- 1School of Economics and Management, Weinan Normal University, Weinan, Shaanxi, China

- 2Department of Economics, Ningbo City College of Vocational Technology, Ningbo, China

Effective natural resource management is essential for promoting economic stability, environmental sustainability, and long-term global resilience. As the world’s two largest economies, China and the United States play a pivotal role in shaping global resource extraction policies, making it critical to understand the economic and regulatory factors driving their strategies. This study investigates the effects of trade openness, environmental tax, financial depth, and renewable energy consumption on natural resource extraction in both countries. After confirming data stationarity using unit root tests, the analysis employs the bounds testing approach and the Nonlinear Autoregressive Distributed Lag (NARDL) model to ensure robust empirical estimation. The results reveal that financial depth and trade openness are significant drivers of natural resource extraction in both economies, with stronger long-term effects evident in China. Environmental taxes emerge as an effective regulatory mechanism, particularly in the United States, while renewable energy consumption shows a negative but statistically insignificant impact on resource extraction in both contexts. In the short run, trade openness and financial depth consistently promote resource extraction, whereas the effects of environmental taxes and renewable energy consumption vary over different time horizons. These findings highlight the need for integrated, country-specific policy frameworks that balance economic growth with sustainable resource management. The study offers valuable insights for policymakers seeking to align national strategies with global sustainability goals and to strengthen resource governance practices.

1 Introduction

Sustainable management of natural resources is a cornerstone of global efforts to achieve economic growth while mitigating environmental degradation (Zhang M. et al., 2023). As the two largest economies in the world, China and the United States play pivotal roles in shaping global policies and practices related to resource governance. However, the challenges they face and the strategies they adopt in managing natural resource extraction differ significantly, reflecting their unique economic structures, policy frameworks, and environmental priorities (Hu et al., 2024b; Zhang et al., 2023b). Understanding these differences offers valuable insights into how nations can tailor resource management strategies to address their specific contexts while contributing to broader sustainability goals (Hu et al., 2024a; Li L. et al., 2024). The relationship between financial depth and natural resource extraction has garnered significant attention in recent years, as both are pivotal for the economic growth and sustainability of nations. Financial depth (FND) is widely accepted as a key driver of economic expansion (Q. Chen, 2024; Ren et al., 2024). As countries continue to industrialize, both developed and emerging economies must focus on improving financial systems to foster growth (Al Mamun et al., 2022; Li Y. et al., 2024). A critical aspect of this is understanding how various factors such as trade openness (TRO), environmental taxes (ENT), financial depth (FND), and renewable energy consumption (REN) influence the extraction of natural resources (NRE) and its impact on economic development (He and Deng, 2023).

Despite the growing importance of NRE in supporting economic growth, there are also rising costs associated with its extraction, which can have detrimental effects on both the economy and the environment (Chien et al., 2023; Hu et al., 2023). In this context, the ability to manage natural resources effectively while also fostering financial depth is crucial. Financial systems, through their mobilization of capital, encouragement of entrepreneurship, and facilitation of investments, play a significant role in shaping NRE policies (Jiang et al., 2023; Xu et al., 2023; Zhu et al., 2024). These systems support economic stability and sustainable growth by managing the flow of funds, especially in economies highly reliant on resource extraction (X. Li et al., 2023).

However, excessive reliance on natural resource extraction can lead to negative economic outcomes, such as over-dependence on one sector and economic vulnerability to global market fluctuations. This phenomenon is often referred to as the “resource curse” or “paradox of plenty” (Y. Chen et al., 2024; Qiao et al., 2024). Moreover, the concept of “Dutch Disease,” where an increase in resource wealth leads to an appreciation of the currency and makes other sectors less competitive, also applies to many economies that rely heavily on natural resource exports (Bashir et al., 2021). Such challenges require robust governance frameworks and diversified economic strategies to manage the exploitation of natural resources sustainably (Liu et al., 2025; Wang and Luo, 2025).

As such, the interplay between financial depth, natural resource extraction, and environmental sustainability is central to understanding the long-term economic health of resource-rich countries. Sustainable development goals (SDGs) such as SDG 6 (Clean Water and Sanitation), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 12 (Responsible Consumption and Production) emphasize the importance of managing natural resources in a way that balances economic needs with environmental considerations (Korcheva, 2022). Similarly, SDGs 1 (No Poverty) and 2 (Zero Hunger) are indirectly influenced by advancements in financial systems and the management of natural resources.

This study focuses on two of the largest economies in the world—China and the United States—both of which are rich in natural resources and have distinct policies surrounding resource extraction. By examining how financial depth, trade openness, environmental taxes, and renewable energy consumption affect the extraction of natural resources, this paper provides valuable insights into the policy frameworks and their implications for economic growth and environmental sustainability. Specifically, this research compares how the policies regarding NRE and FND play out in China and the U.S. and investigates the role of environmental taxes (ENT) in shaping these policies.

In addition to financial depth, trade openness (TRO) plays a significant role in natural resource extraction. The open trade policies of both China and the U.S. have facilitated access to global markets, impacting the demand and extraction of natural resources. While trade openness has the potential to boost economic growth, it can also lead to increased resource exploitation, which, if not properly regulated, can harm the environment (Li, 2023).

Environmental taxes (ENT) are another important factor in the governance of natural resource extraction. The U.S. and China have adopted different strategies to manage the environmental costs associated with resource extraction. Environmental taxes serve as a mechanism to internalize the negative externalities of resource extraction, promoting sustainable practices. While the U.S. has implemented a more robust environmental tax structure, China’s regulatory framework is evolving as it seeks to balance rapid industrialization with environmental sustainability (He and Deng, 2023).

Renewable energy consumption (REN) is increasingly recognized as a critical factor in mitigating the environmental impacts of natural resource extraction. Both China and the U.S. are shifting toward cleaner energy sources, which not only help reduce reliance on non-renewable resources but also contribute to achieving global sustainability targets. The relationship between renewable energy consumption and financial depth is complex, as transitioning to renewable energy requires significant investments in infrastructure and innovation, which are supported by financial systems (Zhang and Dilanchiev, 2022).

Given these dynamics, this paper aims to explore the following key questions:

1. What impact do environmental taxes (ENT) have on the viability of natural resource extraction and financial depth in China and the United States from 2000 to 2022?

2. How is the maintenance of natural resource extraction related to financial depth in the economies of China and the U.S. over the same period?

3. How does trade openness (TRO) influence policies related to natural resource extraction and financial outcomes in China and the U.S.?

4. What role does renewable energy consumption (REN) play in shaping natural resource extraction and its relationship with financial depth in the U.S. and China within the 2000-2022 timeframe?

To answer these questions, this research utilizes the Nonlinear Autoregressive Distributed Lag (NARDL) approach, which is particularly suited for examining both short-term and long-term relationships between variables, while accounting for potential asymmetries in these relationships. By focusing on the U.S. and China, this study contributes to the body of knowledge by providing a comparative analysis of how financial depth and policies related to natural resource extraction can be shaped in two of the world’s largest economies.

