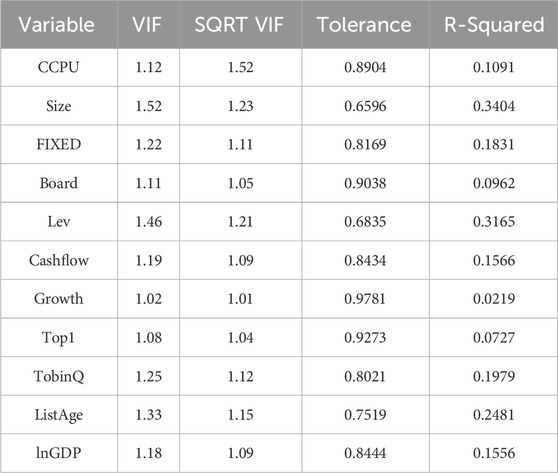

VIF value greater than five indicates multicollinearity issues. The of the multicollinearity test in Table 2 show that the VIF values for all variables range from 1.02 to 1.52, indicating that are no serious multicolarity problems.

4.3 Baseline regression results and discussion

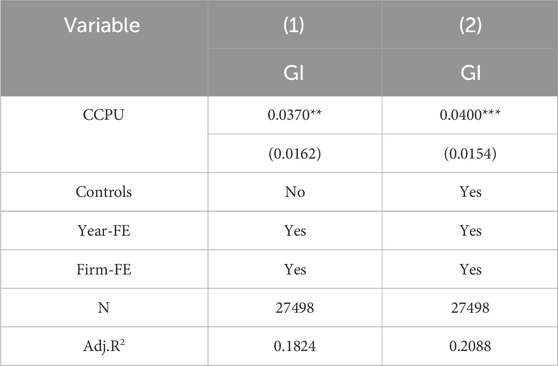

Table 3 presents the estimation results of the baseline model (12) in detail. The results in columns (1) and (2) indicate that coefficient of CCPU is significantly positive at the 5% level when control variables are not considered; when control variables are taken into account, the coefficient of CCPU is significantly positive the 1% level. The empirical results demonstrate that climate policy has a positive promoting effect on corporate green innovation, thereby confirming H1. This result is comparable to Bai et al. (2023). Against the backdrop of increased uncertainty in China’s climate policy, the external environmental risks faced by enterprises have increased, and enterprises are more inclined to improve their competitiveness through green R&D and innovation to seize opportunities for future value growth.

4.4 Robustness checks

4.4.1 Replace the dependent variable

Existing research (Qi et al., 2018) indicates that the number of patent applications only reflects the extent to which enterprises prioritize green innovation and does not represent the actual improvement in their capabilities. In principle, the status of patent grants better reflects the level and capability of green innovation. Therefore, this paper further employs the quantity of green patent authorizations (SI) to measure corporate green innovation. The regression results, as shown in Table 4, validate the reliability of the baseline regression results.

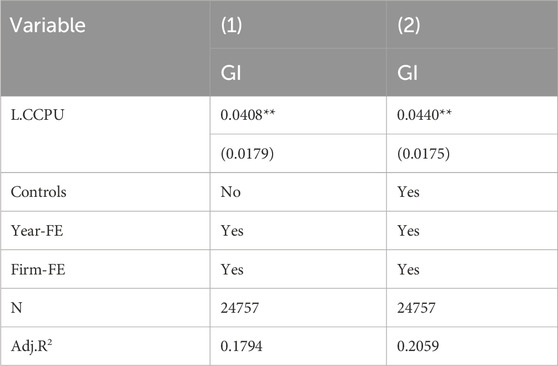

4.4.2 Lagged the independent variable

Due to the fact that changes in climate policy are macro-level factors, while corporate green innovation is a decision made at the micro-level, the influence of macro policies on enterprises is relatively low, resulting in a weaker causal relationship between the two. Additionally, considering the existence of time lags in climate policy uncertainty, its impact on corporate green innovation may not be fully reflected in the short term. Therefore, climate policy uncertainty is lagged by one period. As shown in Table 5, the empirical results further indicate that the conclusions of the baseline regression are reliable.

4.4.3 Replace the independent variable

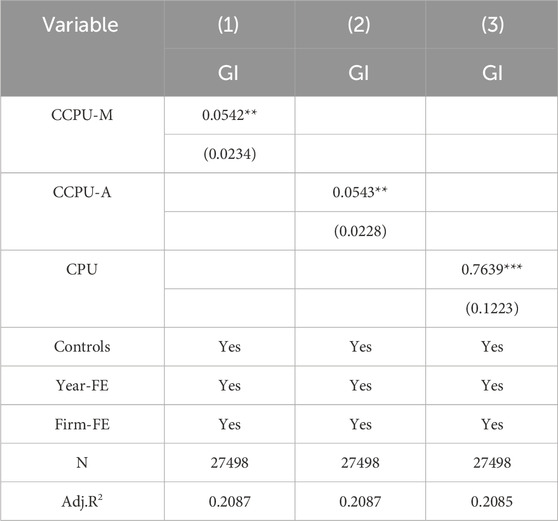

This paper replaces the explanatory variables in the following two ways, referencing the studies by Gu et al. (2018) and Sun et al. (2024). First, this paper uses the annual median of China’s climate policy uncertainty (CCPU-M) and the average (CCPU-A) to measure climate policy uncertainty. Second, it utilizes the climate policy uncertainty index (CPU) developed by Gavriilidis (2021) for measurement. The climate policy uncertainty index follows Baker et al. (2016) method of constructing economic policy uncertainty and is calculated by selecting the keywords of eight major American newspapers, including the Boston Globe, Chicago Tribune, Los Angeles Times, Miami Herald, New York Times, Tampa Bay Times, USA Today, and the Wall Street Journal. Due to the impact of climate on globalization and the fact that the U.S. CPU index may reflect climate-related risks that also affect Chinese economy and development, this is why the CPU index describes CCPU (Bai et al., 2023). As shown in Table 6, the empirical results further indicate that the conclusions of the baseline regression are reliable.

