- School of Economics and Management, Northwest University, Xi’an, Shaanxi, China

Carbon Capture Utilization and Storage (CCUS) is essential for achieving sustainable development and a strong driving force for improving enterprise total factor productivity (TFP). This paper empirically examines the relationship between CCUS and TFP of enterprises based on the collection and organization of CCUS texts in the annual reports of Chinese listed companies from 2002 to 2022. It is found that CCUS has a significant positive impact on corporate TFP. The conclusion still holds after considering issues such as endogenous problems. Mechanism analysis finds that CCUS improves the external environment of enterprises and enhances the ability to obtain bank loans while at the same time improving enterprises’ innovation ability, which in turn helps promote the TFP of enterprises. Heterogeneity analysis finds that the positive impact of CCUS on enterprise TFP is more prominent in large-scale enterprises, state-owned enterprises, and the eight key emitting industries than in small-scale enterprises, non-state-owned enterprises, and other industries. This investigation innovatively employs a text analysis methodology to measure CCUS, reveals the potential determinants influencing CCUS technology on the TFP, and furnishes a scientific foundation for policy refinement.

1 Introduction

Vigorously developing carbon capture, utilization, and storage (CCUS) technology is a strategic choice for reducing carbon dioxide emissions and ensuring future energy security, which is also significant for achieving sustainable development. The Paris Agreement launched the GGA Work Program, which specifies “to limit the global average temperature to 2°C or less compared to the pre-industrial period, and to strive to limit the temperature increase to 2°C or less”. The GGA Work Program specifies the long-term goal of “limiting the global average temperature to 2°C above pre-industrial levels and striving to limit the temperature increase to 1.5°C″ to address the persistent and profound impacts of climate change on the globe. However, according to the United Nations Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment of Climate Change Working Group III report, only about 1,150 billion tons of the current global CO2 emissions budget remain to achieve the 2°C goal, and global CO2 emissions for the 2010–2019 period account for about one-third of this budget. Under the condition that it is impossible to completely abandon fossil energy, carbon capture, utilization, and storage (CCUS) is a critical way to profoundly reduce CO2 emissions in order to respond to climate change (Qin et al., 2020). It is a key technological tool and a bottom-up technological guarantee to achieve the temperature control target of the Paris Agreement.

It has become a hot topic about CCUS solving environmental problems while improving the economic efficiency of enterprises. Although the development of the CCUS industry requires a long-lasting and large amount of capital investment, according to the multiplier theory, large enterprises bear or jointly bear the input costs alone, drive the development of the industrial chain through CCUS, reduce the production cost, realize the economy of scale and economy of scope, and ultimately generate exponential economic benefits. According to Schumpeter’s innovation theory, enterprises develop new carbon capture technologies, such as adsorbents, membrane separation technology, etc., which can improve the efficiency of carbon capture and reduce costs (Xiang et al., 2023), and confirm the decoupling theory from the perspective of micro subject. According to the externality theory, enterprises avoid carbon tax costs by reducing carbon emissions through CCUS. The reduction of carbon emissions by CCUS also meets the requirements of environmental protection regulations, realizing the positive externality. With the restart of the CCER market, enterprises obtain additional income through the carbon trading market, effectively internalizing the externality and solving the problem of market failure.

Based on the textual information of annual reports of listed companies, this paper identifies CCUS with the help of the textual analysis method, constructs the metrics of CCUS, utilizes the TFP to portray the level of economic development of enterprises, and then examines the relationship between CCUS and the TFP of enterprises as well as the mechanism of action therein. It was found that CCUS can increase enterprises’ TFP. From the viewpoint of changes in the external environment of enterprises, the level of CCUS enhances the ability of enterprises to obtain credit, thus promoting the increase of enterprise TFP. From the viewpoint of enterprise internal capability improvement, the CCUS level stimulates enterprise innovation capability, stimulating enterprise total factor productivity growth. Around the role of the CCUS level, the heterogeneity of the impact of CCUS on firms’ total factor productivity is examined from the perspectives of firms’ size, firm attributes, and the industries.

Therefore, this article collects and organizes the CCUS texts disclosed in the annual reports of the listed companies in China from 2003 to 2022 and conducts an empirical investigation on the relationship between CCUS and TPF of enterprises. Compared with the existing literature, the innovations of this paper are mainly reflected in the following aspects: first, most of the existing literature focuses on the economic effects of CCUS (Zhao et al., 2021; Wei N. et al., 2021), and very few of the literature discuss the relationship between CCUS and TFP from the perspective of CCUS texts. Based on this, this paper focuses on analyzing the potential impact of CCUS on listed companies, enriches related studies on CCUS, and validates the decoupling theory from the perspective of micro subjects. In the existing literature, firm performance analyses mainly rely on traditional quantitative indicators such as financial and patent data, which, however, often fail to comprehensively capture a firm’s innovation activities and their complex impact on performance. Text data, as a new type of information source, contains a rich and under-explored potential value. Our study builds on this research gap by innovatively applying text data to enterprise performance analysis. The application of text data can also overcome traditional data problems regarding measurement errors, R&D manipulation, etc., and improve the accuracy and reliability of corporate performance analyses. Our study verifies the effectiveness and advantages of text data in corporate performance analysis through empirical analyses and provides new ideas and methods for research in this field. Second, the existing literature focuses on exploring the economic effects of CCUS on carbon reduction (Kouri et al., 2017; Yao et al., 2018; Liu et al., 2021; Zhang et al., 2022). This paper takes scientific and technological innovation and credit support as the entry point to explore the mechanism of the impact of CCUS on the economic growth of enterprises and enrich the relevant study of CCUS. At the same time, we also provide a new perspective for understanding the role played by CCUs in promoting enterprise TFP growth. Thirdly, the article further discusses the effects of enterprise size, characteristics of state-owned enterprises, and the eight emission reduction industries on the promotion of TFP by CCUS, which will provide valuable references for the later promotion of CCUS.

The rest of the paper is organized as follows: the second part is the literature review; the third part is the theoretical analysis and research hypotheses; the fourth part introduces the empirical research design; the fifth part is the main empirical results and analyses; the sixth part is the further analyses; the seventh part is the conclusions and policy implications are given; and finally, Discussing.

2 Literature review

2.1 About CCUS technology and applications

In recent years, CCUS technology has made remarkable progress. China has also made significant progress in CCUS technology, especially CCUS-EOR technology for enhanced oil recovery (EOR) (Qin et al., 2020). Li et al. (2009) proposed a roadmap for developing carbon dioxide capture and storage (CCS) technology in China and explored the future development direction in this field (Zhang et al., 2021). evaluated the development of CCUS technology in China from different dimensions, pointed out the positioning of CCUS technology under the goal of carbon neutrality, and provided an outlook. Tang et al. (2021) analyze CCUS technology to help the power industry achieve faster decarbonization in the short term.

2.2 TFP of enterprises

Academics have proposed several measurement methods for TFP. Olley and Pakes (1992) proposed the OP method based on the consistent semiparametric estimator method to estimate TFP. Levinsohn and Petrin (2003) improved the OP method by using intermediate inputs as proxy variables for productivity and proposed the LP method to measure TFP. Wooldridge (1996) proposed a one-step consistent estimation method based on the GMM framework to measure TFP after improving the OP and LP estimation methods. Lu and Lian (2012) applied parametric and semiparametric methods such as least-squares, fixed-effects, OP, and LP to calculate the TFP of China’s industrial enterprises. Giannetti et al. (2015) borrowed the OP and LP methods and improved the traditional OLS method to calculate the TFP of listed companies. Yang (2015) relies on the database of China’s industrial enterprises in the period of 1998–2009, comprehensively constructing the panel data, treating the capital variables, treating the price index, etc., and standardization and organization of this database, and calculating enterprise-level TFP based on OP, LP and other methods.

