- 1Yonsei University, Seoul, Republic of Korea

- 2Kyung Hee University, Seoul, Republic of Korea

In the pursuit of sustainable development, green productivity has emerged as a crucial concept, bridging the gap between ecological conservation and economic prosperity to foster both environmental protection and human welfare. This research undertakes an in-depth exploration of the intricate associations among natural resource utilization, the forces of globalization, advancements in financial technology (fintech), human development, and green productivity within the ASEAN region during the period from 2000 to 2021. Employing advanced econometric techniques such as the Augmented Mean Group (AMG), Common Correlated Effects Mean Group (CCEMG), Fixed Effects modeling, and the Moments Quantile Regression (MMQR) to dissect panel data, the study aims to decipher the multifaceted impacts of these variables on environmental sustainability. The results reveal that overreliance on natural resources and the process of globalization pose challenges to green production, while economic expansion and human development initiatives act as catalysts for sustainability. The symbiotic relationship between human development and green business practices further accentuates the importance of holistic policy formulation. Notably, the findings highlight that the implementation of stringent environmental regulations and the adoption of sustainable resource management strategies not only enhance green production but also stimulate economic growth without compromising environmental integrity. This study not only enriches the theoretical framework of ecological economics but also uncovers the critical interdependencies of sustainability components within the ASEAN context. By spotlighting the necessity for integrated policies that harmonize economic and environmental objectives, this research offers valuable insights to policymakers striving to achieve sustainable development in the region. Moreover, it emphasizes the urgency of a comprehensive approach to address the sustainability conundrums faced by ASEAN nations, paving the way for future investigations into the complex web of multiple sustainability issues prevalent in developing economies.

1 Introduction

Since the 1960s, there has been a natural disaster and asset conflict that has resulted in loss of biodiversity, land becoming deserted, diminished resource availability, and worldwide warming. These issues require immediate global resolution (Chiu and Lee, 2020; Hao et al., 2018; Wang et al., 2022; Wen et al., 2022). Many nations have started to develop their green economies, which refer to collaboration in the expansion of the economy, goods and services, and ecological landscape, to deal with the shifting climate worldwide and growing ecological hazards as well as to accomplish the environmentally encompassing progress towards the Sustainable Development Goals (SDGs) (Dai et al., 2025; Li et al., 2025; Zhu et al., 2024). Thus, green productivity is a crucial indicator of how well a nation manages environmental issues, enhances its sustainability, and maintains sustainable economic growth (Degirmenci et al., 2024a; Eweade et al., 2024a). Consequently, policymakers and academics are paying close attention to the question of how to encourage growth in green productivity (GP), as it is widely seen as crucial in the current stage of financial growth. When energy and the environment emerge as the primary drivers of GDP growth, their dearth is especially pronounced since part of the inputs used in production must now be transferred to environmental governance activities, which results in inaccurate policy recommendations (Anser et al., 2024; Liu et al., 2020a; Shen et al., 2024). The concept of “green productivity,” which was first put forth by the Asian Productivity Organization in the 1990s, can easily address this constraint. Thus, the term “green productivity” describes a flexible approach that both enhances its green credentials and production. Since then, a great deal of study has been done on measuring the increase in GP to evaluate the economic system’s sustainability (Liu et al., 2020a; Xia and Xu, 2020; Yan et al., 2020).

The Association of Southeast Asian Nations is regarded as a major macroeconomic union, with a cumulative GDP growth of 5.2% (FocusEconomics, 2018; Özkan et al., 2024). It is anticipated that development will proceed at this rate (Eweade et al., 2024b). Given the robust economies of ASEAN and other Asian regions, it is hardly unexpected that the 21st century has been called the Asian Century (Degirmenci et al., 2025; Nathaniel and Khan, 2020). Though this increase in fiscal activity is commendable, there may be significant ecological consequences. According to the (ASEAN Centre for Energy, 2015), there are alarming concerns that the upward excess power in the environment’s degradation is due to ASEAN’s economic expansion. The ASEAN’s economic boom, which is fueled by the use of fossil fuels, has been connected to the region’s latest run of catastrophic disasters (Awosusi et al., 2024; Degirmenci et al., 2024b; Rosenzweig et al., 2010).

Fin-tech (financial technology) refers to the technology used to provide financial services (Razzaq et al., 2023; Usman et al., 2024). Its emergence offers numerous opportunities, as technology enables banking and insurance firms to streamline processes and deliver solutions efficiently (Nenavath and Mishra, 2023). However, ongoing research aims to fully understand fintech’s impact on creating a robust, sustainable economic development framework. Fin-tech encompasses various innovations, such as artificial intelligence, big data, and mobile access, significantly influencing industry growth and operations (Eweade et al., 2024c; Ignatyuk et al., 2020; Lisha, Mousa, Arnone, Muda and Huerta-Soto, 2023).

Fin-tech simplifies investment access for small investors and addresses unmet financial needs, driving sustainable competitiveness by transforming financial services (Degirmenci et al., 2024a; Karim et al., 2022). According to (Damak and Eweade, 2024; Udeagha and Muchapondwa, 2023), sustainable growth models could generate nearly $12 trillion annually by 2030. Table 1 illustrates the rising patterns of Internet users (% of the population), domestic credit to the private sector, and mobile subscriptions in select ASEAN nations from 2000 to 2021.

In addition to fin-tech, several additional elements play a role in reaching GP. Research revealed that nations had taken advantage of natural resources (NR) to achieve long-term economic growth (Haddad and Hornuf, 2019; Song et al., 2011). This has led to pollution in the nation and is a result of older industries’ lack of technological innovation and energy efficiency. A country’s ability to survive and prosper depends on how far it can take its economy to advance in the international arena (Eweade et al., 2024a; Xuan et al., 2023). According to (Y. Wang et al., 2020; Abid et al., 2023), the utilization of naturally occurring assets, such as coal, oil, natural gas, and other resources, known as fossil fuels, is crucial in economic activity and global warming, which in turn influences total economic development. Although a nation’s prosperity depends on its natural resources, this dependence also carries concerns for the population’s welfare and future advancement. These risks stem from the negative impacts of resource utilization on the climate, natural components, living things, and physical resources. These elements support economic thinking and serve as the cornerstone of welfare and public strength (Huang et al., 2022). These abundant natural resources eventually release greenhouse gases that contribute to pollution and sea level rise. By improving the human development index (HDI) and employing financial technology to revolutionize the extraction of natural resources, it is possible to mitigate these negative effects and promote environmentally sustainable expansion of the economy.

ASEAN is an ideal case study due to its dynamic economic growth and the unique challenges it faces regarding resource dependency, environmental sustainability, and green productivity. The region is home to diverse economies, ranging from highly developed countries like Singapore to emerging markets such as the Philippines and Vietnam, each with varying levels of technological development, natural resource utilization, and environmental concerns. ASEAN countries are also committed to ambitious climate goals, including carbon neutrality and sustainable economic development, making the region an important focus for studying the intersection of fintech, natural resources, and green productivity. Additionally, ASEAN’s collective commitment to achieving the Sustainable Development Goals (SDGs) and addressing global environmental challenges positions it as a critical area for examining the role of innovation and policy in advancing green economies.

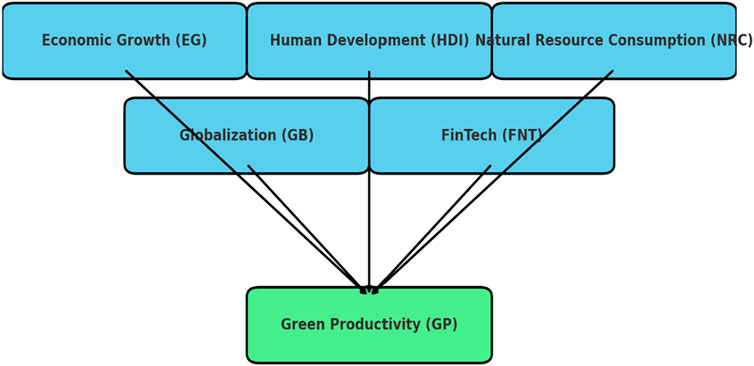

The goal of the current study is to learn more about how green finance policies have evolved and how that has affected the GP change of seven ASEAN countries between 2000 and 2021. Aiming for a carbon emissions peak before 2030, these Asian nations committed to the 2015 Paris Climate Change Conference. They should declare their intention to reach carbon neutrality by 2060, as this will help hasten the process of reducing CO2 emissions. In addition to addressing the pressing economic and environmental issues necessary to fulfill the aforementioned pledges, investigating a workable model for green development will provide ASEAN member nations with models to follow to implement their green economy transformations and advance green development. This encourages us to evaluate green total factor productivity (GTFP) and look into the factors that influence GTFP concerning the two main goals of carbon neutrality and economic development. Figure 1 is the complete conceptual framework.

There are four additional sections throughout the entire study. The review of the literature for each factor influencing GP is covered in the second section. The theoretical context and the methodology are covered in the third section, the fourth section discusses the empirical results. The final component of the report offers recommendations for the future and policy consequences.

