- 1Institute of Finance and Economics, Central University of Finance and Economics, Beijing, China

- 2AVIC China Aero-Polytechnology Establishment, Beijing, China

- 3College of Statistics and Mathematics, Hebei University of Economics and Business, Shijiazhuang, China

- 4Center for Urban Sustainability and Innovation Development (CUSID), Hebei University of Economics and Business, Shijiazhuang, China

The power shortages directly affect the production behavior of firms. The study utilizes a city-specific index of power shortage and a comprehensive database of listed firms in China to investigate the correlation between power shortages and firm CO2 emissions. Empirical results indicate a significant positive relationship between power shortages and firm CO2 emissions, alongside a noted decline in the extent of technological innovation among listed firms and a negative impact on their resource allocation. Further analysis shows that power shortage significantly contributes to the CO2 emissions of non-state-owned firms, non-heavily polluting firms and firms located in areas with high carbon-intensive energy use and fiscal expenditure pressure. These findings are robust across various sensitivity analyses and address concerns regarding endogeneity. Hence, policymakers are advised to take into account the influence of power shortages on CO2 emissions of listed firms, beyond their traditionally recognized adverse effects on economic operations. As frontrunners in China’s low-carbon transition, listed firms should strengthen risk resilience while driving technological innovation and resource optimization, thereby establishing operational paradigms for small and medium - sized firms to emulate.

1 Introduction

The provision of electricity supply is a crucial aspect of infrastructure and an essential input for production in most firms. Nevertheless, in emerging economies, a vast number of individuals and firms continue to endure frequent power shortages and fluctuations in voltage due to insufficient capacity and inadequate infrastructure (Farquharson et al., 2018). Data from the World Bank indicates that more than 30% of firms identify the stability of power provision as the paramount factor influencing their manufacturing processes (World Bank, 2021). Furthermore, over 13.6% of firms surveyed between 2006 and 2017 reported power shortages, which have been estimated to cost businesses in developing nations up to $82 billion in annual losses (Asiedu et al., 2021). Existing research indicates that power supply interruptions cause at least $4.5 billion (1.7% of Pakistan’s GDP) in losses annually (Samad and Zhang, 2018). Power shortages exerted substantial macroeconomic impacts, manifesting as a 7% contraction in real GDP growth and a 48% depreciation in fixed capital formation relative to baseline projections in Nepal (Timilsina and Steinbuks, 2021). Even in a developing country like China, which has achieved notable success in the electricity sector, the issue of power shortages has re-emerged in recent years (Guo et al., 2023). Since the beginning of the 21st century, China has encountered three distinct phases of power shortages, with each additional power supply interruption resulting in economic losses up to 1.44 billion yuan (Chen et al., 2022). The 2022 power shortages across China’s Chongqing, Sichuan, Hubei, Anhui and Zhejiang provinces, municipality resulted from three primary drivers, supply-demand imbalances, policy decisions and structural constraints in generation capacity. Meteorological extremes, particularly record-breaking summer heatwaves and prolonged drought, critically compromised regional electricity supply systems during peak demand periods (Guo et al., 2023).

China has repeatedly faced incidents of power shortages, hindering the progress of its “dual carbon” goals. Emissions of greenhouse gases such as CO2 have caused environmental issues that have attracted global attention. Being the globe’s predominant source of carbon emissions, China has clearly delineated a strategy to reach its peak carbon output and attain carbon neutrality. Electricity supply’s reliability and accessibility are pivotal to fostering superior economic growth, bolstering societal wellbeing, and promoting a transition to a low-carbon energy system (Lin, 2022). As core enablers of socioeconomic progress, investments in electrical grids and energy utilization dynamics significantly stimulate industrial expansion and technological innovation. Concurrently, maintaining grid stability and ensuring uninterrupted electricity provision emerge as vital prerequisites for achieving sustainable economic restructuring, optimizing public service systems, and accelerating ecological civilization construction (Shi et al., 2021).However, the escalating grid integration of renewable energy sources, coupled with intensifying extreme meteorological phenomena and climate change-induced extreme output deficit scenarios in climate-vulnerable wind-solar hybrid systems (Zheng et al., 2024), have collectively compromised the operational stability of China’s power networks, precipitating regional electricity supply-demand imbalances. In the first half of 2021, China experienced the most severe electricity crisis in nearly a decade, with Over half of the nation’s provinces are experiencing electricity allocation measures. Scholarly investigations have systematically categorized CO2 emission determinants into three operational dimensions, technological parameters encompassing innovation capacity and infrastructure modernization (Li et al., 2011), (Ganda, 2019); structural determinants involving energy mix composition and sectoral economic distribution (Sun and Huang, 2022), (Zhao et al., 2022); scale-related elements covering macroeconomic output and demographic expansion (Dong et al., 2018). Current empirical analyses predominantly concentrate on multi-tier examinations across national, provincial, municipal, and industrial levels. As the main participants in carbon emissions, research on the micro-level of listed firms is relatively limited.

Although previous research has analyzed the effects of power shortages on firm performance (Bao et al., 2024), their influence on listed firm low-carbon energy transition remains uncertain (Allcott et al., 2016). Confronted with power shortages, some listed firms may augment their reliance on carbon-intensive energy sources or procure backup generators to maintain uninterrupted production through self-generation. It is anticipated that listed firms’ strategies in response to power shortages will affect their CO2 emissions, a concern that is escalating in significance within the context of most developing nations where grid reliability often correlates with industrialization stages. Our study is driven by the need to assess the potential and manner in which power shortages might impact CO2 emissions of listed firms, extending prior single-country analyses to comparative institutional frameworks.We initially utilized an annual indicator of power shortages in China constructed by Guo et al. (2023). Furthermore, due to data availability, we merged this indicator with information from the listed firms database in China. Beyond establishing correlation between power shortages and CO2 emissions at the firm level through instrumental variable analysis, this study further examines the hypothesized mechanisms underlying this relationship.

The aim of this study is to emphasize the environmental impacts of power shortages and to highlight the environmental factors that listed firms, as “pioneers” of economic development, should prioritize, thereby setting an example for other small and micro firms. We initiate our analysis with an annual city-level index of power shortages in China. Subsequently, we integrate this index with data from the China Listed Firms Annual Report Database spanning 2000 to 2020 due to the data constraints. Beyond pinpointing the correlation between power shortages and firms’ CO2 emissions utilizing an instrumental variable method, we also explore the potential mechanisms. Despite this study being rooted in China’s unique institutional context, it is globally relevant for three key reasons. Firstly, as the world’s second-largest economy, China is undergoing a critical transformation in carbon emission governance, providing an ideal institutional laboratory for research on firm carbon emissions. The government’s “dual carbon” commitment has created a unique policy environment where practical power shortages and institutional top-down carbon emission governance interact, offering insights for both developed and emerging markets. Secondly, China has over 5,300 A-share listed companies and the second-largest total market value globally, and their carbon emission performance has a significant impact on the global market. Thirdly, as power shortages are a common challenge faced by developing countries, China’s remedial experience based on its local power shortage situation can provide transferable lessons for other developing countries.

The marginal contributions of this paper are delineated below: Firstly, this study leverages a unique dataset of listed firms’ operational and emissions records to empirically examine the understudied link between power shortages and firm CO2 emissions. By focusing on China’s “prioritizing large firms” environmental policy, we provide systematic evidence that institutional selectivity strengthens the reliability of emissions assessments in regulated firms. Secondly, the identification strategy innovatively addresses endogeneity concerns by employing the number of high-temperature days (D_High_Tem) and cooling degree days (CDD) as instrumental variables. These climate-driven instruments capture exogenous variations in regional power grid stress, isolating the causal effect of electricity shortages from confounding policy interventions. Lastly, the heterogeneity framework systematically disentangles how institutional and structural factors mediate firm responses. The study develops a novel stratification approach that jointly examines firm-level characteristics (ownership type, pollution intensity) and regional disparities (energy structure and fiscal capacity). This methodology reveals how power shortages interact with China’s unique institutional landscape to produce divergent emission trajectories, providing a template for analyzing energy-environment nexuses in regulated firms.

The ensuing organization of this manuscript is as follows: Section 2 establishes the theoretical framework and formulates research hypotheses; Section 3 outlines the methodological framework; Section 4 describes the selection of variables and sources of data; Section 5 conducts an empirical examination; Section 6 deepens the analysis with supplementary explorations; and Section 7 synthesizes the conclusions and the evidence-based policy recommendations.

2 Theoretical review and research hypotheses

2.1 Theoretical review

As electricity serves a pivotal role in firm production processes, power shortages are likely to have profound consequences on the manufacturing activities of firms (Freeman et al., 2020). An expanding corpus of studies have delved into the repercussions of power shortages on firm efficiency and the strategies employed by businesses to manage inconsistent electrical availability across different nations (Grainger and Zhang, 2019). These studies have revealed that power shortages exert negative influences on firm performance across several key metrics, including productivity (Abdisa, 2018), sales (Allcott et al., 2016) through disrupted supply chain coordination, employees (Alby et al., 2013) via reduced shift scheduling flexibility, and financial metrics such as revenues and profits (Hardy and McCasland, 2021) owing to emergency energy procurement costs. Notably, Guo et al. (2023) constructed a city-level power shortage index in China, revealing a significant adverse effect on firms’ overall efficiency. Discovered that firms encountering power shortages faced a substantial reduction in the probability of engaging in export activities due to compromised compliance with international delivery timelines, with firms experiencing power shortages being 9%–13% less likely to enter the export market. Allcott et al. (Allcott et al., 2016) demonstrated the substantial effects of power shortages on Indian manufacturers’ critical business metrics, revealing 5%–10% contractions in both revenue streams and producer surplus. Parallel observations emerge from Southeast Asia, where Elliott et al. (Elliott et al., 2021) quantified the economic repercussions of grid instability in Vietnam, identifying a linear relationship where each 1% increment in service interruptions corresponds to 0.73% manufacturing revenue decline amplified by foreign investor risk aversion. Empirical data from Bhattacharyya et al. (2021) demonstrate that a 1% increment in electricity supply deficits across U.S. power systems during the 1997-2019 period manifested as quantifiable macroeconomic impacts, inducing GDP losses valued at USD 11.6 billion. Concurrently, Growitsch et al. (Growitsch et al., 2015) conducted systematic economic impact quantification of German power infrastructure failures, revealing an average hourly economic damage of EUR 430 million per outage event.