2.3 CCUS and enterprise TFP

Discussions about CCUS and firms’ total factor productivity (TFP) have given rise to divergent views within the academic community. Dong et al. (2025) also found that CCUS technological innovations significantly enhance green total factor productivity by facilitating the improvement of industrial infrastructure and carbon emission efficiency. Xiang et al. (2023) utilize real ternary options to develop an investment decision model for CCUS projects and analyze their feasibility. Monteiro and Roussanaly (2022) examined the economic feasibility of CO2 utilization in cement production facilities. Nevertheless, several scholars have advanced the argument that the elevated full-process cost of CCUS represents a pivotal barrier to total factor productivity. In their 2020 study, Qin Jishun et al. posited that the impediment to the industrialization of CCUS in China is attributable to a paucity of economic incentives and the elevated costs associated with capture and integration. The IPCC AR6 report elucidated that the collective maturity of global CCUS technology is currently in the demonstration stage, and that the substantial expense of CCUS emission reduction in coal-fired power plants engenders a protracted and hazardous return on investment for enterprises (Peng et al., 2022). Yang et al., (2025) calculated the cost of capture and transport to be 52.47% of the total cost of the CCUS-EOR project of Yanchang Petroleum, and concluded that the project would not be profitable until oil prices exceeded 70 USD/barrel. This makes showing the TFP in the low oil price environment is challenging. The present study analyses whether the CCUS text data disclosed in the annual reports of listed companies can improve the total factor productivity of enterprises.

3 Theoretical analysis and research hypothesis

3.1 Analysis of impact effects

CCUS plays an essential role in connecting firms with the market, providing an incentive-compatible market-based governance mechanism for firms’ TFP. Hu et al. (2023) suggest that the emission reduction benefits under the carbon trading mechanism will also motivate enterprises to optimize resource allocation or upgrade their processes, thus improving productivity. Under the market mechanism of the “dual carbon” target, CCUS becomes the most direct way to reduce carbon emissions. Enterprises can not only reduce carbon emissions on a large scale by developing and upgrading CCUS processes but also cultivate new business growth poles, thus promoting the growth of enterprise TFP. Therefore, this paper proposes the following research hypotheses.

Hypothesis 1. CCUS promotes firms’ TFP.

3.2 Analysis of impact mechanisms

This paper mainly analyzes the influence mechanism of CCUS on the TFP of enterprises in two ways: their external environment and their internal capacity.

3.2.1 CCUS and the corporate external environment

Due to the lack of financial support and other constraints, it is difficult for most enterprises to sustain CCUS programs, resulting in limited economic benefits for enterprises. Therefore, strengthening financial support for enterprises is crucial to enhancing their TFP. In this context, CCUS can accelerate enterprises’ access to capital through government subsidies, credit support, and other channels to build a solid capital guarantee to increase enterprises’ TFP.

Specifically, firstly, with the strengthening of CCUS policy support, enterprises carrying out CCUS projects can receive certain financial subsidies from local governments, thus playing the “leveraging effect” of Cash in the Treasury (Ding et al., 2024). With the support of government subsidies, CCUS enterprises will have more substantial capital turnover and risk-resistant ability, thus alleviating the lack of motivation caused by the high risk and long cycle of enterprise digital transformation. Secondly, enterprises facing a severe external financing environment cannot bear the high costs, making it difficult for CCUS programs to be sustained. According to signaling theory, the development of CCUS will lead banks and other financial institutions to provide financial support for enterprises, which will directly enhance the scale and level of financing for enterprises and solve the problems of “difficult” and “expensive” financing (Yu et al., 2021), thus helping enterprises’ TFP. This will help the growth of the TFP of enterprises. Therefore, this paper proposes the research hypotheses H2a and H2c.

Hypothesis 2. Given other conditions, fiscal subsidies produce an impact mechanism between CCUS and enterprise TFP, i.e., CCUS can promote enterprise TFP through fiscal subsidies.

Hypothesis 3. Given other conditions, bank loans produce an impact mechanism between CCUS and enterprise TFP, i.e., CCUS can promote enterprise TFP through bank loans.

3.2.2 CCUS and in-house capabilities

The development of CCUS by enterprises has simultaneously stimulated their scientific and technological innovation, thus driving the growth of their TFP (Griliches, 1986). The massive upfront investment forces CCUS enterprises to increase R&D investment, and CCUS promotes carbon utilization technological innovation and develops more carbon utilization technologies, such as converting carbon dioxide into high-value-added chemicals and fuels, etc., to increase the utilization value of carbon dioxide and drive up TFP. The construction and implementation of large-scale CCUS projects drive the development of CCUS-related technology and equipment manufacturing, which leads to the intersection of disciplines and the cultivation of industrial talents (Qin et al., 2020) and the use of scientific and technological talents to promote the growth of enterprise TFP. Therefore, this paper proposes the research hypothesis H2c.

Hypothesis 4. Given other conditions, an impact mechanism arises between CCUS and firms’ TFP, i.e., CCUS can promote the growth of firms’ TFP by enhancing firms’ science and technology innovation.

4 Research design

4.1 Data description

This paper selects the listed companies in Shanghai and Shenzhen A-shares from 2002 to 2022 as the research object. The explanatory variables are the TFP data from the annual reports of listed companies in previous years. The core explanatory variables are the textual information of CCUS, which is from the annual reports of the listed corporations in previous years. (1) Download the annual report documents of all A-share listed companies from 2002 to 2022 from Juchao Information Network. (2) Based on the Python platform, convert the PDF documents into TXT documents and clean the data as follows: First, process the tables. The table in the annual report becomes a text box after conversion. Thus, it is impossible to query or analyze its content directly. Because most of the table contents are numbers, a few text contents are heavily templated and contain less incremental text information. Therefore, this paper eliminates all forms through text recognition. Secondly, scanned documents and missing documents are eliminated. (3) Based on the Chinese general dictionary Jieba, Python subdivides the text content, and deactivated words are removed so that the unstructured text data is converted into word vectors for storage. (4) Calculate the word frequency of the word set corresponding to the CCUS metrics. Relevant data on basic corporate information, financial indicators, and corporate governance are from the Wind database and China Research Data Service Platform (CNRDS). The data are processed as follows: first, samples with the normal listing are retained; second, samples such as ST are excluded; third, samples of companies with IPOs of less than 1 year are excluded; and fourth, continuous variables are reduced-tailed at the 1% level. After these filters, the final result is 3,686 listed companies, constituting 32,900 sample unbalanced panel observations.

4.2 Variable settings

4.2.1 CCUS text

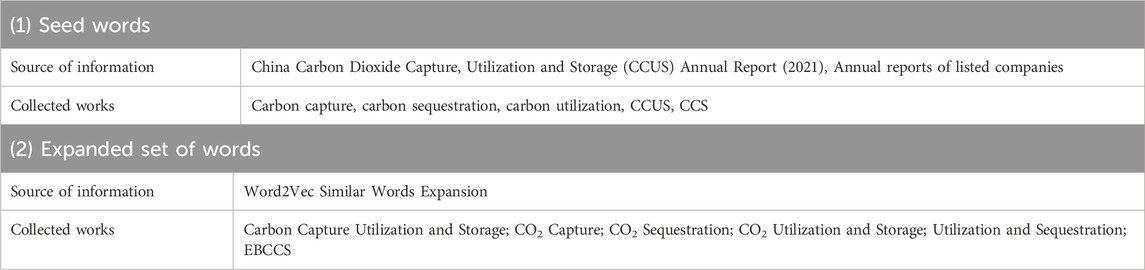

Drawing on (Yang et al., 2024), CCUS variables were constructed from the textual analysis of annual reports released by A-share listed companies. Specifically, the construction process of the CCUS indicator is as follows.

(1) Based on the China Carbon Dioxide Capture, Utilization and Storage (CCUS) Annual Report (2021), a thesaurus of CCUS features has been compiled, including five feature words in two categories: direct and indirect. The direct category includes CCUS, carbon capture, carbon sequestration, and carbon utilization; the indirect category includes CCS.

(2) For the same concept or thing, the expressers often use multiple semantically similar words to describe it, so the seed word set needs to be expanded with similar words. The Word2Vec machine learning technique proposed by Mikolov et al. (2013) is a recent landmark achievement in this field (Lecun et al., 2015). Word2Vec is essentially based on the neural network Word Embedding method, which represents words into multi-dimensional vectors based on contextual semantic information, and obtains the semantic similarity between words by calculating the similarity between the vectors (Bengio et al., 2003). Specifically, this paper adopts the CBOW (Continuous Bag-of-words Model) in Word2Vec to train the Chinese annual report corpus (Equation 1).