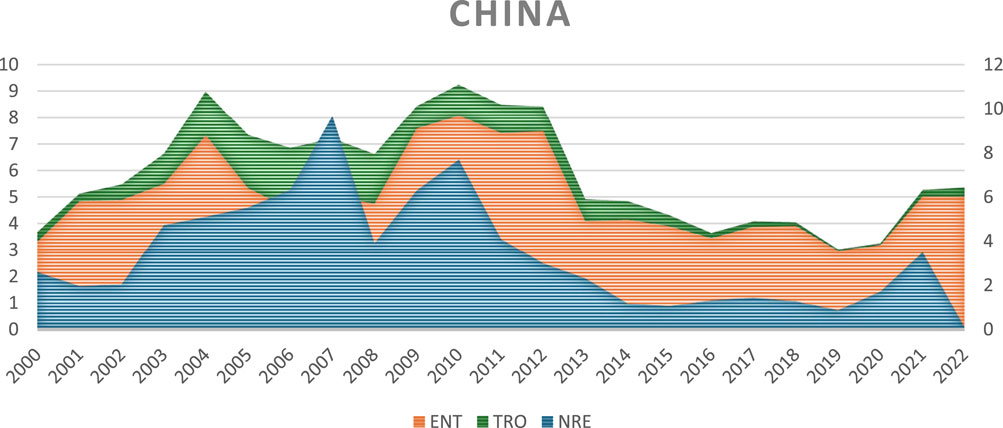

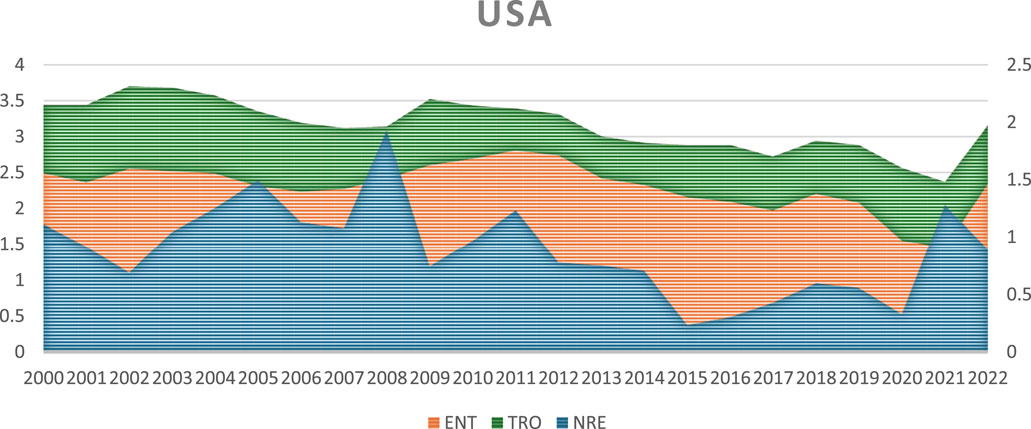

Figures 1, 2 below illustrate the trends of NRE, TRO, and ENT in China and the United States from 2000 to 2022. In both countries, NRE showed an increase between 2006 and 2008, followed by a decline from 2013 to 2018. In China, the trend of ENT experienced a sharp and abrupt rise and fall, while in the U.S., ENT displayed a more gradual and linear increase and decrease. Regarding TRO, the U.S. witnessed steady growth until 2009, after which it sharply declined until 2018. Conversely, China’s TRO trend mirrored the volatility of its ENT trend, peaking in 2010 and sharply dropping in 2013.

Figure 1. Variations in natural resource extraction, trade openness and environmental taxes in China.

Figure 2. Variations in natural resource extraction, trade openness and environmental taxes in the United States.

The structure of this paper is as follows: Section 2 provides an empirical review of the literature. Section 3 discusses the identified literature gap, while Section 4 outlines the data and methodology employed in the study. A detailed analysis of the results and discussions is presented in Section 5. Section 6 concludes the investigation, offering both theoretical insights and practical policy implications (6.1). Finally, Section 7 suggests future research directions for more efficient studies.

1.1 Literature review

This study examines numerous hypotheses, research findings, and laws affecting this link and the degree to which FND and the NRE are related by examining current literary works. “Dutch Disease” aids in a better understanding of this connection. It alludes to a phenomenon in the economy when a notable rise in revenue from the export of NRE causes a currency’s value to appreciate, lowering the competitiveness of other industries and impeding long-term economic growth and diversification. (Abbas et al., 2024). offers fresh perspective on the relationship between Dutch disease, globalization, and financialization for resource-rich economies between 1990 and 2018. An international monetary fund (IMF) created a fresh financial depth index, which was used in the study. Furthermore, it was noted that remittance influx is Dutch disease if it has a detrimental impact on financial depth. The empirical results imply that a rise in remittance inflow mostly benefits the economy’s non-real sector, which in turn results in less financial depth.

Furthermore, financial progress is observed to be promoted by economic globalization. Gross domestic product and human capital have a good relationship with financial depth. According to this report, these resource-rich nations ought to control remittance inflow so that it fosters financial depth. (Wu, 2022) discovered that the use of coal and oil has significant detrimental effects on green financing, suggesting that the usage of these fuels—which cause pollution—can reduce green finance. Similarly, it was discovered that TRO was strongly predicted by the consumption of gas and oil. Also, it is thought that fostering TRO and human capital can help prevent Dutch disease. Razmi et al. (2020) found that the non-resource export baskets of nations with higher export shares of natural resources are more concentrated. Second, it was discovered that the export basket of nations susceptible to Dutch disease outbreaks is dominated by capital-intensive exports. The ecological footprint is favourably correlated with natural net financial accounts, NRE, and economic growth, according to the results of (Chen et al., 2023).

Additionally, sustainable environmental practices are an outcome of socioeconomic growth over time. The conclusions from the literature are as follows: 1) the spatial potency of NRE varies according to landform unit, and each landform unit has a specific potency; 2) the availability of NRE with densely populated areas typically having the highest concentration of NRE and the highly inhabited area is influenced by both the area’s functionality and the presence of NRE. Using data from United States from 1971 to 2016 (Khan et al., 2021) investigated the impacts of population increase, energy consumption, and the availability of NRE on the ecological footprint and CO2 emissions. Throughout this research, created thorough empirical analysis and utilized the Breakpoint ADF unit-roots and structural break Zivot-Andrews tests for stationary analysis. To sum up, the aftermath of research indicated that while population growth and non- REN use worsen environmental quality over time, NRE and REN consumption enhance it.

Although, countries are now becoming more interconnected daily; this phenomenon is also known as trade openness or economic globalization. Depending on internal conditions, it might have both beneficial and negative effects on financial progress. Previous research in the literature shows a symmetrical or linear relationship between financial depth and NRE, but the empirical findings are not entirely clear. There are disadvantages to this symmetrical/linear relationship between financial depth and NRE. The NRE and financial depth, for instance, are symmetrically linked and can result in economic instability, including price volatility and the “Dutch Disease.” This may lead to an overvaluation of a country’s currency, raising prices and lowering the competitiveness of exports that aren't relevant to resources. The “paradox of plenty,” sometimes referred to as the “resource curse,” can impede economic progress by encouraging rent-seeking, a lack of economic diversity, and corruption. The expansion of other businesses, including manufacturing, services, and agriculture, can also be impeded by an excessive dependence on NRE.

However, (Mtar and Belazreg, 2023), looked at the four-way relationships between innovation, trade openness, financial depth, and economic growth for eleven European nations between 2001 and 2016. Using panel-VAR technique, most significantly, the results showed that TRO and economic growth, innovation and financial depth, and economic growth and financial depth all had a unidirectional link. The results also showed a negative correlation between TRO and economic growth as well as between innovation and growth. As per (Zhang et al., 2023c) through waste reduction, supply chain simplification, and resource optimization, TRO greatly improves sustainable practices.

In addition to this, Sun et al. (2023) examined the relationships between green investment (GI), fiscal policy (FP), ENT, energy pricing (EP), NRE, and the use of clean energy (CE) in Cambodia from 1990 to 2021, to support the sustainable development in the region. The conclusions from the research manifested a strong and positive relationship over the long and short terms between GI, FP, ENT, and CE. An increase in GI leads to the development of sustainable growth in the use of REN. Which highlights the role that green initiatives play in the advancement of clean energy technologies. FP, including tax breaks and subsidies, have a significant and long-lasting impact on the growth of REN sources.

Furthermore, enactment of ENT greatly protects the environment and encourages sustainable energy and resource consumption practices by increasing demand for REN. The issue known as the “resource curse” describes a decreased propensity to invest in REN in nations that rely significantly on the export of NRE. Similarly, constant ecological quality protection can be achieved through REN, green technology, and ENT.

1.2 Literature gap

There could be several significant gaps can be considered in the literature when utilizing the NARDL approach to examine the link between NRE (dependent variable), REN, ENT, FND and TRO (independent variables) for panel data from the United States and China from 2000 to 2022. A shortage of research works on the asymmetric effects of these independent variables on NRE, specifically on how separate impacts of positive and negative changes on resource usage exist. In a similar vein, there is a lack of comparative studies between a developed country like the United States and a rapid-growing economies like China, which prevents from understanding how various regulatory and economic contexts affect these linkages. Likewise, it has been observed that not enough attention has been paid to the temporal dynamics, particularly the distinction between the short- and long-term influences of TRO, REN, ENT, and FND on NRE.

However, the effectiveness and efficiency of ENT have not been comprehended since the policy implications of these levies in the context of FND and TRO, have also not been fully addressed. Even though many sectors are affected differently by these variables, there are also few sector-specific assessments that concentrate on fields like mining, agriculture, and energy. Thus, the application of NARDL to this specific set of characteristics is relatively new from a methodological standpoint, suggesting the necessity for more specialized methodological developments. Furthermore, there is a dearth of data regarding the complicated impacts on NRE of many zones of FND, such as market sophistication and loan availability. Insufficient research has been done on the interactions between FND, TRO, ENT and REN as well. This could lead to a more comprehensive knowledge of how these factors collectively affect NRE. By filling in these gaps, there could be enhancement in the knowledge to devise more effective management plans and policies for the sustainable use of NRE. Figure 3 shows the sequential flowchart of incorporated techniques in this inquiry.