Although the the effects of power shortages on firm operational outcomes and strategic responses have received considerable scholarly attention, the influence on firms’ environmental performance, such as the impact on carbon dioxide emissions, remains overlooked in the existing literature. Current research has examined the factors influencing firm CO2 emissions from various perspectives, including both internal and external dimensions. Internally, (Wang Z. et al., 2023) examined that a firm’s political ties have a positive influence on its aggregate CO2 emissions. Alam et al. (2019) using large datasets from the G6 countries discovered that firms’ investments in eco-friendly research and development particularly in clean production technologies are correlated with a reduction in CO2 emissions. Lee and Min (2015) conducted systematic analyses leveraging comprehensive firm-level datasets spanning corporate entities across G6 nations and Japan, demonstrating that green research and development (R&D) investments exhibit a statistically significant mitigating effect on CO2 emission intensity. Externally, (Yu J. et al., 2021) observed that firms in China tend to rely on inexpensive and polluting fossil fuels as a strategy to address escalating economic policy uncertainty, consequently enhancing their CO2 emissions. Zhou et al. (2022) assessed the efficacy of China’s low-carbon pilot city initiative on firm energy conservation practices through mandated energy audits and smart grid investments, discovering that it led to a notable decrease in firm coal usage. Liu et al. (2021) conducted empirical analysis on how China’s evolving sustainability policy framework influenced firm environmental practices. Their study revealed that institutionalizing emission control benchmarks within strategic planning documents combined with cross-ministerial enforcement mechanisms induced measurable decarbonization effects, with carbon intensity metrics declining by 2.37 percentage points across domestic firms during the 2008-2011 period.

However, research on firm carbon emissions has overlooked the unique institutional realities of listed firms in regulated economies such as China. As the “pacesetters” among numerous Chinese firms, the CO2 emissions of listed firms will significantly impact the achievement of China’s “dual carbon” goals. China’s environmental regulation of listed firms is in line with its “focus on the big, leave the small” approach. Piotroski et al. (2015) argued that China’s unique economic system endows listed firms with inherent political advantages particularly in accessing green financing through state-owned banks’ carbon transition funds. Compared to small and micro firms, listed firms face greater pressure to reduce carbon emissions. Qu et al. (2013) believed that to ensure the stable operation of the national economy amid energy security constraints, listed firms may be prioritized for rectification as environmental governance issues become increasingly important. For example, the majority of firms on the national key supervision list are listed firms. Du and Li (2020) analyzed industrial decarbonization trajectories through comprehensive firm-level data, identifying significant CO2 mitigation effects from China’s pollution control frameworks. This consensus, however, faces theoretical challenges from the “green paradox” hypothesis (Sinn, 2008), which posits counterproductive outcomes from premature climate interventions like accelerated fossil extraction before policy enforcement. Smulders et al. (2012) argued that imposing a carbon tax would lead to the “green paradox” effect, stimulating firms to consume fossil fuels and increase carbon emissions during the transition period. Zhang et al. (2021a) empirically validated this phenomenon within China’s regulatory context, identifying persistent green paradox manifestations in current policy implementations.

Although existing literature has extensively analyzed both the operational impacts of power shortages and the determinants of firm CO2 emissions, critical blind spots remain at their intersection. Prior studies overlook how electricity constraints interact with China’s unique regulatory framework, specifically the “focus on the big, leave the small” environmental governance paradigm, to shape emission trajectories of listed firms. These firms face a dual institutional reality: stringent emissions monitoring and coal usage restrictions contrast with preferential access to grid resources, creating adaptation strategies distinct from those of small firms. The research gap is evident where prior investigations into the drivers of Chinese listed firms’ CO2 emissions have overlooked the potential influence of power shortages. To address this gap, we utilize a city-level index of power shortages in China to examine the effects on Chinese Listed firm CO2 emissions. This paper seeks to broaden our understanding of the additional adverse consequences of power shortages in developing economies and emphasizes the necessity for policymakers to ensure a stable power supply.

2.2 Hypotheses

Reviewing previous studies (Farquharson et al., 2018), (Guo et al., 2023), (Yu J. et al., 2023), we find that power shortages can affect the decision-making of listed firms in various aspects. The resulting performance and strategies further influence the CO2 emissions of listed firms. Although no study has directly examined the direct impact of power shortages on the CO2 emissions of listed firms, based on previous research, we can still propose several pathways through which power shortages affect the CO2 emissions of listed firms.

The impact of power shortages on energy usage has attracted significant scholarly interest and has been scrutinized across diverse national settings. Driven by power shortages, businesses have turned to supplementary fossil fuels such as coal, petroleum and natural gas. The combustion of coal for electricity production is relatively more carbon-intensive than that of natural gas or petroleum. Consequently, this leads to reduced efficiency in firm energy consumption and increased CO2 emissions. Qiu et al. (2021) utilized a panel data set from urban areas in China spanning from 2003 to 2017 applying difference-in-differences analysis on low-carbon pilot cities to evaluate the efficacy of policies in reducing urban emissions. Their research revealed that energy consumption is a pivotal factor in the mechanisms underlying emission reductions. Abbasi et al. (2022) analyzed the interaction between fossil fuels, renewables and GDP from 1980 to 2018 using cutting-edge ARDL and Frequency Domain methods to disentangle long-run cointegration versus short-term adjustments. Their data show that fossil fuels notably boost CO2 emissions, with cost-effective fossil fuels being a key factor in emission increases particularly in deregulated energy markets. Yu et al. (2021a) used CTSD data from 2008 to 2011 to explore firms’ emission reduction mechanisms. They concluded that the reliance on inexpensive fossil fuels significantly drives carbon emissions, with energy-intensive operations directly increasing environmental impacts. Alam et al. (2022) revealed U.S. firms with greater cash reserves demonstrate lower emissions, as enhanced financial capacity enables renewable energy adoption and carbon mitigation investments rather than reliance on high-emission energy sources. Zhang et al. (2021b) analyzed China’s 2016 Energy Consumption Permit Trading Scheme’s efficacy using 2006–2019 panel data from 30 provinces.Their research indicates that curtailing energy consumption with high carbon emission is a critical pathway to meeting carbon emission reduction targets. Following the preceding analysis, we introduce our initial hypothesis:

Hypothesis 1. Power shortage has a significant positive impact on listed firm CO2 emissions.

Empirical evidence suggests that power shortages have a detrimental effect on firms’ financial performance, leading to credit constraints among affected firms as reflected in increased loan rejection rates from commercial banks. Based on liquidity theory, it is hypothesized that increased credit constraints could reduce a firm’s capacity for innovation, compromise its market competitiveness, and diminish production efficiency. Consequently, firms may confront funding deficiencies that impede investment in technological advancements, creating a self-reinforcing cycle of energy inefficiency (Zhang et al., 2017). However, studies have also shown that increased investment in technology innovation particularly through public-private R&D partnerships has a positive impact on reducing CO2 emissions in both developed and developing countries (Ma et al., 2022). Specifically, technological advancements in low-carbon emissions contribute to the optimization of industrial production and environmental quality through the reduction of CO2 emissions (Hailemariam et al., 2022). Zhang et al. (2024) analyzed China’s CO2 emission trends from 2000 to 2013, finding that key environmental regulations effectively reduced industrial carbon outputs. In a provincial-level study covering 2000-2016, (Huang et al., 2020) quantified how technological upgrades in pollution control systems decreased CO2 emissions across manufacturing sectors. Their research indicates that environmental technological innovations in adjacent regions significantly contribute to the reduction of CO2 emissions. Ouyang et al. (2020) explored the effects of environmental regulation on firm innovation applying patent citation network analysis. The study indicates that firms can lower pollution costs by enhancing their engagement in technological innovation. Liu et al. (2021) used data from the Chinese Tax Survey Database between 2008 and 2011 and identified that augmented investment in technological innovation measured by software copyright acquisitions serves as a sustainable strategy for firms to attain energy efficiency and reduce CO2 emissions. Petrović and Lobanov (2020) found that between 1981 and 2014, for every 1% increase in R&D investment, CO2 emissions in Organisation for Economic Co-operation and Development countries decreased by an average of 0.09%–0.15% with stronger effects in energy-intensive industries.In the United States, recurring electricity supply deficits have compelled numerous corporations to reconfigure production strategies or procure standalone generation equipment. Empirical studies substantiate that enterprise adoption of independent power generators not only elevates operational costs and diminishes profit margins, but also induces statistically significant crowding-out effects on R&D investments (Reinikka and Svensson, 2002), thereby constraining innovation capacity and productivity enhancement.

Hypothesis 2a. Power shortages can influence Listed firms’ CO2 emissions through the technological innovation.