The CBOW model:

where C denotes the corpus; w denotes the center word; Context(w) denotes the context of the center word. The basic idea of the CBOW model is to predict the probability of the current word based on the context, and by maximizing the above objective function, the Word2Vec word vector corresponding to the center word can be obtained eventually. Subsequently, similar words to the center word can be obtained by calculating the vector similarity. The model is trained based on massive financial texts, and the recommended similar words are more suitable for the textual context, which can effectively avoid the subjectivity of artificially defined word lists and the weak correlation of standard synonym tools.

(3) We manually verified the indicator word set and finally determined that it contains 11 CCUS words. Subsequently, given the typical “right-biased” characteristics of this kind of data, the CCUS in this paper is logarithmically normalized to form the CCUS indicator (CCUS) in Table 1.

4.2.2 The TFP of enterprises

The explanatory variable in this paper is firm TFP. Considering that firms may adjust factor inputs promptly according to observable production efficiency, there is a potent endogenous relationship between firm-level TFP and factor inputs, leading to the usual bias in the productivity obtained from the least squares production function estimation. Blundell and Bond (1998) effectively address the endogeneity problem in the regression by adding instrumental variables through GMM estimation. Therefore, this paper uses the GMM method to compute firms’ TFP. In addition, in the robustness test section later, this paper uses the LP and OP methods to calculate firms’ TFP as alternative explanatory variables.

(1) Olley-Pakes method (abbreviated the OP method)

Olley and Pakes (1992) developed a consistent semi-parametric estimator. The method solves the simultaneity bias problem by assuming that firms make investment decisions based on the current productivity situation of the firm and therefore use the firm’s current investment as a proxy for unobservable productivity shocks. The method consists of two main steps:

Firstly, the relationship between the firm’s current capital stock and the amount of investment needs to be established, and Olley and Pakes construct the following Equation 2:

where K is the capital stock of the firm, I represents current investment,

It is assumed that firms tend to increase their current-period investment if they have higher expectations about the future, i.e., the higher the current period, the higher the current-period investment. Based on this, an optimal investment function is

The second step focuses on estimating the coefficients of the capital term. We define

(2) Levinsohn-Peterin method (abbreviated the LP method)

The Olley-Pakes methodology provides consistent estimates of the firm-level production function, which is subject to several assumptions. One of these assumptions is the requirement that the proxy variable (investment) is always monotonically related to total output. This means that those samples with zero investment are not estimated. Since not every firm has a positive investment yearly, many firms are discarded in the estimation process. Levinsohn and Peterin (2003) develop a new approach to total factor productivity estimation to address this problem. Instead of using the amount of investment as a proxy variable, the method replaces it with an indicator of intermediate goods inputs, which are more readily available from a data perspective.

(3) GMM method

A generalized method of moments was proposed by Blundell and Bond (1998). The method aims to address the endogeneity problem that exists in the model. The basic idea is to address the endogeneity problem in the model by including instrumental variables. A natural instrumental variable for the estimation of the production function is the lagged value of the explanatory variable. Since it is determined in period t-1, it will not be related to the technology shock in the current period.

The production function (Equation 3) is assumed to be of Cobb-Douglas form:

where

TFP is assumed to obey a first-order autoregressive process (AR(1)), seeing Equation 4:

where

GMM addresses endogeneity by constructing moment conditions.

The first step, first-order differencing of the production function (Equation 5) eliminates individual fixed effects

The second step uses lagged variables as instruments to construct moment conditions. Assuming that historical inputs or outputs are orthogonal to the current error term, Define the moment conditions

The third step yields parameter estimates by minimizing the moment-conditional weighted distance (Equation 6).

where W is the weight matrix (usually a two-step approach is used: the first step uses the unit matrix and the second step uses the first step residual covariance matrix).

4.2.3 Control variables

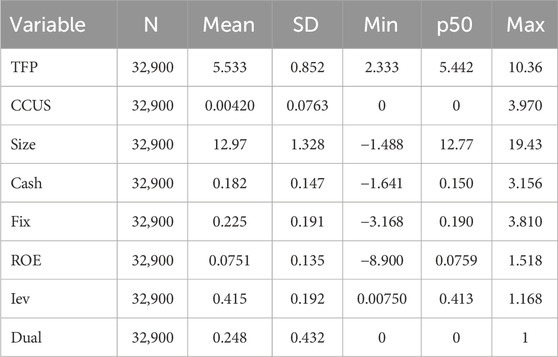

In order to avoid the problem of omitted variables causing the estimated coefficients to be unreliable, this paper adds firm characteristics control variables, financial characteristics control variables, and governance structure control variables. First, firm characteristics are control variables. First, the firm characteristics control variables. Among them, firm size is measured by the logarithm of the number of employees in the firm. Second, financial characteristics are control variables. Among them, capital structure (Lev) is expressed as the ratio of total liabilities to total assets; fixed asset ratio (Fix) is expressed as the ratio of net fixed assets to total assets; profitability (ROA) is quantified as the ratio of after-tax profit to net assets; and cash flow (Cash) is expressed as the after-tax cash flow that can be distributed to all investors after the company pays for all the operating expenses and makes the necessary investments in fixed assets and operating assets. Cash is represented by the after-tax cash flow that the firm can distribute to all investors after paying all operating expenses and making necessary investments in fixed and operating assets. Third, governance structure control variables. Dual is a dummy variable that is one if the chairman of the board and the CEO are combined, and zero if they are not. The descriptive statistics of the main variables are shown in Table 2.

4.3 Model setting

In order to test the impact and mechanism of CCUS on the economic growth performance of enterprises, this paper constructs the following regression model (Equation 7):

In this paper, the explanatory variable is the firm’s TFP, the core explanatory variable is the degree of CCUS development (CCUS), and the Controls are the control variables described earlier. In addition, the model controls for individual (ID) and year (Year). The paper focuses on the coefficients of the variables, if

5 Empirical results and analysis

5.1 CCUS and corporate TFP: Basic results

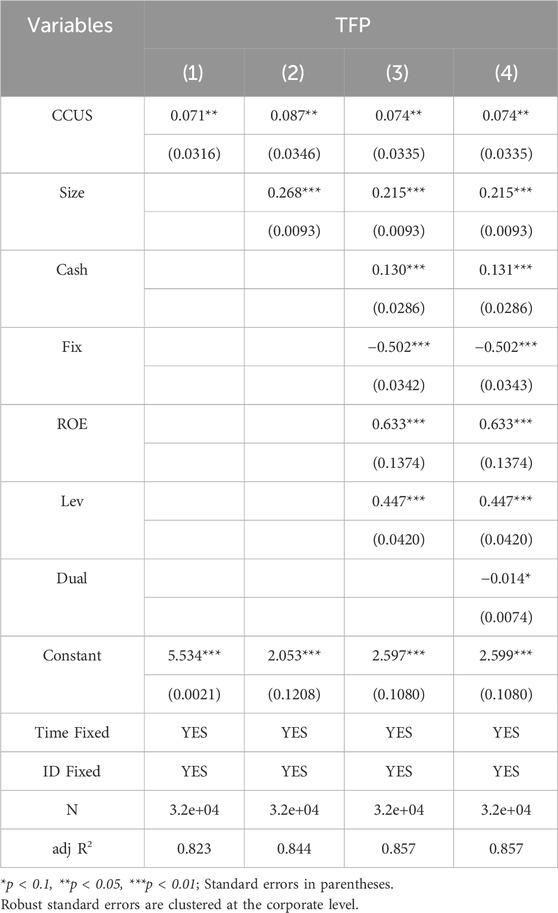

The following article examines the specific impact of the CCUS level on firms’ TFP. Estimates are first based on model (1), and Table 3 reports the results of the regressions of CCUS levels on firms’ TFP. All regression analyses control for individual and year-fixed effects and use firm-level clustering standard errors.

