- 1Finance Department, School of Business, King Faisal University, Al Ahsa, Saudi Arabia

- 2School of Business and Economics, United International University, Dhaka, Bangladesh

Introduction: This study examines the impact of green trade openness, natural resource rents, institutional quality, and R&D investment on environmental sustainability across OECD countries from 2007 to 2022, testing both the Environmental Kuznets Curve (EKC) and Load Capacity Curve (LCC) hypotheses.

Methods: We apply panel econometric techniques, including CS-ARDL and nonlinear NARDL models, alongside causality analysis, to assess bidirectional and asymmetric relationships among variables.

Results: Green trade openness, institutional quality, and R&D investment significantly reduce CO2 emissions and enhance load capacity. Conversely, natural resource rents increase emissions and degrade sustainability metrics. The EKC hypothesis holds with an inverted-U shape, while the LCC demonstrates sustainability improvement beyond economic thresholds.

Discussion: Findings stress the critical role of governance, innovation, and sustainable trade in ecological outcomes. Policy recommendations advocate reinvestment of resource rents into green innovation and strengthening of institutional frameworks to align economic and environmental goals.

Highlights

• EKC and LCC Validation: Empirical testing of EKC and LCC hypotheses in OECD countries, offering new sustainability insights.

• Green Trade and Sustainability: Examines how green trade openness fosters eco-friendly technology and lowers CO2 emissions.

• Institutional Quality Impact: Highlights governance’s role in mitigating environmental harm and promoting green policies.

• Natural Resource Rent and Growth: Evaluates how resource rents can be reinvested for sustainability instead of environmental harm.

• R&D for Green Innovation: Shows how R&D investments accelerate eco-innovation, reducing emissions and boosting sustainability.

1 Background of the study

Given that the OECD nations are responsible for almost 36% of the world’s CO2 emissions, they must prioritize environmental sustainability (Ulucak and Ozcan, 2020). Several models have attempted to explain the correlation between GDP growth and carbon dioxide emissions; one of these is the Environmental Kuznets Curve (hereafter,EKC), which states that, although environmental degradation rises in tandem with GDP growth at the outset, it falls in tandem with rising national wealth and environmental consciousness (Bektaş and Ursavaş, 2023). Some research has shown that globalization and competition might actually make ecological footprints worse rather than better, which raises questions about the EKC’s applicability in OECD nations (Bektaş and Ursavaş, 2023; Gani, 2023). Due to the intricacy involved, a sophisticated comprehension of the ways in which economic policies and practices might complement ecological objectives is required. When it comes to cutting down on carbon dioxide emissions, OECD economies rely heavily on technological innovation. According to Du et al. (2022), emissions may be significantly reduced with the use of new technologies and robust institutional frameworks. For example, according to Ulucak and Ozcan (2020) and Destek et al. (2020), renewable energy sources can reduce the need for fossil fuels, which in turn leads to fewer emissions of carbon dioxide. Both technological and socioeconomic factors contribute to the difficulty of making the switch to renewable energy sources, which calls for heavy funding and government backing to encourage research and development and widespread use. In addition, it is essential to have access to sustainable financing in order to promote environmentally friendly technologies and practices, and financial development plays a pivotal role in making this transition possible (Zioło et al., 2020). Environmental pressures, including CO2 emissions, and their effects on ecological states must be carefully monitored, according to this model. In order to reach the Sustainable Development Goals (SDGs) pertaining to environmentally responsible production and consumption, research based on the PSR paradigm has shown that pollutants such as nitrogen oxides (NOx) must be addressed. According to Görüş and Karagöl (2022), the ecological footprint is a crucial sustainability metric for OECD nations since it shows the relationship between resource use and ecological capability.

The reliance on fossil fuels and the resulting carbon emissions are significant factors contributing to environmental degradation in OECD countries. The energy consumption trends in these countries primarily rely on fossil fuels, which significantly contribute to greenhouse gas emissions (Paramati et al., 2022). Historically, the OECD countries have relied on coal, oil, and natural gas as their primary energy sources, which has resulted in considerable environmental issues, such as air pollution and climate change (Liu, 2024). Additionally, the agricultural sector recognized as a significant contributor to environmental strain, has been associated with the overuse of agrochemicals and inadequate waste management practices, which intensify the ecological impact of these countries (DeBoe et al., 2020). The processes of rapid industrialization and urbanization frequently emphasize economic growth at the expense of environmental wellbeing, resulting in heightened resource extraction and waste production (Wang et al., 2022). Hondroyiannis et al. (2023) postulated that although economic growth has the potential to enhance living standards, it may simultaneously contribute to increased pollution and resource depletion if sustainable management practices are not implemented. Additionally, the aging demographic in these nations presents further challenges, as it could result in heightened consumption behaviors that exacerbate the pressure on environmental resources.

Conversely, various elements play a role in promoting environmental sustainability within OECD nations. The implementation of stringent environmental policies serves as a crucial factor. Chen M. et al. (2022) and Mihai (2023) show a favorable relationship between the strictness of environmental regulations and enhanced environmental performance. Additionally, The findings of Albulescu et al. (2022), Kafeel (2023) underscore that countries that have implemented stringent environmental policies, including carbon taxes and emissions trading systems, have experienced decreases in greenhouse gas emissions and enhancements in air quality. The Porter hypothesis endorses the idea that strict environmental regulations may foster innovation, resulting in improved environmental and economic results (Chen M. et al., 2022; Guo and Фу, 2021)Advancements in technology significantly contribute to the enhancement of sustainability efforts. The findings of Liu (2024) and Chen L. et al. (2022) advocated that the integration of renewable energy sources, including wind, solar, and biomass, has played a crucial role in decreasing dependence on fossil fuels and lessening environmental effects. In their respective studies, Xiao et al. (2022) and Zhang (2023) revealed that the advancements in environmental technologies, such as energy-efficient solutions and waste management systems, play a significant role in minimizing the ecological footprint of OECD countries. Additionally, the advancement of financial systems and the allocation of resources towards green technologies play a crucial role in enabling the shift towards a more sustainable economy (Bashir et al., 2021; Shobande and Ogbeifun, 2021). The idea of a circular economy is increasingly recognized as a practical, sustainable approach to resource management within OECD nations, which focuses on minimizing waste, repurposing materials, and recycling, which can significantly decrease environmental harm (Molocchi, 2021). There is a growing acknowledgment among policymakers regarding the necessity of harmonizing economic activities with the principles of environmental sustainability, resulting in initiatives aimed at fostering sustainable agricultural practices and encouraging responsible consumption (Molocchi, 2021; Salazar et al., 2020).

The present study has considered green trade openness, natural resources rent, institutional quality, and ecological innovation on environmental sustainability in OECD for the period 2000–2022. Green trade openness is the adoption of green trade practices by countries, and it plays a significant role in sustainability. Globalization is found to promote ecological sustainability, especially in resource-exporting economies, as it paves the way for possible improvements by means of trade liberalization. For instance, Erdoğan et al. (2020a) show that globalization can counteract the negativities of resource dependency with better practices and policies for the environment. Ganda (2022) supports this claim, arguing that greater trade openness can help transfer green technologies, increasing environmental quality in emerging economies. The income derived from the extraction of natural resources, known as natural resource rents, has a positive and negative effect on environmental sustainability. On the non-hostile side, causing natural resource degradation, as further highlighted by Chand (2024), as resource extraction can indeed lead to the collapse of cycling systems or some damage. On the other hand, if managed well, natural resource rents can be reinvested into sustainable practices that enhance ecological innovation. Hacıimamoğlu and Sungur (2024) claims that allocating the rents of natural resources to environmentally friendly production areas can help reduce environmental damage considerably. This polarization underlines the role that governance or institutional quality plays in the effective management of resource rents to achieve sustainability objectives. This mediating effect of institutional quality on the natural resource rents and environmental sustainability links remains under-explored in the literature. Kumar et al. (2023) revealed that strong institutions allow for better management of natural resources and facilitate investment of rents in sustainable development instead of degradation. The outcome is that better governance mitigates the detrimental and/or adverse effects of a country being resource-dependent (Achuo, 2023). Moreover, as Li (2024) highlights, good institutional frameworks are crucial for facilitating sustainable development and limiting the emissions of carbon-based energy, painting the picture of governance as crucial for reaching sustainability. The wave of sustainable development and clean air has renewed attention to ecological innovation or the discovery and application of techniques that minimize the adverse impact on climate. In the domain of green industry, Aneja (2023) shows that a shift in technological invention has the potential to improve environmental quality significantly. Green technologies are integrated into production processes, leading to a reduction in emissions and a boost to economic growth, which in turn creates a feedback loop benefiting both. Furthermore, as asserted by Zuo et al. (2021), technological innovations can offset the adverse effects of natural resource rents on environmental quality, evidencing the necessity for nurturing innovation in resource-abundant economies. The dynamic of economic globalization further complicates the interaction of these factors. In its trade, openness can facilitate the spread of green technologies, but can also result in greater resource depletion and environmental harm if not handled correctly. Wu et al. (2021) claim that economic globalization leads to environmental degradation, particularly within developing countries that have relatively weak regulatory frameworks. This reveals a need for strong institutional frameworks that are capable of balancing and exploiting the advantages of globalization while protecting the environment from its destructive impact.

This study examines the impact of green trade openness, natural resource rent, institutional quality, and R&D investment on environmental sustainability in OECD countries from 2000 to 2022. A key research question is whether economic policies and governance structures influence sustainability through mechanisms outlined in the EKC and Load Capacity Curve (hereafter, LCC) hypotheses. Uniquely, this study extends the EKC framework by integrating the LCC hypothesis, offering a nuanced analysis of sustainability limits. By employing advanced panel econometric techniques, the model captures bidirectional relationships between economic growth, trade liberalization, and environmental performance. The study’s originality lies in its investigation of how institutional quality mediates the effects of resource dependence and trade on sustainability. Additionally, it explores the role of reinvesting natural resource rents into green innovation. The empirical model rigorously tests these dynamics, providing actionable insights for policymakers aiming to balance economic development with environmental responsibility.

