- 1Accounting School, Guangzhou Huashang College, Guangzhou, China

- 2Digital Finance Academy Guangzhou Huashang College, Guangzhou, China

Carbon emissions are increasingly becoming a focal point of green policies and lifestyle choices. China’s “dual carbon” policy mandates the expansion of its digital economy to decrease carbon emissions. This study utilizes panel data from 30 Chinese provinces from 2011 to 2023 to investigate the influence of the digital economy on reducing carbon emissions through mediation and threshold effect models. The following conclusions have been made: The digital industry’s expansion hinders carbon emissions, leading to a progressive reduction in carbon emissions as the digital economy advances. The digital economy has a significant threshold effect on carbon emissions, showing a non-linear relationship between the impact of the digital economy on carbon emissions. By utilizing green finance as a mediating factor, the digital economy can address the issue of carbon emissions by improving the level of green finance development, thereby reducing regional carbon emissions. Geographical variations affect how the digital economy impacts carbon emissions, with varying degrees of influence across different locations. To achieve the “dual carbon” development goals, it is essential to carefully analyse the digital economy’s impact on reducing carbon emissions, enhancing the theoretical framework for environmental pollution management, and maximizing the digital economy’s capabilities.

1 Introduction

As scientific and technical advancements progress in today’s society, the issue of global warming has inevitably emerged as a significant challenge for humanity. Substantial releases of greenhouse gases, particularly carbon dioxide, exacerbate global warming and adversely affect human life and social production activities (Liu and Chen, 2022). China has elevated consumption of high-carbon fossil fuels, while its utilization of resources and energy remains minimal. The need for energy consumption in the context of modernization and industrialization continues to increase, presenting a significant challenge for carbon reduction in China (Shi et al., 2018). In response to this problem, the Government has established the strategic objective of attaining peak carbon emissions by 2030 and achieving carbon neutrality by 2060 (Liu et al., 2024).

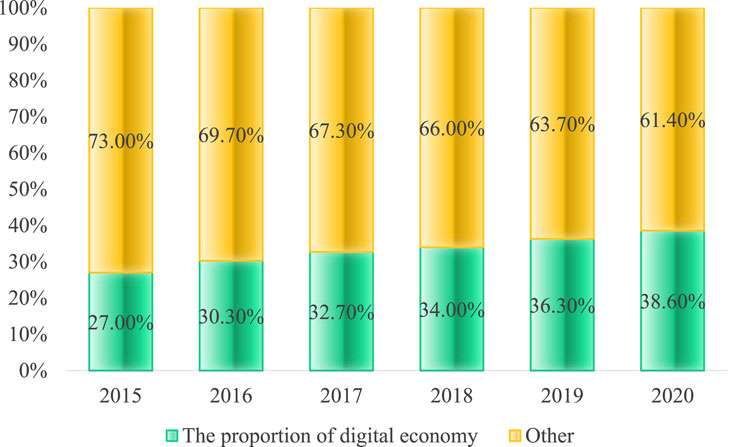

In recent years, the advancement of the digital economy has offered novel concepts and pathways to achieve carbon reduction objectives. According to the data presented in China’s Digital Economy White Paper and illustrated in Figure 1, the digital economy constituted one-third of China’s GDP in 2020 (Huang et al., 2022a; Huang et al., 2022b). The digital economy is a critical element in constructing a modernized economic structure and is responsible for the sustained and stable development of the economy (Tao et al., 2022). Furthermore, the proportion of digital economy GDP in each region is as follows: Beijing, Jiangsu, and Guangdong have over 15% of digital industrialization, Tianjin and Shanghai have over 10%, Zhejiang, Chongqing, Sichuan, Shandong, Fujian, Hubei, and Shaanxi have between 5% and 10%, and the remaining provinces and municipalities have relatively low proportions, all of which are less than 5% (He et al., 2024). Significant disparities exist in the size of the digital economy throughout the provinces. Consequently, it is of considerable importance to examine various regions to investigate the digital economy’s inhibitory influence on carbon emissions. Furthermore, the digital economy is characterized by advanced technology, seamless integration with other sectors, and significant developmental potential, which is crucial for optimizing the development environment. The digital economy can enhance the scope and intensity of economic activity while facilitating the integration of economic and environmental considerations. The digital economy is essential for advancing a low-carbon and environmentally friendly environment, as it is a novel and comprehensive economy (Xu and Liang, 2023).

Consequently, numerous academicians have conducted extensive research on the influence of the digital economy on carbon emissions. Yu HJ. et al. (2024) employed Chinese provincial data to examine the impact of digital economic development on carbon dioxide emissions in China. They concluded that such development can facilitate a reduction in emissions, exhibiting both geographical and temporal variation in its effects. Yu YR. et al. (2024) employed a mixed geographic and temporal-spatial interaction panel regression (MGTWIPR) model to analyse the annual carbon emission data of 31 Chinese provinces from 2015 to 2017. The findings indicate that the influence of digital economic development on carbon transfer is most significant in the source region of western China. Over time, this influence on carbon emission transfer intensifies. An et al. (2024) used static and dynamic spatial Durbin models to analyse the impact of the digital economy on carbon emissions. The Chinese provincial panel data from 2000 to 2021 was used to determine that the digital economy significantly reduces carbon emissions. The effect of the digital economy on carbon emissions exhibits spatial spillovers, with a weaker effect on neighbouring provinces than on the local area.

The 20th Party Congress report emphasises that the primary method of fostering China’s economic development should be the construction of ecological civilization. Green finance is a critical intermediary between economic development and the reduction of carbon emissions (Qin et al., 2022), and it can serve as an intermediary variable to mitigate the environmental pollution caused by carbon emissions under the influence of digital economy technology. This results in the amalgamation of ecological and economic advancement. Among the strategic directives established by the state, green finance has emerged as a pivotal instrument for coordinating environmental management aimed at attaining sustainable development of both the environment and the economy (Ding and Liu, 2023). Green finance is a fundamental instrument and foundation for ecological protection and governance. Therefore, it is crucial to analyse the role of green finance and the digital economy in the context of carbon emission reduction. It can enhance the capital influx of green finance, invigorate financial entities and corporate institutions, and fulfil the objective of safeguarding the ecological environment (Saqib and Usman, 2023).

The connection between the digital economy and finance is evident in actual production activities and economic interactions. The latter plays a crucial role in the real economy’s shift towards a low-carbon model, while the former offers innovative directions and concepts for the latter’s advancement and has substantial implications for carbon emissions (Saqib et al., 2024a). Green finance can facilitate environmental transformation by decreasing carbon emissions and allowing the economy to go towards elevated levels of ambition (Zhang et al., 2023). Safi et al. (2024) analysed a sample of selected OECD economies from 1995 to 2020, highlighting the crucial significance of green finance in mitigating carbon emissions. Ding et al. (2022) investigated the influence of digital finance on carbon emission intensity by analysing data from 30 provinces spanning the years 2011–2019. The empirical findings indicate that digital finance positively influences regional carbon dioxide emission reduction capacity, a conclusion that remains consistent across various robustness tests. Furthermore, how digital finance affects carbon dioxide emission intensity varies. Using carbon emission data from 2011-2020, Jiang et al. (2024) discovered that the intensity of carbon emissions can be reduced by approximately 0.14% through the development of digital finance. A distinct set of robustness and endogeneity tests is then implemented to evaluate the reliability of the empirical result.

Meanwhile, some scholars have examined regional and temporal heterogeneity in assessing the digital economy’s impact on carbon emissions. Chu et al. (2023) utilizing carbon emission data from Chinese countries between 2011 and 2017, contends that advancing digital finance can mitigate carbon emissions and is more efficacious in reducing them under rigorous financial laws and environmental limitations. Chen et al. (2023) employed the extended STIRPAT model to analyse the influence of the digital economy on regional carbon emissions, utilizing panel data from 30 provinces in China from 2011 to 2021. The findings indicate that the digital economy markedly reduces regional carbon emissions, with a more pronounced effect observed in the eastern region and areas exhibiting a higher degree of digital economy advancement. Wang CQ. et al. (2023) tends that the impact of the digital economy on carbon emissions is contingent upon the level of regional development. The impact is most pronounced in the eastern region, while the central and western regions experience a weaker impact. This suggests that the impact effect is primarily observed in developed regions. Based on panel data from 279 localities in China from 2011 to 2020, Hou et al. (2024) developed an econometric model to empirically analyse the impact of the digital economy on carbon emission efficiency. The digital economy enhances carbon emission efficiency, and its impact varies throughout urban heterogeneity, notably seen in regional and urban-scale disparities. The digital economy can mitigate carbon emissions; however, variations in regional digital economy development levels will result in differing aspects of this inhibitory effect.

