- 1School of Economics, Southwest University of Political Science and Law, Chongqing, China

- 2School of Business, Southwest University of Political Science and Law, Chongqing, China

Introduction: The transformation of environmental protection fees into environmental protection taxes in China reflects a broader commitment to ecological civilization. This reform aligns fiscal instruments with environmental objectives, aiming to internalize environmental costs and incentivize greener industrial behavior. However, empirical evidence on its actual impact on industrial green development remains limited. This study addresses this gap by investigating how the reform affects green total factor productivity (GTFP) in key industrial sectors.

Methods: We build a Difference-in-Differences model to assess the causal impact of the 2018 environmental tax change, using it as a quasi-natural experiment. A-share listed companies in industries with high levels of pollution from 2013 to 2022 are included in the sample. To further explore the transmission mechanism, we use mediation effect models to test whether the reform influences GTFP through changes in the degree of resource misallocation and green technological innovation. Multiple robustness checks, including parallel trends test, propensity score matching and placebo test, are conducted to ensure result validity.

Results: The results indicate that the reform significantly improves industrial green development, as measured by firm-level GTFP. In state-owned and highly polluting businesses, the effect is particularly noticeable. According to mechanism testing, the policy effect is communicated through a decrease in the degree of resource misallocation and more investment in green innovation. These findings are robust across alternative model specifications and variable definitions.

Discussion: This study offers new insights into how environmental tax policies contribute to sustainable industrial transformation. It highlights the importance of fiscal policy tools in steering firm behavior toward greener practices. Policymakers should focus on refining tax enforcement and complementing it with innovation incentives to amplify the reform’s effectiveness. The evidence underscores the critical role of institutional design in aligning industrial growth with environmental goals.

1 Introduction

The dilemma of “environmental pollution versus economic development” represents a significant challenge in the pursuit of national sustainable development (Xiong and Xu, 2021). One tool employed by the government to regulate the environment is the environmental protection tax (Huang et al., 2020), which supports the transition of industries toward more environmentally friendly practices and positively influences the harmonious growth of economic, social, and environmental systems. Industrial green growth must be continuously advanced by fully utilizing the functions of environmental protection laws and pricing resources to encourage polluting enterprises to innovate production technologies and implement green practices, thereby establishing a long-term mechanism for ecological protection. China’s economy has grown remarkably since its reform and opening up, rapidly modernizing and industrializing, leading to increasingly prominent ecological and environmental issues (Li and Chen, 2021).

Historically, China did not implement a real environmental protection tax system but used a pollution fee system to make enterprises pay for their emissions. This system, however, had institutional flaws such as insufficient enforcement rigidity and lack of standardization. China’s first “green tax law” with a clear focus on environmental protection was the “Environmental Protection Tax Law of the People’s Republic of China,” which was passed in 2018 and replaced the pollution fee system. This law is essential for creating a green tax and fiscal system, controlling the actions of polluters, and encouraging environmentally friendly methods of production and consumption. The concept of “environmental protection tax” traces back to British economist Pigou’s “Economics of Welfare,” where he noted that the primary cause of environmental pollution is the contradiction between a company’s production costs and social costs, necessitating taxation to elevate the polluters’ production costs and mitigate “negative externalities” in economic development. Today, green development, which promotes the peaceful coexistence of people and nature, has gradually become the cornerstone of high-quality growth. Hence, with the environmental problems in the world getting worse, it is important to look at whether the environmental protection fee-to-tax reform can encourage industrial green development.

One significant indicator of a nation’s progress toward green development is the green level of its businesses (Wang L. et al., 2025). Achieving sustainable and green development necessitates a transition to environmentally friendly economic growth, with an emphasis on enhancing green total factor productivity as a key strategy for promoting high-quality economic development (Zhao et al., 2022; Liu et al., 2023). The green transformation of enterprises is not just a passive adaptation to environmental regulations; it also represents a significant change in production methods and strategic restructuring. The term “green transformation of enterprises” refers to the dynamic evolution process in which enterprises, constrained by environmental factors, achieve a dual improvement in environmental performance and economic benefits through the greening of resource input methods, output structures, and governance mechanisms. Specifically, it is primarily reflected in the systematic transformation across three dimensions: first, the greening of factor input, meaning that enterprises gradually reduce the use of elements that produce significant pollution and energy, while increasing the efficiency of resource distribution; second, the greening of the output structure, whereby green production, carbon emission reduction, and pollution reduction work together to achieve the coordinated goal of maximizing expected output and minimizing unexpected output; third, the greening of management and strategy, whereby enterprises should strengthen the adoption of green concepts at the organizational governance level and enhance their green technological innovation capabilities and sustainable development levels. This transformation process is embedded not only in the micro-operation mechanism of the enterprise but also deeply influenced by changes in the macro-institutional environment.

In recent years, as global low-carbon initiatives continue to evolve, green development has become a crucial strategy for achieving both social and economic prosperity. This shift has been largely driven by the reform of environmental protection fees, specifically the transition from fees to a tax-based system. Empirical studies suggest that China’s strategy of “environmental protection fee-to-tax” has yielded significant environmental benefits by greatly reducing carbon emissions (Du et al., 2024), mitigating industrial water pollution (Zhang et al., 2023), and improving both industrial ecological efficiency (Kong et al., 2025) and energy efficiency (Kong et al., 2024). Although carbon dioxide (CO2) has not yet been directly taxed, the reform has enhanced the synergistic reduction of SO2 and CO2 emissions (Gao et al., 2022). Moreover, large-scale structural transitions in key ecological zones, such as streamflow and sediment load shifts driven by climate change, further highlight the systemic environmental challenges that green reforms must address (Tian et al., 2020).

Beyond its environmental benefits, the reform has also exerted significant influences on corporate behavior and governance. For instance, it has helped mitigate the excessive financialization of firms (Yang et al., 2025) and enhanced internal wage equity (Yang and Tang, 2023). Alongside carbon emissions trading schemes, the reform has encouraged investment in green innovation and patents (Hu et al., 2025; Xi and Jia, 2025). However, challenges persist. Certain firms, especially those in heavily polluting industries, have engaged in “greenwashing” to superficially comply with regulations while avoiding substantive changes (Wang et al., 2023; Hu et al., 2023), indicating a need for more rigorous oversight and institutional coordination. The evolution of green finance has further reinforced the structural transformation toward sustainability. Green credit and investment policies have not only supported corporate transitions to low-carbon models (Xu and Lin, 2025; Nguyen et al., 2025) but also significantly enhanced green productivity (Lee and Lee, 2022; Jiakui et al., 2023). Nevertheless, some studies note that these financial instruments may impede transformation in highly polluting enterprises due to tighter credit constraints (Zhang Z. et al., 2025). At the same time, the burden of rising total energy costs on vulnerable populations, particularly the elderly and low-income groups, has become increasingly significant, emphasizing the need for inclusive environmental taxation frameworks (Tian et al., 2024a).

The rise of the digital economy has become a key enabler of green development, parallel to fiscal and financial reforms. Digital transformation has contributed to increases in GTFP (Wang et al., 2023) and green innovation capacity (Song et al., 2020; Chen et al., 2022; Li and Lin, 2025; Zhang J. et al., 2025), while also creating spatial spillover effects through digital infrastructure (Lyu et al., 2023; Lu and Wang, 2023). Furthermore, the development of smart cities has been shown to enhance urban green performance (Jiang and Sun, 2025). However, keeping global consumption within planetary boundaries while pursuing digital infrastructure growth remains a key sustainability dilemma that requires balancing resource demands with equity concerns (Tian et al., 2024b). Corporate governance and institutional frameworks also play a crucial role. For example, CEO environmental orientation is positively associated with green innovation (Hu and Shi, 2025), and different tax rates and targeted industrial policies have shown the potential to optimize environmental outcomes (Xue et al., 2024; Wang D. et al., 2025). Despite these developments, regional disparities in tax policy effects and market behavior indicate that broader coordination is necessary.

While direct research on the impact of the fee-to-tax reform on industrial green transformation is still limited, related literature supports its role in producing both environmental and economic “double dividends” (Klein and van den Bergh, 2021; Lin and Xu, 2023). Environmental dividends pertain to pollution control and ecological improvement, while economic dividends relate to enhanced productivity and employment (Hosan et al., 2022; Du and Zhou, 2022). These dividends are particularly prominent when environmental tax internalizes externalities and shifts the tax burden from labor to pollution (Albrizio et al., 2017). Furthermore, environmental taxation has been shown to encourage green upgrading by supporting the “strong” Porter hypothesis, which posits that well-designed regulations can enhance economic competitiveness (Liu et al., 2021). Empirical evidence indicates that fee-to-tax reforms stimulate environmental investments in heavily polluting firms (Liu et al., 2022; Guo and Cui, 2024), optimize environmental investment structures (Xie P. et al., 2023), enhance ESG performance (Li and Li, 2022; Zhang and Song, 2022; He et al., 2023; Zhang and Ding, 2024), and promote corporate social responsibility (Long et al., 2022). Specifically, Tian et al. (2023) argue that in aging societies, carbon pricing mechanisms must include targeted protection schemes to safeguard older adults, whose energy dependence and consumption habits differ significantly from the younger population.