The manuscript addresses a critical research gap in the literature on environmental sustainability by integrating green trade openness (hereafter, GTO), institutional quality (hereafter, IQ), natural resource rents (NRR), and research and development (R&D) into a comprehensive framework. Prior research has primarily examined the EKC hypothesis, yet limited attention has been given to the LCC hypothesis in the context of OECD nations. Moreover, the role of institutional quality and green trade openness in environmental sustainability remains underexplored. As far as the literature contribution by the study, the following contribution extends the existing literature by bridging the literature gap. First, this study expands the theoretical and empirical validation of the EKC and LCC hypotheses by testing their applicability in OECD countries. This paper specifies the LCC hypothesis to deepen the understanding as a supplementary for previously excessive focus on the EKC hypothesis. Collectively, this dual strategy allows for a more sophisticated analysis of the relationship between economic growth, environmental degradation, and sustainability limits. Second, by zeroing in on green trade openness (defined as environmentally sustainable international trade practices), the research addresses a critical gap in sustainability studies. It explores the impact of environmentally sustainable trade policies on carbon emissions and ecological wellbeing. Such a contribution is timely and contributes, especially when the world is increasingly moving towards sustainable trade practices in light of climate change. Third, Institutional quality as a driver of environmental sustainability—the study at hand underscores the importance of functioning institutions, which can enable good policy to be implemented, mitigate corruption, and promote investments in green technologies. This emphasis introduces an important new element into the conversation about governance and the politics of environmental management. Fourth, through the research, we look into the capacity of natural resource rents to be a funding source for sustainable development by analyzing whether the resource rents are reinvested to face environmental degradation in order to make applicable recommendations to resource-dependent economies that seek to reconcile economic and environmental objectives. Fifth, the study contributes to the literature by providing new insights into the less well-researched mechanisms behind varieties of green innovation (measured by both CO2 and eco-innovation) and the impact of R&D investment on the environment. It provides an empirical demonstration of how spending on R&D in OECD countries accelerates the transition to cleaner energy, resource efficiency, and environmental sustainability of the economy in the longer term.

2 Literature review

2.1 Green trade openness and environmental sustainability

The concept of green trade openness refers to the degree to which nations participate in the trade of environmentally sustainable goods and services, and it is suggested that this engagement is vital for improving environmental quality. Research indicates that nations characterized by greater green trade openness often demonstrate improved environmental outcomes, as assessed through a range of metrics, including carbon emissions and ecological footprints. For example, Can et al. (2022) developed the Green (Trade) Openness Index, which offers a structured approach to evaluate how trading in environmentally friendly products influences national environmental results; findings indicate that greater involvement in green trade may result in notable decreases in environmental degradation (Muratoğlu et al., 2024).

Research indicates a positive correlation between green trade openness and environmental sustainability, suggesting that countries that prioritize the trade of green technologies and products tend to see improvements in air quality and reductions in greenhouse gas emissions. Hu et al. (2024) illustrate that the incorporation of green trading practices into macroeconomic policy frameworks can enhance ecological sustainability by encouraging the use of cleaner technologies and practices (Ullah et al., 2024). Montesano et al. (2023) highlight the significance of green trade openness in the pursuit of low-carbon emissions and sustainable development. This is especially relevant in emerging economies, where the challenges of industrialization frequently clash with environmental objectives. Additionally, the significance of renewable energy consumption alongside green trade openness is essential to consider. Research indicates that nations that allocate resources to renewable energy and actively participate in green trade are more effectively equipped to reduce environmental consequences. Can et al. (2021) discovered that the interaction between renewable energy usage and green trade openness plays a significant role in enhancing human wellbeing and improving environmental quality in European Union nations, by indicating that integrating green trade with renewable energy initiatives can enhance beneficial environmental results.

Moreover, existing research suggests that green trade openness has the potential to foster eco-innovation, an essential component for attaining long-term environmental sustainability. Countries involved in the trade of green technologies frequently observe a spillover effect that promotes domestic innovation in sustainable practices. This occurrence is especially noticeable in developing economies, where environmentally friendly trade can stimulate local industries to embrace more sustainable production practices, as noted by Montesano et al. (2023). The relationship among trade, innovation, and environmental quality highlights the importance of cohesive policies that encourage sustainable trade practices while also supporting technological progress. Beyond the economic and technological aspects, the social consequences of green trade openness merit significant attention. Encouraging green trade has the potential to generate employment opportunities within sustainable sectors, thereby strengthening community resilience and fostering social wellbeing. Can et al. (2022) contend that the shift towards green trade not only tackles environmental issues but also corresponds with broader social goals, including poverty reduction and fair economic growth. This comprehensive approach to sustainability highlights the interrelation of environmental, economic, and social elements in attaining holistic sustainability results. While the potential benefits of green trade openness are encouraging, there are still obstacles that need to be addressed. The possibility of heightened environmental harm due to non-sustainable trade practices presents a considerable threat. According to Aneja (2023), the presence of non-green products in trade can undermine the advantages of green trade. This situation calls for a thorough assessment of trade policies to prevent the unintended encouragement of environmentally detrimental practices. Policymakers should embrace a comprehensive approach that takes into account the entirety of trade activities and their associated environmental effects. Additionally, the significance of global collaboration in promoting sustainable trade is paramount. The joint endeavors of countries to create uniform standards for environmentally friendly products and to minimize trade obstacles can significantly improve the efficacy of green trade initiatives. van Hinsberg and Can (2024) highlight that a collaborative strategy towards green trade can yield enhanced environmental advantages as nations unite to advance sustainable practices worldwide by highlighting the significance of collaborative agreements and partnerships in promoting the green trade agenda.

2.2 Natural resources rent and environmental sustainability

Natural resource rents, which signify the economic profits from the extraction of natural resources, can impact environmental sustainability through carbon emissions, ecological footprints, and load capacity factors positively or negatively (Görüş and Karagöl, 2022). The distribution of natural resources, mainly fossil fuels, has been associated with high carbon emission rates, which accelerate the damage to environmental sustainability. For example, Balsalobre-Lorente et al. (2018) emphasizes that where consumption of renewable electricity may lead to environmental improvements, the joint effect of economic growth and the consumption of natural resources is usually associated with higher levels of CO2 emissions. Erdoğan et al. (2020b). claim that dependence on natural resources tends to hinder resource-rich economies in their quest for environmental sustainability. Adedoyin et al. (2020) also referenced the negative environmental impact of natural resource rents on carbon emissions, which documents the importance of coal rents and oil rents in determining the environmental outlook of both advanced and developing economies. Natural resource rents also have a significant impact on the ecological footprint, which measures the human demand on Earth’s ecosystems. That being said, the relation between resource rents and ecological footprints is not deterministic, as Qamruzzaman (2024) argues; thus, depending upon the regulatory frameworks in place, these effects can be mediated. This viewpoint is reaffirmed by Abdulraqeb et al. (2024), as resource rents adversely affect public investments in education and health, fundamental factors for building human capital and sustainable growth. Moreover, Zaman et al. (2016) finds a positive association between natural resource rents and CO2 emissions, suggesting a direct connection between resource extraction and environmental degradation. Natural resource rents also impact the load capacity factor (LCF), which is a measure of the ability of an ecosystem to sustain human interventions without degradation. According to research by Yang et al. (2023), the over-exploitation of nature results in excessive environmental stress, which affects the LCF in different economies. The study findings indicate that natural resource rents when rising, carry the risk of losing the ecological balance needed to maintain optimal levels of LCF. The work of Nwani et al. (2023) also supports this conclusion that historical natural resource rents are significantly associated with future energy intensity and carbon emission, with the findings suggesting critical long-term effects of resource exploitation on environmental sustainability. The journey towards environmental sustainability represents a two-way narrative between renewable energy consumption and natural resource rents. Hacıimamoğlu (2024) even argues that natural resource rents can be a valuable addition against environmental damage, provided that they are efficiently directed into the production of an environmentally friendly operation. Kiran (2024) found a positive association between natural resource rents and renewable (green) energy production, making this particularly relevant for transitioning to renewable energy sources. Finding that strategic investments in renewables can insulate against some impacts of natural resource exploitation. However, the evidence is not uniformly encouraging. For example, studies like Huang et al. (2021) and Achuo (2023) demonstrate that excessive reliance on natural resource rents necessarily fosters carbon emissions, which in turn compromises environmental sustainability. Conclusions: Although there has previously been significant potential for natural resource rents to finance aspects of the green economy, the imbalance of various components of current economic and governance systems often undermines realizing this potential. Li (2024) further elaborates on the dilemma by suggesting that when natural resource rents are effectively geared towards green development, this, in turn, can engender carbon emissions reduction. In addition, the extent of the influence of resource rents on the environment may be institutionally mediated. Research by Khan et al. (2020) explored the role of institutional quality in determining the rents of natural resources and the environmental sustainability relationship. Results imply that strong institutions reduce the detrimental effects of resource exploitation and increase the likelihood of sustainable development. This is reinforced by Nchofoung et al. (2021) which empirically corroborates that human development plays an important role alongside natural resource management in attaining sustainable results (Golpîra et al., 2023).

2.3 Institutional quality and environmental sustainability

Extensive literature shows that institutional quality affects carbon emissions in different contexts. For example, Abid (2016) notes that regulatory quality and the rule of law help reduce CO2 emissions, indicating that environmental regulations can be effectively implemented and supported with stricter institutions. The analysis of this institutional factor will help us better understand the role of environmental management on carbon emissions, a widely discussed factor by Liu and Xu (2022), who emphasizes the importance of governance mechanisms to avert environmental damage. Additionally, Rout (2024) evaluation of governance and energy use in India strengthens the idea that for governments to create and enforce good environmental policy, they first need political stability and good governance, which, in turn, impacts greenhouse gas emissions. Gök and Sodhi (2021) further clarify the relationship between governance and carbon emissions by applying a system-generalized method of moments analysis to show that better governance quality improves environmental quality, agreeing with the Environmental Kuznets Curve hypothesis, suggesting that environmental degradation tends to rise in the early stages of economic development but will fall later when institutional quality enhances. Environmental laws are applied (Zeraibi et al., 2021). The association indicates that better governance is associated with lower carbon emissions, indicating that institutional structures help shedding better environmental sustainability.