Based on the preceding analysis, numerous academics have progressively examined the connections between the digital economy, green finance, and carbon emissions (Zhu and Wu, 2021). The digital economy offers novel insights and approaches to advancing green finance, which is essential for facilitating the real economy’s low-carbon transition (Cai and Song, 2022). Green financing can promote environmental advancement and enhance the economy by decreasing carbon emissions (Saqib et al., 2024b). Zhang et al. (2022) utilized data from G20 economies spanning 2008-2018 to assess the impact of the digital economy and green finance on ecological conservation via quantile regression modelling. The regression analysis indicates that the effective advancement of the digital economy and green finance substantially decreases carbon dioxide emissions in urban areas. Yu et al. (2022) examined and assessed the trend and extent of the digital economy’s influence on regional carbon emissions using provincial carbon emissions data while differentiating its green finance mechanism, thereby clarifying the contributions of the digital economy and green finance to carbon emission reduction. The existing literature on carbon emissions provides extensive insights into how environmental policies and regulations influence carbon emissions. Yuan et al. (2022) examines the correlation between the digital economy, green finance, and carbon emissions utilizing provincial and prefecture-level city data and identifies a green finance mechanism influencing the digital economy’s effect on carbon emissions.

Many researchers and experts have examined the rules regulating the digital economy’s impact on greenhouse gas emissions. Nonetheless, two difficulties remain to be addressed. While numerous studies have investigated the influence of the shift to a digital economy on air quality and pollution, additional investigation is necessary to comprehend its implications for carbon emissions (Saqib et al., 2023). Furthermore, specialists have not yet uniformly utilized the same dimension when analysing the connection between the digital economy, green financing, and carbon emissions (Zheng and Li, 2022). The current literature mainly investigates the influence of technological innovations and the enhancement of industrial structures on carbon emissions. Environmental pollution, particularly carbon emissions, constitutes a substantial problem; however, modern solutions directly tackle this obstacle (Brock and Taylor, 2010). There is a notable emphasis on green finance (Lee and Min, 2015). Contemporary studies primarily examine the impact of technological advancements and the optimization of industrial structures on carbon emissions. Nonetheless, technological advancements proficiently address environmental contamination challenges, including carbon emissions (Wiskich, 2021).

In conclusion, extensive research has been conducted on the relationship between the digital economy and carbon emissions; however, the current research direction and trends exhibit significant potential for enhancement. Consequently, this study identifies three areas of deficiencies and marginal contributions as follows: Although existing research confirms that the digital economy generally contributes to carbon emission reduction, most studies assume a linear relationship and overlook potential nonlinear dynamics. Drawing on the environmental Kuznets curve, this paper introduces a threshold effect model using provincial panel data from China (2011–2023) to examine the nonlinear relationship between digital economy development and carbon emissions, thereby addressing a methodological gap in the literature. In addition, while prior studies have often focused on mechanisms such as industrial upgrading or energy transition, this study uniquely incorporates green finance as a mediating variable, revealing how digital economic growth promotes green financial development, which in turn facilitates carbon emission reduction. Furthermore, this paper extends the scope of regional analysis by not only considering the eastern–central–western division but also introducing a coastal–inland distinction, thus more accurately capturing spatial heterogeneity.

2 Theoretical analysis and research hypothesis

The digital economy contributes to reducing the worldwide impact of greenhouse gas emissions by influencing the development of provincial carbon reduction programs (Sun and Wu, 2023). The city’s overall success can be observed through the following metrics. From a city management perspective, the progression of a region toward becoming a digital city may be influenced by the ongoing growth of the territory’s digital economy. The digital economy will enhance the growth and management of these regions by leveraging networked channels like AI and big data, thereby advancing their connectedness and modernization (Wang and Zhao, 2022). A province that maximizes digital technology for real-time data collection and analysis can significantly boost regional business, governance, and operations, enhancing productivity, resource optimization, reducing carbon emissions, and lowering energy consumption (Li and Wang, 2022). Digital technology has progressively infiltrated all businesses, improved operational efficiency and facilitated the transition of traditional industries to modern ones. Consistent enhancement and refinement of production materials and methods in traditional industries have led to a continual rise in energy efficiency in utilizing different materials and energy sources in the sector. This has effectively lowered carbon emissions and energy consumption, contributing to the objective of decreasing regional carbon emissions. Implementing digital technology will improve the management of corporate carbon emissions, resulting in more efficient emission reduction measures and, ultimately, lower emissions (Zhang et al., 2023). An accurate carbon footprint measurement remains possible, allowing for precise monitoring and tracking of carbon emissions. This establishes satisfactory criteria for creating carbon reduction projects based on consumption. It can bridge the disparity between statistical data and self-reported carbon emissions, enabling authorities to establish fair carbon emission quotas for enterprises (Li et al., 2023). The collection, observation, transmission, and analysis of real-time data on the use of company resources through digital technology are carried out to enhance the allocation of energy factors in greater depth, ultimately providing the potential to reduce CO2 emissions. In summary, it is possible to derive the first hypothesis of this piece:

Hypothesis 1. The higher the level of development of the digital economy, the lower the intensity of carbon emissions.

Emerging infrastructure components, including 5G terminals, data centres, and the industrial internet, will be essential to sustain the growing digital economy. The substantial demand fuelling their rapid expansion indirectly raises their carbon footprint (Zhou et al., 2019). Under Moore’s Law, the development of digital infrastructure is currently characterized by a nonlinear exponential growth; this, in turn, has led to a dramatic increase in the demand for major emitting sectors like construction materials and minerals, as well as an unsustainable level of overall energy consumption. Lu and Chen (2023) argue that the impact of the digital economy on carbon emissions in Chinese provinces has a significant threshold characteristic in a threshold regression model with energy intensity as the threshold variable, which has a negative nonlinear relationship per capita carbon emissions. In this case, the development of the digital economy raises the level of carbon emissions. In addition, the usage of digital gadgets in both industrial production and social life has been growing steadily as the digital economy has spread across all sectors. Converting electrical energy into processing power is what digital gadgets are all about (Chen et al., 2024). The rising demand for electricity to power digital equipment, most of which is still produced using coal, will inevitably increase carbon emissions as the digital economy expands. Xie and Zhang (2022) argue that the digital economy is conducive to promoting energy conservation and emission reduction in China’s industries. They use a threshold model to investigate what threshold value would significantly influence carbon emissions from the digital economy, and they discover that the value is somewhere in the intermediate range. However, thanks to developments in environmental protection technology and the widespread use of clean energy, these green industries can be digitally guided to achieve a rational use of production resources, significantly cut waste in the production process, and effectively slow the rising trend of carbon emissions (Fu et al., 2023). The advancement of the digital economy will negatively impact the level of carbon emissions in this scenario. Overall, there is an apparent threshold effect on how the digital economy affects carbon emissions, indicating a nonlinear relationship between the two. As a result, the second hypothesis of this paper is formulated based on this observation.

Hypothesis 2. The impact of the digital economy on carbon emissions exhibits a significant threshold effect, meaning that there is a nonlinear relationship between the two.

Implementing carbon emission and carbon-neutral policies should be supported by green funding to achieve energy savings and emission reductions in industrial units (Wang et al., 2022). By 2030, the three key strategies will be reducing coal consumption, enhancing efficiency, and advancing renewable primary energy sources. There is a requirement for a technological foundation supported mainly by green financing (Kong, 2022).

On the one hand, companies, universities, and research institutions will continue to integrate and develop the digital economy and green finance, which can provide an essential impetus for increasing green finance in the region (Guo et al., 2022). In addition, the proliferation of information industries enabled by big data and digital channels like blockchain has resulted in recruiting more experienced professionals. A more muscular talent system facilitates a deeper level of green finance in cities, which may give excellent requirements for cities to boost green financing. Financial constraints and access to capital are central to business reform and green finance (Hall et al., 2016). The digital economy relies on digital technologies that facilitate the digitization of manufacturing facilities (Huang J. et al., 2022). Digital technology enables organizations to optimize various aspects of their operations and production, resulting in more efficient processes and significantly reducing production costs and losses. The relaxation of financial constraints on industrial facilities has led to abundant resources for promoting green financing, hastening its growth across the industry (Lin and Ma, 2022). Digital technology implementation has eliminated communication obstacles, enabling businesses to recognize low-carbon technologies and market dynamics for low-carbon products promptly. This has enhanced collaboration and communication among businesses, universities, and research institutions, thereby boosting their capabilities for innovation partnerships. Consequently, green finance in the region will be enhanced.

On the other hand, green finance is a fundamental way to deal with air pollution and can significantly reduce CO2 emissions (Zhang et al., 2022). Widespread adoption of green financing can assist in modernizing the industrial structure by encouraging more rational energy consumption and reducing energy usage in production and consumption. New energy consumption is generated to help produce cleaner and more efficient energy in the industrial sector (Zhu et al., 2023). At the same time, the transformation of traditional industries into low-carbon green initiatives is being accelerated to reduce CO2 emissions caused by production activities and human consumption to prevent and control emissions at the source (Xu et al., 2023). Green finance in the energy industry may expedite the growth of renewable energy sources like solar, wind, and more, bolstering the new energy sector and significantly lowering CO2 emissions. Green finance can also substantially curb the cost of reducing CO2 emissions and further reduce CO2 emissions. In summary, it is possible to derive the third hypothesis of this piece:

Hypothesis 3. The improvement of the digital economy will promote the development of green finance in the region, thus reducing carbon emissions.