The “Porter Hypothesis” suggests that promoting technological innovation or adopting advanced technologies can ultimately enhance a firm’s productivity, compensating for environmental investment costs while improving market profitability. Empirical evidence shows that power shortages substantially reduce total factor productivity (TFP), which is one of a critical determinant of CO2 emission reduction, as technological progress enhances energy efficiency and pollution control capabilities. Ladu and Meleddu (2014) demonstrate that higher TFP optimizes resource allocation and decreases energy consumption in Italy from 1996 to 2008. Amri (2018) identifies TFP growth as a key mechanism for curbing CO2 emissions on Tunisia from 1975 to 2014. In emerging economies, (Altinoz et al., 2021) analyses reveal dynamic relationships between digital technologies, TFP, and carbon emissions. The analysis results show that increased total factor productivity has a negative effect on total CO2 emissions. Yu et al. (2023a) and Yu et al. (2023b) have illustrated that the effects of the energy trilemma on TFP markedly enhance the potential for fostering collaborative low-carbon economies and the advancement of sustainable energy practices. Zhang et al. (2024) argue that both total factor productivity and green total factor productivity positively influence the transition to clean energy. In advanced economies, the beneficial effect of TFP on the transition to clean energy exceeds that of TFP. Their longitudinal analysis of OECD countries reveals that while conventional TFP improvements predominantly enhance energy efficiency, GTFP specifically drives renewable technology adoption. Ansari et al. (2022) indicate that a slowdown in TFP growth may increase output that results in higher CO2 emissions, a phenomenon particularly evident in developing economies where environmental regulations are less stringent. Yang et al. (2022) have demonstrated that enhancements in total factor productivity within a specific region can exert a notably significant suppressive impact on CO2 emissions. Therefore, when facing power shortages firms may escalate their reliance on fossil fuels as a proxy for electricity, consequently augmenting CO2 emissions through the mechanism of energy intensity. Wang et al. (2023a) employed a GMM model to assess the correlation between electricity usage and TFP among Belt and Road Initiative (BRI) nations over the period 2000-2021. Since electricity is an essential factor of production, power shortages will decrease a firm’s TFP. Fried and Lagakos (2020) demonstrated that electricity shortages exert significant negative effects on enterprise productivity in both short-term and long-term contexts, with the long-term adverse impact being five times greater than the short-term consequences. Based on the findings of recent studies, the following hypothesis is proposed:

Hypothesis 2b. Power shortages can influence firms’ CO2 emissions through the total factor productivity (TFP) channel.

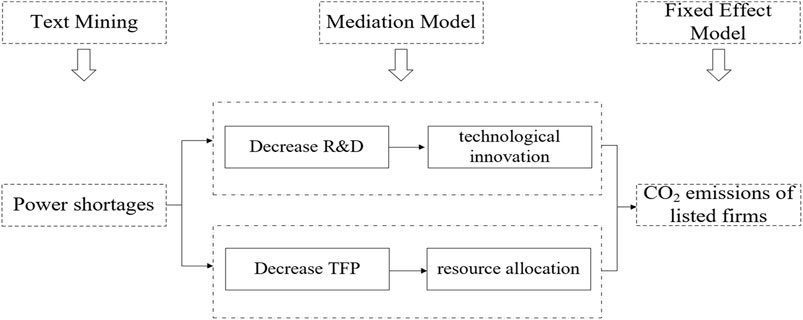

The logic diagram of this paper is illustrated in Figure 1.

3 Methodology

To identify the causal effect of power shortages on listed firm CO2 emissions, this study employs a two-way fixed effects panel regression model, which controls for unobserved heterogeneity across firms and time-invariant confounders. The baseline specification is formalized as Equation 1:

where

4 Variable selection and data sources

4.1 Variable selection

Explained variables: The explained variable in this study is the natural logarithm of firm CO2 emissions (LNCO2). We handle CO2 emissions as follows.

First, we obtain the total CO2 emissions of each firm by multiplying each firm’s actual consumption of various types of energy (such as oil, coal, and electricity) by their respective emission factors.

Electricity emission factors fluctuated between 0.797 and 1.278 kgCO2/kg during 2008–2015, reflecting annual adjustments in regional power grid structures documented by China’s National Bureau of Statistics, while fixed factors were used for coal (1.9003 kgCO2/kg) and oil (3.0202 kgCO2/kg) (Qian et al., 2021). Second, we employ the log-transformed total CO2 emissions as the primary dependent variable to mitigate scale effects in regression analysis.

Core explanatory variables:The key explanatory variable is the city-level power shortage index based on 20 text analysis keywords (PS20), constructed using the methodology proposed by Guo et al. (2023), Yu et al. (2023b).

The city-level power shortage index is constructed through the following steps:

(i) Collect news reports from city-specific daily newspapers across China.

(ii) Identify 20 representative technical phrases across four domains1, covering five operational dimensions, demand-side management, generation optimization, system reliability, operational interventions and infrastructure contingencies, determined through keyword frequency analysis and expert validation.

(iii) Following the methods of Guo et al. (2023), Da et al. (2015), measure the occurrence rate for individual key phrases (k = 1,2,…,20) for each city (j) in year t, denoted as

(iv) Apply 1%–99% Winsorization to

(v) Aggregate

Instrumental variables for power shortages, selected based on a natural climate perspective, include the number of high-temperature days (

Specifically,

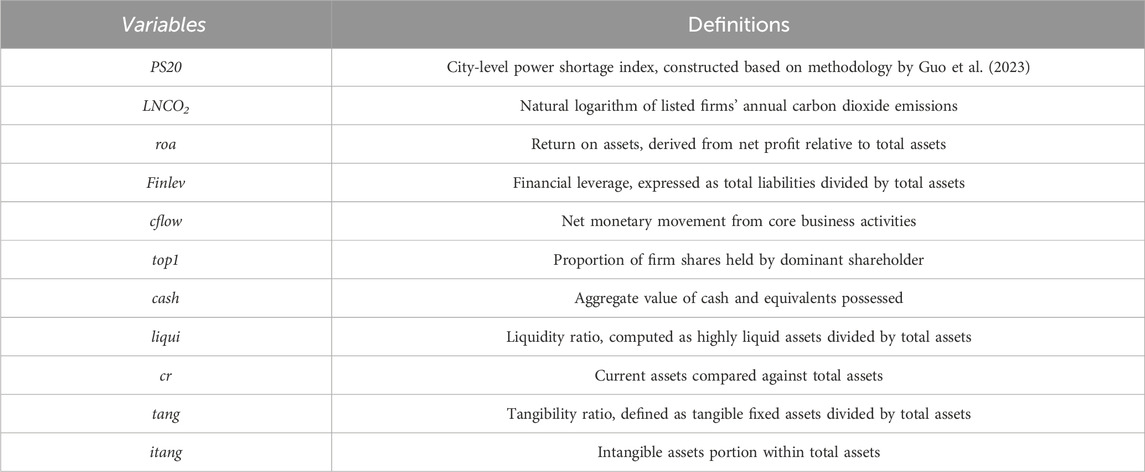

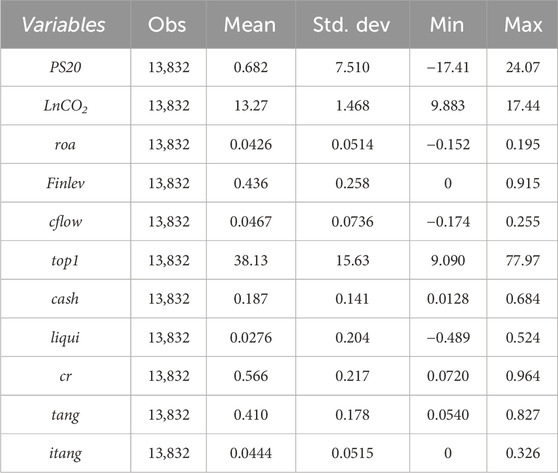

To account for potential confounding factors influencing firm productivity, multiple control variables were incorporated into the model, namely return on total assets, financial debt ratio, cash flow, dominant shareholder ownership percentage, cash holdings, cash substitutes, current asset ratio, asset structure, and proportion of intangible assets. Return on total assets (roa) represents a firm’s net profit relative to its total asset base. The financial leverage ratio (Finlev) is calculated by dividing total liabilities by total assets. Cash flow (cflow) refers to the net operational cash generated through business activities. The largest shareholder’s equity position (top1) quantifies the dominant shareholder’s proportionate ownership in the firm. Cash holdings (cash) are the amount of cash held by the firm. Cash substitutes (liqui) are highly liquid assets that can be quickly converted to cash. The current asset ratio (cr) is equal to current assets divided by total assets. Asset structure (tang) is measured by the ratio of tangible assets. The intangible asset ratio (itang) corresponds to the percentage of intangible holdings. Definitions of the variables are reported in Table 1 and summary statistics are presented in Table 2.

4.2 Data sources

This study investigates the impact of power shortages on CO2 emissions of listed firms. In 2020, China proposed its “dual carbon” goals, demonstrating its nationally determined contribution to addressing global climate change and highlighting its responsibility and commitment as a major nation. Under this grand goal, all industries are facing the urgent need for transformation, upgrading and green development. As an important part of China’s economy, listed firms, with a market value accounting for 14.2% of the global market value, play a key role in the process of achieving the “dual carbon” goals and their carbon emissions have attracted wide attention. China’s environmental regulation policies exhibit a “prioritizing large firms over smaller ones” characteristic, imposing greater carbon reduction pressure on listed companies. Therefore, this study employs A-share listed firms spanning the years 2001–2017 as the research sample. The independent variable, power shortage, utilizes data from the city-level power shortage index for 218 Chinese prefecture-level cities constructed by Guo et al. (2023). The dependent variable, firm CO2 emissions, is calculated by multiplying actual energy consumption with corresponding CO2 emission coefficients for each energy type. Firm-level control variables are obtained from the China Stock Market and Accounting Research database, while temperature datasets originate from the China National Meteorological Information Center.