However, there is also a body of literature that highlights potential drawbacks. Environmental regulatory costs may crowd out innovation investments, reduce production efficiency, and increase the risks of firm exit in heavily polluting sectors (Ji and Zeng, 2022; Lange and Redlinger, 2019). Fee-to-tax reforms may dampen the benefits of digital transformation and lead to declines in household consumption and market scale (Renström et al., 2021; Fan et al., 2021). These consequences are particularly significant for firms with lower investment efficiency (Xie L. et al., 2023). Finally, as green development becomes a global consensus, concerns regarding energy costs and carbon inequality are receiving greater attention. Vulnerable groups, such as the elderly and low-income households, often face disproportionate energy burdens (Tian et al., 2025). To address this, market-based mechanisms such as energy quota trading effectively reduce carbon inequality (Wang Y. et al., 2025). Therefore, integrating targeted domestic policies, international collaboration, and further academic research is essential not only for combating climate change but also for achieving equitable and inclusive green development. As Kang et al. (2024) emphasize, China’s most cost-effective greenhouse gas mitigation strategies may lie beyond just achieving net-zero CO2, suggesting that coordinated reform across different pollutant types and economic sectors is essential.

Scholars have conducted extensive research on the reform of environmental protection fees to tax, as evidenced by a review of pertinent literature. However, the connection between companies’ green development and the reform of environmental protection levies to tax still has room for growth. The existing research exhibits the following issues: First, the current literature focuses more on how environmental protection tax influences microbusiness investments and green innovation, while research at the macro-industrial level is relatively weak. Second, the environmental protection tax’s impact on regulation is primarily examined from a broad industry or sector perspective. There is comparatively less research on this reform’s contribution to green development at the macro level. To establish a solid theoretical and practical basis for the successful implementation of the environmental protection tax and provide scientific guidance for promoting the green transformation of industries, this study thoroughly examined the effects of the environmental protection fee-to-tax policy on the green development of industries and its mechanisms of action.

The novelty of this study lies in the following two aspects: First, in the existing literature, researchers’ studies on the conversion of environmental protection levies into tax mostly focus on micro-fields such as enterprise performance, green total factor productivity, and capacity utilization rate. Although several studies focus on green business growth, there is still a lack of focus on sectors at the macro level. According to Tong et al. (2022) and Yue et al. (2024), the industry is the backbone of the real economy, and its green development contributes to the achievement of the low-carbon and green development objectives, which are the SDGs of the UN and the global objective in general. Thus, this study aimed to close this research gap. The theoretical circle is supported by empirical evidence through a thorough examination of the effects of “environmental protection fee-to-tax” on the green development of industries. Secondly, we introduced the concepts of the degree of resource misallocation and green technological innovation, examined the many aspects of the “environmental protection fee-to-tax” policy’s implementation process and mechanism, as well as how these elements interact. This analysis not only contributes to a better understanding of how current environmental restrictions impact industries’ green development, but it also offers a fresh viewpoint and complements existing research on the impacts of related processes.

This paper is organized as follows: Section 1 (Introduction) presents the study backdrop, issue description, literature evaluation, research discoveries, contributions, and an overview of the entire structure. Section 2 (Policy Background and Conceptual Framework) elaborates on the institutional context of the environmental protection fee-to-tax reform in China, presenting the conceptual framework and research hypotheses. Section 3 (Research Design and Methodology) details the data sources, variable definitions, and model specifications. Section 4 (Results) includes descriptive statistics, baseline regression results, robustness checks, and heterogeneity analysis. Section 5 (Mechanism Analysis) explores the underlying mechanisms. Section 6 (Discussion) offers further insights and interpretations. Section 7 (Conclusion and Policy Implications) summarizes the main findings and provides policy recommendations. Finally, the limitations of this study are discussed in Section 8 (Limitations and Future Research), which also suggests directions for future research.

2 Policy background and conceptual framework

2.1 Institutional background of China’s fee-to-tax reform for environmental protection

As environmental problems throughout the world have gotten worse in recent years, green and sustainable development has become a major social concern. The high-input, high-energy, and high-pollution economic development model has raised output value in China for more than 40 years since the country’s reform and opening up. Resource depletion and environmental degradation have gotten worse even if the economy has moved from rapid expansion to high-quality development. Focusing on economic progress while also conserving the environment, aiming for the peaceful coexistence of humans and nature, and pursuing high-quality development are all crucial. Environmental protection and economic development are intimately related and complimentary.

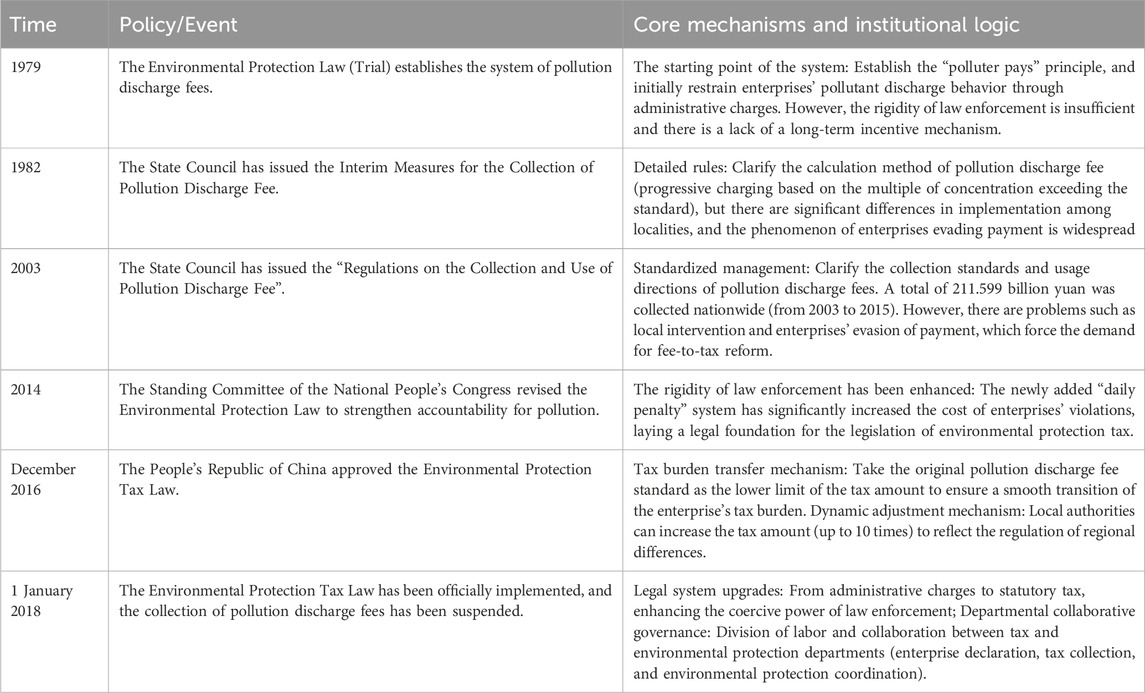

Compared to developed countries, China started late in environmental taxation, and its related legal system is not yet robust, but significant progress has been made in this field. China established its pollution fee system in 1979 based on “International Environmental Law,” followed by detailed regulations in 1982. In 2003 and 2014, China comprehensively adjusted and optimized its pollutant emission management system, resulting in the State Council’s Legislative Affairs Office seeking input on the “Environmental Protection Tax Law” in 2015 and its passage a year and a half later. On 1 January 2018, the “Environmental Protection Tax Law of the People’s Republic of China” went into effect, replacing the nearly forty-year-old pollution fee system. Table 1 presents the policy evolution and mechanism logic of the transformation from environmental protection fee to tax.

A major factor in economic development, the Environmental Protection Tax seeks to safeguard and enhance the environment, lower emissions of pollutants, and encourage the growth of ecological civilization. The implementation of the fee-to-tax reform aligns China’s ecological civilization construction with international standards, emphasizing the guiding role of green development in economic restructuring and reflecting the desire to improve the ecological environment through institutional innovation. The switch to an environmental protection tax from a pollution fee represents a comprehensive systemic and implementation shift. The tax legally establishes the “polluter pays” principle, with tax authorities enforcing the law strictly, making higher emissions a significant constraint on corporate production. Instead of raising tax money, the primary objective of imposing an environmental fee is to establish a mechanism encouraging companies to reduce pollution, aligning with the principle of paying more for more pollution and less for less.

2.2 Conceptual framework and research hypotheses

Environmental resources, characterized by non-competitiveness and non-exclusivity, create asymmetric costs and benefits for corporate involvement in environmental governance. Therefore, on the one hand, effective environmental management needs to rely on the cooperation of governments and enterprises to jointly protect and manage environmental resources to achieve sustainable utilization of resources and healthy development of the environment. On the other hand, the public character and sharing of resources must be considered, adopt cooperative and coordinated measures to protect environmental resources. Governments worldwide have internalized the external costs of environmental pollution by charging businesses for their emissions, making them bear the social costs of their pollution, ultimately protecting the environment (Sun and Zhang, 2022). The environmental protection tax holds a crucial position in environmental governance, with the unique advantages of stronger enforcement rigidity and standardization. China’s environmental protection tax, which is based on the “shifting tax burden” idea, is derived largely from the original pollution charge system.

However, in contrast to the pollution fee, the environmental protection tax is collected and managed independently by the environmental protection department, and the tax department cooperates to complete the collection work. The tax standard has also been greatly adjusted, and the legal status has been improved, so it has stronger rigidity and standardization of law enforcement. Set a more clear constraint and incentive system for businesses’ sustainable growth. Specifically, to a certain degree, the green transformation and upgrading of businesses are encouraged by the reform of the environmental protection tax system, which also increases the environmental legitimacy of businesses by raising their knowledge of environmental responsibility. In this process, companies have to face the obligation to pay environmental tax, while also subject to more stringent supervision and possible penalties from regulators.