2 Literature review and theoretical background

This section reviews empirical studies on the effects of globalization, fintech, natural resource consumption, economic growth, and the Human Development Index (HDI) on green productivity in developing countries. Over time, researchers and policymakers have emphasized the importance of resource availability and environmental sustainability. For example, Ahmad et al. (2020) examined the link between natural resource consumption and ecosystem degradation in 22 emerging economies from 1984 to 2016, suggesting that technological advancements can help restore ecological balance and reduce environmental harm. Similarly, Erdogan et al. (2020) analyzed 23 Sub-Saharan African countries from 1980 to 2016 and found that increased investment in natural resource exploitation leads to higher carbon emissions. Green productivity is closely tied to the use of natural resources, particularly in sectors such as oil and gas, and aims to integrate environmental sustainability into economic growth. The core goal of GP is to support economic development while reducing resource depletion and environmental damage Cheng et al. (2020).

H1:. Natural resource use negatively impacts green productivity.

Sustainable indicators support knowledge sharing, and corporate responsibility in the oil sector enhances sustainability. Globalization and economic growth can reduce CO2 emissions, while renewable energy improves environmental quality (Bloch et al., 2015; Liu J. et al., 2020; Liu et al., 2020c). Although trade and FDI may initially increase emissions, they can later reduce pollution through technology transfer (Shahbaz et al., 2019; Acheampong et al., 2019; Twerefou et al., 2017). However, limited research links globalization directly to green productivity. Evidence from ASEAN and OIC countries shows economic globalization supports growth, while social and political globalization have mixed effects.

H2:. Globalization reduces green productivity through higher resource use.

Advancing human development and globalization—through improved wellbeing, freedom, and opportunity—is vital for economic progress, especially in regions like BRICS. HDI plays a key role in driving sustainable economies by providing resources and knowledge. Prior studies have shown that human and physical capital boost economic growth, and HDI is widely recognized as a key driver of global development. However, its role in green productivity (GP) in ASEAN remains underexplored. This study addresses that gap by examining HDI as a comprehensive indicator for the region.

H3:. Human capital development favorably influences GP in ASEAN countries.

A robust finance sector can significantly drive green growth, with fintech (FNT) promoting financial inclusion through technologies like IoT, Blockchain, and AI. FNT can fund green infrastructure projects, and tools like crowdfunding can help meet environmental, social, and governance (ESG) obligations (Chueca Vergara and Ferruz Agudo, 2021). Fintech also enhances banks’ performance and supports cost-saving initiatives (Hammadi and Nobanee, 2019). As a key driver of the fourth industrial revolution, FNT fosters financial innovation through advanced service models that can transform the financial industry (Nenavath, 2022; Shin and Choi, 2019). Similarly (Zhang et al., 2020), studied the impact of financial technology on household income in China between 2010 and 2014, while other studies explored fintech’s influence on EG in various countries (Deng et al., 2019; Ding et al., 2022; Li et al., 2019; Ye et al., 2022).

H4:. Fintech development positively promotes GP in ASEAN.

2.1 Conceptual and theoretical background

The choice of natural resource consumption, globalization, fintech, human development (HDI), and economic growth is grounded in the frameworks of ecological economics and endogenous growth theory, both of which emphasize the interdependence between economic activities, technological innovation, and environmental sustainability (Li et al., 2024; Lisha, Mousa, Arnone, Muda, Huerta-Soto, et al., 2023; Romer, 1994; Zhou et al., 2024). These theories provide a holistic lens for analyzing how socio-economic variables influence green productivity (GP) and broader sustainability outcomes, particularly in emerging regions such as ASEAN. Natural resource consumption is central to the resource curse hypothesis, which posits that excessive reliance on natural resources often leads to poor economic performance and environmental degradation due to weak institutions, rent-seeking behavior, and limited diversification (Ploeg, 2011; Sachs and Warner, 2001). In the context of green productivity, overextraction of natural resources especially fossil fuels and deforestation can hinder eco-efficiency and damage ecological resilience (Adebayo et al., 2025; Ozkan et al., 2024). Globalization has both positive and negative environmental implications, as it can promote the spread of green technologies through trade and foreign investment (technology diffusion effect), but may also lead to increased pollution due to expanded industrial activity and relaxed environmental regulations (scale and composition effects) (Frankel and Rose, 2005). The pollution haven hypothesis suggests that countries with lax environmental regulations may attract polluting industries, thereby amplifying environmental degradation.

Fintech, as an emerging force in financial innovation, plays a critical role in facilitating green finance, promoting inclusive access to sustainable investments, and enhancing transparency through digital tools such as blockchain, AI, and mobile banking (Deng et al., 2019; Ding et al., 2022). Fintech platforms are increasingly linked to sustainable development by enabling small-scale enterprises and individuals to participate in low-carbon projects and improve environmental outcomes. Human development, captured by HDI, reflects progress in education, health, and income key enablers of environmentally responsible behavior. Higher levels of human capital are associated with greater awareness of environmental issues, stronger demand for clean technologies, and improved institutional capacity to enforce sustainability policies (Chankrajang and Muttarak, 2017). As such, HDI serves as a proxy for a country’s ability to pursue green development pathways.

Economic growth is included based on the Environmental Kuznets Curve (EKC) hypothesis, which suggests an inverted U-shaped relationship between income and environmental degradation. Figure 2, it is the trend of natural resources consumption in ASEAN countries during 2000-2021. At early stages of growth, environmental harm tends to rise, but beyond a certain income threshold, societies invest more in environmental protection and adopt cleaner technologies (Dinda, 2004; 2005; Grossman and Krueger, 1995). Understanding this dynamic is essential for examining whether growth in ASEAN economies supports or undermines green productivity.

2.2 Study contributions and literature gap

This study offers a significant contribution to the literature on sustainability, green productivity (GP), and economic development in ASEAN countries by integrating key variables namely; natural resource consumption, globalization, fintech, HDI, and GP into a unified framework. It supports established theories like the resource curse hypothesis and the Environmental Kuznets Curve, showing that resource dependence can hinder GP, while economic growth and human development promote sustainability. By applying advanced econometric methods such as Fixed Effects and Moments Quantile Regression (MMQR), the study ensures methodological rigor and captures dynamic relationships using panel data. It also accounts for cross-sectional dependence and slope heterogeneity, reflecting the interconnected nature of ASEAN economies. This research addresses existing gaps by exploring the underexamined roles of fintech, globalization, and human development in influencing GP. It broadens the understanding of fintech beyond digital finance and highlights ASEAN’s overlooked position in the sustainability literature, offering fresh insights into regional challenges and opportunities.

3 Empirical data and methodology

3.1 Data statistics

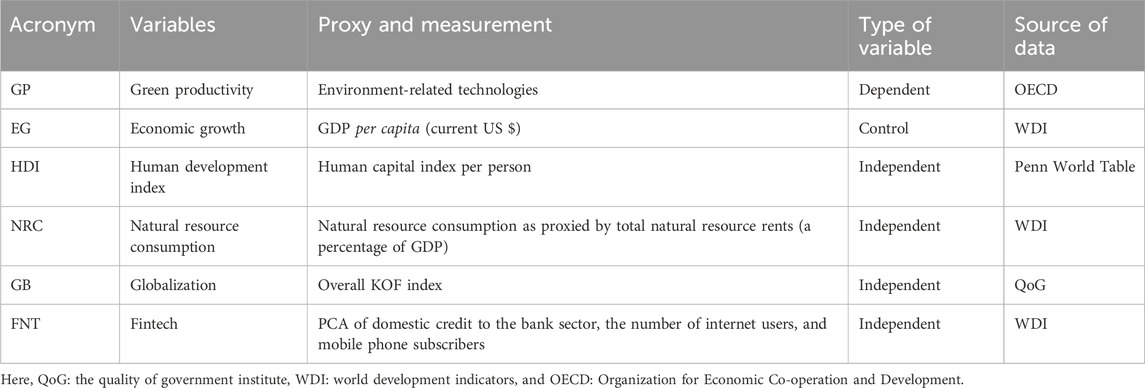

The study considers annual data from 2000 to 2021 for all seven ASEAN nations. The data’s accessibility affected the selection of both the country and the time frame. A few data points were missing, but they were handled statistically. The main reasons the ASEAN countries were chosen were their reliance on mining and agriculture, both of which exacerbate the region’s already increasing carbon emissions and deforestation. Again, the ASEAN’s ability to maintain environmental quality is under threat from declining biocapacity, depleting natural resource deposits, increasing CO2 emissions and urbanization rate, and inadequate human capital development (See Table 2 for the dataset’s sources and parameters).