5 Empirical results

5.1 Baseline results

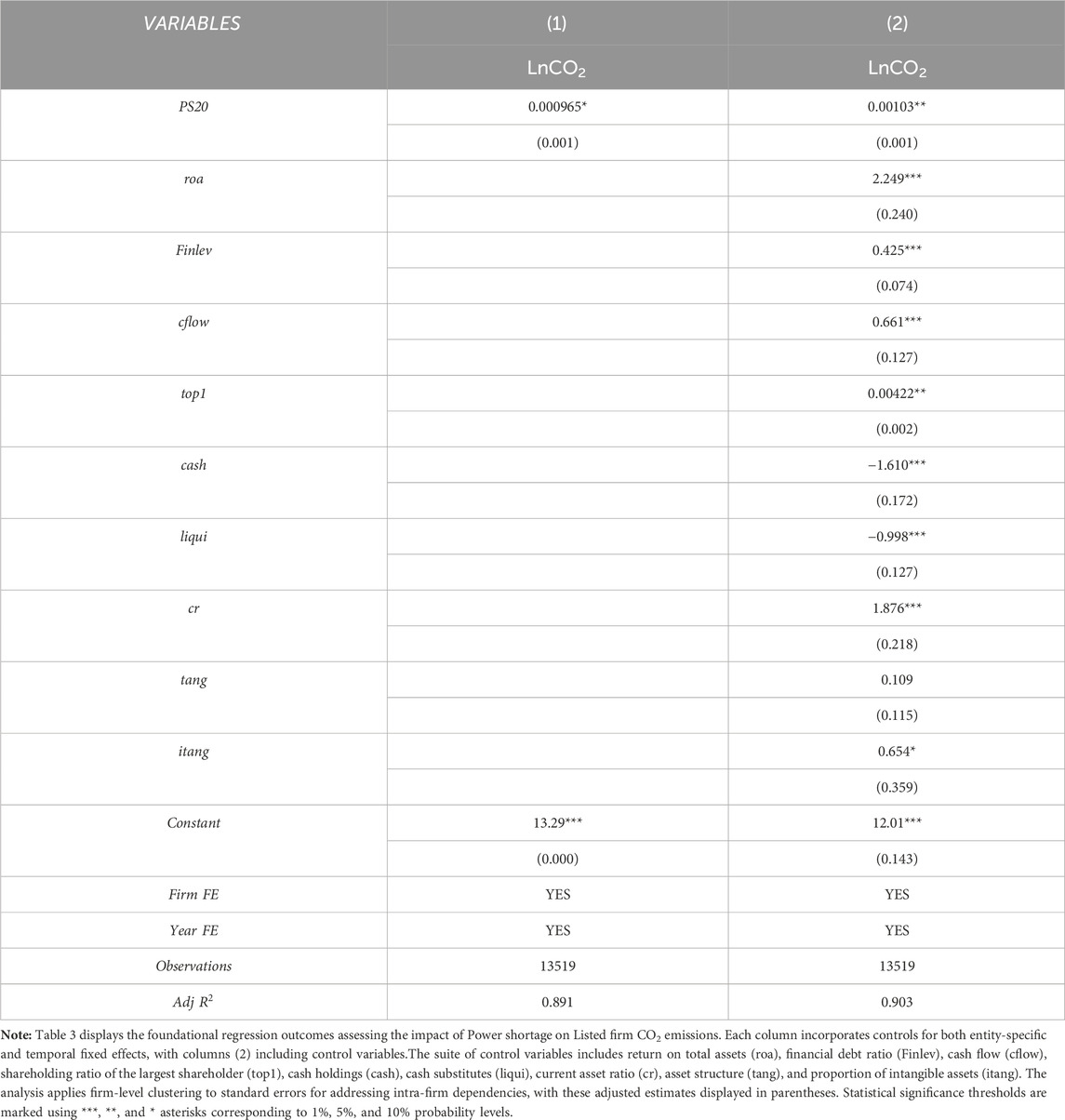

Table 3 presents the core regression analysis examining how power shortages affect listed firm CO2 emissions, with consistent controls for firm and year fixed effects across specifications. In the Column (1), the PS20 variable reveals a positive coefficient reaching statistical significance at the 10% threshold, indicating that power shortages correlate with elevated CO2 emissions. Specifically, the standard deviation shock in power shortages is estimated to increase firm-level CO2 emissions by 0.725%. Introducing firm-level control variables in column (2) maintains the significant positive association for PS20 at the 5% level, with an estimated coefficient of 0.00103. This finding suggests that higher levels of power shortages are linked to elevated firm CO2 emissions, potentially due to firms’ inclination towards carbon-intensive energy sources like coal for self-generation during periods of shortage.

5.2 Instrumental variables regression

Although power shortages are considered an external shock (Cole et al., 2018), there may be endogenous issues of mutual causality between power shortages and CO2 emissions of listed firms. Firms with lower carbon emissions alleviate local governments’ restrictions on power supply and operational pressures on electricity infrastructure imposed to control coal-related energy consumption and emissions, thereby helping maintain local power stability. In contrast, firms with higher carbon emissions, characterized by high energy consumption, high pollution, substantial electricity demand, and accelerated infrastructure wear, are more likely to prompt governments to adopt compulsory measures such as electricity rationing, exacerbating power shortages. To resolve the endogeneity concerns originating from the bidirectional causal relationship, this study employs an instrumental variable (IV) approach. An instrumental variable must satisfy relevance and exogeneity, it must correlate with the endogenous explanatory variable (PS20) and maintain independence from the with the error term. As demonstrated by Guo et al. (2023), rising temperatures significantly increase residential electricity demand, which crowds out industrial electricity consumption and intensifies firm power shortages. For relevance, local temperature and climatic conditions profoundly influence electricity usage patterns and power shortage severity. For exogeneity, neither academia nor industry has identified temperature as a direct determinant of firm carbon emissions. Thus, this research employs temperature-linked indicators as instrumental variables through the two-stage least squares methodological framework. The most commonly used variable in climate-economic impact research is temperature (Schlenker and Roberts, 2009). Accordingly, this paper adopts the number of high-temperature days (

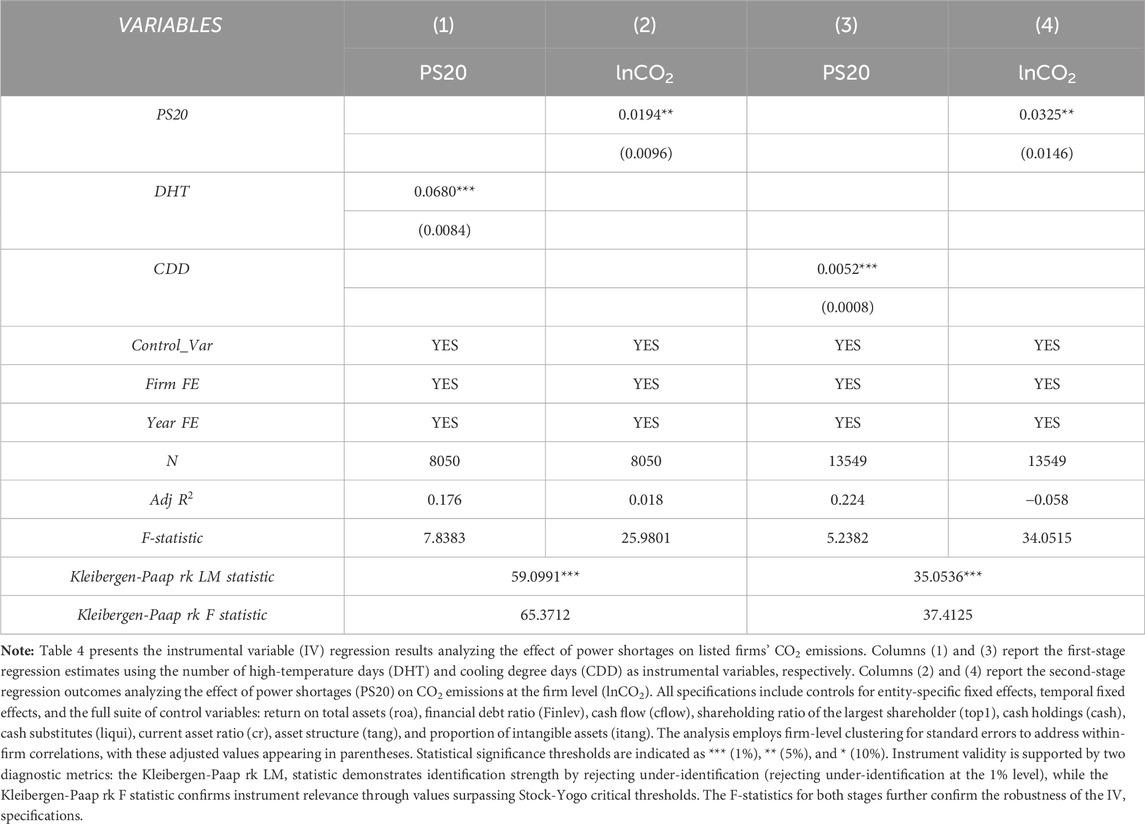

The estimation results from instrumental variable regression are detailed in Table 4. Columns (1) and (3) of Table 4 indicate a positive impact of the instrumental variables, namely the number of high-temperature days (