4.4.4 Change the econometric model

In response to the relevant data characteristics of the sample in this paper, (1) a Poisson model is adopted for robustness checks; (2) the Poisson pseudo-maximum likelihood (PPML) method is used for estimation. As shown in Table 7, the baseline results remain significant.

4.4.5 Omitted variable bias

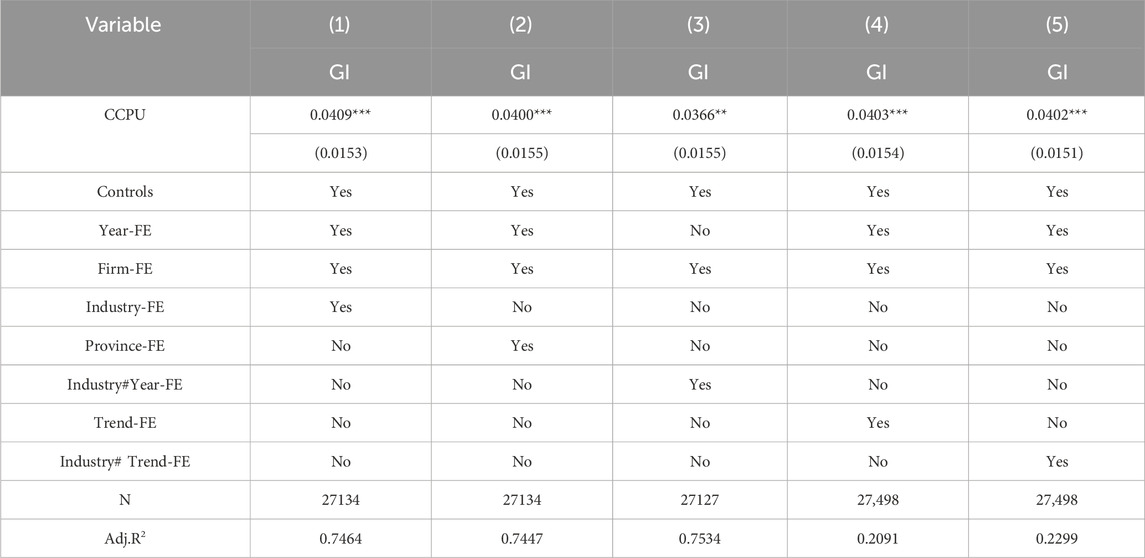

In order to further control for the impact of other unobservable industry-level time-varying factors and provincial macro factors on corporate green innovation, this paper adds industry fixed effects, provincial fixed effects, controls for industry-time interaction fixed effects, controls for time trends, and controls for industry-time trend interaction fixed effects to the baseline model. As shown in Table 8, the baseline results remain significant.

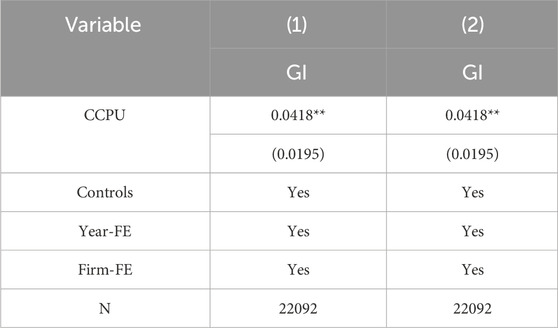

4.4.6 Treatment effects model

Climate policy belongs to macro policy, and corporate micro behavior rarely affects macro policy, which means that there is almost no reverse causality between climate policy uncertainty and corporate green innovation. In addition, by lagging the explanatory variables by one period, this paper effectively avoids the endogeneity problem associated with reverse causation, and the results again validate the previous conclusions. Further, this paper takes into account the possibility of self-selection bias, and to ensure the accuracy of the findings, a treatment effects model is used to mitigate the endogeneity problem caused by self-selection bias. Specifically, this paper selects the provincial extreme high temperature climate variable as an instrumental variable to be added to the first step of the regression, calculates the inverse Mills ratio, and adds it to the second step of the baseline regression model to obtain the empirical results. As shown in Table 9, the problem of self-selection bias is not evident in the original regression, and the results of the benchmark regression are reliable.