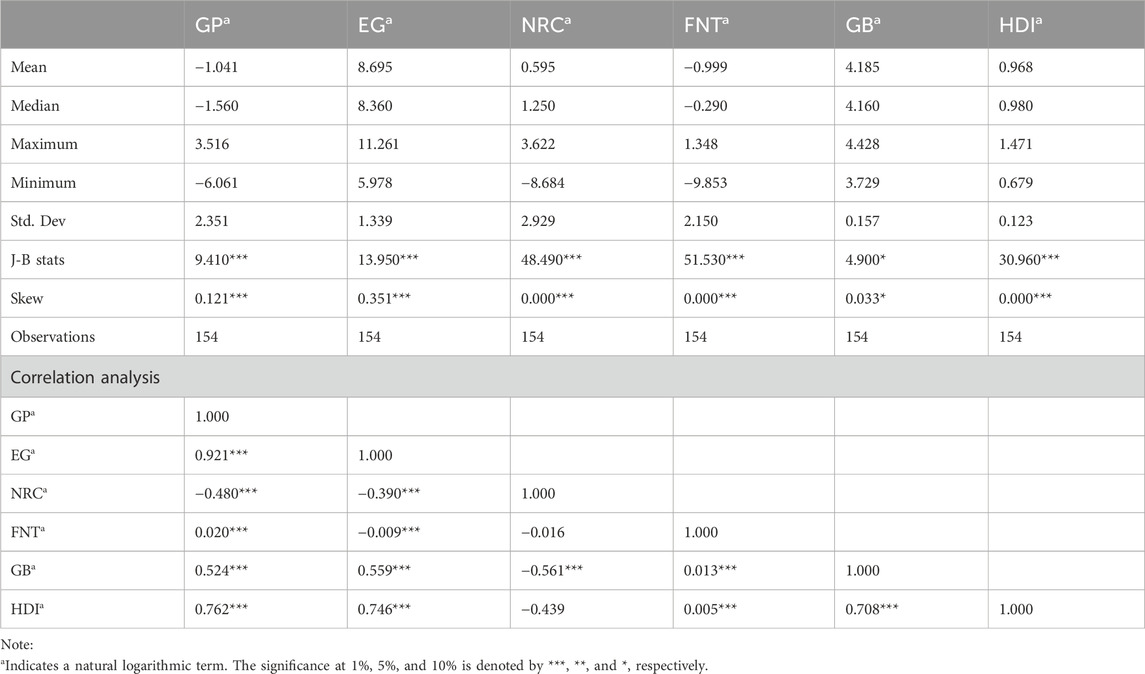

Before analyzing each variable, we reviewed their measures and sources. Table 3 presents basic statistics such as standard deviation, mean, minimum, maximum, and median. The average GP value is slightly negative (−1.041), suggesting ASEAN nations experienced more negative impacts on environmental sustainability during the study period. In contrast, the average GDP growth rate is relatively high (8.695), indicating strong EG from 2000 to 2021, which may lead to environmental degradation if unmanaged.

NRC averages 0.595, suggesting that ASEAN nations are not at unsustainable usage levels, though outliers may exist. The high average globalization index indicates strong global interconnectedness, with both positive and negative implications for GP. EG shows the highest maximum value, reflecting strong overall economic performance, while NRC has the lowest minimum value, highlighting significant variability in resource consumption practices across nations. Additionally, the HDI standard deviation is nearly zero, indicating little variation in data points over time.

The parameters under investigation and GP have a positive correlation except for NRC, according to the correlation analysis in Table 3. This suggests that these variables are in line with the GP trend. The rising green productivity in ASEAN countries may also have contributed to an increase in other factors like HDI, GB, FNT, and EG. Although the nation’s growing resource extraction is thought to be profitable, it also decreases GP and reduces ecological wellbeing in the region, endangering the ecosystem (Panayotou, 1994).

The correlation matrix reveals no strong multicollinearity, as most independent variables exhibit correlation values below the typical threshold of 0.8. Most correlations are below 0.5, with notable exceptions:

Globalization has moderate correlations with GP (0.524) and EG (0.559), indicating a positive relationship. HDI shows strong positive correlations with both green productivity (0.762) and EG (0.746), suggesting that higher human development correlates with better environmental and economic outcomes in ASEAN nations. While these high correlations could imply potential multicollinearity with HDI, they do not indicate multicollinearity among independent variables.

NRC exhibits weak negative correlations with GP (−0.480) and EG (−0.390), suggesting that higher NRC is associated with lower productivity and growth. NRC also has a weak negative correlation with globalization (−0.561) but shows no significant correlation with fintech (−0.016) or HDI (−0.439), indicating minimal multicollinearity concerns. Fintech displays almost no significant correlations, with only a weak positive correlation with GP (0.020). Globalization is moderately positively correlated with both GP (0.524) and EG (0.559), as well as with HDI (0.708), suggesting that increased globalization may enhance human development through improved access to resources and technologies.

3.2 Model formation and methodology estimation

The primary objective of this study is to examine the impact of total natural rent on green production in ASEAN countries, specifically in light of fintech advancements. Financial technology is essential for both energy conservation and EG since studies show that economic growth significantly affects green productivity.

The prototype for the investigation will become Equation 1;

The model necessitates the inclusion of an interaction term (HDI × GB) to evaluate if human development moderates the adverse effects of globalization on GP. The premise is that enhanced human growth, facilitated by education, skills, and innovation, can alleviate the environmental degradation potentially induced by globalization, thus fostering more sustainable productivity. The prototype for the investigation will become Equation 2.

The models are subsequently converted into their logarithmic representations to linearize non-linear connections among variables. The coefficients will be interpreted as elasticities, indicating that each coefficient signifies the percentage change in green productivity resulting from a 1% change in the corresponding independent variable.The prototype for the investigation will become Equations 3, 4.

Human development, financial technology, economic growth, natural resource rents, green productivity, globalization, and interaction term are represented, respectively, by the letters

The slope homogeneity test was used to determine whether the slope coefficients of the cointegration equation are homogenous. The test was first introduced by (Swamy, 1970).

Hashem Pesaran and Yamagata (2008) expanded it and employed it to attain two statistics for the investigation will become Equations 5, 6:

Moreover, to discover contacts between the incorrect expressions of various cross-sectional units in panel data (Pesaran, 2015), developed the cross-sectional dependence (CSD) test. The formula is expressed as Equation 7.

The test statistic has a non-standard distribution with the nonstationarity null hypothesis. Here, is Pesaran’s Cross-sectional Augmented Dickey-Fuller or CADF test the formula is expressed as Equation 8:

Equation 9, on the other hand, displays the cross-sectional Parallel to Im, Pesaran, and Shin (Im et al., 2003) analysis as follows:

where N is the number of observations and CADFi stands for cross-sectional augmented dickey fuller assessment.

Westerlund (2007) cointegration technique is as follows Equation 10:

The estimation of Equation 11 will vintage the following four separate tests:

Mean Group Tests Equation 12:

Panel-based tests Equation 12:

We model the control of the independent factors on the GP of the distribution using the (Machado and Santos Silva, 2019) panel MMQR. The formula is expressed as Equation 13:

The unidentified factors are indicated by

The formula

This model aims to determine optimization issues brought on by the observed quantile Equation 16:

The check function is exemplified by

Fixed Effect (FE) estimate is widely utilized in many disciplines since its justification is clear-cut and compelling. All higher-level variation and any between-effects variance are eliminated by employing the higher-level entities themselves (Allison, 2009), which are included in the model as dummy variables Dj to prevent the issue of heterogeneity bias. The formula is expressed as Equation 17:

This study assesses the directions previously proposed by Dumitrescu and Hurlin (2012) at the final level, the Granger causality test to investigate the relationship among the selected economic variables. The aforementioned strategy is exemplified as:

The factors

Moments Quantile Regression (MMQR) was selected over alternative models like the Generalized Method of Moments (GMM) for several reasons. MMQR allows us to examine the effects of explanatory variables across the entire distribution of green productivity, rather than just the average, as GMM does. This is particularly useful for identifying asymmetric or heterogeneous impacts that may vary at different levels of green productivity. Additionally, MMQR is well-suited to handle unobserved heterogeneity and slope variation across countries, which is important given the economic and environmental diversity among ASEAN nations. Moreover, MMQR is more robust to outliers and non-normal error distributions, which are common in environmental and economic datasets, enhancing the reliability of our findings. While Fixed Effects models help capture country-specific characteristics over time, MMQR builds on this by showing how those effects differ across the conditional distribution of the dependent variable, offering a deeper and more nuanced understanding of the data.

4 Results and discussions

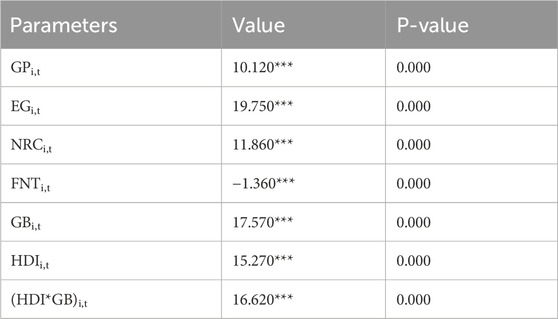

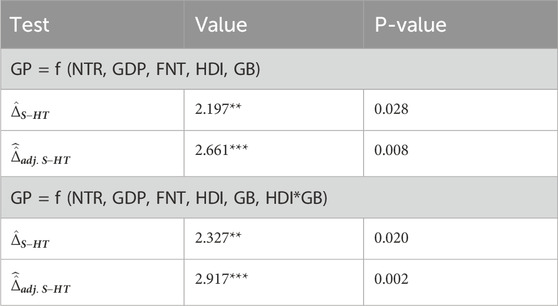

The first assertions made were those of cross-sectional independence (Pesaran, 2015). The results of (Pesaran, 2004) cross-sectional dependence test are shown in Table 4. The outcomes from all variables significantly reject the cross-sectional independent null hypothesis at a 1% significance level. These findings thus show that, between 2000 and 2021, there is a significant cross-sectional dependence on the factors chosen. Slope homogeneity test findings are summarized and explained in Table 5 according to Hashem Pesaran and Yamagata (2008) approach. This illustrates how the slopes of the coefficients vary among our panel data, highlighting the need for a diverse panel design. The presence of slope heterogeneity in both models implies that the impact of independent factors on GP is not uniform across ASEAN countries. This could be due to differences in economic structures, regulatory environments, or levels of technological adoption across these countries. In Model 2, the interaction term (HDI * GB) shows that the moderating effect of human development on globalization’s impact on GP also varies across countries.