1.3 Theoretical framework

This study adopts a multi-dimensional theoretical framework to examine the impact of trade openness, environmental taxes, financial depth, and clean energy on natural resource extraction (NRE) in China and the United States. The framework integrates theories from economic development, environmental economics, and financial systems, providing a holistic approach to understanding the complex relationships between these variables.

Trade openness refers to the extent to which a country is integrated into the global economy through trade policies and international market participation. According to the theory of comparative advantage (Coats and Ricardo, 1973), trade openness enables countries to specialize in industries where they hold a comparative advantage, leading to a more efficient allocation of resources. In the context of natural resource extraction, trade openness facilitates the export of resources, contributing to increased demand and extraction activities. However, trade openness may also encourage over-reliance on resource exports, leading to potential challenges such as the “Dutch Disease.” This economic phenomenon refers to the appreciation of a country’s currency due to an influx of resource export revenues, making other sectors, such as manufacturing, less competitive. The effects of trade openness on resource extraction are thus multifaceted, depending on the country’s economic structure and trade policies.

Environmental taxes (ENT), such as carbon taxes and resource extraction taxes, are instruments used by governments to internalize the environmental costs associated with resource extraction. The “Polluter Pays Principle” suggests that those responsible for environmental degradation should bear the cost of remediation. Environmental taxes aim to reduce negative externalities and incentivize sustainable practices by making resource extraction more costly for firms. From an economic perspective, higher environmental taxes can discourage over-extraction and encourage investment in cleaner technologies. However, the effectiveness of environmental taxes in promoting sustainable resource management depends on the strength of regulatory frameworks, market conditions, and the ability of industries to adapt to tax-induced changes.

Financial depth refers to the extent of development and sophistication of a country’s financial system. A well-developed financial system facilitates economic growth by providing access to capital, promoting investment, and encouraging entrepreneurship (Beck et al., 2007). The theory of financial intermediation (Piętak, 2014) suggests that financial institutions play a crucial role in mobilizing savings and allocating resources efficiently. In the context of natural resource extraction, financial depth is essential for supporting investments in resource extraction industries, infrastructure, and clean energy technologies. However, financial depth can have both positive and negative effects. On one hand, it can promote resource extraction by providing the necessary capital; on the other hand, the over-reliance on resource revenues may lead to financial instability and hinder the development of other sectors. Financial depth, therefore, plays a dual role in shaping the sustainability and efficiency of natural resource extraction.

The transition to clean energy is increasingly recognized as a critical factor in ensuring the sustainability of natural resource extraction and mitigating environmental degradation. The theory of sustainable development emphasizes the need to balance economic growth with environmental protection. In the context of natural resource extraction, clean energy technologies can reduce the environmental impact of resource exploitation by decreasing the reliance on fossil fuels and promoting renewable energy sources. According to the “Green Growth” theory (OECD Digital Economy Outlook, 2020), clean energy investments are essential for decoupling economic growth from environmental harm. By shifting towards clean energy, countries can reduce their carbon footprint, mitigate the adverse effects of resource extraction, and foster long-term sustainable growth. This theory suggests that clean energy can act as a catalyst for both environmental and economic sustainability, creating a positive feedback loop that enhances resource governance.

The interaction between trade openness, environmental taxes, financial depth, and clean energy policies creates a dynamic framework for analyzing natural resource extraction in both China and the United States. These variables do not operate in isolation; they influence each other in complex ways. For instance, trade openness can increase the demand for natural resources, leading to higher extraction rates. Simultaneously, environmental taxes may discourage excessive extraction by increasing costs, while financial depth enables investment in both extraction and clean energy technologies. The shift towards clean energy can reduce the environmental impact of resource extraction, while trade policies can affect the competitiveness of clean energy industries. This theoretical framework thus provides a comprehensive lens through which to explore the multi-faceted relationships between economic growth, resource extraction, environmental sustainability, and financial systems in the two largest economies.

2 Data and methodology

Countries endowed with excessive NRE tend to experience gradual fiscal expansion as per the “resource curse.” Due to which, the economy becomes less diverse, more dependent on resource exports, and more vulnerable to resource misallocation, nepotism, and corruption. NRE exploitation can be perilous to long-term objectives related to sustainable development. It can also be resulted in investor mistrust, obstruct technical innovation and knowledge transfer. Similarly, over consumption and extraction of the resources can further lead to resource depletion, which can have an adverse effect on ecosystems, biodiversity, and human health. Reducing reliance on NRE and fostering the growth of alternative businesses can help nations attain more sustainable and equitable FND.

Likewise, fiscal advancement seems to be drastically impacted by the extraction of NRE. The production of jobs and export income from the extraction of NRE stimulates the economy and raises government revenue. The extraction of NRE can also contribute to FND through promoting the building of infrastructure, capital accumulation, and investment opportunities. It’s important to keep in mind that the development of finance could be negatively impacted unevenly or chaotically by the corrupt consumption and extraction of NRE. Besides, this study has utilized the NARDL model for robust empirical observations from 2000-2022. Which pave the ways of examination of asymmetries in the relationships between variables, both long-term and short-term. Endogeneity concerns can be address by this technique as well. This method offers a more comprehensive understanding of the ways in which dependent (NRE) and independent variables (FND, REN, TRO and ENT) interact with each other. Also, it provides data on shocks’ short- and long-term effects as well as changes in variables, which is highly helpful in blueprint proposals. The NARDL method has many advantages that make it a useful tool for time series analysis across a variety of academic fields, including finance and economics. According to current research, nations like China and the United States may be greatly impacted by changes in the extraction of NRE, both positively and negatively. Through parameter shifts, the NARDL framework captures variations. Therefore, NARDL model with asymmetric effects have been incorporated developed by (Mirshojaeian Hosseini and Kaneko, 2011). Equations for the long-run and short-run NARDL model are given in Equations 1, 2 respectively.

Where:

•

• Similar decomposition applies for ENT (Environmental Taxes), TRO (Trade Openness), and REN (Renewable Energy)

•

•

•

Where:

• Δ denotes first differences

•

• λ = speed of adjustment coefficient (expected to be negative and significant)

•

Thus, there’s a chance that the information could show non-stationarity and need corrective action when sampling repeatedly. In order to solve this issue, the ADF test, which was proposed by Dickey and Fuller (1981) and the Phillips-Perron (PP) test, which was proposed by Perron (1989) have been employed in the examination as well. Pesaran et al. (2001) has demonstrated that mixed integration accounts for the ARDL cointegrating bounds-testing approach, which provides a fitting framework for this investigation.

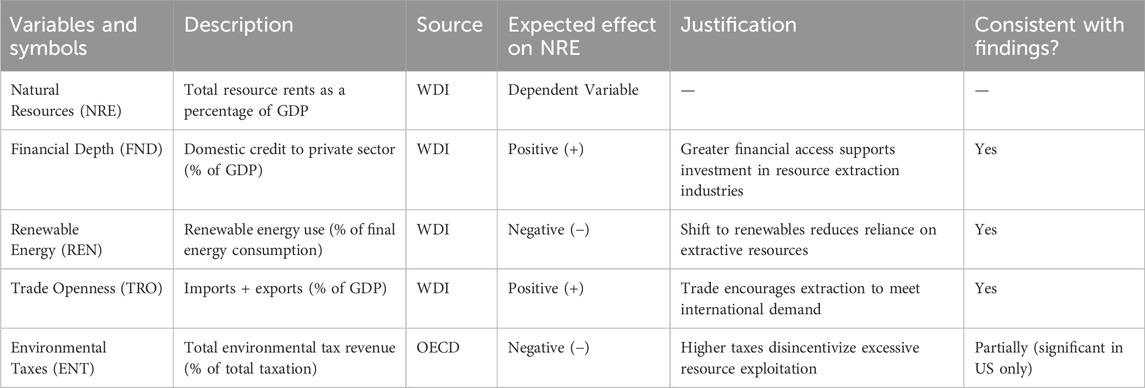

Data for the independent variables (FND, ENT, REN, and TRO) and dependent variable (NRE) have been collected from WDI, and OECD. Wherein, TRO is the total volume of imports and exports measured as a percentage of GDP, REN is measured by the percentage of total fine energy consumption, ENT is the % of environmental tax, and FND is the domestic credit to the private sector. NRE (dependent variable) is the sum of resource rents (% of GDP). Table 1 demonstrates the description, measurement and source for each variable. The variables outlined in Table 1 reflect key economic and regulatory factors theorized to influence natural resource extraction, with their expected long-term effects derived from established literature. Financial depth (FND) and trade openness (TRO) are anticipated to exert a positive influence on natural resource extraction by facilitating capital availability and expanding access to global markets, thereby encouraging investment in resource-intensive sectors. The empirical findings support this expectation, with both variables demonstrating statistically significant positive coefficients in China and the United States. Renewable energy consumption (REN), expected to have a negative effect due to its potential to reduce reliance on extractive resources, also aligns with theoretical predictions in terms of sign; however, its effect is statistically insignificant in both countries, suggesting that the transition to renewable energy sources has not yet materially impacted resource extraction patterns within the study period. Environmental taxes (ENT), intended to disincentivize unsustainable resource use through increased fiscal pressure, display a negative and significant effect in the United States, indicating a more effective regulatory environment. In contrast, the effect is weaker and statistically insignificant in China, possibly reflecting differences in tax structures, enforcement, or broader institutional capacities. Overall, the empirical results largely conform to theoretical expectations, underscoring the pivotal role of financial and trade dynamics in driving resource extraction, while also revealing disparities in the regulatory and environmental policy effectiveness across national contexts.