The digital economy reduces carbon emissions at a national level by enabling sectors to utilize digital technologies for market trend analysis and effective energy resource allocation. Suppose carbon emissions are accurately measured, reported, and confirmed in real-time in the carbon trading market. In that case, it can effectively curb the loss of carbon efficiency, allowing emitters to lower their emissions as needed immediately (Wang S. et al., 2023). The digital economy decreases national carbon emissions by using digital technologies to understand market trends and allocate energy resources more efficiently. Suppose carbon emissions in the carbon trading market are accurately, promptly reported, and verified. In that case, it is possible to monitor carbon efficiency loss effectively and for emitters to reduce emissions as needed immediately. In summary, regions with relatively high levels of digital economy development will be more efficient in their energy use, and the pattern of the digital economy’s effect on carbon emission levels will be more prominent. It is, therefore, possible to derive the fourth hypothesis of this piece:

Hypothesis 4. There is regional heterogeneity in the development of the digital economy in reducing regional carbon emissions intensity.

3 Research design

3.1 Model setting

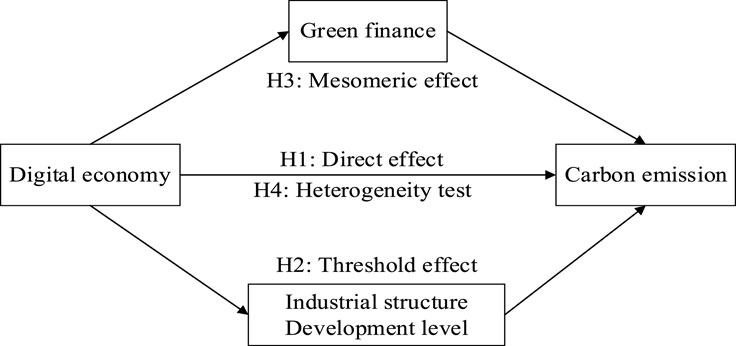

This research paper on green finance seeks to analyse the precise impact of the digital economy on the trend of carbon emissions. The text examines the relationship between these two elements and displays a study framework diagram, shown in Figure 2.

This research utilizes a general panel regression model to examine the impact of the digital economy boom on regional carbon emissions about Hypothesis 1 and Hypothesis 4. The analysis results in the construction of a regression equation.

In the above equation, the subscripts i and t each representing a region and a year,

This research constructs a threshold effect model to investigate the nonlinear correlation between the digital economy and carbon emissions for Hypothesis 2. The equation for the threshold effect model regression is:

Where

This research creates a mediation model to explore how green finance mediates the relationship between the digital economy and carbon emissions, as proposed in Hypothesis 3. The regression equation for the mediation model is as stated:

Where

3.2 Selection of variables

1. Explanatory variables: In this paper, the carbon emission data of each province in China for the period from 2011 to 2023 were selected to measure the carbon emission levels of each province, and the latest Scope 1, Scope 2, and Scope 3 were used to account for the overall criteria as shown below:

Scope 1 encompasses all primary carbon dioxide emissions under the jurisdiction of each province, predominantly encompassing greenhouse gas emissions from transportation and buildings, industrial processes, agriculture, forestry and land use change, and waste disposal activities. Scope 2 encompasses energy-related carbon dioxide emissions beyond a province’s jurisdiction, including emissions from purchased electricity, heating, or cooling used to meet local consumption needs. Scope 3 encompasses indirect carbon dioxide emissions from activities within a province that happen outside its jurisdiction but are not covered in Scope 2. This includes greenhouse gas emissions from the production, transportation, use, and disposal of items the province purchases from outside its jurisdiction. The equation is represented as:

Scope 1 emissions = emissions from transport and buildings + emissions from industrial processes + emissions from agroforestry and land use change + emissions from waste disposal activities. Scope 2 emissions = emissions from purchased electricity + emissions from heating and cooling.

2. Core explanatory variables: This study utilizes the superiority and inferiority solution distance approach to assess the regional digital economy development index based on three indicator levels: digital industry development, digital infrastructure development, and inclusive digital finance. Table 1 displays the various indicators used to measure the digital economy progress index.

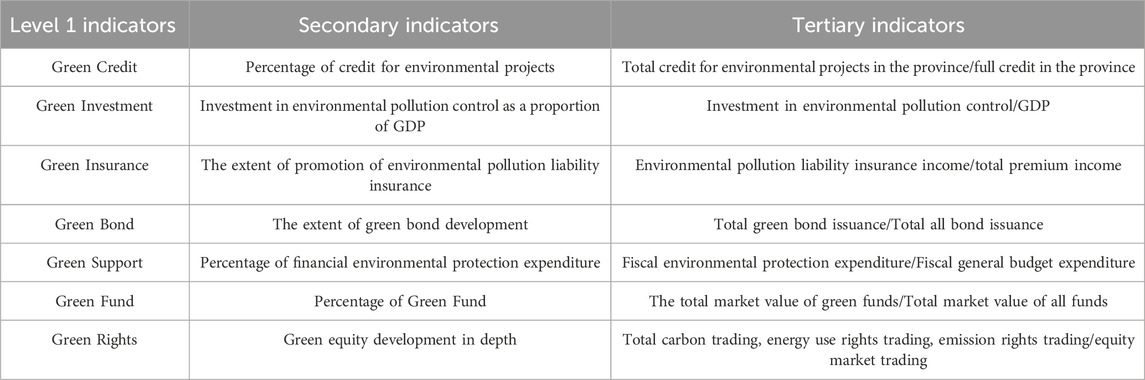

3. Mediating Variable: The study chose green finance as the mediating variable to examine how the digital economy affects carbon emissions. The entropy technique was utilized to choose green finance data from 2011 to 2023 to calculate seven indicators of green finance development. The index system was created based on the definition provided in the “Guiding Opinions on Building a Green Financial System” released in 2016, resulting in the calculation of each region’s green finance development index. Table 2 displays the precise index system and measuring procedures.

4. Control variables: Drawing on the literature on the impact of the digital economy on carbon emissions by experts and scholars from outside China, this paper can select relevant variables in the four dimensions of industrial structure heightening, economic development level, consumer price and talent concentration as the control variables of the model. The level of economic development can be measured by taking the logarithm of GDP per capita, the heightened industrial structure can be measured by the formula of GDP share of primary industry*1 + GDP share of secondary industry*2 + GDP share of tertiary industry*3, the consumer price can be measured by the ratio of total retail sales of social consumer goods to local general public budget expenditure, and the talent concentration can be measured by taking the full-time equivalent of R and D personnel. &D personnel full-time equivalents are calculated by taking the logarithm.

5. Threshold variables: Drawing on Ma Guoqun’s approach, this paper constructs a threshold effect model by using the control variable’s industrial structure and economic development as threshold variables to explore the nonlinear mode and threshold characteristics between the two of the digital economy and carbon emissions (Li and Zhou, 2021).

3.3 Data sources and processing

The information in this article is mainly sourced from various statistical yearbooks and associated statistical sources. The data on energy consumption categorized by energy type and sector is obtained from the “China Energy Statistical Yearbook” and many provincial-level statistical yearbooks. Information regarding industrial processes and product usage is gathered from the “China Industrial Statistical Yearbook” and many provincial-level statistical yearbooks. Information regarding agricultural, forestry, and other land use activities is collected from the “China Agricultural Statistical Yearbook,” “China Livestock Yearbook,” “China Forestry and Grassland Statistics Yearbook,” and other provincial-level statistics yearbooks. Data on waste disposal is obtained from the “China Environmental Statistical Yearbook” and many provincial-level statistical yearbooks. The information regarding purchased electricity, heating, and cooling is obtained from the “China Energy Statistical Yearbook” and different provincial-level statistical yearbooks. Emission factors are derived from legally available data, such as the “Provincial Greenhouse Gas Emissions Inventory Guidelines (Trial)” and government-issued carbon emissions inventory recommendations.

