- University of Electronic Science and Technology of China Zhongshan Institute, Zhongshan, Guangdong, China

Based on balanced panel data from 286 prefecture-level cities across 30 provinces in China spanning 2013–2023, this study employs an intensity difference-in-differences model to systematically evaluate the promoting effect of environmental tax policies on industrial green transformation. It further investigates heterogeneous impact characteristics and underlying mechanisms. Empirical results demonstrate that the implementation of environmental tax policies significantly reduces industrial pollution emission intensity while simultaneously promoting growth in industrial value-added, achieving a “double dividend” effect of both environmental protection and economic growth. This conclusion remains robust after a series of rigorous tests and the exclusion of interference from other policies. Mechanism tests reveal that environmental tax policies primarily drive industrial green transformation through three channels: incentivizing enterprises to increase R&D investment, attracting high-quality foreign direct investment (FDI), and strengthening the efficiency of environmental tax collection and administration. Heterogeneity analysis indicates significant regional disparities in the “double dividend” effect, with it being pronounced only in the economically developed eastern region and the heavy industry-agglomerated northeastern region, while the pollution reduction effect in the central-western regions fell short of expectations. This paper provides crucial empirical evidence for refining environmental tax system design and implementing regionally differentiated environmental governance policies.

1 Introduction

Environmental governance has become an active focus in China, evidenced by annual pollution control expenditures representing 10% of its GDP, a proportion exceeding that of other emerging Asian economies and regions (Zhu et al., 2021). A strategic objective to accelerate the green transformation of development modes was put forward at the 20th National Congress of the Communist Party of China. This objective highlights China’s commitment to advancing greener and lower-carbon socio-economic progress and clarifies this transformation as crucial for achieving high-quality development. As a critical driver of China’s economic expansion, industry holds an indispensable position in the nation’s overall economic advancement; whereas the industrial sector’s energy consumption, environmental pollution, and carbon emissions stand in contrast to the aspirations of green development. Therefore, a major challenge confronting China currently is how to sustain continuous industrial growth while realizing green transformation and reducing adverse environmental consequences. This issue is crucial not only for China’s own sustainable development but also constitutes a significant contribution to global environmental governance efforts.

The implementation of the Environmental Protection Tax Law of the People’s Republic of China on 1 January 2018, marked a significant milestone in China’s transition from administrative charging to tax-based legal governance in environmental management. As an upgraded version of the previous pollution discharge fee system, this legislation demonstrates four major institutional innovations: First, elevation of legal hierarchy. The original pollution discharge fee system belonged to the category of administrative charges, while the Environmental Protection Tax Law(Hereinafter referred to as EPTL), enacted by the Standing Committee of the National People’s Congress, represents a higher level of legal authority with stronger binding force, reflecting the legalization process of national environmental governance. Second, transformation of legislative values. Compared with the single objective of administrative fee collection and emission control under the pollution discharge fee system, the Environmental Protection Tax Law establishes multiple value objectives including “protecting and improving the environment, reducing pollutant emissions, and promoting ecological civilization construction,” achieving a paradigm shift from administrative management to environmental governance. Third, optimization of collection mechanisms. Regarding administration subjects, the reform transformed the system from environmental protection departments’ assessment and collection to tax authorities’ unified administration, forming a new collection model featuring “enterprise declaration, tax collection, environmental coordination, and information sharing,” which significantly improves collection efficiency and standardization. Fourth, adjustment of revenue allocation. The reform allocated all environmental protection tax revenues to local governments, replacing the previous 1:9 central-local sharing ratio of pollution discharge fees. This provides more stable financial support for local environmental governance and strengthens fiscal incentives for local governments.

It is particularly noteworthy that China’s pre-2018 pollution discharge fee system only possessed embryonic characteristics of an environmental tax. The implementation of the EPTL, for the first time, legally clarified key tax elements including taxable objects, tax calculation basis, and tax payable, marking the formal establishment of China’s modern environmental tax system and laying an institutional foundation for building a green taxation system.

The effectiveness of environmental protection taxes in driving industrial green transitions, including their mechanisms and broader impacts, necessitates further in-depth exploration. Moreover, China’s environmental protection efforts currently face the pressures of economic deceleration and anti-globalization currents, which are exacerbating the tension between sustainable development and ecological preservation. Accordingly, identifying a synergistic balance between industrial advancement and ecological health represents a significant challenge. Addressing this challenge necessitates collaboration between China’s policymakers and its research institutions. Our research offers an empirical analysis of how eco-fiscal policies affect industrial decarbonization in two ways. Specifically, we evaluate their effectiveness in reducing emissions while expanding value-added in manufacturing. Specifically, this research evaluates whether environmental protection taxes significantly decrease industrial pollution emissions and their associated effect on industrial output growth. Moreover, this study analyzes regional differences to enhance the scientific foundation for policy design and execution.

Arthur Pigou’s influential 1920 work on welfare economics offers the theoretical basis for EPTL; his work initially proposed the concept of taxation to correct externalities. Bovenberg and Mooij (1997) introduced the externalities and distortions associated with environmental protection taxes into a general equilibrium model, expanding upon Pigou’s theory. They argued that the optimal calibration of these taxes should account not only for the negative externalities from pollution but also for the internal distortive effects of taxation within the economic system. This perspective has become central to following analyses exploring the capacity of environmental protection taxes to simultaneously curtail environmental pollution (Ciccone, 2018) and enhance output levels (as in Allan et al., 2017; Lee et al., 2017), thus achieving a “double dividend” effect.

Academic consensus on the existence of the double dividend from environmental taxes remains absent at present. A double dividend from environmental taxes, promoting both economic growth and enhanced environmental quality, was found by Barker et al. (1993) through a multi-model comparative analysis of the UK’s electricity industry. Similarly, Takeda (2007) established a multi-sector dynamic CGE model and discovered a similar double dividend for environmental taxes in Japan, suggesting that Japan’s environmental tax policies can effectively reconcile environmental protection and economic development. Bossier and Bréchet (1995) studied fiscal reforms in Europe during the 1990s and proposed that adjusting the tax structure could achieve the dual goals of employment growth and CO2 emission reduction. Extending the CGE model, Fraser and Waschik (2013) demonstrated through research findings that Australia also experiences a double dividend from environmental taxes, offering additional support for the positive effects of these taxes. In Mexico, Landa Rivera et al. (2016) utilized the ThreeME model and identified a double dividend from environmental taxes, further confirming the general applicability of environmental taxes across diverse countries. Lu and Zhou (2023) demonstrate that China’s Environmental Protection Tax enhances green innovation through dual pathways of legitimacy pressure and legitimacy management.3 Concurrently, the EPT reform achieves a double dividend for energy enterprises by simultaneously reducing CO2 emissions and strengthening corporate resilience.15 Empirical evidence from Deng et al. (2023) corroborates this dual-benefit effect, revealing significant resilience improvements in energy firms alongside emission reductions following EPT implementation.5 Furthermore, studies confirm that the policy drives substantial efficiency gains in manufacturing carbon unlocking, with Wen and Sun (2023) documenting statistically significant improvements in industrial decarbonization trajectories.