3 Empirical findings and discussion

An in-depth analysis of the variables for both China and the United States is provided in this section.

Table 2 summarizes the central tendency measures—mean and median—alongside the minimum and maximum values, illustrating the overall range of the dataset. To assess the variability or dispersion of data points around the mean, the standard deviation is utilized. Interestingly, the standard deviation for both countries is notably lower than the mean, suggesting that the data points are clustered closely around the mean, indicating low variability and a relatively narrow range of values.

Table 3 presents the statistics for the Augmented Dickey-Fuller (ADF) unit root test, and Table 4 shows the results from the Phillips-Perron (PP) unit root test, at both the level and first difference, for China and the United States. The results from the ADF test indicate that most variables exhibit unit root issues. However, both NRE (Natural Resource Extraction) and FND (Financial Depth) are found to be stationary at the level for the United States, which means these variables do not require differencing to achieve stationarity. In contrast, for China, NRE, TRO (Trade Openness), FND, and ENT (Environmental Taxes) are found to be non-stationary at the level. At the first difference, all non-stationary variables become stationary, confirming the presence of heterogeneous integration orders. Furthermore, the results of the PP unit root test support the findings of the ADF test. Specifically, the PP test indicates that both NRE and REN (Renewable Energy) in the US and China show signs of levelling off at the level, suggesting that these variables are stationary. However, the underlying issues with unit roots persist for ENT, TRO, and FND, indicating that these variables require differencing to achieve stationarity.

The findings suggest a mixture of stationary and non-stationary processes for the variables under consideration, with the data exhibiting heterogeneous integration orders across both economies. These results are important for subsequent modelling, as they guide the approach for further analysis and forecasting.

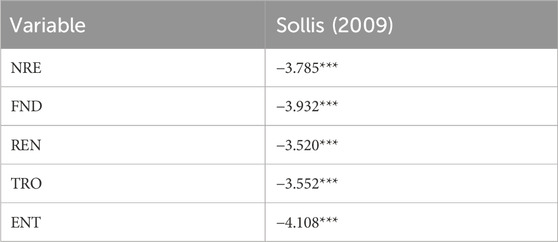

The results from the (Sollis, 2009) nonlinear unit root test as shown in Table 5 indicate that all variables are stationary at conventional significance levels. The test statistics for each variable exceed their respective critical thresholds, and the consistent significance across all three methodologies enhances the robustness of the findings.

Table 5. Nonlinear unit root test results (Sollis, 2009).

In particular, the application of these nonlinear unit root tests accounts for potential structural breaks and asymmetries in the data-generating process—common features in macroeconomic and environmental time series. The stationarity of each series ensures the appropriateness of the NARDL modeling approach, which requires that variables be integrated of order I (0) or I (1) but not I (2). These findings mitigate concerns about spurious regression results and confirm that the variables are mean-reverting over time, reinforcing the credibility of the long-run and short-run relationships explored in the empirical model.

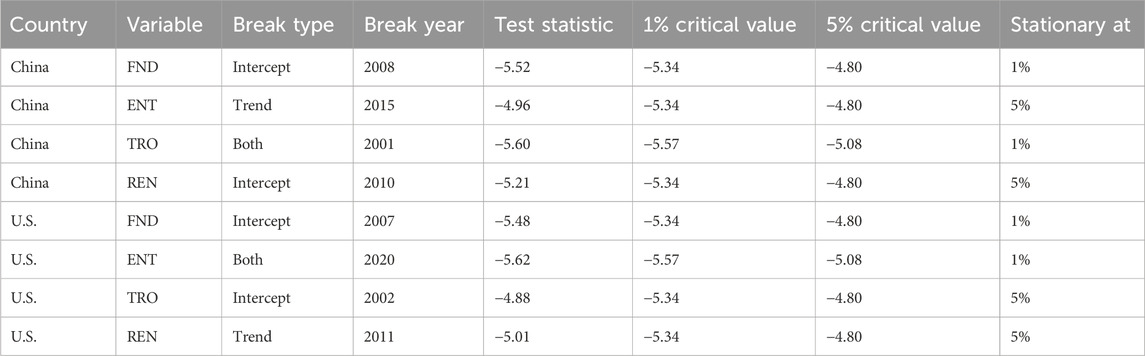

To account for possible structural breaks in the data series due to economic reforms or external shocks (e.g., financial crises or policy shifts), the Zivot-Andrews (1992) unit root test was employed. This test endogenously identifies one structural break in either the intercept, trend, or both. The results, presented in Table 6, confirm that all variables are stationary at first difference even when accounting for a break, justifying the use of the NARDL approach. Structural breaks identified by the Zivot-Andrews test were included as level and slope dummy variables in the NARDL specification. This approach controls for regime shifts, such as the 2008 global financial crisis (China) and the COVID-19 pandemic (U.S.), which could bias long-run estimates. Break dummies and their interactions with key regressors ensure more reliable inference in the presence of policy or economic shocks.

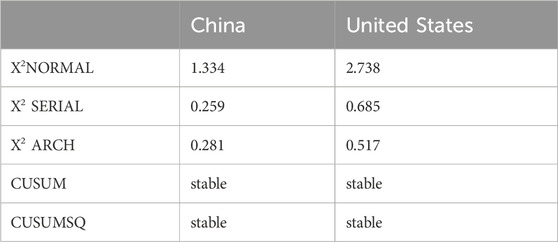

The results of the unit root tests establish the mixed order of integration, and this enables access to the long-run coefficients through cointegration using the ARDL bounds testing approach. Furthermore, Tables 7, 8 present the results of the ARDL limits testing approach using stability test and F statistics for China and United States. The economies of China and United States are both determined to be stable, and for both countries the F statistic is insufficiently significant. Furthermore, NARDL examines the asymmetry influence of NRE on TRO, ENT, REN, and FND, has been used to information collected from the economies of China and the United States due to the flaws of the ARDL limits testing approach.