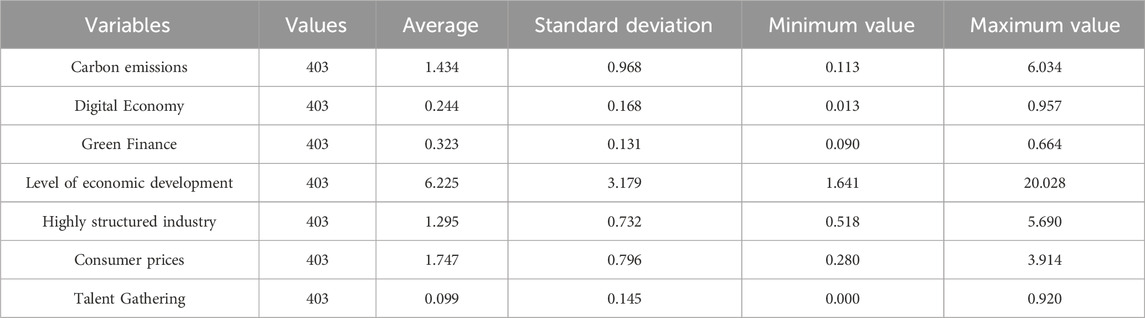

The data obtained were processed and the processed data were subjected to descriptive statistical analysis summarized in Table 3:

The descriptive statistical analysis in Table 3 shows that the explanatory variable carbon emission has a maximum value of 6.034, a minimum value of 0.113, a mean value of 1.434, and a standard deviation of 0.968. The difference between the maximum and minimum values is almost tenfold, suggesting significant variation in carbon emission across provinces or years. The independent variable “digital economy” has a maximum weight of 0.957, a minimum value of 0.013, a mean value of 0.244, and a standard deviation of 0.168, indicating distinct differences in the development of the digital economy between prefectures and cities. The descriptive statistical analysis in Table 3 indicates that the control variables - green financing, economic development level, industrial structure heightening, consumer pricing, and talent concentration - do not contain outliers and are within standard ranges, making them suitable for further study.

4 Empirical analyses

4.1 Baseline regression

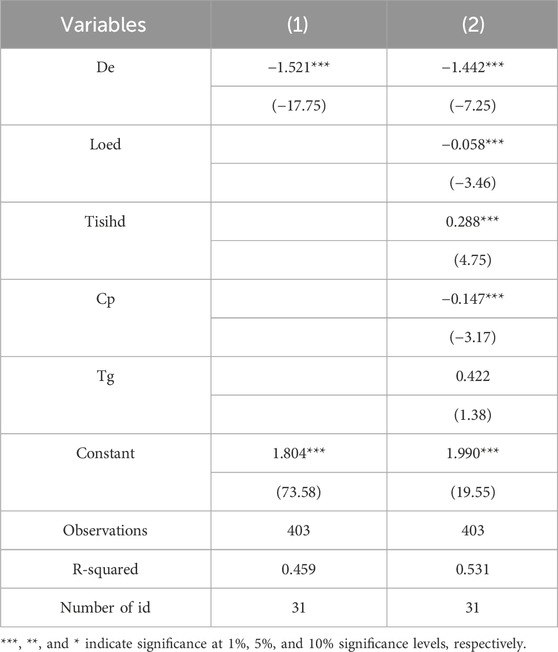

Table 4 displays regression test results analysing the influence of the digital economy on carbon emissions using a double fixed effects model. The second column of the table displays the regression test outcomes after removing the influences of additional control variables. When considering solely the level of development of the digital economy as the explanatory variable, the results indicate that the estimated coefficient is negative and statistically significant at the 1% level. Column 2 includes control variables such as the amount of economic development, industrial structure strengthening, consumer pricing, and talent concentration. Examination of the second column of data in Table 4 indicates that the regression coefficient for the effect of the digital economy on carbon emissions is −1.442, which meets the significance criterion at the 1% level, signifying a substantial negative influence of the digital economy on carbon emissions. The level of carbon emissions in a region will diminish with the rise of the digital economy. Consequently, the results from the baseline regression tests indicate that the digital economy can exert an inhibitory effect on carbon emissions, thereby confirming Hypothesis 1 of this study. The primary reason for this phenomenon is that, on the one hand, the swift advancement of the digital economy fosters the extensive application of digital technology in social development, which subsequently enhances the share of the tertiary industry in economic activities and directs resources towards low-energy-consuming and high-efficiency sectors. The emergence of the platform economy has diminished the need for physical retail establishments, resulting in a notable decrease in carbon emissions within the building and transportation sectors. Another reason the government’s incorporation of environmental quality into its performance evaluation system has facilitated the digital transformation of the carbon trading market. Beijing and Shanghai are presently implementing carbon quota trading, utilizing blockchain technology to track carbon emissions precisely. Moreover, ant forests and similar models have converted individual carbon reduction actions into carbon trading, establishing a sustainable cycle of “growing trees for everybody.” Organizations engaged in developing carbon sinks not only meet their social obligations but also generate commercial value. The results indicate that the advancement of the digital economy has facilitated carbon emission reduction across several levels, including individual, corporate, and national dimensions.

4.2 Threshold effect

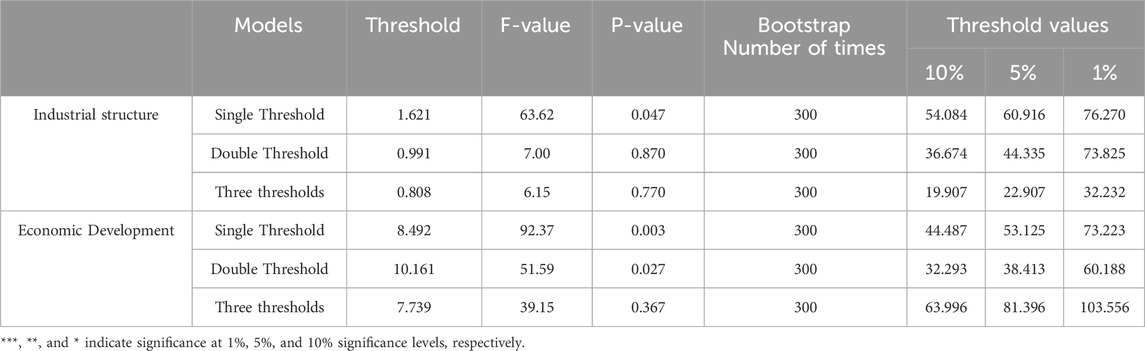

The study constructs a panel regression model to explore the intricate connection between the digital economy and carbon emissions. It focuses on the threshold effect by incorporating industrial structure and economic development as threshold variables. This model reveals how the digital economy influences carbon emissions across various ranges of these two variables. The implementation requires conducting a threshold test on the digital economy using regression data to determine the presence of a threshold effect. The digital economy is a crucial factor. Table 5 presents the comprehensive results.

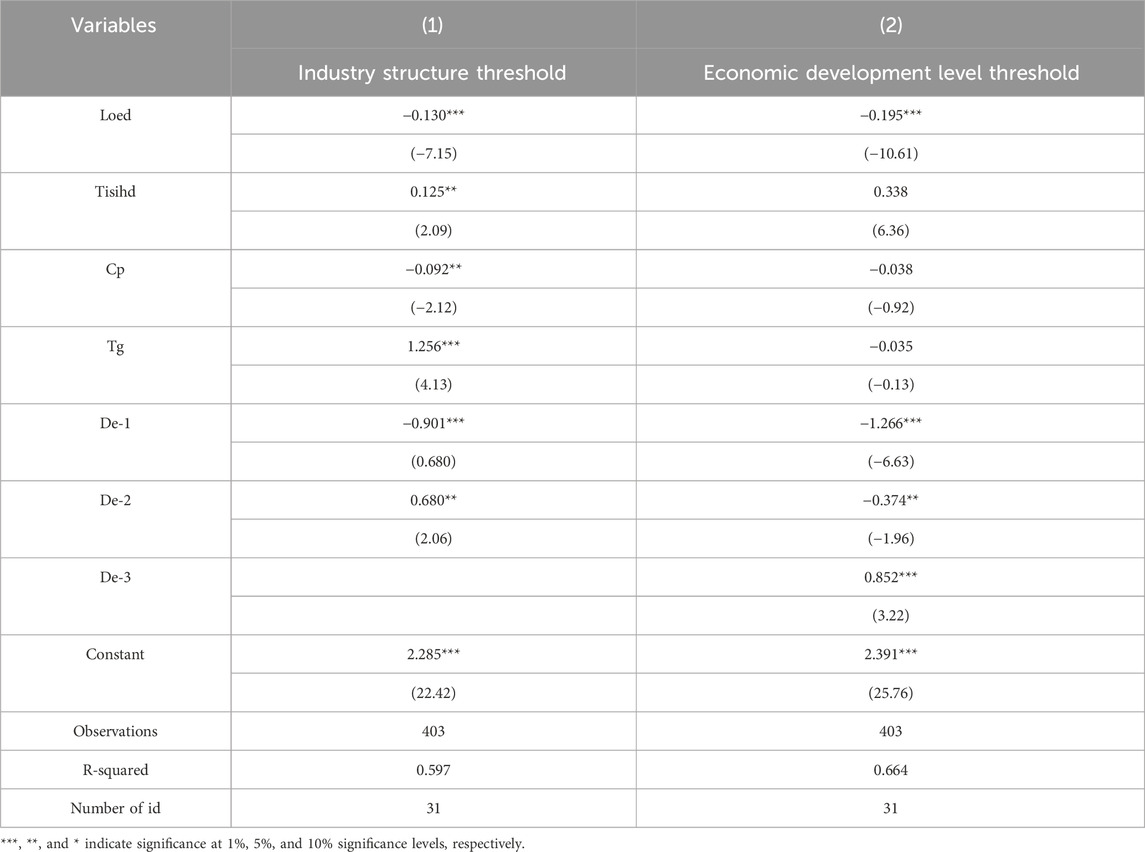

The data in the preceding table indicate that the threshold test with industrial structure as the threshold variable is significant at a single threshold. As a result, the single threshold effect test for industrial structures should be performed. In contrast, the threshold test with economic development as the threshold variable is significant at both the single and double thresholds. As a result, the twofold threshold impact test for economic development should be performed. Table 6 shows the overall regression results:

Column (1) displays the regression outcomes with industrial structure as the threshold variable, while column (2) presents the regression outcomes with economic development as the threshold variable. When industrial structure serves as a threshold variable, the threshold coefficient for industrial structure upgrading is 1.621, and the regression coefficients regarding the influence of the digital economy on carbon emissions are statistically significant at the 1% and 5% levels. Conversely, when economic development level is employed as the threshold variable, the threshold coefficient values are 8.492 and 10.161, with the regression coefficients for the digital economy and carbon emissions demonstrating significance at the 1%, 5%, and 1% levels. This indicates a substantial threshold effect of the digital economy on carbon emissions, revealing a non-linear relationship between the digital economy’s impact and carbon emissions, thereby validating the accuracy of construction H2. From the industrial structure and economic development level as the threshold variables, when the industrial structure and economic development level are at a low level, the impact of the digital economy on carbon emissions are all substantial inhibitory effects. However, when the industrial structure and economic growth level increase, the digital economy significantly affects carbon emissions. This phenomenon indicates that with the rise of industrial structure and economic development level, it will continue to promote the development of enterprises and the economy, which will put forward higher digital technology requirements for enterprise and social development and will exacerbate the increase of carbon emissions from the root. This further indicates a considerable non-linear influence on the relationship between the digital economy and carbon emissions.

4.3 Intermediary effects

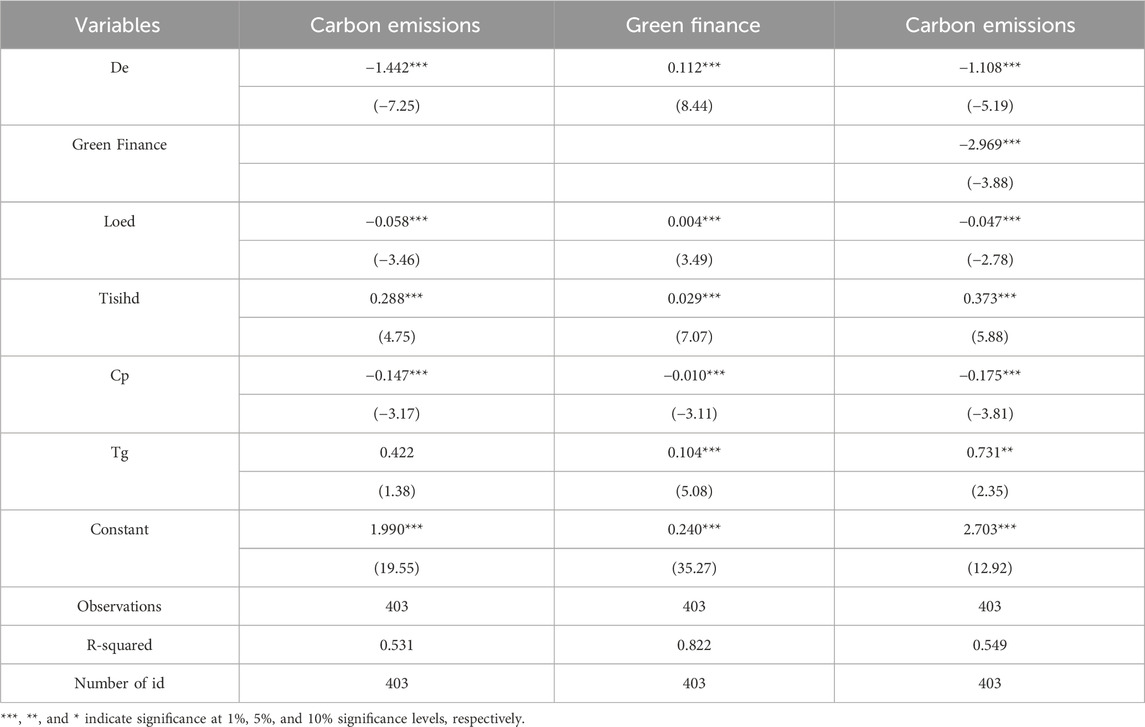

An empirical examination was conducted to assess the mediating effects model of the digital economy on carbon emissions using a generic panel model with fixed factors. The regression findings can be found in Table 7.

The study analysed how the digital economy impacts carbon emissions using an ordinary panel with fixed variables. The panel regression coefficient for the digital economy was found to be −1.442. The P-value for the regression coefficient in the standard panel regression model was statistically significant at the 1% level. The coefficient in the first column of Table 5 shows a negative influence of the digital economy on carbon emissions, suggesting a significant reduction in carbon emissions due to the digital economy. This paper proposes green finance as a mediating variable. The study utilizes the mediating effect model to investigate how the digital economy impacts carbon emissions. Columns (2) and (3) are derived from column (1) to analyze if the impact of the digital economy on carbon emissions is influenced by green funding. In column (2), the coefficient of the digital economy on green financing is 0.112; in column (3), the coefficient of green finance on carbon emissions is −2.969. These coefficients both satisfy the significance test at the 1% level. The study shows that the advancement of the digital economy positively influences the promotion of green finance. The presence of green finance influences the impact of the digital economy on carbon emissions, confirming hypothesis 3 proposed in this paper. Each 1 unit increase in the development index of the digital economy corresponds to a 0.112 unit increase in the level of green financing, as shown in the table data. An increase of 1 unit in green finance level results in a decrease of 2.969 units in the carbon emission coefficient. Additionally, a 1 unit increase in the digital economy coefficient leads to a decrease of 0.334 units in the carbon emission coefficient, influenced by the mediating effect of the digital economy through green finance. The measurement is 0.334 units.

The coefficient of the digital economy on carbon emissions is −1.108 in column (3) when accounting for the impact of green finance. At a significance level of 1%, statistical evidence indicates that the digital economy dramatically reduces the impact of green finance on carbon emissions; the coefficient in question has a p-value below 0.01.

4.4 Heterogeneity analysis

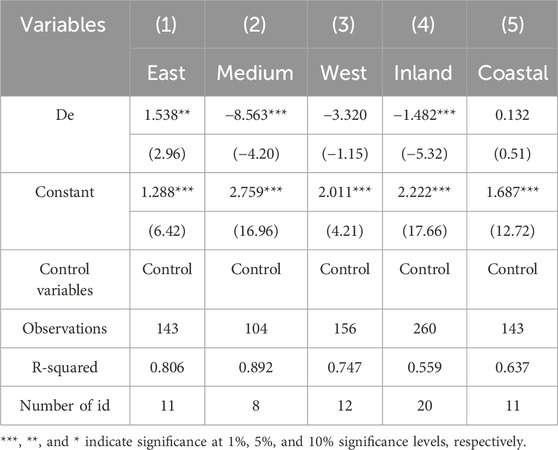

The digital economy may affect carbon emissions differently in other regions, indicating a specific heterogeneity between the two. Therefore, in this article, according to the classification criteria of the National Bureau of Statistics, China is divided into three regions: the eastern region (including Beijing, Tianjin, Hebei, Shandong, Liaoning, Jiangsu, Zhejiang, Shanghai, Fujian, Guangdong, and Hainan provinces), the central region (including Shanxi, Henan, Hubei, Anhui, Hunan, and Jiangxi), and the western part (including Sichuan, Chongqing, Guizhou, Yunnan, Guangxi Zhuang Autonomous Region, Shaanxi, Inner Mongolia Autonomous Region, Ningxia Hui Autonomous Region, Gansu, Qinghai, Xinjiang Uygur Autonomous Region, and Tibet Autonomous Region). Furthermore, each province, municipality, and autonomous region is classified into coastal (Beijing, Tianjin, Hebei, Shandong, Liaoning, Jiangsu, Zhejiang, Shanghai, Fujian, Guangdong, Hainan, and Guangxi Zhuang Autonomous Region) or inland regions (Shanxi, Henan, Hubei, Anhui, Hunan, Jiangxi, Sichuan, Chongqing, Guizhou, Yunnan, Shaanxi, Inner Mongolia Autonomous Region, Ningxia Hui Autonomous Region, Gansu, Qinghai, Xinjiang Uygur Autonomous Region, and Tibet Autonomous Region) based on their geographical location. The regression data for the heterogeneity test of the two classification types are shown in Table 6.