This two-way regulation encourages businesses to meet their social obligations and take action to ensure that environmental preservation and economic development coexist positively (Wang and Feng, 2021; Huang et al., 2024). Consequently, the environmental protection fee is not a result of environmental advocacy, but to increase the burden of enterprises, stifle the vitality of market players, and hinder economic development. On the contrary, screening businesses enhances efficiency and optimizes the industrial structure while safeguarding the environment, and supporting the green growth of the economy and society. Thus, the first hypothesis is:

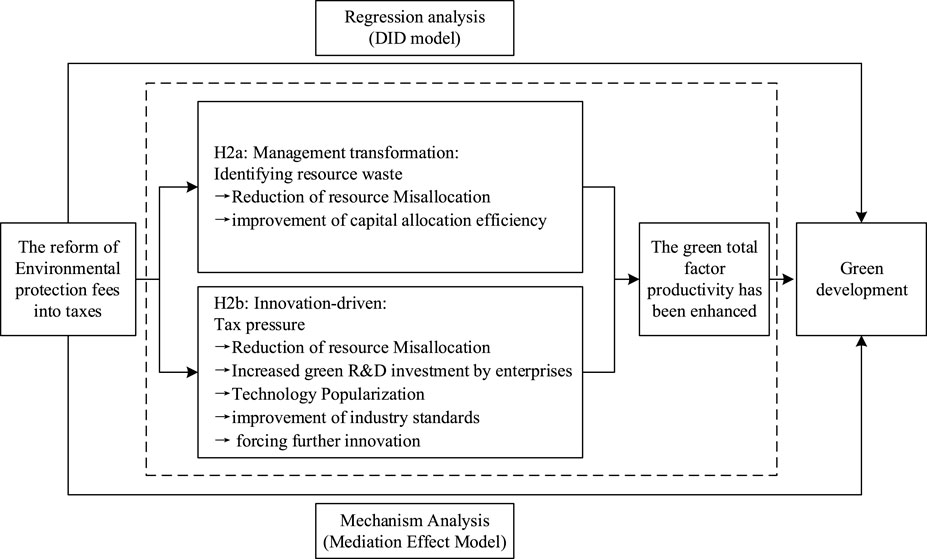

H1. Industrial green development is facilitated by the tax reform’s environmental protection fee.

Better capital allocation efficiency influences industrial green development by increasing GTFP (Xie et al., 2022). Implementing an environmental protection tax not only demonstrates the government’s commitment to environmental protection but also sends a clear message to businesses: maximizing technological innovation and resource efficiency during production and operation are crucial paths for businesses looking to reap long-term rewards. When environmental protection fees are added to tax reform, business managers may be prompted to reflect deeply on resource allocation, realize the problem of resource waste and inefficiency in the traditional extensive management mode, encourage enterprises to adopt a more refined and scientific management mode, and then encourage the switch to green manufacturing as the manner of production (Xue, 2024; Zhang et al., 2024).

By introducing incentive mechanisms such as green evaluation management systems and green technology innovation rewards, it can effectively stimulate the innovation vitality of enterprises, so that they can concentrate limited resources on the most valuable areas, to accomplish both environmental preservation and economic gains in a win-win scenario. The green evaluation management mechanism helps enterprises to identify and evaluate the rationality of resource use in the production process to ensure that every input can produce the greatest environmental protection effect; green technology innovation incentives encourage enterprises to develop new technologies and new processes to reduce pollution emissions and increase energy efficiency as a direct means for businesses to improve their environmental performance and as a reflection of their corporate environmental responsibility. Changes and improvements to the environmental protection tax have a significant effect on how businesses allocate their resources and think about their operations.

The tax reform profoundly impacts corporate management philosophies and resource allocation, requiring reassessment of R&D and human capital, and redirecting investment towards green innovation. This not only shifts investment focus to environmental sectors but also ensures effective resource use, strengthening environmental protection awareness and prompting proactive environmental actions. The reform encourages more refined and intensive production processes, with environmentally performing companies gaining competitive advantages and access to green financing, resulting in enhanced green total factor production and more effective resource allocation (Klenert et al., 2018). Increasing the production of green total factors is not only the pursuit of environmentally friendly production but also a reflection of enterprise competitiveness. Thus, the second hypothesis is:

H2a. The environmental protection fee to tax reform promotes industrial green development by reducing the degree of resource misallocation.

The transition from an environmental protection fee to a tax has sped up businesses’ green growth. Countries all across the world are struggling with environmental issues as they progress economically, and environmental protection has become an important challenge and topic for governments (Lu et al., 2023). The key to solving the severe problem of resource and environmental crisis is to develop a green economy and encourage the synchronized advancement of resource preservation and economic prosperity. The transition to a green industrial economy is facilitated by suitable green technical innovation and industrial structure modification, as per the Sustainable Development Goals (Liu et al., 2025). Neoclassical economic theory points out that environmental protection policies will raise businesses’ manufacturing costs, causing a “crowding out effect.” Given the state of technology and resource allocation, environmental regulations will push out resources like capital and raise the cost of pollution for businesses, thus reducing the green innovation ability of enterprises, thereby weakening their positive environmental protection effects and adversely affecting economic development. However, according to Porter’s (1991) concept, environmental regulations influence the development or uptake of new technologies, increasing production efficiency and competitiveness over the long term, thus fostering economic growth.

The tax reform shifts the burden from the pollution fee system, urging companies to innovate green technologies. Faced with increased tax costs, rational businesses weigh the benefits of technological innovation against the additional tax burden. Green technology innovation, on the one hand, can reduce pollution emissions and environmental pressure on enterprises, and bring environmental performance, and on the other hand, it can bring benefits to enterprises through new products, technologies, and processes, and boost their ability to compete in the market. Given the escalating level of market competition, there are always “first-mover enterprises” that take the lead in innovating to form green patents, build technical barriers, and gain leading edges. In addition, the public is more inclined to choose environment-friendly products, environment-friendly goods occupy a gradual expansion of market share, enterprises actively carry out green technology innovation to produce products will be welcomed by consumers, the formation of product compensation effect, to boost businesses’ customer favorability and foster a feeling of corporate social responsibility. Furthermore, the government’s preferential tax policies for enterprise technological innovation are becoming more and more supportive. Tax reduction and exemption policies are used to incentivize businesses to engage in green R&D and green technology innovation, as well as to improve their overall productivity and attain green development. Therefore, the third hypothesis is:

H2b. The environmental protection fee to tax reform promotes industrial green development by encouraging green technological innovation.

The theoretical framework developed from the above concepts is shown in Figure 1.

3 Research design and methodology

3.1 Empirical strategy

The Difference-in-Differences (DID) model was initially presented by Princeton University’s Ashenfelter and Card in their project evaluation paper from 1985. The disciplines of sociology and econometrics have since made extensive use of this concept. The counterfactual theoretical framework is the foundation of the difference-in-differences model. By contrasting the variations in the variables that are explained, it evaluates the extent of effect when a certain event or policy occurs or not. In the analytical framework based on counterfactual reasoning, the core lies in comparing the differences between the actual changes of the target variables in the experimental group after the policy implementation and the potential changes assumed when the policy was not implemented, to evaluate the true effect of the policy. Even though the experimental group’s modifications following the policy’s implementation are readily apparent, the changes in it without policy intervention cannot be directly observed. Therefore, Applying the difference-in-differences approach requires that the experimental group’s change trend without intervention match the control group’s time trend on the target variable. In terms of policy effect evaluation, the DID model can effectively eliminate the interference of some non-policy factors by combining the differences between time effects and individual effects. Furthermore, one way to better control for any confounding influences between the experimental group and the control group is to introduce control variables that might influence the explained variables. Thus, to a certain extent, it compensates for the deficiency that complete randomization cannot be achieved in sample allocation in “quasi-natural experiments”, and improves the accuracy of policy effect evaluation. Furthermore, the leniency of the data requirements of this model is also one of the important reasons why it has been widely applied in the field of econometrics. This paper uses the DID model to estimate the treatment effect of the policy because the policy of substituting tax for environmental protection fees was formally implemented on 1 January 2018, and it has persisted to this day.

3.2 Data source and sample construction

Enterprises are the micro-subjects of industrial activities. The production, consumption, innovation, and other behaviors of an industry are all realized through enterprises. The production efficiency, resource utilization efficiency, and pollution emission level of enterprises directly affect the green performance of the entire industry. The research subjects for this study are listed companies in the Shanghai and Shenzhen stock exchanges from 2013 to 2022, excluding those in abnormal trading statuses like ST, ST*, and PT, as well as companies in the finance and insurance sectors, based on the operability and availability of data. Interpolation was used to impute missing data, yielding a final sample of 17,860 observations and 1786 businesses. The following are the main sources of data: The “China City Statistical Yearbook,” “China Environmental Statistical Yearbook,” listed companies’ annual reports, social responsibility reports, and information from their websites were the sources of data on corporate green total factor productivity. Other data came from the CSMAR database. Excel was used for the initial data arrangement and screening, while Stata17 was used for regression analysis.