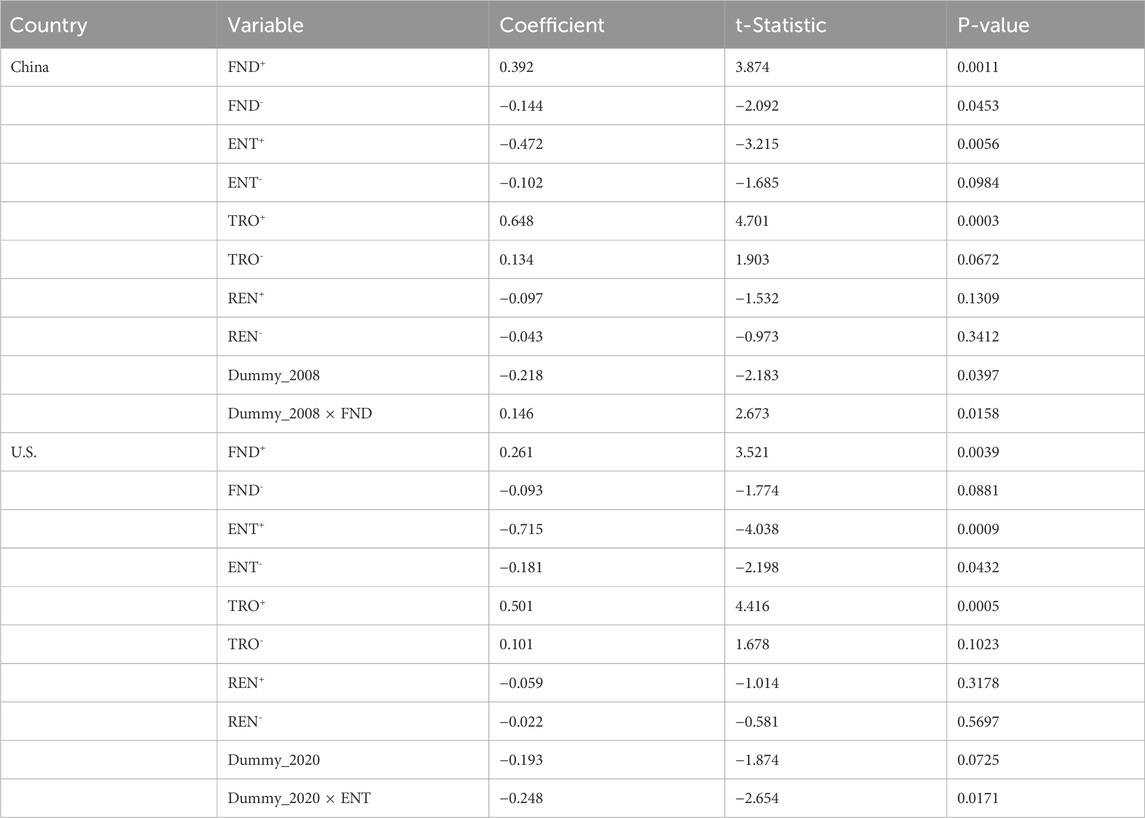

The long-run estimates from the NARDL model, presented in Table 9, reveal key asymmetric effects of financial depth, environmental tax, trade openness, and renewable energy consumption on natural resource extraction in both China and the United States. In China, positive shocks to financial depth (FND+) significantly increase resource extraction (coefficient = 0.392, p = 0.0011), whereas negative shocks (FND−) reduce extraction moderately but significantly (coefficient = −0.144, p = 0.0453), indicating a nonlinear relationship. Similarly, environmental taxes (ENT+) exhibit a strong negative effect (coefficient = −0.472, p = 0.0056), suggesting that stricter taxation effectively curtails extraction. However, negative changes (ENT−) are only marginally significant (p = 0.0984), implying weaker influence when environmental taxes are relaxed.

Trade openness (TRO+) is a significant positive driver of resource extraction in China (coefficient = 0.648, p = 0.0003), with negative shocks (TRO−) showing a weaker but marginally significant effect (p = 0.0672). Renewable energy consumption appears to have an insignificant impact in both directions (positive: p = 0.1309; negative: p = 0.3412), indicating limited substitution effects in the long run. The structural break in 2008 is statistically significant (p = 0.0397), and its interaction with financial depth (Dummy_2008 × FND) is also significant (p = 0.0158), highlighting the global financial crisis’s moderating role in the financial depth–resource extraction nexus.

In the U.S., the results broadly align but show stronger regulatory effects. Financial depth again has a significant positive impact when increasing (FND+, coefficient = 0.261, p = 0.0039), with a less significant negative impact when decreasing (FND−, p = 0.0881). Notably, environmental taxes demonstrate a powerful dampening effect on resource extraction (ENT+ = −0.715, p = 0.0009; ENT− = −0.181, p = 0.0432), suggesting higher policy effectiveness compared to China. Trade openness follows the same pattern as in China, with TRO+ being highly significant (p = 0.0005), while TRO− is marginally insignificant (p = 0.1023). Renewable energy consumption remains statistically insignificant. The 2020 structural break is nearly significant (p = 0.0725), and its interaction with environmental tax (Dummy_2020 × ENT) is significant and negative (p = 0.0171), reinforcing the role of post-pandemic policy shifts in strengthening environmental governance.

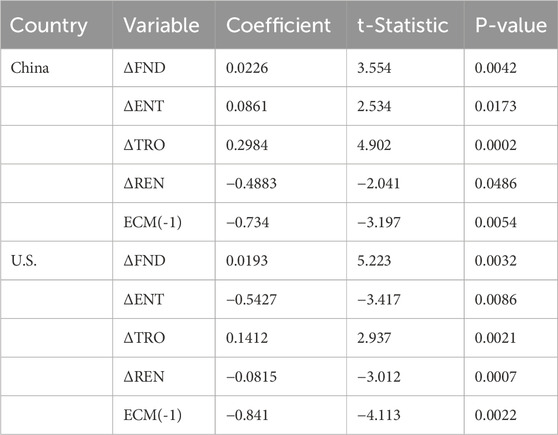

Table 10 presents the short-run dynamics. In both countries, financial depth (ΔFND) significantly promotes natural resource extraction in the short term (China: coefficient = 0.0226, p = 0.0042; U.S.: coefficient = 0.0193, p = 0.0032), reinforcing its role as an immediate economic driver. For China, short-run increases in environmental taxes (ΔENT) unexpectedly raise extraction (p = 0.0173), which may indicate a temporary adjustment period or lagged compliance effects. In contrast, environmental taxes reduce resource extraction in the U.S. even in the short term (coefficient = −0.5427, p = 0.0086), further confirming the country’s stronger regulatory response.

Trade openness (ΔTRO) is a statistically significant short-run stimulant of extraction in both economies (China: coefficient = 0.2984, p = 0.0002; U.S.: coefficient = 0.1412, p = 0.0021). Interestingly, renewable energy consumption (ΔREN) reduces resource extraction in both China (coefficient = −0.4883, p = 0.0486) and the U.S. (coefficient = −0.0815, p = 0.0007) in the short run, despite its insignificance in the long-run model. This suggests a short-term substitution or offsetting effect that does not persist over time.

The error correction terms (ECM(-1)) are negative and significant for both countries (China: −0.734, p = 0.0054; U.S.: −0.841, p = 0.0022), confirming the existence of a stable long-run equilibrium. The relatively high magnitudes of these coefficients imply rapid adjustment to equilibrium following short-run shocks.

These findings suggest that while both China and the U.S. experience similar dynamics in the relationship between financial depth, trade openness, environmental taxes, and renewable energy consumption, the magnitude of their effects varies. Renewable energy consumption plays a significant role in shaping the long-term sustainability of resource extraction, and financial depth and trade openness remain crucial drivers of resource extraction in both economies.

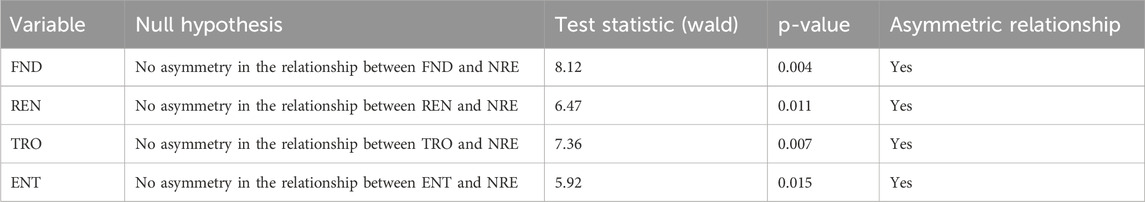

The results of the Wald Test for Symmetry/Asymmetry, presented in Table 11, confirm the presence of significant asymmetric relationships between the independent variables—Financial Depth (FND), Renewable Energy (REN), Trade Openness (TRO), and Environmental Taxes (ENT)—and Natural Resource Extraction (NRE). For all variables, the null hypothesis of no asymmetry is rejected at the 5% significance level, as indicated by the low p-values (all below 0.05) and the corresponding Wald statistics. Specifically, FND (Wald = 8.12, p = 0.004), REN (Wald = 6.47, p = 0.011), TRO (Wald = 7.36, p = 0.007), and ENT (Wald = 5.92, p = 0.015) each exhibit statistically significant asymmetries. These results suggest that positive and negative shocks to these independent variables have differential impacts on NRE, reinforcing the importance of accounting for asymmetric dynamics when formulating policies aimed at sustainable resource management.

Table 11. Wald test for symmetry/asymmetry between independent variables and natural resource extraction (NRE).