However, other studies have reached contrasting results. Bossier and colleagues (citation) conducted a multinational comparative analysis across six Western European economies: Germany, France, Britain, Italy, the Netherlands, and Belgium—and determined that environmental taxes in these countries produced only a blue dividend with respect to employment, without a significant green dividend for environmental quality enhancement. Glomm et al. (2008) analyzed the fuel tax in the United States and identified that it produced a blue dividend in terms of economic growth and improvements in social welfare; however, it performed insufficiently with regard to the green dividend for environmental quality improvement. This implies that, under certain circumstances, environmental taxes may not simultaneously fulfill both environmental and economic goals.

Ekins et al. (2011) observed that while the United Kingdom’s environmental tax derived a green dividend in carbon dioxide emission reduction, its blue dividend concerning economic growth and employment was not significant. Radulescu et al. (2017) argue that while environmental taxes may achieve a double dividend in some countries or regions, more nuanced policy design and adjustments may be necessary in others. This suggests that the economic effects of environmental taxes may vary across different countries or regions. Moreover, Oueslati (2014), employing an endogenous growth model, determined that a double dividend from environmental taxes was absent in the short term, challenging the universality of this phenomenon. Alm and Torgler (2011) note that ethical and moral factors significantly influence tax compliance behavior, which may further impact the effectiveness of environmental tax implementation. A study by Radulescu et al. (2017) reported similar findings, observing no dual benefits from such fiscal measures in Romania or the broader EU. This suggests the impacts of environmental taxes might depend heavily on a nation’s or region’s unique economic and policy characteristics.

In conclusion, the dual benefits of environmental taxes remain a subject of ongoing discussion in the literature. While certain research supports the notion that these taxes can benefit both the environment and the economy, a significant body of work suggests that such dual objectives may not be realized under all conditions. These differing conclusions emphasize the importance of carefully considering the unique economic, social, and environmental circumstances of each country when designing and assessing environmental tax policies to ensure their effectiveness and relevance. The existing literature offers valuable insights for this study. However, continued analysis utilizing advanced research perspectives and methodologies is necessitated to appraise China’s environmental protection tax. As a key environmental economic policy enacted in recent years, the effectiveness of this tax reform in advancing industrial green transitions has gained significant attention from both researchers and policymakers. However, there is a scarcity of systematic evaluations concerning China’s eco-fiscal regulatory framework. Its comprehensive effect on industrial green transitions, in particular, has not been thoroughly assessed. Existing research, exemplified by Hu et al. (2020), concentrates mainly on the environmental consequences of China’s green tax system. The potential economic advantages are frequently overlooked in these studies. Therefore, this paper utilizes an enhanced difference-in-differences (DID) approach to study the effect of EPTL on China’s industrial green transition and its underlying mechanisms. This study makes significant contributions to the existing literature in the following three aspects:

First, methodological innovation. Traditional approaches to measuring environmental regulation—such as qualitative scoring, single-indicator methods, or composite indices—often fail to accurately capture the net policy effects. To address this limitation, this paper innovatively constructs a staggered difference-in-differences (DID) model. This approach effectively mitigates endogeneity issues, particularly estimation bias caused by reverse causality, thereby enhancing the precision of environmental regulation impact assessments.

Second, timeliness and data advancement. Existing studies on environmental regulation predominantly focus on pre-2018 policies, such as the pollution discharge fee system and the Two Control Zones policy, while research on the environmental tax policy implemented in 2018 remains relatively scarce. Moreover, few studies incorporate data beyond 2021 (as in Li et al., 2024). This paper not only systematically examines the effects of the environmental tax policy but also extends the analysis to 2023, filling a critical gap in understanding the policy’s impact amid post-pandemic economic recovery and the expansion of carbon markets.

Third, theoretical and mechanistic insights. By treating China’s 2018 environmental tax reform as a quasi-natural experiment, this study empirically tests the applicability of the “Porter Hypothesis” and the “Pollution Haven Hypothesis” in industrial transformation. More importantly, it uncovers the macro-level transmission mechanism through which environmental regulation promotes industrial green transition from a tax administration perspective. These findings provide both theoretical foundations and practical guidance for the synergistic advancement of environmental policy and industrial upgrading.

The structure of this paper is as follows: the second section presents the empirical research design of the study; the third section provides the empirical results and their analysis; the fourth section concludes with empirical findings and policy recommendations.

2 Research design

2.1 Empirical strategy

This investigation assesses the causal impact of EPTL specifically focusing on industrial emissions and productivity metrics at the municipal level. We employ a methodological approach that utilizes the policy’s staggered rollout as a quasi-natural experiment. To isolate the policy’s net effects, an intensity-based difference-in-differences (DID) method is applied. Equation 1 presents the core econometric specification:

where i and t index cities and years respectively. The outcome variable y captures both industrial emissions intensity and productivity measures. The key regressor IntDID identifies the policy’s causal effect through coefficient α1, while Xjit represents control covariates including demographic, investment, financial, and fiscal variables. City fixed effects (μi) account for time-invariant regional heterogeneity, year fixed effects (νt) absorb temporal shocks, and εit represents idiosyncratic error components.

Dependent Variables: Industrial Pollution Intensity (IP) and Per Capita Industrial Output Value (IOV). This paper selects industrial pollution intensity and per capita industrial output value as dependent variables to evaluate industrial green transformation across two dimensions: pollution reduction and industrial growth. Firstly, reducing total pollution emissions stands as a crucial objective for sustainable development, especially considering the national impetus for green development. Therefore, the “pollution reduction” effect in green transformation is measured in this paper utilizing industrial pollution intensity as an indicator. Secondly, maintaining economic growth while curtailing environmental pollution to achieve dual enhancement of environmental and economic benefits constitutes the aim of green transformation. Based on this premise, per capita industrial output value is included as a key indicator to assess the “growth” dimension of industrial green transformation. This dual-metric approach holistically assesses the eco-levy’s simultaneous effects on industrial emission mitigation and economic expansion.

Key Independent Variable: The intensity difference-in-differences (DID) estimator (IntDIDit) measures the eco-levy’s causal effects on industrial decarbonization and value-added growth. This approach accounts for fundamental distinctions between the current EPTL (implemented 2018) and previous pollution discharge fees regarding legal authority, enforcement mechanisms, and fiscal structures. While tax rates remain regionally consistent, all municipalities face standardized environmental compliance requirements and emission-reduction incentives. Following established identification strategies (Chen, 2017), we construct the treatment variable (Treati) by comparing cities’ sulfur dioxide emission thresholds against sample medians (above median = 1, below = 0). The policy period (Timet) is coded 1 for post-2018 observations and 0 otherwise. The interaction term IntDIDit = Treati × Timet isolates the policy’s net impact on sustainable industrial transition, addressing potential selection bias through this quasi-experimental design.