Sustainable resource practices can reduce ecological footprints if the governance is sound. For example, Zhang et al. (2019) analyzes the efficiency of government investment in environmental protection in the context of fiscal decentralization in China, discovering that appropriate systems can amplify the effect of environmental policy and lower environmental strain. In the same vein, Kulin and Sevä (2019) demonstrates the role of government quality as a cross-level determinant of public preferences for spending on the environment, which in turn shapes ecological outcomes. Li et al. (2021) showcase the role of environmental non-governmental organizations (ENGOs) in promoting sustainable practices, emphasizing their positive impact on air quality and ecological footprints, a result of the better governance and environmental approaches initiated by ENGOs, which implies that institutional quality not only informs what government does but also equips civil society to participate in environmental sustainability initiatives. The relationship between institutional quality and ENGOs illustrates the multiple pathways toward reducing ecological footprints where state and non-state actors play crucial roles.

Similarly, institutional quality influences a load capacity factor, an efficiency and reliability metric of energy systems. Effective governance structures can help increase the load capacity factor by fostering investment in renewables and sustainable infrastructure. For instance, Wu et al. (2023) assesses the effectiveness of environmental regulations in high-quality human habitat cities, revealing that better overall environmental outcomes and higher load capacity factors are associated with more robust governance frameworks. In the energy sector, the role of these disco-ordinator institutions is especially relevant and welcome, given their pivotal components in technological innovation. In addition, Chen S. et al. (2022) examines the association between fiscal decentralization and the effectiveness of environmental policies, suggesting that decentralized governance may result in better alignment of local fiscal policies with environmental objectives that, in turn, can improve load capacity factors. Such a view mirrors the dowel scaled by Cao et al. (2022), which scrutinized the environmental consequences of city-county mergers in China, disclosing that urban consolidation can eventually alleviate pollution and augment the comprehensive operating efficiency of energy systems. The findings imply that institutional quality influences environmental policies, but also directly influences the operational efficiency of energy systems and thus upon sustainability outcomes.

Collaborative governance has been highlighted as one of the most prominent drivers for improving environmental performance and outcomes through stakeholder partnerships. Scott (2015), However, collaborative governance can lead to better environmental outcomes, although the existing literature is based more on subjective measures than on independent environmental outcomes. These knowledge gaps underscore the need for more effective and rigorous empirical research to establish the effectiveness of collaborative governance structures designed to accomplish sustainability objectives. In addition, trust in government institutions is also important for gaining public support for environmental policies. A study conducted by the researcher Fairbrother (2016) exemplifies the importance of faith in government when it comes to protecting the environment, implicating the need for a trustworthy institution if we want the public to engage in environmentally friendly behavior by emphasizing that building trust and collaborative partners in governance may be a way to achieve environmental improvement.

2.4 R&D investment and environmental sustainability

Since the global community is wrestling with the urgent challenges of climate change and the degradation of the environment, the relationship between research and development (R&D) investment and environmental sustainability has attracted much interest in recent years. This literature review presents a synthesis of diverse studies investigating the multi-dimensional effects of R&D investment on environmental sustainability, specifically emphasizing carbon emissions, ecological footprints, and load capacity factors. Green research and development (R&D) investments are gaining traction to improve the corporate environment and social and governance (ESG) scores. Such investments not only lead to better corporate performance but can also act as a signal of sustainable practices, which in turn could improve ESG assessments. Chen et al. (2023) argue that corporate environmental efforts–R&D intensity being one factor–are necessary to attain sustainable outcomes, which may enhance overall firm performance. R&D investment is another factor that affects the environmental quality of a firm, as highlighted by Alam et al. (2019), who provide empirical evidence on the G-6 countries. R&D investment directly affects the environmental performance of firms, impacting energy consumption and carbon emissions. This is also reflected in the ecological footprint, a measure of human demand on the Earth’s ecosystems, which R&D activities also affect. Popescu (2023) suggests that investment in R&D is significantly negatively correlated to the ecological footprint, indicating that increased R&D leads to increased sustainability and reduced environmental impact. This finding is in accord with Usman et al. (2022), who stated that industrial processes based on innovative R&D can contribute less energy consumption and improve efficiency, thus decreasing the ecological footprint. Moreover, Lee et al. (2015) prove that R&D investments lead to lower emissions levels, reinforcing that strategic R&D investments can bolster sustainability. Another domain is focused on the efficiency and reliability of energy production systems, dubbed the load capacity factor, where R&D investment also has a significant role. Dogan (2024) underscores the importance of R&D expenses, specifically for clean energy technology, to support environmental sustainability by increasing load capacity and decreasing carbon footprints. Zhang et al. (2022) reinforce this idea that investment in R&D for green-directed technologies plays a pivotal role in enhancing the total productivity of energy systems and therefore, in achieving the objectives of sustainable development. In addition, Liu et al. (2023) indicates that R&D investment has a positive and significant impact on enterprise green total factor productivity. At the same time, it positively correlates with the load capacity factor; government policies and subsidies play an important role in incentivizing investment in R&D for environmental sustainability. Chen et al. (2023) evaluate how environmental subsidies from the government can induce corporate R&D intensity, facilitating better environmental performance (Chen et al., 2023). Similarly, Zhang et al. (2022) examine the role of environmental regulations in shaping R&D investment in green technology, stressing that these regulations help create the right incentives for innovation and sustainability. Such a regulatory framework is necessary for making sure that returns from research and development (R&D) investments are realized in terms of actual environmental benefits. In addition, R&D investments are the cornerstone of sustainable economic growth, especially in OECD countries Yazgan and Yalçınkaya (2018) further emphasize the importance of the relationship between R&D investment and sustainable economic growth. They find that R&D can stimulate technological innovations and extend the productivity of production factors that can be combined sustainably. This is in line with Baek (2023), which asserts that R&D investment plays a role in sustainable development by enhancing environmental and social performance.

2.5 Research gap in the existing literature

First, Prior research frequently failed to consider the role of green trade openness, which emphasizes trade that reduces environmental harm, in informing environmental sustainability among OECD countries. This study addresses this gap by analyzing its dynamics and controlling for other important variables, including governance and research and development (R&D) investment.

Second, the Environmental Kuznets Curve (EKC) is an extensively studied hypothesis, but there is not much application for the Load Capacity Curve (LCC) hypothesis in sustainability literature. This research examines both frameworks and compares their relevance in accounting for environmental degradation and sustainability in OECD nations.

Third, Similar studies have focused on economic growth and governance so far; however, there is less research on the impact of institutional quality on sustainability. This study analyzes the moderation effects of high-quality institutions and investments in R&D on ecological degradation.

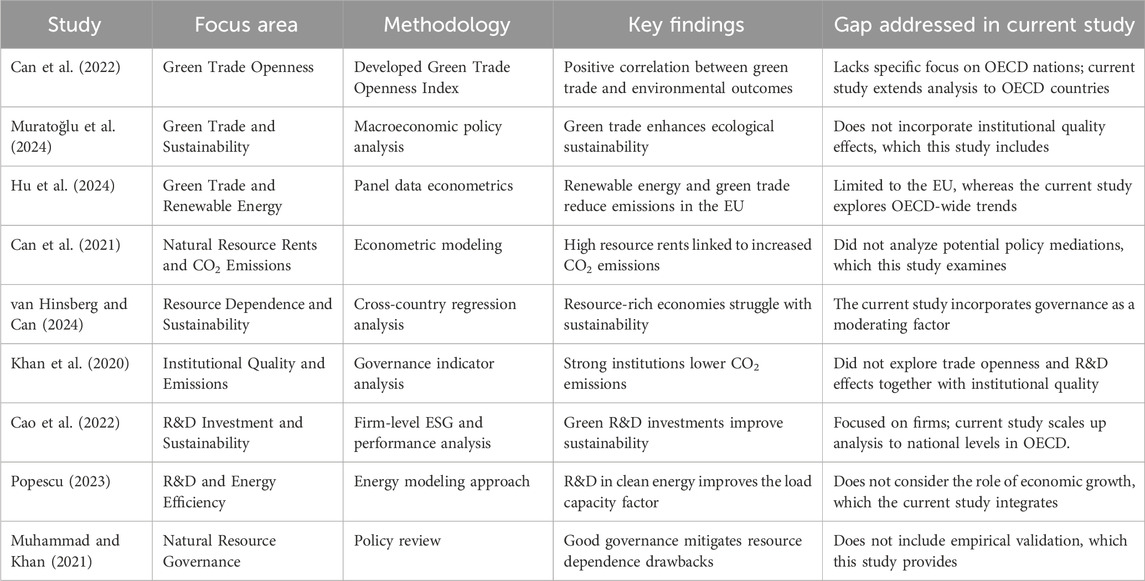

Fourth, The other major area of the research addresses the link between resource rents (incomes generated by natural resources) and sustainability. It identifies reinvestment pathways to sustain the returns in natural resources in post-industrial economies in the OECD. The summary of the combative literature gap is shown in Table 1.

Table 1. Comparative summary of literature on environmental sustainability and economic factors in OECD countries.

3 Data and methodology of the study

3.1 Theoretical development and model specification

The EKC hypothesis states that there is an inverted U-shaped relationship between economic growth and environmental degradation: in the early stages of economic growth, economic development tends to be associated with environmental degradation such that environmental quality deteriorates; as economies develop, environmental quality improves after reaching a certain income threshold. This type of modeling has been tested in several studies focusing on trade openness and institutional quality as determinants of environmental outcomes. Studies suggest that trade openness can negatively affect environmental policy and sustainability performance. Kafeel (2023) shows that openness to trade will positively influence the effort to implement environmental policies, which can improve environmental quality. Muhammad and Khan (2021) note that it is necessary to ensure strong environmental policy implementation in OECD countries to cure pollution and sustainable development. Zhang (2024) provides evidence supporting the trade-environmental policy nexus who emphasize that implementing environmental regulations effectively decreases emissions and further confirms the EKC hypothesis. Furthermore, the importance of institutional quality in promoting environmental sustainability is evident. This requires strong institutions to enforce and institute environmental policy. Low-intermediate environmental regulations play a substantial role in reducing greenhouse gas emissions, corroborating the EKC hypothesis. Marco-Lajara et al. (2023), whose research highlights that institutional mechanisms with a framework less capable of sustaining environmental policies lead to poorer environmental outcomes, complete the theoretical basis for the relationship between institutional quality and environmental outcomes.