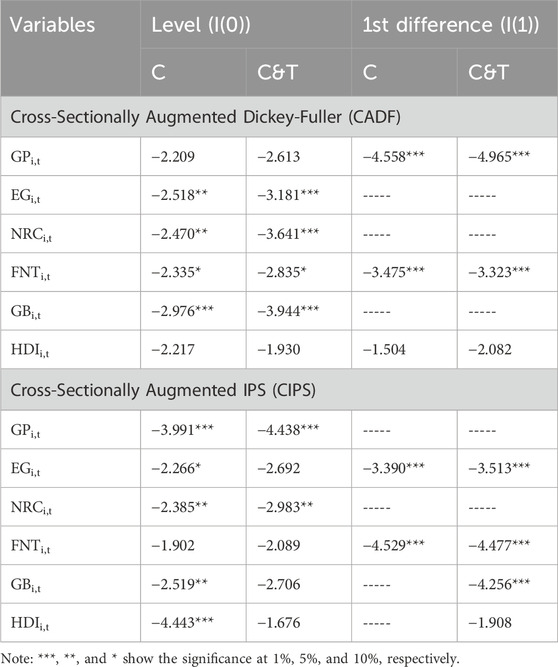

The next step is to evaluate the stationarity of the variables concerning the Cross-Section Dependence (CSD). This is a crucial stage, especially for studies that use cross-sections as a panel. Therefore, if the CSD is not established in such a circumstance, the verdict is seen as unclear and dubious (Aziz et al., 2021). In addition to identifying heterogeneity, the Cross-Sectionally Augmented Dickey-Fuller (CADF) and Cross-sectional IPS (CIPS) tests are employed to assess stationarity (Phillips and Hansen, 1990; Raza and Shah, 2017). The significant result confirms the existence of cross-sectional dependence (CSD), while the negligible result indicates its absence. Although the negligible result suggests a unit root, substantial results from the CADF and CIPS tests confirm that the data is stationary. Findings in Table 6 show that the data is stationary at first difference. The CADF results indicate that, except for GP and fintech, all variables are stationary at level I(0) with a deterministic constant. FNT is stationary at first difference when both constant and trend are considered. HDI does not achieve stationarity at level or first difference under either deterministic condition. However, CIPS results confirm that GDP and FNT are stationary at first difference, while GP is stationary at level. For NRC, GB, GP, and HDI, the results indicate stationarity at level with a deterministic constant.

Stationarity is crucial in econometric models as it affects statistical inferences and the robustness of results. Non-stationary variables, which exhibit changing statistical properties over time, can lead to misleading regression outcomes with false correlations. In this study on GP in ASEAN nations, the variables EG, NRC, and globalization were found to be stationary at their levels (I(0)), indicating stability and no long-term trends. Conversely, GP, fintech, and HDI were non-stationary at level but achieved stationarity through initial differencing, revealing long-term trends and requiring differencing to avoid biased assessments. The presence of mixed orders of integration (I(0) and I(1)) among the variables highlights the need for advanced econometric methods, such as quantile models, to ensure valid conclusions.

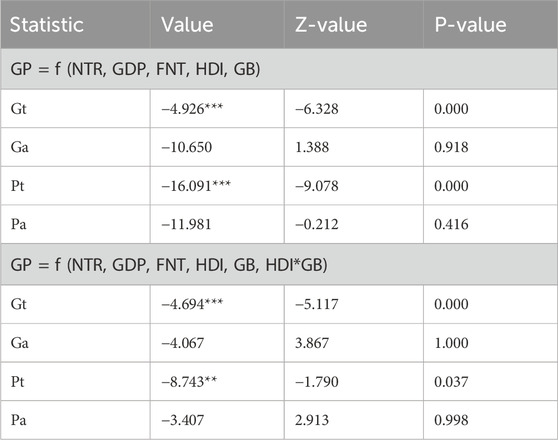

In the next phase, the study assesses cointegration after testing for stationarity and cross-sectional dependence, using (Westerlund, 2007) widely recognized method. The bootstrapping framework supports the validity of this assessment. Table 7 shows robust evidence of cointegration in the first model, as indicated by the significant Gt and Pt statistics, demonstrating that GP is linked to natural resource consumption, economic growth, fintech development, human development, and globalization over time.

In the second model, the interaction term (HDI*GB) also shows significant cointegration with Gt and Pt statistics, suggesting a long-term relationship between human development, globalization, and GP. However, similar to the first model, the Ga and Pa statistics do not indicate significant cointegration, implying that this relationship may differ among countries, with some ASEAN nations experiencing a stronger interaction effect.

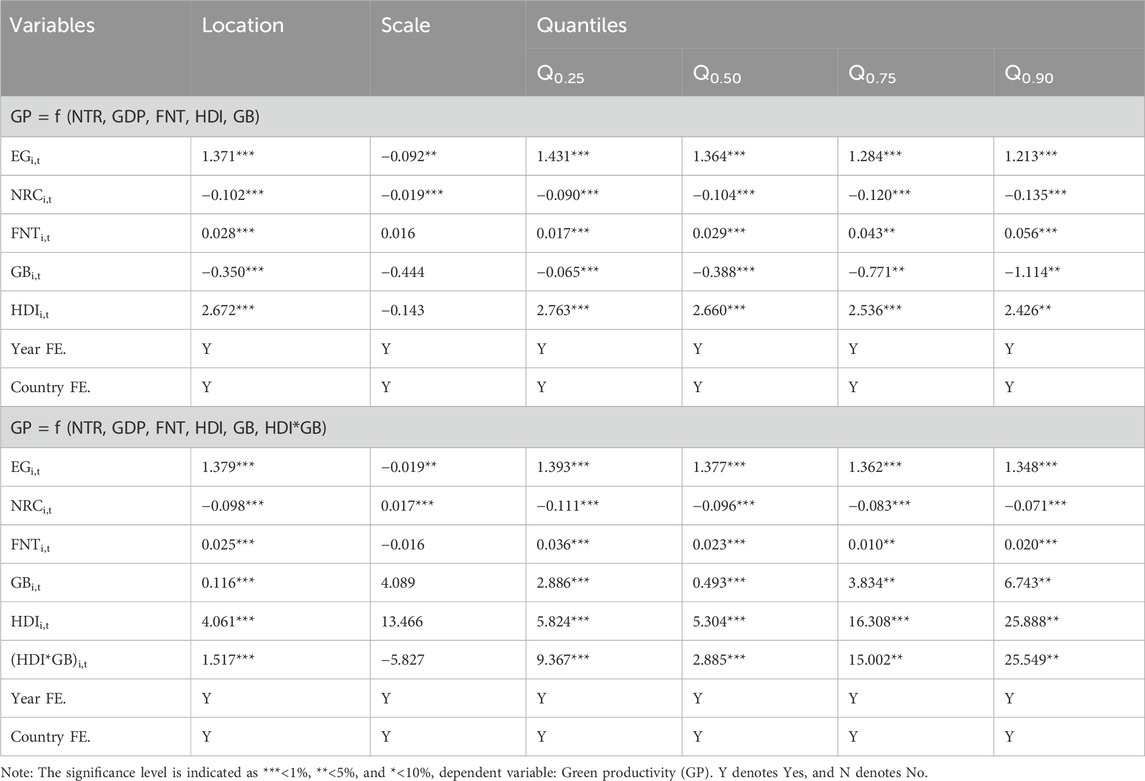

Table 8 presents the results from the MMQR analysis, revealing both positive and negative relationships between predictors and GP in ASEAN. Specifically, NRC and GB negatively impact GP across all quantiles, with NRC showing significant correlations at every quantile. These findings suggest that while NRC and GB contribute to environmental damage, eliminating greenhouse gases is crucial for sustainable growth, even if NRC is essential for economic prosperity.

In the first model, a 1% increase in economic growth corresponds to a 1.371% increase in GP, demonstrating a positive relationship. However, the scale coefficient of −0.092 indicates that this impact slightly diminishes at higher quantiles, suggesting that economic growth’s effect on GP lessens in countries with higher productivity. Overall, economic growth aids sustainability by reducing atmospheric carbon dioxide.

Fintech positively affects GP, with a 1% increase in fintech development resulting in a 0.028% increase in GP, indicating stronger effects at higher quantiles. H3 is supported by the results, as fintech significantly and positively influences green productivity across all quantiles, with stronger effects at higher quantiles. In contrast, globalization negatively impacts GP, with a reduction of −0.065% at Q0.25% and −1.114% at Q0.90, suggesting that more globalized economies face greater environmental challenges. This suggests that as economies become more globalized—particularly those already at higher levels of green productivity—they tend to face greater environmental challenges. This may be attributed to several factors. First, increased global integration often leads to industrial expansion, higher production outputs, and intensified energy use, which can place additional pressure on environmental resources. Second, in the pursuit of global competitiveness, countries may adopt more lenient environmental regulations to attract foreign investment and trade, resulting in a “race to the bottom” effect. Third, globalization can increase dependence on imported goods and services with high environmental footprints, shifting environmental burdens across borders without reducing overall degradation.