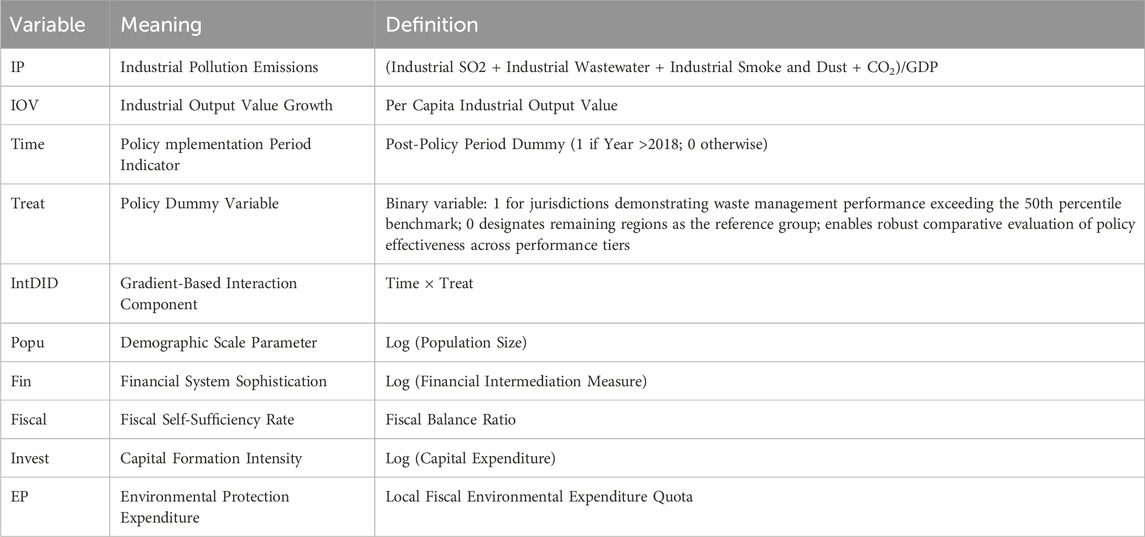

Control Variables. To accurately assess the effect of environmental protection taxes on the green transformation of industries, we select a set of control variables to ensure analytical rigor. These control variables consist of several key economic indicators, intended to explain the diverse factors that may affect industrial green transformations from multiple dimensions. First, we account for regional resident population (Popu), reflecting both the size of the labor market and the potential advantages conferred by demographic dividends for the green transformation of industries. A robust labor market not only supplies adequate human resources to sustain industrial production and innovation activities but also strengthens consumer demand, thereby driving the sustainable development of industry. Second, we employ logged fixed capital formation to control for capital deepening effects on industrial eco-efficiency transitions. Fixed asset investment is a critical determinant of promoting industrial technological progress and augmenting production efficiency. Applying the logarithm allows for more accurately measuring the direct effect of investment scale on the green transformation of industries. Third, we consider the natural logarithm of year-end balances of bank deposits and loans (Fin), which measures the stimulative effect of the level of financial development on industrial green transitions. Robust development of the financial sector can offer essential financial support for industries, facilitating technological innovation and industrial modernization, and thus accelerating the overall process of industrial green transformation. the fiscal autonomy ratio (Fiscal) is incorporated to account for local government budgetary capacity in shaping eco-industrial modernization pathways. A healthy fiscal standing can grant local governments greater autonomy, empowering them to effectively promote the green transformation and sustainable progress of industries through targeted fiscal policies and public investments. Lastly, Environmental Protection Expenditure (EP),this indicator reflects the extent of local government’s investment in environmental protection. A higher level of environmental protection expenditure demonstrates the local government’s emphasis on environmental governance and green development. It can provide the necessary policy support and financial security for the green transformation of industry, thereby promoting industrial enterprises to adopt greener technologies and processes in production, reduce pollutant emissions, and drive the sustainable development of industry. The explanations of all variables are demonstrated in Table 1.

2.2 Sample selection and data sources

The primary data sources for this study are the China City Statistical Yearbook, the China Regional Economic Statistical Yearbook, and official statistical yearbooks published by individual municipalities. These authoritative publications offer comprehensive and detailed data that support our research. For any missing data, we utilized a reasonable estimation method based on the average annual growth rate to complete the dataset, ensuring dataset comprehensiveness and analytical continuity. Data regarding adjustments to environmental protection tax collection standards were primarily sourced from the China Environment Yearbook, which offers a detailed record of the tax’s collection status in each province. To obtain more detailed information, we supplemented the data with policy documents concerning changes in industrial sulfur dioxide emission tax collection practices across various provinces, obtained through online searches. This supplementation enhances the temporal relevance and breadth of our data.

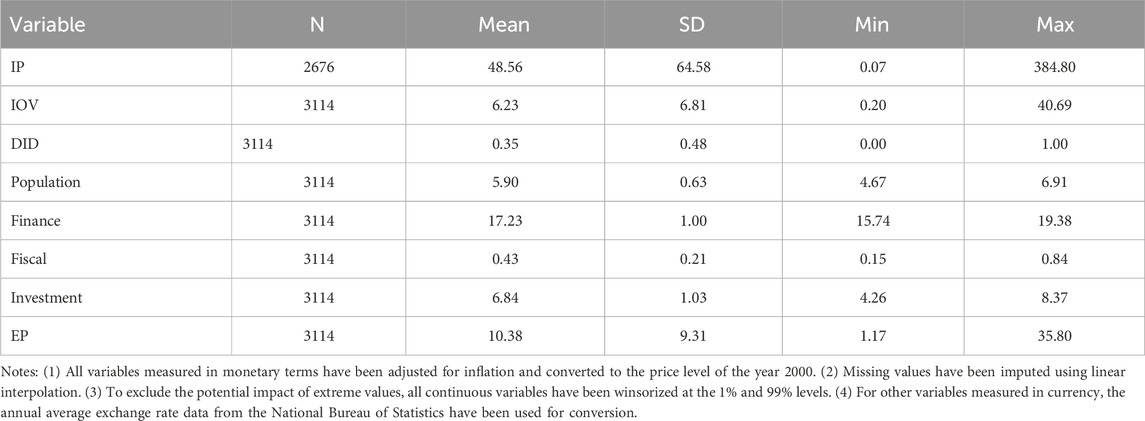

To enhance the methodological rigor and empirical reliability of our findings, we implemented rigorous data preprocessing procedures. First, a 1% and 99% winsorization was applied to address potential outliers that could otherwise skew the results. This procedure minimizes the effect of anomalous data points on model estimation and enhances the reliability of our analysis. Second, to address potential issues with data fluctuations and heteroscedasticity, we performed logarithmic transformations on all absolute numerical data. This transformation enhances the stability and explanatory power of the model. Descriptive statistics for core variables are presented in Table 2.