The relationship between R&D, the environment, and the economy is not unidirectional since R&D and innovation reduce emissions directly and indirectly through their potential effects on policies that govern environmental performance and long-term stability and sustainability. Bektaş and Ursavaş (2023) find evidence that these tax and regulatory drivers result in greater investment in research and development (R&D) for renewable energy technologies, which are also important to achieving goals for sustainability. Liu (2024) also echoes the role of renewable energy consumption and environmental technologies in decreasing CO2 emissions for all OECD countries. In addition, the LCC hypothesis, which deals with total ownership costs for products and services over their lifespan, is also an important aspect to consider when assessing environmental sustainability. LCC promotes more sustainable economic decision-making by considering the long-term environmental consequences of economic activities. This is especially relevant in the circular economy perspective Molocchi (2021), which analyzed the coherence of subsidies with circular economy principles in Italy. Overall, the potential benefits of LCC, alongside other environmental policies, demonstrate how linkages can create sustainable growth without compromising environmental health, ensuring the integrity of sustainability initiatives and promoting sustainable development. Similarly, the role of natural resource rents in achieving sustainable development is an important avenue for future research. If a country is environmentally weak, its natural resources will be exploited. According to Ahmed et al. (2020), utilizing the OECD framework that aims to establish regulations to facilitate eco-innovation is crucial, which can counterbalance the negative influence of resource degradation and management on the surroundings. Such mutual environmental dependencies have intriguing implications in light of the EKC hypothesis: Different polities in the resource-rich zones might produce diverging paths of environmental degradation or improvement depending on their governance and material policy decisions. Cumulatively, the theoretical discussion on green trade openness, natural resources rent, institutional quality, and R&D investment in OECD countries offers a rich tapestry of potential interactions and interconnections that warrant further empirical testing and exploration, particularly in environmental sustainability.

To provide a robust empirical analysis, this study adopts a panel regression framework to analyze the link between GTO, IQ, NRR, R&D investment, and environmental sustainability in OECD countries over the 2007–2022 period. The natural logarithmic transformation of important variables, prior to applying regression, is performed in order to make the statistical estimation process more efficient and to reduce biases that may result from imbalanced data distributions. Log transformation has various uses. This process achieves two things: 1) it normalizes the distribution of the data by correcting for heteroscedasticity, and 2) it allows the residuals in the regression to follow a more stable variance pattern. Many economic and environmental indicators follow right-skewed distributions, and taking logarithms compresses extreme values, making relationships between variables more linear. This transformation is significant for environmental and economic variables covering many orders of magnitude, such as CO2 emissions or indicators of trade openness. Second, taking a log transformation increases model efficiency as it stabilizes variance and also corrects for any potential non-linearity in the relationships of the dependent and independent variables. Using this approach, the coefficients can be interpreted as elasticities for the dependent variable, meaning that a percentage change in predictor variables directly translates to a percentage change in the dependent variable. After applying the log transformation, the regression equations were adjusted accordingly. These alterations of the functional forms make it possible to estimate more accurately how trade, governance, and innovation affect the environmental outputs, showing greater robustness and interpretability in the study’s results. Equation 1 mathematically pottery the relations.

For specification, the KEC hypothesis will be tested by executing the following Equation 2, and the LCC hypothesis will be assessed by implementing Equation 3.

After the natural log transformation, the above Equation 2 and Equation 3 have been rewritten in the regress form for the tenacity of exploring the coefficients of the independent variables. The regression equation is displayed in Equations 4 and 5, respectively.

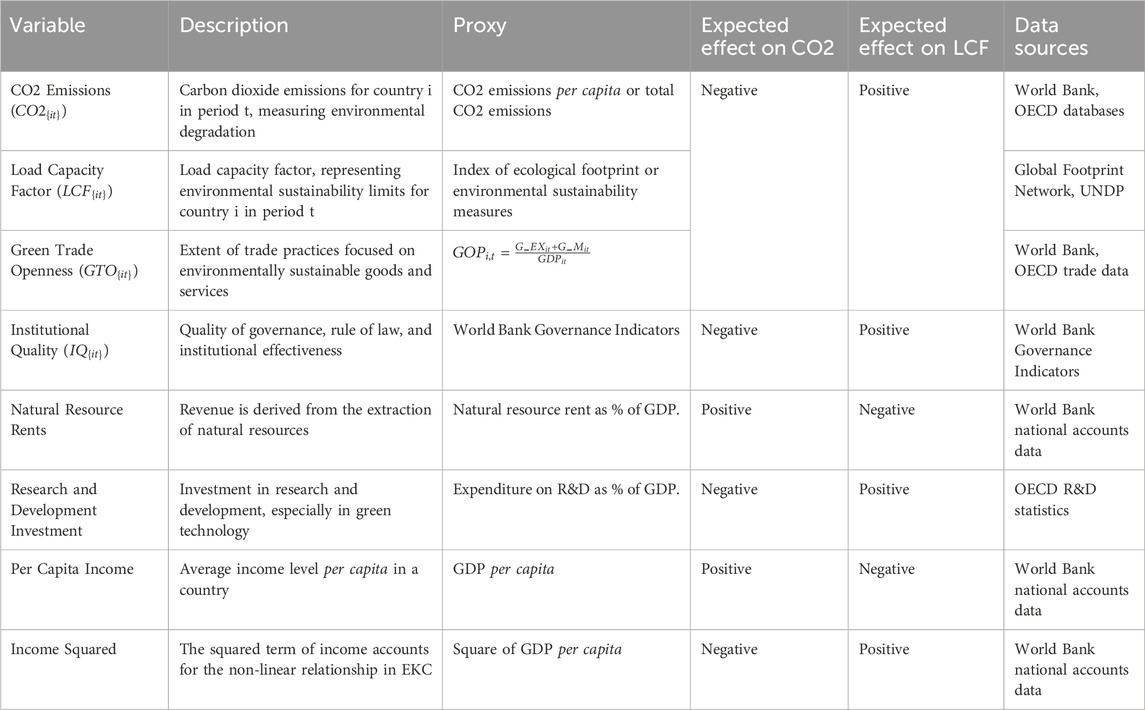

Where The panel regression framework incorporates the following variables:

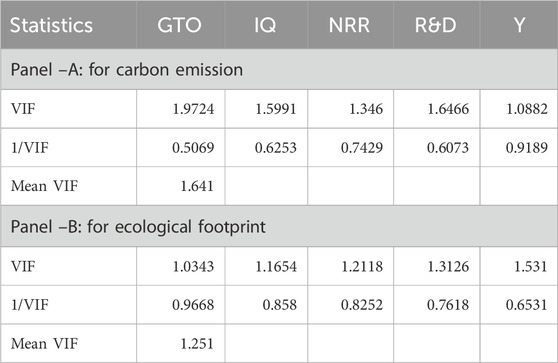

Both the carbon emissions and LCC models underwent a thorough evaluation for multicollinearity, and Table 3 displayed the output of VIF. All of the explanatory variables for carbon emissions, including GTO, Y, IQ, NRR, and R&D, have VIF values that are far below the 10 threshold, suggesting that there are little worries about multicollinearity. The mean VIF of 1.641 guarantees the unbiased coefficient estimate, which indicates solid variable independence. Additionally, For the LCC model, the study revealed the VIF values with an average of 1.251. This result further emphasizes the disaggregation of variables, which boosts trust in interpretation. These findings verify reliable insights into the factors driving environmental sustainability in OECD countries and highlight the need to select predictors well, supporting the models’ resilience.

3.2 Estimation strategies

Stage 1: The study implemented Cross-Sectional Dependence (CD) and Slope Heterogeneity (SH) Juodis and Reese (2022) CD test provides a detection for such cross-sectional dependence, that is, because of global shocks or inter-related economic activities among cross-sectional units. CD can cause biased estimates and inefficiencies in regression models; see Equation 6.

SH test of Bersvendsen and Ditzen (2021) enables testing for variable slopes, i.e., whether panel units have heterogeneous reactions to economic facets. Addressing SH is crucial for accurate policy recommendations. Moreover, The SH test, see Equation 7 is robust to this by taking country-fixed effect in responses. For SH, the adjusted Δ statistic is:

The second stage deals with determining the variables in order of integration. The study implemented the unit-root test of Herwartz et al. (2018). In panel data estimation, it is imperative to check whether a dataset does show non-stationary behavior and can protect against spurious regression results. Specifically, by allowing the test for the integration order of the variables, the test would ensure that the correct econometric model can be specified for a long-run equilibrium analysis. Evaluation of stationary assists in a way to avoid spurious inferences in time-series and panel-data studies. The test is based on the following equation, Equation 8:

where

Stage 3 documents the long-run association in the empirical relations by employing the panel cointegration test offered by Westerlund and Edgerton (2008), Westerlund (2007). The conventional cointegrating test, Pedroni (1999) is limited to empirical applications because they assume the same long-run relationship and cross-sectional independence. In recent years, Westerlund and Edgerton (2007, 2008) proposed various panel cointegration methods that potentially provide more robust inferences of cointegration in the presence of structural breaks and cross-sectional dependence. The Westerlund and Edgerton (2007) specification is based on the Lagrange Multiplier (LM) framework, adding structural breaks through a Fourier approximation. It beats traditional methods, which tend to fail in the face of unknown breakpoints. In contrast, the Westerlund and Edgerton (2008) test extends this method by allowing for cross-sectional dependence through a bootstrap procedure that enhances the reliability of inference in heterogeneous panels. The fundamental equation, see Equations 9–13 to test the null hypothesis of no cointegration follows:

Stage 4 is the execution of CS-ARDL in documenting long-run and short-run coefficients of GTO. IQ. NRR, R&D, Y and Y2. CS-ARDL is a powerful econometric tool to assess the short and long-run linkage between variables in both environmental and economic studies. Therefore, this model is quite appropriate for studying the EKC and LCC hypotheses as it takes into account the cross-sectional dependence and heterogeneity of panel data, which is widely observed in economic studies (Yin and Qamruzzaman, 2024; Yingjun et al., 2024; Qamaruzzaman, 2025; Qamruzzaman, 2025). A tendency for the CS-ARDL model compared with conventional panel estimators is to include cross-sectional means of both the dependent and independent variables to correct biases caused by unobserved common factors (Atilgan, 2024; Zou et al., 2023). This characteristic improves the consistency and reliability of the results and thus is usually preferable for studies with complex interactions among the variables (Ameziane and Benyacoub, 2022; Kuok et al., 2023). Moreover, the CS-ARDL model is also robust to the endogeneity issues and slope heterogeneity, whose consideration is essential for investigating complex relationships in economic data. Recent researchers have implemented the CS-ARDL model in a range of scenarios and confirmed the advantages of this model as an accurate matrix of short-term and long-run dimensions (Dahmani et al., 2022; Voumik and Mimi, 2023). Such methodological rigor is necessary for policymakers seeking to comprehend the nuanced relationships between economic development, ecological sustainability, and resource stewardship. The following equation, see Equation 14 and Equation 15, is executed for the extraction of elasticities of GTO, IQ, NRR, R&D, Y, and Y2.