3.3 Variable definitions

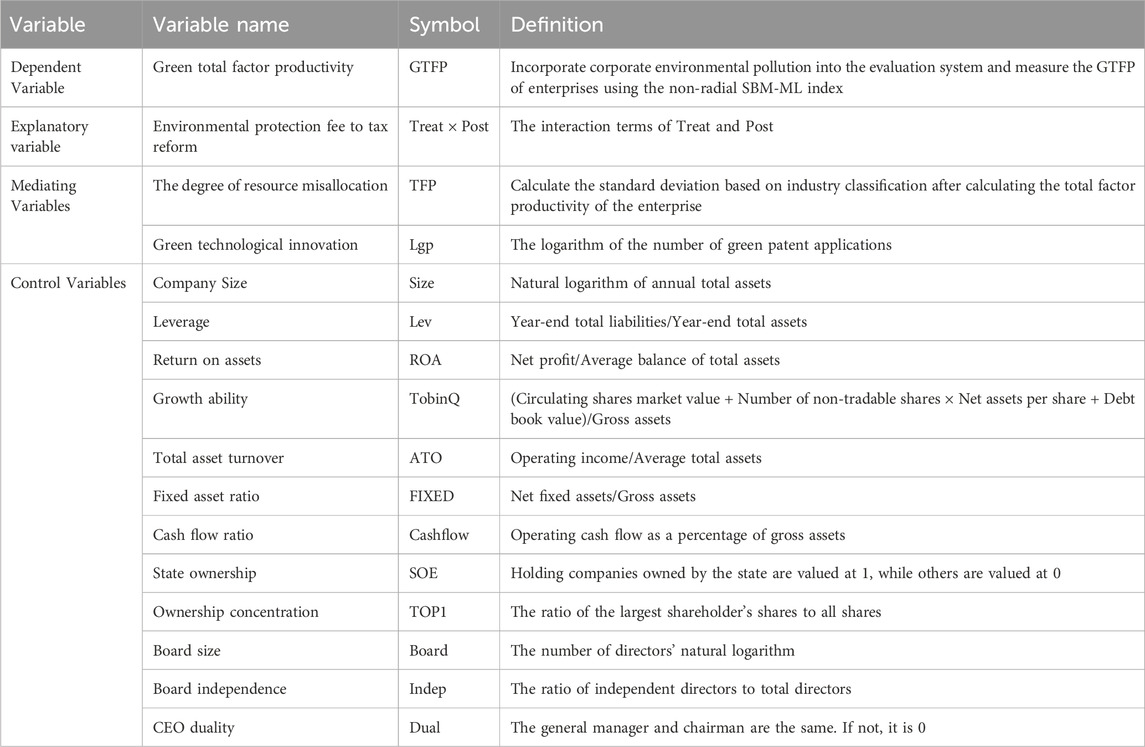

Dependent variable: Green Total Factor Productivity (GTFP). Green Total Factor Productivity (GTFP) is used to measure the enhancement of green growth efficiency and the transformation of growth modes, making it suitable for assessing corporate green development. This indicator incorporates unintended outputs such as resource usage and environmental pollution into total factor productivity, reflecting the concept of green development and thus serving as a proxy for industrial green development. Following existing literature (Tone, 2001; Li et al., 2020; Xia and Xu, 2020; Fang et al., 2021; Li and Chen, 2021; Zhao et al., 2022; Zhang et al., 2022), this study incorporated unwanted outputs into the efficiency assessment and measured corporate green total factor productivity using the non-radial SBM-ML index. Specifically, the following input and output indicators quantified an organization’s GTFP: (1) Factor input: Energy input was computed as a proxy variable by converting the industrial electricity consumption of the city where the enterprise is located into the percentage of the enterprise’s employees among the urban population employed in that city; labor input was represented by the number of employees of the enterprise as a proxy variable; and capital input used the net fixed assets of the enterprise as a proxy variable. (2) Expected output: The company’s operating income was used as a proxy for the anticipated output of the business. (3) Undesired output: The emissions of the “industrial three wastes,” which are industrial sulfur dioxide, industrial wastewater, and industrial smoke and dust, were converted according to the enterprise’s workforce share of the city’s total employment among urban dwellers. These emissions were then used as proxy variables for the enterprise’s undesirable output.

Explanatory variable: Environmental Protection Fee to Tax Reform (Treat × Post). There are no rigorous experimental and control groups since the environmental protection fee to tax reform was introduced nationally. In line with earlier research (Deng et al., 2023), this study used the DID approach to examine the effect of the reform on industrial green development while using non-heavily polluting businesses as the control group. It constructs spatial and temporal dummy variables and their interaction term: the spatial dummy variable (Treat) is one for heavily polluting enterprises and 0 otherwise; the interaction term (Treat × Post) is the coefficient of the reform’s influence on industrial green development, which is the study’s main emphasis. The temporal dummy variable (Post) is 1 for years after 2018 and 0 otherwise. A significantly positive coefficient indicates that the reform promotes industrial green development.

Mediating variables: The degree of resource misallocation (TFP) and Green Technological Innovation (Lgp). Traditional literature attributes total factor productivity primarily to a country’s technology level (Howitt, 2000), but more recent research emphasizes how important resource allocation is to economic growth (He and Qi, 2021). Ideally, total factor productivity across firms should be consistent, with larger disparities indicating greater distortions in resource distribution. This paper uses the dispersion of industry total factor productivity as a proxy for a corporation’s degree of resource misallocation, calculated as the standard deviation within industries (Hsieh and Klenow, 2009; Wei and Li, 2017). For measuring green technological innovation, scholars commonly use the number of green patents or a composite index based on pollution emissions, R&D spending, and patent applications. This study adopts the methodology of Xiang et al. (2022) and measures the degree of corporate green technical innovation using the logarithm of the number of green patent applications.

Control variables: Building on existing research (Huang et al., 2022; Deng et al., 2023), this paper includes control variables related to financial characteristics, ownership features, and board and management attributes. Financial characteristics include Size, Lev, ROA, TobinQ, ATO, FIXED, and Cashflow. Ownership features include SOE and TOP1. Board and management attributes include Board, Indep, and Dual. The specific symbols and definitions of the main variables are detailed in Table 2.

3.4 Model specification

DID model. To evaluate the impact of the environmental protection fee to tax reform, this paper employs the DID method to estimate the policy’s treatment effect. DID is suitable for situations where the experimental group contains multiple treated entities and is one of the most widely used econometric methods for estimating treatment effects. This study builds a twofold difference model (1) to examine the effect of the environmental protection fee to tax reform on industrial green development, using the 2018 adoption of the “Environmental Protection Tax Law” as an opportunity. This is how the model is displayed:

In model (1),

Mechanism test models. To learn more about how the environmental protection tax affects policy, this study adopts a two-stage regression method to identify whether there is an effect of resource misallocation’s degree and green technological innovation on industrial green development. This method mitigates the problems of crowding out and omitted variables between the independent and mediating variables, aiding in elucidating the impact mechanisms. The specific mechanism test model (2) is as follows:

In model (2),

The mediating mechanism was tested in this work using a two-step methodology. First, the total effect of X→Y (Model 1) and the influence of X→M (Model 2) were estimated through an empirical model. Then, combined with the verified mechanism of M→Y in authoritative literature, the theoretical path of “X→M→Y” was constructed. Although the influences of X and M on Y were not estimated simultaneously in a single model, the robustness of the conclusion was enhanced using two steps. First, the extrusion effect was identified. Specifically, the influence of M on Y can be indirectly explained by referring to the literature, thereby reducing the possibility that the total effect of X on Y would be “squeezed out” by other unobservable variables. Second, we controlled for omitted variables. In the X→Y and X→M models, control variables and individual time double fixed effects were included to eliminate the main interfering factor of M on Y. This method, which prioritized balancing the research cost and the reliability of the conclusion, provided a theoretically self-consistent evidence chain for the mediating mechanism.

4 Results

4.1 Descriptive statistics and correlation analysis

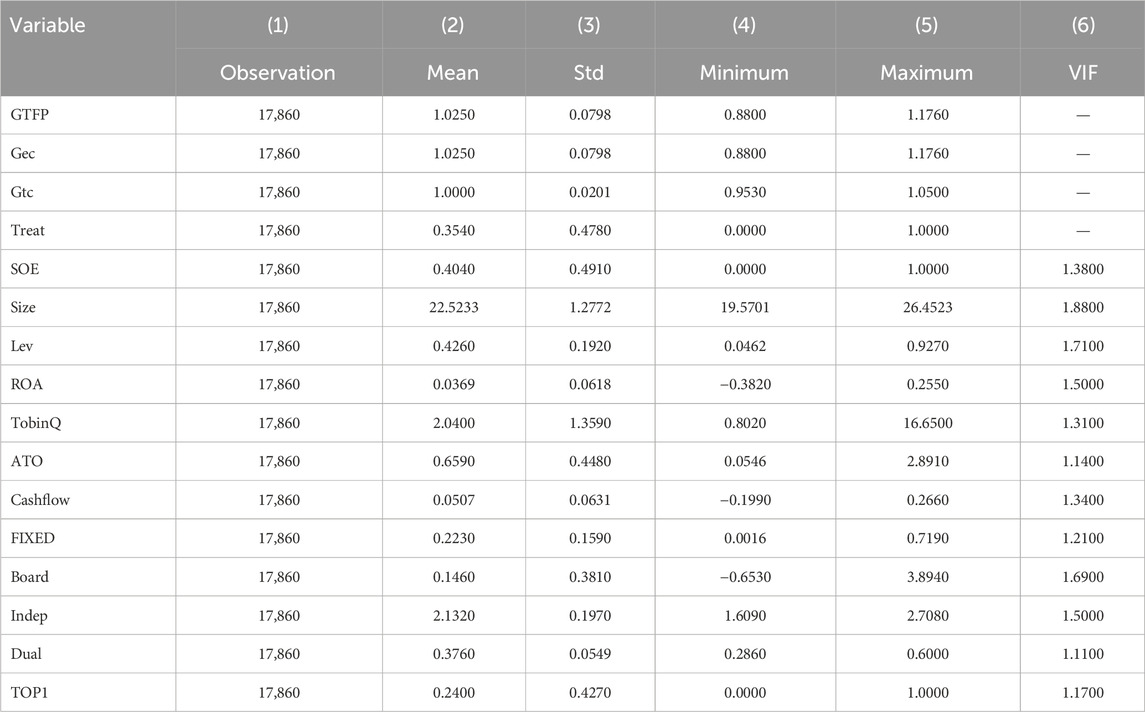

Table 3 displays the variables’ descriptive statistical analysis. In particular, the industry’s green development level is reflected in the green total factor productivity value of 1.025, and the indicator’s average value is higher than 1. This suggests that throughout the period under investigation, the production efficiency of the pertinent businesses has not only improved in terms of traditional economic output but also made positive progress in resource utilization efficiency and environmental cost control. With an average Treat value of 0.354, 35.4% of the samples in this research belong to enterprises in heavily polluting industries. Moreover, these enterprises not only face the challenges of high pollution emissions and high energy consumption in the production process but also are subject to stricter environmental supervision. This demonstrates the substantial influence of the “Environmental protection fee-to-tax” policy on highly polluting businesses and the need for more research. The sample’s average SOE value is 0.404, indicating that 40.4% of the businesses are state-owned. State-owned businesses are a significant component of the sample enterprises and are of great significance for understanding the policy impact.