5 Mechanism analysis and heterogeneity analysis

5.1 Mechanism analysis

5.1.1 The mediating effect of environmental regulation

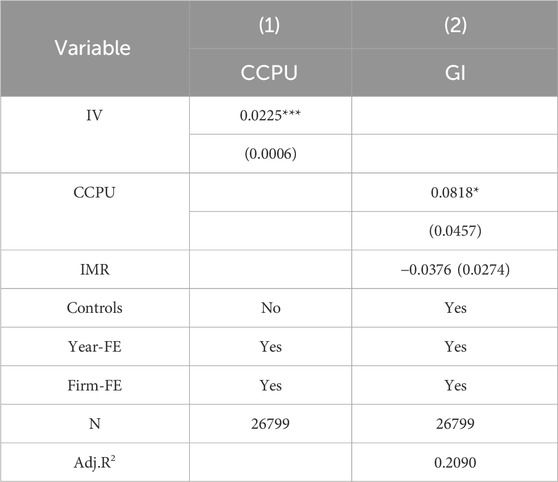

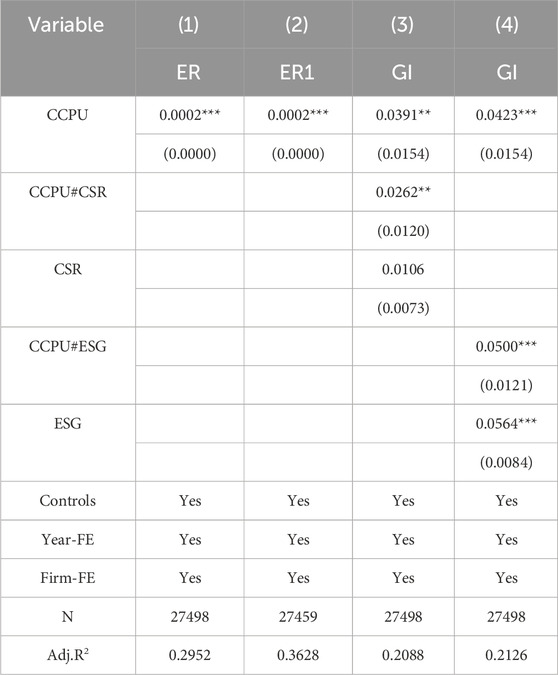

Climate policy belongs to the external macro-environment, while green innovation belongs to the individual behavior of micro-enterprises, and the mechanism by which the former acts on the latter needs to be further clarified. Based on the previous analysis, climate policy uncertainty can influence corporate green innovation by increasing environmental regulation. Next, we will test whether this mechanism exists. A substantial amount of literature has verified the impact of environmental regulation on corporate green innovation (Porter and Linde, 1995a; 1995b; Tello and Yoon, 2008; Peng and Kong, 2024; He and Qiu, 2025). Therefore, this paper only reports the impact of climate policy uncertainty on environmental regulation. Columns (1) and (2) of Table 10 show that the estimated coefficients before the carbon capture and storage policy uncertainty (CCPU) are significantly positive at the 1% level. This indicates that environmental regulation is closely related to climate policy uncertainty; as climate policy uncertainty increases, environmental regulation is strengthened, thereby promoting corporate green innovation. thereby confirming H2.

5.1.2 The moderating effect of corporate social responsibility

Enterprises mostly regard corporate social responsibility as a strategic competitive embedded activity in the process of business development. By releasing positive signals to stakeholders through the fulfillment of social responsibility, enterprises can, on the one hand, mitigate the risk of uncertainty under the intensification of climate policy uncertainty, and, on the other hand, gain the recognition and support of stakeholder enterprises for their green innovation activities. To explore the moderating effect of internal environmental governance factors—corporate social responsibility—on the relationship between climate policy uncertainty and corporate green innovation, this paper conducts an empirical test of Hypothesis 3. The regression results are shown in column (3) of Table 9. Column (3) of Table 10 indicates that the coefficient of the interaction term between corporate social responsibility and climate policy uncertainty is significantly positive at the 5% level, thereby validating H3, which states that corporate social responsibility enhances the promoting effect of climate policy uncertainty on corporate green innovation.

5.1.3 The moderating effect of corporate ESG performance

On one hand, ESG can be seen as an informal environmental regulation from stakeholders, complementing formal environmental regulations. ESG has a “bottom-up” environmental governance effect. This governance effect prompts companies to make internal strategic adjustments from within the organization to adapt to the evolving external environment (Chen et al., 2023a; b). On the other hand, ESG reflects the commitment and practices of companies towards environmental protection, social responsibility, and good governance, good ESG performance can help firms obtain stakeholders’ trust and support, and then gain the critical resources needed for green innovation (Lian et al., 2023). To explore the moderating effect of corporate ESG performance on the relationship between climate policy uncertainty and corporate green innovation, this paper conducts an empirical test of Hypothesis 4. The regression results are shown in column (4) of Table 10. Column (4) of Table 9 indicates that the coefficient of the interaction term between corporate ESG performance and climate policy uncertainty is significantly positive at the 1% level, thereby validating H4, which states that corporate ESG performance enhances the promoting effect of climate policy uncertainty on corporate green innovation.

5.2 Heterogeneity analysis

5.2.1 Nature of equity

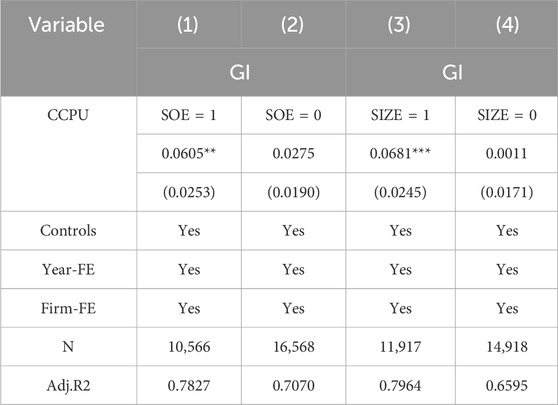

Compared to non-state-owned enterprises, state-owned enterprises (SOEs) usually have closer ties with the government and are more likely to receive government funding and policy support. This paper categorizes enterprises into state-owned enterprises (SOE = 1) and non-state-owned enterprises (SOE = 0) based on the nature of their equity. Columns (1) and (2) of Table 11 present the regression results of the sub-samples based on the nature of equity. The coefficient before CCPU in column (1) is significantly positive at the 5% level, while the coefficient before CCPU in column (2) is not significant. This indicates that the promoting effect of climate policy uncertainty on green innovation is more pronounced for state-owned enterprises compared to non-state-owned enterprises.