5.3 Robustness checks

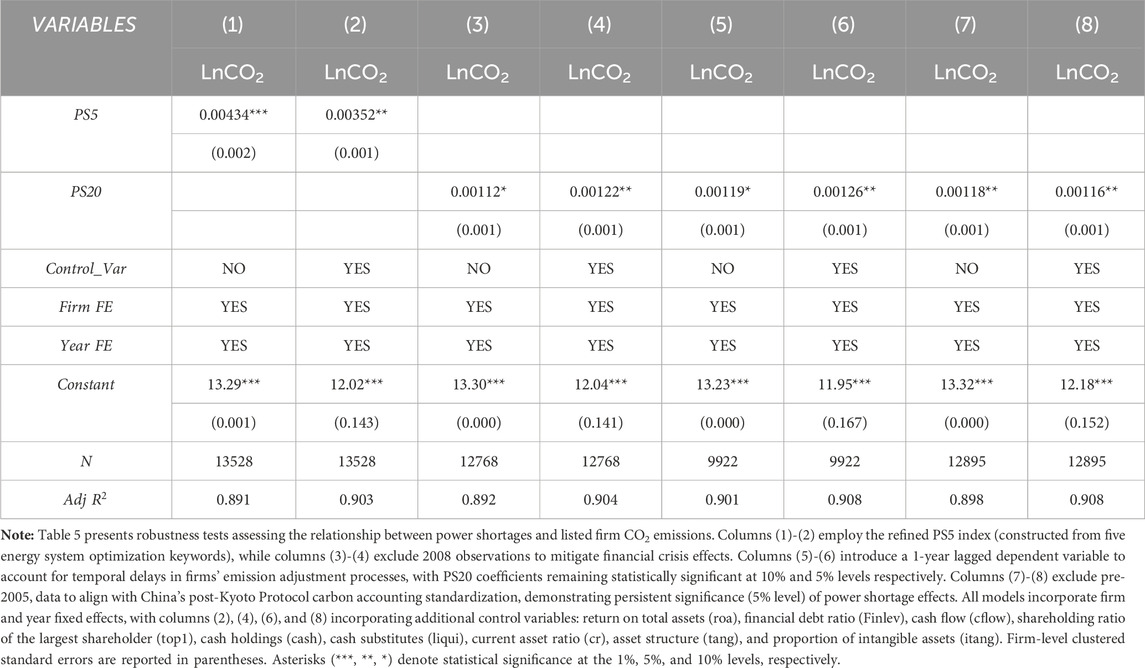

Despite the instrumental variable regression outcomes detailed in Table 4, supplementary robustness checks are imperative to validate the reliability of this study’s empirical conclusions. Firstly, the regressions were re-executed with a refined set of independent variables, narrowing down the power shortage index from 20 to only the top 5 keywords2. The outcomes in columns (1)-(2) of Table 5 confirm a significant positive correlation between power shortages and firm CO2 emissions at 5% level, consistent with the baseline findings. Secondly, the 2008 financial crisis might have affected firms’ operations and decisions. To avoid this impact on regression results, we exclude all 2008 observations and re-estimate the model. Table 5 columns (3)-(4) reveal that power shortage coefficients maintain significant positivity at the 5% level, confirming the core results’ resilience against exogenous macroeconomic shocks. Thirdly, considering the temporal lag between the occurrence of power shortages and listed firms’ adoption of energy-intensive alternatives along with production decision adjustments, this study introduces a one-period lag of the dependent variable into the regression model. The results presented in columns (5) and (6) of Table 5 demonstrate that the regression coefficients of PS20 are 0.00119 and 0.00126, showing statistical significance at the 10% and 5% levels respectively, consistent with the anticipated temporal hysteresis of firm carbon emissions. Finally, given the Kyoto Protocol’s enforcement in 2005 and China’s subsequent participation in the Clean Development Mechanism (CDM) with standardized carbon accounting methodologies, we exclude pre-2005 data to eliminate inconsistencies in emission measurement standards. As shown in columns (7) and (8) of Table 5, the PS20 coefficient remains significantly positive at the 5% level, indicating that the research conclusions remain unaffected by variations in carbon accounting standards.

6 Expansion analysis

6.1 Channel analysis

Building upon the theoretical framework and empirical evidence presented earlier, this study investigates the mechanisms through which power shortages exacerbate listed firms’CO2 emissions, focusing on resource technological innovation and allocation efficiency. Following the methodological approach of Chen et al. (2020), we construct the following mediation model as shown in Equation 5:

Where

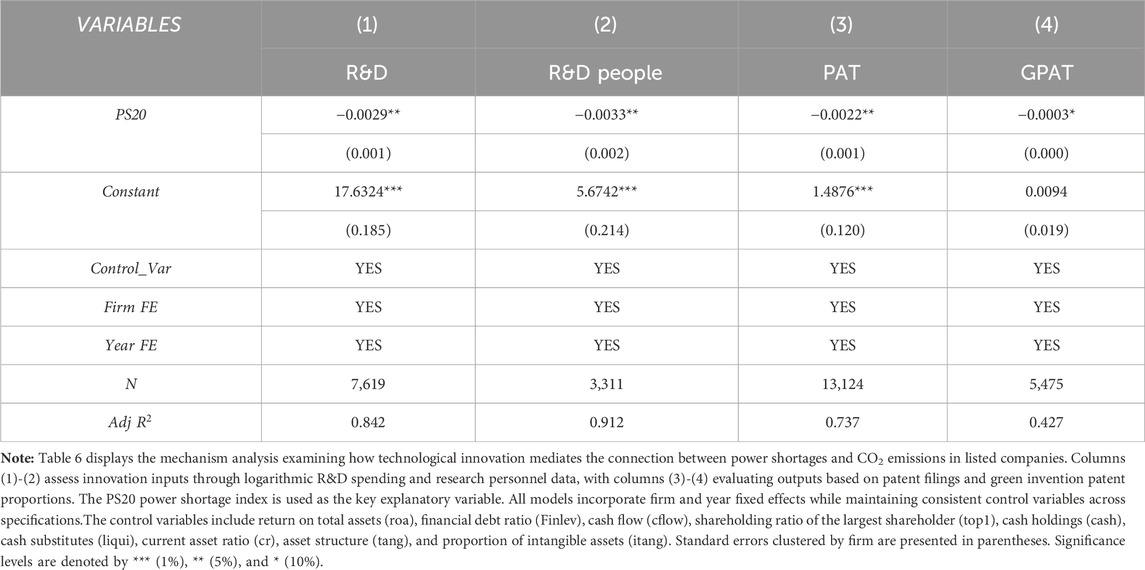

First, we conduct channel analysis through the technological innovation of listed firms. On the input side of innovation, this study employs the natural logarithm of R&D expenditure and the logarithm of R&D personnel headcount as proxy variables to explore their mediating role in the link between power shortages and CO2 emissions. The regression results in columns (1) - (2) of Table 6 show that power shortages significantly reduce R&D expenditure and R&D personnel at the 5% level. Specifically, a one-unit increase in power shortages decreases firm R&D spending and R&D personnel by 0.29% and 0.33%, respectively. On the output side of innovation, we measure innovation performance using the logarithm of patent applications and the proportion of green invention patents to total patent filings within a year. Columns (3)-(4) of Table 6 reveal negative correlations between power shortages and both general technological innovation and green innovation at the 5% and 10% significance levels. These results confirm that technological innovation and green innovation serve as critical mediating channels through which power shortages exacerbate firm carbon emissions. These findings align with existing literature (Liu et al., 2021), (Ouyang et al., 2020) and substantiate Hypothesis 2a, demonstrating that enhancing innovation investments enables firms to adopt more efficient, productive, and environmentally sustainable production technologies.

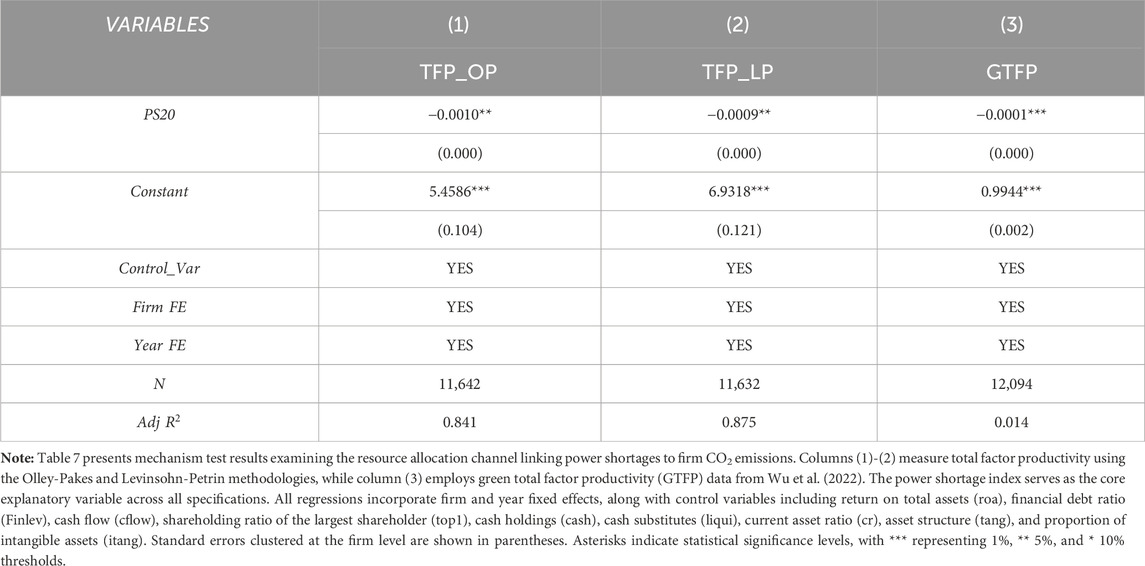

Second, this study examines the resource allocation channel. We measure firm resource allocation efficiency using two established total factor productivity (TFP) metrics: the Olley and Pakes (1996) and the Levinsohn-Petrin approach (Levinsohn and Petrin, 2003). Regression results in Columns (1)-(2) of Table 7 reveal statistically significant negative coefficients for the power shortage index (PS20) at the 5% level, indicating that power shortages substantially impair firms’ TFP. Quantitatively, a one-unit increase in PS20 reduces TFP by 0.09%, demonstrating that energy constraints hinder firms’ capacity to enhance productivity for carbon mitigation, thereby exacerbating CO2 emissions. These findings validate Hypothesis 2b. Furthermore, since reduced carbon emissions signify firm green transition, we employ green total factor productivity (GTFP) data constructed by Wu et al. (2022) to assess its mediating role. Column (3) of Table 7 shows that power shortages significantly reduce GTFP at the 1% level. On the one hand, studies have revealed that in multiple countries, including China (Fisher-Vanden et al., 2015), India (Allcott et al., 2016), and Ethiopia (Abdisa, 2018), power shortages significantly impair firm performance and productivity. On the other hand, research indicates that firms with higher green total factor productivity have greater energy efficiency and lower CO2 emissions (Cui et al., 2021), (Yu P. et al., 2021). We demonstrate that power shortages depress both conventional and green TFP, driving increased firm carbon emissions, thereby robustly supporting Hypothesis 2b.