To mitigate these risks, ASEAN countries should consider integrating stronger environmental safeguards within trade and investment agreements. Promoting the adoption of clean and green technologies through international cooperation and technology transfer is essential. Furthermore, governments should prioritize environmental governance and implement strict regulations to ensure that globalization supports, rather than undermines, sustainable development. Encouraging sustainable consumption and production patterns and investing in green infrastructure can also help offset the environmental pressures associated with globalization. These measures will not only help preserve green productivity but also align regional economic growth with long-term sustainability goals. However, in the second model, the interaction with human development offsets this negative impact, indicating that improvements in human development can mitigate the harmful effects of globalization on GP. H2 is supported in the first model, where globalization harms green productivity across all quantiles. However, in the second model, the interaction with human development mitigates this negative impact, suggesting that the harmful effects of globalization can be offset by improvements in human development.

The coefficient for HDI is positive and highly significant across all quantiles. In the first model, a 1% increase in human development increases green productivity by 2.763% in Q0.25% and 2.426% in Q0.90, indicating a strong positive relationship. In the second model, the positive impact of human capital on GP becomes even more pronounced (e.g., 5.824% at Q0.25% and 25.888% at Q0.90) with the inclusion of the interaction term (HDI*GB), which enhances its effect further. H4 is strongly supported by the results, as human capital significantly and positively impacts GP across all quantiles. The effect is further amplified when HDI interacts with globalization in the second model.

The positive aspects of the connections stem from their indication that human growth complements sustainability by supporting green transformation and green production. The difference in importance could be explained by how the economies react to HDI as a possible GP’s enhanced strategy for ecological wellbeing.

Moreover, in the initial model without the interaction term, the negative impact of natural resource consumption on GP is stronger. For instance, in Q0.25, a 1% increase in NRC decreases GP by −0.090%, and this effect intensifies to −0.135% in Q0.90. After incorporating the interaction term (HDI*GB), the magnitude of this negative impact decreases. In Q0.25, a 1% increase in NRC reduces GP by −0.111%, but in Q0.90, the effect is mitigated to −0.071%. This demonstrates that the harmful influence of natural resource consumption on green productivity is less pronounced in the second model compared to the first. H1 is supported by this result, as natural resource consumption consistently has a significant negative impact on GP across all quantiles. H1 is supported by this result, as natural resource consumption consistently has a significant negative impact on GP across all quantiles.

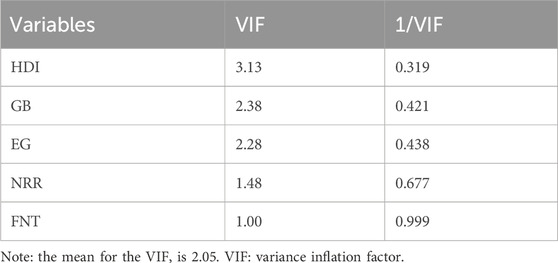

Prior to interpreting the model findings, we conducted a multicollinearity analysis to ensure the stability of our estimates. As presented in Table 9, the Variance Inflation Factor (VIF) values for all independent variables were examined: HDI (3.13), GB (2.38), EG (2.28), NRR (1.48), and FNT (1.00). With all VIFs being well below the common threshold of 10 and a mean VIF of 2.05, multicollinearity is not considered a significant issue in our model. So, the MMQR results provide a comprehensive picture of how economic growth and human development consistently show positive effects, while natural resource consumption and globalization exhibit negative impacts. Financial technology plays a supportive role in promoting GP, especially in higher quantiles. The interaction between human development and globalization in the second model reveals that higher HDI can substantially mitigate globalization’s harmful environmental effects, particularly in more productive countries. Our findings in the second model indicate that higher levels of human development (HDI) can significantly mitigate the negative environmental effects of globalization, especially in countries with higher levels of green productivity. This relationship can be explained by several key mechanisms. First, countries with higher HDI typically have better access to education, healthcare, and institutional quality, which enhances environmental awareness and promotes sustainable behaviors among both individuals and institutions. Second, educated and healthier populations are more likely to support and adopt green technologies, energy-efficient practices, and environmentally responsible policies. Third, strong human development often correlates with improved governance and policy-making capacity, allowing countries to implement regulations that minimize environmental harm while still engaging in global trade and economic integration. In this context, human development serves as a moderating factor that enables countries to better absorb and manage the environmental pressures of globalization. By strengthening HDI, ASEAN nations can foster resilience to globalization’s adverse environmental impacts and align their global engagement with sustainability goals. We have incorporated these insights into the revised manuscript to clarify and enrich the interpretation of this interaction effect.

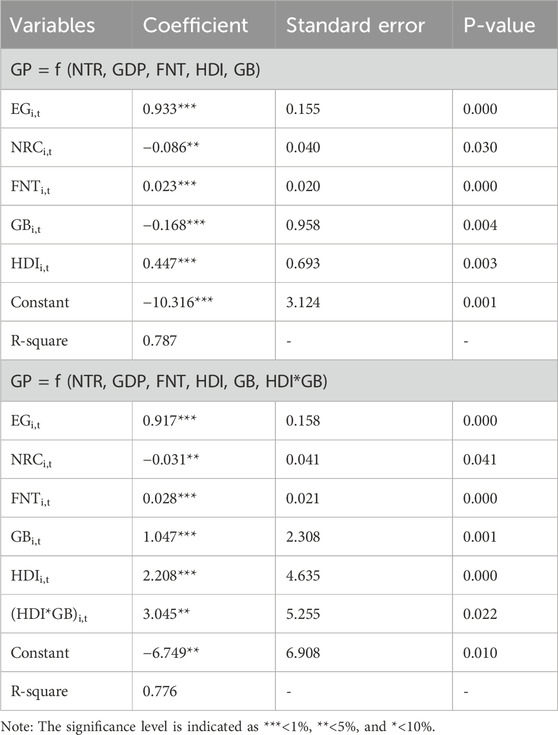

The fixed effects model provides an essential validation mechanism for the results derived from the MMQR by offering a robustness check across the full sample, whereas MMQR focuses on different quantiles. Both methods complement each other in understanding the overall and heterogeneous impacts of the independent variables on GP.

The slightly lower coefficient in the fixed effects model suggests that while the overall effect is positive, the impact varies across different segments of countries, which is captured more precisely in the MMQR. The fixed effects model also confirms the negative relationship (Model 1: −0.086, Model 2: −0.031). The reduction in the magnitude of NRC’s negative impact in Model 2 indicates that the interaction between HDI and GB can alleviate the negative effect of natural resource consumption.

The fixed effect robustness tests, detailed in Table 10, provide further insights. In Model 1 of the fixed effects model, GB negatively impacts GP (−0.168), which aligns with the negative effect observed in lower quantiles in MMQR. However, in Model 2, with the interaction term (HDI*GB), globalization’s impact turns significantly positive (1.047), indicating that in countries with higher human development, globalization can enhance GP.

The interaction between HDI and globalization in the second fixed effects model (Model 2 in Table 10) highlights how human development can amplify the benefits of globalization for sustainability. The fixed effects model confirms the positive impact of the interaction term (3.045), showing that in countries with higher HDI, globalization significantly boosts green productivity. Table 10, fixed effect robustness test.

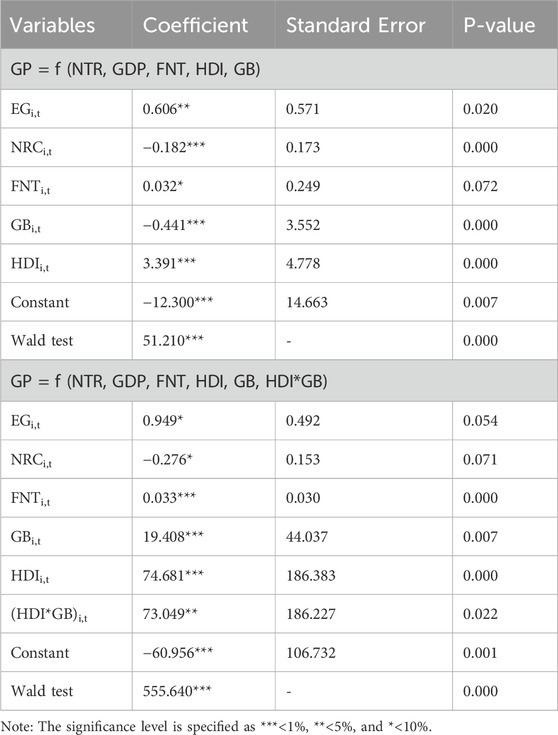

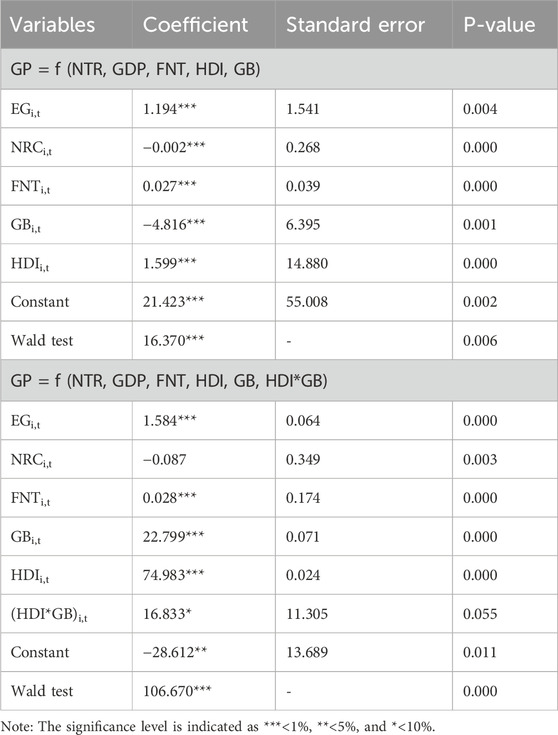

Both Table 11 AMG robustness test and Table 12 CCEMG results also corroborate the MMQR findings, demonstrating consistent relationships across different methodologies and reinforcing the robustness of the analysis by the Wald test.