5.2.2 Firm size

Due to the dual requirements of economic and ecological effects for green innovation, enterprises face relatively high technical and financial thresholds when engaging in green innovation. The size of the enterprise directly relates to its ability to obtain external financing in the credit market and to allocate its own resources for green innovation, thereby affecting the promoting effect of climate policy uncertainty on green innovation in enterprises of different sizes. Referring to the study by Liu Jinke and Xiao Yiyang (2020), this paper calculates the 50th percentile of the natural logarithm of total assets at the end of the period for the enterprises, and classifies samples with a natural logarithm of total assets above the 50th percentile as large enterprises (SIZE = 1), and those below as small and medium-sized enterprises (SIZE = 0). Columns (3) and (4) of Table 11 present the regression results of the sub-samples based on enterprise size. The coefficient before CCPU in column (3) is significantly positive at the 1% level, while the coefficient before CCPU in column (4) is not significant. This indicates that the promoting effect of climate uncertainty on green innovation is more pronounced for large enterprises compared to small and medium-sized enterprises.

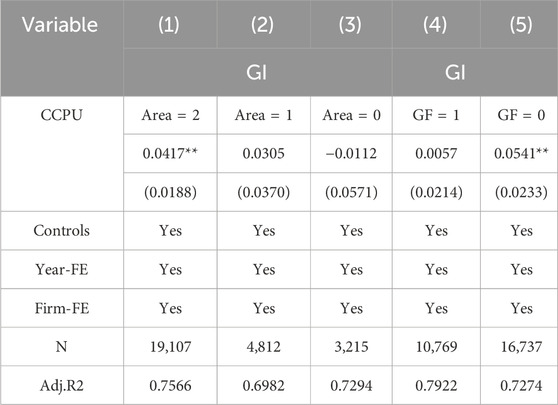

5.2.3 Geographic location

This paper distinguishes between the eastern (Area = 2), central (Area = 1), and western (Area = 0) regions to discuss the differences in impact among these areas. Columns (1), (2), and (3) of Table 12 present the regression results of the sub-samples based on geographical location. The coefficient before CCPU in column (1) is significantly positive at the 5% level, while the coefficients before CCPU in columns (2) and (3) are not significant. This indicates that, compared to the central and western regions, the promoting effect of climate policy uncertainty on green innovation is more pronounced in the eastern region.

5.2.4 Green finance

Existing research shows that Chinese green finance pilot reform has promoted corporate green innovation (Wang et al., 2023), Green finance can support green innovation (Li and Liu, 2021; Wen et al., 2022). This paper calculates the 50th percentile of the green finance development index, and based on the relationship between the green finance development index and the 50th percentile, samples above the 50th percentile are identified as regions with a high level of green finance development (GF = 1), while those below are classified as regions with a low level of green finance development (GF = 0). Columns (4) and (5) of Table 12 present the regression of the sub-samples based on regional financial development levels. The coefficient before CCPU in column (5) is significantly positive at the 5% level, while the coefficient before CCPU in column (4) is not significant. This indicates that the promoting effect of climate policy uncertainty on green innovation is more pronounced in regions with a low level of green finance development.

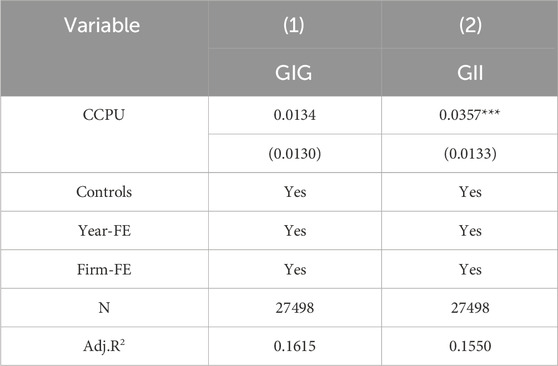

6 Further analysis

The previous analysis focused on the impact of climate policy uncertainty on the level of corporate green innovation. Next, we further analyze the effect of climate policy uncertainty on different types of green innovation. Invention patents require strict scrutiny during the application process, making them more complex and novel, representing high-tech projects. In contrast, utility model patents typically involve innovative improvements in the appearance and structure of products, with lower technical standards and difficulty, catering to low-level innovations that align with government and market demands. Most of the current literature regards the former as substantial green innovation and the latter as strategic green innovation, both of which reflect a company’s green innovation structure (Tong et al., 2014). To explore the impact of climate policy uncertainty on the corporate green innovation structure, we further classify corporate green innovation into substantial green innovation (GIG) and strategic green innovation (GII). The coefficient before CCPU in column 1) of Table 13 is not significant, while the coefficient in column 2) is significantly positive at the 1% level. This indicates that climate policy uncertainty induces companies to engage in strategic green innovation to align with government expectations, but does not effectively promote substantial green innovation.