Stage 5 study implemented nonlinear estimation by following the asymmetric framework introduced by Shin et al. (2014). The following equation, see Equation 16 and Equation 17, is used to document the asymmetric effects of GTO, IQ, NRR, and R&D on CO2 and LCC.

where,

By incorporating the above-decomposed variables, the asymmetric equation, see Equation 18 and Equation 19, can be displayed in the following manner:

The ng-run and short-run coefficients can be documented by implementing the following equations that are Equation 20 and Equation 21.

where,

Stage 6 concentrated on documenting the directional association by executing The Dumitrescu and Hurlin (2012) panel causality model, which is articulated as follows, see Equation 24:

In Equation 22,

The model implies the absence of a specific direction of causality for all individuals in the panel. The DH test also assumes that there can be a causal link between some variables and not necessarily all. Therefore, the alternative hypothesis is formulated as:

where

4 Estimation and interpretation

The results of the SH and CD tests show a strong cross-sectional dependence in all variables analyzed, see Table 4. Particularly, Panel A illustrates the CD test results showing statistically significant values for all variables (CO2, LCF, GTO, IQ, NRR, R&D, and Y) at the 1% significance level. Additionally, SH test results shown in panel B. Both models show statistically significant Δ Statistic and Adjusted Δ Statistic values, providing SH evidence. These findings indicate that cross-sectional dependence and spatial heterogeneity should be considered components of the data set and controlled for in subsequent analyses.

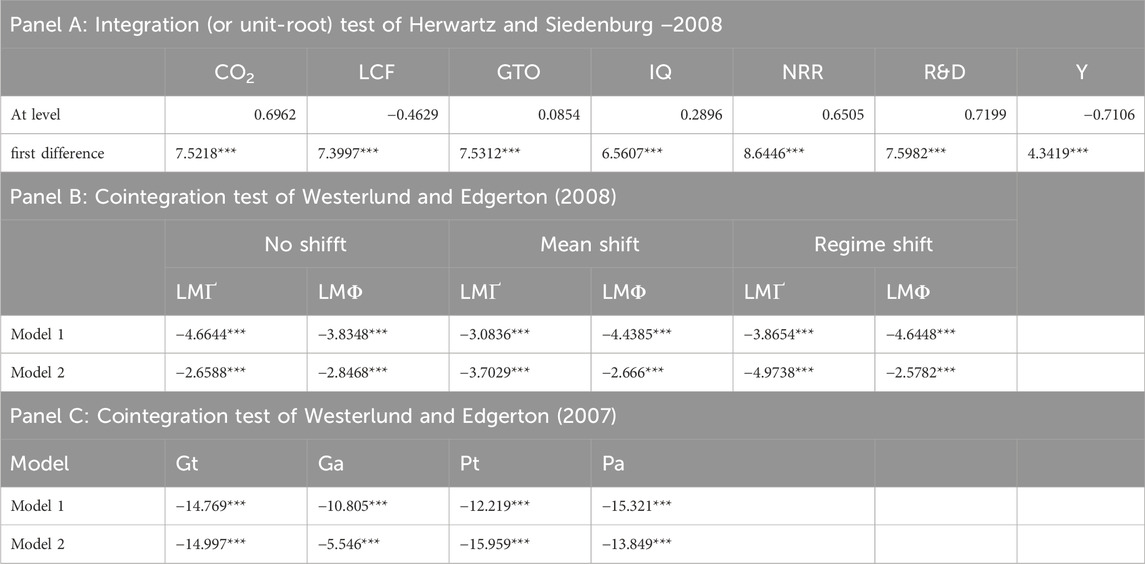

In Panel A, Table 5 reports the unit-root test results and exhibiting that all the variables are non-stationary at the level and stationary at the first difference, as evidenced by the highly statistically significant test statistics. Support for this indicates that the variables are I (1). Results from the cointegration test under various structural shift assumptions are reported in Panel B, which checks for the presence of long-run relationships. The LM statistics, far below the critical values for co-integration across models, highlight robust cointegration evidence, suggesting a long-run stable equilibrium among the variables. In Panel C, the results corroborate the previous analysis, with the test statistics all reporting significant negative values. These results suggest that while the variables do not exhibit stationarity on their own, they do co-move in the long run, reflecting the existence of a long-term, stable, and theoretically consistent economic relationship.

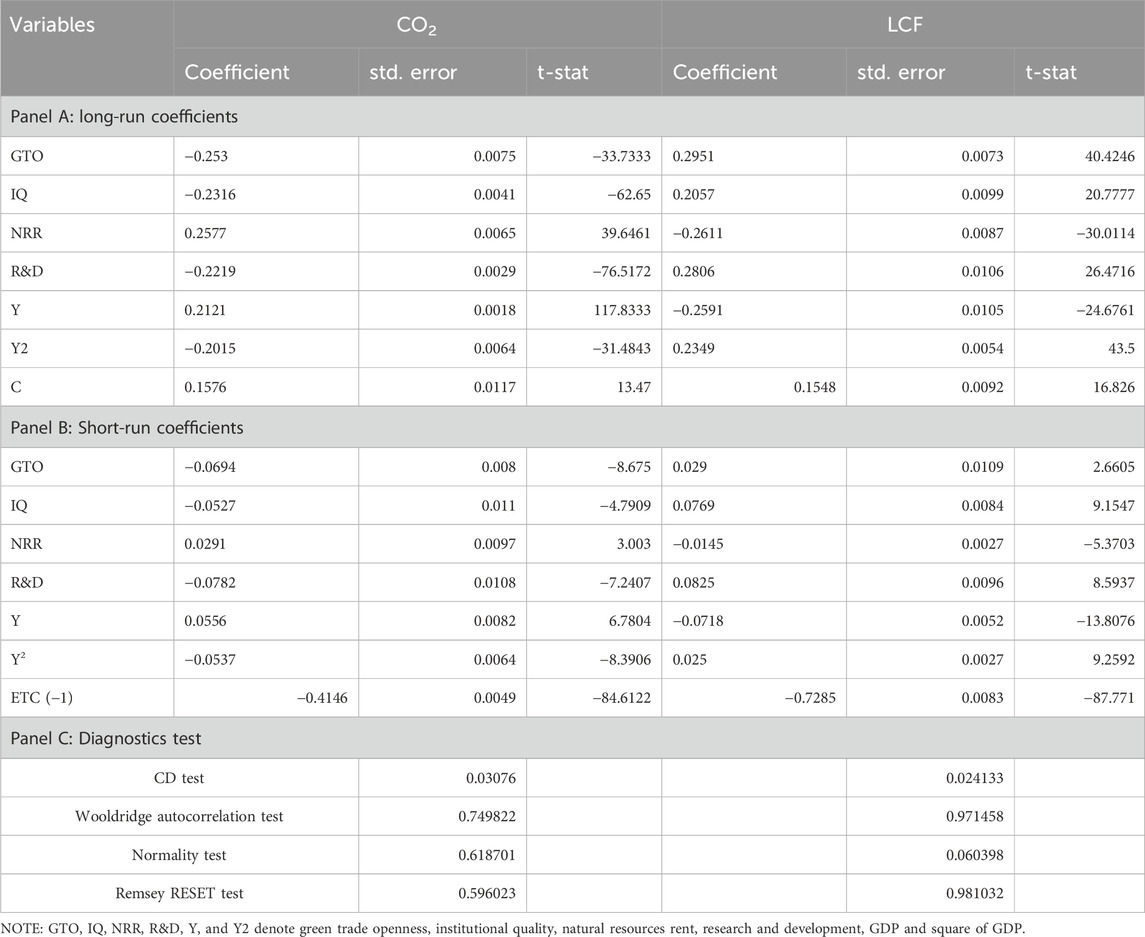

In the long run, see Table 6, GTO (a coefficient of −0.253) and IQ (a coefficient of -0.2316) negatively impact CO2 emissions, implying that a 1% increase in green trade openness or institutional quality reduces CO2 emissions by 0.253% and 0.2316%, respectively. This suggests that countries promoting green trade and strong institutional frameworks experience lower environmental degradation. Conversely, NRR (a coefficient of 0.2577) and Y (a coefficient of 0.2121) positively influence CO2 emissions, signifying that higher dependence on natural resources and GDP growth contributes to increased emissions, possibly due to intensified industrial activities and fossil fuel consumption. The quadratic GDP term Y2 (a coefficient of −0.2015) suggests an inverted U-shaped EKC, indicating emissions initially rise with economic growth but decline after reaching a critical income level, reflecting structural shifts toward cleaner technologies. Additionally, R&D (a coefficient of −0.2219) significantly reduces emissions, emphasizing that investments in technological innovation drive environmental sustainability by promoting cleaner production processes. In the short run, the relationships remain consistent but exhibit weaker effects. GTO (a coefficient of −0.0694) and IQ (−0.0527) still contribute to emission reductions, albeit at a lower magnitude.

Meanwhile, NRR (0.0291) and Y (0.0556) continue to elevate emissions, reflecting the immediate impacts of increased resource exploitation and economic activity. The EKC hypothesis remains valid, with Y2 (−0.0537) supporting eventual reductions in emissions as economies develop. The lagged error correction term, ETC (−1) (−0.4146) indicates significant short-run convergence to long-run equilibrium, suggesting that deviations from equilibrium levels adjust rapidly.

In the long run, GTO (0.2951) and IQ (0.2057) positively influence LCF, meaning that improved trade openness and institutional quality enhance energy efficiency by facilitating access to advanced technologies and regulatory frameworks that encourage sustainable practices. However, NRR (−0.2611) and Y (−0.2591) negatively affect LCF, implying that higher reliance on natural resource rents and GDP growth reduces energy efficiency, possibly due to increased energy consumption in resource extraction and industrialization. The quadratic term Y2 (0.2349) suggests a U-shaped EKC, where energy efficiency initially declines but improves beyond a certain GDP threshold as economies transition toward cleaner energy sources. Additionally, R&D (a coefficient of 0.2806) significantly boosts LCF, reinforcing the positive impact of technological advancements on optimizing energy utilization and grid stability. In the short run, GTO (0.029) and IQ (0.0769) continue contributing to LCF improvements, highlighting the immediate benefits of trade liberalization and governance reforms in promoting efficiency.