As shown in column (1) of Table 3, the regression coefficients for CCUS are significantly positive, indicating that CCUS can significantly increase firm output. Column (2) further shows that the regression coefficient of CCUS is 0.087, which is significant at the 5% level after adding the firm characteristics control variable, i.e., CCUS makes firms’ TFP increase by 8.7% on average. Column (3) shows that the regression coefficient of CCUS after adding the control variables of firm characteristics and financial characteristics simultaneously is 0.074, which is significant at the 5% level, i.e., CCUS makes firms’ TFP increase by 7.4% on average. 7.4% increase in TFP is substantial for heavy industries compared to the average annual TFP growth rate of 1.2–1.8 per cent for manufacturing in Syverson (2011). Column (4) further shows that the regression result is still significant after adding a series of control variables such as firm, financial, and governance characteristics. This verifies research hypothesis 1 that the level of CCUS has a significant positive contribution to firms’ TFP.

Firstly, the control variables’ coefficients of enterprise size are all significantly positive, indicating that large-scale enterprises have higher TFP because CCUS is a high-risk and high-investment activity, and large-scale enterprises are more capable of carrying out CCUS. Secondly, the coefficients of return on equity (ROE), gearing ratio (Lev), and cash flow (Cash) are all significantly positive in the regression of TFP, indicating that firms with good efficiency, high debt ratio, and high cash flow have higher TFP. The coefficient of fixed assets (Fix) is significantly negative in the regression of TFP, which indicates that too many fixed assets in the previous period crowd out the CCUS program and adversely affect the TFP of enterprises. The coefficient of Dual is significantly negative. Looking into the reasons for this, the enterprise will tend to protect the interests of major shareholders or management, and managers may refuse to touch their interests when deciding to carry out CCUS projects hastily.

5.2 Robustness test

5.2.1 Endogenous control

The previous analysis suggests that CCUS contributes to firms’ TFP. However, this effect may be disturbed by endogeneity issues such as omitted variables, measurement error, and reverse causation, and is not robust. Regarding the omitted variable problem, this paper adds a series of control variables in the baseline regression and controls for industry time fixed effects and firm fixed effects in the robustness test section, which mitigates the omitted variable problem to a certain extent. Regarding the measurement error problem, the article mainly utilizes the replacement of explanatory and interpreted variables to confirm the robustness of the article’s findings. Regarding the reverse causation issue, there is an endogeneity problem of reverse causation as firms increase their TFP, thus making them more capable of investing in the CCUS program. This may interfere with the results of the benchmark regression in this paper, making the estimation results biased.

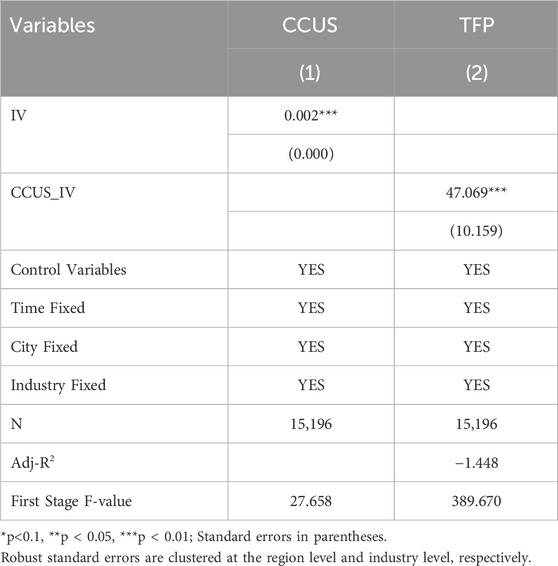

In this regard, this paper eliminates this doubt by constructing instrumental variables using the number of colleges and universities in the region where the listed companies are located (Huang et al., 2022; Zhang and Ha, 2024) and the interaction term of the instrumental variable constructed by the industry to which the firm belongs, respectively. Regarding the relevance of the instrumental variables, the higher number of colleges and universities implies that college graduates constitute an important talent pool for enterprises to provide talent support for CCUS technology. The eight key emitting industries to which the enterprises belong indicate that the enterprises have more incentives to develop CCUS to reduce carbon emissions under the pressure of environmental regulations. Regarding the exogenous requirements of instrumental variables, the number of colleges and universities with a lag of four periods has no noticeable impact on the TFP of enterprises, and the industries to which enterprises belong also have no apparent impact on the TFP of enterprises.

While it is theoretically possible for educational intensity to have an impact on firm TFP through these channels, in the particular context of this study, the effect is relatively small and manageable. Firstly, it is true that the quality of a firm’s employees is closely related to TFP from a labor quality perspective. However, we need to be clear that the application and diffusion of CCUS technology is somewhat specific in terms of its requirements for labor quality. The key industries involved in CCUS, such as oil and gas extraction and the chemical industry, have more prominent requirements for professional skills and experience, and the increase in education levels reflected in college density mainly improves the overall quality of the labor force at the macro level. However, it is difficult to directly and precisely act on the specific skilled workforce needed in these key industries. When recruiting, enterprises pay more attention to the professional background and practical skills of their employees, and these factors are relatively weakly correlated with college density. Thus, regarding the culture of innovation, the impact of improved quality of the local labor force on TFP is somewhat weakened here. Increased college density may create a cultural atmosphere conducive to innovation, incentivizing firms to innovate and boosting TFP. However, we also note that forming an innovation culture is a long-term and complex process, which is affected by a combination of factors, including social culture and the policy environment. Regarding education density alone, its direct impact on firms’ innovation culture is relatively limited, and it is difficult to significantly change firms’ innovation behavior and TFP in the short term. In addition, in our research model, we have controlled for a series of variables that may affect firms’ innovation and TFP, such as firms’ R&D investment, scale, etc., which also reduces the interference of the potential confounders, namely, the innovation culture, to a certain extent. We choose college density as an instrumental variable mainly based on the following considerations: On the one hand, college density reflects, to some extent, the richness of regional educational resources and the ability to cultivate talents, which is correlated with the supply of CCUS technology talents. The development of key industries and the application of CCUS technology require a large number of professional technical and managerial talents, and regions with high college density tend to be able to provide a more adequate talent pool for these industries, thus promoting the application and promotion of CCUS technology in key industries, which in turn affects the total factor productivity of enterprises. On the other hand, the relationship between college density and firms’ TFP is not simply direct causality. However, it works indirectly through intermediate links, such as influencing the application of CCUS technology in key industries. This indirectness makes college density somewhat plausible as an instrumental variable that can satisfy the exclusionary restriction to a certain extent.

The results of the instrumental variable estimation are shown in Table 4, with IV as the instrumental variable. In the first-stage regression, the coefficients of instrumental variables are significant, and the F-values are all greater than 10. The results of the weak instrumental variables test also confirm the reasonableness of the instrumental variables selection, indicating that the instrumental variables satisfy the relevance conditions; in the second-stage regression, the impact of CCUS on the enterprise’s TFP is still significant and positive, which indicates that after eliminating endogeneity problems, CCUS can still significantly improve the enterprise’s TFP. This also confirms the robustness of the previous conclusion.

5.2.2 Substitution of explanatory variables retest

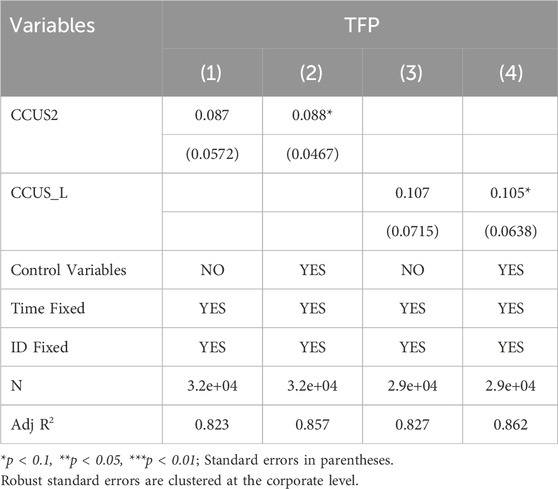

First, the explanatory variable is replaced with the number of occurrences of CCUS-related word frequencies in corporate annual reports. The corporate annual report summarizes the enterprise’s previous year’s work. In this paper, the cumulative number of CCUS-related word frequencies (CCUS2) is used as the explanatory variable for the robustness test (see columns (1)–(2) of Table 5). Second, to further reflect the differences in effectiveness among CCUS texts, this paper generates CCUS with a 1-period lag (CCUS_L) as an explanatory variable for re-estimation, as shown in columns (3)–(4) of Table 5. Overall, the findings are more robust with the inclusion of control variables.