3 Empirical results analysis

3.1 Benchmark regression

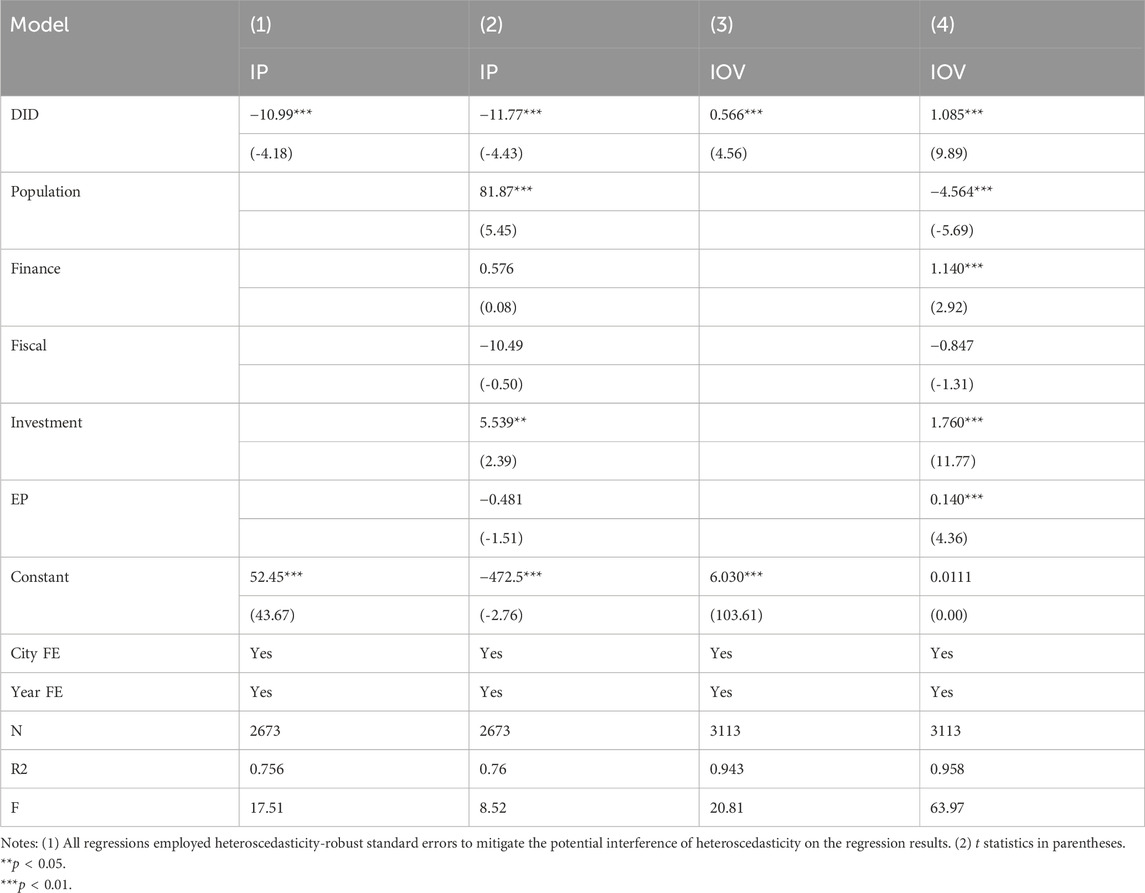

Econometric estimates indicating the dual impact of EPTL are presented in Table 3; these quantify effects on both urban industrial pollution intensity and industrial productivity per worker. The table includes baseline estimations in Models (1) and (3), which exclude control variables. Building on these, Models (2) and (4) additionally incorporate controls such as population size, fixed asset investment, financial system sophistication, and local fiscal autonomy. After thorough adjustment for covariates, the econometric results offer confirmation that the EPTL’s effect in reducing pollution is statistically significant (p < 0.01). It also significantly increases per capita industrial output value. This suggests that the environmental protection tax, as a market-based environmental regulation mechanism, can reduce industrial pollution and stimulate industrial output growth, thus driving China’s industrial green transition forward on two critical fronts: “pollution reduction” and “output growth.”

3.2 Parallel trends test

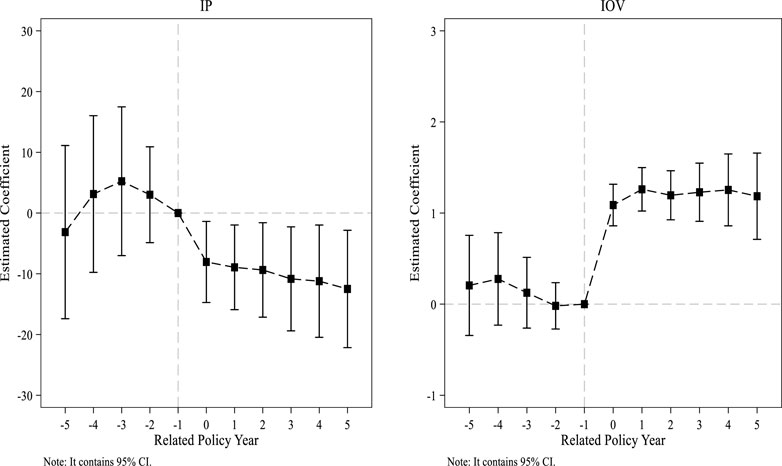

The benchmark regression findings reported in Table 3 indicate that EPTL also reduces pollution and enhances industrial productivity in China’s manufacturing sectors. We performed pre-treatment trend diagnostics based on Autor’s (2003) methodology to establish causal identification. The validity of this test relies on a fundamental premise: prior to policy implementation, the treatment group impacted by the policy and the control group unaffected by it should exhibit similar trends, while a clear divergence between the two groups should appear after policy implementation.

To verify this premise, an event study approach was employed to test for parallel trends. Event-study diagnostics related to EPTL’s impact on industrial emission intensity and value-added growth appear in Figure 1. Analysis of the pre-treatment period demonstrates coefficients without statistically significant trends (all p > 0.1); their point estimates oscillate within the 95% confidence bounds of the null hypothesis. This indicates consistent trends between the treatment and control groups prior to policy enactment. Following the policy’s implementation, however, a significant decrease in industrial pollution emissions was observed. However, empirical evidence reveals a significant decline in industrial pollution emissions alongside a concurrent increase in per capita industrial output following policy implementation. This suggests that RPTL has generated dual positive effects: simultaneously reducing industrial pollution and stimulating industrial output growth, thereby corroborating the parallel trends assumption essential for the DID method.