This study evaluates the regression of model (1) using the Variance Inflation Factor (VIF) test to avoid inaccurate results because of multicollinearity among explanatory variables. High correlations among independent variables can lead to inaccurate model estimates and unstable coefficients. The VIF test evaluates the impact of each independent variable on the model, helping to identify the most influential variables and avoiding the inclusion of highly correlated variables in the model, consequently, the model’s prediction accuracy and explanatory power are improved. A higher VIF value indicates a greater correlation among independent variables, suggesting that the explanatory power of a variable may be influenced by others. The VIF test results are displayed in Table 3, column (6), and they indicate that the average VIF among the explanatory variables is 1.39, all below 2, indicating that the coefficient estimates are relatively reliable, model (1) is stable, and the basic conditions for regression are met, thus preliminarily ruling out the issue of multicollinearity in the model (1).

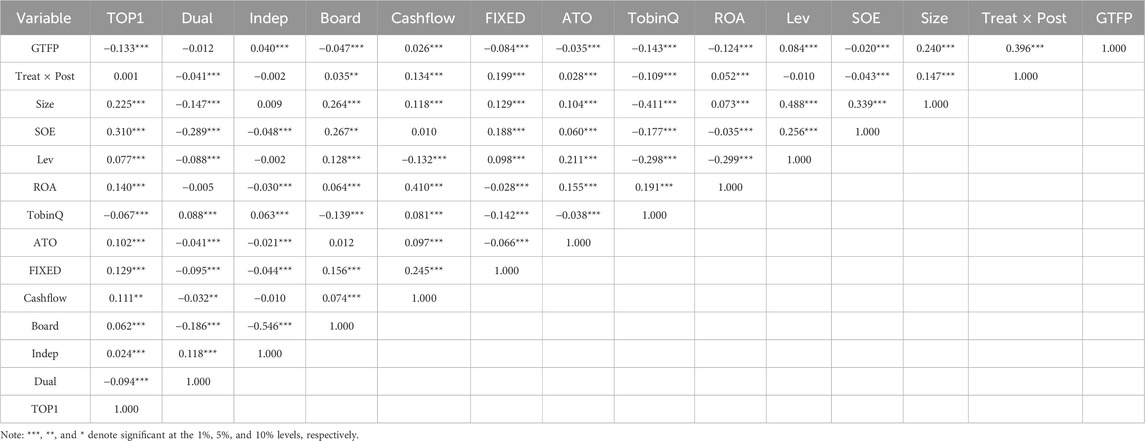

To further verify the absence of multicollinearity among the explanatory variables, the Pearson correlation test is also used in this investigation. This method calculates the ratio of the covariance to the standard deviation between two variables, yielding a value between −1 and 1, which evaluates and measures the direction and strength of their linear connection. The results of the Pearson correlation test for the primary variables are shown in Table 4, showing that the green development of industries (GTFP) has significant correlation coefficients with most control variables. This suggests that the study’s chosen control variables are representative, further eliminating the concern of multicollinearity in the model (1).

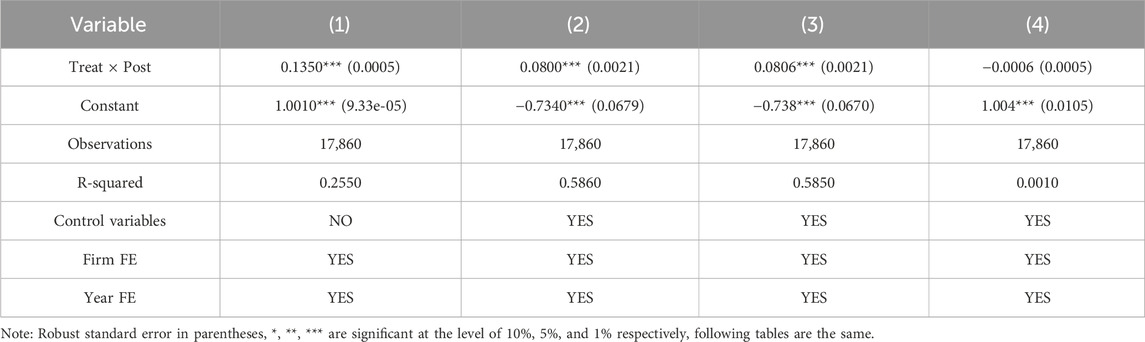

4.2 Baseline regression results

The main purpose of this study was to examine how the reform of environmental protection fee to tax affects industrial green development, using the regression coefficient of the DID (Treat × Post). The expected outcomes of the baseline model (1) are shown in Table 5. While columns (3) and (4) demonstrate the effects of the reform of environmental protection fee to tax on improving green efficiency and promoting green technology, respectively, Column (2) displays the results with control variables included. The regression coefficients for Table 5’s columns (2) through (4) were 0.0800, 0.0806, and −0.0006, respectively, and the first two are both significant at the 1% level, while the last one is not significant. This suggests that while the environmental protection tax change has a favorable impact on industrial green development and green efficiency, it has little influence on the advancement of green technologies. The expense of environmental protection for businesses has increased ever since environmental protection levies were converted to tax. To cope with the pressure of rising costs, enterprises may prioritize methods that can produce quick results in the short term to reduce their tax burden, such as reducing pollutant emissions, thereby enhancing green efficiency. However, the advancement of green technologies often demands sustained investment in technical innovation, research, and development. Owing to constraints such as limited funds and technological capabilities, enterprises may struggle to make substantial progress in green technologies in the short term. The core explanatory variable Treat × Post’s regression coefficient remained significant, indicating that the environmental protection fee to tax reform has raised businesses’ green total factor productivity, regardless of whether control variables and fixed effects are present, thereby supporting the hypothesis (H1) that the reform aids in promoting industrial green development.

One regulatory instrument that actively supports the harmonious growth of the economy, society, and environment is the environmental protection tax, which is dependent on market processes and economic incentives. The pollution fee system implemented before 2018 had weaker direct constraints on enterprises, and the lower penalties for pollution were inadequate deterrents. The implementation of the environmental protection tax rectified these deficiencies, imposing real constraints on enterprises. While penalizing polluting behaviors, the reform uses tax incentives to encourage firms to engage in green R&D, innovation, and environmental investment, further fostering green industrial development. Additionally, under the new legal framework, the environmental protection tax was integrated into the tax collection system, forming a more unified and efficient environmental management mechanism. The cooperation among environmental protection agencies and tax authorities in tax collection tasks has significantly strengthened policy enforcement and standardization. With the environmental protection tax being of higher legal stature than the pollution fee, enforcement rigidity and standardization in promoting green industrial development have improved. Polluting enterprises face challenges such as increased product costs, technological transformation pressures, and tax compliance risks. Despite these challenges, they also present opportunities for transformation and upgrading. In response, companies actively engage in environmental management, incorporating environmental protection into their production and business processes, aiming to enhance their corporate social responsibility image, strengthen core competitiveness, and reduce environmental risks.

4.3 Robustness checks

The parallel trends test, propensity score matching (PSM), and placebo test are the three techniques used in this study’s robustness tests to evaluate the dependability of the baseline regression findings.

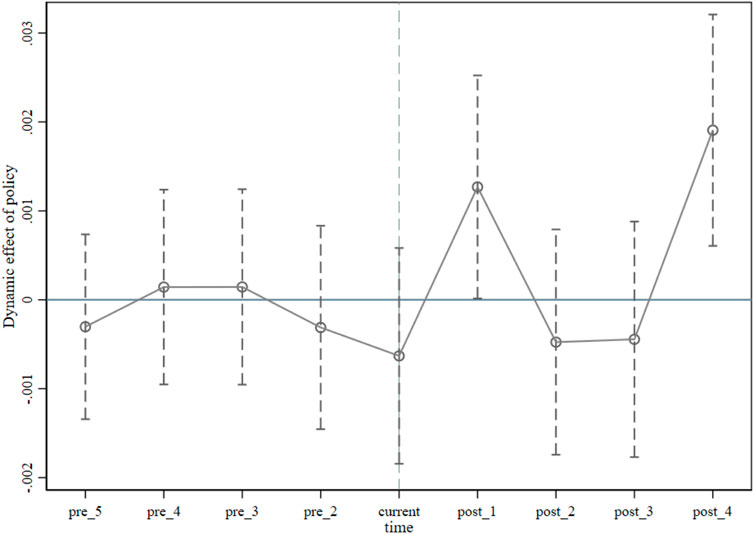

4.3.1 Parallel trends test

The parallel trends assumption, which states that the experimental and control groups should show comparable trends before policy implementation, must be met before using the DID model. If this condition is not met, the interaction term estimated from the DID model may not accurately reflect the policy’s effect. As illustrated in Figure 2, the regression coefficients for the years 2016 (pre_2), 2015 (pre_3), 2014 (pre_4), and 2013 (pre_5) were not substantially different from zero before the environmental protection tax’s implementation, suggesting that the experimental and control groups’ average green total factor productivity differences were not significant before the tax’s introduction, supporting the parallel trends hypothesis. The regression coefficient for 2019 (post_1) was noticeably positive following the enactment of the environmental protection tax. As the COVID-19 pandemic peaked in 2020 and 2021, the parallel trend assumption is not valid for these years. This is likely due to the pandemic-induced asymmetric shocks across industries.