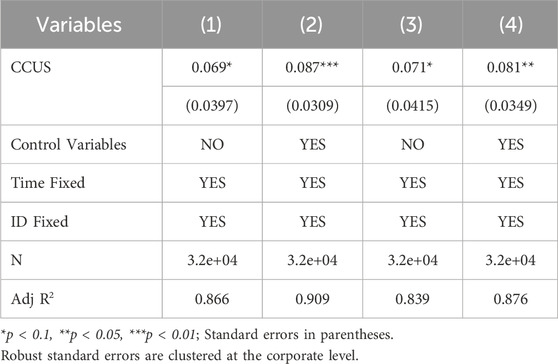

5.2.3 Substitution of dependent variables retest

In order to test the sensitivity of the benchmark regression results of this paper to the calculation method of firms’ TFP, referring to Huang et al. (2023), this paper recalculates firms’ TFP by using OP and LP to replace the dependent variable indicators. Table 6 of the regression results shows that after adding the control variables, the CCUS level of column (2) is significant at the 1% level for the TFP of the LP method. The CCUS level of column (4) is significant at the 5% level for the TFP of the OP method, which confirms that the previous findings are robust and credible.

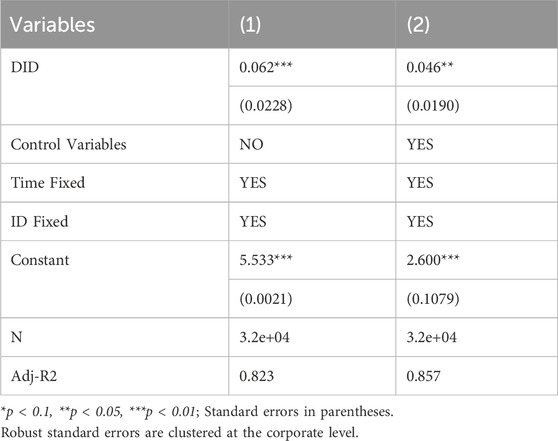

5.2.4 The DID model to test

We add the DID model to test the CCUS’s robustness in this paper. In 2020, the People’s Bank of China, the National Development and Reform Commission, and the China Securities Regulatory Commission jointly issued “Green Bond Support Catalogue (2020 Edition)” (Draft), which explicitly proposes to include CCUS in the support catalogue. This paper uses this as a quasi-likelihood test, and includes listed companies that disclose CCUS-related topics in their annual reports into the experimental group, setting treat = 1 and 0 otherwise; 2020 and beyond are included in the pilot time, setting post = 1 and 0 otherwise, so as to construct the following DID model (Equation 8):

where Y is the explanatory variable for TFP; treat represents a dummy variable for whether or not it is a pilot individual, with 1 for pilot individuals and 0 for non-pilots; post is a dummy variable for before and after the implementation of the green bond support catalogue policy, with zero before the policy is implemented and one after; the cross-multiplier term is the core explanatory variable that this paper focuses on, and the estimated coefficients of which are the causality that this paper attempts to identify; X is the group of control variables; γ is an individual fixed effect; λ is a time fixed effect; and is the random error term.

From the results in Table 7, column (1) of the figure below shows that CCUS can significantly increase firms’ TFP. Column (2) of the study’s findings remains robust with the addition of control variables.

In the DID model test, a series of control variables, such as firm size, firm age, degree of market competition, and the number of environmental penalties imposed on firms, are added to the model to exclude other potential factors from interfering with the results, and to ensure that the relationship between the instrumental variables and the total factor productivity of firms is more robust and reliable.

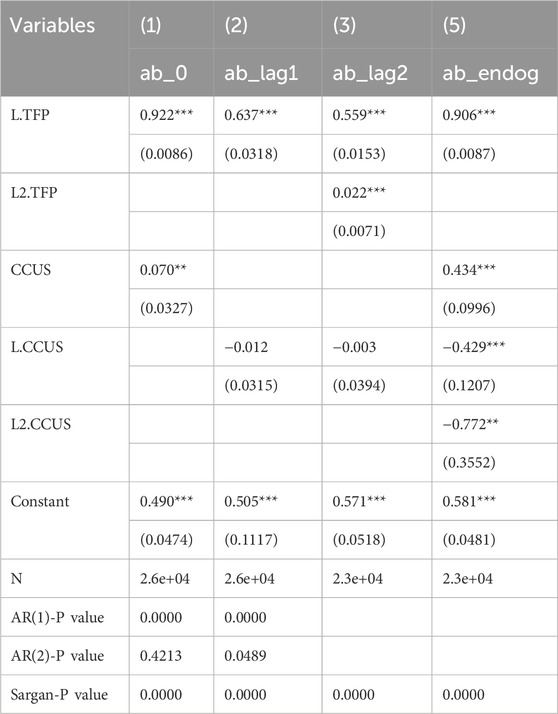

5.2.5 Construction of dynamic panel data models

In order to eliminate the endogeneity bias that may arise from the static panel data model, this paper introduces the lagged term of the explanatory variable firm TFP on the basis of the basic regression model and constructs a dynamic panel data model for robustness testing. The details are as follows Equation 9:

where

It is easy to see from Table 8 that the regression coefficients of the lagged terms of enterprise TFP are all significantly positive, indicating that enterprise TFP exhibits obvious inertia characteristics, and also implying that the regression using the dynamic panel data model is reasonable. In addition, the autocorrelation test results show that the P values of AR (1) statistics are all 0, rejecting the null hypothesis, indicating that there is a first-order serial correlation in the perturbation term; the P values of AR (2) statistics are all greater than 0.1, accepting the null hypothesis, implying that the perturbation term does not have a second-order serial correlation. The results of the validity test of instrumental variables show that the P-values of Sargan test are all 0, indicating that the selection of instrumental variables is valid. Therefore, it can be determined that the model setting of this paper is appropriate and its regression results are reliable and valid. In terms of the regression coefficients of the variables, the regression coefficients of CCUS are all still significantly positive, implying that CCUS leads to an increase in corporate TFP, which indicates that the adoption of the dynamic panel data model does not change the core conclusions, and preliminarily shows that the findings of this paper are robust.

6 Further analysis

6.1 Impact mechanism analysis

6.1.1 Changes in the external environment of enterprises

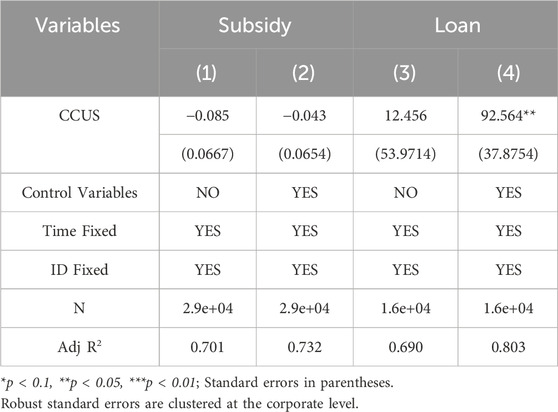

The previous analysis found that CCUS technology has a significant positive impact on the TFP of enterprises, and the question arises as to how this impact is realized. Based on the previous theoretical analysis, the article first focuses on analyzing the impact of CCUS on the TFP of enterprises from the channels of government subsidies and commercial bank credit support.