3.3 Robustness tests

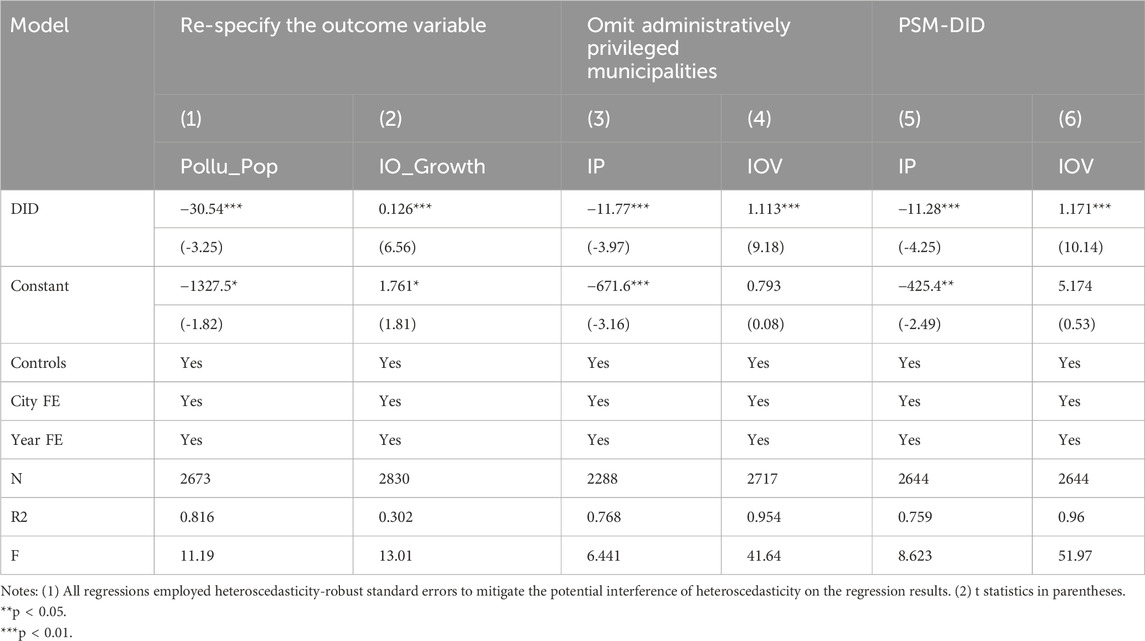

We conducted extensive robustness checks aiming to strengthen the causal identification. Estimates derived utilizing alternative outcome measures—specifically, per capita pollution emissions and annualized industrial value-added growth—are demonstrated in Column (1) of Table 4. These results confirmed coefficient stability across different specifications. Columns (3)–(4) of Table 4 address potential confounding factors related to administrative hierarchy. These estimations exclude privileged jurisdictions such as provincial capitals, centrally-administered municipalities, and special economic planning cities as their significant resource advantages could unduly influence economic results.

Acknowledging the potential for selection bias arising from the implementation of environmental tax collection standards, and recognizing that higher collection standards are typically set in more economically developed areas, which may lead to non-random assignment of treatment and control groups. A doubly robust Propensity Score PSM-DID approach is utilized in Columns (5)–(6) of Table 4 for evaluating the environmental tax policy’s industrial greening impacts. This analysis involved three sequential steps. Firstly, 1:1 nearest-neighbor caliper matching was performed utilizing logistic regression estimates. Then, all observations lacking a match were excluded to achieve covariate balance (mean standardized bias <5%). The final step implemented the difference-in-differences analysis utilizing only the matched sample.

Across all checks reported in Table 4, the results consistently exhibit EPTL having dual effects. It significantly reduces industrial pollution emissions (p < 0.01) and cultivates growth in industrial value-added (p < 0.05). Coefficient estimates demonstrated stability across these alternative specifications; any variations were marginal and remained well in one standard error of the benchmark findings. Such empirical consistency offers strong validation for the robustness of our conclusions and confirms the policy’s capacity to deliver combined environmental and economic advantages.

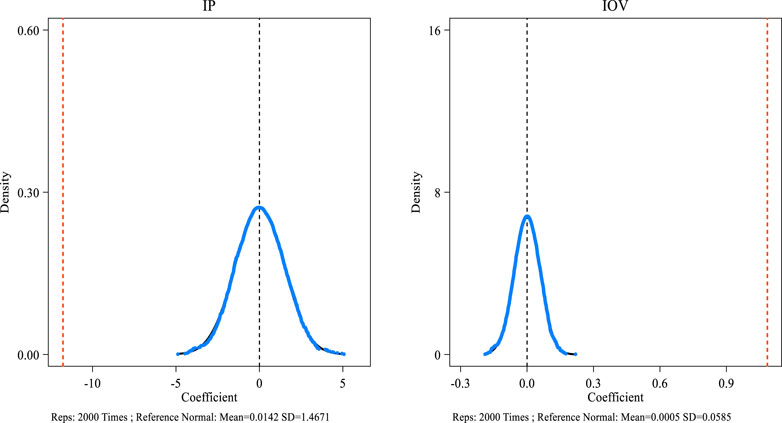

3.4 Placebo test

To verify the robustness of the DID estimates and preclude the effect of potential unobservable confounders, we implemented a randomization procedure. Specifically, we randomly reassigned the individuals affected by the policy and their corresponding time points and ensured that the total number of affected samples remained constant, deriving multiple sets of simulated policy shock estimates. Following this, we generated kernel density plots to analyze the sampling distribution associated with the treatment effect estimates. Figure 2 display these results, indicating that the coefficient estimates follow an approximately Gaussian distribution. This distribution is centered near zero (Kolmogorov-Smirnov p = 0.32), which implies that omitted variable bias in the DID framework is likely minimal. The internal validity of our baseline causal estimates receives reinforcement from this diagnostic check. Employing this validation method enhances the credibility of the study’s conclusions and offers a stronger empirical foundation for assessing the impacts of the policy.