For example, heavily polluting enterprises (often in the treatment group) continued operations with policy support. In contrast, cleaner or service-oriented firms (typically in the control group) faced significant contractions or shutdowns. During the epidemic, businesses that consumed high levels of energy and produced pollutants, such as manufacturing and heavy industry, had fewer restrictions on their production activities. Nevertheless, the light industry and service sector had more restrictions. Many enterprises suspended operations and production, and market demand fluctuated significantly. This has significantly affected the green development paths of the control group enterprises. Owing to policy pressure and environmental responsibility, enterprises in the treatment group still need to maintain basic green investments; however, the financial pressure brought about by the epidemic has restricted their green input. Meanwhile, enterprises in the control group, due to their lighter environmental protection burden, might reduce environmental protection expenditures or entirely suspend operations during the epidemic, resulting in deviations in the data. These exogenous shocks may have distorted the natural trajectory of green development and disrupted the comparability between groups during these years.

Therefore, the regression coefficients for 2020 (post_2) and 2021 (post_3) became insignificantly different from zero. The regression coefficient for 2022 (post_4) was noticeably favorable due to the advancements made in COVID-19 prevention and control as well as the orderly return to work and production. This suggests that the control group used for this research is comparable to the treatment group before the policy shock, fulfilling the parallel trends assumption. This further supports the environmental protection tax’s beneficial impact on encouraging the growth of green industries.

4.3.2 PSM-DID regression

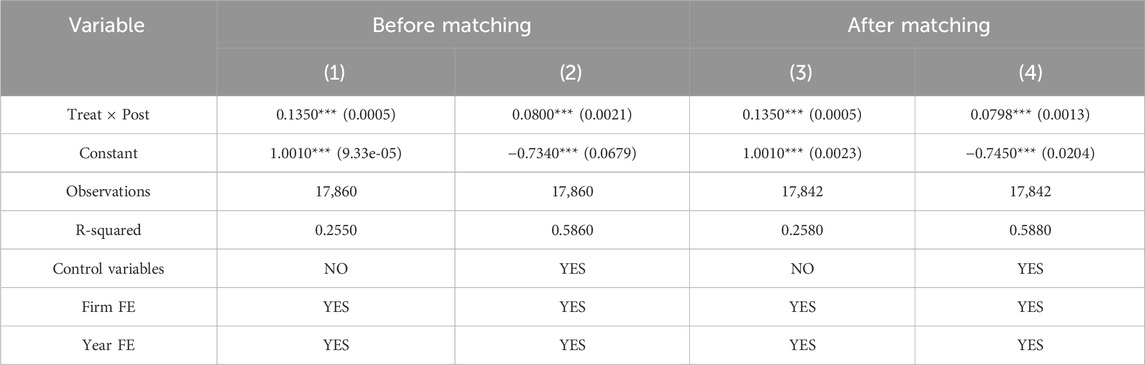

If there is an inherent lack of comparability between the treatment and control groups, the estimation of policy effects would be unreliable because it would be impossible to observe the “counterfactual” outcomes of control group firms that were not impacted by the policy in the quasi-natural experiment of the environmental protection fee-to-tax reform. The PSM technique was employed in this work to further address endogeneity concerns by removing sample selection interference brought on by observed individual variability.

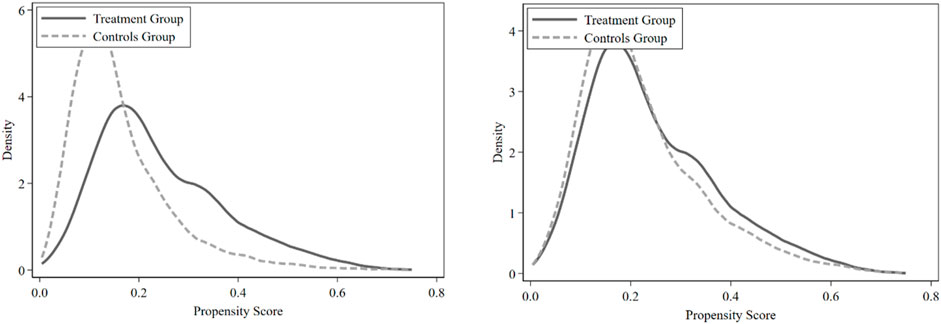

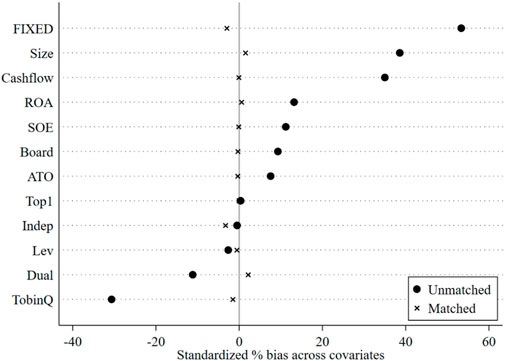

PSM and Difference-in-Differences (DID) are combined in the PSM-DID model, which uses DID to determine the impact of policy implementation and PSM to choose control group samples for the treatment group. The control variables mentioned earlier were used as covariates for PSM. Table 6 displays the outcomes of the model (1) following PSM. The credibility of the estimated policy impacts is increased by this combined method, which guarantees a similar baseline between the treated and control groups, enabling a more thorough investigation of the policy’s influence. Figure 3 shows the standardized deviation of each variable, and Figure 4 displays the score kernel density map both before and after PSM.

Table 6 shows the DID regression results for the sample after effective matching. For comparison, Table 6’s columns (1) and (2) match Table 5’s columns (1) and (2). Table 6 shows that the interaction term (Treat × Post) coefficients in columns (3) and (4) are considerably positive, at 0.1350 and 0.0798, respectively, when compared to the results in columns (1) and (2). These values remain significant at the 1% level and agree with the pre-matching findings, with slight variations in standard errors. This consistency shows strong outcomes and supports the earlier conclusion that the environmental protection fee to tax reform encourages industrial green growth.

4.3.3 Placebo test

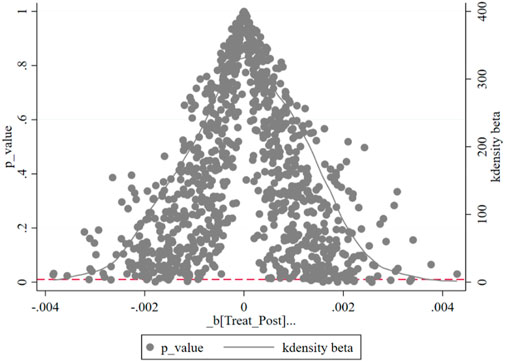

The environmental protection fee-to-tax policy is implemented uniformly throughout the nation, making it challenging to discern the differences between the experimental and control groups. Because of this, this paper uses listed firms in highly polluting sectors as the experimental group and listed companies in other industries as the control group. This is because various industries are affected differently by legislation. To enhance the credibility of the research conclusions, this paper adopts the random sampling method to virtually group the enterprises in the entire sample. The “virtual processing state variable” (Treat) is generated through random numbers, and the interaction terms are constructed in combination with the time virtual variable (Post). On this basis, model (1) with both individual and time fixed is used to estimate the coefficients of the interaction term, and the coefficient estimates, robust standard errors, and significance levels of the virtual interaction term are obtained. The random grouping procedure was carried out 1,000 times to guarantee the results’ robustness.

Figure 5 shows the distribution of the significance levels of virtual interaction items (Treat × Post) after random grouping. The horizontal dotted line in Figure 5 represents the significance threshold of P = 0.1. If the regression coefficient is lower than this threshold, it indicates that the coefficient is significant at least at the 10% level. Conversely, it is not significant. It can be seen from Figure 5 that most of the scattered points are concentrated near the 0 value and far from the true value (the true value is 0.0800. As the value is large and located to the right of the scale line, it is not shown in Figure 5). Furthermore, most of the scattered points are above the significance threshold, indicating that they fail the significance test at the 10% level. This result indicates that the probability of the “Virtual processing state variable” (Treat) passing the significance test is relatively low. This suggests that this paper’s model (1) setting is sound and includes all the elements that are crucial to the industry’s green development. This indirectly proves that the improvement of the effectiveness of green development indeed is not caused by other reasons, but mainly by the strategy of substituting tax for environmental protection levies. The results of the placebo test confirmed that the findings in this research were robust.

4.4 Heterogeneity analysis

Previous studies have explored the heterogeneity of environmental tax reform from various angles, including the impact of city location and city size (Guo et al., 2022). Building on this foundation, our research delved into the subject from the perspectives of the size of the enterprise, natural geographical location, and the nature of enterprise property rights, seeking to offer a more thorough understanding of the reform’s many effects.