6.2 Heterogeneity

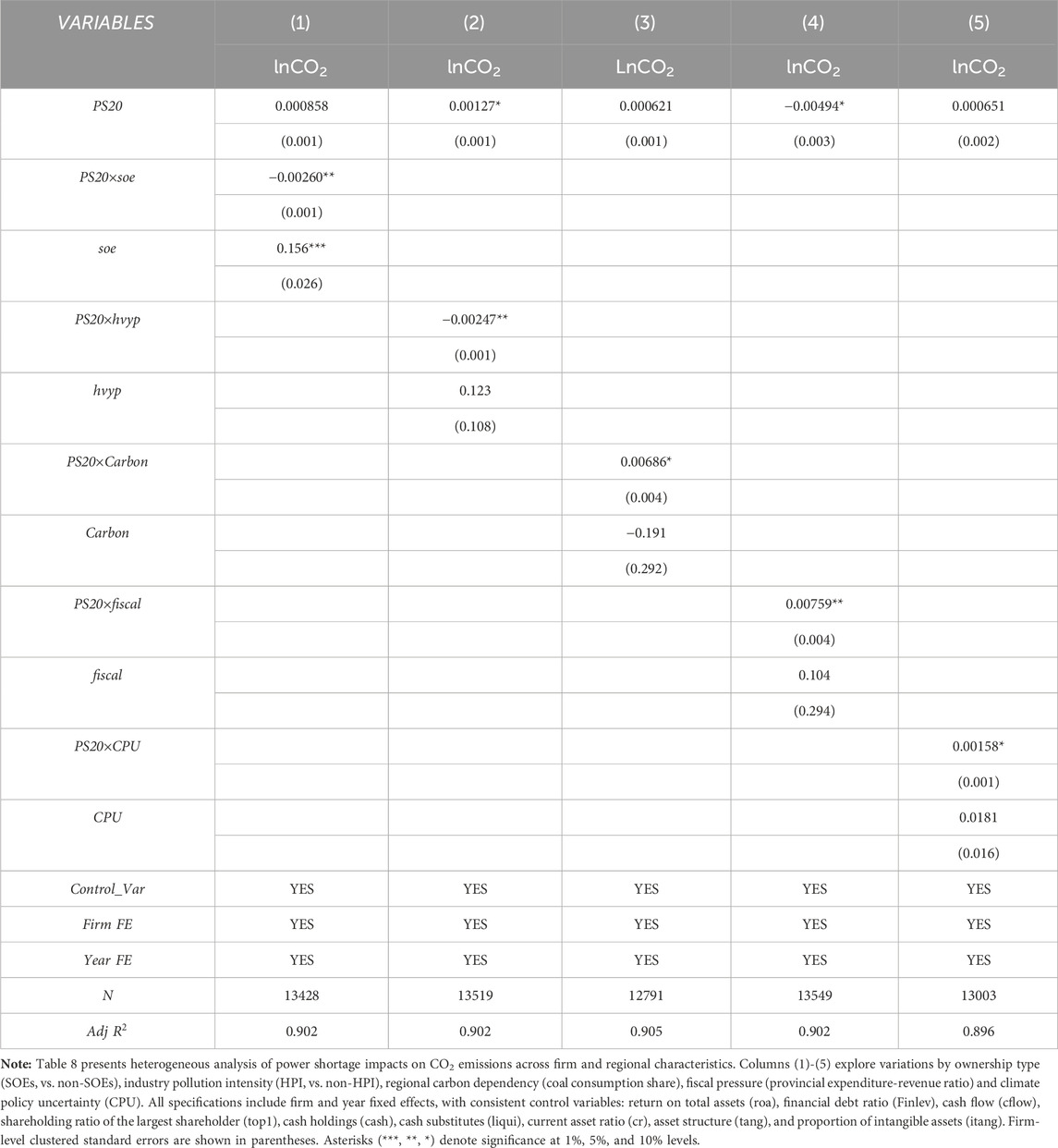

Table 8 presents the heterogeneity regression results. In terms of firm characteristics, state-owned firms (SOEs), given their strategic role in national economic security and prioritized access to energy supply guarantees, are endowed with more stable power allocation mechanisms, resulting in a lower probability of experiencing power shortages compared to non-SOEs. To test this hypothesis, we split the sample into SOEs and non-SOEs, using ownership type as a binary categorical variable (SOEs: soe = 1; otherwise soe = 0). As shown in Column (1) of Table 8, the interaction term between power shortages (PS20) and the SOE dummy is significantly negative, indicating that SOEs exhibit lower sensitivity to power shortage impacts. This is attributed to the priority given by the state grid to ensure power supply to state-owned firms, which are often integral to the national economy and public welfare. Furthermore, to assess industry-specific heterogeneity, we classify firms based on whether they operate in heavily polluting industries (HPIs). The sample is divided into HPI and non-HPI subsamples using a binary variable (hvyp = 1 for HPI firms; otherwise hvyp = 0). Column (2) of Table 8 reveals a significantly negative interaction term between PS20 and the HPI dummy at the 10% level, suggesting that non-pollution-intensive firms face greater emission increases under power shortages.

In examining the heterogeneity based on regional characteristics of firms, areas with higher coal consumption face a self-reinforcing “power shortage–coal dependency–emission surge” vicious cycle, driven by sluggish energy structure transition and insufficient grid flexibility.Firstly, this study evaluates regional energy consumption heterogeneity by measuring coal consumption share as a proxy for carbon-intensive energy use. As shown in Column (3) of Table 8, the significant positive interaction term between power shortages (PS20) and regional carbon intensity indicates that power constraints disproportionately escalate CO2 emissions in coal-dependent regions. Secondly, we quantify fiscal pressure at the provincial level using the ratio of fiscal expenditure to revenue. Column (4) of Table 8 demonstrates a significantly positive interaction between PS20 and fiscal pressure, suggesting that regions with tighter fiscal conditions exhibit heightened vulnerability to power shortages. Thirdly, as global climate change intensifies, countries worldwide are addressing challenges by setting greenhouse gas reduction targets, implementing carbon emission trading systems, promoting renewable energy adoption, and improving energy efficiency. However, frequent adjustments to policy objectives, changes in policy tools, and interactions between policies (Le and Zak, 2005) make it difficult for businesses and society to predict the content, timing, intensity, and effectiveness of climate policies, resulting in Climate Policy Uncertainty (CPU). Therefore, this study adopts the Climate Policy Uncertainty Index constructed by Ma et al. (2023) to measure the uncertainty faced by firms in their respective regions. Column (5) of Table 8 presents the heterogeneous regression results examining the impact of climate policy uncertainty in firms’ regions. The significantly positive regression coefficient of the interaction term between power shortages and regional climate policy uncertainty (PS20×CPU) indicates that power shortages exert a more pronounced effect on carbon emissions from listed firms in regions with higher climate policy uncertainty.

7 Conclusion

The stability of electricity supply is crucial for firm growth and operational continuity. However, power shortages prevalent in emerging economies pose significant challenges. While existing studies demonstrate that electricity constraints reduce firm productivity, few have focused on their impact on CO2 emissions from listed firms in developing countries. This study employs a city-level power shortage index to examine its effect on CO2 emissions of Chinese listed firms, revealing a significant positive correlation. Further analysis indicates that power shortages exacerbate firm carbon emissions by suppressing technological innovation and distorting resource allocation. The positive impact of power shortages on CO2 emissions is particularly pronounced for non-state-owned firms, non-pollution-intensive industries, and firms located in regions with higher reliance on carbon-intensive energy use or greater fiscal revenue and expenditure pressures. These findings persist after controlling for endogeneity concerns and performing various robustness tests.

Given China’s status as a major global carbon emitter and its commitment to dual-carbon goals, policymakers must carefully consider the environmental implications of power shortages in strategic planning. Governments should prioritize the construction and management of electricity infrastructure. Firstly, proactive efforts should be made to upgrade power infrastructure, particularly in regions with high electricity consumption intensity and significant climate policy uncertainty. This includes adopting smart grid technologies to dynamically balance supply-demand mismatches and deploying demand response systems to incentivize off-peak energy use. Against the backdrop of the digital economy’s heavy reliance on electricity, timely modernization of grid systems is essential to enhance supply stability and reliability, reduce power shortage frequency, and provide robust energy security for firm operations and residential consumption. Secondly, governments should optimize regional electricity management by integrating actual energy transition progress with supply capacity. Establishing inter-regional coordination mechanisms could enable surplus renewable energy transfers from western provinces to eastern industrial hubs, rationing policies should be formulated based on firms’ production characteristics and socioeconomic impacts to ensure policy feasibility, sustainability, and the protection of basic electricity needs for listed firms, thereby fostering a stable business environment. Thirdly, governments can guide firms to adopt clean energy through rational energy planning and the establishment of scientific energy systems. This may involve expanding carbon emission trading markets to internalize environmental costs and accelerate low-carbon technology adoption. This approach aims to reduce reliance on traditional high-pollution energy sources, promote diversification of the energy mix, increase the proportion of clean energy in power supply, and support firms in improving energy conservation and emission reduction efficiency. Finally, governments should refine regional electricity management by comprehensively evaluating the progress of energy transition and local power supply capabilities. Policies should be tailored according to firms’ operational profiles and their socioeconomic influence to ensure practicality and sustainability.