Regarding the specific empirical design, this article refers to the existing study of Yang et al. (2015), where government subsidies are measured as government direct subsidies (Subsidy), carried out through logarithmic treatment. Referring to existing studies such as Lu and Yang (2011) and Guo and Fang (2022), credit support is measured by the sum of short-term borrowing and long-term borrowing of firms as a proportion of total assets at the end of the period (Loan). This paper develops a mechanism test based on this. From the basic regression results after adding control variables, first, the CCUS technique does not significantly affect the amount of government subsidies to firms (see column (2) of Table 9). The possible reason for this is that the number of CCUS supported by government subsidies is limited, and most firms may not be able to achieve their TFP improvement through government subsidies. Second, the variable CCUS positively affects commercial bank credit support (see column (4) of Table 9), indicating that firms’ CCUS technologies help firms obtain loans from commercial banks, promoting firms’ TFP.

6.1.2 Intra-enterprise capacity-building

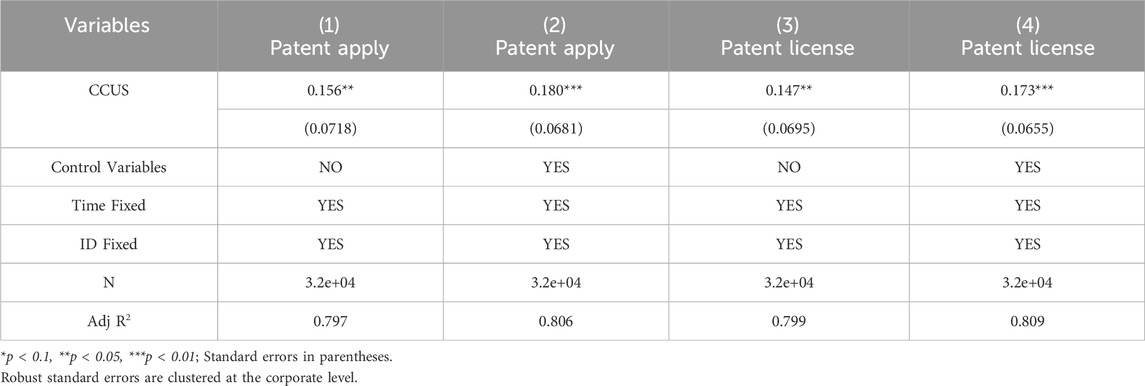

CCUS technology, as a representative of scientific and technological innovation, has become an important force in building the internal capabilities of enterprises and plays a pivotal role in the TFP of enterprises. Yin and Yu (2018) argued from the patent perspective that China already possesses the main elements needed to build a patent pool of CCUS technology. That patent flow significantly improves enterprises’ TFP (Wu and Yin, 2021). Huang et al. (2023) argued that the number of patent applications is a common indicator to characterize the level of R&D and innovation of enterprises. Cai et al. (2019) use the number of patents granted to measure corporate innovation. Therefore, this paper explores whether CCUS technology can enhance the TFP of enterprises in terms of patent application and patent acquisition. Specifically, the number of patent applications (Patent Apply) is measured by using the total number of invention patent applications and the total number of utility model patent applications summed up and logarithm; the number of patent licenses (Patent License) is characterized by the sum of the total number of invention patent licenses and the total number of utility model patent licenses and logarithm.

The results in Table 10 find that CCUS significantly affects firms’ TFP. Columns (1) and (3) show that CCUS significantly increases firms’ TFP by 15.6 and 14.7 percentage points at the 5% level without the control variables, while columns (2) and (4) show that CCUS significantly increases firms’ TFP by 18% and 17.3% at the 1% level with the control variables.

6.1.3 The mechanism test

We add mediation tests to more clearly articulate the mechanism test. In this article, we measure the number of patent applications, patent licenses, and credit support (Loan) to examine the impact of CCUS on firms’ TFP in a more comprehensive way Equations 10, 11.

where

Columns (1) and (2) of the Table 11 below report the impact of CCUS on patent applications and the impact of patent applications on firms’ TFP, respectively. Columns (3) and (4) report the impact of CCUS on patent grants and the impact of patent grants on firms’ TFP, respectively. Columns (5) and (6) report the effect of CCUS on credit lending and the effect of credit lending on firms’ TFP, respectively.

The regression results show that the core explanatory variables are all positive at least at the 10 percent significance level. This indicates that under the influence of CCUS, both internal patent innovation capability and external credit loans are enhanced to some extent. This paper further tests the effects of firms’ innovation ability and credit loans on firms’ TFP, and the corresponding regression results are listed in columns (2), (4), and (6) of the Table 11 below. This paper uses the Bootstrap method to conduct the relevant tests. The results show that patent applications, patent grants, and credit support have a certain degree of mediation effect.

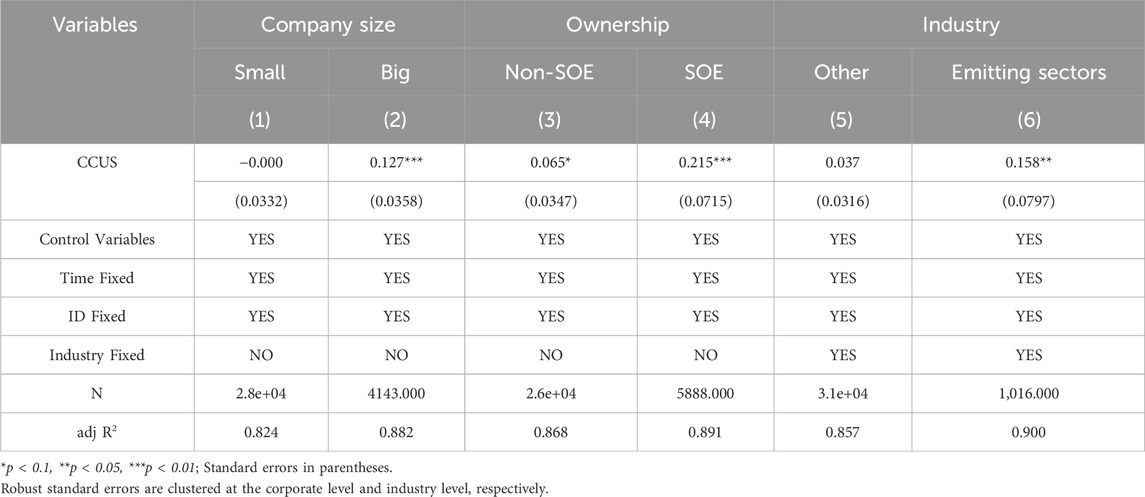

6.2 Heterogeneity analysis

6.2.1 Enterprise size

In this paper, we follow the practice of Huang et al. (2023) to conduct sub-sample regressions by categorizing samples above the mean revenue value as large-scale firms, otherwise as small-scale firms. Compared with small-scale firms, CCUS is more favorable to large-scale firms in improving TFP (see columns (1)–(2) in Table 12). On the one hand, due to the factors of large initial investment and long investment period, large-scale enterprises have enough financial resources to support the development of CCUS, thus promoting the TFP of enterprises. On the other hand, it is difficult for small companies to carry out CCUS projects on their own due to a lack of capital and limited financing possibilities., and the long-term capital investment will also have a serious negative impact on the cash flow of small enterprises, so it is difficult to promote the TFP of enterprises.

6.2.2 Enterprise attributes

In this paper, we divide the sub-sample of SOEs and non-SOEs according to the nature of ownership and conduct sub-sample regressions. Columns (3) to (4) of Table 12 show that CCUS significantly contributes to the TFP of SOEs compared to non-SOEs. The reason is that compared with non-SOEs, SOEs have taken on more functions and missions, focusing on public areas involving national security, the lifeblood of the national economy, and people’s livelihood, and forward-looking strategic emerging industries. CCUS, as an important tool of the country, is a responsibility incumbent upon SOEs. Therefore, state-owned enterprises will not only invest more financial resources in the development of CCUS but also obtain more financial support from banks and other parties, thus promoting the TFP of enterprises. SOEs secure low-cost capital through government-backed green loans. (2) SOEs internalize the risk by allowing them to amortize CCUS’s high capital expenditure over a longer period. Non-state-owned enterprises, especially private enterprises, are plagued by problems such as complex and expensive financing, and it is difficult for them to have enough cash flow to undertake CCUS independently, so they cannot improve the TFP of enterprises.