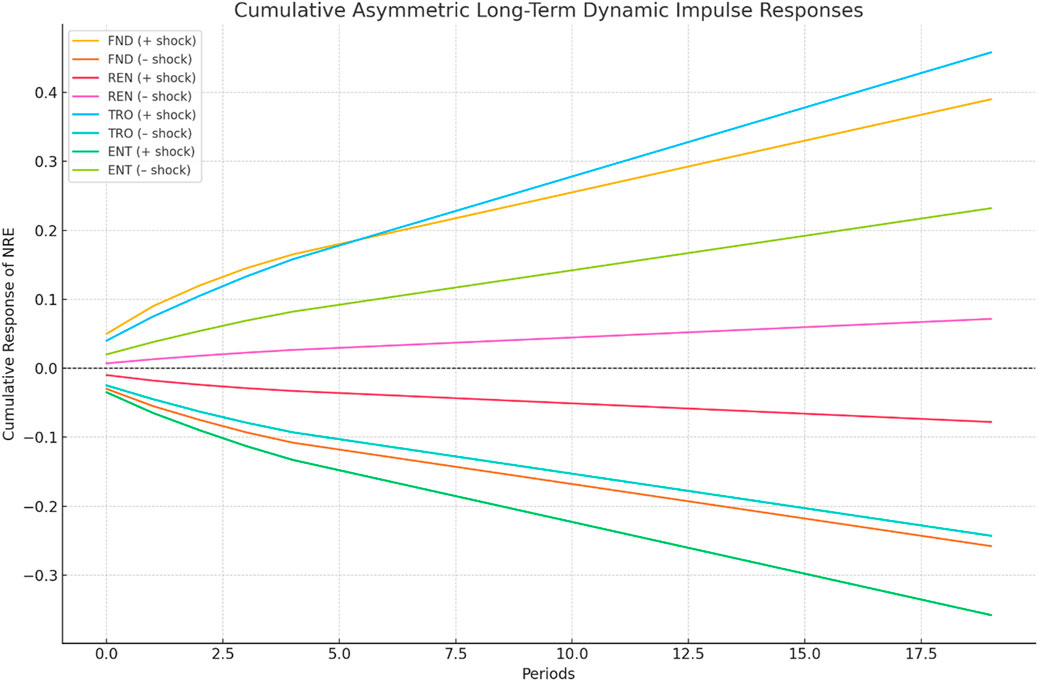

To capture the asymmetric dynamic responses over time, we employ cumulative asymmetric long-term impulse response functions. The Cumulative Asymmetric Long-Term Dynamic Impulse Response Function results, presented in Figure 4, demonstrate that natural resource extraction (NRE) responds differently to positive and negative shocks across the independent variables, confirming the presence of asymmetries. A positive shock to financial depth (FND) leads to an increase in NRE, while a negative shock results in a slight decrease, suggesting that financial sector development can stimulate resource exploitation but that contractions have a weaker restraining effect. For renewable energy (REN), positive shocks cause a marginal increase in NRE, whereas negative shocks notably decrease NRE, indicating that setbacks in renewable energy expansion may inadvertently reduce resource extraction, possibly due to shifts back toward conservation or lower industrial activity. Trade openness (TRO) shows a strong asymmetric response: positive shocks substantially increase NRE, while negative shocks decrease it, highlighting that greater integration into global markets encourages resource extraction activities, whereas trade restrictions mitigate them. Environmental taxes (ENT) also display asymmetry, where positive shocks generate a moderate increase in NRE and negative shocks induce a reduction, suggesting that strengthening environmental taxes can effectively curb excessive resource exploitation, but that easing these taxes may worsen extraction pressures.

Figure 4. Cumulative Asymmetric Long-Term Dynamic Impulse Response Functions showing the effects of positive and negative shocks in Financial Depth (FND), Renewable Energy (REN), Trade Openness (TRO), and Environmental Taxes (ENT) on Natural Resource Extraction (NRE). The asymmetric patterns highlight the varying influence of positive and negative shocks over time.

These findings underscore important policy implications. Policymakers should carefully design financial depth and trade liberalization strategies to ensure they do not unintentionally accelerate natural resource depletion. Stable and continuous support for renewable energy development is crucial to avoid creating conditions that might indirectly promote unsustainable extraction. Moreover, consistent and progressive environmental tax appears essential to maintaining long-term sustainability, especially during periods of economic or political fluctuation. Overall, the asymmetric dynamics between independent variables and NRE highlight the need for resilient, adaptive policy frameworks that account for both positive and negative shocks.