Meanwhile, NRR (−0.0145) and Y (−0.0718) persist in reducing LCF, emphasizing the ongoing challenges posed by resource dependence and growth-driven energy inefficiencies. The quadratic GDP term Y2 (0.025) supports an eventual increase in energy efficiency as structural economic transformations occur. The error correction term ETC (−1) (−0.7285) suggests a stronger short-run adjustment toward equilibrium for LCF compared to CO2 emissions, indicating a faster alignment of energy efficiency indicators with long-run trends.

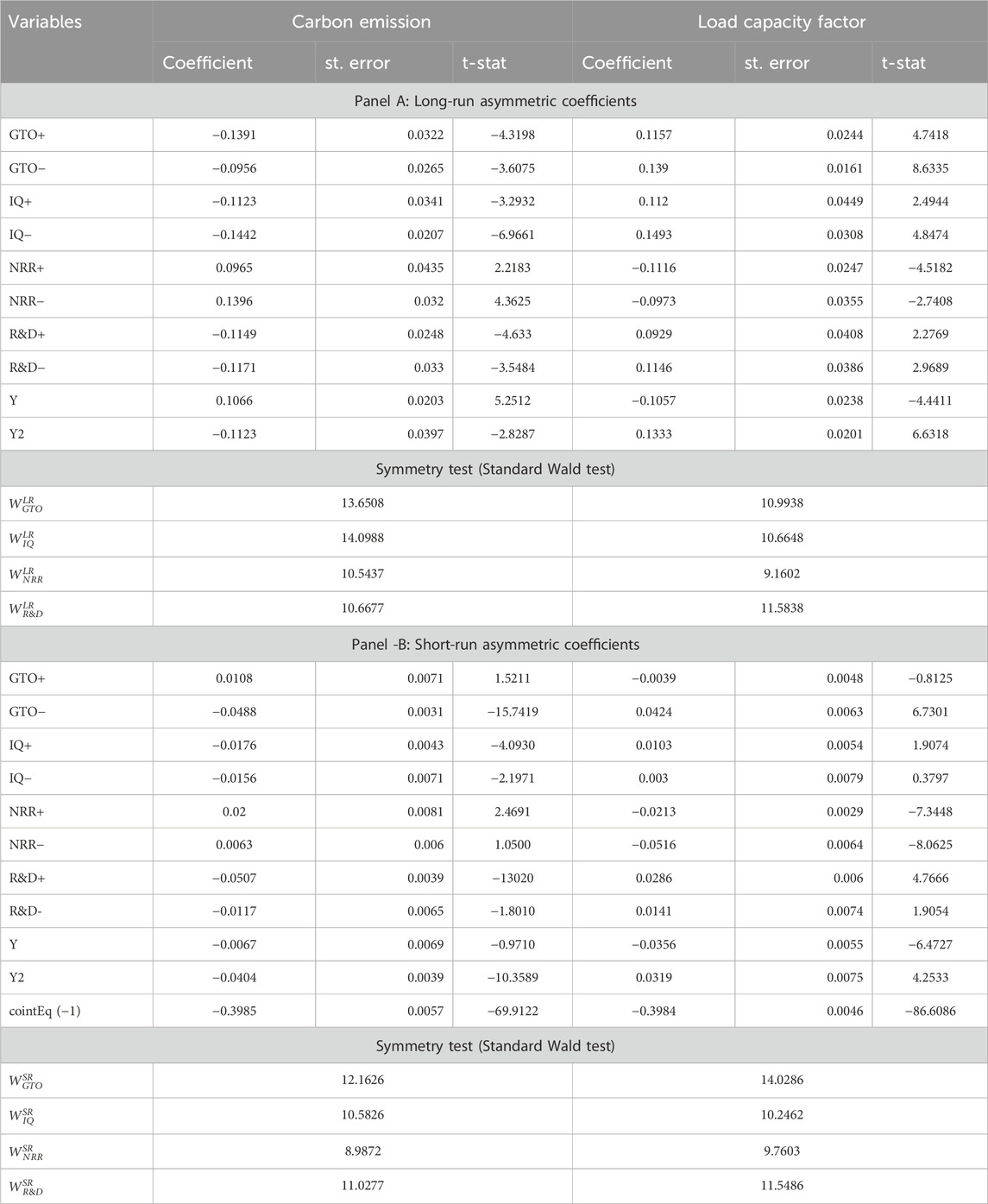

The long-run results (in Table 7) reveal significant asymmetries in how green trade openness (GTO), institutional quality (IQ), natural resources rent (NRR), research and development (R&D), and economic growth (Y) affect CO2 emissions. The estimated coefficients for positive shocks in GTO (a coefficient of −0.1391) and adverse shocks in GTO (a coefficient of −0.0956) indicate that an increase in green trade openness leads to a greater reduction in CO2 emissions compared to a decrease in GTO. A similar pattern is observed for institutional quality (IQ), where positive shocks (a coefficient of −0.1123) and adverse shocks (a coefficient of −0.1442) confirm the substantial asymmetric impact, suggesting that improvements in institutional quality reduce emissions more effectively than deteriorations increase them. However, NRR has the opposite effect, where positive shocks (a coefficient of 0.0965) increase CO2 emissions, while negative shocks (0.1396, p < 0.01) further exacerbate emissions reductions, indicating an asymmetric dependency on natural resources. R&D investments also show an asymmetry, with positive shocks (a coefficient of -0.1149) reducing emissions and negative shocks (a coefficient of −0.1171) having a similar effect, confirming the long-term benefits of research-driven mitigation strategies. GDP (Y) exhibits a positive relationship (a coefficient of 0.1066) with CO2 emissions, while the squared term (Y2) shows a negative effect (a coefficient of −0.1123), supporting the environmental Kuznets curve (EKC) hypothesis. The short-run results show mixed asymmetries. Positive shocks in GTO (0.0108, p > 0.10) are statistically insignificant, but negative shocks (a coefficient of −0.0488) significantly reduce CO2 emissions, reinforcing the long-run pattern. IQ also follows the same asymmetric response, with positive shocks (a coefficient of −0.0176) and negative shocks (a coefficient of −0.0156) reducing emissions, though at slightly different magnitudes. Interestingly, NRR positive shocks (0.0201) increase emissions, whereas negative shocks (a coefficient of 0.0063) are insignificant, unlike the long-run case. R&D has a significant asymmetric effect, where positive shocks (a coefficient of −0.0507) reduce emissions, but negative shocks (a coefficient of −0.0117) are weakly significant, highlighting that short-term R&D cutbacks may not immediately impact emissions. GDP (Y) and Y2 maintain their expected signs but are mostly insignificant in the short run. The error correction term (a coefficient of −0.3985) confirms a rapid adjustment toward equilibrium.

The long-run findings suggest that green trade openness (GTO) asymmetry affects LCF, with positive shocks (a coefficient of 0.1157) increasing capacity utilization. In contrast, negative shocks (a coefficient of 0.1390) have an even stronger increasing effect, which implies that LCF responds more aggressively to reductions in green trade openness. Institutional quality (IQ) follows a similar pattern, where positive shocks (a coefficient of 0.112) and negative shocks (a coefficient of 0.1493) both increase LCC, emphasizing the importance of governance in energy efficiency. Interestingly, NRR exhibits an inverse effect, where positive shocks (a coefficient of −0.1116) reduce LCC, while negative shocks (a coefficient of −0.0973) also decrease it, indicating that natural resource dependence lowers energy capacity utilization regardless of the change direction. Research and development (R&D) positively impact LCC, with positive shocks (a coefficient of 0.0929) and negative shocks (a coefficient of 0.1146) reinforcing the effect, confirming the technological improvements from R&D. GDP (Y) has a negative long-run impact (a coefficient of −0.1057). At the same time, the squared term (Y2) is positive (a coefficient of 0.1333), suggesting a U-shaped relationship between economic growth and LCF.

Short-run asymmetries also exist in LCF responses. Unlike in the long run, positive shocks in GTO (a coefficient of −0.0039) are insignificant. However, negative shocks (a coefficient of 0.0424) significantly increase LCC, implying that a decrease in green trade openness improves capacity utilization more than an increase in GTO. Institutional quality exhibits a weaker short-run effect, with positive shocks (a coefficient of 0.0103) and negative shocks (a coefficient of 0.003) being insignificant, highlighting that governance improvements take time to influence LCF. Natural resource rents maintain an asymmetric influence, where positive shocks (a coefficient of −0.0213) reduce LCF, while negative shocks (a coefficient of −0.0516) decrease it even further, reinforcing that dependency on resources deteriorates energy efficiency. R&D remains crucial, with positive shocks (a coefficient of 0.0286) and negative shocks (a coefficient of 0.0141) confirming the asymmetric role of technological investments. GDP maintains a negative effect (a coefficient of −0.0356), while the squared term (Y2) is positive (a coefficient of 0.0319), similar to the long-run trend. The error correction term (a coefficient of −0.3984) suggests a stable long-term relationship.