This study emphasizes further analysis by identifying the cause‒effect in the estimated relationship between adjusted net national savings and its influencing factors. Thus, Granger’s (1969) work posed the groundwork for the causality test. Specifically, the bivariate regressions in the panel dataset are utilized for this test Equations 19, 20.

There are two different types of panel causality tests that can be used to test the idea that factors are the same across all cross-sections. To begin, standard practice sees panels as a single, fully put together unit. Second, it uses the causality test in a normal way that assumes that all cross-sections have the same amounts (coefficients) Equations 21, 22.

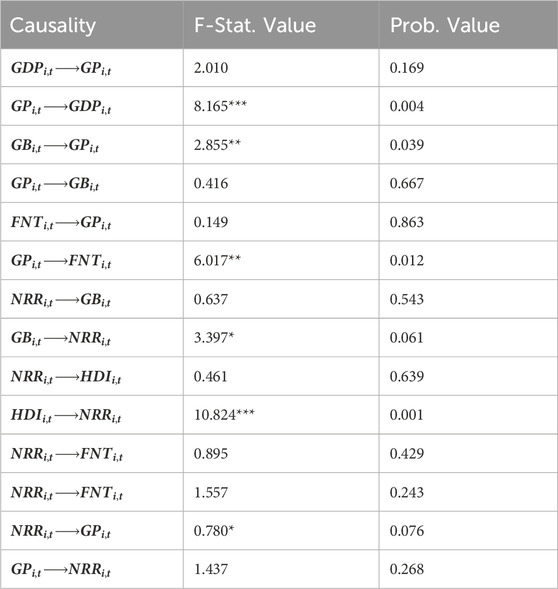

The Granger causality test reveals important relationships between the study’s variables. Table 13 shows that past GDP values do not significantly predict changes in GP, indicating that economic growth alone may not enhance environmental productivity, possibly due to reliance on non-green sectors. Additionally, green productivity Granger causes fintech development, indicating that advances in green productivity create a favorable environment for fintech innovations focused on sustainability. Globalization may also marginally influence natural resource exploitation, as greater integration into the global economy can pressure countries to increase resource extraction to meet demand. Furthermore, human development improvements predict reductions in natural resource rents, suggesting that better education and wellbeing lead to enhanced resource management practices and economic diversification. The weak causality between natural resource rents and green productivity indicates that resource-rich countries should actively integrate sustainable practices into resource management rather than relying solely on GP improvements to address resource dependency.

5 Conclusion and recommendations

This study investigates the dynamics of green productivity in ASEAN countries over the period from 2000 to 2021. It explores the relationship between natural resource consumption, economic growth, financial technology (fintech), human development, globalization, and green productivity using a range of advanced econometric techniques. The study adopts the Method of Moments Quantile Regression (MMQR) to assess how the effects of these variables vary across different quantiles of green productivity, ensuring a comprehensive understanding of their impacts. Additionally, AMG, CCEMG, and Fixed Effects models and Granger causality tests are employed to validate the findings and reveal directional relationships between the key variables. The study also incorporates interaction terms to explore the compounded effects of human development and globalization.

The results show that natural resource consumption negatively affects green productivity, confirming that over-reliance on natural resources impairs environmental sustainability in ASEAN nations. In contrast, economic growth and human development are positively associated with green productivity, highlighting their critical role in fostering sustainability. The interaction between human development and globalization further reduces the negative impact of resource consumption on green productivity, suggesting that improvements in human capital can mitigate environmental harm. The fixed effects model supports the MMQR findings, demonstrating that economic growth, human development, and fintech positively influence green productivity, while natural resource consumption and globalization have a detrimental impact. The Granger causality analysis reveals that green productivity drives economic growth, while globalization stimulates green productivity through technology and knowledge transfer.

5.1 Policy implications

This study highlights the urgent need for ASEAN countries to implement targeted and forward-looking policies that promote sustainable development, especially in the face of growing environmental pressures from natural resource exploitation, globalization, and rapid technological advancement. To ensure a more sustainable path of economic development and improve green productivity (GP), the following key policy implications are proposed: First, ASEAN nations should enforce strict environmental regulations on natural resource extraction. Such measures are necessary to prevent overexploitation, protect ecosystems, and enhance green productivity. Governments should also prioritize a transition to renewable energy sources by offering incentives for public and private sector investments in solar, wind, hydro, and other clean energy technologies.

Second, investing in green technology is essential. ASEAN governments should allocate funds to research and development (R&D) that support eco-innovation, clean production methods, and sustainable infrastructure. Technological education, especially in green industries, should be expanded to prepare a workforce that can adapt to and drive environmentally conscious economic activities. Importantly, this study highlights the transformative role of financial technology (fintech) in promoting green productivity, which warrants more specific policy attention. Fintech can play a central role in accelerating the green transition by enhancing the efficiency and accessibility of green finance. Governments and financial institutions should promote the use of fintech platforms for green lending, crowdfunding for renewable energy projects, and blockchain-based tracking of carbon emissions and supply chain sustainability. By integrating environmental metrics into digital financial services, fintech can empower both individuals and businesses to make informed, eco-friendly financial decisions. Moreover, digital payment systems and mobile banking can support financial inclusion, enabling small-scale green entrepreneurs and rural populations to access sustainable financing options.

Furthermore, aligning human development goals with environmental sustainability is critical. Policymakers should integrate health, education, and environmental awareness into national development plans to foster an informed and environmentally responsible citizenry. Inclusive growth strategies are also essential to ensure that the benefits of sustainability reach marginalized communities and to mitigate the inequalities often exacerbated by environmental degradation.

5.2 Future recommendations

Future studies should incorporate variables like digitalization, artificial intelligence, and industrial automation to assess their impact on green productivity in ASEAN as digital tools gain traction. Research could investigate the influence of stringent environmental policies, such as carbon taxes and pollution limits, on sustainability outcomes.

A sectoral-level analysis would help identify industries with the greatest impact on green productivity, allowing for targeted policy recommendations. Exploring how geopolitical risks, including the Belt and Road Initiative and US-China trade tensions, affect sustainable investments and green technology development is essential. Future research should also focus on the role of institutional quality and governance in promoting sustainable growth and environmental protection, examining how government efficiency and corruption influence green productivity. Dynamic panel data models like the Generalized Method of Moments (GMM) could be employed to address potential endogeneity between green productivity and economic growth.

Investigating nonlinear relationships and threshold effects among variables could provide deeper insights into sustainable growth dynamics. Comparative studies with regions like BRICS or E7 can offer broader perspectives on regional influences on green productivity, assessing whether ASEAN findings align with global trends. Research into green finance and carbon markets should explore how these mechanisms enhance sustainability, focusing on green bonds, carbon pricing, and international climate finance.

6 Limitations of the study

The study has several limitations that should be acknowledged. The reliability of the results is dependent on the quality of existing datasets, which may vary across ASEAN countries and impact findings. The focus on a specific period may overlook long-term trends in green productivity, suggesting that a longer time frame could enhance insights into evolving dynamics. While cross-sectional dependence is addressed, unobserved common shocks affecting all ASEAN countries may still bias estimates. Although attempts are made to account for endogeneity, unobserved factors may still influence results, complicating causal interpretations. Additionally, findings are specific to ASEAN and may not apply to other regions with different economic structures and challenges. The analysis focuses on select variables, omitting critical aspects like social equity and political stability, which limits comprehensiveness. Furthermore, the study does not fully explore interactions between various factors, indicating the need for future research to consider additional variables like technological innovation.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

CH: Conceptualization, Investigation, Methodology, Writing – original draft, Writing – review and editing. WD: Conceptualization, Investigation, Methodology, Writing – original draft, Writing – review and editing. JH: Formal Analysis, Writing – original draft, Writing – review and editing. XL: Conceptualization, Methodology, Writing – original draft, Writing – review and editing. YT: Conceptualization, Methodology, Project administration, Supervision, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abid, N., Dowling, M., Ceci, F., and Aftab, J. (2023). Does resource bricolage foster SMEs’ competitive advantage and financial performance? A resource-based perspective. Bus. Strategy Environ. 32 (8), 5833–5853. doi:10.1002/BSE.3451

Acheampong, A., Adams, S., and Boateng, E. (2019). Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? E BoatengScience Total Environ. 677, 436–446. doi:10.1016/j.scitotenv.2019.04.353

Adebayo, T. S., Eweade, B. S., Özkan, O., and Uzun Ozsahin, D. (2025). Effects of energy security and financial development on load capacity factor in the USA: a wavelet kernel-based regularized least squares approach. Clean Technol. Environ. Policy. doi:10.1007/s10098-024-03109-1

Ahmad, M., Jiang, P., Majeed, A., Umar, M., Khan, Z., and Muhammad, S. (2020). The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: an advanced panel data estimation. Resour. Policy 69, 101817. doi:10.1016/J.RESOURPOL.2020.101817

Anser, M. K., Nassani, A. A., Eweade, B. S., Imo, E. N., and Boltayev, J. Y. (2024). Do women in politics and government efficiency enhance electricity access in Nigeria: analyzing energy prices and foreign investment. Int. J. Sustain. Dev. & World Ecol. 31 (7), 943–958. doi:10.1080/13504509.2024.2358295

ASEAN Centre for Energy (2015). ASEAN Centre for energy (2015) ASEAN plan of action for energy cooperation (APAEC) 20162025 phase I: 2016-2020. Jakarta, Indonesia: ASEAN Centre for Energy. Available online at: https://app.box.com/s/g6b4ynph5wwiuvtxgol3s2rwjwcmrtbj.