Upon examining the regression results presented in Table 8, it is evident that the digital economy negatively influences carbon emissions levels in the central, western, and inland regions. The regression coefficients are recorded as −8.563 for the central region, −3.320 for the western region, and −1.482 for the inland region. The digital economy positively influences carbon emissions in the eastern and coastal regions. The inland and central regions have achieved significance at the 1 per cent level, the eastern region at the 5 per cent level, and the coastal and western regions have not met the significance criteria. The data in the table indicates that the digital economy in the central and inland regions is adversely affected. The primary cause of this phenomenon is the government’s initiative to construct new infrastructure to guide industrial transformation and unlock emission reduction potential. Intelligent grid scheduling algorithms enhance energy distribution efficiency and diminish overall energy usage; for instance, a pilot project in Anhui province has augmented industrial power efficiency by 15 per cent. The digital economy positively influences carbon emissions levels in the eastern and coastal regions. The inland and central regions have achieved significance at the 1 per cent level, the eastern region at the 5 per cent level, and the coastal and western regions have not met the significance criteria. The data in the table indicates a significant negative impact of the digital economy in the central and inland regions. This phenomenon primarily arises from government initiatives to construct new infrastructure to facilitate industrial transformation and enhance emission reduction potential. Intelligent grid scheduling algorithms enhance energy distribution efficiency and diminish overall energy usage; for instance, a pilot project in Anhui province has augmented industrial power efficiency by 15 per cent. The Government promotes the sharing economy and green consumption to minimize production waste and inefficient transportation. Henan’s cold chain logistics platform achieved a 20 per cent reduction in carbon emissions through optimising distribution routes. The digital economy exhibits a non-significant negative impact on carbon emissions in the western region, influenced by a significant negative impact that remains underutilized. The western region exhibits a high proportion of traditional industries and substantial pollution. The digital economy has the potential to considerably expand opportunities for carbon emission reduction by optimizing production processes and facilitating the transformation of energy-intensive industries; however, its impact is limited due to the region’s relatively underdeveloped status. The digital economy exerts a substantial positive influence on the eastern region, whereas its effect on carbon emissions in the coastal region is negligible. The primary cause of this phenomenon is the coastal region’s advanced economic development and industrial structure. The finding on the threshold effect indicates that a more significant industrial structure and economic development level result in a substantial positive influence of the digital economy on carbon emissions. This result aligns with the findings of the heterogeneity test. Consequently, coastal regions can enhance their coastal advantage by leveraging port cities to optimize the logistics chain via IoT technology, thereby diminishing carbon emissions in transportation, and by utilizing the digital transformation of the carbon trading market to augment efficiency and motivate enterprises to lower emissions. The impact of the digital economy on carbon emissions varies throughout different regions, including the East, Central, and West, as well as coastal and inland areas. The results above can support Hypothesis 4, indicating regional variability in the influence of the digital economy on carbon emissions.

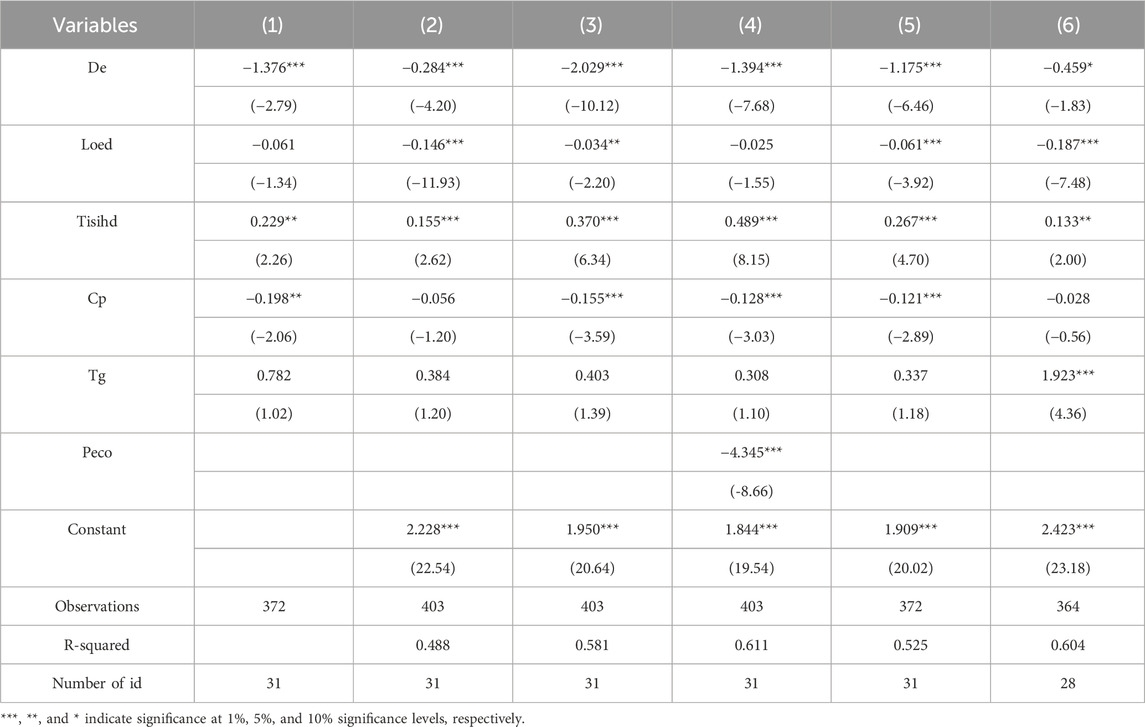

4.5 Robustness tests

The robustness test of the results involves evaluating the reliability of the employed methods and the explanatory power of the indicators. This ensures that even with variations in some coefficients, the assessment conclusions remain justifiable through consistent and reliable methods and indicators. Model (1) employs the GMM model as a substitute for the conventional panel regression model. Model (2) replaces the measurement of the digital economy, utilizing a quasi-natural experiment to examine the effect of the digital economy on carbon emissions, exemplified by the clean energy demonstration provincial policy. The distance between superior and inferior solution methods substitutes the entropy measurement model of the digital economy. Model (4) aims to enhance the control variable platform economy (Peco), defined as the count of enterprises engaged in e-commerce transaction activities. It is quantified by the ratio of businesses engaged in e-commerce trading activities. Model (5) was analysed using sample data from 2012-2023, with 2011 data excluded to reduce the time frame. Model (6) adjusts the sample capacity by excluding the three regions of Beijing, Shanghai, and Guangzhou, and regression analysis is performed using the remaining 28 provinces. The data in the table are analysed, revealing that the regression coefficients for the digital economy are −1.376, −0.284, −2.029, −1.394, −1.175, and −0.459, all of which have successfully passed the significance test. By integrating Tables 4, 9, it is evident that altering various model methodologies reveals a negative inhibitory effect of the digital economy on carbon emissions, with all results passing the significance test. These findings align with the baseline regression results, reinforcing the regression outcomes’ robustness.

5 Discussion and conclusion

5.1 Discussion

This research’s conclusions are theoretical and contemporary within the framework of “dual carbon” development and the establishment of digital China. This research introduces a threshold effect into the analytical framework to study the influence of carbon emissions on the digital economy, unlike previous studies that employed a linear method. This paper expands the research from a regional to a nationwide level and conducts a comprehensive empirical analysis. The digital economy can significantly reduce the increase of carbon emissions, and its impact on carbon emissions progresses through several stages. The carbon emission reduction intensity diminishes as the digital economy expands. This strengthens the nonlinear connection between the digital economy and carbon emissions (Huang et al., 2022a; Huang et al., 2022b). The digital economy’s influence on carbon emissions varies geographically, resulting in qualitative and quantitative differences in its impact across different regions. Neighbouring provinces with similar degrees of digital economy development may experience varying impacts on carbon emissions due to changes in the financial climate, industrial structure, resource conditions, and other variables. Each region should develop tailored measures to minimize carbon emissions in the short term, considering the varying impact of the digital economy on emissions in different locations. This technique aims to stop the local rise in carbon emissions and simultaneously implement measures to reduce carbon emissions on a larger scale. When dealing with carbon emissions, evaluating the problem from multiple perspectives is crucial. This study examines how the digital economy affects carbon emissions, with green funding as a moderating factor. Research has demonstrated that green financing connects the digital economy with carbon emissions (Tao et al., 2022). The development of the digital economy will indirectly suppress carbon emissions by promoting the improvement of the level of green finance. In other words, when the digital economy reaches a particular bottleneck in addressing carbon reduction, it can indirectly promote carbon reduction by enhancing the development of green finance. Therefore, in this process, minimizing the increase in carbon emissions to the greatest extent requires a change in the traditional economic development model. Traditional economic development should rely on digitalization to equip itself, establish a comprehensive and sound digital economic system, and achieve coordinated development between the digital economy and carbon emissions.