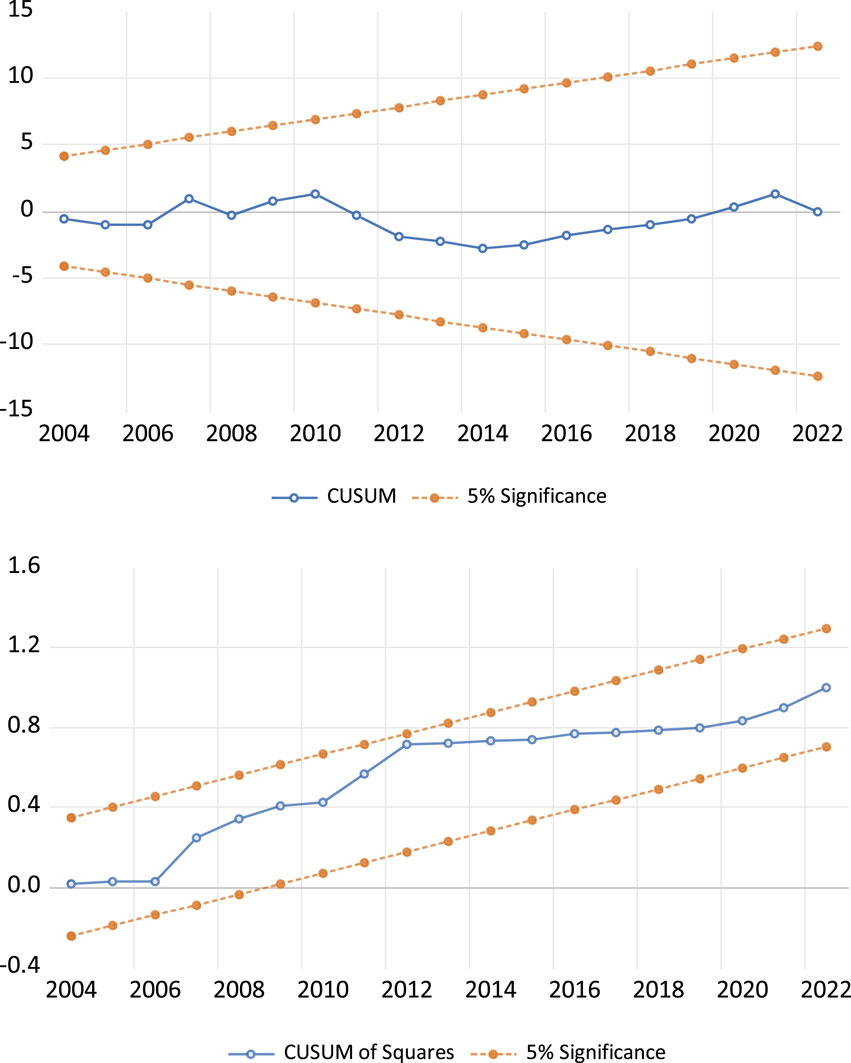

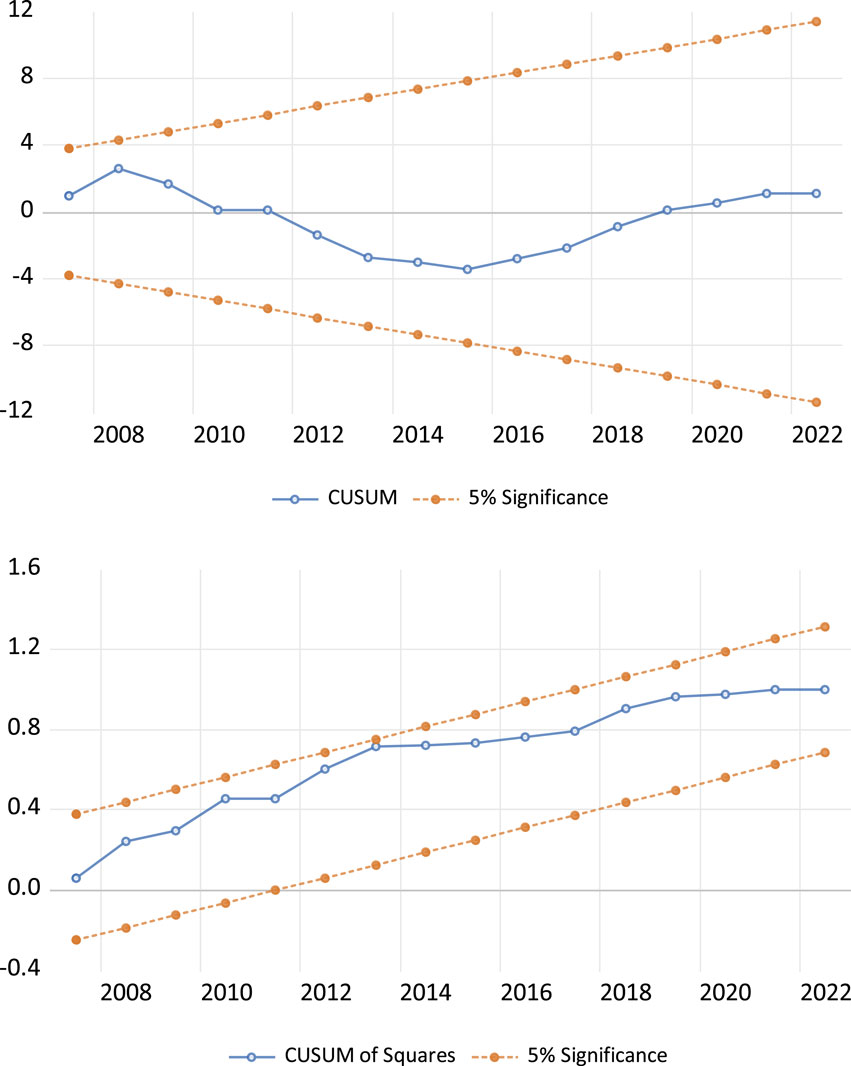

The CUSUM and CUSUM Square tests were employed to assess the stability of the model and the variance of residuals for both China (as shown in Figure 5) and the United States (as shown in Figure 6). The results reveal that in both countries, the CUSUM line remains within the critical bounds throughout the sample period, indicating the absence of significant structural breaks or shifts in the relationship between the variables and natural resource extraction. This suggests that the dynamics influencing natural resource extraction, such as trade openness, financial depth, environmental taxes, and renewable energy consumption, have remained stable over time. Additionally, the CUSUM Square line for both countries stay within the bounds, indicating that the volatility of the model’s residuals is stable and there are no significant changes in the error variance. This stability implies that the model’s error terms have remained consistent, further reinforcing the reliability and robustness of the model. Therefore, the CUSUM and CUSUM Square tests support the validity of the model in both China and the United States, demonstrating that the analysed factors have continuously shaped natural resource extraction without substantial disruptions or volatility fluctuations during the study period.

4 Conclusion and policy recommendations

This study provides robust empirical evidence on the asymmetric effects of financial depth, environmental tax, trade openness, and renewable energy consumption on natural resource extraction in China and the United States. By employing the Nonlinear Autoregressive Distributed Lag (NARDL) model with structural break adjustments, the findings reveal both short- and long-term dynamics that vary across countries and policy instruments. Financial depth and trade openness consistently drive resource extraction in both nations, though with stronger long-run effects in China. Environmental taxes significantly curb extraction, especially in the U.S., while renewable energy consumption, though negatively associated with resource use, exhibits limited statistical significance in the long run. The impulse response analysis further highlights the asymmetric nature of shocks, emphasizing the need for differentiated policy responses to positive and negative economic signals. Overall, the results underscore the importance of adopting integrated, adaptive, and country-specific policy frameworks that align economic development with environmental sustainability. These insights are crucial for informing national strategies and international cooperation aimed at achieving long-term sustainable resource governance.

4.1 Policy recommendations

The findings of this study yield several important policy recommendations to support the sustainable management of natural resources in both China and the United States.

First, financial systems play a pivotal role in shaping natural resource extraction. The dynamic impulse responses reveal that positive shocks to financial depth result in sustained increases in resource use, while negative shocks yield only modest reductions. This asymmetric response underscores the need for strong financial governance. In China, where financial depth exerts a more pronounced long-term influence, it is essential to align financial expansion with environmental safeguards—such as green credit lines, sustainability-linked bonds, and performance-based subsidies—to steer capital toward sustainable technologies. In the U.S., promoting green financing instruments, enhancing disclosure standards, and integrating sustainability risk assessments into financial decision-making can help mitigate environmentally harmful investment flows.

Second, trade openness significantly increases resource extraction over time, especially following positive trade shocks. Given this, both countries should embed environmental safeguards into trade agreements, including carbon border adjustments and sustainable sourcing standards. Encouraging trade in green technologies and circular economy solutions can help decouple trade growth from resource depletion.

Third, the study confirms that environmental taxes are highly effective in curbing natural resource extraction, with the impulse response results showing strong and persistent negative effects of positive tax shocks. This indicates that strengthening environmental tax—such as pollution taxes, resource extraction levies, or carbon pricing—can serve as a powerful tool for discouraging unsustainable practices. For the U.S., maintaining and tightening current environmental tax structures is crucial, while for China, expanding the tax base and improving enforcement mechanisms will enhance regulatory effectiveness.

Fourth, while renewable energy consumption reduces resource extraction in the short term, its long-term impact remains limited, suggesting that clean energy deployment alone is insufficient without structural changes in energy consumption patterns. Policymakers should prioritize scaling up renewable infrastructure, integrating renewables into energy-intensive sectors, and providing targeted incentives to industries that adopt clean energy alternatives.

Moreover, the interaction of structural breaks with key variables (e.g., the global financial crisis in 2008 for China and the COVID-19 pandemic in 2020 for the U.S.) illustrates the sensitivity of natural resource management to external shocks. This highlights the need for resilient, adaptive policy frameworks that anticipate and buffer against global disruptions while staying aligned with sustainability goals.

Ultimately, policymakers must pursue integrated, asymmetric policy frameworks that account for both the magnitude and direction of economic shocks. The results clearly show that financial depth, trade openness, environmental taxes, and renewable energy exert nonlinear and time-varying effects on natural resource extraction. Therefore, dynamic and responsive governance strategies are required to balance economic growth with ecological preservation.

These recommendations also support the achievement of multiple Sustainable Development Goals (SDGs):

• SDG 8 (Decent Work and Economic Growth) through green financial systems,

• SDG 12 (Responsible Consumption and Production) via environmentally conscious trade policies,

• SDG 13 (Climate Action) by strengthening environmental tax frameworks, and

• SDG 7 (Affordable and Clean Energy) by promoting renewable energy transitions.

By adopting these forward-looking strategies, China and the United States can not only enhance their natural resource governance but also contribute meaningfully to global sustainability targets.

5 Limitations and future research directions

Future research could explore the intricate relationships among financial depth (FND), natural resource extraction (NRE), renewable energy consumption (REN), environmental tax (ENT), and trade openness (TRO) across a broader range of countries, opening several promising avenues for investigation. Incorporating more recent and granular data would enable a more accurate evaluation of trends and future projections. A deeper understanding could also be achieved by considering additional factors such as technological innovation, geopolitical dynamics, and climate change legislation. Sector-specific assessments of resource extraction and analyses of regional disparities within countries like China and the United States could yield even more comprehensive insights. Furthermore, future studies could benefit from comparing the effectiveness of different policy frameworks—such as cap-and-trade systems versus carbon taxes—in managing resource exploitation. Employing advanced econometric techniques, including machine learning algorithms and structural equation modeling (SEM), would allow researchers to better capture complex nonlinear relationships. Additionally, examining the resilience and adaptive capacities of the U.S. and China to external shocks, particularly focusing on shifts in financial sector behavior and policy responses, would provide valuable perspectives. Finally, investigating the role of international organizations and global financial institutions in shaping national resource management policies could enrich the global dimension of this research. Overall, pursuing these directions would offer deeper insights into the interconnectedness of NRE, FND, ENT, TRO, and REN, and help formulate policy recommendations that better align national strategies with the Sustainable Development Goals (SDGs).

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZZ: Formal Analysis, Funding acquisition, Investigation, Resources, Supervision, Visualization, Writing – review and editing. YZ: Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

The authors would like to acknowledge the use of ChatGPT for language editing in improving the clarity of the manuscript. The use of ChatGPT was limited to language-related tasks, and the content and conclusions of the study remain solely the responsibility of the authors.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, S., Xu, D., Yuna, G., Hussain, J., Abbas, H., and Rafique, K. (2024). The contribution of resource-based taxation, green innovation, and minerals trade toward ecological sustainability in resource-rich economies. Resour. Policy 93, 105092. doi:10.1016/j.resourpol.2024.105092

Al Mamun, M., Boubaker, S., and Nguyen, D. K. (2022). Green finance and decarbonization: evidence from around the world. Finance Res. Lett. 46, 102807. doi:10.1016/j.frl.2022.102807

Bashir, M., Benjiang, M., Shahbaz, M., and Shahzad, U. (2021). Unveiling the heterogeneous impacts of environmental taxes on energy consumption and energy intensity: empirical evidence from OECD countries.