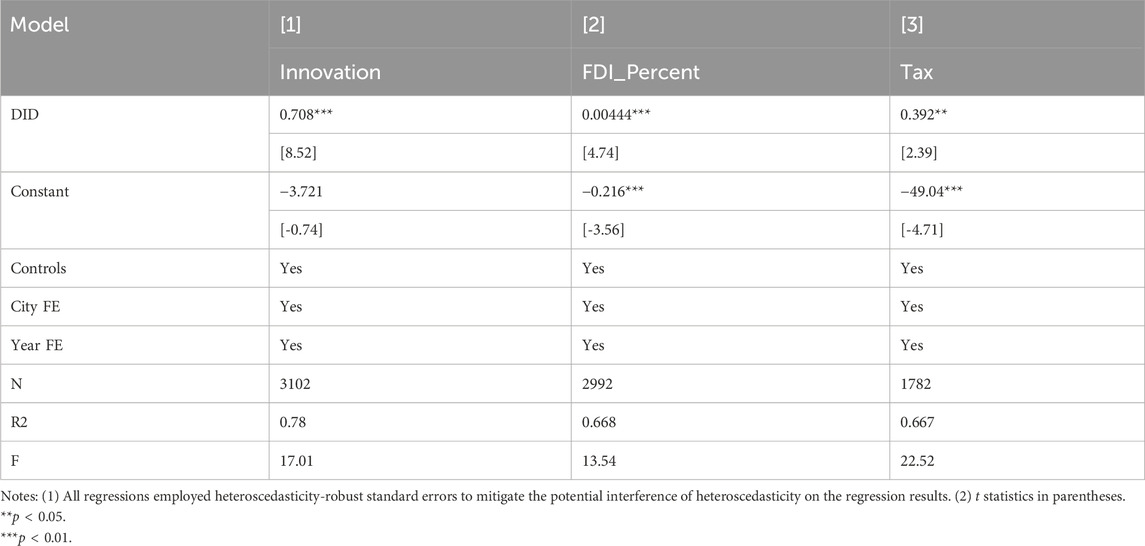

3.5 Mechanism tests

Benchmark regressions confirm dual positive effects of China’s eco-levy policy on industrial green transformation, yet its operational channels require clarification. Based on Models (1)–(3) in Table 5, we examine three mechanisms: scientific innovation investment, foreign direct investment (FDI), and tax administration efficiency.

(1) Innovation-Driven Mechanism

According to the Porter Hypothesis, appropriately designed environmental regulations can stimulate corporate innovation—a fundamental driver of sustainable development. Facing increasingly stringent environmental requirements, enterprises may offset compliance costs through technological upgrading and product iteration. Specifically, firms can achieve emission reduction targets via procurement of advanced production equipment or increased investment in green R&D. Long-term innovation expenditures manifest through enhanced production efficiency, reflected in elevated marginal output per unit.

In Model (1), patent applications in the industrial sector serve as the innovation indicator, with logarithmic transformation applied to scale variables to ensure robustness. The results demonstrate that Environmental Protection Tax implementation exerts statistically significant positive effects on corporate R&D expenditure (β = 0.731, p < 0.01), robustly validated through multiple specifications. This empirical evidence substantiates the Porter Hypothesis, indicating that environmental taxation effectively incentivizes innovation-driven industrial growth (Porter and van der Linde, 1995).

(2) FDI Transmission Mechanism

In Model (2), the level of foreign direct investment (FDI) is measured using the logarithm of FDI inflows. The results indicate that the coefficient of the intensity-based difference-in-differences (DID) estimator remains significantly positive, passing the 1% significance level test. This suggests that the implementation of the environmental tax reform, which replaced pollution fees with taxes, did not lead to the withdrawal of foreign capital. Instead, it attracted more FDI, thereby facilitating industrial upgrading. Since the implementation of the environmental tax policy in 2018, China has exhibited a pronounced “pollution halo hypothesis” effect.

Yu and Li (2020) similarly found that strengthened environmental regulations can significantly enhance the quality of FDI. FDI not only expands the product market of the host country but also drives product upgrading through its brand effect and advanced technological advantages. Moreover, FDI stimulates market vitality through product competition and demonstration effects, compelling firms to engage in technological innovation to increase their market share and product competitiveness.

(3) Enforcement Enhancement Mechanism

In Model (3), a two-way fixed-effects model is employed to assess the ratio of actual tax burden to the model-predicted value as a measure of tax administration intensity. An increase in this ratio signifies a strengthening of tax administration, which in turn may subject firms to greater tax enforcement pressure. The empirical results from Model (3) in Table 5 reveal that the environmental tax reform, which replaced pollution fees with taxes, has significantly enhanced the intensity of tax administration in the region. The Environmental Protection Tax Law is significantly superior to pollution fees in terms of both tax administration intensity and legal standing. Consequently, in response to the increased tax burden, firms are more likely to adopt advanced and environmentally friendly production technologies. This not only helps reduce environmental pollution but may also promote sustainable economic development. The results suggest that, in China, the implementation of the Environmental Protection Tax primarily promotes the process of industrial green transformation through enhanced tax administration.

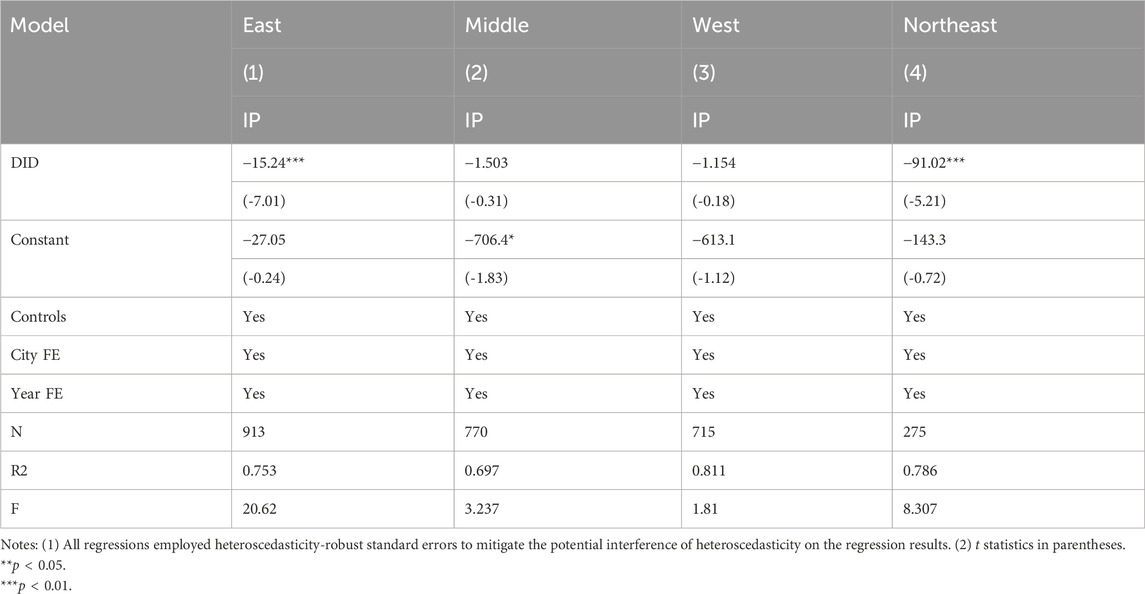

3.6 Heterogeneity analysis

The impact of environmental protection tax policy on industrial green transformation may exhibit significant regional heterogeneity. As shown in Table 6 regarding industrial pollution reduction effects, both the eastern and northeastern regions demonstrate statistically significant emission reduction outcomes, with DID coefficients of −15.24 and −91.02 respectively, both significant at the 1% level. These results likely stem from more comprehensive environmental regulatory systems, stronger corporate pollution control capabilities, and more advanced clean production technologies in these regions. In contrast, the central and western regions show statistically insignificant reduction effects, with coefficient values of −1.503 and −1.154 respectively. This discrepancy may be attributed to relatively weaker environmental enforcement, insufficient corporate environmental investments, and industrial structures predominantly featuring resource-intensive and pollution-intensive sectors in these less developed areas.