7 Conclusion

Based on the data of Chinese listed companies from 2010 to 2020, this study constructs a two-way fixed effects model to examine the driving effect and mechanisms of climate policy uncertainty on corporate green innovation. At the same time, this study validates the previously proposed research hypothesis. The study finds: At first, climate policy uncertainty has a significant positive effect on corporate green innovation. This conclusion remains valid after a series of robustness checks. Second, mechanism analysis indicates that climate policy uncertainty can promote corporate green innovation by enhancing environmental regulation. Corporate social responsibility (CSR) and corporate ESG performance strengthen the promoting effect of climate policy uncertainty on corporate green innovation. Third, heterogeneity analysis reveals that the driving effect of climate policy uncertainty on corporate green innovation is more pronounced in state-owned enterprises, large-scale enterprises, companies in eastern regions, and enterprises in areas with lower levels of green finance development. Fourth, expansion analysis shows that from the perspective of green innovation motivation, climate policy uncertainty can promote strategic green innovation, whereas it has no significant impact on substantive green innovation.

Based on the above research conclusions, this study proposes the following recommendations: At first, fully leverage the guiding effects of climate policy. Currently, China’s economy has entered a crucial period of transformation. In the context of slowing economic growth, when formulating climate policies, the government should take fully into account the stability and predictability of the policies. For example, by publishing policy plans in advance, establishing transition periods, and clarifying implementation guidelines, the government can provide a stable policy environment for enterprises and reduce the risks associated with policy uncertainty. Additionally, before implementing any climate policy, consideration should be given to the impact of the intensity and frequency of policy adjustments. As enterprises face increasingly complex internal and external environments, both formal and informal environmental regulations should be utilized in the policy implementation process to guide companies in leveraging their resources to enhance their ability to deal with climate policy uncertainty, thereby promoting substantive green innovation. Second, actively respond to the challenges posed by climate uncertainty. From a micro perspective, climate change has become an issue that companies must confront, and climate policy uncertainty has become the norm, increasing the complexity of the external environment to some extent. Companies should establish dedicated policy monitoring teams or commission professional organizations to regularly track and analyze trends in climate policy changes, thereby keeping abreast of policy developments in a timely manner. At the same time, based on the unique characteristics and developmental stages of the company, they should formulate differentiated green innovation strategies that focus on substantive green innovation, avoiding a mere emphasis on strategic innovation. Third, since corporate social responsibility and ESG performance can strengthen the driving effect of climate policy uncertainty on corporate green innovation, the government and regulatory agencies should further improve the evaluation system for corporate social responsibility and ESG. Through incentive measures such as tax incentives, financial subsidies, and green credit, they can transform corporate development concepts and encourage companies to enhance their social responsibility and ESG performance. Additionally, it is important to strengthen the requirements for corporate social responsibility and ESG information disclosure to improve market transparency. Fourth, the government should continue to encourage state-owned enterprises and large corporations to leverage their resource endowments to actively engage in green innovation, making them a key force in promoting green and low-carbon economic and social development. At the same time, given the weaker risk resistance of non-state-owned enterprises and small and medium-sized enterprises under climate policy uncertainty, effective incentive and restraint mechanisms should be established to enhance their green innovation capabilities. Local regions should tailor their approaches to guide businesses in conducting green innovation activities.

This study has yielded valuable conclusions, but it remains limited by data constraints, with areas needing further refinement and expansion. In the first place, this study uses a provincial climate policy uncertainty index, which effectively captures regional climate policy uncertainty. However, the impact of climate policy uncertainty is different for each firm. Future research could attempt to construct a firm-level index system to more accurately assess its complex impacts. Second, this study has only explored the different impacts of climate policy uncertainty on substantive green innovation and strategic innovation, and future research could delve deeper into the underlying causes and mechanisms to provide more accurate recommendations. Finally, this study has only examined the structure of green innovation, and future research could conduct more in-depth studies of corporate green innovation based on more categorization criteria.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors upon reasonable request.

Author contributions

DY: Writing – review and editing. JH: Writing – original draft, Writing – review and editing. JY: Writing – original draft.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by the National Natural Science Foundation of China (Nos 72404038 and 72203059), the Humanities and Social Science Project of the Ministry of Education (Nos 22YJCZH221 and 22YJCZH078), the National Natural Science Foundation of Hunan Province (Nos. 2023JJ40336), and the Research Foundation of Education Bureau of Hunan Province (Nos 23B0198 and 22B0195). the National Social Science Fund of Hunan Province (24YBA053), A Project Supported by Scientific Research Fund of Hunan Provincial Education Department (Nos. 24A0181).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, J. (2024). Does the nexus of corporate social responsibility and green dynamic capabilities drive firms toward green technological innovation? The moderating role of green transformational leadership. Technological Forecast. Soc. Change 208, 123698. doi:10.1016/j.techfore.2024.123698

Aghion, P., Bloom, N., Blundell, R., Griffith, R., and Howitt, P. (2005). Competition and innovation: an inverted-U relationship. Q. J. Econ. 120 (2), 701–728. doi:10.1162/0033553053970214

Bai, D., Du, L., Xu, Y., and Abbas, S. (2023). Climate policy uncertainty and corporate green innovation: evidence from Chinese A-share listed industrial corporations. Energy Econ. 127, 107020. doi:10.1016/j.eneco.2023.107020

Baker, S. R., Bloom, N., and Davis, S. J. (2016). Measuring economic policy uncertainty. Q. J. Econ. 131 (4), 1593–1636. doi:10.1093/qje/qjw024

Bloom, N., Bond, S., and Van Reenen, J. (2007). Uncertainty and investment dynamics. Rev. Econ. Stud. 74 (2), 391–415. doi:10.1111/j.1467-937x.2007.00426.x