Listed firms should strengthen risk resilience and improve technological innovation and resource allocation capabilities. In an increasingly volatile energy landscape, power shortages may occur unexpectedly. Beyond financial performance, listed firms should mitigate adverse environmental impacts by implementing targeted risk prevention, assessment, and response measures, such as optimizing production processes, advancing energy transition, and strengthening stakeholder engagement. Additionally, listed firms need to enhance technological innovation and resource allocation efficiency. Internally, firms should continuously accelerate digital transformation and information management, increase investments in digital transformation, and utilize technologies such as big data and artificial intelligence to enhance information processing efficiency and transparency. During power shortages, digital tools can be utilized to optimize energy management, accurately assess risks, and formulate effective response strategies. Externally, listed firms should explore diversified energy solutions, such as investing in distributed energy systems including biomass co-generation and hydrogen fuel cells to improve energy self-sufficiency and reduce dependence on external grids. Increased investment in R&D and adoption of energy-saving technologies such as waste heat recovery systems and pollution control equipment will enhance energy efficiency, reduce emissions, and improve environmental performance, setting benchmarks for smaller firms.

This study explores the relationship between power shortages and carbon emissions using CO2 emission data from listed firms in China, offering practical insights for developing countries implementing carbon reduction strategies amid energy shortages. Moving forward, developing countries can strengthen public education and awareness-building efforts to enhance societal understanding of power shortages. First, through media campaigns, public welfare organizations, and other channels, governments should intensify efforts to educate the public on the impacts of power shortages on firms, raising awareness and recognition of corporate emission reduction initiatives. Second, leveraging the collaborative role of multinational organizations, countries can facilitate cross-border cooperation among firms to share successful experiences and technologies for addressing rising carbon emissions under power shortages. Collaborative research and development of energy-saving technologies, along with shared utilization of energy resources, should be promoted to collectively explore solutions, contributing to the achievement of carbon reduction goals in developing nations.

In future research, it can be further investigated the issue of carbon leakage that may arise from firms relocating their production to regions with ample and stable electricity supply due to chronic power shortages.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

YL: Conceptualization, Data curation, Writing – original draft. CN: Validation, Visualization, Writing – review and editing. BS: Formal Analysis, Investigation, Methodology, Project administration, Resources, Writing – original draft. GZ: Conceptualization, Data curation, Funding acquisition, Investigation, Software, Supervision, Validation, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by Program for Innovation Research in Central University of Finance and Economics, the Program for Innovation Research and “Double First-Class” programme at the Central University of Finance and Economics and Key Laboratory of Quality Infrastructure Efficacy Research, the National Natural Science Foundation of China (No. 72373172) and the National Social Science Foundation of China (No. 19CGL048).

Conflict of interest

Author CN was employed by AVIC China Aero-Polytechnology Establishment.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2025.1590025/full#supplementary-material

Footnotes

1The 20 critical terms consist of peak load management, electricity generation, thermal recovery generation, off-peak operation, grid isolation, demand-side rationing, circuit shutdown, optimized consumption, protective tripping, load shifting, supply interruption, industrial energy usage, phased peak reduction, emergency load shedding, power failure incidents, capacity overloading, feeder switching, grid reliability, consumption curtailment, and energy redistribution.

2The construction of the PS5 variable employs a frequency-weighted methodology, prioritizing five predominant operational indicators in energy system optimization: peak load management, electricity generation, thermal recovery generation, off-peak operation, grid isolation.

References

Abbasi, K. R., Shahbaz, M., Zhang, J., Irfan, M., and Alvarado, R. (2022). Analyze the environmental sustainability factors of China: the role of fossil fuel energy and renewable energy. Renew. Energy 187, 390–402. doi:10.1016/j.renene.2022.01.066

Abdisa, L. T. (2018). Power outages, economic cost, and firm performance: evidence from Ethiopia. Util. Policy 53, 111–120. doi:10.1016/j.jup.2018.06.009

Alam, M. S., Atif, M., Chien-Chi, C., and Soytaş, U. (2019). Does corporate R&D investment affect firm environmental performance? Evidence from G-6 countries. Energy Econ. 78, 401–411. doi:10.1016/j.eneco.2018.11.031

Alam, M. S., Safiullah, M., and Islam, M. S. (2022). Cash-rich firms and carbon emissions. Int. Rev. Financial Analysis 81, 102106. doi:10.1016/j.irfa.2022.102106

Alby, P., Dethier, J. J., and Straub, S. (2013). Firms operating under electricity constraints in developing countries. World Bank Econ. Rev. 27 (1), 109–132. doi:10.1093/wber/lhs018

Allcott, H., Collard-Wexler, A., and O’Connell, S. D. (2016). How do electricity shortages affect industry? Evidence from India. Am. Econ. Rev. 106 (3), 587–624. doi:10.1257/aer.20140389

Altinoz, B., Vasbieva, D., and Kalugina, O. (2021). The effect of information and communication technologies and total factor productivity on CO2 emissions in top 10 emerging market economies. Environ. Sci. Pollut. Res. 28 (45), 63784–63793. doi:10.1007/s11356-020-11630-1

Amri, F. (2018). Carbon dioxide emissions, total factor productivity, ICT, trade, financial development, and energy consumption: testing environmental Kuznets curve hypothesis for Tunisia. Environ. Sci. Pollut. Res. 25, 33691–33701. doi:10.1016/j.techfore.2019.05.028

Ansari, M. A., Akram, V., and Haider, S. (2022). A link between productivity, globalisation and carbon emissions: evidence from emissions by coal, oil and gas. Environ. Sci. Pollut. Res. 29 (22), 33826–33843. doi:10.1007/s11356-022-18557-9

Asiedu, E., Azomahou, T. T., Gaekwad, N. B., and Ouedraogo, M. (2021). The determinants of electricity constraints by firms in developing countries. Energy Econ. 104, 105605. doi:10.1016/j.eneco.2021.105605

Bao, B., Fu, D., Yu, J., and Zhang, Y. (2024). Lights dim, exports down: examining the trade effects of power shortages on Chinese manufacturing firms. China Econ. Rev. 88, 102270. doi:10.1016/j.chieco.2024.102270

Bhattacharyya, A., Yoon, S., and Hastak, M. (2021). Economic impact assessment of severe weather–induced power outages in the US. J. Infrastructure Syst. 27 (4), 04021038. doi:10.1061/(ASCE)IS.1943-555X.0000648

Chen, H., Yan, H., Gong, K., Geng, H., and Yuan, X. C. (2022). Assessing the business interruption costs from power outages in China. Energy Econ. 105 (August 2021), 105757. doi:10.1016/j.eneco.2021.105757

Chen, Y., Fan, Z., Gu, X., and Zhou, L. (2020). Arrival of young talent: the send-down movement and rural education in China. Am. Econ. Rev. 110 (11), 3393–3430. doi:10.1257/aer.20191414

Cole, M. A., Elliott, R. J., Occhiali, G., and Strobl, E. (2018). Power outages and firm performance in Sub-Saharan Africa. J. Dev. Econ. 134, 150–159. doi:10.1016/j.jdeveco.2018.05.003

Cui, J., Wang, C., Zhang, J., and Zheng, Y. (2021). The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. 118 (52), e2109912118. doi:10.1073/pnas.2109912118

Da, Z., Engelberg, J., and Gao, P. (2015). The sum of all FEARS investor sentiment and asset prices. Rev. Financial Stud. 28 (1), 1–32. doi:10.1093/rfs/hhu072

Dong, K., Hochman, G., Zhang, Y., Sun, R., Li, H., and Liao, H. (2018). CO2 emissions, economic and population growth, and renewable energy: empirical evidence across regions. Energy Econ. 75, 180–192. doi:10.1016/j.eneco.2018.08.017

Du, W., and Li, M. (2020). Assessing the impact of environmental regulation on pollution abatement and collaborative emissions reduction: micro-evidence from Chinese industrial enterprises. Environ. Impact Assess. Rev. 82, 106382. doi:10.1016/j.eiar.2020.106382

Elliott, R. J., Nguyen-Tien, V., and Strobl, E. A. (2021). Power outages and firm performance: a hydro-IV approach for a single electricity grid. Energy Econ. 103, 105571. doi:10.1016/j.eneco.2021.105571

Farquharson, D., Jaramillo, P., and Samaras, C. (2018). Sustainability implications of electricity outages in sub-Saharan Africa. Nat. Sustain. 1 (10), 589–597. doi:10.1038/s41893-018-0151-8

Fisher-Vanden, K., Mansur, E. T., and Wang, Q. J. (2015). Electricity shortages and firm productivity: evidence from China's industrial firms. J. Dev. Econ. 114, 172–188. doi:10.1016/j.jdeveco.2015.01.002

Freeman, G. M., Apt, J., and Moura, J. (2020). What causes natural gas fuel shortages at US power plants? Energy Policy 147, 111805. doi:10.1016/j.enpol.2020.111805

Fried, S., and Lagakos, D. (2020). Electricity and firm productivity: a general-equilibrium approach, 15, 67–103. doi:10.1257/mac.20210248

Ganda, F. (2019). The impact of innovation and technology investments on carbon emissions in selected organisation for economic Co-operation and development countries. Journalof Clean. Prod. 217, 469–483. doi:10.1016/j.jclepro.2019.01.235

Grainger, C. A., and Zhang, F. (2019). Electricity shortages and manufacturing productivity in Pakistan. Energy Policy 132, 1000–1008. doi:10.1016/j.enpol.2019.05.040

Growitsch, C., Malischek, R., Nick, S., and Wetzel, H. (2015). The costs of power interruptions in Germany: a regional and sectoral analysis. Ger. Econ. Rev. 16 (3), 307–323. doi:10.1111/geer.12054

Guo, D., Li, Q., Liu, P., Shi, X., and Yu, J. (2023). Power shortage and firm performance: evidence from a Chinese city power shortage index. Energy Econ. 119, 106593. doi:10.1016/j.eneco.2023.106593

Hailemariam, A., Ivanovski, K., and Dzhumashev, R. (2022). Does R&D investment in renewable energy technologies reduce greenhouse gas emissions? Appl. Energy 327, 120056. doi:10.1016/j.apenergy.2022.120056

Hardy, M., and McCasland, J. (2021). Lights off, lights on: the effects of electricity shortages on small firms. World Bank Econ. Rev. 35 (1), 19–33. doi:10.1093/wber/lhz028

Huang, J., Chen, X., Yu, K., and Cai, X. (2020). Effect of technological progress on carbon emissions: new evidence from a decomposition and spatiotemporal perspective in China. J. Environ. Manag. 274, 110953. doi:10.1016/j.jenvman.2020.110953

Ladu, M. G., and Meleddu, M. (2014). Is there any relationship between energy and TFP (total factor productivity)? A panel cointegration approach for Italian regions. Energy 75, 560–567. doi:10.1016/j.energy.2014.08.018

Le, Q., and Zak, P. (2005). Political risk and capital flight. J. Int. Money Finance 25 (2), 308–329. doi:10.1016/j.jimonfin.2005.11.001

Lee, K. H., and Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 108, 534–542. doi:10.1016/j.jclepro.2015.05.114

Levinsohn, J., and Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 70 (2), 317–341. doi:10.1111/1467-937X.00246

Li, H., Mu, H., Zhang, M., and Li, N. (2011). Analysis on influence factors of China's CO2 emissions based on Path–STIRPAT model. Energy Policy 39 (11), 6906–6911. doi:10.1016/j.enpol.2011.08.056

Lin, B. (2022). High-quality economic growth in China's carbon-neutrality process. Econ. Res. J. 57 (1), 56–71.