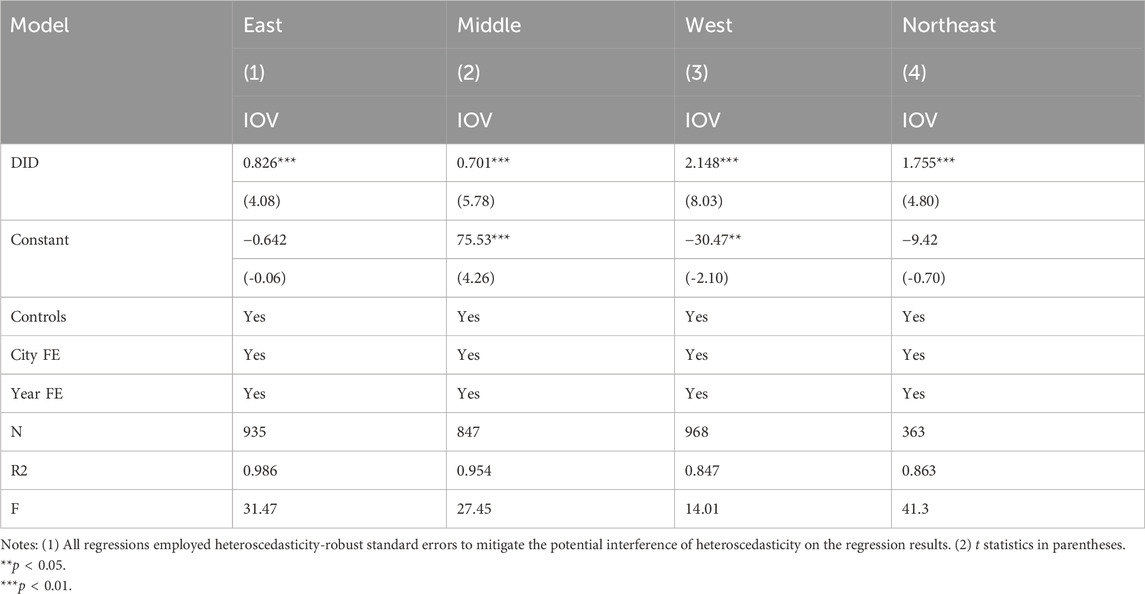

Regarding industrial output growth (see Table 7), the environmental tax policy demonstrates a universally positive effect, with all regional DID coefficients being statistically significant at the 1% level. Notably, the magnitude of this stimulative effect exhibits substantial regional variation: the western region shows the most pronounced response (coefficient = 2.148), which may be attributed to its initially weaker industrial foundation allowing for greater marginal improvements and the strong policy-induced stimulus for industrial upgrading. The northeastern region follows with a considerable effect (coefficient = 1.755), reflecting the transformation potential of this traditional industrial base. Although the eastern and central regions exhibit relatively smaller coefficients (0.826 and 0.701 respectively), they still maintain robust growth trajectories.

4 Conclusion

This study employs an intensity difference-in-differences model to systematically investigate the mechanisms and effects of China’s Environmental Protection Tax policy implemented in 2018 on industrial green transformation. Empirical analysis reveals the following important findings:

First, the Environmental Protection Tax policy demonstrates a significant “double dividend” characteristic. In the environmental dimension, this policy reduces industrial pollution emission intensity by 11.77 units (p < 0.01); in the economic dimension, it increases industrial output by 1.085 units (p < 0.01). This finding provides strong evidence for the synergistic advancement of environmental regulation and economic growth.

Second, the study identifies three underlying mechanisms: (1)The innovation-driven mechanism manifests as a 0.708-unit increase in corporate R&D investment (p < 0.01), preliminarily validating the applicability of the Porter Hypothesis in China; (2)The foreign investment introduction mechanism shows a 0.004-unit growth in foreign direct investment (p < 0.01), confirming the existence of the “pollution halo” effect; (3)The tax administration enhancement mechanism improves tax collection efficiency by 0.392 units (p < 0.05), providing institutional safeguards for policy implementation. These three mechanisms collectively constitute the theoretical framework for China’s environmental tax policy.

Notably, policy effects exhibit significant regional heterogeneity. Eastern and northeastern regions, leveraging well-developed market mechanisms and strong regulatory capacity, achieve synergistic effects across all three mechanisms—significantly reducing pollution emissions (coefficients: 15.24 and −91.02, respectively) while maintaining economic growth. In contrast, central and western regions, constrained by weak innovation foundations and insufficient administrative capacity, primarily rely on the foreign investment introduction mechanism to drive output growth (western region coefficient: 2.148), with limited emission reduction effects. This finding highlights the critical role of mechanism coordination in realizing the “double dividend.”

Based on empirical findings, this paper proposes the following actionable policy recommendations to optimize Environmental Protection Tax policy implementation and advance industrial green transformation:

First, implement regionally differentiated tax rates with supporting incentive measures:For developed eastern regions: Apply progressive tax rates to energy-intensive industries (e.g., steel, cement), setting the baseline rate at RMB 1.8 per pollution equivalent, with a 30% surcharge for enterprises exceeding industry-average emission intensity by 20%. For central-western regions: Adopt “emission reduction rewards”—enterprises achieving ≥5% annual reduction in SO2/COD emissions qualify for up to 30% tax reduction. Simultaneously, allocate 15% of environmental tax revenue to establish a Green Transformation Special Fund, subsidizing 30%–50% of corporate environmental equipment upgrades.

Second, improve innovation incentives to strengthen the Porter effect. Specific measures include: Increasing the super-deduction rate for environmental technology R&D expenses to 150%; Providing 10% tax rebates (capped at RMB 5 million annually) for commercialized patents; Establishing dynamically updated green technology catalogs for key industries, with 20% additional subsidies for catalog-listed technology R&D. These measures will effectively promote corporate investment in green technology innovation.

Third, urgently strengthen tax administration capacity building: Establish a national environmental tax collection platform integrated with ecological environment departments’ monitoring data by 2025; Develop specialized capacity-building plans for central-western regions, ensuring tax officials receive ≥40 professional training hours annually; Create an “environmental credit + tax administration” linkage mechanism: Enterprises maintaining Grade A environmental credit for three consecutive years qualify for 50% reduction in tax inspection frequency.