5.2 Conclusion

Environmental management is a key challenge under the current global warming context, both in China and globally. This study uses a panel data model with double fixed effects and a threshold effect model to examine how the digital economy influences greenhouse gas emissions, with green finance included as a mediating variable. The analysis draws on statistical data from 2011 to 2023 and explores the relationships among the digital economy, green finance, and carbon emissions.

The results show that the emission-reducing impact of the digital economy is stronger in the early stages of development but becomes less significant as the industrial structure matures. This confirms a nonlinear relationship between the digital economy and carbon emissions, with economic development level playing a key role in shaping this dynamic.

Green finance acts as a mediating factor in reducing the carbon emissions associated with digital economic development. A flourishing digital economy promotes green finance, which in turn supports emission reduction across regions. The study also finds significant regional heterogeneity: the impact of the digital economy on carbon emissions is most evident in eastern and coastal areas, moderate in central regions, and weaker in western and inland regions.

5.3 Recommendations for policy

In the short term, China should accelerate the digital transformation of high-emission industries to rapidly reduce carbon emissions. This includes expanding the scale of the digital economy by building advanced digital infrastructure, especially in manufacturing and energy-intensive sectors. Policies should encourage the application of big data and artificial intelligence in traditional industries to improve energy efficiency and lower carbon intensity. In parallel, targeted financial incentives, such as subsidies, tax breaks, and low-interest loans, should be introduced to support businesses in adopting digital technologies across their operations.

From a long-term perspective, it is essential to improve the green financial system to ensure sustainable development. The government should strengthen institutional frameworks and increase investment in green finance, including the development of supporting legislation, standard-setting, and regulatory systems. Efforts should also focus on raising public awareness and participation in green finance, encouraging enterprises and individuals to actively engage in green and low-carbon practices. A comprehensive mechanism should be established to promote the research, development, and deployment of green finance across sectors. Over time, this will help reshape the industrial structure, foster the growth of environmentally responsible enterprises, and build a stable green economic foundation.

Given the regional differences identified in this study, policies should be tailored to the distinct characteristics of various areas. In eastern and coastal regions—where the digital economy is more developed and emission-reduction effects are more evident—efforts should focus on scaling up digital-green integration and innovation. In contrast, western and inland regions—where development is relatively weaker—require policy support such as tax incentives, targeted subsidies, and infrastructure investment to accelerate digital adoption and green finance penetration. In addition, a national talent development strategy should be implemented to address regional disparities in low-carbon expertise. This can include expanding university enrollment in related fields and offering preferential employment policies to attract and retain “dual-carbon” talent across all regions, ensuring coordinated and inclusive national progress in emission reduction.

5.4 Research prospects and limitations

This paper develops an evaluation index system for the level of growth of China’s digital economy, carbon emissions, and green funding based on the availability of data and a review of domestic and foreign literature. The influence of the digital economy and green finance on carbon emissions is analysed using a fixed effects panel regression model and a mediation effects model. The threshold effects model also investigates the nonlinear relationship between the digital economy and carbon emissions. Due to the issue of data availability, there is an opportunity for improvement in this study.

1. The digital economy evaluation index system needs further enhancement. When assessing digital economic progress, it is important to include digital governance, but currently; specific measures are yet to be available for digital governance data. We will delve further into alternative data sources in the upcoming research phase.

2. A limited number of variables influence factors. Various factors influence carbon emissions in the digital economy. Because of data availability issues, the influencing factors chosen for this article still have the potential for improvement. During the selection procedure, some factors were chosen subjectively. Future research will combine approaches such as field investigations and expert interviews to establish the factors and conduct further analysis to assess them more correctly.

3. Further investigation of mediating variables is needed. As evidenced in academic research, the digital economy’s mediating impacts on carbon emissions are affected by factors like green finance, industry structure, technical innovation, and economic agglomeration. Future research will integrate these influencing factors into the study model to thoroughly examine the digital economy’s mediating impacts on carbon emissions.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

XZ: Investigation, Methodology, Writing – original draft. JR: Conceptualization, Methodology, Validation, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by: - Enhancing Research Capacity in Key Disciplines: A Study on the Impact of Innovation Input on Enterprise Performance (Guangdong Provincial Department of Education, 2021 (No.2021ZDJS133). - Scientific Research Project of Guangdong Education Department (No.2021WTSCX121). - A Study on the Moderating Effect of Firm Growth on the Relationship between Financing Constraints and Firm Performance. The Third Batch of University-level Mentor ship Research Projects (2022) (No.2022HSDS28). - The Scientific Research Project of Guangdong Education Department (No.2018WQNCX310). - Special fund project for the development of private education in Guangzhou Huashang College (No.hs2022zyjs02).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Correction note

This article has been corrected with minor changes. These changes do not impact the scientific content of the article.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

An, Q. G., Zheng, L., and Yang, M. (2024). Spatiotemporal heterogeneities in the impact of Chinese digital economy development on carbon emissions. Sustainability 16 (7), 2810. doi:10.3390/su16072810

Brock, W. A., and Taylor, M. S. (2010). The green solow model. J. Econ. Growth 15, 127–153. doi:10.1007/s10887-010-9051-0

Cai, X., and Song, X. (2022). The nexus between digital finance and carbon emissions: evidence from China. Front. Psychol. 13, 997692. doi:10.3389/fpsyg.2022.997692

Chen, M. G., Zhao, S. Y. Y., and Wang, J. W. (2023). The impact of the digital economy on regional carbon emissions: evidence from China. Sustainability 15 (20), 14863. doi:10.3390/su152014863

Chen, S., Zhao, Y., Huang, F.-W., et al. (2024). Carbon leakage perspective: unveiling policy dilemmas in emission trading and carbon tariffs under insurer green finance Energy Economics, 130.

Chu, H. M., Yu, H. J., Chong, Y., and Li, L. (2023). Does the development of digital finance curb carbon emissions? Evidence from county data in China. Environ. Sci. Pollut. Res. 30, 49237–49254. doi:10.1007/s11356-023-25659-5

Ding, W., and Liu, J. (2023). Nonlinear and spatial spillover effects of urbanization on air pollution and ecological resilience in the yellow river basin. Environ. Sci. Pollut. Res. Int. 30, 43229–43244. doi:10.1007/s11356-023-25193-4

Ding, X. M., Gao, L. F., Wang, G. J., and Nie, Y. (2022). Can the development of digital financial inclusion curb carbon emissions? Empirical test from spatial perspective. Front. Environ. Sci. 10, 1045878. doi:10.3389/fenvs.2022.1045878

Fu, K., Li, Y. Z., Mao, H. Q., and Miao, Z. (2023). Firms’ production and green technology strategies: the role of emission asymmetry and carbon taxes. Eur. J. Oper. Res. 305, 1100–1112. doi:10.1016/j.ejor.2022.06.024

Guo, J., Zhang, K., and Liu, K. (2022). Exploring the mechanism of the impact of green finance and digital economy on China's green total factor productivity. Int. J. Environ. Res. Public Health 19 (23), 16303. doi:10.3390/ijerph192316303

Hall, B. H., Moncada-Paterno-Castello, P., Montresor, S., et al. (2016). Financing constraints, R&D investments and innovative performances: new empirical evidence at the firm level for Europe. Econ. Innov. New Technol. 25, 183–196.

He, Z., Ma, S., Deng, Z., and Meng, Y. (2024). Carbon emission reduction enabled by informatization construction: an analysis of spatial effects based on China’s experience. Environ. Sci. Pollut. Res. 31, 35595–35608. doi:10.1007/s11356-024-33565-7

Hou, J., Li, W. D., and Zhang, X. H. (2024). Research on the impacts of digital economy on carbon emission efficiency at China's city level. Plos One 19 (9), e0308001. doi:10.1371/journal.pone.0308001

Huang, H. Y., Mbanyele, W., Fan, S. S., and Zhao, X. (2022a). Digital financial inclusion and energy-environment performance: what can learn from China. Struct. Change Econ. Dyn. 63, 342–366. doi:10.1016/j.strueco.2022.10.007

Huang, H. Y., Mbanyele, W., Wang, F. R., Song, M., and Wang, Y. (2022b). Climbing the quality ladder of green innovation: does green finance matter? Technology. Forecast. Soc. Change 184, 122007. doi:10.1016/j.techfore.2022.122007

Huang, J., Shen, Y., Chen, J., and Zhou, Y. (2022c). Regional digital economy development and enterprise productivity: a study of the Chinese yangtze river delta. Regional Sci. Policy and Pract. 14, 118–138. doi:10.1111/rsp3.12559

Jiang, Y., Zhao, R. Z., and Qin, G. Z. (2024). How does digital finance reduce carbon emissions intensity? Evidence from chain mediation effect of production technology innovation and green technology innovation. Heliyon 10 (9), e30155. doi:10.1016/j.heliyon.2024.e30155

Kong, F. (2022). A better understanding of the role of new energy and green finance to help achieve carbon neutrality goals, with special reference to China. Sci. Prog. 105 (1), 00368504221086361. doi:10.1177/00368504221086361

Lee, K. H., and Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 108, 534–542.