Borenstein, S., Bushnell, J., Wolak, F. A., and Zaragoza-Watkins, M. (2019). Expecting the unexpected: emissions uncertainty and environmental market design. Am. Econ. Rev. 109 (11), 3953–3977. doi:10.1257/aer.20161218

Cai, X., Huang, Y., Ying, S. X., and Chen, H. (2023). Can climate policy promote high-quality development of enterprises? Evidence from China. Front. Environ. Sci. 11, 1115037. doi:10.3389/fenvs.2023.1115037

Chang, C. L., Zhang, J., and Lin, Y. E. (2024). Climate policy uncertainty, corporate social responsibility and corporate investments of the energy firms. Energy Econ. 140, 107968. doi:10.1016/j.eneco.2024.107968

Chen, C., Fan, M., and Fan, Y. (2023a). The impact of ESG ratings under market soft regulation on corporate green innovation: an empirical study from informal environmental governance. Front. Environ. Sci. 11, 1278059. doi:10.3389/fenvs.2023.1278059

Chen, G. J., Chen, L. L., Jin, H., and Zhao, X. Q. (2023b). Economic research journal. Clim. Transition Risk Macroecon. Policy Regul. 58 (05), 60–78.

Chen, T., Dong, H., and Lin, C. (2020a). Institutional shareholders and corporate social responsibility. J. Financial Econ. 135 (2), 483–504. doi:10.1016/j.jfineco.2019.06.007

Chen, Y., Fan, Z., Gu, X., and Zhou, L. A. (2020b). Arrival of young talent: the send-down movement and rural education in China. Am. Econ. Rev. 110 (11), 3393–3430. doi:10.1257/aer.20191414

Cheng, S., Chen, Y., Wang, K., and Jia, L. (2024). Climate policy uncertainty influences carbon emissions in the semiconductor industry. Int. J. Prod. Econ. 278, 109436. doi:10.1016/j.ijpe.2024.109436

Dang, V. A., Gao, N., and Yu, T. (2023). Climate policy risk and corporate financial decisions: evidence from the NOx budget trading program. Manag. Sci. 69 (12), 7517–7539. doi:10.1287/mnsc.2022.4617

Dangelico, R. M., Pujari, D., and Pontrandolfo, P. (2017). Green product innovation in manufacturing firms: a sustainability-oriented dynamic capability perspective. Bus. strategy Environ. 26 (4), 490–506. doi:10.1002/bse.1932

Fang, X. M., and Hu, D. (2023). Corporate ESG performance and innovation: empirical evidence from A-share listed companies. Econ. Res. J. 58 (02), 91–106.

Gu, X. M., Chen, Y. M., and Pan, S. Y. (2018). Economic policy uncertainty and innovation: evidence from listed companies in China. Econ. Res. J. 53 (02), 109–123.

Han, X., and Cao, T. (2021). Study on corporate environmental responsibility measurement method of energy consumption and pollution discharge and its application in industrial parks. J. Clean. Prod. 326, 129359. doi:10.1016/j.jclepro.2021.129359

He, Q., and Qiu, B. (2025). Environmental enforcement actions and corporate green innovation. J. Corp. Finance 91, 102711. doi:10.1016/j.jcorpfin.2024.102711

Horbach, J., and Rammer, C. (2025). Climate change affectedness and innovation in firms. Res. Policy 54 (1), 105122. doi:10.1016/j.respol.2024.105122

Huo, M., Li, C., and Liu, R. (2024). Climate policy uncertainty and corporate green innovation performance: from the perspectives of organizational inertia and management internal characteristics. Manag. Decis. Econ. 45 (1), 34–53. doi:10.1002/mde.3981

Jiang, T., and Luo, Z. B. (2022). LOC102724163 promotes breast cancer cell proliferation and invasion by stimulating MUC19 expression. China Ind. Econ. 23 (05), 100–120. doi:10.3892/ol.2022.13220

Jorgenson, A. K., Fiske, S., Hubacek, K., Li, J., McGovern, T., Rick, T., et al. (2019). Social science perspectives on drivers of and responses to global climate change. Wiley Interdiscip. Rev. Clim. Change 10 (1), e554. doi:10.1002/wcc.554

Lee, K., and Cho, J. (2023). Measuring Chinese climate uncertainty. Int. Rev. Econ. & Finance 88, 891–901. doi:10.1016/j.iref.2023.07.004

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: evidence from China top 100. J. Clean. Prod. 141, 41–49. doi:10.1016/j.jclepro.2016.08.123

Li, D. Y., Xiang, B. H., and Chen, Y. L. (2009). Dynamic capabilities and their functions: the impact of perceived environmental uncertainty. Nankai Bus. Rev. 12 (06), 60–68. doi:10.3969/j.issn.1008-3448.2009.06.009

Li, J., Kong, T., and Gu, L. (2024). The impact of climate policy uncertainty on green innovation in Chinese agricultural enterprises. Finance Res. Lett. 62, 105145. doi:10.1016/j.frl.2024.105145

Li, Q., and Guo, M. (2022). Do the resignations of politically connected independent directors affect corporate social responsibility? Evidence from China. J. Corp. Finance 73, 102174. doi:10.1016/j.jcorpfin.2022.102174

Li, R., and Liu, L. X. (2021). Green finance and enterprises' green innovation. Wuhan Univ. J. Philosophy & Soc. Sci. 74 (06), 126–140.