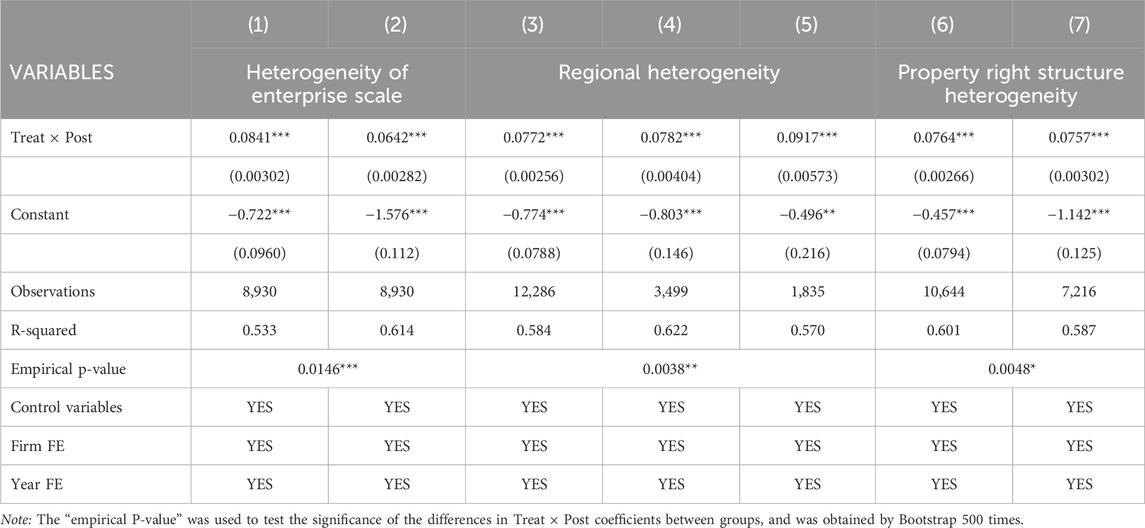

4.4.1 Firm size heterogeneity analysis

Enterprise size plays a crucial role in determining firms’ access to resources, information, regulatory scrutiny, and their overall responsiveness to environmental tax policies. Different-sized enterprises adopt distinct strategic behaviors, face varying levels of production flexibility, and bear dissimilar environmental cost burdens. To explore whether the environmental protection fee-to-tax reform exhibits differential impacts across enterprise scales, this study divided firms into large and small groups based on the median of total asset size. Enterprises above the median were classified as large, and those below as small. Table 7’s results in columns (1) and (2) demonstrate that, at the 1% significance level, the policy’s implementation significantly promotes green development in both large and small enterprises. This confirms that the reform broadly facilitates industrial green transformation. However, the empirical P-value from the Bootstrap method was 0.0146, indicating that the observed differences across firm sizes are statistically significant at the 1% level. The estimated effect coefficients were 0.0841 for large enterprises and 0.0642 for small enterprises, implying a more pronounced policy effect on larger firms.

Several theoretical and practical mechanisms may explain this asymmetry. First, the tax-based reform likely results in higher compliance and abatement costs compared to the previous fee-based system. Large enterprises, by their larger scale, face greater exposure to environmental regulatory costs. This makes them more motivated to adopt energy-saving and emission-reducing technologies, which can significantly improve their green total factor productivity. Second, larger firms often receive greater regulatory scrutiny and are more visible in public and governmental discourse. As key players in the market, they are subject to tighter legal obligations and face reputational pressures that incentivize a shift toward greener production. In this context, the reform not only imposes economic penalties but also acts as a reputational lever pushing large enterprises toward sustainable practices.

Third, larger firms tend to possess more financial, technological, and human capital resources, enabling them to respond more efficiently to regulatory shifts. Their stronger absorptive capacity allows for quicker implementation of green innovations and adjustments in production structures. In contrast, small enterprises often face budget constraints and informational asymmetries, which may hinder their capacity to respond effectively to environmental tax policies. Although they still exhibit positive green development outcomes, the marginal effect of the reform is smaller compared to their larger counterparts. These findings underscore the importance of tailoring environmental policy tools to accommodate firm-specific characteristics. While uniform policies may be necessary for regulatory coherence, differentiated enforcement strategies or targeted support measures—such as subsidies for green technology adoption in SMEs—may enhance the overall effectiveness and equity of green industrial transformation.

4.4.2 Regional heterogeneity analysis

Owing to geographical differences, enterprises in different regions face varied levels of governmental service efficiency, market openness, and regulatory enforcement. The stringency and consistency of environmental protection regulations differ markedly across China’s eastern, central, and western regions, which in turn shape how industrial enterprises respond to the reform that replaces pollution fees with environmental taxes. Consequently, this study re-estimated the baseline regression by splitting the sample into three regions: the East, the Center, and the West. The outcomes are displayed in Table 7’s columns (3) through (5). The eastern, central, and western areas had interaction term coefficients of 0.0772, 0.0782, and 0.0917, respectively. Regardless of the geographic location, the impact of the environmental protection fee-to-tax reform on green industrial development was significantly positive at the 1% level across all regions, confirming the robust effectiveness of the policy.

The empirical P-value calculated using the Bootstrap method further verified the statistical significance of the observed regional differences. When the natural geographical location of the enterprise was used as the grouping standard, the corresponding empirical P-value was 0.0038, which was statistically significant at the 5% level. This demonstrates that there are notable regional variations in the ways environmental protection taxes and levies promote green growth among enterprises. The effect coefficient of policy implementation in the eastern sample was slightly lower than in the central and western areas. A possible reason for this discrepancy may be the relatively smaller number of enterprise observations in the eastern region, which might reduce the statistical power and magnitude of the observed policy effects.

Beyond sample size limitations, several deeper structural factors might account for this regional heterogeneity. First, businesses in the eastern region are generally more advanced in terms of technological capacity, corporate governance, and market orientation. These firms often possess better adaptive capabilities to absorb policy shocks, including the shift from administrative fees to market-oriented environmental taxes. As a result, marginal policy impacts may be less pronounced. Second, enterprises in the East are typically equipped with more sophisticated environmental protection facilities and institutional mechanisms. Their compliance costs under the fee-to-tax reform are therefore comparatively lower, leading to weaker behavioral adjustments. Third, due to the historically stronger administrative capacity and environmental governance systems in the East, local governments may have preemptively implemented similar measures before the formal policy rollout, resulting in partial policy anticipation effects. These factors together attenuate the observable impact of the reform in the eastern region.

In contrast, enterprises in the central and western regions, which often lag in terms of technological progress and environmental management systems, may be more sensitive to external policy stimuli. The fee-to-tax reform introduces higher accountability and cost pressures, compelling firms to adopt greener technologies and production methods. In these regions, the reform might act as a stronger “external push” toward industrial upgrading, thereby yielding more pronounced effects on green total factor productivity.

4.4.3 Property rights heterogeneity analysis

The ownership structure of enterprises plays a crucial role in determining their responsiveness to environmental policy reforms. Differences between state-owned enterprises (SOE) and non-state-owned enterprises (non-SOE) in terms of governance models, financing channels, and policy compliance levels may lead to heterogeneous effects of environmental tax reforms. To examine whether the impact of the environmental protection fee-to-tax reform varies across ownership types, this study conducted a subsample regression by splitting the sample into SOE and non-SOE. The corresponding regression results are reported in Table 7, columns (6) and (7).

The estimated coefficients for the interaction term Treat × Post are 0.0764 for SOE and 0.0757 for non-SOE, both statistically significant at the 1% level. These findings suggest that the environmental protection fee-to-tax reform significantly promotes green development among both SOE and non-SOE. The empirical p-value calculated by the Bootstrap method is 0.0048, which is statistically significant at the 10% level, further confirming the robustness of the heterogeneity across ownership types.

Although the estimated coefficients are relatively close in magnitude, the positive and significant effects for both types of enterprises underscore the universality of the policy’s effectiveness across different ownership structures. Several factors may account for these findings. First, SOE often face stronger political and social pressures to align with national environmental goals, and they typically have better access to resources for implementing green upgrades. Second, non-SOE, driven by market incentives and competitive pressures, may be more sensitive to cost-saving opportunities and technological innovation stimulated by the tax reform, thereby achieving comparable or even greater efficiency in adapting to policy changes. Third, the reform of replacing fees with taxes enhances transparency and enforcement, reducing regulatory arbitrage across different ownership forms and thereby leveling the playing field in environmental compliance.

5 Mechanism Analysis

The ways through which the environmental protection fee to tax reform affects industrial green development are further examined in this section. The tax reform maintained the “tax burden transfer” without substantial changes in the tax base, scope, or method of taxation. Two primary modifications were brought about by the environmental protection fee to tax reform, in contrast to the pollution fee system that existed for over 40 years: First, the creation of environmentally friendly systems of production and consumption is significantly impacted by the environmental protection tax, with strengthened enforcement rigidity and standardization, mandating that businesses include environmental protection into their manufacturing and operations to achieve optimal resource allocation and reduce product costs; second, as part of the initiative regarding green development, businesses must use green technology innovation and technological transformation to preserve their favorable social reputations, influenced by both the “pressure effect” and “incentive effect.”

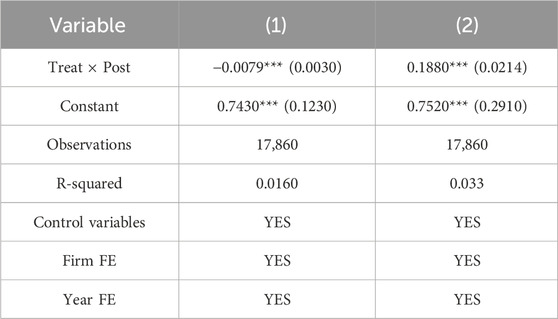

This study employs model (2) to examine the mechanism of environmental tax reform on industrial green development. The effect of the environmental protection fee to tax reform on the industrial degree of resource misallocation is shown in Column (1) of Table 8, with a regression coefficient of −0.0079, which was significant at the 1% level. This suggests that after implementing the strategy of converting environmental protection levies into tax, the degree of resource misallocation in industries decreased by 0.0079, thereby improving resource allocation efficiency, consistent with the existing literature (Cui et al., 2024). When the degree of resource misallocation is reduced, enterprises can make more precise resource inputs and increase resource use efficiency, thereby lowering environmental expenses resulting from resource waste and unreasonable allocation (Wu et al., 2020). This enables enterprises to invest more resources in the green production process, allowing them to achieve a win-win scenario in terms of both economic and environmental benefits by enhancing economic advantages and achieving environmental benefits.