Awosusi, A. A., Eweade, B. S., and Ojekemi, O. S. (2024). Analyzing the environmental role of resource efficiency, economic globalization, and biomass usage in Malaysia: a time-varying causal approach. Environ. Dev. Sustain. doi:10.1007/s10668-024-05196-y

Aziz, N., Sharif, A., Raza, A., and Jermsittiparsert, K. (2021). The role of natural resources, globalization, and renewable energy in testing the EKC hypothesis in MINT countries: new evidence from Method of Moments Quantile Regression approach. Environ. Sci. Pollut. Res. 28 (11), 13454–13468. doi:10.1007/S11356-020-11540-2

Bloch, H., Rafiq, S., and Salim, R. (2015). Economic growth with coal, oil and renewable energy consumption in China: prospects for fuel substitution. ElsevierH Bloch, S Rafiq, R SalimEconomic Modelling.

Chankrajang, T., and Muttarak, R. (2017). Green returns to education: does schooling contribute to pro-environmental behaviours? Evidence from Thailand. Ecol. Econ. 131, 434–448. doi:10.1016/j.ecolecon.2016.09.015

Cheng, Z., Li, L., and Liu, J. (2020). Natural resource abundance, resource industry dependence and economic green growth in China. J. LiuResources Policy, 2020⋅Elsevier 68, 101734. doi:10.1016/j.resourpol.2020.101734

Chiu, Y., and Lee, C. (2020). Effects of financial development on energy consumption: the role of country risks. ElsevierYB Chiu, CC LeeEnergy Econ. 2020⋅Elsevier 90, 104833. doi:10.1016/j.eneco.2020.104833

Chueca Vergara, C., and Ferruz Agudo, L. (2021). Fintech and sustainability: do they affect each other? Sustainability 13 (13), 7012. doi:10.3390/su13137012

Dai, X., Wu, J., Fan, S., and Zhou, Y. (2025). Advancing economic sustainability in E7 economies: the impact of green finance, environmental benefits, and natural resource management. Front. Environ. Sci. 12, 1509564. doi:10.3389/fenvs.2024.1509564

Damak, O. I., and Eweade, B. S. (2024). Do economic growth, the legal system, and energy consumption lessen the ecological footprint? Evidence from South Korea. Energy & Environ., 0958305X241270280. doi:10.1177/0958305X241270280

Degirmenci, T., Acikgoz, F., Guney, E., and Aydin, M. (2024a). Decoupling sustainable development from environmental degradation: insights from environmental policy stringency, renewable energy, economic growth, and load capacity factor in high-income countries. Clean Technol. Environ. Policy. doi:10.1007/s10098-024-03037-0

Degirmenci, T., Aydin, M., Cakmak, B. Y., and Yigit, B. (2024b). A path to cleaner energy: the nexus of technological regulations, green technological innovation, economic globalization, and human capital. Energy 311, 133316. doi:10.1016/j.energy.2024.133316

Degirmenci, T., Erdem, A., and Aydin, M. (2025). The nexus of industrial employment, financial development, urbanization, and human capital in promoting environmental sustainability in E7 economies. Int. J. Sustain. Dev. & World Ecol. 32 (2), 242–258. doi:10.1080/13504509.2024.2426184

Deng, X., Huang, Z., and Cheng, X. (2019). FinTech and sustainable development: evidence from China based on P2P data. Sustainability 11 (22), 6434. doi:10.3390/SU11226434

Dinda, S. (2004). Environmental Kuznets curve hypothesis: a survey. Ecol. Econ. 49 (4), 431–455. doi:10.1016/j.ecolecon.2004.02.011

Dinda, S. (2005). A theoretical basis for the environmental Kuznets curve. Ecol. Econ. 53 (3), 403–413. doi:10.1016/j.ecolecon.2004.10.007

Ding, R., Shi, F., and Hao, S. (2022). Digital inclusive finance, environmental regulation, and regional economic growth: an empirical study based on spatial spillover effect and panel threshold effect. Sustainability 14, 4340. Mdpi.comR Ding, F Shi, S HaoSustainability, 2022⋅mdpi.Com. doi:10.3390/su14074340

Dumitrescu, E. I., and Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Econ. Model. 29 (4), 1450–1460. doi:10.1016/J.ECONMOD.2012.02.014

Erdogan, S., Yıldırım, D. Ç., and Gedikli, A. (2020). Nat. Resour. abundance , financial Dev. Econ. growth An investigation Next-11 Ctries. 65 (December 2019). doi:10.1016/j.resourpol.2019.101559

Eweade, B. S., Joof, F., and Adebayo, T. S. (2024a). Analyzing India’s coal, natural gas, and biomass energy consumption: evidence from a Fourier technique to promote sustainable development. Nat. Resour. Forum, 1477–8947. doi:10.1111/1477-8947.12423

Eweade, B. S., Karlilar, S., Pata, U. K., Adeshola, I., and Olaifa, J. O. (2024b). Examining the asymmetric effects of fossil fuel consumption, foreign direct investment, and globalization on ecological footprint in M exico. Sustain. Dev. 32 (4), 2899–2909. doi:10.1002/sd.2825

Eweade, B. S., Uzuner, G., Akadiri, A. C., and Lasisi, T. T. (2024c). Japan energy mix and economic growth nexus: focus on natural gas consumption. Energy & Environ. 35 (2), 692–724. doi:10.1177/0958305X221130460

FocusEconomics. (2018). FocusEconomics (2018) Economic forecasts from the world’s leading economists, Economic Snapshot for ASEAN. Available online at: https://www.focus-economics.com/regions/asean.

Frankel, J. A., and Rose, A. K. (2005). Is trade good or bad for the environment? Sorting out the causality. Rev. Econ. Statistics 87 (1), 85–91. doi:10.1162/0034653053327577

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110 (2), 353–377. doi:10.2307/2118443

Haddad, C., and Hornuf, L. (2019). The emergence of the global fintech market: economic and technological determinants. SpringerC Haddad, L HornufSmall Bus. Econ. 2019⋅Springer 53 (1), 81–105. doi:10.1007/s11187-018-9991-x

Hammadi, T., and Nobanee, H. (2019). Fintech and sustainability: a mini-review. Papers. doi:10.2139/ssrn.3500873

Hao, Y., Zhu, L., and Ye, M. (2018). The dynamic relationship between energy consumption, investment and economic growth in China’s rural area: new evidence based on provincial panel data. M YeEnergy, Elsevier. ElsevierY Hao, L Zhu.

Hashem Pesaran, M., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econ. 142 (1), 50–93. doi:10.1016/j.jeconom.2007.05.010

Huang, L., and Zhao, W. (2022). The impact of green trade and green growth on natural resources. W ZhaoResources Policy, 2022⋅Elsevier 77, 102749. doi:10.1016/j.resourpol.2022.102749

Ignatyuk, A., Liubkina, O., Murovana, T., and Magomedova, A. (2020). “FinTech as an innovation challenge: from big data to sustainable development,” in E3s-Conferences.orgA Ignatyuk, O Liubkina, T Murovana, A MagomedovaE3S Web of Conferences, 2020⋅e3s-Conferences.Org. doi:10.1051/e3sconf/202016613027

Karim, S., Naz, F., Naeem, M., and Vigne, S. (2022). Is FinTech providing effective solutions to small and medium enterprises (SMEs) in ASEAN countries? Elsevier.

Li, K., Lin, W., Jiang, T., Mao, Y., and Shi, W. (2024). Driving carbon emission reduction in China through green finance and green innovation: an endogenous growth perspective. Environ. Sci. Pollut. Res. 31 (9), 14318–14332. doi:10.1007/s11356-024-32067-w

Li, X., Aghazadeh, S., Liaquat, M., Nassani, A. A., and Sunday Eweade, B. (2025). Transforming Costa Rica’s environmental quality: the role of renewable energy, rule of law, corruption control, and foreign direct investment in building a sustainable future. Renew. Energy 239, 121993. doi:10.1016/j.renene.2024.121993

Li, Y., Jin, X., and Tian, W. (2019). Econometric analysis of disequilibrium relations between internet finance and real economy in China. Int. J. Comput. Intell. Syst. 12 (2), 1454–1464. doi:10.2991/IJCIS.D.191128.001/METRICS

Lisha, L., Mousa, S., Arnone, G., Muda, I., Huerta-Soto, R., and Shiming, Z. (2023). Natural resources, green innovation, fintech, and sustainability: a fresh insight from BRICS. Resour. Policy 80, 103119. doi:10.1016/j.resourpol.2022.103119

Liu, G., Wang, B., Cheng, Z., and Zhang, N. (2020a). The drivers of China’s regional green productivity, 1999–2013. Resour. Conservation Recycl. 153, 104561. doi:10.1016/J.RESCONREC.2019.104561

Liu, J., Ma, C., Ren, Y., and Zhao, X. (2020b). Do real output and renewable energy consumption affect CO2 emissions? Evidence for selected BRICS countries. Energies (Basel). 13, 960. doi:10.3390/en13040960

Liu, M., Ren, X., Cheng, C., and Wang, Z. (2020c). The role of globalization in CO2 emissions: a semi-parametric panel data analysis for G7. Z WangScience Total Environ. 718, 137379. doi:10.1016/j.scitotenv.2020.137379

Machado, J. A. F., and Santos Silva, J. M. C. (2019). Quantiles via moments. ElsevierJAF Machado, JMCS SilvaJournal of Econometrics.