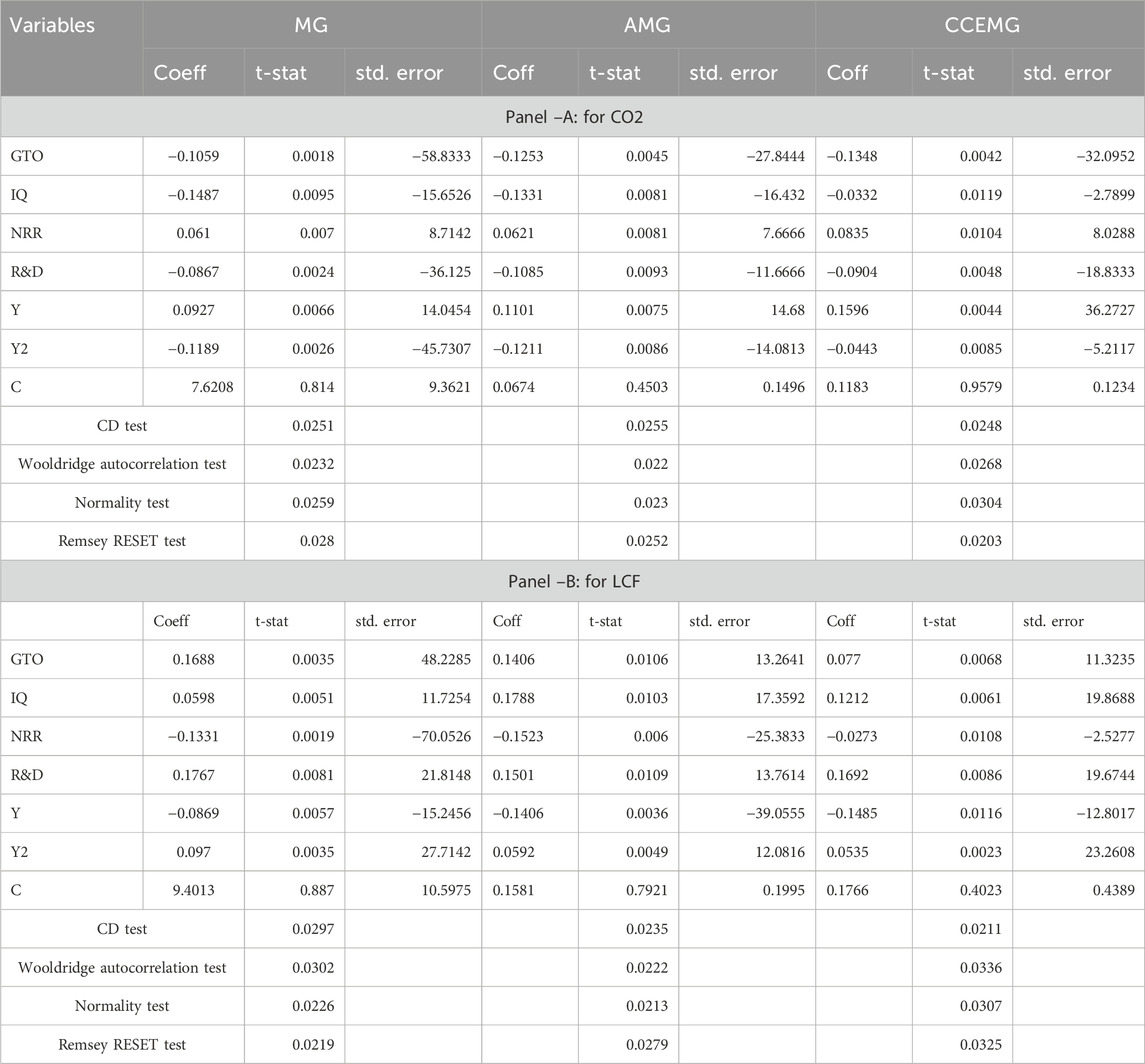

Using the aforementioned modeling approach, the analysis reveals that green trade openness, institutional quality, and research and development reduce CO2 emissions whilst the natural resource rent increases CO2 emissions, see Table 8. A positive Environmental Kuznets Curve relationship is validated in which emissions rise initially and fall at higher stages of development. The findings hold consistently across MG, AMG, and CCEMG models, underscoring the robustness of our findings. In the LCF model, green trade openness, institutional quality, and research and development positively influence energy efficiency, whereas natural resource dependency has an inverse effect. The finding further corroborates the inverted U-shaped association between economic growth and efficiency in the dynamic sense with an inverse mechanism between development and active resource use in the long run. Furthermore, A consistency check with CS-ARDL results proves that the coefficients’ signs are consistent with the findings obtained from MG, AMG, and CCEMG models. This substantiates the stability of the identified correlations, particularly emphasizing the positive influences of green trade openness, institutional quality, and R&D on emissions reduction and energy efficiency gains.

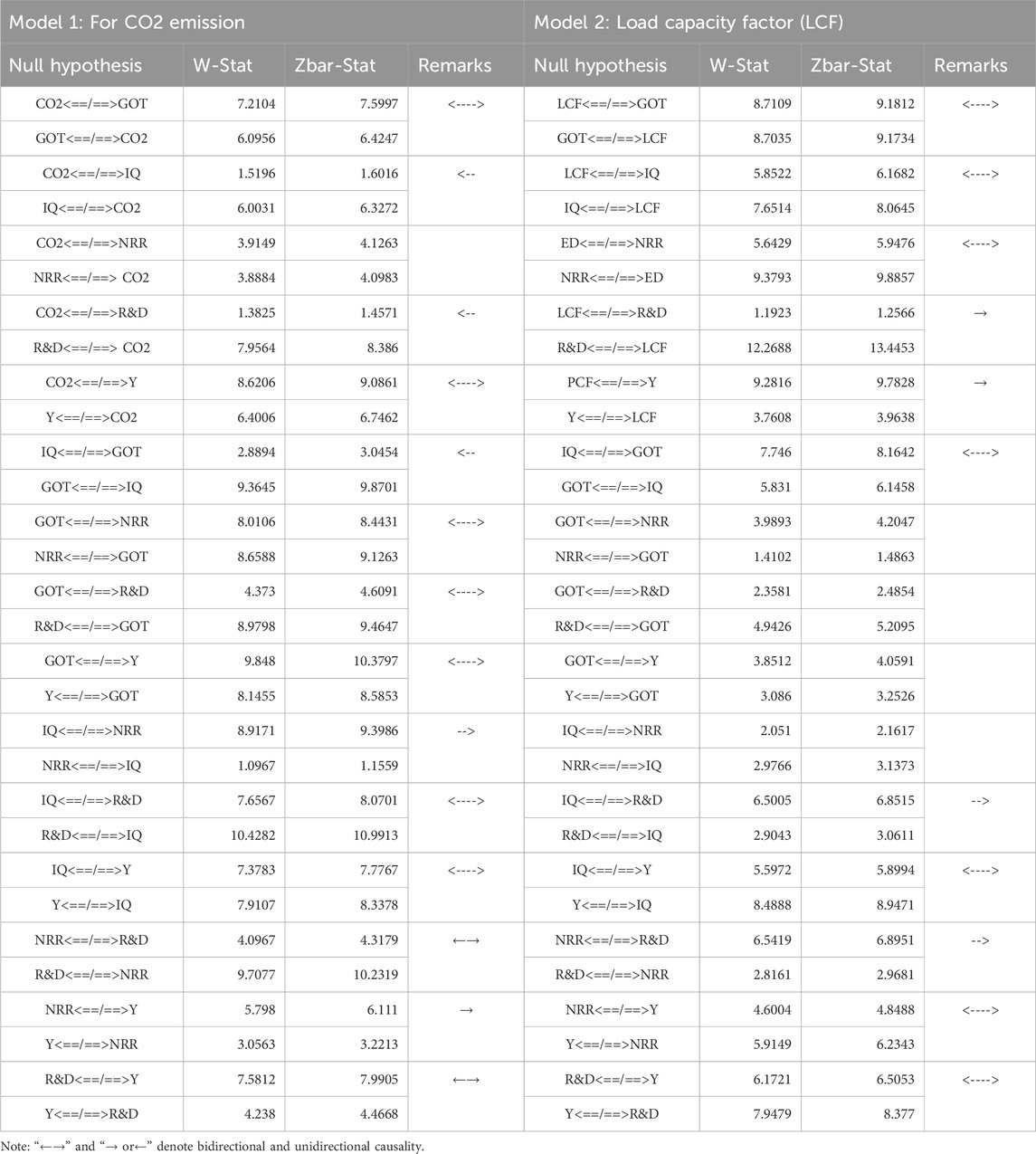

The causality test results, as seen in Table 9, reveal bidirectional and unidirectional relationships among the studied variables. In Model 1 (CO2 emissions), there is a bidirectional relationship between CO2 emissions and gross output (GOT), as well as with income (Y), suggesting a mutual influence. Additionally, intelligence quotient (IQ) and research and development (R&D) expenditures exhibit unidirectional causality towards CO2 emissions, indicating that changes in these factors impact emissions but not vice versa. Model 2 (Load Capacity Factor - LCF) has a bidirectional relationship between LCF and GOT, IQ, and natural resource rents (NRR), implying strong interdependencies. However, R&D has a unidirectional causal influence on LCF, highlighting the role of technological advancements in shaping load capacity. These findings suggest that economic output, intelligence, and technological factors influence CO2 emissions and LCF, while broader economic and developmental factors shape emissions.

5 Discussion

The research results suggested that in the long run, CO2 emissions in the OECD countries are significantly reduced as a product of Green Trade Openness (GTO), which is positively correlated with the Load Capacity Factor (LCF). This relationship also highlights the potential for trade liberalization, especially in environmentally friendly sectors, to help diffuse green technologies and cultivate sustainable production methods. Indeed, the evidence supports the findings of past academic work that suggests international trade contributes to both the diffusion of cleaner technologies and the stiffer enforcement of higher standards of pollution mitigation and environmental quality (Karedla et al., 2021). In addition, Omri et al. (2014) highlights that open economies experience spillovers in technology that boost the efficiency of energy use, thereby augmenting the GTO effect on LCF. In the asymmetric analysis implemented in the study, positive shocks in GTO result in more substantial emissions reduction than negative shocks. Although trade liberalization is a potential natural disaster, damages from trade restrictions are smaller than benefits. This result echoes the observations made by Chen et al. (2021) and the role of trade whereby trade can spur cleaner technologies and practices to diffuse across borders.

Furthermore, the study also found that the short-run effect of GTO on emissions is still negative but weaker than the negative long-run effect, indicating that the negative effects of trade openness are not as immediate, which supports (Chen S. et al., 2022; Chen et al., 2023), which suggests incorporating energy-saving behavior requires policy changes and market incentives. The OECD can use these findings practically to promote the implementation of trade liberalization targeting markets that present an eco-friendly way of living. By creating a more favorable environment for the diffusion of green technologies, the OECD will support member countries in pursuing their goals of ecological sustainability while enhancing economic growth. This strategy follows the recommendations by Mpeqa et al. (2023), who recommended a shift in the interests of policymakers toward investing across multiple endpoints, such as the environmental quality of inward foreign direct investments (FDI), to prevent pollution havens and support coordination-focused know-how and technology sharing. In addition, the OECD’s role in promoting international cooperation on environmental standards can bring additional benefits to trade liberalization. Nevertheless, according to Karedla et al. (2021), trade openness decreases CO2 emissions substantially, which would entail the OECD to promote uniform environmental regulations among members to ensure environmental benefits without tradeoffs due to measures required for trade facilitation. This is especially interesting given the findings of Ozili (2022), as emission transfers through international trade impose far-ranging impacts on global climate policies. The OECD can play a pivotal role by considering investments in green technology as the new trend whereby member countries share knowledge to transition to more sustainable economic models, thus reducing carbon footprints and maintaining economic competitiveness.