Li, Z., and Wang, J. (2022). The dynamic impact of digital economy on carbon emission reduction: evidence city-level empirical data in China. J. Clean. Prod. 351, 131570. doi:10.1016/j.jclepro.2022.131570

Li, Z., and Zhou, Q. (2021). Research on the spatial effect and threshold effect of industrial structure upgrading on carbon emissions in China. J. Water Clim. Change 12, 3886–3898. doi:10.2166/wcc.2021.216

Li, N., Shi, B., and Kang, R. (2023). Analysis of the coupling effect and space-time difference between China's digital economy development and carbon emissions reduction. Int. J. Environ. Res. Public Health 20, 872. doi:10.3390/ijerph20010872

Lin, B., and Ma, R. (2022). How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 320, 115833. doi:10.1016/j.jenvman.2022.115833

Liu, Y., and Chen, L. (2022). The impact of digital finance on green innovation: resource effect and information effect. Environ. Sci. Pollut. Res. 29, 86771–86795. doi:10.1007/s11356-022-21802-w

Liu, X., He, Z., Deng, Z., and Poddar, S. (2024). Analysis of spatiotemporal disparities and spatial spillover effect of a low-carbon economy in Chinese provinces under green technology innovation. Sustainability 16 (21), 9434. doi:10.3390/su16219434

Lu, Y., and Chen, X. (2023). Digital economy, new-type urbanization, and carbon emissions: evidence from China. Environ. Prog. and Sustain. Energy 42 (3), e14045. doi:10.1002/ep.14045

Qin, X., Wu, H., and Li, R. (2022). Digital finance and household carbon emissions in China. China Econ. Rev. 76, 101872. doi:10.1016/j.chieco.2022.101872

Safi, A., Kchouri, B., Elgammal, W., Nicolas, M. K., and Umar, M. (2024). Bridging the green gap: do green finance and digital transformation influence sustainable development? Energy Econ. 134, 107566. doi:10.1016/j.eneco.2024.107566

Saqib, N., and Usman, M. (2023). Are technological innovations and green energy prosperity swiftly reduce environmental deficit in China and United States? Learning from two sides of environmental sustainability. Energy Rep. 10, 1672–1687. doi:10.1016/j.egyr.2023.08.022

Saqib, N., Mahmood, H., Murshed, M., Duran, I. A., and Douissa, I. B. (2023). Harnessing digital solutions for sustainable development: a quantile-based framework for designing an SDG framework for green transition. Environ. Sci. Pollut. Res. 30, 110851–110868. doi:10.1007/s11356-023-30066-x

Saqib, N., Abbas, S., Ozturk, I., Murshed, M., Tarczyńska-Łuniewska, M., Mahtab Alam, M., et al. (2024a). Leveraging environmental ICT for carbon neutrality: Analyzing the impact of financial development, renewable energy and human capital in top polluting economies. Gondwana Res. 126, 305–320. doi:10.1016/j.gr.2023.09.014

Saqib, N., Usman, M., Ozturk, I., and Sharif, A. (2024b). Harnessing the synergistic impacts of environmental innovations, financial development, green growth, and ecological footprint through the lens of sdgs policies for countries exhibiting high ecological footprints. Energy Policy 184, 113863. doi:10.1016/j.enpol.2023.113863

Shi, K., Chen, Y., Li, L., and Huang, C. (2018). Spatiotemporal variations of urban co2 emissions in China: a multiscale perspective. Apply Energy 211, 218–229. doi:10.1016/j.apenergy.2017.11.042

Sun, J. B., and Wu, X. H. (2023). Research on the mechanism and countermeasures of digital economy development promoting carbon emission reduction in Jiangxi province. Environ. Res. Commun. 5 (3), 035002. doi:10.1088/2515-7620/acbd8b

Tao, H., Zhuang, S., Xue, R., Cao, W., Tian, J., and Shan, Y. (2022). Environmental finance: an interdisciplinary review. Technol. Forecast. Soc. Change 179, 121639. doi:10.1016/j.techfore.2022.121639

Wang, L., and Zhao, L. (2022). Digital economy meets artificial intelligence: Forecasting economic conditions based on big data analytics. Mob. Inf. Syst. 2022 (1), 1–9. doi:10.1155/2022/7014874

Wang, J., Du, G., and Liu, M. (2022). Spatiotemporal characteristics and influencing factors of carbon emissions from civil buildings: evidence from urban China. PloS one 17, e0272295. doi:10.1371/journal.pone.0272295

Wang, C. Q., Qi, F. Y., Liu, P. Z., Ibrahim, H., and Wang, X. (2023a). The effect of the digital economy on carbon emissions: an empirical study in China. Environ. Sci. Pollut. Res. 30, 75454–75468. doi:10.1007/s11356-023-27742-3

Wang, S., Wen, J., Yang, X., Deng, P., and Wang, N. (2023b). Impacts of digital trade restrictiveness on green technology innovation: an empirical analysis. Emerg. Mark. Finance Trade 59, 2079–2101. doi:10.1080/1540496x.2023.2172321

Wiskich, A. (2021). A comment on innovation with multiple equilibria and the environment and directed technical change. Energy Econ. 94, 105077. doi:10.1016/j.eneco.2020.105077

Xie, N.-Y., and Zhang, Y. (2022). The impact of digital economy on industrial carbon emission efficiency: evidence from Chinese provincial data. Math. Problems Eng. 2022, 1–12. doi:10.1155/2022/6583809

Xu, S., and Liang, L. (2023). Has digital finance made marine energy carbon emission more efficient in coastal areas of China? Sustainability 15, 1936. doi:10.3390/su15031936

Xu, Q., Liu, Y., Chen, C., and Lou, F. (2023). Research on multi-stage strategy of low carbon building material’s production by small and medium-sized manufacturers: a three-party evolutionary game analysis. Front. Environ. Sci. 10, 1086642. doi:10.3389/fenvs.2022.1086642

Yu, H., Wei, W., Li, J., and Li, Y. (2022). The impact of green digital finance on energy resources and climate change mitigation in carbon neutrality: case of 60 economies. Resour. Policy 79, 103116. doi:10.1016/j.resourpol.2022.103116

Yu, H. J., Shen, S. W., Han, L., and Ouyang, J. (2024a). Spatiotemporal heterogeneities in the impact of the digital economy on carbon emission transfers in China. Technol. Forecast. Soc. Change 200, 123166. doi:10.1016/j.techfore.2023.123166

Yu, Y. R., Liu, D. D., and Dai, Y. (2024b). Carbon emission effect of digital economy development: impact of digital economy development on China's carbon dioxide emissions. Clean Technol. Environ. Policy 26, 2707–2720. doi:10.1007/s10098-024-02751-z

Yuan, B. L., Li, C., Yin, H. Y., and Zeng, M. (2022). Green innovation and China's co2 emissions-the moderating effect of institutional quality. J. Environ. Plan. Manag. 65, 877–906. doi:10.1080/09640568.2021.1915260

Zhang, D., Mohsin, M., and Taghizadeh-Hesary, F. (2022). Does green finance counteract the climate change mitigation: Asymmetric effect of renewable energy investment and R&D. Energy Econ. 113, 106183.

Zhang, K., Li, S., Qin, P., and Wang, B. (2023). Spatial and temporal effects of digital technology development on carbon emissions: evidence from China. Sustainability 15, 485. doi:10.3390/su15010485

Zheng, H. H., and Li, X. (2022). The impact of digital financial inclusion on carbon dioxide emissions: empirical evidence from Chinese provinces data. Energy Rep. 8, 9431–9440. doi:10.1016/j.egyr.2022.07.050

Zhou, X. Y., Zhou, D. Q., Wang, Q. W., and Su, B. (2019). How information and communication technology drives carbon emissions: a sector-level analysis for China. Energy Econ. 81, 380–392. doi:10.1016/j.eneco.2019.04.014

Zhu, Y., and Wu, Y. (2021). “Green bond financing development research in China,” in 2021 5th annual International Conference on data science and business Analytics (ICDSBA). Changsha, China: IEEE, 24–26.

Keywords: digital economy, carbon emissions, green finance, intermediation effects, threshold effects

Citation: Zhang X and Rong J (2025) Mechanism of digital economy on carbon emissions: based on the perspective of green finance development. Front. Environ. Sci. 13:1611355. doi: 10.3389/fenvs.2025.1611355

Received: 14 April 2025; Accepted: 02 September 2025;

Published: 15 October 2025; Corrected: 15 December 2025.

Edited by:

Mobeen Ur Rehman, Keele University, United KingdomReviewed by:

Pin Li, Xi’an University of Science and Technology, ChinaXiumei Xu, Baoshan University, China

Copyright © 2025 Zhang and Rong. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jia Rong, YnVkdXd1amlhbmdAMTYzLmNvbQ==

Xiaoyun Zhang1

Xiaoyun Zhang1 Jia Rong

Jia Rong