6.2.3 Industry attributes

With the continuous progress and development of CCUS technology, the technology is now widely used in power plants, cement and iron and steel industries, etc., to reduce carbon emissions. (Fan et al., 2018; Wei Y. M.et al., 2021; Guo et al., 2024). According to 11 January 2016, the Notice of the General Office of the National Development and Reform Commission on Effectively Doing the Key Work for the Launch of the National Carbon Emission Trading Market explicitly proposed eight key emission industries of electric power, iron and steel, nonferrous metals, petrochemicals, chemical industry, building materials, papermaking, and aviation, and therefore assigned the value of the eight key emission industries as one and the value of the other industries as 0, and carried out a split-sample regression.

Columns (5) to (6) of Table 12 show that CCUS in the eight priority emitting industries can significantly increase the TFP of enterprises compared with that in the non-focused industries. The possible explanation for this is that the eight key emitting industries are more willing to carry out CCUS, thus reducing regulatory pressure, stimulating endogenous motivation, obtaining support for green transformation, utilizing the Porter effect, and increasing the TFP of enterprises.

7 Discussing

CCUS landscape in China offers valuable insights for global stakeholders seeking to balance industrial decarbonization with economic viability.

Policy integration serves as a cornerstone. China proposes to integrate CCUS into the national voluntary emission reduction (CCER) mechanism which demonstrates how carbon markets can incentivize CCUS deployment through tradable credits, thereby lowering compliance costs for industries while ensuring economic feasibility. This approach aligns with international practices like the U.S. 45Q tax credit but adds a localized emphasis on unified market design and methodologically rigorous carbon accounting standards.

Scaling through hybrid models—such as combining CO2-enhanced oil recovery (EOR) with geological storage—has been pivotal. Projects like Sinopec’s 1-million-tonne CCUS demonstration in Shengli and industrial-scale CO2-EOR operations in Jilin oilfield highlight how integrating CCUS with energy production can generate dual revenue streams (oil output and carbon credits), a model adaptable to resource-rich economies.

Cross-sector collaboration exemplified by partnerships such as Shell-Sinopec-BASF’s open-access CCUS hub in East China underscores the importance of multi-stakeholder frameworks. By pooling emissions from diverse industries (e.g., petrochemicals, steel) into shared transport and storage infrastructure, China addresses economies of scale challenges—a lesson critical for industrial clusters in the EU or Southeast Asia.

China focuses on cost-reduction pathways through technological innovation in low-energy capture systems and modular infrastructure, which provides a blueprint for emerging economies. For instance, State Energy Group’s Taizhou plant achieved globally competitive costs through optimized energy recovery and localized equipment design.

The geological utilization strategy in China, leveraging saline aquifers and depleted oil fields, offers replicable insights for countries with similar subsurface profiles. The proactive assessment of 2.4 trillion tones of theoretical storage capacity underscores the need for early geological surveys to de-risk projects. While challenges persist (e.g., regulatory fragmentation), China’s iterative policy experimentation and emphasis on “dual carbon” alignment provide an adaptable template for both developed and developing nations.

8 Conclusions and implications

CCUS is a key technology China must adopt to achieve the “dual carbon” goal, and enterprises are implementing CCUS projects to improve TFP. However, it remains unclear whether it helps enterprises improve TFP. In this regard, this article quantitatively evaluates the impact of CCUS on the TFP of enterprises based on the text on CCUS in the annual reports of listed companies. It is found that the CCUS has a significant and positive impact on the TFP of the enterprises. The conclusion still holds after considering issues such as endogeneity. Mechanism analysis finds that CCUS improves the external environment of enterprises, enhances the ability to obtain bank loans, and at the same time improves the innovation ability of enterprises, which in turn helps to promote the TFP of enterprises. Heterogeneity analysis finds that the positive impact of CCUS on firms’ TFP is more prominent in large-scale firms, state-owned enterprises, and eight key emitting industries than in small-scale firms, non-state-owned enterprises, and other industries.

The findings of this paper may provide useful policy insights for advancing the CCUS project.

Implement financial incentives. First, explore the incorporation of CCUS into the carbon financial trading market, and make full use of the national Certified Voluntary Emission Reduction (CCER) accounting methodology and monitoring methodology to incentivize enterprises to actively implement the CCUS project. Second, policy incentives should be provided to enterprises deploying CCUS by reducing or exempting special revenue payments for oil extraction and providing policy incentives to enterprises deploying CCUS. Third, the scope of green credit should be expanded, and more projects involving CCUS in bank loans should be included. Fourth, facilitate the issuance of CCUS green loans for enterprises and reduce their financing costs.

Encourage the integration of small and medium-sized enterprises. Encourage social capital to actively set up venture capital funds to provide financial support for SMEs and lower the threshold of access to CCUS. Leading enterprises should actively implement industrial transformation and upgrading, extend the upstream and downstream of the industrial chain, and drive SMEs to integrate into the industrial chain supply chain.

Guide enterprises to accelerate technological innovation. The government should provide factor protection for technological innovation in CCUS, including resources such as land, resources, and talents, guide enterprises to strengthen technological cooperation among industries, universities, and research institutes, and support cross-sectoral cooperation in science and technology innovation. CCUS enterprises should increase investment in R&D, set up internal R&D organizations, and cultivate and attract innovative talents to improve their independent innovation capability. Enterprises should implement the CCUS science and technology innovation tolerance mechanism, create an innovative atmosphere of courageous innovation and tolerance of failure, maximize the liberation and stimulate the great potential of the main body of scientific and technological innovation, and enhance the total factor productivity of enterprises.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.wind.com.cn/, https://www.cninfo.com.cn/, https://www.cnrds.com/.

Author contributions

XW: Writing – original draft, Writing – review and editing. JY: Supervision, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bengio, Y., Ducharme, R., Vincent, P., and Jauvin, C. (2003). A neural probabilistic language model. J. Mach. Learn. Res. 3, 1137∼1155. doi:10.1162/153244303322533223

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 87 (1), 115–143. doi:10.1016/s0304-4076(98)00009-8

Cai, S., Ni, S., Zhao, P., Yang, T. T., et al. (2019). The impact of enterprise groups on innovation output: empirical evidence from listed companies in the manufacturing industry. China industrial economy. (01): 137–155. doi:10.1016/s0304-4076(98)00009-8

Ding, L. L., Zhang, X. T., and Bai, Y. (2024). Decision analysis of equity investment in CCUS projects with limited attention under government participation. J. Manag. Eng. 38 (04), 239–250. doi:10.13587/j.cnki.jieem.2024.04.016

Dong, K., Wang, J., Zhao, C., Taghizadeh-Hesary, F., and Phoumin, H. (2025). The Impact of CCUS Innovation on Green Total Factor Productivity in China. In Energy Transition And Carbon Neutrality In Asean: Developing Carbon Capture, Utilization And Storage Technologies (pp. 225–251).

Fan, J. L., Xu, M., Li, F., Yang, L., and Zhang, X. (2018). Carbon capture and storage (CCS) retrofit potential of coal-fired power plants in China: the technology lock-in and cost optimization perspective. Appl. energy 229, 326–334. doi:10.1016/j.apenergy.2018.07.117

Giannetti, M., Liao, G., and Yu, X. (2015). The brain gain of corporate boards: evidence from China. J. Finance 70 (4), 1629–1682. doi:10.1111/jofi.12198

Griliches, Z. (1986). Productivity, R and D, and basic research at the firm level in the 1970's. Am. Econ. Rev. 76 (1), 141–154.

Guo, J. J., and Fang, Y. (2022). Green credit, financing structure and corporate environmental investment. World Econ. 45 (08), 57–80. doi:10.19985/j.cnki.cassjwe.2022.08.008

Guo, Y., Luo, L., Liu, T., Hao, L., Li, Y., Liu, P., et al. (2024). A review of low-carbon technologies and projects for the global cement industry. J. Environ. Sci. 136, 682–697. doi:10.1016/j.jes.2023.01.021

Hu, J., Fang, Q., and Long, W. B. (2023). Carbon emission regulation, corporate emission reduction incentives, and total factor productivity: a natural experiment based on China's carbon emission trading mechanism. Econ. Res. 58 (04), 77–94.