Understanding the link between institutional quality (IQ) and environmental sustainability—especially CO2 emissions—is a pivotal focus of research highlighting good governance’s role in reaching environmental objectives. The results show that greater governmental effectiveness is associated with lower CO2 emissions and higher energy efficiency for OECD countries. Such a relationship shows the importance of strong policy frameworks, transparency, and regulatory enforcement in curbing environmental degradation (Du et al., 2022; Abid, 2016; Ahmad et al., 2023). Existing literature shows that stronger institutions that can enforce environmental laws and encourage green investment lead to decreased pollution (Ali et al., 2019; Borojo et al., 2022; Fang, 2023). Asymmetric institutional impact indicates that better governance has a more significant effect on lowering emissions than worse governance on raising emissions. This is consistent with the argument that effective governance can translate to potential positive environmental outcomes in the long run (Tabassum, 2023; Tamazian et al., 2010). The implication is that governance reforms need to translate into environmental benefits over time despite their relatively weak impact on emissions reductions in the short term (Ahmed et al., 2020; Nawaz, 2023). The literature endorses that political stability, anti-corruption, and regulatory quality contribute significantly to effective environmental policies (Asongu and Odhiambo, 2019; Ullah et al., 2022; Xaisongkham and Liu, 2022). Against this backdrop, the OECD must launch holistic policy frameworks to enhance institutional quality among member states. These would be such strategies as increasing transparency in governance, building political stability and anti-corruption Action. Focusing on these aspects will help the OECD create the required conducive environment for building sustainable practices and green investments that will help reduce CO2 emissions and improve quality environmental (Muhammad and Khan, 2021; A'Yun, 2023; Dées, 2020). The bottom-line effects of these efforts are considerable, for not only do OECD advance environmental sustainability, but also foster economic growth by drawing in foreign investments and driving innovation in green technologies (Asongu and Odhiambo, 2020; Limazie, 2024). In addition, OECD governance can be a source of inspiration and an example for non-OECD countries interested in such an activity. Through sharing policies and frameworks of good governance, the OECD can develop a “universality” in environmental governance, which prioritizes sustainability. Chiu and Zhang (2023) and Mukhtarov (2023) Such a joint approach could strengthen the effort of climate action globally and pave the way for a more lived future.

The study’s results reveal a significant relationship between natural resource rents (NRR) and carbon dioxide (CO2) emissions in OECD countries, reinforcing the resource curse theory. Shifting towards NRR has increased CO2 emissions, which negatively impacts the benefits available to local communities (LCF). This relationship is even more pronounced because resource extraction is carbon-intensive, and many economies depend on fossil fuels (Long et al., 2017). In particular, the evidence based on NRR suggests that an expansion of resource dependency has high environmental costs (Ganda, 2022); the study (Fahad, 2024) positively articulates that energy-inefficient deployment of energy resources is common in such economies because of a lack of energy rent incentives to foster environmentally sustainable energy transitions. Given these realities, the OECD must implement policies that advance economic diversification and investment in renewable energy sources. Such policies would mitigate the adverse environmental impacts of resource dependency. For example, promoting technological innovations and improving efficient resource use have been linked to lower emissions in other settings (Le, 2023). The OECD can also use its position to promote the adoption of frameworks in its member countries that prioritize investments in renewable energy, which would reduce dependence on fossil fuels and promote energy efficiency (Mahmood, 2023). These policies have implications not only for environmental improvement but also for economic endurance and sustainability as countries move away from dependence on resource extraction in favor of diversified economies (Asiedu et al., 2021). Given these facts, the normative response of the OECD should include establishing guidelines that would push its member states to adopt investments regarding green technologies and renewable energy infrastructures. The OECD can aid in reducing the environmental degradation associated with NRR by fostering innovation and offering financial and PI incentives for sustainable practices. Furthermore, Zaman et al. (2016) and Raihan (2023) revealed in respective studies that the OECD could also insist on incorporating environmental perspectives into economic planning by ensuring the extraction and utilization of natural resources are in line with sustainability principles. Not only does this technique tackle environmental issues immediately, but it also stretches OECD countries a prominent role in the worldwide shift towards sustainable development, eventually bolstering the SDGs as stated by Khan (2021). Altinoz (2022) postulated that the OECD has the opportunity and mandate to intervene: its facilitating role in advancing renewable and sustainable economic practices can reshape environmental sustainability in resource-rich economies.

The findings regarding the impact of R&D investment on CO2 emissions and load capacity factor (LCF) in OECD countries reveal a significant relationship that underscores the importance of technological advancements in promoting environmental sustainability. Specifically, R&D investment is shown to reduce CO2 emissions and improve LCF, suggesting that increased investment in research and development is pivotal for fostering cleaner production processes and enhancing energy efficiency, which aligns with the broader understanding that technological innovation is essential for achieving sustainable environmental outcomes, as it enables the development of green technologies that mitigate emissions and improve energy utilization (Dogan, 2024; Orlando et al., 2022). The robustness of these findings is further highlighted by the observation that both positive and negative shocks in R&D consistently lead to reductions in emissions, which suggests that research-driven strategies for environmental mitigation are effective regardless of the nature of the economic shock, reinforcing the notion that sustained investment in R&D is crucial for long-term sustainability (Vaitiekuniene, 2024). The literature supports this view, with prior studies indicating that R&D expenditures are a key driver of green innovations and facilitate the transition towards low-carbon economies (Du, 2024; Esquivias et al., 2022). Moreover, the short-term impact of R&D on emissions is significant yet weaker, indicating that while immediate benefits may be observed, the full effects of technological innovations require time for widespread adoption and integration into existing systems. This finding is consistent with the literature, which suggests that economies prioritizing R&D investments tend to experience long-term sustainability benefits, as the gradual implementation of innovative technologies leads to more substantial reductions in emissions over time (Wan, 2024; Yang, 2024). By emphasizing the importance of R&D investment, these results underscore the necessity for governments and corporations to prioritize funding for green technologies and innovations. This strategic focus contributes to immediate environmental benefits and lays the groundwork for a sustainable future (Dogan, 2024; Zhang, 2024).

6 Conclusion and policy suggestions

6.1 Conclusion

The study provides compelling evidence that GTO, IQ, NRR, and R&D significantly influence environmental sustainability and energy efficiency in OECD nations. Green trade openness and institutional quality emerge as key drivers of emission reductions and efficiency improvements. At the same time, reliance on natural resource rents exacerbates environmental degradation. Meanwhile, R&D investments offer a viable path toward long-term sustainability. The asymmetric results further underscore the importance of proactive policy measures, as positive shocks in GTO, IQ, and R&D yield greater environmental benefits than negative shocks contribute to damages. These findings support the need for targeted policies that promote green trade, enhance governance, reduce resource dependency, and foster technological innovation to achieve sustainable economic growth.

6.2 Policy suggestions

Based on the study findings, the following policy guidelines have been formulated for OECD nations to foster environmental sustainability.

First, the OECD should advocate for deepened trade liberalization in green sectors, allowing the scaling of green technologies to cross borders more easily. At the same time, it will encourage sustainable market anti-degradation practices, and OECD members will uphold high standards in environmental protection for all stakeholders. Since the benefits of GTO outweigh the damages from trade restrictions, policymakers at the OECD level should push for an international framework that prizes green trade policies while incentivizing efforts for carbon mitigation.

Second, the OECD should recognize that good Governance (IQ) translates into lower emissions and higher energy efficiency among the member states. Building transparency, implementing anti-corruption measures, and ensuring regulatory stability will provide fertile ground for green investments. The OECD can indeed make a good move towards a real change for sustainability by promoting governance reforms that will enhance political stability and environmental oversight. In its capacity as a global leader, the OECD must also advocate for the sharing of best practices in environmental governance across borders, allowing those member states to set the gold standard for sustainability-oriented policymaking to which other countries can aspire.

Third, OECD countries must stop relying on natural resource rents (NRR), as this has been identified as one of the major drivers of CO2 emissions. All resource extraction is carbon-intensive, and fossil fuel dependence comes with compounded environmental impacts. People in the OECD must speed up economic diversification to increase and invest in electricity infrastructure that runs from renewable energy. The organization will set ambitious guidelines on technological innovation and green energy adoption while facilitating long-term economic resilience through a gradual trajectory away from fossil fuels. The global economy should be based on sustainability principles and resource utilization appropriate to the effort to achieve global climate goals.

Fourth, the OECD should focus on investment in R&D to generate innovation in green technology. Numerous empirical studies have shown that more money spent on R&D improves energy efficiency and results in cleaner production in a way that significantly reduces emissions. Finally, governments cannot continue to fund only short-term goals, and we need to ensure sustainable R&D is integrated into economic policy by leveraging the OECD. That means policymakers should put in place incentive structures to reward emissions-reducing technology improvements, such as industrial process and product system-level innovations that lead to a transition to a low-carbon economy. The OECD must be a global proponent of investment in technology to drive sustainability if G20 nations are to be successful in other economic areas.

Suggestions for underdeveloped nations are as follows: First, this research delves into understanding renewable energy, its potential to mitigate dependence on fossil fuels, and its subsequent impact on CO2 emissions. The results confirm that OECD states have indeed curbed emissions by transitioning to cleaner energy sources like solar, wind and hydroelectric power. Thus, developing nations must focus on investment in renewable energy infrastructure with government-backed incentives to encourage private sector participation. Since financial development is crucial to facilitate sustainable transitions, governments should create the necessary financial mechanisms to finance green projects. Additionally, the Involvement of Public Private Partners can further accelerate knowledge exchange and scalability of renewable energy projects. Second, Given that underdeveloped nations combine weak governance structures—and often sparse policymaking—working hand-in-hand with OECD nations can further bolster the implementation of policy. Third, Sharing green technologies to facilitate local industry training to speed up the development of underdeveloped countries is also a way advanced economies can assist.

6.3 Future research direction