When green technological innovation is used as the mediating variable, the findings are presented in Column (2) of Table 8 with a regression coefficient of 0.1880, which was significantly positive at the 1% level. This indicates that green technological innovation has increased by 0.1880 since the policy of substituting tax for environmental protection levies was implemented, aligning with the existing literature (Wang et al., 2021; Wu et al., 2022; Liu et al., 2022; Lu et al., 2025). Furthermore, green technological innovation can introduce more advanced technologies and processes, enhance businesses’ production efficiency, reduce resource usage and emissions of pollutants during the production process, help businesses transition from traditional, high-pollution, high-energy industries to green industries, promote the modernization and optimization of the industrial structure, and facilitate green development (Cao et al., 2022; Yan et al., 2023).

Thus, the mechanism can be described as follows: the environmental protection fee-to-tax reform drives industrial green development by reducing the degree of resource misallocation and by enhancing green technological innovation, with both factors playing a mediating role. Therefore, hypotheses H2a and H2b are validated.

6 Discussion

This study empirically investigated the effects of China’s environmental protection fee-to-tax reform on industrial green development, focusing on the mediating functions of corporate’s degree of resource misallocation and green technical innovation. Founded on the view that environmental regulation can function as both a constraint and a driver of sustainable economic transformation, our findings confirmed all three hypotheses (H1, H2a, H2b).

First, consistent with H1, the reform significantly promotes industrial green development. This aligns with the “double dividend” hypothesis, which posits that environmental tax policies yield both ecological and economic benefits (Klein and van den Bergh, 2021; Liu et al., 2022). By replacing the discretionary pollution fee with a statutory tax, the reform has improved enforcement and compliance, especially in high-emission industries. The legal formalization of environmental costs has reshaped firm behavior, encouraging companies to incorporate environmental considerations. Second, H2a is validated by evidence that the reform enhances firms’ resource allocation efficiency. Firms have now increased incentives to reduce pollution at the source and redirected investments from high-emission sectors to greener operations. This transition encourages a shift away from extensive, resource-heavy growth models toward more refined, sustainable production. In particular, for large firms with greater capital and organizational flexibility, the environmental tax serves as a catalyst for internal audits and structural optimization, ultimately enhancing GTFP (Xie et al., 2022; Zhang et al., 2024). Third, H2b is also supported: green technological innovation serves as a key mechanism through which the tax reform facilitates green industrial transformation. Consistent with the strong version of the Porter Hypothesis, our results suggest that the reform urges enterprises to adopt green technologies not only to reduce tax burdens but also to meet growing environmental expectations from consumers, investors, and regulators. The rise in green innovation, supported by tax incentives and policy instruments such as green financing, has led to an increase in eco-friendly R&D, patents, and clean production processes.

In addition, the effects of the reform demonstrate clear heterogeneity. Regionally, the impact is more pronounced in China’s central and western regions, where, historically, industrial pollution has been heavier and regulatory standards have been lower. Enterprises in these areas likely experience greater marginal benefits from the transition. Firm-level differences are also significant. Larger enterprises benefit more from the reform due to their ability to absorb costs and invest in innovation. These findings highlight the importance of considering spatial and scale-related factors in the design and implementation of environmental policies (He et al., 2023). Despite the reform’s positive effects, several challenges remain. First, risks regarding superficial compliance, or “greenwashing,” persist (Hu et al., 2023), underscoring the need for stronger monitoring and regulatory enforcement. Second, smaller enterprises, often with limited access to capital, may experience crowding-out effects as higher costs hinder their ability for green investment (Ji and Zeng, 2022). Targeted support, such as tax relief, subsidies, or green credit, should be considered to mitigate this risk. Third, the equity implications of environmental taxation require attention. Vulnerable groups, including the elderly and low-income populations, may face disproportionate burdens from rising production and energy costs (Tian et al., 2025). This underscores the importance of integrating redistributive mechanisms and social safeguards into market-based environmental tools.

Overall, this research enhances the understanding of how environmental tax reform drives green industrial transformation. It provides concrete evidence that the fee-to-tax reform for environmental protection promotes green growth not only through direct policy pressure but also through deeper changes in resource allocation and innovation behavior. The findings support environmental governance models that combine fiscal, technological, and managerial tools to achieve sustainable development goals.

7 Conclusion and policy implications

7.1 Conclusion

An important turning point in the development of a green tax system has been reached with the “Environmental Protection Tax Law”, by adjusting the polluting behavior of market entities from the perspective of a statutory tax system. It is the first law in China that reflects the “green tax system” and encourages the development of an ecological civilization by using tax leverage and market mechanisms to incentivize businesses to reduce their emissions and conserve energy. Moreover, it significantly contributes to promoting green industrial transformation, speeding up the development of an ecological society, and attaining superior growth. Using information from listed businesses on the Shanghai and Shenzhen stock exchanges from 2013 to 2022, this analysis is predicated on the idea that environmental protection fees associated with tax reform encourage industrial green development, employs DID and mediation effect models to explore the impact and mechanisms of the reform on industrial green development.

The primary findings are that industrial green development has significantly benefited from the environmental protection fee to tax reform, indicating that the reform has facilitated green development in the industry to some extent. Varied geographic regions have varied policy effects from the environmental protection fee to tax reform; the center and western regions see more noticeable consequences than the eastern region. The impact of the reform varies significantly depending on the size of the business, with larger enterprises experiencing a more pronounced impact. The reform influences industrial green development through mechanisms such as improving the degree of resource misallocation and enhancing green technology innovation.

7.2 Policy implications

To ensure that the environmental protection tax change effectively promotes green growth, and considering the mechanism studies and empirical findings, the following targeted policy recommendations are suggested.

First, the implementation of the environmental protection tax system needs refinement. The environmental protection tax system must be enforced effectively and transparently. However, the current implementation faces several issues: unclear tax standards, insufficient enforcement, and a lack of tax information disclosure, all of which collectively weaken policy effectiveness. Improvements can be made in the following three areas. (1) To ensure a seamless transition from the pollutant discharge fee to the environmental protection tax system, implementation procedures should be clarified and improved, along with ensuring better coordination between environmental and general tax policies. (2) Openness and transparency need to be strengthened by enhancing the public disclosure of tax standards, enterprise-level environmental tax data, and tax enforcement outcomes, thereby improving compliance and credibility. (3) Law enforcement must be fortified by enhancing the regulatory capacity of tax and environmental authorities, increasing penalties for non-compliance, and ensuring consistent application across regions.

Second, differentiated tax incentive policies that consider heterogeneity need to be developed. Our results show that the effects of environmental tax reform vary according to industry, region, and enterprise sizes, due to differences in pollution intensity, environmental sensitivity, and development capacity. Similarly, improvements can be made in the following three areas. (1) Tax rates need to be adjusted according to the type and volume of pollutants. Enterprises engaging in green production or exceeding emission standards can receive preferential tax treatment to encourage proactive environmental actions. (2) Region-specific tax policies that take into account ecological fragility and environmental carrying capacity must be formulated. In areas with high ecological sensitivity, higher tax rates should be implemented, along with targeted support policies. (3) For large enterprises with significant emissions, stricter tax rates should be applied to promote transformation. Financial incentives, training, and environmental technology advice should be provided to small and medium-sized businesses (SMEs) to lower compliance costs and facilitate the transition.

Third, green development mechanisms should be facilitated through tax reform. Environmental tax reform should not only penalize pollution but also enable transformation by supporting industrial upgrading and integrating environmental objectives into business plans. Correspondingly, efforts can be made in the following three areas. (1) Enterprises should be encouraged to embed environmental protection into production and operations, improving resource allocation efficiency, enhancing competitiveness, and supporting green brand building. (2) Green innovation and technology adoption must be supported, particularly among high-emission enterprises in central and western regions. Tax credits, R&D subsidies, and fast-track patent support should be provided to lower the costs of green transformation. (3) Synergy between environmental tax and other fiscal policies should be promoted, creating a cohesive green tax system that aligns incentives and amplifies policy effects.

8 Limitations and future research

In general, this paper examined the impact of environmental protection fee tax reform on industrial green development from the perspective of green total factor productivity and confirmed that environmental protection fee tax reform plays a significant role in promoting industrial green development. However, it is undeniable that there are still shortcomings, and future research should delve into greater depth regarding the following two aspects:

First, the sample date should be extended. To investigate the effects of the impact of the fee-to-tax reform on industrial green development, this study used Shanghai-Shenzhen A-share listed firms from 2013 to 2022 as research samples, depending on the validity and availability of restricted data sets. Future research can further extend the sample data period to capture the long-term impact of environmental tax policies more comprehensively while minimizing the short-term disruption caused by the epidemic, given that the COVID-19 outbreak may have had an impact on the sample data and study conclusions.

Second, developed countries should be taken as the research objects. This study used China as an empirical sample, which provided a specific empirical basis for developing countries; however, this study does not fully encompass the practical experiences and policy effects of developed countries. The actual situation in China may differ significantly from the impact of policy execution and market response to the environmental tax system in industrialized nations, which limits the universality of research conclusions and the pertinence of policy recommendations to some extent. Future studies may further explore the applicability of environmental tax policies in developing countries, drawing on the experience of developed countries, particularly in optimizing and adjusting policies to suit different economic development levels and industrial structures.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.stats.gov.cn/easyquery.htm?cn=E0103.

Author contributions

ZL: Formal Analysis, Writing – review and editing, Supervision, Writing – original draft, Project administration, Funding acquisition, Conceptualization. DG: Investigation, Data curation, Methodology, Software, Formal Analysis, Resources, Visualization, Writing – original draft. LY: Writing – original draft, Software, Resources, Investigation, Formal Analysis, Data curation, Validation. ZW: Investigation, Writing – review and editing, Software, Data curation, Visualization, Resources, Formal Analysis. HF: Writing – review and editing, Data curation, Methodology, Conceptualization, Formal analysis, Software.

Funding