Liu, X., Ji, Q., and Yu, J. (2021). Sustainable development goals and firm carbon emissions: evidence from a quasi-natural experiment in China. Energy Econ. 103, 105627. doi:10.1016/j.eneco.2021.105627

Ma, Q., Tariq, M., Mahmood, H., and Khan, Z. (2022). The nexus between digital economy and carbon dioxide emissions in China: the moderating role of investments in researchand development. Technol. Soc. 68, 101910. doi:10.1016/j.techsoc.2022.101910

Ma, Y.-R., Liu, Z., Ma, D., Zhai, P., Guo, K., Zhang, D., et al. (2023). A news-based climate policy uncertainty index for China. Sci. Data 10 (1), 881. doi:10.1038/s41597-023-02817-5

Olley, S., and Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica 64 (6), 1263–1297. doi:10.3386/w3977

Ouyang, X., Li, Q., and Du, K. (2020). How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 139, 111310. doi:10.1016/j.enpol.2020.111310

Petrović, P., and Lobanov, M. M. (2020). The impact of R&D expenditures on CO2 emissions: evidence from sixteen OECD countries. J. Clean. Prod. 248, 119187. doi:10.1016/j.jclepro.2019.119187

Piotroski, J. D., Wong, T. J., and Zhang, T. (2015). Political incentives to suppress negative information: evidence from Chinese listed firms. J. Account. Res. 53 (2), 405–459. doi:10.1111/1475-679X.12071

Qian, H., Xu, S., Cao, J., Ren, F., Wei, W., Meng, J., et al. (2021). Air pollution reduction and climate co-benefits in China’s industries. Nat. Sustain. 4 (5), 417–425. doi:10.1038/s41893-020-00669-0

Qiu, S., Wang, Z., and Liu, S. (2021). The policy outcomes of low-carbon city construction on urban green development: evidence from a quasi-natural experiment conducted in China. Sustain. Cities Soc. 66, 102699. doi:10.1016/j.scs.2020.102699

Qu, W., Leung, P., and Cooper, B. (2013). A study of voluntary disclosure of listed Chinese firms–a stakeholder perspective. Manag. Auditing J. 28 (3), 261–294. doi:10.1108/02686901311304376

Reinikka, R., and Svensson, J. (2002). Coping with poor public capital. J. Dev. Econ. 69 (1), 51–69. doi:10.1016/S0304-3878(02)00052-4

Samad, H. A., and Zhang, F. (2018). Electrification and household welfare: evidence from Pakistan (World Bank Policy Research Working Paper No. 8582). Washington, DC: World Bank. doi:10.1596/1813-9450-8582

Schlenker, W. H., and Roberts, M. J. (2009). Nonlinear temperature effects indicate severe damages to US crop yields under climate change. Proc. Natl. Acad. Sci., 106(37):15594–15598. doi:10.1073/pnas.0906865106

Shi, X., Cheong, T. S., Yu, J., and Liu, X. (2021). Quality of life and relative household energy consumption in China. China and World Econ. 29 (5), 127–147. doi:10.1111/cwe.12390

Sinn, H. W. (2008). Public policies against global warming: a supply side approach. Int. Tax. Public Financ. 15, 360–394. doi:10.1007/s10797-008-9082-z

Smulders, S., Tsur, Y., and Zemel, A. (2012). Announcing climate policy: can a green paradox arise without scarcity? J. Environ. Econ. Manag. 64, 364–376. doi:10.1016/j.jeem.2012.02.007

Stock, J. H., and Yogo, M. (2002). Testing for weak instruments in linear IV regression, 80, 108. doi:10.1017/CBO9780511614491.006

Sun, W., and Huang, C. (2022). Predictions of carbon emission intensity based on factor analysis and an improved extreme learning machine from the perspective of carbon emission efficiency. J. Clean. Prod. 338, 130414. doi:10.1016/j.jclepro.2022.130414

Timilsina, G., and Steinbuks, J. (2021). Economic costs of electricity load shedding in Nepal. Renew. Sustain. Energy Rev. 146, 111112. doi:10.1016/j.rser.2021.111112

Wang, M., Zhu, C., Wang, X., Ntim, V. S., and Liu, X. (2023a). Effect of information and communication technology and electricity consumption on green total factor productivity. Appl. energy 347, 121366. doi:10.1016/j.apenergy.2023.121366

Wang, Z., Fu, H., and Ren, X. (2023b). Political connections and corporate carbon emission: new evidence from Chinese industrial firms. Technol. Forecast. Soc. Change 188, 122326. doi:10.1016/j.techfore.2023.122326

Wu, J., Xia, Q., and Li, Z. (2022). Green innovation and enterprise green total factor productivity at a micro level: a perspective of technical distance. J. Clean. Prod. 344, 131070. doi:10.1016/j.jclepro.2022.131070

Yang, Y., Wei, X., Wei, J., and Gao, X. (2022). Industrial structure upgrading, green total factor productivity and carbon emissions. Sustainability 14 (2), 1009. doi:10.3390/su14021009

Yu, B., Fang, D., Pan, Y., and Jia, Y. (2023a). Countries’ green total-factor productivity towards a low-carbon world: the role of energy trilemma. Energy 278, 127894. doi:10.1016/j.energy.2023.127894

Yu, J., Liu, P., Fu, D., and Shi, X. (2023b). How do power shortages affect CO2 emission intensity? Firm-level evidence from China. Energy 282, 128927. doi:10.1016/j.energy.2023.128927

Yu, J., Shi, X., Guo, D., and Yang, L. (2021a). Economic policy uncertainty (EPU) and firm carbon emissions: evidence using a China provincial EPU index. Energy Econ. 94, 105071. doi:10.1016/j.eneco.2020.105071

Yu, P., Cai, Z., and Sun, Y. (2021b). Does the emissions trading system in developing countries accelerate carbon leakage through OFDI? Evidence from China. Energy Econ. 101, 105397. doi:10.1016/j.eneco.2021.105397

Zhang, C., Zhu, H., and Li, X. (2024). Which productivity can promote clean energy transition—total factor productivity or green total factor productivity? J. Environ. Manag. 366, 121899. doi:10.1016/j.jenvman.2024.121899

Zhang, G., Jia, Y., Su, B., and Xu, J. (2021a). Environmental regulation, economic development and air pollution in the cities of China: spatial econometric analysis based on policy scoring and satellite data. J. Clean. Prod. 328, 129496. doi:10.1016/j.jclepro.2021.129496

Zhang, Y., Guo, S., Shi, X., Qian, X., and Nie, R. (2021b). A market instrument to achieve carbon neutrality: is China’s energy-consumption permit trading scheme effective? Appl. Energy 299, 117338. doi:10.1016/j.apenergy.2021.117338

Zhang, Y. J., Peng, Y. L., Ma, C. Q., and Shen, B. (2017). Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy policy 100, 18–28. doi:10.1016/j.enpol.2016.10.005

Zhao, J., Jiang, Q., Dong, X., Dong, K., and Jiang, H. (2022). How does industrial structure adjustment reduce CO2 emissions? Spatial and mediation effects analysis for China. Energy Econ. 105, 105704. doi:10.1016/j.eneco.2021.105704

Zheng, D., Tong, D., Davis, S. J., Qin, Y., Liu, Y., Xu, R., et al. (2024). Climate change impacts on the extreme power shortage events of wind-solar supply systems worldwide during 1980–2022. Nat. Commun. 15, 5225. doi:10.1038/s41467-024-48966-y

Keywords: power shortages, CO2 emissions of listed firms, carbon-intensive energy, dual carbon goals, low-carbon transition

Citation: Li Y, Ni C, Shen B and Zhao G (2025) Does power shortage diminish firm CO2 emissions? evidence from Chinese listed firms . Front. Environ. Sci. 13:1590025. doi: 10.3389/fenvs.2025.1590025

Received: 08 March 2025; Accepted: 31 March 2025;

Published: 22 April 2025.

Edited by:

Saige Wang, University of Science and Technology Beijing, ChinaReviewed by:

Yunfei An, Henan University, ChinaPeng Liu, Guangdong University of Finance and Economics, China

Xijian Su, Dongbei University of Finance and Economics, China

Copyright © 2025 Li, Ni, Shen and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Bo Shen, c2hlbmJvQGh1ZWIuZWR1LmNu

Yushan Li

Yushan Li Chao Ni2

Chao Ni2 Guoqin Zhao

Guoqin Zhao