Li, W. J., and Zheng, M. N. (2016). Is it substantive innovation or strategic innovation? — Impact of macroeconomic policies on micro-enterprises' innovation. Econ. Res. J. 51 (04), 60–73.

Li, Z. H., and Li, H. K. (2024). The theoretical analysis and empirical testing of the risk impact of climate change on the insurance industry. Insur. Stud. (07), 18–35. doi:10.13497/j.cnki.is.2024.07.002

Lian, Y., Li, Y., and Cao, H. (2023). How does corporate ESG performance affect sustainable development: a green innovation perspective. Front. Environ. Sci. 11, 1170582. doi:10.3389/fenvs.2023.1170582

Liao, Z. (2020). Is environmental innovation conducive to corporate financing? The moderating role of advertising expenditures. Bus. Strategy Environ. 29 (3), 954–961. doi:10.1002/bse.2409

Lin, Y., and Cheung, A. W. K. (2024). Climate policy uncertainty and energy transition: evidence from prefecture-level cities in China. Energy Econ. 139, 107938. doi:10.1016/j.eneco.2024.107938

Liu, C., Pan, X. F., Li, P., and Feng, Y. X. (2023). Impact and mechanism of digital transformation on the green innovation efficiency of manufacturing enterprises in China. China Soft Sci. (04), 121–129. doi:10.3969/j.issn.1002-9753.2023.04.012

Liu, J. K., and Xiao, Y. Y. (2022). China's environmental protection tax and green innovation: incentive effect or crowding-out effect? Econ. Res. J. 57 (01), 72–88.

Liu, R. Z., and He, C. (2021). Study on the threshold effect of environmental regulation on income inequality of urban residents. China Soft Sci. (08), 41–52. doi:10.3969/j.issn.1002-9753.2021.08.005

Ma, Y. Q., Zhao, L. K., Yang, H. Y., and Tang, G. Q. (2021). Air pollution and corporate green innovation: based on the empirical evidence of A-share listed companies in heavy polluting industries. Industrial Econ. Res. (06), 116–128. doi:10.13269/j.cnki.ier.2021.06.009

Ma, Y. R., Liu, Z., Ma, D., Zhai, P., Guo, K., Zhang, D., et al. (2023). A news-based climate policy uncertainty index for China. Sci. Data 10 (1), 881. doi:10.1038/s41597-023-02817-5

Niu, S., Zhang, J., Luo, R., and Feng, Y. (2023). How does climate policy uncertainty affect green technology innovation at the corporate level? New evidence from China. Environ. Res. 237, 117003. doi:10.1016/j.envres.2023.117003

Nordhaus, W. (2019). Climate change: the ultimate challenge for economics. Am. Econ. Rev. 109 (6), 1991–2014. doi:10.1257/aer.109.6.1991

Peng, D., and Kong, Q. (2024). Corporate green innovation under environmental regulation: the role of ESG ratings and greenwashing. Energy Econ. 140, 107971. doi:10.1016/j.eneco.2024.107971

Porter, M. E., and Linde, C. V. D. (1995a). Green and competitive: ending the stalemate. Harv. Bus. Rev. 73 (5), 120–134.

Porter, M. E., and Linde, C. V. D. (1995b). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qi, S. Z., Lin, S., and Cui, J. B. (2018). Do environmental rights trading schemes induce green innovation? Evidence from listed firms in China. Econ. Res. J. 53 (12), 129–143.

Ren, X., Zhang, X., Yan, C., and Gozgor, G. (2022). Climate policy uncertainty and firm-level total factor productivity: evidence from China. Energy Econ. 113, 106209. doi:10.1016/j.eneco.2022.106209

Ruan, L., Yang, L., and Dong, K. (2024). Corporate green innovation: the influence of ESG information disclosure. J. Innovation & Knowl. 9 (4), 100628. doi:10.1016/j.jik.2024.100628

Song, Y., and Dong, J. (2024). Impact of climate policy uncertainty on corporate green investment: examining the moderating role of financing constraints. Front. Mar. Sci. 11, 1456079. doi:10.3389/fmars.2024.1456079

Sun, G., Fang, J., Li, T., and Ai, Y. (2024). Effects of climate policy uncertainty on green innovation in Chinese enterprises. Int. Rev. Financial Analysis 91, 102960. doi:10.1016/j.irfa.2023.102960

Swim, J., Clayton, S., Doherty, T., Gifford, R., Howard, G., Reser, J., et al. (2009). Psychology and global climate change: addressing a multi-faceted phenomenon and set of challenges. A report by the American Psychological Association’s task force on the interface between psychology and global climate change, 66. Washington: American Psychological Association, 241–250.

Tello, S. F., and Yoon, E. (2008). Examining drivers of sustainable innovation. Int. J. Bus. Strategy 8 (3), 164–169.