Finally, establish a scientific policy evaluation and dynamic adjustment mechanism: Construct a quarterly monitoring system containing core indicators (emission intensity, green patent counts, environmental investment ratio, etc.); Introduce third-party institutions to conduct annual policy evaluations; Use evaluation results as the primary basis for tax rate adjustments, establishing a biennial dynamic adjustment mechanism to ensure continuous alignment with economic development and environmental protection requirements.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

QZ: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Methodology, Writing – original draft, Writing – review and editing. C-HY: Resources, Software, Validation, Visualization, Supervision, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. The 2024 Annual General Project of Guangdong Provincial Philosophy and Social Science Planning “The Mechanism, Effect, and System Optimization of Environmental Protection Tax in Promoting Industrial Green Transformation” (No.: GD24CYJ42); The Ministry of and Social Sciences General Project (No. 24YJA790097).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Allan, G. J., Lecca, P., McGregor, P. G., McIntyre, S. G., and Swales, J. K. (2017). Computable general equilibrium modelling in regional science. Adv. Spatial Sci., 59–78. doi:10.1007/978-3-319-50590-9_4

Alm, J., and Torgler, B. (2011). Do ethics matter? Tax compliance and morality. J. Bus. Ethics 101 (4), 635–651. doi:10.1007/s10551-011-0761-9

Autor, D. H. (2003). Outsourcing at will: the contribution of unjust dismissal doctrine to the growth of employment outsourcing. J. Labor Econ. 21 (1), 1–42. doi:10.1086/344122

Barker, T., Baylis, S., and Madsen, P. (1993). UK carbon/energy tax: the macroeconomic effects. Energy Policy 21 (3), 296–308. doi:10.1016/0301-4215(93)90251-a

Bossier, F., and Bréchet, T. (1995). A fiscal reform for increasing employment and mitigating CO2 emissions in Europe. Energy Policy 23 (9), 789–798. doi:10.1016/0301-4215(95)00077-v

Bovenberg, A. L., and Mooij, R. A. (1997). Environmental taxation and endogenous growth: a synthesis. Int. Tax Public Finance 4, 339–359. doi:10.1016/S0047-2727(96)01596-4

Chen, S. X. G. (2017). The effect of a fiscal squeeze on tax enforcement: evidence from a natural experiment in China. J. Public Econ. 147, 62–76. doi:10.1016/j.jpubeco.2017.01.001

Ciccone, A. (2018). Environmental effects of a vehicle tax reform: empirical evidence from Norway. Transp. Policy 69, 141–157. doi:10.1016/j.tranpol.2018.05.002

Deng, Y. Y., Dong, K. Y., and Xue, J. J. (2023). How does environmental regulation affect the double dividend for energy firms? Evidence from China's EPT policy. Econ. Analysis Policy 79, 807–820. doi:10.1016/j.eap.2023.07.001

Ekins, P., Summerton, P., Thoung, C., and Lee, D. (2011). A major environmental tax reform for the UK: results for the economy, employment and the environment. Environ. Resour. Econ. 50 (3), 447–474. doi:10.1007/s10640-011-9484-8

Fraser, I., and Waschik, R. (2013). The double dividend hypothesis in a CGE model: specific factors and the carbon base. Energy Econ. 39, 283–295. doi:10.1016/j.eneco.2013.05.009

Glomm, G., Kawaguchi, D., and Sepulveda, F. (2008). Green taxes and double dividends in a dynamic economy. J. Policy Model. 30 (1), 19–32. doi:10.1016/j.jpolmod.2007.09.001

Hu, B., Dong, H., Jiang, P., and Zhu, J. (2020). Analysis of the applicable rate of environmental tax through different tax rate scenarios in China. Sustainability 12 (10), 4233. doi:10.3390/su12104233

Landa Rivera, G., Reynès, F., Islas Cortes, I., Bellocq, F.-X., and Grazi, F. (2016). Towards a low carbon growth in Mexico: is a double dividend possible? A dynamic general equilibrium assessment. Energy Policy 96, 314–327. doi:10.1016/j.enpol.2016.06.012

Lee, S., Chewpreecha, U., Pollitt, H., and Kojima, S. (2017). An economic assessment of carbon tax reform to meet japan’s NDC target under different nuclear assumptions using the E3ME model. Environ. Econ. Policy Stud. 20 (2), 411–429. doi:10.1007/s10018-017-0199-0

Li, C., Teng, Y., Zhou, Y. X., and Feng, X. T. (2024). Can environmental protection tax force enterprises to improve green technology innovation? Environ. Sci. Pollut. Res. 31 (6), 9371–9391. doi:10.1007/s11356-023-31736-6

Lu, N., and Zhou, W. (2023). The impact of green taxes on green innovation of enterprises: a quasi-natural experiment based on the levy of environmental protection taxes. Environ. Sci. Pollut. Res. 30 (40), 92568–92580. doi:10.1007/s11356-023-28718-z

Oueslati, W. (2014). Environmental tax reform: short-Term versus long-term macroeconomic effects. J. Macroecon. 40, 190–201. doi:10.1016/j.jmacro.2014.02.004

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Radulescu, M., Sinisi, C. I., Popescu, C., Iacob, S. E., and Popescu, L. (2017). Environmental tax policy in Romania in the context of the EU: double dividend theory. Sustainability 9 (11), 1986. doi:10.3390/su9111986

Takeda, S. (2007). The double dividend from carbon regulations in Japan. J. Jpn. Int. Econ. 21 (3), 336–364. doi:10.1016/j.jjie.2006.01.002

Wen, L. M., and Sun, S. F. (2023). Can environmental protection tax drive manufacturing carbon unlocking? Empirical evidence from China. Front. Ecol. Evol. 11. doi:10.3389/fevo.2023.1274785

Yu, X., and Li, Y. (2020). Effect of environmental regulation policy tools on the quality of foreign direct investment: an empirical study of China. J. Clean. Prod. 270 (29), 122346. doi:10.1016/j.jclepro.2020.122346

Keywords: environmental tax, industrial pollution emissions, industrial output growth, technological innovation, foreign direct investment, tax administration, intensity difference-in-differences

Citation: Zhao Q and Yuan C-H (2025) Research on the dual effects of environmental protection tax law on green transformation of China’s industry. Front. Environ. Sci. 13:1602644. doi: 10.3389/fenvs.2025.1602644

Received: 30 March 2025; Accepted: 02 July 2025;

Published: 18 July 2025.

Edited by:

Otilia Manta, Romanian Academy, RomaniaReviewed by:

Jinyu Chen, Capital University of Economics and Business, ChinaHind Hammouch, Sidi Mohamed Ben Abdellah University, Morocco

Copyright © 2025 Zhao and Yuan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qing Zhao, emhhb2d1b3FpbmcxOTc3QDE2My5jb20=

Qing Zhao

Qing Zhao Chih-Hung Yuan

Chih-Hung Yuan