Beck, T., Demirgüç-Kunt, A., and Levine, R. (2007). Finance, inequality and the poor. J. Econ. Growth 12 (1), 27–49. doi:10.1007/s10887-007-9010-6

Chen, H., Yi, J., Chen, A., Peng, D., and Yang, J. (2023). Green technology innovation and CO2 emission in China: evidence from a spatial-temporal analysis and a nonlinear spatial durbin model. Energy Policy 172, 113338. doi:10.1016/j.enpol.2022.113338

Chen, Q. (2024). From concept to capital: investigating the influence of green innovation on equity financing in BRICS economies. Int. Rev. Financial Analysis 93, 103233. doi:10.1016/J.IRFA.2024.103233

Chen, Y., Li, Q., and Liu, J. Y. (2024). Innovating sustainability: VQA-based AI for carbon neutrality challenges. J. Organ. End User Comput. 36, 1–22. doi:10.4018/JOEUC.337606

Chien, F. S., Hsu, C. C., Moslehpour, M., Sadiq, M., Tufail, B., and Ngo, T. Q. (2023). A step toward sustainable development: the nexus of environmental sustainability, technological advancement and green finance: evidence from Indonesia. Environ. Dev. Sustain. 26, 11581–11602. doi:10.1007/s10668-023-03424-5

Coats, A. W., and Ricardo, D. (1973). The principles of political economy and taxation. Econ. Hist. Rev. 26 (4), 723. doi:10.2307/2593726

Dickey, D. A., and Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49 (4), 1057. doi:10.2307/1912517

He, J., and Deng, Z. (2023). Revisiting natural resources rents and sustainable financial development: evaluating the role of mineral and forest for global data. Resour. Policy 80, 103166. doi:10.1016/j.resourpol.2022.103166

Hu, F., Mou, S., Wei, S., Qiu, L., Hu, H., and Zhou, H. (2024a). Research on the evolution of China’s photovoltaic technology innovation network from the perspective of patents. Energy Strategy Rev. 51, 101309. doi:10.1016/j.esr.2024.101309

Hu, F., Qiu, L., Wei, S., Zhou, H., Bathuure, I. A., and Hu, H. (2023). The spatiotemporal evolution of global innovation networks and the changing position of China: a social network analysis based on cooperative patents. R&D Manag. 54, 574–589. doi:10.1111/radm.12662

Hu, F., Shi, X., Wei, S., Qiu, L., Hu, H., Zhou, H., et al. (2024b). Structural evolution and policy orientation of China’s rare earth innovation network: a social network analysis based on collaborative patents. Pol. J. Environ. Stud. doi:10.15244/pjoes/174511

Jiang, C., Wang, Y., Yang, Z., and Zhao, Y. (2023). Do adaptive policy adjustments deliver ecosystem-agriculture-economy co-benefits in land degradation neutrality efforts? Evidence from southeast coast of China. Environ. Monit. Assess. 195 (10), 1215. doi:10.1007/s10661-023-11821-6

Khan, I., Hou, F., and Le, H. P. (2021). The impact of natural resources, energy consumption, and population growth on environmental quality: fresh evidence from the United States of America. Sci. Total Environ. 754, 142222. doi:10.1016/J.SCITOTENV.2020.142222

Korcheva, A. (2022). “United nations environment programme finance initiative,” in Encyclopedia of sustainable management. doi:10.1007/978-3-030-02006-4_1022-1

Li, L. (2023). Commodity prices volatility and economic growth: empirical evidence from natural resources industries of China. Resour. Policy 80, 103152. doi:10.1016/j.resourpol.2022.103152

Li, L., Xia, Y., Ren, S., and Yang, X. (2024a). Homogeneity pursuit in the functional-coefficient quantile regression model for panel data with censored data. Stud. Nonlinear Dyn. and Econ. doi:10.1515/snde-2023-0024

Li, X., Wang, F., Al-Razgan, M., Mahrous Awwad, E., Zilola Abduvaxitovna, S., Li, Z., et al. (2023). Race to environmental sustainability: can structural change, economic expansion and natural resource consumption effect environmental sustainability? A novel dynamic ARDL simulations approach. Resour. Policy 86, 104044. doi:10.1016/j.resourpol.2023.104044

Li, Y., Qian, K., Wang, Z., and Xu, A. (2024b). The evolution of China’s wind power industry innovation network from the perspective of multidimensional proximity. Technol. Analysis and Strategic Manag., 1–15. doi:10.1080/09537325.2024.2405145

Liu, K., Luo, J., Faridi, M. Z., Nazar, R., and Ali, S. (2025). Green shoots in uncertain times: decoding the asymmetric nexus between monetary policy uncertainty and renewable energy. Energy and Environ. doi:10.1177/0958305X241310198

Mirshojaeian Hosseini, H., and Kaneko, S. (2011). Dynamic sustainability assessment of countries at the macro level: a principal component analysis. Ecol. Indic. 11 (3), 811–823. doi:10.1016/J.ECOLIND.2010.10.007

Mtar, K., and Belazreg, W. (2023). On the nexus of innovation, trade openness, financial development and economic growth in European countries: new perspective from a GMM panel VAR approach. Int. J. Finance Econ. 28 (1), 766–791. doi:10.1002/IJFE.2449

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57 (6), 1361. doi:10.2307/1913712

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 16 (3), 289–326. doi:10.1002/JAE.616

Piętak, Ł. (2014). Review of theories and models of economic growth. Comp. Econ. Res. Central East. Eur. 17, 45–60. doi:10.2478/cer-2014-0003

Qiao, G., Chen, H., Li, G., Liu, H., and Wang, X. (2024). The role of filial piety in filial tourism: an intergenerational analysis of decision-making. Asia Pac. J. Tour. Res. 29 (8), 1017–1031. doi:10.1080/10941665.2024.2362199

Razmi, S. F., Ramezanian Bajgiran, B., Behname, M., Salari, T. E., and Razmi, S. M. J. (2020). The relationship of renewable energy consumption to stock market development and economic growth in Iran. Renew. Energy 145, 2019–2024. doi:10.1016/j.renene.2019.06.166

Ren, Y., Zhang, J., and Wang, X. (2024). How does data factor utilization stimulate corporate total factor productivity: a discussion of the productivity paradox. Int. Rev. Econ. and Finance 96, 103681. doi:10.1016/j.iref.2024.103681

Sollis, R. (2009). A simple unit root test against asymmetric STAR nonlinearity with an application to real exchange rates in Nordic countries. Econ. Model. 26 (1), 118–125. doi:10.1016/j.econmod.2008.06.002

Sun, Y., Wang, S., and Xing, Z. (2023). Do international trade diversification, intellectual capital, and renewable energy transition ensure effective natural resources management in BRICST region, 81.103429

Wang, Y., and Luo, J. (2025). Effect and challenge of credit guarantee plan in financing of small enterprises. Singap. Econ. Rev. doi:10.1142/S0217590825490116

Wu, H. (2022). Trade openness, green finance and natural resources: a literature review. Resour. Policy 78, 102801. doi:10.1016/j.resourpol.2022.102801

Xu, A., Wang, W., and Zhu, Y. (2023). Does smart city pilot policy reduce CO2 emissions from industrial firms? Insights from China. J. Innovation Knowl. 8, 100367. doi:10.1016/j.jik.2023.100367

Zhang, M., Zhang, D., and Yang, Y. (2023a). Green bond and trade openness effects on sustainable business practices in natural resource markets. Resour. Policy 86, 104188. doi:10.1016/j.resourpol.2023.104188

Zhang, S., Li, X., Zhang, C., Luo, J., Cheng, C., and Ge, W. (2023b). Measurement of factor mismatch in industrial enterprises with labor skills heterogeneity. J. Bus. Res. 158, 113643. doi:10.1016/j.jbusres.2023.113643

Zhang, S., Zhang, C., Su, Z., Zhu, M., and Ren, H. (2023c). New structural economic growth model and labor income share. J. Bus. Res. 160, 113644. doi:10.1016/j.jbusres.2023.113644

Zhang, Y., and Dilanchiev, A. (2022). Economic recovery, industrial structure and natural resource utilization efficiency in China: effect on green economic recovery. Resour. Policy 79, 102958. doi:10.1016/j.resourpol.2022.102958

Keywords: financial depth, resource extraction, environmental taxes, renewable energy, sustainable resource management, NARDL

Citation: Zhang Z and Zhou Y (2025) Economic growth vs environmental sustainability: examining resource extraction in the World’s largest economies. Front. Environ. Sci. 13:1586619. doi: 10.3389/fenvs.2025.1586619

Received: 03 March 2025; Accepted: 13 May 2025;

Published: 20 May 2025.

Edited by:

Faik Bilgili, Erciyes University, TürkiyeReviewed by:

Utku Utkulu, Dokuz Eylül University, TürkiyeMiguel Angel Yepez Peña, Andean University of Cusco, Peru

Copyright © 2025 Zhang and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yanqi Zhou, ZmFkaWFzdW1yZWVucHVAZ21haWwuY29t

Zhaojin Zhang1

Zhaojin Zhang1 Yanqi Zhou

Yanqi Zhou