Tong, T. W., He, W., He, Z. L., and Lu, J. (2014). “Patent regime shift and firm innovation: evidence from the second amendment to China’s patent law,”, 2014. Briarcliff Manor, NY 10510: Academy of Management. doi:10.5465/ambpp.2014.14174abstract14174

Wang, C., Qureshi, I., Guo, F., and Zhang, Q. (2022). Corporate social responsibility and disruptive innovation: the moderating effects of environmental turbulence. J. Bus. Res. 139, 1435–1450. doi:10.1016/j.jbusres.2021.10.046

Wang, C., Wang, H., Bai, Y., Shan, J., Nie, P., and Chen, Y. (2024a). The impact of climate policy uncertainty on corporate pollution Emissions——evidence from China. J. Environ. Manag. 363, 121426. doi:10.1016/j.jenvman.2024.121426

Wang, H., Du, D., Tang, X., and Tsui, S. (2023a). Green finance pilot reform and corporate green innovation. Front. Environ. Sci. 11, 1273564. doi:10.3389/fenvs.2023.1273564

Wang, H., Feng, Z., Yuan, L., and Lin, W. F. (2024b). Green R&D intervention of public research institutions and green innovation of enterprises: from the perspective of environmental externalities. China Ind. Econ. (09), 81–99. doi:10.19581/j.cnki.ciejournal.2024.09.005

Wang, H., Sun, H., Xiao, H. Y., and Xin, L. (2021). “Be cautious” or “Win in danger”? Environmental policy uncertainty and green innovation of pollution-intensive enterprises. Industrial Econ. Res. (02), 30–41+127. doi:10.13269/j.cnki.ier.2021.02.003

Wang, S., Sheng, A. Q., Jin, W., and Wang, Q. J. (2023b). Corporate ESG impression management under climate policy uncertainty: experiential evidence based on tone of ESG text. Finance Trade Res. 34 (09), 69–84. doi:10.19337/j.cnki.34-1093/f.2023.09.007

Wang, S., Yu, L., and Lei, L. (2024c). Climate policy uncertainty and upgrading dilemma of Chinese enterprises. J. Finance Econ. 50 (02), 123–138. doi:10.16538/j.cnki.jfe.20231120.103

Wang, S., and Zhou, Z. J. (2023). Climate policy uncertainty and corporate bond issuance: empirical evidence based on bond credit spreads. J. Shanghai Univ. Finance Econ. 25 (06), 59–72+87. doi:10.16538/j.cnki.jsufe.2023.06.005

Wang, Y. G., and Li, X. (2023). Promoting or inhibiting: the impact of government R&D subsidies on the green innovation performance of firms. China Ind. Econ. (02), 131–149. doi:10.19581/j.cnki.ciejournal.2023.02.008

Wen, S. Y., Liu, H., and Wang, H. (2022). Green finance, green innovation, and high-quality economic development. J. Financial Res. (08), 1–17. doi:10.3969/j.issn.1672-2949.2023.10.006

Winn, M., Kirchgeorg, M., Griffiths, A., Linnenluecke, M. K., and Günther, E. (2011). Impacts from climate change on organizations: a conceptual foundation. Bus. strategy Environ. 20 (3), 157–173. doi:10.1002/bse.679

Xu, X. M., Jing, R. L., and Li, J. S. (2024). Heterogeneous environmental regulation, digital investment and SMEs′ green innovation. Sci. Res. Manag. 45 (08), 126–134. doi:10.19571/j.cnki.1000-2995.2024.08.013

Yan, B., Cheng, M., and Wang, N. H. (2024). ESG green spillover, supply chain transmission and corporate green innovation. Econ. Res. J. 59 (07), 72–91.

Yang, Z., Wang, W. N., Chen, J., and Ling, H. C. (2024). Corporate social responsibility and ambidextrous innovation: seeking progress in stability or winning in risk. Stat. Res. 41 (07), 119–133. doi:10.19343/j.cnki.11-1302/c.2024.07.008

Yuan, B., and Cao, X. (2022). Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 68, 101868. doi:10.1016/j.techsoc.2022.101868

Zeng, J., Ling, W., Hua, M., and Chan, K. C. (2024). Impact of an increase in tax deductibility of R&D expenditure on firms' ESG: evidence from China. Int. Rev. Financial Analysis 96, 103567.

Zhai, P. X., Lei, L., Fan, Y., Guo, K., and Ji, Q. (2024). Syst. Engineering-Theory & Pract. 44 (11), 3520–3536. doi:10.12011/SETP2023-1910

Zhang, G., Wang, J., and Liu, Y. (2024a). Energy transition in China: is there a role for climate policy uncertainty? J. Environ. Manag. 370, 122814. doi:10.1016/j.jenvman.2024.122814

Zhang, N., Sun, Y. Y., Zhao, X. J., Chang, S. C., and Wu, L. Y. (2024b). The impact of climate policy uncertainty on the green innovation of enterprises. Clim. Change Res. 20 (05), 636–650. doi:10.12006/j.issn.1673-1719.2024.107

Zhao, L., Ma, Y., Chen, N., and Wen, F. (2025). How does climate policy uncertainty shape corporate investment behavior? Res. Int. Bus. Finance 74, 102696. doi:10.1016/j.ribaf.2024.102696

Zhao, S., Cao, Y., Feng, C., Guo, K., and Zhang, J. (2022). How do heterogeneous R&D investments affect China's green productivity: revisiting the Porter hypothesis. Sci. Total Environ. 825, 154090. doi:10.1016/j.scitotenv.2022.154090

Keywords: climate policy uncertainty, corporate green innovation, environmental regulation, corporate social responsibility, ESG performance

Citation: Yi D, Hu J and Yang J (2025) Climate policy uncertainty, environmental regulation, and corporate green innovation. Front. Environ. Sci. 13:1570848. doi: 10.3389/fenvs.2025.1570848

Received: 04 February 2025; Accepted: 10 April 2025;

Published: 29 April 2025.

Edited by:

Jinyu Chen, Central South University, ChinaCopyright © 2025 Yi, Hu and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jianlan Yang, YmlsbGNodWsxMDA4NkBnbWFpbC5jb20=

Dan Yi1

Dan Yi1 Jianlan Yang

Jianlan Yang