Nathaniel, S., and Khan, S. (2020). The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. ElsevierS Nathaniel, Sar. Khan 272, 122709. doi:10.1016/j.jclepro.2020.122709

Nenavath, S. (2022). Impact of fintech and green finance on environmental quality protection in India: by applying the semi-parametric difference-in-differences (SDID). Renew. Energy 193, 913–919. doi:10.1016/J.RENENE.2022.05.020

Nenavath, S., and Mishra, S. (2023). Impact of green finance and fintech on sustainable economic growth: empirical evidence from India. Heliyon 9 (5), e16301. doi:10.1016/j.heliyon.2023.e16301

Özkan, O., Degirmenci, T., Destek, M. A., and Aydin, M. (2024). Unlocking time-quantile impact of energy vulnerability, financial development, and political globalization on environmental sustainability in Turkey: evidence from different pollution indicators. J. Environ. Manag. 365, 121499. doi:10.1016/j.jenvman.2024.121499

Ozkan, O., Eweade, B. S., and Usman, O. (2024). Assessing the impact of resource efficiency, renewable energy R&D spending, and green technologies on environmental sustainability in Germany: evidence from a Wavelet Quantile-on-Quantile Regression. J. Clean. Prod. 450, 141992. doi:10.1016/j.jclepro.2024.141992

Panayotou, T. (1994). “Empirical tests and policy analysis of environmental degradation at different stages of economic development,” in Pacific and asian journal of energy, 4. 1

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. SSRN Electron. J. 1229. doi:10.2139/ssrn.572504

Pesaran, M. H. (2015). Testing weak cross-sectional dependence in large panels. Econ. Rev. 34 (6–10), 1089–1117. doi:10.1080/07474938.2014.956623

Phillips, P., and Hansen, B. (1990). Statistical inference in instrumental variables regression with I (1) processes. Academic.Oup.comPCB Phillips, BE HansenThe Rev. Econ. Stud. 57, 99. doi:10.2307/2297545

Ploeg, F. V. D. (2011). Natural resources: curse or blessing? J. Econ. Literature 49 (2), 366–420. doi:10.1257/jel.49.2.366

Raza, S., and Shah, N. (2017). Tourism growth and income inequality: does Kuznets Curve hypothesis exist in top tourist arrival countries. Taylor & FrancisSA Raza, N ShahAsia Pac. J. Tour. Res. 2017⋅Taylor & Francis 22 (8), 874–884. doi:10.1080/10941665.2017.1343742

Razzaq, A., Sharif, A., Ozturk, I., and Skare, M. (2023). Asymmetric influence of digital finance, and renewable energy technology innovations on green growth in China. Renewable Energy.

Romer, P. M. (1994). The origins of endogenous growth. J. Econ. Perspect. 8 (1), 3–22. doi:10.1257/jep.8.1.3

Rosenzweig, C., Solecki, W., Hammer, S. A., and Mehrotra, S. (2010). Cities lead the way in climate-change action. Nature 467 (7318), 909–911. doi:10.1038/467909A

Sachs, J. D., and Warner, A. M. (2001). The curse of natural resources. Eur. Econ. Rev. 45 (4–6), 827–838. doi:10.1016/S0014-2921(01)00125-8

Shahbaz, M., Balsalobre, D., and Shahzad, S. J. H. (2019). The influencing factors of CO2 emissions and the role of biomass energy consumption: statistical experience from G-7 countries. Environ. Model. Assess. 24 (2), 143–161. doi:10.1007/S10666-018-9620-8

Shen, J., Ibrahim, R. L., Ajide, K. B., and Al-Faryan, M. A. S. (2024). Tracking environmental sustainability pathways in Africa: do natural resource dependence, renewable energy, and technological innovations amplify or reduce the pollution noises? Energy & Environ. 35 (1), 88–112. doi:10.1177/0958305X221124221

Shin, Y., and Choi, Y. (2019). Feasibility of the FinTech industry as an innovation platform for sustainable economic growth in Korea. Mdpi.comYJ Shin, Y ChoiSustainability, 2019⋅mdpi.Com 11 (19), 5351. doi:10.3390/su11195351

Song, Z., Storesletten, K., and Zilibotti, F. (2011). Growing like China. Am. Econ. Rev. 101 (1), 196–233. doi:10.1257/AER.101.1.196

Swamy, P. (1970). Efficient inference in a random coefficient regression model. JSTORPAVB SwamyEconometrica J. Econ. Soc. 38 (2), 311–323. doi:10.2307/1913012

Twerefou, D., Danso-Mensah, K., and Bokpin, G. (2017). The environmental effects of economic growth and globalization in Sub-Saharan Africa: a panel general method of moments approach. Elsevier.

Udeagha, M., and Muchapondwa, E. (2023). Green finance, fintech, and environmental sustainability: fresh policy insights from the BRICS nations. Taylor & FrancisMC Udeagha, E MuchapondwaInternational J. Sustain. Dev. & World Ecol. 2023⋅Taylor & Francis 30 (6), 633–649. doi:10.1080/13504509.2023.2183526

Usman, O., Ozkan, O., Adeshola, I., and Eweade, B. S. (2024). Analysing the nexus between clean energy expansion, natural resource extraction, and load capacity factor in China: a step towards achieving COP27 targets. Environ. Dev. Sustain. doi:10.1007/s10668-023-04399-z

Wang, E. Z., Lee, C. C., and Li, Y. (2022). Assessing the impact of industrial robots on manufacturing energy intensity in 38 countries. Energy Econ. 105, 105748. doi:10.1016/J.ENECO.2021.105748

Wang, Y., Xu, L., and Solangi, Y. (2020). Strategic renewable energy resources selection for Pakistan: based on SWOT-Fuzzy AHP approach. SolangiSustainable Cities Soc. 52, 101861. doi:10.1016/j.scs.2019.101861

Wen, H., Lee, C. C., and Zhou, F. (2022). How does fiscal policy uncertainty affect corporate innovation investment? Evidence from China’s new energy industry. Energy Econ. 105, 105767. doi:10.1016/J.ENECO.2021.105767

Westerlund, J. (2007). Testing for error correction in panel data. Oxf. Bull. Econ. Statistics 69 (6), 709–748. doi:10.1111/j.1468-0084.2007.00477.x

Xia, F., and Xu, J. (2020). Green total factor productivity: a re-examination of quality of growth for provinces in China. China Econ. Rev. 62, 101454. doi:10.1016/J.CHIECO.2020.101454

Xuan, D., Jiang, X., and Fang, Y. (2023). Can globalization and the green economy hedge natural resources? Functions of population growth and financial development in BRICS countries. Y FangResources Policy, Elsevier. ElsevierD Xuan, X Jiang.

Yan, Z., Zou, B., Du, K., and Li, K. (2020). Do renewable energy technology innovations promote China’s green productivity growth? Fresh evidence from partially linear functional-coefficient models. Energy Econ. 90, 104842. doi:10.1016/j.eneco.2020.104842

Ye, B., Yuan, J., and Guan, Y. (2022). Internet finance, financing of small and micro enterprises and the macroeconomy. Emerg. Mark. Finance Trade 58 (10), 2851–2866. doi:10.1080/1540496X.2021.2013194

Zhang, X., Zhang, J., Wan, G., and Luo, Z. (2020). Fintech, growth and inequality: evidence from China’S household survey data. Singap. Econ. Rev. (SER) 65 (Suppl. 01), 75–93. doi:10.1142/S0217590819440028

Zhou, F., Bin Samsurijan, M. S., Ibrahim, R. L., and Al-Faryan, M. A. S. (2024). An assessment of the aggregated and disaggregated effects of natural resources rents on environmental sustainability in BRICS economies. Int. J. Sustain. Dev. & World Ecol. 31 (4), 375–394. doi:10.1080/13504509.2023.2291135

Keywords: fintech, sustainable development, green productivity, human development, globalization natural resource use negatively impacts green productivity

Citation: He C, Dai W, He J, Li X and Tu Y (2025) Dissecting the relationship between fin-tech indicators, natural resources and green productivity in ASEAN: regarding human development and globalization perspectives. Front. Environ. Sci. 13:1576038. doi: 10.3389/fenvs.2025.1576038

Received: 13 February 2025; Accepted: 10 April 2025;

Published: 30 April 2025.

Edited by:

Jinyu Chen, Central South University, ChinaReviewed by:

B. Herawan Hayadi, Bina Bangsa University, IndonesiaRidwan Ibrahim, University of Lagos, Nigeria

Tunahan Degirmenci, Sakarya University, Türkiye

Kamel Si Mohammed, Université de Lorraine, France

Copyright © 2025 He, Dai, He, Li and Tu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yulin Tu, dHlsOTQxMjE1QHlvbnNlaS5hYy5rcg==

†These authors have contributed equally to this work

Chao He

Chao He Wanci Dai1†

Wanci Dai1†