Huang, B., Li, H. T., Liu, J. Q., and Lei, J. H. (2023). Digital technology innovation and high-quality development of Chinese evidence from firms’ digital patents. Economic Research, 58(03):97–115.

Huang, K. N., Miao, Z. K., and Qiao, Y. B. (2022). How college density affects firm innovation-Evidence from listed companies in China's manufacturing industry. Econ. Theory Econ. Manag. 42 (03), 54–66.

Kouri, S., Tsupari, E., Kärki, J., Teir, S., Sormunen, R., Arponen, T., et al. (2017). The potential for CCUS in selected industrial sectors-summary of concept evaluations in Finland. Energy Procedia 114, 6418–6431. doi:10.1016/j.egypro.2017.03.1778

LeCun, Y., Bengio, Y., and Hinton, G. (2015). Deep learning. Nature 521, 436–444. doi:10.1038/nature14539

Levinsohn, J., and Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 70 (2), 317–341. doi:10.1111/1467-937x.00246

Li, X. C., Fang, Z. M., Wei, N., and Bai, B. (2009). Discuss the technical route of CO2 capture and storage in China. Geotechnics 30 (09):2674–2696. doi:10.16285/j.rsm.2009.09.005

Liu, M. X., Liang, X., and Lin, Q. G. (2021). Study on economic benefits and risk assessment of carbon capture, utilization, and storage projects in China under carbon neutrality. Therm. Power Gener. 50 (09), 18–26. doi:10.19666/j.rlfd.202101009

Lu, X. D., and Lian, Y. J. (2012). Estimation of total factor productivity of Chinese industrial enterprises:1999-2007. Econ. Q. 11 (02), 541–558. doi:10.13821/j.cnki.ceq.2012.02.013

Lu, Z. F., and Yang, D. M. (2011). Commercial credit: alternative financing or buyer's market? Manag. World (04), 6–14+45. doi:10.19744/j.cnki.11-1235/f.2011.04.003

Mikolov, T., Sutskever, I., Chen, K., Corrado, G. S., and Dean, J. (2013). Distributed representations of words and phrases and their compositionality. Adv. Neural Inf. Process. Syst., 3111∼3119.

Monteiro, J., and Roussanaly, S. (2022). CCUS scenarios for the cement industry: is CO2 utilization feasible? J. CO2 Util. 61, 102015. doi:10.1016/j.jcou.2022.102015

Olley, S., and Pakes, A. (1992). The dynamics of productivity in the telecommunications equipment industry. Cambridge, Mass: National Bureau of Economic Research.

Peng, X. T., Lu, H. D., and Zhang, X. (2022). IPCC AR6 report interpretation: an assessment of global carbon capture utilization and storage (CCUS) technology development. Prog. Clim. Change Res. 18 (05), 580–590.

Qin, J. S., Li, Y. L., Wu, D. B., Wong, H., and Wang, G. F. (2020). Global progress of CCUS and China’s countermeasures. Oil and Gas Geology and Recovery, 27 (01):20–28. doi:10.13673/j.cnki.cn37-1359/te.2020.01.003

Syverson, C. (2011). What determines productivity? J. Econ. Lit. 49 (2), 326–365. doi:10.1257/jel.49.2.326

Tang, H., Zhang, S., and chen, W. (2021). Assessing representative CCUS layouts for China's power sector toward carbon neutrality. Environ. Sci. and Technol. 55 (16), 11225–11235. doi:10.1021/acs.est.1c03401

Wei, N., Liu, S. N., Li, G. J., Li, X. C., et al. (2021). Carbon emission reduction potential of crude steel production in China assessed by CCUS. China Environmental Science, 41: 5866. doi:10.19674/j.cnki.issn1000-6923.2021.0397

Wei, Y. M., Kang, J. N., Liu, L. C., Li, Q., Wang, P. T., Hou, J. J., et al. (2021). A proposed global layout of carbon capture and storage in line with a 2 °C climate target. Nat. Clim. Change 11 (2), 112–118. doi:10.1038/s41558-020-00960-0

Wooldridge, J. M. (1996). Estimating systems of equations with different instruments for different equations. J. Econ. 74 (2), 387–405. doi:10.1016/0304-4076(95)01762-3

Wu, H. Y., and Yin, D. S. (2021). Patent flows and total factor productivity of Chinese industrial enterprises. Econ. Manag. 43 (04), 21–38. doi:10.19616/j.cnki.bmj.2021.04.002

Xiang, X., Li, K., Li, X., and Hou, Y. (2023). Investment feasibilities of CCUS technology retrofitting China's coal chemical enterprises with different CO2 geological sequestration and utilization approaches. Int. J. Greenh. Gas Control 128, 103960. doi:10.1016/j.ijggc.2023.103960

Xiang, Y., Yuan, Y., Zhou, P., Liu, G., Lyu, W., Li, M., et al. (2023). Metal corrosion in carbon capture, utilization, and storage: progress and challenges. Chin. Eng. Sci. 25 (03), 197–208. doi:10.15302/j-sscae-2023.07.026

Yang, R. D. (2015). Research on total factor productivity of Chinese manufacturing enterprises. Econ. Res. 50 (02), 61–74.

Yang, Y., Wei, J., and Luo, L. J. (2015). Who uses government subsidies for innovation? --The joint moderating effect of ownership and factor market distortions. Manag. World (01), 75–86+98+188. doi:10.19744/j.cnki.11-1235/f.2015.01.009

Yang, Z., Ling, H. C., and Chen, J. (2024). Urban green development concern and corporate green technology innovation. World Econ. (01), 211–232. doi:10.19985/j.cnki.cassjwe.2024.01.007

Yang, Y. Z., Zhou, J. S., Hu, H. W., and Guo, C. Y. (2025). Development Status, Economic Benefits and Future Prospects of CCUS-EOR Industry. China Mining Industry, 34 (02), 190–203.

Yao, X., Zhong, P., Zhang, X., and Zhu, L. (2018). Business model design for the carbon capture utilization and storage (CCUS) project in China. Energy policy 121, 519–533. doi:10.1016/j.enpol.2018.06.019

Yin, C. H., and Yu, X. (2018). CCS technology innovation network mapping analysis based on patent information. Technol. Econ. 37 (05), 64–70+114.

Yu, C. L., Yang, G. G., and Du, M. Y. (2021). Industrial policy and technological innovation in China's digital economy industry. Stat. Res. 38 (1), 51–64. doi:10.19343/j.cnki.11-1302/c.2021.01.005

Zhang, W. J., and Ha, W. (2024). Spatial layout of university campuses and university-enterprise collaborative innovation: micro-empirical evidence based on specialized, unique and new “small giant” enterprises. Res. High. Educ. 45 (03), 42–53.

Zhang, X., Li, Y., Ma, Q., and Liu, L. (2021). Development of carbon capture, utilization and storage technology in China. Strategic Study Chin. Acad. Eng. 23 (6), 70–80. doi:10.15302/j-sscae-2021.06.004

Zhang, X. L., Huang, X. D., Zhang, D., Geng, Y., and Tian, L. X. (2022). Research on the transition path and policy of energy economy under the goal of carbon neutrality. Management World, 38 (01):35–66. doi:10.19744/j.cnki.11-1235/f.2022.0005

Keywords: CCUS, TFP, corporate innovation, text analysis, bank loans, innovation capacity

Citation: Wu X and Yang J (2025) Carbon capture, utilization, and storage enhances corporate total factor productivity. Front. Environ. Sci. 13:1571444. doi: 10.3389/fenvs.2025.1571444

Received: 05 February 2025; Accepted: 27 May 2025;

Published: 18 June 2025.

Edited by:

Le Wen, Auckland University of Technology, New ZealandReviewed by:

Ridwan Ibrahim, University of Lagos, NigeriaHamid Mahmood, Xi’an Jiaotong University, China

Danbo Chen, The Ohio State University, United States

Copyright © 2025 Wu and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jianfei Yang, MTE2NTExNTc1MUBxcS5jb20=

Xiaoqi Wu

Xiaoqi Wu Jianfei Yang*

Jianfei Yang*